Document

Press Release

UGI Reports Strong Fiscal 2025 Results

Issues Fiscal 2026 Guidance

November 20, 2025

VALLEY FORGE, PA - UGI Corporation (NYSE: UGI) today reported financial results for the fiscal year ended September 30, 2025 and provided guidance for fiscal year 2026.

HEADLINES

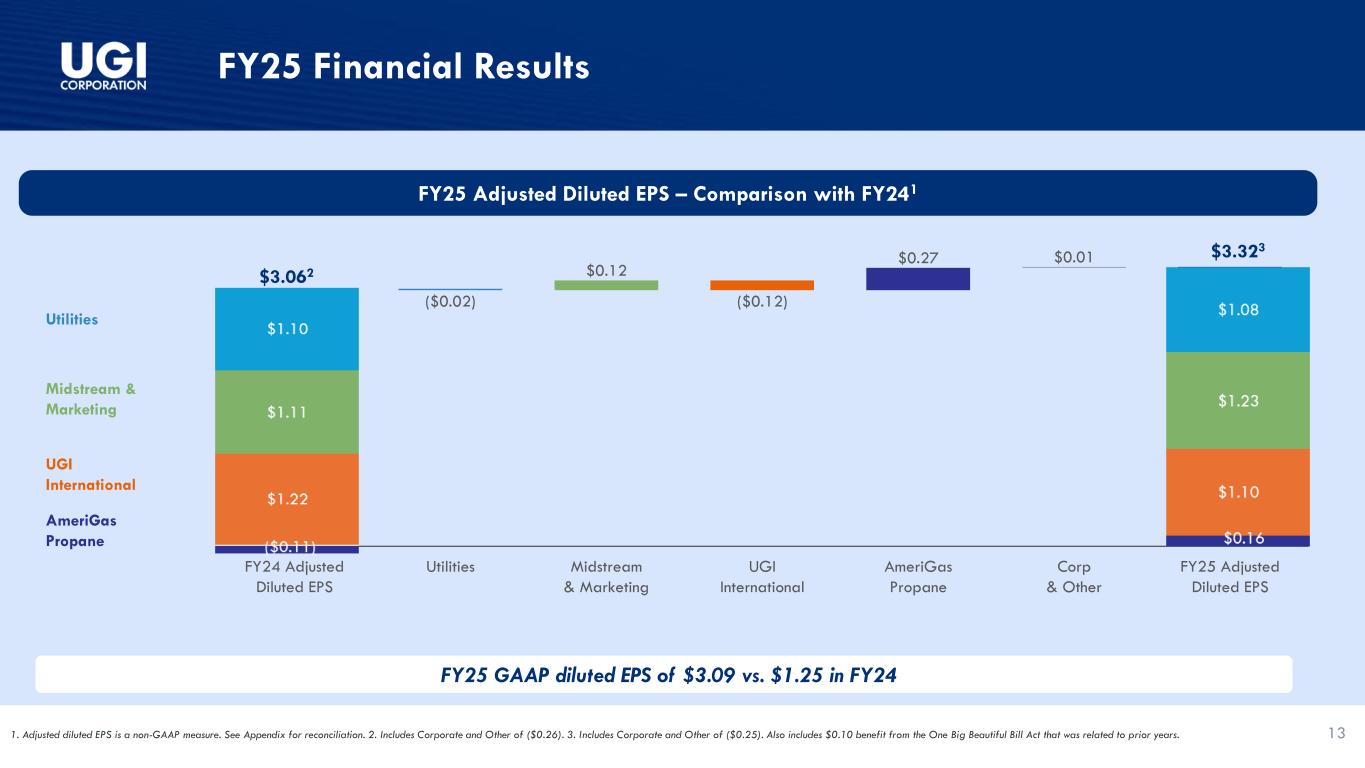

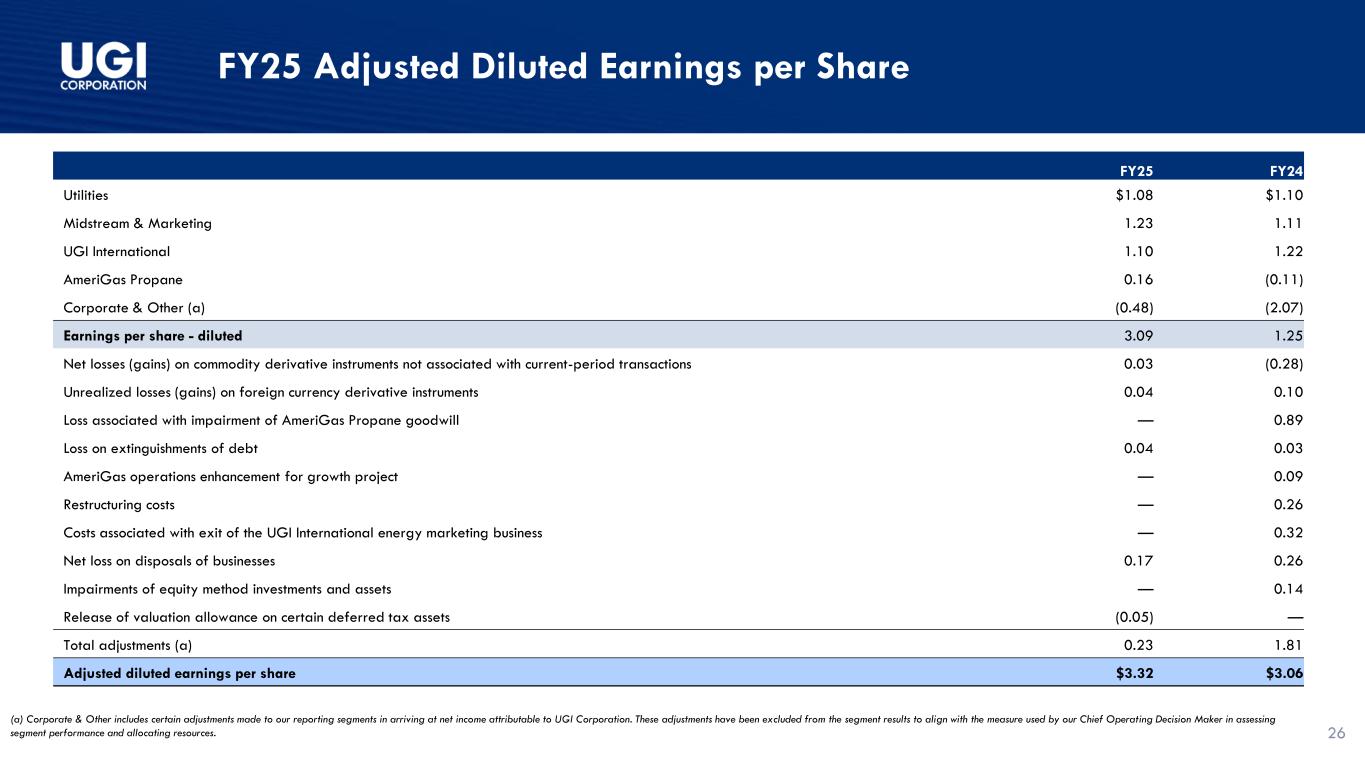

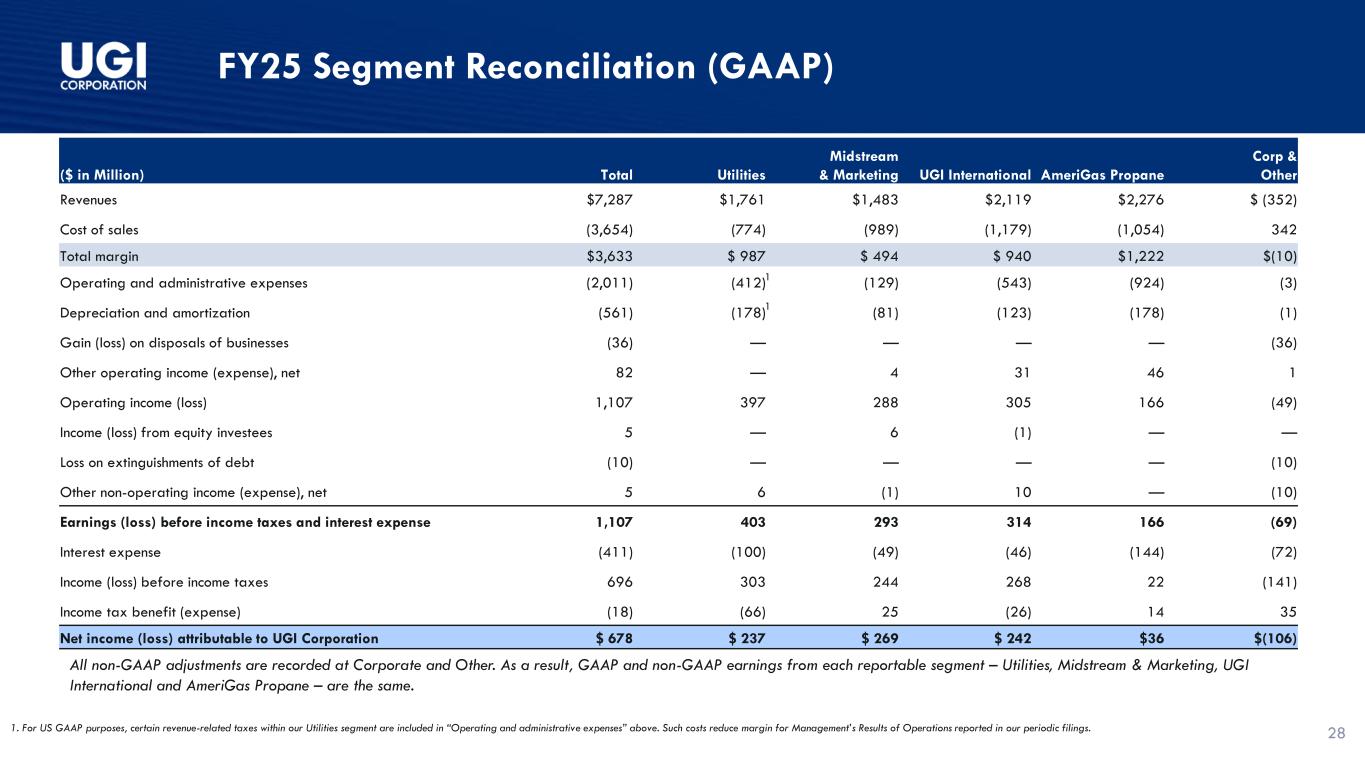

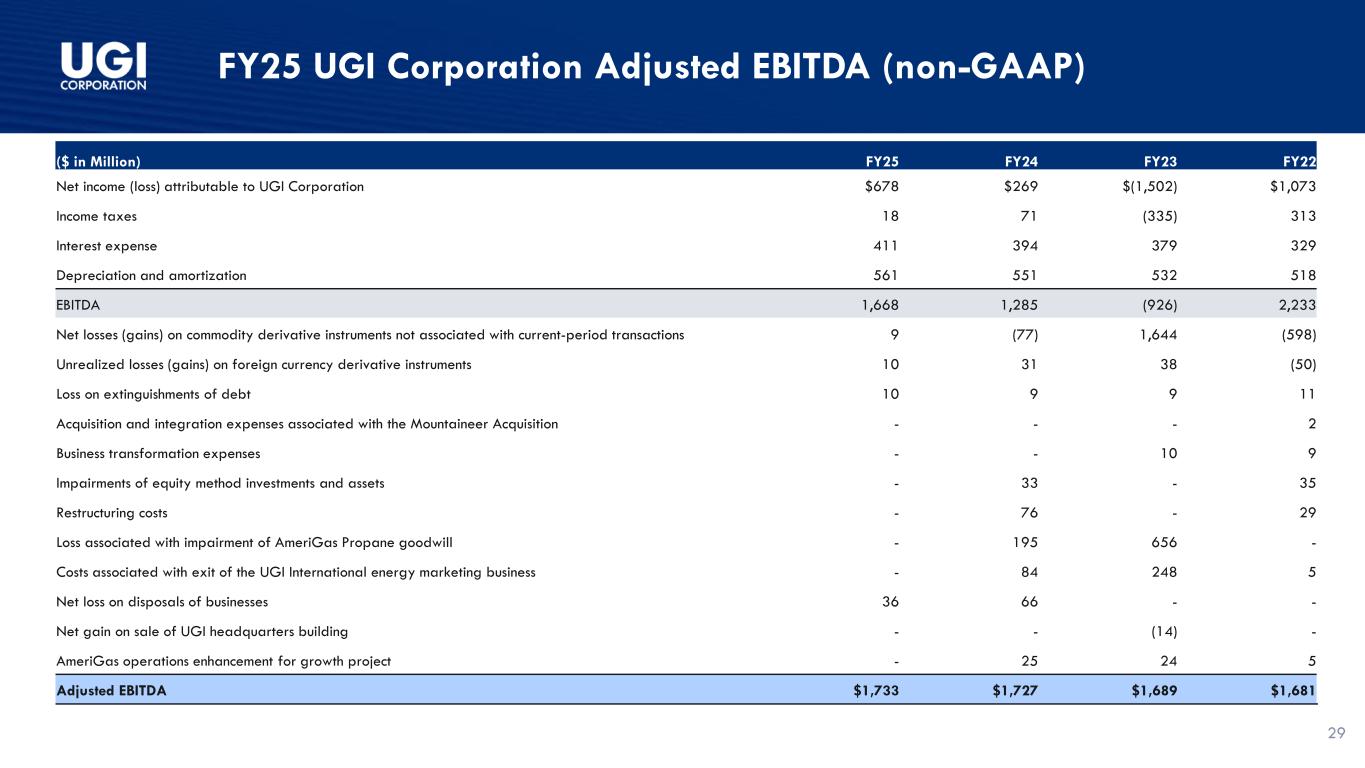

•GAAP net income of $678 million and adjusted net income of $728 million compared to GAAP net income of $269 million and adjusted net income of $658 million in the prior year.

•GAAP diluted earnings per share (“EPS”) of $3.09 and adjusted diluted EPS of $3.32 compared to GAAP diluted EPS of $1.25 and adjusted diluted EPS of $3.06 in the prior year.

•Reportable segments earnings before interest expense and income tax1 ("EBIT") of $1,176 million compared to $1,178 million in the prior year.

•Delivered adjusted diluted EPS above the top end of our revised guidance range issued on May 7, 2025.

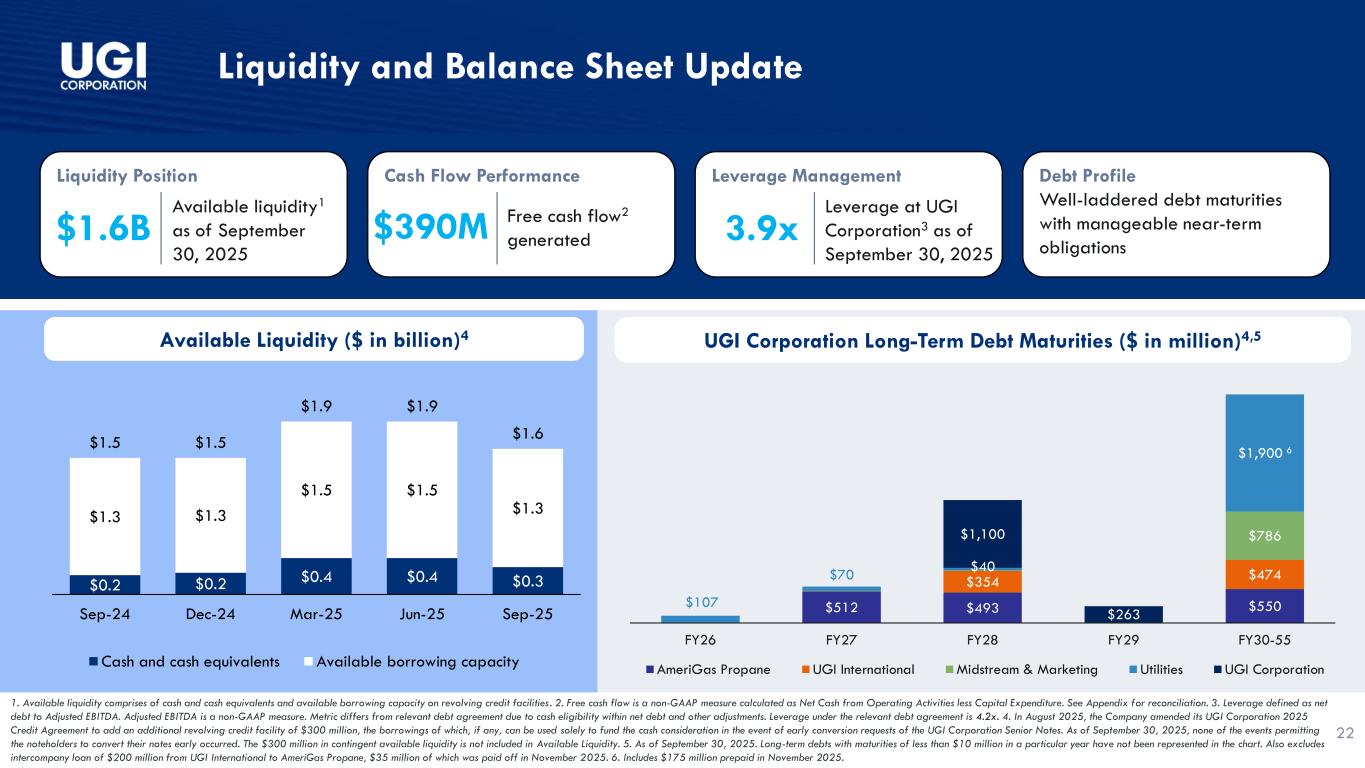

•Strengthened the balance sheet with available liquidity of approximately $1.6 billion and a leverage ratio of 3.9x at UGI Corporation and 4.9x at AmeriGas Propane.

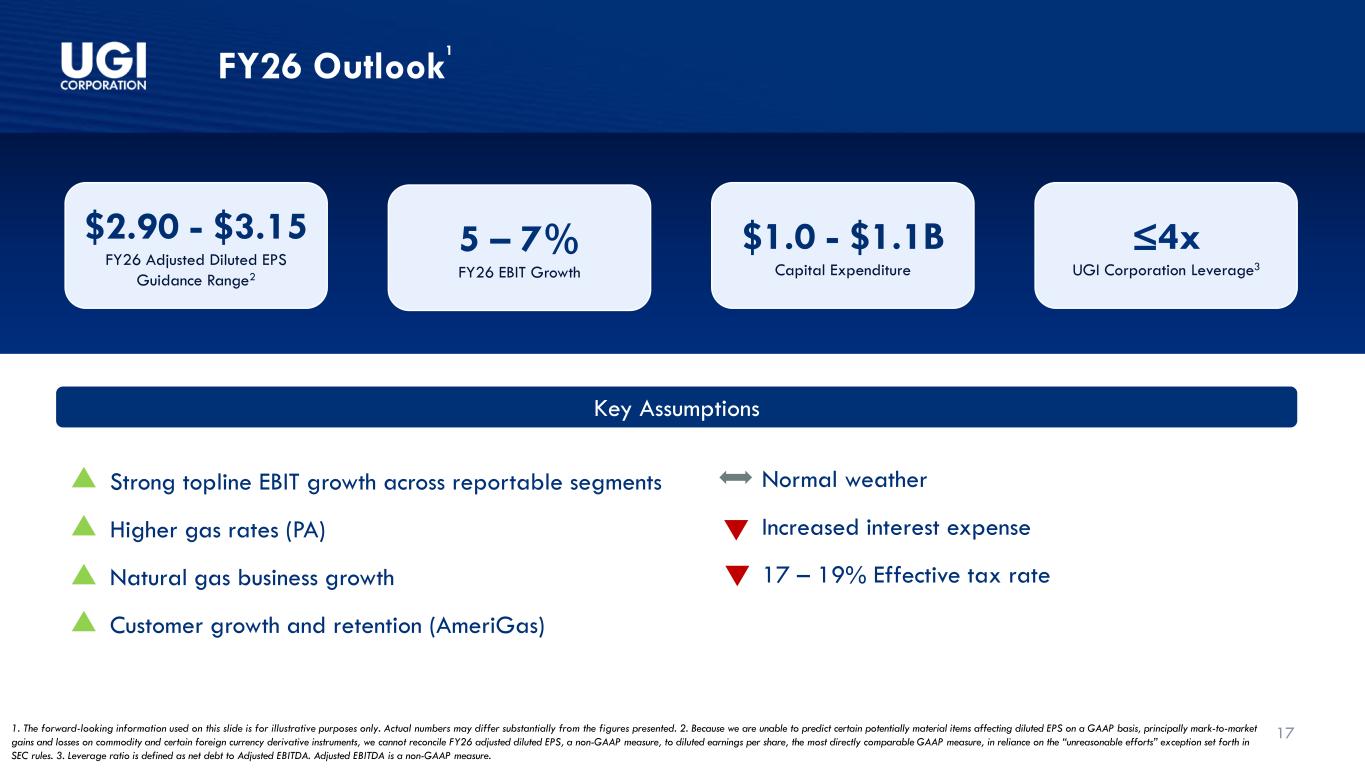

•Issues fiscal 2026 adjusted diluted EPS guidance range of $2.90 - $3.152, inclusive of an expected 5 - 7% growth in reportable segments EBIT.

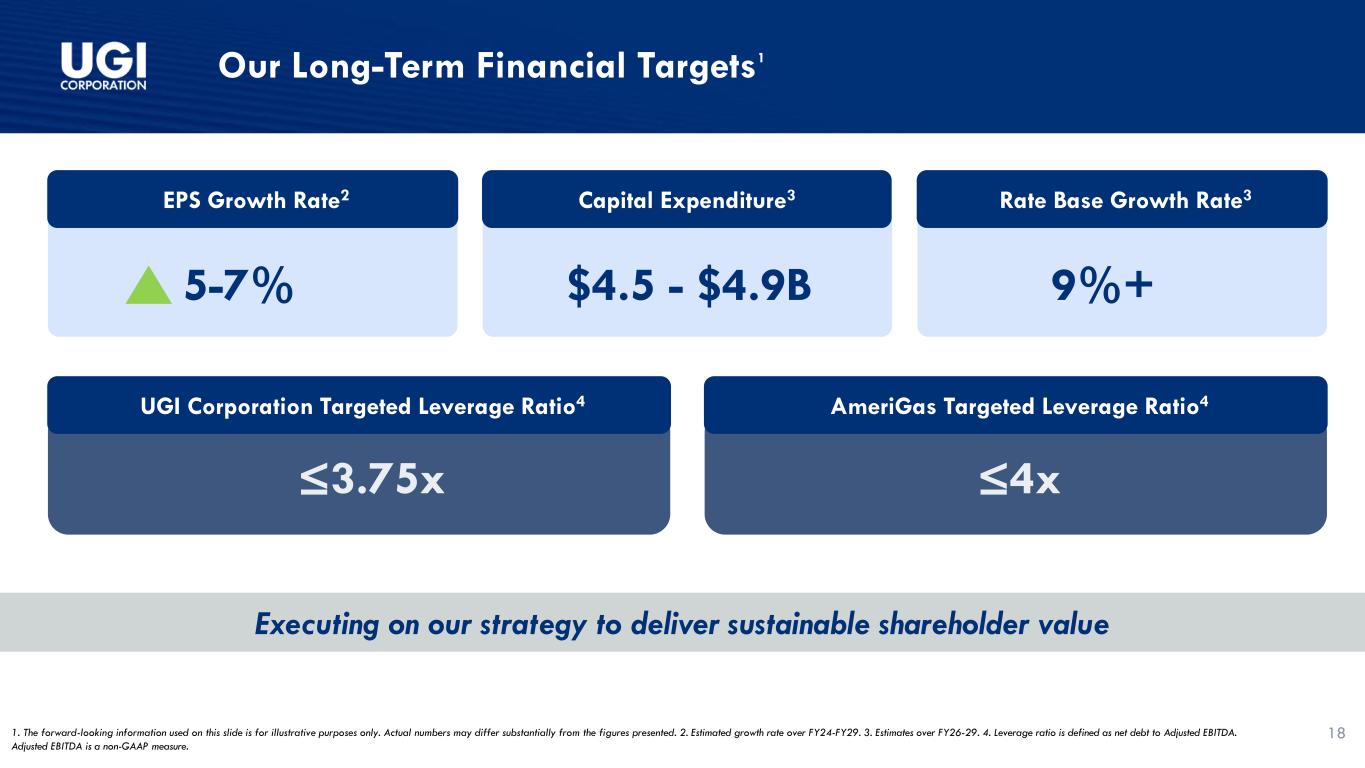

•Increases and extends its expected EPS compound annual growth rate to 5 - 7% between FY24 and FY29.

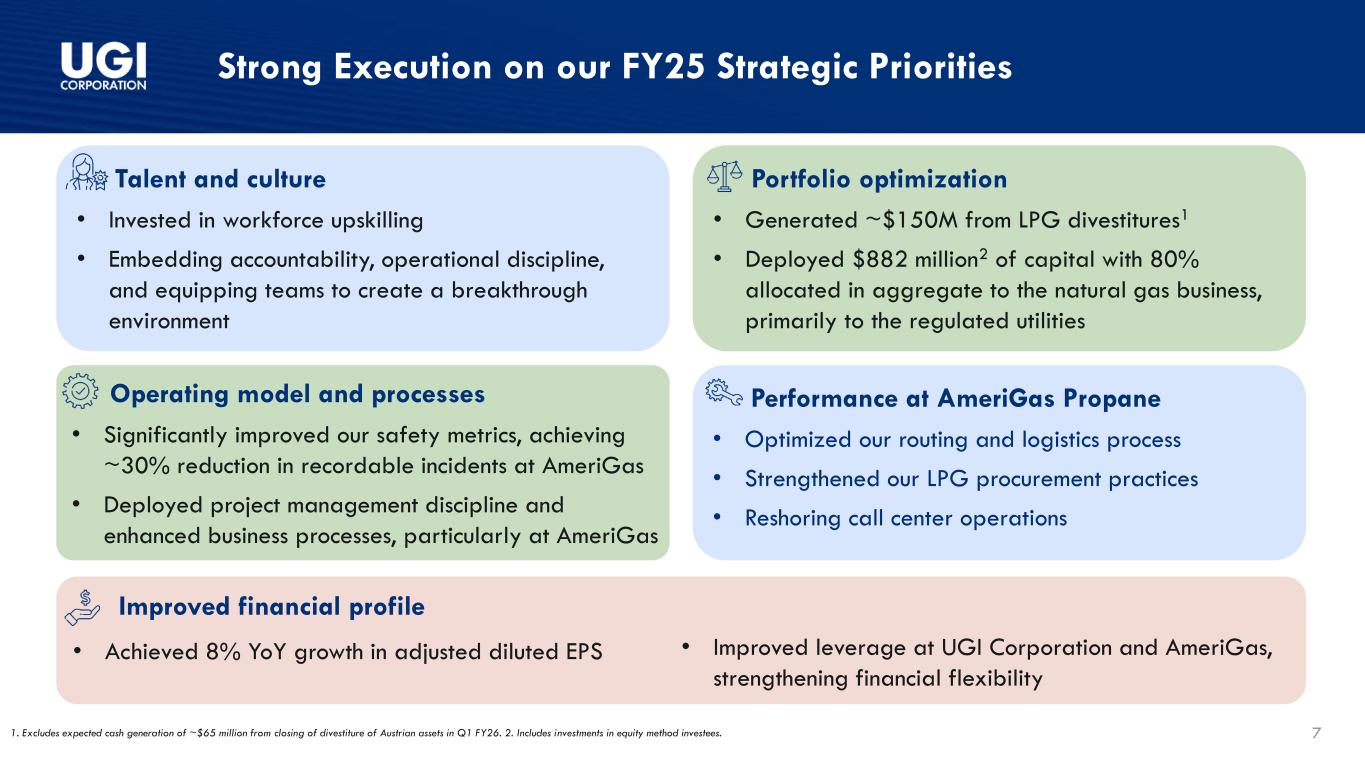

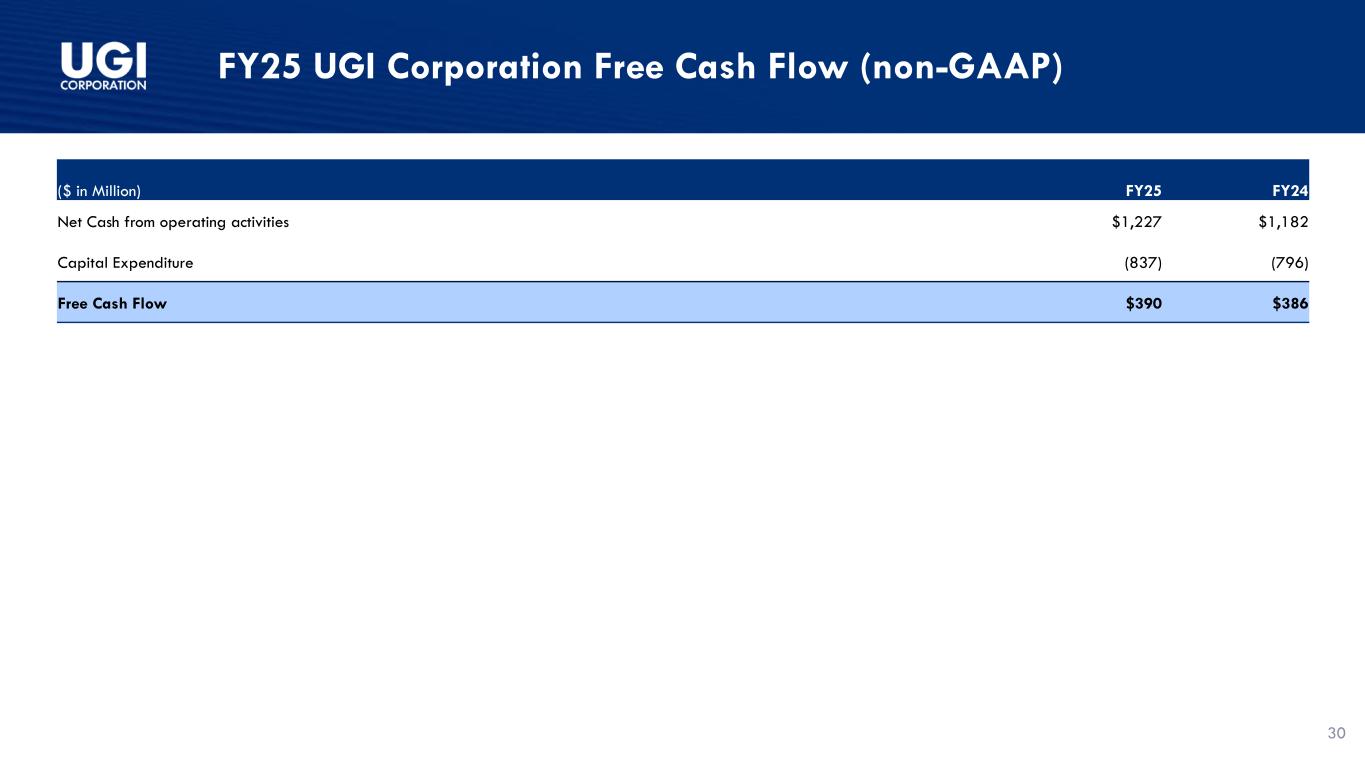

“UGI delivered an outstanding year with record adjusted earnings per share that exceeded our revised guidance range," said Robert Flexon, President and Chief Executive Officer of UGI Corporation. "Our diversified portfolio demonstrated its strength as continued improvements at AmeriGas which led to its higher EBIT coupled with solid operational performance from our Utilities segment, and significant tax benefits, drove exceptional results. We strengthened our balance sheet, generated approximately $530 million of free cash flow inclusive of cash generated from asset sales, and returned value to shareholders through dividend payments.

"This year, we invested in upskilling our workforce and cultivating a performance-driven culture focused on driving breakthrough outcomes in our operating and supporting functions. This foundation is crucial as we enhance our operating processes, transform how we work across the organization, and optimize UGI's intrinsic value for all stakeholders. I am particularly excited about the progress we've made at AmeriGas and anticipate that the winter season ahead will demonstrate the tangible impact of the initiatives underway."

2026 OUTLOOK

UGI provides an adjusted EPS guidance range of $2.90 - $3.152 per diluted share for the fiscal year ending September 30, 2026. This guidance range assumes normal weather and the current tax regime.

EARNINGS CALL and WEBCAST

UGI Corporation will hold a live Internet Audio Webcast of its conference call to discuss Fiscal 2025 earnings and other current activities at 9:00 AM ET on Friday, November 21, 2025. Interested parties may listen to the audio webcast both live and in replay on the Internet at https://www.ugicorp.com/investors/financial-reports/presentations or by visiting the company website https://www.ugicorp.com and clicking on Investors and then Presentations. A replay of the webcast will be available after the event through to 11:59 PM ET November 19, 2026.

CONTACT INVESTOR RELATIONS

Tel: +1 610-337-1000

Tameka Morris, ext. 6297

Arnab Mukherjee, ext. 7498

ABOUT UGI

UGI Corporation (NYSE: UGI) is a distributor and marketer of energy products and services in the US and Europe. UGI offers safe, reliable, affordable, and sustainable energy solutions to customers through its subsidiaries, which provide natural gas transmission and distribution, electric generation and distribution, midstream services, propane distribution, renewable natural gas generation, distribution and marketing, and energy marketing services.

Comprehensive information about UGI Corporation is available on the Internet at https://www.ugicorp.com.

USE OF NON-GAAP MEASURES

Management uses “adjusted net income attributable to UGI Corporation” and "adjusted diluted earnings per share," both of which are non-GAAP financial measures, when evaluating UGI's overall performance. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impacts of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results. Volatility in net income attributable to UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions but included in earnings in accordance with U.S. generally accepted accounting principles ("GAAP").

Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures.

Tables on the last page of this press release reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to above.

1Reportable segments' EBIT represents an aggregate of our reportable operating segment level EBIT as determined in accordance with GAAP.

2Because we are unable to predict certain potentially material items affecting diluted earnings per share on a GAAP basis, principally mark-to-market gains and losses on commodity and certain foreign currency derivative instruments, we cannot reconcile the fiscal year 2026 adjusted diluted earnings per share, a non-GAAP measure, to diluted earnings per share, the most directly comparable GAAP measure, in reliance on the “unreasonable efforts” exception set forth in SEC rules.

USE OF FORWARD-LOOKING STATEMENTS

This press release contains statements, estimates and projections that are forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended). Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words and terms of similar meaning, although not all forward-looking statements contain such words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future. Management believes that these are reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control; accordingly, there is no assurance that results will be realized. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. We undertake no obligation (and expressly disclaim any obligation) to update publicly any forward-looking statement, whether as a result of new information or future events, except as required by the federal securities laws.

SEGMENT RESULTS ($ in millions, except where otherwise indicated)

Utilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the year ended September 30, |

|

2025 |

|

2024 |

|

Increase (Decrease) |

| Revenues |

|

$ |

1,761 |

|

|

$ |

1,598 |

|

|

$ |

163 |

|

|

10 |

% |

| Total margin (a) |

|

$ |

963 |

|

|

$ |

924 |

|

|

$ |

39 |

|

|

4 |

% |

| Operating and administrative expenses |

|

$ |

388 |

|

|

$ |

363 |

|

|

$ |

25 |

|

|

7 |

% |

| Operating income |

|

$ |

397 |

|

|

$ |

394 |

|

|

$ |

3 |

|

|

1 |

% |

| Earnings before interest expense and income taxes |

|

$ |

403 |

|

|

$ |

400 |

|

|

$ |

3 |

|

|

1 |

% |

|

|

|

|

|

|

|

|

|

| Gas Utility system throughput - billions of cubic feet |

|

|

|

|

|

|

|

|

| Core market |

|

102 |

|

|

93 |

|

|

9 |

|

|

10 |

% |

| Total |

|

378 |

|

|

378 |

|

|

— |

|

|

— |

% |

| Natural gas heating degree days - % warmer than normal |

|

(2.4) |

% |

|

(16.0) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

556 |

|

|

$ |

482 |

|

|

$ |

74 |

|

|

15 |

% |

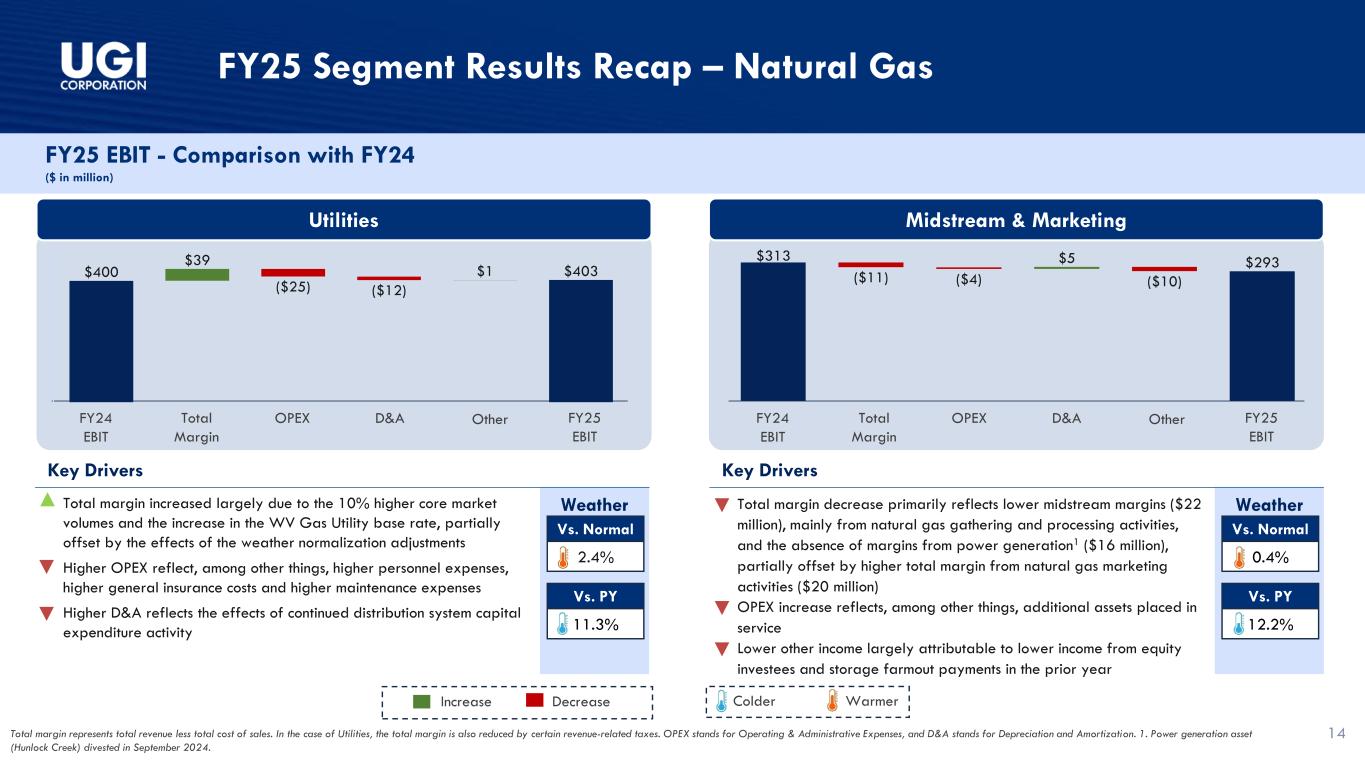

•Temperatures were 2% warmer than normal and 11% colder than the prior year.

•Core market volumes were 10% higher largely reflecting the impact from the colder weather compared to the prior year.

•Total margin increased $39 million primarily due to higher core market volumes, higher gas base rates in West Virginia, and continued customer growth.

•Operating and administrative expenses increased $25 million reflecting, among other things, higher personnel expenses, higher general insurance costs and higher maintenance expenses.

•Operating income increased $3 million due to the higher total margin largely offset by higher operating and administrative expenses and higher depreciation expense ($12 million) from continued distribution system capital expenditure activity.

(a) Total margin represents total revenue less total cost of sales. In the case of the Utilities, total margin is also reduced by certain revenue-related taxes.

Midstream & Marketing

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the year ended September 30, |

|

2025 |

|

2024 |

|

Increase (Decrease) |

| Revenues |

|

$ |

1,483 |

|

|

$ |

1,369 |

|

|

$ |

114 |

|

|

8 |

% |

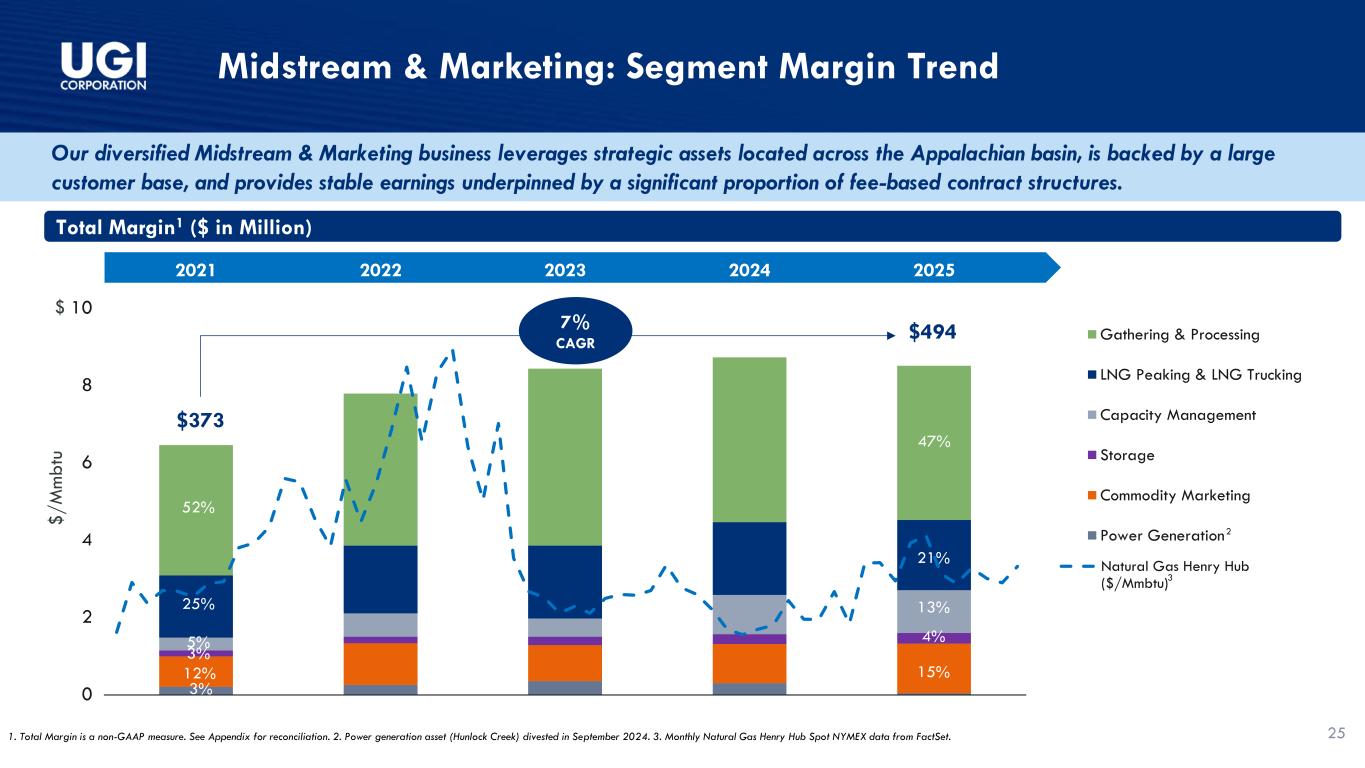

| Total margin (a) |

|

$ |

494 |

|

|

$ |

505 |

|

|

$ |

(11) |

|

|

(2) |

% |

| Operating and administrative expenses |

|

$ |

129 |

|

|

$ |

125 |

|

|

$ |

4 |

|

|

3 |

% |

| Operating income |

|

$ |

288 |

|

|

$ |

301 |

|

|

$ |

(13) |

|

|

(4) |

% |

| Earnings before interest expense and income taxes |

|

$ |

293 |

|

|

$ |

313 |

|

|

$ |

(20) |

|

|

(6) |

% |

|

|

|

|

|

|

|

|

|

| Heating degree days - % warmer than normal |

|

(0.4) |

% |

|

(13.3) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

114 |

|

|

$ |

150 |

|

|

$ |

(36) |

|

|

(24) |

% |

•Temperatures were 12% colder than the prior year and fairly consistent with normal weather.

•Total margin decreased $11 million reflecting lower midstream margins ($22 million), mainly from lower natural gas gathering and processing activities, and the absence of power generation associated with Hunlock that was sold in September 2024 ($16 million). These decreases were partially offset by higher total margin from gas marketing activities ($20 million).

•Operating and administrative expenses increased $4 million reflecting, among other things, additional assets placed in service this year.

•Operating income decreased $13 million due to lower total margin and higher operating and administrative expenses.

•EBIT decreased $20 million primarily due to the decrease in operating income ($13 million) and lower income from equity investees ($4 million).

UGI International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the year ended September 30, |

|

2025 |

|

2024 |

|

Increase (Decrease) |

| Revenues |

|

$ |

2,119 |

|

|

$ |

2,279 |

|

|

$ |

(160) |

|

|

(7) |

% |

| Total margin (a) |

|

$ |

940 |

|

|

$ |

978 |

|

|

$ |

(38) |

|

|

(4) |

% |

| Operating and administrative expenses |

|

$ |

543 |

|

|

$ |

578 |

|

|

$ |

(35) |

|

|

(6) |

% |

| Operating income |

|

$ |

305 |

|

|

$ |

311 |

|

|

$ |

(6) |

|

|

(2) |

% |

| Earnings before interest expense and income taxes |

|

$ |

314 |

|

|

$ |

323 |

|

|

$ |

(9) |

|

|

(3) |

% |

|

|

|

|

|

|

|

|

|

| LPG retail gallons sold (millions) |

|

698 |

|

|

725 |

|

|

(27) |

|

|

(4) |

% |

| Heating degree days - % warmer than normal |

|

(3.3) |

% |

|

(11.8) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

93 |

|

|

$ |

87 |

|

|

$ |

6 |

|

|

7 |

% |

Base-currency results are translated into U.S. dollars based upon exchange rates experienced during the reporting periods. The functional currency of a significant portion of our UGI International results is the euro and, to a much lesser extent, the British pound sterling. During Fiscal 2025 and Fiscal 2024, the average unweighted euro-to-dollar translation rates were $1.11 and $1.08, respectively, and the average unweighted British pound sterling-to-dollar translation rate were $1.31 and $1.27, respectively.

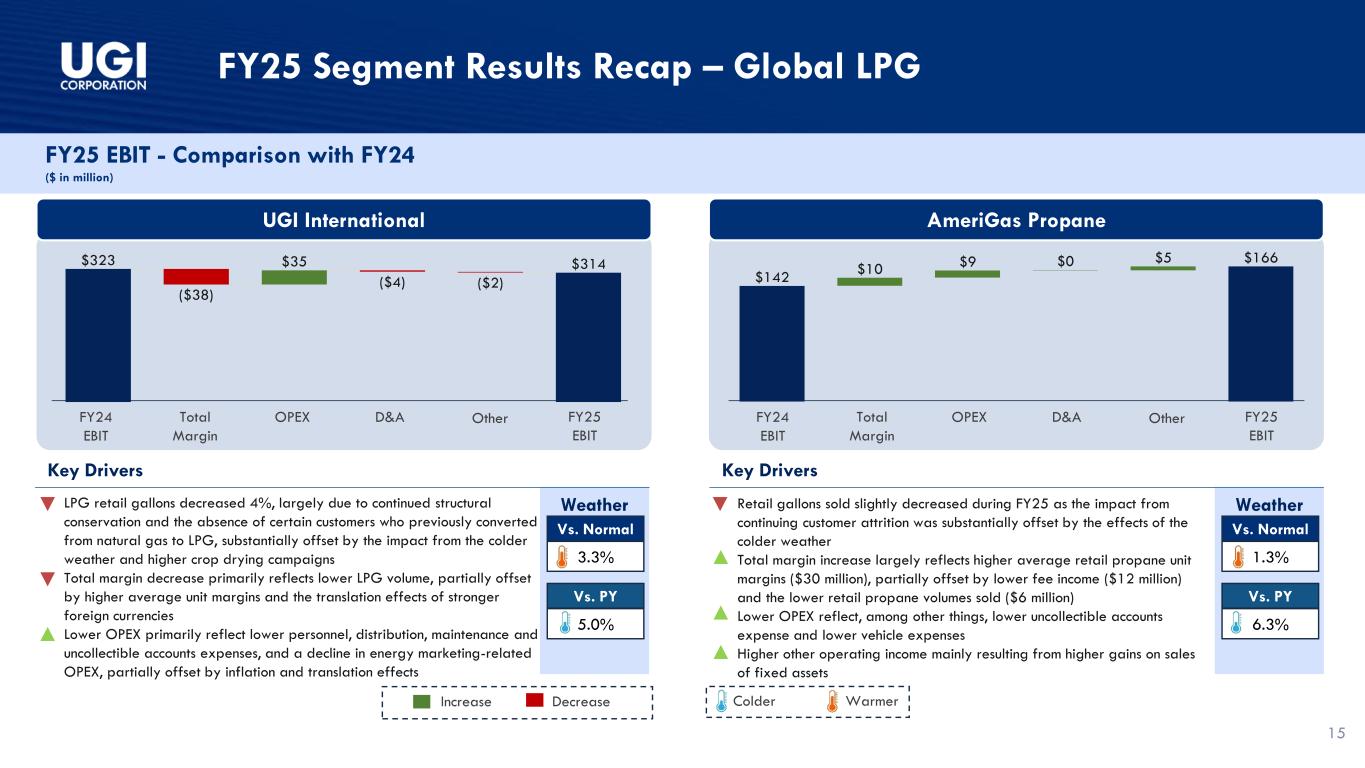

•Temperatures were 3% warmer than normal and 5% colder than the prior-year.

•Retail volumes were 4% lower than the prior-year period largely due to continued structural conservation and the absence of certain customers who previously converted from natural gas to LPG, substantially offset by the effects of colder weather and higher crop drying campaigns.

•Total margin decreased $38 million reflecting lower retail gallons, partially offset by higher average LPG unit margins and the translation effects of the stronger foreign currencies ($9 million).

•Operating and administrative expenses decreased $35 million primarily due to lower personnel-related, distribution, maintenance and uncollectible account expenses, as well as from the exit of the energy marketing business. These decreases were partially offset by the translation effects of the stronger foreign currencies ($10 million).

•Operating income decreased $6 million due to lower total margin ($38 million), partially offset by lower operating and administrative expenses ($35 million) and higher depreciation and amortization expense ($4 million).

•EBIT decreased $9 million reflecting reduced operating income and lower realized gains on foreign currency exchange contracts ($5 million).

AmeriGas Propane

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the year ended September 30, |

|

2025 |

|

2024 |

|

(Decrease) increase |

| Revenues |

|

$ |

2,276 |

|

|

$ |

2,271 |

|

|

$ |

5 |

|

|

— |

% |

| Total margin (a) |

|

$ |

1,222 |

|

|

$ |

1,212 |

|

|

$ |

10 |

|

|

1 |

% |

| Operating and administrative expenses |

|

$ |

924 |

|

|

$ |

933 |

|

|

$ |

(9) |

|

|

(1) |

% |

| Operating income / earnings before interest expense and income taxes |

|

$ |

166 |

|

|

$ |

142 |

|

|

$ |

24 |

|

|

17 |

% |

|

|

|

|

|

|

|

|

|

| Retail gallons sold (millions) |

|

733 |

|

|

737 |

|

|

(4) |

|

|

(1) |

% |

| Heating degree days - % warmer than normal |

|

(1.3) |

% |

|

(8.0) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

81 |

|

|

$ |

86 |

|

|

$ |

(5) |

|

|

(6) |

% |

•Temperatures were 1% warmer than normal and 6% colder than the prior year.

•Retail gallons sold decreased slightly as the effect of the colder than prior year weather was offset by customer attrition.

•Total margin increased $10 million reflecting higher average LPG unit margins partially offset by lower fee income and slightly lower retail volumes sold.

•Operating and administrative expenses decreased $9 million reflecting, among other things, lower uncollectible account expenses and vehicle fuel costs.

•Operating income and EBIT increased $24 million largely due to higher total margin, reduced operating and administrative expenses and higher other operating income ($5 million), mainly resulting from higher gains on sales of fixed assets.

REPORT OF EARNINGS - UGI CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Millions of dollars, except per share)

Unaudited |

|

Three Months Ended

September 30, |

|

Twelve Months Ended

September 30, |

| |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

|

| Utilities |

|

$ |

216 |

|

|

$ |

202 |

|

|

$ |

1,761 |

|

|

$ |

1,598 |

|

| Midstream & Marketing |

|

251 |

|

|

239 |

|

|

1,483 |

|

|

1,369 |

|

| UGI International |

|

394 |

|

|

426 |

|

|

2,119 |

|

|

2,279 |

|

| AmeriGas Propane |

|

367 |

|

|

402 |

|

|

2,276 |

|

|

2,271 |

|

| Corporate & Other (a) |

|

(31) |

|

|

(27) |

|

|

(352) |

|

|

(307) |

|

| Total revenues |

|

$ |

1,197 |

|

|

$ |

1,242 |

|

|

$ |

7,287 |

|

|

$ |

7,210 |

|

| Earnings (loss) before interest expense and income taxes: |

|

|

|

|

|

|

|

|

| Utilities |

|

$ |

(9) |

|

|

$ |

— |

|

|

$ |

403 |

|

|

$ |

400 |

|

| Midstream & Marketing |

|

17 |

|

|

15 |

|

|

293 |

|

|

313 |

|

| UGI International |

|

18 |

|

|

18 |

|

|

314 |

|

|

323 |

|

| AmeriGas Propane |

|

(34) |

|

|

(40) |

|

|

166 |

|

|

142 |

|

| Total reportable segments |

|

(8) |

|

|

(7) |

|

|

1,176 |

|

|

1,178 |

|

| Corporate & Other (a) |

|

27 |

|

|

(249) |

|

|

(69) |

|

|

(444) |

|

| Total earnings (loss) before interest expense and income taxes |

|

19 |

|

|

(256) |

|

|

1,107 |

|

|

734 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

| Utilities |

|

(25) |

|

|

(24) |

|

|

(100) |

|

|

(93) |

|

| Midstream & Marketing |

|

(14) |

|

|

(12) |

|

|

(49) |

|

|

(41) |

|

| UGI International |

|

(12) |

|

|

(11) |

|

|

(46) |

|

|

(44) |

|

| AmeriGas Propane |

|

(38) |

|

|

(34) |

|

|

(144) |

|

|

(156) |

|

| Corporate & Other, net (a) |

|

(17) |

|

|

(17) |

|

|

(72) |

|

|

(60) |

|

| Total interest expense |

|

(106) |

|

|

(98) |

|

|

(411) |

|

|

(394) |

|

| Income (loss) before income taxes |

|

(87) |

|

|

(354) |

|

|

696 |

|

|

340 |

|

| Income tax benefit (expense ) |

|

74 |

|

|

81 |

|

|

(18) |

|

|

(71) |

|

| Net income (loss) attributable to UGI Corporation |

|

(13) |

|

|

(273) |

|

|

678 |

|

|

269 |

|

| Earnings (loss) per share attributable to UGI Corporation shareholders: |

|

|

|

|

|

|

| Basic |

|

$ |

(0.06) |

|

|

$ |

(1.27) |

|

|

$ |

3.15 |

|

|

$ |

1.27 |

|

| Diluted |

|

$ |

(0.06) |

|

|

$ |

(1.27) |

|

|

$ |

3.09 |

|

|

$ |

1.25 |

|

| Weighted Average common shares outstanding (thousands): |

|

|

|

|

|

|

|

|

| Basic |

|

215,093 |

|

|

214,905 |

|

|

214,945 |

|

|

211,309 |

|

| Diluted |

|

221,372 |

|

|

215,368 |

|

|

219,160 |

|

|

215,271 |

|

| Supplemental information: |

|

|

|

|

|

|

|

|

| Net income (loss) attributable to UGI Corporation: |

|

|

|

|

|

|

| Utilities |

|

$ |

(23) |

|

|

$ |

(17) |

|

|

$ |

237 |

|

|

$ |

237 |

|

| Midstream & Marketing |

|

11 |

|

|

4 |

|

|

269 |

|

|

238 |

|

| UGI International |

|

13 |

|

|

49 |

|

|

242 |

|

|

262 |

|

| AmeriGas Propane |

|

20 |

|

|

(40) |

|

|

36 |

|

|

(23) |

|

| Corporate & Other (a) |

|

(34) |

|

|

(269) |

|

|

(106) |

|

|

(445) |

|

| Total net income (loss) attributable to UGI Corporation |

|

$ |

(13) |

|

|

$ |

(273) |

|

|

$ |

678 |

|

|

$ |

269 |

|

(a)Corporate & Other includes specific items attributable to our reportable segments that are not included in profit measures used by our chief operating decision maker in assessing our reportable segments' performance or allocating resources. These specific items are shown in the section titled "Non-GAAP Financial Measures - Adjusted Net Income Attributable to UGI and Adjusted Diluted Earnings Per Share" below. Corporate & Other also includes the elimination of certain intercompany transactions.

Non-GAAP Financial Measures - Adjusted Net Income Attributable to UGI and Adjusted Diluted Earnings Per Share

(unaudited)

The following tables reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and reconcile diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to previously:

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal Year Ended September 30, |

2025 |

|

2024 |

| Adjusted net income attributable to UGI Corporation (millions): |

|

|

|

| Net income attributable to UGI Corporation |

$ |

678 |

|

|

$ |

269 |

|

Net losses (gains) on commodity derivative instruments not associated with current-period transactions (net of tax of $(2) and $17, respectively) |

7 |

|

|

(60) |

|

Unrealized losses (gains) on foreign currency derivative instruments (net of tax of $(3) and $(9), respectively) |

7 |

|

|

22 |

|

Loss associated with impairment of AmeriGas Propane goodwill (net of tax of $0 and $(3), respectively) |

— |

|

|

192 |

|

Loss on extinguishments of debt (net of tax of $(2) and $(3), respectively) |

8 |

|

|

6 |

|

|

|

|

|

AmeriGas operations enhancement for growth project (net of tax of $0 and $(6), respectively) |

— |

|

|

19 |

|

Restructuring costs (net of tax of $0 and $(20), respectively) |

— |

|

|

56 |

|

Costs associated with exit of the UGI International energy marketing business (net of tax of $0 and $(15), respectively) |

— |

|

|

69 |

|

|

|

|

|

Net loss on disposals of businesses (net of tax of $2 and $(11), respectively) |

38 |

|

|

55 |

|

Impairments of equity method investments and assets (net of tax of $0 and $(3), respectively) |

— |

|

|

30 |

|

| Release of valuation allowance on certain deferred tax assets |

(10) |

|

|

— |

|

| Total adjustments (1) (2) |

50 |

|

|

389 |

|

| Adjusted net income attributable to UGI Corporation |

$ |

728 |

|

|

$ |

658 |

|

|

|

|

|

| Adjusted diluted earnings per share: |

|

|

|

| UGI Corporation earnings per share - diluted |

$ |

3.09 |

|

|

$ |

1.25 |

|

| Net losses (gains) on commodity derivative instruments not associated with current-period transactions |

0.03 |

|

|

(0.28) |

|

| Unrealized losses (gains) on foreign currency derivative instruments |

0.04 |

|

|

0.10 |

|

| Loss associated with impairment of AmeriGas Propane goodwill |

— |

|

|

0.89 |

|

| Loss on extinguishments of debt |

0.04 |

|

|

0.03 |

|

|

|

|

|

| AmeriGas operations enhancement for growth project |

— |

|

|

0.09 |

|

| Restructuring costs |

— |

|

|

0.26 |

|

| Costs associated with exit of the UGI International energy marketing business |

— |

|

|

0.32 |

|

|

|

|

|

| Net loss on disposals of businesses |

0.17 |

|

|

0.26 |

|

| Impairments of equity method investments and assets |

— |

|

|

0.14 |

|

| Release of valuation allowance on certain deferred tax assets |

(0.05) |

|

|

— |

|

| Total adjustments (1) |

0.23 |

|

|

1.81 |

|

| Adjusted diluted earnings per share |

$ |

3.32 |

|

|

$ |

3.06 |

|

(1)Corporate & Other includes certain adjustments made to our reporting segments in arriving at net income attributable to UGI Corporation. These adjustments have been excluded from the segment results to align with the measure used by our chief operating decision maker in assessing segment performance and allocating resources.

(2)Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.