CHIEF EXECUTIVE OFFICER KELLI VALADE

3 FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES The Company urges caution in considering its current trends and any outlook on earnings disclosed either in this presentation or in its press releases. In addition, certain matters discussed in either this presentation or related press releases may constitute forward-looking statements. These forward-looking statements, which reflect management's best judgment based on factors currently known, are intended to speak only as of the date such statements are made and involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its subsidiaries, and underlying restaurants to be materially different from the performance indicated or implied by such statements. Words such as “expect”, “anticipate”, “believe”, “intend”, “plan”, “hope”, "will", and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date this presentation was published or to reflect the occurrence of unanticipated events. Factors that could cause actual performance to differ materially from the performance indicated by these forward-looking statements include, among others: economic, public health and political conditions that impact consumer confidence and spending; commodity and labor inflation; the ability to effectively staff restaurants and support personnel; the Company's ability to maintain adequate levels of liquidity for its cash needs, including debt obligations, payment of dividends, planned share repurchases and capital expenditures as well as the ability of its customers, suppliers, franchisees and lenders to access sources of liquidity to provide for their own cash needs; competitive pressures from within the restaurant industry; the Company's ability to integrate and derive the expected benefits from its acquisition of Keke's Breakfast Cafe; the level of success of the Company’s operating initiatives and advertising and promotional efforts; adverse publicity; health concerns arising from food-related pandemics, outbreaks of flu viruses or other diseases; changes in business strategy or development plans; terms and availability of capital; regional weather conditions; overall changes in the general economy (including with regard to energy costs), particularly at the retail level; political environment and geopolitical events (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC reports and other filings, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item 1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 27, 2023 (and in the Company’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K). The presentation includes references to the Company’s non-GAAP financials measures. All such measures are designated by an asterisk (*). The Company believes that, in addition to GAAP measures, certain non-GAAP financial measures are useful information to investors and analysts to assist in the evaluation of operating performance on a period-to-period basis. However, non-GAAP measures should be considered as a supplement to, not a substitute for, operating income, net income, and net income per share, or other financial performance measures prepared in accordance with GAAP. The Company uses adjusted EBITDA, adjusted net income and adjusted net income per share internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including incentive compensation for certain employees. These non-GAAP measures are adjusted for certain items the Company does not consider in the evaluation of its ongoing core operating performance. These adjustments are either non-recurring in nature or vary from period to period without correlation to the Company's ongoing core operating performance. See Appendix for non-GAAP reconciliations to the following GAAP measures: $ Millions (except per share amounts) 2018 2019 2020 2021 2022 2023 YTD Sep 2024 Operating Income $73.6 $165.0 $6.7 $104.1 $60.6 $52.8 $30.9 Net Income (Loss) $43.7 $117.4 ($5.1) $78.1 $74.7 $19.9 $14.8 Net Income (Loss) per Share $0.67 $1.90 ($0.08) $1.19 $1.23 $0.35 $0.28

1 Q3 2024 RESULTS 2 STATE OF THE INDUSTRY 3 DENNY’S 4 KEKE’S 5 FRANCHISEE Q&A 6 LONG-RANGE OUTLOOK AGENDA

5 GOALS FOR TODAY Opportunity to hear from members of talented executive leadership team Communicate ambition and path to revenue and cash flow growth Provide long-range outlook 1 2 3

THE EXECUTIVE LEADERSHIP TEAM David Schmidt President – Keke’s Inc. September 2022 Stephen Dunn EVP, Chief Global Development Officer October 2004 Chris Bode President – Denny’s Inc. September 2024 Kelli Valade Chief Executive Officer June 2022 Gail Sharps-Myers EVP, Chief Legal & Administrative Officer and Corporate Secretary June 2020 Robert Verostek EVP, Chief Financial Officer June 1999 Patty Trevino SVP, Chief Brand Officer August 2024 Jay Gilmore SVP, Chief Accounting Officer and Corporate Controller February 1999 Minh Le SVP, Chief Technology Officer September 2024 Monigo Saygbay-Hallie EVP, Chief People Officer August 2024 ~

Q3 2024 RESULTS

8 Q3 2024 HIGHLIGHTS – DENNY’S • Domestic system-wide same- restaurant sales* of (0.1%). • Sequential improvement of 50bps. • Outperformed the BBI Family Dining sales benchmark for the third consecutive quarter. • Outperformed the BBI Casual Dining sales benchmark for six out of the last seven quarters. • Outperformed test results and is driving incremental traffic. • Rolled out Banda Burrito to nearly 1,000 restaurants which increased same- restaurant sales* by 70bps. • Total off-premises sales of 20%. • Completed six remodels, including three company restaurants. *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP.

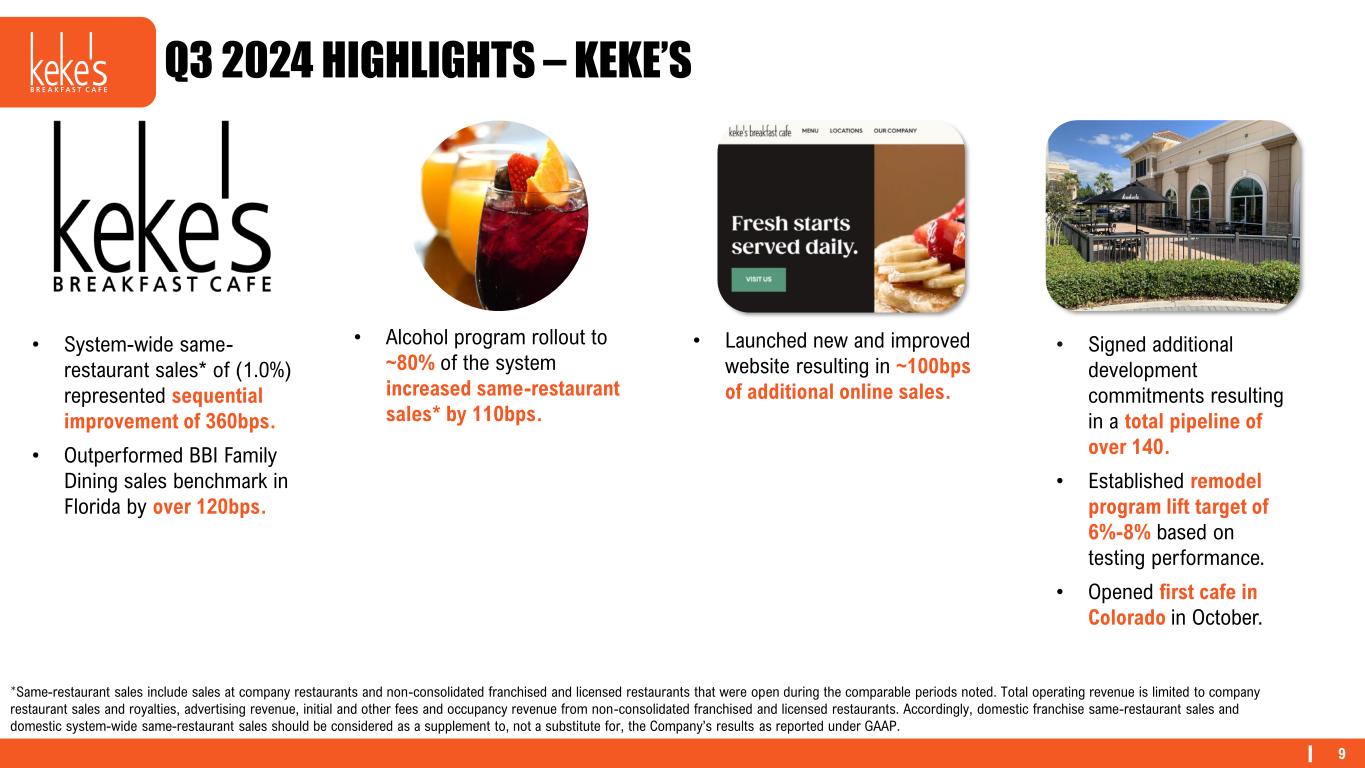

9 Q3 2024 HIGHLIGHTS – KEKE’S • Alcohol program rollout to ~80% of the system increased same-restaurant sales* by 110bps. • Signed additional development commitments resulting in a total pipeline of over 140. • Established remodel program lift target of 6%-8% based on testing performance. • Opened first cafe in Colorado in October. • System-wide same- restaurant sales* of (1.0%) represented sequential improvement of 360bps. • Outperformed BBI Family Dining sales benchmark in Florida by over 120bps. • Launched new and improved website resulting in ~100bps of additional online sales. *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP.

10 Q3 2024 Highlights – DENNY’S CORPORATION $111.8M $11.7M $20.0M Adjusted EBITDA* $0.14 Adjusted Net Income Per Share* $6.2M 11.8% Adjusted Company Restaurant Operating Margin* $30.1M 51.0% Adjusted Franchise Operating Margin* Total Operating Revenue Total Operating Income $7.8M Capital Expenditures Denny’s: (0.1%) Keke’s: (1.0%) Same-Restaurant Sales* Additionally, see Appendix for reconciliation of Net Income (Loss) to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income to Non-GAAP Financial Measures. *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP.

11 (1.0%) Q3 2024 SYSTEM-WIDE SAME-RESTAURANT SALES* (3.1%) Q3 2024 YTD SYSTEM-WIDE SAME-RESTAURANT SALES* 3 # OF STATES $1.8M Q3 2024 LTM AUV SALES 2006 YEAR FOUNDED 82% FRANCHISE MIX 16% OFF-PREMISES SALES MIX 62 # OF CAFES (0.1%) Q3 2024 DOMESTIC SYSTEM- WIDE SAME- RESTAURANT SALES* (0.7%) Q3 2024 YTD DOMESTIC SYSTEM- WIDE SAME- RESTAURANT SALES* 15 COUNTRIES & U.S. TERRITORIES $1.9M Q3 2024 LTM AUV SALES 1953 YEAR FOUNDED 96% FRANCHISE MIX 20% OFF-PREMISES SALES MIX 1,525 # OF RESTAURANTS DENNY’S CORPORATION AT A GLANCE Denny’s Domestic System- Wide Same-Restaurant Sales* (1%) – 0% 75 - 95 Total G&A Expense Including ~$11M Related to Share-Based Compensation $82M - $85M30-40 Restaurant Openings Including 12-16 Keke’s Cafes Adjusted EBITDA* $81M - $84M UPDATED FULL YEAR 2024 GUIDANCE Restaurant Closures in a Strategic Initiative to Accelerate Lower Volume Closures *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. Additionally, see Appendix for reconciliation of Net Income (Loss) to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income to Non-GAAP Financial Measures. (1) Keke’s unit data includes one additional franchise opening subsequent to the end of Q3 2024 in Colorado. Data through Q3 2024 Data through Q3 2024(1)

STATE OF THE INDUSTRY

13 CHOPPY ECONOMIC CONDITIONS WILL PERSIST IN THE NEAR-TERM

14 PERSONAL SAVINGS RATES TRAIL PRE-PANDEMIC AVERAGE 0.0 5.0 10.0 15.0 20.0 25.0 30.0 2018 2019 2020 2021 2022 2023 2024 Personal Savings Rate Pre-Pandemic Average Stimulus Stimulus Source: Federal Reserve Bank of St. Louis Federal Reserve FRED database.

15 FOOD AWAY FROM HOME INFLATION CONTINUES TO OUTPACE -2.0 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 2018 2019 2020 2021 2023 2024 Food Away From Home Food At Home Source: Federal Reserve Bank of St. Louis Federal Reserve FRED database.

16 GUESTS ARE MANAGING THEIR SPEND Order from restaurant less often Seek out deals / specials Seek cheaper restaurants Order more takeout to avoid delivery fee Order less expensive items No impact 13% 19% 32% 38% 40% 55% Source: Technomic Q1 2024 Consumer & Operator Outlook Report. Based: 1,000 consumers ages 18+.

17 ESPECIALLY <$50,000 HH INCOME

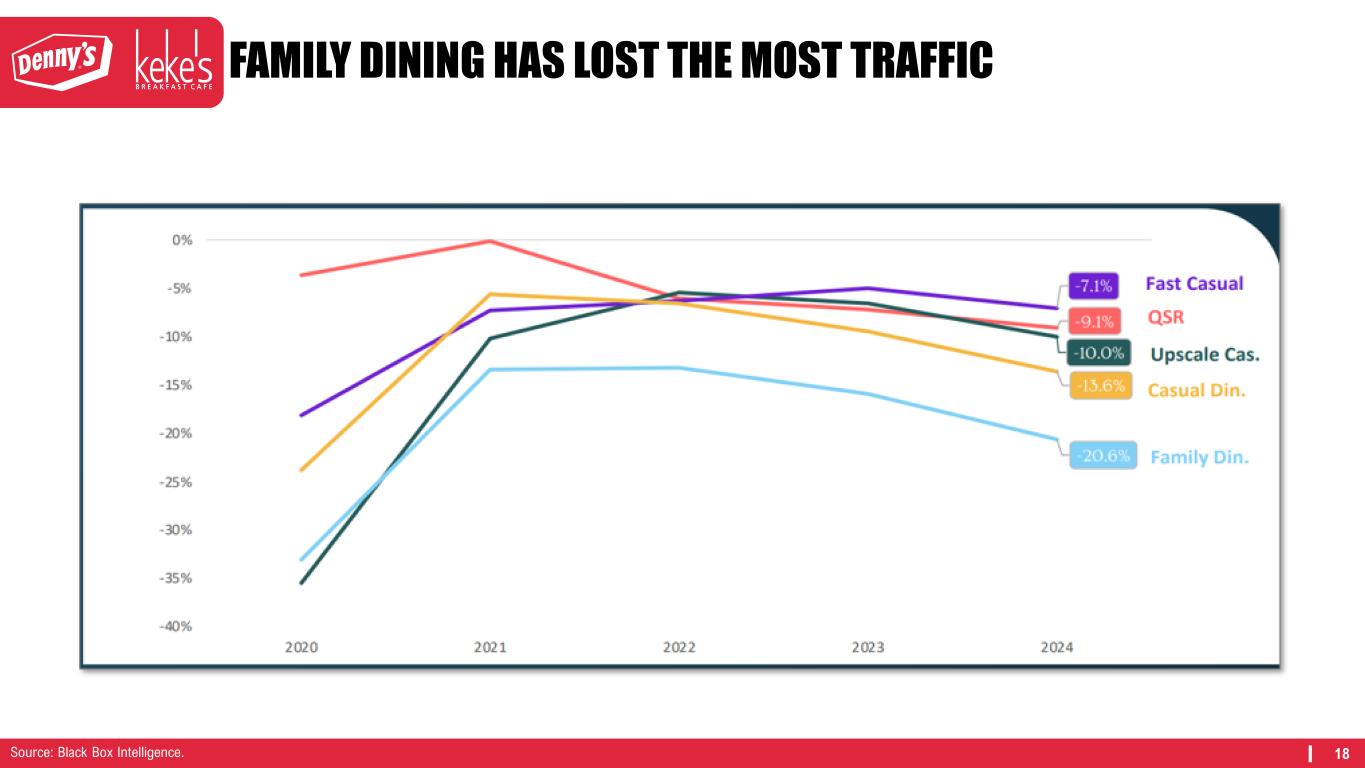

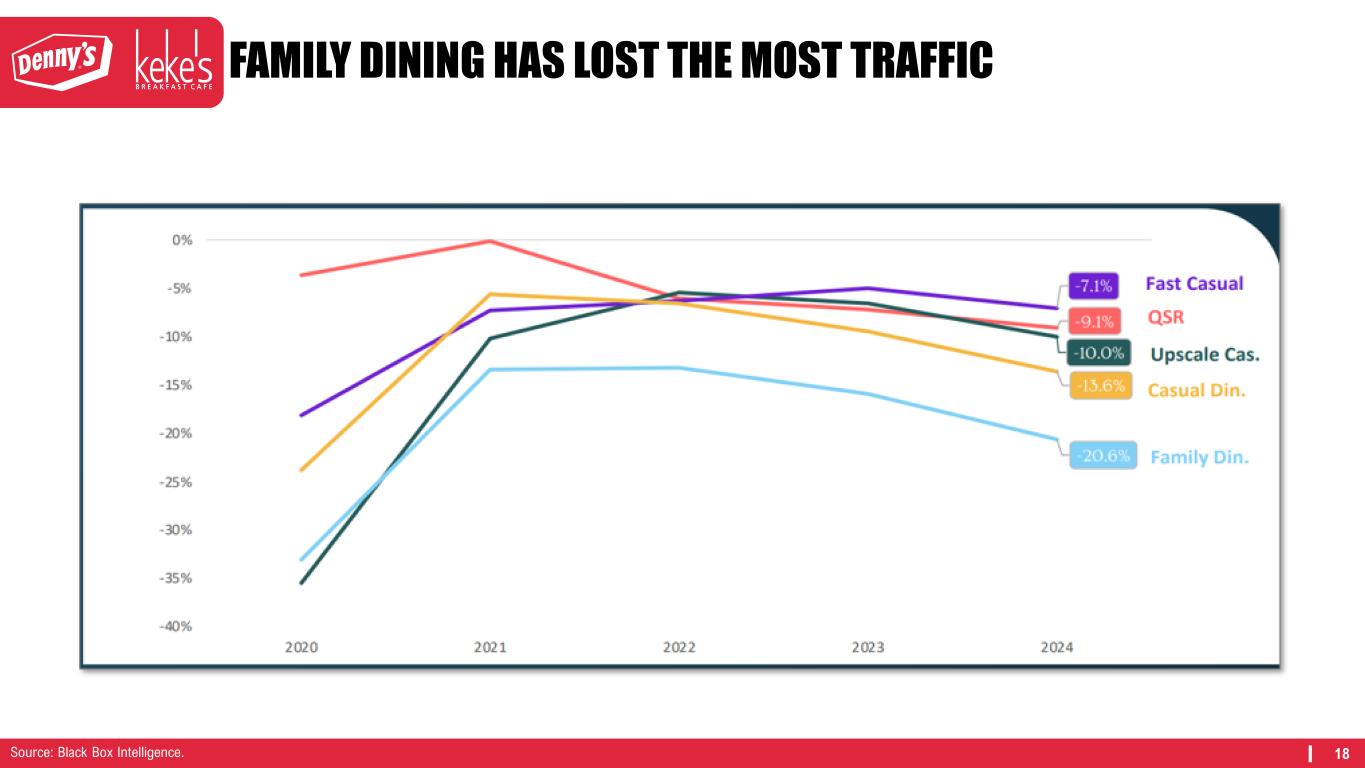

18 FAMILY DINING HAS LOST THE MOST TRAFFIC Source: Black Box Intelligence.

19 AND YET...

20 RESILIENCE & RELEVANCE Relevant in cultural conversation New restaurant openings outperform system averages Outperform peer BBI indices Guest net sentiment scores continue to improve

21 0.7% 1.3% 0.5% 2.8% 5.8% 0.9% 1.1% 0.8% 2.0% 6.3% 3.6% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Denny's BBI Family CONSISTENT, SOLID SAME-RESTAURANT SALES* SMOOTHED FOR COVID IMPACT After strong growth in 2022 and 2023, guiding same-restaurant sales* of (1%) – 0% for 2024. Pandemic Same-Restaurant Sales* Q1 2023 Q2 2023 Q3 2023 Denny’s (1.3%) (0.6%) (0.1%) vs. BBI Family +0.22% +0.03% +0.53% *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. Source: Black Box Intelligence.

22 Strategy: Two Complementary Breakfast-Forward Brands that are Asset-Light and Generate Significant Cash Flow Create Leading Edge Tech Solutions Robust New Café Growth Assemble Best-in- Class People & Teams Validate & Optimize the Business Model Elevate Profitable Traffic Purpose Vision Key Areas of Focus We Create Fresh Starts for Everyone, Every Day To Serve 40M Fresh Starts Annually by 2030 Strengthen the Core Rapid Growth We Love to Feed People – Body, Mind & Soul Grow AUVs to $2.2M through increased guest frequency and expanding the guest base Take Back Breakfast Regain Value Leadership Accelerate Off-Premises DENNY’S CORPORATION

23 FAMILY DINING OVERVIEW Units / % Franchised 1,525 / 96% 1,809 / 100% 658 / 0% 357 / 99% 1,985 / 23% 435 / 0% International Presence 167 / 11% 124 / 7% 0 / 0% 0 / 0% 0 / 0% 0 / 0% System-Wide Sales $3.0B $3.6B $2.7B $1.6B $1.4B $782M Domestic Average Unit Volume $1.9M $2.0M $4.0M $4.6M $0.7M $1.8M Total Unit CAGR vs 2019 (2.3%) (0.4%) (0.1%) (7.3%) (0.5%) (2.5%) Domestic AUV CAGR vs 2019 2.3% 0.8% 1.1% 6.5% (1.4%) 2.5% Source: Technomic Top 1,500 Chain Restaurants Performance Data 2024 for Golden Corral, Waffle House, and Bob Evans. Most recent public documents for Denny’s, IHOP, and Cracker Barrel.

24 (4.2%) (2.6%) (1.9%) (2.4%) (1.0%) (0.5%) (1.3%) 0.2% 0.03% 0.5% (1.4%) (2.0%) (1.9%) 1.0% 1.5% 1.2% 1.1% 2.4% (0.7%) 1.2% (6.0%) (4.0%) (2.0%) 0.0% 2.0% 4.0% Q 2 2 2 Q 3 2 2 Q 4 2 2 Q 1 2 3 Q 2 2 3 Q 3 2 3 Q 4 2 3 Q 1 2 4 Q 2 2 4 Q 3 2 4 Domestic System-Wide Same-Restaurant Sales* Gap vs Family Dining Gap vs Casual Dining FULL-SERVICE DINING OVERVIEW $5,112 $4,784 $4,357 $4,023 $3,958 $3,399 $2,830 $2,808 $2,694 $2,688 Olive Garden Texas Roadhouse Applebee's Chili's Grill & Bar Buffalo Wild Wings IHOP Outback Steakhouse LongHorn Steakhouse Denny's Cracker Barrel Family Dining Accounts for 30% of the Top 10 U.S. Full-Service Restaurants Denny’s has outperformed BBI Family Dining the last three quarters and exceeded BBI Casual Dining in six of the last seven quarters Top 10 U.S. Full Service Restaurants (2023 U.S. System-Wide Sales) ($ in 000’s) 908 638 1,536 1,230 1,264 1,696 688 580 1,407 662 U.S. Units as of 2023# #9 FSR *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. Sources: Technomic Top 1,500 Chain Restaurants Performance Data 2024 and Black Box Intelligence.

25 DAYTIME EATERY OVERVIEW Units / % Franchised 61 / 82% 538 / 15% 67 / 0% 97 / 62% 71 / 100% 63 / 0% U.S. Geography Southeast Southeast Nationwide Nationwide South South / Northeast System-Wide Sales $108M $1.2B $191M $184M $81M $78M Average Unit Volume $1.8M $2.2M $3.1M $2.1M $1.2M $1.3M Total Unit CAGR vs 2019 6.1% 7.7% 13.8% 9.3% 17.7% 17.5% AUV CAGR vs 2019 2.4% 13.9% 1.2% 8.9% 7.4% 1.6% Source: Technomic Top 1,500 Chain Restaurants Performance Data 2024 for all except Keke’s and First Watch which references most recent public documents.

26 DAYTIME EATERY OVERVIEW 538 97 71 67 63 61 46 38 27 21 4 5 Unit Count Daytime Eatery Profile Hours & Menu Growth Economics Limited hour breakfast brands primarily operate during the breakfast and lunch dayparts Fastest growing category with ample white space With limited hours and a focus on breakfast food and alcohol, margins outpace other FSR. 17% 3% Breakfast Full-service Restaurant Unit Growth Outpaces FSR 2023 Year-over-Year Unit Growth (1) Source: Technomic Top 1,500 Chain Restaurants Performance Data 2024 for all except Keke’s and First Watch which references most recent public documents. (1) Breakfast includes Another Broken Egg Café, Broken Yolk Café, Eggs Up Grill, First Watch, Keke’s Breakfast Cafe, Ruby Slipper Cafe, Snooze, and the Toasted Yolk Cafe.

27 ACQUISITION OF KEKE’S HAS CREATED EXCITING GROWTH OPPORTUNITIES Unit Economics Solid Margins Brand Strength Commands Premium Pricing vs. Denny's Growth Potential No Scaled National Franchisor Poised for Growth New Customer Reach Only 11% Visit Overlap with Denny’s Trade-Area Opportunities Complementary to Denny’s Leveraging Strengths Franchise Model Breakfast Strength Scale of Shared Services

28 TWO COMPLEMENTARY BREAKFAST-FORWARD BRANDS Household Income $1.9M $1.8M Average Check $63k $78k Off-Premises % of Sales $16 $18 Alcohol Mix 20% 16% Net Sentiment <1% 3% 49 Average Unit Volume 69 Data through Q3 2024.

29 IMPORTANTLY, KEKE’S IS A COMPLEMENTARY BREAKFAST PLAYER TO DENNY’S 89% 11% Denny’s Guests shared with Keke’s Denny’s Guests that do not visit Keke’s $78,000 $63,000 Guest Overlap Each have strength in differing guest profiles and needs, exemplified here both by income levels as well as low incidence of shared visits Guest Household Income Sources: Guest Household Income - Technomic (Q2 2024 LTM); Guest Overlap – eSite Analytics.

THIS TRANSFORMATION IS AND WILL CONTINUE TO BE DRIVEN BY OUR CRAVE FRAMEWORK FOR GROWTH

31 C-R-A-V-E STRATEGIC FRAMEWORK Va l ida te & Opt imize the Bus iness Model to Max imize Res tauran t Margins E l eva te Pro f i t ab le Tra f f ic Th rough the Gues t Exper ience & Un ique ly C raveable Food C rea te Lead ing Edge So lu t ions Wi th Technology & Innova t ion Robust New Res tauran t G row th as the Franch isor o f Cho ice Assemble Bes t I n C l ass Peop le and Teams Through Cu l tu re, Tools & Sys tems

32 KEY THEMES AUV Growth Restaurant Growth Margin Growth Cash Flow & Capital Allocation

DENNY’S AMERICA’S DINER FOR TODAY’S AMERICA

34 DENNY’S LEADERSHIP TEAM Patty Trevino SVP – Chief Brand Officer August 2024 Ethan Gallagher SVP – Finance January 2024 Chris Bode President – Denny’s Inc. September 2024 Fasika Melaku SVP – Human Resources & Chief Learning Officer September 2015 ~

35 OFFERING GUESTS AN EVER-IMPROVING EXPERIENCE IS CRITICAL DENNY’S FAMILY DINING RESTAURANT INDUSTRY Overall Net Sentiment (BBI) Denny’s Year-Over-Year Change +11 +10 +8 +22Overall ’24 vs. ‘192022 2023 2024 20 31 41 49 23 28 32 40 28 32 23 27 2021 2022 2023 2024 Data through Q3 2024.

36 3.76 3.79 3.83 3.99 4.22 4.36 2019 2020 2021 2022 2023 YTD 2024 SERVICE IMPROVEMENTS ARE SHOWING MEASURABLE GAINS +0.6 Average Google Rating Data through Q3 2024.

37 FOCUSED ON NARROWING VARIABILITY BETWEEN RESTAURANTS Primary Learning Plan Completion Net Sentiment Score Top 20% 88% 51 Difference 17pp 30 Bottom 20% 71% 21

38 TRAINING IMPROVEMENTS DIRECTLY IMPACT BBI & KEY RESULTS Franchisee A Franchisee B Franchisee C 88% 69% 2022 +29% vs. 32% 2022 Sales 1.6pp Traffic 0.7pp vs. Brand +18pts vs. 26% 2022 Sales 1.4pp Traffic 1.5pp vs. Brand 83% vs. 50% 2022 85% vs. 43% 2022 +17% vs. 43% 2022 Sales 1.6pp Traffic 1.4pp vs. Brand Learning Completion Overall BBI Progress Sales Impact

39 INVESTMENTS IN EQUIPMENT DRIVING PRODUCT QUALITY KITCHEN EQUIPMENT INVESTMENTS Improved Product Quality Consistent Execution Greater Efficiency New Product Opportunities

40 INVESTMENTS IN TECHNOLOGY DRIVING EFFICIENCY GAINS Server Tablets Kitchen Video Systems Improved Accuracy and Speed QR Pay Enabled GUEST FACING TECHNOLOGY ENHANCEMENTS IMPROVED GUEST EXPERIENCE XENIAL MARGINS ENHANCEMENTS $5K-$10K PER RESTAURANT Labor Efficiencies Increased Productivity Lower Waste Increased Frequency

With More Investments To Go! • Product Quality • Value Leadership • Off-Premises • Remodels • Portfolio Optimization

SVP – DENNY’S CHIEF BRAND OFFICER DENNY’S PATH TO OUTPACING CATEGORY TRAFFIC TRENDS PATTY TREVINO ~

LOOKING FORWARD, WE ARE FOCUSED ON LEVERAGING OUR BRAND STRENGTHS TO RECLAIM TRAFFIC THROUGH INCREASED FREQUENCY AND AN EXPANDING GUEST BASE.

44 DENNY’S PATH TO OUTPACING CATEGORY TRAFFIC Start with Strengths Win Key Use Occasions Engage With the Next Generation of Devotees Increasing from 2.2 visits per year to 2.5 delivers +$400K in AUV growth Increasing frequency and expanding the guest base by focusing on strengths and taking share in relevant use occasions

45 “Denny’s is a place where dreams and waffles come true.” - Stephen Colbert “Denny’s is like the Louvre. If the Louvre had a gumball machine and half the paintings were velvet.” - Patton Oswalt “Denny’s transcends all cultural and ethnic and economic boundaries. It’s a beautiful place. You can find everybody in Denny’s. I was just there.” - Flea of Red Hot Chili Peppers “It had all the coffee you could drink and no one would chase you out.” - Jensen Huang HOLD A PLACE IN RELEVANT CONVERSATIONS

46 EARNING MAJOR HEADLINES

47 DENNY’S IS ‘AMERICA’S DINER’ Only Denny’s can claim the title of America’s Diner for Today’s America Open for All Generational Spanning Memory-Maker Always-there-for-you Hospitality

48 MATERIAL VIDEO

49 FURTHER STRENGTHENING STRATEGIES BY BUILDING ON GUEST INSIGHTS WHO WE SERVE WHERE WE PLAY HOW WE WIN

50 WHO WE SERVE & WHERE WE PLAY Guests are highly diversified across multiple demographics Past 12-Month Users Denny’s Guest Profile Generation Z 18% Millennials 28% Generation X 19% Baby Boomers 32% Matures 3% Asian 10% Black / African American 15% Hispanic / Latino 34% Other 8% White (non-Hispanic / Latino) 33% Source: Technomic Consumer Survey Data Q3’23 through Q2’24 - Denny’s (n=9,498); G e n e ra ti o n E th n ic it y

51 LEVERAGING MULTIPLE ATTRIBUTES TO GROW 1. BREAKFAST food leadership OFF-PREMISES expansion VALUE leadership in family diningOff-Premises 1 2 3 Breakfast Value

52 Off-Premises Breakfast Value REIGNITE BREAKFAST GROWTH THROUGH 3 AREAS OF FOCUS CORE MENU OPTIMIZATION QUALITY INVESTMENT NEW INNOVATION

53 CRAVE-WORTHY BREAKFAST WINS UNDERWAY Menu Optimization Study Improved Bacon NEW Strawberry Stuffed French Toast Slam NEW Grand Slam Burrito (Banda) Off-Premises Breakfast Value

54 SOLIDIFY VALUE LEADERSHIP THROUGH BARBELL STRATEGY VALUE UPSELL Leverage brand strength to offer compelling value consistently, to both build traffic and add value beyond price Drive traffic through compelling value offerings Value consists of price, portion and quality Menu engineering to ensure the most profitable plates are highlighted Premium offerings featured in restaurant which facilitate new trial and elevate Denny’s image around food quality Off-Premises Breakfast Value

55

56 BEETLEJUICE COMMERCIAL Off-Premises Breakfast Value

57 COMMERCIAL Off-Premises Breakfast Value

58 Off-Premises Breakfast Value $2 $4 $6 $8 EXCITEMENT FROM FANS

+2.0% to +2.5% SALES LIFT Date Range: 8/22/2024 – 9/25/2024 (5 weeks).

60 ACCELERATE OFF-PREMISES GROWTH BY INVESTING IN EASE AND ACCESS Third-Party Marketplaces First-Party Channels (Web and App) Off-Premises Breakfast Value

61 GROW DIGITAL AND OFF-PREMISES SALES Off-Premises Breakfast Value HIGH LIFETIME VALUE 1% OVERLAP BETWEEN GUESTS LATE NIGHT BUSINESS PAID DIGITAL CHANNELS

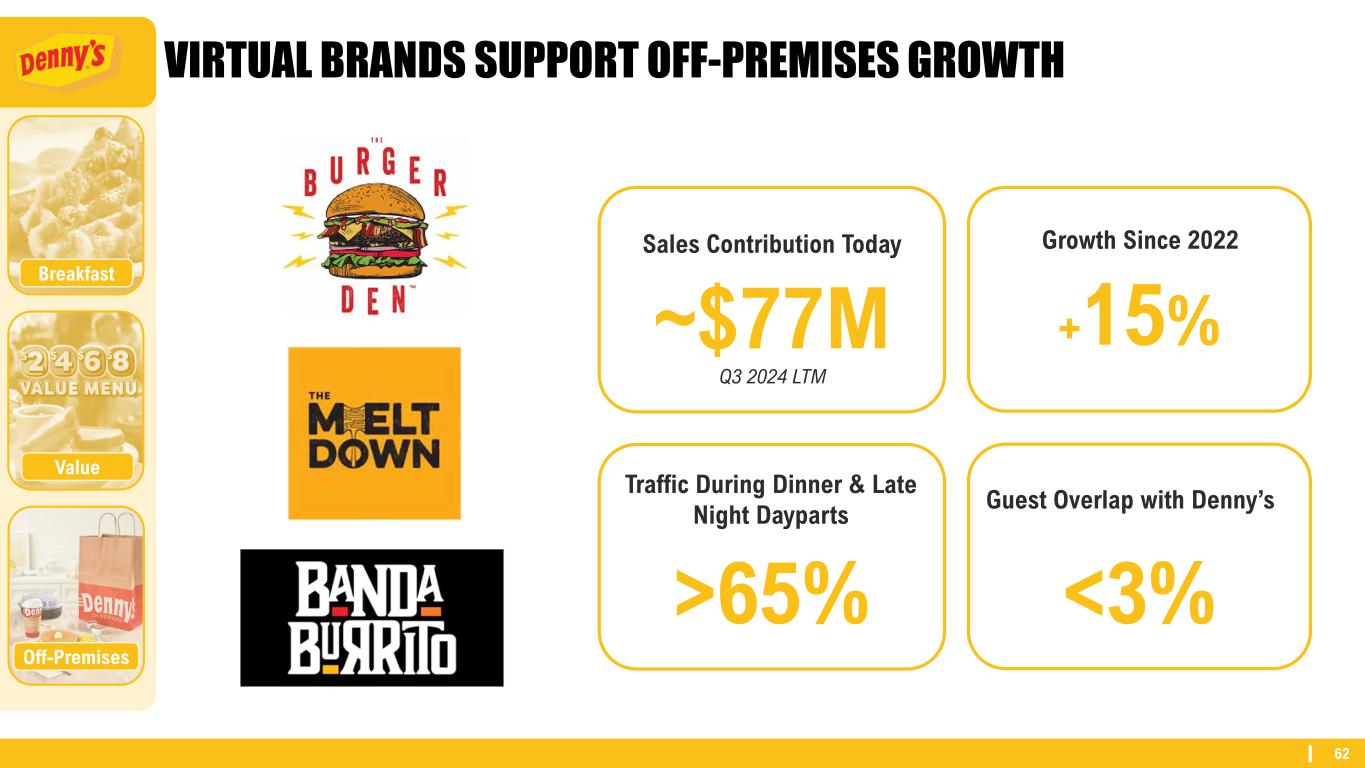

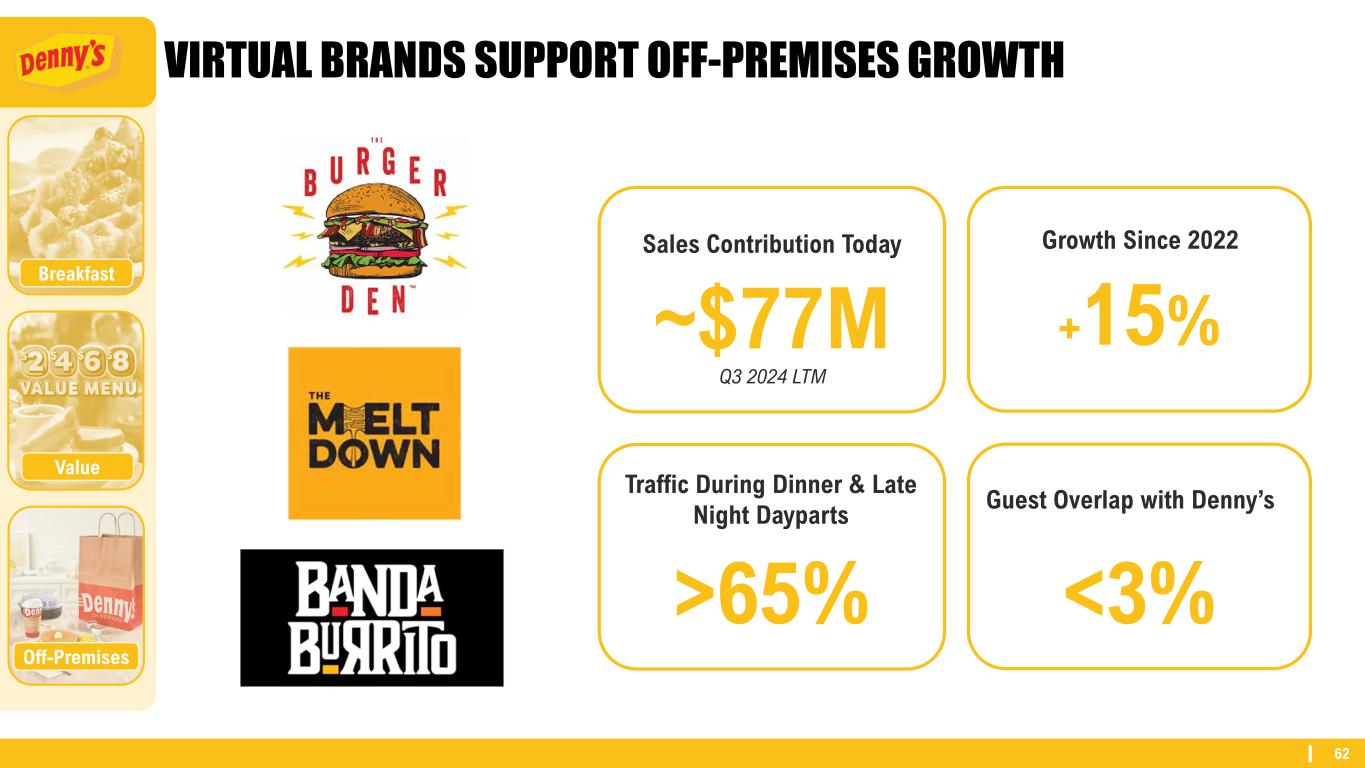

62 VIRTUAL BRANDS SUPPORT OFF-PREMISES GROWTH ~$77M +15% >65% <3% Traffic During Dinner & Late Night Dayparts Growth Since 2022 Guest Overlap with Denny’s Sales Contribution Today Off-Premises Breakfast Value Q3 2024 LTM

63 UNLOCKING THE POWER OF THIS ICONIC BRAND Owning Brand Positioning Optimized Media Support Personalization through Loyalty/CRM

64 BRAND POSITIONING Personalization through CRM Brand Positioning Increased Media Support EMBRACING “AMERICA’S DINER” BRAND POSITIONING

65 LEVERAGING MARKETING CO-OP OPPORTUNITY Personalization through CRM Brand Positioning Media Optimization 54 Co-ops — 100% Opt-in 1,106 restaurants 85% of the Denny’s System Co-op program provides a match to Co-ops that contribute 0.5% into the program. ($8.6M Franchisee Contributions) 16 Co-ops reactivated since 2023

66 PERSONALIZATION THROUGH CRM Personalization through CRM Brand Positioning Increased Media Support 72% of CONSUMERS ONLY ENGAGE WITH PERSONALIZED MESSAGES Smart Insights Study 2020 81% of CONSUMERS WANT BRANDS TO UNDERSTAND THEM BETTER…AND KNOW WHEN AND HOW TO APPROACH THEM Accenture Study 2019

67 PERSONALIZATION THROUGH CRM Personalization through CRM Brand Positioning Increased Media Support IDENTIFYING the Customer where they are available to connect the Brand Value UNDERSTANDING what the Customer needs and how they are open to engaging with Denny’s ENGAGING the right message to those Customers who are going to help us achieve our goals PERSONALIZATION & RELEVANCY

68 REDESIGNING AND RELAUNCHING LOYALTY PROGRAM Off-Premises Breakfast Value COUPON DISTRIBUTION EASY AND PERSONALIZED • ~5M Active Members •Loyalty Guests Visit 1.4x More Per Year • +$44M In System Sales Contribution • No Personalization • New Digital Team Leading the Redesign •New Program Targeted for 2H 2025 •Points Based System Incentivizing Earn/Burn for Easy Data Collection •Leverage Data for Offer Personalization •External Communication for Member Acquisition •Potential Sales Lift through Database Growth and Frequency FROM TO

69 GUEST FIRST APPROACH turning tactics into meaning

IGNITE CRAVE IGNITE CONNECTION IGNITE CULTURE FOOD THAT’S CRAVEABLE AND OWNABLE EASY TO ACCESS DENNY’S AMPLIFY OUR VOICE

EVP – CHIEF DEVELOPMENT OFFICER PORTFOLIO GROWTH AND OPTIMIZATION STEVE DUNN

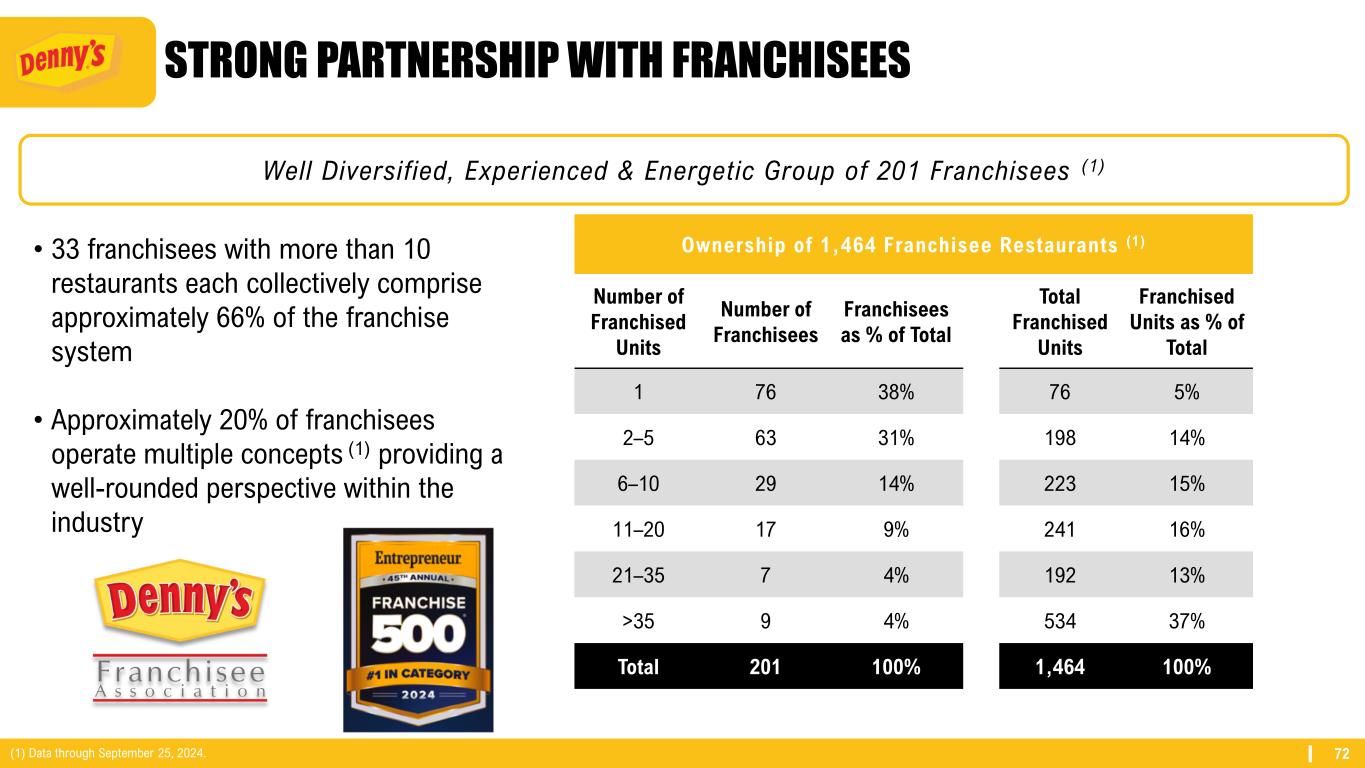

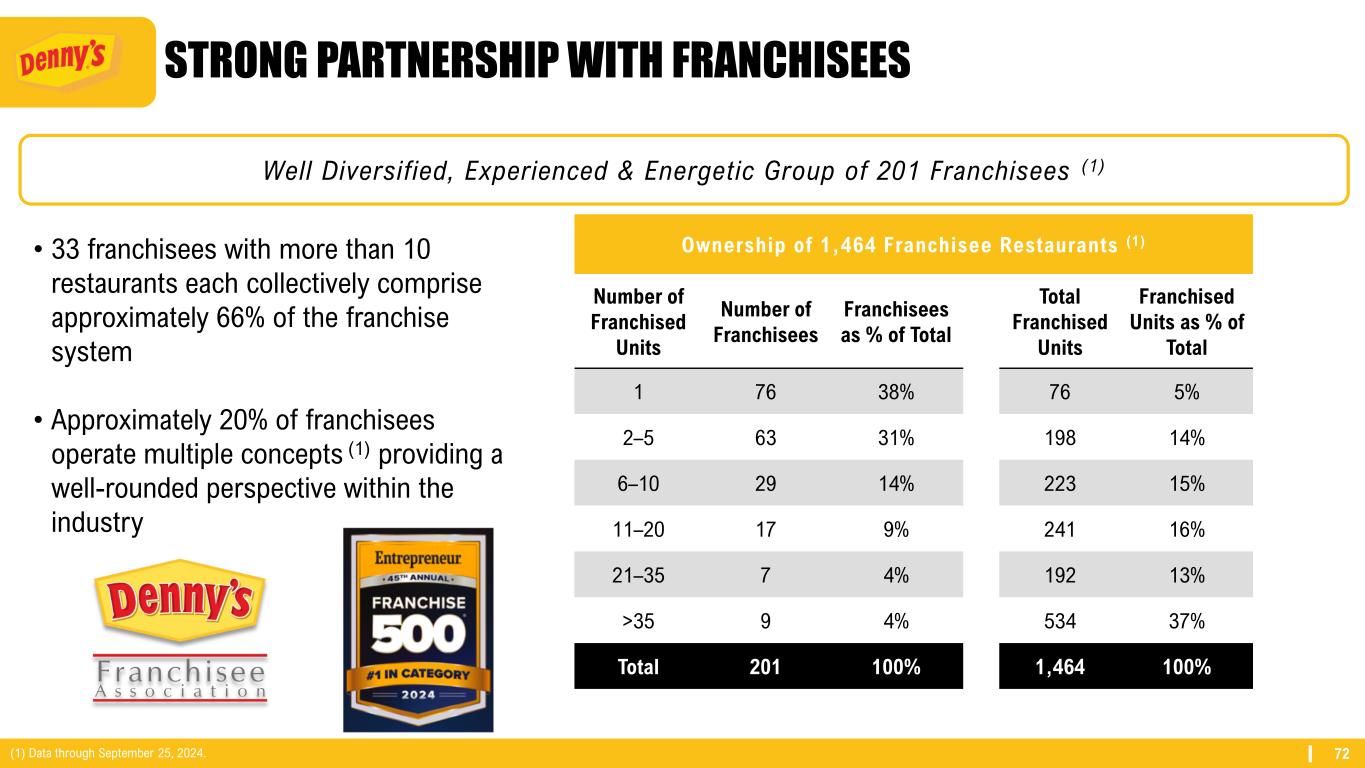

72 STRONG PARTNERSHIP WITH FRANCHISEES Well Diversified, Experienced & Energetic Group of 201 Franchisees (1) • 33 franchisees with more than 10 restaurants each collectively comprise approximately 66% of the franchise system • Approximately 20% of franchisees operate multiple concepts (1) providing a well-rounded perspective within the industry Ownership of 1,464 Franchisee Restaurants (1) Number of Franchised Units Number of Franchisees Franchisees as % of Total Total Franchised Units Franchised Units as % of Total 1 76 38% 76 5% 2–5 63 31% 198 14% 6–10 29 14% 223 15% 11–20 17 9% 241 16% 21–35 7 4% 192 13% >35 9 4% 534 37% Total 201 100% 1,464 100% (1) Data through September 25, 2024.

73 DOMESTIC FOOTPRINT 5 8 44 30 3 11 6 13 27 26 4 4 23 4 3 2 1 82 360 19 119 5 22 2 7 4 23 40 13 30 17 9 20 33 9 196 41 4 2 3 1 3 20 1 2 34 1 2 3 5 6 Total of 1,358 restaurants in the U.S. with strongest presence in California, Texas, Florida and Arizona (1). Top DMAs Number of Restaurants 42% of Domestic System Los Angeles 170 12.5% Houston 65 4.8% Phoenix 64 4.7% Dallas / Ft. Worth 50 3.7% Sacramento / Stockton 44 3.2% Orlando / Daytona 39 2.9% San Francisco / Oakland 38 2.8% San Diego 35 2.6% Las Vegas 34 2.5% Miami / Ft. Lauderdale 33 2.4% (1) Data through September 2023 3 27 8 6 5 10 44 30 11 12 26 4 4 23

74 INTERNATIONAL FOOTPRINT Countries & U.S. Territories Number of Restaurants United States 1,358 Canada 86 Philippines 16 Puerto Rico 15 Mexico 15 Honduras 7 New Zealand 7 United Arab Emirates 5 Guatemala 4 Costa Rica 3 El Salvador 3 Guam 2 Indonesia 2 Curacao 1 United Kingdom 1 Total System 1,525 Denny’s Global Footprint (1) Strong International Prescence of 167 restaurants with over 50% in Canada(1). (1) Data through September 2023

75 GLOBAL DEVELOPMENT PIPELINE (1) Data through September 2023 16 12 12 20 17 7 14 8 8 8 11 3 30 20 20 28 28 10 0 5 10 15 20 25 30 35 2019 2020 2021 2022 2023 Q3 2024 YTD Domestic Openings International Openings System Openings 2024 Guidance 18 - 24 Robust Pipeline of Nearly 150 Global Development Commitments

76 PORTFOLIO ASSESSMENT – PREPARING FOR GROWTH Domestic Franchise Portfolio Quintile Assessment Average AUV Average EBITDA Strategies Quintile 1 $2.9M $250k - $350k Continue growing; benefitted from pricing power and growing off- premises businessQuintile 2 $2.1M Quintile 3 $1.7M $125k - $175k Strategies to improve sales and profitability will continue to lift these restaurantsQuintile 4 $1.4M Quintile 5 $1.1M <$25k Some closures will be necessary, some will be acquired by stronger operators, some will improve based on execution of strategies Key Growth Units Assess for Closure / Rehabilitation (1) As of latest quintile assessment for the LTM period as of August 2023. Steady Contributors (1)

77 Rehabilitate ~40% Consider for Closure Through 2025 ~60% ~150 total restaurants ~50 to close in 2024 By closing lower volume restaurants and opening higher volume restaurants, the overall health of the brand is improving and will result in higher AUVs and net unit growth in the future PORTFOLIO OPTIMIZATION – PREPARING FOR GROWTH Quintile 5 Assessment: Evaluate closures based on demand and cash flow results • Comprehensive operations business reviews • Improved customer service training efforts • Incremental local store marketing efforts • Review lease terms for potential savings Playbook to Elevate Performance

78 $1.1 $1.9 $2.3 Franchise Closures Existing Franchise New Franchise Openings NEW RESTAURANTS OUTPERFORM Average Unit Sales Volumes ($Ms)

79 DENNY’S VIDEO

80 REMODELS UNDERWAY +6.4% SALES LIFT +6.5% TRAFFIC LIFT 17 REMODELS COMPLETED TO DATE ~$250k AVERAGE INVESTMENT Results based on APT pre/post vs. control analysis.

81 LOW INVESTMENT, HIGH LIFT IN V E S TM E N T SALES LIFT Source: Restaurant Research LLC: 2024 Chain Remodeling Analysis Report $300K $200K $100K $500K+ $400K 2% 6%4% 8% 6.4% SALES LIFT

82 HELPING FRANCHISEE GROW Remodel Financial Support Upfront cash after completion of remodel in exchange for a higher royalty rate Remodel Acceleration Incentives Increased incentives for each year a remodel is accelerated compared to the due date Supported Financing Third-party $25M remodel loan pool 1 2 3

CHIEF EXECUTIVE OFFICER RISE OF A NEW DAY & KEY TAKEAWAYS KELLI VALADE

84 • Growth in TRAFFIC • Ownable, Clear Value Proposition • Optimized Digital & Off-Premises Channels • Traffic Driving Creative & Media Plan • Best In Class CRM & Loyalty Program • Net Positive Unit Growth • Stronger ROI from Investments in Food, Technology & Restaurant Image • Growth from CHECK • Discounting Throughout the Menu • Digital & Off-Premises Channels • Improved Messaging & Working Media • Customer Database • Negative Unit Growth • Proven, Tested Initiatives RISE OF A NEW DAY Where We Are GoingToday

85 KEY THEMES AUV Growth Restaurant Growth Margin Growth Cash Flow & Capital Allocation

Q&A

PRESIDENT, KEKE’S INC. DAVID SCHMIDT

88 THE KEKE'S LEADERSHIP TEAM David Schmidt President September, 2022 Manuel Rodriguez VP of Operations March, 2023 Annalise Miller VP People & Culture May, 2023

OUR PURPOSE: TO CREATE FRESH STARTS FOR EVERYONE, EVERY DAY. OUR VISION: TO SERVE 40 MILLION FRESH STARTS ANNUALLY BY 2030. WELCOME TO KEKE'S BREAKFAST CAFE

90 BRAND HISTORY Keke's grew to 53 locations before the acquisition by focusing on quality ingredients, operational excellence, and service – with no marketing. These core competencies are critical to protect and weave into the brand's story as we look to the future. First Keke’s Breakfast Cafe opens in Orlando, FL November 2006 50th cafe opens in Wesley Chapel, FL February 2021 Acquired by Denny’s Corporation May 2022 First cafe outside of Florida opens in Hendersonville, TN January 2024 First cafes in Colorado and California open Keke's is now coast to coast! October 2024

91 KEKE’S BREAKFAST CAFE BY THE NUMBERS of operating experience since opening in 2006. Extensive restaurant experience. 11 Company Cafes 51 Franchised Cafes 3 States and Growing Strong revenues with limited operating hours of 7:00am– 2:30pm. Top performing cafes generate $3M+ AUV. Primarily in-line locations with footprints of 3,800– 4,500 ft2 require less upfront capital and have lower maintenance costs. 18 Years 62 Cafes(1) $1.8M+ AUV <4,500 ft2 Product Mix Combines great economics and rapid growth trajectory with industry-leading service and quality standards. Data through October 19, 2024. After the end of Q3 2024, Keke’s opened one additional franchise cafe in Colorado.

92 FOOTPRINT Orlando Tampa Gainesville Jacksonville Tallahassee West Palm BeachFort Myers DMA Cafes % of FL Sales Orlando 25 44% Tampa 20 31% Jacksonville 5 7% West Palm Beach 4 9% Fort Myers 3 5% Gainesville 1 2% Tallahassee 1 2% Florida Tennessee 2 Nashville Colorado 1 Denver Data through October 19, 2024. After the end of Q3 2024, Keke’s opened one additional franchise cafe in Colorado.

93 SOLIDIFYING FOUNDATION Leadership Team Training Technology Insights & Analytics Marketing Supply Chain Culture Operations

94 VIDEO

"There are two types of guests–those who love Keke's Breakfast Cafe and those who haven't tried us yet!” BRAND DIFFERENTIATORS

96 DAYTIME EATERY CATEGORY IS HIGHLY SEGMENTED The Daytime Eatery category is highly regional and fragmented

97 UNIQUELY POSITIONED TO LEAD IN THIS FAST-GROWING CATEGORY Franchised Structure Visionary Leadership Winning Recipe Denny’s Partnership

98 SIGNIFICANT COMPETITIVE ADVANTAGE Franchised Structure Visionary Leadership Winning Recipe Denny’s Partnership 1. World-Class Franchisor 2. Shared Support Structure 3. Benefits of Scale

99 ASSET LIGHT GROWTH STRATEGY LEVERAGES DENNY’S EXPERTISE Franchised Structure Visionary Leadership Winning Recipe Denny’s Partnership 1. No franchisor of scale in Daytime Eatery space 2. Existing franchisees eager to grow 3. Operational experience in difficult markets

100 EXPERIENCED LEADERSHIP Franchised Structure Visionary Leadership Winning Recipe Denny’s Partnership 1. Experienced Leadership Team 2. Small but mighty 3. Culture of Accountability, Recognition & Collaboration

101 WELL-LOVED BRAND WITH EXCEPTIONAL GUEST LOYALTY Franchised Structure Visionary Leadership Winning Recipe Denny’s Partnership 1. Abundance (Portion size) 2. Fresh/Quality 3. Service 4. Atmosphere

102 AWARD WINNING RECOGNITION FOR QUALITY FOOD

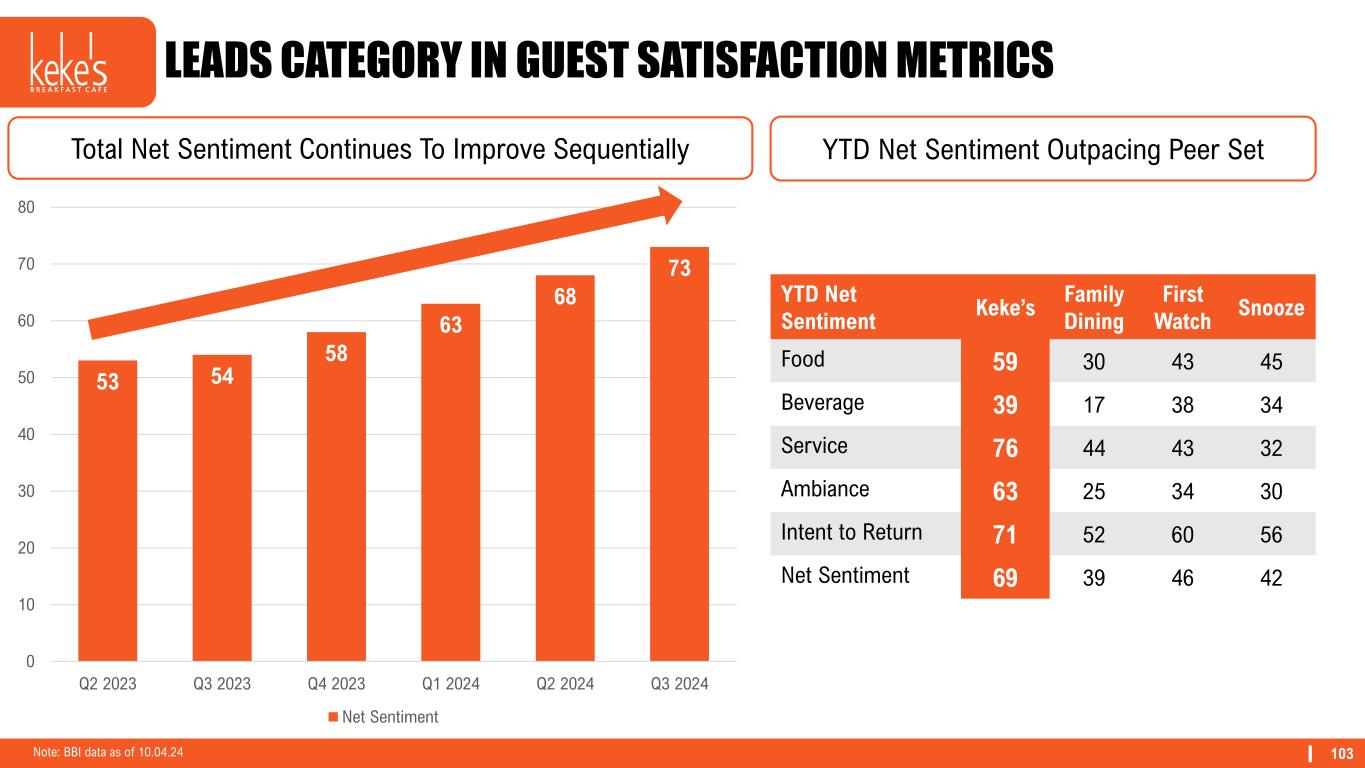

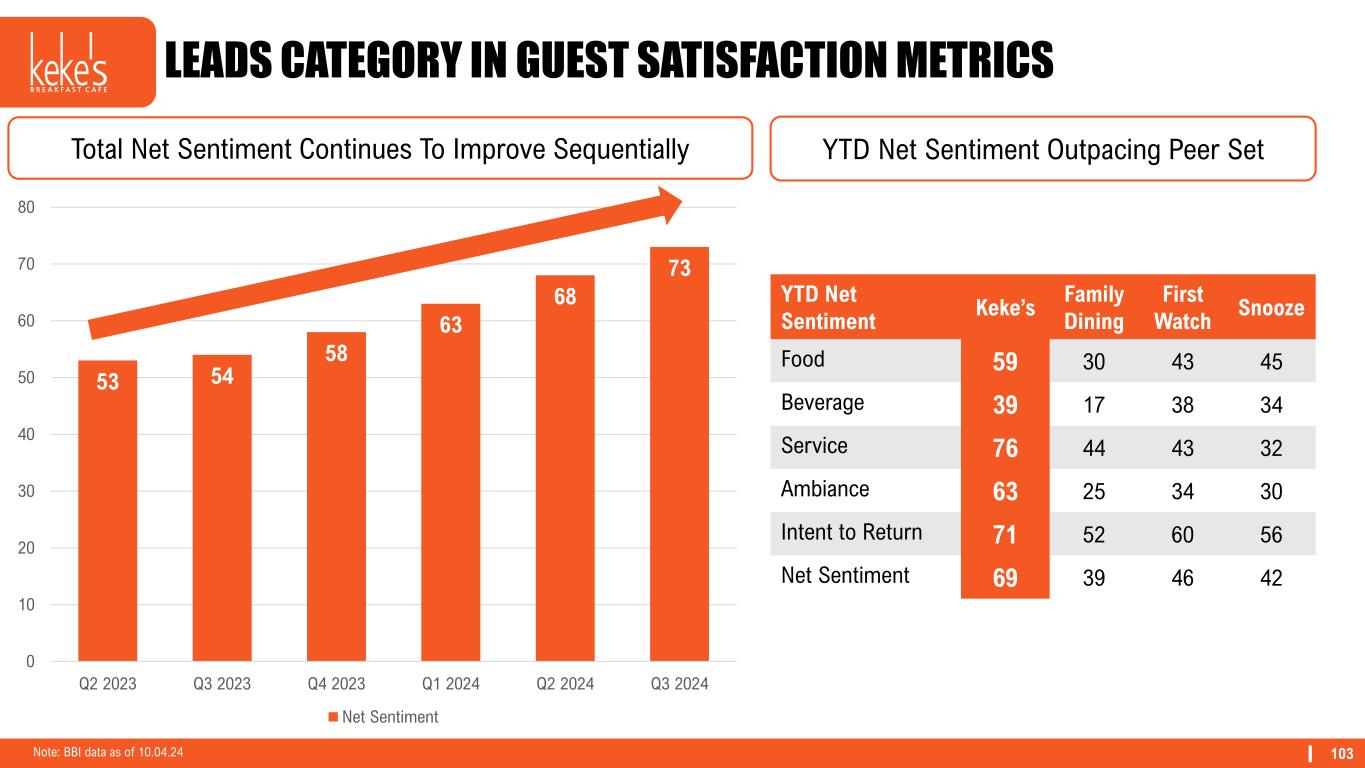

103 53 54 58 63 68 73 0 10 20 30 40 50 60 70 80 90 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Net Sentiment LEADS CATEGORY IN GUEST SATISFACTION METRICS Note: BBI data as of 10.04.24 YTD Net Sentiment Keke’s Family Dining First Watch Snooze Food 59 30 43 45 Beverage 39 17 38 34 Service 76 44 43 32 Ambiance 63 25 34 30 Intent to Return 71 52 60 56 Net Sentiment 69 39 46 42 Total Net Sentiment Continues To Improve Sequentially YTD Net Sentiment Outpacing Peer Set

104 OVERALL GOOGLE STAR RATING IS BEST IN CLASS Note: BBI data as of 10.04.24 Average rating 4.45 4.75 4.54 2022 2023 2024YTD

105 FLORIDA SALES TRENDS Same-Restaurant Sales* Have Experienced Recent Improvements – Closed the Gap in Q3 2024 Florida has Trailed the US Same-Restaurant Sales Benchmarks for Seven Consecutive Quarters -6% -4% -2% 0% 2% 4% 6% 8% 10% 12% Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Florida Same-Restaurant Sales* BBI Family - US BBI Family - FL Keke's *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP.

106 SIGNIFICANT AUV GROWTH OPPORTUNITIES Design & Remodel • First cafe with new design opened in Jan 2024 • First remodel completed in July 2024 Beverage Program • Phase 1 rolled out Q2/Q3 ’24 • Phase 2 testing in New Cafes Marketing • 1% marketing contribution initiated in mid-2023 • Increased to 2% in 2024 Traffic Driving Levers Off-Premises • Active in 97% of cafes • Q3 2024 - 16% of sales

107 BEVERAGE PROGRAM Design & Remodel Off-Premises Beverage Program Marketing • Phase 1 Complete • Mimosa, Bellini, Sangria • Rolled out in Q1 2024 • Active in 80% of system • 4%-6% Incremental Sales • Phase 2 Testing • Includes expanded cocktail menu and espresso beverages

108 EVOLVING MARKETING PROGRAM Design & Remodel Off-Premises Beverage Program Marketing • First paid media campaign in Q3’24 • 4%-6% Transaction Lift

109 DESIGN & REMODEL INITIATIVE Design & Remodel Off-Premises Beverage Program Marketing • Six new cafes currently on the updated image • First remodel completed in July 2024

11 0 EARLY REMODEL PROGRAM RESULTS +6%-8% SALES LIFT +30% IRR ~25%+ CASH ON CASH $150K+ CAPEX Target Metrics

111 OFF-PREMISES Design& Remodel Off-Premises Beverage Program Marketing • Early Phase of Opportunity • Grown from 14% in 2023 to 16% in Q3 2024 • Target 18%-20% of sales

112 KEKE’S GROWING PARTNERSHIP WITH FRANCHISEES Ownership of 51 Franchisee Restaurants (1) Number of Franchised Units Number of Franchisees Franchisees as % of Total Total Franchised Units Franchised Units as % of Total 1 9 47% 9 18% 2–5 8 42% 28 54% 6–10 2 11% 14 27% Total 19 100% 51 100% Rapidly Expanding Group of 19 Franchisees (1) • 2 franchisees with more than 5 restaurants each collectively comprise approximately 27% of the franchise system • Majority of existing franchisees are solely focused on operating Keke’s franchises • Company seeks to leverage both Keke's and Denny's existing franchisee networks for the 250+ franchised Keke’s units expected to open over the next five years (1) Data through October 19, 2024

113 1 0 0 0 1 1 2 3 4 5 6 7 8 7 3 2 3 4 14 0 2 4 6 8 10 12 14 16 18 20 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 LONG RANGE OUTLOOK - PORTFOLIO GROWTH New Cafe Openings (2006 – 2024) New Cafe Growth Pipeline of Over 140 Expected to Come From: 2024 Midpoint of Guidance Long-Range Outlook 25%-30% Cafe Growth CAGR Additional Development Expected through Seed & Feed Strategy and New Franchisees

114 IMPLEMENTING SEED & FEED STRATEGY Build New Company Cafes Refranchise Cash Outflow • Launch into new market • Build initial market presence • Establish efficiencies Cash Inflow • Capital return • Secure additional development commitments • Franchisee to build out market • Targeting an 85%-90% franchise mix

115 UNTAPPED WHITE-SPACE – OVER 140 DEVELOPMENT COMMITMENTS

116 RISE OF A NEW DAY • Small, but Expanding Regional Chain • Leveraging Shared Services Support From Denny’s Corporation • Updated Design Menu • Building Marketing Foundation • Slow and Steady Growth • Tested Remodel Image • Largest National Franchisor in the Daytime Eatery Space • Maximizing Shared Services Support from Denny’s Corporation • Strategic Menu Engineering • Leveraging a Robust Brand Building Fund to Drive Incremental Sales • Aggressive Growth • System Gains From Remodel Rollout Where We Are GoingToday

117 KEY THEMES AUV Growth Restaurant Growth Margin Growth Cash Flow & Capital Allocation

Q&A

BREAK

FRANCHISEE FIRESIDE CHAT

121 ROLAND SPONGBERG ✓ Joined the Denny’s franchise system in 2004 ✓ Largest Denny’s franchisee with 108 restaurants nationwide ✓ 23% of portfolio is non-traditional travel center locations ✓ Early adopter of the new remodel design and POS rollout ✓Diversified portfolio consisting of Wendy’s, El Pollo Loco, Krispy Kreme and Blaze Pizza

122 CLYDE RUCKER ✓ Joined the Denny’s franchise system in 2017 and expanded his portfolio through Denny’s refranchising and development program ✓ 9th largest Denny’s franchisee with 36 restaurants across Texas and Florida ✓Was an early adopter of the new remodel program and has invested to convert over 35% of his portfolio already ✓ Early adopter of the new POS rollout ✓Diversified portfolio includes Jack In the Box

123 ✓Opened their first Keke’s Cafe in 2017 ✓Owns 6 Keke’s Cafes in the Orlando and Ft Myers areas ✓ Currently has 2 additional Keke’s Cafes under construction ✓Has the 2nd largest AUV cafe in the Keke’s system JOHN EHRHARD

124 ✓Opened their first Keke’s Cafe in 2014 ✓Operate 7 Keke’s Cafes in the Tampa/St. Petersburg DMA ✓ Plans to expand into Georgia very soon! JORDAN & ASHLEY SWAN

125 FRANCHISEE Q&A MODERATED BY RAPHAEL GROSS Roland Spongberg Clyde Rucker John Ehrhard Ashley Swan

EVP – CHIEF FINANCIAL OFFICER LONG-RANGE OUTLOOK ROBERT VEROSTEK

127 KEY THEMES AUV Growth Restaurant Growth Margin Growth Cash Flow & Capital Allocation

128 RECALIBRATING G&A $63 $9 Q3 2024 LTM Corporate Administrative Expenses Franchise Operating Margin G&A $72M 5%-6% Reduction1 G&A reduction partially offset in 2025 by ~1.5% due to the 53rd week.

129 Near-Term Expectations • Expect higher portion of free cash flow to be deployed against capital expenditures: • Accelerating company remodels for both brands through 2026 • At least 50% of new Keke’s openings expected to be company cafes followed by a seed and feed strategy BALANCING CAPITAL ALLOCATION FOR LONG-TERM GAIN $27 $16 $14 $17 $22 $27 $20 $22 $14 $7 $7 $7 $12 $10 $18 $4 $22 $22 $25 $36 $106 $59 $83 $68 $96 $34 $31 $65 $52 $11 $31 $38 $36 $42 $58 $133 $78 $105 $82 $103 $41 $38 $77 $62 $29 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 YTD Q3 2024 Capital Expenditures Share Repurchases Total Investments

130 Rise of a New Day 5% - 7% Adjusted EBITDA* Growth CAGR Flat to Slightly Positive Same- Restaurant Sales* 3% Net Unit Growth CAGR 5% - 6% G&A Reduction Over Next 12 Months Balancing Seed & Feed with Share Repurchases 2.5x – 3.5x Debt Leverage LONG-RANGE OUTLOOK 0% - 1% UNIT GROWTH CAGR $2.2M AUV TARGET Mid-Teens COMPANY MARGIN TARGET 25% - 30% UNIT GROWTH CAGR $2.2M AUV TARGET Upper-Teens COMPANY MARGIN TARGET *Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. Additionally, see Appendix for reconciliation of Net Income (Loss) to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income to Non-GAAP Financial Measures.

CHIEF EXECUTIVE OFFICER CLOSING THOUGHTS KELLI VALADE

132 RECAP OF COMPELLING BUSINESS MODEL Largest National Franchisor in the Daytime Eatery Space Maximizing Shared Services Support from Denny’s Corporation Strategic Menu Engineering Leveraging a Robust Brand Building Fund to Drive Incremental Sales Aggressive Growth System Gains From Remodel Rollout % of Sales (a) Growth in TRAFFIC Ownable, Clear Value Proposition Optimized Digital & Off-Premises Channels Traffic Driving Creative & Media Plan Best In Class CRM & Loyalty Program Net Positive Unit Growth Stronger ROI from Investments in Food, Technology & Restaurant Image Enhanced Long-Term Cash Flow Generation Higher Total Shareholder Return

Q&A

Appendix

136 RECONCILIATION OF NET INCOME (LOSS) TO NON-GAAP FINANCIAL MEASURES $ Millions 2018 2019 20201 2021 2022 2023 YTD Sep 2024 Net Income (Loss) $43.7 $117.4 ($5.1) $78.1 $74.7 $19.9 $14.8 Provision for (Benefit from) Income Taxes 8.6 31.8 (2.0) 26.0 24.7 7.0 4.2 Goodwill Impairment Charges - - - - - 6.4 0.0 Operating (Gains) Losses and Other Charges, Net 2.6 (91.2) 1.8 (46.1) (1.0) 2.5 2.0 Other Nonoperating Expense (Income), Net 0.6 (2.8) (4.2) (15.2) (52.6) 8.3 (1.7) Share‐Based Compensation Expense 6.0 6.7 7.9 13.6 11.4 8.9 8.4 Deferred Compensation Plan Valuation Adjustments (1.0) 2.6 1.6 2.1 (2.2) 1.9 1.4 Interest Expense, Net 20.7 18.5 18.0 15.1 13.8 17.6 13.6 Depreciation and Amortization 27.0 19.8 16.2 15.4 14.9 14.4 10.9 Legal Settlement Expenses 0.3 1.1 0.5 2.1 4.2 2.3 1.8 Pre-Opening Expenses 0.1 0.0 - - - 0.3 0.8 COVID-19 Related Expenses - - 3.5 (1.4) - - - Leadership Transition Costs - - - - 0.3 - - Acquisition Costs - - - - 0.6 - - Other Adjustments 0.2 (0.0) 0.0 - (0.1) (0.1) 2.5 Adjusted EBITDA $108.8 $104.0 $38.2 $89.8 $88.8 $89.4 $58.7 Adjusted EBITDA Margin % 17.3% 19.2% 13.0% 22.6% 19.4% 19.3% 17.4% Net Income (Loss) $43.7 $117.4 ($5.1) $78.1 $74.7 $19.9 $14.8 (Gains) Losses and Amort. on Interest Rate Swap Derivatives, Net - - (2.2) (12.6) (55.0) 11.0 0.5 Losses (Gains) on Sales of Assets and Other, Net (0.5) (93.6) (4.7) (47.8) (3.4) (2.2) (0.1) Impairment Charges2 1.6 - 4.1 0.4 1.0 8.6 0.8 Legal Settlement Expenses 0.3 1.1 0.5 2.1 4.2 2.3 1.8 Pre-Opening Expenses 0.1 0.0 - - - 0.3 0.8 COVID-19 Related Expenses - - 3.5 (1.4) - - - Leadership Transition Costs - - - - 0.3 - - Acquisition Costs - - - - 0.6 - - Other Adjustments 0.2 (0.0) 0.0 - (0.1) (0.1) 2.5 Tax Effect3 (0.3) 23.8 (0.3) 14.8 13.0 (5.0) (1.4) Adjusted Net Income (Loss) $45.0 $48.6 ($4.2) $33.6 $35.4 $34.8 $19.7 Net Income (Loss) Per Share - Diluted $0.67 $1.90 ($0.08) $1.19 $1.23 $0.35 $0.28 Adjustments Per Share $0.02 ($1.11) $0.01 ($0.68) ($0.65) $0.27 $0.09 Adjusted Net Income (Loss) Per Share $0.69 $0.79 ($0.07) $0.51 $0.58 $0.62 $0.37 Diluted Weighted Average Shares Outstanding (000’s) 65,562 61,833 60,812 65,573 60,879 56,196 52,739 1. Includes 53 operating weeks. 2. Impairment charges include goodwill impairment charges of $6.4 million and less than $0.1 million for full year 2023 and for year-to-date period ended June 26, 2024, respectively. 3. Tax adjustments for full year 2018, 2019, 2020, 2021, 2022, 2023 and year-to-date period ended September 25, 2024 reflect an effective tax rate of 16.4%, 25.7%, 25.6%, 25.0%, 24.9%, 25.0% and 22.2%, respectively.

137 RECONCILIATION OF OPERATING INCOME TO NON-GAAP FINANCIAL MEASURES The Company believes that, in addition to GAAP measures, certain other non-GAAP financial measures are useful information to investors and analysts to assist in the evaluation of restaurant-level operating efficiency and performance of ongoing restaurant-level operations. However, non-GAAP measures should be considered as a supplement to, not a substitute for, operating income, net income, and net income per share, or other financial performance measures prepared in accordance with GAAP. The Company uses restaurant-level operating margin, company restaurant operating margin and franchise operating margin internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including incentive compensation for certain employees. Restaurant-level operating margin is the total of company restaurant operating margin and franchise operating margin and excludes: (i) general and administrative expenses, which include primarily non-restaurant-level costs associated with support of company and franchised restaurants and other activities at their corporate office; (ii) depreciation and amortization expense, substantially all of which is related to company restaurant-level assets, because such expenses represent historical sunk costs which do not reflect current cash outlays for the restaurants; (iii) special items, included within operating (gains), losses and other charges, net, to provide investors with a clearer perspective of its ongoing operating performance and a more relevant comparison to prior period results. Company restaurant operating margin is defined as company restaurant sales less costs of company restaurant sales (which include product costs, company restaurant level payroll and benefits, occupancy costs, and other operating costs including utilities, repairs and maintenance, marketing and other expenses) and presents it as a percent of company restaurant sales. Adjusted company operating restaurant margin is defined as company restaurant operating margin less certain items such as legal settlement expenses, pre-opening expenses, and other items the Company does not consider in the evaluation of its ongoing core operating performance. Franchise operating margin is defined as franchise and license revenue (which includes franchise royalties and other non-food and beverage revenue streams such as initial franchise and other fees, advertising revenue and occupancy revenue) less costs of franchise and license revenue and presents it as a percent of franchise and license revenue. Adjusted franchise operating margin is defined as franchise operating margin less certain items the Company does not consider in the evaluation of its ongoing core operating performance. Adjusted restaurant-level operating margin is the total of adjusted company restaurant operating margin and adjusted franchise operating margin and is defined as restaurant-level operating margin adjusted for certain items the Company does not consider in the evaluation of its ongoing core operating performance. These adjustments are either non- recurring in nature or vary from period to period without correlation to the Company's ongoing core operating performance. See most recent press release for a further breakdown of adjusted restaurant-level operating margin. $ Millions 2018 2019 20201 2021 2022 2023 YTD Sep 2024 Operating Income $73.6 $165.0 $6.7 $104.1 $60.6 $52.8 $30.9 General and Administrative Expenses 63.8 69.0 55.0 68.7 67.2 77.8 61.5 Depreciation and Amortization 27.0 19.8 16.2 15.4 14.9 14.4 10.9 Goodwill Impairment Charges - - - - - 6.4 0.0 Operating (Gains) Losses and Other Charges, Net 2.6 (91.2) 1.8 (46.1) (1.0) 2.5 2.0 Restaurant-Level Operating Margin $167.1 $162.7 $79.7 $142.1 $141.6 $153.9 $105.3 Restaurant-Level Operating Margin Consists Of: Company Restaurant Operating Margin (2) 63.2 48.0 3.6 28.1 20.3 27.9 16.9 Franchise Operating Margin (3) 104.0 114.7 76.1 114.0 121.3 125.9 88.5 Restaurant-Level Operating Margin $167.1 $162.7 $79.7 $142.1 $141.6 $153.9 $105.3 Adjustments (4) 0.6 1.1 6.4 1.3 4.2 2.5 5.1 Adjusted Restaurant-Level Operating Margin $167.7 $163.7 $86.1 $143.4 $145.8 $156.4 $110.5 Adjusted Restaurant-Level Operating Margin Consists Of: Adjusted Company Restaurant Operating Margin 63.5 49.0 2.6 30.4 24.5 30.5 19.5 Adjusted Franchise Operating Margin 104.1 114.7 83.6 112.9 121.3 125.9 91.0 Adjusted Restaurant-Level Operating Margin $167.7 $163.7 $86.1 $143.4 $145.8 $156.4 $110.5 1. Includes 53 operating weeks. 2. Company restaurant operating margin is calculated as operating income plus general and administrative expenses; depreciation and amortization; operating (gains), losses and other charges, net; and costs of franchise and license revenue, excluding depreciation and amortization; less franchise and license revenue. 3. Franchise operating margin is calculated as operating income plus general and administrative expenses; depreciation and amortization; operating (gains), losses and other charges, net; and costs of company restaurant sales, excluding depreciation and amortization; less company restaurant sales. 4. Adjustments include legal settlement expenses, pre-opening costs, and other adjustments the Company does not consider in the evaluation of its ongoing core operating performance. Adjustments for the quarter and year-to-date period ended September 25, 2024 include a $2.6 million distribution to franchisees related to a review of advertising costs.