Document

Exhibit 99.1(a)

NASD: BOKF

BOK Financial Corporation Reports Annual Earnings of $531 million or $8.02 Per Share and

Quarterly Earnings of $83 million or $1.26 Per Share in the Fourth Quarter

|

|

|

| CEO Commentary |

Stacy Kymes, president and chief executive officer, stated, "I am exceptionally proud of the BOKF team and our results this year - the second highest earnings we have ever achieved. Our focus at BOKF has always been on providing long-term shareholder value driven by our diverse business model and talented team, both of which empower us to perform well during any economic environment. This was once again proven when the industry faced stress in the first half the year and our company was well prepared. Our disciplined risk management, which extends beyond the credit risk management that has long been a strength, resulted in strong levels of capital and liquidity at a critical time. We took advantage of this position to thoughtfully grow when others were pulling back. We have made real investments in growing our core C&I loans, while also investing in people and new markets like central Texas. While the fourth quarter was exceptionally noisy with numerous non-recurring items, our core results were very strong serving as a great starting point for 2024." |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fourth Quarter 2023 Financial Highlights |

| (Unless indicated otherwise, all comparisons are to the prior quarter) |

•Net income was $82.6 million or $1.26 per diluted share for the fourth quarter of 2023 compared to $134.5 million or $2.04 per diluted share for the third quarter of 2023. The fourth quarter included a 52 cent per share reduction as a result of the FDIC special assessment.

•Net interest revenue totaled $296.7 million, a decrease of $4.2 million compared to the prior quarter. Net interest margin was 2.64 percent compared to 2.69 percent, primarily due to deposit repricing activity and liability mix-shift. For the fourth quarter of 2023, our core net interest margin excluding trading activities, a non-GAAP measure, was 3.03 percent compared to 3.14 percent in the prior quarter.

•Fees and commissions revenue was $196.8 million, largely consistent with the prior quarter. Lower brokerage and trading revenue and other revenue was offset by increased transaction card revenue.

•Operating expense increased $59.8 million to $384.1 million. Personnel expense grew $12.2 million with higher regular compensation, incentive compensation, including deferred compensation plans, and employee benefits expense. Non-personnel expense increased $47.5 million including the FDIC special assessment of $43.8 million. Increased professional fees and services, business promotion, and charitable expenses were partially offset by lower occupancy and equipment costs.

•Other gains and losses, net increased $39.0 million to $40.5 million. This quarter included a $31.0 million pre-tax gain, before related professional fees, on the sale of our insurance brokerage and consulting business, BOKF Insurance. The value of our deferred compensation investments also increased $5.9 million versus a decline of $427 thousand in the prior quarter.

•Losses on available for sale securities totaled $27.6 million in the fourth quarter. The gain on sale received from the disposition of BOKF Insurance was used to reposition a small portion of our available for sale securities portfolio.

•The effective tax rate was 26.0 percent for the fourth quarter of 2023, an increase from 19.8 percent for the prior quarter. The fourth quarter of 2023 included an acceleration of $3.1 million of tax expense as a result of exiting three low income housing tax credit investments. The third quarter of 2023 included a reduction in tax expense resulting from decreases in uncertain tax positions.

•Period-end loans grew by $181 million to $23.9 billion at December 31, 2023, mostly driven by growth in commercial loans and commercial real estate loans secured by multifamily properties. Average outstanding loan balances were $23.7 billion, a $291 million increase.

•The provision for credit losses of $6.0 million in the fourth quarter of 2023 reflects a stable economic forecast and continued loan growth. Net charge-offs were $4.1 million or 0.07 percent of average loans on an annualized basis in the fourth quarter. The resulting combined allowance for credit losses totaled $326 million or 1.36 percent of outstanding loans at December 31, 2023 compared to $325 million or 1.37 percent of outstanding loans at September 30, 2023.

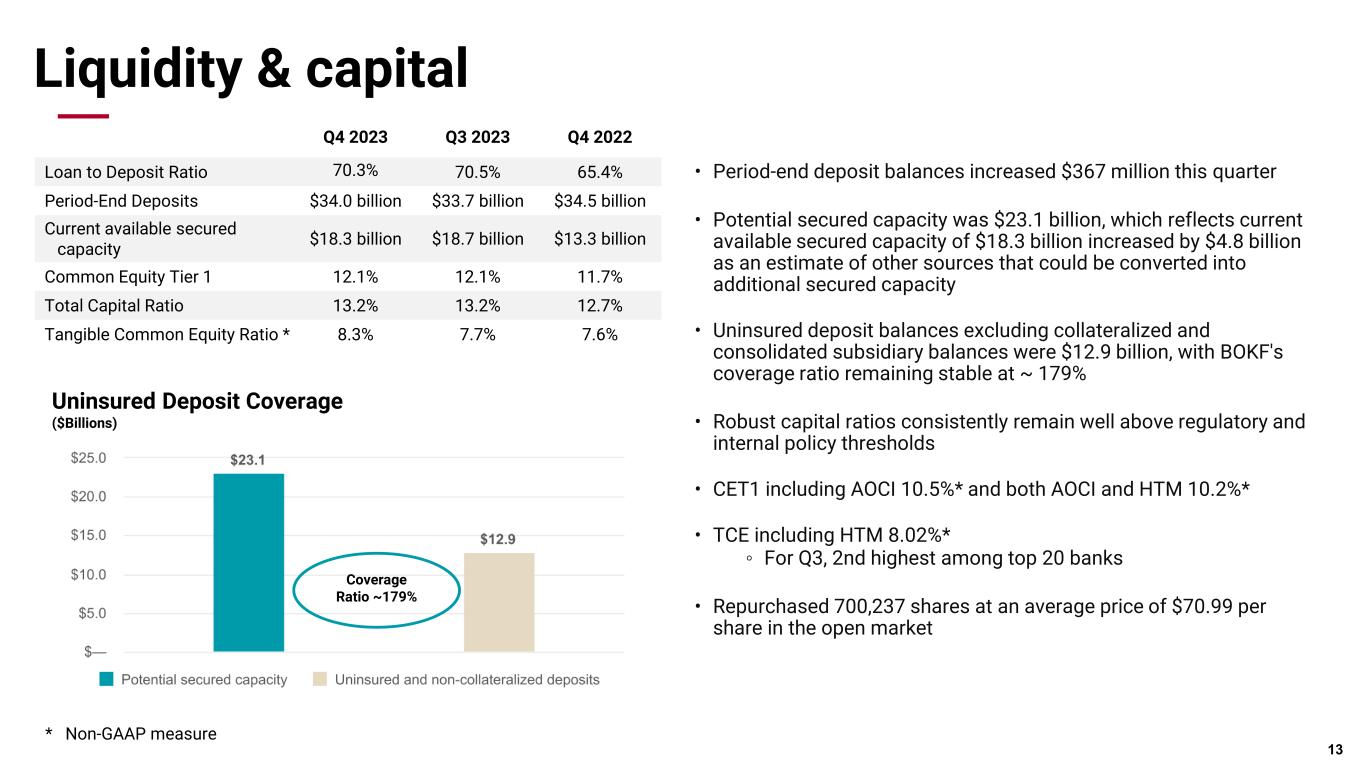

•Period-end deposits increased $367 million to $34.0 billion while average deposits increased $388 million to $33.7 billion. Average interest-bearing deposits increased $1.2 billion while average demand deposits declined by $779 million. The loan to deposit ratio was 70 percent at December 31, 2023, consistent with September 30, 2023.

•The company's tangible common equity ratio, a non-GAAP measure, was 8.29 percent at December 31, 2023 and 7.74 percent at September 30, 2023. The tangible common equity ratio is primarily based on total shareholders' equity, which includes unrealized gains and losses on available for sale securities. Adjusted for all unrealized securities portfolio gains and losses, including those in the investment portfolio, the tangible common equity ratio would be 8.02 percent.

•The company's common equity Tier 1 capital ratio was 12.06 percent at December 31, 2023. In addition, the company's Tier 1 capital ratio was 12.07 percent, total capital ratio was 13.16 percent, and leverage ratio was 9.45 percent at December 31, 2023. At September 30, 2023, the company's common equity Tier 1 capital ratio was 12.06 percent, Tier 1 capital ratio was 12.07 percent, total capital ratio was 13.16 percent, and leverage ratio was 9.52 percent.

•The company repurchased 700,237 shares of common stock at an average price paid of $70.99 a share in the fourth quarter of 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fourth Quarter 2023 Segment Highlights |

•Commercial Banking contributed $159.0 million to net income in the fourth quarter of 2023, an increase of $1.1 million over the prior quarter. Combined net interest revenue and fee revenue was consistent with the third quarter of 2023. A decrease in net interest revenue resulting from a shift in deposit balances from demand to interest-bearing transaction accounts was largely offset by a $2.5 million increase in transaction card revenue driven by fourth quarter activity. Net loans charged-off decreased $1.9 million to $3.0 million in the fourth quarter of 2023. Personnel expense increased $3.0 million led by higher cash-based incentive compensation and regular compensation. Non-personnel expense decreased $4.3 million driven by the retirement of certain ATMs in the prior quarter. Average loans increased $283 million or 1 percent to $19.9 billion. Average deposits increased $374 million or 2 percent to $15.5 billion.

•Consumer Banking contributed $53.7 million to net income in the fourth quarter of 2023, a decrease of $4.3 million compared to the prior quarter. The net cost of the changes in the fair value of mortgage servicing rights and related economic hedges was $5.2 million compared to $1.3 million for the third quarter of 2023. Combined net interest revenue and fee revenue increased $1.1 million, largely due to an increase in the funds credit on deposit balances. Net loans charged-off were $1.4 million in the fourth quarter of 2023 compared to recoveries of $73 thousand in the third quarter of 2023. Operating expense totaled $55.1 million, consistent with the prior quarter. Average loans increased $65 million or 4 percent to $1.9 billion. Average deposits were mostly unchanged from the previous quarter.

•Wealth Management contributed $62.7 million to net income in the fourth quarter of 2023, an increase of $19.7 million compared to the third quarter of 2023. This quarter included a pre-tax gain of $31.0 million, before related professional fees, on the sale of our insurance brokerage and consulting business, BOKF Insurance. Combined net interest and fee revenue increased $1.5 million. Total revenue from institutional trading activities increased $4.1 million due to favorable market opportunities, largely related to our municipal bond trading activity. Investment banking revenue decreased $3.3 million following a record quarter from our Public and Corporate Finance group. Personnel expense increased $2.4 million due to increased cash-based incentive compensation, driven by growth in trading activities and transaction related employee costs on the BOKF Insurance sale. Non-personnel expense increased $4.5 million with $2.5 million in professional fees directly related to the sale of BOKF Insurance and the remainder primarily resulting from settlement of certain disputed matters. Average loans decreased $65 million or 3 percent to $2.2 billion. Average deposits increased $199 million or 3 percent to $8.1 billion. Assets under management or administration were $104.7 billion, an increase of $5.7 billion.

|

|

|

Annual 2023 Financial Highlights |

| (Unless indicated otherwise, all comparisons are to the prior year) |

•Net income was $530.7 million or $8.02 per diluted share for the year ended December 31, 2023 compared to $520.3 million or $7.68 per diluted share for the year ended December 31, 2022.

•Net interest revenue totaled $1.3 billion, an increase of $60.8 million compared to the prior year. Net interest margin was 2.93 percent compared to 2.98 percent, primarily due to competitive deposit pricing and liability mix-shift.

•Fees and commissions revenue increased $123.9 million to $781.1 million. Brokerage and trading revenue increased $99.6 million. Trading revenue in the prior year was negatively affected by disruption in the fixed income markets in the first quarter of 2022. Fiduciary and asset management revenue grew $11.0 million along with increased Cavanal Hill fund fees, mutual fund fees, and trust business line fees.

•Operating expense increased $168.4 million to $1.3 billion. Personnel expense grew $95.7 million, reflecting a combination of annual merit increases and salary adjustments, higher sales activity, and business expansion. Non-personnel expense increased $72.7 million including the FDIC special assessment of $43.8 million. Increased data processing and communications, business promotion, ongoing FDIC assessment costs, and occupancy and equipment expenses were partially offset by lower mortgage banking costs.

•Other gains and losses, net increased $56.7 million to $56.8 million. The fourth quarter of 2023 included a pre-tax $31.0 million gain, before related professional fees, on the sale of our insurance brokerage and consulting business, BOKF Insurance. We also recognized a $17.3 million increase in the value of deferred compensation investments, which are held to offset the cost of various employee benefit programs.

•Losses on available for sale securities totaled $30.6 million for the year ended December 31, 2023. We strategically repositioned a small portion of our portfolio throughout the year, mostly in the fourth quarter.

•Period-end loans grew by $1.3 billion to $23.9 billion at December 31, 2023, mostly driven by growth in commercial loans and commercial real estate loans secured by multifamily properties. Average outstanding loan balances were $23.1 billion, a $1.8 billion or 9 percent increase.

•The provision for credit losses was $46.0 million in 2023, primarily due to loan growth and changes in our economic forecast during the year, including a more challenging commercial real estate environment. Net charge-offs were $18.1 million or 0.08 percent of average loans on an annualized basis in 2023. The resulting combined allowance for credit losses totaled $326 million or 1.36 percent of outstanding loans at December 31, 2023 compared to $297 million or 1.31 percent of outstanding loans at December 31, 2022.

•Period-end deposits decreased $461 million to $34.0 billion while average deposits decreased $4.6 billion to $33.2 billion. Average interest-bearing deposits decreased $487 million while average demand deposits decreased by $4.2 billion. The loan to deposit ratio was 70 percent at December 31, 2023 and was 65 percent at December 31, 2022.

|

|

|

|

2023 Annual Segment Highlights |

•Commercial Banking contributed $664.5 million to net income in 2023, an increase of $202.9 million compared to 2022. Combined net interest revenue and fee revenue increased $288.4 million, primarily due to an increase in the spread on deposits combined with loan growth. Net loans charged-off decreased $3.8 million to $14.0 million in 2023. Personnel expense increased $16.1 million led by higher regular compensation and cash-based incentive compensation. Non-personnel expense increased $7.4 million, driven primarily by ongoing technology projects, retirement of certain ATMs, and increased insurance assessment costs. Corporate expense allocations increased $7.7 million. Average loans increased $1.8 billion or 10 percent to $19.4 billion. Average deposits decreased $3.0 billion or 16 percent to $15.3 billion.

•Consumer Banking contributed $222.7 million to net income in 2023, an increase of $216.8 million compared to the prior year. Combined net interest revenue and fee revenue increased $293.3 million, largely due to an increase in the spread on deposits. Mortgage banking revenue increased $6.7 million, primarily due to growth in mortgage servicing revenue driven by recent purchases of mortgage servicing rights, partially offset by a decline in mortgage production volumes due to a combination of factors including rising mortgage interest rates, industry-wide housing inventory constraints, and overall market conditions. Deposit service charges and fees decreased $3.7 million as non-sufficient funds fees were eliminated and consumer overdraft fees were reduced in the fourth quarter of 2022. Operating expense increased $2.9 million led by higher regular compensation costs. Average loans increased $112 million or 7 percent to $1.8 billion. Average deposits decreased $749 million or 9 percent to $8.0 billion.

•Wealth Management contributed $215.5 million to net income in 2023, an increase of $109.5 million compared to 2022. The current year included a pre-tax gain of $31.0 million, before related professional fees, on the sale of our insurance brokerage and consulting business, BOKF Insurance. Combined net interest and fee revenue increased $155.9 million, primarily driven by an increase in the spread on deposits combined with growth in brokerage and trading revenues and customer hedging revenues. The prior year was negatively affected by the disruption in the fixed income markets. Fiduciary and asset management revenue increased $10.8 million led by higher Cavanal Hill fund fees, mutual fund fees, and trust business line fees. Personnel expense increased $27.9 million due to a combination of higher trading volumes and business expansion. Non-personnel expense increased $12.2 million due to increased professional fees and services from the sale of BOKF Insurance combined with higher data processing and communications expense from ongoing technology projects. Average loans increased $35.4 million or 2 percent to $2.2 billion. Average deposits decreased $752 million or 9 percent to $7.7 billion. Assets under management or administration increased $5.0 billion or 5 percent compared to the prior year.

Net interest revenue was $296.7 million for the fourth quarter of 2023 compared to $300.9 million for the prior quarter. Net interest margin was 2.64 percent compared to 2.69 percent, primarily driven by deposit price competition and liability mix-shift. For the fourth quarter of 2023, our core net interest margin excluding trading activities, a non-GAAP measure, was 3.03 percent compared to 3.14 percent in the prior quarter.

Average earning assets increased $315 million. Average loan balances increased $291 million, largely due to growth in commercial and commercial real estate loans. Average available for sale securities increased $138 million while average investment securities decreased $67 million. Average interest-bearing deposits increased $1.2 billion. Funds purchased and repurchase agreements declined $222 million while average other borrowings increased $153 million.

The yield on average earning assets was 5.64 percent, up 15 basis points. The loan portfolio yield increased 11 basis points to 7.36 percent while the yield on the available for sale securities portfolio increased 16 basis points to 3.27 percent. The yield on trading securities grew 29 basis points to 5.05 percent.

Funding costs were 3.98 percent, up 17 basis points. The cost of interest-bearing deposits increased 26 basis points to 3.43 percent. The cost of other borrowings was up 7 basis points to 5.55 percent while the cost of funds purchased and repurchase agreements decreased 2 basis points to 4.79 percent. The benefit to net interest margin from assets funded by non-interest liabilities was 98 basis points, a decrease of 3 basis points.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees and Commissions Revenue |

Fees and commissions revenue totaled $196.8 million for the fourth quarter of 2023, largely unchanged compared to the prior quarter.

Brokerage and trading revenue decreased $1.4 million to $60.9 million. Investment banking revenue decreased $2.4 million to $11.5 million following a record quarter from our Public and Corporate Finance group, which underwrites municipal bonds. Trading revenue grew $1.1 million to $35.5 million, largely related to our municipal bond trading activity. Insurance brokerage fees decreased $890 thousand to $1.8 million in conjunction with the sale of this business in the fourth quarter.

Transaction card revenue increased $2.5 million to $28.8 million as a result of fourth quarter activity. All other fee businesses performed consistently with the prior quarter.

Total operating expense was $384.1 million for the fourth quarter of 2023, an increase of $59.8 million compared to the third quarter of 2023, primarily driven by the $43.8 million FDIC special assessment.

Personnel expense was $203.0 million, including $5.4 million of deferred compensation expense. Excluding deferred compensation costs, personnel expense increased $6.9 million over the prior quarter. Regular compensation increased $3.2 million, primarily due to compensation related to business expansion and transaction related employee costs on the BOKF Insurance sale. Higher sales activity led to a $4.0 million increase in cash based incentive compensation. Employee benefits expense increased $1.1 million, primarily due to seasonal employee healthcare costs.

Excluding the FDIC special assessment, non-personnel expense was $137.3 million, an increase of $3.8 million. Professional fees and services expense increased $3.1 million with $2.5 million related to the sale of BOKF Insurance. Business promotion expense grew $1.7 million. We also made a $1.5 million charitable donation to the BOKF Foundation as we continue to support the communities we serve. Occupancy and equipment costs decreased $2.2 million driven by the retirement of certain ATMs in the prior quarter.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, Deposits and Capital |

Loans

Outstanding loans were $23.9 billion at December 31, 2023, growing $181 million over September 30, 2023, largely due to growth in commercial and commercial real estate loans. Unfunded loan commitments increased $388 million compared to the third quarter of 2023.

Outstanding commercial loan balances, which includes healthcare, services, energy and general business loans, increased $84 million over the prior quarter.

General business loans increased $67 million to $3.6 billion or 15 percent of total loans. General business loans include $2.2 billion of wholesale/retail loans and $1.4 billion of loans from other commercial industries.

Healthcare sector loan balances increased $60 million, totaling $4.1 billion or 17 percent of total loans. Our healthcare sector loans primarily consist of $3.4 billion of senior housing and care facilities, including independent living, assisted living and skilled nursing. Generally, we loan to borrowers with a portfolio of multiple facilities, which serves to help diversify risks specific to a single facility.

Services sector loan balances increased $9.9 million to $3.6 billion or 15 percent of total loans. Services loans consist of a large number of loans to a variety of businesses, including Native American tribal and state and local municipal government entities, Native American tribal casino operations, foundations and not-for-profit organizations, educational services and specialty trade contractors.

Energy loan balances decreased $54 million to $3.4 billion or 14 percent of total loans. The majority of this portfolio is first lien, senior secured, reserve-based lending to oil and gas producers, which we believe is the lowest risk form of energy lending. Approximately 69 percent of committed production loans are secured by properties primarily producing oil. The remaining 31 percent is secured by properties primarily producing natural gas. Unfunded energy loan commitments were $4.5 billion at December 31, 2023, a $436 million increase compared September 30, 2023.

Commercial real estate loan balances grew by $96 million and represent 22 percent of total loans. Loans secured by multifamily properties increased $138 million to $1.9 billion. Loans secured by industrial facilities increased $43 million to $1.5 billion. This growth was partially offset by a $72 million decrease in loans secured by office facilities and a $15 million decrease in loans secured by retail properties. Unfunded commercial real estate loan commitments were $1.8 billion at December 31, 2023, a decrease of $147 million compared to September 30, 2023. We take a disciplined approach to managing our concentration of commercial real estate loan commitments as a percentage of Tier 1 Capital.

Loans to individuals were largely unchanged compared to September 30, 2023 and represent 16 percent of total loans. An increase of $58 million in residential mortgage loans was offset by a decrease in personal loans.

Liquidity and Capital

Our funding sources, which primarily include deposits and borrowings from the Federal Home Loan Banks, provide adequate liquidity to meet our needs. The loan to deposit ratio was 70 percent at December 31, 2023, consistent with the prior quarter, providing significant on-balance sheet liquidity to meet future loan demand and contractual obligations.

Period-end deposits totaled $34.0 billion at December 31, 2023, a $367 million increase. Interest-bearing transaction account balances increased $1.1 billion while time deposits increased $85 million. Demand deposits decreased $778 million.

Average deposits were $33.7 billion at December 31, 2023, a $388 million increase. Average interest-bearing transaction account balances increased $1.0 billion and average time deposits increased $162 million. Average demand deposit account balances decreased $779 million. Average Commercial Banking deposits increased $374 million to $15.5 billion or 46 percent of total deposits. Wealth Management deposits increased $199 million to $8.1 billion or 24 percent of total deposits. Consumer Banking deposits decreased $46 million to $7.9 billion or 23 percent of total deposits.

The company's common equity Tier 1 capital ratio was 12.06 percent at December 31, 2023. In addition, the company's Tier 1 capital ratio was 12.07 percent, total capital ratio was 13.16 percent, and leverage ratio was 9.45 percent at December 31, 2023. At the beginning of 2020, we elected to delay the regulatory capital impact of the transition of the allowance for credit losses from the incurred loss methodology to CECL for two years, followed by a three-year transition period. This election added 6 basis points to the company's common equity tier 1 capital ratio at December 31, 2023. At September 30, 2023, the company's common equity Tier 1 capital ratio was 12.06 percent, Tier 1 capital ratio was 12.07 percent, total capital ratio was 13.16 percent, and leverage ratio was 9.52 percent.

The company's tangible common equity ratio, a non-GAAP measure, was 8.29 percent at December 31, 2023 and 7.74 percent at September 30, 2023. The tangible common equity ratio is primarily based on total shareholders' equity, which includes unrealized gains and losses on available for sale securities. Adjusted for all unrealized securities portfolio gains and losses, including those in the investment portfolio, the tangible common equity ratio would be 8.02 percent. The company has elected to exclude unrealized gains and losses from available for sale securities from its calculation of Tier 1 capital for regulatory capital purposes, consistent with the treatment under the previous capital rules.

The company repurchased 700,237 shares of common stock at an average price paid of $70.99 a share in the fourth quarter of 2023. We pursue share buybacks opportunistically, but within the context of maintaining our strong capital position.

Nonperforming assets totaled $148 million or 0.62 percent of outstanding loans and repossessed assets at December 31, 2023, compared to $123 million or 0.52 percent at September 30, 2023. Excluding loans guaranteed by U.S. government agencies, nonperforming assets totaled $139 million or 0.58 percent of outstanding loans and repossessed assets at December 31, 2023, compared to $113 million or 0.48 percent at September 30, 2023.

Nonaccruing loans increased $26 million compared to September 30, 2023. New nonaccruing loans identified in the fourth quarter totaled $55 million, offset by $12 million in payments received and $5.0 million of charge-offs. Nonaccruing healthcare loans increased $40 million, partially offset by a $13 million decrease in nonaccruing residential real estate mortgage loans.

Net charge-offs were $4.1 million or 0.07 percent of average loans on an annualized basis in the fourth quarter. Charge-offs for the fourth quarter were primarily composed of a single $2.5 million healthcare loan.

The provision for credit losses of $6.0 million in the fourth quarter of 2023 reflects a stable economic forecast and continued loan growth. The provision for credit losses was $7.0 million in the third quarter of 2023.

At December 31, 2023, the combined allowance for loan losses and accrual for off-balance sheet credit risk from unfunded loan commitments was $326 million or 1.36 percent of outstanding loans and 240 percent of nonaccruing loans.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities and Derivatives |

The fair value of the available for sale securities portfolio totaled $12.3 billion at December 31, 2023, a $380 million increase over September 30, 2023. At December 31, 2023, the available for sale securities portfolio consisted primarily of $6.8 billion of residential mortgage-backed securities fully backed by U.S. government agencies and $4.1 billion of commercial mortgage-backed securities fully backed by U.S. government agencies. At December 31, 2023, the available for sale securities portfolio had a net unrealized loss of $617 million compared to $1.0 billion at September 30, 2023.

We hold an inventory of trading securities in support of sales to a variety of customers. At December 31, 2023, the trading securities portfolio totaled $5.2 billion compared to $4.7 billion at September 30, 2023.

The company also maintains a portfolio of residential mortgage-backed securities issued by U.S. government agencies and interest rate derivative contracts as an economic hedge of the changes in the fair value of our mortgage servicing rights. This portfolio of fair value option securities increased $456 thousand to $20.7 million at December 31, 2023.

Derivative contracts are carried at fair value. At December 31, 2023, the net fair values of derivative contracts, before consideration of cash margin, reported as assets under our customer derivative programs totaled $593 million compared to $594 million at September 30, 2023. The aggregate net fair value of derivative contracts, before consideration of cash margin, held under these programs reported as liabilities totaled $587 million at December 31, 2023 and $582 million at September 30, 2023.

The net cost of the changes in the fair value of mortgage servicing rights and related economic hedges was $5.2 million during the fourth quarter of 2023, including a $14.4 million decrease in the fair value of mortgage servicing rights, a $9.3 million increase in the fair value of securities and derivative contracts held as an economic hedge and $101 thousand of related net interest expense.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Conference Call and Webcast |

The company will hold a conference call at 9 a.m. Central time on Wednesday, January 24, 2024 to discuss the financial results with investors. The live audio webcast and presentation slides will be available on the company’s website at www.bokf.com. The conference call can also be accessed by dialing 1-877-407-4018 or 1-201-689-8471. A conference call and webcast replay will also be available shortly after conclusion of the live call at www.bokf.com or by dialing 1-844-512-2921 or 1-412-317-6671 and referencing conference ID # 13743529.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| About BOK Financial Corporation |

BOK Financial Corporation is a $50 billion regional financial services company headquartered in Tulsa, Oklahoma with $105 billion in assets under management or administration. The company's stock is publicly traded on NASDAQ under the Global Select market listings (BOKF). BOK Financial Corporation's holdings include BOKF, NA; BOK Financial Securities, Inc., and BOK Financial Private Wealth, Inc. BOKF, NA's holdings include TransFund, and Cavanal Hill Investment Management, Inc. BOKF, NA operates banking divisions across eight states as: Bank of Albuquerque; Bank of Oklahoma; Bank of Texas; and BOK Financial in Arizona, Arkansas, Colorado, Kansas and Missouri; as well as having limited purpose offices in Nebraska, Wisconsin, Connecticut and Tennessee. Through its subsidiaries, BOK Financial Corporation provides commercial and consumer banking, brokerage trading, investment, trust services, mortgage origination and servicing, and an electronic funds transfer network. For more information, visit www.bokf.com.

The company will continue to evaluate critical assumptions and estimates, such as the appropriateness of the allowance for credit losses and asset impairment as of December 31, 2023 through the date its financial statements are filed with the Securities and Exchange Commission and will adjust amounts reported if necessary.

This news release contains forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections about BOK Financial Corporation, the financial services industry and the economy generally. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “plans,” “projects,” “will,” “intends,” variations of such words and similar expressions are intended to identify such forward-looking statements. Management judgments relating to and discussion of the provision and allowance for credit losses, allowance for uncertain tax positions, accruals for loss contingencies and valuation of mortgage servicing rights involve judgments as to expected events and are inherently forward-looking statements. Assessments that acquisitions and growth endeavors will be profitable are necessary statements of belief as to the outcome of future events based in part on information provided by others which BOK Financial has not independently verified. These various forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expected, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to changes in government, changes in commodity prices, interest rates and interest rate relationships, inflation, demand for products and services, the degree of competition by traditional and nontraditional competitors, changes in banking regulations, tax laws, prices, levies and assessments, the impact of technological advances, and trends in customer behavior as well as their ability to repay loans. BOK Financial Corporation and its affiliates undertake no obligation to update, amend or clarify forward-looking statements, whether as a result of new information, future events, or otherwise.

BALANCE SHEETS – UNAUDITED

BOK FINANCIAL CORPORATION

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2023 |

|

Sep. 30, 2023 |

|

|

| ASSETS |

|

|

|

|

|

| Cash and due from banks |

$ |

947,613 |

|

|

$ |

854,161 |

|

|

|

| Interest-bearing cash and cash equivalents |

400,652 |

|

|

520,774 |

|

|

|

| Trading securities |

5,193,505 |

|

|

4,748,101 |

|

|

|

| Investment securities, net of allowance |

2,244,153 |

|

|

2,298,418 |

|

|

|

| Available for sale securities |

12,286,681 |

|

|

11,906,647 |

|

|

|

| Fair value option securities |

20,671 |

|

|

20,215 |

|

|

|

| Restricted equity securities |

423,099 |

|

|

435,112 |

|

|

|

| Residential mortgage loans held for sale |

56,935 |

|

|

72,489 |

|

|

|

| Loans: |

|

|

|

|

|

| Commercial |

14,803,769 |

|

|

14,719,839 |

|

|

|

| Commercial real estate |

5,337,647 |

|

|

5,241,300 |

|

|

|

| Loans to individuals |

3,763,552 |

|

|

3,762,879 |

|

|

|

| Total loans |

23,904,968 |

|

|

23,724,018 |

|

|

|

| Allowance for loan losses |

(277,123) |

|

|

(272,114) |

|

|

|

| Loans, net of allowance |

23,627,845 |

|

|

23,451,904 |

|

|

|

| Premises and equipment, net |

622,223 |

|

|

616,439 |

|

|

|

| Receivables |

317,922 |

|

|

255,164 |

|

|

|

| Goodwill |

1,044,749 |

|

|

1,044,749 |

|

|

|

| Intangible assets, net |

59,979 |

|

|

65,804 |

|

|

|

| Mortgage servicing rights |

293,884 |

|

|

311,382 |

|

|

|

| Real estate and other repossessed assets, net |

2,875 |

|

|

3,753 |

|

|

|

| Derivative contracts, net |

410,304 |

|

|

546,109 |

|

|

|

| Cash surrender value of bank-owned life insurance |

409,548 |

|

|

406,623 |

|

|

|

| Receivable on unsettled securities sales |

391,910 |

|

|

28,707 |

|

|

|

| Other assets |

1,070,282 |

|

|

1,344,846 |

|

|

|

| TOTAL ASSETS |

$ |

49,824,830 |

|

|

$ |

48,931,397 |

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

| Deposits: |

|

|

|

|

|

| Demand |

$ |

9,196,493 |

|

|

$ |

9,974,223 |

|

|

|

| Interest-bearing transaction |

20,964,101 |

|

|

19,897,179 |

|

|

|

| Savings |

847,085 |

|

|

853,933 |

|

|

|

| Time |

3,012,022 |

|

|

2,927,217 |

|

|

|

| Total deposits |

34,019,701 |

|

|

33,652,552 |

|

|

|

| Funds purchased and repurchase agreements |

1,122,748 |

|

|

2,722,998 |

|

|

|

| Other borrowings |

7,701,552 |

|

|

6,201,644 |

|

|

|

| Subordinated debentures |

131,150 |

|

|

131,152 |

|

|

|

| Accrued interest, taxes and expense |

338,996 |

|

|

244,105 |

|

|

|

| Due on unsettled securities purchases |

254,057 |

|

|

235,473 |

|

|

|

| Derivative contracts, net |

587,473 |

|

|

403,947 |

|

|

|

| Other liabilities |

523,734 |

|

|

522,318 |

|

|

|

| TOTAL LIABILITIES |

44,679,411 |

|

|

44,114,189 |

|

|

|

| Shareholders' equity: |

|

|

|

|

|

| Capital, surplus and retained earnings |

5,741,542 |

|

|

5,743,004 |

|

|

|

| Accumulated other comprehensive loss |

(599,100) |

|

|

(928,985) |

|

|

|

| TOTAL SHAREHOLDERS' EQUITY |

5,142,442 |

|

|

4,814,019 |

|

|

|

| Non-controlling interests |

2,977 |

|

|

3,189 |

|

|

|

| TOTAL EQUITY |

5,145,419 |

|

|

4,817,208 |

|

|

|

| TOTAL LIABILITIES AND EQUITY |

$ |

49,824,830 |

|

|

$ |

48,931,397 |

|

|

|

AVERAGE BALANCE SHEETS – UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Dec. 31, 2023 |

|

Sep. 30, 2023 |

|

June 30, 2023 |

|

Mar. 31, 2023 |

|

Dec. 31, 2022 |

| ASSETS |

|

|

|

|

|

|

|

|

|

| Interest-bearing cash and cash equivalents |

$ |

605,839 |

|

|

$ |

598,734 |

|

|

$ |

708,475 |

|

|

$ |

616,596 |

|

|

$ |

568,307 |

|

| Trading securities |

5,448,403 |

|

|

5,444,587 |

|

|

4,274,803 |

|

|

3,031,969 |

|

|

3,086,985 |

|

| Investment securities, net of allowance |

2,264,194 |

|

|

2,331,595 |

|

|

2,408,122 |

|

|

2,473,796 |

|

|

2,535,305 |

|

| Available for sale securities |

12,063,398 |

|

|

11,925,800 |

|

|

12,033,597 |

|

|

11,738,693 |

|

|

10,953,851 |

|

| Fair value option securities |

20,086 |

|

|

41,741 |

|

|

245,469 |

|

|

300,372 |

|

|

92,012 |

|

| Restricted equity securities |

432,780 |

|

|

445,532 |

|

|

351,944 |

|

|

316,724 |

|

|

216,673 |

|

| Residential mortgage loans held for sale |

61,146 |

|

|

77,208 |

|

|

72,959 |

|

|

65,769 |

|

|

98,613 |

|

| Loans: |

|

|

|

|

|

|

|

|

|

| Commercial |

14,680,001 |

|

|

14,527,676 |

|

|

14,316,474 |

|

|

14,046,237 |

|

|

13,846,339 |

|

| Commercial real estate |

5,293,021 |

|

|

5,172,876 |

|

|

4,896,230 |

|

|

4,757,362 |

|

|

4,488,091 |

|

|

|

|

|

|

|

|

|

|

|

| Loans to individuals |

3,732,086 |

|

|

3,713,756 |

|

|

3,676,350 |

|

|

3,672,648 |

|

|

3,641,574 |

|

| Total loans |

23,705,108 |

|

|

23,414,308 |

|

|

22,889,054 |

|

|

22,476,247 |

|

|

21,976,004 |

|

| Allowance for loan losses |

(273,717) |

|

|

(267,205) |

|

|

(252,890) |

|

|

(238,909) |

|

|

(242,450) |

|

| Loans, net of allowance |

23,431,391 |

|

|

23,147,103 |

|

|

22,636,164 |

|

|

22,237,338 |

|

|

21,733,554 |

|

| Total earning assets |

44,327,237 |

|

|

44,012,300 |

|

|

42,731,533 |

|

|

40,781,257 |

|

|

39,285,300 |

|

| Cash and due from banks |

883,858 |

|

|

799,291 |

|

|

875,280 |

|

|

857,771 |

|

|

865,796 |

|

Derivative contracts, net |

372,789 |

|

|

412,707 |

|

|

410,793 |

|

|

546,018 |

|

|

1,239,717 |

|

Cash surrender value of bank-owned life insurance |

407,665 |

|

|

408,295 |

|

|

409,313 |

|

|

408,124 |

|

|

406,826 |

|

| Receivable on unsettled securities sales |

276,856 |

|

|

268,344 |

|

|

163,903 |

|

|

177,312 |

|

|

194,996 |

|

| Other assets |

3,445,265 |

|

|

3,418,615 |

|

|

3,317,285 |

|

|

3,211,986 |

|

|

3,216,983 |

|

| TOTAL ASSETS |

$ |

49,713,670 |

|

|

$ |

49,319,552 |

|

|

$ |

47,908,107 |

|

|

$ |

45,982,468 |

|

|

$ |

45,209,618 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

| Demand |

$ |

9,378,886 |

|

|

$ |

10,157,821 |

|

|

$ |

10,998,201 |

|

|

$ |

12,406,408 |

|

|

$ |

14,176,189 |

|

| Interest-bearing transaction |

20,449,370 |

|

|

19,415,599 |

|

|

18,368,592 |

|

|

18,639,900 |

|

|

18,898,315 |

|

| Savings |

845,705 |

|

|

874,530 |

|

|

926,882 |

|

|

958,443 |

|

|

969,275 |

|

| Time |

3,002,252 |

|

|

2,839,947 |

|

|

2,076,037 |

|

|

1,477,720 |

|

|

1,417,606 |

|

| Total deposits |

33,676,213 |

|

|

33,287,897 |

|

|

32,369,712 |

|

|

33,482,471 |

|

|

35,461,385 |

|

Funds purchased and repurchase agreements |

2,476,973 |

|

|

2,699,027 |

|

|

3,670,994 |

|

|

1,759,237 |

|

|

1,046,447 |

|

| Other borrowings |

7,120,963 |

|

|

6,968,309 |

|

|

5,275,291 |

|

|

4,512,280 |

|

|

2,523,195 |

|

| Subordinated debentures |

131,151 |

|

|

131,151 |

|

|

131,153 |

|

|

131,166 |

|

|

131,180 |

|

| Derivative contracts, net |

524,101 |

|

|

429,989 |

|

|

576,558 |

|

|

428,023 |

|

|

445,105 |

|

| Due on unsettled securities purchases |

363,358 |

|

|

435,927 |

|

|

436,353 |

|

|

316,738 |

|

|

575,957 |

|

| Other liabilities |

483,934 |

|

|

461,686 |

|

|

503,134 |

|

|

511,530 |

|

|

408,029 |

|

| TOTAL LIABILITIES |

44,776,693 |

|

|

44,413,986 |

|

|

42,963,195 |

|

|

41,141,445 |

|

|

40,591,298 |

|

| Total equity |

4,936,977 |

|

|

4,905,566 |

|

|

4,944,912 |

|

|

4,841,023 |

|

|

4,618,320 |

|

| TOTAL LIABILITIES AND EQUITY |

$ |

49,713,670 |

|

|

$ |

49,319,552 |

|

|

$ |

47,908,107 |

|

|

$ |

45,982,468 |

|

|

$ |

45,209,618 |

|

STATEMENTS OF EARNINGS – UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Year Ended |

|

December 31, |

|

December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

| Interest revenue |

$ |

638,324 |

|

|

$ |

451,606 |

|

|

$ |

2,342,464 |

|

|

$ |

1,392,102 |

|

| Interest expense |

341,649 |

|

|

98,980 |

|

|

1,070,284 |

|

|

180,722 |

|

| Net interest revenue |

296,675 |

|

|

352,626 |

|

|

1,272,180 |

|

|

1,211,380 |

|

| Provision for credit losses |

6,000 |

|

|

15,000 |

|

|

46,000 |

|

|

30,000 |

|

Net interest revenue after provision for credit losses |

290,675 |

|

|

337,626 |

|

|

1,226,180 |

|

|

1,181,380 |

|

| Other operating revenue: |

|

|

|

|

|

|

|

| Brokerage and trading revenue |

60,896 |

|

|

63,008 |

|

|

240,610 |

|

|

140,978 |

|

| Transaction card revenue |

28,847 |

|

|

27,136 |

|

|

106,858 |

|

|

104,266 |

|

| Fiduciary and asset management revenue |

51,408 |

|

|

49,899 |

|

|

207,318 |

|

|

196,326 |

|

| Deposit service charges and fees |

27,770 |

|

|

26,429 |

|

|

108,514 |

|

|

110,636 |

|

| Mortgage banking revenue |

12,834 |

|

|

10,065 |

|

|

55,698 |

|

|

49,365 |

|

| Other revenue |

15,035 |

|

|

17,034 |

|

|

62,120 |

|

|

55,642 |

|

| Total fees and commissions |

196,790 |

|

|

193,571 |

|

|

781,118 |

|

|

657,213 |

|

| Other gains, net |

40,452 |

|

|

8,427 |

|

|

56,795 |

|

|

123 |

|

| Gain (loss) on derivatives, net |

8,592 |

|

|

4,548 |

|

|

(9,921) |

|

|

(73,011) |

|

| Gain (loss) on fair value option securities, net |

1,031 |

|

|

(2,568) |

|

|

(4,292) |

|

|

(20,358) |

|

| Change in fair value of mortgage servicing rights |

(14,356) |

|

|

(2,904) |

|

|

(3,115) |

|

|

80,261 |

|

| Loss on available for sale securities, net |

(27,626) |

|

|

(3,988) |

|

|

(30,636) |

|

|

(971) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other operating revenue |

204,883 |

|

|

197,086 |

|

|

789,949 |

|

|

643,257 |

|

| Other operating expense: |

|

|

|

|

|

|

|

| Personnel |

203,022 |

|

|

186,419 |

|

|

766,610 |

|

|

670,918 |

|

| Business promotion |

8,629 |

|

|

7,470 |

|

|

31,796 |

|

|

26,435 |

|

| Charitable contributions to BOKF Foundation |

1,542 |

|

|

2,500 |

|

|

2,707 |

|

|

2,500 |

|

| Professional fees and services |

16,288 |

|

|

18,365 |

|

|

55,337 |

|

|

56,342 |

|

| Net occupancy and equipment |

30,355 |

|

|

29,227 |

|

|

121,502 |

|

|

116,867 |

|

| Insurance |

8,495 |

|

|

4,677 |

|

|

30,780 |

|

|

17,994 |

|

| FDIC special assessment |

43,773 |

|

|

— |

|

|

43,773 |

|

|

— |

|

| Data processing and communications |

45,584 |

|

|

43,048 |

|

|

181,365 |

|

|

165,907 |

|

| Printing, postage and supplies |

3,844 |

|

|

3,890 |

|

|

15,225 |

|

|

15,857 |

|

| Amortization of intangible assets |

3,543 |

|

|

3,736 |

|

|

13,882 |

|

|

15,692 |

|

| Mortgage banking costs |

8,085 |

|

|

9,016 |

|

|

30,524 |

|

|

35,834 |

|

| Other expense |

10,923 |

|

|

10,108 |

|

|

39,380 |

|

|

40,134 |

|

| Total other operating expense |

384,083 |

|

|

318,456 |

|

|

1,332,881 |

|

|

1,164,480 |

|

|

|

|

|

|

|

|

|

| Net income before taxes |

111,475 |

|

|

216,256 |

|

|

683,248 |

|

|

660,157 |

|

| Federal and state income taxes |

28,953 |

|

|

47,864 |

|

|

152,115 |

|

|

139,864 |

|

|

|

|

|

|

|

|

|

| Net income |

82,522 |

|

|

168,392 |

|

|

531,133 |

|

|

520,293 |

|

| Net income (loss) attributable to non-controlling interests |

(53) |

|

|

(37) |

|

|

387 |

|

|

20 |

|

Net income attributable to BOK Financial Corporation shareholders |

$ |

82,575 |

|

|

$ |

168,429 |

|

|

$ |

530,746 |

|

|

$ |

520,273 |

|

|

|

|

|

|

|

|

|

| Average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

64,750,171 |

|

|

66,627,955 |

|

|

65,651,569 |

|

|

67,212,728 |

|

| Diluted |

64,750,171 |

|

|

66,627,955 |

|

|

65,651,569 |

|

|

67,212,735 |

|

|

|

|

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

|

| Basic |

$ |

1.26 |

|

|

$ |

2.51 |

|

|

$ |

8.02 |

|

|

$ |

7.68 |

|

| Diluted |

$ |

1.26 |

|

|

$ |

2.51 |

|

|

$ |

8.02 |

|

|

$ |

7.68 |

|

QUARTERLY EARNINGS TREND – UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands, except ratio and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Dec. 31, 2023 |

|

Sep. 30, 2023 |

|

June 30, 2023 |

|

Mar. 31, 2023 |

|

Dec. 31, 2022 |

|

|

|

|

|

|

|

|

|

|

| Interest revenue |

$ |

638,324 |

|

|

$ |

617,044 |

|

|

$ |

570,367 |

|

|

$ |

516,729 |

|

|

$ |

451,606 |

|

| Interest expense |

341,649 |

|

|

316,148 |

|

|

248,106 |

|

|

164,381 |

|

|

98,980 |

|

| Net interest revenue |

296,675 |

|

|

300,896 |

|

|

322,261 |

|

|

352,348 |

|

|

352,626 |

|

| Provision for credit losses |

6,000 |

|

|

7,000 |

|

|

17,000 |

|

|

16,000 |

|

|

15,000 |

|

Net interest revenue after provision for credit losses |

290,675 |

|

|

293,896 |

|

|

305,261 |

|

|

336,348 |

|

|

337,626 |

|

| Other operating revenue: |

|

|

|

|

|

|

|

|

|

| Brokerage and trading revenue |

60,896 |

|

|

62,312 |

|

|

65,006 |

|

|

52,396 |

|

|

63,008 |

|

| Transaction card revenue |

28,847 |

|

|

26,387 |

|

|

26,003 |

|

|

25,621 |

|

|

27,136 |

|

| Fiduciary and asset management revenue |

51,408 |

|

|

52,256 |

|

|

52,997 |

|

|

50,657 |

|

|

49,899 |

|

| Deposit service charges and fees |

27,770 |

|

|

27,676 |

|

|

27,100 |

|

|

25,968 |

|

|

26,429 |

|

| Mortgage banking revenue |

12,834 |

|

|

13,356 |

|

|

15,141 |

|

|

14,367 |

|

|

10,065 |

|

| Other revenue |

15,035 |

|

|

15,865 |

|

|

14,250 |

|

|

16,970 |

|

|

17,034 |

|

| Total fees and commissions |

196,790 |

|

|

197,852 |

|

|

200,497 |

|

|

185,979 |

|

|

193,571 |

|

| Other gains, net |

40,452 |

|

|

1,474 |

|

|

12,618 |

|

|

2,251 |

|

|

8,427 |

|

| Gain (loss) on derivatives, net |

8,592 |

|

|

(9,010) |

|

|

(8,159) |

|

|

(1,344) |

|

|

4,548 |

|

| Gain (loss) on fair value option securities, net |

1,031 |

|

|

(203) |

|

|

(2,158) |

|

|

(2,962) |

|

|

(2,568) |

|

Change in fair value of mortgage servicing rights |

(14,356) |

|

|

8,039 |

|

|

9,261 |

|

|

(6,059) |

|

|

(2,904) |

|

| Loss on available for sale securities, net |

(27,626) |

|

|

— |

|

|

(3,010) |

|

|

— |

|

|

(3,988) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other operating revenue |

204,883 |

|

|

198,152 |

|

|

209,049 |

|

|

177,865 |

|

|

197,086 |

|

| Other operating expense: |

|

|

|

|

|

|

|

|

|

| Personnel |

203,022 |

|

|

190,791 |

|

|

190,652 |

|

|

182,145 |

|

|

186,419 |

|

| Business promotion |

8,629 |

|

|

6,958 |

|

|

7,640 |

|

|

8,569 |

|

|

7,470 |

|

Charitable contributions to BOKF Foundation |

1,542 |

|

|

23 |

|

|

1,142 |

|

|

— |

|

|

2,500 |

|

| Professional fees and services |

16,288 |

|

|

13,224 |

|

|

12,777 |

|

|

13,048 |

|

|

18,365 |

|

| Net occupancy and equipment |

30,355 |

|

|

32,583 |

|

|

30,105 |

|

|

28,459 |

|

|

29,227 |

|

| Insurance |

8,495 |

|

|

7,996 |

|

|

6,974 |

|

|

7,315 |

|

|

4,677 |

|

| FDIC special assessment |

43,773 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Data processing and communications |

45,584 |

|

|

45,672 |

|

|

45,307 |

|

|

44,802 |

|

|

43,048 |

|

| Printing, postage and supplies |

3,844 |

|

|

3,760 |

|

|

3,728 |

|

|

3,893 |

|

|

3,890 |

|

Amortization of intangible assets |

3,543 |

|

|

3,474 |

|

|

3,474 |

|

|

3,391 |

|

|

3,736 |

|

| Mortgage banking costs |

8,085 |

|

|

8,357 |

|

|

8,300 |

|

|

5,782 |

|

|

9,016 |

|

| Other expense |

10,923 |

|

|

11,475 |

|

|

8,574 |

|

|

8,408 |

|

|

10,108 |

|

| Total other operating expense |

384,083 |

|

|

324,313 |

|

|

318,673 |

|

|

305,812 |

|

|

318,456 |

|

| Net income before taxes |

111,475 |

|

|

167,735 |

|

|

195,637 |

|

|

208,401 |

|

|

216,256 |

|

| Federal and state income taxes |

28,953 |

|

|

33,256 |

|

|

44,001 |

|

|

45,905 |

|

|

47,864 |

|

| Net income |

82,522 |

|

|

134,479 |

|

|

151,636 |

|

|

162,496 |

|

|

168,392 |

|

Net income (loss) attributable to non-controlling interests |

(53) |

|

|

(16) |

|

|

328 |

|

|

128 |

|

|

(37) |

|

Net income attributable to BOK Financial Corporation shareholders |

$ |

82,575 |

|

|

$ |

134,495 |

|

|

$ |

151,308 |

|

|

$ |

162,368 |

|

|

$ |

168,429 |

|

|

|

|

|

|

|

|

|

|

|

| Average shares outstanding: |

|

|

|

|

|

|

|

|

|

| Basic |

64,750,171 |

|

|

65,548,307 |

|

|

65,994,132 |

|

|

66,331,775 |

|

|

66,627,955 |

|

| Diluted |

64,750,171 |

|

|

65,548,307 |

|

|

65,994,132 |

|

|

66,331,775 |

|

|

66,627,955 |

|

| Net income per share: |

|

|

|

|

|

|

|

|

|

| Basic |

$ |

1.26 |

|

|

$ |

2.04 |

|

|

$ |

2.27 |

|

|

$ |

2.43 |

|

|

$ |

2.51 |

|

| Diluted |

$ |

1.26 |

|

|

$ |

2.04 |

|

|

$ |

2.27 |

|

|

$ |

2.43 |

|

|

$ |

2.51 |

|

FINANCIAL HIGHLIGHTS – UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands, except ratio and share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Dec. 31, 2023 |

|

Sep. 30, 2023 |

|

June 30, 2023 |

|

Mar. 31, 2023 |

|

Dec. 31, 2022 |

| Capital: |

|

|

|

|

|

|

|

|

|

| Period-end shareholders' equity |

$ |

5,142,442 |

|

|

$ |

4,814,019 |

|

|

$ |

4,863,854 |

|

|

$ |

4,874,786 |

|

|

$ |

4,682,649 |

|

| Risk weighted assets |

$ |

38,820,979 |

|

|

$ |

38,791,023 |

|

|

$ |

38,218,164 |

|

|

$ |

37,192,197 |

|

|

$ |

38,142,231 |

|

| Risk-based capital ratios: |

|

|

|

|

|

|

|

|

|

| Common equity tier 1 |

12.06 |

% |

|

12.06 |

% |

|

12.13 |

% |

|

12.19 |

% |

|

11.69 |

% |

| Tier 1 |

12.07 |

% |

|

12.07 |

% |

|

12.13 |

% |

|

12.20 |

% |

|

11.71 |

% |

| Total capital |

13.16 |

% |

|

13.16 |

% |

|

13.24 |

% |

|

13.21 |

% |

|

12.67 |

% |

| Leverage ratio |

9.45 |

% |

|

9.52 |

% |

|

9.75 |

% |

|

9.94 |

% |

|

9.91 |

% |

Tangible common equity ratio1 |

8.29 |

% |

|

7.74 |

% |

|

7.79 |

% |

|

8.46 |

% |

|

7.63 |

% |

Adjusted tangible common equity ratio1 |

8.02 |

% |

|

7.35 |

% |

|

7.49 |

% |

|

8.22 |

% |

|

7.36 |

% |

|

|

|

|

|

|

|

|

|

|

| Common stock: |

|

|

|

|

|

|

|

|

|

| Book value per share |

$ |

79.15 |

|

|

$ |

73.31 |

|

|

$ |

73.28 |

|

|

$ |

73.19 |

|

|

$ |

69.93 |

|

| Tangible book value per share |

$ |

62.15 |

|

|

$ |

56.40 |

|

|

$ |

56.50 |

|

|

$ |

56.42 |

|

|

$ |

53.19 |

|

| Market value per share: |

|

|

|

|

|

|

|

|

|

| High |

$ |

87.52 |

|

|

$ |

92.41 |

|

|

$ |

90.91 |

|

|

$ |

106.47 |

|

|

$ |

110.28 |

|

| Low |

$ |

62.42 |

|

|

$ |

77.61 |

|

|

$ |

74.40 |

|

|

$ |

80.00 |

|

|

$ |

88.46 |

|

| Cash dividends paid |

$ |

35,739 |

|

|

$ |

35,655 |

|

|

$ |

35,879 |

|

|

$ |

36,006 |

|

|

$ |

36,188 |

|

| Dividend payout ratio |

43.28 |

% |

|

26.51 |

% |

|

23.71 |

% |

|

22.18 |

% |

|

21.49 |

% |

| Shares outstanding, net |

64,967,177 |

|

|

65,664,840 |

|

|

66,369,208 |

|

|

66,600,833 |

|

|

66,958,634 |

|

| Stock buy-back program: |

|

|

|

|

|

|

|

|

|

| Shares repurchased |

700,237 |

|

|

700,500 |

|

|

266,000 |

|

|

447,071 |

|

|

314,406 |

|

| Amount |

$ |

49,710 |

|

|

$ |

58,961 |

|

|

$ |

22,366 |

|

|

$ |

44,100 |

|

|

$ |

32,429 |

|

Average price paid per share2 |

$ |

70.99 |

|

|

$ |

84.17 |

|

|

$ |

84.08 |

|

|

$ |

98.64 |

|

|

$ |

103.14 |

|

|

|

|

|

|

|

|

|

|

|

Performance ratios (quarter annualized): |

| Return on average assets |

0.66 |

% |

|

1.08 |

% |

|

1.27 |

% |

|

1.43 |

% |

|

1.48 |

% |

| Return on average equity |

6.64 |

% |

|

10.88 |

% |

|

12.28 |

% |

|

13.61 |

% |

|

14.48 |

% |

Return on average tangible common equity1 |

8.56 |

% |

|

14.08 |

% |

|

15.86 |

% |

|

17.71 |

% |

|

19.14 |

% |

| Net interest margin |

2.64 |

% |

|

2.69 |

% |

|

3.00 |

% |

|

3.45 |

% |

|

3.54 |

% |

Efficiency ratio1,3 |

71.62 |

% |

|

64.01 |

% |

|

58.75 |

% |

|

56.79 |

% |

|

56.61 |

% |

|

|

|

|

|

|

|

|

|

|

| Other data: |

|

|

|

|

|

|

|

|

|

| Tax equivalent interest |

$ |

2,112 |

|

|

$ |

2,214 |

|

|

$ |

2,200 |

|

|

$ |

2,285 |

|

|

$ |

2,287 |

|

| Net unrealized loss on available for sale securities |

$ |

(616,624) |

|

|

$ |

(1,034,520) |

|

|

$ |

(898,906) |

|

|

$ |

(741,508) |

|

|

$ |

(865,553) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Dec. 31, 2023 |

|

Sep. 30, 2023 |

|

June 30, 2023 |

|

Mar. 31, 2023 |

|

Dec. 31, 2022 |

| Mortgage banking: |

|

|

|

|

|

|

|

|

|

| Mortgage production revenue |

$ |

(2,535) |

|

|

$ |

(1,887) |

|

|

$ |

(284) |

|

|

$ |

(633) |

|

|

$ |

(3,983) |

|

|

|

|

|

|

|

|

|

|

|

| Mortgage loans funded for sale |

$ |

139,255 |

|

|

$ |

173,727 |

|

|

$ |

214,785 |

|

|

$ |

138,624 |

|

|

$ |

141,090 |

|

Add: Current period-end outstanding commitments |

34,783 |

|

|

49,284 |

|

|

55,031 |

|

|

71,693 |

|

|

45,492 |

|

Less: Prior period end outstanding commitments |

49,284 |

|

|

55,031 |

|

|

71,693 |

|

|

45,492 |

|

|

75,779 |

|

Total mortgage production volume |

$ |

124,754 |

|

|

$ |

167,980 |

|

|

$ |

198,123 |

|

|

$ |

164,825 |

|

|

$ |

110,803 |

|

|

|

|

|

|

|

|

|

|

|

Mortgage loan refinances to mortgage loans funded for sale |

10 |

% |

|

9 |

% |

|

8 |

% |

|

9 |

% |

|

10 |

% |

| Realized margin on funded mortgage loans |

(0.98) |

% |

|

(0.94) |

% |

|

(0.14) |

% |

|

(1.25) |

% |

|

(1.10) |

% |

| Production revenue as a percentage of production volume |

(2.03) |

% |

|

(1.12) |

% |

|

(0.14) |

% |

|

(0.38) |

% |

|

(3.59) |

% |

|

|

|

|

|

|

|

|

|

|

| Mortgage servicing revenue |

$ |

15,369 |

|

|

$ |

15,243 |

|

|

$ |

15,425 |

|

|

$ |

15,000 |

|

|

$ |

14,048 |

|

Average outstanding principal balance of mortgage loans serviced for others |

20,471,030 |

|

|

20,719,116 |

|

|

20,807,044 |

|

|

21,121,319 |

|

|

18,923,078 |

|

| Average mortgage servicing revenue rates |

0.30 |

% |

|

0.29 |

% |

|

0.30 |

% |

|

0.29 |

% |

|

0.29 |

% |

|

|

|

|

|

|

|

|

|

|

Gain (loss) on mortgage servicing rights, net of economic hedge: |

Gain (loss) on mortgage hedge derivative contracts, net |

$ |

8,275 |

|

|

$ |

(8,980) |

|

|

$ |

(8,099) |

|

|

$ |

(1,711) |

|

|

$ |

4,373 |

|

| Gain (loss) on fair value option securities, net |

1,031 |

|

|

(203) |

|

|

(2,158) |

|

|

(2,962) |

|

|

(2,568) |

|

| Gain (loss) on economic hedge of mortgage servicing rights |

9,306 |

|

|

(9,183) |

|

|

(10,257) |

|

|

(4,673) |

|

|

1,805 |

|

| Gain (loss) on changes in fair value of mortgage servicing rights |

(14,356) |

|

|

8,039 |

|

|

9,261 |

|

|

(6,059) |

|

|

(2,904) |

|

| Loss on changes in fair value of mortgage servicing rights, net of economic hedges, included in other operating revenue |

(5,050) |

|

|

(1,144) |

|

|

(996) |

|

|

(10,732) |

|

|

(1,099) |

|

Net interest revenue (expense) on fair value option securities4 |

(101) |

|

|

(112) |

|

|

(232) |

|

|

187 |

|

|

(118) |

|

| Total economic benefit (cost) of changes in the fair value of mortgage servicing rights, net of economic hedges |

$ |

(5,151) |

|

|

$ |

(1,256) |

|

|

$ |

(1,228) |

|

|

$ |

(10,545) |

|

|

$ |

(1,217) |

|

1 See Reconciliation of Non-GAAP Measures following.

2 Excludes 1 percent excise tax on corporate stock repurchases.

3 Prior period ratios have been adjusted to be consistent with the current period presentation.

4 Actual interest earned on fair value option securities less internal transfer-priced cost of funds.

EXPLANATION AND RECONCILIATION OF NON-GAAP MEASURES – UNAUDITED

BOK FINANCIAL CORPORATION

(in thousands, except ratio and share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Dec. 31, 2023 |

|

Sep. 30, 2023 |

|

June 30, 2023 |

|

Mar. 31, 2023 |

|

Dec. 31, 2022 |

Reconciliation of tangible common equity ratio and adjusted tangible common equity ratio: |

| Total shareholders' equity |

$ |

5,142,442 |

|

|

$ |

4,814,019 |

|

|

$ |

4,863,854 |

|

|

$ |

4,874,786 |

|

|

$ |

4,682,649 |

|

Less: Goodwill and intangible assets, net |

1,104,728 |

|

|

1,110,553 |