Document

Press Release

UGI Reports Fiscal 2024 Second Quarter Results, Concludes Strategic Review and Affirms Fiscal 2024 Guidance

May 1, 2024

VALLEY FORGE, PA - UGI Corporation (NYSE: UGI) today reported financial results for the fiscal quarter ended March 31, 2024 and announced that its Board has unanimously decided to conclude the strategic review of its LPG businesses, which was primarily focused on AmeriGas Propane.

HIGHLIGHTS

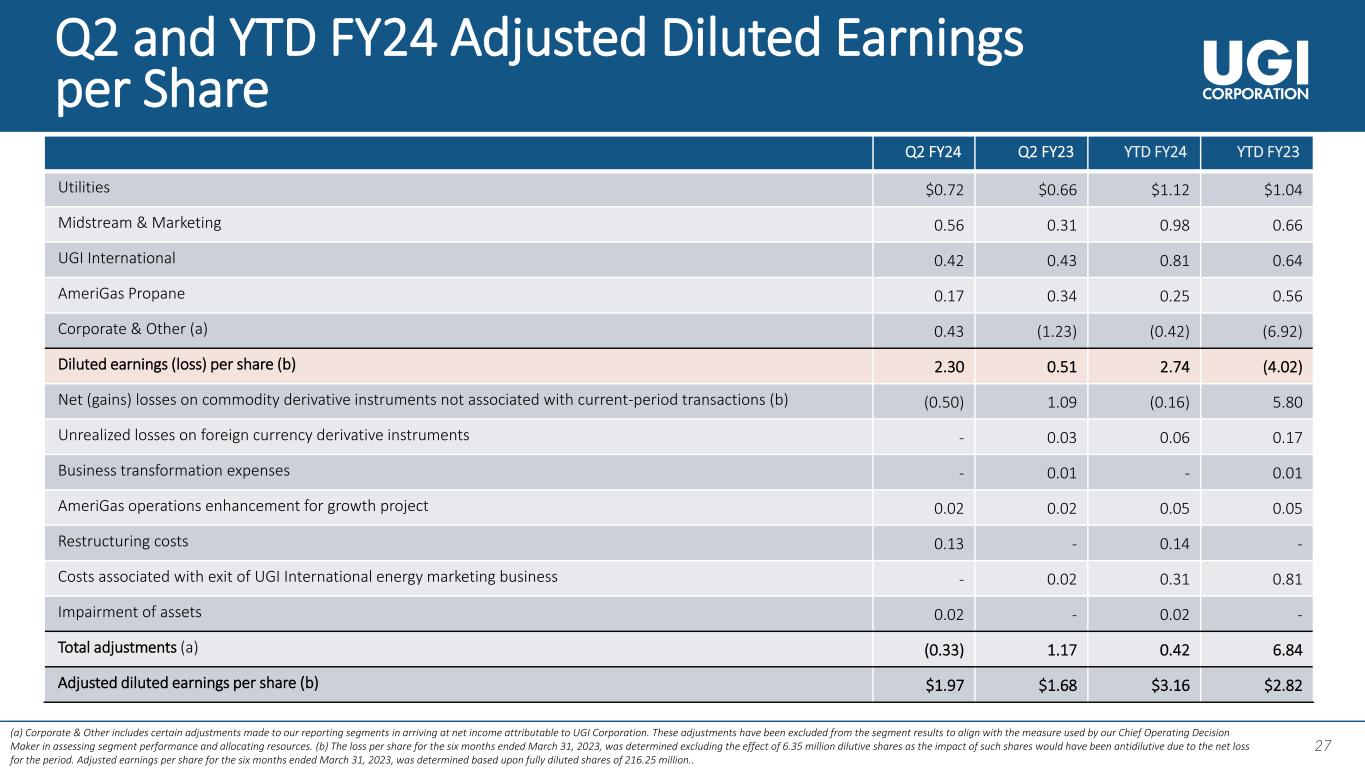

•Q2 GAAP diluted EPS of $2.30 and adjusted diluted EPS of $1.97 compared to GAAP diluted EPS of $0.51 and adjusted diluted EPS of $1.68 in the prior-year period.

•Year-to-date GAAP diluted EPS of $2.74 and adjusted diluted EPS of $3.16 compared to GAAP diluted EPS of $(4.02) and adjusted diluted EPS of $2.82 in the prior-year period.

•Year-to-date reportable segments earnings before interest expense and income taxes1 ("EBIT") of $1,073 million compared to $987 million in the prior-year period.

•Strong second quarter results despite warmer than normal weather across our service territories, led by higher margins from natural gas marketing activities in our Midstream & Marketing business and reduced operating expenses across the entity.

•Concludes the strategic review of the LPG businesses and retains ownership of AmeriGas Propane.

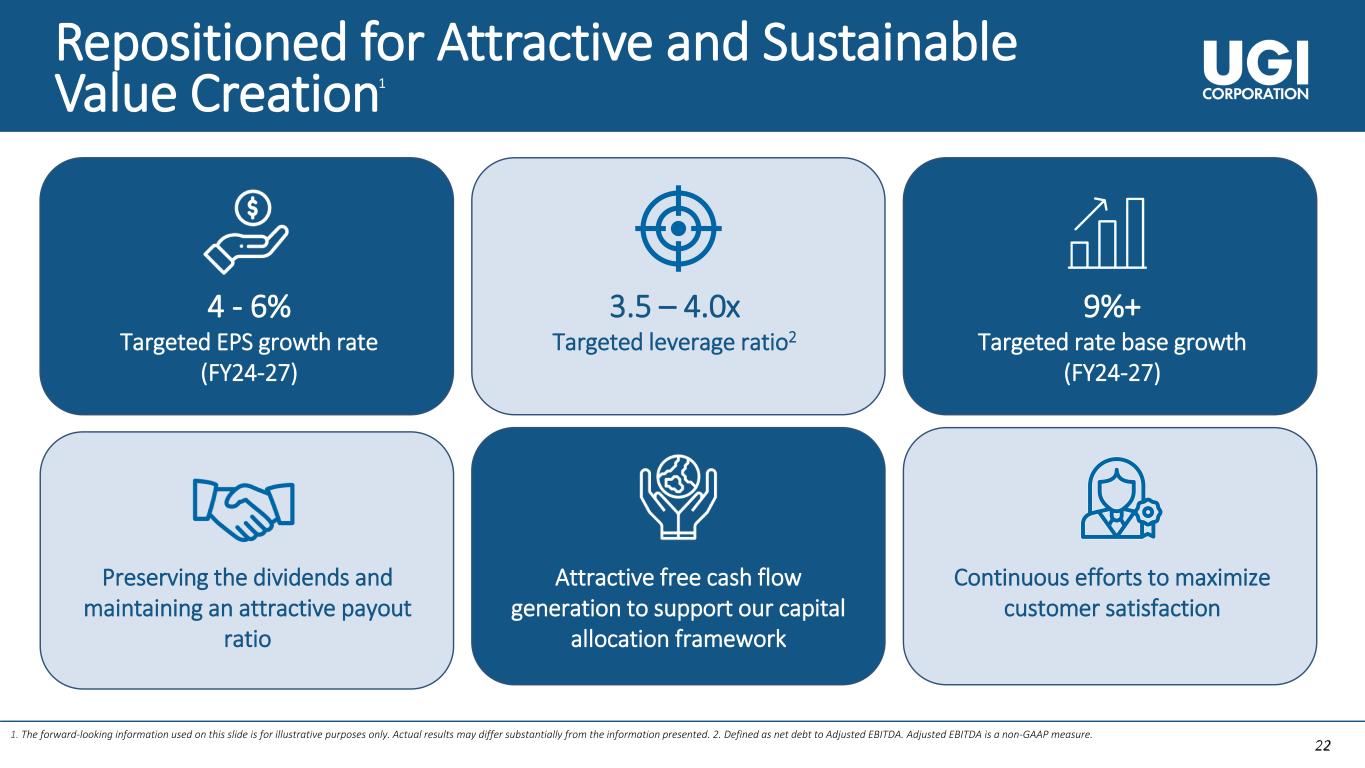

•Repositions UGI to drive a high-performing, customer centered and results-driven organization, targeting a long-term EPS growth rate of 4 – 6%.

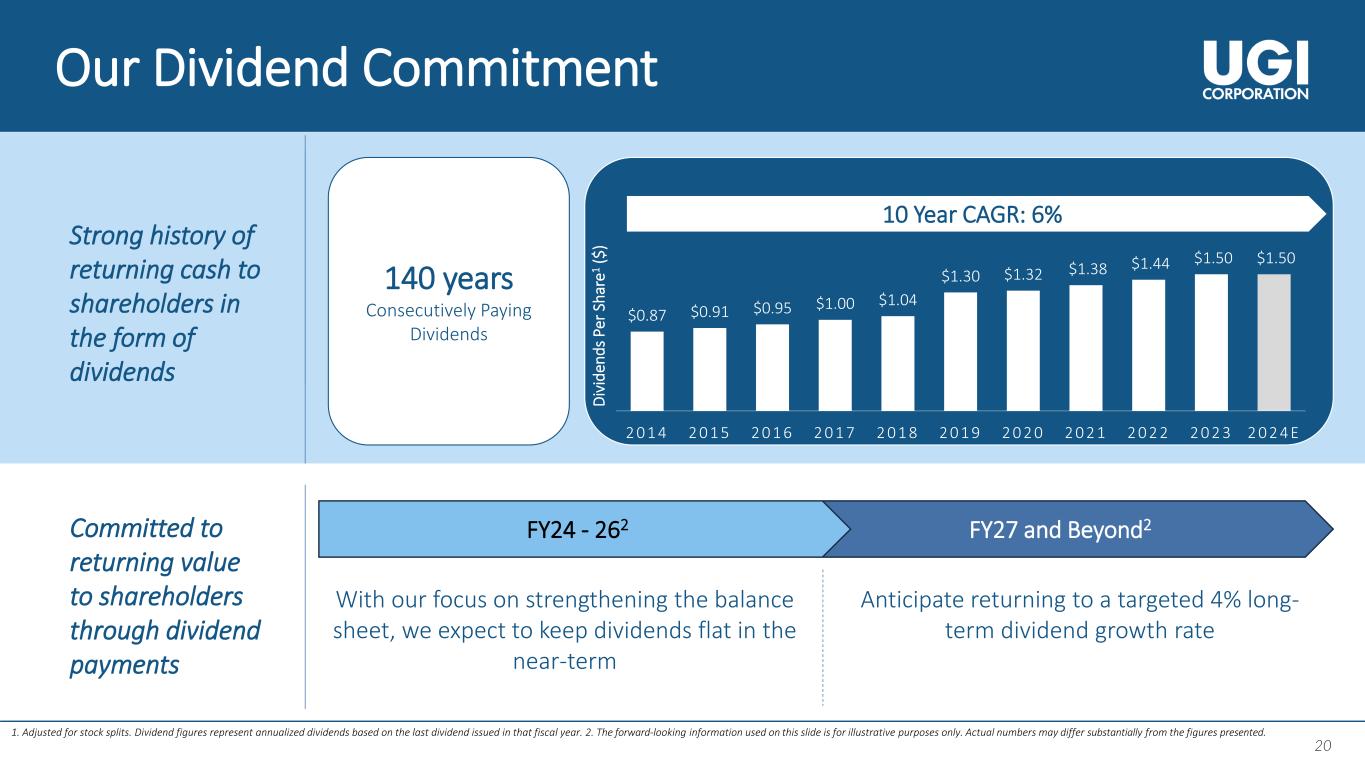

•Announces the 140th consecutive year of paying dividends and affirms its commitment to return value to shareholders through dividend payments.

•Affirms its fiscal 2024 adjusted diluted EPS guidance range of $2.70 - $3.002 per share.

"We are pleased with the strong fiscal second quarter performance in the midst of warmer than normal weather across our service territories," said Mario Longhi, Interim President and Chief Executive Officer. “Our natural gas businesses delivered the highest second quarter earnings, reporting a 32% growth over the prior year. Across our business, we also made important strides in implementing effective cost control as we strive to improve operational efficiency. These results reflect the resilience of our portfolio and the commitment of our team to deliver long-term value to our shareholders.”

STRATEGIC REVIEW CONCLUSION

After extensive deliberation, the Board has determined that in the current market the best path forward to maximize shareholder value is to retain ownership of AmeriGas Propane.

During the review, the company and its financial advisors evaluated several value creation opportunities including a potential sale, spin, and joint venture of AmeriGas. While the company conducted due diligence with multiple strategic and financial parties, the Board decided that the company should focus on a restructuring and operational improvement plan for AmeriGas.

The review concluded that disciplined execution of a revised operational strategy and optimization of UGI’s diverse mix of strategically located assets best positions the company to create long-term shareholder value.

Mario Longhi said, “After a comprehensive review process, the Board agreed that in the current market, the best path forward in creating shareholder value is to execute on its repositioned long-term strategy and strengthen the balance sheet. This includes maintaining an intense focus on customer retention, improved free cash flow generation, effective cost control and disciplined capital allocation. Although the process has concluded, we remain open to all opportunities to optimize our portfolio and unlock further value for shareholders.”

"For the fiscal year, we are on track to deliver full-year results within our fiscal 2024 adjusted EPS guidance range. We are confident that diligent execution on the fundamentals will enable UGI to build a strong momentum of balanced growth and value creation.”

EARNINGS CALL AND WEBCAST

UGI Corporation will hold a live Internet Audio Webcast of its conference call to discuss the quarterly earnings and other current activities at 9:00 AM ET on Thursday, May 2, 2024. Interested parties may listen to the audio webcast both live and in replay on the Internet at https://www.ugicorp.com/investors/financial-reports/presentations or by visiting the company website https://www.ugicorp.com and clicking on Investors and then Presentations. A replay of the webcast will be available after the event through to 11:59 PM ET May 1, 2025.

CONTACT INVESTOR RELATIONS

Tel: +1 610-337-1000

Tameka Morris, ext. 6297

Arnab Mukherjee, ext. 7498

ABOUT UGI

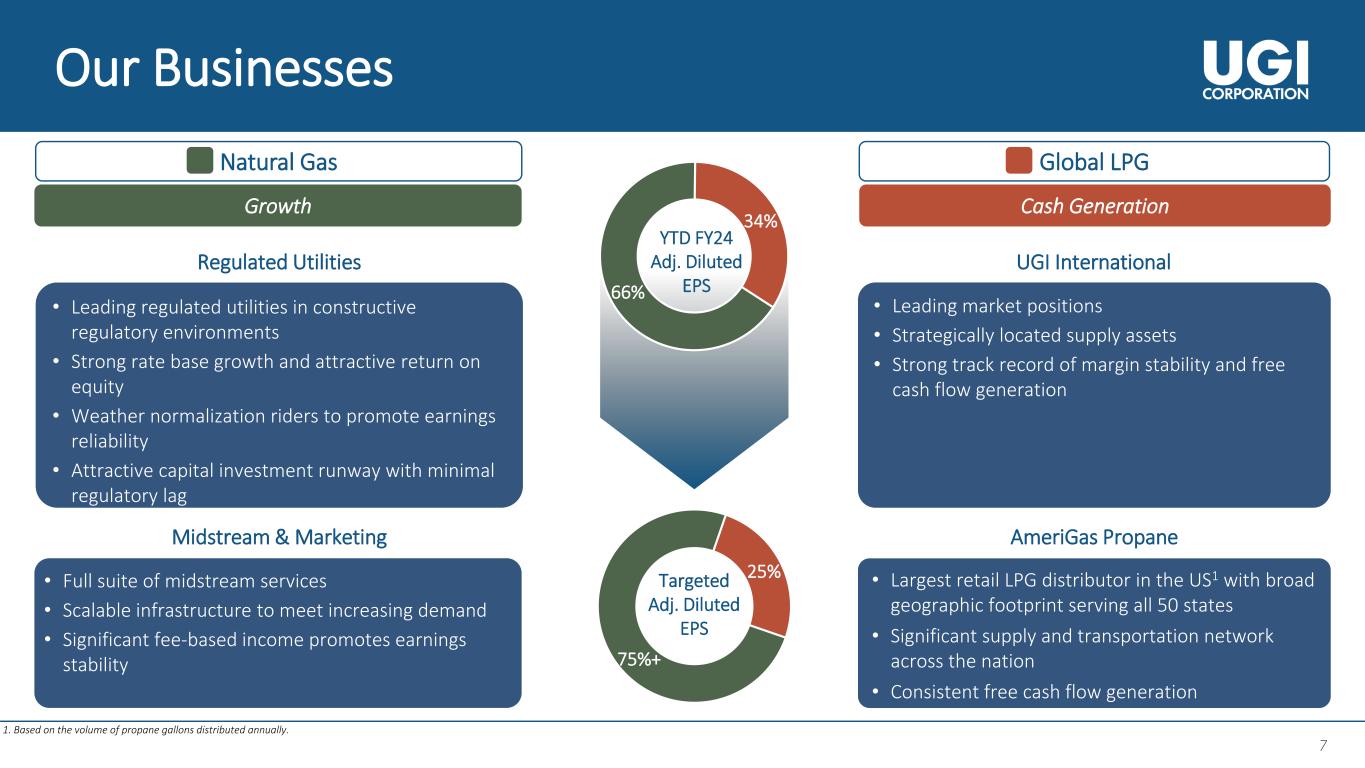

UGI Corporation (NYSE: UGI) is a distributor and marketer of energy products and services in the US and Europe. UGI offers safe, reliable, affordable, and sustainable energy solutions to customers through its subsidiaries, which provide natural gas transmission and distribution, electric generation and distribution, midstream services, propane distribution, renewable natural gas generation, distribution and marketing, and energy marketing services.

Comprehensive information about UGI Corporation is available on the Internet at https://www.ugicorp.com.

USE OF NON-GAAP MEASURES

Management uses "adjusted net income attributable to UGI Corporation" and "adjusted diluted earnings per share," both of which are non-GAAP financial measures, when evaluating UGI's overall performance. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impacts of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results. Volatility in net income attributable to UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions but included in earnings in accordance with U.S. generally accepted accounting principles ("GAAP").

Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures.

The tables on the last page of this press release reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to above.

1 Reportable segments' EBIT represents an aggregate of our reportable operating segment level EBIT, as determined in accordance with GAAP.

2 Because we are unable to predict certain potentially material items affecting diluted earnings per share on a GAAP basis, principally mark-to-market gains and losses on commodity and certain foreign currency derivative instruments, we cannot reconcile fiscal year 2024 adjusted diluted earnings per share, a non-GAAP measure, to diluted earnings per share, the most directly comparable GAAP measure, in reliance on the “unreasonable efforts” exception set forth in SEC rules.

USE OF FORWARD-LOOKING STATEMENTS

This press release contains statements, estimates and projections that are forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended). Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words and terms of similar meaning, although not all forward-looking statements contain such words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future. Management believes that these are reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control; accordingly, there is no assurance that results will be realized. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. We undertake no obligation (and expressly disclaim any obligation) to update publicly any forward-looking statement, whether as a result of new information or future events, except as required by the federal securities laws. Among them are adverse weather conditions (including increasingly uncertain weather patterns due to climate change) resulting in reduced demand, the seasonal nature of our business, and disruptions in our operations and supply chain; cost volatility and availability of energy products, including propane and other LPG, natural gas, and electricity, as well as the availability of LPG cylinders, and the capacity to transport product to our customers; changes in domestic and foreign laws and regulations, including safety, health, tax, transportation, consumer protection, data privacy, accounting, and environmental matters, such as regulatory responses to climate change; the inability to timely recover costs through utility rate proceedings; increased customer conservation measures due to high energy prices and improvements in energy efficiency and technology resulting in reduced demand; adverse labor relations and our ability to address existing or potential workforce shortages; the impact of pending and future legal or regulatory proceedings, inquiries or investigations; competitive pressures from the same and alternative energy sources; failure to acquire new customers or retain current customers, thereby reducing or limiting any increase in revenues; liability for environmental claims; customer, counterparty, supplier, or vendor defaults; liability for uninsured claims and for claims in excess of insurance coverage, including those for personal injury and property damage arising from explosions, acts of war, terrorism, natural disasters, pandemics and other catastrophic events that may result from operating hazards and risks incidental to generating and distributing electricity and transporting, storing and distributing natural gas and LPG in all forms; transmission or distribution system service interruptions; political, regulatory and economic conditions in the United States, Europe and other foreign countries, including uncertainties related to the war between Russia and Ukraine, the European energy crisis, and foreign currency exchange rate fluctuations (particularly the euro); credit and capital market conditions, including reduced access to capital markets and interest rate fluctuations; changes in commodity market prices resulting in significantly higher cash collateral requirements; impacts of our indebtedness and the restrictive covenants in our debt agreements; reduced distributions from subsidiaries impacting the ability to pay dividends or service debt; changes in Marcellus and Utica Shale gas production; the availability, timing and success of our acquisitions, commercial initiatives and investments to grow our businesses; our ability to successfully integrate acquired businesses and achieve anticipated synergies; the interruption, disruption, failure, malfunction, or breach of our information technology systems, and those of our third-party vendors or service providers, including due to cyber-attack; the inability to complete pending or future energy infrastructure projects; our ability to achieve the operational benefits and cost efficiencies expected from the completion of pending and future business transformation initiatives, including the impact of customer service disruptions resulting in potential customer loss due to the transformation activities; our ability to attract, develop, retain and engage key employees; uncertainties related to global pandemics; the impact of proposed or future tax legislation; the impact of declines in the stock market or bond market, and a low interest rate environment, on our pension liability; our ability to protect our intellectual property; and our ability to overcome supply chain issues that may result in delays or shortages in, as well as increased costs of, equipment, materials or other resources that are critical to our business operations.

SEGMENT RESULTS ($ in millions, except where otherwise indicated)

Utilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended March 31, |

|

2024 |

|

2023 |

|

(Decrease) Increase |

| Revenues |

|

$ |

646 |

|

|

$ |

774 |

|

|

$ |

(128) |

|

|

(17) |

% |

| Total margin (a) |

|

$ |

363 |

|

|

$ |

338 |

|

|

$ |

25 |

|

|

7 |

% |

| Operating and administrative expenses |

|

$ |

97 |

|

|

$ |

97 |

|

|

$ |

— |

|

|

— |

% |

| Operating income |

|

$ |

225 |

|

|

$ |

203 |

|

|

$ |

22 |

|

|

11 |

% |

| Earnings before interest expense and income taxes |

|

$ |

226 |

|

|

$ |

205 |

|

|

$ |

21 |

|

|

10 |

% |

| Gas Utility system throughput - billions of cubic feet |

|

|

|

|

|

|

|

|

| Core market |

|

45 |

|

|

44 |

|

|

1 |

|

|

2 |

% |

| Total |

|

121 |

|

|

125 |

|

|

(4) |

|

|

(3) |

% |

| Gas Utility heating degree days - % (warmer) than normal (b) |

|

(16.4) |

% |

|

(19.7) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

91 |

|

|

$ |

133 |

|

|

$ |

(42) |

|

|

(32) |

% |

•Gas Utility service territory experienced temperatures that were 16% warmer than normal and 5% colder than the prior-year period.

•Core market volumes increased due to colder than prior-year weather and growth in core market customers.

•Total margin increased $25 million primarily due to higher gas and electric base rates, higher DSIC benefits, and continued customer growth.

•Operating income increased $22 million due to the higher total margin, partially offset by higher depreciation expense ($4 million) from continued distribution system capital expenditure activity.

Midstream & Marketing

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended March 31, |

|

2024 |

|

2023 |

|

(Decrease) Increase |

| Revenues |

|

$ |

483 |

|

|

$ |

638 |

|

|

$ |

(155) |

|

|

(24) |

% |

| Total margin (a) |

|

$ |

200 |

|

|

$ |

159 |

|

|

$ |

41 |

|

|

26 |

% |

| Operating and administrative expenses |

|

$ |

29 |

|

|

$ |

35 |

|

|

$ |

(6) |

|

|

(17) |

% |

| Operating income |

|

$ |

151 |

|

|

$ |

103 |

|

|

$ |

48 |

|

|

47 |

% |

| Earnings before interest expense and income taxes |

|

$ |

153 |

|

|

$ |

105 |

|

|

$ |

48 |

|

|

46 |

% |

| Heating degree days - % (warmer) than normal (b) |

|

(13.4) |

% |

|

(18.0) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

33 |

|

|

$ |

23 |

|

|

$ |

10 |

|

|

43 |

% |

•Temperatures were 13% warmer than normal and 3% colder than the prior-year period.

•Total margin increased $41 million primarily reflecting higher margins from natural gas marketing activities, including the effects of capacity management and peaking activities.

•Operating and administrative expenses decreased $6 million largely due to lower employee compensation and benefit, and maintenance expenses.

•Operating income increased $48 million largely reflecting higher total margin and reduced operating and administrative expenses.

UGI International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended March 31, |

|

2024 |

|

2023 |

|

(Decrease) Increase |

| Revenues |

|

$ |

673 |

|

|

$ |

948 |

|

|

$ |

(275) |

|

|

(29) |

% |

| Total margin (a) |

|

$ |

305 |

|

|

$ |

315 |

|

|

$ |

(10) |

|

|

(3) |

% |

| Operating and administrative expenses (a) |

|

$ |

155 |

|

|

$ |

171 |

|

|

$ |

(16) |

|

|

(9) |

% |

| Operating income |

|

$ |

124 |

|

|

$ |

120 |

|

|

$ |

4 |

|

|

3 |

% |

| Earnings before interest expense and income taxes |

|

$ |

131 |

|

|

$ |

128 |

|

|

$ |

3 |

|

|

2 |

% |

| LPG retail gallons sold (millions) |

|

221 |

|

|

222 |

|

|

(1) |

|

|

— |

% |

| Heating degree days - % (warmer) than normal (b) |

|

(13.2) |

% |

|

(7.0) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

19 |

|

|

$ |

30 |

|

|

$ |

(11) |

|

|

(37) |

% |

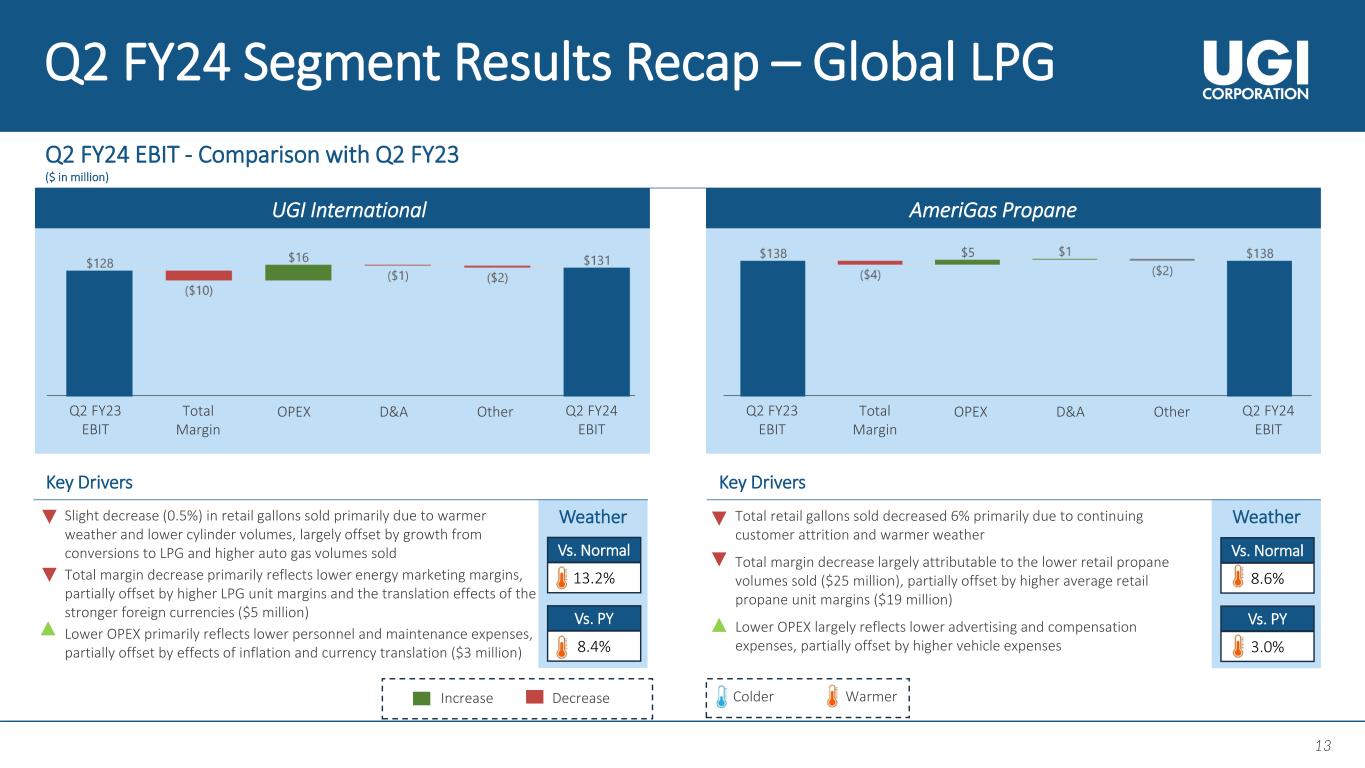

UGI International base-currency results are translated into U.S. dollars based upon exchange rates experienced during the reporting periods. Differences in these translation rates affect the comparison of line item amounts presented in the table above. The functional currency of a significant portion of our UGI International results is the euro and, to a much lesser extent, the British pound sterling. During the 2024 and 2023 three-month periods, the average unweighted euro-to-dollar translation rates were approximately $1.09 and $1.07, respectively, and the average unweighted British pound sterling-to-dollar translation rates were approximately $1.27 and $1.22, respectively.

•Temperatures were 13% warmer than normal and 8% warmer than the prior-year period.

•Retail volume was comparable to the prior-year period as the effects of the warmer weather were largely offset by higher autogas volumes and natural gas to LPG conversion.

•Total margin decreased $10 million primarily due to reduced margins from the non-core energy marketing operations, partially offset by higher LPG unit margins and the translation effects of the stronger foreign currencies (~$5 million).

•Operating and administrative expenses decreased $16 million reflecting lower personnel-related and maintenance expenses, partially offset by the translation effects of the stronger foreign currencies (~$3 million).

•Operating income increased $4 million reflecting lower operating and administrative expenses ($16 million), largely offset by reduced total margin and lower foreign currency transaction gains ($4 million).

AmeriGas Propane

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended March 31, |

|

2024 |

|

2023 |

|

(Decrease) Increase |

| Revenues |

|

$ |

795 |

|

|

$ |

867 |

|

|

$ |

(72) |

|

|

(8) |

% |

| Total margin (a) |

|

$ |

433 |

|

|

$ |

437 |

|

|

$ |

(4) |

|

|

(1) |

% |

| Operating and administrative expenses |

|

$ |

258 |

|

|

$ |

263 |

|

|

$ |

(5) |

|

|

(2) |

% |

| Operating income/earnings before interest expense and income taxes |

|

$ |

138 |

|

|

$ |

138 |

|

|

$ |

— |

|

|

— |

% |

| Retail gallons sold (millions) |

|

261 |

|

|

279 |

|

|

(18) |

|

|

(6) |

% |

| Heating degree days - % (warmer) colder than normal (b) |

|

(8.6) |

% |

|

(4.8) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

24 |

|

|

$ |

28 |

|

|

$ |

(4) |

|

|

(14) |

% |

•Temperatures were 9% warmer than normal and 3% warmer than the prior-year period.

•Retail gallons sold decreased 6% due to warmer weather and continued customer attrition.

•Total margin decreased $4 million as the impact of lower volumes was partially offset by higher LPG unit margins ($19 million).

•Operating and administrative expenses decreased $5 million reflecting, among other things, lower compensation and advertising expenses, partially offset by higher vehicle expenses ($4 million).

•Operating income was comparable to the prior year as lower total margin was offset by reduced operating and administrative expenses.

(a)Total margin represents total revenue less total cost of sales. In the case of Utilities, total margin is also reduced by certain revenue-related taxes.

(b)Deviation from average heating degree days is determined on a 10-year period utilizing volume-weighted weather data.

REPORT OF EARNINGS – UGI CORPORATION

(Millions of dollars, except per share)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

March 31, |

|

Six Months Ended

March 31, |

|

Twelve Months Ended

March 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

$ |

646 |

|

|

$ |

774 |

|

|

$ |

1,139 |

|

|

$ |

1,366 |

|

|

$ |

1,627 |

|

|

$ |

1,860 |

|

| Midstream & Marketing |

483 |

|

|

638 |

|

|

877 |

|

|

1,307 |

|

|

1,417 |

|

|

2,427 |

|

| UGI International |

673 |

|

|

948 |

|

|

1,398 |

|

|

1,825 |

|

|

2,538 |

|

|

3,238 |

|

| AmeriGas Propane |

795 |

|

|

867 |

|

|

1,424 |

|

|

1,633 |

|

|

2,372 |

|

|

2,750 |

|

| Corporate & Other (a) |

(130) |

|

|

(121) |

|

|

(250) |

|

|

(266) |

|

|

(303) |

|

|

(443) |

|

| Total revenues |

$ |

2,467 |

|

|

$ |

3,106 |

|

|

$ |

4,588 |

|

|

$ |

5,865 |

|

|

$ |

7,651 |

|

|

$ |

9,832 |

|

| Earnings (loss) before interest expense and income taxes: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

226 |

|

|

205 |

|

|

$ |

361 |

|

|

$ |

333 |

|

|

$ |

393 |

|

|

$ |

377 |

|

| Midstream & Marketing |

153 |

|

|

105 |

|

|

255 |

|

|

212 |

|

|

334 |

|

|

309 |

|

| UGI International |

131 |

|

|

128 |

|

|

248 |

|

|

194 |

|

|

288 |

|

|

246 |

|

| AmeriGas Propane |

138 |

|

|

138 |

|

|

209 |

|

|

248 |

|

|

229 |

|

|

242 |

|

| Total reportable segments |

648 |

|

|

576 |

|

|

1,073 |

|

|

987 |

|

|

1,244 |

|

|

1,174 |

|

| Corporate & Other (a) |

81 |

|

|

(319) |

|

|

(124) |

|

|

(1,961) |

|

|

(779) |

|

|

(1,719) |

|

| Total earnings (loss) before interest expense and income taxes |

729 |

|

|

257 |

|

|

949 |

|

|

(974) |

|

|

465 |

|

|

(545) |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

(24) |

|

|

(21) |

|

|

(47) |

|

|

(42) |

|

|

(87) |

|

|

(75) |

|

| Midstream & Marketing |

(9) |

|

|

(11) |

|

|

(20) |

|

|

(22) |

|

|

(43) |

|

|

(43) |

|

| UGI International |

(11) |

|

|

(9) |

|

|

(22) |

|

|

(16) |

|

|

(43) |

|

|

(29) |

|

| AmeriGas Propane |

(40) |

|

|

(39) |

|

|

(81) |

|

|

(82) |

|

|

(162) |

|

|

(163) |

|

| Corporate & Other, net (a) |

(16) |

|

|

(13) |

|

|

(30) |

|

|

(23) |

|

|

(59) |

|

|

(41) |

|

| Total interest expense |

(100) |

|

|

(93) |

|

|

(200) |

|

|

(185) |

|

|

(394) |

|

|

(351) |

|

| Income (loss) before income taxes |

629 |

|

|

164 |

|

|

749 |

|

|

(1,159) |

|

|

71 |

|

|

(896) |

|

| Income tax (expenses) benefits (b) |

(133) |

|

|

(54) |

|

|

(159) |

|

|

315 |

|

|

(139) |

|

|

288 |

|

| Net Income (loss) including noncontrolling interests |

496 |

|

|

110 |

|

|

590 |

|

|

(844) |

|

|

(68) |

|

|

(608) |

|

| Add net loss attributable to noncontrolling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

| Net income (loss) attributable to UGI Corporation |

$ |

496 |

|

|

$ |

110 |

|

|

$ |

590 |

|

|

$ |

(844) |

|

|

$ |

(68) |

|

|

$ |

(607) |

|

| Earnings (loss) per share attributable to UGI shareholders: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

2.36 |

|

|

$ |

0.52 |

|

|

$ |

2.81 |

|

|

$ |

(4.02) |

|

|

$ |

(0.32) |

|

|

$ |

(2.89) |

|

| Diluted |

$ |

2.30 |

|

|

$ |

0.51 |

|

|

$ |

2.74 |

|

|

$ |

(4.02) |

|

|

$ |

(0.32) |

|

|

$ |

(2.89) |

|

| Weighted Average common shares outstanding (thousands): |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

209,826 |

|

|

209,857 |

|

|

209,789 |

|

|

209,902 |

|

|

210,347 |

|

|

209,962 |

|

| Diluted |

215,245 |

|

|

216,120 |

|

|

215,393 |

|

|

209,902 |

|

|

210,347 |

|

|

209,962 |

|

| Supplemental information: |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to UGI Corporation: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

$ |

155 |

|

|

$ |

143 |

|

|

$ |

241 |

|

|

$ |

224 |

|

|

$ |

236 |

|

|

$ |

233 |

|

| Midstream & Marketing |

120 |

|

|

66 |

|

|

212 |

|

|

143 |

|

|

262 |

|

|

197 |

|

| UGI International |

91 |

|

|

92 |

|

|

174 |

|

|

137 |

|

|

209 |

|

|

166 |

|

| AmeriGas Propane |

37 |

|

|

73 |

|

|

53 |

|

|

122 |

|

|

2 |

|

|

62 |

|

| Total reportable segments |

403 |

|

|

374 |

|

|

680 |

|

|

626 |

|

|

709 |

|

|

658 |

|

| Corporate & Other (a) |

93 |

|

|

(264) |

|

|

(90) |

|

|

(1,470) |

|

|

(777) |

|

|

(1,265) |

|

| Total net income (loss) attributable to UGI Corporation |

$ |

496 |

|

|

$ |

110 |

|

|

$ |

590 |

|

|

$ |

(844) |

|

|

$ |

(68) |

|

|

$ |

(607) |

|

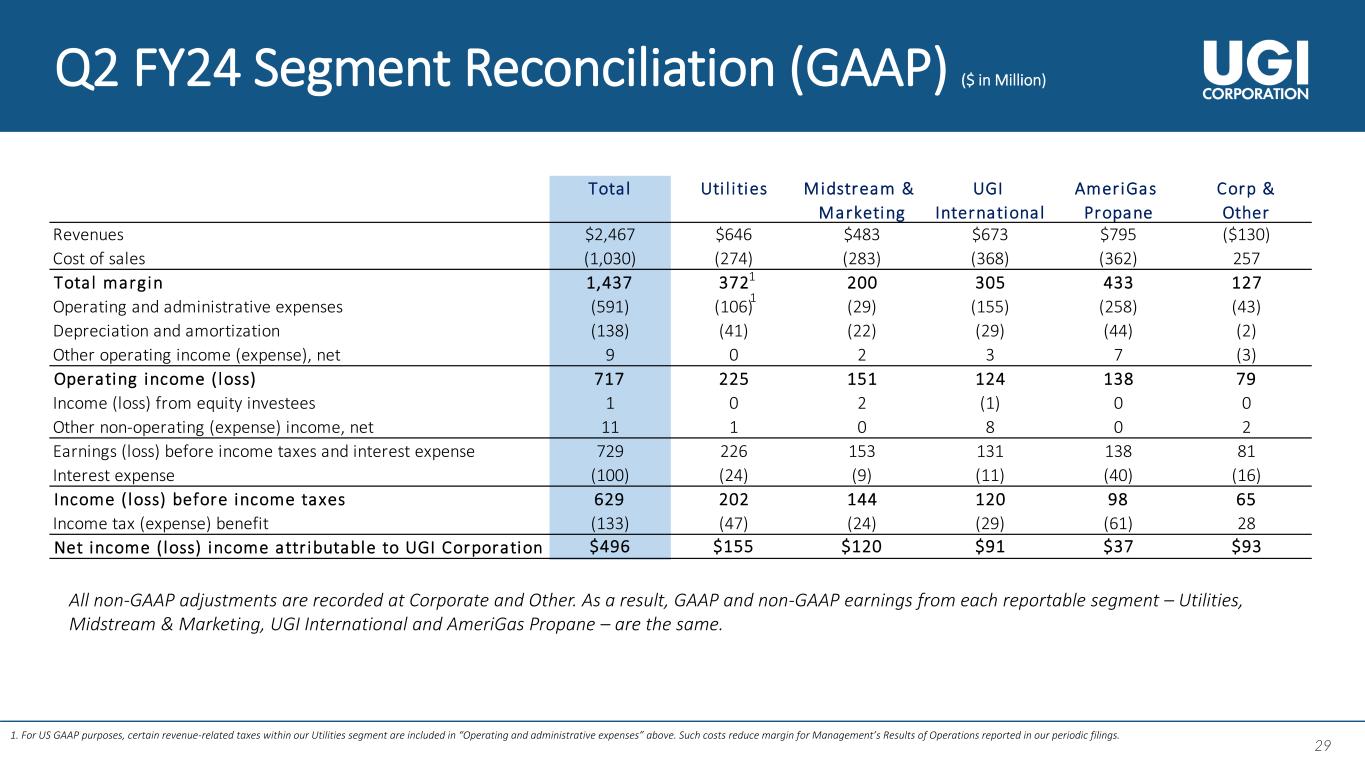

(a) Corporate & Other includes specific items attributable to our reportable segments that are not included in profit measures used by our Chief Operating Decision Maker in assessing our reportable segments' performance or allocating resources. These specific items are shown in the section titled "Non-GAAP Financial Measures - Adjusted Net Income (Loss) Attributable to UGI and Adjusted Diluted Earnings Per Share" below. Corporate & Other also includes the elimination of certain intercompany transactions.

(b) Income tax expense for the twelve months ended March 31, 2023 includes a $20 million income tax benefit from adjustments as a result of the changes in the Pennsylvania corporate income tax rates for future years, signed into law in July 2022.

Non-GAAP Financial Measures - Adjusted Net Income Attributable to UGI and Adjusted Diluted Earnings Per Share.

The following tables reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and reconcile diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to previously:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

Six Months Ended

March 31, |

|

Twelve Months Ended

March 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Adjusted net income (loss) attributable to UGI Corporation (millions): |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to UGI Corporation |

$ |

496 |

|

|

$ |

110 |

|

|

$ |

590 |

|

|

$ |

(844) |

|

|

$ |

(68) |

|

|

$ |

(607) |

|

|

Net (gains) losses on commodity derivative instruments not associated with current-period transactions (net of tax of $19, $(66), $1, $(429), $11 and $(382), respectively) |

(110) |

|

|

235 |

|

|

(33) |

|

|

1,234 |

|

|

(42) |

|

|

1,019 |

|

|

Unrealized (gains) losses on foreign currency derivative instruments (net of tax of $0, $(3), $(6), $(14), $(3) and $(1), respectively) |

(1) |

|

|

7 |

|

|

13 |

|

|

36 |

|

|

4 |

|

|

4 |

|

|

Loss associated with impairment of AmeriGas Propane goodwill (net of tax of $0, $0, $0, $0, $4, and $0, respectively) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

660 |

|

|

— |

|

|

Loss on extinguishment of debt (net of tax of $0, $0, $0, $0, $(2) and $0, respectively) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

7 |

|

|

— |

|

|

Impairment of certain equity method investments (net of tax of $0, $0, $0, $0, $0 and $(13), respectively) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

22 |

|

|

Business transformation expenses (net of tax of $0, $0, $0, $(1), $(2), and $(2), respectively) |

— |

|

|

2 |

|

|

— |

|

|

3 |

|

|

4 |

|

|

7 |

|

|

Costs associated with exit of the UGI International energy marketing business (net of tax of $(1), $4, $(14), $(64), $(17) and $(65), respectively) |

1 |

|

|

4 |

|

|

66 |

|

|

170 |

|

|

77 |

|

|

174 |

|

|

Impact of change in tax law |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(19) |

|

|

AmeriGas operations enhancement for growth project (net of tax of $(1), $(1), $(3), $(3), $(6) and $(3), respectively) |

5 |

|

|

5 |

|

|

10 |

|

|

10 |

|

|

18 |

|

|

10 |

|

|

Restructuring costs (net of tax of $(9), $0, $(10), $0, $(10) and $(5), respectively) |

27 |

|

|

— |

|

|

30 |

|

|

— |

|

|

30 |

|

|

11 |

|

|

Net gain on sale of UGI headquarters building (net of tax of $0, $0, $0, $0, $4 and $0, respectively) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(10) |

|

|

— |

|

|

Impairment of assets (net of tax of $(2), $0, (2), $0, $(2) and $0, respectively) |

5 |

|

|

— |

|

|

5 |

|

|

— |

|

|

5 |

|

|

— |

|

|

Total adjustments (1) |

(73) |

|

|

253 |

|

|

91 |

|

|

1,453 |

|

|

753 |

|

|

1,228 |

|

|

Adjusted net income attributable to UGI Corporation |

$ |

423 |

|

|

$ |

363 |

|

|

$ |

681 |

|

|

$ |

609 |

|

|

$ |

685 |

|

|

$ |

621 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

UGI Corporation earnings (loss) per share — diluted (2) |

$ |

2.30 |

|

|

$ |

0.51 |

|

|

$ |

2.74 |

|

|

$ |

(4.02) |

|

|

$ |

(0.32) |

|

|

$ |

(2.89) |

|

|

Net (gains) losses on commodity derivative instruments not associated with current-period transactions |

(0.50) |

|

|

1.09 |

|

|

(0.16) |

|

|

5.80 |

|

|

(0.29) |

|

|

4.78 |

|

|

Unrealized losses (gains) on foreign currency derivative instruments |

— |

|

|

0.03 |

|

|

0.06 |

|

|

0.17 |

|

|

0.02 |

|

|

0.02 |

|

|

Loss associated with impairment of AmeriGas Propane goodwill |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

3.14 |

|

|

— |

|

|

Loss on extinguishment of debt |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

0.03 |

|

|

— |

|

|

Impairment of certain equity method investments |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

0.10 |

|

|

Business transformation expenses |

— |

|

|

0.01 |

|

|

— |

|

|

0.01 |

|

|

0.02 |

|

|

0.03 |

|

|

Costs associated with the exit of the UGI International energy marketing business |

— |

|

|

0.02 |

|

|

0.31 |

|

|

0.81 |

|

|

0.37 |

|

|

0.83 |

|

|

Impact of change in tax law |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.09) |

|

|

AmeriGas operations enhancement for growth project |

0.02 |

|

|

0.02 |

|

|

0.05 |

|

|

0.05 |

|

|

0.09 |

|

|

0.05 |

|

|

Restructuring costs |

0.13 |

|

|

— |

|

|

0.14 |

|

|

— |

|

|

0.14 |

|

|

0.05 |

|

|

Net gain on sale of UGI headquarters building |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.05) |

|

|

— |

|

|

Impairment of assets |

0.02 |

|

|

— |

|

|

0.02 |

|

|

— |

|

|

0.02 |

|

|

— |

|

|

Total adjustments (2) |

(0.33) |

|

|

1.17 |

|

|

0.42 |

|

|

6.84 |

|

|

3.49 |

|

|

5.77 |

|

|

Adjusted diluted earnings per share (2) |

$ |

1.97 |

|

|

$ |

1.68 |

|

|

$ |

3.16 |

|

|

$ |

2.82 |

|

|

$ |

3.17 |

|

|

$ |

2.88 |

|

(1)Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

(2)The loss per share for the twelve months ended March 31, 2024, was determined excluding the effect of 5.76 million dilutive shares as the impact of such shares would have been antidilutive to the net loss for the period. Adjusted earnings per share for the twelve months ended March 31, 2024, was determined based upon fully diluted shares of 216.11 million. The loss per share for the six and twelve months ended March 31, 2023, was determined excluding the effect of 6.35 million dilutive shares and 5.99 million dilutive shares, respectively, as the impact of such shares would have been antidilutive to the net loss for the period. Adjusted earnings per share for the six and twelve months ended March 31, 2023, was determined based upon fully diluted shares of 216.25 million and 215.95 million, respectively.

Press Release

Press Release