Delaware |

11-3131700 |

|||||||

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $0.001 per share | AMED | The NASDAQ Global Select Market | ||||||||||||

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |||||||||||

Emerging growth company |

☐ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ | |||||||||||

| 99.1 | ||||||||||||||

| 99.2 | ||||||||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||||||||

| For the Three-Month Periods Ended March 31, |

||||||||||||||

| 2024 | 2023 | |||||||||||||

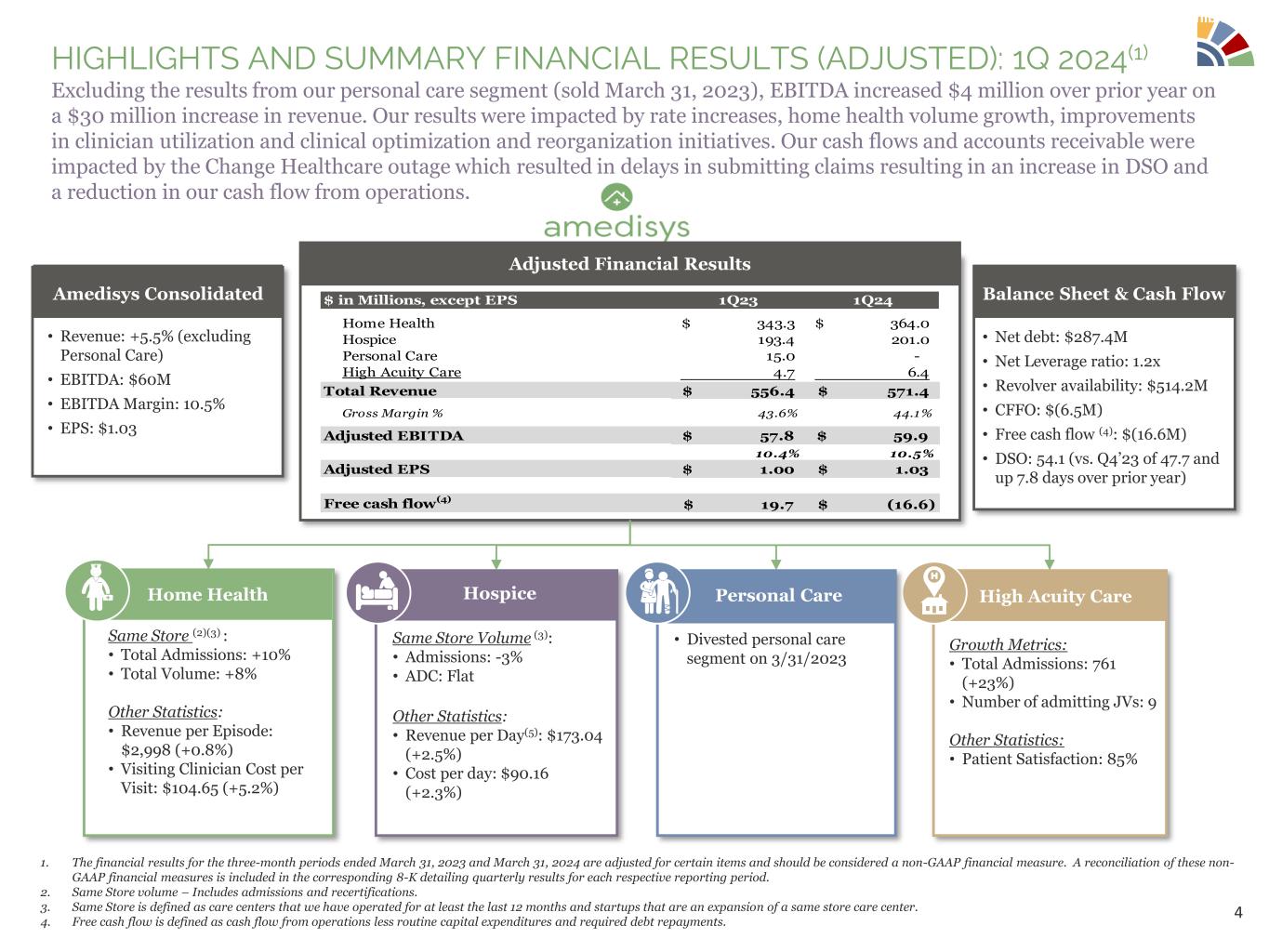

| Net service revenue | $ | 571,414 | $ | 556,389 | ||||||||||

| Operating expenses: | ||||||||||||||

| Cost of service, inclusive of depreciation | 321,537 | 315,010 | ||||||||||||

| General and administrative expenses: | ||||||||||||||

| Salaries and benefits | 127,946 | 126,339 | ||||||||||||

| Non-cash compensation | 7,433 | 3,273 | ||||||||||||

| Merger-related expenses | 20,667 | 720 | ||||||||||||

| Depreciation and amortization | 4,271 | 4,443 | ||||||||||||

| Other | 57,941 | 64,225 | ||||||||||||

| Total operating expenses | 539,795 | 514,010 | ||||||||||||

| Operating income | 31,619 | 42,379 | ||||||||||||

| Other income (expense): | ||||||||||||||

| Interest income | 1,727 | 406 | ||||||||||||

| Interest expense | (8,119) | (7,517) | ||||||||||||

| Equity in earnings from equity method investments | 910 | 123 | ||||||||||||

| Miscellaneous, net | 1,090 | (682) | ||||||||||||

| Total other expense, net | (4,392) | (7,670) | ||||||||||||

| Income before income taxes | 27,227 | 34,709 | ||||||||||||

| Income tax expense | (12,633) | (9,800) | ||||||||||||

| Net income | 14,594 | 24,909 | ||||||||||||

| Net (income) loss attributable to noncontrolling interests | (194) | 337 | ||||||||||||

| Net income attributable to Amedisys, Inc. | $ | 14,400 | $ | 25,246 | ||||||||||

| Basic earnings per common share: | ||||||||||||||

| Net income attributable to Amedisys, Inc. common stockholders | $ | 0.44 | $ | 0.78 | ||||||||||

| Weighted average shares outstanding | 32,670 | 32,558 | ||||||||||||

| Diluted earnings per common share: | ||||||||||||||

| Net income attributable to Amedisys, Inc. common stockholders | $ | 0.44 | $ | 0.77 | ||||||||||

| Weighted average shares outstanding | 32,979 | 32,643 | ||||||||||||

| March 31, 2024 (unaudited) | December 31, 2023 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 108,234 | $ | 126,450 | |||||||

| Restricted cash | 12,470 | 12,413 | |||||||||

| Patient accounts receivable | 359,359 | 313,373 | |||||||||

| Prepaid expenses | 20,332 | 14,639 | |||||||||

| Other current assets | 26,053 | 30,060 | |||||||||

| Total current assets | 526,448 | 496,935 | |||||||||

| Property and equipment, net of accumulated depreciation of $96,056 and $92,422 | 42,684 | 41,845 | |||||||||

| Operating lease right of use assets | 88,425 | 88,939 | |||||||||

| Goodwill | 1,244,679 | 1,244,679 | |||||||||

| Intangible assets, net of accumulated amortization of $15,128 and $14,008 | 101,778 | 102,675 | |||||||||

| Other assets | 85,857 | 85,097 | |||||||||

| Total assets | $ | 2,089,871 | $ | 2,060,170 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 36,249 | $ | 28,237 | |||||||

| Payroll and employee benefits | 131,631 | 136,835 | |||||||||

| Accrued expenses | 147,464 | 140,049 | |||||||||

| Termination fee paid by UnitedHealth Group | 106,000 | 106,000 | |||||||||

| Current portion of long-term obligations | 37,232 | 36,314 | |||||||||

| Current portion of operating lease liabilities | 26,284 | 26,286 | |||||||||

| Total current liabilities | 484,860 | 473,721 | |||||||||

| Long-term obligations, less current portion | 356,080 | 361,862 | |||||||||

| Operating lease liabilities, less current portion | 62,220 | 62,751 | |||||||||

| Deferred income tax liabilities | 43,229 | 40,635 | |||||||||

| Other long-term obligations | 828 | 1,418 | |||||||||

| Total liabilities | 947,217 | 940,387 | |||||||||

| Equity: | |||||||||||

| Preferred stock, $0.001 par value, 5,000,000 shares authorized; none issued or outstanding | — | — | |||||||||

| Common stock, $0.001 par value, 60,000,000 shares authorized; 38,146,546 and 38,131,478 shares issued; 32,676,115 and 32,667,631 shares outstanding | 38 | 38 | |||||||||

Additional paid-in capital |

795,063 | 787,177 | |||||||||

| Treasury stock, at cost, 5,470,431 and 5,463,847 shares of common stock | (469,243) | (468,626) | |||||||||

| Retained earnings | 762,325 | 747,925 | |||||||||

| Total Amedisys, Inc. stockholders’ equity | 1,088,183 | 1,066,514 | |||||||||

| Noncontrolling interests | 54,471 | 53,269 | |||||||||

| Total equity | 1,142,654 | 1,119,783 | |||||||||

| Total liabilities and equity | $ | 2,089,871 | $ | 2,060,170 | |||||||

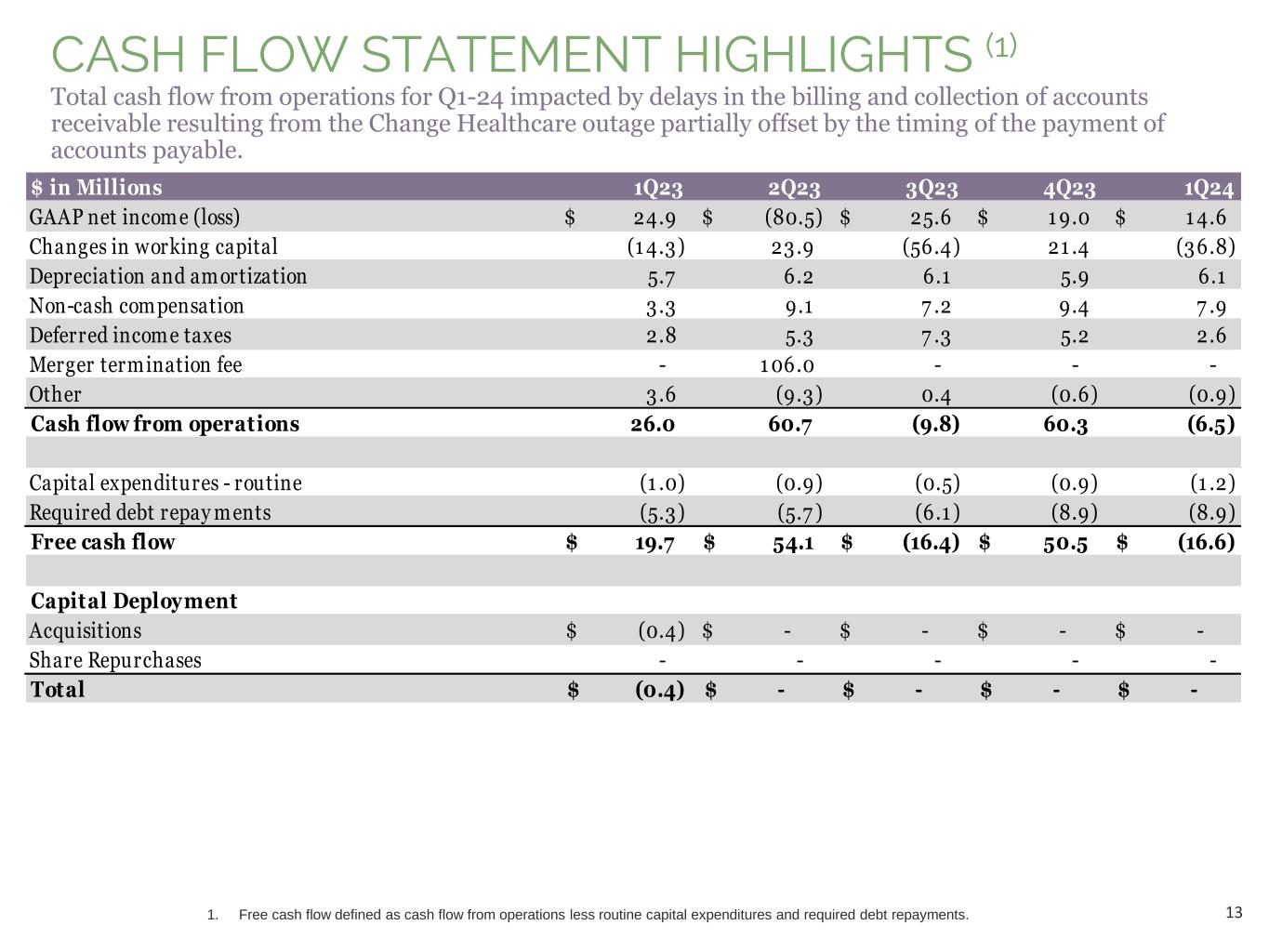

| For the Three-Month Periods Ended March 31, |

||||||||||||||

| 2024 | 2023 | |||||||||||||

| Cash Flows from Operating Activities: | ||||||||||||||

| Net income | $ | 14,594 | $ | 24,909 | ||||||||||

| Adjustments to reconcile net income to net cash (used in) provided by operating activities: | ||||||||||||||

| Depreciation and amortization (inclusive of depreciation included in cost of service) | 6,138 | 5,694 | ||||||||||||

| Non-cash compensation | 7,886 | 3,273 | ||||||||||||

| Amortization and impairment of operating lease right of use assets | 8,566 | 8,622 | ||||||||||||

| Loss (gain) on disposal of property and equipment | 4 | (70) | ||||||||||||

| Loss on personal care divestiture | — | 2,186 | ||||||||||||

| Deferred income taxes | 2,594 | 2,772 | ||||||||||||

| Equity in earnings from equity method investments | (910) | (123) | ||||||||||||

| Amortization of deferred debt issuance costs | 248 | 248 | ||||||||||||

| Return on equity method investments | 170 | 1,787 | ||||||||||||

| Changes in operating assets and liabilities, net of impact of acquisitions: | ||||||||||||||

| Patient accounts receivable | (46,806) | (7,476) | ||||||||||||

| Other current assets | (1,696) | (4,128) | ||||||||||||

| Operating lease right of use assets | (1,042) | (918) | ||||||||||||

| Other assets | 155 | (111) | ||||||||||||

| Accounts payable | 8,652 | (3,457) | ||||||||||||

| Accrued expenses | 3,029 | 741 | ||||||||||||

| Other long-term obligations | (591) | (28) | ||||||||||||

| Operating lease liabilities | (7,532) | (7,960) | ||||||||||||

| Net cash (used in) provided by operating activities | (6,541) | 25,961 | ||||||||||||

| Cash Flows from Investing Activities: | ||||||||||||||

| Proceeds from the sale of deferred compensation plan assets | 21 | 19 | ||||||||||||

| Purchases of property and equipment | (2,670) | (1,350) | ||||||||||||

| Investments in technology assets | (223) | (210) | ||||||||||||

| Investment in equity method investee | (196) | — | ||||||||||||

| Proceeds from personal care divestiture | — | 47,787 | ||||||||||||

| Acquisitions of businesses, net of cash acquired | — | (350) | ||||||||||||

| Net cash (used in) provided by investing activities | (3,068) | 45,896 | ||||||||||||

| Cash Flows from Financing Activities: | ||||||||||||||

| Proceeds from issuance of stock under employee stock purchase plan | — | 816 | ||||||||||||

| Shares withheld to pay taxes on non-cash compensation | (617) | (1,308) | ||||||||||||

| Noncontrolling interest contributions | 1,764 | — | ||||||||||||

| Noncontrolling interest distributions | (756) | (285) | ||||||||||||

| Purchase of noncontrolling interest | — | (800) | ||||||||||||

| Proceeds from borrowings under revolving line of credit | — | 8,000 | ||||||||||||

| Repayments of borrowings under revolving line of credit | — | (8,000) | ||||||||||||

| Principal payments of long-term obligations | (8,941) | (55,313) | ||||||||||||

| Net cash used in financing activities | (8,550) | (56,890) | ||||||||||||

| Net (decrease) increase in cash, cash equivalents and restricted cash | (18,159) | 14,967 | ||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 138,863 | 54,133 | ||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 120,704 | $ | 69,100 | ||||||||||

| For the Three-Month Periods Ended March 31, |

||||||||||||||

| 2024 | 2023 | |||||||||||||

| Supplemental Disclosures of Cash Flow Information: | ||||||||||||||

| Cash paid for interest | $ | 8,188 | $ | 6,654 | ||||||||||

| Cash paid for income taxes, net of refunds received | $ | 828 | $ | 352 | ||||||||||

| Cash paid for operating lease liabilities | $ | 8,574 | $ | 8,878 | ||||||||||

| Cash paid for finance lease liabilities | $ | 2,236 | $ | 2,457 | ||||||||||

| Supplemental Disclosures of Non-Cash Activity: | ||||||||||||||

| Right of use assets obtained in exchange for operating lease liabilities | $ | 7,173 | $ | 7,083 | ||||||||||

| Right of use assets obtained in exchange for finance lease liabilities | $ | 4,326 | $ | 20,790 | ||||||||||

| Reductions to right of use assets resulting from reductions to operating lease liabilities | $ | 168 | $ | 141 | ||||||||||

| Reductions to right of use assets resulting from reductions to finance lease liabilities | $ | 496 | $ | 369 | ||||||||||

| Days revenue outstanding (1) | 54.1 | 46.3 | ||||||||||||

| For the Three-Month Periods Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

Financial Information (in millions): |

|||||||||||

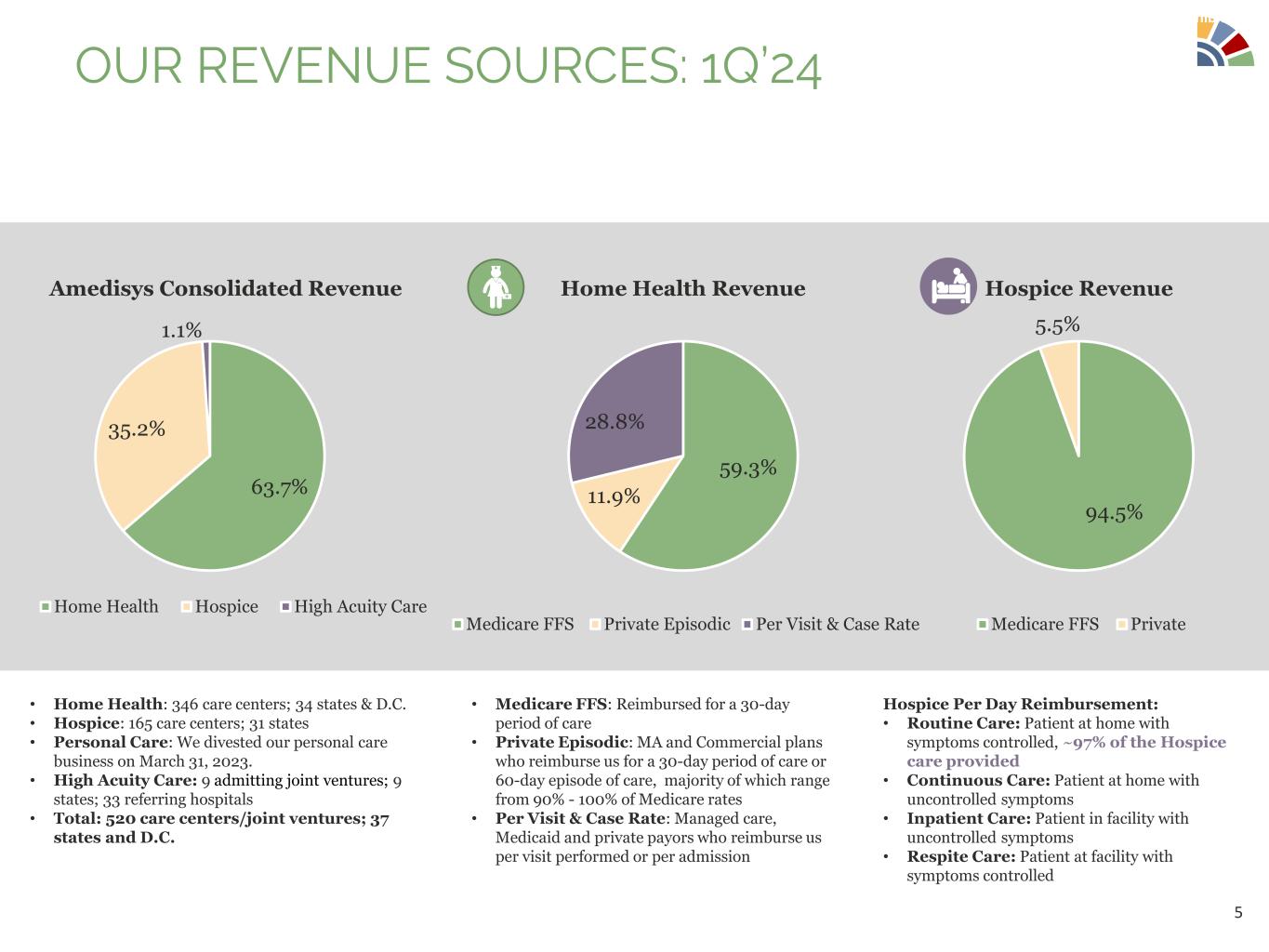

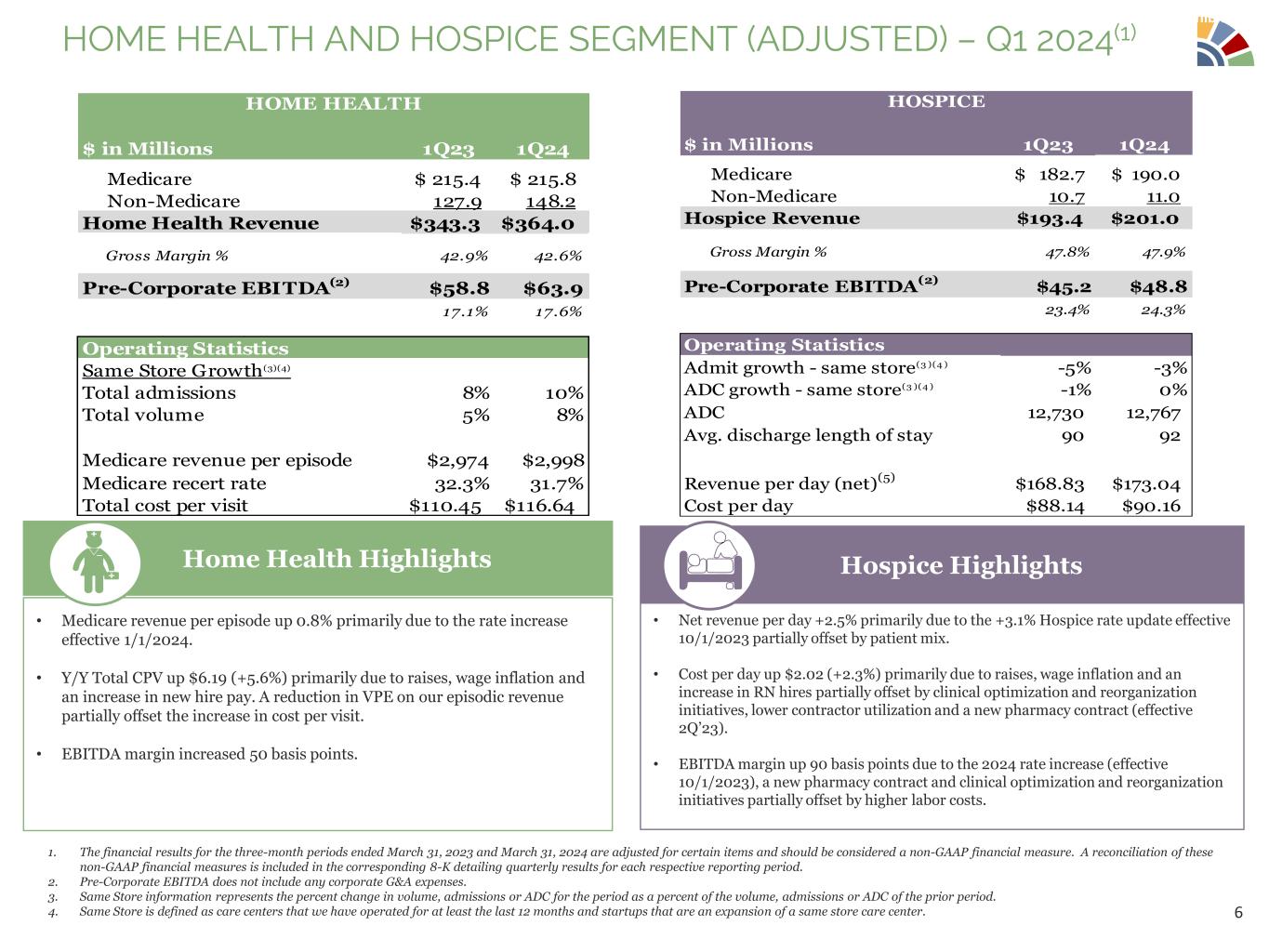

| Medicare | $ | 215.8 | $ | 215.4 | |||||||

| Non-Medicare | 148.2 | 127.9 | |||||||||

| Net service revenue | 364.0 | 343.3 | |||||||||

| Cost of service, inclusive of depreciation | 210.4 | 197.0 | |||||||||

| Gross margin | 153.6 | 146.3 | |||||||||

| General and administrative expenses | 91.0 | 89.1 | |||||||||

| Depreciation and amortization | 1.8 | 1.1 | |||||||||

| Operating income | $ | 60.8 | $ | 56.1 | |||||||

Same Store Growth(1): |

|||||||||||

| Medicare revenue | — | % | (7 | %) | |||||||

| Non-Medicare revenue | 16 | % | 12 | % | |||||||

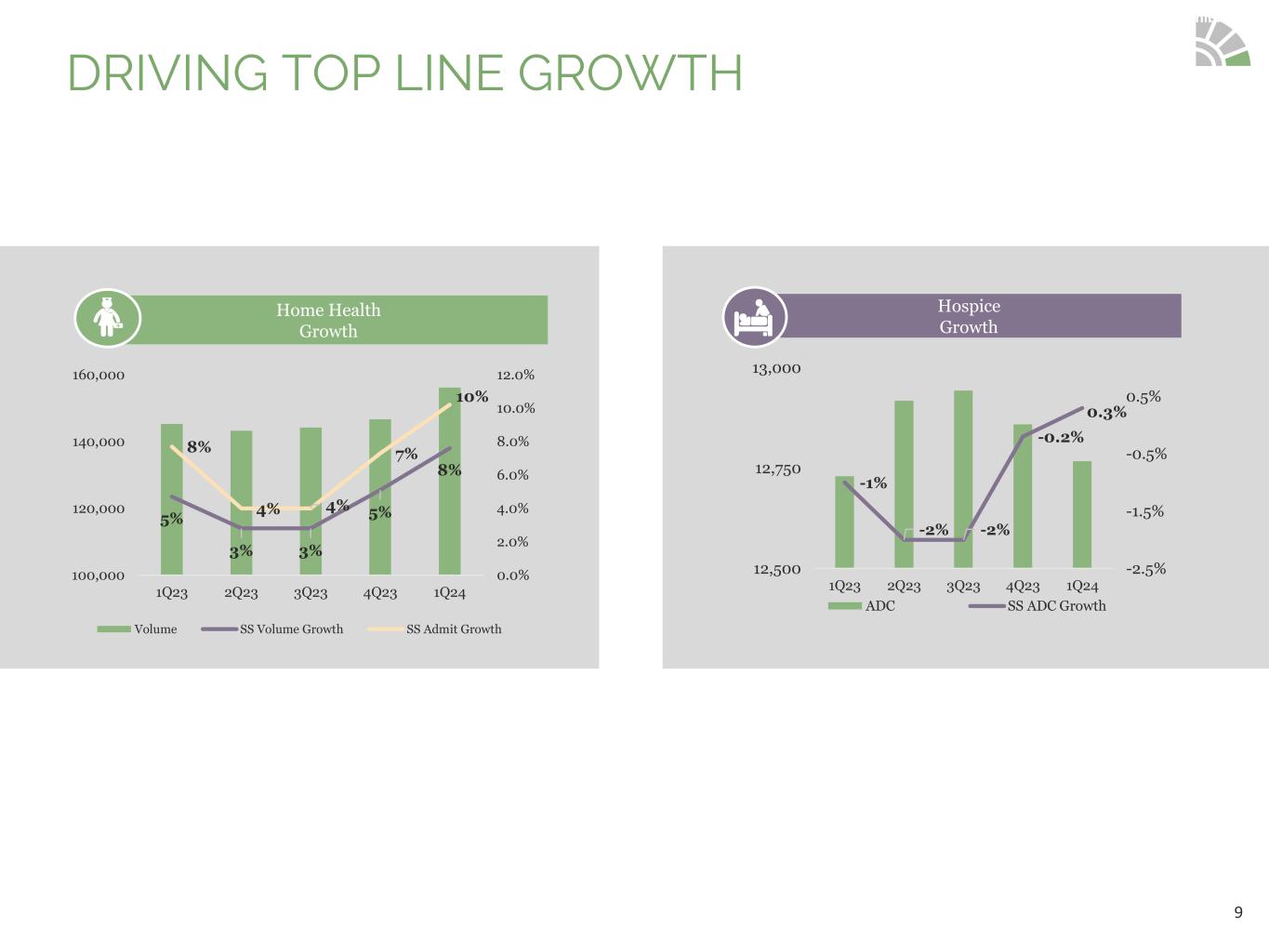

| Total admissions | 10 | % | 8 | % | |||||||

Total volume(2) |

8 | % | 5 | % | |||||||

Key Statistical Data - Total(3): |

|||||||||||

| Admissions | 112,215 | 101,963 | |||||||||

| Recertifications | 43,961 | 43,325 | |||||||||

| Total volume | 156,176 | 145,288 | |||||||||

| Medicare completed episodes | 72,998 | 73,563 | |||||||||

Average Medicare revenue per completed episode(4) |

$ | 2,998 | $ | 2,974 | |||||||

Medicare visits per completed episode(5) |

11.9 | 12.4 | |||||||||

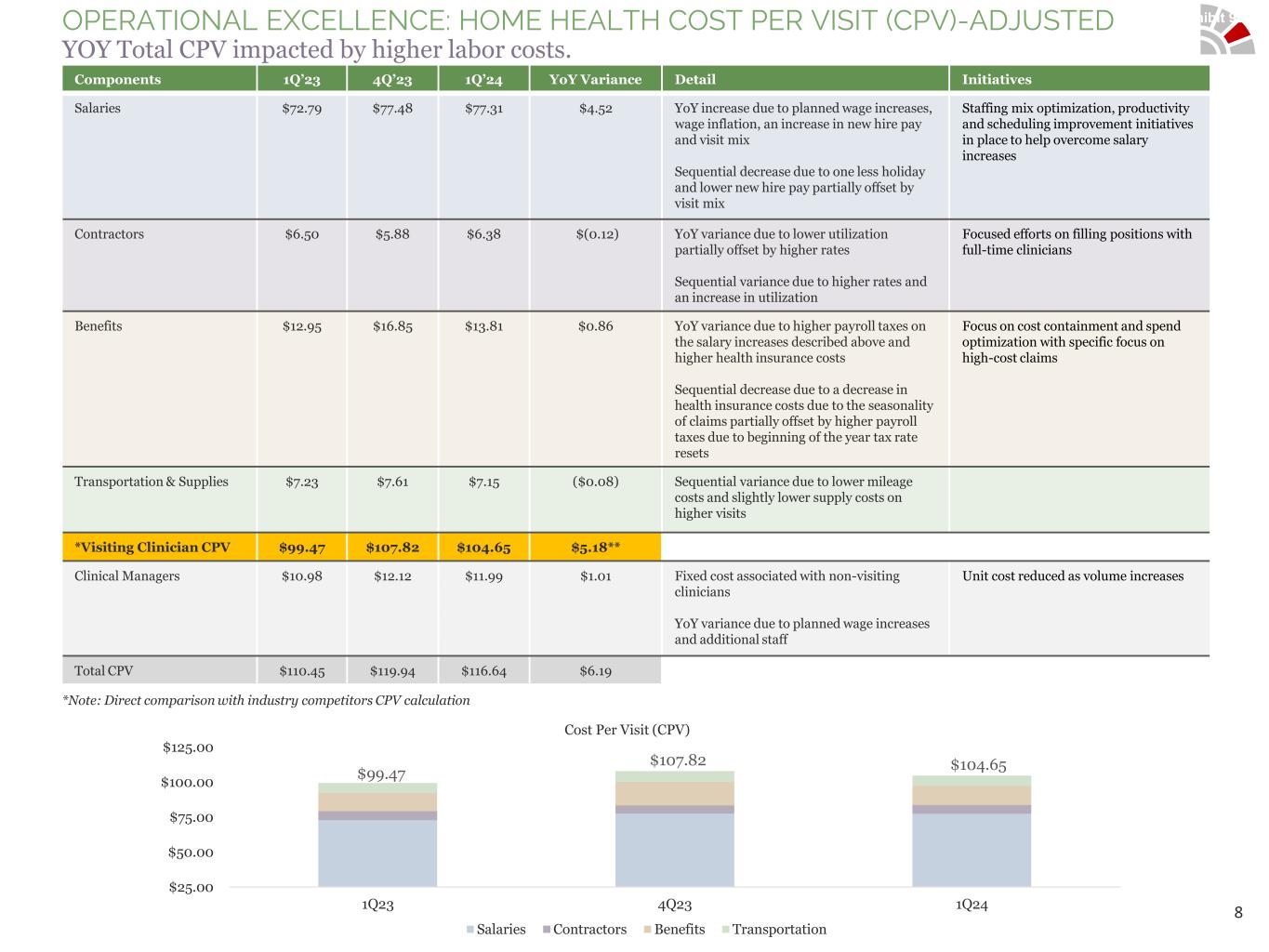

| Visiting clinician cost per visit | $ | 105.38 | $ | 100.00 | |||||||

| Clinical manager cost per visit | 11.99 | 10.97 | |||||||||

| Total cost per visit | $ | 117.37 | $ | 110.97 | |||||||

| Visits | 1,792,629 | 1,775,206 | |||||||||

| For the Three-Month Periods Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

Financial Information (in millions): |

|||||||||||

| Medicare | $ | 190.0 | $ | 182.7 | |||||||

| Non-Medicare | 11.0 | 10.7 | |||||||||

| Net service revenue | 201.0 | 193.4 | |||||||||

| Cost of service, inclusive of depreciation | 105.3 | 101.4 | |||||||||

| Gross margin | 95.7 | 92.0 | |||||||||

| General and administrative expenses | 48.1 | 47.9 | |||||||||

| Depreciation and amortization | 0.7 | 0.6 | |||||||||

| Operating income | $ | 46.9 | $ | 43.5 | |||||||

Same Store Growth(1): |

|||||||||||

| Medicare revenue | 4 | % | — | % | |||||||

| Hospice admissions | (3 | %) | (5 | %) | |||||||

| Average daily census | — | % | (1 | %) | |||||||

Key Statistical Data - Total(2): |

|||||||||||

| Hospice admissions | 12,657 | 12,998 | |||||||||

| Average daily census | 12,767 | 12,730 | |||||||||

| Revenue per day, net | $ | 173.04 | $ | 168.83 | |||||||

| Cost of service per day | $ | 90.64 | $ | 88.21 | |||||||

| Average discharge length of stay | 92 | 90 | |||||||||

| For the Three-Month Periods Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

Financial Information (in millions): |

|||||||||||

| Medicare | $ | — | $ | — | |||||||

| Non-Medicare | — | 15.0 | |||||||||

| Net service revenue | — | 15.0 | |||||||||

| Cost of service, inclusive of depreciation | — | 11.1 | |||||||||

| Gross margin | — | 3.9 | |||||||||

| General and administrative expenses | — | 2.3 | |||||||||

| Depreciation and amortization | — | — | |||||||||

| Operating income | $ | — | $ | 1.6 | |||||||

| Key Statistical Data - Total: | |||||||||||

| Billable hours | — | 440,464 | |||||||||

| Clients served | — | 7,892 | |||||||||

| Shifts | — | 191,379 | |||||||||

| Revenue per hour | $ | — | $ | 33.97 | |||||||

| Revenue per shift | $ | — | $ | 78.19 | |||||||

| Hours per shift | — | 2.3 | |||||||||

| For the Three-Month Periods Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

Financial Information (in millions): |

|||||||||||

| Medicare | $ | — | $ | — | |||||||

| Non-Medicare | 6.4 | 4.7 | |||||||||

| Net service revenue | 6.4 | 4.7 | |||||||||

| Cost of service, inclusive of depreciation | 5.8 | 5.5 | |||||||||

| Gross margin | 0.6 | (0.8) | |||||||||

| General and administrative expenses | 5.9 | 4.4 | |||||||||

| Depreciation and amortization | 0.9 | 0.8 | |||||||||

| Operating loss | $ | (6.2) | $ | (6.0) | |||||||

| Key Statistical Data - Total: | |||||||||||

| Full risk admissions | 139 | 158 | |||||||||

| Limited risk admissions | 622 | 459 | |||||||||

| Total admissions | 761 | 617 | |||||||||

| Total admissions growth | 23 | % | 85 | % | |||||||

| Full risk revenue per episode | $ | 10,073 | $ | 11,343 | |||||||

| Limited risk revenue per episode | $ | 6,780 | $ | 5,711 | |||||||

| Number of admitting joint ventures | 9 | 9 | |||||||||

| For the Three-Month Periods Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

Financial Information (in millions): |

|||||||||||

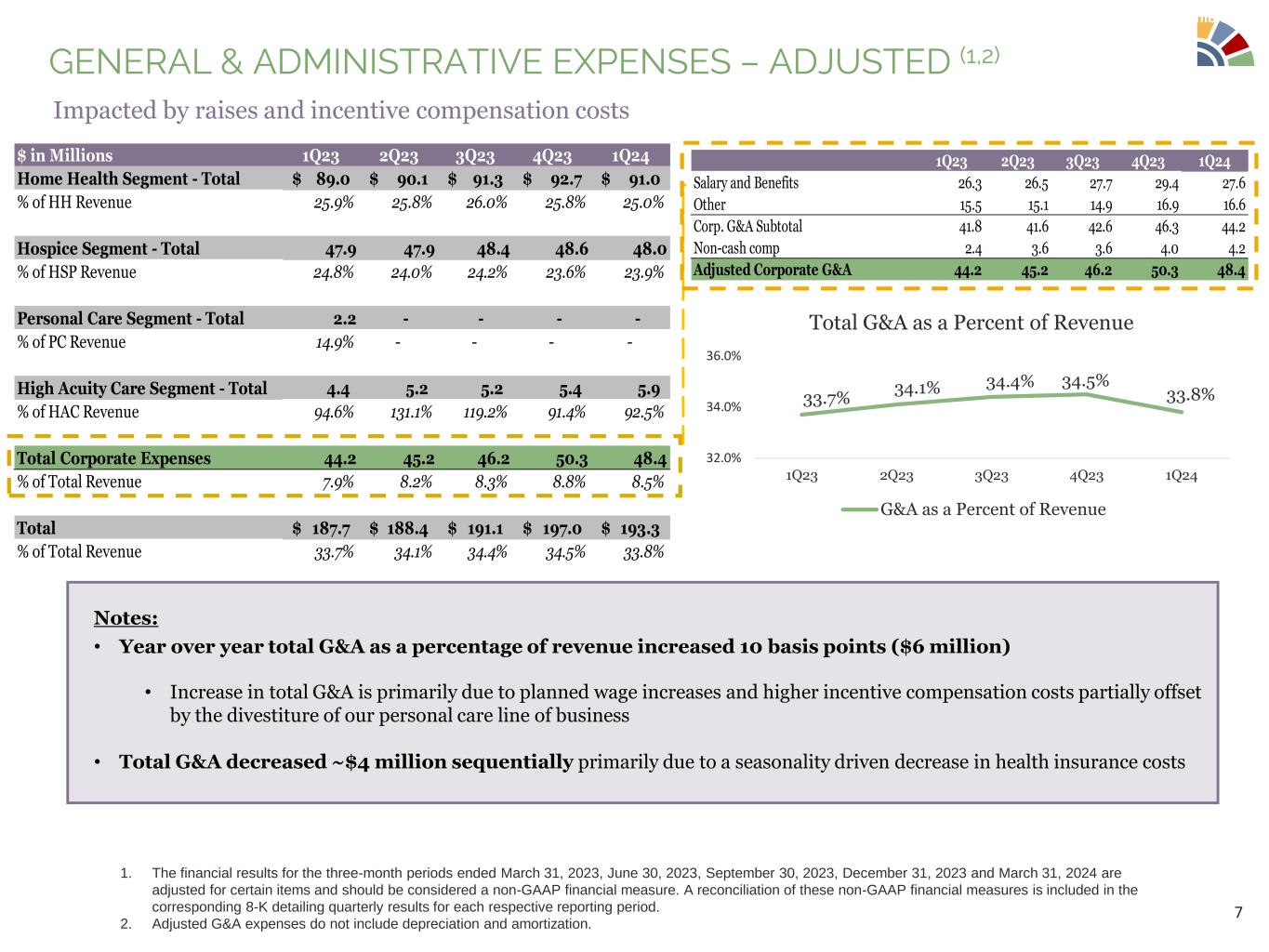

| General and administrative expenses | $ | 69.0 | $ | 50.9 | |||||||

| Depreciation and amortization | 0.9 | 1.9 | |||||||||

| Total operating expenses | $ | 69.9 | $ | 52.8 | |||||||

| For the Three-Month Periods Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| Net income attributable to Amedisys, Inc. | $ | 14,400 | $ | 25,246 | |||||||

| Add: | |||||||||||

| Income tax expense | 12,633 | 9,800 | |||||||||

| Interest expense, net | 6,392 | 7,111 | |||||||||

| Depreciation and amortization | 6,138 | 5,694 | |||||||||

Certain items(1) |

20,296 | 9,987 | |||||||||

Adjusted EBITDA(2)(5) |

$ | 59,859 | $ | 57,838 | |||||||

| For the Three-Month Periods Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| Net income attributable to Amedisys, Inc. | $ | 14,400 | $ | 25,246 | |||||||

| Add: | |||||||||||

Certain items(1) |

19,548 | 7,489 | |||||||||

Adjusted net income attributable to Amedisys, Inc.(3)(5) |

$ | 33,948 | $ | 32,735 | |||||||

| For the Three-Month Periods Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| Net income attributable to Amedisys, Inc. common stockholders per diluted share | $ | 0.44 | $ | 0.77 | |||||||

| Add: | |||||||||||

Certain items(1) |

0.59 | 0.23 | |||||||||

Adjusted net income attributable to Amedisys, Inc. common stockholders per diluted share(4)(5) |

$ | 1.03 | $ | 1.00 | |||||||

| For the Three-Month Periods Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| (Income) Expense | (Income) Expense | ||||||||||

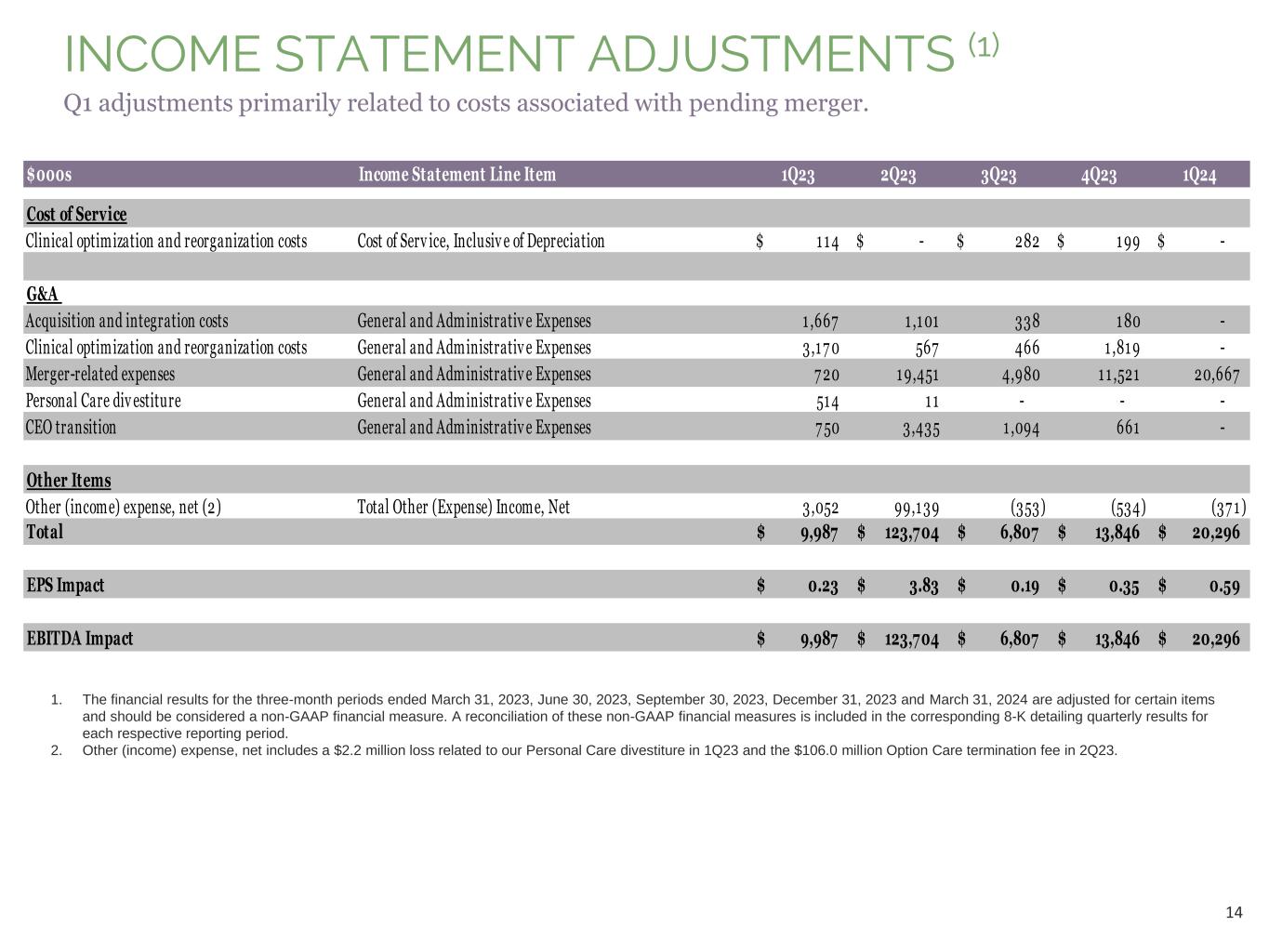

| Certain Items Impacting Cost of Service, Inclusive of Depreciation: | |||||||||||

| Clinical optimization and reorganization costs | $ | — | $ | 114 | |||||||

| Certain Items Impacting General and Administrative Expenses: | |||||||||||

| Acquisition and integration costs | — | 1,667 | |||||||||

| CEO transition | — | 750 | |||||||||

| Merger-related expenses | 20,667 | 720 | |||||||||

| Clinical optimization and reorganization costs | — | 3,170 | |||||||||

| Personal care divestiture | — | 514 | |||||||||

| Certain Items Impacting Total Other Income (Expense): | |||||||||||

| Other (income) expense, net | (371) | 3,052 | |||||||||

| Total | $ | 20,296 | $ | 9,987 | |||||||

| Net of tax | $ | 19,548 | $ | 7,489 | |||||||

| Diluted EPS | $ | 0.59 | $ | 0.23 | |||||||