Mid Penn Bank 2025 Supplemental Executive Retirement Plan Agreement This 2025 Supplemental Executive Retirement Plan Agreement (this “Agreement”) is adopted this 24th day of October, 2025 (the “Effective Date”), by and between Mid Penn Bank, a Pennsylvania bank and trust company headquartered in Millersburg, Pennsylvania (the “Bank”), and Rory G. Ritrievi (the “Executive”). This Agreement is supplemental to, and does not amend, restate, or replace, the Amended and Restated Supplemental Executive Retirement Plan Agreement between you and the Bank dated September 6, 2022, which remains in full force and effect. The purpose of this Agreement is to provide specified benefits to the Executive, a member of a select group of management or highly compensated employees who contribute materially to the continued growth, development and future success of the Bank. This Agreement shall be unfunded for tax purposes and for purposes of Title I of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended from time to time. Article 1 Definitions Whenever used in this Agreement, the following words and phrases shall have the meanings specified: 1.1 “Accrued Benefit” means the dollar value of the liability that should be accrued by the Bank, under generally accepted accounting principles, for the Bank’s obligation to the Executive under this Agreement, calculated by applying Accounting Standards Codification 710- 10 (or any successor thereto) and the Discount Rate. 1.2 “Affiliate” means any business entity with whom the Bank would be considered a single employer under Code Section 414(b) and 414(c). Such term shall be interpreted in a manner consistent with the definition of “service recipient” contained in Code Section 409A. 1.3 “Beneficiary” means each designated person or entity, or the estate of the deceased Executive, entitled to any benefits upon the death of the Executive pursuant to Article 3. 1.4 “Beneficiary Designation Form” means the form established from time to time by the Plan Administrator that the Executive completes, signs and returns to the Plan Administrator to designate one or more Beneficiaries. 1.5 “Board” means the Board of Directors of the Bank as from time to time constituted. 1.6 “Change in Control” means a change in the ownership or effective control of the Bank, or in the ownership of a substantial portion of the assets of the Bank, as such change is defined in Code Section 409A and regulations thereunder.

2 1.7 “Code” means the Internal Revenue Code of 1986, as amended, and all regulations and guidance thereunder, including such regulations and guidance as may be promulgated after the Effective Date. 1.8 “Competing Business” means a business or enterprise (other than the Corporation, the Bank and their Affiliates) that is engaged in the commercial banking, financial services, investment or insurance business in which the Corporation, the Bank or any of their Affiliates is engaged. 1.9 “Corporation” means Mid Penn Bancorp, Inc. 1.10 “Disability” means a condition of the Executive whereby the Executive either: (i) is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than twelve (12) months; or (ii) is, by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than twelve (12) months, receiving income replacement benefits for a period of not less than three (3) months under an accident and health plan covering employees or directors of the Bank. Medical determination of Disability may be made by either the Social Security Administration or by the provider of disability insurance covering employees or directors of the Bank, provided that the definition of “disability” applied under such insurance program complies with the requirements of the preceding sentence. Upon the request of the Plan Administrator, the Executive must submit proof to the Plan Administrator of the Social Security Administration’s or the provider’s determination. 1.11 “Discount Rate” means the rate used by the Plan Administrator for determining the Accrued Benefit. The initial Discount Rate is four point five percent (4.5%). The Plan Administrator may adjust the Discount Rate to maintain the rate within reasonable standards according to generally accepted accounting principles and applicable bank regulatory guidance. 1.12 “Early Termination” means Separation from Service before attainment of Normal Retirement Age, except when such Separation from Service occurs within twenty-four (24) months following a Change in Control or due to death, Disability or Termination for Cause. 1.13 “Normal Retirement Age” means age seventy-three (73). 1.14 “Normal Retirement Date” means the later of Normal Retirement Age or Separation from Service. 1.15 “Participant” means any other director or employee of the Bank who is a party to an agreement providing for benefits substantially similar to this Agreement. 1.16 “Person” shall have the meaning ascribed to such term in Section 3(9) of ERISA. 1.17 “Plan Administrator” means the Compensation Committee of the Board, or such other committee or person as the Board shall appoint.

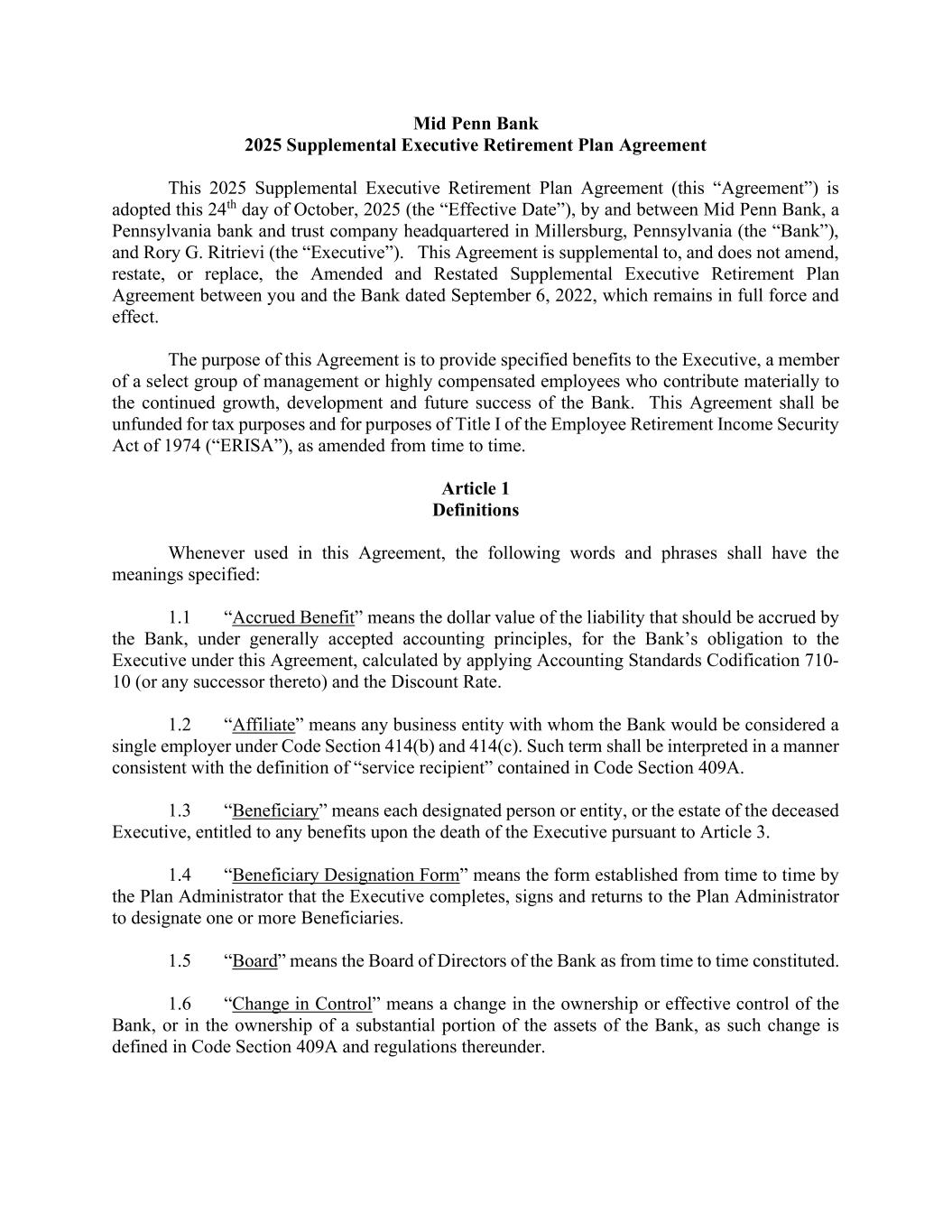

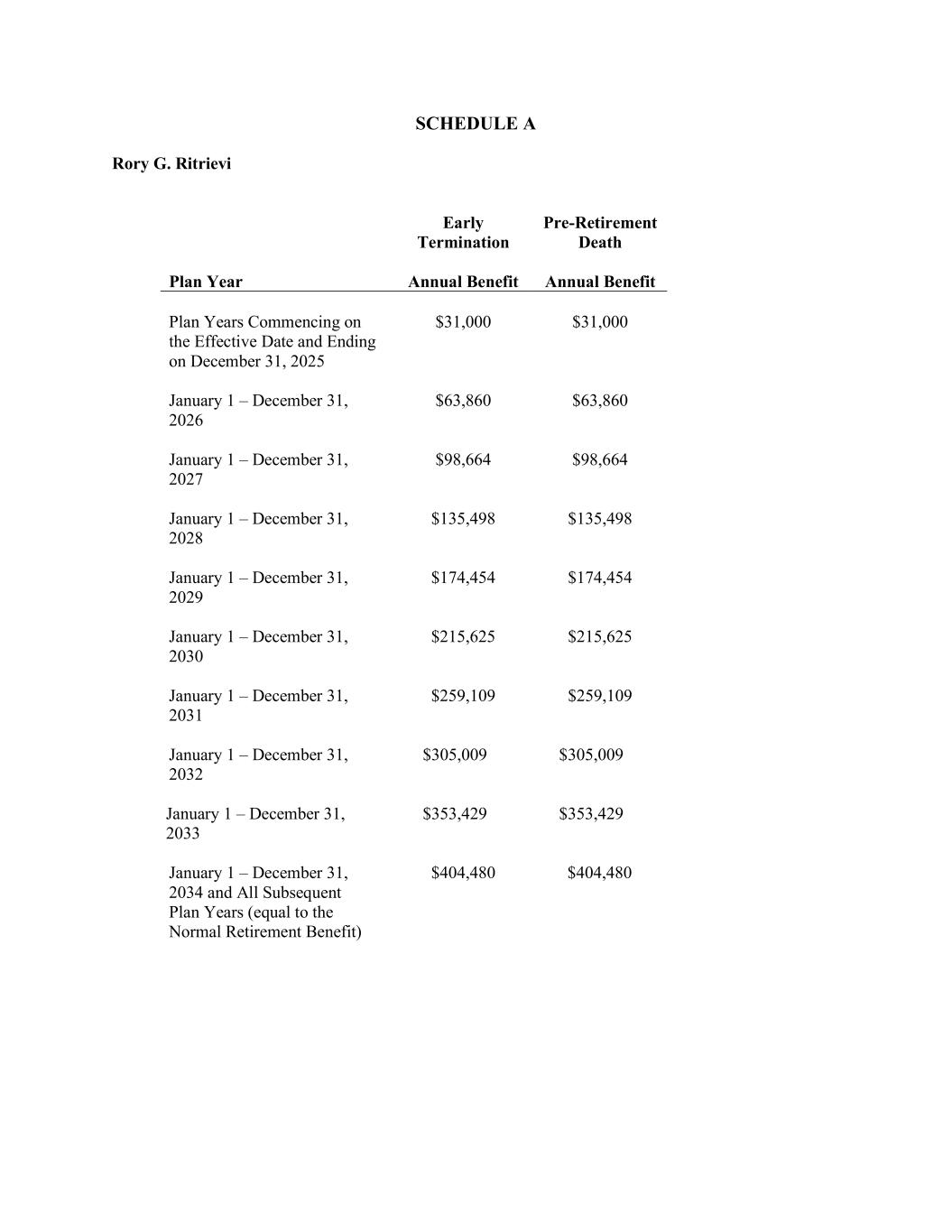

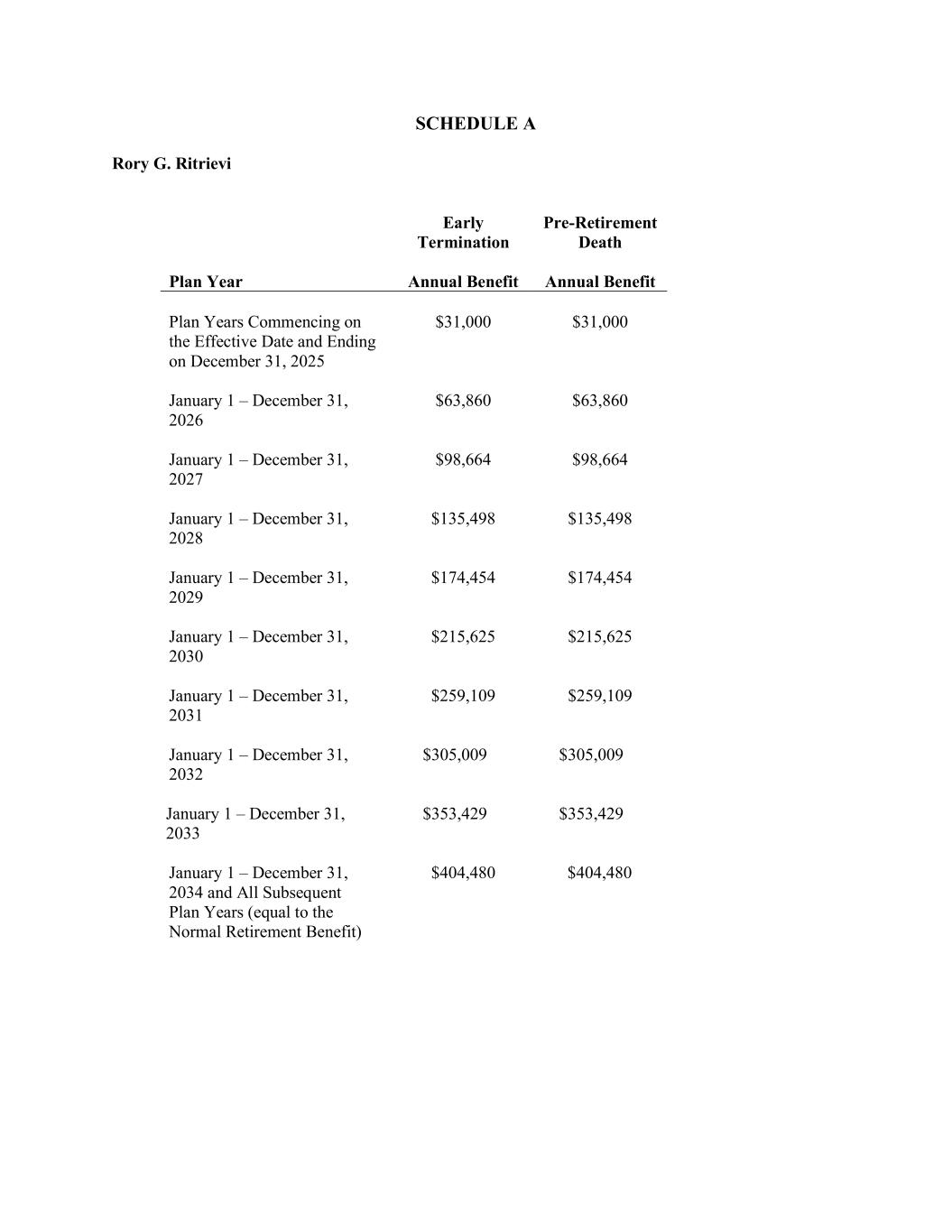

3 1.18 “Plan Year” means each twelve (12) month period commencing on January 1st and ending on December 31st of such year. The initial Plan Year shall commence on the Effective Date and end on the following December 31st. 1.19 “Schedule A” means the schedule attached to this Agreement and made a part hereof. Schedule A shall be updated upon a change in any of the benefit amounts under Article 2. 1.20 “Separation from Service” means termination of the Executive’s employment with the Bank and its Affiliates for reasons other than death or Disability. Whether a Separation from Service has occurred shall be determined in accordance with the requirements of Code Section 409A based on whether the facts and circumstances indicate that the Bank and Executive reasonably anticipated that no further services would be performed after a certain date or that the level of bona fide services the Executive would perform after such date (whether as an employee or as an independent contractor) would permanently decrease to no more than twenty percent (20%) of the average level of bona fide services performed (whether as an employee or an independent contractor) over the immediately preceding thirty-six (36) month period (or the full period of services to the Bank if the Executive has been providing services to the Bank less than thirty-six (36) months). A Separation from Service will not be deemed to have occurred while the Executive is on military leave, sick leave, or other bona fide leave of absence if the period of such leave does not exceed six (6) months or, if longer, the period for which a statute or contract provides the Executive with the right to reemployment with the Bank. If the Executive’s leave exceeds six (6) months, but the Executive is not entitled to reemployment under a statute or contract, the Executive incurs a Separation from Service on the next day following the expiration of such six (6) month period. In determining whether a Separation from Service occurs the Plan Administrator shall take into account, among other things, the definition of “service recipient” and “employer” set forth in Treasury regulation §1.409A-l(h)(3). The Plan Administrator shall have full and final authority to determine conclusively whether a Separation from Service occurs and the date of such Separation from Service. 1.21 “Specified Employee” means an employee who at the time of Separation from Service is a key employee of the Bank or its Affiliates, if any stock of the Bank or its Affiliates is publicly traded on an established securities market or otherwise. For purposes of this Agreement, an employee is a “key employee” if the employee meets the requirements of Code Section 416(i)(1)(A)(i), (ii), or (iii) (applied in accordance with the regulations thereunder and disregarding section 416(i)(5)) at any time during the twelve (12) month period ending on December 31 (the “identification period”). If the employee is a key employee during an identification period, the employee is treated as a key employee for purposes of this Agreement during the twelve (12) month period that begins on the first day of April following the close of the identification period. 1.22 “Termination for Cause” means Separation from Service for “Cause,” as such term is defined in Executive’s Amended and Restated Employment Agreement with the Corporation and Bank dated September 6, 2022, as the same may be amended from time to time. 1.23 “Termination for Good Reason” means Separation from Service for “Good Reason”, as such term is defined in Executive’s Amended and Restated Employment Agreement

4 with the Corporation and Bank dated September 6, 2022, as the same may be amended from time to time. Article 2 Distributions 2.1 Normal Retirement Benefit. Upon Separation from Service after attaining Normal Retirement Age, the Bank shall distribute to the Executive the benefit described in this Section 2.1 in lieu of any other benefit under this Article. 2.1.1 Amount of Benefit. The initial annual benefit under this Section 2.1 is Four Hundred Four Thousand Four Hundred Eighty Dollars ($404,480) (the “Normal Retirement Benefit”). The Normal Retirement Benefit shall be increased by a factor of 2.0% each year commencing on the first anniversary of the Executive’s attaining Normal Retirement Age. The Bank may increase the annual benefit under this Section 2.1 at the sole and absolute discretion of the Board. Any such discretionary increase shall require the recalculation of all the amounts on Schedule A. 2.1.2 Distribution of Benefit. The Bank shall distribute the annual benefit to the Executive in twelve (12) equal monthly installments commencing on the first day of the month following Executive’s Separation from Service following the Normal Retirement Date. The annual benefit shall be distributed to the Executive for fifteen (15) years. 2.2 Early Termination Benefit. If Early Termination occurs, the Bank shall distribute to the Executive the benefit described in this Section 2.2 in lieu of any other benefit under this Article. 2.2.1 Amount of Benefit – Early Termination By Executive Absent Good Reason. In the event of an Early Termination by Executive other than a Termination for Good Reason, the annual benefit under this Section 2.2 is the Early Termination Annual Benefit set forth on Schedule A for the Plan Year ended immediately prior to the date on which the Early Termination occurs. Additionally, the annual benefit amount shall be increased by a pro-rated amount relative to the Executive’s service during the partial Plan Year in which the Early Termination occurs. This amount will be added to the annual benefit amount at the end of the preceding Plan Year on Schedule A. 2.2.2 Amount of Benefit – Early Termination for Good Reason or Absent Cause. In the event of an Early Termination by Executive that constitutes a Termination for Good Reason or Executive’s employment has been terminated by the Bank (other than a Termination for Cause), the annual benefit under this Section 2.2 is the Early Termination Annual Benefit calculated in accordance with Section 2.2.1, plus Executive shall also receive credit as though the Early Termination occurred on the thirty-sixth (36th) month following the actual date of Early Termination.

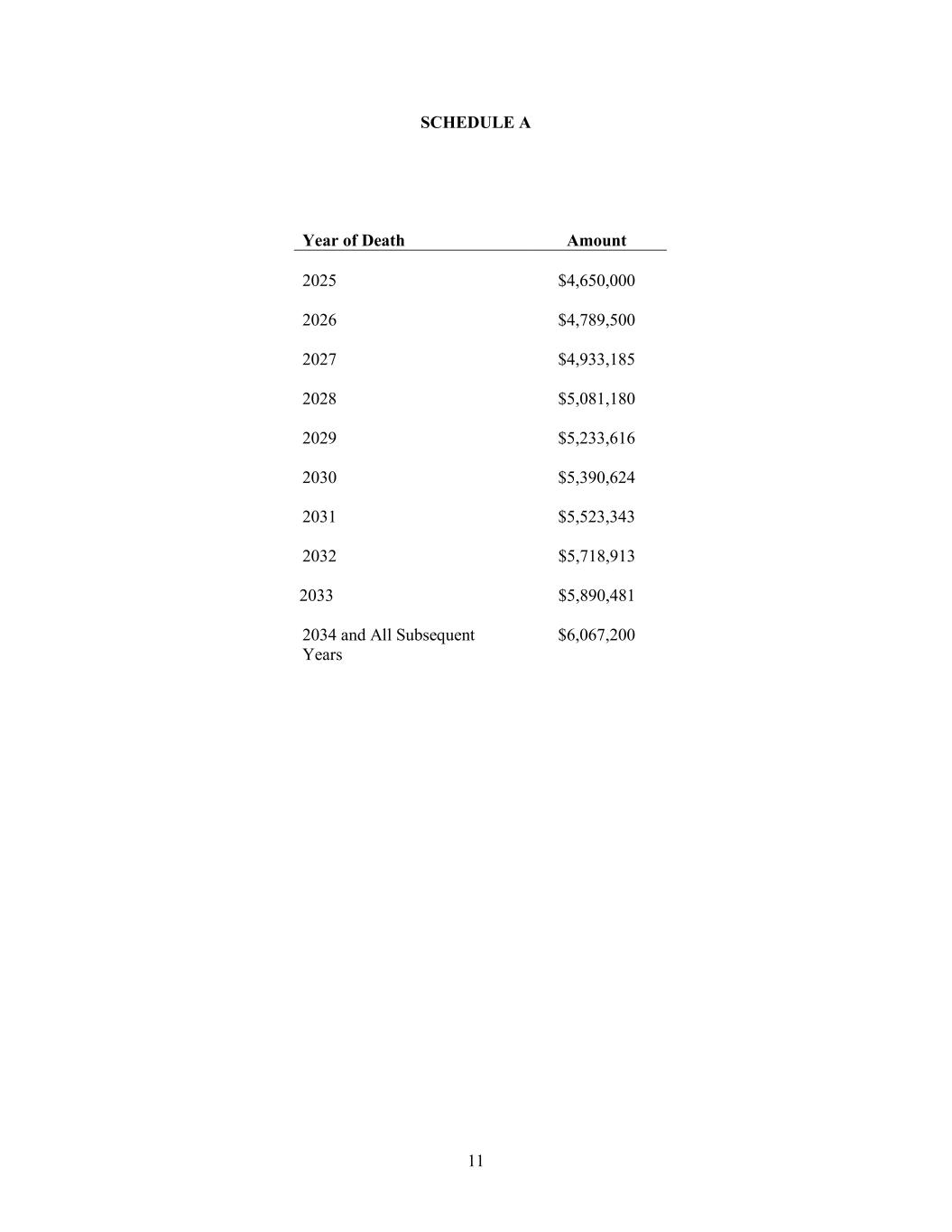

5 2.2.3 Distribution of Benefit. The Bank shall distribute the annual benefit to the Executive in twelve (12) equal monthly installments commencing on the first day of the month following the Normal Retirement Date. The annual benefit shall be distributed to the Executive for fifteen (15) years. 2.3 Disability Benefit. If the Executive experiences a Disability prior to Normal Retirement Age, the Bank shall distribute to the Executive the benefit described in this Section 2.3 in lieu of any other benefit under this Article. 2.3.1 Amount of Benefit. The annual benefit under this Section 2.3 shall be equal to the amount of the benefit payable under Section 2.1.1, as the same may be increased from time to time in accordance with the terms thereof. 2.3.2 Distribution of Benefit. The Bank shall distribute the annual benefit to the Executive in twelve (12) equal monthly installments commencing on the first day of the month following the Disability. The annual benefit shall be distributed to the Executive for fifteen (15) years. 2.4 Change in Control Benefit. If a Change in Control occurs prior to Normal Retirement Age followed by Separation from Service within twenty-four (24) months following the Change in Control, the Bank shall distribute to the Executive the benefit described in this Section 2.4 in lieu of any other benefit under this Article. 2.4.1 Amount of Benefit. The annual benefit under this Section 2.4 shall be equal to the amount of the benefit payable under Section 2.1.1, as the same may be increased from time to time in accordance with the terms thereof. 2.4.2 Distribution of Benefit. The Bank shall distribute the annual benefit to the Executive in twelve (12) equal monthly installments commencing on the first day of the month following the Normal Retirement Date. The annual benefit shall be distributed to the Executive for fifteen (15) years. 2.5 Death Prior to Commencement of Benefit Payments. If the Executive dies prior to Separation from Service and Normal Retirement Age, the Bank shall distribute to the Beneficiary the benefit described in this Section 2.5. This benefit shall be distributed in lieu of any other benefit under this Article. 2.5.1 Amount of Benefit. The benefit under this Section 2.5 is the Pre-retirement Death Benefit amount set forth on Schedule A for the Plan Year ended immediately prior to the date on which the Separation from Service due to death occurs. Additionally, the annual benefit amount shall be increased by a pro-rated amount relative to the Executive’s service during the partial Plan Year in which the Separation from Service due to death takes place.

6 2.5.2 Distribution of Benefit. The Bank shall distribute the annual benefit to the Beneficiary in twelve (12) equal monthly installments commencing within sixty (60) days following the Executive’s death. The annual benefit shall be distributed to the Beneficiary for fifteen (15) years. 2.6 Death During Distribution of a Benefit. If the Executive dies after benefit payments have commenced under this Agreement, but before receiving all such payments, the Bank shall pay the remaining benefits to the Executive’s Beneficiary at the same time and in the same amounts they would have been paid to the Executive had the Executive survived. 2.7 Restriction on Commencement of Distributions. Notwithstanding any provision of this Agreement to the contrary, if the Executive is considered a Specified Employee, the provisions of this Section 2.7 shall govern all distributions hereunder. If benefit distributions which would otherwise be made to the Executive due to Separation from Service are limited by Code Section 409A and regulations thereunder because the Executive is a Specified Employee, then such distributions shall not be made during the first six (6) months following Separation from Service. Rather, any distribution which would otherwise be paid to the Executive during such period shall be accumulated and paid to the Executive in a lump sum on the first day of the seventh month following Separation from Service. All subsequent distributions shall be paid in the manner specified. 2.8 Distributions Upon Taxation of Amounts Deferred. If, pursuant to Code Section 409A, the Federal Insurance Contributions Act or other state, local or foreign tax, the Executive becomes subject to tax on the amounts deferred hereunder, then the Bank may make a limited distribution to the Executive in a manner that conforms to the requirements of Code Section 409A. Any such distribution will decrease the Executive’s benefits distributable under this Agreement. 2.9 Acceleration of Payments. Except as specifically permitted herein, no acceleration of the time or schedule of any payment may be made hereunder. Notwithstanding the foregoing, payments may be accelerated, in accordance with the provisions of Treasury Regulation §1.409A- 3(j)(4) in the following circumstances: (i) as a result of certain domestic relations orders; (ii) in compliance with ethics agreements with the federal government; (iii) in compliance with the ethics laws or conflicts of interest laws; (iv) in limited cashouts (but not in excess of the limit under Code Section 402(g)(l)(B)); (v) to pay employment-related taxes; or (vi) to pay any taxes that may become due at any time that the Agreement fails to meet the requirements of Code Section 409A. 2.10 Delays in Payment by Bank. A payment may be delayed to a date after the designated payment date under any of the circumstances described below, and the provision will not fail to meet the requirements of establishing a permissible payment event. The delay in the payment will not constitute a subsequent deferral election, so long as the Bank treats all payments to similarly situated Participants on a reasonably consistent basis. 2.10.1 Payments subject to Code Section 162(m). If the Bank reasonably anticipates that the Bank’s deduction with respect to any distribution under this Agreement would be limited or eliminated by application of Code Section 162(m), then to the extent deemed necessary by the Bank to ensure that the entire amount of any distribution from this Agreement is deductible, the Bank may delay payment of any amount that

7 would otherwise be distributed under this Agreement. The delayed amounts shall be distributed to the Executive (or the Beneficiary in the event of the Executive’s death) at the earliest date the Bank reasonably anticipates that the deduction of the payment of the amount will not be limited or eliminated by application of Code Section 162(m). 2.10.2 Payments that would violate Federal securities laws or other applicable law. A payment may be delayed where the Bank reasonably anticipates that the making of the payment will violate Federal securities laws or other applicable law provided that the payment is made at the earliest date at which the Bank reasonably anticipates that the making of the payment will not cause such violation. The making of a payment that would cause inclusion in gross income or the application of any penalty provision of the Code is not treated as a violation of law. 2.10.3 Solvency. A payment may be delayed where the payment would jeopardize the ability of the Bank to continue as a going concern. 2.11 Treatment of Payment as Made on Designated Payment Date. Solely for purposes of determining compliance with Code Section 409A, any payment under this Agreement made after the required payment date shall be deemed made on the required payment date provided that such payment is made by the latest of: (i) the end of the calendar year in which the payment is due; (ii) the 15th day of the third calendar month following the payment due date; (iii) if the Bank cannot calculate the payment amount on account of administrative impracticality which is beyond the Executive’s control, the end of the first calendar year which payment calculation is practicable; and (iv) if the Bank does not have sufficient funds to make the payment without jeopardizing the Bank’s solvency, in the first calendar year in which the Bank’s funds are sufficient to make the payment. 2.12 Facility of Payment. If a distribution is to be made to a minor, or to a person who is otherwise incompetent, then the Plan Administrator may make such distribution: (i) to the legal guardian, or if none, to a parent of a minor payee with whom the payee maintains his or her residence; or (ii) to the conservator or administrator or, if none, to the person having custody of an incompetent payee. Any such distribution shall fully discharge the Bank and the Plan Administrator from further liability on account thereof. 2.13 Certain Reduction of Payments. 2.13.1 Anything in this Agreement to the contrary notwithstanding, in the event that it shall be determined as set forth herein that any payment or distribution by the Corporation or the Bank to or for the benefit of Executive, whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise (a “Payment”), would constitute an “excess parachute payment” within the meaning of Section 280G of the Code, and that it would be economically advantageous to Executive to reduce the Payment to avoid or reduce the taxation of excess parachute payments under Section 4999 of the Code, the aggregate present value of amounts payable or distributable to or for the benefit of Executive

8 pursuant to this Agreement (such payments or distributions pursuant to this Agreement are hereinafter referred to as “Agreement Payments”) shall be reduced (but not below zero) to the Reduced Amount. The “Reduced Amount” shall be an amount expressed in present value which maximizes the aggregate present value of Agreement Payments without causing any Payment to be subject to the taxation under Section 4999 of the Code. For purposes of this Section 2.13, present value shall be determined in accordance with Section 280G(d)(4) of the Code. 2.13.2 All determinations to be made under this Section 2.13 shall be made, in writing, by the Corporation’s independent certified public accountant immediately prior to the Change in Control (the “Accounting Firm”), which firm shall provide its determinations and any supporting calculations in writing to both the Bank and Executive within ten (10) days of the date of termination. Any such determination by the Accounting Firm shall be binding upon the Bank and Executive. Executive shall in his or her sole discretion determine which and how much of the Agreement Payments shall be eliminated or reduced consistent with the requirements of this Section 2.13, which determination shall be made by delivery of written notice to the Bank within 10 days of Executive’s receipt of the determination of the Accounting Firm. Within five (5) days after Executive’s timely determination, the Bank shall pay (or cause to be paid) or distribute (or cause to be distributed) to or for the benefit of Executive, such amounts as are then due to Executive under this Agreement. In the event Executive does not make such timely determination then within 15 days after the Bank’s receipt of the determination of the Accounting Firm, the Bank in its sole discretion may pay (or cause to be paid) or distribute (or cause to be distributed) to or for the benefit of Executive such portion of the Agreement Payments as it may deem appropriate, but no less than the Reduced Amount. 2.13.3 As a result of the uncertainty in the application of Section 280G of the Code at the time of the initial determination by the Accounting Firm hereunder, it is possible that Agreement Payments, as the case may be, will have been made by the Bank which should not have been made (“Overpayment”) or that additional Agreement Payments which have not been made by the Bank could have been made (“Underpayment”), in each case, consistent with the calculations required to be made hereunder. Within two (2) years after the Separation from Service, the Accounting Firm shall review the determination made by it pursuant to the preceding paragraph. In the event that the Accounting Firm determines that an Overpayment has been made, any such Overpayment shall be treated for all purposes as a loan to Executive which Executive shall repay to the Bank together with interest at the applicable Federal rate provided for in Section 7872(f)(2) of the Code (the “Federal Rate”); provided, however, that no amount shall be payable by Executive to the Bank if and to the extent such payment would not reduce the amount which is subject to taxation under Section 4999 of the Code. In the event that the Accounting Firm determines that an Underpayment has occurred, any such Underpayment shall be promptly paid by the Bank to or for the benefit of Executive together with interest thereon at the Federal Rate.

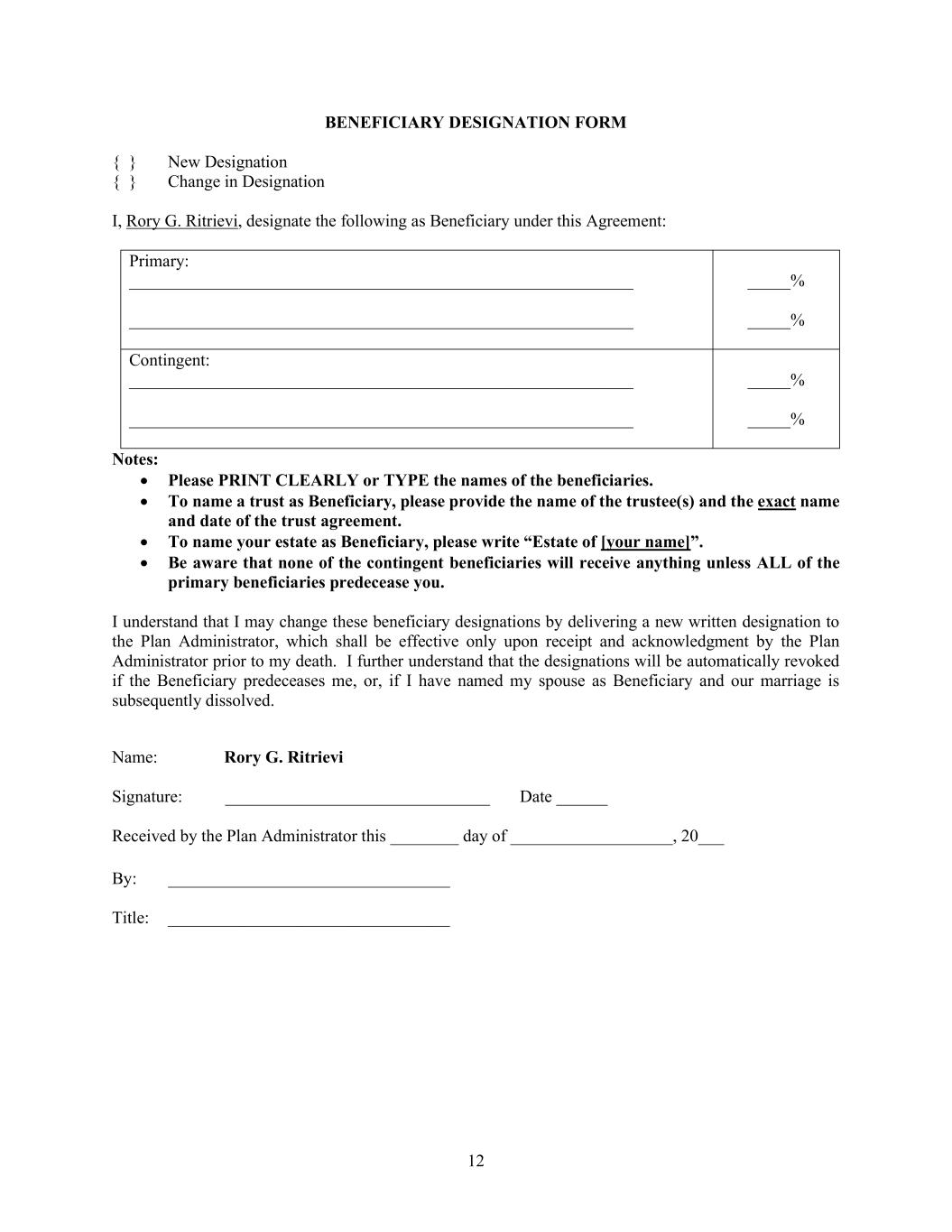

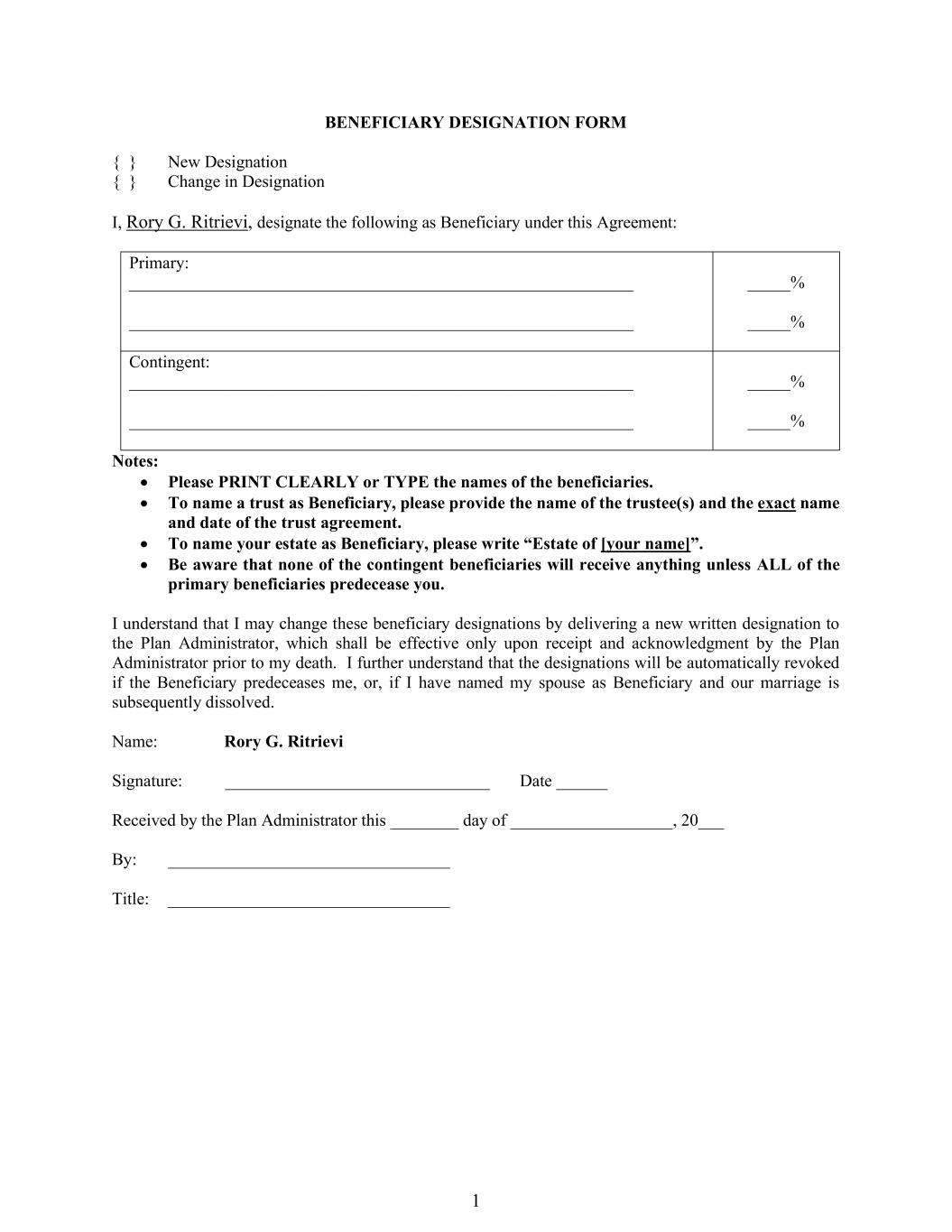

9 2.13.4 All of the fees and expenses of the Accounting Firm in performing the determinations referred to in paragraphs (b) and (c) above shall be borne solely by the Corporation or the Bank. The Bank agrees to indemnify and hold harmless the Accounting Firm of and from any and all claims, damages and expenses of any nature resulting from or relating to its determinations pursuant to paragraphs (b) and (c) above, except for claims, damages or expenses resulting from the gross negligence or willful misconduct of the Accounting Firm. 2.14 Change in Form or Timing of Distributions. For distribution of benefits under this Article 2, the Executive and the Bank may, subject to the terms of Section 7.1, amend this Agreement to delay the timing or change the form of distributions. Any such amendment (a) may not accelerate the time or schedule of any distribution, except as provided in Code Section 409A; (b) must, for benefits distributable under Section 2.2 be made at least twelve (12) months prior to the first scheduled distribution; (c) must, for benefits distributable under Sections 2.1, 2.2, and 2.4, delay the commencement of distributions for a minimum of five (5) years from the date the first distribution was originally scheduled to be made; and (d) must take effect not less than twelve (12) months after the amendment is made. Article 3 Beneficiaries 3.1 In General. The Executive shall have the right, at any time, to designate a Beneficiary to receive any benefit distributions under this Agreement upon the death of the Executive. The Beneficiary designated under this Agreement may be the same as or different from the beneficiary designated under any other plan of the Bank in which the Executive participates. 3.2 Designation. The Executive shall designate a Beneficiary by completing and signing the Beneficiary Designation Form and delivering it to the Plan Administrator or its designated agent. If the Executive names someone other than the Executive’s spouse as a Beneficiary, the Plan Administrator may, in its sole discretion, determine that spousal consent is required to be provided in a form designated by the Plan Administrator, executed by the Executive’s spouse and returned to the Plan Administrator. The Executive’s beneficiary designation shall be deemed automatically revoked if the Beneficiary predeceases the Executive or if the Executive names a spouse as Beneficiary and the marriage is subsequently dissolved. The Executive shall have the right to change a Beneficiary by completing, signing and otherwise complying with the terms of the Beneficiary Designation Form and the Plan Administrator’s rules and procedures. Upon the acceptance by the Plan Administrator of a new Beneficiary Designation Form, all Beneficiary designations previously filed shall be cancelled. The Plan Administrator shall be entitled to rely on the last Beneficiary Designation Form filed by the Executive and accepted by the Plan Administrator prior to the Executive’s death. 3.3 Acknowledgment. No designation or change in designation of a Beneficiary shall be effective until received, accepted and acknowledged in writing by the Plan Administrator or its designated agent.

10 3.4 No Beneficiary Designation. If the Executive dies without a valid beneficiary designation, or if all designated Beneficiaries predecease the Executive, then the Executive’s spouse shall be the designated Beneficiary. If the Executive has no surviving spouse, any benefit shall be paid to the Executive’s estate. 3.5 Facility of Distribution. If the Plan Administrator determines in its discretion that a benefit is to be distributed to a minor, to a person declared incompetent or to a person incapable of handling the disposition of that person’s property, the Plan Administrator may direct distribution of such benefit to the guardian, legal representative or person having the care or custody of such minor, incompetent person or incapable person. The Plan Administrator may require proof of incompetence, minority or guardianship as it may deem appropriate prior to distribution of the benefit. Any distribution of a benefit shall be a distribution for the account of the Executive and the Beneficiary, as the case may be, and shall completely discharge any liability under this Agreement for such distribution amount. Article 4 General Limitations 4.1 Termination for Cause. Notwithstanding any provision of this Agreement to the contrary, the Bank shall not distribute any benefit under this Agreement if the Executive’s employment with the Bank is terminated by the Bank due to a Termination for Cause. 4.2 Misstatement. No benefit shall be distributed if an insurance company which issued a life insurance policy covering the Executive and owned by the Bank denies coverage (i) for material misstatements of fact made by the Executive on an application for such life insurance, or (ii) for any other reason. 4.3 Removal. Notwithstanding any provision of this Agreement to the contrary, the Bank shall not distribute any benefit under this Agreement if the Executive is subject to a final removal or prohibition order issued by an appropriate federal banking agency pursuant to Section 8(e) of the Federal Deposit Insurance Act. 4.4 Regulatory Restrictions. Notwithstanding anything herein to the contrary, any payments made to the Executive pursuant to this Agreement, or otherwise, shall be subject upon compliance with 12 U.S.C. Section 1828 and FDIC Regulation 12 CFR Part 359, Golden Parachute Indemnification Payments and any other regulations or guidance promulgated thereunder. 4.5 Competition after Separation from Service. The Executive shall forfeit, for the Executive and the Beneficiary, any unpaid benefits payable hereunder, if the Executive: (a) directly or indirectly, and whether as principal or investor or as an employee, officer, director, manager, partner, consultant, agent, or otherwise, alone or in association with any other Person, becomes involved in a Competing Business (as defined below) in any county in the Commonwealth of Pennsylvania in which the Corporation, the Bank or any of their Affiliates has maintained a branch or other office during the period of Executive’s employment (excluding an ownership

11 interest of $100,000 or less in the stock of one or more publicly-traded companies); or (b) directly or indirectly, whether alone or in association with any other Person, for the purpose of conducting or engaging in any Competing Business, calls upon, solicits, or advises any Person who is, or was, during the then most recent 12-month period, a customer of the Corporation, the Bank or any of their Affiliates, or takes away or interferes or attempts to take away or interfere with any custom, trade, business, patronage, or affairs of the Corporation, the Bank or any of their Affiliates, or hires or attempts to hire, or otherwise engages or attempts to engage as an independent contractor or otherwise any Person who is, or was during the then most recent 12- month period, an employee, officer, representative, or agent of the Corporation, the Bank or any of their Affiliates, or solicits, induces, or attempts to solicit or induce any Person who is an employee, officer, representative, or agent of the Corporation, the Bank or any of their Affiliates to leave the employ of the Corporation, the Bank or any of their Affiliates or cease their business relationship with Corporation, the Bank or any of their Affiliates (as the case may be), or violate the terms of their contracts, or any employment arrangements, with the Corporation, the Bank or any of their Affiliates. The restrictive provisions set forth in this Section 4.5 are intended to operate independently of, and not replace or be superseded by, any similar provisions contained in any other agreement between Executive and the Bank or Corporation. Although Executive and the Corporation and the Bank consider the restrictions contained in this Section 4.5 to be the minimum restriction reasonable for the purposes of preserving the Corporation’s and the Bank’s goodwill and other proprietary rights, if a final determination is made by a court that the time or territory, or any other restriction contained in this Section 4.5 is an unreasonable or otherwise unenforceable restriction against the Executive, the provisions of this Section 4.5 will not be rendered void, but will be deemed amended to apply as to such maximum time and territory and to such other extent as the court may determine to be reasonable. Notwithstanding the foregoing, (A) this Section 4.5 shall not apply following a Separation of Service if such Separation of Service is the result of an involuntary termination of Executive’s employment by the Bank (other than a Termination for Cause) or a Termination for Good Reason; and (B) this Section 4.5 shall be effective for thirty-six months following a Separation from Service triggering the Change in Control Benefit described in Section 2.4. Article 5 Administration of Agreement 5.1 Plan Administrator Duties. The Plan Administrator shall be responsible for the management, operation, and administration of the Agreement. When making a determination or calculation, the Plan Administrator shall be entitled to rely on information furnished by the Bank, Executive or Beneficiary. No provision of this Agreement shall be construed as imposing on the Plan Administrator any fiduciary duty under ERISA or other law, or any duty similar to any fiduciary duty under ERISA or other law.

12 5.2 Authority of Plan Administrator. The Plan Administrator shall enforce this Agreement in accordance with its terms, shall be charged with the general administration of this Agreement, and shall have all powers necessary to accomplish its purposes. 5.3 Binding Effect of Decisions. The decision or action of the Plan Administrator with respect to any question arising out of or in connection with the administration, interpretation or application of this Agreement and the rules and regulations promulgated hereunder shall be final, conclusive and binding upon all persons having any interest in this Agreement. 5.4 Compensation and Indemnity of Plan Administrator. The Plan Administrator shall serve without compensation for services rendered hereunder. The Plan Administrator is authorized at the expense of the Bank to employ such legal counsel and/or recordkeeper as it may deem advisable to assist in the performance of its duties hereunder. Expenses and fees incurred in connection with the administration of this Agreement shall be paid by the Bank. 5.5 Bank Information. To enable the Plan Administrator to perform its functions, the Bank shall supply full and timely information to the Plan Administrator on all matters relating to the date and circumstances of the Executive’s death, Disability or Separation from Service, and such other pertinent information as the Plan Administrator may reasonably require. 5.6 Termination of Participation. If the Plan Administrator determines in good faith that the Executive no longer qualifies as a member of a select group of management or highly compensated employees, as determined in accordance with ERISA, the Plan Administrator shall have the right, in its sole discretion, to cease further benefit accruals hereunder. Article 6 Claims and Review Procedures 6.1 Claims Procedure. An Executive or Beneficiary (“claimant”) who has not received benefits under this Agreement that he or she believes should be distributed shall make a claim for such benefits as follows: 6.1.1 Initiation – Written Claim. The claimant initiates a claim by submitting to the Plan Administrator a written claim for the benefits. If such a claim relates to the contents of a notice received by the claimant, the claim must be made within sixty (60) days after such notice was received by the claimant. All other claims must be made within one hundred eighty (180) days of the date on which the event that caused the claim to arise occurred. The claim must state with particularity the determination desired by the claimant. 6.1.2 Timing of Plan Administrator Response. The Plan Administrator shall respond to such claimant within thirty (30) days after receiving the claim. If the Plan Administrator determines that special circumstances require additional time for processing the claim, the Plan Administrator can extend the response period by an additional thirty (30) days by notifying the claimant in writing, prior to the end of the initial thirty (30) day period, that an additional period is required. The notice

13 of extension must set forth the special circumstances and the date by which the Plan Administrator expects to render its decision. 6.1.3 Notice of Decision. If the Plan Administrator denies part or all of the claim, the Plan Administrator shall notify the claimant in writing of such denial. The Plan Administrator shall write the notification in a manner calculated to be understood by the claimant. The notification shall set forth: (a) The specific reasons for the denial; (b) A reference to the specific provisions of this Agreement on which the denial is based; (c) A description of any additional information or material necessary for the claimant to perfect the claim and an explanation of why it is needed; (d) An explanation of this Agreement’s review procedures and the time limits applicable to such procedures; and (e) A statement of the claimant’s right to bring a civil action under ERISA Section 502(a) following an adverse benefit determination on review. 6.2 Review Procedure. If the Plan Administrator denies part or the entire claim, the claimant shall have the opportunity for a full and fair review by the Plan Administrator of the denial as follows: 6.2.1 Initiation – Written Request. To initiate the review, the claimant, within sixty (60) days after receiving the Plan Administrator’s notice of denial, must file with the Plan Administrator a written request for review. 6.2.2 Additional Submissions – Information Access. The claimant shall then have the opportunity to submit written comments, documents, records and other information relating to the claim. The Plan Administrator shall also provide the claimant, upon request and free of charge, reasonable access to, and copies of, all documents, records and other information relevant (as defined in applicable ERISA regulations) to the claimant’s claim for benefits. 6.2.3 Considerations on Review. In considering the review, the Plan Administrator shall take into account all materials and information the claimant submits relating to the claim, without regard to whether such information was submitted or considered in the initial benefit determination. 6.2.4 Timing of Plan Administrator Response. The Plan Administrator shall respond in writing to such claimant within thirty (30) days after receiving the request for review. If the Plan Administrator determines that special circumstances require additional time for processing the claim, the Plan Administrator can extend the response period by an additional thirty (30) days by notifying the claimant in writing, prior to the end of the initial thirty (30) day period, that an additional period

14 is required. The notice of extension must set forth the special circumstances and the date by which the Plan Administrator expects to render its decision. 6.2.5 Notice of Decision. The Plan Administrator shall notify the claimant in writing of its decision on review. The Plan Administrator shall write the notification in a manner calculated to be understood by the claimant. The notification shall set forth: (a) The specific reasons for the denial; (b) A reference to the specific provisions of this Agreement on which the denial is based; (c) A statement that the claimant is entitled to receive, upon request and free of charge, reasonable access to, and copies of, all documents, records and other information relevant (as defined in applicable ERISA regulations) to the claimant’s claim for benefits; and (d) A statement of the claimant’s right to bring a civil action under ERISA Section 502(a). Article 7 Amendments and Termination 7.1 Amendments, Generally. Except as provided in Section 7.2, this Agreement may be amended only by a written agreement signed by both the Bank and the Executive. 7.2 Amendment to Ensure Proper Characterization of Agreement. Notwithstanding anything in this Agreement to the contrary, this Agreement may be amended by the Bank at any time, if found necessary in the opinion of the Bank: (i) to ensure that the Agreement is characterized as a plan of deferred compensation maintained for a select group of management or highly compensated employees as described under ERISA; (ii) to conform the Agreement to the requirements of any applicable law; or (iii) to comply with the written instructions of the Bank’s auditors or banking regulators. 7.3 Agreement Termination, Generally. Except as provided in Section 7.4, this Agreement may be terminated only by a written agreement signed by the Bank and the Executive. Such termination shall not cause a distribution of benefits under this Agreement. Rather, upon such termination, benefit distributions will be made at the earliest distribution event permitted under Article 2. 7.4 Effect of Complete Terminations. Notwithstanding anything to the contrary in Section 7.3, and subject to the requirements of Code Section 409A and Treasury Regulations §1.409A-3(j)(4)(ix), at certain times the Bank may completely terminate and liquidate the Agreement. In the event of such a complete termination in accordance with subsections 7.4.1 or 7.4.3 below, the Bank shall pay the Executive the Accrued Benefit. In the event of such a complete termination in accordance with subsection 7.4.2 below, the Bank shall pay the Executive the present value, determined using the Discount Rate, of the benefit described in Section 2.4

15 hereof. In either event, such complete termination of the Agreement shall occur only under the following circumstances and conditions: 7.4.1 Corporate Dissolution or Bankruptcy. The Bank may terminate and liquidate this Agreement within twelve (12) months of a corporate dissolution taxed under Code Section 331, or with the approval of a bankruptcy court pursuant to 11 U.S.C.§503(b)(1)(A), provided that all benefits paid under the Agreement are included in the Executive’s gross income in the latest of: (i) the calendar year which the termination occurs; (ii) the calendar year in which the amount is no longer subject to a substantial risk of forfeiture; or (iii) the first calendar year in which the payment is administratively practicable. 7.4.2 Change in Control. The Bank may terminate and liquidate this Agreement by taking irrevocable action to terminate and liquidate within the thirty (30) days preceding or the twelve (12) months following a Change in Control. This Agreement will then be treated as terminated only if all substantially similar arrangements sponsored by the Bank which are treated as deferred under a single plan under Treasury Regulations §1.409A-l(c)(2) are terminated and liquidated with respect to each participant who experienced the Change in Control so that the Executive and any participants in any such similar arrangements are required to receive all amounts of compensation deferred under the terminated arrangements within twelve (12) months of the date the Bank takes the irrevocable action to terminate the arrangements. 7.4.3 Discretionary Termination. The Bank may terminate and liquidate this Agreement provided that: (i) the termination does not occur proximate to a downturn in the financial health of the Bank; (ii) all arrangements sponsored by the Bank and Affiliates that would be aggregated with any terminated arrangements under Treasury Regulations §1.409A-l(c) are terminated; (iii) no payments, other than payments that would be payable under the terms of this Agreement if the termination had not occurred, are made within twelve (12) months of the date the Bank takes the irrevocable action to terminate this Agreement; (iv) all payments are made within twenty-four (24) months following the date the Bank takes the irrevocable action to terminate and liquidate this Agreement; and (v) neither the Bank nor any of its Affiliates adopts a new arrangement that would be aggregated with any terminated arrangement under Treasury Regulations §1.409A-l(c) if the Executive participated in both arrangements at any time within three (3) years following the date the Bank takes the irrevocable action to terminate this Agreement. Article 8 Miscellaneous 8.1 Binding Effect. This Agreement shall bind the Executive, Beneficiary and the Bank and their respective successors, heirs, executors and administrators.

16 8.2 No Effect on Other Rights. This Agreement constitutes the entire agreement between the Bank and the Executive as to the subject matter hereof. No rights are granted to the Executive by virtue of this Agreement other than those specifically set forth herein. Nothing contained herein will confer upon the Executive the right to be retained in the service of the Bank nor limit the right of the Bank to discharge or otherwise deal with the Executive without regard to the existence hereof. 8.3 Non-Transferability. Benefits under this Agreement cannot be sold, transferred, assigned, pledged, attached or encumbered in any manner. 8.4 Tax Withholding and Reporting. The Bank shall withhold any taxes that are required to be withheld, including but not limited to taxes owed under Code Section 409A from the benefits provided under this Agreement. The Executive acknowledges that the Bank’s sole liability regarding taxes is to forward any amounts withheld to the appropriate taxing authorities. The Bank shall satisfy all applicable reporting requirements, including those under Code Section 409A. 8.5 Applicable Law. This Agreement and all rights hereunder shall be governed by the laws of the Commonwealth of Pennsylvania, except to the extent preempted by the laws of the United States of America. 8.6 Unfunded Arrangement. The Executive and the Beneficiary are general unsecured creditors of the Bank for the distribution of benefits under this Agreement. The benefits represent the mere promise by the Bank to distribute such benefits. The rights to benefits are not subject in any manner to anticipation, alienation, sale, transfer, assignment, pledge, encumbrance, attachment or garnishment by creditors. Any insurance on the Executive’s life or other informal funding asset is a general asset of the Bank to which the Executive and Beneficiary have no preferred or secured claim. 8.7 Reorganization. The Bank shall not merge or consolidate into or with another bank, or reorganize, or sell substantially all of its assets to another bank, firm or person unless such succeeding or continuing bank, firm or person agrees to assume and discharge the obligations of the Bank under this Agreement. Upon the occurrence of such an event, the term “Bank” as used in this Agreement shall be deemed to refer to the successor or survivor entity. 8.8 Entire Agreement. This Agreement constitutes the entire agreement between the Bank and the Executive as to the subject matter hereof. No rights are granted to the Executive by virtue of this Agreement other than those specifically set forth herein. 8.9 Interpretation. Wherever the fulfillment of the intent and purpose of this Agreement requires and the context will permit, the use of the masculine gender includes the feminine and use of the singular includes the plural. 8.10 Alternative Action. In the event it shall become impossible for the Bank or the Plan Administrator to perform any act required by this Agreement due to regulatory or other constraints, the Bank or Plan Administrator may perform such alternative act as most nearly carries out the

17 intent and purpose of this Agreement and is in the best interests of the Bank, provided that such alternative act does not violate Code Section 409A. 8.11 Headings. Article and section headings are for convenient reference only and shall not control or affect the meaning or construction of any provision herein. 8.12 Validity. If any provision of this Agreement shall be illegal or invalid for any reason, said illegality or invalidity shall not affect the remaining parts hereof, but this Agreement shall be construed and enforced as if such illegal or invalid provision had never been included herein. 8.13 Notice. Any notice, consent or demand required or permitted to be given to the Bank or Plan Administrator under this Agreement shall be sufficient if in writing and hand- delivered or sent by registered or certified mail to the Bank’s principal business office. Any notice or filing required or permitted to be given to the Executive or Beneficiary under this Agreement shall be sufficient if in writing and hand-delivered or sent by mail to the last known address of the Executive or Beneficiary, as appropriate. Any notice shall be deemed given as of the date of delivery or, if delivery is made by mail, as of the date shown on the postmark or on the receipt for registration or certification. 8.14 Coordination with Other Benefits. The benefits provided for the Executive or the Beneficiary under this Agreement are in addition to any other benefits available to the Executive under any other plan or program for employees of the Bank. This Agreement shall supplement and shall not supersede, modify, or amend any other such plan or program except as may otherwise be expressly provided herein. 8.15 Aggregation of Agreement. If the Bank offers other non-qualified deferred compensation plans, this Agreement and those plans shall be treated as a single plan to the extent required under Code Section 409A. 8.16 Compliance with Section 409A. This Agreement shall be interpreted and administered consistent with Code Section 409A. The Bank and the Executive intend that the Agreement comply with the provisions of Code Section 409A to prevent the inclusion in gross income of any amounts deferred hereunder in a taxable year prior to the year in which amounts are actually paid to the Executive or Beneficiary. This Agreement shall be construed, administered and governed in a manner that affects such intent, and the Administrator shall not take any action that would be inconsistent therewith. [signature page follows]

18 IN WITNESS WHEREOF, the Executive and a duly authorized representative of the Bank have signed this Agreement. EXECUTIVE MID PENN BANK By: Rory G. Ritrievi Title: [Signature Page to 2025 Supplemental Executive Retirement Plan Agreement of Rory G. Ritrievi]

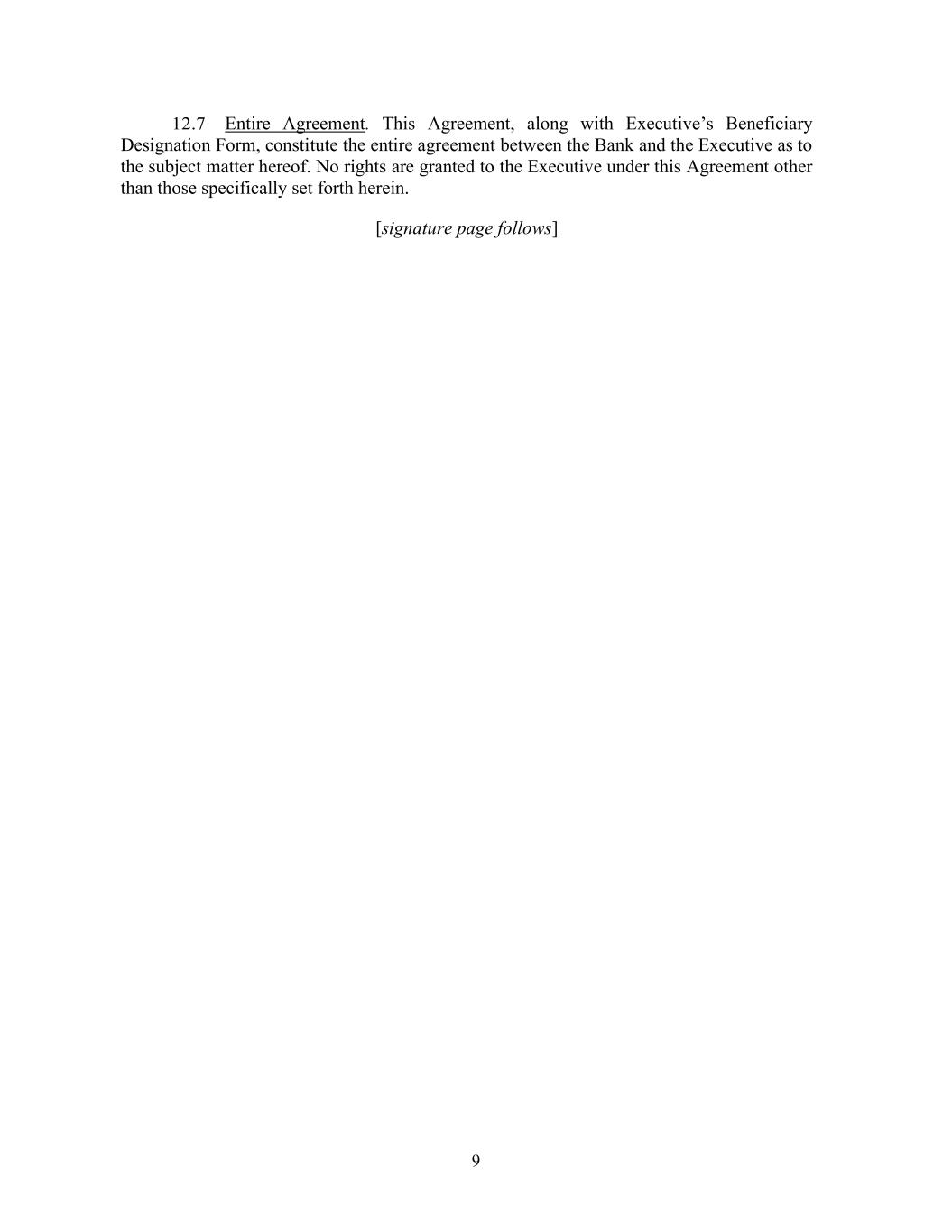

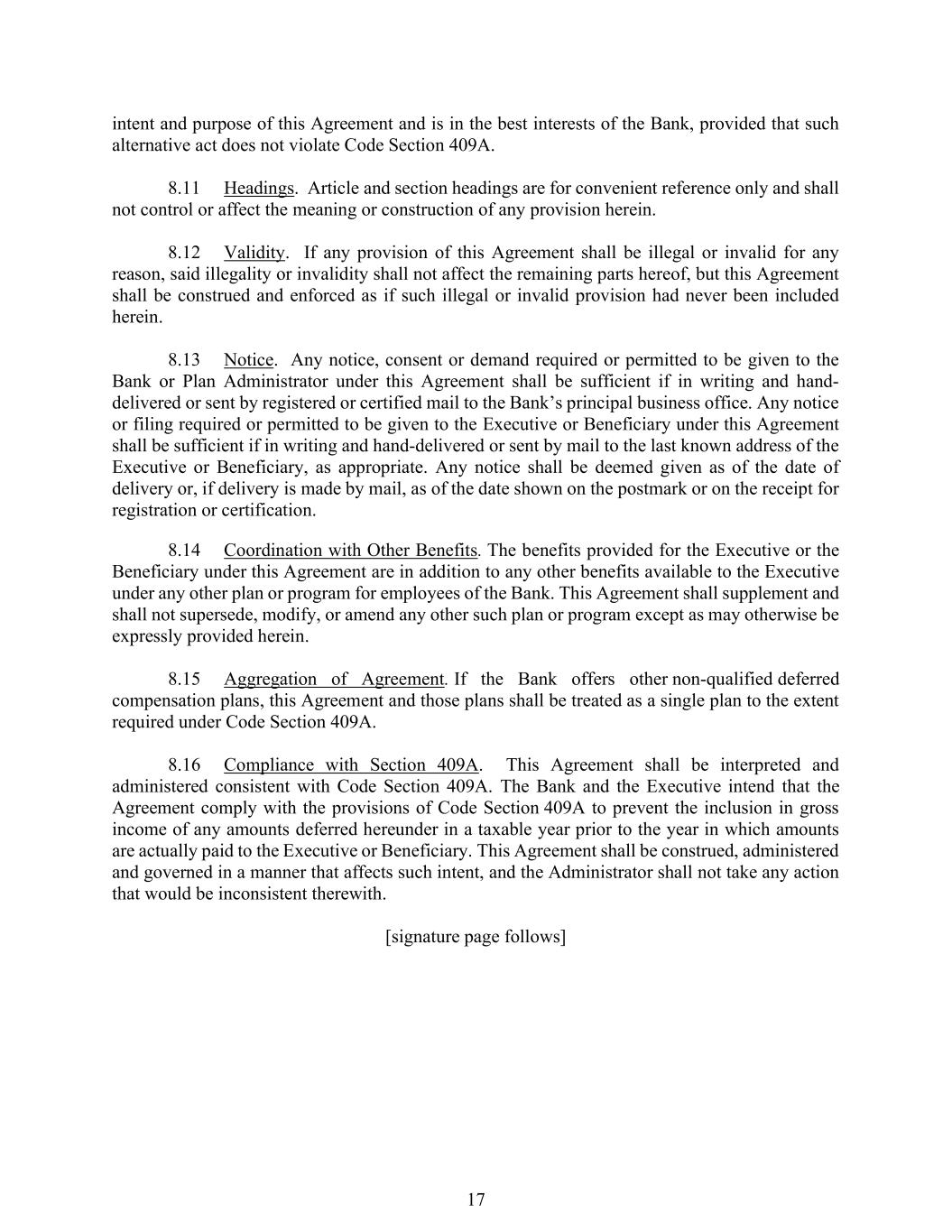

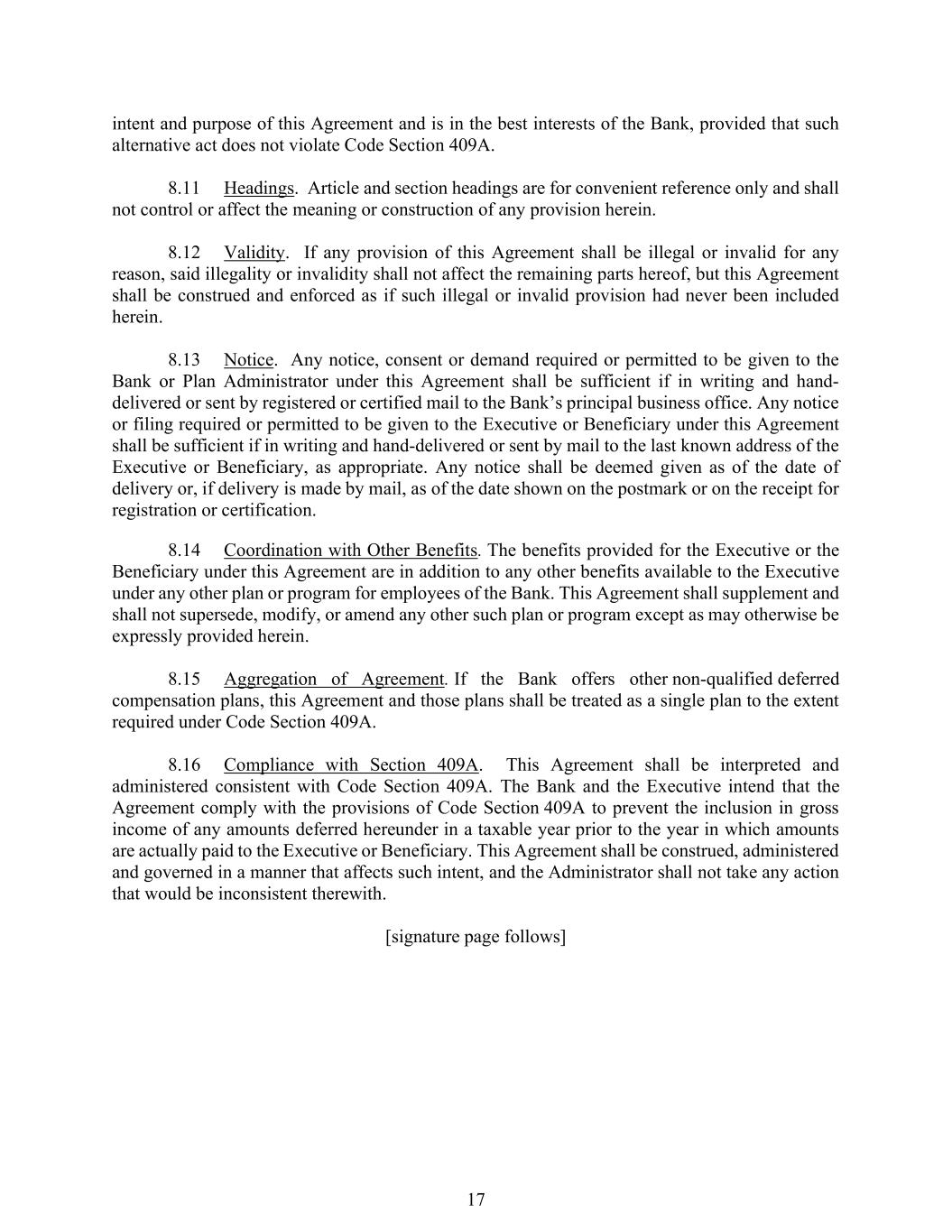

SCHEDULE A Rory G. Ritrievi Early Termination Pre-Retirement Death Plan Year Annual Benefit Annual Benefit Plan Years Commencing on the Effective Date and Ending on December 31, 2025 $31,000 $31,000 January 1 – December 31, 2026 $63,860 $63,860 January 1 – December 31, 2027 $98,664 $98,664 January 1 – December 31, 2028 $135,498 $135,498 January 1 – December 31, 2029 $174,454 $174,454 January 1 – December 31, 2030 $215,625 $215,625 January 1 – December 31, 2031 $259,109 $259,109 January 1 – December 31, 2032 $305,009 $305,009 January 1 – December 31, 2033 $353,429 $353,429 January 1 – December 31, 2034 and All Subsequent Plan Years (equal to the Normal Retirement Benefit) $404,480 $404,480

1 BENEFICIARY DESIGNATION FORM { } New Designation { } Change in Designation I, Rory G. Ritrievi, designate the following as Beneficiary under this Agreement: Primary: ___________________________________________________________ ___________________________________________________________ _____% _____% Contingent: ___________________________________________________________ ___________________________________________________________ _____% _____% Notes: Please PRINT CLEARLY or TYPE the names of the beneficiaries. To name a trust as Beneficiary, please provide the name of the trustee(s) and the exact name and date of the trust agreement. To name your estate as Beneficiary, please write “Estate of [your name]”. Be aware that none of the contingent beneficiaries will receive anything unless ALL of the primary beneficiaries predecease you. I understand that I may change these beneficiary designations by delivering a new written designation to the Plan Administrator, which shall be effective only upon receipt and acknowledgment by the Plan Administrator prior to my death. I further understand that the designations will be automatically revoked if the Beneficiary predeceases me, or, if I have named my spouse as Beneficiary and our marriage is subsequently dissolved. Name: Rory G. Ritrievi Signature: _______________________________ Date ______ Received by the Plan Administrator this ________ day of ___________________, 20___ By: _________________________________ Title: _________________________________