Document

Freeport-McMoRan

Reports First-Quarter 2023 Results

•Production and sales impacted by February weather event; achieved full recovery in March

•Consolidated unit net cash costs in line with January 2023 estimate

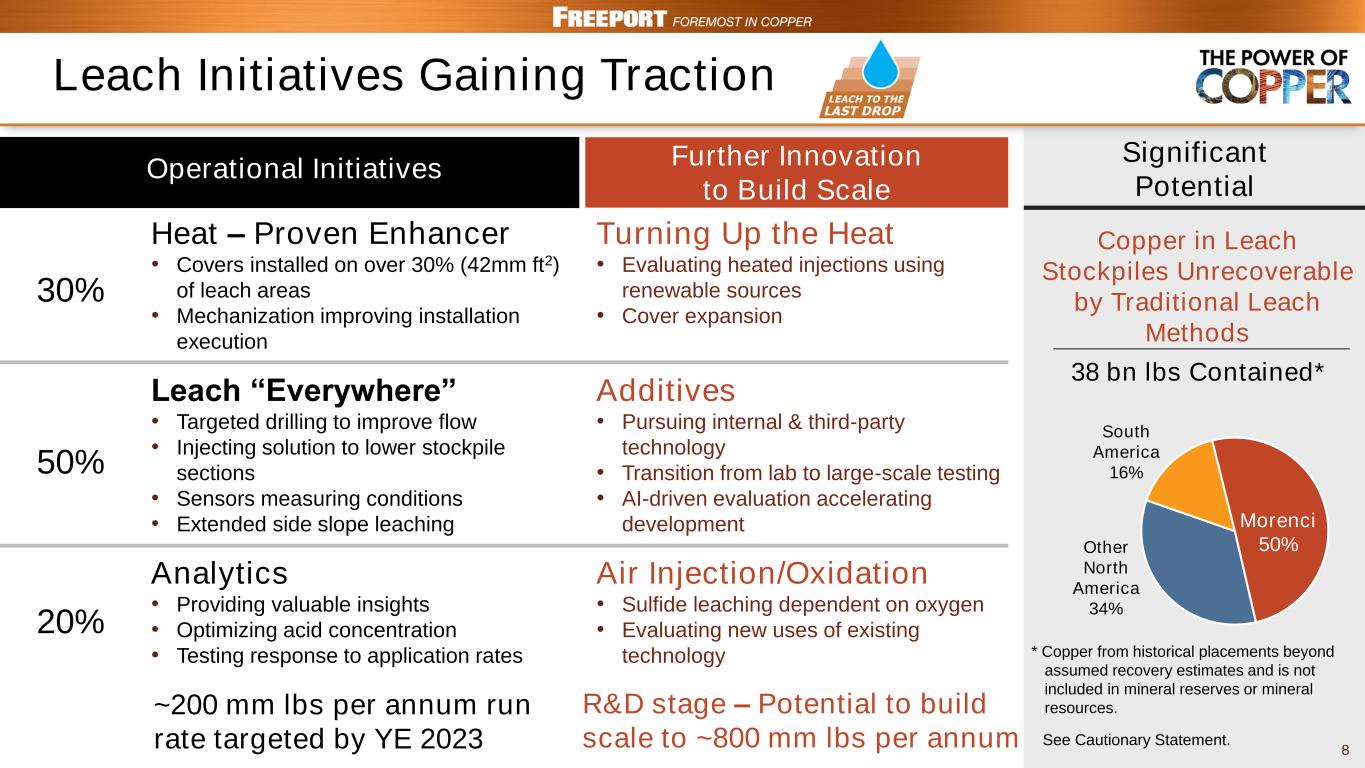

•Advancing leach recovery initiatives

•Strong balance sheet and positive outlook for cash flow generation to support continued organic growth and cash returns to shareholders

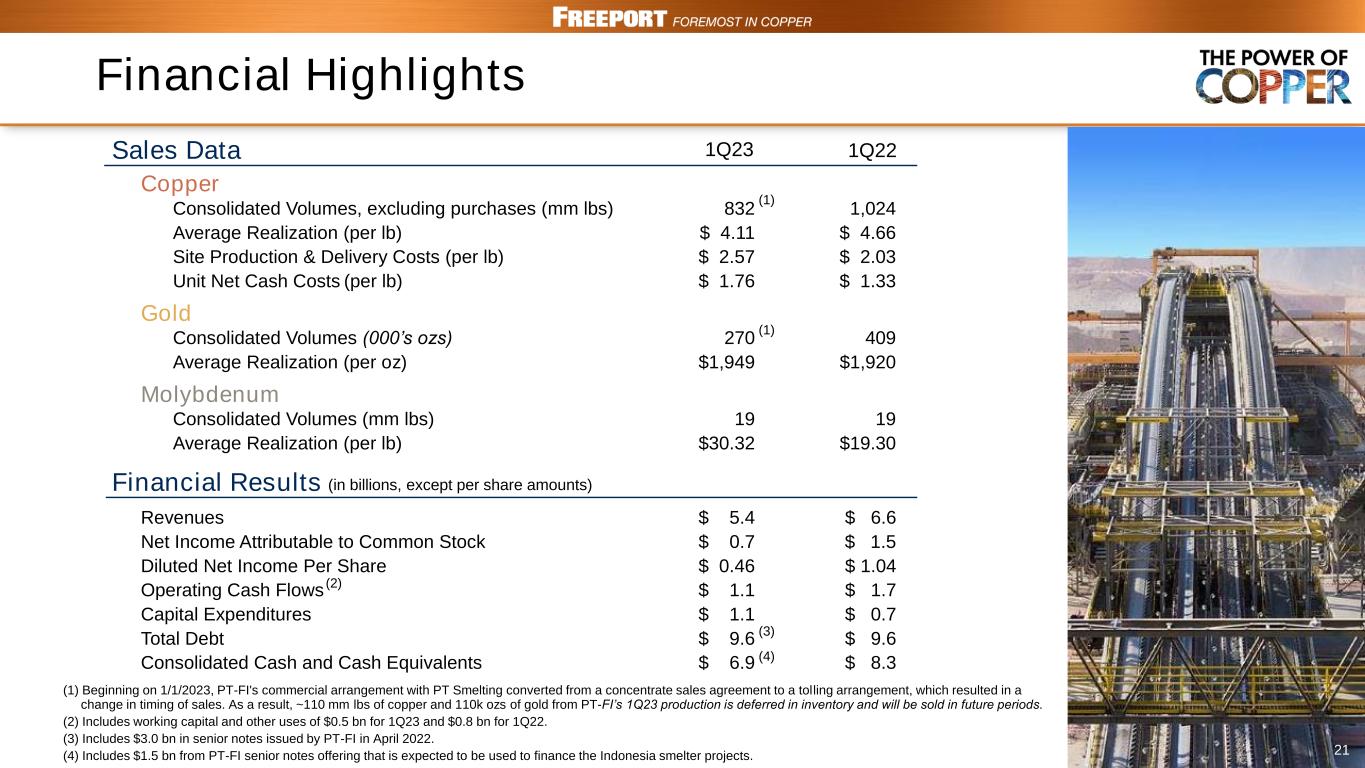

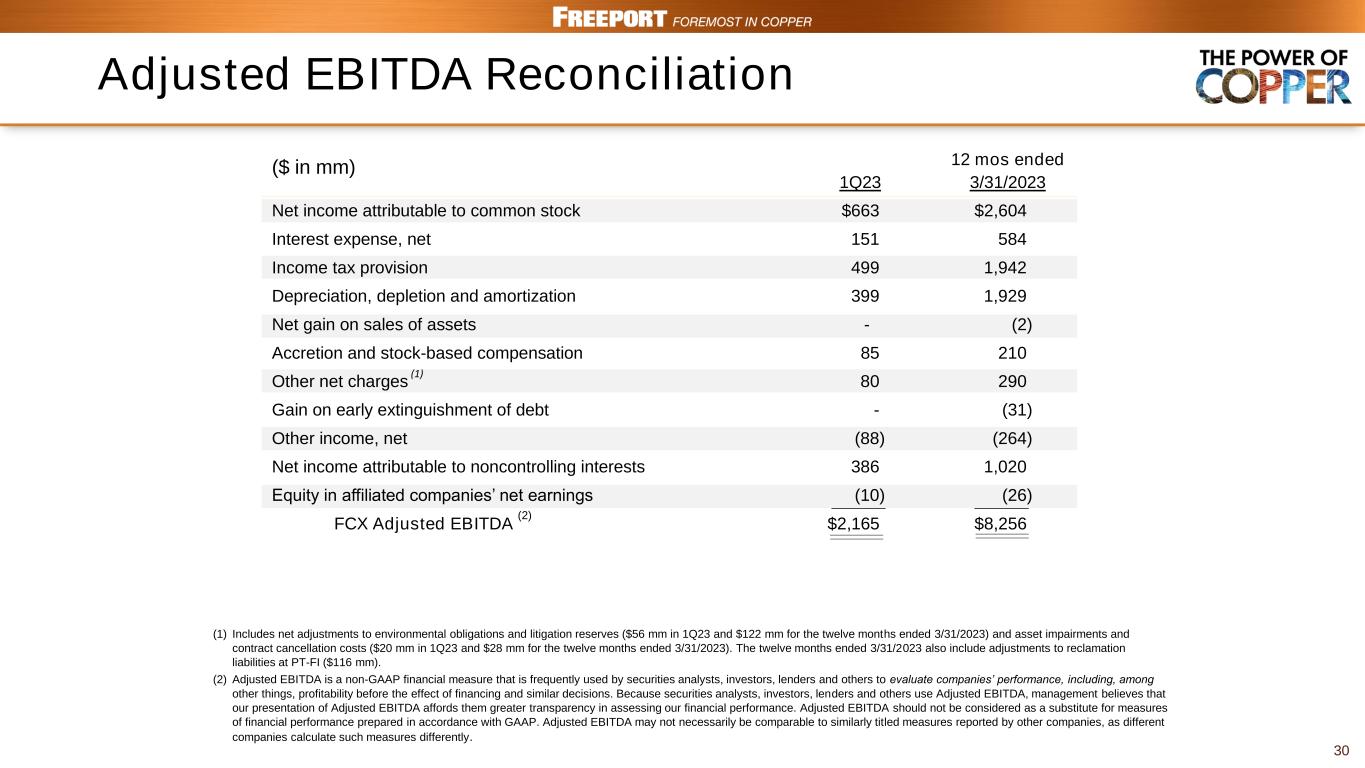

▪Net income attributable to common stock in first-quarter 2023 totaled $663 million, $0.46 per share, and adjusted net income attributable to common stock totaled $757 million, $0.52 per share, after excluding net charges totaling $94 million, $0.06 per share.

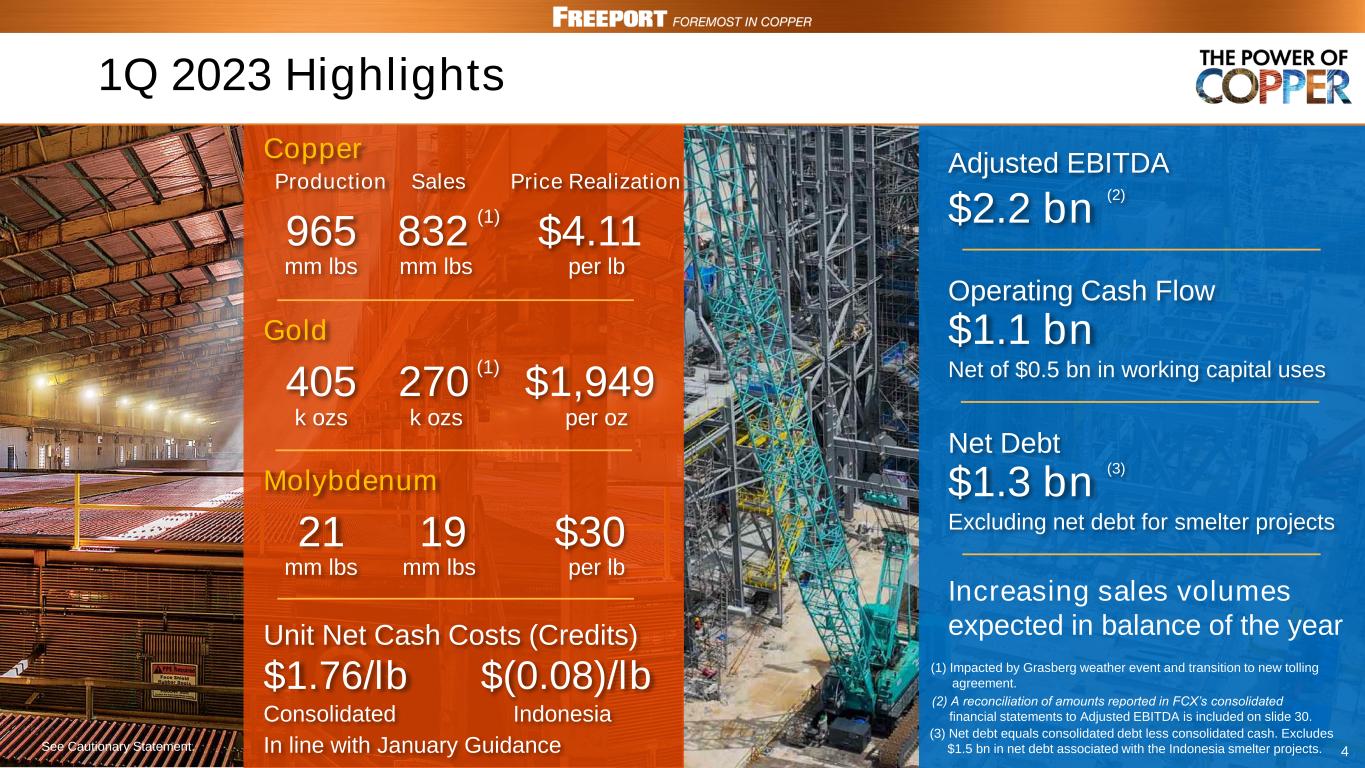

▪Consolidated production totaled 965 million pounds of copper, 405 thousand ounces of gold and 21 million pounds of molybdenum in first-quarter 2023.

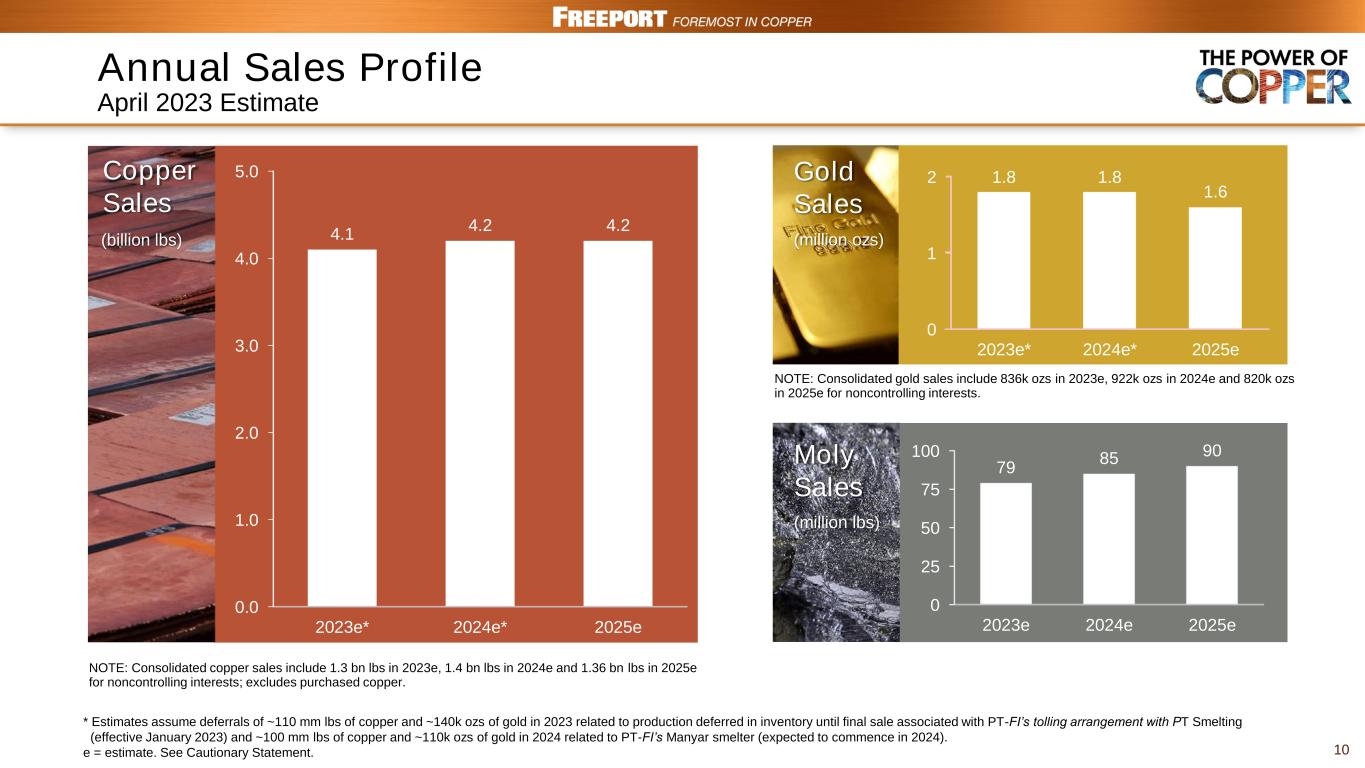

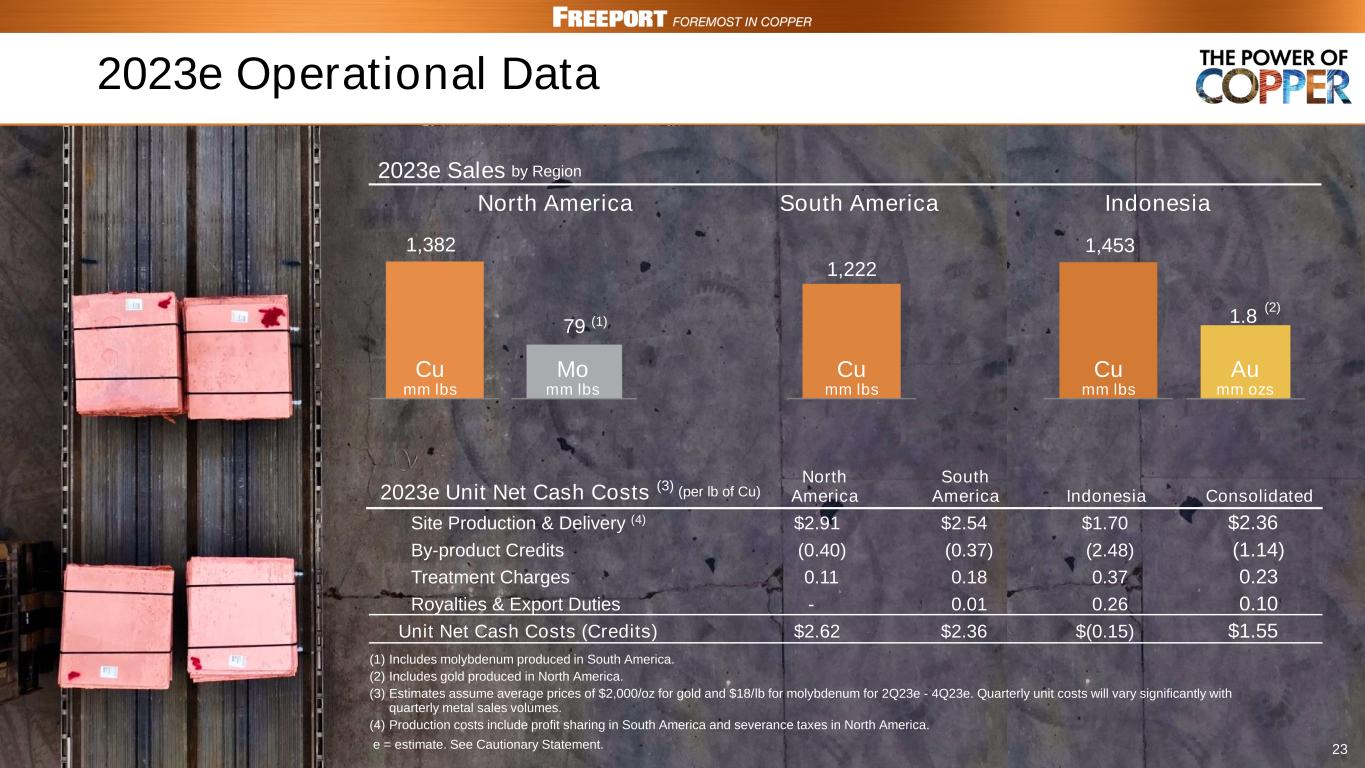

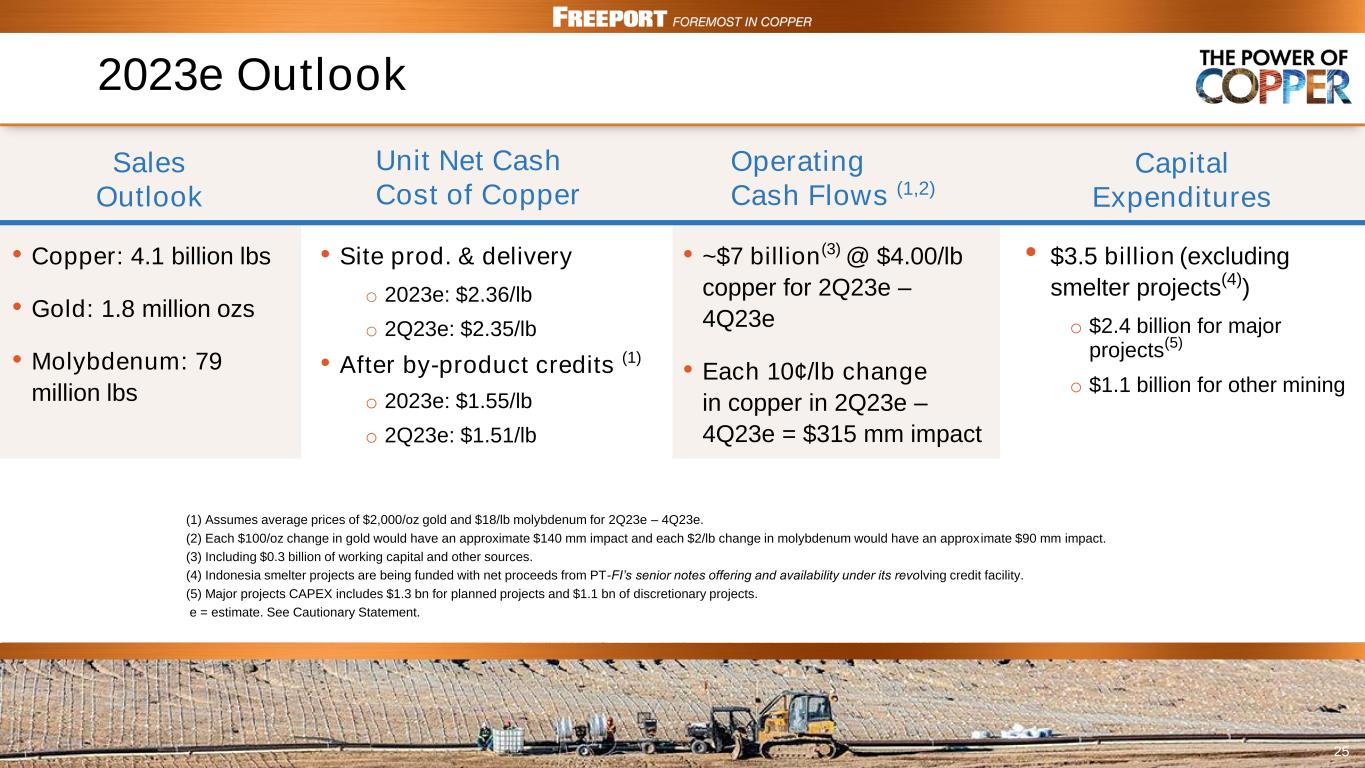

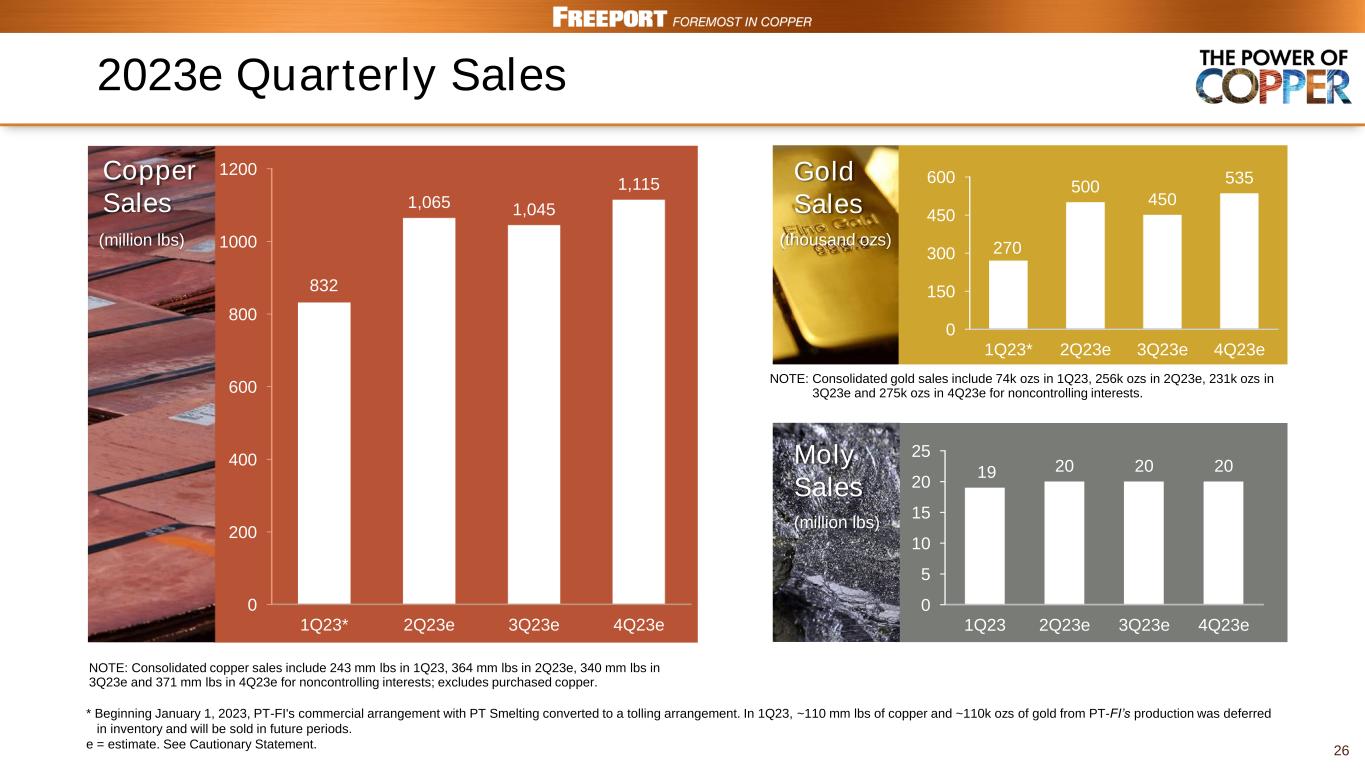

▪Consolidated sales totaled 832 million pounds of copper, 270 thousand ounces of gold and 19 million pounds of molybdenum in first-quarter 2023. Consolidated sales for the year 2023 are expected to approximate 4.1 billion pounds of copper, 1.8 million ounces of gold and 79 million pounds of molybdenum, including 1.1 billion pounds of copper, 500 thousand ounces of gold and 20 million pounds of molybdenum in second-quarter 2023.

▪Average realized prices in first-quarter 2023 were $4.11 per pound for copper, $1,949 per ounce for gold and $30.32 per pound for molybdenum.

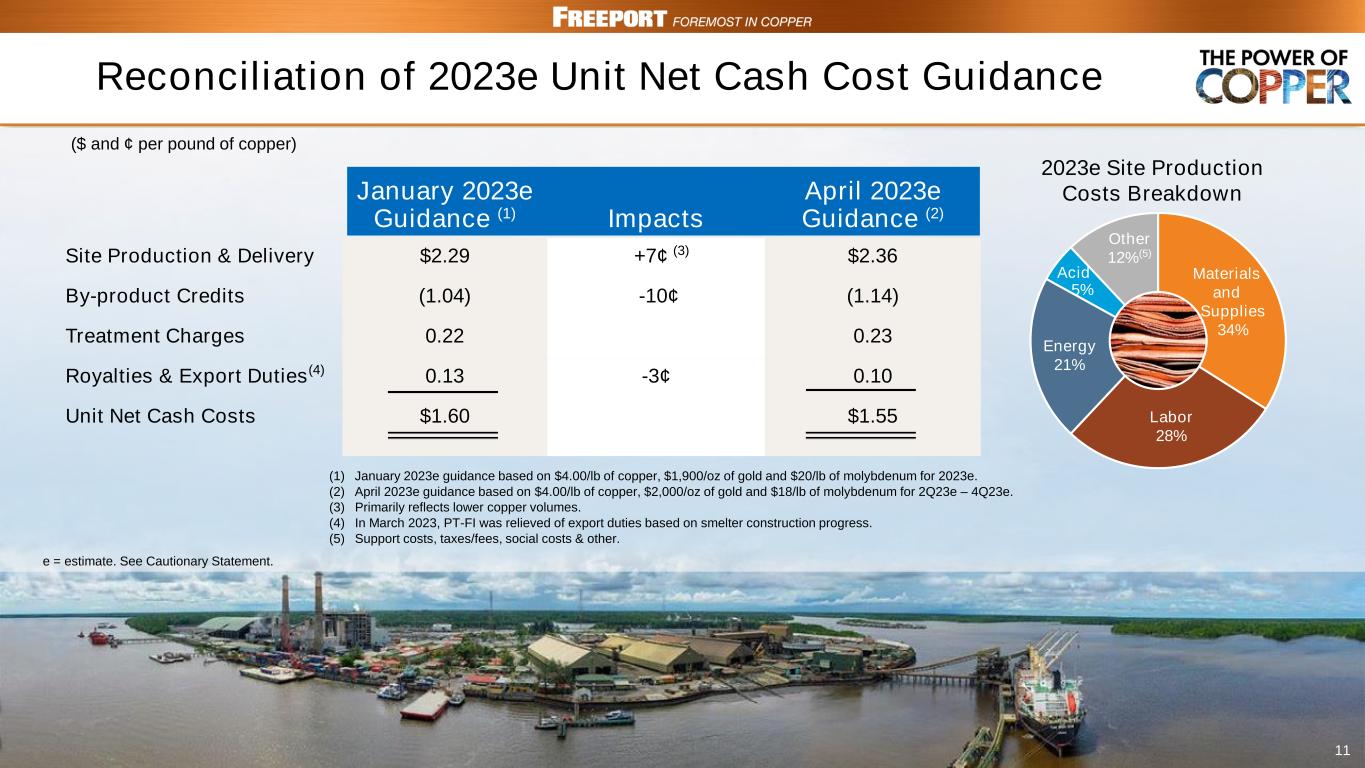

▪Average unit net cash costs in first-quarter 2023 were $1.76 per pound of copper. Unit net cash costs for the year 2023 are expected to average $1.55 per pound of copper.

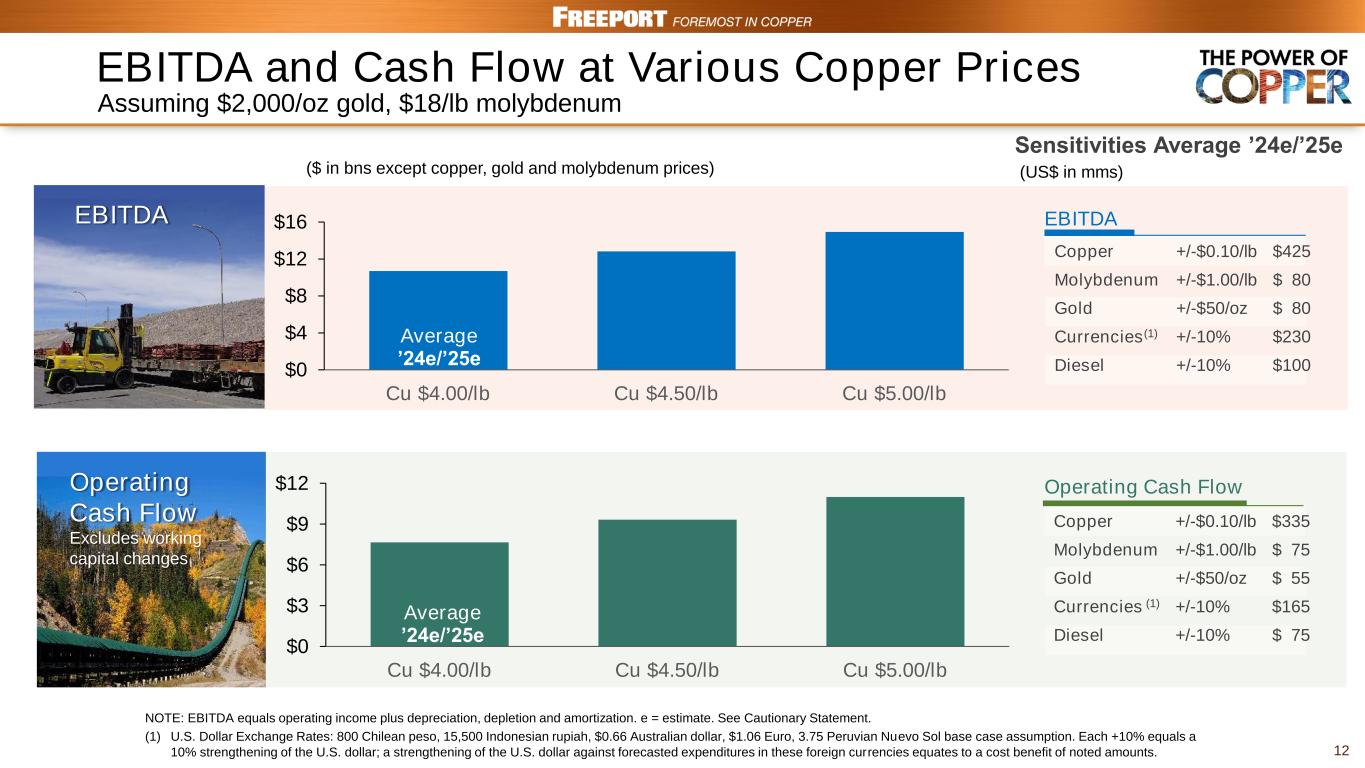

▪Operating cash flows totaled $1.1 billion (net of $0.5 billion of working capital and other uses) in first-quarter 2023. Based on current sales volume and cost estimates, and assuming average prices of $4.00 per pound for copper, $2,000 per ounce for gold and $18.00 per pound for molybdenum for the remainder of 2023, operating cash flows are expected to approximate $7.0 billion (including $0.3 billion of working capital and other sources) for the year 2023.

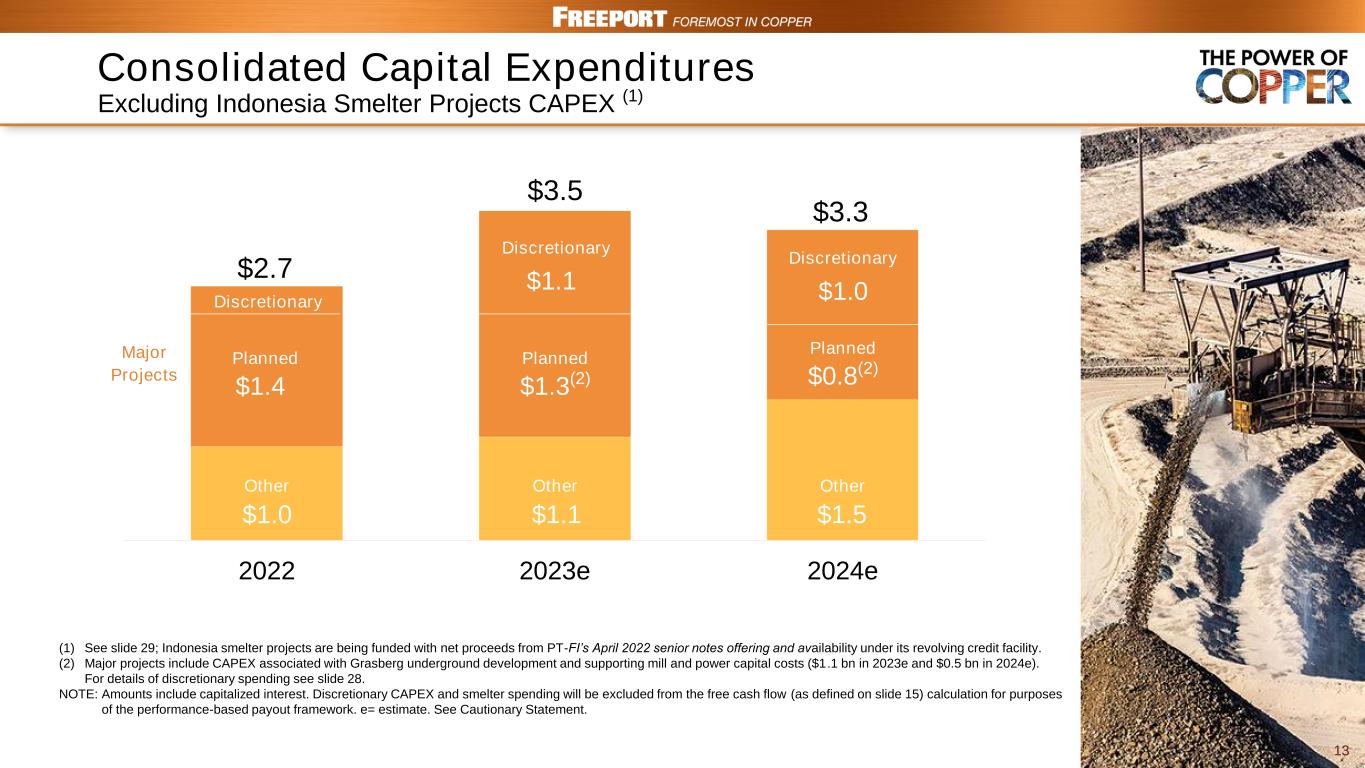

▪Capital expenditures totaled $1.1 billion (including $0.4 billion for major mining projects and $0.3 billion for the Indonesia smelter projects) in first-quarter 2023. Capital expenditures for the year 2023 are expected to approximate $5.1 billion (including $2.4 billion for major mining projects and $1.6 billion for the Indonesia smelter projects).

▪At March 31, 2023, consolidated debt totaled $9.6 billion and consolidated cash and cash equivalents totaled $6.9 billion, resulting in net debt of $2.8 billion ($1.3 billion excluding net debt for the Indonesia smelter projects). In March 2023, FCX used approximately $1 billion in cash to fund the maturity of its 3.875% Senior Notes. Refer to the supplemental schedule, "Net Debt," on page VII.

PHOENIX, AZ, April 21, 2023 - Freeport-McMoRan Inc. (NYSE: FCX) reported first-quarter 2023 net income attributable to common stock of $663 million, $0.46 per share, and adjusted net income attributable to common stock of $757 million, $0.52 per share, after excluding net charges totaling $94 million, $0.06 per share, primarily associated with adjustments to environmental obligations, contested tax matters and asset impairments. For additional information, refer to the supplemental schedule, "Adjusted Net Income," on page VI.

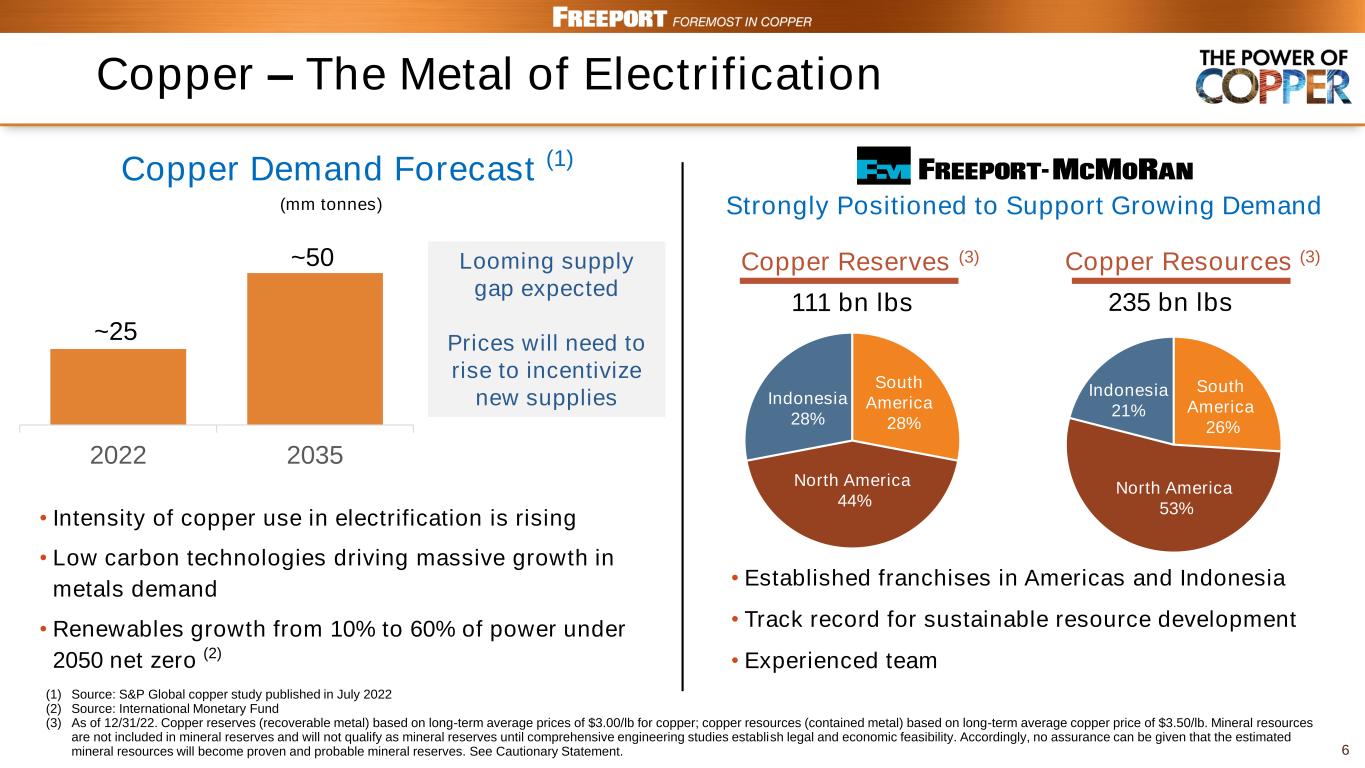

Richard C. Adkerson, Chairman and Chief Executive Officer, said, "Our company is a premier global leader in the copper industry, with large-scale, long-lived reserves and an attractive portfolio of organic growth opportunities. We are focused on executing our strategy to supply copper efficiently and responsibly to a world with growing requirements for this critically important metal. Our results in the first quarter reflect the commitment and resolve of our team to overcome challenges and enhance our foundation for long-term success. We are strongly positioned with a favorable long-term market outlook, strong balance sheet and financial strength, a high-quality asset base and an experienced and motivated team to deliver long-term value to all stakeholders."

SUMMARY FINANCIAL DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

|

(in millions, except per share amounts) |

|

Revenuesa,b |

$ |

5,389 |

|

|

$ |

6,603 |

|

|

|

|

|

|

Operating incomea |

$ |

1,601 |

|

|

$ |

2,809 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to common stockc,d |

$ |

663 |

|

|

$ |

1,527 |

|

|

|

|

|

|

| Diluted net income per share of common stock |

$ |

0.46 |

|

|

$ |

1.04 |

|

|

|

|

|

|

|

Diluted weighted-average common shares outstanding |

1,443 |

|

|

1,469 |

|

|

|

|

|

|

Operating cash flowse |

$ |

1,050 |

|

|

$ |

1,691 |

|

|

|

|

|

|

| Capital expenditures |

$ |

1,121 |

|

|

$ |

723 |

|

|

|

|

|

|

| At March 31: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

6,852 |

|

|

$ |

8,338 |

|

|

|

|

|

|

| Total debt, including current portion |

$ |

9,635 |

|

|

$ |

9,621 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a.For segment financial results, refer to the supplemental schedules, "Business Segments," beginning on page VIII.

b.Includes favorable adjustments to prior period provisionally priced concentrate and cathode copper sales totaling $210 million ($72 million to net income attributable to common stock or $0.05 per share) in first-quarter 2023 and $102 million ($42 million to net income attributable to common stock or $0.03 per share) in first-quarter 2022. For further discussion, refer to the supplemental schedule, "Derivative Instruments," beginning on page VII.

c.Includes net charges totaling $94 million ($0.06 per share) in first-quarter 2023 and $38 million ($0.03 per share) in first-quarter 2022 that are described in the supplemental schedule, "Adjusted Net Income," on page VI.

d.FCX defers recognizing profits on intercompany sales until final sales to third parties occur. For a summary of net impacts from changes in these deferrals, refer to the supplemental schedule, "Deferred Profits," on page VIII.

e.Working capital and other uses totaled $467 million in first-quarter 2023 and $811 million in first-quarter 2022.

SUMMARY OPERATING DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

Copper (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

| Production |

|

965 |

|

|

1,009 |

|

|

|

|

|

|

| Sales, excluding purchases |

|

832 |

|

a |

1,024 |

|

|

|

|

|

|

| Average realized price per pound |

|

$ |

4.11 |

|

|

$ |

4.66 |

|

|

|

|

|

|

Site production and delivery costs per poundb |

|

$ |

2.57 |

|

|

$ |

2.03 |

|

|

|

|

|

|

Unit net cash costs per poundb |

|

$ |

1.76 |

|

|

$ |

1.33 |

|

|

|

|

|

|

Gold (thousands of recoverable ounces) |

|

|

|

|

|

|

|

|

|

| Production |

|

405 |

|

|

415 |

|

|

|

|

|

|

| Sales |

|

270 |

|

a |

409 |

|

|

|

|

|

|

| Average realized price per ounce |

|

$ |

1,949 |

|

|

$ |

1,920 |

|

|

|

|

|

|

Molybdenum (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

| Production |

|

21 |

|

|

21 |

|

|

|

|

|

|

| Sales, excluding purchases |

|

19 |

|

|

19 |

|

|

|

|

|

|

| Average realized price per pound |

|

$ |

30.32 |

|

|

$ |

19.30 |

|

|

|

|

|

|

a.Beginning on January 1, 2023, PT Freeport Indonesia's (PT-FI) commercial arrangement with PT Smelting converted from a concentrate sales agreement to a tolling arrangement, which resulted in a change in timing of sales. As a result of the transition, approximately 110 million pounds of copper and 110 thousand ounces of gold from PT-FI's first-quarter 2023 production is deferred in inventory and will be sold in future periods.

b.Reflects per pound weighted-average production and delivery costs and unit net cash costs (net of by-product credits) for all copper mines, before net noncash and other costs. For reconciliations of per pound unit net cash costs by operating division to production and delivery costs applicable to sales reported in FCX's consolidated financial statements, refer to the supplemental schedules, "Product Revenues and Production Costs," beginning on page X.

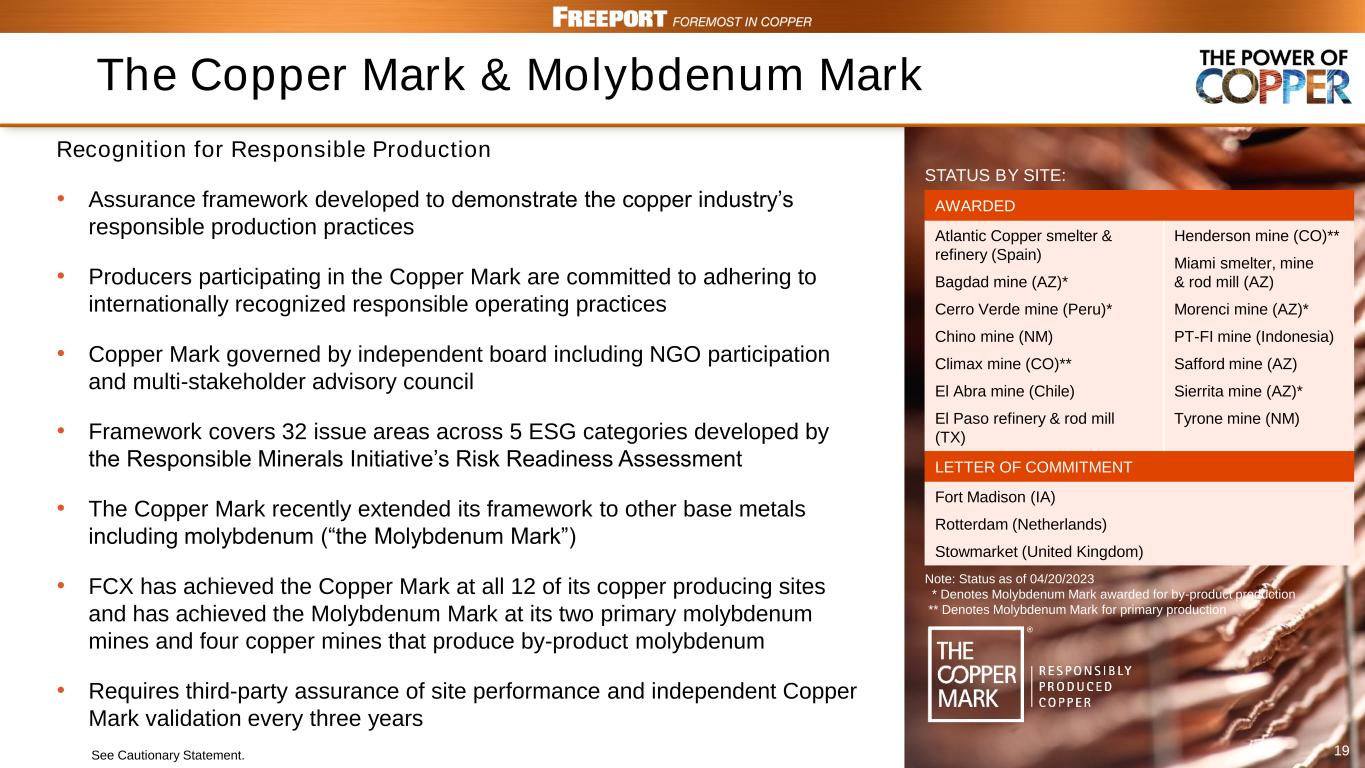

Responsible Production

2022 Annual Report on Sustainability. Today, FCX published its 2022 Annual Report on Sustainability, available on FCX's website at fcx.com/sustainability, marking FCX’s 22nd year of reporting on its sustainability progress. FCX is committed to building upon its achievements in sustainability and its position as a leading responsible copper producer.

The Copper Mark. FCX demonstrates its responsible production performance through the Copper Mark, a comprehensive assurance framework developed specifically for the copper industry. To achieve the Copper Mark, each site is required to complete an independent external assurance process to assess conformance with 32 ESG criteria. Awarded sites must be revalidated every three years.

FCX has achieved the Copper Mark at all 12 of its copper producing sites globally. In addition, following the extension of the Copper Mark framework to molybdenum producers in 2022, FCX’s two primary molybdenum mines and its four copper mines that produce by-product molybdenum were awarded the Molybdenum Mark.

Consolidated Sales Volumes

First-quarter 2023 sales:

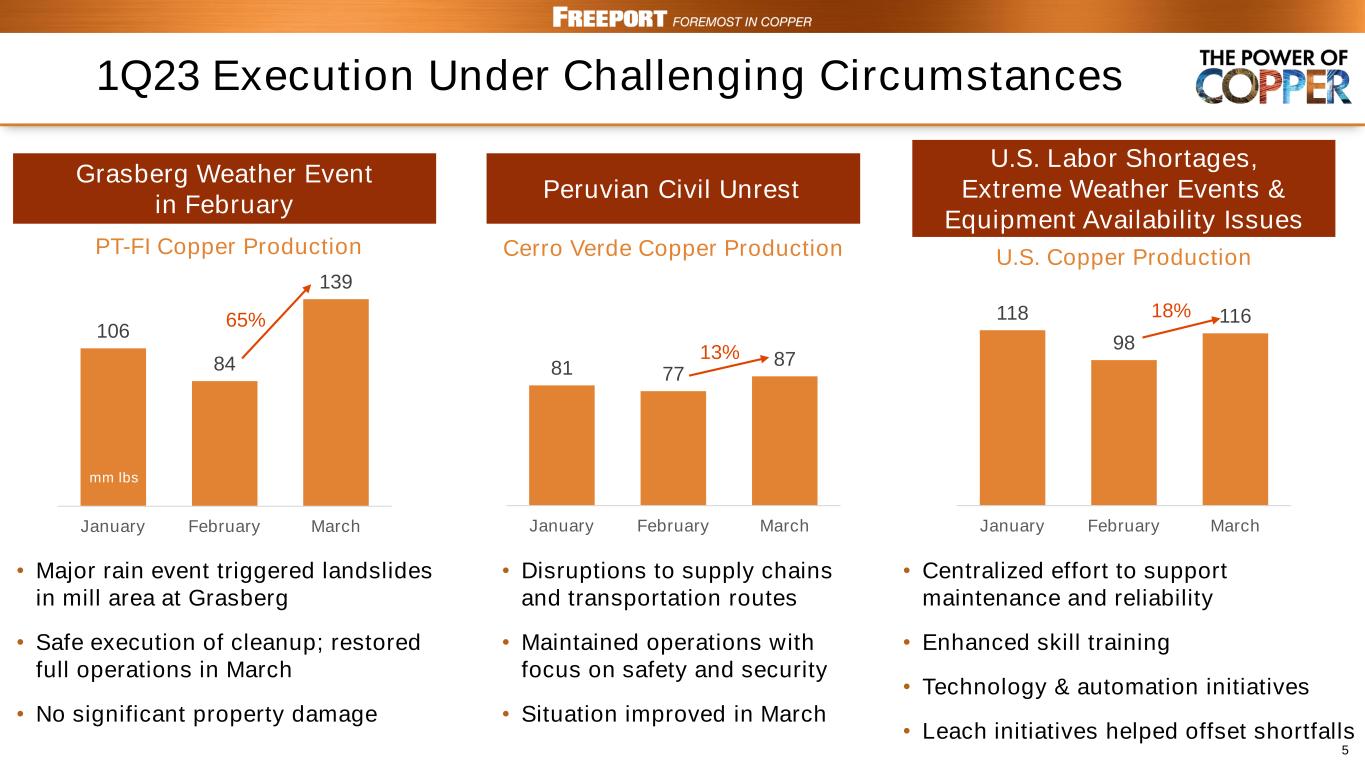

•Copper sales of 832 million pounds were 8% lower than the January 2023 estimate of 900 million pounds, primarily reflecting lower operating rates at the Grasberg minerals district associated with a significant weather event that temporarily disrupted operations during February 2023. Lower copper sales in first-quarter 2023, compared to first-quarter 2022 sales of 1.0 billion pounds, also reflected the deferral of sales recognition for approximately 110 million pounds related to the PT Smelting tolling arrangement and the timing of shipments.

•Gold sales of 270 thousand ounces were 10% lower than the January 2023 estimate of 300 thousand ounces, primarily associated with the significant weather event at the Grasberg minerals district. Lower gold sales in first-quarter 2023, compared to first-quarter 2022 sales of 409 thousand ounces, also reflected the deferral of sales recognition for approximately 110 thousand ounces associated with the PT Smelting tolling arrangement.

•Molybdenum sales of 19 million pounds approximated the January 2023 estimate and first-quarter 2022 sales.

Consolidated sales volumes for the year 2023 are expected to approximate 4.1 billion pounds of copper, 1.8 million ounces of gold and 79 million pounds of molybdenum, including 1.1 billion pounds of copper, 500 thousand ounces of gold and 20 million pounds of molybdenum in second-quarter 2023. Consolidated copper and gold production volumes for the year 2023 are expected to be above consolidated sales volumes, primarily reflecting a deferral of approximately 110 million pounds of copper and 140 thousand ounces of gold from mine production under the PT Smelting tolling arrangement to be processed and sold as refined metal in future periods. Projected sales volumes are dependent on extension of PT-FI's export license after June 10, 2023, operational performance, weather-related conditions, timing of shipments, and other factors detailed in the Cautionary Statement below.

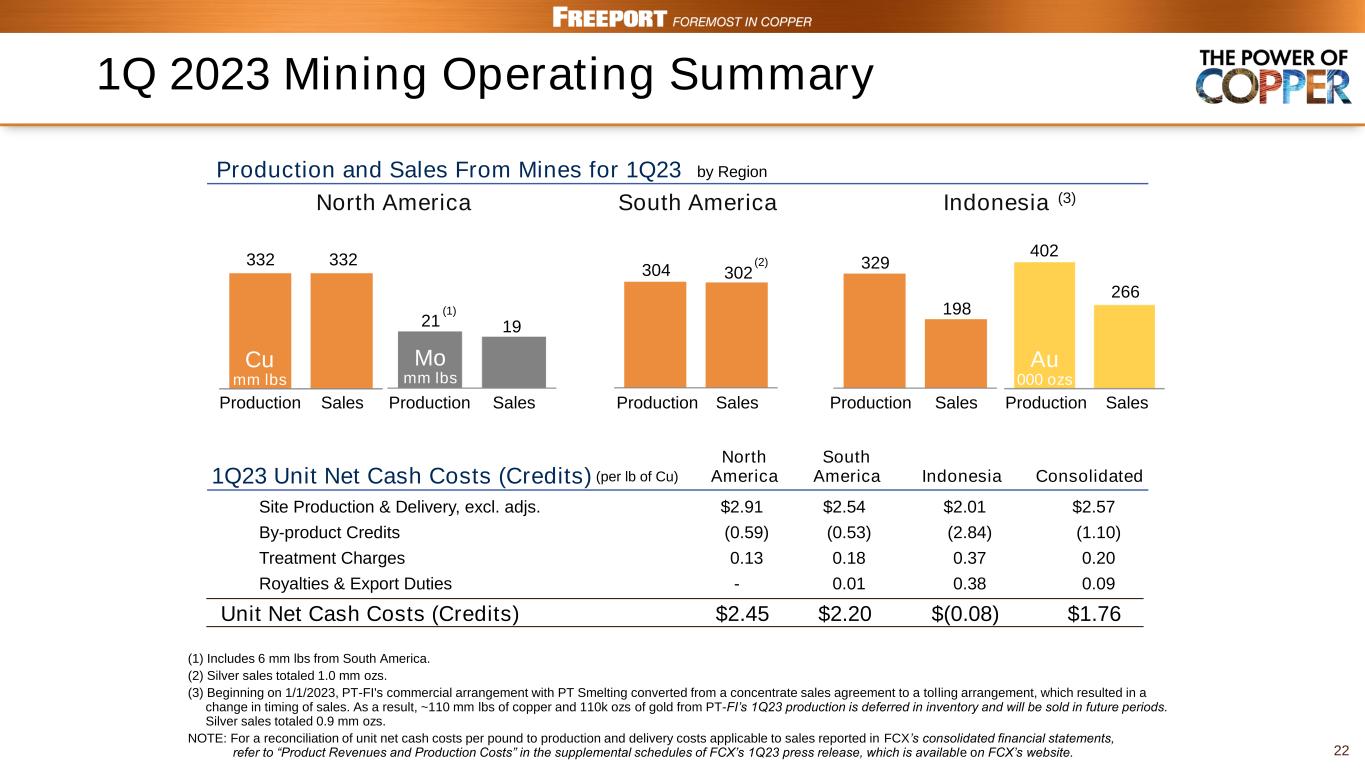

Consolidated Unit Net Cash Costs

First-quarter 2023 consolidated average unit net cash costs (net of by-product credits) for FCX's copper mines of $1.76 per pound of copper were in line with the January 2023 estimate of $1.78 per pound, as higher by-product credits were mostly offset by the impact of lower sales volumes. First-quarter 2023 unit net cash costs were 32% higher than the first-quarter 2022 average of $1.33 per pound, primarily reflecting the impact on consolidated results of lower copper sales volumes from PT-FI. Refer to "Mining Operations" below for further discussion.

Assuming average prices of $2,000 per ounce of gold and $18.00 per pound of molybdenum for the remainder of 2023 and achievement of current sales volume and cost estimates, consolidated unit net cash costs (net of by-product credits) for FCX's copper mines are expected to average $1.55 per pound of copper for the year 2023 (including $1.51 per pound of copper in second-quarter 2023). The impact of price changes on consolidated unit net cash costs would approximate $0.04 per pound of copper for each $100 per ounce change in the average price of gold and $0.02 per pound of copper for each $2 per pound change in the average price of molybdenum for the remainder of 2023. Quarterly unit net cash costs vary with fluctuations in sales volumes and realized prices, primarily for gold and molybdenum.

MINING OPERATIONS

Leaching Innovation Initiatives. FCX is advancing a series of initiatives across its North America and South America operations to incorporate new applications, technologies and data analytics to its leaching processes. FCX believes these leach innovation initiatives provide opportunities to produce incremental copper from its large existing leach stockpiles. Initial results support the potential for incremental low-cost additions to FCX's production and reserve profile and FCX is targeting an annual run rate of approximately 200 million pounds of copper per year through these initiatives by the end of 2023.

North America Copper Mines. FCX operates seven open-pit copper mines in North America - Morenci, Bagdad, Safford (including Lone Star), Sierrita and Miami in Arizona, and Chino and Tyrone in New Mexico. In addition to copper, certain of these mines produce molybdenum concentrate, gold and silver. All of the North America mining operations are wholly owned, except for Morenci. FCX records its 72% undivided joint venture interest in Morenci using the proportionate consolidation method.

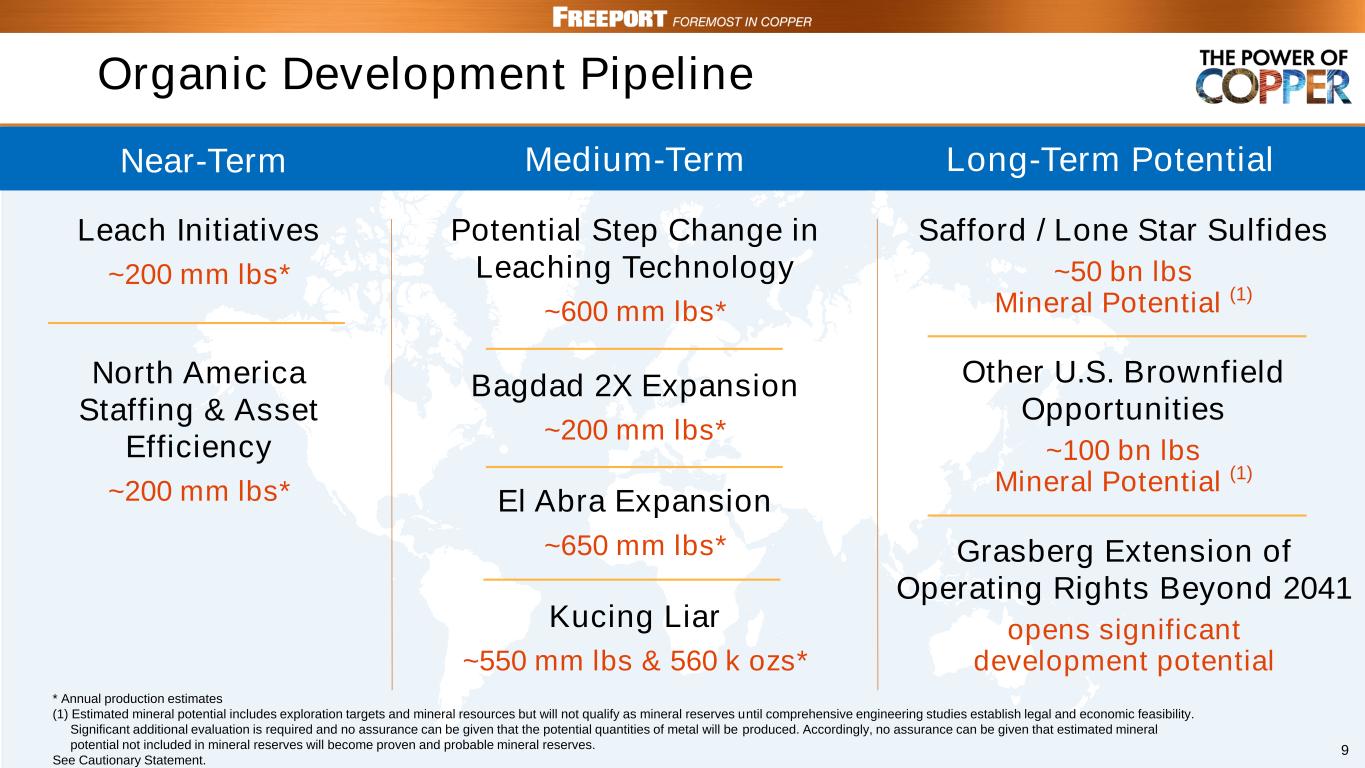

Operating and Development Activities. FCX has substantial reserves and future opportunities in the U.S., primarily associated with existing mining operations.

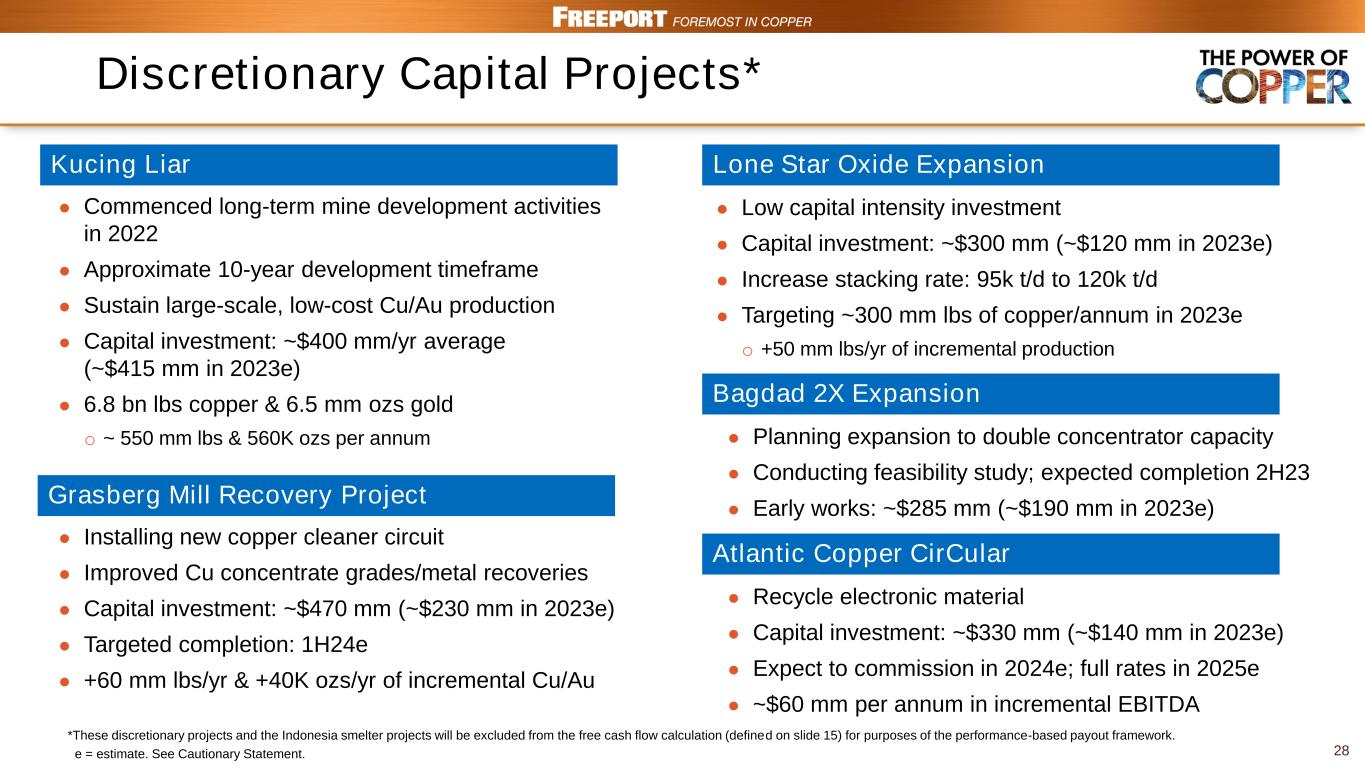

At Safford/Lone Star, production from oxide ores is approaching 300 million pounds of copper per year, which reflects expansion of the initial design capacity of 200 million pounds of copper per year. FCX has conducted significant exploration drilling in the area in recent years. The positive drilling results indicate opportunities to expand production to include sulfide ores in the future. FCX is advancing metallurgical testing and mine development planning for a potential significant long-term investment for development of identified large sulfide resources.

FCX is planning an expansion to double the concentrator capacity of the Bagdad operation in northwest Arizona. FCX is conducting a feasibility study, which is expected to be completed in the second half of 2023. In parallel, FCX is advancing plans for expanded tailings infrastructure projects to support Bagdad's long-range plans. The timing of future developments will be dependent on market conditions, labor and supply chain considerations and other economic factors.

Operating Data. Following is summary consolidated operating data for the North America copper mines:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

Copper (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

Production |

|

332 |

|

|

354 |

|

|

|

|

|

|

Sales, excluding purchases |

|

332 |

|

|

381 |

|

|

|

|

|

|

Average realized price per pound |

|

$ |

4.16 |

|

|

$ |

4.62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Molybdenum (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

Productiona |

|

7 |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit net cash costs per pound of copperb |

|

|

|

|

|

|

|

|

|

Site production and delivery, excluding adjustments |

|

$ |

2.91 |

|

|

$ |

2.38 |

|

|

|

|

|

|

By-product credits |

|

(0.59) |

|

|

(0.34) |

|

|

|

|

|

|

Treatment charges |

|

0.13 |

|

|

0.09 |

|

|

|

|

|

|

Unit net cash costs |

|

$ |

2.45 |

|

|

$ |

2.13 |

|

|

|

|

|

|

a.Refer to summary operating data on page 3 for FCX's consolidated molybdenum sales, which include sales of molybdenum produced at the North America copper mines.

b.For a reconciliation of unit net cash costs per pound to production and delivery costs applicable to sales reported in FCX's consolidated financial statements, refer to the supplemental schedules, "Product Revenues and Production Costs," beginning on page X.

FCX's consolidated copper sales volumes from North America of 332 million pounds in first-quarter 2023 were lower than first-quarter 2022 copper sales volumes of 381 million, primarily reflecting the timing of shipments in first-quarter 2022 and reduced production in first-quarter 2023 associated with lower mining rates, lower ore grades and unplanned maintenance, partly offset by incremental copper associated with leach initiatives. North America copper sales are estimated to approximate 1.4 billion pounds for the year 2023.

Average unit net cash costs (net of by-product credits) for the North America copper mines of $2.45 per pound of copper in first-quarter 2023 were higher than first-quarter 2022 unit net cash costs of $2.13 per pound, primarily reflecting lower sales volumes and increased costs for maintenance and supplies, labor and energy, partly offset by higher molybdenum by-product credits.

Average unit net cash costs (net of by-product credits) for the North America copper mines are expected to approximate $2.62 per pound of copper for the year 2023, based on achievement of current sales volume and cost estimates and assuming an average molybdenum price of $18.00 per pound for the remainder of 2023. North America's average unit net cash costs for the year 2023 would change by approximately $0.03 per pound for each $2 per pound change in the average price of molybdenum for the remainder of 2023.

South America Mining. FCX operates two copper mines in South America - Cerro Verde in Peru (in which FCX owns a 53.56% interest) and El Abra in Chile (in which FCX owns a 51% interest). These operations are consolidated in FCX's financial statements. In addition to copper, the Cerro Verde mine produces molybdenum concentrate and silver.

Beginning in December 2022, heightened tensions, protests and social unrest emerged in Peru following a change in the country's political leadership. Cerro Verde operated at reduced rates from time to time during first-quarter 2023. While demonstrations and road blockages subsided in recent weeks, the potential for civil unrest and disruption of commerce and supply chains continues. Cerro Verde resumed normal operations in March 2023. FCX continues to monitor the situation with a priority on safety and security.

Operating and Development Activities. El Abra's large sulfide resource supports a potential major mill project similar to the large-scale concentrator at Cerro Verde. Technical and economic studies continue to be evaluated to determine the optimal scope and timing for the sulfide project. FCX is advancing plans to invest in water infrastructure to provide options to extend existing operations, while continuing to monitor potential changes in Chile's regulatory and fiscal matters.

Operating Data. Following is summary consolidated operating data for South America mining:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

Copper (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

Production |

|

304 |

|

|

274 |

|

|

|

|

|

|

Sales |

|

302 |

|

|

264 |

|

|

|

|

|

|

Average realized price per pound |

|

$ |

4.08 |

|

|

$ |

4.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Molybdenum (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

Productiona |

|

6 |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit net cash costs per pound of copperb |

|

|

|

|

|

|

|

|

|

Site production and delivery, excluding adjustments |

|

$ |

2.54 |

|

|

$ |

2.43 |

|

|

|

|

|

|

By-product credits |

|

(0.53) |

|

|

(0.43) |

|

|

|

|

|

|

Treatment charges |

|

0.18 |

|

|

0.15 |

|

|

|

|

|

|

Royalty on metals |

|

0.01 |

|

|

0.01 |

|

|

|

|

|

|

Unit net cash costs |

|

$ |

2.20 |

|

|

$ |

2.16 |

|

|

|

|

|

|

a.Refer to summary operating data on page 3 for FCX's consolidated molybdenum sales, which include sales of molybdenum produced at Cerro Verde.

b.For a reconciliation of unit net cash costs per pound to production and delivery costs applicable to sales reported in FCX's consolidated financial statements, refer to the supplemental schedules, "Product Revenues and Production Costs," beginning on page X.

FCX's consolidated copper sales volumes from South America of 302 million pounds in first-quarter 2023 were higher than first-quarter 2022 copper sales volumes of 264 million pounds, primarily reflecting higher mining rates. Copper sales from South America mining are expected to approximate 1.2 billion pounds for the year 2023.

Average unit net cash costs (net of by-product credits) for South America mining of $2.20 per pound of copper in first-quarter 2023 were higher than first-quarter 2022 unit net cash costs of $2.16 per pound, primarily reflecting higher energy and other input costs, partly offset by the impact of higher sales volumes and molybdenum by-product credits.

Average unit net cash costs (net of by-product credits) for South America mining are expected to approximate $2.36 per pound of copper for the year 2023, based on current sales volume and cost estimates and assuming an average price of $18.00 per pound of molybdenum for the remainder of 2023.

Indonesia Mining. PT-FI operates one of the world’s largest copper and gold mines at the Grasberg minerals district in Central Papua, Indonesia. PT-FI produces copper concentrate that contains significant quantities of gold and silver. FCX has a 48.76% ownership interest in PT-FI and manages its mining operations. PT-FI's results are consolidated in FCX's financial statements.

Under the terms of agreements entered into in 2018, FCX’s economic interest in PT-FI approximated 81% through 2022, and beginning January 1, 2023, FCX's economic interest in PT-FI is 48.76%. This arrangement was developed to replicate the economics of PT-FI's former joint venture partner interests, which were acquired by the Indonesia government in 2018.

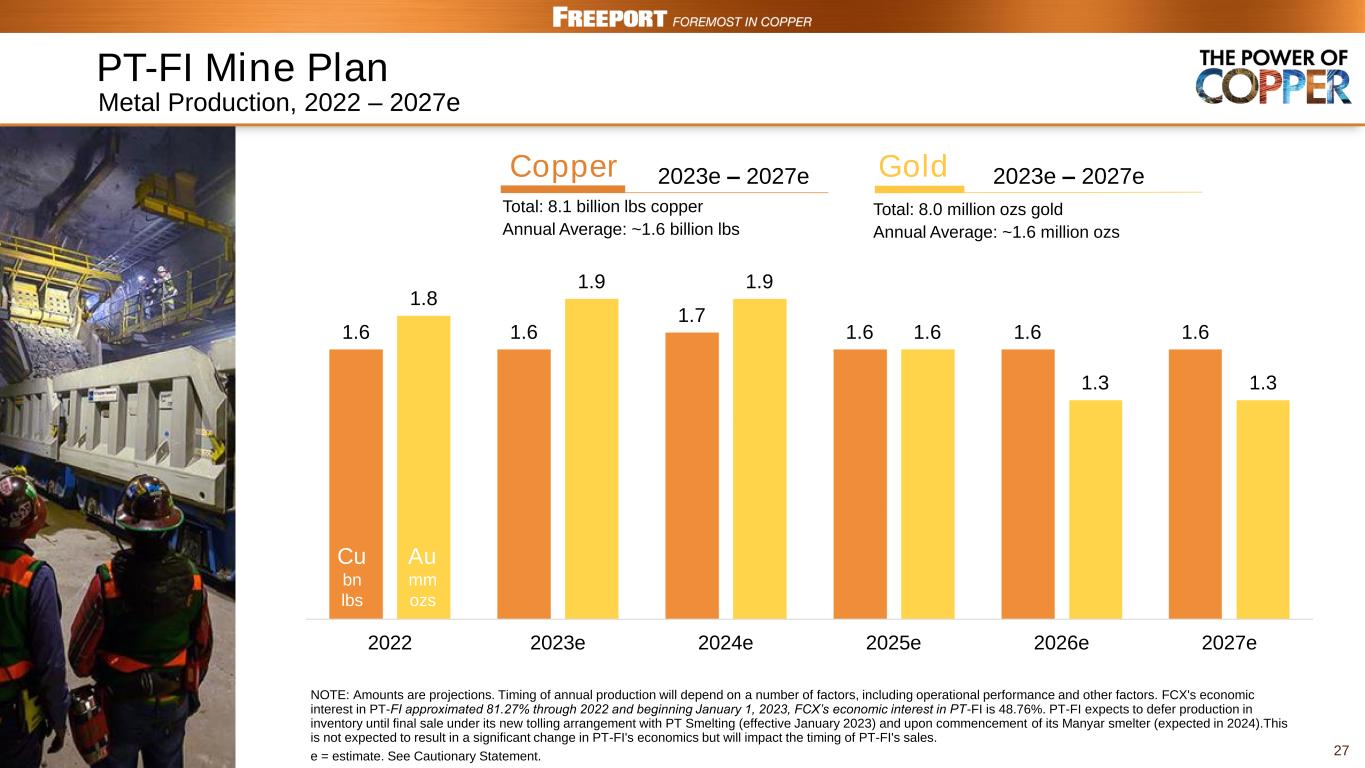

Operating and Development Activities. Over a multi-year investment period, PT-FI has successfully commissioned three large-scale block cave mines in the Grasberg minerals district (Grasberg Block Cave, Deep Mill Level Zone and Big Gossan), providing cumulative annualized production volumes of approximately 1.6 billion pounds of copper and 1.6 million ounces of gold.

PT-FI is completing a project to install additional milling facilities, currently expected to be completed in early 2024. The project will increase milling capacity to approximately 240,000 metric tons of ore per day to provide sustained large scale production volumes. PT-FI is also advancing a mill recovery project with the installation of a new copper cleaner circuit that is expected to be completed in 2024, and is expected to provide incremental metal production of approximately 60 million pounds of copper and 40 thousand ounces of gold per year.

Kucing Liar. Long-term mine development activities are ongoing for PT-FI's Kucing Liar deposit in the Grasberg minerals district, which is expected to produce over 6 billion pounds of copper and 6 million ounces of gold between 2028 and the end of 2041. Pre-production development activities commenced in 2022 and are expected to continue over an approximate 10-year timeframe. Capital investments are estimated to average approximately $400 million per year over this period. At full operating rates of approximately 90,000 metric tons of ore per day, annual production from Kucing Liar is expected to approximate 550 million pounds of copper and 560 thousand ounces of gold, providing PT-FI with sustained long-term, large-scale and low-cost production. Kucing Liar will benefit from substantial shared infrastructure and PT-FI's experience and long-term success in block-cave mining.

Mining Rights. PT-FI and the Indonesia government continue to engage in discussions regarding the extension of PT-FI's mining rights under its special mining license (IUPK) beyond 2041. An extension beyond 2041 would enable continuity of large-scale operations for the benefit of all stakeholders and provide growth options through additional resource development opportunities in the highly attractive Grasberg minerals district.

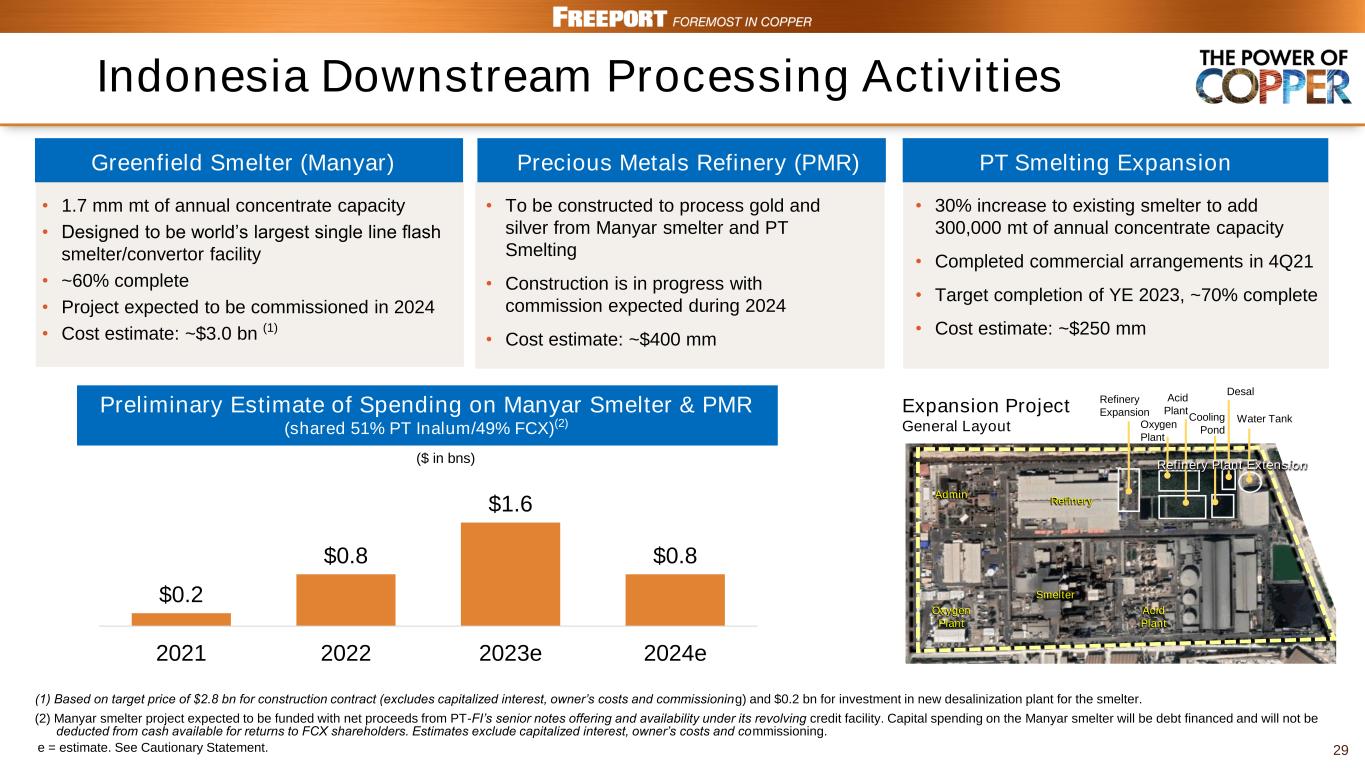

Indonesia Smelter. In connection with PT-FI’s 2018 agreement with the Indonesia government to secure the extension of its long-term mining rights, PT-FI committed to construct additional domestic smelting capacity totaling 2 million metric tons of concentrate per year by the end of 2023 (subject to force majeure provisions). PT-FI is actively engaged in the following projects for additional domestic smelting capacity:

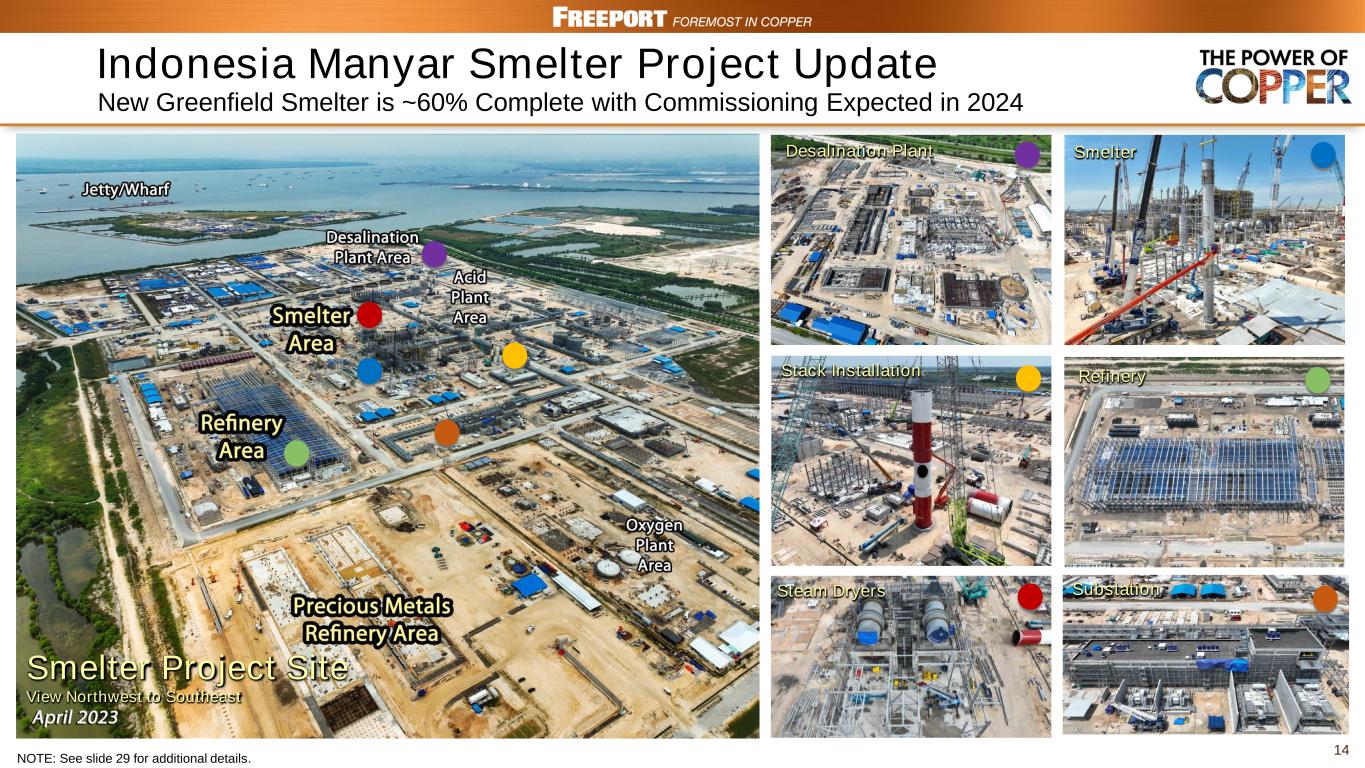

•Construction of the Manyar smelter in Gresik, Indonesia with a capacity to process approximately 1.7 million metric tons of copper concentrate per year. Smelter construction was approximately 60% complete at March 31, 2023, and is expected to be commissioned during 2024 at an estimated cost of $3.0 billion, including $2.8 billion for a construction contract (excluding capitalized interest, owner’s costs and commissioning) and $0.2 billion for investment in a desalinization plant.

•Expansion of PT Smelting's capacity by 30% to 1.3 million metric tons of copper concentrate per year, which is expected to be completed by the end of 2023. PT-FI is funding the cost of the expansion, estimated to approximate $250 million, with a loan that will convert to equity and increase PT-FI’s ownership in PT Smelting to a majority ownership interest upon project completion.

•Construction of a precious metals refinery (PMR) to process gold and silver from the Manyar smelter and PT Smelting at an estimated cost of $400 million. Construction is in progress with commissioning expected during 2024.

During first-quarter 2023, capital expenditures for the Manyar smelter and PMR (collectively, the Indonesia smelter projects) totaled $0.3 billion, and are expected to approximate $1.6 billion for the year 2023. Capital expenditures for the Indonesia smelter projects are being funded with proceeds received from PT-FI's April 2022 senior notes offering and availability under its revolving credit facility.

Export License. In March 2023, PT-FI received an extension of its export license through June 10, 2023. PT-FI's IUPK provides that exports may continue through 2023, subject to force majeure considerations. PT-FI is working with the Indonesia government to obtain approval to continue exports as required until the Manyar smelter and PMR are fully commissioned.

In March 2023, the Indonesia government verified that construction progress on the Manyar smelter exceeded 50%, allowing PT-FI to be relieved of the payment of export duties, which were previously 2.5%.

Operating Data. Following is summary consolidated operating data for Indonesia mining:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

Copper (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

|

Production |

|

329 |

|

|

381 |

|

|

|

|

|

|

Sales |

|

198 |

|

|

379 |

|

|

|

|

|

|

Average realized price per pound |

|

$ |

4.07 |

|

|

$ |

4.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gold (thousands of recoverable ounces) |

|

|

|

|

|

|

|

|

|

Production |

|

402 |

|

|

412 |

|

|

|

|

|

|

Sales |

|

266 |

|

|

406 |

|

|

|

|

|

|

Average realized price per ounce |

|

$ |

1,949 |

|

|

$ |

1,920 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit net cash credits per pound of coppera |

|

|

|

|

|

|

|

|

|

| Site production and delivery, excluding adjustments |

|

$ |

2.01 |

|

|

$ |

1.41 |

|

b |

|

|

|

|

| Gold and silver credits |

|

(2.84) |

|

|

(2.17) |

|

|

|

|

|

|

Treatment charges |

|

0.37 |

|

|

0.25 |

|

|

|

|

|

|

Export dutiesc |

|

0.09 |

|

|

0.21 |

|

d |

|

|

|

|

Royalty on metals |

|

0.29 |

|

|

0.24 |

|

|

|

|

|

|

| Unit net cash credits |

|

$ |

(0.08) |

|

|

$ |

(0.06) |

|

|

|

|

|

|

a.For a reconciliation of unit net cash credits per pound to production and delivery costs applicable to sales reported in FCX's consolidated financial statements, refer to the supplemental schedules, "Product Revenues and Production Costs," beginning on page X.

b.Excludes a charge totaling $0.11 per pound of copper associated with an administrative fine levied by the Indonesia government.

c.Reflects export duty rates of 2.5% in first-quarter 2023 and 5% in first-quarter 2022. As noted above, the Indonesia government verified that construction progress on the Manyar smelter exceeded 50%, and as such export duties were eliminated effective March 29, 2023.

d.Excludes a charge totaling $0.05 per pound of copper to reserve for exposure associated with export duties in prior periods.

On February 11, 2023, PT-FI’s operations were temporarily disrupted because of significant rainfall and landslides, which restricted access to infrastructure near its milling operations. After recovery activities and the clearing of debris, PT-FI resumed operations by the end of February 2023 and achieved a full recovery in March 2023. PT-FI's milling rates for ore extracted from its underground mines averaged 164,800 metric tons of ore per day in first-quarter 2023. PT-FI expects milling rates to average in excess of 200,000 metric tons of ore per day for the remainder of 2023.

PT-FI's consolidated sales of 198 million pounds of copper and 266 thousand ounces of gold in first-quarter 2023 were lower than first-quarter 2022 consolidated sales of 379 million pounds of copper and 406 thousand ounces of gold, primarily as a result of the timing of sales associated with the transition to a tolling arrangement with PT Smelting in 2023 and the impact of a temporary disruption of operations in February 2023 associated with the significant weather event.

Consolidated sales volumes from PT-FI are expected to approximate 1.5 billion pounds of copper and 1.8 million ounces of gold for the year 2023, net of a deferral of approximately 110 million pounds of copper and 140 thousand ounces of gold from mine production under tolling arrangements to be processed and sold as refined metal in future periods.

PT-FI's unit net cash credits (including gold and silver credits) of $0.08 per pound of copper in first-quarter 2023 were in line with unit net cash credits of $0.06 per pound in first-quarter 2022, reflecting higher gold and silver credits, mostly offset by lower sales volumes and higher treatment charges.

Assuming an average gold price $2,000 per ounce for the remainder of 2023 and achievement of current sales volumes and cost estimates, unit net cash credits (including gold and silver credits) for PT-FI are expected to approximate $0.15 per pound of copper for the year 2023. PT-FI's average unit net cash credits for the year 2023 would change by approximately $0.11 per pound of copper for each $100 per ounce change in the average price of gold for the remainder of 2023.

Molybdenum Mines. FCX operates two wholly owned molybdenum mines in Colorado - the Climax open-pit mine and the Henderson underground mine. The Climax and Henderson mines produce high-purity, chemical-grade molybdenum concentrate, which is typically further processed into value-added molybdenum chemical products. The majority of the molybdenum concentrate produced at the Climax and Henderson mines and at FCX's North America and South America copper mines is processed at FCX's conversion facilities.

The Platts Metals Daily Molybdenum Dealer Oxide weekly average price for molybdenum averaged $32.78 per pound in first-quarter 2023, compared with $19.08 per pound in first-quarter 2022. The molybdenum price declined to approximately $21.50 per pound on April 20, 2023. Long-term market fundamentals are positive with favorable demand drivers and limited supply.

Operating and Development Activities. Production from the Molybdenum mines totaled 8 million pounds of molybdenum in first-quarter 2023 and was slightly higher than production of 7 million pounds of molybdenum in first-quarter 2022, primarily reflecting higher milling rates. FCX's consolidated molybdenum sales and average realized prices include sales of molybdenum produced at the Molybdenum mines and at FCX's North America and South America copper mines, which are presented on page 3.

Average unit net cash costs for the Molybdenum mines of $12.24 per pound of molybdenum in first-quarter 2023 were higher than average unit net cash costs of $10.89 per pound in first-quarter 2022, primarily reflecting increased contract labor and input costs, partly offset by higher sales volumes. Based on current sales volume and cost estimates, average unit net cash costs for the Molybdenum mines are expected to approximate $13.36 per pound of molybdenum for the year 2023.

For a reconciliation of unit net cash costs per pound to production and delivery costs applicable to sales reported in FCX's consolidated financial statements, refer to the supplemental schedules, "Product Revenues and Production Costs," beginning on page X.

EXPLORATION

FCX's mining exploration activities are primarily associated with its existing mines, focusing on opportunities to expand reserves and resources to support development of additional future production capacity. Exploration results continue to indicate opportunities for significant future potential reserve additions at FCX's existing properties in North America and South America. Exploration expenditures for the year 2023 are expected to approximate $110 million, compared with $105 million in 2022. FCX plans to advance Lone Star and other opportunities at FCX's North America copper mines.

LIQUIDITY, CASH FLOWS, CASH AND DEBT

Liquidity. At March 31, 2023, FCX had $6.9 billion in consolidated cash and cash equivalents and $3.0 billion of availability under its revolving credit facility. In addition, PT-FI and Cerro Verde have $1.3 billion and $350 million, respectively, of availability under their respective revolving credit facilities.

Operating Cash Flows. FCX generated operating cash flows of $1.1 billion (net of $0.5 billion of working capital and other uses) in first-quarter 2023.

Based on current sales volume and cost estimates, and assuming average prices of $4.00 per pound of copper, $2,000 per ounce of gold and $18.00 per pound of molybdenum for the remainder of 2023, FCX's consolidated operating cash flows are estimated to approximate $7.0 billion (including $0.3 billion of working capital and other sources) for the year 2023. The impact of price changes for the remainder of 2023 on operating cash flows would approximate $315 million for each $0.10 per pound change in the average price of copper, $140 million for each $100 per ounce change in the average price of gold and $90 million for each $2 per pound change in the average price of molybdenum.

Capital Expenditures. Capital expenditures totaled $1.1 billion in first-quarter 2023 (including $0.4 billion for major mining projects and $0.3 billion for the Indonesia smelter projects).

Capital expenditures are expected to approximate $5.1 billion for the year 2023 (including $2.4 billion for major mining projects and $1.6 billion for the Indonesia smelter projects). Projected capital expenditures for major mining projects include $1.3 billion for planned projects primarily associated with underground mine development in the Grasberg minerals district and supporting mill and power capital costs and $1.1 billion for discretionary growth projects. Capital expenditures for the Indonesia smelter projects are being funded with the proceeds received from PT-FI's April 2022 senior notes offering and availability under PT-FI's revolving credit facility.

Cash. Following is a summary of the U.S. and international components of consolidated cash and cash equivalents available to the parent company, excluding cash committed for the Indonesia smelter projects and net of noncontrolling interests' share, taxes and other costs at March 31, 2023 (in billions):

|

|

|

|

|

|

|

|

|

| Cash at domestic companies |

$ |

3.4 |

|

|

| Cash at international operations |

3.5 |

|

|

| Total consolidated cash and cash equivalents |

6.9 |

|

|

| Cash for Indonesia smelter projects |

(1.5) |

|

a |

| Noncontrolling interests' share |

(1.0) |

|

|

Cash, net of noncontrolling interests' share |

4.4 |

|

|

| Withholding taxes |

(0.1) |

|

|

| Net cash available |

$ |

4.3 |

|

|

a.Estimated remaining net proceeds from PT-FI's April 2022 senior notes offerings.

Debt. Following is a summary of total debt and the weighted-average interest rates at March 31, 2023 (in billions, except percentages):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-

Average

Interest Rate |

| Senior notes: |

|

|

|

| Issued by FCX |

$ |

6.2 |

|

|

4.9% |

| Issued by PT-FI |

3.0 |

|

|

5.4% |

| Issued by Freeport Minerals Corporation |

0.4 |

|

|

7.5% |

| Other |

— |

|

a |

2.0% |

| Total debt |

$ |

9.6 |

|

|

5.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a.Rounds to less than $0.1 billion.

At March 31, 2023, there were no borrowings and $8 million in letters of credit issued under FCX's $3.0 billion revolving credit facility.

In March 2023, FCX repaid in full the outstanding principal balance of its 3.875% Senior Notes totaling $996 million at maturity.

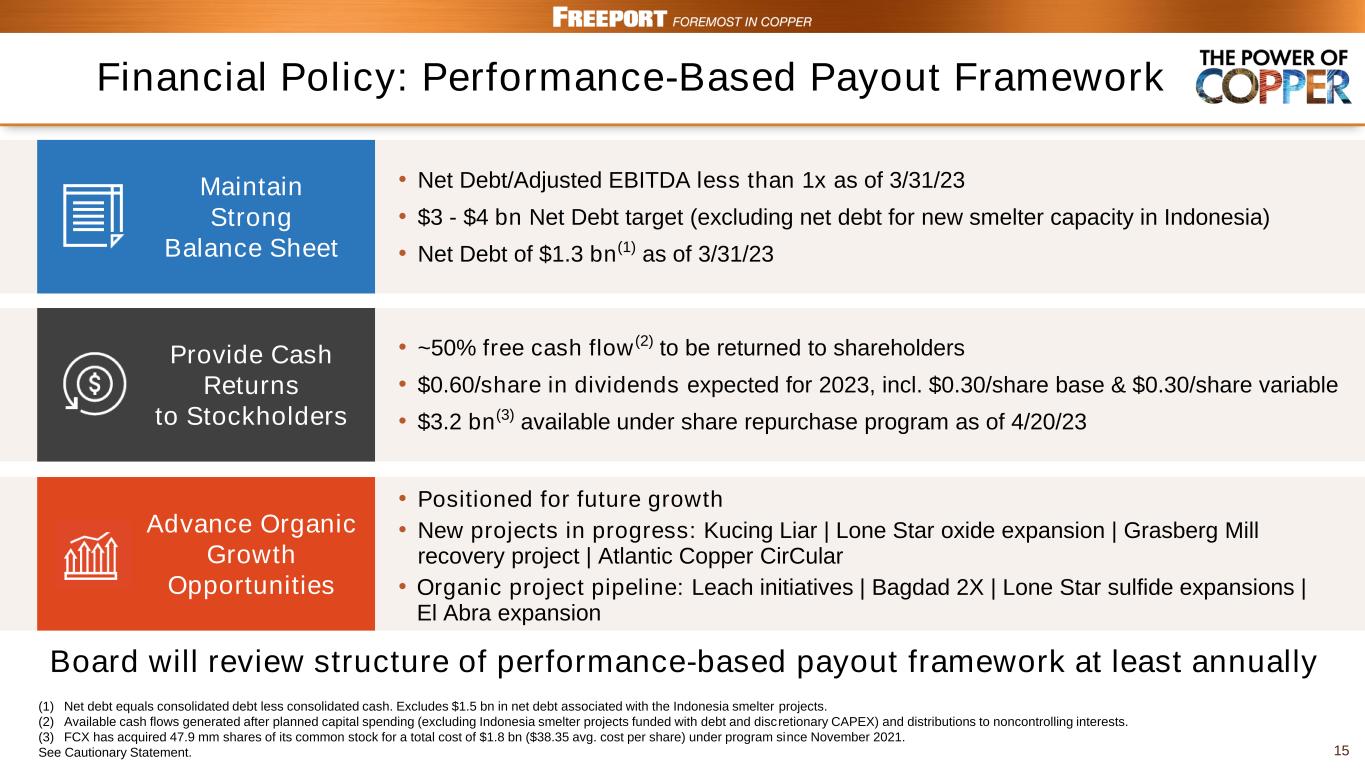

FINANCIAL POLICY

FCX's financial policy is aligned with its strategic objectives of maintaining a strong balance sheet, providing cash returns to shareholders and advancing opportunities for future growth. The policy includes a base dividend and a performance-based payout framework, whereby up to 50% of available cash flows generated after planned capital spending and distributions to noncontrolling interests are allocated to shareholder returns and the balance to debt reduction and investments in value enhancing growth projects, subject to FCX maintaining its net debt at a level not to exceed the net debt target of $3.0 billion to $4.0 billion (excluding project debt for additional smelting capacity in Indonesia). The Board will review the structure of the performance-based payout framework at least annually.

At March 31, 2023, FCX's net debt, excluding net debt for the Indonesia smelter projects, totaled $1.3 billion. Refer to the supplemental schedule, "Net Debt," on page VII.

On March 22, 2023, FCX declared cash dividends totaling $0.15 per share on its common stock (which included a base cash dividend of $0.075 per share and a variable, performance-based cash dividend of $0.075 per share), which will be paid on May 1, 2023, to shareholders of record as of April 14, 2023. The declaration and payment of dividends (base or variable) is at the discretion of the Board, which will consider FCX's financial results, cash requirements, global economic conditions and other factors it deems relevant.

As of April 20, 2023, FCX has 1.43 billion shares of common stock outstanding and $3.2 billion is available under its share repurchase program. The timing and amount of share repurchases is at the discretion of management and will depend on a variety of factors. The share repurchase program may be modified, increased, suspended or terminated at any time at the Board’s discretion.

WEBCAST INFORMATION

A conference call with securities analysts to discuss FCX's first-quarter results is scheduled for today at 10:00 a.m. Eastern Time. The conference call will be broadcast on the internet along with slides. Interested parties may listen to the conference call live and view the slides by accessing fcx.com. A replay of the webcast will be available through Friday, May 19, 2023.

-----------------------------------------------------------------------------------------------------------

FREEPORT: Foremost in Copper

FCX is a leading international mining company with headquarters in Phoenix, Arizona. FCX operates large, long-lived, geographically diverse assets with significant proven and probable reserves of copper, gold and molybdenum. FCX is one of the world’s largest publicly traded copper producers.

FCX’s portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits; and significant mining operations in North America and South America, including the large-scale Morenci minerals district in Arizona and the Cerro Verde operation in Peru.

By supplying responsibly produced copper, FCX is proud to be a positive contributor to the world well beyond its operational boundaries. Additional information about FCX is available on FCX's website at fcx.com.

Cautionary Statement: This press release contains forward-looking statements in which FCX discusses its potential future performance. Forward-looking statements are all statements other than statements of historical facts, such as plans, projections, or expectations relating to business outlook, strategy, goals or targets; global market conditions; ore grades and milling rates; production and sales volumes; unit net cash costs and operating costs; capital expenditures; operating plans; cash flows; liquidity; PT-FI’s financing, construction and completion of additional domestic smelting capacity in Indonesia in accordance with the terms of its IUPK; extension of PT-FI's IUPK beyond 2041 and export permit beyond June 10, 2023; FCX’s commitment to deliver responsibly produced copper and molybdenum, including plans to implement, validate and maintain validation of its operating sites under specific frameworks; execution of FCX's energy and climate strategies and the underlying assumptions and estimated impacts on FCX’s business related thereto; achievement of 2030 climate targets and 2050 net zero aspiration; improvements in operating procedures and technology innovations; exploration efforts and results; development and production activities, rates and costs; future organic growth opportunities; tax rates; export quotas; the impact of copper, gold and molybdenum price changes; the impact of deferred intercompany profits on earnings; mineral reserve and mineral resource estimates; final resolution of settlements associated with ongoing legal proceedings; debt repurchases; and the ongoing implementation of FCX’s financial policy and future returns to shareholders, including dividend payments (base or variable) and share repurchases. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “could,” “to be,” “potential,” “assumptions,” “guidance,” “aspirations,” “future,” "commitments," "pursues," "initiatives," "objectives," "opportunities," "strategy" and any similar expressions are intended to identify those assertions as forward-looking statements. The declaration and payment of dividends (base or variable), and timing and amount of any share repurchases is at the discretion of the Board and management, respectively, and is subject to a number of factors, including maintaining FCX’s net debt target, capital availability, FCX’s financial results, cash requirements, global economic conditions, changes in laws, contractual restrictions and other factors deemed relevant by the Board or management, as applicable. The share repurchase program may be modified, increased, suspended or terminated at any time at the Board’s discretion.

FCX cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause FCX's actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, supply of and demand for, and prices of the commodities FCX produces, primarily copper; price and availability of consumables and components FCX purchases as well as constraints on supply and logistics, and transportation services; changes in FCX’s cash requirements, financial position, financing or investment plans; changes in general market, economic, regulatory or industry conditions; reductions in liquidity and access to capital; changes in tax laws and regulations, including the impact of the Inflation Reduction Act; any major public health crisis; political and social risks, including the potential effects of violence in Indonesia, civil unrest in Peru, and relations with local communities and Indigenous Peoples; operational risks inherent in mining, with higher inherent risks in underground mining; mine sequencing; changes in mine plans or operational modifications, delays, deferrals or cancellations; production rates; timing of shipments; results of technical, economic or feasibility studies; potential inventory adjustments; potential impairment of long-lived mining assets; PT-FI's ability to export and sell copper concentrate and anode slimes; satisfaction of requirements in accordance with PT-FI’s IUPK to extend mining rights from 2031 through 2041; the Indonesia government’s approval of a deferred schedule for completion of additional domestic smelting capacity in Indonesia; discussions relating to the extension of PT-FI's IUPK beyond 2041; cybersecurity incidents; labor relations, including labor-related work stoppages and costs; compliance with applicable environmental, health and safety laws and regulations; weather- and climate-related risks; environmental risks, including availability of secure water supplies, and litigation results; FCX’s ability to comply with its responsible production commitments under specific frameworks and any changes to such frameworks and other factors described in more detail under the heading “Risk Factors” in FCX’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the U.S. Securities and Exchange Commission (SEC).

Investors are cautioned that many of the assumptions upon which FCX’s forward-looking statements are based are likely to change after the date the forward-looking statements are made, including for example commodity prices, which FCX cannot control, and production volumes and costs or technological solutions and innovation, some aspects of which FCX may not be able to control. Further, FCX may make changes to its business plans that could affect its results. FCX cautions investors that it undertakes no obligation to update any forward-looking statements, which speak only as of the date made, notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes.

This press release also contains financial measures such as net debt, adjusted net income and unit net cash costs per pound of copper and molybdenum, which are not recognized under U.S. generally accepted accounting principles. As required by SEC Regulation G, reconciliations of these measures to amounts reported in FCX’s consolidated financial statements are in the supplemental schedules of this press release.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Freeport-McMoRan Inc. |

| SELECTED OPERATING DATA |

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

| MINING OPERATIONS: |

Production |

|

Sales |

|

COPPER (millions of recoverable pounds) |

|

|

|

|

| (FCX's net interest in %) |

|

|

|

|

| North America |

|

|

|

|

|

|

|

|

Morenci (72%)a |

143 |

|

|

154 |

|

|

142 |

|

|

166 |

|

|

| Safford (100%) |

63 |

|

|

69 |

|

|

64 |

|

|

71 |

|

|

| Sierrita (100%) |

43 |

|

|

52 |

|

|

42 |

|

|

52 |

|

|

| Bagdad (100%) |

34 |

|

|

34 |

|

|

36 |

|

|

42 |

|

|

| Chino (100%) |

36 |

|

|

28 |

|

|

35 |

|

|

32 |

|

|

| Tyrone (100%) |

13 |

|

|

14 |

|

|

13 |

|

|

15 |

|

|

| Miami (100%) |

3 |

|

|

3 |

|

|

3 |

|

|

3 |

|

|

| Other (100%) |

(3) |

|

|

— |

|

|

(3) |

|

|

— |

|

|

| Total North America |

332 |

|

|

354 |

|

|

332 |

|

|

381 |

|

|

|

|

|

|

|

|

|

|

|

| South America |

|

|

|

|

|

|

|

|

| Cerro Verde (53.56%) |

245 |

|

|

237 |

|

|

246 |

|

|

229 |

|

|

| El Abra (51%) |

59 |

|

|

37 |

|

|

56 |

|

|

35 |

|

|

|

|

|

|

|

|

|

|

|

| Total South America |

304 |

|

|

274 |

|

|

302 |

|

|

264 |

|

|

|

|

|

|

|

|

|

|

|

| Indonesia |

|

|

|

|

|

|

|

|

Grasberg (48.76%)b |

329 |

|

|

381 |

|

|

198 |

|

|

379 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

965 |

|

|

1,009 |

|

|

832 |

|

c |

1,024 |

|

c |

| Less noncontrolling interests |

311 |

|

|

199 |

|

|

243 |

|

|

194 |

|

|

| Net |

654 |

|

|

810 |

|

|

589 |

|

|

830 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average realized price per pound |

|

|

|

|

$ |

4.11 |

|

|

$ |

4.66 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GOLD (thousands of recoverable ounces) |

|

|

|

|

|

|

|

|

| (FCX's net interest in %) |

|

|

|

|

|

|

|

|

| North America (100%) |

3 |

|

|

3 |

|

|

4 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

Indonesia (48.76%)b |

402 |

|

|

412 |

|

|

266 |

|

|

406 |

|

|

| Consolidated |

405 |

|

|

415 |

|

|

270 |

|

|

409 |

|

|

| Less noncontrolling interests |

144 |

|

d |

77 |

|

|

74 |

|

d |

76 |

|

|

| Net |

261 |

|

|

338 |

|

|

196 |

|

|

333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average realized price per ounce |

|

|

|

|

$ |

1,949 |

|

|

$ |

1,920 |

|

|

|

|

|

|

|

|

|

|

|

MOLYBDENUM (millions of recoverable pounds) |

|

|

|

|

|

|

|

|

| (FCX's net interest in %) |

|

|

|

|

|

|

|

|

| Climax (100%) |

5 |

|

|

4 |

|

|

N/A |

|

N/A |

|

| Henderson (100%) |

3 |

|

|

3 |

|

|

N/A |

|

N/A |

|

North America copper mines (100%)a |

7 |

|

|

7 |

|

|

N/A |

|

N/A |

|

| Cerro Verde (53.56%) |

6 |

|

|

7 |

|

|

N/A |

|

N/A |

|

| Consolidated |

21 |

|

|

21 |

|

|

19 |

|

|

19 |

|

|

| Less noncontrolling interests |

2 |

|

|

3 |

|

|

2 |

|

|

2 |

|

|

| Net |

19 |

|

|

18 |

|

|

17 |

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average realized price per pound |

|

|

|

|

$ |

30.32 |

|

|

$ |

19.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Amounts are net of Morenci's joint venture partners' undivided interests. |

|

|

|

|

|

|

|

|

|

| b. Beginning January 1, 2023, FCX’s economic interest in PT Freeport Indonesia (PT-FI) is 48.76%. Prior to January 1, 2023, FCX's economic interest in PT-FI approximated 81%. |

|

|

|

|

|

|

|

|

|

c. Consolidated sales volumes exclude purchased copper of 48 million pounds in first-quarter 2023 and 15 million pounds in first-quarter 2022. |

| d. Includes approximately 190 thousand ounces of gold production and sales volumes attributed to PT Mineral Industri Indonesia's approximate 19% economic interest in accordance with the PT-FI shareholders agreement. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Freeport-McMoRan Inc. |

|

| SELECTED OPERATING DATA (continued) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

| 100% North America Copper Mines |

|

|

|

|

|

|

|

|

| Leach Operations |

|

|

|

|

|

|

|

|

Leach ore placed in stockpiles (metric tons per day) |

613,200 |

|

|

708,600 |

|

|

|

|

|

|

| Average copper ore grade (%) |

0.27 |

|

|

0.28 |

|

|

|

|

|

|

Copper production (millions of recoverable pounds) |

234 |

|

|

245 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mill Operations |

|

|

|

|

|

|

|

|

Ore milled (metric tons per day) |

297,500 |

|

|

291,400 |

|

|

|

|

|

|

| Average ore grades (%): |

|

|

|

|

|

|

|

|

Copper |

0.34 |

|

|

0.36 |

|

|

|

|

|

|

Molybdenum |

0.02 |

|

|

0.02 |

|

|

|

|

|

|

| Copper recovery rate (%) |

80.4 |

|

|

80.9 |

|

|

|

|

|

|

Production (millions of recoverable pounds): |

|

|

|

|

|

|

|

|

Copper |

154 |

|

|

169 |

|

|

|

|

|

|

Molybdenum |

8 |

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 100% South America Mining |

|

|

|

|

|

|

|

|

| Leach Operations |

|

|

|

|

|

|

|

|

Leach ore placed in stockpiles (metric tons per day) |

203,900 |

|

|

139,800 |

|

|

|

|

|

|

| Average copper ore grade (%) |

0.33 |

|

|

0.36 |

|

|

|

|

|

|

Copper production (millions of recoverable pounds) |

86 |

|

|

61 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mill Operations |

|

|

|

|

|

|

|

|

Ore milled (metric tons per day) |

405,100 |

|

|

394,400 |

|

|

|

|

|

|

| Average ore grades (%): |

|

|

|

|

|

|

|

|

Copper |

0.34 |

|

|

0.33 |

|

|

|

|

|

|

Molybdenum |

0.01 |

|

|

0.02 |

|

|

|

|

|

|

| Copper recovery rate (%) |

83.9 |

|

|

86.6 |

|

|

|

|

|

|

Production (millions of recoverable pounds): |

|

|

|

|

|

|

|

|

Copper |

218 |

|

|

213 |

|

|

|

|

|

|

Molybdenum |

6 |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 100% Indonesia Mining |

|

|

|

|

|

|

|

|

Ore extracted and milled (metric tons per day): |

|

|

|

|

|

|

|

|

| Grasberg Block Cave underground mine |

89,700 |

|

|

100,400 |

|

|

|

|

|

|

| Deep Mill Level Zone underground mine |

70,000 |

|

|

78,400 |

|

|

|

|

|

|

| Big Gossan underground mine |

7,000 |

|

|

7,700 |

|

|

|

|

|

|

| Other adjustments |

(1,900) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

164,800 |

|

|

186,500 |

|

|

|

|

|

|

Average ore grades: |

|

|

|

|

|

|

|

|

| Copper (%) |

1.17 |

|

|

1.23 |

|

|

|

|

|

|

Gold (grams per metric ton) |

1.07 |

|

|

1.03 |

|

|

|

|

|

|

| Recovery rates (%): |

|

|

|

|

|

|

|

|

Copper |

90.3 |

|

|

89.4 |

|

|

|

|

|

|

Gold |

78.2 |

|

|

77.2 |

|

|

|

|

|

|

Production (recoverable): |

|

|

|

|

|

|

|

|

Copper (millions of pounds) |

329 |

|

|

381 |

|

|

|

|

|

|

Gold (thousands of ounces) |

402 |

|

|

412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 100% Molybdenum Mines |

|

|

|

|

|

|

|

|

Ore milled (metric tons per day) |

27,300 |

|

|

22,700 |

|

|

|

|

|

|

| Average molybdenum ore grade (%) |

0.17 |

|

|

0.18 |

|

|

|

|

|

|

Molybdenum production (millions of recoverable pounds) |

8 |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Freeport-McMoRan Inc. |

| CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

March 31, |

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

|

(In Millions, Except Per Share Amounts) |

|

Revenuesa |

$ |

5,389 |

|

|

$ |

6,603 |

|

b |

|

|

|

|

| Cost of sales: |

|

|

|

|

|

|

|

|

Production and deliveryc,d |

3,165 |

|

|

3,150 |

|

|

|

|

|

|

| Depreciation, depletion and amortization |

399 |

|

|

489 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of sales |

3,564 |

|

|

3,639 |

|

|

|

|

|

|

| Selling, general and administrative expenses |

126 |

|

|

115 |

|

|

|

|

|

|

| Mining exploration and research expenses |

31 |

|

|

24 |

|

|

|

|

|

|

| Environmental obligations and shutdown costs |

67 |

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

3,788 |

|

|

3,794 |

|

|

|

|

|

|

| Operating income |

1,601 |

|

|

2,809 |

|

|

|

|

|

|

Interest expense, nete |

(151) |

|

d |

(127) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

88 |

|

d |

31 |

|

|

|

|

|

|

| Income before income taxes and equity in affiliated companies' net earnings |

1,538 |

|

|

2,713 |

|

|

|

|

|

|

Provision for income taxesf |

(499) |

|

|

(824) |

|

|

|

|

|

|

| Equity in affiliated companies' net earnings |

10 |

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

1,049 |

|

|

1,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to noncontrolling interests |

(386) |

|

|

(377) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to common stockholdersg |

$ |

663 |

|

|

$ |

1,527 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income per share attributable to common stock |

$ |

0.46 |

|

|

$ |

1.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|