Document

Earnings Release and

Supplemental Operating and Financial Data for the

Quarter and Year Ended December 31, 2023

Table of Contents

|

|

|

|

|

|

| Section |

|

|

|

| Earnings Release |

|

|

|

| Portfolio Data: |

|

|

|

| Summary Operating Metrics |

|

| Geographic Diversification |

|

| Property Summary - Occupancy at End of Each Period Shown |

|

| Portfolio Occupancy at the End of Each Period |

|

| Center Sales Per Square Foot Ranking |

|

| Top 25 Tenants Based on Percentage of Total Annualized Base Rent |

|

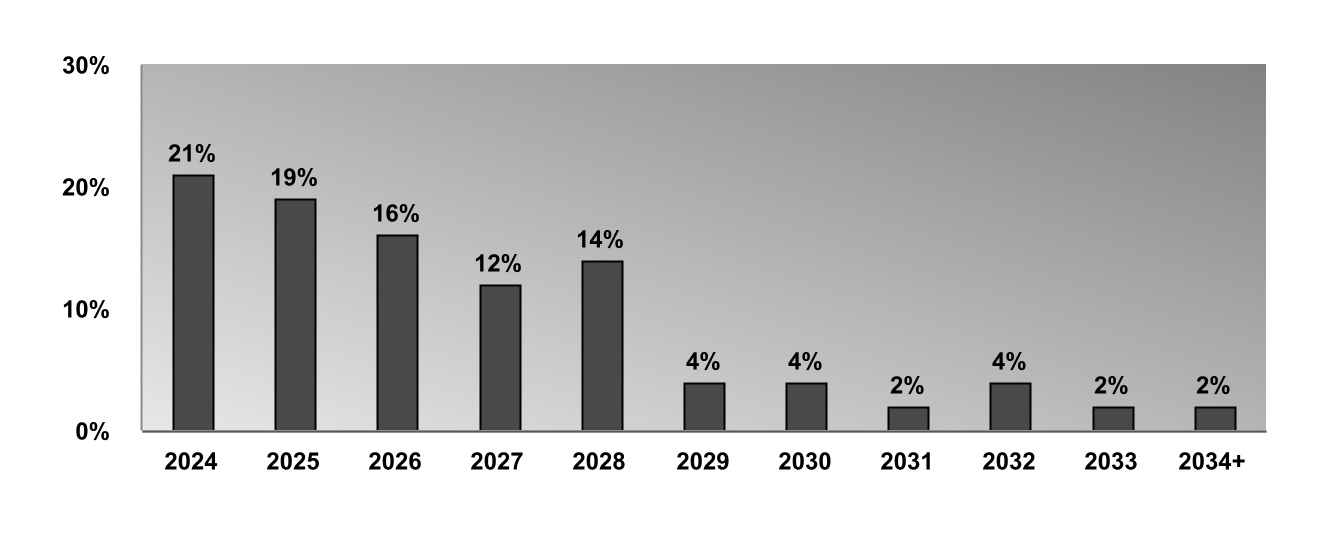

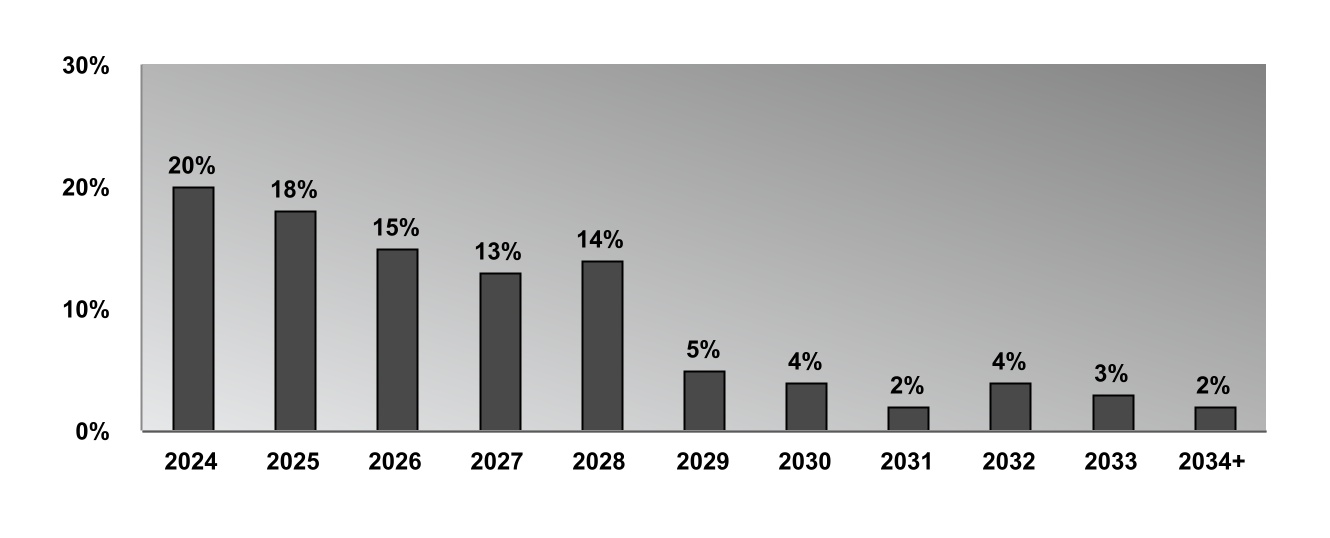

Lease Expirations as of December 31, 2023 |

|

| Capital Expenditures |

|

| Leasing Activity |

|

| External Growth Summary |

|

| |

|

| Financial Data: |

|

| |

|

| Consolidated Balance Sheets |

|

| Consolidated Statements of Operations |

|

| Components of Rental Revenues |

|

|

|

| Unconsolidated Joint Venture Information |

|

| Debt Outstanding Summary |

|

| Future Scheduled Principal Payments |

|

| Financial Covenants |

|

| Enterprise Value, Net Debt, Liquidity, Debt Ratios and Credit Ratings |

|

|

|

| Non-GAAP and Supplemental Measures: |

|

|

|

| FFO and FAD Analysis |

|

| Portfolio NOI and Same Center NOI |

|

| Adjusted EBITDA and EBITDAre |

|

| Net Debt |

|

| Pro Rata Balance Sheet Information |

|

| Pro Rata Statement of Operations Information |

|

| Guidance for 2024 |

|

| Non-GAAP Definitions |

|

|

|

| Investor Information |

|

News Release

Tanger Reports Fourth Quarter and Full Year 2023 Results and Introduces 2024 Guidance

Expanded Portfolio by Adding Three New Centers

Achieved 8th Consecutive Quarter of Positive Rent Spreads

Balance Sheet Remains Well-Positioned for Growth

Greensboro, NC, February 15, 2024, Tanger® (NYSE:SKT), a leading owner and operator of outlet and open-air retail shopping destinations, today reported financial results and operating metrics for the three months and year ended December 31, 2023.

“I am pleased to report another quarter of strong results as we delivered robust organic growth, while also executing on our external growth strategy with the grand opening of Tanger Outlets Nashville and the acquisitions of Tanger Outlets Asheville and Bridge Street Town Centre in Huntsville, our first non-outlet center," said Stephen Yalof, President and Chief Executive Officer. “Leasing momentum continued to accelerate with our eighth-consecutive quarter of positive rent spreads and over 2.3 million square feet of leases executed in 2023, a record for the Company, driving growth in NOI while elevating and diversifying our tenant mix.”

Mr. Yalof continued, “As we progress through 2024, we will leverage the strength of our retail operating, leasing and marketing platforms to create value in our open-air portfolio. We are well-positioned with a strong balance sheet, and as we have demonstrated, we will continue to execute on our long-term growth strategies to unlock additional value for our shareholders.”

Fourth Quarter Results

•Net income available to common shareholders was $0.22 per share, or $23.5 million, compared to $0.17 per share, or $18.1 million, for the prior year period. The 2022 period included a $0.03 per share, or $3.2 million, gain on the sale of a non-core outlet center located in Blowing Rock, North Carolina.

•Funds From Operations (“FFO”) available to common shareholders was $0.52 per share, or $58.2 million, compared to $0.47 per share, or $51.6 million, for the prior year period.

•Core Funds From Operations (“Core FFO”) available to common shareholders was $0.52 per share, or $58.2 million, compared to $0.47 per share, or $51.8 million, for the prior year period.

Full Year Results

•Net income available to common shareholders was $0.92 per share, or $98.0 million, compared to $0.77 per share, or $81.2 million, for the prior year period. Net income available to common shareholders for 2022 included the gain on the sale of an outlet center mentioned above.

•FFO available to common shareholders was $1.96 per share, or $218.4 million, compared to $1.83 per share, or $201.5 million, for the prior year period.

•Core FFO available to common shareholders was $1.96 per share, or $217.6 million, compared to $1.83 per share, or $201.8 million, for the prior year period.

FFO and Core FFO are widely accepted supplemental non-GAAP financial measures used in the real estate industry to measure and compare the operating performance of real estate companies. Complete reconciliations containing adjustments from GAAP net income to FFO and Core FFO, if applicable, are included in this release. Per share amounts for net income, FFO and Core FFO are on a diluted basis.

Operating Metrics

Key portfolio results for the total stabilized portfolio, including the Company’s pro rata share of unconsolidated joint ventures, were as follows:

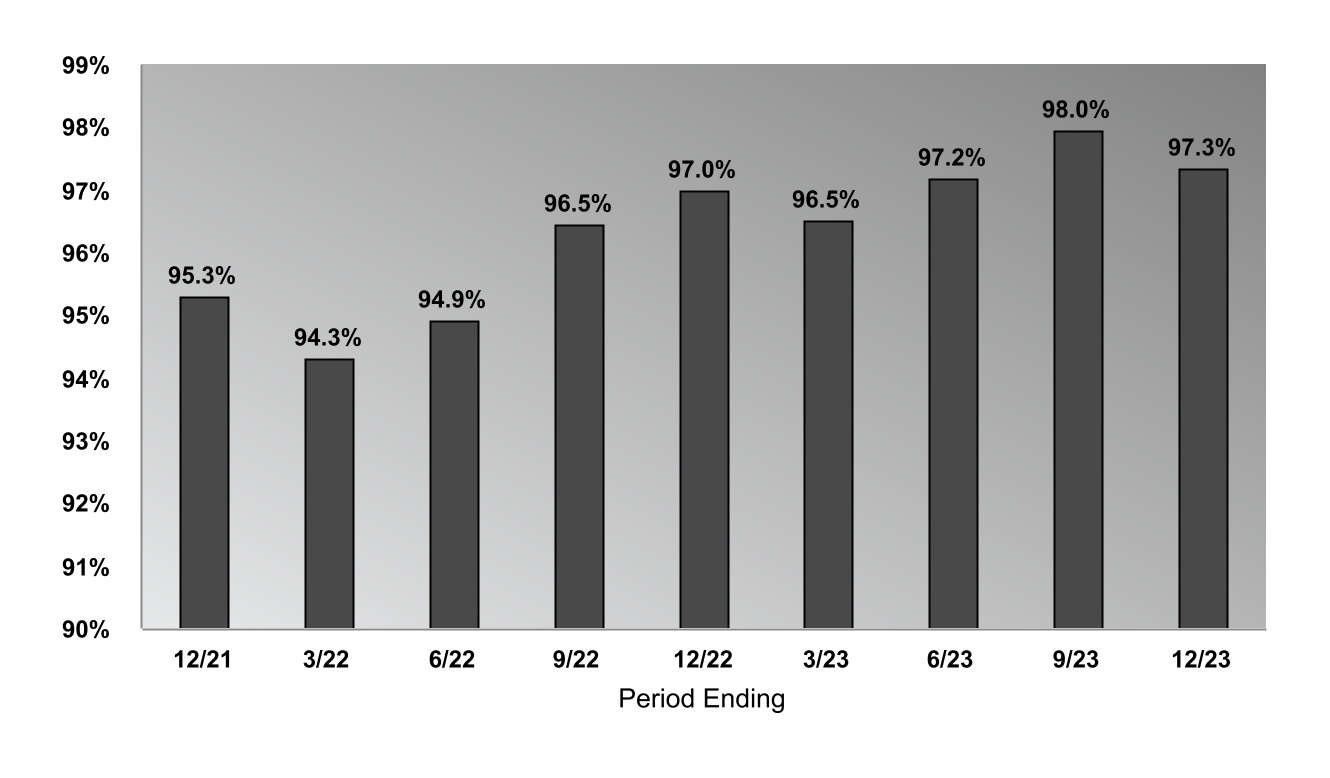

•Occupancy was 97.3% on December 31, 2023, compared to 98.0% on September 30, 2023 and 97.0% on December 31, 2022. The sequential change from September 30, 2023 was driven by the acquisitions of Tanger Asheville and Bridge Street Town Centre. On a same center basis, occupancy was 97.9% on December 31, 2023

•Same center net operating income (“Same Center NOI”), which is presented on a cash basis, increased 5.4% to $91.1 million for the fourth quarter of 2023 from $86.5 million for the fourth quarter of 2022, and for the full-year period, increased 6.2% to $345.5 million for 2023 from $325.5 million for 2022. Both periods in 2023 benefited from occupancy gains, rent growth, operating expense efficiencies, out-of-period rent collections and the milder winter experienced in 2023

•Average tenant sales per square foot was $436 for the twelve months ended December 31, 2023 compared to $437 for the twelve months ended September 30, 2023 and $444 for the twelve months ended December 31, 2022

•On a same center basis, average tenant sales per square foot was $433 for the twelve months ended December 31, 2023 compared to $437 for the twelve months ended September 30, 2023 and $444 for the twelve months ended December 31, 2022

•The occupancy cost ratio (“OCR”), representing annualized occupancy costs as a percentage of tenant sales, was 9.3% for the twelve months ended December 31, 2023 compared to 9.1% for the twelve months ended September 30, 2023 and 8.6% for the twelve months ended December 31, 2022

•Lease termination fees (which are excluded from Same Center NOI) for the total portfolio totaled $188,000 for the fourth quarter of 2023 and $672,000 for full year 2023, compared to $23,000 for the fourth quarter of 2022 and $2.9 million for full year 2022

Same Center NOI is a supplemental non-GAAP financial measure of operating performance. A complete definition of Same Center NOI and a reconciliation to the nearest comparable GAAP measure is included in this release.

External Growth Activity

The Company completed the following external growth activities during the fourth quarter of 2023, which were funded through cash on hand, available liquidity and common shares issued under its at-the-market (“ATM”) equity offering program as discussed below:

•Tanger Outlets Nashville, the Company’s newest development in Nashville, TN, opened on October 27, 2023. The center is approximately 291,000 square feet with a cost of approximately $145 million and a projected stabilized yield range of 7.5% to 8.0%. The open-air center offers shopping and dining across seven retail buildings and a unique, placemaking community space. Tanger Nashville reflects the Company’s commitment to diversify and enhance the shopping experience for its customers with nearly one quarter of the center’s dynamic assortment new to Tanger’s portfolio or first to the outlet channel.

•Tanger Outlets Asheville, a 382,000-square-foot, open-air shopping center in Asheville, NC, was acquired on November 13, 2023 for $70 million. The established center is occupied by a diverse mix of brands that includes leading home furnishings providers as well as iconic apparel, footwear and accessories brands. Management expects the center to deliver a first-year return in the mid-eight percent range, with potential for additional growth over time.

•Bridge Street Town Centre, an 825,000-square-foot, open-air lifestyle center in Huntsville, AL, was acquired on November 30, 2023 for $193.5 million. The center comprises over 80 retail stores, restaurants, and entertainment venues and serves as the dominant shopping destination in the market. Management expects the center to deliver a first-year return in the mid-eight percent range, with potential for additional growth over time.

Leasing Activity

For the total portfolio, including the Company’s pro rata share of unconsolidated joint ventures, as of January 31, 2024, Tanger has renewals executed or in process for 23.8% of the space scheduled to expire during 2024 compared to 41.0% of expiring 2023 space as of January 31, 2023. Relative to 2023, the Company expects a higher re-tenanting rate in 2024 as it focuses on portfolio enhancement and further elevating and diversifying its retailer mix.

The following key leasing metrics are presented for the total domestic portfolio, including the Company’s pro rata share of domestic unconsolidated joint ventures.

•Total renewed or re-tenanted leases (including leases for both comparable and non-comparable space) executed during the twelve months ended December 31, 2023 included 544 leases, totaling over 2.3 million square feet

•Blended average rental rates were positive for the eighth consecutive quarter at 13.3% on a cash basis for leases executed for comparable space during the twelve months ended December 31, 2023. These blended rent spreads, which were up 320 basis points year over year, are comprised of re-tenanted rent spreads of 37.5% and renewal rent spreads of 11.2%

Dividend

In January 2024, the Company’s Board of Directors declared a quarterly cash dividend of $0.26 per share, payable on February 15, 2024 to holders of record on January 31, 2024.

Balance Sheet and Liquidity

During the fourth quarter of 2023, Tanger sold 3.4 million common shares under its ATM equity offering program at a weighted average price of $25.77 per share, generating gross proceeds of $87.3 million. During 2023, the Company sold 3.5 million shares at a weighted average price of $25.75 per share, generating gross proceeds of $90.0 million, and as of December 31, 2023, the Company has a remaining authorization of $220.1 million.

The following balance sheet and liquidity metrics are presented for the total portfolio, including the Company’s pro rata share of unconsolidated joint ventures. As of December 31, 2023:

•Net debt to Adjusted EBITDAre (calculated as net debt divided by Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (“Adjusted EBITDAre”)) increased to 5.8x for 2023 from 5.1x for 2022, reflecting incremental Nashville development spending and the acquisitions of Tanger Asheville and Bridge Street Town Centre in the fourth quarter of 2023. Management estimates that Net debt to Adjusted EBITDAre would be in a range of 5.2x to 5.3x for 2023 assuming a full year of Adjusted EBITDAre for Nashville and the acquisitions.

•Interest coverage ratio (calculated as Adjusted EBITDAre divided by interest expense) was 4.7x for both 2023 and 2022

•Cash and cash equivalents and short-term investments totaled $29.0 million with $507.0 million of availability on the Company’s $520 million unsecured lines of credit

•Total outstanding debt aggregated $1.6 billion with $104.2 million (principal) of floating rate debt, representing approximately 6% of total debt outstanding and 2% of total enterprise value

•Weighted average interest rate was 3.5% and weighted average term to maturity of outstanding debt, including extension options, was approximately 4.7 years

•Approximately 89% of the total portfolio’s square footage was unencumbered by mortgages with secured debt of $225.1 million (principal), representing 14% of total debt outstanding

•Funds Available for Distribution (“FAD”) payout ratio was 58% for 2023

As of December 31, 2023, $300 million of the outstanding balance of the Company’s $325 million unsecured term loan, which matures in January 2027 plus a one-year extension, was fixed with interest rate swaps at a weighted average daily Secured Overnight Financing Rate (“Daily SOFR”) of 0.4%, which matured on February 1, 2024. The Company has entered into $325 million of forward-starting swaps that commenced February 1, 2024 and have varying maturities through January 2027, as outlined in the table below. Collectively, these swaps fix the Daily SOFR base rate at a weighted average of 3.9% as of February 1, 2024, resulting in incremental interest expense of approximately $10 million, or $0.09 per share, in 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effective Date |

|

Maturity Date |

|

Notional Amount

(in thousands) |

|

Bank Pay Rate |

|

Company Fixed Pay Rate |

|

Company Adjusted Fixed Pay Rate (1) |

|

| Interest rate swaps: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| At December 31, 2023 |

|

February 1, 2024 |

|

$300,000 |

|

|

Daily SOFR |

|

0.4 |

% |

|

0.5 |

% |

|

| Forward-starting: |

|

|

|

|

|

|

|

|

|

|

|

| February 1, 2024 |

|

February 1, 2026 |

|

$75,000 |

|

|

Daily SOFR |

|

3.5 |

% |

|

3.6 |

% |

|

| February 1, 2024 |

|

August 1, 2026 |

|

$75,000 |

|

|

Daily SOFR |

|

3.7 |

% |

|

3.8 |

% |

|

| February 1, 2024 |

|

January 1, 2027 |

|

$175,000 |

|

|

Daily SOFR |

|

4.2 |

% |

|

4.3 |

% |

|

|

|

|

|

$325,000 |

|

|

Daily SOFR |

|

3.9 |

% |

|

4.0 |

% |

|

(1) Includes a 10-basis point credit adjustment spread related to the Company’s unsecured term loan.

Adjusted EBITDAre, Net debt and FAD are supplemental non-GAAP financial measures of operating performance. Definitions of Adjusted EBITDAre, Net debt and FAD and reconciliations to the nearest comparable GAAP measures are included in this release.

Guidance for 2024

Based on the Company’s internal budgeting process and its view on current market conditions, management currently believes the Company’s full year 2024 net income, FFO and Core FFO per share will be as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| For the year ending December 31, 2024: |

|

|

|

|

Low

Range |

High Range |

|

|

|

| Estimated diluted net income per share |

$ |

0.83 |

|

$ |

0.91 |

|

|

|

|

| Depreciation and amortization of real estate assets - consolidated and the Company’s share of unconsolidated joint ventures |

1.18 |

|

1.18 |

|

|

|

|

|

|

|

|

|

|

| Estimated diluted FFO per share |

$ |

2.01 |

|

$ |

2.09 |

|

|

|

|

| Compensation related to executive severance |

0.01 |

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Estimated diluted Core FFO per share |

$ |

2.02 |

|

$ |

2.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tanger’s estimates reflect the following key assumptions (dollars in millions):

|

|

|

|

|

|

|

|

|

|

|

|

| For the year ending December 31, 2024: |

|

|

|

|

Low

Range |

High Range |

|

|

|

| Same Center NOI growth - total portfolio at pro rata share |

2.0 |

% |

4.0 |

% |

|

|

|

| General and administrative expense, excluding executive severance |

$76.5 |

|

$79.5 |

|

|

|

|

| Interest expense - consolidated |

$59.5 |

|

$61.5 |

|

|

|

|

Other income (expense) (1) |

$— |

|

$2.0 |

|

|

|

|

| Annual recurring capital expenditures, renovations and second generation tenant allowances |

$50.0 |

|

$60.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes interest income.

Weighted average diluted common shares are expected to range from approximately 109 million to 110 million for earnings per share and 114 million to 115 million for FFO and Core FFO per share. The estimates above do not include the impact of the acquisition or sale of any outparcels, properties or joint venture interests, or any additional financing activity.

Fourth Quarter and Full Year 2023 Conference Call

Tanger will host a conference call to discuss its fourth quarter and full year 2023 results for analysts, investors and other interested parties on Friday, February 16, 2024, at 8:30 a.m. Eastern Time. To access the conference call, listeners should dial 1-877-605-1702. Alternatively, a live audio webcast of this call will be available to the public on Tanger’s Investor Relations website, investors.tanger.com. A telephone replay of the call will be available from February 16, 2024 at approximately 11:30 a.m. through March 1, 2024 at 11:59 p.m. by dialing 1-877-660-6853, replay access code #13743616. An online archive of the webcast will also be available through March 1, 2024.

Upcoming Events

The Company is scheduled to participate in the following upcoming events:

•Wolfe Research’s Virtual Real Estate Conference 2024 on February 28, 2024

•Citi’s 2024 Global Property CEO Conference held at the Diplomat Resort & Spa in Hollywood, FL from March 4 through March 6, 2024

•A tour of Tanger Outlets Nashville in connection with ICR’s Nashville Multi-Property REIT Tour on March 11, 2024

•A tour of Tanger Outlets National Harbor in connection with Evercore ISI’s Multi-Property REIT Tour of Washington, DC on March 25, 2024

•BofA’s NYC Retail REIT Headquarter Tour on March 27, 2024

About Tanger®

Tanger Inc. (NYSE: SKT) is a leading owner and operator of outlet and open-air retail shopping destinations, with over 43 years of expertise in the retail and outlet shopping industries. Tanger’s portfolio of 38 outlet centers, one adjacent managed center and one open-air lifestyle center comprises over 15 million square feet well positioned across tourist destinations and vibrant markets in 20 U.S. states and Canada. A publicly traded REIT since 1993, Tanger continues to innovate the retail experience for its shoppers with over 3,000 stores operated by more than 700 different brand name companies.

Tanger is furnishing a Form 8-K with the Securities and Exchange Commission (“SEC”) that includes a supplemental information package for the quarter and year ended December 31, 2023. For more information on Tanger, call 1-800-4TANGER or visit tanger.com.

The Company uses, and intends to continue to use, its Investor Relations website, which can be found at investors.tanger.com, as a means of disclosing material nonpublic information and for complying with its disclosure obligations under Regulation FD. Additional information about the Company can also be found through social media channels. The Company encourages investors and others interested in the Company to review the information on its Investor Relations website and on social media channels. The information contained on, or that may be accessed through, our website or social media platforms is not incorporated by reference into, and is not a part of, this document.

Safe Harbor Statement

Certain statements made in this news release contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies, beliefs and expectations, are generally identifiable by use of the words “anticipate,” “believe,” “can,” “continue,” “could,” “designed,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” or similar expressions. Such forward-looking statements include the Company’s expectations regarding future financial results and assumptions underlying that guidance, long-term growth, trends in retail traffic and tenant revenues, development initiatives and strategic partnerships, the anticipated impact of the Company’s newly acquired assets in Huntsville and Asheville, as well as its newly opened Nashville development and related costs and anticipated yield, expectations regarding operational metrics, renewal trends, new revenue streams, its strategy and value proposition to retailers, participation in upcoming events, uses of and efforts to reduce costs of capital, liquidity, dividend payments and cash flows.

You should exercise caution in relying on forward-looking statements since they involve known and unknown risks, uncertainties and other important factors which are, in some cases, beyond our control and which could materially affect our actual results, performance or achievements. Other important factors which may cause actual results to differ materially from current expectations include, but are not limited to: our inability to develop new retail centers or expand existing retail centers successfully; risks related to the economic performance and market value of our retail centers; the relative illiquidity of real property investments; impairment charges affecting our properties; our dispositions of assets may not achieve anticipated results; competition for the acquisition and development of retail centers, and our inability to complete the acquisitions of retail centers we may identify; competition for tenants with competing retail centers; the diversification of our tenant mix and our entry into the operation of full price retail may not achieve our expected results; environmental regulations affecting our business; risks associated with possible terrorist activity or other acts or threats of violence and threats to public safety; risks related to the impact of macroeconomic conditions, including rising interest rates and inflation, on our tenants and on our business, financial condition, liquidity, results of operations and compliance with debt covenants; our dependence on rental income from real property; our dependence on the results of operations of our retailers and their bankruptcy, early termination or closing could adversely affect us; the impact of geopolitical conflicts; the immediate and long-term impact of the outbreak of a highly infectious or contagious disease on our tenants and on our business (including the impact of actions taken to contain the outbreak or mitigate its impact); the fact that certain of our properties are subject to ownership interests held by third parties, whose interests may conflict with ours; risks related to climate change; increased costs and reputational harm associated with the increased focus on environmental, sustainability and social initiatives; risks related to uninsured losses; the risk that consumer, travel, shopping and spending habits may change; risks associated with our Canadian investments; risks associated with attracting and retaining key personnel; risks associated with debt financing; risks associated with our guarantees of debt for, or other support we may provide to, joint venture properties; the effectiveness of our interest rate hedging arrangements; our potential failure to qualify as a REIT; our legal obligation to make distributions to our shareholders; legislative or regulatory actions that could adversely affect our shareholders; our dependence on distributions from the Operating Partnership to meet our financial obligations, including dividends; the risk of a cyber-attack or an act of cyber-terrorism on our systems; the uncertainties of costs to comply with regulatory changes (including potential costs to comply with proposed rules of the SEC to standardize climate-related disclosures); and other important factors set forth under Item 1A - “Risk Factors” in the Company’s and the Operating Partnership’s most recently filed Annual Report on Form 10-K, as may be updated or supplemented in the Company’s Quarterly Reports on Form 10-Q and the Company’s other filings with the SEC. Accordingly, there is no assurance that the Company’s expectations will be realized. The Company disclaims any intention or obligation to update the forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to refer to any further disclosures the Company makes or related subjects in the Company’s Current Reports on Form 8-K that the Company files with the SEC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Contact Information |

|

|

Media Contact Information |

|

|

|

|

|

Doug McDonald |

|

|

|

KWT Global |

SVP, Finance and Capital Markets |

|

|

|

Tanger@kwtglobal.com |

336-856-6066 |

|

|

|

|

tangerir@tanger.com |

|

|

|

|

TANGER INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Year ended |

|

December 31, |

|

December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rental revenues |

$119,884 |

|

|

$109,832 |

|

|

$438,889 |

|

|

$421,419 |

|

| Management, leasing and other services |

2,486 |

|

|

2,297 |

|

|

8,660 |

|

|

7,157 |

|

| Other revenues |

5,107 |

|

|

4,332 |

|

|

16,858 |

|

|

14,037 |

|

| Total revenues |

127,477 |

|

|

116,461 |

|

|

464,407 |

|

|

442,613 |

|

| Expenses: |

|

|

|

|

|

|

|

| Property operating |

41,929 |

|

|

38,405 |

|

|

145,547 |

|

|

143,936 |

|

General and administrative (1) |

21,455 |

|

|

19,366 |

|

|

76,130 |

|

|

71,532 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

32,233 |

|

|

33,996 |

|

|

108,889 |

|

|

111,904 |

|

| Total expenses |

95,617 |

|

|

91,767 |

|

|

330,566 |

|

|

327,372 |

|

| Other income (expense): |

|

|

|

|

|

|

|

| Interest expense |

(11,931) |

|

|

(12,097) |

|

|

(47,928) |

|

|

(46,967) |

|

| Loss on early extinguishment of debt |

— |

|

|

(222) |

|

|

— |

|

|

(222) |

|

| Gain on sale of assets |

— |

|

|

3,156 |

|

|

— |

|

|

3,156 |

|

|

|

|

|

|

|

|

|

Other income (expense) (2) |

2,706 |

|

|

1,875 |

|

|

9,729 |

|

|

6,029 |

|

| Total other income (expense) |

(9,225) |

|

|

(7,288) |

|

|

(38,199) |

|

|

(38,004) |

|

| Income before equity in earnings of unconsolidated joint ventures |

22,635 |

|

|

17,406 |

|

|

95,642 |

|

|

77,237 |

|

| Equity in earnings of unconsolidated joint ventures |

2,210 |

|

|

1,799 |

|

|

8,240 |

|

|

8,594 |

|

| Net income |

24,845 |

|

|

19,205 |

|

|

103,882 |

|

|

85,831 |

|

| Noncontrolling interests in Operating Partnership |

(1,061) |

|

|

(841) |

|

|

(4,483) |

|

|

(3,768) |

|

| Noncontrolling interests in other consolidated partnerships |

— |

|

|

— |

|

|

(248) |

|

|

— |

|

| Net income attributable to Tanger Inc. |

23,784 |

|

|

18,364 |

|

|

99,151 |

|

|

82,063 |

|

| Allocation of earnings to participating securities |

(332) |

|

|

(226) |

|

|

(1,186) |

|

|

(869) |

|

Net income available to common shareholders of

Tanger Inc. |

$23,452 |

|

|

$18,138 |

|

|

$97,965 |

|

|

$81,194 |

|

|

|

|

|

|

|

|

|

| Basic earnings per common share: |

|

|

|

|

|

|

|

| Net income |

$0.22 |

|

|

$0.17 |

|

|

$0.94 |

|

|

$0.78 |

|

|

|

|

|

|

|

|

|

| Diluted earnings per common share: |

|

|

|

|

|

|

|

| Net income |

$0.22 |

|

|

$0.17 |

|

|

$0.92 |

|

|

$0.77 |

|

(1)The year ended December 31, 2023 includes the reversal of $0.8 million of previously expensed compensation related to a voluntary executive departure. The year ended December 31, 2022 includes $2.4 million of executive severance costs.

(2)The year ended December 31, 2022 includes a $2.4 million gain on the sale of the corporate aircraft.

TANGER INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

December 31, |

|

December 31, |

| |

2023 |

|

2022 |

| Assets |

|

|

|

| Rental property: |

|

|

|

| Land |

$303,605 |

|

|

$275,079 |

|

| Buildings, improvements and fixtures |

2,938,434 |

|

|

2,553,452 |

|

| Construction in progress |

29,201 |

|

|

27,340 |

|

|

3,271,240 |

|

|

2,855,871 |

|

| Accumulated depreciation |

(1,318,264) |

|

|

(1,224,962) |

|

| Total rental property, net |

1,952,976 |

|

|

1,630,909 |

|

| Cash and cash equivalents |

12,778 |

|

|

212,124 |

|

| Short-term investments |

9,187 |

|

|

52,450 |

|

| Investments in unconsolidated joint ventures |

71,900 |

|

|

73,809 |

|

| Deferred lease costs and other intangibles, net |

91,269 |

|

|

58,574 |

|

|

|

|

|

| Operating lease right-of-use assets |

77,400 |

|

|

78,636 |

|

| Prepaids and other assets |

108,609 |

|

|

111,163 |

|

| Total assets |

$2,324,119 |

|

|

$2,217,665 |

|

| |

|

|

|

| Liabilities and Equity |

|

|

|

| Liabilities |

|

|

|

| Debt: |

|

|

|

| Senior, unsecured notes, net |

$1,039,840 |

|

|

$1,037,998 |

|

| Unsecured term loan, net |

322,322 |

|

|

321,525 |

|

| Mortgages payable, net |

64,041 |

|

|

68,971 |

|

| Unsecured lines of credit |

13,000 |

|

|

— |

|

| Total debt |

1,439,203 |

|

|

1,428,494 |

|

| Accounts payable and accrued expenses |

118,505 |

|

|

104,741 |

|

| Operating lease liabilities |

86,076 |

|

|

87,528 |

|

| Other liabilities |

89,022 |

|

|

82,968 |

|

| Total liabilities |

1,732,806 |

|

|

1,703,731 |

|

| Commitments and contingencies |

|

|

|

| Equity |

|

|

|

| Tanger Inc.: |

|

|

|

Common shares, $0.01 par value, 300,000,000 shares authorized, 108,793,251 and 104,497,920 shares issued and outstanding at December 31, 2023 and December 31, 2022, respectively |

1,088 |

|

|

1,045 |

|

| Paid in capital |

1,079,387 |

|

|

987,192 |

|

| Accumulated distributions in excess of net income |

(490,171) |

|

|

(485,557) |

|

| Accumulated other comprehensive loss |

(23,519) |

|

|

(11,037) |

|

| Equity attributable to Tanger Inc. |

566,785 |

|

|

491,643 |

|

| Equity attributable to noncontrolling interests: |

|

|

|

| Noncontrolling interests in Operating Partnership |

24,528 |

|

|

22,291 |

|

| Noncontrolling interests in other consolidated partnerships |

— |

|

|

— |

|

| Total equity |

591,313 |

|

|

513,934 |

|

| Total liabilities and equity |

$2,324,119 |

|

|

$2,217,665 |

|

TANGER INC. AND SUBSIDIARIES

CENTER INFORMATION

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

| |

|

2023 |

|

2022 |

| Gross Leasable Area Open at End of Period (in thousands): |

|

|

|

|

| Consolidated |

|

12,690 |

|

|

11,353 |

|

| Unconsolidated |

|

2,113 |

|

|

2,113 |

|

| Pro rata share of unconsolidated |

|

1,056 |

|

|

1,056 |

|

| Managed |

|

758 |

|

|

457 |

|

|

|

|

|

|

Total Owned and/or Managed Properties (1) |

|

15,561 |

|

|

13,924 |

|

Total Owned Properties including pro rata share of unconsolidated JVs (1) |

|

13,747 |

|

|

12,410 |

|

| |

|

|

|

|

| Centers in Operation at End of Period: |

|

|

|

|

| Consolidated |

|

32 |

|

|

29 |

|

| Unconsolidated |

|

6 |

|

|

6 |

|

| Managed |

|

2 |

|

|

1 |

|

| Total Owned and/or Managed Properties |

|

40 |

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ending Occupancy: |

|

|

|

|

Consolidated (2) |

|

97.3 |

% |

|

96.9 |

% |

| Unconsolidated |

|

98.1 |

% |

|

98.1 |

% |

Total Owned Properties including pro rata share of unconsolidated JVs (2) |

|

97.3 |

% |

|

97.0 |

% |

|

|

|

|

|

Total U.S. States Operated in at End of Period (3) |

|

20 |

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

(1)Amounts may not recalculate due to the effect of rounding.

(2)Metrics for December 2023 include the results of Tanger Outlets Asheville and Bridge Street Town Centre, both of which were acquired in the fourth quarter of 2023, and exclude the results of Tanger Outlets Nashville, which opened during the fourth quarter of 2023 and has not yet stabilized.

(3)The Company also has an ownership interest in two centers located in Ontario, Canada.

TANGER INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP SUPPLEMENTAL MEASURES (1)

(in thousands, except per share)

(Unaudited)

Below is a reconciliation of Net Income to FFO and Core FFO:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Year ended |

| |

|

December 31, |

|

December 31, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net income |

|

$24,845 |

|

|

$19,205 |

|

|

$103,882 |

|

|

$85,831 |

|

| Adjusted for: |

|

|

|

|

|

|

|

|

| Depreciation and amortization of real estate assets - consolidated |

|

31,373 |

|

|

33,384 |

|

|

106,450 |

|

|

109,513 |

|

| Depreciation and amortization of real estate assets - unconsolidated joint ventures |

|

2,621 |

|

|

2,602 |

|

|

10,514 |

|

|

11,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of assets |

|

— |

|

|

(3,156) |

|

|

— |

|

|

(3,156) |

|

|

|

|

|

|

|

|

|

|

| FFO |

|

58,839 |

|

|

52,035 |

|

|

220,846 |

|

|

203,206 |

|

| FFO attributable to noncontrolling interests in other consolidated partnerships |

|

— |

|

|

— |

|

|

(248) |

|

|

— |

|

| Allocation of earnings to participating securities |

|

(591) |

|

|

(413) |

|

|

(2,151) |

|

|

(1,683) |

|

FFO available to common shareholders (2) |

|

$58,248 |

|

|

$51,622 |

|

|

$218,447 |

|

|

$201,523 |

|

| As further adjusted for: |

|

|

|

|

|

|

|

|

Compensation-related adjustments (3) |

|

— |

|

|

— |

|

|

(806) |

|

|

2,447 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of non-real estate asset (4) |

|

— |

|

|

— |

|

|

— |

|

|

(2,418) |

|

| Loss on early extinguishment of debt |

|

— |

|

|

222 |

|

|

— |

|

|

222 |

|

|

|

|

|

|

|

|

|

|

| Impact of above adjustments to the allocation of earnings to participating securities |

|

— |

|

|

(2) |

|

|

6 |

|

|

(2) |

|

Core FFO available to common shareholders (2) |

|

$58,248 |

|

|

$51,842 |

|

|

$217,647 |

|

|

$201,772 |

|

FFO available to common shareholders per share - diluted (2) |

|

$0.52 |

|

|

$0.47 |

|

|

$1.96 |

|

|

$1.83 |

|

Core FFO available to common shareholders per share - diluted (2) |

|

$0.52 |

|

|

$0.47 |

|

|

$1.96 |

|

|

$1.83 |

|

| |

|

|

|

|

|

|

|

|

| Weighted Average Shares: |

|

|

|

|

|

|

|

|

| Basic weighted average common shares |

|

105,797 |

|

|

103,781 |

|

|

104,682 |

|

|

103,687 |

|

| Effect of notional units |

|

1,142 |

|

|

1,406 |

|

|

1,052 |

|

|

1,240 |

|

| Effect of outstanding options and restricted common shares |

|

854 |

|

|

730 |

|

|

798 |

|

|

709 |

|

| Diluted weighted average common shares (for earnings per share computations) |

|

107,793 |

|

|

105,917 |

|

|

106,532 |

|

|

105,636 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exchangeable operating partnership units |

|

4,723 |

|

|

4,750 |

|

|

4,734 |

|

|

4,759 |

|

Diluted weighted average common shares (for FFO and Core FFO per share computations) (2) |

|

112,516 |

|

|

110,667 |

|

|

111,266 |

|

|

110,395 |

|

(1)Refer to Non-GAAP Definitions beginning on page

xiv for definitions of the non-GAAP supplemental measures used in this release.

(2)Assumes the Class A common limited partnership units of the Operating Partnership held by the noncontrolling interests are exchanged for common shares of the Company. Each Class A common limited partnership unit is exchangeable for one of the Company’s common shares, subject to certain limitations to preserve the Company’s REIT status.

(3)For the 2023 period, represents the reversal of previously expensed compensation related to a voluntary executive departure. For the 2022 period, represents executive severance costs.

(4)Represents gain on sale of the corporate aircraft.

Below is a reconciliation of FFO to FAD (1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Year ended |

| |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| FFO available to common shareholders |

|

$58,248 |

|

|

$51,622 |

|

|

$218,447 |

|

|

$201,523 |

|

| Adjusted for: |

|

|

|

|

|

|

|

|

| Corporate depreciation excluded above |

|

860 |

|

|

612 |

|

|

2,439 |

|

|

2,391 |

|

| Amortization of finance costs |

|

801 |

|

|

1,044 |

|

|

3,196 |

|

|

3,348 |

|

| Amortization of net debt discount |

|

167 |

|

|

137 |

|

|

622 |

|

|

509 |

|

| Amortization of equity-based compensation |

|

3,452 |

|

|

3,019 |

|

|

12,492 |

|

|

12,984 |

|

| Straight-line rent adjustments |

|

819 |

|

|

500 |

|

|

2,229 |

|

|

1,690 |

|

| Market rent adjustments |

|

101 |

|

|

918 |

|

|

646 |

|

|

1,417 |

|

| Second generation tenant allowances and lease incentives |

|

(4,887) |

|

|

(4,608) |

|

|

(12,606) |

|

|

(9,547) |

|

| Capital improvements |

|

(20,098) |

|

|

(12,268) |

|

|

(39,874) |

|

|

(22,940) |

|

| Adjustments from unconsolidated joint ventures |

|

(824) |

|

|

(251) |

|

|

(1,353) |

|

|

(86) |

|

FAD available to common shareholders (2) |

|

$38,639 |

|

|

$40,725 |

|

|

$186,238 |

|

|

$191,289 |

|

| Dividends per share |

|

$0.2600 |

|

|

$0.2200 |

|

|

$0.9700 |

|

|

$0.8025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO payout ratio |

|

50 |

% |

|

47 |

% |

|

49 |

% |

|

44 |

% |

| FAD payout ratio |

|

76 |

% |

|

59 |

% |

|

58 |

% |

|

46 |

% |

Diluted weighted average common shares (2) |

|

112,516 |

|

|

110,667 |

|

|

111,266 |

|

|

110,395 |

|

(1)Refer to page

ix for a reconciliation of net income to FFO available to common shareholders.

(2)Assumes the Class A common limited partnership units of the Operating Partnership held by the noncontrolling interests are exchanged for common shares of the Company. Each Class A common limited partnership unit is exchangeable for one of the Company’s common shares, subject to certain limitations to preserve the Company’s REIT status.

Below is a reconciliation of Net Income to Portfolio NOI and Same Center NOI for the consolidated portfolio and total portfolio at pro rata share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Year ended |

|

|

December 31, |

|

December 31, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net income |

|

$24,845 |

|

|

$19,205 |

|

|

$103,882 |

|

|

$85,831 |

|

| Adjusted to exclude: |

|

|

|

|

|

|

|

|

| Equity in earnings of unconsolidated joint ventures |

|

(2,210) |

|

|

(1,799) |

|

|

(8,240) |

|

|

(8,594) |

|

| Interest expense |

|

11,931 |

|

|

12,097 |

|

|

47,928 |

|

|

46,967 |

|

| Gain on sale of assets |

|

— |

|

|

(3,156) |

|

|

— |

|

|

(3,156) |

|

|

|

|

|

|

|

|

|

|

| Loss on early extinguishment of debt |

|

— |

|

|

222 |

|

|

— |

|

|

222 |

|

| Other income |

|

(2,706) |

|

|

(1,875) |

|

|

(9,729) |

|

|

(6,029) |

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

32,233 |

|

|

33,996 |

|

|

108,889 |

|

|

111,904 |

|

| Other non-property (income) expenses |

|

208 |

|

|

357 |

|

|

(1,119) |

|

|

312 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate general and administrative expenses |

|

21,625 |

|

|

19,348 |

|

|

76,299 |

|

|

71,657 |

|

Non-cash adjustments (1) |

|

924 |

|

|

1,422 |

|

|

2,895 |

|

|

3,132 |

|

| Lease termination fees |

|

(143) |

|

|

(12) |

|

|

(542) |

|

|

(2,870) |

|

| Portfolio NOI - Consolidated |

|

86,707 |

|

|

79,805 |

|

|

320,263 |

|

|

299,376 |

|

| Non-same center NOI - Consolidated |

|

(2,964) |

|

|

(346) |

|

|

(3,014) |

|

|

(1,296) |

|

Same Center NOI - Consolidated (2) |

|

$83,743 |

|

|

$79,459 |

|

|

$317,249 |

|

|

$298,080 |

|

|

|

|

|

|

|

|

|

|

| Portfolio NOI - Consolidated |

|

$86,707 |

|

|

$79,805 |

|

|

$320,263 |

|

|

$299,376 |

|

Pro rata share of unconsolidated joint ventures (3) |

|

7,362 |

|

|

7,013 |

|

|

28,290 |

|

|

27,401 |

|

Portfolio NOI - Total portfolio at pro rata share (3) |

|

94,069 |

|

|

86,818 |

|

|

348,553 |

|

|

326,777 |

|

Non-same center NOI - Total portfolio at pro rata share (3) |

|

(2,964) |

|

|

(346) |

|

|

(3,014) |

|

|

(1,296) |

|

Same Center NOI - Total portfolio at pro rata share (2) (3) |

|

$91,105 |

|

|

$86,472 |

|

|

$345,539 |

|

|

$325,481 |

|

(1)Non-cash items include straight-line rent, above and below market rent amortization, straight-line rent expense on land leases and gains or losses on outparcel sales, as applicable.

(2)Centers excluded from Same Center NOI:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Blowing Rock |

December 2022 |

Sold |

Consolidated |

| Nashville |

October 2023 |

New Development |

Consolidated |

| Asheville |

November 2023 |

Acquired |

Consolidated |

| Huntsville |

November 2023 |

Acquired |

Consolidated |

(3)Pro rata share metrics are presented on a constant currency basis. Constant currency is a non-GAAP measure, calculated by applying the average foreign exchange rate for the current period to all periods presented.

Below are reconciliations of Net Income to Adjusted EBITDA, EBITDAre and Adjusted EBITDAre:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Year ended |

|

|

December 31, |

|

December 31, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net income |

|

$24,845 |

|

|

$19,205 |

|

|

$103,882 |

|

|

$85,831 |

|

| Adjusted to exclude: |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

9,565 |

|

|

10,111 |

|

|

38,149 |

|

|

43,372 |

|

| Income tax expense (benefit) |

|

(376) |

|

|

(48) |

|

|

(408) |

|

|

138 |

|

| Depreciation and amortization |

|

32,233 |

|

|

33,996 |

|

|

108,889 |

|

|

111,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of assets |

|

— |

|

|

(3,156) |

|

|

— |

|

|

(3,156) |

|

Compensation-related adjustments (1) |

|

— |

|

|

— |

|

|

(806) |

|

|

2,447 |

|

Gain on sale of non-real estate asset (2) |

|

— |

|

|

— |

|

|

— |

|

|

(2,418) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on early extinguishment of debt |

|

— |

|

|

222 |

|

|

— |

|

|

222 |

|

| Adjusted EBITDA |

|

$66,267 |

|

|

$60,330 |

|

|

$249,706 |

|

|

$238,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Year ended |

|

|

December 31, |

|

December 31, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

| Net income |

|

$24,845 |

|

$19,205 |

|

$103,882 |

|

$85,831 |

| Adjusted to exclude: |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

9,565 |

|

|

10,111 |

|

|

38,149 |

|

|

43,372 |

|

| Income tax expense (benefit) |

|

(376) |

|

|

(48) |

|

|

(408) |

|

|

138 |

|

| Depreciation and amortization |

|

32,233 |

|

|

33,996 |

|

|

108,889 |

|

|

111,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of assets |

|

— |

|

|

(3,156) |

|

|

— |

|

|

(3,156) |

|

Pro rata share of interest expense, net - unconsolidated joint ventures (3) |

|

2,229 |

|

|

2,134 |

|

|

8,779 |

|

|

6,972 |

|

Pro rata share of depreciation and amortization - unconsolidated joint ventures (3) |

|

2,621 |

|

|

2,602 |

|

|

10,514 |

|

|

11,018 |

|

EBITDAre (3) |

|

$71,117 |

|

$64,844 |

|

$269,805 |

|

$256,079 |

Compensation-related adjustments (1) |

|

— |

|

|

— |

|

|

(806) |

|

|

2,447 |

|

Gain on sale of non-real estate asset (2) |

|

— |

|

|

— |

|

|

— |

|

|

(2,418) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on early extinguishment of debt |

|

— |

|

|

222 |

|

|

— |

|

|

222 |

|

Adjusted EBITDAre (3) |

|

$71,117 |

|

$65,066 |

|

$268,999 |

|

$256,330 |

(1)For the 2023 period, represents the reversal of previously expensed compensation related to a voluntary executive departure. For the 2022 period, represents executive severance costs.

(2)Represents gain on sale of the corporate aircraft.

(3)Amount for the three months ended December 31, 2022 reflects the correction of an immaterial error in the prior year’s presentation.

Below is a reconciliation of Total Debt to Net Debt for the consolidated portfolio and total portfolio at pro rata share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, 2023 |

|

|

Consolidated |

|

Pro Rata

Share of Unconsolidated JVs |

|

Total at

Pro Rata Share |

| |

|

|

|

| Total debt |

|

$1,439,203 |

|

|

$159,979 |

|

|

$1,599,182 |

|

| Less: |

|

|

|

|

|

|

| Cash and cash equivalents |

|

(12,778) |

|

|

(7,020) |

|

|

(19,798) |

|

Short-term investments (1) |

|

(9,187) |

|

|

— |

|

|

(9,187) |

|

| Total cash and cash equivalents and short-term investments |

|

(21,965) |

|

|

(7,020) |

|

|

(28,985) |

|

| Net debt |

|

$1,417,238 |

|

|

$152,959 |

|

|

$1,570,197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, 2022 |

|

|

Consolidated |

|

Pro Rata

Share of Unconsolidated JVs |

|

Total at

Pro Rata Share |

| |

|

|

|

| Total debt |

|

$1,428,494 |

|

|

$164,505 |

|

|

$1,592,999 |

|

| Less: |

|

|

|

|

|

|

| Cash and cash equivalents |

|

(212,124) |

|

|

(8,686) |

|

|

(220,810) |

|

Short-term investments (1) |

|

(52,450) |

|

|

— |

|

|

(52,450) |

|

| Total cash and cash equivalents and short-term investments |

|

(264,574) |

|

|

(8,686) |

|

|

(273,260) |

|

| Net debt |

|

$1,163,920 |

|

|

$155,819 |

|

|

$1,319,739 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Represents short-term bank deposits with initial maturities greater than three months and less than or equal to one year.

NON-GAAP DEFINITIONS

Funds From Operations

Funds From Operations (“FFO”) is a widely used measure of the operating performance for real estate companies that supplements net income (loss) determined in accordance with generally accepted accounting principles in the United States (“GAAP”). We determine FFO based on the definition set forth by the National Association of Real Estate Investment Trusts (“Nareit”), of which we are a member. In December 2018, Nareit issued “Nareit Funds From Operations White Paper - 2018 Restatement” which clarifies, where necessary, existing guidance and consolidates alerts and policy bulletins into a single document for ease of use. Nareit defines FFO as net income (loss) available to the Company’s common shareholders computed in accordance with GAAP, excluding (i) depreciation and amortization related to real estate, (ii) gains or losses from sales of certain real estate assets, (iii) gains and losses from change in control, (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity and (v) after adjustments for unconsolidated partnerships and joint ventures calculated to reflect FFO on the same basis.

FFO is intended to exclude historical cost depreciation of real estate as required by GAAP which assumes that the value of real estate assets diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO excludes depreciation and amortization of real estate assets, gains and losses from property dispositions and extraordinary items, it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income (loss).

We present FFO because we consider it an important supplemental measure of our operating performance. In addition, a portion of cash bonus compensation to certain members of management is based on our FFO or Core FFO, which is described in the section below. We believe it is useful for investors to have enhanced transparency into how we evaluate our performance and that of our management. In addition, FFO is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO is also widely used by us and others in our industry to evaluate and price potential acquisition candidates. We believe that FFO payout ratio, which represents regular distributions to common shareholders and unitholders of the Operating Partnership expressed as a percentage of FFO, is useful to investors because it facilitates the comparison of dividend coverage between REITs. Nareit has encouraged its member companies to report their FFO as a supplemental, industry-wide standard measure of REIT operating performance.

FFO has significant limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

•FFO does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

•FFO does not reflect changes in, or cash requirements for, our working capital needs;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and FFO does not reflect any cash requirements for such replacements; and

•Other companies in our industry may calculate FFO differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, FFO should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or our dividend paying capacity. We compensate for these limitations by relying primarily on our GAAP results and using FFO only as a supplemental measure.

Core FFO

If applicable, we present Core Funds From Operations (“Core FFO”) as a supplemental measure of our performance. We define Core FFO as FFO further adjusted to eliminate the impact of certain items that we do not consider indicative of our ongoing operating performance. These further adjustments are itemized in the table above, if applicable. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Core FFO you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Core FFO should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

We present Core FFO because we believe it assists investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. In addition, we believe it is useful for investors to have enhanced transparency into how we evaluate management’s performance and the effectiveness of our business strategies. We use Core FFO when certain material, unplanned transactions occur as a factor in evaluating management’s performance and to evaluate the effectiveness of our business strategies, and may use Core FFO when determining incentive compensation.

Core FFO has limitations as an analytical tool. Some of these limitations are:

•Core FFO does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

•Core FFO does not reflect changes in, or cash requirements for, our working capital needs;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Core FFO does not reflect any cash requirements for such replacements;

•Core FFO does not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our ongoing operations; and

•Other companies in our industry may calculate Core FFO differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, Core FFO should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using Core FFO only as a supplemental measure.

Funds Available for Distribution

Funds Available for Distribution (“FAD”) is a non-GAAP financial measure that we define as FFO (defined as net income (loss) available to the Company’s common shareholders computed in accordance with GAAP, excluding (i) depreciation and amortization related to real estate, (ii) gains or losses from sales of certain real estate assets, (iii) gains and losses from change in control, (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity and (v) after adjustments for unconsolidated partnerships and joint ventures calculated to reflect FFO on the same basis), excluding corporate depreciation, amortization of finance costs, amortization of net debt discount (premium), amortization of equity-based compensation, straight-line rent amounts, market rent amounts, second generation tenant allowances and lease incentives, recurring capital improvement expenditures, and our share of the items listed above for our unconsolidated joint ventures. Investors, analysts and the Company utilize FAD as an indicator of common dividend potential. The FAD payout ratio, which represents regular distributions to common shareholders and unitholders of the Operating Partnership expressed as a percentage of FAD, facilitates the comparison of dividend coverage between REITs.

We believe that net income (loss) is the most directly comparable GAAP financial measure to FAD. FAD does not represent cash generated from operating activities in accordance with GAAP and should not be considered as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of liquidity or our ability to make distributions. Other companies in our industry may calculate FAD differently than we do, limiting its usefulness as a comparative measure.

Portfolio Net Operating Income and Same Center Net Operating Income

We present portfolio net operating income (“Portfolio NOI”) and same center net operating income (“Same Center NOI”) as supplemental measures of our operating performance. Portfolio NOI represents our property level net operating income which is defined as total operating revenues less property operating expenses and excludes termination fees and non-cash adjustments including straight-line rent, net above and below market rent amortization, impairment charges, loss on early extinguishment of debt and gains or losses on the sale of assets recognized during the periods presented. We define Same Center NOI as Portfolio NOI for the properties that were operational for the entire portion of both comparable reporting periods and which were not acquired, or subject to a material expansion or non-recurring event, such as a natural disaster, during the comparable reporting periods. We present Portfolio NOI and Same Center NOI on both a consolidated and total portfolio, including pro rata share of unconsolidated joint ventures, basis.

We believe Portfolio NOI and Same Center NOI are non-GAAP metrics used by industry analysts, investors and management to measure the operating performance of our properties because they provide performance measures directly related to the revenues and expenses involved in owning and operating real estate assets and provide a perspective not immediately apparent from net income (loss), FFO or Core FFO. Because Same Center NOI excludes properties developed, redeveloped, acquired and sold; as well as non-cash adjustments, gains or losses on the sale of outparcels and termination rents; it highlights operating trends such as occupancy levels, rental rates and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Portfolio NOI and Same Center NOI, and accordingly, our Portfolio NOI and Same Center NOI may not be comparable to other REITs.