|

Federally chartered instrumentality

of the United States

|

001-14951 | 52-1578738 | ||||||||||||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer Identification No.) | ||||||||||||

| 1999 K Street, N.W., 4th Floor, | 20006 | |||||||||||||

| Washington, | DC | |||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||

| Title of each class | Trading symbol | Exchange on which registered | ||||||||||||

| Class A voting common stock | AGM.A | New York Stock Exchange | ||||||||||||

| Class C non-voting common stock | AGM | New York Stock Exchange | ||||||||||||

| 6.000% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series C | AGM.PRC | New York Stock Exchange | ||||||||||||

| 5.700% Non-Cumulative Preferred Stock, Series D | AGM.PRD | New York Stock Exchange | ||||||||||||

| 5.750% Non-Cumulative Preferred Stock, Series E | AGM.PRE | New York Stock Exchange | ||||||||||||

| 5.250% Non-Cumulative Preferred Stock, Series F | AGM.PRF | New York Stock Exchange | ||||||||||||

| 4.875% Non-Cumulative Preferred Stock, Series G | AGM.PRG | New York Stock Exchange | ||||||||||||

| $ in thousands, except per share amounts | Quarter Ended | ||||||||||||||||

| Sep. 30, 2023 | Jun. 30, 2023 | Sep. 30, 2022 | Sequential % Change |

YoY % Change |

|||||||||||||

| Net Change in Business Volume |

$914,959 | $252,934 | $847,247 | N/A | N/A | ||||||||||||

| Net Interest Income (GAAP) | $87,643 | $78,677 | $67,853 | 11% | 29% | ||||||||||||

| Net Effective Spread (Non-GAAP) |

$83,424 | $81,832 | $65,641 | 2% | 27% | ||||||||||||

| Diluted EPS (GAAP) | $4.69 | $3.70 | $3.18 | 27% | 47% | ||||||||||||

| Core EPS (Non-GAAP) | $4.13 | $3.86 | $3.07 | 7% | 35% | ||||||||||||

| As of | |||||||||||

| September 30, 2023 | December 31, 2022 | ||||||||||

| (in thousands) | |||||||||||

| Assets: | |||||||||||

| Cash and cash equivalents | $ | 782,318 | $ | 861,002 | |||||||

| Investment securities: | |||||||||||

| Available-for-sale, at fair value (amortized cost of $5,114,476 and $4,769,426, respectively) | 4,873,414 | 4,579,564 | |||||||||

| Held-to-maturity, at amortized cost | 45,032 | 45,032 | |||||||||

| Other investments | 5,807 | 3,672 | |||||||||

| Total Investment Securities | 4,924,253 | 4,628,268 | |||||||||

| Farmer Mac Guaranteed Securities: | |||||||||||

| Available-for-sale, at fair value (amortized cost of $5,536,437 and $8,019,495, respectively) | 5,058,697 | 7,607,226 | |||||||||

| Held-to-maturity, at amortized cost | 4,157,414 | 1,021,154 | |||||||||

| Total Farmer Mac Guaranteed Securities | 9,216,111 | 8,628,380 | |||||||||

| USDA Securities: | |||||||||||

| Trading, at fair value | 1,302 | 1,767 | |||||||||

| Held-to-maturity, at amortized cost | 2,322,355 | 2,409,834 | |||||||||

| Total USDA Securities | 2,323,657 | 2,411,601 | |||||||||

| Loans: | |||||||||||

| Loans held for investment, at amortized cost | 9,130,933 | 9,008,979 | |||||||||

| Loans held for investment in consolidated trusts, at amortized cost | 1,422,854 | 1,211,576 | |||||||||

| Allowance for losses | (16,614) | (15,089) | |||||||||

| Total loans, net of allowance | 10,537,173 | 10,205,466 | |||||||||

| Financial derivatives, at fair value | 28,855 | 37,409 | |||||||||

| Accrued interest receivable (includes $10,666 and $12,514, respectively, related to consolidated trusts) | 230,523 | 229,061 | |||||||||

| Guarantee and commitment fees receivable | 49,809 | 47,151 | |||||||||

| Deferred tax asset, net | 4,711 | 18,004 | |||||||||

| Prepaid expenses and other assets | 213,971 | 266,768 | |||||||||

| Total Assets | $ | 28,311,381 | $ | 27,333,110 | |||||||

| Liabilities and Equity: | |||||||||||

| Liabilities: | |||||||||||

| Notes payable | $ | 25,123,545 | $ | 24,469,113 | |||||||

| Debt securities of consolidated trusts held by third parties | 1,334,014 | 1,181,948 | |||||||||

| Financial derivatives, at fair value | 188,362 | 175,326 | |||||||||

| Accrued interest payable (includes $6,568 and $8,081, respectively, related to consolidated trusts) | 172,150 | 117,887 | |||||||||

| Guarantee and commitment obligation | 47,607 | 46,582 | |||||||||

| Accounts payable and accrued expenses | 58,776 | 68,863 | |||||||||

| Reserve for losses | 1,660 | 1,433 | |||||||||

| Total Liabilities | 26,926,114 | 26,061,152 | |||||||||

| Commitments and Contingencies | |||||||||||

| Equity: | |||||||||||

| Preferred stock: | |||||||||||

| Series C, par value $25 per share, 3,000,000 shares authorized, issued and outstanding | 73,382 | 73,382 | |||||||||

| Series D, par value $25 per share, 4,000,000 shares authorized, issued and outstanding | 96,659 | 96,659 | |||||||||

Series E, par value $25 per share, 3,180,000 shares authorized, issued and outstanding |

77,003 | 77,003 | |||||||||

| Series F, par value $25 per share, 4,800,000 shares authorized, issued and outstanding | 116,160 | 116,160 | |||||||||

| Series G, par value $25 per share, 5,000,000 shares authorized, issued and outstanding | 121,327 | 121,327 | |||||||||

| Common stock: | |||||||||||

| Class A Voting, $1 par value, no maximum authorization, 1,030,780 shares outstanding | 1,031 | 1,031 | |||||||||

| Class B Voting, $1 par value, no maximum authorization, 500,301 shares outstanding | 500 | 500 | |||||||||

| Class C Non-Voting, $1 par value, no maximum authorization, 9,309,351 shares and 9,270,265 shares outstanding, respectively | 9,309 | 9,270 | |||||||||

| Additional paid-in capital | 130,921 | 128,939 | |||||||||

| Accumulated other comprehensive loss, net of tax | (35,839) | (50,843) | |||||||||

| Retained earnings | 794,814 | 698,530 | |||||||||

| Total Equity | 1,385,267 | 1,271,958 | |||||||||

| Total Liabilities and Equity | $ | 28,311,381 | $ | 27,333,110 | |||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | ||||||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||

| Investments and cash equivalents | $ | 79,947 | $ | 21,581 | $ | 209,429 | $ | 38,497 | |||||||||||||||

| Farmer Mac Guaranteed Securities and USDA Securities | 161,351 | 74,695 | 442,649 | 169,231 | |||||||||||||||||||

| Loans | 140,513 | 97,514 | 388,837 | 241,393 | |||||||||||||||||||

| Total interest income | 381,811 | 193,790 | 1,040,915 | 449,121 | |||||||||||||||||||

| Total interest expense | 294,168 | 125,937 | 795,537 | 251,816 | |||||||||||||||||||

| Net interest income | 87,643 | 67,853 | 245,378 | 197,305 | |||||||||||||||||||

| Release of/(provision for) losses | 136 | (617) | (1,484) | 699 | |||||||||||||||||||

| Net interest income after release of/(provision for) losses | 87,779 | 67,236 | 243,894 | 198,004 | |||||||||||||||||||

| Non-interest income/(expense): | |||||||||||||||||||||||

| Guarantee and commitment fees | 5,520 | 2,643 | 12,942 | 9,551 | |||||||||||||||||||

| Gains on financial derivatives | 2,671 | 772 | 4,763 | 21,551 | |||||||||||||||||||

| (Losses)/gains on trading securities | (2) | (41) | 14 | (75) | |||||||||||||||||||

| Release of/(provision for) reserve for losses | 45 | 167 | (227) | 440 | |||||||||||||||||||

| Other income | 1,271 | 651 | 3,239 | 1,805 | |||||||||||||||||||

| Non-interest income | 9,505 | 4,192 | 20,731 | 33,272 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Compensation and employee benefits | 14,103 | 11,648 | 43,391 | 36,661 | |||||||||||||||||||

| General and administrative | 9,100 | 6,919 | 26,047 | 21,717 | |||||||||||||||||||

| Regulatory fees | 831 | 812 | 2,497 | 2,437 | |||||||||||||||||||

| Operating expenses | 24,034 | 19,379 | 71,935 | 60,815 | |||||||||||||||||||

| Income before income taxes | 73,250 | 52,049 | 192,690 | 170,461 | |||||||||||||||||||

| Income tax expense | 15,113 | 10,631 | 40,306 | 35,735 | |||||||||||||||||||

| Net income | 58,137 | 41,418 | 152,384 | 134,726 | |||||||||||||||||||

| Preferred stock dividends | (6,792) | (6,791) | (20,374) | (20,374) | |||||||||||||||||||

| Net income attributable to common stockholders | $ | 51,345 | $ | 34,627 | $ | 132,010 | $ | 114,352 | |||||||||||||||

| Earnings per common share: | |||||||||||||||||||||||

| Basic earnings per common share | $ | 4.74 | $ | 3.21 | $ | 12.20 | $ | 10.61 | |||||||||||||||

| Diluted earnings per common share | $ | 4.69 | $ | 3.18 | $ | 12.08 | $ | 10.51 | |||||||||||||||

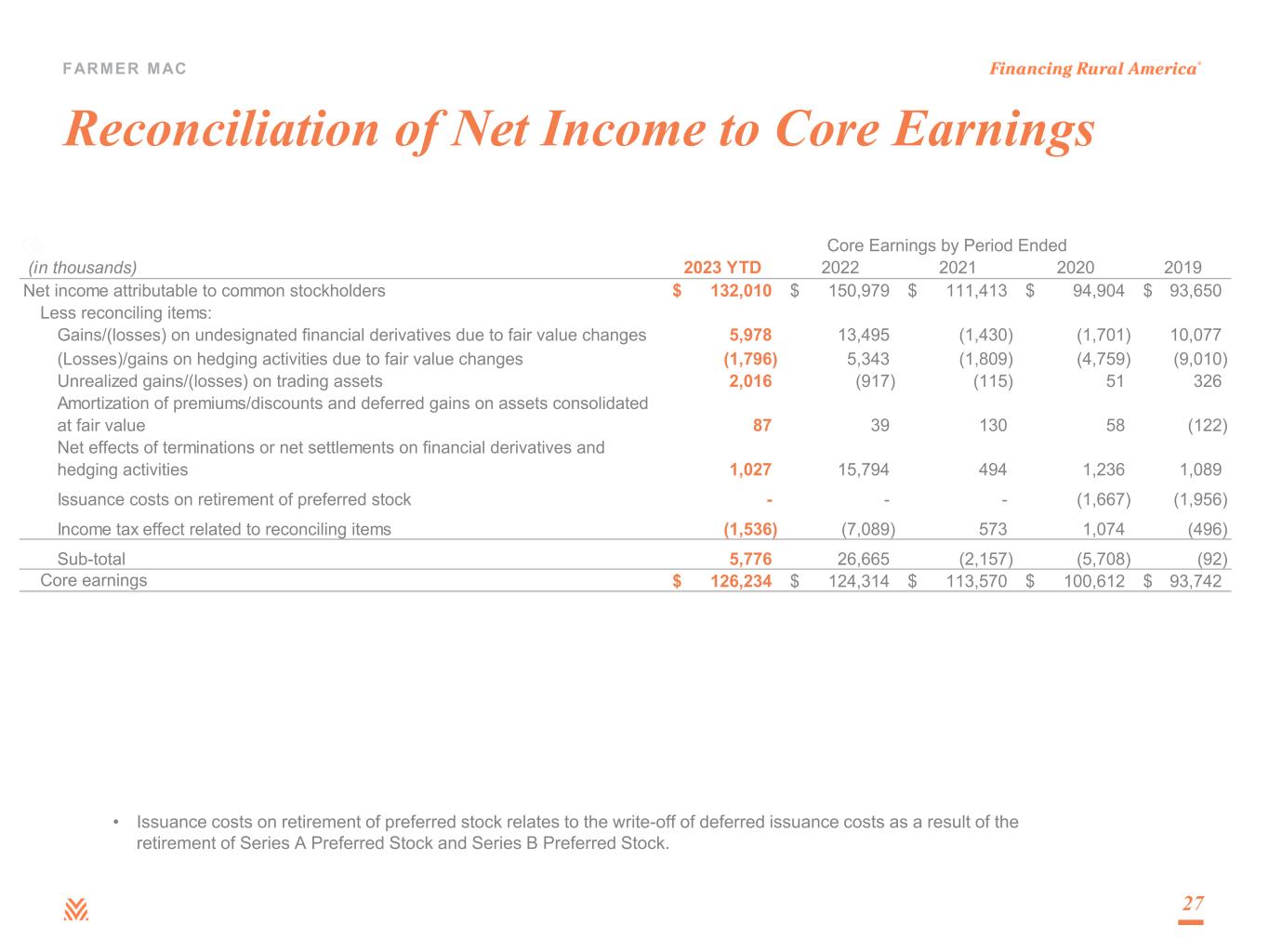

| Reconciliation of Net Income Attributable to Common Stockholders to Core Earnings | |||||||||||||||||

| For the Three Months Ended | |||||||||||||||||

| September 30, 2023 | June 30, 2023 | September 30, 2022 | |||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||

| Net income attributable to common stockholders | $ | 51,345 | $ | 40,421 | $ | 34,627 | |||||||||||

| Less reconciling items: | |||||||||||||||||

| Gains on undesignated financial derivatives due to fair value changes | 2,921 | 2,141 | 6,441 | ||||||||||||||

| Gains/(losses) on hedging activities due to fair value changes | 3,210 | (4,901) | (624) | ||||||||||||||

| Unrealized gains/(losses) on trading assets | 1,714 | (57) | (757) | ||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | 29 | 29 | 24 | ||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | (79) | 583 | (3,522) | ||||||||||||||

| Income tax effect related to reconciling items | (1,638) | 464 | (327) | ||||||||||||||

| Sub-total | 6,157 | (1,741) | 1,235 | ||||||||||||||

| Core earnings | $ | 45,188 | $ | 42,162 | $ | 33,392 | |||||||||||

| Composition of Core Earnings: | |||||||||||||||||

| Revenues: | |||||||||||||||||

Net effective spread(1) |

$ | 83,424 | $ | 81,832 | $ | 65,641 | |||||||||||

Guarantee and commitment fees(2) |

4,828 | 4,581 | 4,201 | ||||||||||||||

Other(3) |

1,056 | 409 | 473 | ||||||||||||||

| Total revenues | 89,308 | 86,822 | 70,315 | ||||||||||||||

| Credit related expense (GAAP): | |||||||||||||||||

| (Release of)/provision for losses | (181) | 1,142 | 450 | ||||||||||||||

| Total credit related expense | (181) | 1,142 | 450 | ||||||||||||||

| Operating expenses (GAAP): | |||||||||||||||||

| Compensation and employee benefits | 14,103 | 13,937 | 11,648 | ||||||||||||||

| General and administrative | 9,100 | 9,420 | 6,919 | ||||||||||||||

| Regulatory fees | 831 | 831 | 812 | ||||||||||||||

| Total operating expenses | 24,034 | 24,188 | 19,379 | ||||||||||||||

| Net earnings | 65,455 | 61,492 | 50,486 | ||||||||||||||

Income tax expense(4) |

13,475 | 12,539 | 10,303 | ||||||||||||||

| Preferred stock dividends (GAAP) | 6,792 | 6,791 | 6,791 | ||||||||||||||

| Core earnings | $ | 45,188 | $ | 42,162 | $ | 33,392 | |||||||||||

| Core earnings per share: | |||||||||||||||||

| Basic | $ | 4.17 | $ | 3.89 | $ | 3.09 | |||||||||||

| Diluted | $ | 4.13 | $ | 3.86 | $ | 3.07 | |||||||||||

| Reconciliation of Net Income Attributable to Common Stockholders to Core Earnings | |||||||||||

| For the Nine Months Ended | |||||||||||

| September 30, 2023 | September 30, 2022 | ||||||||||

| (in thousands, except per share amounts) | |||||||||||

| Net income attributable to common stockholders | $ | 132,010 | $ | 114,352 | |||||||

| Less reconciling items: | |||||||||||

| Gains on undesignated financial derivatives due to fair value changes | 5,978 | 11,899 | |||||||||

| (Losses)/gains on hedging activities due to fair value changes | (1,796) | 5,491 | |||||||||

| Unrealized gains/(losses) on trading assets | 2,016 | (948) | |||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | 87 | (18) | |||||||||

| Net effects of terminations or net settlements on financial derivatives | 1,027 | 14,526 | |||||||||

| Income tax effect related to reconciling items | (1,536) | (6,499) | |||||||||

| Sub-total | 5,776 | 24,451 | |||||||||

| Core earnings | $ | 126,234 | $ | 89,901 | |||||||

| Composition of Core Earnings: | |||||||||||

| Revenues: | |||||||||||

Net effective spread(1) |

$ | 242,429 | $ | 184,426 | |||||||

Guarantee and commitment fees(2) |

14,063 | 13,467 | |||||||||

Other(3) |

2,532 | 1,294 | |||||||||

| Total revenues | 259,024 | 199,187 | |||||||||

| Credit related expense (GAAP): | |||||||||||

| Provision for/(release of) losses | 1,711 | (1,139) | |||||||||

| Total credit related expense | 1,711 | (1,139) | |||||||||

| Operating expenses (GAAP): | |||||||||||

| Compensation and employee benefits | 43,391 | 36,661 | |||||||||

| General and administrative | 26,047 | 21,717 | |||||||||

| Regulatory fees | 2,497 | 2,437 | |||||||||

| Total operating expenses | 71,935 | 60,815 | |||||||||

| Net earnings | 185,378 | 139,511 | |||||||||

Income tax expense(4) |

38,770 | 29,236 | |||||||||

| Preferred stock dividends (GAAP) | 20,374 | 20,374 | |||||||||

| Core earnings | $ | 126,234 | $ | 89,901 | |||||||

| Core earnings per share: | |||||||||||

| Basic | $ | 11.66 | $ | 8.33 | |||||||

| Diluted | $ | 11.56 | $ | 8.27 | |||||||

| Reconciliation of GAAP Basic Earnings Per Share to Core Earnings Basic Earnings Per Share | |||||||||||||||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, 2023 | June 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | |||||||||||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||||||||||||

| GAAP - Basic EPS | $ | 4.74 | $ | 3.73 | $ | 3.21 | $ | 12.20 | $ | 10.61 | |||||||||||||||||||

| Less reconciling items: | |||||||||||||||||||||||||||||

| Gains on undesignated financial derivatives due to fair value changes | 0.27 | 0.20 | 0.60 | 0.55 | 1.10 | ||||||||||||||||||||||||

| Gains/(losses) on hedging activities due to fair value changes | 0.30 | (0.45) | (0.06) | (0.17) | 0.51 | ||||||||||||||||||||||||

| Unrealized gains/(losses) on trading securities | 0.16 | — | (0.07) | 0.19 | (0.09) | ||||||||||||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | — | — | — | 0.01 | — | ||||||||||||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | (0.01) | 0.05 | (0.32) | 0.10 | 1.36 | ||||||||||||||||||||||||

| Income tax effect related to reconciling items | (0.15) | 0.04 | (0.03) | (0.14) | (0.60) | ||||||||||||||||||||||||

| Sub-total | 0.57 | (0.16) | 0.12 | 0.54 | 2.28 | ||||||||||||||||||||||||

| Core Earnings - Basic EPS | $ | 4.17 | $ | 3.89 | $ | 3.09 | $ | 11.66 | $ | 8.33 | |||||||||||||||||||

| Shares used in per share calculation (GAAP and Core Earnings) | 10,839 | 10,833 | 10,799 | 10,825 | 10,787 | ||||||||||||||||||||||||

| Reconciliation of GAAP Diluted Earnings Per Share to Core Earnings Diluted Earnings Per Share | |||||||||||||||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, 2023 | June 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | |||||||||||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||||||||||||

| GAAP - Diluted EPS | $ | 4.69 | $ | 3.70 | $ | 3.18 | $ | 12.08 | $ | 10.51 | |||||||||||||||||||

| Less reconciling items: | |||||||||||||||||||||||||||||

| Gains on undesignated financial derivatives due to fair value changes | 0.27 | 0.20 | 0.59 | 0.54 | 1.09 | ||||||||||||||||||||||||

| Gains/(losses) on hedging activities due to fair value changes | 0.29 | (0.45) | (0.06) | (0.16) | 0.50 | ||||||||||||||||||||||||

| Unrealized gains/(losses) on trading securities | 0.16 | — | (0.07) | 0.18 | (0.09) | ||||||||||||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | — | — | — | 0.01 | — | ||||||||||||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | (0.01) | 0.05 | (0.32) | 0.09 | 1.34 | ||||||||||||||||||||||||

| Income tax effect related to reconciling items | (0.15) | 0.04 | (0.03) | (0.14) | (0.60) | ||||||||||||||||||||||||

| Sub-total | 0.56 | (0.16) | 0.11 | 0.52 | 2.24 | ||||||||||||||||||||||||

| Core Earnings - Diluted EPS | $ | 4.13 | $ | 3.86 | $ | 3.07 | $ | 11.56 | $ | 8.27 | |||||||||||||||||||

| Shares used in per share calculation (GAAP and Core Earnings) | 10,938 | 10,916 | 10,874 | 10,924 | 10,875 | ||||||||||||||||||||||||

| Reconciliation of GAAP Net Interest Income/Yield to Net Effective Spread | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2023 | June 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income/yield | $ | 87,643 | 1.22 | % | $ | 78,677 | 1.12 | % | $ | 67,853 | 1.04 | % | $ | 245,378 | 1.16 | % | $ | 197,305 | 1.03 | % | |||||||||||||||||||||||||||||||||||||||

| Net effects of consolidated trusts | (1,024) | 0.02 | % | (1,044) | 0.02 | % | (843) | 0.02 | % | (3,123) | 0.02 | % | (3,044) | 0.02 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Expense related to undesignated financial derivatives | (805) | (0.01) | % | (1,568) | (0.02) | % | (2,613) | (0.05) | % | (3,999) | (0.02) | % | (5,633) | (0.03) | % | ||||||||||||||||||||||||||||||||||||||||||||

| Amortization of premiums/discounts on assets consolidated at fair value | (24) | — | % | (24) | — | % | (21) | — | % | (71) | — | % | 28 | — | % | ||||||||||||||||||||||||||||||||||||||||||||

| Amortization of losses due to terminations or net settlements on financial derivatives | 844 | 0.01 | % | 890 | 0.01 | % | 640 | 0.01 | % | 2,448 | 0.01 | % | 1,723 | 0.01 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Fair value changes on fair value hedge relationships | (3,210) | (0.04) | % | 4,901 | 0.07 | % | 625 | 0.01 | % | 1,796 | 0.01 | % | (5,953) | (0.03) | % | ||||||||||||||||||||||||||||||||||||||||||||

| Net effective spread | $ | 83,424 | 1.20 | % | $ | 81,832 | 1.20 | % | $ | 65,641 | 1.03 | % | $ | 242,429 | 1.18 | % | $ | 184,426 | 1.00 | % | |||||||||||||||||||||||||||||||||||||||

| Core Earnings by Business Segment | |||||||||||||||||||||||||||||||||||||||||||||||||||||

For the Three Months Ended September 30, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agricultural Finance | Rural Infrastructure | Treasury | Corporate | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Farm & Ranch | Corporate AgFinance |

Rural

Utilities

|

Renewable Energy | Funding | Investments | Reconciling Adjustments |

Consolidated Net Income | ||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 33,735 | $ | 8,250 | $ | 6,393 | $ | 1,150 | $ | 37,642 | $ | 473 | $ | — | $ | — | $ | 87,643 | |||||||||||||||||||||||||||||||||||

Less: reconciling adjustments(1)(2)(3) |

(1,017) | — | (31) | — | (3,230) | 59 | — | 4,219 | — | ||||||||||||||||||||||||||||||||||||||||||||

| Net effective spread | 32,718 | 8,250 | 6,362 | 1,150 | 34,412 | 532 | — | 4,219 | — | ||||||||||||||||||||||||||||||||||||||||||||

| Guarantee and commitment fees | 4,447 | 78 | 279 | 24 | — | — | — | 692 | 5,520 | ||||||||||||||||||||||||||||||||||||||||||||

Other income/(expense)(3) |

807 | — | — | — | 3 | 6 | 240 | 2,884 | 3,940 | ||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | 37,972 | 8,328 | 6,641 | 1,174 | 34,415 | 538 | 240 | 7,795 | 97,103 | ||||||||||||||||||||||||||||||||||||||||||||

| Release of/(provision for) losses | 13 | 3,694 | (3,504) | (66) | — | (1) | — | — | 136 | ||||||||||||||||||||||||||||||||||||||||||||

| Release of/(provision for) reserve for losses | 58 | — | (13) | — | — | — | — | — | 45 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating expenses | — | — | — | — | — | — | (24,034) | — | (24,034) | ||||||||||||||||||||||||||||||||||||||||||||

| Total non-interest expense | 58 | — | (13) | — | — | — | (24,034) | — | (23,989) | ||||||||||||||||||||||||||||||||||||||||||||

| Core earnings before income taxes | 38,043 | 12,022 | 3,124 | 1,108 | 34,415 | 537 | (23,794) | 7,795 | (4) |

73,250 | |||||||||||||||||||||||||||||||||||||||||||

| Income tax (expense)/benefit | (7,989) | (2,525) | (656) | (233) | (7,226) | (113) | 5,267 | (1,638) | (15,113) | ||||||||||||||||||||||||||||||||||||||||||||

| Core earnings before preferred stock dividends | 30,054 | 9,497 | 2,468 | 875 | 27,189 | 424 | (18,527) | 6,157 | (4) |

58,137 | |||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | — | — | (6,792) | — | (6,792) | ||||||||||||||||||||||||||||||||||||||||||||

| Segment core earnings/(losses) | $ | 30,054 | $ | 9,497 | $ | 2,468 | $ | 875 | $ | 27,189 | $ | 424 | $ | (25,319) | $ | 6,157 | (4) |

$ | 51,345 | ||||||||||||||||||||||||||||||||||

| Total Assets | $ | 14,660,371 | $ | 1,619,664 | $ | 6,648,693 | $ | 320,572 | $ | — | $ | 4,866,969 | $ | 195,112 | $ | — | $ | 28,311,381 | |||||||||||||||||||||||||||||||||||

| Total on- and off-balance sheet program assets at principal balance | $ | 18,461,835 | $ | 1,741,306 | $ | 7,118,295 | $ | 330,575 | $ | — | $ | — | $ | — | $ | — | $ | 27,652,011 | |||||||||||||||||||||||||||||||||||

| Outstanding Business Volume | ||||||||||||||||||||

| On or Off Balance Sheet |

As of September 30, 2023 | As of December 31, 2022 | ||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Agricultural Finance: | ||||||||||||||||||||

| Farm & Ranch: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 4,987,818 | $ | 5,150,750 | |||||||||||||||

| Loans held in consolidated trusts: | ||||||||||||||||||||

Beneficial interests owned by third-party investors (Pass-Through)(1) |

On-balance sheet | 859,917 | 914,918 | |||||||||||||||||

Beneficial interests owned by third-party investors (Structured)(1) |

On-balance sheet | 562,937 | 296,658 | |||||||||||||||||

IO-FMGS(2) |

On-balance sheet | 9,580 | 10,622 | |||||||||||||||||

| USDA Securities | On-balance sheet | 2,329,830 | 2,407,302 | |||||||||||||||||

AgVantage Securities(1) |

On-balance sheet | 5,685,000 | 5,605,000 | |||||||||||||||||

| LTSPCs and unfunded commitments | Off-balance sheet | 2,992,061 | 2,822,309 | |||||||||||||||||

Other Farmer Mac Guaranteed Securities(3) |

Off-balance sheet | 455,681 | 500,953 | |||||||||||||||||

| Loans serviced for others | Off-balance sheet | 579,011 | 20,280 | |||||||||||||||||

| Total Farm & Ranch | $ | 18,461,835 | $ | 17,728,792 | ||||||||||||||||

| Corporate AgFinance: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 1,223,777 | $ | 1,166,253 | |||||||||||||||

AgVantage Securities(1) |

On-balance sheet | 383,173 | 359,600 | |||||||||||||||||

| Unfunded commitments | Off-balance sheet | 134,356 | 77,654 | |||||||||||||||||

| Total Corporate AgFinance | $ | 1,741,306 | $ | 1,603,507 | ||||||||||||||||

| Total Agricultural Finance | $ | 20,203,141 | $ | 19,332,299 | ||||||||||||||||

| Rural Infrastructure Finance: | ||||||||||||||||||||

| Rural Utilities: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 3,024,640 | $ | 2,801,696 | |||||||||||||||

AgVantage Securities(1) |

On-balance sheet | 3,617,542 | 3,044,156 | |||||||||||||||||

| LTSPCs and unfunded commitments | Off-balance sheet | 475,015 | 512,592 | |||||||||||||||||

Other Farmer Mac Guaranteed Securities(3) |

Off-balance sheet | 1,098 | 1,169 | |||||||||||||||||

| Total Rural Utilities | $ | 7,118,295 | $ | 6,359,613 | ||||||||||||||||

| Renewable Energy: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 318,073 | $ | 219,570 | |||||||||||||||

| Unfunded commitments | Off-balance sheet | 12,502 | 10,600 | |||||||||||||||||

| Total Renewable Energy | $ | 330,575 | $ | 230,170 | ||||||||||||||||

| Total Rural Infrastructure Finance | $ | 7,448,870 | $ | 6,589,783 | ||||||||||||||||

| Total | $ | 27,652,011 | $ | 25,922,082 | ||||||||||||||||

Net Effective Spread(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agricultural Finance | Rural Infrastructure Finance | Treasury | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Farm & Ranch | Corporate AgFinance | Rural Utilities | Renewable Energy | Funding | Investments | Net Effective Spread | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the quarter ended: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

September 30, 2023(2) |

$ | 32,718 | 0.97 | % | $ | 8,250 | 2.05 | % | $ | 6,362 | 0.39 | % | $ | 1,150 | 1.46 | % | $ | 34,412 | 0.49 | % | $ | 532 | 0.04 | % | $ | 83,424 | 1.20 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2023 | 34,388 | 1.03 | % | 7,444 | 1.92 | % | 5,808 | 0.38 | % | 1,100 | 1.47 | % | 32,498 | 0.48 | % | 594 | 0.04 | % | 81,832 | 1.20 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31, 2023 | 32,465 | 0.97 | % | 7,148 | 1.94 | % | 5,507 | 0.36 | % | 858 | 1.53 | % | 31,738 | 0.47 | % | (543) | (0.04) | % | 77,173 | 1.15 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2022 | 32,770 | 0.98 | % | 7,471 | 1.94 | % | 4,960 | 0.34 | % | 935 | 1.76 | % | 27,656 | 0.42 | % | (2,689) | (0.19) | % | 71,103 | 1.07 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2022 | 33,343 | 1.04 | % | 7,600 | 1.99 | % | 4,220 | 0.30 | % | 705 | 1.97 | % | 22,564 | 0.36 | % | (2,791) | (0.21) | % | 65,641 | 1.03 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2022 | 32,590 | 1.05 | % | 6,929 | 1.87 | % | 3,733 | 0.27 | % | 468 | 1.78 | % | 18,508 | 0.30 | % | (1,282) | (0.10) | % | 60,946 | 0.99 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31, 2022 | 30,354 | 1.02 | % | 7,209 | 1.96 | % | 3,159 | 0.23 | % | 375 | 1.69 | % | 16,738 | 0.28 | % | 4 | — | % | 57,839 | 0.97 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2021 | 28,998 | 0.99 | % | 6,321 | 1.84 | % | 2,521 | 0.19 | % | 356 | 1.53 | % | 15,979 | 0.28 | % | 158 | 0.01 | % | 54,333 | 0.94 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2021 | 28,914 | 1.06 | % | 7,163 | 1.80 | % | 2,067 | 0.16 | % | 236 | 1.09 | % | 17,386 | 0.31 | % | 159 | 0.01 | % | 55,925 | 0.99 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Core Earnings by Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 2023 | June 2023 | March 2023 | December 2022 | September 2022 | June 2022 | March 2022 | December 2021 | September 2021 | |||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net effective spread | $ | 83,424 | $ | 81,832 | $ | 77,173 | $ | 71,103 | $ | 65,641 | $ | 60,946 | $ | 57,839 | $ | 54,333 | $ | 55,925 | |||||||||||||||||||||||||||||||||||

| Guarantee and commitment fees | 4,828 | 4,581 | 4,654 | 4,677 | 4,201 | 4,709 | 4,557 | 4,637 | 4,322 | ||||||||||||||||||||||||||||||||||||||||||||

| Gains on sale of mortgage loans | — | — | — | — | — | — | — | 6,539 | — | ||||||||||||||||||||||||||||||||||||||||||||

| Other | 1,056 | 409 | 1,067 | 390 | 473 | 307 | 514 | 241 | 687 | ||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | 89,308 | 86,822 | 82,894 | 76,170 | 70,315 | 65,962 | 62,910 | 65,750 | 60,934 | ||||||||||||||||||||||||||||||||||||||||||||

| Credit related expense/(income): | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Release of)/provision for losses | (181) | 1,142 | 750 | 1,945 | 450 | (1,535) | (54) | (1,428) | 255 | ||||||||||||||||||||||||||||||||||||||||||||

| REO operating expenses | — | — | — | 819 | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Total credit related expense/(income) | (181) | 1,142 | 750 | 2,764 | 450 | (1,535) | (54) | (1,428) | 255 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compensation and employee benefits | 14,103 | 13,937 | 15,351 | 12,105 | 11,648 | 11,715 | 13,298 | 11,246 | 10,027 | ||||||||||||||||||||||||||||||||||||||||||||

| General and administrative | 9,100 | 9,420 | 7,527 | 8,055 | 6,919 | 7,520 | 7,278 | 8,492 | 6,330 | ||||||||||||||||||||||||||||||||||||||||||||

| Regulatory fees | 831 | 831 | 835 | 832 | 812 | 813 | 812 | 812 | 750 | ||||||||||||||||||||||||||||||||||||||||||||

| Total operating expenses | 24,034 | 24,188 | 23,713 | 20,992 | 19,379 | 20,048 | 21,388 | 20,550 | 17,107 | ||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | 65,455 | 61,492 | 58,431 | 52,414 | 50,486 | 47,449 | 41,576 | 46,628 | 43,572 | ||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 13,475 | 12,539 | 12,756 | 11,210 | 10,303 | 9,909 | 9,024 | 9,809 | 9,152 | ||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | 6,792 | 6,791 | 6,791 | 6,791 | 6,791 | 6,792 | 6,791 | 6,792 | 6,774 | ||||||||||||||||||||||||||||||||||||||||||||

| Core earnings | $ | 45,188 | $ | 42,162 | $ | 38,884 | $ | 34,413 | $ | 33,392 | $ | 30,748 | $ | 25,761 | $ | 30,027 | $ | 27,646 | |||||||||||||||||||||||||||||||||||

| Reconciling items: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gains/(losses) on undesignated financial derivatives due to fair value changes | $ | 2,921 | $ | 2,141 | $ | 916 | $ | 1,596 | $ | 6,441 | $ | 2,846 | $ | 2,612 | $ | (1,242) | $ | (405) | |||||||||||||||||||||||||||||||||||

| Gains/(losses) on hedging activities due to fair value changes | 3,210 | (4,901) | (105) | (148) | (624) | 428 | 5,687 | (2,079) | 1,818 | ||||||||||||||||||||||||||||||||||||||||||||

| Unrealized gains/(losses) on trading assets | 1,714 | (57) | 359 | 31 | (757) | (285) | 94 | (76) | 36 | ||||||||||||||||||||||||||||||||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | 29 | 29 | 29 | 57 | 24 | (62) | 20 | 71 | 23 | ||||||||||||||||||||||||||||||||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | (79) | 583 | 523 | 1,268 | (3,522) | 2,536 | 15,512 | (429) | (351) | ||||||||||||||||||||||||||||||||||||||||||||

| Income tax effect related to reconciling items | (1,638) | 464 | (362) | (590) | (327) | (1,148) | (5,024) | 789 | (236) | ||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 51,345 | $ | 40,421 | $ | 40,244 | $ | 36,627 | $ | 34,627 | $ | 35,063 | $ | 44,662 | $ | 27,061 | $ | 28,531 | |||||||||||||||||||||||||||||||||||