000085046012/312024Q1FALSE00008504602024-01-012024-03-3100008504602024-04-24xbrli:shares00008504602024-03-31iso4217:USD00008504602023-12-31iso4217:USDxbrli:shares00008504602023-01-012023-03-310000850460us-gaap:CommonStockMember2023-12-310000850460us-gaap:AdditionalPaidInCapitalMember2023-12-310000850460us-gaap:TreasuryStockCommonMember2023-12-310000850460us-gaap:RetainedEarningsMember2023-12-310000850460us-gaap:RetainedEarningsMember2024-01-012024-03-310000850460us-gaap:CommonStockMember2024-01-012024-03-310000850460us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000850460us-gaap:CommonStockMember2024-03-310000850460us-gaap:AdditionalPaidInCapitalMember2024-03-310000850460us-gaap:TreasuryStockCommonMember2024-03-310000850460us-gaap:RetainedEarningsMember2024-03-310000850460us-gaap:CommonStockMember2022-12-310000850460us-gaap:AdditionalPaidInCapitalMember2022-12-310000850460us-gaap:TreasuryStockCommonMember2022-12-310000850460us-gaap:RetainedEarningsMember2022-12-3100008504602022-12-310000850460us-gaap:RetainedEarningsMember2023-01-012023-03-310000850460us-gaap:CommonStockMember2023-01-012023-03-310000850460us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000850460us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000850460us-gaap:CommonStockMember2023-03-310000850460us-gaap:AdditionalPaidInCapitalMember2023-03-310000850460us-gaap:TreasuryStockCommonMember2023-03-310000850460us-gaap:RetainedEarningsMember2023-03-3100008504602023-03-31wire:inventory_pool0000850460us-gaap:LandAndLandImprovementsMember2024-03-310000850460us-gaap:LandAndLandImprovementsMember2023-12-310000850460us-gaap:ConstructionInProgressMember2024-03-310000850460us-gaap:ConstructionInProgressMember2023-12-310000850460us-gaap:BuildingAndBuildingImprovementsMember2024-03-310000850460us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000850460us-gaap:MachineryAndEquipmentMember2024-03-310000850460us-gaap:MachineryAndEquipmentMember2023-12-310000850460us-gaap:FurnitureAndFixturesMember2024-03-310000850460us-gaap:FurnitureAndFixturesMember2023-12-31xbrli:pure0000850460us-gaap:EmployeeStockOptionMember2024-01-012024-03-310000850460us-gaap:EmployeeStockOptionMember2023-01-012023-03-310000850460wire:CreditAgreementMember2021-02-092021-02-09wire:bank0000850460wire:CreditAgreementMember2021-02-090000850460wire:BloombergShortTermBankYieldIndexMemberwire:CreditAgreementInterestRateOptionOneMemberwire:CreditAgreementMembersrt:MinimumMember2022-10-202022-10-200000850460srt:MaximumMemberwire:BloombergShortTermBankYieldIndexMemberwire:CreditAgreementInterestRateOptionOneMemberwire:CreditAgreementMember2022-10-202022-10-200000850460srt:MaximumMemberus-gaap:FederalFundsEffectiveSwapRateMemberwire:CreditAgreementMemberwire:CreditAgreementInterestRateOptionTwoMember2022-10-202022-10-200000850460wire:BloombergShortTermBankYieldIndexMemberwire:CreditAgreementMemberwire:CreditAgreementInterestRateOptionTwoMember2022-10-202022-10-200000850460wire:CreditAgreementMembersrt:MinimumMemberus-gaap:BaseRateMemberwire:CreditAgreementInterestRateOptionTwoMember2022-10-202022-10-200000850460srt:MaximumMemberwire:CreditAgreementMemberus-gaap:BaseRateMemberwire:CreditAgreementInterestRateOptionTwoMember2022-10-202022-10-200000850460wire:CreditAgreementMembersrt:MinimumMember2022-10-202022-10-200000850460srt:MaximumMemberwire:CreditAgreementMember2022-10-202022-10-200000850460wire:CreditAgreementMember2024-03-3100008504602024-02-290000850460us-gaap:SubsequentEventMember2024-04-140000850460us-gaap:SubsequentEventMemberwire:PrysmianS.p.AMember2024-04-142024-04-140000850460us-gaap:SubsequentEventMemberwire:PrysmianS.p.AMember2024-04-142024-04-14

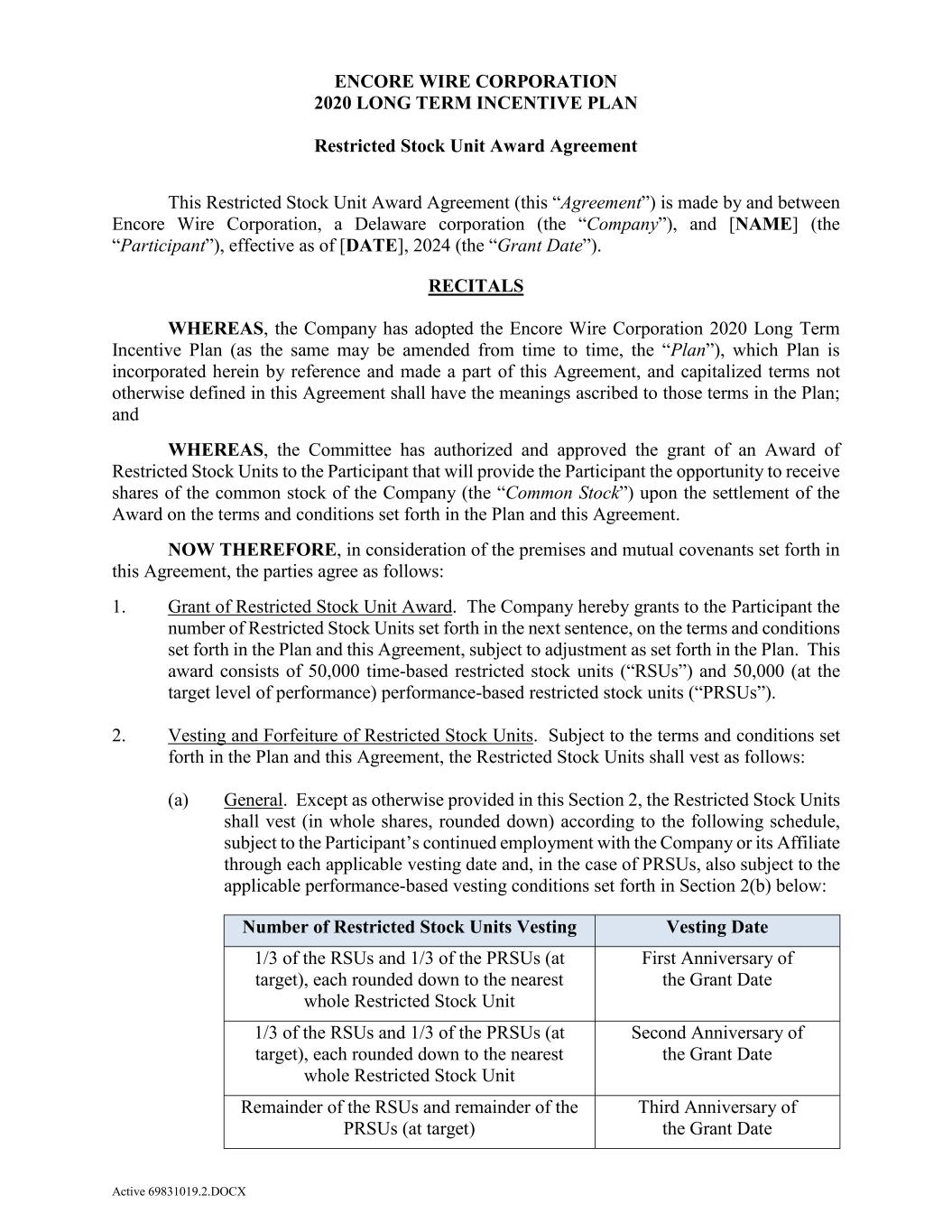

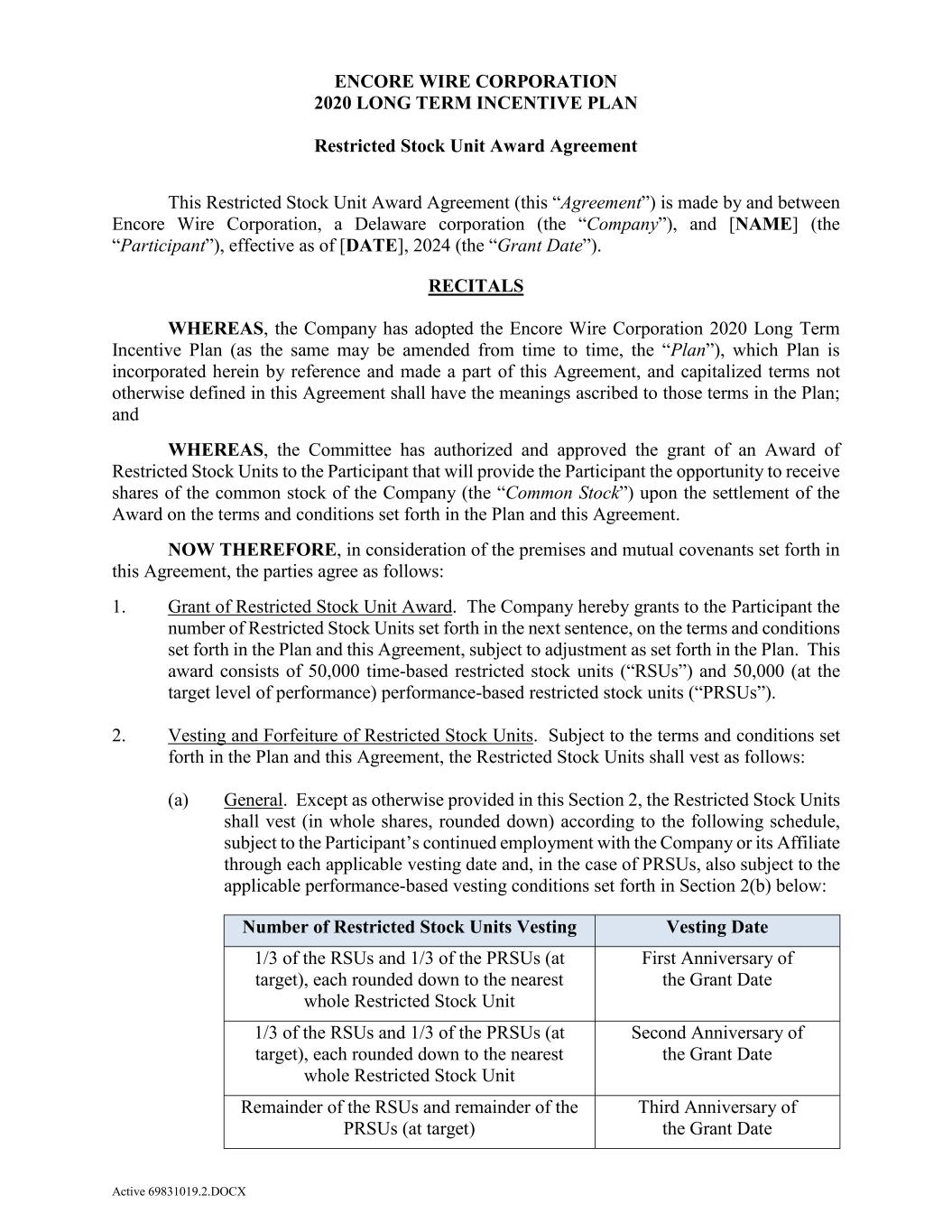

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________

FORM 10-Q

___________________________________________

(Mark One)

|

|

|

|

|

|

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

or

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-20278

__________________________________________________________

ENCORE WIRE CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

75-2274963 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

| 1329 Millwood Road |

|

|

| McKinney |

Texas |

|

75069 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (972) 562-9473

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $.01 per share |

WIRE |

The NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated Filer |

☒ |

Accelerated filer |

☐ |

|

|

|

|

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

|

|

|

|

Emerging growth company |

☐ |

|

|

|

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of shares of Common Stock, par value $0.01, outstanding as of April 24, 2024: 15,788,916

ENCORE WIRE CORPORATION

FORM 10-Q

FOR THE QUARTER ENDED MARCH 31, 2024

Table of Contents

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

Encore Wire Corporation

Balance Sheets

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

|

(Unaudited) |

|

(Audited) |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

614,088 |

|

|

$ |

560,635 |

|

Accounts receivable, net of allowance of $2,455 and $2,455 |

471,246 |

|

|

475,291 |

|

| Inventories, net |

173,669 |

|

|

163,679 |

|

| Income tax receivable |

— |

|

|

4,769 |

|

| Prepaid expenses and other |

3,151 |

|

|

6,201 |

|

| Total current assets |

1,262,154 |

|

|

1,210,575 |

|

| Property, plant and equipment, net |

779,017 |

|

|

756,863 |

|

| Other assets |

369 |

|

|

474 |

|

| Total assets |

$ |

2,041,540 |

|

|

$ |

1,967,912 |

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

| Trade accounts payable |

$ |

84,355 |

|

|

$ |

80,548 |

|

| Accrued liabilities |

69,157 |

|

|

79,590 |

|

| Income taxes payable |

14,895 |

|

|

— |

|

| Total current liabilities |

168,407 |

|

|

160,138 |

|

| Long-term liabilities: |

|

|

|

| Deferred income taxes and other |

60,176 |

|

|

60,197 |

|

| Total long-term liabilities |

60,176 |

|

|

60,197 |

|

| Total liabilities |

228,583 |

|

|

220,335 |

|

| Commitments and contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

Preferred stock, $.01 par value: |

|

|

|

Authorized shares – 2,000,000; none issued |

— |

|

|

— |

|

Common stock, $.01 par value: |

|

|

|

Authorized shares – 40,000,000; |

|

|

|

Issued shares – 27,442,440 and 27,276,834 |

274 |

|

|

273 |

|

| Additional paid-in capital |

108,452 |

|

|

106,035 |

|

Treasury stock, at cost – 11,661,524 and 11,661,524 shares |

(867,222) |

|

|

(867,222) |

|

| Retained earnings |

2,571,453 |

|

|

2,508,491 |

|

| Total stockholders’ equity |

1,812,957 |

|

|

1,747,577 |

|

| Total liabilities and stockholders’ equity |

$ |

2,041,540 |

|

|

$ |

1,967,912 |

|

See accompanying notes.

Encore Wire Corporation

Statements of Income

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

632,661 |

|

|

$ |

660,492 |

|

|

|

|

|

| Cost of goods sold |

496,672 |

|

|

455,407 |

|

|

|

|

|

| Gross profit |

135,989 |

|

|

205,085 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general, and administrative expenses |

61,088 |

|

|

58,704 |

|

|

|

|

|

| Operating income |

74,901 |

|

|

146,381 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest and other income |

7,330 |

|

|

9,174 |

|

|

|

|

|

| Income before income taxes |

82,231 |

|

|

155,555 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes |

18,954 |

|

|

36,072 |

|

|

|

|

|

| Net income |

$ |

63,277 |

|

|

$ |

119,483 |

|

|

|

|

|

| Earnings per common and common equivalent share – basic |

$ |

4.02 |

|

|

$ |

6.60 |

|

|

|

|

|

| Earnings per common and common equivalent share – diluted |

$ |

3.92 |

|

|

$ |

6.50 |

|

|

|

|

|

| Weighted average common and common equivalent shares outstanding – basic |

15,738 |

|

|

18,099 |

|

|

|

|

|

| Weighted average common and common equivalent shares outstanding – diluted |

16,143 |

|

|

18,369 |

|

|

|

|

|

| Cash dividends declared per share |

$ |

0.02 |

|

|

$ |

0.02 |

|

|

|

|

|

See accompanying notes.

Encore Wire Corporation

Statements of Stockholders' Equity

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 |

Common Stock |

Additional

Paid-In

Capital |

Treasury Stock |

Retained

Earnings |

Total Stockholders' Equity |

| (Unaudited) |

Shares |

Amount |

Shares |

Amount |

| Balance at December 31, 2023 |

27,276 |

|

$ |

273 |

|

$ |

106,035 |

|

(11,662) |

|

$ |

(867,222) |

|

$ |

2,508,491 |

|

$ |

1,747,577 |

|

| Net income |

— |

|

— |

|

— |

|

— |

|

— |

|

63,277 |

|

63,277 |

|

| Exercise of stock options |

40 |

|

— |

|

1,728 |

|

— |

|

— |

|

— |

|

1,728 |

|

| Stock-based compensation |

126 |

|

1 |

|

689 |

|

— |

|

— |

|

— |

|

690 |

|

Dividend declared—$0.02 per share |

— |

|

— |

|

— |

|

— |

|

— |

|

(315) |

|

(315) |

|

| Purchase of treasury stock |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

| Balance at March 31, 2024 |

27,442 |

|

$ |

274 |

|

$ |

108,452 |

|

(11,662) |

|

$ |

(867,222) |

|

$ |

2,571,453 |

|

$ |

1,812,957 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2023 |

Common Stock |

Additional

Paid-In

Capital |

Treasury Stock |

Retained

Earnings |

Total Stockholders' Equity |

| (Unaudited) |

Shares |

Amount |

Shares |

Amount |

| Balance at December 31, 2022 |

27,139 |

|

$ |

271 |

|

$ |

83,622 |

|

(9,000) |

|

$ |

(402,639) |

|

$ |

2,137,412 |

|

$ |

1,818,666 |

|

| Net income |

— |

|

— |

|

— |

|

— |

|

— |

|

119,483 |

|

119,483 |

|

| Exercise of stock options |

10 |

|

— |

|

316 |

|

— |

|

— |

|

— |

|

316 |

|

| Stock-based compensation |

93 |

|

1 |

|

4,040 |

|

— |

|

— |

|

— |

|

4,041 |

|

Dividend declared—$0.02 per share |

— |

|

— |

|

— |

|

— |

|

— |

|

(350) |

|

(350) |

|

| Purchase of treasury stock |

— |

|

— |

|

— |

|

(702) |

|

(128,252) |

|

— |

|

(128,252) |

|

| Balance at March 31, 2023 |

27,242 |

|

$ |

272 |

|

$ |

87,978 |

|

(9,702) |

|

$ |

(530,891) |

|

$ |

2,256,545 |

|

$ |

1,813,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes.

Encore Wire Corporation

Statements of Cash Flow

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended March 31, |

|

2024 |

|

2023 |

|

(Unaudited) |

|

|

|

|

| Operating Activities: |

|

|

|

| Net income |

$ |

63,277 |

|

|

$ |

119,483 |

|

Adjustments to reconcile net income to net cash

provided by operating activities: |

|

|

|

| Depreciation and amortization |

8,526 |

|

|

7,692 |

|

|

|

|

|

| Deferred income taxes |

(9) |

|

|

(2,391) |

|

| Stock-based compensation attributable to equity awards |

689 |

|

|

4,040 |

|

| Other |

221 |

|

|

673 |

|

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable |

4,045 |

|

|

18,931 |

|

| Inventories |

(9,990) |

|

|

(20,691) |

|

| Other assets |

3,093 |

|

|

1,478 |

|

| Trade accounts payable and accrued liabilities |

(3,384) |

|

|

(41,031) |

|

| Current income taxes receivable / payable |

19,664 |

|

|

38,753 |

|

| Net cash provided by operating activities |

86,132 |

|

|

126,937 |

|

|

|

|

|

| Investing Activities: |

|

|

|

| Purchases of property, plant and equipment |

(34,242) |

|

|

(31,768) |

|

| Proceeds from sale of assets |

149 |

|

|

— |

|

|

|

|

|

| Net cash used in investing activities |

(34,093) |

|

|

(31,768) |

|

|

|

|

|

| Financing Activities: |

|

|

|

|

|

|

|

| Purchase of treasury stock |

— |

|

|

(128,252) |

|

|

|

|

|

|

|

|

|

| Proceeds from issuance of common stock, net |

1,729 |

|

|

317 |

|

| Dividends paid |

(315) |

|

|

(367) |

|

| Net cash provided by/(used in) financing activities |

1,414 |

|

|

(128,302) |

|

|

|

|

|

| Net increase (decrease) in cash and cash equivalents |

53,453 |

|

|

(33,133) |

|

| Cash and cash equivalents at beginning of period |

560,635 |

|

|

730,557 |

|

| Cash and cash equivalents at end of period |

$ |

614,088 |

|

|

$ |

697,424 |

|

See accompanying notes.

ENCORE WIRE CORPORATION

NOTES TO FINANCIAL STATEMENTS

(Unaudited)

March 31, 2024

NOTE 1 – SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The unaudited financial statements of Encore Wire Corporation (the “Company”) have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete annual financial statements. In the opinion of management, all adjustments, consisting only of normal recurring adjustments considered necessary for a fair presentation, have been included. Results of operations for interim periods presented do not necessarily indicate the results that may be expected for the entire year. These financial statements should be read in conjunction with the audited financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Revenue Recognition

Our revenue is derived by fulfilling customer orders for the purchase of our products, which include electrical building wire and cable. We recognize revenue at the point in time that control of the ordered products is transferred to the customer, which is typically upon shipment to the customer from our manufacturing facilities and based on agreed upon shipping terms on the related purchase order. Amounts billed and due from our customers are classified as accounts receivables on the balance sheet and require payment on a short-term basis through standard payment terms.

Revenue is measured as the amount of consideration we expect to receive in exchange for fulfilling product orders. The amount of consideration we expect to receive includes estimates for trade payment discounts and customer rebates, which are estimated using historical experience and other relevant factors, and are recorded within the same period that the revenue is recognized. We review and update these estimates regularly and the impact of any adjustments are recognized in the period the adjustments are identified. The adjustments resulting from updated estimates of trade payment discounts and customer rebates were not material.

Recent Accounting Pronouncements

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the sole source of authoritative U.S. GAAP, along with the Securities and Exchange Commission (“SEC”) and Public Company Accounting Oversight Board (“PCAOB”) issued rules and regulations that apply only to SEC registrants. The FASB issues an Accounting Standard Update (“ASU”) to communicate changes to the codification. The Company considers the applicability and impact of all ASUs. In March 2024, the SEC adopted “The Enhancement and Standardization of Climate-Related Disclosures for Investors” (the “Final Rule”). The Final Rule sets forth amendments to the SEC’s rules under the Securities Act of 1933 and Securities Exchange Act of 1934 that require registrants to provide certain climate-related information in their registration statements and annual reports. The Final Rule requires information about a registrant’s climate-related risks that have materially impacted, or are reasonably likely to have a material impact on, its business strategy, results of operations, or financial condition. In addition, the Final Rule requires registrants to disclose how they assess and oversee climate-related risks. Shortly after the SEC voted to approve the Final Rule, several lawsuits were filed challenging the rule. The U.S. Judicial Panel on Multidistrict Litigation ordered that such lawsuits be consolidated and proceed in the U.S. Court of Appeals for the Eighth Circuit. On April 4, 2024, the SEC voluntarily stayed implementation of the Final Rule, pending resolution of the litigation challenging it. The timing regarding the resolution of such litigation is unknown at this time. The Company is evaluating the impact of the new rules on its financial statements. No new standards have been adopted in 2024.

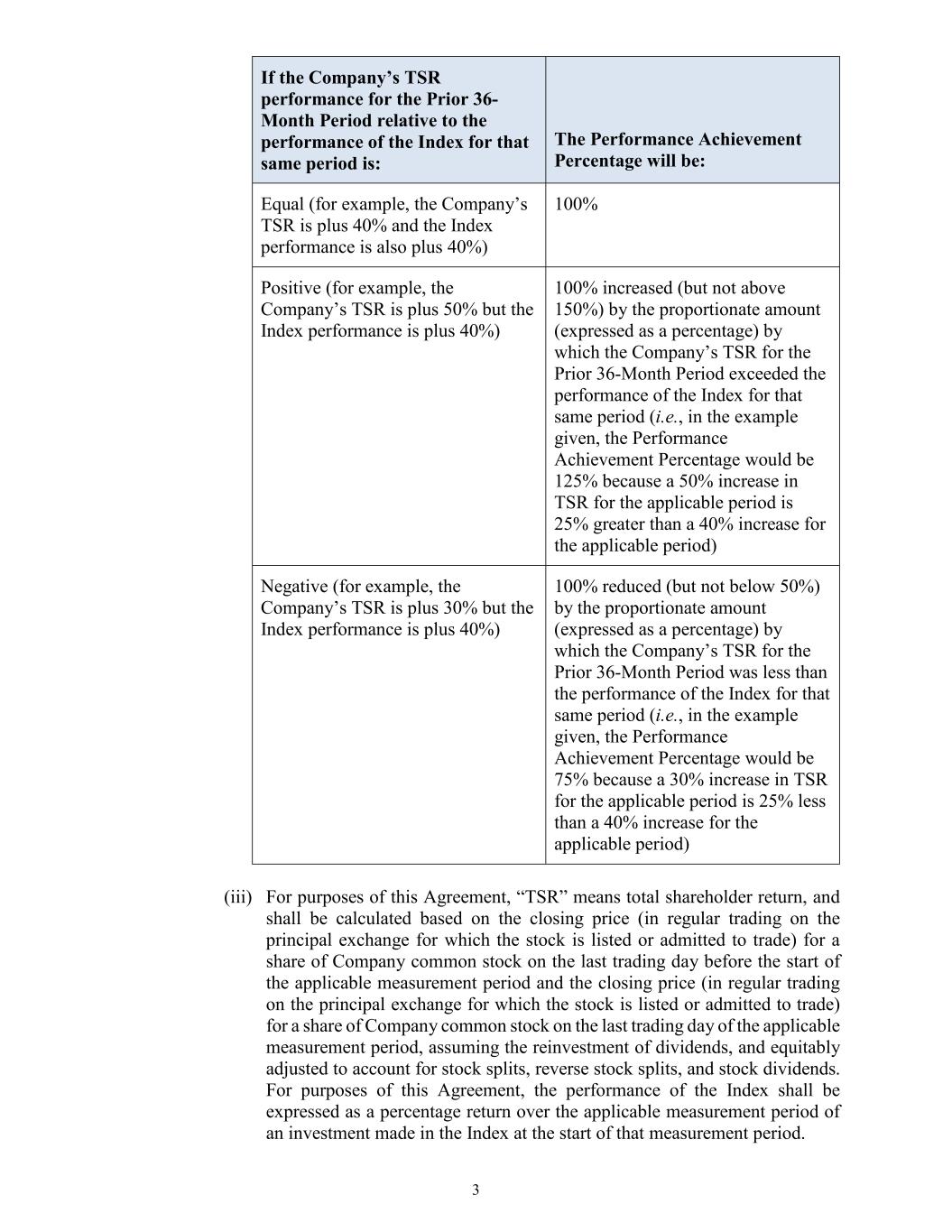

NOTE 2 – INVENTORIES

Inventories consist of the following:

|

|

|

|

|

|

|

|

|

|

|

|

| In Thousands |

March 31, 2024 |

|

December 31, 2023 |

|

|

|

|

| Raw materials |

$ |

41,364 |

|

|

$ |

64,512 |

|

| Work-in-process |

71,334 |

|

|

55,921 |

|

| Finished goods |

157,943 |

|

|

139,348 |

|

| Total Inventory at FIFO cost |

270,641 |

|

|

259,781 |

|

| Adjust to LIFO cost |

(96,972) |

|

|

(96,102) |

|

|

|

|

|

| Inventory, net |

$ |

173,669 |

|

|

$ |

163,679 |

|

Inventories are stated at the lower of cost, determined by the last-in, first-out (“LIFO”) method, or market. The Company maintains two inventory pools for LIFO purposes. As permitted by U.S. GAAP, the Company maintains its inventory costs and cost of goods sold on a first-in, first-out (“FIFO”) basis and makes a monthly adjustment to total inventory and cost of goods sold from FIFO to LIFO. The Company applies the lower of cost or market (“LCM”) test by comparing the LIFO cost of its raw materials, work-in-process and finished goods inventories to estimated market values, which are based primarily on the most recent quoted market price of copper and other material prices as of the end of each reporting period. The Company performs a lower of cost or market calculation quarterly. As of March 31, 2024, no LCM adjustment was required. However, decreases in copper and other material prices could necessitate establishing an LCM reserve in future periods. Additionally, future reductions in the quantity of inventory on hand could cause copper or other raw materials that are carried in inventory at costs different from the cost of copper and other raw materials in the period in which the reduction occurs to be included in costs of goods sold for that period at the different price.

In the first quarter of 2024, LIFO adjustments were recorded that increased cost of goods sold by $0.9 million, compared to LIFO adjustments that increased cost of goods sold by $23.9 million in the first quarter of 2023.

NOTE 3 - PROPERTY, PLANT and EQUIPMENT

Property, plant and equipment consists of the following:

|

|

|

|

|

|

|

|

|

|

|

|

| In Thousands |

March 31, 2024 |

|

December 31, 2023 |

|

|

|

|

| Land and land improvements |

$ |

90,162 |

|

|

$ |

90,162 |

|

| Construction-in-progress |

174,216 |

|

|

163,514 |

|

| Buildings and improvements |

313,281 |

|

|

313,691 |

|

| Machinery and equipment |

497,183 |

|

|

478,060 |

|

| Furniture and fixtures |

17,308 |

|

|

17,231 |

|

| Property, plant and equipment, gross |

1,092,150 |

|

|

1,062,658 |

|

| Accumulated depreciation |

(313,133) |

|

|

(305,795) |

|

| Property, plant and equipment, net |

$ |

779,017 |

|

|

$ |

756,863 |

|

In the first quarter of 2024, depreciation expense was $8.5 million, compared to $7.7 million in the first quarter of 2023.

NOTE 4 – ACCRUED LIABILITIES

Accrued liabilities consist of the following:

|

|

|

|

|

|

|

|

|

|

|

|

| In Thousands |

March 31, 2024 |

|

December 31, 2023 |

|

|

|

|

| Sales rebates payable |

$ |

27,324 |

|

|

$ |

39,123 |

|

| SAR Liability |

19,995 |

|

|

22,182 |

|

| Property taxes payable |

1,503 |

|

|

5,827 |

|

| Accrued salaries |

14,478 |

|

|

6,947 |

|

| Other accrued liabilities |

5,857 |

|

|

5,511 |

|

| Total accrued liabilities |

$ |

69,157 |

|

|

$ |

79,590 |

|

NOTE 5 – INCOME TAXES

Income taxes were accrued at an effective rate of 23.0% in the first quarter of 2024 versus 23.2% in the first quarter of 2023, consistent with the Company’s estimated liabilities. In all periods, the differences between the provisions for income taxes and the income taxes computed using the federal income tax statutory rate are due primarily to the incremental taxes accrued for state and local taxes and the Section 162(m) limitation on executive compensation.

NOTE 6 – EARNINGS PER SHARE

Earnings per common and common equivalent share is computed using the weighted average number of shares of common stock and common stock equivalents outstanding during each period. If dilutive, the effect of stock awards, treated as common stock equivalents, is calculated using the treasury stock method.

The following table sets forth the computation of basic and diluted earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended March 31, |

|

|

| In Thousands |

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

| Numerator: |

|

|

|

|

|

|

|

| Net income |

$ |

63,277 |

|

|

$ |

119,483 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

| Denominator for basic earnings per share – weighted average shares |

15,738 |

|

|

18,099 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of dilutive securities: |

|

|

|

|

|

|

|

| Employee stock awards |

405 |

|

|

270 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Denominator for diluted earnings per share – weighted average shares |

16,143 |

|

|

18,369 |

|

|

|

|

|

There were no anti-dilutive employee stock awards excluded from the determination of diluted earnings per common and common equivalent shares for the first quarter of 2024 or 2023.

NOTE 7 – DEBT

On February 9, 2021, the Company terminated its previous credit agreement and entered into a new Credit Agreement (the “2021 Credit Agreement”) with two banks, Bank of America, N.A., as administrative agent and letter of credit issuer, and Wells Fargo Bank, National Association, as syndication agent. The 2021 Credit Agreement matures on February 9, 2026 and provides for maximum borrowings of $200.0 million. At our request, and subject to certain conditions, the commitments under the 2021 Credit Agreement may be increased by a maximum of up to $100.0 million as long as existing or new lenders agree to provide such additional commitments.

The 2021 Credit Agreement contains provisions to replace LIBOR with a replacement rate as described in the 2021 Credit Agreement. On October 20, 2022, the Company entered into the First Amendment to the 2021 Credit Agreement (the 2021 Credit Agreement as amended, the "Amended 2021 Credit Agreement") which replaced LIBOR with Bloomberg Short-Term Bank Yield Index ("BSBY") as permitted under the 2021 Credit Agreement. Borrowings under the line of credit bear interest, at the Company’s option, at either (1) BSBY plus a margin that varies from 1.000% to 1.875% depending upon the Leverage Ratio (as defined in the 2021 Credit Agreement), or (2) the base rate (which is the highest of the federal funds rate plus 0.5%, the prime rate, or BSBY plus 1.0%) plus 0% to 0.375% (depending upon the Leverage Ratio). A commitment fee ranging from 0.200% to 0.325% (depending upon the Leverage Ratio) is payable on the unused line of credit. As of March 31, 2024, there were no borrowings outstanding under the Amended 2021 Credit Agreement, and letters of credit outstanding in the amount of $0.3 million left $199.7 million of credit available under the Amended 2021 Credit Agreement. Obligations under the Amended 2021 Credit Agreement are the only contractual borrowing obligations or commercial borrowing commitments of the Company. The foregoing description of the Amended 2021 Credit Agreement is not complete and is qualified in its entirety by reference to the full text of the Amended 2021 Credit Agreement (filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, and incorporated herein by reference).

Obligations under the Amended 2021 Credit Agreement are unsecured and contain customary covenants and events of default. The Company was in compliance with the covenants as of and for the period ended March 31, 2024.

NOTE 8 – STOCKHOLDERS’ EQUITY

On November 10, 2006, the Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to an authorized number of shares of its common stock from time to time in open market or private transactions, at the Company's discretion. This authorization originally expired on December 31, 2007, and the Company’s Board of Directors has authorized several increases and annual extensions of this stock repurchase program, most recently in February 2024, authorizing the repurchase of up to 2,000,000 shares of our common stock. As of March 31, 2024, 2,000,000 shares remained authorized for repurchase through March 31, 2025. The Company did not repurchase shares of its stock in the three months ended March 31, 2024, compared to 702,478 shares repurchased in the three months ended March 31, 2023.

NOTE 9 - CONTINGENCIES

There are no material pending proceedings to which the Company is a party or to which any of its property is subject. However, the Company is from time to time involved in litigation, certain other claims and arbitration matters arising in the ordinary course of its business.

NOTE 10 – SUBSEQUENT EVENTS

As previously announced, on April 14, 2024, the Company entered into an Agreement and Plan of Merger (“Merger Agreement”) by and among the Company, Prysmian S.p.A., a company organized under the laws of the Republic of Italy (“Parent”), Applause Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), and solely as provided in Section 9.12 therein, Prysmian Cables and Systems USA, LLC, a Delaware limited liability company, providing for the merger of Merger Sub with and into the Company, with the Company continuing as the surviving corporation and becoming a wholly owned subsidiary of Parent (“Merger”).

Upon the consummation of the Merger, each outstanding share of common stock of the Company, par value $.01 per share (the “Common Stock”), as of immediately prior to the effective time of the Merger (other than certain enumerated exceptions in the Merger Agreement) will be converted into the right to receive (A) $290.00 per share in cash, plus, (B) if applicable, an amount in cash, rounded to the nearest cent, equal to $0.0635 per share multiplied by the number of calendar days elapsed after April 14, 2025 until and excluding the closing date of the Merger (with no such additional consideration if the closing date occurs on or prior to April 14, 2025).

The Merger Agreement provides for a go-shop period that will expire at 11:59 p.m. on May 19, 2024, during which the Company has the right to solicit, encourage or facilitate the making of any alternative acquisition proposal. The transaction is expected to close in the second half of 2024, and is subject to customary closing conditions, including Hart-Scott-Rodino Act clearance.

Under the Merger Agreement, the Company may be required to pay Parent a termination fee of up to $146.54 million if the Merger Agreement is terminated under certain specified circumstances and Parent may be required to pay a reverse termination fee of $180.00 million to the Company if the Merger Agreement is terminated under certain circumstances.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Encore Wire Corporation is a leading manufacturer of a broad range of copper and aluminum electrical wire and cables, supplying power generation and distribution solutions to meet our customers’ needs today and in the future. The Company focuses on maintaining a low-cost of production while providing exceptional customer service and quickly shipping complete orders coast-to-coast. Our products are proudly made in America at our vertically-integrated, single-site, Texas campus.

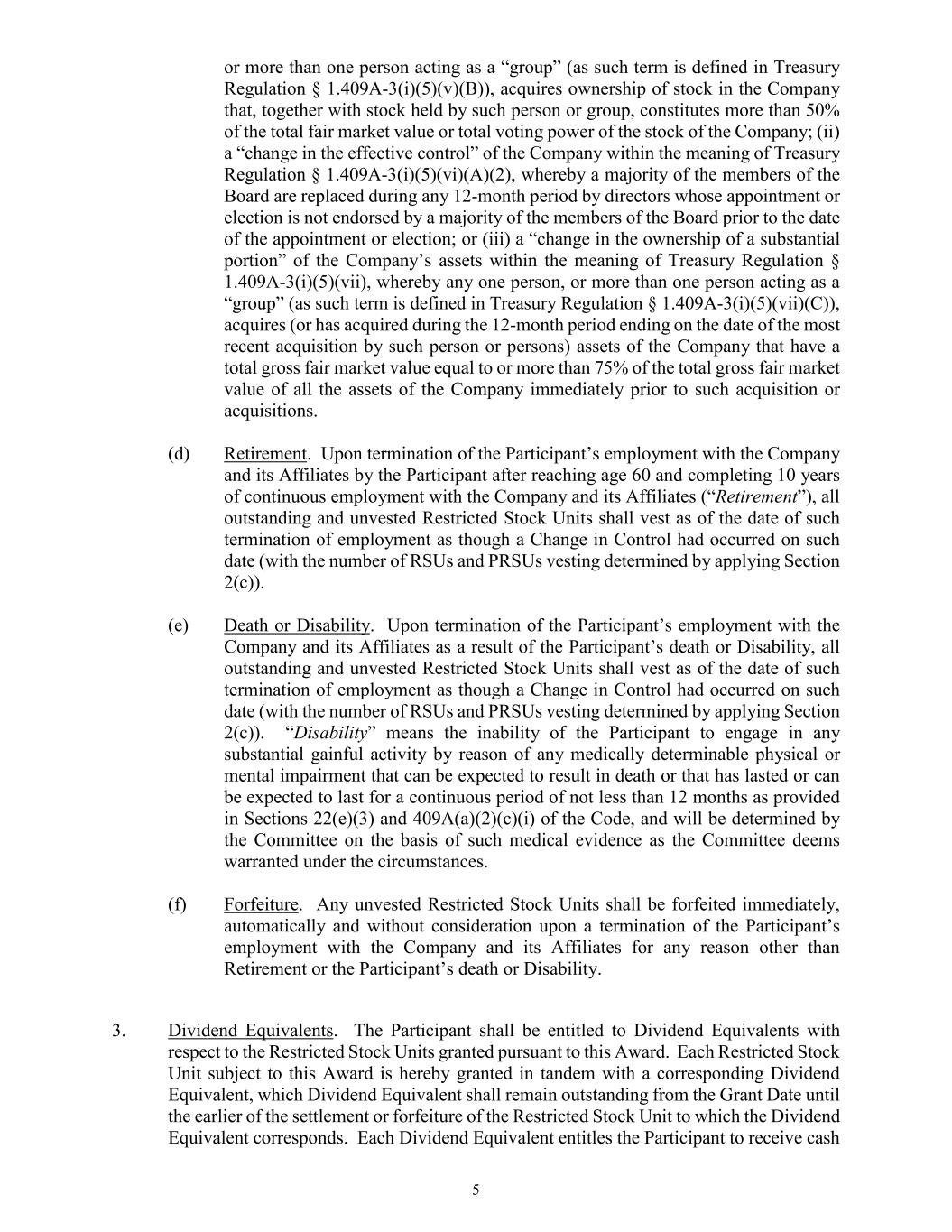

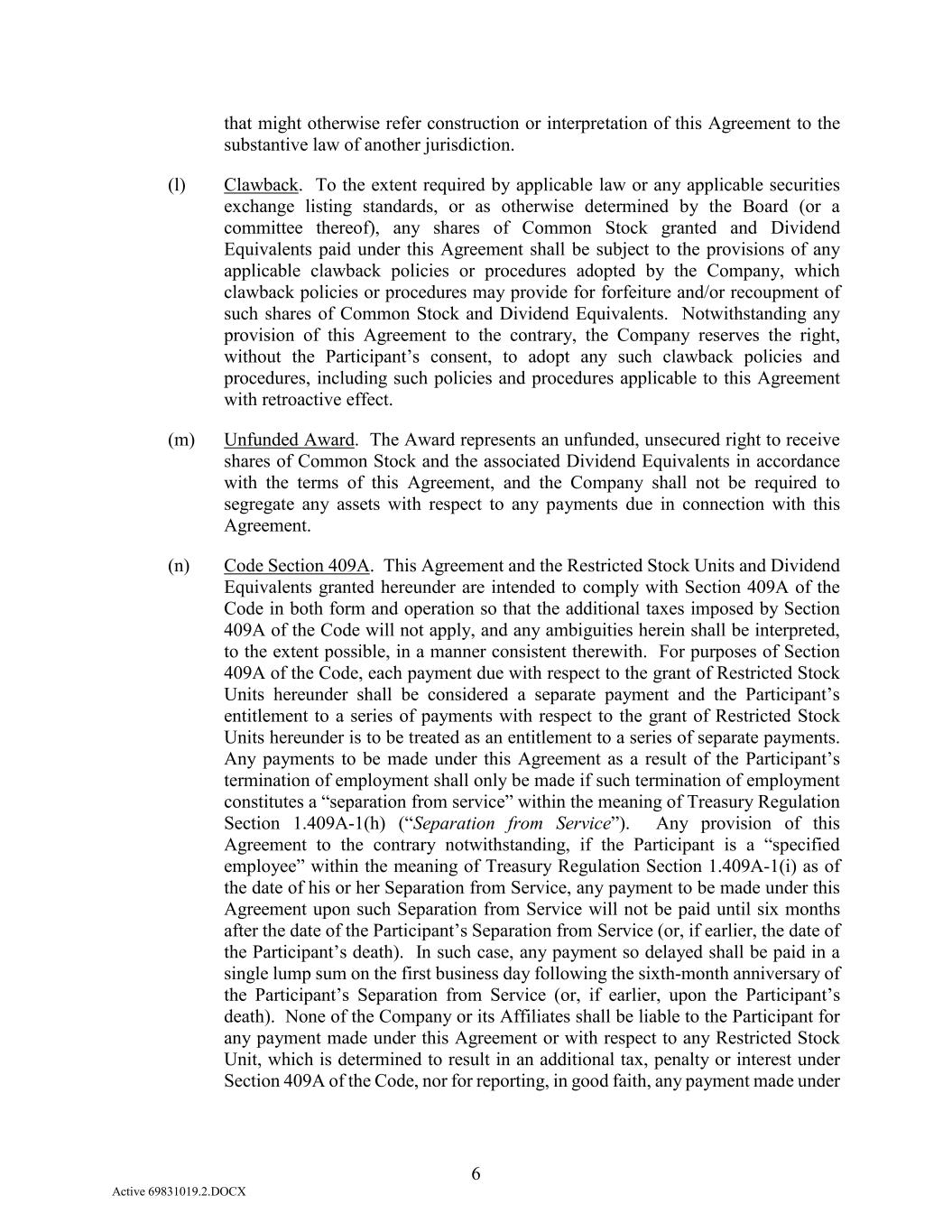

The Company’s operating results in any given period are driven by several key factors, including the volume of product produced and shipped, the cost of copper and other raw materials, the competitive pricing environment in the wire industry and the resulting influence on gross margin, and the efficiency with which the Company’s plants operate during the period, among others. Price competition for electrical wire and cable is intense, and the Company sells its products in accordance with prevailing market prices. Copper, a commodity product, is the principal raw material used by the Company in manufacturing its products. The price of copper fluctuates depending on general economic conditions, in relation to supply and demand, and other factors, which causes monthly variations in the cost of the Company’s purchased copper. Additionally, the SEC allows shares of certain physically backed copper exchange-traded funds (“ETFs”) to be listed and publicly traded. Such funds and other copper ETFs like them hold copper cathode as collateral against their shares. The acquisition of copper cathode by copper ETFs may materially decrease or interrupt the availability of copper for immediate delivery in the United States, which could materially increase the Company’s cost of copper. In addition to raising copper prices and potential supply shortages, we believe that ETFs and similar copper-backed derivative products could lead to increased price volatility for copper. The Company cannot predict copper prices or the effect of fluctuations in the cost of copper on the Company’s future operating results. Wire prices can, and frequently do, change on a daily basis. This competitive pricing market for wire does not always mirror changes in copper prices, making margins highly volatile. The tables below highlight the range of closing prices of copper on a per pound basis on the Comex exchange for the periods shown.

COMEX COPPER CLOSING PRICE 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 2024 |

|

February 2024 |

|

March 2024 |

|

Quarter Ended March 31, 2024 |

|

|

| High |

$ |

3.91 |

|

|

$ |

3.90 |

|

|

$ |

4.11 |

|

|

$ |

4.11 |

|

|

|

| Low |

3.73 |

|

|

3.69 |

|

|

3.84 |

|

|

3.69 |

|

|

|

| Average |

3.81 |

|

|

3.80 |

|

|

3.98 |

|

|

3.86 |

|

|

|

COMEX COPPER CLOSING PRICE 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 2023 |

|

February 2023 |

|

March 2023 |

|

Quarter Ended March 31, 2023 |

|

|

| High |

$ |

4.27 |

|

|

$ |

4.23 |

|

|

$ |

4.17 |

|

|

$ |

4.27 |

|

|

|

| Low |

3.74 |

|

|

3.96 |

|

|

3.86 |

|

|

3.74 |

|

|

|

| Average |

4.12 |

|

|

4.09 |

|

|

4.05 |

|

|

4.08 |

|

|

|

The following discussion and analysis relate to factors that have affected the operating results of the Company for the quarters and three months ended March 31, 2024 and 2023. Reference should also be made to the audited financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Recent Developments

On April 14, 2024, the Company entered into an Agreement and Plan of Merger (“Merger Agreement”) by and among the Company, Prysmian S.p.A., a company organized under the laws of the Republic of Italy (“Parent”), Applause Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), and solely as provided in Section 9.12 therein, Prysmian Cables and Systems USA, LLC, a Delaware limited liability company, providing for the merger of Merger Sub with and into the Company, with the Company continuing as the surviving corporation and becoming a wholly owned subsidiary of Parent (“Merger”).

Upon the consummation of the Merger, each outstanding share of common stock of the Company, par value $.01 per share (the “Common Stock”), as of immediately prior to the effective time of the Merger (other than (a) shares of Common Stock owned by the Company as treasury stock or otherwise, excluding shares of Common Stock held by any Company Employee Plan (as defined in the Merger Agreement) or trust related thereto (other than shares of Common Stock reserved for issuance under any of the Company Equity Plans (as defined in the Merger Agreement)) or held by Parent or Merger Sub (or any direct or indirect parent of Merger Sub) immediately prior to the effective time of the Merger, (b) shares of Common Stock owned by any wholly owned subsidiary of Parent (other than Merger Sub or any direct or indirect parent of Merger Sub) immediately prior to the effective time of the merger and (c) shares of Common Stock that are held by holders who have not voted in favor of the adoption of the Merger Agreement or consented thereto in writing and are entitled to demand and properly demand appraisal of such shares pursuant to Section 262 of the General Corporation Law of the State of Delaware) will be converted into the right to receive (A) $290.00 per share in cash, plus, (B) if applicable, an amount in cash, rounded to the nearest cent, equal to $0.0635 per share multiplied by the number of calendar days elapsed after April 14, 2025 until and excluding the closing date of the Merger (with no such additional consideration if the closing date occurs on or prior to April 14, 2025).

Consummation of the Merger is subject to certain conditions set forth in the Merger Agreement, including, but not limited to, the following: (i) the affirmative vote of the holders of a majority of the shares of Common Stock outstanding on the record date for the meeting of the Company’s stockholders (the “Company Stockholder Meeting”) in favor of adopting the Merger Agreement (the “Required Company Stockholder Vote”), (ii) the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), and, if applicable, the receipt of certain other specified regulatory approvals, and (iii) the absence of any law or order by a U.S. court or other governmental entity of competent jurisdiction in the U.S. that prohibits or makes illegal the consummation of the Merger. The obligation of each party to consummate the Merger is also conditioned upon the other party’s representations and warranties being true and correct (subject to certain exceptions and materiality qualifiers) and the other party having performed in all material respects its obligations under the Merger Agreement. The obligation of Parent and Merger Sub to consummate the Merger is also conditioned upon the absence of a material adverse effect on the Company since the date of the Merger Agreement.

The Merger Agreement includes customary representations, warranties, and covenants of the parties, including termination provisions for both the Company and the Parent. Under the Merger Agreement, the Company may be required to pay Parent a termination fee of up to $146.54 million if the Merger Agreement is terminated under certain specified circumstances and Parent may be required to pay a reverse termination fee of $180.00 million to the Company if the Merger Agreement is terminated under certain circumstances. The Merger Agreement also places certain restrictions on the conduct of the Company’s business prior to the completion of the Merger, which could delay or prevent the Company from undertaking business opportunities that may arise or any other action it would otherwise take with respect to the operations of the Company absent these restrictions.

Results of Operations

Quarter Ended March 31, 2024 Compared to Quarter Ended March 31, 2023

Net sales were $632.7 million in the first quarter of 2024 compared to $660.5 million in the first quarter of 2023. Copper unit volume, measured in pounds of copper contained in the wire sold, increased 19.7% in the first quarter of 2024 versus the first quarter of 2023. Aluminum unit volume also increased in the first quarter of 2024 versus the first quarter of 2023. The decrease in net sales dollars was driven by an anticipated decrease in the average selling prices in the first quarter of 2024 compared to the first quarter of 2023.

Cost of goods sold was $496.7 million, or 78.5% of net sales, in the first quarter of 2024, compared to $455.4 million, or 68.9% of net sales in the first quarter of 2023. Gross profit decreased to $136.0 million, or 21.5% of net sales, in the first quarter of 2024 from $205.1 million, or 31.1% of net sales in the first quarter of 2023.

Gross profit percentage for the first quarter of 2024 was 21.5% compared to 31.1% in the first quarter of 2023. The average selling price of wire per copper pound sold decreased 16.2% in the first quarter of 2024 versus the first quarter of 2023, while the average cost of copper per pound purchased decreased 5.0%. The overall increase in total volumes shipped, offset by an anticipated decrease in the average selling price of copper, resulted in the decreased gross profit margin in the first quarter of 2024 compared to the first quarter of 2023.

Net income for the first quarter of 2024 was $63.3 million versus $119.5 million in the first quarter of 2023. Fully diluted earnings per common share were $3.92 in the first quarter of 2024 versus $6.50 in the first quarter of 2023.

Total raw material cost as a percentage of sales increased to 67.9% in the first quarter of 2024, from 60.0% in the first quarter of 2023. Overhead costs increased to 10.6% of net sales in the first quarter of 2024, from 8.9% of net sales in the first quarter of 2023. Overhead costs contain some fixed and semi-fixed components which do not fluctuate as much as sales dollars fluctuate.

Selling expenses, consisting of commissions and freight, for the first quarter of 2024 were $28.2 million, or 4.5% of net sales, compared to $28.9 million, or 4.4% of net sales in the first quarter of 2023. Commissions paid to independent manufacturers’ representatives are paid as a relatively stable percentage of sales dollars and exhibited little change as a percentage of sales. Freight costs as a percentage of net sales were 2.0% of net sales in the first quarter of 2024, compared to 1.9% in the first quarter of 2023.

General and administrative (“G&A”) expenses for the first quarter of 2024 were $32.9 million, or 5.2% of net sales, compared to $29.8 million, or 4.5% of net sales, in the first quarter of 2023.

Net interest and other income was $7.3 million in the first quarter of 2024 compared to $9.2 million in the first quarter of 2023. The decrease in net interest and other income was primarily driven by a decrease in the Company's cash balance in the first quarter of 2024 compared to the first quarter of 2023.

Liquidity and Capital Resources

The Company maintains a substantial inventory of finished products to satisfy customers’ delivery requirements promptly. As is customary in the building wire industry, the Company provides payment terms to most of its customers that exceed terms that it receives from its suppliers. Copper suppliers generally give very short payment terms (less than 15 days) while the Company and the building wire industry give customers much longer terms. In general, the Company’s standard payment terms result in the collection of a significant majority of net sales within approximately 75 days of the date of invoice. As a result of this timing difference, building wire companies must have sufficient cash and access to capital resources to finance their working capital needs, thereby creating a barrier to entry for companies who do not have sufficient liquidity and capital resources. The two largest components of working capital, receivables and inventory, and to a lesser extent, capital expenditures, are the primary drivers of the Company’s liquidity needs. Generally, these needs will cause the Company’s cash balance to rise and fall inversely to the receivables and inventory balances. The Company’s receivables and inventories will rise and fall in concert with several factors, most notably the price of copper and other raw materials and the level of unit sales. Capital expenditures have historically been necessary to expand and update the production capacity of the Company’s manufacturing operations. The Company has historically satisfied its liquidity and capital expenditure needs with cash generated from operations and borrowings under its various debt arrangements. The Company historically uses its revolving credit facility to manage day to day operating cash needs as required by daily fluctuations in working capital and has the facility in place should such a need arise in the future.

For more information on the Company’s revolving credit facility, see Note 7 to the Company’s financial statements included in Item 1 to this report, which is incorporated herein by reference.

Cash provided by operating activities was $86.1 million in the first three months of 2024 compared to cash provided of $126.9 million in the first three months of 2023. The following changes in components of cash flow from operations were notable. The Company had net income of $63.3 million in the first three months of 2024 compared to net income of $119.5 million in the first three months of 2023. Accounts receivable decreased $4.0 million in the first three months of 2024 compared to decreasing $18.9 million in the first three months of 2023. Accounts receivable generally fluctuates in proportion to dollar sales and, to a lesser extent, are affected by the timing of when sales occur during a given quarter. With an average of 60 to 75 days of sales outstanding, quarters in which sales are more back-end loaded will have higher accounts receivable balances outstanding at quarter-end. Inventory, net increased $10.0 million in the first three months of 2024 compared to increasing $20.7 million in the first three months of 2023. Trade accounts payable and accrued liabilities negatively impacted cash by $3.4 million in the first three months of 2024 versus negatively impacting cash by $41.0 million in the first three months of 2023. In the first three months of 2024, changes in current and deferred taxes favorably impacted cash by $19.7 million versus $36.4 million of favorable impact in the first three months of 2023. These changes in cash flow were the primary drivers of the $40.8 million decrease in cash flows provided by operating activities in the first three months of 2024 compared to the first three months of 2023.

Cash used in investing activities increased to $34.1 million in the first three months of 2024 from $31.8 million in the first three months of 2023.

Cash used in financing activities in the first three months of 2024 consisted of $0.3 million of cash dividends paid and $1.7 million of proceeds from exercised stock options. These activities provided $1.4 million of cash in financing activities for the first three months of 2024 compared to $128.3 million used in the first three months of 2023. For the three months ended March 31, 2024 and 2023, the Company did not access its revolving line of credit.

The Company’s cash balance was $614.1 million at March 31, 2024 compared to $697.4 million at March 31, 2023.

During the remainder of 2024, the Company expects its capital expenditures will consist primarily of expenditures related to the purchases of manufacturing equipment throughout its facilities to update equipment and the previously announced expansion plans which remain on schedule. The incremental investments previously announced continue in earnest, focused on broadening our position as a low-cost manufacturer in the sector and increasing manufacturing capacity to drive growth. In 2023, we began construction of a state-of-the-art residential wire and cable manufacturing facility which will replace our original residential manufacturing plant, leveraging automation and advanced manufacturing technology to increase capacity, improve order fill and further modernize our campus.

This investment will strengthen our position in the residential market segment while also supporting the production of feed wire used across our campus. We anticipate this facility will be substantially complete in early Q3 2024 and will help to further elevate our ability to ship 100% complete orders quickly. Capital spending in the remainder of 2024 through 2026 will further expand vertical integration in our manufacturing processes to reduce costs as well as modernize select wire manufacturing facilities to increase capacity and efficiency and improve our position as a sustainable and environmentally responsible company. Total capital expenditures were $164.5 million in 2023. We expect total capital expenditures to range from $130 - $150 million in the full year of 2024, $130 - $150 million in 2025, and $100 - $120 million in 2026. We expect to continue to fund these investments with existing cash reserves and operating cash flows.

Critical Accounting Estimates and Policies

Management’s discussion and analysis of its financial condition and results of operations are based upon the Company’s financial statements, which have been prepared in accordance with U.S. GAAP. The Company’s unaudited financial statements are impacted by the accounting policies used and the estimates and assumptions made by management in their preparation. See Note 1 to the notes to the financial statements for information on the Company’s significant accounting policies.

As of March 31, 2024, there have been no significant changes to the Company’s critical accounting policies and related estimates previously disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Information Regarding Forward-Looking Statements

This quarterly report on Form 10-Q contains various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements related to the expected timing of the closing of the pending Merger and expectations following the closing of the Merger. Forward-looking statements can be identified by words such as: “anticipate”, “intend”, “plan”, “goal”, “seek”, “believe”, “project”, “estimate”, “expect”, “strategy”, “future”, “likely”, “may”, “should”, “will” and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, such statements are subject to certain risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. Therefore, you should not rely on any of these forward-looking statements. Examples of such uncertainties and risks include, but are not limited to, the possibility that the Company may be unable to obtain the required stockholder approval, antitrust or other regulatory approvals or that other conditions to consummation of the Merger may not be satisfied, such that the Merger may not be consummated or that the consummation may be delayed, the reaction of distributors, vendors, other partners and employees to the announcement or consummation of the Merger, general macro-economic conditions, including risks associated with unforeseeable events such as pandemics, wars and other hostilities, emergencies or other disasters, risks associated with certain covenants in the Merger Agreement that may limit or disrupt our current plans and operations, the amount of the costs, fees, expenses and charges related to the Merger that may not be recovered if the Merger is not consummated for any reason, the outcome of any legal proceedings that may be brought related to the Merger, the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, other risks and uncertainties described Item 1A. Risk Factors, the pricing environment of copper, aluminum and other raw materials, our order fill rates, profitability and stockholder value, payment of future dividends, future purchases of stock, the impact of competitive pricing and other risks detailed from time to time in the Company’s reports filed with the SEC. Actual results may vary materially from those anticipated. Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. For more information regarding “forward-looking statements,” see “Information Regarding Forward-Looking Statements” in Part II, Item 7 of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which is hereby incorporated by reference.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

There have been no material changes from the information provided in Item 7A, “Quantitative and Qualitative Disclosures About Market Risk,” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Item 4. Controls and Procedures.

The Company maintains controls and procedures designed to ensure that information required to be disclosed by it in the reports it files with or submits to the SEC is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and to ensure that information required to be disclosed by the Company in such reports is accumulated and communicated to the Company’s management, including the Chief Executive and Chief Financial Officers, as appropriate, to allow timely decisions regarding required disclosure.

Based on an evaluation of the Company’s disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended) as of the end of the period covered by this report conducted by the Company’s management, with the participation of the Chief Executive and Chief Financial Officers, the Chief Executive and Chief Financial Officers concluded that the Company’s disclosure controls and procedures were effective to ensure that information required to be disclosed by the Company in the reports it files with or submits to the SEC is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and to ensure that information required to be disclosed by the Company in such reports is accumulated and communicated to the Company’s management, including the Chief Executive and Chief Financial Officers, as appropriate, to allow timely decisions regarding required disclosure.

There have been no changes in the Company’s internal control over financial reporting or in other factors that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting during the period covered by this report.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings.

For information on the Company’s legal proceedings, see Note 9 to the Company’s financial statements included in Item 1 to this report and incorporated herein by reference.

Item 1A. Risk Factors.

Item 1A of Part I of our annual report on Form 10-K for the year ended December 31, 2023 includes a detailed discussion of the risk factors that could materially affect our business, financial condition or future prospects. The information below updates and supplements, and should be read in conjunction with, the risk factors in our 2023 Form 10-K.

Risks related to the Merger

The pendency of the Merger could have a material adverse effect on our business, consolidated financial condition or results of operations, or the market price of our common stock.

On April 14, 2024, the Company entered into the Merger Agreement. During the period between the date of the signing of the Merger Agreement and the closing of the Merger, our business has been and is exposed to certain inherent risks due to the effect of the announcement and the pendency of the Merger, including the following:

• the potential for us to experience difficulties maintaining relationships with customers and business partners, who may defer decisions about working with us, move to our competitors, or seek to delay or change existing business relationships with us;

• potential uncertainties in the event there is negative sentiment in the marketplace with respect to the Merger, which could adversely impact investor confidence in our business;

• our potential inability to retain and hire key personnel during the pendency of the Merger, as our personnel may experience uncertainty about their future roles following the Merger;

• diversion of our management’s time and attention, as well as distraction of our key personnel, from the Company’s ordinary course of business operations;

• the occurrence of any event, change, or other circumstance that could give rise to the termination of the Merger Agreement, including in circumstances requiring the Company to pay a termination fee; and

• our inability to solicit other acquisition proposals after the expiration of the go-shop period, pursue alternative business opportunities, make strategic changes to our business, and other restrictions on our ability to conduct our business pursuant to the Merger Agreement.

Expenses related to the pending Merger are significant and may adversely affect our operating results.

We have incurred and expect to continue to incur significant expenses in connection with the pending Merger, including legal and investment banking fees. If the Merger is not consummated, we may under certain circumstances be required to pay to Parent a termination fee of up to $146.54 million. Our financial position and results of operations may be adversely affected if we were required to pay the termination fee.

The Merger may not be completed within the expected timeframe, or at all, and any significant delay or the failure to complete the Merger could adversely affect our business, consolidated financial condition or results of operations, or the market price of our common stock.

There can be no assurance that the Merger will be completed within the intended timeframe, or at all. If the Merger is not completed within the intended timeframe or at all, or if the Merger is significantly delayed, we may be subject to a number of material risks, including the following:

• to the extent that the current market price of our common stock reflects an assumption that the Merger will be completed, the market price may be negatively impacted because of a failure to complete the Merger within the expected timeframe, or at all;

• we could be subject to litigation related to any failure to complete the Merger; • we have incurred, and expect to continue incurring, significant costs, expenses, and fees for professional services and other Merger-related costs, for which we may receive little or no benefit if the Merger is not completed, and many of these fees and costs will be payable by us even if the Merger is not completed; and

• a significant delay in completing the Merger or the failure to complete the Merger may result in negative publicity, which, in turn, could negatively affect our relationships with business partners and could impact investor and consumer confidence in our business.

The occurrence of any of these events individually or in combination could materially adversely affect our business, consolidated financial condition or results of operations, or the market price of our common stock.

Shareholder litigation could prevent or delay the closing of the Merger or otherwise negatively impact our business, consolidated financial condition or results of operations, or the market price of our common stock.

We may incur additional costs in connection with the defense or settlement of any future shareholder litigation related to the pending Merger. Such litigation may adversely affect our ability to complete the Merger. We could incur significant costs in connection with any such litigation, including costs associated with the indemnification obligations to our directors, which could adversely affect our business, consolidated financial condition or results of operations, or the market price of our common stock.

The Merger Agreement contains provisions that could discourage a potential competing acquirer of us.

The Merger Agreement contains non-solicitation provisions that, upon expiration of the go-shop period and subject to limited exceptions, restrict our ability to solicit, initiate, or knowingly encourage or induce competing third-party proposals (or engage in, continue or otherwise participate in negotiations or discussions regarding such third-party proposals) for the acquisition of our stock or assets. Under certain limited circumstances, our Board of Directors may (i) withdraw, qualify or modify its recommendation that our stockholders adopt the Merger Agreement and/or (ii) terminate the Merger Agreement to enter into a definitive agreement with respect to a third-party acquisition proposal. However, before doing so, our Board of Directors must abide by certain procedures described in the Merger Agreement, including provisions that give Parent an opportunity to negotiate in good faith to modify the terms of the Merger Agreement in a manner that any such third-party acquisition proposal would not constitute a superior proposal. In some circumstances, upon termination of the Merger Agreement, we will be required to pay a termination fee to Parent of up to $146.54 million.

These provisions could discourage a potential third-party acquirer that might have an interest in acquiring all or a significant portion of us from considering or proposing that acquisition, even if the acquirer was prepared to pay consideration with a higher per share cash or market value than the market value proposed to be received or realized in the Merger, or might otherwise result in a potential third-party acquirer proposing to pay a lower price to our stockholders than they might otherwise have proposed to pay due to the added expense of the termination fee that may become payable in certain circumstances.

All of the matters described above, alone or in combination, could materially and adversely affect our business, financial condition, results of operations and stock price.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

Note 8 to the Company’s financial statements included in Item 1 to this report is hereby incorporated herein by reference.

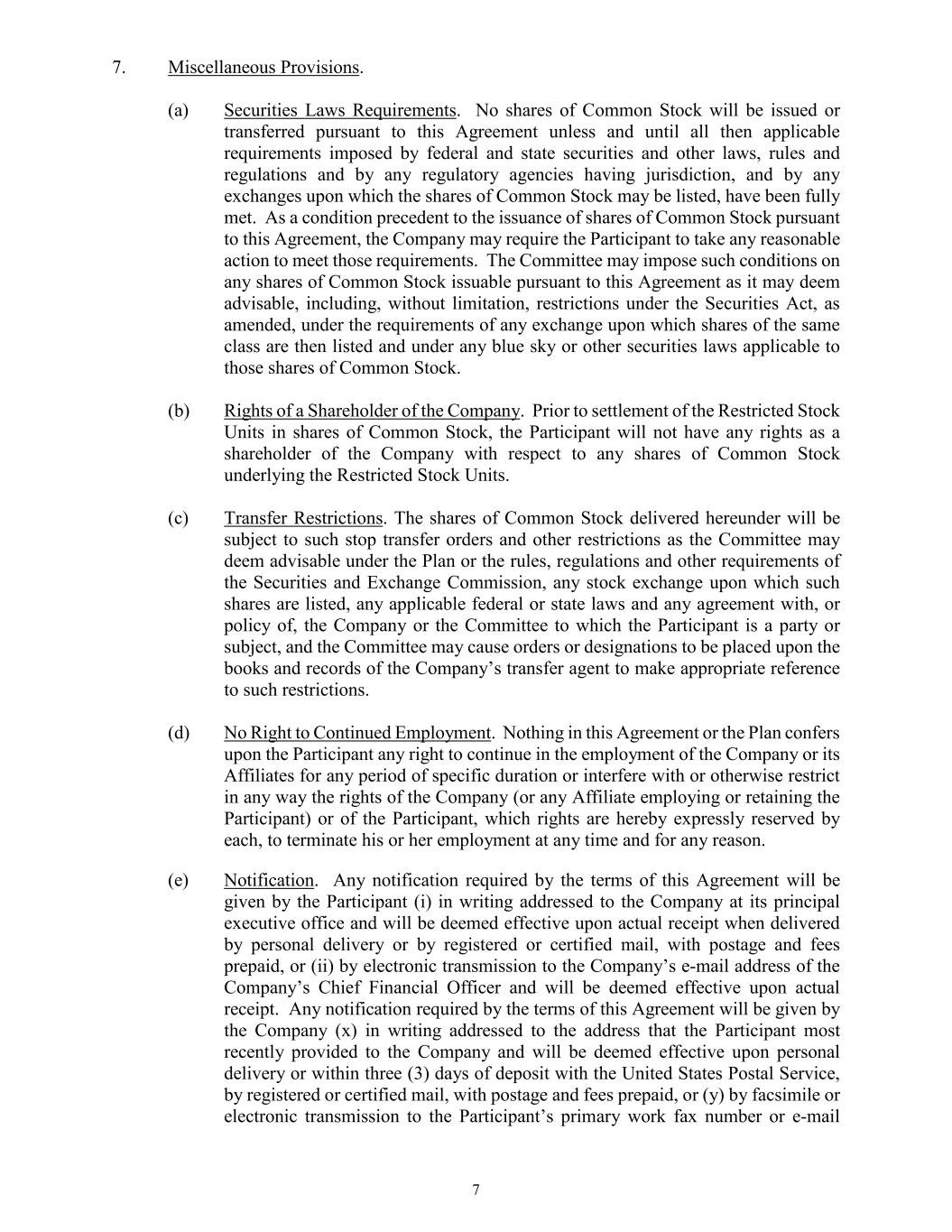

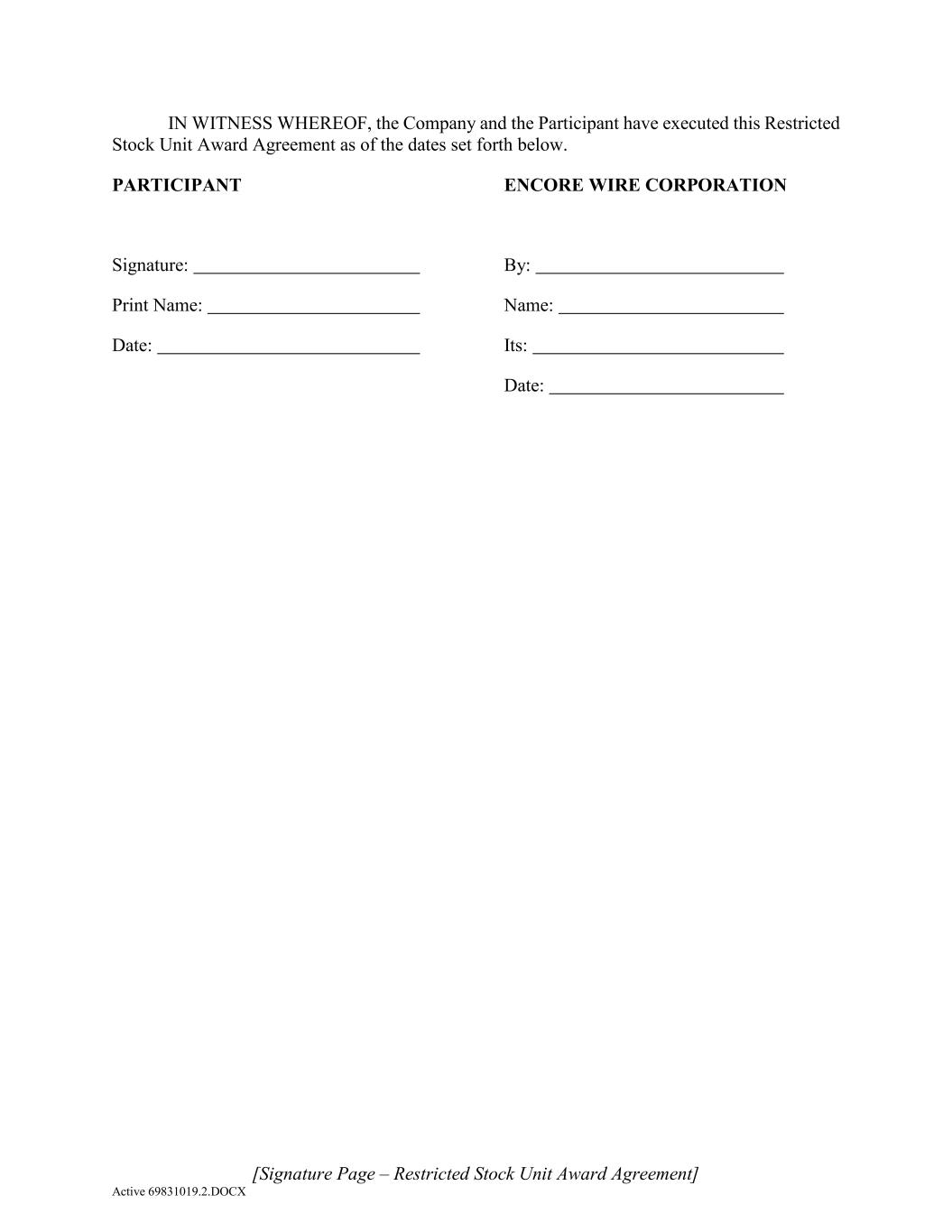

The following table provides information relating to our purchases of shares of our common stock during the three months ended March 31, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

|

(c) |

|

(d) |

| Period |

|

Total Number of Shares Purchased |

|

Average Price Paid Per Share |

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) |

|

Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs (1) |

| January 2024 |

|

— |

|

|

$ |

— |

|

|

— |

|

|

813,617 |

|

| February 2024 |

|

— |

|

|

— |

|

|

— |

|

|

2,000,000 |

|

| March 2024 |

|

— |

|

|

— |

|

|

— |

|

|

2,000,000 |

|

|

|

— |

|

|

$ |

— |

|

|

— |

|

|

|

(1) On November 10, 2006, the Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to an authorized number of shares of its common stock from time to time in open market or private transactions, at the Company's discretion. This authorization originally expired on December 31, 2007, and the Company’s Board of Directors has authorized several increases and annual extensions of this stock repurchase program, most recently in February 2024, authorizing the repurchase of up to 2,000,000 shares of our common stock. As of March 31, 2024, 2,000,000 shares remained authorized for repurchase through March 31, 2025. The Company did not repurchase shares of its stock in the three months ended March 31, 2024, compared to 702,478 shares repurchased in the three months ended March 31, 2023.

Item 5. Other Information.

Rule 10b5-1 Trading Plans

During the three months ended March 31, 2024, none of our executive officers or directors adopted or terminated any contract, instruction or written plan for the purchase or sale of our securities that was intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) or any "non-Rule 10b5-1 trading arrangement." * Management contract or compensatory plan

Item 6. Exhibits.

|

|

|

|

|

|

| Exhibit Number |

Description |

| 2.1 |

|

| 3.1 |

|

| 3.2 |

|

| 3.3 |

|

| 4.1 |

Form of certificate for Common Stock (filed as Exhibit 1 to the Company’s registration statement on Form 8-A, filed with the SEC on June 4, 1992, and incorporated herein by reference). |

| 10.1* |

|

| 10.2* |

|

| 31.1 |

|

| 31.2 |

|

| 32.1 |

|

| 32.2 |

|

| 101.INS |

XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 101.SCH |

Inline XBRL Taxonomy Extension Schema Document |

| 101.CAL |

Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF |

Inline XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB |

Inline XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE |

Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 |

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ENCORE WIRE CORPORATION |

|

(Registrant) |

|

|

| Dated: April 25, 2024 |

/s/ DANIEL L. JONES |

|

Daniel L. Jones

Chairman, President and Chief Executive Officer |

|

|

| Dated: April 25, 2024 |

/s/ BRET J. ECKERT |

|

Bret J. Eckert

Executive Vice President and Chief Financial Officer |

EX-10.1

2

exhibit101prsu.htm

EX-10.1

exhibit101prsu