Investor Presentation June 30, 2024

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about the Company’s plans, objectives, expectations and intentions that are not historical facts, and other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “should,” “projects,” “seeks,” “estimates” or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are based on current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control. In addition, these forward-looking statements are based on assumptions that are subject to change. The following factors, among others, could cause actual results to differ materially from the anticipated results (express or implied) or other expectations in the forward-looking statements: 1) Risks associated with lending and potential adverse changes in the credit quality of the Company’s loan portfolio; 2) Changes in monetary and fiscal policies, including interest rate policies of the Federal Reserve Board, which could adversely affect the Company’s net interest income and margin, the fair value of its financial instruments, profitability, and stockholders’ equity; 3) Legislative or regulatory changes, including increased FDIC insurance rates and assessments, changes in the review and regulation of bank mergers, or increased banking and consumer protection regulations, that may adversely affect the Company’s business and strategies; 4) Risks related to overall economic conditions, including the impact on the economy of a rising interest rate environment, infl ationary pressures, and geopolitical instability, including the wars in Ukraine and the Middle East; 5) Risks associated with the Company’s ability to negotiate, complete, and successfully integrate any future acquisitions; 6) Costs or difficulties related to the completion and integration of pending or future acquisitions; 7) Impairment of the goodwill recorded by the Company in connection with acquisitions, which may have an adverse impact on earnings and capital; 8) Reduction in demand for banking products and services, whether as a result of changes in customer behavior, economic conditions, banking environment, or competition; 9) Deterioration of the reputation of banks and the financial services industry, which could adversely affect the Company's abil ity to obtain and maintain customers; 10) Changes in the competitive landscape, including as may result from new market entrants or further consolidation in the financial services industry, resulting in the creation of larger competitors with greater financial resources; 11) Risks presented by continued public stock market volatility, which could adversely affect the market price of the Company’s common stock and the ability to raise additional capital or grow through acquisitions; 12) Risks associated with dependence on the Chief Executive Officer, the senior management team and the Presidents of Glacier Bank’s divisions; 13) Material failure, potential interruption or breach in security of the Company’s systems or changes in technological which cou ld expose the Company to cybersecurity risks, fraud, system failures, or direct liabilities; 14) Risks related to natural disasters, including droughts, fires, floods, earthquakes, pandemics, and other unexpected events; 15) Success in managing risks involved in the foregoing; and 16) Effects of any reputational damage to the Company resulting from any of the foregoing. 2

Glacier Bancorp, Inc. 6/30/2024 Snapshot Ticker GBCI Total Assets $27.81 billion Gross Loans $16.85 billion Deposits $20.10 billion TCBV Per Share $18.26 Dividends $0.33 Stock Price $37.32 Market Cap $4.23 billion 3

Differentiated Bank Model • Genuine community banking model • Backed by resources and support of Glacier Bancorp • Strategy of growth through acquisitions and organically 4

Glacier is a “Company of Banks” 5

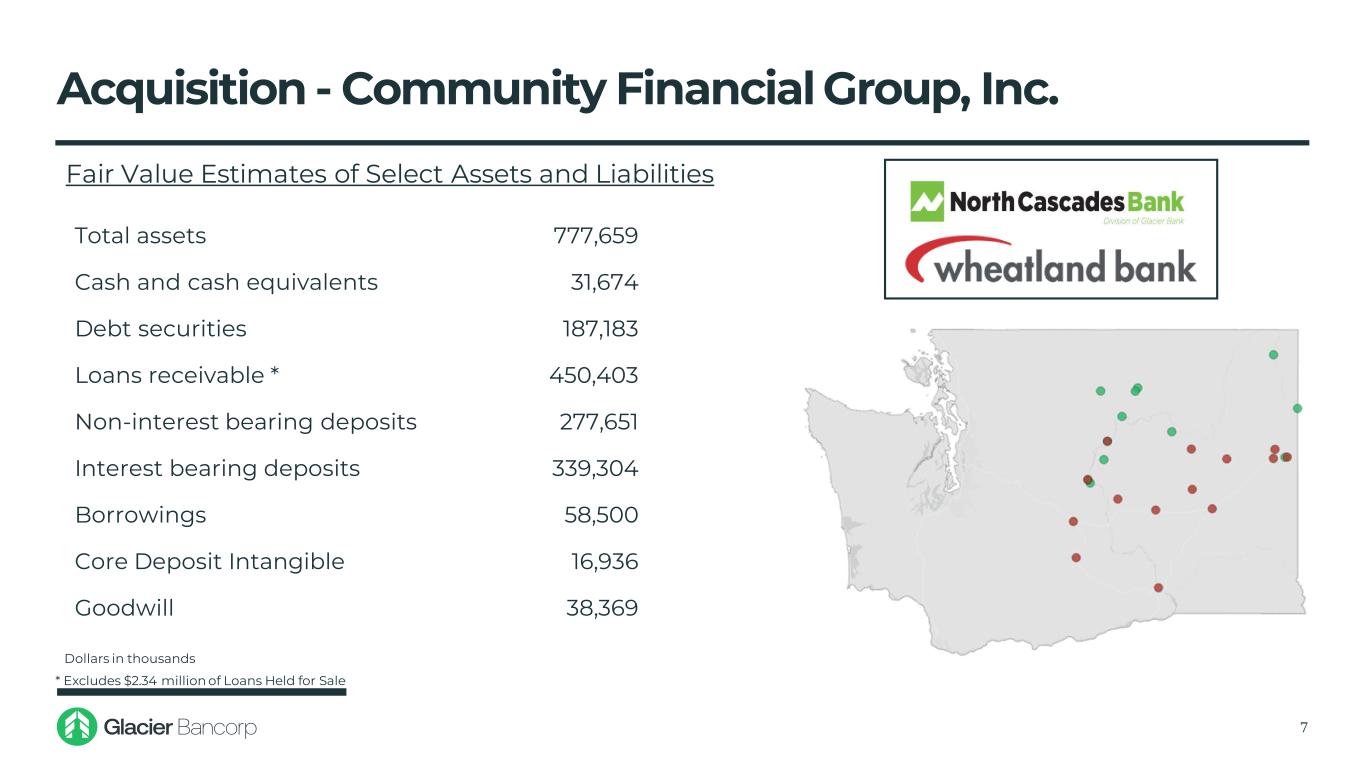

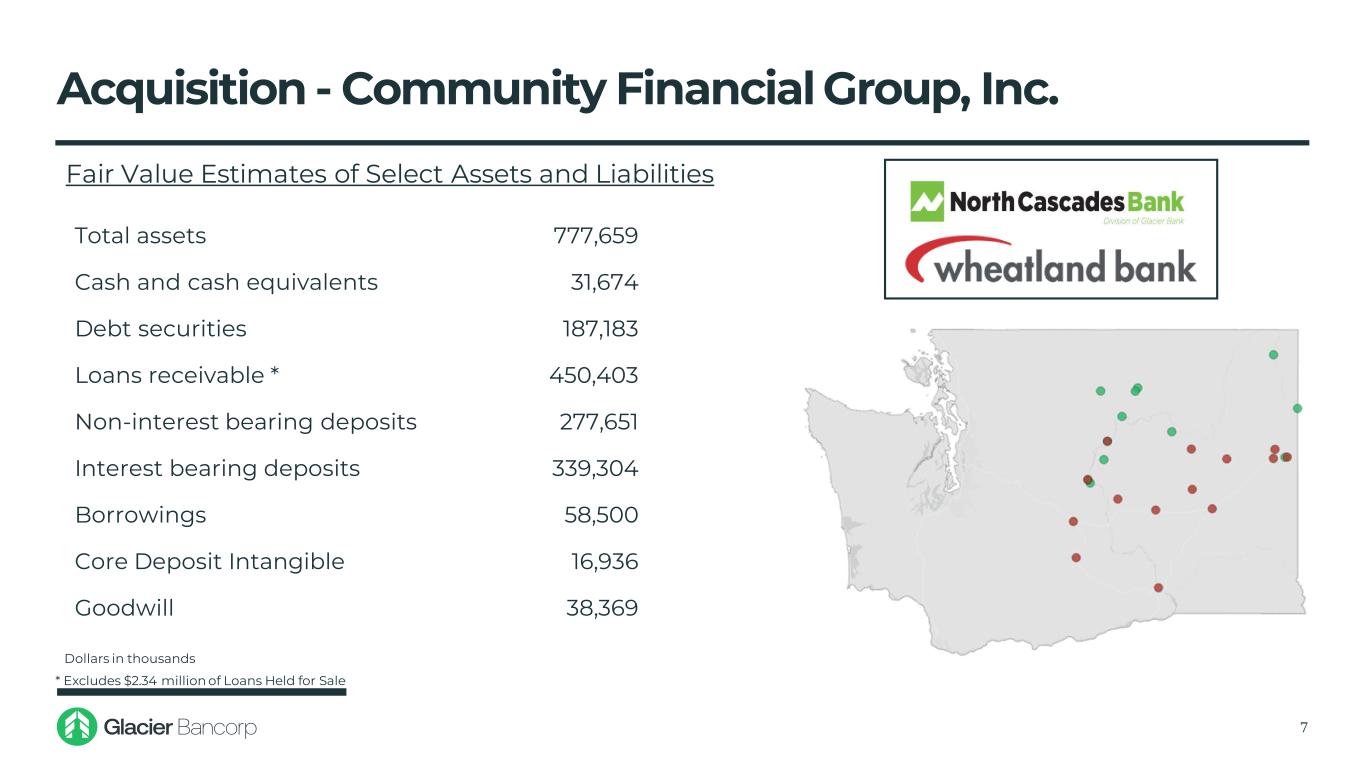

Acquisition - Community Financial Group, Inc. • A new bank division, Wheatland Bank, was formed upon combining with the North Cascades Bank division • Established a market-leading Eastern Washington franchise • The acquisition was consistent with Glacier’s long-term strategy of buying good banks in good markets with good people • The new Wheatland Bank division is Glacier’s 7th largest division by asset size, with over $1.6 billion in assets and 250 employees • The acquisition complements GBCI’s existing strong loan and deposit portfolios and deepens its agricultural presence in one of the top Ag producing markets in the United States 6

Acquisition - Community Financial Group, Inc. 7 * Excludes $2.34 million of Loans Held for Sale Total assets 777,659 Cash and cash equivalents 31,674 Debt securities 187,183 Loans receivable * 450,403 Non-interest bearing deposits 277,651 Interest bearing deposits 339,304 Borrowings 58,500 Core Deposit Intangible 16,936 Goodwill 38,369 Fair Value Estimates of Select Assets and Liabilities Dollars in thousands

Acquisition - Six Montana Branches of HTLF Bank 8 • On July 19, 2024, Glacier Bank completed the acquisition of six Montana branch locations of the Rocky Mountain Bank division of HTLF Bank, a wholly owned subsidiary of Heartland Financial USA, Inc. • The six branches Glacier Bank will acquire are located in : • The branches will join Glacier Bank divisions operating in Montana • At closing, the acquired branches had preliminary gross loans of $290 million and deposits of $395 million • Billings, MT – 2 locations • Stevensville, MT – 1 location • Bozeman, MT – 1 location • Whitehall, MT – 1 location • Plentywood, MT – 1 location B ozema n, MTBi l l i ngs , MT St evens vi l l e, MT Pl ent yw ood, MTW hi t eha l l , MT RMB GBCI

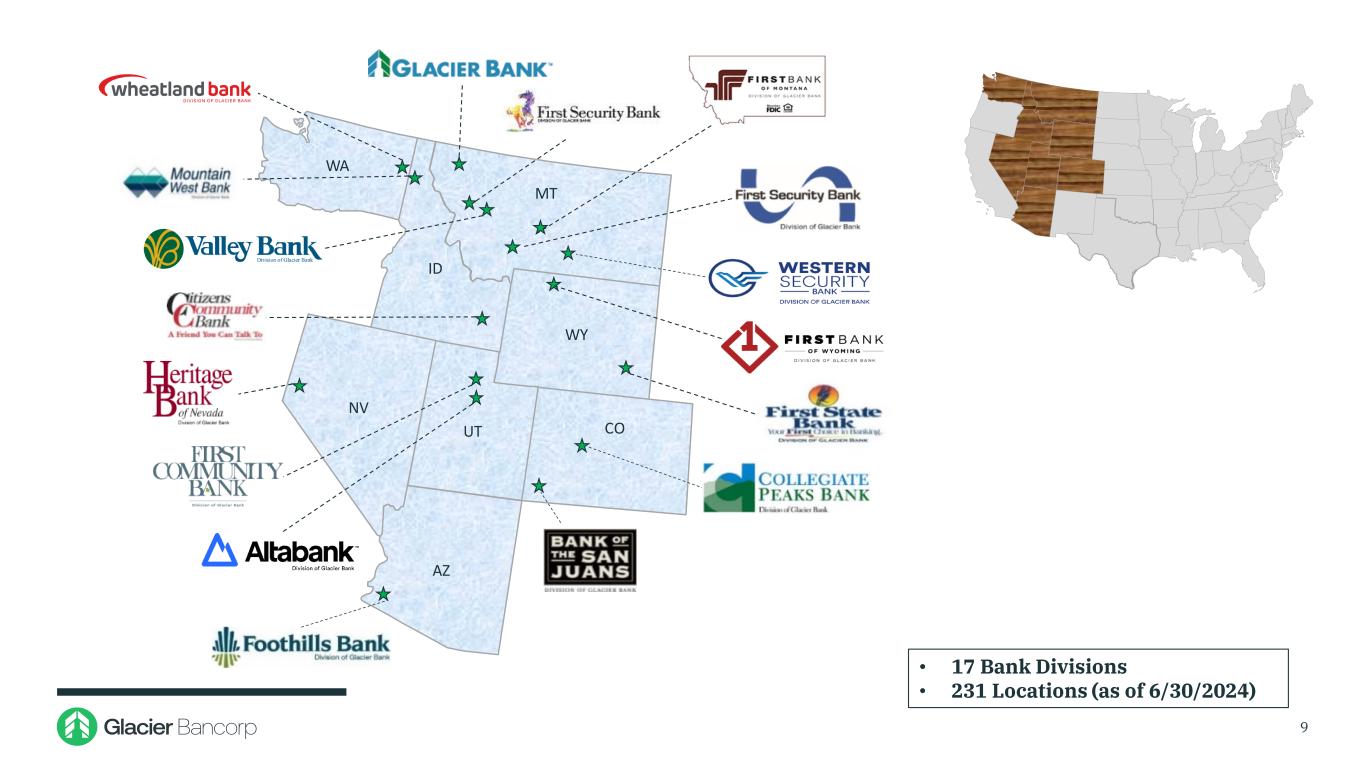

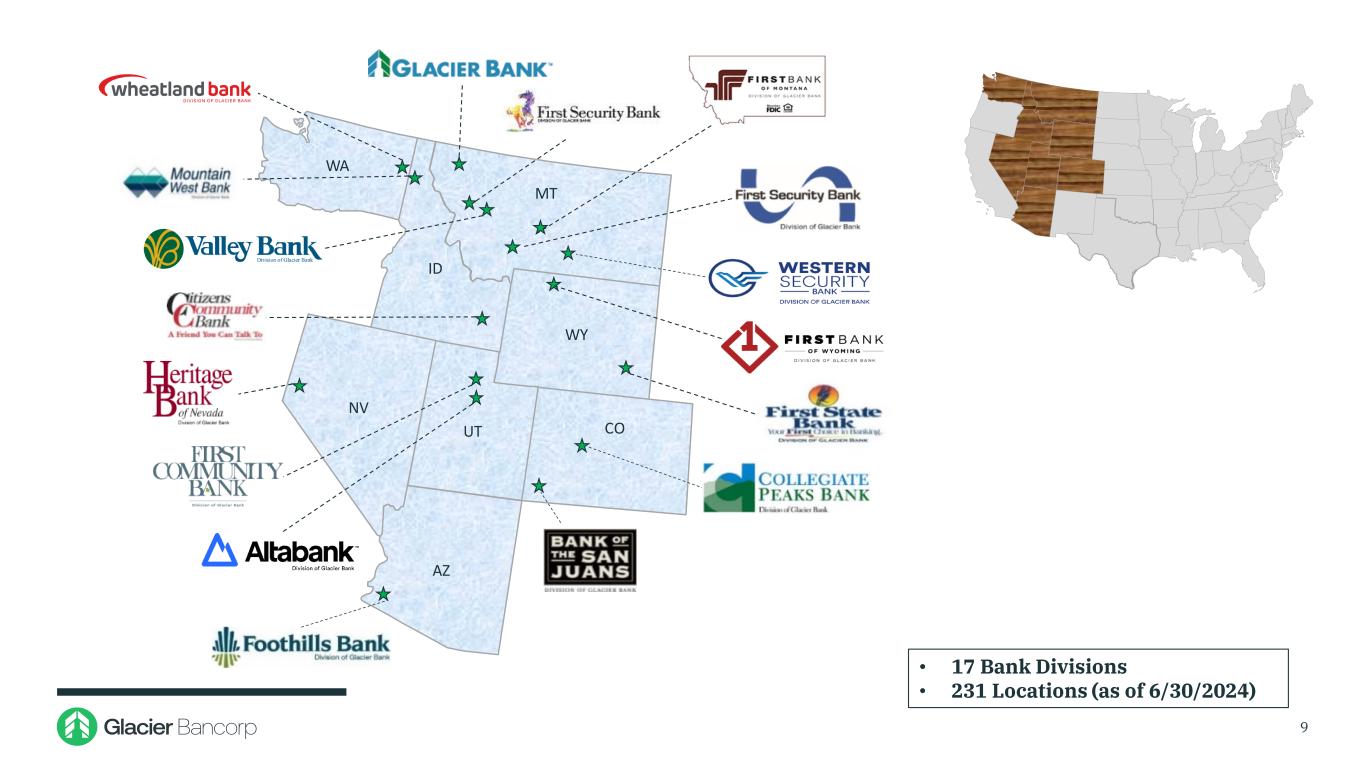

WY ID UT AZ NV WA CO MT • 17 Bank Divisions • 231 Locations (as of 6/30/2024) 9

$7.9 $8.3 $9.1 $9.5 $9.7 $12.1 $13.7 $18.5 $25.9 $26.6 $27.7 $28.2 $- $5 $10 $15 $20 $25 $30 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 6/30/2024* Total Assets ($B) Acquisitions July 2024 Six Montana Branches GBCI Acquisition History – 2013 through 6/30/2024 10 • Long history of adding high quality community banks that fit the Glacier banking model May 2013 $301M Assets July 2013 $330M Assets August 2014 $349M Assets February 2015 $176M Assets October 2015 $270M Assets October 2021 $4,132M Assets July 2019 $978M Assets April 2017 $386M Assets April 2019 $379M Assets February 2018 $1,110M Assets January 2018 $551M Assets February 2020 $745M Assets August 2016 $76M Assets Source: S&P Capital IQ Pro Note: Assets for acquired bank based on date of deal completion *Acquisition of six Montana branches from the Rocky Mountain Bank division of HTLF Bank closed on 7/19/2024; GBCI assets shown for 6/30/2024 are pro forma for the acquired branches January 2024 $778M Assets

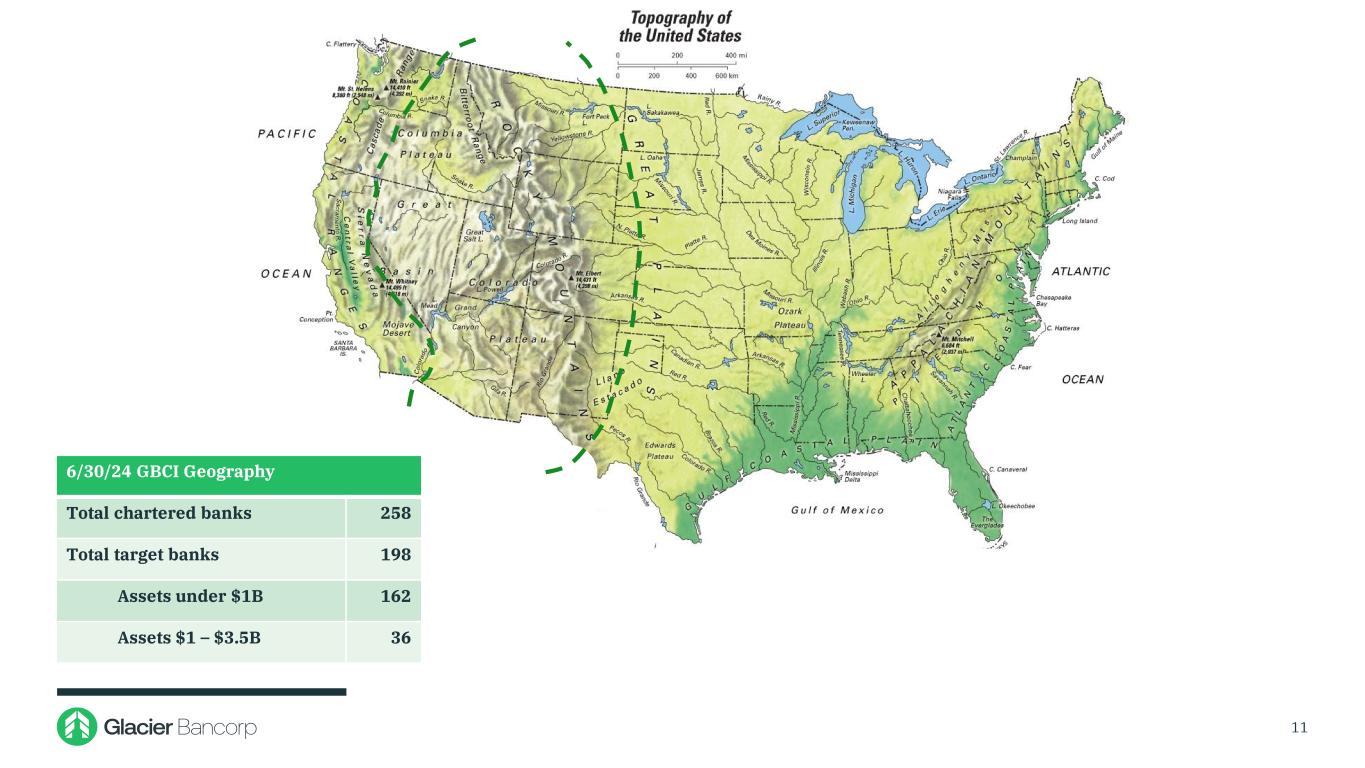

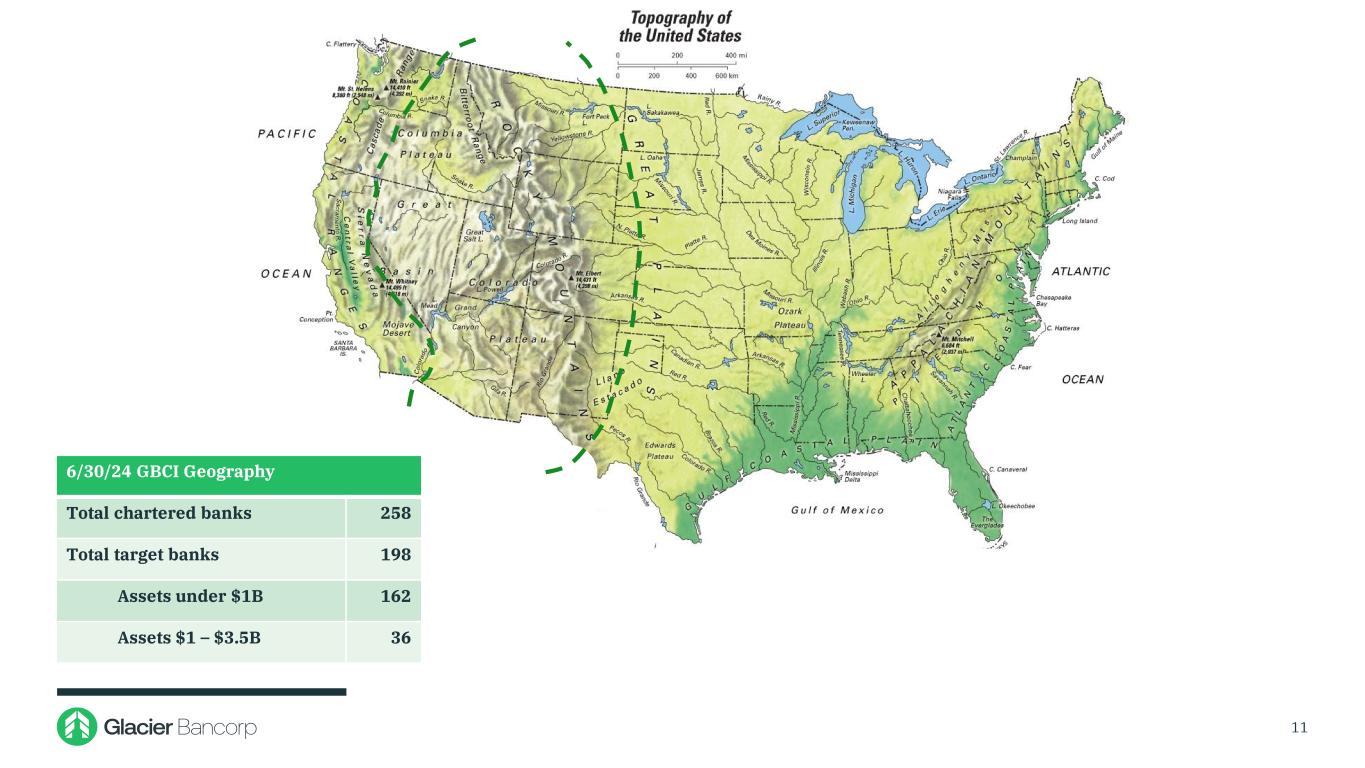

6/30/24 GBCI Geography Total chartered banks 258 Total target banks 198 Assets under $1B 162 Assets $1 – $3.5B 36 11

Solid Financial Results 12

13 Diluted Earnings Per Share $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 $2.75 $3.00 $3.25 $2.38 $2.81 $2.01 $0.55 $0.29 $0.50 $0.39 $2.74 $1.05 • The decrease in second quarter 2024 EPS over second quarter 2023 EPS was driven primarily by the significant increase in funding costs combined with the increased costs associated with the Wheatland acquisition • Second quarter 2024 non-interest expense of $141.0 million increased $10.3 million over the prior year second quarter $2.86 $0.68

0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 1.62%1.64% 1.33% 0.81% 0.87% 0.56% • ROA in the first quarter of 2024 was in the 15th♦ percentile among Glacier’s peer group 14 Return on Assets ♦BHCPR as of 3/31/2024 1.15%

4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 16.15% 15.49% 16.59%16.85% 12.14% 12.75% 8.04% • The Company’s historically high capital levels have made it more difficult to produce higher ROTE. 15 Return on Tangible Equity

$100 $200 $300 $400 $500 $600 $700 $800 $900 $503 $600 $663 $788 $692 $722 $670 4.39% 4.09% 3.42% 3.27% 2.73% YTD 2.91% YTD 2.64%Q2 2.74% Q1 3.08% Q1 2.59% • Net interest income of $670 million, annualized, for the first half of 2024 decreased $53 million, or 7.30%, over net interest income of $722 million for the first half of 2023 • Net interest margin of 2.64% for the first half of 2024 decreased 27 basis points over the net interest margin of 2.91% for the first half of 2023 16 Net Interest Income / Margin * (Dollars in millions) * Net interest income and margin are annualized Q2 2.68%

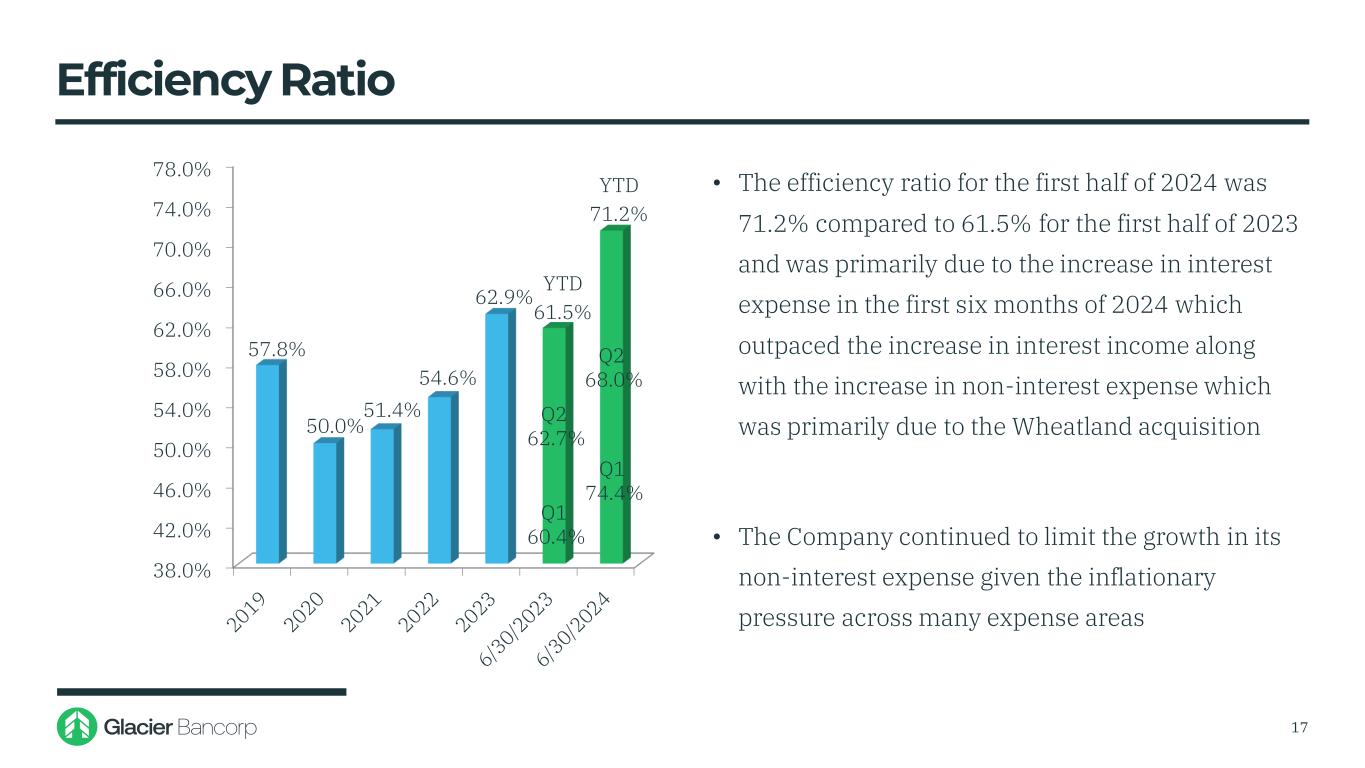

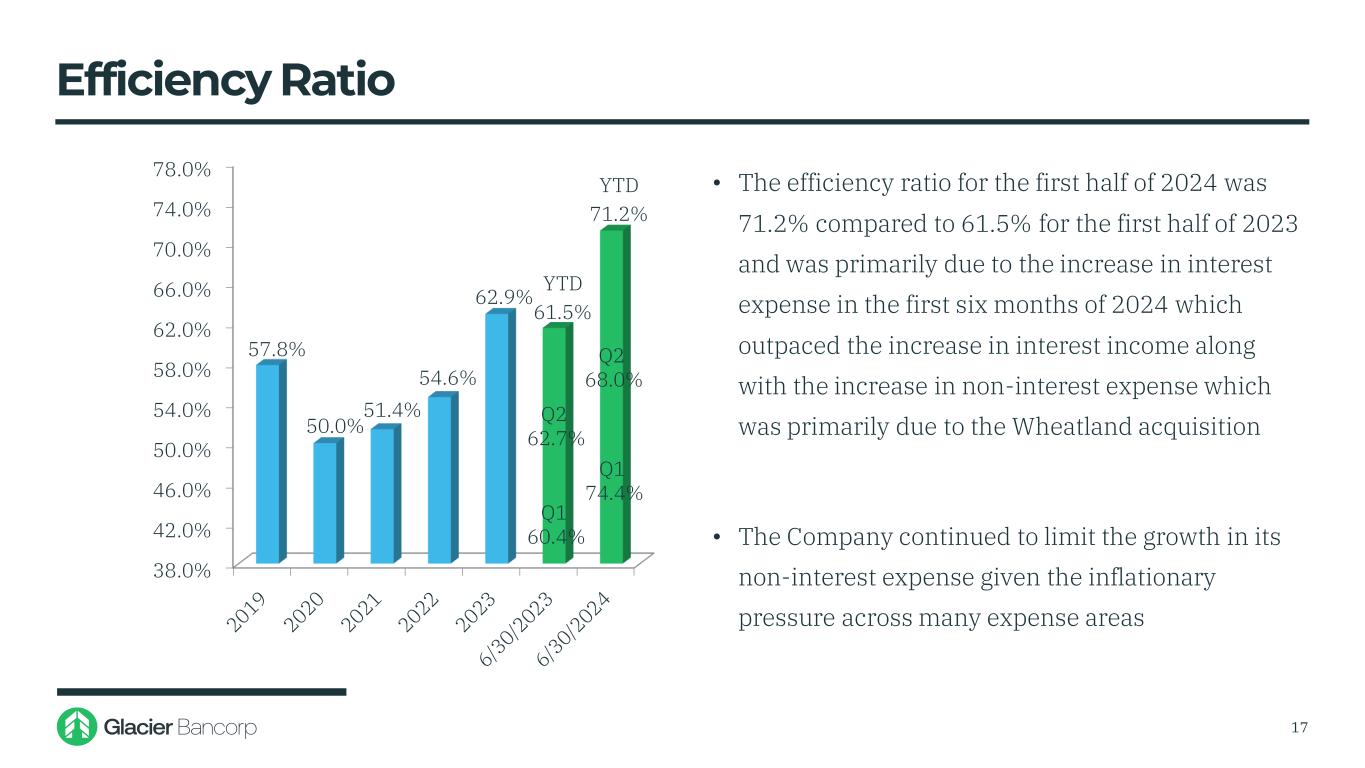

38.0% 42.0% 46.0% 50.0% 54.0% 58.0% 62.0% 66.0% 70.0% 74.0% 78.0% 57.8% 50.0% 51.4% 54.6% 62.9% YTD 61.5% YTD 71.2% • The efficiency ratio for the first half of 2024 was 71.2% compared to 61.5% for the first half of 2023 and was primarily due to the increase in interest expense in the first six months of 2024 which outpaced the increase in interest income along with the increase in non-interest expense which was primarily due to the Wheatland acquisition • The Company continued to limit the growth in its non-interest expense given the inflationary pressure across many expense areas 17 Efficiency Ratio Q1 60.4% Q2 62.7% Q1 74.4% Q2 68.0%

Strong Balance Sheet 18

$13,864 $18,504 $25,941 $26,635 $27,743 $27,805 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 $22,000 $24,000 $26,000 $28,000 $30,000 • Total assets organically decreased $715 million, or 3%, during the first six months of 2024 • Total assets grew $1.107 billion, or 4%, in 2023 • Decreased cash position by $554 million in the first six months of 2024 19 Asset Trends (Dollars in millions)

11.00% 12.00% 13.00% CET1 11.7% 12.7% Peers Glacier • Regulatory capital CET1 ratio well above peer median 20 CET 1 Capital Relative to Peers♦ ♦ Proxy Compensation Peer Group Median as of 3/31/2024

Ample Liquidity of $14.2 Billion at June 30, 2024 • Ready access to liquidity totaling $9.3 billion • $4.7 billion in available borrowing capacity o Federal Reserve: $2.0 billion o FHLB: $2.1 billion o Correspondent banks: $0.6 billion • $3.8 billion of unpledged marketable securities • Cash of $0.8 billion • Additional liquidity totaling $4.9 billion • Access to brokered deposits: $4.2 billion • Over-pledged marketable securities: $0.7 billion 21

Strong Core Deposit Base • Our community banking model is customer relationship driven • Uninsured deposits, excluding collateralized public deposits and cash held at the holding company, are 24% of total deposits • 32% of uninsured deposits are with customers that also have a loan relationship with us • Deposit accounts less than $250,000 have increased 1.2% year to date • Non-interest bearing deposits • 56% of non-interest bearing balances are in accounts with $250,000 or less • 51% of non-interest bearing deposits are with customers with multiple accounts • 80% of non-interest bearing balances are in business accounts 22

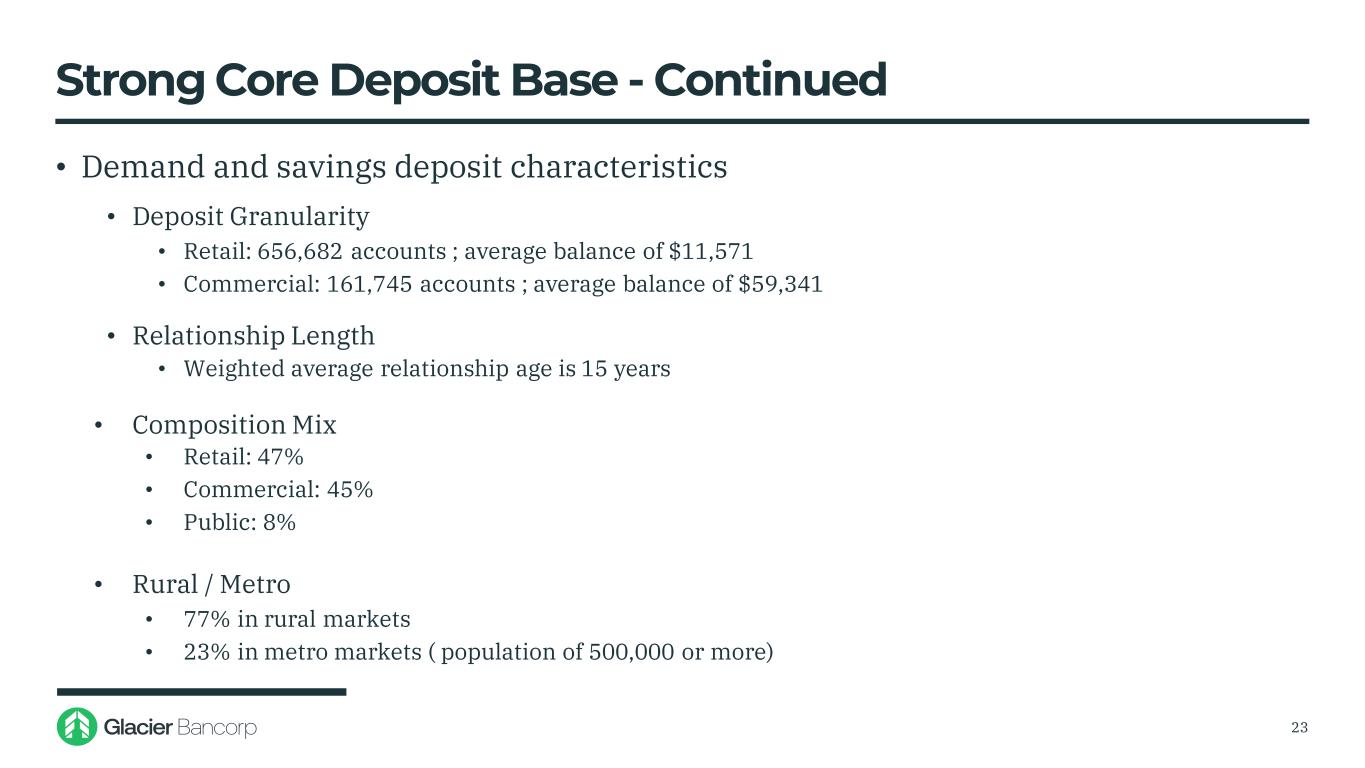

Strong Core Deposit Base - Continued • Demand and savings deposit characteristics • Deposit Granularity • Retail: 656,682 accounts ; average balance of $11,571 • Commercial: 161,745 accounts ; average balance of $59,341 • Relationship Length • Weighted average relationship age is 15 years • Composition Mix • Retail: 47% • Commercial: 45% • Public: 8% • Rural / Metro • 77% in rural markets • 23% in metro markets ( population of 500,000 or more) 23

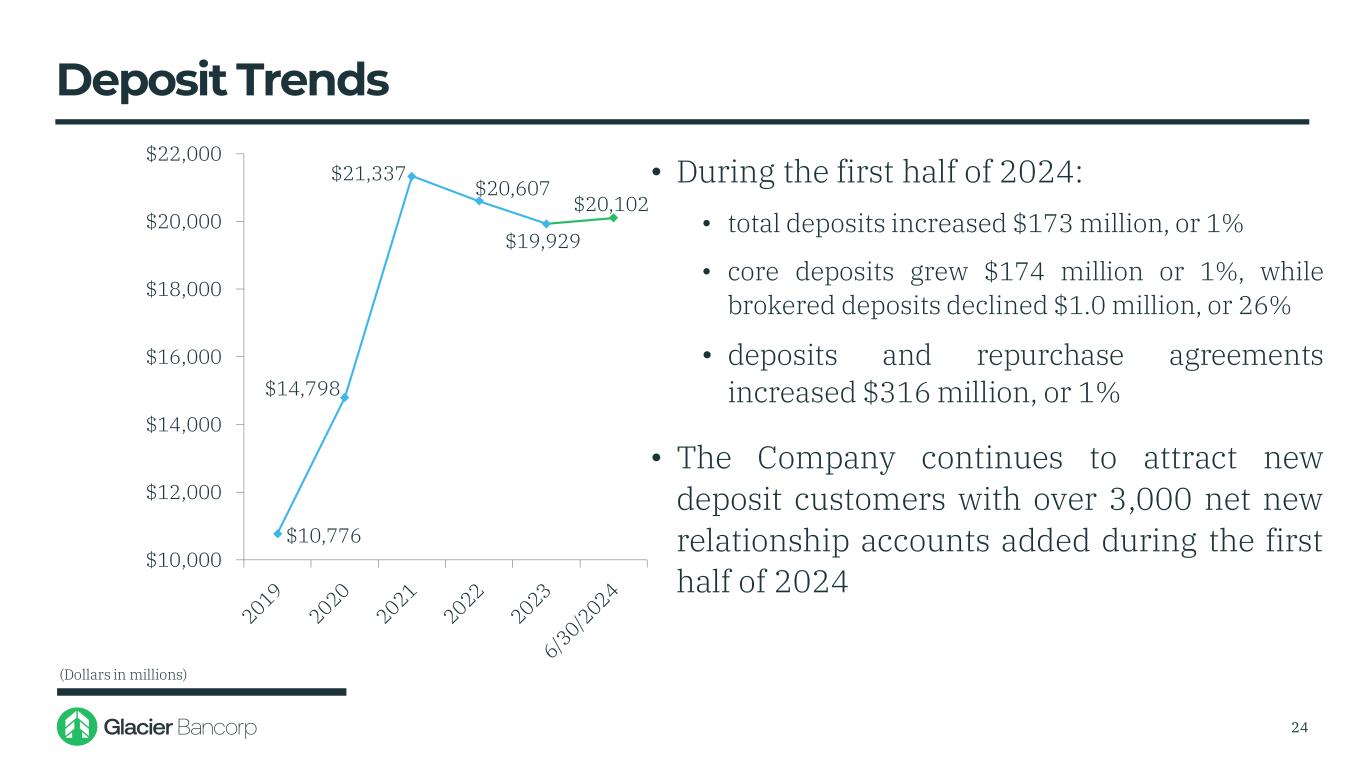

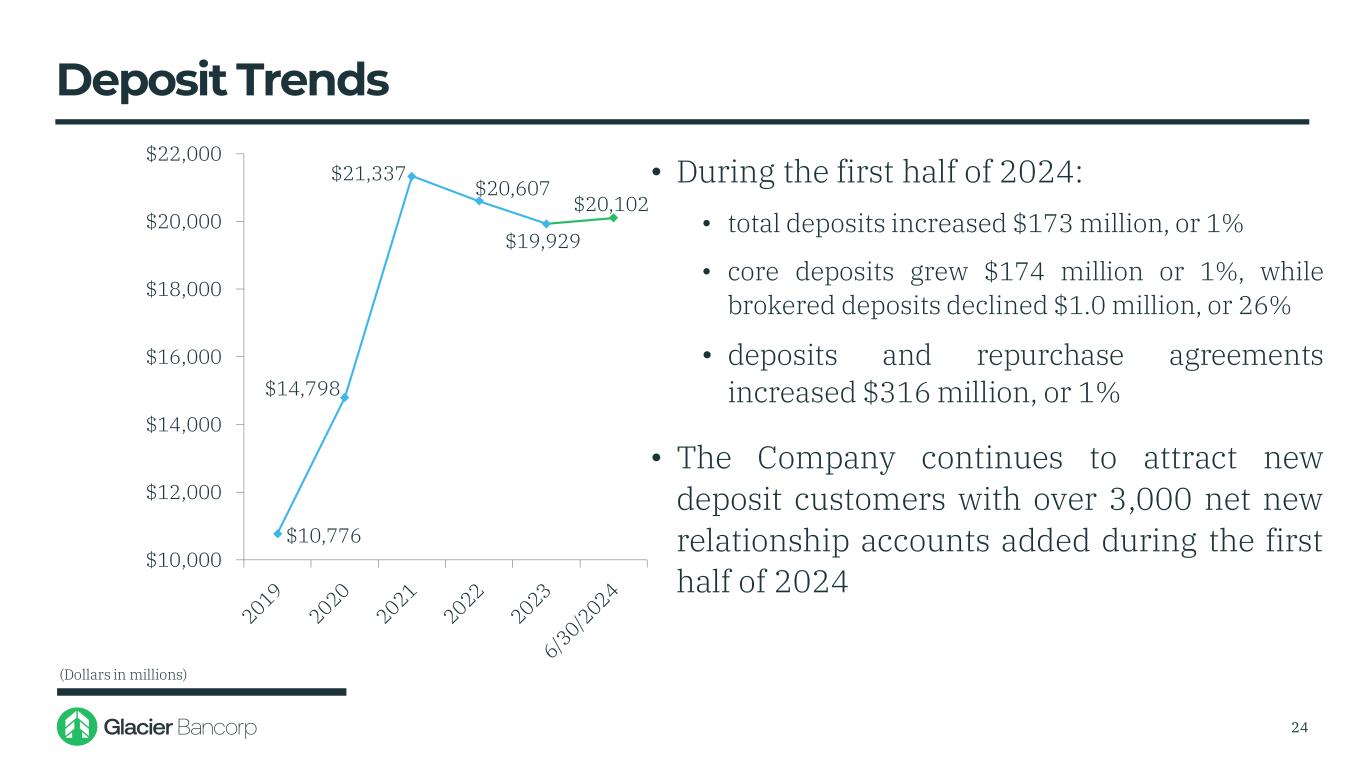

$10,776 $14,798 $21,337 $20,607 $19,929 $20,102 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 $22,000 • During the first half of 2024: • total deposits increased $173 million, or 1% • core deposits grew $174 million or 1%, while brokered deposits declined $1.0 million, or 26% • deposits and repurchase agreements increased $316 million, or 1% • The Company continues to attract new deposit customers with over 3,000 net new relationship accounts added during the first half of 2024 24 Deposit Trends (Dollars in millions)

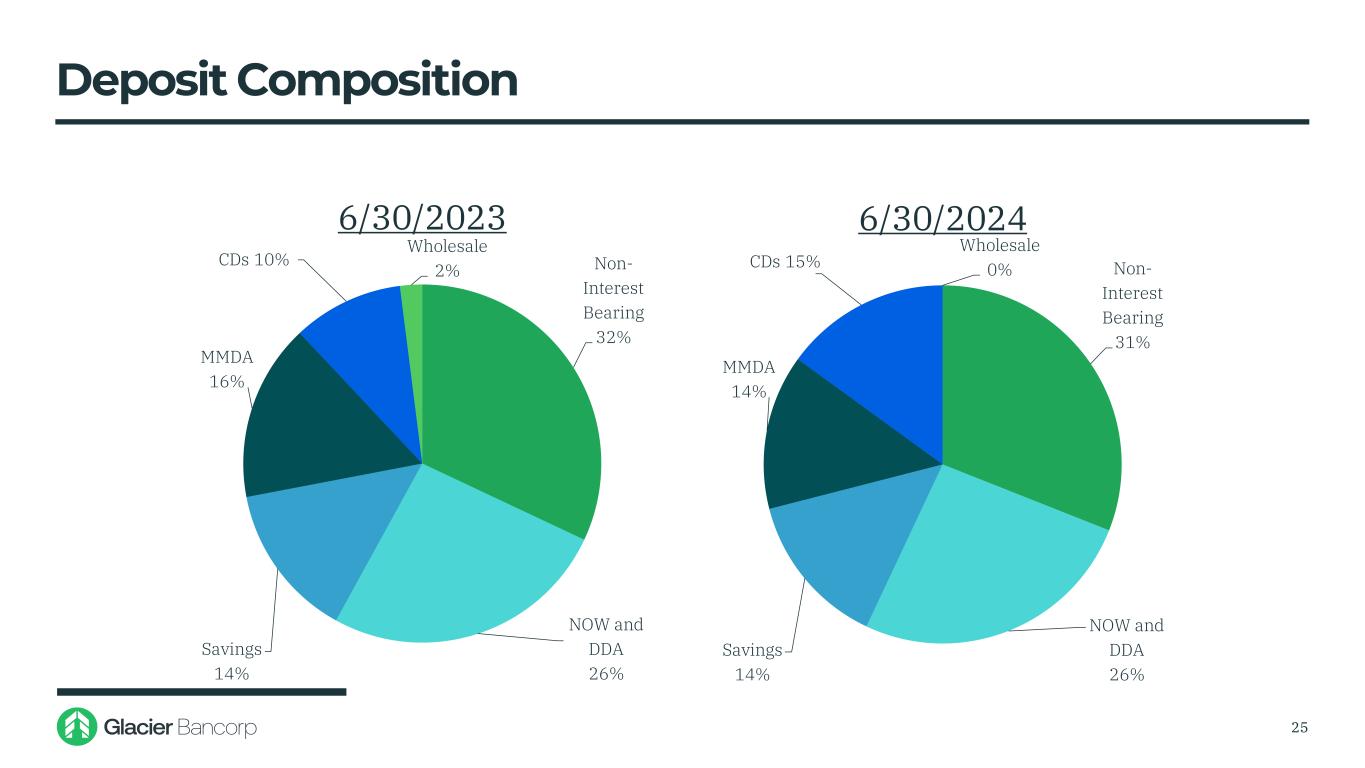

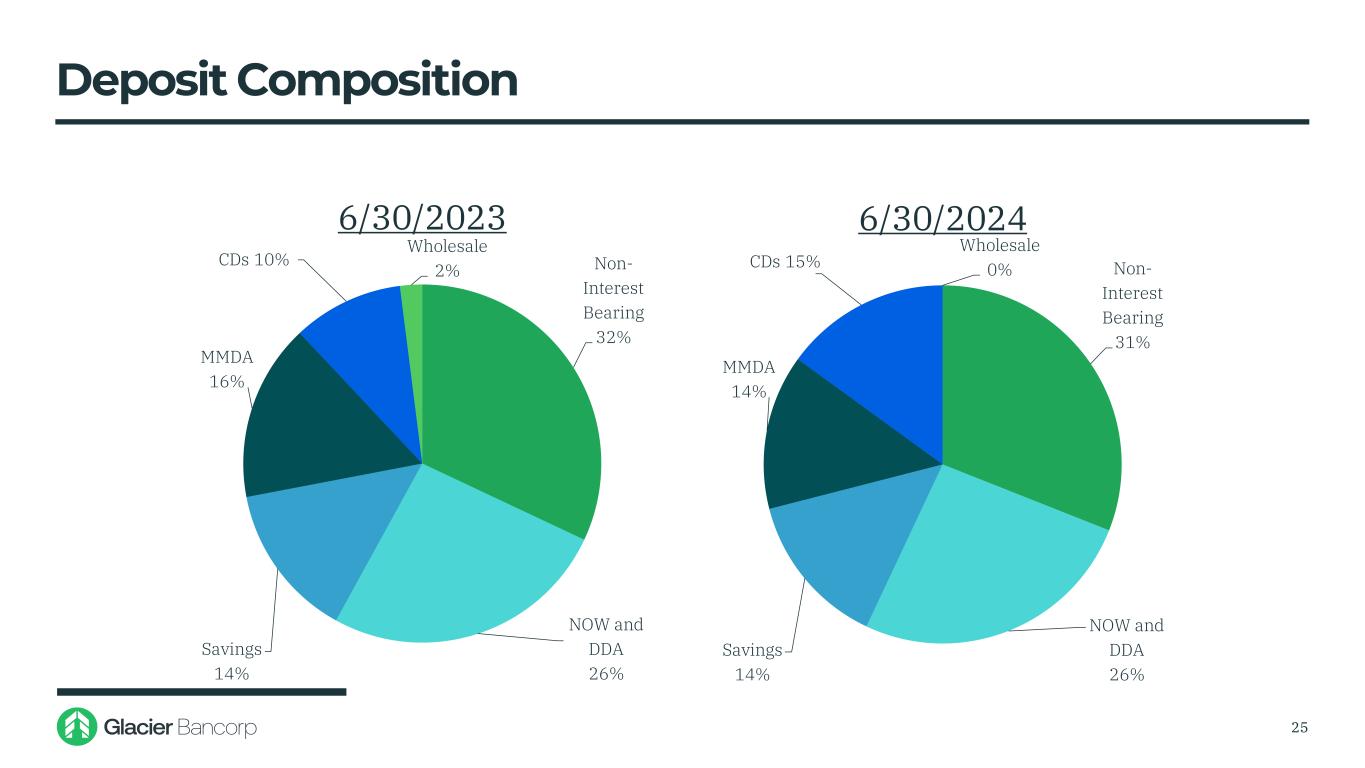

Non- Interest Bearing 32% NOW and DDA 26% Savings 14% MMDA 16% CDs 10% Wholesale 2% 6/30/2023 Non- Interest Bearing 31% NOW and DDA 26% Savings 14% MMDA 14% CDs 15% Wholesale 0% 6/30/2024 25 Deposit Composition

$3,697 $5,455 $7,779 $7,691 $6,023 $6,093 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 • Non-interest bearing deposits increased $70 million, or 1%, during the first half of 2024 • Non-interest bearing deposits remained at 30% of total core deposits at June 30, 2024 compared to 33% at June 30, 2023 26 Non-Interest Bearing Deposits (Dollars in millions)

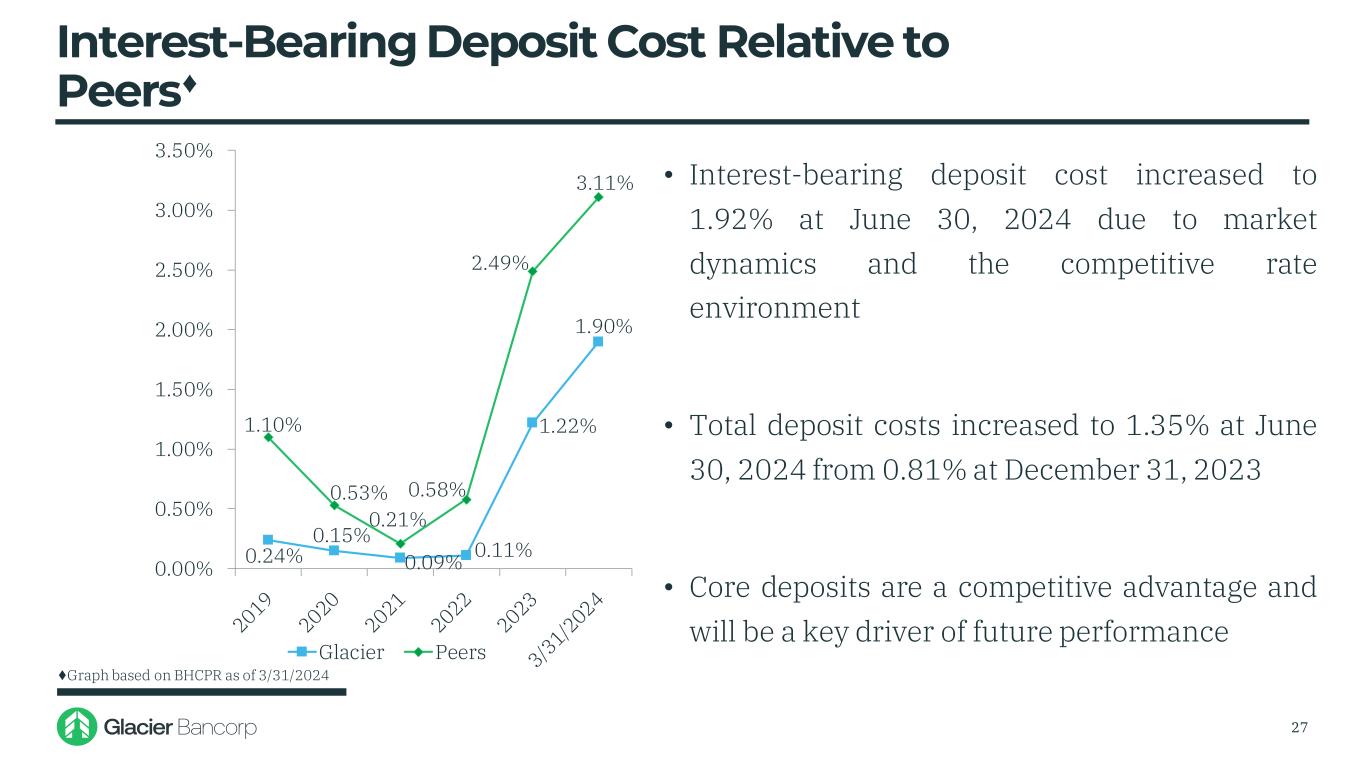

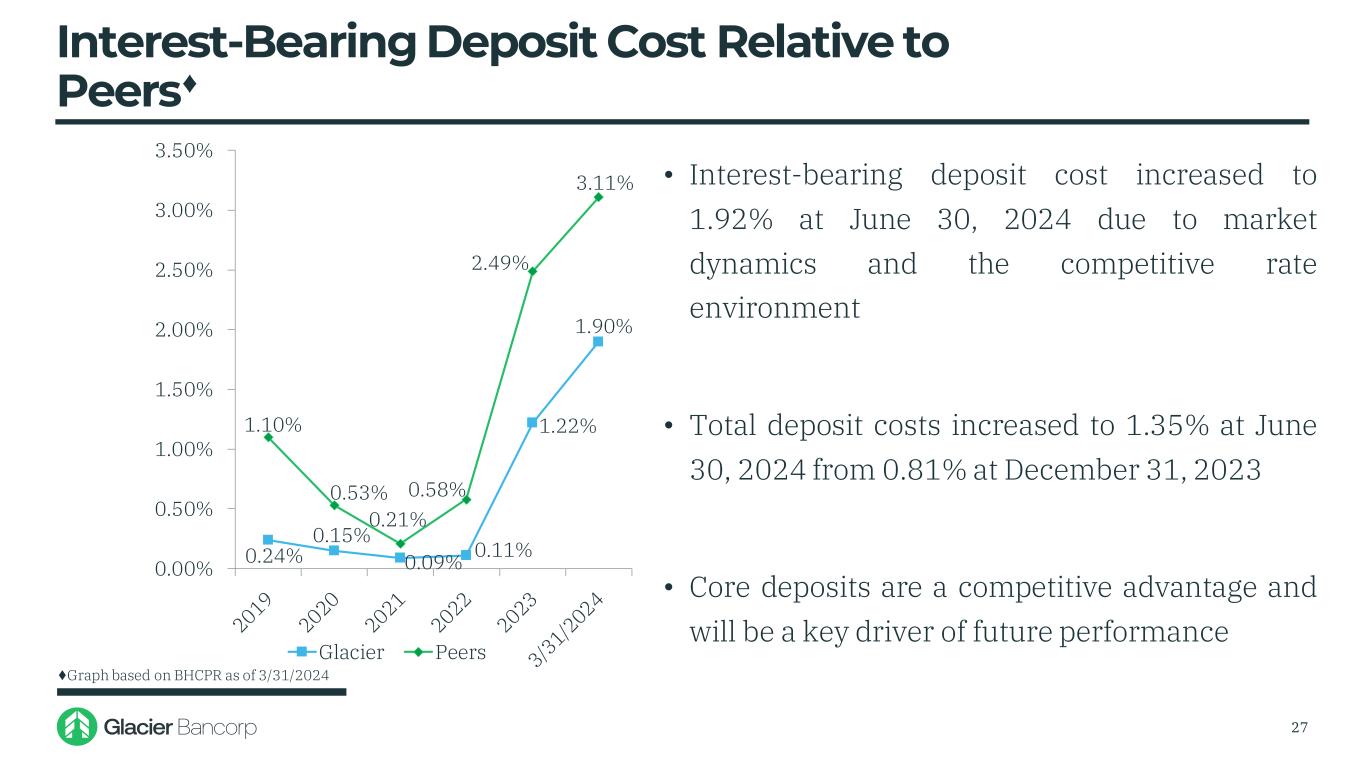

0.24% 0.15% 0.09% 0.11% 1.22% 1.90% 1.10% 0.53% 0.21% 0.58% 2.49% 3.11% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% Glacier Peers • Interest-bearing deposit cost increased to 1.92% at June 30, 2024 due to market dynamics and the competitive rate environment • Total deposit costs increased to 1.35% at June 30, 2024 from 0.81% at December 31, 2023 • Core deposits are a competitive advantage and will be a key driver of future performance 27 Interest-Bearing Deposit Cost Relative to Peers♦ ♦Graph based on BHCPR as of 3/31/2024

$9,513 $11,123 $13,432 $15,247 $16,198 $16,852 $9,000 $10,000 $11,000 $12,000 $13,000 $14,000 $15,000 $16,000 $17,000 $18,000 • Including the $450 million in loans from the Wheatland acquisition, gross loans increased $654 million, or 8% annualized, during the first half of 2024 with the largest increase in commercial real estate of $411 million, or 8% annualized 28 Loan Trends (Dollars in millions)

$0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $364 $1,158 $419 $1,815 $951 $708 $204 • Organic loan growth for the first half of 2024 was $204 million, or 3% annualized, compared to $708 million, or 9% annualized, for the first half of 2023 29 Organic Loan Growth (Dollars in millions)

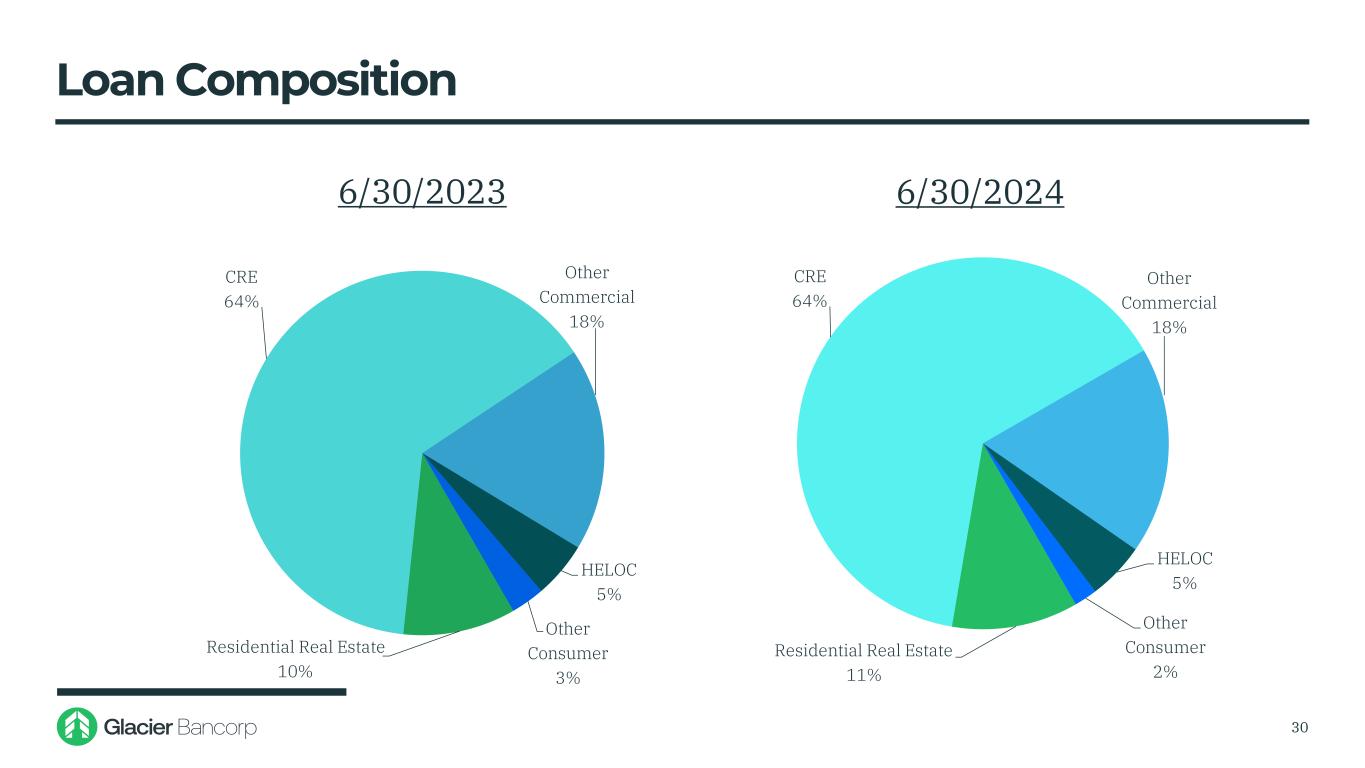

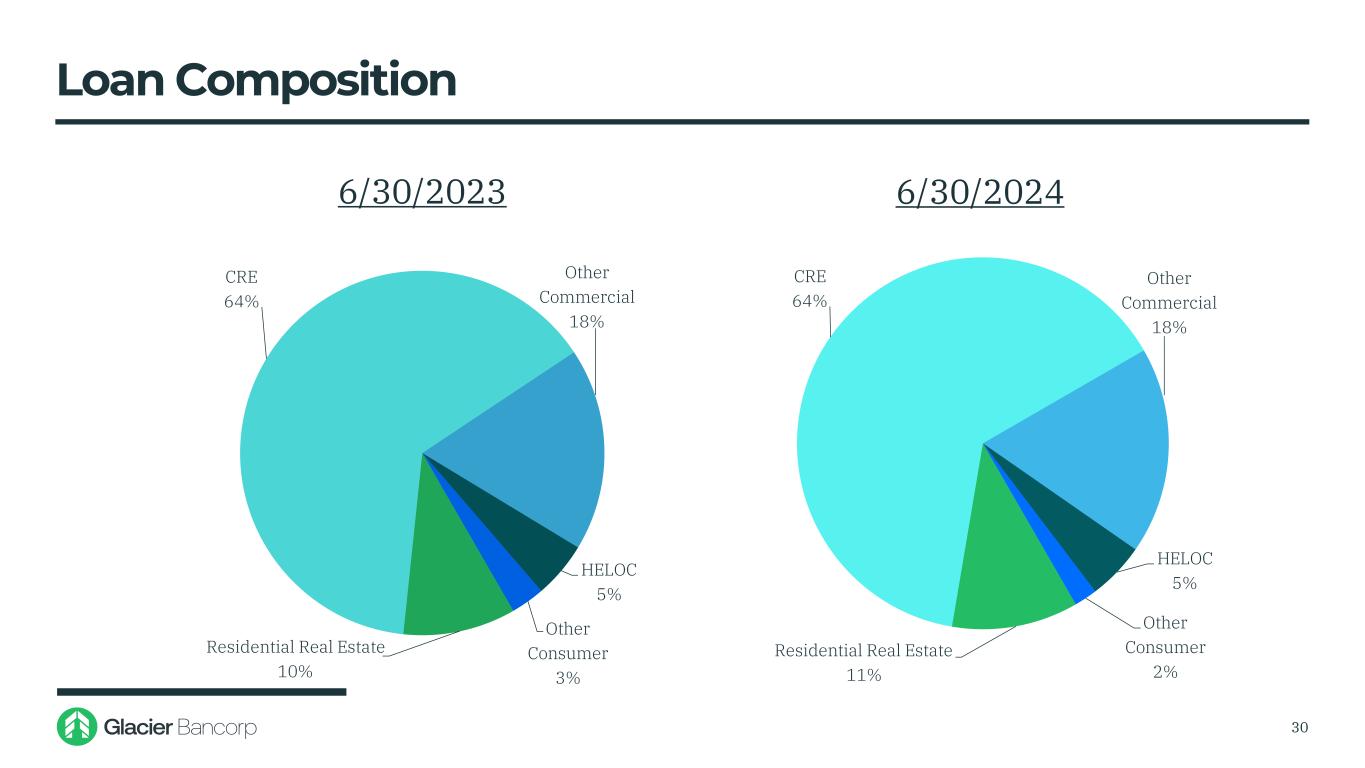

Residential Real Estate 10% CRE 64% Other Commercial 18% HELOC 5% Other Consumer 3% 6/30/2023 Residential Real Estate 11% CRE 64% Other Commercial 18% HELOC 5% Other Consumer 2% 6/30/2024 30 Loan Composition

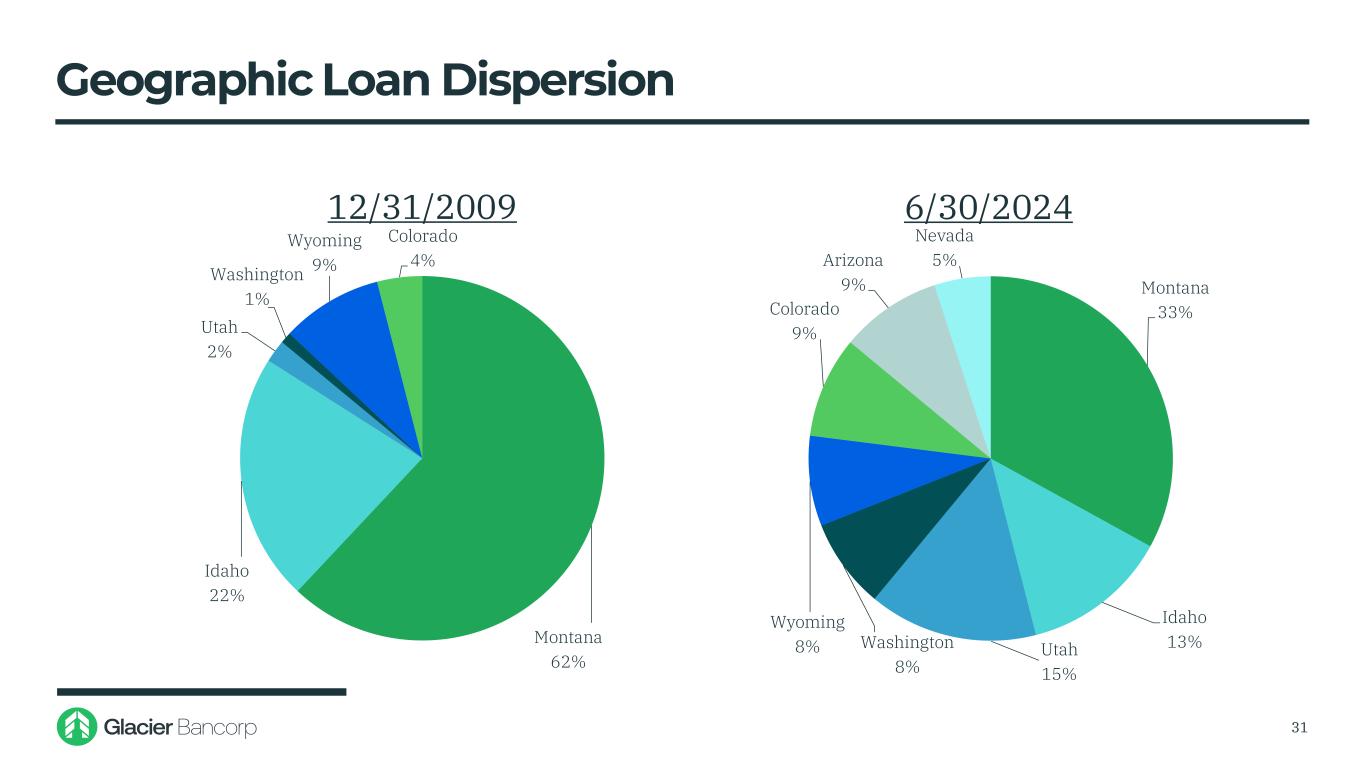

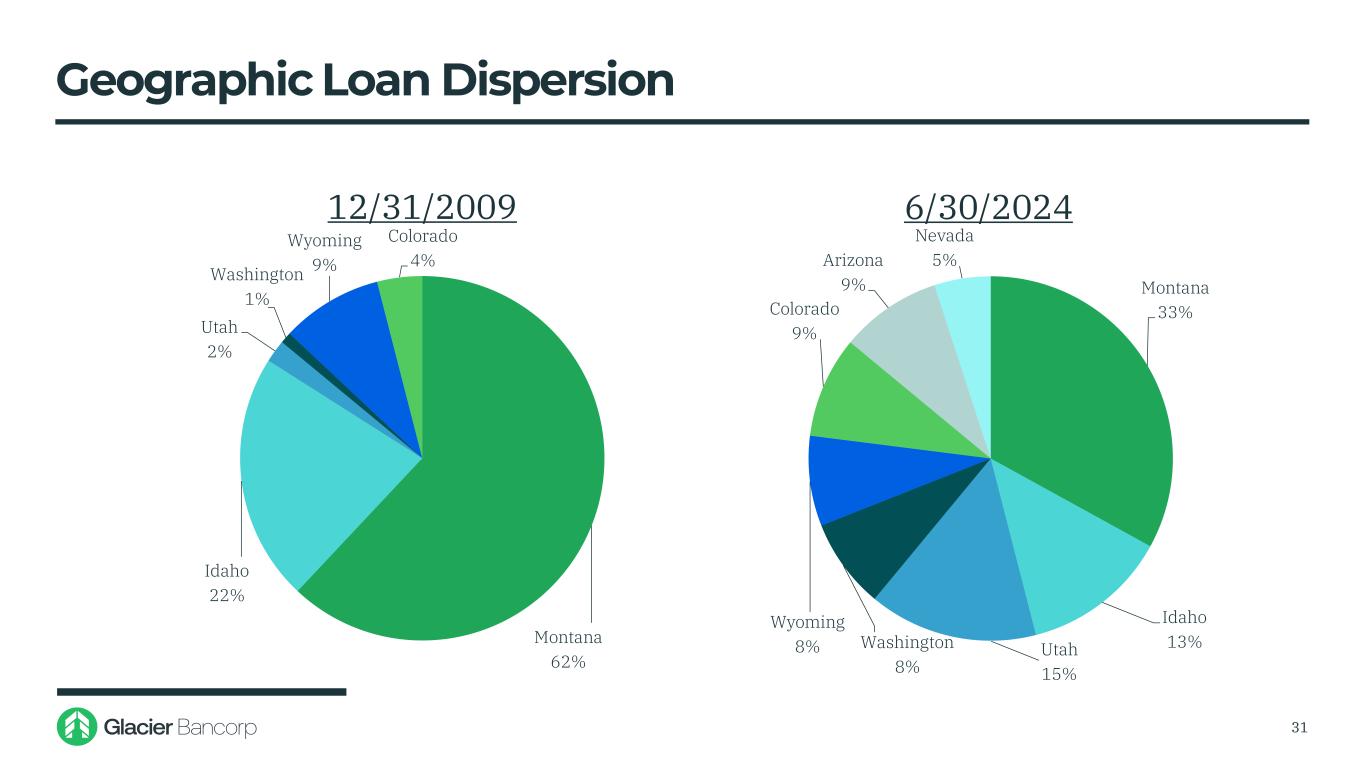

Montana 62% Idaho 22% Utah 2% Washington 1% Wyoming 9% Colorado 4% 12/31/2009 Montana 33% Idaho 13%Utah 15% Washington 8% Wyoming 8% Colorado 9% Arizona 9% Nevada 5% 6/30/2024 31 Geographic Loan Dispersion

Term CRE Portfolio * Diversified and Low Risk Portfolio • Total portfolio $7.0 billion (42% of total portfolio) • Non-owner portfolio $3.9 billion (23% of total portfolio) • $879 thousand average loan balance • 58% average LTV • 0.04% past due rate • 0.01% non-performing • 98% of loans have recourse through guaranties • Geographically dispersed across 8 states 32 44% 56% TOTAL CRE BY OCCUPANCY TYPE Owner Occupied Non-Owner Occupied UT 17% ID 11% MT 23%WY 6% NV 9% CO 11% WA 9% AZ 14% CRE GEOGRAPHIC DISPERSION * Loans are based on regulatory classification, which is based primarily on the type of collateral for the loans. CRE loans may differ when comparing to disclosures in the Company’s Form 10-Q which are based on the purpose of the loan.

Office CRE * • $671 thousand average loan balance • 59% average LTV • 0.02% past due • 0.00% non-performing • 98% of loans have recourse through guaranties • Includes $138 million in medical office • 16% of office portfolio matures or reprices prior to 2026 • Limited exposure to loans above $10 million (1% of total loans). No office CRE loans above $20 million 33 $543 $571 $176 $166 $0 $0 $100 $200 $300 $400 $500 $600 Under $1mil $1mil - $5mil $5mil - $10mil $10mil - $20mil Over $20mil CRE Office by Size Segment (in millions) % of Total Office 37% 39% 12% 11% 0% % of Total Portfolio 3% 3% 1% 1% 0% $76 $163 $195 $284 $207 $130 $99 $296 $7 $- $50 $100 $150 $200 $250 $300 $350 2024 2025 2026 2027 2028 2029 2030 2031-2035 2036 & After CRE Office by Earlier of Next Repricing or Maturity (in millions) * Loans are based on regulatory classification, which is based primarily on the type of collateral for the loans. CRE loans may differ when comparing to disclosures in the Company’s Form 10-Q which are based on the purpose of the loan.

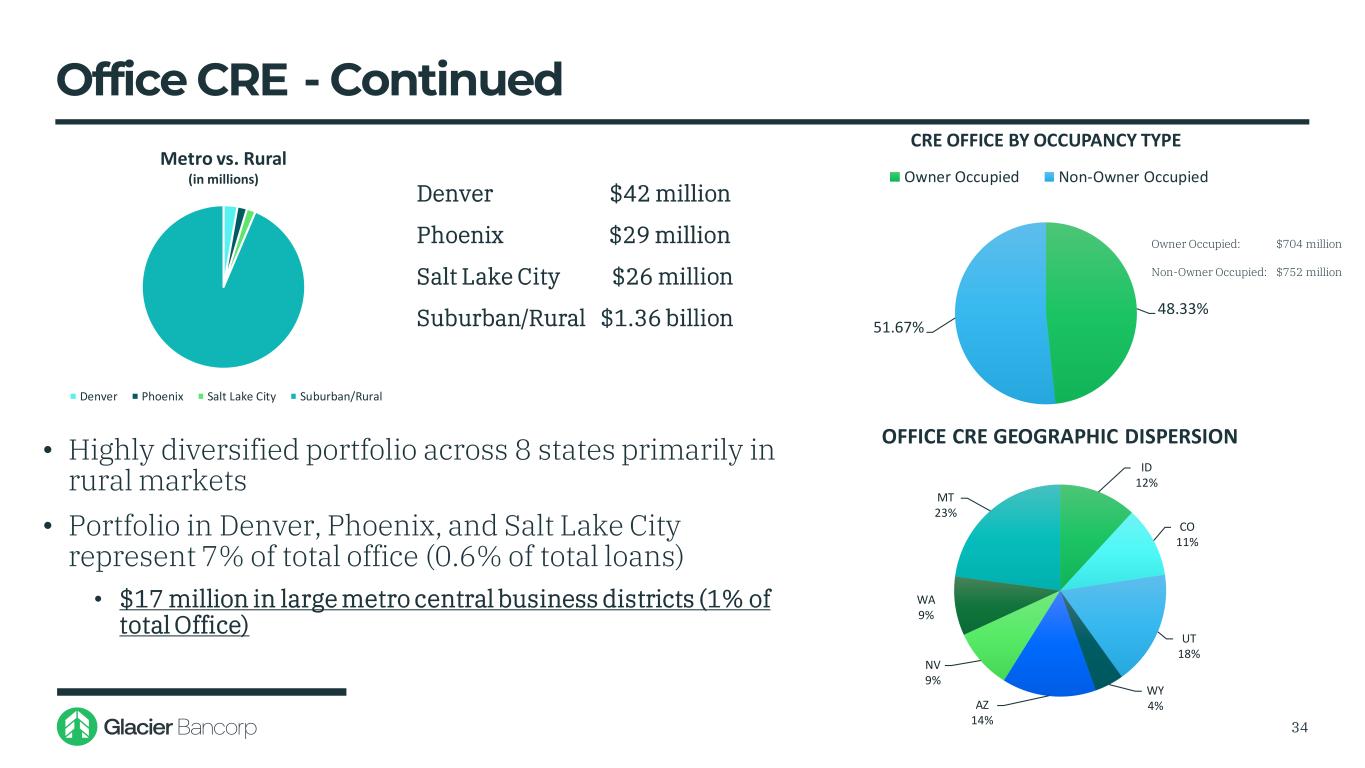

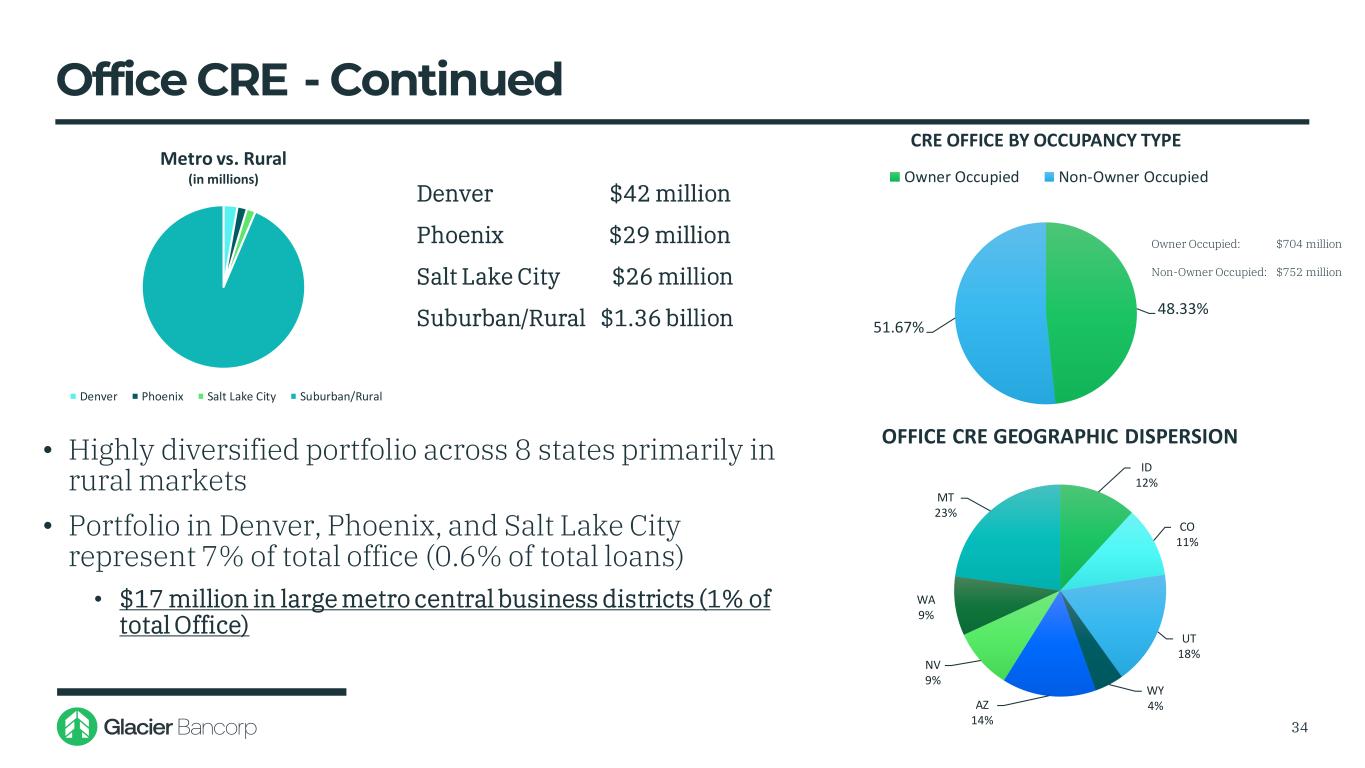

Office CRE - Continued Denver $42 million Phoenix $29 million Salt Lake City $26 million Suburban/Rural $1.36 billion • Highly diversified portfolio across 8 states primarily in rural markets • Portfolio in Denver, Phoenix, and Salt Lake City represent 7% of total office (0.6% of total loans) • $17 million in large metro central business districts (1% of total Office) 34 Owner Occupied: $704 million Non-Owner Occupied: $752 million Metro vs. Rural (in millions) Denver Phoenix Salt Lake City Suburban/Rural 48.33% 51.67% CRE OFFICE BY OCCUPANCY TYPE Owner Occupied Non-Owner Occupied ID 12% CO 11% UT 18% WY 4%AZ 14% NV 9% WA 9% MT 23% OFFICE CRE GEOGRAPHIC DISPERSION

$2,800 $5,528 $10,370 $9,022 $8,288 $7,900 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000 $11,000 • Investment securities ended second quarter 2024 at 28% of total assets compared to 31% at the end of second quarter 2023 • Investments decreased $388 million, or 5%, during the first half of 2024 • Projected quarterly cash flow of $250 million to fund loan growth 35 Investment Portfolio Trends (Dollars in millions)

US Gov't & Federal Agency 15% US Gov't Sponsored Enterprises 3% State & Local Gov'ts 21% Corporate Bonds 0% Residential MBS 48% Commercial MBS 13% 6/30/2023 US Gov't & Federal Agency 17% US Gov't Sponsored Enterprises 4% State & Local Gov'ts 22% Corporate Bonds 0% Residential MBS 44% Commercial MBS 13% 6/30/2024 36 Investment Composition

Improved Credit Quality 37

0.00% 0.10% 0.20% 0.30% 0.40% 0.27% 0.19% 0.12% 0.09% 0.12% 0.06% • NPAs decreased $7.6 million during the first half of 2024 to 0.06% of Bank assets compared to the $720 thousand decrease in the first half of 2023 to 0.12% of Bank assets 38 NPAs to Bank Assets 0.26%

CECL and Allowance for Credit Losses (ACL) • Commercial Asset Quality Ratings • Consumer Loan Past Due Status • Additional Qualitative Adjustments • Prepayment Speed Assumptions • Low levels of unemployment • Historical Loss Period Capture 39 (Dollars in millions) Other Key Model Inputs National Economic Assumptions (December 2023) 1Q 24 2Q 24 3Q 24 2023 2024 GDP Change 0.3% 0. 5% 0.4% 3.1% 1.7% Unemployment Rate 3.8% 3.9% 4.0% 3.6% 3.9% 1.19% of Total Loans 1.19% of Total Loans

$0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $57 $39,765 $23,076 $19,963 $14,795 $8,243 $11,767 • Loan portfolio growth, composition, average loan size, credit quality considerations, economic forecasts and other environmental factors will determine the future level of credit loss expense or benefit 40 Provision For Credit Losses (Dollars in thousands)

$0 $2,500 $5,000 $7,500 $10,000 $12,500 $6,806 $7,653 $2,329 $7,815 $10,316 $4,412 $5,962 • For the first six months of 2024, net charge-offs as a percentage of total loans were 0.04% compared to 0.03% in the first six months of 2023 41 Net Charge-Offs (Dollars in thousands)

1.00% 1.25% 1.50% 1.75% 1.31% 1.42% 1.29% 1.20%1.19% 1.19% 1.19% • ACL was in the 46th♦ percentile of Glacier’s peer group for first quarter of 2024 • The ACL was 1.19% of loans at the end of second quarter 2024 compared to 1.19% at the end of second quarter 2023 • As credit trends change, expect the ACL to adjust accordingly 42 ACL as a Percentage of Loans ♦BHCPR as of 3/31/2024

Shareholder Return 43

$0.50 $0.60 $0.70 $0.80 $0.90 $1.00 $1.10 $1.20 $1.30 • At June 30, 2024, Glacier’s dividend yield was 3.54% • The Company has declared 157 consecutive quarterly dividends 44 Dividends Declared

10 Year Total Return 6/30/2014 – 6/30/2024 45

1 Year Total Return 6/30/2023 – 6/30/2024 46

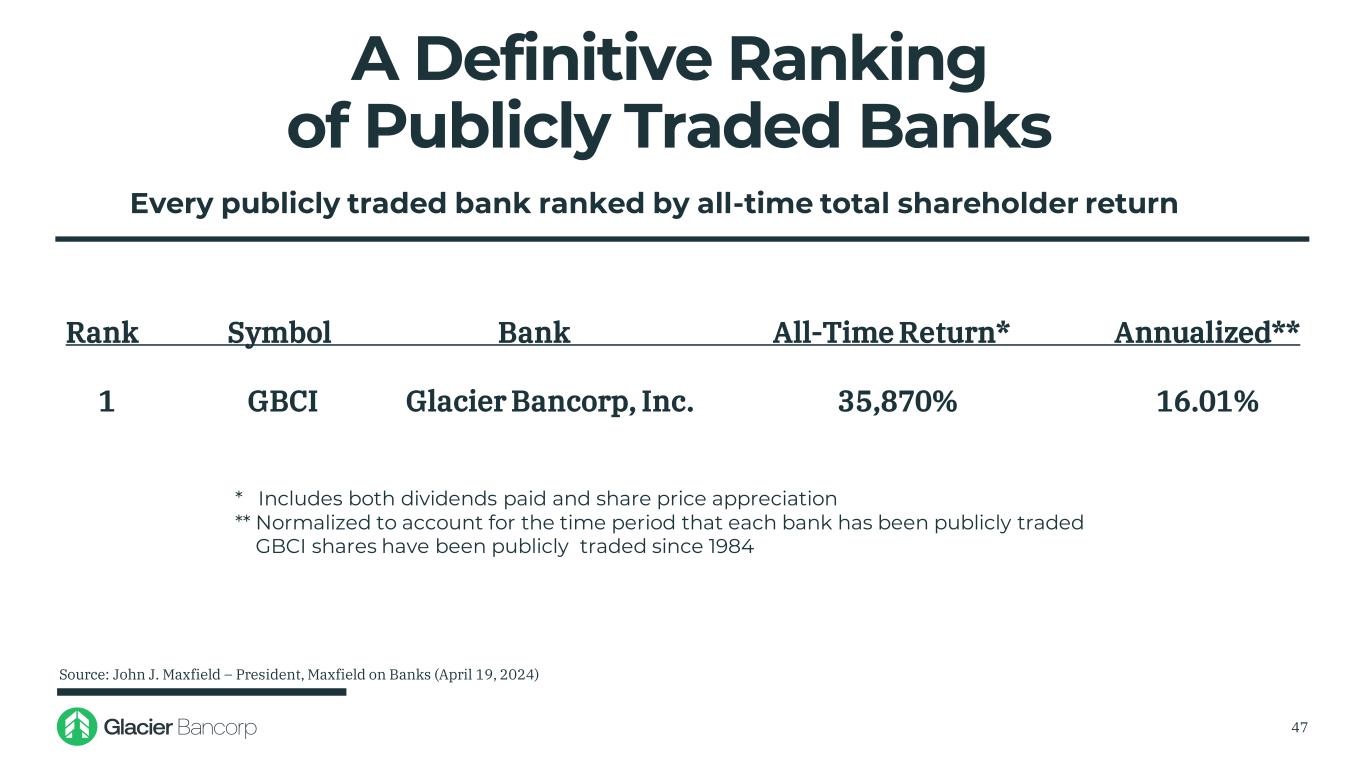

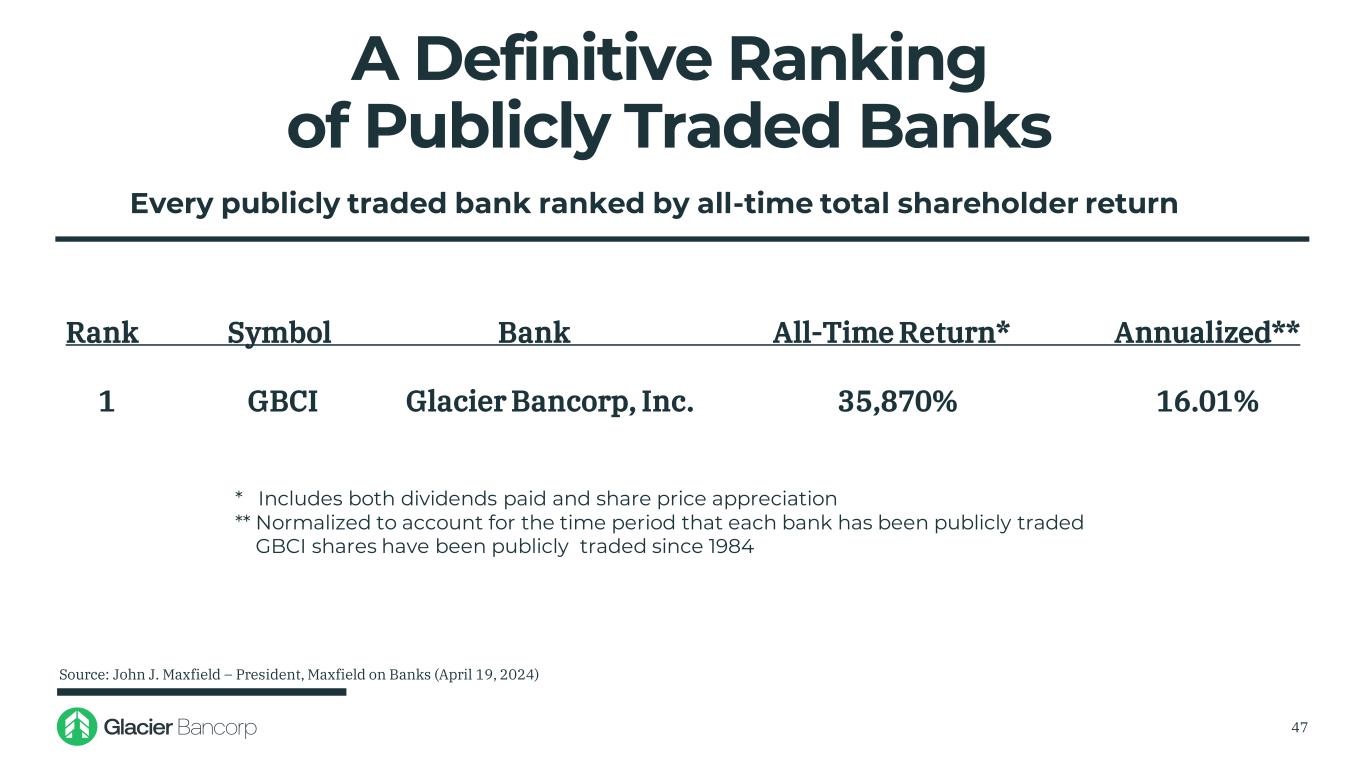

47 A Definitive Ranking of Publicly Traded Banks Every publicly traded bank ranked by all-time total shareholder return * Includes both dividends paid and share price appreciation ** Normalized to account for the time period that each bank has been publicly traded GBCI shares have been publicly traded since 1984 Source: John J. Maxfield – President, Maxfield on Banks (April 19, 2024) Rank Symbol Bank All-Time Return* Annualized** 1 GBCI Glacier Bancorp, Inc. 35,870% 16.01%

Named by Forbes as a World’s Best Bank Five consecutive years (2020-2024) 48