Operational efficiency drives further cash cost reduction. São Paulo, November 6th, 2025. Suzano S.A. (B3: SUZB3 | NYSE: SUZ), one of the world’s largest integrated pulp and paper producers, announces today its consolidated results for the third quarter of 2025 (3Q25). HIGHLIGHTS • Pulp sales of 3,165 thousand tonnes (+20% vs. 3Q24). • Paper sales1 of 436 thousand tonnes (+21% vs. 3Q24). • Adjusted EBITDA2 and Operating cash generation3: R$5.2 billion and R$3.4 billion, respectively. • Adjusted EBITDA2/t from pulp of R$1,410/t (-35% vs. 3Q24). • Adjusted EBITDA2/t from paper of R$1,694/t (-26% vs. 3Q24). • Average net pulp price in export market: US$524/t (-22% vs. 3Q24). • Average net paper price1 of R$7,118/t (+4% vs. 3Q24). • Pulp cash cost ex-downtimes of R$801/t (-7% vs. 3Q24). • Leverage of 3.3 times in US$ and 3.1 times in R$. • Free Cash Flow Yield ("FCF Yield" - LTM) of 18.1% (+1,2 p.p. vs. 3Q24). • Return on Invested Capital ("ROIC" - LTM) of 12.0% (-1.3 p.p. vs. 3Q24). Financial Data (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Net Revenue 12,153 13,296 -9% 12,274 -1% 51,179 Adjusted EBITDA2 5,200 6,087 -15% 6,523 -20% 22,634 Adjusted EBITDA Margin2 43% 46% -3 p.p. 53% -10 p.p. 44% Net Financial Result 1,052 4,425 -76% 868 21 (2,383) Net Income 1,961 5,012 -61% 3,237 -39 6,585 Operating Cash Generation3 3,416 4,149 -18% 4,394 -22% 15,032 Net Debt/ Adjusted EBITDA2 (x) (R$) 3.1 x 3.0 x 0.1 x 3.2 x -0.1 x 3.1 x Net Debt/ Adjusted EBITDA2 (x) (US$) 3.3 x 3.1 x 0.2 x 3.1 x 0.2 x 3.3 x Operational Data ('000 t) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Sales 3,601 3,680 -2% 2,995 20% 14,036 Pulp 3,165 3,269 -3% 2,635 20% 12,368 Paper1 436 411 6% 360 21% 1,668 (1) Includes the results from the Consumer Goods Unit (tissue) and the performance of the Suzano Packaging US Unit (Pine Bluff and Waynesville). (2) Excludes non-recurring items. (3) Considers Adjusted EBITDA less sustaining capex (cash basis). EARNINGS RELEASE 3Q25

The consolidated quarterly financial information was prepared in accordance with the standards set by the Securities and Exchange Commission of Brazil (CVM) and the Accounting Pronouncements Committee (CPC) and complies with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB). The operating and financial information is presented on a consolidated basis and in Brazilian real (R$). Note that figures may present discrepancies due to rounding. CONTENTS EXECUTIVE SUMMARY .............................................................................................................................................................. 3 PULP BUSINESS PERFORMANCE ............................................................................................................................................ 4 PULP SALES VOLUME AND REVENUE .............................................................................................................................. 4 PULP CASH COST ................................................................................................................................................................ 7 PULP SEGMENT EBITDA .................................................................................................................................................... 9 OPERATING CASH GENERATION FROM THE PULP SEGMENT ..................................................................................... 10 PAPER BUSINESS PERFORMANCE .......................................................................................................................................... 11 PAPER SALES VOLUME AND REVENUE ............................................................................................................................ 11 PAPER SEGMENT EBITDA .................................................................................................................................................. 14 OPERATING CASH GENERATION FROM THE PAPER SEGMENT ................................................................................... 15 FINANCIAL PERFORMANCE ..................................................................................................................................................... 16 NET REVENUE ...................................................................................................................................................................... 16 CALENDAR OF SCHEDULED MAINTENANCE DOWNTIMES .......................................................................................... 16 COST OF GOODS SOLD (COGS) ........................................................................................................................................ 17 SELLING EXPENSES ........................................................................................................................................................... 17 GENERAL AND ADMINISTRATIVE EXPENSES ................................................................................................................ 18 OTHER OPERATING INCOME (EXPENSES) ..................................................................................................................... 18 ADJUSTED EBITDA ............................................................................................................................................................ 19 FINANCIAL RESULT ........................................................................................................................................................... 19 DERIVATIVE OPERATIONS ............................................................................................................................................... 21 NET INCOME (LOSS) .......................................................................................................................................................... 24 DEBT ..................................................................................................................................................................................... 24 CAPITAL EXPENDITURE .................................................................................................................................................... 27 OPERATING CASH FLOW ................................................................................................................................................... 28 FREE CASH FLOW ............................................................................................................................................................... 29 ROIC ("RETURN ON INVESTED CAPITAL") ..................................................................................................................... 30 CHANGES IN NET DEBT ..................................................................................................................................................... 30 ESG ....................................................................................................................................................................................... 30 TOTAL OPERATIONAL EXPENDITURE - PULP ................................................................................................................ 31 CAPITAL MARKETS ..................................................................................................................................................................... 31 FIXED INCOME ........................................................................................................................................................................... 32 RATING ......................................................................................................................................................................................... 32 UPCOMING EVENTS ................................................................................................................................................................... 33 APPENDICES ................................................................................................................................................................................ 34 APPENDIX 1 – Operating Data ...................................................................................................................................... 34 APPENDIX 2 – Consolidated Income Statement and Goodwill Amortization .................................................. 36 APPENDIX 3 – Consolidated Balance Sheet ............................................................................................................... 37 APPENDIX 4 – Consolidated Statement of Cash Flow ............................................................................................ 38 APPENDIX 5 – EBITDA ..................................................................................................................................................... 39 APPENDIX 6 – Segmented Income Statement ......................................................................................................... 40 Forward-Looking Statements ....................................................................................................................................... 42 3Q25 EARNINGS RELEASE Page 2 of 43

EXECUTIVE SUMMARY Following a period of uncertainty regarding the U.S. tariff policy, pulp prices experienced a gradual rebound from the end of August in relation to the lowest level of the year recorded in the first half of the quarter by PIX China Pulp indices. Despite an improvement in market sentiment, Suzano's average net price in US$ declined by 6%, while PIX China and PIX Europe were down 9% and 12%, respectively. The performance of Suzano's pulp segment was impacted by lower price, primarily due to a lower average net price, depreciation of the average US$ against the R$, and reduced sales volume, in turn as a result of the lower production volume as announced by the Company in August, despite lower cash production costs. This combination of factors led to a reduction in adjusted EBITDA from pulp compared to the prior period. In the paper business unit, a slight increase in adjusted EBITDA was observed, mainly driven by higher sales volumes and improved performance of Suzano Packaging US assets (Pine Bluff), partially offset by lower prices in both domestic and international markets. In this context, consolidated adjusted EBITDA amounted to R$5.2 billion in 3Q25, down 15% from 2Q25 and down 20% from 3Q24. Operating cash generation reached R$3.4 billion in the quarter, representing reductions of 18% vs. 2Q25 and 22% vs. 3Q24. Notably, the paperboard assets acquired in the United States in October 2024 (currently operating as Suzano Packaging US) delivered their first positive adjusted EBITDA of R$43 million in the period (vs. negative R$66 million in the previous quarter). As for financial management, net debt in US$ remained stable in 3Q25, at US$13.0 billion. Leverage in US$ ended the quarter at 3.3 times, due to the decrease in Adjusted EBITDA in the last 12 months. The quarter was also marked by liability management operations that allowed the average debt term to be extended from 74 to 80 months, without an increase in cost (maintained at 5.0% p.a.). The foreign exchange hedging policy continued to play its part, with average strikes of Zero Cost Collar operations contracted at 5.64 (put) and 6.54 (call) and notional value of US$6.0 billion. 3Q25 EARNINGS RELEASE Page 3 of 43

PULP BUSINESS PERFORMANCE PULP SALES VOLUME AND REVENUE The third quarter of 2025 saw a gradual recovery in hardwood pulp prices, with September prices higher than July levels and an improvement in market sentiment, driven by the exemption of pulp from the U.S. tariff policy toward Brazil and greater transparency regarding the impact of tariffs on the global paper and packaging sector. In China, at the beginning of the quarter, the market was characterized by buyer hesitation due to geopolitical uncertainties, leading to inventory drawdowns and a 12.7% reduction in pulp stocks at ports by the end of the quarter compared to the previous quarter’s close, according to SCI. As these uncertainties subsided throughout the quarter, pulp demand rebounded, as indicated by a 6% increase in Brazilian hardwood pulp exports to China compared to the previous period, as reported by Brazilian foreign trade statistics. Additionally, paper production increased 5% across all segments in 3Q25 vs. 2Q25, with the tissue paper segment standing out, posting an 8% increase in the same comparison period, according to SCI. In Europe, according to Utipulp, hardwood pulp consumption declined by 6% compared to the previous quarter, in line with seasonal trends. European demand for printing and writing papers remains under pressure, while the tissue paper segment continues to demonstrate greater resilience. In North America, the tissue paper market continued to perform well, serving as a key driver of regional hardwood pulp demand in the region. Regarding hardwood pulp supply, the quarter was marked by Suzano’s announcement of production cuts, as disclosed in a Material Fact on August 6, 2025, and the launch of a new swing campaign for dissolving pulp by a major producer operating in Brazil. For softwood pulp, new unscheduled downtimes by Nordic producers further constrained supply, though not yet to a degree sufficient to rebalance the market. The average PIX/FOEX indices for hardwood pulp in China decreased by 9% compared to 2Q25. In Europe, they decreased 12% compared to 2Q25. The difference between softwood and hardwood pulp prices in the quarter was US$185/t in China and US$476/t in Europe, based on gross prices, driving the shift from softwood pulp to hardwood pulp. 3Q25 EARNINGS RELEASE Page 4 of 43

Suzano’s pulp sales were 3% lower compared to the previous quarter, primarily due to reduced volumes shipped to Europe, partially offset by increased sales to North America. Compared to 3Q24, the increase was 20%, mainly driven by the increases observed in Asia and North America. Pulp Sales Volume ('000 t) +20% -3% q 2,635 3,269 3,165 176 150 148 2,459 3,119 3,017 Export Market Brazilian Market 3Q24 2Q25 3Q25 Average net price in US$ of pulp sold by Suzano was US$525/t in 3Q25, down 6% from 2Q25 and down 22% from 3Q24. In the export market, average net price charged by the Company was US$524/t down 6% from 2Q25 and down 22% from 3Q24. The average net price in R$ was R$2,859/t in 3Q25, down 9% from 2Q25, primarily due to the decline in the average net price in US$ and a 4% depreciation of the average US$ against the R$. Compared to 3Q24, the 23% reduction was driven by the same factors previously mentioned. Average Net Price (US$/t) -22% -6% q 671 555 525 3Q24 2Q25 3Q25 3Q25 EARNINGS RELEASE Page 5 of 43

Net revenue from pulp sales decreased 12% from 2Q25, due to a 6% reduction in net average price in US$, a 4% depreciation of the average US$ against the R$ and a 3% decrease in sales volume. Compared to 3Q24, the 8% decline is mainly due to a 22% decrease in the average net price in US$ and a 2% depreciation of the average US$ against the R$, partially offset by a 20% increase in sales volume. Pulp Net Revenue (R$ million) -8% -12% q 9,803 10,288 9,050 660 477 432 9,143 9,810 8,618 Brazilian Market Export Market 3Q24 2Q25 3Q25 3Q25 EARNINGS RELEASE Page 6 of 43

PULP CASH COST Although there were no scheduled maintenance downtimes in 3Q25, it is important to note that there was an impact of R$11/ton on cash cost during the period due to stoppages related to the application of Regulatory Standard 13 (Inspection of Boilers and Pressure Vessels), which requires the washing of recovery and/or auxiliary boilers to maintain the operational stability of the mills between downtimes. These boiler washings in 3Q25 took place in Três Lagoas, Mucuri, and Ribas. Additionally, there was an impact from both the competitiveness project in Limeira, which required the restart of the biomass boiler, and the start-up of the new boiler in Aracruz. Consolidated Pulp Cash Cost ex-downtime (R$/t) -7% -4% q 863 832 801 3Q24 2Q25 3Q25 Pulp Cash Cost (R$/t) -13% -3% q 932 838 812 863 832 801 25 43 6 11 Cash Cost ex-downtimes Start-up Ribas Downtimes Effect 3Q24 2Q25 3Q25 Cash cost excluding downtimes in 3Q25 was R$801/t, representing a 4% decrease compared to 2Q25, due to: i) lower wood costs, explained by: a) reduced specific consumption (due to higher basic density and improved wood quality); b) greater operational efficiency in logistics and harvesting; ii) reduced inputs cost, mainly due to consume reduction of caustic soda, chlorine dioxide, and calcium oxide, as well as lower energy prices (excluding FX effects), especially for natural gas, following a decline in Brent prices; iii) a 4% depreciation of the average US$ against the R$, resulting in lower R$-denominated prices, notably for caustic soda and natural gas. The positive impacts on cash cost were partially offset by lower fixed cost dilution due to reduced production volume, as well as lower utility results. 3Q25 EARNINGS RELEASE Page 7 of 43

Consolidated Pulp Cash Cost ex-downtime (R$/t)¹ (1) Excludes the impact of maintenance and administrative downtimes. Cash cost excluding downtimes for 3Q25 decreased by 7% compared to 3Q24, due to: i) lower wood costs, driven by a reduced average radius, higher indirect cost dilution per higher volume on Ribas mill, lower diesel prices and improved performance in harvesting and logistics operations, partially offset by the mill mix and increased specific consumption of wood; ii) lower input costs, explained by reduced consumption, mainly of caustic soda and fuel oil, due to the start-up of the Ribas unit in 3Q24 and the project to convert lime kilns from fuel oil to natural gas at the Imperatriz and Ribas units, partially offset by the increase in caustic soda prices during the period; iii) better utilities result driven by higher export volumes from the new operation at the Ribas Unit; iv) higher fixed cost dilution due to higher production volume at the Ribas Unit; and v) depreciation of the average US$ vs. the average R$, especially benefiting input prices such as natural gas and caustic soda. Consolidated Pulp Cash Cost ex-downtime (R$/t)¹ (1) Excludes the impact of maintenance and administrative downtimes. 3Q25 EARNINGS RELEASE Page 8 of 43

Cash Cost 3Q25¹ Fixed costs 22% Wood 38% Chemicals 24% Energy 13% Other variables 3% Cash Cost 3Q24¹ Fixed costs 21% Wood 39% Chemicals 23% Energy 15% Other variables 2% (1) Based on cash cost excluding downtimes. Excludes energy sales. PULP SEGMENT EBITDA Pulp Segment 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Adjusted EBITDA (R$ million)¹ 4,462 5,378 -17% 5,697 -22% 19,823 Sales volume (k t) 3,165 3,269 -3% 2,635 20% 12,368 Pulp adjusted¹ EBITDA (R$/t) 1,410 1,645 -14% 2,162 -35% 1,603 (1) Excludes non-recurring items. Adjusted EBITDA from pulp was 17% lower in 3Q25 vs. 2Q25, due to: i) a 6% decrease in average net prices in US$; ii) a 4% depreciation of the average US$ against the R$; and iii) a 3% reduction in sales volume. These impacts were partially offset by improved cash COGS, which benefited mostly from lower cash production costs. Adjusted EBITDA per tonne was 14% lower, explained by the same effects, excluding sales volume. Compared to 3Q24, the 22% reduction in Adjusted EBITDA from pulp is attributable to: i) a 22% decline in average net prices in US$; ii) a 2% depreciation of the average US$ against the R$; and iii) higher SG&A expenses, driven by increased personnel costs related to variable compensation and labor downsizing, as well as higher commercial expenses. These impacts were partially offset by a 20% increase in sales volume and improved cash COGS, which benefited from lower cash production costs and lower impact of maintenance downtimes, despite higher logistics costs during the period. Adjusted EBITDA per tonne decreased 35% due to the same factors, excluding sales volume. 3Q25 EARNINGS RELEASE Page 9 of 43

Adjusted EBITDA¹ (R$ million) and Adjusted EBITDA Margin (%) from Pulp 5,697 5,378 4,462 58% 52% 49% Adjusted EBITDA Margin EBITDA Pulp 3Q24 2Q25 3Q25 (1) Excludes non-recurring items. Pulp Adjusted EBITDA per tonne (R$/t) -35% -14% q 2,162 1,645 1,410 3Q24 2Q25 3Q25 OPERATING CASH GENERATION FROM THE PULP SEGMENT Pulp Segment (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Adjusted EBITDA1 4,462 5,378 -17% 5,697 -22% 19,823 Maintenance Capex2 (1,534) (1,737) -12% (1,953) -21% (6,786) Operating Cash Flow 2,928 3,641 -20% 3,744 -22% 13,037 (1) Excludes non-recurring items. (2) Cash basis. 3Q25 EARNINGS RELEASE Page 10 of 43

Operating cash generation per tonne in the pulp segment reached R$925/t in 3Q25, decreasing 17% and 35% compared to 2Q25 and 3Q24, respectively, due to the decline EBITDA per tonne, partially offset by lower sustaining capex per tonne. Operating Cash Generation from Pulp per tonne (R$/t) -35% -17% q 1,421 1,114 925 3Q24 2Q25 3Q25 PAPER BUSINESS PERFORMANCE The following data and analyses incorporate the joint results of the paper and consumer goods (tissue) businesses. PAPER SALES VOLUME AND REVENUE According to data published by Brazil's Forestry Industry Association (Ibá), demand for Printing & Writing paper in Brazil, including imports, increased 4% in the first two months of 3Q25 compared to the first two months of the previous quarter, and decreased 7% compared to the same period of 3Q24. Compared to the previous quarter, the growth in demand is due to increased sales in the uncoated paper lines, following the segment’s historical seasonality along with an improved outlook for volumes for the National Textbook Program compared to previous years, in addition to strong consumption levels in the cut-size and coated paper lines. Compared to the same period in 3Q24, the decrease is mainly due to lower demand for coated paper, as last year there was additional demand for this line due to the municipal elections in Brazil, which took place precisely in the third quarter. Regarding the international markets served by the Company, it was observed a structural decline in demand as the main performance driver in mature markets. In Europe, the situation is more challenging due to the imbalance between supply and demand, while in North America, apparent consumption is being sustained by rising imports and declining exports, prior to the implementation of tariffs. In Latin America, demand for Printing & Writing papers remained stable. Regarding paperboard demand in Brazil, there was a 5% increase in the first two months of 3Q25 compared to the first two months of the previous quarter, and a 4% decrease compared to the same period in 3Q24. The growth compared to the previous quarter is due to the segment’s historical seasonality, as companies prepare for year-end sales, while the decrease compared to the same quarter last year is a result of inventory adjustments throughout the supply chain and a slowdown in consumer demand, reflecting the macroeconomic context. 3Q25 EARNINGS RELEASE Page 11 of 43

When consolidating the aforementioned paper market segments (accessible to Suzano), total demand in Brazil decreased by 6% in the first two months of 3Q25 in relation to the same period of 3Q24, according to Ibá data. Thus, Suzano's results were supported by higher exports from its operations in Brazil, in addition to the inclusion of Suzano Packaging's sales volume. In this regard, the Paper and Packaging Business Unit continues to make progress with its strategic plans: In the packaging segments, Suzano is adhering to the Suzano Packaging integration schedule, ensuring synergy and focus on increasing profitability in its U.S. operations, while also investing in its innovation-focused product portfolio in Brazil, using existing assets to target packaging solutions and the replacement of single-use plastics. In traditional I&E markets, the focus remains on evolving the exclusive go-to-market model, with the goal of expanding both the customer base and the regions served, as well as enhancing cost competitiveness. With the acquisition of Kimberly Clark’s tissue business in Brazil, the consumer goods segment has played a more significant role in our paper business results since 3Q23. Suzano’s paper sales (printing & writing, paperboard and tissue) in the Brazilian market totaled 248 thousand tonnes in 3Q25, up 6% from the previous quarter, driven by the performance and expansion across all paper segments served, in line with market trends. Compared to 3Q24, there was a 5% decrease due to coated paper sales, reflecting the normalization of demand after the increase observed in the same period of the previous year, which was driven by the Brazilian elections. International paper sales totaled 188 thousand tonnes, accounting for 43% of total sales volume in 3Q25. The 6% increase compared to 2Q25 was driven by higher exports from the Brazilian operations, resulting from strategic allocation across markets and segments in response to market conditions, as well as increased sales from Suzano Packaging. Year-over-year, the growth of in external market sales reflects the addition of volumes from the new Suzano Packaging US operation, alongside higher exports from Brazil during the same comparative period. Paper Sales Volume ('000 t) +21% +6% q 360 411 436 262 235 248 98 177 188 Brazilian Market Export Market 3Q24 2Q25 3Q25 (1) Includes the consumer goods unit and the Suzano Packaging US Unit. 3Q25 EARNINGS RELEASE Page 12 of 43

Average net price decreased by 3% compared to the previous quarter, reflecting decreases of 2% and 4% in prices in the domestic and international markets, respectively, due to the regional mix effect and the depreciation of the average US$ against the R$, partially offset by a 6% increase in volumes in both the domestic and international markets. Compared to 3Q24, the increase of 4% was due to the launch of the new Suzano Packaging US operation and higher prices, due to favorable product and segment mix in sales volumes. Average Net Paper Price (R$/t)¹ +4% -3% q 6,866 7,315 7,118 3Q24 2Q25 3Q25 (1) Includes the consumer goods unit and the Suzano Packaging US Unit. Net revenue from paper sales amounted to R$3,103 million, up 3% from 2Q25, mainly due to higher sales volume in both the domestic and international markets, partially offset by a lower net average price in both markets. Compared to 3Q24, net revenue from paper sales grew by 26% due to the new Suzano Packaging US operation, which boosted sales volume (+21%), as well as the average net price of the segment. Paper Revenue (R$ million)¹ +26% +3% q 2,471 3,008 3,103 1,898 1,797 1,861 573 1,211 1,242 Brazilian market Export market 3Q24 2Q25 3Q25 (1) Includes the consumer goods unit and the Suzano Packaging US Unit. 3Q25 EARNINGS RELEASE Page 13 of 43

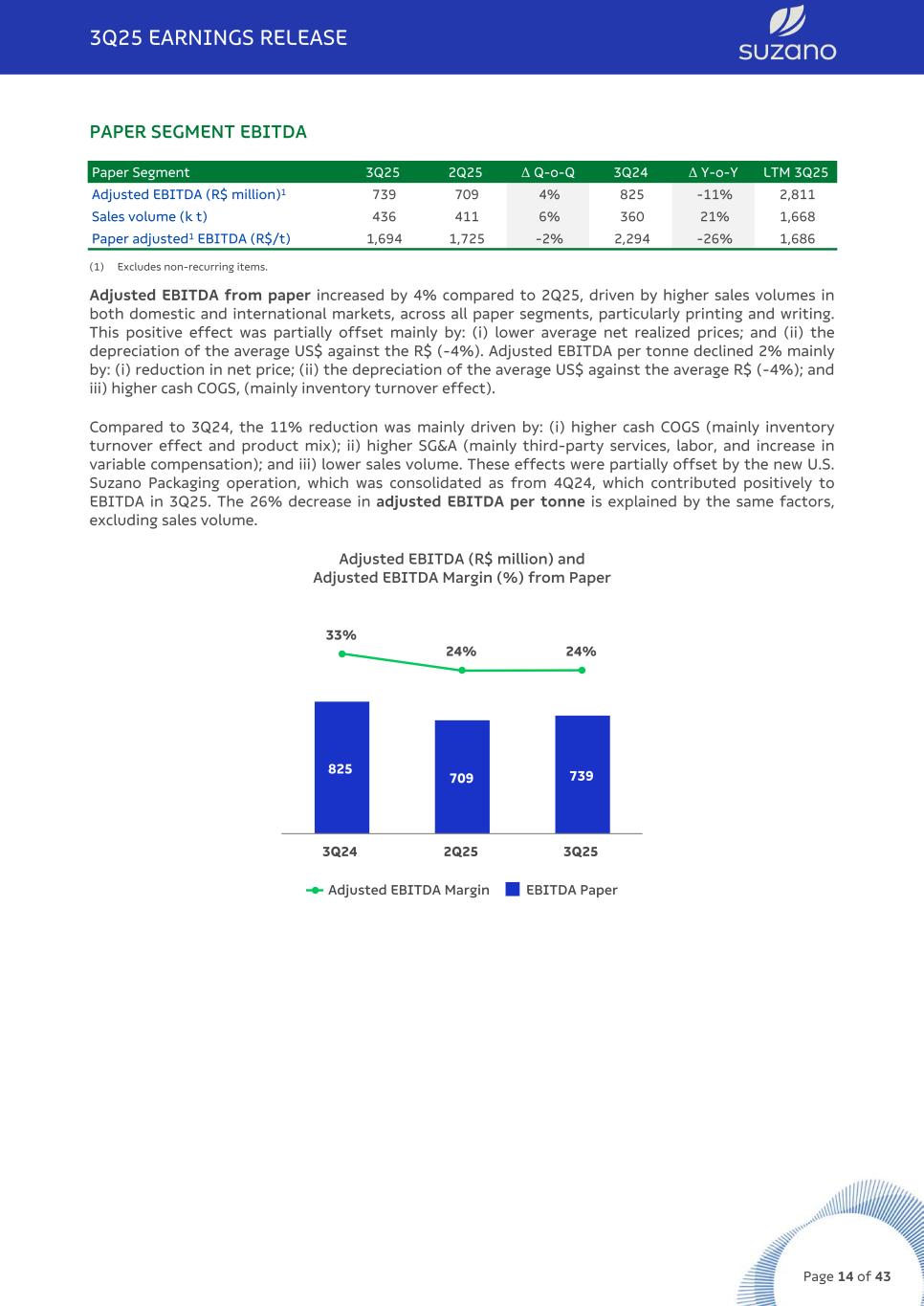

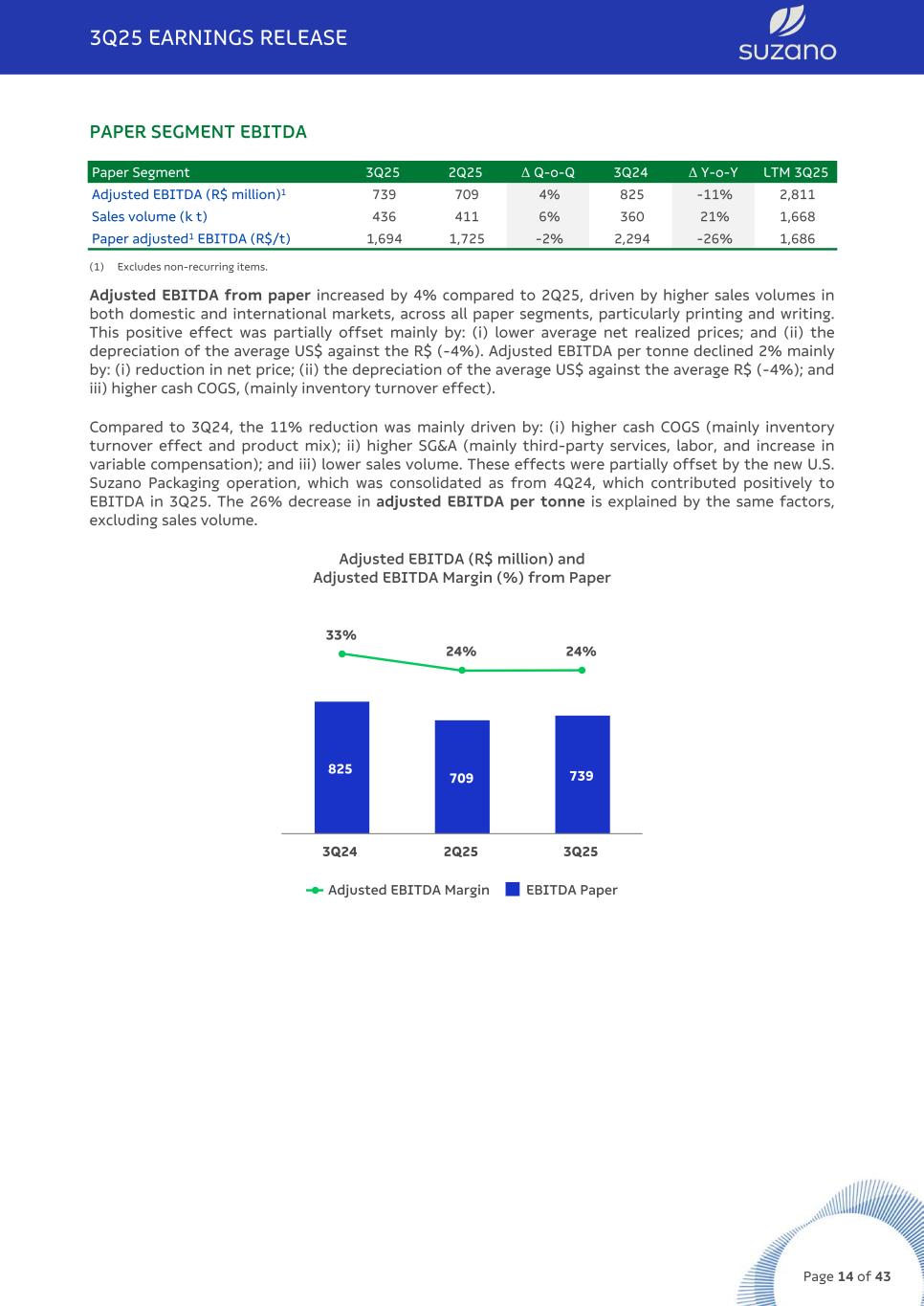

PAPER SEGMENT EBITDA Paper Segment 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Adjusted EBITDA (R$ million)1 739 709 4% 825 -11% 2,811 Sales volume (k t) 436 411 6% 360 21% 1,668 Paper adjusted1 EBITDA (R$/t) 1,694 1,725 -2% 2,294 -26% 1,686 (1) Excludes non-recurring items. Adjusted EBITDA from paper increased by 4% compared to 2Q25, driven by higher sales volumes in both domestic and international markets, across all paper segments, particularly printing and writing. This positive effect was partially offset mainly by: (i) lower average net realized prices; and (ii) the depreciation of the average US$ against the R$ (-4%). Adjusted EBITDA per tonne declined 2% mainly by: (i) reduction in net price; (ii) the depreciation of the average US$ against the average R$ (-4%); and iii) higher cash COGS, (mainly inventory turnover effect). Compared to 3Q24, the 11% reduction was mainly driven by: (i) higher cash COGS (mainly inventory turnover effect and product mix); ii) higher SG&A (mainly third-party services, labor, and increase in variable compensation); and iii) lower sales volume. These effects were partially offset by the new U.S. Suzano Packaging operation, which was consolidated as from 4Q24, which contributed positively to EBITDA in 3Q25. The 26% decrease in adjusted EBITDA per tonne is explained by the same factors, excluding sales volume. Adjusted EBITDA (R$ million) and Adjusted EBITDA Margin (%) from Paper 825 709 739 33% 24% 24% Adjusted EBITDA Margin EBITDA Paper 3Q24 2Q25 3Q25 3Q25 EARNINGS RELEASE Page 14 of 43

Paper Adjusted EBITDA (R$/t) -26% -2% q 2,294 1,725 1,694 3Q24 2Q25 3Q25 OPERATING CASH GENERATION FROM THE PAPER SEGMENT Op. Cash Generation - Paper (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Adjusted EBITDA1 739 709 4% 825 -11% 2,811 Maintenance Capex2 (251) (202) 25% (175) 43% (816) Operating Cash Flow 488 508 -4% 650 -25% 1,995 (1) Excludes non-recurring items. (2) Cash basis. Operating cash generation per tonne in the paper segment was R$1,119/t in 3Q25, decreasing 9% from 2Q25, due to a 17% increase in sustaining capex per tonne and a 2% reduction in EBITDA per tonne. Compared to the same period last year, there was a 38% decrease driven by a 26% decline in adjusted EBITDA per tonne and an 18% increase in sustaining capex per tonne. Paper Operating Cash Generation per tonne (R$/t) -38% -9% q 1,807 1,235 1,119 3Q24 2Q25 3Q25 3Q25 EARNINGS RELEASE Page 15 of 43

FINANCIAL PERFORMANCE NET REVENUE Suzano's net revenue in 3Q25 was R$12,153 million, 81% of which came from exports (vs. 80% in 2Q25 and 79% in 3Q24). Compared to 2Q25, the 9% decrease is primarily attributable to a lower average net pulp price in US$ (-6%), the depreciation of the average US$ against the R$ (-4%), and reduced pulp sales volumes (-3%). These impacts were partially offset by a higher volume of paper sold in the period (+6%). The 1% decrease in consolidated net revenue in 3Q25 vs. 3Q24 is explained by a 22% decline in the average net pulp price in US$ and a 2% depreciation of the average US$ against the R$. These impacts were partially mitigated by a 20% increase in pulp sales volume and the positive impact from the new Suzano Packaging US operation. Net Revenue¹ (R$ million) -1% -9% q 12,274 13,296 12,153 2,558 2,274 2,293 9,716 11,022 9,860 Brazilian Market Export Market 3Q24 2Q25 3Q25 Net Revenue Breakdown (3Q25) Other Paper 6% Paperboard 8% Printing & Writing 11% Pulp 75% (1) Does not include Portocel service revenue. CALENDAR OF SCHEDULED MAINTENANCE DOWNTIMES (1) Includes integrated capacities and fluff. (2) Veracel is a joint operation between Suzano (50%) and Stora Enso (50%) with total annual capacity of 1,120 thousand tonnes. 3Q25 EARNINGS RELEASE Page 16 of 43

COST OF GOODS SOLD (COGS) COGS (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 COGS 8,454 8,608 -2% 6,848 23% 33,552 (-) Depreciation, depletion and amortization (2,616) (2,571) 2% (2,034) 29% (9,953) Cash COGS 5,838 6,037 -3% 4,814 21% 23,599 Sales volume (000' t) 3,601 3,680 -2% 2,995 20% 14,036 Cash COGS/ton (R$/t) 1,621 1,641 -1% 1,607 1% 1,681 Cash COGS in 3Q25 totaled R$5,838 million or R$1,621/t. Compared to 2Q25, cash COGS decreased by 3%, primarily due to: (i) lower pulp production cash costs; (ii) a 4% depreciation of the average US$ against the R$, impacting items exposed to the foreign currency; (iii) reduced impact from scheduled maintenance downtimes; and (iv) lower pulp sales volume. On a per-tonne basis, cash COGS decreased 1% due to the same factors, excluding sales volumes. Compared to 3Q24, cash COGS increased by 21% mainly driven by: (i) higher sales volumes of pulp and paper; and (ii) increased logistics costs (due to the impact from the 10% U.S. import tariffs and the ramp-up effect from Ribas do Rio Pardo). These effects were partially offset by: (i) lower pulp production cash costs; (ii) reduced impact from scheduled maintenance downtimes; and (iii) the effect of a 2% depreciation of the average US$ against the R$ on items exposed to the foreign currency. On a per-tonne basis, cash COGS increased 1% year on year due to higher logistics costs, as mentioned previously. SELLING EXPENSES Selling Expenses (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Selling expenses 850 838 1% 728 17% 3,300 (-) Depreciation, depletion and amortization (243) (243) 0% (239) 2% (965) Cash selling expenses 607 595 2% 489 24% 2,335 Sales volume (000' t) 3,601 3,680 -2% 2,995 20% 14,036 Cash selling expenses/ton (R$/t) 168 162 4% 163 3% 166 Cash selling expenses increased 2% compared to 2Q25, primarily due to the update of expected credit losses provision and higher fixed commercial costs of various types. This increase was partially offset by lower logistics expenses, resulting from changes in client and regional mix and a 4% depreciation of the average US$ against the R$. On a per-tonne basis, cash selling expenses rose by 4% reflecting the aforementioned factors. Compared to 3Q24, cash selling expenses were 24%, higher, primarily as a result of: (i) the update of expected credit losses provision; ii) the additional impact from the new Suzano Packaging US operation; iii) higher sales volumes; and iv) increased labor costs and other fixed commercial expenses. These effects were partially offset by lower international logistics expenses (inland freight). Cash selling expenses per tonne increased 3%, due to the same factors mentioned above, excluding sales volumes. 3Q25 EARNINGS RELEASE Page 17 of 43

GENERAL AND ADMINISTRATIVE EXPENSES General and Administrative Expenses (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 General and Administrative Expenses 665 647 3% 569 17% 2,976 (-) Depreciation, depletion and amortization (33) (32) 1% (36) -10% (133) Cash general and administrative expenses 632 615 3% 533 19% 2,843 Sales volume (000' t) 3,601 3,680 -2% 2,995 20% 14,036 Cash general and administrative expenses/t (R$/t) 176 167 5% 178 -1% 203 Compared to 2Q25, the 3% increase in cash general and administrative expenses is primarily explained by higher variable compensation and third-party service costs, particularly consulting and audit fees. These impacts were partially offset by lower labor expenses, reduced spending on institutional projects, and other services. On a per-tonne basis, these expenses decreased 5% due to the same factors. Compared to 3Q24, cash general and administrative expenses rose by 19%, primarily due to higher personnel costs associated with variable compensation and labor, the latter partly attributable to the new Suzano Packaging US operations. This increase was partially offset by lower spending on institutional projects. On a per-tonne basis, the reduction was 1% due to the volume effect. OTHER OPERATING INCOME (EXPENSES) Other Operating Income (Expenses) (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Other operating income (expenses) (136) (155) -12% (8) —% 436 (-) Depreciation, depletion and amortization 3 7 —% 6 —% 15 Cash other operating income (expenses) (138) (162) -15% (14) —% 420 Sales volume (000' t) 3,601 3,680 -2% 2,995 20% 14,036 Other operating income (expenses)/t (R$/t) (38) (44) -13% (5) —% 30 Other operating income (expenses) recorded an expense of R$136 million in 3Q25, compared to R$155 million in 2Q25 and R$8 million in 3Q24. The positive variation compared to 2Q25 is mainly explained by the absence of adjustment to the fair value of biological assets (which occurs in the second and fourth quarters of each year), partially offset by higher expenses related to asset write- offs. Compared to 3Q24, the negative variation was mainly explained by the higher expenses related to asset write-offs. In relation to the equity method item, the Company concluded in the previous quarter the strategic review of investments related to Spinnova Plc and Woodspin Oy (according to note 14 of the Financial Statements). As a result, accounting effects were recognized that also impacted this item in 3Q25, which characterizes the main negative effect of R$79 million observed in the quarter. 3Q25 EARNINGS RELEASE Page 18 of 43

ADJUSTED EBITDA Consolidated 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Adjusted EBITDA (R$ million)¹ 5,200 6,087 -15% 6,523 -20% 22,634 Adjusted EBITDA Margin 43% 46% -3 p.p 53% -10 p.p 44% Sales Volume (k t) 3,601 3,680 -2% 2,995 20% 14,036 Adjusted EBITDA¹/ton (R$/t) 1,444 1,654 -13% 2,178 -34% 1,613 (1) Excludes non-recurring items. The -15% decrease in Adjusted EBITDA in 3Q25 compared to 2Q25 is primarily attributable to: i) a lower average pulp net price in US$ (-6%); ii) the 4% depreciation of the average US$ against the R$; and iii) a lower pulp sales volume during the period (-3%). These impacts were partially offset by a reduction in cash COGS (see the "Cost of Goods Sold" section for further details). Adjusted EBITDA per tonne decreased 13% due to the same factors, excluding sales volume. Compared to 3Q24, Adjusted EBITDA declined by 20% driven by: (i) a lower average net pulp price in US$ (-22%); (ii) higher SG&A expenses (see the "Selling Expenses" and "General and Administrative Expenses" sections for further details); and (iii) a 2% depreciation of the average US$ against the R$. These impacts were partially offset by a 20% increase in pulp sales volume and lower cash COGS (see the "Cost of Goods Sold" section for further details). Adjusted EBITDA per tonne decreased 34% due to the lower average net pulp price in US$ and to the depreciation of the average US$ vs. the average R$. These effects were partially offset mainly by the lower cash COGS per ton. FINANCIAL RESULT Financial Result (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Financial Expenses (1,823) (1,606) 14% (1,567) 16% (6,762) Interest on loans and financing (local currency) (638) (486) 31% (376) 70% (1,938) Interest on loans and financing (foreign currency) (903) (957) -6% (1,021) -12% (3,932) Capitalized interest¹ 79 73 9% 81 -2% 282 Other financial expenses (362) (237) 53% (251) 44% (1,173) Financial Income 462 383 21% 421 10% 1,720 Interest on financial investments 442 354 25% 393 12% 1,530 Other financial income 21 29 -29% 28 -27% 190 Monetary and Exchange Variations 1,334 2,989 -55% 1,231 8% 597 Foreign exchange variations (Debt) 1,767 3,444 -49% 1,370 29% 1,215 Other foreign exchange variations (433) (455) -4% (139) —% (617) Derivative income (loss), net2 1,079 2,659 -59% 782 38% 2,061 Operating Cash flow hedge 817 1,863 -56% 621 32% 1,836 Cash flow - Cerrado project hedge — — -100% 13 -100% — Debt hedge 244 725 -66% 199 23% 188 Others³ 19 72 -74% (50) —% 37 Net Financial Result 1,052 4,425 -76% 868 21% (2,383) (1) Capitalized interest due to construction in progress. (2) Mark-to-market variation (3Q25: R$493 million | 2Q25: -R$494 million), plus adjustments paid and received (3Q25: R$92 million). (3) Includes commodity hedging and embedded derivatives.. 3Q25 EARNINGS RELEASE Page 19 of 43

Financial expenses increased by 14% compared to 2Q25, primarily reflecting higher local currency interest rates in turn driven by an increased debt balance in local currency (3Q25: R$23.9 billion | 2Q25: R$21.8 billion) and higher average CDI rate for the period (3Q25: 14.90% p.a. | 2Q25: 14.48% p.a.). Additionally, other financial expenses were affected by premiums paid in the bonds repurchase transactions (Bonds 2026 e 2027) in the foreign market and debentures (8th issuance) in the local market as a result of the liability management exercises carried out during the quarter. Compared to 3Q24, financial expenses increased by 16%, as a result of the higher CDI rate (3Q25: 14.90% p.a. | 3Q24: 10.43% p.a.), the higher outstanding balance of local currency debt (3Q25: R$23.9 billion | 3Q24: R$18.0 billion) and repurchase premiums associated with liability management executed in 3Q25. Financial income increased by 21% compared to 2Q25, reflecting the increase in the average CDI rate in the period and a higher average offshore cash balance of the Company. Compared to 3Q24, the 10% growth is also attributable to the higher average offshore cash balance, partially offset by a lower SOFR rate (3Q25: 4.33% p.a | 3Q24: 5.28% p.a.). Inflation adjustment and exchange variation had a positive impact of R$1,334 million on the Company’s financial result due to the 3% depreciation of the US$ against the R$ in 3Q25 vs. 2Q25, which affected foreign currency debt (US$12,981 million at the end of 3Q25). This effect was partially offset by the negative result of exchange variation on other balance sheet items in foreign currency. Note that the accounting impact of exchange variation on foreign currency debt has a cash impact only on the respective maturities. Derivative operations resulted in an income of R$1,079 million in 3Q25, mainly due to the positive impact from the US$ depreciation (-3%). The mark-to-market adjustment of derivative instruments on September 30, 2025 generated an income of R$493 million, compared to a loss of R$494 million on June 30, 2025, a positive variation of R$987 million. Note that the impact of US$ depreciation on the derivatives portfolio generates a cash impact only upon the respective maturities. The net effect on cash, which refers to the maturity of derivative operations in the third quarter, was a positive R$92 million (R$80 million gain on debt hedge, R$11 million gain on cash flow hedge and R$1 million gain from commodities). As a result of the above factors, net financial result in 3Q25, considering all financial expense and income lines, was an income of R$1,052 million, compared to an income of R$4,425 million in 2Q25 and an income of R$867 million in 3Q24. 3Q25 EARNINGS RELEASE Page 20 of 43

DERIVATIVE OPERATIONS Suzano carries out derivative operations exclusively for hedging purposes. The following table reflects the position of derivative hedging instruments on September 30, 2025: Hedge1 Notional (US$ million) Fair Value (R$ million) Sep/25 Jun/25 Sep/25 Jun/25 Debt 6,806 5,425 (710) (873) Cash Flow – Operating (ZCC + NDF) 6,053 6,934 1,104 298 Others2 411 460 99 81 Total 13,271 12,820 493 (494) (1) See note 4 of the 3Q25 Quarterly Financial Statements (ITR) for further details and the fair value sensitivity analysis. (2) Includes commodity hedging and embedded derivatives. The Company’s foreign exchange exposure policy seeks to minimize the volatility of its cash generation and ensure greater flexibility in cash flow management. Currently, the policy stipulates that surplus US$ may be partially hedged (at least 40% and up to 75% of exchange variation exposure over the next 24 months) using plain vanilla instruments such as Zero Cost Collars (ZCC) and Non-Deliverable Forwards (NDF). Based on the policy, in April 2025, seeking to increase currency hedge in a scenario of a devalued R$ and high interest rates, the Board of Directors authorized a new extraordinary cash flow hedge program totaling US$600 million for a period of 25-30 months. The extraordinary hedge volume was partially executed up to the third quarter and is reflected in the table below. At the end of 3Q25, 64% of the exchange variation exposure from the cash flow hedge portfolio was covered. ZCC transactions establish minimum and maximum limits for the exchange rate that minimize adverse effects in the event of significant appreciation of the R$. As such, if the exchange rate is within such limits, the Company neither pays nor receives any financial adjustments. This characteristic allows for capturing greater benefits from export revenue in a potential scenario of R$ depreciation vs. US$ within the range contracted. In cases of extreme R$ appreciation, the Company is protected by the minimum limits, which are considered appropriate for the operation. However, this protection instrument also limits, temporarily and partially, potential gains in scenarios of extreme R$ depreciation when exchange rates exceed the maximum limits contracted. On September 30, 2025, the outstanding notional value of operations involving forward US$ sales through ZCCs related to Cash Flows was US$5,963 million, with an average forward rate ranging from R$5.64 to R$6.54 and maturities distributed between October 2025 and October 2027. On the same date, the outstanding notional value of operations involving forward US$ sales through NDFs was US$90 million, whose maturities are distributed between February 2026 and June 2026 and with an average rate of R$5.92. Cash flow hedge operations in 3Q25 resulted in an income of R$817 million. The mark-to-market adjustment (“MtM” or “fair value”) of these operations was an income of R$1,104 million. The following table presents a sensitivity analysis of the cash impact that the Company could have on its cash flow hedge portfolios (ZCC and NDF) if the exchange rate remains the same as at the end of 3Q25 (R$/US$ = 5.32) in the coming quarters, as well as the projected cash impact for R$0.10 variations below / above the strike of put/call options, respectively, defined in each quarter. Note that the figures presented in the table are the Company’s projections based on the end-of-period curves and could vary depending on market conditions. 3Q25 EARNINGS RELEASE Page 21 of 43

Cash Adjustment (R$ million) Maturity (up to) Strike Range Notional (US$ million) Actual Exchange Rate 3Q25 (R$5.32) Sensitivity at R$0.10 / US$ variation (+/-) Zero Cost Collars 3Q25 7 4Q25 5.08 - 5.90 1,251 10 125 1Q26 5.14 - 5.91 1,127 22 113 2Q26 5.36 - 6.17 1,257 115 126 3Q26 6.18 - 7.08 45 39 5 4Q26 6.33 - 7.41 660 668 66 1Q27 6.34 - 7.47 608 620 61 2Q27 6.42 - 7.44 680 749 68 3Q27 6.21 - 7.15 325 289 33 4Q27 7.05 - 8.28 10 17 1 Total 5.64 - 6.54 5,963 7 2,530 596 NDF 3Q25 4 1Q26 5.85 27 14 3 2Q26 5.95 63 40 6 Total 5.92 90 4 54 9 To mitigate the effects of exchange and interest rate variations on its debt and its cash flows, the Company also uses currency and interest rate swaps. Swap contracts are entered into considering different interest rates and inflation indices in order to mitigate the mismatch between financial assets and liabilities. On September 30, 2025, the Company had an outstanding notional amount of US$6,806 million in swap contracts as shown in the table below. In 3Q25, the result of debt hedge transactions was an income of R$244 million, mainly due to US$ depreciation in the period (-3%). The mark-to-market adjustment (fair value) of these operations was a loss of R$710 million. Notional (US$ million) Fair Value (R$ million) Debt Hedge Maturity (up to) Currency Sep/25 Jun/25 Sep/25 Jun/25 Swap (CDI x US$) 2034 US$ 1,607 1,085 (25) (351) Swap (CNH x US$) 2027 US$ 166 166 (3) – Swap (SOFR x US$) 2031 US$ 2,015 1,576 132 112 Swap (CDI x SOFR) 2034 US$ 660 635 (53) (164) Swap (Pré x CDI) 2031 R$ 451¹ 495¹ 27 47 Swap (IPCA x CDI) 2044 R$ 1,906¹ 1,468¹ (788) (517) Total 6,806 5,425 (710) (873) (1) Translated at the quarterly closing exchange rate (R$5.32). The following table presents a sensitivity analysis¹ of the cash impact that the Company could have on its debt hedge portfolio (swaps) if the exchange rate remains the same as at the end of 3Q25 (R$/US$ = 5.32) in the coming quarters, as well as the projected variation in cash impact for each R$0.10 variation on the same reference exchange rate (3Q25). Note that the figures presented in the table are the Company’s projections based on the end-of-period curves and could vary depending on market conditions. 3Q25 EARNINGS RELEASE Page 22 of 43

Cash Adjustment (R$ million) Maturity (up to) Notional (US$ million) Actual R$ / US$ = 5.32 (3Q25) Sensitivity at R$ 0.10 / US$ variation (+/-)1 3Q25 80 4Q25 169 156 2 2026 342 (87) 10 2027 532 3 11 2028 247 59 25 >=2029 5,515 6,198 235 Total 6,806 80 6,328 284 (1) Sensitivity analysis considers variation only in the exchange rate (R$/US$), while other variables are presumed constant. Other transactions involving the Company’s derivatives are related to the embedded derivative resulting from forestry partnerships and commodity hedges, as shown in the table. Notional (US$ million) Fair Value (R$ million) Cash Adjustment (R$ million) Other hedges Maturity (up to) Index Sep/25 Jun/25 Sep/25 Jun/25 Sep/25 Jun/25 Embedded derivative 2039 Fixed | USD US- CPI 153 138 99 95 — — NDF CNY 2025 CNY | US$ 2 2 — — — — Commodities 2027 Brent/VLSFO/ Others 258 321 — (13) 1 (3) Total 413 460 99 81 1 (3) A portion of the forestry partnership agreements and standing timber supply agreements is denominated in US$ per cubic meter of standing timber, adjusted by U.S. inflation measured by the Consumer Price Index (CPI), which is not related to inflation in the economic environment where the forests are located and, hence, constitutes an embedded derivative. This instrument, presented in the table above, consists of a sale swap contract of the variations in the US-CPI during the period of the contracts. Refer to note 4 of the 3Q25 Financial Statements for further details and for a sensitivity analysis of the fair value in case of a sharp rise in the US-CPI and US$. On September 30, 2025, the outstanding notional value of the operation was US$153 million. The result from this swap in 3Q25 was a gain of R$5 million. The mark-to-market (fair value) adjustment of these operations generated a gain of R$99 million at the end of the quarter. The Company is also exposed to the price of some commodities and, therefore, constantly assesses the contracting of derivative financial instruments to mitigate such risks. On September 30, 2025, the outstanding notional value of these operations was US$258 million. The result of these hedges in 3Q25 was a gain of R$14 million. The mark-to-market (fair value) of these operations was a negative R$0.35 million at the end of the quarter. 3Q25 EARNINGS RELEASE Page 23 of 43

Results - Hedge Operations (R$ million) 244 817 14 5 Total 1,079 Derivatives Notional (US$ million) 6,8066,053 259 153 Total 13,271 Derivatives Fair Value (R$ million) (710) 1,104 99 Total 493 Debt Hedge Cash flow Hedge Commodity Hedge + NDF CNY Embedded Derivatives NET INCOME (LOSS) In 3Q25, the Company posted net income of R$1,961 million, as against net income of R$5,012 million in 2Q25 and of R$3,237 million in 3Q24. The 61% decrease in 3Q25 vs. 2Q25 was primarily attributable to a lower financial result, driven by a smaller depreciation of the closing US$ against the R$ (3% in 3Q25 vs. 5% in 2Q25), as well as a decline in net revenue. These impacts were partially offset mainly by: (i) lower income tax and social contribution expenses (primarily related to lower foreign exchange gains on debt and derivative mark-to-market gains); (ii) reduced COGS; and (iii) lower SG&A expenses. The 39% decrease compared to 3Q24 is attributable to higher COGS and SG&A, as well as a decline in net revenue. The aforementioned factors were partially offset by a positive variation in income tax and social contribution (mainly due to the decline in current income tax, in turn explained by the lower operating result), in addition to improved financial result, driven by a greater depreciation of the closing US$ against the R$ (3% in 3Q25 vs. 2% in 3Q24). DEBT Debt (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y Local Currency 23,920 21,783 10% 17,983 33% Short Term 1,022 787 30% 858 19% Long Term 22,898 20,996 9% 17,126 34% Foreign Currency 69,042 69,844 -1% 69,787 -1% Short Term 2,768 2,094 32% 6,864 -60% Long Term 66,274 67,750 -2% 62,923 5% Gross Debt 92,962 91,627 1% 87,770 6% (-) Cash 23,891 20,788 15% 17,596 36% Net debt 69,072 70,840 -2% 70,175 -2% Net debt/Adjusted EBITDA¹ (x) - R$ 3.1 x 3.0 x 0.1 x 3.2 x -0.1 x Net debt/Adjusted EBITDA¹ (x) – US$ 3.3 x 3.1 x 0.2 x 3.1 x 0.2 x (1) Excludes non-recurring items. 3Q25 EARNINGS RELEASE Page 24 of 43

On September 30, 2025, gross debt totaled R$93.0 billion and was composed of 96% long-term maturities and 4% short-term maturities. Foreign currency debt corresponded to 74% of the Company's total debt at the end of the quarter. The percentage of gross debt in foreign currency, considering the effect of debt hedge, was 87%. Compared to 2Q25, gross debt increased 1%, mainly due to liability management transactions that offset the new debt raised during the period. Suzano ended 3Q25 with 40% of its total debt linked to ESG instruments. Suzano contracts debt in foreign currency as a natural hedge, since net operating cash generation is mostly denominated in foreign currency (US$) due to its predominant status as an exporter. This structural exposure allows the Company to match loans and financing payments in US$ with receivable flows from sales. Changes in Gross Debt (R$ million) (1) Corresponding mainly to transaction costs (issue, funding, goodwill, discount and loss on business combinations, etc.). On September 30, 2025, the total average cost of debt in US$ was 5.0% p.a. (considering the debt in R$ adjusted by the market swap curve). As of June 30, 2025 this cost was also 5.0% p.a. The average term of consolidated debt at the end of the quarter was 80 months, compared to 74 months at the end of 2Q25. Exposure by Instrument Bond 47% Export Financing 20% Others 1% IFC 5% NCR 6% BNDES 7% ECA 2% Debenture 10% CPR 2% Exposure by Index¹ Fixed (US$) 76% CDI/SELIC 13% SOFR 11% Exposure by Currency² US$ 87% R$ 13% (1) Considers the portion of debt with swap for fixed rate in foreign currency. The exposure of the original debt was: Fixed (US$) – 47%, SOFR – 27%, CDI – 10%, Other (Fixed R$, IPCA, Long-term interest rate) – 16%. (2) Considers the portion of debt with currency swaps. The original debt was 74% in US$ and 26% in R$. Cash and cash equivalents and financial investments on September 30, 2025 amounted to R$23.9 billion, 65% of which in foreign currency, allocated to interest-bearing account or in short-term fixed- income investments abroad. The remaining 35% was invested in local currency fixed-income bonds (mainly CDBs, but also in government bonds and others), remunerated at the CDI rate. 3Q25 EARNINGS RELEASE Page 25 of 43

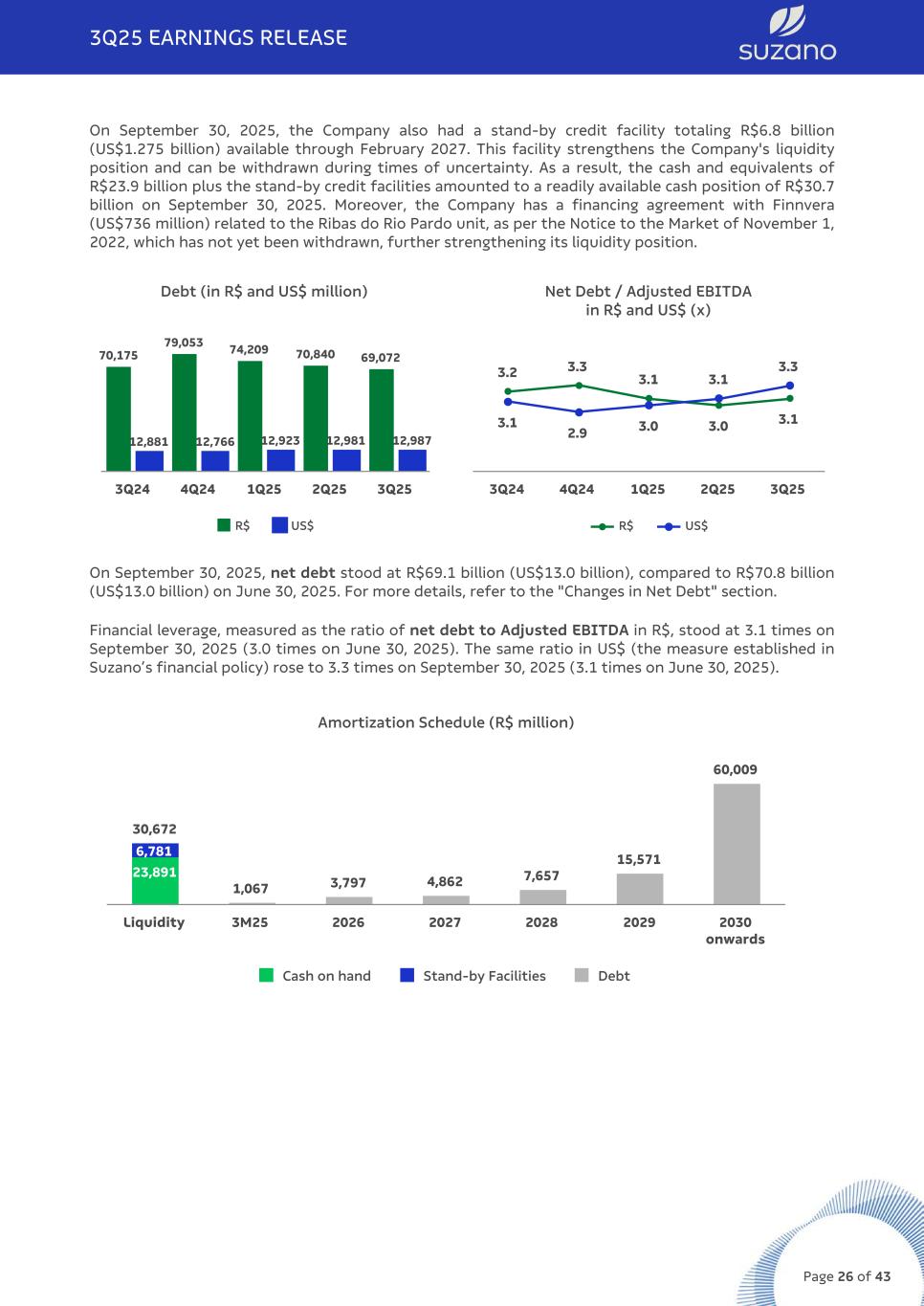

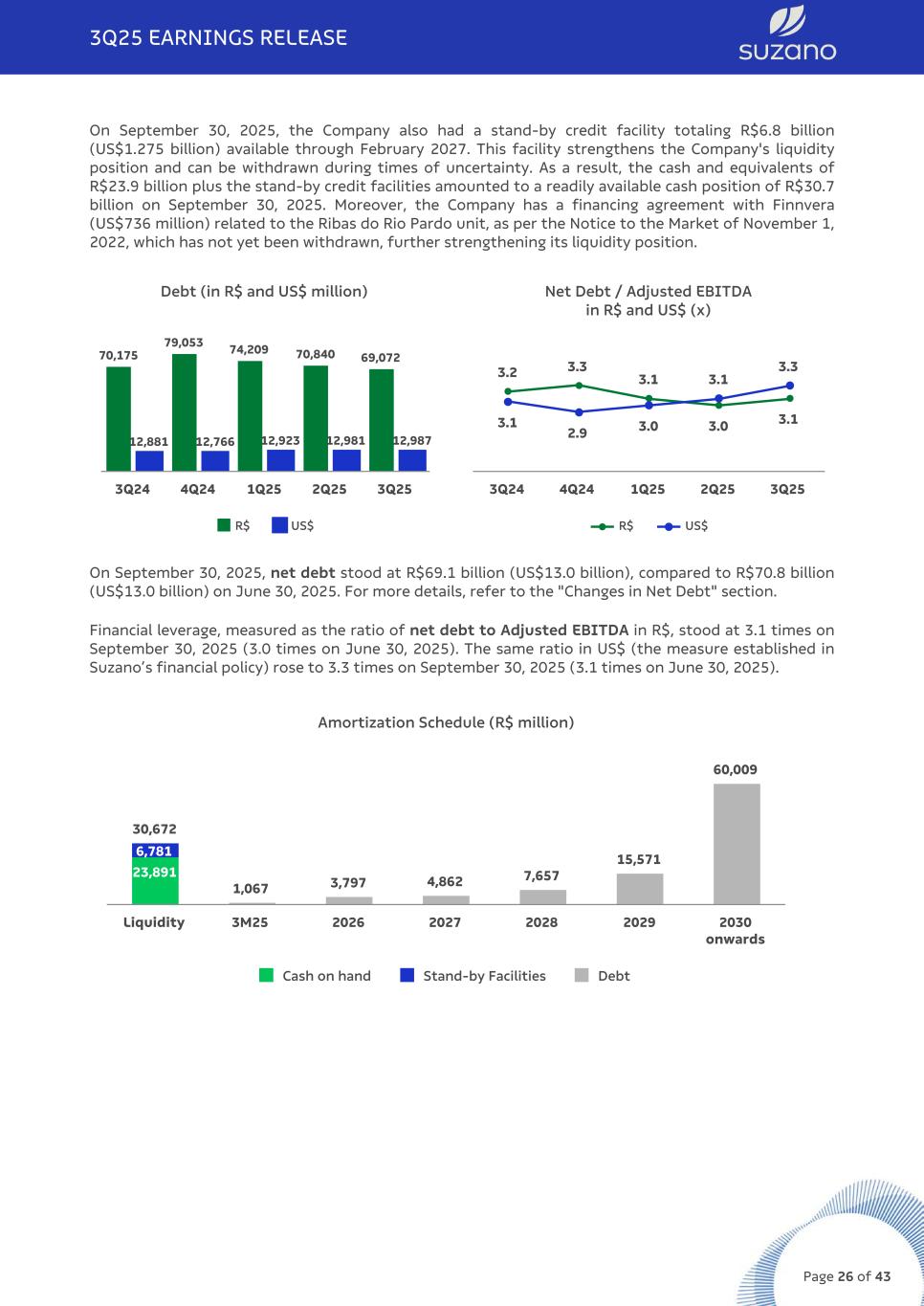

On September 30, 2025, the Company also had a stand-by credit facility totaling R$6.8 billion (US$1.275 billion) available through February 2027. This facility strengthens the Company's liquidity position and can be withdrawn during times of uncertainty. As a result, the cash and equivalents of R$23.9 billion plus the stand-by credit facilities amounted to a readily available cash position of R$30.7 billion on September 30, 2025. Moreover, the Company has a financing agreement with Finnvera (US$736 million) related to the Ribas do Rio Pardo unit, as per the Notice to the Market of November 1, 2022, which has not yet been withdrawn, further strengthening its liquidity position. Debt (in R$ and US$ million) 70,175 79,053 74,209 70,840 69,072 12,881 12,766 12,923 12,981 12,987 R$ US$ 3Q24 4Q24 1Q25 2Q25 3Q25 Net Debt / Adjusted EBITDA in R$ and US$ (x) 3.2 3.3 3.1 3.0 3.13.1 2.9 3.0 3.1 3.3 R$ US$ 3Q24 4Q24 1Q25 2Q25 3Q25 On September 30, 2025, net debt stood at R$69.1 billion (US$13.0 billion), compared to R$70.8 billion (US$13.0 billion) on June 30, 2025. For more details, refer to the "Changes in Net Debt" section. Financial leverage, measured as the ratio of net debt to Adjusted EBITDA in R$, stood at 3.1 times on September 30, 2025 (3.0 times on June 30, 2025). The same ratio in US$ (the measure established in Suzano’s financial policy) rose to 3.3 times on September 30, 2025 (3.1 times on June 30, 2025). Amortization Schedule (R$ million) 30,672 1,067 3,797 4,862 7,657 15,571 60,009 23,891 6,781 Cash on hand Stand-by Facilities Debt Liquidity 3M25 2026 2027 2028 2029 2030 onwards 3Q25 EARNINGS RELEASE Page 26 of 43

The breakdown of total gross debt between trade and non-trade finance on September 30, 2025 is shown below: 2025 2026 2027 2028 2029 2030 onwards Total Trade Finance¹ 36% 36% 69% 44% 24% 10% 36% Non-Trade Finance² 64% 64% 31% 56% 76% 90% 64% (1) ECC, ECN, EPP (2) Bonds, BNDES, CPR, Debentures, RCN, among others. CAPITAL EXPENDITURE In 3Q25, capital expenditure (cash basis) totaled R$3,659 million. The 15% increase compared to 2Q25 was driven by the disbursement of the first installment, amounting to R$878 million, as disclosed in a Material Fact notice on August 6, 2025, related to the agreement with Eldorado Brasil Celulose S.A. for the exchange of biological assets corresponding to 18 million cubic meters of standing timber, located in the state of Mato Grosso do Sul. This increase was partially offset by: (i) lower disbursements in maintenance, particularly industrial maintenance, due to a lower concentration of projects executed during the period; (ii) reduced disbursements related to the Cerrado Project, in line with its disbursement schedule; and (iii) reduced investments in expansion and modernization, mainly associated with the disbursement curve of the Company’s strategic projects, such as the new tissue plant, the competitiveness project at the Limeira mill, and the Fluff capacity expansion. Compared to 3Q24, the 36% reduction is mainly attributable to: i) lower investments in Land and Forests, given the high investment of R$2,123 million in the previous year (as disclosed in a Material Fact notice on July 31, 2024); ii) reduced disbursements related to the Cerrado Project, in line with its disbursement schedules; and (iii) lower forest maintenance costs due to reduced forest purchases. These factors were partially offset by higher investments recorded under expansion and modernization, particularly those related to the projects announced in Espírito Santo (new tissue plant in Aracruz), the competitiveness project at the Limeira mill and expansion of Fluff's capacity. Investments (R$ million)¹ 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Guidance 2025 Maintenance 1,785 1,938 -8% 2,128 -16% 7,602 7,813 Industrial maintenance 434 542 -20% 331 31% 1,967 1,737 Forestry maintenance 1,287 1,377 -7% 1,743 -26% 5,458 5,790 Others 64 20 0% 54 18% 177 286 Expansion and modernization 366 454 -19% 237 54% 1,681 1,572 Land and forestry 1,392 569 0% 2,473 -44% 3,106 3,018 Others — — — 1 — 1 6 Cerrado Project 116 219 -47% 893 -87% 1,284 850 Total 3,659 3,180 15% 5,733 -36% 13,674 13,259 (1) The amounts shown in the table do not reflect the impact of monetizing ICMS credits in the state of Espírito Santo. They do not consider the acquisition of non-controlling interest in Lenzing and the investments related to the acquisition of Pactiv's assets (Suzano Packaging US). 3Q25 EARNINGS RELEASE Page 27 of 43

OPERATING CASH FLOW Operating Cash Flow (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Adjusted EBITDA¹ 5,200 6,087 -15% 6,523 -20% 22,634 Maintenance Capex² (1,785) (1,938) -8% (2,128) -16% (7,602) Operating Cash Flow 3,416 4,149 -18% 4,394 -22% 15,032 Operating Cash Flow (R$/t) 948 1,128 -16% 1,467 -35% 1,071 (1) Excludes non-recurring items. (2) Cash basis. Operating cash flow, measured by adjusted EBITDA less sustaining capex (cash basis), amounted to R$3,416 million in 3Q25. The reduction in operating cash flow per tonne of 16% vs. 2Q25 and of 35% vs. 3Q24 was due to a decrease in adjusted EBITDA per tonne, partially offset by lower sustaining capex per tonne. Operating Cash Generation per tonne (R$/t) -35% -16% q 1,467 1,128 948 3Q24 2Q25 3Q25 3Q25 EARNINGS RELEASE Page 28 of 43

FREE CASH FLOW Free Cash Flow (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y LTM 3Q25 Adjusted EBITDA 5,200 6,087 -15% 6,523 -20% 22,634 (-) Total Capex¹ (3,492) (3,203) 9% (7,692) -55% (14,084) (-) Leases contracts – IFRS 16 (346) (342) 1% (313) 11% (1,439) (+/-) △ Working capital² 463 (864) —% 568 —% 1,550 (-) Net interest³ (1,569) (652) 141% (1,170) 34% (4,485) (-) Income taxes (47) (24) 96% (91) —% (332) (-) Dividend and interest on own capital payment/Share Buyback Program — (169) -100% (2,497) —% (2,706) (+/-) Derivative cash adjustment 92 155 -41% 331 —% 173 Free cash flow 300 989 -70% (4,341) -107% 1,311 (+) Total Capex ex-maintenance 1,804 1,464 23% 5,677 -68% 7,117 (+) Dividend and interest on own capital payment/Share Buyback Program — 169 -100% 2,497 —% 2,706 Free cash flow – Adjusted4 2,104 2,622 -20% 3,833 -45% 11,134 Free Cash Flow Yield ("FCF Yield") - LTM5 18.1% 20.3% -2,2 p.p. 16.9% 1,2 p.p. 18.1% (1) On an accrual basis, except for the investment related to the Cerrado Project starting from 2Q23. It also considers acquiring land and forest assets, taking an ownership interest in Lenzing (3Q24), and acquiring Pactiv Evergreen's assets (Suzano Packaging US - in 4Q24). Including expenses with land lease, which are neutralized in the Working Capital line, considering that the item "Lease contracts – IFRS 16" includes the total leases (land, machinery and equipment, real estate, ships and vessels, and vehicles). (2) Considers costs of capitalized loans paid (3Q25: R$79 million | 2Q25: R$73 million | 3Q24: R$81 million), with no impact on free cash flow, which is included in the Total Capex item with the opposite sign. (3) Considers interest paid on debt and interest received on financial investments, and interest paid as a premium for early debt settlement. (4) Free cash flow prior to dividend payment, interest on capital, share buyback program and capex ex-maintenance (accrual basis). (5) Adjusted LTM free cash flow per share (excluding treasury shares) divided by the closing share price for the quarter (3Q25: R$49.90/share | 2Q25: R$51.21/share | 3Q24: R$54.44/share). Adjusted Free Cash Flow was R$2,104 million in 3Q25 vs. R$2,622 million in 2Q25 and R$3,833 million in 3Q24. Compared to 2Q25, Adjusted Free Cash Flow declined by 20%, primarily due to: (i) a higher concentration of interest payments in the period, reflecting the bond payment schedule and the premium paid for early debt settlement as part of liability management efforts; and (ii) lower Adjusted EBITDA. These impacts were partially offset, primarily by the release of working capital (price effect, receivables anticipation programs, and volume), in contrast to the consumption observed in 2Q25. Compared to 3Q24, Adjusted Free Cash Flow decreased 45% primarily due to: (i) lower Adjusted EBITDA; (ii) higher interest payments due to the increase in the share of debt in local currency combined with the rise in the average CDI; and (iii) lower positive cash adjustment of derivatives compared to the same period last year. These effects were offset by lower sustaining capex on an accrual basis. 3Q25 EARNINGS RELEASE Page 29 of 43

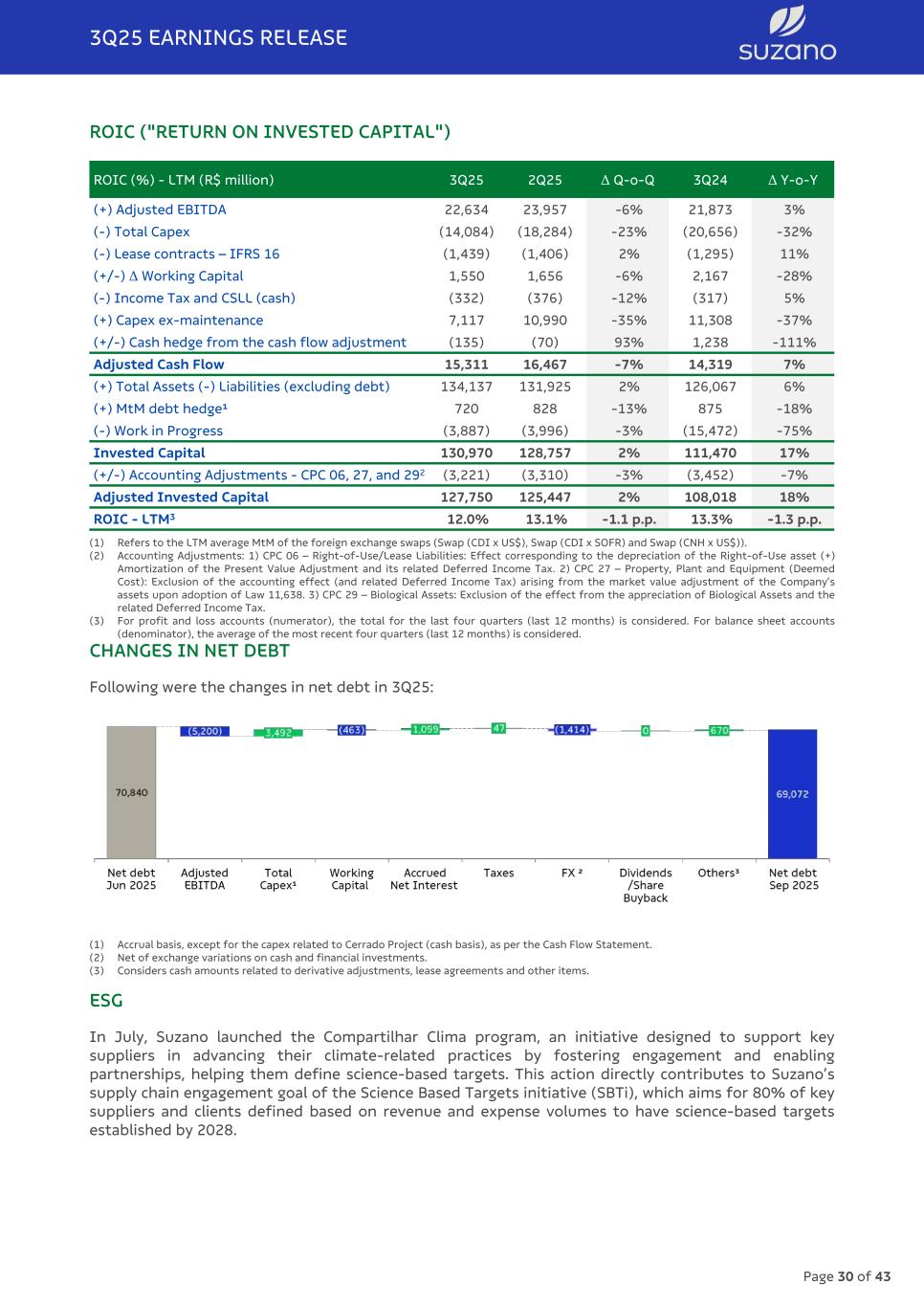

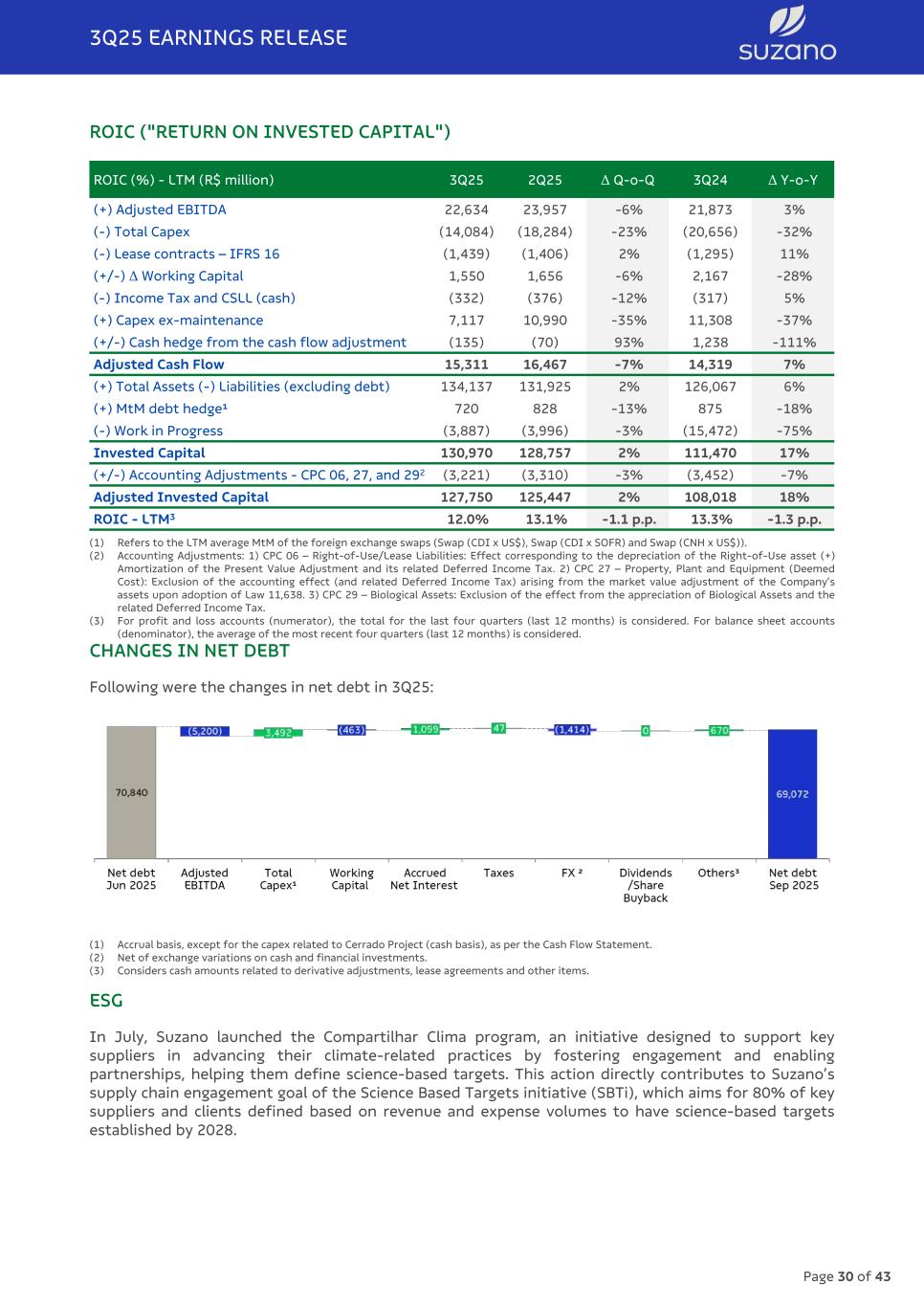

ROIC ("RETURN ON INVESTED CAPITAL") ROIC (%) - LTM (R$ million) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y (+) Adjusted EBITDA 22,634 23,957 -6% 21,873 3% (-) Total Capex (14,084) (18,284) -23% (20,656) -32% (-) Lease contracts – IFRS 16 (1,439) (1,406) 2% (1,295) 11% (+/-) Δ Working Capital 1,550 1,656 -6% 2,167 -28% (-) Income Tax and CSLL (cash) (332) (376) -12% (317) 5% (+) Capex ex-maintenance 7,117 10,990 -35% 11,308 -37% (+/-) Cash hedge from the cash flow adjustment (135) (70) 93% 1,238 -111% Adjusted Cash Flow 15,311 16,467 -7% 14,319 7% (+) Total Assets (-) Liabilities (excluding debt) 134,137 131,925 2% 126,067 6% (+) MtM debt hedge¹ 720 828 -13% 875 -18% (-) Work in Progress (3,887) (3,996) -3% (15,472) -75% Invested Capital 130,970 128,757 2% 111,470 17% (+/-) Accounting Adjustments - CPC 06, 27, and 292 (3,221) (3,310) -3% (3,452) -7% Adjusted Invested Capital 127,750 125,447 2% 108,018 18% ROIC - LTM3 12.0% 13.1% -1.1 p.p. 13.3% -1.3 p.p. (1) Refers to the LTM average MtM of the foreign exchange swaps (Swap (CDI x US$), Swap (CDI x SOFR) and Swap (CNH x US$)). (2) Accounting Adjustments: 1) CPC 06 – Right-of-Use/Lease Liabilities: Effect corresponding to the depreciation of the Right-of-Use asset (+) Amortization of the Present Value Adjustment and its related Deferred Income Tax. 2) CPC 27 – Property, Plant and Equipment (Deemed Cost): Exclusion of the accounting effect (and related Deferred Income Tax) arising from the market value adjustment of the Company’s assets upon adoption of Law 11,638. 3) CPC 29 – Biological Assets: Exclusion of the effect from the appreciation of Biological Assets and the related Deferred Income Tax. (3) For profit and loss accounts (numerator), the total for the last four quarters (last 12 months) is considered. For balance sheet accounts (denominator), the average of the most recent four quarters (last 12 months) is considered. CHANGES IN NET DEBT Following were the changes in net debt in 3Q25: (1) Accrual basis, except for the capex related to Cerrado Project (cash basis), as per the Cash Flow Statement. (2) Net of exchange variations on cash and financial investments. (3) Considers cash amounts related to derivative adjustments, lease agreements and other items. ESG In July, Suzano launched the Compartilhar Clima program, an initiative designed to support key suppliers in advancing their climate-related practices by fostering engagement and enabling partnerships, helping them define science-based targets. This action directly contributes to Suzano’s supply chain engagement goal of the Science Based Targets initiative (SBTi), which aims for 80% of key suppliers and clients defined based on revenue and expense volumes to have science-based targets established by 2028. 3Q25 EARNINGS RELEASE Page 30 of 43

TOTAL OPERATIONAL EXPENDITURE - PULP As disclosed in the Material Fact notice of December 12th, 2024, the total operational expenditure forecast for 2027 is approximately R$1,900 per tonne. The indicator has been evolving according to plan, considering the exchange rate and monetary assumptions used. Said estimate refers to the currency in real terms of 2025. The Company also reports that the total operational expenditure for 2024 was R$2,183/t, consisting of cash cost of production (including downtimes) of R$875/t, sustaining capex of R$618/t and freight plus SG&A of R$690/t. CAPITAL MARKETS On September 30, 2025, Suzano’s stock was quoted at R$49.90/share (SUZB3) and US$9.40/share (SUZ). The Company’s stock is listed on the Novo Mercado, the listing segment of the São Paulo Stock Exchange (B3 – Brasil, Bolsa e Balcão) with the highest corporate governance standards, and on the New York Stock Exchange (NYSE) - Level II. Stock Performance SUZB3 IBOV SUZ US INDU oct-24 nov-24 dec-24 jan-25 feb-25 apr-25 may-25 jun-25 jul-25 aug-25 sep-25 60 80 100 120 140 Source: Bloomberg. Liquidity - SUZB3 355 416 313 333 228 23,037 24,985 22,993 21,323 14,274 Avg. Number of Trades (Daily) Avg. Daily Volume (R$ million) 3Q24 4Q24 1Q25 2Q25 3Q25 Source: Bloomberg. 3Q25 EARNINGS RELEASE Page 31 of 43 SUZB3 -9% IBOV 10% INDU 10% SUZ US -7%

As part of the 5th share buyback program announced and currently open (“August/2024 Program”), until the end of September 2025, the Company had traded 14,820,500 shares at an average cost of acquisition of R$54.46 each, representing R$805 million in market value, according to the monthly reports released by the Company under CVM Instruction 44. On September 30, 2025, the Company's capital stock consisted of 1,264,117,615 common shares, of which 28,208,827 common shares were held in treasury. Suzano’s market capitalization on the same date (ex-treasury shares) stood at R$61.7 billion. Free float in 3Q25 corresponded to 49% of the total capital. Free Float distribution on 9/30/2025 (B3 + NYSE) Ownership structure on 9/30/2025 72% 28% Foreign Local 8% 92% Individual Investors Institutional Investors 49% 2% 49% Other Shareholders Treasury Controlling Shareholders FIXED INCOME Unit Sep/25 Jun/25 Sep/24 Δ Q-o-Q Δ Y-o-Y Suzano 2028 – Price US$/k 94.58 93.02 91.34 2% 4% Suzano 2028 – Yield % 4.48 4.88 4.94 -8% -9% Suzano 2029 – Price US$/k 103.67 102.94 103.31 1% 0% Suzano 2029 – Yield % 4.78 5.08 5.13 -6% -7% Suzano 2030 – Price US$/k 100.87 99.83 99.69 1% 1% Suzano 2030 – Yield % 4.77 5.04 5.07 -5% -6% Suzano 2031 – Price US$/k 94.68 93.49 92.15 1% 3% Suzano 2031 – Yield % 4.90 5.11 5.23 -4% -6% Suzano 2032 – Price US$/k 89.65 88.23 87.03 2% 3% Suzano 2032 - Yield % 5.07 5.28 5.29 -4% -4% Suzano 2036 - Preço US$/k 100.06 — — 0% 0% Suzano 2036 - Yield % 5.49 — — 0% 0% Suzano 2047 – Price US$/k 111.67 106.55 110.25 5% 1% Suzano 2047 – Yield % 6.02 6.44 6.15 -6% -2% Treasury 10 years % 4.15 4.23 3.78 -2% 10% Note: Senior Notes issued with face value of 100 US$/k. RATING Agency National Scale Global Scale Outlook Fitch Ratings AAA BBB- Positive Standard & Poor’s br.AAA BBB- Positive Moody’s Aaa Baa3 Positive 3Q25 EARNINGS RELEASE Page 32 of 43

UPCOMING EVENTS Earnings Conference Call (3Q25) Date: November 7, 2025 (Friday) Portuguese (simultaneous translation) English 10h00 (Brasília) 10:00 a.m. (Brasília) 08h00 (New York) 08:00 a.m. (New York) 13h00 (London) 01:00 p.m. (London) The conference call will be held in English and feature a presentation, with simultaneous webcast. The access links will be available on the Company’s Investor Relations website (https://ir.suzano.com.br). If you are unable to participate, the webcast link will be available for future consultation on the Investor Relations website of Suzano. IR CONTACTS Marcos Assumpção Camila Nogueira Roberto Costa Mariana Spinola André Azambuja Victor Valladares Gabriela Bonassi Tel.: +55 (11) 3503-9330 ri@suzano.com.br www.suzano.com.br/ri 3Q25 EARNINGS RELEASE Page 33 of 43

APPENDICES APPENDIX 1 – Operating Data Revenue Breakdown (R$ '000) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y 9M25 9M24 Δ Y-o-Y Exports 9,860,185 11,021,851 -11% 9,715,968 1% 30,286,345 26,306,788 15% Pulp 8,618,256 9,810,475 -12% 9,143,023 -6% 26,582,858 24,687,930 8% Paper 1,241,929 1,211,376 3% 572,945 117% 3,703,487 1,618,858 129% Domestic Market 2,292,960 2,274,044 1% 2,557,578 -10% 6,715,616 6,919,496 -3% Pulp 431,737 477,487 -10% 659,962 -35% 1,366,640 1,709,910 -20% Paper 1,861,223 1,796,557 4% 1,897,616 -2% 5,348,976 5,209,586 3% Total Net Revenue 12,153,145 13,295,895 -9% 12,273,546 -1% 37,001,961 33,226,284 11% Pulp 9,049,993 10,287,962 -12% 9,802,985 -8% 27,949,498 26,397,840 6% Paper 3,103,152 3,007,933 3% 2,470,561 26% 9,052,463 6,828,444 33% Sales volume (‘000) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y 9M25 9M24 Δ Y-o-Y Exports 3,204,767 3,295,197 -3% 2,556,854 25% 9,175,141 7,348,816 25% Pulp 3,017,102 3,118,674 -3% 2,459,208 23% 8,642,064 7,053,758 23% Paper 187,665 176,523 6% 97,646 92% 533,077 295,058 81% Paperboard 88,598 83,027 7% 9,120 871% 268,298 26,298 920% Printing & Writing 97,579 92,687 5% 86,053 13% 261,894 264,691 -1% Other paper¹ 1,488 809 84% 2,473 -40% 2,885 4,069 -29% Domestic Market 396,505 384,725 3% 438,268 -10% 1,146,708 1,237,283 -7% Pulp 148,214 150,059 -1% 176,069 -16% 442,529 526,980 -16% Paper 248,291 234,666 6% 262,199 -5% 704,179 710,303 -1% Paperboard 41,984 38,265 10% 42,579 -1% 113,344 110,889 2% Printing & Writing 143,168 133,520 7% 155,896 -8% 403,463 414,044 -3% Other paper¹ 63,139 62,881 0% 63,724 -1% 187,372 185,370 1% Total Sales Volume 3,601,272 3,679,922 -2% 2,995,122 20% 10,321,849 8,586,099 20% Pulp 3,165,316 3,268,733 -3% 2,635,277 20% 9,084,593 7,580,738 20% Paper 435,956 411,189 6% 359,845 21% 1,237,256 1,005,361 23% Paperboard 130,582 121,292 8% 51,699 153% 381,642 137,187 178% Printing & Writing 240,747 226,207 6% 241,949 0% 665,357 678,735 -2% Other paper¹ 64,627 63,690 1% 66,197 -2% 190,257 189,439 0% (1) Paper of other manufacturers sold by Suzano and tissue paper. Average net price (R$/t) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y 9M25 9M24 Δ Y-o-Y Exports 3,077 3,345 -8% 3,800 -19% 3,301 3,580 -8% Pulp 2,856 3,146 -9% 3,718 -23% 3,076 3,500 -12% Paper 6,618 6,862 -4% 5,868 13% 6,947 5,487 27% Domestic Market 5,783 5,911 -2% 5,836 -1% 5,856 5,592 5% Pulp 2,913 3,182 -8% 3,748 -22% 3,088 3,245 -5% Paper 7,496 7,656 -2% 7,237 4% 7,596 7,334 4% Total 3,375 3,613 -7% 4,098 -18% 3,585 3,870 -7% Pulp 2,859 3,147 -9% 3,720 -23% 3,077 3,482 -12% Paper 7,118 7,315 -3% 6,866 4% 7,317 6,792 8% 3Q25 EARNINGS RELEASE Page 34 of 43

Average net price (US$/t) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y 9M25 9M24 Δ Y-o-Y Exports 565 590 -4% 685 -18% 584 683 -14% Pulp 524 555 -6% 670 -22% 544 667 -18% Paper 1,215 1,211 0% 1,058 15% 1,229 1,046 18% Domestic Market 1,061 1,043 2% 1,052 1% 1,036 1,066 -3% Pulp 535 562 -5% 676 -21% 546 619 -12% Paper 1,376 1,351 2% 1,305 5% 1,344 1,398 -4% Total Net Revenue 619 638 -3% 739 -16% 634 738 -14% Pulp 525 555 -6% 671 -22% 544 664 -18% Paper 1,306 1,291 1% 1,238 6% 1,295 1,295 0% FX Rate R$/US$ 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y 9M25 9M24 Δ Y-o-Y Closing 5.32 5.46 -3% 5.45 -2% 5.32 5.45 -2% Average 5.45 5.67 -4% 5.55 -2% 5.65 5.24 8% 3Q25 EARNINGS RELEASE Page 35 of 43

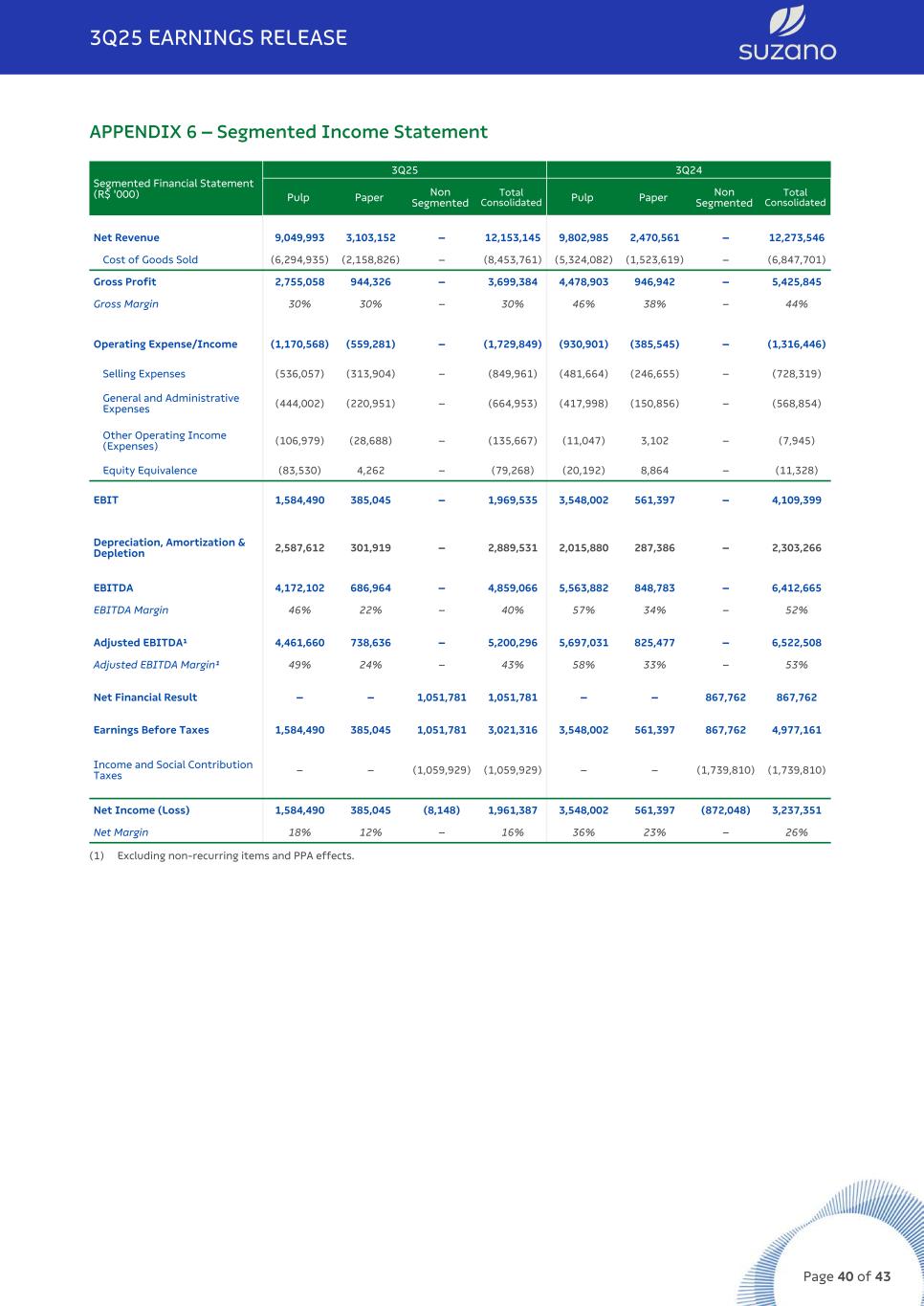

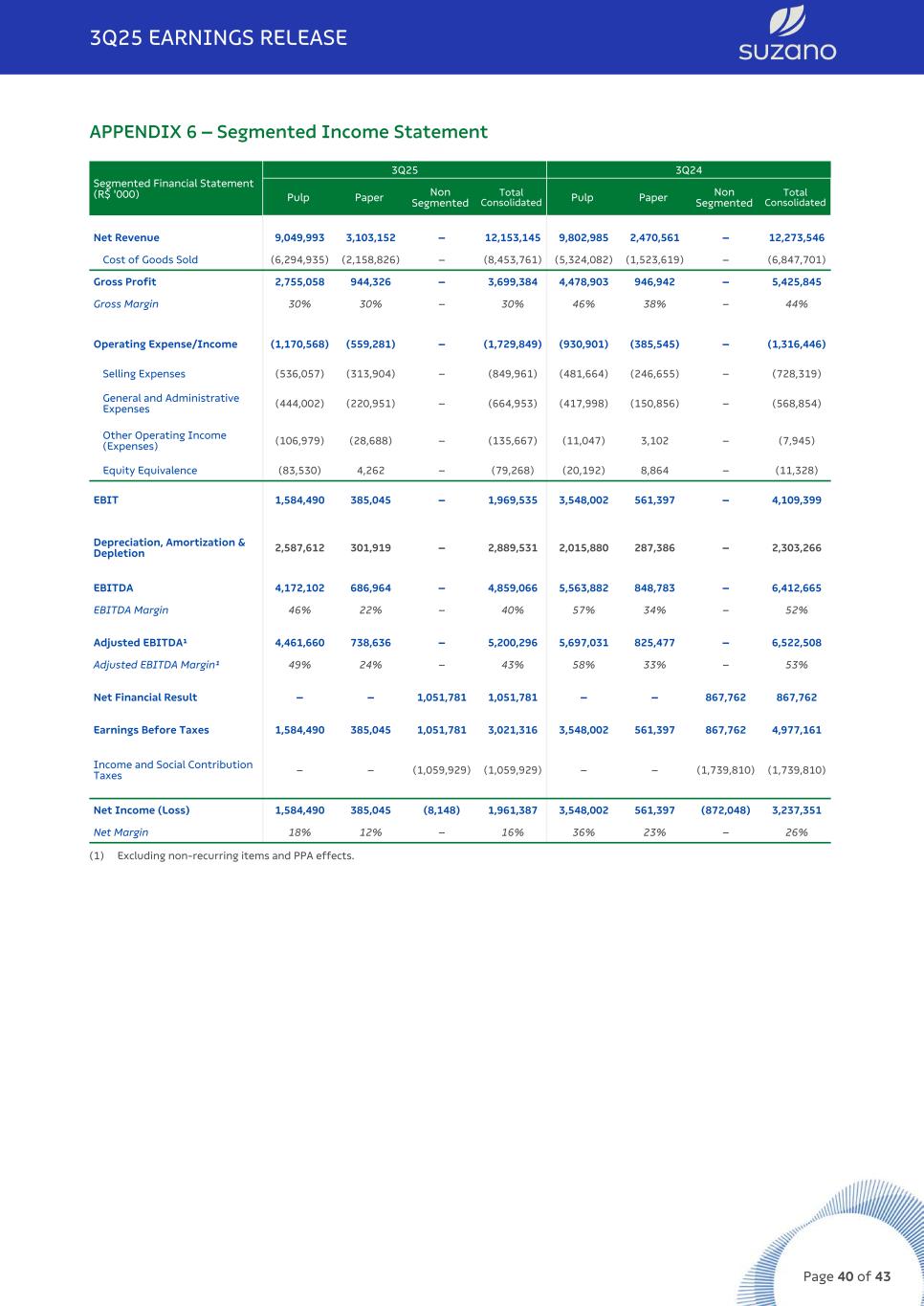

APPENDIX 2 – Consolidated Income Statement and Goodwill Amortization Income Statement (R$ ‘000) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y 9M25 9M24 Δ Y-o-Y Net Revenue 12,153,145 13,295,895 -9% 12,273,546 -1% 37,001,961 33,226,284 11% Cost of Goods Sold (8,453,761) (8,608,124) -2% (6,847,701) 23% (24,791,052) (18,640,810) 33% Gross Debt 3,699,384 4,687,771 -21% 5,425,845 -32% 12,210,909 14,585,474 -16% Gross Margin 30% 35% -5 p.p. 44% -14 p.p. 33% 44% -11 p.p. Operating Expense/Income (1,729,849) (1,812,627) -5% (1,316,446) 31% (5,107,195) (3,310,203) 54% Selling Expenses (849,961) (838,250) 1% (728,319) 17% (2,443,093) (2,081,788) 17% General and Administrative Expenses (664,953) (647,466) 3% (568,854) 17% (1,985,970) (1,629,599) 22% Other Operating Income (Expenses) (135,667) (154,906) -12% (7,945) — (409,782) 416,026 — Equity Equivalence (79,268) (172,005) -54 (11,328) — (268,350) (14,842) — EBIT 1,969,535 2,875,144 -31% 4,109,399 -52% 7,103,714 11,275,271 -37% Depreciation, Amortization & Depletion 2,889,531 2,839,264 2% 2,303,266 25% 8,226,217 6,414,046 28% EBITDA 4,859,066 5,714,408 -15% 6,412,665 -24% 15,329,931 17,689,317 -13% EBITDA Margin 40% 43% -3 p.p. 52% -12 p.p. 41% 53% -12 p.p. Adjusted EBITDA¹ 5,200,296 6,087,418 -15% 6,522,508 -20% 16,153,488 17,368,281 -7% Adjusted EBITDA Margin¹ 43% 46% -3 p.p. 53% -10 p.p. 44% 52% -9 p.p. Net Financial Result 1,051,781 4,424,965 -76% 867,762 21 13,172,959 (13,245,961) — Financial Expenses 462,095 383,259 21% 420,938 10% 1,284,207 1,302,043 -1% Financial Revenues (1,823,415) (1,606,439) 14% (1,567,007) 16% (5,069,939) (3,850,300) 32% Exchange Rate Variation 1,079,117 2,659,346 -59% 782,452 38 7,431,622 (3,742,426) — Net Proceeds Generated by Derivatives 1,333,984 2,988,799 -55% 1,231,379 8 9,527,069 (6,955,278) — Earnings Before Taxes 3,021,316 7,300,109 -59% 4,977,161 -39 20,276,673 (1,970,690) — Income and Social Contribution Taxes (1,059,929) (2,288,156) -54% (1,739,810) -39 (6,955,155) 1,662,556 — Net Income (Loss) 1,961,387 5,011,953 -61% 3,237,351 -39 13,321,518 (308,134) — Net Margin 16% 38% -22 p.p. 26% -10 p.p. 36% -1% 37 p.p. (1) Excluding non-recurring items and PPA effects. Goodwill amortization - PPA (R$ ‘000) 3Q25 2Q25 Δ Q-o-Q 3Q24 Δ Y-o-Y COGS (119,676) (117,810) 2% (115,596) 4% Selling Expenses (210,282) (206,445) 2% (207,374) 1 General and administrative expenses (1,215) (1,215) —% (7,974) -85% Other operational revenues (expenses) 7,785 12,192 -36% 11,044 -30% 3Q25 EARNINGS RELEASE Page 36 of 43

APPENDIX 3 – Consolidated Balance Sheet Assets (R$ ’000) 09/30/2025 06/30/2025 09/30/2024 Current Assets Cash and cash equivalents 15,838,866 12,283,589 5,818,031 Financial investments 7,734,686 8,087,850 11,311,861 Trade accounts receivable 6,129,481 7,287,028 7,268,889 Inventories 8,955,941 8,619,236 7,729,122 Recoverable taxes 962,181 997,666 952,314 Recoverable income taxes 525,979 450,232 351,085 Derivative financial instruments 1,363,240 1,100,397 1,232,059 Advance to suppliers 87,696 88,514 118,167 Other assets 977,159 994,602 996,174 Total Current Assets 42,575,229 39,909,114 35,777,702 Non-Current Assets Financial investments 317,098 416,100 465,639 Recoverable taxes 965,156 962,263 1,220,442 Deferred taxes 1,479,244 2,376,910 3,316,202 Derivative financial instruments 6,753,164 4,055,943 2,791,429 Advance to suppliers 2,682,250 2,604,168 2,502,248 Judicial deposits 576,227 595,786 485,353 Other assets 191,775 196,833 139,656 Biological assets 24,445,461 23,221,979 20,832,432 Investments 1,422,565 1,406,416 1,917,844 Property, plant and equipment 64,459,518 64,968,479 64,474,165 Right of use on lease agreements 5,341,832 5,286,063 5,150,077 Intangible 13,207,399 13,422,839 14,138,800 Total Non-Current Assets 121,841,689 119,513,779 117,434,287 Total Assets 164,416,918 159,422,893 153,211,989 Liabilities and Equity (R$ ’000) 09/30/2025 06/30/2025 09/30/2024 Current Liabilities Trade accounts payable 5,428,821 5,951,839 5,341,937 Loans, financing and debentures 3,790,079 2,881,840 7,721,426 Accounts payable for lease operations 846,668 838,023 794,647 Derivative financial instruments 1,188,743 1,044,493 565,392 Taxes payable 184,302 210,665 239,687 Income taxes payable 239,249 280,624 372,898 Payroll and charges 1,062,163 857,033 889,889 Liabilities for assets acquisitions and subsidiaries 18,588 21,011 17,596 Dividends and interest on own capital payable 1,992 1,997 3,106 Advance from customers 168,785 146,569 170,124 Other liabilities 391,191 382,862 374,219 Total Current Liabilities 13,320,581 12,616,956 16,490,921 Non-Current Liabilities Loans, financing and debentures 89,172,126 88,745,316 80,049,026 Accounts payable for lease operations 5,999,074 5,949,974 5,814,627 Derivative financial instruments 6,434,548 4,606,340 4,853,868 Liabilities for assets acquisitions and subsidiaries 78,213 91,524 90,152 Provision for judicial liabilities 2,818,263 2,845,990 2,961,539 Actuarial liabilities 742,593 738,016 850,987 Deferred taxes — — 12,596 Share-based compensation plans 368,732 331,590 307,798 Provision for loss on investments in subsidiaries 5,188 1,446 — Advance from customers 74,715 74,715 74,715 Other liabilities 144,460 149,721 104,002 Total Non-Current Liabilities 105,837,912 103,534,632 95,119,310 Total Liabilities 119,158,493 116,151,588 111,610,231 Shareholders’ Equity Share capital 19,235,546 19,235,546 19,235,546 Capital reserves 69,181 57,620 48,162 Treasury shares (1,511,146) (1,511,146) (1,339,197) Retained earnings reserves 12,978,898 12,978,898 22,472,411 Other reserves 944,961 945,642 1,322,487 Retained earnings 13,400,962 11,431,251 (268,657) Controlling shareholders’ 45,118,402 43,137,811 41,470,752 Non-controlling interest 140,023 133,494 131,006 Total Equity 45,258,425 43,271,305 41,601,758 Total Liabilities and Equity 164,416,918 159,422,893 153,211,989 3Q25 EARNINGS RELEASE Page 37 of 43