Document

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of October, 2025

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

BANCO SANTANDER, S.A.

________________________

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

Item 1. January - September 2025 Financial Report |

|

Index

This report was approved by the board of directors on 28 October 2025, following a favourable report from the audit committee. Important information regarding this report can be found on pages 93 and 94.

SIGNIFICANT EVENTS IN THE PERIOD

In Q2 2025, Santander announced the entry into an agreement with Erste Group Bank AG (Erste) to sell approximately 49% of its stake in Santander Bank Polska S.A. and the 50% of the asset management company (TFI) which was not integrated within Santander Polska to Erste, for a total cash amount of approximately EUR 7 billion. In addition, Santander announced its intention to acquire 100% of Santander Consumer Bank Polska by purchasing the 60% stake currently held by Santander Bank Polska S.A. (approximately EUR 0.7 billion), thereby bringing the business fully within the perimeter of Grupo Santander and excluding it from the scope of the sale. Santander and Erste also announced a strategic collaboration to leverage the strengths and international presence of both institutions in Corporate & Investment Banking (CIB) and to enable Erste to benefit from Santander’s global payments platforms. The transaction is subject to customary closing conditions, including regulatory approvals, such as that of the Polish Financial Supervision Authority (KNF). Completion is expected in the next few months. The abovementioned transaction will hereinafter be referred to as the 'Poland disposal', based on the assumption that it will be completed under the terms described above.

In accordance with IFRS 5 requirements, the business subject to the Poland disposal has been classified as 'non-current assets/liabilities held for sale' and the related results have been reported under 'discontinued operations'. Accordingly:

•In the Group’s consolidated balance sheet, the assets associated with the Poland disposal are classified under the 'non-current assets held for sale' line item and the related liabilities under 'liabilities associated with non-current assets held for sale'. This classification applies solely to the balance sheet as at 30 June 2025 and does not affect balance sheets for prior periods.

•In the statutory income statement, the results associated with the business subject to the Poland disposal are reported under a single line in the consolidated income statement — 'profit/(loss) after tax from discontinued operations' — for results corresponding to both 2025 and 2024. Consequently, the results from the Poland disposal perimeter are excluded line by line from the breakdown of continuing operations in both periods.

However:

•In the underlying income statement, both at the Group and the primary and secondary segment levels (which are presented on an underlying basis only), the results from Poland continue to be reported line by line and disaggregated, as they were in previous quarterly disclosures given the fact that the management of Santander Polska remains unchanged until the Poland disposal is completed. This reporting approach is consistent with the information used internally in management reporting, as well as with other public Group disclosures.

•For the same reason, all management metrics included in this report have been calculated including Poland, i.e. maintaining the same perimeter that existed at the time of the announcement of the Poland disposal. However, if we were to exclude Poland, the Group's main management ratios would not be materially affected.

Additionally, in Q3 2025, Santander announced it has reached an agreement to acquire 100% of TSB Banking Group plc's (TSB) share capital from Banco de Sabadell, S.A. (Sabadell) with a valuation of GBP 2.65 billion (approximately EUR 3.1 billion) in an all-cash transaction. This agreement does not impact the information presented is this report nor is it expected to affect future publications until the transaction is completed. The transaction is subject to the corresponding regulatory approvals.

Finally, after the close of Q3 2025, Santander announced the merger of Openbank and Santander Consumer Finance (SCF) into a single legal entity. This is expected to result in all our European consumer finance businesses progressively operating under the Openbank brand.

|

|

|

|

|

|

|

|

|

| January - September 2025 |

|

3 |

KEY CONSOLIDATED DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE SHEET (EUR million) |

Sep-25 |

Jun-25 |

% |

Sep-25 |

Sep-24 |

% |

Dec-24 |

| Total assets |

1,840,668 |

|

1,815,888 |

|

1.4 |

|

1,840,668 |

|

1,802,259 |

|

2.1 |

|

1,837,081 |

|

| Loans and advances to customers |

1,027,209 |

|

1,010,727 |

|

1.6 |

|

1,027,209 |

|

1,067,419 |

|

(3.8) |

|

1,054,069 |

|

| Customer deposits |

1,026,130 |

|

1,008,229 |

|

1.8 |

|

1,026,130 |

|

1,045,911 |

|

(1.9) |

|

1,055,936 |

|

| Total funds |

1,339,096 |

|

1,307,359 |

|

2.4 |

|

1,339,096 |

|

1,327,308 |

|

0.9 |

|

1,348,422 |

|

| Total equity |

109,914 |

|

108,985 |

|

0.9 |

|

109,914 |

|

105,063 |

|

4.6 |

|

107,327 |

|

|

Note: total funds includes customer deposits, mutual funds, pension funds and managed portfolios.

If we include loans, deposits and funds associated with the Poland disposal, as at 30 September 2025 loans and advances to customers would have been EUR 1,065,294 million; customer deposits EUR 1,077,885 million and total funds EUR 1,398,767 million.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME STATEMENT (EUR million) |

Q3'25 |

Q2'25 |

% |

9M'25 |

9M'24 |

% |

2024 |

| Net interest income |

10,348 |

|

10,590 |

|

(2.3) |

|

31,559 |

|

32,543 |

|

(3.0) |

|

43,787 |

|

| Total income |

14,325 |

|

14,503 |

|

(1.2) |

|

43,507 |

|

43,259 |

|

0.6 |

|

58,380 |

|

|

|

|

|

|

|

|

|

| Net operating income |

8,310 |

|

8,395 |

|

(1.0) |

|

25,128 |

|

24,659 |

|

1.9 |

|

33,231 |

|

|

|

|

|

|

|

|

|

| Profit before tax |

4,657 |

|

4,415 |

|

5.5 |

|

13,761 |

|

13,121 |

|

4.9 |

|

17,347 |

|

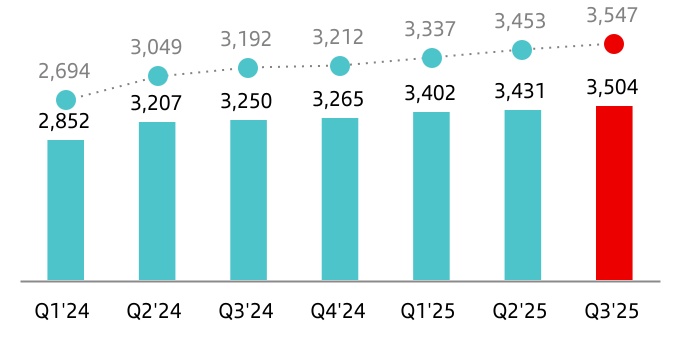

| Profit attributable to the parent |

3,504 |

|

3,431 |

|

2.1 |

|

10,337 |

|

9,309 |

|

11.0 |

|

12,574 |

|

|

|

|

|

|

|

|

|

|

|

Note: net operating income as total income minus operating expenses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPS, PROFITABILITY AND EFFICIENCY (%) 1 |

Q3'25 |

Q2'25 |

% |

9M'25 |

9M'24 |

% |

2024 |

| EPS (euros) |

0.23 |

|

0.22 |

|

2.7 |

|

0.66 |

|

0.57 |

|

16.3 |

|

0.77 |

|

| RoE |

13.8 |

|

13.7 |

|

|

13.7 |

|

12.9 |

|

|

13.0 |

|

| RoTE |

16.9 |

|

16.9 |

|

|

16.8 |

|

16.2 |

|

|

16.3 |

|

| RoTE (post-AT1) |

16.2 |

|

16.2 |

|

|

16.1 |

|

15.4 |

|

|

15.5 |

|

| RoA |

0.85 |

|

0.82 |

|

|

0.83 |

|

0.76 |

|

|

0.76 |

|

| RoRWA |

2.46 |

|

2.37 |

|

|

2.39 |

|

2.15 |

|

|

2.18 |

|

Efficiency ratio 2 |

41.1 |

|

41.2 |

|

|

41.3 |

|

41.7 |

|

|

41.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNDERLYING INCOME STATEMENT 2 (EUR million) |

Q3'25 |

Q2'25 |

% |

9M'25 |

9M'24 |

% |

2024 |

| Net interest income |

11,100 |

|

11,338 |

|

(2.1) |

|

33,816 |

|

34,682 |

|

(2.5) |

|

46,668 |

|

| Total income |

15,267 |

|

15,473 |

|

(1.3) |

|

46,277 |

|

46,185 |

|

0.2 |

|

62,211 |

|

|

|

|

|

|

|

|

|

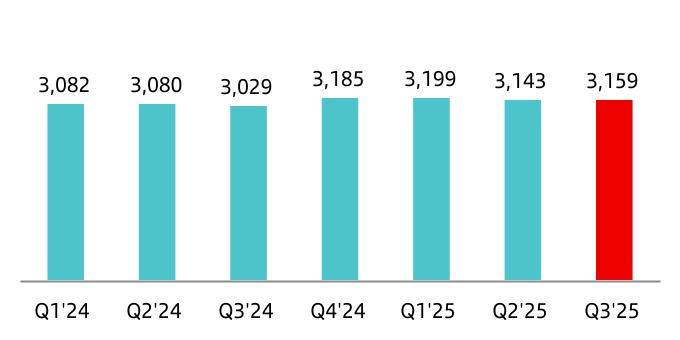

| Net operating income |

8,999 |

|

9,097 |

|

(1.1) |

|

27,144 |

|

26,923 |

|

0.8 |

|

36,177 |

|

|

|

|

|

|

|

|

|

| Profit before tax |

5,197 |

|

5,116 |

|

1.6 |

|

15,500 |

|

14,427 |

|

7.4 |

|

19,027 |

|

| Underlying profit attributable to the parent |

3,504 |

|

3,431 |

|

2.1 |

|

10,337 |

|

9,309 |

|

11.0 |

|

12,574 |

|

| Changes in constant euros: |

|

|

|

|

|

| Q3'25 / Q2'25: NII: -1.6%; Total income: -0.9%; Net operating income: -0.7%; Profit before tax: +2.0%; Attributable profit: +2.7%. |

| 9M'25 / 9M'24: NII: +1.5%; Total income: +4.4%; Net operating income: +5.3%; Profit before tax: +11.7%; Attributable profit: +15.7%. |

|

|

|

|

|

|

|

|

|

4 |

|

January - September 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

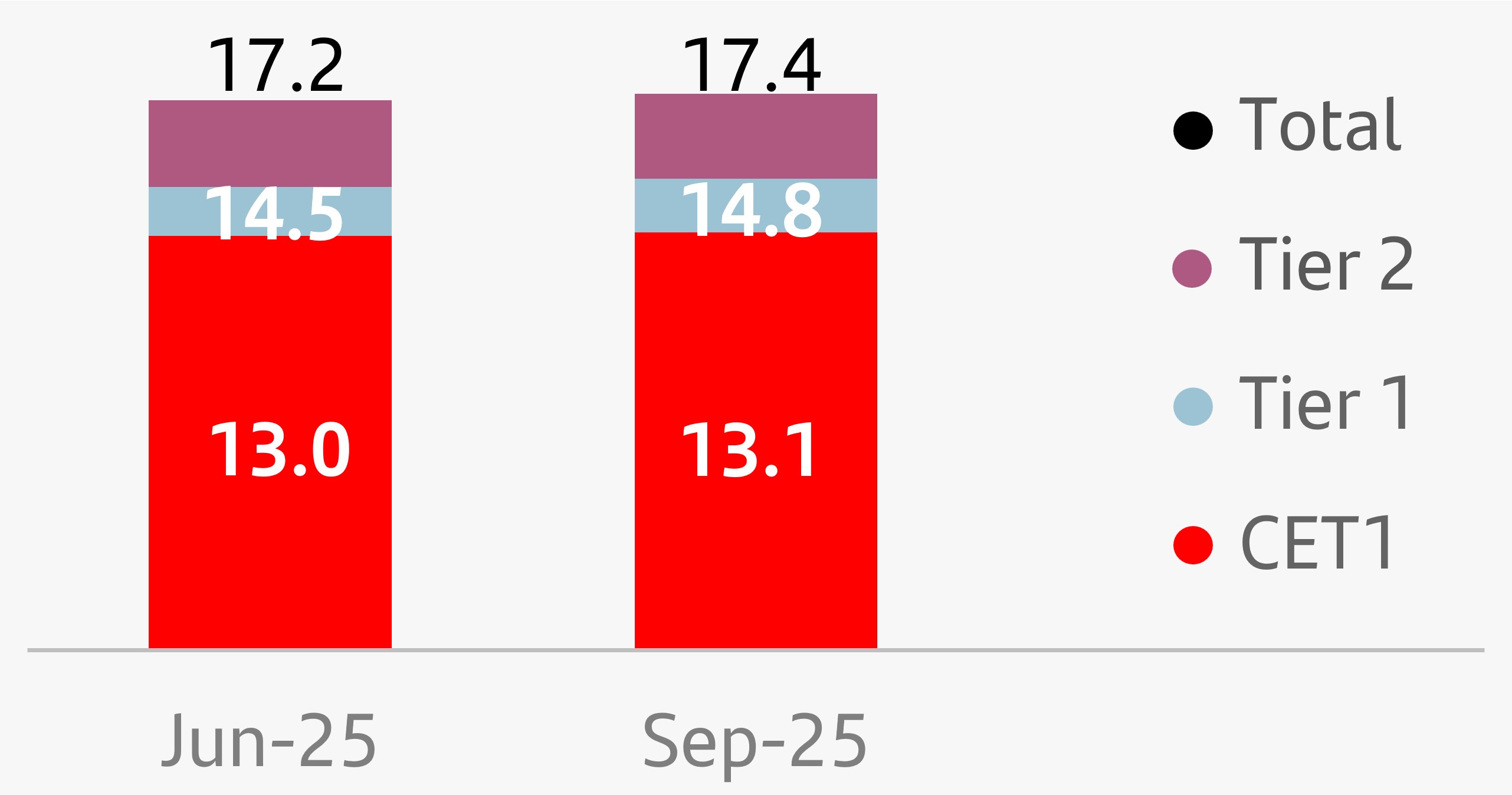

| SOLVENCY (%) |

Sep-25 |

Jun-25 |

|

Sep-25 |

Sep-24 |

|

Dec-24 |

| Phased-in CET1 ratio |

13.1 |

|

13.0 |

|

|

13.1 |

|

12.5 |

|

|

12.8 |

|

| Phased-in total capital ratio |

17.4 |

|

17.2 |

|

|

17.4 |

|

17.1 |

|

|

17.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CREDIT QUALITY (%) 1 |

Sep-25 |

Jun-25 |

|

Sep-25 |

Sep-24 |

|

Dec-24 |

Cost of risk 2, 3 |

1.13 |

|

1.14 |

|

|

1.13 |

|

1.18 |

|

|

1.15 |

|

| NPL ratio |

2.92 |

|

2.91 |

|

|

2.92 |

|

3.06 |

|

|

3.05 |

|

| NPL coverage ratio |

67 |

|

67 |

|

|

67 |

|

64 |

|

|

65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MARKET CAPITALIZATION AND SHARES |

Sep-25 |

Jun-25 |

% |

Sep-25 |

Sep-24 |

% |

Dec-24 |

| Shares (millions) |

14,885 |

|

14,885 |

|

0.0 |

|

14,885 |

|

15,494 |

|

(3.9) |

|

15,152 |

|

| Number of shareholders |

3,520,788 |

|

3,508,261 |

|

0.4 |

|

3,520,788 |

|

3,501,621 |

|

0.5 |

3,485,134 |

|

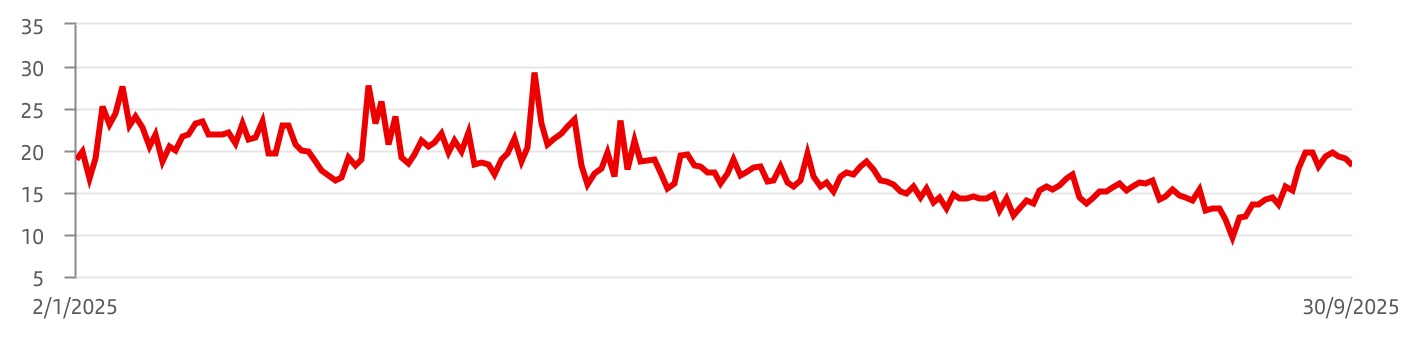

| Share price (euros) |

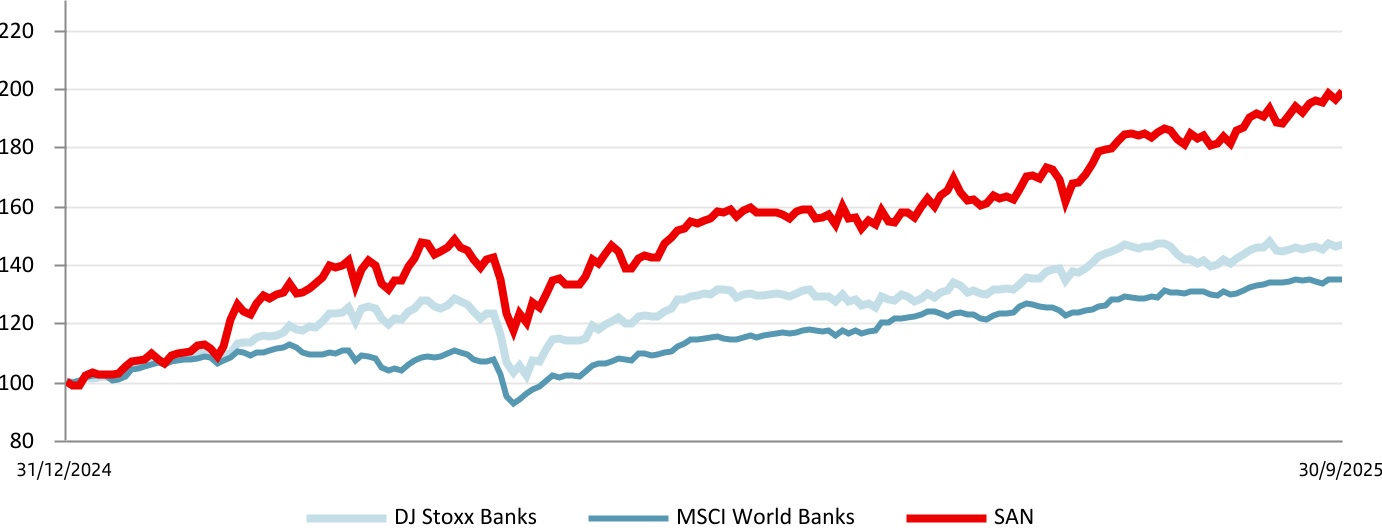

8.874 |

|

7.027 |

|

26.3 |

|

8.874 |

|

4.601 |

|

92.9 |

|

4.465 |

|

| Market capitalization (EUR million) |

132,092 |

|

104,599 |

|

26.3 |

|

132,092 |

|

71,281 |

|

85.3 |

|

67,648 |

|

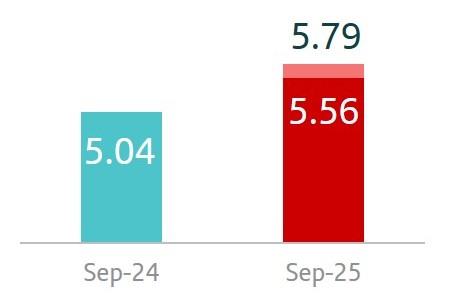

| Tangible book value per share (euros) |

5.56 |

|

5.50 |

|

|

5.56 |

|

5.04 |

|

|

5.24 |

|

| Price / Tangible book value per share (X) |

1.60 |

|

1.28 |

|

|

1.60 |

|

0.91 |

|

|

0.85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSTOMERS (thousands) 4 |

Sep-25 |

Jun-25 |

% |

Sep-25 |

Sep-24 |

% |

Dec-24 |

| Total customers |

178,374 |

|

176,431 |

|

1.1 |

|

178,374 |

|

170,944 |

|

4.3 |

172,537 |

|

| Active customers |

105,528 |

|

104,733 |

|

0.8 |

|

105,528 |

|

102,313 |

|

3.1 |

|

103,262 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Digital customers |

62,258 |

|

61,100 |

|

1.9 |

|

62,258 |

|

57,801 |

|

7.7 |

59,317 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER DATA 4 |

Sep-25 |

Jun-25 |

% |

Sep-25 |

Sep-24 |

% |

Dec-24 |

|

|

|

|

|

|

|

|

| Number of employees |

201,304 |

|

204,330 |

|

(1.5) |

|

201,304 |

|

208,080 |

|

(3.3) |

|

206,753 |

|

| Number of branches |

7,389 |

|

7,683 |

|

(3.8) |

|

7,389 |

|

8,206 |

|

(10.0) |

|

8,086 |

|

|

|

|

|

|

|

|

Note: for Argentina and any grouping which includes it, the variations in constant euros have been calculated considering the Argentine peso exchange rate on the last working day for each of the periods presented. For further information, see the 'Alternative performance measures' section in the appendix to this report. Certain figures contained in this report, have been subject to rounding to enhance their presentation. Accordingly, in certain instances, the sum of the numbers in a column or a row in tables contained in this report may not conform exactly to the total figure given for that column or row.

|

|

|

|

|

|

|

| 1. |

|

| 2. |

In addition to financial information prepared in accordance with International Financial Reporting Standards (IFRS) and derived from our consolidated financial statements, this report contains certain financial measures that constitute alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015, and other non-IFRS measures, including the figures related to “underlying” results, which do not include factors that are outside the ordinary course of our business, or have been reclassified within the underlying income statement. Further details are provided in the ' Alternative performance measures' section of the appendix to this report. For further details on the APMs and non-IFRS measures used, including their definition or a reconciliation between any applicable management indicators and the financial data presented in the annual consolidated financial statements prepared under IFRS, please see our 2024 Annual Financial Report, published in the CNMV on 28 February 2025, our 20-F report for the year ending 31 December 2024 filed with the SEC in the United States on 28 February 2025 as well as the ' Alternative performance measures' section of the appendix to this report.

|

|

|

|

|

| 3. |

Allowances for loan-loss provisions over the last 12 months / Average loans and advances to customers over the last 12 months. |

| 4. |

Customers, employees and branches include Poland. |

|

|

|

|

|

|

|

|

|

|

|

January - September 2025 |

|

5 |

OUR BUSINESS MODEL

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CUSTOMER FOCUS |

Building a digital bank with branches |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

→ We continue to build a digital bank with branches, with a multichannel offering to fulfil all our customers' financial needs. |

|

|

178 mn |

|

106 mn |

|

|

|

total customers |

|

active customers |

|

|

|

|

|

|

|

|

|

|

| SCALE |

Global and in-market scale |

|

|

|

|

|

|

|

|

|

|

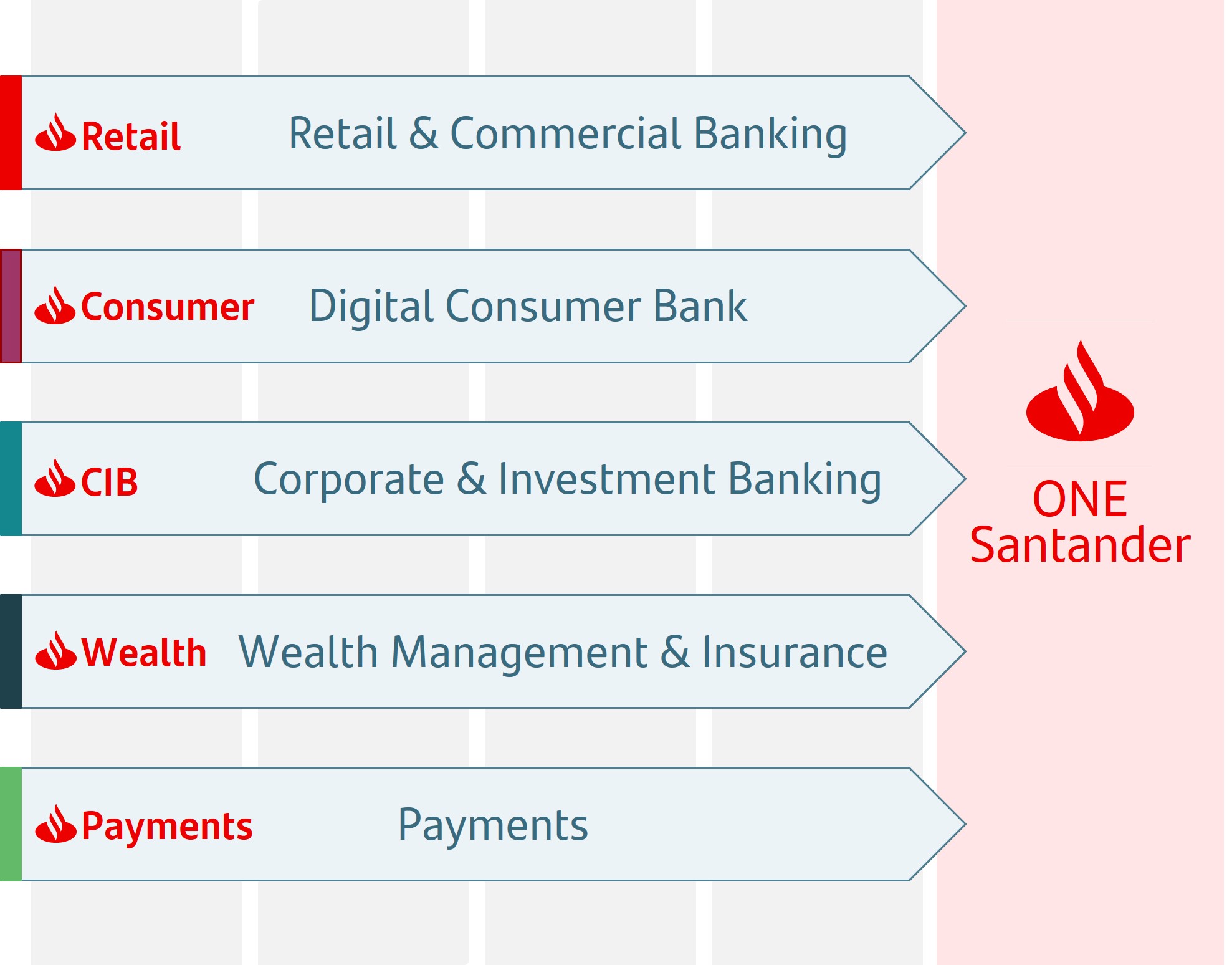

→ Our global and in-market scale helps us to improve our local banks' profitability, adding value and network benefits.

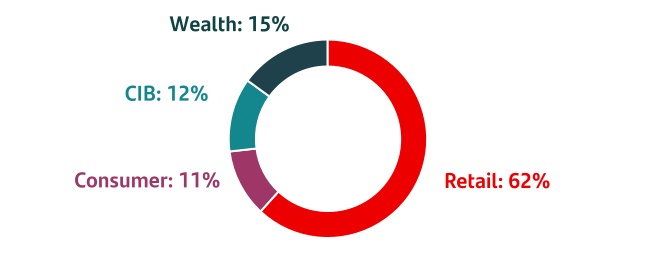

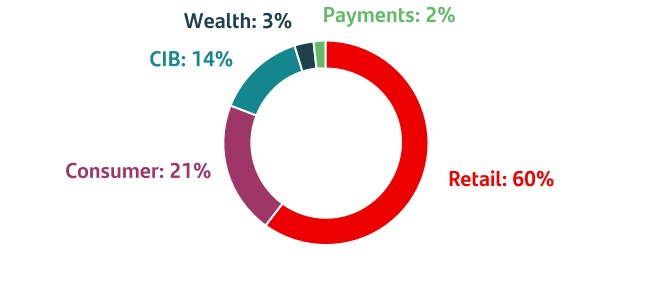

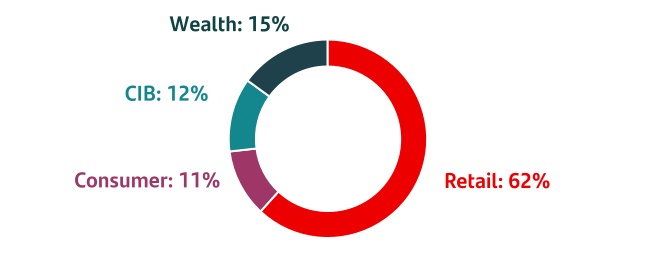

→ Our activities are organized under five global businesses: Retail & Commercial Banking (Retail), Digital Consumer Bank (Consumer), Corporate & Investment Banking (CIB), Wealth Management & Insurance (Wealth) and Payments.

→ Our five global businesses support value creation based on the profitable growth and operational leverage that ONE Santander provides.

|

|

|

|

|

|

|

|

|

|

|

|

| DIVERSIFICATION |

Business, geographical and balance sheet |

|

|

|

|

|

|

|

|

|

→ Well-balanced diversification between businesses and markets with a solid and simple balance sheet that gives us recurrent net operating income with low volatility and more predictable results. |

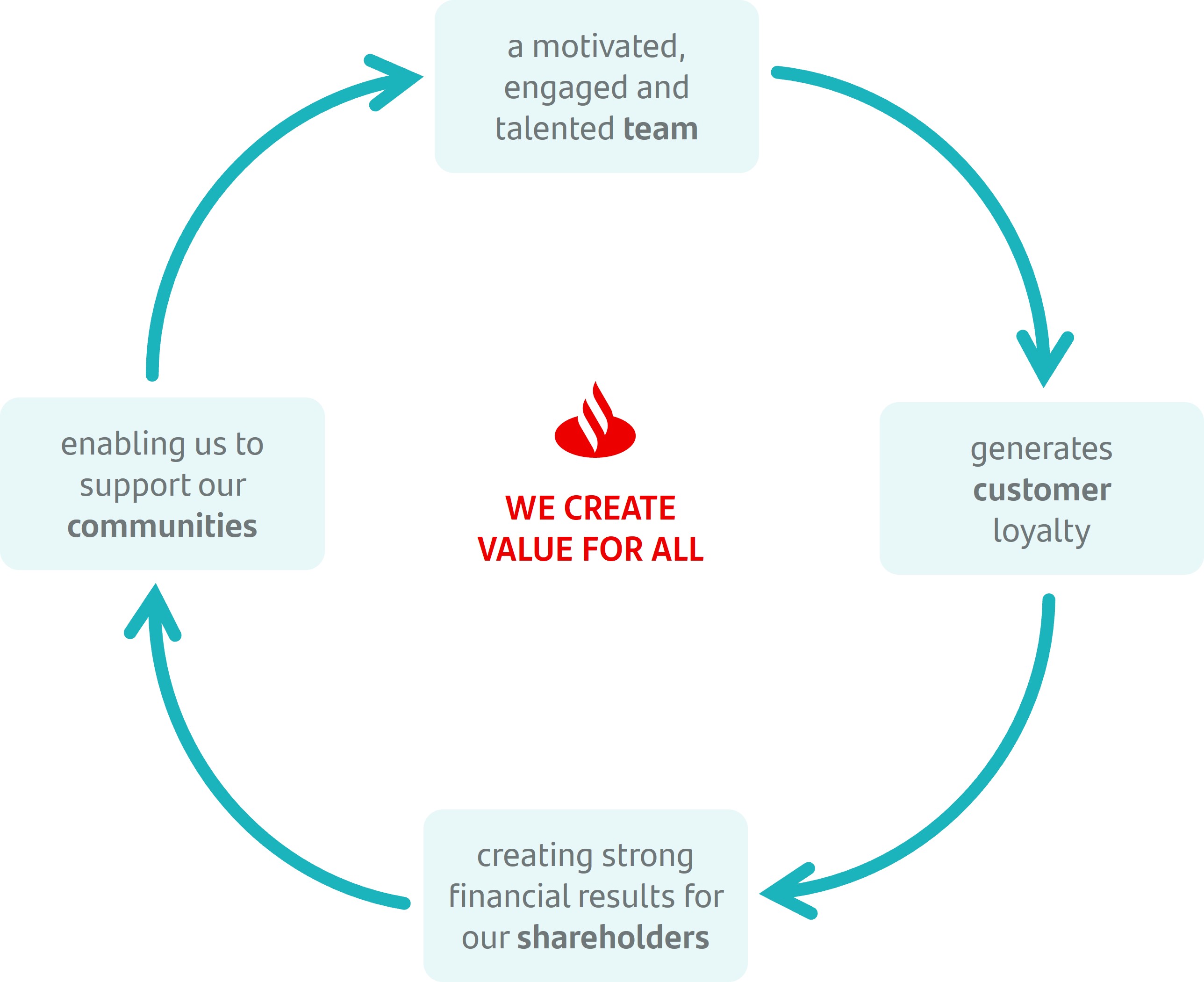

Our corporate culture

The Santander Way remains unchanged to continue to deliver for all our stakeholders.

|

|

|

|

|

|

|

|

|

|

|

|

|

Our purpose |

|

|

|

|

|

|

To help people and businesses prosper |

|

|

|

|

|

Our aim |

|

|

|

|

|

To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities |

|

|

|

|

|

Our how |

|

|

|

|

|

Everything we do should be Simple, Personal and Fair |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

January - September 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Significant events

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General background |

|

|

|

|

|

|

|

|

GROUP FINANCIAL INFORMATION

General background

Grupo Santander's operating environment in Q3 2025 was characterized by a moderate global economic slowdown, with falling interest rates and a decline in inflation across most of our footprint. Labour markets continued to have relatively low unemployment rates across most of our countries. Geopolitical and commercial tensions remained, however though easing slightly compared to previous quarters. We expect the main macroeconomic trends to continue during the rest of the year.

|

|

|

|

|

|

|

|

|

|

|

|

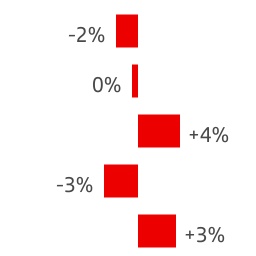

Country |

GDP Change1 |

Economic performance |

|

Eurozone |

+1.5% |

GDP growth slowed in Q2 2025, due to the decline in exports to the US. The labour market was resilient, with unemployment rate at historic lows (6.2% in July). Inflation is close to the 2% target. Since cutting interest rates to 2% in June, the ECB has since held rates, signalling that is comfortable with the current degree of monetary policy easing. |

|

Spain |

+3.1% |

Indicators in Q3 2025 point to solid growth, albeit more moderate in the year as a whole, mainly driven by domestic demand. The labour market remained strong, with the number of people enrolled in social security at record levels, though growth decelerated slightly in Q3 2025. Inflation rebounded year-on-year to 3% in September, driven by energy prices, but we expect a decline over the rest of the year. We expect core inflation (2.4% in September) to fall more gradually due to the stickiness of services prices. |

|

United Kingdom |

+1.2% |

The economy was more resilient than expected in Q2 2025, with growth driven by public spending and inventories. The labour market is stabilizing following the corporate tax hike and minimum wage increase in April, with the unemployment rate at 4.8% in July and stable wage growth, Though it remained elevated at +5% year-on-year. In August, headline inflation stabilized (3.8% in September) and core inflation eased to 3.5%, but both remain elevated. In this context, the Bank of England cut interest rates to 4% in August. |

|

Portugal |

+1.8% |

The economy returned to growth in Q2 2025, driven by private consumption. The labour market remained strong with the unemployment rate falling to 5.9% in August, reflecting full employment, and real wages grew 3.7%. Headline inflation declined to 2.4% in September, boosted by lower prices in the leisure, culture and hospitality component, and core inflation fell to 2.0% amid continued rigidity in service prices. Public finances were solid, with a fiscal surplus, debt reduction and an improved sovereign credit rating. |

|

Poland |

+3.4% |

GDP growth accelerated in Q2 2025 on the back of stronger consumption, although investment declined following a very strong Q1 2025. The labour market, while still solid, is weakening. The unemployment rate rose to 5.6% in September and wage growth slowed to 7.1% in August. Inflation continued to ease, reaching 2.9% in September which led the central bank to cut interest rates to 4.5% in October. |

|

United States |

+2.1% |

Leaving aside the volatility caused by bringing forward imports, the economy slowed down in the first half of the year, although by less than expected. Labour market cooling became more evident, with the unemployment rate at 4.3% in August. Even though inflation remained elevated (3.0% in September), increased risks to employment led the Fed to resume interest rate cuts in September, lowering rates by 25 bps and setting the federal funds target range at 4.0%-4.25%. |

|

Mexico |

0.0% |

The economy surprised to the upside in Q2 2025, with 0.6% quarterly growth, driven by expansion in industry and services. The labour market remained resilient, with low unemployment (2.7%). The annual headline inflation rate was below 4% (3.8% in September) but core inflation remained sticky at 4.3%. The central bank continued to cut the official interest rate, albeit at a more moderate rate, -25 bps per meeting, reaching 7.5% in September. |

|

Brazil |

+2.2% |

The economy slowed in Q2 2025, with weakness in manufacturing and agriculture but strong momentum in mining and services, with the unemployment rate at historic lows (5.6% in August). The annual inflation rate remained elevated (5.2% in September) and medium-term expectations are above target. After raising the interest rate to 15% in June, the central bank held rates in Q3 2025 and reaffirmed the message that rates will remain high for an extended period. |

|

Chile |

+3.1% |

The economy performed well in Q2 2025, boosted by private consumption and especially by investment. Inflation rebounded, with headline inflation up to 4.4% and core inflation to 3.9% in September. Although we expect inflation will converge towards the 3% inflation target in 2026, the central bank expressed concern about the persistence of core inflation. As such, following a 25 bp cut in July to 4.75%, it decided to hold rates in the following months, signalling that it would continue to cautiously move towards the neutral interest rate. |

|

Argentina |

+6.3% |

Economic growth increased year-on-year in Q2 2025, though it decreased slightly in the quarter (-0.1%). Monthly inflation remained around 2%, unaffected by the increased exchange rate volatility in recent months. The central bank adopted a monetary aggregates framework, enabling the policy rate to be determined by market conditions, rather than setting it through monetary policy decisions. |

1.Year-on-year changes for Q2 2025.

|

|

|

|

|

|

|

|

|

January - September 2025 |

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Significant events

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Highlights of the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Highlights of the period: Main figures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3'25 ATTRIBUTABLE PROFIT |

|

|

EUR 3,504 mn |

|

|

|

|

|

|

|

|

+2% in euros |

/Q2'25 |

|

|

+3% in constant euros |

|

|

|

|

|

|

|

|

9M'25 ATTRIBUTABLE PROFIT |

|

|

EUR 10,337 mn |

|

|

|

|

|

|

|

|

+11% in euros |

/9M'24 |

|

|

+16% in constant euros |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RoTE (post-AT1) |

|

|

|

|

|

|

|

|

16.1% |

|

|

+0.7 pp |

/9M'24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VOLUMES AND REVENUE |

|

|

Loan and advances to customers |

Customer

funds |

|

|

+2% |

+7% |

|

|

Net interest income |

Net fee

income |

|

|

+2% |

+8% |

|

|

Note: YoY changes in constant euros and Argentina in current euros. |

|

|

|

|

|

|

|

|

EFFICIENCY |

|

|

41.3% |

|

|

-0.4 pp /9M'24 |

|

|

|

|

|

|

|

|

COST OF RISK |

|

|

1.13% |

|

|

-5 bps /Sep-24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

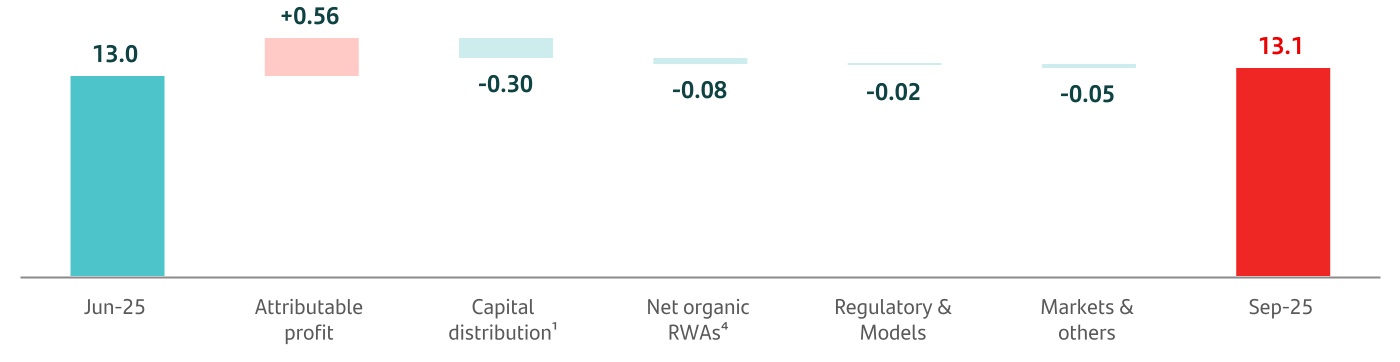

CET11 |

|

|

13.1% |

|

|

+0.1 pp /Jun-25 |

|

uIn Q3 2025, profit attributable to the parent was EUR 3,504 million, a sixth consecutive quarterly record, up 2% compared to Q2 2025. In constant euros, profit rose 3% quarter-on-quarter, despite the impact of Argentina. Excluding it, profit grew 4%, driven by a resilient NII even in a less favourable interest rate environment, solid net fee income and lower provisions, with controlled costs.

uIn 9M 2025, attributable profit increased 11% year-on-year to EUR 10,337 million, also an all-time-high. In constant euros, profit rose 16% backed by solid performances across all revenue lines, especially in net fee income, with costs flat in real terms and better cost of risk.

In addition, the year-on-year comparison was favoured by the charges in Q2 2024 following the discontinuation of the merchant platform in Germany and Superdigital in Latin America.

uStrong profit growth across our global businesses, most of them at or close to double digits year-on-year, supported by the solid increase in revenue.

uThese results in 9M 2025 put us on track to meet our 2025 targets.

uProfitability improved significantly year-on-year with RoTE (post-AT1) increasing 0.7 pp to 16.1% in 9M 2025, compared to 15.4% in the same period of 2024, advancing toward our c.16.5% target for 2025.

uWe continue to record sustained earnings per share growth, increasing 16% year-on-year to EUR 66.1 cents in 9M 2025, boosted by the positive profit trends and the share buybacks executed over the last 12 months.

uIn terms of business volumes, growth of customer funds outpaced loans and advances to customers as we continued to focus on active capital management, disciplined capital allocation and profitable growth.

Gross loans and advances to customers (excluding reverse repos) rose 2% year-on-year in constant euros, supported by increases in all businesses except in Retail, where they were flat.

Customer funds (customer deposits excluding repos plus mutual funds) grew 7% year-on-year in constant euros, increasing across all global businesses, underpinned by a rise in both demand and time deposits, and double-digit growth in mutual funds.

uIn a less favourable environment than initially expected, shaped by geopolitical and trade tensions and lower interest rates, total income was flat year-on-year, remaining on track to meet our target. In constant euros, it was 4% up, underpinned by the solid net interest income performance, which rose 2%, and positive net fee income performance (+8%), boosted by higher customer activity and network benefits in all businesses except in Consumer, which was impacted by new regulation in Germany and weaker trends in new car registrations in Europe, particularly in H1 2025.

uThe structural changes we have implemented to move towards a simpler and more integrated model through ONE Transformation continue to contribute to better costs, efficiency gains and profitable growth. Costs decreased in current euros, in line with our 2025 year-end target. The efficiency ratio improved to 41.3%, the best efficiency ratio we have reported in more than 15 years, with notable improvements in Payments and Wealth.

uCredit quality remains robust, supported by our good risk management and low unemployment levels across our footprint. The NPL ratio improved 14 bps year-on-year to 2.92%. Total loan-loss reserves reached EUR 22,850 million, resulting in an NPL coverage ratio of 67% (+3 pp year-on-year).

uThe Group's cost of risk improved 5 bps year-on-year to 1.13%, in line with our target for 2025. Cost of risk in Retail and Consumer, which accounted for approximately 80% of the Group's net loan-loss provisions, improved to 0.89% and 2.06%, respectively, compared to the same period in 2024.

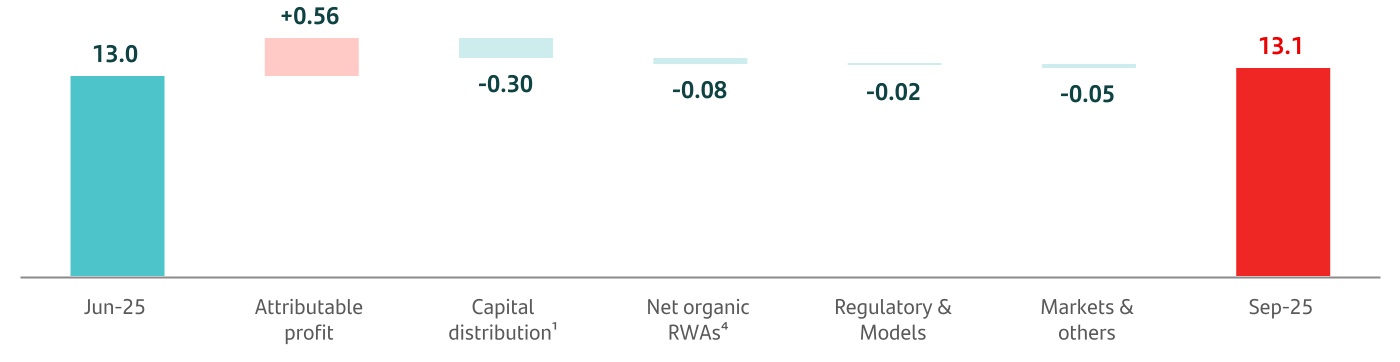

uThe CET1 ratio ended September 2025 at 13.1%, having increased 0.1 pp in the quarter, and is slightly above the top end of our operating range of 12–13% and our 2025 target. A solid contribution from attributable profit growth in the quarter more than offset charges related to capital distributions2, net RWA growth and other negative effects. Profitable growth in RWAs, which are being originated with RoRWAs above back book profitability, is strengthening our future organic capital generation and improving the Group's profitability and value creation.

Note: in this section, results are presented on an underlying basis and loans and advances to customers, customer funds and other metrics include Poland, in line with previously published quarterly information, i.e. maintaining the same perimeter that existed at the time of the announcement of the Poland disposal. For further information, see the '

Significant events in the period' and '

Alternative performance measures' sections in this report.

1.CET1 ratio on a phased-in basis, calculated in accordance with the transitory treatment of the CRR.

2.In line with our current ordinary shareholder remuneration policy of approximately 50% of the Group's reported profit (excluding non-cash, non-capital ratios impact items), divided approximately equally between cash dividends and share buybacks. The implementation of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals.

|

|

|

|

|

|

|

|

|

8 |

|

January - September 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Significant events

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Highlights of the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

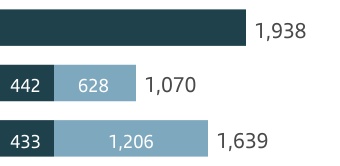

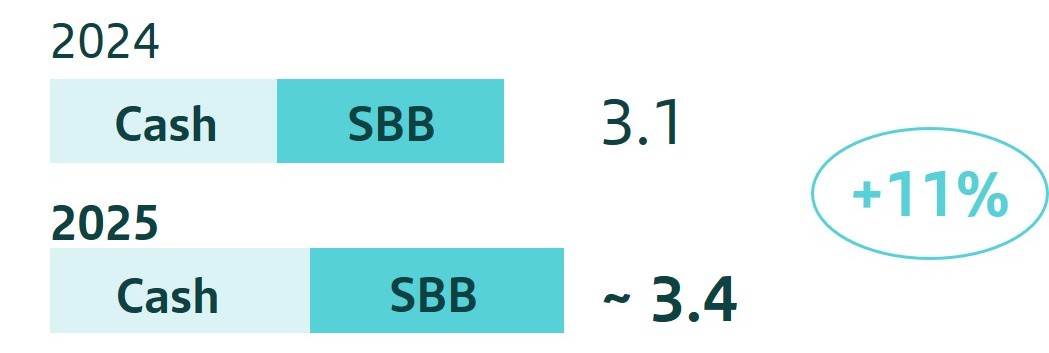

SHAREHOLDER REMUNERATION* |

|

|

EUR billion |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

+15% |

higher than 2024 interim cash dividend |

|

|

*Remuneration based on the results of

the first half of each period |

|

|

|

|

|

|

|

|

TNAVps + CASH DPS |

|

|

|

|

|

|

|

|

n Cash DPS: €22.5 cents |

|

|

+15% |

|

|

|

/ Sep-24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

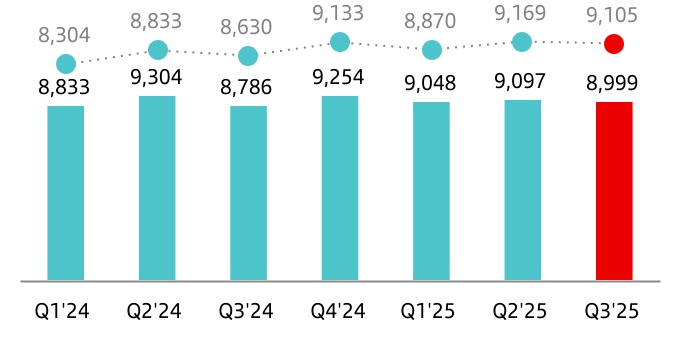

uIn application of the current shareholder remuneration policy, the board of directors approved an interim payment charged against 2025 results, which will be made in two parts:

i)an interim cash dividend against 2025 results of EUR 11.50 cents per share approved by the board of directors on 30 September 2025, equivalent to c.25% of the Group's underlying profit in H1 2025, 15% higher than its 2024 equivalent, which will be paid from 3 November 2025. Including the EUR 11.00 cent dividend per share paid in May 2025, the cash dividend per share paid during 2025 will also be 15% higher than that paid in 2024.

ii)a share buyback programme against 2025 results of up to EUR 1.7 billion, which commenced on 31 July 2025 once the applicable regulatory approval had been obtained, as announced during the Q2 2025 results presentation and in the Inside Information disclosed on 30 July 2025.

This programme puts us on track to reach our goal to distribute at least EUR 10 billion through share buybacks charged against 2025 and 2026 results and against expected capital excess1.

uTotal shareholder remuneration charged against H1 2025 results will be approximately EUR 3,400 million, 11% higher than the remuneration charged against H1 2024 results. The amount is approximately 50% of H1 2025 attributable profit (around 25% through cash dividend payments and around 25% through share buybacks).

uAt the end of the quarter, TNAV per share was EUR 5.56. Including the final cash dividend against 2024 results and the interim cash dividend charged against 2025 results, TNAV per share increased 15% year-on-year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# OF CUSTOMERS (Sep-25) |

|

|

Total customers: |

178 |

mn |

|

|

|

|

|

|

|

Active customers: |

106 |

mn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

uWe continue to implement our global platforms across our businesses. For example, Gravity, our technology which enhances customer experience through digital channels, reduces transaction costs and improves response times, is already fully implemented in Spain, the US and Chile, and we are in the process of rolling it out in Mexico in Q4 2025.

uThese developments, along with other initiatives focused on delivering a great customer experience and improving service quality, enable us to rank in the top 3 for NPS2 in most of our markets and to continue growing the Group’s customer base.

uAs a result, we had 178 million total customers, with a year-on-year increase of more than 7 million, and active customers grew more than 3 million, reaching 106 million.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

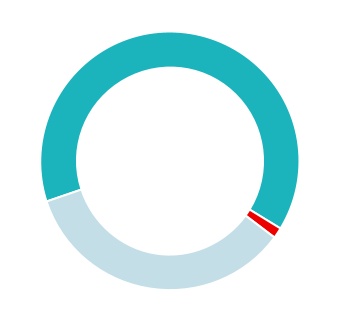

Contribution to Group revenue 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail |

|

50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consumer |

|

21% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIB |

|

14% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wealth |

|

6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments |

|

9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9M 2025 data. Year-on-year changes in constant euros.

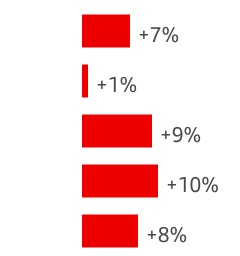

uIn Retail, attributable profit grew 9% to EUR 5,670 million, backed by better net fee income and provisions, with good performance in net interest income and costs declining in real terms.

uThe efficiency ratio stood at 39.2% and cost of risk improved to 0.89%. RoTE (post-AT1) was 17.6%.

uIn Consumer, attributable profit was EUR 1,561 million (+6%), driven by improvements in net interest income, provisions and other results and provisions, which more than offset weaker trends in other revenue and the impact of lower fiscal benefits following reduced electric vehicle demand.

uThe efficiency ratio stood at 40.9%, cost of risk improved to 2.06% and RoTE (post-AT1) was 10.4%.

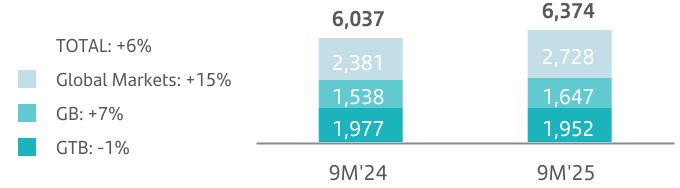

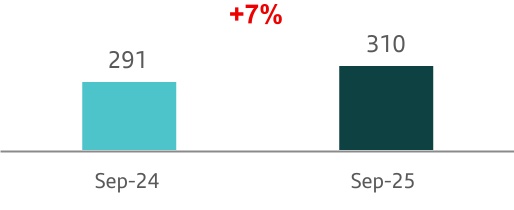

uIn CIB, attributable profit increased double digits to EUR 2,168 million, driven by higher revenue, supported by a rise in net interest income in Global Markets and a higher net fee income across business lines.

uThe efficiency ratio stood at 44.9%. RoTE (post-AT1) improved 2.3 pp to 19.7%.

uIn Wealth, attributable profit amounted to EUR 1,439 million, also rising double-digits, driven by net fee income, the good performance of our joint ventures in Insurance and our Portfolio Investments business.

uThe efficiency ratio improved 1.3 pp to 35.9% and RoTE (post-AT1) was 66.0%.

uIn Payments, attributable profit reached EUR 558 million, boosted by double-digit growth in net interest income and net fee income, with costs falling 1% in real terms, more than offsetting higher provisions in part due to higher activity.

uCost of risk was 7.73%. In PagoNxt, EBITDA margin reached 31.6% (+8.9 pp year-on-year).

1.As previously announced, Santander intends to allocate at least EUR 10 billion to shareholders through share buybacks charged against 2025 and 2026 results and against the expected capital excess. This share buyback target includes i) buybacks that are part of the existing shareholder remuneration policy; and ii) additional buybacks following the publication of annual results to distribute year-end excesses of CET1 capital. The implementation of the shareholder remuneration policy and additional buybacks are subject to future corporate and regulatory decisions and approvals.

2.Net Promoter Score, internal benchmark of individual customers' satisfaction audited by Stiga/Deloitte in H1 2025.

3.As % of total operating areas, excluding the Corporate Centre.

|

|

|

|

|

|

|

|

|

January - September 2025 |

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Significant events

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statutory income statement |

|

|

|

|

|

|

|

|

Grupo Santander results

As a result of the announcement of the Poland disposal and in accordance with IFRS 5 requirements, in the statutory income statement, results associated with the business subject to the Poland disposal are reported under a single line in the consolidated income statement — 'profit/(loss) after tax from discontinued operations' — for results corresponding to both 2025 and 2024. Consequently, the results from the Poland disposal perimeter are excluded line by line from the breakdown of continuing operations in both periods. For further information, see the

'Significant events in the period' section of this report.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Grupo Santander. Summarized income statement |

| EUR million |

|

|

|

|

|

|

|

|

|

|

|

Change |

|

|

Change |

|

Q3'25 |

Q2'25 |

% |

|

9M'25 |

9M'24 |

% |

|

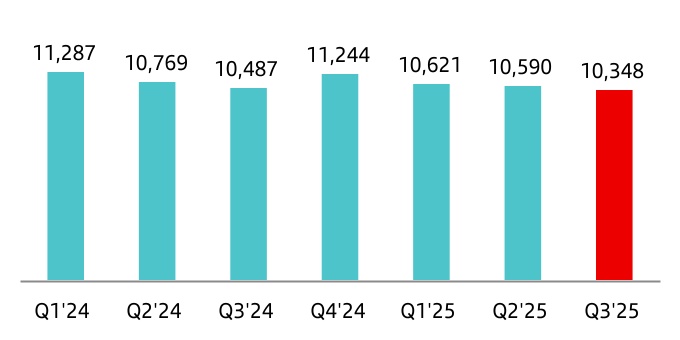

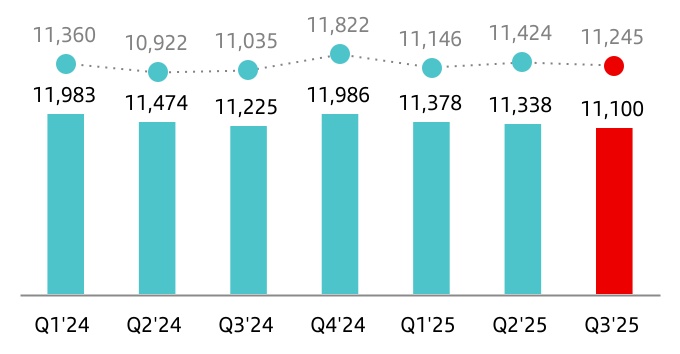

| Net interest income |

10,348 |

|

10,590 |

|

(2.3) |

|

|

31,559 |

|

32,543 |

|

(3.0) |

|

|

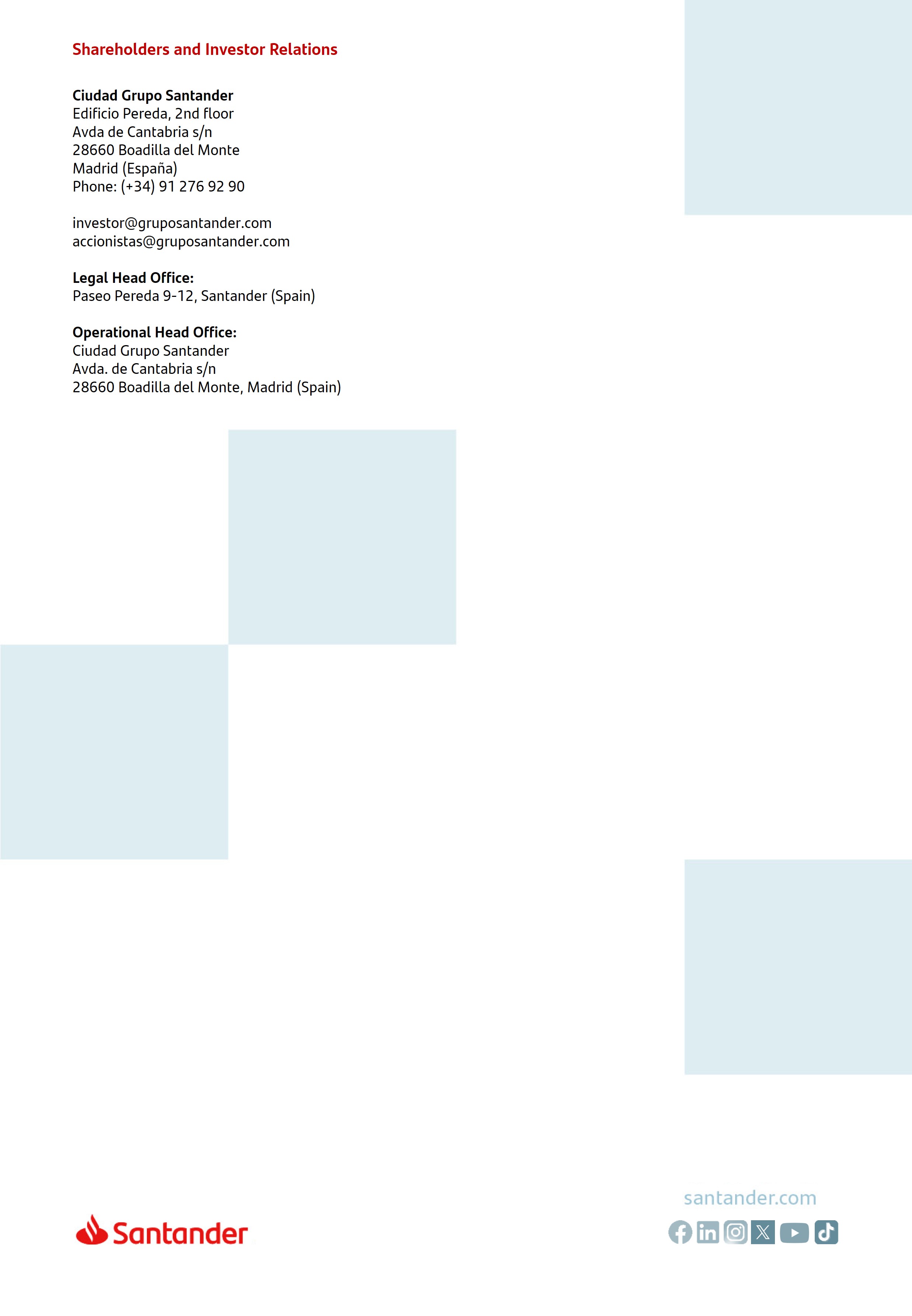

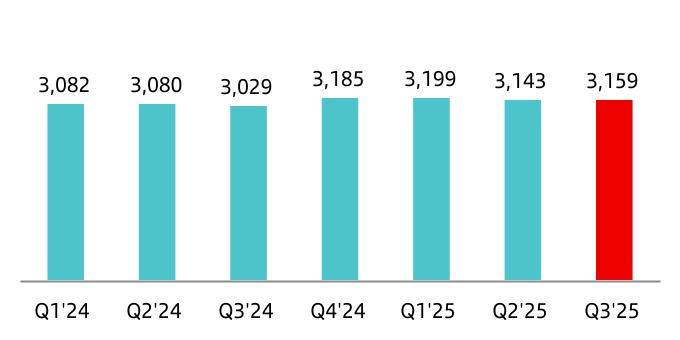

Net fee income1 |

3,159 |

|

3,143 |

|

0.5 |

|

|

9,501 |

|

9,191 |

|

3.4 |

|

|

Gains or losses on financial assets and liabilities and exchange differences2 |

621 |

|

364 |

|

70.6 |

|

|

1,653 |

|

1,444 |

|

14.5 |

|

|

| Dividend income |

88 |

|

383 |

|

(77.0) |

|

|

559 |

|

581 |

|

(3.8) |

|

|

| Share of results of entities accounted for using the equity method |

148 |

|

171 |

|

(13.5) |

|

|

480 |

|

480 |

|

— |

|

|

Other operating income/expenses (net)3 |

(39) |

|

(148) |

|

(73.6) |

|

|

(245) |

|

(980) |

|

(75.0) |

|

|

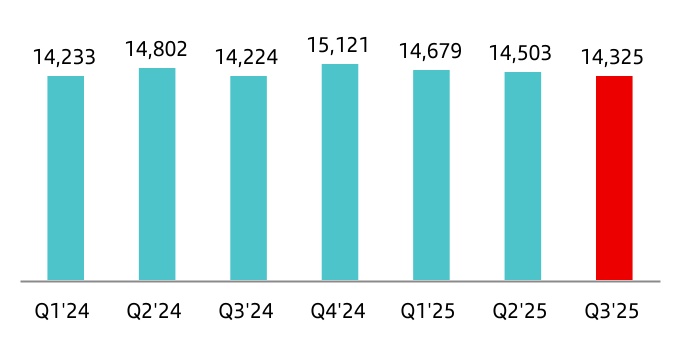

| Total income |

14,325 |

|

14,503 |

|

(1.2) |

|

|

43,507 |

|

43,259 |

|

0.6 |

|

|

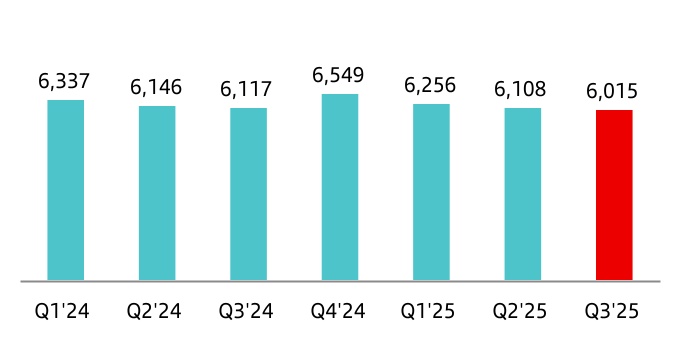

| Operating expenses |

(6,015) |

|

(6,108) |

|

(1.5) |

|

|

(18,379) |

|

(18,600) |

|

(1.2) |

|

|

| Administrative expenses |

(5,219) |

|

(5,304) |

|

(1.6) |

|

|

(15,957) |

|

(16,215) |

|

(1.6) |

|

|

| Staff costs |

(3,322) |

|

(3,320) |

|

0.1 |

|

|

(10,045) |

|

(10,187) |

|

(1.4) |

|

|

| Other general administrative expenses |

(1,897) |

|

(1,984) |

|

(4.4) |

|

|

(5,912) |

|

(6,028) |

|

(1.9) |

|

|

| Depreciation and amortization |

(796) |

|

(804) |

|

(1.0) |

|

|

(2,422) |

|

(2,385) |

|

1.6 |

|

|

| Provisions or reversal of provisions |

(769) |

|

(677) |

|

13.6 |

|

|

(2,019) |

|

(2,292) |

|

(11.9) |

|

|

| Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net) |

(2,848) |

|

(3,447) |

|

(17.4) |

|

|

(9,372) |

|

(9,131) |

|

2.6 |

|

|

|

|

|

|

|

|

|

|

|

| Impairment on other assets (net) |

(41) |

|

(45) |

|

(8.9) |

|

|

(188) |

|

(435) |

|

(56.8) |

|

|

| Gains or losses on non-financial assets and investments, net |

10 |

|

(34) |

|

— |

|

|

(22) |

|

371 |

|

— |

|

|

| Negative goodwill recognized in results |

— |

|

(1) |

|

(100.0) |

|

|

22 |

|

— |

|

— |

|

|

| Gains or losses on non-current assets held for sale not classified as discontinued operations |

(5) |

|

224 |

|

— |

|

|

212 |

|

(51) |

|

— |

|

|

| Profit or loss before tax from continuing operations |

4,657 |

|

4,415 |

|

5.5 |

|

|

13,761 |

|

13,121 |

|

4.9 |

|

|

| Tax expense or income from continuing operations |

(1,193) |

|

(1,043) |

|

14.4 |

|

|

(3,560) |

|

(3,919) |

|

(9.2) |

|

|

| Profit from the period from continuing operations |

3,464 |

|

3,372 |

|

2.7 |

|

|

10,201 |

|

9,202 |

|

10.9 |

|

|

| Profit or loss after tax from discontinued operations |

426 |

|

350 |

|

21.7 |

|

|

1,152 |

|

979 |

|

17.7 |

|

|

| Profit for the period |

3,890 |

|

3,722 |

|

4.5 |

|

|

11,353 |

|

10,181 |

|

11.5 |

|

|

| Profit attributable to non-controlling interests |

(386) |

|

(291) |

|

32.6 |

|

|

(1,016) |

|

(872) |

|

16.5 |

|

|

| Profit attributable to the parent |

3,504 |

|

3,431 |

|

2.1 |

|

|

10,337 |

|

9,309 |

|

11.0 |

|

|

|

|

|

|

|

|

|

|

|

| EPS (euros) |

0.23 |

|

0.22 |

|

2.7 |

|

|

0.66 |

|

0.57 |

|

16.3 |

|

|

| Diluted EPS (euros) |

0.22 |

|

0.22 |

|

2.7 |

|

|

0.66 |

|

0.57 |

|

16.2 |

|

|

|

|

|

|

|

|

|

|

|

| Memorandum items: |

|

|

|

|

|

|

|

|

| Average total assets |

1,833,163 |

|

1,815,203 |

|

1.0 |

|

|

1,834,698 |

|

1,792,871 |

|

2.3 |

|

|

| Average stockholders' equity |

101,598 |

|

99,904 |

|

1.7 |

|

|

101,001 |

|

96,341 |

|

4.8 |

|

|

|

|

|

|

|

|

| Note: the summarized income statement groups some lines of the consolidated statutory income statement on page 91 as follows: |

1.‘Commission income’ and ‘Commission expense’. |

2.‘Gain or losses on financial assets and liabilities not measured at fair value through profit or loss, net’; ‘Gain or losses on financial assets and liabilities held for trading, net’; ‘Gains or losses on non-trading financial assets and liabilities mandatorily at fair value through profit or loss’; ‘Gain or losses on financial assets and liabilities measured at fair value through profit or loss, net’; ‘Gain or losses from hedge accounting, net’; and ‘Exchange differences, net’. |

3.‘Other operating income’; ‘Other operating expenses’; ’Income from insurance and reinsurance contracts’; and ‘Expenses from insurance and reinsurance contracts’. |

|

|

|

|

|

|

|

|

|

10 |

|

January - September 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Significant events

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statutory income statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATUTORY INCOME STATEMENT |

|

|

|

|

|

In accordance with IFRS 5 requirements, results associated with the business subject to the Poland disposal are reported under a single line in the consolidated income statement — 'profit/(loss) after tax from discontinued operations' — for results in both 2025 and 2024. For further information, see the

'Significant events in the period' section of this report.

Results performance compared to 9M 2024

In Q3 2025, profit attributable to the parent totalled EUR 3,504 million, reaching a new quarterly record for the sixth quarter in a row, supported by good performances in our global businesses. In 9M 2025, profit totalled EUR 10,337 million, 11% higher compared to 9M 2024.

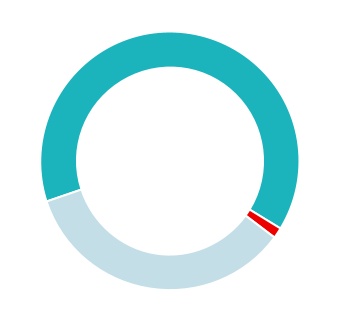

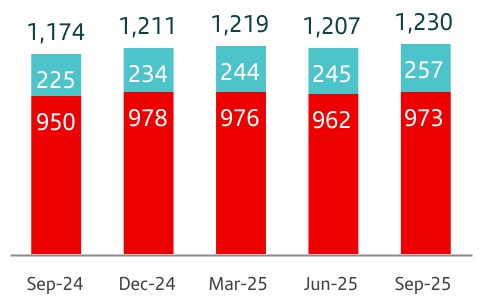

Total income

Total income amounted to EUR 43,507 million, 1% up year-on-year. By line:

•Net interest income (NII) totalled EUR 31,559 million, 3% lower than 9M 2024, mainly due to the impact from the sharp fall in interest rates in Argentina, especially Retail, and a decline in Wealth.

This decrease was partially offset by the good performances in Consumer, driven by active margin management and higher volumes, and in Payments, supported by increased activity levels.

|

|

|

|

|

|

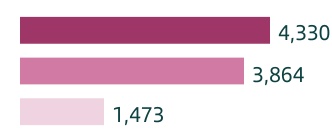

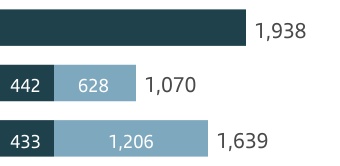

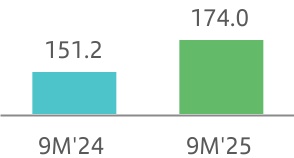

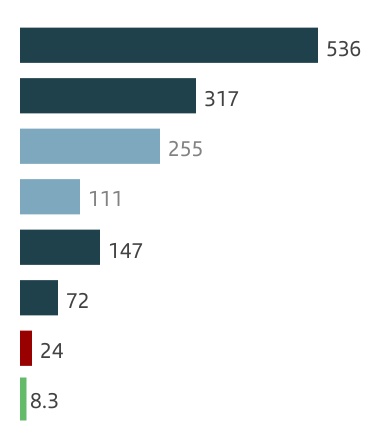

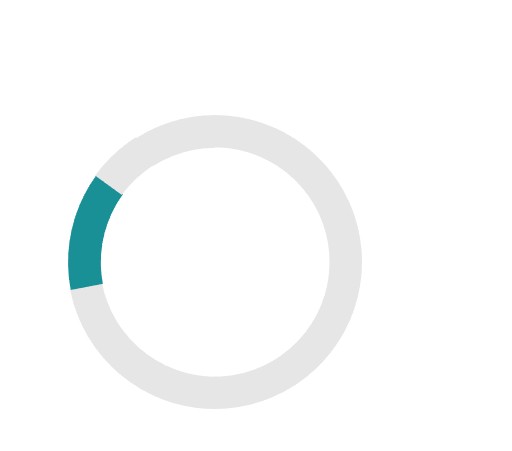

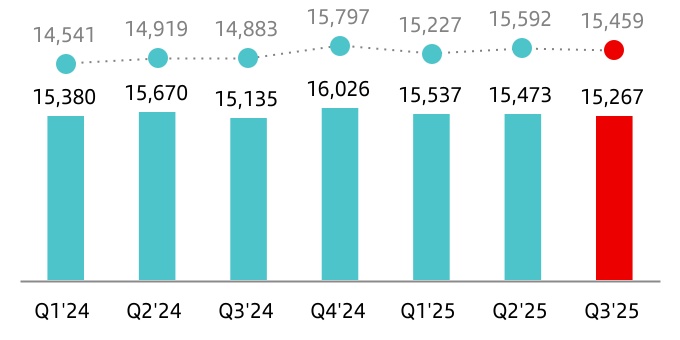

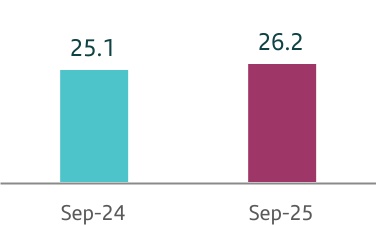

| Net interest income |

| EUR million |

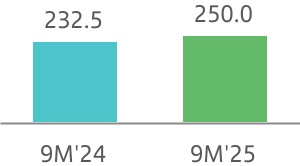

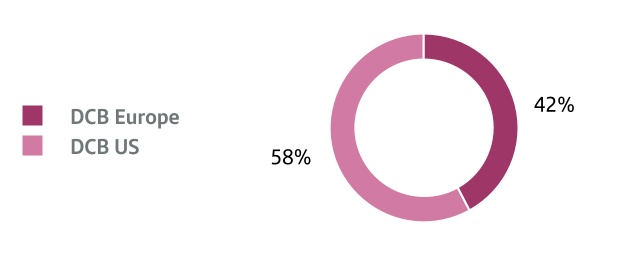

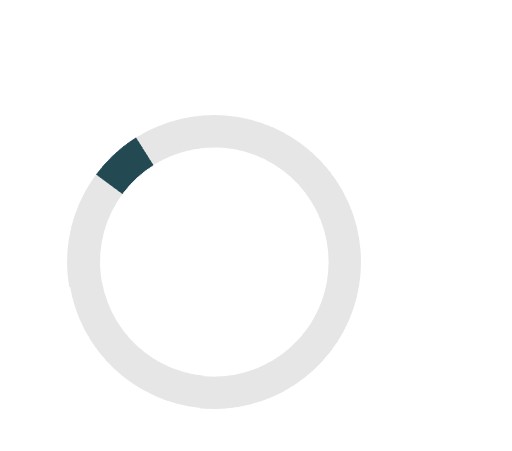

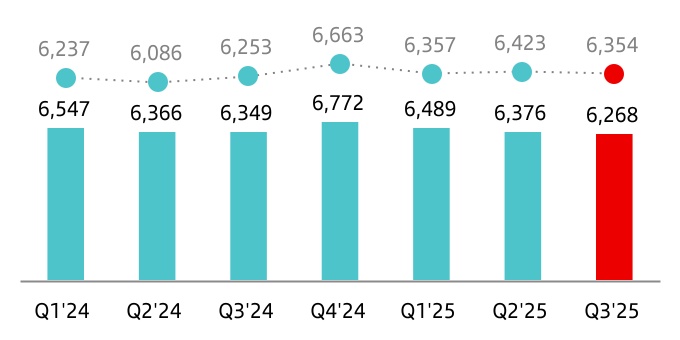

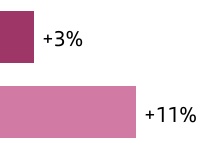

•Net fee income amounted to EUR 9,501 million, up 3% compared to 9M 2024, with solid performances across most global businesses. Notably, there were increases in CIB, mainly driven by Global Banking and Global Transaction Banking, in Wealth, due to strong performances in Private Banking and Santander Asset Management (SAM), and in Payments, due to higher activity levels.

|

|

|

|

|

|

| Net fee income |

| EUR million |

•Gains or losses on financial assets and liabilities and exchange differences reached EUR 1,653 million (EUR 1,444 million in 9M 2024) mainly due to lower impacts from foreign exchange hedges in Corporate Centre and results in Portfolio Investments in Wealth.

•Dividend income was EUR 559 million (EUR 581 million in 9M 2024).

•Income from companies accounted for by the equity method reached EUR 480 million, compared to EUR 480 million in 9M 2024, and mainly included results from Insurance in Wealth and Consumer.

•Other operating income recorded a loss of EUR 245 million, compared to a EUR 980 million loss in 9M 2024, which was impacted by a larger hyperinflation adjustment in Argentina and the temporary levy on revenue earned in Spain, which was recorded in full in Q1 2024 (EUR 335 million), whereas in 9M 2025, the expected tax on income obtained in Spain for the year is accrued under 'Tax expense or income from continuing operations'.

In summary, we saw a resilient performance in total income, reflecting our diversification and global scale, even in the current interest rate environment.

|

|

|

|

|

|

|

|

|

January - September 2025 |

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Significant events

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statutory income statement |

|

|

|

|

|

|

|

|

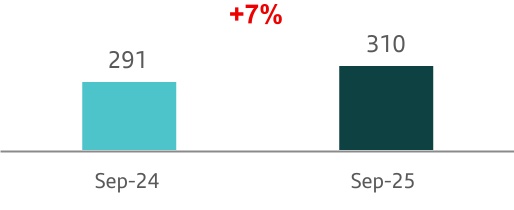

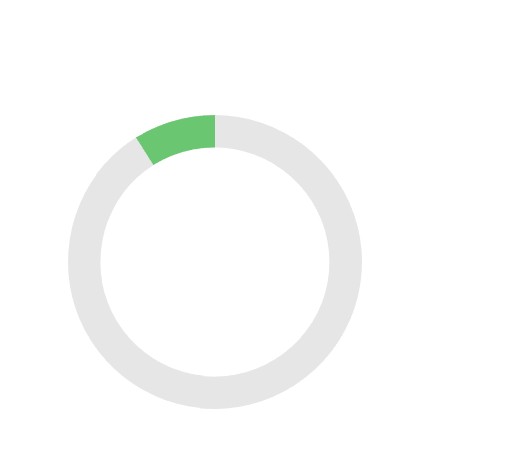

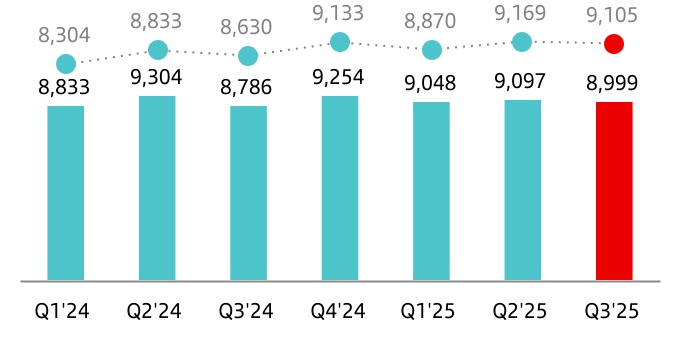

Operating expenses

Operating expenses in 9M 2025 amounted to EUR 18,379 million, 1% lower year-on-year, reflecting our progress in transformation.

Our cost management continued to focus on further improving our structural efficiency and, as a result, we remain one of the most efficient banks in the world.

We continued to drive our business model transformation plan, ONE Transformation, across our footprint, reflected in greater operational leverage and better commercial dynamics.

|

|

|

|

|

|

| Operating expenses |

| EUR million |

Provisions or reversal of provisions

Provisions (net of provisions reversals) amounted to EUR 2,019 million. In 9M 2024, this line totalled EUR 2,292 million, affected by the charge in PagoNxt following the discontinuation of our Superdigital platform in Latin America in Q2 2024.

Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net)

Impairment of financial assets not measured at fair value through profit or loss (net) was EUR 9,372 million and included provisions in Q2 2025 which strengthen the balance sheet after having updated macroeconomic parameters in Brazil’s credit provisioning models. In 9M 2024, the impairment was EUR 9,131 million.

Impairment on other assets (net)

The impairment on other assets (net) was EUR 188 million. In 9M 2024, the impairment on other assets totalled EUR 435 million, including the charges in PagoNxt following the discontinuation of our merchant platform in Germany in Q2 2024.

Gains or losses on non-financial assets and investments (net)

This line recorded a loss of EUR 22 million in 9M 2025. In the same period in 2024, net gains were EUR 371 million, which included a capital gain of EUR 352 million generated upon closing the agreement with Sodexo in Brazil in Q2 2024.

Negative goodwill recognized in results

In 9M 2025, negative goodwill recognized in results was EUR 22 million relating to the acquisition of CrediScotia Financiera from Scotiabank which expands Consumer's presence in Peru. There was no negative goodwill recorded in 9M 2024.

Gains or losses on non-current assets held for sale not classified as discontinued operations

This item, which mainly includes impairments of foreclosed assets, recorded a EUR 212 million gain in 9M 2025 which included a capital gain of EUR 231 million in Q2 2025 from the sale of Santander’s remaining 30.5% stake in CACEIS. In 9M 2024, this line recorded a loss of EUR 51 million.

Profit or loss before tax from continuing operations

Profit before tax was EUR 13,761 million in 9M 2025, up 5% year-on-year, supported by the solid net fee income performance, lower costs, the impact of the full recognition of the temporary levy on revenue earned in Spain in Q1 2024 in the other operating income line and the charge in Q2 2024 following the aforementioned discontinuation of platforms in PagoNxt.

Tax expense or income from continuing operations

Total tax expense in 9M 2025 amounted to EUR 3,560 million which includes EUR 263 million corresponding to the quarterly accrual of the expected tax on income obtained in Spain for the year. In 9M 2024, tax expense was EUR 3,919 million.

Profit or loss after tax from discontinued operations

Profit from discontinued operations totalled EUR 1,152 million in 9M 2025 compared to EUR 979 million in 9M 2024. This line includes the results associated with the Poland disposal, which increased year-on-year driven by a good revenue performance and lower provisions.

Profit attributable to non-controlling interests

Profit attributable to non-controlling interests amounted to EUR 1,016 million in 9M 2025 compared to EUR 872 million in 9M 2024.

Profit attributable to the parent

Profit attributable to the parent rose to a new record of EUR 10,337 million in 9M 2025, compared to EUR 9,309 million in 9M 2024. This 11% increase year-on-year was driven by a strong net fee income increase and better costs and provisions.

|

|

|

|

|

|

|

|

|

12 |

|

January - September 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Significant events

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underlying income statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNDERLYING INCOME STATEMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

→ Sixth consecutive quarter of record profit, boosted by solid performances across our global businesses.

→ We continue to drive profitable growth and solid efficiency, through an execution of ONE Transformation.

→ Risk indicators were robust, supported by good risk management and low unemployment rates.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable profit |

|

RoTE (post-AT1) |

RoRWA |

|

|

|

EUR 10,337 million |

+11% in euros |

|

16.1% |

2.39% |

|

|

|

+16% in constant euros |

|

+0.7 pp |

+0.2 pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: changes vs. 9M 2024. |

|

|

|

|

|

|

|

|

|

|

|

Since Q2 2025, in contrast to the statutory income statement, in the underlying income statement, results obtained in Poland continue to be reported line by line and disaggregated, as they were in previous quarterly disclosures given that the management of Santander Polska remains unchanged until the Poland disposal is completed.

For the same reason, all management metrics included in this report have been calculated including Poland, i.e. maintaining the same perimeter that existed at the time of the announcement of the Poland disposal. For further information, see the '

Significant events in the period' and

'Alternative performance measures' sections in this report.

Results performance compared to 9M 2024

The Group presents, both at the total Group level and for each of the business units, the changes in euros registered in the income statement, as well as variations excluding the exchange rate effect (i.e. in constant euros, except for Argentina and any grouping which includes it), understanding that the latter provide a better analysis of the Group’s management. For further information, see the

'Alternative performance measures' section in this report.

At the Group level, exchange rates had an unfavourable year-on-year impact of 4.2 pp on total income and a favourable impact of 3.7 pp on administrative expenses and amortizations, mainly due to the depreciation of the Brazilian real and the Mexican peso.

To better understand the business trends, we reclassified certain items under some headings of the underlying income statement.

These reclassifications between the statutory and underlying income statements include:

In 9M 2025:

•As previously explained, in the statutory income statement, the results associated with the business subject to the Poland disposal are reported in the 'profit/(loss) after tax from discontinued operations' line.

However, in the underlying income statement, the results from Poland are disaggregated across the corresponding line items as they were in previous quarterly disclosures.

In 9M 2024:

•In the statutory income statement, the results associated with the business subject to the Poland disposal are reported in the 'profit/(loss) after tax from discontinued operations' line.

However, in the underlying income statement, the results from Poland are disaggregated across the corresponding line items as they were in previous quarterly disclosures.

•The temporary levy on revenue earned in Spain amounted to EUR 335 million in Q1 2024, which was reclassified from total income to other gains (losses) and provisions.

•The recognition of provisions to strengthen the balance sheet in Brazil, amounted to EUR 352 million gross in Q2 2024 (EUR 174 million net of tax and non-controlling interests).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summarized underlying income statement (EUR million) |

|

|

|

|

|

|

|

|

|

|

|

|

Change |

|

|

Change |

|

Q3'25 |

Q2'25 |

% |

% excl. FX |

9M'25 |

9M'24 |

% |

% excl. FX |

| Net interest income |

11,100 |

|

11,338 |

|

(2.1) |

(1.6) |

33,816 |

|

34,682 |

|

(2.5) |

1.5 |

| Net fee income |

3,327 |

|

3,315 |

|

0.4 |

0.6 |

10,011 |

|

9,666 |

|

3.6 |

8.4 |

Gains (losses) on financial transactions 1 |

639 |

|

391 |

|

63.4 |

62.9 |

1,708 |

|

1,493 |

|

14.4 |

18.1 |

| Other operating income |

201 |

|

429 |

|

(53.1) |

(52.1) |

742 |

|

344 |

|

115.7 |

115.5 |

| Total income |

15,267 |

|

15,473 |

|

(1.3) |

(0.9) |

46,277 |

|

46,185 |

|

0.2 |

4.4 |

| Administrative expenses and amortizations |

(6,268) |

|

(6,376) |

|

(1.7) |

(1.1) |

(19,133) |

|

(19,262) |

|

(0.7) |

3.0 |

| Net operating income |

8,999 |

|

9,097 |

|

(1.1) |

(0.7) |

27,144 |

|

26,923 |

|

0.8 |

5.3 |

| Net loan-loss provisions |

(2,931) |

|

(3,017) |

|

(2.9) |

(2.6) |

(9,109) |

|

(9,219) |

|

(1.2) |

4.9 |

| Other gains (losses) and provisions |

(871) |

|

(964) |

|

(9.6) |

(9.4) |

(2,535) |

|

(3,277) |

|

(22.6) |

(20.9) |

| Profit before tax |

5,197 |

|

5,116 |

|

1.6 |

2.0 |

15,500 |

|

14,427 |

|

7.4 |

11.7 |

| Tax on profit |

(1,307) |

|

(1,368) |

|

(4.5) |

(4.4) |

(4,121) |

|

(4,246) |

|

(2.9) |

0.7 |

| Profit from continuing operations |

3,890 |

|

3,748 |

|

3.8 |

4.4 |

11,379 |

|

10,181 |

|

11.8 |

16.3 |

| Net profit from discontinued operations |

— |

|

— |

|

— |

— |

— |

|

— |

|

— |

— |

| Consolidated profit |

3,890 |

|

3,748 |

|

3.8 |

4.4 |

11,379 |

|

10,181 |

|

11.8 |

16.3 |

| Non-controlling interests |

(386) |

|

(317) |

|

21.8 |

22.7 |

(1,042) |

|

(872) |

|

19.5 |

22.7 |

| Net capital gains and provisions |

— |

|

— |

|

— |

— |

— |

|

— |

|

— |

— |

| Profit attributable to the parent |

3,504 |

|

3,431 |

|

2.1 |

2.7 |

10,337 |

|

9,309 |

|

11.0 |

15.7 |

Underlying profit attributable to the parent 2 |

3,504 |

|

3,431 |

|

2.1 |

2.7 |

10,337 |

|

9,309 |

|

11.0 |

15.7 |

|

|

|

|

|

|

|

|

|

1. Includes exchange differences.

2. Excludes net capital gains and provisions.

|

|

|

|

|

|

|

|

|

January - September 2025 |

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Significant events

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underlying income statement |

|

|

|

|

|

|

|

|

Additionally, regarding results that fall outside the ordinary course of our business and are therefore excluded from underlying income statement:

In 9M 2025:

•The ‘net capital gains and provisions’ line includes the following two events of the same value but opposite signs:

•A capital gain in Q2 2025 of EUR 231 million from the sale of Santander’s remaining 30.5% stake in CACEIS.

•A one-off charge of EUR 467 million in Q2 2025 (EUR 231 million, net of tax and minority interests), which strengthens the balance sheet after having updated macroeconomic parameters in Brazil’s credit provisioning models, in accordance with IFRS 9 regulations, which resulted in increased provisions, reflecting expectations of a more complex economic environment.

In 9M 2024:

•There were no impacts outside the ordinary course of our business and therefore no amount was recorded under the ‘net capital gains and provisions’ line.

For further information on the reconciliation between the statutory and underlying income statements, see the '

Alternative performance measures' section in this report.

All in all, profit attributable to the parent and underlying profit attributable to the parent were the same, EUR 10,337 million in 9M 2025 and EUR 9,309 million in 9M 2024. This represents an 11% year-on-year increase in euros, +16% in constant euros.

This year-on-year comparison was favoured by the recognition in Q2 2024 of the impacts in PagoNxt following the discontinuation of our merchant platforms in Germany and Superdigital in Latin America.

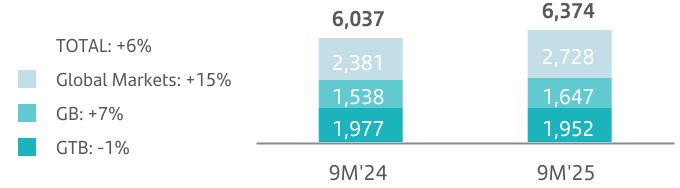

Total income amounted to EUR 46,277 million in 9M 2025, flat compared to 9M 2024. In constant euros, total income rose 4% year-on-year, as follows:

•Net interest income (NII) performed well, with a 2% increase year-on-year despite a less favourable interest rate environment, particularly in Argentina. Excluding Argentina, NII rose 3%. By business:

•In Retail, NII decreased 1%. Excluding Argentina, it rose 1%, due to good performances in Chile (lower cost of deposits), Mexico (volumes and lower cost of deposits) and the UK (higher mortgage lending profitability and lower cost of deposits).

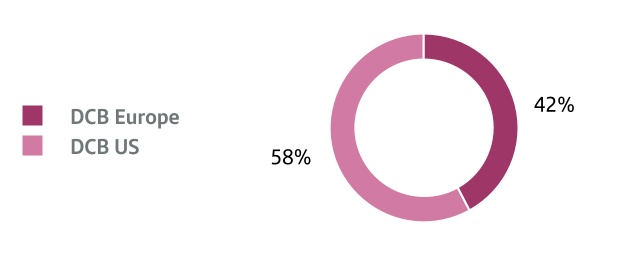

•In Consumer, NII rose 6% supported by our good margin management across our main markets and also by higher volumes in DCB Europe and Latin America in addition to the CrediScotia acquisition in Peru.

•In CIB, NII also increased 7%, even with a negative impact from Argentina. Excluding it, NII grew 16% driven by a strong increase in activity and lower funding costs in Global Markets.

•In Wealth, NII declined 15%, affected by some deposit cost inelasticity to interest rate declines and by the lower yield on assets, despite higher volumes in Private Banking.

•In Payments, NII rose 23%, with doubled-digit growth in both PagoNxt and Cards, boosted by higher activity.

|

|

|

|

|

|

| Net interest income |

| EUR million |

|

constant euros |

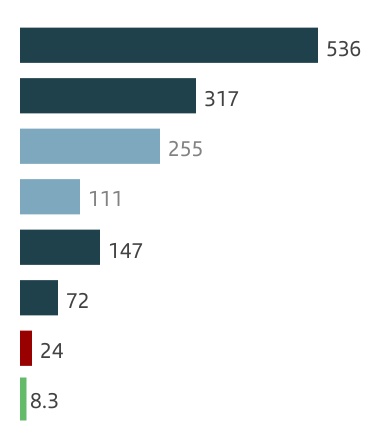

•Net fee income grew 8% year-on-year driven by widespread growth across all businesses, except Consumer. By business:

•In Retail, net fee income increased 5%, supported mainly by mutual funds, foreign exchange fees and insurance.

•In Consumer, net fee income fell 2%, despite strong growth in the US and positive trends across Latin America, mainly due to DCB Europe, which was impacted by new insurance regulation in Germany and weaker trends in new car registrations, especially in H1 2025.

•In CIB, it increased 7%, driven by Global Transaction Banking (GTB) and Global Banking (GB) in the US, boosted by our US Banking Build-Out (US BBO) initiative.

•In Wealth, net fee income rose 19%, with strong growth in Private Banking and SAM driven by solid commercial activity, a positive market performance and our focus on promoting fee-generating products.

•In Payments, net fee income rose 16% boosted by higher activity (both PagoNxt and Cards).

This net fee income growth was higher than our mid- to high-single digit growth target for 2025.

|

|

|

|

|

|

| Net fee income |

| EUR million |

|

constant euros |

•Gains on financial transactions rose 18%, boosted by an increase in the Corporate Centre due to lower impacts from foreign exchange hedges, and better results from the performance of the stakes managed by our Portfolio Investments business line.

|

|

|

|

|

|

|

|

|

14 |

|