National Health Investors Investor Update November 6, 2025 Pear Valley Senior Living operated by Compass Senior Living

Disclaimers This presentation, as well as information included in oral statements made, or to be made, by our senior management contain forward- looking statements that are based on current expectations, estimates, beliefs and assumptions. Words such as “may,” “will,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. While we may elect to update these forward-looking statements at some point in the future, we disclaim any obligation to do so, except as may be required by law, even if our estimates or assumptions change. In light of these and other uncertainties, the inclusion of a forward-looking statement in this presentation should not be regarded as a representation by us that our plans and objectives will be achieved. You should not place undue reliance on these forward-looking statements. Factors which could cause our actual results to be materially different from those in or implied by the forward looking statements we make, many of which are beyond our control, include, among other things, the operating success of our managers, tenants and borrowers for collection of our lease and interest income; the success of property development and construction activities; risks associated with pandemics, epidemics or outbreak; the risk that the cash flows of our tenants, managers and borrowers may be adversely affected by increased liability claims and liability insurance costs; risks related to environmental laws and the costs associated with liabilities related to hazardous substances; the risk of damage from catastrophic weather and other natural or man-made disasters and the physical effects of climate change; our ability to reinvest cash in real estate investments in a timely manner and on acceptable terms; the risk that the illiquidity of real estate investments could impede our ability to respond to adverse changes in the performance of our properties; operational risks with respect to our senior housing operating portfolio structured communities; risks related to our ability to maintain the privacy and security of Company information; our ability to continue to qualify for taxation as a real estate investment trust; and other risks which are described under the heading “Risk Factors” in Item 1A in our Form 10-K for the year ended December 31, 2024 and under the heading “Risk Factors” in Item 1A in our Form 10-Q for the quarter ended September 30, 2025. In this presentation we refer to non-GAAP financial measures. These non-GAAP measures are not prepared in accordance with generally accepted accounting principles. Reconciliations to certain non-GAAP measures can be found at the end of this presentation, in the Company’s quarterly supplementals which can be found on our website at www.nhireit.com, and in our quarterly Form 10-Q filings and annual Form 10-K filing. Throughout this presentation, certain abbreviations and acronyms are used to simplify the format. A list of definitions is provided at the end of this presentation to clarify the meaning of any reference that may be ambiguous. 2

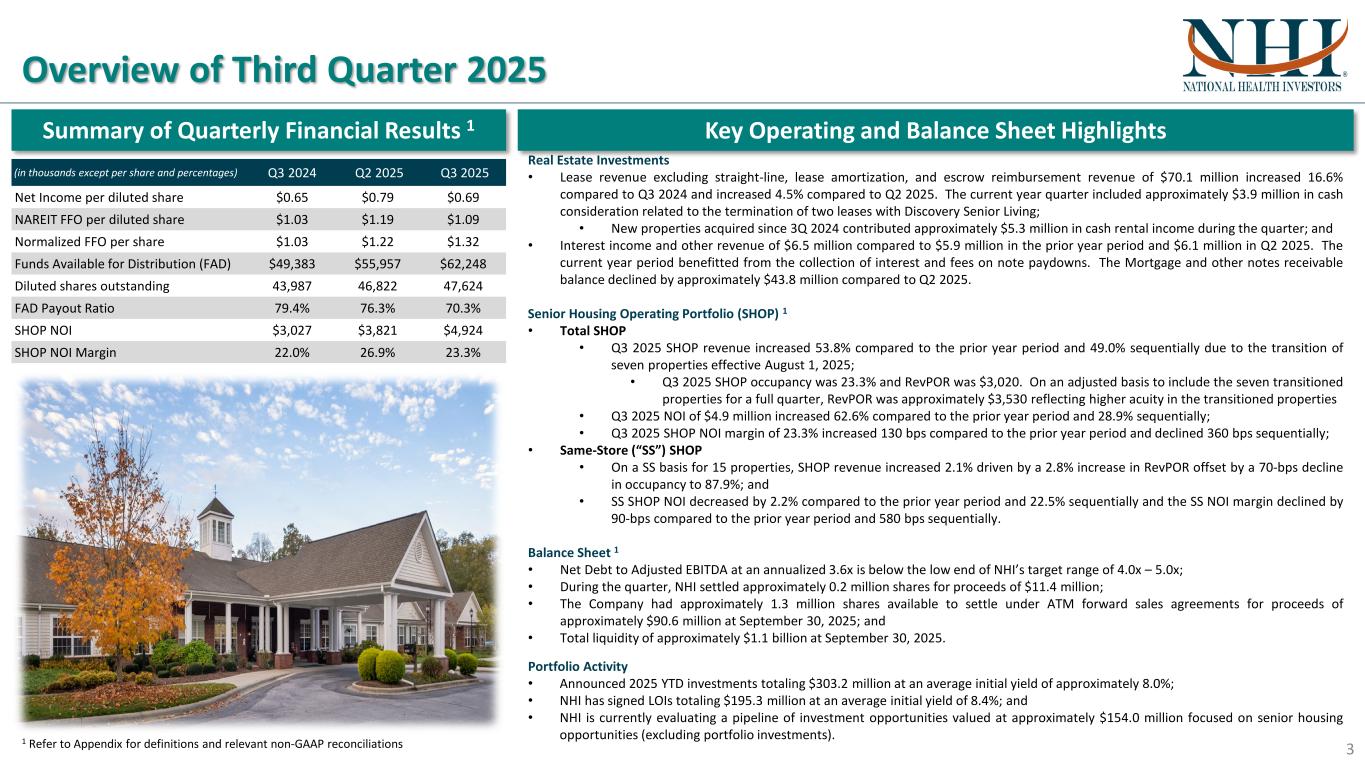

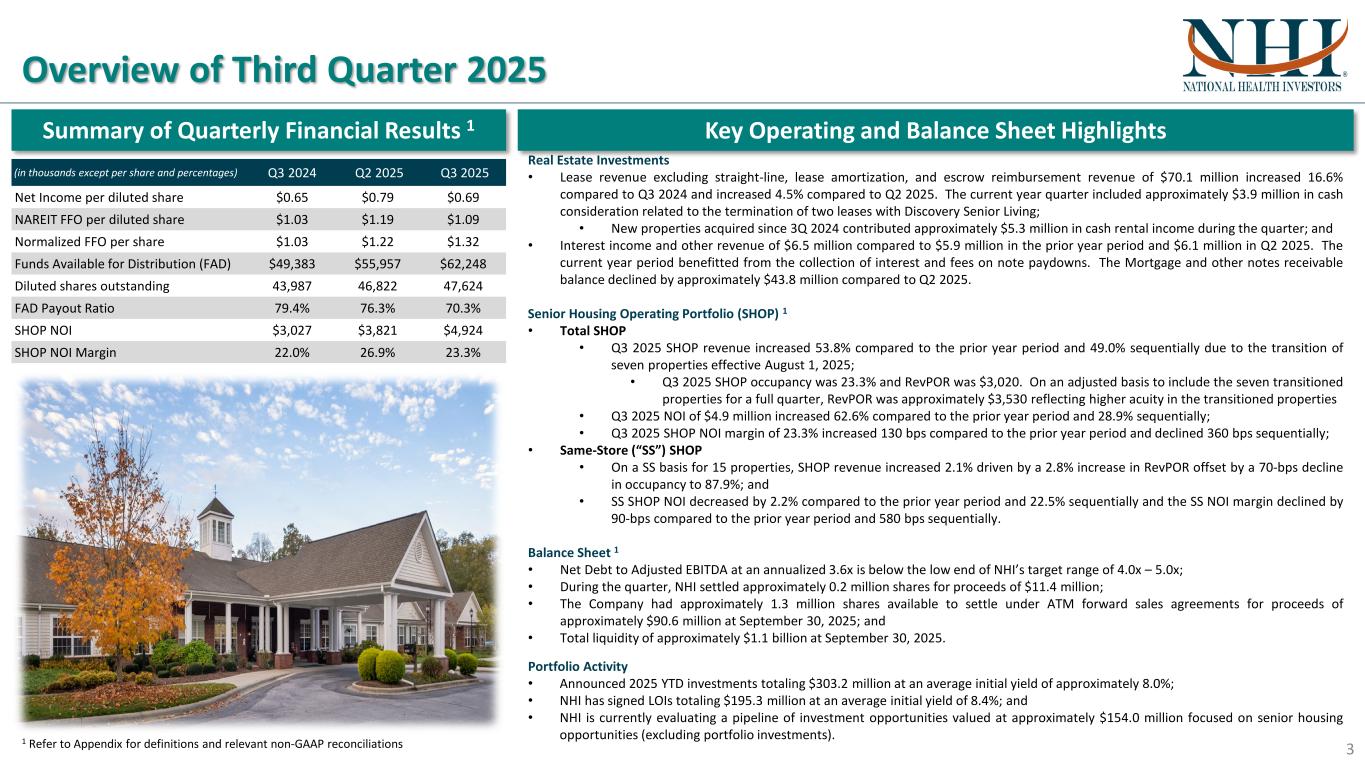

Overview of Third Quarter 2025 3 Real Estate Investments • Lease revenue excluding straight-line, lease amortization, and escrow reimbursement revenue of $70.1 million increased 16.6% compared to Q3 2024 and increased 4.5% compared to Q2 2025. The current year quarter included approximately $3.9 million in cash consideration related to the termination of two leases with Discovery Senior Living; • New properties acquired since 3Q 2024 contributed approximately $5.3 million in cash rental income during the quarter; and • Interest income and other revenue of $6.5 million compared to $5.9 million in the prior year period and $6.1 million in Q2 2025. The current year period benefitted from the collection of interest and fees on note paydowns. The Mortgage and other notes receivable balance declined by approximately $43.8 million compared to Q2 2025. Senior Housing Operating Portfolio (SHOP) 1 • Total SHOP • Q3 2025 SHOP revenue increased 53.8% compared to the prior year period and 49.0% sequentially due to the transition of seven properties effective August 1, 2025; • Q3 2025 SHOP occupancy was 23.3% and RevPOR was $3,020. On an adjusted basis to include the seven transitioned properties for a full quarter, RevPOR was approximately $3,530 reflecting higher acuity in the transitioned properties • Q3 2025 NOI of $4.9 million increased 62.6% compared to the prior year period and 28.9% sequentially; • Q3 2025 SHOP NOI margin of 23.3% increased 130 bps compared to the prior year period and declined 360 bps sequentially; • Same-Store (“SS”) SHOP • On a SS basis for 15 properties, SHOP revenue increased 2.1% driven by a 2.8% increase in RevPOR offset by a 70-bps decline in occupancy to 87.9%; and • SS SHOP NOI decreased by 2.2% compared to the prior year period and 22.5% sequentially and the SS NOI margin declined by 90-bps compared to the prior year period and 580 bps sequentially. Balance Sheet 1 • Net Debt to Adjusted EBITDA at an annualized 3.6x is below the low end of NHI’s target range of 4.0x – 5.0x; • During the quarter, NHI settled approximately 0.2 million shares for proceeds of $11.4 million; • The Company had approximately 1.3 million shares available to settle under ATM forward sales agreements for proceeds of approximately $90.6 million at September 30, 2025; and • Total liquidity of approximately $1.1 billion at September 30, 2025. Portfolio Activity • Announced 2025 YTD investments totaling $303.2 million at an average initial yield of approximately 8.0%; • NHI has signed LOIs totaling $195.3 million at an average initial yield of 8.4%; and • NHI is currently evaluating a pipeline of investment opportunities valued at approximately $154.0 million focused on senior housing opportunities (excluding portfolio investments). Summary of Quarterly Financial Results 1 Key Operating and Balance Sheet Highlights (in thousands except per share and percentages) Q3 2024 Q2 2025 Q3 2025 Net Income per diluted share $0.65 $0.79 $0.69 NAREIT FFO per diluted share $1.03 $1.19 $1.09 Normalized FFO per share $1.03 $1.22 $1.32 Funds Available for Distribution (FAD) $49,383 $55,957 $62,248 Diluted shares outstanding 43,987 46,822 47,624 FAD Payout Ratio 79.4% 76.3% 70.3% SHOP NOI $3,027 $3,821 $4,924 SHOP NOI Margin 22.0% 26.9% 23.3% 1 Refer to Appendix for definitions and relevant non-GAAP reconciliations

Updated 2025 Guidance 4 2025 Guidance Midpoints 1 2025 Guidance Assumptions & Considerations NHI’s 2025 annual guidance includes the following assumptions: • $75 million in unidentified new investments at an initial average yield of 8.0%; • Continued rent concessions and loan repayments; • Continued fulfillment of existing commitments; • Same-Store SHOP NOI annual growth in a range of 7% - 9%; • SHOP conversion and new investment NOI in a range of $5.8 million - $6.0 million; and • Continued collection of deferred rents. In addition to the assumptions listed above, NHI’s guidance range is based on several other assumptions, many of which are outside the Company’s control and all of which are subject to change. The guidance range may change if actual results vary from these assumptions. As of Aug-25 As of Nov-25 (in millions except per share amounts) Midpoint Midpoint Net income attributable to common stockholders $ 134.0 $ 139.9 Adjustments to NAREIT Funds From Operations (FFO) Depreciation (net) 2 76.9 78.4 Gains on sales (net) and impairments of real estate (0.2) (0.4) NAREIT FFO $ 210.7 $ 217.9 Adjustments to Normalized Funds From Operations (NFFO) Non-cash write-offs of straight-line rents receivable 12.2 12.2 Other 3 2.8 0.2 NFFO $ 225.6 $ 230.3 Adjustments to Funds Available for Distribution (FAD) Straight-line revenue and lease incentive amortizations (net) 2 (2.7) (2.7) Equity method investment adjustments (3.5) (3.2) Equity method investment non-refundable fees received 1.9 2.5 Non-cash stock-based compensation 5.6 5.6 SHOP 2 and equity method investment recurring capital expenditures (2.4) (2.7) Transaction costs 1.2 1.2 Other 4 3.1 1.6 FAD $ 228.9 $ 232.6 Weighted average diluted common shares 47.0 47.0 NAREIT FFO per diluted common share $ 4.48 $ 4.64 NFFO per diluted common share $ 4.80 $ 4.90 1 Refer to Appendix for definitions and relevant non-GAAP reconciliations 2 Net of amounts attributable to non-controlling interests 3 Includes estimated proxy contest expenses of $1.6 million and net gains from operations transfer 4 Includes credit loss reserve, non-real estate deprecation (net) and amortizations associated with debt facilities

Investment Overview 5 • Same-Store and SHOP transitions have excellent growth profile • Rent resets with large tenants including NHC and Bickford • Capex program supports organic growth and adds value to owned real estate • SHOP NOI growth of 62.6% in Q3 2025 driven by recent transitions • Completed first SHOP acquisition which doubles NOI contribution to approximately 10% of total adjusted NOI • Growth profile significantly stronger than traditional lease investments • Leverage below 4.0x – 5.0x net debt to adjusted EBITDA range • Significant investment capacity on revolver and ATM • Closed $303.2 million in 2025 YTD investments, $195.3 million in signed LOIs, and a $154.0 million pipeline • Supply of senior housing inventory is growing at less than 1.0% and slowing as new starts are more than 60% below historical average • Demand is surging as 85+ population growth expected to accelerate over the next 15 years Active Management Creates Multiple Avenues for Organic Growth Significant SHOP Growth Opportunity Financial Strength Positions NHI for External Growth Strong Industry Dynamics Support Long Term Growth 1 1 University of Virginia’s Weldon Cooper Center for Public Service; National Investment Center for Senior Housing & Care (“NIC”); NIC data is from NICMAP Primary & Secondary markets through 3Q 2025.

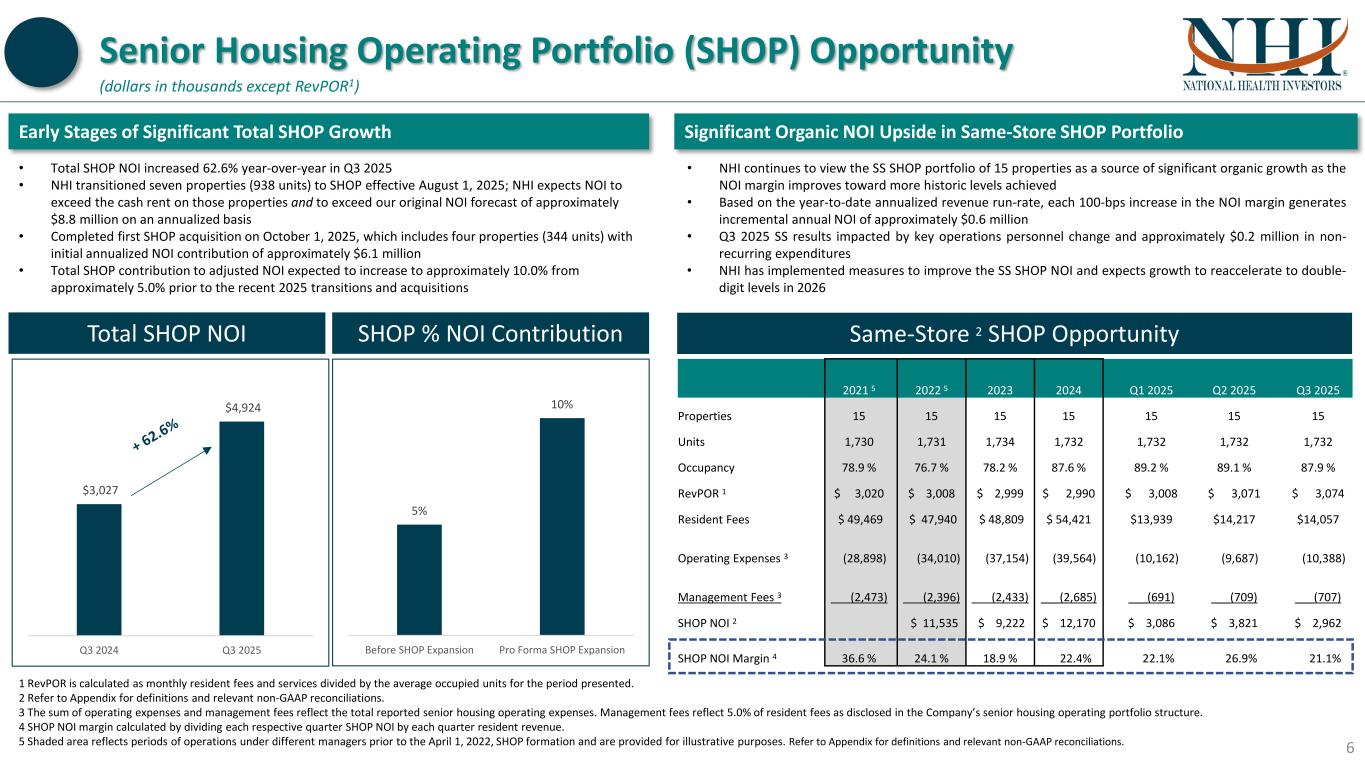

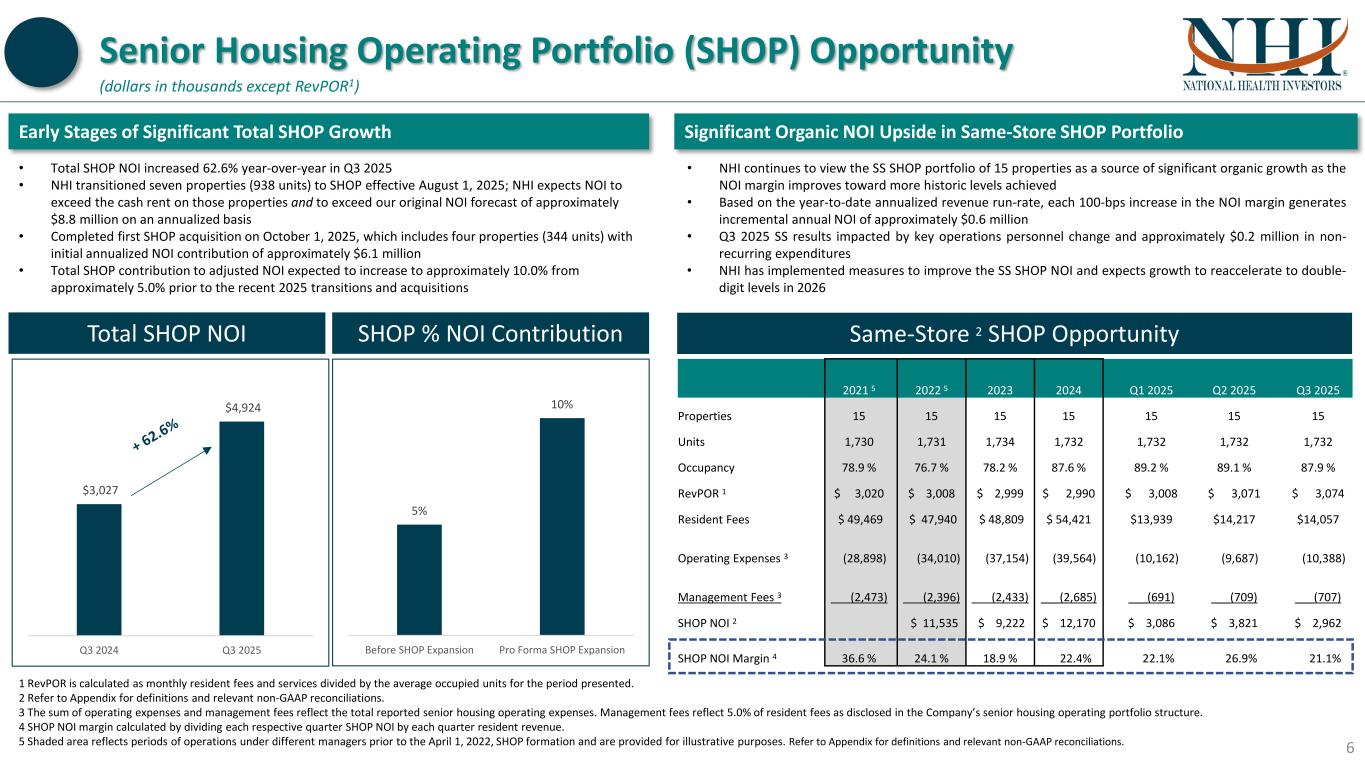

Senior Housing Operating Portfolio (SHOP) Opportunity 6 (dollars in thousands except RevPOR1) • NHI continues to view the SS SHOP portfolio of 15 properties as a source of significant organic growth as the NOI margin improves toward more historic levels achieved • Based on the year-to-date annualized revenue run-rate, each 100-bps increase in the NOI margin generates incremental annual NOI of approximately $0.6 million • Q3 2025 SS results impacted by key operations personnel change and approximately $0.2 million in non- recurring expenditures • NHI has implemented measures to improve the SS SHOP NOI and expects growth to reaccelerate to double- digit levels in 2026 Significant Organic NOI Upside in Same-Store SHOP Portfolio 2021 5 2022 5 2023 2024 Q1 2025 Q2 2025 Q3 2025 Properties 15 15 15 15 15 15 15 Units 1,730 1,731 1,734 1,732 1,732 1,732 1,732 Occupancy 78.9 % 76.7 % 78.2 % 87.6 % 89.2 % 89.1 % 87.9 % RevPOR 1 $ 3,020 $ 3,008 $ 2,999 $ 2,990 $ 3,008 $ 3,071 $ 3,074 Resident Fees $ 49,469 $ 47,940 $ 48,809 $ 54,421 $13,939 $14,217 $14,057 Operating Expenses 3 (28,898) (34,010) (37,154) (39,564) (10,162) (9,687) (10,388) Management Fees 3 (2,473) (2,396) (2,433) ___(2,685) ___(691) ___(709) ___(707) SHOP NOI 2 $ 11,535 $ 9,222 $ 12,170 $ 3,086 $ 3,821 $ 2,962 SHOP NOI Margin 4 36.6 % 24.1 % 18.9 % 22.4% 22.1% 26.9% 21.1% 1 RevPOR is calculated as monthly resident fees and services divided by the average occupied units for the period presented. 2 Refer to Appendix for definitions and relevant non-GAAP reconciliations. 3 The sum of operating expenses and management fees reflect the total reported senior housing operating expenses. Management fees reflect 5.0% of resident fees as disclosed in the Company’s senior housing operating portfolio structure. 4 SHOP NOI margin calculated by dividing each respective quarter SHOP NOI by each quarter resident revenue. 5 Shaded area reflects periods of operations under different managers prior to the April 1, 2022, SHOP formation and are provided for illustrative purposes. Refer to Appendix for definitions and relevant non-GAAP reconciliations. Early Stages of Significant Total SHOP Growth • Total SHOP NOI increased 62.6% year-over-year in Q3 2025 • NHI transitioned seven properties (938 units) to SHOP effective August 1, 2025; NHI expects NOI to exceed the cash rent on those properties and to exceed our original NOI forecast of approximately $8.8 million on an annualized basis • Completed first SHOP acquisition on October 1, 2025, which includes four properties (344 units) with initial annualized NOI contribution of approximately $6.1 million • Total SHOP contribution to adjusted NOI expected to increase to approximately 10.0% from approximately 5.0% prior to the recent 2025 transitions and acquisitions $3,027 $4,924 Q3 2024 Q3 2025 5% 10% Before SHOP Expansion Pro Forma SHOP Expansion Total SHOP NOI SHOP % NOI Contribution Same-Store 2 SHOP Opportunity

Multiple Avenues for Organic Growth 7 • SHOP Conversions • Effective August 1, 2025, NHI transitioned six properties formerly leased to Discovery to a SHOP portfolio managed by Sinceri Senior Living • Effective August 1, 2025, NHI expanded its SHOP joint venture with Discovery by adding one property in Tulsa, OK that was previously leased to Discovery • SHOP conversion NOI on the seven properties is expected to exceed NHI’s original forecast of approximately $3.7 million, or $8.8 million on an annualized basis • Rent Resets and Monetizing Deferral Repayments • Board’s Special Committee is actively engaged with management on the NHC master lease, which matures on December 31, 2026, to create shareholder value • Pandemic related deferral repayments continue to exceed expectations and provide opportunity for future shareholder value creation • NHI collected $11.2 million in deferral repayments during 2024 and approximately $9.1 million in YTD in 2025 • NHI was able to monetize deferral repayments of approximately $3.3 million in connection with the Discovery Senior Living lease termination • Bickford repaid $1.3 million in Q3 2025 and still has an outstanding balance of approximately $8.7 million at October 31, 2025; Bickford’s strong lease coverage (see slide 9) is a benefit as April 2026 rent reset approaches • Internal Investments • Board of Directors approved $25.0 million during the first quarter of 2024 for additional investment in existing leased properties; Investments are expected to be funded within two years of project approval • Qualifying projects designed to assist current tenants with improving property level NOI • Investments earn a return of no less than 8.0% and are recognized through additional rental income • At September 30, 2025, $19.6 million has been committed and $9.9 million has been funded SHOP Conversions, Internal Investment, and Rent Resets Create Incremental Organic Growth Opportunities (dollars in thousands)

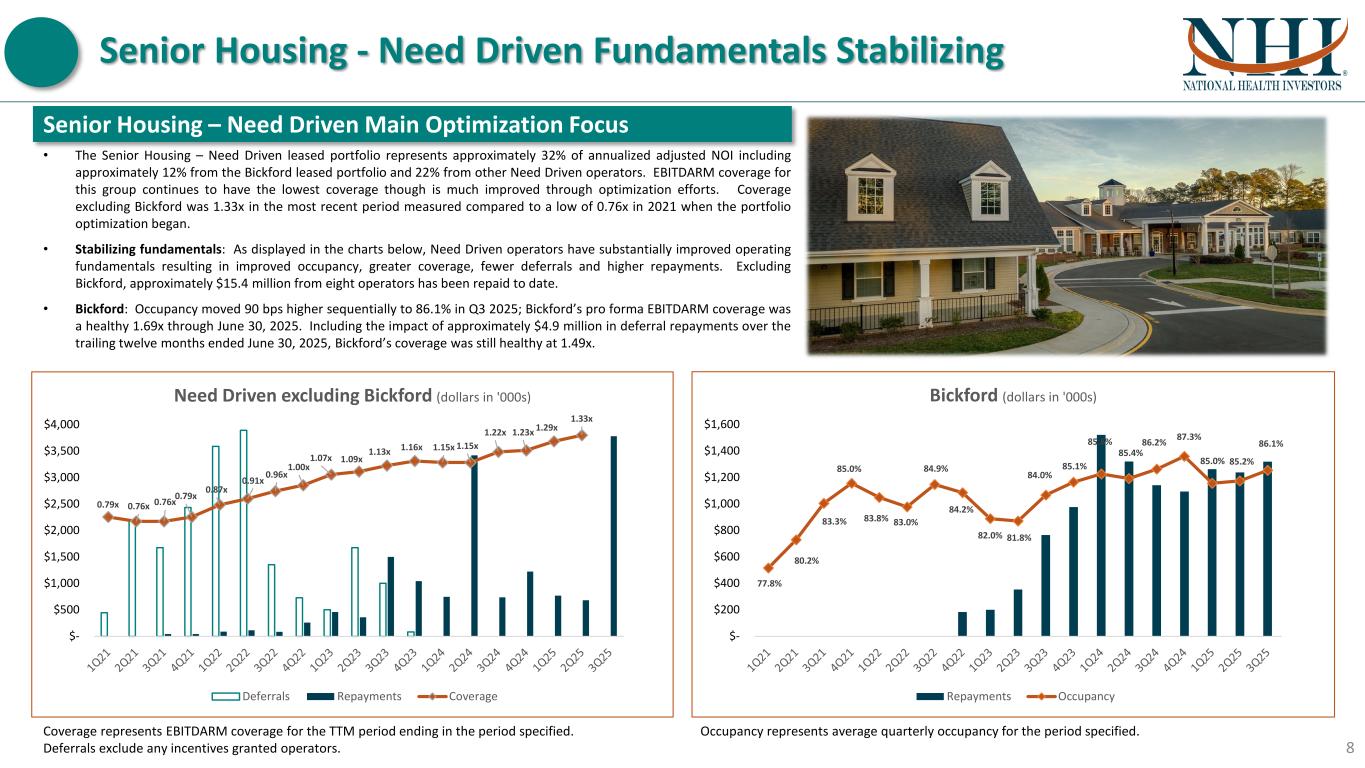

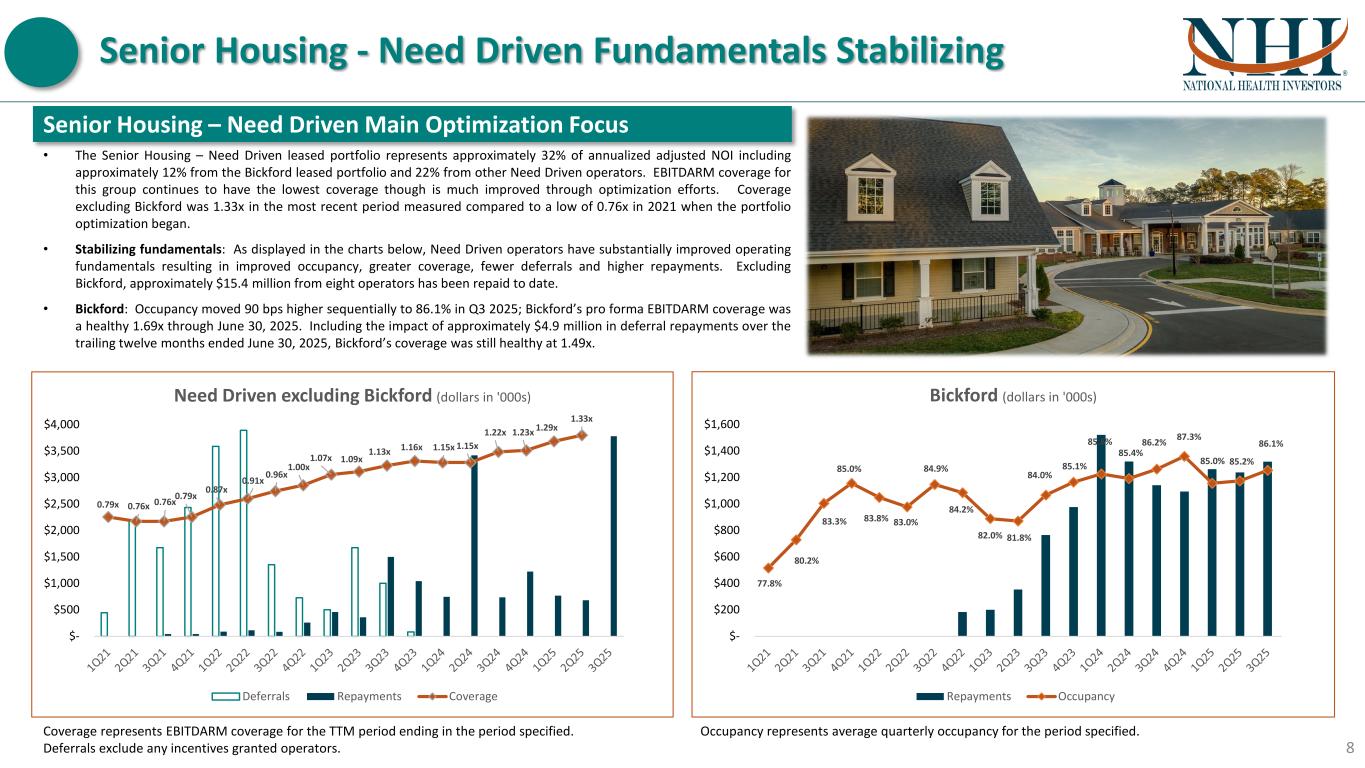

Senior Housing - Need Driven Fundamentals Stabilizing 8 • The Senior Housing – Need Driven leased portfolio represents approximately 32% of annualized adjusted NOI including approximately 12% from the Bickford leased portfolio and 22% from other Need Driven operators. EBITDARM coverage for this group continues to have the lowest coverage though is much improved through optimization efforts. Coverage excluding Bickford was 1.33x in the most recent period measured compared to a low of 0.76x in 2021 when the portfolio optimization began. • Stabilizing fundamentals: As displayed in the charts below, Need Driven operators have substantially improved operating fundamentals resulting in improved occupancy, greater coverage, fewer deferrals and higher repayments. Excluding Bickford, approximately $15.4 million from eight operators has been repaid to date. • Bickford: Occupancy moved 90 bps higher sequentially to 86.1% in Q3 2025; Bickford’s pro forma EBITDARM coverage was a healthy 1.69x through June 30, 2025. Including the impact of approximately $4.9 million in deferral repayments over the trailing twelve months ended June 30, 2025, Bickford’s coverage was still healthy at 1.49x. Senior Housing – Need Driven Main Optimization Focus Coverage represents EBITDARM coverage for the TTM period ending in the period specified. Deferrals exclude any incentives granted operators. Occupancy represents average quarterly occupancy for the period specified. 0.79x 0.76x 0.76x0.79x 0.87x 0.91x 0.96x 1.00x 1.07x 1.09x 1.13x 1.16x 1.15x 1.15x 1.22x 1.23x 1.29x 1.33x 0.00x 0.20x 0.40x 0.60x 0.80x 1.00x 1.20x 1.40x $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 Need Driven excluding Bickford (dollars in '000s) Deferrals Repayments Coverage 77.8% 80.2% 83.3% 85.0% 83.8% 83.0% 84.9% 84.2% 82.0% 81.8% 84.0% 85.1% 85.8% 85.4% 86.2% 87.3% 85.0% 85.2% 86.1% 72.0% 74.0% 76.0% 78.0% 80.0% 82.0% 84.0% 86.0% 88.0% 90.0% $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 Bickford (dollars in '000s) Repayments Occupancy

Asset Diversification Creates Stronger Portfolio 9 The Senior Housing – Need Driven portfolio has experienced significant coverage improvement since the start of the portfolio optimization in 2021. The SNF and Discretionary (largely CCRC) portfolios which generate ~53% of adjusted NOI have proved resilient throughout. Coverage represents EBITDARM coverage for the TTM period ending in the period specified. 0.60x 0.80x 1.00x 1.20x 1.40x 1.60x 1.80x 1Q 2 02 1 2Q 2 02 1 3Q 2 02 1 4Q 2 02 1 1Q 2 02 2 2Q 2 02 2 3Q 2 02 2 4Q 2 02 2 1Q 2 02 3 2Q 2 02 3 3Q 2 02 3 4Q 2 02 3 1Q 2 02 4 2Q 2 02 4 3Q 2 02 4 4Q 2 02 4 1Q 2 02 5 2Q 2 02 5 EBITDARM Coverage Senior Housing - Need Driven Bickford Need Driven ex. Bickford 0.60x 1.10x 1.60x 2.10x 2.60x 3.10x 3.60x 1Q 2 02 1 2Q 2 02 1 3Q 2 02 1 4Q 2 02 1 1Q 2 02 2 2Q 2 02 2 3Q 2 02 2 4Q 2 02 2 1Q 2 02 3 2Q 2 02 3 3Q 2 02 3 4Q 2 02 3 1Q 2 02 4 2Q 2 02 4 3Q 2 02 4 4Q 2 02 4 1Q 2 02 5 2Q 2 02 5 EBITDARM Coverage Senior Housing - Discretionary Skilled Nursing

2025 Investments: Closed $303.2 million at an average initial yield of 8.0% Recent Investments and Pipeline Significant Pipeline Creates Pathway for External Growth Opportunities 10 (dollars in millions) 1 Represents contractual rent or interest / purchase price. SHOP yields are after routine capex. 2 Investment funded partially with the satisfaction of a mortgage which contained a purchase option for NHI. 3 Property acquired in a deed in lieu of foreclosure transaction to satisfy the repayment of a $10.0 million mortgage note receivable. 4 Investment funded partially with the satisfaction of a construction loan and mortgage which contained a purchase option for NHI. Investment History with New & Existing Relationships Pipeline: Approximately $154.0 million including SHOP (excluding portfolio deals) Signed LOIs: $195.3 million at an average yield of 8.4% Date Tenant / Borrower Investment Type Yield 1 Investment 4Q 2025 Senior Living Communities 2 Lease & loan 8.3% $ 54.0 4Q 2025 Compass Senior Living SHOP 7.5% 74.3 2Q 2025 Encore Senior Living Construction loan 9.0% 28.0 2Q 2025 Agemark Senior Living Lease 8.0% 63.5 1Q 2025 Senior Living Hospitality Loan 9.0% 1.9 1Q 2025 Mainstay 3 Lease 8.0% 8.6 1Q 2025 Vizion Loan 9.2% 5.4 1Q 2025 Juniper Communities Lease 8.0% 46.3 1Q 2025 Generations Lease 8.0% 21.2 YTD 2025 8.0% $ 303.2 4Q 2024 William James Group Lease 8.5% $ 6.9 4Q 2024 CFG Corporate loan 10.0% 25.0 4Q 2024 Spring Arbor Senior Living Lease 8.2% 121.3 3Q 2024 Sanders Clearsky Construction loan 9.0% 27.7 2Q 2024 Encore Senior Living 4 Lease 8.3% 32.1 2Q 2024 Compass Senior Living Mortgage loan 8.5% 9.5 1Q 2024 Carriage Crossing Mortgage loan 8.8% 15.0 Total 2024 8.6% $ 237.5 Total 8.3% $ 540.7 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 New Existing Yield

Financial Strength Positions NHI for Potential Accretive External Growth Strong Balance Sheet Provides Ample Liquidity for Investment • NHI’s current leverage at 3.6x is below its target leverage of 4.0x – 5.0x net debt to adjusted EBITDA as recent acquisitions have been funded largely equity • Total liquidity of approximately $1.1 billion includes: • Approximately 1.3 million shares available to settle under ATM forward sales agreements for proceeds of approximately $90.6 million • Approximately $600.0 million of available revolver capacity and an incremental $315.8 million on the ATM • Subsequent to September 30, 2025, NHI extended the $125 million term loan to Jun-26 and repaid $50 million in private placement notes • Investment grade ratings and “stable” outlooks from Moody’s, S&P Global, and Fitch 11 Net Debt to Annualized Adjusted EBITDA 1 (dollars in millions) Liquidity as of September 30, 2025 1 Refer to Appendix for definitions and relevant non-GAAP reconciliations. Debt Maturity Schedule Cash and Restricted Cash $ 81.6 Credit Facility Availability 600.0 Equity available under ATM forward sale agreements 90.6 ATM assuming settlement of ATM forward sale agreements 315.8 Total Liquidity $ 1,088.0 $50 $100 $125 $100 $750$600 2025 2026 2027 2028 2029 Thereafter Private Placement Term Loan Line of Credit Senior Notes Available Line of Credit 5.1x 4.8x 4.9x 4.9x 4.0x 4.5x 4.7x 4.6x 4.6x 4.4x 4.4x 4.4x 4.2x 4.4x 4.1x 4.1x 3.9x 3.6x 2Q21 4Q21 2Q22 4Q22 2Q23 4Q23 2Q24 4Q24 2Q25

Optimization Creating More Invested Capital Efficiency 12 Optimization Improved ROIC • Pandemic impacts start in late 2020 with first rent concessions granted • Dispositions of underperforming properties begins in 2Q21 and included 48 senior housing properties and seven SNFs • Bickford rent reset and SHOP formation at the beginning of 2Q22 • ROIC improving as dispositions of underperforming assets slow and Normalized FAD stabilizes on solid collections, accretive acquisitions, and continued deferral repayments • 3Q25 ROIC at 8.45% exceeds NHI’s weighted average cost of capital and surpasses pre-pandemic levels Re tu rn o n In ve st ed C ap ita l Refer to Appendix for definitions and relevant non-GAAP reconciliations. 8.33% 8.27% 8.16% 8.04% 7.92% 7.69% 7.53% 7.30% 7.16% 7.47% 7.58% 7.72% 7.80% 7.65% 7.81% 7.94% 8.05% 8.28% 8.29% 8.34% 8.27% 8.25% 8.45% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25

Favorable Industry Dynamics: A Pathway For Long Term Growth 13 Supply Growth is Slowing Inventory growth of 0.6% across the care continuum is at an historic low Rolling 4-Quarter units started in Q3 2025 were 63% below the historical average Source: National Investment Center for Senior Housing & Care (“NIC”); data is from NICMAP Primary & Secondary markets through 3Q 2025. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 1Q 20 09 3Q 20 09 1Q 20 10 3Q 20 10 1Q 20 11 3Q 20 11 1Q 20 12 3Q 20 12 1Q 20 13 3Q 20 13 1Q 20 14 3Q 20 14 1Q 20 15 3Q 20 15 1Q 20 16 3Q 20 16 1Q 20 17 3Q 20 17 1Q 20 18 3Q 20 18 1Q 20 19 3Q 20 19 1Q 20 20 3Q 20 20 1Q 20 21 3Q 20 21 1Q 20 22 3Q 20 22 1Q 20 23 3Q 20 23 1Q 20 24 3Q 20 24 1Q 20 25 3Q 20 25 Inventory Growth Senior Housing Independent Living Assisted Living 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 1Q 20 08 3Q 20 08 1Q 20 09 3Q 20 09 1Q 20 10 3Q 20 10 1Q 20 11 3Q 20 11 1Q 20 12 3Q 20 12 1Q 20 13 3Q 20 13 1Q 20 14 3Q 20 14 1Q 20 15 3Q 20 15 1Q 20 16 3Q 20 16 1Q 20 17 3Q 20 17 1Q 20 18 3Q 20 18 1Q 20 19 3Q 20 19 1Q 20 20 3Q 20 20 1Q 20 21 3Q 20 21 1Q 20 22 3Q 20 22 1Q 20 23 3Q 20 23 1Q 20 24 3Q 20 24 1Q 20 25 3Q 20 25 Senior Housing: Rolling 4-Quarter Units Started

5.7 6.3 7.6 10.8 2010 2020 2030E 2040E U.S. 85+ Population (in millions) Favorable Industry Dynamics: A Pathway For Long Term Growth 14 Source: University of Virginia’s Weldon Cooper Center for Public Service; National Investment Center for Senior Housing & Care (“NIC”); NIC data is from NICMAP Primary & Secondary markets through 3Q 2025. The 85+ population growth is expected to accelerate to 1.9% by 2030 and 3.5% in the following decade Absorption remains well above historic averages resulting in the highest ever number of occupied senior housing units Demand Growth is Surging -10.0% -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 1Q 20 09 3Q 20 09 1Q 20 10 3Q 20 10 1Q 20 11 3Q 20 11 1Q 20 12 3Q 20 12 1Q 20 13 3Q 20 13 1Q 20 14 3Q 20 14 1Q 20 15 3Q 20 15 1Q 20 16 3Q 20 16 1Q 20 17 3Q 20 17 1Q 20 18 3Q 20 18 1Q 20 19 3Q 20 19 1Q 20 20 3Q 20 20 1Q 20 21 3Q 20 21 1Q 20 22 3Q 20 22 1Q 20 23 3Q 20 23 1Q 20 24 3Q 20 24 1Q 20 25 3Q 20 25 Absorption Senior Housing Independent Living Assisted Living

Appendix: Definitions 15 ADJUSTED EBITDA & EBITDARM NHI considers Adjusted EBITDA to be an important supplemental measure because it provides information which is used to evaluate the Company’s performance and serves as an indication of the ability to service debt. NHI defines Adjusted EBITDA as consolidated earnings before interest, taxes, depreciation and amortization, including amounts in discontinued operations, excluding real estate asset impairments and gains on dispositions and certain items which, due to their infrequent or unpredictable nature, may create some difficulty in comparing Adjusted EBITDA for the current period to similar prior periods, and may include, but are not limited to, impairment of non-real estate assets, gains and losses attributable to the acquisition and disposition of assets and liabilities, and recoveries of previous write- downs. Adjusted EBITDA also includes NHI’s proportionate share of unconsolidated equity method investments presented on a similar basis. Since others may not use the Company’s definition of Adjusted EBITDA, caution should be exercised when comparing NHI’s Adjusted EBITDA to that of other companies. EBITDARM is earnings before interest, taxes, depreciation, amortization, rent and management fees. ADJUSTED NET OPERATING INCOME Adjusted net operating income (“Adjusted NOI”) is a non-U.S. GAAP supplemental financial measure used to evaluate the operating performance of real estate. We define Adjusted NOI as total revenues, less straight-line revenue, less corporate interest income, less tenant reimbursements and property operating expenses, and adjusted for non-cash revenue items including, but not limited to, amortization of commitment fees, deferred financing costs and original issue discounts and lease incentive amortization. We believe Adjusted NOI provides investors relevant and useful information as it measures the operating performance of our properties at the property level on an unleveraged basis. We use adjusted NOI to make decisions about resource allocations and to assess the property level performance of our properties. FAD PAYOUT RATIO The Funds Available for Distribution (FAD) payout ratio is a metric used in the REIT (Real Estate Investment Trust) industry to gauge the percentage of FAD that a company distributes to shareholders as dividends. The FAD payout ratio is calculated by dividing the company’s accrued dividends payable to common stockholders by its FAD for the period indicated. NET OPERATING INCOME Net operating income (“NOI”) is a non-U.S. GAAP supplemental financial measure used to evaluate the operating performance of real estate. NHI defines NOI as total revenues, less tenant reimbursements and property operating expenses. The Company believes NOI provides investors relevant and useful information as it measures the operating performance of properties at the property level on an unleveraged basis. NHI uses NOI to make decisions about resource allocations and to assess the property level performance of our properties. NAREIT FUNDS FROM OPERATIONS (FFO) FFO per share, as defined by the National Association of Real Estate Investment Trusts (NAREIT) and applied by us, is calculated using the two-class method with net income allocated to common stockholders and holders of unvested restricted stock by applying the respective weighted-average shares outstanding during each period. The calculation of FFO begins with net income attributable to common stockholders (computed in accordance with GAAP) and excludes gains (or losses) from sales of real estate property, impairments of real estate, and real estate depreciation and amortization after adjusting for unconsolidated partnerships and joint ventures, if any. Diluted FFO per share assumes the exercise of stock options and other potentially dilutive securities.

Appendix: Definitions 16 NAREIT FUNDS FROM OPERATIONS (FFO) FFO per share, as defined by the National Association of Real Estate Investment Trusts (NAREIT) and applied by us, is calculated using the two-class method with net income allocated to common stockholders and holders of unvested restricted stock by applying the respective weighted-average shares outstanding during each period. The calculation of FFO begins with net income attributable to common stockholders (computed in accordance with GAAP) and excludes gains (or losses) from sales of real estate property, impairments of real estate, and real estate depreciation and amortization after adjusting for unconsolidated partnerships and joint ventures, if any. Diluted FFO per share assumes the exercise of stock options and other potentially dilutive securities. NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO) Normalized FFO excludes from FFO certain items which, due to their infrequent or unpredictable nature, may create some difficulty in comparing FFO for the current period to similar prior periods, and may include, but are not limited to, impairment of non-real estate assets, gains and losses attributable to the acquisition and disposition of non-real estate assets and liabilities, and recoveries of previous write-downs. FFO and Normalized FFO are important supplemental measures of operating performance for a REIT. Because the historical cost accounting convention used for real estate assets requires depreciation (except on land), such accounting presentation implies that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen and fallen with market conditions, presentations of operating results for a REIT that uses historical cost accounting for depreciation could be less informative and should be supplemented with a measure such as FFO. The term FFO was designed by the REIT industry to address this issue. NORMALIZED FUNDS AVAILABLE FOR DISTRIBUTION (FAD) Normalized FAD is an important supplemental performance measure for a REIT. GAAP requires a lessor to recognize contractual lease payments into income on a straight-line basis over the expected term of the lease. This straight-line adjustment has the effect of reporting lease income that is significantly more or less than the contractual cash flows received pursuant to the terms of the lease agreement. GAAP also requires the original issue discount of our senior unsecured notes and debt issuance costs to be amortized as non-cash adjustments to earnings. We also adjust Normalized FAD for the net change in our allowance for expected credit losses, non-cash stock-based compensation, SHOP recurring capital expenditures as well as certain noncash items related to our equity method investments such as straight-line lease expense and amortization of purchase accounting adjustments. Normalized FAD is an important supplemental measure of liquidity for a REIT as a useful indicator of the ability to distribute dividends to stockholders. OCCUPANCY Occupancy is the average percentage of all units in our SHOP segment that are occupied during the time period described. NHI defines occupancy as the average number of units occupied in any given time period divided by the total number of available units. RETURN ON INVESTED CAPITAL (ROIC) ROIC is a performance metric that intends to measure the percentage return earned on capital invested by a company. NHI calculates ROIC as TTM Normalized FAD plus contractual interest divided by the average of total assets plus accumulated deprecation less straight-line rent receivable over the TTM period. RevPOR RevPOR is the average monthly revenue generated by occupied units in the SHOP segment. NHI defines RevPOR as monthly resident fees and services revenue divided the number of monthly occupied units for the period presented.

Appendix: Definitions 17 Same-Store (SS) We define Same-Store as properties owned, consolidated and operational for the full period in both comparison periods and that are not otherwise excluded; provided, however, that we may include selected properties that otherwise meet the Same-Store criteria if they are included in substantially all of, but not a full, period for one or both of the comparison periods, and in our judgment such inclusion provides a more meaningful presentation of our segment performance. Newly acquired properties, recently developed or redeveloped properties, and properties undergoing operator transitions in our SHOP reportable business segment will be included in Same-Store after five full quarters from the date of acquisition, transition, or being placed into service. Our SHOP and NNN that have undergone operator or business model transitions will be included in Same-Store once operating under consistent operating structures for the full period in both periods presented. Properties are excluded from Same-Store if they are: (i) sold, classified as held for sale or properties whose operations were classified as discontinued operations in accordance with GAAP; (ii) impacted by significant disruptive events such as flood or fire; (iii) those properties that are currently undergoing a significant disruptive redevelopment; or (iv) those properties that are scheduled to undergo operator or business model transitions, or have transitioned operators or business models after the start of the prior comparison period.

Reconciliations: FFO, Normalized FFO, Normalized FAD 18 (unaudited, $ in thousands, except share and per share amounts) Q3 2025 Q3 2024 Q2 2025 Net income attributable to common stockholders $ 32,812 $ 28,511 $ 36,938 Elimination of certain non-cash items in net income: Real estate depreciation 19,662 17,494 19,477 Real estate depreciation related to noncontrolling interests (400) (412) (414) Gains on sales of real estate, net (113) (102) (110) NAREIT FFO attributable to common stockholders 51,961 45,491 55,891 Non-cash write-offs of straight-line rent receivable 12,141 - - Non-cash rental income related to operations transfer on early lease termination (1,375) - - Proxy contest and related expenses - - 1,308 Normalized FFO attributable to common stockholders 62,727 45,491 57,199 Non-cash lease revenue adjustments, net (616) (568) (459) Non-real estate depreciation, net 487 237 377 Amortization of debt issuance costs and discounts, net 658 873 940 Adjustments related to equity method investments, net (273) (453) (1,907) Recurring capital expenditures, net (668) (603) (494) Equity method investment non-refundable entrance fees 929 302 623 Note receivable credit loss expense (benefit) (1,979) 3,434 (1,393) Non-cash stock-based compensation 983 670 1,071 Normalized FAD attributable to common stockholders $ 62,248 $ 49,383 $ 55,957 BASIC Weighted average common shares outstanding 47,433,336 43,476,067 46,691,953 NAREIT FFO attributable to common stockholders per share $ 1.10 $ 1.05 $ 1.20 Normalized FFO attributable to common stockholders per share $ 1.32 $ 1.05 $ 1.23 DILUTED Weighted average common shares outstanding 47,623,623 43,987,072 46,822,465 NAREIT FFO attributable to common stockholders per share $ 1.09 $ 1.03 $ 1.19 Normalized FFO attributable to common stockholders per share $ 1.32 $ 1.03 $ 1.22 Dividends excluding dividends on unvested restricted shares $ 43,777 $ 39,231 $ 42,677 Normalized FAD payout ratio 70.3% 79.4% 76.3%

Reconciliations: Net Operating Income & Adjusted NOI 19 Three Months Ended September 30, (unaudited, dollars in thousands) 2025 2024 Net Income $ 32,478 $ 28,242 Interest 13,766 14,939 Gains on sales of real estate (113) (102) (Gain) loss from equity method investment (73) - Franchise, excise and other taxes 244 83 Legal 134 240 Loan and realty gains (losses) (1,979) 3,434 General and administrative 6,311 4,810 Depreciation 20,216 17,768 Consolidated NOI $ 70,984 $ 69,414 Straight-line revenue (1,199) (1,161) Amortization of lease incentives 725 723 Amortization of commitment fees and discounts (327) (196) Non-cash write-off of straight-line rent receivable 12,141 - Non-cash rental income related to operations transfer (1,375) - Non-segment/Corporate (38) (112) Adjusted NOI $ 80,911 $ 68,668

Reconciliations: SHOP NOI & Same-Store SHOP NOI 20 Total SHOP 2023 Q3 2024 Q4 2024 2024 Q1 2025 Q2 2025 Q3 2025($ in thousands) Total revenues $ 48,809 $ 13,771 $ 14,004 $ 54,421 $ 13,939 $ 14,217 $ 21,177 Labor (16,165) (4,304) (4,435) (17,166) (4,299) (4,324) (7,168) Dietary (3,763) (1,118) (1,090) (4,287) (1,045) (1,104) (1,483) Utilities (3,537) (1,071) (970) (3,887) (1,097) (940) (1,567) Taxes and insurance (5,889) (1,611) (1,569) (6,412) (1,538) (1,413) (2,217) Other senior housing operating expenses (10,233) (2,640) (2,692) (10,499) (2,874) (2,615) (3,818) NOI 9,222 3,027 3,248 12,170 3,086 3,821 4,924 Depreciation (9,158) (2,591) (2,639) (10,157) (2,758) (2,811) (3,733) Net income (loss) $ 64 $ 436 $ 609 $ 2,013 $ 328 $ 1,010 $ 1,191 Total revenues $ 48,809 $ 13,771 $ 14,004 $ 54,421 $ 13,939 $ 14,217 $ 21,177 Units 1,734 1,732 1,732 1,732 1,732 1,732 2,670 Occupancy 78.2% 88.6% 89.4% 87.6% 89.2% 89.1% 87.5% Average occupied units 1,356 1,535 1,549 1,517 1,544 1,543 2,337 RevPOR $ 2,999 $ 2,989 $ 3,014 $ 2,990 $ 3,008 $ 3,071 $ 3,020 Same-Store SHOP 2023 Q3 2024 Q4 2024 2024 Q1 2025 Q2 2025 Q3 2025($ in thousands) Total revenues $ 48,809 $ 13,771 $ 14,004 $ 54,421 $ 13,939 $ 14,217 $ 14,057 Labor (16,165) (4,304) (4,435) (17,166) (4,299) (4,324) (4,398) Dietary (3,763) (1,118) (1,090) (4,287) (1,045) (1,104) (1,058) Utilities (3,537) (1,071) (970) (3,887) (1,097) (940) (1,085) Taxes and insurance (5,889) (1,611) (1,569) (6,412) (1,538) (1,413) (1,721) Other senior housing operating expenses (10,233) (2,640) (2,692) (10,499) (2,874) (2,615) (2,833) NOI 9,222 3,027 3,248 12,170 3,086 3,821 2,962 Depreciation (9,158) (2,591) (2,639) (10,157) (2,758) (2,811) (2,843) Net income (loss) $ 64 $ 436 $ 609 $ 2,013 $ 328 $ 1,010 $ 119 Total revenues $ 48,809 $ 13,771 $ 14,004 $ 54,421 $ 13,939 $ 14,217 $ 14,057 Units 1,734 1,732 1,732 1,732 1,732 1,732 1,732 Occupancy 78.2% 88.6% 89.4% 87.6% 89.2% 89.1% 87.9% Average occupied units 1,356 1,535 1,549 1,517 1,544 1,543 1,522 RevPOR $ 2,999 $ 2,989 $ 3,014 $ 2,990 $ 3,008 $ 3,071 $ 3,074

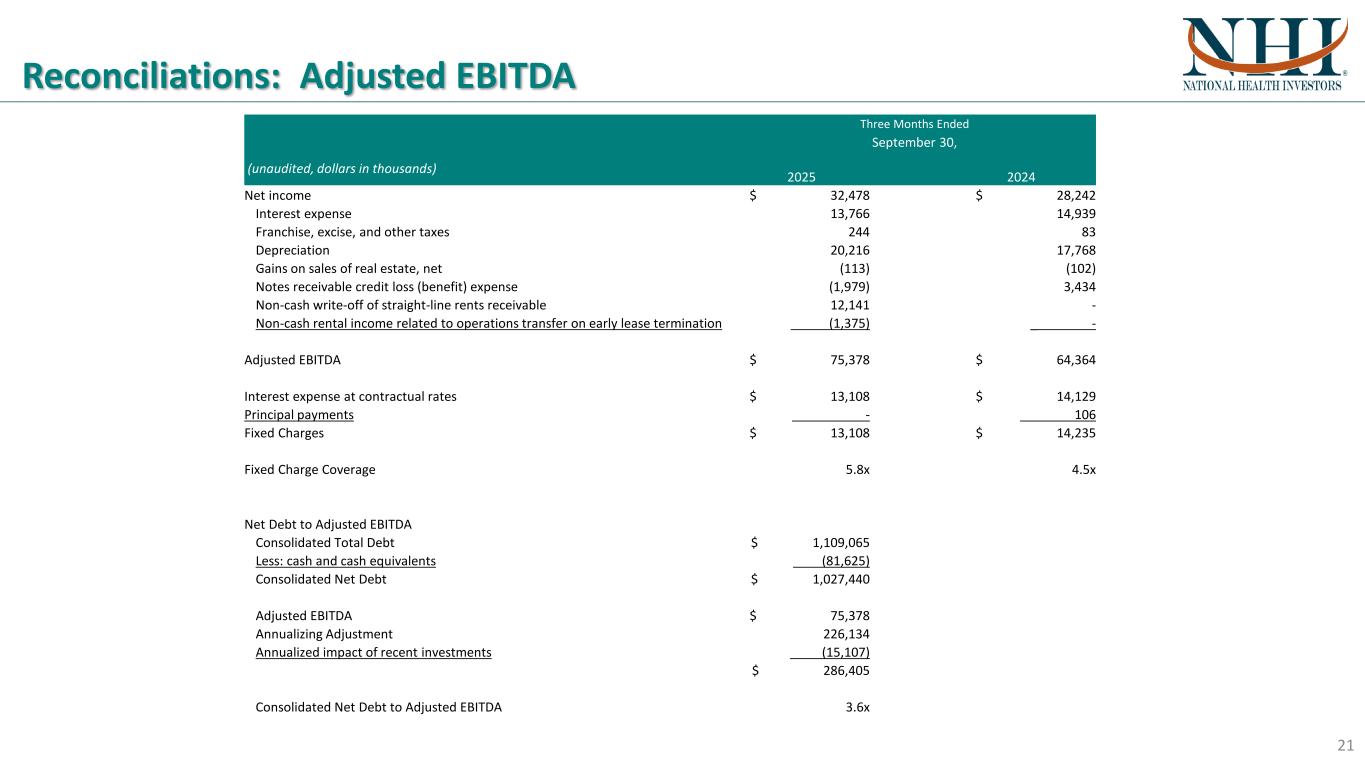

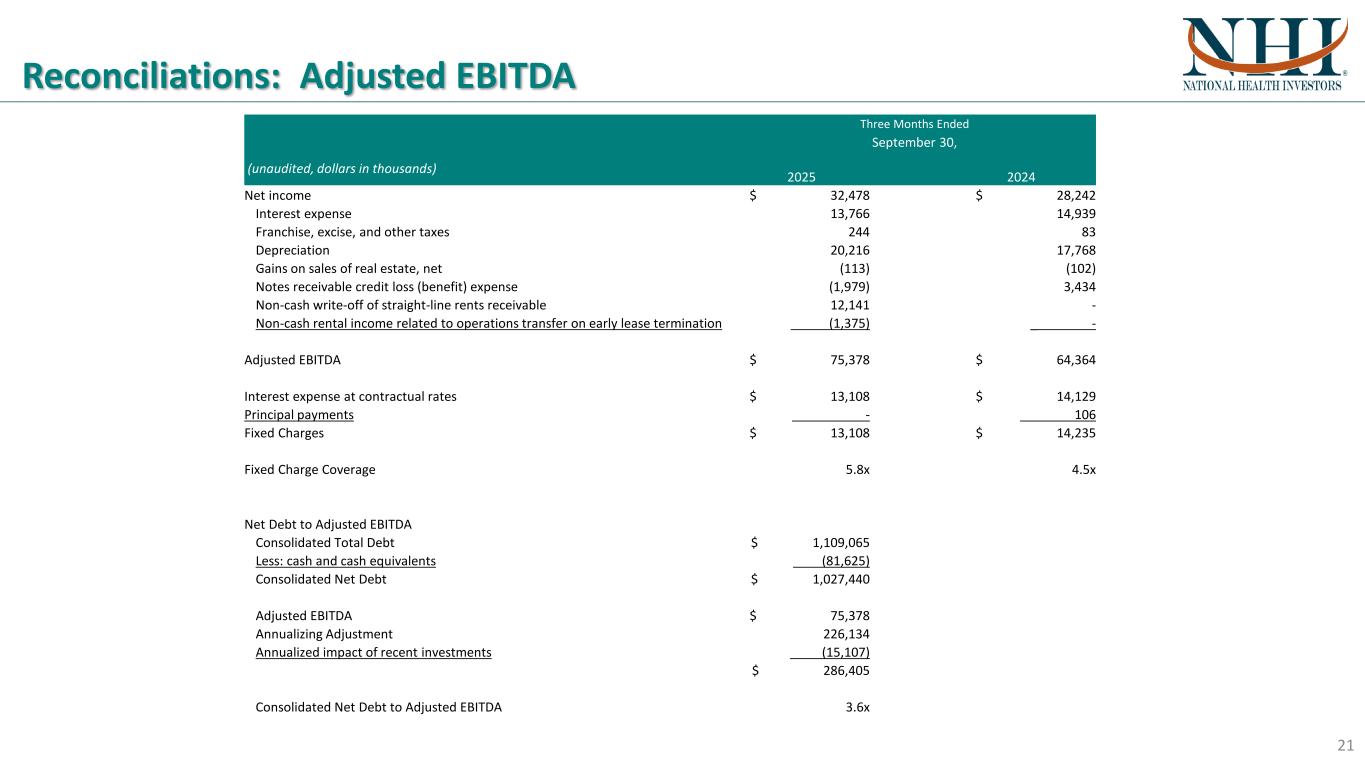

Reconciliations: Adjusted EBITDA 21 Three Months Ended September 30, (unaudited, dollars in thousands) 2025 2024 Net income $ 32,478 $ 28,242 Interest expense 13,766 14,939 Franchise, excise, and other taxes 244 83 Depreciation 20,216 17,768 Gains on sales of real estate, net (113) (102) Notes receivable credit loss (benefit) expense (1,979) 3,434 Non-cash write-off of straight-line rents receivable 12,141 - Non-cash rental income related to operations transfer on early lease termination (1,375) _ - Adjusted EBITDA $ 75,378 $ 64,364 Interest expense at contractual rates $ 13,108 $ 14,129 Principal payments - 106 Fixed Charges $ 13,108 $ 14,235 Fixed Charge Coverage 5.8x 4.5x Net Debt to Adjusted EBITDA Consolidated Total Debt $ 1,109,065 Less: cash and cash equivalents (81,625) Consolidated Net Debt $ 1,027,440 Adjusted EBITDA $ 75,378 Annualizing Adjustment 226,134 Annualized impact of recent investments (15,107) $ 286,405 Consolidated Net Debt to Adjusted EBITDA 3.6x

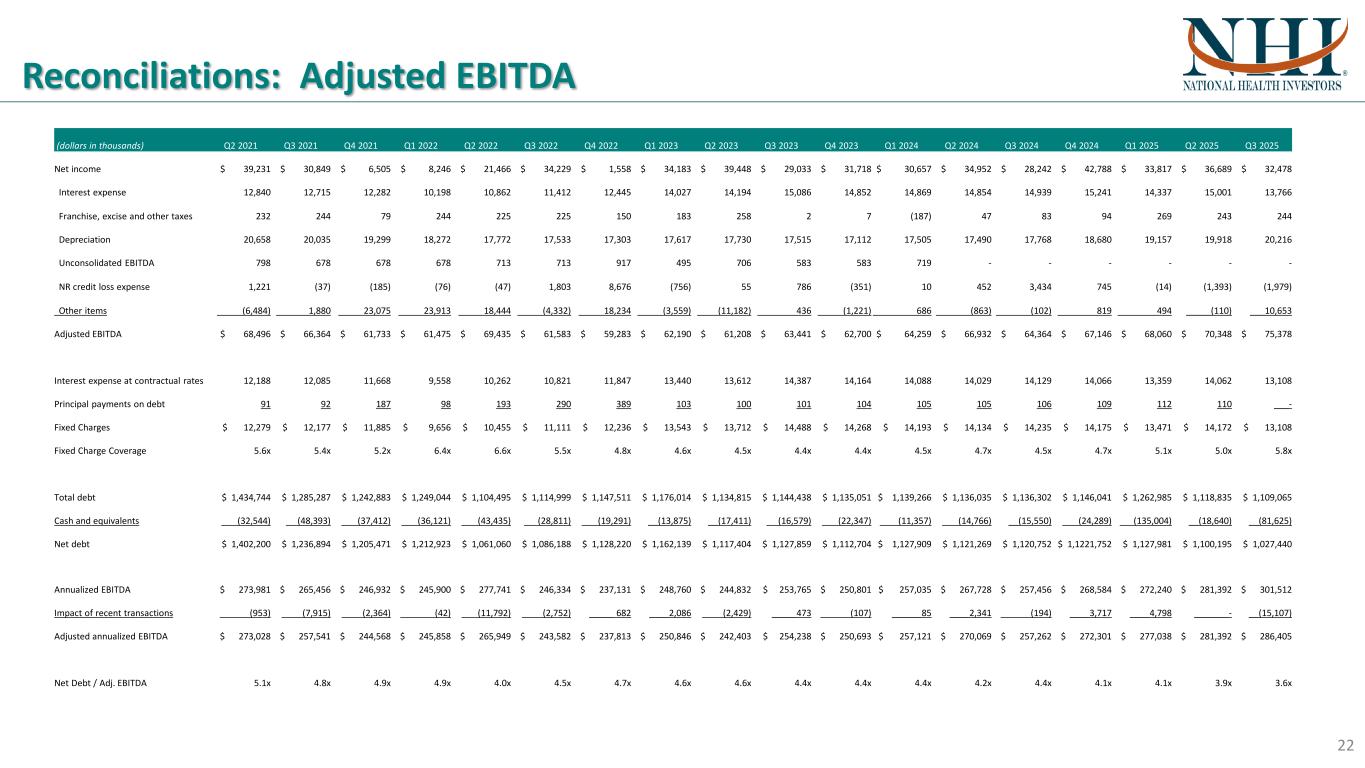

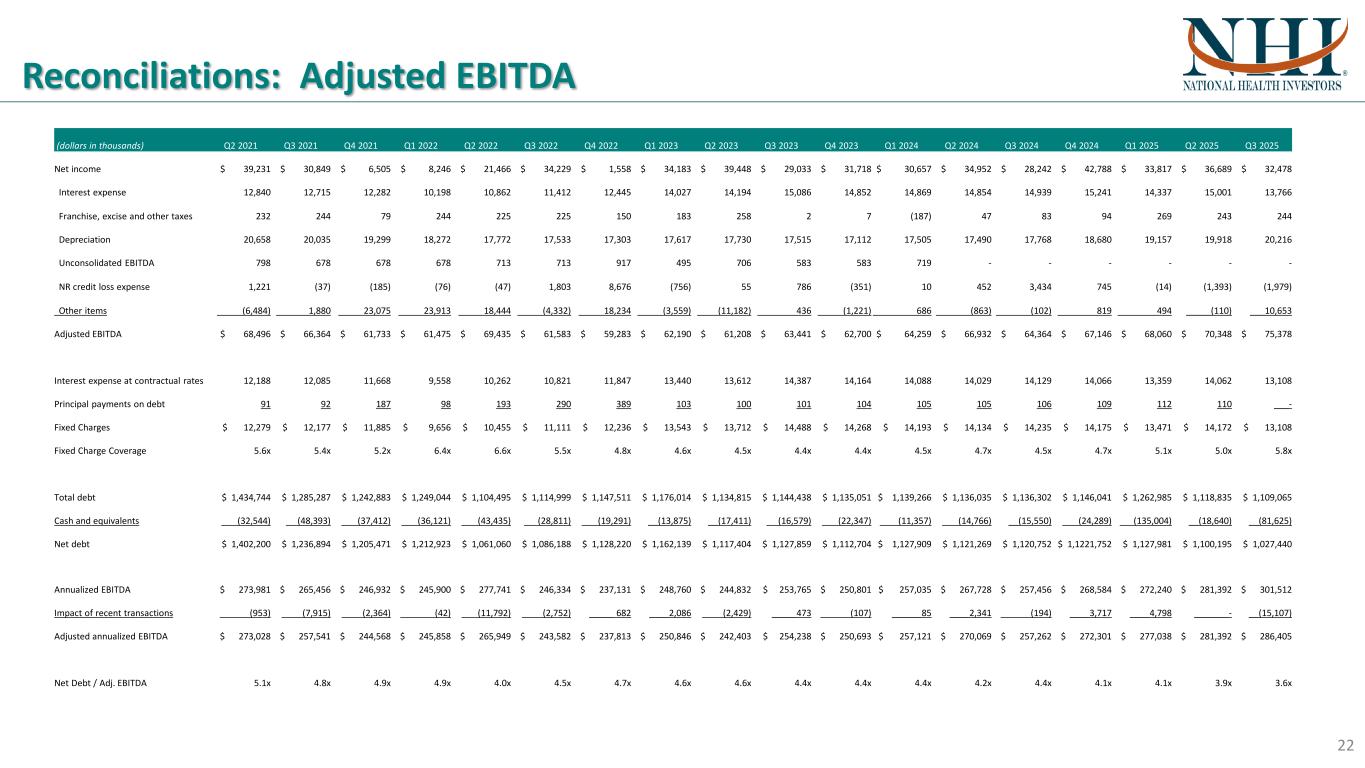

Reconciliations: Adjusted EBITDA 22 (dollars in thousands) Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Net income $ 39,231 $ 30,849 $ 6,505 $ 8,246 $ 21,466 $ 34,229 $ 1,558 $ 34,183 $ 39,448 $ 29,033 $ 31,718 $ 30,657 $ 34,952 $ 28,242 $ 42,788 $ 33,817 $ 36,689 $ 32,478 Interest expense 12,840 12,715 12,282 10,198 10,862 11,412 12,445 14,027 14,194 15,086 14,852 14,869 14,854 14,939 15,241 14,337 15,001 13,766 Franchise, excise and other taxes 232 244 79 244 225 225 150 183 258 2 7 (187) 47 83 94 269 243 244 Depreciation 20,658 20,035 19,299 18,272 17,772 17,533 17,303 17,617 17,730 17,515 17,112 17,505 17,490 17,768 18,680 19,157 19,918 20,216 Unconsolidated EBITDA 798 678 678 678 713 713 917 495 706 583 583 719 - - - - - - NR credit loss expense 1,221 (37) (185) (76) (47) 1,803 8,676 (756) 55 786 (351) 10 452 3,434 745 (14) (1,393) (1,979) Other items (6,484) 1,880 23,075 23,913 18,444 (4,332) 18,234 (3,559) (11,182) 436 (1,221) 686 (863) (102) 819 494 _____(110) ___10,653 Adjusted EBITDA $ 68,496 $ 66,364 $ 61,733 $ 61,475 $ 69,435 $ 61,583 $ 59,283 $ 62,190 $ 61,208 $ 63,441 $ 62,700 $ 64,259 $ 66,932 $ 64,364 $ 67,146 $ 68,060 $ 70,348 $ 75,378 Interest expense at contractual rates 12,188 12,085 11,668 9,558 10,262 10,821 11,847 13,440 13,612 14,387 14,164 14,088 14,029 14,129 14,066 13,359 14,062 13,108 Principal payments on debt 91 92 187 98 193 290 389 103 100 101 104 105 105 106 109 112 110 ___- Fixed Charges $ 12,279 $ 12,177 $ 11,885 $ 9,656 $ 10,455 $ 11,111 $ 12,236 $ 13,543 $ 13,712 $ 14,488 $ 14,268 $ 14,193 $ 14,134 $ 14,235 $ 14,175 $ 13,471 $ 14,172 $ 13,108 Fixed Charge Coverage 5.6x 5.4x 5.2x 6.4x 6.6x 5.5x 4.8x 4.6x 4.5x 4.4x 4.4x 4.5x 4.7x 4.5x 4.7x 5.1x 5.0x 5.8x Total debt $ 1,434,744 $ 1,285,287 $ 1,242,883 $ 1,249,044 $ 1,104,495 $ 1,114,999 $ 1,147,511 $ 1,176,014 $ 1,134,815 $ 1,144,438 $ 1,135,051 $ 1,139,266 $ 1,136,035 $ 1,136,302 $ 1,146,041 $ 1,262,985 $ 1,118,835 $ 1,109,065 Cash and equivalents (32,544) (48,393) (37,412) (36,121) (43,435) (28,811) (19,291) __(13,875) __(17,411) (16,579) (22,347) (11,357) (14,766) __(15,550) (24,289) (135,004) __(18,640) __(81,625) Net debt $ 1,402,200 $ 1,236,894 $ 1,205,471 $ 1,212,923 $ 1,061,060 $ 1,086,188 $ 1,128,220 $ 1,162,139 $ 1,117,404 $ 1,127,859 $ 1,112,704 $ 1,127,909 $ 1,121,269 $ 1,120,752 $ 1,1221,752 $ 1,127,981 $ 1,100,195 $ 1,027,440 Annualized EBITDA $ 273,981 $ 265,456 $ 246,932 $ 245,900 $ 277,741 $ 246,334 $ 237,131 $ 248,760 $ 244,832 $ 253,765 $ 250,801 $ 257,035 $ 267,728 $ 257,456 $ 268,584 $ 272,240 $ 281,392 $ 301,512 Impact of recent transactions (953) (7,915) (2,364) (42) (11,792) (2,752) _____ 682 ____2,086 (2,429) _____473 (107) ______85 ____2,341 (194) ____3,717 ____4,798 _______- __(15,107) Adjusted annualized EBITDA $ 273,028 $ 257,541 $ 244,568 $ 245,858 $ 265,949 $ 243,582 $ 237,813 $ 250,846 $ 242,403 $ 254,238 $ 250,693 $ 257,121 $ 270,069 $ 257,262 $ 272,301 $ 277,038 $ 281,392 $ 286,405 Net Debt / Adj. EBITDA 5.1x 4.8x 4.9x 4.9x 4.0x 4.5x 4.7x 4.6x 4.6x 4.4x 4.4x 4.4x 4.2x 4.4x 4.1x 4.1x 3.9x 3.6x

Reconciliations: ROIC 23 (dollars in thousands) 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 Total Assets $ 3,166,971 $ 3,139,273 $ 3,120,346 $ 3,183,273 $ 3,077,445 $ 2,912,177 $ 2,838,876 $ 2,802,503 $ 2,587,291 $ 2,508,785 $ 2,507,424 Add: Accumulated Depreciation 555,762 576,605 597,638 618,299 622,943 593,215 576,668 582,175 593,036 599,423 611,688 Less: Straight-line Receivable (89,090) (92,418) (95,703) (98,354) (97,723) (99,895) (96,198) (94,739) (79,697) (81,959) (76,895) Invested Capital $ 3,633,643 $ 3,623,460 $ 3,622,281 $ 3,703,218 $ 3,602,665 $ 3,405,497 $ 3,319,346 $ 3,289,939 $ 3,100,630 $ 3,026,249 $ 3,042,217 Normalized FAD $ 60,925 $ 60,270 $ 59,003 $ 59,551 $ 52,839 $ 51,173 $ 45,911 $ 52,669 $ 56,279 $ 47,378 $ 44,712 Add: Contractual Interest 12,832 11,907 11,537 12,230 12,188 12,085 11,668 9,558 10,262 10,821 11,847 FAD before contractual interest $ 73,757 $ 72,177 $ 70,540 $ 71,781 $ 65,027 $ 63,258 $ 57,579 $ 62,227 $ 66,541 $ 58,199 $ 56,559 TTM Invested Capital $ 3,511,852 $ 3,555,284 $ 3,593,428 $ 3,639,943 $ 3,637,053 $ 3,591,424 $ 3,530,601 $ 3,464,133 $ 3,343,616 $ 3,228,332 $ 3,155,676 TTM Normalized FAD plus contractual interest $ 290,548 $ 290,094 $ 289,023 $ 288,256 $ 279,525 $ 270,606 $ 257,645 $ 248,091 $ 249,605 $ 244,546 $ 243,526 Return on Invested Capital 8.27% 8.16% 8.04% 7.92% 7.69% 7.53% 7.30% 7.16% 7.47% 7.58% 7.72% (dollars in thousands) 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Total Assets $ 2,533,230 $ 2,498,495 $ 2,499,090 $ 2,488,480 $ 2,478,125 $ 2,476,912 $ 2,460,090 $ 2,614,371 $ 2,782,885 $ 2,695,959 $ 2,690,064 Add: Accumulated Depreciation 625,743 638,631 656,155 673,276 690,790 705,829 723,606 742,295 761,462 781,390 801,614 Less: Straight-line Receivable (79,103) (82,295) (83,549) (84,713) (84,257) (85,321) (86,334) (87,150) (88,311) (89,097) (77,906) Invested Capital $ 3,079,870 $ 3,054,831 $ 3,071,696 $ 3,077,043 $ 3,084,659 $ 3,097,420 $ 3,097,362 $ 3,269,516 $ 3,456,036 $ 3,388,251 $ 3,413,772 Normalized FAD $ 47,739 $ 44,586 $ 48,171 $ 47,347 $ 50,975 $ 51,780 $ 49,383 $ 52,071 $ 56,001 $ 55,957 $ 62,248 Add: Contractual Interest 13,440 13,612 14,387 14,164 14,088 14,028 14,129 14,066 13,359 14,062 13,108 FAD before contractual interest $ 61,179 $ 58,198 $ 62,558 $ 61,511 $ 65,063 $ 65,808 $ 63,512 $ 66,137 $ 69,360 $ 70,019 $ 75,356 TTM Invested Capital $ 3,107,781 $ 3,060,759 $ 3,054,973 $ 3,065,131 $ 3,073,620 $ 3,077,130 $ 3,085,636 $ 3,125,200 $ 3,200,999 $ 3,261,717 $ 3,324,987 TTM Normalized FAD plus contractual interest $ 242,479 $ 234,136 $ 238,495 $ 243,447 $ 247,329 $ 254,939 $ 255,893 $ 260,518 $ 264,815 $ 269,028 $ 280,872 Return on Invested Capital 7.80% 7.65% 7.81% 7.94% 8.05% 8.28% 8.29% 8.34% 8.27% 8.25% 8.45%

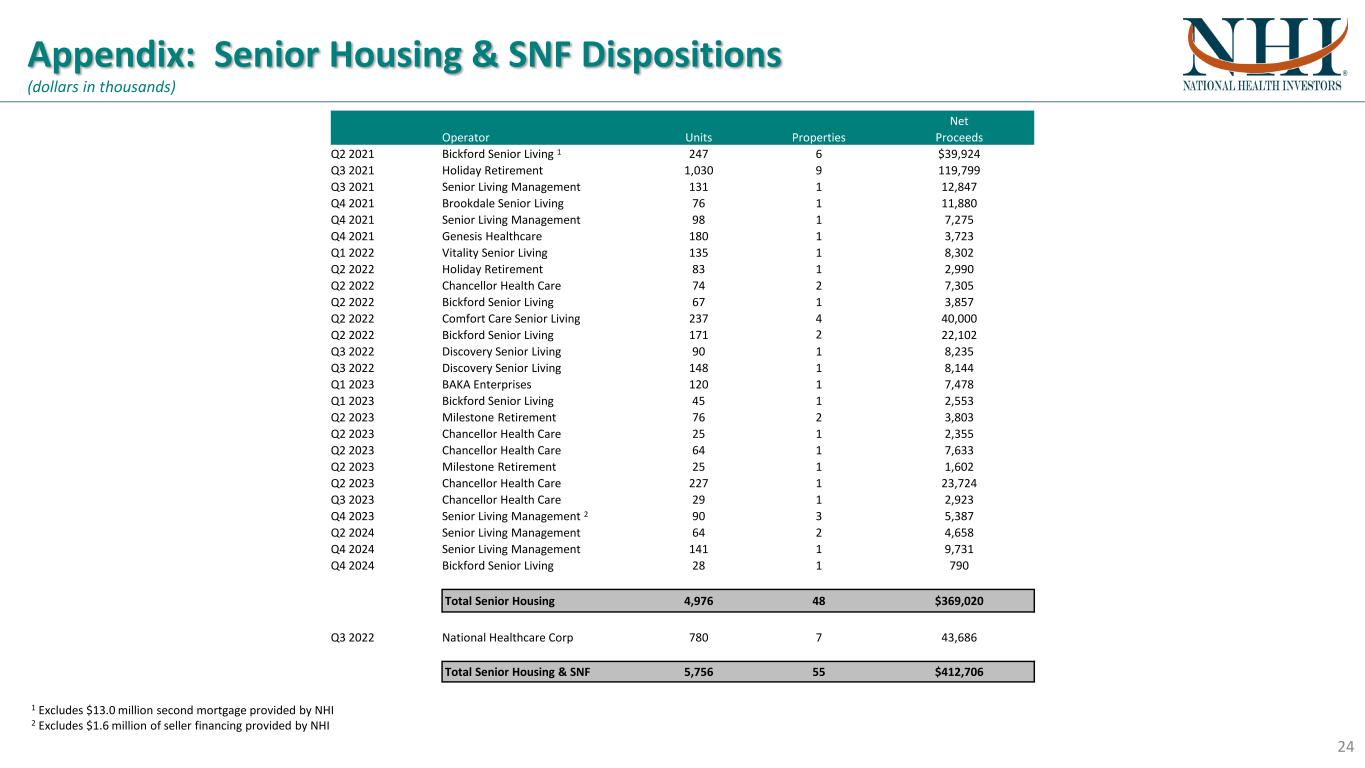

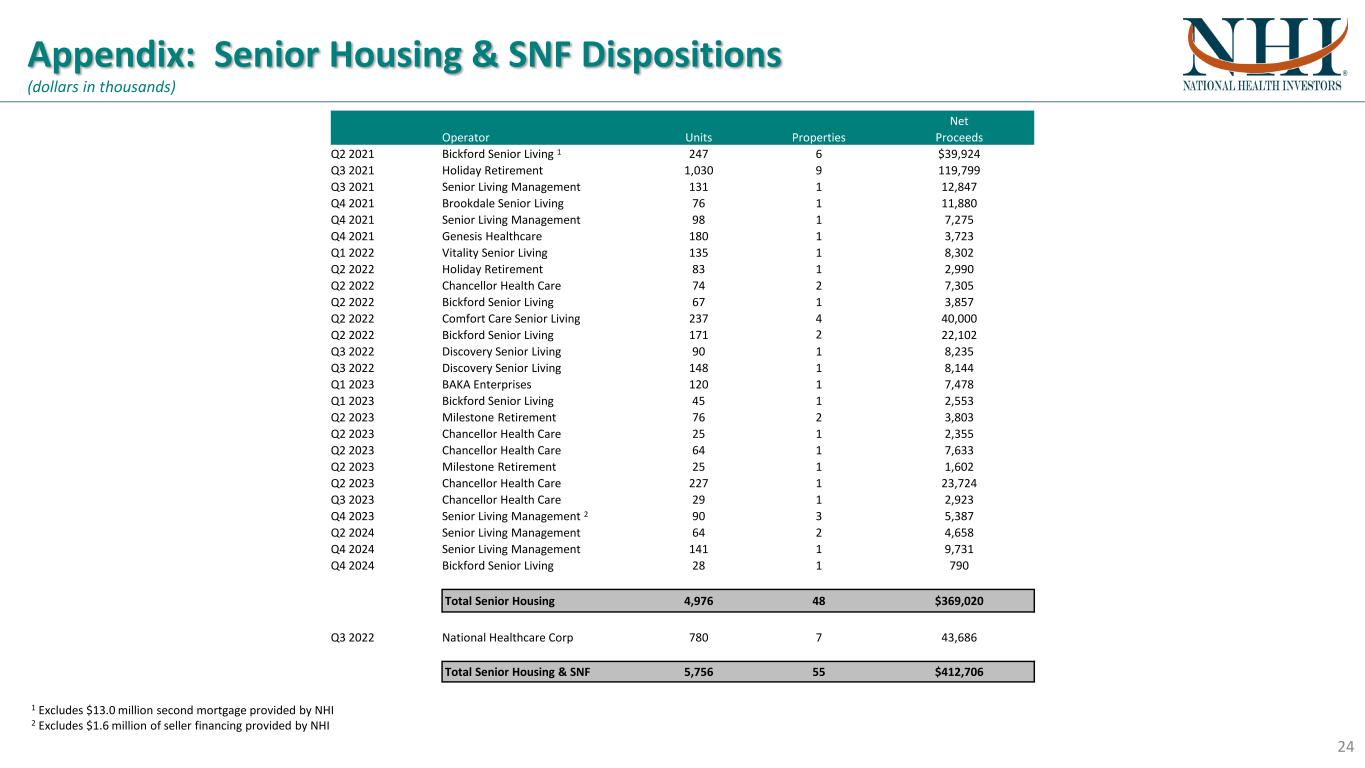

Appendix: Senior Housing & SNF Dispositions 24 1 Excludes $13.0 million second mortgage provided by NHI 2 Excludes $1.6 million of seller financing provided by NHI (dollars in thousands) Net Operator Units Properties Proceeds Q2 2021 Bickford Senior Living 1 247 6 $39,924 Q3 2021 Holiday Retirement 1,030 9 119,799 Q3 2021 Senior Living Management 131 1 12,847 Q4 2021 Brookdale Senior Living 76 1 11,880 Q4 2021 Senior Living Management 98 1 7,275 Q4 2021 Genesis Healthcare 180 1 3,723 Q1 2022 Vitality Senior Living 135 1 8,302 Q2 2022 Holiday Retirement 83 1 2,990 Q2 2022 Chancellor Health Care 74 2 7,305 Q2 2022 Bickford Senior Living 67 1 3,857 Q2 2022 Comfort Care Senior Living 237 4 40,000 Q2 2022 Bickford Senior Living 171 2 22,102 Q3 2022 Discovery Senior Living 90 1 8,235 Q3 2022 Discovery Senior Living 148 1 8,144 Q1 2023 BAKA Enterprises 120 1 7,478 Q1 2023 Bickford Senior Living 45 1 2,553 Q2 2023 Milestone Retirement 76 2 3,803 Q2 2023 Chancellor Health Care 25 1 2,355 Q2 2023 Chancellor Health Care 64 1 7,633 Q2 2023 Milestone Retirement 25 1 1,602 Q2 2023 Chancellor Health Care 227 1 23,724 Q3 2023 Chancellor Health Care 29 1 2,923 Q4 2023 Senior Living Management 2 90 3 5,387 Q2 2024 Senior Living Management 64 2 4,658 Q4 2024 Senior Living Management 141 1 9,731 Q4 2024 Bickford Senior Living 28 1 790 Total Senior Housing 4,976 48 $369,020 Q3 2022 National Healthcare Corp 780 7 43,686 Total Senior Housing & SNF 5,756 55 $412,706