Exhibit 10.1 THIS THIRD AMENDMENT to the AMENDED AND RESTATED CREDIT AGREEMENT, dated as of September 20, 2023 (this “Amendment”), among UGI CORPORATION, a Pennsylvania corporation (the “Borrower”), the LENDERS party hereto and JPMORGAN CHASE BANK, N.A., as Administrative Agent. W I T N E S S E T H : WHEREAS, the parties hereto have entered into that certain Amended and Restated Credit Agreement, dated as of May 4, 2021 (as amended, restated, supplemented or otherwise modified prior to the date hereof, the “Existing Credit Agreement”; the Existing Credit Agreement as amended by this Amendment, the “Amended Credit Agreement”), among the Borrower, the Lenders party thereto, the Administrative Agent and the other parties thereto; WHEREAS, the Borrower has requested that the Revolving Lenders and the Term A-1 Lenders agree to extend the Revolving Maturity Date and the Term A-1 Maturity Date, respectively, and that the Administrative Agent and the Lenders otherwise amend the Existing Credit Agreement as set forth herein; and WHEREAS, subject to the terms and conditions set forth herein, the Administrative Agent, the Revolving Lenders and the Term A-1 Lenders have agreed to extend the Revolving Maturity Date and the Term A-1 Maturity Date. NOW, THEREFORE, the parties hereto agree as follows: Section 1. Amendments to the Existing Credit Agreement. In each case with effect on and after the Amendment Effective Date, the Existing Credit Agreement is hereby amended as follows: (a) The definition of “Revolving Maturity Date” appearing in Section 1.01 of the Existing Credit Agreement is amended to delete the reference to “August 1, 2024” appearing therein and to replace such reference with “May 4, 2025”. (b) The definition of “Term A-1 Maturity Date” appearing in Section 1.01 of the Existing Credit Agreement is amended to delete the reference to “August 21, 2024” appearing therein and to replace such reference with “May 4, 2025”. (c) The definition of “Applicable Rate” appearing in Section 1.01 of the Existing Credit Agreement is amended to delete the pricing grids now appearing therein and to substitute the following therefore: Applicable Rate (Leverage-Based) Level Net Leverage Ratio Term Benchmark Spread and RFR Spread for Revolving Loans and Term A-1 Loans ABR Spread for Revolving Loans and Term A-1 Loans Applicable Commitment Fee Rate for Revolving Commitments Term Benchmark Spread and RFR Spread for Term A-2 Loans and Term A-3 Loans ABR Spread for Term A-2 Loans and Term A-3 Loans Applicable Commitment Fee Rate for Term A-3 Commitment 1 ≤ 2.75:1:00 175.0 bps 75.0 bps 25.0 bps 137.5 bps 37.5 bps 22.5 bps 2 > 2.75:1.00 187.5 bps 87.5 bps 27.5 bps 150.0 bps 50.0 bps 25.0 bps LEGAL 4886‐4786‐6994v.3

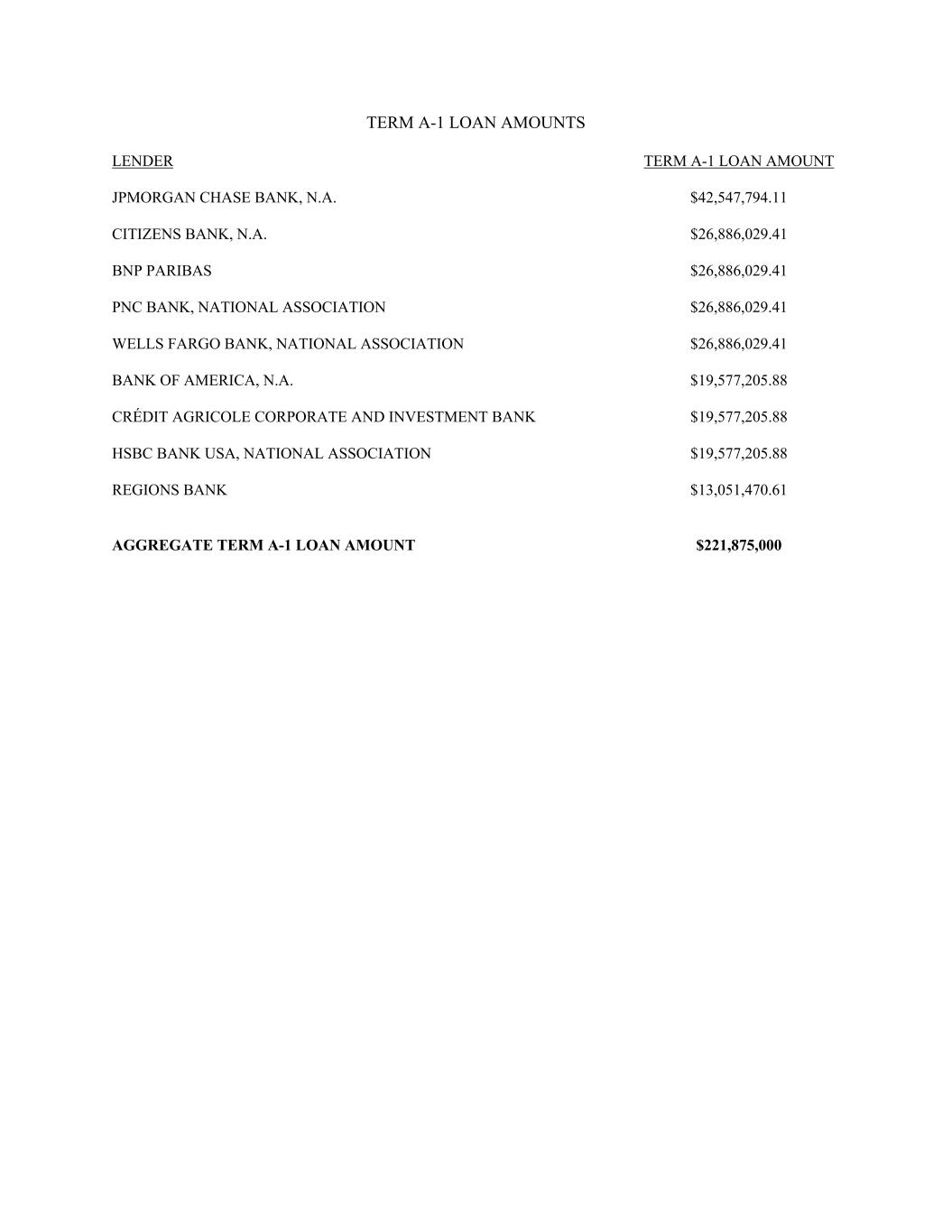

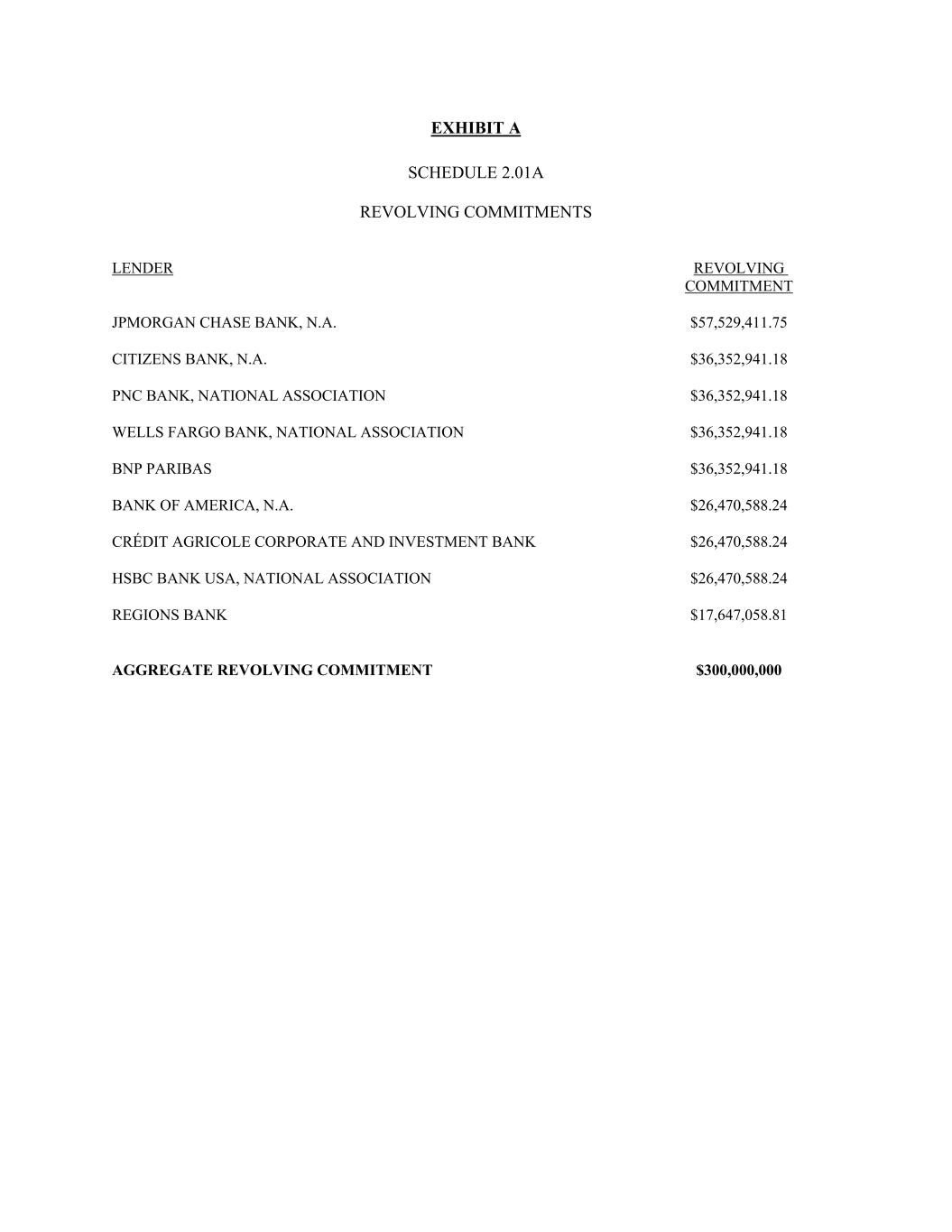

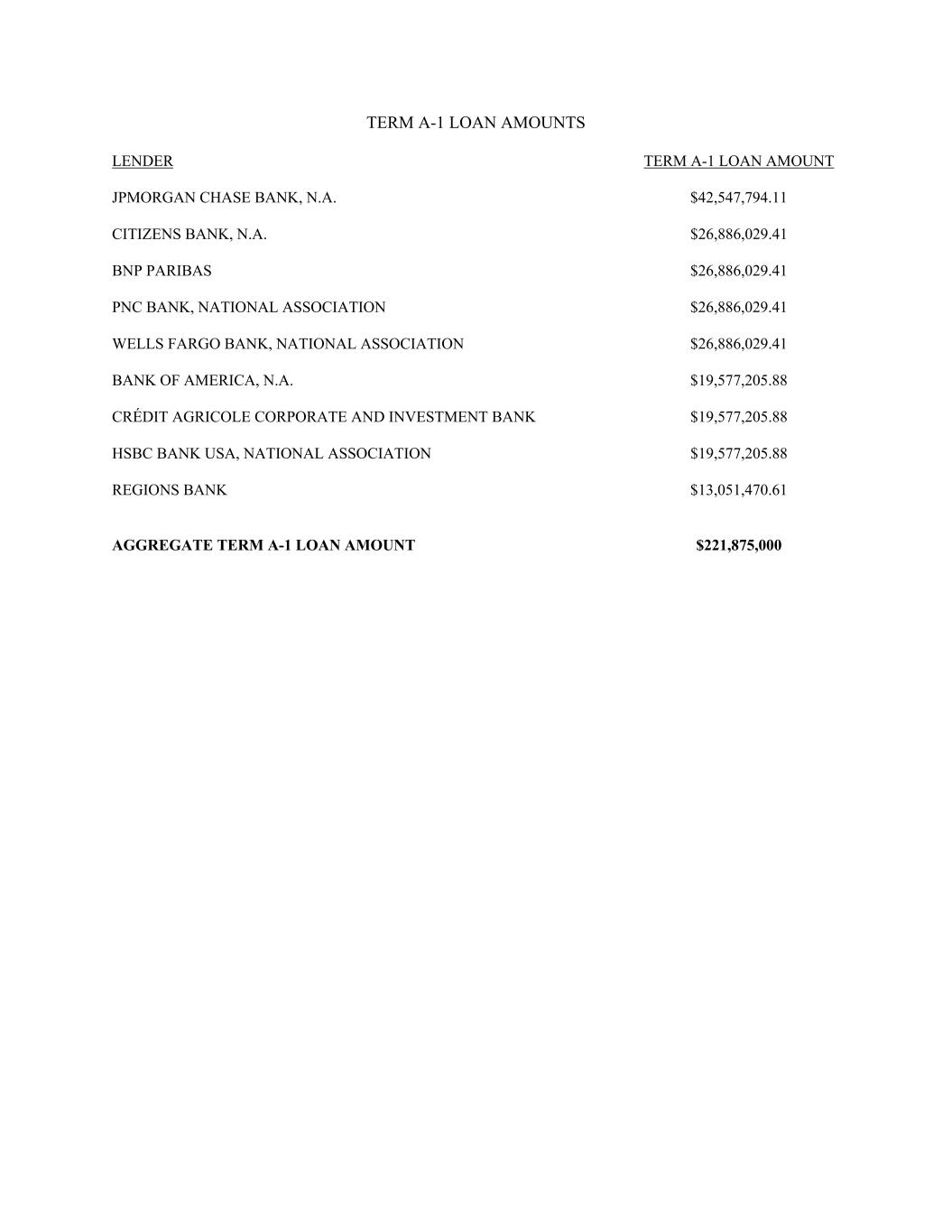

2 and ≤ 3.25:1.00 3 > 3.25:1.00 and ≤ 3.75:1.00 212.5 bps 112.5 bps 35.0 bps 175.0 bps 75.0 bps 32.5 bps 4 > 3.75:1.00 and ≤ 4.25:1.00 237.5 bps 137.5 bps 40.0 bps 200.0 bps 100.0 bps 37.5 bps 5 > 4.25:1.00 262.5 bps 162.5 bps 45.0 bps 225.0 bps 125.0 bps 42.5 bps Applicable Rate (Ratings-Based) Category Index Debt Rating Term Benchmark Spread and RFR Spread for Revolving Loans and Term A-1 Loans ABR Spread for Revolving Loans and Term A-1 Loans Applicable Commitment Fee Rate for Revolving Commitments Term Benchmark Spread and RFR Spread for A-2 Loans and Term A-3 Loans ABR Spread for Term A-2 Loans and Term A-3 Loans Applicable Commitment Fee Rate for Term A-3 Commitment 1 Baa2 or BBB or above 150.0 bps 50.0 bps 25.0 bps 112.5 bps 12.5 bps 22.5 bps 2 Baa3 or BBB- 175.0 bps 75.0 bps 27.5 bps 137.5 bps 37.5 bps 25.0 bps 3 Ba1 or BB+ 212.5 bps 112.5 bps 35.0 bps 175.0 bps 75.0 bps 32.5 bps 4 Ba2 or BB 237.5 bps 137.5 bps 40.0 bps 200.0 bps 100.0 bps 37.5 bps 5 Ba3 or BB- or Unrated or below 262.5 bps 162.5 bps 45.0 bps 225.0 bps 125.0 bps 42.5 bps (d) Schedule 2.01A of the Existing Credit Agreement is amended to delete the tables regarding the Revolving Commitments and Term A-1 Commitments appearing therein and to substitute them with the tables regarding the Revolving Commitments and Term A-1 Loans attached hereto as Exhibit A. Section 2. Departing Lender. The parties hereto hereby acknowledge and agree that: (a) Credit Suisse AG, New York Branch (the “Departing Lender”) is entering into this Amendment solely to evidence its exit from the Existing Credit Agreement as a Revolving Lender and as a Term A-1 Lender and shall have absolutely no obligation hereunder with respect to the Revolving Loans and Term A-1 Loans. Upon the effectiveness hereof and the payment described in Section 2(b)(ii), the Departing Lender shall no longer (i) constitute a “Revolving Lender” or a “Term A-1 Lender” for all purposes under the Loan Documents and (ii) have any obligations with respect to the Revolving Loans or the Term A-1 Loans (other than any of its obligations under the Existing Credit Agreement that expressly survive the Existing Credit Agreement after it ceases to be a Revolving Lender and a Term A-1 Lender) under any of the Loan Documents, in each case, without further action required on the part of any Person;

3 and (b) Upon the effectiveness hereof (i) the Departing Lender’s “Revolving Commitment” under the Existing Credit Agreement shall be terminated, (ii) the Departing Lender shall have received payment in full in immediately available funds of all of its Revolving Loans and Term A-1 Loans, all interest thereon and all other amounts payable to it under the Existing Credit Agreement and for which an invoice has been provided in accordance with Section 9.03(a) of the Existing Credit Agreement, (iii) the Departing Lender shall not be a Revolving Lender or a Term A-1 Lender hereunder or under the Amended Credit Agreement as evidenced by its execution and delivery of its signature page hereto and (iv) the defined terms “Revolving Lender” and “Term A-1 Lender” shall exclude the Departing Lender. For the avoidance of doubt, the Departing Lender waives the payment of any break funding payment pursuant to Section 2.16 of the Existing Credit Agreement. (c) The Administrative Agent is hereby authorized to take such steps under the Amended Credit Agreement as reasonably required to give effect to the departure of the Departing Lender, including, without limitation, reallocating outstanding obligations among the remaining Lenders ratably based on their Commitments as in effect after giving effect to this Amendment. Section 3. Conditions to Amendment Effective Date. This Amendment shall become effective as of the date hereof (the “Amendment Effective Date”) upon satisfaction of the following conditions precedent: (a) the Administrative Agent shall have received, from each of the Borrower, the Administrative Agent, the Revolving Lenders, the Term A-1 Lenders, the Departing Lender and the Required Lenders under the Existing Credit Agreement as of the Amendment Effective Date, a counterpart of this Amendment, signed on behalf of such party; and (b) the Administrative Agent shall have received payment of all fees and other amounts due and payable on or prior to the Amendment Effective Date, including the Administrative Agent’s and its affiliates’ reasonable out-of-pocket expenses (including reasonable out-of-pocket fees and expenses of counsel for the Administrative Agent) in connection with this Amendment in accordance with Section 9.03(a) of the Existing Credit Agreement. Section 4. Representations and Warranties of the Borrower. The Borrower hereby represents and warrants as follows: (a) The execution of this Amendment is within the Borrower’s corporate or other organizational powers and has been duly authorized by all necessary corporate or other organizational actions and, if required, actions by equity holders. This Amendment has been duly executed and delivered by the Borrower and this Amendment and the Existing Credit Agreement as modified hereby constitute legal, valid and binding obligations of the Borrower, enforceable in accordance with their terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law. (b) As of the date hereof and after giving effect to the terms of this Amendment, (i) no Default or Event of Default has occurred and is continuing and (ii) the representations and warranties contained in Article III of the Existing Credit Agreement, as amended hereby, are true and correct in all material respects (except that any such representations and warranties specifically which are already qualified as to materiality or by reference to Material Adverse Effect shall be treated as correct in all respects), except to the extent such representations and warranties expressly relate to any earlier date, in

4 which case such representations and warranties were true and correct in all material respects (except that any representation or warranty which is already qualified as to materiality or by reference to Material Adverse Effect shall be true and correct in all respects) as of such earlier date. (c) None of the execution and delivery by the Borrower of this Amendment and the performance by the Borrower of this Amendment, the Amended Credit Agreement and the transactions contemplated hereby and thereby (a) require any consent or approval of, registration or filing with, or any other action by, any Governmental Authority, except such as have been obtained or made and are in full force and effect, (b) will violate any applicable law or regulation or the charter, by-laws or other organizational documents of the Borrower or any of its Subsidiaries or any order of any Governmental Authority, (c) will violate or result in a default under any indenture, material agreement or other material instrument binding upon the Borrower or any of its Subsidiaries or its assets, or give rise to a right thereunder to require any payment to be made by the Borrower or any of its Subsidiaries, and (d) will result in the creation or imposition of any Lien on any asset of the Borrower or any of its Subsidiaries. Section 5. Reference to and Effect on the Existing Credit Agreement. (a) Upon the effectiveness of this Amendment, each reference in the Existing Credit Agreement to “this Agreement,” “hereunder,” “hereof,” “herein,” “hereby” or words of like import shall mean and be a reference to the Amended Credit Agreement and each reference to the Existing Credit Agreement in any other document, instrument or agreement executed and/or delivered in connection the Existing Credit Agreement shall mean and be a reference to the Amended Credit Agreement. (b) Except as specifically amended above, each Loan Document and all other documents, instruments and agreements executed and/or delivered in connection therewith shall remain in full force and effect and are hereby ratified and confirmed. (c) Except with respect to the subject matter hereof, the execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of the Administrative Agent or the Lenders, nor constitute a waiver of any provision of the Existing Credit Agreement, the Loan Documents or any other documents, instruments and agreements executed and/or delivered in connection therewith. This Amendment shall constitute a Loan Document. (d) This Amendment is not intended to and shall not constitute a novation of the Existing Credit Agreement or the obligations created thereunder. Section 6. Governing Law. This Amendment shall be construed in accordance with and governed by the laws of the State of New York. Section 7. Headings. Section headings in this Amendment are included herein for convenience of reference only and shall not constitute a part of this Amendment for any other purpose. Section 8. Counterparts. Delivery of an executed counterpart of a signature page of this Amendment by telecopy, e-mailed .pdf or any other electronic means that reproduces an image of the actual executed signature page shall be effective as delivery of a manually executed counterpart of this Amendment. The words “execution,” “signed,” “signature,” “delivery,” and words of like import in or relating to any document to be signed in connection with this Amendment and the transactions contemplated hereby shall be deemed to include Electronic Signatures, deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal

5 Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act; provided that nothing herein shall require the Administrative Agent to accept electronic signatures in any form or format without its prior written consent. [Remainder of Page Intentionally Left Blank]

Signature Page to Third Amendment to Amended and Restated Credit Agreement IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the date first above written. UGI CORPORATION, as the Borrower By: /s/ Sean P. O’Brien Name: Sean P. O’Brien Title: Chief Financial Officer

Signature Page to Third Amendment to Amended and Restated Credit Agreement JPMORGAN CHASE BANK, N.A., as a Lender and as Administrative Agent By: /s/ Umar Hassan Name: Umar Hassan Title: Authorized Officer

Signature Page to Third Amendment to Amended and Restated Credit Agreement Name of Lender: Bank of America, N.A. By /s/ Tommy Nguyen Name: Tommy Nguyen Title: Vice President

Signature Page to Third Amendment to Amended and Restated Credit Agreement Name of Lender: BNP Paribas By /s/ Nicolas ANBERREE Name: Nicolas ANBERREE Title: Director By /s/ Sriram CHANDRASEKARAN Name: Sriram CHANDRASEKARAN Title: Director

Signature Page to Third Amendment to Amended and Restated Credit Agreement Name of Lender: Wells Fargo Bank, National Association By /s/ Patrick Engel Name: Patrick Engel Title: Managing Director

Signature Page to Third Amendment to Amended and Restated Credit Agreement Name of Lender: CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK, as lender By /s/ Paul Arens Name: Paul Arens Title: Director By /s/ Gordon Yip Name: Gordon Yip Title: Director

Signature Page to Third Amendment to Amended and Restated Credit Agreement Name of Lender: CITIZENS BANK, N.A. By /s/ David W. Dinella Name: David W. Dinella Title: Senior Vice President

Signature Page to Third Amendment to Amended and Restated Credit Agreement Name of Lender: PNC Bank, National Association By /s/ Alex Rolfe Name: Alex Rolfe Title: Senior Vice President

Signature Page to Third Amendment to Amended and Restated Credit Agreement Name of Lender: REGIONS BANK By /s/ Tedrick Tarver Name: Tedrick Tarver Title: Director

Signature Page to Third Amendment to Amended and Restated Credit Agreement Name of Lender: HSBC BANK USA, NATIONAL ASSOCIATION By /s/ Kyle O’Reilly Name: Kyle O’Reilly Title: SVP #23203

Signature Page to Third Amendment to Amended and Restated Credit Agreement The undersigned Departing Lender hereby acknowledges and agrees that, from and after the Amendment Effective Date, it is no longer a Revolving Lender or Term A-1 Lender under the Credit Agreement CREDIT SUISSE AG, NEW YORK BRANCH, as a Departing Lender By /s/ Mikhail Faybusovich Name: Mikhail Faybusovich Title: Authorized Signatory By /s/ John Basilici Name: John Basilici Title: Authorized Signatory

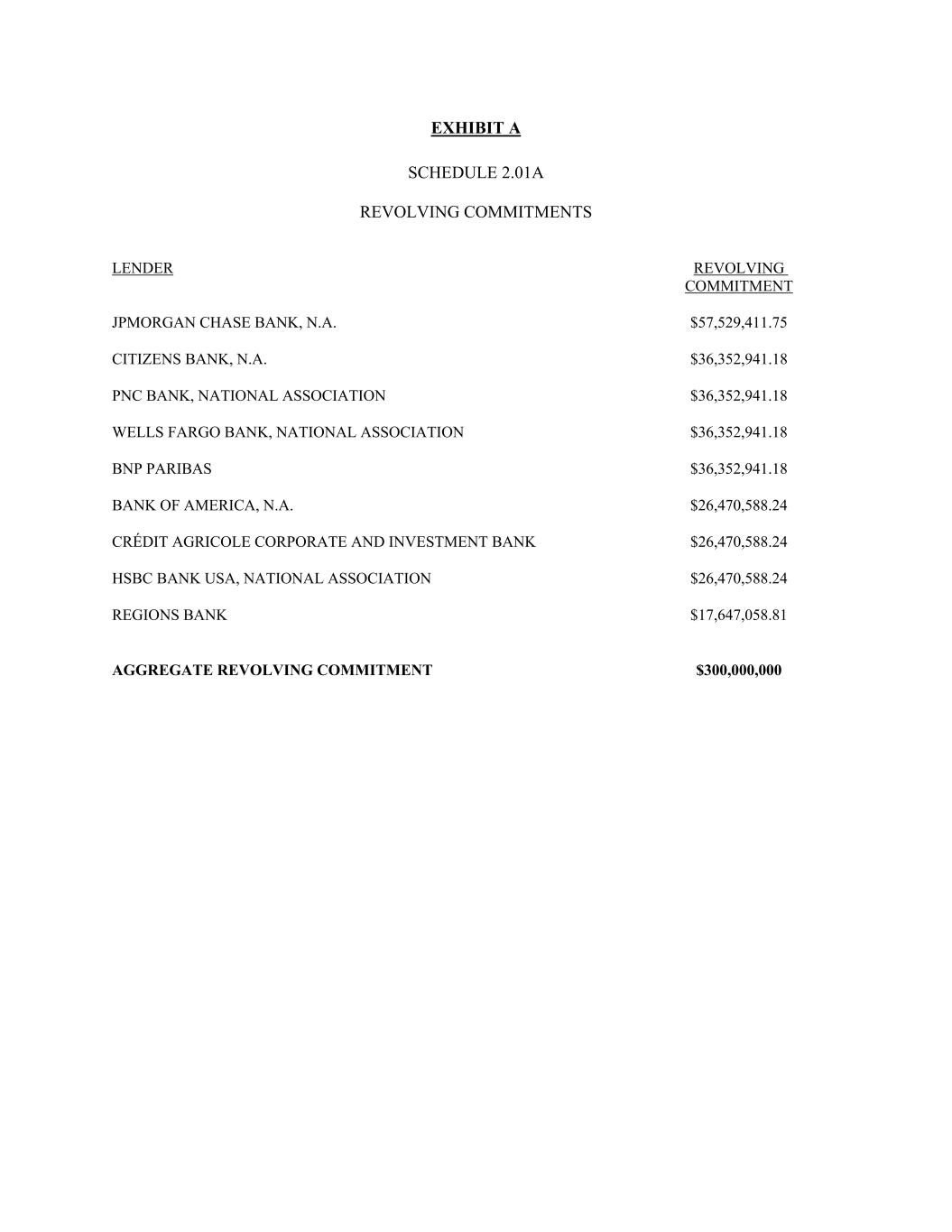

EXHIBIT A SCHEDULE 2.01A REVOLVING COMMITMENTS LENDER REVOLVING COMMITMENT JPMORGAN CHASE BANK, N.A. $57,529,411.75 CITIZENS BANK, N.A. $36,352,941.18 PNC BANK, NATIONAL ASSOCIATION $36,352,941.18 WELLS FARGO BANK, NATIONAL ASSOCIATION $36,352,941.18 BNP PARIBAS $36,352,941.18 BANK OF AMERICA, N.A. $26,470,588.24 CRÉDIT AGRICOLE CORPORATE AND INVESTMENT BANK $26,470,588.24 HSBC BANK USA, NATIONAL ASSOCIATION $26,470,588.24 REGIONS BANK $17,647,058.81 AGGREGATE REVOLVING COMMITMENT $300,000,000

TERM A-1 LOAN AMOUNTS LENDER TERM A-1 LOAN AMOUNT JPMORGAN CHASE BANK, N.A. $42,547,794.11 CITIZENS BANK, N.A. $26,886,029.41 BNP PARIBAS $26,886,029.41 PNC BANK, NATIONAL ASSOCIATION $26,886,029.41 WELLS FARGO BANK, NATIONAL ASSOCIATION $26,886,029.41 BANK OF AMERICA, N.A. $19,577,205.88 CRÉDIT AGRICOLE CORPORATE AND INVESTMENT BANK $19,577,205.88 HSBC BANK USA, NATIONAL ASSOCIATION $19,577,205.88 REGIONS BANK $13,051,470.61 AGGREGATE TERM A-1 LOAN AMOUNT $221,875,000