false000082718700008271872025-11-282025-11-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 28, 2025

SLEEP NUMBER CORPORATION

(Exact name of registrant as specified in its charter)

Minnesota

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

|

|

| 000-25121 |

41-1597886 |

| (Commission File Number) |

(IRS Employer Identification No.) |

1001 Third Avenue South, Minneapolis, MN 55404

(Address of principal executive offices) (Zip Code)

(763) 551-7000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

SNBR |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

| ITEM 5.02 |

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS. |

On November 28, 2025, the Company appointed Amy K. O'Keefe as the Executive Vice President and Chief Financial Officer (CFO) of the Company to succeed Robert (Bob) P. Ryder, who was serving as interim CFO, effective as of December 8, 2025. Ryder will continue to serve in an advisory role to the Company through December 12, 2025, supporting the transition.

Ms. O’Keefe, age 54, brings over 30 years of experience leading operational, strategic, and financial transformations across public and private companies in the consumer products, technology, and wellness sectors. O'Keefe was most recently the Chief Financial and Administrative Officer at Avaya LLC, a global communications software company, from June 2023 to May 2025. From October 2020 to December 2022, Ms. O'Keefe was the Chief Financial Officer of Weight Watchers International (Nasdaq: WW), a global wellness company providing subscription-based commercial weight management programs with both in-person and digital-only offerings. From March 2017 to June 2020, Ms. O'Keefe was Chief Financial Officer of Drive DeVilbiss Healthcare Limited, a global manufacturer and distributor of medical products. She previously served as Chief Financial Officer of Savant Systems, LLC, a global designer and developer of home automation and control systems, from April 2015 to December 2016, and Chief Financial Officer of D&M Holdings Inc., a global designer and manufacturer of audio products, from January 2011 to July 2014. Prior to that time, Ms. O’Keefe held several corporate finance positions with Stanley Black & Decker Inc. (formerly known as The Black & Decker Corporation) (NYSE: SWK), including as Divisional Chief Financial Officer for certain divisions, and was a certified public accountant for Ernst & Young LLP. Ms. O'Keefe has served on the board of directors of TruBridge Inc. (Nasdaq: TBRG), a healthcare organizational software company, since October 2024, where she chairs the Compensation Committee and is a member of the Audit Committee. Ms. O’Keefe received a B.B.A. in Accounting from Loyola College.

Pursuant to the terms of the Company’s offer letter dated November 17, 2025 (the "Offer Letter"), Ms. O'Keefe will be entitled to:

•Annual base salary of $625,000;

•Participation in the Company's Annual Incentive Plan ("AIP") for fiscal year 2026 with a target incentive of 70% of base salary;

•Eligibility for target of $1.2M in annual long-term incentive awards beginning in March 2027;

•A combination of long-term incentive inducement grant awards ("Inducement Grant") under Nasdaq rules with a total value of $1,800,000, which will be granted on December 15, 2025 and March 15, 2026, subject to the terms of the Company's 2020 Equity Incentive Plan, as amended, and applicable Inducement Grant award agreements:

◦$400,000 time vested special restricted stock unit ("Special RSU") award, vesting 33% per year on each of the first three anniversaries of the date of grant of December 15, 2025, subject to continued employment with the number of Special RSUs granted determined by dividing the grant value by the average closing share price for the 20 trading days immediately preceding the date of grant;

◦$600,000 time vested 2026 restricted stock unit ("2026 RSU") award, vesting 33% per year on each of the first three anniversaries of the date of grant of March 15, 2026, subject to continued employment, and with the number of 2026 RSUs granted determined by the grant value approved by the Management Development and Compensation Committee ("Compensation Committee") of the Sleep Number Board of Directors at the time of the grant;

◦$800,000 performance stock unit ("PSU") award, vesting on the third anniversary of the date of grant with the number of shares to be earned based on actual Company performance for fiscal years 2026 to 2028, and with the target number of PSUs awarded calculated based on a methodology determined by the Compensation Committee at the time of the grant;

•Participate in the Company's Executive Severance Pay Plan (under which, upon termination of employment without cause, Ms. O'Keefe would be entitled to severance pay equal to (a) one times the sum of (i) annual base salary and (ii) annual target incentive, plus (b) a pro rata annual incentive for the year of termination) and modified so that the Company will not modify the Executive Severance Pay Plan as to Ms. O'Keefe in a detrimental manner for one year;

•$150,000 one-time relocation payment plus an additional amount based on a 40% tax rate to help cover applicable taxes for a total payment of $250,000 subject to tax withholding;

•Receive the similar perquisites provided to other senior executives of the Company, including reimbursement for tax and financial planning services up to $10,000 and the ability to participate in an annual executive physical program;

•Participate in the same health and welfare benefit plans as the Company makes available to all team members. Ms. O'Keefe will also be eligible to participate in the Sleep Number Profit Sharing and 401(k) Plan and the Sleep Number Executive Deferral Plan in accordance with the respective terms of such plans.

The foregoing description of Ms. O'Keefe's offer letter is a summary of the material terms of the offer letter, and is qualified in its entirety by reference to the Amy O'Keefe Offer Letter filed as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

|

|

|

|

|

|

| ITEM 7.01 |

REGULATION FD DISCLOSURE |

On December 2, 2025, Sleep Number Corporation (the “Company”) posted an investor presentation to its website at https://ir.sleepnumber.com/overview/default.aspx. A copy of the investor presentation is attached as Exhibit 99.2 to this Current Report on Form 8-K.

A copy of the investor presentation is furnished pursuant to this Item 7.01 as Exhibit 99.2 to this Current Report on Form 8-K and incorporated by reference herein in its entirety. The investor presentation includes references to non-GAAP financial information. Reconciliations between the non-GAAP financial measures and the comparable GAAP financial measures are available in the investor presentation.

The information furnished shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, or the Exchange Act, as amended, except as specifically identified therein as being incorporated by reference.

The furnishing of the information set forth in this Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely by Regulation FD.

|

|

|

|

|

|

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits.

|

|

|

|

|

|

| Exhibit No. |

Description of Exhibit |

| 10.1 |

|

| 99.1 |

|

| 99.2 |

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

SLEEP NUMBER CORPORATION |

| |

|

(Registrant) |

| |

|

|

|

|

| Dated: December 2, 2025 |

|

By: |

|

/s/ Samuel R. Hellfeld |

| |

|

Name: |

|

Samuel R. Hellfeld |

| |

|

Title: |

|

Executive Vice President, Chief Legal and Risk Officer |

EX-10.1

2

exhibit101cfoofferletter.htm

EX-10.1

Document

November 17, 2025

Ms. Amy K. O’Keefe

Delivered electronically

Dear Amy,

On behalf of Sleep Number Corporation, I am excited to extend the offer of employment as the Executive Vice President and Chief Financial Officer reporting to me. Your anticipated start date will be Monday, December 8, 2025.

Your offer is for an exempt position, which includes:

•Base Salary – Starting bi-weekly salary of $24,038.47 ($625,000.00 annualized).

•Annual Incentive Plan (AIP) – You will be eligible to participate in the Sleep Number Annual Incentive Plan (AIP) for 2026 at a target incentive of 70% of eligible earnings, as defined in the plan document. The actual payout will be based on the Company’s achievement of performance goals, with a maximum payout that can be up to 200% of target, subject to the Compensation Committee’s approval of the 2026 AIP (expected in February 2026).

•Long-term Incentives – Beginning in March 2027 you will be eligible to receive annual Long-term Incentive (LTI) awards which are typically granted on March 15th of each year. Your LTI annual award guideline will be $1,200,000. Our mix of annual LTI awards for the Executive Vice President level is 50% in Performance Stock Units (PSUs) and 50% in time-based Restricted Stock Units (RSUs). We utilize competitive LTI guidelines to inform the annual award target and consider performance and other factors in recommending annual award amounts.

Your offer includes the following special, one-time compensation with a total upfront value of $1,800,000:

•Time-Vested Restricted Stock Unit (“RSU”) Award – You will receive a special RSU award with a grant value of $400,000. The number of RSUs granted will be determined by dividing the grant value by the average closing share price for the 20 trading days immediately preceding the date of grant (anticipated as 12/15/25). Your RSU award will vest in three equal annual installments on each anniversary from the date of grant, subject to continued employment and the terms of the award.

•Time-Vested Restricted Stock Unit (“RSU”) Award – You will receive a 2026 RSU award with a grant value of $600,000. The number of RSUs granted will be determined by the grant value approved by the Compensation Committee for grants issued for the Executive Team (anticipated as 3/15/26). Your RSU award will vest in three equal annual installments on each anniversary from the date of grant, subject to continued employment and the terms of the award.

•Performance Stock Unit (“PSU”) Award – You will receive a 2026 PSU award with a grant value at target of $800,000. The target number of PSUs awarded will be calculated based on a methodology determined by the Board at the time of the grant (anticipated as 3/15/2026). The PSUs will vest three years after the date of grant, subject to continued employment and the terms of the award. These stock units are subject to a performance adjustment based on the Company’s performance for the three fiscal years from 2026 to 2028.

1001 3rd Ave South, Minneapolis, MN 55404 P 763.551.7000 F 763.694.3300 sleepnumber.com

Attached is an overview of the key provisions of these LTI awards. The specific terms and conditions for these LTI awards are defined in applicable award agreements and plan documents. Samples of the two applicable award agreements are attached for your reference. The grant date for your special RSU LTI awards will be on the 15th of the month following your start date. With an anticipated start date of December 8, 2025, the grant date would be December 15th, 2025.

The RSUs and PSUs will be issued as an “inducement grant” under the applicable rules of the Nasdaq Stock Market, and the Company will complete all required filings, including without limitation the timely filing of a Form S-8 on or before the date of the inducement grant. The specific terms and conditions for these LTI awards will be defined in applicable award agreements and plan documents.

The following is a summary of additional items included in this offer:

•You will be eligible to participate in the Sleep Number Executive Deferral Plan. This plan enables you to defer a portion of your salary, AIP payout, or PSU/RSU payouts at vesting. The plan provides flexibility on timing of when and how deferrals are paid out. You can allocate deferrals among a range of investment crediting options. Your first opportunity to participate in the plan will be for 2026 deferral elections (election to be made by 12/31/2025).

•You will be eligible for the following executive perquisites provided to members of the Executive Team: reimbursement for financial counseling expenses (including tax preparation and estate planning) up to $10,000 annually and an annual executive physical through Mayo Clinic’s Executive Health Program. Both of these perquisites are fully taxable, and you will be responsible for any tax obligations on the imputed income amounts.

•This position qualifies you for participation in the Executive Severance Pay Plan in accordance with its terms which may be modified at the sole discretion of Sleep Number Corporation, with or without notice. For the purpose of the Executive Severance Pay Plan, you will be eligible for benefits at the “Tier II” level, which applies to Executive Vice Presidents. Please see the enclosed Plan document for specifics. Additionally, Sleep Number will not amend or modify the Executive Severance Pay Plan as it relates to you in a manner that is detrimental to you for at least one year after your employment start date.

•We understand that you will move to Minneapolis, Minnesota as your principal residence. As such, Sleep Number shall pay a one-time Relocation Payment to cover expenses related to your relocation in the amount of $150,000. Sleep Number will also provide an additional amount based on a 40% tax rate to help cover taxes. This amount shall be paid in a lump sum no later than 30 days following the commencement of your move date. In the event that you voluntarily leave the Company without Good Reason (as that term is defined in the Sleep Number Corporation Executive Severance Pay Plan) during the first twenty four (24) months of employment (the “Exit Event”), you agree to re-pay Sleep Number the full amount of the Relocation Payment as follows: (i) if the Exit Event is prior to the first anniversary of your start date, you shall repay to the Company 50% of the Relocation Payment and (ii) if the Exit Event is on or after the first anniversary of your start date, but prior to the second anniversary of your Start Date, you shall repay to the Company 33% of the Relocation Payment.

•We acknowledge that you will retain your current public company board of directors seat.

•You will be eligible for a comprehensive and competitive benefits package as a team member. The following is a list of our benefit offerings, which are described in the attached new hire benefits guide. More specific information can be found in the plan documents and communications for each of these benefit programs.

◦Health, dental, vision, life and disability insurance

◦Flexible spending and health savings accounts

◦401(k) plan

◦Participation in our Flex Time Off (FTO) program

◦Participation in our Corporate Holiday program (includes 9 days)

◦Significant discount on our products including your gift of quality sleep (a free 360 p5 Smart Bed with the option to upgrade and individualize)

1001 3rd Ave South, Minneapolis, MN 55404 P 763.551.7000 F 763.694.3300 sleepnumber.com

Amy, the entire team is looking forward to building the future with you. We know you will make a significant contribution in achieving our vision to become one of the world’s most beloved brands by delivering unparalleled sleep experiences. We look forward to your formal acceptance of employment.

/s/ Linda Findley

Linda Findley

President & Chief Executive Officer

This offer is subject to full Board approval of your appointment which we will seek following your acceptance.

This offer is contingent on your successful completion of a background investigation and compliance with the Immigration Reform Control Act of 1986 (IRCA). Furthermore, this offer is conditional upon your signing our Employee Inventions, Confidentiality and Non-Compete Agreement and Code of Business Conduct. A copy of each is enclosed.

This offer will remain valid until Friday, November 21 unless we notify you otherwise. You should understand that this offer of employment does not constitute a contract of employment, nor is it to be construed as a guarantee of continuing employment for any period of time. Employment with Sleep Number is “at will.” We recognize your right to terminate the employment relationship at any time, and for any reason, and similarly, we reserve the right to alter, modify or terminate the relationship at any time and for any reason.

The purpose of this letter is solely to notify you of the proposed salary and grants described above. The definitive terms of the grant will be set forth in definitive agreements that will be provided to you through the Charles Schwab website. The terms set forth in such definitive agreements will supersede the terms set forth in this letter in all respects and such definitive agreements will be the final and conclusive terms of your grant. As with other forms of compensation, individual incentive awards should be kept confidential.

1001 3rd Ave South, Minneapolis, MN 55404 P 763.551.7000 F 763.694.3300 sleepnumber.com

EX-99.1

3

exhibit991newcfopressrelea.htm

EX-99.1

Document

Sleep Number Names Amy O’Keefe as CFO

O’Keefe Brings Proven Expertise in Driving Profitability and Cash Flow in Public

and Private Companies

Company Reaffirms Full Year 2025 Financial Guidance

MINNEAPOLIS, December 2, 2025 -- Sleep Number Corporation (Nasdaq: SNBR) today announces Amy O’Keefe as its Chief Financial Officer (CFO), effective December 8, 2025. Interim CFO Bob Ryder will remain with the company to ensure a smooth transition through December 12, 2025.

"Since joining Sleep Number, we’ve taken decisive action to stabilize the business and position it for sustainable growth. Our strategy is clear and centered on our strong brand, differentiated products, and simplified operating model to deliver value for shareholders, customers, and team members. We believe that Amy’s experience in driving profitability and operational excellence will be valuable to us as we move the business forward,” said Linda Findley, Sleep Number’s President and CEO. “On behalf of the Board and our team members, I would like to thank Bob for his contributions to Sleep Number and for stepping in as interim CFO. We wish him continued success in his future endeavors.”

O’Keefe brings over 30 years of experience in leading operational, strategic, and financial transformations across public and private companies in the consumer products, technology, and wellness sectors. She is widely recognized for partnering with CEOs, boards, and executive teams to create shareholder value, accelerate operational performance improvement, and build high-impact, high-integrity finance organizations.

“I am excited to join Sleep Number at such a pivotal time in its turnaround. With science-based sleep technology, highly differentiated products and broad brand recognition, Sleep Number has exceptional assets upon which to build,” said O’Keefe. “I look forward to partnering with Linda and the entire team to advance the significant work already done, strengthen the financial foundation and position the company for sustainable, profitable growth.”

Most recently, O’Keefe served as Chief Financial and Administrative Officer of Avaya, where she played a key leadership role in its operational, strategic, and financial transformation, driving significantly improved free cash flow. Prior to Avaya, O’Keefe spent nearly half of her career at The Black & Decker Corporation and subsequently served as Chief Financial Officer for multiple public and private companies, including Weight Watchers International, Drive DeVilbiss Healthcare, Savant Systems, and D&M Holdings. She also serves on the Board of Directors of TruBridge, Inc., where she is the Compensation Committee Chair and serves on the Audit Committee.

Reiteration of Guidance and Turnaround Strategy

Sleep Number is reaffirming its full year 2025 financial guidance and expectations for net sales, adjusted EBITDA, year-end profitability exit rate, and compliance with its revised loan covenants, including in the fourth quarter of 2025. The company continues to perform within expectations at this stage in its turnaround.

The company also released an updated investor presentation, ahead of its upcoming participation in investor conferences. The presentation provides a comprehensive overview of its strategic transformation, operational progress, and financial outlook.

The updated investor presentation outlines a focused, company-wide turnaround strategy designed to reposition the brand, expand customer reach, and reignite growth. It highlights actions taken since April 2025 under new leadership, including significant cost reductions, operational streamlining, and an amended and extended credit agreement that provides financial flexibility to execute the plan.

The full presentation is available on Sleep Number’s Investor Relations website ir.sleepnumber.com under the “Events & Presentations” section.

About Sleep Number Corporation

Sleep Number is a sleep wellness company. We are guided by our purpose to improve lives by personalizing sleep; to date, our innovations have improved 16 million lives. Our sleep wellness platform helps solve sleep problems, whether it’s providing individualized temperature control for each sleeper through our Climate360® smart bed or applying our 36 billion hours of longitudinal sleep data and expertise to research with global institutions. Our smart bed ecosystem drives best-in-class engagement through dynamic, adjustable, and effortless sleep with personalized sleep and health insights; our millions of Smart Sleepers are loyal brand advocates. And our 3,200 mission-driven team members passionately innovate to drive value creation through our vertically integrated business model, including our exclusive direct-to-consumer selling in 611 stores and online.

To learn more about life-changing, individualized sleep, visit a Sleep Number® store near you, our investor relations site, or SleepNumber.com.

Forward-looking Statements

Statements used in this news release relating to future plans, events, or performance, such as the statement that: the company has taken decisive action to stabilize the business and position it for sustainable growth; it believes that the new CFO’s experience in driving profitability and operational excellence will be valuable to the company as it moves the business forward; its reaffirmation of its full year 2025 financial guidance and expectations for net sales, adjusted EBITDA, year-end profitability exit rate, and compliance with revised loan covenants, including in the fourth quarter of 2025, as the company continues to perform within expectations at this stage in its turnaround are forward-looking statements subject to certain risks and uncertainties which could cause the company’s results to differ materially. The most important risks and uncertainties are described in the company’s filings with the Securities and Exchange Commission, including in Item 1A of its Annual Report on Form 10-K. Forward-looking statements speak only as of the date made, and the company has no obligation to update such statements.

Investor Contact

investorrelations@sleepnumber.com

Media Contact

Muriel Lussier, Sleep Number Communications

muriel.lussier@sleepnumber.com

EX-99.2

4

exhibit992investorrelati.htm

EX-99.2

exhibit992investorrelati

INVESTOR PRESENTATION Nasdaq: SNBR December 2025

This investor presentation contains statements regarding the company’s expectations, future plans, events, financial results or performance, such as the following statements that are forward-looking statements subject to certain risks and uncertainties which could cause the company’s results to differ materially: the company has initiated a comprehensive financial and operational transformation, setting a clear vision for growth, new opportunities, and lasting shareholder value; the company’s gross margin profile and reduced fixed cost structure is anticipated to result in strong free cash flow as growth returns; the company expects to generate positive free cash flow in 2026 and beyond, creating the opportunity to de-lever the balance sheet; the recently amended and extended credit agreement provides the company with the financial flexibility to execute the business turnaround; with expected improvements in financial results from the turnar ound, the company is positioned to restructure the balance sheet with longer-duration debt to drive long-term shareholder value creation; the company’s simpler and differentiated product offering in 2026 will improve shop-ability, conversion, margins, and efficiency; and the company has certain expectations for full year 2025 adjusted EBITDA and 2025 exit rate of profitability. The most important risks and uncertainties are described in the Company’s filings with the Securities and Exchange Commission, including in Item 1A of the Company’s Annual Report on Form 10-K and other periodic reports. Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update any forward-looking statement. USE OF NON-GAAP FINANCIAL MEASURES INFORMATION The company defines earnings before interest, taxes, depreciation and amortization (adjusted EBITDA) as net income (loss) plus: income tax expense (benefit), interest expense, depreciation and amortization, stock-based compensation, restructuring costs, other non-recurring items, and asset impairments. Management believes adjusted EBITDA is a useful indicator of the company’s financial performance and its ability to generate cash from operating activities. The company's definition of adjusted EBITDA may not be comparable to similarly titled definitions used by other companies. FORWARD LOOKING STATEMENTS 2

3 WHY NOW, WHY SLEEP NUMBER | The company has initiated a comprehensive financial and operational transformation, setting a clear vision for growth, new opportunities, and lasting shareholder value EXPECTED RETURNS AND TIMELINE UNIQUE POSITION ADVANTAGE CLEAR VALUE CREATION PATHWAY SHAREHOLDER VALUE PROPOSITION • New CEO and management team in place in Q2 2025 immediately began activating a turnaround plan focused on the consumer • Modernized marketing engine is already driving efficiency • Revised loan covenants and maturity extension create space to invest in marketing and product • A simpler and differentiated product offering in 2026 will improve shop-ability, conversion, margins, and efficiency • Building on HSN activation, additional distribution pilots to be executed in 2026 • Sleep is recognized as a key element of overall individual health • Strong brand awareness and reputation • Highly differentiated product that offers the most personalized mattress on the market • 900+ patents and patents pending creates product innovation moat • Established fleet of 600+ high-quality retail stores • New leadership with deep experience in consumer products and marketing • Clear focus on the consumer through a simple turnaround strategy – Sleep Number Shifts: • Product – simplifying the offering with a focus on consumer benefits • Marketing – modernization of tactics and focus on funnel optimization and ROI • Distribution – opportunity to expand distribution into both physical and digital channels • Underpinned by significant reductions to the fixed cost structure and financing secured to support the turnaround • Gross margin profile and reduced fixed cost structure is anticipated to result in strong free cash flow as growth returns • Expect to generate positive free cash flow in 2026 and beyond, creating the opportunity to de-lever the balance sheet • With expected improvements in financial results from the turnaround, the company is positioned to restructure the balance sheet with longer-duration debt to drive long-term shareholder value creation

Leading with Speed and a Clear Vision Sleep Number is in a turnaround. Since I joined in April 2025, every part of the business has been impacted by change. We: • Created a more streamlined operation to ensure quicker decision making, • Reduced costs across the business by more than $135M as compared to 2024, excluding restructuring and other non-recurring costs, and • Executed an amendment and extension of our bank agreement through the end of 2027. We are now in a position where we can implement our strategy to further shareholder, consumer, and team member value. We call it Sleep Number Shifts – a focused, company-wide effort to reposition our brand, expand our reach to new customer groups, and reignite growth. We still have a lot of work ahead of us, and I am optimistic about Sleep Number. This is a powerful brand, with a highly differentiated product. We have more than 3,200 dedicated team members with a renewed passion for fast action and a commitment to our purpose of improving lives by personalizing sleep. I believe that our leaner cost structure will stabilize the business and our 2026 plans are achievable. We appreciate your support and will keep you updated as we move forward. Linda Findley, President and CEO, Sleep Number December 2025

5 Stabilizing the foundation and positioning for growth Immediate Actions Taken Since April 2025 • Streamlined organization for faster decision-making across all business units • Achieved >$135M in cost savings in 2025 vs. 2024 (excluding restructuring and non-recurring costs), with more to come • Successfully amended and extended bank agreement through 2027 • ~3,200 team members with renewed focus on execution speed Strategic Framework Established: "Sleep Number Shifts" • Company-wide effort to strengthen market position • Targeting new customer segments to broaden reach • Focused initiatives to reignite revenue growth Set a Path Forward • Build back to profitable growth leveraging brand strength and differentiated technology • Cash generation focus to reduce debt and strengthen balance sheet • Value creation for shareholders, customers, and team members

1. Trailing-twelve months Total Retail comparable sales per store open at least one year as of September 27, 2025. See Appendix for reconciliations. 2. Enterprise value as of September 27, 2025. 3. Trailing-twelve months as of September 27, 2025. See Appendix for reconciliations. 4. Leverage ratio as of September 27, 2025, under revolving credit facility calculated as total debt including operating lease l iabilities / consolidated EBITDAR. Covenant maximum of 5.25x. COMPANY AT-A-GLANCE | A sleep wellness company and market leader in design, manufacturing, marketing and distribution of innovative sleep solutions • The leader in premium personalized sleep through the design, engineering, manufacturing, distribution and marketing of innovative sleep solutions • Our beds integrate physical and digital innovations for unparalleled comfort; they automatically respond to the needs of each sleeper with ideal firmness, position and temperature benefits • Our beds with integrated biosignal technology collect billions of data points nightly from millions of sleepers, generating comprehensive longitudinal data • Our products are awarded the industry's top recognitions, including ranked #1 in customer satisfaction for mattresses purchased in-store and online, including #1 in comfort, by J.D. Power and one of TIME's Best Inventions of 2025 • By leveraging our data and engagement tools, we deliver personalized digital sleep and health insights to sleepers, driving greater loyalty, repeat purchases, and referrals • We have developed an industry-leading IP portfolio supported by 900+ patents and patents pending worldwide • Our ~3,200 mission-driven team members seamlessly integrate our digital and physical experiences to achieve a value-added retail experience through our experiential stores, online, phone and chat channels 6 $1.2 $1.2 $1.3 $1.4 $1.5 $1.7 $1.9 $2.2 $2.1 $1.9 $1.7 $1.4 ’14 ’15 ’16 ’17 ’18 ’19 ’20 ’21 ’22 ’23 ’24 3Q ’25 LTM 611 Stores $1.4B Net Sales3 900+ Patent Assets 2.3M Average Sales per Store1 $85M Adjusted EBITDA3 3.1M Smart Sleepers $743M Enterprise Value2 5.0x Net Leverage Ratio Under RCF4 16M+ Improved Lives by Higher Quality Sleep Net Sales ($B) $148 $133 $146 $169 $166 $190 $268 $277 $148 $127 $120 $85 ’14 ’15 ’16 ’17 ’18 ’19 ’20 ’21 ’22 ’23 ’24 3Q ’25 LTM Adjusted EBITDA1 ($M)

7 sleep number shifts OUR TURNAROUND STRATEGY | Sleep Number Shifts, a focused, company-wide effort REPOSITION OUR BRAND By highlighting our core value proposition: helping people get a great night of sleep, tonight EXPAND CUSTOMER REACH By offering what they want most: comfort, value and durability REIGNITE GROWTH By ensuring we have the right infrastructure to deliver on our priorities

8 SLEEP NUMBER SHIFTS | Driving growth through strategic transformation: our three-pillar approach While we continue to see benefits in our vertically integrated model, we believe there are opportunities to expand distribution into new channels, both physical and digital DISTRIBUTION 3 We are reshaping our marketing and creative to better connect with today’s consumer and drive engagement with a focus on better ROI MARKETING 2 We are simplifying our offering with the goal of growing our new customer base while building on the demand from our repeat customers PRODUCT 1 THREE FOCUSED INITIATIVES THAT WILL TRANSFORM SLEEP NUMBER Shift from a traditional retailer into a customer-centric sleep wellness company, positioned for sustainable growth through simplified offerings, smarter marketing, and expanded reach

PRODUCTS | Simplifying our product line to meet the needs of a new customer segment 9 • Starting in 2026, we will adapt our offerings to deliver what consumers want most – comfort, value and durability • Leveraging extensive IP and staying true to core differentiators, while building value for those new to the brand • Moving quickly to take advantage of improved supply chain efficiency and simplified service, all at a long-term attractive margin across the portfolio Product Commitments Portfolio Simplification • Sharpen differentiation and reduce bed SKUs • Enhance marketing to deliver on value proposition • Offer market-leading smart technology and temperature solutions that solve most pressing sleep needs, encouraging consumer step up Simplify product portfolio to deliver superior value Improve Gross Margin • Improve net product margins through smarter design, sourcing and promotional discipline • Renew focus on manufacturability and serviceability, reducing supply chain and service complexity Optimize for improved operational efficiency and margin uplift Elevate Core Differentiation Retain leadership and differentiation through customer-centered sleep innovation • Get credit for core differentiator of personalized comfort adjustability (air technology) • Leverage digital assets and health expertise to deliver stronger customer value across price points • Target messaging and innovation around improving health through better sleep

MARKETING | Enhanced full funnel strategy to drive cost effective growth 10 • Build on top of strong brand relevance to attract consumers from a larger addressable market • Exploiting on the correlation between marketing and consumer demand, deliver improvements in marketing effectiveness and return on investment at greater scale • In parallel, evolving all aspects of marketing and creative work, including deploying a brand refresh focused on target segments Marketing Commitments Reset Brand Positioning • Sharpen our positioning and messaging with a focus on key benefits and value to target new consumers • Elevate look and feel to drive relevance with key target audiences Reposition the brand to clearly tell the product benefit story Customer Engagement • Increase positive brand mentions through strategic communications tactics • Reimagine customer interactions with a focus on their priorities to deliver a strong end-to-end experience Drive customer advocacy by delivering a quality, seamless and personalized experience across all interactions Optimize Funnel Performance Retain leadership and differentiation through customer-centered sleep innovation • Drive efficiency in marketing spend by focusing the next dollar on the highest ROI placements that drive cost effective growth • Continue to improve Cost Per Acquisition by ensuring effectiveness of each funnel stage • Enhance lead quality through close collaboration between sales and marketing

DISTRIBUTION | Optimize and expand our addressable market 11 • Optimizing store footprint and leaning into digital to meet customers where they are, while exploring selective partnerships and new routes to market • Simplifying the shopping experience in our retail stores and our website to better matches our customers' needs and price points Distribution Commitments New Distribution Channels • Expand presence on leading and relevant platforms to capture online demand • Introduce pop-up and showroom concepts in high- density urban areas • Enhance website, mobile, and social commerce capabilities to digitally engage consumers Meet consumers where they shop Partnership Expansions • Collaborate with complementary wellness and home brands to create bundled offerings and cross-promotions • Engage influencers and affiliate networks to amplify brand awareness • Utilize co-marketing campaigns to tap into new customer segments and drive incremental sales Leverage consumer points of engagement across expanded set of relevant brands Store Optimization Based in economics and consumer shopping behaviors • Consolidate underperforming locations to improve profitability and align with high-traffic markets • Leverage data analytics to identify optimal store size, layouts, and locations for better customer engagement • Integrate digital tools in-store to enhance personalization and reduce operational costs • Focus on experiential retail to differentiate from competitors and drive conversion

12 LEADERSHIP AND CAPABILITIES | Experienced and driven team leading the transformation All members of the executive leadership team report into new President and CEO Linda Findley. We streamlined our leadership and their teams into an agile, cross-functional team by consolidating roles across key functions to enhance operational efficiency, enhance accountability and drive transformation LINDA FINDLEY President, Chief Executive Officer Experience (24+ years) Led consumer brands, operations management, organizational transformation, marketing strategy, and global expansion with top roles at Blue Apron, Etsy, Evernote, and Alibaba Ralph Lauren and HeliosX Board Member AMY O’KEEFE Executive Vice President, Chief Financial Officer Experience (30+ years) Extensive experience as a public-company CFO leading transformations in consumer products, technology, and wellness sectors at Avaya, The Black & Decker Corporation, Weight Watchers, Drive DeVilbiss Healthcare TruBridge Board Member CHRISTOPHER KRUSMARK Executive Vice President, Chief Retail and People Officer Experience (19+ years) Oversees retail and people operations, building on prior leadership in human resources, finance, and sales operations, and experience as a CPA with EY and Arthur Andersen Hired Board Member AMBER MINSON Executive Vice President, Chief Marketing Officer Experience (28+ years) Specialized experience in building and scaling high performance marketing organizations at Casper, Blue Apron, Intuit, Alibaba, HSN, and Comcast NBCUniversal MELISSA BARRA Executive Vice President, Chief Product and Enterprise Strategy Officer Experience (19+ years) Brings senior leadership experience in finance, strategy, and corporate development from Best Buy, Grupo Futuro, Citibank, and GE Capital Blue Cross Blue Shield and Pentair Board Member SAM HELLFELD Executive Vice President, Chief Legal and Risk Officer and Secretary Experience (21+ years) Heads legal and risk management teams, with a foundation in corporate governance, IP, and litigation as a partner at national law firms and federal court clerkships TANYA SKOGERBOE Senior Vice President, Chief Supply Chain and Transformation Officer Experience (15+ years) Oversees supply chain operations and held positions in services and strategy, customer experience and commercial channel operations MAKERS and Think Small Board Member

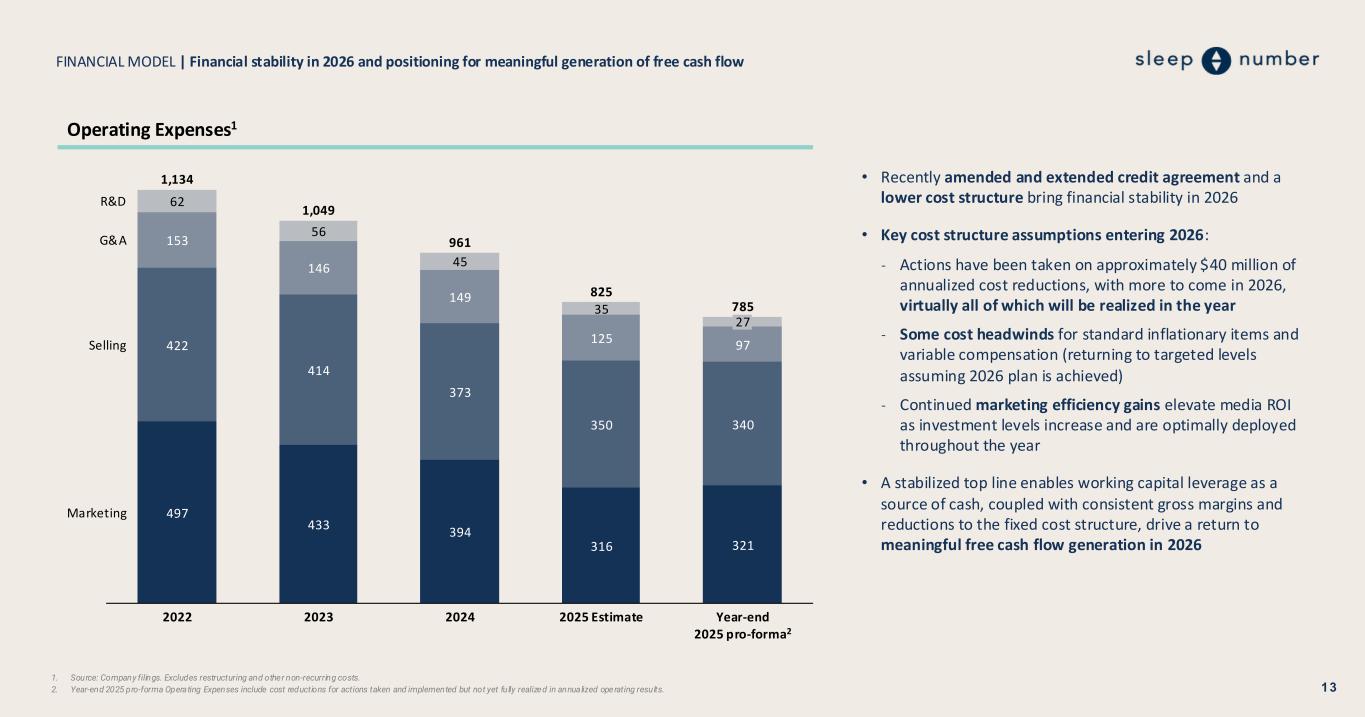

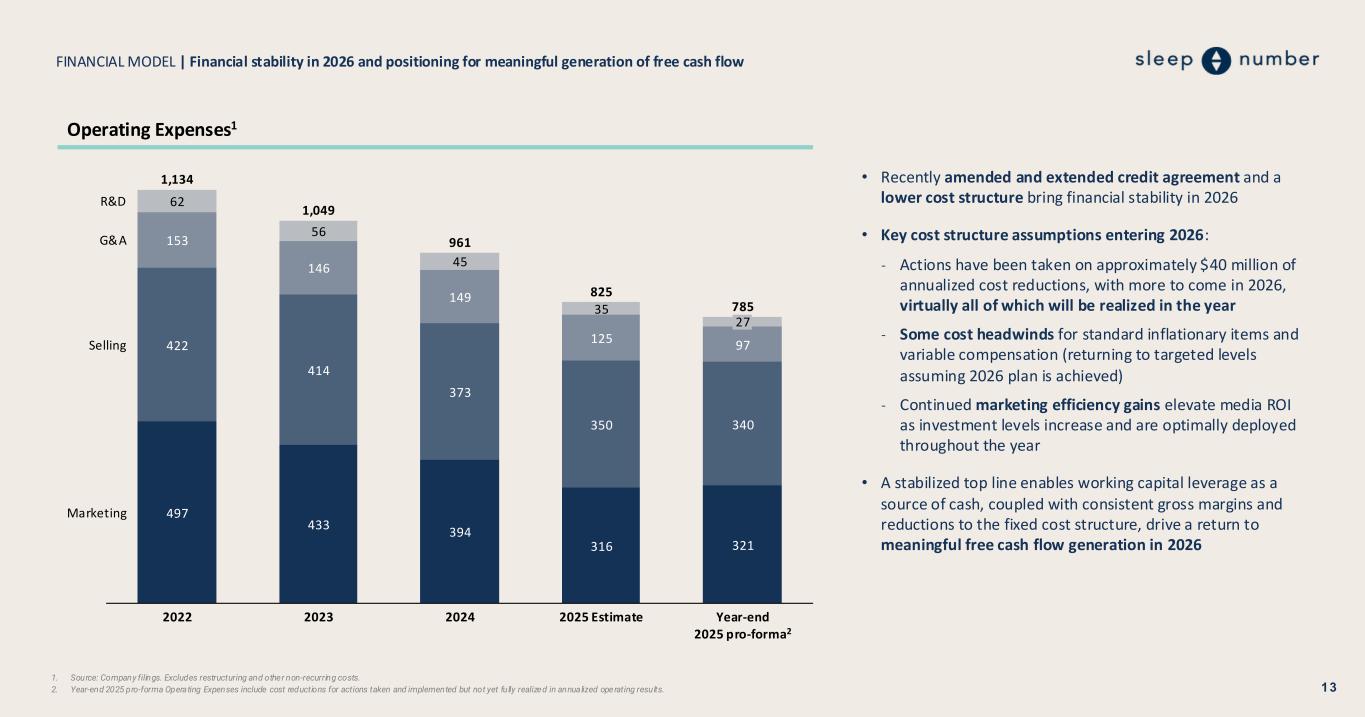

FINANCIAL MODEL | Financial stability in 2026 and positioning for meaningful generation of free cash flow 1. Source: Company filings. Excludes restructuring and other non-recurring costs. 2. Year-end 2025 pro-forma Operating Expenses include cost reductions for actions taken and implemented but not yet fully realized in annualized operating results. 13 • Recently amended and extended credit agreement and a lower cost structure bring financial stability in 2026 • Key cost structure assumptions entering 2026: ˗ Actions have been taken on approximately $40 million of annualized cost reductions, with more to come in 2026, virtually all of which will be realized in the year ˗ Some cost headwinds for standard inflationary items and variable compensation (returning to targeted levels assuming 2026 plan is achieved) ˗ Continued marketing efficiency gains elevate media ROI as investment levels increase and are optimally deployed throughout the year • A stabilized top line enables working capital leverage as a source of cash, coupled with consistent gross margins and reductions to the fixed cost structure, drive a return to meaningful free cash flow generation in 2026 497 433 394 316 321 422 414 373 350 340 153 146 149 125 97 62 56 45 35 2022 2023 2024 2025 Estimate Year-end 2025 pro-forma2 R&D G&A Selling Marketing 1,134 1,049 961 825 785 27 Operating Expenses1

FINANCIAL MODEL | Return to growth and a lower fixed cost structure leads to expanding Adjusted EBITDA Margin1 12.8% 11.0% 11.1% 11.7% 10.8% 11.2% 14.4% 12.7% 7.0% 6.7% 7.1% 5.0% 7.9% ’14 ’15 ’16 ’17 ’18 ’19 ’20 ’21 ’22 ’23 ’24 ’25 E ’25 Pro- Forma Adjusted EBITDA Margin1 1. Source: Company filings. See Appendix for reconciliations. 2. 2025 pro-forma adjusted EBITDA margin includes pro-forma cost reductions for actions taken and implemented but not yet fully realized in annualized operating results. 14 Pre-Pandemic Industry Contraction Earning potential • Strong brand awareness and a highly differentiated product are supported by a transformed business model, amplifying the company’s earning potential • Lower fixed cost structure: ˗ Lower corporate overhead across all functions ˗ Fewer retail locations ˗ Fewer assembly and distribution centers, consolidated manufacturing footprint • Strong gross profit margin profile • Improved marketing efficiency 2

Why Now, Why Sleep Number Our leaner cost structure and gross margin profile is expected to create stabilization, regardless of industry trends Unique Position Advantage • Strong and recognizable brand • Unique and innovative product Clear Value Creation Pathway • New leadership team driving the business turnaround • Clear focus on the consumer: product, marketing, and distribution Shareholder Value Creation • Gross margin profile and reduced fixed cost structure leads to strong cash flow generation with growth • New marketing efficiencies will produce return on growth at stable spend • Free cash flow used to reduce balance sheet leverage Expected Returns and Timeline • Modernization of marketing is underway, supported by stabilized investments in demand generation • Simpler and differentiated product offering launching in 2026, supported by expanded distribution

FINANCIALS | Reconciliation of Adjusted EBITDA 16

FINANCIALS | Reconciliation of Free Cash Flow 17

18 For more information, visit ir.sleepnumber.com