Document

Press Release

UGI Reports Second Quarter Results and Increases Fiscal 2025 Guidance

May 7, 2025

VALLEY FORGE, PA - UGI Corporation (NYSE: UGI) today reported financial results for the fiscal quarter ended March 31, 2025.

HIGHLIGHTS

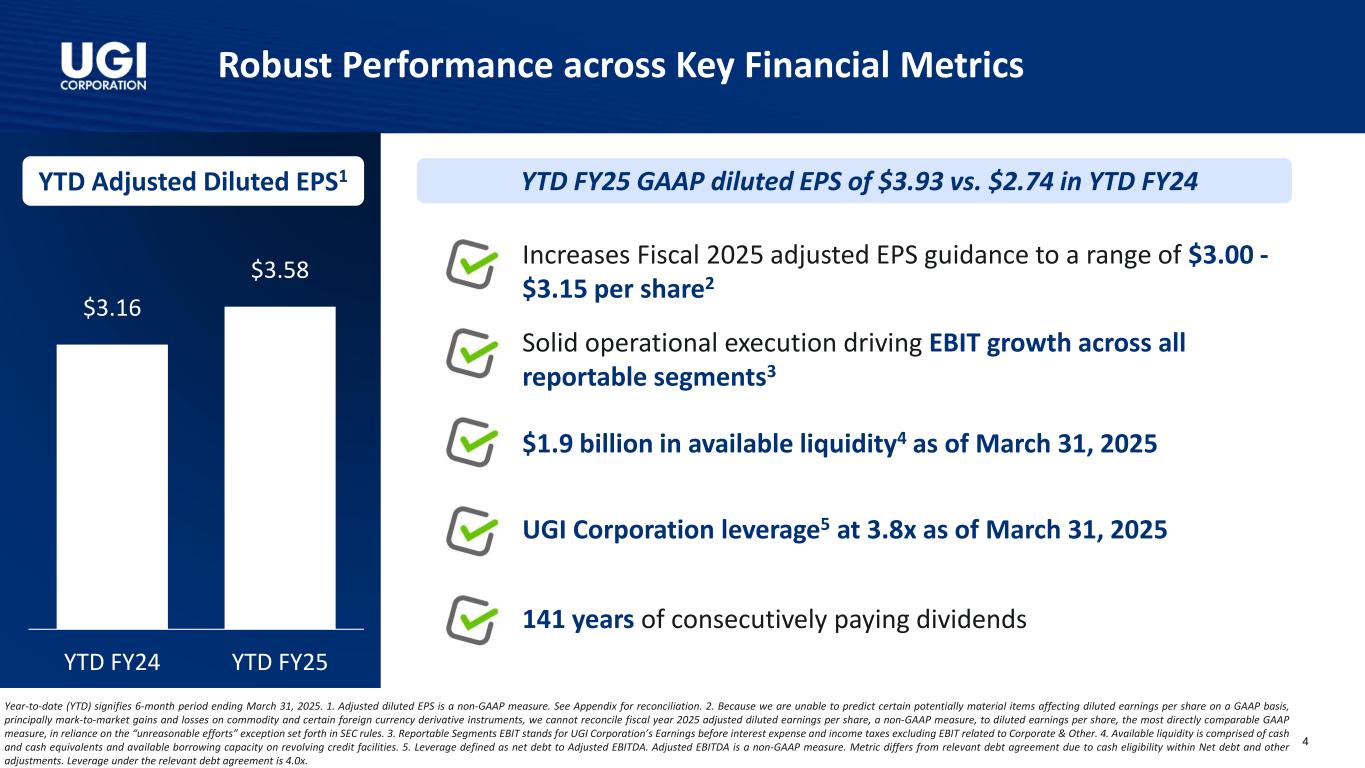

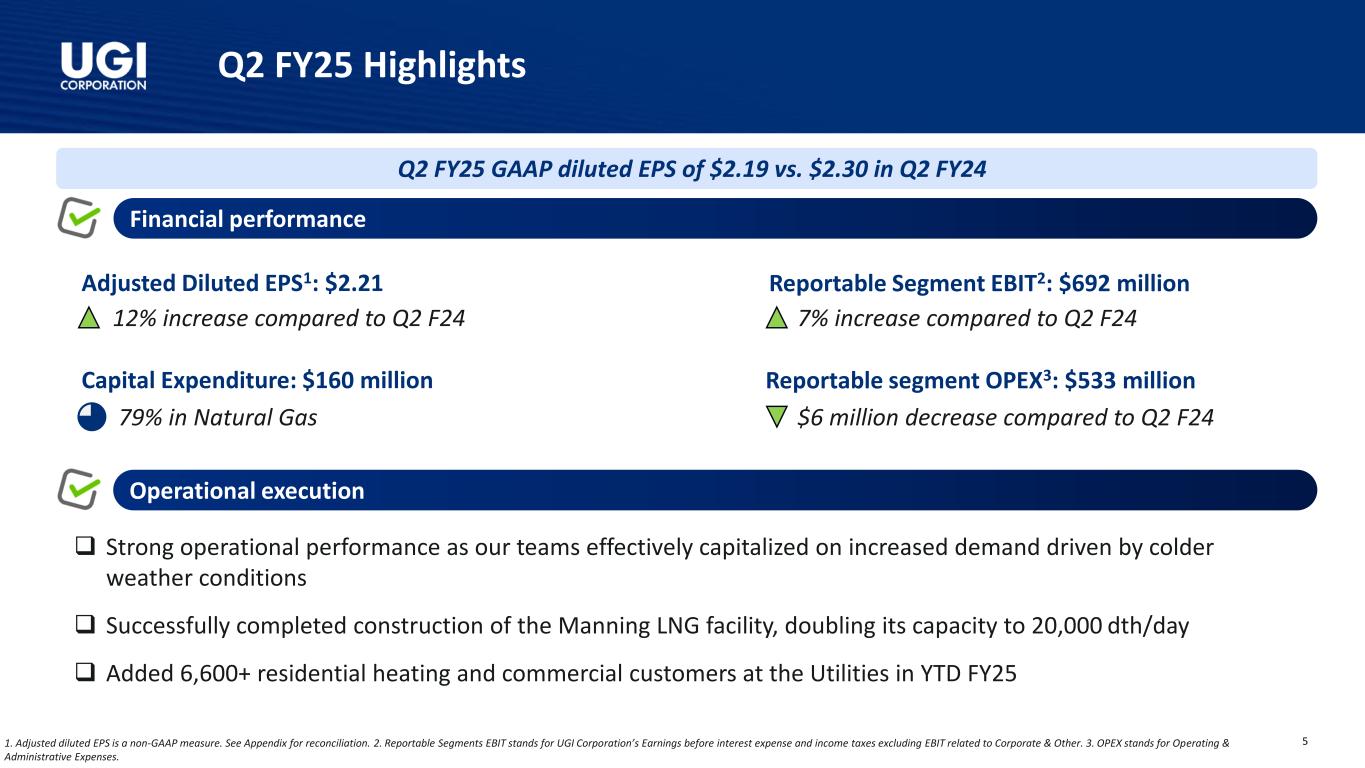

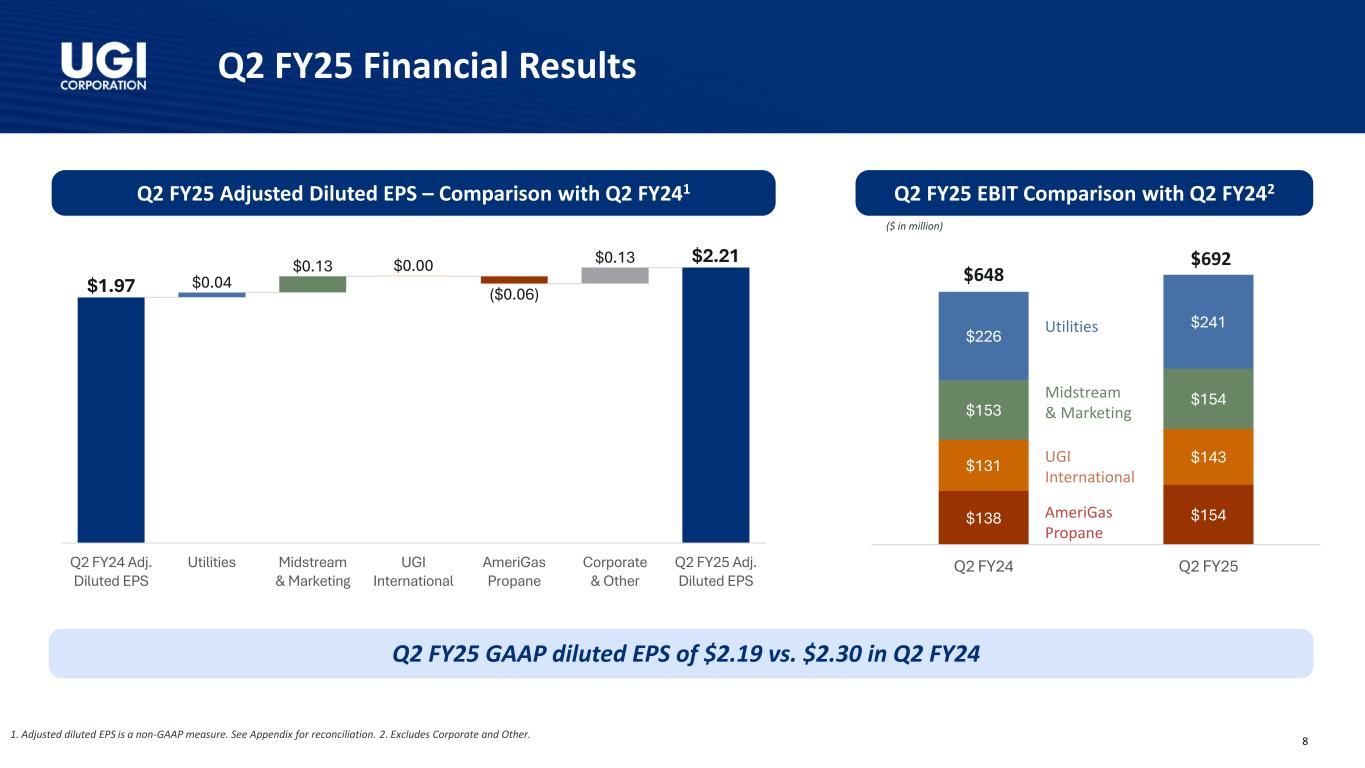

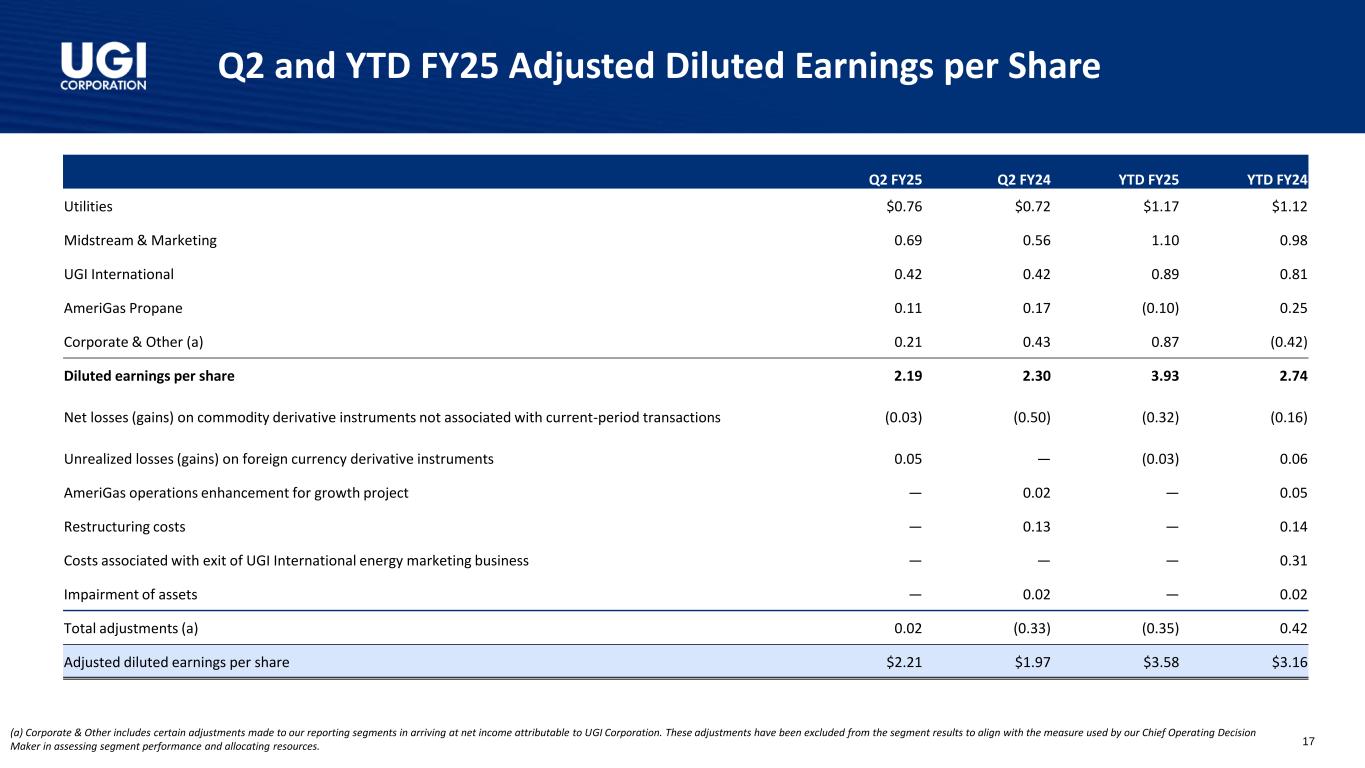

•Q2 GAAP diluted EPS of $2.19 and adjusted diluted EPS of $2.21 compared to GAAP diluted EPS of $2.30 and adjusted diluted EPS of $1.97 in the prior-year period.

•Year-to-date GAAP diluted EPS of $3.93 and adjusted diluted EPS of $3.58 compared to GAAP diluted EPS of $2.74 and adjusted diluted EPS of $3.16 in the prior-year period.

•Year-to-date reportable segments earnings before interest expense and income taxes1 ("EBIT") of $1,112 million compared to $1,073 million in the prior-year period.

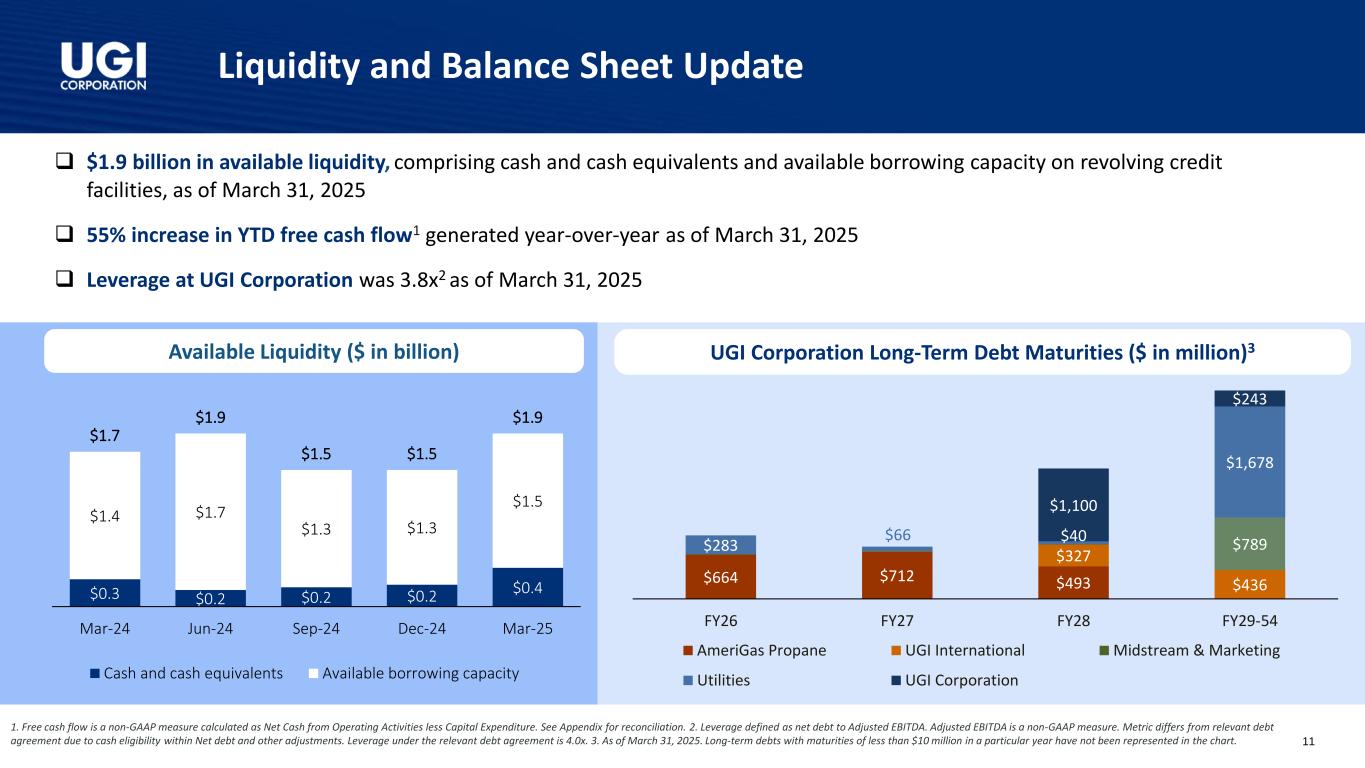

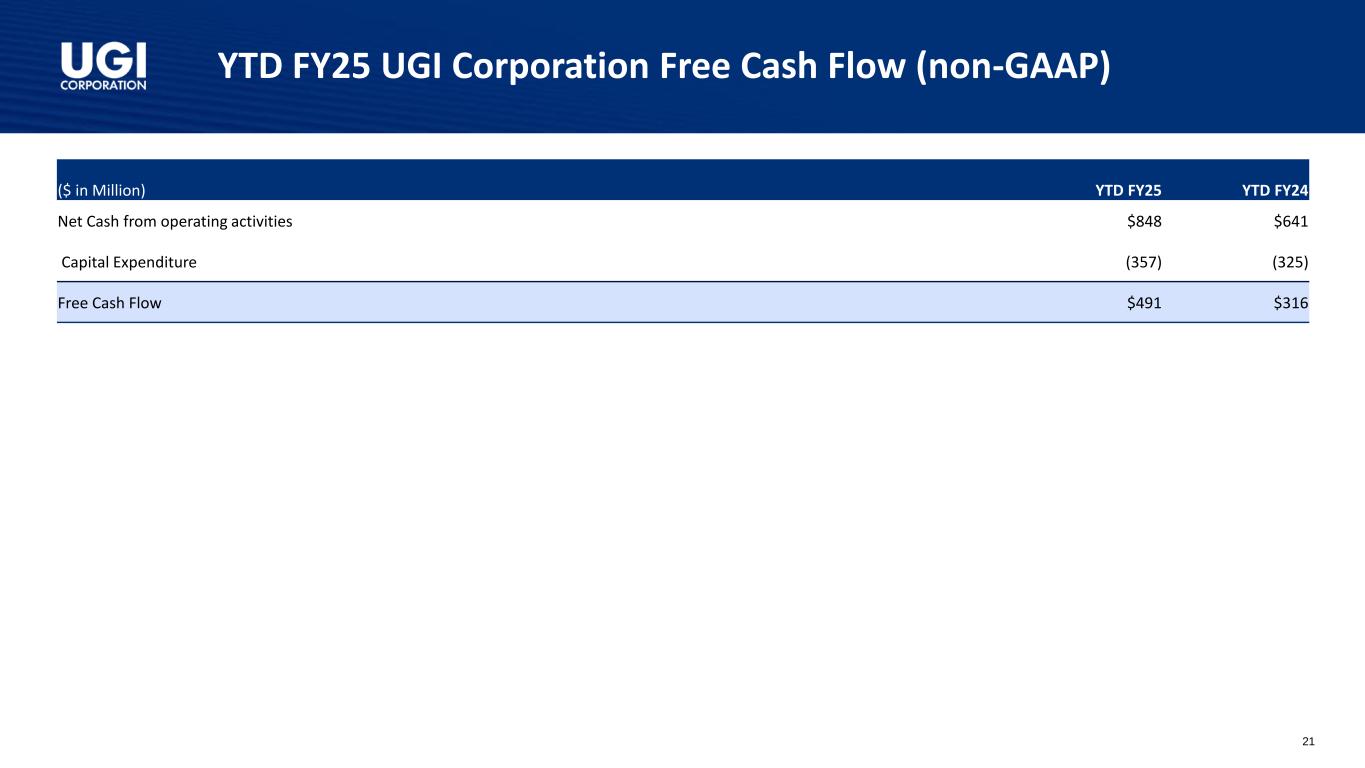

•Available liquidity of approximately $1.9 billion as of March 31, 2025.

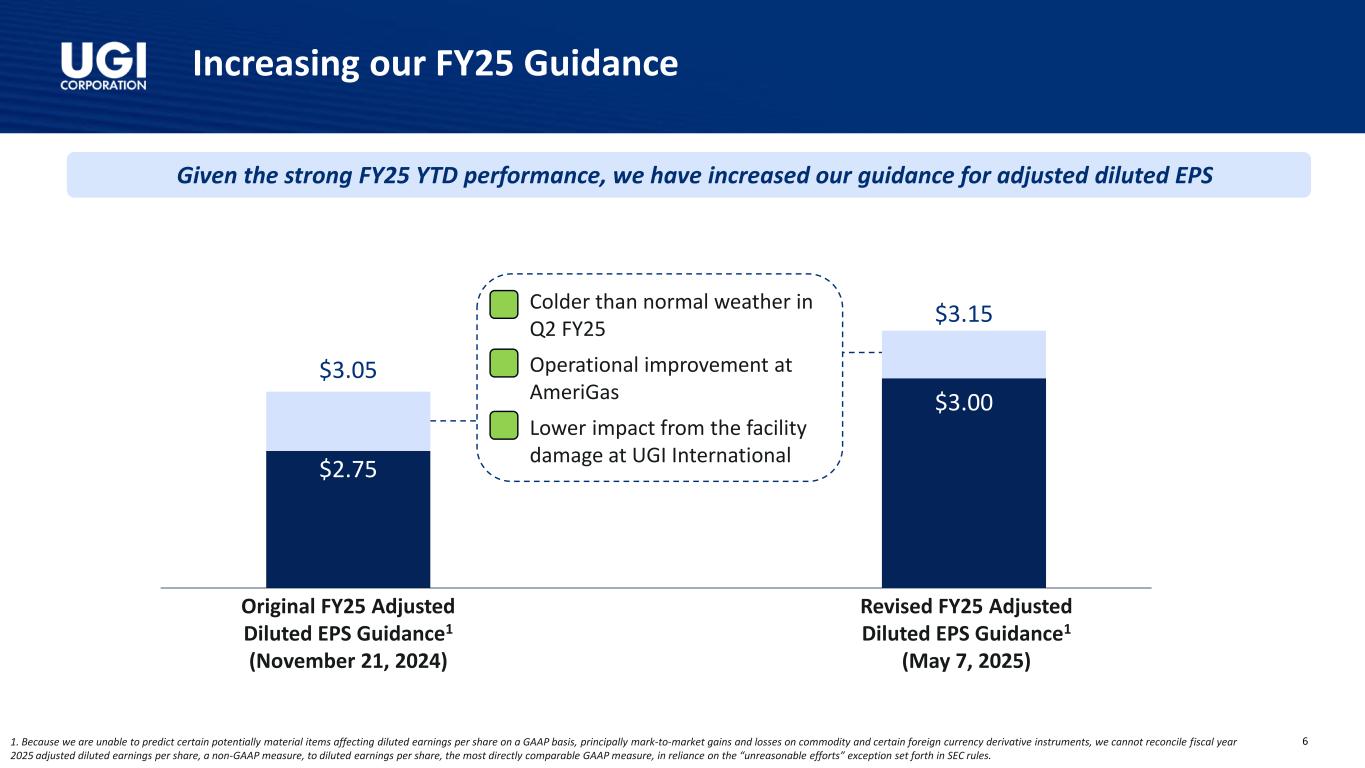

•Increases Fiscal 2025 adjusted EPS guidance to a range of $3.00 - $3.152 per share.

"We delivered strong second quarter results with adjusted diluted EPS rising 12% year-over-year," said Bob Flexon, President and Chief Executive Officer. "Solid operational execution enabled us to effectively meet the higher demand from colder weather while maintaining cost efficiency. Our year-to-date results demonstrate the company's ability to meet evolving market conditions while maintaining our commitment to operational excellence and improving UGI's financial profile.

"Looking ahead, our natural gas businesses continue to be our primary growth engine, with strategic infrastructure investments predominantly in the regulated utilities businesses, driving rate base expansion. At AmeriGas, the redesign of our business processes and operational practices are underway, as we prioritize enhanced service quality that leads to higher levels of customer retention. Internationally, our disciplined approach is generating strong cash flows that support our corporate priorities. Through focused capital allocation, infrastructure modernization, and strategic portfolio optimization, we are well positioned to create incremental value for our stakeholders."

EARNINGS CALL AND WEBCAST

UGI Corporation will hold a live Internet Audio Webcast of its conference call to discuss the quarterly earnings and other current activities at 9:00 AM ET on Thursday, May 8, 2025. Interested parties may listen to the audio webcast both live and in replay on the Internet at https://www.ugicorp.com/investors/financial-reports/presentations or by visiting the company website https://www.ugicorp.com and clicking on Investors and then Presentations. A replay of the webcast will be available after the event through to 11:59 PM ET May 7, 2026.

CONTACT INVESTOR RELATIONS

Tel: +1 610-337-1000

Tameka Morris, ext. 6297

Arnab Mukherjee, ext. 7498

ABOUT UGI

UGI Corporation (NYSE: UGI) is a distributor and marketer of energy products and services in the US and Europe. UGI offers safe, reliable, affordable, and sustainable energy solutions to customers through its subsidiaries, which provide natural gas transmission and distribution, electric generation and distribution, midstream services, propane distribution, renewable natural gas generation, distribution and marketing, and energy marketing services.

Comprehensive information about UGI Corporation is available on the Internet at https://www.ugicorp.com.

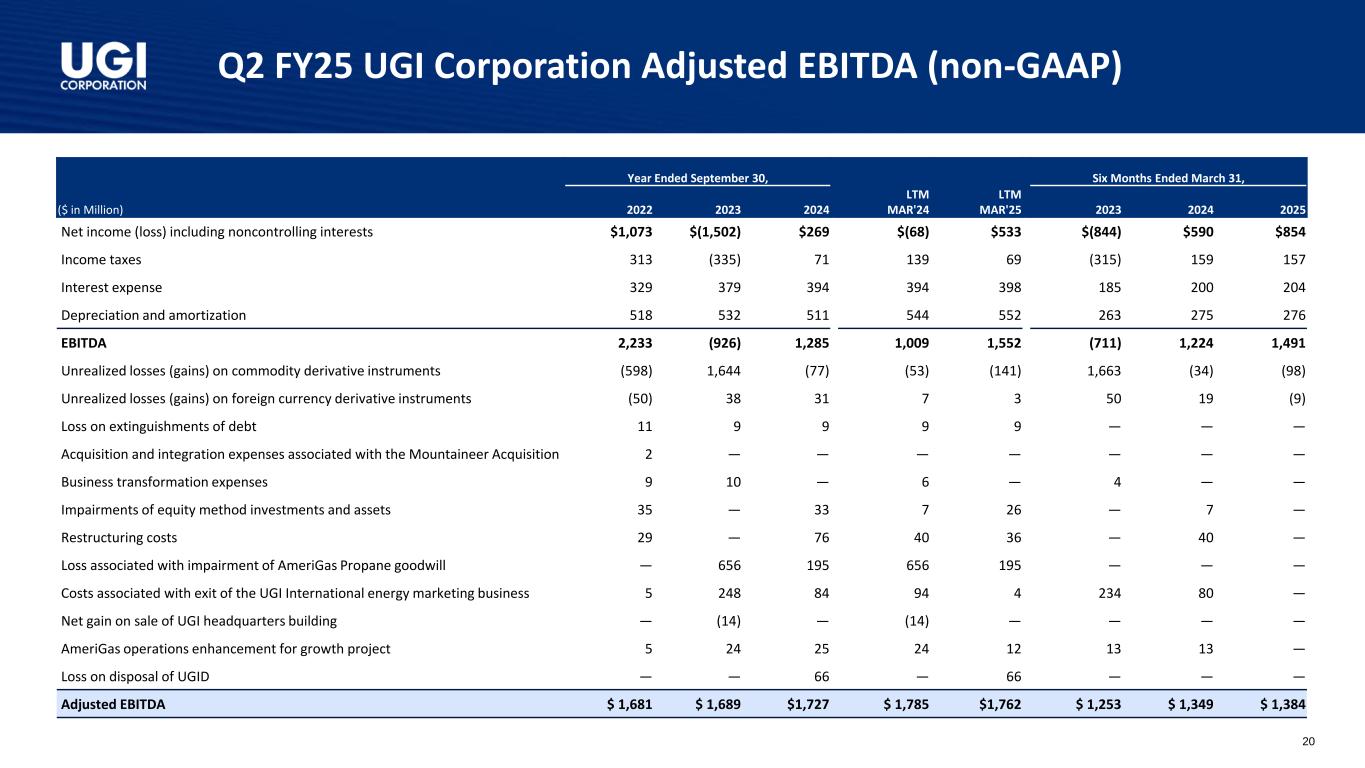

USE OF NON-GAAP MEASURES

Management uses "adjusted net income attributable to UGI Corporation" and "adjusted diluted earnings per share," both of which are non-GAAP financial measures, when evaluating UGI's overall performance. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impacts of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results. Volatility in net income attributable to UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions but included in earnings in accordance with U.S. generally accepted accounting principles ("GAAP").

Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures.

The tables on the last page of this press release reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to above.

1 Reportable segments' EBIT represents an aggregate of our reportable operating segment level EBIT, as determined in accordance with GAAP.

2 Because we are unable to predict certain potentially material items affecting diluted earnings per share on a GAAP basis, principally mark-to-market gains and losses on commodity and certain foreign currency derivative instruments, we cannot reconcile fiscal year 2025 adjusted diluted earnings per share, a non-GAAP measure, to diluted earnings per share, the most directly comparable GAAP measure, in reliance on the “unreasonable efforts” exception set forth in SEC rules.

USE OF FORWARD-LOOKING STATEMENTS

This press release contains statements, estimates and projections that are forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended). Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words and terms of similar meaning, although not all forward-looking statements contain such words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future. Management believes that these are reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control; accordingly, there is no assurance that results will be realized. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. We undertake no obligation (and expressly disclaim any obligation) to update publicly any forward-looking statement, whether as a result of new information or future events, except as required by the federal securities laws.

SEGMENT RESULTS ($ in millions, except where otherwise indicated)

Utilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended March 31, |

|

2025 |

|

2024 |

|

(Decrease) Increase |

| Revenues |

|

$ |

773 |

|

|

$ |

646 |

|

|

$ |

127 |

|

|

20 |

% |

| Total margin (a) |

|

$ |

385 |

|

|

$ |

363 |

|

|

$ |

22 |

|

|

6 |

% |

| Operating and administrative expenses |

|

$ |

103 |

|

|

$ |

97 |

|

|

$ |

6 |

|

|

6 |

% |

| Operating income |

|

$ |

240 |

|

|

$ |

225 |

|

|

$ |

15 |

|

|

7 |

% |

| Earnings before interest expense and income taxes |

|

$ |

241 |

|

|

$ |

226 |

|

|

$ |

15 |

|

|

7 |

% |

| Gas Utility system throughput - billions of cubic feet |

|

|

|

|

|

|

|

|

| Core market |

|

53 |

|

|

45 |

|

|

8 |

|

|

18 |

% |

| Total |

|

128 |

|

|

121 |

|

|

7 |

|

|

6 |

% |

| Gas Utility degree days—% colder (warmer) than normal (b) |

|

0.3 |

% |

|

(16.4) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

100 |

|

|

$ |

91 |

|

|

$ |

9 |

|

|

10 |

% |

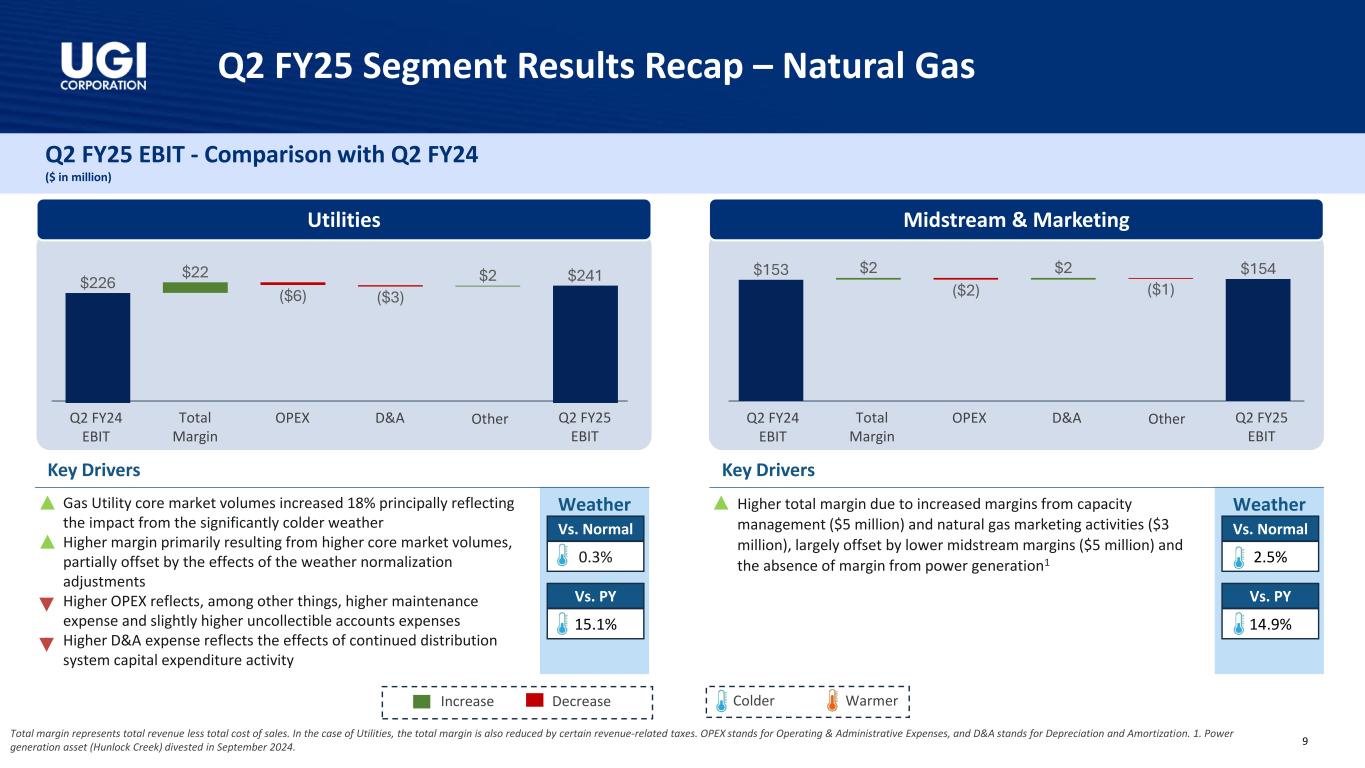

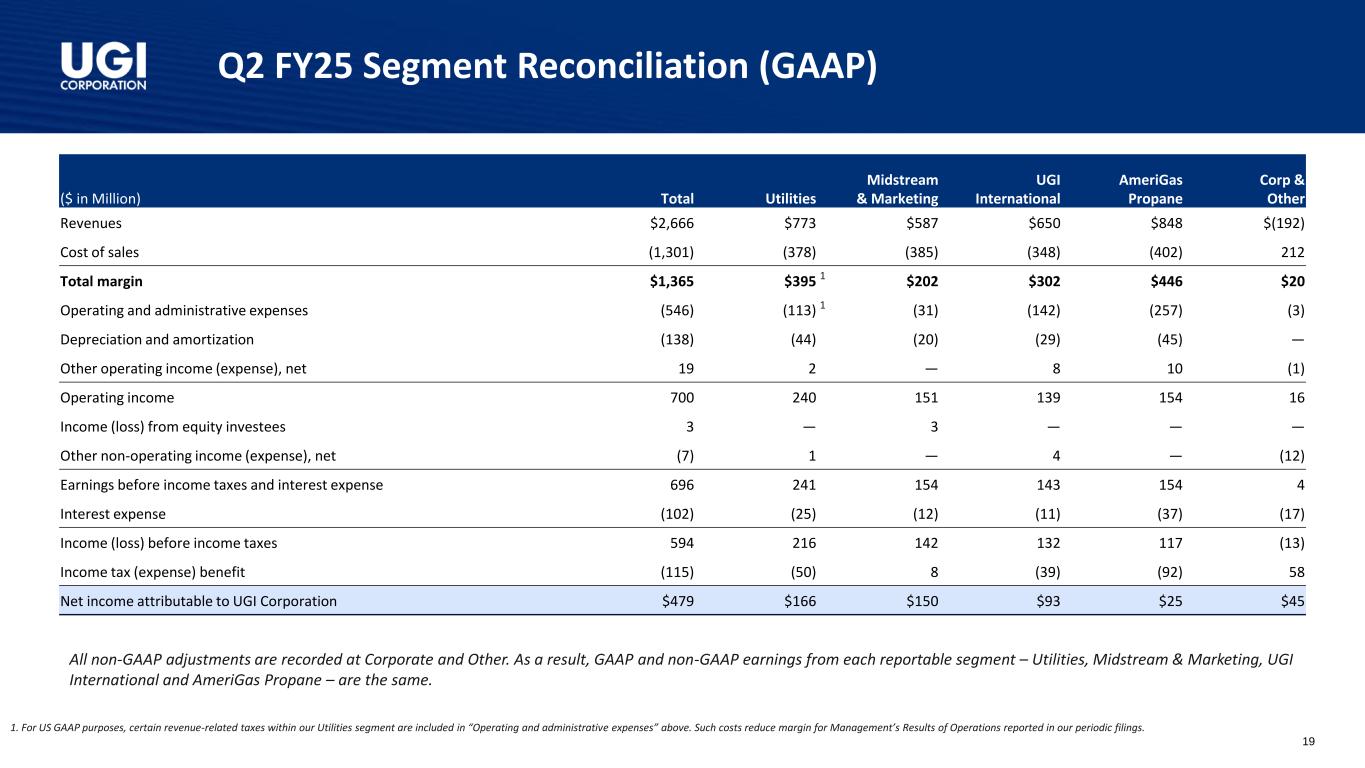

•Gas Utility service territory experienced temperatures that were 15% colder than the prior-year period.

•Core market volumes increased 18% largely due to colder than prior-year weather.

•Total margin increased $22 million primarily resulting from higher core market volumes and continued growth in core market customers, partially offset by the effects of the weather normalization adjustments.

•Operating and administrative expenses increased $6 million primarily reflecting, among other things, higher maintenance expenses and higher uncollectible accounts expenses.

•Operating income increased $15 million due to the higher total margin ($22 million), partially offset by higher operating and administrative expenses ($6 million) and increased depreciation expense ($3 million) from continued distribution system capital expenditure activity.

Midstream & Marketing

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended March 31, |

|

2025 |

|

2024 |

|

(Decrease) Increase |

| Revenues |

|

$ |

587 |

|

|

$ |

483 |

|

|

$ |

104 |

|

|

22 |

% |

| Total margin (a) |

|

$ |

202 |

|

|

$ |

200 |

|

|

$ |

2 |

|

|

1 |

% |

| Operating and administrative expenses |

|

$ |

31 |

|

|

$ |

29 |

|

|

$ |

2 |

|

|

7 |

% |

| Operating income |

|

$ |

151 |

|

|

$ |

151 |

|

|

$ |

— |

|

|

— |

% |

| Earnings before interest expense and income taxes |

|

$ |

154 |

|

|

$ |

153 |

|

|

$ |

1 |

|

|

1 |

% |

| Heating degree days - % colder (warmer) than normal (b) |

|

2.5 |

% |

|

(13.4) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

27 |

|

|

$ |

33 |

|

|

$ |

(6) |

|

|

(18) |

% |

•Temperatures were 15% colder than the prior-year period.

•Total margin increased $2 million largely due to higher margins from capacity management ($5 million) and gas marketing activities ($3 million), partially offset by lower midstream margins ($5 million) which arose mainly from lower natural gas gathering and processing activities and the absence of power generation margin associated with the sale of Hunlock Creek in September 2024.

•Operating income was consistent with the prior-year period as higher total margin ($2 million) was offset by increased operating and administrative expenses ($2 million).

UGI International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended March 31, |

|

2025 |

|

2024 |

|

(Decrease) Increase |

| Revenues |

|

$ |

650 |

|

|

$ |

673 |

|

|

$ |

(23) |

|

|

(3) |

% |

| Total margin (a) |

|

$ |

302 |

|

|

$ |

305 |

|

|

$ |

(3) |

|

|

(1) |

% |

| Operating and administrative expenses (a) |

|

$ |

142 |

|

|

$ |

155 |

|

|

$ |

(13) |

|

|

(8) |

% |

| Operating income |

|

$ |

139 |

|

|

$ |

124 |

|

|

$ |

15 |

|

|

12 |

% |

| Earnings before interest expense and income taxes |

|

$ |

143 |

|

|

$ |

131 |

|

|

$ |

12 |

|

|

9 |

% |

| LPG retail gallons sold (millions) |

|

213 |

|

|

221 |

|

|

(8) |

|

|

(4) |

% |

| Heating degree days - % (warmer) than normal (b) |

|

(2.2) |

% |

|

(13.2) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

17 |

|

|

$ |

19 |

|

|

$ |

(2) |

|

|

(11) |

% |

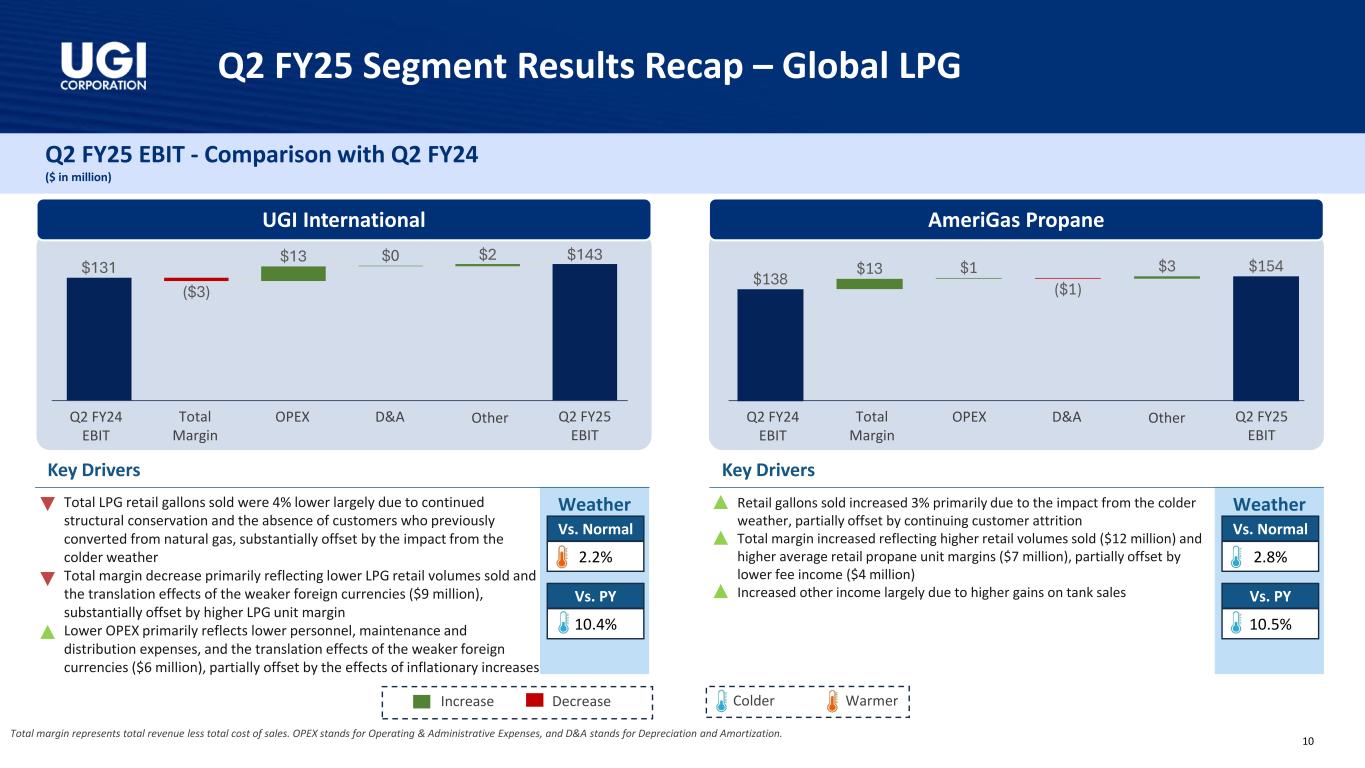

UGI International base-currency results are translated into U.S. dollars based upon exchange rates experienced during the reporting periods. Differences in these translation rates affect the comparison of line item amounts presented in the table above. The functional currency of a significant portion of our UGI International results is the euro and, to a much lesser extent, the British pound sterling. During the 2025 and 2024 three-month periods, the average unweighted euro-to-dollar translation rates were approximately $1.05 and $1.09, respectively, and the average unweighted British pound sterling-to-dollar translation rates were approximately $1.26 and $1.27, respectively.

•Temperatures were 2% warmer than normal and 10% colder than the prior-year period.

•Retail volumes were 4% lower than the prior-year period largely due to continued structural conservation and the absence of certain customers who previously converted from natural gas to LPG, substantially offset by the effects of colder weather.

•Total margin decreased $3 million primarily due to lower LPG volumes and the translation effects of the weaker foreign currencies (~$9 million), substantially offset by higher LPG unit margins.

•Operating and administrative expenses decreased $13 million reflecting lower personnel-related, maintenance and distribution expenses and the translation effects of the weaker foreign currencies (~$6 million).

•Operating income increased $15 million reflecting lower operating and administrative expenses ($13 million) and higher other operating income, partially offset by lower total margin ($3 million).

•Earnings before interest expense and income taxes increased $12 million due to the higher operating income, partially offset by lower realized gains on foreign currency exchange contracts ($3 million).

AmeriGas Propane

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended March 31, |

|

2025 |

|

2024 |

|

(Decrease) Increase |

| Revenues |

|

$ |

848 |

|

|

$ |

795 |

|

|

$ |

53 |

|

|

7 |

% |

| Total margin (a) |

|

$ |

446 |

|

|

$ |

433 |

|

|

$ |

13 |

|

|

3 |

% |

| Operating and administrative expenses |

|

$ |

257 |

|

|

$ |

258 |

|

|

$ |

(1) |

|

|

— |

% |

| Operating income / earnings before interest expense and income taxes |

|

$ |

154 |

|

|

$ |

138 |

|

|

$ |

16 |

|

|

12 |

% |

| Retail gallons sold (millions) |

|

269 |

|

|

261 |

|

|

8 |

|

|

3 |

% |

| Heating degree days - % colder (warmer) than normal (b) |

|

2.8 |

% |

|

(8.6) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

16 |

|

|

$ |

24 |

|

|

$ |

(8) |

|

|

(33) |

% |

•Temperatures were 3% colder than normal and 11% colder than the prior-year period.

•Retail gallons increased 3% due to the impact of the colder weather, partially offset by the effect of net customer attrition.

•Total margin increased $13 million due to higher LPG volumes and increased LPG unit margins ($7 million), partially offset by lower fee income ($4 million) primarily attributable to lower fuel recovery fee and tank rental income.

•Operating income increased $16 million largely reflecting increased total margin ($13 million) and higher gain from asset sales ($4 million).

(a)Total margin represents total revenue less total cost of sales. In the case of Utilities, total margin is also reduced by certain revenue-related taxes.

(b)Deviation from average heating degree days is determined on a 10-year period utilizing volume-weighted weather data.

REPORT OF EARNINGS – UGI CORPORATION

(Millions of dollars, except per share)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

March 31, |

|

Six Months Ended

March 31, |

|

Twelve Months Ended

March 31, |

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

$ |

773 |

|

|

$ |

646 |

|

|

$ |

1,258 |

|

|

$ |

1,139 |

|

|

$ |

1,717 |

|

|

$ |

1,627 |

|

| Midstream & Marketing |

587 |

|

|

483 |

|

|

954 |

|

|

877 |

|

|

1,446 |

|

|

1,417 |

|

| UGI International |

650 |

|

|

673 |

|

|

1,288 |

|

|

1,398 |

|

|

2,169 |

|

|

2,538 |

|

| AmeriGas Propane |

848 |

|

|

795 |

|

|

1,475 |

|

|

1,424 |

|

|

2,322 |

|

|

2,372 |

|

| Corporate & Other (a) |

(192) |

|

|

(130) |

|

|

(279) |

|

|

(250) |

|

|

(336) |

|

|

(303) |

|

| Total revenues |

$ |

2,666 |

|

|

$ |

2,467 |

|

|

$ |

4,696 |

|

|

$ |

4,588 |

|

|

$ |

7,318 |

|

|

$ |

7,651 |

|

| Earnings before interest expense and income taxes: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

241 |

|

|

226 |

|

|

$ |

382 |

|

|

$ |

361 |

|

|

$ |

421 |

|

|

$ |

393 |

|

| Midstream & Marketing |

154 |

|

|

153 |

|

|

249 |

|

|

255 |

|

|

307 |

|

|

334 |

|

| UGI International |

143 |

|

|

131 |

|

|

253 |

|

|

248 |

|

|

328 |

|

|

288 |

|

| AmeriGas Propane |

154 |

|

|

138 |

|

|

228 |

|

|

209 |

|

|

161 |

|

|

229 |

|

| Total reportable segments |

692 |

|

|

648 |

|

|

1,112 |

|

|

1,073 |

|

|

1,217 |

|

|

1,244 |

|

| Corporate & Other (a) |

4 |

|

|

81 |

|

|

103 |

|

|

(124) |

|

|

(217) |

|

|

(779) |

|

| Total earnings before interest expense and income taxes |

696 |

|

|

729 |

|

|

1,215 |

|

|

949 |

|

|

1,000 |

|

|

465 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

(25) |

|

|

(24) |

|

|

(51) |

|

|

(47) |

|

|

(97) |

|

|

(87) |

|

| Midstream & Marketing |

(12) |

|

|

(9) |

|

|

(24) |

|

|

(20) |

|

|

(45) |

|

|

(43) |

|

| UGI International |

(11) |

|

|

(11) |

|

|

(21) |

|

|

(22) |

|

|

(43) |

|

|

(43) |

|

| AmeriGas Propane |

(37) |

|

|

(40) |

|

|

(70) |

|

|

(81) |

|

|

(145) |

|

|

(162) |

|

| Corporate & Other, net (a) |

(17) |

|

|

(16) |

|

|

(38) |

|

|

(30) |

|

|

(68) |

|

|

(59) |

|

| Total interest expense |

(102) |

|

|

(100) |

|

|

(204) |

|

|

(200) |

|

|

(398) |

|

|

(394) |

|

| Income before income taxes |

594 |

|

|

629 |

|

|

1,011 |

|

|

749 |

|

|

602 |

|

|

71 |

|

| Income tax expense |

(115) |

|

|

(133) |

|

|

(157) |

|

|

(159) |

|

|

(69) |

|

|

(139) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to UGI Corporation |

$ |

479 |

|

|

$ |

496 |

|

|

$ |

854 |

|

|

$ |

590 |

|

|

$ |

533 |

|

|

$ |

(68) |

|

| Earnings (loss) per share attributable to UGI shareholders: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

2.23 |

|

|

$ |

2.36 |

|

|

$ |

3.97 |

|

|

$ |

2.81 |

|

|

$ |

2.49 |

|

|

$ |

(0.32) |

|

| Diluted |

$ |

2.19 |

|

|

$ |

2.30 |

|

|

$ |

3.93 |

|

|

$ |

2.74 |

|

|

$ |

2.46 |

|

|

$ |

(0.32) |

|

| Weighted Average common shares outstanding (thousands): |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

214,976 |

|

|

209,826 |

|

|

214,965 |

|

|

209,789 |

|

|

213,897 |

|

|

210,347 |

|

| Diluted |

218,944 |

|

|

215,245 |

|

|

217,331 |

|

|

215,393 |

|

|

216,319 |

|

|

210,347 |

|

| Supplemental information: |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to UGI Corporation: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

$ |

166 |

|

|

$ |

155 |

|

|

$ |

255 |

|

|

$ |

241 |

|

|

$ |

251 |

|

|

$ |

236 |

|

| Midstream & Marketing |

150 |

|

|

120 |

|

|

239 |

|

|

212 |

|

|

265 |

|

|

262 |

|

| UGI International |

93 |

|

|

91 |

|

|

193 |

|

|

174 |

|

|

281 |

|

|

209 |

|

| AmeriGas Propane |

25 |

|

|

37 |

|

|

(21) |

|

|

53 |

|

|

(97) |

|

|

2 |

|

| Total reportable segments |

434 |

|

|

403 |

|

|

666 |

|

|

680 |

|

|

700 |

|

|

709 |

|

| Corporate & Other (a) |

45 |

|

|

93 |

|

|

188 |

|

|

(90) |

|

|

(167) |

|

|

(777) |

|

| Total net income (loss) attributable to UGI Corporation |

$ |

479 |

|

|

$ |

496 |

|

|

$ |

854 |

|

|

$ |

590 |

|

|

$ |

533 |

|

|

$ |

(68) |

|

(a) Corporate & Other includes specific items attributable to our reportable segments that are not included in profit measures used by our Chief Operating Decision Maker in assessing our reportable segments' performance or allocating resources. These specific items are shown in the section titled "Non-GAAP Financial Measures - Adjusted Net Income (Loss) Attributable to UGI and Adjusted Diluted Earnings Per Share" below. Corporate & Other also includes the elimination of certain intercompany transactions.

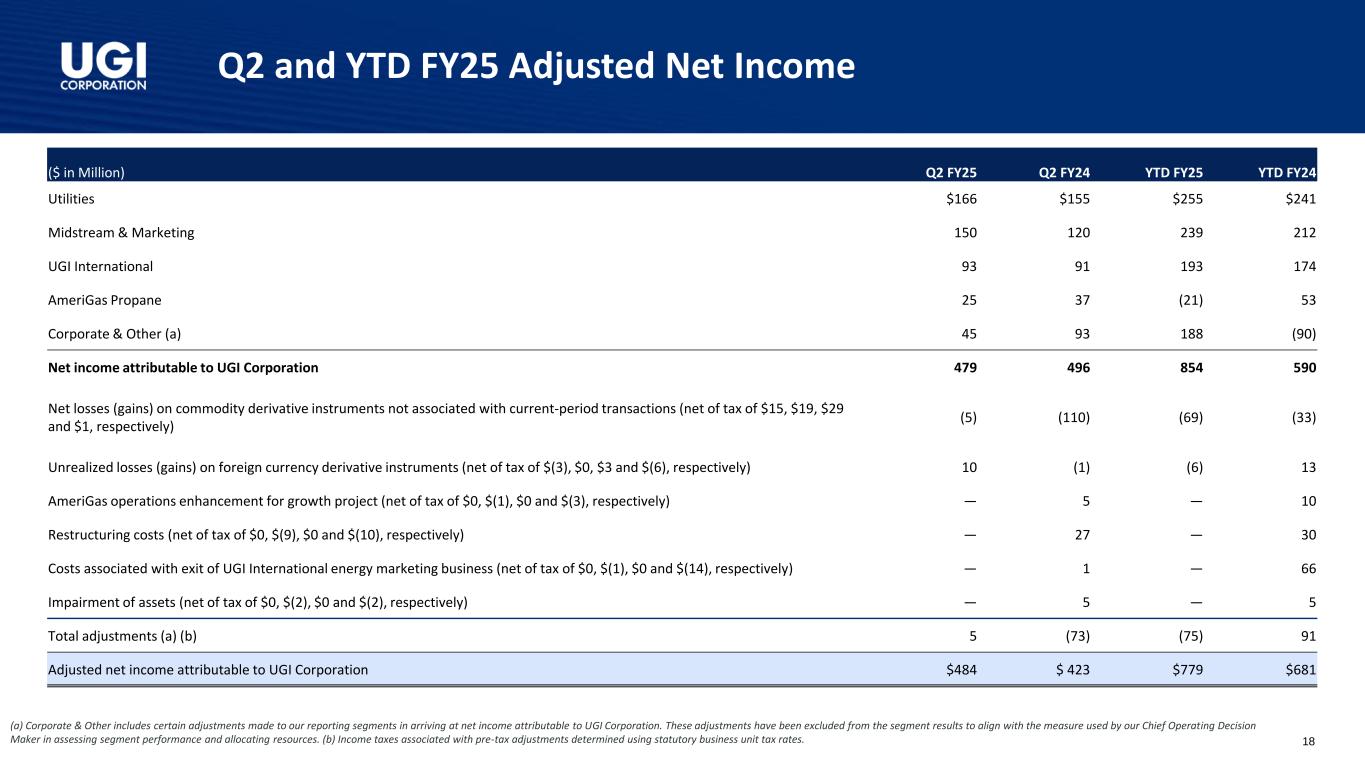

Non-GAAP Financial Measures - Adjusted Net Income Attributable to UGI and Adjusted Diluted Earnings Per Share.

The following tables reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and reconcile diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to previously:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

Six Months Ended

March 31, |

|

Twelve Months Ended

March 31, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Adjusted net income attributable to UGI Corporation (millions): |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to UGI Corporation |

$ |

479 |

|

|

$ |

496 |

|

|

$ |

854 |

|

|

$ |

590 |

|

|

$ |

533 |

|

|

$ |

(68) |

|

|

Net gains on commodity derivative instruments not associated with current-period transactions (net of tax of $15, $19, $29, $1, $45 and $11, respectively) |

(5) |

|

|

(110) |

|

|

(69) |

|

|

(33) |

|

|

(96) |

|

|

(42) |

|

|

Unrealized losses (gains) on foreign currency derivative instruments (net of tax of $(3), $0, $3, $(6), $0 and $(3), respectively) |

10 |

|

|

(1) |

|

|

(6) |

|

|

13 |

|

|

3 |

|

|

4 |

|

|

Loss associated with impairment of AmeriGas Propane goodwill (net of tax of $0, $0, $0, $0, $(3), and $4, respectively) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

192 |

|

|

660 |

|

|

Loss on extinguishment of debt (net of tax of $0, $0, $0, $0, $(3) and $(2), respectively) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

6 |

|

|

7 |

|

|

Impairment of equity method investments and assets (net of tax of $0, $(2), $0, $(2), $(1) and $(2), respectively) |

— |

|

|

5 |

|

|

— |

|

|

5 |

|

|

25 |

|

|

5 |

|

|

Business transformation expenses (net of tax of $0, $0, $0, $0, $0, and $(2), respectively) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

4 |

|

|

Costs associated with exit of the UGI International energy marketing business (net of tax of $0, $(1), $0, $(14), $(1) and $(17), respectively) |

— |

|

|

1 |

|

|

— |

|

|

66 |

|

|

3 |

|

|

77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AmeriGas operations enhancement for growth project (net of tax of $0, $(1), $0, $(3), $(3) and $(6), respectively) |

— |

|

|

5 |

|

|

— |

|

|

10 |

|

|

9 |

|

|

18 |

|

|

Restructuring costs (net of tax of $0, $(9), $0, $(10), $(10) and $(10), respectively) |

— |

|

|

27 |

|

|

— |

|

|

30 |

|

|

26 |

|

|

30 |

|

|

Net gain on sale of UGI headquarters building (net of tax of $0, $0, $0, $0, $0 and $4, respectively) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on disposal of UGID (net of tax of $0, $0, $0, $0, $(11), and $0, respectively) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

55 |

|

|

— |

|

|

Total adjustments (1) |

5 |

|

|

(73) |

|

|

(75) |

|

|

91 |

|

|

223 |

|

|

753 |

|

|

Adjusted net income attributable to UGI Corporation |

$ |

484 |

|

|

$ |

423 |

|

|

$ |

779 |

|

|

$ |

681 |

|

|

$ |

756 |

|

|

$ |

685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

UGI Corporation earnings (loss) per share — diluted (2) |

$ |

2.19 |

|

|

$ |

2.30 |

|

|

$ |

3.93 |

|

|

$ |

2.74 |

|

|

$ |

2.46 |

|

|

$ |

(0.32) |

|

|

Net gains on commodity derivative instruments not associated with current-period transactions |

(0.03) |

|

|

(0.50) |

|

|

(0.32) |

|

|

(0.16) |

|

|

(0.44) |

|

|

(0.29) |

|

|

Unrealized losses (gains) on foreign currency derivative instruments |

0.05 |

|

|

— |

|

|

(0.03) |

|

|

0.06 |

|

|

0.01 |

|

|

0.02 |

|

|

Loss associated with impairment of AmeriGas Propane goodwill |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

0.89 |

|

|

3.14 |

|

|

Loss on extinguishment of debt |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

0.03 |

|

|

0.03 |

|

|

Impairment of equity method investments and assets |

— |

|

|

0.02 |

|

|

— |

|

|

0.02 |

|

|

0.12 |

|

|

0.02 |

|

|

Business transformation expenses |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

0.02 |

|

|

Costs associated with the exit of the UGI International energy marketing business |

— |

|

|

— |

|

|

— |

|

|

0.31 |

|

|

0.01 |

|

|

0.37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AmeriGas operations enhancement for growth project |

— |

|

|

0.02 |

|

|

— |

|

|

0.05 |

|

|

0.04 |

|

|

0.09 |

|

|

Restructuring costs |

— |

|

|

0.13 |

|

|

— |

|

|

0.14 |

|

|

0.12 |

|

|

0.14 |

|

|

Net gain on sale of UGI headquarters building |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.05) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on disposal of UGID |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

0.25 |

|

|

— |

|

|

Total adjustments (2) |

0.02 |

|

|

(0.33) |

|

|

(0.35) |

|

|

0.42 |

|

|

1.03 |

|

|

3.49 |

|

|

Adjusted diluted earnings per share (2) |

$ |

2.21 |

|

|

$ |

1.97 |

|

|

$ |

3.58 |

|

|

$ |

3.16 |

|

|

$ |

3.49 |

|

|

$ |

3.17 |

|

(1)Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

(2)The loss per share for the twelve months ended March 31, 2024, was determined excluding the effect of 5.76 million dilutive shares as the impact of such shares would have been antidilutive to the net loss for the period. Adjusted earnings per share for the twelve months ended March 31, 2024, was determined based upon fully diluted shares of 216.11 million.

Press Release

Press Release