Document

USANA Health Sciences Reports Fourth Quarter and Full Year 2024 Results and Provides Fiscal Year 2025 Outlook

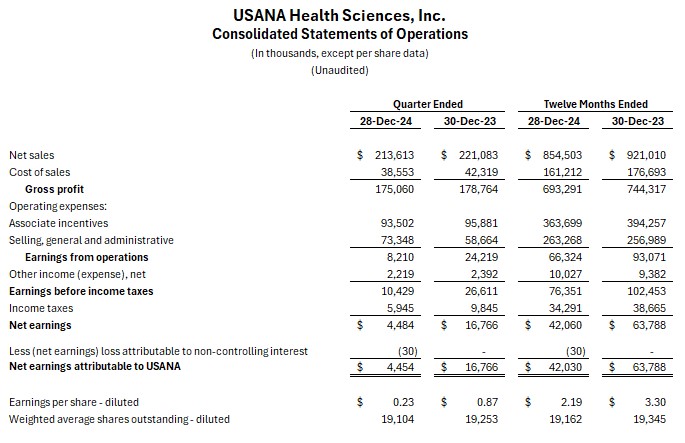

SALT LAKE CITY, February 25, 2025 (BUSINESS WIRE)—USANA Health Sciences, Inc. (NYSE: USNA) (the “Company”) today announced financial results for its fiscal fourth quarter and fiscal year ended December 28, 2024. The Company completed the acquisition of a 78.8% controlling ownership stake of Hiya Health Products, LLC (“Hiya”) on December 23, 2024. Consequently, the Company’s fourth quarter and fiscal year 2024 include the effect of less than a week of Hiya’s operating results, which were not significant to the Company’s consolidated results for the same periods. In light of the Hiya acquisition, the Company is now including metrics for Adjusted diluted EPS(1) and Adjusted EBITDA(2). Net earnings, Diluted EPS, Adjusted diluted EPS(1) and Adjusted EBITDA(2) in this press release represent amounts attributable to USANA.

Key Financial Results and Guidance

Fourth Quarter 2024 vs. Fourth Quarter 2023

•Net sales of $214 million versus $221 million.

•Net earnings of $4.5 million as compared to $16.8 million.

•Diluted EPS of $0.23 as compared with $0.87.

•Adjusted diluted EPS(1) of $0.64 as compared with $0.87.

•Adjusted EBITDA(2) of $25 million versus $32 million.

•USANA Active Customers of 454,000 versus 483,000.

Fiscal Year 2024 vs. Fiscal Year 2023

•Net sales of $855 million as compared with $921 million.

•Net earnings of $42.0 million as compared to $63.8 million.

•Diluted EPS of $2.19 versus $3.30.

•Adjusted diluted EPS(1) of $2.59 as compared with $3.30.

•Adjusted EBITDA(2) of $110 million versus $128 million.

Fiscal Year 2025 Outlook

•Consolidated net sales between $920 million and $1.0 billion, or 8% - 17% growth.

•Net earnings between $29 million and $41 million.

•Diluted EPS between $1.50 and $2.20.

•Adjusted Diluted EPS(1) between $2.35 and $3.00.

•Adjusted EBITDA(2) between $107 million and $123 million.

Q4 2024 Financial Performance

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Results |

(Net earnings, EPS and EBITDA figures represent amounts attributable to USANA) |

Year-over-Year |

Sequentially |

| Net Sales |

$214 million |

-3% (No meaningful FX impact) |

+7% |

Net Earnings |

$4.5 million |

-73% |

-58% |

Diluted EPS |

$0.23 |

-74% |

-59% |

Adjusted Diluted EPS(1) |

$0.64 |

-26% |

+14% |

Adjusted EBITDA(2) |

$25 million |

-21% |

+4% |

“USANA delivered fourth quarter results above our internal expectations, highlighted by 7% sequential net sales growth,” said Jim Brown, President and Chief Executive Officer. “Positive momentum in the Americas & Europe region generated year-over-year and sequential sales growth in this region while performance in our Asia Pacific region declined slightly and was in line with our expectations. On a consolidated basis, we generated solid cash flow during the quarter and our balance sheet remains in a healthy net cash position. Overall, we delivered solid performance to finish the year and are confident in our ability to build on this performance in 2025.”

Mr. Brown added, “We also completed our acquisition of Hiya during the quarter, which is a meaningful milestone for USANA and an exciting addition to our business. Hiya is a growing, highly cash generative, direct-to-consumer children’s wellness brand. Hiya has an experienced management team that continues to lead the company and a compelling subscription business model that we believe is positioned to deliver long-term sustainable growth over the next several years.

We look forward to supporting Hiya as they build upon their leadership position in the children’s health and wellness market.”

Fiscal Year 2024 vs. Fiscal Year 2023 Financial Performance

|

|

|

|

|

|

|

|

|

| Consolidated Results |

| Net Sales |

$855 million |

-7% YOY |

|

|

-6% constant currency |

|

|

-$14 million YOY FX impact |

Net Earnings |

$42.0 million |

-34% |

| Diluted EPS |

$2.19 |

-34% |

Adjusted Diluted EPS(1) |

$2.59 |

-21% |

Adjusted EBITDA(2) |

$110 million |

-14% |

Net earnings, EPS and EBITDA figures represent amounts attributable to USANA

Mr. Brown continued, “Full year operating results reflected continued, cautious consumer sentiment in many of our key Asia Pacific markets. This made it difficult to attract new customers and generate positive momentum throughout the year. Notwithstanding these factors, our commercial team made progress on several meaningful initiatives which will begin rolling out across our direct sales business this year. We are confident that these initiatives will lay the foundation for the Company to generate long term growth.”

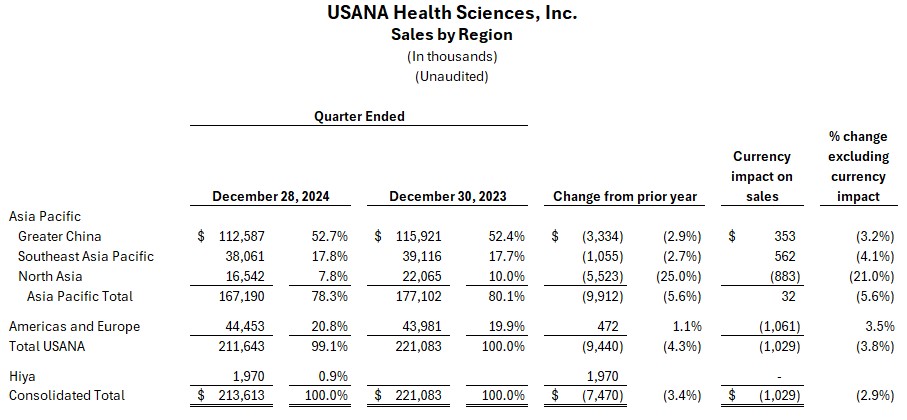

Q4 2024 Regional Results:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asia Pacific Region |

|

|

|

Year-Over-Year |

Year-over-Year (Constant Currency) |

Sequentially |

| Net Sales |

$167 million |

-6% |

No material FX impact |

+4% |

| USANA Active Customers |

361,000 |

-6% |

n.a. |

Flat |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asia Pacific Sub-Regions |

|

|

|

Year-Over-Year |

Year-over-Year (Constant Currency) |

Sequentially |

| Greater China |

Net Sales |

$113 million |

-3% |

No material FX impact |

+10% |

| USANA Active |

246,000 |

-4% |

n.a. |

+1% |

| Customers |

| North Asia |

Net Sales |

$17 million |

-25% |

-21% |

-19% |

| USANA Active |

38,000 |

-21% |

n.a. |

-7% |

| Customers |

| Southeast Asia Pacific |

Net Sales |

$38 million |

-3% |

-4% |

+2% |

| USANA Active |

77,000 |

-4% |

n.a. |

+1% |

| Customers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Americas and Europe Region |

|

|

|

Year-Over-Year |

Year-over-Year (Constant Currency) |

Sequentially |

| Net Sales |

$44 million |

+1% |

+3% |

+11% |

| USANA Active Customers |

93,000 |

-7% |

n.a. |

+1% |

Hiya contributed approximately $2 million to net sales during the fourth quarter and fiscal year ended 2024.

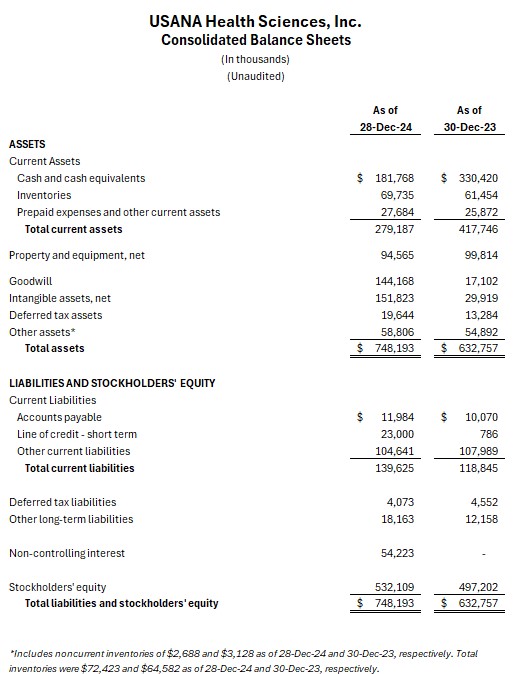

Balance Sheet and Share Repurchase Activity

During the fourth quarter, the Company continued to generate strong operating cash flow and invested approximately $206 million for the acquisition of Hiya. Consequently, the Company ended the year with $182 million in cash and cash equivalents. The Company did not repurchase any shares during the quarter. As of December 28, 2024, the Company had approximately $62 million remaining under the current share repurchase authorization.

Fiscal Year 2025 Outlook

Mr. Brown continued, “Our growth strategy for the direct sales business in 2025 is centered on our Associate sales force and providing them with the resources needed to generate sustainable active customer growth. This growth strategy includes several key initiatives, including (i) a higher cadence of new product launches and improvements to existing products tailored to local markets, (ii) strategic enhancements and modifications to our Associate incentive offering, which are intended to incent customer growth and improve pay for performance, (iii) strengthening our brand messaging, story, and value proposition, and (iv) accelerating Associate engagement activities in our regions around the world. I’m confident that the successful execution of these initiatives will position us for growth going forward.

“Hiya’s strategic priorities for this year include capitalizing on recent product launches to drive further growth in its direct-to-consumer model, expanding strategic partnerships, and laying the groundwork for channel expansion. We are also working closely with the Hiya team to identify both short- and long-term synergy opportunities. Overall, we remain confident that the Hiya team, which continues to be led by co-founders Darren Litt and Adam Gillman, will deliver strong growth in 2025.”

The Company is providing its outlook for fiscal year 2025, as detailed in the table below:

|

|

|

|

|

|

|

Twelve Months Ended

January 3, 2026 |

|

Range |

| Consolidated net sales |

$920 million to $1.0 billion |

Net Earnings |

$29 million to $41 million |

| Diluted EPS |

$1.50 to $2.20 |

Adjusted diluted EPS(1) |

$2.35 to $3.00 |

Adjusted EBITDA(2) |

$107 million to $123 million |

Doug Hekking, Chief Financial Officer, said, “We are introducing our consolidated fiscal 2025 outlook, which now includes additional non-GAAP financial metrics to help provide transparency and comparability with prior years following our acquisition of Hiya. Notably, we have included certain transaction-related expenses and integration costs for the Hiya acquisition in our outlook.

Furthermore, the purchase price allocation for this acquisition includes a significant amount recognized as intangible assets with material amortization expense that will have a non-cash impact on reported results. Therefore, we are providing estimates for Adjusted diluted EPS(1) and Adjusted EBITDA(2) as part of our outlook to provide enhanced comparability between periods and improved clarity on cash flow generation of the combined enterprise on a year-over-year basis. Additionally, our outlook does not currently reflect the potential increased costs of proposed tariffs on our business as we continue to assess the changing business environment.”

The Company’s outlook reflects:

•Net sales from the USANA business of $775 to $840 million, which includes an expected unfavorable currency exchange rate impact of approximately $30 million, or -4% on net sales;

•Net sales from Hiya of $145 to $160 million, reflecting a year-over-year range of +29% to +42%;

•Effective tax rate of 41.5% to 45.0%;

•Annualized diluted share count of 19.1 million; and

•Fiscal 2025 is a 53-week year and includes one additional week of sales compared to fiscal 2024. Prior to 2025, the last 53-week year was in fiscal 2020.

_________________________

(1) Adjusted Diluted Earnings Per Share is a non-GAAP financial measure. The Company excludes acquisition-related costs, such as business transaction costs, integration expense and amortization expense from acquisition related intangible assets in calculating Adjusted Diluted Earnings Per Share. Please refer to “Non-GAAP Financial Measures” and “Reconciliation of Diluted Earnings Per Share (GAAP) to Adjusted Diluted Earnings Per Share (Non-GAAP)” in this press release for an explanation and reconciliation of this non-GAAP financial measure.

(2) Adjusted EBITDA is a non-GAAP financial measure. Please refer to “Non-GAAP Financial Measures” and “Reconciliation of Net Earnings (GAAP) to Adjusted EBITDA (Non-GAAP)” in this press release for an explanation and reconciliation of this non-GAAP financial measure.

Non-GAAP Financial Measures

This press release contains the non-GAAP financial measures Adjusted EBITDA and Adjusted diluted EPS. Adjusted EBITDA is a Non-GAAP financial measure of earnings before interest, taxes, depreciation, and amortization that also excludes certain adjustments as indicated below in the reconciliation from net earnings. Adjusted diluted EPS is a Non-GAAP financial measure of diluted earnings per share that excludes certain adjustments as indicated below in the reconciliation from diluted EPS.

Adjusted EBITDA (non-GAAP) is net earnings (loss) (its most directly comparable GAAP financial measure) adjusted for interest expense, net, (benefit from) provision for income taxes, depreciation and amortization, non-cash share-based compensation, and transaction-related expenses and integration costs for the Hiya acquisition. Adjusted EBITDA attributable to USANA (non-GAAP) is Adjusted EBITDA (non-GAAP) further adjusted to exclude the Adjusted EBITDA attributable to non-controlling interest related to Hiya.

Adjusted diluted earnings per share (non-GAAP) is diluted earnings (loss) per share (its most directly comparable GAAP financial measure) adjusted for amortization of intangible assets, transaction-related expenses, and integration costs related to the Hiya acquisition.

Management believes that Adjusted EBITDA (non-GAAP), Adjusted EBITDA attributable to USANA (non-GAAP), and Adjusted diluted earnings per share (non-GAAP), along with GAAP measures used by management, most appropriately reflect how the Company measures the business internally.

The Company prepares its financial statements using U.S. generally accepted accounting principles (“GAAP”) and investors should not directly compare with or infer relationship from any of the Company’s operating results presented in accordance with GAAP to Adjusted EBITDA and Adjusted diluted earnings per share. Non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, other companies, including companies in our industry, may calculate similarly titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of non-GAAP financial information as a tool for comparison.

As a result, the non-GAAP financial information of Hiya is presented for supplemental informational purposes only and should not be considered in isolation from, or as a substitute for financial information presented in accordance with GAAP.

Reconciliation of Diluted Earnings Per Share (GAAP) to Adjusted Diluted Earnings Per Share (non-GAAP)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

Twelve Months Ended |

|

September 28, 2024 |

|

December 28, 2024 |

|

December 30, 2023 |

|

December 28, 2024 |

|

December 30, 2023 |

| Net earnings attributable to USANA (GAAP) |

$ 10,607 |

|

$ 4,454 |

|

$ 16,766 |

|

$ 42,030 |

|

$ 63,788 |

|

|

|

|

|

|

|

|

|

|

| Earnings per common share - Diluted (GAAP) |

$ 0.56 |

|

$ 0.23 |

|

$ 0.87 |

|

$ 2.19 |

|

$ 3.30 |

| Weighted Average common shares outstanding - Diluted |

19,083 |

|

19,104 |

|

19,253 |

|

19,162 |

|

19,345 |

|

|

|

|

|

|

|

|

|

|

| Adjustment to net earnings: |

|

|

|

|

|

|

|

|

|

| Transaction costs - Hiya |

$ - |

|

$ 8,243 |

|

$ - |

|

$ 8,243 |

|

$ - |

| Integration and transition costs - Hiya |

- |

|

- |

|

- |

|

- |

|

- |

Inventory step-up - Hiya |

- |

|

38 |

|

- |

|

38 |

|

- |

| Amortization of intangible assets - Hiya |

- |

|

294 |

|

- |

|

294 |

|

- |

| Adjustments to net earnings attributable to non-controlling interest |

- |

|

(70) |

|

- |

|

(70) |

|

- |

| Income tax effect of adjustments to net earnings |

- |

|

(823) |

|

- |

|

(823) |

|

- |

|

|

|

|

|

|

|

|

|

|

| Adjusted net earnings attributable to USANA |

$ 10,607 |

|

$ 12,136 |

|

$ 16,766 |

|

$ 49,712 |

|

$ 63,788 |

|

|

|

|

|

|

|

|

|

|

| Adjusted earnings per common share - Diluted |

$ |

0.56 |

|

|

$ |

0.64 |

|

|

$ |

0.87 |

|

|

$ |

2.59 |

|

|

$ |

3.30 |

|

| Weighted average common shares outstanding - Diluted |

19,083 |

|

19,104 |

|

19,253 |

|

19,162 |

|

19,345 |

Reconciliation of Net Earnings (GAAP) to Adjusted EBITDA (non-GAAP)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

Twelve Months Ended |

|

September 28, 2024 |

|

December 28, 2024 |

|

December 30, 2023 |

|

December 28, 2024 |

|

December 30, 2023 |

| Net earnings attributable to USANA (GAAP) |

$ 10,607 |

|

$ 4,454 |

|

$ 16,766 |

|

$ 42,030 |

|

$ 63,788 |

| Net earnings attributable to non-controlling interest |

- |

|

30 |

|

- |

|

30 |

|

- |

| Net earnings |

$ 10,607 |

|

$ 4,484 |

|

$ 16,766 |

|

$ 42,060 |

|

$ 63,788 |

|

|

|

|

|

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

| Income taxes |

8,001 |

|

5,945 |

|

9,845 |

|

34,291 |

|

38,665 |

| Interest (income) expense |

(3,093) |

|

(2,609) |

|

(2,760) |

|

(11,038) |

|

(9,375) |

| Depreciation and amortization |

5,559 |

|

5,590 |

|

4,871 |

|

21,935 |

|

20,395 |

| Amortization of intangible assets - Hiya |

- |

|

294 |

|

- |

|

294 |

|

- |

| Earnings before interest, taxes, depreciation, and amortization (EBITDA) |

21,074 |

|

13,704 |

|

28,722 |

|

87,542 |

|

113,473 |

|

|

|

|

|

|

|

|

|

|

| Add EBITDA adjustments: |

|

|

|

|

|

|

|

|

|

| Non-cash share-based compensation |

3,542 |

|

3,613 |

|

3,643 |

|

14,558 |

|

14,595 |

| Transaction costs - Hiya |

- |

|

8,243 |

|

- |

|

8,243 |

|

- |

| Integration and transition costs - Hiya |

- |

|

- |

|

- |

|

- |

|

- |

Inventory step-up - Hiya |

- |

|

38 |

|

- |

|

38 |

|

- |

| Consolidated adjusted EBITDA |

24,616 |

|

25,598 |

|

32,365 |

|

110,381 |

|

128,068 |

| Less: Adjusted EBITDA attributable to non-controlling interest |

- |

|

(101) |

|

- |

|

(101) |

|

- |

| Adjusted EBITDA attributable to USANA |

$ 24,616 |

|

$ 25,497 |

|

$ 32,365 |

|

$ 110,280 |

|

$ 128,068 |

Management Commentary Document and Conference Call

For further information on the USANA’s operating results, please see the Management Commentary document, which has been posted on the Company’s website (http://ir.usana.com) under the Investor Relations section. USANA’s management team will hold a conference call and webcast to discuss today’s announcement with investors on Wednesday, February 26, 2025 at 11:00 AM Eastern Time. Investors may listen to the call by accessing USANA’s website at http://ir.usana.com. The call will consist of brief opening remarks by the Company’s management team, followed by a questions and answers session.

Safe Harbor

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. These forward-looking statements are based on current plans, expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management. Words such as “expect,” “enhance,” “drive,” “anticipate,” “intend,” “improve,” “promote,” “should,” “believe,” “continue,” “plan,” “goal,” “opportunity,” “estimate,” “predict,” “may,” “will,” “could,” and “would,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements.

Such forward-looking statements include, but are not limited to, statements that Hiya is a growing, highly cash-generative brand that is positioned to deliver long-term sustainable growth over the next several years and strong growth in 2025; statements about the Company’s long-term growth; and the statements under the sub-heading “Fiscal Year 2025 Outlook.” Our actual results could differ materially from those projected in these forward-looking statements, which involve a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control, including: risks relating to global economic conditions generally, including continued inflationary pressure around the world and negative impact on our operating costs, consumer demand and consumer behavior in general; reliance upon our network of independent Associates; risk that our Associate compensation plan, or changes that we make to the compensation plan, will not produce desired results, benefit our business or, in some cases, could harm our business; risk associated with our launch of new products or reformulated existing products; risks related to governmental regulation of our products, manufacturing and direct selling business model in the United States, China and other key markets; potential negative effects of deteriorating foreign and/or trade relations between or among the United States, China and other key markets, including potential adverse impact from tariffs levied by the US, China, or other markets that are important to the Company; potential negative effects from geopolitical relations and conflicts around the world, including the Russia-Ukraine conflict and the conflict in Israel; compliance with data privacy and security laws and regulations in our markets around the world; potential negative effects of material breaches of our information technology systems to the extent we experience a material breach; material failures of our information technology systems; adverse publicity risks globally; risks associated with early stage operations in India and future international expansion and operations; uncertainty relating to the fluctuation in U.S. and other international currencies; the potential for a resurgence of COVID-19, or another pandemic, in any of our markets in the future and any related impact on consumer health, domestic and world economies, including any negative impact on discretionary spending, consumer demand, and consumer behavior in general; risk that the Hiya acquisition disrupts each company’s current plans and operations; the diversion of the attention of the management teams of USANA and Hiya from ongoing business operations; the ability of to retain key personnel of Hiya; the ability to realize the benefits of the acquisition, including efficiencies and cost synergies; the ability to successfully integrate Hiya’s business with USANA’s business, at all or in a timely manner; and the amount of the costs, fees, expenses and charges related to the acquisition. The contents of this release should be considered in conjunction with the risk factors, warnings, and cautionary statements that are contained in our most recent filings with the Securities and Exchange Commission. The forward-looking statements in this press release set forth our beliefs as of the date hereof. We do not undertake any obligation to update any forward-looking statement after the date hereof or to conform such statements to actual results or changes in the Company’s expectations, except as required by law.

About USANA

USANA develops and manufactures high-quality nutritional supplements, functional foods and personal care products that are sold directly to Associates and Preferred Customers throughout the United States, Canada, Australia, New Zealand, Hong Kong, China, Japan, Taiwan, South Korea, Singapore, Mexico, Malaysia, the Philippines, the Netherlands, the United Kingdom, Thailand, France, Belgium, Colombia, Indonesia, Germany, Spain, Romania, Italy, and India.

More information on USANA can be found at www.usana.com. USANA also holds a 78.8% controlling ownership stake in Hiya Health Products, a children's health and wellness company with a variety of clean-label products. More information on Hiya can be found at www.hiyahealth.com.

Investor contact: Andrew Masuda

Investor Relations

(801) 954-7201

investor.relations@usanainc.com

Media contact: Sarah Searle

(801) 954-7626

media@usanainc.com

USANA HEALTH SCIENCES, INC. AND SUBSIDIARIES

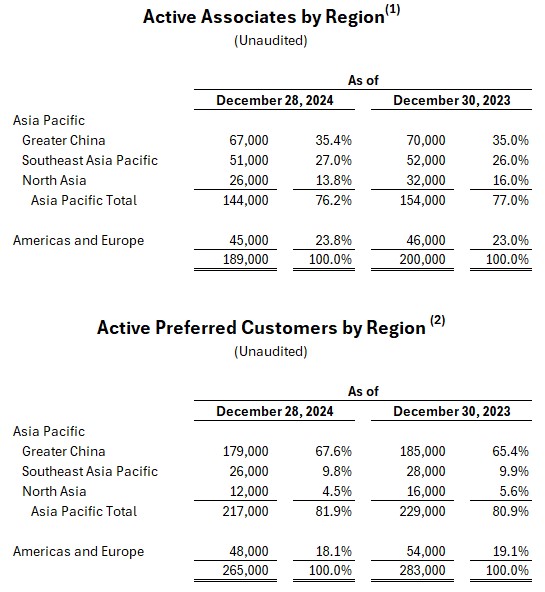

ACTIVE ASSOCIATES AND ACTIVE PREFERRED CUSTOMERS BY REGION

(unaudited)

(1) Associates are independent distributors of our products who also purchase our products for their personal use. We only count as active those Associates who have purchased from us any time during the most recent three-month period, either for personal use or resale.

(2) Preferred Customers purchase our products strictly for their personal use and are not permitted to resell or to distribute the products. We only count as active those Preferred Customers who have purchased from us any time during the most recent three-month period. China utilizes a Preferred Customer program that has been implemented specifically for that market.