Artesian Resources Corporation Reports Second Quarter and

Year-To-Date 2025 Results

Newark, Delaware, August 4, 2025 – Artesian

Resources Corporation (Nasdaq: ARTNA), a leading provider on the Delmarva Peninsula of water and wastewater services, and a number of other related business services, today announced second quarter and year-to-date results for 2025.

Second Quarter Results

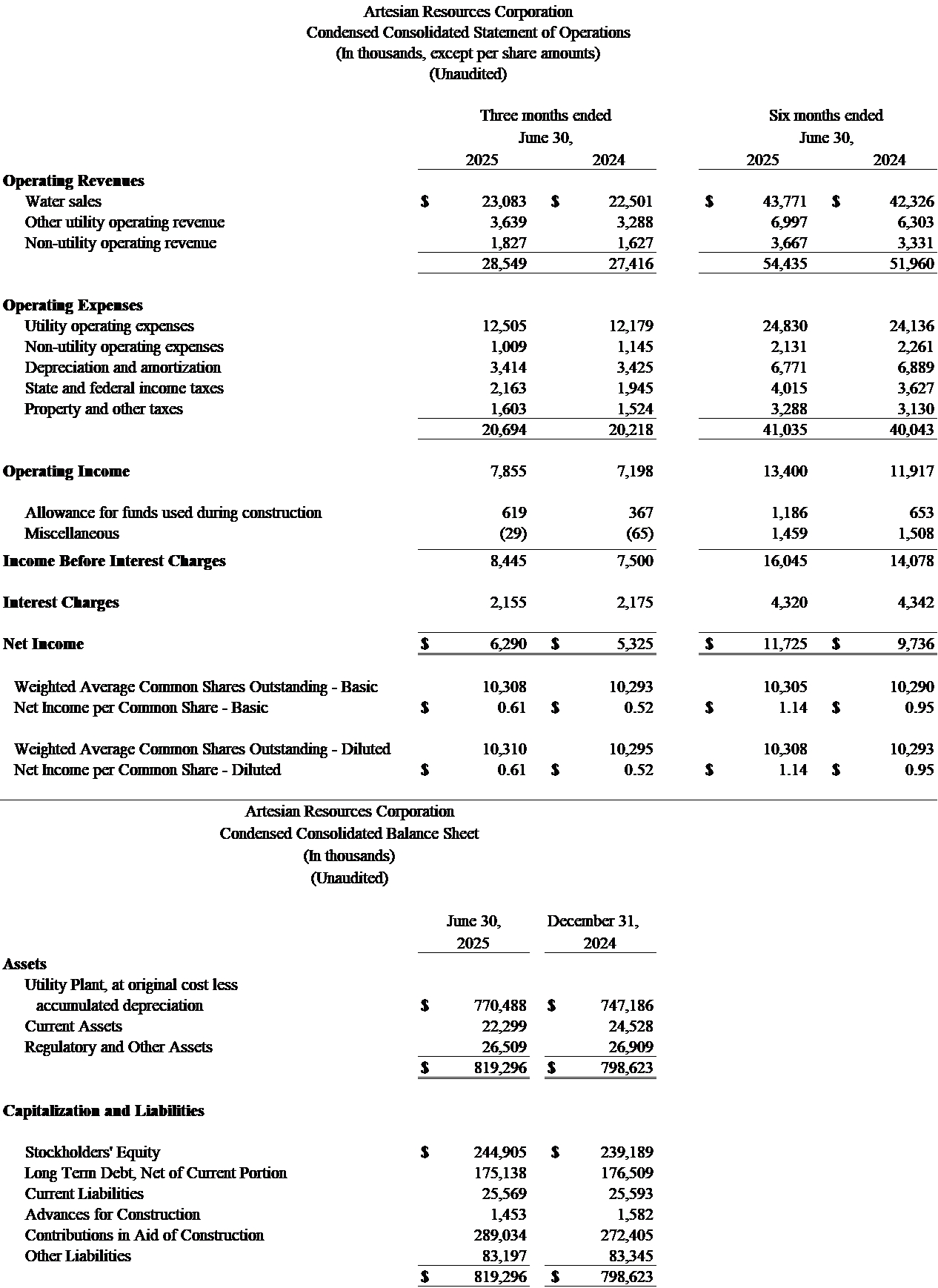

Net income for the three months ended June 30, 2025 was $6.3 million, a $1.0 million, or 18.1%, increase compared to net income recorded during the three

months ended June 30, 2024. Diluted net income per share increased 17.3% to $0.61, compared to $0.52 for the same period in 2024.

“Our increased earnings this quarter reflects not only higher water sales but also the continued growth of our wastewater customer base and revenues

generated by our Service Line Protection Plan offerings. As the communities we serve grow and infrastructure demands increase, we remain committed to delivering high-quality, reliable water and wastewater service, while ensuring long-term value for

our customers and shareholders,” said Nicki Taylor, Chair, President and CEO of Artesian.

Revenues totaled $28.5 million for the three months ended June 30, 2025, $1.1 million, or 4.1%, more than revenues for the three months ended June 30,

2024.

Water sales revenue increased $0.6 million, or 2.6%, primarily the result of an increase in Distribution System

Improvement Charges (DSIC) revenue, a temporary rate increase of 1.22% of gross water sales placed into effect on June 3, 2025, as permitted under Delaware law, until permanent rates are determined by the Delaware Public Service Commission (DEPSC)

and an increase in the number of customers served.

Other utility operating revenue increased approximately $0.4 million, or 10.7%, due to an increase in wastewater

revenue associated with an increase in the number of customers served.

Non-utility operating revenue increased approximately $0.2 million, or 12.3%, due to an increase in Service Line

Protection Plan, or SLPP, revenue, resulting from an increase in rates that were placed into effect on December 1, 2024.

Operating expenses, excluding depreciation and income taxes, increased $0.3 million, or 1.8%. Utility operating expenses increased $0.3 million, or 2.7%,

as a result of increases associated with transmission, distribution and collection system, purchased power and administrative costs, partially offset by a decrease in payroll and employee benefit costs. Effective in May 2025, upon expiration of an

existing electric supply contract, our water and wastewater utilities entered into a four-year electric supply contract with Constellation NewEnergy, Inc. at an electric supply rate approximately 25% over the prior rate. The total estimated annual

increase in electric supply expense beginning in May 2025 is approximately $0.5 million.

Non-utility operating expenses decreased $0.1 million, or 11.9%, due to a decrease in administrative, payroll and employee benefit

costs.

Federal and state income tax expense increased $0.2 million, or 11.2%, due to higher pre-tax book income, partially offset by higher

regulatory deferred income tax amortization in 2025 compared to 2024.

Property and other taxes increased $0.1 million, or 5.2%, due to an increase in New Castle County, Delaware tax rates on utility plant

and an increase in utility plant subject to taxation.

Other income increased $0.3 million, due to an increase in allowance for funds used during construction, or AFUDC, as a result of higher long-term

construction activity subject to AFUDC.

Year-to-Date Results

Net income for the six months ended June 30, 2025 was $11.7 million, a $2.0 million, or 20.4%, increase compared to net income recorded during the six

months ended June 30, 2024. Diluted net income per share increased 20.0% to $1.14, compared to $0.95 for the same period in 2024.

Revenues totaled $54.4 million for the six months ended June 30, 2025, $2.5 million, or 4.8%, more than revenues for the six months ended June 30, 2024.

Water sales revenue increased $1.4 million, or 3.4%, the result of an increase in overall water consumption, DSIC

revenue, number of customers served and a temporary rate increase of 1.22% of gross water sales placed into effect on June 3, 2025, as permitted under Delaware law, until permanent rates are determined by the DEPSC.

Other utility operating revenue increased approximately $0.7 million, or 11.0%, due to an increase in wastewater

revenue associated with an increase in the number of customers served.

Non-utility operating revenue increased approximately $0.3 million, or 10.1%, due to an increase in SLPP revenue,

resulting from an increase in rates that were placed into effect on December 1, 2024.

Operating expenses, excluding depreciation and income taxes, increased $0.7 million, or 2.4%. Utility operating expenses increased $0.7 million, or 2.9%,

a result of increases in administrative, purchased power and transmission, distribution and collection system costs, partially offset by a decrease in payroll, employee benefit, supply and treatment costs.

Non-utility operating expenses decreased $0.1 million, or 5.7%, due to a decrease in payroll and employee benefit costs.

Depreciation and amortization expense decreased $0.1 million, or 1.7%, due to a decrease in depreciation expense related to an increase

in depreciation on utility plant funded by Contributions in Aid of Construction.

Federal and state income tax expense increased $0.4 million, or 10.7%, due to higher pre-tax book income, partially offset by higher

regulatory deferred income tax amortization in 2025 compared to 2024.

Property and other taxes increased $0.2 million, or 5.0%, due to an increase in New Castle County, Delaware tax rates on utility plant

and an increase in utility plant subject to taxation.

Other income increased $0.5 million, due to an increase in AFUDC, as a result of higher long-term construction activity subject to AFUDC.

Capital Expenditures

As part of Artesian’s ongoing effort to ensure high-quality reliable service to customers, $26.3 million was invested in the first six months of 2025 in

water and wastewater infrastructure projects. These investments include renewals associated with the rehabilitation of aging infrastructure, installation of new mains, construction of a new wastewater treatment plant, upgrading elevated storage

tanks, upgrading and replacing our meter reading equipment, and upgrading existing pumping stations to better serve our customers.

“We continue to invest in critical infrastructure and treatment of emerging contaminants,” said Nicki Taylor. “Our proactive work to address PFAS through

targeted removal initiatives, alongside our attention to replacement of aging infrastructure, positions us to meet future regulatory standards and maintain the high level of service our customers expect. These investments are not only essential for

compliance, but are crucial to ensure the long-term sustainability and resilience of our operations.”

About Artesian Resources

Artesian Resources Corporation operates as a holding company of wholly-owned subsidiaries offering water and wastewater services, and a number of other

related core business services, on the Delmarva Peninsula. Artesian Water Company, the principal subsidiary, is the oldest and largest regulated water utility on the Delmarva Peninsula and has been providing water service since 1905. Artesian Water

Company supplies 9.4 billion gallons of water per year through 1,491 miles of main to over a third of Delawareans.

Forward Looking Statements

This release contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding, among other things,

the costs related to electric supply increases, our growth strategy, our expectations regarding infrastructure investments, our ability to comply with future regulatory standards, and continued growth in our business and the number of customers

served. These statements involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements including: changes in weather, changes in our contractual obligations,

changes in government policies, the timing and results of our rate requests, failure to receive regulatory approval, changes in economic and market conditions generally and other matters discussed in our filings with the Securities and Exchange

Commission. While the Company may elect to update forward-looking statements, we specifically disclaim any obligation to do so and you should not rely on any forward-looking statement as representation of the Company’s views as of any date

subsequent to the date of this release.

Contact:

Virginia Eisenbrey

(302) 453-6900

VEisenbrey@artesianwater.com