Document

NN, Inc.

6210 Ardrey Kell Road, Suite 120

Charlotte, NC 28277

FOR IMMEDIATE RELEASE

NN, INC. REPORTS FIRST QUARTER 2025 RESULTS

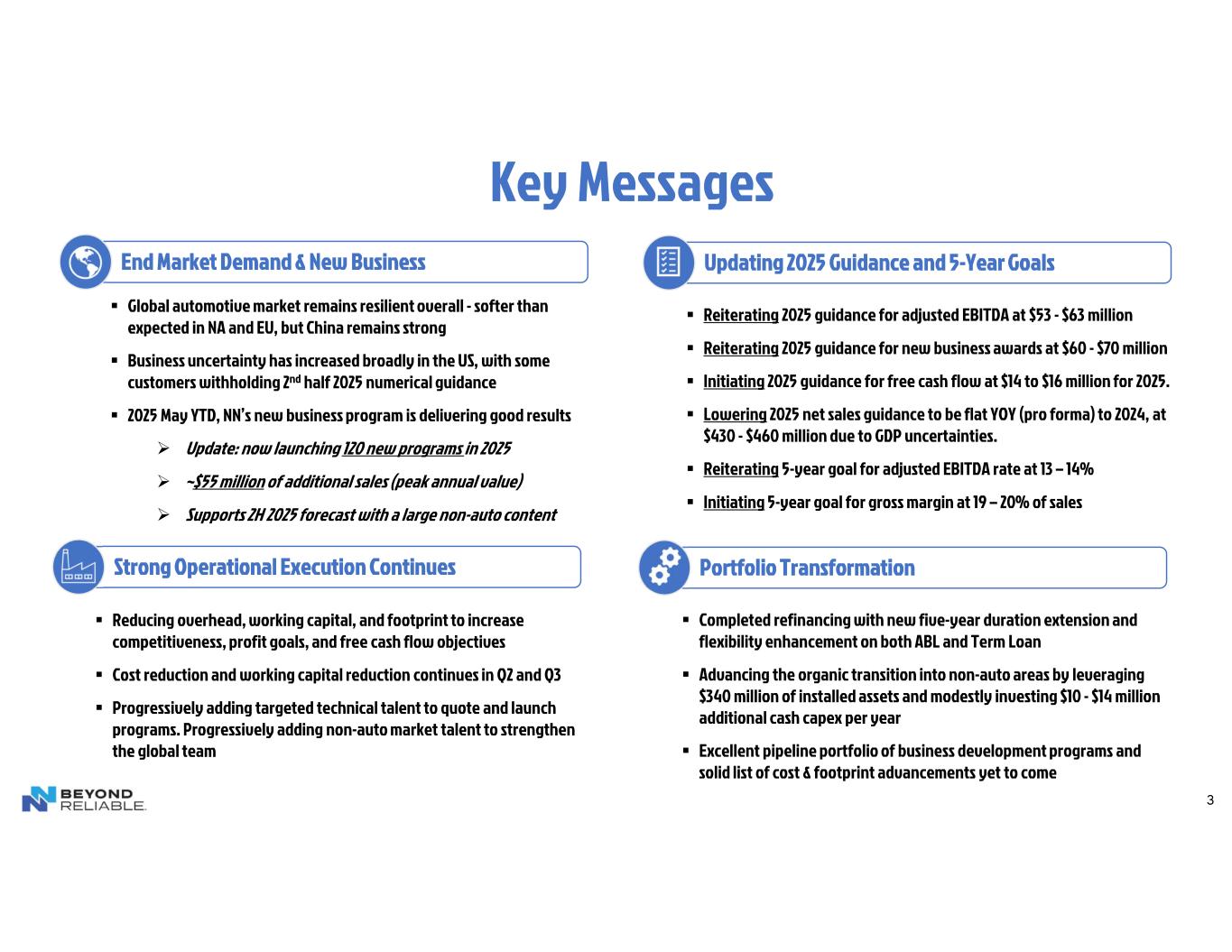

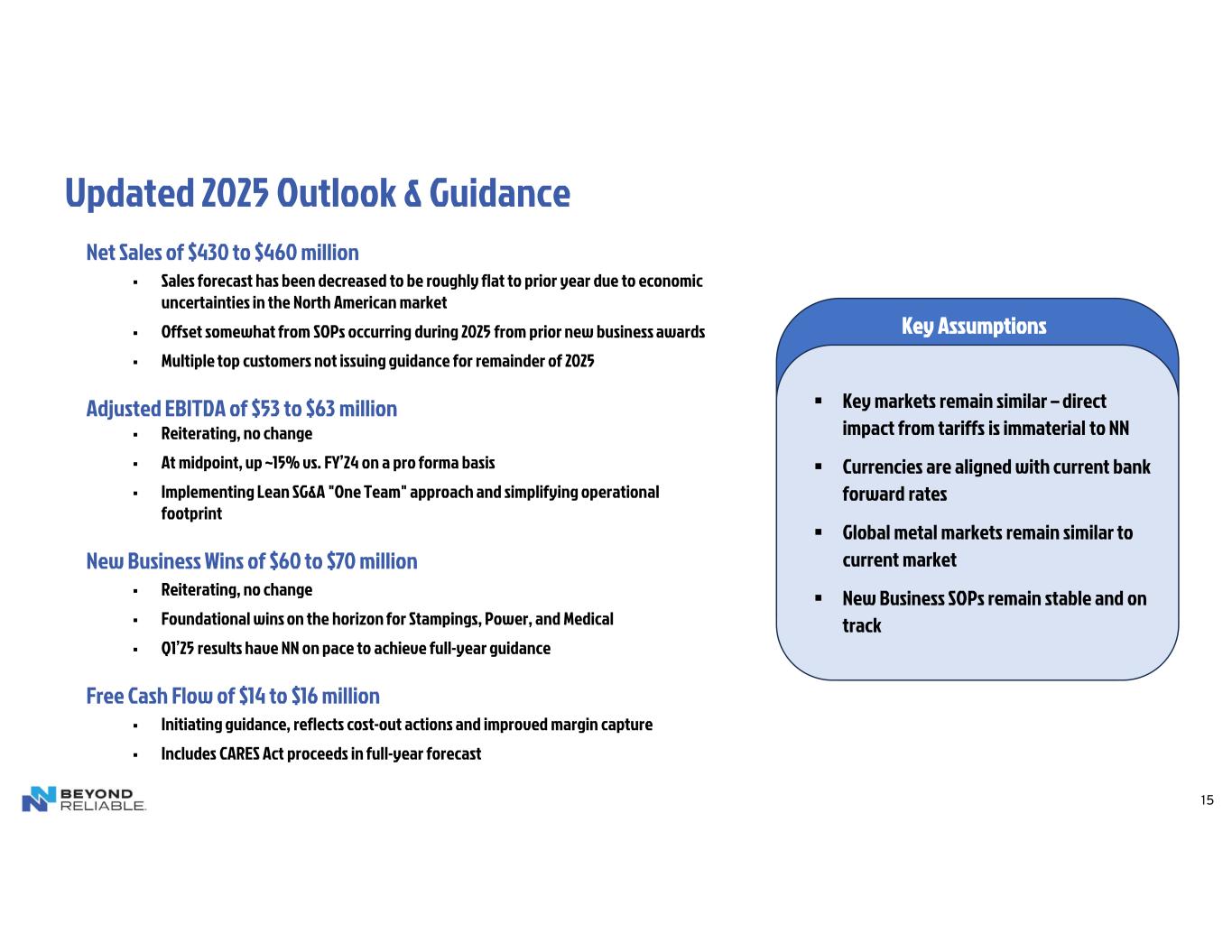

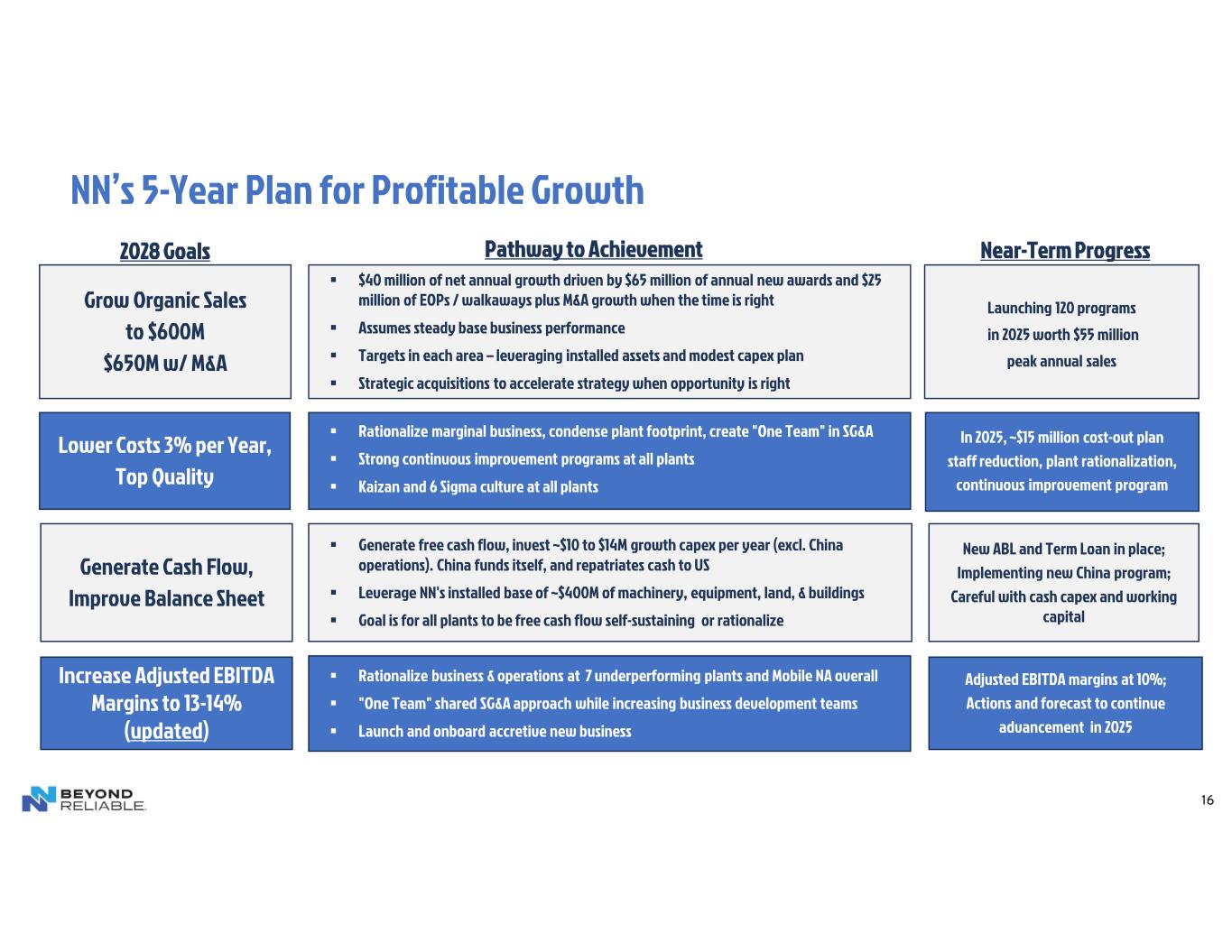

Company reaffirms full-year adjusted EBITDA 2025 outlook and five-year sales and margin targets

Company initiates full-year 2025 free cash flow guidance of $14-$16 million

CHARLOTTE, N.C., May 7, 2025 – NN, Inc. (NASDAQ: NNBR) (“NN” or the “Company”), a global diversified industrial company that engineers and manufactures high-precision components and assemblies, today reported results for the first quarter ended March 31, 2025.

First Quarter Highlights

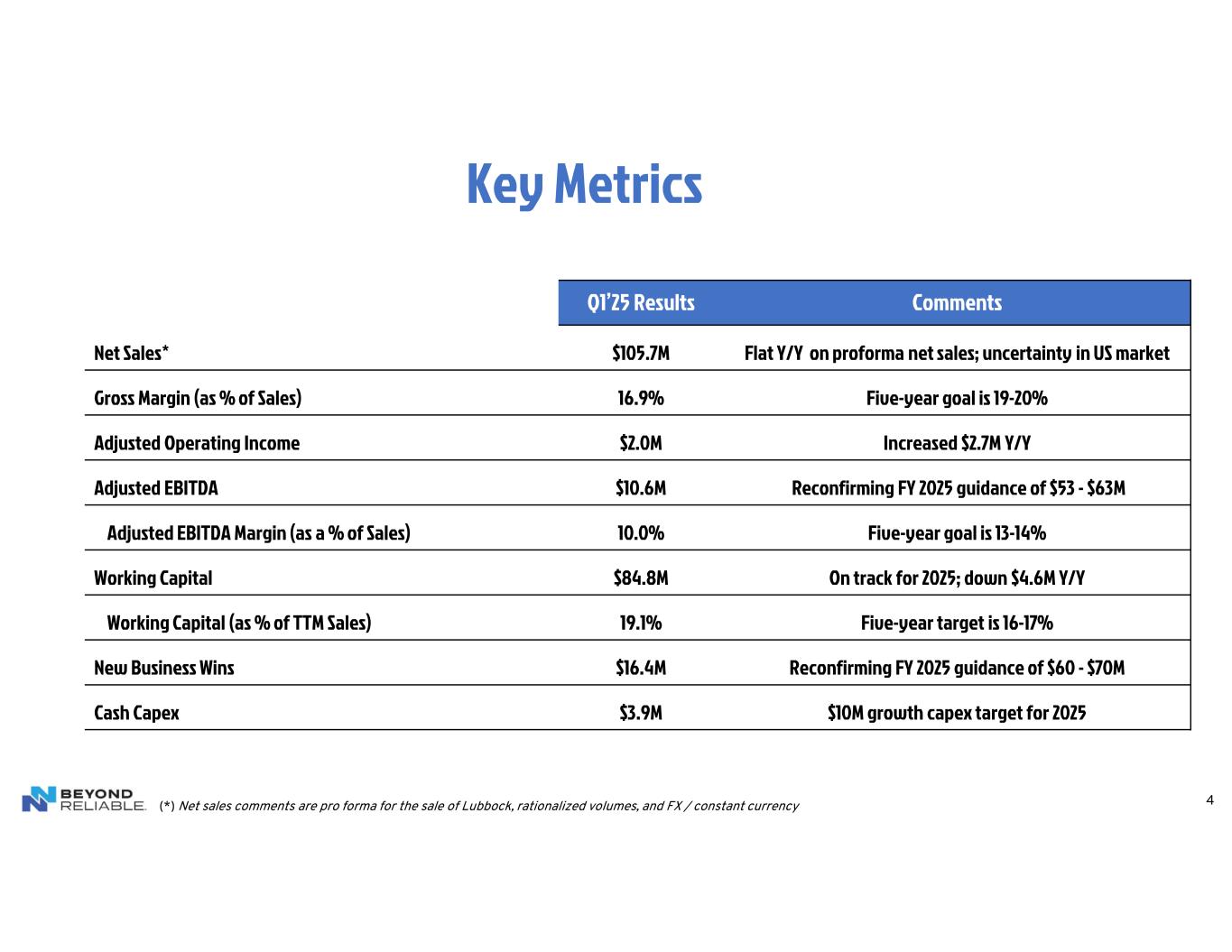

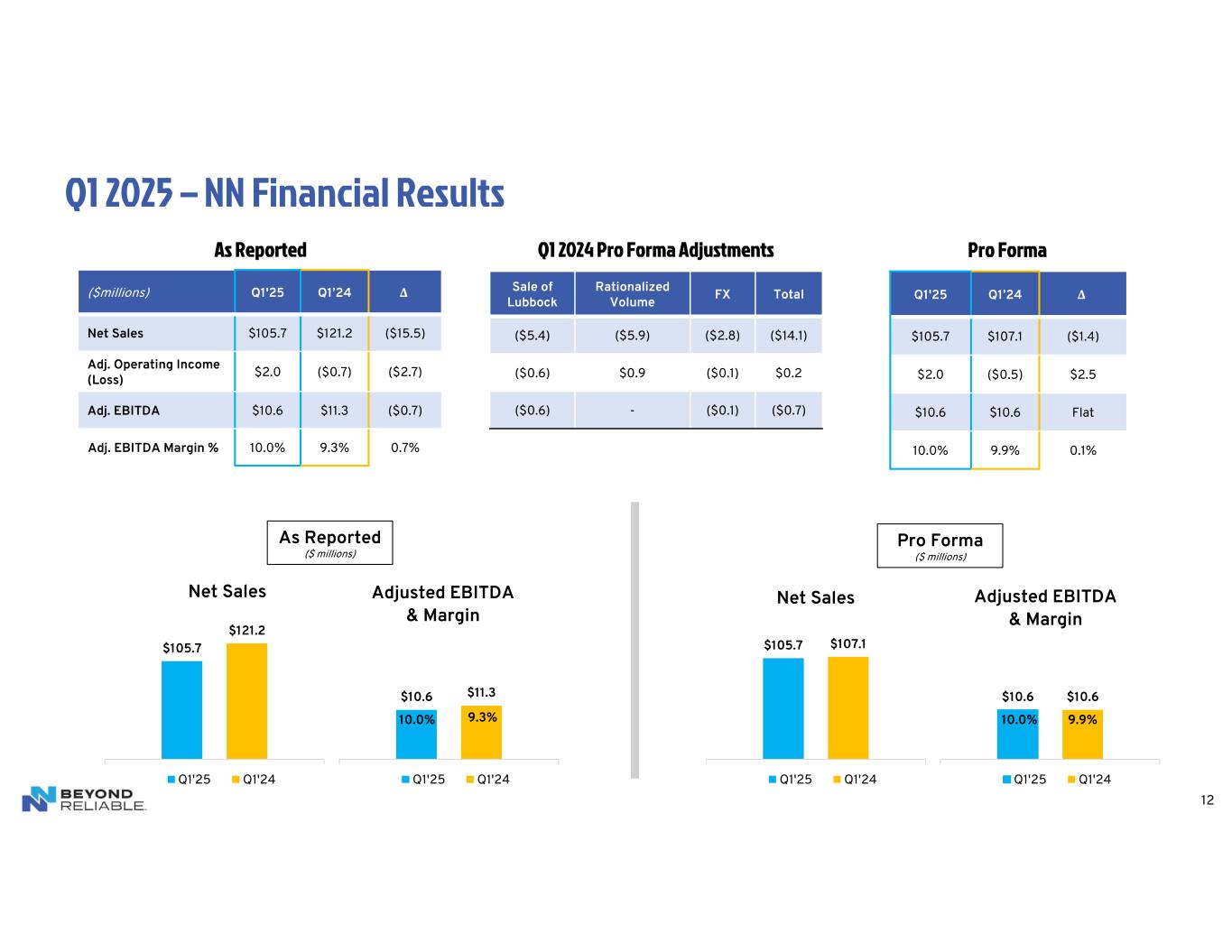

•Net sales of $105.7 million, decreased by 12.8% versus the prior year first quarter.

•Pro forma net sales, adjusted for the sale of Lubbock, rationalized business, and currency translation, decreased by 1.3% compared to the prior year first quarter.

◦Strong China domestic sales growth continues, up by 12.5% versus the prior year first quarter.

◦NN does not directly sell Chinese manufactured products into the U.S.

•GAAP earnings per share of $(0.23) and adjusted earnings per share results of $(0.03), increases versus ($0.34) and ($0.08), respectively, versus the prior year first quarter.

•Pro forma adjusted EBITDA of $10.6 million, flat to prior year first quarter.

•Adjusted EBITDA margin of 10%, an increase compared to 9.3% in the prior year first quarter.

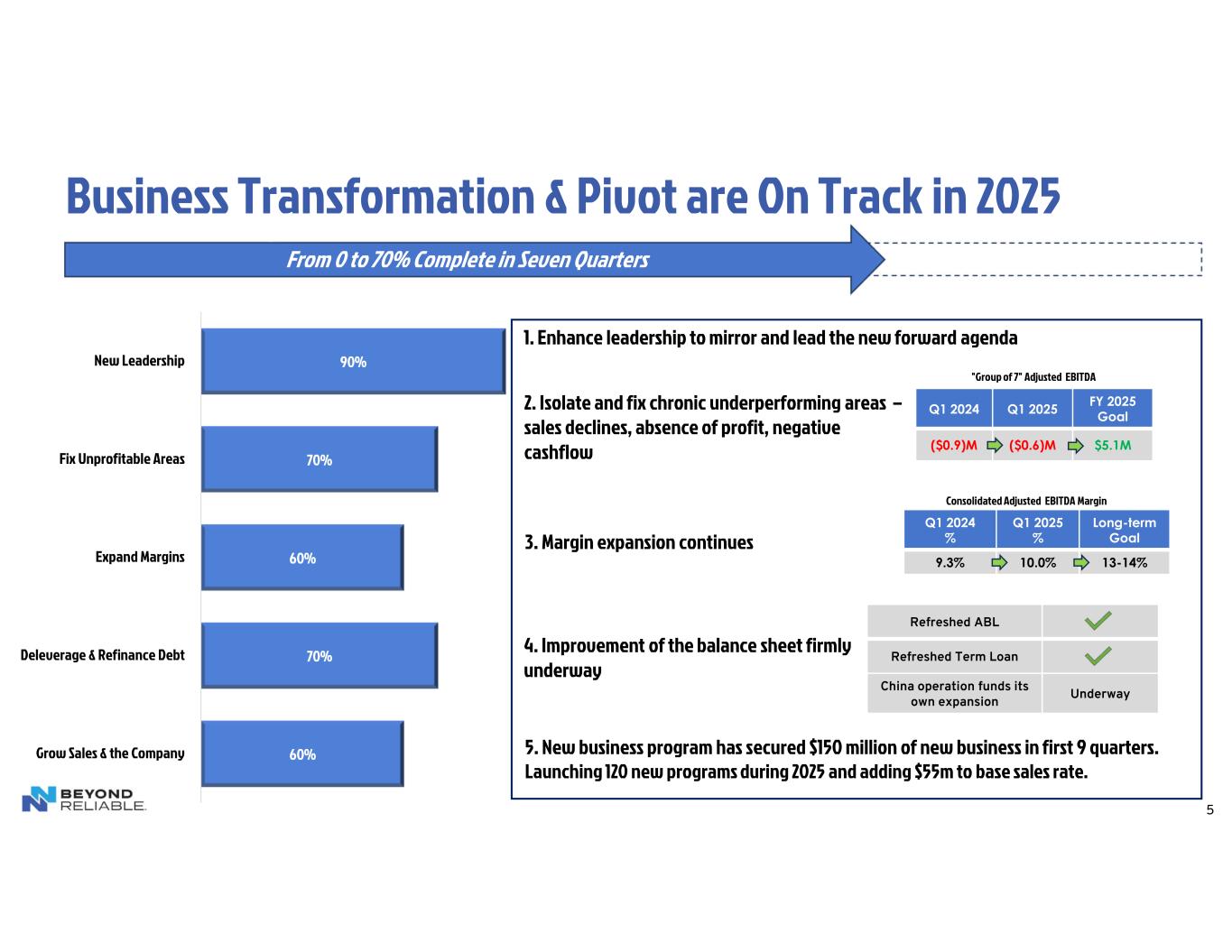

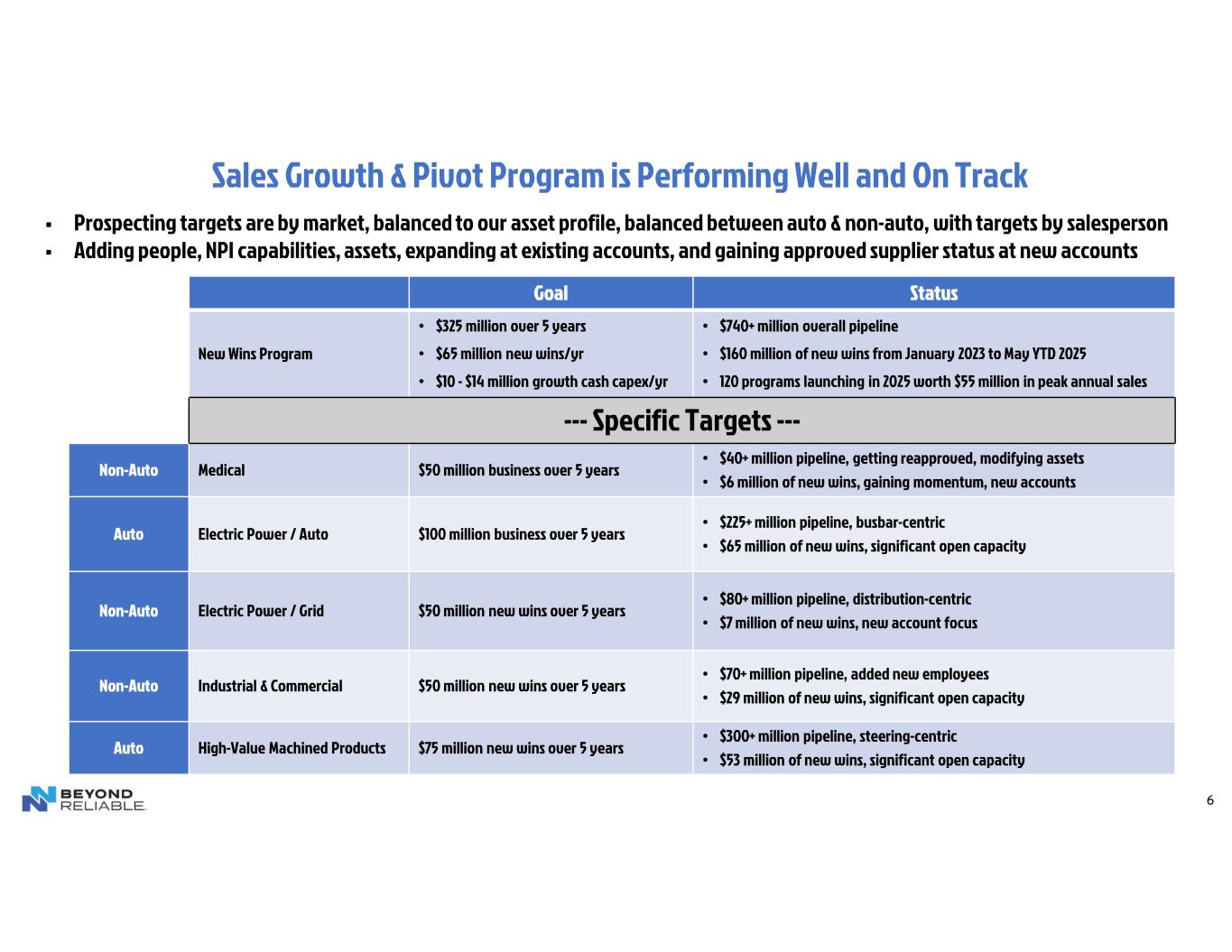

•NN is tracking to all long-term goals and transformational pillars - growth, diversification, costs, and cash.

•Recently raised 5-year adjusted EBITDA margin target to 13-14%.

◦Rationalization of underperforming business and plants remains on track with additional footprint reductions under evaluation; an estimated $15 million total cost savings are expected in 2025.

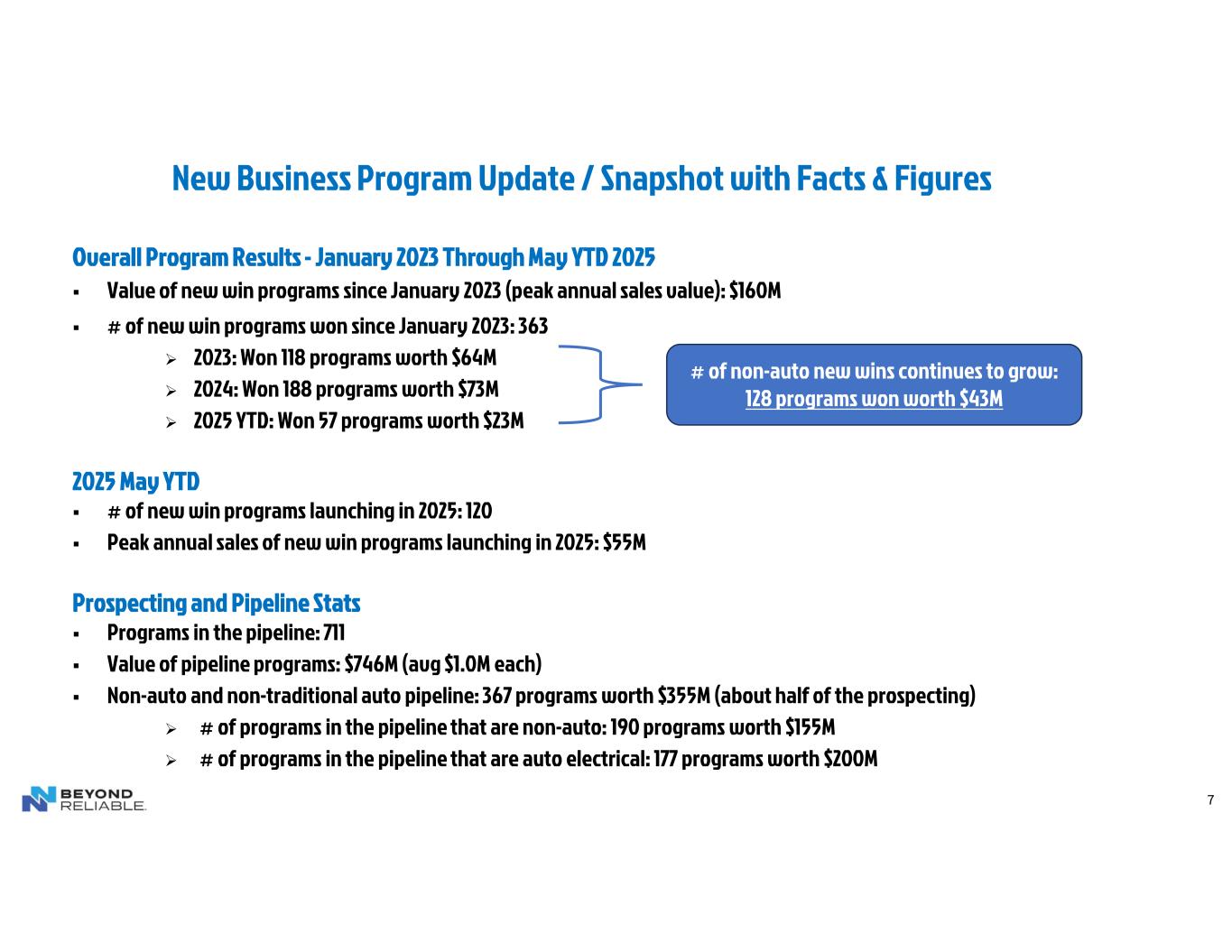

•New business wins were $16.4 million, concentrated in the key focus areas of industrial products, electrical and power products, medical, and high-value automotive products.

◦NN’s new business pipeline remains robust at over $740 million and continues to expand in key targeted growth areas. Approximately 30% of the pipeline focused on non-traditional automotive applications.

◦NN’s pipeline and new business wins are improving sales and margin mix and strengthening the Company’s sales growth and structural earnings power.

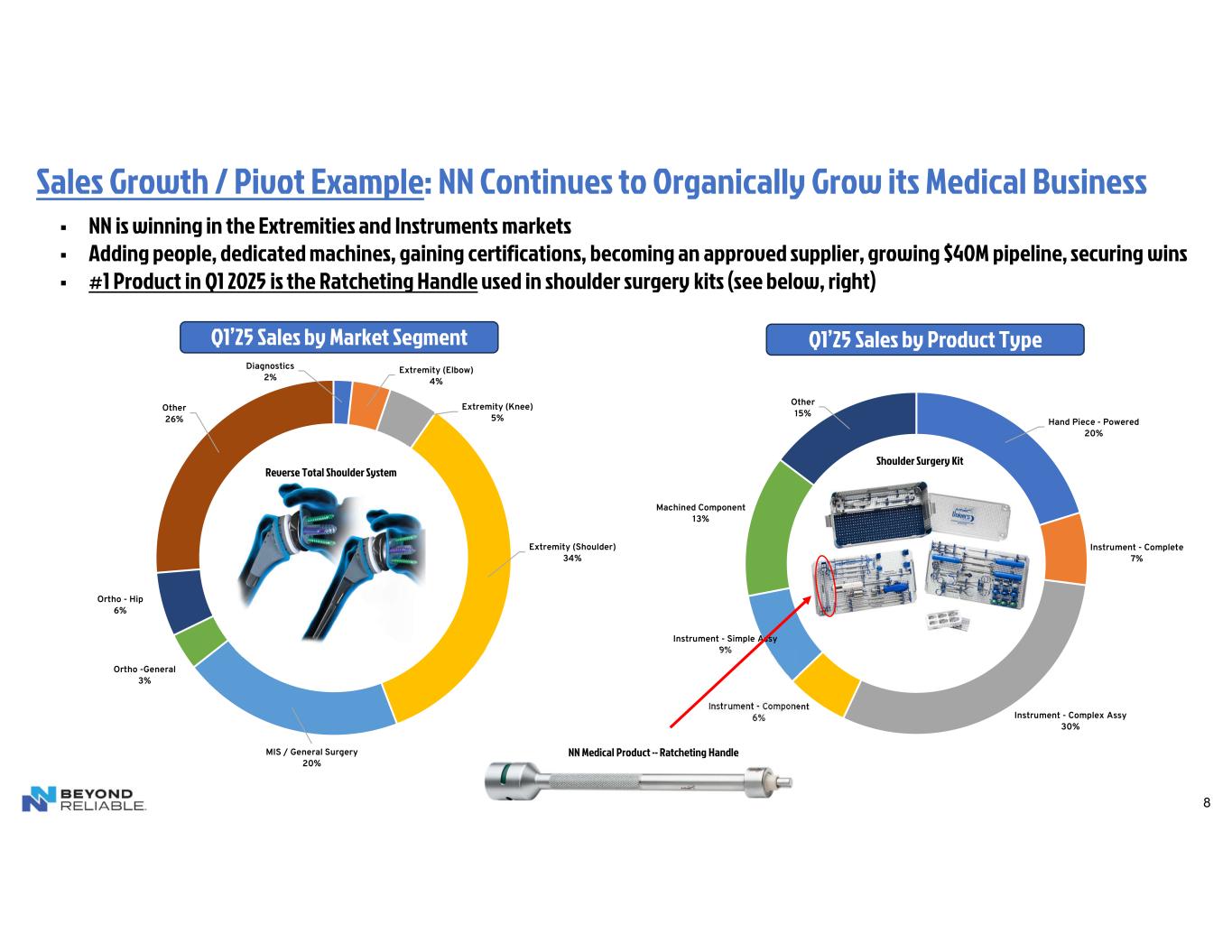

•Medical products business growth plan stays focused; currently adding specialized equipment to meet expanded new business pipeline and support initial wins. NN’s medical pipeline is currently at peak levels of $40+ million since re-entering the medical market in October 2023.

•Term Loan refinancing process completed post quarter-end, positioning the Company to advance its 5-year transformation plans.

“NN marked another quarter of solid steps forward across key areas of our transformation, and our results for the quarter have kept us on track with our full-year outlook and five-year plan. Our strategic and transformation-led progress was highlighted by growth and new wins in targeted markets, including stamped, medical, and electrical products, as well as high-value automotive” said Harold Bevis, President and Chief Executive Officer of NN, Inc. “Our commercial growth agenda captured $16.4 million of new business wins in the quarter, progress that has kept the Company on pace to meet its aggressive multi-year sales growth target.

Mr. Bevis continued, “Our commercial pipeline remains robust at over $740 million and we continue to grow our presence in highly-accretive growth markets. Due to programs won in prior years and programs won in 2025 year to date through early May, we have now won 120 new programs worth $55 million (peak annual sales) launching in 2025. This will add incremental sales in the second half of fiscal 2025. We have had some foundational wins thus far in 2025, and we are excited about our future.”

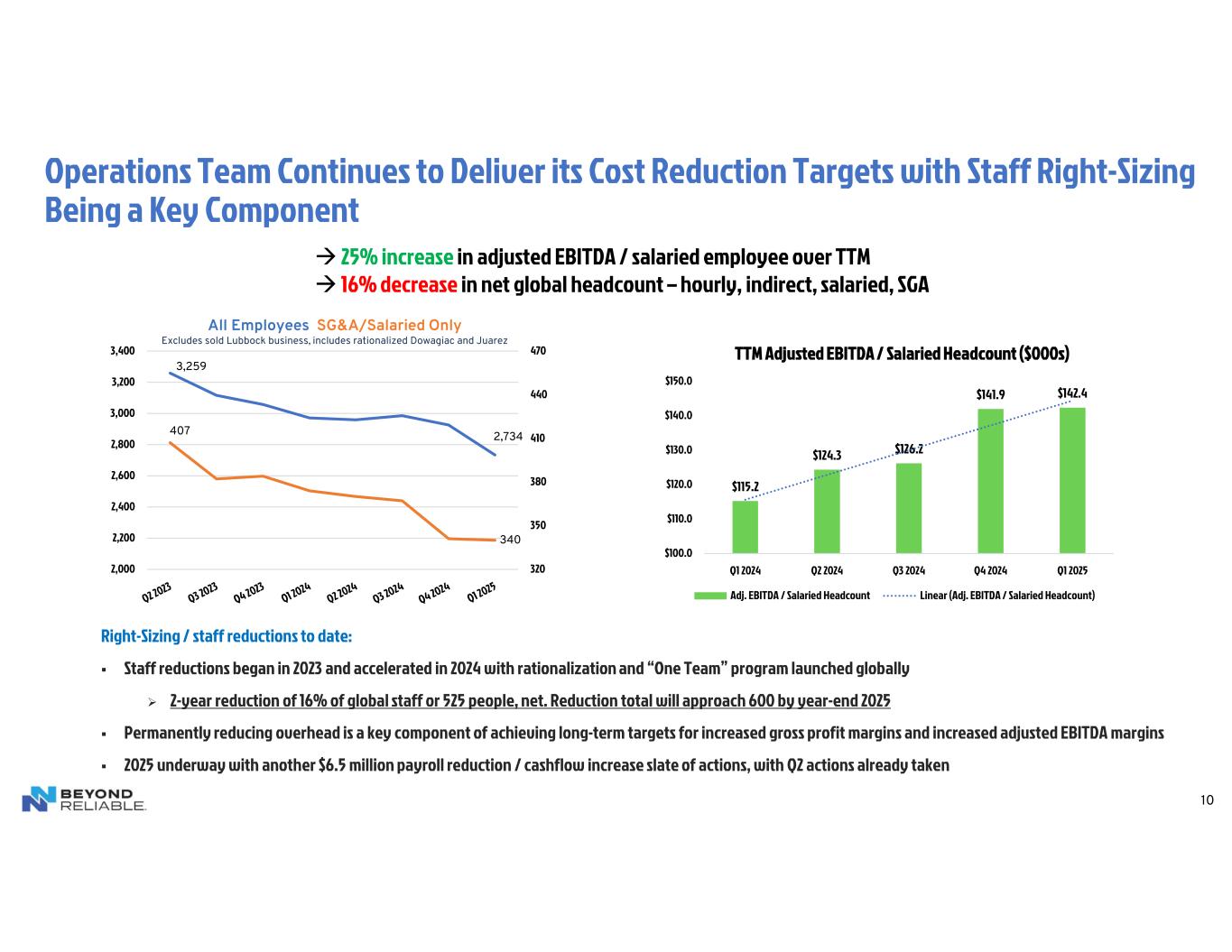

“Operationally, our team continues to diligently execute against our cost-out and plant level productivity enhancement initiatives, with a 2025 goal of $15 million cost reduction. 2025 will mark a significant turning point in NN’s free cash flow performance, and we are initiating full-year 2025 guidance of $14 to $16 million.”

Mr. Bevis concluded, “Despite heightened macroeconomic uncertainty, the threat of U.S. tariffs is thus far immaterial to NN, and our business segments have showed continued resilience. We believe we are well positioned to continue driving organic growth, reduce our cost profile, and increase our cash flow. Although there are well-known uncertainties across the global economy, we know that have ample cause for optimism and we remain excited about our transformation plan, both commercially and operationally. 2025 will serve as a pivotal year in our progression, and we look forward to delivering strong results for our shareholders and stakeholders this year and continuing upon that momentum into the future.”

First Quarter Results

Net sales were $105.7 million, a decrease of 12.8% compared to the first quarter of 2024 net sales of $121.2 million, primarily due to the rationalization of underperforming business and plants, the sale of our Lubbock operations in 2024, lower volumes and unfavorable foreign exchange effects. These decreases were partially offset by higher precious metals pass-through pricing. Loss from operations for the first quarter of 2025 was $4.8 million, flat compared to prior year.

First Quarter Adjusted Results

Pro forma net sales when adjusted for rationalized sales and currency changes and the sale of Lubbock, were a decrease of 1.3% in the first quarter when compared to the first quarter of 2024.

Adjusted income from operations for the first quarter of 2025 was $2.0 million compared to adjusted loss from operations of $0.7 million for the same period in 2024. Adjusted EBITDA was $10.6 million, or 10.0% of sales, compared to $11.3 million, or 9.3% of sales, for the same period in 2024.

Adjusted net loss from operations was $1.4 million, or $0.03 per diluted share, compared to adjusted net loss of $4.0 million, or $0.08 per diluted share, for the same period in 2024. Free cash flow was a use of cash of $7.1 million compared to a generation of cash of $0.3 million for the same period in 2024.

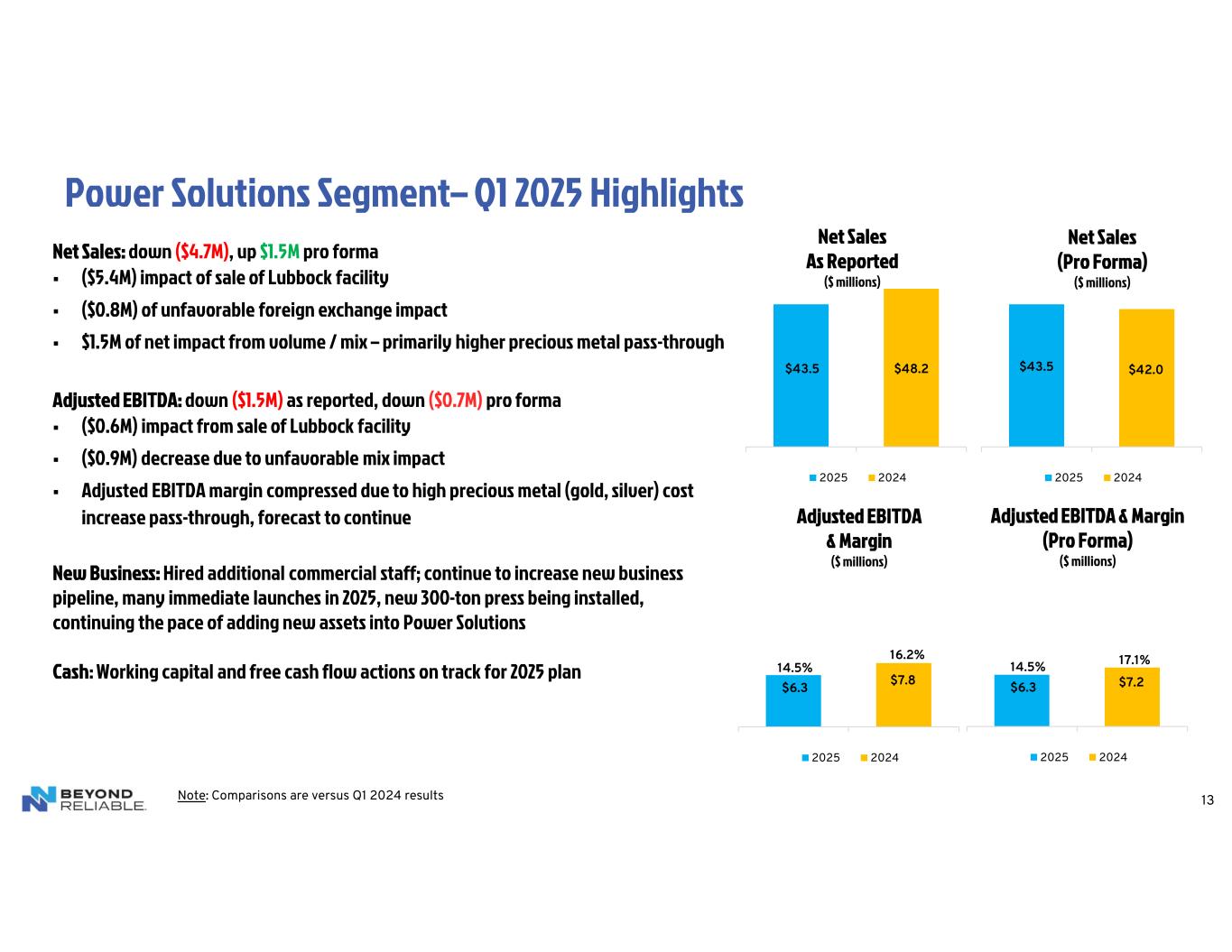

Power Solutions

Net sales for the first quarter of 2025 were $43.5 million compared to $48.2 million in the same period in 2024.

The decrease is primarily due to the sale of our Lubbock operations, lower volumes and unfavorable foreign exchange effects of $0.8 million. These decreases were partially offset by higher precious metals pass-through pricing. Income from operations was $3.0 million compared to income from operations of $4.0 million for the same period in 2024.

Adjusted income from operations was $5.5 million compared to $6.8 million in the first quarter of 2024. The decrease in adjusted income from operations was primarily due to lower revenues and unfavorable product mix, partially offset by lower operating costs due to the sale of the Lubbock operations in 2024.

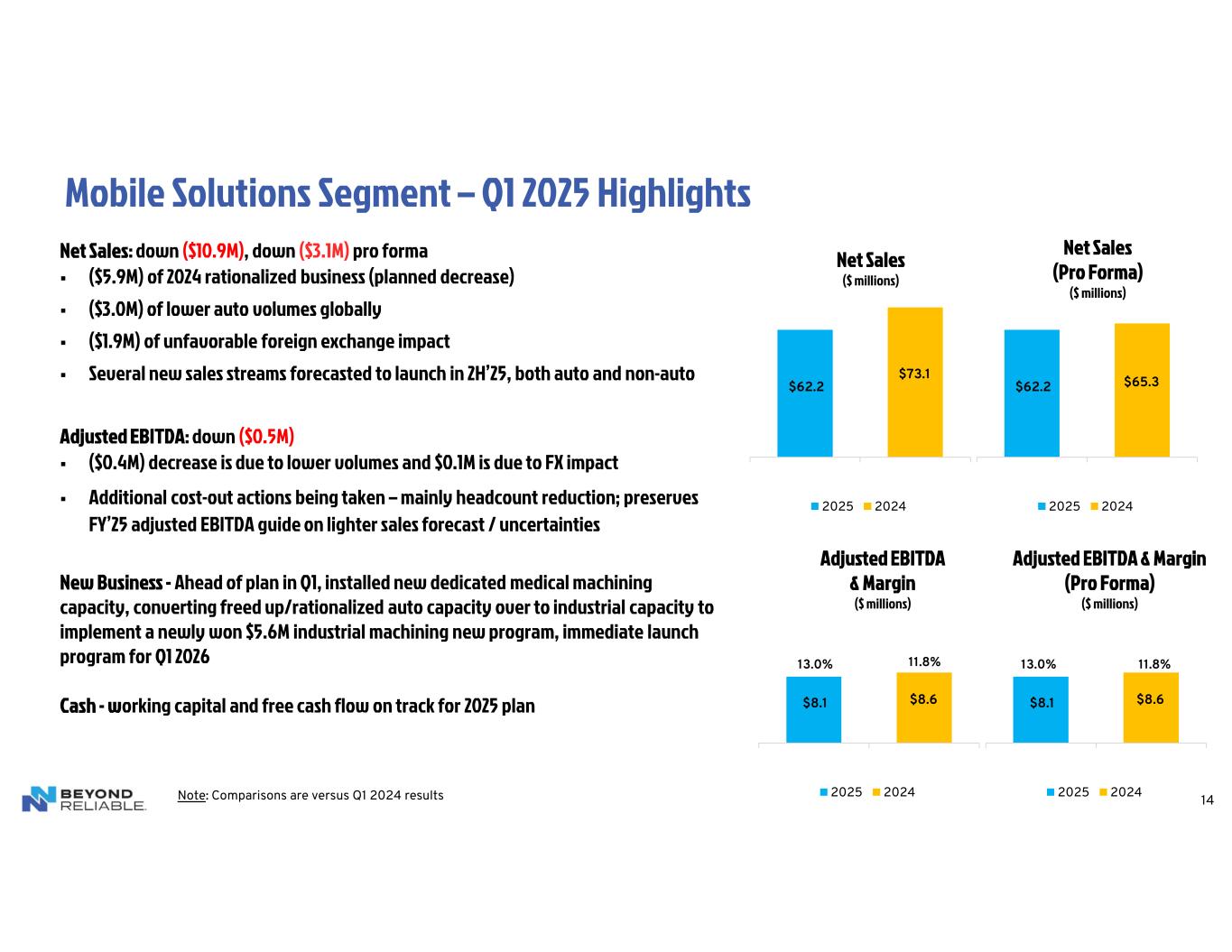

Mobile Solutions

Net sales for the first quarter of 2025 were $62.2 million compared to $73.1 million in the first quarter of 2024. The decrease in sales was primarily due to the closure of the Juarez plant, lower volumes and unfavorable foreign exchange effects of $1.9 million. Loss from operations was $2.7 million compared to loss from operations of $2.1 million for the same period in 2024.

Adjusted income from operations was $1.6 million compared to adjusted loss from operations of $1.2 million in the first quarter of 2024. The increase in adjusted income from operations was primarily due to lower headcount and lower incentive compensation expense.

2025 Outlook

Guidance assumes that key markets remain stable, global foreign currency exchange rates remain consistent with current bank forward rates, the global metals market conditions remain similar to current levels, and start of production on new programs remains stable.

Note that core performance metrics for net sales and adjusted EBITDA are normalized for sale of Lubbock and rationalized business during 2024.

•Net sales to range between $430 to $460 million

•Adjusted EBITDA to range between $53 to $63 million

•Free cash flow to range between $14 to $16 million; guidance assumes receipt of CARES Act refund in 2025

•New business wins to range between $60 to $70 million

◦Targeting larger amounts from stamped products, electrical products, and medical products

◦China will fund its own new wins program

◦Continue to leverage $340 million of machinery and equipment to minimize cash capex spend

Chris Bohnert, Senior Vice President and Chief Financial Officer, commented, “Thus far the direct impacts of tariff and trade negotiations are immaterial to our results and, as a result, we are maintaining our full-year 2025 guidance range for adjusted EBITDA. Given the current lower relative visibility in the context of growing global economic uncertainty, we expect prevailing market conditions to push our adjusted EBITDA guidance towards the lower half of the provided range. In response to the contraction in GDP in early 2025, we are slightly modifying our full-year net sales outlook, now expecting net sales in the range of $430 million to $460 million. Additionally, with the recently completed refinancing of our term loan, we are initiating full-year free cash flow guidance, expecting results to range between $14 million and $16 million. Our action plans and forecast are supported by continued operational and cost efficiencies across this year, which will help us maintain the strong pace of our transformation and rate of growth.”

Conference Call

NN will discuss its results during its quarterly investor conference call on May 8, 2025, at 9 a.m. ET. The call and supplemental presentation may be accessed via NN's website, www.nninc.com. The conference call can also be accessed by dialing 1-877-255-4315 or 1-412-317-6579. For those who are unavailable to listen to the live broadcast, a replay will be available shortly after the call until May 8, 2026.

NN discloses in this press release the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of restructuring and integration expense, acquisition and transition expenses, foreign exchange impacts on inter-company loans, amortization of intangibles and deferred financing costs, and other non-operating impacts on our business.

The financial tables found later in this press release include a reconciliation of adjusted income (loss) from operations, adjusted operating margin, adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow to the U.S. GAAP financial measures of income (loss) from operations, net income (loss), net income (loss) per diluted common share, and cash provided (used) by operating activities.

About NN, Inc.

NN, Inc., a global diversified industrial company, combines advanced engineering and production capabilities with in-depth materials science expertise to design and manufacture high-precision components and assemblies for a variety of markets on a global basis. Headquartered in Charlotte, North Carolina, NN has facilities in North America, South America, Europe and China. For more information about the company and its products, please visit www.nninc.com.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Except for specific historical information, many of the matters discussed in this press release may express or imply projections of revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. These statements may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to NN, Inc. (the “Company”) based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “growth,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project”, “trajectory” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the impacts of pandemics, epidemics, disease outbreaks and other public health crises on our financial condition, business operations and liquidity; the potential impacts of tariffs on the U.S. economy, the economy of other countries in which we conduct operations and our industry, as well as the potential implications and ramifications of tariffs on our business and the local and global supply chains supporting the same, and our ability to mitigate any adverse impacts of such; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; material changes in the costs and availability of raw materials; economic, social, political and geopolitical instability, military conflict, currency fluctuation, and other risks of doing business outside of the United States; inflationary pressures and changes in the cost or availability of materials, supply chain shortages and disruptions, the availability of labor and labor disruptions along the supply chain; our dependence on certain major customers, some of whom are not parties to long-term agreements (and/or are terminable on short notice); the impact of acquisitions and divestitures, as well as expansion of end markets and product offerings; our ability to hire or retain key personnel; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; our ability to secure, maintain or enforce patents or other appropriate protections for our intellectual property; new laws and governmental regulations; the impact of climate change on our operations; uncertainty of government policies and actions after recent U.S. elections in respect to global trade, tariffs and international trade agreements; and cyber liability or potential liability for breaches of our or our service providers’ information technology systems or business operations disruptions. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s filings made with the U.S. Securities and Exchange Commission. Any forward-looking statement speaks only as of the date of this press release, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements.

With respect to any non-GAAP financial measures included in the following document, the accompanying information required by SEC Regulation G can be found in the back of this document or in the “Investors” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.”

Investor & Media Contacts:

Joe Caminiti or Stephen Poe

NNBR@alpha-ir.com

312-445-2870

Financial Tables Follow

NN, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

| (in thousands, except per share data) |

2025 |

|

2024 |

|

|

|

|

| Net sales |

$ |

105,688 |

|

|

$ |

121,198 |

|

|

|

|

|

| Cost of sales (exclusive of depreciation and amortization shown separately below) |

91,646 |

|

|

101,086 |

|

|

|

|

|

| Selling, general, and administrative expense |

11,170 |

|

|

13,348 |

|

|

|

|

|

| Depreciation and amortization |

8,774 |

|

|

12,547 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other operating income, net |

(1,113) |

|

|

(1,000) |

|

|

|

|

|

| Loss from operations |

(4,789) |

|

|

(4,783) |

|

|

|

|

|

| Interest expense |

5,194 |

|

|

5,366 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense (income), net |

(2,169) |

|

|

4,153 |

|

|

|

|

|

| Loss before provision for income taxes and share of net income from joint venture |

(7,814) |

|

|

(14,302) |

|

|

|

|

|

| Provision for income taxes |

(1,310) |

|

|

(506) |

|

|

|

|

|

| Share of net income from joint venture |

2,439 |

|

|

2,271 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(6,685) |

|

|

$ |

(12,537) |

|

|

|

|

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

| Foreign currency transaction gain (loss) |

3,125 |

|

|

(2,346) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reclassification adjustments from the interest rate swap included in net loss, net of tax |

— |

|

|

(449) |

|

|

|

|

|

| Other comprehensive income (loss) |

$ |

3,125 |

|

|

$ |

(2,795) |

|

|

|

|

|

| Comprehensive loss |

$ |

(3,560) |

|

|

$ |

(15,332) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss per share |

$ |

(0.23) |

|

|

$ |

(0.34) |

|

|

|

|

|

| Shares used to calculate basic and diluted net loss per share |

49,075 |

|

|

47,724 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NN, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands, except per share data) |

March 31,

2025 |

|

December 31,

2024 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

11,739 |

|

|

$ |

18,128 |

|

| Accounts receivable, net |

67,750 |

|

|

61,549 |

|

| Inventories |

62,927 |

|

|

61,877 |

|

| Income tax receivable |

12,688 |

|

|

12,634 |

|

| Prepaid assets |

5,600 |

|

|

2,855 |

|

| Other current assets |

12,270 |

|

|

10,519 |

|

| Total current assets |

172,974 |

|

|

167,562 |

|

| Property, plant and equipment, net |

162,040 |

|

|

162,034 |

|

| Operating lease right-of-use assets |

38,305 |

|

|

39,317 |

|

| Intangible assets, net |

41,005 |

|

|

44,410 |

|

| Investment in joint venture |

37,622 |

|

|

34,971 |

|

| Deferred tax assets |

1,329 |

|

|

1,329 |

|

| Other non-current assets |

7,449 |

|

|

7,270 |

|

| Total assets |

$ |

460,724 |

|

|

$ |

456,893 |

|

| Liabilities, Preferred Stock, and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

45,876 |

|

|

$ |

38,879 |

|

| Accrued salaries, wages and benefits |

17,698 |

|

|

19,915 |

|

| Income tax payable |

534 |

|

|

659 |

|

| Short-term debt and current maturities of long-term debt |

3,719 |

|

|

5,039 |

|

| Current portion of operating lease liabilities |

5,566 |

|

|

6,038 |

|

| Other current liabilities |

16,711 |

|

|

13,382 |

|

| Total current liabilities |

90,104 |

|

|

83,912 |

|

| Deferred tax liabilities |

5,088 |

|

|

4,969 |

|

|

|

|

|

| Long-term debt, net of current maturities |

147,604 |

|

|

143,591 |

|

| Operating lease liabilities, net of current portion |

41,007 |

|

|

42,291 |

|

| Other non-current liabilities |

11,673 |

|

|

14,111 |

|

| Total liabilities |

295,476 |

|

|

288,874 |

|

| Commitments and contingencies |

|

|

|

| Series D perpetual preferred stock |

97,904 |

|

|

93,497 |

|

| Stockholders' equity: |

|

|

|

| Common stock |

505 |

|

|

499 |

|

| Additional paid-in capital |

452,187 |

|

|

455,811 |

|

| Accumulated deficit |

(340,306) |

|

|

(333,621) |

|

| Accumulated other comprehensive loss |

(45,042) |

|

|

(48,167) |

|

| Total stockholders’ equity |

67,344 |

|

|

74,522 |

|

| Total liabilities, preferred stock, and stockholders’ equity |

$ |

460,724 |

|

|

$ |

456,893 |

|

NN, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

| (in thousands) |

2025 |

|

2024 |

| Cash flows from operating activities |

|

|

|

| Net loss |

$ |

(6,685) |

|

|

$ |

(12,537) |

|

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

| Depreciation and amortization |

8,774 |

|

|

12,547 |

|

| Amortization of debt issuance costs and discount |

716 |

|

|

544 |

|

| Paid-in-kind interest |

316 |

|

|

730 |

|

|

|

|

|

|

|

|

|

| Total derivative loss (gain), net of cash settlements |

(1,762) |

|

|

3,331 |

|

| Share of net income from joint venture |

(2,439) |

|

|

(2,271) |

|

|

|

|

|

| Share-based compensation expense |

839 |

|

|

846 |

|

| Deferred income taxes |

174 |

|

|

(260) |

|

| Other |

(519) |

|

|

(666) |

|

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable |

(5,403) |

|

|

(6,888) |

|

| Inventories |

(220) |

|

|

(1,554) |

|

| Other operating assets |

(3,444) |

|

|

(4,821) |

|

| Income taxes receivable and payable, net |

(163) |

|

|

(163) |

|

| Accounts payable |

6,468 |

|

|

6,130 |

|

| Other operating liabilities |

3 |

|

|

5,744 |

|

| Net cash provided by (used in) operating activities |

(3,345) |

|

|

712 |

|

| Cash flows from investing activities |

|

|

|

| Acquisition of property, plant and equipment |

(3,907) |

|

|

(5,460) |

|

|

|

|

|

| Proceeds from sale of property, plant, and equipment |

177 |

|

|

98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

(3,730) |

|

|

(5,362) |

|

| Cash flows from financing activities |

|

|

|

| Proceeds from long-term debt |

11,000 |

|

|

13,001 |

|

| Repayments of long-term debt |

(9,026) |

|

|

(29,808) |

|

| Cash paid for debt issuance costs |

— |

|

|

(646) |

|

|

|

|

|

|

|

|

|

| Proceeds from sale-leaseback of equipment |

— |

|

|

4,910 |

|

| Proceeds from sale-leaseback of land and buildings |

— |

|

|

16,863 |

|

| Repayments of financing obligations |

(297) |

|

|

(99) |

|

| Repayments of short-term debt |

(63) |

|

|

— |

|

| Other |

(1,031) |

|

|

(651) |

|

| Net cash provided by financing activities |

583 |

|

|

3,570 |

|

| Effect of exchange rate changes on cash flows |

103 |

|

|

(213) |

|

| Net change in cash and cash equivalents |

(6,389) |

|

|

(1,293) |

|

| Cash and cash equivalents at beginning of year |

18,128 |

|

|

21,903 |

|

| Cash and cash equivalents at end of quarter |

$ |

11,739 |

|

|

$ |

20,610 |

|

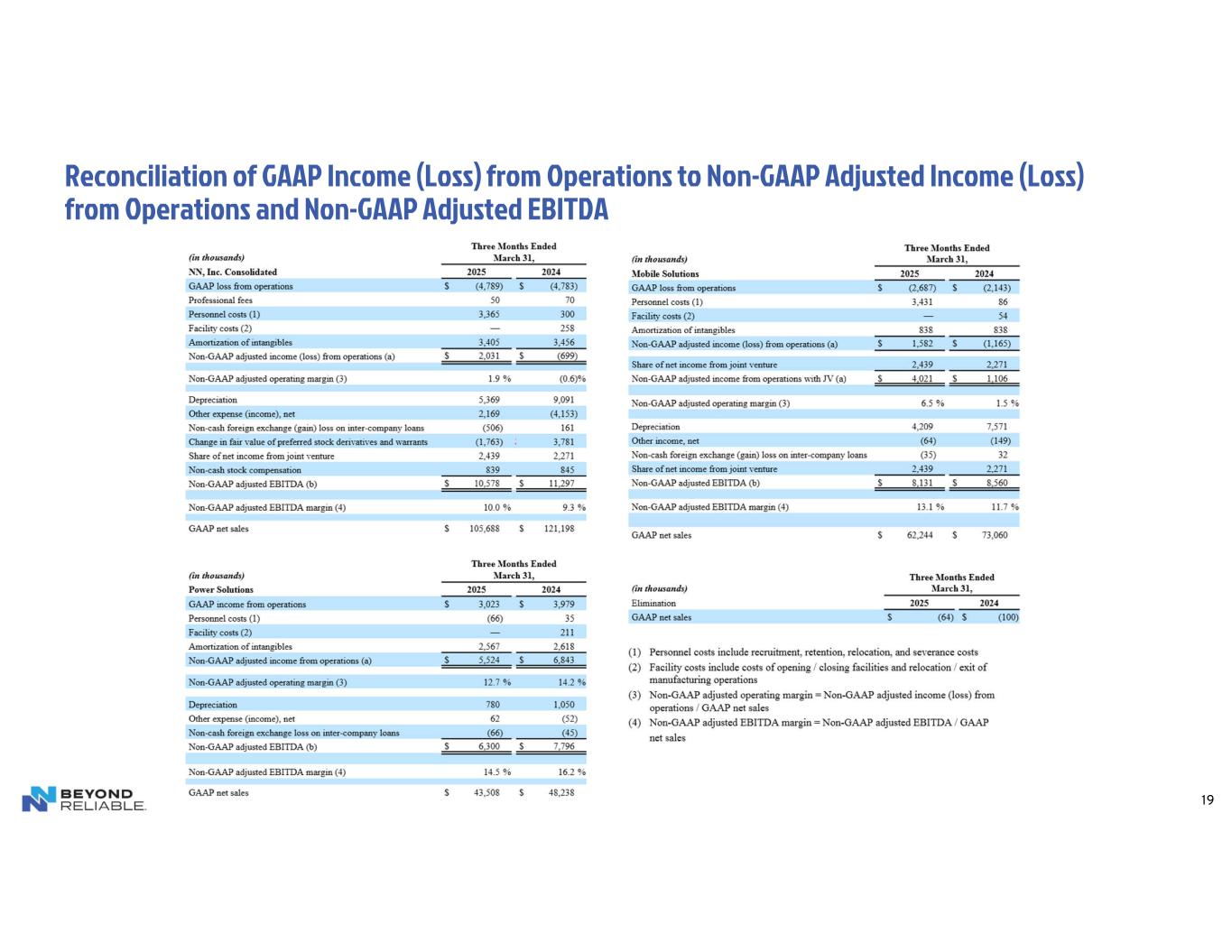

Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| (in thousands) |

| NN, Inc. Consolidated |

2025 |

|

2024 |

| GAAP loss from operations |

$ |

(4,789) |

|

|

$ |

(4,783) |

|

|

|

|

|

|

|

|

|

| Professional fees |

50 |

|

|

70 |

|

| Personnel costs (1) |

3,365 |

|

|

300 |

|

| Facility costs (2) |

— |

|

|

258 |

|

| Amortization of intangibles |

3,405 |

|

|

3,456 |

|

|

|

|

|

| Non-GAAP adjusted income (loss) from operations (a) |

$ |

2,031 |

|

|

$ |

(699) |

|

|

|

|

|

| Non-GAAP adjusted operating margin (3) |

1.9 |

% |

|

(0.6) |

% |

| GAAP net sales |

$ |

105,688 |

|

|

$ |

121,198 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| (in thousands) |

| Power Solutions |

2025 |

|

2024 |

| GAAP income from operations |

$ |

3,023 |

|

|

$ |

3,979 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Personnel costs (1) |

(66) |

|

|

35 |

|

| Facility costs (2) |

— |

|

|

211 |

|

| Amortization of intangibles |

2,567 |

|

|

2,618 |

|

|

|

|

|

| Non-GAAP adjusted income from operations (a) |

$ |

5,524 |

|

|

$ |

6,843 |

|

|

|

|

|

| Non-GAAP adjusted operating margin (3) |

12.7 |

% |

|

14.2 |

% |

| GAAP net sales |

$ |

43,508 |

|

|

$ |

48,238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| (in thousands) |

| Mobile Solutions |

2025 |

|

2024 |

| GAAP loss from operations |

$ |

(2,687) |

|

|

$ |

(2,143) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Personnel costs (1) |

3,431 |

|

|

86 |

|

| Facility costs (2) |

— |

|

|

54 |

|

| Amortization of intangibles |

838 |

|

|

838 |

|

|

|

|

|

| Non-GAAP adjusted income (loss) from operations (a) |

$ |

1,582 |

|

|

$ |

(1,165) |

|

|

|

|

|

| Share of net income from joint venture |

2,439 |

|

|

2,271 |

|

|

|

|

|

| Non-GAAP adjusted income from operations with JV (a) |

$ |

4,021 |

|

|

$ |

1,106 |

|

|

|

|

|

| Non-GAAP adjusted operating margin (3) |

6.5 |

% |

|

1.5 |

% |

| GAAP net sales |

$ |

62,244 |

|

|

$ |

73,060 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| (in thousands) |

| Elimination |

2025 |

|

2024 |

| GAAP net sales |

$ |

(64) |

|

|

$ |

(100) |

|

(1)Personnel costs include recruitment, retention, relocation, and severance costs

(2)Facility costs include costs of opening / closing facilities and relocation / exit of manufacturing operations

(3)Non-GAAP adjusted operating margin = Non-GAAP adjusted income (loss) from operations / GAAP net sales

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| (in thousands) |

2025 |

|

2024 |

| GAAP net loss |

$ |

(6,685) |

|

|

$ |

(12,537) |

|

|

|

|

|

| Provision for income taxes |

1,310 |

|

|

506 |

|

| Interest expense |

5,194 |

|

|

5,366 |

|

|

|

|

|

|

|

|

|

| Change in fair value of preferred stock derivatives and warrants |

(1,763) |

|

|

3,781 |

|

|

|

|

|

| Depreciation and amortization |

8,774 |

|

|

12,547 |

|

|

|

|

|

| Professional fees |

50 |

|

|

70 |

|

| Personnel costs (1) |

3,365 |

|

|

300 |

|

| Facility costs (2) |

— |

|

|

258 |

|

|

|

|

|

| Non-cash stock compensation |

839 |

|

|

845 |

|

| Non-cash foreign exchange (gain) loss on inter-company loans |

(506) |

|

|

161 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjusted EBITDA (b) |

$ |

10,578 |

|

|

$ |

11,297 |

|

|

|

|

|

| Non-GAAP adjusted EBITDA margin (3) |

10.0 |

% |

|

9.3 |

% |

| GAAP net sales |

$ |

105,688 |

|

|

$ |

121,198 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Personnel costs include recruitment, retention, relocation, and severance costs |

(2) Facility costs include costs of opening / closing facilities and relocation / exit of manufacturing operations |

(3) Non-GAAP adjusted EBITDA margin = Non-GAAP adjusted EBITDA / GAAP net sales |

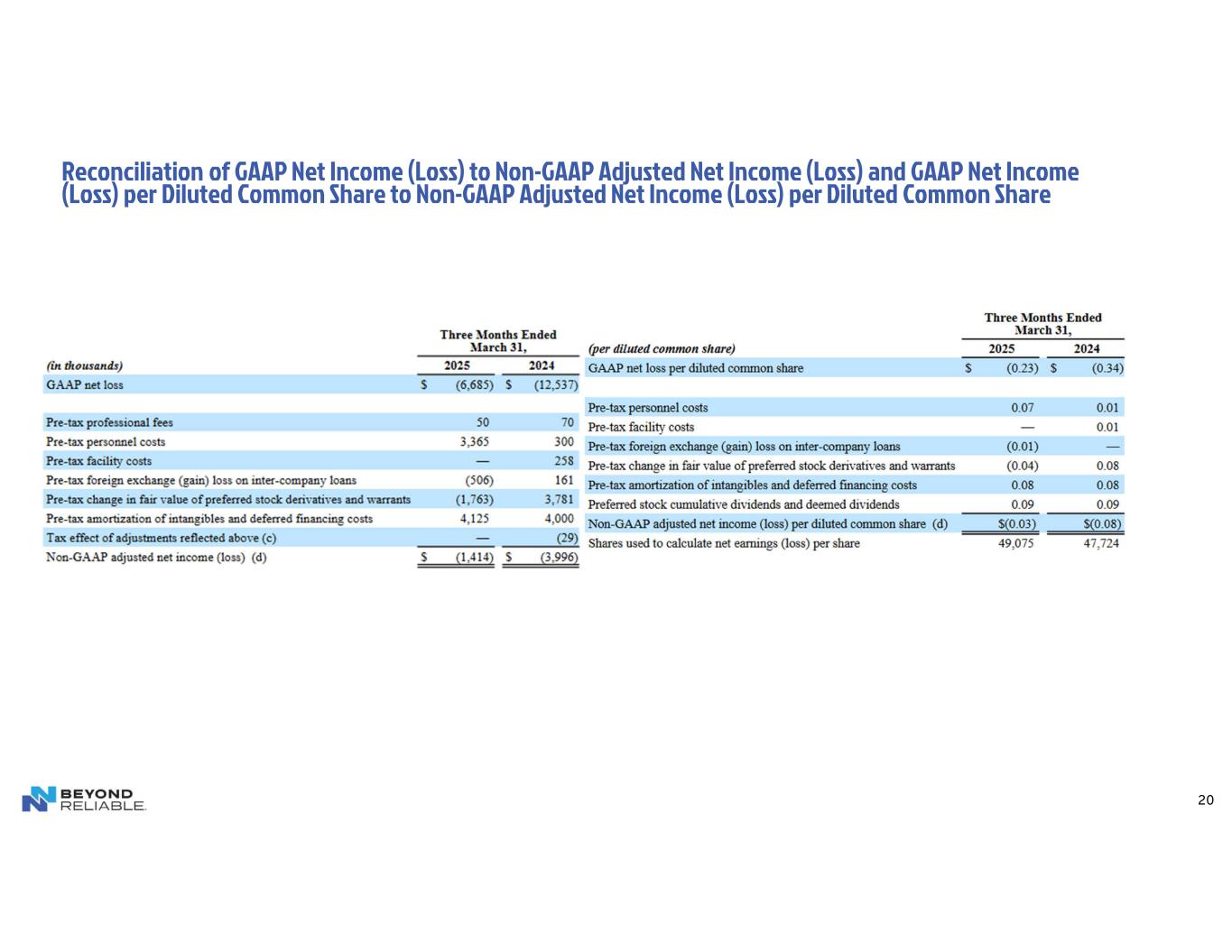

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted Net Income and GAAP Net Income (Loss) per Diluted Common Share to Non-GAAP Adjusted Net Income (Loss) per Diluted Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| (in thousands) |

2025 |

|

2024 |

| GAAP net loss |

$ |

(6,685) |

|

|

$ |

(12,537) |

|

|

|

|

|

|

|

|

|

| Pre-tax professional fees |

50 |

|

|

70 |

|

| Pre-tax personnel costs |

3,365 |

|

|

300 |

|

| Pre-tax facility costs |

— |

|

|

258 |

|

| Pre-tax foreign exchange (gain) loss on inter-company loans |

(506) |

|

|

161 |

|

|

|

|

|

|

|

|

|

| Pre-tax change in fair value of preferred stock derivatives and warrants |

(1,763) |

|

|

3,781 |

|

|

|

|

|

| Pre-tax amortization of intangibles and deferred financing costs |

4,125 |

|

|

4,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax effect of adjustments reflected above (c) |

— |

|

|

(29) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjusted net income (loss) (d) |

$ |

(1,414) |

|

|

$ |

(3,996) |

|

|

|

|

|

|

Three Months Ended March 31, |

| (per diluted common share) |

2025 |

|

2024 |

| GAAP net loss per diluted common share |

$ |

(0.23) |

|

|

$ |

(0.34) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pre-tax personnel costs |

0.07 |

|

|

0.01 |

|

| Pre-tax facility costs |

— |

|

|

0.01 |

|

| Pre-tax foreign exchange (gain) loss on inter-company loans |

(0.01) |

|

|

— |

|

|

|

|

|

|

|

|

|

| Pre-tax change in fair value of preferred stock derivatives and warrants |

(0.04) |

|

|

0.08 |

|

|

|

|

|

| Pre-tax amortization of intangibles and deferred financing costs |

0.08 |

|

|

0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock cumulative dividends and deemed dividends |

0.09 |

|

|

0.09 |

|

| Non-GAAP adjusted net income (loss) per diluted common share (d) |

$(0.03) |

|

$(0.08) |

| Shares used to calculate net earnings (loss) per share |

49,075 |

|

|

47,724 |

|

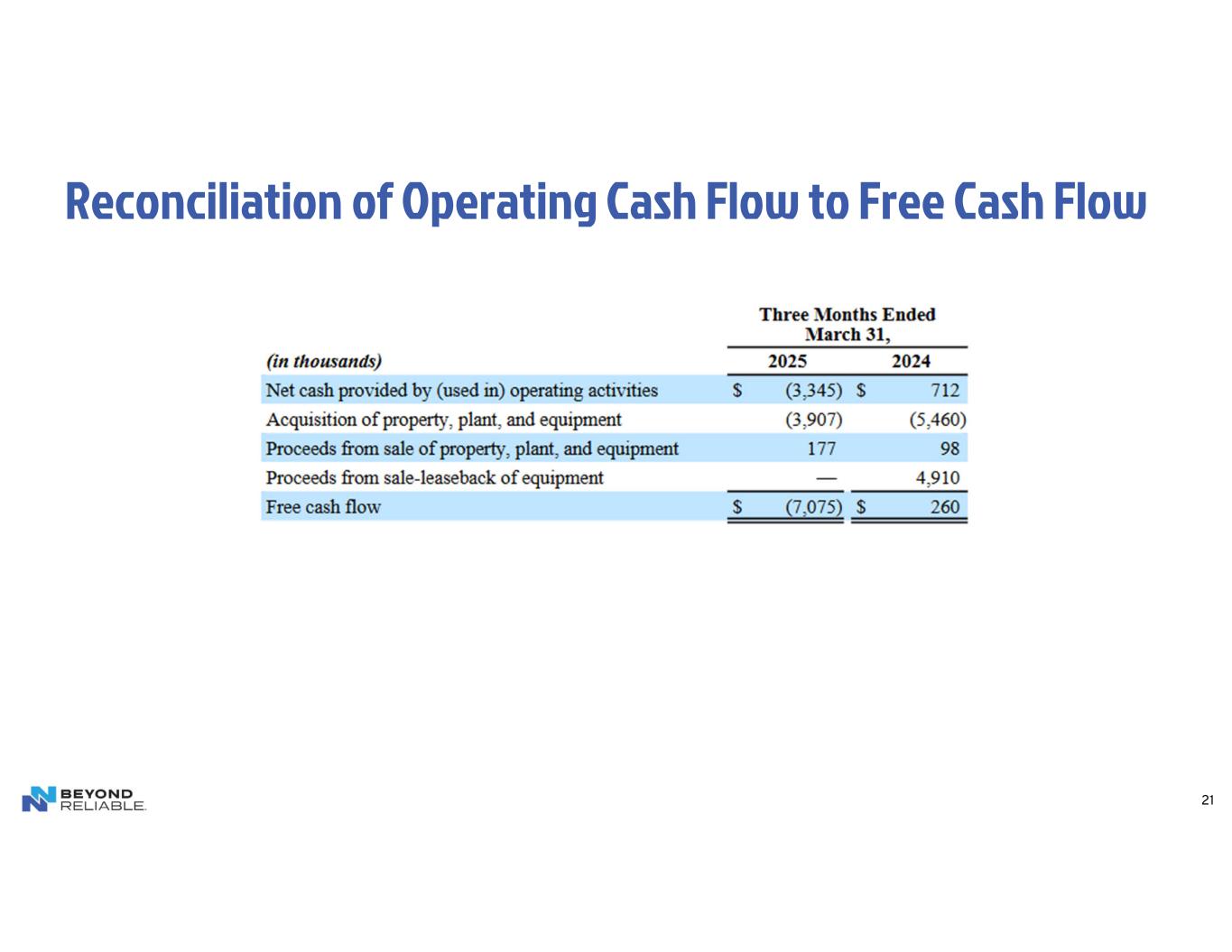

Reconciliation of Operating Cash Flow to Free Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

| (in thousands) |

2025 |

|

2024 |

|

|

|

|

| Net cash provided by (used in) operating activities |

$ |

(3,345) |

|

|

$ |

712 |

|

|

|

|

|

| Acquisition of property, plant, and equipment |

(3,907) |

|

|

(5,460) |

|

|

|

|

|

| Proceeds from sale of property, plant, and equipment |

177 |

|

|

98 |

|

|

|

|

|

| Proceeds from sale-leaseback of equipment |

— |

|

|

4,910 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow |

$ |

(7,075) |

|

|

$ |

260 |

|

|

|

|

|

The Company discloses in this presentation the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of acquisition, divestiture and integration related expenses, foreign-exchange impacts on inter-company loans, reorganizational and impairment charges. The costs we incur in completing acquisitions, including the amortization of intangibles and deferred financing costs, and divestitures are excluded from these measures because their size and inconsistent frequency are unrelated to our commercial performance during the period, and we believe are not indicative of our ongoing operating costs. We exclude the impact of currency translation from these measures because foreign exchange rates are not under management’s control and are subject to volatility. Other non-operating charges are excluded as the charges are not indicative of our ongoing operating cost. We believe the presentation of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow provides useful information in assessing our underlying business trends and facilitates comparison of our long-term performance over given periods.

The non-GAAP financial measures provided herein may not provide information that is directly comparable to that provided by other companies in the Company's industry, as other companies may calculate such financial results differently. The Company's non-GAAP financial measures are not measurements of financial performance under GAAP and should not be considered as alternatives to actual income growth derived from income amounts presented in accordance with GAAP. The Company does not consider these non-GAAP financial measures to be a substitute for, or superior to, the information provided by GAAP financial results.

(a) Non-GAAP adjusted income (loss) from operations represents GAAP income (loss) from operations, adjusted to exclude the effects of restructuring and integration expense; non-operational charges related to acquisition and transition expense, intangible amortization costs for fair value step-up in values related to acquisitions, non-cash impairment charges, and when applicable, our share of income from joint venture operations. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted income (loss) from operations is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from operations.

(b) Non-GAAP adjusted EBITDA represents GAAP net income (loss), adjusted to include income taxes, interest expense, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value that was recognized in earnings, change in fair value of preferred stock derivatives and warrants, depreciation and amortization, charges related to acquisition and transition costs, non-cash stock compensation expense, foreign exchange gain (loss) on inter-company loans, restructuring and integration expense, costs related to divested businesses and litigation settlements, income from discontinued operations, and non-cash impairment charges, to the extent applicable. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations.

(c) This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the respective table. NN, Inc. estimates the tax effect of the adjustment items identified in the reconciliation schedule above by applying the applicable statutory rates by tax jurisdiction unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment.

(d) Non-GAAP adjusted net income (loss) represents GAAP net income (loss) adjusted to exclude the tax-affected effects of charges related to acquisition and transition costs, foreign exchange gain (loss) on inter-company loans, restructuring and integration charges, amortization of intangibles costs for fair value step-up in values related to acquisitions and amortization of deferred financing costs, non-cash impairment charges, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, costs related to divested businesses and litigation settlements, income (loss) from discontinued operations, and preferred stock cumulative dividends and deemed dividends. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry.