UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 6, 2023

ChoiceOne Financial Services, Inc.

(Exact Name of Registrant as

Specified in Charter)

| Michigan (State or Other Jurisdiction of Incorporation) |

000-19202 (Commission File Number) |

38-2659066 (IRS Employer Identification No.) |

|||

| 109 East Division Sparta, Michigan (Address of Principal Executive Offices) |

49345 (Zip Code) |

||||

Registrant's telephone number, including area code: (616) 887-7366

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock | COFS | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o ChoiceOne Financial Services, Inc. ("ChoiceOne") is furnishing as Exhibit 99.1 to this Form 8-K presentation materials that are to be used by ChoiceOne management in meetings with investors beginning September 6, 2023. The information in Item 7.01 and Item 9.01 of this report, including Exhibit 99.1, is furnished to, and not filed with, the Commission.

|

|

| Item 7.01 | Regulation FD Disclosure |

| Item 9.01 | Financial Statements and Exhibits |

| Exhibit No | Exhibit |

| 99.1 | ChoiceOne Financial Services, Inc. Investor Presentation. This Exhibit is furnished to, and not filed with, the Commission. |

***

| -2- |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: | September 6, 2023 | CHOICEONE FINANCIAL SERVICES, INC. (Registrant) |

|

| By: | /s/ Adom J. Greenland | ||

| Adom J. Greenland Its Chief Financial Officer and Treasurer |

|||

-3-

EXHIBIT 99.1

2 2 2 FORWARD - LOOKING STATEMENTS • This presentation contains forward - looking statements that are based on management’s beliefs, assumptions, current expectations, estimates and projections about the financial services industry, the economy, and ChoiceOne. Words such as “anticipates,” “believes,” “estima tes,” “expects,” “forecasts,” “intends,” “is likely,” “plans,” “predicts,” “projects,” “may,” “could,” “look forward,” “continue”, “future”, and variations of such words and similar expressions are intended to identify such forward - looking statements. • All statements with references to future time periods are forward - looking. These statements are not guarantees of future perfor mance and involve certain risks, uncertainties and assumptions (“risk factors”) that are difficult to predict with regard to timing, extent, li kel ihood, and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed, implied or forecasted in s uch forward - looking statements. Furthermore, ChoiceOne undertakes no obligation to update, amend, or clarify forward - looking statements, whether as a result of new information, future events, or otherwise. • Additional risk factors include, but are not limited to, the risk factors described in Item 1A in ChoiceOne’s Annual Report on Form 10 - K for the year ended December 31, 2022.

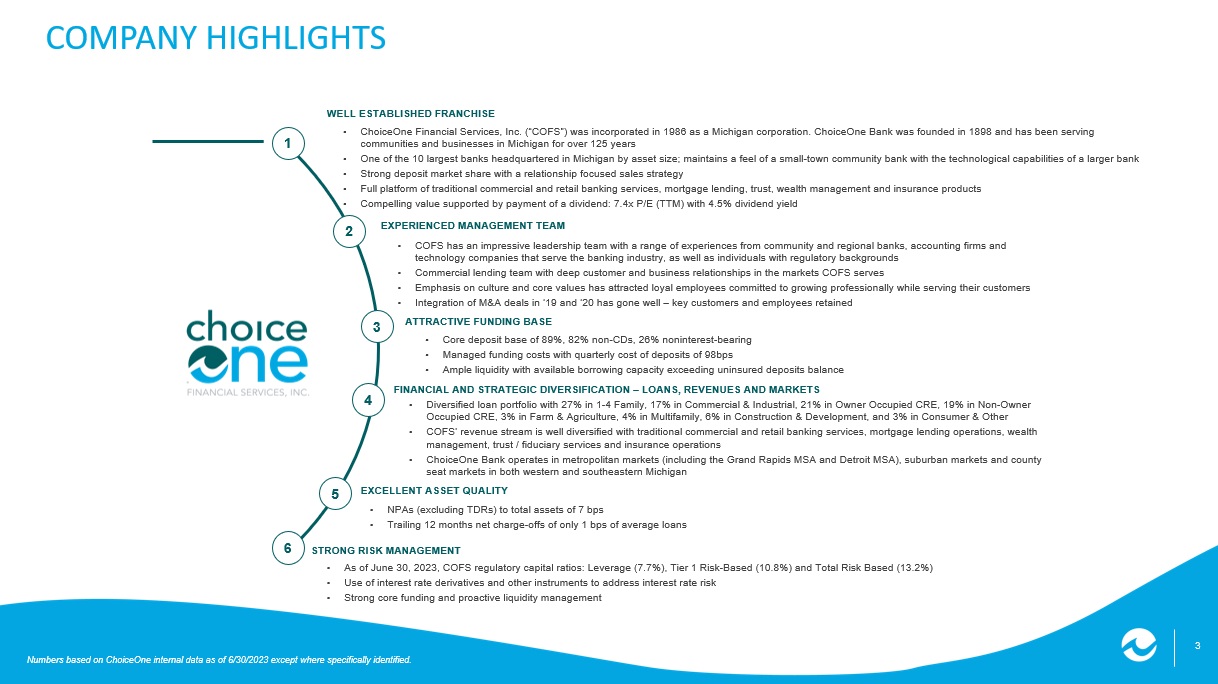

3 COMPANY HIGHLIGHTS Numbers based on ChoiceOne internal data as of 6/30/2023 except where specifically identified. • As of June 30, 2023, COFS regulatory capital ratios: Leverage (7.7%), Tier 1 Risk - Based (10.8%) and Total Risk Based (13.2%) • Use of interest rate derivatives and other instruments to address interest rate risk • Strong core funding and proactive liquidity management STRONG RISK MANAGEMENT 6 • ChoiceOne Financial Services, Inc. (“COFS”) was incorporated in 1986 as a Michigan corporation. ChoiceOne Bank was founded in 18 98 and has been serving communities and businesses in Michigan for over 125 years • One of the 10 largest banks headquartered in Michigan by asset size; maintains a feel of a small - town community bank with the te chnological capabilities of a larger bank • Strong deposit market share with a relationship focused sales strategy • Full platform of traditional commercial and retail banking services, mortgage lending, trust, wealth management and insurance pr oducts • Compelling value supported by payment of a dividend: 7.4x P/E (TTM) with 4.5% dividend yield WELL ESTABLISHED FRANCHISE • NPAs (excluding TDRs) to total assets of 7 bps • Trailing 12 months net charge - offs of only 1 bps of average loans EXCELLENT ASSET QUALITY • Core deposit base of 89%, 82% non - CDs, 26% noninterest - bearing • Managed funding costs with quarterly cost of deposits of 98bps • Ample liquidity with available borrowing capacity exceeding uninsured deposits balance ATTRACTIVE FUNDING BASE • Diversified loan portfolio with 27% in 1 - 4 Family, 17% in Commercial & Industrial, 21% in Owner Occupied CRE, 19% in Non - Owner Occupied CRE, 3% in Farm & Agriculture, 4% in Multifamily, 6% in Construction & Development, and 3% in Consumer & Other • COFS’ revenue stream is well diversified with traditional commercial and retail banking services, mortgage lending operations , w ealth management, trust / fiduciary services and insurance operations • ChoiceOne Bank operates in metropolitan markets (including the Grand Rapids MSA and Detroit MSA), suburban markets and county seat markets in both western and southeastern Michigan FINANCIAL AND STRATEGIC DIVERSIFICATION – LOANS, REVENUES AND MA RKETS 1 2 3 5 • COFS has an impressive leadership team with a range of experiences from community and regional banks, accounting firms and technology companies that serve the banking industry, as well as individuals with regulatory backgrounds • Commercial lending team with deep customer and business relationships in the markets COFS serves • Emphasis on culture and core values has attracted loyal employees committed to growing professionally while serving their cus tom ers • Integration of M&A deals in ‘19 and ‘20 has gone well – key customers and employees retained EXPERIENCED MANAGEMENT TEAM 4 4 Our vision is to be the best bank in Michigan.

Our mission is to provide superior service, quality advice, and show utmost respect to everyone we meet.

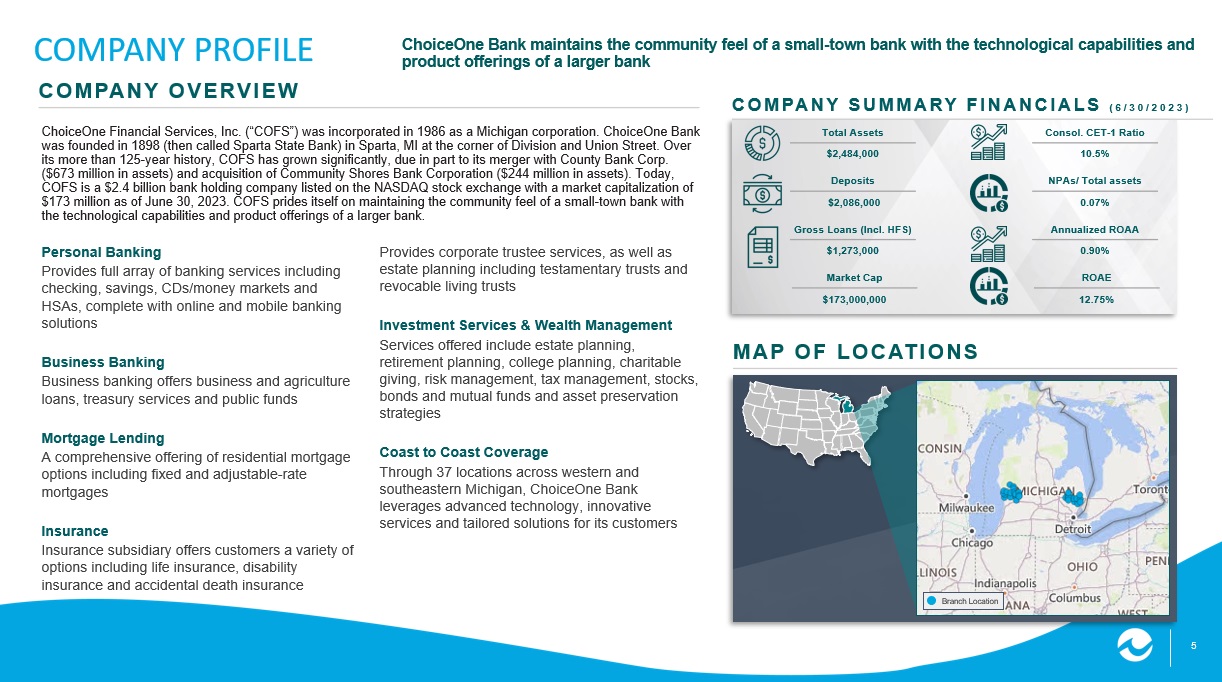

5 COMPANY PROFILE ChoiceOne Financial Services, Inc. (“COFS”) was incorporated in 1986 as a Michigan corporation. ChoiceOne Bank was founded in 1898 (then called Sparta State Bank) in Sparta, MI at the corner of Division and Union Street. Over its more than 125 - year history, COFS has grown significantly, due in part to its merger with County Bank Corp. ($673 million in assets) and acquisition of Community Shores Bank Corporation ($244 million in assets). Today, COFS is a $2.4 billion bank holding company listed on the NASDAQ stock exchange with a market capitalization of $173 million as of June 30, 2023. COFS prides itself on maintaining the community feel of a small - town bank with the technological capabilities and product offerings of a larger bank. ChoiceOne Bank maintains the community feel of a small - town bank with the technological capabilities and product offerings of a larger bank COMPANY OVERVIEW COMPANY SUMMARY FINANCIALS (6/30/2023) Total Assets $2,484,000 Deposits $2,086,000 Gross Loans (Incl. HFS) $1,273,000 Market Cap $173,000,000 Annualized ROAA 0.90% ROAE 12.75% Consol. CET - 1 Ratio 10.5% NPAs/ Total assets 0.07% MAP OF LOCATIONS Branch Location Personal Banking Provides full array of banking services including checking, savings, CDs/money markets and HSAs, complete with online and mobile banking solutions Business Banking Business banking offers business and agriculture loans, treasury services and public funds Mortgage Lending A comprehensive offering of residential mortgage options including fixed and adjustable - rate mortgages Insurance Insurance subsidiary offers customers a variety of options including life insurance, disability insurance and accidental death insurance Provides corporate trustee services, as well as estate planning including testamentary trusts and revocable living trusts Investment Services & Wealth Management Services offered include estate planning, retirement planning, college planning, charitable giving, risk management, tax management, stocks, bonds and mutual funds and asset preservation strategies Coast to Coast Coverage Through 37 locations across western and southeastern Michigan, ChoiceOne Bank leverages advanced technology, innovative services and tailored solutions for its customers 6 Award Nominee ( West MI Hispanic Chamber of Commerce – 2018 ) AWARDS & ACCOMPLISHMENTS With an abundance of accolades & awards, ChoiceOne Bank has been recognized as a top - tier community bank in Michigan and in the banking industry.

Named Best Small Bank by Newsweek 3 Years in a row. 2021 – 2022 - 2023 “ChoiceOne Bank has always taken the lead in presenting our customers with the financial technology they require … Our innovative strategies allow us to offer our customers technology - based services and solutions while still maintaining our personal approach to banking with our Customer Service Center and full - service branch network.” – Kelly J. Potes National Top 20 Most Innovative Community Bank ( Independent Banker – 2018 ) Financial Literacy Award ( Michigan Bankers Association – 2023, 2022 & 2020 ) Editor’s Choice Award for Community Commitment ( Cardrates.com – 2019 ) Best Small Business Solutions Nomination ( Finovate Awards – 2019 ) Global Innovation Awards Nominee ( BAI – 2018 ) Newsmaker Finalist of the Year ( Grand Rapids Business Journal – 2019 & 2018 ) True North Community Partner Award ( True North Community Services – 2019 & 2018 ) Silver Addy ( AAF – 2019 ) Startup Innovation Finalist with Plinqit ( Bank Director Best of FinXTech – 2019 & 2018 ) Mastercard Doing Well By Doing Good ( Segment Award – 2022 ) ABA Foundation Community Commitment Awards ( Economic Inclusion Honorable Mention – 2021 )

7 Mr. Michael J. Burke Jr. has served as President at ChoiceOne Bank since May 2020. Previously, he served as President, CEO, COO and Director at Lakestone Bank & Trust. Mr. Burke is also involved with the Lapeer Development Corporation, McLaren Lapeer Region Board of Trustees, Capac DDA, Lapeer Historic Courthouse Committee and Lapeer DDA, among others. He received his Bachelor of Arts degree in Finance from the University of Michigan - Flint. MICHAEL J. BURKE, JR. | PRESIDENT Mr. Adom Greenland is the Executive Vice President, Chief Financial Officer and Treasurer at COFS. His previous role was Chief Operating Officer overseeing technology and bank operations. Before joining COFS he worked as a Certified Public Accountant (CPA) at PwC for over 10 years, which included an international rotation in London, England. He holds both a Bachelor's degree and Master's degree in Accounting from Michigan State University. Mr. Kelly J. Potes, CFP, joined ChoiceOne Bank in 1984 and has held various management positions including Assistant Controller, Bank Investment Portfolio Manager, Head of ALCO, Head of Bank Retail Services, and Head of Investment Services. In 1998, he left ChoiceOne Bank to become the President and Owner of Kent - Ottawa Investment Advisors, an investment advisory firm. In 2001, he returned to ChoiceOne Bank as Senior Vice President of Retail Services, and General Manager of ChoiceOne Insurance Agencies, Inc. before being named Chief Executive Officer in 2016. ADOM J. GREENLAND | EVP & CFO KELLY J. POTES | CEO MANAGEMENT TEAM Mr. Bradley A. Henion has been Senior Vice President and Chief Lending Officer of ChoiceOne Bank since November 2015. His career also includes Senior Vice President positions with GreenStone Farm Credit Services in East Lansing, MI, and Bank of America (formerly LaSalle Bank) in Grand Rapids, MI. Mr. Henion holds a Master of Business Administration (MBA) in Finance from Baker College and has a Bachelor of Science in Accountancy from Ferris State University. BRADLEY A. HENION | EVP & CLO "With a vision to be the best bank in Michigan and a mission to provide superior service, quality advice and show our utmost respect to everyone we meet, our tech - savvy community bank is prepared to meet our customers’ financial needs, however they choose, and build solid personal relationships . ” - Kelly J .

Potes 8 Ms. Shelly M. Childers has served as Senior Vice President and Chief Information Officer at ChoiceOne Bank since 2019. Prior to that Ms. Childers was the Senior Vice President and Chief Information Officer at Lakestone Bank and Trust. Ms. Childers has over 25 years of experience leading both the operational and digital sides of banking technology. Her background also includes experience in leading bank technology through acquisitions, mergers, and software conversions. Ms. Childers holds a Bachelor of Business Administration and Finance from the University of Michigan. Mr. Jamula joined ChoiceOne Bank as Senior Vice President of Wealth Management in June of 2021. Mr. Jamula has over 28 years of banking experience, which includes leadership positions at TCF Bank, Chemical Bank and Fifth Third Bank covering Wealth Management and Private Banking. Prior to joining ChoiceOne Bank, Mr. Jamula was the Regional Director of Banking Services at TCF Bank. Mr. Jamula holds a Bachelor of Business Administration in Accounting from Grand Valley State University. Ms. Heather D. Brolick has been Chief Human Resources Officer of ChoiceOne Bank since October 2020 following its acquisition of Community Shores Bank Corporation. Ms. Brolick served as Director, President and Chief Executive Officer of Community Shores Bank Corporation and Community Shores Bank From 2006 until 2020. Ms. Brolick also currently serves as a Board member and Chairperson of the Board of Directors of Harbor Hospice and a Board member and Chairperson of the Board of Harbor Hospice Foundation, among others. SHELLY M. CHILDERS | SVP & CIO HEATHER D. BROLICK | SVP & CHRO MANAGEMENT TEAM ROB JAMULA | SVP WEALTH MANAGEMENT LEE A. BRAFORD | SVP & CCO Mr. Lee A. Braford has been a Senior Vice President and Chief Credit Officer of ChoiceOne Bank since January 2011. He was employed with the firm in various management capacities from August 1980 to 1997, as well. Mr. Braford was previously employed by Bank West and Cornerstone University. He also serves on the board of the Sparta Community Foundation, previously as its Chairman.

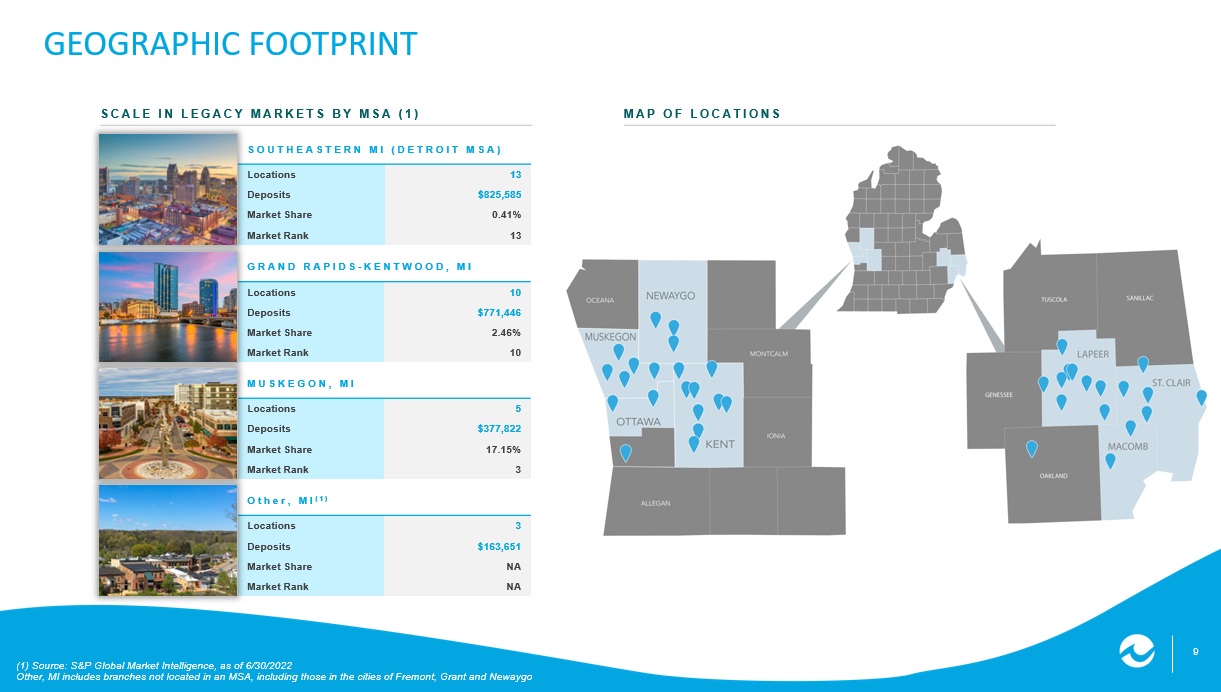

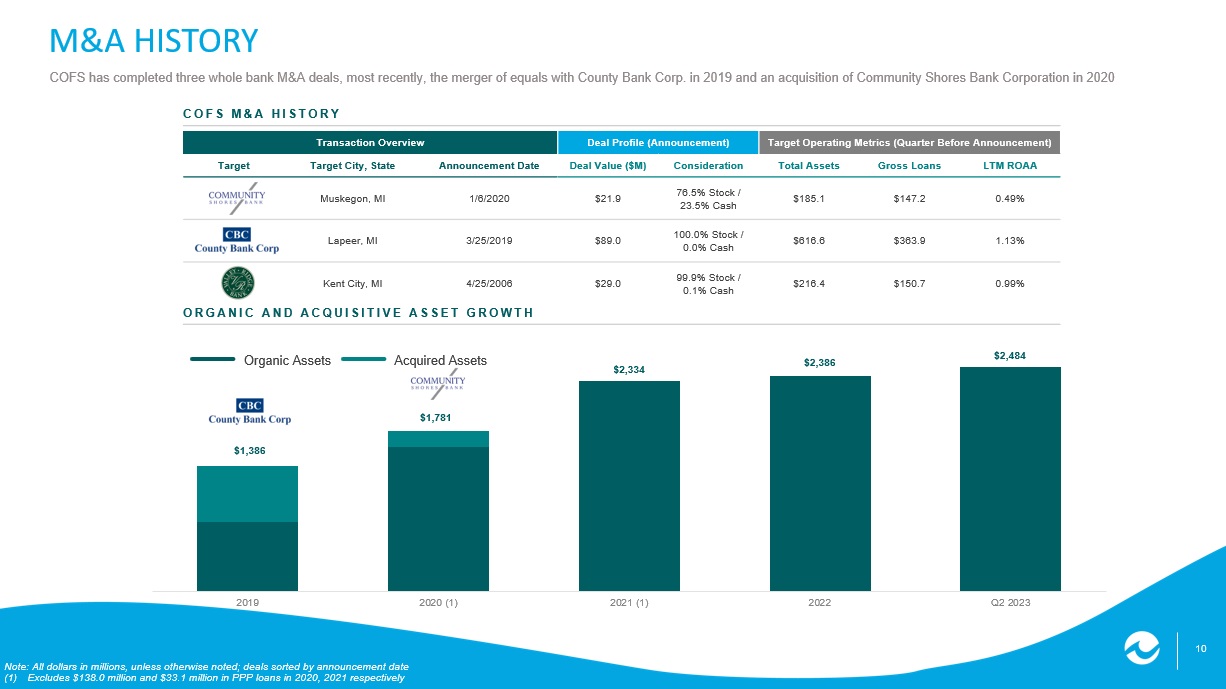

9 GRAND RAPIDS - KENTWOOD, MI Locations 10 Deposits $771,446 Market Share 2.46% Market Rank 10 SOUTHEASTERN MI (DETROIT MSA) Locations 13 Deposits $825,585 Market Share 0.41% Market Rank 13 MUSKEGON, MI Locations 5 Deposits $377,822 Market Share 17.15% Market Rank 3 Other, MI (1) Locations 3 Deposits $163,651 Market Share NA Market Rank NA GEOGRAPHIC FOOTPRINT MAP OF LOCATIONS SCALE IN LEGACY MARKETS BY MSA (1) (1) Source: S&P Global Market Intelligence, as of 6/30/2022 Other, MI includes branches not located in an MSA, including those in the cities of Fremont, Grant and Newaygo 10 Transaction Overview Deal Profile (Announcement) Target Operating Metrics (Quarter Before Announcement) Target Target City, State Announcement Date Deal Value ($M) Consideration Total Assets Gross Loans LTM ROAA Muskegon, MI 1/6/2020 $21.9 76.5% Stock / 23.5% Cash $185.1 $147.2 0.49% Lapeer, MI 3/25/2019 $89.0 100.0% Stock / 0.0% Cash $616.6 $363.9 1.13% Kent City, MI 4/25/2006 $29.0 99.9% Stock / 0.1% Cash $216.4 $150.7 0.99% Note: All dollars in millions, unless otherwise noted; deals sorted by announcement date (1) Excludes $138.0 million and $33.1 million in PPP loans in 2020, 2021 respectively M&A HISTORY COFS has completed three whole bank M&A deals, most recently, the merger of equals with County Bank Corp.

in 2019 and an acqu isi tion of Community Shores Bank Corporation in 2020 COFS M&A HISTORY ORGANIC AND ACQUISITIVE ASSET GROWTH Organic Assets Acquired Assets 1) $1,386 $1,781 $2,334 $2,386 2019 2020 (1) 2021 (1) 2022 Q2 2023 $2,484 12 $856,191 $1,117,798 $1,068,831 $1,194,616 $1,273,152 $ - $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 2019 2020 2021 2022 Q2 2023 Note: All dollars in thousands (1) Includes $138.0 million, $33.1 million and $0 million in PPP loans in 2020, 2021 and 2022, respectively.

FINANCIAL SUMMARY

All PPP loans are assumed to be deposits for "Total Deposits" graphic. (2) Core loans - exclude Paycheck Protection Program (“PPP”) loans, held for sale loans, and loans to other financial institutions.

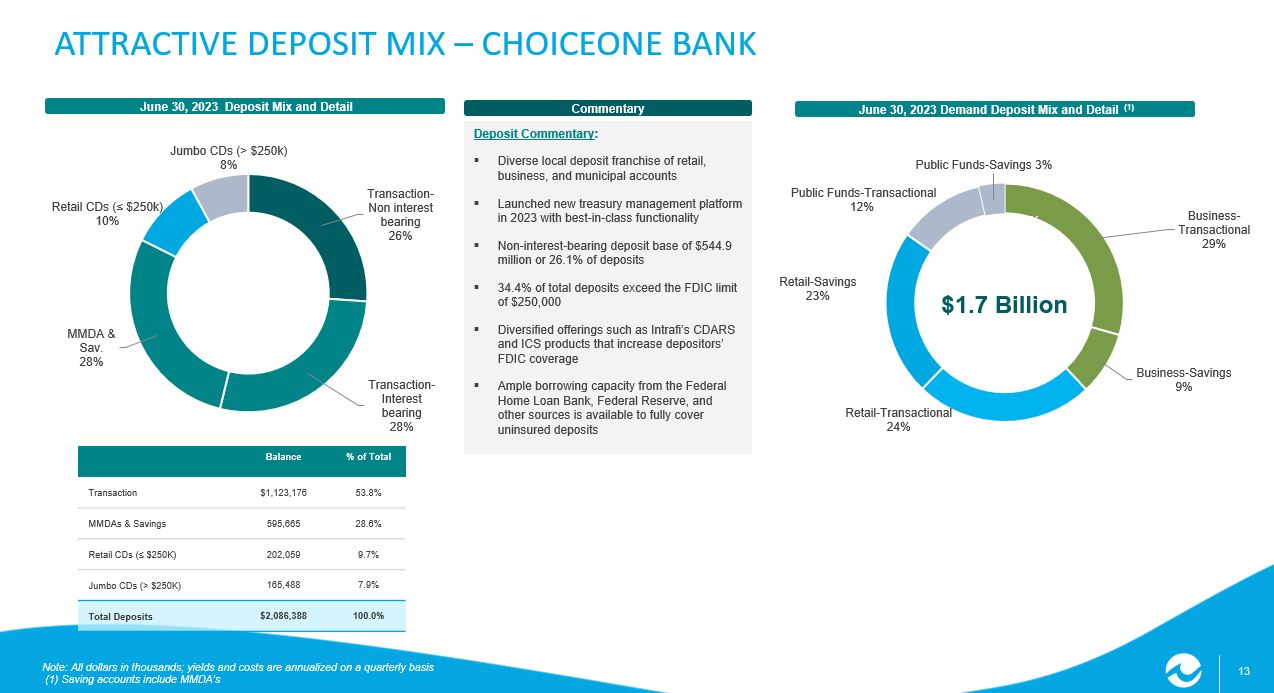

Loans held for sale were $10.6 million and $8.9 million in Q2 2022 and Q2 2023, respectively HISTORIC BALANCE SHEET GROWTH – COFS Outline of COFS’ notable balance sheet growth following two M&A transactions in 2019 and 2020, both including & excluding the im pact of PPP loans Total Equity Total Deposits Gross Loans (Including Held For Sale) (1) Total Assets PPP 13.5% Core loan (2) growth for the trailing 12 months $1,386,128 $1,919,342 $2,366,682 $2,385,915 $2,483,726 $ - $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 2019 2020 2021 2022 Q2 2023 $1,154,602 $1,674,578 $2,052,294 $2,118,003 $2,086,388 $ - $500,000 $1,000,000 $1,500,000 $2,000,000 2019 2020 2021 2022 Q2 2023 $192,139 $227,268 $221,669 $168,874 $179,240 $ - $50,000 $100,000 $150,000 $200,000 $250,000 2019 2020 2021 2022 Q2 2023 13 Business - Transactional 29% Business - Savings 9% Retail - Transactional 24% Retail - Savings 23% Public Funds - Transactional 12% Public Funds - Savings 3% Deposit Commentary : ▪ Diverse local deposit franchise of retail, business, and municipal accounts ▪ Launched new treasury management platform in 2023 with best - in - class functionality ▪ Non - interest - bearing deposit base of $544.9 million or 26.1% of deposits ▪ 34.4% of total deposits exceed the FDIC limit of $250,000 ▪ Diversified offerings such as Intrafi’s CDARS and ICS products that increase depositors’ FDIC coverage ▪ Ample borrowing capacity from the Federal Home Loan Bank, Federal Reserve, and other sources is available to fully cover uninsured deposits June 30, 2023 Deposit Mix and Detail Note: All dollars in thousands; yields and costs are annualized on a quarterly basis (1) Saving accounts include MMDA’s ATTRACTIVE DEPOSIT MIX – CHOICEONE BANK Balance % of Total Transaction $1,123,176 53.8% MMDAs & Savings 595,665 28.6% Retail CDs (≤ $250K) 202,059 9.7% Jumbo CDs (> $250K) 165,488 7.9% Total Deposits $2,086,388 100.0% Transaction - Non interest bearing 26% Transaction - Interest bearing 28% MMDA & Sav.

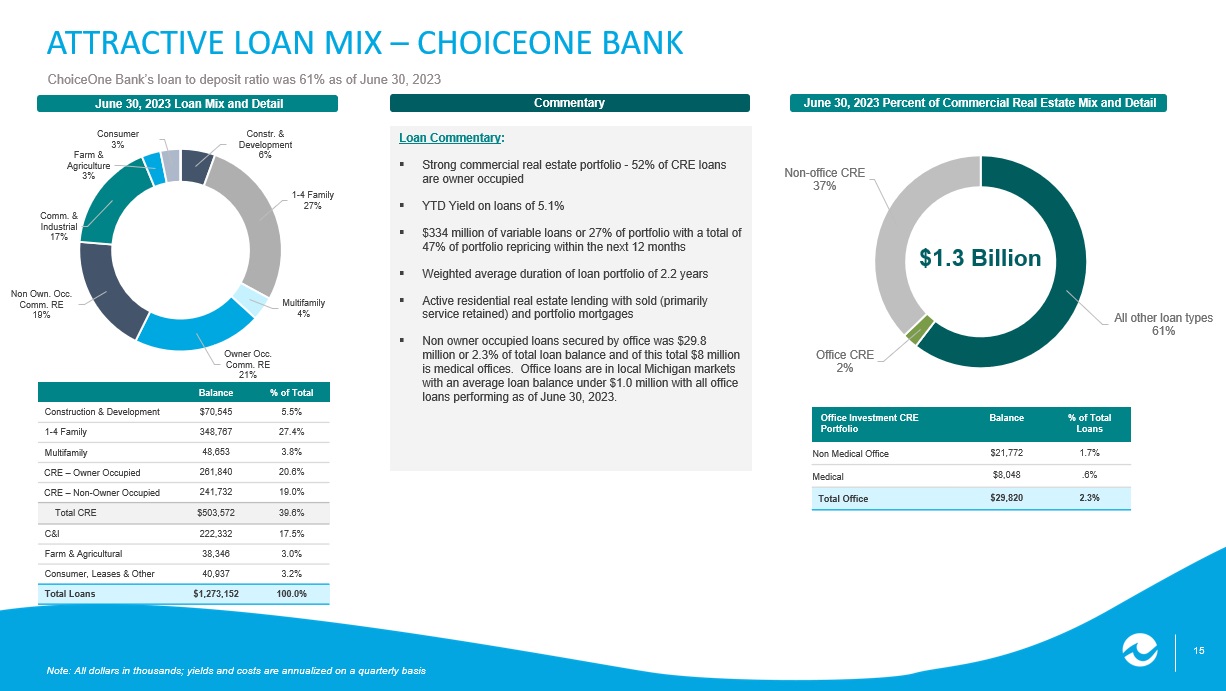

28% Retail CDs (≤ $250k) 10% Jumbo CDs (> $250k) 8% Commentary 27% 26% 72% 73% 74% June 30, 2023 Demand Deposit Mix and Detail (1) $1.7 Billion 14 0.27% 0.91% 0.25% 2.50% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% Q3 2015 Q2 2019 Last Cycle Q3 2015 - Q2 2019 Cost of IB Deposits Fed Funds $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 Q4 2022 Q1 2023 Q2 2023 NIB Deposits IB Deposits Deposit Commentary : ▪ Deposits, excluding brokered deposits, decreased $33.1 million or 1.6% compared to March 31, 2023. ▪ Deposit outflows have stabilized in the second quarter of 2023 with monthly growth of deposits in May and June of 2023. ▪ In the last 12 months ended June 30, 2023, approximately $39 million or 38% of the trailing 12 - month deposit runoff has been transferred from bank deposits to the ChoiceOne Wealth department and is off balance sheet. ▪ Non - interest - bearing and transactional account balances drive lower cost of deposits. ▪ Management team has demonstrated historical success of controlling deposit costs in previous interest rate cycle June 30, 2023 Deposit Mix and Detail ATTRACTIVE DEPOSIT MIX – CHOICEONE BANK (CONTINUED) Commentary 27% 26% 72% 73% 74% Historic cost of interest - bearing deposits vs Fed Funds Average Rate Paid on IB Deposits .65% .65% 1.33% $2,118,003 $2,105,901 $2,086,388 26% 28% 26% 72% 74% 74% 28% Beta 0.20% 1.33% 0.25% 5.25% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% Q4 2021 Q2 2023 Current Cycle to date Q4 2021 – Q2 2023 Cost of IB Deposits Fed Funds 23% Beta 15 All other loan types 61% Office CRE 2% Non - office CRE 37% Loan Commentary : ▪ Strong commercial real estate portfolio - 52% of CRE loans are owner occupied ▪ YTD Yield on loans of 5.1% ▪ $334 million of variable loans or 27% of portfolio with a total of 47% of portfolio repricing within the next 12 months ▪ Weighted average duration of loan portfolio of 2.2 years ▪ Active residential real estate lending with sold (primarily service retained) and portfolio mortgages ▪ Non owner occupied loans secured by office was $29.8 million or 2.3% of total loan balance and of this total $8 million is medical offices.

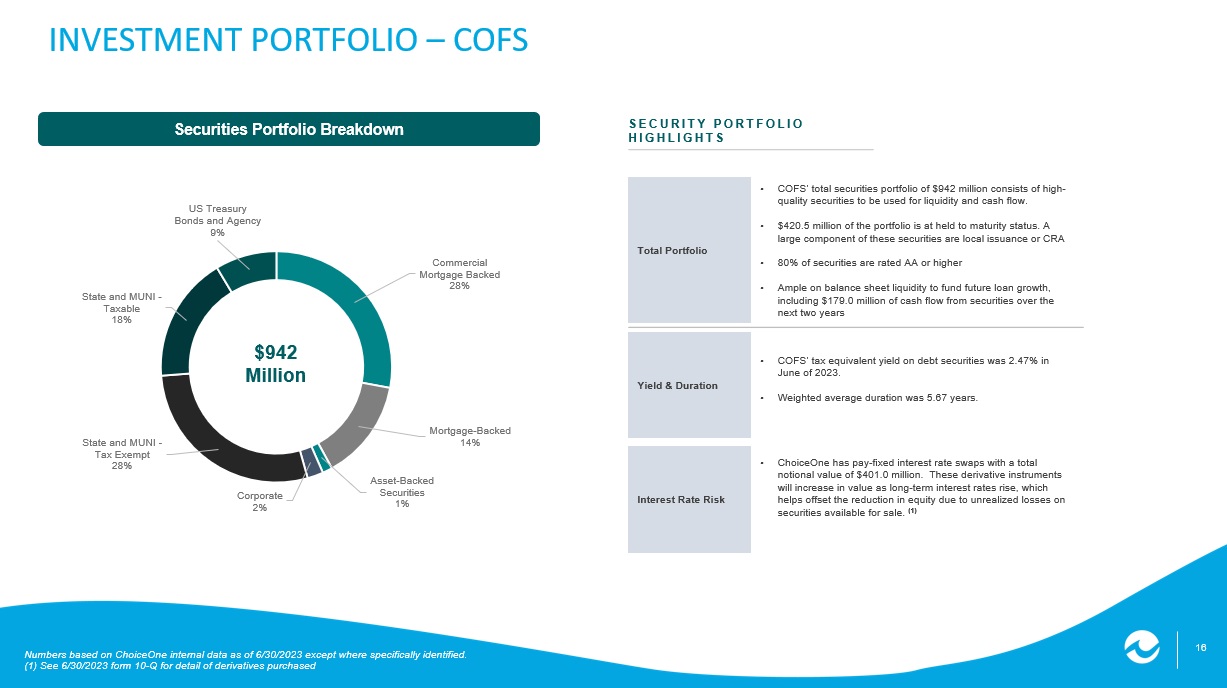

Office loans are in local Michigan markets with an average loan balance under $1.0 million with all office loans performing as of June 30, 2023. Balance % of Total Construction & Development $70,545 5.5% 1 - 4 Family 348,767 27.4% Multifamily 48,653 3.8% CRE – Owner Occupied 261,840 20.6% CRE – Non - Owner Occupied 241,732 19.0% Total CRE $503,572 39.6% C&I 222,332 17.5% Farm & Agricultural 38,346 3.0% Consumer, Leases & Other 40,937 3.2% Total Loans $1,273,152 100.0% June 30, 2023 Loan Mix and Detail June 30, 2023 Percent of Commercial Real Estate Mix and Detail Note: All dollars in thousands; yields and costs are annualized on a quarterly basis ATTRACTIVE LOAN MIX – CHOICEONE BANK ChoiceOne Bank’s loan to deposit ratio was 61% as of June 30, 2023 Commentary Constr. & Development 6% 1 - 4 Family 27% Multifamily 4% Owner Occ. Comm. RE 21% Non Own. Occ. Comm. RE 19% Comm. & Industrial 17% Farm & Agriculture 3% Consumer 3% $1.3 Billion Office Investment CRE Portfolio Balance % of Total Loans Non Medical Office $21,772 1.7% Medical $8,048 .6% Total Office $29,820 2.3% 16 Commercial Mortgage Backed 28% Mortgage - Backed 14% Asset - Backed Securities 1% Corporate 2% State and MUNI - Tax Exempt 28% State and MUNI - Taxable 18% US Treasury Bonds and Agency 9% Numbers based on ChoiceOne internal data as of 6/30/2023 except where specifically identified.

(1) See 6/30/2023 form 10 - Q for detail of derivatives purchased INVESTMENT PORTFOLIO – COFS Securities Portfolio Breakdown SECURITY PORTFOLIO HIGHLIGHTS $942 Million Total Portfolio • COFS’ total securities portfolio of $942 million consists of high - quality securities to be used for liquidity and cash flow. • $420.5 million of the portfolio is at held to maturity status. A large component of these securities are local issuance or CRA • 80% of securities are rated AA or higher • Ample on balance sheet liquidity to fund future loan growth, including $179.0 million of cash flow from securities over the next two years Yield & Duration • COFS’ tax equivalent yield on debt securities was 2.47% in June of 2023. • Weighted average duration was 5.67 years. Interest Rate Risk • ChoiceOne has pay - fixed interest rate swaps with a total notional value of $401.0 million. These derivative instruments will increase in value as long - term interest rates rise, which helps offset the reduction in equity due to unrealized losses on securities available for sale. (1)

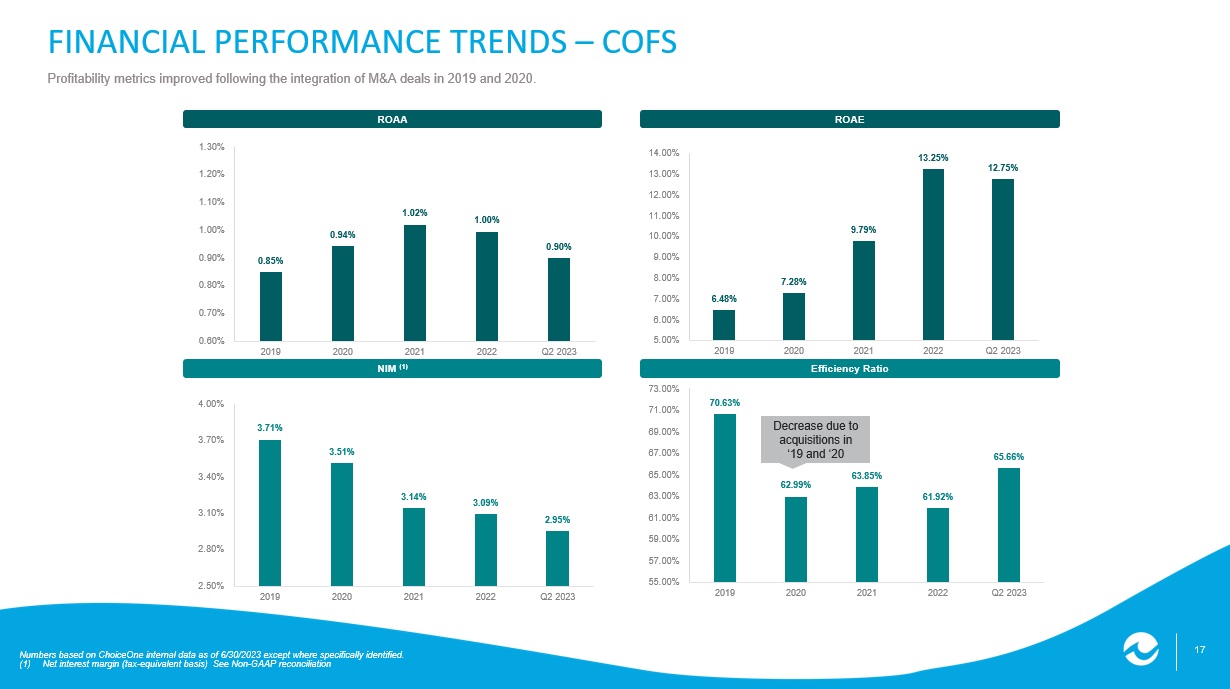

17 70.63% 62.99% 63.85% 61.92% 65.66% 55.00% 57.00% 59.00% 61.00% 63.00% 65.00% 67.00% 69.00% 71.00% 73.00% 2019 2020 2021 2022 Q2 2023 FINANCIAL PERFORMANCE TRENDS – COFS Profitability metrics improved following the integration of M&A deals in 2019 and 2020. Efficiency Ratio NIM (1) ROAE ROAA Numbers based on ChoiceOne internal data as of 6/30/2023 except where specifically identified.

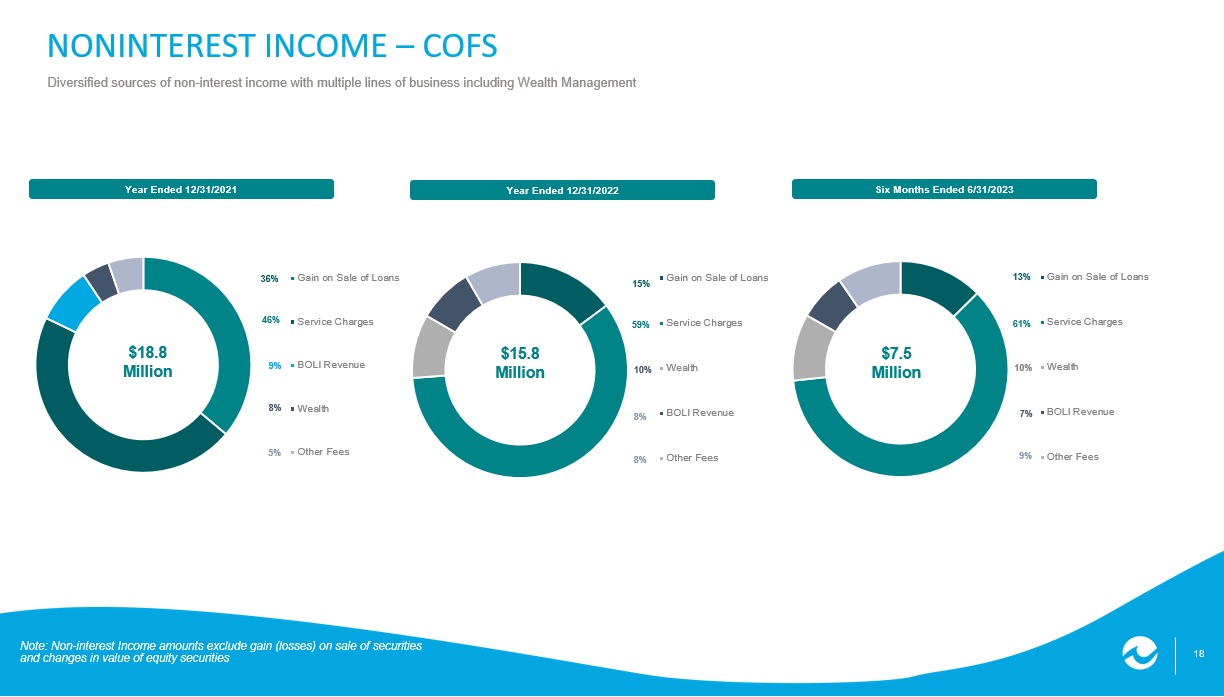

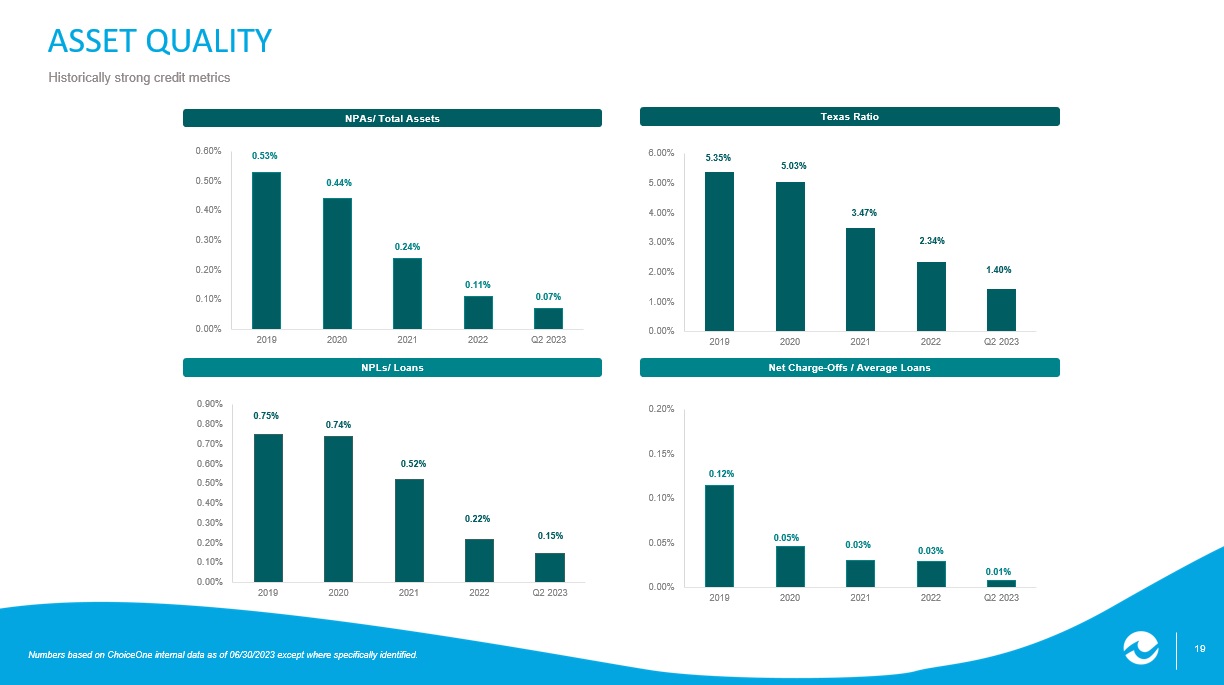

(1) Net interest margin (tax - equivalent basis) See Non - GAAP reconciliation Decrease due to acquisitions in ‘19 and ‘20 0.85% 0.94% 1.02% 1.00% 0.90% 0.60% 0.70% 0.80% 0.90% 1.00% 1.10% 1.20% 1.30% 2019 2020 2021 2022 Q2 2023 3.71% 3.51% 3.14% 3.09% 2.95% 2.50% 2.80% 3.10% 3.40% 3.70% 4.00% 2019 2020 2021 2022 Q2 2023 6.48% 7.28% 9.79% 13.25% 12.75% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% 2019 2020 2021 2022 Q2 2023 18 Gain on Sale of Loans Service Charges Wealth BOLI Revenue Other Fees 10% Gain on Sale of Loans Service Charges BOLI Revenue Wealth Other Fees Gain on Sale of Loans Service Charges Wealth BOLI Revenue Other Fees 36% 8% 9% 5% 46% of equ ity sec uriti es NONINTEREST INCOME – COFS Diversified sources of non - interest income with multiple lines of business including Wealth Management Year Ended 12/31/2022 $18.8 Million Year Ended 12/31/2021 Six Months Ended 6/31/2023 $15.8 Million 15% 10% 8% 8% 59% 13% 7% 9% 61% $7.5 Million Note: Non - interest Income amounts exclude gain (losses) on sale of securities and changes in value of equity securities 19 ASSET QUALITY Historically strong credit metrics Net Charge - Offs / Average Loans NPLs/ Loans Texas Ratio NPAs/ Total Assets Numbers based on ChoiceOne internal data as of 06/30/2023 except where specifically identified.

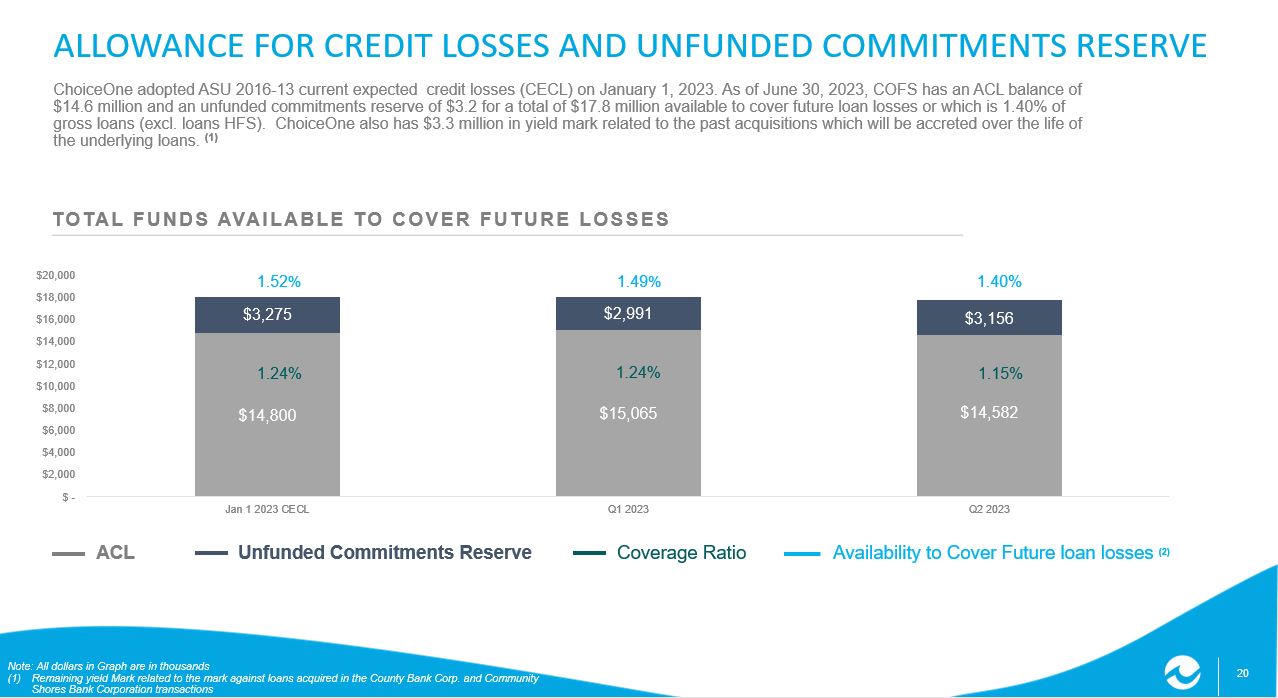

0.53% 0.44% 0.24% 0.11% 0.07% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 2019 2020 2021 2022 Q2 2023 0.12% 0.05% 0.03% 0.03% 0.01% 0.00% 0.05% 0.10% 0.15% 0.20% 2019 2020 2021 2022 Q2 2023 0.75% 0.74% 0.52% 0.22% 0.15% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% 2019 2020 2021 2022 Q2 2023 5.35% 5.03% 3.47% 2.34% 1.40% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2019 2020 2021 2022 Q2 2023 20 $14,800 $15,065 $14,582 $3,275 $2,991 $3,156 $ - $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 Jan 1 2023 CECL Q1 2023 Q2 2023 Note: All dollars in Graph are in thousands (1) Remaining yield Mark related to the mark against loans acquired in the County Bank Corp.

and Community Shores Bank Corporation transactions (2) Availability to Cover Future loan losses includes the Allowance for Credit Losses, and the unfunded commitments reserve to gross loans (excl. loans HFS). ALLOWANCE FOR CREDIT LOSSES AND UNFUNDED COMMITMENTS RESERVE ChoiceOne adopted ASU 2016 - 13 current expected credit losses (CECL) on January 1, 2023. As of June 30, 2023, COFS has an ACL ba lance of $14.6 million and an unfunded commitments reserve of $3.2 for a total of $17.8 million available to cover future loan losses or which is 1.40% of gross loans (excl. loans HFS). ChoiceOne also has $3.3 million in yield mark related to the past acquisitions which will be acc reted over the life of the underlying loans. (1) TOTAL FUNDS AVAILABLE TO COVER FUTURE LOSSES ACL Unfunded Commitments Reserve Coverage Ratio Availability to Cover Future loan losses (2) 1.52 % 1.49 % 1.40% 1.24% 1.24% 1.15% 21 STRONG RISK MANAGEMENT Interest Rate Risk Management • ChoiceOne uses interest rate swaps as part of our interest rate risk management strategy.

ChoiceOne has pay - fixed interest rate swaps with a total notional value of $401.0 million, a fair value of $11.2 million and a weighted average coupon of approximately 3.07%. These derivative instruments will increase in value as long - term interest rates rise, which helps offset the reduction in equity due to unrealized losses on securities available for sale. • $200 million of the total notional value is a forward starting pay - fix, receive floating swap starting in April 2024 with an eight - year term set to expire in 2032. The forward starting pay fixed, receive floating swap agreements will pay a fixed coupon rate of 2.75% while receiving the SOFR Rate starting in April 2024. • In March 2023, ChoiceOne terminated all Receive - Fix, Pay Floating Swap Agreements for a cash payment of $4.2 million. The loss is being amortized with an expense of approximately $300 thousand monthly through April 2024, which was the remaining period of the agreements. • Diversified income streams with growth in our Wealth Management department. In the last $12 months, over $39 million of deposits were transferred off balance sheet to ChoiceOne Wealth Management. • Focus on transactional non - interest - bearing deposits and service fees with newly launched Treasury platform PROACTIVE STEPS TO MITIGATE INTEREST RATE RISK AND INCREASE FUNC TIONAL LIQUIDITY . Numbers based on ChoiceOne internal data as of 06/30/2023 except where specifically identified. Liquidity Risk Management • Increased cash position and used a variety of funding sources including brokered CD’s to add liquidity and preserve borrowing capacity • Borrowed $160 million from the Federal Reserve’s Bank Term Funding Program (BTFP) at a rate of 4.71% fixed for 1 year. This borrowing can be prepaid without penalty. • Pledging of eligible assets to FHLB, Fed Discount window, and BTFP to enhance operational liquidity and ease of access to reliable sources of funding.

This secured a total of $791.7 in unused available borrowings, exceeding uninsured deposits • Proactive discussions with large deposit customers offering extended FDIC insurance through programs such as Intrafi C OF S T R ADES ON TH E NAS D A Q ® Market Makers in ChoiceOne Stock D. A. Davidson & Co. Nick Bi cking 800.394.9230 Raymond James & Associates Anthony LanFranca 312.655.2961 Stifel, Nicolaus & Company, Inc. Paul Drueke 616.224.1553 Stock Registrar & Transfer Agent Continental Stock Transfer & Trust Company 1 State Street Plaza, 30th Floor New York, NY 10004 - 1561 212.509.4000 ChoiceOne trades on the NASDAQ S t ock E x change under its s ymbol, “COFS.”

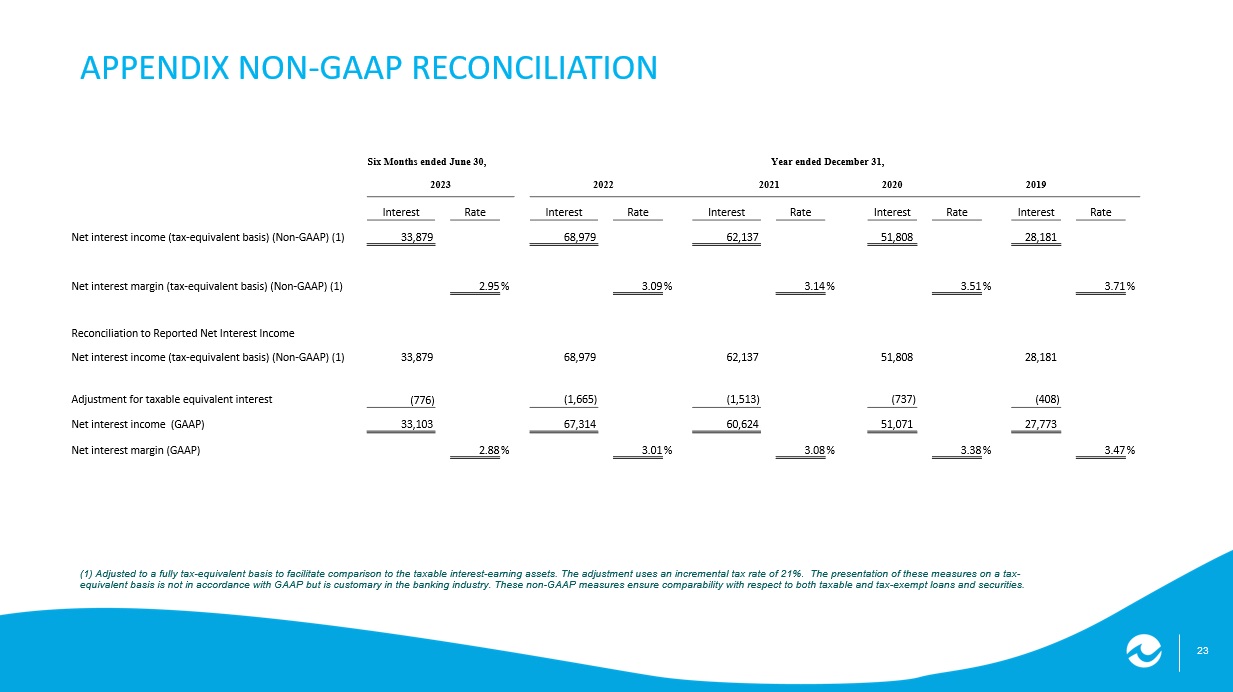

23 (1) Adjusted to a fully tax - equivalent basis to facilitate comparison to the taxable interest - earning assets. The adjustment use s an incremental tax rate of 21%. The presentation of these measures on a tax - equivalent basis is not in accordance with GAAP but is customary in the banking industry. These non - GAAP measures ensure compara bility with respect to both taxable and tax - exempt loans and securities. APPENDIX NON - GAAP RECONCILIATION Six Months ended June 30, Year ended December 31, 2023 2022 2021 2020 2019 Interest Rate Interest Rate Interest Rate Interest Rate Interest Rate Net interest income (tax - equivalent basis) (Non - GAAP) (1) 33,879 68,979 62,137 51,808 28,181 Net interest margin (tax - equivalent basis) (Non - GAAP) (1) 2.95 % 3.09 % 3.14 % 3.51 % 3.71 % Reconciliation to Reported Net Interest Income Net interest income (tax - equivalent basis) (Non - GAAP) (1) 33,879 68,979 62,137 51,808 28,181 Adjustment for taxable equivalent interest (776) (1,665) (1,513) (737) (408) Net interest income (GAAP) 33,103 67,314 60,624 51,071 27,773 Net interest margin (GAAP) 2.88 % 3.01 % 3.08 % 3.38 % 3.47 %