Document

SIGNET JEWELERS REPORTS FIRST QUARTER FISCAL 2025 RESULTS

Delivered First Quarter Expectations

Engagement Recovery Momentum Continues

Reaffirms April Increase to Full Year Outlook

HAMILTON, Bermuda, June 13, 2024 – Signet Jewelers Limited (“Signet” or the "Company") (NYSE:SIG), the world's largest retailer of diamond jewelry, today announced its results for the 13 weeks ended May 4, 2024 (“first quarter Fiscal 2025”).

"Our results reflect notable acceleration from a sluggish February to the top half of expectations, with an even stronger May,” said Signet Chief Executive Officer Virginia C. Drosos. “Compared to the previous quarter, we increased North America engagement unit sales by 400 basis points excluding Digital banners. Further, customers continue to respond well to our new product offerings and loyalty program, reflected in a meaningful improvement in comparable sales for Fashion since February. We expect continued momentum in the second quarter, leading to a positive same store sales inflection in the second half of Fiscal 25.”

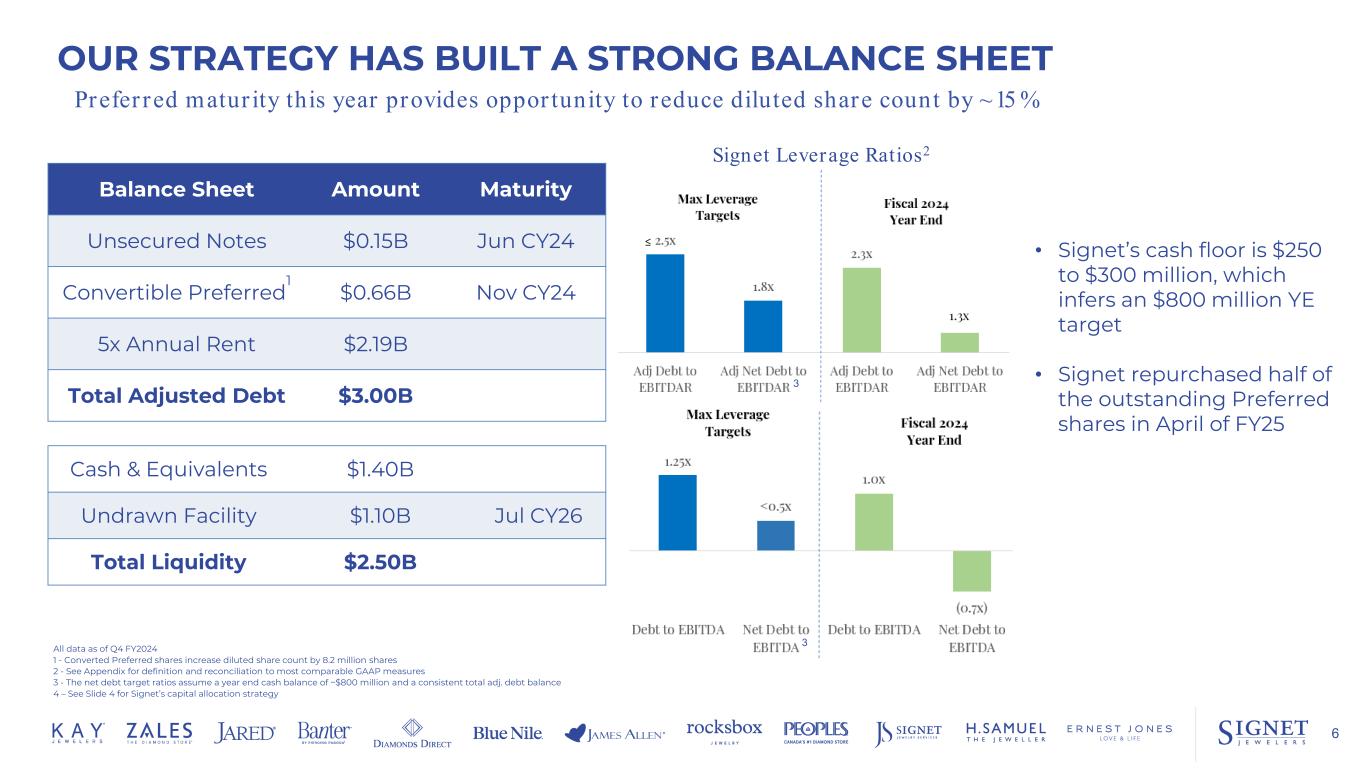

“Our flexible operating model continues to work as designed, leading to adjusted merchandise margin expansion of 100 basis points, continued working capital optimization, and improved free cash flow over the prior year,” said Joan Hilson, Chief Financial, Strategy & Services Officer. “Signet’s strong balance sheet provides a clear line of sight to redeeming all convertible preferred shares. We are reaffirming our increased full year guidance."

First Quarter Fiscal 2025 Highlights:

•Sales of $1.5 billion, down $157.2 million or 9.4% (down 9.6%(1) on a constant currency basis) to Q1 of FY24.

•Same store sales (“SSS”)(2) down 8.9% to Q1 of FY24.

•Operating income of $49.8 million, down $51.9 million from Q1 of FY24.

•Adjusted operating income(1) of $57.8 million, down $48.7 million from Q1 of FY24.

•Diluted loss per share of $0.90, compared to a diluted earnings per share ("EPS") $1.79 in Q1 of FY24. The current year diluted loss per share reflects the impact of a deemed dividend of $85.1 million related to the redemption of half of the preferred shares in Q1.

•Adjusted diluted EPS(1) of $1.11, compared to $1.78 in Q1 of FY24.

•Cash and cash equivalents, at quarter end, of $729.3 million, compared to $655.9 million in Q1 of FY24.

•Year-to-date cash used in operating activities of $158.2 million, compared to $381.8 million in Q1 of FY24.

•Repurchased $7.4 million, or approximately 73,000 common shares, during the first quarter.

(1) Certain non-GAAP financial measures used within this release have been renamed this quarter. There have been no changes to how these non-GAAP measures are defined or reconciled to the most directly comparable GAAP measures. See the non-GAAP financial measures section below for additional information.

(2) Same store sales include physical stores and eCommerce sales.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions, except per share amounts) |

|

Fiscal 25 Q1 |

|

Fiscal 24 Q1 |

|

|

|

|

|

|

|

|

| Sales |

|

$ |

1,510.8 |

|

$ |

1,668.0 |

|

|

|

|

|

|

|

|

SSS % change (1) (2) |

|

(8.9) |

% |

|

(13.9) |

% |

|

|

|

|

|

|

|

|

| GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

$ |

49.8 |

|

$ |

101.7 |

|

|

|

|

|

|

|

|

| Operating margin |

|

3.3 |

% |

|

6.1 |

% |

|

|

|

|

|

|

|

|

| Diluted EPS (loss per share) |

|

$ |

(0.90) |

|

$ |

1.79 |

|

|

|

|

|

|

|

|

Adjusted (3) |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating income |

|

$ |

57.8 |

|

$ |

106.5 |

|

|

|

|

|

|

|

|

| Adjusted operating margin |

|

3.8 |

% |

|

6.4 |

% |

|

|

|

|

|

|

|

|

| Adjusted diluted EPS |

|

$ |

1.11 |

|

$ |

1.78 |

|

|

|

|

|

|

|

|

(1) Same store sales include physical stores and eCommerce sales.

(2) Fiscal 2025 Q1 same store sales have been calculated by aligning the sales weeks of the current quarter to the equivalent sales weeks in the prior fiscal year period.

(3) See non-GAAP financial measures below.

First Quarter Fiscal 2025 Results:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change from previous year |

|

|

First Quarter Fiscal 2025 |

Same

store

sales (1)

|

|

Non-same

store sales,

net |

|

Total sales at

constant

exchange rate (2)

|

|

Exchange

translation

impact |

|

Total sales

as reported |

|

Total sales

(in millions) |

North America segment |

(9.2) |

% |

|

0.2 |

% |

|

(9.0) |

% |

|

— |

% |

|

(9.0) |

% |

|

$ |

1,420.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International segment |

(3.2) |

% |

|

(16.3) |

% |

|

(19.5) |

% |

|

2.5 |

% |

|

(17.0) |

% |

|

$ |

77.2 |

|

Other segment (3) |

nm |

|

nm |

|

nm |

|

nm |

|

nm |

|

$ |

13.6 |

|

Signet |

(8.9) |

% |

|

(0.7) |

% |

|

(9.6) |

% |

|

0.2 |

% |

|

(9.4) |

% |

|

$ |

1,510.8 |

|

(1) The 53rd week in Fiscal 2024 has resulted in a shift as the current fiscal year began a week later than the previous fiscal year. As such, same store sales for Fiscal 2025 have been calculated by aligning the sales weeks of the current quarter to the equivalent sales weeks in the prior fiscal year quarter. Total reported sales continue to be calculated based on the reported fiscal periods.

(2) See non-GAAP financial measures below.

(3) Includes sales from Signet’s diamond sourcing operation.

nm Not meaningful.

By reportable segment:

North America

•Total sales of $1.4 billion, down $141.2 million or 9.0% to Q1 of FY24 reflecting a decrease of 1.6% in total average transaction value ("ATV"), on a lower number of transactions.

•SSS declined 9.2% compared to Q1 of FY24.

International

•Total sales of $77.2 million, down $15.8 million or 17.0% to Q1 of FY24 (down 19.5% on a constant currency basis) reflecting a decrease of 15.3% in total ATV driven by the previously announced sale of prestige watch locations, as well as a lower number of transactions.

•SSS declined 3.2% versus Q1 of FY24.

Gross margin was $572.4 million, down from $632.0 million in Q1 of FY24. Gross margin was 37.9% of sales, or flat to Q1 of FY24 as favorable merchandise margins, including a more than 300 basis point improvement in Digital banners (James Allen and Blue Nile), and a higher mix of Services business offset by deleveraging of fixed costs such as store occupancy.

SG&A was $515.4 million, down from $530.4 million in Q1 of FY24. SG&A was 34.1% of sales, 230 basis points higher versus Q1 of FY24. The change in SG&A as a percentage of sales was primarily driven by deleverage on fixed costs.

Operating income was $49.8 million or 3.3% of sales, compared to $101.7 million, or 6.1% of sales in the prior year first quarter.

Adjusted operating income was $57.8 million, or 3.8% of sales, compared to $106.5 million, or 6.4% of sales in the prior year first quarter.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First quarter Fiscal 2025 |

|

First quarter Fiscal 2024 |

| Operating income in millions |

|

$ |

|

% of sales |

|

$ |

|

% of sales |

| North America segment |

|

$ |

83.2 |

|

|

5.9 |

% |

|

$ |

124.7 |

|

|

8.0 |

% |

| International segment |

|

(13.0) |

|

|

(16.8) |

% |

|

(6.9) |

|

|

(7.4) |

% |

| Other segment |

|

(3.1) |

|

|

nm |

|

(0.7) |

|

|

nm |

| Corporate and unallocated expenses |

|

(17.3) |

|

|

nm |

|

(15.4) |

|

|

nm |

| Total operating income |

|

$ |

49.8 |

|

|

3.3 |

% |

|

$ |

101.7 |

|

|

6.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First quarter Fiscal 2025 |

|

First quarter Fiscal 2024 |

Adjusted operating income in millions (1) |

|

$ |

|

% of sales |

|

$ |

|

% of sales |

| North America segment |

|

$ |

85.2 |

|

|

6.0 |

% |

|

$ |

129.5 |

|

|

8.3 |

% |

| International segment |

|

(7.0) |

|

|

(9.1) |

% |

|

(6.9) |

|

|

(7.4) |

% |

| Other segment |

|

(3.1) |

|

|

nm |

|

(0.7) |

|

|

nm |

| Corporate and unallocated expenses |

|

(17.3) |

|

|

nm |

|

(15.4) |

|

|

nm |

| Total adjusted operating income |

|

$ |

57.8 |

|

|

3.8 |

% |

|

$ |

106.5 |

|

|

6.4 |

% |

(1) See non-GAAP financial measures below.

nm Not meaningful.

The current quarter income tax expense was $6.5 million compared to income tax expense of $9.5 million in Q1 of FY24. Adjusted income tax expense was $8.4 million compared to $14.7 million in Q1 of FY24.

Diluted loss per share was $0.90, down from diluted EPS of $1.79 in Q1 of FY24. Diluted loss per share in the current quarter primarily includes $1.91 for deemed dividends for the premium on redemption of preferred shares, $0.10 of restructuring charges and $0.04 of asset impairments. Excluding these charges (and related tax and dilution effects), diluted EPS was $1.11 on an adjusted basis.

Loss per share in the first quarter of Fiscal 2025 excludes the anti-dilutive impact of the preferred shares in the share count based on the net loss attributable to common shareholders recorded in the first quarter of Fiscal 2025. Adjusted diluted EPS in the current quarter includes the impact of the preferred shares in the dilutive share count based on the level of adjusted net income attributable to common shareholders this quarter.

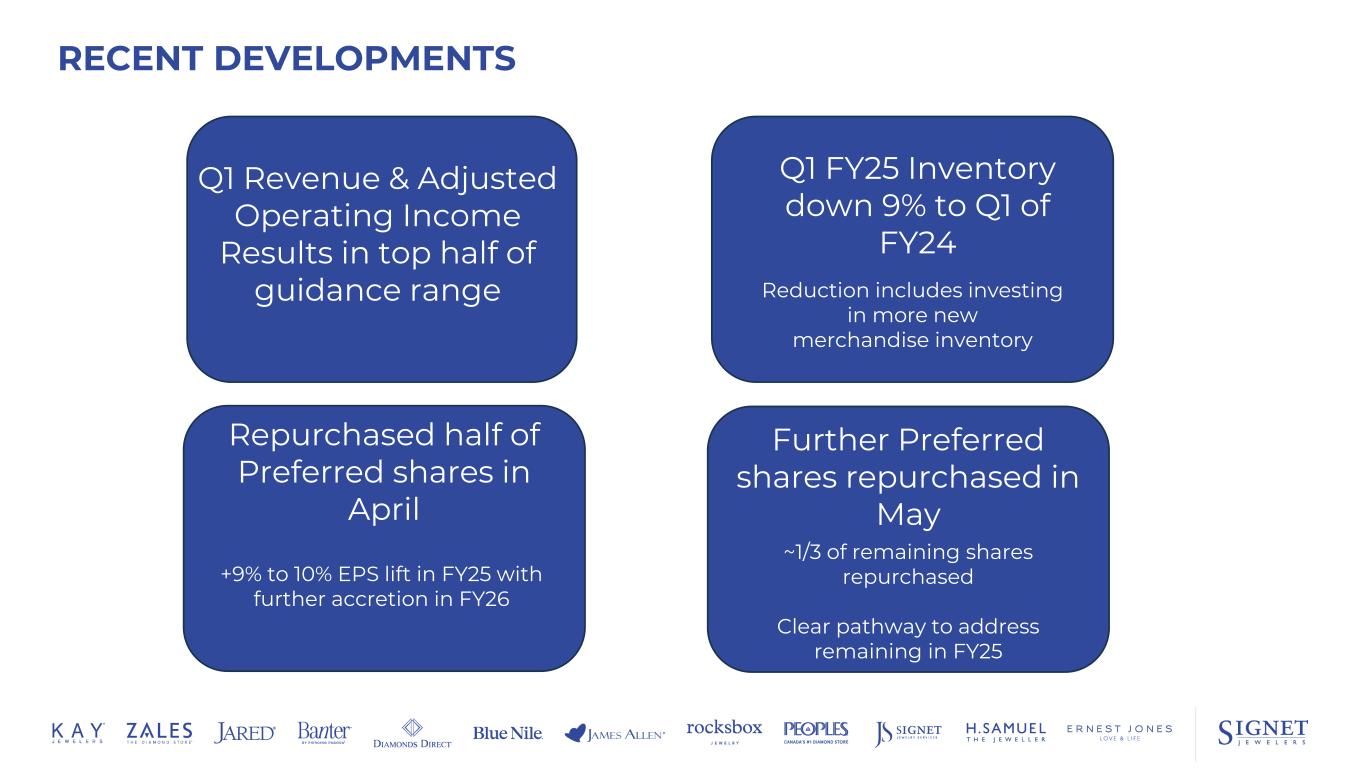

Balance Sheet and Statement of Cash Flows Highlights:

Year to date cash used in operating activities was $158.2 million compared to cash used in operating activities of $381.8 million in Q1 of FY24. Cash and cash equivalents were $729.3 million as of quarter end, compared to $655.9 million in Q1 of FY24. The Company paid $414.1 million to redeem half of the preferred shares, including accrued dividends, on April 15, 2024. Subsequent to the end of the first quarter, Signet redeemed an additional 100,000 Preferred Shares, or 32% of the remaining preferred shares, for an aggregate price of approximately $129.0 million, which represents common share volume weighted average price of approximately $97 per share. Inventory ended the quarter at $2.0 billion, down $199.9 million or 9.2% to Q1 of FY24, driven by Signet's demand planning efforts and life cycle management.

The Company ended the first quarter with an Adjusted Debt to Adjusted EBITDAR ratio of 2.2x on a trailing 12-month basis, well below the stated goal of at or below 2.5x, and was 1.6x on an Adjusted Net Debt basis. Net Debt to Adjusted EBITDA was (0.3)x on a trailing 12-month basis.

Capital Returns to Shareholders:

Signet's Board of Directors has declared a quarterly cash dividend on common shares of $0.29 per share for the second quarter of Fiscal 2025, payable August 23, 2024 to shareholders of record on July 26, 2024, with an ex-dividend date of July 26, 2024.

In the first quarter Signet repurchased approximately 73,000 common shares at an average cost per share of $101.10, or $7.4 million.

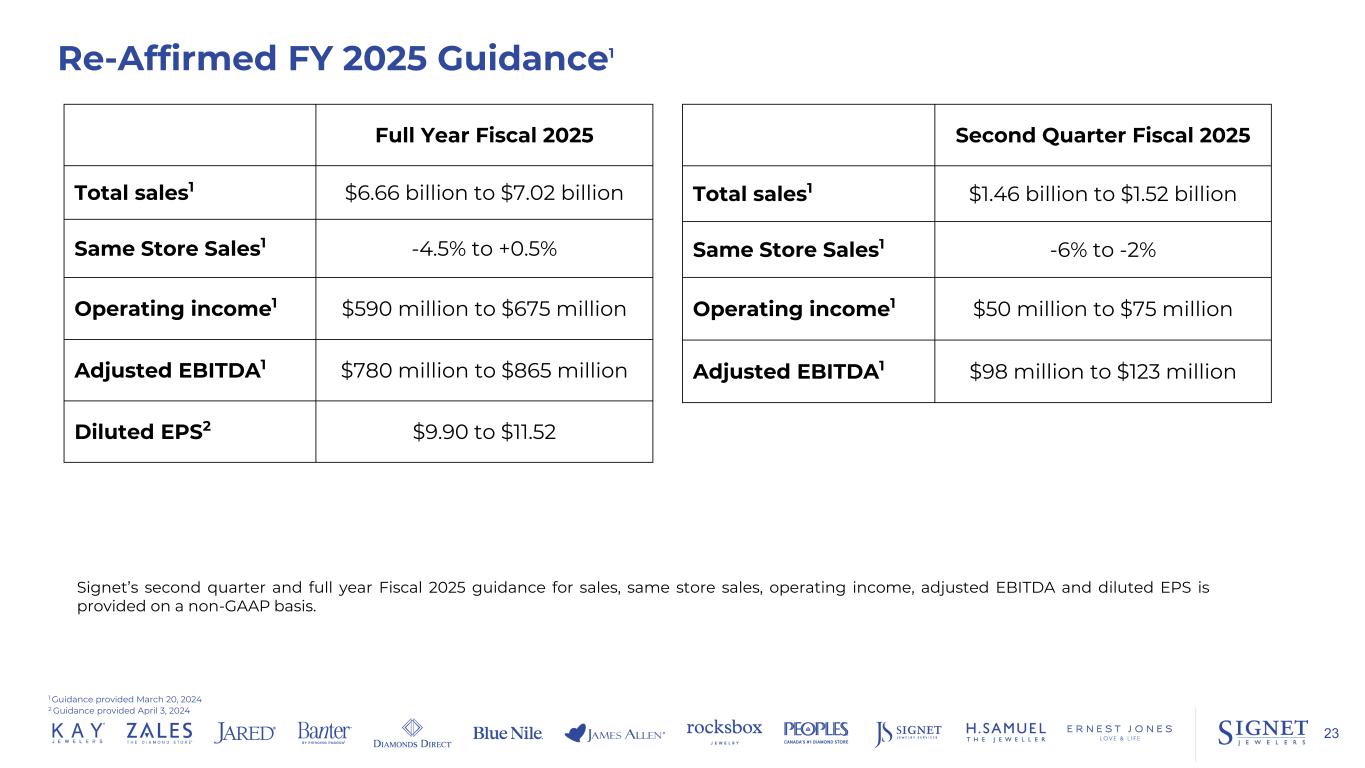

Second Quarter and Full Year Fiscal 2025 Guidance:

Signet's second quarter Fiscal 2025 guidance for sales, same store sales, operating income and adjusted EBITDA is provided on an adjusted basis:

|

|

|

|

|

|

|

|

|

Second Quarter |

|

|

| Total sales |

$1.46 billion to $1.52 billion |

|

|

| Same store sales |

(6)% to (2)% |

|

|

Operating income (1) |

$50 million to $75 million |

|

|

Adjusted EBITDA (1) |

$98 million to $123 million |

|

|

(1) See description of non-GAAP financial measures below.

Forecasted adjusted operating income and adjusted EBITDA exclude potential non-recurring charges, such as restructuring charges, asset impairments or integration-related costs. However, given the potential impact of non-recurring charges to the GAAP operating income, we cannot provide forecasted GAAP operating income or the probable significance of such items without unreasonable efforts. As such, we do not present a reconciliation of forecasted adjusted operating income or adjusted EBITDA to corresponding forecasted GAAP amounts.

Signet's full year Fiscal 2025 guidance for sales, same store sales, operating income, adjusted EBITDA, and diluted EPS is provided on an adjusted basis:

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2025 |

| Total sales |

|

|

$6.66 billion to $7.02 billion |

| Same store sales |

|

|

(4.5)% to +0.5% |

Operating income (1) |

|

|

$590 million to $675 million |

Adjusted EBITDA (1) |

|

|

$780 million to $865 million |

Diluted EPS (1) |

|

|

$9.90 to $11.52 |

(1) See description of non-GAAP financial measures below.

Forecasted adjusted operating income, adjusted EBITDA and adjusted diluted EPS provided above exclude potential non-recurring charges, such as restructuring charges, asset impairments or integration-related costs. However, given the potential impact of non-recurring charges to the GAAP operating income and diluted EPS, we cannot provide forecasted GAAP operating income or diluted EPS or the probable significance of such items without unreasonable efforts. As such, we do not present a reconciliation of forecasted adjusted operating income, adjusted EBITDA and adjusted diluted EPS to corresponding forecasted GAAP amounts.

The Company's Fiscal 2025 outlook is based on the following assumptions:

•The Company expects an approximately 1.5% to 2.0% negative impact to sales from integration issues with its Digital banners. The Company expects to resolve the issues in the second half of the year but is not reflected as such in guidance. Importantly, the issues are not tied to nor impacting the eCommerce channels of our core banners, which are performing well.

•Approximately $225 million in non-comparable sales headwinds reflecting over $100 million from the 53rd week in Fiscal 2024, approximately $75 million in the UK from the sale of previously announced prestige watch locations in the UK and up to 30 Ernest Jones store closures, and approximately $50 million from total store closures in North America in Fiscal 2024 and Fiscal 2025. The Company anticipates net square footage decline of 1% to flat for the year.

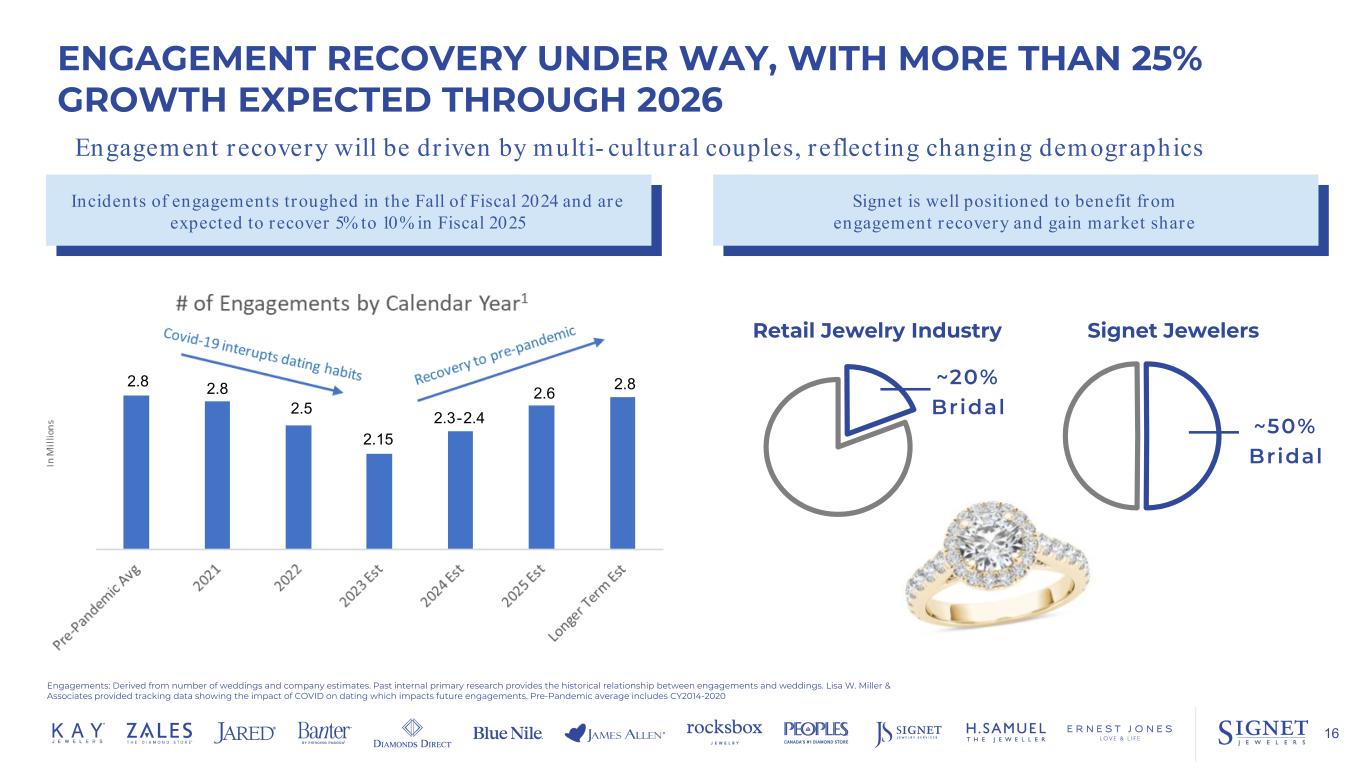

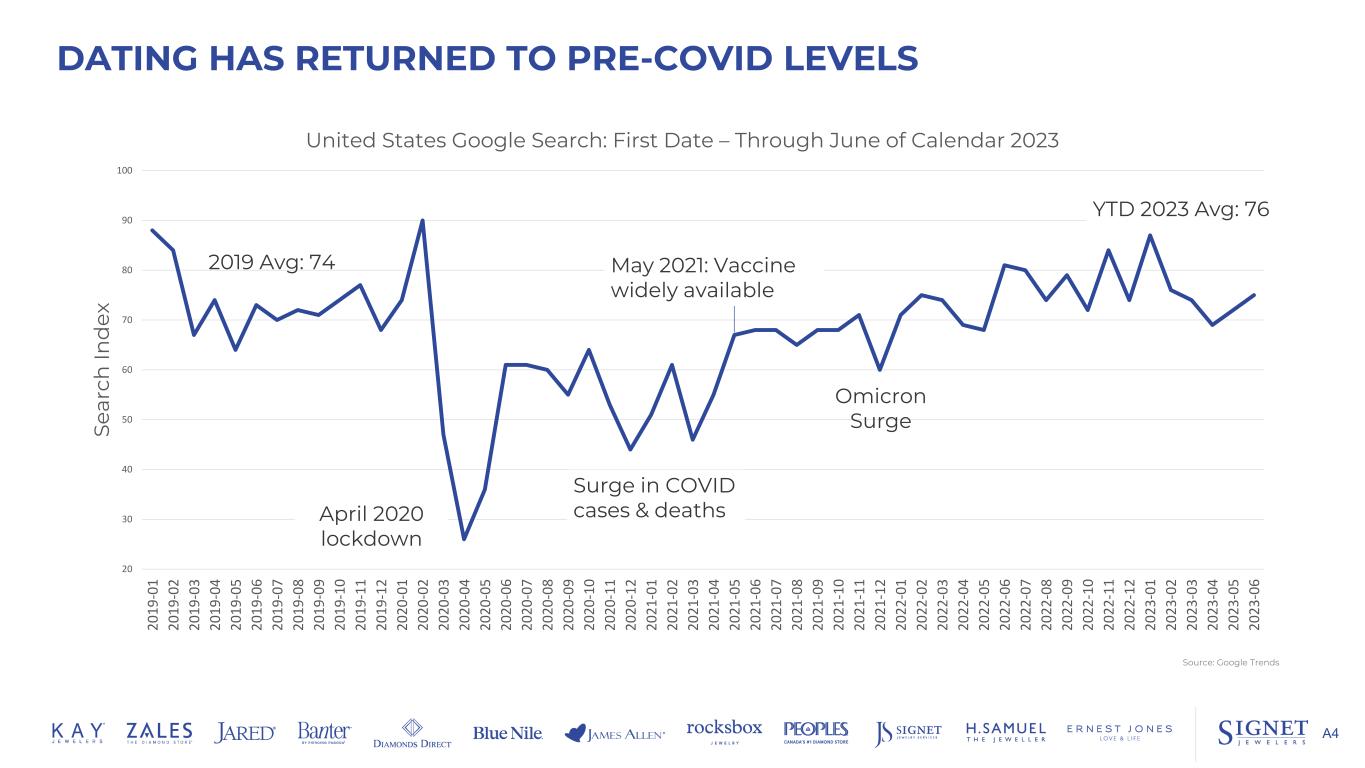

•The Company continues to expect a three-year recovery in US engagement rates, with Fiscal 2025 engagement incidents increasing 5% to 10% to Fiscal 2024.

•Approximately $150 million to $180 million in new cost savings initiatives leveraging technology such as AI, sourcing efficiencies, and spend discipline.

•Planned capital expenditures of approximately $160 million to $180 million, reflecting investments in 20 to 30 new stores, nearly 300 renovations with focus on Kay, Jared and Diamonds Direct stores, Connected Commerce capabilities, and digital and technology advancement.

•Annual tax rate of 19% to 20% excludes potential discrete items.

•Approximately $1.1 billion allocated to retirement of debt, redemption of preferred shares and open-market common share repurchases in Fiscal 2025.

Our Purpose and Sustainable Growth:

Signet reaffirmed its commitment to leadership in sustainable business practices in the Company’s latest Corporate Citizenship & Sustainability Report released this week. The Report, which uses the Company's Sustainability framework defined by Love for All People, Love for Our Team and Love for Our Planet and Products, introduces revised 2030 Corporate Sustainability Goals to improve impact and measurability across its global operations. The Report details incremental progress achieved during Fiscal 2024 including the integration of environmental considerations into Signet’s product packaging and store operations. It also describes how Signet delivers positive social impact, such as the largest single-year donation to St. Jude Children’s Research Hospital toward a new $100 million commitment to increase survivorship from childhood cancers in the U.S. and around the world.

Conference Call:

A conference call is scheduled for June 13, 2024 at 8:30 a.m. ET and a simultaneous audio webcast is available at www.signetjewelers.com.

The call details are:

Toll Free – North America +1 800 549 8228

Local – Toronto +1 289 819 1520

Conference ID 59089

Registration for the listen-only webcast is available at the following link:

https://events.q4inc.com/attendee/422676577

A replay and transcript of the call will be posted on Signet's website as soon as they are available and will be accessible for one year.

About Signet and Safe Harbor Statement:

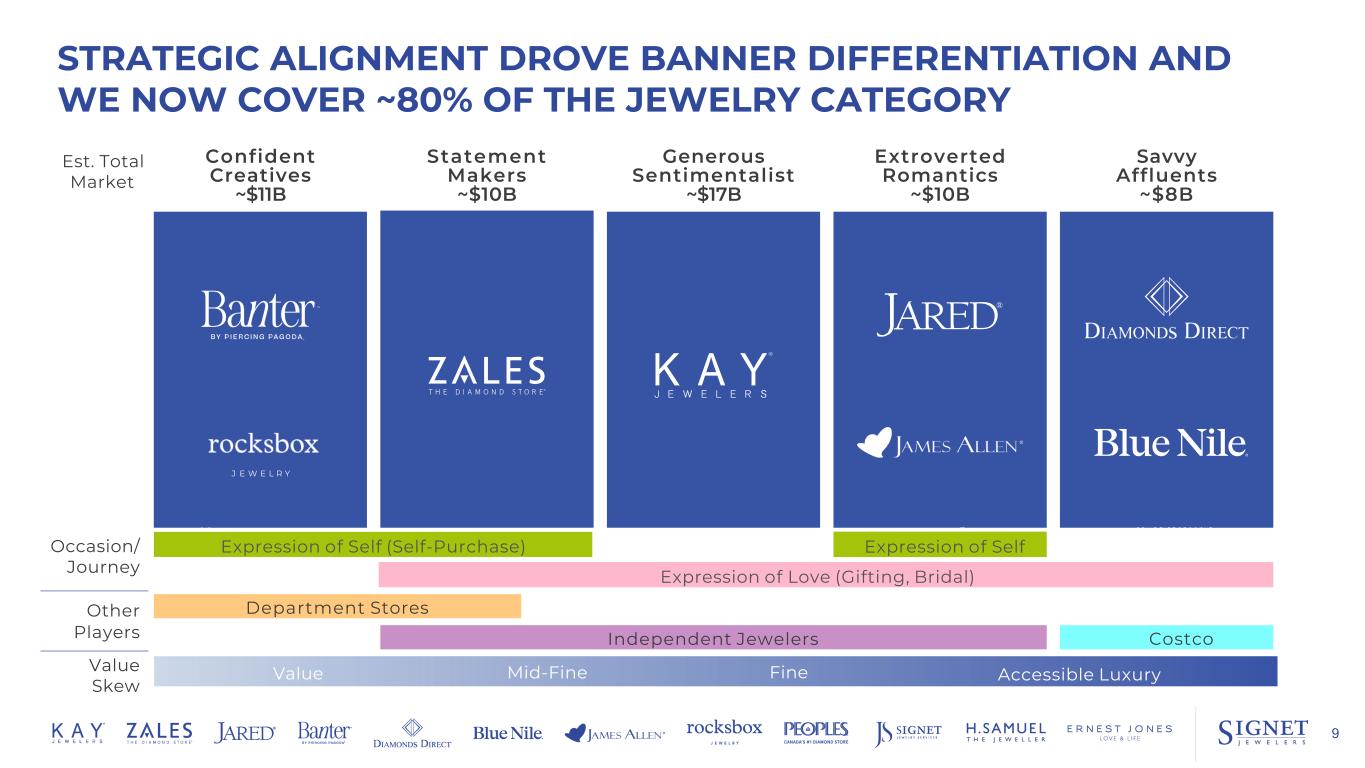

Signet Jewelers Limited is the world's largest retailer of diamond jewelry. As a Purpose-driven and sustainability-focused company, Signet is a participant in the United Nations Global Compact and adheres to its principles-based approach to responsible business. Signet operates approximately 2,700 stores primarily under the name brands of Kay Jewelers, Zales, Jared, Banter by Piercing Pagoda, Diamonds Direct, Blue Nile, James Allen, Rocksbox, Peoples Jewellers, H. Samuel, and Ernest Jones. Further information on Signet is available at www.signetjewelers.com. See also www.kay.com, www.zales.com, www.jared.com, www.banter.com, www.diamondsdirect.com, www.bluenile.com, www.jamesallen.com, www.rocksbox.com, www.peoplesjewellers.com, www.hsamuel.co.uk, www.ernestjones.co.uk.

This release contains statements which are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based upon management's beliefs and expectations as well as on assumptions made by and data currently available to management, appear in a number of places throughout this document and include statements regarding, among other things, results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate. The use of the words "expects," "intends," "anticipates," "estimates," "predicts," "believes," "should," "potential," "may," "preliminary," "forecast," "objective," "plan," or "target," and other similar expressions are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future performance and are subject to a number of risks and uncertainties which could cause the actual results to not be realized, including, but not limited to: difficulty or delay in executing or integrating an acquisition, including Diamonds Direct and Blue Nile; executing other major business or strategic initiatives, such as expansion of the services business or realizing the benefits of our restructuring plans; the impact of the Israel-Hamas conflict on our operations; the negative impacts that public health crisis, disease outbreak, epidemic or pandemic has had, and could have in the future, on our business, financial condition, profitability and cash flows, including without limitation risks relating to shifts in consumer spending away from the jewelry category, trends toward more experiential purchases such as travel, disruptions in the dating cycle caused by the COVID-19 pandemic and the pace at which such impacts on engagements are expected to recover, and the impacts of the expiration of government stimulus on overall consumer spending (including the recent expiration of student loan relief); general economic or market conditions, including impacts of inflation or other pricing environment factors on our commodity costs (including diamonds) or other operating costs; a prolonged slowdown in the growth of the jewelry market or a recession in the overall economy; financial market risks; a decline in consumer discretionary spending or deterioration in consumer financial position; disruptions in our supply chain; our ability to attract and retain labor; our ability to optimize our transformation strategies; changes to regulations relating to customer credit; disruption in the availability of credit for customers and customer inability to meet credit payment obligations, which has occurred and may continue to deteriorate; our ability to achieve the benefits related to the outsourcing of the credit portfolio, including due to technology disruptions and/or disruptions arising from changes to or termination of the relevant outsourcing agreements, as well as a potential increase in credit costs due to the current interest rate environment; deterioration in the performance of individual businesses or of our market value relative to its book value, resulting in impairments of long-lived assets or intangible assets or other adverse financial consequences; the volatility of our stock price; the impact of financial covenants, credit ratings or interest volatility on our ability to borrow; our ability to maintain adequate levels of liquidity for our cash needs, including debt obligations, payment of dividends, planned share repurchases (including future Preferred Share conversions, execution of accelerated share repurchases and the payment of related excise taxes) and capital expenditures as well as the ability of our customers, suppliers and lenders to access sources of liquidity to provide for their own cash needs; potential regulatory changes; future legislative and regulatory requirements in the US and globally relating to climate change, including any new climate related disclosure or compliance requirements, such as those recently issued in the state of California or adopted by the SEC; exchange rate fluctuations; the cost, availability of and demand for diamonds, gold and other precious metals, including any impact on the global market supply of diamonds due to the ongoing Israel-Hamas conflict, the potential sale or divestiture of the De Beers Diamond Company and its diamond mining operations by parent company Anglo-American plc, and the ongoing Russia-Ukraine conflict or related sanctions; stakeholder reactions to disclosure regarding the source and use of certain minerals; scrutiny or detention of goods produced in certain territories resulting from trade restrictions; seasonality of our business; the merchandising, pricing and inventory policies followed by us and our ability to manage inventory levels; our relationships with suppliers including the ability to continue to utilize extended payment terms and the ability to obtain merchandise that customers wish to purchase; the failure to adequately address the impact of existing tariffs and/or the imposition of additional duties, tariffs, taxes and other charges or other barriers to trade or impacts from trade relations; the level of competition and promotional activity in the jewelry sector; our ability to optimize our multi-year strategy to gain market share, expand and improve existing services, innovate and achieve sustainable, long-term growth; the maintenance and continued innovation of our OmniChannel retailing and ability to increase digital sales, as well as management of digital marketing costs; changes in consumer attitudes regarding jewelry and failure to anticipate and keep pace with changing fashion trends; changes in the costs, retail prices, supply and consumer acceptance of, and demand for gem quality lab-created diamonds and adequate identification of the use of substitute products in our jewelry; ability to execute successful marketing programs and manage social media; the ability to optimize our real estate footprint, including operating in attractive trade areas and accounting for changes in consumer traffic in mall locations; the performance of and ability to recruit, train, motivate and retain qualified team members - particularly in regions experiencing low unemployment rates; management of social, ethical and environmental risks; ability to deliver on our environmental, social and governance goals; the reputation of Signet and its banners; inadequacy in and disruptions to internal controls and systems, including related to the migration to new information technology systems which impact financial reporting; security breaches and other disruptions to our or our third-party providers’ information technology infrastructure and databases; an adverse development in legal or regulatory proceedings or tax matters, including any new claims or litigation brought by employees, suppliers, consumers or shareholders, regulatory initiatives or investigations, and ongoing compliance with regulations and any consent orders or other legal or regulatory decisions; failure to comply with labor regulations; collective bargaining activity; changes in corporate taxation rates, laws, rules or practices in the US and other jurisdictions in which our subsidiaries are incorporated, including developments related to the tax treatment of companies engaged in Internet commerce or deductions associated with payments to foreign related parties that are subject to a low effective tax rate; risks related to international laws and Signet being a Bermuda corporation; risks relating to the outcome of pending litigation; our ability to protect our intellectual property or assets including cash which could be affected by failure of a financial institution or conditions affecting the banking system and financial markets as a whole; changes in assumptions used in making accounting estimates relating to items such as extended service plans; or the impact of weather-related incidents, natural disasters, organized crime or theft, increased security costs, strikes, protests, riots or terrorism, acts of war (including the ongoing Russia-Ukraine and Israel-Hamas conflicts), or another public health crisis or disease outbreak, epidemic or pandemic on our business.

For a discussion of these and other risks and uncertainties which could cause actual results to differ materially from those expressed in any forward looking statement, see the “Risk Factors” and “Forward-Looking Statements” sections of Signet’s Fiscal 2024 Annual Report on Form 10-K filed with the SEC on March 21, 2024 and quarterly reports on Form 10-Q and the “Safe Harbor Statements” in current reports on Form 8-K filed with the SEC. Signet undertakes no obligation to update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

Investors:

Rob Ballew

Senior Vice President, Investor Relations

robert.ballew@signetjewelers.com

or

investorrelations@signetjewelers.com

Media:

Colleen Rooney

Chief Communications & ESG Officer In addition to reporting the Company's financial results in accordance with generally accepted accounting principles ("GAAP"), the Company reports certain financial measures on a non-GAAP basis.

+1-330-668-5932

colleen.rooney@signetjewelers.com

Non-GAAP Financial Measures

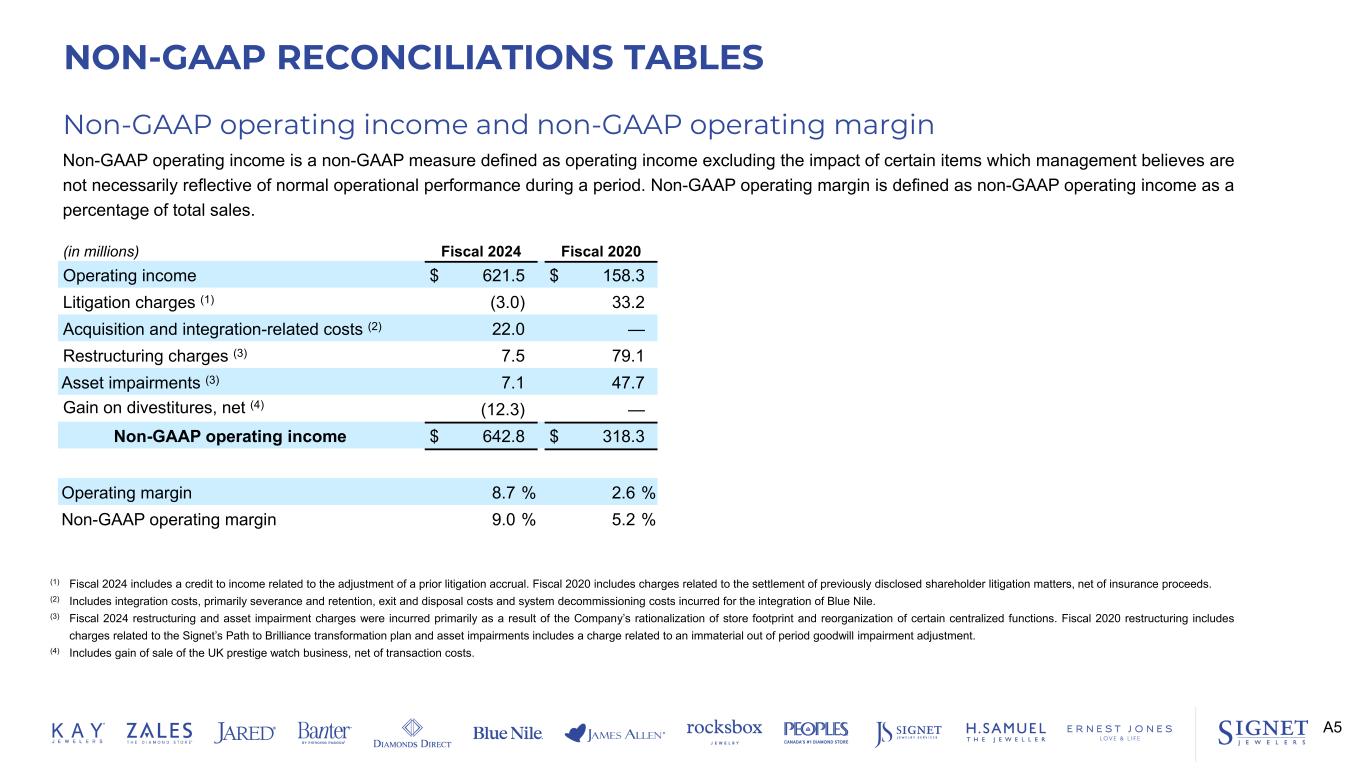

The Company believes that non-GAAP financial measures, when reviewed in conjunction with GAAP financial measures, can provide more information to assist investors in evaluating historical trends and current period performance and liquidity. These non-GAAP financial measures should be considered in addition to, and not superior to or as a substitute for, the GAAP financial measures presented in this earnings release and the Company’s condensed consolidated financial statements and other publicly filed reports. In addition, our non-GAAP financial measures may not be the same as or comparable to similar non-GAAP measures presented by other companies.

The Company previously referred to certain non-GAAP measures as non-GAAP operating income, non-GAAP operating margin and non-GAAP diluted EPS. Beginning in Fiscal 2025, these non-GAAP measures are now referred to as adjusted operating income, adjusted operating margin and adjusted diluted EPS, respectively. There have been no changes to how these non-GAAP measures are defined or reconciled to the most directly comparable GAAP measures.

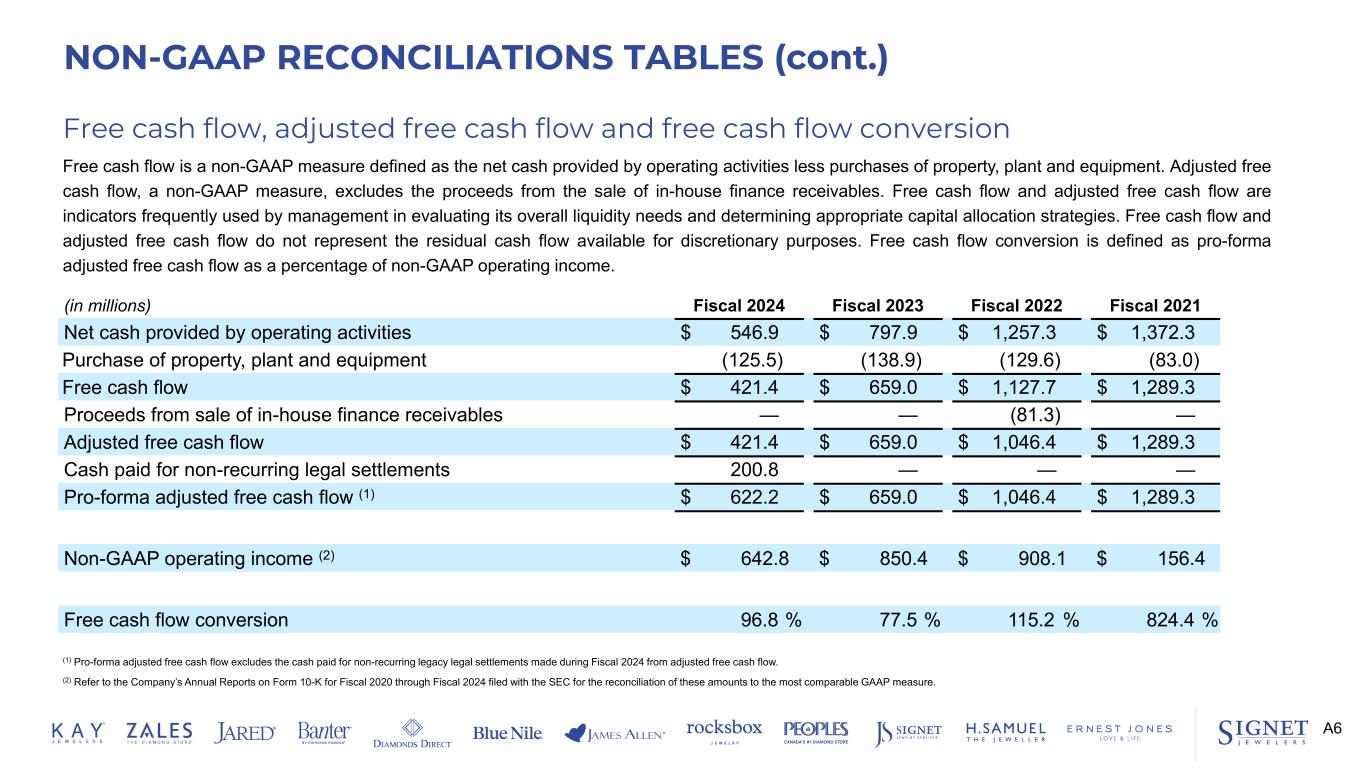

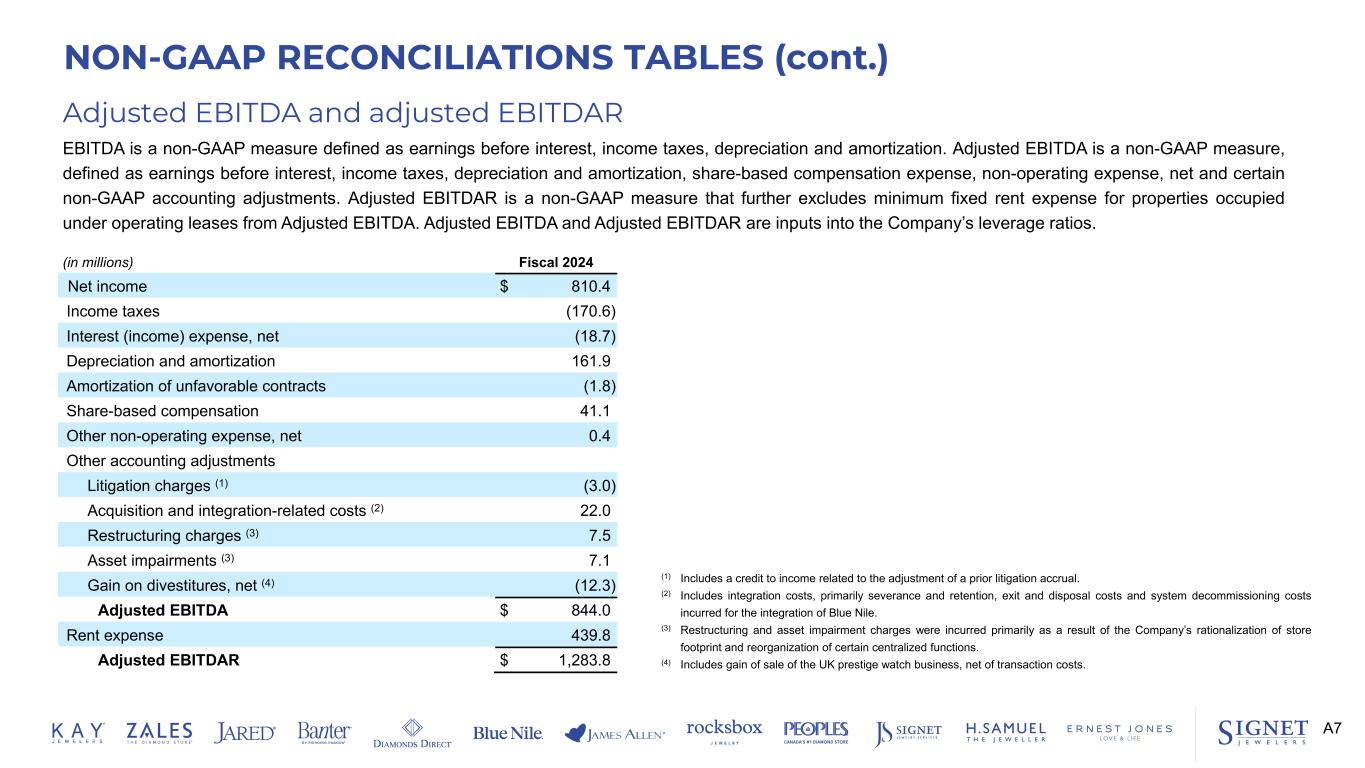

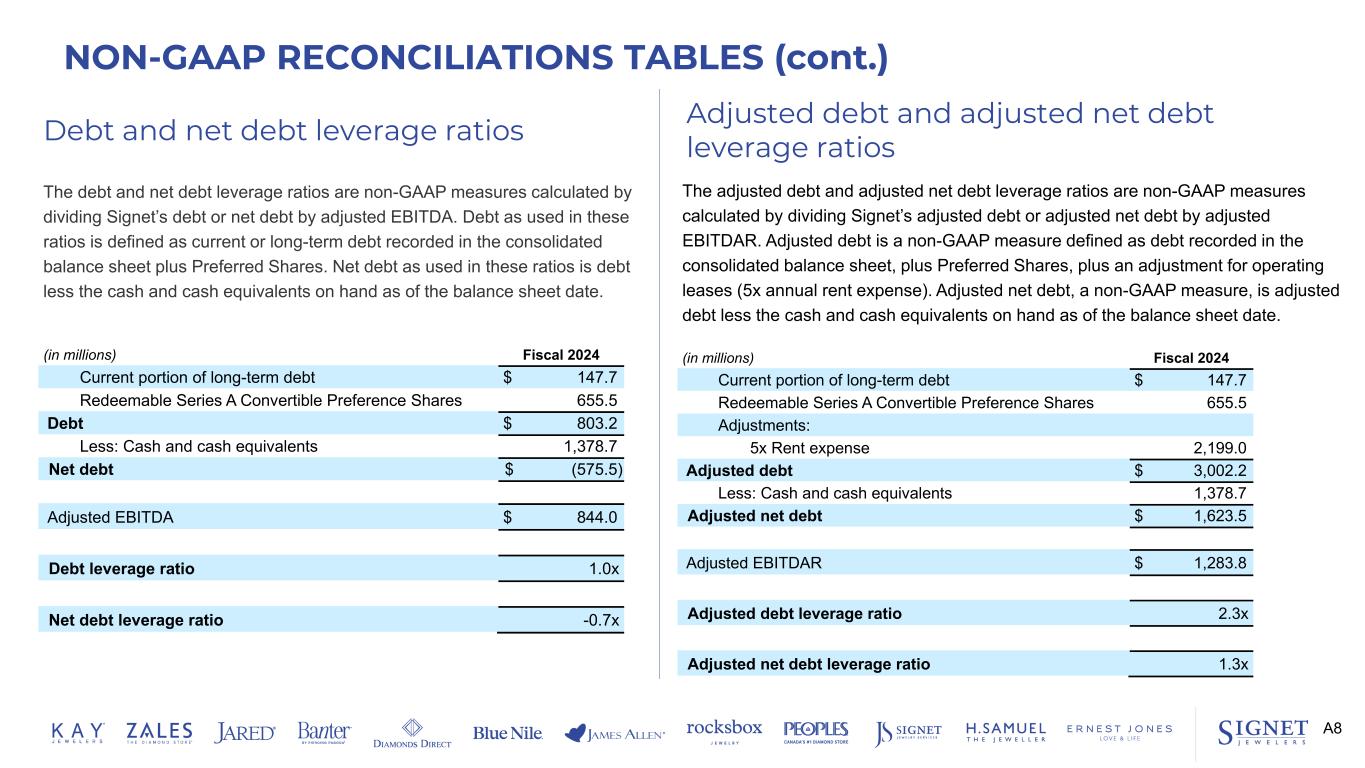

The Company reports the following non-GAAP financial measures: sales changes on a constant currency basis, free cash flow, adjusted operating income, adjusted operating margin, adjusted diluted earnings per share ("EPS"), adjusted earnings before interest, income taxes, depreciation and amortization (“adjusted EBITDA”) and adjusted EBITDAR, and the debt and net debt leverage ratios, including on an adjusted basis.

The Company provides the year-over-year change in total sales excluding the impact of foreign currency fluctuations to provide transparency to performance and enhance investors’ understanding of underlying business trends. The effect from foreign currency, calculated on a constant currency basis, is determined by applying current year average exchange rates to prior year sales in local currency.

Free cash flow is a non-GAAP measure defined as the net cash used in operating activities less purchases of property, plant and equipment. Management considers this metric to be helpful in understanding how the business is generating cash from its operating and investing activities that can be used to meet the financing needs of the business. Free cash flow is an indicator frequently used by management in evaluating its overall liquidity needs and determining appropriate capital allocation strategies. Free cash flow does not represent the residual cash flow available for discretionary purposes.

Adjusted operating income is a non-GAAP measure defined as operating income excluding the impact of certain items which management believes are not necessarily reflective of normal operational performance during a period. Management finds the information useful when analyzing operating results to appropriately evaluate the performance of the business without the impact of these certain items. Management believes the consideration of measures that exclude such items can assist in the comparison of operational performance in different periods which may or may not include such items. Management also utilizes adjusted operating margin, defined as adjusted operating income as a percentage of total sales, to further evaluate the effectiveness and efficiency of the Company’s flexible operating model.

Adjusted diluted EPS is a non-GAAP measure defined as diluted EPS excluding the impact of certain items which management believes are not necessarily reflective of normal operational performance during a period. Management finds the information useful when analyzing financial results in order to appropriately evaluate the performance of the business without the impact of these certain items. In particular, management believes the consideration of measures that exclude such items can assist in the comparison of performance in different periods which may or may not include such items. The Company estimates the tax effect of all non-GAAP adjustments by applying a statutory tax rate to each item. The income tax items are used to estimate adjusted income tax expense, and represent the discrete amount that affected the diluted EPS during the period.

Adjusted EBITDA is a non-GAAP measure, defined as earnings before interest and income taxes, depreciation and amortization, share-based compensation expense, other non-operating expense, net and certain non-GAAP accounting adjustments. Adjusted EBITDAR takes this adjusted EBITDA and further excludes minimum fixed rent expense for properties occupied under operating leases. Adjusted EBITDA and Adjusted EBITDAR are considered important indicators of operating performance as they exclude the effects of financing and investing activities by eliminating the effects of interest, depreciation and amortization costs and certain accounting adjustments.

The debt and net debt leverage ratios are non-GAAP measures calculated by dividing Signet’s debt or net debt by adjusted EBITDA. Debt as used in these ratios is defined as current or long-term debt recorded in the condensed consolidated balance sheet plus Preferred Shares. Net debt as used in these ratios is debt less the cash and cash equivalents on hand as of the balance sheet date. The adjusted debt and adjusted net debt leverage ratios are non-GAAP measures calculated by dividing Signet’s adjusted debt or adjusted net debt by adjusted EBITDAR.

Adjusted debt is a non-GAAP measure defined as debt recorded in the condensed consolidated balance sheet, plus Preferred Shares, plus an adjustment for operating leases (5x annual rent expense). Adjusted net debt, a non-GAAP measure, is adjusted debt less the cash and cash equivalents on hand as of the balance sheet dates. Management believes these financial measures are helpful to investors and analysts to analyze trends in Signet’s business and evaluate Signet’s performance. The debt and adjusted debt leverage ratios are key to the Company’s capital allocation strategy as measures of the Company’s optimized capital structure. The net debt and adjusted net debt leverage ratios are supplemental to the debt and adjusted debt ratios as both investors and management find it useful to consider cash on hand available to pay down debt. These ratios are presented on a trailing twelve-month (“TTM”) basis, which uses either adjusted EBITDA or adjusted EBITDAR calculated on the prior four fiscal quarters.

The following information provides reconciliations of the most comparable financial measures calculated and presented in accordance with GAAP to presented non-GAAP financial measures.

Free cash flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended |

| (in millions) |

May 4, 2024 |

|

April 29, 2023 |

|

|

| Net cash used in operating activities |

$ |

(158.2) |

|

|

$ |

(381.8) |

|

|

|

Purchase of property, plant and equipment |

(23.3) |

|

|

(27.1) |

|

|

|

Free cash flow |

$ |

(181.5) |

|

|

$ |

(408.9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted operating income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended |

|

|

| (in millions) |

May 4, 2024 |

|

April 29, 2023 |

|

|

|

|

|

|

| Total operating income |

$ |

49.8 |

|

|

$ |

101.7 |

|

|

|

|

|

|

|

Restructuring charges (1) |

4.6 |

|

|

— |

|

|

|

|

|

|

|

Asset impairments (1) |

1.9 |

|

|

— |

|

|

|

|

|

|

|

Loss on divestitures, net (2) |

1.3 |

|

|

— |

|

|

|

|

|

|

|

Integration-related expenses (3) |

0.2 |

|

|

7.8 |

|

|

|

|

|

|

|

Litigation charges (4) |

— |

|

|

(3.0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total adjusted operating income |

$ |

57.8 |

|

|

$ |

106.5 |

|

|

|

|

|

|

|

North America segment adjusted operating income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended |

|

|

| (in millions) |

May 4, 2024 |

|

April 29, 2023 |

|

|

|

|

|

|

| North America segment operating income |

$ |

83.2 |

|

|

$ |

124.7 |

|

|

|

|

|

|

|

Restructuring charges (1) |

0.6 |

|

|

— |

|

|

|

|

|

|

|

Asset impairments (1) |

1.2 |

|

|

— |

|

|

|

|

|

|

|

Integration-related expenses (3) |

0.2 |

|

|

7.8 |

|

|

|

|

|

|

|

Litigation charges (4) |

— |

|

|

(3.0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America segment adjusted operating income |

$ |

85.2 |

|

|

$ |

129.5 |

|

|

|

|

|

|

|

International segment adjusted operating loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended |

|

| (in millions) |

May 4, 2024 |

|

April 29, 2023 |

|

|

|

|

| International segment operating loss |

$ |

(13.0) |

|

|

$ |

(6.9) |

|

|

|

|

|

Restructuring charges (1) |

4.0 |

|

|

— |

|

|

|

|

|

Asset impairments (1) |

0.7 |

|

|

— |

|

|

|

|

|

Loss on divestitures, net (2) |

1.3 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| International segment adjusted operating loss |

$ |

(7.0) |

|

|

$ |

(6.9) |

|

|

|

|

|

Adjusted income tax provision

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended |

|

|

| (in millions) |

May 4, 2024 |

|

April 29, 2023 |

|

|

|

|

| Income tax expense |

$ |

6.5 |

|

|

$ |

9.5 |

|

|

|

|

|

Restructuring charges (1) |

1.1 |

|

|

— |

|

|

|

|

|

Asset impairments (1) |

0.5 |

|

|

— |

|

|

|

|

|

Loss on divestitures, net (2) |

0.3 |

|

|

— |

|

|

|

|

|

Integration-related expenses (3) |

— |

|

|

1.9 |

|

|

|

|

|

| Pension settlement loss |

— |

|

|

4.1 |

|

|

|

|

|

Litigation charges (4) |

— |

|

|

(0.8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted income tax expense |

$ |

8.4 |

|

|

$ |

14.7 |

|

|

|

|

|

Adjusted effective tax rate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended |

|

May 4, 2024 |

|

April 29, 2023 |

|

|

| Effective tax rate |

11.1 |

% |

|

8.9 |

% |

|

|

Restructuring charges (1) |

0.9 |

% |

|

— |

% |

|

|

Asset impairments (1) |

0.4 |

% |

|

— |

% |

|

|

Loss on divestitures, net (2) |

0.2 |

% |

|

— |

% |

|

|

Integration-related expenses (3) |

— |

% |

|

1.5 |

% |

|

|

| Pension settlement loss |

— |

% |

|

3.4 |

% |

|

|

Litigation charges (4) |

— |

% |

|

(0.7) |

% |

|

|

|

|

|

|

|

|

| Adjusted effective tax rate |

12.6 |

% |

|

13.1 |

% |

|

|

Adjusted diluted EPS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended |

|

|

|

May 4, 2024 |

|

April 29, 2023 |

|

|

|

|

| Diluted EPS |

$ |

(0.90) |

|

|

$ |

1.79 |

|

|

|

|

|

Restructuring charges (1) |

0.10 |

|

|

— |

|

|

|

|

|

Asset impairments (1) |

0.04 |

|

|

— |

|

|

|

|

|

Loss on divestitures, net (2) |

0.03 |

|

|

— |

|

|

|

|

|

Integration-related expenses (3) |

— |

|

|

0.14 |

|

|

|

|

|

Litigation charges (4) |

— |

|

|

(0.06) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax impact of items above (5) |

(0.04) |

|

|

(0.09) |

|

|

|

|

|

Deemed dividend on redemption of Preferred Shares (6) |

1.91 |

|

|

— |

|

|

|

|

|

Dilution effect (7) |

(0.03) |

|

|

— |

|

|

|

|

|

| Adjusted diluted EPS |

$ |

1.11 |

|

|

$ |

1.78 |

|

|

|

|

|

Adjusted EBITDA and adjusted EBITDAR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended |

|

53 week period ended |

|

52 week period ended |

|

53 week period ended |

|

52 week period ended |

| (in millions) |

May 4, 2024 |

|

April 29, 2023 |

|

April 30, 2022 |

|

February 3, 2024 |

|

January 28, 2023 |

|

May 4, 2024 |

|

April 29, 2023 |

| Calculation: |

A |

|

B |

|

C |

|

D |

|

E |

|

A + D - B |

|

B + E - C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

$ |

52.1 |

|

|

$ |

97.4 |

|

|

$ |

(83.5) |

|

|

$ |

810.4 |

|

|

$ |

376.7 |

|

|

$ |

765.1 |

|

|

$ |

557.6 |

|

Income taxes |

6.5 |

|

|

9.5 |

|

|

(55.2) |

|

|

(170.6) |

|

|

74.5 |

|

|

(173.6) |

|

|

139.2 |

|

Interest (income) expense, net |

(8.6) |

|

|

(5.6) |

|

|

4.4 |

|

|

(18.7) |

|

|

13.5 |

|

|

(21.7) |

|

|

3.5 |

|

Depreciation and amortization |

36.6 |

|

|

43.1 |

|

|

40.0 |

|

|

161.9 |

|

|

164.5 |

|

|

155.4 |

|

|

167.6 |

|

Amortization of unfavorable contracts |

(0.5) |

|

|

(0.5) |

|

|

(0.5) |

|

|

(1.8) |

|

|

(1.8) |

|

|

(1.8) |

|

|

(1.8) |

|

Other non-operating (income) expense, net (8) |

(0.2) |

|

|

0.4 |

|

|

134.5 |

|

|

0.4 |

|

|

140.2 |

|

|

(0.2) |

|

|

6.1 |

|

Share-based compensation |

7.6 |

|

|

11.3 |

|

|

10.5 |

|

|

41.1 |

|

|

42.0 |

|

|

37.4 |

|

|

42.8 |

|

Other accounting adjustments (9) |

8.0 |

|

|

4.8 |

|

|

194.4 |

|

|

21.3 |

|

|

245.5 |

|

|

24.5 |

|

|

55.9 |

|

Adjusted EBITDA |

$ |

101.5 |

|

|

$ |

160.4 |

|

|

$ |

244.6 |

|

|

$ |

844.0 |

|

|

$ |

1,055.1 |

|

|

$ |

785.1 |

|

|

$ |

970.9 |

|

Rent expense |

109.3 |

|

|

111.0 |

|

|

110.1 |

|

|

439.8 |

|

|

446.5 |

|

|

438.1 |

|

|

447.4 |

|

Adjusted EBITDAR |

$ |

210.8 |

|

|

$ |

271.4 |

|

|

$ |

354.7 |

|

|

$ |

1,283.8 |

|

|

$ |

1,501.6 |

|

|

$ |

1,223.2 |

|

|

$ |

1,418.3 |

|

Debt and net debt leverage ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

| (in millions) |

May 4, 2024 |

|

April 29, 2023 |

Debt and net debt: |

|

|

|

Current portion of long-term debt |

$ |

147.8 |

|

|

$ |

— |

|

Long-term debt |

— |

|

|

147.5 |

|

Redeemable Series A Convertible Preference Shares |

328.0 |

|

|

654.3 |

|

Debt |

$ |

475.8 |

|

|

$ |

801.8 |

|

| Less: Cash and cash equivalents |

729.3 |

|

|

655.9 |

|

| Net debt |

$ |

(253.5) |

|

|

$ |

145.9 |

|

|

|

|

|

| TTM Adjusted EBITDA |

$ |

785.1 |

|

|

$ |

970.9 |

|

|

|

|

|

| Debt leverage ratio |

0.6x |

|

0.8x |

|

|

|

|

| Net debt leverage ratio |

-0.3x |

|

0.2x |

Adjusted debt and adjusted net debt leverage ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

| (in millions) |

May 4, 2024 |

|

April 29, 2023 |

Adjusted debt and adjusted net debt: |

|

|

|

Current portion of long-term debt |

$ |

147.8 |

|

|

$ |

— |

|

Long-term debt |

— |

|

|

147.5 |

|

Redeemable Series A Convertible Preference Shares |

328.0 |

|

|

654.3 |

|

Adjustments: |

|

|

|

TTM 5x rent expense |

2,190.5 |

|

|

2,237.0 |

|

Adjusted debt |

$ |

2,666.3 |

|

|

$ |

3,038.8 |

|

| Less: Cash and cash equivalents |

729.3 |

|

|

655.9 |

|

| Adjusted net debt |

$ |

1,937.0 |

|

|

$ |

2,382.9 |

|

|

|

|

|

| TTM Adjusted EBITDAR |

$ |

1,223.2 |

|

|

$ |

1,418.3 |

|

|

|

|

|

| Adjusted debt leverage ratio |

2.2x |

|

2.1x |

|

|

|

|

| Adjusted net debt leverage ratio |

1.6x |

|

1.7x |

Footnotes to Non-GAAP Reconciliation Tables

(1) Restructuring and asset impairment charges were incurred primarily as a result of the Company’s rationalization of store footprint and reorganization of certain centralized functions.

(2) Includes net losses from the previously announced divestiture of the UK prestige watch business.

(3) Fiscal 2025 includes severance and retention expenses related to the integration of Blue Nile which were recorded to SG&A. Fiscal 2024 includes expenses related to integration of Blue Nile, primarily severance and retention, and exit and disposal costs, of which $1.3 million and $6.5 million were recorded to cost of sales and SG&A, respectively.

(4) Includes a credit to income related to the adjustment of a prior litigation accrual recognized in Fiscal 2023.

(5) The Fiscal 2024 tax effect includes a $0.07 impact of the other comprehensive income recognized in earnings from the release of the remaining tax benefit associated with the buy-out of the UK pension completed in the first quarter of Fiscal 2024.

(6) The Company recorded a deemed dividend to net income attributable to common shareholders of $85.1 million, which represents the excess of the conversion value of the Preferred Shares over their carrying value, and includes $1.5 million of related expenses.

(7) First quarter of Fiscal 2025 adjusted diluted EPS was calculated using 48.0 million diluted weighted average common shares outstanding. The additional dilutive shares were excluded from the calculation of diluted EPS as their effect was antidilutive.

(8) For the 13 weeks ended April 30, 2022 and 52 weeks ended January 28, 2023 non-operating expenses primarily includes pre-tax pension settlement charges of $131.9 million and $133.7 million, respectively.

(9) Other accounting adjustments are inclusive of those items described within footnotes 1 through 4 above. Additional accounting adjustments include litigation charges; acquisition and integration-related expenses, including the impact of the fair value step-up for inventory from Diamonds Direct and Blue Nile, as well as direct transaction-related and integration costs, primarily professional fees and severance, incurred related to the acquisition of Blue Nile; and certain asset impairments as previously disclosed in prior periods.

Condensed Consolidated Statements of Operations (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended |

|

|

(in millions, except per share amounts) |

|

May 4, 2024 |

|

April 29, 2023 |

|

|

|

|

Sales |

|

$ |

1,510.8 |

|

|

$ |

1,668.0 |

|

|

|

|

|

Cost of sales |

|

(938.4) |

|

|

(1,036.0) |

|

|

|

|

|

Gross margin |

|

572.4 |

|

|

632.0 |

|

|

|

|

|

Selling, general and administrative expenses |

|

(515.4) |

|

|

(530.4) |

|

|

|

|

|

| Other operating (expense) income, net |

|

(7.2) |

|

|

0.1 |

|

|

|

|

|

| Operating income |

|

49.8 |

|

|

101.7 |

|

|

|

|

|

| Interest income, net |

|

8.6 |

|

|

5.6 |

|

|

|

|

|

| Other non-operating income (expense), net |

|

0.2 |

|

|

(0.4) |

|

|

|

|

|

| Income before income taxes |

|

58.6 |

|

|

106.9 |

|

|

|

|

|

Income taxes |

|

(6.5) |

|

|

(9.5) |

|

|

|

|

|

| Net income |

|

$ |

52.1 |

|

|

$ |

97.4 |

|

|

|

|

|

Dividends on redeemable convertible preferred shares |

|

(92.2) |

|

|

(8.6) |

|

|

|

|

|

| Net (loss) income attributable to common shareholders |

|

$ |

(40.1) |

|

|

$ |

88.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per common share: |

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.90) |

|

|

$ |

1.96 |

|

|

|

|

|

Diluted |

|

$ |

(0.90) |

|

|

$ |

1.79 |

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

44.6 |

|

|

45.3 |

|

|

|

|

|

Diluted |

|

44.6 |

|

|

54.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per common share |

|

$ |

0.29 |

|

|

$ |

0.23 |

|

|

|

|

|

Condensed Consolidated Balance Sheets (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

|

May 4, 2024 |

|

February 3, 2024 |

|

April 29, 2023 |

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

729.3 |

|

|

$ |

1,378.7 |

|

|

$ |

655.9 |

|

|

|

|

|

|

|

|

Inventories |

|

1,983.6 |

|

|

1,936.6 |

|

|

2,183.5 |

|

Income taxes |

|

9.3 |

|

|

9.4 |

|

|

45.4 |

|

Other current assets |

|

202.4 |

|

|

211.9 |

|

|

198.3 |

|

Total current assets |

|

2,924.6 |

|

|

3,536.6 |

|

|

3,083.1 |

|

Non-current assets: |

|

|

|

|

|

|

| Property, plant and equipment, net |

|

475.1 |

|

|

497.7 |

|

|

568.2 |

|

Operating lease right-of-use assets |

|

979.4 |

|

|

1,001.8 |

|

|

1,072.7 |

|

Goodwill |

|

754.5 |

|

|

754.5 |

|

|

751.4 |

|

Intangible assets, net |

|

402.2 |

|

|

402.8 |

|

|

406.8 |

|

Other assets |

|

315.2 |

|

|

319.3 |

|

|

286.2 |

|

Deferred tax assets |

|

300.2 |

|

|

300.5 |

|

|

37.0 |

|

Total assets |

|

$ |

6,151.2 |

|

|

$ |

6,813.2 |

|

|

$ |

6,205.4 |

|

Liabilities, Redeemable convertible preferred shares, and Shareholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

147.8 |

|

|

$ |

147.7 |

|

|

$ |

— |

|

Accounts payable |

|

599.3 |

|

|

735.1 |

|

|

701.5 |

|

Accrued expenses and other current liabilities |

|

356.0 |

|

|

400.2 |

|

|

378.1 |

|

Deferred revenue |

|

360.6 |

|

|

362.9 |

|

|

368.7 |

|

Operating lease liabilities |

|

253.0 |

|

|

260.3 |

|

|

273.9 |

|

Income taxes |

|

31.4 |

|

|

69.8 |

|

|

53.3 |

|

Total current liabilities |

|

1,748.1 |

|

|

1,976.0 |

|

|

1,775.5 |

|

Non-current liabilities: |

|

|

|

|

|

|

Long-term debt |

|

— |

|

|

— |

|

|

147.5 |

|

Operating lease liabilities |

|

818.5 |

|

|

835.7 |

|

|

902.0 |

|

Other liabilities |

|

93.9 |

|

|

96.0 |

|

|

96.8 |

|

Deferred revenue |

|

878.9 |

|

|

881.8 |

|

|

874.9 |

|

Deferred tax liabilities |

|

202.0 |

|

|

201.7 |

|

|

172.9 |

|

Total liabilities |

|

3,741.4 |

|

|

3,991.2 |

|

|

3,969.6 |

|

Commitments and contingencies |

|

|

|

|

|

|

| Redeemable Series A Convertible Preference Shares |

|

328.0 |

|

|

655.5 |

|

|

654.3 |

|

Shareholders’ equity: |

|

|

|

|

|

|

| Common shares |

|

12.6 |

|

|

12.6 |

|

|

12.6 |

|

Additional paid-in capital |

|

181.6 |

|

|

230.7 |

|

|

210.5 |

|

Other reserves |

|

0.4 |

|

|

0.4 |

|

|

0.4 |

|

| Treasury shares at cost |

|

(1,622.9) |

|

|

(1,646.9) |

|

|

(1,556.5) |

|

Retained earnings |

|

3,779.7 |

|

|

3,835.0 |

|

|

3,182.0 |

|

Accumulated other comprehensive loss |

|

(269.6) |

|

|

(265.3) |

|

|

(267.5) |

|

Total shareholders’ equity |

|

2,081.8 |

|

|

2,166.5 |

|

|

1,581.5 |

|

Total liabilities, redeemable convertible preferred shares and shareholders’ equity |

|

$ |

6,151.2 |

|

|

$ |

6,813.2 |

|

$ |

6,205.4 |

Condensed Consolidated Statements of Cash Flows (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 weeks ended |

(in millions) |

|

May 4, 2024 |

|

April 29, 2023 |

Operating activities |

|

|

|

|

| Net income |

|

$ |

52.1 |

|

|

$ |

97.4 |

|

| Adjustments to reconcile net income to net cash used in operating activities: |

|

|

|

|

Depreciation and amortization |

|

36.6 |

|

|

43.1 |

|

Amortization of unfavorable contracts |

|

(0.5) |

|

|

(0.5) |

|

Share-based compensation |

|

7.6 |

|

|

11.3 |

|

Deferred taxation |

|

0.5 |

|

|

51.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other non-cash movements |

|

5.7 |

|

|

2.5 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

| Inventories |

|

(48.9) |

|

|

(29.8) |

|

| Other assets |

|

12.3 |

|

|

(27.6) |

|

| Accounts payable |

|

(136.7) |

|

|

(170.3) |

|

| Accrued expenses and other liabilities |

|

(40.8) |

|

|

(264.9) |

|

Change in operating lease assets and liabilities |

|

(2.8) |

|

|

(31.3) |

|

| Deferred revenue |

|

(4.7) |

|

|

(7.8) |

|

| Income tax receivable and payable |

|

(38.6) |

|

|

(55.4) |

|

|

|

|

|

|

| Net cash used in operating activities |

|

(158.2) |

|

|

(381.8) |

|

Investing activities |

|

|

|

|

Purchase of property, plant and equipment |

|

(23.3) |

|

|

(27.1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other investing activities, net |

|

1.8 |

|

|

— |

|

| Net cash used in investing activities |

|

(21.5) |

|

|

(27.1) |

|

Financing activities |

|

|

|

|

Dividends paid on common shares |

|

(10.2) |

|

|

(9.0) |

|

Dividends paid on redeemable convertible preferred shares |

|

(10.3) |

|

|

(8.2) |

|

Repurchase of common shares |

|

(7.4) |

|

|

(39.1) |

|

|

|

|

|

|

| Repurchase of redeemable convertible preferred shares |

|

(412.0) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other financing activities, net |

|

(27.6) |

|

|

(44.4) |

|

| Net cash used in financing activities |

|

(467.5) |

|

|

(100.7) |

|

Cash and cash equivalents at beginning of period |

|

1,378.7 |

|

|

1,166.8 |

| Decrease in cash and cash equivalents |

|

(647.2) |

|

|

(509.6) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

(2.2) |

|

|

(1.3) |

|

Cash and cash equivalents at end of period |

|

$ |

729.3 |

|

|

$ |

655.9 |

|

Real Estate Portfolio:

Signet has a diversified real estate portfolio. On May 4, 2024, Signet operated 2,676 stores totaling 4.1 million square feet of selling space. Compared to year-end Fiscal 2024, store count decreased by 22 and square feet of selling space decreased 0.6%.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Store count by segment |

February 3, 2024 |

|

Openings |

|

Closures |

|

May 4, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America segment |

2,411 |

|

1 |

|

(7) |

|

2,405 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International segment |

287 |

|

— |

|

(16) |

|

271 |

Signet |

2,698 |

|

1 |

|

(23) |

|

2,676 |