FORM 6-K SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934 For the month of October, 2025 Commission File Number: 001-12518 Banco Santander, S.A. (Exact name of registrant as specified in its charter) Ciudad Grupo Santander 28660 Boadilla del Monte (Madrid) Spain (Address of principal executive office) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

BANCO SANTANDER, S.A. ________________________ TABLE OF CONTENTS Item 1. January - September 2025 Earnings presentation

9M’25 Earnings Presentation 29 October 2025

2 Important information Non-IFRS and alternative performance measures Banco Santander, S.A. (“Santander”) cautions that this document may contain financial information prepared according to International Financial Reporting Standards (IFRS) and taken from our consolidated financial statements, as well as alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015, and other non-IFRS measures. The APMs and non-IFRS measures were calculated with information from Grupo Santander; however, they are neither defined or detailed in the applicable financial reporting framework nor audited or reviewed by our auditors. We use the APMs and non-IFRS measures when planning, monitoring and evaluating our performance. We consider them to be useful metrics for our management and investors to compare operating performance between accounting periods. Nonetheless, the APMs and non-IFRS measures are supplemental information; their purpose is not to substitute the IFRS measures. Furthermore, companies in our industry and others may calculate or use APMs and non-IFRS measures differently, thus making them less useful for comparison purposes. APMs using environmental, social and governance labels have not been calculated in accordance with the Taxonomy Regulation or with the indicators for principal adverse impact in SFDR. For more details on APMs and non-IFRS measures, please see the 2024 Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the SEC) on 28 February 2025 (https://www.santander.com/content/dam/santander-com/en/documentos/informacion-sobre-resultados-semestrales-y-anuales-suministrada-a-la-sec/2025/sec-2024-annual-20-f-2024-en.pdf), as well as the section “Alternative performance measures” of Banco Santander, S.A. (Santander) Q3 2025 Financial Report, published on 29 October 2025 (https://www.santander.com/en/shareholders-and-investors/financial-and- economic-information#quarterly-results). Sustainability information This document may contain, in addition to financial information, sustainability-related information, including environmental, social and governance-related metrics, statements, goals, targets, commitments and opinions. Sustainability information is not audited nor reviewed by an external auditor. Sustainability information is prepared following various external and internal frameworks, reporting guidelines and measurement, collection and verification methods and practices, which may materially differ from those applicable to financial information and are in many cases emerging and evolving. Sustainability information is based on various materiality thresholds, estimates, assumptions, judgments and underlying data derived internally and from third parties. Sustainability information is thus subject to significant measurement uncertainties may not be comparable to sustainability information of other companies or over time or across periods and its use is not meant to imply that the information is fit for any particular purpose or that it is material to us under mandatory reporting standards. The sustainability information is for informational purposes only, without any liability being accepted in connection with it except where such liability cannot be limited under overriding provisions of applicable law. Forward-looking statements Santander hereby warns that this document may contain 'forward-looking statements', as defined by the US Private Securities Litigation Reform Act of 1995. Such statements can be understood through words and expressions like 'expect', 'project', 'anticipate', 'should', 'intend', 'probability', 'risk', 'VaR', 'RoRAC', 'RoRWA', 'TNAV', 'target', 'goal', 'objective', 'estimate', 'future', 'ambition', 'aspiration', 'commitment', 'commit', 'focus', 'pledge' and similar expressions. They include (but are not limited to) statements on future business development, shareholder remuneration policy and NFI. However, risks, uncertainties and other important factors may lead to developments and results that differ materially from those anticipated, expected, projected or assumed in forward-looking statements. The important factors below (and others mentioned in this document), as well as other unknown or unpredictable factors, could affect our future development and results and could lead to outcomes materially different from what our forward-looking statements anticipate, expect, project or assume: • general economic or industry conditions (e.g., an economic downturn; higher volatility in the capital markets; inflation; deflation; changes in demographics, consumer spending, investment or saving habits; and the effects of the wars in Ukraine and the Middle East or the outbreak of public health emergencies in the global economy) in areas where we have significant operations or investments; • exposure to market risks (e.g., risks from interest rates, foreign exchange rates, equity prices and new benchmark indices); • potential losses from early loan repayment, collateral depreciation or counterparty risk; • political instability in Spain, the UK, other European countries, Latin America and the US; • changes in monetary, fiscal and immigration policies and trade tensions, including the imposition of tariffs and retaliatory responses; • legislative, regulatory or tax changes (including regulatory capital and liquidity requirements) and greater regulation prompted by financial crises;

3 Important information • acquisitions, integrations, divestitures and challenges arising from deviating management’s resources and attention from other strategic opportunities and operational matters; • climate-related conditions, regulations, targets and weather events; • uncertainty over the scope of actions that may be required by us, governments and other to achieve goals relating to climate, environmental and social matters, as well as the evolving nature of underlying science and potential conflicts and inconsistencies among governmental standards and regulations. Important factors affecting sustainability information may materially differ from those applicable to financial information. Sustainability information is based on various materiality thresholds, estimates, assumptions, judgments and underlying data derived internally and from third parties. Sustainability information is thus subject to significant measurement uncertainties, may not be comparable to sustainability information of other companies or over time or across periods and its inclusion is not meant to imply that the information is fit for any particular purpose or that it is material to us under mandatory reporting standards. The sustainability information is for informational purposes only, without any liability being accepted in connection with it except where such liability cannot be limited under overriding provisions of applicable law; • our own decisions and actions, including those affecting or changing our practices, operations, priorities, strategies, policies or procedures; • changes affecting our access to liquidity and funding on acceptable terms, especially due to credit spread shifts or credit rating downgrade for the entire group or core subsidiaries; • our exposure to operational losses; and • potential losses associated with cyberattacks, data breaches, data losses and other security incidents Forward looking statements are based on current expectations and future estimates about Santander’s and third-parties’ operations and businesses and address matters that are uncertain to varying degrees, including, but not limited to developing standards that may change in the future; plans, projections, expectations, targets, objectives, strategies and goals relating to environmental, social, safety and governance performance, including expectations regarding future execution of Santander’s and third parties’ energy and climate strategies, and the underlying assumptions and estimated impacts on Santander’s and third-parties’ businesses related thereto; Santander’s and third-parties’ approach, plans and expectations in relation to carbon use and targeted reductions of emissions; changes in operations or investments under existing or future environmental laws and regulations; and changes in government regulations and regulatory requirements, including those related to climate-related initiatives. Forward-looking statements are aspirational, should be regarded as indicative, preliminary and for illustrative purposes only, speak only as of the date of this document and are informed by the knowledge, information and views available on such date and are subject to change without notice. Banco Santander is not required to update or revise any forward-looking statements, regardless of new information, future events or otherwise, except as required by applicable law. Past performance does not indicate future outcomes Statements about historical performance or growth rates must not be construed as suggesting that future performance, share price or earnings (including earnings per share) will necessarily be the same or higher than in a previous period. Nothing mentioned in this document should be taken as a profit and loss forecast. Not a securities offer This document and the information it contains, does not constitute an offer to sell nor the solicitation of an offer to buy any securities. Third Party Information In particular, regarding the data provided by third parties, neither Santander, nor any of its directors, managers or employees, either explicitly or implicitly, guarantees that these contents are exact, accurate, comprehensive or complete, nor are they obliged to keep them updated, nor to correct them in the case that any deficiency, error or omission were to be detected. Moreover, in reproducing these contents in by any means, Santander may introduce any changes it deems suitable, and may omit, partially or completely, any of the elements of this document, and in case of any deviation, Santander assumes no liability for any discrepancy. Sale of 49% stake in Santander Bank Polska to Erste Group All figures, including P&L, loans and advances to customers, customer funds and other metrics are presented on an underlying basis and include Santander Bank Polska, in line with previously published quarterly information, i.e. maintaining the same perimeter that existed at the time of the announcement of the sale of 49% stake in Santander Bank Polska to Erste Group (https://www.santander.com/content/dam/santander- com/en/documentos/informacion-privilegiada/2025/05/hr-2025-05-05-santander-announces-the-sale-of-49-per-cent-of-santander-polska-to-erste-group-bank-and-agrees-strategic-cooperation-across-cib-and- payments-en.pdf). For further information, see the 'Alternative performance measures' section of Banco Santander, S.A. (Santander) Q3 2025 Financial Report, published on 29 October 2025 (https://www.santander.com/en/shareholders-and-investors/financial-and-economic-information#quarterly-results).

4 Index 9M'25 Highlights Progress on our strategy 1 Group review 2 Final remarks 3 Appendix 4

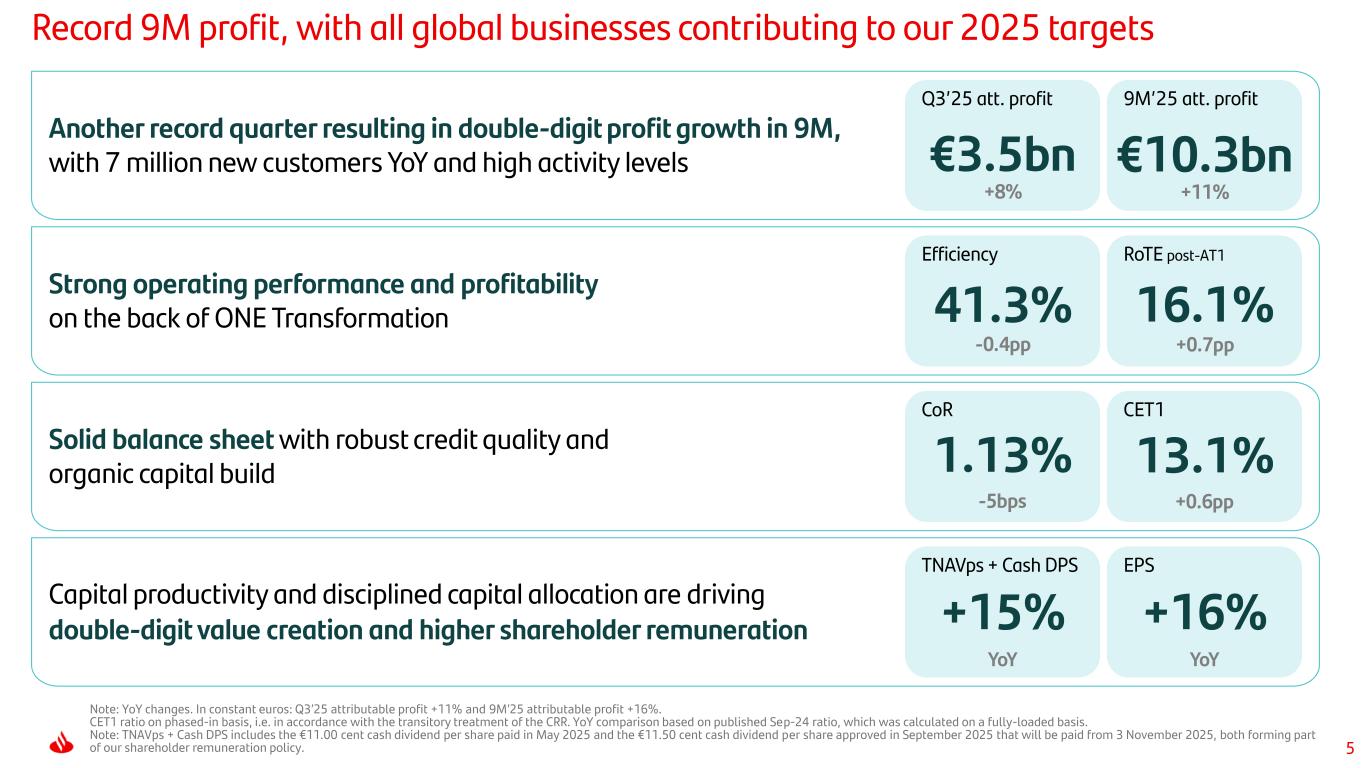

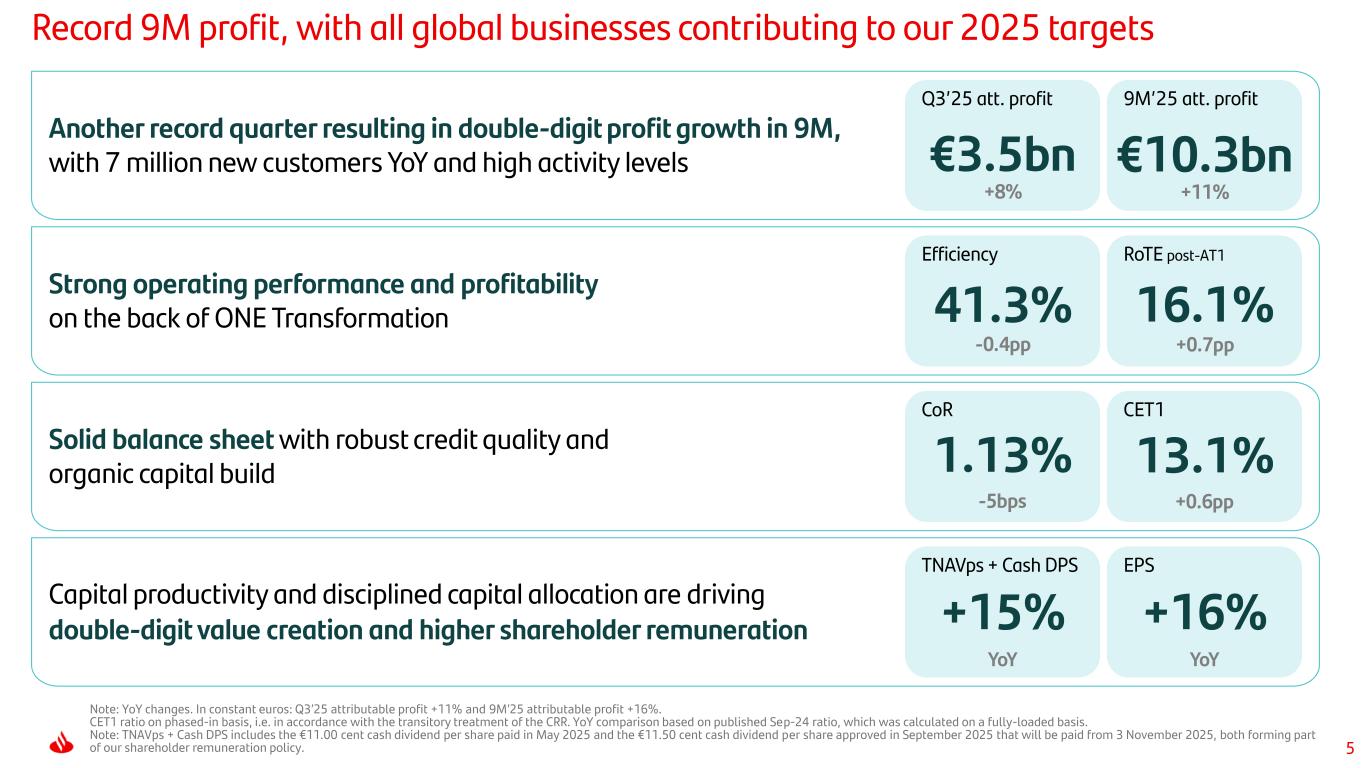

5 TNAVps + Cash DPS Record 9M profit, with all global businesses contributing to our 2025 targets 9M’25 att. profitQ3’25 att. profit Efficiency RoTE post-AT1 CoR CET1 Another record quarter resulting in double-digit profit growth in 9M, with 7 million new customers YoY and high activity levels Strong operating performance and profitability on the back of ONE Transformation Solid balance sheet with robust credit quality and organic capital build Capital productivity and disciplined capital allocation are driving double-digit value creation and higher shareholder remuneration YoY Note: YoY changes. In constant euros: Q3’25 attributable profit +11% and 9M’25 attributable profit +16%. CET1 ratio on phased-in basis, i.e. in accordance with the transitory treatment of the CRR. YoY comparison based on published Sep-24 ratio, which was calculated on a fully-loaded basis. Note: TNAVps + Cash DPS includes the €11.00 cent cash dividend per share paid in May 2025 and the €11.50 cent cash dividend per share approved in September 2025 that will be paid from 3 November 2025, both forming part of our shareholder remuneration policy. +15% 41.3% 1.13% 16.1% 13.1% -5bps +0.7pp-0.4pp +0.6pp +11% €10.3bn€3.5bn +8% EPS YoY +16%

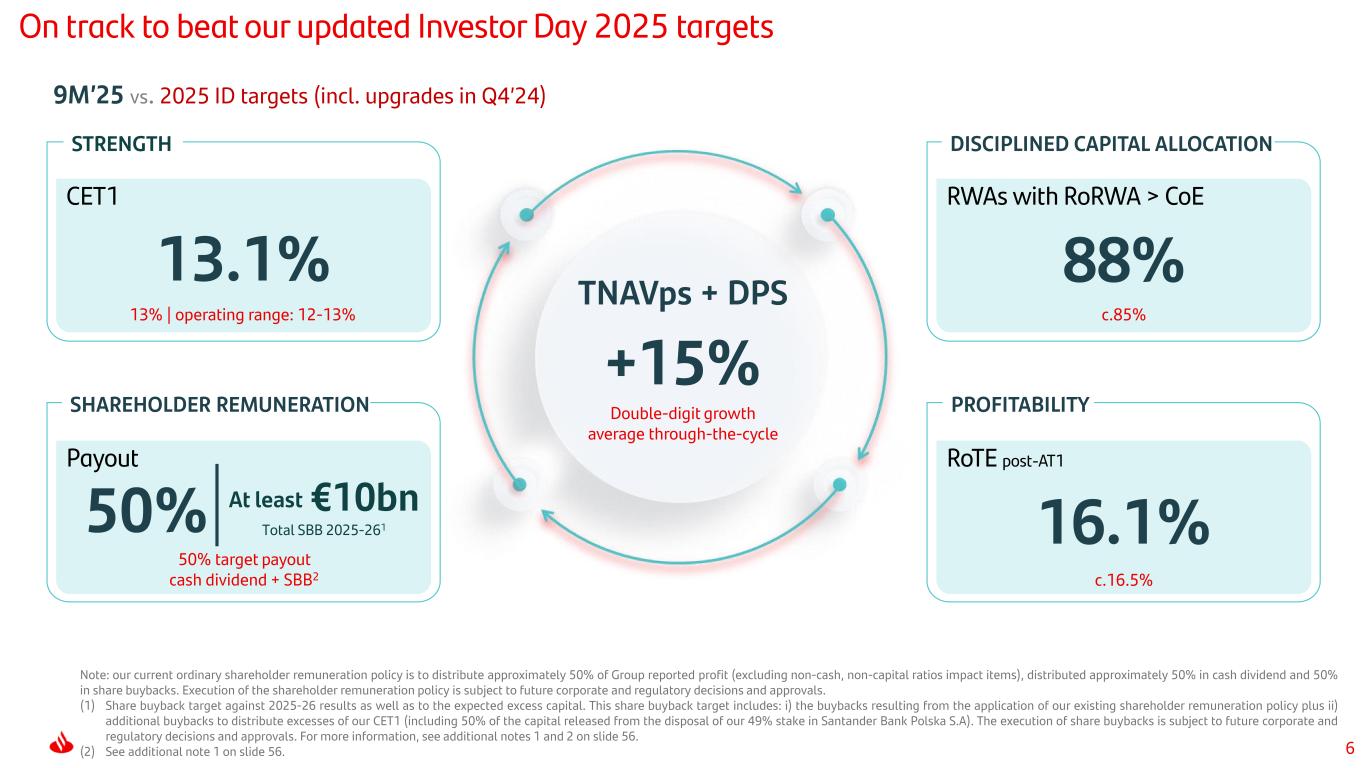

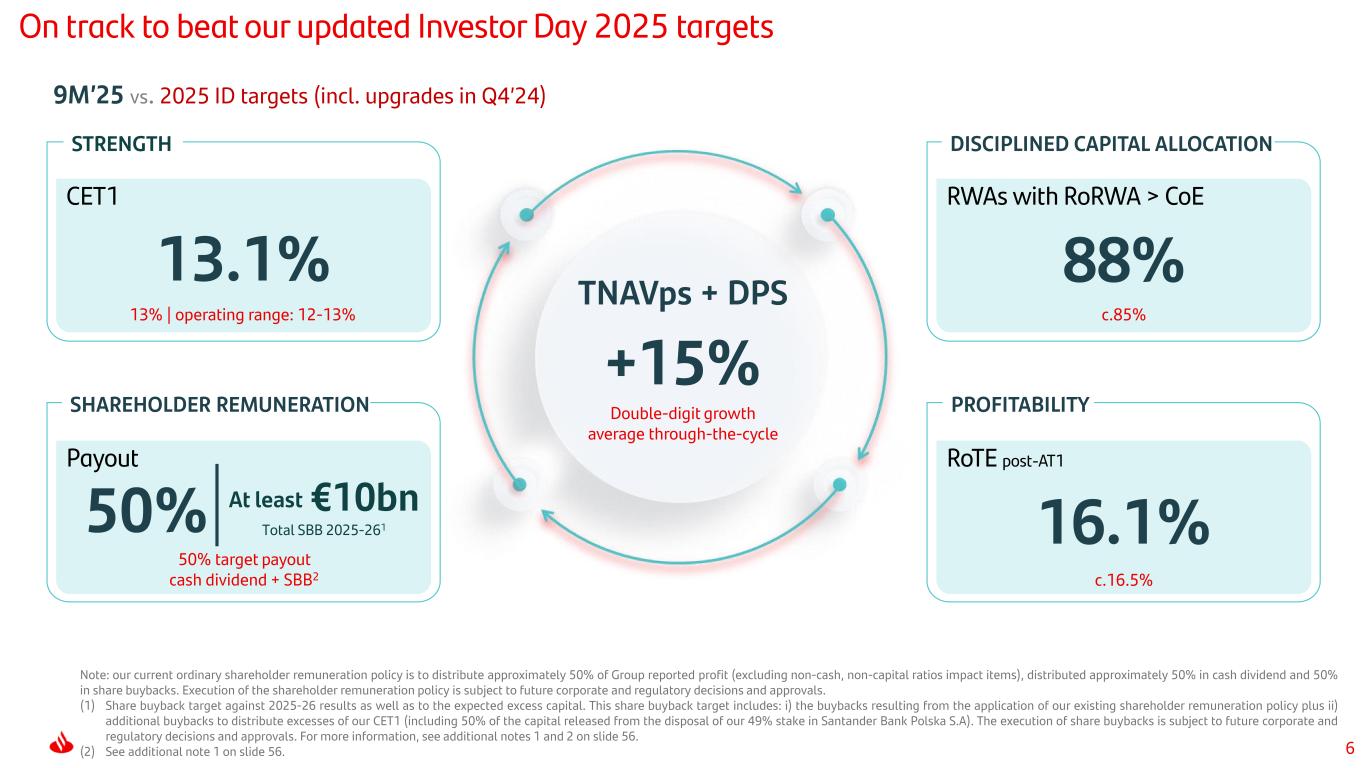

6 On track to beat our updated Investor Day 2025 targets RoTE post-AT1Payout RWAs with RoRWA > CoECET1 Note: our current ordinary shareholder remuneration policy is to distribute approximately 50% of Group reported profit (excluding non-cash, non-capital ratios impact items), distributed approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. (1) Share buyback target against 2025-26 results as well as to the expected excess capital. This share buyback target includes: i) the buybacks resulting from the application of our existing shareholder remuneration policy plus ii) additional buybacks to distribute excesses of our CET1 (including 50% of the capital released from the disposal of our 49% stake in Santander Bank Polska S.A). The execution of share buybacks is subject to future corporate and regulatory decisions and approvals. For more information, see additional notes 1 and 2 on slide 56. (2) See additional note 1 on slide 56. 9M’25 vs. 2025 ID targets (incl. upgrades in Q4’24) STRENGTH 13% | operating range: 12-13% DISCIPLINED CAPITAL ALLOCATION c.85% SHAREHOLDER REMUNERATION PROFITABILITY c.16.5% At least €10bn Total SBB 2025-261 TNAVps + DPS Double-digit growth average through-the-cycle 50% 13.1% 16.1% +15% 88% 50% target payout cash dividend + SBB2

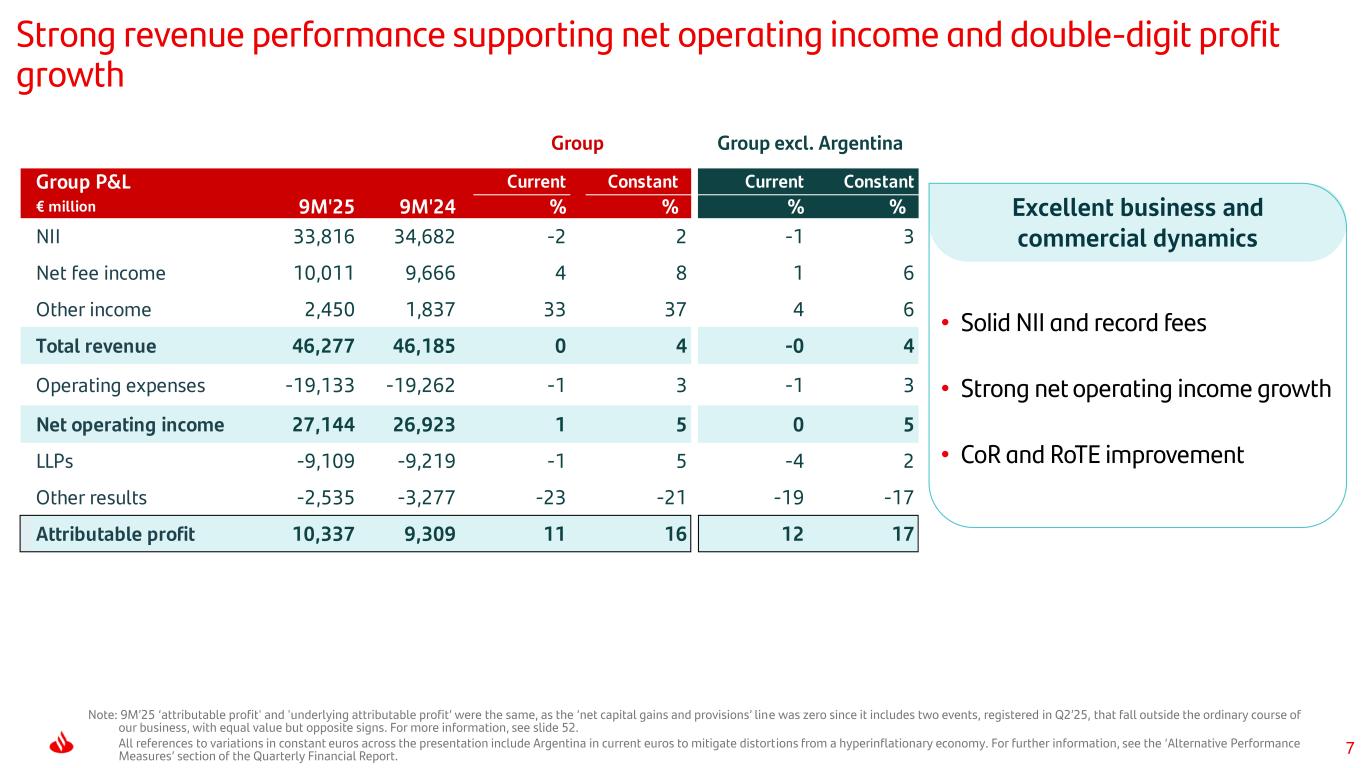

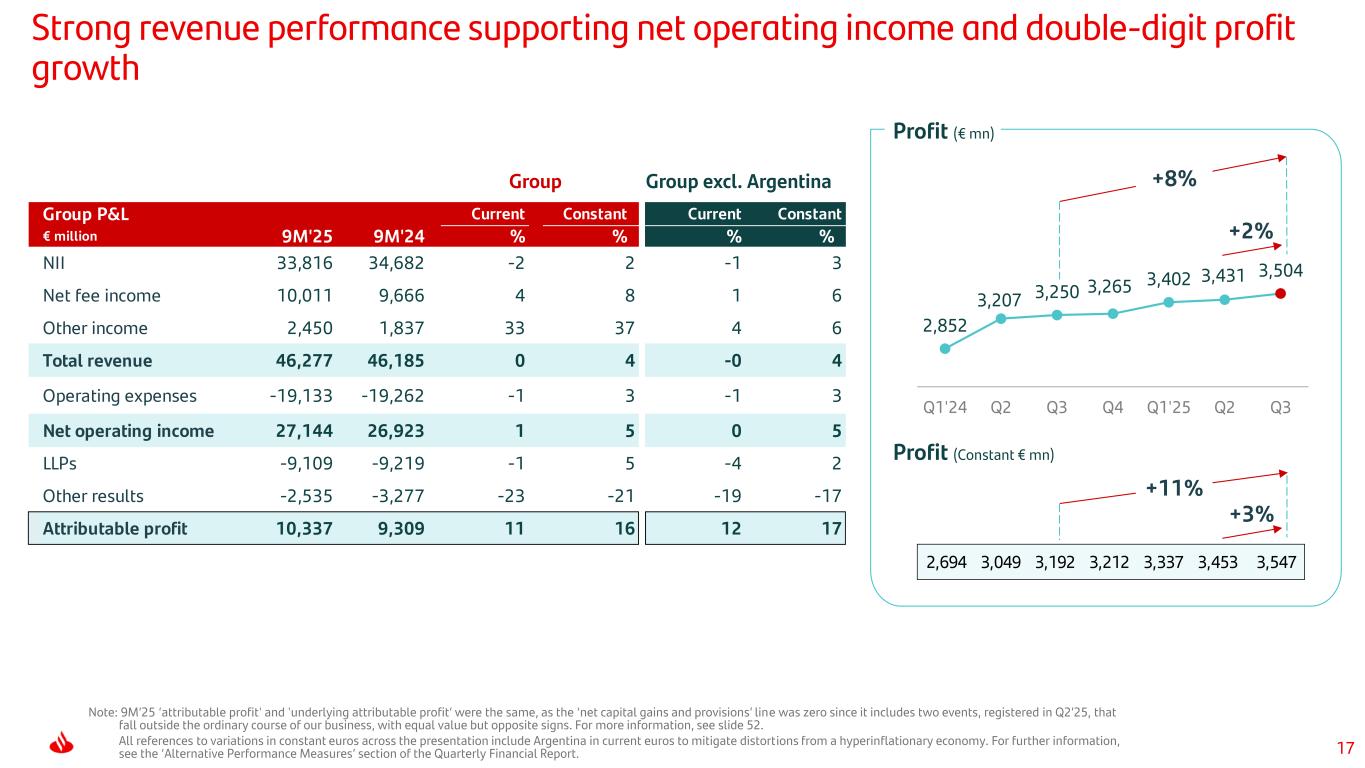

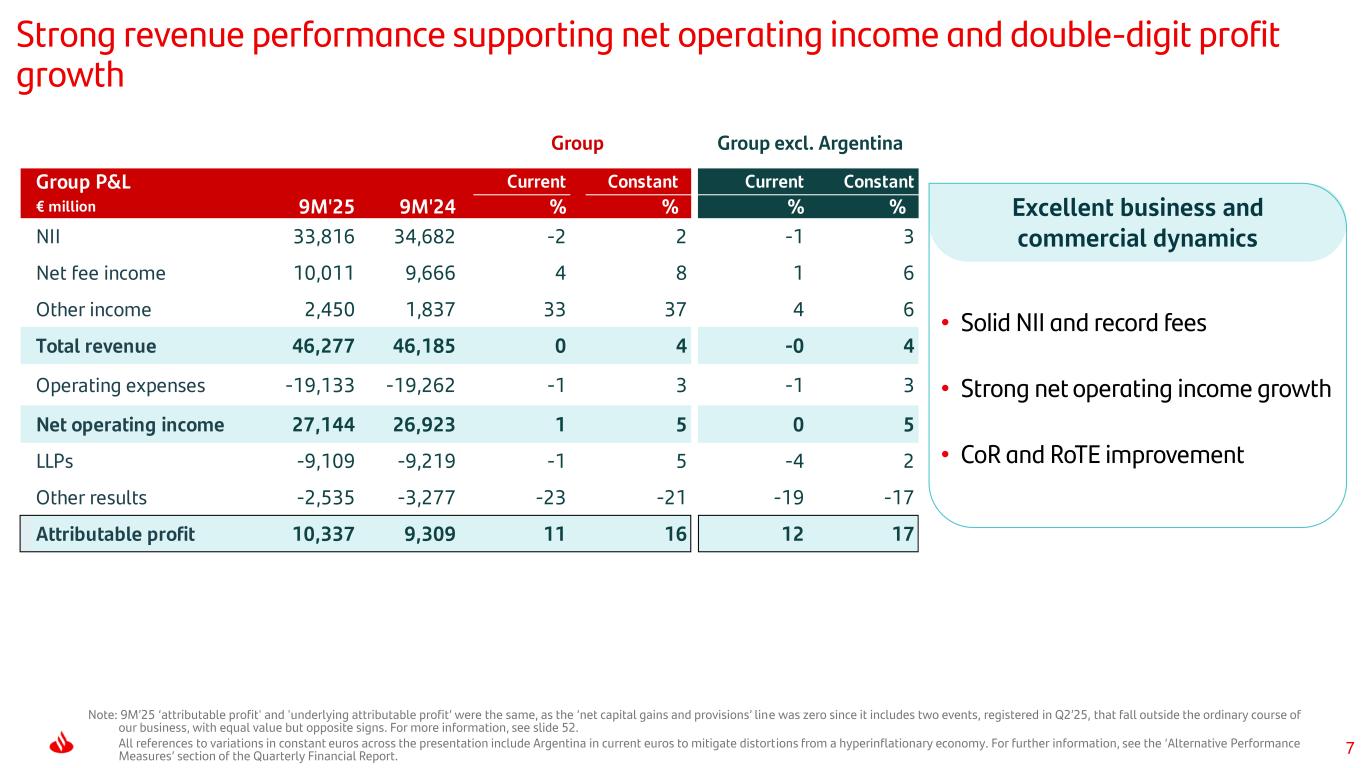

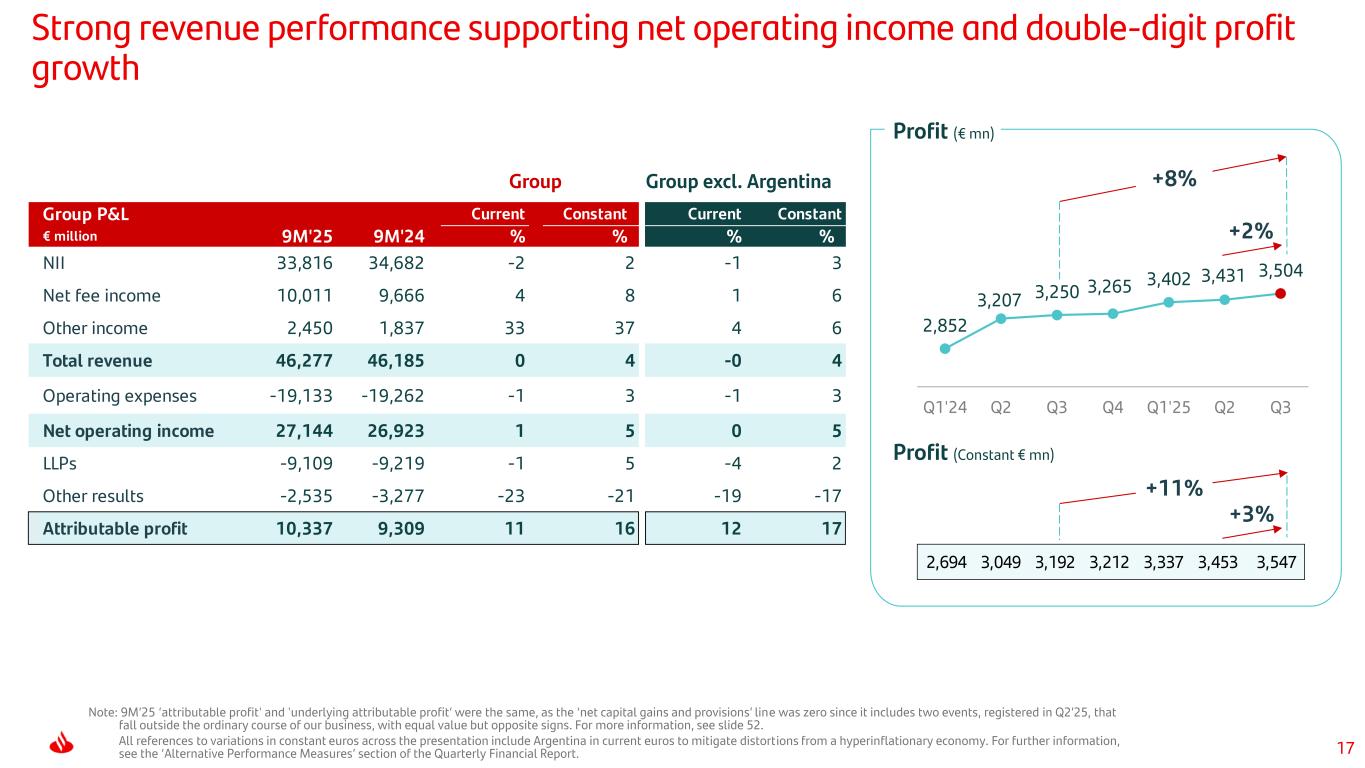

7 Excellent business and commercial dynamics Strong revenue performance supporting net operating income and double-digit profit growth • Solid NII and record fees • Strong net operating income growth • CoR and RoTE improvement Note: 9M’25 ‘attributable profit' and 'underlying attributable profit’ were the same, as the ‘net capital gains and provisions’ line was zero since it includes two events, registered in Q2’25, that fall outside the ordinary course of our business, with equal value but opposite signs. For more information, see slide 52. All references to variations in constant euros across the presentation include Argentina in current euros to mitigate distortions from a hyperinflationary economy. For further information, see the ‘Alternative Performance Measures’ section of the Quarterly Financial Report. Current Constant Current Constant € million 9M'25 9M'24 % % % % NII 33,816 34,682 -2 2 -1 3 Net fee income 10,011 9,666 4 8 1 6 Other income 2,450 1,837 33 37 4 6 Total revenue 46,277 46,185 0 4 -0 4 Operating expenses -19,133 -19,262 -1 3 -1 3 Net operating income 27,144 26,923 1 5 0 5 LLPs -9,109 -9,219 -1 5 -4 2 Other results -2,535 -3,277 -23 -21 -19 -17 Attributable profit 10,337 9,309 11 16 12 17 Group P&L Group excl. ArgentinaGroup

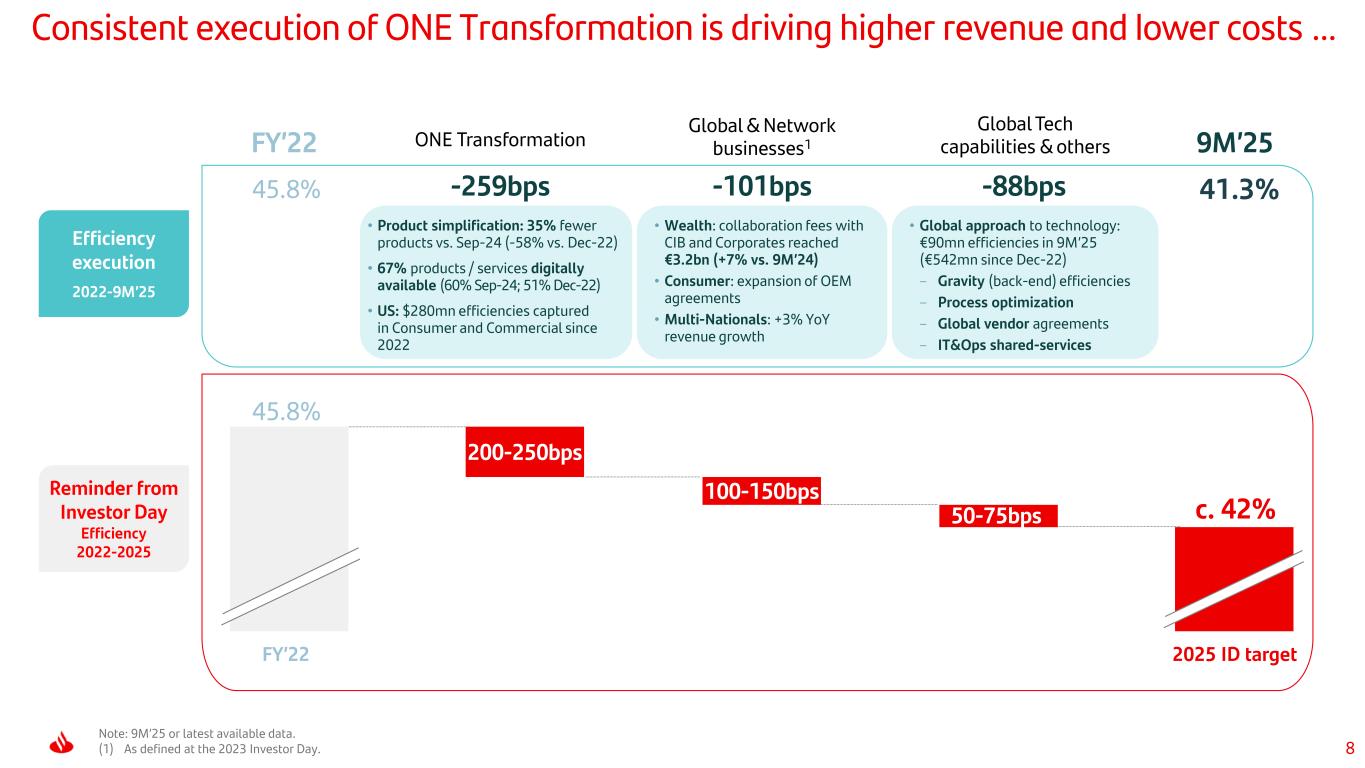

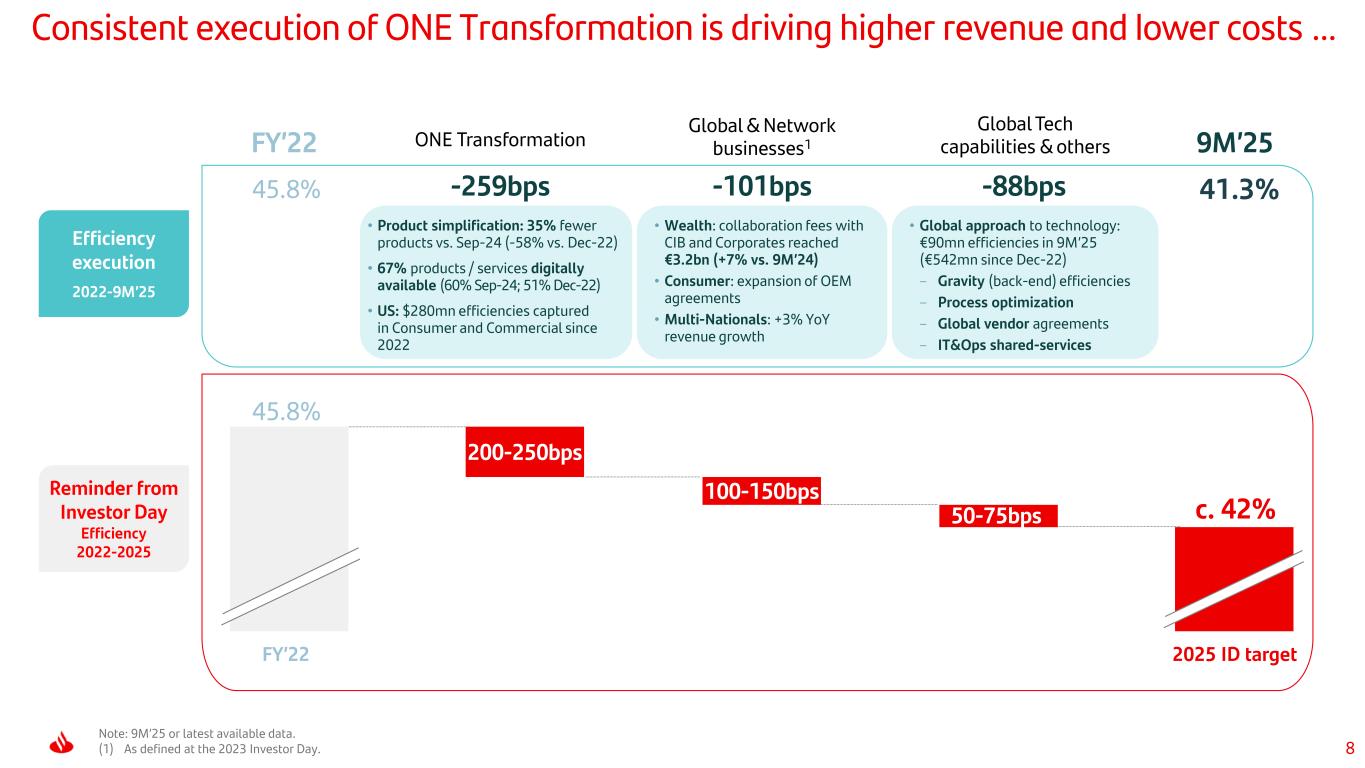

8 Consistent execution of ONE Transformation is driving higher revenue and lower costs … • Wealth: collaboration fees with CIB and Corporates reached €3.2bn (+7% vs. 9M’24) • Consumer: expansion of OEM agreements • Multi-Nationals: +3% YoY revenue growth • Product simplification: 35% fewer products vs. Sep-24 (-58% vs. Dec-22) • 67% products / services digitally available (60% Sep-24; 51% Dec-22) • US: $280mn efficiencies captured in Consumer and Commercial since 2022 • Global approach to technology: €90mn efficiencies in 9M’25 (€542mn since Dec-22) - Gravity (back-end) efficiencies - Process optimization - Global vendor agreements - IT&Ops shared-services -259bps -101bps -88bps ONE Transformation Global & Network businesses1 Global Tech capabilities & others 9M’25FY’22 Note: 9M’25 or latest available data. (1) As defined at the 2023 Investor Day. Efficiency execution 2022-9M’25 Reminder from Investor Day Efficiency 2022-2025 200-250bps c. 42% 100-150bps 50-75bps FY’22 2025 ID target 45.8% 41.3%45.8%

9 … and double-digit profit growth, supported by our 5 global businesses Note: YoY changes in constant euros. (*) Payments YoY variation excluding the PagoNxt write-downs in Q2’24 of our investments related to our merchant platform in Germany and Superdigital in Latin America (€243mn, net of tax and minority interests). Contribution to Group revenue as a percentage of total operating areas, excluding the Corporate Centre. Global businesses’ RoTEs are adjusted based on Group’s deployed capital; targets have been adjusted for AT1 costs. GROUP CONSUMER CIB WEALTH PAYMENTS RETAIL Revenue (€ bn) Efficiency9M’25 Profit (€ bn) c.17% c.12% c.20% c.60% >30% c.16.5% RoTE post-AT1 PagoNxt EBITDA margin RoTE post-AT1 Profitability 2025 targets Profitability 9M’25 Contribution to Group revenue 21% 14% 6% 9% 50%23.3 39.2% 5.7 +1% +0.2pp +9% 9.7 40.9% 1.6 +3% +0.2pp +6% 6.4 44.9% 2.2 +6% +0.6pp +10% 3.0 35.9% 1.4 +13% -1.3pp +21% 4.4 40.8% 0.6 +19% -5.2pp +62%* 46.3 41.3% 10.3 +4% -0.4pp +16% 16.1% +0.7pp 66.0% -9.9pp 31.6% +8.9pp +2.3pp 17.6% -0.5pp 10.4% -0.7pp 19.7%

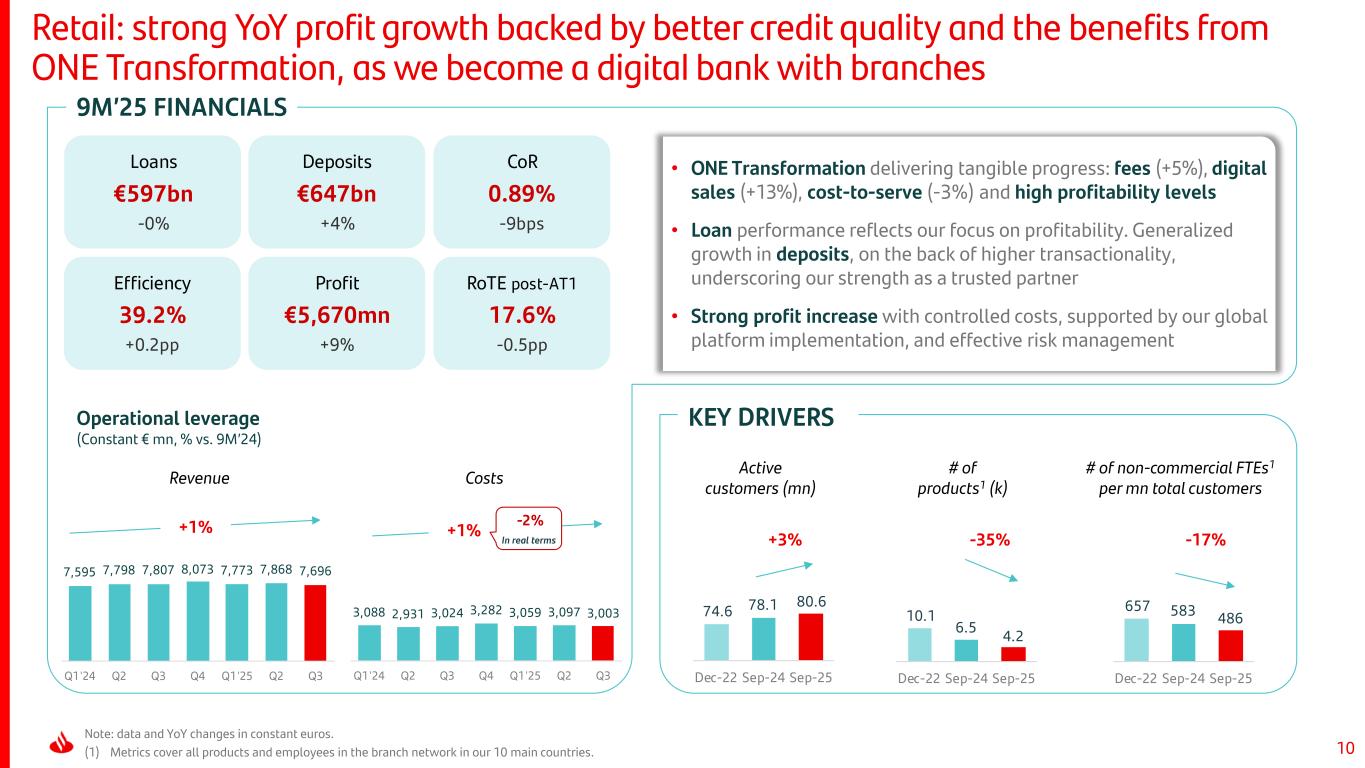

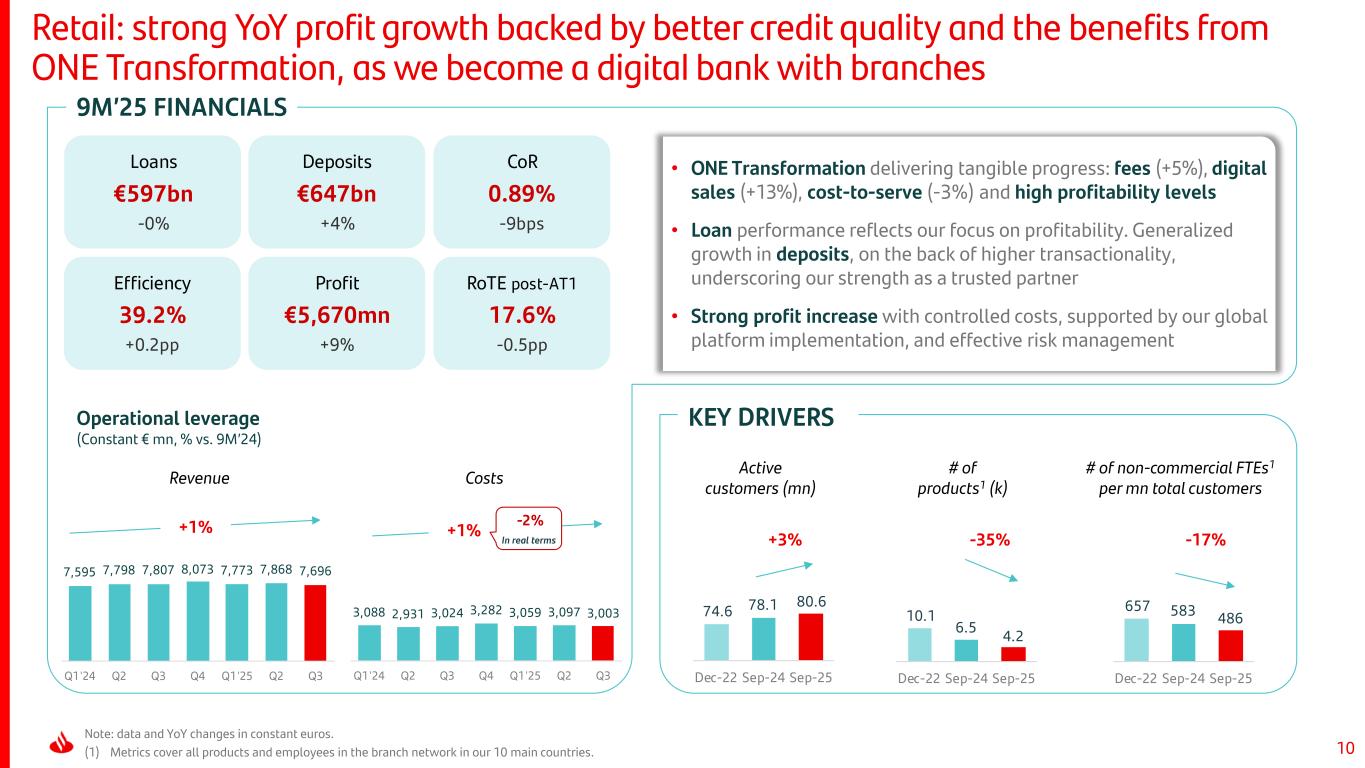

10 10.1 6.5 4.2 Dec-22 Sep-24 Sep-25 657 583 486 Dec-22 Sep-24 Sep-25 74.6 78.1 80.6 Dec-22 Sep-24 Sep-25 9M’25 FINANCIALS Note: data and YoY changes in constant euros. (1) Metrics cover all products and employees in the branch network in our 10 main countries. Retail: strong YoY profit growth backed by better credit quality and the benefits from ONE Transformation, as we become a digital bank with branches # of products1 (k) # of non-commercial FTEs1 per mn total customers Active customers (mn) KEY DRIVERS CostsRevenue Deposits €647bn +4% CoR 0.89% -9bps Efficiency 39.2% +0.2pp Profit €5,670mn +9% Loans €597bn -0% 3,088 2,931 3,024 3,282 3,059 3,097 3,003 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3 +1% +1% 7,595 7,798 7,807 8,073 7,773 7,868 7,696 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3 In real terms -2% +3% -35% -17% • ONE Transformation delivering tangible progress: fees (+5%), digital sales (+13%), cost-to-serve (-3%) and high profitability levels • Loan performance reflects our focus on profitability. Generalized growth in deposits, on the back of higher transactionality, underscoring our strength as a trusted partner • Strong profit increase with controlled costs, supported by our global platform implementation, and effective risk management Operational leverage (Constant € mn, % vs. 9M’24) RoTE post-AT1 17.6% -0.5pp

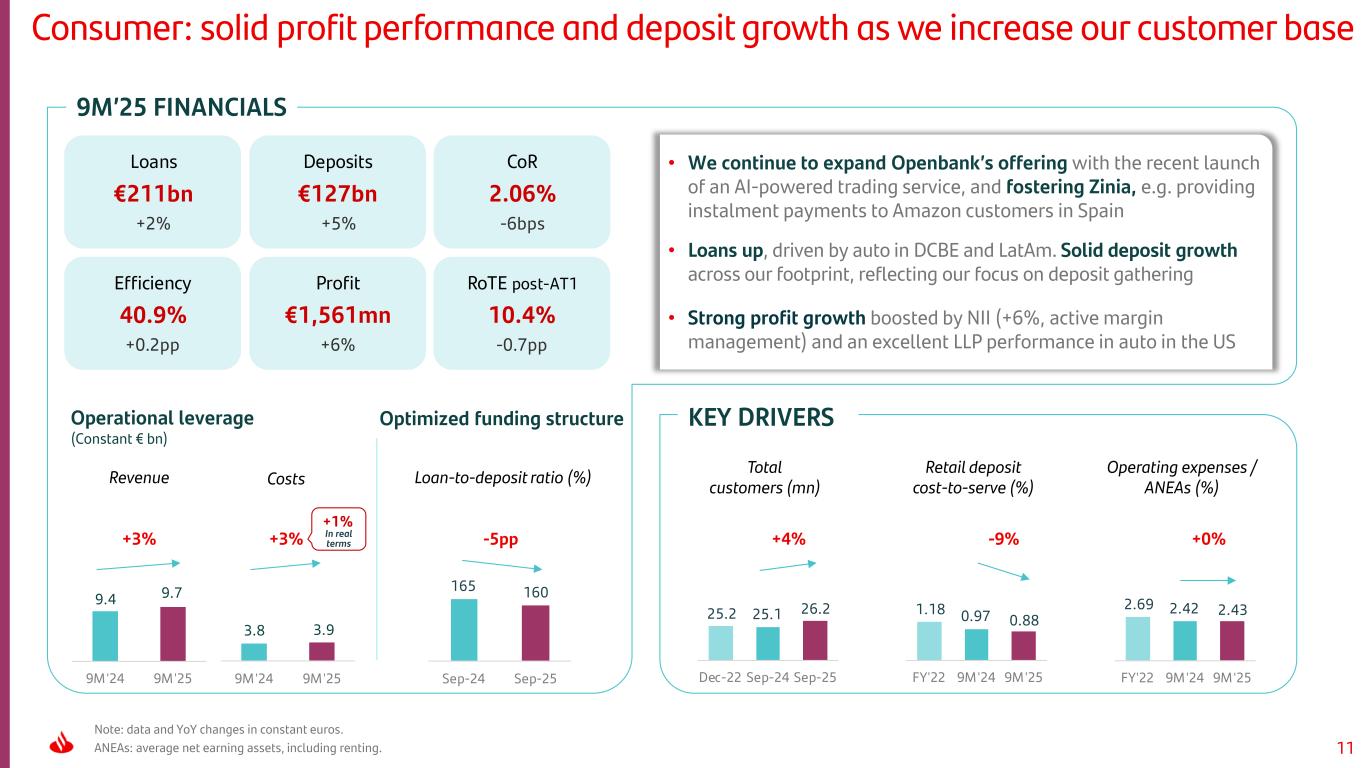

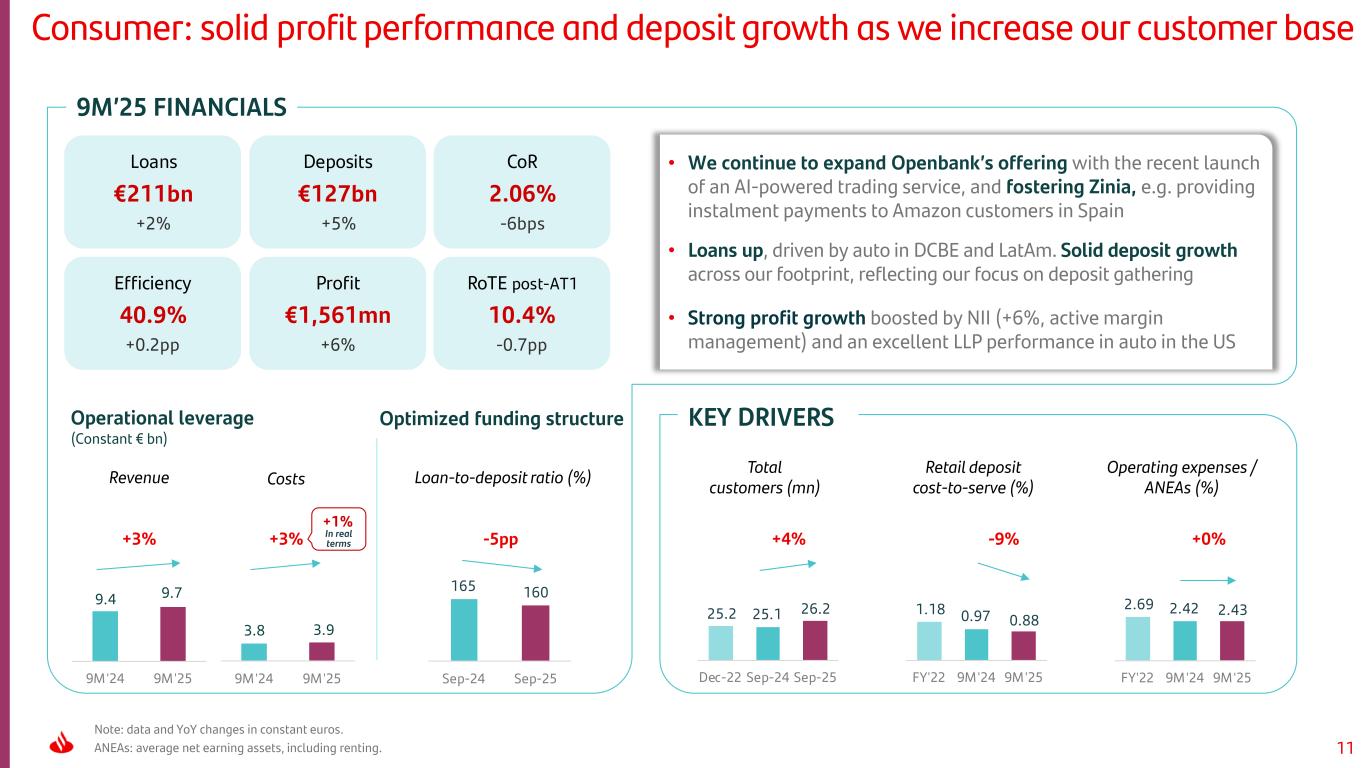

11 25.2 25.1 26.2 Dec-22 Sep-24 Sep-25 9M’25 FINANCIALS Note: data and YoY changes in constant euros. ANEAs: average net earning assets, including renting. Retail deposit cost-to-serve (%) Operating expenses / ANEAs (%) KEY DRIVERS CostsRevenue Loan-to-deposit ratio (%) Optimized funding structure Total customers (mn) Loans €211bn +2% Deposits €127bn +5% Efficiency 40.9% +0.2pp Profit €1,561mn +6% CoR 2.06% -6bps +3% +3% 9.4 9.7 9M'24 9M'25 165 160 Sep-24 Sep-25 3.8 3.9 9M'24 9M'25 In real terms +1% Consumer: solid profit performance and deposit growth as we increase our customer base 1.18 0.97 0.88 FY'22 9M'24 9M'25 2.69 2.42 2.43 FY'22 9M'24 9M'25 +4% -9% +0%-5pp • We continue to expand Openbank’s offering with the recent launch of an AI-powered trading service, and fostering Zinia, e.g. providing instalment payments to Amazon customers in Spain • Loans up, driven by auto in DCBE and LatAm. Solid deposit growth across our footprint, reflecting our focus on deposit gathering • Strong profit growth boosted by NII (+6%, active margin management) and an excellent LLP performance in auto in the US Operational leverage (Constant € bn) RoTE post-AT1 10.4% -0.7pp

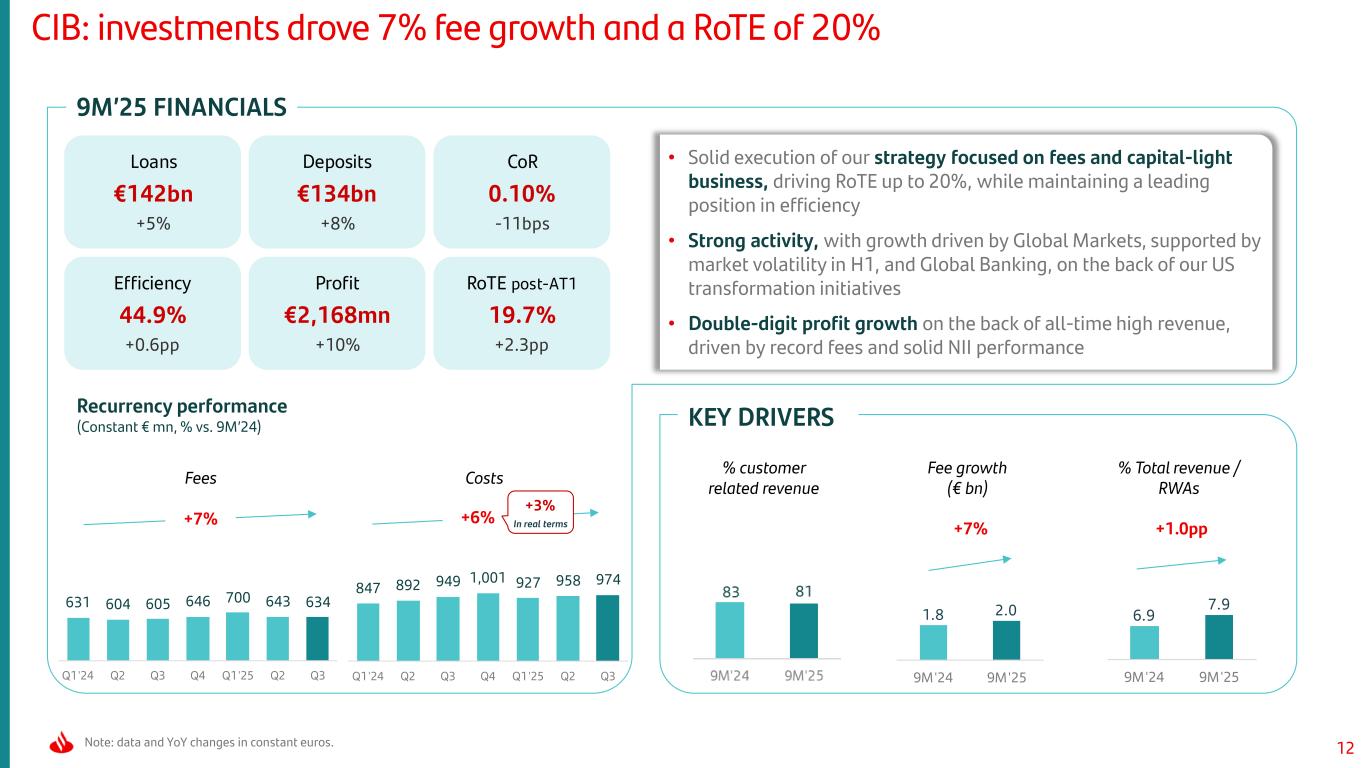

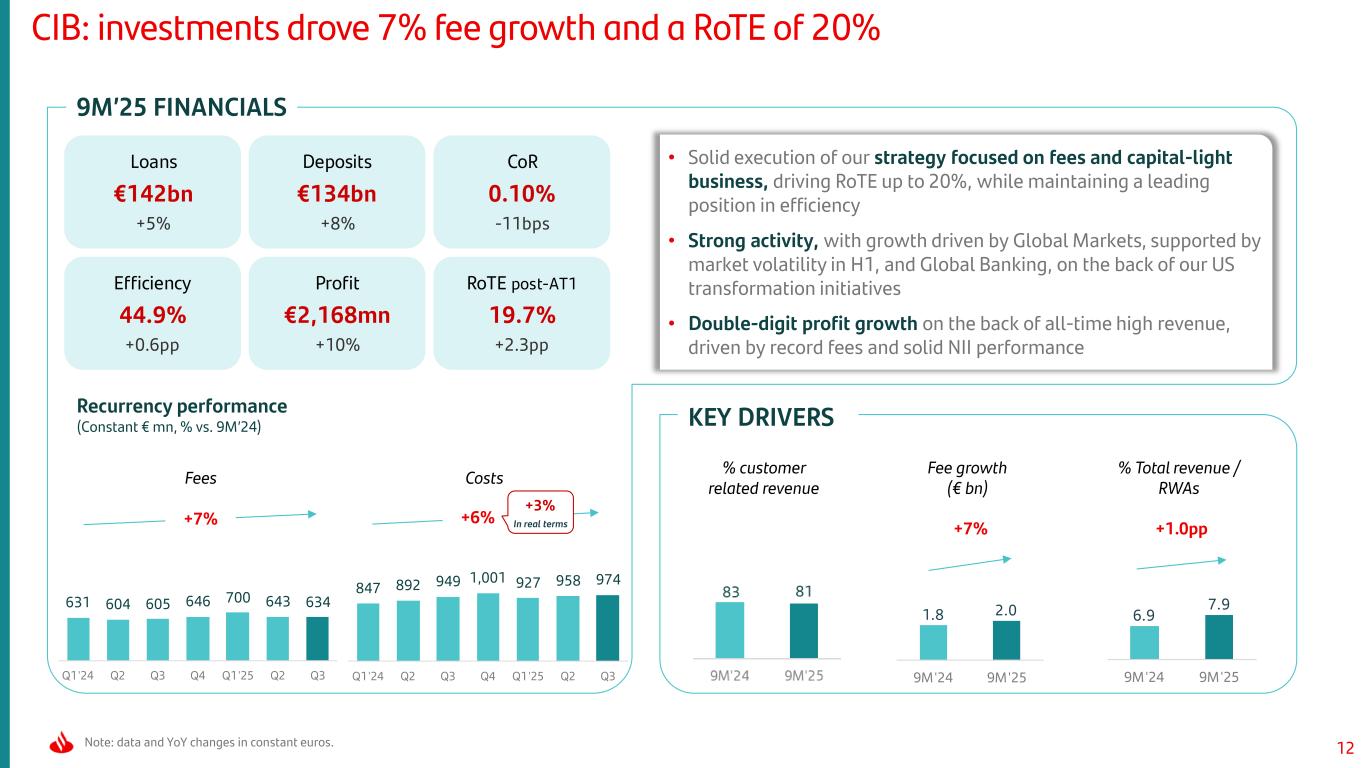

12Note: data and YoY changes in constant euros. 9M’25 FINANCIALS KEY DRIVERS % customer related revenue Fee growth (€ bn) % Total revenue / RWAs CIB: investments drove 7% fee growth and a RoTE of 20% • Solid execution of our strategy focused on fees and capital-light business, driving RoTE up to 20%, while maintaining a leading position in efficiency • Strong activity, with growth driven by Global Markets, supported by market volatility in H1, and Global Banking, on the back of our US transformation initiatives • Double-digit profit growth on the back of all-time high revenue, driven by record fees and solid NII performance CostsFees Loans €142bn +5% Deposits €134bn +8% CoR 0.10% -11bps Efficiency 44.9% +0.6pp Profit €2,168mn +10% 847 892 949 1,001 927 958 974 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3 1.8 2.0 9M'24 9M'25 631 604 605 646 700 643 634 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3 +7% +7% +6% In real terms +3% Recurrency performance (Constant € mn, % vs. 9M’24) 6.9 7.9 9M'24 9M'25 +1.0pp RoTE post-AT1 19.7% +2.3pp

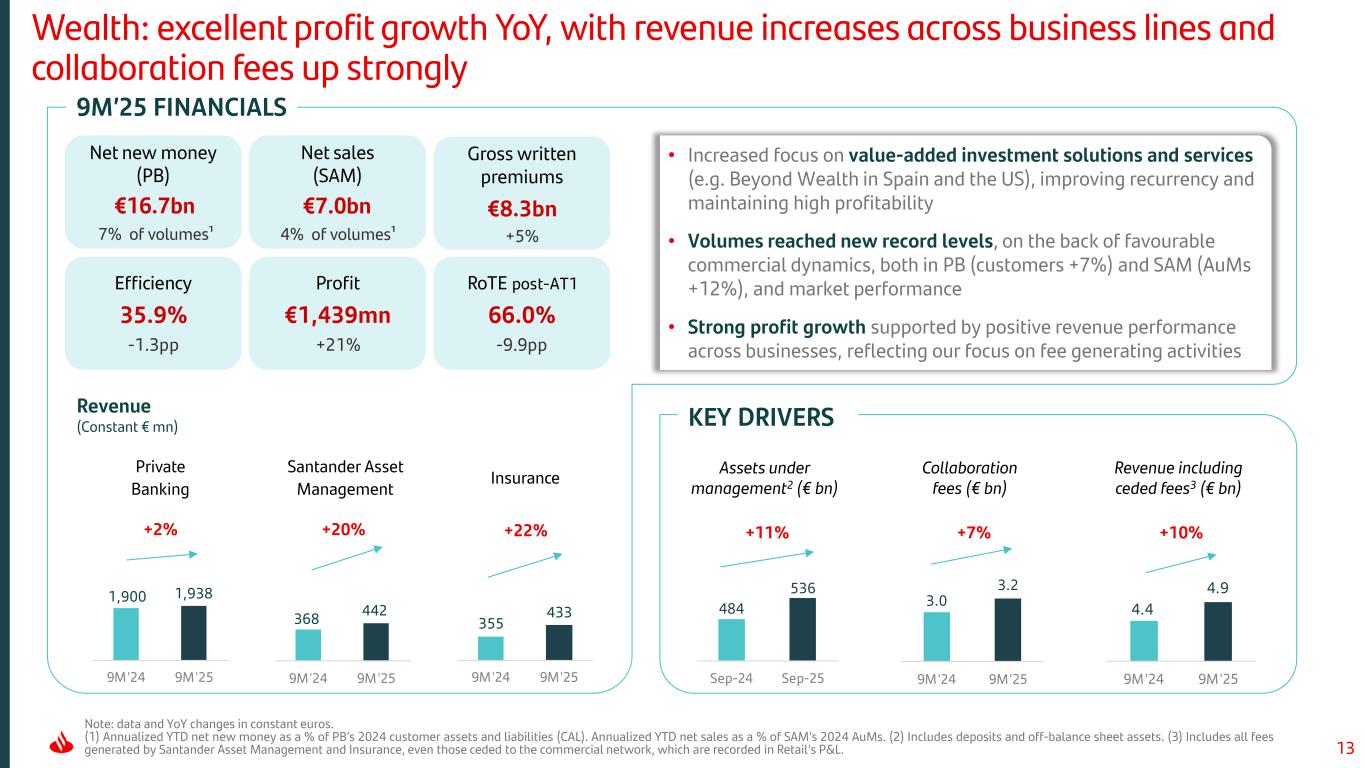

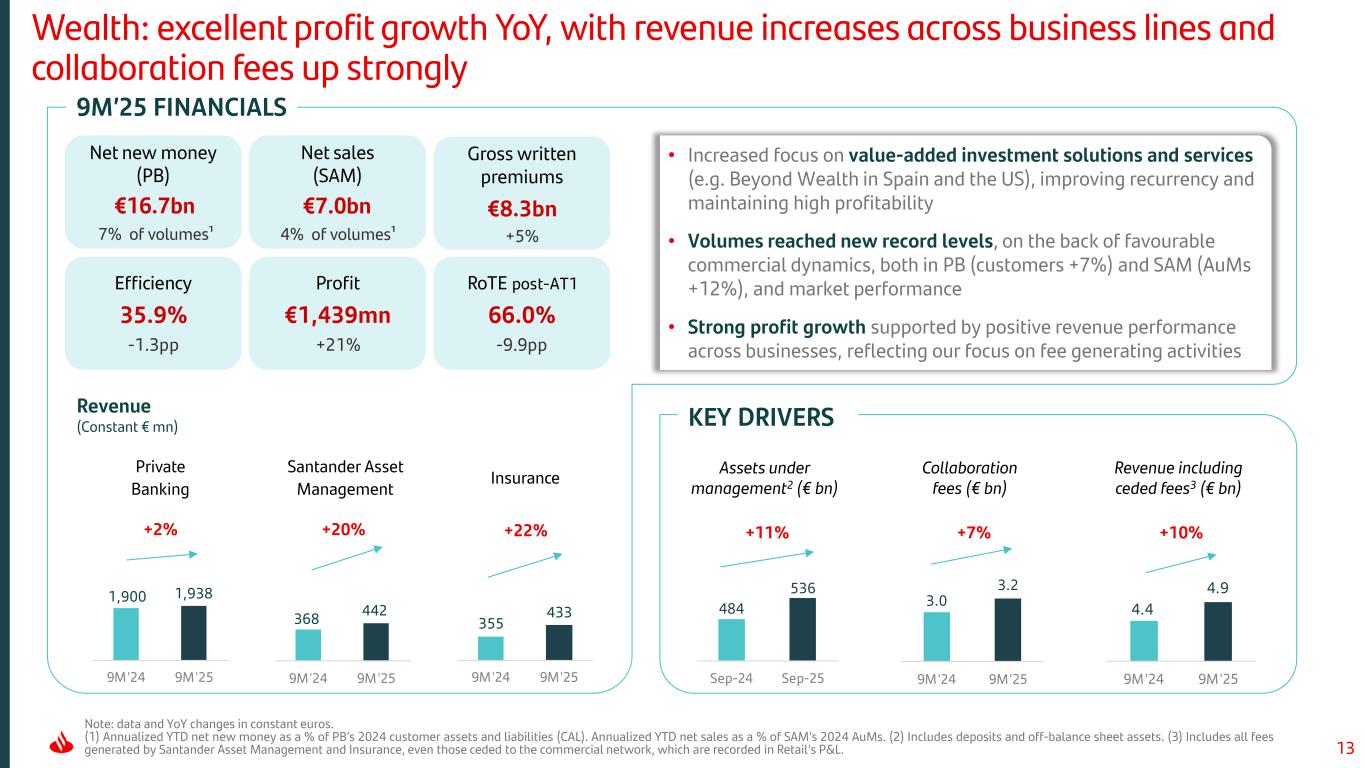

13 3.0 3.2 9M'24 9M'25 9M’25 FINANCIALS Note: data and YoY changes in constant euros. (1) Annualized YTD net new money as a % of PB’s 2024 customer assets and liabilities (CAL). Annualized YTD net sales as a % of SAM’s 2024 AuMs. (2) Includes deposits and off-balance sheet assets. (3) Includes all fees generated by Santander Asset Management and Insurance, even those ceded to the commercial network, which are recorded in Retail’s P&L. Private Banking Santander Asset Management Insurance Assets under management2 (€ bn) Collaboration fees (€ bn) Revenue including ceded fees3 (€ bn) KEY DRIVERS • Increased focus on value-added investment solutions and services (e.g. Beyond Wealth in Spain and the US), improving recurrency and maintaining high profitability • Volumes reached new record levels, on the back of favourable commercial dynamics, both in PB (customers +7%) and SAM (AuMs +12%), and market performance • Strong profit growth supported by positive revenue performance across businesses, reflecting our focus on fee generating activities Net new money (PB) Net sales (SAM) Gross written premiums Efficiency 35.9% -1.3pp Profit €1,439mn +21% 368 442 9M'24 9M'25 355 433 9M'24 9M'25 1,900 1,938 9M'24 9M'25 +2% +20% +22% Wealth: excellent profit growth YoY, with revenue increases across business lines and collaboration fees up strongly +11% Revenue (Constant € mn) 484 536 Sep-24 Sep-25 RoTE post-AT1 66.0% -9.9pp €8.3bn +5% 4.4 4.9 9M'24 9M'25 +7% +10% €16.7bn 7% of volumes¹ €7.0bn 4% of volumes¹

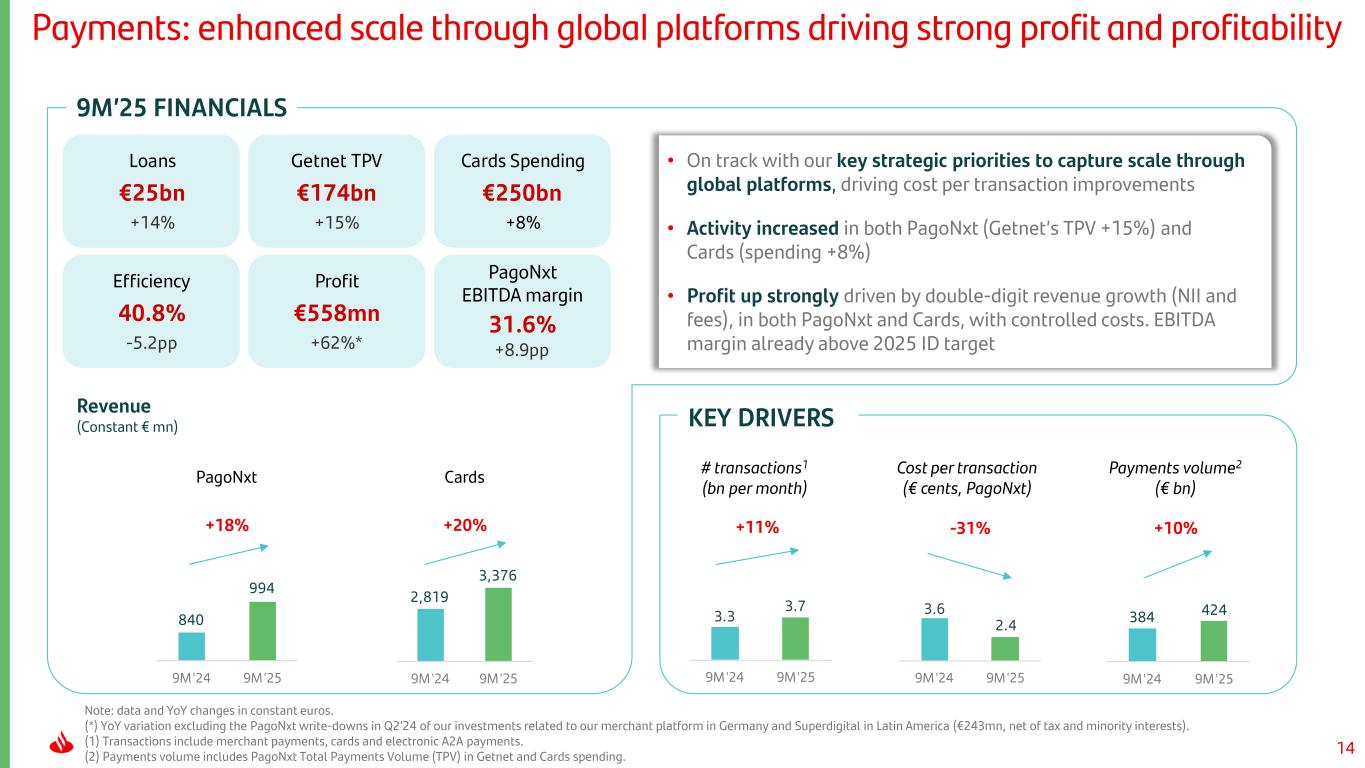

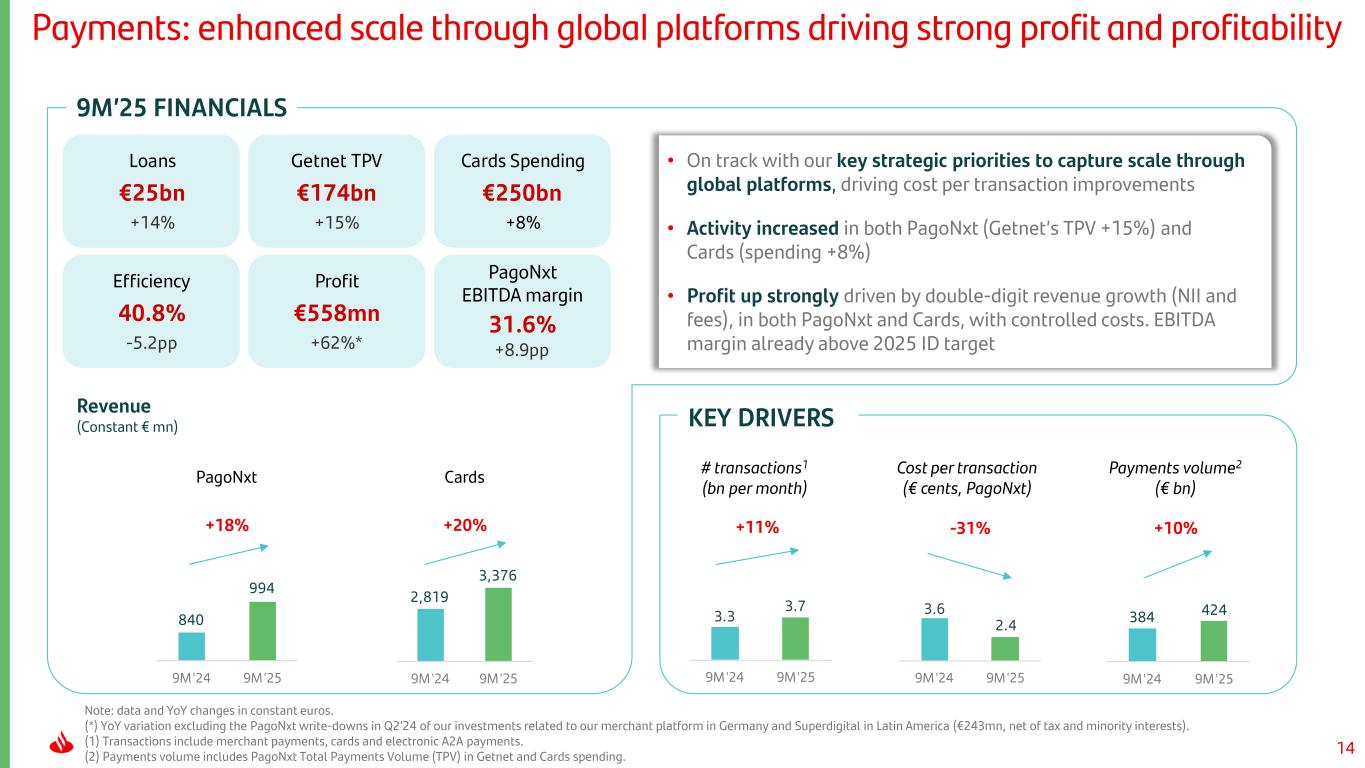

14 Note: data and YoY changes in constant euros. (*) YoY variation excluding the PagoNxt write-downs in Q2’24 of our investments related to our merchant platform in Germany and Superdigital in Latin America (€243mn, net of tax and minority interests). (1) Transactions include merchant payments, cards and electronic A2A payments. (2) Payments volume includes PagoNxt Total Payments Volume (TPV) in Getnet and Cards spending. 9M’25 FINANCIALS # transactions1 (bn per month) Cost per transaction (€ cents, PagoNxt) PagoNxt Cards KEY DRIVERS • On track with our key strategic priorities to capture scale through global platforms, driving cost per transaction improvements • Activity increased in both PagoNxt (Getnet’s TPV +15%) and Cards (spending +8%) • Profit up strongly driven by double-digit revenue growth (NII and fees), in both PagoNxt and Cards, with controlled costs. EBITDA margin already above 2025 ID target PagoNxt EBITDA margin Loans €25bn +14% Efficiency 40.8% -5.2pp Profit €558mn +62%* 3.3 3.7 9M'24 9M'25 3.6 2.4 9M'24 9M'25 840 994 9M'24 9M'25 2,819 3,376 9M'24 9M'25 +18% +20% Payments: enhanced scale through global platforms driving strong profit and profitability +11% -31% Revenue (Constant € mn) Getnet TPV €174bn +15% Cards Spending €250bn +8% 31.6% +8.9pp Payments volume2 (€ bn) 384 424 9M'24 9M'25 +10%

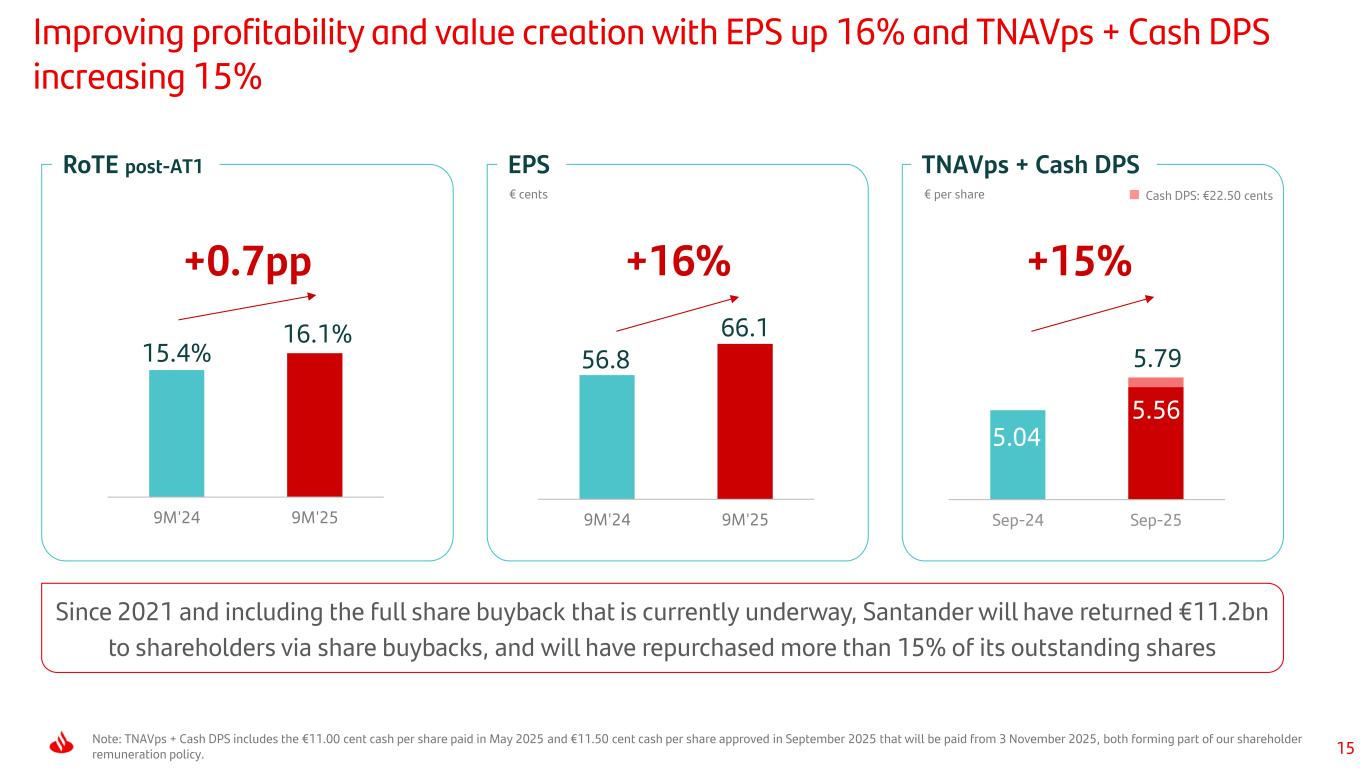

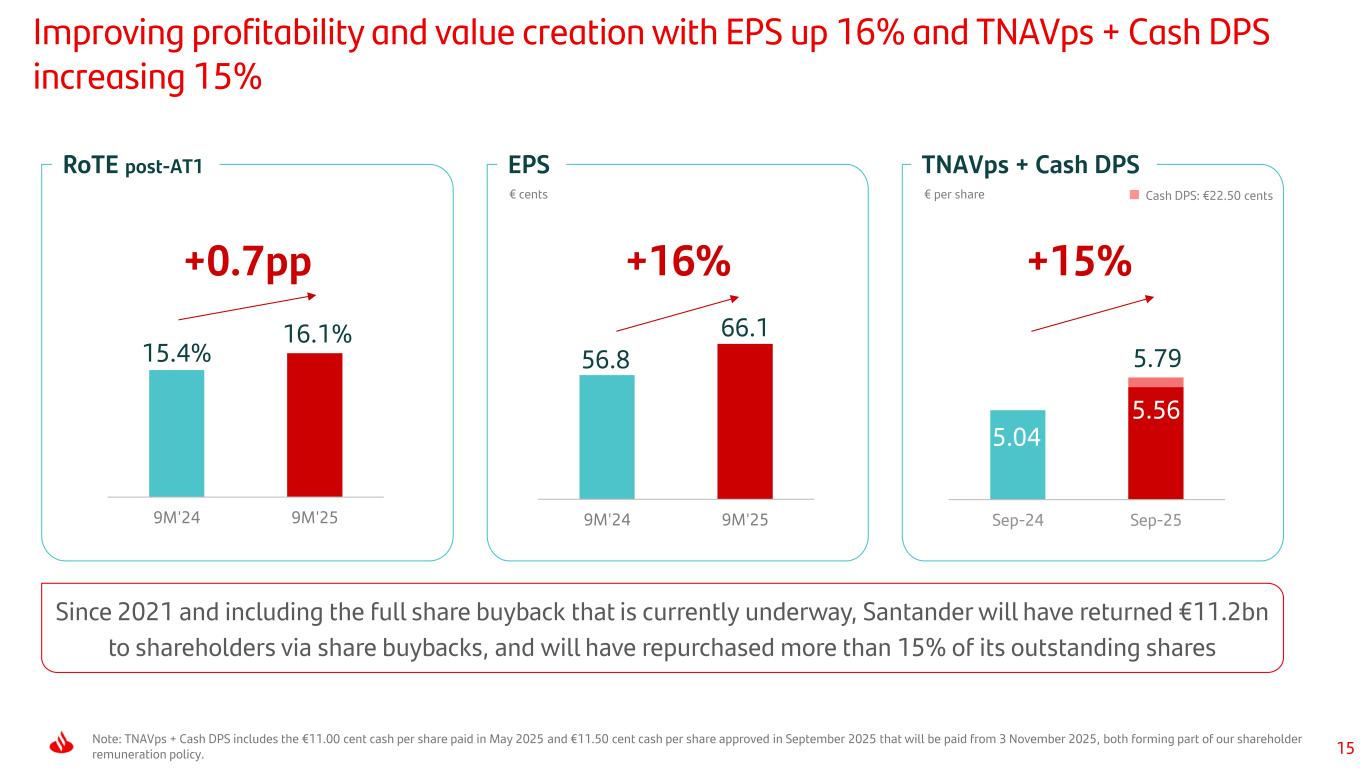

15 Note: TNAVps + Cash DPS includes the €11.00 cent cash per share paid in May 2025 and €11.50 cent cash per share approved in September 2025 that will be paid from 3 November 2025, both forming part of our shareholder remuneration policy. Improving profitability and value creation with EPS up 16% and TNAVps + Cash DPS increasing 15% Since 2021 and including the full share buyback that is currently underway, Santander will have returned €11.2bn to shareholders via share buybacks, and will have repurchased more than 15% of its outstanding shares RoTE post-AT1 EPS TNAVps + Cash DPS € per share Cash DPS: €22.50 cents€ cents 5.04 5.56 5.79 Sep-24 Sep-25 56.8 66.1 9M'24 9M'25 +0.7pp +15% 15.4% 16.1% 9M'24 9M'25 +16%

16 Index 9M'25 Highlights Progress on our strategy 1 Group review 2 Final remarks 3 Appendix 4

17 Strong revenue performance supporting net operating income and double-digit profit growth Note: 9M’25 ‘attributable profit' and 'underlying attributable profit’ were the same, as the ‘net capital gains and provisions’ line was zero since it includes two events, registered in Q2’25, that fall outside the ordinary course of our business, with equal value but opposite signs. For more information, see slide 52. All references to variations in constant euros across the presentation include Argentina in current euros to mitigate distortions from a hyperinflationary economy. For further information, see the ‘Alternative Performance Measures’ section of the Quarterly Financial Report. +3% 2,852 3,207 3,250 3,265 3,402 3,431 3,504 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3 +2% Profit (€ mn) Profit (Constant € mn) 2,694 3,049 3,192 3,212 3,337 3,453 3,547 Current Constant Current Constant € million 9M'25 9M'24 % % % % NII 33,816 34,682 -2 2 -1 3 Net fee income 10,011 9,666 4 8 1 6 Other income 2,450 1,837 33 37 4 6 Total revenue 46,277 46,185 0 4 -0 4 Operating expenses -19,133 -19,262 -1 3 -1 3 Net operating income 27,144 26,923 1 5 0 5 LLPs -9,109 -9,219 -1 5 -4 2 Other results -2,535 -3,277 -23 -21 -19 -17 Attributable profit 10,337 9,309 11 16 12 17 Group P&L Group excl. ArgentinaGroup +8% +11%

18 14,541 14,919 14,883 15,797 15,227 15,592 15,459 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3 • >95% of total revenue is customer related • Solid revenue increase YoY across lines, with all businesses growing in a more challenging environment, reflecting the benefits of our model • In the quarter, revenue flat excluding Argentina. Of note, strong growth in Consumer and Payments • Retail: positive performance across most countries with strong fees • Consumer up driven by NII, across almost all our footprint, as a result of our focus on profitability and lower funding costs • CIB: record 9M revenue on the back of an excellent start to the year in Global Markets • Wealth up double digits. All business lines growing on the back of our focus on fee activities, record AuMs and favourable market performance • Payments boosted by double-digit growth in NII and fees, in both PagoNxt and Cards, driven by strong activity Revenue growth underpinned by customer activity across our businesses Note: data and YoY % changes in constant euros. TOTAL REVENUE GROUP DETAIL BY BUSINESS Constant € mn 46,277 44,344 +137 +315 +337 +346 +711 +87 9M'24 Retail Consumer CIB Wealth Payments CC 9M'25 YoY growth +1% +3% +6% +13% +19% +4% +4%

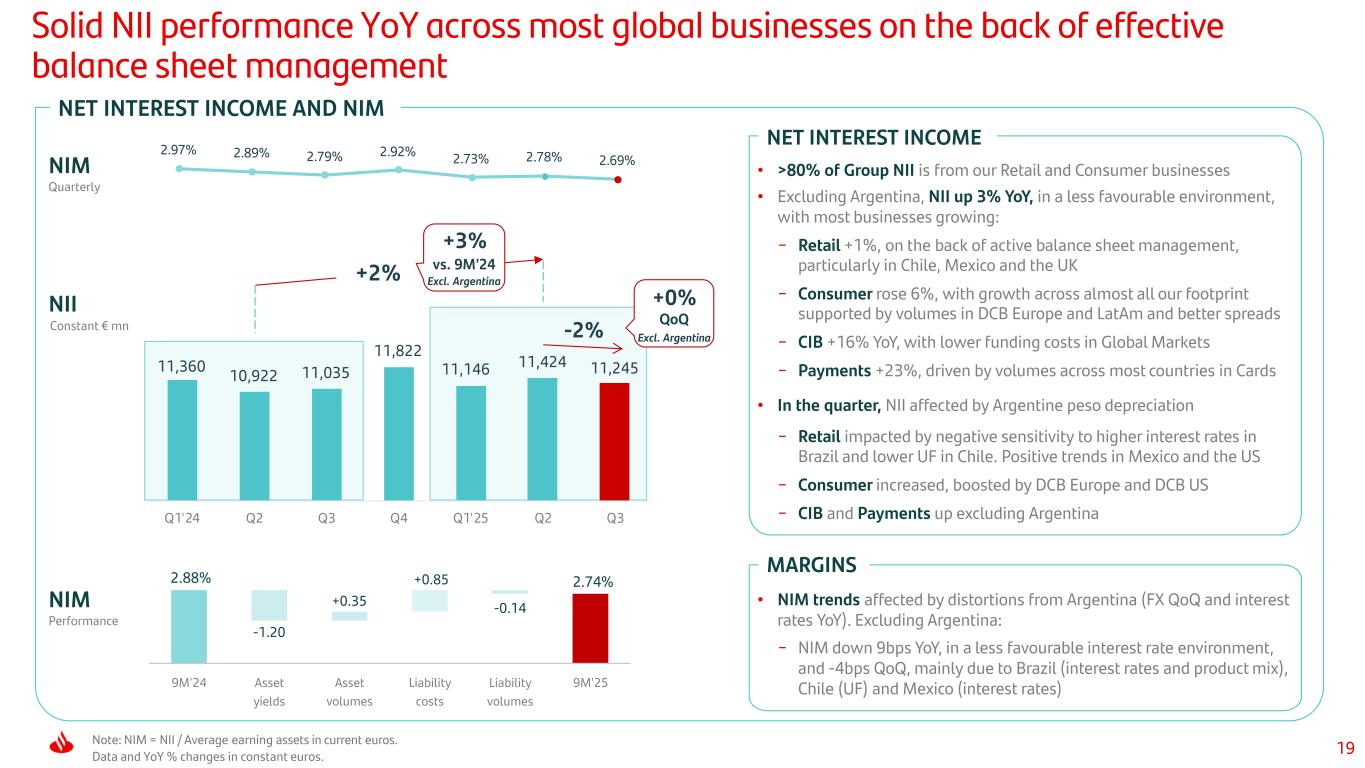

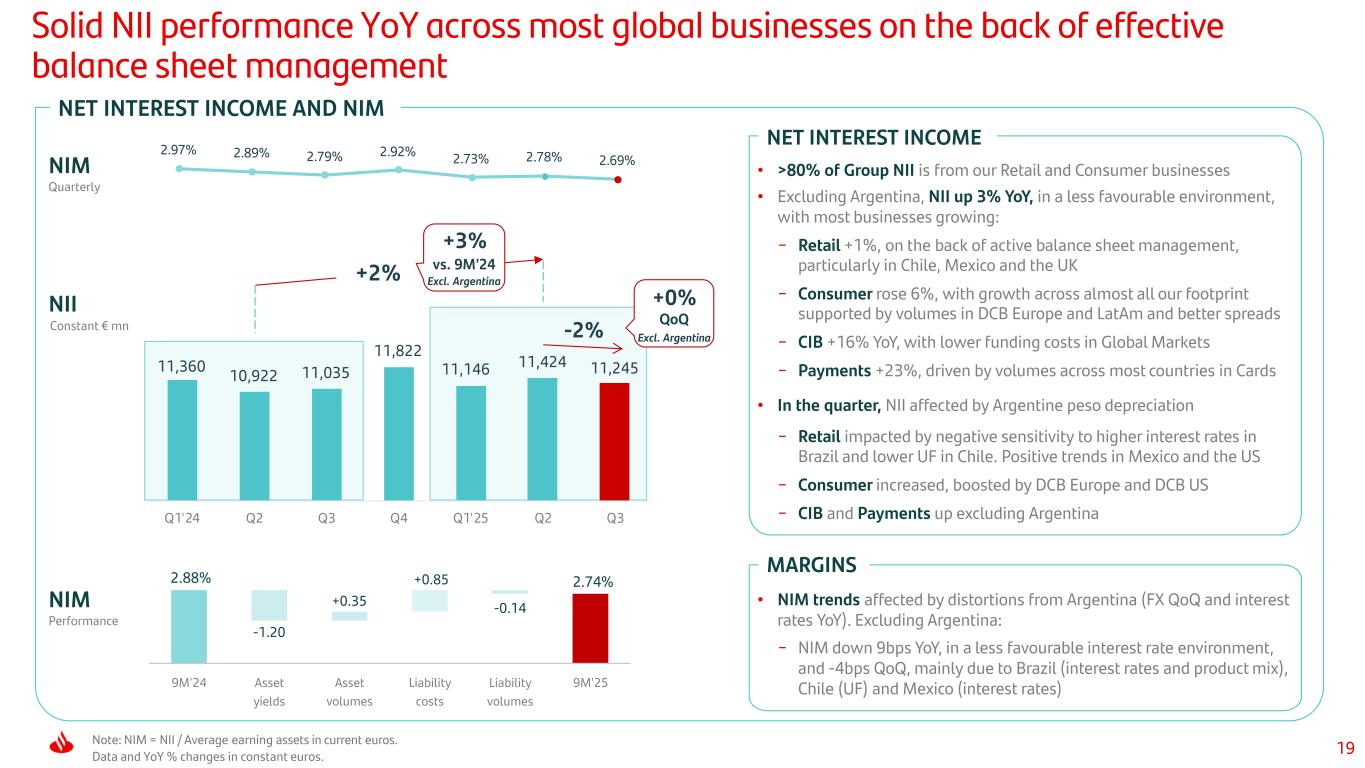

19 • >80% of Group NII is from our Retail and Consumer businesses • Excluding Argentina, NII up 3% YoY, in a less favourable environment, with most businesses growing: − Retail +1%, on the back of active balance sheet management, particularly in Chile, Mexico and the UK − Consumer rose 6%, with growth across almost all our footprint supported by volumes in DCB Europe and LatAm and better spreads − CIB +16% YoY, with lower funding costs in Global Markets − Payments +23%, driven by volumes across most countries in Cards • In the quarter, NII affected by Argentine peso depreciation − Retail impacted by negative sensitivity to higher interest rates in Brazil and lower UF in Chile. Positive trends in Mexico and the US − Consumer increased, boosted by DCB Europe and DCB US − CIB and Payments up excluding Argentina • NIM trends affected by distortions from Argentina (FX QoQ and interest rates YoY). Excluding Argentina: − NIM down 9bps YoY, in a less favourable interest rate environment, and -4bps QoQ, mainly due to Brazil (interest rates and product mix), Chile (UF) and Mexico (interest rates) Solid NII performance YoY across most global businesses on the back of effective balance sheet management NIM Performance NII NET INTEREST INCOME AND NIM Note: NIM = NII / Average earning assets in current euros. Data and YoY % changes in constant euros. NIM Quarterly Constant € mn NET INTEREST INCOME MARGINS 2.97% 2.89% 2.79% 2.92% 2.73% 2.78% 2.69% +2% Excl. Argentina vs. 9M’24 2.74% -1.20 -0.14 2.88% +0.35 +0.85 9M'24 Asset yields Asset volumes Liability costs Liability volumes 9M'25 +3% -2% QoQ Excl. Argentina +0% 11,360 10,922 11,035 11,822 11,146 11,424 11,245 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3

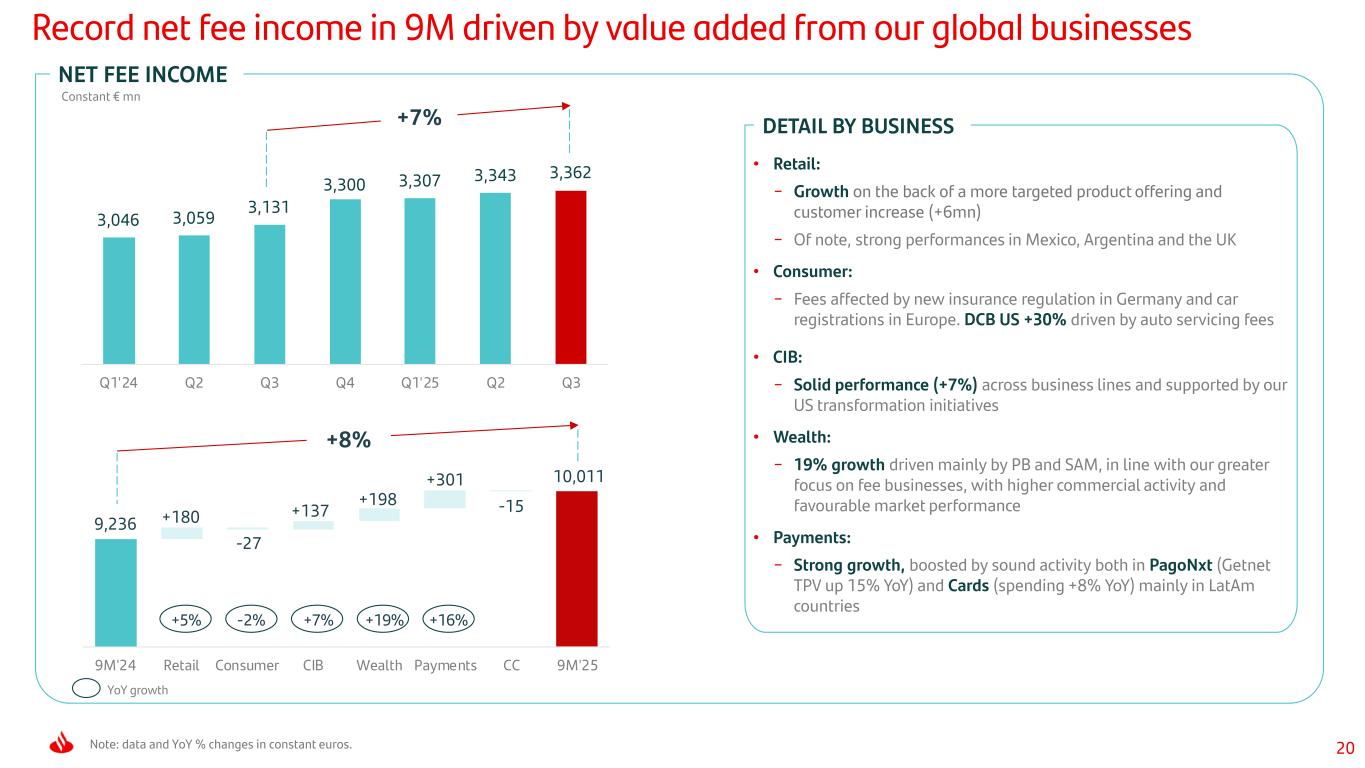

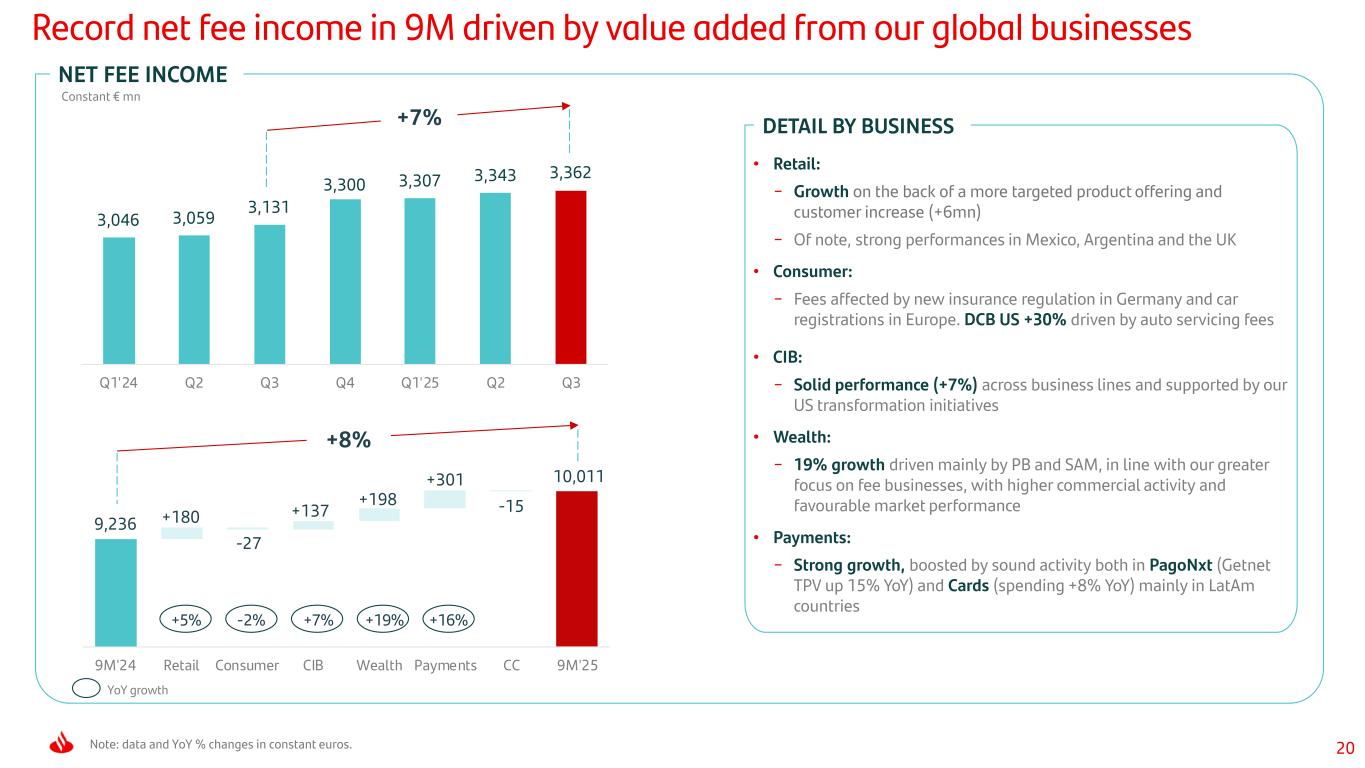

20 • Retail: − Growth on the back of a more targeted product offering and customer increase (+6mn) − Of note, strong performances in Mexico, Argentina and the UK • Consumer: − Fees affected by new insurance regulation in Germany and car registrations in Europe. DCB US +30% driven by auto servicing fees • CIB: − Solid performance (+7%) across business lines and supported by our US transformation initiatives • Wealth: − 19% growth driven mainly by PB and SAM, in line with our greater focus on fee businesses, with higher commercial activity and favourable market performance • Payments: − Strong growth, boosted by sound activity both in PagoNxt (Getnet TPV up 15% YoY) and Cards (spending +8% YoY) mainly in LatAm countries Record net fee income in 9M driven by value added from our global businesses DETAIL BY BUSINESS Note: data and YoY % changes in constant euros. 10,011 9,236 +180 -27 +137 +198 +301 -15 9M'24 Retail Consumer CIB Wealth Payments CC 9M'25 +5% -2% +7% +19% +16% +7% 3,046 3,059 3,131 3,300 3,307 3,343 3,362 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3 +8% NET FEE INCOME Constant € mn YoY growth

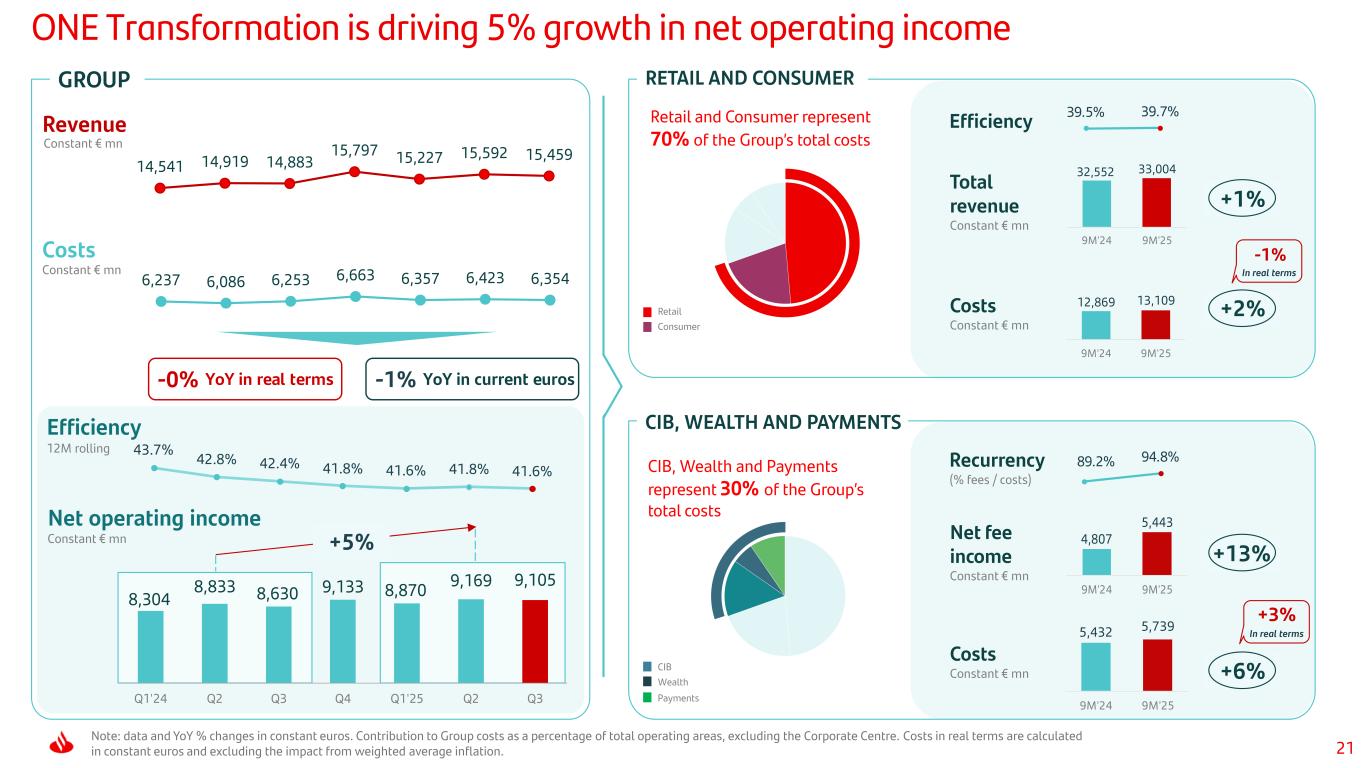

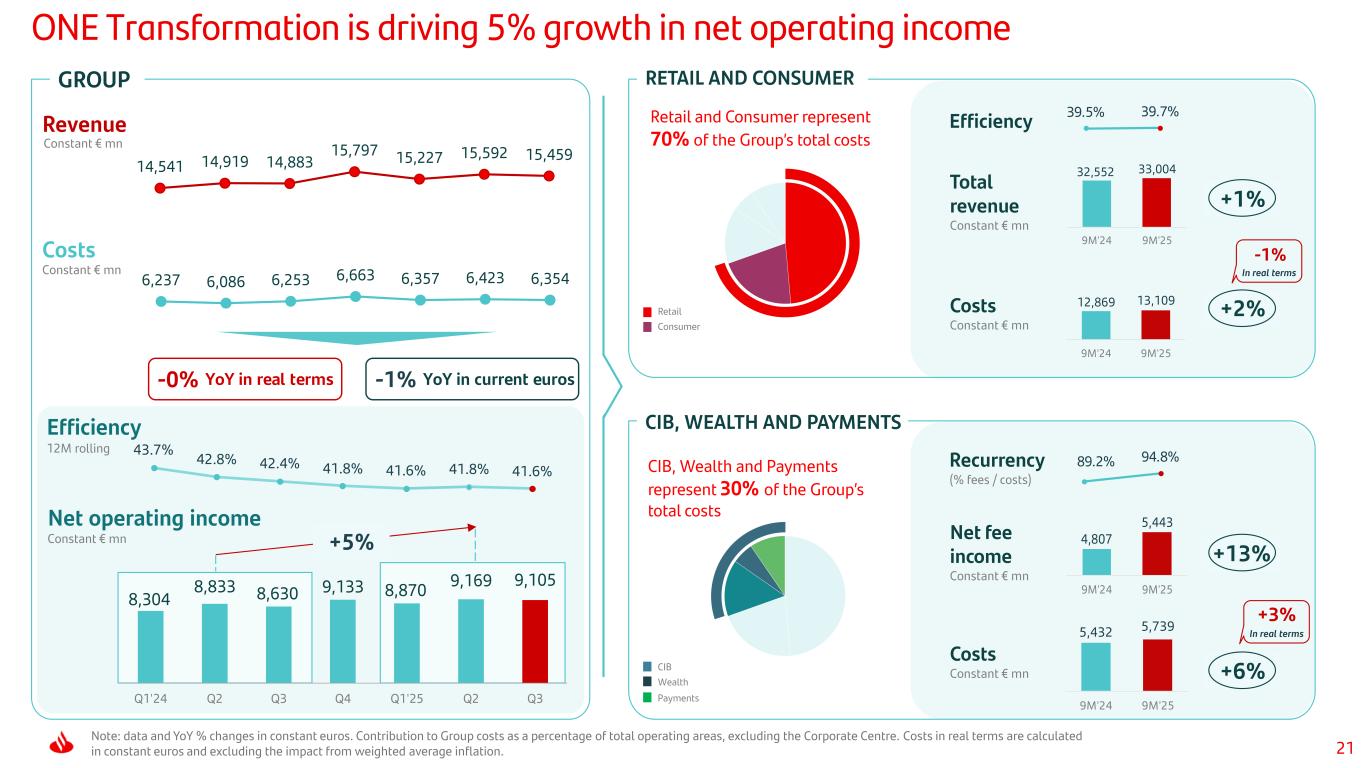

21 8,304 8,833 8,630 9,133 8,870 9,169 9,105 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3 6,237 6,086 6,253 6,663 6,357 6,423 6,354 CIB, WEALTH AND PAYMENTS ONE Transformation is driving 5% growth in net operating income Efficiency 12M rolling Costs Net operating income Revenue 14,541 14,919 14,883 15,797 15,227 15,592 15,459 Retail Consumer Retail and Consumer represent 70% of the Group’s total costs CIB Wealth CIB, Wealth and Payments represent 30% of the Group’s total costs Efficiency Total revenue Constant € mn Recurrency (% fees / costs) Note: data and YoY % changes in constant euros. Contribution to Group costs as a percentage of total operating areas, excluding the Corporate Centre. Costs in real terms are calculated in constant euros and excluding the impact from weighted average inflation. GROUP RETAIL AND CONSUMER Payments Costs Constant € mn Net fee income Constant € mn Costs Constant € mn Constant € mn Constant € mn Constant € mn +1% +2% +13% +6% -0% YoY in real terms -1% YoY in current euros 4,807 5,443 9M'24 9M'25 5,432 5,739 9M'24 9M'25 89.2% 94.8% 12,869 13,109 9M'24 9M'25 32,552 33,004 9M'24 9M'25 39.5% 39.7% 43.7% 42.8% 42.4% 41.8% 41.6% 41.8% 41.6% +5% In real terms In real terms -1% +3%

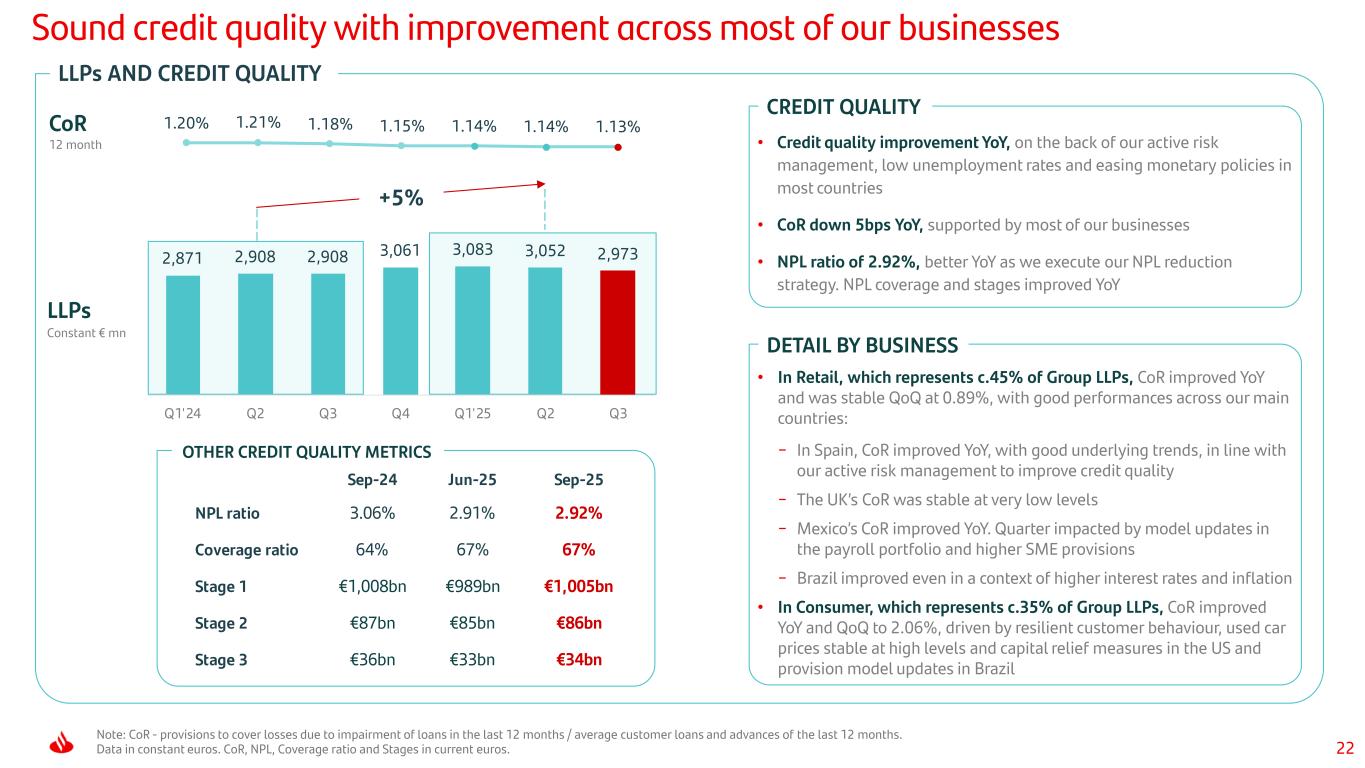

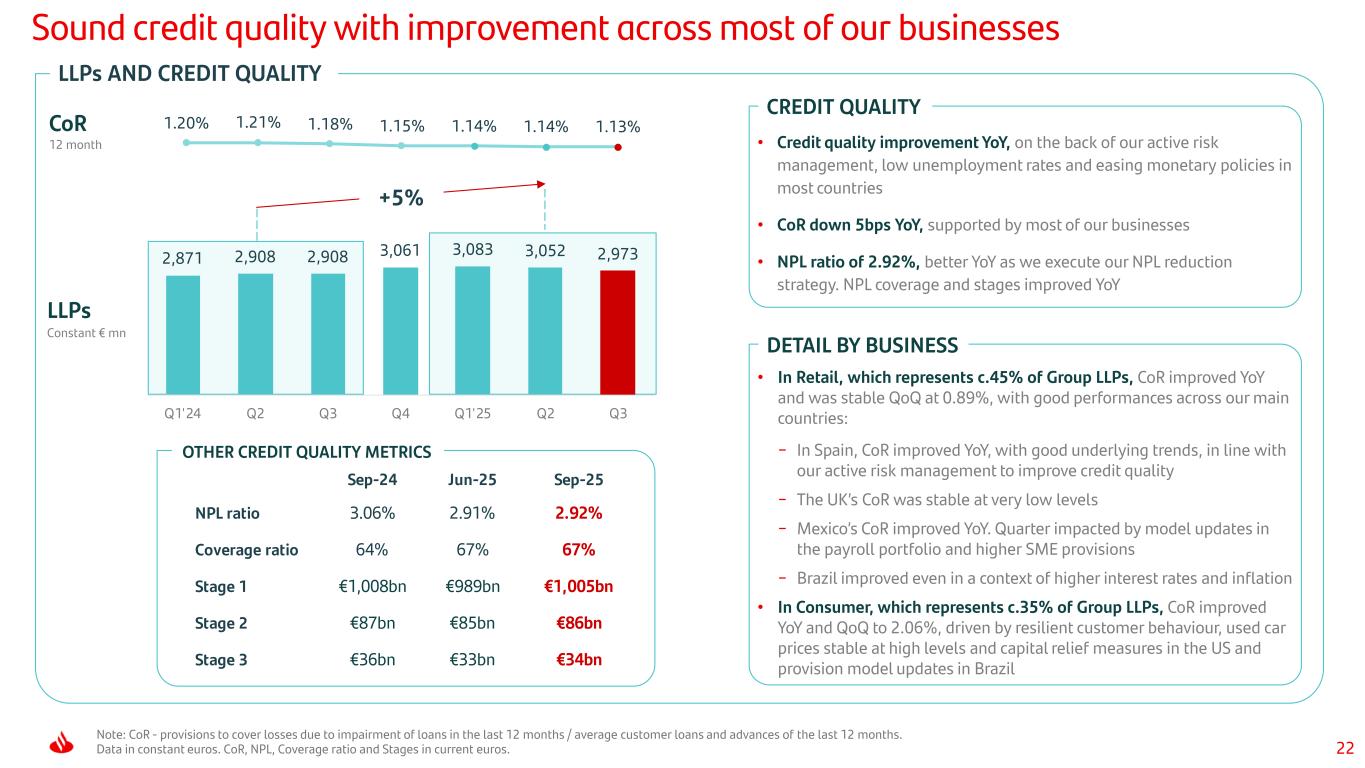

22 • Credit quality improvement YoY, on the back of our active risk management, low unemployment rates and easing monetary policies in most countries • CoR down 5bps YoY, supported by most of our businesses • NPL ratio of 2.92%, better YoY as we execute our NPL reduction strategy. NPL coverage and stages improved YoY • In Retail, which represents c.45% of Group LLPs, CoR improved YoY and was stable QoQ at 0.89%, with good performances across our main countries: − In Spain, CoR improved YoY, with good underlying trends, in line with our active risk management to improve credit quality − The UK’s CoR was stable at very low levels − Mexico’s CoR improved YoY. Quarter impacted by model updates in the payroll portfolio and higher SME provisions − Brazil improved even in a context of higher interest rates and inflation • In Consumer, which represents c.35% of Group LLPs, CoR improved YoY and QoQ to 2.06%, driven by resilient customer behaviour, used car prices stable at high levels and capital relief measures in the US and provision model updates in Brazil 2,871 2,908 2,908 3,061 3,083 3,052 2,973 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3 Sound credit quality with improvement across most of our businesses Note: CoR - provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months. Data in constant euros. CoR, NPL, Coverage ratio and Stages in current euros. CoR 12 month LLPs CREDIT QUALITY DETAIL BY BUSINESS LLPs AND CREDIT QUALITY Constant € mn Sep-24 Jun-25 Sep-25 NPL ratio 3.06% 2.91% 2.92% Coverage ratio 64% 67% 67% Stage 1 €1,008bn €989bn €1,005bn Stage 2 €87bn €85bn €86bn Stage 3 €36bn €33bn €34bn OTHER CREDIT QUALITY METRICS 1.20% 1.21% 1.18% 1.15% 1.14% 1.14% 1.13% +5%

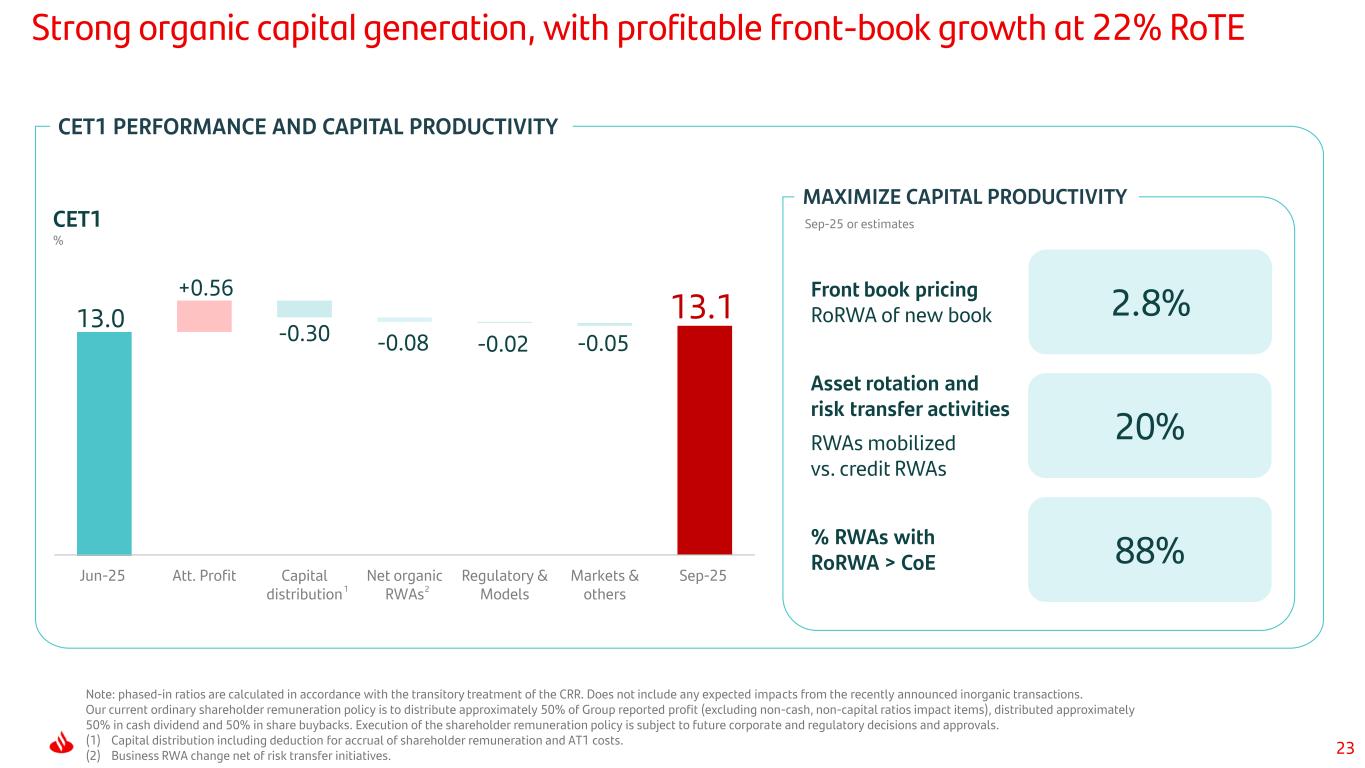

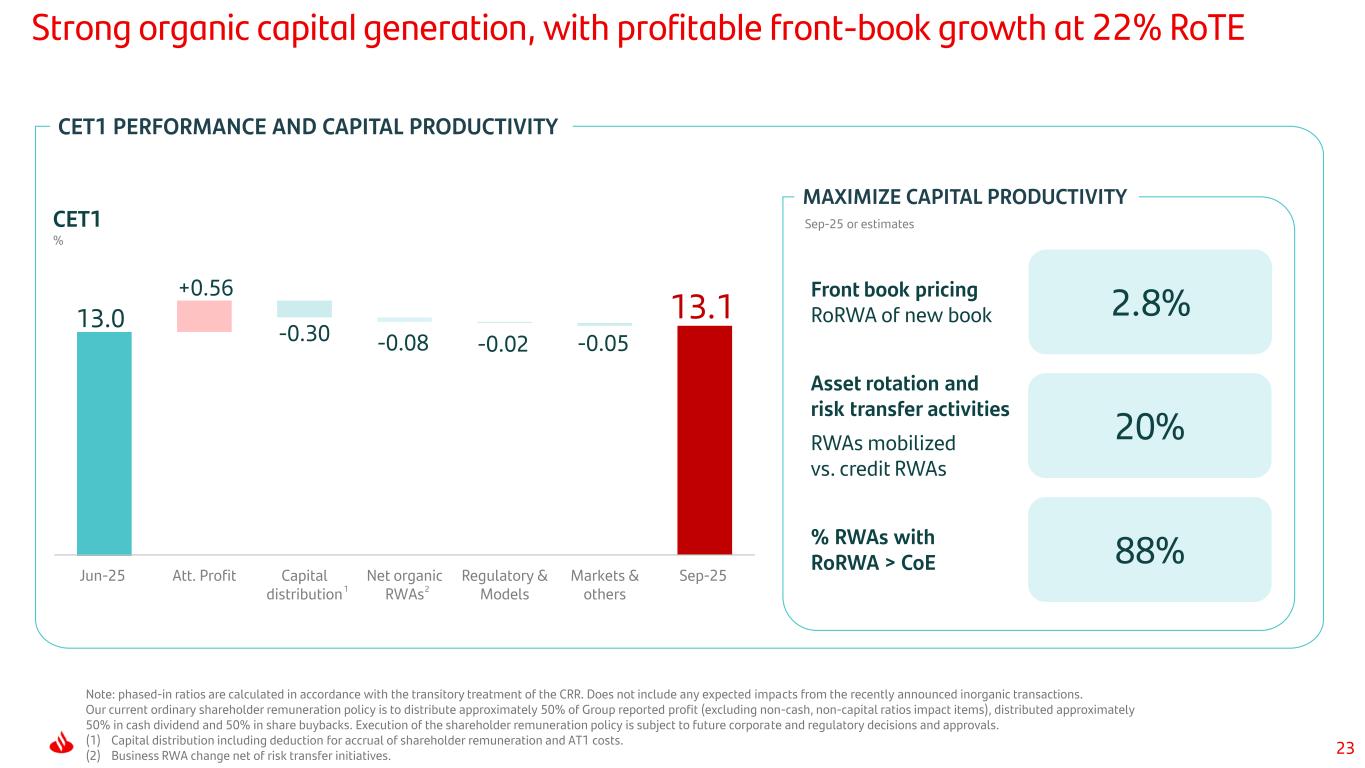

23 13.1 -0.30 -0.08 -0.02 -0.05 13.0 +0.56 Jun-25 Att. Profit Capital distribution Net organic RWAs Regulatory & Models Markets & others Sep-25 Strong organic capital generation, with profitable front-book growth at 22% RoTE CET1 % Sep-25 or estimates Front book pricing RoRWA of new book Asset rotation and risk transfer activities RWAs mobilized vs. credit RWAs % RWAs with RoRWA > CoE CET1 PERFORMANCE AND CAPITAL PRODUCTIVITY MAXIMIZE CAPITAL PRODUCTIVITY 2 Note: phased-in ratios are calculated in accordance with the transitory treatment of the CRR. Does not include any expected impacts from the recently announced inorganic transactions. Our current ordinary shareholder remuneration policy is to distribute approximately 50% of Group reported profit (excluding non-cash, non-capital ratios impact items), distributed approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. (1) Capital distribution including deduction for accrual of shareholder remuneration and AT1 costs. (2) Business RWA change net of risk transfer initiatives. 2.8% 20% 88% 1

24 Index 9M'25 Highlights Progress on our strategy 1 Group review 2 Final remarks 3 Appendix 4

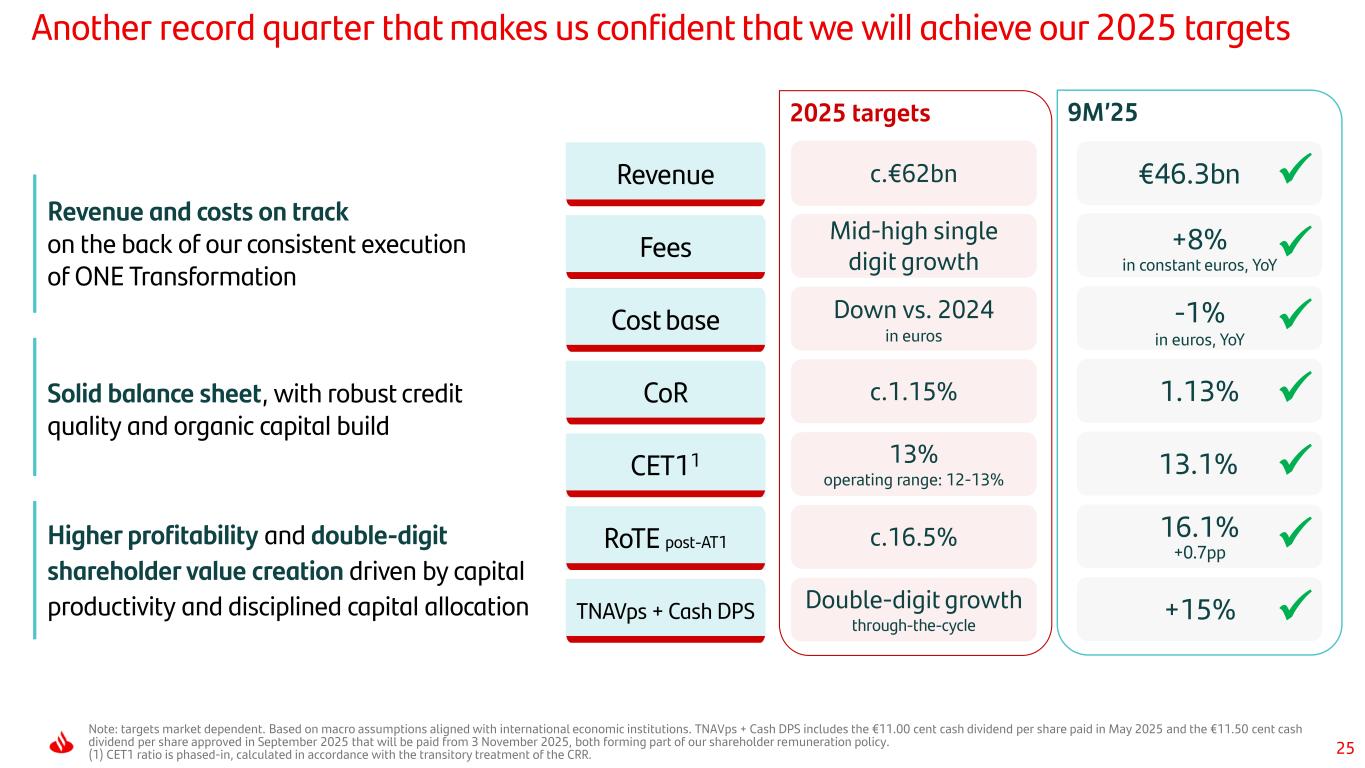

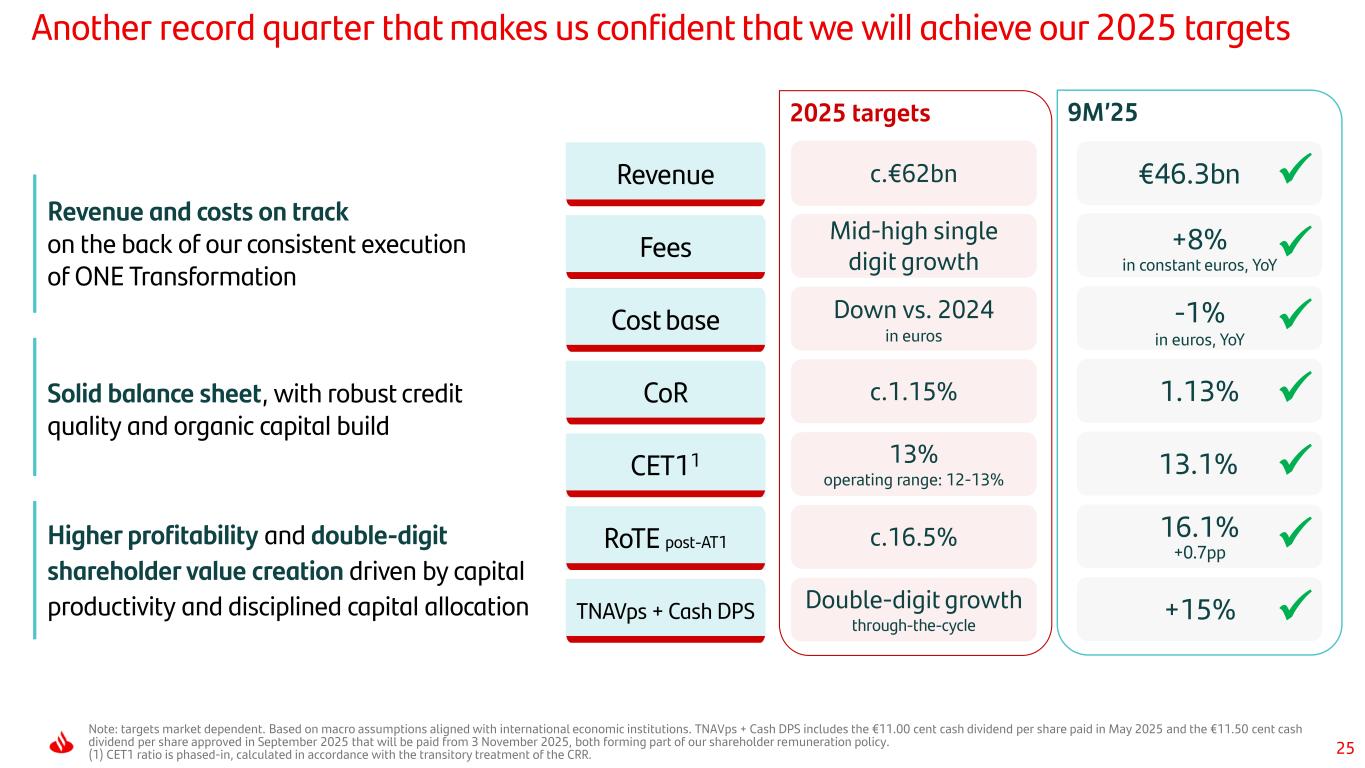

25 Another record quarter that makes us confident that we will achieve our 2025 targets Fees Cost base CoR CET11 RoTE post-AT1 TNAVps + Cash DPS 2025 targets Mid-high single digit growth Down vs. 2024 in euros c.1.15% 13% operating range: 12-13% c.16.5% Double-digit growth through-the-cycle c.€62bnRevenue Note: targets market dependent. Based on macro assumptions aligned with international economic institutions. TNAVps + Cash DPS includes the €11.00 cent cash dividend per share paid in May 2025 and the €11.50 cent cash dividend per share approved in September 2025 that will be paid from 3 November 2025, both forming part of our shareholder remuneration policy. (1) CET1 ratio is phased-in, calculated in accordance with the transitory treatment of the CRR. Revenue and costs on track on the back of our consistent execution of ONE Transformation Solid balance sheet, with robust credit quality and organic capital build Higher profitability and double-digit shareholder value creation driven by capital productivity and disciplined capital allocation 9M’25 ✓ ✓ ✓ ✓ ✓ ✓ ✓ in constant euros, YoY in euros, YoY €46.3bn -1% +8% 1.13% 13.1% 16.1% +0.7pp +15%

27 Index 9M'25 Highlights Progress on our strategy 1 Group review 2 Final remarks 3 Appendix 4

28 Appendix 2025 Investor Day targets summary Group P&L QoQ and excluding Argentina CET1 performance YTD Detail by global business and country Reconciliation of underlying results to statutory results Glossary and additional notes

29 TNAVps+DPS (Growth YoY) ONE Transformation is driving double-digit growth in value creation New 2025 targets Double-digit growth average through-the-cycle (1) Our current ordinary shareholder remuneration policy is to distribute c.50% of Group reported profit (excluding non-cash, non-capital ratios impact items), distributed approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. (2) Those customers who meet transactional threshold in the past 90 days. (3) Total transactions annual growth include merchant payments, cards and electronic A2A payments. Target c.+8% CAGR 2022-25. (4) 2022-2024 ratios on a fully-loaded basis (as published in the Q4 2024 Financial Report), excluding the transitory treatment of IFRS 9 and the CRR. Sep-25 ratio on phased-in basis, calculated in accordance with the transitory treatment of the CRR. (5) Green finance raised & facilitated (€bn): since 2019. Financial inclusion (# People, mn): since 2023. Targets were set in 2019 and 2021, before the publication of the European taxonomy in Q2 2023. Therefore, target definitions are not fully aligned with the taxonomy. For further information, see the 'Alternative performance measures' section of the Quarterly Financial Report. 2022 2023 2024 9M'25 2025 ID targets RoTE post-AT1 (%) - - 15.5 16.1 - RoTE pre-AT1 (%) 13.4 15.1 16.3 16.8 15-17% Payout (Cash + SBB)¹ (%) 40 50 50 50 50 EPS growth (%) 23 21.5 17.9 16.3 Double-digit Total customers (mn) 160 165 173 178 c.200 Active customers (mn)² 99 100 103 106 c.125 Simplification & automation Efficiency ratio (%) 45.8 44.1 41.8 41.3 c.42 Customer activity Transactions volume per active customer (% growth)³ - 10 9 7 c.+8 CET1 (%)⁴ 12.0 12.3 12.8 13.1 >12 RWA with RoRWA>CoE (%) 80 84 87 88 c.85 Green financed raised & facilitated (€bn) 94.5 115.3 139.4 165.4 120 Socially Responsible Investments (AuM) (€bn) 53 67.7 88.8 118.8 100 Financial inclusion (# People, mn) - 1.8 4.3 5.7 5 +6% +15% +14% +15% Profitability Customer centric Sustainability⁵ Capital c.16.5% post-AT1 >17% pre-AT1 CET1: 13% Operating range: 12-13%

30 Appendix 2025 Investor Day targets summary Group P&L QoQ and excluding Argentina CET1 performance YTD Detail by global business and country Reconciliation of underlying results to statutory results Glossary and additional notes

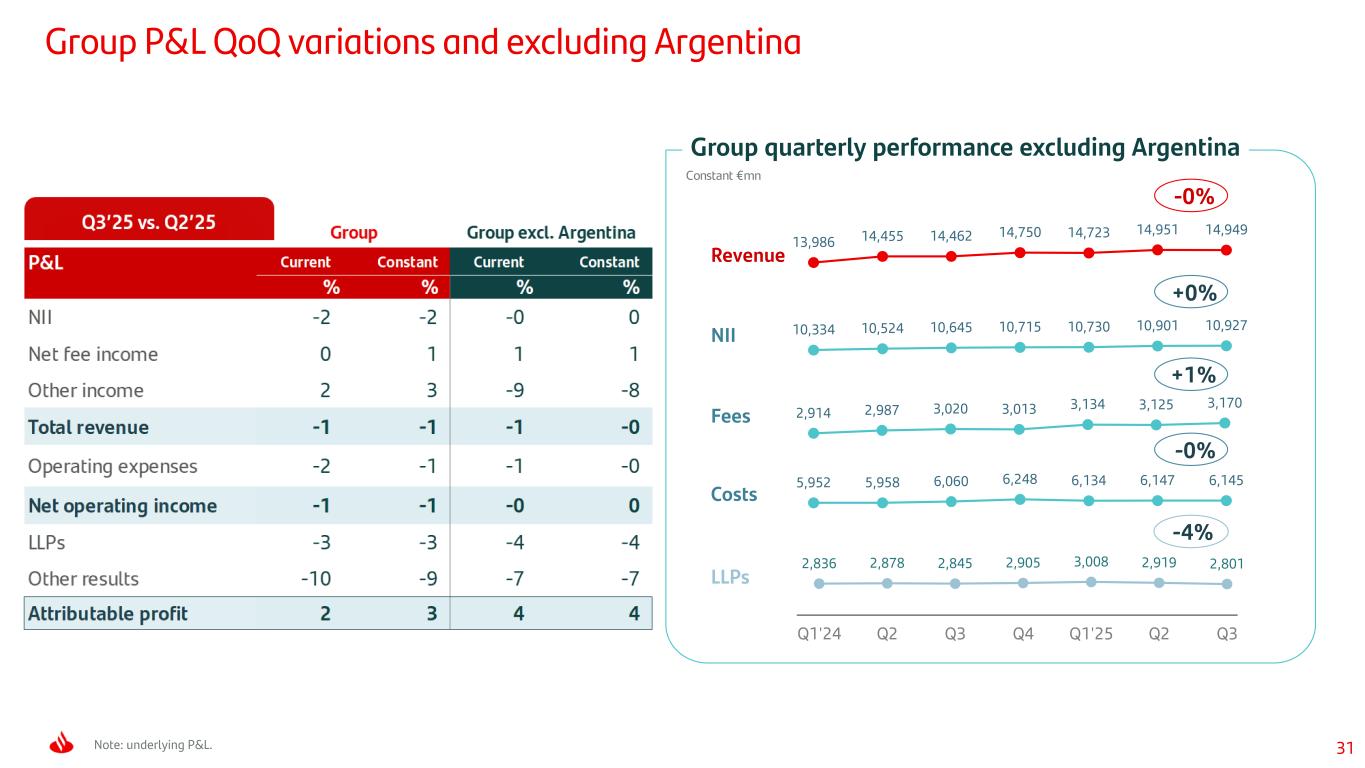

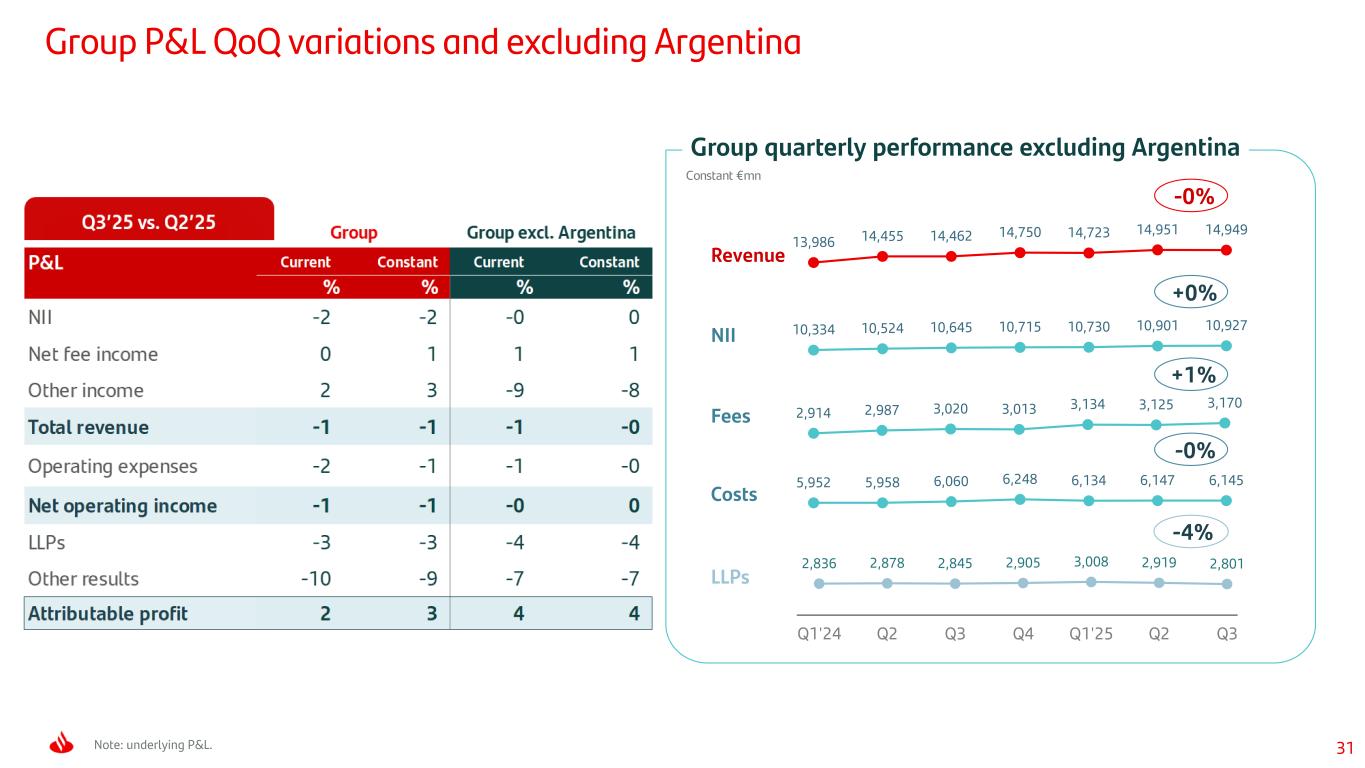

31 -0% Group P&L QoQ variations and excluding Argentina Note: underlying P&L. Fees NII 2,914 2,987 3,020 3,013 3,134 3,125 3,170 Costs LLPs Revenue 2,836 2,878 2,845 2,905 3,008 2,919 2,801 Q1'24 Q2 Q3 Q4 Q1'25 Q2 Q3 13,986 14,455 14,462 14,750 14,723 14,951 14,949 10,334 10,524 10,645 10,715 10,730 10,901 10,927 Constant €mn 5,952 5,958 6,060 6,248 6,134 6,147 6,145 Group quarterly performance excluding Argentina -4% +0% +1% -0%

32 Appendix 2025 Investor Day targets summary Group P&L QoQ and excluding Argentina CET1 performance YTD Detail by global business and country Reconciliation of underlying results to statutory results Glossary and additional notes

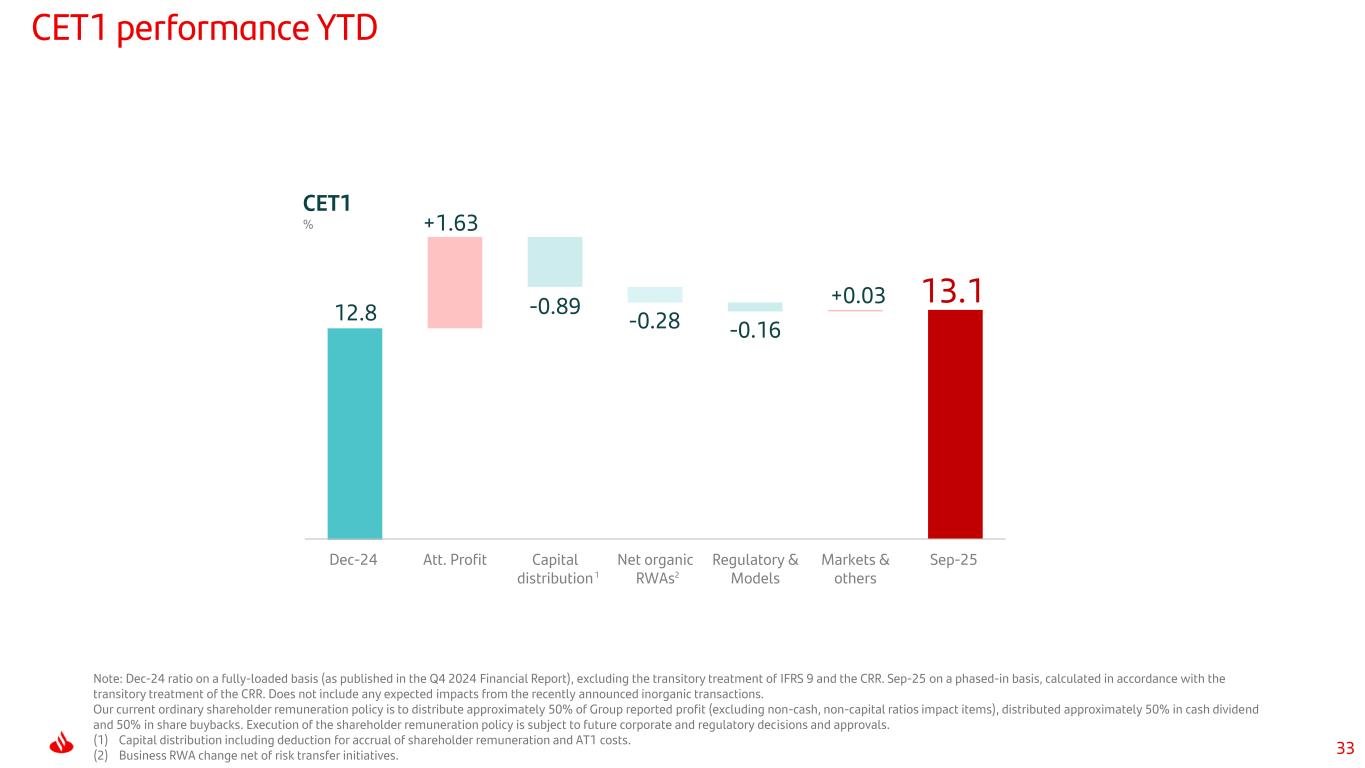

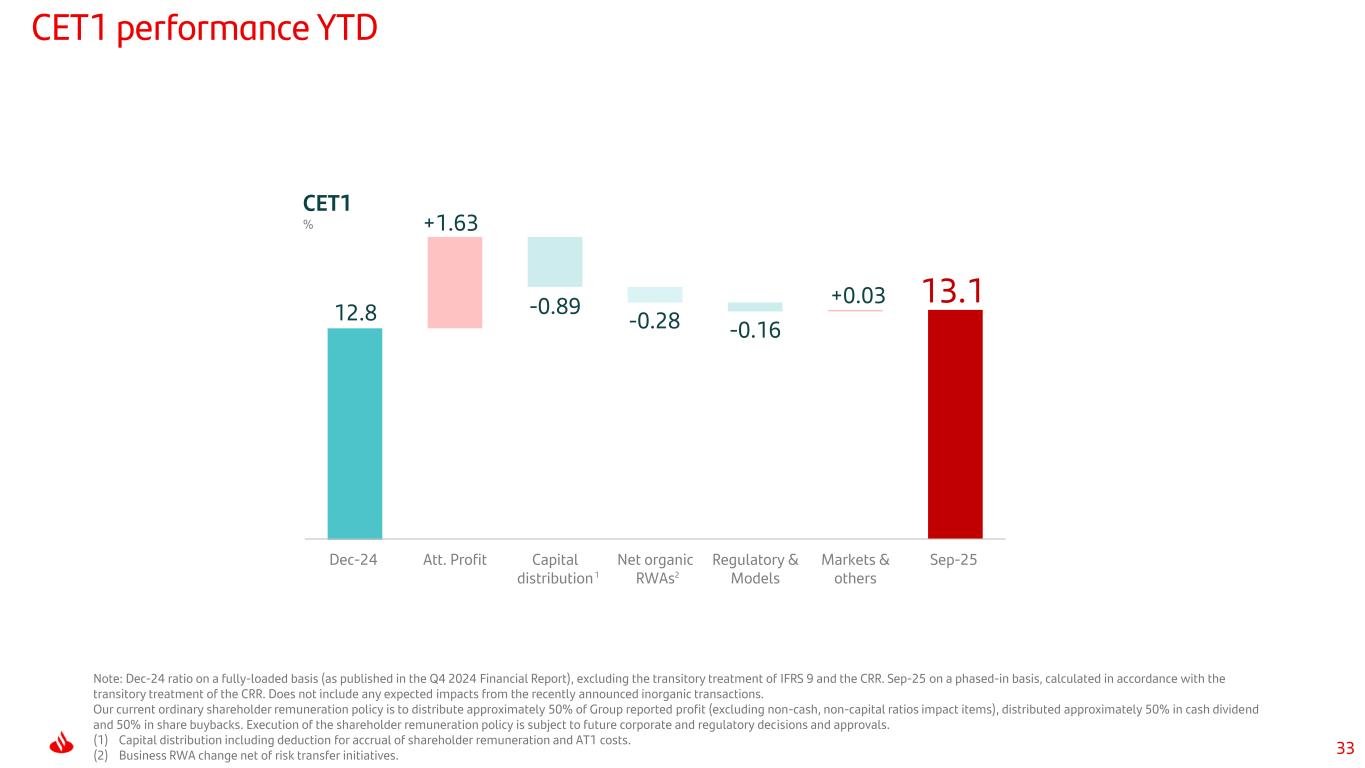

33 CET1 performance YTD CET1 % 2 Note: Dec-24 ratio on a fully-loaded basis (as published in the Q4 2024 Financial Report), excluding the transitory treatment of IFRS 9 and the CRR. Sep-25 on a phased-in basis, calculated in accordance with the transitory treatment of the CRR. Does not include any expected impacts from the recently announced inorganic transactions. Our current ordinary shareholder remuneration policy is to distribute approximately 50% of Group reported profit (excluding non-cash, non-capital ratios impact items), distributed approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. (1) Capital distribution including deduction for accrual of shareholder remuneration and AT1 costs. (2) Business RWA change net of risk transfer initiatives. 1 13.1 -0.89 -0.28 -0.16 12.8 +1.63 +0.03 Dec-24 Att. Profit Capital distribution Net organic RWAs Regulatory & Models Markets & others Sep-25

34 Appendix 2025 Investor Day targets summary Group P&L QoQ and excluding Argentina CET1 performance YTD Detail by global business and country Reconciliation of underlying results to statutory results Glossary and additional notes

35 Detail by global business

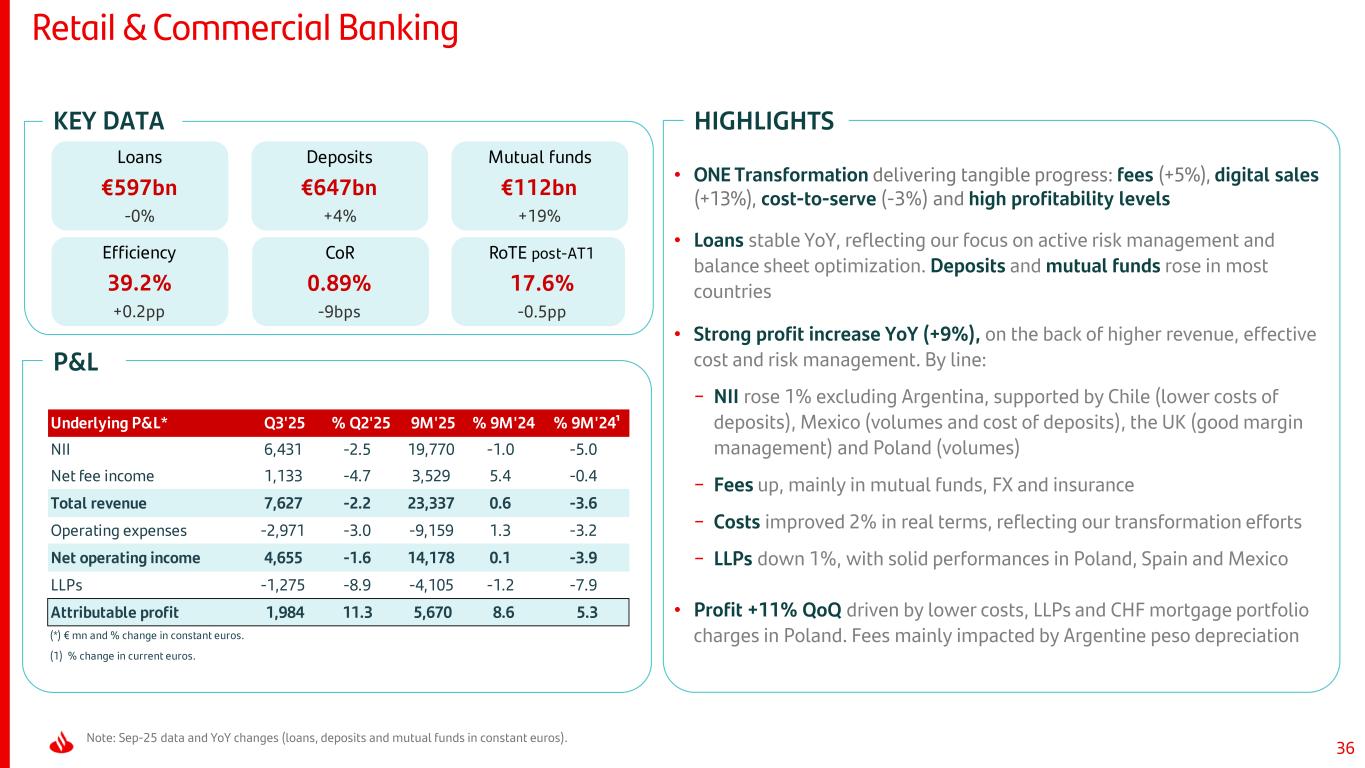

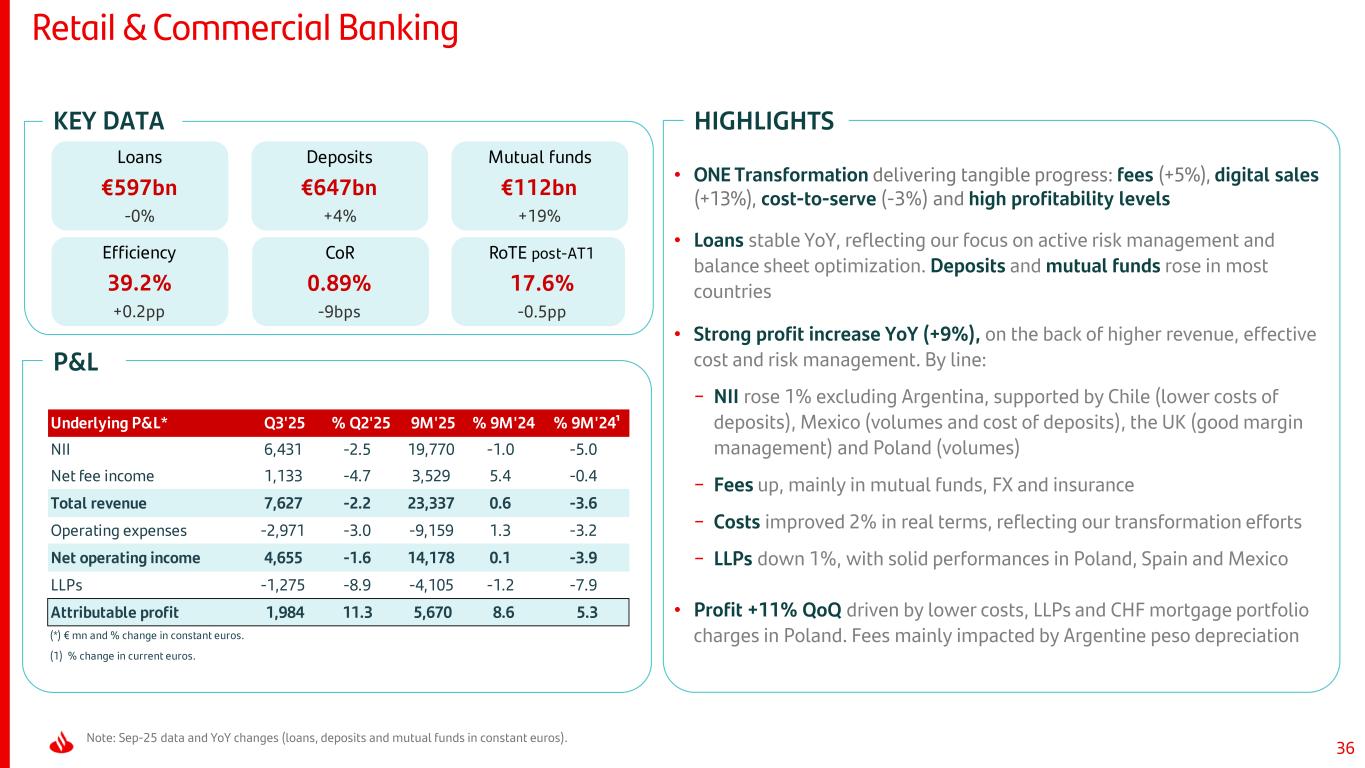

36 Retail & Commercial Banking Note: Sep-25 data and YoY changes (loans, deposits and mutual funds in constant euros). HIGHLIGHTSKEY DATA P&L Loans €597bn -0% Mutual funds €112bn +19% Efficiency 39.2% +0.2pp CoR 0.89% -9bps Deposits €647bn +4% Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 6,431 -2.5 19,770 -1.0 -5.0 Net fee income 1,133 -4.7 3,529 5.4 -0.4 Total revenue 7,627 -2.2 23,337 0.6 -3.6 Operating expenses -2,971 -3.0 -9,159 1.3 -3.2 Net operating income 4,655 -1.6 14,178 0.1 -3.9 LLPs -1,275 -8.9 -4,105 -1.2 -7.9 Attributable profit 1,984 11.3 5,670 8.6 5.3 (*) € mn and % change in constant euros. (1) % change in current euros. • ONE Transformation delivering tangible progress: fees (+5%), digital sales (+13%), cost-to-serve (-3%) and high profitability levels • Loans stable YoY, reflecting our focus on active risk management and balance sheet optimization. Deposits and mutual funds rose in most countries • Strong profit increase YoY (+9%), on the back of higher revenue, effective cost and risk management. By line: − NII rose 1% excluding Argentina, supported by Chile (lower costs of deposits), Mexico (volumes and cost of deposits), the UK (good margin management) and Poland (volumes) − Fees up, mainly in mutual funds, FX and insurance − Costs improved 2% in real terms, reflecting our transformation efforts − LLPs down 1%, with solid performances in Poland, Spain and Mexico • Profit +11% QoQ driven by lower costs, LLPs and CHF mortgage portfolio charges in Poland. Fees mainly impacted by Argentine peso depreciation RoTE post-AT1 17.6% -0.5pp

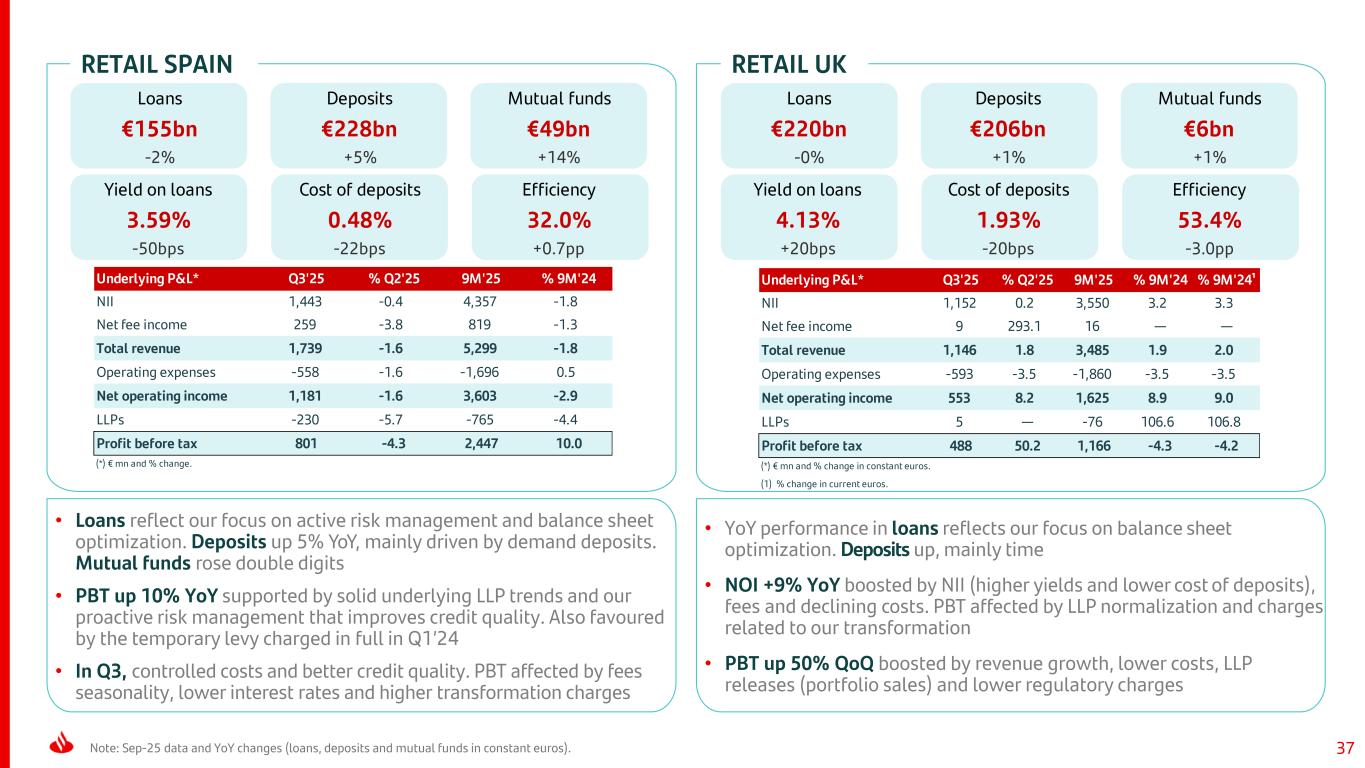

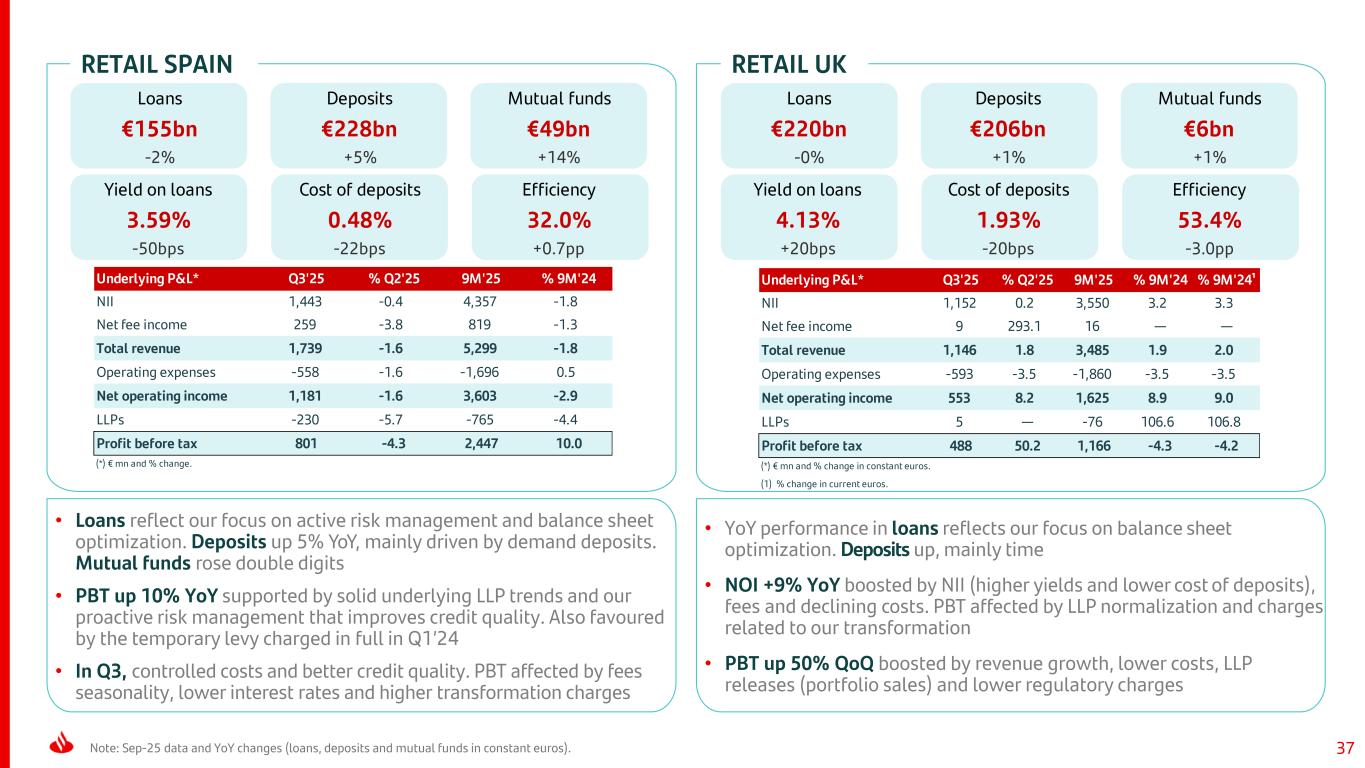

37 RETAIL SPAIN Note: Sep-25 data and YoY changes (loans, deposits and mutual funds in constant euros). RETAIL UK Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 NII 1,443 -0.4 4,357 -1.8 Net fee income 259 -3.8 819 -1.3 Total revenue 1,739 -1.6 5,299 -1.8 Operating expenses -558 -1.6 -1,696 0.5 Net operating income 1,181 -1.6 3,603 -2.9 LLPs -230 -5.7 -765 -4.4 Profit before tax 801 -4.3 2,447 10.0 (*) € mn and % change. Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 1,152 0.2 3,550 3.2 3.3 Net fee income 9 293.1 16 — — Total revenue 1,146 1.8 3,485 1.9 2.0 Operating expenses -593 -3.5 -1,860 -3.5 -3.5 Net operating income 553 8.2 1,625 8.9 9.0 LLPs 5 — -76 106.6 106.8 Profit before tax 488 50.2 1,166 -4.3 -4.2 (*) € mn and % change in constant euros. (1) % change in current euros. Loans €155bn -2% Deposits €228bn +5% Mutual funds €49bn +14% Yield on loans 3.59% -50bps Cost of deposits 0.48% -22bps Efficiency 32.0% +0.7pp Loans €220bn -0% Deposits €206bn +1% Mutual funds €6bn +1% Yield on loans 4.13% +20bps Cost of deposits 1.93% -20bps Efficiency 53.4% -3.0pp • YoY performance in loans reflects our focus on balance sheet optimization. Deposits up, mainly time • NOI +9% YoY boosted by NII (higher yields and lower cost of deposits), fees and declining costs. PBT affected by LLP normalization and charges related to our transformation • PBT up 50% QoQ boosted by revenue growth, lower costs, LLP releases (portfolio sales) and lower regulatory charges • Loans reflect our focus on active risk management and balance sheet optimization. Deposits up 5% YoY, mainly driven by demand deposits. Mutual funds rose double digits • PBT up 10% YoY supported by solid underlying LLP trends and our proactive risk management that improves credit quality. Also favoured by the temporary levy charged in full in Q1’24 • In Q3, controlled costs and better credit quality. PBT affected by fees seasonality, lower interest rates and higher transformation charges

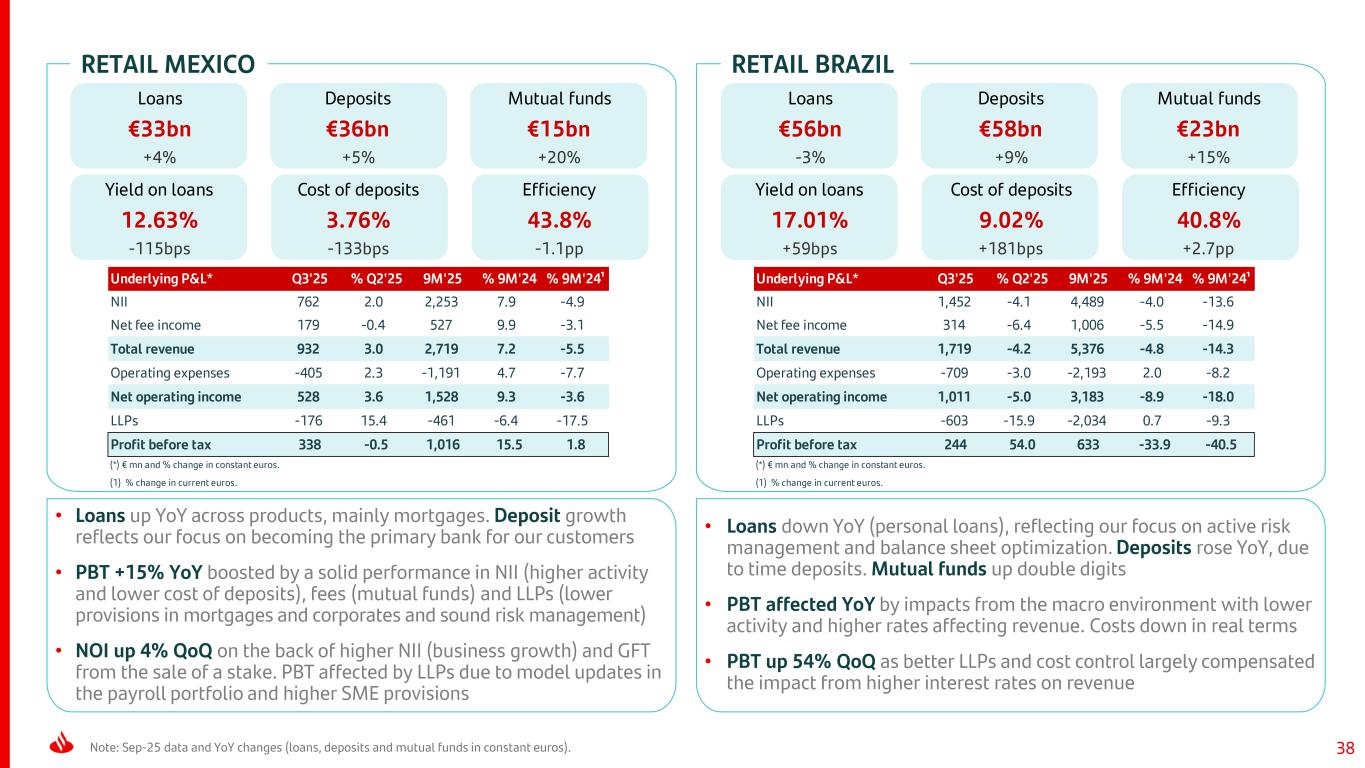

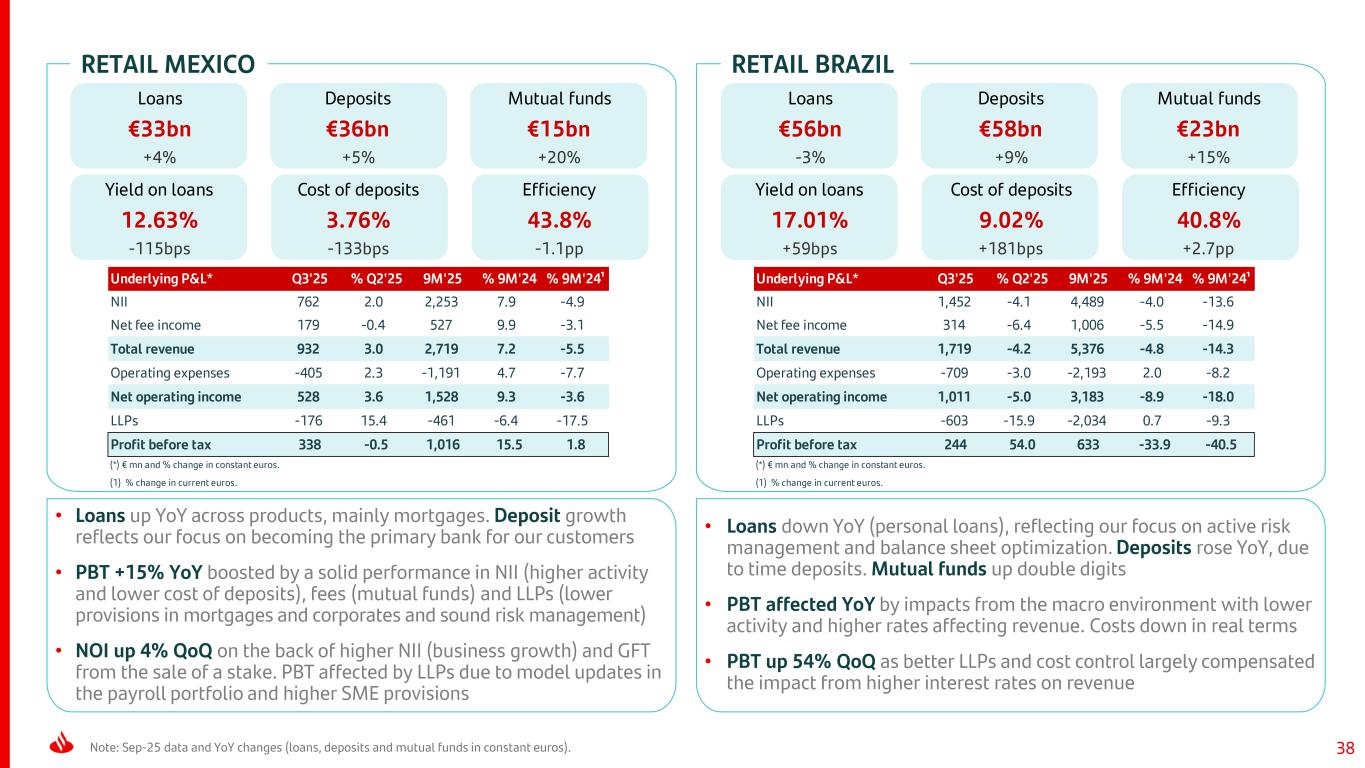

38Note: Sep-25 data and YoY changes (loans, deposits and mutual funds in constant euros). RETAIL MEXICO RETAIL BRAZIL Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 762 2.0 2,253 7.9 -4.9 Net fee income 179 -0.4 527 9.9 -3.1 Total revenue 932 3.0 2,719 7.2 -5.5 Operating expenses -405 2.3 -1,191 4.7 -7.7 Net operating income 528 3.6 1,528 9.3 -3.6 LLPs -176 15.4 -461 -6.4 -17.5 Profit before tax 338 -0.5 1,016 15.5 1.8 (*) € mn and % change in constant euros. (1) % change in current euros. Loans €33bn +4% Deposits €36bn +5% Mutual funds €15bn +20% Yield on loans 12.63% -115bps Cost of deposits 3.76% -133bps Efficiency 43.8% -1.1pp Loans €56bn -3% Deposits €58bn +9% Mutual funds €23bn +15% Yield on loans 17.01% +59bps Cost of deposits 9.02% +181bps Efficiency 40.8% +2.7pp Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 1,452 -4.1 4,489 -4.0 -13.6 Net fee income 314 -6.4 1,006 -5.5 -14.9 Total revenue 1,719 -4.2 5,376 -4.8 -14.3 Operating expenses -709 -3.0 -2,193 2.0 -8.2 Net operating income 1,011 -5.0 3,183 -8.9 -18.0 LLPs -603 -15.9 -2,034 0.7 -9.3 Profit before tax 244 54.0 633 -33.9 -40.5 (*) € mn and % change in constant euros. (1) % change in current euros. • Loans up YoY across products, mainly mortgages. Deposit growth reflects our focus on becoming the primary bank for our customers • PBT +15% YoY boosted by a solid performance in NII (higher activity and lower cost of deposits), fees (mutual funds) and LLPs (lower provisions in mortgages and corporates and sound risk management) • NOI up 4% QoQ on the back of higher NII (business growth) and GFT from the sale of a stake. PBT affected by LLPs due to model updates in the payroll portfolio and higher SME provisions • Loans down YoY (personal loans), reflecting our focus on active risk management and balance sheet optimization. Deposits rose YoY, due to time deposits. Mutual funds up double digits • PBT affected YoY by impacts from the macro environment with lower activity and higher rates affecting revenue. Costs down in real terms • PBT up 54% QoQ as better LLPs and cost control largely compensated the impact from higher interest rates on revenue

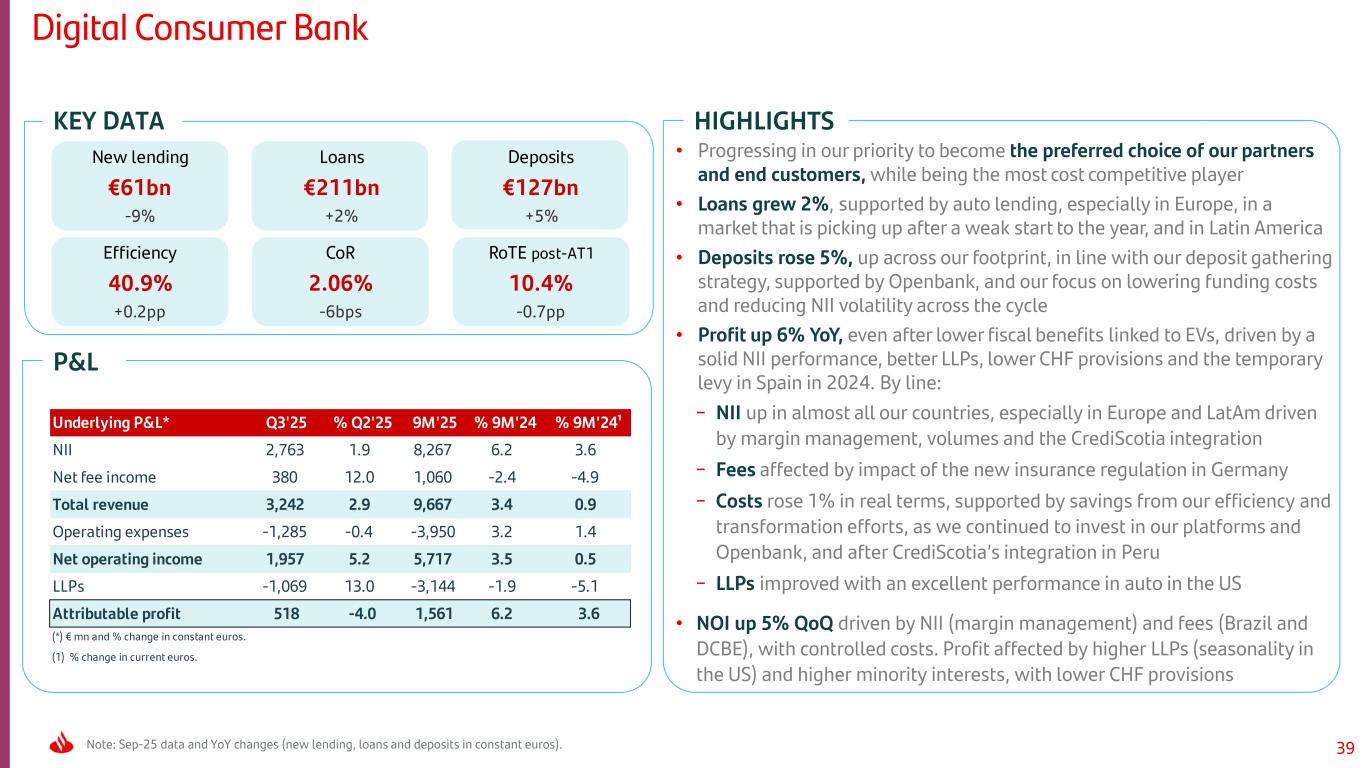

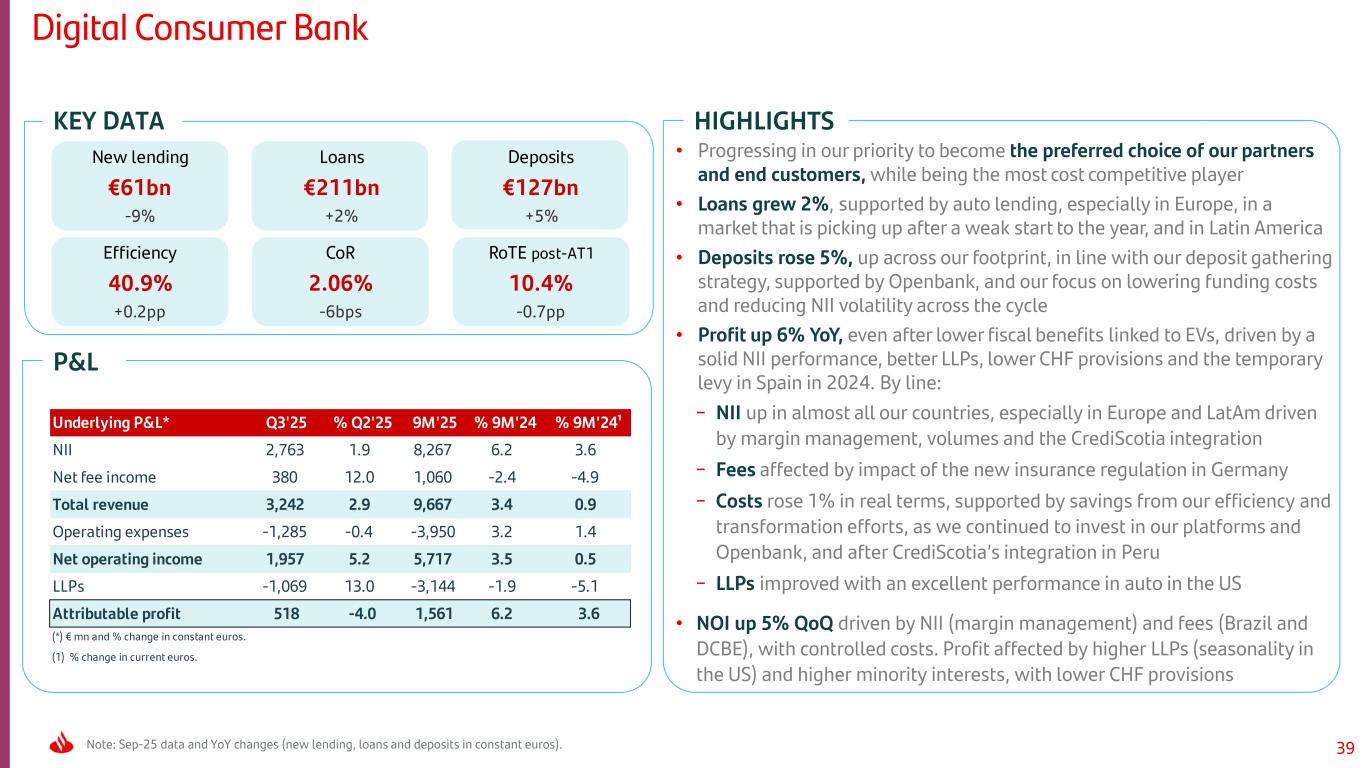

39 Digital Consumer Bank Note: Sep-25 data and YoY changes (new lending, loans and deposits in constant euros). HIGHLIGHTSKEY DATA P&L Loans €211bn +2% Efficiency 40.9% +0.2pp CoR 2.06% -6bps Deposits €127bn +5% Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 2,763 1.9 8,267 6.2 3.6 Net fee income 380 12.0 1,060 -2.4 -4.9 Total revenue 3,242 2.9 9,667 3.4 0.9 Operating expenses -1,285 -0.4 -3,950 3.2 1.4 Net operating income 1,957 5.2 5,717 3.5 0.5 LLPs -1,069 13.0 -3,144 -1.9 -5.1 Attributable profit 518 -4.0 1,561 6.2 3.6 (*) € mn and % change in constant euros. (1) % change in current euros. • Progressing in our priority to become the preferred choice of our partners and end customers, while being the most cost competitive player • Loans grew 2%, supported by auto lending, especially in Europe, in a market that is picking up after a weak start to the year, and in Latin America • Deposits rose 5%, up across our footprint, in line with our deposit gathering strategy, supported by Openbank, and our focus on lowering funding costs and reducing NII volatility across the cycle • Profit up 6% YoY, even after lower fiscal benefits linked to EVs, driven by a solid NII performance, better LLPs, lower CHF provisions and the temporary levy in Spain in 2024. By line: − NII up in almost all our countries, especially in Europe and LatAm driven by margin management, volumes and the CrediScotia integration − Fees affected by impact of the new insurance regulation in Germany − Costs rose 1% in real terms, supported by savings from our efficiency and transformation efforts, as we continued to invest in our platforms and Openbank, and after CrediScotia’s integration in Peru − LLPs improved with an excellent performance in auto in the US • NOI up 5% QoQ driven by NII (margin management) and fees (Brazil and DCBE), with controlled costs. Profit affected by higher LLPs (seasonality in the US) and higher minority interests, with lower CHF provisions New lending €61bn -9% RoTE post-AT1 10.4% -0.7pp

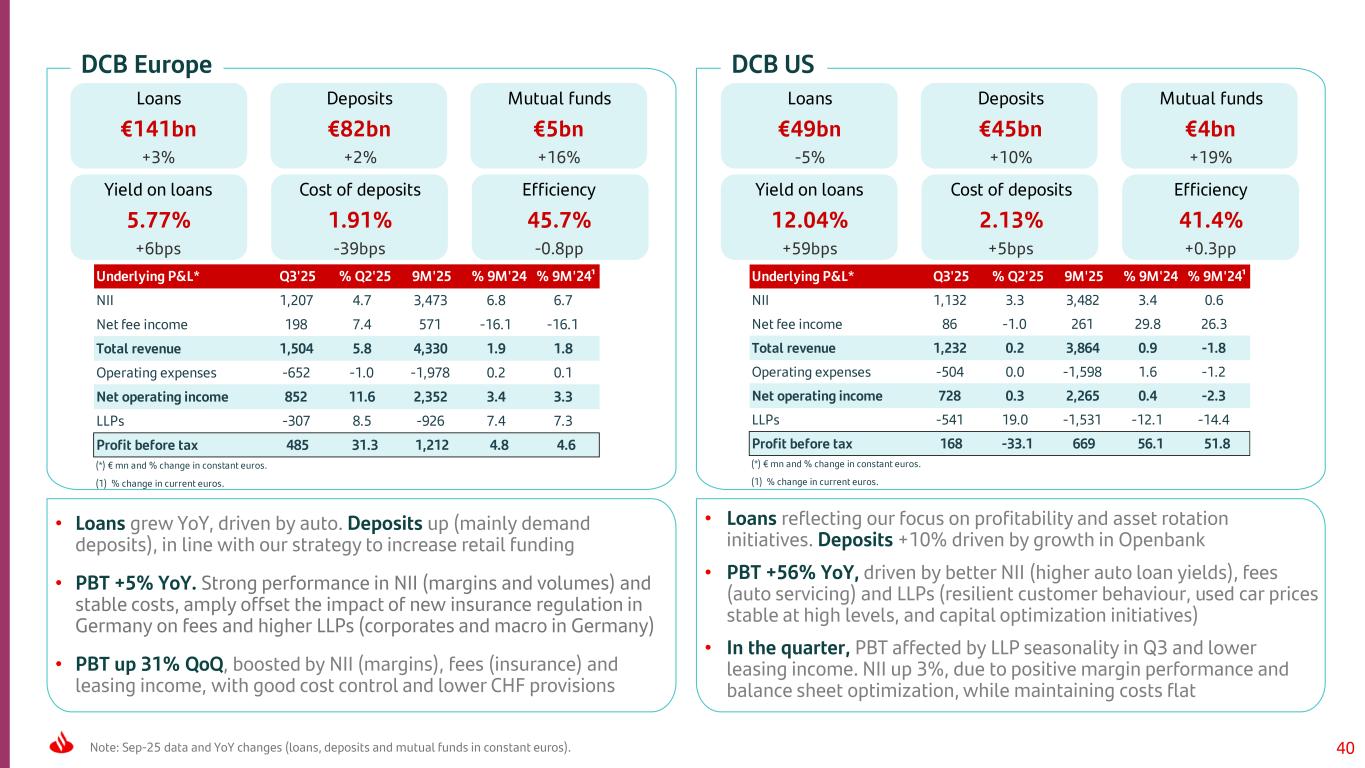

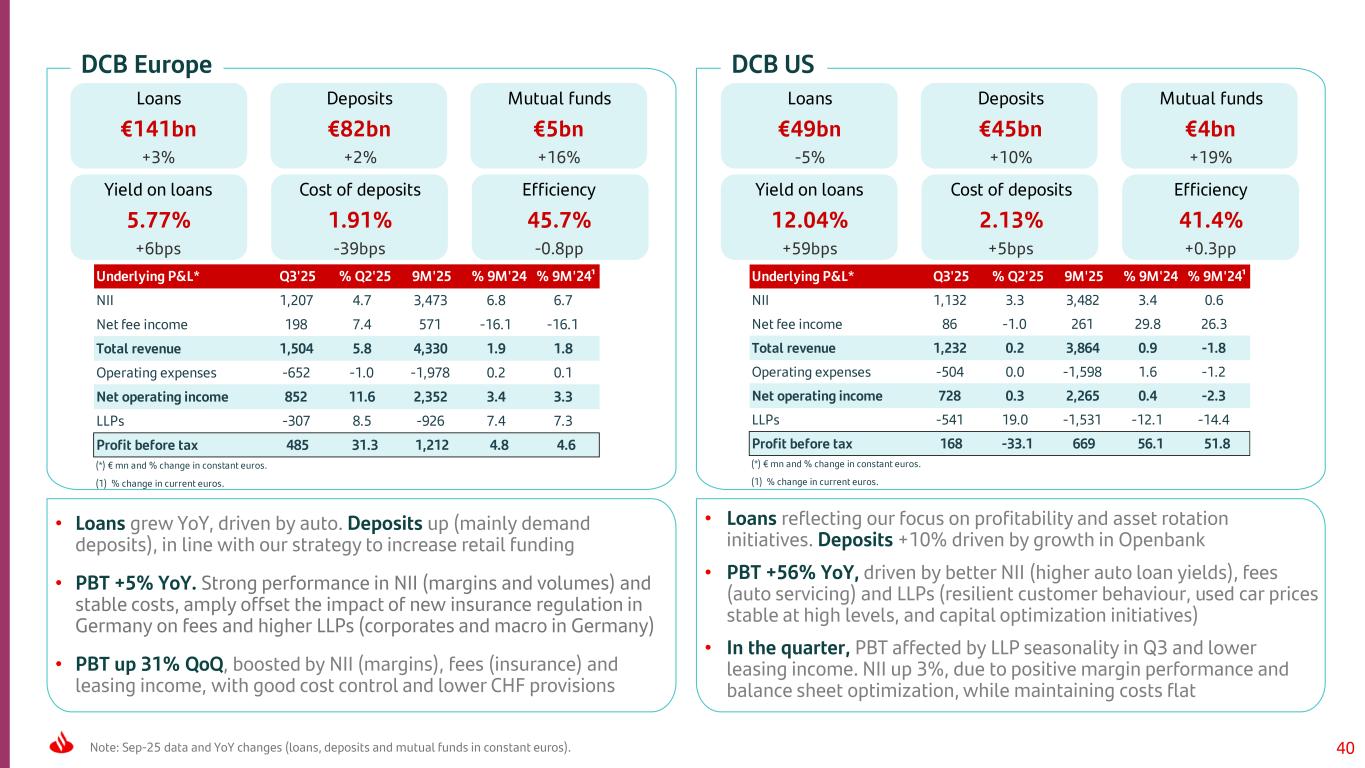

40Note: Sep-25 data and YoY changes (loans, deposits and mutual funds in constant euros). DCB Europe DCB US Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 1,132 3.3 3,482 3.4 0.6 Net fee income 86 -1.0 261 29.8 26.3 Total revenue 1,232 0.2 3,864 0.9 -1.8 Operating expenses -504 0.0 -1,598 1.6 -1.2 Net operating income 728 0.3 2,265 0.4 -2.3 LLPs -541 19.0 -1,531 -12.1 -14.4 Profit before tax 168 -33.1 669 56.1 51.8 (*) € mn and % change in constant euros. (1) % change in current euros. Loans €141bn +3% Deposits €82bn +2% Mutual funds €5bn +16% Yield on loans 5.77% +6bps Cost of deposits 1.91% -39bps Efficiency 45.7% -0.8pp Loans €49bn -5% Deposits €45bn +10% Mutual funds €4bn +19% Yield on loans 12.04% +59bps Cost of deposits 2.13% +5bps Efficiency 41.4% +0.3pp Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 1,207 4.7 3,473 6.8 6.7 Net fee income 198 7.4 571 -16.1 -16.1 Total revenue 1,504 5.8 4,330 1.9 1.8 Operating expenses -652 -1.0 -1,978 0.2 0.1 Net operating income 852 11.6 2,352 3.4 3.3 LLPs -307 8.5 -926 7.4 7.3 Profit before tax 485 31.3 1,212 4.8 4.6 (*) € mn and % change in constant euros. (1) % change in current euros. • Loans grew YoY, driven by auto. Deposits up (mainly demand deposits), in line with our strategy to increase retail funding • PBT +5% YoY. Strong performance in NII (margins and volumes) and stable costs, amply offset the impact of new insurance regulation in Germany on fees and higher LLPs (corporates and macro in Germany) • PBT up 31% QoQ, boosted by NII (margins), fees (insurance) and leasing income, with good cost control and lower CHF provisions • Loans reflecting our focus on profitability and asset rotation initiatives. Deposits +10% driven by growth in Openbank • PBT +56% YoY, driven by better NII (higher auto loan yields), fees (auto servicing) and LLPs (resilient customer behaviour, used car prices stable at high levels, and capital optimization initiatives) • In the quarter, PBT affected by LLP seasonality in Q3 and lower leasing income. NII up 3%, due to positive margin performance and balance sheet optimization, while maintaining costs flat

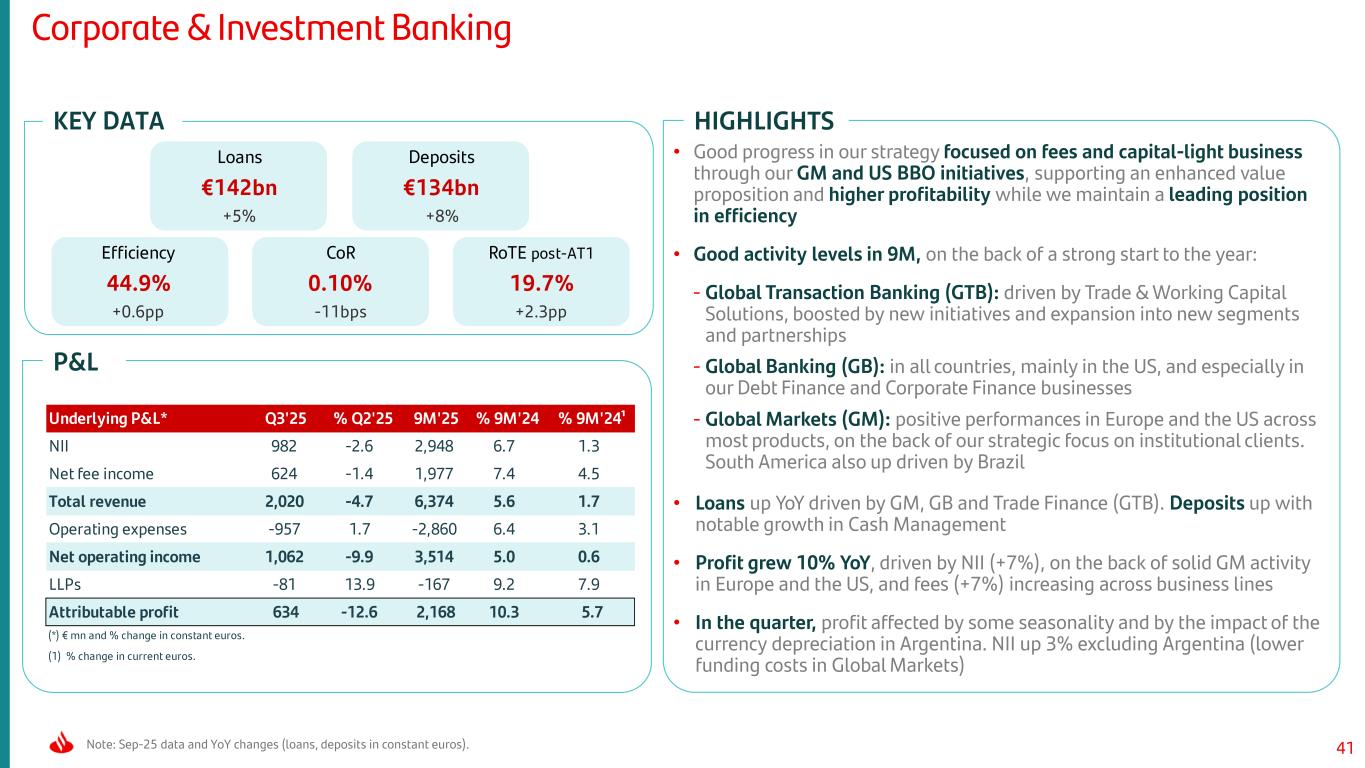

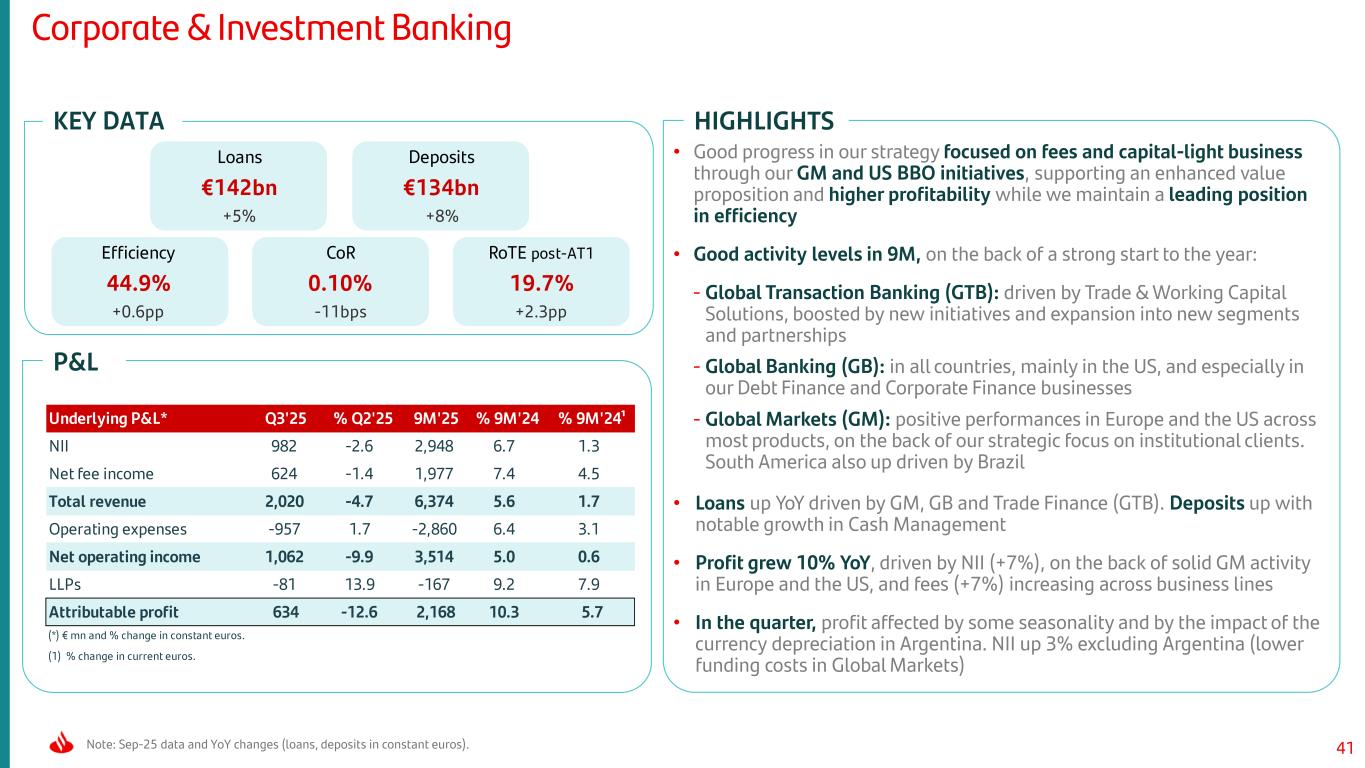

41 Corporate & Investment Banking Note: Sep-25 data and YoY changes (loans, deposits in constant euros). HIGHLIGHTSKEY DATA P&L Loans €142bn +5% Deposits €134bn +8% CoR 0.10% -11bps Efficiency 44.9% +0.6pp Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 982 -2.6 2,948 6.7 1.3 Net fee income 624 -1.4 1,977 7.4 4.5 Total revenue 2,020 -4.7 6,374 5.6 1.7 Operating expenses -957 1.7 -2,860 6.4 3.1 Net operating income 1,062 -9.9 3,514 5.0 0.6 LLPs -81 13.9 -167 9.2 7.9 Attributable profit 634 -12.6 2,168 10.3 5.7 (*) € mn and % change in constant euros. (1) % change in current euros. • Good progress in our strategy focused on fees and capital-light business through our GM and US BBO initiatives, supporting an enhanced value proposition and higher profitability while we maintain a leading position in efficiency • Good activity levels in 9M, on the back of a strong start to the year: - Global Transaction Banking (GTB): driven by Trade & Working Capital Solutions, boosted by new initiatives and expansion into new segments and partnerships - Global Banking (GB): in all countries, mainly in the US, and especially in our Debt Finance and Corporate Finance businesses - Global Markets (GM): positive performances in Europe and the US across most products, on the back of our strategic focus on institutional clients. South America also up driven by Brazil • Loans up YoY driven by GM, GB and Trade Finance (GTB). Deposits up with notable growth in Cash Management • Profit grew 10% YoY, driven by NII (+7%), on the back of solid GM activity in Europe and the US, and fees (+7%) increasing across business lines • In the quarter, profit affected by some seasonality and by the impact of the currency depreciation in Argentina. NII up 3% excluding Argentina (lower funding costs in Global Markets) RoTE post-AT1 19.7% +2.3pp

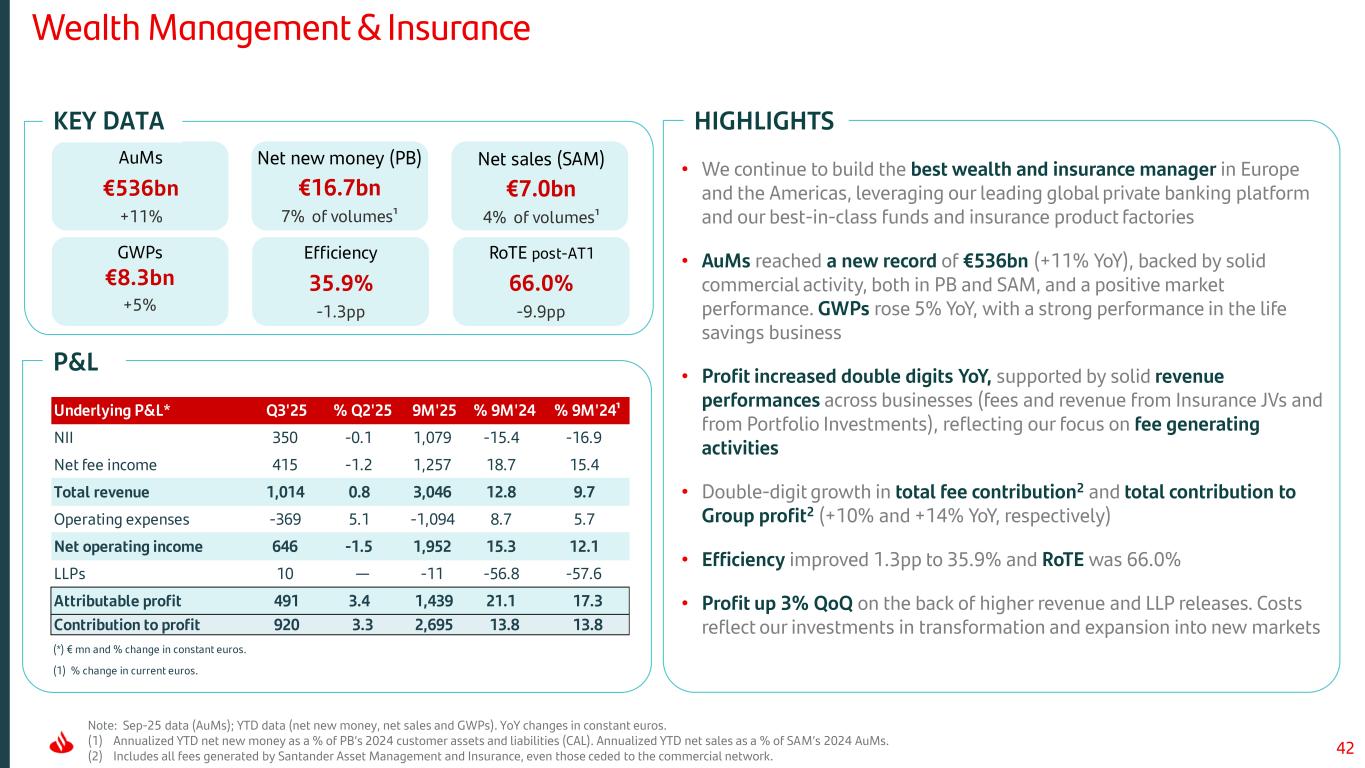

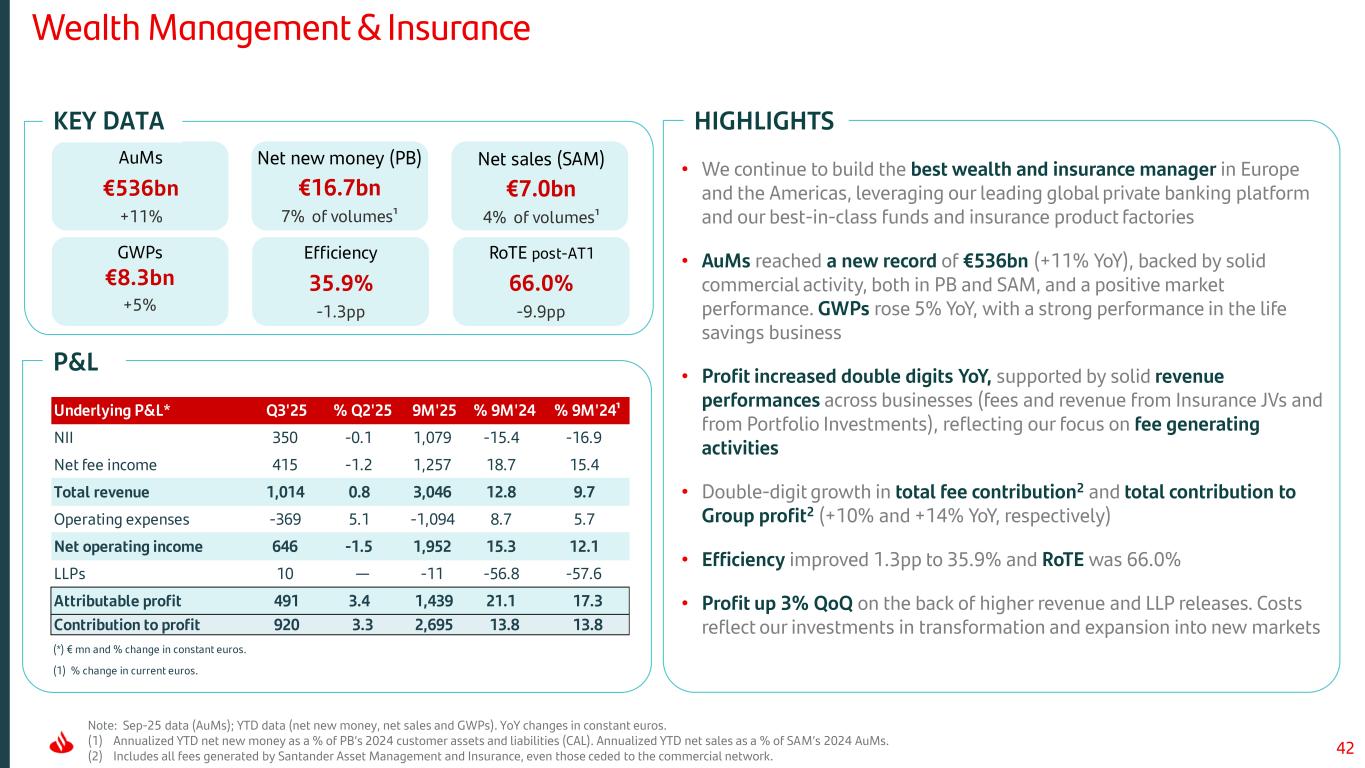

42 AuMs €536bn +11% Wealth Management & Insurance HIGHLIGHTS Note: Sep-25 data (AuMs); YTD data (net new money, net sales and GWPs). YoY changes in constant euros. (1) Annualized YTD net new money as a % of PB’s 2024 customer assets and liabilities (CAL). Annualized YTD net sales as a % of SAM’s 2024 AuMs. (2) Includes all fees generated by Santander Asset Management and Insurance, even those ceded to the commercial network. P&L KEY DATA GWPs Efficiency 35.9% -1.3pp • We continue to build the best wealth and insurance manager in Europe and the Americas, leveraging our leading global private banking platform and our best-in-class funds and insurance product factories • AuMs reached a new record of €536bn (+11% YoY), backed by solid commercial activity, both in PB and SAM, and a positive market performance. GWPs rose 5% YoY, with a strong performance in the life savings business • Profit increased double digits YoY, supported by solid revenue performances across businesses (fees and revenue from Insurance JVs and from Portfolio Investments), reflecting our focus on fee generating activities • Double-digit growth in total fee contribution2 and total contribution to Group profit2 (+10% and +14% YoY, respectively) • Efficiency improved 1.3pp to 35.9% and RoTE was 66.0% • Profit up 3% QoQ on the back of higher revenue and LLP releases. Costs reflect our investments in transformation and expansion into new markets €8.3bn +5% RoTE post-AT1 66.0% -9.9pp Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 350 -0.1 1,079 -15.4 -16.9 Net fee income 415 -1.2 1,257 18.7 15.4 Total revenue 1,014 0.8 3,046 12.8 9.7 Operating expenses -369 5.1 -1,094 8.7 5.7 Net operating income 646 -1.5 1,952 15.3 12.1 LLPs 10 — -11 -56.8 -57.6 Attributable profit 491 3.4 1,439 21.1 17.3 Contribution to profit 920 3.3 2,695 13.8 13.8 (*) € mn and % change in constant euros. (1) % change in current euros. Net new money (PB) €16.7bn 7% of volumes¹ Net sales (SAM) €7.0bn 4% of volumes¹

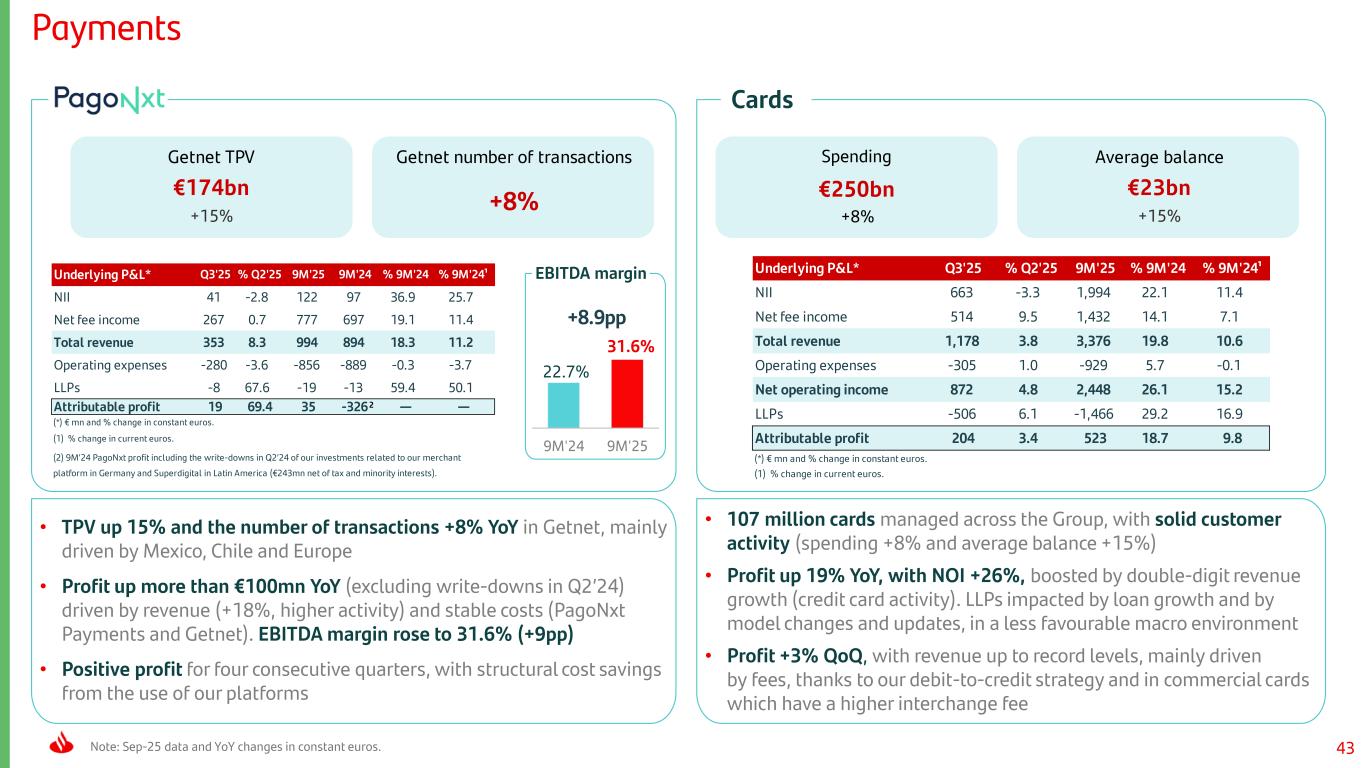

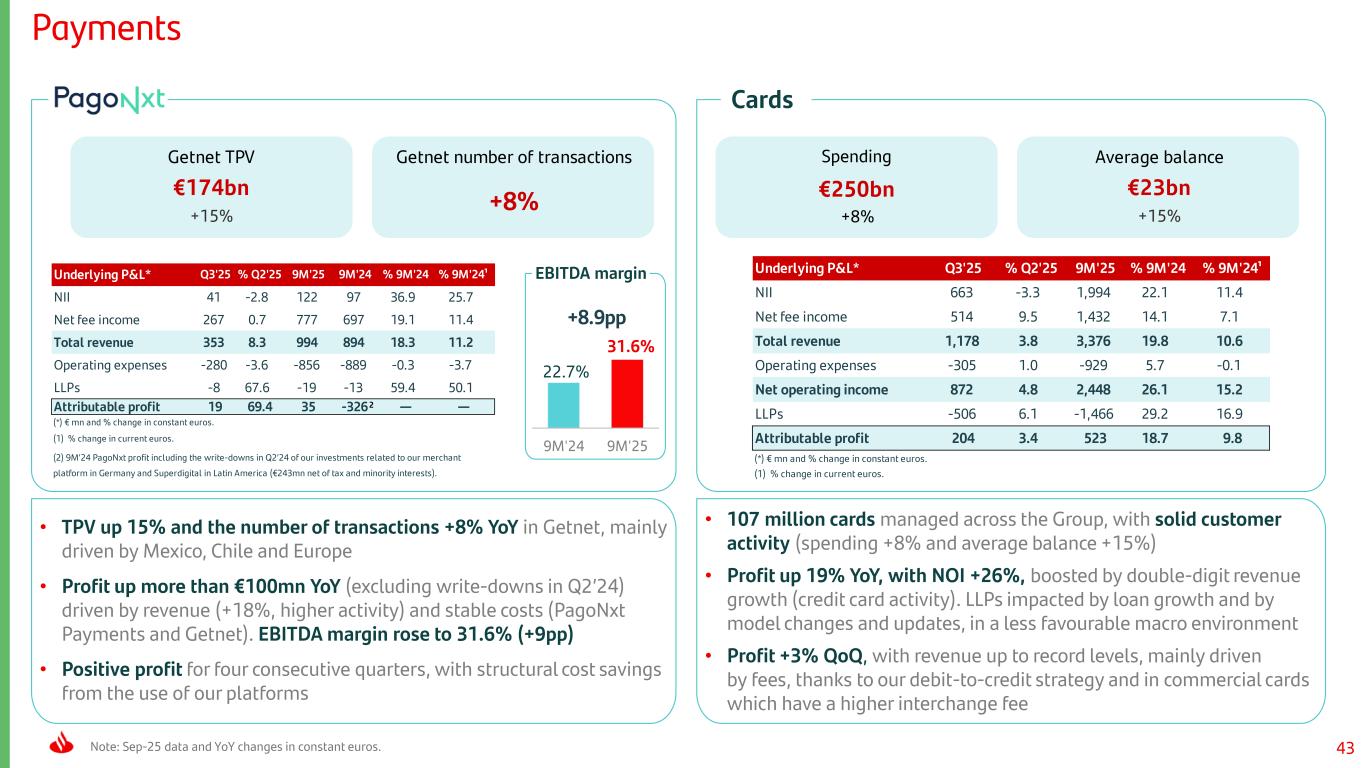

43 Underlying P&L* Q3'25 % Q2'25 9M'25 9M'24 % 9M'24 % 9M'24¹ NII 41 -2.8 122 97 36.9 25.7 Net fee income 267 0.7 777 697 19.1 11.4 Total revenue 353 8.3 994 894 18.3 11.2 Operating expenses -280 -3.6 -856 -889 -0.3 -3.7 LLPs -8 67.6 -19 -13 59.4 50.1 Attributable profit 19 69.4 35 -326 — — (*) € mn and % change in constant euros. (1) % change in current euros. (2) 9M’24 PagoNxt profit including the write-downs in Q2’24 of our investments related to our merchant platform in Germany and Superdigital in Latin America (€243mn net of tax and minority interests). 2 Payments Note: Sep-25 data and YoY changes in constant euros. Cards 22.7% 31.6% 9M'24 9M'25 Spending Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 663 -3.3 1,994 22.1 11.4 Net fee income 514 9.5 1,432 14.1 7.1 Total revenue 1,178 3.8 3,376 19.8 10.6 Operating expenses -305 1.0 -929 5.7 -0.1 Net operating income 872 4.8 2,448 26.1 15.2 LLPs -506 6.1 -1,466 29.2 16.9 Attributable profit 204 3.4 523 18.7 9.8 (*) € mn and % change in constant euros. (1) % change in current euros. EBITDA margin +8.9pp • 107 million cards managed across the Group, with solid customer activity (spending +8% and average balance +15%) • Profit up 19% YoY, with NOI +26%, boosted by double-digit revenue growth (credit card activity). LLPs impacted by loan growth and by model changes and updates, in a less favourable macro environment • Profit +3% QoQ, with revenue up to record levels, mainly driven by fees, thanks to our debit-to-credit strategy and in commercial cards which have a higher interchange fee • TPV up 15% and the number of transactions +8% YoY in Getnet, mainly driven by Mexico, Chile and Europe • Profit up more than €100mn YoY (excluding write-downs in Q2’24) driven by revenue (+18%, higher activity) and stable costs (PagoNxt Payments and Getnet). EBITDA margin rose to 31.6% (+9pp) • Positive profit for four consecutive quarters, with structural cost savings from the use of our platforms Getnet TPV €174bn +15% Getnet number of transactions +8% Average balance €23bn +15% €250bn +8%

44 • NII affected by lower interest rates • Gain / losses on financial transactions improved with a lower impact from foreign currency hedges • Costs up due to higher IT expenses • LLPs and other provisions increased particularly in H1’25 impacted by our NPL ratio reduction plan, which improves the Group's credit quality • The sum of the rest of the lines improved YoY, mainly due to lower tax pressure • Attributable loss fairly stable YoY Corporate Centre HIGHLIGHTSP&L Underlying P&L* 9M'25 9M'24 NII -364 -195 Gains / losses on financial transactions -135 -429 Operating expenses -285 -275 LLPs and other provisions -452 -241 Tax and minority interests 195 108 Attributable profit -1,059 -1,012 (*) € mn.

45 Detail by country

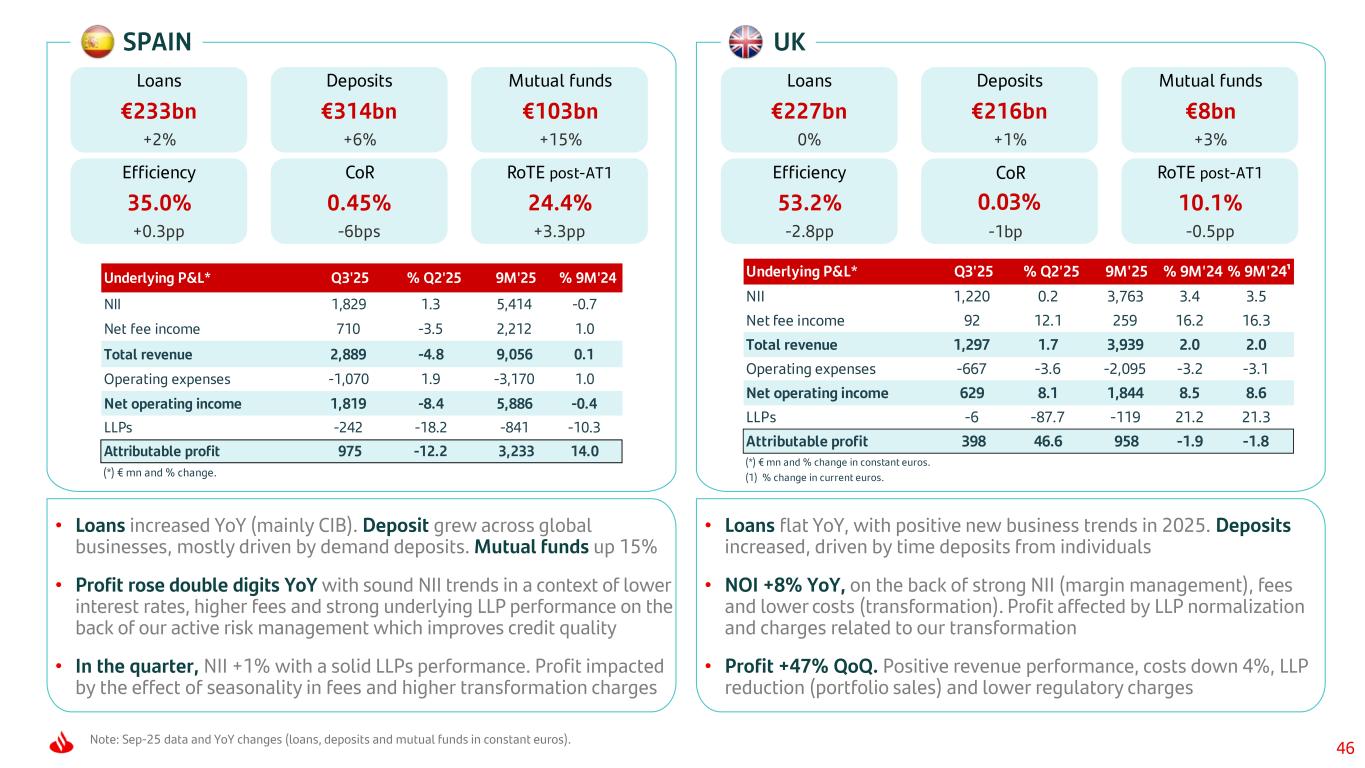

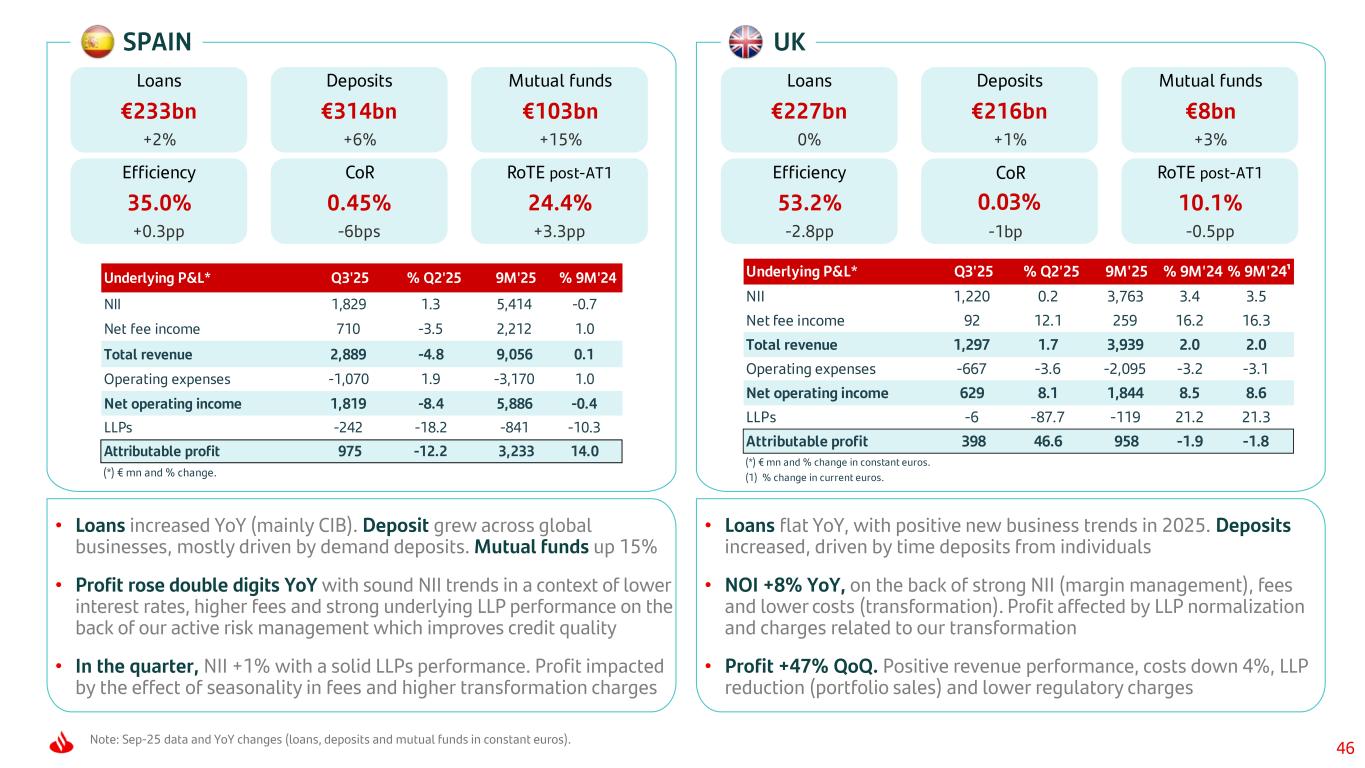

46 Note: Sep-25 data and YoY changes (loans, deposits and mutual funds in constant euros). SPAIN UK Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 NII 1,829 1.3 5,414 -0.7 Net fee income 710 -3.5 2,212 1.0 Total revenue 2,889 -4.8 9,056 0.1 Operating expenses -1,070 1.9 -3,170 1.0 Net operating income 1,819 -8.4 5,886 -0.4 LLPs -242 -18.2 -841 -10.3 Attributable profit 975 -12.2 3,233 14.0 (*) € mn and % change. Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 1,220 0.2 3,763 3.4 3.5 Net fee income 92 12.1 259 16.2 16.3 Total revenue 1,297 1.7 3,939 2.0 2.0 Operating expenses -667 -3.6 -2,095 -3.2 -3.1 Net operating income 629 8.1 1,844 8.5 8.6 LLPs -6 -87.7 -119 21.2 21.3 Attributable profit 398 46.6 958 -1.9 -1.8 (*) € mn and % change in constant euros. (1) % change in current euros. Loans €233bn +2% Deposits €314bn +6% Mutual funds €103bn +15% Efficiency 35.0% +0.3pp CoR 0.45% -6bps Loans €227bn 0% Deposits €216bn +1% Mutual funds €8bn +3% Efficiency 53.2% -2.8pp • Loans flat YoY, with positive new business trends in 2025. Deposits increased, driven by time deposits from individuals • NOI +8% YoY, on the back of strong NII (margin management), fees and lower costs (transformation). Profit affected by LLP normalization and charges related to our transformation • Profit +47% QoQ. Positive revenue performance, costs down 4%, LLP reduction (portfolio sales) and lower regulatory charges • Loans increased YoY (mainly CIB). Deposit grew across global businesses, mostly driven by demand deposits. Mutual funds up 15% • Profit rose double digits YoY with sound NII trends in a context of lower interest rates, higher fees and strong underlying LLP performance on the back of our active risk management which improves credit quality • In the quarter, NII +1% with a solid LLPs performance. Profit impacted by the effect of seasonality in fees and higher transformation charges RoTE post-AT1 24.4% +3.3pp RoTE post-AT1 10.1% -0.5pp CoR 0.03% -1bp

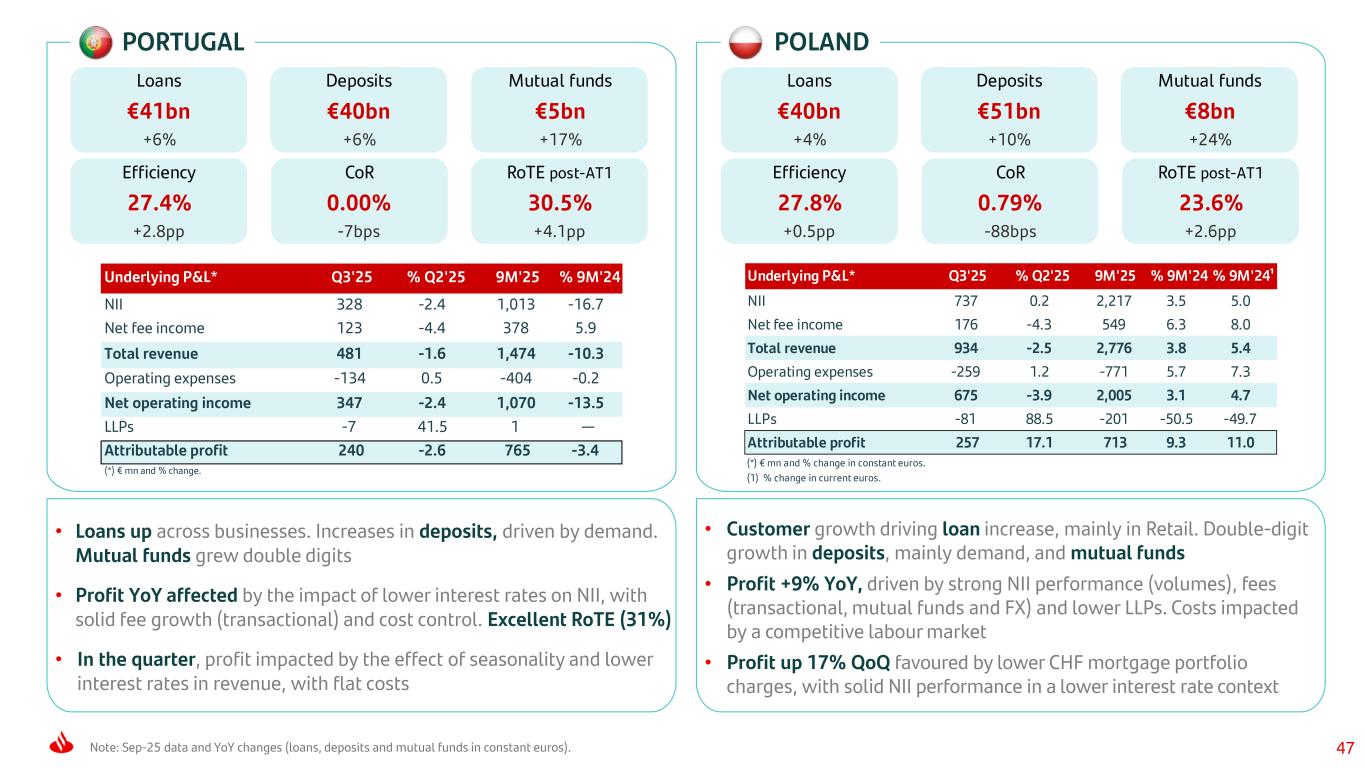

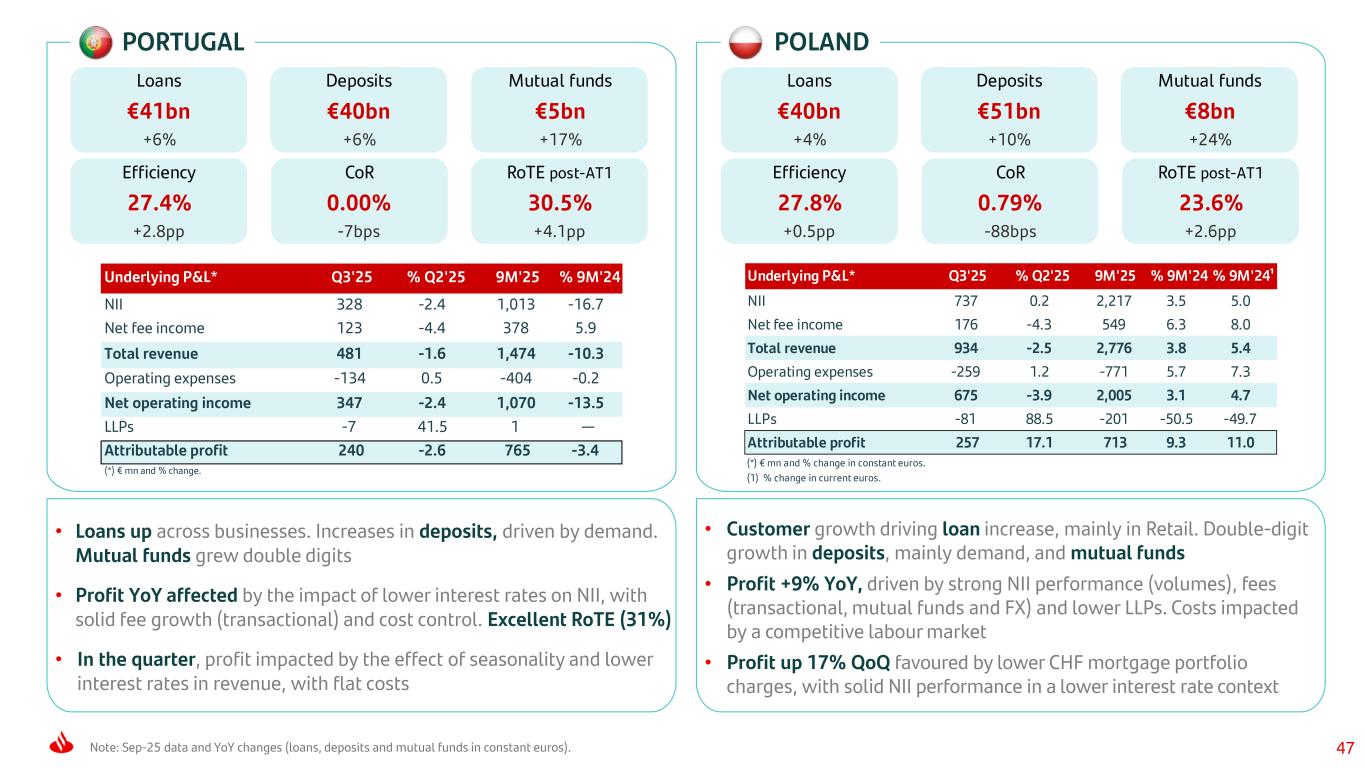

47Note: Sep-25 data and YoY changes (loans, deposits and mutual funds in constant euros). PORTUGAL POLAND Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 737 0.2 2,217 3.5 5.0 Net fee income 176 -4.3 549 6.3 8.0 Total revenue 934 -2.5 2,776 3.8 5.4 Operating expenses -259 1.2 -771 5.7 7.3 Net operating income 675 -3.9 2,005 3.1 4.7 LLPs -81 88.5 -201 -50.5 -49.7 Attributable profit 257 17.1 713 9.3 11.0 (*) € mn and % change in constant euros. (1) % change in current euros. Loans €41bn +6% Deposits €40bn +6% Mutual funds €5bn +17% Efficiency 27.4% +2.8pp CoR 0.00% -7bps Loans €40bn +4% Deposits €51bn +10% Mutual funds €8bn +24% Efficiency 27.8% +0.5pp CoR 0.79% -88bps • Customer growth driving loan increase, mainly in Retail. Double-digit growth in deposits, mainly demand, and mutual funds • Profit +9% YoY, driven by strong NII performance (volumes), fees (transactional, mutual funds and FX) and lower LLPs. Costs impacted by a competitive labour market • Profit up 17% QoQ favoured by lower CHF mortgage portfolio charges, with solid NII performance in a lower interest rate context • Loans up across businesses. Increases in deposits, driven by demand. Mutual funds grew double digits • Profit YoY affected by the impact of lower interest rates on NII, with solid fee growth (transactional) and cost control. Excellent RoTE (31%) • In the quarter, profit impacted by the effect of seasonality and lower interest rates in revenue, with flat costs Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 NII 328 -2.4 1,013 -16.7 Net fee income 123 -4.4 378 5.9 Total revenue 481 -1.6 1,474 -10.3 Operating expenses -134 0.5 -404 -0.2 Net operating income 347 -2.4 1,070 -13.5 LLPs -7 41.5 1 — Attributable profit 240 -2.6 765 -3.4 (*) € mn and % change. RoTE post-AT1 30.5% +4.1pp RoTE post-AT1 23.6% +2.6pp

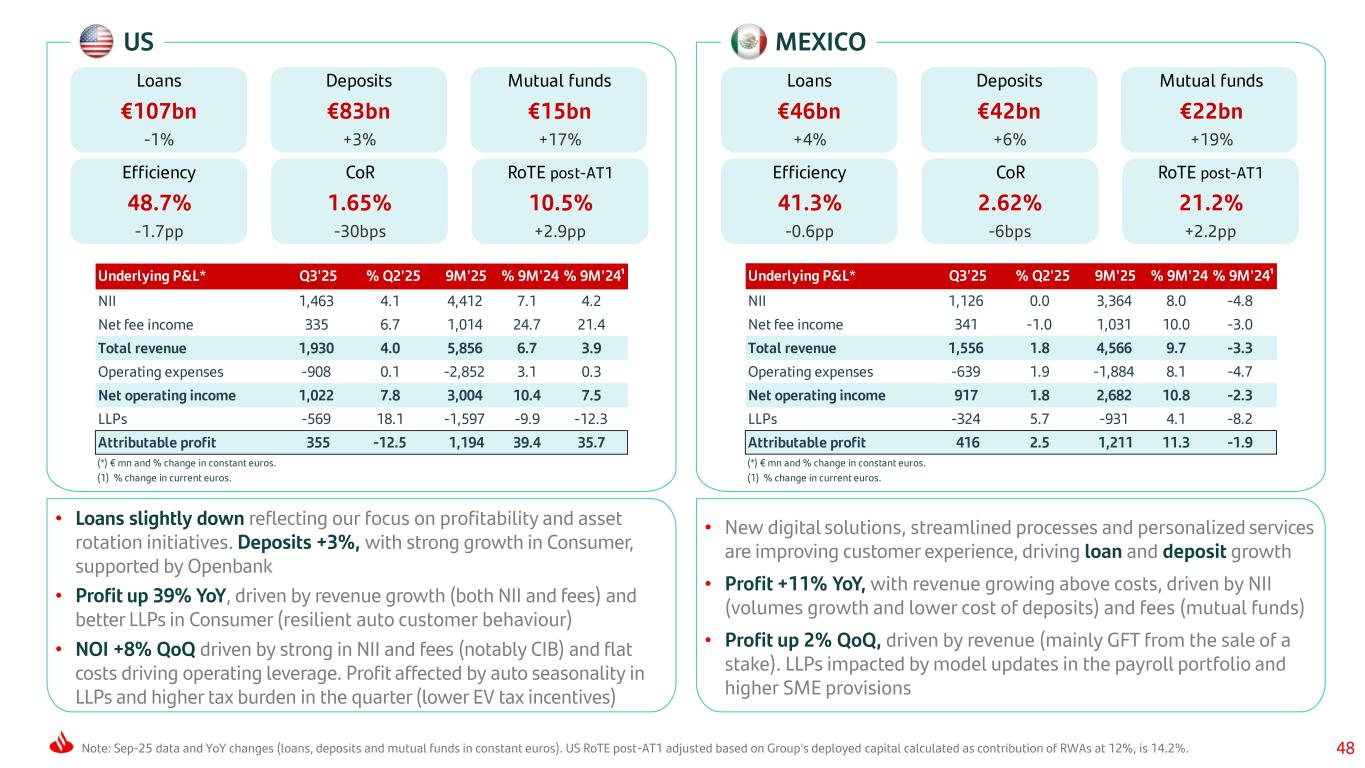

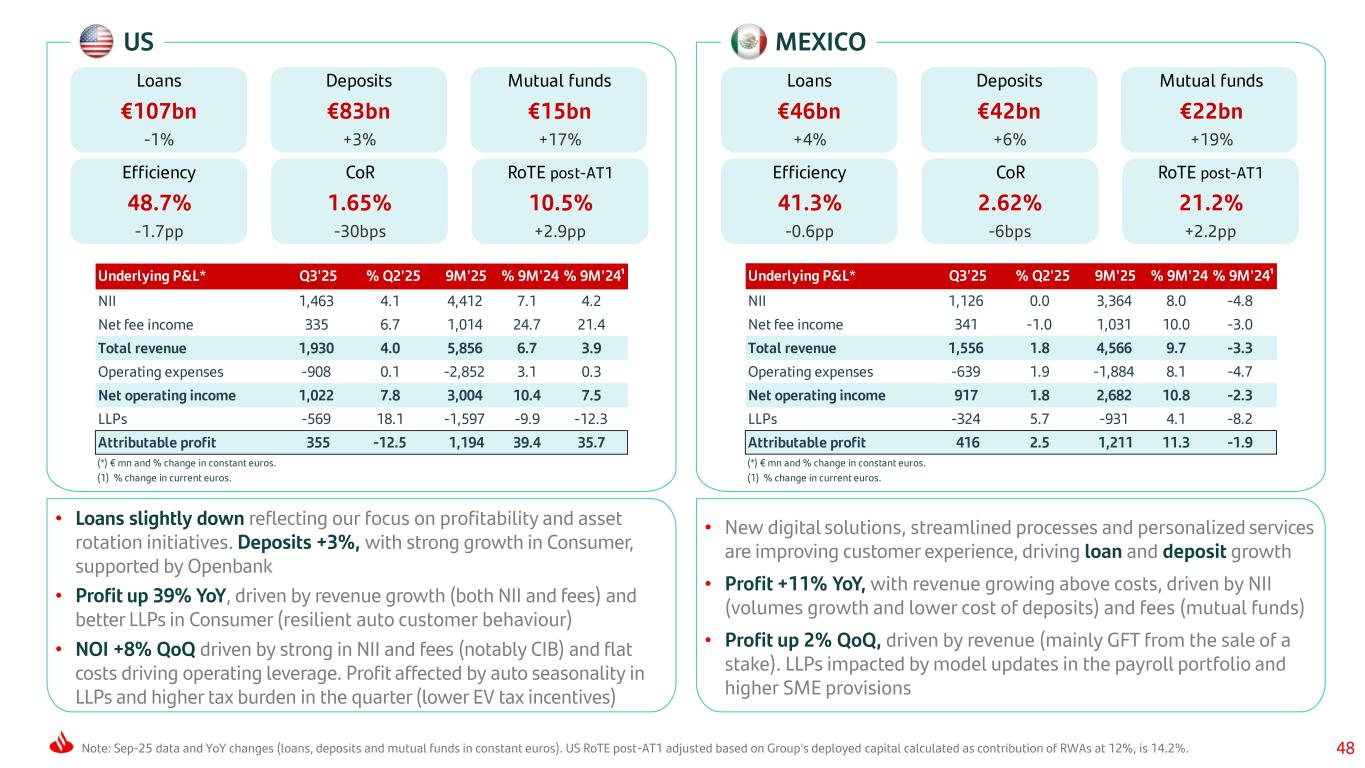

48 • Loans slightly down reflecting our focus on profitability and asset rotation initiatives. Deposits +3%, with strong growth in Consumer, supported by Openbank • Profit up 39% YoY, driven by revenue growth (both NII and fees) and better LLPs in Consumer (resilient auto customer behaviour) • NOI +8% QoQ driven by strong in NII and fees (notably CIB) and flat costs driving operating leverage. Profit affected by auto seasonality in LLPs and higher tax burden in the quarter (lower EV tax incentives) • New digital solutions, streamlined processes and personalized services are improving customer experience, driving loan and deposit growth • Profit +11% YoY, with revenue growing above costs, driven by NII (volumes growth and lower cost of deposits) and fees (mutual funds) • Profit up 2% QoQ, driven by revenue (mainly GFT from the sale of a stake). LLPs impacted by model updates in the payroll portfolio and higher SME provisions Note: Sep-25 data and YoY changes (loans, deposits and mutual funds in constant euros). US RoTE post-AT1 adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%, is 14.2%. US MEXICO Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 1,463 4.1 4,412 7.1 4.2 Net fee income 335 6.7 1,014 24.7 21.4 Total revenue 1,930 4.0 5,856 6.7 3.9 Operating expenses -908 0.1 -2,852 3.1 0.3 Net operating income 1,022 7.8 3,004 10.4 7.5 LLPs -569 18.1 -1,597 -9.9 -12.3 Attributable profit 355 -12.5 1,194 39.4 35.7 (*) € mn and % change in constant euros. (1) % change in current euros. Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 1,126 0.0 3,364 8.0 -4.8 Net fee income 341 -1.0 1,031 10.0 -3.0 Total revenue 1,556 1.8 4,566 9.7 -3.3 Operating expenses -639 1.9 -1,884 8.1 -4.7 Net operating income 917 1.8 2,682 10.8 -2.3 LLPs -324 5.7 -931 4.1 -8.2 Attributable profit 416 2.5 1,211 11.3 -1.9 (*) € mn and % change in constant euros. (1) % change in current euros. Loans €107bn -1% Deposits €83bn +3% Mutual funds €15bn +17% Efficiency 48.7% -1.7pp CoR 1.65% -30bps Loans €46bn +4% Deposits €42bn +6% Mutual funds €22bn +19% Efficiency 41.3% -0.6pp CoR 2.62% -6bps RoTE post-AT1 10.5% +2.9pp RoTE post-AT1 21.2% +2.2pp

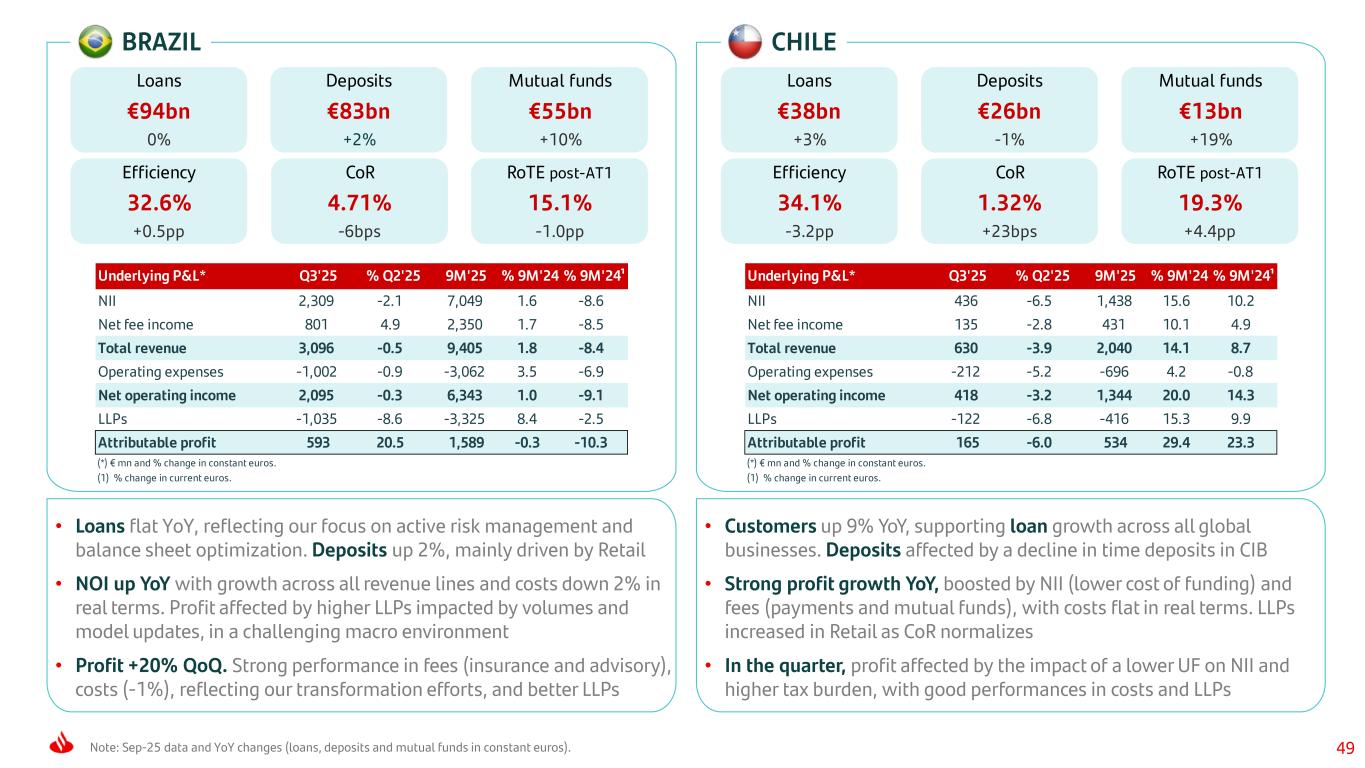

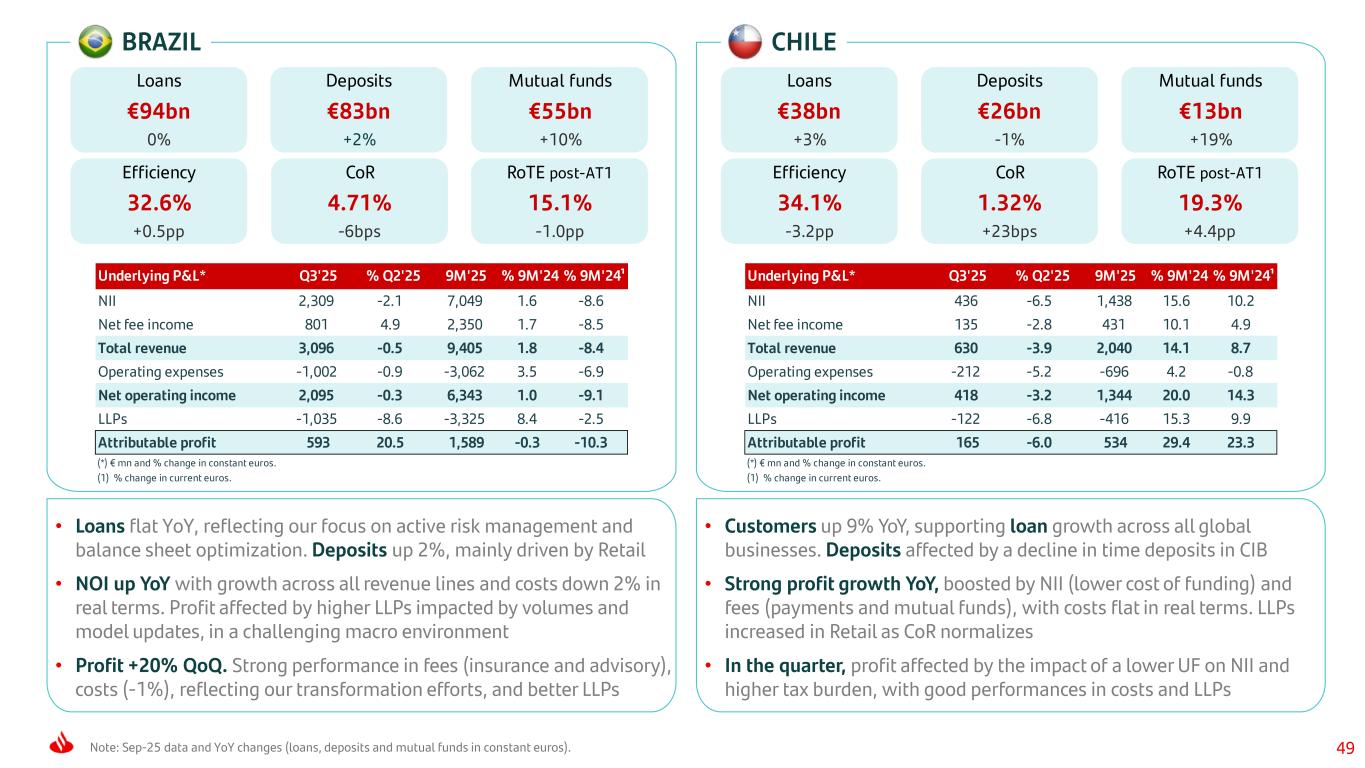

49Note: Sep-25 data and YoY changes (loans, deposits and mutual funds in constant euros). BRAZIL • Loans flat YoY, reflecting our focus on active risk management and balance sheet optimization. Deposits up 2%, mainly driven by Retail • NOI up YoY with growth across all revenue lines and costs down 2% in real terms. Profit affected by higher LLPs impacted by volumes and model updates, in a challenging macro environment • Profit +20% QoQ. Strong performance in fees (insurance and advisory), costs (-1%), reflecting our transformation efforts, and better LLPs CHILE • Customers up 9% YoY, supporting loan growth across all global businesses. Deposits affected by a decline in time deposits in CIB • Strong profit growth YoY, boosted by NII (lower cost of funding) and fees (payments and mutual funds), with costs flat in real terms. LLPs increased in Retail as CoR normalizes • In the quarter, profit affected by the impact of a lower UF on NII and higher tax burden, with good performances in costs and LLPs Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 2,309 -2.1 7,049 1.6 -8.6 Net fee income 801 4.9 2,350 1.7 -8.5 Total revenue 3,096 -0.5 9,405 1.8 -8.4 Operating expenses -1,002 -0.9 -3,062 3.5 -6.9 Net operating income 2,095 -0.3 6,343 1.0 -9.1 LLPs -1,035 -8.6 -3,325 8.4 -2.5 Attributable profit 593 20.5 1,589 -0.3 -10.3 (*) € mn and % change in constant euros. (1) % change in current euros. Underlying P&L* Q3'25 % Q2'25 9M'25 % 9M'24 % 9M'24¹ NII 436 -6.5 1,438 15.6 10.2 Net fee income 135 -2.8 431 10.1 4.9 Total revenue 630 -3.9 2,040 14.1 8.7 Operating expenses -212 -5.2 -696 4.2 -0.8 Net operating income 418 -3.2 1,344 20.0 14.3 LLPs -122 -6.8 -416 15.3 9.9 Attributable profit 165 -6.0 534 29.4 23.3 (*) € mn and % change in constant euros. (1) % change in current euros. Loans €94bn 0% Deposits €83bn +2% Mutual funds €55bn +10% Efficiency 32.6% +0.5pp CoR 4.71% -6bps Loans €38bn +3% Deposits €26bn -1% Mutual funds €13bn +19% Efficiency 34.1% -3.2pp CoR 1.32% +23bps RoTE post-AT1 15.1% -1.0pp RoTE post-AT1 19.3% +4.4pp

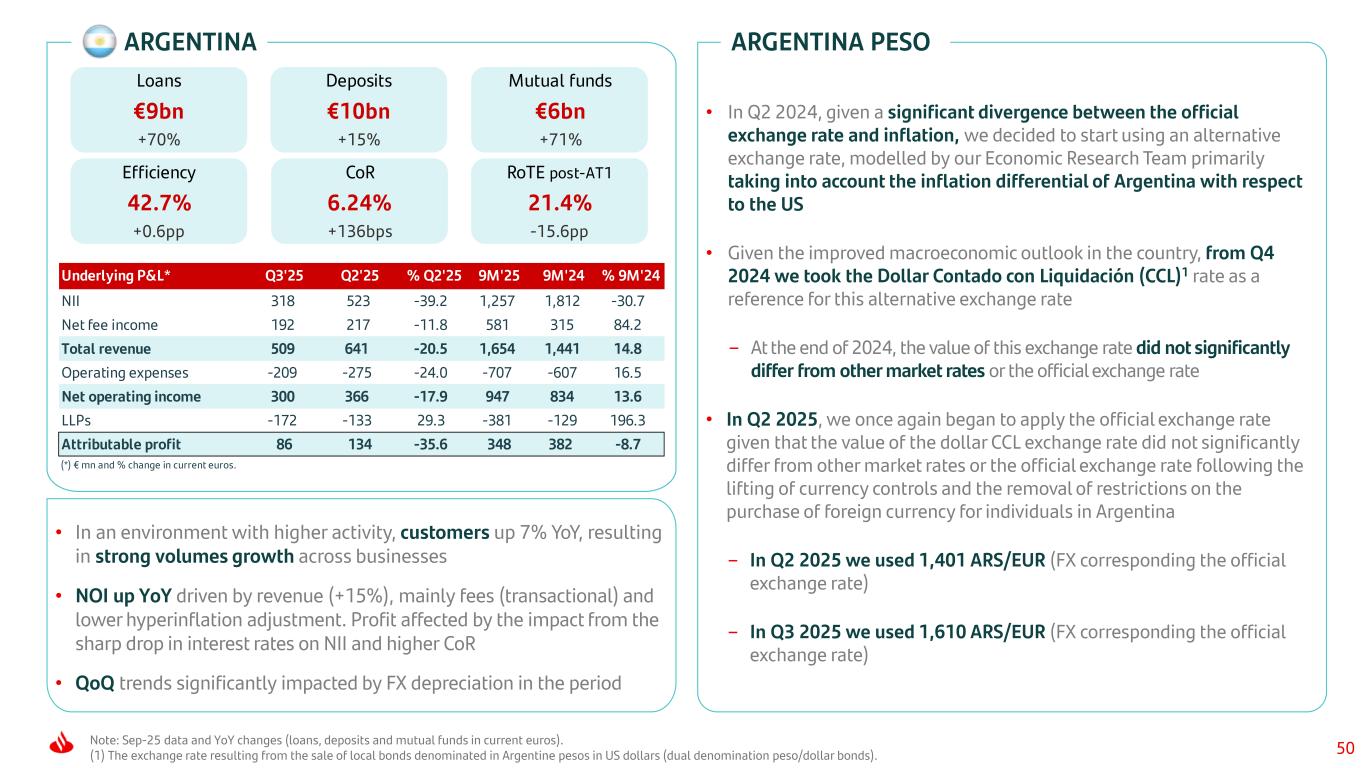

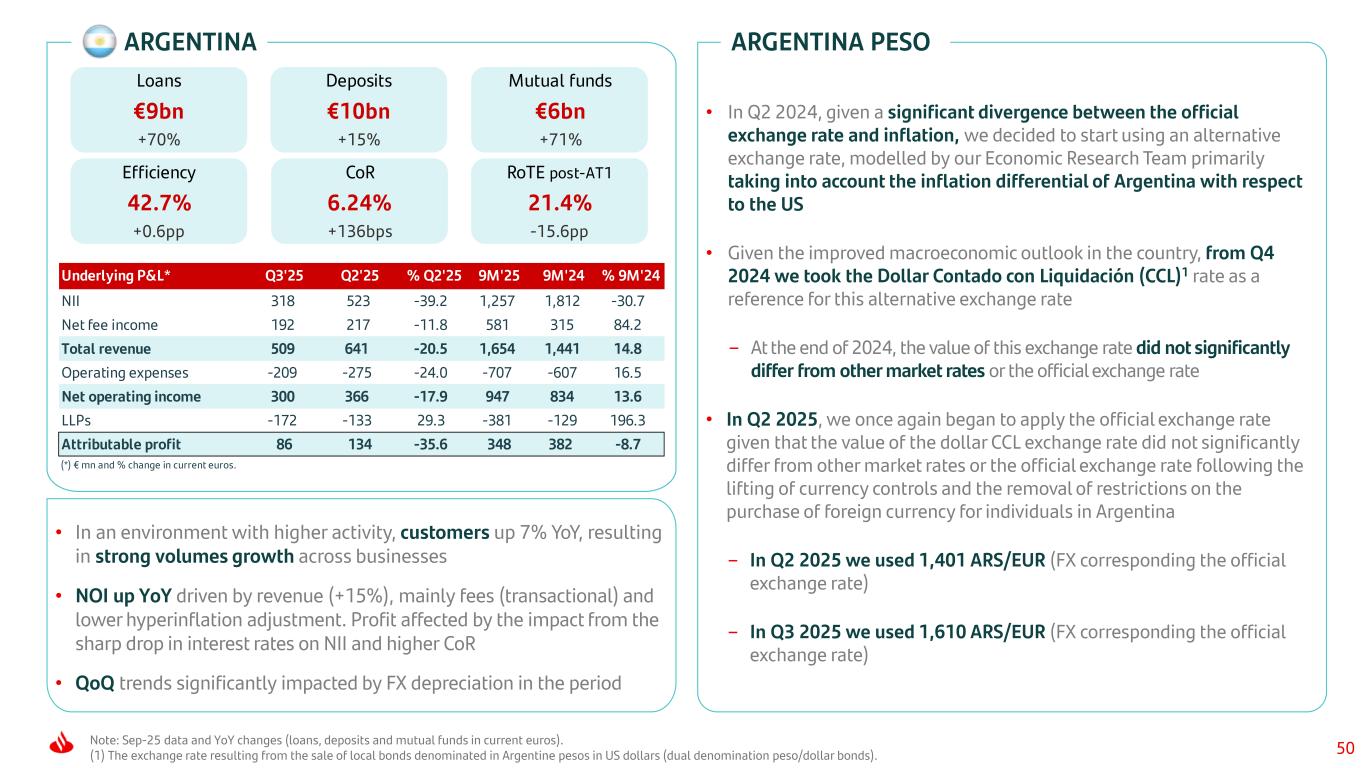

50 • In Q2 2024, given a significant divergence between the official exchange rate and inflation, we decided to start using an alternative exchange rate, modelled by our Economic Research Team primarily taking into account the inflation differential of Argentina with respect to the US • Given the improved macroeconomic outlook in the country, from Q4 2024 we took the Dollar Contado con Liquidación (CCL)1 rate as a reference for this alternative exchange rate – At the end of 2024, the value of this exchange rate did not significantly differ from other market rates or the official exchange rate • In Q2 2025, we once again began to apply the official exchange rate given that the value of the dollar CCL exchange rate did not significantly differ from other market rates or the official exchange rate following the lifting of currency controls and the removal of restrictions on the purchase of foreign currency for individuals in Argentina – In Q2 2025 we used 1,401 ARS/EUR (FX corresponding the official exchange rate) – In Q3 2025 we used 1,610 ARS/EUR (FX corresponding the official exchange rate) Note: Sep-25 data and YoY changes (loans, deposits and mutual funds in current euros). (1) The exchange rate resulting from the sale of local bonds denominated in Argentine pesos in US dollars (dual denomination peso/dollar bonds). ARGENTINA PESOARGENTINA Underlying P&L* Q3'25 Q2'25 % Q2'25 9M'25 9M'24 % 9M'24 NII 318 523 -39.2 1,257 1,812 -30.7 Net fee income 192 217 -11.8 581 315 84.2 Total revenue 509 641 -20.5 1,654 1,441 14.8 Operating expenses -209 -275 -24.0 -707 -607 16.5 Net operating income 300 366 -17.9 947 834 13.6 LLPs -172 -133 29.3 -381 -129 196.3 Attributable profit 86 134 -35.6 348 382 -8.7 (*) € mn and % change in current euros. Loans €9bn +70% Deposits €10bn +15% Mutual funds €6bn +71% Efficiency 42.7% +0.6pp CoR 6.24% +136bps • In an environment with higher activity, customers up 7% YoY, resulting in strong volumes growth across businesses • NOI up YoY driven by revenue (+15%), mainly fees (transactional) and lower hyperinflation adjustment. Profit affected by the impact from the sharp drop in interest rates on NII and higher CoR • QoQ trends significantly impacted by FX depreciation in the period RoTE post-AT1 21.4% -15.6pp

51 Appendix 2025 Investor Day targets summary Group P&L QoQ and excluding Argentina CET1 performance YTD Detail by global business and country Reconciliation of underlying results to statutory results Glossary and additional notes

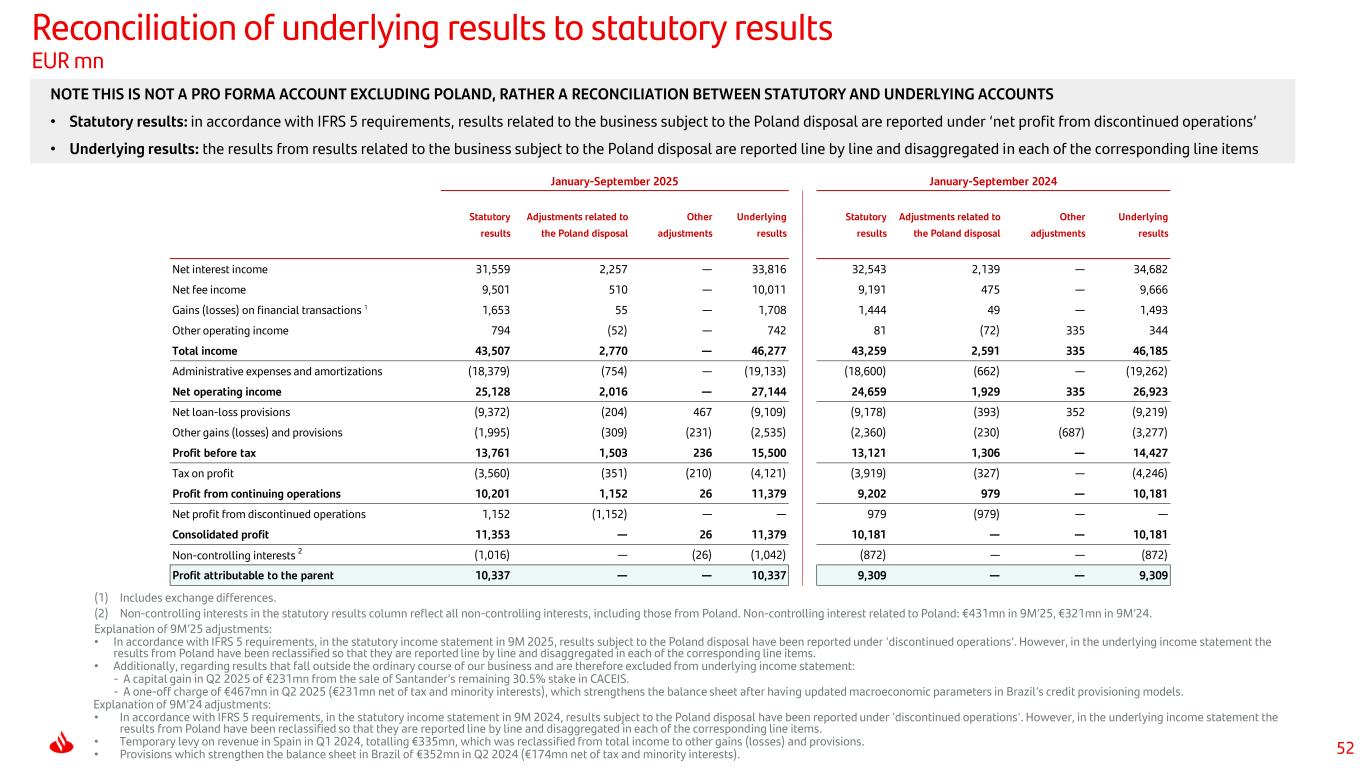

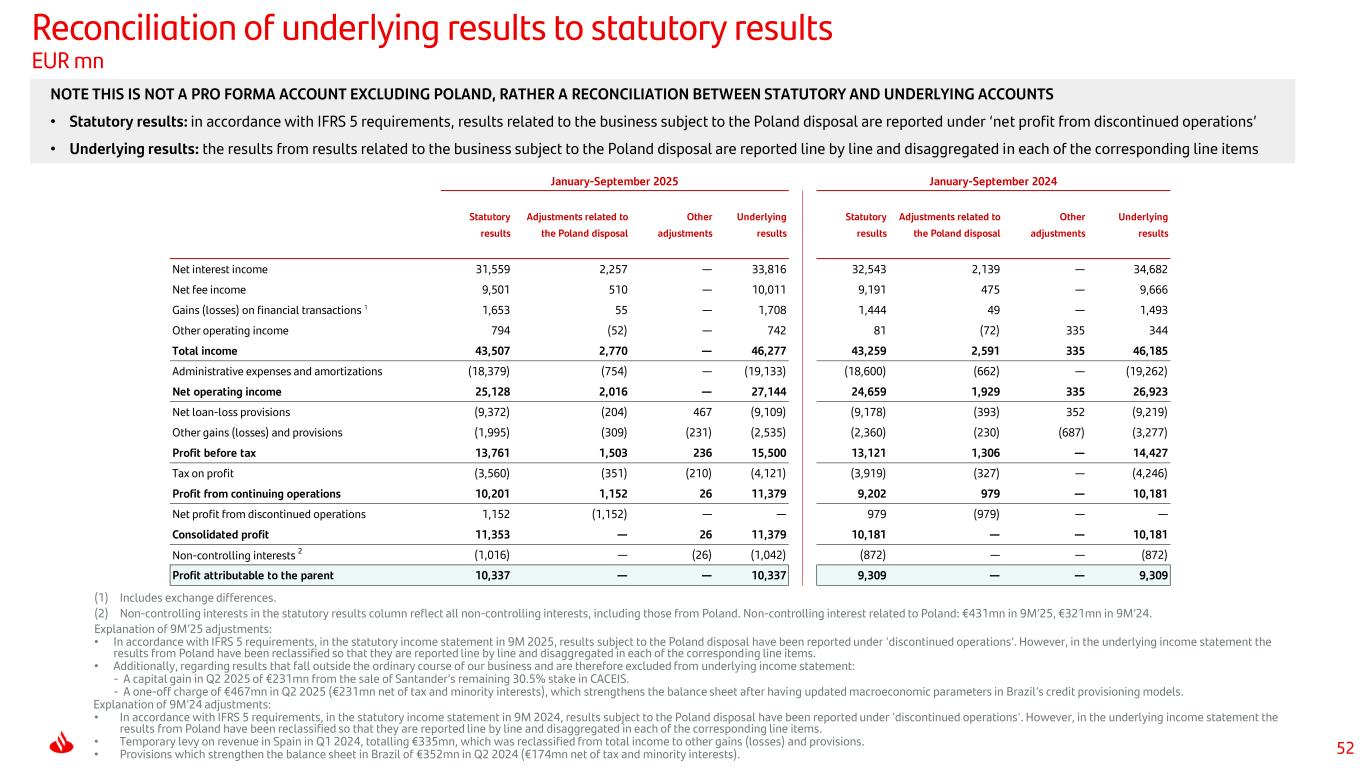

52 Reconciliation of underlying results to statutory results EUR mn (1) Includes exchange differences. (2) Non-controlling interests in the statutory results column reflect all non-controlling interests, including those from Poland. Non-controlling interest related to Poland: €431mn in 9M’25, €321mn in 9M’24. Explanation of 9M’25 adjustments: • In accordance with IFRS 5 requirements, in the statutory income statement in 9M 2025, results subject to the Poland disposal have been reported under 'discontinued operations’. However, in the underlying income statement the results from Poland have been reclassified so that they are reported line by line and disaggregated in each of the corresponding line items. • Additionally, regarding results that fall outside the ordinary course of our business and are therefore excluded from underlying income statement: - A capital gain in Q2 2025 of €231mn from the sale of Santander’s remaining 30.5% stake in CACEIS. - A one-off charge of €467mn in Q2 2025 (€231mn net of tax and minority interests), which strengthens the balance sheet after having updated macroeconomic parameters in Brazil’s credit provisioning models. Explanation of 9M’24 adjustments: • In accordance with IFRS 5 requirements, in the statutory income statement in 9M 2024, results subject to the Poland disposal have been reported under 'discontinued operations'. However, in the underlying income statement the results from Poland have been reclassified so that they are reported line by line and disaggregated in each of the corresponding line items. • Temporary levy on revenue in Spain in Q1 2024, totalling €335mn, which was reclassified from total income to other gains (losses) and provisions. • Provisions which strengthen the balance sheet in Brazil of €352mn in Q2 2024 (€174mn net of tax and minority interests). NOTE THIS IS NOT A PRO FORMA ACCOUNT EXCLUDING POLAND, RATHER A RECONCILIATION BETWEEN STATUTORY AND UNDERLYING ACCOUNTS • Statutory results: in accordance with IFRS 5 requirements, results related to the business subject to the Poland disposal are reported under ‘net profit from discontinued operations’ • Underlying results: the results from results related to the business subject to the Poland disposal are reported line by line and disaggregated in each of the corresponding line items Statutory results Adjustments related to the Poland disposal Other adjustments Underlying results Statutory results Adjustments related to the Poland disposal Other adjustments Underlying results Net interest income 31,559 2,257 — 33,816 32,543 2,139 — 34,682 Net fee income 9,501 510 — 10,011 9,191 475 — 9,666 Gains (losses) on financial transactions 1 1,653 55 — 1,708 1,444 49 — 1,493 Other operating income 794 (52) — 742 81 (72) 335 344 Total income 43,507 2,770 — 46,277 43,259 2,591 335 46,185 Administrative expenses and amortizations (18,379) (754) — (19,133) (18,600) (662) — (19,262) Net operating income 25,128 2,016 — 27,144 24,659 1,929 335 26,923 Net loan-loss provisions (9,372) (204) 467 (9,109) (9,178) (393) 352 (9,219) Other gains (losses) and provisions (1,995) (309) (231) (2,535) (2,360) (230) (687) (3,277) Profit before tax 13,761 1,503 236 15,500 13,121 1,306 — 14,427 Tax on profit (3,560) (351) (210) (4,121) (3,919) (327) — (4,246) Profit from continuing operations 10,201 1,152 26 11,379 9,202 979 — 10,181 Net profit from discontinued operations 1,152 (1,152) — — 979 (979) — — Consolidated profit 11,353 — 26 11,379 10,181 — — 10,181 Non-controlling interests 2 (1,016) — (26) (1,042) (872) — — (872) Profit attributable to the parent 10,337 — — 10,337 9,309 — — 9,309 January-September 2024January-September 2025

53 Appendix 2025 Investor Day targets summary Group P&L QoQ and excluding Argentina CET1 performance YTD Detail by global business and country Reconciliation of underlying results to statutory results Glossary and additional notes

54 Glossary - Acronyms • A2A: Account-to-account • AM: Asset management • AuMs: Assets under Management • bn: Billion • bps: Basis points • c.: Circa • CET1: Common equity tier 1 • CHF: Swiss franc • CF: Corporate Finance • CIB: Corporate & Investment Banking • CoE: Cost of equity • Consumer: Digital Consumer Bank • CoR: Cost of risk • DCB Europe: Digital Consumer Bank Europe • DCM: Debt Capital Markets • DPS: Dividend per share • EPS: Earnings per share • FX: Foreign exchange • FY: Full year • GFT: Gains on financial transactions • ID: Investor Day • IFRS 5: International Financial Reporting Standard 5, on non-current assets held for sale and discontinued operations • IFRS 9: International Financial Reporting Standard 9, regarding financial instruments • k: Thousands • LLPs: Loan-loss provisions • mn: Million • NII: Net interest income • NIM: Net interest margin • n.m.: Not meaningful • NPL: Non-performing loans • OEM: Original equipment manufacturer • Payments: PagoNxt and Cards • PB: Private Banking • PBT: Profit before tax • P&L: Profit and loss • pp: Percentage points • ps: Per share • QoQ: Quarter-on-quarter • Repos: Repurchase agreements • Retail: Retail & Commercial Banking • RoE: Return on equity • RoRWA: Return on risk-weighted assets • RoTE: Return on tangible equity • RWA: Risk-weighted assets • SAM: Santander Asset Management • SBB: Share buybacks • SME: Small and medium enterprises • US BBO: US Banking Build-Out • TNAV: Tangible net asset value • TPV: Total payments volume • YoY: Year-on-Year • YTD: Year to date • Wealth: Wealth Management & Insurance • #: Number

55 Glossary - Definitions PROFITABILITY AND EFFICIENCY • RoTE: Profit attributable to the parent (annualized)1/ Average stockholders' equity2 (excl. minority interests) - intangible assets • RoTE (post-AT1): Profit attributable to the parent minus AT1 costs (annualized)1 / Average stockholders' equity2 (excl. minority interests) - intangible assets • RoRWA: Consolidated profit (annualized) / Average risk-weighted assets • Efficiency: Underlying operating expenses / Underlying total income. Operating expenses defined as administrative expenses + amortizations VOLUMES • Loans: Gross loans and advances to customers (excl. reverse repos) • Customer funds: Customer deposits excluding repos + marketed mutual funds CREDIT RISK • NPL ratio: Credit impaired customer loans and advances, guarantees and undrawn balances / Total risk. Total risk is defined as: Non-impaired and impaired customer loans and advances and guarantees + impaired undrawn customer balances • NPL coverage ratio: Total allowances to cover impairment losses on customer loans and advances, guarantees and undrawn balances / Credit impaired customer loans and advances, guarantees and undrawn balances • Cost of risk: Underlying allowances for loan-loss provisions over the last 12 months / Average loans and advances to customers over the last 12 months CAPITALIZATION • TNAV per share (Tangible net asset value per share): Tangible book value / Number of shares excluding treasury stock. Tangible book value calculated as Stockholders' equity (excl. minority interests) - intangible assets Note: the averages for the RoTE, RoTE post-AT1 and RoRWA denominators are calculated using the monthly average over the period, which we believe should not differ materially from using daily balances. The risk-weighted assets included in the denominator of the RoRWA metric are calculated in line with the criteria laid out in the CRR (Capital Requirements Regulation). (1) Excluding the adjustment to the valuation of goodwill. (2) Stockholders’ equity = Capital and Reserves + Accumulated other comprehensive income + Profit attributable to the parent + Dividends. For the financial Sustainability indicators, please see ‘Alternative Performance Measures’ section of the Quarterly Financial Report.

56 Additional notes (1) As announced on 5 February 2025, the shareholder remuneration policy that the board intends to apply for the 2025 results consists of a total shareholder remuneration of approximately 50% of the Group reported profit (excluding non-cash, non-capital ratios impact items), to be distributed in approximately equal parts between cash dividends and share buybacks. Additionally, on the same date, the board announced its objective to allocate EUR 10 billion to shareholder remuneration in the form of share buybacks charged against 2025 and 2026 results, as well as anticipated capital excess. This target includes i) the buybacks that form part of the aforementioned shareholder remuneration policy, and ii) additional buybacks following the publication of the full year results, to distribute end-of-year CET1 excess capital. On 5 May 2025, Santander announced its intention to distribute approximately 50% of the capital that will be released once the sale of its 49% stake in Santander Bank Polska S.A. is completed, through a share buyback of approximately EUR 3.2 billion in early 2026, as part of an additional buyback to distribute excess capital and, as a result, it could exceed the EUR 10 billion target. Upon announcing the agreement to acquire TSB Banking Group plc on 1 July 2025, the bank confirmed its goal to distribute at least EUR 10 billion in share buybacks charged against 2025 and 2026 results and excess capital. The execution of the shareholder remuneration policy and the aforementioned share buybacks are subject to the corresponding internal and regulatory decisions and approvals. (2) Subject to customary closing conditions, including regulatory approvals, such as that of the Polish Financial Supervision Authority (KNF).

Thank You. Our purpose is to help people and businesses prosper. Our culture is based on believing that everything we do should be:

SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Banco Santander, S.A. Date: 29 October 2025 By: /s/ José García Cantera Name: José García Cantera Title: Chief Financial Officer