UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 12, 2024

ELECTROMED, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Minnesota | 001-34839 | 41-1732920 |

|

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

500 Sixth Avenue NW

New Prague, MN 56071

(Address of Principal Executive Offices) (Zip Code)

(952) 758-9299

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $0.01 par value | ELMD | NYSE American LLC | ||

| (Title of each class) | (Trading Symbol) | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On November 12, 2024, Electromed, Inc., a Minnesota corporation (the “Company”), issued a press release announcing its financial results for the fiscal quarter ended September 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference into this Item 2.02.

| Item 7.01 | Regulation FD Disclosure. |

The Company has updated its investor presentation, a copy of which is furnished as Exhibit 99.2 to this Current Report on Form 8-K and incorporated by reference into this Item 7.01. The Company intends to use the presentation in whole or in part, in one or more meetings with investors and analysts.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

| Exhibit Number | Description | |

| 99.1 | Press Release dated November 12, 2024 | |

| 99.2 | Company Investor Presentation dated November 12, 2024 | |

| 104 | Cover Page Interactive Data File (embedded in the cover page and formatted in inline XBRL) |

The information contained in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ELECTROMED, INC. | ||

| Date: November 12, 2024 | By: | /s/ Bradley M. Nagel |

| Name: | Bradley M. Nagel | |

| Title: | Chief Financial Officer | |

Exhibit 99.1

Electromed, Inc. Announces Fiscal 2025 First Quarter Financial Results

Electromed delivers eighth consecutive quarter of year-over-year revenue and profit growth, while continuing to invest in strategic growth initiatives

NEW PRAGUE, Minn.--(BUSINESS WIRE) -- Electromed, Inc. (“Electromed”) (NYSE American: ELMD), a leader in innovative airway clearance technologies, today announced financial results for the three months ended September 30, 2024 (“Q1 FY 2025”).

Q1 FY 2025 Financial Highlights

| ● | Net revenue increased 19.0% to $14.7 million in Q1 FY 2025, from $12.3 million in the first quarter of the prior fiscal year. |

| ● | Gross margin was 78.3% of net revenues, compared to 77.1% in the first quarter of the prior fiscal year. |

| ● | Operating income increased to $1.9 million or 13.2% of revenue compared to $0.1 million or 1.2% of revenue in the first quarter of the prior fiscal year. |

| ● | Net income was $1.5 million, or $0.16 per diluted share, compared to $0.2 million, or $0.02 per diluted share in the first quarter of the prior fiscal year. |

| ● | Share repurchases of Electromed stock totaled 262,756 at an average price of $17.26 per share, or an aggregate amount of approximately $4.5 million against an authorization of $5 million. |

“The Electromed team performed at a high level in the first quarter, generating strong results and getting fiscal 2025 off to an outstanding start”, said Jim Cunniff, President, and Chief Executive Officer. “This is particularly impressive given our excellent results in fiscal 2024, and demonstrates the team’s ability to grow profitably, enhancing shareholder value. Our direct sales force now totals 53 reps and we increased our total number of sales territories to 57 by the end of the first quarter of fiscal 2025. This highly accomplished team has been the catalyst for our growth. Additionally, we launched an exciting new marketing campaign, called Triple Down on Bronchiectasis, which highlights the vital role of airway clearance as a key component of a complete bronchiectasis treatment program, and the response has been overwhelmingly positive. Finally, to lead our various market development initiatives, we have hired Peter Horwich as our new VP of Marketing. It has been an exciting quarter, and I look forward to working towards another record-breaking year in fiscal 2025.”

Q1 FY 2025 Results

All amounts below are for the three months ended September 30, 2024 (“Q1 FY 2025”) and compare to the three months ended September 30, 2023 (“Q1 FY 2024”).

Net revenues grew 19.0% to $14.7 million, from $12.3 million in Q1 FY 2024.

Revenue in our direct homecare business increased year-over-year by 18.5% to $13.2 million, from $11.2 million. The increase in revenue was due to an increase in referrals driven by an increase in direct sales representatives, higher quality referrals, higher net revenue per approval, and efficiencies within our reimbursement department. Field sales force employees totaled 60 at quarter end, 53 of which were direct sales representatives. The annualized homecare revenue per weighted average direct sales representative in Q1 FY 2025 was $985,000, at the higher end of Electromed’s increased annual target range of $900,000 to $1,000,000.

Gross profit increased to $11.5 million, or 78.3% of net revenues from $9.5 million or 77.1% of net revenues, in Q1 FY 2024. The increase in gross profit dollars for the three months ended September 30, 2024, was primarily due to increased revenue volume and a higher average net revenue per device. The gross margin rate increased year over year, primarily driven by a higher average net revenue per device.

Selling, general and administrative expenses were $9.4 million representing an increase of $0.2 million or 2.6%, compared to Q1 FY 2024. The increase in the current period was primarily due to increases in share-based compensation associated with the vesting of performance-based equity awards, salaries, and incentive compensation related to the higher average number of sales, sales support, marketing, and an increase in reimbursement personnel to process higher patient referrals.

Operating income was $1.9 million, compared to $0.1 million in Q1 FY 2024. The increase in operating income was driven primarily by increased revenue and gross profit and growth in selling, general and administrative expense growth tracking below revenue growth.

Net income was $1.5 million, or $0.16 per diluted share, compared to $0.2 million, or $0.02 per diluted share in Q1 FY 2024.

As of September 30, 2024, Electromed had $13.9 million in cash, $22.4 million in accounts receivable and no debt, achieving an overall working capital of $33.6 million. The cash balance reflects a decrease of $2.2 million in the quarter. The decrease primarily resulted from the share repurchase of approximately $4.5 million of Electromed common stock, offset by $2.3 million of positive operating cash flow within the quarter.

Conference Call and Webcast Information

The conference call with members of Electromed management will be held at 5:00 p.m. Eastern Time on Tuesday, November 12, 2024.

Interested parties may participate in the call by dialing (844) 826-3033 (Domestic) or (412) 317-5185 (International).

The live conference call webcast will be accessible in the Investor Relations section of Electromed’s website and directly via the following link: https://url.us.m.mimecastprotect.com/s/7BVqCR6MPEIA8DR8fPijF15Pbr?domain=viavid.webcasts.com

For those who cannot listen to the live broadcast, a replay will be available by dialing (844) 512-2921 (Domestic) or (412) 317-6671 (International) and referencing the replay pin number 10193708. Additionally, an online replay will be available for one year in the Investor Relations section of Electromed’s website at: https://investors.smartvest.com/events-and-presentations/default.aspx

About Electromed, Inc.

Electromed, Inc. manufactures, markets, and sells products that provide airway clearance therapy, including the SmartVest® Airway Clearance System, to patients with compromised pulmonary function. It is headquartered in New Prague, Minnesota, and was founded in 1992. Further information about Electromed can be found at www.smartvest.com.

Cautionary Statements

Certain statements in this press release constitute forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can generally be identified by words such as “anticipate,” “believe,” continue,” “estimate,” “expect,” “intend,” “may,” “plan” “potential,” “should,” “will,” and similar expressions, including the negative of these terms, but they are not the exclusive means of identifying such statements. Forward-looking statements cannot be guaranteed, and actual results may vary materially due to the uncertainties and risks, known or unknown associated with such statements. Examples of risks and uncertainties for Electromed include, but are not limited to, the competitive nature of our market; changes to Medicare, Medicaid, or private insurance reimbursement policies; changes to state and federal health care laws; changes affecting the medical device industry; our ability to develop new sales channels for our products such as the homecare distributor channel; our need to maintain regulatory compliance and to gain future regulatory approvals and clearances; new drug or pharmaceutical discoveries; general economic and business conditions; our ability to renew our line of credit or obtain additional credit as necessary; our ability to protect and expand our intellectual property portfolio; the risks associated with expansion into international markets, as well as other factors we may describe from time to time in Electromed’s reports filed with the Securities and Exchange Commission (including Electromed’s most recent Annual Report on Form 10-K, as amended from time to time, and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K). Investors should not consider any list of such factors to be an exhaustive statement of all the risks, uncertainties or potentially inaccurate assumptions investors should take into account when making investment decisions. Shareholders and other readers should not place undue reliance on “forward-looking statements,” as such statements speak only as of the date of this press release. We undertake no obligation to update them in light of new information or future events.

Brad

Nagel, Chief Financial Officer

(952) 758-9299

investorrelations@electromed.com

Mike

Cavanaugh, Investor Relations

ICR Westwicke

(617) 877-9641

mike.cavanaugh@westwicke.com

Source: Electromed, Inc.

Electromed, Inc.

Condensed Balance Sheets

| September 30, 2024 | June 30, 2024 | |||||||

| (Unaudited) | (Audited) | |||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 13,864,000 | $ | 16,080,000 | ||||

| Accounts receivable (net of allowances for credit losses of $45,000) | 22,366,000 | 23,333,000 | ||||||

| Contract assets | 754,000 | 719,000 | ||||||

| Inventories | 3,434,000 | 3,712,000 | ||||||

| Prepaid expenses and other current assets | 592,000 | 329,000 | ||||||

| Total current assets | 41,010,000 | 44,173,000 | ||||||

| Property and equipment, net | 5,003,000 | 5,165,000 | ||||||

| Finite-life intangible assets, net | 660,000 | 657,000 | ||||||

| Other assets | 90,000 | 87,000 | ||||||

| Deferred income taxes | 2,152,000 | 2,152,000 | ||||||

| Total assets | $ | 48,915,000 | $ | 52,234,000 | ||||

| Liabilities and Shareholders’ Equity | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 1,784,000 | $ | 1,010,000 | ||||

| Accrued compensation | 2,150,000 | 3,893,000 | ||||||

| Income tax payable | 188,000 | 277,000 | ||||||

| Warranty reserve | 1,641,000 | 1,567,000 | ||||||

| Other accrued liabilities | 1,656,000 | 930,000 | ||||||

| Total current liabilities | 7,419,000 | 7,677,000 | ||||||

| Other long-term liabilities | 8,000 | 12,000 | ||||||

| Total liabilities | 7,427,000 | 7,689,000 | ||||||

| Shareholders’ Equity | ||||||||

| Common stock, $0.01 par value per share, 13,000,000 shares authorized; | ||||||||

| 8,457,071 and 8,637,883 shares issued and outstanding, as of September 30, 2024, and June 30, 2024, respectively | 85,000 | 87,000 | ||||||

| Additional paid-in capital | 20,816,000 | 20,790,000 | ||||||

| Retained earnings | 20,587,000 | 23,668,000 | ||||||

| Total shareholders’ equity | 41,488,000 | 44,545,000 | ||||||

| Total liabilities and shareholders’ equity | $ | 48,915,000 | $ | 52,234,000 | ||||

Electromed, Inc.

Condensed Statements of Operations

| Three Months Ended September 30 | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Net revenues | $ | 14,668,000 | $ | 12,324,000 | ||||

| Cost of revenues | 3,177,000 | 2,826,000 | ||||||

| Gross profit | 11,491,000 | 9,498,000 | ||||||

| Operating expenses | ||||||||

| Selling, general and administrative | 9,387,000 | 9,150,000 | ||||||

| Research and development | 166,000 | 206,000 | ||||||

| Total operating expenses | 9,553,000 | 9,356,000 | ||||||

| Operating income | 1,938,000 | 142,000 | ||||||

| Interest income, net | 195,000 | 77,000 | ||||||

| Net income before income taxes | 2,133,000 | 219,000 | ||||||

| Income tax expense (benefit) | 659,000 | 64,000 | ||||||

| Net income | $ | 1,474,000 | $ | 155,000 | ||||

| Income per share: | ||||||||

| Basic | $ | 0.17 | $ | 0.02 | ||||

| Diluted | $ | 0.16 | $ | 0.02 | ||||

| Weighted-average common shares outstanding: | ||||||||

| Basic | 8,564,489 | 8,537,388 | ||||||

| Diluted | 8,980,714 | 8,782,824 | ||||||

Electromed, Inc.

Condensed Statements of Cash Flows

| Three Months Ended September 30, | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash Flows from Operating Activities | ||||||||

| Net income | $ | 1,474,000 | $ | 155,000 | ||||

| Adjustments to reconcile net income to net cash provided by (used for) operating activities: | ||||||||

| Depreciation | 202,000 | 202,000 | ||||||

| Amortization of finite-life intangible assets | 18,000 | 12,000 | ||||||

| Share-based compensation expense | 697,000 | 371,000 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 967,000 | 675,000 | ||||||

| Contract assets | (35,000 | ) | (57,000 | ) | ||||

| Inventories | 278,000 | (240,000 | ) | |||||

| Prepaid expenses and other assets | (266,000 | ) | 901,000 | |||||

| Income tax payable, net | (89,000 | ) | (226,000 | ) | ||||

| Accounts payable and accrued liabilities | 806,000 | (863,000 | ) | |||||

| Accrued compensation | (1,743,000 | ) | (1,174,000 | ) | ||||

| Net cash provided by (used for) operating activities | 2,309,000 | (244,000 | ) | |||||

| Cash Flows from Investing Activities | ||||||||

| Expenditures for property and equipment | (37,000 | ) | (109,000 | ) | ||||

| Expenditures for finite-life intangible assets | (21,000 | ) | (24,000 | ) | ||||

| Net cash used for investing activities | (58,000 | ) | (133,000 | ) | ||||

| Cash Flows from Financing Activities | ||||||||

| Issuance of common stock upon exercise of options | 84,000 | 29,000 | ||||||

| Taxes paid on net share settlement of stock awards | (15,000 | ) | - | |||||

| Repurchase of common stock | (4,536,000 | ) | - | |||||

| Net cash (used for) provided by financing activities | (4,467,000 | ) | 29,000 | |||||

| Net decrease in cash | (2,216,000 | ) | (348,000 | ) | ||||

| Cash And Cash Equivalents | ||||||||

| Beginning of period | 16,080,000 | 7,372,000 | ||||||

| End of period | $ | 13,864,000 | $ | 7,024,000 | ||||

Exhibit 99.2

| 1 Investor Presentation Electromed, Inc.

Investor Presentation November 12, 2024 NYSE American: ELMD Innovation Leader in Airway Clearance Technologies | 2 Investor Presentation Forward Looking Statements Certain statements in this press release constitute forward - looking statements as defined in the US Private Securities Litigation Reform Act of 1995 . Forward - looking statements can generally be identified by words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will,” and similar expressions, including the negative of these terms, but they are not the exclusive means of identifying such statements . Forward - looking statements cannot be guaranteed, and actual results may vary materially due to the uncertainties and risks, known or unknown associated with such statements . Examples of risks and uncertainties for the Company include, but are not limited to the competitive nature of our market ; changes to Medicare, Medicaid, or private insurance reimbursement policies ; changes to state and federal health care laws ; changes affecting the medical device industry ; our ability to develop new sales channels for our products such as the homecare distributor channel ; our need to maintain regulatory compliance and to gain future regulatory approvals and clearances ; new drug or pharmaceutical discoveries ; general economic and business conditions ; our ability to renew our line of credit or obtain additional credit as necessary ; our ability to protect and expand our intellectual property portfolio ; the risks associated with expansion into international markets, as well as other factors we may describe from time to time in the Company’s reports filed with the Securities and Exchange Commission (including the Company’s most recent Annual Report on Form 10 - K, as amended from time to time, and subsequent Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K) . Investors should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or potentially inaccurate assumptions investors should take into account when making investment decisions . Shareholders and other readers should not place undue reliance on “forward - looking statements,” as such statements speak only as of the date of this press release . We undertake no obligation to update them in light of new information or future events .

| 3 Investor Presentation Electromed – Who We Are Electromed, Inc. is a growing medical device company focused on airway management to help people around the world breathe better, stay healthier, and lead active and fulfilling lives. As of and for 12 months ended 9/30/2024 Key Stats : Headquarters: New Prague, MN Ticker: ELMD Established: 1992 Annual Revenue: $57.1M Market Cap: $180M Share Count: 8.4M 174 Employees Manufacturing in Minnesota HFCWO Market Focus | 4 Investor Presentation Electromed Highlights » Growing and profitable medical technology company » A leader in the large and expanding airway clearance market » The SmartVest ® Airway Clearance System’s H igh F requency C hest W all Oscillation (“HFCWO”) technology supported by clinical outcomes data with strong reimbursement.

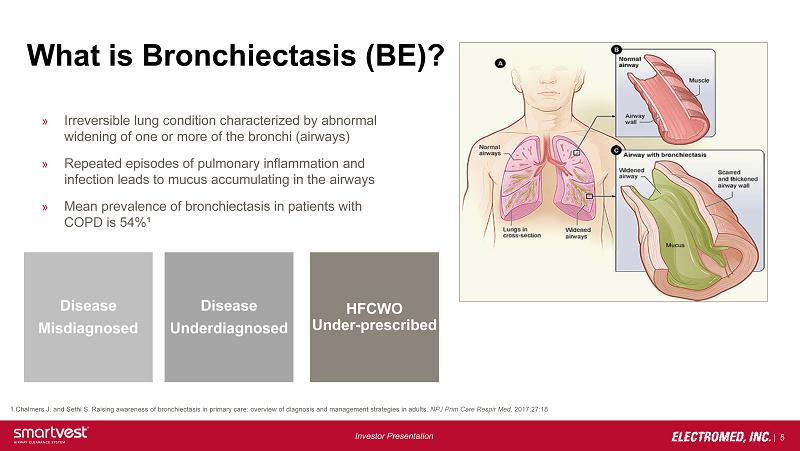

» Attractive direct - to - patient and provider model » Strong financial profile with attractive gross margins and well - capitalized balance sheet $35.8 $41.7 $48.1 $54.7 $57.1 $2.4 $2.3 $3.2 $5.2 $6.2 FY'21 FY'22 FY'23 FY'24 TTM 9/30/2024 Revenue Net Income 29% Net Income CAGR* *FY ‘21 through TTM 9/30/2024 | 5 Investor Presentation What is Bronchiectasis (BE)? » Irreversible lung condition characterized by abnormal widening of one or more of the bronchi (airways) » Repeated episodes of pulmonary inflammation and infection leads to mucus accumulating in the airways » Mean prevalence of bronchiectasis in patients with COPD is 54%¹ 1.Chalmers J. and Sethi S. Raising awareness of bronchiectasis in primary care: overview of diagnosis and management strategi es in adults. NPJ Prim Care Respir Med .

2017;27:18 HFCWO Under - prescribed Disease Underdiagnosed Disease Misdiagnosed | 6 Investor Presentation U.S. Market: Large, Growing, Underpenetrated 1. Derived from GUIDEHOUSE 2023 NASM claims database 2. Derived from GUIDEHOUSE 2023 literature review and 2023 CDC NHANES data Bronchiectasis HFCWO penetration ~15% 1 Diagnosed BE population growing at ~12% annually 1 Estimated Net Bronchiectasis prevalence, DIAGNOSED 1 Estimated bronchiectasis prevalence, UNDIAGNOSED with COPD/BE overla p 2 Estimated HFCWO bronchiectasis penetration, treated population 1 ~824K U.S. BE Diagnosed 1 4.1 million U.S. Undiagnosed 2 ~127K HFCWO ADOPTED 1 | 7 Investor Presentation How is Bronchiectasis Treated? Antibiotics, Anti - Inflammatories, Airway Clearance

| 8 Investor Presentation How is Bronchiectasis Treated? HFCWO Therapy – Mimics Manual CPT | 9 Investor Presentation Sleek and light weight generator Intuitive user interface for better patient adherence More portable and easier for travel SmartVest Clearway ® HFCWO Designed with the Patient in Mind An Enhanced Patient Experience SmartVest ® has a well - established reimbursement code from CMS – E0483; Electromed has over 275M contracted lives in the US | 10 Investor Presentation SmartNotes™ Patient Progress Report SmartNotes combine patient Quality of Life and Therapy Utilization data to provide physicians with extended views into disease management » TeleRespiratory Services : A team of Respiratory Therapists stay connected with patients and support their therapy utilization.

» Outcomes Management : Easy - to - read report provides physicians with a comprehensive view of disease progression and therapy impact. Patient Outcomes and Treatment Progress to Physicians | 11 Investor Presentation Clinical Evidence Electromed has Published Studies Showing Effectiveness of HFCWO to Treat Bronchiectasis 1.Sievert CE, et al 2016.

Using High Frequency Chest Wall Oscillation in a Bronchiectasis Patient Population: An Outcomes - Based Case Review. Respiratory Therapy, 11(4), 34 - 38. 2. Sievert CE, et al 2018. Incidence of Bronchiectasis - Related Exacerbation Rates After HFCWO Treatment — A Longitudinal Outcome - B ased Study, Respiratory Therapy, 13(2), 38 - 41. 57 % Reduction in antibiotic prescriptions 1 59 % Decrease in hospitalizations 1 75 % Fewer emergency department visits 2 Therapy with SmartVest® significantly decreased exacerbations requiring hospitalization, antibiotic use, and stabilizes lung function. Powner (2018) Therapy with HFCWO demonstrated key health outcomes improved in post - compared to pre - index period: cough, all - cause hospitalizations, pneumonia, and pulmonary hospitalizations. DeKoven (2022)

| 12 Investor Presentation Direct - to - Patient Model Drives Attractive Margin Profile Manufacturer DME Patient $ $ vs.

Electromed Patient $$ Traditional Medical Equipment Channel Direct - to - Patient Distribution (Electromed) ELMD expects gross margins in the mid - 70s and improving with the SmartVest ® Clearway ® | 13 Investor Presentation Net Revenue Breakdown - $57.1M (TTM ended 9/30/2024) 1% [PE RCE NTA GE] 94% By Setting Homecare By Payer Homecare Qualified Referral Volume 73% 3% 22% 2% 51% 47% 2% Home Care 1 Hospitals Other Medicare Commercial/Other 2 Medicaid Bronchiectasis Cystic Fibrosis Neuromuscular Other 1.Includes $1.9 million from home care distributor revenue 2.Includes Managed Medicare and Managed Medicaid | 14 Investor Presentation Growth Strategy How will Electromed Increase Market Share? Continued sales force expansion along with complementary infrastructure investments Increase brand awareness and revenue with direct - to - consumer and physician marketing Market development to improve diagnosis rates and evidence to support the adoption of the SmartVest system for patients SmartAdvantage ™ best - in - class customer care and support Expand e - prescribing capability

| 15 Investor Presentation Long - Term Objectives Electromed is committed to delivering long - term profitable growth Double - digit Revenue Growth Operating Margin Improvement Increase market share Deeper penetration of current SmartVest prescribers Operating leverage as revenue increases | 16 Investor Presentation Why Invest? Large, expanding chronic lung diseases market Clinically proven technology Broad payor coverage Consistent double - digit organic revenue growth High gross margins , robust cash flow and expanding operating leverage

| 17 Investor Presentation Management Incentives Aligned w/Investors CEO Incentive Management’s Incentive Compensation Reward based on increasing total shareholder return . Focused solely on delivering financial results .

| 18 Investor Presentation Attractive Valuation (TTM and as of 9/30/2024 Results) Metric ELMD RUS ME Sales Growth 14.8% > 2.4% EV / Revenue Gross Margin 3.2x 76.6% > > 3.9x 52.5% Operating Margin 14.7% > (5.3%)

| 19 Investor Presentation Mike Cavanaugh ( 617) 877 - 8641 m ike.cavanaugh@westwicke.com Maren Czura (332) 242 - 4365 maren.czura@westwicke.com Jim Cunniff , President & CEO (952) 758 - 9299 jcunniff @Electromed.com Brad Nagel, CFO (952) 758 - 9299 bnagel@Electromed.com | 20 Investor Presentation APPENDIX

| 21 Investor Presentation Financial Highlights and Balance Sheet Financial Summary Three months ended ( in $ millions, except shares amounts) September 30, 2024 (unaudited) September 30, 2023 (unaudited) Revenues $14.7 $12.3 Gross Profit $11.5 $9.5 Gross margin 78% 77% Operating income $1.9 $0.1 Operating margin 13% 1% Net income $1.5 $0.2 Diluted EPS $0.16 $0.02 Diluted Shares 8,980,714 8,782,824 Cash provided by (used for) operations $2.3 ($0.2)