Document

Freeport-McMoRan

Reports First-Quarter 2024 Results

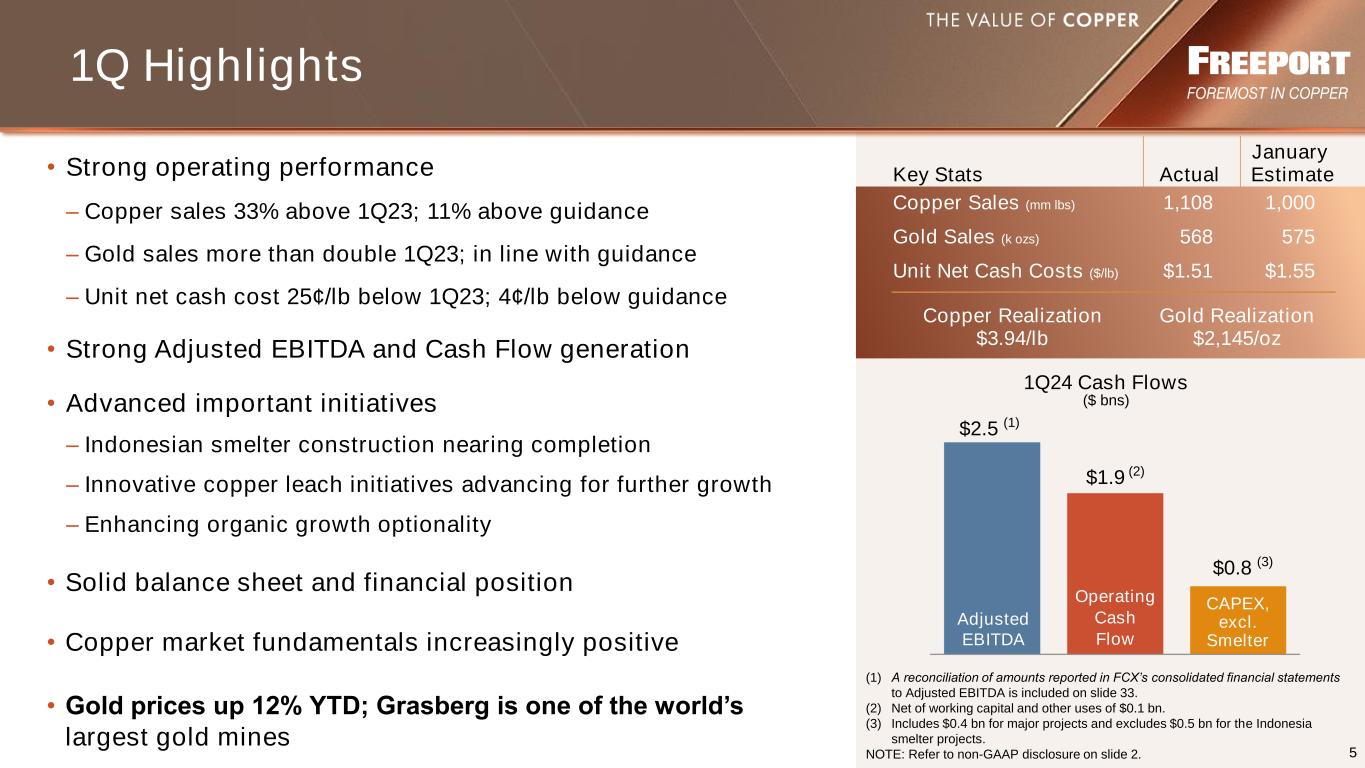

•Strong first-quarter 2024 operating performance:

◦Copper sales volumes exceeded January 2024 estimate and first-quarter 2023

◦Unit net cash costs below January 2024 estimate and first-quarter 2023

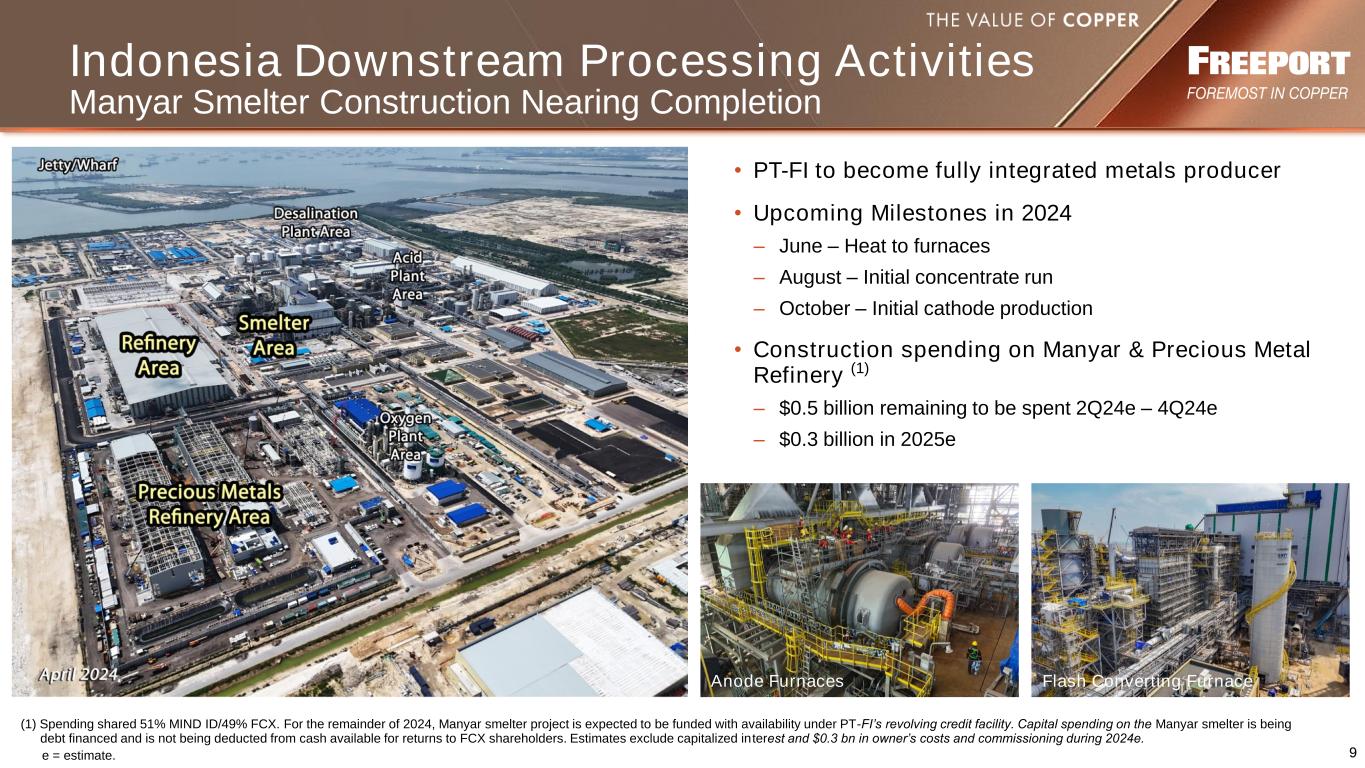

•Indonesia smelter projects nearing completion with start-up activities expected in second-quarter 2024

•Solid financial position

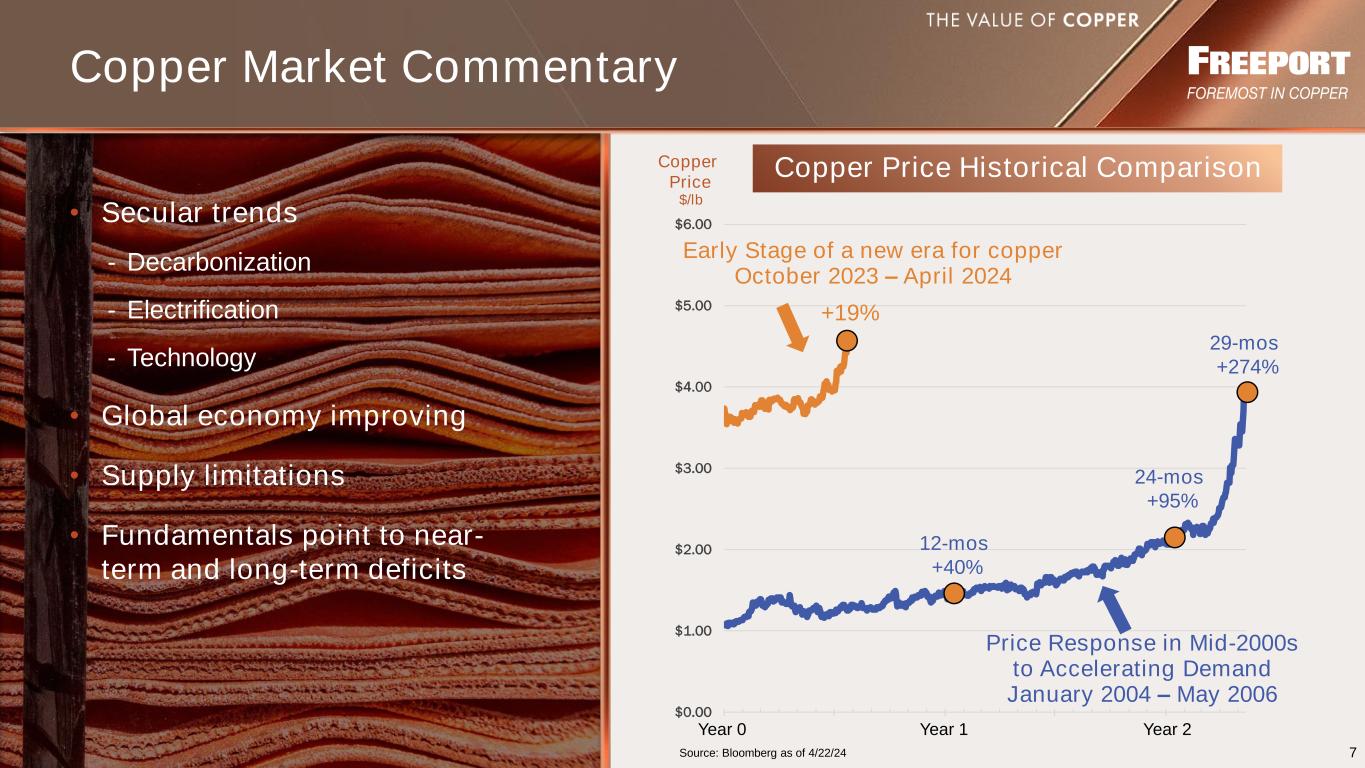

•Favorable market fundamentals

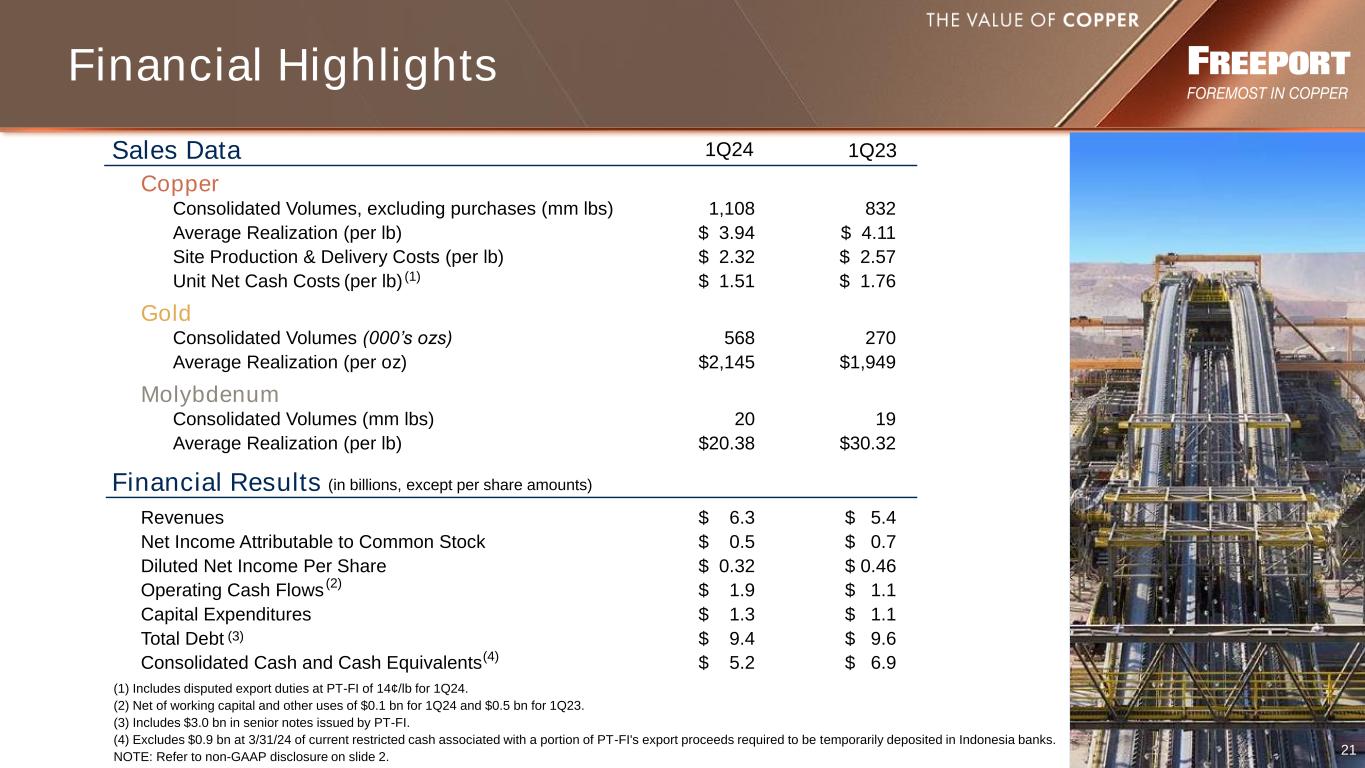

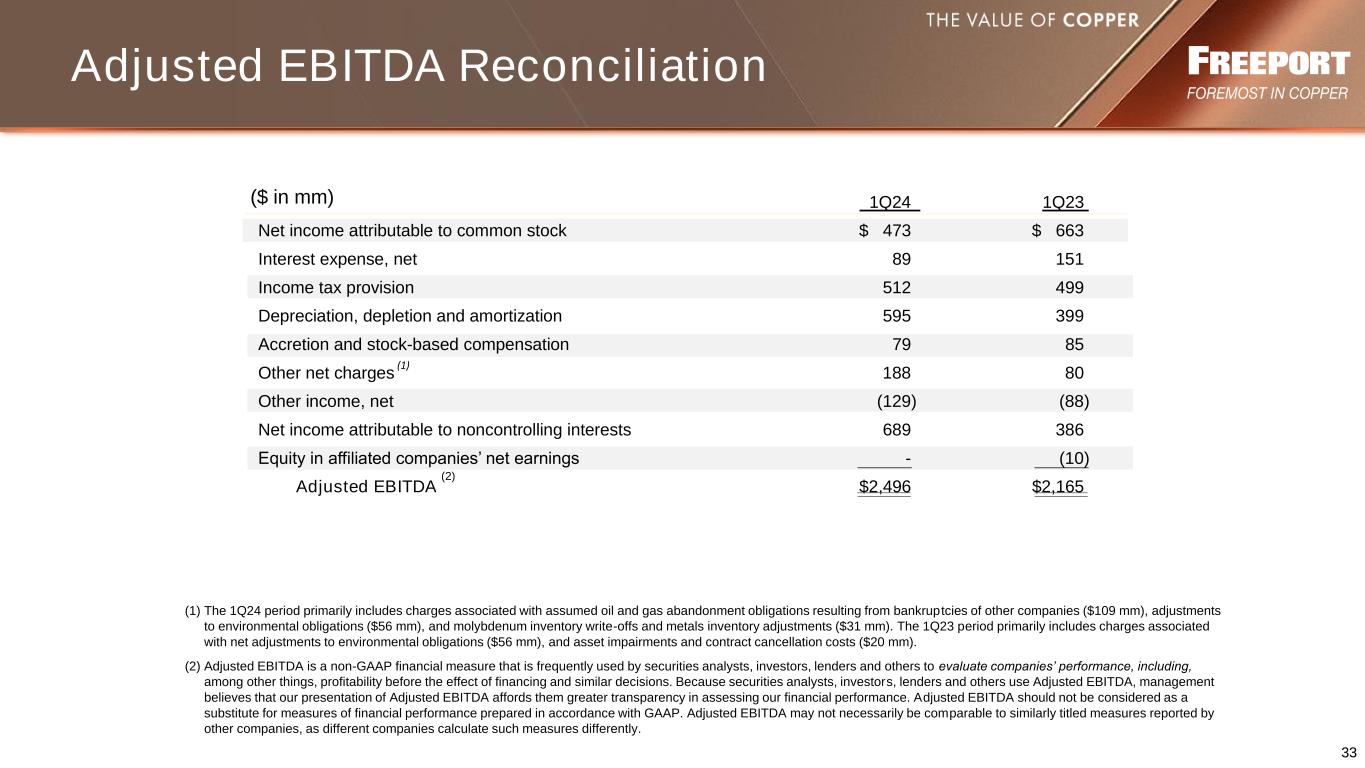

▪Net income attributable to common stock in first-quarter 2024 totaled $473 million, $0.32 per share, and adjusted net income attributable to common stock totaled $474 million, $0.32 per share.

▪Consolidated production totaled 1.1 billion pounds of copper, 549 thousand ounces of gold and 18 million pounds of molybdenum in first-quarter 2024.

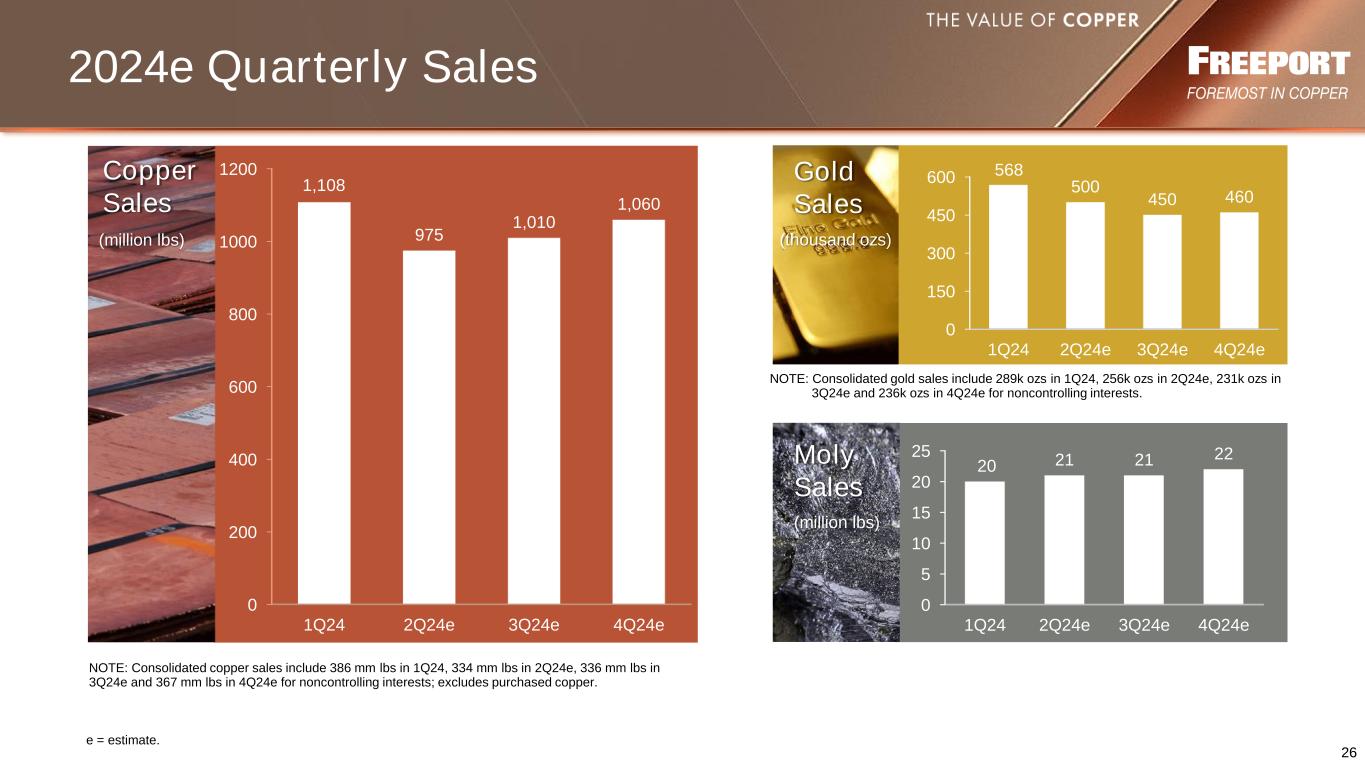

▪Consolidated sales totaled 1.1 billion pounds of copper, 568 thousand ounces of gold and 20 million pounds of molybdenum in first-quarter 2024.

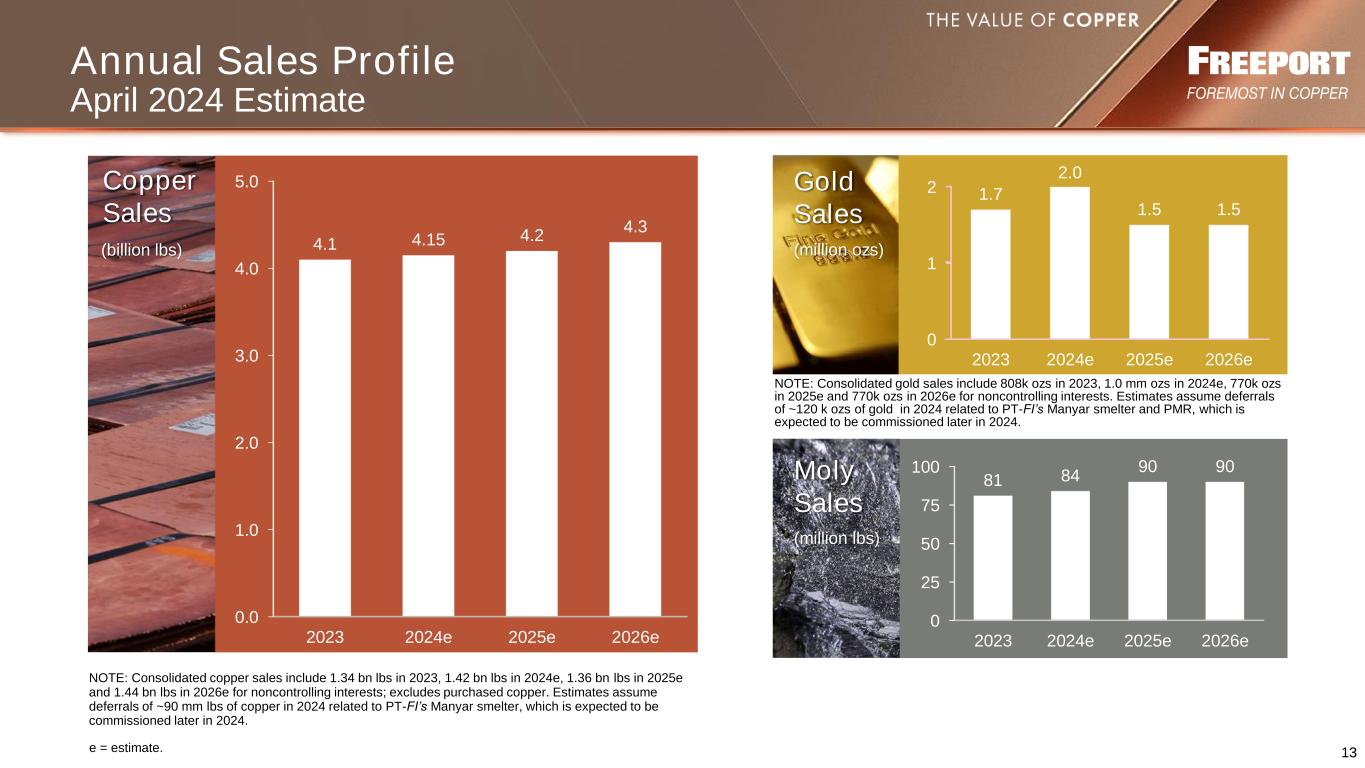

▪Consolidated sales are expected to approximate 4.15 billion pounds of copper, 2.0 million ounces of gold and 84 million pounds of molybdenum for the year 2024, including 1.0 billion pounds of copper, 500 thousand ounces of gold and 21 million pounds of molybdenum in second-quarter 2024.

▪Average realized prices were $3.94 per pound for copper, $2,145 per ounce for gold and $20.38 per pound for molybdenum in first-quarter 2024.

▪Average unit net cash costs were $1.51 per pound of copper in first-quarter 2024. Unit net cash costs are expected to average $1.57 per pound of copper for the year 2024.

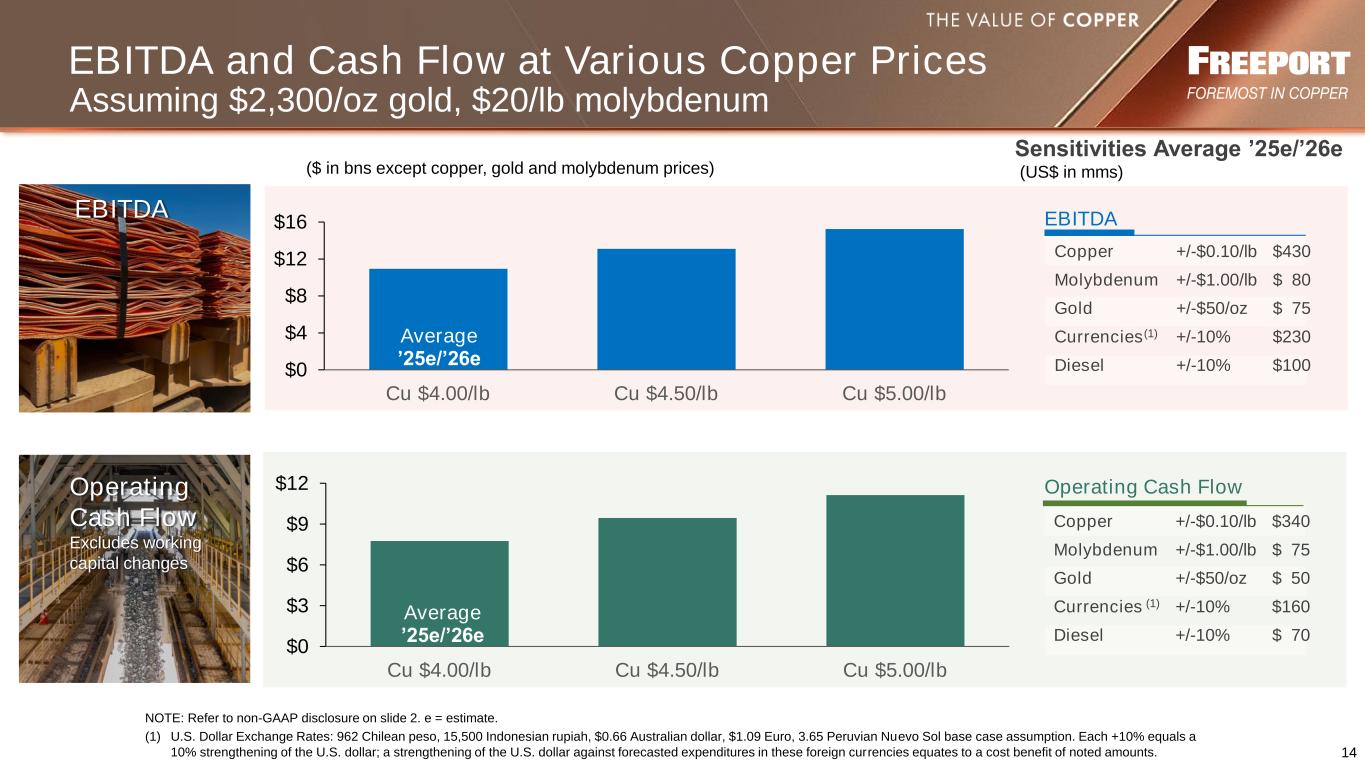

▪Operating cash flows totaled $1.9 billion, net of $0.1 billion of working capital and other uses, in first-quarter 2024. Operating cash flows are expected to approximate $7.4 billion, net of $0.2 billion of working capital and other uses, for the year 2024, based on achievement of current sales volume and cost estimates, and assuming average prices of $4.25 per pound for copper, $2,300 per ounce for gold and $20.00 per pound for molybdenum for the remainder of 2024.

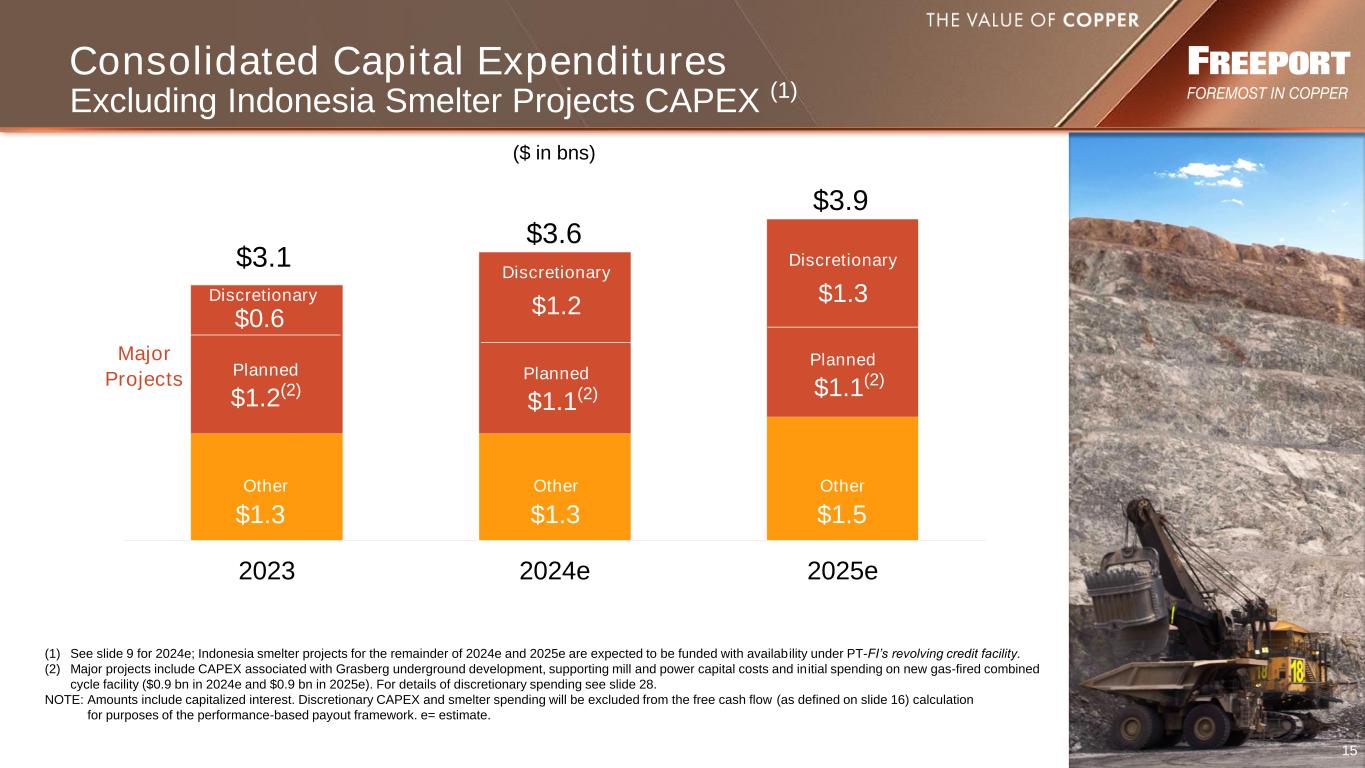

▪Capital expenditures totaled $1.3 billion, including $0.4 billion for major mining projects and $0.5 billion for the Indonesia smelter projects, in first-quarter 2024. Capital expenditures are expected to approximate $4.6 billion, including $2.3 billion for major mining projects and $1.0 billion for the Indonesia smelter projects, for the year 2024.

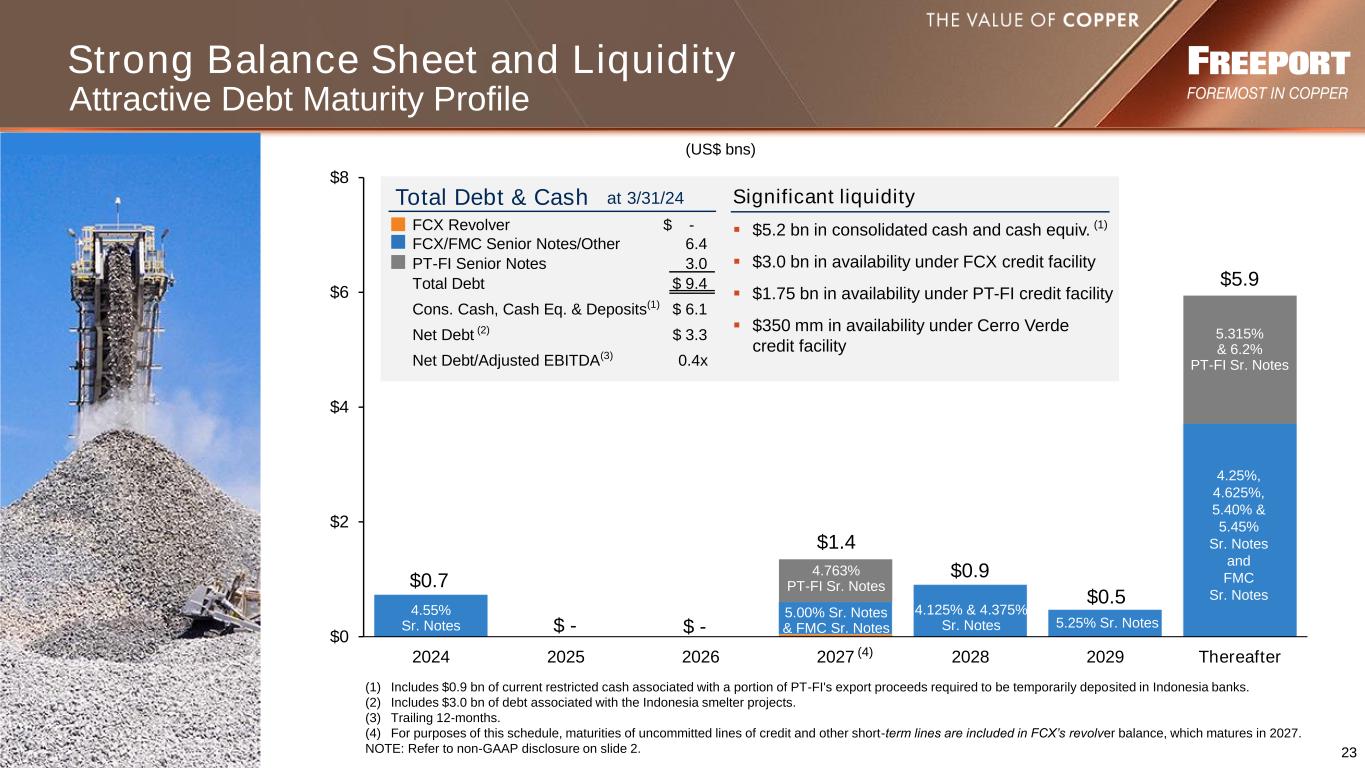

▪At March 31, 2024, consolidated debt totaled $9.4 billion and consolidated cash and cash equivalents totaled $5.2 billion, $6.1 billion including $0.9 billion of current restricted cash associated with a portion of PT Freeport Indonesia’s (PT-FI) export proceeds required to be temporarily deposited in Indonesia banks. Net debt totaled $0.3 billion, excluding $3.0 billion of debt for the Indonesia smelter projects. Refer to the supplemental schedule, “Net Debt,” on page VIII.

▪Kathleen L. Quirk, President, will transition to President and Chief Executive Officer (CEO) effective as of the annual meeting of shareholders on June 11, 2024. Richard C. Adkerson, who has served as CEO since 2003, will continue as Chairman of the Board of Directors.

PHOENIX, AZ, April 23, 2024 – Freeport-McMoRan Inc. (NYSE: FCX) reported first-quarter 2024 net income attributable to common stock of $473 million, $0.32 per share, and adjusted net income attributable to common stock of $474 million, $0.32 per share. For additional information, refer to the supplemental schedule, “Adjusted Net Income,” on page VI.

Richard C. Adkerson, Chairman and CEO, said, “During my 20-year tenure as CEO, our team has established Freeport as a global leader in the metals industry, with a strategic focus of being Foremost in Copper. We have a solid foundation for the future, with a high-quality portfolio of large-scale producing assets, an attractive pipeline of future growth options, an exceptionally talented and committed team and a high-performance culture. My passion for Freeport and our future prospects has never been stronger. As Chairman, I look forward to supporting Kathleen in the upcoming CEO transition and to contributing to achieving our business objectives on strategic matters of significance.”

Kathleen L. Quirk, President, said, “Our first-quarter results reflect strong execution of our operating plans, consistent with our long-standing focus on operational execution. As I prepare to become CEO, my priorities are focused on the drivers that enhance value for our stakeholders, including reliable execution of our plans, enhancing our productivity and cost performance, generating strong cash flow and building value through our organic growth pipeline. Market fundamentals for copper are positive, supported by copper’s increasingly important role in the global economy and limited available supplies to meet growing demand. Freeport is strongly positioned for the future as a leading producer of copper with multiple options for future growth and an experienced team with a track record of accomplishment.”

SUMMARY FINANCIAL DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

2023 |

|

|

|

|

|

|

(in millions, except per share amounts) |

|

Revenuesa,b |

$ |

6,321 |

|

|

$ |

5,389 |

|

|

|

|

|

|

Operating incomea |

$ |

1,634 |

|

|

$ |

1,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to common stockc,d |

$ |

473 |

|

|

$ |

663 |

|

|

|

|

|

|

| Diluted net income per share of common stock |

$ |

0.32 |

|

|

$ |

0.46 |

|

|

|

|

|

|

|

Diluted weighted-average common shares outstanding |

1,444 |

|

|

1,443 |

|

|

|

|

|

|

Operating cash flowse |

$ |

1,896 |

|

|

$ |

1,050 |

|

|

|

|

|

|

| Capital expenditures |

$ |

1,254 |

|

|

$ |

1,121 |

|

|

|

|

|

|

| At March 31: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

5,208 |

|

|

$ |

6,852 |

|

|

|

|

|

|

| Restricted cash and cash equivalents, current |

$ |

1,034 |

|

f |

$ |

118 |

|

|

|

|

|

|

| Total debt, including current portion |

$ |

9,425 |

|

|

$ |

9,635 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a.For segment financial results, refer to the supplemental schedules, “Business Segments,” beginning on page IX.

b.Includes (unfavorable) favorable adjustments to prior period provisionally priced concentrate and cathode copper sales totaling $(7) million ($(2) million to net income attributable to common stock or less than $0.01 per share) in first-quarter 2024 and $210 million ($72 million to net income attributable to common stock or $0.05 per share) in first-quarter 2023. For further discussion, refer to the supplemental schedule, “Derivative Instruments,” on page VIII.

c.Includes net charges totaling $1 million (less than $0.01 per share) in first-quarter 2024 and $94 million ($0.06 per share) in first-quarter 2023, that are described in the supplemental schedule, “Adjusted Net Income,” on page VI.

d.FCX defers recognizing profits on intercompany sales until final sales to third parties occur. For a summary of net impacts from changes in these deferrals, refer to the supplemental schedule, “Deferred Profits,” on page IX.

e.Working capital and other uses totaled $97 million in first-quarter 2024 and $452 million in first-quarter 2023.

f.Includes $0.9 billion at March 31, 2024, associated with a portion of PT-FI’s export proceeds required to be temporarily deposited in Indonesia banks for 90 days in accordance with a regulation issued by the Indonesia government.

SUMMARY OPERATING DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2024 |

|

2023 |

|

|

|

|

|

Copper (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

| Production |

|

1,085 |

|

|

965 |

|

|

|

|

|

|

| Sales, excluding purchases |

|

1,108 |

|

|

832 |

|

|

|

|

|

|

| Average realized price per pound |

|

$ |

3.94 |

|

|

$ |

4.11 |

|

|

|

|

|

|

Site production and delivery costs per pounda |

|

$ |

2.32 |

|

|

$ |

2.57 |

|

|

|

|

|

|

Unit net cash costs per pounda |

|

$ |

1.51 |

|

|

$ |

1.76 |

|

|

|

|

|

|

Gold (thousands of recoverable ounces) |

|

|

|

|

|

|

|

|

|

| Production |

|

549 |

|

|

405 |

|

|

|

|

|

|

| Sales |

|

568 |

|

|

270 |

|

|

|

|

|

|

| Average realized price per ounce |

|

$ |

2,145 |

|

|

$ |

1,949 |

|

|

|

|

|

|

Molybdenum (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

| Production |

|

18 |

|

|

21 |

|

|

|

|

|

|

| Sales, excluding purchases |

|

20 |

|

|

19 |

|

|

|

|

|

|

| Average realized price per pound |

|

$ |

20.38 |

|

|

$ |

30.32 |

|

|

|

|

|

|

a.Reflects per pound weighted-average production and delivery costs and unit net cash costs (net of by-product credits) for all copper mines, before net noncash and other costs. For reconciliations of per pound unit net cash costs by operating division to production and delivery costs applicable to sales reported in FCX’s consolidated financial statements, refer to the supplemental schedules, “Product Revenues and Production Costs,” beginning on page XI.

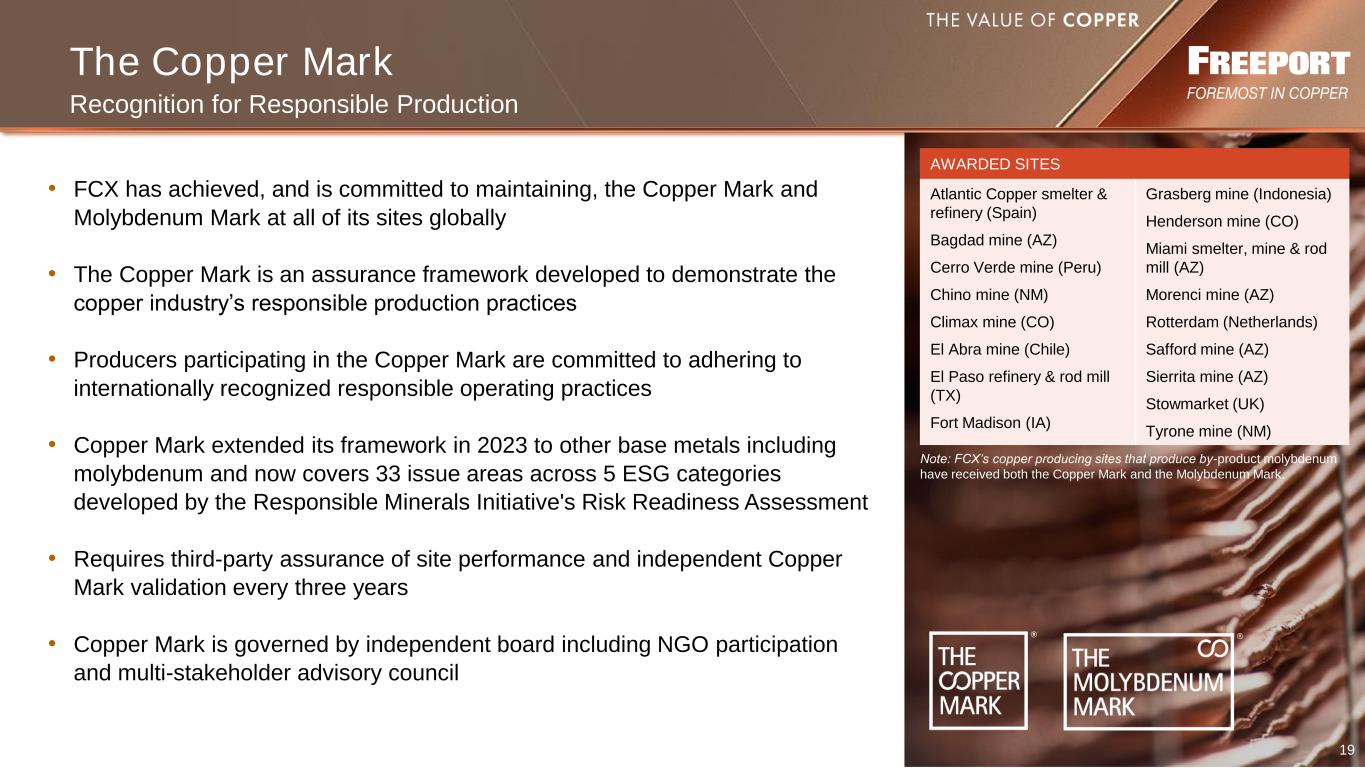

Responsible Production

2023 Annual Report on Sustainability. FCX expects to publish its 2023 Annual Report on Sustainability on FCX's website at fcx.com/sustainability on April 25, 2024. This marks FCX’s 23rd year of reporting on its sustainability progress. FCX is committed to building upon its achievements in sustainability and its position as a leading responsible copper producer.

Consolidated Sales Volumes

•First-quarter 2024 copper sales of 1.1 billion pounds were 11% higher than the January 2024 estimate of 1.0 billion pounds and 33% higher than first-quarter 2023 sales of 0.8 billion pounds, primarily reflecting higher mining and milling rates and ore grades at PT-FI. First-quarter 2023 sales were also impacted by weather-related disruptions and the initial deferral of sales recognition related to the PT Smelting tolling arrangement.

•First-quarter 2024 gold sales of 568 thousand ounces approximated the January 2024 estimate of 575 thousand ounces. First-quarter 2024 gold sales were more than double first-quarter 2023 sales of 270 thousand ounces, primarily reflecting higher mining and milling rates and ore grades at PT-FI. First-quarter 2023 sales were also impacted by weather-related disruptions and the initial deferral of sales recognition related to the PT Smelting tolling arrangement.

•First-quarter 2024 molybdenum sales of 20 million pounds approximated the January 2024 estimate and first-quarter 2023 sales of 19 million pounds.

Consolidated sales volumes for the year 2024 are expected to approximate 4.15 billion pounds of copper, 2.0 million ounces of gold and 84 million pounds of molybdenum, including 1.0 billion pounds of copper, 500 thousand ounces of gold and 21 million pounds of molybdenum in second-quarter 2024. PT-FI’s current export licenses for copper concentrates and anode slimes extend through May 2024. Consolidated sales volume estimates include exports of copper concentrates and anode slimes by PT-FI from June 2024 through December 2024 totaling 0.4 billion pounds of copper and 0.9 million ounces of gold. Consolidated copper and gold production volumes for the year 2024 are expected to exceed 2024 sales volumes, reflecting the deferral of approximately 90 million pounds of copper and 120 thousand ounces of gold that will be processed by the Manyar smelter and precious metals refinery (PMR) (collectively, the Indonesia smelter projects) and sold as refined metal in future periods.

Projected sales volumes are dependent on operational performance; extension of PT-FI’s export permits for copper concentrates and anode slimes beyond May 2024; the timing of the ramp-up of the Indonesia smelter projects; weather-related conditions, including ongoing El Niño weather impacts; timing of shipments and other factors detailed in the “Cautionary Statement” below.

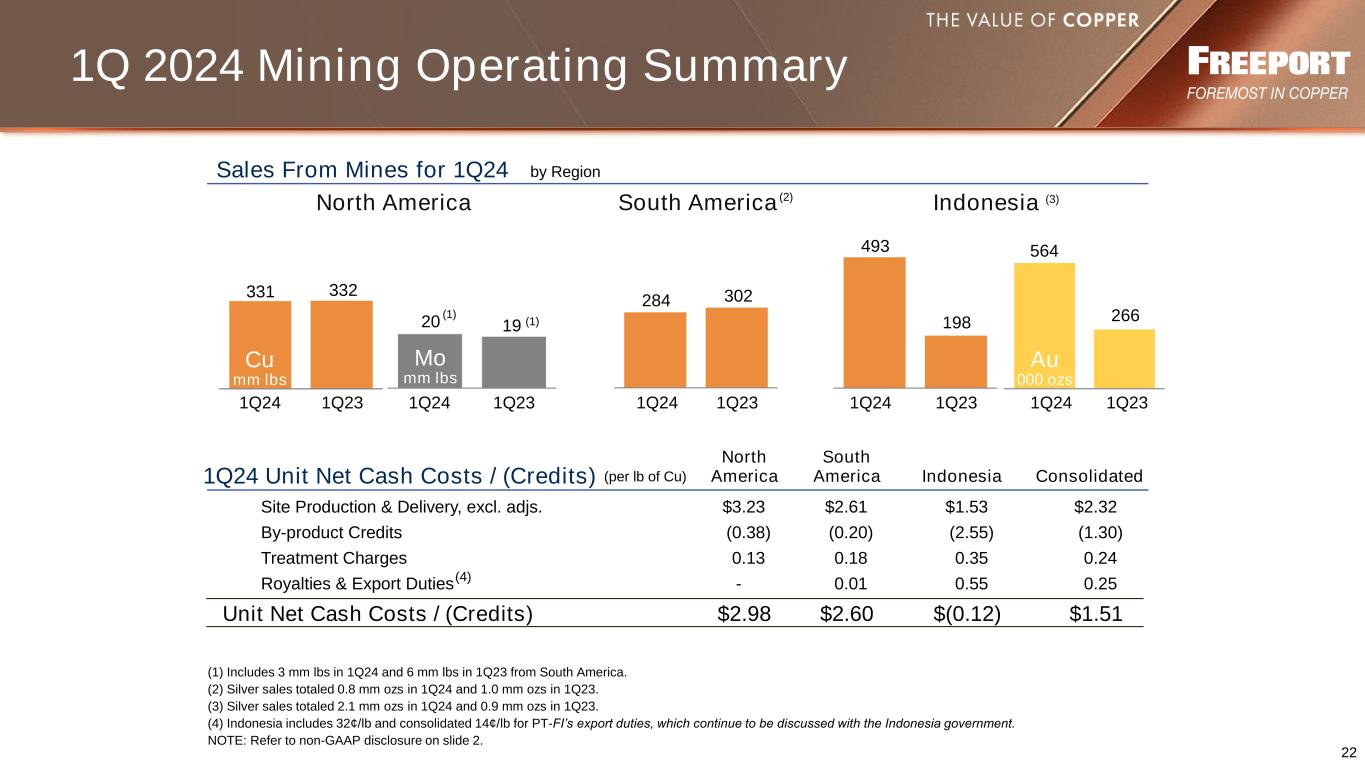

Consolidated Unit Net Cash Costs

First-quarter 2024 consolidated average unit net cash costs (net of by-product credits) for FCX’s copper mines of $1.51 per pound of copper were lower than the January 2024 estimate of $1.55 per pound, primarily reflecting higher copper volumes at PT-FI, partly offset by lower by-product credits.

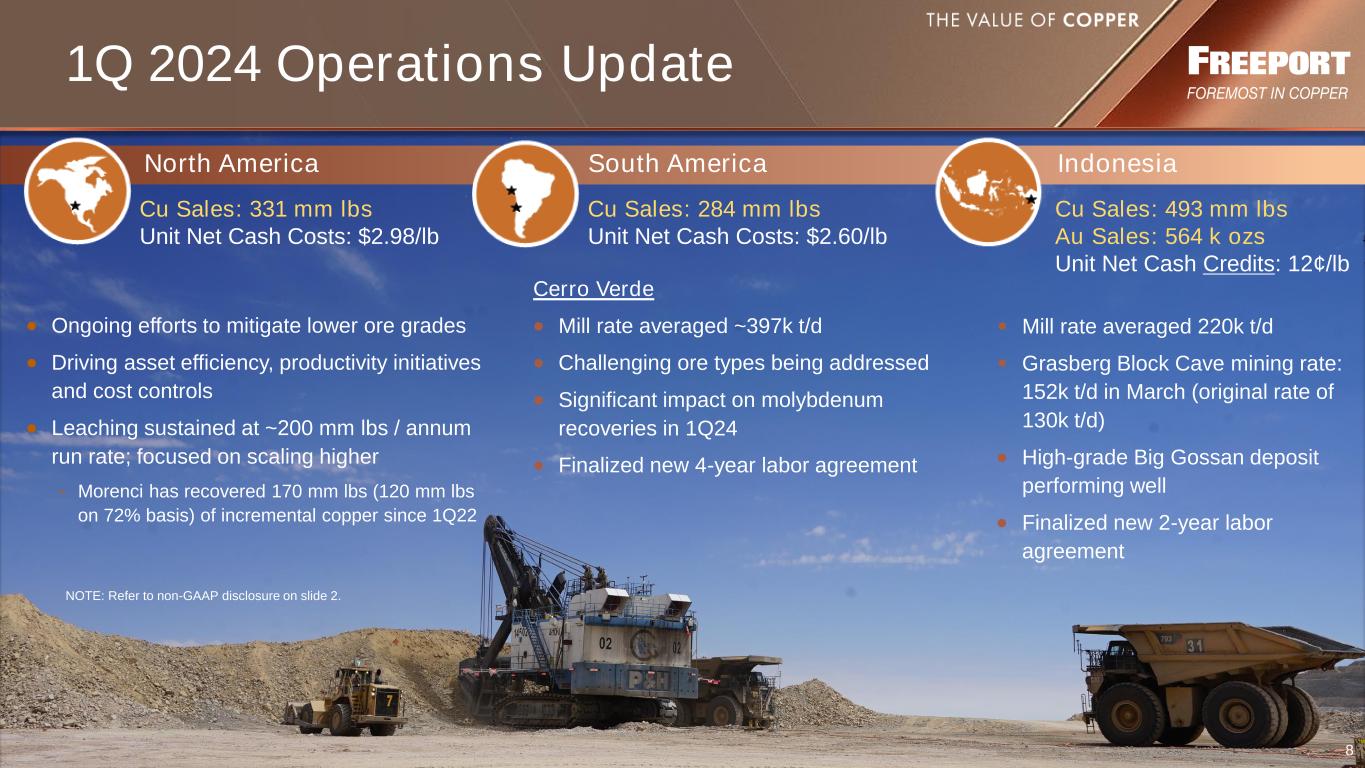

First-quarter 2024 consolidated average unit net cash costs (net of by-product credits) for FCX’s copper mines of $1.51 per pound of copper were lower than first-quarter 2023 average unit net cash costs of $1.76 per pound, primarily reflecting higher copper volumes at PT-FI and higher by-product credits, partly offset by higher export duties at PT-FI. Refer to “Operations” below for further discussion.

Consolidated unit net cash costs (net of by-product credits) for FCX’s copper mines are expected to average $1.57 per pound of copper for the year 2024 (including $1.57 per pound of copper in second-quarter 2024), based on achievement of current sales volume and cost estimates and assuming average prices of $2,300 per ounce of gold and $20.00 per pound of molybdenum for the remainder of 2024. Quarterly unit net cash costs vary with fluctuations in sales volumes and realized prices, primarily for gold and molybdenum. The impact of price changes on consolidated unit net cash costs would approximate $0.04 per pound of copper for each $100 per ounce change in the average price of gold and $0.02 per pound of copper for each $2 per pound change in the average price of molybdenum for the remainder of 2024.

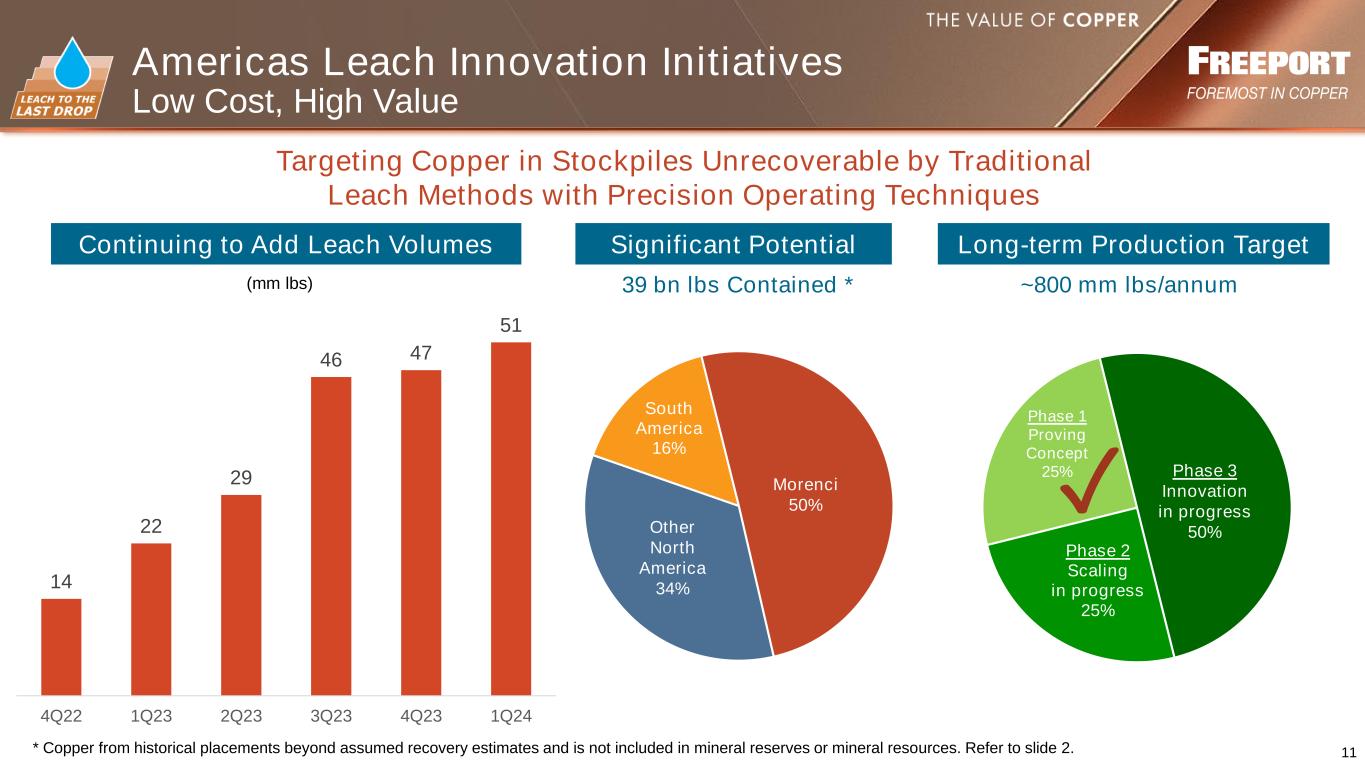

OPERATIONS

Leaching Innovation Initiatives. FCX is continuing to advance a series of initiatives across its North America and South America operations to incorporate new applications, technologies and data analytics to its leaching processes. In late 2023, FCX achieved its initial annual run rate target of approximately 200 million pounds of copper. Incremental copper production from these initiatives totaled 51 million pounds in first-quarter 2024, compared with 22 million pounds in first-quarter 2023. FCX is pursuing opportunities to apply recent operational enhancements at a larger scale and is testing new technology applications that it believes have the potential for significant increases in recoverable metal beyond the current run rate.

North America. FCX manages seven copper operations in North America – Morenci, Bagdad, Safford (including Lone Star), Sierrita and Miami in Arizona, and Chino and Tyrone in New Mexico. FCX also operates a copper smelter in Miami, Arizona. In addition to copper, certain of these operations produce molybdenum concentrate, gold and silver. All of the North America operations are wholly owned, except for Morenci. FCX records its 72% undivided joint venture interest in Morenci using the proportionate consolidation method.

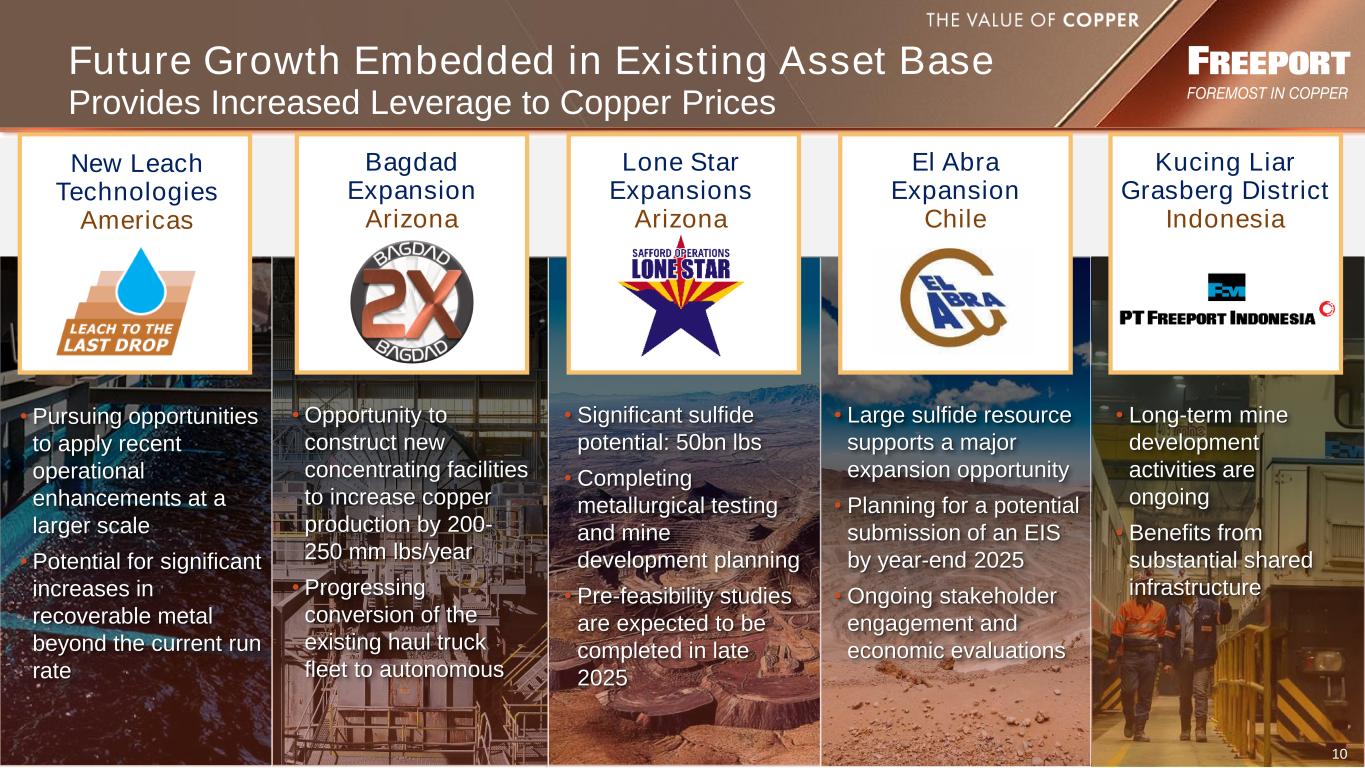

Development Activities. FCX has substantial reserves and future opportunities in the U.S., primarily associated with existing operations.

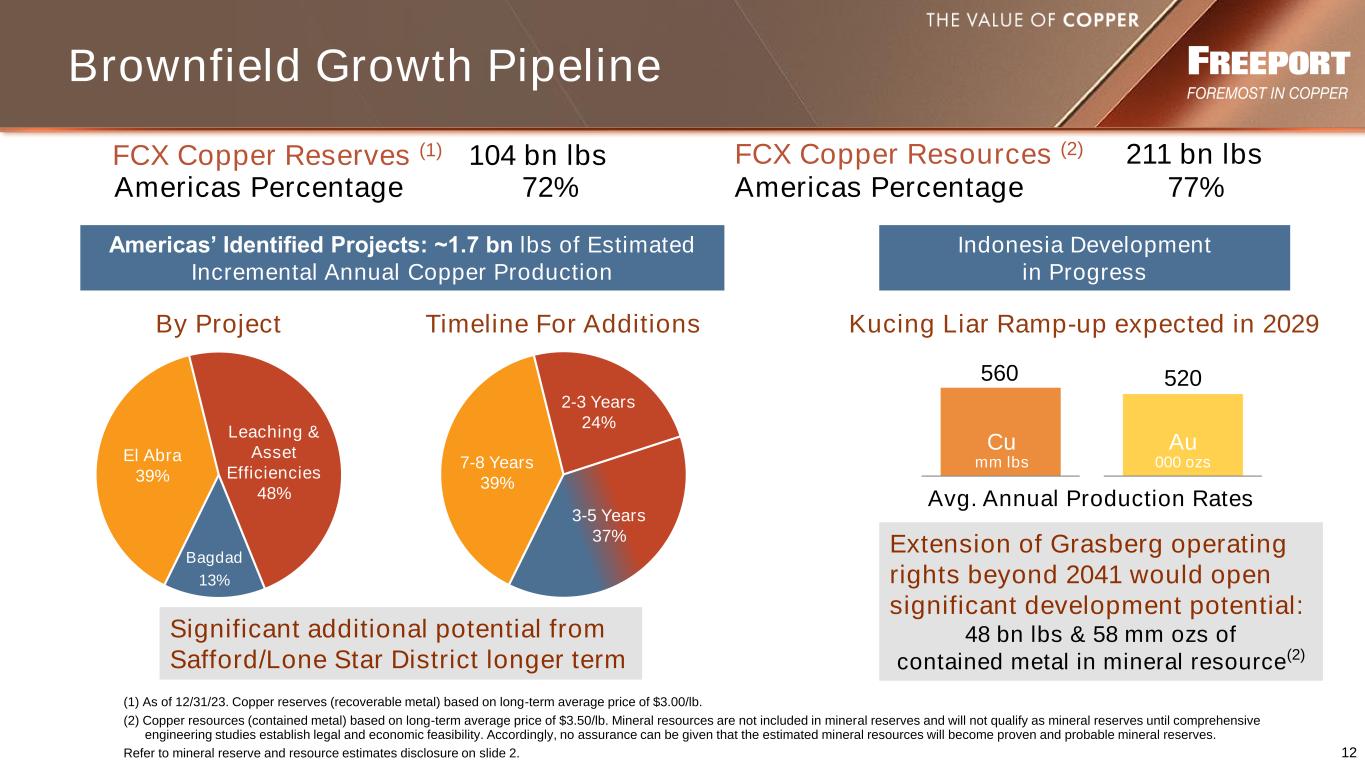

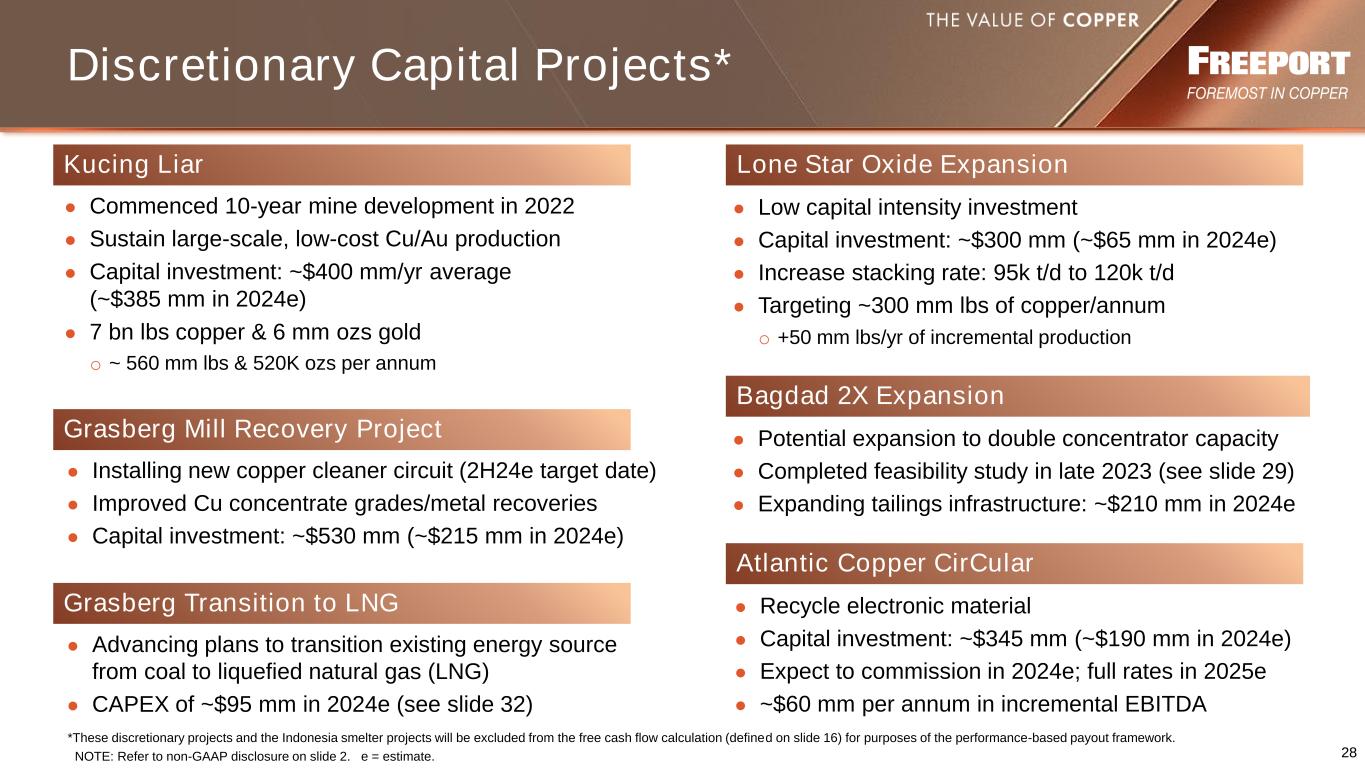

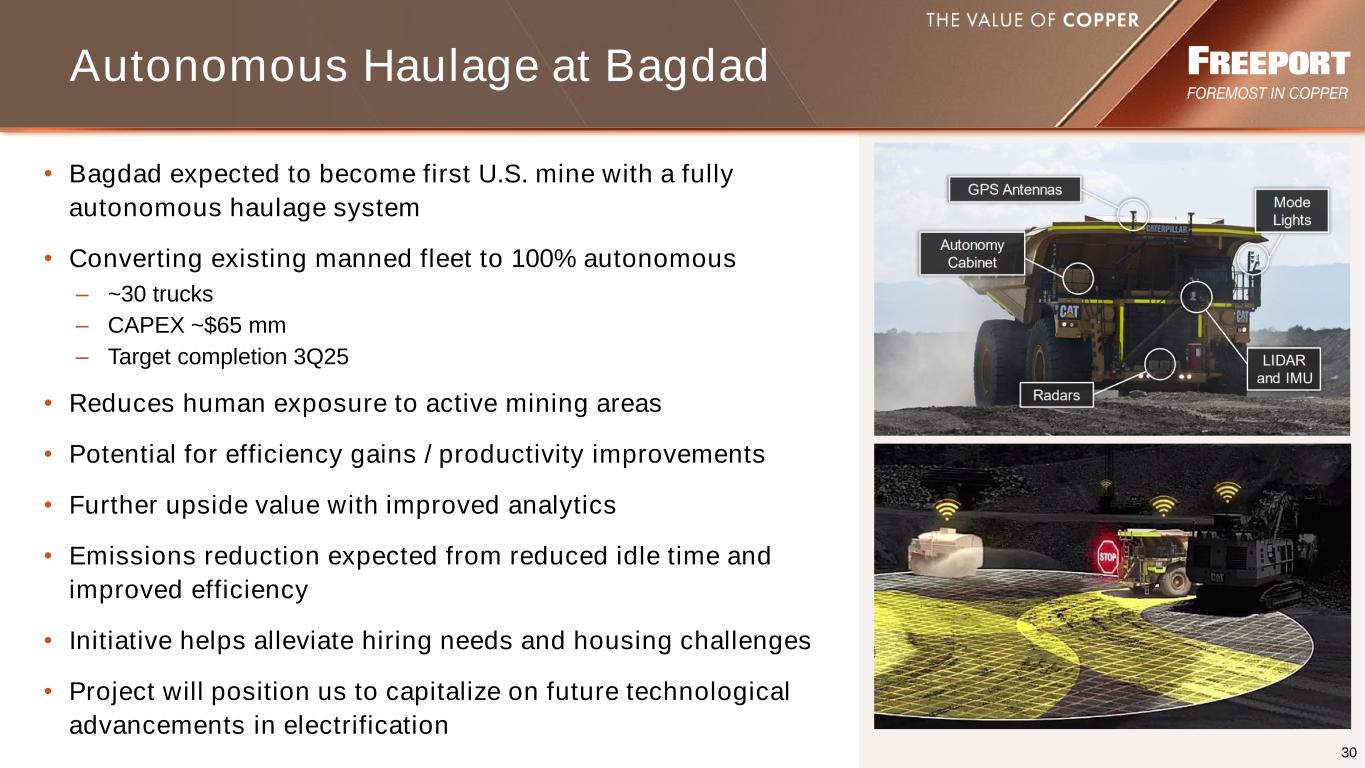

FCX has a potential expansion project to more than double the concentrator capacity of the Bagdad operation in northwest Arizona. Bagdad’s reserve life currently exceeds 80 years and supports an expanded operation. In late 2023, FCX completed technical and economic studies, which indicated the opportunity to construct new concentrating facilities to increase copper production by 200-250 million pounds per year, more than double Bagdad’s current annual production rate. Estimated incremental project capital costs approximate $3.5 billion (excluding infrastructure that would be required in the long-range plans). Expanded operations would provide improved efficiency and reduce unit net cash costs through economies of scale. Project economics indicate that the expansion would require an incentive copper price in the range of $3.50 to $4.00 per pound and would require approximately three to four years to complete. The decision to proceed and timing of the potential expansion will take into account overall copper market conditions, availability of labor and other factors, including progress on conversion of the existing haul truck fleet to autonomous and expanding housing alternatives to support long-range plans. In parallel, FCX is advancing activities for expanded tailings infrastructure projects required under long-range plans in order to advance the potential construction timeline.

FCX is completing projects at its Safford/Lone Star operation to increase volumes to achieve 300 million pounds of copper per year from oxide ores, which reflects expansion of the initial design capacity of 200 million

pounds of copper per year. Additionally, positive drilling conducted in recent years indicate a large mineralized district with opportunities to expand production significantly. FCX is completing metallurgical testing and mine development planning and is commencing pre-feasibility studies for a potential significant expansion. Pre-feasibility studies are expected to be completed in late 2025. The decision to proceed and timing of the potential expansion will take into account results of technical and economic studies, overall copper market conditions and other factors.

Operating Data. Following is summary consolidated operating data for the North America copper mines:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2024 |

|

2023 |

|

|

|

|

|

Copper (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

Production |

|

314 |

|

|

332 |

|

|

|

|

|

|

Sales, excluding purchases |

|

331 |

|

|

332 |

|

|

|

|

|

|

Average realized price per pound |

|

$ |

3.96 |

|

|

$ |

4.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Molybdenum (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

Productiona |

|

7 |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit net cash costs per pound of copperb |

|

|

|

|

|

|

|

|

|

Site production and delivery, excluding adjustments |

|

$ |

3.23 |

|

|

$ |

2.91 |

|

|

|

|

|

|

By-product credits |

|

(0.38) |

|

|

(0.59) |

|

|

|

|

|

|

Treatment charges |

|

0.13 |

|

|

0.13 |

|

|

|

|

|

|

Unit net cash costs |

|

$ |

2.98 |

|

|

$ |

2.45 |

|

|

|

|

|

|

a.Refer to summary operating data on page 3 for FCX’s consolidated molybdenum sales, which include sales of molybdenum produced at the North America copper mines.

b.For a reconciliation of unit net cash costs per pound to production and delivery costs applicable to sales reported in FCX’s consolidated financial statements, refer to the supplemental schedules, “Product Revenues and Production Costs,” beginning on page XI.

FCX’s consolidated copper sales volumes from North America of 331 million pounds in first-quarter 2024 approximated first-quarter 2023 copper sales volumes of 332 million pounds. Production in first-quarter 2024 was slightly lower than first-quarter 2023, reflecting lower ore grades, partly offset by improved leach recovery performance. FCX continues to drive initiatives to enhance productivity and improve equipment reliability to offset declines in ore grades. North America copper sales are estimated to approximate 1.3 billion pounds for the year 2024.

Average unit net cash costs (net of by-product credits) for the North America copper mines of $2.98 per pound of copper in first-quarter 2024 were higher than first-quarter 2023 unit net cash costs of $2.45 per pound, primarily reflecting higher mining costs and lower molybdenum by-product credits.

Average unit net cash costs (net of by-product credits) for the North America copper mines are expected to approximate $3.00 per pound of copper for the year 2024, based on achievement of current sales volume and cost estimates and assuming an average price of $20.00 per pound of molybdenum for the remainder of 2024. North America’s average unit net cash costs for the year 2024 would change by approximately $0.03 per pound for each $2 per pound change in the average price of molybdenum for the remainder of 2024.

South America. FCX manages two copper operations in South America – Cerro Verde in Peru (in which FCX owns a 53.56% interest) and El Abra in Chile (in which FCX owns a 51% interest). These operations are consolidated in FCX’s financial statements. In addition to copper, the Cerro Verde mine produces molybdenum concentrate and silver.

Development Activities. At the El Abra operations in Chile, FCX has drilled out and modeled a large sulfide resource that would support a potential major mill project similar to the large-scale concentrator at Cerro Verde. FCX is engaged in planning for a potential submission of an environmental impact statement by year-end 2025, subject to ongoing stakeholder engagement and economic evaluations. In parallel, FCX is updating its technical studies and economic models to incorporate recent capital cost trends.

Operating Data. Following is summary consolidated operating data for South America operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2024 |

|

2023 |

|

|

|

|

|

Copper (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

Production |

|

280 |

|

|

304 |

|

|

|

|

|

|

Sales |

|

284 |

|

|

302 |

|

|

|

|

|

|

Average realized price per pound |

|

$ |

3.94 |

|

|

$ |

4.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Molybdenum (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

Productiona |

|

3 |

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit net cash costs per pound of copperb |

|

|

|

|

|

|

|

|

|

Site production and delivery, excluding adjustments |

|

$ |

2.61 |

|

|

$ |

2.54 |

|

|

|

|

|

|

By-product credits |

|

(0.20) |

|

|

(0.53) |

|

|

|

|

|

|

Treatment charges |

|

0.18 |

|

|

0.18 |

|

|

|

|

|

|

Royalty on metals |

|

0.01 |

|

|

0.01 |

|

|

|

|

|

|

Unit net cash costs |

|

$ |

2.60 |

|

|

$ |

2.20 |

|

|

|

|

|

|

a.Refer to summary operating data on page 3 for FCX’s consolidated molybdenum sales, which include sales of molybdenum produced at Cerro Verde.

b.For a reconciliation of unit net cash costs per pound to production and delivery costs applicable to sales reported in FCX’s consolidated financial statements, refer to the supplemental schedules, “Product Revenues and Production Costs,” beginning on page XI.

FCX’s consolidated copper sales from South America operations in first-quarter 2024 were lower than first-quarter 2023, primarily reflecting lower volumes of leach ore placed in stockpiles and lower milling rates associated with mill maintenance. Molybdenum production in first-quarter 2024 was significantly lower than first-quarter 2023 as a result of mill maintenance and the impact of certain ore types on recoveries. Copper sales from South America operations are expected to approximate 1.1 billion for the year 2024, which assume no significant impacts to water availability, which is being monitored closely in light of ongoing El Niño weather patterns.

Average unit net cash costs (net of by-product credits) for South America operations of $2.60 per pound of copper in first-quarter 2024 were higher than first-quarter 2023 unit net cash costs of $2.20 per pound, primarily reflecting lower molybdenum by-product credits and lower copper volumes.

Average unit net cash costs (net of by-product credits) for South America operations are expected to approximate $2.51 per pound of copper for the year 2024, based on achievement of current sales volume and cost estimates and assuming an average price of $20.00 per pound of molybdenum for the remainder of 2024.

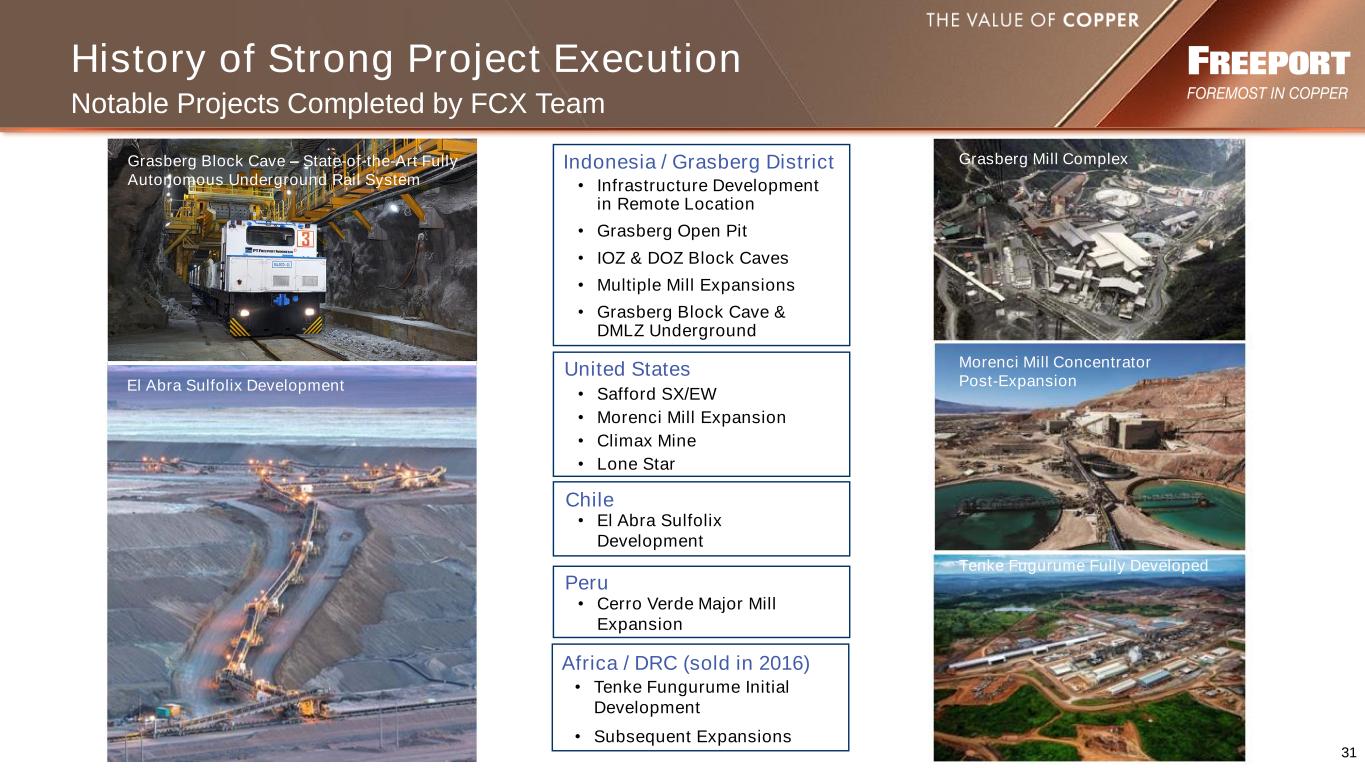

Indonesia. PT-FI operates one of the world’s largest copper and gold mines at the Grasberg minerals district in Central Papua, Indonesia. PT-FI produces copper concentrate that contains significant quantities of gold and silver. FCX has a 48.76% ownership interest in PT-FI and manages its operations. PT-FI’s results are consolidated in FCX’s financial statements. Upon completion and full ramp-up of the Indonesia smelter projects, PT-FI will be a fully integrated producer of refined copper and gold.

Regulatory Matters. Over the past several years, the Indonesia government has enacted various laws and regulations related to downstream processing of various products, including copper concentrates. In 2018, PT-FI agreed to expand its domestic smelting and refining capacity and has made substantial progress towards completion (refer to “Indonesia Smelting and Refining” below).

PT-FI’s current export licenses for copper concentrate and anode slimes extend through May 2024. PT-FI is working with the Indonesia government to obtain approvals to continue exports of copper concentrates and anode slimes until the Indonesia smelter projects are fully commissioned and reach designed operating conditions, which is currently expected by year-end 2024.

PT-FI also continues to discuss the applicability of the Indonesia government’s revised regulation on duties for various exported products, including copper concentrates because of inconsistencies with its special mining

license (IUPK). PT-FI incurred export duties totaling $156 million in first-quarter 2024 under the revised regulation. PT-FI is currently paying an export duty on copper concentrates of 7.5%.

Mining Rights. The Indonesia government is updating regulations that would enable PT-FI to apply for an extension of its IUPK beyond 2041. An extension would enable continuity of large-scale operations for the benefit of all stakeholders and provide growth options through additional resource development opportunities in the highly attractive Grasberg minerals district.

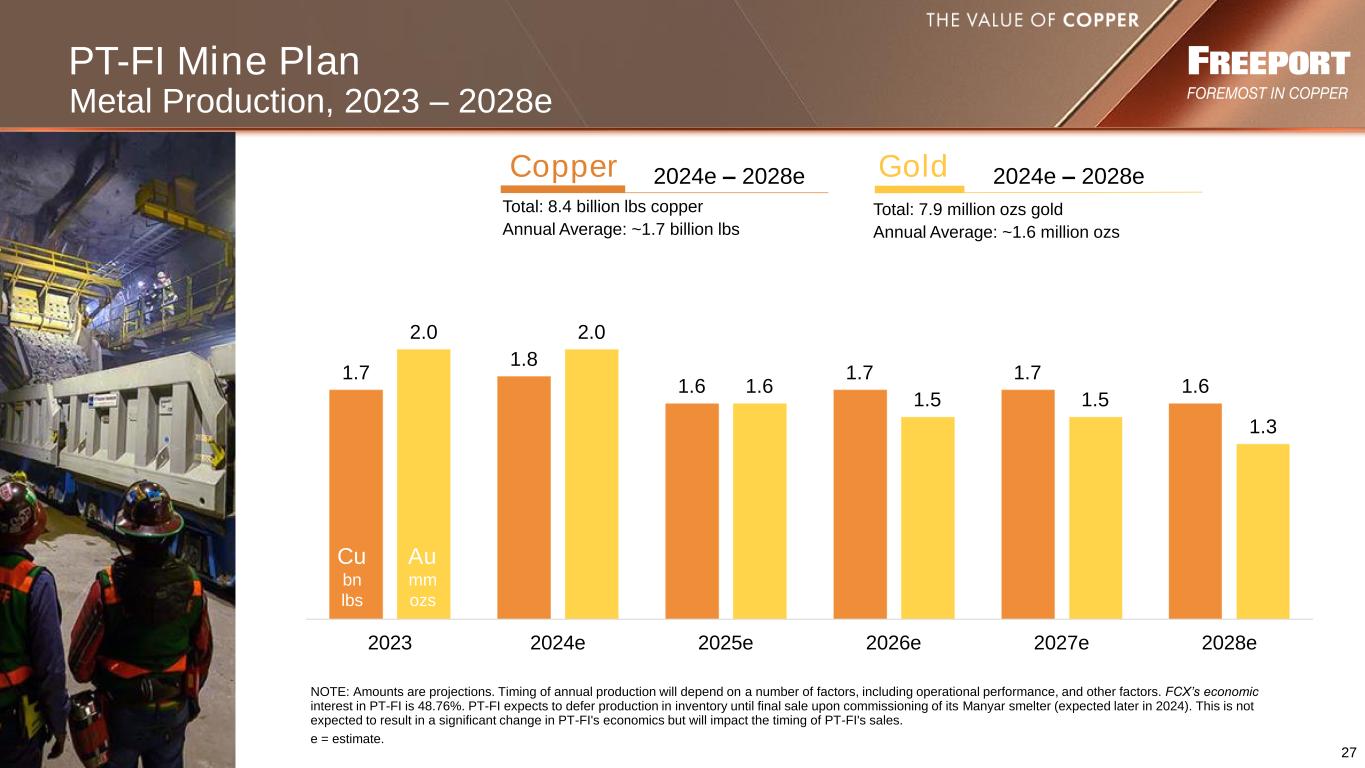

Operating and Development Activities. Over a multi-year investment period, PT-FI has successfully commissioned three large-scale underground mines in the Grasberg minerals district (Grasberg Block Cave, Deep Mill Level Zone and Big Gossan), which provided production volumes of 0.5 billion pounds of copper and 0.5 million ounces of gold in first-quarter 2024. Milling rates for ore from these underground mines averaged 219,500 metric tons of ore per day in first-quarter 2024, a 33% increase from 164,800 metric tons of ore per day in first-quarter 2023.

In December 2023, PT-FI completed the installation of new milling facilities, which allows PT-FI to further leverage the success of the underground mines and provide sustained large-scale production volumes. PT-FI is completing a mill recovery project with the installation of a new copper cleaner circuit in the second half of 2024.

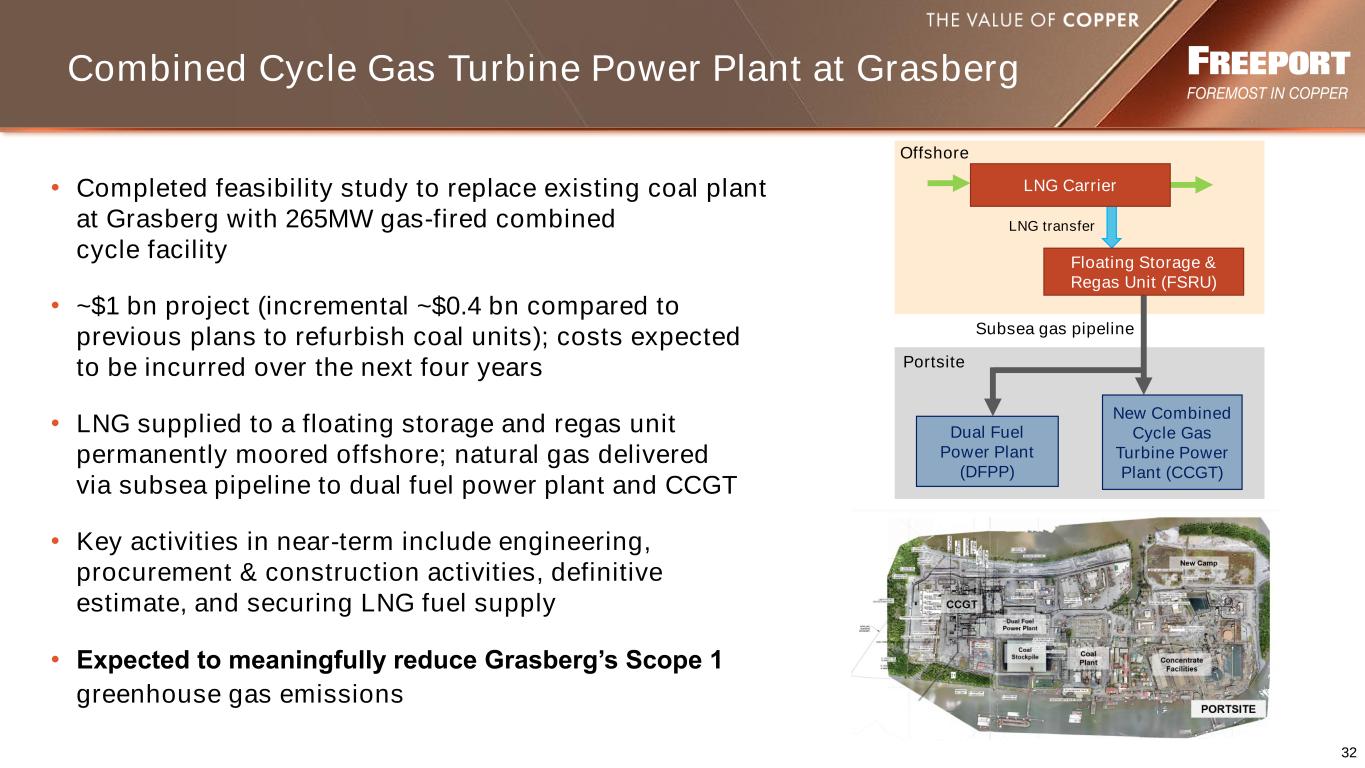

PT-FI plans to transition its existing energy source from coal to liquefied natural gas, which would meaningfully reduce PT-FI’s Scope 1 greenhouse gas emissions at the Grasberg minerals district. PT-FI is planning investments in a new gas-fired combined cycle facility. Capital expenditures for the new facilities, to be incurred over the next four years, approximate $1 billion representing an incremental cost of $0.4 billion compared to previously planned investments to refurbish the existing coal units.

Kucing Liar. Long-term mine development activities are ongoing for PT-FI’s Kucing Liar deposit in the Grasberg minerals district, which is expected to produce over 7 billion pounds of copper and 6 million ounces of gold between 2029 and the end of 2041. An extension of PT-FI’s operating rights beyond 2041 would extend the life of the project. Pre-production development activities commenced in 2022 and are expected to continue over an approximate 10-year timeframe. Capital investments are estimated to average approximately $400 million per year over this period. At full operating rates of approximately 90,000 metric tons of ore per day, annual production from Kucing Liar is expected to approximate 560 million pounds of copper and 520 thousand ounces of gold, providing PT-FI with sustained long-term, large-scale and low-cost production. Kucing Liar will benefit from substantial shared infrastructure and PT-FI’s experience and long-term success in block-cave mining.

Indonesia Smelting and Refining. In connection with PT-FI’s 2018 agreement with the Indonesia government to secure the extension of its long-term mining rights, PT-FI agreed to expand its domestic smelting and refining capacity. At March 31, 2024, progress of the Indonesia smelter projects approximated 92%.

Construction progress of the Manyar smelter in Gresik, Indonesia (with a capacity to process approximately 1.7 million metric tons of copper concentrate per year) is advancing on schedule with a target of May 2024 for material construction completion, which will be followed by a ramp-up period through December 2024. Construction of the smelter has an estimated cost of $3.0 billion, including $2.8 billion for a construction contract (excluding capitalized interest, owner’s costs and commissioning) and $0.2 billion for investment in a desalination plant.

The PMR is being constructed to process gold and silver from the Manyar smelter and PT Smelting. Construction is in progress with commissioning expected during the second half of 2024. Current cost estimates total $665 million.

During first-quarter 2024, capital expenditures for the Indonesia smelter projects totaled $0.5 billion and are expected to approximate $1.0 billion for the year 2024. Capital expenditures for the Indonesia smelter projects for the remainder of 2024 are expected to be funded with availability under PT-FI’s revolving credit facility.

In December 2023, PT Smelting completed an expansion of its capacity by 30% to 1.3 million metric tons of copper concentrate per year. The project was funded by PT-FI with borrowings totaling approximately $250 million that are expected to convert to equity in late second-quarter 2024, increasing PT-FI’s ownership in PT Smelting to approximately 65% from 39.5%.

Operating Data. Following is summary consolidated operating data for Indonesia operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2024 |

|

2023 |

|

|

|

|

|

Copper (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

Production |

|

491 |

|

|

329 |

|

|

|

|

|

|

Sales |

|

493 |

|

|

198 |

|

|

|

|

|

|

Average realized price per pound |

|

$ |

3.92 |

|

|

$ |

4.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gold (thousands of recoverable ounces) |

|

|

|

|

|

|

|

|

|

Production |

|

545 |

|

|

402 |

|

|

|

|

|

|

Sales |

|

564 |

|

|

266 |

|

|

|

|

|

|

Average realized price per ounce |

|

$ |

2,145 |

|

|

$ |

1,949 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit net cash credits per pound of coppera |

|

|

|

|

|

|

|

|

|

| Site production and delivery, excluding adjustments |

|

$ |

1.53 |

|

|

$ |

2.01 |

|

|

|

|

|

|

| Gold, silver and other by-product credits |

|

(2.55) |

|

|

(2.84) |

|

|

|

|

|

|

Treatment charges |

|

0.35 |

|

|

0.37 |

|

|

|

|

|

|

Export dutiesb |

|

0.32 |

|

|

0.09 |

|

|

|

|

|

|

Royalty on metals |

|

0.23 |

|

|

0.29 |

|

|

|

|

|

|

| Unit net cash credits |

|

$ |

(0.12) |

|

|

$ |

(0.08) |

|

|

|

|

|

|

a.For a reconciliation of unit net cash credits per pound to production and delivery costs applicable to sales reported in FCX’s consolidated financial statements, refer to the supplemental schedules, “Product Revenues and Production Costs,” beginning on page XI.

b.See “Regulatory Matters” above for discussion of export duties. First-quarter 2023 reflects an export duty rate of 2.5%. Export duties were eliminated effective March 29, 2023, upon verification that construction progress of the Manyar smelter exceeded 50%, before being reinstated in July 2023 as part of the 2023 revised regulation.

PT-FI’s consolidated sales of 493 million pounds of copper and 564 thousand ounces of gold in first-quarter 2024 were more than double first-quarter 2023 sales of 198 million pounds of copper and 266 thousand ounces of gold, primarily reflecting higher mining and milling rates and ore grades. First-quarter 2023 sales were also impacted by weather-related disruptions and the initial deferral of sales recognition related to the PT Smelting tolling arrangement.

Consolidated sales volumes from PT-FI are expected to approximate 1.7 billion pounds of copper and 2.0 million ounces of gold for the year 2024, which includes exports of copper concentrates and anode slimes from June 2024 through December 2024 totaling 0.4 billion pounds of copper and 0.9 million ounces of gold. Consolidated copper and gold production volumes from PT-FI for the year 2024 are expected to exceed 2024 sales volumes, reflecting the deferral of approximately 90 million pounds of copper and 120 thousand ounces of gold that will be processed by the Indonesia smelter projects and sold as refined metal in future periods. Projected sales volumes are dependent on operational performance; extension of PT-FI’s export permits for copper concentrates and anode slimes beyond May 2024; weather-related conditions; and other factors detailed in the “Cautionary Statement” below.

PT-FI’s unit net cash credits (including gold, silver and other by-product credits) were $0.12 per pound of copper in first-quarter 2024 and $0.08 per pound of copper in first-quarter 2023. The favorable unit net cash credits in first-quarter 2024, compared to first-quarter 2023, primarily reflect higher sales volumes, partially offset by lower by-product credits and higher export duties.

Average unit net cash credits (including gold, silver and other by-product credits) for PT-FI are expected to approximate $0.12 per pound of copper for the year 2024, based on achievement of current sales volumes and cost estimates and assuming an average price of $2,300 per ounce of gold for the remainder of 2024. PT-FI’s average unit net cash credits for the year 2024 would change by approximately $0.09 per pound of copper for each $100 per ounce change in the average price of gold for the remainder of 2024.

Molybdenum. FCX operates two wholly owned primary molybdenum operations in Colorado – the Climax open-pit mine and the Henderson underground mine. The Climax and Henderson mines produce high-purity, chemical-grade molybdenum concentrate, which is typically further processed into value-added molybdenum chemical products. The majority of the molybdenum concentrate produced at the Climax and Henderson mines and at FCX’s North America copper mines and South America operations is processed at FCX’s conversion facilities.

Operating and Development Activities. Production from the primary molybdenum operations totaled 8 million pounds of molybdenum in each of first-quarter 2024 and 2023. FCX’s consolidated molybdenum sales and average realized prices include sales of molybdenum produced at the primary molybdenum operations and at FCX’s North America copper mines and South America operations, which are presented on page 3.

Average unit net cash costs for the primary molybdenum operations of $15.80 per pound of molybdenum in first-quarter 2024 were higher than average unit net cash costs of $12.24 per pound in first-quarter 2023, primarily reflecting higher costs for contract labor and maintenance supplies. Average unit net cash costs for the primary molybdenum operations are expected to approximate $15.47 per pound of molybdenum for the year 2024, based on achievement of current sales volumes and cost estimates.

For a reconciliation of unit net cash costs per pound to production and delivery costs applicable to sales reported in FCX’s consolidated financial statements, refer to the supplemental schedules, “Product Revenues and Production Costs,” beginning on page XI.

LIQUIDITY, CASH FLOWS, CASH AND DEBT

Liquidity. At March 31, 2024, FCX had $5.2 billion in consolidated cash and cash equivalents, $6.1 billion including $0.9 billion of current restricted cash associated with PT-FI’s export proceeds required to be temporarily deposited in Indonesia banks and $3.0 billion of availability under its revolving credit facility. In addition, PT-FI and Cerro Verde have $1.75 billion and $350 million, respectively, of availability under their revolving credit facilities.

Operating Cash Flows. FCX generated operating cash flows of $1.9 billion, net of $0.1 billion of working capital and other uses, in first-quarter 2024.

FCX’s consolidated operating cash flows are estimated to approximate $7.4 billion, net of $0.2 billion of working capital and other uses, for the year 2024, based on current sales volume and cost estimates, and assuming average prices of $4.25 per pound of copper, $2,300 per ounce of gold and $20.00 per pound of molybdenum for the remainder of 2024. The impact of price changes for the remainder of 2024 on operating cash flows would approximate $270 million for each $0.10 per pound change in the average price of copper, $105 million for each $100 per ounce change in the average price of gold and $90 million for each $2 per pound change in the average price of molybdenum.

Capital Expenditures. Capital expenditures totaled $1.3 billion in first-quarter 2024, including $0.4 billion for major mining projects and $0.5 billion for the Indonesia smelter projects.

Capital expenditures are expected to approximate $4.6 billion for the year 2024, including $2.3 billion for major mining projects and $1.0 billion for the Indonesia smelter projects. Projected capital expenditures for the Indonesia smelter projects in 2024 exclude capitalized interest and $0.3 billion of estimated commissioning and owner’s costs. Projected capital expenditures for major mining projects include $1.1 billion for planned projects, primarily associated with underground mine development in the Grasberg minerals district and potential expansion projects in North America, and $1.2 billion for discretionary growth projects.

Capital expenditures for the Indonesia smelter projects for the remainder of 2024 are expected to be funded with availability under PT-FI’s revolving credit facility.

Cash. Following is a summary of the U.S. and international components of consolidated cash and cash equivalents available to the parent company, net of noncontrolling interests’ share, taxes and other costs at March 31, 2024 (in billions):

|

|

|

|

|

|

|

|

|

| Cash at domestic companies |

$ |

2.3 |

|

|

| Cash at international operations |

2.9 |

|

a |

| Total consolidated cash and cash equivalents |

5.2 |

|

|

|

|

|

| Noncontrolling interests’ share |

(1.4) |

|

|

| Cash, net of noncontrolling interests’ share |

3.8 |

|

|

| Withholding taxes |

(0.1) |

|

|

| Net cash available |

$ |

3.7 |

|

|

a.Excludes $0.9 billion of current restricted cash associated with a portion of PT-FI’s export proceeds required to be temporarily deposited in Indonesia banks for 90 days in accordance with a regulation issued by the Indonesia government.

Debt. Following is a summary of total debt and the weighted-average interest rates at March 31, 2024 (in billions, except percentages):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-

Average

Interest Rate |

| Senior notes: |

|

|

|

| Issued by FCX |

$ |

6.0 |

|

|

4.9% |

| Issued by PT-FI |

3.0 |

|

|

5.4% |

| Issued by Freeport Minerals Corporation |

0.3 |

|

|

7.5% |

| Other |

0.1 |

|

|

4.0% |

| Total debt |

$ |

9.4 |

|

|

5.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At March 31, 2024, there were no borrowings and $7 million in letters of credit issued under FCX’s $3.0 billion revolving credit facility. FCX has $0.7 billion in scheduled senior note maturities in November 2024 with no further senior note maturities until 2027. FCX’s total debt has an average remaining duration of approximately 10 years.

As of March 31, 2024, PT-FI and Cerro Verde had no borrowings outstanding under their respective revolving credit facilities.

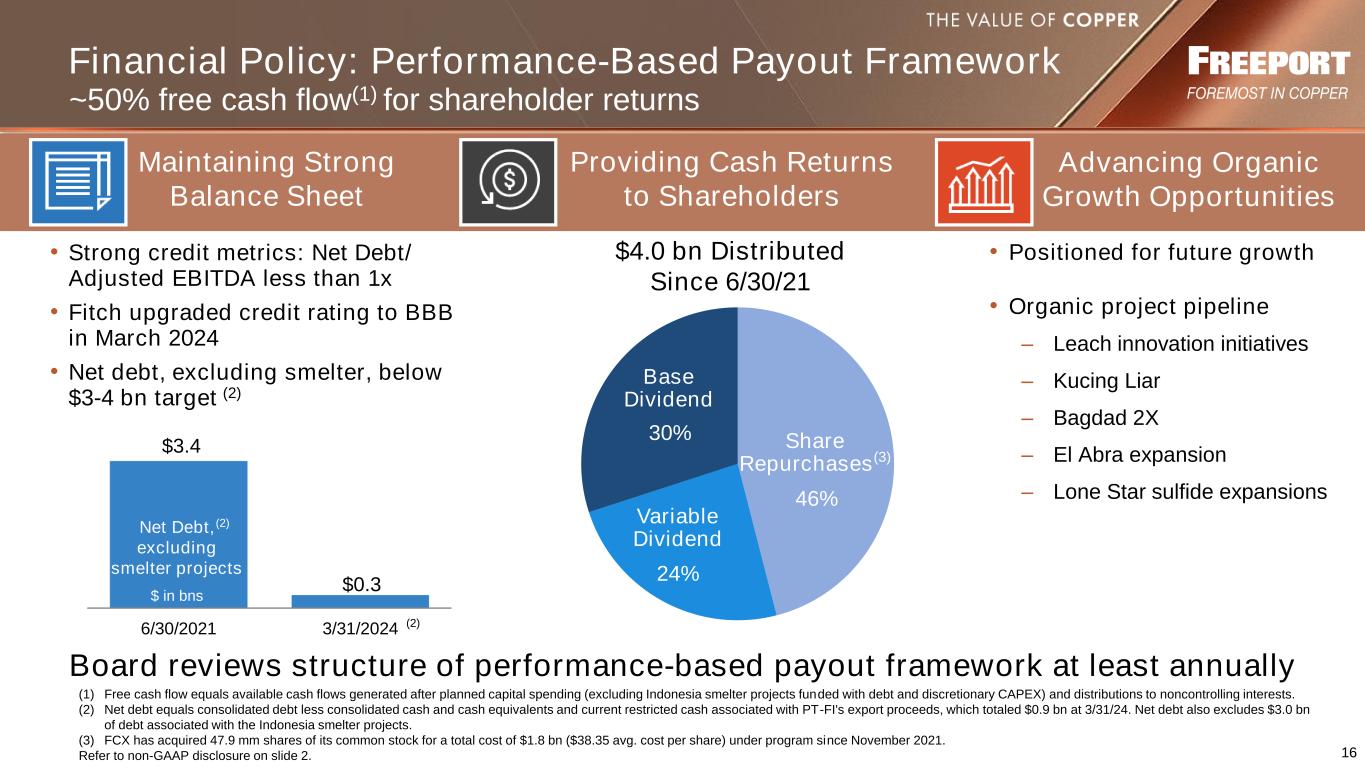

FINANCIAL POLICY

FCX’s financial policy is aligned with its strategic objectives of maintaining a solid balance sheet, providing cash returns to shareholders and advancing opportunities for future growth. The policy includes a base dividend and a performance-based payout framework, whereby up to 50% of available cash flows generated after planned capital spending and distributions to noncontrolling interests would be allocated to shareholder returns and the balance to debt reduction and investments in value enhancing growth projects, subject to FCX maintaining its net debt at a level not to exceed the net debt target of $3.0 billion to $4.0 billion (excluding debt for the Indonesia smelter projects). The Board of Directors (Board) reviews the structure of the performance-based payout framework at least annually.

At March 31, 2024, FCX’s net debt, excluding $3.0 billion of debt for the Indonesia smelter projects, totaled $0.3 billion (which was net of $0.9 billion of current restricted cash associated with PT-FI’s export proceeds). Refer to the supplemental schedule, “Net Debt,” on page VIII.

On March 27, 2024, FCX’s Board declared cash dividends totaling $0.15 per share on its common stock (including a $0.075 per share quarterly base cash dividend and a $0.075 per share quarterly variable, performance-based cash dividend), which will be paid on May 1, 2024, to shareholders of record as of April 15, 2024. The declaration and payment of dividends (base or variable) are at the discretion of the Board and will depend on FCX’s financial results, cash requirements, global economic conditions and other factors deemed relevant by the Board.

As of April 22, 2024, FCX has 1.44 billion shares of common stock outstanding and $3.2 billion is available under its share repurchase program. The timing and amount of share repurchases is at the discretion of

management and will depend on a variety of factors. The share repurchase program may be modified, increased, suspended or terminated at any time at the Board’s discretion.

WEBCAST INFORMATION

A conference call with securities analysts to discuss FCX’s first-quarter 2024 results is scheduled for today at 10:00 a.m. Eastern Time. The conference call will be broadcast on the internet along with slides. Interested parties may listen to the conference call live and view the slides by accessing fcx.com. A replay of the webcast will be available through Friday, May 17, 2024.

-----------------------------------------------------------------------------------------------------------

FREEPORT: Foremost in Copper

FCX is a leading international metals company with the objective of being foremost in copper. Headquartered in Phoenix, Arizona, FCX operates large, long-lived, geographically diverse assets with significant proven and probable reserves of copper, gold and molybdenum. FCX is one of the world’s largest publicly traded copper producers.

FCX’s portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits; and significant operations in North America and South America, including the large-scale Morenci minerals district in Arizona and the Cerro Verde operation in Peru.

By supplying responsibly produced copper, FCX is proud to be a positive contributor to the world well beyond its operational boundaries. Additional information about FCX is available on FCX’s website at fcx.com.

Cautionary Statement: This press release contains forward-looking statements in which FCX discusses its potential future performance, operations and projects. Forward-looking statements are all statements other than statements of historical facts, such as plans, projections, or expectations relating to business outlook, strategy, goals or targets; global market conditions; ore grades and milling rates; production and sales volumes; unit net cash costs (credits) and operating costs; capital expenditures; operating plans; cash flows; liquidity; PT-FI’s construction and completion of additional domestic smelting and refining capacity in Indonesia in accordance with the terms of its IUPK; extension of PT-FI’s IUPK beyond 2041; export licenses; export duties; export volumes; FCX’s commitment to deliver responsibly produced copper and molybdenum, including plans to implement, validate and maintain validation of its operating sites under specific frameworks; execution of FCX’s energy and climate strategies and the underlying assumptions and estimated impacts on FCX’s business and stakeholders related thereto; achievement of 2030 climate targets and 2050 net zero aspiration; improvements in operating procedures and technology innovations and applications; exploration efforts and results; development and production activities, rates and costs; future organic growth opportunities; tax rates; the impact of copper, gold and molybdenum price changes; the impact of deferred intercompany profits on earnings; mineral reserve and mineral resource estimates; final resolution of settlements associated with ongoing legal and environmental proceedings; debt repurchases; and the ongoing implementation of FCX’s financial policy and future returns to shareholders, including dividend payments (base or variable) and share repurchases. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “could,” “to be,” “potential,” “assumptions,” “guidance,” “aspirations,” “future,” “commitments,” “pursues,” “initiatives,” “objectives,” “opportunities,” “strategy” and any similar expressions are intended to identify those assertions as forward-looking statements. The declaration and payment of dividends (base or variable), and timing and amount of any share repurchases are at the discretion of the Board and management, respectively, and are subject to a number of factors, including not exceeding FCX’s net debt target, capital availability, FCX’s financial results, cash requirements, global economic conditions, changes in laws, contractual restrictions and other factors deemed relevant by the Board or management, as applicable. The share repurchase program may be modified, increased, suspended or terminated at any time at the Board’s discretion.

FCX cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause FCX’s actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, supply of and demand for, and prices of the commodities FCX produces, primarily copper; PT-FI’s ability to continue to export and sell copper concentrates and anode slimes; changes in export duties, including results of proceedings to dispute export duties; completion of additional domestic smelting and refining capacity in Indonesia; production rates; timing of shipments; price and availability of consumables and components FCX purchases as well as constraints on supply and logistics, and transportation services; changes in FCX’s cash requirements, financial position, financing or investment plans; changes in general market, economic, geopolitical, regulatory or industry conditions; reductions in liquidity and access to capital; changes in tax laws and regulations; political and social risks, including the potential effects of violence in Indonesia, civil unrest in Peru, and relations with local communities and Indigenous Peoples; operational risks inherent in mining, with higher inherent risks in underground mining; mine sequencing; changes in mine plans or operational modifications, delays, deferrals or cancellations, including the ability to smelt and refine; results of technical, economic or feasibility studies; potential inventory adjustments; potential impairment of long-lived mining assets; satisfaction of requirements in accordance with PT-FI’s IUPK to extend mining rights from 2031 through 2041; discussions relating to the extension of PT-FI’s IUPK beyond 2041; cybersecurity risks; any major public health crisis; labor relations, including labor-related work stoppages and increased costs; compliance with applicable environmental, health and safety laws and regulations; weather- and climate-related risks; environmental risks, including availability of secure water supplies; litigation results; tailings management; FCX’s ability to comply with its responsible production commitments under specific frameworks and any changes to such frameworks and other factors described in more detail under the heading “Risk Factors” in FCX’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission.

Investors are cautioned that many of the assumptions upon which FCX’s forward-looking statements are based are likely to change after the date the forward-looking statements are made, including for example commodity prices, which FCX cannot control, and production volumes and costs or technological solutions and innovations, some aspects of which FCX may not be able to control. Further, FCX may make changes to its business plans that could affect its results. FCX undertakes no obligation to update any forward-looking statements, which speak only as of the date made, notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes.

This press release also contains measures such as net debt, adjusted net income and unit net cash costs (credits) per pound of copper and molybdenum, which are not recognized under U.S. generally accepted accounting principles. Reconciliations of these measures to amounts reported in FCX’s consolidated financial statements are in the supplemental schedules of this press release.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Freeport-McMoRan Inc. |

| SELECTED OPERATING DATA |

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Production |

|

Sales |

|

COPPER (millions of recoverable pounds) |

|

|

|

|

| (FCX’s net interest in %) |

|

|

|

|

| North America |

|

|

|

|

|

|

|

|

Morenci (72%)a |

129 |

|

|

143 |

|

|

139 |

|

|

142 |

|

|

| Safford (100%) |

56 |

|

|

63 |

|

|

59 |

|

|

64 |

|

|

| Sierrita (100%) |

42 |

|

|

43 |

|

|

44 |

|

|

42 |

|

|

| Chino (100%) |

40 |

|

|

36 |

|

|

39 |

|

|

35 |

|

|

| Bagdad (100%) |

37 |

|

|

34 |

|

|

38 |

|

|

36 |

|

|

| Tyrone (100%) |

10 |

|

|

13 |

|

|

11 |

|

|

13 |

|

|

| Miami (100%) |

2 |

|

|

3 |

|

|

3 |

|

|

3 |

|

|

| Other (100%) |

(2) |

|

|

(3) |

|

|

(2) |

|

|

(3) |

|

|

| Total North America |

314 |

|

|

332 |

|

|

331 |

|

|

332 |

|

|

|

|

|

|

|

|

|

|

|

| South America |

|

|

|

|

|

|

|

|

| Cerro Verde (53.56%) |

227 |

|

|

245 |

|

|

230 |

|

|

246 |

|

|

| El Abra (51%) |

53 |

|

|

59 |

|

|

54 |

|

|

56 |

|

|

|

|

|

|

|

|

|

|

|

| Total South America |

280 |

|

|

304 |

|

|

284 |

|

|

302 |

|

|

|

|

|

|

|

|

|

|

|

| Indonesia |

|

|

|

|

|

|

|

|

| Grasberg (48.76%) |

491 |

|

|

329 |

|

|

493 |

|

|

198 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

1,085 |

|

|

965 |

|

|

1,108 |

|

b |

832 |

|

b |

| Less noncontrolling interests |

383 |

|

|

311 |

|

|

386 |

|

|

243 |

|

|

| Net |

702 |

|

|

654 |

|

|

722 |

|

|

589 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average realized price per pound |

|

|

|

|

$ |

3.94 |

|

|

$ |

4.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GOLD (thousands of recoverable ounces) |

|

|

|

|

|

|

|

|

| (FCX’s net interest in %) |

|

|

|

|

|

|

|

|

| North America (100%) |

4 |

|

|

3 |

|

|

4 |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

| Indonesia (48.76%) |

545 |

|

|

402 |

|

c |

564 |

|

|

266 |

|

c |

| Consolidated |

549 |

|

|

405 |

|

|

568 |

|

|

270 |

|

|

| Less noncontrolling interests |

279 |

|

|

144 |

|

|

289 |

|

|

74 |

|

|

| Net |

270 |

|

|

261 |

|

|

279 |

|

|

196 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average realized price per ounce |

|

|

|

|

$ |

2,145 |

|

|

$ |

1,949 |

|

|

|

|

|

|

|

|

|

|

|

MOLYBDENUM (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

| (FCX’s net interest in %) |

|

|

|

|

|

|

|

|

| Climax (100%) |

5 |

|

|

5 |

|

|

N/A |

|

N/A |

|

| Henderson (100%) |

3 |

|

|

3 |

|

|

N/A |

|

N/A |

|

North America copper mines (100%)a |

7 |

|

|

7 |

|

|

N/A |

|

N/A |

|

| Cerro Verde (53.56%) |

3 |

|

|

6 |

|

|

N/A |

|

N/A |

|

| Consolidated |

18 |

|

|

21 |

|

|

20 |

|

|

19 |

|

|

| Less noncontrolling interests |

1 |

|

|

2 |

|

|

2 |

|

|

2 |

|

|

| Net |

17 |

|

|

19 |

|

|

18 |

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average realized price per pound |

|

|

|

|

$ |

20.38 |

|

|

$ |

30.32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| a. Amounts are net of Morenci’s joint venture partners’ undivided interests. |

|

|

|

|

|

|

|

|

|

b. Consolidated sales volumes exclude purchased copper of 42 million pounds in first-quarter 2024 and 48 million pounds in first-quarter 2023. |

|

|

|

|

|

|

|

|

|

| c. Includes approximately 190 thousand ounces of gold production and sales volumes attributed to PT Mineral Industri Indonesia’s (MIND ID) approximate 19% economic interest in accordance with the PT-FI shareholder agreement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Freeport-McMoRan Inc. |

|

| SELECTED OPERATING DATA (continued) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

2023 |

|

|

|

|

|

North Americaa |

|

|

|

|

|

|

|

|

| Leach Operations |

|

|

|

|

|

|

|

|

Leach ore placed in stockpiles (metric tons per day) |

617,400 |

|

|

613,200 |

|

|

|

|

|

|

| Average copper ore grade (%) |

0.21 |

|

|

0.27 |

|

|

|

|

|

|

Copper production (millions of recoverable pounds) |

211 |

|

|

234 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mill Operations |

|

|

|

|

|

|

|

|

Ore milled (metric tons per day) |

307,600 |

|

|

297,500 |

|

|

|

|

|

|

| Average ore grades (%): |

|

|

|

|

|

|

|

|

Copper |

0.32 |

|

|

0.34 |

|

|

|

|

|

|

Molybdenum |

0.02 |

|

|

0.02 |

|

|

|

|

|

|

| Copper recovery rate (%) |

81.0 |

|

|

80.4 |

|

|

|

|

|

|

Production (millions of recoverable pounds): |

|

|

|

|

|

|

|

|

Copper |

153 |

|

|

154 |

|

|

|

|

|

|

Molybdenum |

8 |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| South America |

|

|

|

|

|

|

|

|

| Leach Operations |

|

|

|

|

|

|

|

|

Leach ore placed in stockpiles (metric tons per day) |

170,400 |

|

|

203,900 |

|

|

|

|

|

|

| Average copper ore grade (%) |

0.41 |

|

|

0.33 |

|

|

|

|

|

|

Copper production (millions of recoverable pounds) |

71 |

|

|

86 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mill Operations |

|

|

|

|

|

|

|

|

Ore milled (metric tons per day) |

397,200 |

|

|

405,100 |

|

|

|

|

|

|

| Average ore grades (%): |

|

|

|

|

|

|

|

|

Copper |

0.33 |

|

|

0.34 |

|

|

|

|

|

|

Molybdenum |

0.01 |

|

|

0.01 |

|

|

|

|

|

|

| Copper recovery rate (%) |

83.3 |

|

|

83.9 |

|

|

|

|

|

|

Production (millions of recoverable pounds): |

|

|

|

|

|

|

|

|

Copper |

209 |

|

|

218 |

|

|

|

|

|

|

Molybdenum |

3 |

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Indonesia |

|

|

|

|

|

|

|

|

Ore extracted and milled (metric tons per day): |

|

|

|

|

|

|

|

|

| Grasberg Block Cave underground mine |

139,300 |

|

|

89,700 |

|

|

|

|

|

|

| Deep Mill Level Zone underground mine |

67,300 |

|

|

70,000 |

|

|

|

|

|

|

| Big Gossan underground mine |

9,000 |

|

|

7,000 |

|

|

|

|

|

|

| Other adjustments |

3,900 |

|

|

(1,900) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

219,500 |

|

|

164,800 |

|

|

|

|

|

|

Average ore grades: |

|

|

|

|

|

|

|

|

| Copper (%) |

1.31 |

|

|

1.17 |

|

|

|

|

|

|

Gold (grams per metric ton) |

1.13 |

|

|

1.07 |

|

|

|

|

|

|

| Recovery rates (%): |

|

|

|

|

|

|

|

|

Copper |

89.4 |

|

|

90.3 |

|

|

|

|

|

|

Gold |

77.5 |

|

|

78.2 |

|

|

|

|

|

|

Production (recoverable): |

|

|

|

|

|

|

|

|

Copper (millions of pounds) |

491 |

|

|

329 |

|

|

|

|

|

|

Gold (thousands of ounces) |

545 |

|

|

402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Molybdenumb |

|

|

|

|

|

|

|

|

Ore milled (metric tons per day) |

27,300 |

|

|

27,300 |

|

|

|

|

|

|

| Average molybdenum ore grade (%) |

0.17 |

|

|

0.17 |

|

|

|

|

|

|

Molybdenum production (millions of recoverable pounds) |

8 |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a.Amounts represent 100% operating data, including joint venture interests’ share. |

|

|

|

|

|

|

|

|

|

| b. Represents FCX’s primary molybdenum operations in Colorado. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Freeport-McMoRan Inc. |

| CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

March 31, |

|

|

|

|

2024 |

|

2023 |

|

|

|

|

|

|

(In Millions, Except Per Share Amounts) |

|

|

|

|

|

Revenuesa |

$ |

6,321 |

|

|

$ |

5,389 |

|

|

|

|

|

|

| Cost of sales: |

|

|

|

|

|

|

|

|

Production and deliveryb |

3,844 |

|

|

3,165 |

|

|

|

|

|

|

| Depreciation, depletion and amortization |

595 |

|

|

399 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of sales |

4,439 |

|

|

3,564 |

|

|

|

|

|

|

| Selling, general and administrative expenses |

144 |

|

|

126 |

|

|

|

|

|

|

| Exploration and research expenses |

37 |

|

|

31 |

|

|

|

|

|

|

| Environmental obligations and shutdown costs |

67 |

|

|

67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

4,687 |

|

|

3,788 |

|

|

|

|

|

|

| Operating income |

1,634 |

|

|

1,601 |

|

|

|

|

|

|

Interest expense, netc |

(89) |

|

|

(151) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

129 |

|

|

88 |

|

|

|

|

|

|

| Income before income taxes and equity in affiliated companies’ net earnings |

1,674 |

|

|

1,538 |