| WASHINGTON, D.C. 20579 | ||

| CURRENT REPORT | ||

| Delaware | 0-20388 | 36-3795742 | ||||||

| (State of other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of Each Class | Trading Symbol | Name of exchange on which registered | ||||||||||||

| Common Stock, par value $0.01 per share | LFUS | NASDAQ Global Select Market |

||||||||||||

| Item 2.02 | Results of Operations and Financial Condition | ||||

| Item 7.01 | Regulation FD Disclosure | ||||

| Item 9.01 | Financial Statements and Exhibits. | ||||

| (d) | Exhibits | ||||

| The following exhibit is furnished with this Form 8-K: | |||||

| Littelfuse, Inc. | |||||

| Date: November 1, 2022 | By: /s/ Meenal A. Sethna |

||||

| Meenal A. Sethna Executive Vice President and Chief Financial Officer |

|||||

|

|

||||

| NEWS RELEASE |

Littelfuse Inc.

8755 West Higgins Road, Suite 500

Chicago, Illinois 60631

p: (773) 628-1000 f: (773) 628-0802

www.littelfuse.com

|

||||

| (Unaudited) | ||||||||||||||

| (in thousands) | October 1, 2022 |

January 1, 2022 |

||||||||||||

| ASSETS | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | 474,003 | $ | 478,473 | ||||||||||

| Short-term investments | 79 | 28 | ||||||||||||

| Trade receivables, less allowances of $83,872 and $59,232 at October 1, 2022 and January 1, 2022, respectively | 339,729 | 275,192 | ||||||||||||

| Inventories | 536,026 | 445,671 | ||||||||||||

| Prepaid income taxes and income taxes receivable | 5,833 | 2,035 | ||||||||||||

| Prepaid expenses and other current assets | 75,643 | 68,812 | ||||||||||||

| Total current assets | 1,431,313 | 1,270,211 | ||||||||||||

| Net property, plant, and equipment | 458,234 | 437,889 | ||||||||||||

| Intangible assets, net of amortization | 605,310 | 407,126 | ||||||||||||

| Goodwill | 1,168,458 | 929,790 | ||||||||||||

| Investments | 23,770 | 39,211 | ||||||||||||

| Deferred income taxes | 10,461 | 13,127 | ||||||||||||

| Right of use lease assets, net | 46,175 | 29,616 | ||||||||||||

| Other long-term assets | 34,207 | 24,734 | ||||||||||||

| Total assets | $ | 3,777,928 | $ | 3,151,704 | ||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | $ | 219,447 | $ | 222,039 | ||||||||||

| Accrued liabilities | 177,127 | 159,689 | ||||||||||||

| Accrued income taxes | 42,016 | 27,905 | ||||||||||||

| Current portion of long-term debt | 10,220 | 25,000 | ||||||||||||

| Total current liabilities | 448,810 | 434,633 | ||||||||||||

| Long-term debt, less current portion | 975,610 | 611,897 | ||||||||||||

| Deferred income taxes | 116,595 | 81,289 | ||||||||||||

| Accrued post-retirement benefits | 36,842 | 37,037 | ||||||||||||

| Non-current operating lease liabilities | 35,778 | 22,305 | ||||||||||||

| Other long-term liabilities | 75,402 | 71,023 | ||||||||||||

| Total equity | 2,088,891 | 1,893,520 | ||||||||||||

| Total liabilities and equity | $ | 3,777,928 | $ | 3,151,704 | ||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||

| (in thousands, except per share data) | October 1, 2022 |

September 25, 2021 |

October 1, 2022 |

September 25, 2021 |

||||||||||||||||||||||

| Net sales | $ | 658,880 | $ | 539,581 | $ | 1,900,646 | $ | 1,526,863 | ||||||||||||||||||

| Cost of sales | 402,059 | 325,009 | 1,122,258 | 954,429 | ||||||||||||||||||||||

| Gross profit | 256,821 | 214,572 | 778,388 | 572,434 | ||||||||||||||||||||||

| Selling, general, and administrative expenses | 90,219 | 67,468 | 258,820 | 199,071 | ||||||||||||||||||||||

| Research and development expenses | 25,752 | 15,779 | 68,796 | 46,912 | ||||||||||||||||||||||

| Amortization of intangibles | 15,567 | 10,446 | 39,883 | 31,608 | ||||||||||||||||||||||

| Restructuring, impairment, and other charges | 3,413 | 772 | 4,265 | 1,998 | ||||||||||||||||||||||

| Total operating expenses | 134,951 | 94,465 | 371,764 | 279,589 | ||||||||||||||||||||||

| Operating income | 121,870 | 120,107 | 406,624 | 292,845 | ||||||||||||||||||||||

| Interest expense | 8,399 | 4,602 | 17,069 | 13,901 | ||||||||||||||||||||||

| Foreign exchange loss | 18,191 | 3,154 | 40,051 | 8,315 | ||||||||||||||||||||||

| Other (income) expense, net | (698) | (1,240) | 9,789 | (10,867) | ||||||||||||||||||||||

| Income before income taxes | 95,978 | 113,591 | 339,715 | 281,496 | ||||||||||||||||||||||

| Income taxes | 20,510 | 21,537 | 59,713 | 49,634 | ||||||||||||||||||||||

| Net income | $ | 75,468 | $ | 92,054 | $ | 280,002 | $ | 231,862 | ||||||||||||||||||

| Earnings per share: | ||||||||||||||||||||||||||

| Basic | $ | 3.05 | $ | 3.74 | $ | 11.32 | $ | 9.43 | ||||||||||||||||||

| Diluted | $ | 3.02 | $ | 3.69 | $ | 11.21 | $ | 9.31 | ||||||||||||||||||

| Weighted-average shares and equivalent shares outstanding: | ||||||||||||||||||||||||||

| Basic | 24,755 | 24,622 | 24,726 | 24,582 | ||||||||||||||||||||||

| Diluted | 24,988 | 24,926 | 24,986 | 24,904 | ||||||||||||||||||||||

| Comprehensive income | $ | 47,280 | $ | 87,100 | $ | 218,262 | $ | 227,491 | ||||||||||||||||||

| Nine Months Ended | ||||||||||||||

| (in thousands) | October 1, 2022 | September 25, 2021 | ||||||||||||

| OPERATING ACTIVITIES | ||||||||||||||

| Net income | $ | 280,002 | $ | 231,862 | ||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | 183,942 | 96,824 | ||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||

| Trade receivables | (56,431) | (83,793) | ||||||||||||

| Inventories | (83,803) | (71,232) | ||||||||||||

| Accounts payable | (3,838) | 53,945 | ||||||||||||

| Accrued liabilities and income taxes | (4,399) | 23,294 | ||||||||||||

| Prepaid expenses and other assets | (2,034) | (10,236) | ||||||||||||

| Net cash provided by operating activities | 313,439 | 240,664 | ||||||||||||

| INVESTING ACTIVITIES | ||||||||||||||

| Acquisitions of businesses, net of cash acquired | (532,772) | (110,646) | ||||||||||||

| Purchases of property, plant, and equipment | (77,773) | (57,526) | ||||||||||||

| Net proceeds from sale of property, plant and equipment, and other | 565 | 2,561 | ||||||||||||

| Net cash used in investing activities | (609,980) | (165,611) | ||||||||||||

| FINANCING ACTIVITIES | ||||||||||||||

| Net proceeds (payments) of credit facility | 373,125 | (30,000) | ||||||||||||

| Cash dividends paid | (41,055) | (36,648) | ||||||||||||

| All other cash provided by financing activities | (10,147) | 5,771 | ||||||||||||

| Net cash provided by (used in) financing activities | 321,923 | (60,877) | ||||||||||||

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (31,963) | (5,832) | ||||||||||||

| (Decrease) increase in cash, cash equivalents, and restricted cash | (6,581) | 8,344 | ||||||||||||

| Cash, cash equivalents, and restricted cash at beginning of period | 482,836 | 687,525 | ||||||||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | 476,255 | $ | 695,869 | ||||||||||

| Third Quarter | Year-to-Date | |||||||||||||||||||||||||||||||||||||

| (in thousands) | 2022 | 2021 | % Growth /(Decline) |

2022 | 2021 | % Growth |

||||||||||||||||||||||||||||||||

| Net sales | ||||||||||||||||||||||||||||||||||||||

| Electronics | $ | 397,629 | $ | 347,240 | 14.5 | % | $ | 1,121,626 | $ | 959,122 | 16.9 | % | ||||||||||||||||||||||||||

| Transportation | 181,735 | 124,415 | 46.1 | % | 548,266 | 386,262 | 41.9 | % | ||||||||||||||||||||||||||||||

| Industrial | 79,516 | 67,926 | 17.1 | % | 230,754 | 181,479 | 27.2 | % | ||||||||||||||||||||||||||||||

| Total net sales | $ | 658,880 | $ | 539,581 | 22.1 | % | $ | 1,900,646 | $ | 1,526,863 | 24.5 | % | ||||||||||||||||||||||||||

| Operating income | ||||||||||||||||||||||||||||||||||||||

| Electronics | $ | 113,140 | $ | 100,524 | 12.6 | % | $ | 339,675 | $ | 230,283 | 47.5 | % | ||||||||||||||||||||||||||

| Transportation | 12,987 | 15,806 | (17.8) | % | 57,604 | 55,380 | 4.0 | % | ||||||||||||||||||||||||||||||

| Industrial | 12,178 | 6,571 | 85.3 | % | 39,968 | 18,452 | 116.6 | % | ||||||||||||||||||||||||||||||

| Other(a) | (16,435) | (2,794) | N.M. | (30,623) | (11,270) | N.M. | ||||||||||||||||||||||||||||||||

| Total operating income | $ | 121,870 | $ | 120,107 | 1.5 | % | $ | 406,624 | $ | 292,845 | 38.9 | % | ||||||||||||||||||||||||||

| Operating Margin | 18.5 | % | 22.3 | % | 21.4 | % | 19.2 | % | ||||||||||||||||||||||||||||||

| Interest expense | 8,399 | 4,602 | 17,069 | 13,901 | ||||||||||||||||||||||||||||||||||

| Foreign exchange loss | 18,191 | 3,154 | 40,051 | 8,315 | ||||||||||||||||||||||||||||||||||

| Other (income) expense, net | (698) | (1,240) | 9,789 | (10,867) | ||||||||||||||||||||||||||||||||||

| Income before income taxes | $ | 95,978 | $ | 113,591 | (15.5) | % | $ | 339,715 | $ | 281,496 | 20.7 | % | ||||||||||||||||||||||||||

| Third Quarter | Year-to-Date | |||||||||||||||||||||||||||||||||||||

| (in thousands) | 2022 | 2021 | % Growth /(Decline) |

2022 | 2021 | % Growth /(Decline) |

||||||||||||||||||||||||||||||||

| Operating Margin | ||||||||||||||||||||||||||||||||||||||

| Electronics | 28.5 | % | 28.9 | % | (0.4) | % | 30.3 | % | 24.0 | % | 6.3 | % | ||||||||||||||||||||||||||

| Transportation | 7.1 | % | 12.7 | % | (5.6) | % | 10.5 | % | 14.3 | % | (3.8) | % | ||||||||||||||||||||||||||

| Industrial | 15.3 | % | 9.7 | % | 5.6 | % | 17.3 | % | 10.2 | % | 7.1 | % | ||||||||||||||||||||||||||

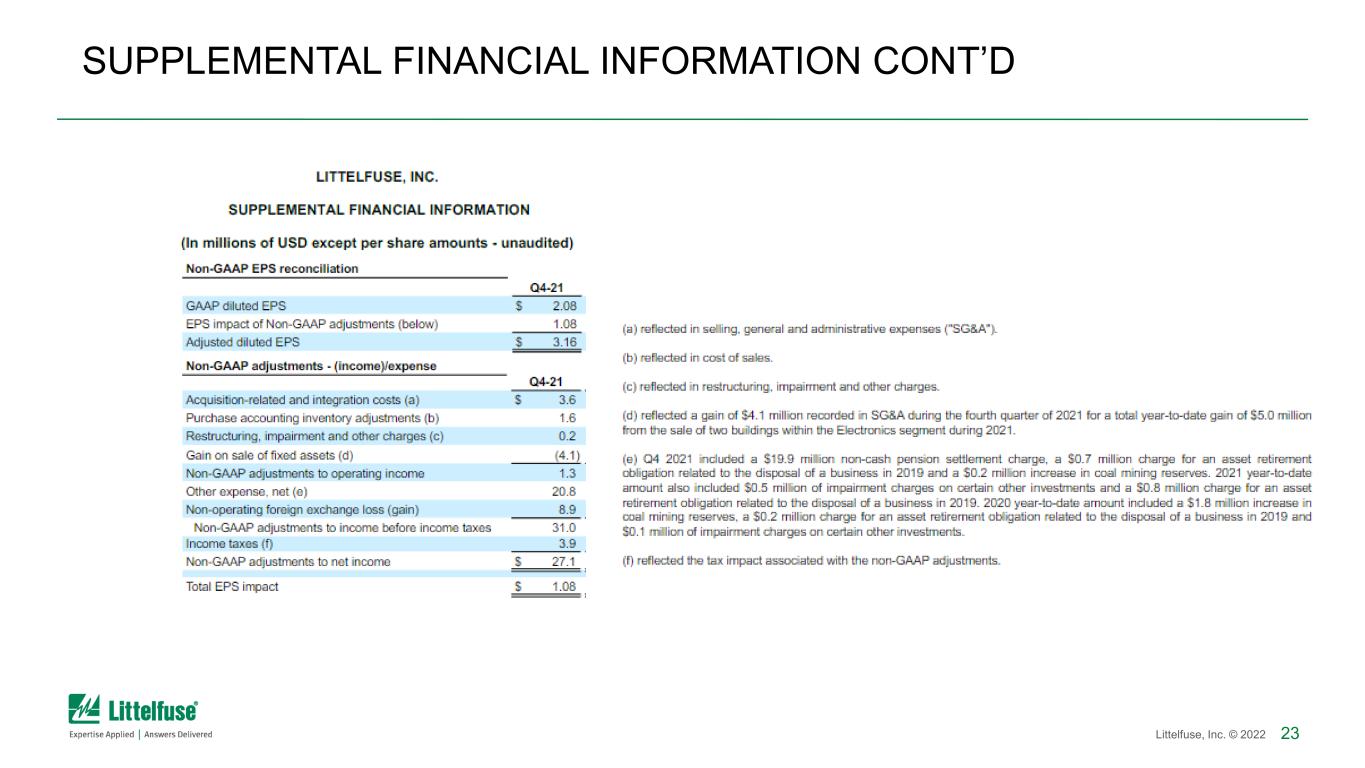

| Non-GAAP EPS reconciliation | ||||||||||||||||||||||||||

| Q3-22 | Q3-21 | YTD-22 | YTD-21 | |||||||||||||||||||||||

| GAAP diluted EPS | $ | 3.02 | $ | 3.69 | $ | 11.21 | $ | 9.31 | ||||||||||||||||||

| EPS impact of Non-GAAP adjustments (below) | 1.26 | 0.26 | 2.32 | 0.73 | ||||||||||||||||||||||

| Adjusted diluted EPS | $ | 4.28 | $ | 3.95 | $ | 13.53 | $ | 10.04 | ||||||||||||||||||

| Non-GAAP adjustments - (income) / expense | ||||||||||||||||||||||||||

| Q3-22 | Q3-21 | YTD-22 | YTD-21 | |||||||||||||||||||||||

| Acquisition-related and integration costs (a) | $ | 6.2 | $ | 2.0 | $ | 14.8 | $ | 3.4 | ||||||||||||||||||

| Purchase accounting inventory adjustments (b) | 6.8 | — | 11.6 | 6.8 | ||||||||||||||||||||||

| Restructuring, impairment and other charges (c) | 3.4 | 0.8 | 4.3 | 2.0 | ||||||||||||||||||||||

| Gain on sale of fixed assets (d) | — | — | — | (0.9) | ||||||||||||||||||||||

| Non-GAAP adjustments to operating income | 16.4 | 2.8 | 30.7 | 11.3 | ||||||||||||||||||||||

| Other expense (income), net (e) | — | 0.1 | (0.5) | 0.6 | ||||||||||||||||||||||

| Non-operating foreign exchange loss | 18.2 | 3.2 | 40.1 | 8.3 | ||||||||||||||||||||||

| Non-GAAP adjustments to income before income taxes | 34.6 | 6.1 | 70.3 | 20.2 | ||||||||||||||||||||||

| Income taxes (f) | 3.0 | (0.4) | 12.2 | 2.1 | ||||||||||||||||||||||

| Non-GAAP adjustments to net income | $ | 31.6 | $ | 6.5 | $ | 58.1 | $ | 18.1 | ||||||||||||||||||

| Total EPS impact | $ | 1.26 | $ | 0.26 | $ | 2.32 | $ | 0.73 | ||||||||||||||||||

| Adjusted operating margin / Adjusted EBITDA reconciliation | ||||||||||||||||||||||||||

| Q3-22 | Q3-21 | YTD-22 | YTD-21 | |||||||||||||||||||||||

| Net sales | $ | 658.9 | $ | 539.6 | $ | 1,900.6 | $ | 1,526.9 | ||||||||||||||||||

| GAAP operating income | $ | 121.9 | $ | 120.1 | $ | 406.6 | $ | 292.8 | ||||||||||||||||||

| Add back non-GAAP adjustments | 16.4 | 2.8 | 30.7 | 11.3 | ||||||||||||||||||||||

| Adjusted operating income | $ | 138.3 | $ | 122.9 | $ | 437.3 | $ | 304.1 | ||||||||||||||||||

| Adjusted operating margin | 21.0 | % | 22.8 | % | 23.0 | % | 19.9 | % | ||||||||||||||||||

| Add back amortization | 15.6 | 10.4 | 39.9 | 31.6 | ||||||||||||||||||||||

| Add back depreciation | 17.0 | 14.2 | 48.3 | 41.4 | ||||||||||||||||||||||

| Adjusted EBITDA | $ | 170.9 | $ | 147.5 | $ | 525.5 | $ | 377.1 | ||||||||||||||||||

| Adjusted EBITDA margin | 25.9 | % | 27.3 | % | 27.6 | % | 24.7 | % | ||||||||||||||||||

| Adjusted EBITDA by Segment | Q3-22 | Q3-21 | ||||||||||||||||||||||||||||||||||||

| Electronics | Transportation | Industrial | Electronics | Transportation | Industrial | |||||||||||||||||||||||||||||||||

| GAAP operating income | $ | 113.1 | $ | 13.0 | $ | 12.2 | $ | 100.5 | $ | 15.8 | $ | 6.6 | ||||||||||||||||||||||||||

| Add: | ||||||||||||||||||||||||||||||||||||||

| Add back amortization | 9.7 | 4.7 | 1.2 | 6.8 | 2.4 | 1.2 | ||||||||||||||||||||||||||||||||

| Add back depreciation | 9.4 | 6.7 | 1.0 | 8.7 | 4.6 | 0.8 | ||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 132.2 | $ | 24.4 | $ | 14.4 | $ | 116.0 | $ | 22.9 | $ | 8.6 | ||||||||||||||||||||||||||

| Adjusted EBITDA Margin | 33.3 | % | 13.4 | % | 18.1 | % | 33.4 | % | 18.4 | % | 12.7 | % | ||||||||||||||||||||||||||

| Adjusted EBITDA by Segment | YTD-22 | YTD-21 | ||||||||||||||||||||||||||||||||||||

| Electronics | Transportation | Industrial | Electronics | Transportation | Industrial | |||||||||||||||||||||||||||||||||

| GAAP operating income | $ | 339.7 | $ | 57.6 | $ | 40.0 | $ | 230.3 | $ | 55.4 | $ | 18.5 | ||||||||||||||||||||||||||

| Add: | ||||||||||||||||||||||||||||||||||||||

| Add back amortization | 22.5 | 13.7 | 3.7 | $ | 21.0 | $ | 7.1 | $ | 3.5 | |||||||||||||||||||||||||||||

| Add back depreciation | 26.5 | 19.0 | 2.9 | $ | 25.0 | $ | 14.0 | $ | 2.5 | |||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 388.7 | $ | 90.3 | $ | 46.5 | $ | 276.3 | $ | 76.5 | $ | 24.5 | ||||||||||||||||||||||||||

| Adjusted EBITDA Margin | 34.7 | % | 16.5 | % | 20.1 | % | 28.8 | % | 19.8 | % | 13.5 | % | ||||||||||||||||||||||||||

| Net sales reconciliation | Q3-22 vs. Q3-21 | |||||||||||||||||||||||||

| Electronics | Transportation | Industrial | Total | |||||||||||||||||||||||

| Net sales growth | 15 | % | 46 | % | 17 | % | 22 | % | ||||||||||||||||||

| Less: | ||||||||||||||||||||||||||

| Acquisitions | 11 | % | 49 | % | — | % | 18 | % | ||||||||||||||||||

| FX impact | (3) | % | (7) | % | (1) | % | (4) | % | ||||||||||||||||||

| Organic net sales growth | 7 | % | 4 | % | 18 | % | 8 | % | ||||||||||||||||||

| Net sales reconciliation | YTD-22 vs. YTD-21 | |||||||||||||||||||||||||

| Electronics | Transportation | Industrial | Total | |||||||||||||||||||||||

| Net sales growth | 17 | % | 42 | % | 27 | % | 24 | % | ||||||||||||||||||

| Less: | ||||||||||||||||||||||||||

| Acquisitions | 4 | % | 46 | % | 5 | % | 14 | % | ||||||||||||||||||

| FX impact | (3) | % | (5) | % | (1) | % | (3) | % | ||||||||||||||||||

| Organic net sales growth | 16 | % | 1 | % | 23 | % | 13 | % | ||||||||||||||||||

| Income tax reconciliation | ||||||||||||||||||||||||||

| Q3-22 | Q3-21 | YTD-22 | YTD-21 | |||||||||||||||||||||||

| Income taxes | $ | 20.5 | $ | 21.5 | $ | 59.7 | $ | 49.6 | ||||||||||||||||||

| Effective rate | 21.4 | % | 19.0 | % | 17.6 | % | 17.6 | % | ||||||||||||||||||

| Non-GAAP adjustments - income taxes | 3.0 | (0.4) | 12.2 | 2.1 | ||||||||||||||||||||||

| Adjusted income taxes | $ | 23.4 | $ | 21.1 | $ | 71.9 | $ | 51.7 | ||||||||||||||||||

| Adjusted effective rate | 18.0 | % | 17.6 | % | 17.5 | % | 17.1 | % | ||||||||||||||||||

| Free cash flow reconciliation | ||||||||||||||||||||||||||

| Q3-22 | Q3-21 | YTD-22 | YTD-21 | |||||||||||||||||||||||

| Net cash provided by operating activities | $ | 148.1 | $ | 114.3 | $ | 313.4 | $ | 240.7 | ||||||||||||||||||

| Less: Purchases of property, plant and equipment | (21.7) | (24.9) | (77.8) | (57.5) | ||||||||||||||||||||||

| Free cash flow | $ | 126.5 | $ | 89.4 | $ | 235.7 | $ | 183.2 | ||||||||||||||||||

| Consolidated Total Debt | As of October 1, 2022 |

|||||||

| Consolidated Total Debt | $ | 985.8 | ||||||

| Unamortized debt issuance costs | 5.0 | |||||||

| Consolidated funded indebtedness | 990.8 | |||||||

| Cash held in U.S. (up to $400 million) | 115.9 | |||||||

| Net debt | $ | 874.9 | ||||||

| Consolidated EBITDA | Twelve Months Ended October 1, 2022 |

|||||||

| Net Income | $ | 331.9 | ||||||

| Interest expense | 21.7 | |||||||

| Income taxes | 67.3 | |||||||

| Depreciation | 62.8 | |||||||

| Amortization | 51.0 | |||||||

| Non-cash additions: | ||||||||

| Stock-based compensation expense | 23.3 | |||||||

| Non-cash pension settlement charge | 19.9 | |||||||

| Purchase accounting inventory step-up charge | 13.1 | |||||||

| Unrealized loss on investments | 14.6 | |||||||

| Other | 126.4 | |||||||

| Consolidated EBITDA (1) | $ | 732.0 | ||||||

| Consolidated Net Leverage Ratio (as defined in the Credit Agreement) * | 1.2x | |||||||