0000868671false00008686712023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 8-K

____________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2023

____________________________________________________________

GLACIER BANCORP, INC.

(Exact name of registrant as specified in its charter)

____________________________________________________________

|

|

|

|

|

|

|

|

|

| Montana |

000-18911 |

81-0519541 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

| 49 Commons Loop |

Kalispell, |

Montana |

59901 |

| (Address of principal executive offices) |

(Zip Code) |

|

|

|

|

|

|

|

|

|

|

|

|

| (406) |

756-4200 |

| (Registrant’s telephone number, including area code) |

____________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

GBCI |

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On August 8, 2023, Glacier Bancorp, Inc. (“GBCI”) issued a press release regarding the matters described in Item 8.01 of this current report on Form 8-K, a copy of which is furnished as Exhibit 99.1 and is incorporated herein by reference.

Attached as Exhibit 99.2 and incorporated by reference herein is an investor presentation dated August 8, 2023, that will be used by GBCI in its presentation regarding the matters described in Item 8.01 of this current report on Form 8-K.

The information in this Item 7.01, including Exhibits 99.1 and 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of GBCI under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filings.

Item 8.01 Other Events

On August 8, 2023, GBCI and its wholly owned subsidiary, Glacier Bank, entered into a Plan and Agreement of Merger (the “Merger Agreement”) with Community Financial Group, Inc. (“CFGW”) and its wholly owned subsidiary, Wheatland Bank. Under the terms of the Merger Agreement, CFGW will merge with and into GBCI, with GBCI as the surviving entity (the “Holding Company Merger”). Immediately thereafter, Wheatland Bank will merge with and into Glacier Bank, with Glacier Bank surviving as a wholly owned subsidiary of GBCI (the “Bank Merger”). Following the Bank Merger, the branches of Wheatland Bank will operate as branches of Glacier Bank under a new bank division. Glacier Bank’s existing North Cascades Bank division will be combined with this division.

Concurrently with the execution of the Merger Agreement, the directors and certain executive officers of CFGW entered into voting agreements with GBCI pursuant to which each such director and executive officer, in his or her capacity as a shareholder, has agreed, among other things, to vote his or her shares of CFGW common stock in favor of the proposed transactions contemplated by the Merger Agreement.

Subject to the terms and conditions of the Merger Agreement, at the date and time when the Holding Company Merger becomes effective (the “Effective Time”), each share of CFGW stock issued and outstanding will be converted into and represent the right to receive from GBCI merger consideration in the form of 1.0931 shares of GBCI common stock.

It is estimated that the merger consideration will have a total aggregate value of $80.6 million (based on the closing price of $33.97 for GBCI common stock on August 7, 2023).

Consummation of the transaction is subject to required regulatory approvals, CFGW shareholder approval, and other customary conditions of closing. It is anticipated that the closing of the transaction will take place late in the Fourth Quarter 2023. For additional information regarding the terms of the proposed transaction, reference is made to the press release dated August 8, 2023, which is attached as Exhibit 99.1.

Forward-Looking Statements

This current report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “estimate,” “expect,” “will,” and similar references to future periods. Such forward-looking statements include but are not limited to statements regarding the expected closing of the transaction and the potential benefits of the business combination transaction involving GBCI and CFGW, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts regarding either company or the proposed combination of the companies.

These forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, that may cause actual results or events to differ materially from those projected, including but not limited to the following: risks that the merger transaction will not close when expected or at all because required regulatory, shareholder or other approvals or conditions to closing are delayed or not received or satisfied on a timely basis or at all; risks that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which GBCI and CFGW operate; uncertainties regarding the ability of Glacier Bank and Wheatland Bank to promptly and effectively integrate their businesses; changes in business and operational strategies that may occur between signing and closing; uncertainties regarding the reaction to the transaction of the companies’ respective customers, employees, and counterparties; and risks relating to the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. GBCI undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this report. For more information, see the risk factors described in GBCI’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission (“SEC”).

Additional Information and Where to Find It

In connection with the proposed merger transactions, GBCI expects to file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”) that will include a Proxy Statement of CFGW and a Prospectus of GBCI, as well as other relevant documents concerning the proposed transaction. Shareholders of CFGW are urged to read carefully the Registration Statement and the Proxy Statement/Prospectus included therein regarding the proposed merger transactions when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus included in the Registration Statement, as well as other filings containing information about GBCI, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from GBCI at www.glacierbancorp.com under the tab “SEC Filings” or by requesting them in writing or by telephone from GBCI at: Glacier Bancorp, Inc., 49 Commons Loop, Kalispell, Montana 59901, ATTN: Corporate Secretary; Telephone (406) 751-7706.

Item 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

99.1 Press Release dated August 8, 2023.

99.2 Investor Presentation dated August 8, 2023.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

| Dated: |

August 8, 2023 |

GLACIER BANCORP, INC. |

|

|

|

|

|

|

/s/ Randall M. Chesler |

|

|

By: |

Randall M. Chesler |

|

|

|

President and Chief Executive Officer |

EX-99.1

2

a991pressrelease.htm

EXHIBIT-99.1

a991pressrelease

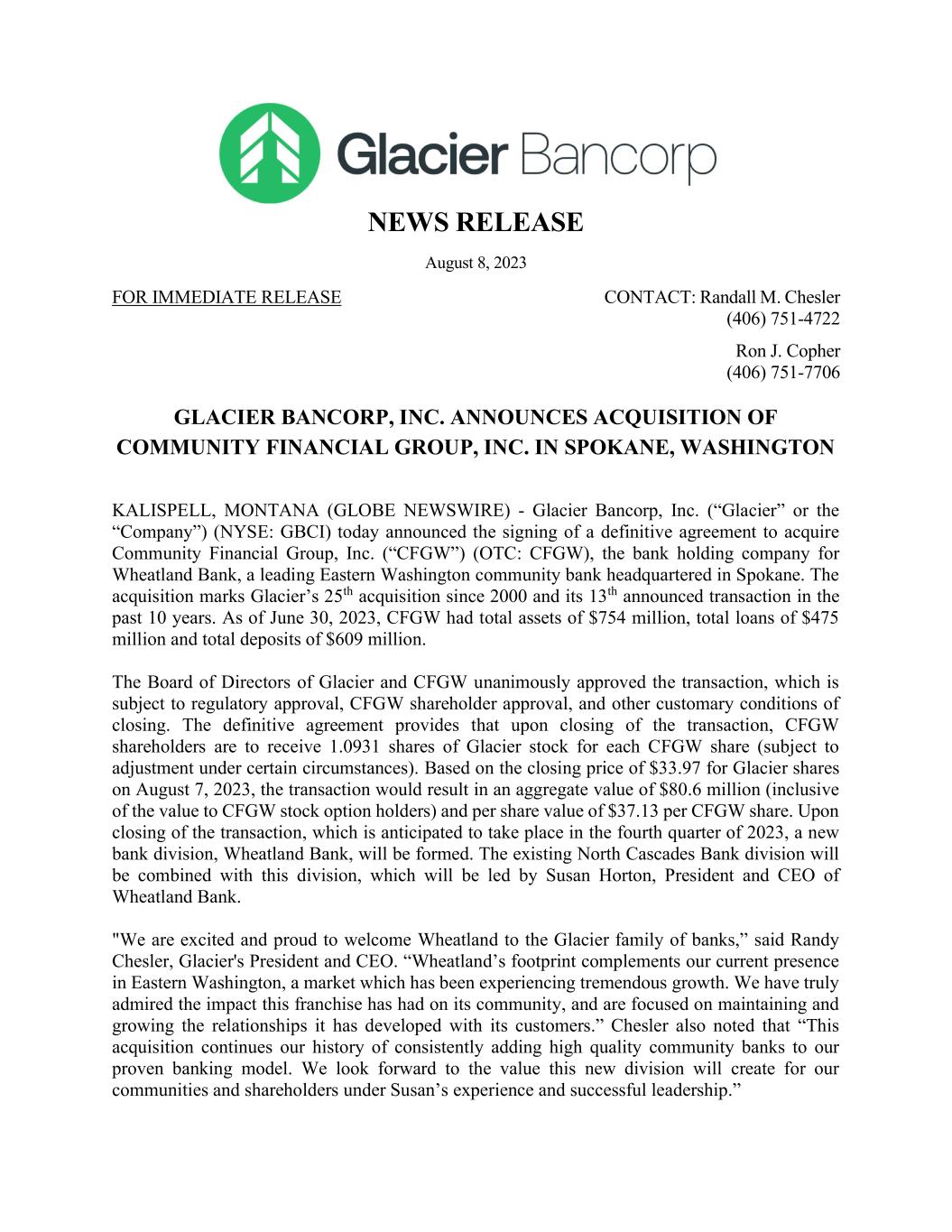

NEWS RELEASE August 8, 2023 FOR IMMEDIATE RELEASE CONTACT: Randall M. Chesler (406) 751-4722 Ron J. Copher (406) 751-7706 GLACIER BANCORP, INC. ANNOUNCES ACQUISITION OF COMMUNITY FINANCIAL GROUP, INC. IN SPOKANE, WASHINGTON KALISPELL, MONTANA (GLOBE NEWSWIRE) - Glacier Bancorp, Inc. (“Glacier” or the “Company”) (NYSE: GBCI) today announced the signing of a definitive agreement to acquire Community Financial Group, Inc. (“CFGW”) (OTC: CFGW), the bank holding company for Wheatland Bank, a leading Eastern Washington community bank headquartered in Spokane. The acquisition marks Glacier’s 25th acquisition since 2000 and its 13th announced transaction in the past 10 years. As of June 30, 2023, CFGW had total assets of $754 million, total loans of $475 million and total deposits of $609 million. The Board of Directors of Glacier and CFGW unanimously approved the transaction, which is subject to regulatory approval, CFGW shareholder approval, and other customary conditions of closing. The definitive agreement provides that upon closing of the transaction, CFGW shareholders are to receive 1.0931 shares of Glacier stock for each CFGW share (subject to adjustment under certain circumstances). Based on the closing price of $33.97 for Glacier shares on August 7, 2023, the transaction would result in an aggregate value of $80.6 million (inclusive of the value to CFGW stock option holders) and per share value of $37.13 per CFGW share. Upon closing of the transaction, which is anticipated to take place in the fourth quarter of 2023, a new bank division, Wheatland Bank, will be formed. The existing North Cascades Bank division will be combined with this division, which will be led by Susan Horton, President and CEO of Wheatland Bank. "We are excited and proud to welcome Wheatland to the Glacier family of banks,” said Randy Chesler, Glacier's President and CEO. “Wheatland’s footprint complements our current presence in Eastern Washington, a market which has been experiencing tremendous growth. We have truly admired the impact this franchise has had on its community, and are focused on maintaining and growing the relationships it has developed with its customers.” Chesler also noted that “This acquisition continues our history of consistently adding high quality community banks to our proven banking model. We look forward to the value this new division will create for our communities and shareholders under Susan’s experience and successful leadership.”

Susan Horton, President and CEO of CFGW, commented, “Glacier is truly the partner we have always dreamed of and we couldn’t be more excited to join the Glacier family of banks. We will have the strength and depth of resources of a $28 billion asset bank, expand our local Wheatland footprint and immediately double in size after integrating the North Cascades Bank division, to become a Top 5 eastern Washington bank. This partnership will cement Wheatland Bank’s legacy, strengthen our position in the marketplace and create more opportunity for all stakeholders.” Glacier management will review additional information regarding the transaction on a conference call beginning at 9:00 a.m. Mountain Time on Wednesday, August 9, 2023. Please note that our conference call host no longer offers a general dial-in number. Investors who would like to join the call may now register by following this link to obtain dial-in instructions: https://register.vevent.com/register/BI1bd11bc56828443396425b47211c77c0 To participate via the webcast, log on to: https://edge.media-server.com/mmc/p/s7kmk2tr If you are unable to participate during the live webcast, the call will be archived on our website, www.glacierbancorp.com A slide presentation to accompany management’s commentary may be accessed from Glacier’s August 8, 2023 Form 8-K filing with the Securities and Exchange Commission (the "SEC") or at https://www.glacierbancorp.com/news-market-information/annual-reports-presentations. Glacier was advised in the transaction by Keefe, Bruyette & Woods, A Stifel Company as financial advisor and Miller Nash LLP as legal counsel. CFGW was advised by Piper Sandler Cos. as financial advisor and Otteson Shapiro LLP as legal counsel. About Glacier Bancorp, Inc. Glacier Bancorp, Inc. is the parent company for Glacier Bank and its bank divisions: Altabank (American Fork, UT), Bank of the San Juans (Durango, CO), Citizens Community Bank (Pocatello, ID), Collegiate Peaks Bank (Buena Vista, CO), First Bank of Montana (Lewistown, MT), First Bank of Wyoming (Powell, WY), First Community Bank Utah (Layton, UT), First Security Bank (Bozeman, MT), First Security Bank of Missoula (Missoula, MT), First State Bank (Wheatland, WY), Glacier Bank (Kalispell, MT), Heritage Bank of Nevada (Reno, NV), Mountain West Bank (Coeur d’Alene, ID), North Cascades Bank (Chelan, WA), The Foothills Bank (Yuma, AZ), Valley Bank of Helena (Helena, MT), and Western Security Bank (Billings, MT). Visit Glacier’s website at www.glacierbancorp.com. Important Information and Where You Can Find It This communication relates to the proposed merger transaction involving Glacier and CFGW. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities.

In connection with the proposed merger transactions, Glacier will file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”) that will include a Proxy Statement of CFGW and a Prospectus of Glacier, as well as other relevant documents concerning the proposed transaction. Shareholders of CFGW are urged to read carefully the Registration Statement and the Proxy Statement/Prospectus included therein regarding the proposed merger transactions when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus included in the Registration Statement, as well as other filings containing information about Glacier, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Glacier at www.glacierbancorp.com under the tab “SEC Filings” or by requesting them in writing or by telephone from Glacier at: Glacier Bancorp, Inc., 49 Commons Loop, Kalispell, Montana 59901, ATTN: Corporate Secretary; Telephone (406) 751-7706. Forward-Looking Statements This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “estimate,” “expect,” “will,” and similar references to future periods. Such forward- looking statements include but are not limited to statements regarding the expected closing of the transaction and the potential benefits of the business combination transaction involving Glacier and CFGW, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts regarding either company or the proposed combination of the companies. These forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, that may cause actual results or events to differ materially from those projected, including but not limited to the following: risks that the merger transaction will not close when expected or at all because required regulatory, shareholder or other approvals or conditions to closing are delayed or not received or satisfied on a timely basis or at all; risks that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Glacier and CFGW operate; uncertainties regarding the ability of Glacier Bank and Wheatland Bank to promptly and effectively integrate their businesses; changes in business and operational strategies that may occur between signing and closing; uncertainties regarding the reaction to the transaction of the companies’ respective customers, employees, and counterparties; and risks relating to the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. Glacier undertakes no obligation to publicly revise or update the forward- looking statements to reflect events or circumstances that arise after the date of this report. For more information, see the risk factors described in Glacier’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the SEC.

EX-99.2

3

a992investorpresentation.htm

EXHIBIT--99.2

a992investorpresentation

Acquisition of August 8, 2023

Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about the Company’s plans, objectives, expectations and intentions that are not historical facts, and other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “should,” “projects,” “seeks,” “estimates”, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are based on current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. The following factors ,among others, could cause actual results to differ materially from the anticipated results (express or implied) or other expectations in the forward-looking statements, including those set forth in this presentation: 1) the occurrence of any event, change or other circumstance that could give rise to the right of one or both parties to terminate the definitive merger agreement between the Company and CFGW; 2) the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated; 3) the risk that any announcements related to the proposed combination could have adverse effects on the market price of the common stock of either or both parties to the combination; 4) the possibility that the anticipated benefits of the transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where the Company and CFGW do business; 5) potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction that could make it difficult to retain or hire key personnel and maintain relationships with customers; 6) the Company’s and CFGW’s success in executing their respective business plans and strategies and managing the risks involved; 7) the risk that the proposed combination may be more difficult or time-consuming than anticipated, including in areas such as asset realization, systems integration and other key strategies; 8) the unforeseen risk relating to liabilities of the Company or CFGW that may exist; 9) the Company’s success in managing risks involved in the foregoing; and 10) the effects of any reputational damage to the Company resulting from the foregoing. The foregoing are representative of the factors that could affect the outcome of our forward-looking statements. In addition, such statements could be affected by general industry and market conditions and growth rates, general interest rate and currency exchange rate fluctuations, changes and trends in the securities markets, changes in regulations, and other factors. The Company provides further detail regarding these risks and uncertainties in its latest Form 10-K and subsequent Form 10-Qs, including in the respective “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” sections of such reports, as well as in subsequent filings with the Securities and Exchange Commission. Please take into account that these forward-looking statements speak only as of the date of this presentation. The Company does not undertake any obligation to publicly correct, revise, or update any forward-looking statement if it later becomes aware that actual results are likely to differ materially from those expressed in such forward-looking statement, except as required under federal securities laws. 2

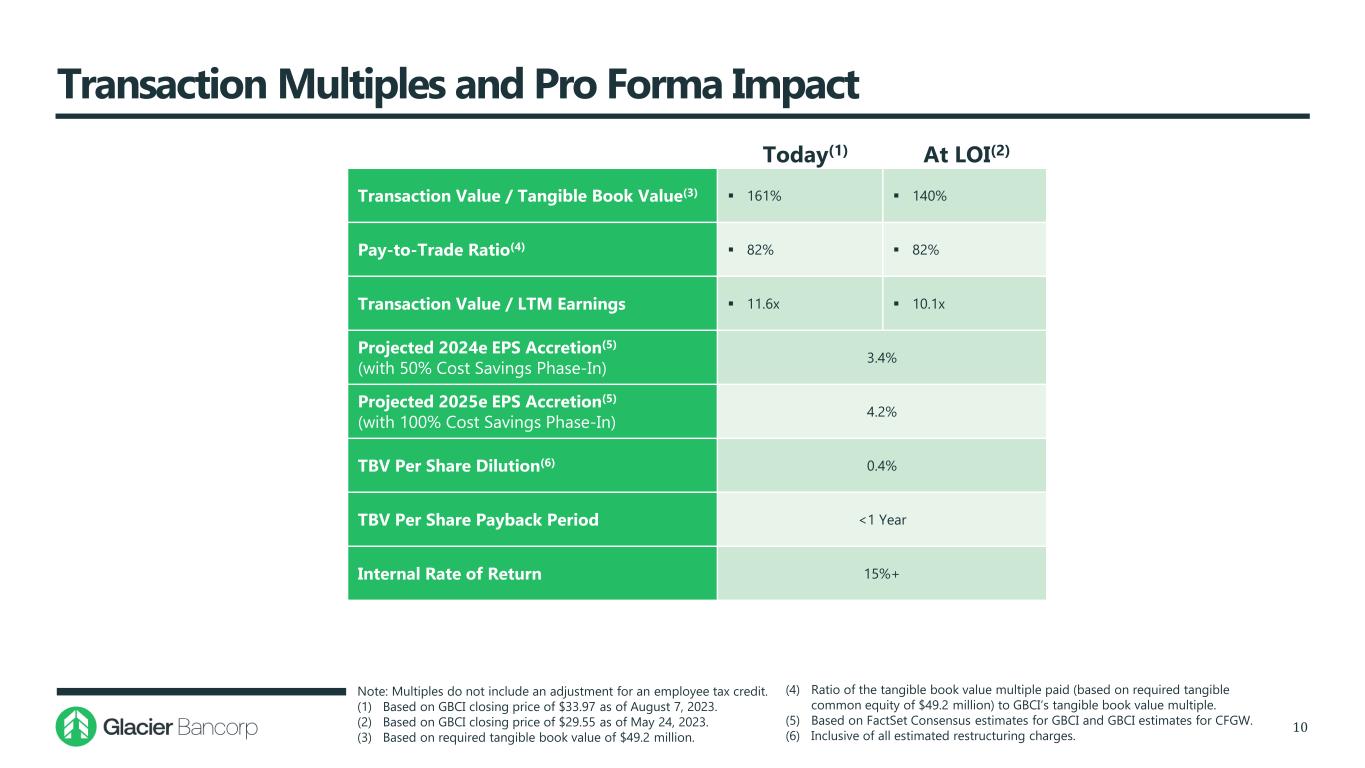

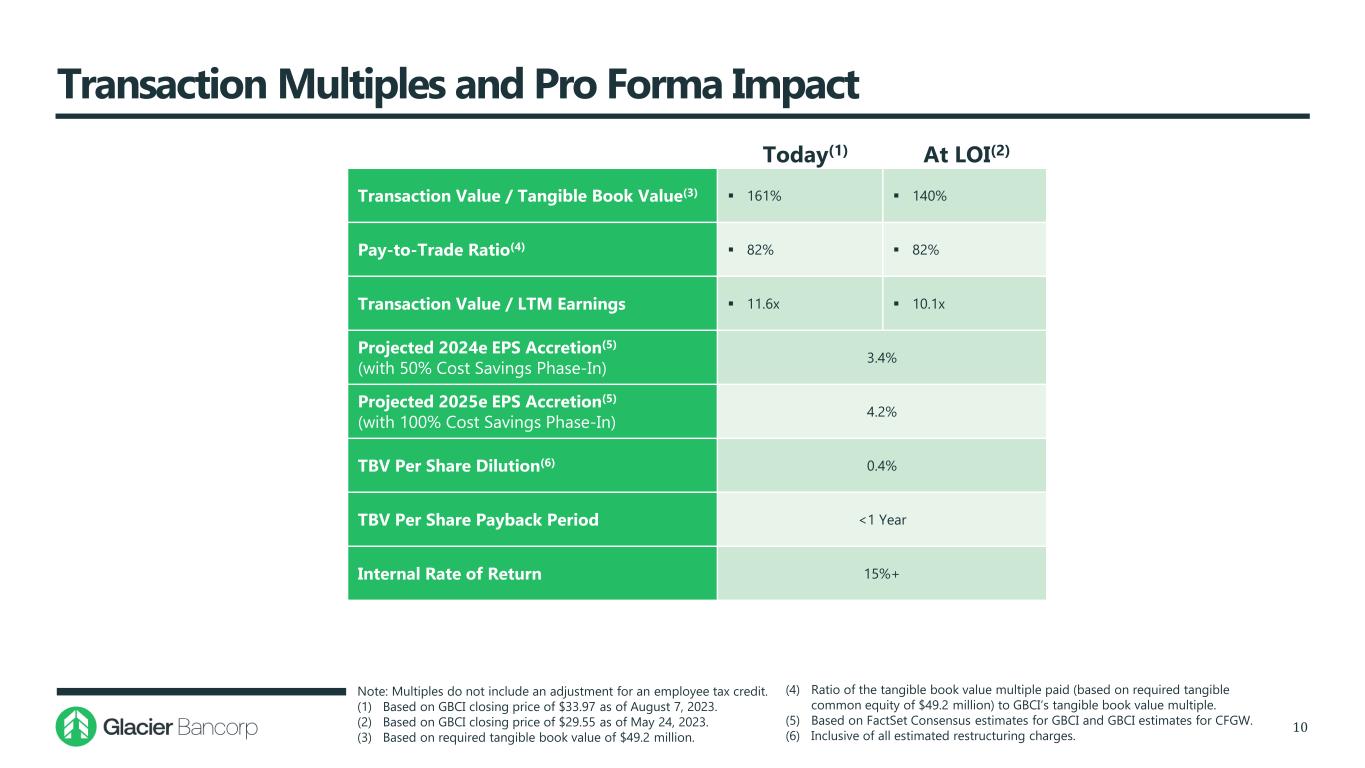

Transaction Highlights 3 Transaction Overview Financially Attractive Glacier Bancorp, Inc. (“GBCI”) (NYSE: GBCI) will acquire Community Financial Group, Inc. (“CFGW”) (OTC: CFGW), the bank holding company for Wheatland Bank (the “Bank”), a community bank headquartered in Spokane, Washington ‒ Premier banking franchise with 14 full-service branches in Eastern Washington GBCI will remain with 17 separate bank divisions post-transaction close ‒ The Bank’s operations will be conducted through a new bank division headquartered in Spokane, WA – Wheatland Bank, a division of Glacier Bank ‒ North Cascades Bank, an existing division of Glacier Bank, will be combined into the new Wheatland Bank division ‒ The resulting new Wheatland division will have 23 branches and will be a top 5 bank by deposit market share in Eastern WA Represents Glacier’s 25th acquisition since 2000 and its 13th announced transaction in the past ten years Pricing metrics, deal structure and conservative assumptions reflective of Glacier’s consistent, disciplined approach to acquisitions ‒ Immediately accretive to EPS – accretion of 3.4% in 2024 and 4.2% in 2025 ‒ Minimal dilution to tangible book value per share; <1 year payback period ‒ Internal rate of return (IRR) above 15% ‒ Conservative cost savings, estimated at 20% of CFGW’s noninterest expense ‒ Pay-to-Trade ratio of 82%(1) Source: S&P Global Market Intelligence. (1) Ratio of the tangible book value multiple paid (based on required tangible common equity of $49.2 million) to GBCI’s tangible book value multiple as of August 7, 2023.

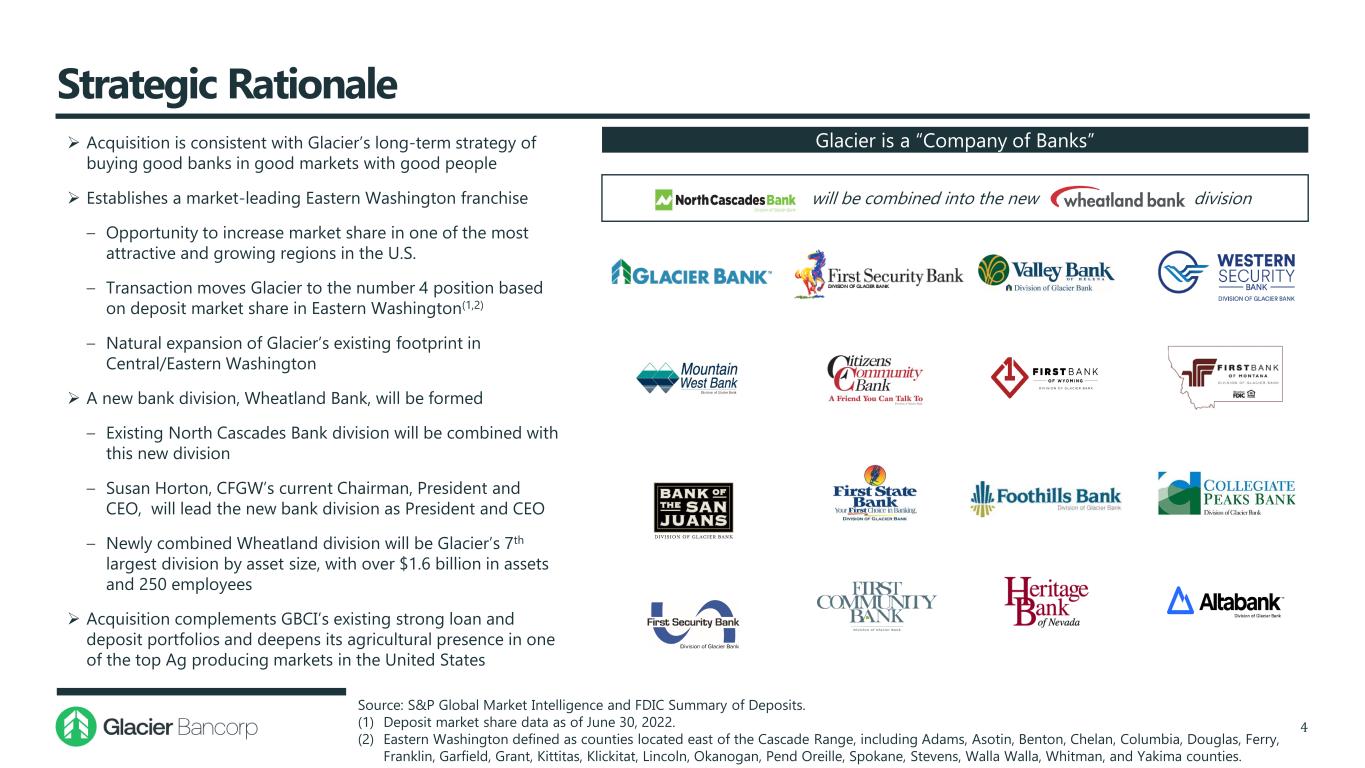

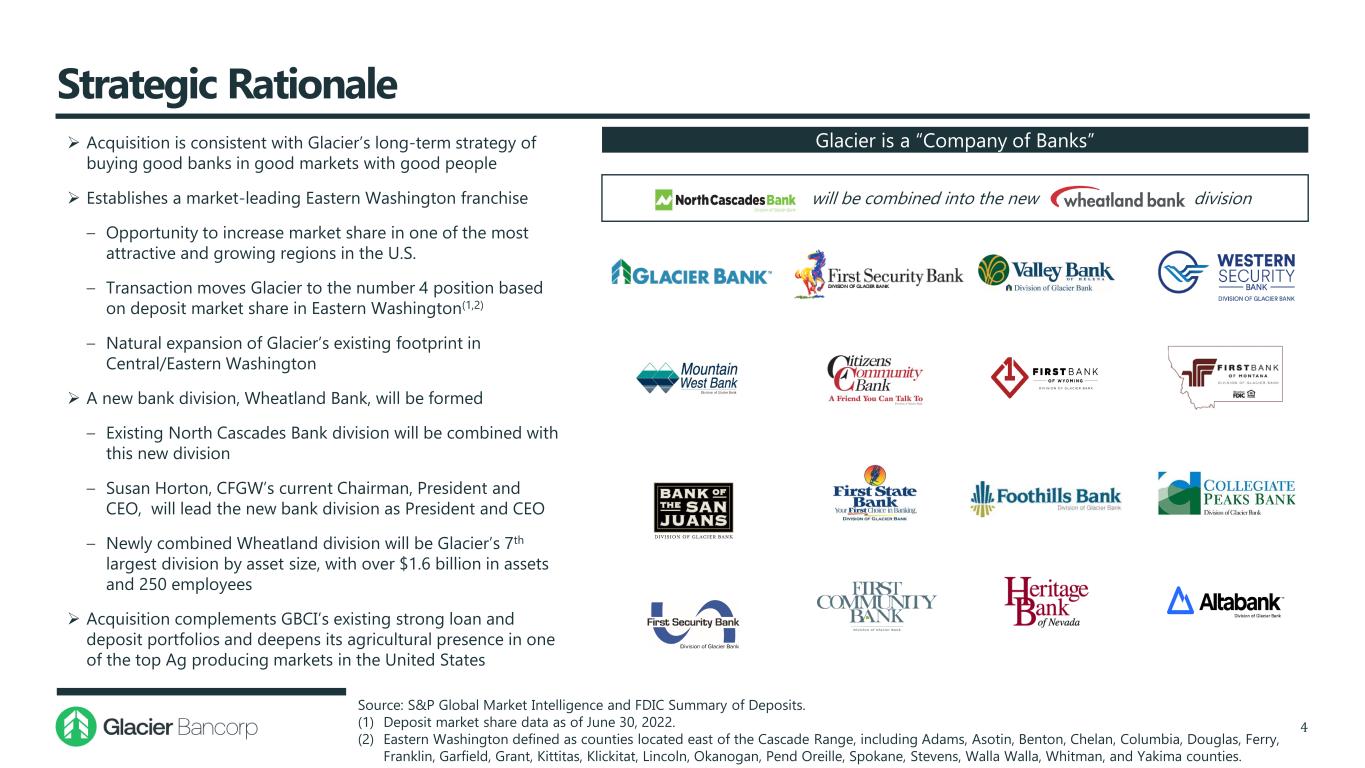

Strategic Rationale 4 Glacier is a “Company of Banks” Acquisition is consistent with Glacier’s long-term strategy of buying good banks in good markets with good people Establishes a market-leading Eastern Washington franchise ‒ Opportunity to increase market share in one of the most attractive and growing regions in the U.S. ‒ Transaction moves Glacier to the number 4 position based on deposit market share in Eastern Washington(1,2) ‒ Natural expansion of Glacier’s existing footprint in Central/Eastern Washington A new bank division, Wheatland Bank, will be formed ‒ Existing North Cascades Bank division will be combined with this new division ‒ Susan Horton, CFGW’s current Chairman, President and CEO, will lead the new bank division as President and CEO ‒ Newly combined Wheatland division will be Glacier’s 7th largest division by asset size, with over $1.6 billion in assets and 250 employees Acquisition complements GBCI’s existing strong loan and deposit portfolios and deepens its agricultural presence in one of the top Ag producing markets in the United States Source: S&P Global Market Intelligence and FDIC Summary of Deposits. (1) Deposit market share data as of June 30, 2022. (2) Eastern Washington defined as counties located east of the Cascade Range, including Adams, Asotin, Benton, Chelan, Columbia, Douglas, Ferry, Franklin, Garfield, Grant, Kittitas, Klickitat, Lincoln, Okanogan, Pend Oreille, Spokane, Stevens, Walla Walla, Whitman, and Yakima counties. will be combined into the new division

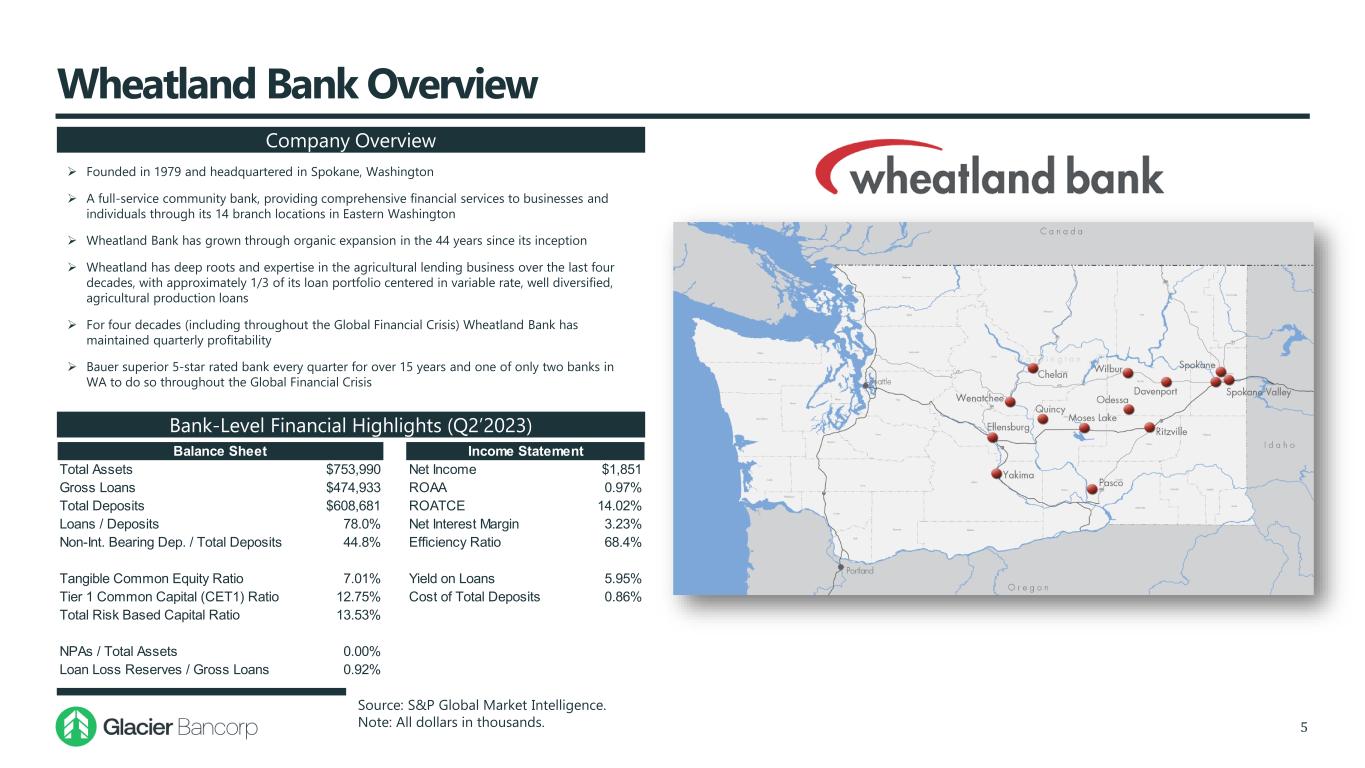

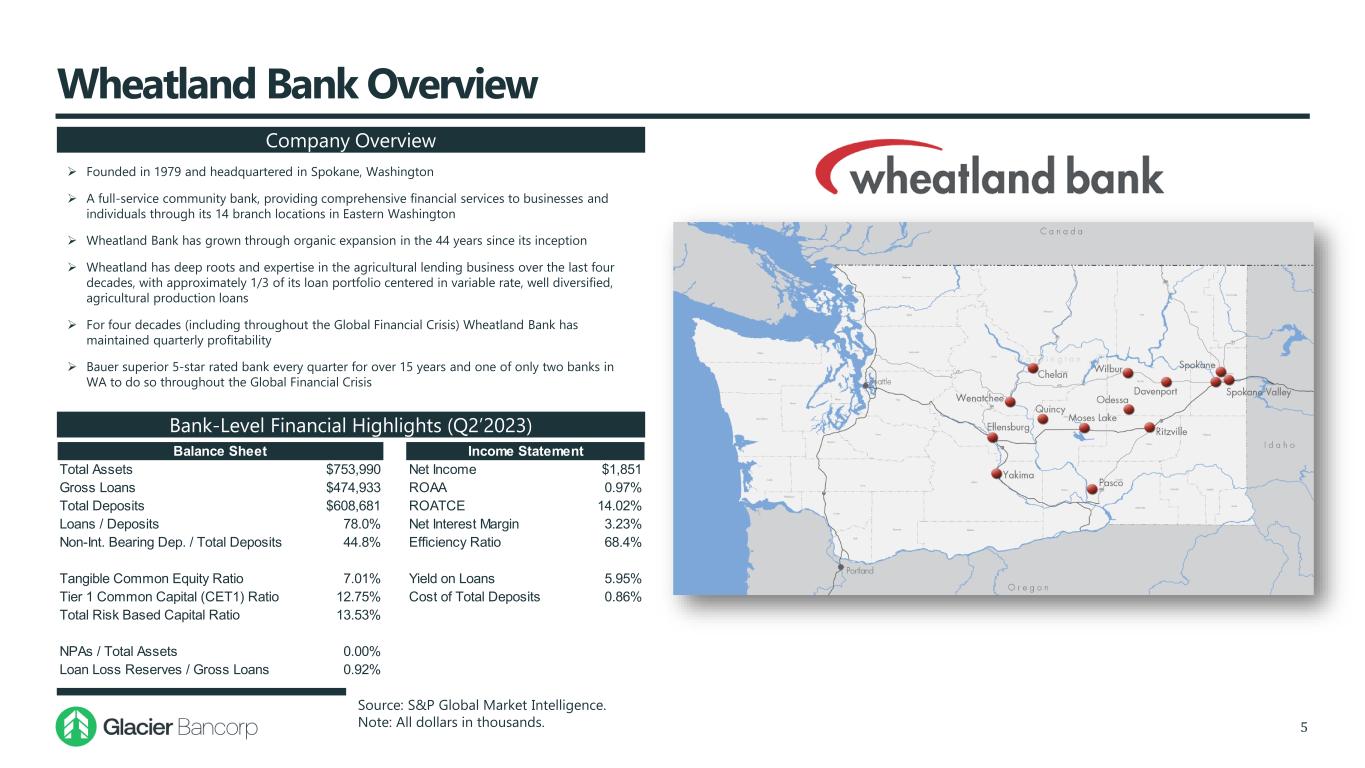

Wheatland Bank Overview 5 Founded in 1979 and headquartered in Spokane, Washington A full-service community bank, providing comprehensive financial services to businesses and individuals through its 14 branch locations in Eastern Washington Wheatland Bank has grown through organic expansion in the 44 years since its inception Wheatland has deep roots and expertise in the agricultural lending business over the last four decades, with approximately 1/3 of its loan portfolio centered in variable rate, well diversified, agricultural production loans For four decades (including throughout the Global Financial Crisis) Wheatland Bank has maintained quarterly profitability Bauer superior 5-star rated bank every quarter for over 15 years and one of only two banks in WA to do so throughout the Global Financial Crisis Bank-Level Financial Highlights (Q2’2023) Company Overview Source: S&P Global Market Intelligence. Note: All dollars in thousands. Total Assets $753,990 Net Income $1,851 Gross Loans $474,933 ROAA 0.97% Total Deposits $608,681 ROATCE 14.02% Loans / Deposits 78.0% Net Interest Margin 3.23% Non-Int. Bearing Dep. / Total Deposits 44.8% Efficiency Ratio 68.4% Tangible Common Equity Ratio 7.01% Yield on Loans 5.95% Tier 1 Common Capital (CET1) Ratio 12.75% Cost of Total Deposits 0.86% Total Risk Based Capital Ratio 13.53% NPAs / Total Assets 0.00% Loan Loss Reserves / Gross Loans 0.92% Balance Sheet Income Statement

Superior Asset Quality 6 Source: S&P Global Market Intelligence. Note: Net charge-offs are annualized. (1) Aggregate of all US commercial banks as aggregated by S&P Global Market Intelligence. As of the date of this presentation, Q2 2023 data was not available. Net Charge-offs / Average Loans (%) 0.11% 0.20% 0.26% 0.12% 0.11% 0.02% 0.02% 0.06% 0.23% 1.41% 2.26% 1.77% 0.80% 0.20% 0.06% 0.05% 0.05% 0.17% 0.11% 0.08% 0.07% 0.02% 0.05% 0.06% 0.17% 0.27% 0.24% 0.43% 0.40% 0.44% 0.49% 0.28% 0.00% 0.21% 0.37% 0.95% 0.30% (0.60%) 0.03% (0.01%) 0.11% (0.09%) 0.04% (0.01%) (0.01%) 0.05% 0.00% (0.12%) 0.67% 0.98% 1.16% 0.92% 0.64% 0.56% 0.43% 0.62% 1.34% 2.67% 2.67% 1.64% 1.12% 0.70% 0.49% 0.43% 0.46% 0.48% 0.46% 0.49% 0.49% 0.24% 0.26% 2000Y 2001Y 2002Y 2003Y 2004Y 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y 2022Y 2023Q2 GBCI Wheatland All US Commercial Banks (1) • Over the last decade, Wheatland has had no net loan losses and has been in a net recovery position on a cumulative basis • Wheatland has averaged only 0.16% annual net charge-offs since 2000 • Aggregate net charge-offs since 2000 (23.5 years) of only $5.3 million

Best-in-Class Deposit Base 7 Source: S&P Global Market Intelligence and FactSet. (1) Median of the KBW Nasdaq Regional Banking Index. 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y 2022Y 2023Q2 GBCI Wheatland Median KRX Cost of Deposits (%) Noninterest-Bearing Deposits / Total Deposits (%) 18.9% 21.0% 22.2% 24.6% 25.7% 27.6% 27.7% 30.5% 31.6% 34.3% 36.9% 36.5% 37.3% 32.3%30.6% 32.7% 37.0% 39.6% 44.3% 43.2% 46.5% 47.6% 48.3% 46.8% 49.9% 50.4% 51.1% 44.8% 17.3% 20.2% 23.3% 24.6% 25.5% 27.4% 27.8% 28.1% 26.5% 26.3% 31.6% 34.0% 32.8% 29.0% 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y 2022Y 2023Q2 GBCI Wheatland Median KRX 1.57% 0.65% 0.86% (1) • Granular deposit base – over 17,000 transaction accounts averaging just over $35,000 • Consistently high noninterest-bearing account balances • 0.11% average annual cost of funds for the decade ending 2022 • Approximately 55% of deposits are business accounts with average balances of $85,000, and 45% are consumer accounts with average balances of $21,000 • 70% of deposits are within FDIC Insurance limits (1)

Eastern Washington’s Dynamic Economy 8 Source: S&P Global, Office of Governor, Washington State Department of Commerce, U.S. Census Bureau, Office of Financial Management, U.S. Congress Joint Economic Committee, FRED. Major EmployersHighlights The new Wheatland Bank will be a Top 5 Eastern Washington bank Significant agriculture epicenter with a diverse set of crops; ranked top 5 in production in the U.S for the following: ‒ #1 producer of hops, cherries, apples, pears and blueberries ‒ #2 producer of potatoes, apricots, grapes, carrots, chickpeas, canola and raspberries ‒ #3 or #4 producer of wheat, mint, asparagus, lentils, sweet corn and peas Washington State has over 35,000 farms (95% family owned) producing 300 different crops Continued business expansion, including 2 new Amazon shipping facilities in 2022, 2 more under construction, and a $1 billion Darigold facility in 2023 Key transportation hub, with access to the Columbia River, barge access, expansive train system and an international airport Fairchild Air Force Base

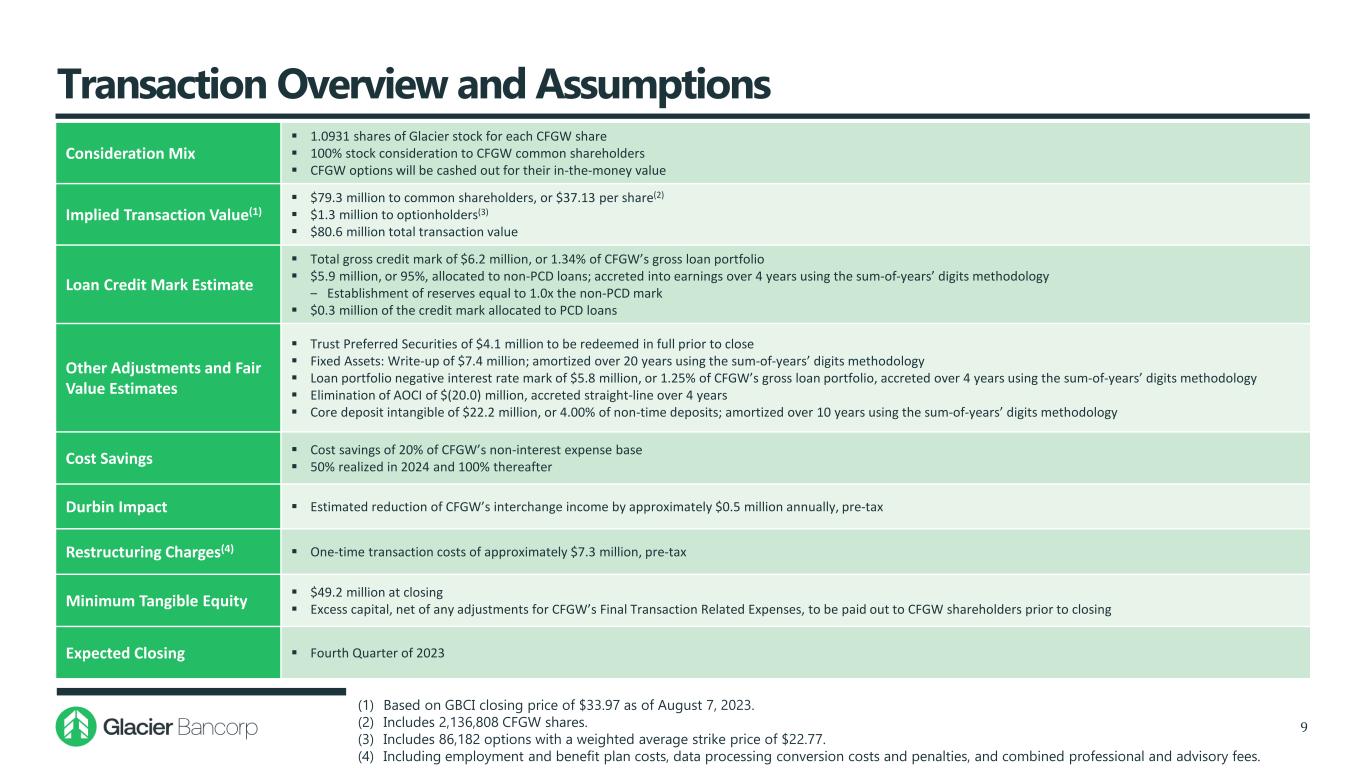

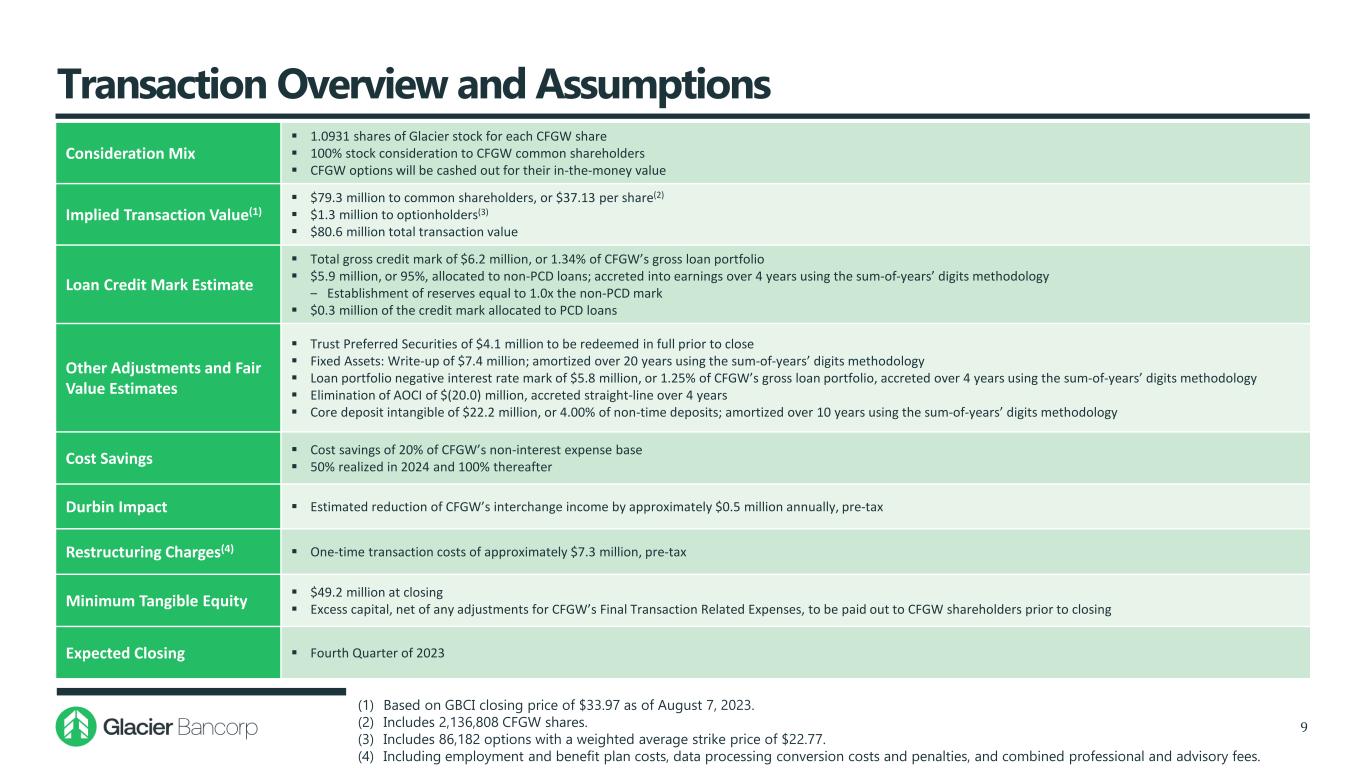

Transaction Overview and Assumptions 9 Consideration Mix 1.0931 shares of Glacier stock for each CFGW share 100% stock consideration to CFGW common shareholders CFGW options will be cashed out for their in-the-money value Implied Transaction Value(1) $79.3 million to common shareholders, or $37.13 per share(2) $1.3 million to optionholders(3) $80.6 million total transaction value Loan Credit Mark Estimate Total gross credit mark of $6.2 million, or 1.34% of CFGW’s gross loan portfolio $5.9 million, or 95%, allocated to non-PCD loans; accreted into earnings over 4 years using the sum-of-years’ digits methodology ‒ Establishment of reserves equal to 1.0x the non-PCD mark $0.3 million of the credit mark allocated to PCD loans Other Adjustments and Fair Value Estimates Trust Preferred Securities of $4.1 million to be redeemed in full prior to close Fixed Assets: Write-up of $7.4 million; amortized over 20 years using the sum-of-years’ digits methodology Loan portfolio negative interest rate mark of $5.8 million, or 1.25% of CFGW’s gross loan portfolio, accreted over 4 years using the sum-of-years’ digits methodology Elimination of AOCI of $(20.0) million, accreted straight-line over 4 years Core deposit intangible of $22.2 million, or 4.00% of non-time deposits; amortized over 10 years using the sum-of-years’ digits methodology Cost Savings Cost savings of 20% of CFGW’s non-interest expense base 50% realized in 2024 and 100% thereafter Durbin Impact Estimated reduction of CFGW’s interchange income by approximately $0.5 million annually, pre-tax Restructuring Charges(4) One-time transaction costs of approximately $7.3 million, pre-tax Minimum Tangible Equity $49.2 million at closing Excess capital, net of any adjustments for CFGW’s Final Transaction Related Expenses, to be paid out to CFGW shareholders prior to closing Expected Closing Fourth Quarter of 2023 (1) Based on GBCI closing price of $33.97 as of August 7, 2023. (2) Includes 2,136,808 CFGW shares. (3) Includes 86,182 options with a weighted average strike price of $22.77. (4) Including employment and benefit plan costs, data processing conversion costs and penalties, and combined professional and advisory fees.

Transaction Multiples and Pro Forma Impact 10 Transaction Value / Tangible Book Value(3) 161% 140% Pay-to-Trade Ratio(4) 82% 82% Transaction Value / LTM Earnings 11.6x 10.1x Projected 2024e EPS Accretion(5) (with 50% Cost Savings Phase-In) 3.4% Projected 2025e EPS Accretion(5) (with 100% Cost Savings Phase-In) 4.2% TBV Per Share Dilution(6) 0.4% TBV Per Share Payback Period <1 Year Internal Rate of Return 15%+ Today(1) At LOI(2) Note: Multiples do not include an adjustment for an employee tax credit. (1) Based on GBCI closing price of $33.97 as of August 7, 2023. (2) Based on GBCI closing price of $29.55 as of May 24, 2023. (3) Based on required tangible book value of $49.2 million. (4) Ratio of the tangible book value multiple paid (based on required tangible common equity of $49.2 million) to GBCI’s tangible book value multiple. (5) Based on FactSet Consensus estimates for GBCI and GBCI estimates for CFGW. (6) Inclusive of all estimated restructuring charges.

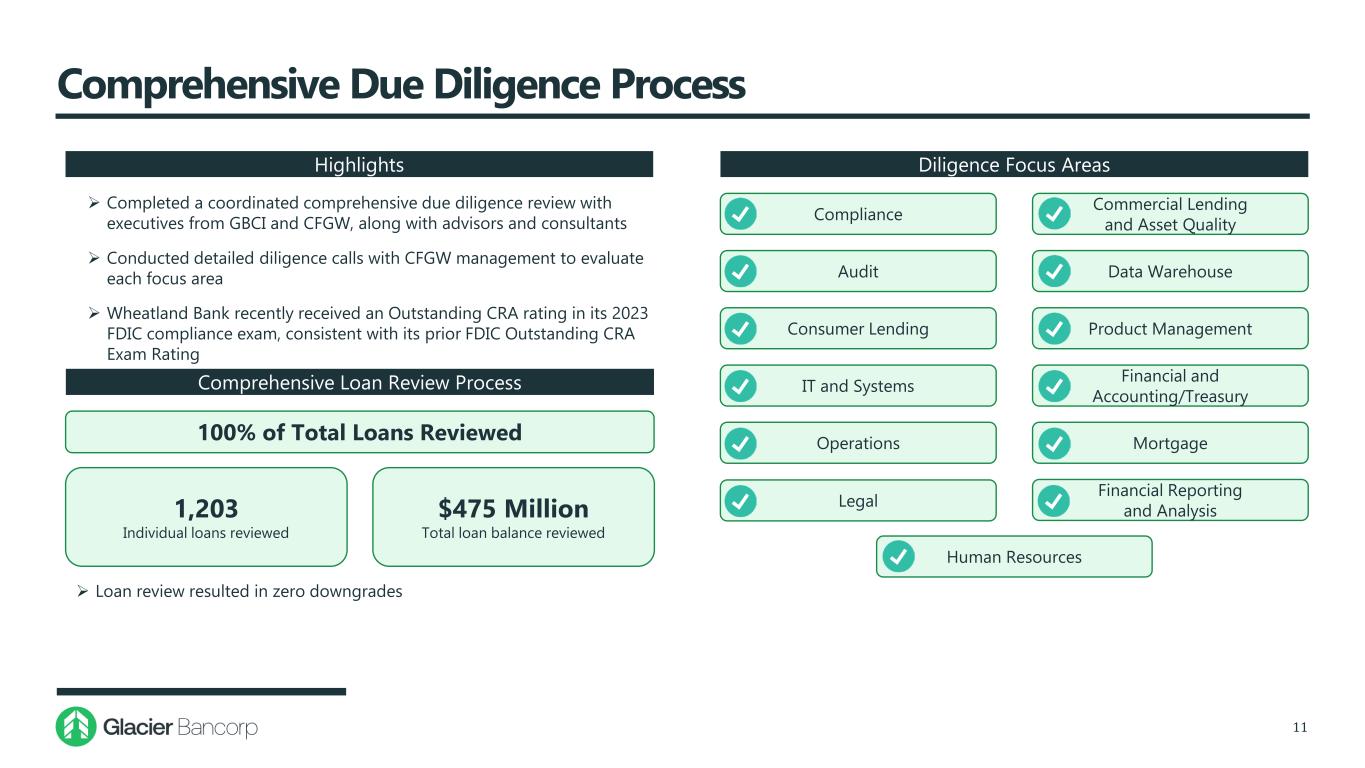

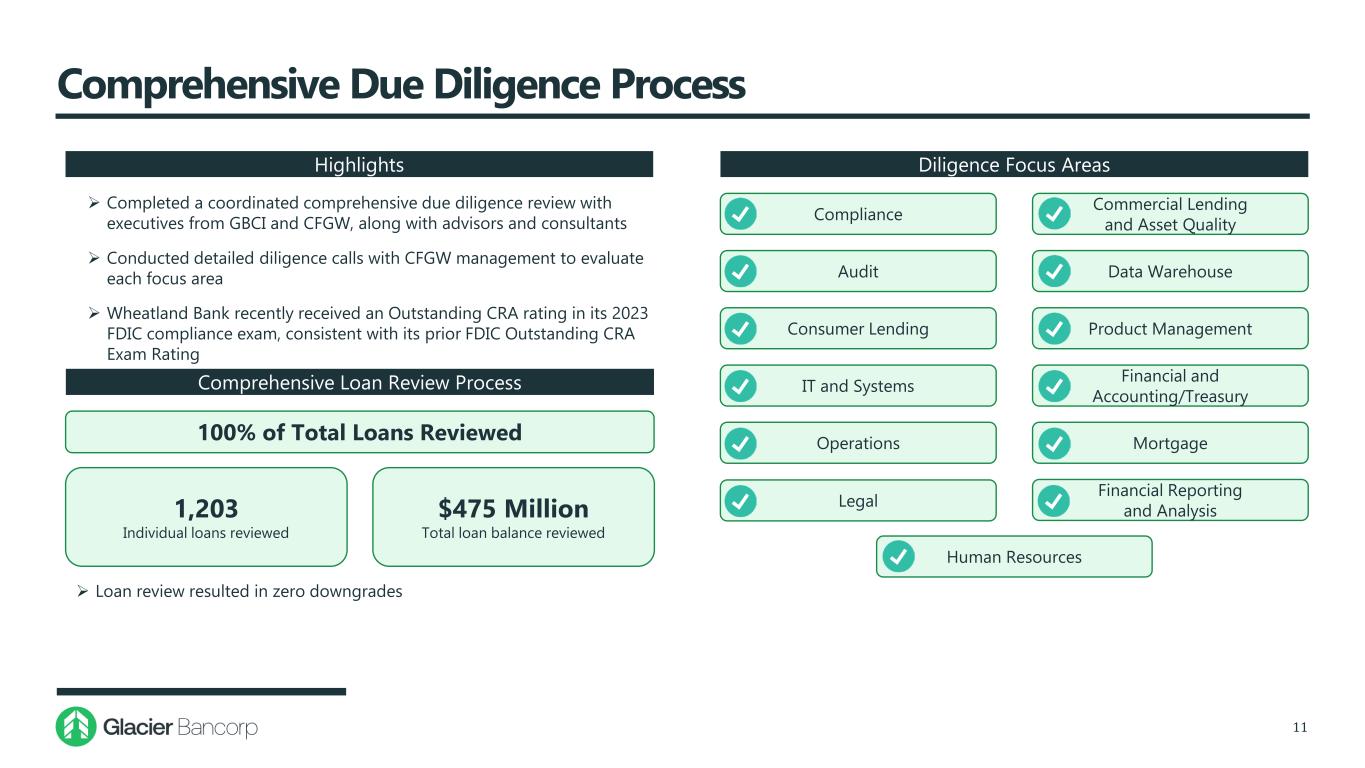

Comprehensive Due Diligence Process 11 Completed a coordinated comprehensive due diligence review with executives from GBCI and CFGW, along with advisors and consultants Conducted detailed diligence calls with CFGW management to evaluate each focus area Wheatland Bank recently received an Outstanding CRA rating in its 2023 FDIC compliance exam, consistent with its prior FDIC Outstanding CRA Exam Rating Comprehensive Loan Review Process 100% of Total Loans Reviewed 1,203 Individual loans reviewed $475 Million Total loan balance reviewed Diligence Focus Areas Consumer Lending IT and Systems Operations Compliance Audit Legal Commercial Lending and Asset Quality Human Resources Data Warehouse Product Management Financial and Accounting/Treasury Mortgage Financial Reporting and Analysis Highlights Loan review resulted in zero downgrades

Concluding Observations 12 CFGW acquisition continues Glacier’s tradition of adding the highest quality community banks that fit the Glacier banking model Eastern Washington is a key growth market in the Glacier footprint and one of the top agricultural markets in the nation CFGW management and staff provide Glacier with executive and lending talent, deep market knowledge, Ag industry expertise, and strong customer relationships Pricing metrics, deal structure, and conservative assumptions reflective of Glacier’s consistent, disciplined approach to acquisitions Transaction will further enhance Glacier’s long-term record of creating shareholder value

Appendix 13

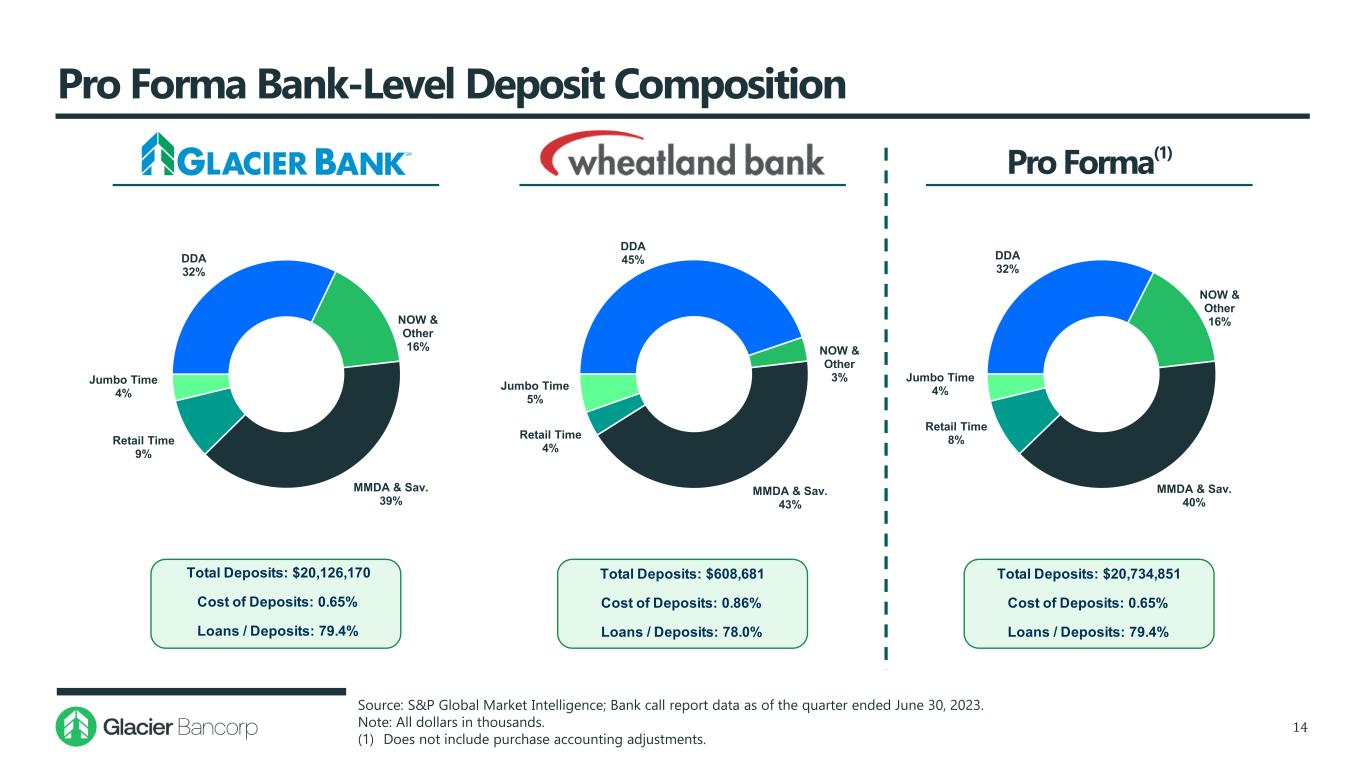

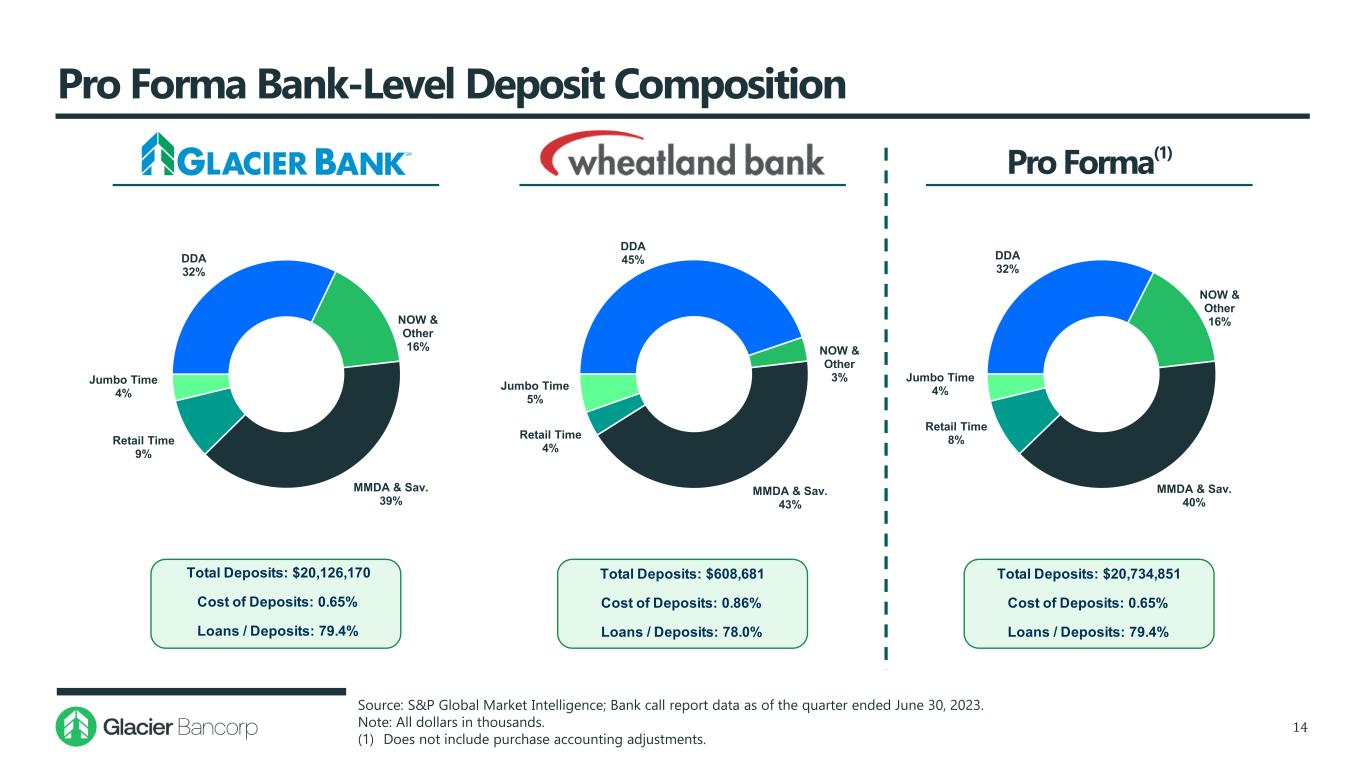

DDA 32% NOW & Other 16% MMDA & Sav. 40% Retail Time 8% Jumbo Time 4% DDA 32% NOW & Other 16% MMDA & Sav. 39% Retail Time 9% Jumbo Time 4% Cost of Deposits: 0.86% Loans / Deposits: 78.0% Total Deposits: $608,681 Cost of Deposits: 0.65% Loans / Deposits: 79.4% Total Deposits: $20,734,851Total Deposits: $20,126,170 Cost of Deposits: 0.65% Loans / Deposits: 79.4% Pro Forma Bank-Level Deposit Composition 14 Source: S&P Global Market Intelligence; Bank call report data as of the quarter ended June 30, 2023. Note: All dollars in thousands. (1) Does not include purchase accounting adjustments. DDA 45% NOW & Other 3% MMDA & Sav. 43% Retail Time 4% Jumbo Time 5% Pro Forma(1)

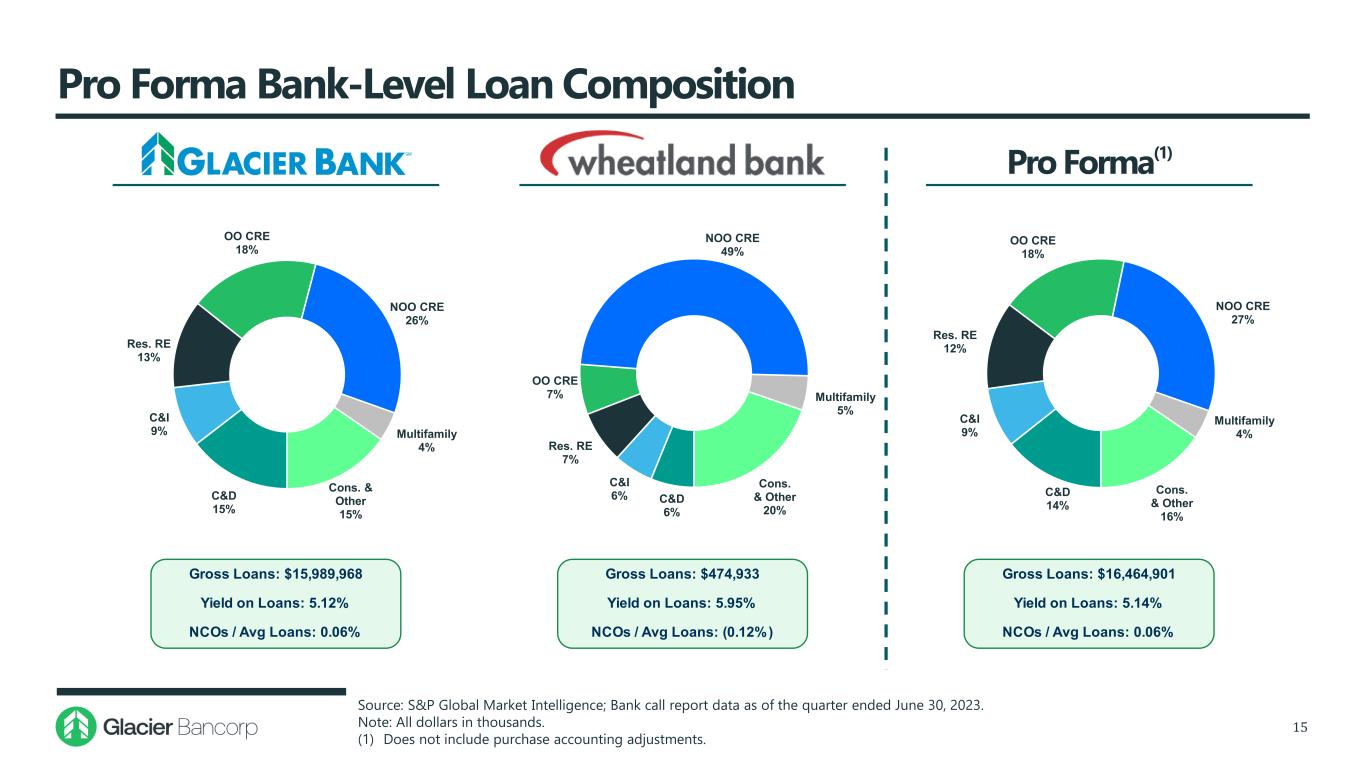

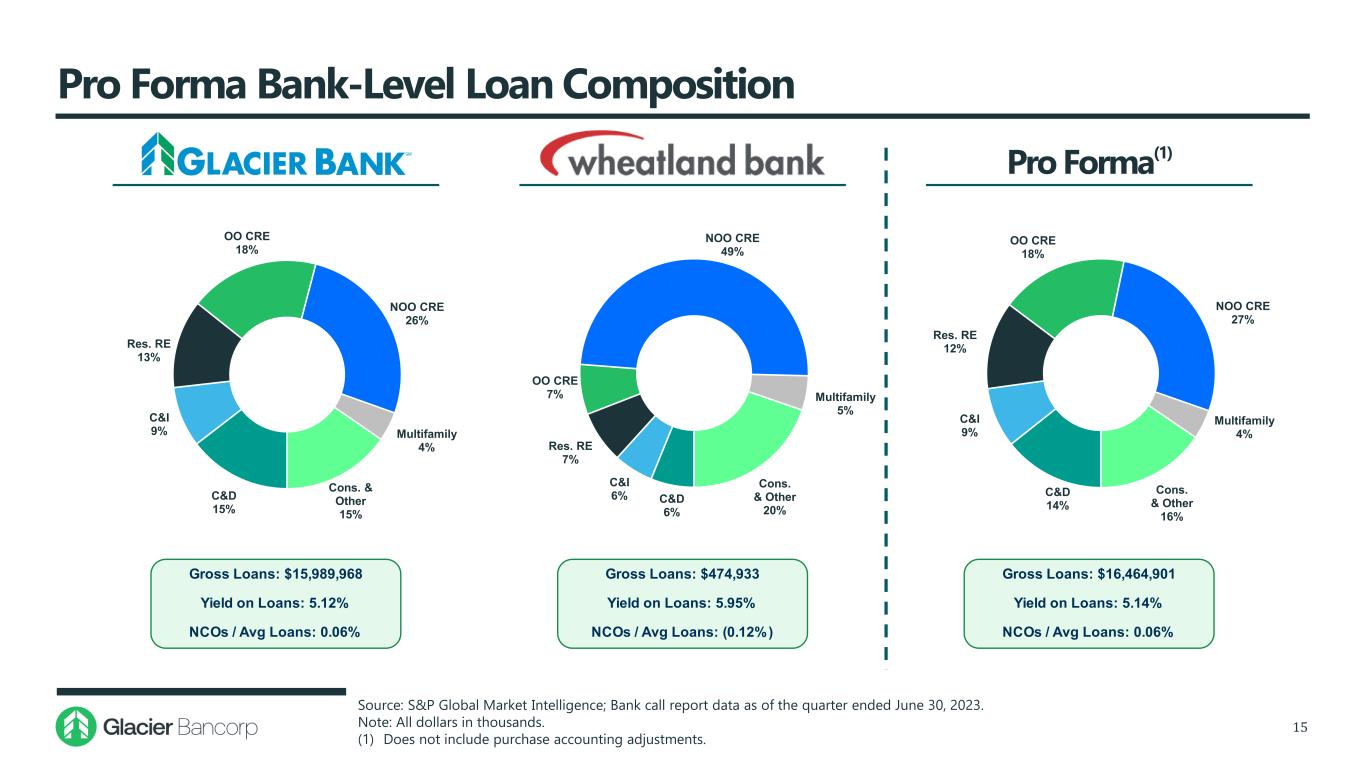

NCOs / Avg Loans: 0.06% Gross Loans: $16,464,901 Yield on Loans: 5.14% NCOs / Avg Loans: 0.06% Gross Loans: $15,989,968 Yield on Loans: 5.12% NCOs / Avg Loans: (0.12%) Gross Loans: $474,933 Yield on Loans: 5.95% Pro Forma Bank-Level Loan Composition 15 Pro Forma(1) C&D 15% C&I 9% Res. RE 13% OO CRE 18% NOO CRE 26% Multifamily 4% Cons. & Other 15% C&D 6% C&I 6% Res. RE 7% OO CRE 7% NOO CRE 49% Multifamily 5% Cons. & Other 20% C&D 14% C&I 9% Res. RE 12% OO CRE 18% NOO CRE 27% Multifamily 4% Cons. & Other 16% Source: S&P Global Market Intelligence; Bank call report data as of the quarter ended June 30, 2023. Note: All dollars in thousands. (1) Does not include purchase accounting adjustments.

Important Information and Where You Can Find It 16 In connection with the proposed merger transactions, Glacier will file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”) that will include a Proxy Statement of CFGW and a Prospectus of Glacier, as well as other relevant documents concerning the proposed transaction. Shareholders of CFGW are urged to read carefully the Registration Statement and the Proxy Statement/Prospectus included therein regarding the proposed merger transactions when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus included in the Registration Statement, as well as other filings containing information about Glacier, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Glacier at www.glacierbancorp.com under the tab “SEC Filings” or by requesting them in writing or by telephone from Glacier at: Glacier Bancorp, Inc., 49 Commons Loop, Kalispell, Montana 59901, ATTN: Corporate Secretary; Telephone (406) 751-7706. Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “estimate,” “expect,” “will,” and similar references to future periods. Such forward-looking statements include but are not limited to statements regarding the expected closing of the transaction and the potential benefits of the business combination transaction involving Glacier and CFGW, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts regarding either company or the proposed combination of the companies. These forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, that may cause actual results or events to differ materially from those projected, including but not limited to the following: risks that the merger transaction will not close when expected or at all because required regulatory, shareholder or other approvals or conditions to closing are delayed or not received or satisfied on a timely basis or at all; risks that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Glacier and CFGW operate; uncertainties regarding the ability of Glacier Bank and Wheatland Bank to promptly and effectively integrate their businesses; changes in business and operational strategies that may occur between signing and closing; uncertainties regarding the reaction to the transaction of the companies’ respective customers, employees, and counterparties; and risks relating to the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. Glacier undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this report. For more information, see the risk factors described in Glacier’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the SEC.

17