Document

Exhibit 99.1

For Immediate Release

First Interstate BancSystem, Inc. Reports First Quarter Earnings

Billings, MT - April 24, 2024 - First Interstate BancSystem, Inc. (NASDAQ: FIBK) (the “Company”) today reported financial results for the first quarter of 2024. For the quarter, the Company reported net income of $58.4 million, or $0.57 per share, which compares to net income of $61.5 million, or $0.59 per share, for the fourth quarter of 2023 and net income of $56.3 million, or $0.54 per share, for the first quarter of 2023.

HIGHLIGHTS

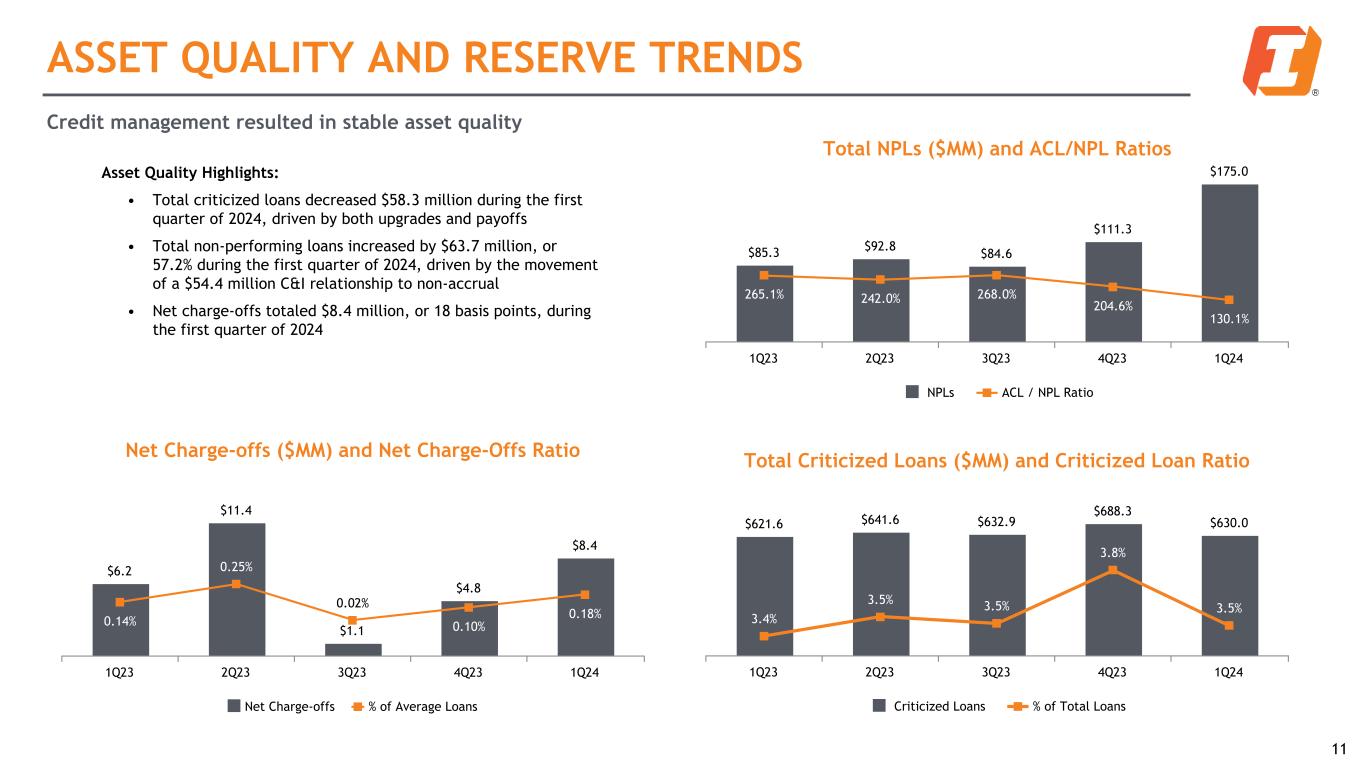

•Criticized loans decreased $58.3 million at March 31, 2024, compared to December 31, 2023, driven by loan upgrades and payoffs.

•Non-performing assets increased $61.6 million at March 31, 2024, compared to December 31, 2023, driven primarily by one non-accrual commercial and industrial loan relationship in the first quarter of 2024.

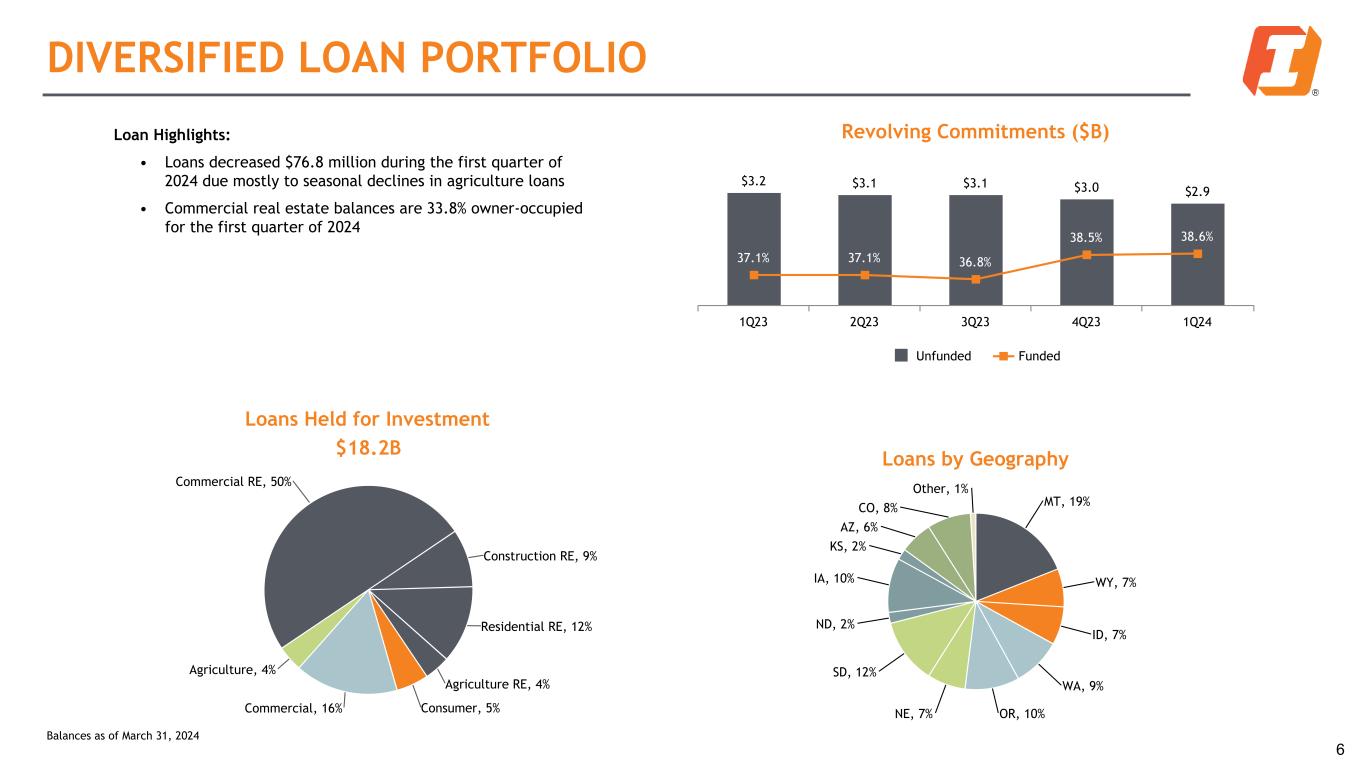

•Loans held for investment decreased $76.8 million at March 31, 2024, compared to December 31, 2023, driven by seasonal declines in agriculture loans.

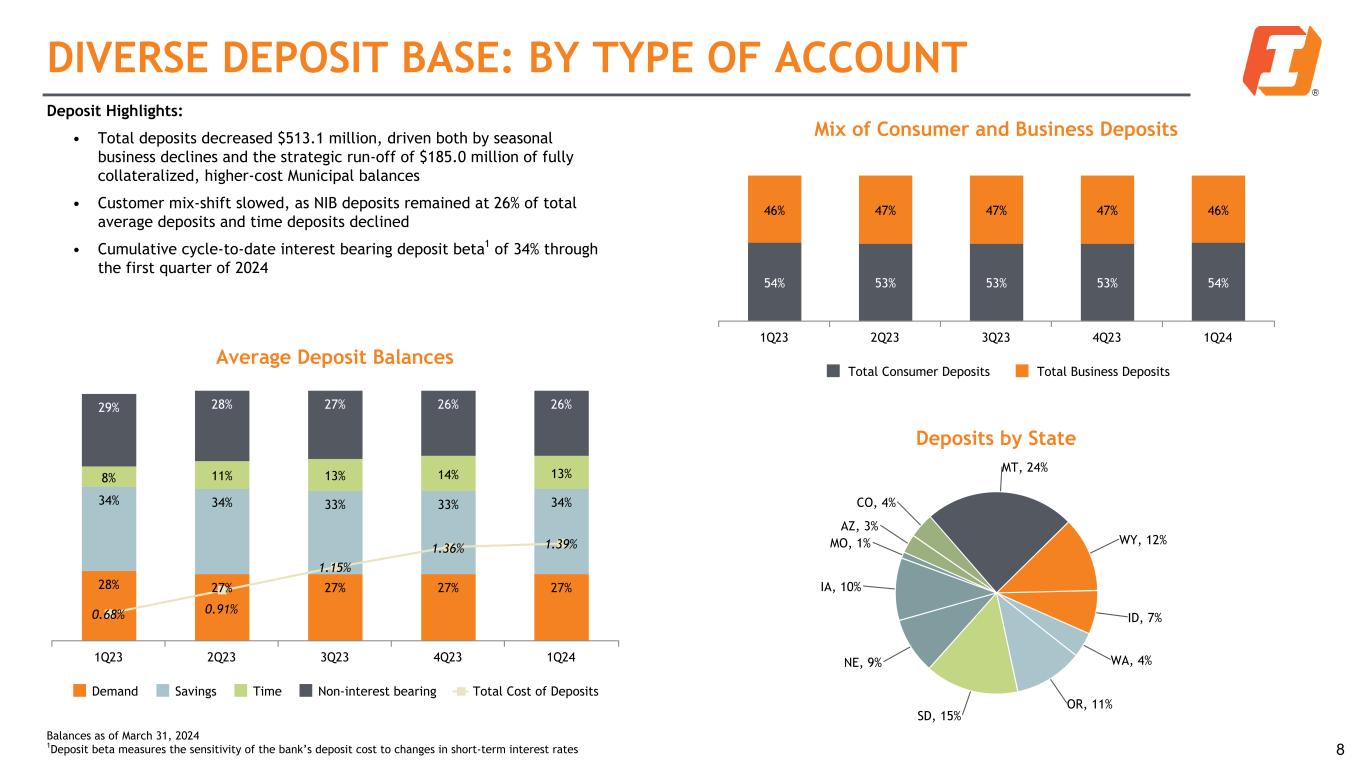

•Total deposits decreased $513.1 million at March 31, 2024, compared to December 31, 2023, primarily due to seasonal declines in business deposits and selective run-off of two higher-cost municipal accounts totaling $185.0 million.

•Net interest margin decreased to 2.91% for the first quarter of 2024, an 8 basis point decrease from the fourth quarter of 2023. Net interest margin, on a fully taxable equivalent (“FTE”) basis,1 a non-GAAP financial measure, decreased to 2.93% for the first quarter of 2024, an 8 basis point decrease from the fourth quarter of 2023.

•Non-interest expense decreased $5.8 million for the first quarter of 2024, compared to the fourth quarter of 2023 and decreased $5.6 million compared to the first quarter of 2023.

“We executed well in the first quarter, with results generally in-line with our expectations, which we believe positions us well for the remainder of 2024,” said Kevin P. Riley, President and Chief Executive Officer of First Interstate BancSystem, Inc. “With our strong financial performance, we expect to continue to generate improvements in our capital ratios and maintain a healthy dividend for our shareholders.”

“Given our strong levels of capital and liquidity, adequate allowance for credit loss levels, and continued expense control, we remain confident in our ability to generate solid returns,” said Mr. Riley.

DIVIDEND DECLARATION

On April 23, 2024, the Company’s board of directors declared a dividend of $0.47 per common share, payable on May 16, 2024, to common stockholders of record as of May 6, 2024. The dividend equates to a 6.9% annualized yield based on the $27.30 per share average closing price of the Company’s common stock as reported on NASDAQ during the first quarter of 2024.

1 See Non-GAAP Financial Measures included herein for a reconciliation the most directly comparable GAAP financial measures.

NET INTEREST INCOME

Net interest income decreased $7.7 million, or 3.7%, to $200.1 million, during the first quarter of 2024, compared to net interest income of $207.8 million during the fourth quarter of 2023, primarily due to an increase in interest expense resulting from higher costs of interest-bearing liabilities and one less accrual day in the first quarter of 2024. Net interest income decreased $38.8 million, or 16.2%, during the first quarter of 2024 compared to the first quarter of 2023, also primarily due to an increase in interest expense resulting from higher costs of interest-bearing liabilities and one additional day in the first quarter of 2024.

•Interest accretion attributable to the fair valuation of acquired loans from acquisitions contributed to net interest income during the first quarter of 2024, the fourth quarter of 2023, and the first quarter of 2023, in the amounts of $6.5 million, $5.4 million, and $5.2 million, respectively.

The net interest margin ratio was 2.91% for the first quarter of 2024, compared to 2.99% during the fourth quarter of 2023, and 3.33% during the first quarter of 2023. The net FTE interest margin ratio2, a non-GAAP financial measure, was 2.93% for the first quarter of 2024, compared to 3.01% during the fourth quarter of 2023, and 3.36% during the first quarter of 2023. Excluding interest accretion from the fair value of acquired loans, on a quarter-over-quarter basis, the adjusted net interest margin ratio (FTE)2, a non-GAAP financial measure, was 2.84%, a decrease of 10 basis points from the prior quarter, primarily driven by higher interest-bearing deposit costs and increased borrowings, which was partially offset by loan yield expansion. Excluding interest accretion from the fair value of acquired loans, on a year-over-year basis, the net interest margin ratio decreased 45 basis points, primarily as a result of higher interest-bearing deposit and borrowing costs, which was partially offset by loan yield expansion and a modestly favorable change in the mix of earning assets.

PROVISION FOR (REDUCTION OF) CREDIT LOSSES

During the first quarter of 2024, the Company recorded a provision for credit losses of $5.3 million. This compares to a provision for credit losses of $5.4 million during the fourth quarter of 2023 and $15.2 million during the first quarter of 2023.

For the first quarter of 2024, the allowance for credit losses included net charge-offs of $8.4 million, or an annualized 0.18% of average loans outstanding, compared to net charge-offs of $4.8 million, or an annualized 0.10% of average loans outstanding, for the fourth quarter of 2023 and net charge-offs of $6.2 million, or an annualized 0.14% of average loans outstanding in the first quarter of 2023. Net loan charge-offs in the first quarter of 2024 were composed of charge-offs of $11.0 million and recoveries of $2.6 million.

The Company’s allowance for credit losses as a percentage of period-end loans held for investment was unchanged at 1.25% for March 31, 2024 and December 31, 2023, compared to 1.24% at March 31, 2023. Coverage of non-performing loans decreased to 130.1% at March 31, 2024, compared to 204.6% at December 31, 2023 and 265.1% at March 31, 2023.

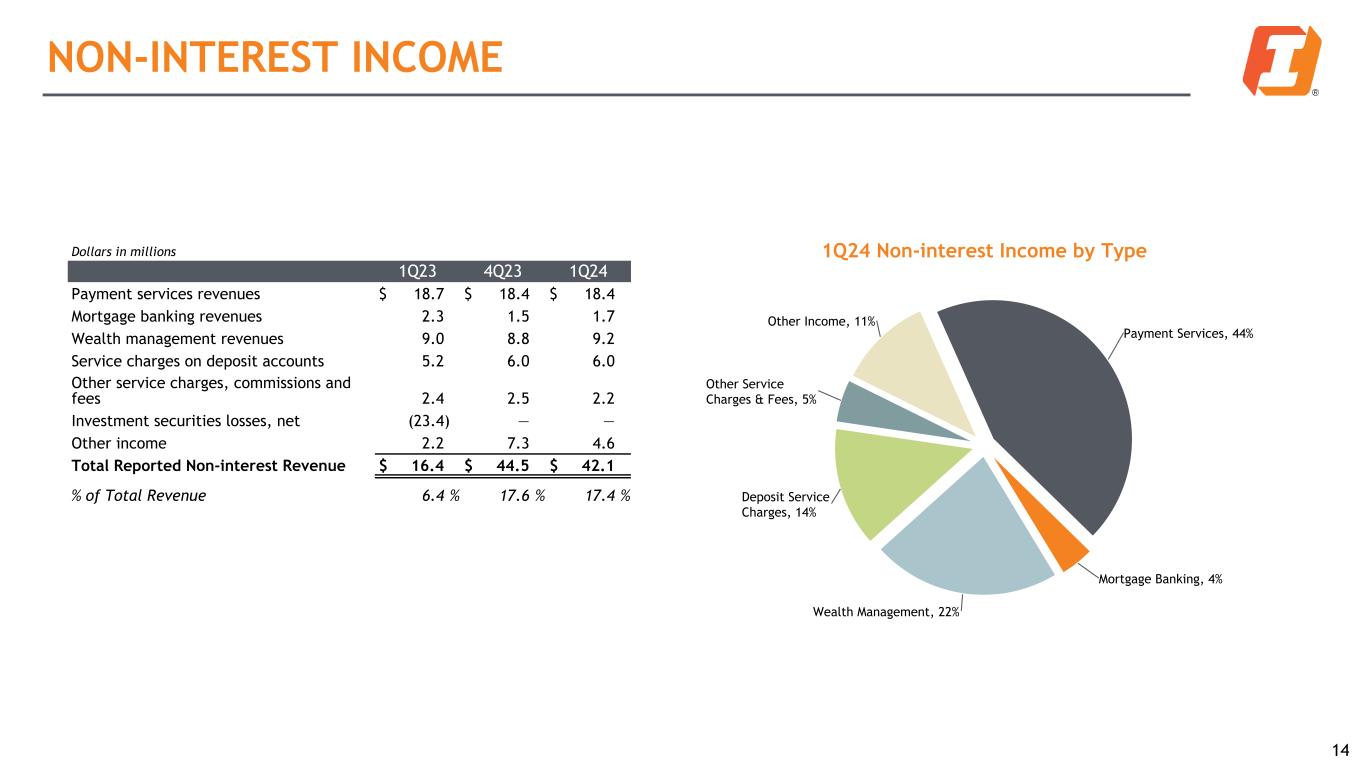

NON-INTEREST INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the Quarter Ended |

Mar 31, 2024 |

|

Dec 31, 2023 |

|

$ Change |

% Change |

|

Mar 31, 2023 |

|

$ Change |

% Change |

| (Dollars in millions) |

|

|

|

|

| Payment services revenues |

$ |

18.4 |

|

|

$ |

18.4 |

|

|

$ |

— |

|

— |

% |

|

$ |

18.7 |

|

|

$ |

(0.3) |

|

(1.6) |

% |

| Mortgage banking revenues |

1.7 |

|

|

1.5 |

|

|

0.2 |

|

13.3 |

|

|

2.3 |

|

|

(0.6) |

|

(26.1) |

|

| Wealth management revenues |

9.2 |

|

|

8.8 |

|

|

0.4 |

|

4.5 |

|

|

9.0 |

|

|

0.2 |

|

2.2 |

|

| Service charges on deposit accounts |

6.0 |

|

|

6.0 |

|

|

— |

|

— |

|

|

5.2 |

|

|

0.8 |

|

15.4 |

|

| Other service charges, commissions, and fees |

2.2 |

|

|

2.5 |

|

|

(0.3) |

|

(12.0) |

|

|

2.4 |

|

|

(0.2) |

|

(8.3) |

|

| Investment securities loss |

— |

|

|

— |

|

|

— |

|

— |

|

|

(23.4) |

|

|

23.4 |

|

(100.0) |

|

| Other income |

4.6 |

|

|

7.3 |

|

|

(2.7) |

|

(37.0) |

|

|

2.2 |

|

|

2.4 |

|

109.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-interest income |

$ |

42.1 |

|

|

$ |

44.5 |

|

|

$ |

(2.4) |

|

(5.4) |

% |

|

$ |

16.4 |

|

|

$ |

25.7 |

|

156.7 |

% |

Non-interest income was $42.1 million for the first quarter of 2024, decreasing $2.4 million and increasing $25.7 million compared to the fourth quarter of 2023 and the first quarter of 2023, respectively. The decrease from the fourth quarter of 2023 was primarily the result of a gain of $2.9 million resulting from the disposition of premises and equipment during the fourth quarter of 2023. The increase from the first quarter of 2023 was primarily the result of the realized loss of $23.4 million on the disposition of available-for-sale investment securities and a reduction of $1.9 million related to the fair value of loans held for sale recognized through other income in the first quarter of 2023.

2 See Non-GAAP Financial Measures included herein for a reconciliation the most directly comparable GAAP financial measures.

NON-INTEREST EXPENSE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the Quarter Ended |

Mar 31, 2024 |

|

Dec 31, 2023 |

|

$ Change |

% Change |

|

Mar 31, 2023 |

|

$ Change |

% Change |

| (Dollars in millions) |

|

|

|

|

| Salaries and wages |

$ |

65.2 |

|

|

$ |

64.0 |

|

|

$ |

1.2 |

|

1.9 |

% |

|

$ |

65.6 |

|

|

$ |

(0.4) |

|

(0.6) |

% |

| Employee benefits |

19.3 |

|

|

13.5 |

|

|

5.8 |

|

43.0 |

|

|

22.8 |

|

|

(3.5) |

|

(15.4) |

|

| Occupancy and equipment |

17.3 |

|

|

17.4 |

|

|

(0.1) |

|

(0.6) |

|

|

18.4 |

|

|

(1.1) |

|

(6.0) |

|

| Other intangible amortization |

3.7 |

|

|

3.9 |

|

|

(0.2) |

|

(5.1) |

|

|

4.0 |

|

|

(0.3) |

|

(7.5) |

|

| Other expenses |

52.7 |

|

|

67.0 |

|

|

(14.3) |

|

(21.3) |

|

|

54.8 |

|

|

(2.1) |

|

(3.8) |

|

| Other real estate owned expense |

2.0 |

|

|

0.2 |

|

|

1.8 |

|

NM |

|

0.2 |

|

|

1.8 |

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-interest expense |

$ |

160.2 |

|

|

$ |

166.0 |

|

|

$ |

(5.8) |

|

(3.5) |

% |

|

$ |

165.8 |

|

|

$ |

(5.6) |

|

(3.4) |

% |

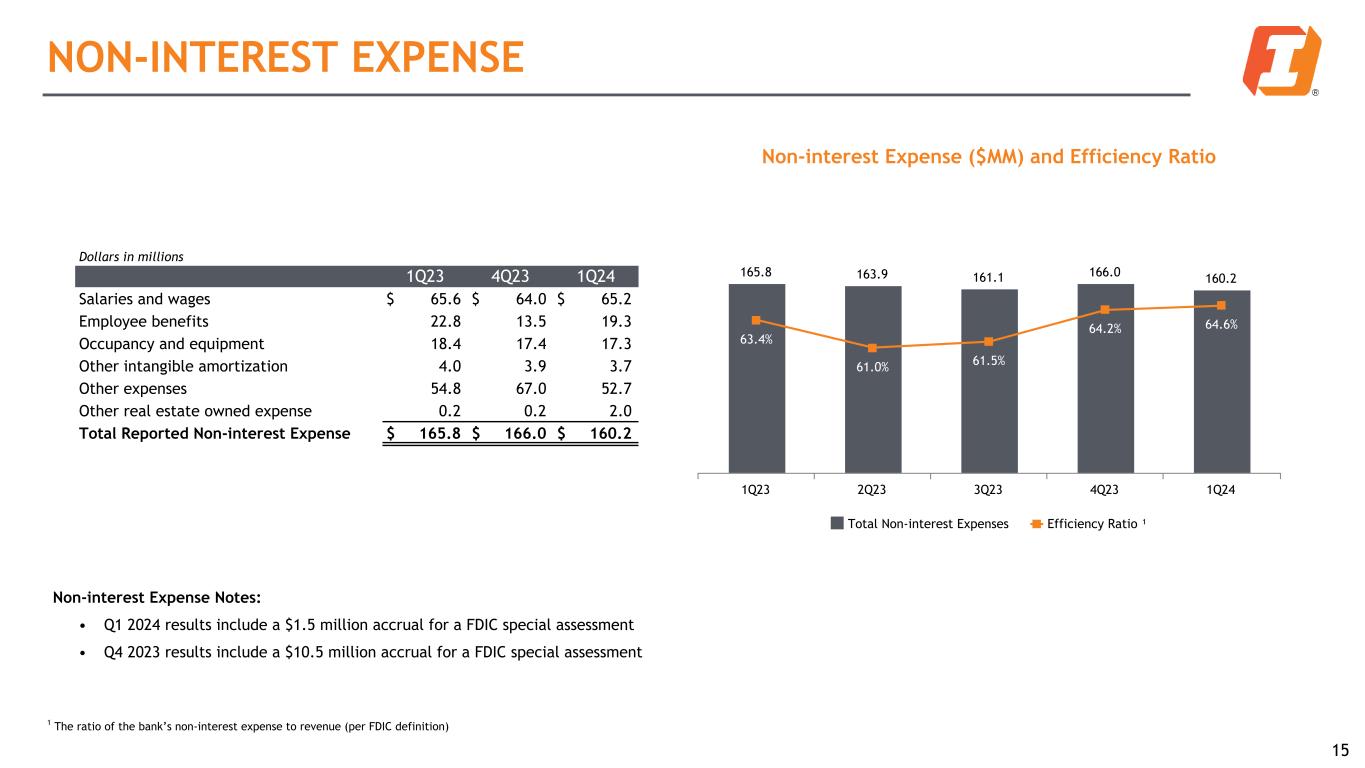

The Company’s non-interest expense was $160.2 million for the first quarter of 2024, a decrease of $5.8 million from the fourth quarter of 2023 and a decrease of $5.6 million from the first quarter of 2023.

Salary and wages expense increased $1.2 million during the first quarter of 2024 compared to the fourth quarter of 2023, primarily due to higher short-term incentive accruals and annual merit increases, partially offset by a realization of the reduction in salaries and wages from expense initiatives undertaken by the Company. Salaries and wages expense decreased $0.4 million during the first quarter of 2024 compared to the first quarter of 2023, primarily due to lower salaries and wages and net severance costs which were partially offset by higher short-term incentive accruals in the first quarter of 2024.

Employee benefit expenses increased $5.8 million during the first quarter of 2024 compared to the fourth quarter of 2023, primarily due to higher long-term incentive accruals of $6.9 million and an increase of $2.1 million due to the seasonal reset of payroll taxes, partially offset by lower health insurance costs of $3.1 million. Employee benefit expenses decreased $3.5 million during the first quarter of 2024 compared to the first quarter of 2023, primarily due to lower health insurance costs of $2.1 million and lower payroll taxes of $1.8 million, partially offset by higher long-term incentive accruals of $0.6 million.

Other expenses decreased $14.3 million during the first quarter of 2024 compared to the fourth quarter of 2023, primarily due to a decrease of $9.0 million related to the FDIC special assessment accrual. The Company recorded a special assessment of $10.5 million in the fourth quarter of 2023 compared to $1.5 million recorded in the first quarter of 2024. Additionally, in the fourth quarter of 2023, other expenses reflected an increase in the credit card rewards accrual of $2.1 million to reflect higher engagement by our clients in our rewards program. The remaining quarter-over-quarter decrease and year-over-year decrease in other expenses was related to normal fluctuations in operating expenses.

Other real estate owned expenses increased $1.8 million during the first quarter of 2024 compared to both the fourth quarter of 2023 and the first quarter of 2023 primarily due to the write down of two other real estate owned properties in the first quarter of 2024.

BALANCE SHEET

Total assets decreased $526.4 million, or 1.7%, to $30,144.8 million as of March 31, 2024, from $30,671.2 million as of December 31, 2023, primarily due to decreases in investment securities and loans, and decreased $1,492.9 million, or 4.7%, from $31,637.7 million as of March 31, 2023, primarily due to declines in deposits and securities sold under repurchase agreements.

Investment securities decreased $423.3 million, or 4.7%, to $8,626.1 million as of March 31, 2024, from $9,049.4 million as of December 31, 2023, primarily as a result of normal pay-downs and maturities. Investment securities decreased $799.4 million, or 8.5%, from $9,425.5 million as of March 31, 2023, primarily as a result of normal pay-downs and maturities, partially offset by a $40.3 million increase in fair market values and a reduction of $2.5 million in allowance for credit losses on available-for-sale investment securities during the period.

The following table presents the composition and comparison of loans held for investment as of the quarters-ended:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mar 31, 2024 |

Dec 31, 2023 |

$ Change |

% Change |

Mar 31, 2023 |

$ Change |

% Change |

|

| Real Estate: |

|

|

|

|

|

|

|

|

| Commercial |

$ |

9,060.4 |

|

$ |

8,869.2 |

|

$ |

191.2 |

|

2.2 |

% |

$ |

8,680.8 |

|

$ |

379.6 |

|

4.4 |

% |

|

| Construction |

1,609.2 |

|

1,826.5 |

|

(217.3) |

|

(11.9) |

|

1,893.0 |

|

(283.8) |

|

(15.0) |

|

|

| Residential |

2,258.4 |

|

2,244.3 |

|

14.1 |

|

0.6 |

|

2,191.1 |

|

67.3 |

|

3.1 |

|

|

| Agricultural |

719.7 |

|

716.8 |

|

2.9 |

|

0.4 |

|

769.7 |

|

(50.0) |

|

(6.5) |

|

|

| Total real estate |

13,647.7 |

|

13,656.8 |

|

(9.1) |

|

(0.1) |

|

13,534.6 |

|

113.1 |

|

0.8 |

|

|

| Consumer: |

|

|

|

|

|

|

|

|

| Indirect |

739.9 |

|

740.9 |

|

(1.0) |

|

(0.1) |

|

817.3 |

|

(77.4) |

|

(9.5) |

|

|

| Direct and advance lines |

136.7 |

|

141.6 |

|

(4.9) |

|

(3.5) |

|

146.9 |

|

(10.2) |

|

(6.9) |

|

|

| Credit card |

72.6 |

|

76.5 |

|

(3.9) |

|

(5.1) |

|

71.5 |

|

1.1 |

|

1.5 |

|

|

| Total consumer |

949.2 |

|

959.0 |

|

(9.8) |

|

(1.0) |

|

1,035.7 |

|

(86.5) |

|

(8.4) |

|

|

| Commercial |

2,922.2 |

|

2,906.8 |

|

15.4 |

|

0.5 |

|

3,028.0 |

|

(105.8) |

|

(3.5) |

|

|

| Agricultural |

696.0 |

|

769.4 |

|

(73.4) |

|

(9.5) |

|

660.4 |

|

35.6 |

|

5.4 |

|

|

| Other, including overdrafts |

0.2 |

|

0.1 |

|

0.1 |

|

100.0 |

|

1.6 |

|

(1.4) |

|

(87.5) |

|

|

| Deferred loan fees and costs |

(12.5) |

|

(12.5) |

|

— |

|

— |

|

(14.6) |

|

2.1 |

|

(14.4) |

|

|

| Loans held for investment, net of deferred loan fees and costs |

$ |

18,202.8 |

|

$ |

18,279.6 |

|

$ |

(76.8) |

|

(0.4) |

% |

$ |

18,245.7 |

|

$ |

(42.9) |

|

(0.2) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The ratio of loans held for investment to deposits increased to 79.8%, as of March 31, 2024, compared to 78.4% as of December 31, 2023 and 75.7% as of March 31, 2023.

Total deposits decreased $513.1 million, or 2.2%, to $22,810.0 million as of March 31, 2024, from $23,323.1 million as of December 31, 2023, with decreases in all categories except for of savings deposits and time deposits $250 and over. Total deposits decreased $1,297.0 million, or 5.4%, from $24,107.0 million as of March 31, 2023, with decreases in all types of deposits except for time deposits.

Securities sold under repurchase agreements increased $11.5 million, or 1.5%, to $794.2 million as of March 31, 2024, from $782.7 million as of December 31, 2023, and decreased $176.6 million, or 18.2%, from $970.8 million as of March 31, 2023, resulting from normal fluctuations in the liquidity needs of the Company’s clients.

Other borrowed funds is comprised of Federal Home Loan Bank and Bank Term Funding Program variable-rate, overnight and fixed-rate borrowings with contractual tenors of up to one year. Other borrowed funds decreased $261.0 million, or 10.0%, to $2,342.0 million as of March 31, 2024, from $2,603.0 million as of December 31, 2023, and decreased $368.0 million from March 31, 2023, as a result of adjusting the funding mix between other borrowed funds and long-term debt.

Long-term debt increased $250.0 million, or 207.0%, to $370.8 million as of March 31, 2024, from $120.8 million as of December 31, 2023 and March 31, 2023, as a result of an 18-month Federal Home Loan Bank borrowing.

The Company is considered to be “well-capitalized” as of March 31, 2024, having exceeded all regulatory capital adequacy requirements. During the first quarter of 2024, the Company paid regular common stock dividends of approximately $48.7 million, or $0.47 per share.

CREDIT QUALITY

As of March 31, 2024, non-performing assets increased $61.6 million, or 48.2%, to $189.4 million, compared to $127.8 million as of December 31, 2023, primarily due to an increase in non-accrual loans driven by the movement of a $54.4 million commercial and industrial loan relationship to non-accrual.

Criticized loans decreased $58.3 million, or 8.5%, to $630.0 million as of March 31, 2024, from $688.3 million as of December 31, 2023, driven by upgrades and paydowns in the commercial real estate and construction real estate portfolios.

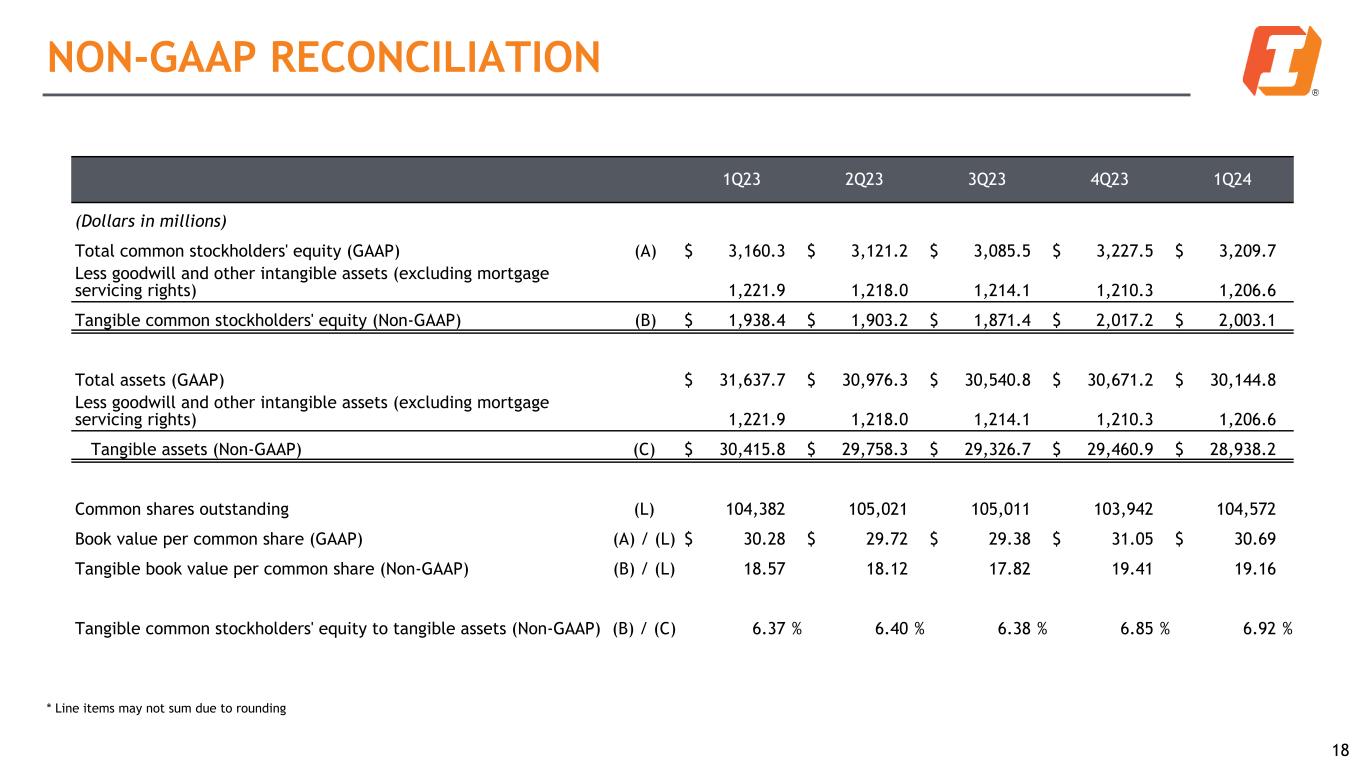

NON-GAAP FINANCIAL MEASURES

In addition to results presented in accordance with accounting principles generally accepted in the United States of America, or GAAP, this press release contains the following non-GAAP financial measures that management uses to evaluate our performance relative to our capital adequacy standards: (i) tangible common stockholders’ equity; (ii) tangible assets; (iii) tangible book value per common share; (iv) tangible common stockholders’ equity to tangible assets; (v) average tangible common stockholders’ equity; (vi) return on average tangible common stockholders’ equity; and (vii) adjusted net interest margin ratio (FTE). Tangible common stockholders’ equity is calculated as total common stockholders’ equity less goodwill and other intangible assets (excluding mortgage servicing rights). Tangible assets are calculated as total assets less goodwill and other intangible assets (excluding mortgage servicing rights). Tangible book value per common share is calculated as tangible common stockholders’ equity divided by common shares outstanding. Tangible common stockholders’ equity to tangible assets is calculated as tangible common stockholders’ equity divided by tangible assets. Average tangible common stockholders’ equity is calculated as average stockholders’ equity less average goodwill and other intangible assets (excluding mortgage servicing rights). Return on average tangible common stockholders’ equity is calculated as net income available to common shareholders divided by average tangible common stockholders’ equity. Adjusted net interest margin ratio (FTE) is calculated as adjusted net FTE interest income divided by adjusted average interest earning assets. These non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies because other companies may not calculate these non-GAAP measures in the same manner. They also should not be considered in isolation or as a substitute for measures prepared in accordance with GAAP.

The Company adjusts the most directly comparable capital adequacy GAAP financial measures to the non-GAAP financial measures described in subclauses (i) through (vi) above to exclude goodwill and other intangible assets (except mortgage servicing rights). To derive the non-GAAP financial measure identified in subclause (vii) above, the Company adjusts its net interest income to include its FTE interest income and exclude purchase accounting interest accretion on acquired loans. Management believes these non-GAAP financial measures, which are intended to complement the capital ratios defined by banking regulators and to present on a consistent basis our and our acquired companies’ organic continuing operations without regard to acquisition costs and other adjustments that we consider to be unpredictable and dependent on a significant number of factors that are outside our control, are useful to investors in evaluating the Company’s performance because, as a general matter, they either do not represent an actual cash expense and are inconsistent in amount and frequency depending upon the timing and size of our acquisitions (including the size, complexity and/or volume of past acquisitions, which may drive the magnitude of acquisition related costs, but may not be indicative of the size, complexity and/or volume of future acquisitions or related costs), or they cannot be anticipated or estimated in a particular period (in particular as it relates to unexpected recovery amounts). This impacts the ratios that are important to analysts and allows investors to compare certain aspects of the Company’s capitalization to other companies.

See the Non-GAAP Financial Measures table included herein and the textual discussion for a reconciliation of the above described non-GAAP financial measures to their most directly comparable GAAP financial measures.

Cautionary Note Regarding Forward-Looking Statements and Factors that Could Affect Future Results

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Rule 3b-6 promulgated thereunder, that involve inherent risks and uncertainties. Any statements about our plans, objectives, expectations, strategies, beliefs, or future performance or events constitute forward-looking statements. Such statements are identified by words or phrases such as “believes,” “expects,” “anticipates,” “plans,” “trends,” “objectives,” “continues” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “may,” or similar expressions. Forward-looking statements involve known and unknown risks, uncertainties, assumptions, estimates and other important factors that change over time and could cause actual results to differ materially from any results, performance or events expressed or implied by such forward-looking statements. Furthermore, the following factors, among others, may cause actual results to differ materially from current expectations in the forward-looking statements, including those set forth in this press release:

•new or changes in existing, governmental regulations;

•negative developments in the banking industry and increased regulatory scrutiny;

•tax legislative initiatives or assessments;

•more stringent capital requirements, to the extent they may become applicable to us;

•changes in accounting standards;

•any failure to comply with applicable laws and regulations, including, but not limited to, the Community Reinvestment Act and fair lending laws, the USA PATRIOT ACT of 2001, the Office of Foreign Asset Control guidelines and requirements, the Bank Secrecy Act, and the related Financial Crimes Enforcement Network and Federal Financial Institutions Examination Council Guidelines and regulations;

•federal deposit insurance increases;

•lending risks and risks associated with loan sector concentrations;

•a decline in economic conditions that could reduce demand for our products and services and negatively impact the credit quality of loans;

•loan credit losses exceeding estimates;

•exposure to losses in collateralized loan obligation securities;

•changes to United States trade policies, including the imposition of tariffs and retaliatory tariffs;

•the soundness of other financial institutions;

•the ability to meet cash flow needs and availability of financing sources for working capital and other needs;

•a loss of deposits or a change in product mix that increases the Company’s funding costs;

•inability to access funding or to monetize liquid assets;

•changes in interest rates;

•interest rate effect on the value of our investment securities;

•cybersecurity risks, including “denial-of-service attacks,” “hacking,” and “identity theft” that could result in the disclosure of confidential information;

•privacy, information security, and data protection laws, rules, and regulations that affect or limit how we collect and use personal information;

•the potential impairment of our goodwill and other intangible assets;

•our reliance on other companies that provide key components of our business infrastructure;

•events that may tarnish our reputation;

•main stream and social media contagion;

•the loss of the services of key members of our management team and directors;

•our ability to attract and retain qualified employees to operate our business;

•costs associated with repossessed properties, including environmental remediation;

•the effectiveness of our systems of internal operating and accounting controls;

•our ability to implement technology-facilitated products and services or be successful in marketing these products and services to our clients;

•difficulties we may face in combining the operations of acquired entities or assets with our own operations or assessing the effectiveness of businesses in which we make strategic investments or with which we enter into strategic contractual relationships;

•competition from new or existing financial institutions and non-banks;

•investing in technology;

•incurrence of significant costs related to mergers and related integration activities;

•the volatility in the price and trading volume of our common stock;

•“anti-takeover” provisions in our certificate of incorporation and regulations, which may make it more difficult for a third party to acquire control of us even in circumstances that could be deemed beneficial to stockholders;

•changes in our dividend policy or our ability to pay dividends;

•our common stock not being an insured deposit;

•the potential dilutive effect of future equity issuances;

•the subordination of our common stock to our existing and future indebtedness;

•the impact of the combined deficiencies resulting in a material weakness in our internal control over financial reporting;

•the effect of global conditions, earthquakes, volcanoes, tsunamis, floods, fires, drought, and other natural catastrophic events; and

•the impact of climate change and environmental sustainability matters.

These factors are not necessarily all the factors that could cause our actual results, performance, or achievements to differ materially from those expressed in or implied by any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above and included and described in more detail in our periodic reports filed with the Securities and Exchange Commission, or SEC, under the Securities Exchange Act of 1934, as amended, under the caption “Risk Factors.” Interested parties are urged to read in their entirety such risk factors prior to making any investment decision with respect to the Company. Forward-looking statements speak only as of the date they are made, and we do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

First Quarter 2024 Conference Call for Investors

First Interstate BancSystem, Inc. will host a conference call to discuss the results for the first quarter of 2024 at 11:00 a.m. Eastern Time (9:00 a.m. Mountain Time) on Thursday, April 25, 2024. The conference call will be accessible by telephone and through the Internet. Participants may join the call by dialing 1-800-274-8461; the access code is FIBANC. To participate via the Internet, visit www.FIBK.com. The call will be recorded and made available for replay on April 25, 2024, after 1:00 p.m. Eastern Time (11:00 a.m. Mountain Time), through May 25, 2024, prior to 9:00 a.m. Eastern Time (7:00 a.m. Mountain Time), by dialing 1-888-562-2815. The call will also be archived on our website, www.FIBK.com, for one year.

About First Interstate BancSystem, Inc.

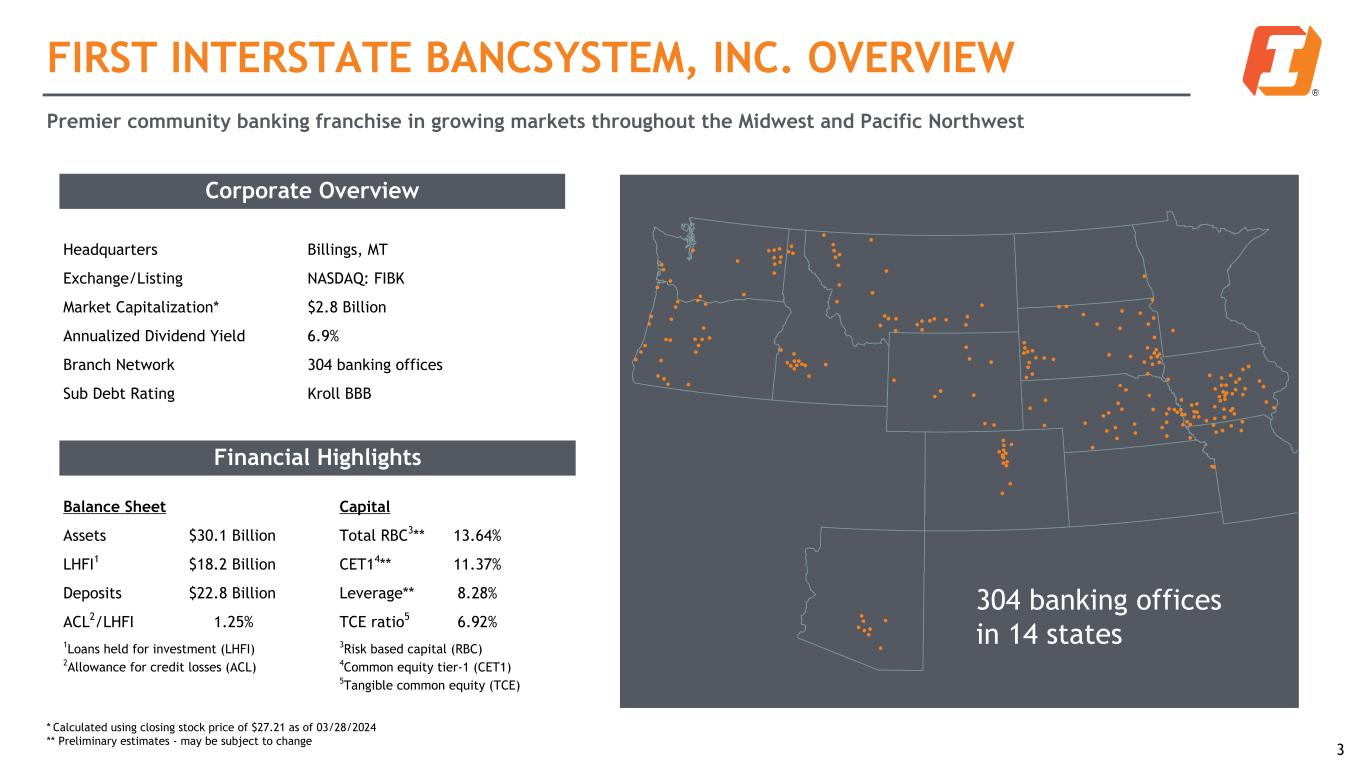

First Interstate BancSystem, Inc. is a financial and bank holding company focused on community banking. Incorporated in 1971 and headquartered in Billings, Montana, the Company operates banking offices, including detached drive-up facilities, in communities across Arizona, Colorado, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, North Dakota, Oregon, South Dakota, Washington, and Wyoming, in addition to offering online and mobile banking services. Through our bank subsidiary, First Interstate Bank, the Company delivers a comprehensive range of banking products and services to individuals, businesses, municipalities, and others throughout the Company’s market areas.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contact: |

|

David Della Camera, CFA |

|

NASDAQ: FIBK |

|

|

Director of Corporate Development and Financial Strategy

First Interstate BancSystem, Inc.

(406) 255-5363

david.dellacamera@fib.com |

|

www.FIBK.com

(FIBK-ER) |

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Consolidated Statements of Income

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

% Change |

|

| (In millions, except % and per share data) |

Mar 31,

2024 |

Dec 31,

2023 |

Sep 30,

2023 |

Jun 30,

2023 |

Mar 31,

2023 |

|

1Q24 vs 4Q23 |

1Q24 vs 1Q23 |

|

| Net interest income |

$ |

200.1 |

|

$ |

207.8 |

|

$ |

213.7 |

|

$ |

218.4 |

|

$ |

238.9 |

|

|

(3.7) |

% |

(16.2) |

% |

|

| Net interest income on a fully-taxable equivalent ("FTE") basis |

201.8 |

|

209.5 |

|

215.4 |

|

220.2 |

|

240.7 |

|

|

(3.7) |

|

(16.2) |

|

|

| Provision for (reduction in) credit losses |

5.3 |

|

5.4 |

|

(0.1) |

|

11.7 |

|

15.2 |

|

|

(1.9) |

|

(65.1) |

|

|

| Non-interest income: |

|

|

|

|

|

|

|

|

|

| Payment services revenues |

18.4 |

|

18.4 |

|

19.2 |

|

20.1 |

|

18.7 |

|

|

— |

|

(1.6) |

|

|

| Mortgage banking revenues |

1.7 |

|

1.5 |

|

2.0 |

|

2.6 |

|

2.3 |

|

|

13.3 |

|

(26.1) |

|

|

| Wealth management revenues |

9.2 |

|

8.8 |

|

8.7 |

|

8.8 |

|

9.0 |

|

|

4.5 |

|

2.2 |

|

|

| Service charges on deposit accounts |

6.0 |

|

6.0 |

|

6.0 |

|

5.8 |

|

5.2 |

|

|

— |

|

15.4 |

|

|

| Other service charges, commissions, and fees |

2.2 |

|

2.5 |

|

2.2 |

|

2.4 |

|

2.4 |

|

|

(12.0) |

|

(8.3) |

|

|

| Total fee-based revenues |

37.5 |

|

37.2 |

|

38.1 |

|

39.7 |

|

37.6 |

|

|

0.8 |

|

(0.3) |

|

|

| Investment securities loss |

— |

|

— |

|

— |

|

(0.1) |

|

(23.4) |

|

|

— |

|

(100.0) |

|

|

| Other income |

4.6 |

|

7.3 |

|

3.9 |

|

4.5 |

|

2.2 |

|

|

(37.0) |

|

109.1 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-interest income |

42.1 |

|

44.5 |

|

42.0 |

|

44.1 |

|

16.4 |

|

|

(5.4) |

|

156.7 |

|

|

| Non-interest expense: |

|

|

|

|

|

|

|

|

|

| Salaries and wages |

65.2 |

|

64.0 |

|

65.4 |

|

68.1 |

|

65.6 |

|

|

1.9 |

|

(0.6) |

|

|

| Employee benefits |

19.3 |

|

13.5 |

|

19.7 |

|

19.3 |

|

22.8 |

|

|

43.0 |

|

(15.4) |

|

|

| Occupancy and equipment |

17.3 |

|

17.4 |

|

17.0 |

|

17.3 |

|

18.4 |

|

|

(0.6) |

|

(6.0) |

|

|

| Other intangible amortization |

3.7 |

|

3.9 |

|

3.9 |

|

3.9 |

|

4.0 |

|

|

(5.1) |

|

(7.5) |

|

|

| Other expenses |

52.7 |

|

67.0 |

|

54.6 |

|

54.7 |

|

54.8 |

|

|

(21.3) |

|

(3.8) |

|

|

| Other real estate owned expense |

2.0 |

|

0.2 |

|

0.5 |

|

0.6 |

|

0.2 |

|

|

NM |

NM |

|

|

|

|

|

|

|

|

|

|

|

| Total non-interest expense |

160.2 |

|

166.0 |

|

161.1 |

|

163.9 |

|

165.8 |

|

|

(3.5) |

|

(3.4) |

|

|

| Income before income tax |

76.7 |

|

80.9 |

|

94.7 |

|

86.9 |

|

74.3 |

|

|

(5.2) |

|

3.2 |

|

|

| Provision for income tax |

18.3 |

|

19.4 |

|

22.0 |

|

19.9 |

|

18.0 |

|

|

(5.7) |

|

1.7 |

|

|

| Net income |

$ |

58.4 |

|

$ |

61.5 |

|

$ |

72.7 |

|

$ |

67.0 |

|

$ |

56.3 |

|

|

(5.0) |

% |

3.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average basic shares outstanding |

102,844 |

|

103,629 |

|

103,822 |

|

103,821 |

|

103,738 |

|

|

(0.8) |

% |

(0.9) |

% |

|

| Weighted-average diluted shares outstanding |

103,040 |

|

103,651 |

|

103,826 |

|

103,823 |

|

103,819 |

|

|

(0.6) |

|

(0.8) |

|

|

| Earnings per share - basic |

$ |

0.57 |

|

$ |

0.59 |

|

$ |

0.70 |

|

$ |

0.65 |

|

$ |

0.54 |

|

|

(3.4) |

|

5.6 |

|

|

| Earnings per share - diluted |

0.57 |

|

0.59 |

|

0.70 |

|

0.65 |

|

0.54 |

|

|

(3.4) |

|

5.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NM - not meaningful |

|

|

|

|

|

|

|

|

|

|

|

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

| (In millions, except % and per share data) |

Mar 31,

2024 |

Dec 31,

2023 |

Sep 30,

2023 |

Jun 30,

2023 |

Mar 31,

2023 |

|

1Q24 vs 4Q23 |

1Q24 vs 1Q23 |

| Assets: |

|

|

|

|

|

|

|

|

| Cash and due from banks |

$ |

315.8 |

|

$ |

378.2 |

|

$ |

371.5 |

|

$ |

479.0 |

|

$ |

332.9 |

|

|

(16.5) |

% |

(5.1) |

% |

| Interest-bearing deposits in banks |

319.1 |

|

199.7 |

|

219.5 |

|

201.4 |

|

747.7 |

|

|

59.8 |

|

(57.3) |

|

| Federal funds sold |

0.1 |

|

0.1 |

|

2.1 |

|

0.1 |

|

0.1 |

|

|

— |

|

— |

|

| Cash and cash equivalents |

635.0 |

|

578.0 |

|

593.1 |

|

680.5 |

|

1,080.7 |

|

|

9.9 |

|

(41.2) |

|

|

|

|

|

|

|

|

|

|

| Investment securities, net |

8,626.1 |

|

9,049.4 |

|

8,887.2 |

|

9,175.6 |

|

9,425.5 |

|

|

(4.7) |

|

(8.5) |

|

| Investment in Federal Home Loan Bank and Federal Reserve Bank stock |

178.4 |

|

223.2 |

|

189.5 |

|

210.4 |

|

214.5 |

|

|

(20.1) |

|

(16.8) |

|

| Loans held for sale, at fair value |

22.7 |

|

47.4 |

|

59.1 |

|

76.5 |

|

80.9 |

|

|

(52.1) |

|

(71.9) |

|

| Loans held for investment |

18,202.8 |

|

18,279.6 |

|

18,213.3 |

|

18,263.4 |

|

18,245.7 |

|

|

(0.4) |

|

(0.2) |

|

| Allowance for credit losses |

(227.7) |

|

(227.7) |

|

(226.7) |

|

(224.6) |

|

(226.1) |

|

|

NM |

0.7 |

|

| Net loans held for investment |

17,975.1 |

|

18,051.9 |

|

17,986.6 |

|

18,038.8 |

|

18,019.6 |

|

|

(0.4) |

|

(0.2) |

|

| Goodwill and intangible assets (excluding mortgage servicing rights) |

1,206.6 |

|

1,210.3 |

|

1,214.1 |

|

1,218.0 |

|

1,221.9 |

|

|

(0.3) |

|

(1.3) |

|

| Company owned life insurance |

504.7 |

|

502.4 |

|

500.8 |

|

502.0 |

|

499.4 |

|

|

0.5 |

|

1.1 |

|

| Premises and equipment |

439.9 |

|

444.3 |

|

446.3 |

|

443.7 |

|

443.4 |

|

|

(1.0) |

|

(0.8) |

|

| Other real estate owned |

14.4 |

|

16.5 |

|

11.6 |

|

14.4 |

|

13.4 |

|

|

(12.7) |

|

7.5 |

|

| Mortgage servicing rights |

27.6 |

|

28.3 |

|

29.1 |

|

29.8 |

|

30.1 |

|

|

(2.5) |

|

(8.3) |

|

| Other assets |

514.3 |

|

519.5 |

|

623.4 |

|

586.6 |

|

608.3 |

|

|

(1.0) |

|

(15.5) |

|

| Total assets |

$ |

30,144.8 |

|

$ |

30,671.2 |

|

$ |

30,540.8 |

|

$ |

30,976.3 |

|

$ |

31,637.7 |

|

|

(1.7) |

% |

(4.7) |

% |

|

|

|

|

|

|

|

|

|

| Liabilities and stockholders' equity: |

|

|

|

|

|

|

|

|

| Deposits |

$ |

22,810.0 |

|

$ |

23,323.1 |

|

$ |

23,679.5 |

|

$ |

23,579.2 |

|

$ |

24,107.0 |

|

|

(2.2) |

% |

(5.4) |

% |

| Securities sold under repurchase agreements |

794.2 |

|

782.7 |

|

889.5 |

|

929.9 |

|

970.8 |

|

|

1.5 |

|

(18.2) |

|

| Long-term debt |

370.8 |

|

120.8 |

|

120.8 |

|

120.8 |

|

120.8 |

|

|

207.0 |

|

207.0 |

|

| Other borrowed funds |

2,342.0 |

|

2,603.0 |

|

2,067.0 |

|

2,589.0 |

|

2,710.0 |

|

|

(10.0) |

|

(13.6) |

|

| Subordinated debentures held by subsidiary trusts |

163.1 |

|

163.1 |

|

163.1 |

|

163.1 |

|

163.1 |

|

|

— |

|

— |

|

| Other liabilities |

455.0 |

|

451.0 |

|

535.4 |

|

473.1 |

|

405.7 |

|

|

0.9 |

|

12.2 |

|

| Total liabilities |

26,935.1 |

|

27,443.7 |

|

27,455.3 |

|

27,855.1 |

|

28,477.4 |

|

|

(1.9) |

|

(5.4) |

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

| Common stock |

2,450.7 |

|

2,448.9 |

|

2,484.9 |

|

2,481.4 |

|

2,478.7 |

|

|

0.1 |

|

(1.1) |

|

| Retained earnings |

1,145.9 |

|

1,135.1 |

|

1,122.3 |

|

1,098.8 |

|

1,080.7 |

|

|

1.0 |

|

6.0 |

|

| Accumulated other comprehensive loss |

(386.9) |

|

(356.5) |

|

(521.7) |

|

(459.0) |

|

(399.1) |

|

|

8.5 |

|

(3.1) |

|

| Total stockholders' equity |

3,209.7 |

|

3,227.5 |

|

3,085.5 |

|

3,121.2 |

|

3,160.3 |

|

|

(0.6) |

|

1.6 |

|

| Total liabilities and stockholders' equity |

$ |

30,144.8 |

|

$ |

30,671.2 |

|

$ |

30,540.8 |

|

$ |

30,976.3 |

|

$ |

31,637.7 |

|

|

(1.7) |

% |

(4.7) |

% |

|

|

|

|

|

|

|

|

|

| Common shares outstanding at period end |

104,572 |

|

103,942 |

|

105,011 |

|

105,021 |

|

104,382 |

|

|

0.6 |

% |

0.2 |

% |

| Book value per common share at period end |

$ |

30.69 |

|

$ |

31.05 |

|

$ |

29.38 |

|

$ |

29.72 |

|

$ |

30.28 |

|

|

(1.2) |

|

1.4 |

|

| Tangible book value per common share at period end** |

19.16 |

|

19.41 |

|

17.82 |

|

18.12 |

|

18.57 |

|

|

(1.3) |

|

3.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| **Non-GAAP financial measure - see Non-GAAP Financial Measures included herein for a reconciliation of book value per common share (GAAP) at period end to tangible book value per common share (non-GAAP) at period end. |

| NM - not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Loans and Deposits

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

| (In millions, except %) |

Mar 31,

2024 |

Dec 31,

2023 |

Sep 30,

2023 |

Jun 30,

2023 |

Mar 31,

2023 |

|

1Q24 vs 4Q23 |

1Q24 vs 1Q23 |

|

|

|

|

|

|

|

|

|

| Loans held for investment: |

|

|

|

|

|

|

|

|

| Real Estate: |

|

|

|

|

|

|

|

|

| Commercial |

$ |

9,060.4 |

|

$ |

8,869.2 |

|

$ |

8,766.2 |

|

$ |

8,813.9 |

|

$ |

8,680.8 |

|

|

2.2 |

% |

4.4 |

% |

| Construction |

1,609.2 |

|

1,826.5 |

|

1,930.3 |

|

1,836.5 |

|

1,893.0 |

|

|

(11.9) |

|

(15.0) |

|

| Residential |

2,258.4 |

|

2,244.3 |

|

2,212.2 |

|

2,198.3 |

|

2,191.1 |

|

|

0.6 |

|

3.1 |

|

| Agricultural |

719.7 |

|

716.8 |

|

731.5 |

|

755.7 |

|

769.7 |

|

|

0.4 |

|

(6.5) |

|

| Total real estate |

13,647.7 |

|

13,656.8 |

|

13,640.2 |

|

13,604.4 |

|

13,534.6 |

|

|

(0.1) |

|

0.8 |

|

| Consumer: |

|

|

|

|

|

|

|

|

| Indirect |

739.9 |

|

740.9 |

|

751.7 |

|

764.1 |

|

817.3 |

|

|

(0.1) |

|

(9.5) |

|

| Direct |

136.7 |

|

141.6 |

|

142.3 |

|

144.0 |

|

146.9 |

|

|

(3.5) |

|

(6.9) |

|

| Credit card |

72.6 |

|

76.5 |

|

71.6 |

|

72.1 |

|

71.5 |

|

|

(5.1) |

|

1.5 |

|

| Total consumer |

949.2 |

|

959.0 |

|

965.6 |

|

980.2 |

|

1,035.7 |

|

|

(1.0) |

|

(8.4) |

|

| Commercial |

2,922.2 |

|

2,906.8 |

|

2,925.1 |

|

3,002.7 |

|

3,028.0 |

|

|

0.5 |

|

(3.5) |

|

| Agricultural |

696.0 |

|

769.4 |

|

690.5 |

|

688.0 |

|

660.4 |

|

|

(9.5) |

|

5.4 |

|

| Other |

0.2 |

|

0.1 |

|

5.0 |

|

1.7 |

|

1.6 |

|

|

100.0 |

|

(87.5) |

|

| Deferred loan fees and costs |

(12.5) |

|

(12.5) |

|

(13.1) |

|

(13.6) |

|

(14.6) |

|

|

— |

|

(14.4) |

|

| Loans held for investment |

$ |

18,202.8 |

|

$ |

18,279.6 |

|

$ |

18,213.3 |

|

$ |

18,263.4 |

|

$ |

18,245.7 |

|

|

(0.4) |

% |

(0.2) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

| Non-interest-bearing |

$ |

5,900.3 |

|

$ |

6,029.6 |

|

$ |

6,402.6 |

|

$ |

6,518.2 |

|

$ |

6,861.1 |

|

|

(2.1) |

% |

(14.0) |

% |

| Interest-bearing: |

|

|

|

|

|

|

|

|

| Demand |

6,103.6 |

|

6,507.8 |

|

6,317.9 |

|

6,481.9 |

|

6,714.1 |

|

|

(6.2) |

|

(9.1) |

|

| Savings |

7,872.2 |

|

7,775.8 |

|

7,796.3 |

|

7,836.7 |

|

8,282.9 |

|

|

1.2 |

|

(5.0) |

|

| Time, $250 and over |

819.3 |

|

811.6 |

|

817.1 |

|

657.9 |

|

526.5 |

|

|

0.9 |

|

55.6 |

|

| Time, other |

2,114.6 |

|

2,198.3 |

|

2,345.6 |

|

2,084.5 |

|

1,722.4 |

|

|

(3.8) |

|

22.8 |

|

| Total interest-bearing |

16,909.7 |

|

17,293.5 |

|

17,276.9 |

|

17,061.0 |

|

17,245.9 |

|

|

(2.2) |

|

(1.9) |

|

| Total deposits |

$ |

22,810.0 |

|

$ |

23,323.1 |

|

$ |

23,679.5 |

|

$ |

23,579.2 |

|

$ |

24,107.0 |

|

|

(2.2) |

% |

(5.4) |

% |

|

|

|

|

|

|

|

|

|

Total core deposits (1) |

$ |

21,990.7 |

|

$ |

22,511.5 |

|

$ |

22,862.4 |

|

$ |

22,921.3 |

|

$ |

23,580.5 |

|

|

(2.3) |

% |

(6.7) |

% |

|

|

|

|

|

|

|

|

|

(1) Core deposits are defined as total deposits less time deposits, $250 and over, and brokered deposits. |

|

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Credit Quality

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

| (In millions, except %) |

Mar 31,

2024 |

Dec 31,

2023 |

Sep 30,

2023 |

Jun 30,

2023 |

Mar 31,

2023 |

|

1Q24 vs 4Q23 |

1Q24 vs 1Q23 |

|

|

|

|

|

|

|

|

|

| Allowance for Credit Losses: |

|

|

|

|

|

|

|

|

| Allowance for credit losses |

$ |

227.7 |

|

$ |

227.7 |

|

$ |

226.7 |

|

$ |

224.6 |

|

$ |

226.1 |

|

|

NM |

0.7 |

% |

| As a percentage of loans held for investment |

1.25 |

% |

1.25 |

% |

1.24 |

% |

1.23 |

% |

1.24 |

% |

|

|

|

| As a percentage of non-accrual loans |

132.38 |

|

214.00 |

|

278.50 |

|

260.86 |

|

279.83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loan charge-offs during quarter |

$ |

8.4 |

|

$ |

4.8 |

|

$ |

1.1 |

|

$ |

11.4 |

|

$ |

6.2 |

|

|

75.0 |

% |

35.5 |

% |

| Annualized as a percentage of average loans |

0.18 |

% |

0.10 |

% |

0.02 |

% |

0.25 |

% |

0.14 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-Performing Assets: |

|

|

|

|

|

|

|

|

| Non-accrual loans |

$ |

172.0 |

|

$ |

106.4 |

|

$ |

81.4 |

|

$ |

86.1 |

|

$ |

80.8 |

|

|

61.7 |

% |

112.9 |

% |

| Accruing loans past due 90 days or more |

3.0 |

|

4.9 |

|

3.2 |

|

6.7 |

|

4.5 |

|

|

(38.8) |

|

(33.3) |

|

| Total non-performing loans |

175.0 |

|

111.3 |

|

84.6 |

|

92.8 |

|

85.3 |

|

|

57.2 |

|

105.2 |

|

| Other real estate owned |

14.4 |

|

16.5 |

|

11.6 |

|

14.4 |

|

13.4 |

|

|

(12.7) |

|

7.5 |

|

| Total non-performing assets |

$ |

189.4 |

|

$ |

127.8 |

|

$ |

96.2 |

|

$ |

107.2 |

|

$ |

98.7 |

|

|

48.2 |

% |

91.9 |

% |

|

|

|

|

|

|

|

|

|

| Non-performing assets as a percentage of: |

|

|

|

|

|

|

|

|

| Loans held for investment and OREO |

1.04 |

% |

0.70 |

% |

0.53 |

% |

0.59 |

% |

0.54 |

% |

|

|

|

| Total assets |

0.63 |

|

0.42 |

|

0.31 |

|

0.35 |

|

0.31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-accrual loans to loans held for investment |

0.94 |

|

0.58 |

|

0.45 |

|

0.47 |

|

0.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accruing Loans 30-89 Days Past Due |

$ |

62.8 |

|

$ |

67.3 |

|

$ |

51.2 |

|

$ |

49.5 |

|

$ |

52.3 |

|

|

(6.7) |

% |

20.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Criticized Loans: |

|

|

|

|

|

|

|

|

| Special Mention |

$ |

160.1 |

|

$ |

210.5 |

|

$ |

197.3 |

|

$ |

221.9 |

|

$ |

243.8 |

|

|

(23.9) |

% |

(34.3) |

% |

| Substandard |

405.8 |

|

457.1 |

|

414.6 |

|

386.9 |

|

355.0 |

|

|

(11.2) |

|

14.3 |

|

| Doubtful |

64.1 |

|

20.7 |

|

21.0 |

|

32.8 |

|

22.8 |

|

|

209.7 |

|

181.1 |

|

| Total |

$ |

630.0 |

|

$ |

688.3 |

|

$ |

632.9 |

|

$ |

641.6 |

|

$ |

621.6 |

|

|

(8.5) |

% |

1.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NM - not meaningful |

|

|

|

|

|

|

|

|

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Selected Ratios - Annualized

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or for the Quarter ended: |

|

|

Mar 31,

2024 |

|

Dec 31,

2023 |

|

Sep 30,

2023 |

|

Jun 30,

2023 |

|

Mar 31,

2023 |

|

| Annualized Financial Ratios (GAAP) |

|

| Return on average assets |

0.77 |

% |

|

0.80 |

% |

|

0.94 |

% |

|

0.86 |

% |

|

0.71 |

% |

|

| Return on average common stockholders' equity |

7.28 |

|

|

7.77 |

|

|

9.20 |

|

|

8.44 |

|

|

7.25 |

|

|

| Yield on average earning assets |

4.74 |

|

|

4.69 |

|

|

4.63 |

|

|

4.52 |

|

|

4.43 |

|

|

| Cost of average interest-bearing liabilities |

2.39 |

|

|

2.24 |

|

|

2.09 |

|

|

1.88 |

|

|

1.46 |

|

|

| Interest rate spread |

2.35 |

|

|

2.45 |

|

|

2.54 |

|

|

2.64 |

|

|

2.97 |

|

|

| Efficiency ratio |

64.62 |

|

|

64.25 |

|

|

61.48 |

|

|

60.95 |

|

|

63.38 |

|

|

| Loans held for investment to deposit ratio |

79.80 |

|

|

78.38 |

|

|

76.92 |

|

|

77.46 |

|

|

75.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Annualized Financial Ratios - Operating** (Non-GAAP) |

|

| Net FTE interest margin ratio |

2.93 |

% |

|

3.01 |

% |

|

3.07 |

% |

|

3.12 |

% |

|

3.36 |

% |

|

| Tangible book value per common share |

$ |

19.16 |

|

|

$ |

19.41 |

|

|

$ |

17.82 |

|

|

$ |

18.12 |

|

|

$ |

18.57 |

|

|

| Tangible common stockholders' equity to tangible assets |

6.92 |

% |

|

6.85 |

% |

|

6.38 |

% |

|

6.40 |

% |

|

6.37 |

% |

|

| Return on average tangible common stockholders' equity |

11.63 |

|

|

12.65 |

|

|

15.04 |

|

|

13.69 |

|

|

11.87 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Capital Ratios |

|

| Total risk-based capital to total risk-weighted assets |

13.64 |

% |

* |

13.28 |

% |

|

13.19 |

% |

|

12.90 |

% |

|

12.63 |

% |

|

| Tier 1 risk-based capital to total risk-weighted assets |

11.37 |

|

* |

11.08 |

|

|

11.02 |

|

|

10.76 |

|

|

10.52 |

|

|

| Tier 1 common capital to total risk-weighted assets |

11.37 |

|

* |

11.08 |

|

|

11.02 |

|

|

10.76 |

|

|

10.52 |

|

|

| Leverage Ratio |

8.28 |

|

* |

8.22 |

|

|

8.22 |

|

|

7.99 |

|

|

7.72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *Preliminary estimate - may be subject to change. The regulatory capital ratios presented include the assumption of the transitional method as a result of legislation by the United States Congress to provide relief for the economy and financial institutions in the United States from the COVID‑19 pandemic. The referenced relief ends on December 31, 2024, which allows a total five-year phase-in of the impact of CECL on capital and relief over the next two years for the impact on the allowance for credit losses resulting from the COVID‑19 pandemic. |

|

| **Non-GAAP financial measures - see Non-GAAP Financial Measures included herein for a reconciliation of net interest margin to net FTE interest margin, book value per common share to tangible book value per common share, return on average common stockholders’ equity (GAAP) to return on average tangible common stockholders’ equity, and tangible common stockholders’ equity to tangible assets (non-GAAP). |

|

|

|

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Average Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

March 31, 2024 |

|

December 31, 2023 |

|

March 31, 2023 |

| (In millions, except %) |

Average

Balance |

Interest(2) |

Average

Rate |

|

Average

Balance |

Interest(2) |

Average

Rate |

|

Average

Balance |

Interest(2) |

Average

Rate |

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

Loans (1) |

$ |

18,289.2 |

|

$ |

253.6 |

|

5.58 |

% |

|

$ |

18,255.9 |

|

$ |

254.1 |

|

5.52 |

% |

|

$ |

18,273.6 |

|

$ |

237.2 |

|

5.26 |

% |

| Investment securities |

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

8,726.3 |

|

64.5 |

|

2.97 |

|

|

8,710.1 |

|

64.8 |

|

2.95 |

|

|

9,983.4 |

|

72.2 |

|

2.93 |

|

| Tax-exempt |

189.0 |

|

0.9 |

|

1.92 |

|

|

190.0 |

|

0.9 |

|

1.88 |

|

|

225.4 |

|

1.1 |

|

1.98 |

|

| Investment in FHLB and FRB stock |

198.3 |

|

3.3 |

|

6.69 |

|

|

192.1 |

|

3.1 |

|

6.40 |

|

|

210.5 |

|

3.0 |

|

5.78 |

|

| Interest-bearing deposits in banks |

296.7 |

|

4.1 |

|

5.56 |

|

|

221.0 |

|

3.1 |

|

5.57 |

|

|

365.7 |

|

4.2 |

|

4.66 |

|

| Federal funds sold |

0.1 |

|

— |

|

— |

|

|

0.3 |

|

— |

|

— |

|

|

0.8 |

|

— |

|

— |

|

| Total interest-earning assets |

$ |

27,699.6 |

|

$ |

326.4 |

|

4.74 |

% |

|

$ |

27,569.4 |

|

$ |

326.0 |

|

4.69 |

% |

|

$ |

29,059.4 |

|

$ |

317.7 |

|

4.43 |

% |

| Non-interest-earning assets |

2,825.6 |

|

|

|

|

2,938.3 |

|

|

|

|

2,951.5 |

|

|

|

| Total assets |

$ |

30,525.2 |

|

|

|

|

$ |

30,507.7 |

|

|

|

|

$ |

32,010.9 |

|

|

|

| Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Demand deposits |

$ |

6,150.2 |

|

$ |

12.9 |

|

0.84 |

% |

|

$ |

6,469.1 |

|

$ |

15.3 |

|

0.94 |

% |

|

$ |

6,973.4 |

|

$ |

8.7 |

|

0.51 |

% |

| Savings deposits |

7,781.8 |

|

39.1 |

|

2.02 |

|

|

7,769.3 |

|

37.4 |

|

1.91 |

|

|

8,406.9 |

|

22.8 |

|

1.10 |

|

| Time deposits |

2,972.3 |

|

27.1 |

|

3.67 |

|

|

3,179.4 |

|

27.2 |

|

3.39 |

|

|

2,055.3 |

|

8.8 |

|

1.74 |

|

| Repurchase agreements |

802.1 |

|

2.3 |

|

1.15 |

|

|

842.2 |

|

2.1 |

|

0.99 |

|

|

1,005.8 |

|

1.1 |

|

0.44 |

|

| Other borrowed funds |

2,771.9 |

|

35.6 |

|

5.17 |

|

|

2,087.6 |

|

29.7 |

|

5.64 |

|

|

2,615.2 |

|

31.2 |

|

4.84 |

|

| Long-term debt |

356.8 |

|

4.3 |

|

4.85 |

|

|

120.8 |

|

1.4 |

|

4.60 |

|

|

120.8 |

|

1.5 |

|

5.04 |

|

| Subordinated debentures held by subsidiary trusts |

163.1 |

|

3.3 |

|

8.14 |

|

|

163.1 |

|

3.4 |

|

8.27 |

|

|

163.1 |

|

2.9 |

|

7.21 |

|

| Total interest-bearing liabilities |

$ |

20,998.2 |

|

$ |

124.6 |

|

2.39 |

% |

|

$ |

20,631.5 |

|

$ |

116.5 |

|

2.24 |

% |

|

$ |

21,340.5 |

|

$ |

77.0 |

|

1.46 |

% |

| Non-interest-bearing deposits |

5,832.2 |

|

|

|

|

6,222.1 |

|

|

|

|

7,064.9 |

|

|

|

| Other non-interest-bearing liabilities |

466.4 |

|

|

|

|

513.8 |

|

|

|

|

458.5 |

|

|

|

| Stockholders’ equity |

3,228.4 |

|

|

|

|

3,140.3 |

|

|

|

|

3,147.0 |

|

|

|

| Total liabilities and stockholders’ equity |

$ |

30,525.2 |

|

|

|

|

$ |

30,507.7 |

|

|

|

|

$ |

32,010.9 |

|

|

|

Net FTE interest income (non-GAAP)(3) |

|

$ |

201.8 |

|

|

|

|

$ |

209.5 |

|

|

|

|

$ |

240.7 |

|

|

Less FTE adjustments (2) |

|

(1.7) |

|

|

|

|

(1.7) |

|

|

|

|

(1.8) |

|

|

| Net interest income from consolidated statements of income |

|

$ |

200.1 |

|

|

|

|

$ |

207.8 |

|

|

|

|

$ |

238.9 |

|

|

| Interest rate spread |

|

|

2.35 |

% |

|

|

|

2.45 |

% |

|

|

|

2.97 |

% |

| Net interest margin |

|

|

2.91 |

|

|

|

|

2.99 |

|

|

|

|

3.33 |

|

Net FTE interest margin (non-GAAP)(3) |

|

|

2.93 |

|

|

|

|

3.01 |

|

|

|

|

3.36 |

|

Cost of funds, including non-interest-bearing demand deposits (4) |

|

|

1.87 |

|

|

|

|

1.72 |

|

|

|

|

1.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Average loan balances include loans held for sale and loans held for investment, net of deferred fees and costs, which include non-accrual loans. Interest income includes amortization of deferred loan fees net of deferred loan costs, which is not material. |

(2) Management believes fully taxable equivalent, or FTE, interest income is useful to investors in evaluating the Company’s performance as a comparison of the returns between a tax-free investment and a taxable alternative. The Company adjusts interest income and average rates for tax exempt loans and securities to an FTE basis utilizing a 21.00% tax rate. |

(3) Non-GAAP financial measure - see Non-GAAP Financial Measures included herein for a reconciliation to GAAP measures. |

(4) Calculated by dividing total annualized interest on interest-bearing liabilities by the sum of total interest-bearing liabilities plus non-interest-bearing deposits. |

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Non-GAAP Financial Measures

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of or For the Quarter Ended |

| (In millions, except % and per share data) |

|

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2023 |

Mar 31, 2023 |

| Total common stockholders' equity (GAAP) |

(A) |