| Washington | 0-20355 | 91-1223280 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $.005 per share | COST | NASDAQ | ||||||||||||

| COSTCO WHOLESALE CORPORATION | |||||||||||

| Dated: December 11, 2025 | By: | /s/ Gary Millerchip | |||||||||

| Gary Millerchip | |||||||||||

| Executive Vice President and Chief Financial Officer | |||||||||||

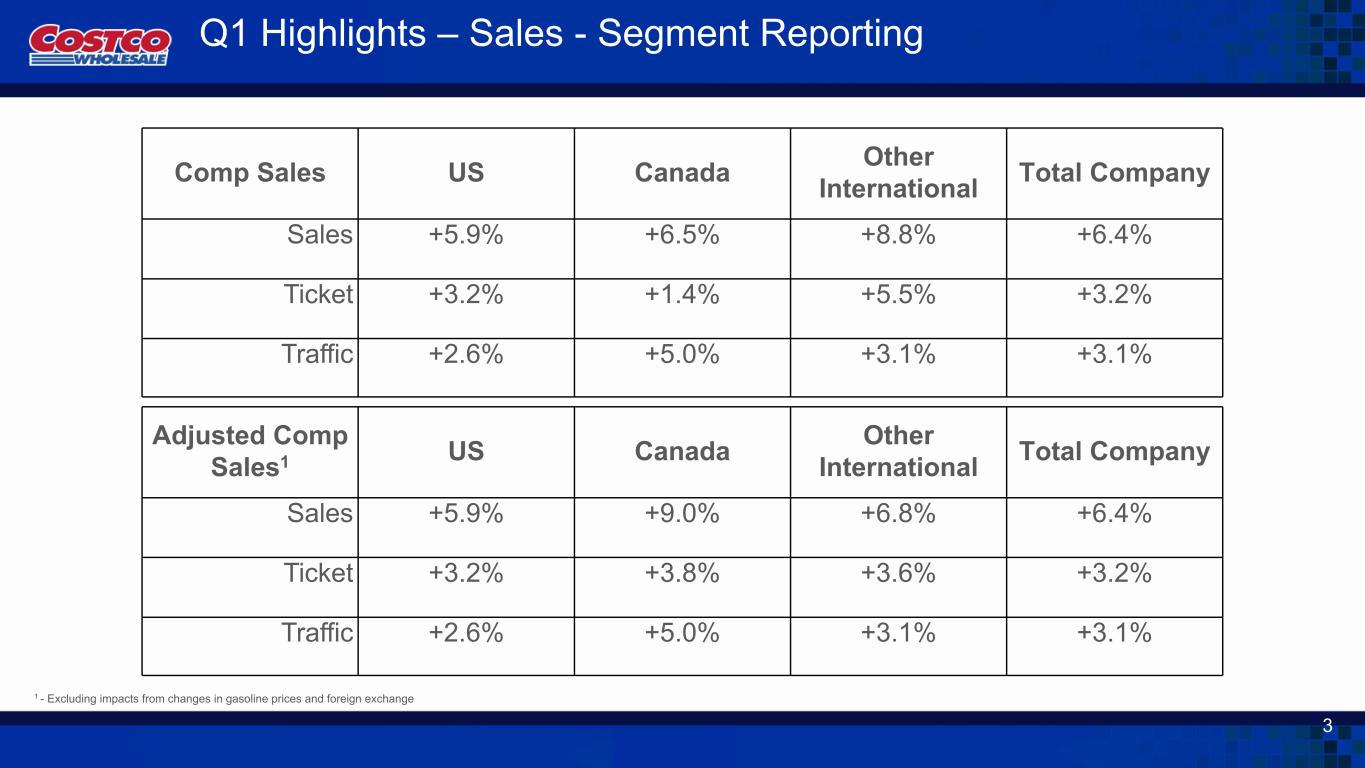

| 12 Weeks | 12 Weeks | ||||||||||

| Adjusted* | |||||||||||

| U.S. | 5.9% | 5.9% | |||||||||

| Canada | 6.5% | 9.0% | |||||||||

| Other International | 8.8% | 6.8% | |||||||||

| Total Company | 6.4% | 6.4% | |||||||||

| Digitally-Enabled | 20.5% | 20.5% | |||||||||

| 12 Weeks Ended | |||||||||||

| November 23, 2025 |

November 24, 2024 |

||||||||||

| REVENUE | |||||||||||

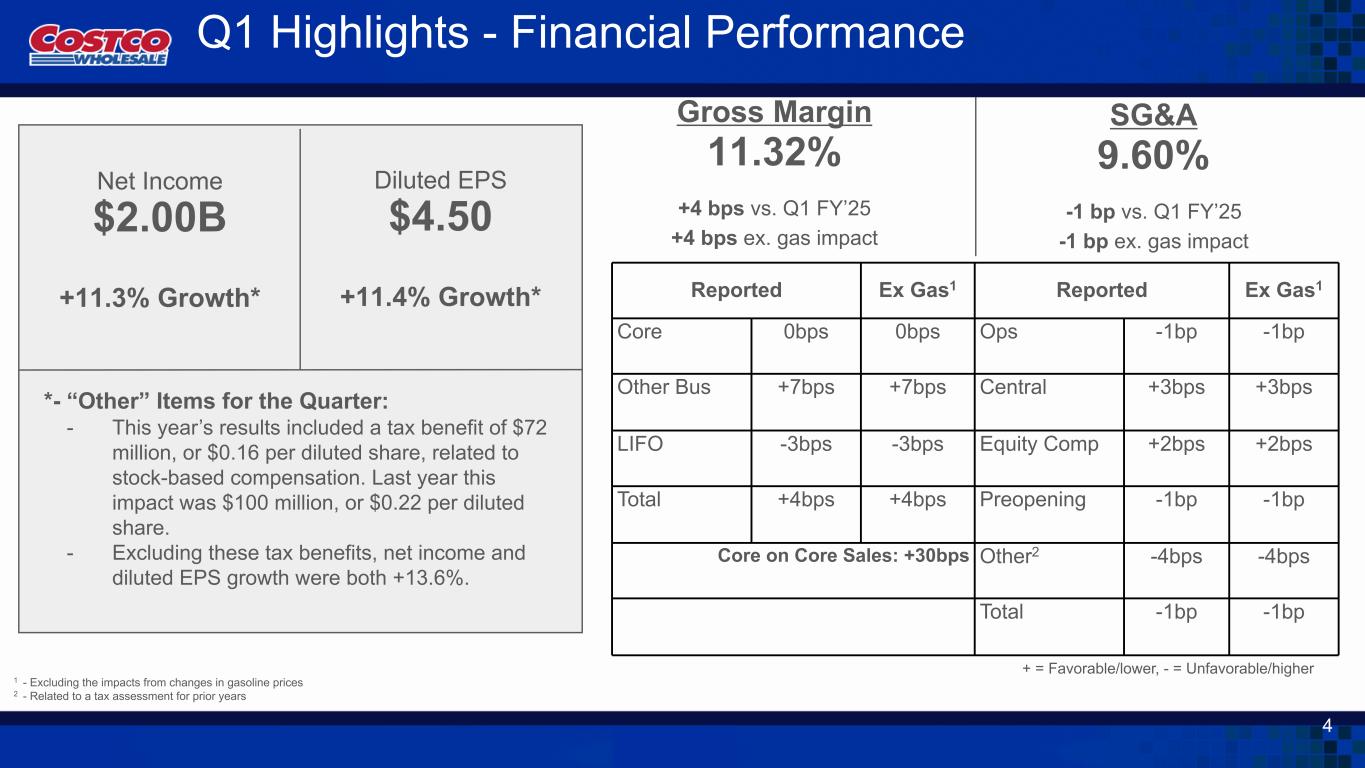

| Net sales | $ | 65,978 | $ | 60,985 | |||||||

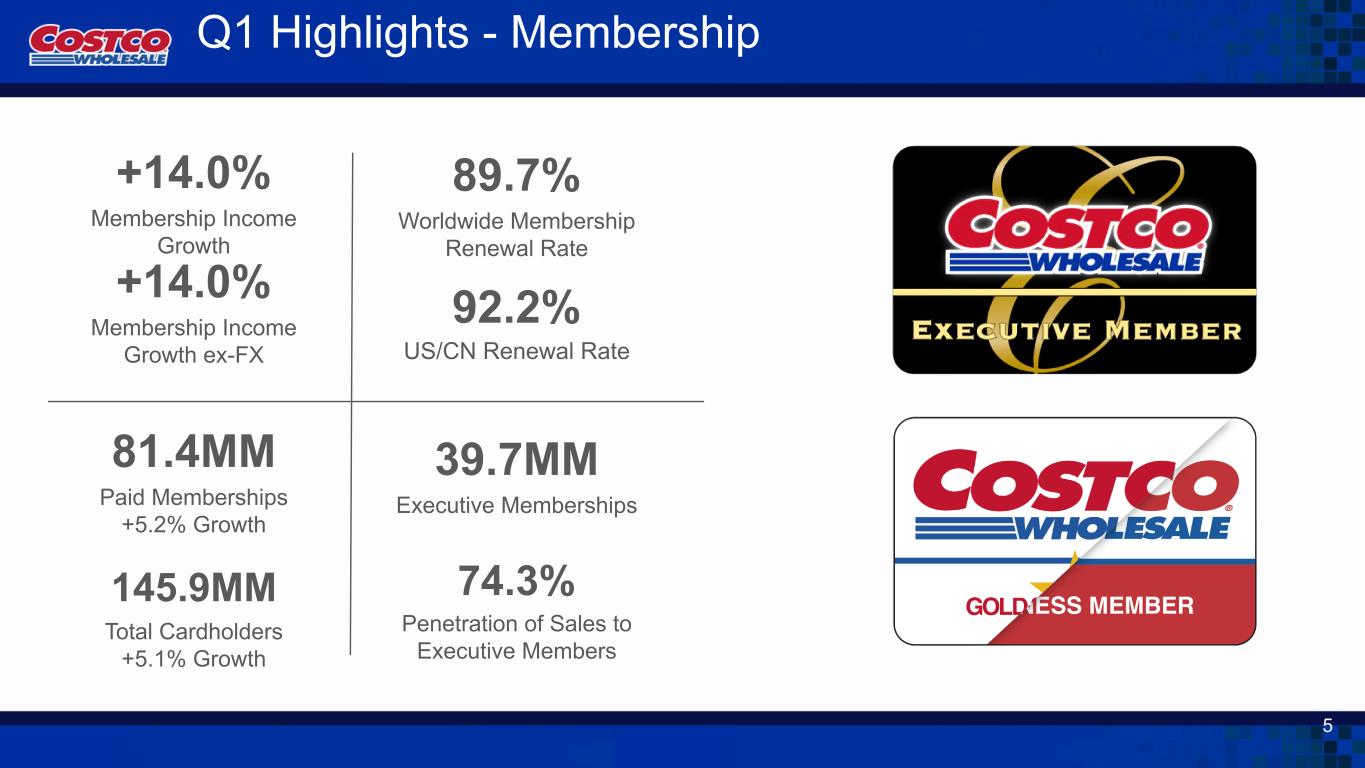

| Membership fees | 1,329 | 1,166 | |||||||||

| Total revenue | 67,307 | 62,151 | |||||||||

| OPERATING EXPENSES | |||||||||||

| Merchandise costs | 58,510 | 54,109 | |||||||||

| Selling, general and administrative | 6,334 | 5,846 | |||||||||

| Operating income | 2,463 | 2,196 | |||||||||

| OTHER INCOME (EXPENSE) | |||||||||||

| Interest expense | (35) | (37) | |||||||||

| Interest income and other, net | 155 | 147 | |||||||||

| INCOME BEFORE INCOME TAXES | 2,583 | 2,306 | |||||||||

| Provision for income taxes | 582 | 508 | |||||||||

| NET INCOME | $ | 2,001 | $ | 1,798 | |||||||

| NET INCOME PER COMMON SHARE: | |||||||||||

| Basic | $ | 4.51 | $ | 4.05 | |||||||

| Diluted | $ | 4.50 | $ | 4.04 | |||||||

| Shares used in calculation (000’s): | |||||||||||

| Basic | 443,961 | 443,988 | |||||||||

| Diluted | 444,515 | 444,891 | |||||||||

|

|

November 23, 2025 |

August 31, 2025 |

|||||||||

| ASSETS | |||||||||||

| CURRENT ASSETS | |||||||||||

| Cash and cash equivalents | $ | 16,217 | $ | 14,161 | |||||||

| Short-term investments | 966 | 1,123 | |||||||||

| Receivables, net | 3,231 | 3,203 | |||||||||

| Merchandise inventories | 21,141 | 18,116 | |||||||||

| Other current assets | 1,856 | 1,777 | |||||||||

| Total current assets | 43,411 | 38,380 | |||||||||

| OTHER ASSETS | |||||||||||

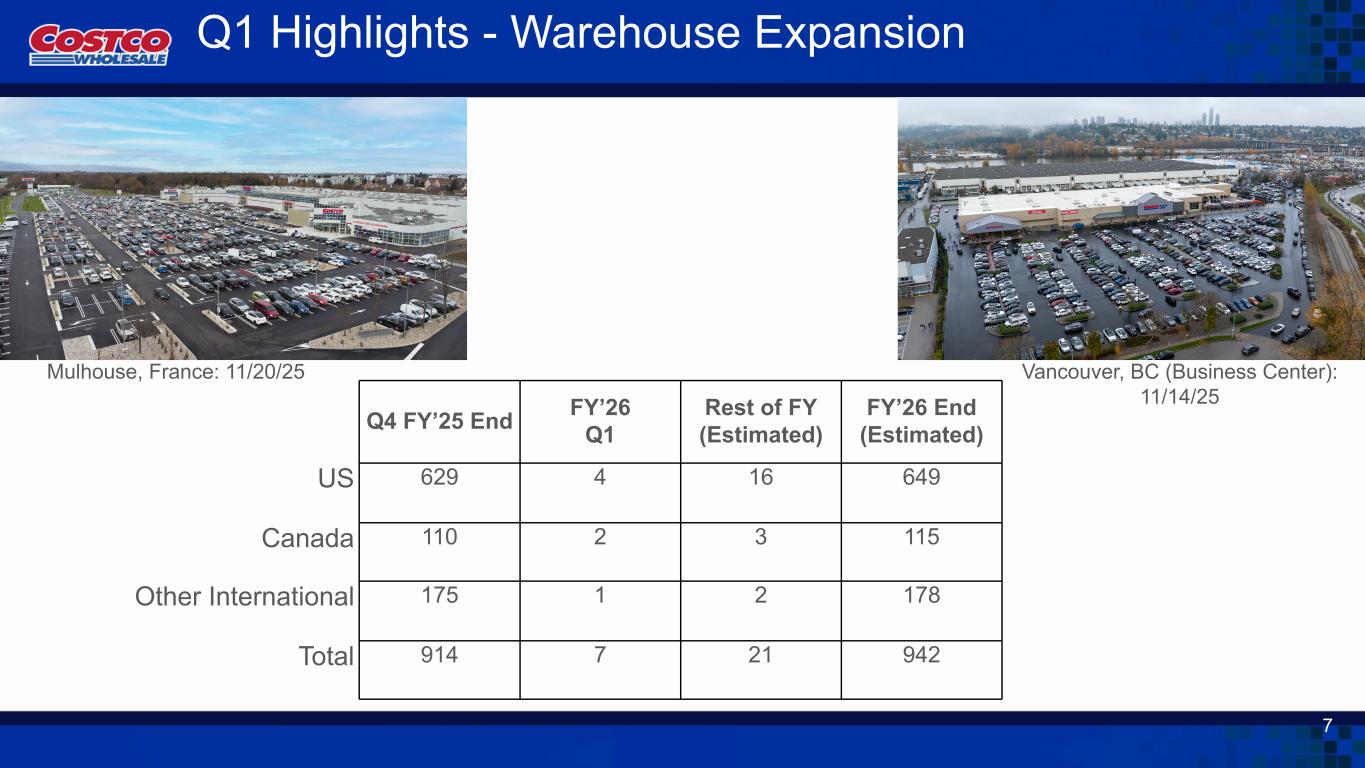

| Property and equipment, net | 32,616 | 31,909 | |||||||||

| Operating lease right-of-use assets | 2,730 | 2,725 | |||||||||

| Other long-term assets | 4,033 | 4,085 | |||||||||

| TOTAL ASSETS | $ | 82,790 | $ | 77,099 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| CURRENT LIABILITIES | |||||||||||

| Accounts payable | $ | 23,513 | $ | 19,783 | |||||||

| Accrued salaries and benefits | 5,172 | 5,205 | |||||||||

| Accrued member rewards | 2,712 | 2,677 | |||||||||

| Deferred membership fees | 2,990 | 2,854 | |||||||||

| Other current liabilities | 7,418 | 6,589 | |||||||||

| Total current liabilities | 41,805 | 37,108 | |||||||||

| OTHER LIABILITIES | |||||||||||

| Long-term debt, excluding current portion | 5,666 | 5,713 | |||||||||

| Long-term operating lease liabilities | 2,436 | 2,460 | |||||||||

| Other long-term liabilities | 2,580 | 2,654 | |||||||||

| TOTAL LIABILITIES | 52,487 | 47,935 | |||||||||

| COMMITMENTS AND CONTINGENCIES | |||||||||||

| EQUITY | |||||||||||

| Preferred stock $0.005 par value; 100,000,000 shares authorized; no shares issued and outstanding | — | — | |||||||||

| Common stock $0.005 par value; 900,000,000 shares authorized; 443,919,000 and 443,237,000 shares issued and outstanding | 2 | 2 | |||||||||

| Additional paid-in capital | 8,408 | 8,282 | |||||||||

| Accumulated other comprehensive loss | (1,976) | (1,770) | |||||||||

| Retained earnings | 23,869 | 22,650 | |||||||||

| TOTAL EQUITY | 30,303 | 29,164 | |||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 82,790 | $ | 77,099 | |||||||

| 12 Weeks Ended | |||||||||||

| November 23, 2025 |

November 24, 2024 |

||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||

| Net income | $ | 2,001 | $ | 1,798 | |||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 597 | 548 | |||||||||

| Non-cash lease expense | 75 | 72 | |||||||||

| Stock-based compensation | 486 | 463 | |||||||||

| Other non-cash operating activities, net | (5) | (72) | |||||||||

Changes in working capital |

1,534 | 451 | |||||||||

| Net cash provided by operating activities | 4,688 | 3,260 | |||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||

| Additions to property and equipment | (1,526) | (1,264) | |||||||||

| Purchases of short-term investments | (195) | (247) | |||||||||

| Maturities of short-term investments | 340 | 541 | |||||||||

| Other investing activities, net | (17) | (15) | |||||||||

| Net cash used in investing activities | (1,398) | (985) | |||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||

| Repayments of short-term borrowings | — | (194) | |||||||||

| Proceeds from short-term borrowings | — | 133 | |||||||||

| Tax withholdings on stock-based awards | (357) | (389) | |||||||||

| Repurchases of common stock | (210) | (207) | |||||||||

| Cash dividend payments | (577) | (515) | |||||||||

| Financing lease payments and other financing activities, net | (23) | (21) | |||||||||

| Net cash used in financing activities | (1,167) | (1,193) | |||||||||

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | (67) | (81) | |||||||||

| Net change in cash and cash equivalents | 2,056 | 1,001 | |||||||||

| CASH AND CASH EQUIVALENTS BEGINNING OF YEAR | 14,161 | 9,906 | |||||||||

| CASH AND CASH EQUIVALENTS END OF PERIOD | $ | 16,217 | $ | 10,907 | |||||||