Document

Investor Relations: Sam Ramraj, (626) 302-2540

Media Relations: (626) 302-2255

News@sce.com

Edison International Reports First-Quarter 2025 Results

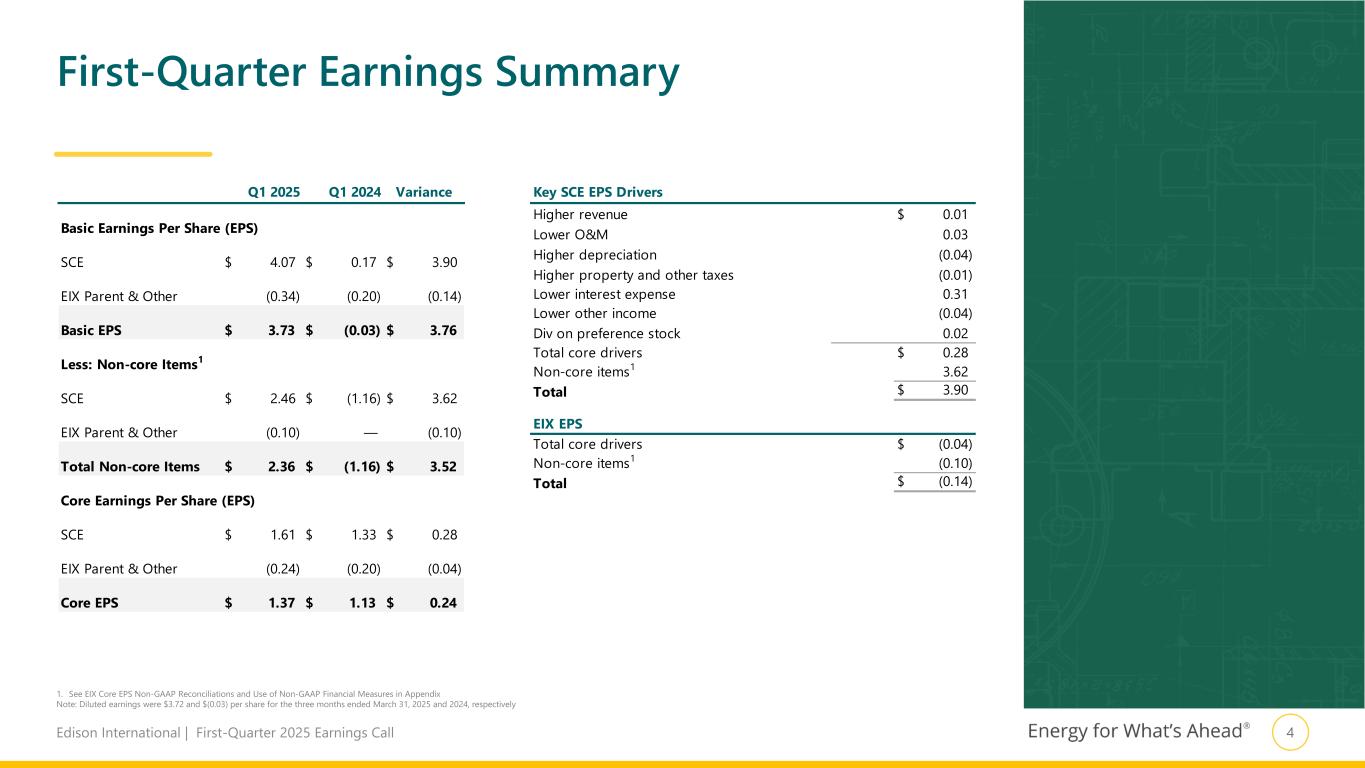

•First-quarter 2025 GAAP EPS of $3.73; Core EPS of $1.37

•Eaton Fire investigation continues; working closely with state and county leaders and communities to rebuild wildfire-impacted areas stronger

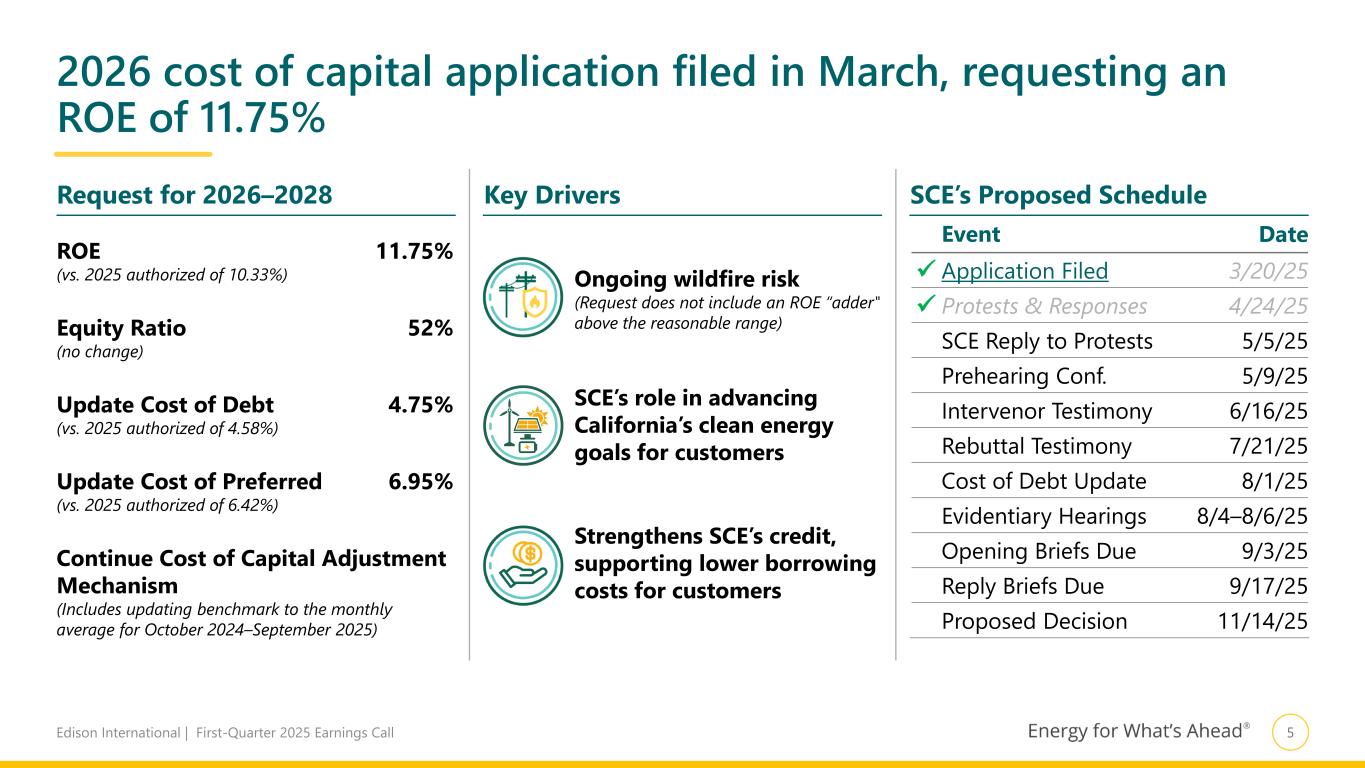

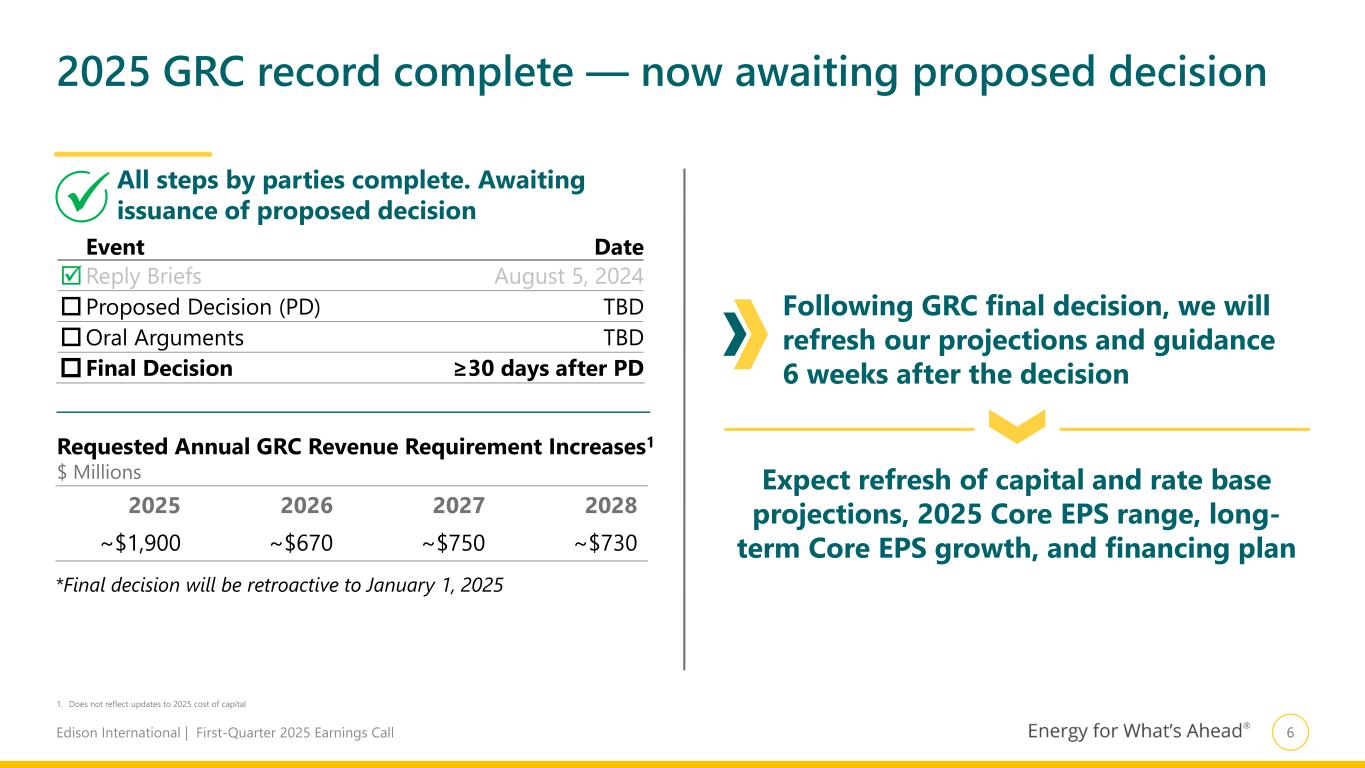

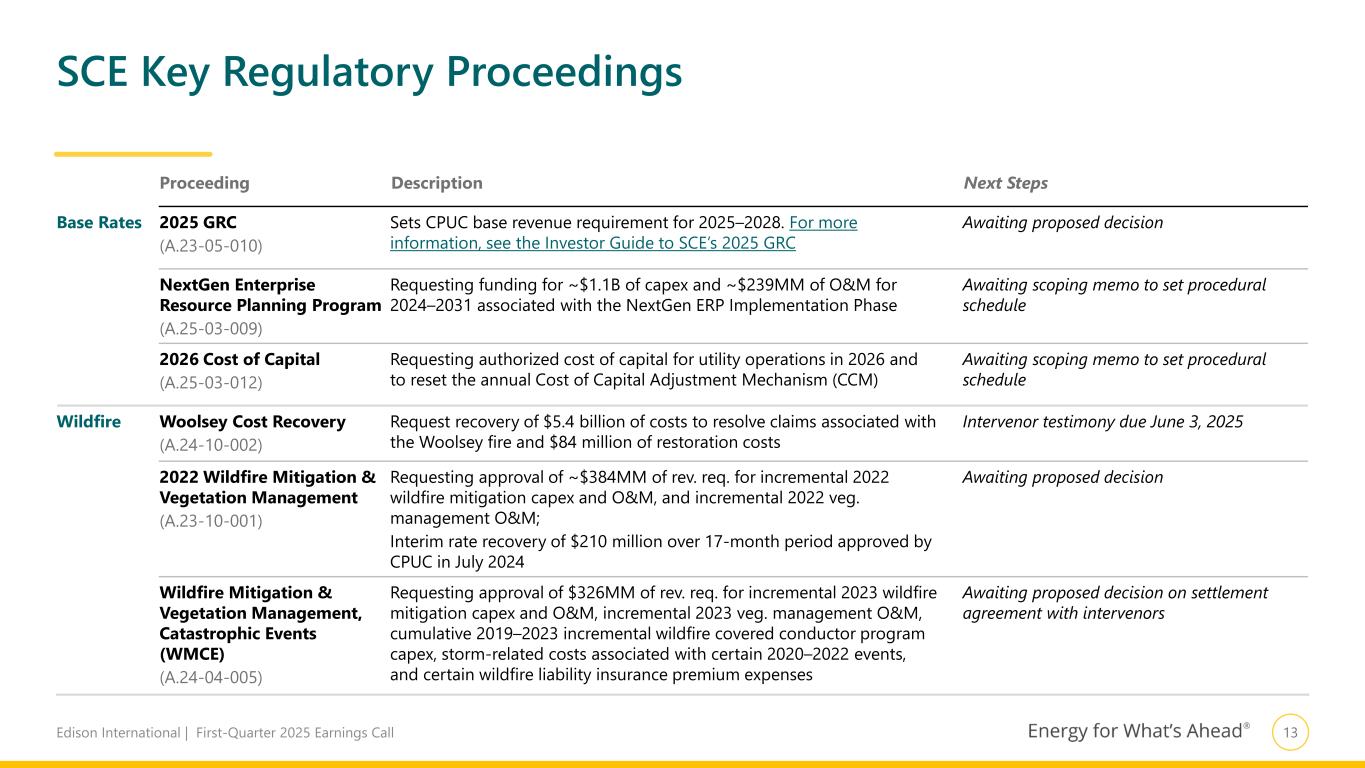

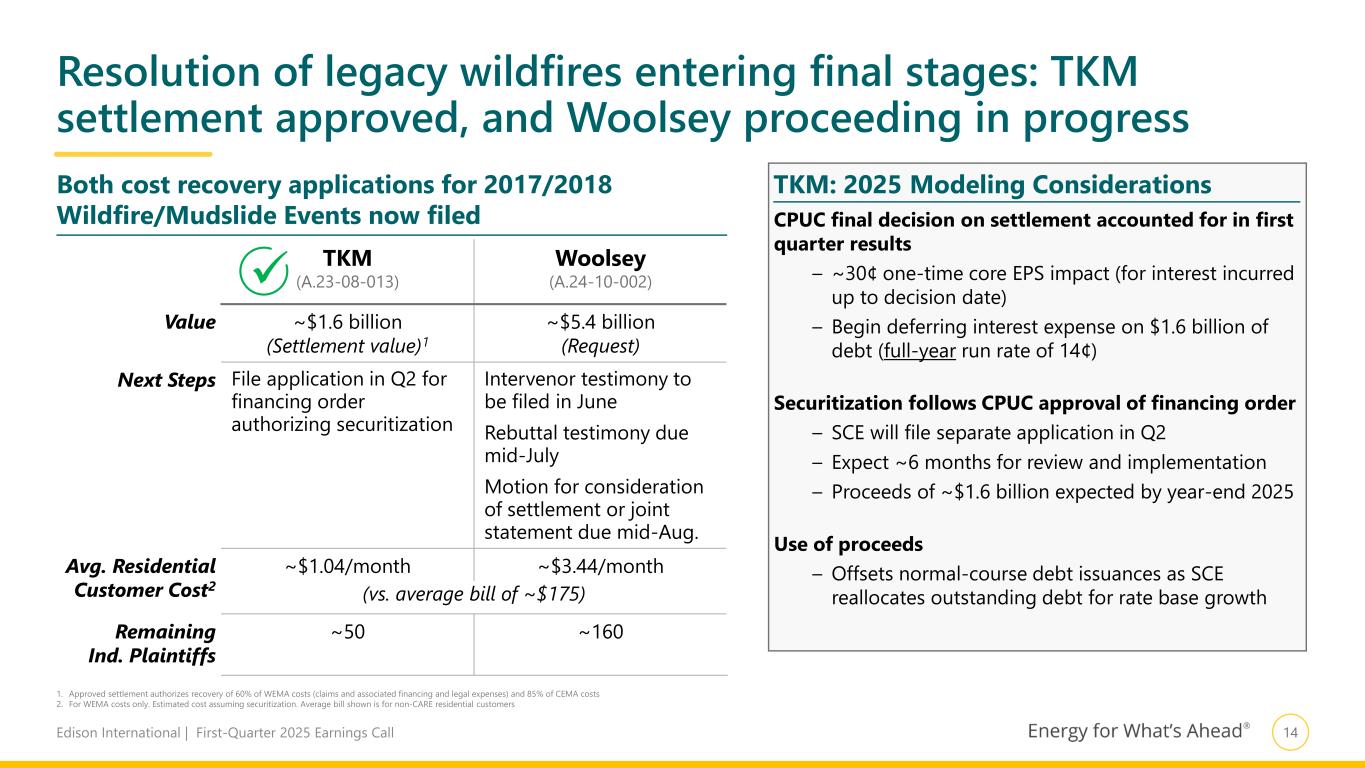

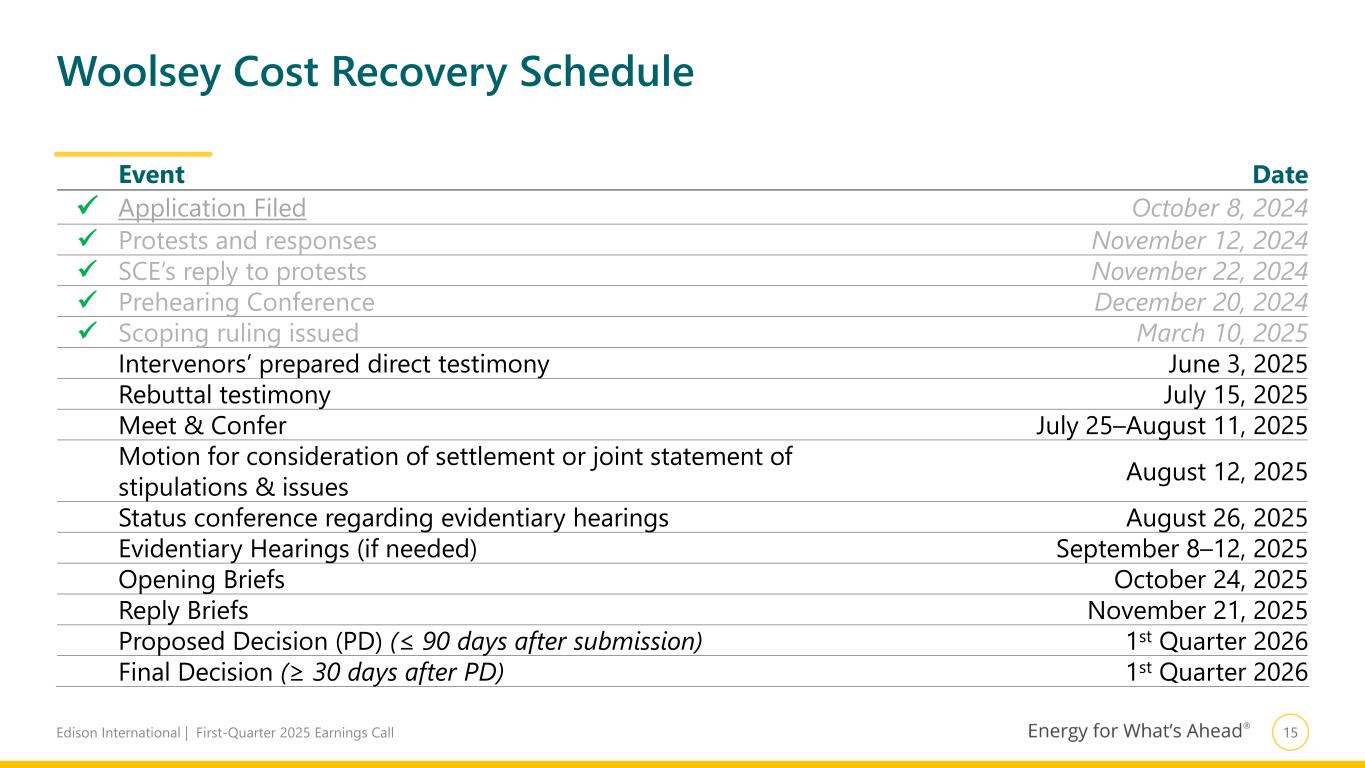

•Strong regulatory progress: TKM settlement approved; filed 2026 Cost of Capital and NextGen ERP applications; reached settlement in WMCE proceeding

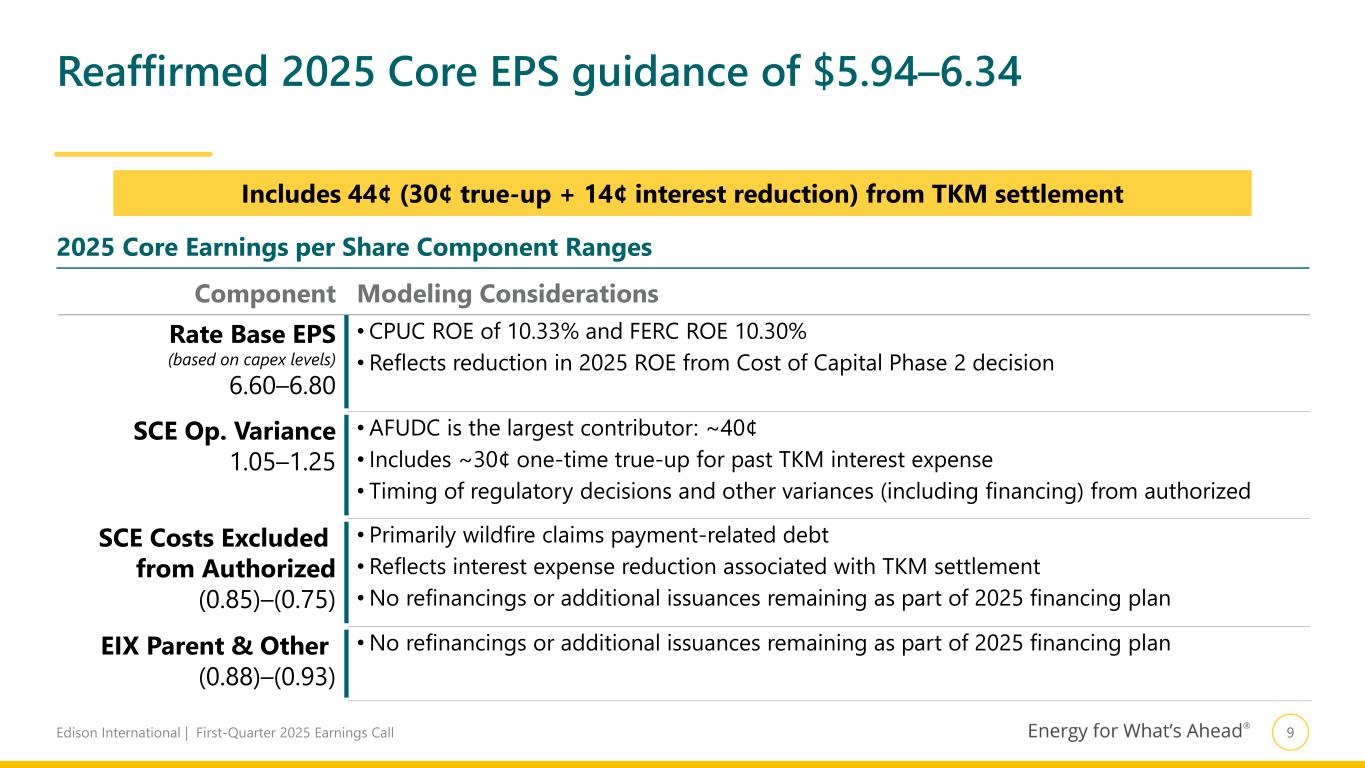

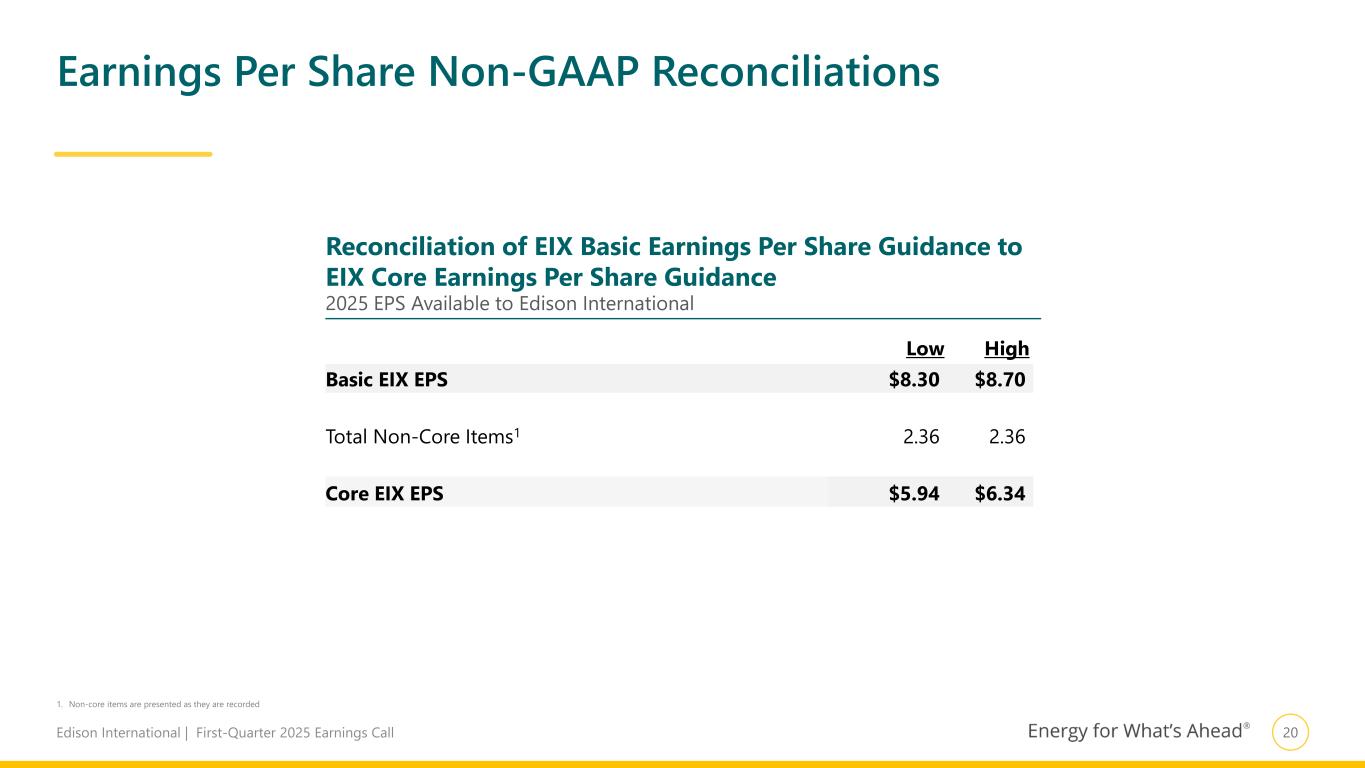

•Affirmed 2025 Core EPS guidance of $5.94-$6.34

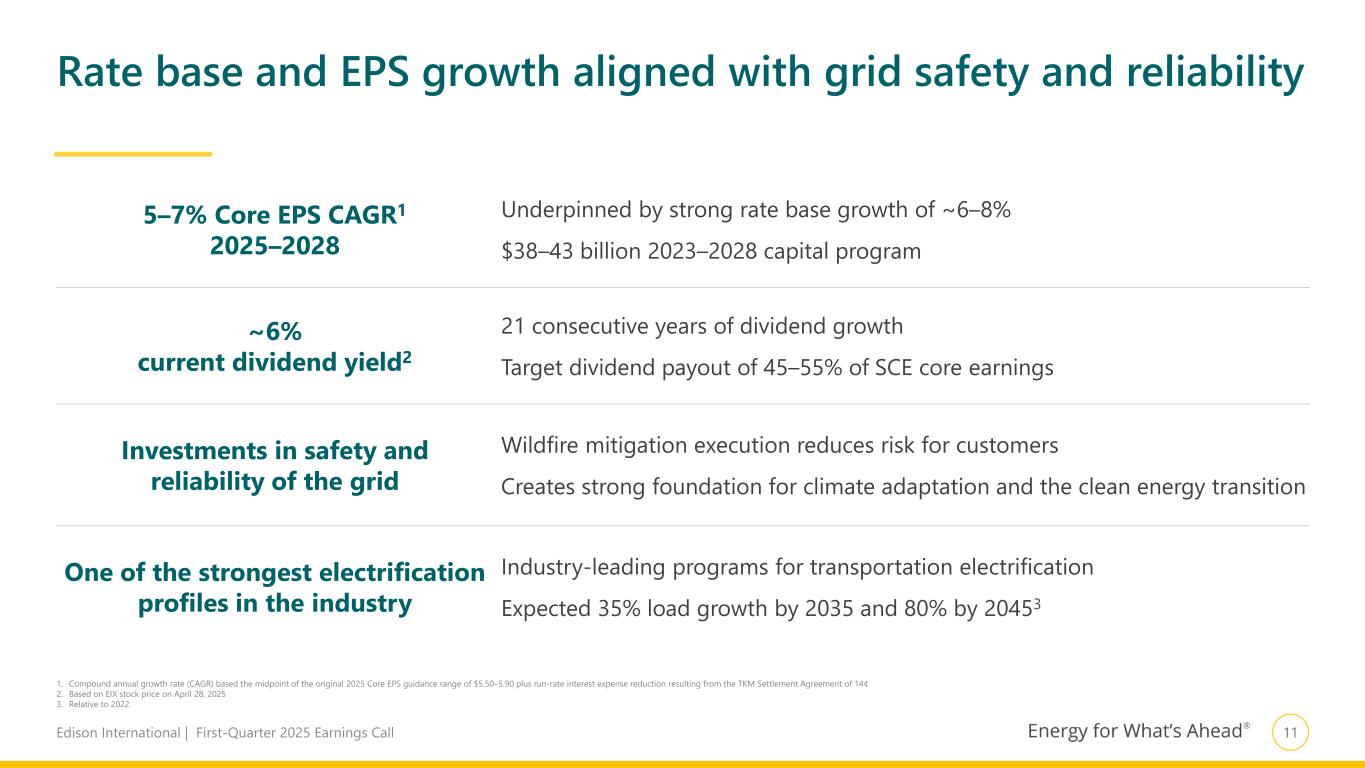

•Continued confidence in delivering 5-7% Core EPS growth from 2025 to 2028 ($6.74-$7.14)

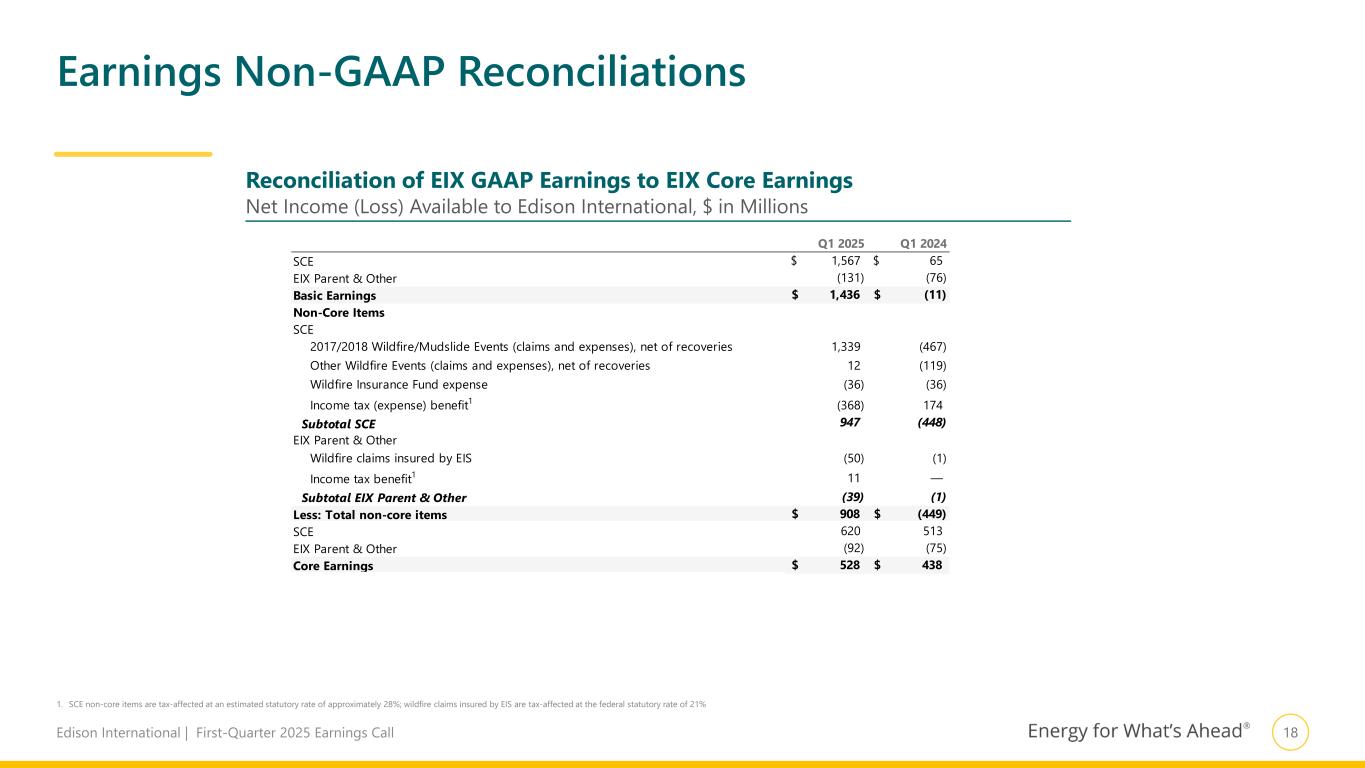

ROSEMEAD, Calif., April 29, 2025 — Edison International (NYSE: EIX) today reported first-quarter net income of $1,436 million, or $3.73 per share, compared to a net loss of $11 million, or $0.03 per share, in the first quarter of last year. As adjusted, first-quarter core earnings were $528 million, or $1.37 per share, compared to core earnings of $438 million, or $1.13 per share, in the first quarter of last year.

Southern California Edison’s first-quarter 2025 core earnings per share (EPS) increased year over year, primarily due to a benefit to interest expense related to cost recoveries authorized under the TKM Settlement Agreement.

Edison International Parent and Other’s first-quarter 2025 core loss per share increased year over year, primarily due to higher interest expense.

"We have continued engaging with key stakeholders to find solutions to support the safety of the community and enhance California’s industry-leading AB 1054 regulatory framework,” said Pedro J. Pizarro, president and CEO of Edison International. “The conversations we’ve had make us confident that stakeholders understand the criticality of addressing the issue and the important role the investor-owned utilities play in supporting California’s growth and economic development.”

Pizarro added, “We are working closely with state and county leaders and the communities of Altadena and Malibu to rebuild wildfire-impacted areas stronger than ever. Once constructed, SCE’s grid hardening in these areas will increase reliability and reduce the exposure of electrical distribution infrastructure to high wind and other extreme weather events, helping us better protect and serve our communities.”

Edison International uses core earnings internally for financial planning and analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International’s earnings results to facilitate comparisons of the company’s performance from period to period. Please see the attached tables to reconcile core earnings to basic GAAP earnings.

2025 Earnings Guidance

The company affirmed it's earnings guidance range for 2025 as summarized in the following chart. See the presentation accompanying the company’s conference call for further information and assumptions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 Earnings Guidance

as of Feb. 27, 2025

|

2025 Earnings Guidance

as of April 29, 2025

|

|

|

|

Low |

High |

Low |

High |

|

|

EIX Basic EPS |

$ |

5.94 |

|

$ |

6.34 |

|

$ |

8.30 |

|

$ |

8.70 |

|

|

|

Less: Non-Core Items |

— |

|

— |

|

2.36 |

|

2.36 |

|

|

|

EIX Core EPS |

$ |

5.94 |

|

$ |

6.34 |

|

$ |

5.94 |

|

$ |

6.34 |

|

|

*There were $908 million, or $2.36 per share, of non-core items recorded for the three months ended March 31, 2025. Basic EPS guidance only incorporates non-core items to March 31, 2025.

First-Quarter 2025 Earnings Conference Call and Webcast Details

|

|

|

|

|

|

When: |

Tuesday, April 29, 1:30-2:30 p.m. (PDT) |

| Telephone Numbers: |

1-888-673-9780 (U.S.) and 1-312-470-0178 (Int'l) — Passcode: Edison |

| Telephone Replay: |

1-800-685-6667 (U.S.) and 1-203-369-3864 (Int’l) — Passcode: 5794 |

|

Telephone replay available through May 13 at 6 p.m. (PDT) |

Webcast |

www.edisoninvestor.com |

Edison International has posted its earnings conference call prepared remarks by the CEO and CFO, the teleconference presentation, and Form 10-Q to the company’s investor relations website. These materials are available at www.edisoninvestor.com.

About Edison International

Edison International (NYSE: EIX) is one of the nation’s largest electric utility holding companies, focused on providing clean and reliable energy and energy services through its independent companies. Headquartered in Rosemead, California, Edison International is the parent company of Southern California Edison Company, a utility delivering electricity to 15 million people across Southern, Central and Coastal California. Edison International is also the parent company of Trio (formerly Edison Energy), a portfolio of nonregulated competitive businesses providing integrated sustainability and energy advisory services to large commercial, industrial and institutional organizations in North America and Europe.

Appendix

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and core earnings per share (EPS) internally for financial planning and for analysis of performance of Edison International and Southern California Edison. We also use core earnings and core EPS when communicating with analysts and investors regarding our earnings results to facilitate comparisons of the Company’s performance from period to period. Financial measures referred to as net income, basic EPS, core earnings, or core EPS also apply to the description of earnings or earnings per share.

Core earnings and core EPS are non-GAAP financial measures and may not be comparable to those of other companies. Core earnings and core EPS are defined as basic earnings and basic EPS excluding income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings. Basic earnings and losses refer to net income or losses attributable to Edison International shareholders. Core earnings are reconciled to basic earnings in the attached tables. The impact of participating securities (vested awards that earn dividend equivalents that may participate in undistributed earnings with common stock) for the principal operating subsidiary is not material to the principal operating subsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which is included in Edison International Parent and Other.

Safe Harbor Statement

Statements contained in this release about future performance, including, without limitation, operating results, capital expenditures, rate base growth, dividend policy, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this release, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results include, but are not limited to the:

•ability of SCE to recover its costs through regulated rates, timely or at all, including uninsured wildfire-related and debris flow-related costs (including amounts paid for self-insured retention and co-insurance, and amounts not recoverable from the Wildfire Insurance Fund), and costs incurred for wildfire restoration efforts and to mitigate the risk of utility equipment causing future wildfires;

•the cybersecurity of Edison International's and SCE's critical information technology systems for grid control and business, employee and customer data, and the physical security of Edison International's and SCE's critical assets and personnel;

•risks associated with the operation and maintenance of electrical facilities, including worker, contractor, and public safety issues, the risk of utility assets causing or contributing to wildfires, failure, availability, efficiency, and output of equipment and facilities, and availability and cost of spare parts;

•impact of affordability of customer rates on SCE's ability to execute its strategy, including the impact of affordability on SCE’s ability to obtain regulatory approval of, or cost recovery for, operations and maintenance expenses, proposed capital investment projects, and increased costs due to supply chain constraints, tariffs, inflation and rising interest rates;

•ability of SCE to update its grid infrastructure to maintain system integrity and reliability, and meet electrification needs;

•ability of SCE to implement its operational and strategic plans, including its Wildfire Mitigation Plan and capital investment program, including those related to project site identification, public opposition, environmental mitigation, construction, permitting, contractor performance, changes in the California Independent System Operator's (“CAISO”) transmission plans, and governmental approvals;

•risks of regulatory or legislative restrictions that would limit SCE's ability to implement operational measures to mitigate wildfire risk, including Public Safety Power Shutoff (“PSPS”) and fast curve settings, when conditions warrant or would otherwise limit SCE's operational practices relative to wildfire risk mitigation;

•ability of SCE to obtain safety certifications from the Office of Energy Infrastructure Safety of the California Natural Resources Agency (“OEIS“);

•risk that California Assembly Bill 1054 (“AB 1054“) does not effectively mitigate the significant exposure faced by California investor-owned utilities related to liability for damages arising from catastrophic wildfires where utility facilities are alleged to be a substantial cause, including the longevity of the Wildfire Insurance Fund and the California Public Utilities Commission (“CPUC”) interpretation of and actions under AB 1054, including its interpretation of the prudency standard clarified by AB 1054;

•ability of Edison International and SCE to effectively attract, manage, develop and retain a skilled workforce, including its contract workers;

•decisions and other actions by the CPUC, the Federal Energy Regulatory Commission, and the United States Nuclear Regulatory Commission and other governmental authorities, including decisions and actions related to nationwide or statewide crisis, approval of regulatory proceeding settlements, determinations of authorized rates of return or return on equity, the recoverability of wildfire-related and debris flow-related costs, issuance of SCE's wildfire safety certification, wildfire mitigation efforts, approval and implementation of electrification programs, and delays in executive, regulatory and legislative actions;

•governmental, statutory, regulatory, or administrative changes or initiatives affecting the electricity industry, including the market structure rules applicable to each market adopted by the North American Electric Reliability Corporation, CAISO, Western Electricity Coordinating Council, and similar regulatory bodies in adjoining regions, and changes in the United States' and California's environmental priorities that lessen the importance placed on greenhouse gas reduction and other climate related priorities;

•potential for penalties or disallowances for non-compliance with applicable laws and regulations, including fines, penalties and disallowances related to wildfires where SCE's equipment is alleged to be associated with ignition;

•extreme weather-related incidents (including events caused, or exacerbated, by climate change), such as wildfires, debris flows, flooding, droughts, high wind events and extreme heat events and other natural disasters (such as earthquakes), which could cause, among other things, worker and public safety issues, property damage, outages and other operational issues (such as issues due to damaged infrastructure), PSPS activations and unanticipated costs;

•risks associated with the decommissioning of San Onofre, including those related to worker and public safety, public opposition, permitting, governmental approvals, on-site storage of spent nuclear fuel and other radioactive material, delays, contractual disputes, and cost overruns;

•risks associated with cost allocation resulting in higher rates for utility bundled service customers because of possible customer bypass or departure for other electricity providers such as Community Choice Aggregators (“CCA,” which are cities, counties, and certain other public agencies with the authority to generate and/or purchase electricity for their local residents and businesses) and Electric Service Providers (entities that offer electric power and ancillary services to retail customers, other than electrical corporations (like SCE) and CCAs);

•actions by credit rating agencies to downgrade Edison International or SCE’s credit ratings or to place those ratings on negative watch or negative outlook.

Other important factors are discussed under the headings “Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this release.

First Quarter Reconciliation of Basic Earnings Per Share to Core Earnings Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2025 |

|

2024 |

|

Change |

Earnings (loss) per share available to Edison International |

|

|

|

|

|

SCE |

$ |

4.07 |

|

|

$ |

0.17 |

|

|

$ |

3.90 |

|

Edison International Parent and Other |

(0.34) |

|

|

(0.20) |

|

|

(0.14) |

|

Edison International |

3.73 |

|

|

(0.03) |

|

|

3.76 |

|

Less: Non-core items |

|

|

|

|

|

SCE |

2.46 |

|

|

(1.16) |

|

|

3.62 |

|

Edison International Parent and Other |

(0.10) |

|

|

— |

|

|

(0.10) |

|

Total non-core items |

2.36 |

|

|

(1.16) |

|

|

3.52 |

|

Core earnings (loss) per share |

|

|

|

|

|

SCE |

1.61 |

|

|

1.33 |

|

|

0.28 |

|

Edison International Parent and Other |

(0.24) |

|

|

(0.20) |

|

|

(0.04) |

|

Edison International |

$ |

1.37 |

|

|

$ |

1.13 |

|

|

$ |

0.24 |

|

Note: Diluted earnings were $3.72 and $(0.03) per share for the three months ended March 31, 2025 and 2024, respectively.

First Quarter Reconciliation of Basic Earnings to Core Earnings (in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

(in millions) |

2025 |

|

2024 |

|

Change |

Net income (loss) available to Edison International |

|

|

|

|

|

SCE |

$ |

1,567 |

|

|

$ |

65 |

|

|

$ |

1,502 |

|

Edison International Parent and Other |

(131) |

|

|

(76) |

|

|

(55) |

|

Edison International |

1,436 |

|

|

(11) |

|

|

1,447 |

|

| Less: Non-core items |

|

|

|

|

|

SCE 1,2,3 |

947 |

|

|

(448) |

|

|

1,395 |

|

Edison International Parent and Other4 |

(39) |

|

|

(1) |

|

|

(38) |

|

Total non-core items |

908 |

|

|

(449) |

|

|

1,357 |

|

Core earnings (losses) |

|

|

|

|

|

SCE |

620 |

|

|

513 |

|

|

107 |

|

Edison International Parent and Other |

(92) |

|

|

(75) |

|

|

(17) |

|

Edison International |

$ |

528 |

|

|

$ |

438 |

|

|

$ |

90 |

|

1.Includes net earnings recorded in the three months ended March 31, 2025 related to TKM Settlement Agreement: $1,341 million ($966 million after-tax) of claim costs and $59 million ($42 million after-tax) of legal expenses authorized for recovery, partially offset by shareholder-funded wildfire mitigation expenses of $50 million ($36 million after-tax) and impairment of incremental restoration-related assets of $8 million ($6 million after-tax). Charges of $3 million ($2 million after-tax) recorded in the three months ended March 31, 2025, and $467 million ($336 million after-tax) recorded in the three months ended March 31, 2024, respectively, related to claim costs and related legal expenses, net of expected regulatory recoveries.

2.Includes net earnings of $12 million ($9 million after-tax) recorded in the three months ended March 31, 2025, which consisted of $14 million insurance reimbursements for costs incurred in previous years, partially offset by $2 million legal expenses, net of expected regulatory recoveries. Charges of $119 million ($86 million after-tax) recorded in the three months ended March 31, 2024, for wildfire claims and related legal expenses, net of expected insurance and regulatory recoveries.

3.Includes amortization of SCE's Wildfire Insurance Fund expenses of $36 million ($26 million after-tax) for the three months ended March 31, 2025 and 2024.

4.Includes wildfire claims insured by EIS of $50 million ($39 million after-tax) and $1 million ($1 million after-tax) for the three months ended March 31, 2025 and 2024, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

| Condensed Consolidated Statements of Income |

Edison International |

|

|

|

|

|

Three months ended March 31, |

| (in millions, except per-share amounts, unaudited) |

2025 |

|

2024 |

| Operating revenue |

$ |

3,811 |

|

|

$ |

4,078 |

|

| Purchased power and fuel |

1,047 |

|

|

1,008 |

|

| Operation and maintenance |

983 |

|

|

1,317 |

|

| Wildfire-related claims, net of (recoveries) |

(1,305) |

|

|

615 |

|

| Wildfire Insurance Fund expense |

36 |

|

|

36 |

|

| Depreciation and amortization |

742 |

|

|

702 |

|

| Property and other taxes |

166 |

|

|

155 |

|

| Impairment |

8 |

|

|

— |

|

| Total operating expenses |

1,677 |

|

|

3,833 |

|

| Operating income |

2,134 |

|

|

245 |

|

| Interest expense |

(301) |

|

|

(444) |

|

| Other income, net |

107 |

|

|

138 |

|

| Income (loss) before income taxes |

1,940 |

|

|

(61) |

|

| Income tax expense (benefit) |

448 |

|

|

(113) |

|

| Net income |

1,492 |

|

|

52 |

|

| Less: Preference stock dividend requirements of SCE |

34 |

|

|

41 |

|

| Preferred stock dividend requirements of Edison International |

22 |

|

|

22 |

|

| Net income (loss) attributable to Edison International common shareholders |

$ |

1,436 |

|

|

$ |

(11) |

|

| Basic earnings per share: |

|

|

|

| Weighted average shares of common stock outstanding |

385 |

|

385 |

| Basic earnings (loss) per common share available to Edison International common shareholders |

$ |

3.73 |

|

|

$ |

(0.03) |

|

| Diluted earnings per share: |

|

|

|

| Weighted average shares of common stock outstanding, including effect of dilutive securities |

386 |

|

385 |

| Diluted earnings (loss) per common share available to Edison International common shareholders |

$ |

3.72 |

|

|

$ |

(0.03) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Condensed Consolidated Balance Sheets |

Edison International |

|

|

|

|

| (in millions, unaudited) |

March 31,

2025 |

|

December 31,

2024 |

| ASSETS |

|

|

|

| Cash and cash equivalents |

$ |

1,318 |

|

|

$ |

193 |

|

Receivables, less allowances of $300 and $352 for uncollectible accounts at respective dates |

1,864 |

|

|

2,169 |

|

| Accrued unbilled revenue |

805 |

|

|

848 |

|

| Inventory |

539 |

|

|

538 |

|

| Prepaid expenses |

262 |

|

|

103 |

|

| Regulatory assets |

2,124 |

|

|

2,748 |

|

| Wildfire Insurance Fund contributions |

138 |

|

|

138 |

|

| Other current assets |

377 |

|

|

418 |

|

| Total current assets |

7,427 |

|

|

7,155 |

|

| Nuclear decommissioning trusts |

4,231 |

|

|

4,286 |

|

| Other investments |

59 |

|

|

57 |

|

| Total investments |

4,290 |

|

|

4,343 |

|

Utility property, plant and equipment, less accumulated depreciation and amortization of $14,447 and $14,207 at respective dates |

59,950 |

|

|

59,047 |

|

Nonutility property, plant and equipment, less accumulated depreciation of $122 and $124 at respective dates |

204 |

|

|

207 |

|

| Total property, plant and equipment |

60,154 |

|

|

59,254 |

|

Receivables, less allowances $44 and $43 for uncollectible accounts at respective dates |

85 |

|

|

62 |

|

Regulatory assets (include $1,500 and $1,512 related to a Variable Interest Entity ("VIE") at respective dates) |

10,548 |

|

|

8,886 |

|

| Wildfire Insurance Fund contributions |

1,844 |

|

|

1,878 |

|

| Operating lease right-of-use assets |

1,169 |

|

|

1,180 |

|

| Long-term insurance receivables |

406 |

|

|

418 |

|

| Other long-term assets |

2,497 |

|

|

2,403 |

|

| Total other assets |

16,549 |

|

|

14,827 |

|

| Total assets |

$ |

88,420 |

|

|

$ |

85,579 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Condensed Consolidated Balance Sheets |

Edison International |

|

|

|

|

| (in millions, except share amounts, unaudited) |

March 31,

2025 |

|

December 31,

2024 |

LIABILITIES AND EQUITY |

|

|

|

| Short-term debt |

$ |

5 |

|

|

$ |

998 |

|

| Current portion of long-term debt |

2,999 |

|

|

2,049 |

|

| Accounts payable |

2,156 |

|

|

2,000 |

|

| Wildfire-related claims |

55 |

|

|

60 |

|

| Accrued interest |

495 |

|

|

422 |

|

| Regulatory liabilities |

563 |

|

|

1,347 |

|

| Current portion of operating lease liabilities |

123 |

|

|

124 |

|

| Other current liabilities |

1,373 |

|

|

1,439 |

|

| Total current liabilities |

7,769 |

|

|

8,439 |

|

Long-term debt (include $1,468 related to a VIE at respective dates) |

35,387 |

|

|

33,534 |

|

| Deferred income taxes and credits |

7,726 |

|

|

7,180 |

|

| Pensions and benefits |

379 |

|

|

384 |

|

| Asset retirement obligations |

2,554 |

|

|

2,580 |

|

| Regulatory liabilities |

10,430 |

|

|

10,159 |

|

| Operating lease liabilities |

1,046 |

|

|

1,056 |

|

| Wildfire-related claims |

803 |

|

|

941 |

|

| Other deferred credits and other long-term liabilities |

3,529 |

|

|

3,566 |

|

| Total deferred credits and other liabilities |

26,467 |

|

|

25,866 |

|

| Total liabilities |

69,623 |

|

|

67,839 |

|

|

|

|

|

Preferred stock (50,000,000 shares authorized; 1,159,317 shares of Series A and 503,454 shares of Series B issued and outstanding at respective dates) |

1,645 |

|

|

1,645 |

|

Common stock, no par value (800,000,000 shares authorized; 384,763,662 and 384,784,719 shares issued and outstanding at respective dates) |

6,315 |

|

|

6,353 |

|

|

|

|

|

| Retained earnings |

8,662 |

|

|

7,567 |

|

| Total Edison International's shareholders' equity |

16,622 |

|

|

15,565 |

|

| Noncontrolling interests – preference stock of SCE |

2,175 |

|

|

2,175 |

|

| Total equity |

18,797 |

|

|

17,740 |

|

| Total liabilities and equity |

$ |

88,420 |

|

|

$ |

85,579 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Condensed Consolidated Statements of Cash Flows |

Edison International |

|

|

|

|

|

Three Months Ended March 31, |

| (in millions, unaudited) |

2025 |

|

2024 |

Cash flows from operating activities: |

|

|

|

| Net income |

$ |

1,492 |

|

|

$ |

52 |

|

| Adjustments to reconcile to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

742 |

|

|

707 |

|

| Equity allowance for funds used during construction |

(46) |

|

|

(47) |

|

|

|

|

|

| Impairment |

8 |

|

|

— |

|

| Deferred income taxes |

421 |

|

|

(114) |

|

| Wildfire Insurance Fund amortization expense |

36 |

|

|

36 |

|

| Other |

28 |

|

|

13 |

|

| Nuclear decommissioning trusts |

(34) |

|

|

(20) |

|

| Changes in operating assets and liabilities: |

|

|

|

| Receivables |

269 |

|

|

84 |

|

| Inventory |

(1) |

|

|

5 |

|

| Accounts payable |

70 |

|

|

(19) |

|

| Tax receivables and payables |

14 |

|

|

(2) |

|

| Other current assets and liabilities |

(235) |

|

|

(300) |

|

| Derivative assets and liabilities, net |

33 |

|

|

(17) |

|

| Regulatory assets and liabilities, net |

(1,443) |

|

|

250 |

|

| Wildfire-related insurance receivable |

12 |

|

|

— |

|

| Wildfire-related claims |

(143) |

|

|

419 |

|

| Other noncurrent assets and liabilities |

1 |

|

|

(4) |

|

| Net cash provided by operating activities |

1,224 |

|

|

1,043 |

|

| Cash flows from financing activities: |

|

|

|

Long-term debt issued, net of discount and issuance costs of $49 and $24 for the respective periods |

3,501 |

|

|

2,976 |

|

| Long-term debt repaid |

(1) |

|

|

(601) |

|

|

|

|

|

| Short-term debt repaid |

— |

|

|

(390) |

|

|

|

|

|

| Common stock repurchased |

(29) |

|

|

— |

|

|

|

|

|

| Preferred stock repurchased |

— |

|

|

(19) |

|

| Commercial paper repayments, net of borrowing |

(1,687) |

|

|

(622) |

|

| Dividends and distribution to noncontrolling interests |

(34) |

|

|

(43) |

|

| Common stock dividends paid |

(319) |

|

|

(295) |

|

| Preferred stock dividends paid |

(44) |

|

|

(44) |

|

| Other |

(13) |

|

|

26 |

|

| Net cash provided by financing activities |

1,374 |

|

|

988 |

|

| Cash flows from investing activities: |

|

|

|

| Capital expenditures |

(1,408) |

|

|

(1,279) |

|

| Proceeds from sale of nuclear decommissioning trust investments |

1,406 |

|

|

1,258 |

|

| Purchases of nuclear decommissioning trust investments |

(1,372) |

|

|

(1,257) |

|

| Other |

— |

|

|

2 |

|

| Net cash used in investing activities |

(1,374) |

|

|

(1,276) |

|

| Net increase in cash, cash equivalents and restricted cash |

1,224 |

|

|

755 |

|

| Cash, cash equivalents and restricted cash at beginning of period |

684 |

|

|

532 |

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

1,908 |

|

|

$ |

1,287 |

|

|

|

|

|