| (Mark One) | |||||

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| OR | |||||

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ending 31 December 2023 | |||||

| OR | |||||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| Title of each class | Name of each exchange on which registered | |||||||

| American Depositary Shares, each representing the right to receive one Share of Capital Stock of Banco Santander, S.A., par value euro 0.50 each | SAN | New York Stock Exchange | ||||||

| Shares of Capital Stock of Banco Santander, S.A., par value euro 0.50 each | Not applicable | New York Stock Exchange * |

||||||

| Non-cumulative Preferred Stock Series 6 | SAN PRB | New York Stock Exchange | ||||||

| 4.250% Second Ranking Senior Debt Securities due 2027 | SAN27 | New York Stock Exchange | ||||||

| 3.800% Senior Non Preferred Fixed Rate Notes due 2028 | SAN28 | New York Stock Exchange | ||||||

| 2.706% Senior Preferred Fixed Rate Notes due 2024 | SAN24 | New York Stock Exchange | ||||||

| 3.306% Senior Non Preferred Fixed Rate Notes due 2029 | SAN29 | New York Stock Exchange | ||||||

| 4.379% Senior Non Preferred Fixed Rate Notes due 2028 | SAN28A | New York Stock Exchange | ||||||

| 5.179% Subordinated Debt Securities due 2025 | SAN/25 | New York Stock Exchange | ||||||

| 2.746% Senior Non Preferred Fixed Rate Notes due 2025 | SAN25 | New York Stock Exchange | ||||||

| 3.490% Senior Non Preferred Fixed Rate Notes due 2030 | SAN30 | New York Stock Exchange | ||||||

| 2.749% Tier 2 Subordinated Fixed Rate Notes due 2030 | SAN30A | New York Stock Exchange | ||||||

| 1.849% Senior Non Preferred Fixed Rate Notes due 2026 | SAN26 | New York Stock Exchange | ||||||

| 2.958% Senior Non Preferred Fixed Rate Notes due 2031 | SAN31 | New York Stock Exchange | ||||||

| 4.750% Non-Step-Up Non-Cumulative Contingent Convertible Perpetual Preferred Tier 1 Securities | SANP1 | New York Stock Exchange | ||||||

| 4.125% Non-Step-Up Non-Cumulative Contingent Convertible Perpetual Preferred Tier 1 Securities | SANP2 | New York Stock Exchange | ||||||

| 0.701% Senior Preferred Fixed-to-Fixed Rate Notes due 2024 | SAN24A | New York Stock Exchange | ||||||

| 1.722% Senior Non Preferred Callable Fixed-to-Fixed Rate Notes due 2027 | SAN27A | New York Stock Exchange | ||||||

| 3.225% Tier 2 Subordinated Callable Fixed-to-Fixed Rate Notes due 2032 | SAN32 | New York Stock Exchange | ||||||

| 3.496% Senior Preferred Fixed Rate Notes due 2025 | SAN25A | New York Stock Exchange | ||||||

| 4.175% Senior Non Preferred Fixed-to-Fixed Rate Notes due 2028 | SAN28B | New York Stock Exchange | ||||||

| 3.892% Senior Preferred Fixed Rate Notes due 2024 | SAN24B | New York Stock Exchange | ||||||

| Senior Preferred Floating Rate Notes due 2024 | SAN24C | New York Stock Exchange | ||||||

| 5.147% Senior Non Preferred Fixed Rate Notes due 2025 | SAN25B | New York Stock Exchange | ||||||

| 5.294% Senior Non Preferred Fixed Rate Notes due 2027 | SAN27B | New York Stock Exchange | ||||||

| 6.921% Tier 2 Subordinated Fixed Rate Notes due 2033 | SAN33 | New York Stock Exchange | ||||||

| 5.588% Senior Preferred Fixed Rate Notes due 2028 | SAN28C | New York Stock Exchange | ||||||

| 6.527% Senior Preferred Callable Fixed-to-Fixed Rate Notes due 2027 | SAN27C | New York Stock Exchange | ||||||

| 6.607% Senior Preferred Fixed Rate Notes due 2028 | SAN28D | New York Stock Exchange | ||||||

| 6.938% Senior Preferred Fixed Rate Notes due 2033 | SAN33A | New York Stock Exchange | ||||||

| 9.625% Non-Step-Up Non-Cumulative Contingent Convertible Perpetual Preferred Tier 1 Securities | SANP3 | New York Stock Exchange | ||||||

| 9.625% Non-Step-Up Non-Cumulative Contingent Convertible Perpetual Preferred Tier 1 Securities | SANP4 | New York Stock Exchange | ||||||

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

||||||

U.S. GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other ☐ |

||||||

| Cross-reference to Form 20-F | Consolidated directors' report | Consolidated financial statements | Supplemental information | |||||||||||||||||

Form 20-F Item Number and Caption |

Location |

Page |

|||||||||

Presentation of Financial and Other Information |

|||||||||||

Cautionary Statement Regarding Forward-Looking Statements |

|||||||||||

PART I |

|||||||||||

ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

||||||||||

A. Directors and Senior Management |

Not required for Annual Report on Form 20-F |

- |

|||||||||

B. Advisers |

Not required for Annual Report on Form 20-F |

- |

|||||||||

C. Auditors |

Not required for Annual Report on Form 20-F |

- |

|||||||||

ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

||||||||||

A. Offer Statistics |

Not required for Annual Report on Form 20-F |

- |

|||||||||

B. Method and Expected Timetable |

Not required for Annual Report on Form 20-F |

- |

|||||||||

ITEM 3. |

KEY INFORMATION |

||||||||||

| Selected financial data | |||||||||||

| A. [Reserved] | |||||||||||

B. Capitalization and indebtedness |

Not required for Annual Report on Form 20-F |

- |

|||||||||

C. Reasons for the offer and use of proceeds |

Not required for Annual Report on Form 20-F |

- |

|||||||||

D. Risk factors |

|||||||||||

ITEM 4. |

INFORMATION ON THE COMPANY |

||||||||||

A. History and development of the company |

|||||||||||

Acquisitions, Dispositions, Reorganizations |

|||||||||||

Capital Increases |

|||||||||||

Recent Events |

|||||||||||

B. Business overview |

|||||||||||

Selected Statistical information |

|||||||||||

Competition in Spain |

|||||||||||

Supervision and Regulation |

|||||||||||

C. Organizational structure |

|||||||||||

| D. Property, plants and equipment | |||||||||||

ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

||||||||||

ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

||||||||||

| A. Operating results | |||||||||||

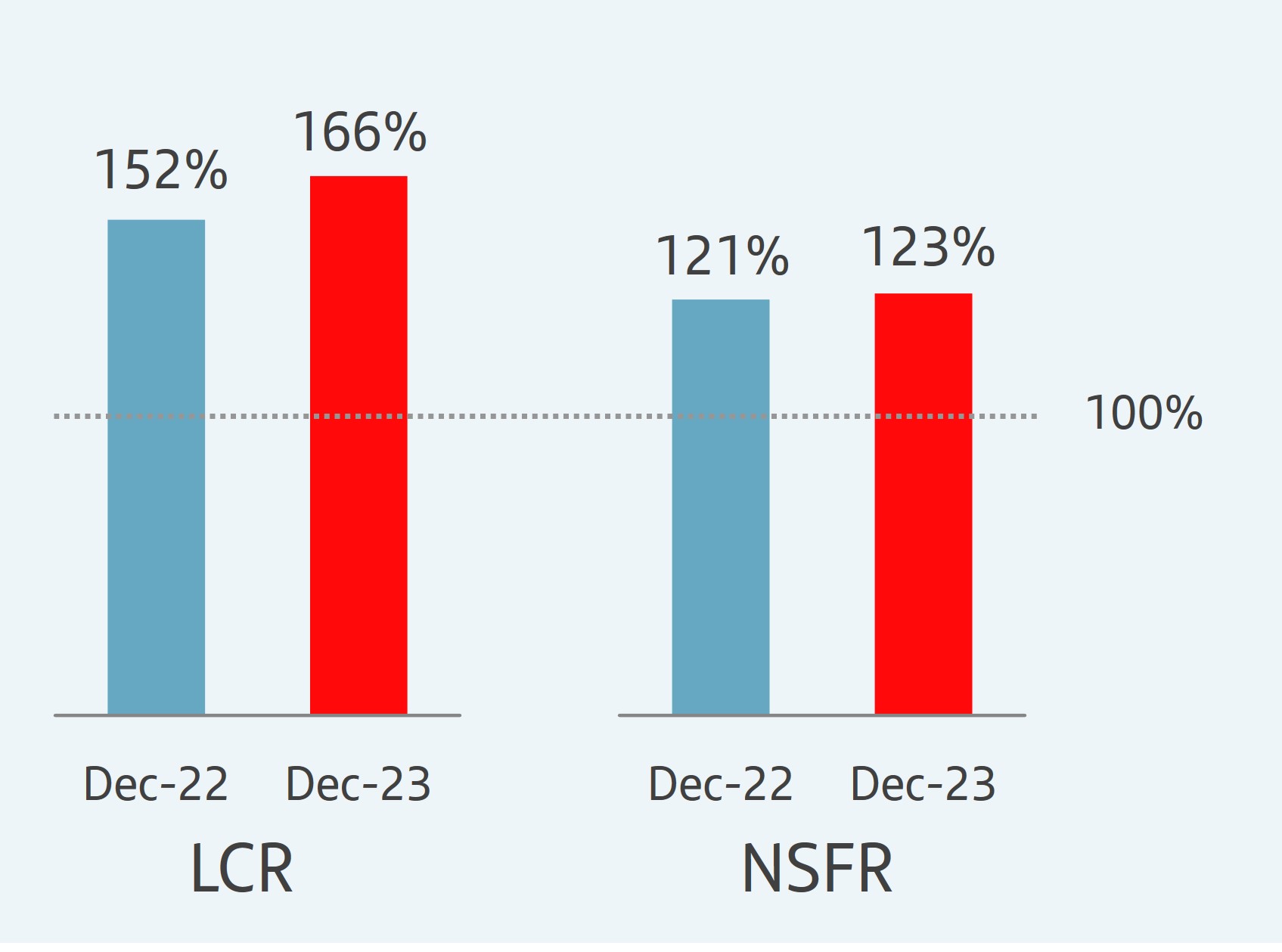

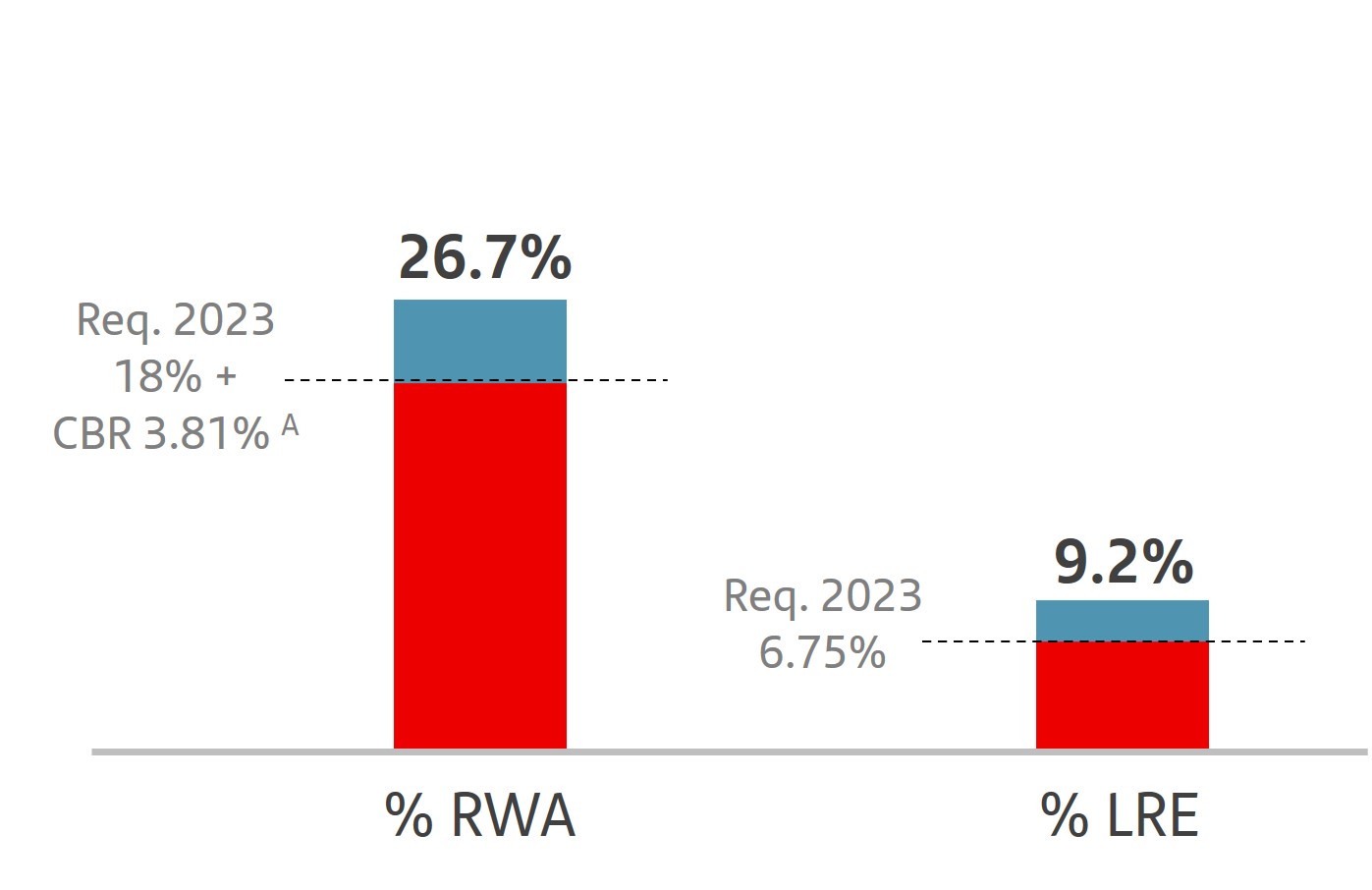

| B. Liquidity and capital resources | |||||||||||

| Tabular disclosure of contractual obligations | |||||||||||

| Off balance sheet arrangements | |||||||||||

| C. Research and development, patents and licenses, etc. | |||||||||||

| D. Trend information | |||||||||||

| Cross-reference to Form 20-F | Consolidated directors' report | Consolidated financial statements | Supplemental information | |||||||||||||||||

Form 20-F Item Number and Caption |

Location |

Page |

|||||||||

| E. Critical accounting estimates | |||||||||||

ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

||||||||||

A. Directors and senior management |

|||||||||||

B. Compensation |

|||||||||||

C. Board practices |

|||||||||||

D. Employees |

|||||||||||

E. Share ownership |

|||||||||||

| F. Disclosure of a registrant's action to recover erroneously awarded compensation | None | ||||||||||

ITEM 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

||||||||||

A. Major shareholders |

|||||||||||

B. Related party transactions |

|||||||||||

C. Interests of experts and counsel |

Not required for Annual Report on Form 20-F |

- |

|||||||||

ITEM 8. |

FINANCIAL INFORMATION |

||||||||||

A. Consolidated statements and other financial information |

|||||||||||

Financial statements |

|||||||||||

Legal proceedings |

|||||||||||

Shareholders remuneration |

|||||||||||

B. Significant Changes |

Not applicable |

- |

|||||||||

ITEM 9. |

THE OFFER AND LISTING |

||||||||||

A. Offer and listing details |

|||||||||||

B. Plan of distribution |

Not required for Annual Report on Form 20-F |

- |

|||||||||

C. Markets |

|||||||||||

D. Selling shareholders |

Not required for Annual Report on Form 20-F |

- |

|||||||||

E. Dilution |

Not required for Annual Report on Form 20-F |

- |

|||||||||

| F. Expenses of the issue | Not required for Annual Report on Form 20-F |

- |

|||||||||

ITEM 10. |

ADDITIONAL INFORMATION |

||||||||||

A. Share capital |

Not required for Annual Report on Form 20-F |

- |

|||||||||

B. Memorandum and articles of association |

|||||||||||

C. Material contracts |

|||||||||||

D. Exchange controls |

|||||||||||

E. Taxation |

|||||||||||

F. Dividends and paying agents |

Not required for Annual Report on Form 20-F |

- |

|||||||||

G. Statement by experts |

Not required for Annual Report on Form 20-F |

- |

|||||||||

H. Documents on display |

|||||||||||

I. Subsidiary information |

Not required for Annual Report on Form 20-F |

- |

|||||||||

| J. Annual report to security holders | Not required for Annual Report on Form 20-F |

- |

|||||||||

| Cross-reference to Form 20-F | Consolidated directors' report | Consolidated financial statements | Supplemental information | |||||||||||||||||

Form 20-F Item Number and Caption |

Location |

Page |

|||||||||

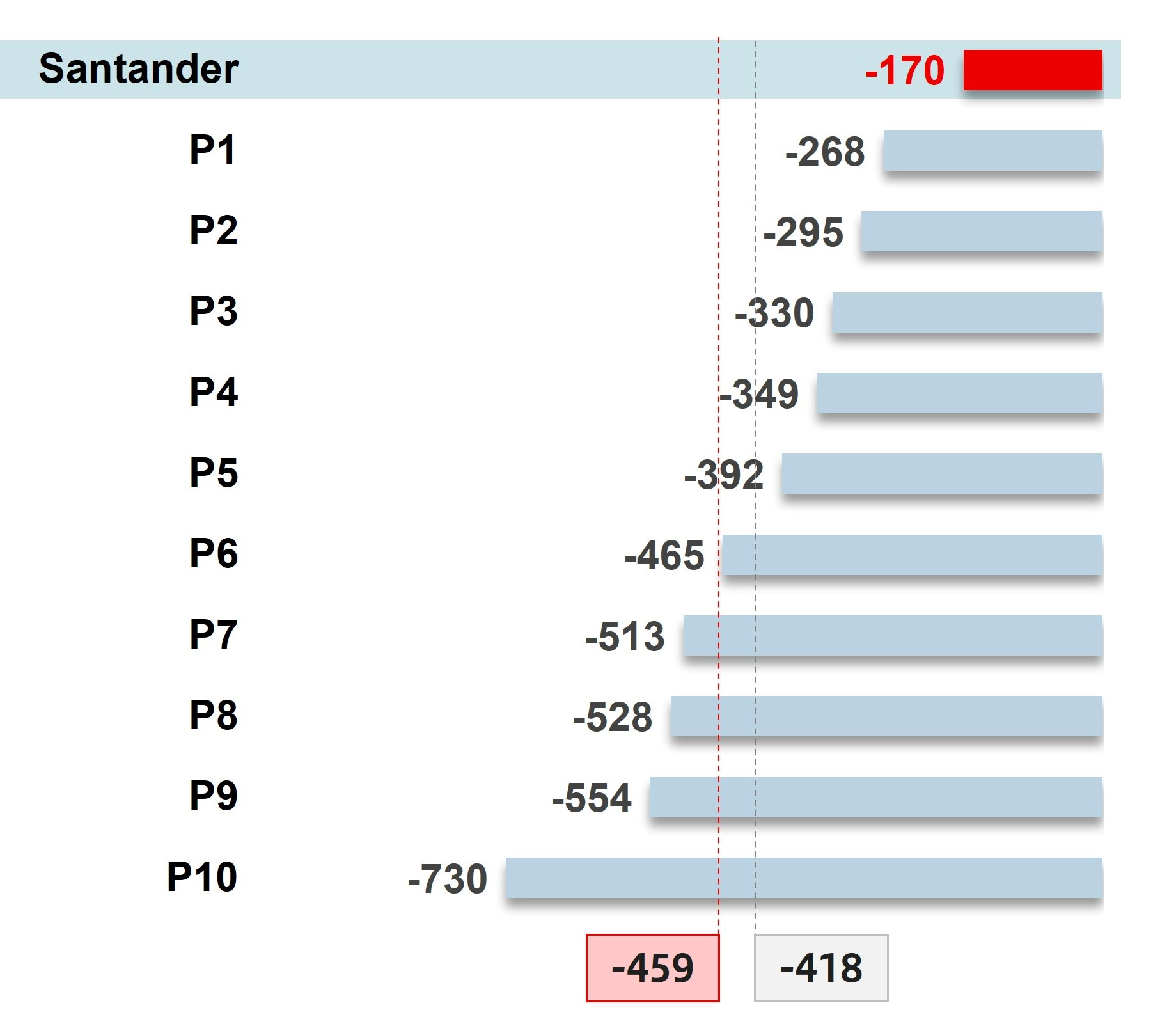

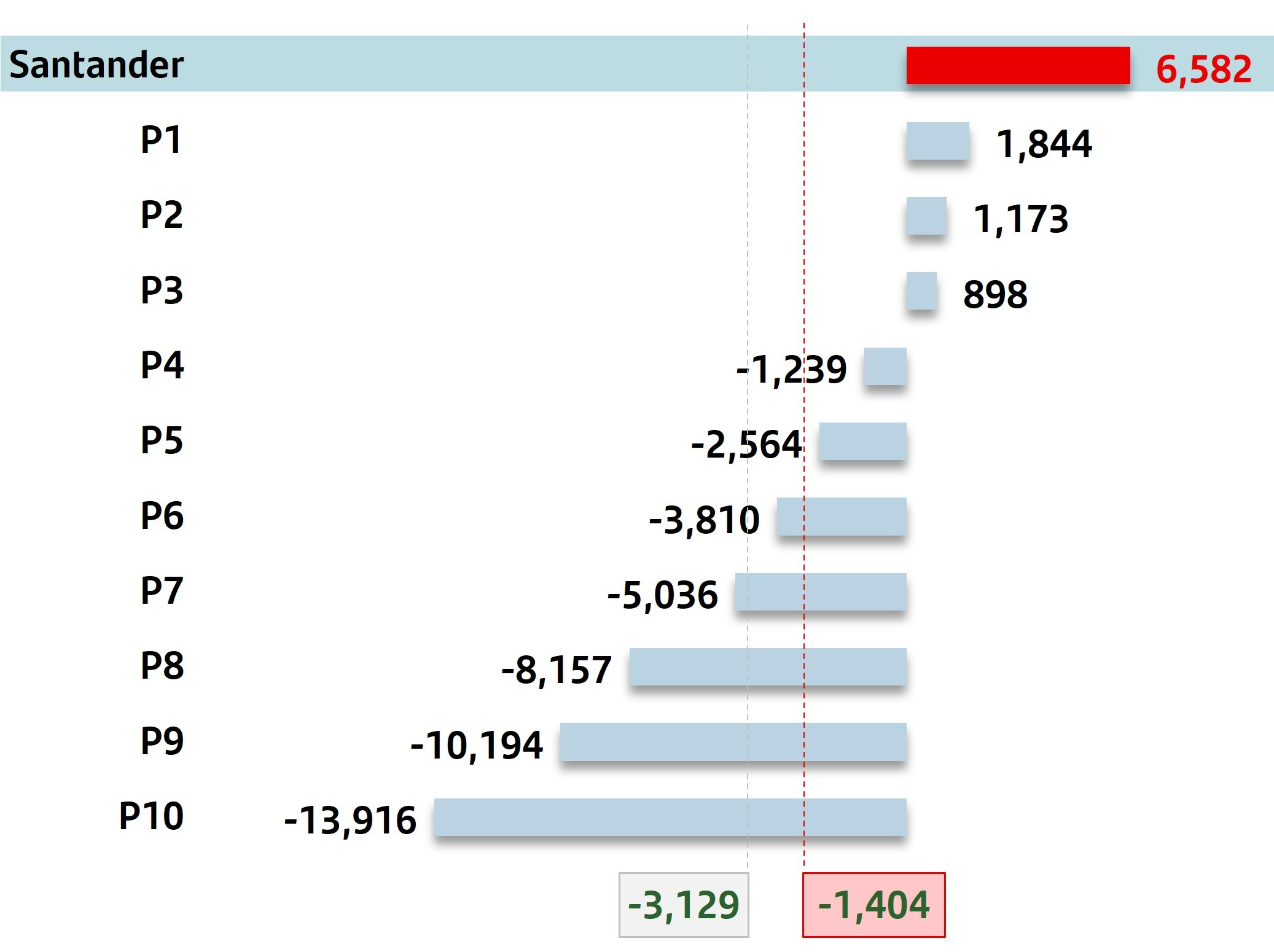

ITEM 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

||||||||||

ITEM 12. |

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

||||||||||

| A. Debt securities | Not required for Annual Report on Form 20-F |

- |

|||||||||

| B. Warrants and rights | Not required for Annual Report on Form 20-F |

- |

|||||||||

| C. Other securities | Not required for Annual Report on Form 20-F |

- |

|||||||||

D. American Depositary Shares |

|||||||||||

PART II |

|||||||||||

ITEM 13. |

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

Not applicable |

- |

||||||||

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

Not applicable |

- |

||||||||

ITEM 15. |

CONTROLS AND PROCEDURES |

||||||||||

ITEM 16 |

[Reserved] |

||||||||||

| A. Audit committee financial expert | |||||||||||

| B. Code of ethics | |||||||||||

| C. Principal accountant fees and services | |||||||||||

| D. Exemptions from the listing standards for audit committees | Not applicable |

- |

|||||||||

| E. Purchases of equity securities by the issuer and affiliated purchasers | |||||||||||

| F. Change in registrant’s certifying accountant | Not applicable |

- |

|||||||||

| G. Corporate governance | |||||||||||

| H. Mine safety disclosure | Not applicable |

- |

|||||||||

| I. Disclosure regarding foreign jurisdictions that prevent inspections | Not applicable | - | |||||||||

| J. Insider trading policies | Not applicable | - | |||||||||

| K. Cybersecurity | |||||||||||

PART III |

|||||||||||

ITEM 17. |

FINANCIAL STATEMENTS |

||||||||||

ITEM 18. |

FINANCIAL STATEMENTS |

||||||||||

ITEM 19 |

EXHIBITS |

||||||||||

| Part 1 | |||||

| Part 2 | |||||

|

2023

Annual report

Unless otherwise specified, references in this annual report to other documents, including but not limited to other reports and websites, including our own, are for information purposes only. If the contents of such other documents and websites refer to this annual report, they are not nor should be considered part of it.

Unless the context suggests otherwise, 'Banco Santander' means Banco Santander, S.A., and 'Santander', 'the Group' and 'Grupo Santander' mean Banco Santander, S.A. and subsidiaries.

|

||||||||

Business model and strategy |

||||||||||||||

| ||||||||||||||

Our purpose

|

Our aim

|

Our how

|

||||||||||||||||||||||||||||||

| To help people and businesses prosper | To be the best open financial services platform by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities |

Everything we do should be

Simple, Personal and Fair

|

||||||||||||||||||||||||||||||

which motivates | ||

|

support for our

communities

| ||

so we deliver | ||

|

An engaged and

talented team

| ||

|

strong financial

results for our

shareholders

| ||

generates | ||

|

customer

loyalty

| ||

leading to | ||

| 2023 | 2022 | |||||||

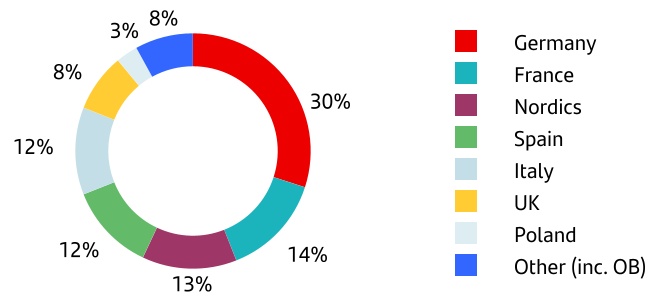

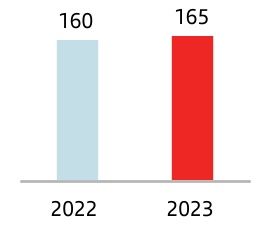

| Total customers (mn) | 165 | 160 | ||||||

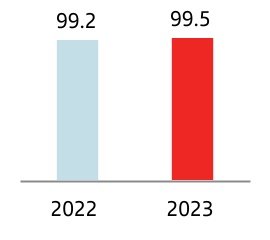

| Active customers (mn) | 100 | 99 | ||||||

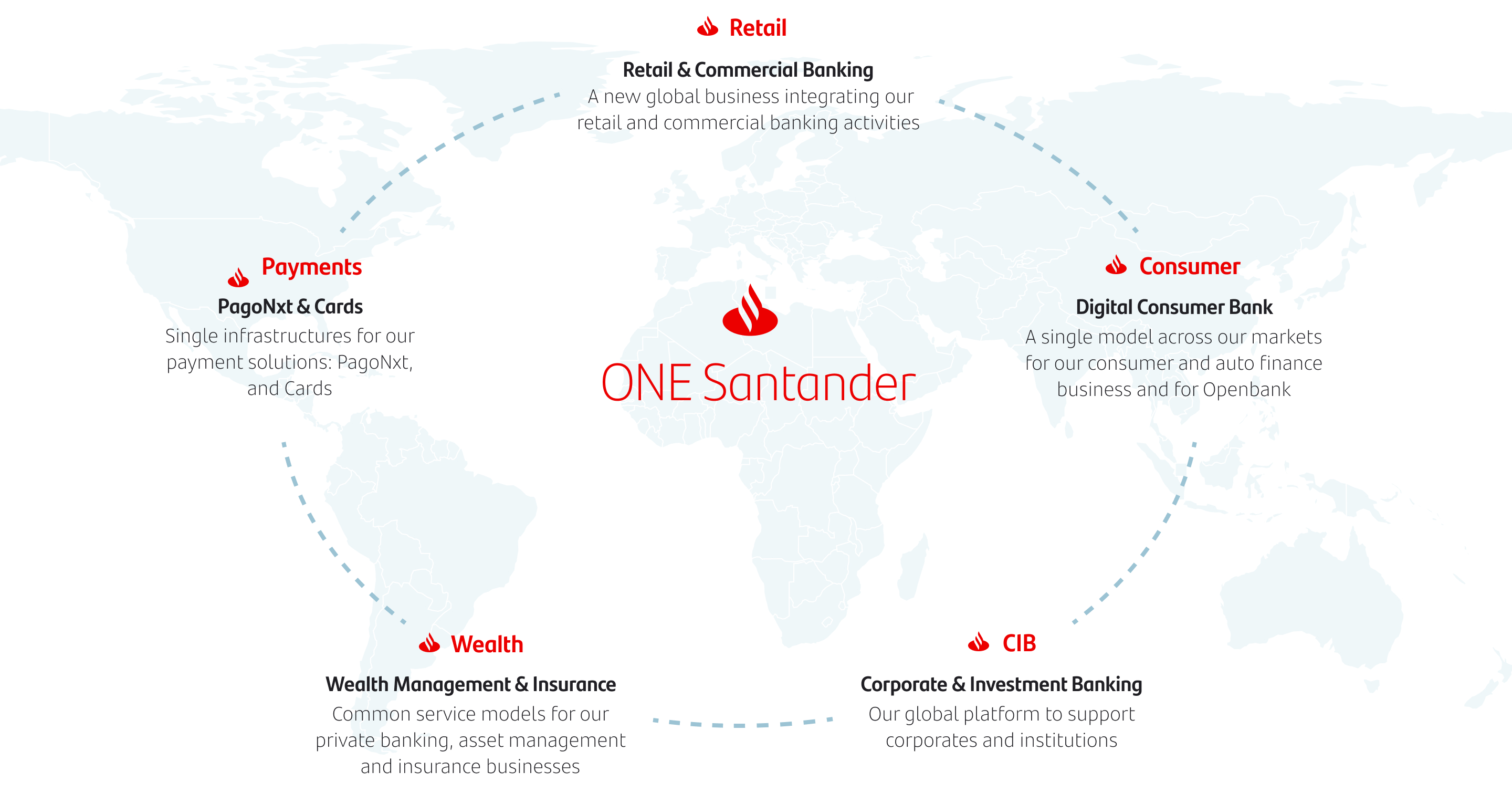

ONE

Santander

|

|||||||||||||||||||||||||||||||||||||||||

| Global businesses |  |

Retail & Commercial Banking |  |

||||||||||||||||||||||||||||||||||||||

|

Digital Consumer Bank |  |

|||||||||||||||||||||||||||||||||||||||

|

Corporate & Investment Banking |  |

|||||||||||||||||||||||||||||||||||||||

|

Wealth Management & Insurance |  |

|||||||||||||||||||||||||||||||||||||||

|

Payments |  |

|||||||||||||||||||||||||||||||||||||||

|

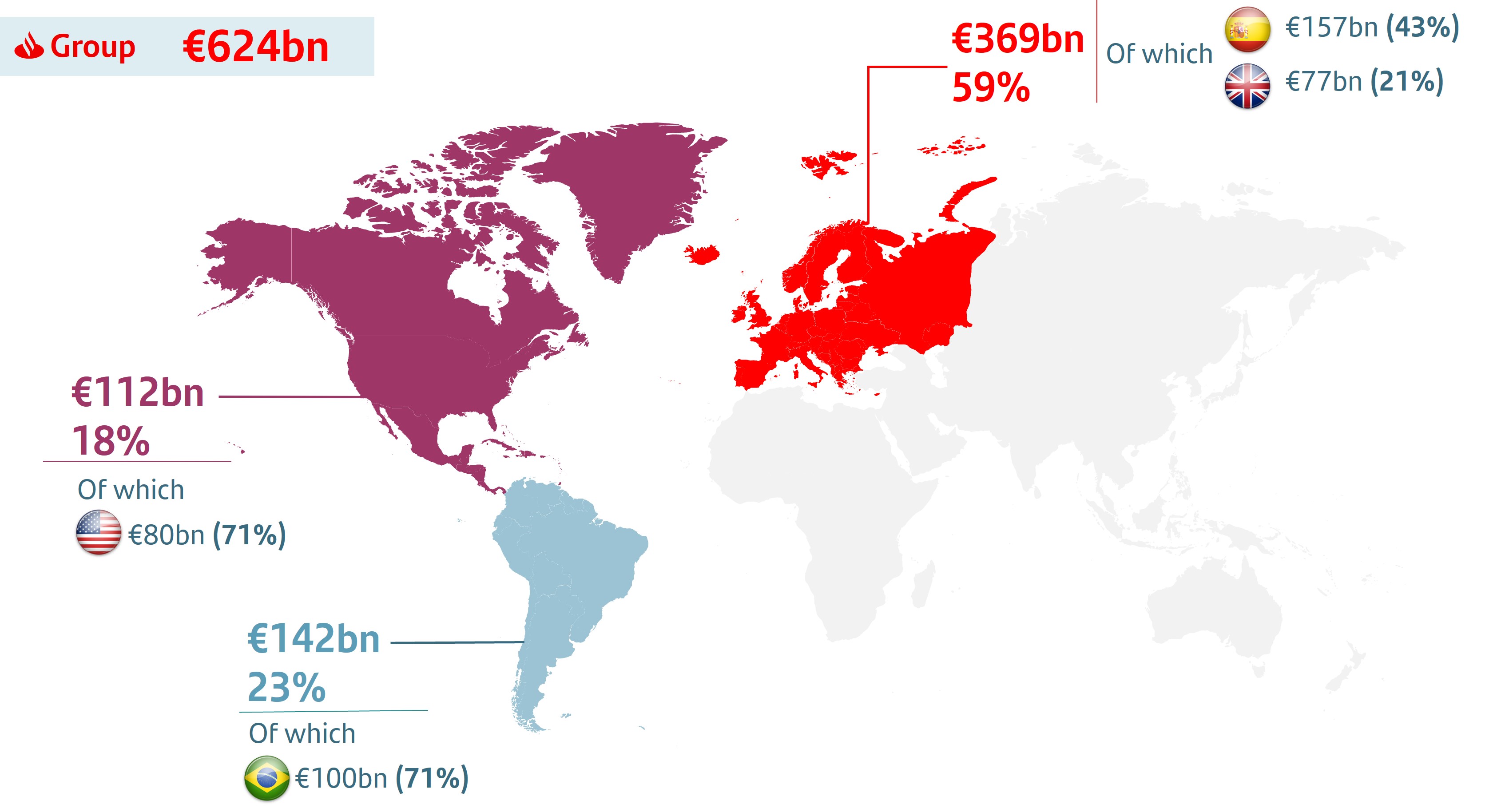

Europe

|

North America

|

South America

|

DCB Europe

|

||||||||||||||||||||||||||||||||||||||

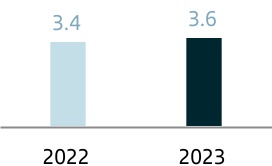

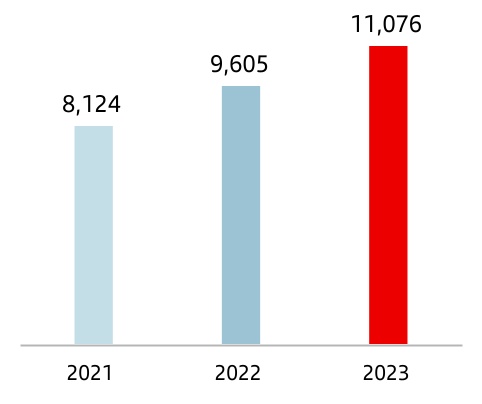

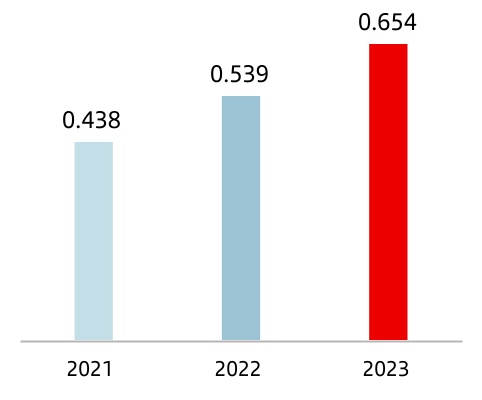

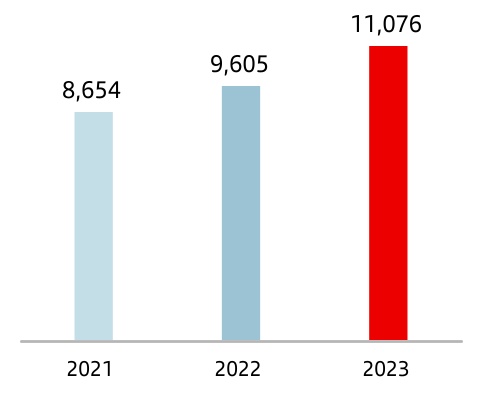

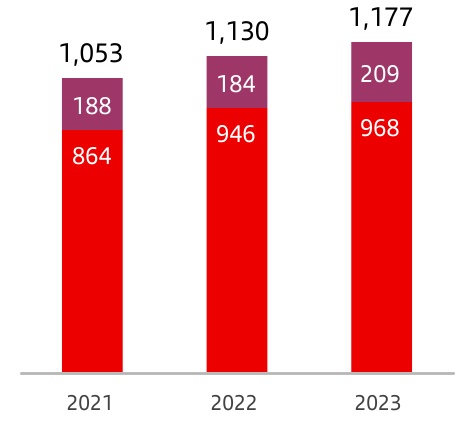

| Group net operating income (pre-provision profit) | ||

| EUR billion | ||

|

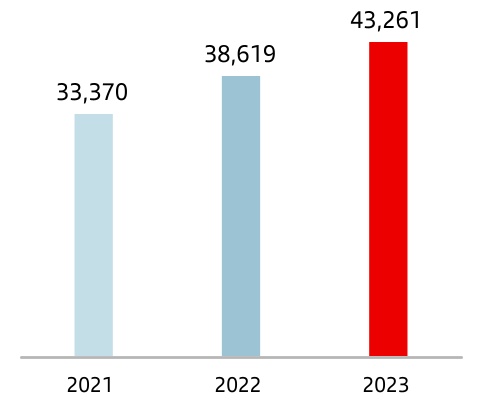

→Record results with 5mn new customers YoY contributing to double-digit revenue growth

→First year of ONE Transformation driving profitable growth and structural efficiency improvement

→Strong balance sheet, with solid credit quality metrics and a higher capital ratio

→Delivering double-digit value creation and higher shareholder remuneration

| ||

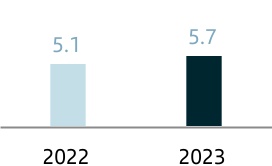

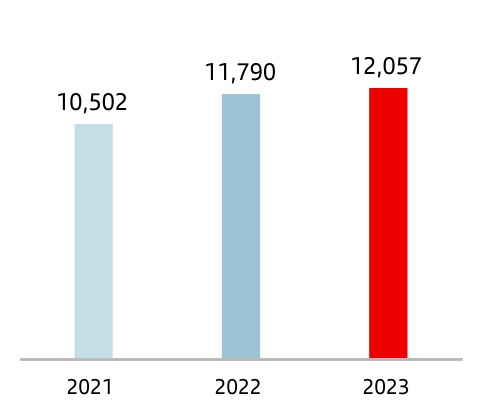

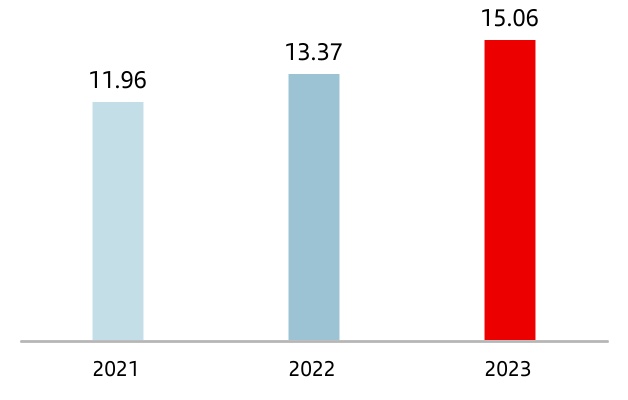

| FY’23 Attributable Profit | FY’23 Revenue | |||||||

|

€11.1bn

+15%

|

€58bn

+11%

|

|||||||

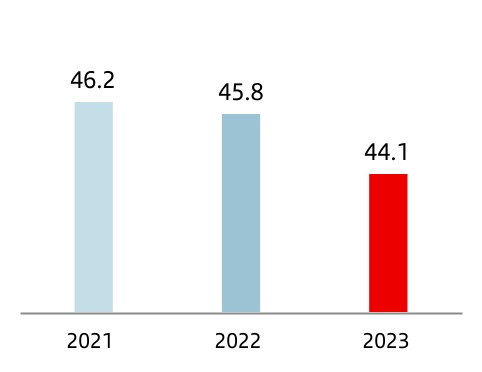

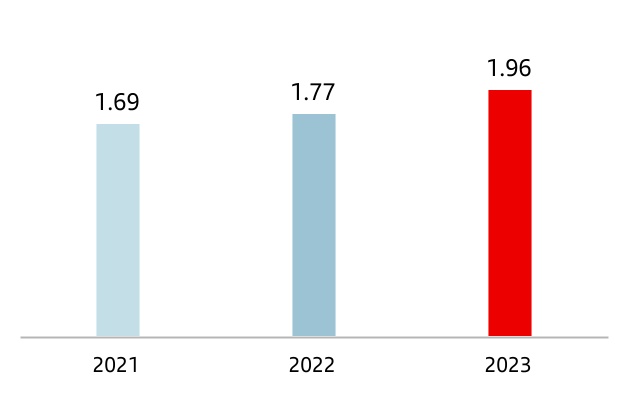

| Cost-to-income | RoTE | |||||||

|

44.1%

–173bps

|

15.1%

+169bps

|

|||||||

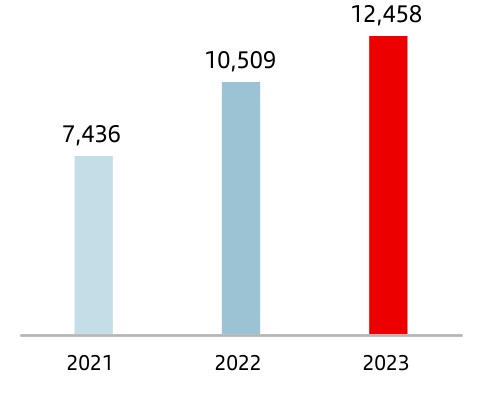

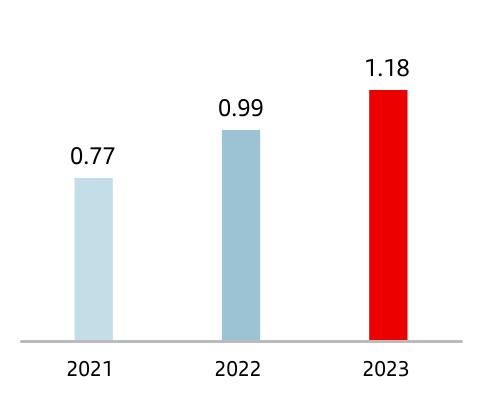

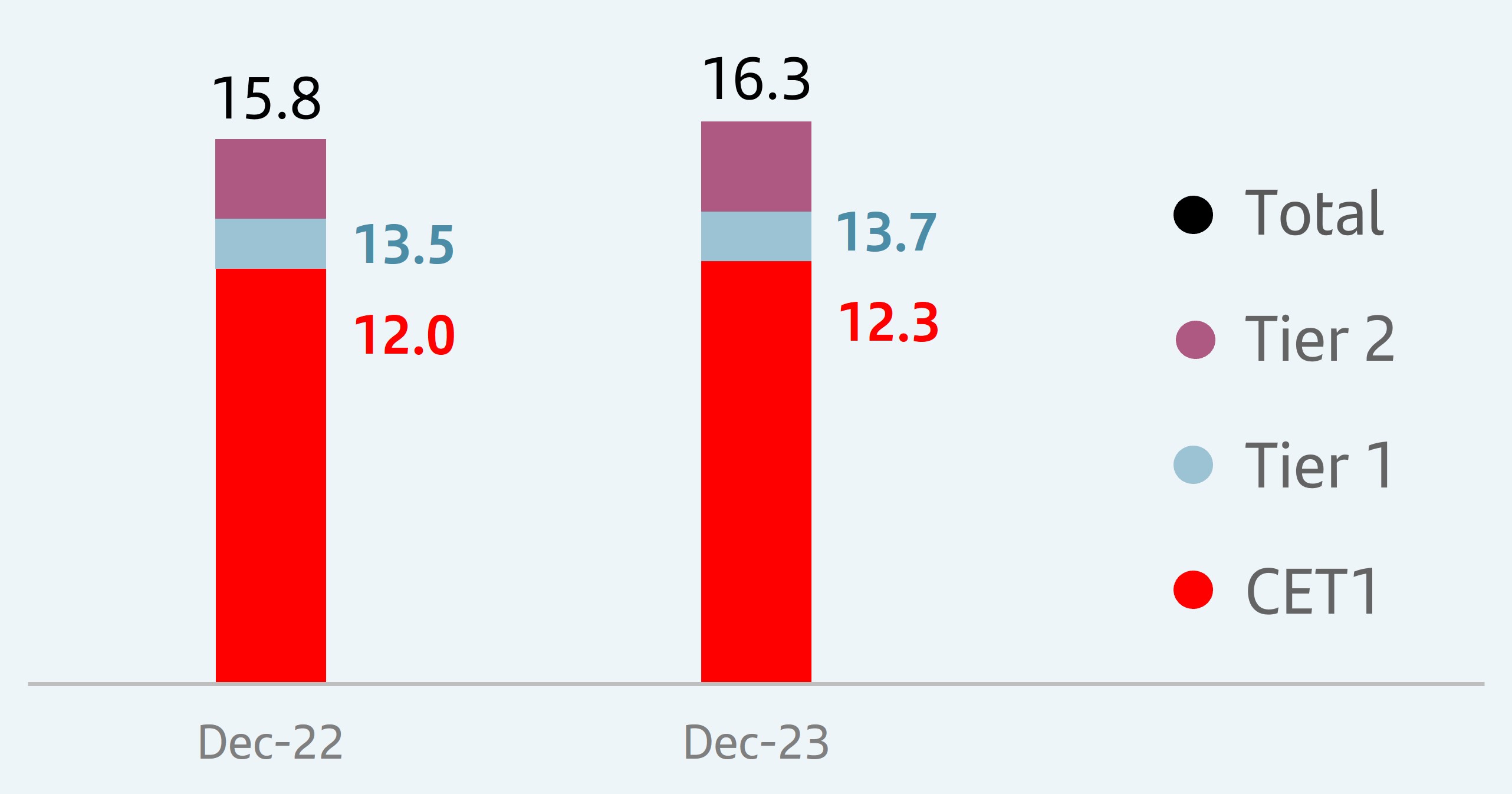

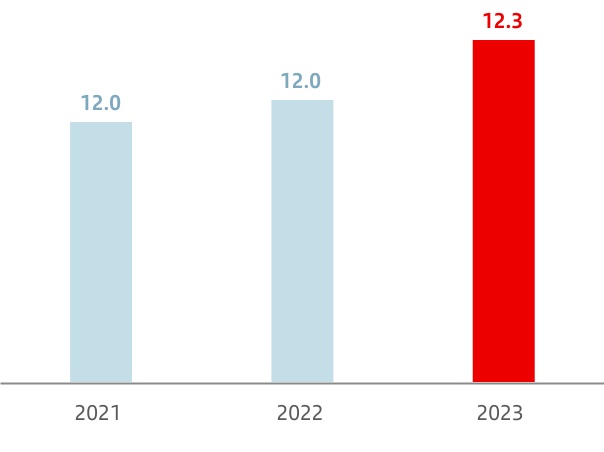

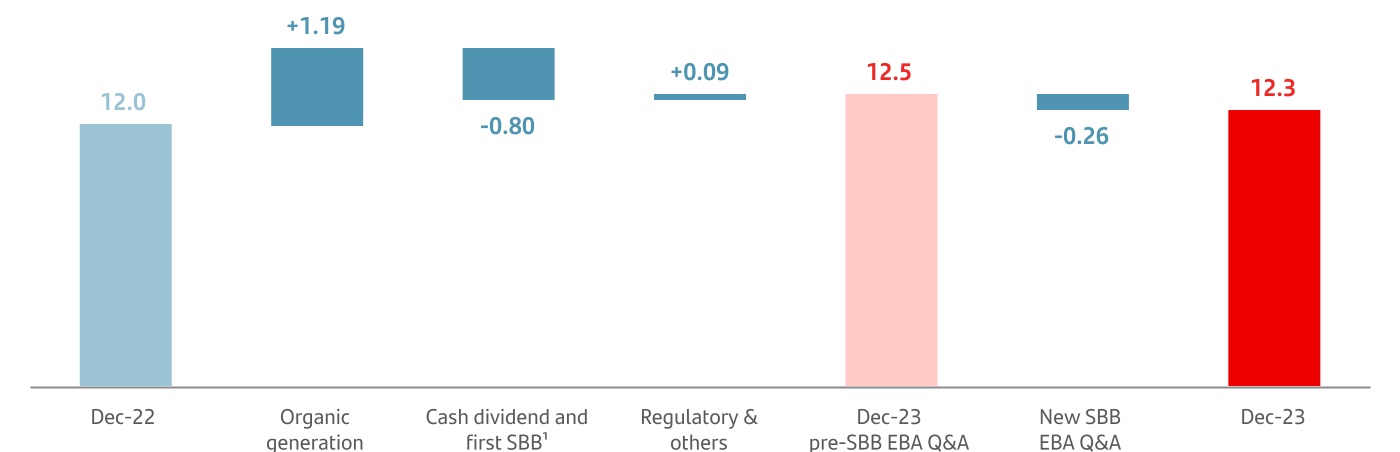

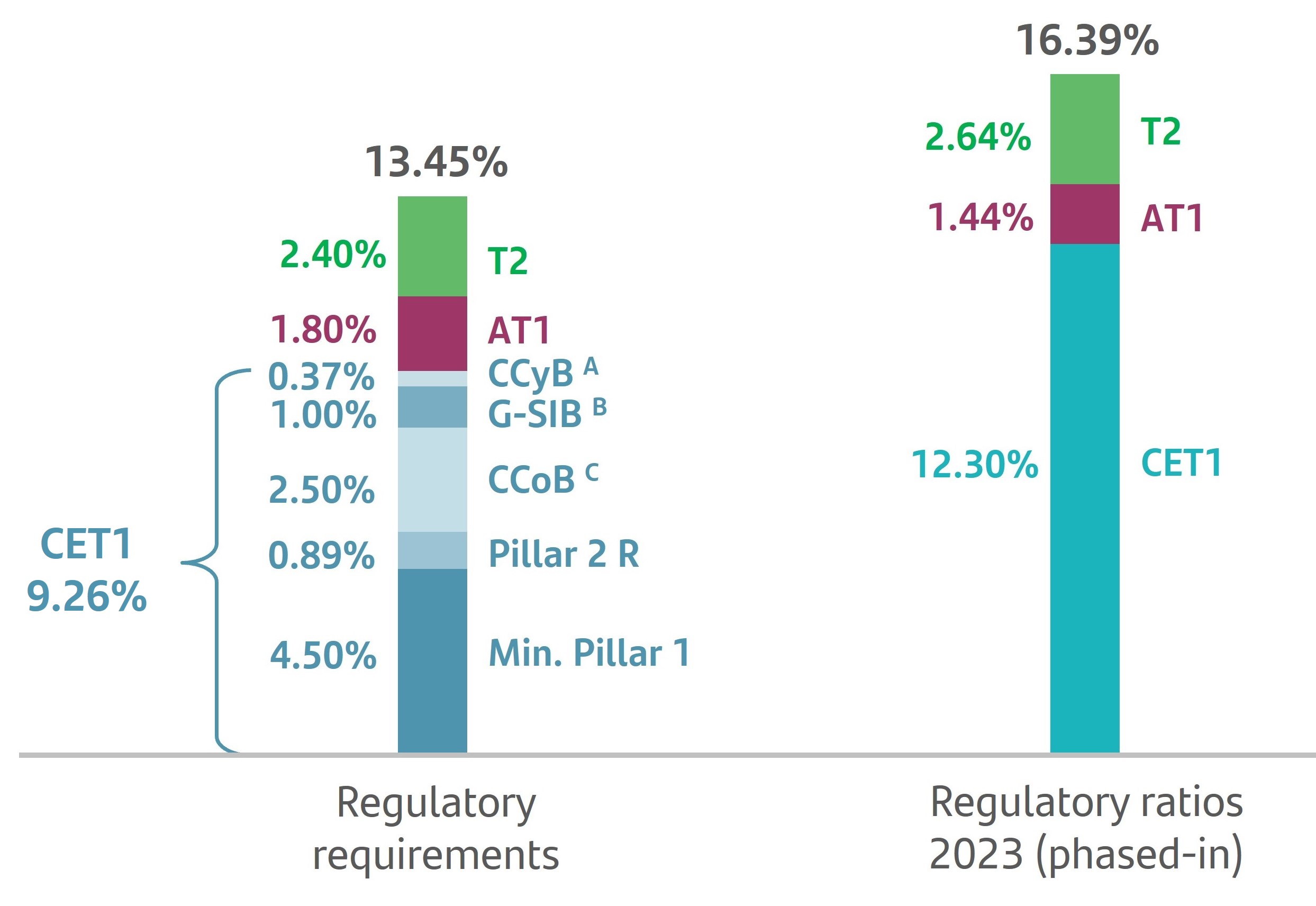

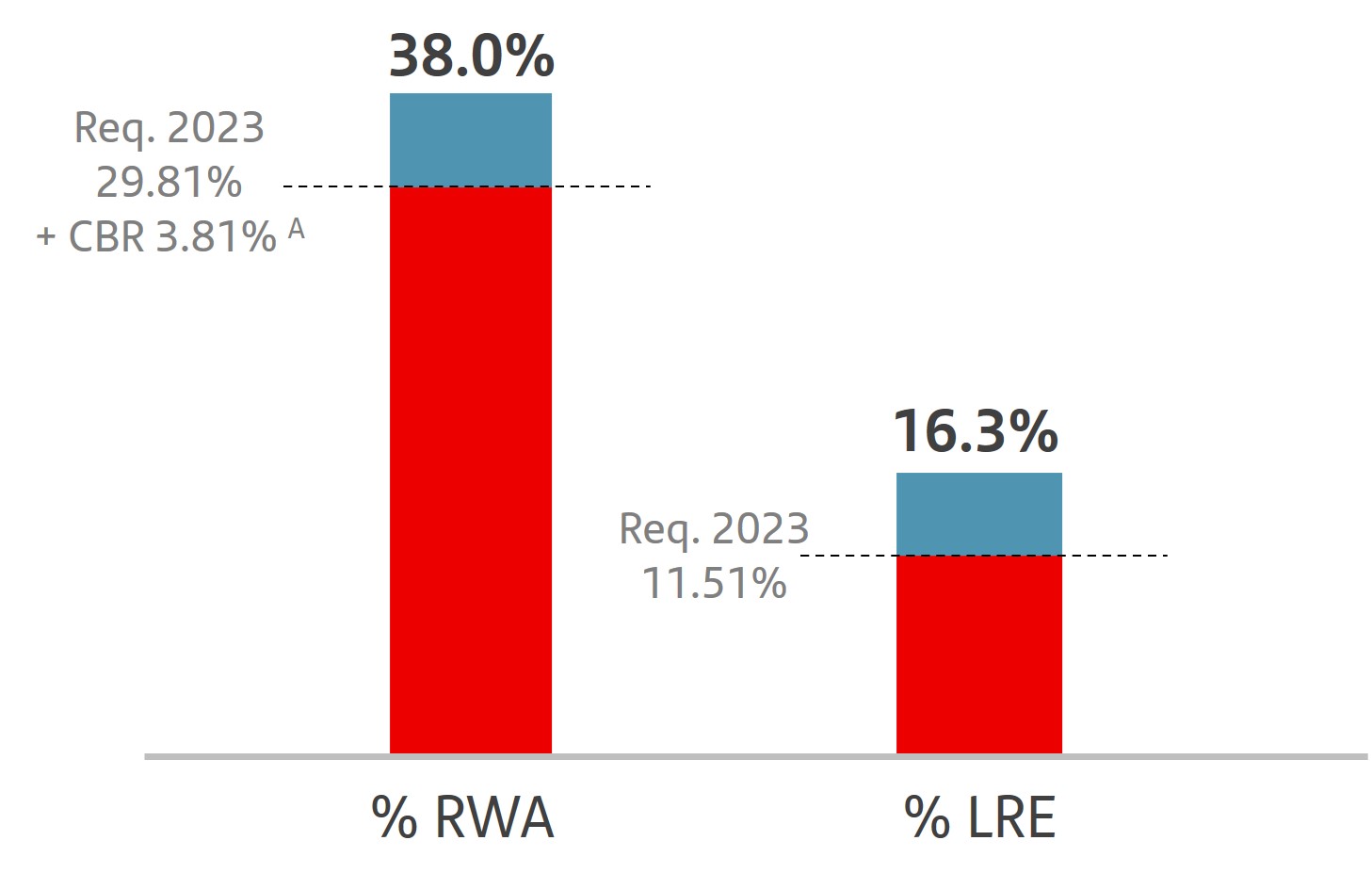

| CoR | FL CET1 | |||||||

|

1.18%

+0.19pp

|

12.3%

+0.2pp

|

|||||||

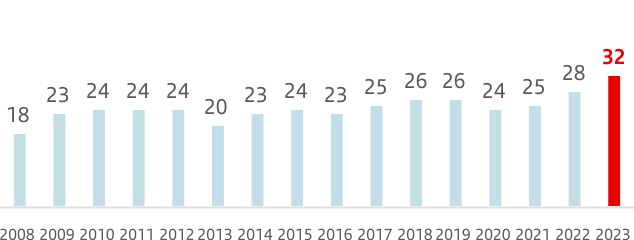

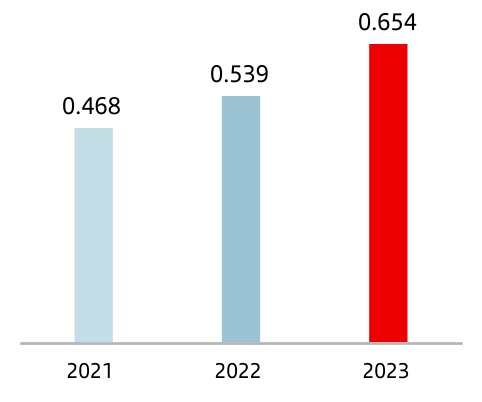

| TNAVps + DPS | EPS | |||||||

|

+15%

Cash DPS +c.50%

|

+21.5% |

|||||||

| 2023 targets | 2023 achievement | |||||||||||||

RevenueA |

|

Double-digit growth | +13% | ü | ||||||||||

| Efficiency ratio |  |

44-45% | 44.1% | ü | ||||||||||

| CoR |  |

<1.2% | 1.18% | ü | ||||||||||

| FL CET1 |  |

>12% | 12.3% | ü | ||||||||||

| RoTE |  |

>15% | 15.1% | ü | ||||||||||

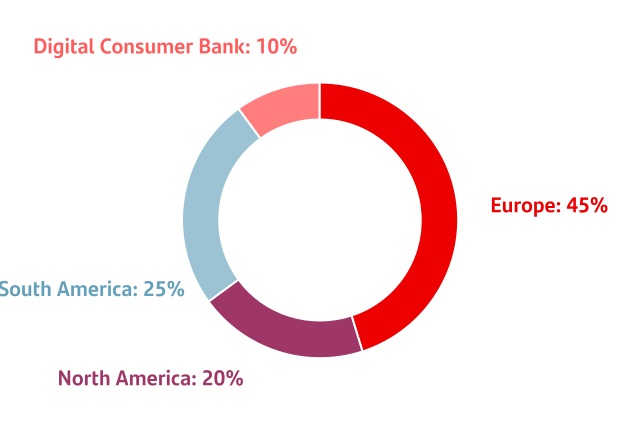

| 2023 vs. 2022 |

Attributable profit

(€ bn)

|

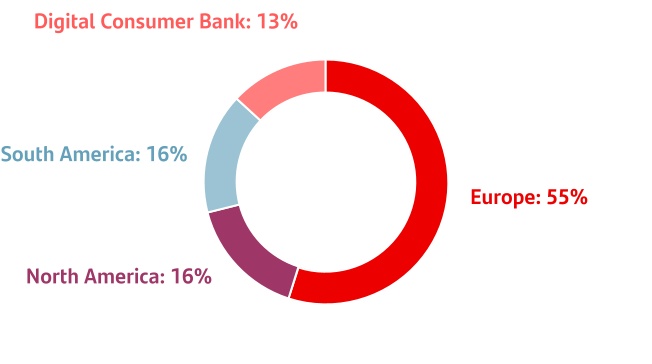

Contribution to Group's profitA |

Efficiency | RoTE | |||||||||||||

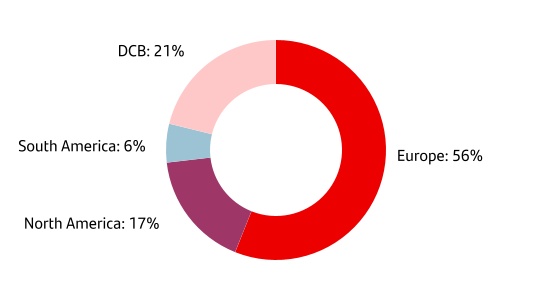

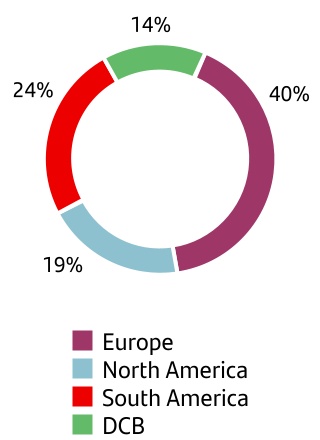

| Europe | 5.5 | 45% | 42.1% | 14.5% | |||||||||||||

| North America | 2.4 | 20% | 49.1% | 9.8% | |||||||||||||

| South America | 3.0 | 25% | 38.5% | 14.4% | |||||||||||||

| DCB Europe | 1.2 | 10% | 47.6% | 12.3% | |||||||||||||

|

DCB Europe is the Digital Consumer Bank defined under the criteria prior to the 20 December 2023 announcement.

A. As % of total operating areas, excluding the Corporate Centre.

| |||||||||||||||||

|

|

|||||||

North America |

Europe | |||||||

We are leveraging the strength of our global businesses to accelerate the transformation of our businesses in the US and Mexico |

We remain focused on customer experience and service quality, and on making the structural changes needed to develop a common operating model for Europe |

|||||||

|

|

|||||||

South America |

DCB Europe (former DCB) |

|||||||

We are focused on increasing the value we bring to the Group and on working to become the most profitable bank in each of the countries where we operate in the region |

Continue to reinforce our auto leadership through strategic alliances, leasing and subscription. In non-auto, keep upscaling our buy now, pay later business. Transformation for future growth deploying a simpler organizational structure to deliver through best-in-class digital platforms, launching new channels and products |

|||||||

| 2024 Group targets | ||||||||||||||||||||||||||

| Revenue | Efficiency | CoR |

FL CET1

after Basel III

implementation

|

RoTE | ||||||||||||||||||||||

|

Mid-single

digitA growth

|

<43% | c.1.2% | >12.0% | 16% | ||||||||||||||||||||||

Double-digit growth of TNAV per share + dividend per share through-the-cycle | ||||||||||||||||||||||||||

|

A.YoY revenue growth in constant euros, but Argentina in current euros.

Note: All targets presented in this chapter are market dependent and do not represent guidance. Actual results may vary materially.

| ||||||||||||||||||||||||||

|

Think Value |

Delivering double-digit value creation, on average through-the-cycle |

|||||||||||||||

|

Think Customer |

Building a digital bank with branches with well targeted products and services to grow our customer base |

|||||||||||||||

|

Think Global |

Best customer experience leveraging our global and in-market scale, network and technology capabilities to accelerate profitable growth |

|||||||||||||||

| Strength | ||||||||

|

FL CET1

>12%

12.3%

|

||||||||

| Shareholder remuneration | ||||||||

|

Payout

50%

Cash dividend + SBB

50% annually

|

||||||||

| Disciplined capital allocation | ||||||||

|

RWAs with RoRWA > CoE

c.85%

84%

|

||||||||

| Profitability | ||||||||

|

RoTE

15-17%

15.1%

|

||||||||

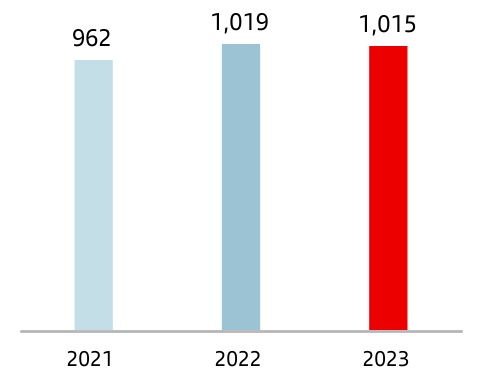

| 2023 | 2025 targets | ||||||||||||||||

| Customer centric | Total customers (mn) | 165 |  |

c. 200 | |||||||||||||

| Active customers (mn) | 100 |  |

c. 125 | ||||||||||||||

| Simplification & automation | Efficiency ratio (%) | 44.1 |  |

c.42 | |||||||||||||

| Customer activity | Transactions volume per active customer (month, % growth) | 10 |  |

c. +8% | |||||||||||||

| Our new model capitalizes on our strategic advantage of combining global capabilities with local expertise | ||||||||||||||||||||

Serve our customers better |

Be more efficient |

|||||||||||||||||||

Better risk management from a global perspective across business lines |

||||||||||||||||||||

Grow more and faster |

More resilient balance sheet |

|||||||||||||||||||

Improved and more disciplined capital allocation for higher profitability |

||||||||||||||||||||

Customer experience

|

Operational leverage

|

Global platform

|

2025 target

|

|||||||||||||||||||||||||||||||||||||||||

Product simplification and digital first |

Common operating model, globally leveraging process automation |

Proprietary back-end (Gravity) and our cloud based front-end (ODS) technologies |

c.17% RoTE

15.1% 2023

<42% C/I

43.1% 2023

|

|||||||||||||||||||||||||||||||||||||||||

| Key drivers | ||

| ||

Customer experience

|

Operational leverage

|

Global platform

|

2025 target

|

|||||||||||||||||||||||||||||||||||||||||

Global relationship management (OEMs, importers and retailers) |

Operational & commercial benchmark to maximize profitability and growth |

From multiple country-specific platforms to global platforms

(e.g. leasing, BNPL)

|

>14% RoTE

11.5% 2023

c.40% C/I 42.8% 2023

|

|||||||||||||||||||||||||||||||||||||||||

| Key drivers | ||

| ||

Customer experience

|

Operational leverage

|

Global platform

|

2025 target

|

|||||||||||||||||||||||||||||||||||||||||

Trusted advisor for our customers, leveraging our global and local products |

Continue growing fee and transactional business through our global centres of expertise and tech |

Optimize capital returns on the back of global origination and distribution capabilities

|

>20% RoTE

17.5% 2023

<45% C/I 45.0% 2023

|

|||||||||||||||||||||||||||||||||||||||||

| Key drivers | ||

| ||

Customer experience

|

Operational leverage

|

Global platform

|

2025 target

|

|||||||||||||||||||||||||||||||||||||||||

Providing our customers with a specialized product & service proposition in all countries |

Leverage our global operations and factories to connect countries and increase collaboration with CIB and Retail |

Global platforms and infrastructure

to improve efficiency and time-to-market

|

c.60% RoTE

72.2% 2023

c.10% Revenue growth +22% 2023

|

|||||||||||||||||||||||||||||||||||||||||

| Key drivers | ||

| ||

Customer experience

|

Operational leverage

|

Global platform

|

2025 target

|

|||||||||||||||||||||||||||||||||||||||||

Deliver best-in-class payment solutions leveraging our global and local scale |

Reduce cost per transaction through capex optimization and operational efficiency |

Migrate volumes to common global platforms to gain scale and offer competitive pricing in the open market |

PagoNxt

>30% EBITDA margin

24.8% 2023 c.30% Revenue growth

+17% 2023

|

|||||||||||||||||||||||||||||||||||||||||

| Key drivers | ||

| ||

| 2023 vs. 2022 |

Revenue

(€bn)

|

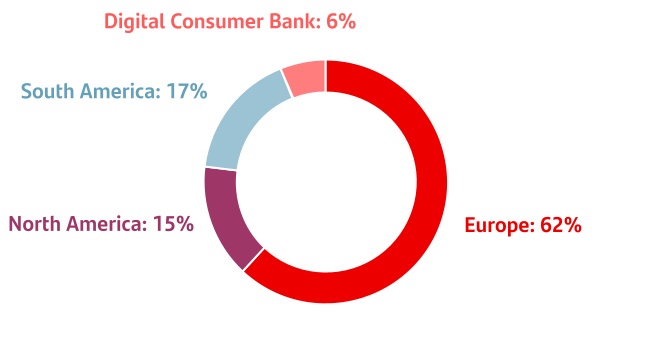

Contribution to Group revenueA |

Efficiency | RoTEB |

2025 RoTEB target |

|||||||||||||||

|

30

+12%

|

51% |

43.1%

-157bps

|

15.1%

+1.0pp

|

c.17% | |||||||||||||||

|

12

+1%

|

21% |

42.8%

+86bps

|

11.5%

-4.0pp

|

>14% | |||||||||||||||

|

8

+17%

|

13% |

45.0%

+171bps

|

17.5%

+1.6pp

|

>20% | |||||||||||||||

|

3

+22%

|

6% |

37.9%

-333bps

|

72.2%

+19.8pp

|

c.60% | |||||||||||||||

|

Revenue

(€bn)

|

Contribution to Group's revenueA |

Efficiency | EBITDA margin PagoNxt | 2025 EBITDA margin PagoNxt target | ||||||||||||||||

|

5

+12%

|

9% |

44.2%

-235bps

|

24.8%

+15.7pp

|

>30% | |||||||||||||||

|

Note: YoY change in constant euros. New global business definitions as published on 20 December 2023.

A.As % of total operating units, excluding the Corporate Centre.

B. Global businesses’ RoTEs are adjusted based on the Group’s deployed capital.

For more information, see section 8 'Alternative Performance Measures' of 'Economic and financial review' chapter.

|

||||||||||||||||||||

| 2023 | 2025 targets | |||||||||||||

| Green finance raised and facilitated (since 2019) | €114.6bn |  |

€120bn | |||||||||||

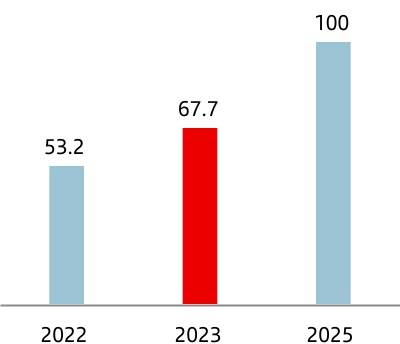

| Socially responsible investments (AuMs) | €67.7bn |  |

€100bn | |||||||||||

Financial inclusion (# People) |

1.8mn |  |

5mn | |||||||||||

|

Responsible

banking Consolidated non-financial information statement

|

|||||

| |||||

|

Green

finance

EUR 114.6 bnA

EUR 120 bn target by 2025

EUR 220 bn target by 2023

|

Socially responsible investment AUM

EUR 67.7 bn

EUR 100 bn target by 2025

|

Financial

inclusion 1.8 mn

EUR 5 mn target by 2025

|

||||||||||||

|

Set 2 new decarbonization targets for 2030 for corporate auto manufacturing portfolio and auto lending portfolio in Europe. |

|

Progress on portfolio alignment in relevant portfolios, including disclosure of financed emissions for UK Mortgages and Brazil Agriculture. |

|

Progress embedding climate and environmental factors in our risk management practices, leveraging on market good practices and supervisory expectations, including setting three additional risk appetite limits consistent with our decarbonization strategy. |

||||||||||||||||||

|

1. We drive economic growth by helping people and businesses prosper. |

||||

|

→EUR 352,181 million to help people buy homes and EUR 208,276 million to purchase other goods.A

→EUR 346,211 million to help set up or grow companies (39% to individuals and SMEs).A

→EUR 10,937 million paid to suppliers. 91% are local and account for 94% of total procurement turnover.

→EUR 9,664 million in total taxes paid by the Group. EUR 10,250 million in taxes channelled from customers to tax authorities.

→Santander’s stock of credit contributes to generating economic activity of more than EUR 290 billion, around 2.5% of GDP on average in the main countries where we operate.B

|

||||||||

|

2. We help create jobs. |

||||

|

→212,764 employees. EUR 13,726 million paid in wages and benefits.

→53% of our workforce are women, 31.4% of whom are in senior executive positions. 40% of our board members are women.

→In 2023 we achieved our target of ~0% Equal Pay GapC two years ahead.

→Santander’s stock of credit helps support more than 8 million jobs in the main countries where we operate.B

|

||||||||

|

3. We tackle global challenges. |

||||

|

→EUR 20.2 billionD in green finance raised and facilitated and EUR 67.7 billion assets under management in Socially Responsible Investment.

→1.8 million new people financially included and a total of 1.2 million underbanked entrepreneurs supported through EUR 1,172 million in credit disbursed.

→EUR 174 million invested in communities, including 105 million to promote higher education, employability and entrepreneurship, benefitting 2.7 million people.

|

||||||||

|

Our values

Simple Personal Fair

|

||||||||

|

Our behaviours

|

||||||||

|

Our leadership principles

→Promote a 'Group First' mindset

→Lead transformation

→Build, develop and grow talent

→Display T.E.A.M.S. flawlessly

→Drive diversity, equity and inclusion

|

||||||||

|

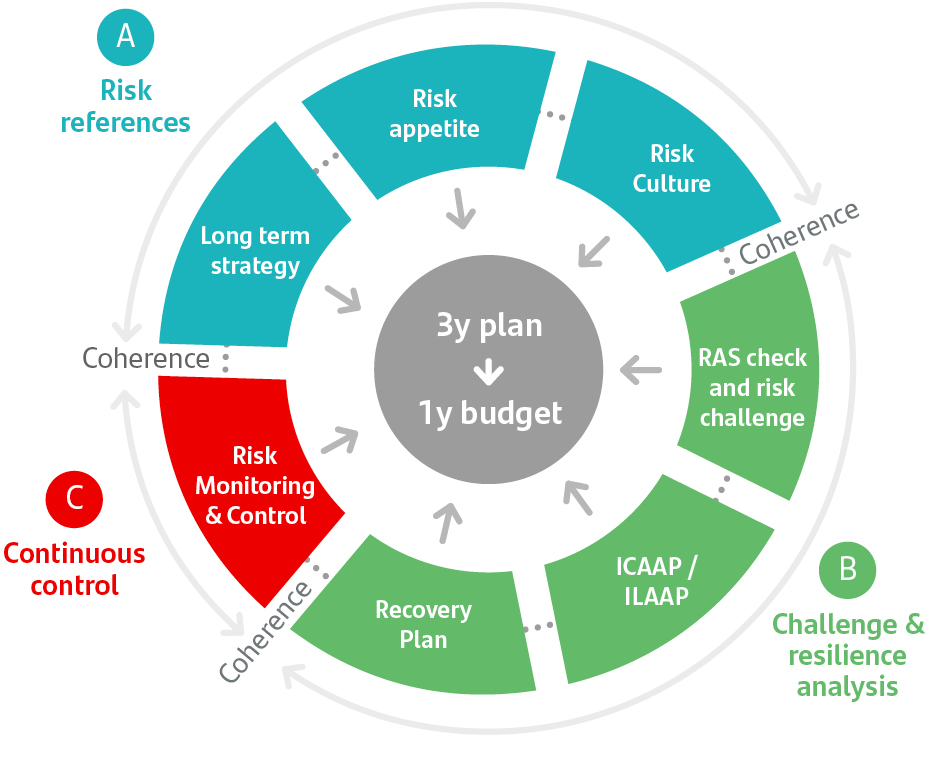

Our strong risk management culture

|

||||||||

| Ambition | Action | |||||||||||||||||||

|

E

Support the transition to a low-carbon economy

|

→Support and engage with customers in accelerating their transition, and develop a best-in-class sustainable finance and investment proposition.

→Progress with decarbonizing our portfolios to align to net zero by 2050, while considering other environmental goals.

|

|||||||||||||||||||

|

S

Promote inclusive growth

|

→Promote employees' wellbeing and equal treatment and opportunity for all.

→Support financial inclusion by promoting access to financial products and services and financial health, including financial literacy.

→Foster customer information transparency and data privacy.

→Support education, employability and entrepreneurship.

|

|||||||||||||||||||

|

G

Strong governance and culture across the organization

|

→Drive culture, conduct and ethical behaviour, doing everything the Santander Way: Simple, Personal and Fair.

→Continue integrating ESG in governance and our core activities, and enhancing capabilities across teams including business, risk management and data reporting.

|

|||||||||||||||||||

→We increased two ESG targets at our Investor Day: 35% of senior executive positions to be held by women by 2025 and to financially include 5 million people between 2023 and 2025. |

→To help fulfil our ambition to be net zero by 2050, in 2023 we have set two new decarbonization targets for 2030 in the transport sector: auto lending in Europe and auto manufacturing. This way, we now have seven targets in five high emitting sectors. |

→We have set a target to invest EUR 400 million between 2023-2026 to foster education, employability and entrepreneurship. |

||||||||||||||||||||||||||||||

|

→In Corporate & Investment Banking, we raised and facilitated EUR 20.2 bnA in greenB finance in 2023, reaching EUR 114.6 bn since 2019:

•Santander remains among the top banks in renewable energy project finance, with 85 transactions and EUR 6.7 bn in financing.

•We financed the construction of green assets and an EV battery gigafactory plant, signed green loans with clients such as Grenergy, structured sustainable transactions in Export and Supply Chain finance, and launched Green Deposits.

•We advised on several corporate finance transactions in the renewable energy sector and acted as sole financial advisor in one of the largest ever hydrogen transactions globally at the time.

|

||||||||

|

→In Retail & Commercial Banking, in 2023, we strengthened our green proposition with new solutions for clients, e.g.:

•Green mortgages, electric vehicles or financing of solar panel installations (11 partnerships for solar panel solutions across our three regions). At the end of the year, we had a stock of EUR 22.6 bn in mortgages aligned with the EU Taxonomy.

•EUR 1.4 bn in new financing agreements with multilateral development banks to finance the investment and liquidity needs of our customers in Europe and Latin America.

•The EIB granted EUR 300 million to Banco Santander Brasil for small-scale solar energy investments.

|

||||||||

|

→Our SRI AUM amounted to EUR 67.7 bn, of which EUR 48.1 bn are from SAM and EUR 19.6 bn from our Private Banking services associated with third party funds:

•70.8% of financed emissions from SAM’s portfolio were either aligning to net zero or under either individual or collective engagement in which SAM is involved.

•SAM Spain was the first asset manager to adhere to and report on the CNMV stewardship code compliance.

|

||||||||

→In Digital Consumer Bank, in 2023, in Europe we financed more than 208,000 new electric vehicles, with volume of EUR 6.5 bn. This equals a market share of EV sales in Europe of over 10%. |

|||||||||||

→In Cards, in 2023, we acquired 37 million cards (72% of the year's total) made of sustainable materials (recycled PVC or PLA).C |

|||||||||||

→We exceeded our target for 30% of senior executive positions by 2025 to be held by women in Q2, reaching 31.4% by year end. Additionally, we have reached our target of Equal Pay gap close to zero two years in advance. |

|||||||||||

→We financially included 1.8 million new people through our access and finance initiatives and granted EUR 1,172 m in microloans to a total of 1.2 million underbanked entrepreneurs during the year. In addition, we reached 11.5 million people with financial education initiatives, including content in social media. |

|||||||||||

|

→We invested EUR 174 million in our communities:

•EUR 105 million in supporting education, employment and entrepreneurship through Santander Universities, our unique global initiative. In 2023 we granted 28,849 scholarships.

•EUR 69 million in other programmes with 2.2 million people helped.

|

|||||||||||

|

|||||||||||

|

World’s best bank for financial inclusion by Euromoney for the third year in a row; World’s best bank for SMEs and World’s best bank for emerging markets by Euromoney (Euromoney Awards for Excellence). |

|

We were the highest ranked bank on Fortune's list of 50 companies that are changing the world, owing to Santander Universities support for education, entrepreneurship and employability over the past 27 years. |

|||||||||||||||||

|

For more details on our policies and governance structure, see section 9.2 'Main internal regulations and governance'

|

||||

Impact materiality |

|

How business affects people and/or the environment through positive and negative impacts. |

||||||

Financial materiality |

|

How sustainability matters can affect financial results through risk and opportunity. |

||||||

| Financial materiality | |||||||||||||||||

| Sustainability matters | Impact materiality | Risk | Opportunity |

Double materiality

(final output)

|

|||||||||||||

| ESRS E1: Climate Change | |||||||||||||||||

| ESRS E2: Pollution | |||||||||||||||||

| ESRS E3: Water and marine resources | |||||||||||||||||

| ESRS E4: Biodiversity and ecosystems | |||||||||||||||||

| ESRS E5: Resource use & circular economy | |||||||||||||||||

| ESRS S1: Own workforce | |||||||||||||||||

| ESRS S2: Workers in the value chain | |||||||||||||||||

| ESRS S3: Affected Communities | |||||||||||||||||

| ESRS S4: Consumers and end-users | |||||||||||||||||

| ESRS G1: Business conduct | |||||||||||||||||

Thresholds: ¢ Critical ¢ Significant ¢ Important ¢ Informative ¢ Minimal | |||||||||||||||||

| Impact | Risk | Opportunities | ||||||||||||||||||||||||

| Climate change | Santander can have a positive impact by financing customers’ transition to a low-carbon economy. This transition will benefit the reduction of total emissions released into the atmosphere, thus making a positive contribution to the Paris Agreement. |

Climate change can cause economic losses to our customers, who might be affected by physical or transition risk.

These risks could lead to increased default rates or reduced value of collaterals. Our diversification by geography and sector reduces this risk across our balance sheet and we manage this risk by embedding climate into risk management. For more details, see section 2.3 Risk Management.

|

Supporting our customers in their transition has become a key business driver.

Our target is to raise or facilitate €220 bn in green finance by 2030. To do so, we are building capabilities and developing our value proposition for customers across sectors and activities (finance, investment, advisory etc.).

|

|||||||||||||||||||||||

| Business conduct | Santander’s behaviour and actions have an influence due to the bank’s leadership in the markets where we operate. |

Inadequate behaviour or conduct could lead to fines and reputational risk.

Fostering a solid corporate culture in which everything we do should be Simple, Personal and Fair is how we mitigate this risk.

|

Applying a solid corporate culture and conduct when dealing with customers can earn their trust and help set us apart. |

|||||||||||||||||||||||

| Consumers and end-users | Santander can have a positive impact on consumers and end users due to our ability to help customers access financial services and in promoting their financial health. |

Lack of transparency in customer information or unfair disclosure may lead to customer dissatisfaction and complaints, which would entail direct and indirect costs. Data privacy events may hamper customers’ trust.

A deterioration in the financial health of our customers may increase the risk of default on loans. We mitigate this risk by developing a solid corporate culture and behaviours and policies to set clear guidelines about how we deal with customers, process customer data and interact with vulnerable customers.

|

Robust data privacy measures and Know Your Customer protocols can boost our revenue by building trust with customers.

Our financial inclusion proposition is also a source of new customers.

|

|||||||||||||||||||||||

| Own workforce | Santander employs over 200,000 people worldwide. We aim to have a positive impact on our workforce through working conditions, remuneration schemes and Diversity, Equity and Inclusion policies. |

Less motivated people could lead to higher rotation and absenteeism, which could increase our cost base. Poor talent retention can also harm our performance.

Our own workforce strategy seeks to mitigate this risk with initiatives in areas such as diversity, equity and inclusion, culture, and health and well-being.

|

A well skilled and diverse workforce boosts results by increasing productivity, fostering innovation and enhancing customer satisfaction. |

|||||||||||||||||||||||

| Affected communities | Santander can have a positive impact by using our scale and local leadership to help the communities where we operate access basic needs (affordable housing, water and sanitation, etc.) and make a positive contribution to the sustainable development goals (SDGs). |

Some of the activities we finance can pose environmental and social risk related to the communities where these operations take place. We mitigate this risk through our Environmental, Social and Climate Change (ESCC) policy and other internal controls. |

Financing basic needs in the regions where we operate (affordable housing, water and sanitation, etc.) is an opportunity to increase revenue.

Our financial education proposition and our support for higher education, employability and entrepreneurship help build trust and enhance the perception of the bank in the communities where we operate.

|

|||||||||||||||||||||||

Thresholds: ¢ Critical ¢ Significant ¢ Important ¢ Informative ¢ Minimal | ||||||||||||||||||||||||||

| ó | ó | ó | ó | |||||||||||||||||||||||||||||||||||||||||

|

Aligning our portfolio with the Paris Agreement goals

Contribute to

limiting temperature

increases to 1.5ºC in line with the NZBA and NZAMi

|

Supporting our customers in the transition

Provide customers with a wide range of solutions to support their transition to a low-carbon economy

|

Reducing our environmental

impact

Remain carbon neutral in own operations and consume 100% electricity from renewable sources by 2025A

|

Embedding climate in risk management

Manage climate and environmental

risk according to regulatory and supervisory expectations

|

|||||||||||||||||||||||||||||||||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2025/2030 target | |||||||||||||||||||||||||||||||||||||||||

Electricity from renewable sourcesA |

43% | 50% | 57% | 75% | 88% | 97% |  |

100% by 2025 | |||||||||||||||||||||||||||||||||||||||

Carbon neutral in our own operationsB |

|

|

|

|

|

Every year | |||||||||||||||||||||||||||||||||||||||||

Green finance raised and facilitated (EUR bn)C |

19 | 33.8 | 65.7 | 94.5 |

114.6 |

120 bn by 2025 220 bn by 2030 |

|||||||||||||||||||||||||||||||||||||||||

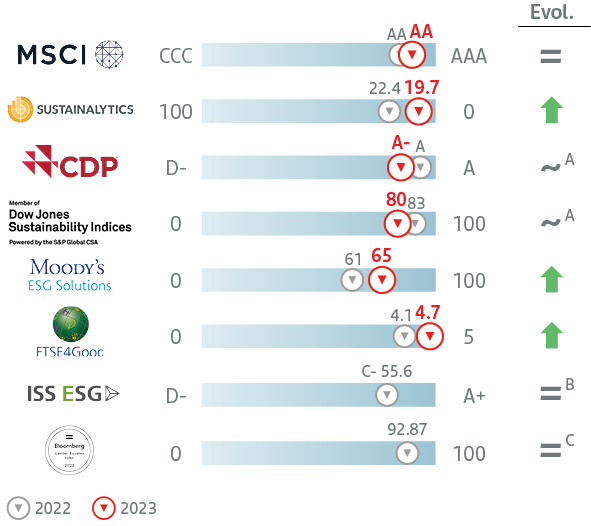

AuMs in Socially Responsible Investments (SRI) (EUR bn) |

27.1 | 53.2 |

67.7 |

|

100 bn by 2025 | ||||||||||||||||||||||||||||||||||||||||||

Thermal coal-related power & mining phase out (EUR bn) |

7 | 5.9 |

4.9 |

|

0 by 2030 | ||||||||||||||||||||||||||||||||||||||||||

Emissions intensity of power generation portfolio |

0.21 | 0.17 | 0.19 |  |

0.11 tCO2e / MWh in 2030 |

||||||||||||||||||||||||||||||||||||||||||

Absolute emissions of energy (oil & gas) portfolio |

23.84 | 22.58 | 27.43 |  |

16.98 mtCO2e in 2030 |

||||||||||||||||||||||||||||||||||||||||||

Emissions intensity of aviation portfolio |

92.47 | 93.05 | 97.21 |  |

61.71 gCO2e/ RPK in 2030 |

||||||||||||||||||||||||||||||||||||||||||

Emissions intensity of steel portfolio |

1.58 | 1.40 | 1.36 |  |

1.07 tCO2e/ tS in 2030 |

||||||||||||||||||||||||||||||||||||||||||

| New in 2023 | Emissions intensity of auto manufacturing portfolio |

149 | 138 |  |

103 gCO2/vkm in 2030 |

||||||||||||||||||||||||||||||||||||||||||

Emissions intensity of auto lending portfolioD |

137 |  |

75-89 gCO2e/vkm in 2030 |

||||||||||||||||||||||||||||||||||||||||||||

|

From…To | Cumulative target |  |

Commitment Achieved |

||||||||||||||||

|

Since 2021, we are a founding member of the Net Zero Banking Alliance (NZBA, under the United Nations Environment Programme Finance Initiative), committing the Group to:

→support the transition of operational and attributable greenhouse gas (GHG) emissions from lending and investment portfolios towards pathways to net zero by mid-century; and

→set intermediate targets for priority GHG emitting sectors for 2030 (or sooner).

|

||||||||

Santander Asset Management (SAM) aims to achieve net zero greenhouse gas emissions with its assets under management by 2050. SAM joined the global Net Zero Asset Managers initiative (NZAMi) in 2021 as part of its commitment to fight climate change and set an interim target to halve net emissions for 50% of its AUM in scope by 2030. |

||||||||

|

For more details on our 'Climate Finance Report' and the net zero announcement press release, see our corporate website santander.com. |

||||

|

For more details on SAM’s strategy, see 'Our net zero strategy' in section 3. 'Responsible Investment'. |

||||

|

For more details on the topics discussed by the RBSCC and actions taken, see section 4.9 'Responsible banking, sustainability and culture committee' in the 'Corporate governance' chapter. |

||||

|

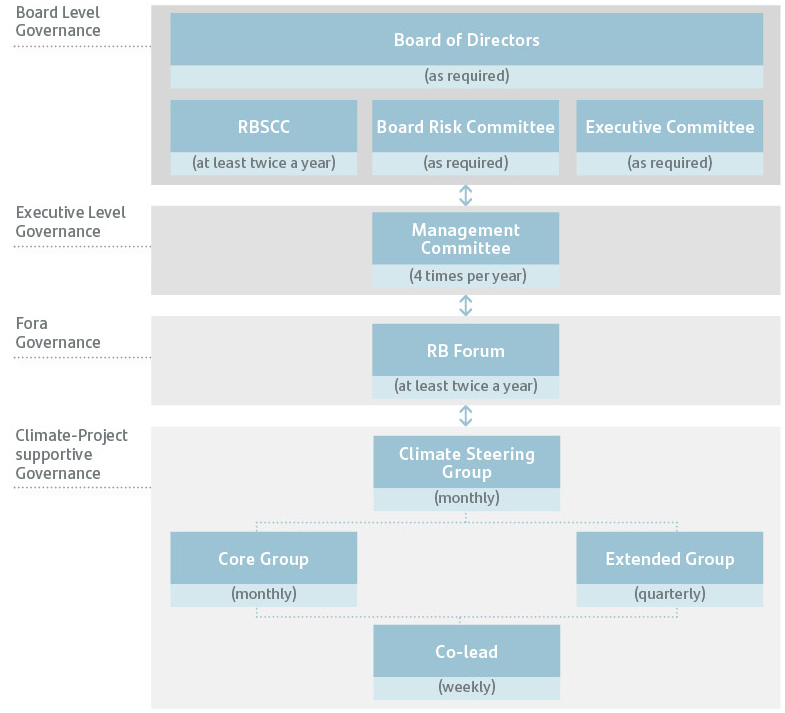

|||||

|

|

|

|

|||||||||||||||||||||||

| Pillar of the climate change strategy | Aligning our portfolio with the Paris Agreement goals | Supporting our customers in the green transition | Reducing our environmental impact | Embedding climate in risk management | ||||||||||||||||||||||

| Main areas | Responsible banking, global businesses and local units set alignment targets | Green Finance, CIB (ESG solutions), SCF and Wealth Management & Insurance | Facilities, General services and Responsible banking | Global and local teams across all areas of Risk and Compliance | ||||||||||||||||||||||

|

For more details on ESG in remuneration schemes, see section 6.4 'Directors' remuneration policy for 2024, 2025 and 2026' in the 'Corporate governance' chapter. |

||||

|

For more details on our risk management approach and progress, see section 10.'ESG risk factors' in 'Risk, compliance and conduct management.' chapter. For more details on our Climate Finance Report, visit our corporate website santander.com. |

||||

| Decarbonization targets | ||||||||||||||||||||||||||

| Sector | Scenario | Emissions | Metric | Baseline | 2020 | 2021 | 2030 targets | |||||||||||||||||||

|

Power generation | IEA Net Zero 2050 | Scope 1 | tCO2e/MWh |

0.21

(2019 baseline year)

|

0.17 | 0.19 | 0.11 (-46%) | ||||||||||||||||||

|

Energy (Oil & Gas) | IEA Net Zero 2050 | Scope 1 + 2 + 3A |

mtCO2e |

23.84

(2019 baseline year)

|

22.58 | 27.43 | 16.98 (-29%) | ||||||||||||||||||

|

Aviation | IEA Net Zero 2050 | Scope 1 + 2 | gCO2e/RPK |

92.47

(2019 baseline year)

|

93.05 | 97.21 | 61.71 (-33%) | ||||||||||||||||||

|

Steel | IEA Net Zero 2050 | Scope 1 + 2 | tCO2e/tS |

1.58

(2019 baseline year)

|

1.40 | 1.36 | 1.07 (-32%) | ||||||||||||||||||

|

Auto manufacturing | IEA Net Zero 2050 | Scope 3A |

gCO2/vkm |

149

(2020 baseline year)

|

149 | 138 | 103 (-31%)B |

||||||||||||||||||

|

Auto lendingC |

IEA Net Zero 2050 | Scope 1 + 2 | gCO2e/vkm |

137

(2022 baseline year)

|

N/A | N/A | 75-89 (-35-45%) | ||||||||||||||||||

|

Thermal coal | Phase-out targets to eliminate exposure by 2030 to power generation customers with a revenue dependency on coal of over 10%, and thermal coal mining | ||||||||||||||||||||||||

|

A Use of sold products.

B Target reduction is -25% vs 2021 reference

C Consumer lending for the acquisition of passenger cars, covering a significant majority of the exposure in Europe.

| ||||||||||||||||||||||||||

|

The automotive sector is one of the key sectors to tackle in the transition to a low-carbon economy. According to the International Energy Agency (IEA), road transport accounts for over 15% of global energy-related emissions. The switch from internal-combustion engines (ICE) to electric vehicles (EV) and plug-in hybrid electric vehicles (PHEV) is the most important decarbonization lever for this sector.

We are helping our auto manufacturer customers adapt their business models and product offering towards EVs and PHEVs.

As we are a leading auto end-user lender in Europe, we are also helping our retail customers finance purchases of an increasing number of EVs and PHEVs.

As part of our net zero ambition, we are committing to decarbonize our global auto manufacturing and European auto lending loan portfolios, with a 2030 target and a 2030 target range, respectively.

|

||||||||

|

The fulfillment of both targets for the automotive sector will depend on, among other conditions, several external factors such as:

→Regulation and policy: Effective government measures and policies are needed to reach the EV sales and decarbonization levels that net zero scenario requires. Countries will need to meet the timelines set to end sales of ICE. The introduction of low emissions zones would support this change. Further adoption of subsidies on EV purchases will be key to drive up penetration, as we have seen in the Nordic countries.

→Technology: A guaranteed supply of the required materials to produced EVs and PHEVs at scale is needed, to match demand. Also, reducing EV and PHEV production costs is needed to ensure affordability in comparison with the less clean alternative (ICE), and thus ensure a just transition.

→Infrastructure: Reaching a high penetration of EVs and PHEVs will require a deep transformation of the supply chains and the infrastructure that powers them (increasing the number of charging points and their performance) to shift from a model of predominantly ICE cars to an EV and PHEV majority. The investment needed for this infrastructure will require support from governments and other actors, which could be affected by conflicting interests such as energy security.

|

||||||||

| Two-step tiering system | ||||||||

GHG emissions profile alignment

|

•Current GHG emissions profile

•Future targeted GHG emissions trajectory

•Assessment of alignment with Santander’s pathway

|

|||||||

|

||||||||

Transition plan quality assessment

|

•Internal methodology to assess perceived quality of transition plans

•Developed using established transition plan assessment methodologies

|

|||||||

| Transition Pillar | Overview | |||||||

1. Targets |

Quality and ambition of quantitative targets to reduce GHG emissions | |||||||

| 2. Action plan | Depth of decarbonization strategy to achieve GHG emissions reduction targets | |||||||

| 3. Disclosure | Transparency on GHG emissions reporting across relevant scopes | |||||||

| 4. Governance | Management oversight and governance of transition strategy | |||||||

| Tier Categories | Description | |||||||||||||

Tier 1 |

Leader |

•Emissions profile fully aligned with Santander’s pathway

•Strong transition plan

|

||||||||||||

| Tier 2 | Strong |

•Emissions profile fully aligned with Santander’s pathway but improvement needed in transition plan; or

•Strong transition plan but emissions profile partially aligned with Santander’s pathway

|

||||||||||||

| Tier 3 | Moderate |

•Emissions profile partially aligned with Santander’s pathway, but improvement needed in transition plan; or

•Emissions profile not aligned with Santander’s pathway, but strong transition plan

|

||||||||||||

| Tier 4 | Weak |

•Emissions profile not aligned with Santander’s pathway

•Weak transition plan

|

||||||||||||

| Sector | What we finance |

Value proposition 2023 |

|||||||||||||||||||||||||||||||||

|

Renewables

|

Renewable energy production and transportation. Energy storage. |

Financing of solar panels, wind farms and battery and storage battery production. |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||

|

Real Estate

|

Purchase, construction and renovation of energy-efficient buildings. Renewable power system installation and refurbishments that use 30% less energy. |

Developer loans, private solar panel installation, smart meters, energy-efficient lighting, mortgages with an A or B energy rating. |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Mobility

|

Clean transport and infrastructure. |

Leasing and financing of electric and hybrid vehicles (<50 g CO2 per passenger-km), charging stations, bicycle lanes and others. |

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Agriculture

|

Sustainable and protected agriculture. Land and forest conservation. Sustainable farming. |

Financing of sustainable agriculture practice such as more efficient irrigation systems, machinery and reduced fertilizer use. |

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Waste & Water Management

|

Activities to adapt to, or mitigate, climate change; preserve biodiversity; boost the circular economy and waste & water management. |

Financing of water, waste and soil treatment, greater energy efficiency, lower emissions and conservation. |

|

|

|

||||||||||||||||||||||||||||||

|

Circular economy

|

|||||||||||||||||||||||||||||||||||

|

For more details on 'Santander and the Brazilian Amazon', visit our corporate website santander.com or our 'Climate Finance Report'. |

||||

|

805 million kWh

total electricity

|

97%

renewable

electricity |

3,444,543 GJ

energy consumption

|

||||||||||||

|

172,711 t CO2e

total emissions (market based)

| ||||||||||||||

|

Scope 1

25,755 t CO2e

direct emissions

|

Scope 2

21,516 t CO2e

indirect emissions from electricity and other (market based)

|

Scope 3

125,441 t CO2e

indirect emissions from employee commuting and business travel

|

||||||||||||

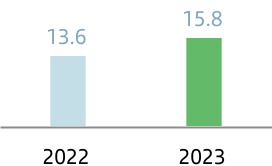

SRI AUM (EUR billion)12 | ||

| +27% | ||

| 2022 vs 2023 | ||

|

For more details on our ESG approach, visit our website santanderassetmanagement.com/sustainability. |

||||

|

For more details, see our stewardship activities report at santanderassetmanagement.com/content/view/11966/file/SAM_Stewardship_Report_221123_EN.pdf |

||||

|

For more details, visit our website santanderprivatebanking.com |

||||

Insurance products aligned with SFICS14 | ||||||||||||||

| Core insurance products in our geographies | ||||||||||||||

|

Personal accident insurance for Seniors

Auto Insurance

Dependency Insurance

Senior Home Insurance

|

|

Life Insurance for low income people

Health Insurance for self employed or low income people

|

|||||||||||

|

Life Insurance for low income people

Personal accident insurance for low income people

|

|

Life Insurance

for low income women

Life Insurance

for micro-entrepreneurs

|

|||||||||||

|

Micro mobility Insurance |  |

Life Insurance for low income people |

|||||||||||

|

Motor insurance for EV |  |

Multirisk Insurance for SMEs (photovoltaic pannels) |

|||||||||||

|

We want to be an employer of choice.

Our approach is based on three pillars:

|

Main regulations | |||||||||||||

| Human resources framework | ||||||||||||||

| Remuneration policy | Performance management policy | Learning and development policy | Group Succession policy | |||||||||||||||||||||||||||||

| Having the right talent and skills in place to enable the Bank's transformation; attracting and engaging the best talent, with a strong focus on employee development; and having a best-in-class employee value proposition. | ||||||||||||||||||||||||||||||||

| Culture policy | General health, safety and wellbeing policy | |||||||||||||||||||

| Putting the employee at the centre of all we do; working to have the best culture and a great employee experience delivered through diversity, equity and inclusion, culture, and health and well-being initiatives; and listening to employees so we can continuously improve. | ||||||||||||||||||||

| International mobility policy | ||||||||||||||

| Driving change in the company; shaping a more dynamic organization that’s ready to face the future with a positive impact on society; having the best organizational design; utilizing new ways of working to drive value; and holding meaningful conversations with our stakeholders. | ||||||||||||||

|

For more information related to the level of approval and public disclosure, see section 9.2 'Main internal regulations and governance'

|

||||

| LONG-TERM POSITIONS |

1. International assignments (EXPATS)

2. Permanent movements

|

|||||||

| TEMPORARY COLLABORATIONS (GIGs) |

1. Project-based assignments (Mundo Santander)

2. SWAP programme

|

|||||||

|

In 2023, our employees' inclusion sentiment (in terms of gender, nationality, sexual orientation, religion, etc.) was 9.3 out of 10 (+0.5 above the finance sector benchmark and in the top 5% of the finance sectorA)

A.2023 Your Voice Survey

|

||||

| 1. Women on the board | 2. Women in senior executive positions | |||||||||||||||||||

40% |

31.4% |

|||||||||||||||||||

| We are committed to having women members make up between 40% and 60% of our board of directors | In early 2023, we raised our public target to have women in at least 35% of our senior executive positions in 2025. Santander leaders are involved in achieving this target as part of their long-term incentives |

|||||||||||||||||||

| 1. Equal Pay | 2. Gender Pay Gap | |||||||||||||||||||

c. 0% |

27.8% |

|||||||||||||||||||

| We have accomplished the target for 2025 (~0%) two years early. We set up fair pay programmes to eliminate the equal pay gap. They include systematic reviews tied to remuneration cycles (merit-based promotions and bonuses). |

Santander addresses the gender pay gap with a methodology based on best practices and common guidelines for the Group. The pay gap in 2023 decreased compared to the previous year (30.2% in 2022). |

|||||||||||||||||||

|

1. The equal pay gap measures 'equal pay for equal work' for women and men in the same job at the same level. Our comparison does not consider such factors as tenure, length of service, previous experience and background. The year-end figure is 0.44%. Having met the target set the Group has set itself the objective of maintaining a pay equity ratio in line with best market practices.

2. The gender pay gap measures differences in remuneration between women and men in an organization, business, industry or the broader economy, irrespective of the type of work. At Santander, fewer women hold senior and business management roles than men (something we are focused on addressing), while more women work in Retail & Commercial Banking and support roles. We calculate the gender pay gap as the difference in the median remuneration paid to male and female employees, expressed as a percentage of the male remuneration.

| ||||||||||||||||||||

| Women | LGBTIQ+ | |||||||

|

Santander Woman Network (2019)

EmpowHer (2017)

Women in Business (2015)

>8,000

members in 10 countries

|

Embrace (2015)

>5,000

members in 5 countries

|

|||||||

| Persons with disabilities | Black colleagues | |||||||

|

Enable (2022)

Thrive (2020)

Habilidade não tem limites (2018)

>1,000

members

|

BOLD (2017)

Reach (2015)

Talento não tem cor (2018)

>1,300

members

|

|||||||

|

8.4 (out of 10)

Average employee rating of the statement 'Employee health and well-being is a priority at Santander' (+0.4 above the finance sector benchmark, and in the top 25% of the finance sectorA).

| ||

| A. 2023 Your Voice Survey | ||

|

|||||

BeHealthy

BeHealthy

|

22%

Passives

|

|||||

|

70%

Promoters

|

8%

Detractors

|

|||||||

|

+27K

employees participating in social activities

|

+83K

labour hours volunteered

|

|||||||

|

For more details, see section 6.2 'Other community support programmes’. |

||||

|

For more details on board remuneration, see section 6. 'Remuneration' in the 'Corporate governance’ chapter. |

||||

|

|||||

|

8.7 (out of 10)

Employees’ rating of the question on whether they are satisfied with the amount of flexibility they have in their work schedulesA

| ||

| A. 2023 Your Voice Survey | ||

|

→The customer comes first. Customer and business impact must take precedence in any working arrangement. |

||||

|

→Managers play a critical role in organizing their team's work. Team and individual productivity are key to building working models. |

||||

|

→The office is our main place of work. Workplaces are no longer just where we do our job; they're also social space that meets diverse working needs and affords the best opportunity for collaboration, innovation and creativity. Building critical mass at workspaces is key to our culture. |

||||

|

→Test and learn approach trough constant listening that evolves over time, with the focus on customer, individual performance, productivity outputs, and employer branding. |

||||

|

→Flexibility, fairness, inclusion and equal opportunity are guiding principles in decision-making. |

||||

| Our approach is to make every customer experience Simple, Personal, and Fair. | Main regulations | |||||||||||||||||||

|

Compliance and conduct;

Cybersecurity Corporate frameworks

|

||||||||||||||||||||

| Customer conduct risk management model | Approval of products and services policy | |||||||||||||||||||

| The customer is at the centre of everything we do. We constantly listen to our customers to deliver the best practices. | ||||||||||||||||||||

| Customer service, dissatisfactions handling and root-cause analysis policy | ||||||||||||||||||||

|

Vulnerable customers, consideration of special

circumstances and prevention of overindebtedness policy

|

||||||||||||||||||||

| We place great importance on protecting vulnerable groups who may be susceptible to financial vulnerability or situations that may impact their ability to make informed decisions through solutions to financially include people and boost our customers' financial health. | ||||||||||||||||||||

| Data protection policy | ||||||||||||||||||||

| We apply high standards to enable individuals to maintain control over their personal data, while protecting and providing resources to keep it safe online. | ||||||||||||||||||||

|

For more information related to the level of approval and public disclosure, see section 9.2 'Main internal regulations and governance' |

||||

|

For more details, see tables 4, 5 and 6 in section 8.2. 'Customers'. |

||||

| ||

|

Top 3

for NPS in 7 marketsA

A.Santander US has a separate target and is not included.

| ||

|

For more details, see section 7.2 'Compliance and conduct risk management' in 'Risk, compliance & conduct management' chapter. |

||||

|

For more details on our vulnerable customer initiatives, see section 5.3 'Financial health and inclusion’. |

||||

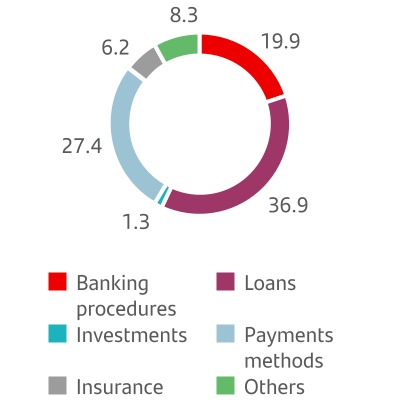

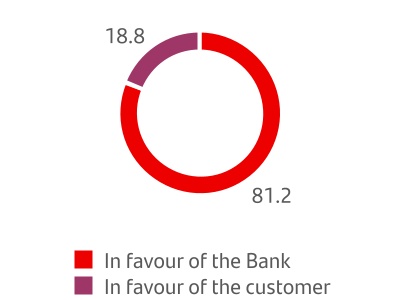

Complaint typeA,B (%) | ||

ResolutionA,B (%) | ||

→The World's Best Bank for Financial Inclusion (Euromoney) for the second year in a row. |

|

||||

Our targets Our targets | ||

|

11.8 mnB |

Target achieved three years early | |||||||||

| 2019 | 2022 | ||||||||||

Financially included peopleA |

Target | |||||||

+5 mnB | ||||||||

1.8 mn |

||||||||

| 2023 | 2024 | 2025 | ||||||

|

Promoting access to cash and transactions

We aim to ensure underserved communities can get cash anywhere, through our remote branches and agreements with private and state-run entities that widen our footprint.

|

Branches in underbanked and remote regionsA |

|

|

|

|

|

||||||||||||||||||||||||||

Partnerships to reach underserved communitiesB |

|

|

|

|||||||||||||||||||||||||||||

|

Promoting digital access

We help people access the banking system so they can make payments; use basic, tailored financial services; take greater control of their finances; and make faster and more secure transactions.

|

Digital wallets and points of saleC |

|

|

|||||||||||||||||||||||||||||

Basic accountsD |

|

|

||||||||||||||||||||||||||||||

|

Financial solutions for vulnerable groups

We offer financial support to vulnerable groups so customers will have access to basic products and know how to use them.

|

Support to senior citizen customersE |

|

|

|

||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||

|

Microfinance

We promote social mobility and help low-income and underbanked entrepreneurs set up and grow businesses.

|

Microfinance programmes |  |

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||

|

Supporting customers in financial distress

We have debt relief programmes that include payment deferrals and line of credit extensions.

|

Supporting customers in financial distressF |

|

|

|

||||||||||||||||||||||||||||

|

Financing low-income households' basic needs

We offer products and services that enable low-income households to access housing and meet other basic financial needs.

|

Affordable housing supplyG |

|

|

|||||||||||||||||||||||||||||

Credit support for low-income households/people with difficulty getting creditH |

|

|

|

|

||||||||||||||||||||||||||||

|

For more details on financial education, visit our website santander.com/en/our-approach/inclusive-and-sustainable-growth/financial-education |

||||

|

For more information on our cybersecurity plan and the initiatives undertaken during the year, see section 5. 'Research, development and innovation (R&D&I)' in 'Economic and financial review' chapter; and section '6.2 Operational risk management' in 'Risk, compliance & conduct management' chapter. |

||||

|

Progress in 2023

GRI 3-3, 203-1, 203-2, 413-1

| ||||||||||||||||||||

| ó | ||||||||||||||||||||

Over 174 million euros in community investment in 202316 | ||||||||||||||||||||

| ó | ó | |||||||||||||||||||

|

Support for higher education, employability and entrepreneurship

|

Other community

support programmes  |

|||||||||||||||||||

|

105 million

euros invested

|

69 million

euros invested16

|

|||||||||||||||||||

|

105

million euros invested

|

498,930

people and businesses helped17

|

1,238

partner universities and academic institutions in 26 countries18

|

||||||||||||

|

For more details, visit the website metared.org |

||||

|

For more details, visit the website mycampusdigital.com |

||||

|

For more details, visit the website

santander.com/universities

|

||||

|

For more details, visit the website

santanderopenacademy.com

|

||||

|

636

partner universities and institutions with Universia in 22 countries

| ||

|

For more details, visit the website universia.net |

||||

|

475

scholarships for university students with disabilities

|

50

people with disabilities hired by companies

|

160

people helped through the Plan Circular19

|

||||||||||||

|

For more details, visit the website fundacionuniversia.net |

||||

|

7,036

entrepreneurship and business initiatives helped

| ||

|

For more details, visit the website santanderx.com |

||||

|

|

||||

|

69

million euros in social investment20

|

2.2

million people helped21

|

||||

| ó | ó | ó | ||||||||||||||||||||||||||||||

|

Childhood education

Helping children and young people get a well-rounded, quality education.

|

Social welfare

Helping vulnerable people and those at risk of social exclusion.

|

Arts and sciences

Helping people access cultural events and programmes.

|

||||||||||||||||||||||||||||||

|

For more details on Fundación Banco Santander’s core work, visit the website fundacionbancosantander.com/es/fundacion/memorias |

||||

| Our approach is to act responsibly and with integrity across our value chain | Main regulations | |||||||||||||||||||||||||||||||||||||||||||

| Risk corporate ; Compliance and conduct corporate; and Financial crime and compliance corporate frameworks |

||||||||||||||||||||||||||||||||||||||||||||

| General code of conduct |

Code of conduct in securities markets |

Corporate defence

policy

|

||||||||||||||||||||||||

| Our code of conduct sets out shared principles and values set out in The Santander Way. | ||||||||||||||||||||||||||

Canal Abierto (whistleblowing) policy |

Environmental, social and climate change risk | Tax policy | ||||||||||||||||||||||||

| Conflict of interest Policy | Defense sector | Financing for sensitive sectors | ||||||||||||||||||||||||

| Anti-bribery and corruption policy (ABC policy) | Anti-money laundering and countering the financing terrorism policy | |||||||||||||||||||||||||||||||||||||

| Our commitment to ethical principles is reflected in our determination to fight corruption, and our status as a signatory to the United Nations Global Compact. | ||||||||||||||||||||||||||||||||||||||

| Financing of political parties policy | ||||||||||||||||||||||||||||||||||||||

| Third-party certification policy | ||||||||||||||||||||||||||||||||||||||

| Our business conduct principles apply to vendors. | ||||||||||||||||||||||||||||||||||||||

| Outsourcing and third-party management model | ||||||||||||||||||||||||||||||||||||||

|

For more information related to the level of approval and public disclosure, see section 9.2 'Main internal regulations and governance'

|

||||

|

For more details, see section 7.2 ‘Compliance and conduct risk management’ in the ‘Risk management and compliance’ chapter. |

||||

|

|||||

|

For more details on the Group’s tax strategy, visit our corporate website santander.com. |

||||

| 2023 | 2022 | |||||||

Received reports |

3,611 | 3,935 | ||||||

Closed reports |

2,929 | 3,477 | ||||||

| Disciplinary action | 655 | 907 | ||||||

which led to dismissal |

366 | 387 | ||||||

|

|||||

|

For more information on Santander’s environmental, social and climate change risk management policy, see section 9.2 'Main internal regulations and governance'. |

||||

|

|||||

|

|||||

|

For more details, see section 7.2 'Ethical channels’.

|

||||

|

For more details on financial crime, see section 7.2 ‘Compliance and conduct risk management’ in ‘Risk management and compliance’ chapter. |

||||

| 1. Total taxes paid | |||||||||||||||||

| EUR million | |||||||||||||||||

| 2023 | |||||||||||||||||

| Jurisdiction | Corporate income taxA |

Other taxes paid |

Total taxes paid by the GroupB |

Third-party taxesC |

Total contribution |

||||||||||||

| Spain | 323 | 1,310 | 1,633 | 1,642 | 3,275 | ||||||||||||

| UK | 728 | 500 | 1,228 | 569 | 1,797 | ||||||||||||

| Portugal | 302 | 190 | 492 | 220 | 712 | ||||||||||||

| Poland | 150 | 281 | 431 | 252 | 683 | ||||||||||||

| Germany | 173 | 90 | 263 | 2 | 265 | ||||||||||||

| Rest of Europe | 518 | 282 | 800 | (3) | 797 | ||||||||||||

| Total Europe | 2,194 | 2,653 | 4,847 | 2,682 | 7,529 | ||||||||||||

| Brazil | 1,396 | 583 | 1,979 | 3,141 | 5,120 | ||||||||||||

| Mexico | 840 | 497 | 1,337 | 916 | 2,253 | ||||||||||||

| Chile | 167 | 93 | 260 | 352 | 612 | ||||||||||||

| Argentina | 54 | 389 | 443 | 2,186 | 2,629 | ||||||||||||

| Uruguay | 57 | 100 | 157 | 50 | 207 | ||||||||||||

| Rest of Latin America | 48 | 20 | 68 | 16 | 84 | ||||||||||||

| Total Latin America | 2,562 | 1,682 | 4,244 | 6,661 | 10,905 | ||||||||||||

| United States | 446 | 111 | 557 | 898 | 1,455 | ||||||||||||

| Other | 12 | 4 | 16 | 9 | 25 | ||||||||||||

| TOTAL | 5,214 | 4,450 | 9,664 | 10,250 | 19,914 | ||||||||||||

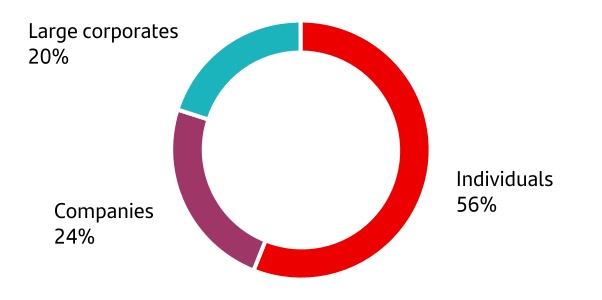

2. GROUP CUSTOMERSA | |||||||||||

| 2023 | 2022 | var. | |||||||||

Europe |

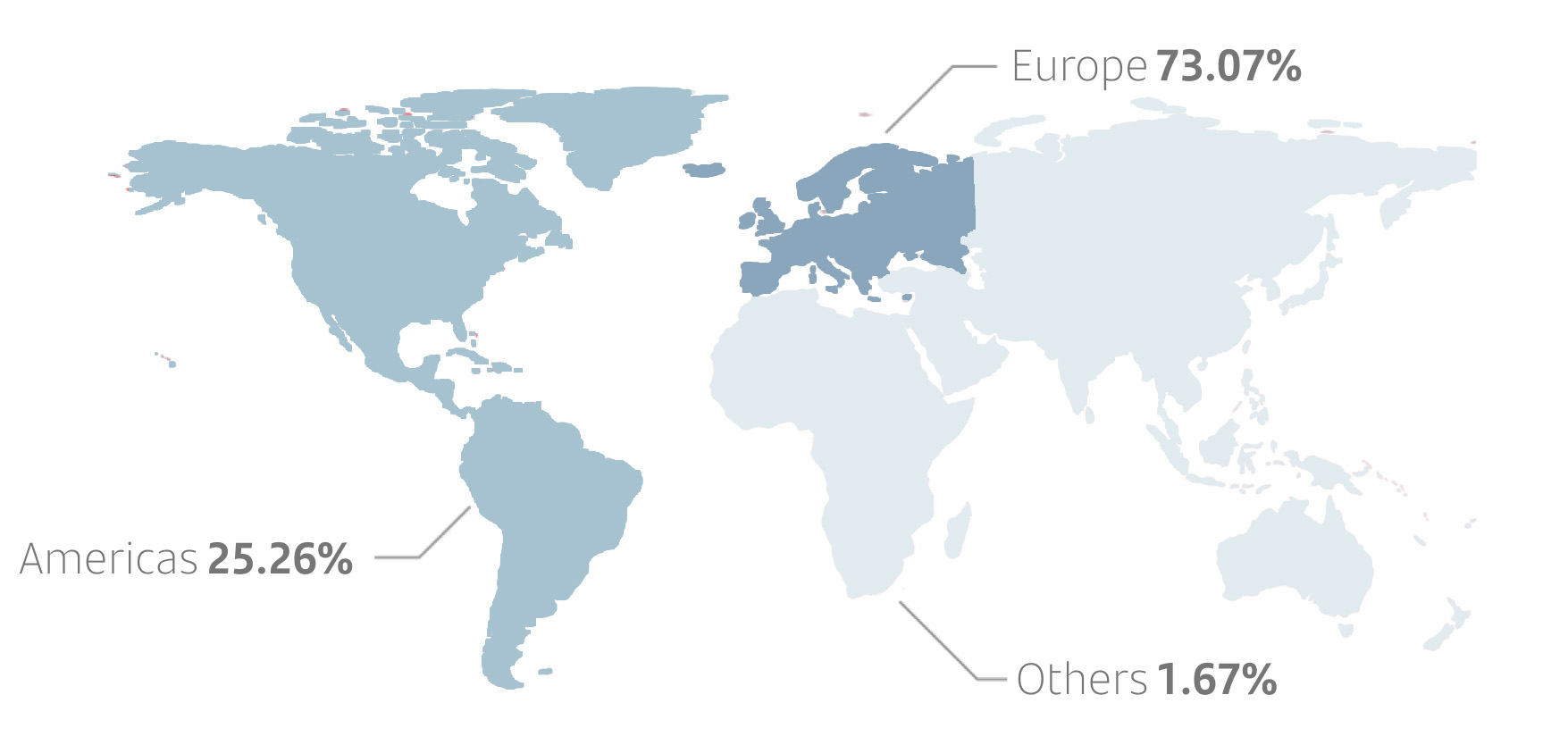

46,293,433 | 45,563,811 | 2% | ||||||||

| Spain | 15,022,877 | 14,319,525 | 5% | ||||||||

| United Kingdom | 22,480,761 | 22,402,482 | —% | ||||||||

| Portugal | 2,908,192 | 2,922,944 | (1)% | ||||||||

| Poland | 5,877,433 | 5,696,967 | 3% | ||||||||

Others EuropeB |

4,170 | 221,894 | (98)% | ||||||||

South America |

73,028,442 | 69,553,448 | 5% | ||||||||

BrazilC |

62,804,350 | 60,117,170 | 4% | ||||||||

Chile |

4,052,314 | 3,577,094 | 13% | ||||||||

Argentina |

4,771,370 | 4,385,406 | 9% | ||||||||

Others South AmericaD |

1,400,408 | 1,473,778 | (5)% | ||||||||

| North America | 25,027,302 | 24,980,487 | —% | ||||||||

United StatesF |

4,510,043 | 4,523,339 | —% | ||||||||

| México | 20,517,259 | 20,239,179 | 1% | ||||||||

Others- North AmericaF |

0 | 217,969 | (100)% | ||||||||

Digital Consumer Bank |

20,192,858 | 19,746,178 | 2% | ||||||||

Santander Consumer BankG |

17,665,556 | 17,793,206 | (1)% | ||||||||

Santander Digital |

2,527,302 | 1,952,972 | 29% | ||||||||

Total |

164,542,034 | 159,843,924 | 3% | ||||||||

| 3. DIALOGUE BY CHANNEL | |||||||||||

| 2023 | 2022 | Var .2023/2022 %. | |||||||||

Branches |

|||||||||||

Number of branches |

8,518 | 9,019 | (5.6) | % | |||||||

Digital bankingA |

|||||||||||

Digital customersB (millions) |

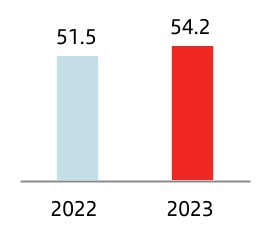

54.2 | 51.5 | 5.2 | % | |||||||

| 4. GROUP NPS | ||||||||||||||

| 2022 | 2021 | 2020 | 2019 | |||||||||||

| Argentina | 1 | 1 | 2 | 3 | ||||||||||

| Brazil | 4 | 3 | 1 | 2 | ||||||||||

| Chile | 1 | 1 | 1 | 1 | ||||||||||

| Uruguay | 2 | 2 | 2 | 3 | ||||||||||

| Spain | 3 | 2 | 2 | 2 | ||||||||||

| Poland | 3 | 3 | 3 | 4 | ||||||||||

| Portugal | 2 | 2 | 3 | 1 | ||||||||||

| UK | 5 | 6 | 3 | 6 | ||||||||||

| Mexico | 2 | 3 | 4 | 4 | ||||||||||

| USA | 9 | 9 | 8 | 9 | ||||||||||

5. GROUP NPS BY CHANNELA | |||||||||||

| 2023 | 2022 | 2021 | |||||||||

| Branch | 70 | 66 | 64 | ||||||||

| Contact center | 72 | 60 | 43 | ||||||||

InternetB |

67 | 62 | 58 | ||||||||

| Mobile | 67 | 65 | 69 | ||||||||

6. CUSTOMER SATISFACTIONA | ||||||||||||||

| 2023 | 2022 | 2021 | 2020 | |||||||||||

| Argentina | 92 | 93 | 91 | 90 | ||||||||||

| Brazil | 88 | 88 | n/a | 89 | ||||||||||

| Chile | 89 | 90 | 90 | 87 | ||||||||||

| Uruguay | 95 | 97 | 96 | 93 | ||||||||||

| Spain | 89 | 89 | 84 | 87 | ||||||||||

| Poland | 95 | 95 | 96 | 99 | ||||||||||

| Portugal | 86 | 90 | 90 | 86 | ||||||||||

| UK | 96 | 96 | 95 | 94 | ||||||||||

| Mexico | 98 | 94 | 94 | 95 | ||||||||||

| USA | 89 | 89 | 88 | 87 | ||||||||||

GroupB |

91 | 92 | 92 | 91 | ||||||||||

7. TOTAL COMPLAINTSA | |||||||||||

| 2023 | 2022 | 2021 | |||||||||

SpainB |

88,326 | 76,272 | 120,953 | ||||||||

PortugalC |

4,789 | 3,584 | 3,570 | ||||||||

United KingdomD |

25,309 | 20,624 | 20,069 | ||||||||

PolandE |

6,272 | 5,169 | 5,179 | ||||||||

Brazil |

207,211 | 215,906 | 195,340 | ||||||||

Mexico |

68,565 | 70,100 | 82,033 | ||||||||

Chile |

8,441 | 7,873 | 8,009 | ||||||||

Argentina |

5,525 | 5,294 | 5,013 | ||||||||

USF |

5,712 | 1,717 | 3,205 | ||||||||

SCFG |

33,074 | 29,777 | 35,215 | ||||||||

8.1 Financially included peopleA | |||||

| million people (Accumulated since 2023) | 2023 | ||||

Access |

1.0 | ||||

Finance |

0.8 | ||||

| Total | 1.8 | ||||

8.2 People helped through Financial education initiativesA,B | |||||||||||

| million people | 2023 | 2022 | 2021 | ||||||||

Financial educationA |

11.5 | 2.7 | 1.3 | ||||||||

| 9. Microfinance | |||||||||||

| million euros / people | 2023 | 2022 | 2021 | ||||||||

Total credit disbursedA |

1,172.3 | 950.0 | 571.0 | ||||||||

Total micro-entrepreneurs supportedB |

1.2 | 1.6 | 1.0 | ||||||||

| million euros | 2023 | 2022 | 2021 | ||||||||

Support for higher education, employability, and entrepreneurship |

105 | 100 | 106 | ||||||||

Other local initiatives |

69 | 63 | 46 | ||||||||

Total |

174 | 163 | 152 | ||||||||

| 11.1 People helped through Santander Universities programmes | |||||||||||

| people helped | 2023 | 2022 | 2021 | ||||||||

Higher educationA |

28,849 | 49,490 | 40,632 | ||||||||

EmployabilityB |

463,045 | 195,798 | 98,480 | ||||||||

EntrepreneurshipA |

7,036 | 20,739 | 23,120 | ||||||||

TotalA |

498,930 | 266,027 | 162,232 | ||||||||

11.2 People helped from local initiativesA | |||||||||||

| million people | 2023 | 2022 | 2021 | ||||||||

Support for childhood education |

0.6 | 0.4 | 0.8 | ||||||||

Support for social welfare |

1.0 | 0.9 | 1.3 | ||||||||

| Support for the arts and science | 0.1 | 0.0 | 0.0 | ||||||||

| Others | 0.5 | 1.0 | 0.0 | ||||||||

Total |

2.2 | 2.3 | 2.1 | ||||||||

12. EMPLOYEES BY REGION AND GENDERA | ||||||||||||||||||||||||||

No employees |

% men |

% women |

||||||||||||||||||||||||