| Washington | 0-20355 | 91-1223280 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $.005 per share | COST | NASDAQ | ||||||||||||

| COSTCO WHOLESALE CORPORATION | |||||||||||

| Dated: May 29, 2025 | By: | /s/ Gary Millerchip | |||||||||

| Gary Millerchip | |||||||||||

| Executive Vice President and Chief Financial Officer | |||||||||||

| 12 Weeks | 12 Weeks | 36 Weeks | 36 Weeks | ||||||||||||||||||||

| Adjusted* | Adjusted* | ||||||||||||||||||||||

| U.S. | 6.6% | 7.9% | 6.7% | 7.9% | |||||||||||||||||||

| Canada | 2.9% | 7.8% | 4.4% | 8.3% | |||||||||||||||||||

| Other International | 3.2% | 8.5% | 3.2% | 8.7% | |||||||||||||||||||

| Total Company | 5.7% | 8.0% | 5.9% | 8.1% | |||||||||||||||||||

| E-commerce | 14.8% | 15.7% | 16.4% | 17.2% | |||||||||||||||||||

| 12 Weeks Ended | 36 Weeks Ended | ||||||||||||||||||||||

| May 11, 2025 |

May 12, 2024 |

May 11, 2025 |

May 12, 2024 |

||||||||||||||||||||

| REVENUE | |||||||||||||||||||||||

| Net sales | $ | 61,965 | $ | 57,392 | $ | 185,480 | $ | 171,440 | |||||||||||||||

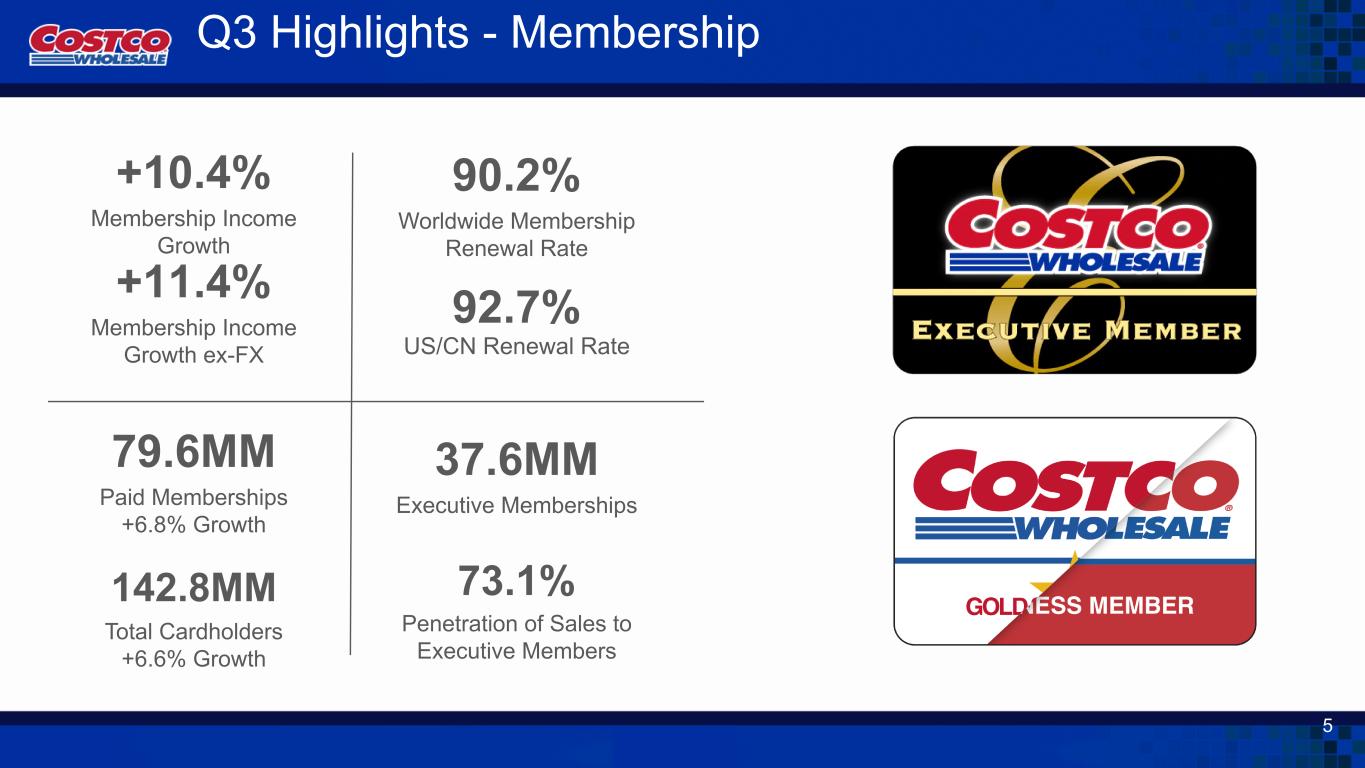

| Membership fees | 1,240 | 1,123 | 3,599 | 3,316 | |||||||||||||||||||

| Total revenue | 63,205 | 58,515 | 189,079 | 174,756 | |||||||||||||||||||

| OPERATING EXPENSES | |||||||||||||||||||||||

| Merchandise costs | 54,996 | 51,173 | 164,849 | 152,770 | |||||||||||||||||||

| Selling, general and administrative | 5,679 | 5,145 | 17,188 | 15,743 | |||||||||||||||||||

| Operating income | 2,530 | 2,197 | 7,042 | 6,243 | |||||||||||||||||||

| OTHER INCOME (EXPENSE) | |||||||||||||||||||||||

| Interest expense | (35) | (41) | (108) | (120) | |||||||||||||||||||

| Interest income and other, net | 85 | 128 | 374 | 504 | |||||||||||||||||||

| INCOME BEFORE INCOME TAXES | 2,580 | 2,284 | 7,308 | 6,627 | |||||||||||||||||||

| Provision for income taxes | 677 | 603 | 1,819 | 1,614 | |||||||||||||||||||

| NET INCOME | $ | 1,903 | $ | 1,681 | $ | 5,489 | $ | 5,013 | |||||||||||||||

| NET INCOME PER COMMON SHARE: | |||||||||||||||||||||||

| Basic | $ | 4.29 | $ | 3.79 | $ | 12.36 | $ | 11.29 | |||||||||||||||

| Diluted | $ | 4.28 | $ | 3.78 | $ | 12.34 | $ | 11.27 | |||||||||||||||

| Shares used in calculation (000s): | |||||||||||||||||||||||

| Basic | 443,958 | 443,892 | 443,976 | 443,870 | |||||||||||||||||||

| Diluted | 444,762 | 444,828 | 444,846 | 444,662 | |||||||||||||||||||

|

|

May 11, 2025 |

September 1, 2024 |

|||||||||

| ASSETS | |||||||||||

| CURRENT ASSETS | |||||||||||

| Cash and cash equivalents | $ | 13,836 | $ | 9,906 | |||||||

| Short-term investments | 1,014 | 1,238 | |||||||||

| Receivables, net | 2,875 | 2,721 | |||||||||

| Merchandise inventories | 18,606 | 18,647 | |||||||||

| Other current assets | 1,820 | 1,734 | |||||||||

| Total current assets | 38,151 | 34,246 | |||||||||

| OTHER ASSETS | |||||||||||

| Property and equipment, net | 30,582 | 29,032 | |||||||||

| Operating lease right-of-use assets | 2,718 | 2,617 | |||||||||

| Other long-term assets | 4,031 | 3,936 | |||||||||

| TOTAL ASSETS | $ | 75,482 | $ | 69,831 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| CURRENT LIABILITIES | |||||||||||

| Accounts payable | $ | 19,820 | $ | 19,421 | |||||||

| Accrued salaries and benefits | 4,813 | 4,794 | |||||||||

| Accrued member rewards | 2,583 | 2,435 | |||||||||

| Deferred membership fees | 2,931 | 2,501 | |||||||||

| Other current liabilities | 7,432 | 6,313 | |||||||||

| Total current liabilities | 37,579 | 35,464 | |||||||||

| OTHER LIABILITIES | |||||||||||

| Long-term debt, excluding current portion | 5,717 | 5,794 | |||||||||

| Long-term operating lease liabilities | 2,463 | 2,375 | |||||||||

| Other long-term liabilities | 2,598 | 2,576 | |||||||||

| TOTAL LIABILITIES | 48,357 | 46,209 | |||||||||

| COMMITMENTS AND CONTINGENCIES | |||||||||||

| EQUITY | |||||||||||

| Preferred stock $0.005 par value; 100,000,000 shares authorized; no shares issued and outstanding | — | — | |||||||||

| Common stock $0.005 par value; 900,000,000 shares authorized; 443,519,000 and 443,126,000 shares issued and outstanding | 2 | 2 | |||||||||

| Additional paid-in capital | 8,148 | 7,829 | |||||||||

| Accumulated other comprehensive loss | (1,915) | (1,828) | |||||||||

| Retained earnings | 20,890 | 17,619 | |||||||||

| TOTAL EQUITY | 27,125 | 23,622 | |||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 75,482 | $ | 69,831 | |||||||

| 36 Weeks Ended | |||||||||||

| May 11, 2025 |

May 12, 2024 |

||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||

| Net income | $ | 5,489 | $ | 5,013 | |||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 1,652 | 1,531 | |||||||||

| Non-cash lease expense | 208 | 220 | |||||||||

| Stock-based compensation | 720 | 686 | |||||||||

| Other non-cash operating activities, net | (15) | (35) | |||||||||

Changes in working capital |

1,414 | 966 | |||||||||

| Net cash provided by operating activities | 9,468 | 8,381 | |||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||

| Purchases of short-term investments | (573) | (1,007) | |||||||||

| Maturities of short-term investments | 786 | 1,441 | |||||||||

| Additions to property and equipment | (3,532) | (3,133) | |||||||||

| Other investing activities, net | (24) | (7) | |||||||||

| Net cash used in investing activities | (3,343) | (2,706) | |||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||

| Repayments of short-term borrowings | (635) | (637) | |||||||||

| Proceeds from short-term borrowings | 616 | 628 | |||||||||

| Proceeds from issuance of long-term debt | — | 498 | |||||||||

| Tax withholdings on stock-based awards | (392) | (313) | |||||||||

| Repurchases of common stock | (623) | (484) | |||||||||

| Cash dividend payments | (1,030) | (8,527) | |||||||||

| Financing lease payments and other financing activities, net | (118) | (113) | |||||||||

| Net cash used in financing activities | (2,182) | (8,948) | |||||||||

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS | (13) | (23) | |||||||||

| Net change in cash and cash equivalents | 3,930 | (3,296) | |||||||||

| CASH AND CASH EQUIVALENTS BEGINNING OF YEAR | 9,906 | 13,700 | |||||||||

| CASH AND CASH EQUIVALENTS END OF PERIOD | $ | 13,836 | $ | 10,404 | |||||||