Document

DENNY’S CORPORATION REPORTS RESULTS FOR FOURTH QUARTER AND FULL YEAR 2024

SPARTANBURG, S.C., February 12, 2025 - Denny’s Corporation (the "Company") (NASDAQ: DENN), owner and operator of Denny's Inc. ("Denny's") and Keke's Inc. ("Keke's") today reported results for its fourth quarter and full year ended December 25, 2024 and provided a business update on the Company’s operations.

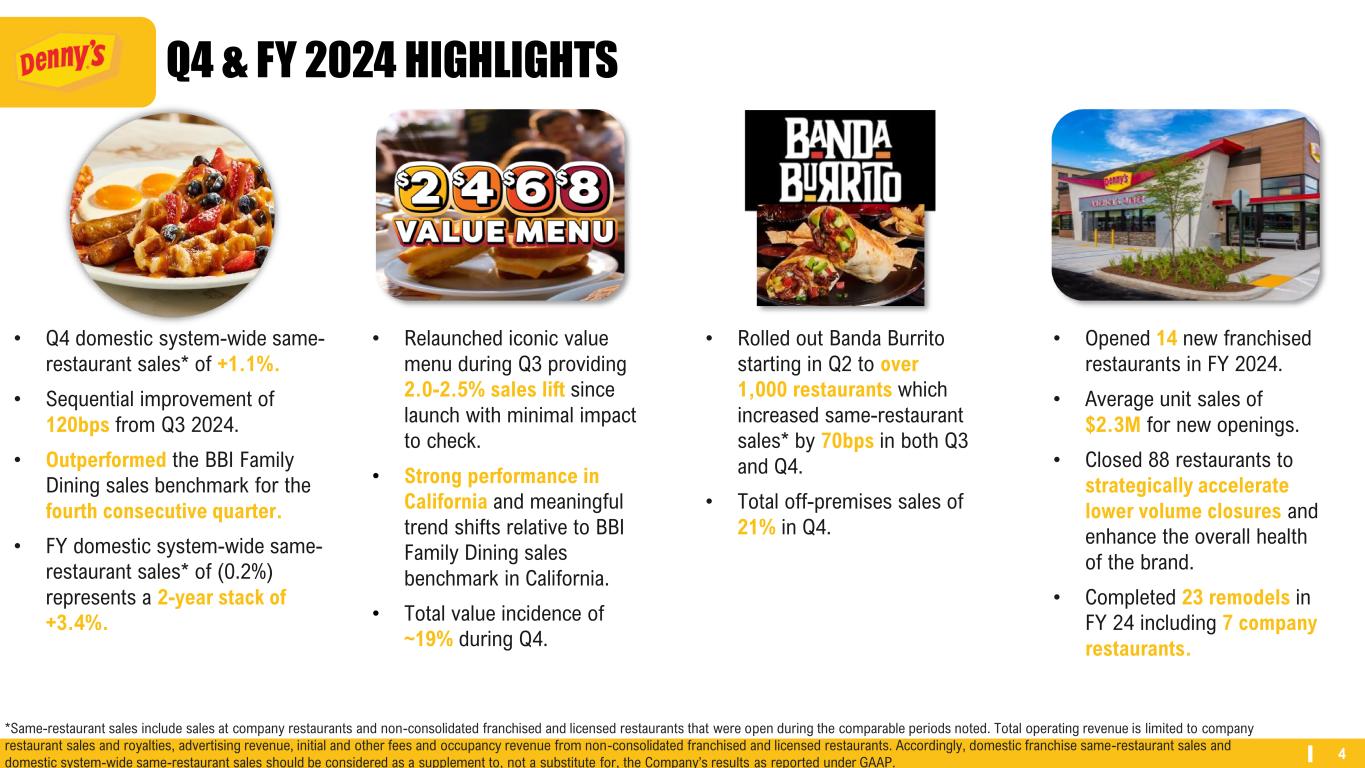

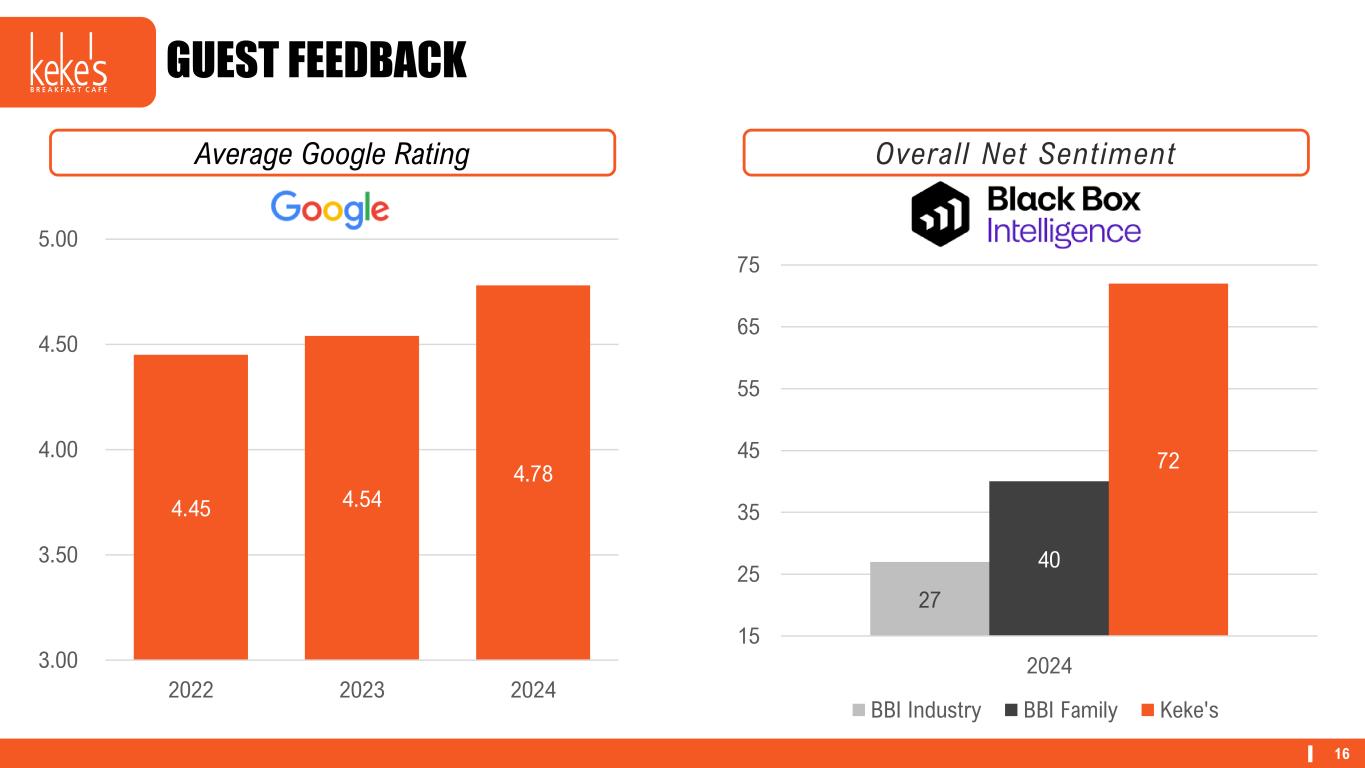

Kelli Valade, Chief Executive Officer, stated, "We are proud of our progress through 2024, culminating in strong performances from both Denny's and Keke's, which outperformed their respective BBI Family Dining indices in the fourth quarter. We have made significant progress in our strategy to enhance the overall health of our flagship brand by accelerating the closure of lower-volume restaurants and completing 23 remodels, and also opened a record number of Keke’s cafes while expanding into six new states. Looking ahead to 2025, there is still work to be done within our brands, particularly as we navigate near-term consumer sentiment that has been affected by macroeconomic factors. With the actions we are taking to maintain our position as a value leader, invest in our brands, reduce costs, and drive traffic, we are well positioned to deliver shareholder value.”

Fourth Quarter 2024 Highlights(1)

•Total operating revenue was $114.7 million compared to $115.4 million for the prior year quarter.

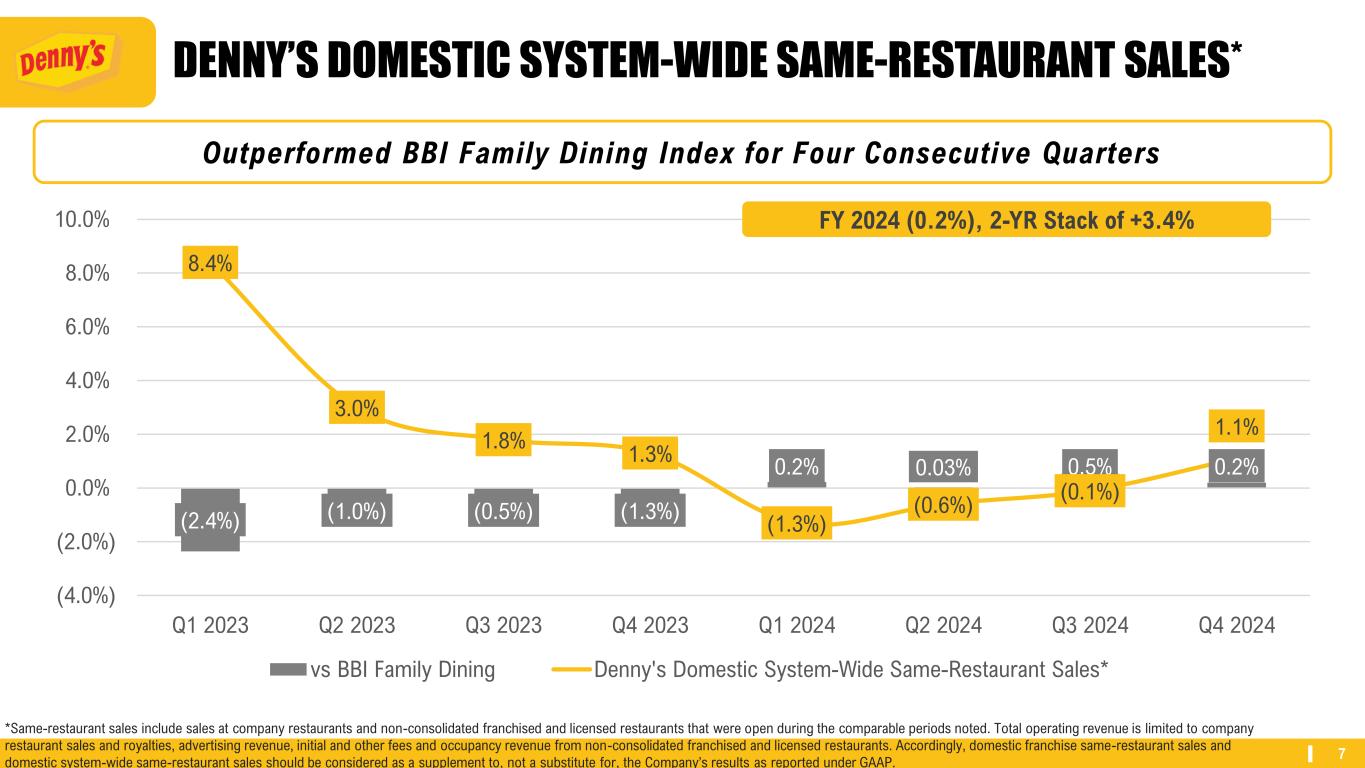

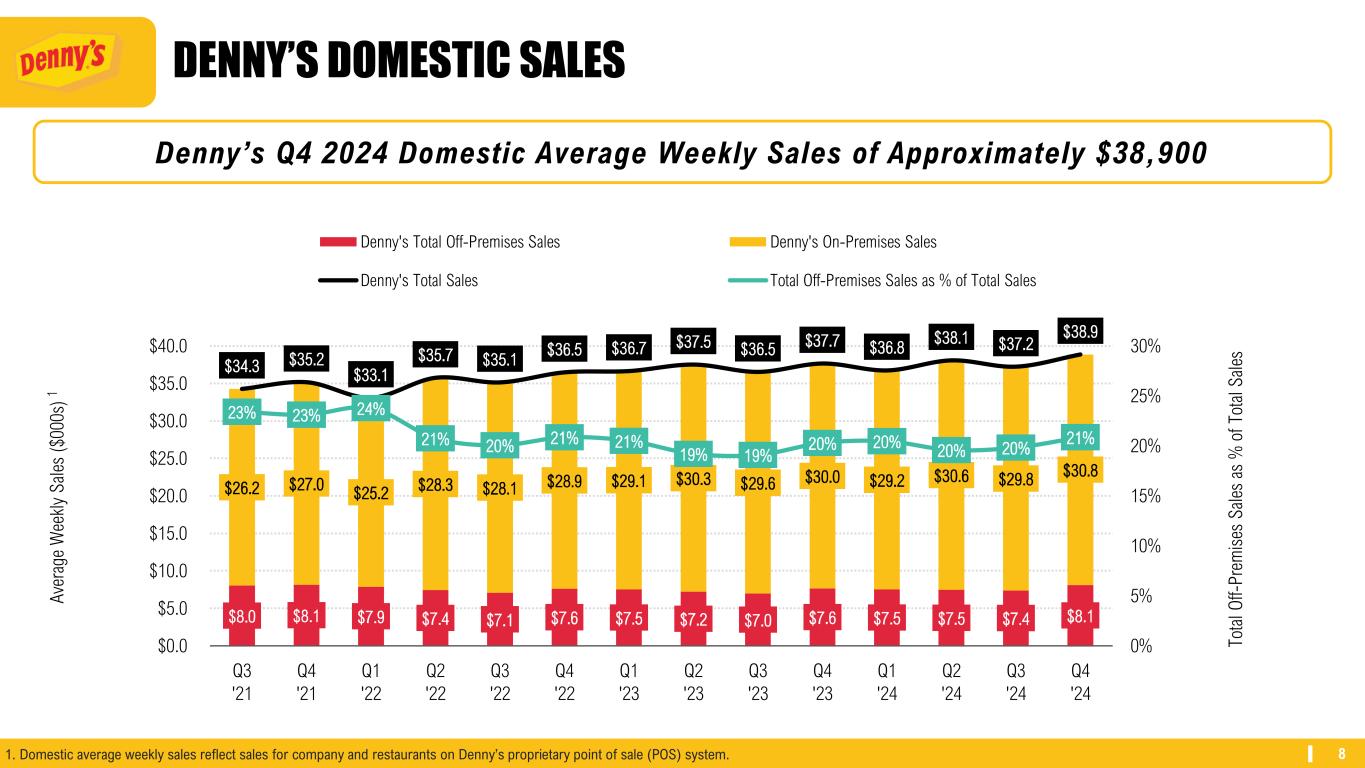

•Denny's domestic system-wide same-restaurant sales** were 1.1%.

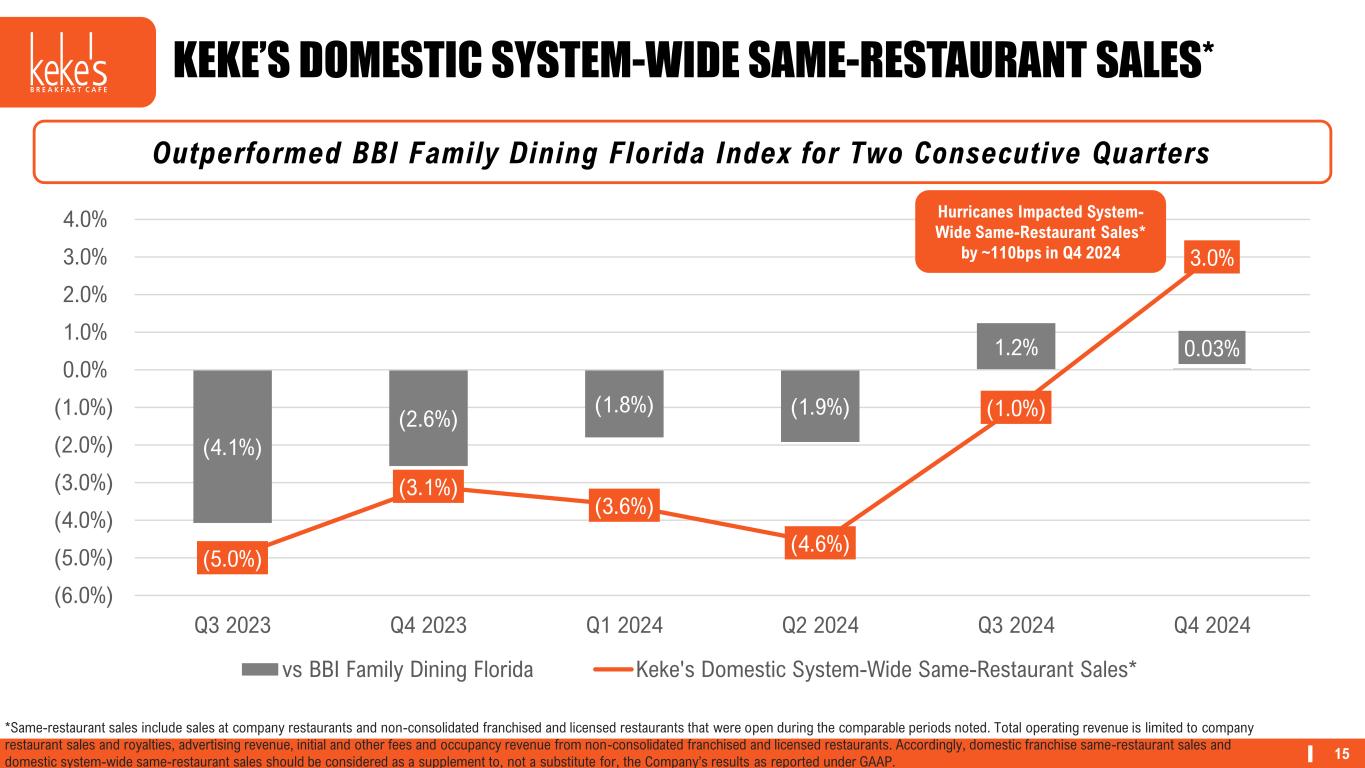

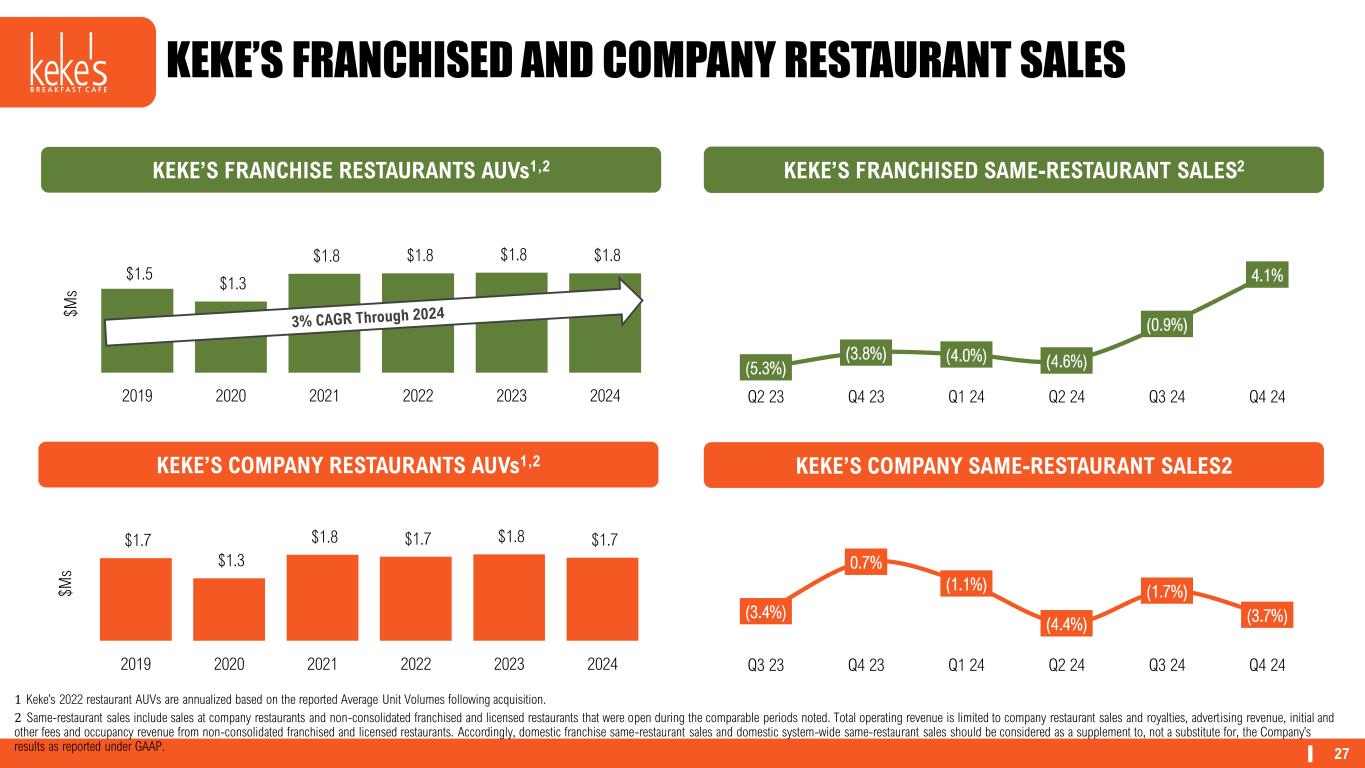

•Keke's domestic system-wide same-restaurant sales** were 3.0%.

•Denny's opened four franchised restaurants and closed 30 franchise restaurants as part of the planned acceleration of lower-volume restaurant closures.

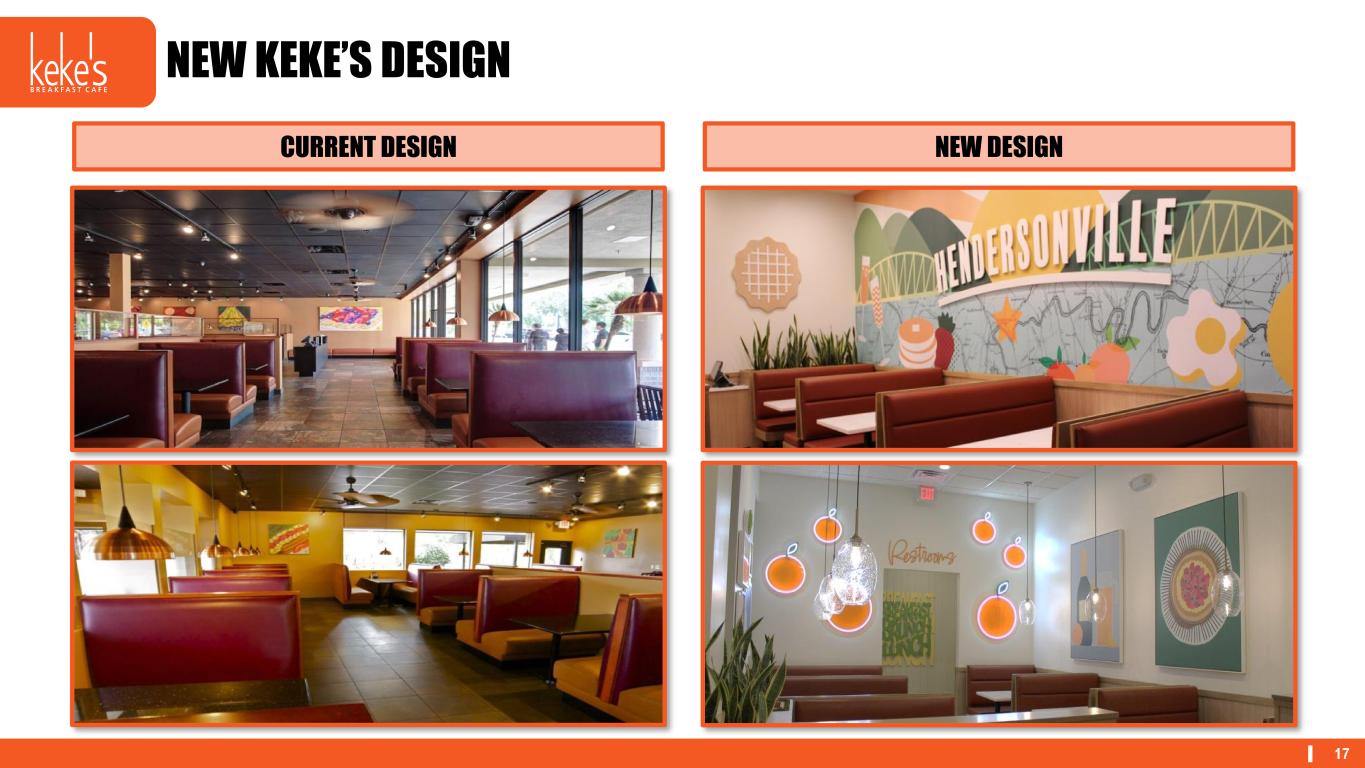

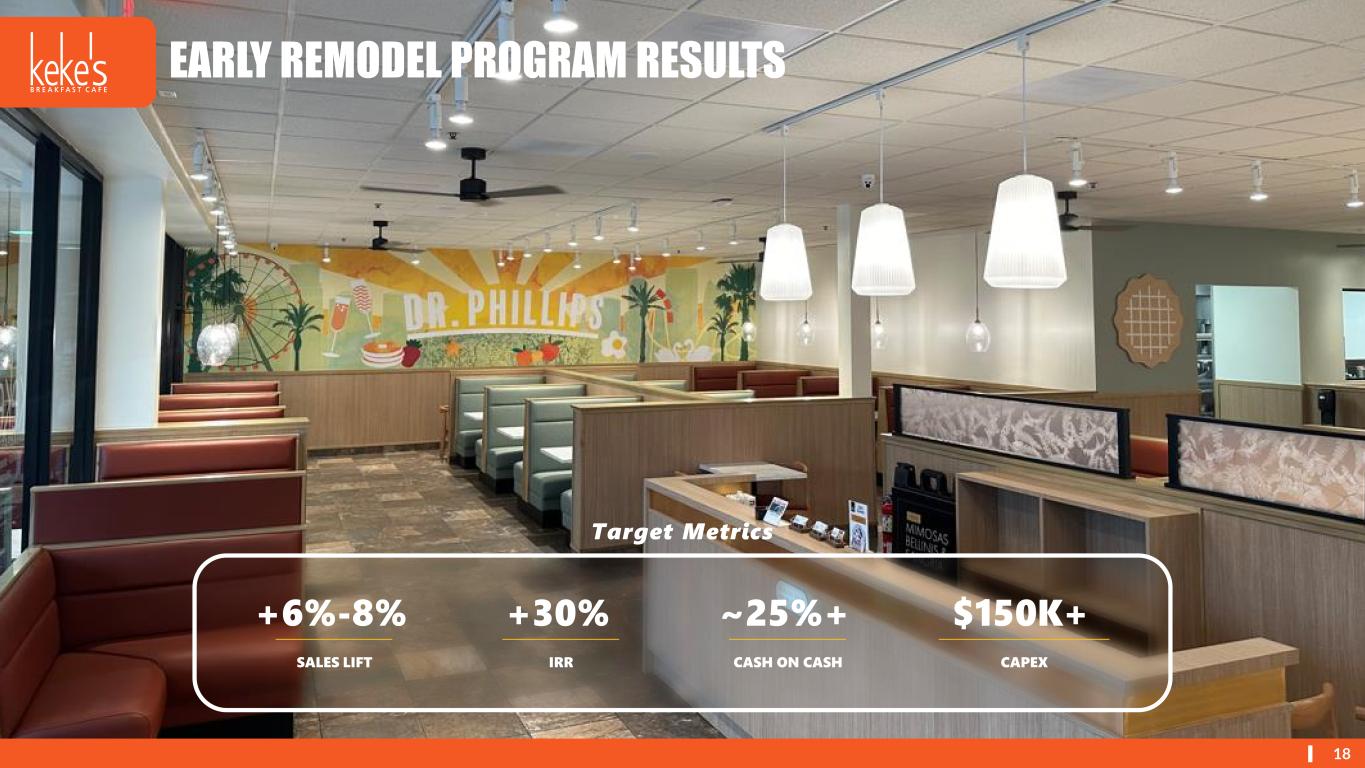

•Reignited Denny's Diner 2.0 remodel program and completed six remodels.

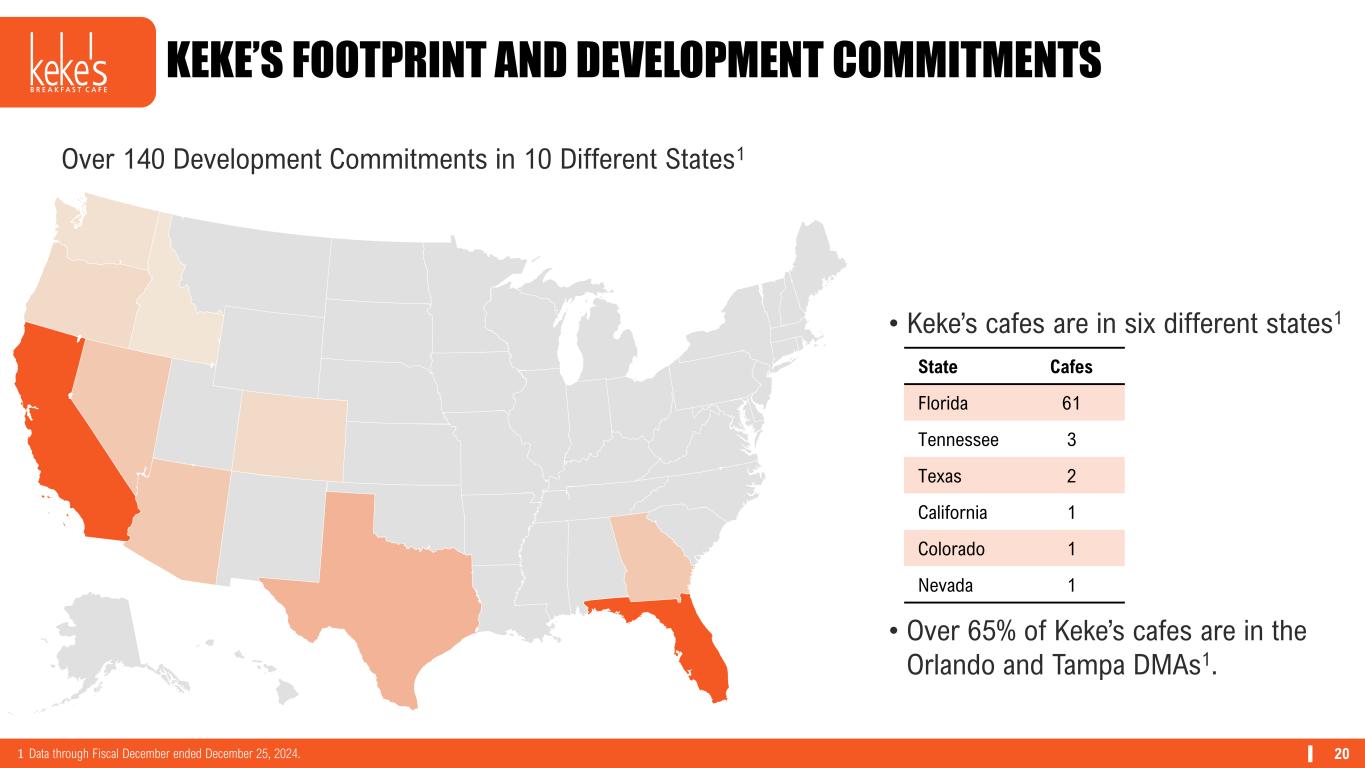

•Keke's opened eight new cafes and entered four new states including California, Colorado, Nevada, and Texas.

•Keke's expanded its first ever remodel test program to two additional company cafes.

•Operating income was $14.5 million compared to $7.7 million for the prior year quarter.

•Adjusted franchise operating margin* was $31.9 million, or 51.2% of franchise and license revenue, and adjusted company restaurant operating margin* was $5.9 million, or 11.3% of company restaurant sales.

•Net income was $6.8 million, or $0.13 per diluted share.

•Adjusted net income* and adjusted net income per share* were $7.6 million and $0.14, respectively.

•Adjusted EBITDA* of $22.2 million increased 11.1% compared to the prior year quarter.

Full Year 2024 Highlights(1)

•Total operating revenue was $452.3 million compared to $463.9 million for the prior year.

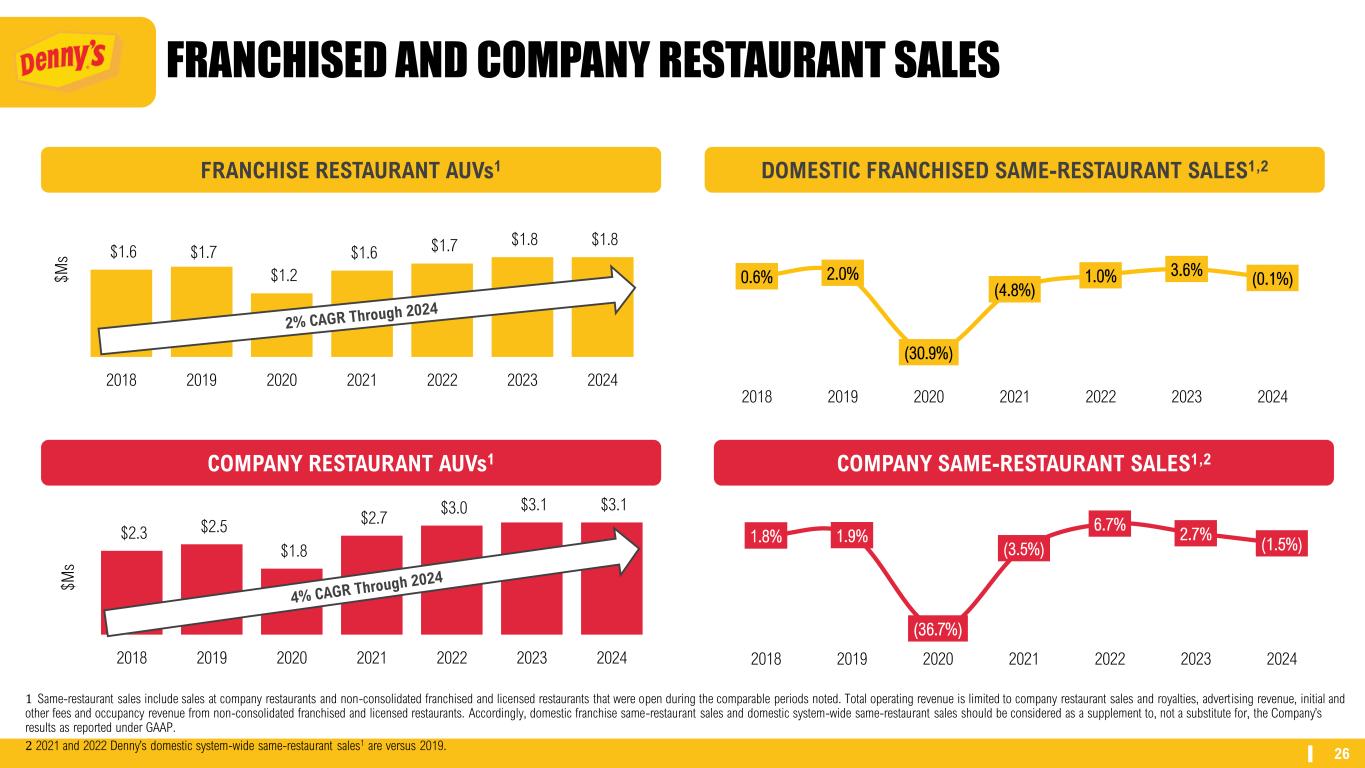

•Denny's domestic system-wide same-restaurant sales** were (0.2%).

•Keke's domestic system-wide same-restaurant sales** were (1.7%).

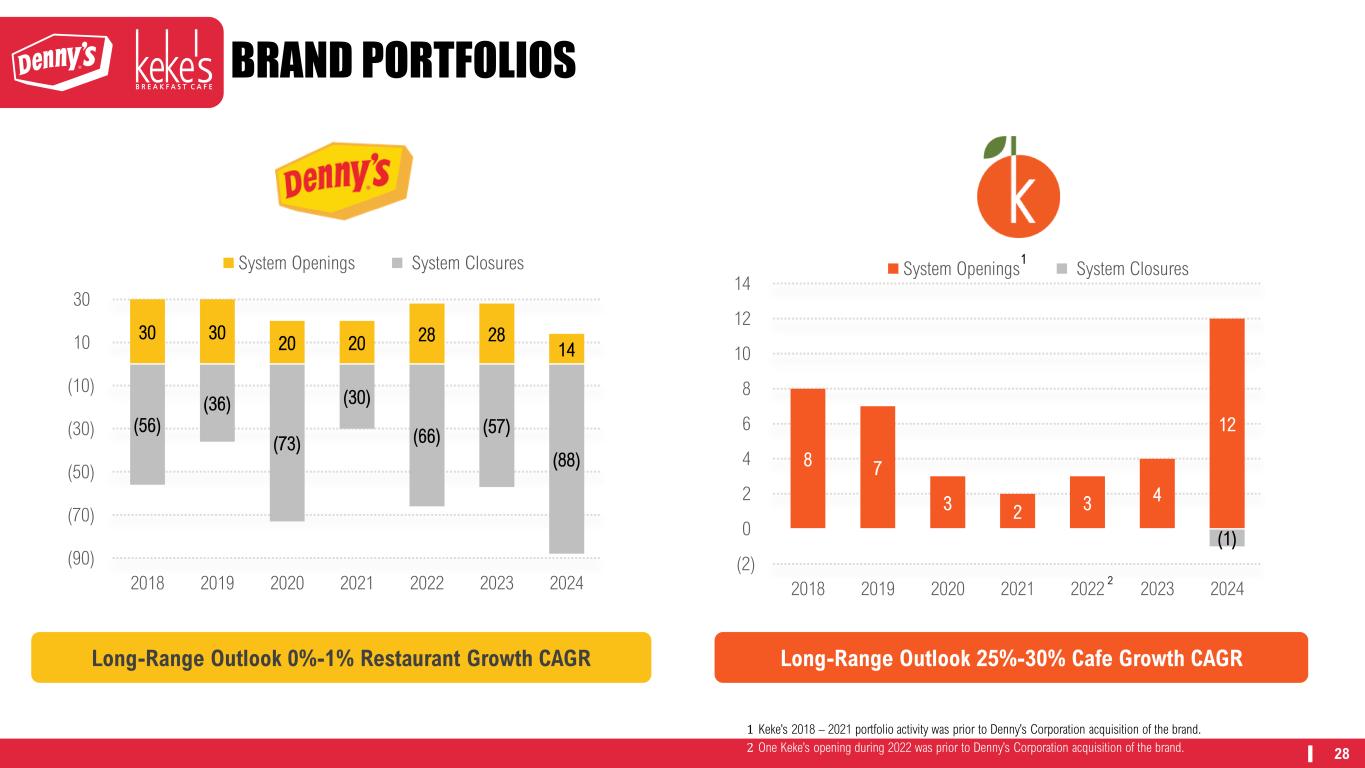

•Denny's opened 14 franchised restaurants and closed 88 restaurants as part of the planned acceleration of lower-volume restaurant closures.

•Reignited Denny's Diner 2.0 remodel program and completed 23 remodels, including seven at company restaurants, or over 11% of the Denny's company fleet.

•Record 12 Keke's openings in a single year, while growing to six different states.

•Completed three Keke's remodels at company cafes.

•Operating income was $45.3 million compared to $52.8 million for the prior year.

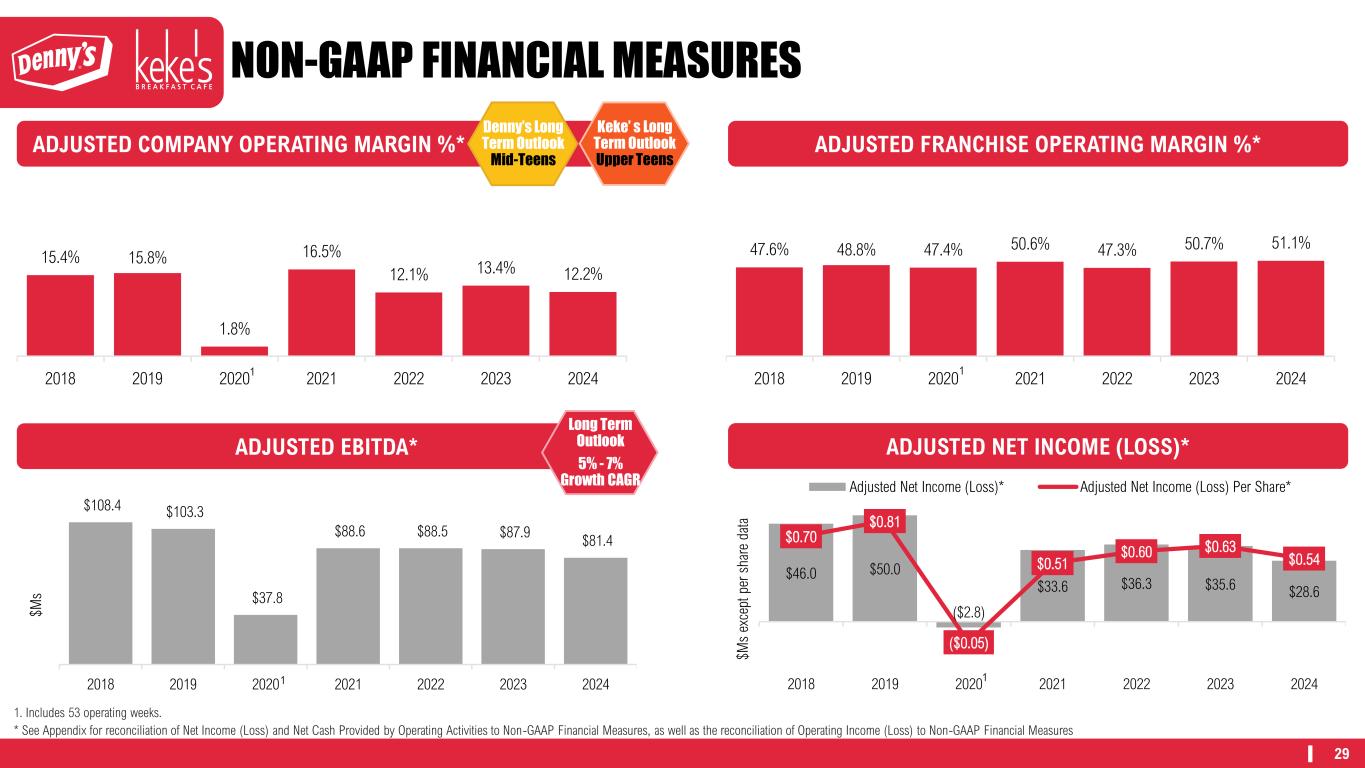

•Adjusted franchise operating margin* was $123.0 million, or 51.1% of franchise and license revenue, and adjusted company restaurant operating margin* was $25.8 million, or 12.2% of company restaurant sales.

•Net income was $21.6 million, or $0.41 per diluted share.

•Adjusted net income* and adjusted net income per share* were $28.6 million and $0.54, respectively.

•Adjusted EBITDA* was $81.4 million.

(1) The Company has evolved its definition of non-GAAP measures. Please see the definitions, explanations, and reconciliations further in this release.

Fourth Quarter 2024 Results

Total operating revenue was $114.7 million compared to $115.4 million for the prior year quarter.

Franchise and license revenue was $62.3 million compared to $61.3 million for the prior year quarter. This change was primarily driven by higher local advertising co-op contributions for the current quarter and positive same-restaurant sales** at both brands, partially offset by decreases in equivalent units and franchise occupancy revenue at Denny's.

Company restaurant sales were $52.4 million compared to $54.0 million for the prior year quarter. This change was primarily driven by six fewer Denny's equivalent units, including three refranchised units, partially offset by three additional Keke's equivalent units for the current quarter.

Adjusted franchise operating margin* was $31.9 million, or 51.2% of franchise and license revenue, compared to $31.5 million, or 51.4% for the prior year quarter. This margin increase was primarily driven by positive same-restaurant sales** at both brands, partially offset by fewer Denny's equivalent units.

Adjusted company restaurant operating margin* was $5.9 million, or 11.3% of company restaurant sales, compared to $6.1 million, or 11.4% for the prior year quarter. This margin change was primarily due to investments in marketing and expected new cafe opening inefficiencies, partially offset by lower legal settlement expense.

Total general and administrative expenses were $18.7 million compared to $19.3 million in the prior year quarter. This change was due to lower deferred compensation valuation adjustments, corporate administrative expenses, and incentive compensation.

The provision for income taxes was $3.5 million, reflecting an effective tax rate of 33.8% for the current quarter.

Net income was $6.8 million, or $0.13 per diluted share. Adjusted net income* per share was $0.14.

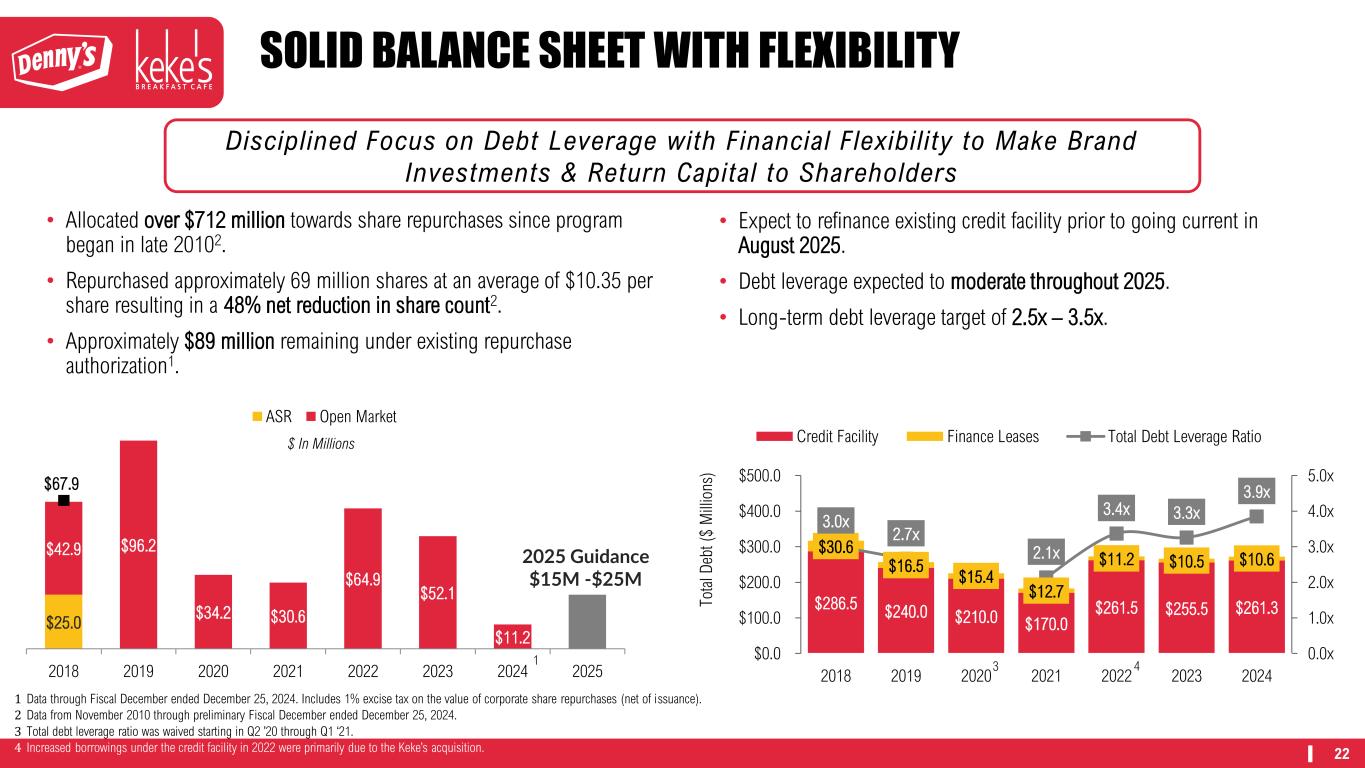

The Company ended the quarter with $271.9 million of total debt outstanding, including $261.3 million of borrowings under its credit facility.

Capital Allocation

The Company invested $10.9 million in cash capital expenditures during the current quarter, and $28.6 million on the full year, which included Keke's new cafe development and company remodels at both brands.

The Company also allocated $11.2 million to share repurchases for the full year resulting in approximately $89.2 million remaining under its existing repurchase authorization.

Business Outlook

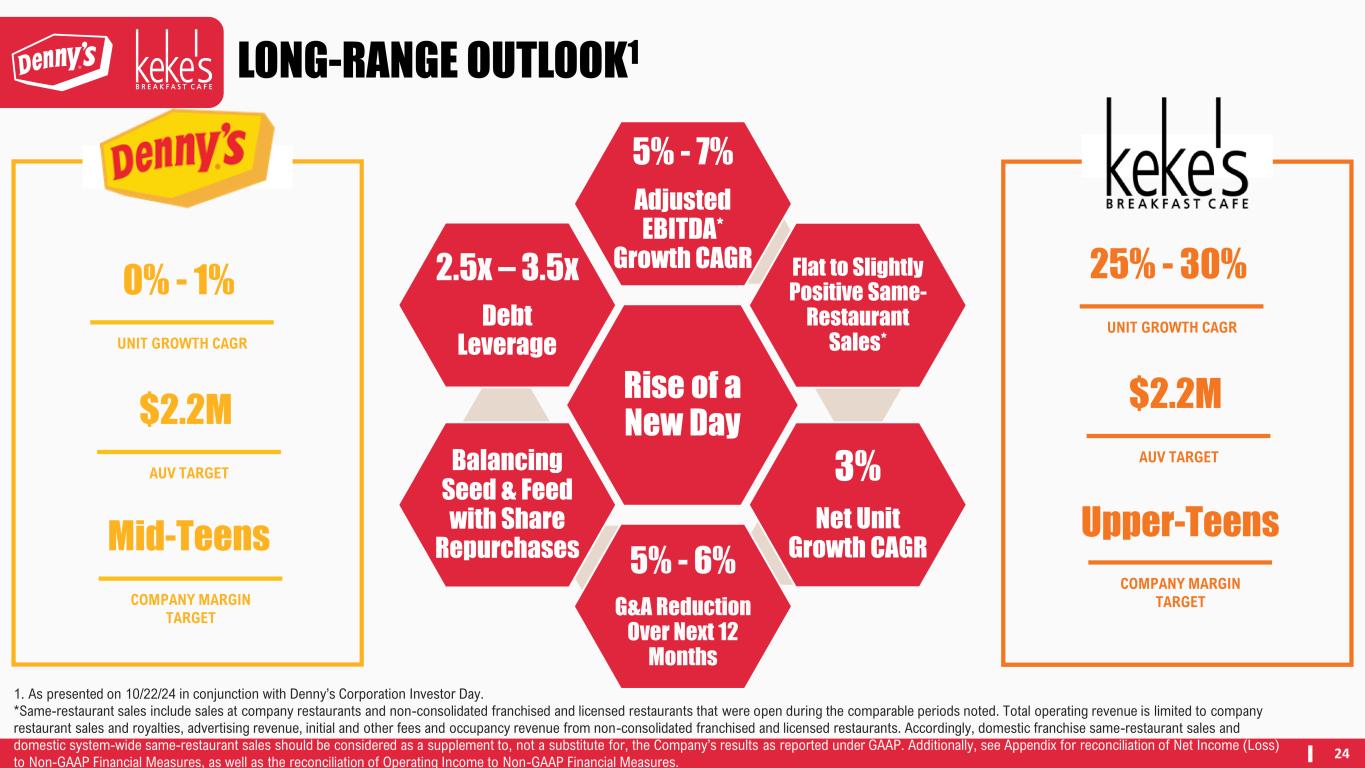

The following full year 2025 (53 operating weeks) expectations reflect performance through the first six fiscal weeks and the expectation that recent shifts in consumer sentiment due to macro events will moderate over time.

•Denny's domestic system-wide same-restaurant sales** between (2.0%) and 1.0%.

•Consolidated restaurant openings of 25 to 40.

•Consolidated restaurant closures between 70 and 90.

•Commodity inflation between 2.0% and 4.0%.

•Labor inflation between 2.5% and 3.5%.

•Total general and administrative expenses between $80 million and $85 million, inclusive of:

◦Corporate and administrative expenses between $60 million and $62 million, including approximately $1 million related to the 53rd week;

◦Incentive compensation between $6 million and $9 million; and,

◦Approximately $14 million related to share-based compensation expense which does not impact Adjusted EBITDA*.

•Adjusted EBITDA* between $80 million and $85 million, inclusive of approximately $2 million related to the 53rd week.

•Share repurchases between $15 million and $25 million.

* Please refer to the Reconciliation of Net Income to Non-GAAP Financial Measures, as well as the Reconciliation of Operating Income to Non-GAAP Financial Measures included in the tables below. The Company is not able to reconcile the forward-looking non-GAAP estimate set forth above to its most directly comparable U.S. generally accepted accounting principles (GAAP) estimates without unreasonable efforts because it is unable to predict, forecast or determine the probable significance of the items impacting these estimates, including gains, losses and other charges, with a reasonable degree of accuracy. Accordingly, the most directly comparable forward-looking GAAP estimate is not provided.

** Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company's results as reported under GAAP.

Conference Call and Webcast Information

The Company will provide further commentary on the results for the fourth quarter ended December 25, 2024 on a webcast today, Wednesday, February 12, 2025 at 8:30 a.m. Eastern Time. Interested parties are invited to listen to the webcast accessible through the Company's investor relations website at investor.dennys.com.

About Denny's Corporation

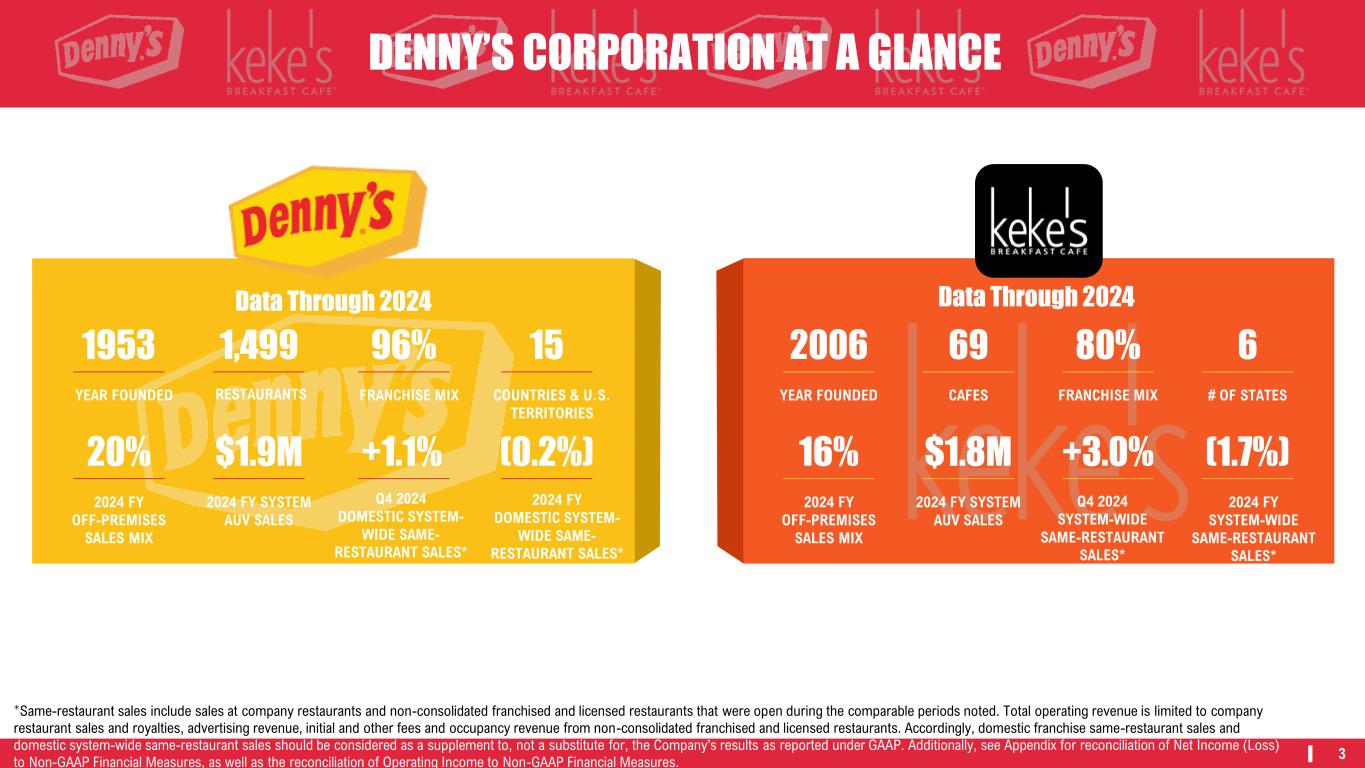

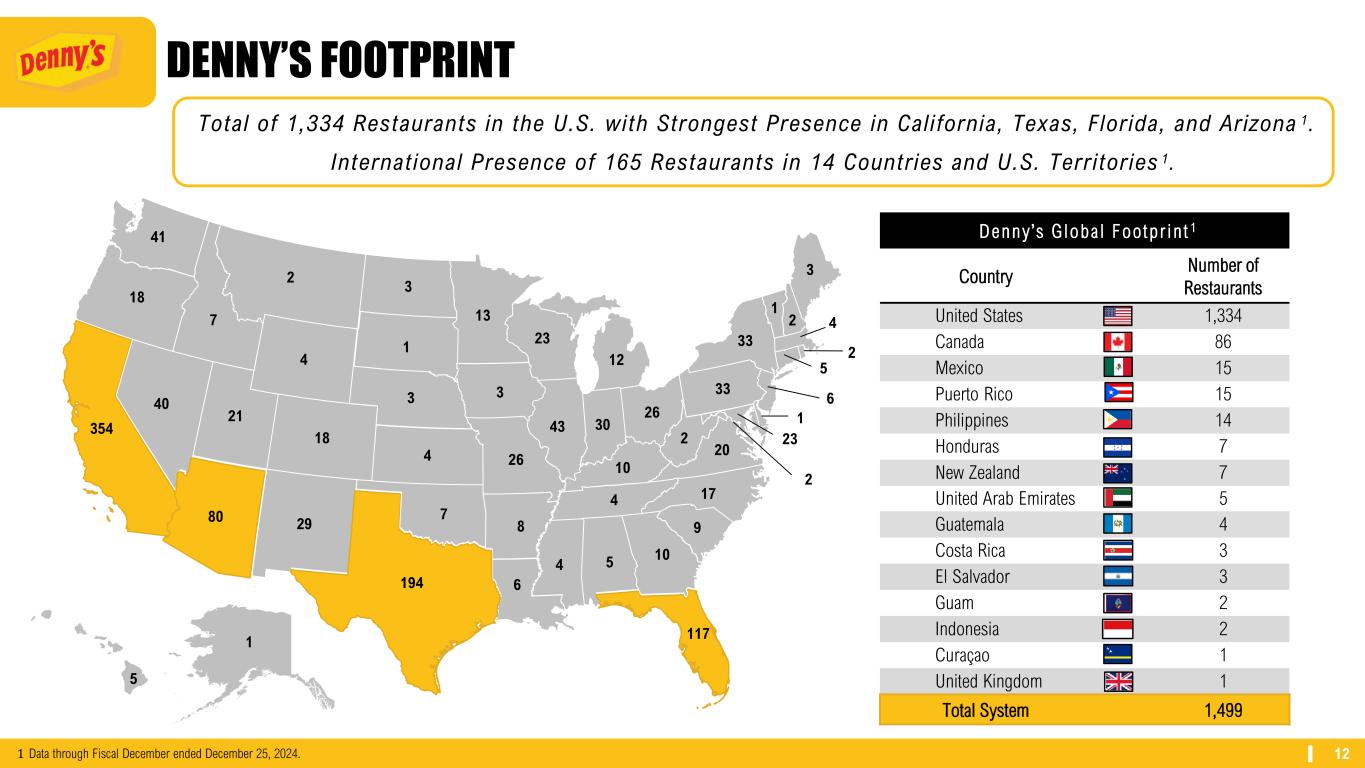

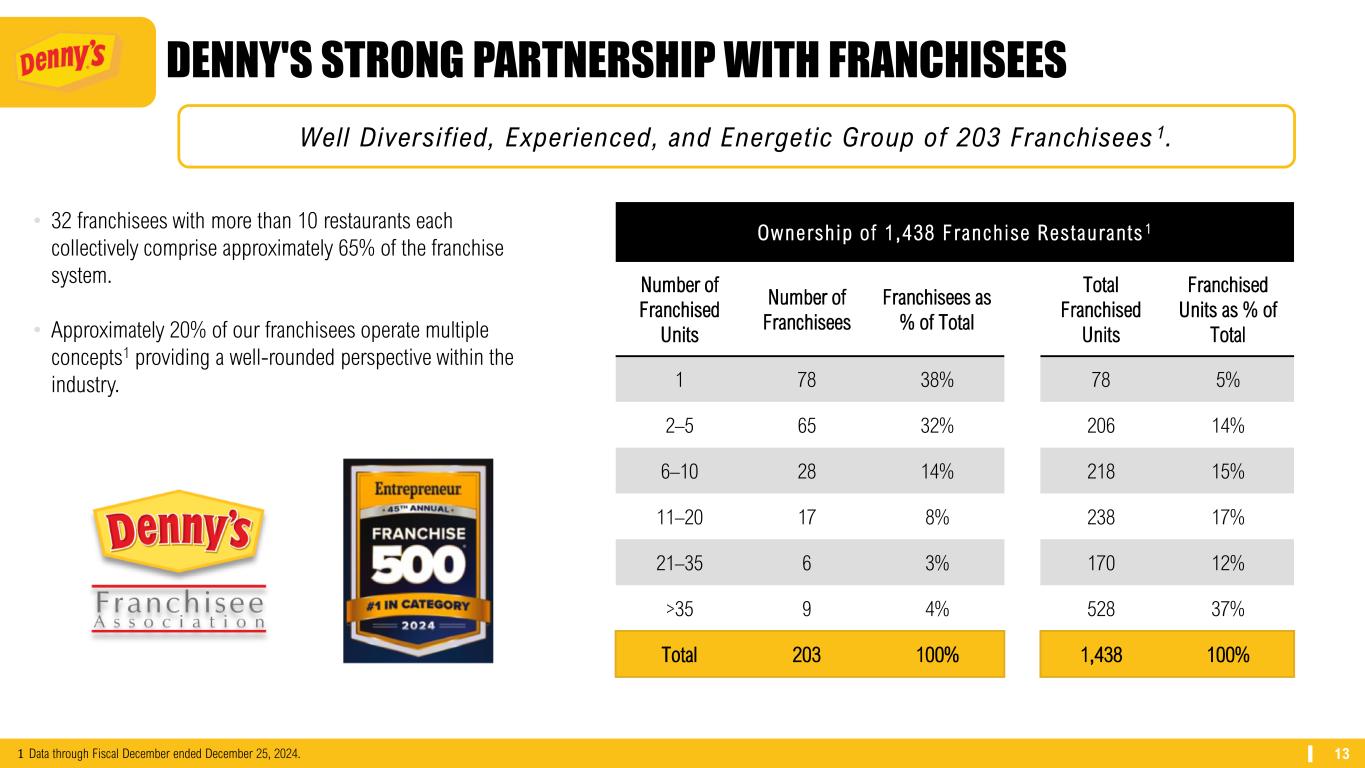

Denny’s Corporation is one of America’s largest full-service restaurant chains based on number of restaurants. As of December 25, 2024, the Company consisted of 1,568 restaurants, 1,493 of which were franchised and licensed restaurants and 75 of which were company operated.

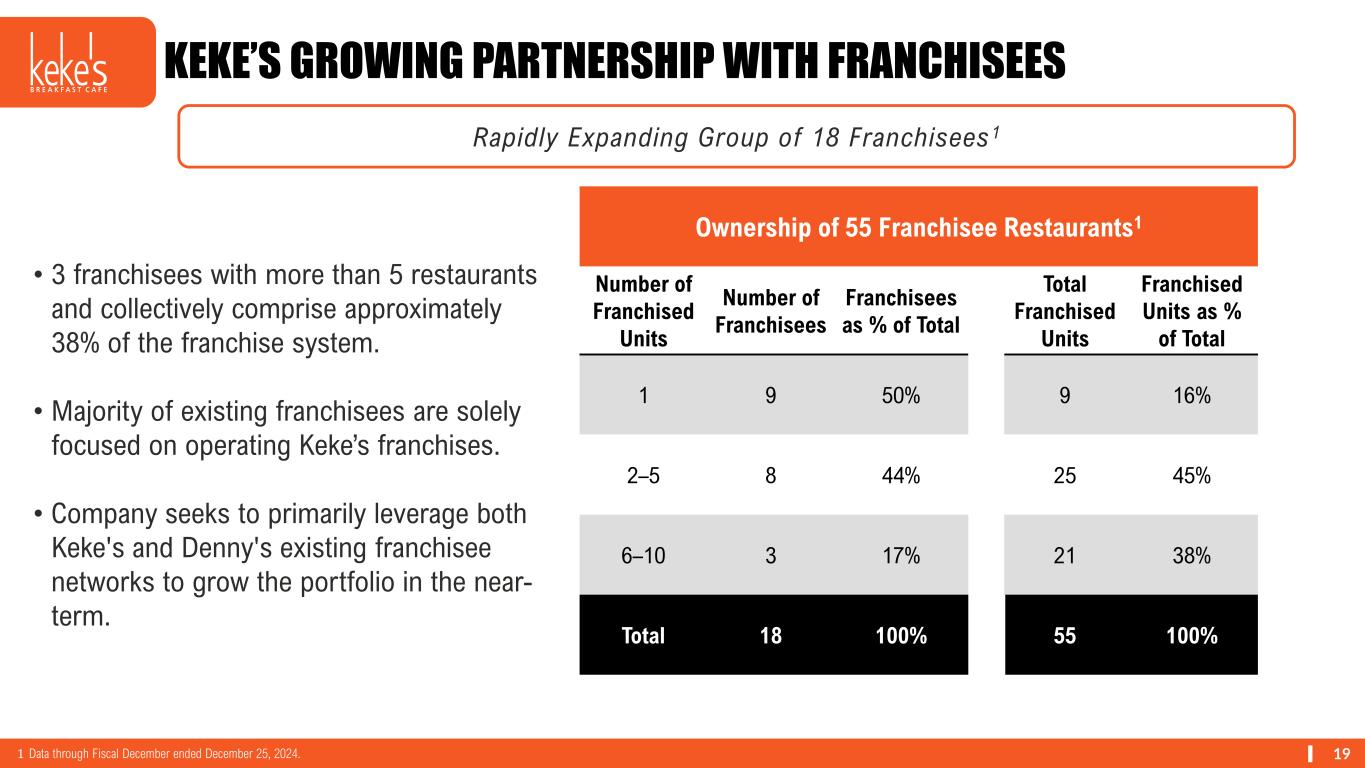

The Company consists of the Denny’s brand and the Keke’s brand. As of December 25, 2024, the Denny's brand consisted of 1,499 global restaurants, 1,438 of which were franchised and licensed restaurants and 61 of which were company operated. As of December 25, 2024, the Keke's brand consisted of 69 restaurants, 55 of which were franchised restaurants and 14 of which were company operated.

For further information on Denny's Corporation, including news releases, links to SEC filings, and other financial information, please visit investor.dennys.com.

Non-GAAP Definition Changes

The Company has evolved its definition of non-GAAP financial measures to provide more clarity and comparability relative to peers. Denny's Corporation management uses certain non-GAAP measures in analyzing operating performance and believes that the presentation of these measures provides investors and analysts with information that is beneficial to gaining an understanding of the Company's financial results. Non-GAAP disclosures should not be viewed as a substitute for financial results determined in accordance with GAAP.

The Company excludes certain legal settlement expenses not considered to be normal and recurring, pre-opening expenses, and other items management does not consider in the evaluation of its ongoing core operating performance from adjusted operating margin*, adjusted net income*, adjusted net income per share*, and adjusted EBITDA*. In addition, the Company no longer deducts cash payments for restructuring and exit costs, or cash payments for share-based compensation from Adjusted EBITDA*.

Reconciliations of these non-GAAP measures are included in the tables of this press release and a recast of historical non-GAAP financial measures can be found on the Company's website, or its most recent investor presentation.

Cautionary Language Regarding Forward-Looking Statements

The Company urges caution in considering its current trends and any outlook on earnings disclosed in this press release. In addition, certain matters discussed in this release may constitute forward-looking statements. These forward-looking statements, which reflect management's best judgment based on factors currently known, are intended to speak only as of the date such statements are made and involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its subsidiaries, and underlying restaurants to be materially different from the performance indicated or implied by such statements. Words such as “expect”, “anticipate”, “believe”, “intend”, “plan”, “hope”, "will", and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this release or to reflect the occurrence of unanticipated events. Factors that could cause actual performance to differ materially from the performance indicated by these forward-looking statements include, among others: economic, public health and political conditions that impact consumer confidence and spending, commodity and labor inflation; the ability to effectively staff restaurants and support personnel; the Company's ability to maintain adequate levels of liquidity for its cash needs, including debt obligations, payment of dividends, planned share repurchases and capital expenditures as well as the ability of its customers,

suppliers, franchisees and lenders to access sources of liquidity to provide for their own cash needs; competitive pressures from within the restaurant industry; the Company's ability to integrate and derive the expected benefits from its acquisition of Keke's Breakfast Cafe; the level of success of the Company’s operating initiatives and advertising and promotional efforts; adverse publicity; health concerns arising from food-related pandemics, outbreaks of flu viruses or other diseases; changes in business strategy or development plans; terms and availability of capital; regional weather conditions; overall changes in the general economy (including with regard to energy costs), particularly at the retail level; political environment and geopolitical events (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC reports and other filings, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item 1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 27, 2023 (and in the Company’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K).

Investor Contact: 877-784-7167

Media Contact: 864-597-8005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DENNY’S CORPORATION |

| Consolidated Balance Sheets |

| (Unaudited) |

|

|

|

|

|

|

|

| ($ in thousands) |

12/25/24 |

|

12/27/23 |

| Assets |

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

$ |

1,698 |

|

|

$ |

4,893 |

|

|

|

Investments |

1,106 |

|

|

1,281 |

|

|

|

Receivables, net |

24,433 |

|

|

21,391 |

|

|

|

Inventories |

1,747 |

|

|

2,175 |

|

|

|

Assets held for sale |

381 |

|

|

1,455 |

|

|

|

Prepaid and other current assets |

10,628 |

|

|

12,855 |

|

|

|

|

Total current assets |

39,993 |

|

|

44,050 |

|

|

Property, net |

111,417 |

|

|

93,494 |

|

|

Finance lease right-of-use assets, net |

6,200 |

|

|

6,098 |

|

|

Operating lease right-of-use assets, net |

124,738 |

|

|

116,795 |

|

|

Goodwill |

66,357 |

|

|

65,908 |

|

|

Intangible assets, net |

91,739 |

|

|

93,428 |

|

|

Deferred financing costs, net |

1,066 |

|

|

1,702 |

|

|

|

|

|

|

|

Other noncurrent assets |

54,764 |

|

|

43,343 |

|

|

|

|

Total assets |

$ |

496,274 |

|

|

$ |

464,818 |

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

Current finance lease liabilities |

$ |

1,284 |

|

|

$ |

1,383 |

|

|

|

Current operating lease liabilities |

15,487 |

|

|

14,779 |

|

|

|

Accounts payable |

19,985 |

|

|

24,070 |

|

|

|

Other current liabilities |

58,842 |

|

|

63,068 |

|

|

|

|

Total current liabilities |

95,598 |

|

|

103,300 |

|

|

Long-term liabilities |

|

|

|

|

|

Long-term debt |

261,300 |

|

|

255,500 |

|

|

|

Noncurrent finance lease liabilities |

9,284 |

|

|

9,150 |

|

|

|

Noncurrent operating lease liabilities |

120,841 |

|

|

114,451 |

|

|

|

Liability for insurance claims, less current portion |

5,866 |

|

|

6,929 |

|

|

|

Deferred income taxes, net |

9,964 |

|

|

6,582 |

|

|

|

Other noncurrent liabilities |

27,446 |

|

|

31,592 |

|

|

|

|

Total long-term liabilities |

434,701 |

|

|

424,204 |

|

|

|

|

Total liabilities |

530,299 |

|

|

527,504 |

|

|

|

|

|

|

|

|

| Shareholders' deficit |

|

|

|

|

|

Common stock |

513 |

|

|

529 |

|

|

|

Paid-in capital |

— |

|

|

6,688 |

|

|

|

Deficit |

(2,499) |

|

|

(21,784) |

|

|

|

Accumulated other comprehensive loss, net |

(32,039) |

|

|

(41,659) |

|

|

|

Treasury stock |

— |

|

|

(6,460) |

|

|

|

|

Total shareholders' deficit |

(34,025) |

|

|

(62,686) |

|

|

|

|

Total liabilities and shareholders' deficit |

$ |

496,274 |

|

|

$ |

464,818 |

|

|

|

|

|

|

|

|

| Debt Balances |

|

Credit facility revolver due 2026 |

$ |

261,300 |

|

|

$ |

255,500 |

|

|

Finance lease liabilities |

10,568 |

|

|

10,533 |

|

|

|

Total debt |

$ |

271,868 |

|

|

$ |

266,033 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DENNY’S CORPORATION |

Condensed Consolidated Statements of Income |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

Quarter Ended |

| ($ in thousands, except per share amounts) |

12/25/24 |

|

12/27/23 |

| Revenue: |

|

|

|

|

Company restaurant sales |

$ |

52,390 |

|

|

$ |

54,046 |

|

|

Franchise and license revenue |

62,284 |

|

|

61,307 |

|

|

|

Total operating revenue |

114,674 |

|

|

115,353 |

|

| Costs of company restaurant sales, excluding depreciation and amortization |

47,228 |

|

|

48,646 |

|

| Costs of franchise and license revenue, excluding depreciation and amortization |

30,425 |

|

|

29,795 |

|

| General and administrative expenses |

18,658 |

|

|

19,255 |

|

| Depreciation and amortization |

3,919 |

|

|

3,507 |

|

| Goodwill impairment charges |

— |

|

|

6,363 |

|

| Operating (gains), losses and other charges, net |

(10) |

|

|

63 |

|

|

|

Total operating costs and expenses, net |

100,220 |

|

|

107,629 |

|

| Operating income |

14,454 |

|

|

7,724 |

|

| Interest expense, net |

4,410 |

|

|

4,309 |

|

| Other nonoperating income, net |

(222) |

|

|

(1,182) |

|

| Income before income taxes |

10,266 |

|

|

4,597 |

|

| Provision for income taxes |

3,470 |

|

|

1,695 |

|

| Net income |

$ |

6,796 |

|

|

$ |

2,902 |

|

|

|

|

|

|

|

| Net income per share - basic |

$ |

0.13 |

|

|

$ |

0.05 |

|

| Net income per share - diluted |

$ |

0.13 |

|

|

$ |

0.05 |

|

|

|

|

|

|

|

| Basic weighted average shares outstanding |

52,103 |

|

|

53,648 |

|

| Diluted weighted average shares outstanding |

52,258 |

|

|

53,893 |

|

|

|

|

|

|

|

| Comprehensive income (loss) |

$ |

18,202 |

|

|

$ |

(10,997) |

|

|

|

|

|

| General and Administrative Expenses |

|

|

Corporate administrative expenses |

$ |

15,504 |

|

|

$ |

16,420 |

|

|

Share-based compensation |

2,272 |

|

|

403 |

|

|

Incentive compensation |

591 |

|

|

1,305 |

|

|

Deferred compensation valuation adjustments |

291 |

|

|

1,127 |

|

|

|

Total general and administrative expenses |

$ |

18,658 |

|

|

$ |

19,255 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DENNY’S CORPORATION |

Condensed Consolidated Statements of Income |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

Fiscal Year Ended |

| ($ in thousands, except per share amounts) |

12/25/24 |

|

12/27/23 |

| Revenue: |

|

|

|

|

Company restaurant sales |

$ |

211,781 |

|

|

$ |

215,532 |

|

|

Franchise and license revenue |

240,553 |

|

|

248,390 |

|

|

|

Total operating revenue |

452,334 |

|

|

463,922 |

|

| Costs of company restaurant sales, excluding depreciation and amortization |

189,744 |

|

|

187,599 |

|

| Costs of franchise and license revenue, excluding depreciation and amortization |

120,226 |

|

|

122,452 |

|

| General and administrative expenses |

80,197 |

|

|

77,770 |

|

| Depreciation and amortization |

14,857 |

|

|

14,385 |

|

| Goodwill impairment charges |

20 |

|

|

6,363 |

|

| Operating (gains), losses and other charges, net |

1,974 |

|

|

2,530 |

|

|

|

Total operating costs and expenses, net |

407,018 |

|

|

411,099 |

|

| Operating income |

45,316 |

|

|

52,823 |

|

| Interest expense, net |

17,974 |

|

|

17,597 |

|

| Other nonoperating (income) expense, net |

(1,907) |

|

|

8,288 |

|

| Income before income taxes |

29,249 |

|

|

26,938 |

|

| Provision for income taxes |

7,678 |

|

|

6,993 |

|

| Net income |

$ |

21,571 |

|

|

$ |

19,945 |

|

|

|

|

|

|

|

| Net income per share - basic |

$ |

0.41 |

|

|

$ |

0.36 |

|

| Net income per share - diluted |

$ |

0.41 |

|

|

$ |

0.35 |

|

|

|

|

|

|

|

| Basic weighted average shares outstanding |

52,499 |

|

|

55,984 |

|

| Diluted weighted average shares outstanding |

52,614 |

|

|

56,196 |

|

|

|

|

|

|

|

| Comprehensive income |

$ |

31,191 |

|

|

$ |

20,983 |

|

|

|

|

|

| General and Administrative Expenses |

|

|

Corporate administrative expenses |

$ |

62,347 |

|

|

$ |

60,339 |

|

|

Share-based compensation |

10,678 |

|

|

8,880 |

|

|

Incentive compensation |

5,459 |

|

|

6,640 |

|

|

Deferred compensation valuation adjustments |

1,713 |

|

|

1,911 |

|

|

|

Total general and administrative expenses |

$ |

80,197 |

|

|

$ |

77,770 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DENNY’S CORPORATION |

| Reconciliation of Net Income to Non-GAAP Financial Measures |

| (Unaudited) |

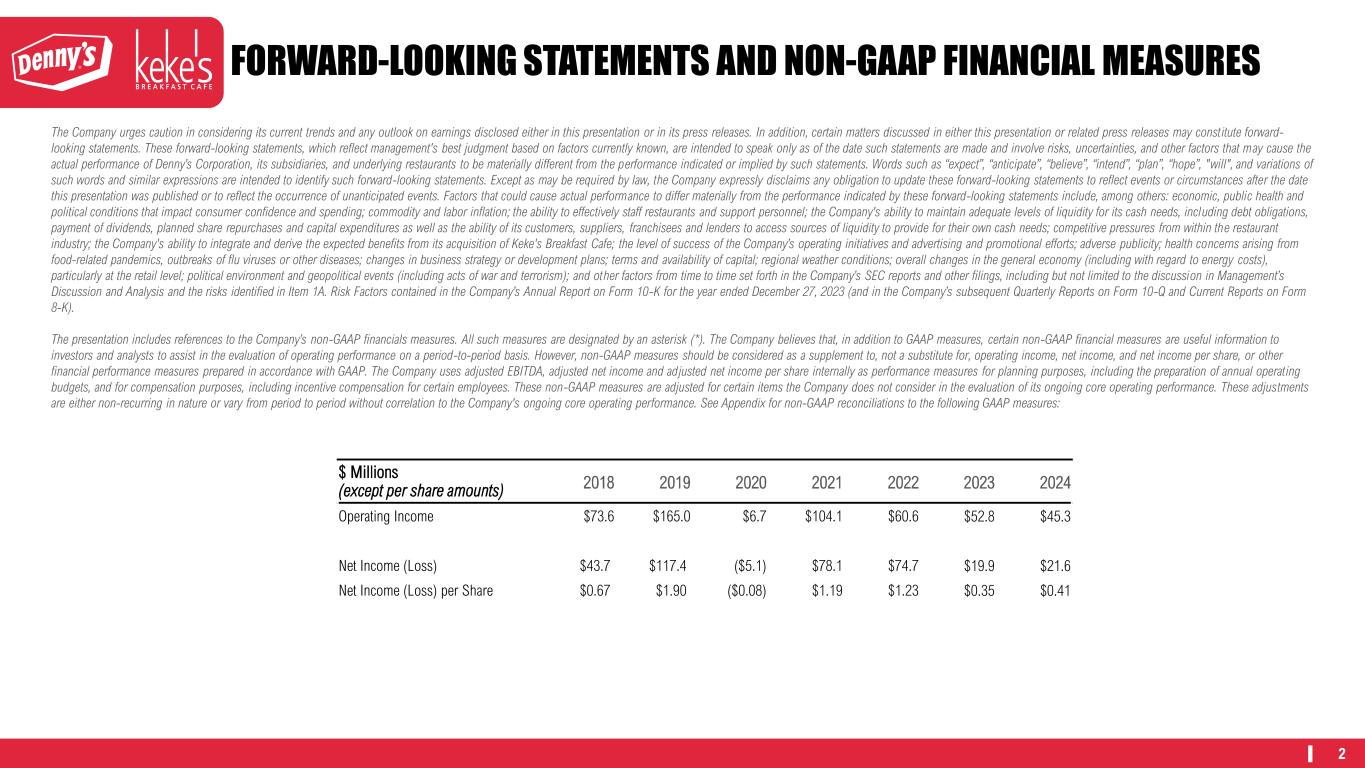

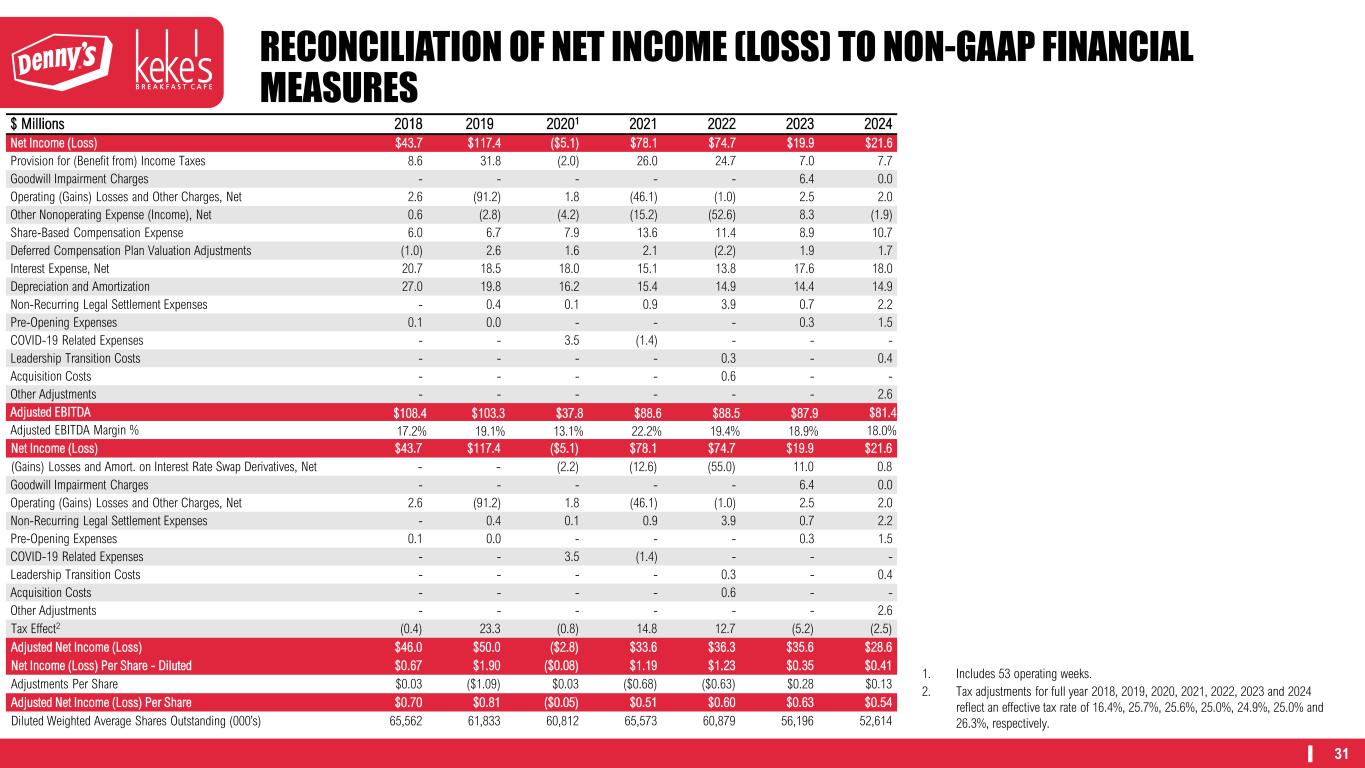

The Company believes that, in addition to GAAP measures, certain non-GAAP financial measures are useful information to investors and analysts to assist in the evaluation of operating performance on a period-to-period basis. However, non-GAAP measures should be considered as a supplement to, not a substitute for, operating income, net income, and net income per share, or other financial performance measures prepared in accordance with GAAP. The Company uses adjusted EBITDA, adjusted net income and adjusted net income per share internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including incentive compensation for certain employees. These non-GAAP measures are adjusted for certain items the Company does not consider in the evaluation of its ongoing core operating performance. These adjustments are either non-recurring in nature or vary from period to period without correlation to the Company's ongoing core operating performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Fiscal Year Ended |

($ in thousands, except per share amounts) |

12/25/24 |

|

12/27/23 |

|

12/25/24 |

|

12/27/23 |

| Net income |

$ |

6,796 |

|

|

$ |

2,902 |

|

|

$ |

21,571 |

|

|

$ |

19,945 |

|

| Provision for income taxes |

3,470 |

|

|

1,695 |

|

|

7,678 |

|

|

6,993 |

|

| Goodwill impairment charges |

— |

|

|

6,363 |

|

|

20 |

|

|

6,363 |

|

Operating (gains), losses and other charges, net |

(10) |

|

|

63 |

|

|

1,974 |

|

|

2,530 |

|

| Other nonoperating (income) expense, net |

(222) |

|

|

(1,182) |

|

|

(1,907) |

|

|

8,288 |

|

| Share-based compensation expense |

2,272 |

|

|

403 |

|

|

10,678 |

|

|

8,880 |

|

| Deferred compensation plan valuation adjustments |

291 |

|

|

1,127 |

|

|

1,713 |

|

|

1,911 |

|

| Interest expense, net |

4,410 |

|

|

4,309 |

|

|

17,974 |

|

|

17,597 |

|

| Depreciation and amortization |

3,919 |

|

|

3,507 |

|

|

14,857 |

|

|

14,385 |

|

| Non-recurring legal settlement expenses |

— |

|

|

590 |

|

|

2,165 |

|

|

679 |

|

| Pre-opening expenses |

782 |

|

|

158 |

|

|

1,548 |

|

|

288 |

|

Other adjustments (1) |

443 |

|

|

— |

|

|

3,083 |

|

|

— |

|

| Adjusted EBITDA |

$ |

22,151 |

|

|

$ |

19,935 |

|

|

$ |

81,354 |

|

|

$ |

87,859 |

|

|

|

|

|

|

|

|

|

| Net income |

$ |

6,796 |

|

|

$ |

2,902 |

|

|

$ |

21,571 |

|

|

$ |

19,945 |

|

| Losses and amortization on interest rate swap derivatives, net |

258 |

|

|

121 |

|

|

760 |

|

|

10,959 |

|

| Goodwill impairment charges |

— |

|

|

6,363 |

|

|

20 |

|

|

6,363 |

|

| Operating (gains), losses and other charges, net |

(10) |

|

|

63 |

|

|

1,974 |

|

|

2,530 |

|

| Non-recurring legal settlement expenses |

— |

|

|

590 |

|

|

2,165 |

|

|

679 |

|

| Pre-opening expenses |

782 |

|

|

158 |

|

|

1,548 |

|

|

288 |

|

Other adjustments (1) |

443 |

|

|

— |

|

|

3,083 |

|

|

— |

|

Tax effect (2) |

(719) |

|

|

(2,054) |

|

|

(2,512) |

|

|

(5,205) |

|

| Adjusted net income |

$ |

7,550 |

|

|

$ |

8,143 |

|

|

$ |

28,609 |

|

|

$ |

35,559 |

|

|

|

|

|

|

|

|

|

| Diluted weighted average shares outstanding |

52,258 |

|

|

53,893 |

|

|

52,614 |

|

|

56,196 |

|

|

|

|

|

|

|

|

|

| Net income per share - diluted |

$ |

0.13 |

|

|

$ |

0.05 |

|

|

$ |

0.41 |

|

|

$ |

0.35 |

|

| Adjustments per share |

0.01 |

|

|

0.10 |

|

|

0.13 |

|

|

0.28 |

|

| Adjusted net income per share |

$ |

0.14 |

|

|

$ |

0.15 |

|

|

$ |

0.54 |

|

|

$ |

0.63 |

|

|

|

|

|

|

|

| (1) |

Other adjustments for the quarter ended December 25, 2024 include $0.4 million of leadership transition costs. Other adjustments for the year-to-date period ended December 25, 2024 include $0.4 million of leadership transition costs and a $2.6 million distribution to franchisees related to a review of advertising costs. |

| (2) |

Tax adjustments for the quarter and year-to-date period ended December 25, 2024 reflect effective tax rates of 48.8% and 26.3%, respectively. Tax adjustments for the quarter and year-to-date period ended December 27, 2023 reflect effective tax rates of 28.2% and 25.0%, respectively. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DENNY’S CORPORATION |

| Reconciliation of Operating Income to Non-GAAP Financial Measures |

| (Unaudited) |

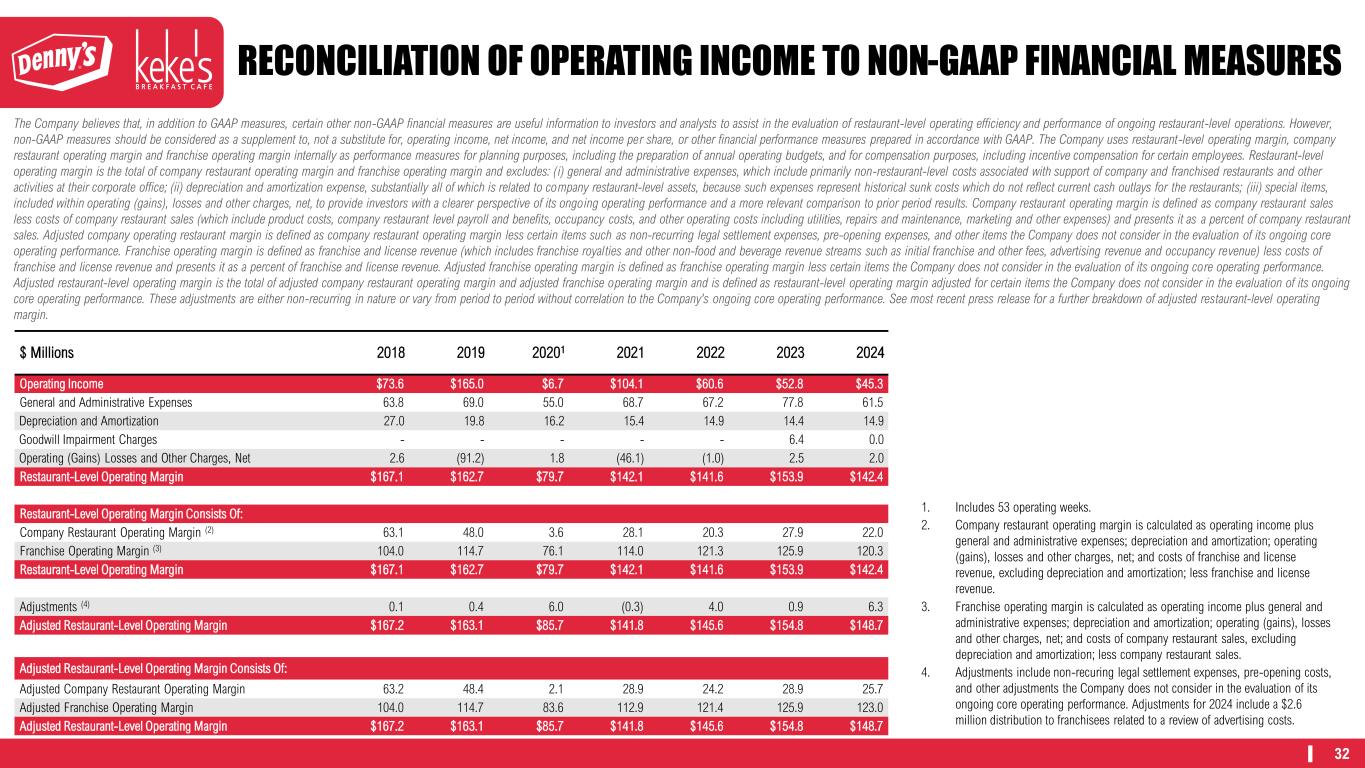

The Company believes that, in addition to GAAP measures, certain other non-GAAP financial measures are useful information to investors and analysts to assist in the evaluation of restaurant-level operating efficiency and performance of ongoing restaurant-level operations. However, non-GAAP measures should be considered as a supplement to, not a substitute for, operating income, net income, and net income per share, or other financial performance measures prepared in accordance with GAAP. The Company uses restaurant-level operating margin, company restaurant operating margin and franchise operating margin internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including incentive compensation for certain employees.

Restaurant-level operating margin is the total of company restaurant operating margin and franchise operating margin and excludes: (i) general and administrative expenses, which include primarily non-restaurant-level costs associated with support of company and franchised restaurants and other activities at their corporate office; (ii) depreciation and amortization expense, substantially all of which is related to company restaurant-level assets, because such expenses represent historical sunk costs which do not reflect current cash outlays for the restaurants; (iii) special items, included within operating (gains), losses and other charges, net, to provide investors with a clearer perspective of its ongoing operating performance and a more relevant comparison to prior period results.

Company restaurant operating margin is defined as company restaurant sales less costs of company restaurant sales (which include product costs, company restaurant level payroll and benefits, occupancy costs, and other operating costs including utilities, repairs and maintenance, marketing and other expenses) and presents it as a percent of company restaurant sales. Adjusted company operating restaurant margin is defined as company restaurant operating margin less certain items such as legal settlement expenses, pre-opening expenses, and other items the Company does not consider in the evaluation of its ongoing core operating performance.

Franchise operating margin is defined as franchise and license revenue (which includes franchise royalties and other non-food and beverage revenue streams such as initial franchise and other fees, advertising revenue and occupancy revenue) less costs of franchise and license revenue and presents it as a percent of franchise and license revenue. Adjusted franchise operating margin is defined as franchise operating margin less certain items the Company does not consider in the evaluation of its ongoing core operating performance.

Adjusted restaurant-level operating margin is the total of adjusted company restaurant operating margin and adjusted franchise operating margin and is defined as restaurant-level operating margin adjusted for certain items the Company does not consider in the evaluation of its ongoing core operating performance. These adjustments are either non-recurring in nature or vary from period to period without correlation to the Company's ongoing core operating performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Fiscal Year Ended |

| ($ in thousands) |

12/25/24 |

|

12/27/23 |

|

12/25/24 |

|

12/27/23 |

| Operating income |

$ |

14,454 |

|

|

$ |

7,724 |

|

|

$ |

45,316 |

|

|

$ |

52,823 |

|

| General and administrative expenses |

18,658 |

|

|

19,255 |

|

|

80,197 |

|

|

77,770 |

|

| Depreciation and amortization |

3,919 |

|

|

3,507 |

|

|

14,857 |

|

|

14,385 |

|

| Goodwill impairment charges |

— |

|

|

6,363 |

|

|

20 |

|

|

6,363 |

|

| Operating (gains), losses and other charges, net |

(10) |

|

|

63 |

|

|

1,974 |

|

|

2,530 |

|

| Restaurant-level operating margin |

$ |

37,021 |

|

|

$ |

36,912 |

|

|

$ |

142,364 |

|

|

$ |

153,871 |

|

|

|

|

|

|

|

|

|

| Restaurant-level operating margin consists of: |

|

|

|

|

|

|

|

Company restaurant operating margin (1) |

$ |

5,162 |

|

|

$ |

5,400 |

|

|

$ |

22,037 |

|

|

$ |

27,933 |

|

Franchise operating margin (2) |

31,859 |

|

|

31,512 |

|

|

120,327 |

|

|

125,938 |

|

| Restaurant-level operating margin |

$ |

37,021 |

|

|

$ |

36,912 |

|

|

$ |

142,364 |

|

|

$ |

153,871 |

|

Adjustments (3) |

782 |

|

|

748 |

|

|

6,353 |

|

|

967 |

|

| Adjusted restaurant-level operating margin |

$ |

37,803 |

|

|

$ |

37,660 |

|

|

$ |

148,717 |

|

|

$ |

154,838 |

|

|

|

|

|

|

|

| (1) |

Company restaurant operating margin is calculated as operating income plus general and administrative expenses; depreciation and amortization; operating (gains), losses and other charges, net; and costs of franchise and license revenue, excluding depreciation and amortization; less franchise and license revenue. |

| (2) |

Franchise operating margin is calculated as operating income plus general and administrative expenses; depreciation and amortization; operating (gains), losses and other charges, net; and costs of company restaurant sales, excluding depreciation and amortization; less company restaurant sales. |

| (3) |

Adjustments include non-recurring legal settlement expenses, pre-opening costs, and other adjustments the Company does not consider in the evaluation of its ongoing core operating performance. Adjustments for the year-to-date period ended December 25, 2024 include a $2.6 million distribution to franchisees related to a review of advertising costs. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DENNY’S CORPORATION |

| Operating Margins |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

| ($ in thousands) |

12/25/24 |

|

12/27/23 |

Company restaurant operations: (1) |

|

|

|

|

|

|

Company restaurant sales |

$ |

52,390 |

|

100.0 |

% |

|

$ |

54,046 |

|

100.0 |

% |

|

Costs of company restaurant sales, excluding depreciation and amortization: |

|

|

|

|

|

|

|

Product costs |

13,377 |

|

25.5 |

% |

|

13,993 |

|

25.9 |

% |

|

|

Payroll and benefits |

19,800 |

|

37.8 |

% |

|

20,184 |

|

37.3 |

% |

|

|

Occupancy |

4,442 |

|

8.5 |

% |

|

4,550 |

|

8.4 |

% |

|

|

Other operating costs: |

|

|

|

|

|

|

|

|

Utilities |

1,645 |

|

3.1 |

% |

|

1,811 |

|

3.4 |

% |

|

|

|

Repairs and maintenance |

1,046 |

|

2.0 |

% |

|

994 |

|

1.8 |

% |

|

|

|

Marketing |

2,511 |

|

4.8 |

% |

|

1,396 |

|

2.6 |

% |

|

|

|

Legal settlements |

(109) |

|

(0.2) |

% |

|

1,827 |

|

3.4 |

% |

|

|

|

Pre-opening costs |

782 |

|

1.5 |

% |

|

158 |

|

0.3 |

% |

|

|

|

Other direct costs |

3,734 |

|

7.1 |

% |

|

3,733 |

|

6.9 |

% |

|

Total costs of company restaurant sales, excluding depreciation and amortization |

$ |

47,228 |

|

90.1 |

% |

|

$ |

48,646 |

|

90.0 |

% |

|

Company restaurant operating margin (non-GAAP) (2) |

$ |

5,162 |

|

9.9 |

% |

|

$ |

5,400 |

|

10.0 |

% |

|

|

|

Adjustments (3) |

782 |

1.5 |

% |

|

748 |

1.4 |

% |

|

Adjusted company restaurant operating margin (non-GAAP) (2) |

$ |

5,944 |

|

11.3 |

% |

|

$ |

6,148 |

|

11.4 |

% |

|

|

|

|

|

|

|

|

|

Franchise operations: (4) |

|

|

|

|

|

|

Franchise and license revenue: |

|

|

|

|

|

|

Royalties |

$ |

30,284 |

|

48.6 |

% |

|

$ |

30,025 |

|

49.0 |

% |

|

Advertising revenue |

20,875 |

|

33.5 |

% |

|

19,676 |

|

32.1 |

% |

|

Initial and other fees |

2,808 |

|

4.5 |

% |

|

2,888 |

|

4.7 |

% |

|

Occupancy revenue |

8,317 |

|

13.4 |

% |

|

8,718 |

|

14.2 |

% |

|

Total franchise and license revenue |

$ |

62,284 |

|

100.0 |

% |

|

$ |

61,307 |

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

Costs of franchise and license revenue, excluding depreciation and amortization: |

|

|

|

|

|

|

Advertising costs |

$ |

20,875 |

|

33.5 |

% |

|

$ |

19,676 |

|

32.1 |

% |

|

Occupancy costs |

5,057 |

|

8.1 |

% |

|

5,307 |

|

8.7 |

% |

|

Other direct costs |

4,493 |

|

7.2 |

% |

|

4,812 |

|

7.8 |

% |

|

Total costs of franchise and license revenue, excluding depreciation and amortization |

$ |

30,425 |

|

48.8 |

% |

|

$ |

29,795 |

|

48.6 |

% |

|

Franchise operating margin (non-GAAP) (2) |

$ |

31,859 |

|

51.2 |

% |

|

$ |

31,512 |

|

51.4 |

% |

|

|

Adjustments (3) |

— |

|

— |

% |

|

— |

|

— |

% |

|

Adjusted franchise operating margin (non-GAAP) (2) |

$ |

31,859 |

|

51.2 |

% |

|

$ |

31,512 |

|

51.4 |

% |

|

|

|

|

|

|

|

|

|

Total operating revenue (5) |

$ |

114,674 |

|

100.0 |

% |

|

$ |

115,353 |

|

100.0 |

% |

Total costs of operating revenue (5) |

77,653 |

|

67.7 |

% |

|

78,441 |

|

68.0 |

% |

Restaurant-level operating margin (non-GAAP) (5) |

$ |

37,021 |

|

32.3 |

% |

|

$ |

36,912 |

|

32.0 |

% |

|

|

|

|

|

|

|

|

|

| (1) |

As a percentage of company restaurant sales. |

| (2) |

Other operating expenses such as general and administrative expenses and depreciation and amortization relate to both company and franchise operations and are not allocated to costs of company restaurant sales and costs of franchise and license revenue. As such, operating margin and adjusted operating margin are considered non-GAAP financial measures and should be considered as a supplement to, not as a substitute for, operating income, net income or other financial measures prepared in accordance with GAAP. |

| (3) |

Adjustments include non-recurring legal settlement expenses, pre-opening costs, and other adjustments the Company does not consider in the evaluation of its ongoing core operating performance. |

| (4) |

As a percentage of franchise and license revenue. |

| (5) |

As a percentage of total operating revenue. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DENNY’S CORPORATION |

| Operating Margins |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended |

| ($ in thousands) |

12/25/24 |

|

12/27/23 |

Company restaurant operations: (1) |

|

|

|

|

|

|

Company restaurant sales |

$ |

211,781 |

|

100.0 |

% |

|

$ |

215,532 |

|

100.0 |

% |

|

Costs of company restaurant sales, excluding depreciation and amortization: |

|

|

|

|

|

|

|

Product costs |

53,931 |

|

25.5 |

% |

|

55,789 |

|

25.9 |

% |

|

|

Payroll and benefits |

80,605 |

|

38.1 |

% |

|

80,666 |

|

37.4 |

% |

|

|

Occupancy |

18,129 |

|

8.6 |

% |

|

16,809 |

|

7.8 |

% |

|

|

Other operating costs: |

|

|

|

|

|

|

|

|

Utilities |

6,954 |

|

3.3 |

% |

|

7,848 |

|

3.6 |

% |

|

|

|

Repairs and maintenance |

4,023 |

|

1.9 |

% |

|

3,661 |

|

1.7 |

% |

|

|

|

Marketing |

7,850 |

|

3.7 |

% |

|

5,603 |

|

2.6 |

% |

|

|

|

Legal settlements |

1,700 |

|

0.8 |

% |

|

2,302 |

|

1.1 |

% |

|

|

|

Pre-opening costs |

1,548 |

|

0.7 |

% |

|

288 |

|

0.1 |

% |

|

|

|

Other direct costs |

15,004 |

|

7.1 |

% |

|

14,633 |

|

6.8 |

% |

|

Total costs of company restaurant sales, excluding depreciation and amortization |

$ |

189,744 |

|

89.6 |

% |

|

$ |

187,599 |

|

87.0 |

% |

|

Company restaurant operating margin (non-GAAP) (2) |

$ |

22,037 |

|

10.4 |

% |

|

$ |

27,933 |

|

13.0 |

% |

|

|

Adjustments (3) |

3,713 |

|

1.8 |

% |

|

967 |

|

0.4 |

% |

|

Adjusted company restaurant operating margin (non-GAAP) (2) |

$ |

25,750 |

|

12.2 |

% |

|

$ |

28,900 |

|

13.4 |

% |

|

|

|

|

|

|

|

|

|

Franchise operations: (4) |

|

|

|

|

|

|

Franchise and license revenue: |

|

|

|

|

|

|

Royalties |

$ |

118,705 |

|

49.3 |

% |

|

$ |

120,131 |

|

48.4 |

% |

|

Advertising revenue |

79,973 |

|

33.2 |

% |

|

78,494 |

|

31.6 |

% |

|

Initial and other fees |

8,711 |

|

3.6 |

% |

|

13,882 |

|

5.6 |

% |

|

Occupancy revenue |

33,164 |

|

13.8 |

% |

|

35,883 |

|

14.4 |

% |

|

Total franchise and license revenue |

$ |

240,553 |

|

100.0 |

% |

|

$ |

248,390 |

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

Costs of franchise and license revenue, excluding depreciation and amortization: |

|

|

|

|

|

|

Advertising costs |

$ |

79,973 |

|

33.2 |

% |

|

$ |

78,494 |

|

31.6 |

% |

|

Occupancy costs |

20,539 |

|

8.5 |

% |

|

22,160 |

|

8.9 |

% |

|

Other direct costs |

19,714 |

|

8.2 |

% |

|

21,798 |

|

8.8 |

% |

|

Total costs of franchise and license revenue, excluding depreciation and amortization |

$ |

120,226 |

|

50.0 |

% |

|

$ |

122,452 |

|

49.3 |

% |

|

Franchise operating margin (non-GAAP) (2) |

$ |

120,327 |

|

50.0 |

% |

|

$ |

125,938 |

|

50.7 |

% |

|

Adjustments (3) |

2,640 |

|

1.1 |

% |

|

— |

|

0.0 |

% |

|

Adjusted franchise operating margin (non-GAAP) (2) |

$ |

122,967 |

|

51.1 |

% |

|

$ |

125,938 |

|

50.7 |

% |

|

|

|

|

|

|

|

|

|

Total operating revenue (5) |

$ |

452,334 |

|

100.0 |

% |

|

$ |

463,922 |

|

100.0 |

% |

Total costs of operating revenue (5) |

309,970 |

|

68.5 |

% |

|

310,051 |

|

66.8 |

% |

Restaurant-level operating margin (non-GAAP) (5) |

$ |

142,364 |

|

31.5 |

% |

|

$ |

153,871 |

|

33.2 |

% |

|

|

|

|

|

|

|

|

|

| (1) |

As a percentage of company restaurant sales. |

| (2) |

Other operating expenses such as general and administrative expenses and depreciation and amortization relate to both company and franchise operations and are not allocated to costs of company restaurant sales and costs of franchise and license revenue. As such, operating margin and adjusted operating margin are considered non-GAAP financial measures and should be considered as a supplement to, not as a substitute for, operating income, net income or other financial measures prepared in accordance with GAAP. |

| (3) |

Adjustments include non-recurring legal settlement expenses, pre-opening costs, and other adjustments the Company does not consider in the evaluation of its ongoing core operating performance. Adjustments for the year-to-date period ended December 25, 2024 include a $2.6 million distribution to franchisees related to a review of advertising costs. |

| (4) |

As a percentage of franchise and license revenue. |

| (5) |

As a percentage of total operating revenue. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DENNY’S CORPORATION |

| Statistical Data |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Denny's |

|

Keke's |

Changes in Same-Restaurant Sales (1) |

Quarter Ended |

|

Fiscal Year Ended |

|

Quarter Ended |

|

Fiscal Year Ended |

| (Increase (decrease) vs. prior year) |

12/25/24 |

|

12/27/23 |

|

12/25/24 |

|

12/27/23 |

|

12/25/24 |

|

12/27/23 |

|

12/25/24 |

|

12/27/23 |

|

Company Restaurants |

0.0% |

|

(1.2)% |

|

(1.5%) |

|

2.7% |

|

(3.7)% |

|

0.7% |

|

(2.7%) |

|

(1.1)% |

|

Domestic Franchise Restaurants |

1.2% |

|

1.5% |

|

(0.1%) |

|

3.6% |

|

4.1% |

|

(3.8)% |

|

(1.6%) |

|

(4.4)% |

|

Domestic System-wide Restaurants |

1.1% |

|

1.3% |

|

(0.2%) |

|

3.6% |

|

3.0% |

|

(3.1)% |

|

(1.7%) |

|

(3.9)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Unit Sales |

|

|

|

|

|

|

|

| ($ in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Restaurants |

$800 |

|

$770 |

|

$3,086 |

|

$3,073 |

|

$407 |

|

$442 |

|

$1,728 |

|

$1,796 |

|

Franchised Restaurants |

$482 |

|

$467 |

|

$1,875 |

|

$1,843 |

|

$459 |

|

$432 |

|

$1,829 |

|

$1,828 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company's results as reported under GAAP. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restaurant Unit Activity |

Denny's |

|

Keke's |

|

|

|

|

|

Franchised |

|

|

|

|

|

Franchised |

|

|

|

|

|

Company |

|

& Licensed |

|

Total |

|

Company |

|

& Licensed |

|

Total |

| Ending Units September 25, 2024 |

61 |

|

|

1,464 |

|

|

1,525 |

|

|

11 |

|

|

50 |

|

|

61 |

|

|

Units Opened |

— |

|

|

4 |

|

|

4 |

|

|

3 |

|

|

5 |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units Closed |

— |

|

|

(30) |

|

|

(30) |

|

|

— |

|

|

— |

|

|

— |

|

|

|

Net Change |

— |

|

|

(26) |

|

|

(26) |

|

|

3 |

|

|

5 |

|

|

8 |

|

| Ending Units December 25, 2024 |

61 |

|

|

1,438 |

|

|

1,499 |

|

|

14 |

|

|

55 |

|

|

69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equivalent Units |

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter 2024 |

59 |

|

|

1,454 |

|

|

1,513 |

|

|

11 |

|

|

51 |

|

|

62 |

|

|

Fourth Quarter 2023 |

65 |

|

|

1,512 |

|

|

1,577 |

|

|

8 |

|

|

50 |

|

|

58 |

|

|

|

Net Change |

(6) |

|

|

(58) |

|

|

(64) |

|

|

3 |

|

|

1 |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ending Units December 27, 2023 |

65 |

|

|

1,508 |

|

|

1,573 |

|

|

8 |

|

|

50 |

|

|

58 |

|

|

Units Opened |

— |

|

|

14 |

|

|

14 |

|

|

7 |

|

|

5 |

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units Refranchised |

(3) |

|

|

3 |

|

|

— |

|

|

(1) |

|

|

1 |

|

|

— |

|

|

Units Closed |

(1) |

|

|

(87) |

|

|

(88) |

|

|

— |

|

|

(1) |

|

|

(1) |

|

|

|

Net Change |

(4) |

|

|

(70) |

|

|

(74) |

|

|

6 |

|

|

5 |

|

|

11 |

|

| Ending Units December 25, 2024 |

61 |

|

|

1,438 |

|

|

1,499 |

|

|

14 |

|

|

55 |

|

|

69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equivalent Units |

|

|

|

|

|

|

|

|

|

|

|

|

Year-to-Date 2024 |

62 |

|

|

1,478 |

|

|

1,540 |

|

|

11 |

|

|

50 |

|

|

61 |

|

|

Year-to-Date 2023 |

65 |

|

|

1,522 |

|

|

1,587 |

|

|

8 |

|

|

48 |

|

|

56 |

|

|

|

Net Change |

(3) |

|

|

(44) |

|

|

(47) |

|

|

3 |

|

|

2 |

|

|

5 |

|

|

|