Document

Press Release

UGI Reports First Quarter Fiscal 2024 Results

January 31, 2024

VALLEY FORGE, PA - UGI Corporation (NYSE: UGI) today reported financial results for the fiscal quarter ended December 31, 2023.

HIGHLIGHTS

•Q1 GAAP diluted EPS of $0.44 and adjusted diluted EPS of $1.20 compared to GAAP diluted EPS of $(4.54) and adjusted diluted EPS of $1.14 in the prior-year period.

•Q1 reportable segments earnings before interest expense and income taxes1 ("EBIT") of $425 million compared to $411 million in the prior-year period.

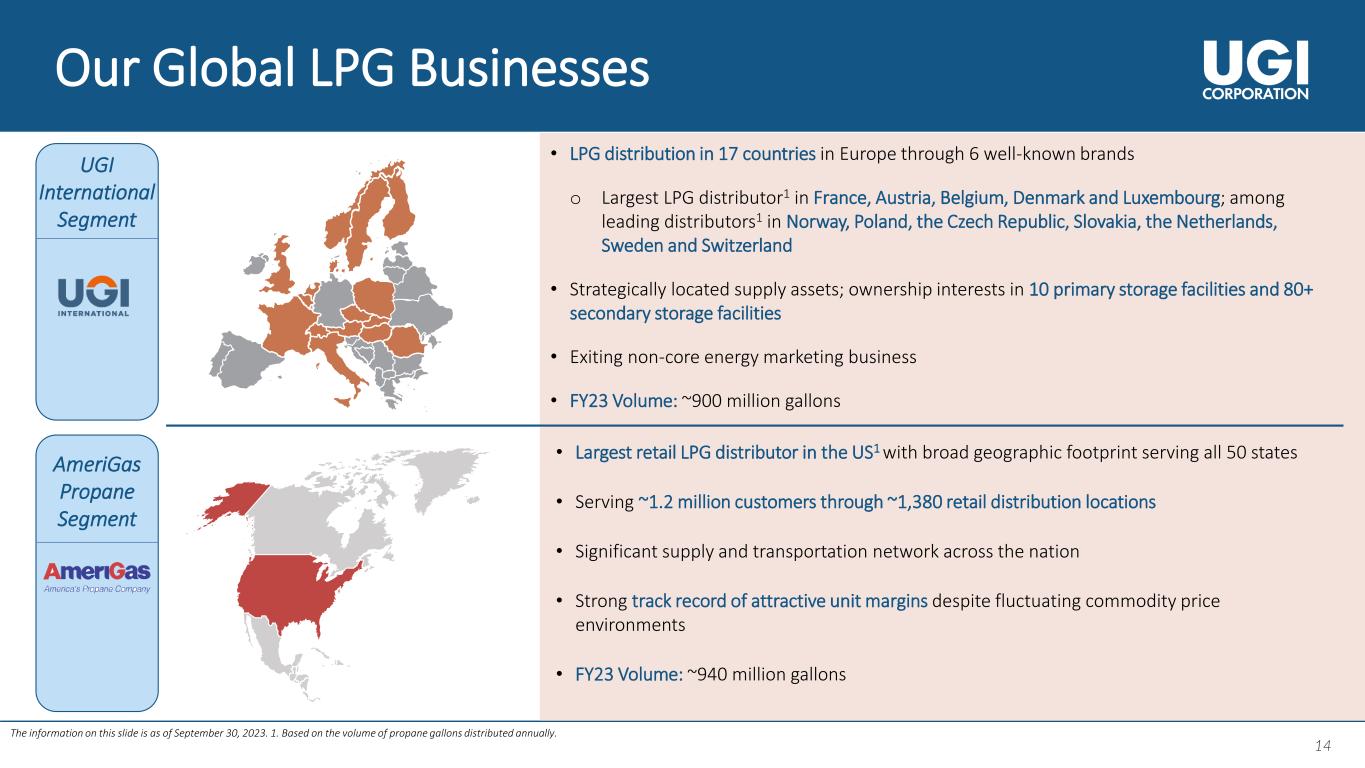

•Strong first quarter results despite warmer than normal weather across our service territories, largely due to a 77% increase in EBIT from UGI International attributable to the continued exit of the non-core energy marketing business, higher LPG volumes, and increased unit margins.

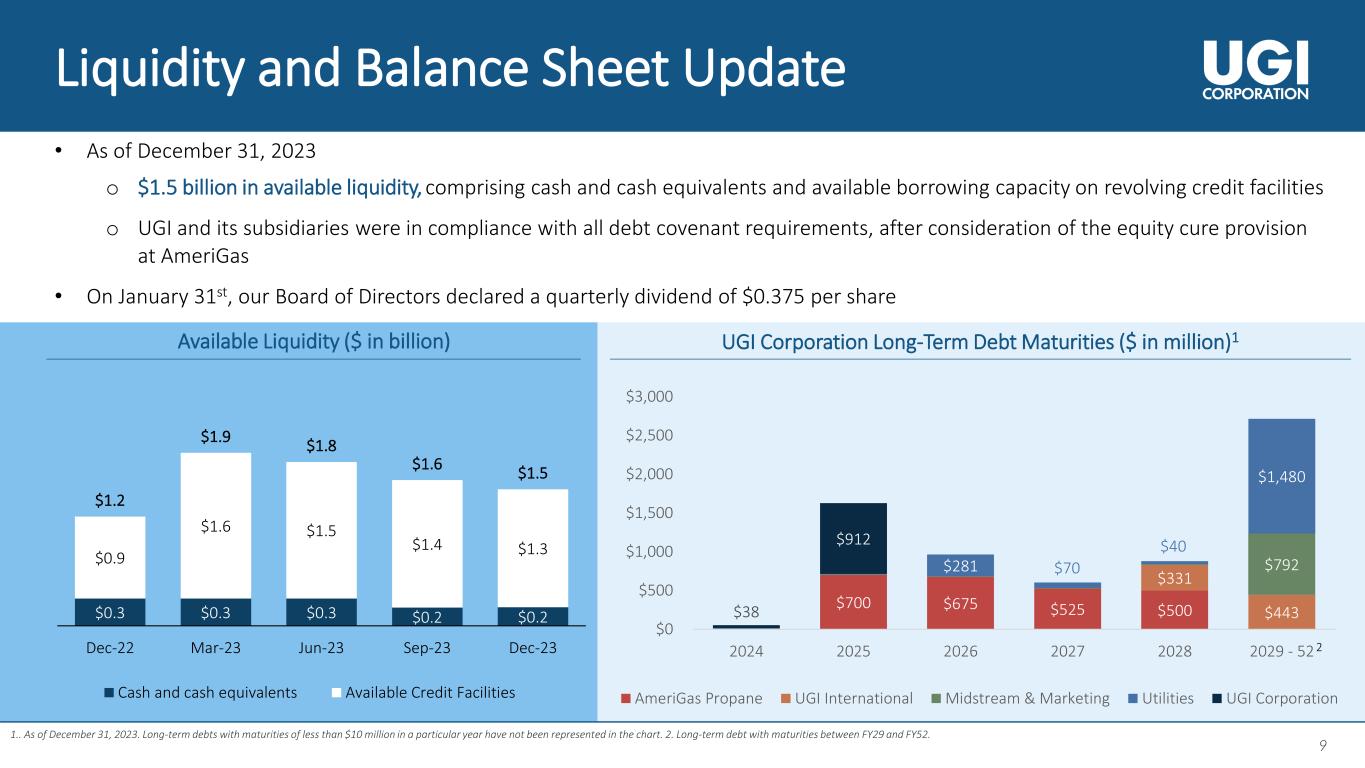

•Available liquidity of approximately $1.5 billion as of December 31, 2023.

•Received approval from the West Virginia Public Service Commission for Mountaineer's gas rate case. The settlement permitted a $13.9 million annual distribution rate increase, effective January 1, 2024, and a weather normalization adjustment mechanism effective October 1, 2024.

"Our fiscal first quarter results reflect the strong performance of UGI International and the natural gas businesses, and underscores our commitment to our customers, shareholders and employees," said Mario Longhi, Interim President and Chief Executive Officer. “As previously anticipated and discussed on our year-end earnings call, AmeriGas experienced a decline in its year-over-year financial results. While effort was made to address the segment's performance, it is clear that there is a need for renewed focus on execution.

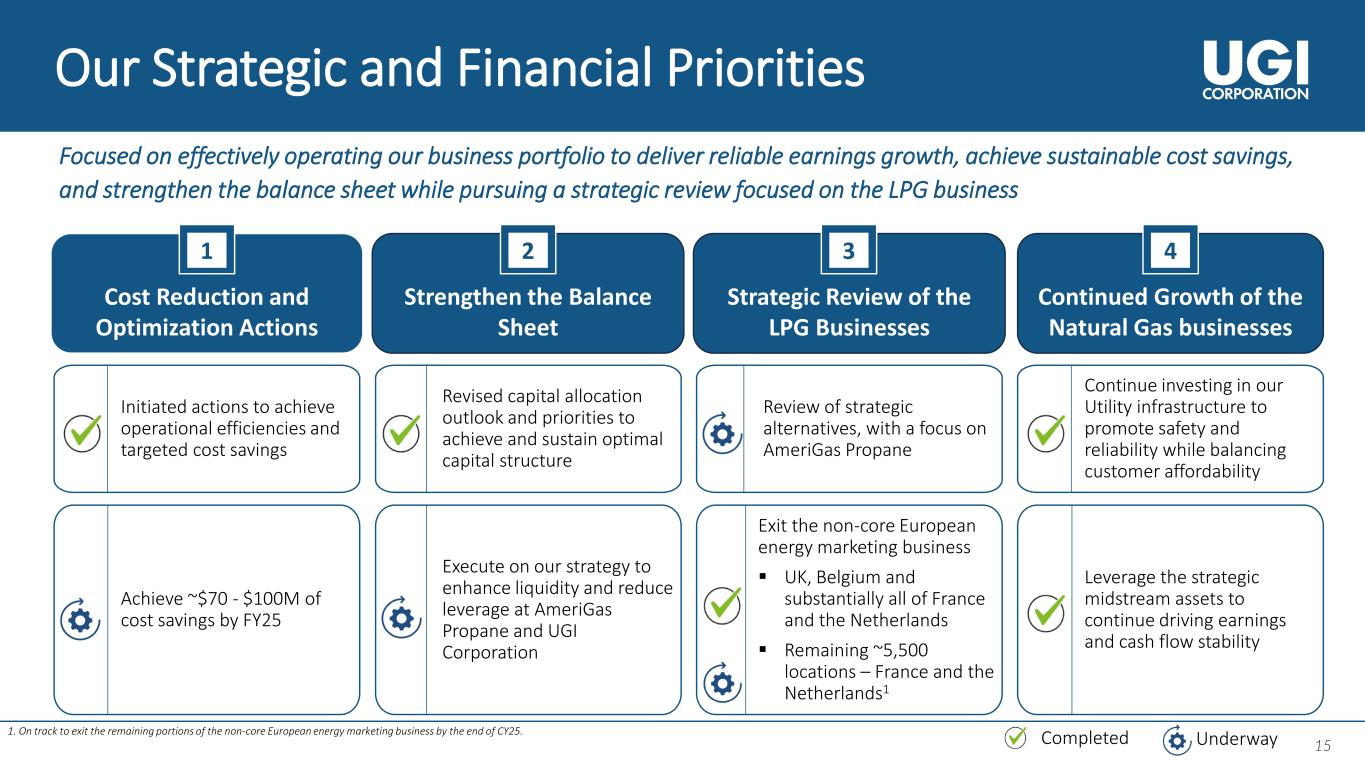

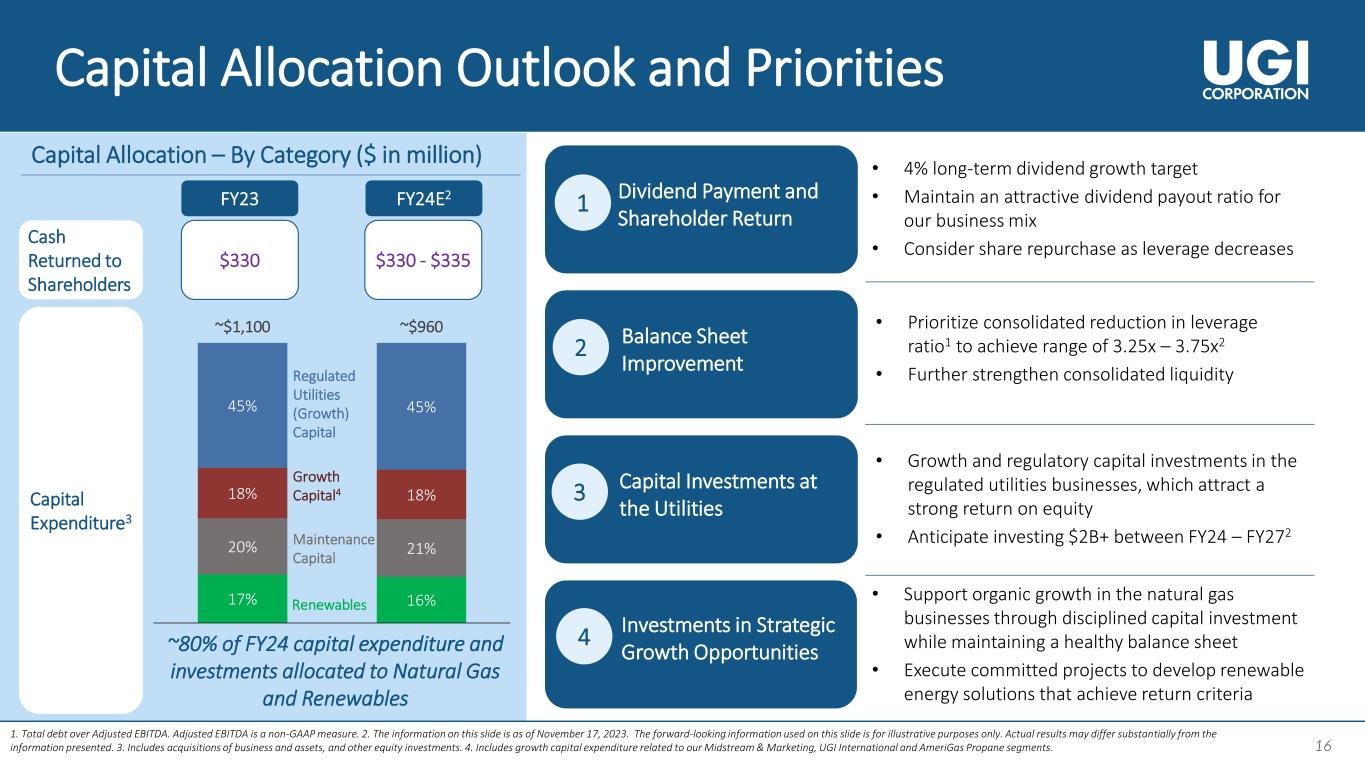

"Our strategic priorities are geared towards delivering reliable earnings growth, returning cash to shareholders through dividends, achieving sustainable cost savings, and strengthening the balance sheet. We have initiated actions to align our cost structure with the performance of each business, adjusted our capital allocation priorities, and lowered capital expenditures in the near term. Diligent execution of these actions should strengthen our core businesses and better position UGI to deliver sustainable value for its shareholders."

EARNINGS CALL AND WEBCAST

UGI Corporation will hold a live Internet Audio Webcast of its conference call to discuss the quarterly earnings and other current activities at 9:00 AM ET on Thursday, February 1, 2024. Interested parties may listen to the audio webcast both live and in replay on the Internet at https://www.ugicorp.com/investors/financial-reports/presentations or by visiting the company website https://www.ugicorp.com and clicking on Investors and then Presentations. A replay of the webcast will be available after the event through to 11:59 PM ET January 31, 2025.

CONTACT INVESTOR RELATIONS

Tel: +1 610-337-1000

Tameka Morris, ext. 6297

Arnab Mukherjee, ext. 7498

Shelly Oates, ext. 3202

ABOUT UGI

UGI Corporation (NYSE: UGI) is a distributor and marketer of energy products and services in the US and Europe. UGI offers safe, reliable, affordable, and sustainable energy solutions to customers through its subsidiaries, which provide natural gas transmission and distribution, electric generation and distribution, midstream services, propane distribution, renewable natural gas generation, distribution and marketing, and energy marketing services.

Comprehensive information about UGI Corporation is available on the Internet at https://www.ugicorp.com.

USE OF NON-GAAP MEASURES

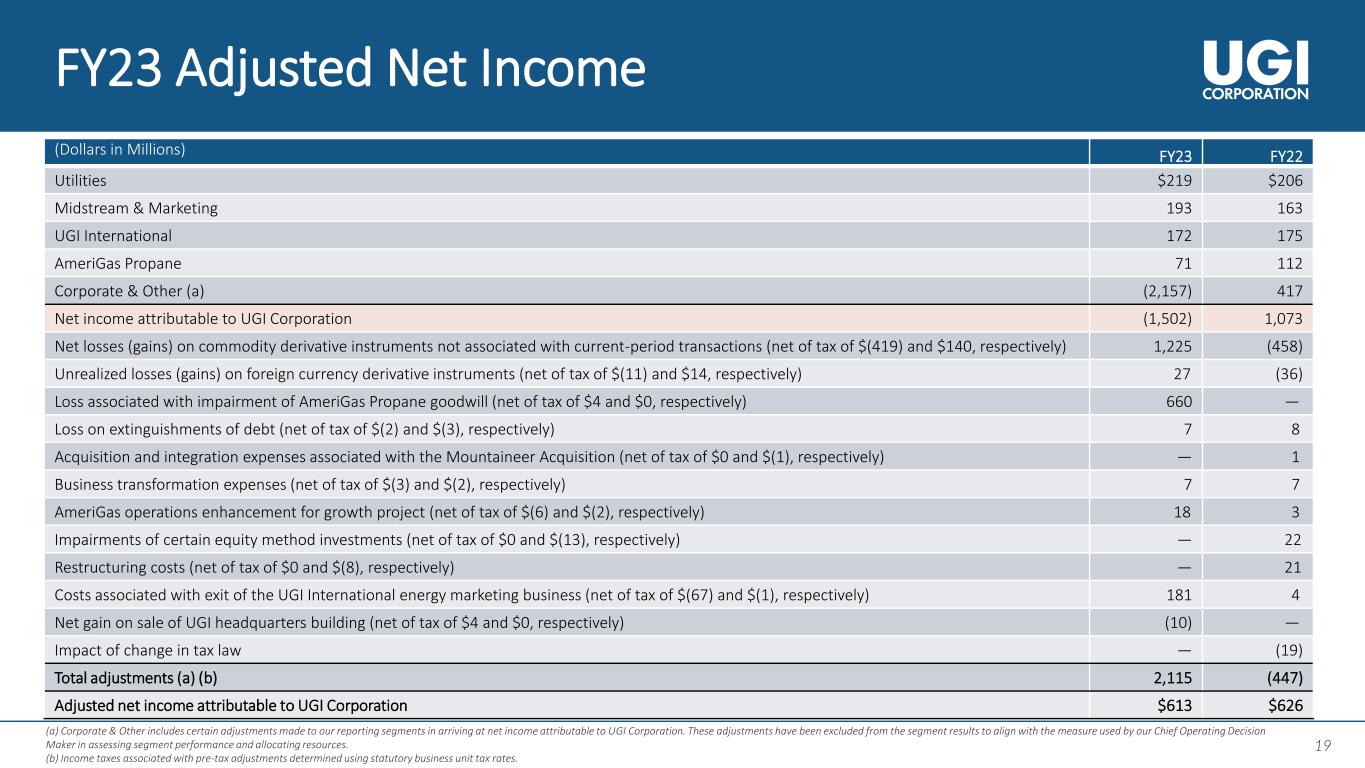

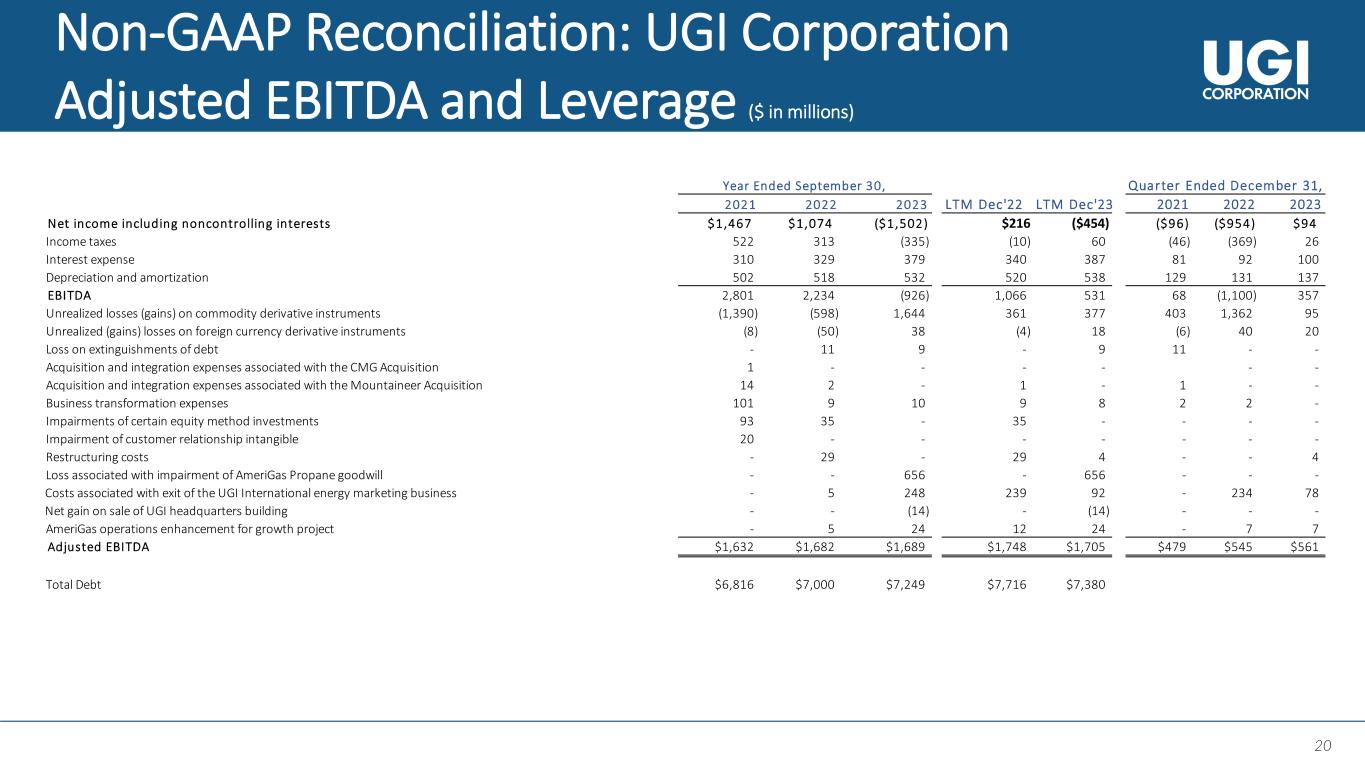

Management uses "adjusted net income attributable to UGI Corporation" and "adjusted diluted earnings per share," both of which are non-GAAP financial measures, when evaluating UGI's overall performance. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impacts of (1) gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and (2) other significant discrete items that can affect the comparison of period-over-period results. Volatility in net income attributable to UGI can occur as a result of gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions but included in earnings in accordance with U.S. generally accepted accounting principles ("GAAP").

Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures.

The tables on the last page of this press release reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to above.

1 Reportable segments' EBIT represents an aggregate of our reportable operating segment level EBIT, as determined in accordance with GAAP.

USE OF FORWARD-LOOKING STATEMENTS

This press release contains statements, estimates and projections that are forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended). Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words and terms of similar meaning, although not all forward-looking statements contain such words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future. Management believes that these are reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control; accordingly, there is no assurance that results will be realized. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. We undertake no obligation (and expressly disclaim any obligation) to update publicly any forward-looking statement, whether as a result of new information or future events, except as required by the federal securities laws. Among them are adverse weather conditions (including increasingly uncertain weather patterns due to climate change) resulting in reduced demand, the seasonal nature of our business, and disruptions in our operations and supply chain; cost volatility and availability of energy products, including propane and other LPG, natural gas, and electricity, as well as the availability of LPG cylinders, and the capacity to transport product to our customers; changes in domestic and foreign laws and regulations, including safety, health, tax, transportation, consumer protection, data privacy, accounting, and environmental matters, such as regulatory responses to climate change; the inability to timely recover costs through utility rate proceedings; increased customer conservation measures due to high energy prices and improvements in energy efficiency and technology resulting in reduced demand; adverse labor relations and our ability to address existing or potential workforce shortages; the impact of pending and future legal or regulatory proceedings, inquiries or investigations; competitive pressures from the same and alternative energy sources; failure to acquire new customers or retain current customers, thereby reducing or limiting any increase in revenues; liability for environmental claims; customer, counterparty, supplier, or vendor defaults; liability for uninsured claims and for claims in excess of insurance coverage, including those for personal injury and property damage arising from explosions, acts of war, terrorism, natural disasters, pandemics and other catastrophic events that may result from operating hazards and risks incidental to generating and distributing electricity and transporting, storing and distributing natural gas and LPG in all forms; transmission or distribution system service interruptions; political, regulatory and economic conditions in the United States, Europe and other foreign countries, including uncertainties related to the war between Russia and Ukraine, the European energy crisis, and foreign currency exchange rate fluctuations (particularly the euro); credit and capital market conditions, including reduced access to capital markets and interest rate fluctuations; changes in commodity market prices resulting in significantly higher cash collateral requirements; impacts of our indebtedness and the restrictive covenants in our debt agreements; reduced distributions from subsidiaries impacting the ability to pay dividends or service debt; changes in Marcellus and Utica Shale gas production; the availability, timing and success of our acquisitions, commercial initiatives and investments to grow our businesses; our ability to successfully integrate acquired businesses and achieve anticipated synergies; the interruption, disruption, failure, malfunction, or breach of our information technology systems, and those of our third-party vendors or service providers, including due to cyber-attack; the inability to complete pending or future energy infrastructure projects; our ability to achieve the operational benefits and cost efficiencies expected from the completion of pending and future business transformation initiatives, including the impact of customer service disruptions resulting in potential customer loss due to the transformation activities; our ability to attract, develop, retain and engage key employees; uncertainties related to global pandemics; the impact of proposed or future tax legislation; the impact of declines in the stock market or bond market, and a low interest rate environment, on our pension liability; our ability to protect our intellectual property; and our ability to overcome supply chain issues that may result in delays or shortages in, as well as increased costs of, equipment, materials or other resources that are critical to our business operations.

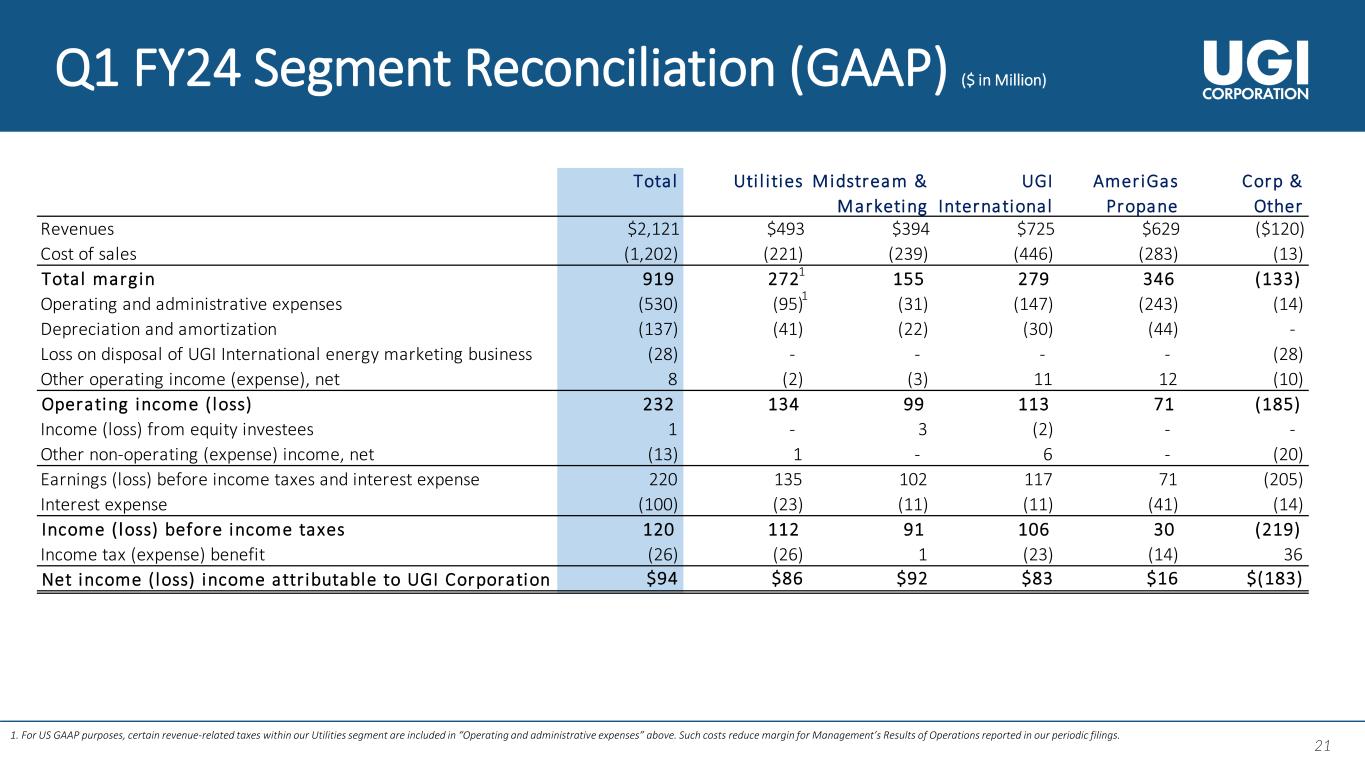

SEGMENT RESULTS ($ in millions, except where otherwise indicated)

Utilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended December 31, |

|

2023 |

|

2022 |

|

Increase (Decrease) |

| Revenues |

|

$ |

493 |

|

|

$ |

592 |

|

|

$ |

(99) |

|

|

(17) |

% |

| Total margin (a) |

|

$ |

265 |

|

|

$ |

256 |

|

|

$ |

9 |

|

|

4 |

% |

| Operating and administrative expenses |

|

$ |

88 |

|

|

$ |

91 |

|

|

$ |

(3) |

|

|

(3) |

% |

| Operating income |

|

$ |

134 |

|

|

$ |

126 |

|

|

$ |

8 |

|

|

6 |

% |

| Earnings before interest expense and income taxes |

|

$ |

135 |

|

|

$ |

128 |

|

|

$ |

7 |

|

|

5 |

% |

| Gas Utility system throughput - billions of cubic feet |

|

|

|

|

|

|

|

|

| Core market |

|

30 |

|

|

34 |

|

|

(4) |

|

|

(12) |

% |

| Total |

|

104 |

|

|

94 |

|

|

10 |

|

|

11 |

% |

| Gas Utility heating degree days - % (warmer) than normal (b) |

|

(11.0) |

% |

|

0.2 |

% |

|

|

|

|

| Capital expenditures |

|

$ |

82 |

|

|

$ |

117 |

|

|

$ |

(35) |

|

|

(30) |

% |

•Gas Utility service territory experienced temperatures that were 11% warmer than normal as well as the prior-year period.

•Core market volumes decreased due to warmer than prior-year weather partially offset by growth in core market customers.

•Total volumes increased largely due to higher large firm delivery service and interruptible delivery service volumes.

•Total margin increased $9 million primarily due to the increase in our PA gas base rates, higher DSIC and IREP benefits, and continued customer growth. The effect of the warmer weather was partially offset by the weather normalization adjustment.

•Operating income increased $8 million due to the higher total margin ($9 million) and lower operating and administrative expenses ($3 million), partially offset by higher depreciation expense ($4 million) from continued distribution system capital expenditure activity.

Midstream & Marketing

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended December 31, |

|

2023 |

|

2022 |

|

(Decrease) Increase |

| Revenues |

|

$ |

394 |

|

|

$ |

669 |

|

|

$ |

(275) |

|

|

(41) |

% |

| Total margin (a) |

|

$ |

155 |

|

|

$ |

155 |

|

|

$ |

— |

|

|

— |

% |

| Operating and administrative expenses |

|

$ |

31 |

|

|

$ |

29 |

|

|

$ |

2 |

|

|

7 |

% |

| Operating income |

|

$ |

99 |

|

|

$ |

106 |

|

|

$ |

(7) |

|

|

(7) |

% |

| Earnings before interest expense and income taxes |

|

$ |

102 |

|

|

$ |

107 |

|

|

$ |

(5) |

|

|

(5) |

% |

| Heating degree days - % warmer than normal (b) |

|

(9.4) |

% |

|

(1.0) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

19 |

|

|

$ |

11 |

|

|

$ |

8 |

|

|

73 |

% |

•Temperatures were 9% warmer than normal and 11% warmer than the prior-year period.

•Total margin was comparable with the prior year period as higher margins from natural gas marketing activities were offset by lower margins from renewable energy marketing activities.

•Operating and administrative expenses increased $2 million largely due to the recovery of an uncollectible account in the prior year.

UGI International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended December 31, |

|

2023 |

|

2022 |

|

(Decrease) Increase |

| Revenues |

|

$ |

725 |

|

|

$ |

877 |

|

|

$ |

(152) |

|

|

(17) |

% |

| Total margin (a) |

|

$ |

279 |

|

|

$ |

215 |

|

|

$ |

64 |

|

|

30 |

% |

| Operating and administrative expenses (a) |

|

$ |

147 |

|

|

$ |

143 |

|

|

$ |

4 |

|

|

3 |

% |

| Operating income |

|

$ |

113 |

|

|

$ |

56 |

|

|

$ |

57 |

|

|

102 |

% |

| Earnings before interest expense and income taxes |

|

$ |

117 |

|

|

$ |

66 |

|

|

$ |

51 |

|

|

77 |

% |

| LPG retail gallons sold (millions) |

|

214 |

|

|

205 |

|

|

9 |

|

|

4 |

% |

| Heating degree days - % warmer than normal (b) |

|

(12.0) |

% |

|

(12.3) |

% |

|

|

|

|

| Capital expenditures |

|

$ |

12 |

|

|

$ |

27 |

|

|

$ |

(15) |

|

|

(56) |

% |

UGI International base-currency results are translated into U.S. dollars based upon exchange rates experienced during the reporting periods. Differences in these translation rates affect the comparison of line item amounts presented in the table above. The functional currency of a significant portion of our UGI International results is the euro and, to a much lesser extent, the British pound sterling. During the 2023 and 2022 three-month periods, the average unweighted euro-to-dollar translation rates were approximately $1.08 and $1.02, respectively, and the average unweighted British pound sterling-to-dollar translation rates were approximately $1.24 and $1.17, respectively.

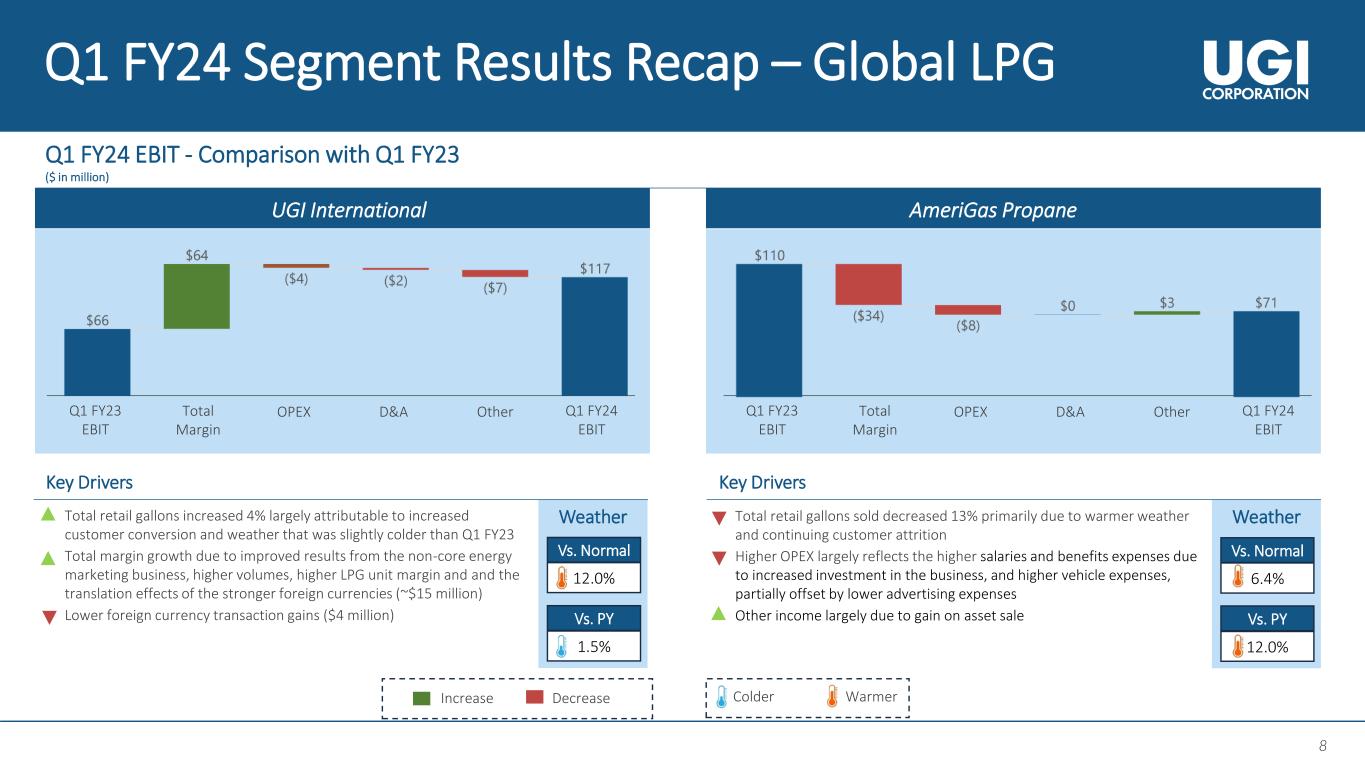

•Temperatures were 12% warmer than normal and 1.5% colder than the prior-year period.

•Retail volume increased 4% primarily due to colder than prior-year weather.

•Total margin increased $64 million primarily due to the continued exist from the non-core energy marketing operations, higher LPG unit margins and the translation effects of the stronger foreign currencies (~$15 million).

•Operating and administrative expenses increased $4 million reflecting the translation effects of the stronger foreign currencies (~$9 million), partially offset by lower personnel-related expenses.

•Operating income increased $57 million reflecting increased total margin, partially offset by higher operating and administrative expenses and lower foreign currency transaction gains ($4 million).

AmeriGas Propane

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the fiscal quarter ended December 31, |

|

2023 |

|

2022 |

|

(Decrease) Increase |

| Revenues |

|

$ |

629 |

|

|

$ |

766 |

|

|

$ |

(137) |

|

|

(18) |

% |

| Total margin (a) |

|

$ |

346 |

|

|

$ |

380 |

|

|

$ |

(34) |

|

|

(9) |

% |

| Operating and administrative expenses |

|

$ |

243 |

|

|

$ |

235 |

|

|

$ |

8 |

|

|

3 |

% |

| Operating loss/loss before interest expense and income taxes |

|

$ |

71 |

|

|

$ |

110 |

|

|

$ |

(39) |

|

|

(35) |

% |

| Retail gallons sold (millions) |

|

206 |

|

|

236 |

|

|

(30) |

|

|

(13) |

% |

| Heating degree days - % (warmer) colder than normal (b) |

|

(6.4) |

% |

|

6.2 |

% |

|

|

|

|

| Capital expenditures |

|

$ |

20 |

|

|

$ |

23 |

|

|

$ |

(3) |

|

|

(13) |

% |

•Temperatures were 6% warmer than normal and 12% warmer than the prior-year period.

•Retail gallons sold decreased 13% due to warmer weather and continued customer attrition.

•Total margin decreased $34 million primarily due to the impact of lower volumes.

•Operating and administrative expenses increased $8 million largely reflecting higher employee compensation and benefits ($5 million), as the business increased its delivery capacity, and increased vehicle fuel and maintenance expenses ($4 million).

•Operating income decreased $39 million reflecting lower total margin and higher operating and administrative expenses, partially offset by higher other income ($3 million) largely attributable to gain on asset sales.

(a)Total margin represents total revenue less total cost of sales. In the case of Utilities, total margin is also reduced by certain revenue-related taxes.

(b)Deviation from average heating degree days is determined on a 10-year period utilizing volume-weighted weather data.

REPORT OF EARNINGS – UGI CORPORATION

(Millions of dollars, except per share)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended

December 31, |

|

Twelve Months Ended

December 31, |

| |

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

|

|

|

|

$ |

493 |

|

|

$ |

592 |

|

|

$ |

1,755 |

|

|

$ |

1,793 |

|

| Midstream & Marketing |

|

|

|

|

394 |

|

|

669 |

|

|

1,572 |

|

|

2,460 |

|

| UGI International |

|

|

|

|

725 |

|

|

877 |

|

|

2,813 |

|

|

3,514 |

|

| AmeriGas Propane |

|

|

|

|

629 |

|

|

766 |

|

|

2,444 |

|

|

2,931 |

|

| Corporate & Other (a) |

|

|

|

|

(120) |

|

|

(145) |

|

|

(294) |

|

|

(506) |

|

| Total revenues |

|

|

|

|

$ |

2,121 |

|

|

$ |

2,759 |

|

|

$ |

8,290 |

|

|

$ |

10,192 |

|

| Earnings (loss) before interest expense and income taxes: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

|

|

|

|

$ |

135 |

|

|

$ |

128 |

|

|

$ |

372 |

|

|

$ |

366 |

|

| Midstream & Marketing |

|

|

|

|

102 |

|

|

107 |

|

|

286 |

|

|

294 |

|

| UGI International |

|

|

|

|

117 |

|

|

66 |

|

|

285 |

|

|

238 |

|

| AmeriGas Propane |

|

|

|

|

71 |

|

|

110 |

|

|

229 |

|

|

331 |

|

| Total reportable segments |

|

|

|

|

425 |

|

|

411 |

|

|

1,172 |

|

|

1,229 |

|

| Corporate & Other (a) |

|

|

|

|

(205) |

|

|

(1,642) |

|

|

(1,179) |

|

|

(683) |

|

| Total earnings (loss) before interest expense and income taxes |

|

|

|

|

220 |

|

|

(1,231) |

|

|

(7) |

|

|

546 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

|

|

|

|

(23) |

|

|

(21) |

|

|

(84) |

|

|

(70) |

|

| Midstream & Marketing |

|

|

|

|

(11) |

|

|

(11) |

|

|

(45) |

|

|

(42) |

|

| UGI International |

|

|

|

|

(11) |

|

|

(7) |

|

|

(41) |

|

|

(28) |

|

| AmeriGas Propane |

|

|

|

|

(41) |

|

|

(43) |

|

|

(161) |

|

|

(162) |

|

| Corporate & Other, net (a) |

|

|

|

|

(14) |

|

|

(10) |

|

|

(56) |

|

|

(38) |

|

| Total interest expense |

|

|

|

|

(100) |

|

|

(92) |

|

|

(387) |

|

|

(340) |

|

| Income (loss) before income taxes |

|

|

|

|

120 |

|

|

(1,323) |

|

|

(394) |

|

|

206 |

|

| Income tax (expenses) benefits (b) |

|

|

|

|

(26) |

|

|

369 |

|

|

(60) |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to UGI Corporation |

|

|

|

|

$ |

94 |

|

|

$ |

(954) |

|

|

$ |

(454) |

|

|

$ |

216 |

|

| Earnings (loss) per share attributable to UGI shareholders: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

|

|

$ |

0.45 |

|

|

$ |

(4.54) |

|

|

$ |

(2.16) |

|

|

$ |

1.03 |

|

| Diluted |

|

|

|

|

$ |

0.44 |

|

|

$ |

(4.54) |

|

|

$ |

(2.16) |

|

|

$ |

1.00 |

|

| Weighted Average common shares outstanding (thousands): |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

|

|

209,782 |

|

|

209,934 |

|

|

209,778 |

|

|

210,012 |

|

| Diluted |

|

|

|

|

215,570 |

|

|

209,934 |

|

|

209,778 |

|

|

215,880 |

|

| Supplemental information: |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to UGI Corporation: |

|

|

|

|

|

|

|

|

|

|

|

| Utilities |

|

|

|

|

$ |

86 |

|

|

$ |

81 |

|

|

$ |

224 |

|

|

$ |

224 |

|

| Midstream & Marketing |

|

|

|

|

92 |

|

|

77 |

|

|

208 |

|

|

189 |

|

| UGI International |

|

|

|

|

83 |

|

|

45 |

|

|

210 |

|

|

163 |

|

| AmeriGas Propane |

|

|

|

|

16 |

|

|

49 |

|

|

38 |

|

|

127 |

|

| Total reportable segments |

|

|

|

|

277 |

|

|

252 |

|

|

680 |

|

|

703 |

|

| Corporate & Other (a) |

|

|

|

|

(183) |

|

|

(1,206) |

|

|

(1,134) |

|

|

(487) |

|

| Total net income (loss) attributable to UGI Corporation |

|

|

|

|

$ |

94 |

|

|

$ |

(954) |

|

|

$ |

(454) |

|

|

$ |

216 |

|

(a) Corporate & Other includes specific items attributable to our reportable segments that are not included in profit measures used by our Chief Operating Decision Maker in assessing our reportable segments' performance or allocating resources. These specific items are shown in the section titled "Non-GAAP Financial Measures - Adjusted Net Income (Loss) Attributable to UGI and Adjusted Diluted Earnings Per Share" below. Corporate & Other also includes the elimination of certain intercompany transactions.

(b) Income tax expense for the twelve months ended December 31, 2022 includes $20 million income tax benefit from adjustments as a result of the changes in

the Pennsylvania corporate income tax rates for future years, signed into law in July 2022.

Non-GAAP Financial Measures - Adjusted Net Income Attributable to UGI and Adjusted Diluted Earnings Per Share

The following tables reconcile net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and reconcile diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to previously:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

Twelve Months Ended

December 31, |

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Adjusted net income (loss) attributable to UGI Corporation (millions): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to UGI Corporation |

|

|

|

|

|

|

$ |

94 |

|

|

$ |

(954) |

|

|

$ |

(454) |

|

|

$ |

216 |

|

|

Net losses on commodity derivative instruments not associated with current-period transactions (net of tax of $(18), $(363), $(74) and $(112), respectively) |

|

|

|

|

|

|

77 |

|

|

999 |

|

|

303 |

|

|

249 |

|

|

Unrealized losses (gains) on foreign currency derivative instruments (net of tax of $(6), $(11), $(6) and $1, respectively) |

|

|

|

|

|

|

14 |

|

|

29 |

|

|

12 |

|

|

(3) |

|

|

Loss associated with impairment of AmeriGas Propane goodwill (net of tax of $0, $0, $4, and $0, respectively) |

|

|

|

|

|

|

— |

|

|

— |

|

|

660 |

|

|

— |

|

|

Loss on extinguishment of debt (net of tax of $0, $0, $(2) and $0, respectively) |

|

|

|

|

|

|

— |

|

|

— |

|

|

7 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business transformation expenses (net of tax of $0, $(1), $(2), and $(2), respectively) |

|

|

|

|

|

|

— |

|

|

1 |

|

|

6 |

|

|

7 |

|

|

Costs associated with exit of the UGI International energy marketing business (net of tax of $(13), $(68), $(12) and $(69), respectively) |

|

|

|

|

|

|

65 |

|

|

166 |

|

|

80 |

|

|

170 |

|

|

Impact of change in tax law |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

(19) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AmeriGas operations enhancement for growth project (net of tax of $(2), $(2), $(6) and $(4), respectively) |

|

|

|

|

|

|

5 |

|

|

5 |

|

|

18 |

|

|

8 |

|

|

Impairment of certain equity method investments (net of tax of $0, $0, $0 and $(13), respectively) |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

22 |

|

|

Restructuring costs (net of tax of $(1), $0, $(1) and $(8), respectively) |

|

|

|

|

|

|

3 |

|

|

— |

|

|

3 |

|

|

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net gain on sale of UGI headquarters building (net of tax of $0, $0, $4 and $0, respectively) |

|

|

|

|

|

|

— |

|

|

— |

|

|

(10) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total adjustments (1) |

|

|

|

|

|

|

164 |

|

|

1,200 |

|

|

1,079 |

|

|

455 |

|

|

Adjusted net income attributable to UGI Corporation |

|

|

|

|

|

|

$ |

258 |

|

|

$ |

246 |

|

|

$ |

625 |

|

|

$ |

671 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

UGI Corporation earnings (loss) per share — diluted (2) |

|

|

|

|

|

|

$ |

0.44 |

|

|

$ |

(4.54) |

|

|

$ |

(2.16) |

|

|

$ |

1.00 |

|

|

Net losses on commodity derivative instruments not associated with current-period transactions |

|

|

|

|

|

|

0.37 |

|

|

4.73 |

|

|

1.36 |

|

|

1.15 |

|

|

Unrealized losses (gains) on foreign currency derivative instruments |

|

|

|

|

|

|

0.06 |

|

|

0.14 |

|

|

0.06 |

|

|

(0.01) |

|

|

Loss associated with impairment of AmeriGas Propane goodwill |

|

|

|

|

|

|

— |

|

|

— |

|

|

3.15 |

|

|

— |

|

|

Loss on extinguishment of debt |

|

|

|

|

|

|

— |

|

|

— |

|

|

0.03 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business transformation expenses |

|

|

|

|

|

|

— |

|

|

— |

|

|

0.03 |

|

|

0.03 |

|

|

Costs associated with the exit of the UGI International energy marketing business |

|

|

|

|

|

|

0.30 |

|

|

0.79 |

|

|

0.38 |

|

|

0.79 |

|

|

Impact of change in tax law |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

(0.09) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AmeriGas operations enhancement for growth project |

|

|

|

|

|

|

0.02 |

|

|

0.02 |

|

|

0.09 |

|

|

0.03 |

|

|

Impairment of certain equity method investments |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

0.10 |

|

|

Restructuring costs |

|

|

|

|

|

|

0.01 |

|

|

— |

|

|

0.01 |

|

|

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net gain on sale of UGI headquarters building |

|

|

|

|

|

|

— |

|

|

— |

|

|

(0.05) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total adjustments (2) |

|

|

|

|

|

|

0.76 |

|

|

5.68 |

|

|

5.06 |

|

|

2.10 |

|

|

Adjusted diluted earnings per share (2) |

|

|

|

|

|

|

$ |

1.20 |

|

|

$ |

1.14 |

|

|

$ |

2.90 |

|

|

$ |

3.10 |

|

(1)Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

(2)The loss per share for the twelve months ended December 31, 2023, was determined excluding the effect of 5.97 million dilutive shares as the impact of such shares would have been antidilutive to the net loss for the period. Adjusted earnings per share for the twelve months ended December 31, 2023, was determined based upon fully diluted shares of 215.75 million. The loss per share for the three months ended December 31, 2022, was determined excluding the effect of 6.43 million dilutive shares as the impact of such shares would have been antidilutive to the net loss for the period. Adjusted earnings per share for the three months ended December 31, 2022, were determined based upon fully diluted shares of 216.37 million.

Press Release

Press Release