| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

|

Delaware

|

33-0336973

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

2855 Gazelle Court, Carlsbad, CA

|

92010

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Title of each class

|

Trading symbol

|

Name of each exchange on which registered

|

||

|

Common Stock, $.001 Par Value

|

“IONS”

|

The Nasdaq Stock Market LLC

|

|

Large Accelerated Filer ☒

|

Accelerated Filer ☐

|

|

|

Non-accelerated Filer ☐

|

Smaller Reporting Company ☐

|

|

|

Emerging Growth Company ☐

|

| * |

Excludes 39,747,443 shares of common stock held by directors and officers and by stockholders whose beneficial ownership is known by the Registrant to exceed 10 percent

of the common stock outstanding at June 30, 2023. Exclusion of shares held by any person should not be construed to indicate that such

person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the Registrant, or that such person is controlled by or under common control with the Registrant.

|

| ● |

Our ability to generate substantial revenue from the sale of our medicines;

|

| ● |

The availability of adequate coverage and payment rates for our medicines;

|

| ● |

Our and our partners’ ability to compete effectively;

|

| ● |

Our ability to successfully manufacture our medicines;

|

| ● |

Our ability to successfully develop and obtain marketing approvals for our medicines;

|

| ● |

Our ability to secure and maintain effective corporate partnerships;

|

| ● |

Our ability to sustain cash flows and achieve consistent profitability;

|

| ● |

Our ability to protect our intellectual property;

|

| ● |

Our ability to maintain the effectiveness of our personnel; and

|

| ● |

The impacts of pandemics, climate change, wars and other global events.

|

|

Page

|

||

|

Item 1.

|

4

|

|

|

Item 1A.

|

49

|

|

|

Item 1B.

|

65

|

|

|

Item 1C.

|

65

|

|

|

Item 2.

|

67

|

|

|

Item 3.

|

67

|

|

|

Item 4.

|

67

|

|

|

Item 5.

|

68

|

|

|

Item 6.

|

69

|

|

|

Item 7.

|

69

|

|

|

Item 7A.

|

79

|

|

|

Item 8.

|

79

|

|

|

Item 9.

|

79

|

|

|

Item 9A.

|

80

|

|

|

Item 9B.

|

82

|

|

|

Item 9C.

|

82

|

|

|

Item 10.

|

82

|

|

|

Item 11.

|

82

|

|

|

Item 12.

|

83

|

|

|

Item 13.

|

83

|

|

|

Item 14.

|

83

|

|

|

Item 15.

|

83

|

|

|

91

|

|

•

|

DEVOTE: In the Phase 2/3 DEVOTE study, Biogen is evaluating the safety and potential to achieve increased efficacy with a higher dose of SPINRAZA

compared to the currently approved dose. In 2022, Biogen reported final data from Part A of the ongoing, three-part DEVOTE study. Results from Part A, an open-label safety evaluation period in children and teens with later-onset SMA, suggest

that the higher dosing regimen of SPINRAZA leads to higher levels of the drug in the cerebrospinal fluid, or CSF, supporting further development of a higher dose of SPINRAZA. Additionally, the results indicated that SPINRAZA was generally

well-tolerated.

|

|

•

|

RESPOND: In the Phase 4 RESPOND study, Biogen is evaluating the benefit of SPINRAZA in infants and children with a suboptimal clinical response to

the gene therapy, onasemnogene abeparvovec. In 2023, Biogen presented interim results from the RESPOND study that showed improved motor function in most participants treated with SPINRAZA following treatment with onasemnogene abeparvovec.

|

|

•

|

ASCEND: In the Phase 3b ASCEND study, Biogen is evaluating the clinical outcomes and assessing the safety of a higher dose of SPINRAZA in children,

teens and adults with later-onset SMA following treatment with risdiplam.

|

|

•

|

33% and 21% reduction in SOD1 protein, the intended target for QALSODY, respectively

|

|

•

|

51% and 41% reduction in plasma neurofilament, a marker of neuron injury, respectively

|

|

•

|

WAINUA achieved a LS mean reduction of 82% in serum TTR concentration from baseline, compared to an 11% reduction from baseline in the external

placebo group (p<0.0001).

|

|

•

|

WAINUA stopped disease progression as measured by mNIS+7 resulting in a 0.28 point LS mean increase compared to a 25.06 point increase for the

external placebo group from baseline (24.8 point LS mean improvement; p<0.0001).

|

|

•

|

WAINUA improved quality of life demonstrating a 5.5 point LS mean decrease (improvement) on the Norfolk QoL-DN, compared to a 14.2 point increase

(worsening) in the external placebo group (19.7 point LS mean improvement; p<0.0001).

|

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

10,266,822

|

SPINAL MUSCULAR ATROPHY (SMA) TREATMENT VIA TARGETING OF SMN2 SPLICE SITE INHIBITORY SEQUENCES

|

2025

|

Methods of increasing exon-7 containing SMN2 mRNA in a cell using an oligonucleotide having the sequence of SPINRAZA

|

||||

|

United States

|

8,110,560

|

SPINAL MUSCULAR ATROPHY (SMA) TREATMENT VIA TARGETING OF SMN2 SPLICE SITE INHIBITORY SEQUENCES

|

2025

|

Methods of using antisense oligonucleotides having sequence of SPINRAZA to alter splicing of SMN2 and/or to treat SMA

|

||||

|

Europe

|

1910395

|

COMPOSITIONS AND METHODS FOR MODULATION OF SMN2 SPLICING

|

2026

|

Sequence and chemistry (full 2’-MOE) of SPINRAZA

|

||||

|

Europe

|

3308788

|

COMPOSITIONS AND METHODS FOR MODULATION OF SMN2 SPLICING

|

2026

|

Pharmaceutical compositions that include SPINRAZA

|

||||

|

United States

|

7,838,657

|

SPINAL MUSCULAR ATROPHY (SMA) TREATMENT VIA TARGETING OF SMN2 SPLICE SITE INHIBITORY SEQUENCES

|

2027

|

Oligonucleotides having sequence of SPINRAZA

|

||||

|

United States

|

8,361,977

|

COMPOSITIONS AND METHODS FOR MODULATION OF SMN2 SPLICING

|

2030

|

Sequence and chemistry (full 2’-MOE) of SPINRAZA

|

||||

|

United States

|

8,980,853

|

COMPOSITIONS AND METHODS FOR MODULATION OF SMN2 SPLICING IN A SUBJECT

|

2030

|

Methods of administering SPINRAZA

|

||||

|

United States

|

9,717,750

|

COMPOSITIONS AND METHODS FOR MODULATION OF SMN2 SPLICING IN A SUBJECT

|

2030

|

Methods of administering SPINRAZA to a patient

|

||||

|

Europe

|

3449926

|

COMPOSITIONS AND METHODS FOR MODULATION OF SMN2 SPLICING IN A SUBJECT

|

2030

|

Pharmaceutical compositions that include SPINRAZA for treating SMA

|

||||

|

Europe

|

3305302

|

COMPOSITIONS AND METHODS FOR MODULATION OF SMN2 SPLICING IN A SUBJECT

|

2030

|

Antisense compounds including SPINRAZA for treating SMA

|

||||

|

United States

|

9,926,559

|

COMPOSITIONS AND METHODS FOR MODULATION OF SMN2 SPLICING IN A SUBJECT

|

2034

|

SPINRAZA doses for treating SMA

|

||||

|

United States

|

10,436,802

|

METHODS FOR TREATING SPINAL MUSCULAR ATROPHY

|

2035

|

SPINRAZA dosing regimen for treating SMA

|

|

Jurisdiction

|

Registration No.

|

Mark

|

||||

|

United States

|

5156572

|

SPINRAZA

|

_

|

(word mark)

|

||

|

Europe

|

013388145

|

SPINRAZA

|

(word mark)

|

|||

|

Europe

|

014812291 and 015309941

|

|

(design mark)

|

|||

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

10,385,341

|

COMPOSITIONS FOR MODULATING SOD-1 EXPRESSION

|

2035

|

Composition of QALSODY

|

||||

|

United States

|

10,669,546

|

COMPOSITIONS FOR MODULATING SOD-1 EXPRESSION

|

2035

|

Methods of treating a SOD-1 associated neurodegenerative disorder by administering QALSODY

|

||||

|

United States

|

10,968,453

|

COMPOSITIONS FOR MODULATING SOD-1 EXPRESSION

|

2035

|

Methods of treating a SOD-1 associated neurodegenerative disorder by administering a pharmaceutical composition of QALSODY

|

||||

|

Europe

|

3126499

|

COMPOSITIONS FOR MODULATING SOD-1 EXPRESSION

|

2035

|

Composition of QALSODY

|

|

Jurisdiction

|

Registration No.

|

Mark

|

||||

|

United States

|

7164425

|

QALSODY

|

_

|

(word mark)

|

||

|

United States

|

7116182

|

|

(design mark)

|

|||

|

Europe

|

1542485

|

QALSODY

|

(word mark)

|

|||

|

Europe

|

018517819

|

|

(design mark)

|

|||

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

10,683,499

|

COMPOSITIONS AND METHODS FOR MODULATING TTR EXPRESSION

|

2034

|

Composition of eplontersen

|

||||

|

Europe

|

3524680

|

COMPOSITIONS AND METHODS FOR MODULATING TTR EXPRESSION

|

2034

|

Composition of eplontersen

|

|

Jurisdiction

|

Application No.

|

Mark

|

||||

|

United States

|

98054331

|

WAINUA

|

_

|

(word mark)

|

||

|

United States

|

98228658

|

|

(design mark)

|

|||

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

8,101,743

|

MODULATION OF TRANSTHYRETIN EXPRESSION

|

2025

|

Antisense sequence and chemistry of TEGSEDI

|

||||

|

United States

|

8,697,860

|

DIAGNOSIS AND TREATMENT OF DISEASE

|

2031

|

Composition of TEGSEDI

|

||||

|

United States

|

9,061,044

|

MODULATION OF TRANSTHYRETIN EXPRESSION

|

2031

|

Sodium salt composition of TEGSEDI

|

||||

|

United States

|

9,399,774

|

MODULATION OF TRANSTHYRETIN EXPRESSION

|

2031

|

Methods of treating transthyretin amyloidosis by administering TEGSEDI

|

||||

|

Europe

|

2563920

|

MODULATION OF TRANSTHYRETIN EXPRESSION

|

2031

|

Composition of TEGSEDI

|

|

Jurisdiction

|

Registration No.

|

Mark

|

||||

|

United States

|

5740635

|

TEGSEDI

|

_

|

(word mark)

|

||

|

Europe

|

017224742

|

TEGSEDI

|

(word mark)

|

|||

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

Europe

|

1622597

|

MODULATION OF APOLIPOPROTEIN C-III EXPRESSION

|

2024

|

Antisense sequence and chemistry of WAYLIVRA

|

||||

|

Europe

|

2441449

|

MODULATION OF APOLIPOPROTEIN C-III EXPRESSION

|

2024

|

Antisense compounds that hybridize within the nucleotide region of apo-CIII targeted by WAYLIVRA

|

||||

|

Europe

|

3002007

|

MODULATION OF APOLIPOPROTEIN C-III EXPRESSION

|

2024

|

Antisense compounds complementary to an apo-CIII nucleic acid for use in therapy

|

||||

|

United States

|

9,157,082

|

MODULATION OF APOLIPOPROTEIN C-III (APOCIII) EXPRESSION

|

2032

|

Methods of using apo-CIII antisense compounds for reducing pancreatitis and chylomicronemia and increasing HDL

|

||||

|

United States

|

9,593,333

|

MODULATION OF APOLIPOPROTEIN C-III (APOCIII) EXPRESSION IN LIPOPROTEIN LIPASE DEFICIENT (LPLD) POPULATIONS

|

2034

|

Methods of treating lipoprotein lipase deficiency with an apo-CIII specific inhibitor wherein triglyceride levels are reduced

|

||||

|

Europe

|

2956176

|

MODULATION OF APOLIPOPROTEIN C-III (APOCIII) EXPRESSION IN LIPOPROTEIN LIPASE DEFICIENT (LPLD) POPULATIONS

|

2034

|

Apo-CIII specific inhibitors including WAYLIVRA for treating lipoprotein lipase deficiency or FCS

|

|

Jurisdiction

|

Registration No.

|

Mark

|

||||

|

Europe

|

016409609

|

WAYLIVRA

|

(word mark)

|

|||

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

9,163,239

|

COMPOSITIONS AND METHODS FOR MODULATING APOLIPOPROTEIN C-III EXPRESSION

|

2034

|

Composition of olezarsen

|

||||

|

Europe

|

2991656

|

COMPOSITIONS AND METHODS FOR MODULATING APOLIPOPROTEIN C-III EXPRESSION

|

2034

|

Composition of olezarsen

|

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

9,315,811

|

METHODS FOR MODULATING KALLIKREIN (KLKB1) EXPRESSION

|

2032

|

Methods of treating HAE

|

||||

|

Europe

|

2717923

|

METHODS FOR MODULATING KALLIKREIN (KLKB1) EXPRESSION

|

2032

|

Compounds for use in treating an inflammatory condition, including HAE

|

||||

|

United States

|

10,294,477

|

COMPOSITIONS AND METHODS FOR MODULATING PKK EXPRESSION

|

2035

|

Composition of donidalorsen

|

||||

|

Europe

|

3137091

|

COMPOSITIONS AND METHODS FOR MODULATING PKK EXPRESSION

|

2035

|

Composition of donidalorsen

|

|

Jurisdiction

|

Patent No.

(Patent Application No.)

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

11,786,546

|

COMPOUNDS AND METHODS FOR MODULATING GFAP

|

2041

|

Composition of zilganersen

|

||||

|

Europe

|

(20846055.0)

|

COMPOUNDS AND METHODS FOR MODULATING GFAP

|

2041

|

Composition of zilganersen

|

|

Jurisdiction

|

Patent Application No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

17/613,183

|

COMPOUNDS AND METHODS FOR REDUCING FUS EXPRESSION

|

2040

|

Composition of ulefnersen

|

||||

|

Europe

|

20815459.1

|

COMPOUNDS AND METHODS FOR REDUCING FUS EXPRESSION

|

2040

|

Composition of ulefnersen

|

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

9,574,193

|

METHODS AND COMPOSITIONS FOR MODULATING APOLIPOPROTEIN (A) EXPRESSION

|

2033

|

Methods of lowering Apo(a) and/or Lp(a) levels with an oligonucleotide

complementary within the nucleotide region of Apo(a) targeted by pelacarsen

|

||||

|

United States

|

10,478,448

|

METHODS AND COMPOSITIONS FOR MODULATING APOLIPOPROTEIN (A) EXPRESSION

|

2033

|

Methods of treating hyperlipidemia with an oligonucleotide complementary

within the nucleotide region of Apo(a) targeted by pelacarsen

|

||||

|

United States

|

9,884,072

|

METHODS AND COMPOSITIONS FOR MODULATING APOLIPOPROTEIN (A) EXPRESSION

|

2033

|

Oligonucleotides complementary within the nucleotide region of Apo(a) targeted by pelacarsen

|

||||

|

Europe

|

2855500

|

METHODS AND COMPOSITIONS FOR MODULATING APOLIPOPROTEIN (A) EXPRESSION

|

2033

|

Oligonucleotides complementary within the nucleotide region of Apo(a) targeted by pelacarsen for decreasing Apo(a) expression

|

||||

|

United States

|

9,181,550

|

COMPOSITIONS AND METHODS FOR MODULATING APOLIPOPROTEIN (a) EXPRESSION

|

2034

|

Composition of pelacarsen

|

||||

|

Europe

|

2992009

|

COMPOSITIONS AND METHODS FOR MODULATING APOLIPOPROTEIN (a) EXPRESSION

|

2034

|

Composition of pelacarsen

|

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

8,642,752

|

MODULATION OF HEPATITIS B VIRUS (HBV) EXPRESSION

|

2032

|

Composition of bepirovirsen

|

||||

|

Europe

|

3505528

|

MODULATION OF HEPATITIS B VIRUS (HBV) EXPRESSION

|

2032

|

Composition of bepirovirsen

|

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

Europe

|

3043827

|

MODULATORS OF COMPLEMENT FACTOR B

|

2034

|

Compound comprising the antisense oligonucleotide portion of IONIS-FB-LRx.

|

||||

|

United States

|

10,280,423

|

COMPOSITIONS AND METHODS FOR MODULATING COMPLEMENT FACTOR B EXPRESSION

|

2035

|

Composition of IONIS-FB-LRx.

|

||||

|

Europe

|

3137596

|

COMPOSITIONS AND METHODS FOR MODULATING COMPLEMENT FACTOR B EXPRESSION

|

2035

|

Composition of IONIS-FB-LRx.

|

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

7,399,845

|

6-MODIFIED BICYCLIC NUCLEIC ACID ANALOGS

|

2027

|

cEt nucleosides and oligonucleotides containing these nucleoside analogs

|

||||

|

United States

|

7,741,457

|

6-MODIFIED BICYCLIC NUCLEIC ACID ANALOGS

|

2027

|

cEt nucleosides and oligonucleotides containing these nucleoside analogs

|

||||

|

United States

|

8,022,193

|

6-MODIFIED BICYCLIC NUCLEIC ACID ANALOGS

|

2027

|

Oligonucleotides containing cEt nucleoside analogs

|

||||

|

Europe

|

1984381

|

6-MODIFIED BICYCLIC NUCLEIC ACID ANALOGS

|

2027

|

cEt nucleosides and oligonucleotides containing these nucleoside analogs

|

||||

|

Europe

|

2314594

|

6-MODIFIED BICYCLIC NUCLEIC ACID ANALOGS

|

2027

|

Oligonucleotides containing cEt nucleoside analogs and methods of use

|

||||

|

United States

|

7,569,686

|

COMPOUNDS AND METHODS FOR SYNTHESIS OF BICYCLIC NUCLEIC ACID ANALOGS

|

2027

|

Methods of synthesizing cEt nucleosides

|

||||

|

Europe

|

2092065

|

ANTISENSE COMPOUNDS

|

2027

|

Gapmer oligonucleotides having 2’-modifed and LNA nucleosides

|

||||

|

Europe

|

2410053

|

ANTISENSE COMPOUNDS

|

2027

|

Gapmer oligonucleotides having wings comprised of 2’-MOE and bicyclic nucleosides

|

||||

|

Europe

|

2410054

|

ANTISENSE COMPOUNDS

|

2027

|

Gapmer oligonucleotides having a 2’-modifed nucleoside in the 5’-wing and a bicyclic nucleoside in the 3’-wing

|

||||

|

United States

|

9,550,988

|

ANTISENSE COMPOUNDS

|

2028

|

Gapmer oligonucleotides having BNA nucleosides and 2’-MOE nucleosides

|

||||

|

United States

|

10,493,092

|

ANTISENSE COMPOUNDS

|

2028

|

Gapmer oligonucleotides having BNA nucleosides and 2’-MOE nucleosides and/or 2’-OMe nucleosides

|

||||

|

Europe

|

3067421

|

OLIGOMERIC COMPOUNDS COMPRISING BICYCLIC NUCLEOTIDES AND USES THEREOF

|

2032

|

Gapmer oligonucleotides having at least one bicyclic, one 2’-modified nucleoside and one 2’-deoxynucleoside

|

||||

|

United States

|

11,629,348

|

LINKAGE MODIFIED OLIGONUCLEOTIDES AND USES THEREOF

|

2040

|

Gapmer oligonucleotides having 2-4 mesyl phosphoramidate internucleoside linkages at specified positions in the gap

|

|

Jurisdiction

|

Patent No.

|

Title

|

Expiration

|

Description of Claims

|

||||

|

United States

|

9,127,276

|

CONJUGATED ANTISENSE COMPOUNDS AND THEIR USE

|

2034

|

Preferred THA LICA conjugated to any group of nucleosides, including gapmers, double-stranded siRNA compounds, and fully modified oligonucleotides

|

||||

|

United States

|

9,181,549

|

CONJUGATED ANTISENSE COMPOUNDS AND THEIR USE

|

2034

|

Preferred THA conjugate having our preferred linker and cleavable moiety conjugated to any oligomeric compound or any nucleoside having a 2’-MOE

modification or a cEt modification

|

||||

|

Europe

|

2991661

|

CONJUGATED ANTISENSE COMPOUNDS AND THEIR USE

|

2034

|

Preferred THA LICA conjugated to any group of nucleosides, including gapmers, double-stranded siRNA compounds, and fully modified oligonucleotides

|

| ● |

The federal Health Insurance Portability and Accountability Act of 1996, or HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act,

which governs the conduct of certain electronic healthcare transactions and protects the security and privacy of protected health information;

|

| ● |

Foreign and state laws governing the privacy and security of health information, such as the General Data Protection Regulation, or GDPR, in the EU; and the California

Consumer Privacy Act, or CCPA, in California, some of which are more stringent than HIPAA and many of which differ from each other in significant ways and may not have the same effect; and

|

| ● |

The Physician Payments Sunshine Act, which requires manufacturers of medicines, devices, biologics, and medical supplies to report annually to the HHS information related

to payments and other transfers of value to physicians (defined to include doctors, dentists, optometrists, podiatrists, and chiropractors), other healthcare providers (such as physician assistants and nurse practitioners), and teaching

hospitals, and ownership and investment interests held by physicians and their immediate family members.

|

|

Medicine

|

Company

|

Medicine Description (1)

|

Phase (1)

|

Route of Administration (1)

|

||||

|

Zolgensma

(Onasemnogene abeparvovec)

|

Novartis

|

Gene therapy targeting the genetic root cause of SMA by replacing the missing or nonworking SMN1 gene

|

Approved for pediatric SMA patients less than 2 years of age

|

Intravenous infusion

|

||||

|

Evrysdi

(Risdiplam)

|

Roche

|

A small molecule medicine that modulates splicing of the SMN2 gene

|

Approved for SMA in pediatric and adult patients

|

Oral

|

||||

|

OAV101

(Onasemnogene abeparvovec)

|

Novartis

|

Gene therapy targeting the genetic root cause of SMA by replacing the missing or nonworking SMN1 gene

|

Phase 3

|

Intrathecal injection

|

| (1) |

Taken from public documents including respective company press releases, company presentations, and scientific presentations.

|

|

Medicine

|

Company

|

Medicine Description (1)

|

Phase (1)

|

Route of Administration (1)

|

||||

|

NI-005 / AP-101

|

Neurimmune (AL-S Pharma) / Lilly

|

A human derived antibody targeting misfolded SOD1

|

Phase 2

|

Intravenous Infusion

|

| (1) |

Taken from public documents including respective company press releases, company presentations, and scientific presentations.

|

|

Medicine

|

Company

|

Medicine Description (1)

|

Phase (1)

|

Route of Administration (1)

|

||||

|

Onpattro

(Patisiran)

|

Alnylam

|

An RNAi medicine formulated with lipid nanoparticles to inhibit TTR mRNA

|

Received CRL in the U.S. for ATTR-CM

Approved in US, EU, Japan and select other markets for ATTRv-PN

|

Intravenous infusion

|

||||

|

Vyndaqel/Vyndamax

(Tafamidis and tafamidis meglumine)

|

Pfizer

|

A small molecule medicine to stabilize TTR protein

|

Approved in EU, Japan and select other markets for ATTRv-PN, ATTR-CM; indications vary by region

|

Oral

|

||||

|

Amvuttra

(Vutrisiran)

|

Alnylam

|

An RNAi medicine conjugated with GalNAc to inhibit TTR mRNA

|

Approved for ATTRv-PN in the U.S., EU and Japan, Phase 3 for ATTR-CM

|

Subcutaneous Injection

|

||||

|

Acoramidis

|

BridgeBio

|

Small molecule that binds and stabilizes TTR in the blood

|

Submitted in U.S., EU and Japan

|

Oral

|

||||

|

NTLA-2001

|

Intellia/ Regeneron

|

CRISPR therapeutic candidate designed to reduce circulating TTR protein levels

|

Phase 3 ATTR-CM

|

Intravenous Infusion

|

||||

|

ALXN2220

|

AstraZeneca

|

A monoclonal IgG1 which acts by targeting and depleting TTR protein

|

Phase 3 ATTR-CM

|

Intravenous Infusion

|

||||

|

NNC6019-0001

|

Novo Nordisk

|

A monoclonal antibody to deplete amyloid via antibody-mediated phagocytosis

|

Phase 2 ATTR-CM

|

Intravenous Infusion

|

| (1) |

Taken from public documents including respective company press releases, company presentations, and scientific presentations.

|

|

Medicine

|

Company

|

Medicine Description (1)

|

Phase (1)

|

Route of Administration (1)

|

||||

|

ARO-APOC3

(Plozasiran)

|

Arrowhead

|

Targets APOCIII by utilizing Targeted RNAi Molecule Platform

|

Phase 3 FCS,

Phase 2 SHTG

|

Subcutaneous Injection

|

||||

|

Pegozafermin

|

89bio

|

FGF21 analog

|

Phase 3 SHTG

|

Subcutaneous Injection

|

| (1) |

Taken from public documents including respective company press releases, company presentations, and scientific presentations.

|

|

Medicine

|

Company

|

Medicine Description (1)

|

Phase (1)

|

Route of Administration (1)

|

||||

|

Takhzyro

(lanadelumab-flyo)

|

Takeda

|

A monoclonal antibody that inhibits plasma kallikrein activity

|

Approved for HAE patients two years and older

|

Subcutaneous Injection

|

||||

|

Cinryze

(C1 esterase inhibitor)

|

Takeda

|

A human plasma protein that mediates inflammation and coagulation

|

Approved for HAE patients six years and older

|

Intravenous Infusion

|

||||

|

Orladeyo

(berotralstat)

|

BioCryst

|

Oral plasma kallikrein inhibitor

|

Approved for HAE patients 12 years and older

|

Oral

|

||||

|

Haegarda

(C1 esterase inhibitor)

|

CSL Behring

|

C1 esterase inhibitor

|

Approved for HAE patients 6 years and older

|

Subcutaneous Injection

|

||||

|

Garadacimab

|

CSL Behring

|

An anti-factor XIIa monoclonal antibody

|

Under regulatory review in the U.S. and EU

|

Subcutaneous Injection

|

||||

|

Deucrictibant

|

Pharvaris

|

An oral B2-receptor antagonist

|

Phase 2

|

Oral

|

||||

|

STAR-0215

|

Astria

|

A monoclonal antibody inhibitor of plasma kallikrein

|

Phase 2

|

Subcutaneous Injection

|

||||

|

NTLA-2002

|

Intellia

|

CRISPR therapeutic candidate designed to inactivate the kallikrein B1 gene

|

Phase 1/2

|

Intravenous Infusion

|

| (1) |

Taken from public documents including respective company press releases, company presentations, and scientific presentations.

|

|

Medicine

|

Company

|

Medicine Description (1)

|

Phase (1)

|

Route of Administration (1)

|

||||

|

Olpasiran

|

Amgen/ Arrowhead

|

RNAi therapeutic designed to lower Lp(a)

|

Phase 3

|

Subcutaneous Injection

|

||||

|

Zerlasiran

|

Silence

|

RNAi therapeutic designed to lower Lp(a)

|

Phase 2

|

Subcutaneous Injection

|

||||

|

Lepodisiran

|

Lilly

|

RNAi therapeutic designed to lower Lp(a)

|

Phase 2

|

Subcutaneous Injection

|

||||

|

Muvalaplin

|

Lilly

|

Small molecule therapy to lower Lp(a)

|

Phase 2

|

Oral

|

| (1) |

Taken from public documents including respective company press releases, company presentations, and scientific presentations.

|

|

Medicine

|

Company

|

Medicine Description (1)

|

Phase (1)

|

Route of Administration (1)

|

||||

|

Elebsiran

(VIR-2218)

|

Vir Biotech / Alnylam

|

RNAi therapeutic to reduce HBV viral antigens

|

Phase 2

|

Subcutaneous Injection

|

||||

|

Imdusiran

(AB-729)

|

Arbutus Biopharma

|

RNAi therapeutic to reduce HBV viral antigens

|

Phase 2

|

Subcutaneous Injection

|

||||

|

Xalnesiran

|

Roche

|

RNAi therapeutic to reduce HBV viral antigens

|

Phase 2

|

Subcutaneous Injection

|

| (1) |

Taken from public documents including respective company press releases, company presentations, and scientific presentations.

|

|

Medicine

|

Company

|

Medicine Description (1)

|

Phase (1)

|

Route of Administration (1)

|

||||

|

Tarpeyo (budesonide)

|

Calliditas

|

A corticosteroid indicated to reduce proteinuria in adults with primary IgAN

|

Approved for IgAN

|

Oral

|

||||

|

Filspari

(Sparsentan) |

Travere

|

An endothelin & angiotensin II receptor antagonist to reduce proteinuria in adults with primary IgAN

|

Approved for IgAN

|

Oral

|

||||

|

Atrasentan

|

Novartis (Chinook)

|

An endothelin A receptor antagonist

|

Phase 3 (IgAN)

|

Oral

|

||||

|

Iptacopan

|

Novartis (Chinook)

|

A factor B inhibitor of the alternative complement pathway

|

Phase 3 (IgAN)

|

Oral

|

||||

|

Zigakibart

|

Novartis (Chinook)

|

An anti-APRIL monoclonal antibody

|

Phase 3 (IgAN)

|

Subcutaneous Injection

|

||||

|

Sibeprenlimab

|

Otsuka (Visterra)

|

A humanized IgG2 monoclonal antibody that inhibits APRIL

|

Phase 3 (IgAN)

|

Intravenous Infusion

|

||||

|

Atacicept

|

Vera

|

A recombinant fusion protein a dual inhibitor of BLyS and APRIL

|

Phase 3 (IgAN)

|

Subcutaneous Injection

|

||||

|

Ravulizumab

|

Alexion (AstraZeneca)

|

A humanized monoclonal antibody to complement factor 5

|

Phase 2 (IgAN)

|

Subcutaneous Injection

|

||||

|

Vemircopan

|

Alexion (AstraZeneca)

|

A complement factor D inhibitor

|

Phase 2 (IgAN)

|

Oral

|

||||

|

Felzartamab

|

Hi-Bio

|

A monoclonal antibody directed against CD38

|

Phase 2 (IgAN)

|

Intravenous Infusion

|

| (1) |

Taken from public documents including respective company press releases, company presentations, and scientific presentations.

|

|

Medicine

|

Company

|

Medicine Description (1)

|

Phase (1)

|

Route of Administration (1)

|

||||

|

Ivervay (avacincaptad pegol)

|

Iveric Bio

|

A complement C5 inhibitor approved for GA secondary to AMD

|

Approved (GA)

|

Intravitreal

|

||||

|

Syfovre (pegcetacoplan)

|

Apellis

|

A complement C5 inhibitor approved for GA secondary to AMD

|

Approved (GA)

|

Intravitreal

|

||||

|

Tinlarebant

|

Belite Bio

|

A small molecule RBP4 antagonist

|

Phase 3 (GA)

|

Oral

|

||||

|

Danicopan

|

Alexion

|

A factor D inhibitor

|

Phase 2 (GA)

|

Oral

|

||||

|

PPY988 (GT005)

|

Novartis

|

A gene therapy with encoding for human complement factor I

|

Phase 2 (GA)

|

Intraocular

|

||||

|

AVD-104

|

Aviceda

|

A glycomimetic nanoparticle

|

Phase 2 (GA)

|

Intravitreal

|

||||

|

ANX007

|

Annexon Bio

|

A fragment antigen-binding (fab) antibody

|

Phase 2 (GA)

|

Intravitreal

|

| (1) |

Taken from public documents including respective company press releases, company presentations, and scientific presentations.

|

|

Innovate to improve the lives

of people with serious diseases

|

Empowering our

employees and communities

|

Operating

responsibly and sustainably

|

|

We innovate across the business and work tirelessly to discover, develop and deliver important new medicines for

people with serious diseases.

|

We are committed to fostering an inclusive culture that drives excellence, embraces diversity, and supports our

communities.

|

We operate with integrity to help create a better, more sustainable future for all through environmental

stewardship and responsible business practices and stakeholder interactions.

|

|

• Innovation and R&D

• Access and Affordability

• Patient Advocacy and Engagement

|

• Workplace Culture, Talent Attraction and Development

• Diversity, Equity and Inclusion

• Social Impact and Community Engagement

|

• Environmental Sustainability

• Governance and Integrity

• Data Privacy and Cybersecurity

|

| ● |

Comprehensive medical, dental and vision insurance;

|

| ● |

401(k) matching;

|

| ● |

Stock options, RSUs and an Employee Stock Purchase Plan, or ESPP;

|

| ● |

Vacation, holiday, sick time and paid time off for volunteering;

|

| ● |

Wellness programs;

|

| ● |

Flexible spending accounts for health and dependent day care needs;

|

| ● |

Family care benefits;

|

| ● |

Life, AD&D insurance and long-term disability insurance coverage options; and

|

| ● |

Employee Assistance Program, or EAP.

|

|

Name

|

Age

|

Position

|

||

|

Brett P. Monia, Ph.D.

|

62

|

Chief Executive Officer

|

||

|

Joseph T. Baroldi

|

46

|

Executive Vice President, Chief Business Officer

|

||

|

Brian Birchler

|

58

|

Executive Vice President, Corporate and Development Operations

|

||

|

C. Frank Bennett, Ph.D.

|

67

|

Executive Vice President, Chief Scientific Officer

|

||

|

Onaiza Cadoret-Manier

|

59

|

Executive Vice President, Chief Global Product Strategy and Operations Officer

|

||

|

Richard S. Geary, Ph.D.

|

66

|

Executive Vice President, Chief Development Officer

|

||

|

Elizabeth L. Hougen

|

62

|

Executive Vice President, Finance and Chief Financial Officer

|

||

|

Patrick R. O’Neil, Esq.

|

50

|

Chief Legal Officer, General Counsel and Corporate Secretary

|

||

|

Eugene Schneider, M.D.

|

51

|

Executive Vice President, Chief Clinical Development and Operations Officer

|

||

|

Eric E. Swayze, Ph.D.

|

58

|

Executive Vice President, Research

|

| ● |

receipt and scope of marketing authorizations;

|

| ● |

establishment and demonstration in the medical and patient community of the efficacy and safety of our medicines and their potential advantages over competing products;

|

| ● |

cost and effectiveness of our medicines compared to other available therapies;

|

| ● |

patient convenience of the dosing regimen for our medicines; and

|

| ● |

reimbursement policies of government and third-party payers.

|

| ● |

priced lower than our medicines;

|

| ● |

reimbursed more favorably by government and other third-party payers than our medicines;

|

| ● |

safer than our medicines;

|

| ● |

more effective than our medicines; or

|

| ● |

more convenient to use than our medicines.

|

| ● |

Onasemnogene abeparvovec and risdiplam compete with SPINRAZA;

|

| ● |

Taldefgrobep alfa, Evrysdi + GYM329 and NMD670 could compete with SPINRAZA;

|

| ● |

Patisiran, tafamidis, tafamidis meglumine and vutrisiran compete with TEGSEDI and WAINUA;

|

| ● |

Acoramidis, NTLA-2001 and NNC6019-0001 could compete with TEGSEDI and WAINUA;

|

| ● |

ARO-APOC3 and pegozafermin could compete with WAYLIVRA and olezarsen;

|

| ● |

Lanadelumab-flyo, C1 esterase inhibitor, berotralstat, C1 esterase inhibitor subcutaneous,

garadacimab, deucrictibant, NTLA-2002 and STAR-0215 could compete with donidalorsen;

|

| ● |

Olpasiran, zerlasiran, lepodisiran and muvalaplin could compete with pelacarsen;

|

| ● |

NI-005/AP-101 could compete with QALSODY;

|

| ● |

VIR-2218 + PEG-IFN-α, VIR-3434 ± VIR-2218 ± PEG-IFN-α, VIR-2218 + BRII-179, NI-204VIR-2218 + GS-9688 + nivolumab, AB-729, imdusiran + Peg-IFNa-2α + NA, xalnesiran +

RG6084 + NA, xalnesiran + NA, xalnesiran + pegIFN + NA, xalnesiran + RO7049389 + NA, xalnesiran + ruzotolimod + NA, RO7049389 + ruzotolimod + NA could complete with bepirovirsen; and

|

| ● |

Budesonide, sparsentan, atrasentan, iptacopan, zigakibart, sibeprenlimab, atacicept, ravulizumab, vemircopan, felzartamab, povetacicept, avacincaptad pegol,

pegcetacoplan, tinlarebant, danicopan, GT005, AVD-104 and ANX007 could compete with IONIS-FB-LRx.

|

| ● |

in the U.S., TEGSEDI’s label contains a boxed warning for thrombocytopenia and glomerulonephritis;

|

| ● |

TEGSEDI requires periodic blood and urine monitoring; and

|

| ● |

in the U.S., TEGSEDI is available only through a REMS program.

|

| ● |

fund our development activities for SPINRAZA and QALSODY;

|

| ● |

seek and obtain regulatory approvals for SPINRAZA and QALSODY; and

|

| ● |

successfully commercialize SPINRAZA and QALSODY.

|

| ● |

such authorities may disagree with the design or implementation of our clinical studies;

|

| ● |

we or our partners may be unable to demonstrate to the satisfaction of the FDA or other regulatory authorities that a medicine is safe and effective for any indication;

|

| ● |

such authorities may not accept clinical data from studies conducted at clinical facilities that have deficient clinical practices or that are in countries where the

standard of care is potentially different from the U.S.;

|

| ● |

we or our partners may be unable to demonstrate that our medicine’s clinical and other benefits outweigh its safety risks to support approval;

|

| ● |

such authorities may disagree with the interpretation of data from preclinical or clinical studies;

|

| ● |

such authorities may find deficiencies in the manufacturing processes or facilities of third-party manufacturers who manufacture clinical and commercial supplies for our

medicines; and

|

| ● |

the approval policies or regulations of such authorities or their prior guidance to us or our partners during clinical development may significantly change in a manner

rendering our clinical data insufficient for approval.

|

| ● |

the clinical study may produce negative or inconclusive results;

|

| ● |

regulators may require that we hold, suspend or terminate clinical research for noncompliance with regulatory requirements;

|

| ● |

we, our partners, the FDA or foreign regulatory authorities could suspend or terminate a clinical study due to adverse side effects of a medicine on subjects or lack of

efficacy in the trial;

|

| ● |

we or our partners may decide, or regulators may require us, to conduct additional preclinical testing or clinical studies;

|

| ● |

enrollment in our clinical studies may be slower than we anticipate;

|

| ● |

we or our partners, including our independent clinical investigators, contract research organizations and other third-party service providers on which we rely, may not

identify, recruit or train suitable clinical investigators at a sufficient number of study sites or timely enroll a sufficient number of study subjects in the clinical study;

|

| ● |

the institutional review board for a prospective site might withhold or delay its approval for the study;

|

| ● |

people who enroll in the clinical study may later drop out due to adverse events, a perception they are not benefiting from participating in the study, fatigue with the

clinical study process or personal issues;

|

| ● |

a clinical study site may deviate from the protocol for the study;

|

| ● |

the cost of our clinical studies may be greater than we anticipate;

|

| ● |

our partners may decide not to exercise any existing options to license and conduct additional clinical studies for our medicines; and

|

| ● |

the supply or quality of our medicines or other materials necessary to conduct our clinical studies may be insufficient, inadequate or delayed.

|

| ● |

AstraZeneca for the joint development and funding of WAINUA;

|

| ● |

Novartis for development and funding of pelacarsen;

|

| ● |

GSK for development and funding of bepirovirsen; and

|

| ● |

Roche for development and funding of IONIS-FB-LRx.

|

| ● |

conduct clinical studies;

|

| ● |

seek and obtain marketing authorizations; and

|

| ● |

manufacture and commercialize our medicines.

|

| ● |

pursue alternative technologies or develop alternative products that may be competitive with the medicine that is part of the collaboration with us;

|

| ● |

pursue higher-priority programs or change the focus of its own development programs; or

|

| ● |

choose to devote fewer resources to our medicines than it does to its own medicines.

|

| ● |

successful commercialization of our commercial medicines;

|

| ● |

the profile and launch timing of our medicines in development;

|

| ● |

changes in existing collaborative relationships and our ability to establish and maintain additional collaborative arrangements;

|

| ● |

continued scientific progress in our research, drug discovery and development programs;

|

| ● |

the size of our programs and progress with preclinical and clinical studies;

|

| ● |

the time and costs involved in obtaining marketing authorizations;

|

| ● |

competing technological and market developments, including the introduction by others of new therapies that address our markets; and

|

| ● |

our manufacturing requirements and capacity to fulfill such requirements.

|

| ● |

compliance with differing or unexpected regulatory requirements for our medicines and foreign employees;

|

| ● |

complexities associated with managing multiple payer reimbursement regimes, government payers or patient self-pay systems;

|

| ● |

difficulties in staffing and managing foreign operations;

|

| ● |

in certain circumstances, increased dependence on the commercialization efforts and regulatory compliance of third-party distributors or strategic partners;

|

| ● |

foreign government taxes, regulations and permit requirements;

|

| ● |

U.S. and foreign government tariffs, trade and export restrictions, price and exchange controls and other regulatory requirements;

|

| ● |

anti-corruption laws, including the Foreign Corrupt Practices Act, or the FCPA, and its equivalent in foreign jurisdictions;

|

| ● |

economic weakness, including inflation, natural disasters, war, events of terrorism, political instability or public health issues or pandemics, in particular foreign

countries or globally;

|

| ● |

fluctuations in currency exchange rates, which could result in increased operating expenses and reduced revenue, and other obligations related to doing business in

another country;

|

| ● |

compliance with tax, employment, privacy, immigration and labor laws, regulations and restrictions for employees living or traveling abroad;

|

| ● |

workforce uncertainty in countries where labor unrest is more common than in the U.S.; and

|

| ● |

changes in diplomatic and trade relationships.

|

| ● |

interruption of our research, development and manufacturing efforts;

|

| ● |

injury to our employees and others;

|

| ● |

environmental damage resulting in costly clean up; and

|

| ● |

liabilities under federal, state and local laws and regulations governing health and human safety, as well as the use, storage, handling and disposal of these materials

and resultant waste products.

|

| ● |

analyzing reports of certain threats and actors;

|

| ● |

conducting scans of the threat environment;

|

| ● |

evaluating our and our industry’s risk profile;

|

| ● |

evaluating certain threats reported to us;

|

| ● |

conducting internal and external audits;

|

| ● |

conducting threat assessments for certain internal and external threats; and

|

| ● |

conducting vulnerability assessments to identify vulnerabilities.

|

| ● |

incident response plan;

|

| ● |

disaster recovery/business continuity plans;

|

| ● |

risk assessments;

|

| ● |

encryption of certain data;

|

| ● |

network security and access controls for certain systems;

|

| ● |

physical security;

|

| ● |

asset management, tracking and disposal;

|

| ● |

systems monitoring; and

|

| ● |

employee training.

|

|

Property Description

|

Location

|

Square

Footage

|

Owned

or Leased

|

Initial Lease

Term End Date

|

Lease

Extension Options

|

|||||

|

Laboratory and office space facility

|

Carlsbad, CA

|

176,300

|

Leased

|

2037

|

Two, five-year options to extend

|

|||||

|

Office and meeting space facility

|

Carlsbad, CA

|

74,000

|

Leased

|

2037

|

Two, five-year options to extend

|

|||||

|

Manufacturing facility

|

Carlsbad, CA

|

26,800

|

Owned

|

|||||||

|

Manufacturing support facility

|

Carlsbad, CA

|

25,800

|

Leased

|

2026

|

One, five-year option to extend

|

|||||

|

Office space facility

|

Boston, MA

|

14,300

|

Leased

|

2029

|

One, five-year option to extend

|

|||||

|

Office space facility

|

Carlsbad, CA

|

5,800

|

Leased

|

2027

|

None

|

|||||

|

Warehouse facility

|

Carlsbad, CA

|

4,200

|

Leased

|

2028

|

None

|

|||||

|

Office space facility

|

Dublin, Ireland

|

3,900

|

Leased

|

2025

|

None

|

|||||

|

331,100

|

|

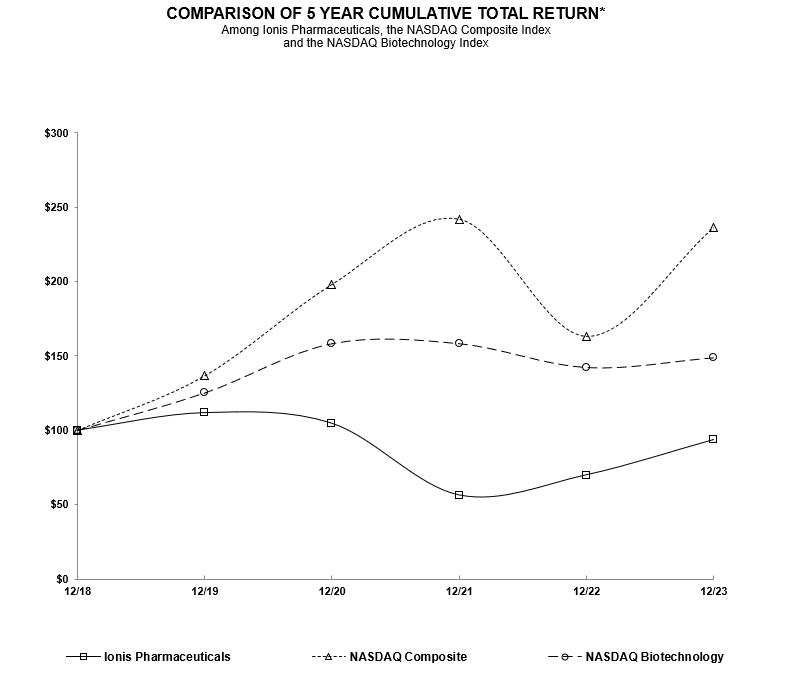

Dec-18

|

Dec-19

|

Dec-20

|

Dec-21

|

Dec-22

|

Dec-23

|

|||||||||||||||||||

|

Ionis Pharmaceuticals, Inc.

|

$

|

100.00

|

$

|

111.75

|

$

|

104.59

|

$

|

56.29

|

$

|

69.87

|

$

|

93.58

|

||||||||||||

|

Nasdaq Composite Index

|

$

|

100.00

|

$

|

136.69

|

$

|

198.10

|

$

|

242.03

|

$

|

163.28

|

$

|

236.17

|

||||||||||||

|

Nasdaq Biotechnology Index

|

$

|

100.00

|

$

|

125.11

|

$

|

158.17

|

$

|

158.20

|

$

|

142.19

|

$

|

148.72

|

||||||||||||

| (1) |

This section is not “soliciting material,” is not deemed “filed” with the SEC, is not subject to the liabilities of Section 18 of the Exchange Act and is not to be

incorporated by reference in any of our filings under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

|

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Total revenue

|

$

|

787.6

|

$

|

587.4

|

||||

|

Total operating expenses

|

$

|

1,141.4

|

$

|

997.6

|

||||

|

Loss from operations

|

$

|

(353.7

|

)

|

$

|

(410.2

|

)

|

||

|

Net loss

|

$

|

(366.3

|

)

|

$

|

(269.7

|

)

|

||

|

Cash, cash equivalents and short-term investments

|

$

|

2,331.2

|

$

|

1,986.9

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Revenue:

|

||||||||

|

Commercial revenue:

|

||||||||

|

SPINRAZA royalties

|

$

|

240.4

|

$

|

242.3

|

||||

|

Other commercial revenue:

|

||||||||

|

TEGSEDI and WAYLIVRA revenue, net

|

34.9

|

30.1

|

||||||

|

Licensing and other royalty revenue

|

33.3

|

31.0

|

||||||

|

Total other commercial revenue

|

68.2

|

61.1

|

||||||

|

Total commercial revenue

|

308.6

|

303.4

|

||||||

|

R&D revenue:

|

||||||||

|

Amortization from upfront payments

|

125.3

|

68.6

|

||||||

|

Milestone payments

|

100.5

|

74.0

|

||||||

|

License fees

|

116.8

|

37.0

|

||||||

|

Other services

|

10.0

|

27.6

|

||||||

|

Collaborative agreement revenue

|

352.6

|

207.2

|

||||||

|

WAINUA joint development revenue

|

126.4

|

76.8

|

||||||

|

Total R&D revenue

|

479.0

|

284.0

|

||||||

|

Total revenue

|

$

|

787.6

|

$

|

587.4

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

WAINUA joint development revenue

|

$

|

126.4

|

$

|

76.8

|

||||

|

Research and development expenses related to Phase 3 development expenses for WAINUA

|

150.8

|

147.1

|

||||||

|

Medical affairs expenses for WAINUA

|

4.1

|

2.0

|

||||||

|

Commercialization expenses for WAINUA

|

15.6

|

2.6

|

||||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Operating expenses, excluding non-cash compensation expense related to equity awards

|

$

|

1,035.7

|

$

|

897.3

|

||||

|

Non-cash compensation expense related to equity awards

|

105.7

|

100.3

|

||||||

|

Total operating expenses

|

$

|

1,141.4

|

$

|

997.6

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Cost of sales, excluding non-cash compensation expense related to equity awards

|

$

|

8.7

|

$

|

13.4

|

||||

|

Non-cash compensation expense related to equity awards

|

0.4

|

0.7

|

||||||

|

Total cost of sales

|

$

|

9.1

|

$

|

14.1

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Research, development and patent expenses, excluding non-cash compensation expense related to equity awards

|

$

|

821.7

|

$

|

759.4

|

||||

|

Non-cash compensation expense related to equity awards

|

77.9

|

73.7

|

||||||

|

Total research, development and patent expenses

|

$

|

899.6

|

$

|

833.1

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Drug discovery expenses, excluding non-cash compensation expense related to equity awards

|

$

|

125.6

|

$

|

181.3

|

||||

|

Non-cash compensation expense related to equity awards

|

16.2

|

16.2

|

||||||

|

Total drug discovery expenses

|

$

|

141.8

|

$

|

197.5

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

WAINUA

|

$

|

115.5

|

$

|

103.9

|

||||

|

TEGSEDI and WAYLIVRA

|

8.1

|

10.6

|

||||||

|

Olezarsen

|

138.3

|

68.1

|

||||||

|

Donidalorsen

|

24.9

|

14.1

|

||||||

|

Zilganersen

|

8.4

|

5.6

|

||||||

|

Ulefnersen

|

10.8

|

8.4

|

||||||

|

Other development projects

|

101.0

|

123.5

|

||||||

|

Development overhead expenses

|

123.3

|

92.0

|

||||||

|

Total drug development, excluding non-cash compensation expense related to equity awards

|

530.3

|

426.2

|

||||||

|

Non-cash compensation expense related to equity awards

|

34.5

|

31.5

|

||||||

|

Total drug development expenses

|

$

|

564.8

|

$

|

457.7

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Medical affairs expenses, excluding non-cash compensation expense related to equity awards

|

$

|

19.5

|

$

|

15.9

|

||||

|

Non-cash compensation expense related to equity awards

|

3.4

|

2.0

|

||||||

|

Total medical affairs expenses

|

$

|

22.9

|

$

|

17.9

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Manufacturing and development chemistry expenses, excluding non-cash compensation expense related to equity awards

|

$

|

65.3

|

$

|

76.2

|

||||

|

Non-cash compensation expense related to equity awards

|

8.8

|

9.9

|

||||||

|

Total manufacturing and development chemistry expenses

|

$

|

74.1

|

$

|

86.1

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Personnel costs

|

$

|

27.2

|

$

|

21.2

|

||||

|

Occupancy

|

28.7

|

19.2

|

||||||

|

Consulting

|

4.8

|

0.8

|

||||||

|

Patent expenses

|

4.3

|

4.7

|

||||||

|

Insurance

|

3.6

|

3.8

|

||||||

|

Computer software and licenses

|

2.7

|

1.9

|

||||||

|

Other

|

9.7

|

8.2

|

||||||

|

Total R&D support expenses, excluding non-cash compensation expense related to equity awards

|

81.0

|

59.8

|

||||||

|

Non-cash compensation expense related to equity awards

|

15.0

|

14.1

|

||||||

|

Total R&D support expenses

|

$

|

96.0

|

$

|

73.9

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Selling, general and administrative expenses, excluding non-cash compensation expense related to equity awards

|

$

|

205.1

|

$

|

124.4

|

||||

|

Non-cash compensation expense related to equity awards

|

27.5

|

25.9

|

||||||

|

Total selling, general and administrative expenses

|

$

|

232.6

|

$

|

150.3

|

||||

|

Year Ended December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

Convertible senior notes:

|

||||||||

|

Non-cash amortization of debt issuance costs

|

$

|

5.9

|

$

|

5.3

|

||||

|

Interest expense payable in cash

|

6.4

|

0.7

|

||||||

|

Interest on mortgage for primary R&D and manufacturing facilities

|

0.4

|

2.1

|

||||||

|

Total interest expense

|

$

|

12.7

|

$

|

8.1

|

||||

|

Contractual Obligations

|

Payments Due by Period

(in millions)

|

|||||||||||

|

(selected balances described below)

|

Total

|

Less than 1 year

|

More than 1 year

|

|||||||||

|

1.75% Notes (principal and interest payable)

|

$

|

620.3

|

$

|

10.1

|

$

|

610.2

|

||||||

|

0% Notes (principal payable)

|

632.5

|

—

|

632.5

|

|||||||||

|

0.125% Notes (principal and interest payable)

|

44.6

|

44.6

|

—

|

|||||||||

|

Building mortgage payments (principal and interest payable)

|

10.2

|

0.5

|

9.7

|

|||||||||

|

Operating leases

|

279.5

|

20.4

|

259.1

|

|||||||||

|

Other obligations (principal and interest payable)

|

0.8

|

0.1

|

0.7

|

|||||||||

|

Total

|

$

|

1,587.9

|

$

|

75.7

|

$

|

1,512.2

|

||||||

| ● |

Assessing the propriety of revenue recognition and associated deferred revenue;

|

| ● |

Determining the appropriate cost estimates for unbilled preclinical studies and clinical development activities; and

|

| ● |

Assessing the appropriate estimate of anticipated future royalty payments under our royalty purchase agreement

|

| ● |

Identifying the performance obligations contained in the agreement

|

| ● |

Determining the transaction price, including any variable consideration

|

| ● |

Allocating the transaction price to each of our performance obligations

|

| ● |

Whether a milestone payment is probable (discussed in detail above under “Determining the

transaction price, including any variable consideration”);

|

| ● |

Whether a milestone payment relates to services we are performing or if our partner is performing the services;

|

| ● |

If we are performing services, we recognize revenue over our estimated period of performance in a similar manner to the amortization of upfront payments (discussed above

under “R&D Services with Upfront Payments”); and

|

| ● |

Conversely, we recognize in full those milestone payments that we earn based on our partners’ activities when our partner achieves the milestone event and we do not have

a performance obligation.

|

| * |

Contract, instruction or written plan intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) under the Exchange Act.

|

| ** |

“Non-Rule 10b5-1 trading arrangement” as defined in item 408(c) of Regulation S-K under the Exchange Act.

|

|

Action

|

Date

|

Trading Arrangement

|

Total Shares

to be Sold

|

Expiration Date

|

||||||||

|

Rule 10b5-1*

|

Non-Rule 10b5-1**

|

|||||||||||

|

Joseph Wender, Board Member

|

Adoption

|

November 30, 2023

|

X

|

104,079

|

February 28, 2025

|

|||||||

|

(1)

|

Any information that is included on or linked to our website is not part of this Form 10-K.

|

|

Plan Category

|

Number of Shares to

be Issued Upon Exercise

of Outstanding Options

|

Weighted Average

Exercise Price of

Outstanding Options

|

Number of Shares

Remaining Available

for Future Issuance

|

|||||

|

Equity compensation plans approved by stockholders (a)

|

14,090,732

|

$

|

48.43

|

9,976,286

|

(b)

|

|||

|

Total

|

14,090,732

|

$

|

48.43

|

9,976,286

|

||||

| (a) |

Consists of five Ionis plans: 1989 Stock Option Plan, Amended and Restated 2002 Non-Employee Directors’ Stock Option Plan, 2011 Equity Incentive Plan, 2020 Equity

Incentive Plan and Employee Stock Purchase Plan, or ESPP.

|

| (b) |

Of these shares, 386,792 were available for purchase under the ESPP as of December 31, 2023.

|

|

Exhibit Number

|

Description of Document

|

||

|

2.1

|

Agreement and Plan of Merger, dated as of August 30, 2020, among Akcea Therapeutics, Inc., Ionis Pharmaceuticals, Inc. and Avalanche Merger Sub, Inc., filed as an exhibit to the Registrant’s Current Report on Form 8-K filed August 31, 2020 and incorporated herein by reference.

|

||

|

3.1

|

Amended and Restated Certificate of Incorporation filed June 19, 1991,

filed as an exhibit to the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2017 and incorporated herein by reference.

|

||

|

3.2

|

Certificate of Amendment to Restated Certificate of Incorporation, filed

as an exhibit to the Registrant’s Notice of Annual Meeting and Proxy Statement, for the 2014 Annual Meeting of Stockholders, filed on April 25, 2014 and incorporated herein by reference.

|

||

|

3.3

|

Certificate of Amendment to Restated Certificate of Incorporation, filed as an

exhibit to the Registrant’s Current Report on Form 8-K filed December 18, 2015 and incorporated herein by reference.

|

||

|

3.4

|

Amended and Restated Bylaws, filed as an exhibit to the

Registrant’s Current Report on Form 8-K filed March 29, 2021 and incorporated herein by reference.

|

||

|

4.1

|

Description of the Registrant’s Securities, filed as an exhibit to the

Registrant’s Annual Report on Form 10-K for the year ended December 31, 2021 and incorporated herein by reference.

|

||

|

4.2

|

Certificate of Designation of the Series C Junior Participating Preferred Stock, filed as an exhibit to Registrant’s Current Report on Form 8-K filed December 13, 2000 and incorporated herein by reference.

|

||

|

4.3

|

Specimen Common Stock Certificate, filed as an exhibit to the

Registrant’s Annual Report on Form 10-K for the year ended December 31, 2017 and incorporated herein by reference.

|

||

|

4.4

|

Indenture, dated as of December 19, 2019, by and between the Registrant and U.S. Bank National Association, as trustee, including Form of 0.125 percent

Convertible Senior Note due 2024, filed as an exhibit to the Registrant’s Current Report on Form 8-K filed December 23, 2019 and incorporated herein by

reference.

|

||

|

4.5

|

Form of Exchange and/or Subscription Agreement for Convertible Senior Notes due 2024, filed as an exhibit to the Registrant’s Current Report on Form 8-K filed December 12, 2019 and incorporated herein by reference.

|

||

|

4.6

|

Form of Convertible Note Hedge Transactions Confirmation for Convertible

Senior Notes due 2024, filed as an exhibit to the Registrant’s Current Report on Form 8-K filed December 12, 2019 and incorporated herein by reference.

|

||

|

4.7

|

Form of Warrant Transactions Confirmation for Convertible Senior Notes due

2024, filed as an exhibit to the Registrant’s Current Report on Form 8-K filed December 12, 2019 and incorporated herein by reference.

|

||

|

4.8

|

Indenture, dated as of April 12, 2021, by and between the Registrant and U.S. Bank National Association, as trustee, including Form of 0 percent

Convertible Senior Note due 2026, filed as an exhibit to the Registrant’s Current Report on Form 8-K filed April 13, 2021 and incorporated herein by reference.

|

||

|

4.9

|

Form of Warrant Confirmation for Convertible Senior Notes due 2026,

filed as an exhibit to the Registrant’s Current Report on Form 8-K filed April 13, 2021 and incorporated herein by reference.

|

||

|

4.10

|

Form of Convertible Note Hedge Confirmation for Convertible Senior Notes due 2026, filed as an exhibit to the Registrant’s Current Report on Form 8-K filed April 13, 2021 and incorporated herein by reference.

|

||

|

4.11

|

Indenture, dated as of June 12, 2023, by and between the Registrant and U.S. Bank Trust Company, a National Association, as trustee, including Form of

1.75 percent Global Note due in 2028, filed as an exhibit to the Registrant’s Current Report on Form 8-K filed June 12, 2023 and incorporated herein by

reference.

|

||

|

10.1*

|

Second Amended Non-Employee Director Compensation Policy, filed as an exhibit

to the Registrant’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 and incorporated herein by reference.

|

||

|

10.2*

|