Document

LEASE

509 W 34, L.L.C.,

a Delaware Limited Liability Company

Landlord

and

ALLIANCEBERNSTEIN L.P.,

a Delaware Limited Partnership

Tenant

for

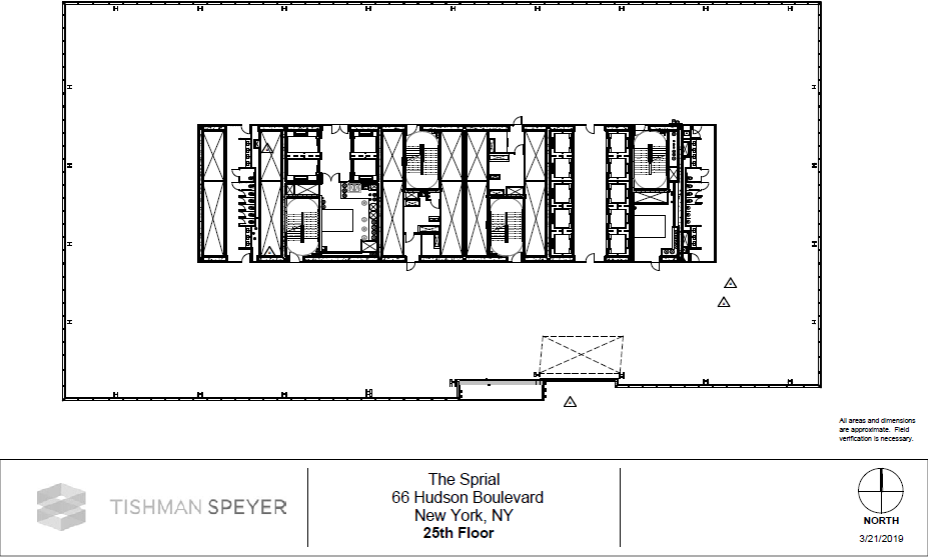

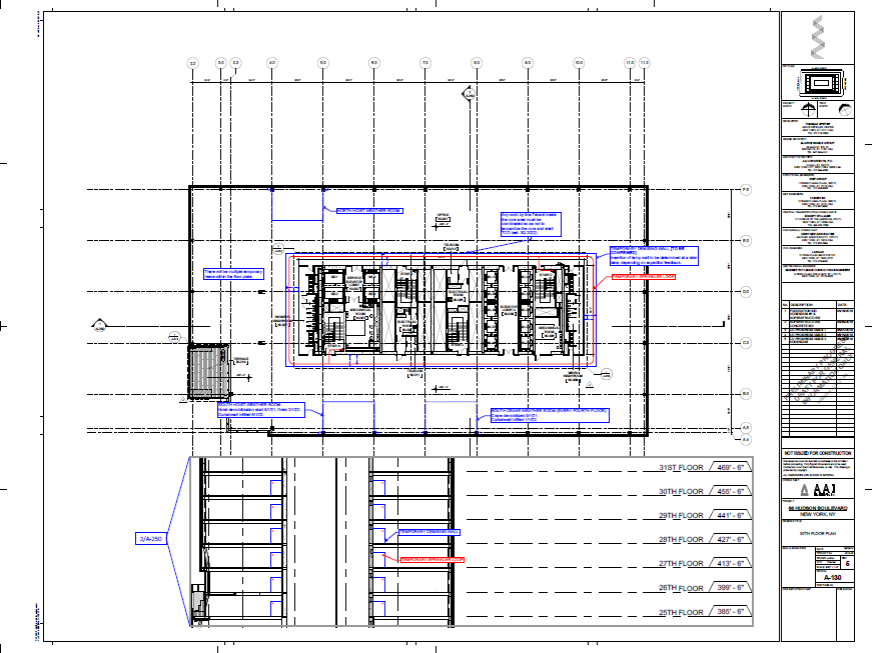

Entire 25th, 26th, 27th and 28th Floors

66 Hudson Boulevard

New York, New York

April ____, 2019

1930820.10 29086-0006-000

TABLE OF CONTENTS

1930820.10 29086-0006-000

1930820.10 29086-0006-000

Schedule of Exhibits

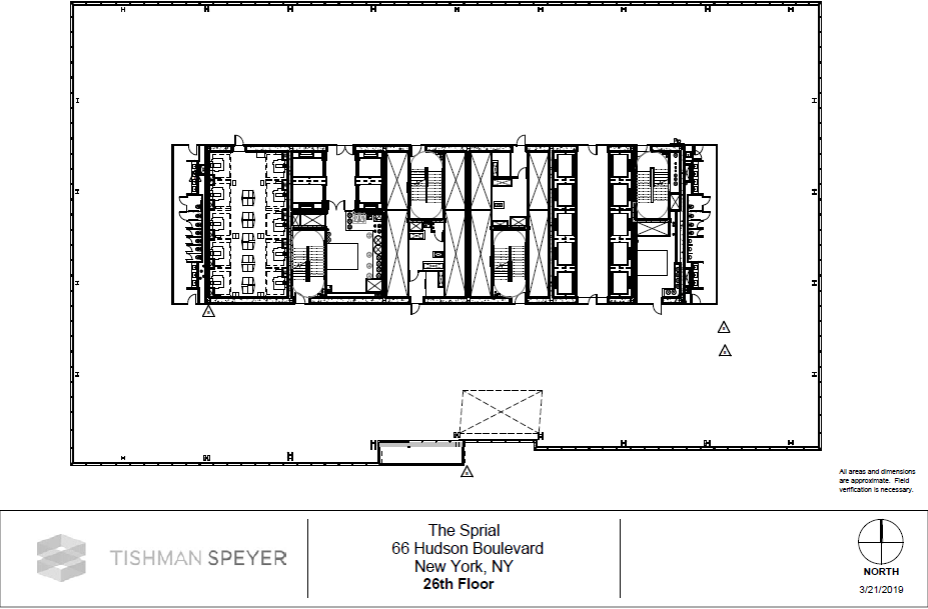

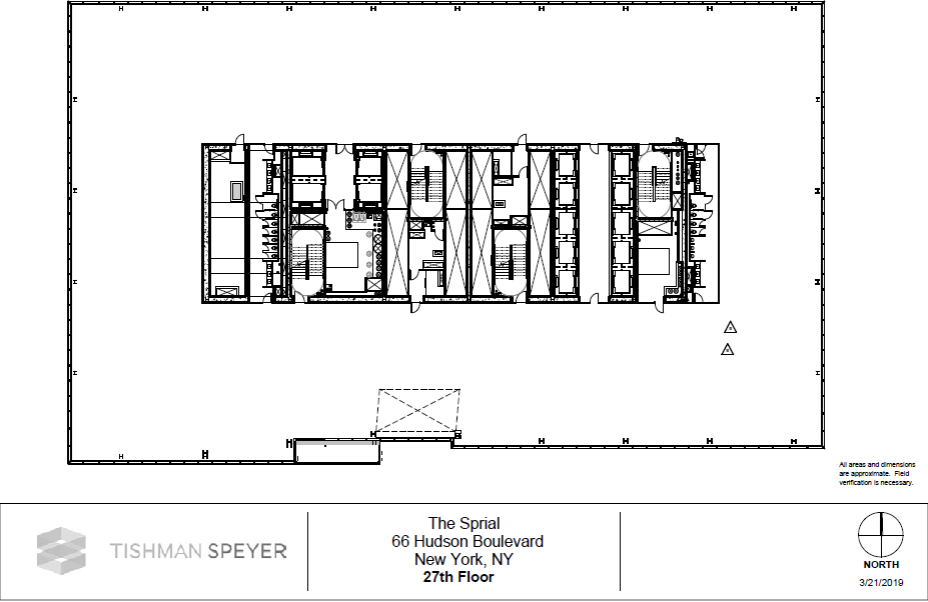

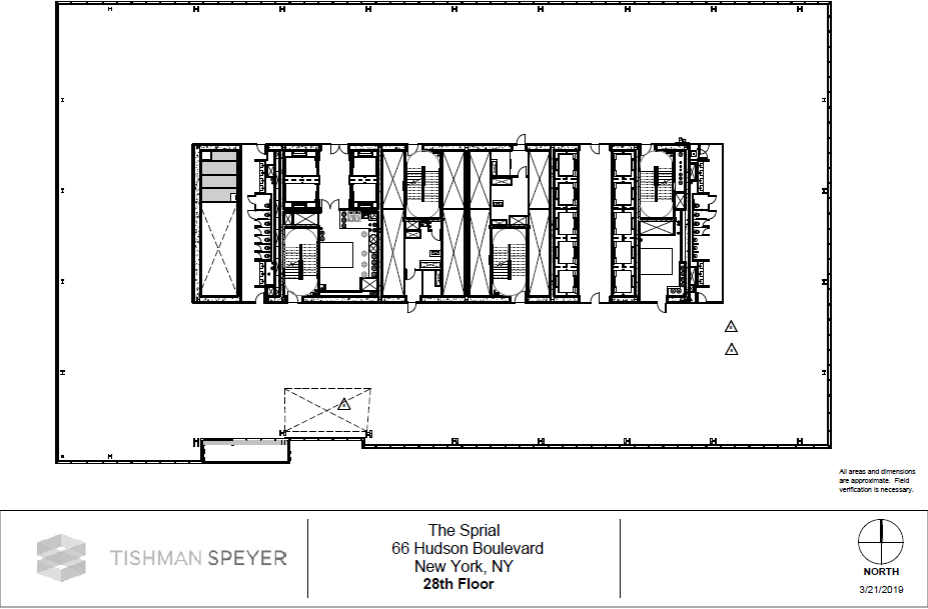

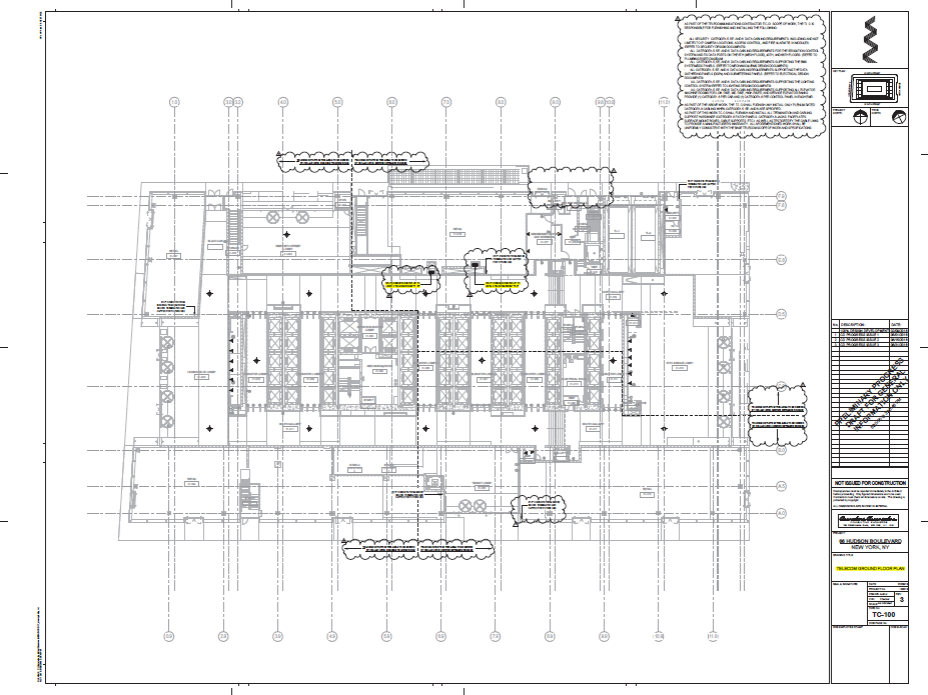

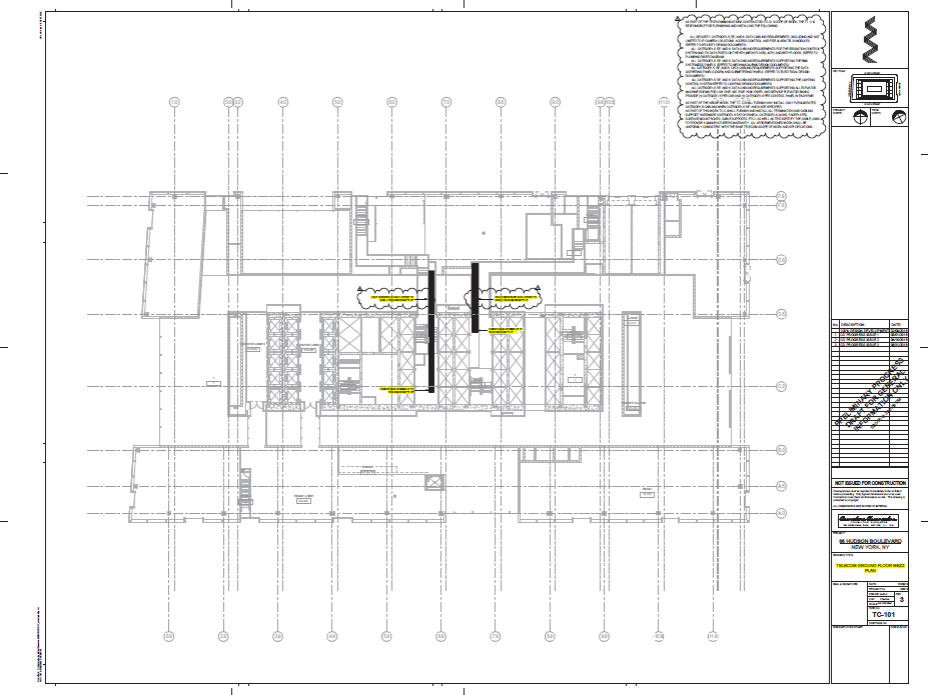

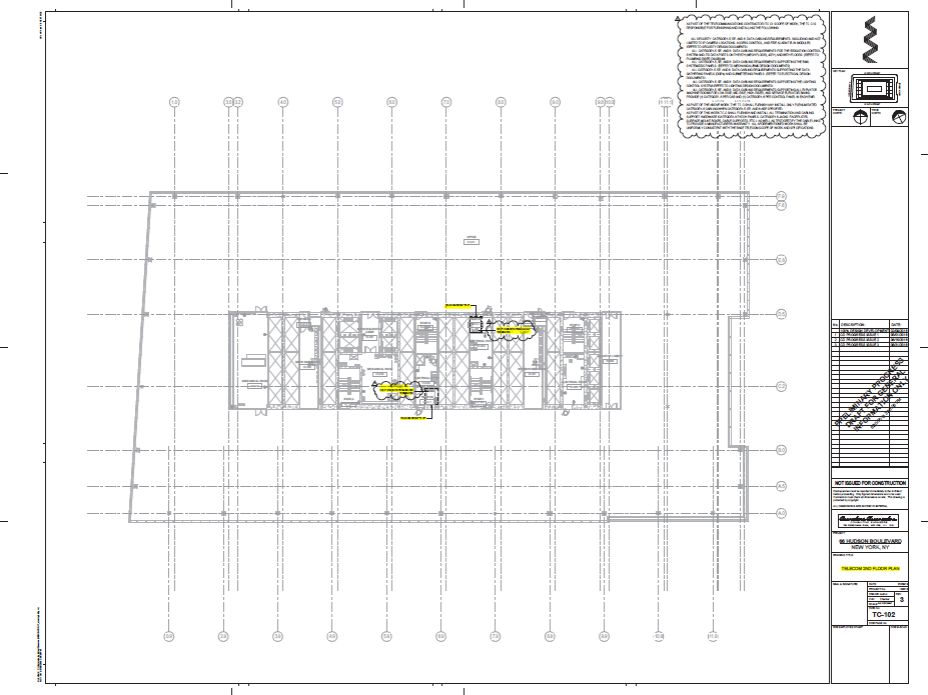

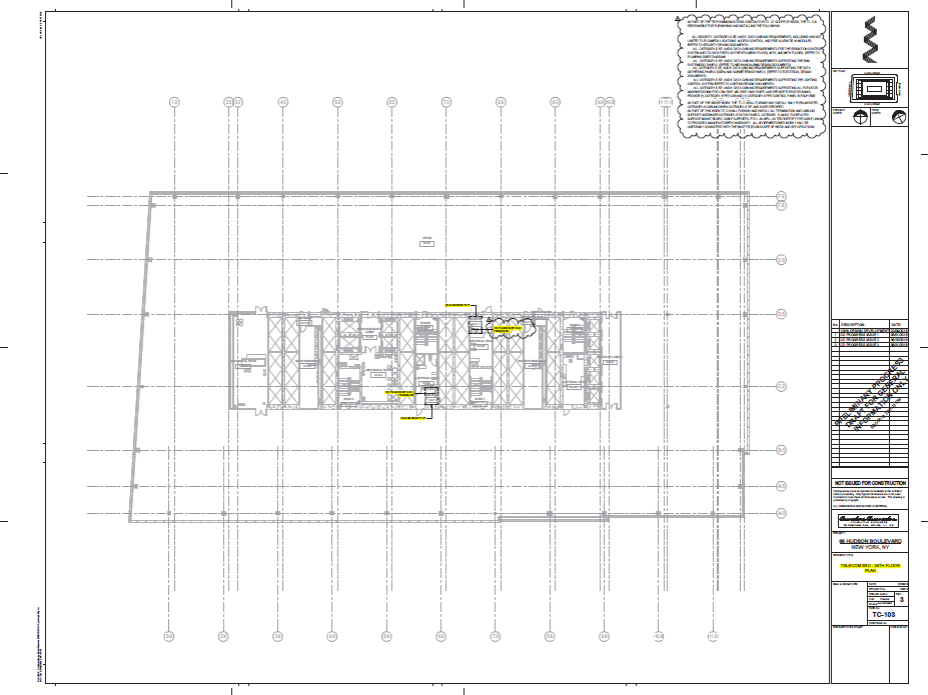

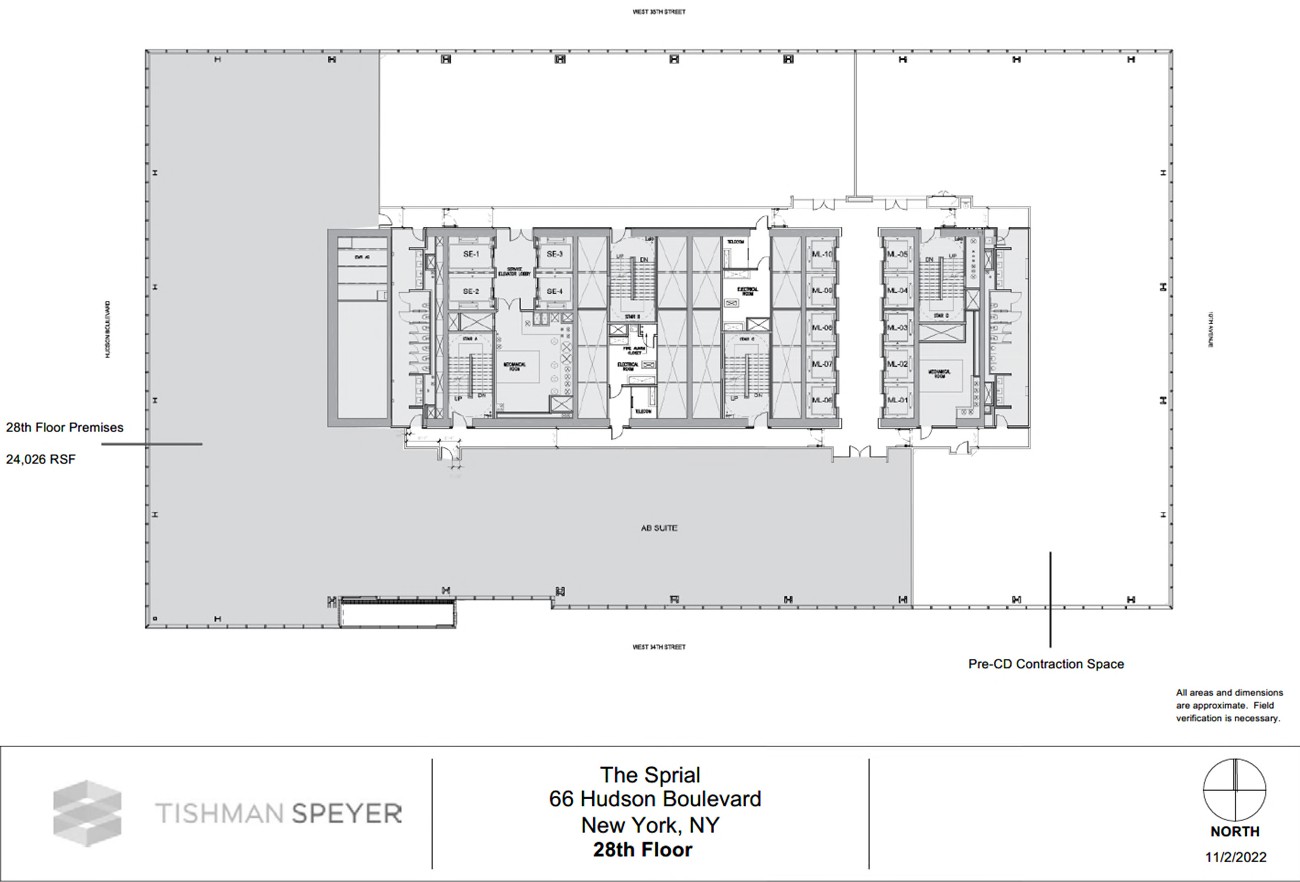

Exhibit A Office Premises

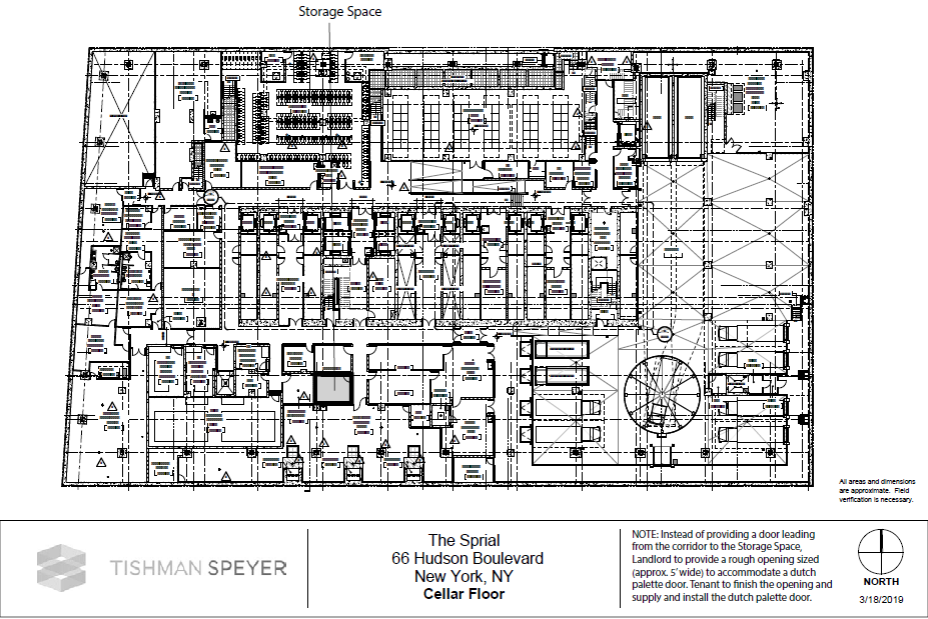

Exhibit A-1 Storage Space

Exhibit B Definitions

Exhibit C-1 Landlord’s Premises Work

Exhibit C-2 Base Building Outline Specification/BOD

Exhibit C-3 Base Building Condition

Exhibit C-4 Logistics Items

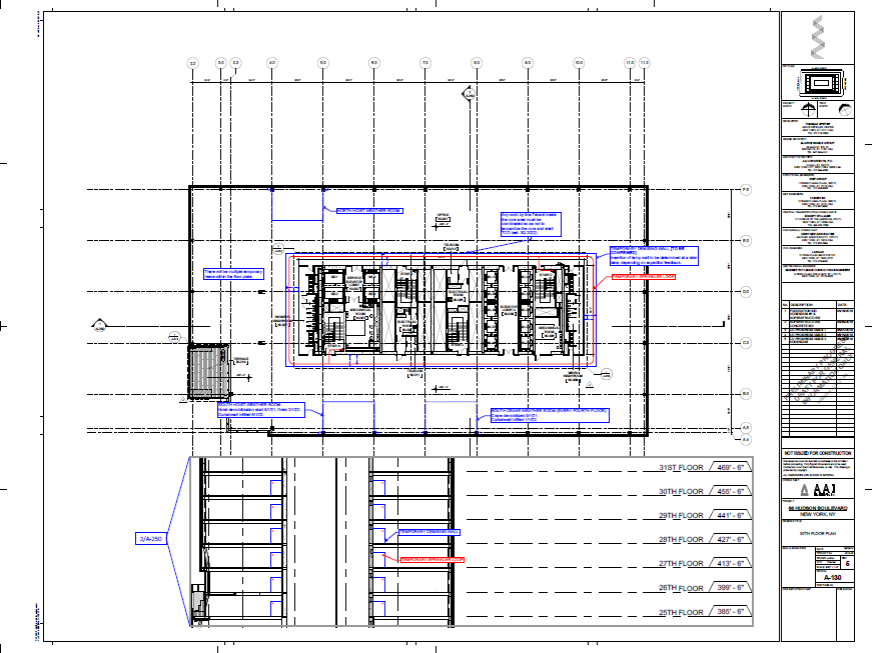

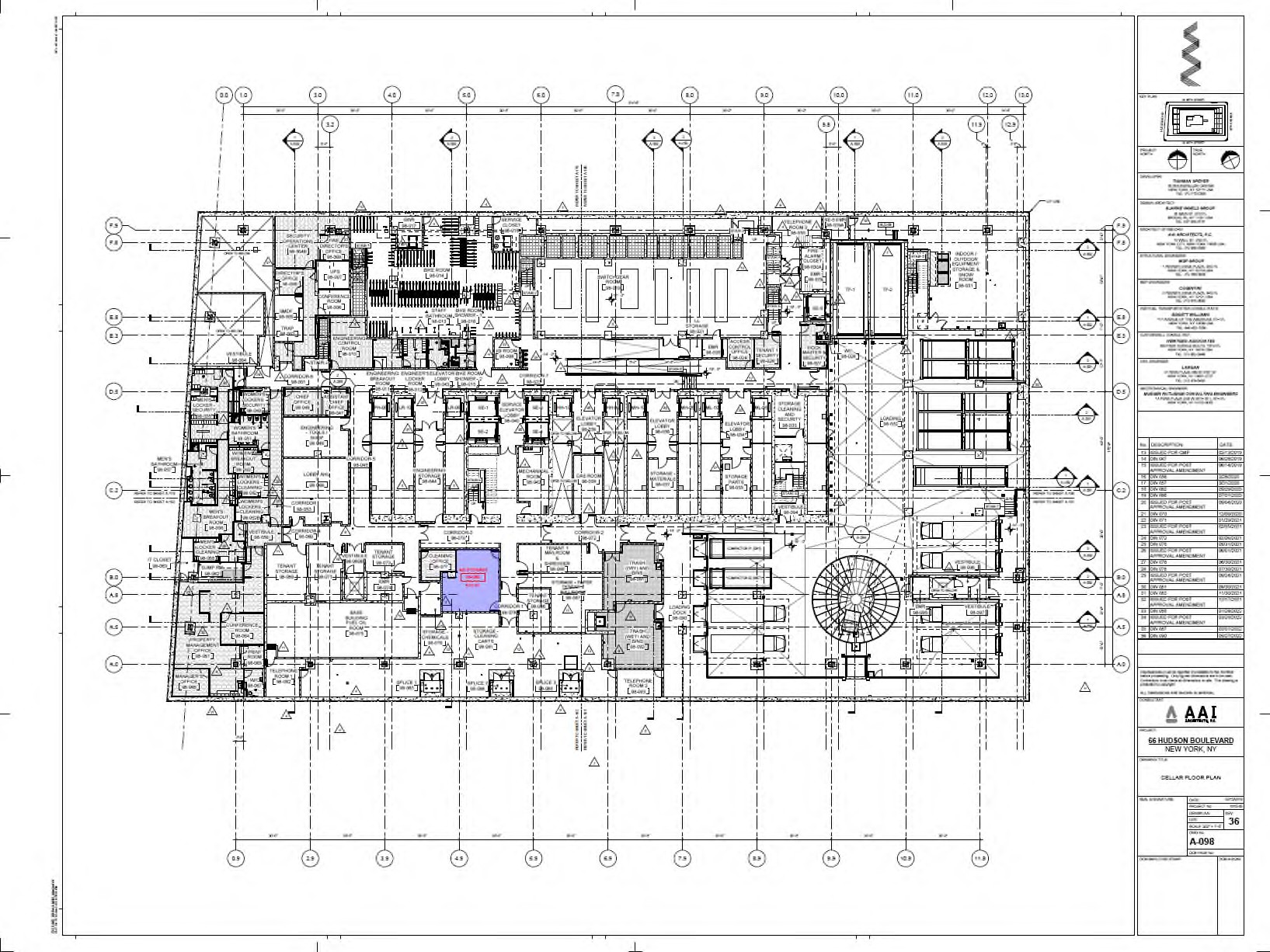

Exhibit C-5 List of Base Building Plans

Exhibit D Land Description

Exhibit E Cleaning Specifications

Exhibit F Rules and Regulations

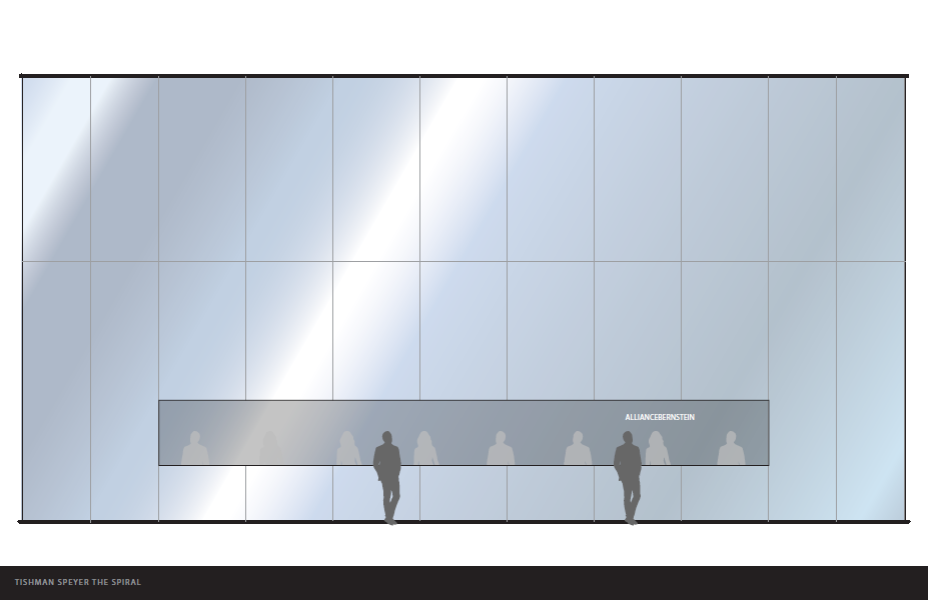

Exhibit G Approved Signage

Exhibit H Building Signage Package

Exhibit I Form of Subtenant SNDA

Exhibit J-1 Form of Living Wage Agreement

Exhibit J-2 HireNYC Statement on Goals

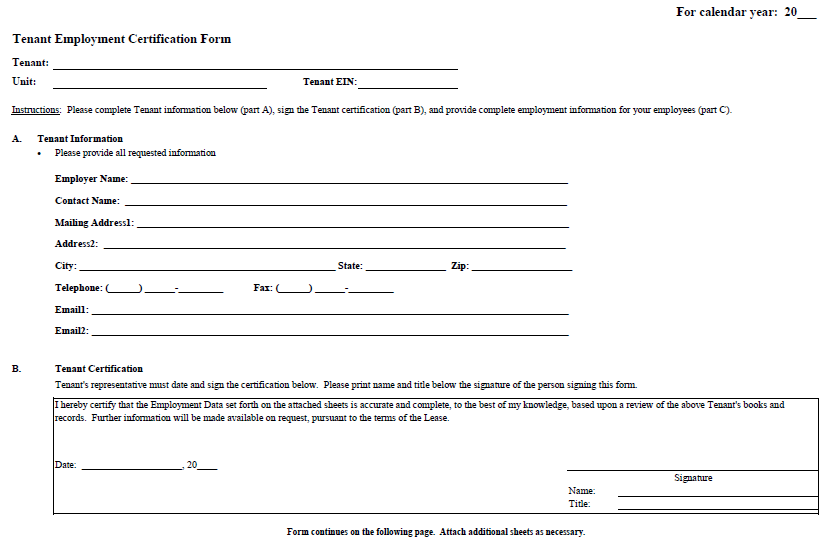

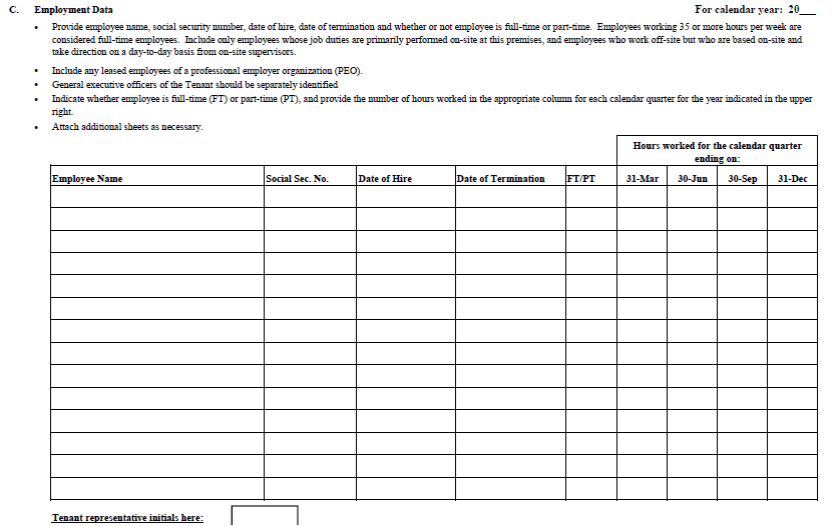

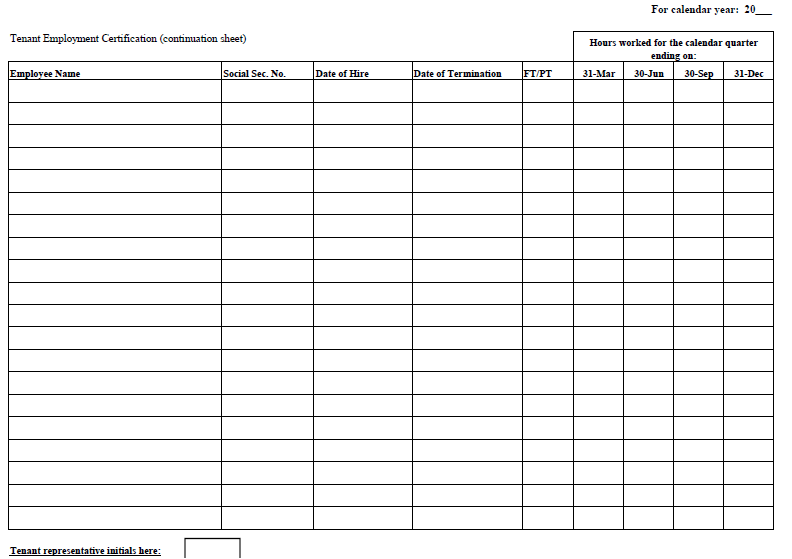

Exhibit K Tenant Employment Certification Form

Exhibit L RSF/USF Schedule

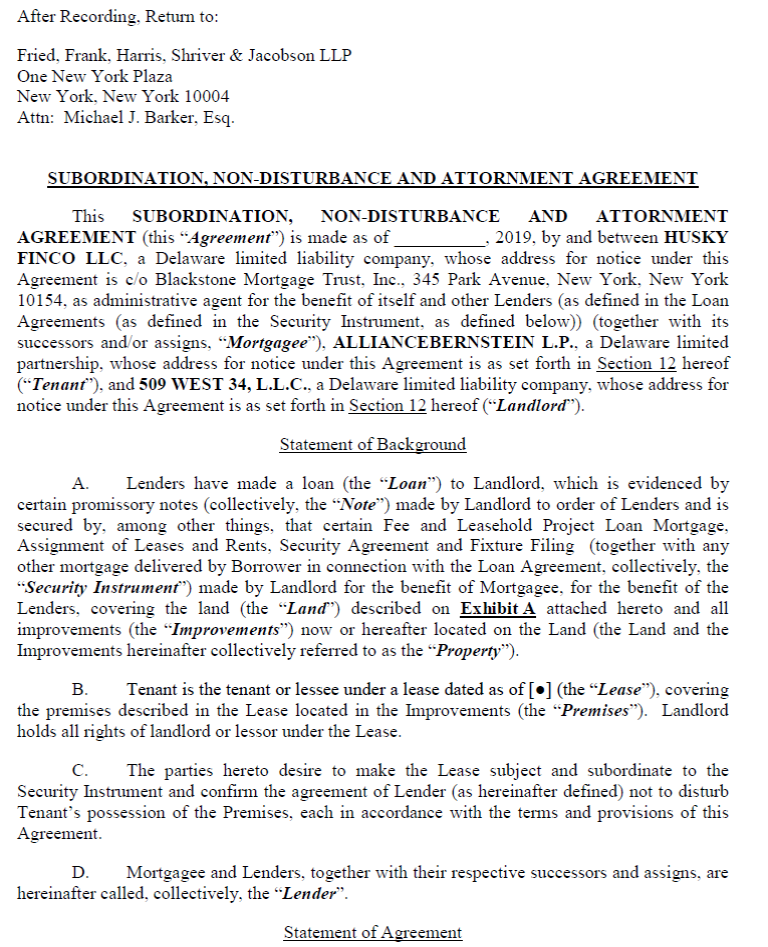

Exhibit M-1 Form of Mortgagee SNDA

Exhibit M-2 Form of PILOT SNDA

Exhibit N Elevator Performance

Exhibit O Competitor List

Exhibit P Construction Rules

Exhibit Q Form of Condominium SNDA

Exhibit R Shaft Space

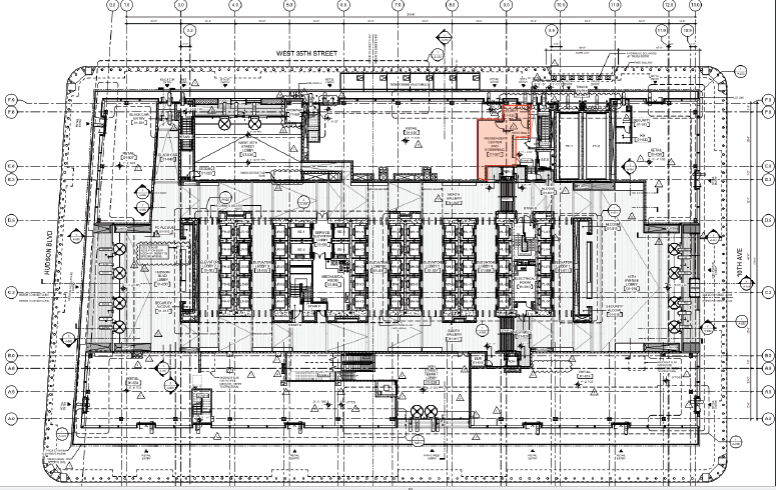

Exhibit S Messenger Center Location

Exhibit T Form of Memorandum of Lease

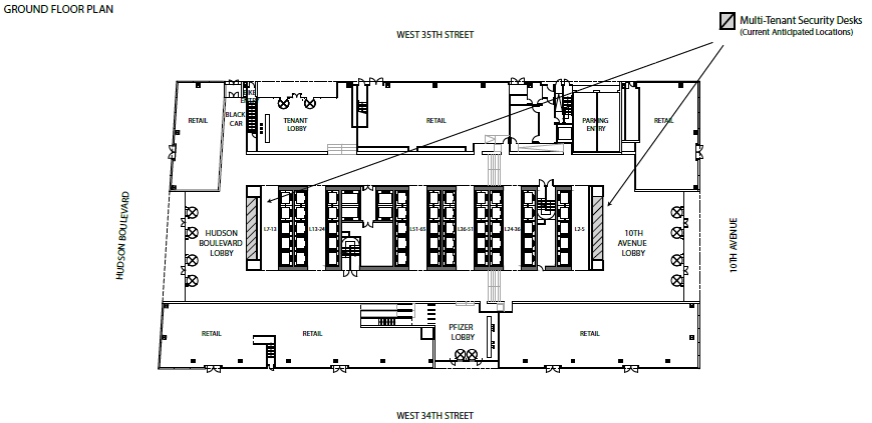

Exhibit U Multi-Tenant Security Desk Locations

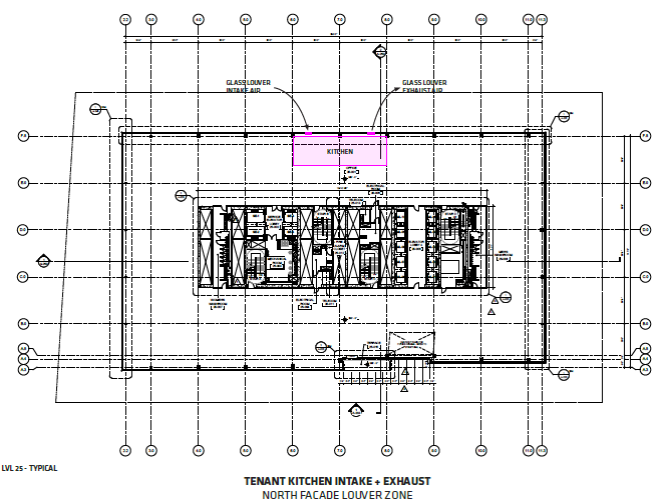

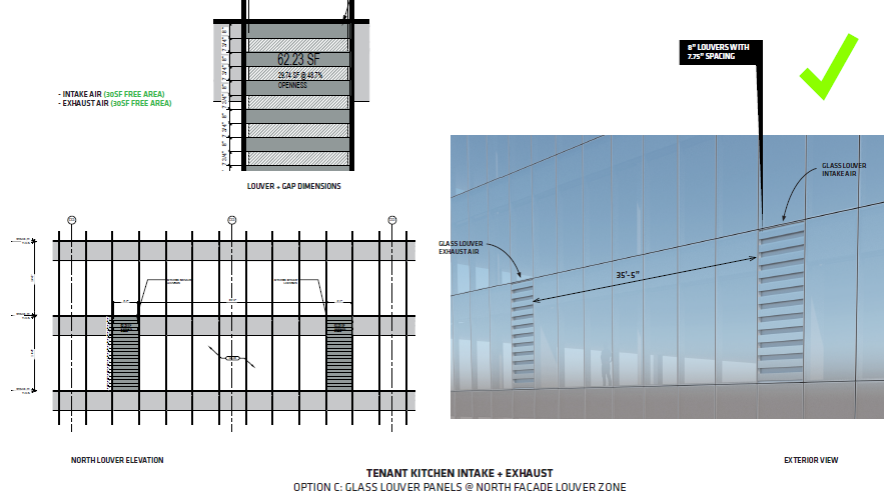

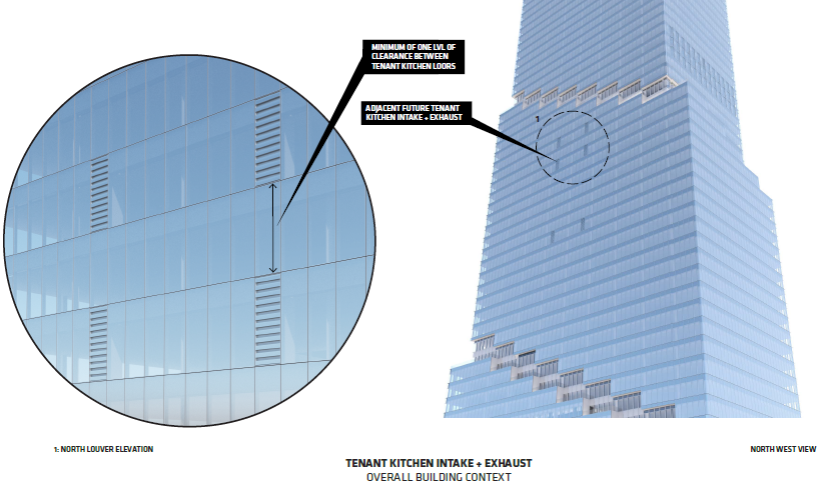

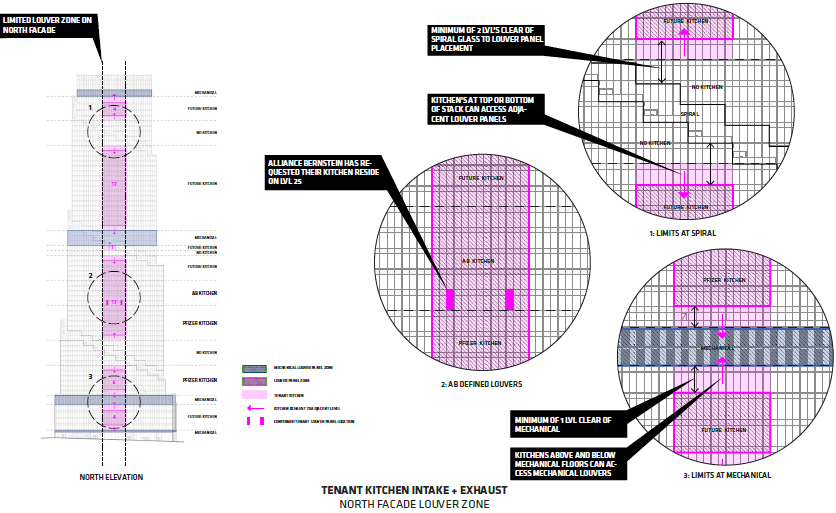

Exhibit V Louver Locations

Exhibit W Tenant Design Guidelines

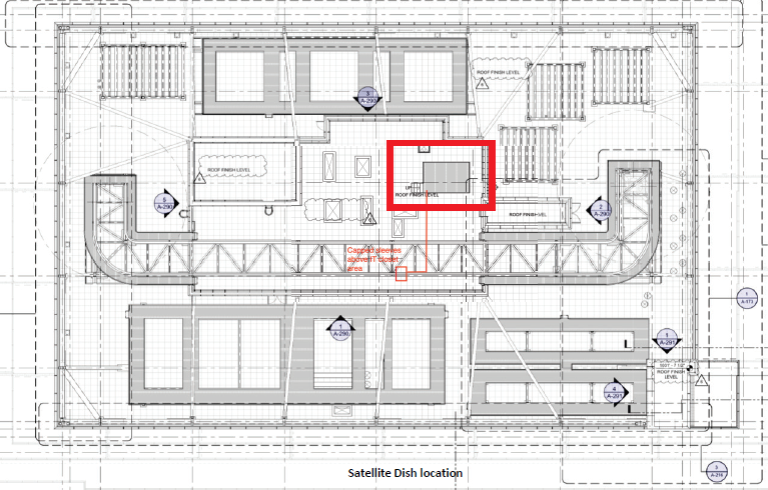

Exhibit X Location of Satellite Dish Area

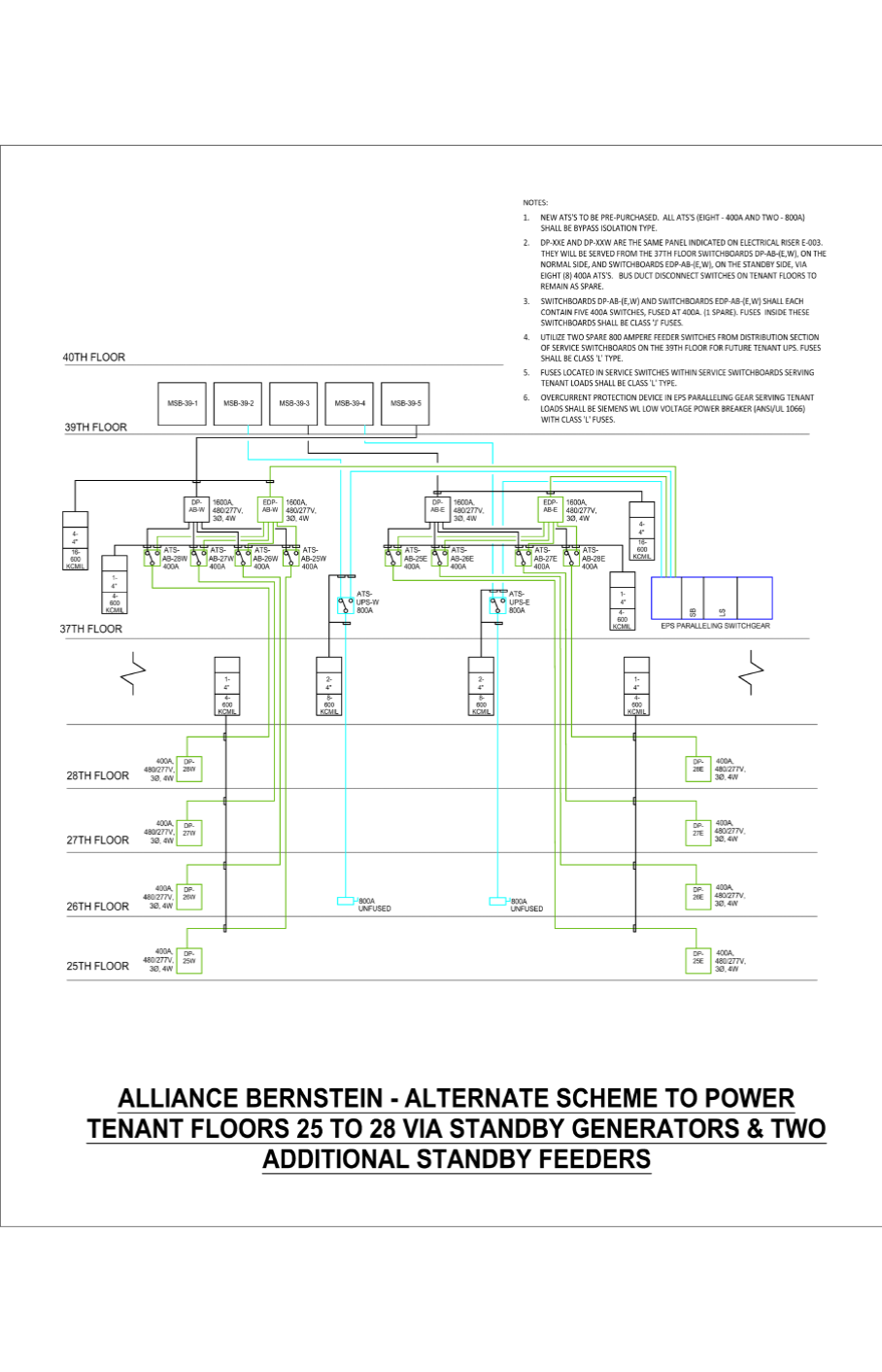

Exhibit Y 800 Ampere Riser Plan and 1600 Ampere ATS Plan

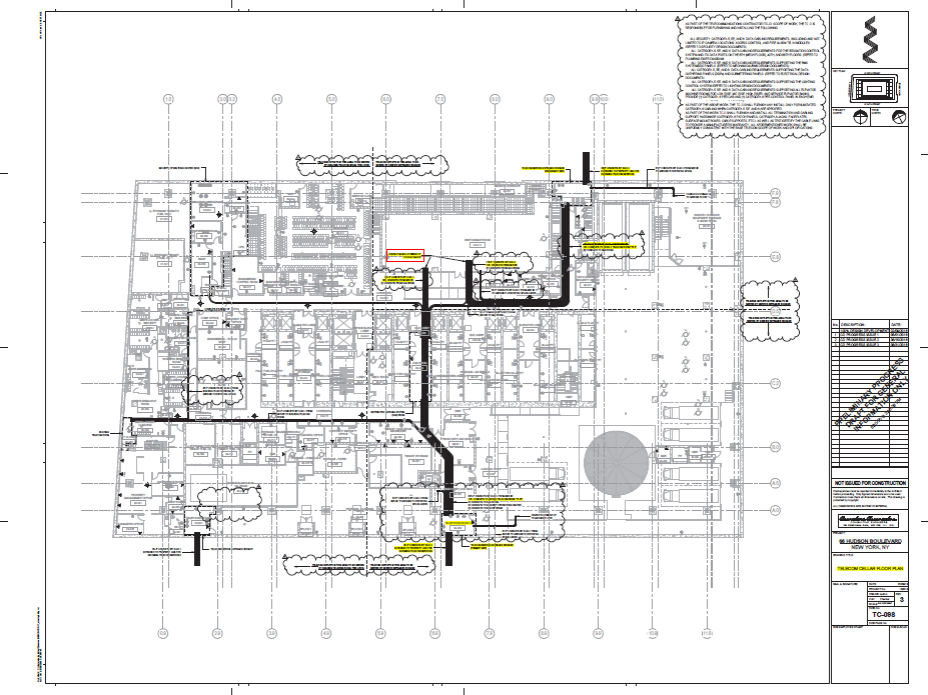

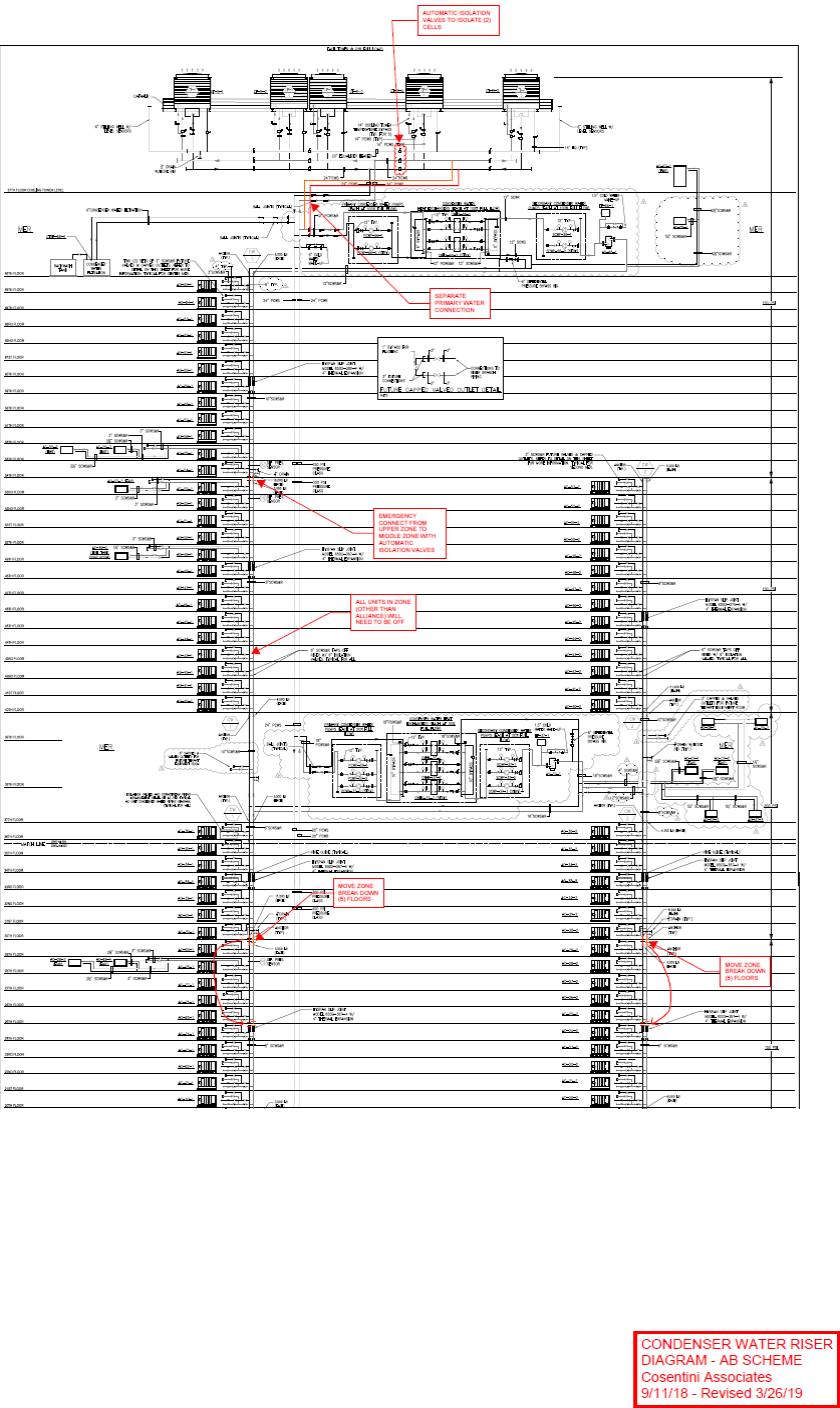

Exhibit Z Redundant Primary Condenser Water Riser

Exhibit AA Termination Milestone Landlord’s Premises Work Obligation

Exhibit BB Termination Fee Calculation Formula

Exhibit CC Form of Termination Fee Letter of Credit

Exhibit DD Landlord’s Contribution Adjustment THIS LEASE is made as of the ____ day of April, 2019 (“Effective Date”), between 509 W 34, L.L.C.

1930820.10 29086-0006-000

LEASE

(“Landlord”), a Delaware limited liability company, and ALLIANCEBERNSTEIN L.P. (“Tenant”), a Delaware limited partnership.

Landlord and Tenant hereby agree as follows:

Article 1

BASIC LEASE PROVISIONS

|

|

|

|

|

|

| PREMISES |

Subject to Article 31 and Article 32 of this Lease, the entire rentable area of the 25th through and including the 28th floors of the Building (the “Office Premises” and when combined with the Storage Space (as hereinafter defined) collectively, the “Premises”), all as more particularly shown on Exhibit A or, if Landlord notifies Tenant on or before the second anniversary of the Effective Date of a change in the Premises, then, subject to Section 4.3(h), the entire rentable area of 4 other contiguous floors all served by a single elevator bank (it being understood and agreed that any RSF Expansion Space, any Pre-CD Expansion Space and any Expansion Space, all as hereinafter defined, shall also be served by such single elevator bank) and no lower in the Building than the initially stated Office Premises above (the “Initial Office Premises”) in lieu of the Initial Office Premises (the “Substitute Office Premises”) as specified in such notice (the “Relocation Notice”); provided, however, if the rentable area of the Substitute Office Premises is smaller than the rentable area of the Initial Office Premises by more than 5%, then Tenant shall have the option to increase the rentable area of the Substitute Office Premises by adding to the Premises (with any demising work required in connection therewith being performed by Landlord at Landlord’s sole cost and expense) either (a) if the highest floor of the Initial Office Premises is a partial floor, a portion of such floor such that the balance of such floor not leased by Tenant is in increments of one-quarter of the rentable square footage of such floor; or (b) if the highest floor of the Premises is a full floor, a portion of a full floor contiguous thereto in increments of one-quarter of the rentable square footage of such floor, in either case, which particular demising location shall be mutually acceptable to Landlord and Tenant acting in good faith (as applicable, the “Substitute Premises Additional Space”); provided Tenant exercises such option by delivering notice thereof to Landlord within 60 days after Landlord delivers the Relocation Notice to Tenant. Landlord shall also deliver on the Commencement Date the portion of the basement of the Building as more particularly described on Exhibit A-1 attached hereto (“Storage Space”), which shall contain approximately 500 usable square feet. Except as expressly hereinbefore provided in this paragraph, if applicable, the Substitute Premises Additional Space shall be added to the Substitute Office Premises in the same manner as the RSF Expansion Space (as hereinafter defined) would be added to the Premises pursuant to Section 4.3(e)(ii) below, appropriately modified, mutatis mutandis. The Initial Office Premises or Substitute Office Premises, as applicable, shall be deemed to be the “Initial Premises” for all purposes of this Lease. |

1

1930820.10 29086-0006-000

|

|

|

|

|

|

| BUILDING |

The building, fixtures, equipment and other improvements and appurtenances now located or hereafter erected, located or placed upon the land (the “Land”) in Manhattan, New York City, New York, described on Exhibit D currently contemplated to be known as 66 Hudson Boulevard, New York. |

| REAL PROPERTY |

The Building, together with the Land. |

| COMMENCEMENT DATE |

The date upon which Landlord delivers the Premises vacant, broom clean, free of personal property and with respect to the Office Premises, with the work described on Exhibit C-1 attached hereto (“Landlord’s Premises Work”) other than items 20, 23, 24, 25, 26, 28 and 30 (collectively, the “Post-Turnover Work”) Substantially Completed, but not prior to January 1, 2024. Landlord’s Premises Work, excluding the Post-Turnover Work, is herein referred to as the “Turnover Work”. |

| RENT COMMENCEMENT DATE |

As defined in Section 2.5 hereof. |

| EXPIRATION DATE |

If the Rent Commencement Date shall be the 1st day of a calendar month, then the date which is the day immediately preceding the 20th anniversary of the Rent Commencement Date, or if the Rent Commencement Date shall be other than the 1st day of a calendar month, then the date which is the last day of the month in which the 20th anniversary of the Rent Commencement Date occurs (the “Initial Expiration Date”), or the last day of any renewal or extended term, if the Term of this Lease is extended in accordance with any express provision hereof. |

| TERM |

The period commencing on the Commencement Date and ending on the Expiration Date. |

| PERMITTED USES |

Without limiting the provisions of Article 3, executive, administrative and general offices and such ancillary uses as shall be reasonably required in connection therewith (provided the Storage Space may only be used as a mailroom and/or for storage purposes), which uses shall always be consistent with such uses in and the operation of Comparable Buildings and in compliance with Requirements and, subject to Section 3.3, the Base Building CO, all as more particularly described in Article 3. |

| TENANT’S PROPORTIONATE SHARE |

A fraction (expressed as a percentage), the numerator of which is the Agreed Area of the Office Premises (and, with respect to Taxes only, the Agreed Area of the Storage Space), and the denominator of which is the Agreed Area of Building (as hereinafter defined), which, for the Initial Premises as of the Effective Date, shall be (a) in respect of Taxes, 6.7013% and, (b) in respect of Operating Expenses, 6.7509% (subject to adjustment in each such case as set forth in Section 4.3). Except as set forth in Section 4.3 (and, as applicable pursuant to the terms of Section 9.5), Tenant’s Proportionate Share shall not be increased or decreased during the Term other than to reflect the addition or deletion of leasable space in the Premises (whether pursuant to any of Landlord’s or Tenant’s rights expressly provided herein or otherwise) or as a result of additions or deletions to the Agreed Area of Building which are within the footprint of the Land and as permitted under this Lease. Any calculation of Tenant’s Proportionate Share shall be to 4 decimal points. |

2

1930820.10 29086-0006-000

|

|

|

|

|

|

| AGREED AREA OF BUILDING |

In respect of Taxes, 2,831,187 rentable square feet and, in respect of Operating Expenses, 2,802,975 rentable square feet, (subject to adjustment in each such case as set forth in Section 4.3 and, as applicable, Section 9.5). |

AGREED AREA OF PREMISES |

The rentable square footage of the Premises, from time to time, as shown on Exhibit L attached hereto (as the same may be adjusted and updated pursuant to Section 4.3), which, as of the Effective Date, in respect of the Office Premises (the “Agreed Area of the Office Premises”) is 189,226 rentable square feet, and in respect of the Storage Space (the “Agreed Area of the Storage Space”), is 500 usable square feet of Storage Space. |

3

1930820.10 29086-0006-000

|

|

|

|

|

|

FIXED RENT |

Lease Years 1-5

Floor

Rentable Square Feet

PSF

Annual Fixed Rent

Monthly Fixed Rent

25th Floor

47,808

$105

$5,019,863.00

$418,322.00

26th Floor

46,734

$105

$4,907,096.00

$408,925.00

27th Floor

47,447

$105

$4,981,890.00

$415,158.00

28th Floor

47,237

$105

$4,959,884.00

$413,324.00

Lease Years 6-10

Floor

Rentable Square Feet

PSF

Annual Fixed Rent

Monthly Fixed Rent

25th Floor

47,808

$114

$5,450,137.00

$454,178.00

26th Floor

46,734

$114

$5,327,704.00

$443,975.00

27th Floor

47,447

$114

$5,408,910.00

$450,742.00

28th Floor

47,237

$114

$5,385,016.00

$448,751.00

Lease Years 11-15

Floor

Rentable Square Feet

PSF

Annual Fixed Rent

Monthly Fixed Rent

25th Floor

47,808

$123

$5,880,411.00

$490,034.00

26th Floor

46,734

$123

$5,748,312.00

$479,026.00

27th Floor

47,447

$123

$5,835,929.00

$486,327.00

28th Floor

47,237

$123

$5,810,149.00

$484,179.00

Lease Years 16-20

Floor

Rentable Square Feet

PSF

Annual Fixed Rent

Monthly Fixed Rent

25th Floor

47,808

$132

$6,310,685.00

$525,890.00

26th Floor

46,734

$132

$6,168,921.00

$514,077.00

27th Floor

47,447

$132

$6,262,948.00

$521,912.00

28th Floor

47,237

$132

$6,235,282.00

$519,607.00 |

4

1930820.10 29086-0006-000

|

|

|

|

|

|

|

Fixed Rent for the Storage Space shall be the product of (i) 35% by (ii) the above PSF amounts of Annual Fixed Rent payable for the Office Premises by (iii) the Agreed Area of the Storage Space, and payable at the times and in the manner as Annual Fixed Rent is payable for the Office Premises. If Landlord sends the Relocation Notice, the Fixed Rent per rentable square foot of the Substitute Office Premises shall equal the Fixed Rent per rentable square foot of the Initial Office Premises set forth above (i.e., $105.00 for Lease Years 1-5; $114.00 for Lease Years 6-10; $123.00 for Lease Years 11-15; and $132.00 for Lease Years 16-20, each multiplied by the rentable square feet of the Substitute Office Premises). If Landlord gives Tenant a Relocation Notice, Landlord and Tenant, at either party’s request, shall promptly execute and exchange an appropriate agreement specifying the new Fixed Rent applicable to the Premises in a form reasonably satisfactory to both parties, but no such agreement shall be necessary in order to make the provisions hereof effective.

|

| ADDITIONAL RENT |

All sums other than Fixed Rent payable by Tenant to Landlord under this Lease, including, without limitation, Recurring Additional Rent (as hereinafter defined), late charges, overtime or excess service charges, damages, and interest and other costs related to Tenant’s failure to perform any of its obligations under this Lease. For all purposes of this Lease, “Recurring Additional Rent” means, collectively, PILOT Payments, Tax Payments, Impositions Payments, Additional Tax Payments and Tenant’s Operating Payments. |

| RENT |

Fixed Rent and Additional Rent, collectively. |

| INTEREST RATE |

The lesser of (i) 2% per annum above the then-current Base Rate, and (ii) the maximum rate permitted by applicable law. |

5

1930820.10 29086-0006-000

|

|

|

|

|

|

| TENANT’S ADDRESS FOR NOTICES |

AllianceBernstein L.P.

One Nashville Place

150 4th Ave. N

Nashville, Tennessee 37219

Attn: General Counsel

Copies to (until Tenant commences business operations from the Premises):

AllianceBernstein L.P.

1345 Sixth Avenue

New York, New York 10105

Attn: General Counsel

and

AllianceBernstein L.P.

1345 Sixth Avenue

New York, New York 10105

Attn: SVP, Counsel and Corporate Secretary

and

AllianceBernstein L.P.

1345 Sixth Avenue

New York, New York 10105

Attn: Corporate Real Estate

Copies to (from and after Tenant commences business operations from the Premises):

AllianceBernstein L.P.

66 Hudson Boulevard

New York, New York 10001

Attn: General Counsel

and

AllianceBernstein L.P.

66 Hudson Boulevard

New York, New York 10001

Attn: SVP, Counsel and Corporate Secretary

and

AllianceBernstein L.P.

66 Hudson Boulevard

New York, New York 10001

Attn: Corporate Real Estate

And copies to (in either case):

Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza

New York, New York 10004

Attn: Ross Silver, Esq.

and

leaseadminstration@alliancebernstein.com (provided that failure to send such notice to such email address shall not vitiate the effectiveness of such notice if sent to the other addresses for Tenant set forth above in accordance with Article 22)

|

6

1930820.10 29086-0006-000

|

|

|

|

|

|

| LANDLORD’S ADDRESS FOR NOTICES |

509 W 34, L.L.C.

c/o Tishman Speyer Properties, L.P.

45 Rockefeller Plaza

New York, New York 10111

Attn: Chief Financial Officer

|

|

Copies to:

509 W 34, L.L.C.

c/o Tishman Speyer Properties, L.P.

45 Rockefeller Plaza

New York, New York 10111

Attn: Property Manager

|

|

and:

Tishman Speyer Properties, L.P.

45 Rockefeller Plaza

New York, New York 10111

Attn: Chief Legal Officer

|

| TENANT’S BROKER |

Newmark Knight Frank. |

| LANDLORD’S AGENT |

Tishman Speyer Properties, L.P. or any other Person designated at any time and from time to time by Landlord as Landlord’s Agent. |

| LANDLORD’S CONTRIBUTION |

Initially, $100 per rentable square foot of the Agreed Office Area of the Premises, as adjusted to $96.41 per rentable square foot of the Agreed Area of the Office Premises in accordance with Exhibit DD attached hereto, and subject to further adjustment as otherwise provided in this Lease (including in any Exhibits). |

|

|

All capitalized terms used in this Lease without definition are defined in Exhibit B.

Article 2

PREMISES, TERM, RENT

Section 38.1Lease of Premises. Subject to the terms of this Lease, Landlord leases to Tenant and Tenant leases from Landlord the Premises for the Term. In addition, Landlord grants to Tenant the right to use, on a non-exclusive basis and in common with other tenants, the Common Areas.

Section 38.2Commencement Date. (a) Landlord and Tenant acknowledge that effective as of the Effective Date, this Lease shall be a binding obligation of Landlord and Tenant irrespective of whether the Commencement Date has occurred. The Term of this Lease shall commence on the Commencement Date and, unless sooner terminated or extended as hereinafter provided, shall end on the Expiration Date. Except as otherwise expressly provided in this Lease, if Landlord does not tender possession of the Premises to Tenant on or before any specified date, for any reason whatsoever, Landlord shall not be liable for any damage thereby, this Lease shall not be void or voidable thereby, the Term shall not commence until the occurrence of the Commencement Date and the same shall not affect any obligations of Tenant hereunder. Except as otherwise expressly provided in this Lease, there shall be no postponement of the Commencement Date (or the Rent Commencement Date) for (i) any delay in the delivery of possession of the Premises which results from Tenant Delay or (ii) any delay by Landlord in the performance of the Post-Turnover Work and any Punch List Items relating to Landlord’s Premises Work, subject to the terms of this Lease. The provisions of this Section 2.2(a) are intended to constitute “an express provision to the contrary” within the meaning of Section 223-a of the New York Real Property Law or any successor Requirement.

7

1930820.10 29086-0006-000

(a)Landlord shall send Tenant a notice not later than 30 days prior to the date when Landlord reasonably anticipates delivering the Premises to Tenant with the Turnover Work Substantially Complete. Landlord shall give notice to Tenant (each, a “Landlord’s SC Notice”) on or before the date which is 10 Business Days prior to the date (the “Anticipated Commencement Date”) the Turnover Work is Substantially Complete and the date (the “Anticipated Post-Turnover Work SC Date”; the Anticipated Commencement Date and/or the Anticipated Post-Turnover Work SC Date, as applicable, the “SC Date”) the Post-Turnover Work is Substantially Complete. Upon delivery of an Landlord’s SC Notice, such Landlord’s Premises Work shall be deemed Substantially Complete on the applicable SC Date and, with respect to the Turnover Work only, the Premises shall be deemed delivered to Tenant on the Anticipated Commencement Date subject to Tenant’s right to dispute the same as provided below in in this Section 2.2(b). On or within 5 Business Days after the applicable SC Date, Landlord and Tenant shall jointly inspect the Premises (an “SC Inspection”). Within 5 Business Days after any such SC Inspection, Tenant shall send Landlord a notice (each, a “Tenant’s SC Notice”) stating whether or not Tenant agrees that such Landlord’s Premises Work is Substantially Complete (and if Tenant fails to give Landlord such notice prior to the expiration of such 5-Business Day period, then Tenant shall be deemed to have agreed that such Landlord’s Premises Work is Substantially Complete). If Tenant concludes that such Landlord’s Premises Work is not Substantially Complete, then Tenant shall specify and list in reasonable detail in Tenant’s SC Notice all items asserted to be incomplete or unsatisfactorily completed (excluding the Post-Turnover Work (with respect to the Turnover Work only) and Punch List Items relating to Landlord’s Premises Work) (the “Incomplete Work”). If Tenant concludes that such Landlord’s Premises Work is Substantially Complete, Tenant shall include in Tenant’s SC Notice, a punch list setting forth any Punch List Items relating to such Landlord’s Premises Work (other than the Post-Turnover Work (with respect to the Turnover Work only) (and if Tenant fails to give Landlord such punch list prior to the expiration of such 5-Business Day period, then (a) such Landlord’s Premises Work shall be deemed to be Substantially Complete on the date set forth in the applicable Landlord’s SC Notice and (b) there shall be no Punch List Items relating to such Landlord’s Premises Work. If within 5 Business Days after Tenant’s timely delivery of a Tenant’s SC Notice asserting Incomplete Work, Landlord and Tenant have not agreed upon whether or not there is any Incomplete Work, then either party may submit any dispute concerning the Incomplete Work to expedited arbitration in accordance with the provisions of Article 36. Landlord, at Landlord’s sole cost and expense, shall commence the completion of such Incomplete Work in accordance with good construction practices as soon as practicable after the later to occur of (i) the date on which Landlord and Tenant shall have confirmed their agreement to the Incomplete Work in writing, and (ii) the date on which the item(s) set forth on the punch list shall have been determined pursuant to this Section 2.2(b). Once Landlord reasonably believes such Incomplete Work has been Substantially Completed, Landlord shall deliver to Tenant a Landlord’s SC Notice and, within 3 Business Days following Landlord’s notice to Tenant of such Substantial Completion, Landlord and Tenant will jointly perform an SC Inspection to determine if Tenant agrees that the Incomplete Work has been Substantially Completed. If it is resolved or the parties otherwise agree that such Landlord’s Premises Work was not Substantially Complete on the SC Date set forth in the applicable Landlord’s SC Notice, then the date such Landlord’s Premises Work is Substantially Complete (or, in the event of the Turnover Work, the Commencement Date), shall be the date as so resolved or agreed. If within 5 Business Days after Tenant’s timely delivery of the applicable punch list, Landlord and Tenant have not agreed upon a final list of Punch List Items relating to the applicable Landlord’s Premises Work in writing, then either party may submit any dispute concerning the Punch List to expedited arbitration in accordance with the provisions of Article 36.

8

1930820.10 29086-0006-000

Landlord, at Landlord’s sole cost and expense, shall complete all Punch List Items relating to Landlord’s Premises Work set forth on the agreed upon punch list in accordance with good construction practices, and shall use reasonable efforts to complete all such Punch List Items relating to Landlord’s Premises Work within 45 days after the later to occur of (A) the date on which Landlord and Tenant shall have confirmed their agreement to the punch list in writing and (B) the date on which the Punch List Items relating to Landlord’s Premises Work set forth on the punch list shall have been determined pursuant to Article 36, except for any Punch List Items relating to Landlord’s Premises Work that (I) in accordance with good construction scheduling practices should only be completed after completion by Tenant of one or more item(s) of the Initial Installations; it being agreed that Landlord shall commence completion of any such Punch List Items relating to Landlord’s Premises Work within 10 Business Days (or as soon as reasonably practicable thereafter) after Landlord’s receipt of notice from Tenant of completion of the item(s) of the Initial Installations in question, and Landlord shall prosecute completion of such Punch List Items relating to Landlord’s Premises Work diligently and with continuity until completion) or (II) cannot, with due diligence, be completed within such 45-day period (provided that promptly (but not more than 10 Business Days) after the dates set forth in clause (A) or clause (B) above), Landlord shall diligently commence and prosecute the same with continuity to completion. Subject to Section 6.3 (as if the Punch List Items relating to Landlord’s Premises Work are Restorative Work (as hereinafter defined in Section 6.3)) and Article 14, Tenant shall provide Landlord with such access to the Premises to perform the Post-Turnover Work and Punch List Items relating to Landlord’s Premises Work as may be reasonably required by Landlord to complete the Post-Turnover Work and Punch List Items, and Tenant will use reasonable efforts to avoid any interference with the performance of the Post-Turnover Work and Punch List Items relating to Landlord’s Premises Work. Subject to Section 6.3 (as if the Post-Turnover Work and Punch List Items relating to Landlord’s Premises Work are Restorative Work), Landlord’s performance of the Post-Turnover Work and Punch List Items relating to Landlord’s Premises Work shall not interfere beyond a de minimis extent with Tenant’s performance of the Initial Installations. Except as otherwise provided in Section 2.8(b)(vii), there shall be no Rent abatement or allowance to Tenant for a diminution of rental value, no actual or constructive eviction of Tenant, in whole or in part, no relief from any of Tenant’s other obligations under this Lease, and no liability on the part of Landlord, by reason of inconvenience, annoyance or injury to business arising from the performance of the Post-Turnover Work and Punch List Items relating to Landlord’s Premises Work or the storage of any materials in connection therewith; provided that Landlord complies with the applicable provisions of Section 6.3 (as if the Post-Turnover Work and Punch List Items relating to Landlord’s Premises Work are Restorative Work). Notwithstanding the foregoing provisions of this Section 2.2(b), Tenant may notify Landlord of latent defects and other items not then reasonably observable in the Premises, in each case with respect to Landlord’s Premises Work, which could not reasonably have been observed by Tenant at the time of the applicable SC Inspection on or before the earlier of (1) the 18-month anniversary of the Commencement Date (with respect to the Turnover Work), (2) the 18-month anniversary of the date the Post-Turnover Work is determined to be Substantially Complete (with respect to the Post-Turnover Work) and (3) the date that is 60 days after Tenant first becomes aware of such defective item of Landlord’s Premises Work, and, in the event of a timely notice from Tenant, Landlord shall promptly make or cause to be made such necessary repairs and replacements with respect thereto (which obligations, for the avoidance of doubt, shall survive the completion of the performance of Landlord’s Premises Work and the Initial Installations).

(b)Once the Commencement Date is determined, Landlord and Tenant shall execute an agreement stating the Commencement Date, the Rent Commencement Date and the Expiration Date, but the failure to do so will not affect the determination of such dates.

Section 38.3Payment of Rent. Tenant shall pay to Landlord, without notice or demand, and without any set-off, counterclaim, abatement or deduction whatsoever, except as may be expressly set forth in this Lease, in lawful money of the United States by wire transfer of funds, (i) Fixed Rent in equal monthly installments, in advance, on the 1st day of each month during the Term, commencing on the Rent Commencement Date, and (ii) Additional Rent, at the times and in the manner set forth in this Lease. Except as expressly provided to the contrary in this Lease and excluding Fixed Rent, any Additional Rent for which no time period is expressly provided in this Lease for the payment thereof shall become due and payable by Tenant to Landlord within 30 days after delivery to Tenant of Landlord’s reasonably detailed invoice for such amount.

9

1930820.10 29086-0006-000

Section 38.4First Month’s Rent. If the Rent Commencement Date is on the 1st day of a month, then on the Rent Commencement Date Tenant shall pay the 1st month’s Fixed Rent payment. If the Rent Commencement Date is not the 1st day of a month, then on the Rent Commencement Date Tenant shall pay Fixed Rent for the period from the Rent Commencement Date through the last day of such month, appropriately pro-rated to account for the period of less than a full calendar month.

Section 38.5Rent Abatement. Notwithstanding any provision of this Lease to the contrary and provided this Lease is in full force and effect and no Event of Default then exists, Fixed Rent and Recurring Additional Rent shall be abated for a period (the “Free Rent Period”) commencing on the Commencement Date and ending on December 31, 2024 (it being understood that so long as Tenant cures any Event of Default and this Lease is not terminated, Tenant shall be entitled to the full amount of the credit referred to above in respect of the Premises). The day immediately following the last day of the Free Rent Period shall be referred to in this Lease as the “Rent Commencement Date”; provided that, for purposes of Article 7 only, if an Event of Default occurs during the Free Rent Period, the Rent Commencement Date shall be deemed to be the date on which such Event of Default occurred (but the foregoing shall not vitiate Tenant’s rights to any abatement of Rent thereunder as a result of the early occurrence of the Rent Commencement Date that Tenant is otherwise entitled upon a cure of such Event of Default pursuant to the first sentence of this Section 2.5). In the event a fire or other casualty or other event occurs during the Free Rent Period that entitles Tenant to an abatement of Rent pursuant to terms of this Lease with respect to all or a portion of the Premises, the Free Rent Period (in the case of such an abatement with respect to the entire Premises), or the Free Rent Period as to the applicable portion of the Premises (in the case of such an abatement with respect to a portion of the Premises), shall be tolled for the entire period of such abatement and shall resume when Rent would otherwise recommence with respect to the Premises (or applicable portion thereof), pursuant to this Lease.

Section 38.6Landlord Delay. If a Landlord Delay occurs, then, as Tenant’s sole remedy for such Landlord Delay (except specific remedies set forth in this Lease, in which case the occurrences for which such section apply shall not be deemed a Landlord Delay), (a) Tenant shall receive a credit equal to one days’ Fixed Rent and Recurring Additional Rent (on an RSF basis) payable by Tenant for the portion of the Premises the subject of such Landlord Delay as of the Rent Commencement Date for the Premises, for each day of such Landlord Delay and (b) Landlord shall reimburse Tenant for out-of-pocket costs incurred by Tenant (without duplication) solely as a direct result of Landlord Delay. Notwithstanding any other provision herein to the contrary, to the extent that there is a simultaneous delay resulting from a Landlord Delay and an Unavoidable Delay (i.e., the specific period of delay is caused by both a Landlord Delay and an Unavoidable Delay), such that such specific period of delay would have occurred solely from an Unavoidable Delay even if Landlord Delay had not occurred, the number of days of such simultaneous delay shall be deemed to be an Unavoidable Delay. Notwithstanding anything to the contrary contained in this Lease, Tenant shall not be entitled to any of the credits against Fixed Rent and Recurring Additional Rent on account of a Landlord Delay if such Landlord Delay occurs on the same day or days (or is for the same underlying act or omission) as an occurrence under any other Section of this Lease, which causes a deferral or extension of the Rent Commencement Date (or provides Tenant with a rent abatement or credit) for the space affected by such Landlord Delay (i.e., not “double” counted).

Section 38.7Termination Milestone Dates. (a) If (i) on or before July 1, 2022 (as the same shall be extended by Unavoidable Delay which actually delays such installation, the “Steel Milestone Date”), Landlord shall not have installed steel framing through the 25th floor (the “Steel Milestone”), Tenant shall have the right as its sole and exclusive remedy (subject to the terms below) to terminate this Lease by sending written notice to Landlord of such termination on or before the date which is 90 days after the Steel Milestone Date, subject to the terms below.

10

1930820.10 29086-0006-000

If Tenant properly exercises its right to terminate this Lease in accordance with the terms of this Section 2.7(a), then, except as otherwise provided below, this Lease shall terminate upon the date that is 30 days after Tenant’s termination notice is delivered to Landlord as if such date were the Expiration Date; provided, however, if the Steel Milestone is satisfied on or before the date that is 30 days after Tenant delivered any such notice of termination, this Lease shall not be so terminated and Tenant’s termination right under this Section 2.7(a) shall be null and void and this Lease shall remain in full force and effect.

(a)If Substantial Completion of the work set forth on Exhibit AA attached hereto (the “Termination Milestone Landlord’s Premises Work Obligation”) has not occurred on or before January 1, 2023 (as the same is extended by Unavoidable Delay which actually delays completion of the Termination Milestone Landlord’s Premises Work Obligation, the “First Landlord’s Work Milestone Date”), then Tenant shall have the right as its sole and exclusive remedy (subject to the terms below) to terminate this Lease by sending written notice to Landlord of such termination on or before the date which is 60 days after the First Landlord’s Work Milestone Date. If Tenant properly exercises its right to terminate this Lease in accordance with the terms of this Section 2.7(b), then, except as otherwise provided below, this Lease shall terminate upon the date which is 30 days after Tenant’s termination notice is delivered to Landlord as if such date were the Expiration Date; provided, however, if the Termination Milestone Landlord’s Premises Work Obligation has been Substantially Completed (or is deemed to have been Substantially Completed) on or before the date that is 30 days after Tenant delivered any such notice of termination, this Lease shall not be so terminated and Tenant’s termination right under this Section 2.7(b) shall be null and void and this Lease shall remain in full force and effect. Failure by Tenant to exercise such right to terminate this Lease pursuant to this Section 2.7(b) within the time period expressly set forth above shall constitute a waiver of such right and this Lease shall remain in full force and effect.

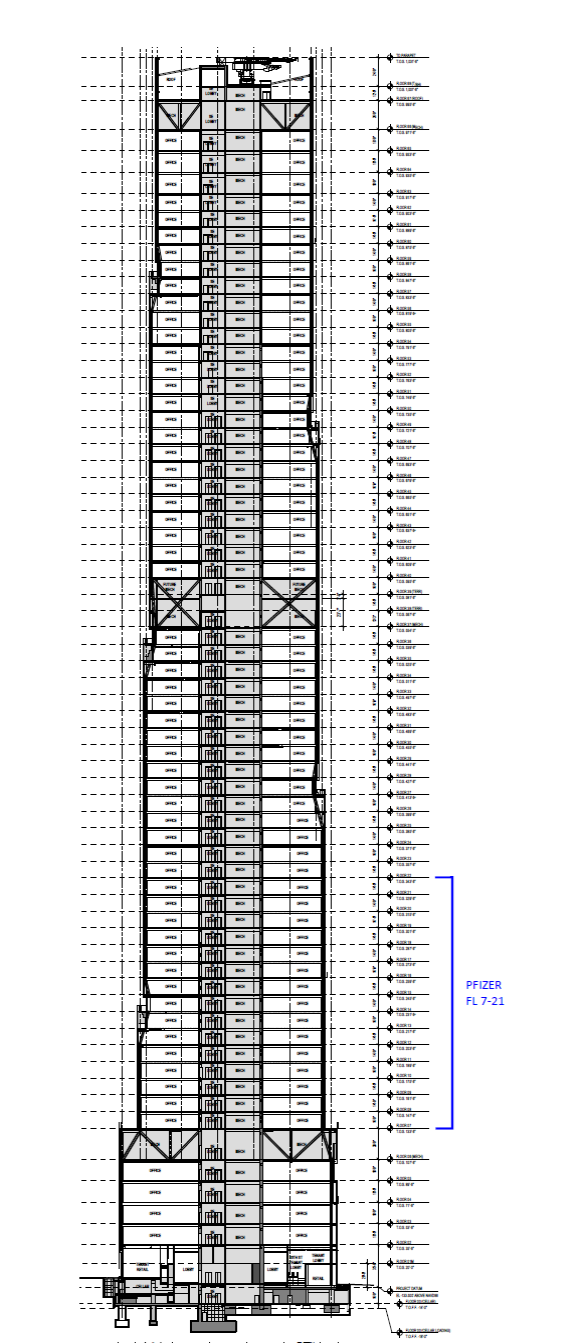

(b)If Substantial Completion of Landlord’s Premises Work and Landlord’s Building Work has not occurred on or before January 1, 2025 (as the same is extended by Unavoidable Delay and/or Tenant Delay which actually delays completion of Landlord’s Premises Work and/or Landlord’s Building Work, the “Second Landlord’s Work Milestone Date”), then either Landlord or Tenant shall have the right (the “Outside Termination Right”) as its sole and exclusive remedy (subject to the terms below) to terminate this Lease by sending written notice to the other party of such termination on or before the date which is 30 days after the Second Landlord’s Work Milestone Date; provided that, with respect to a termination by Landlord, Landlord has also terminated the leases of all other office tenants of the Building other than the Pfizer Lease (as hereinafter defined) (except to the extent Landlord has such termination right in the Pfizer Lease). Notwithstanding the foregoing, Landlord shall have the right, in its sole discretion, to exercise the Outside Termination Right if Substantial Completion of Landlord’s Premises Work and Landlord’s Building Work has not yet occurred, on or after January 1, 2024, provided that Tenant has theretofore entered into a lease in New York City for a substantially similar or greater amount of rentable square footage of office space as the Agreed Area of the Office Premises in lieu of space in the Building. If Landlord or Tenant properly exercises its right to terminate this Lease in accordance with the terms of this Section 2.7(c), then this Lease shall terminate upon the date that is 30 days after such party’s termination notice is delivered to the other party as if such date were the Expiration Date. Failure by Landlord or Tenant to exercise such right to terminate this Lease pursuant to this Section 2.7(c) within the time period expressly set forth above shall constitute a waiver of such right and this Lease shall remain in full force and effect.

(c)Notwithstanding the foregoing, in no event shall any extension of the Steel Milestone Date, the First Landlord’s Work Milestone Date and/or the Second Landlord’s Work Milestone Date, by reason of Unavoidable Delay under this Section 2.7, when aggregated, exceed 180 days.

11

1930820.10 29086-0006-000

(d)In the event this Lease is terminated by Tenant or Landlord pursuant to, and in accordance with, the provisions of this Section 2.7, Landlord shall pay to Tenant, within 30 days after the termination date, as liquidated damages and Tenant’s sole remedy, the applicable Termination Fee. For the purposes hereof, “Termination Fee” means with respect to a termination (i) under Section 2.7(a), $10,000,000.00; (ii) under Section 2.7(b), $23,612,170.00 (subject to adjustment as hereinafter provided); and (iii) under Section 2.7(c), $23,612,170.00 (subject to adjustment as hereinafter provided). Notwithstanding the foregoing, the Termination Fee set forth in clause (ii) and clause (iii) of this Section 2.7(e) (as adjusted, the “Maximum Termination Fee Amount”) shall be subject to appropriate adjustment in accordance with the formula attached hereto as Exhibit BB in the event that the Agreed Area of the Office Premises changes prior to the applicable termination milestone date, including, without limitation, pursuant to Section 4.3 below, or to account for the Substitute Office Premises, the addition of any Pre-CD Expansion Space, and/or the subtraction of any Pre-CD Contraction Space, if and as applicable. The provisions of this Section 2.7(e) shall survive the Expiration Date.

Section 38.8Non-Termination Milestone Dates.

(a)Without limiting Tenant’s remedies in Section 2.7, in the event that any of the events described in clauses (i)–(viii) of this Section 2.8(a) (each, a “Milestone”) are not satisfied by the applicable date set forth below (each, a “Milestone Date”), Tenant shall have the remedies set forth in Section 2.8 below, subject to the terms and conditions of this Section 2.8:

(i)Substantial Completion of the Turnover Work on or before January 1, 2024 (as the same is extended by Unavoidable Delay which actually delays Substantial Completion of the Turnover Work);

(ii)Substantial Completion of the Storage Space in substantial accordance with the Base Building Plans, with all essential services available for Tenant’s use in substantial accordance with Section 10.21, on or before the Commencement Date (as such Milestone Date shall be extended by Unavoidable Delay which actually delays satisfaction of this Milestone and which Unavoidable Delay has not already been taken into account with respect to extension of the satisfaction of the Milestone described in Section 2.8(a)(i) above (i.e., no “double counting” for the same the same instance of Unavoidable Delay));

(iii)Satisfaction of each of the following, on or before the Commencement Date (as such Milestone Date shall be extended by Unavoidable Delay which actually delays satisfaction of this Milestone and which Unavoidable Delay has not already been taken into account with respect to extension of the satisfaction of the Milestone described in Section 2.8(a)(i) above (i.e., no “double counting” for the same the same instance of Unavoidable Delay), and/or Tenant Delay which actually delays satisfaction of this Milestone):

A.All services specified as items 1, 2 and 3 on Exhibit C-4 available for Tenant’s use and Substantial Completion of all work specified in item 9 on Exhibit C-4 (including the Live Load Upgrade, if timely elected and required to be performed by Landlord) in substantial accordance with Exhibit C-4;

B.Substantial Completion of the Passenger Work Elevators, operational for Tenant’s exclusive use in substantial accordance with Section 10.2;

C.Substantial Completion of the Building loading dock (or, in the alternative, equivalent loading provisions for Tenant requirements on-site), which Tenant and other tenants have the right to use, in substantial accordance with the Base Building Plans, operational and available for Tenant’s non-exclusive use;

12

1930820.10 29086-0006-000

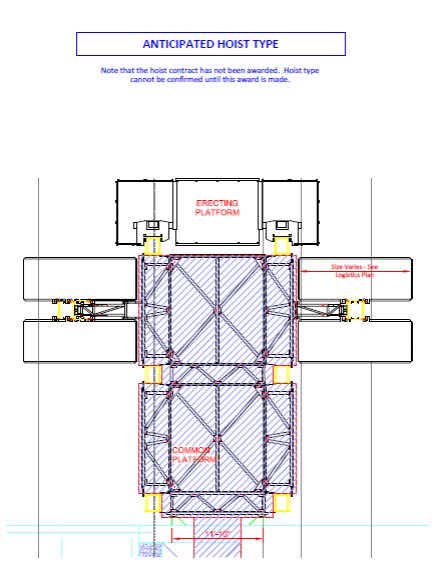

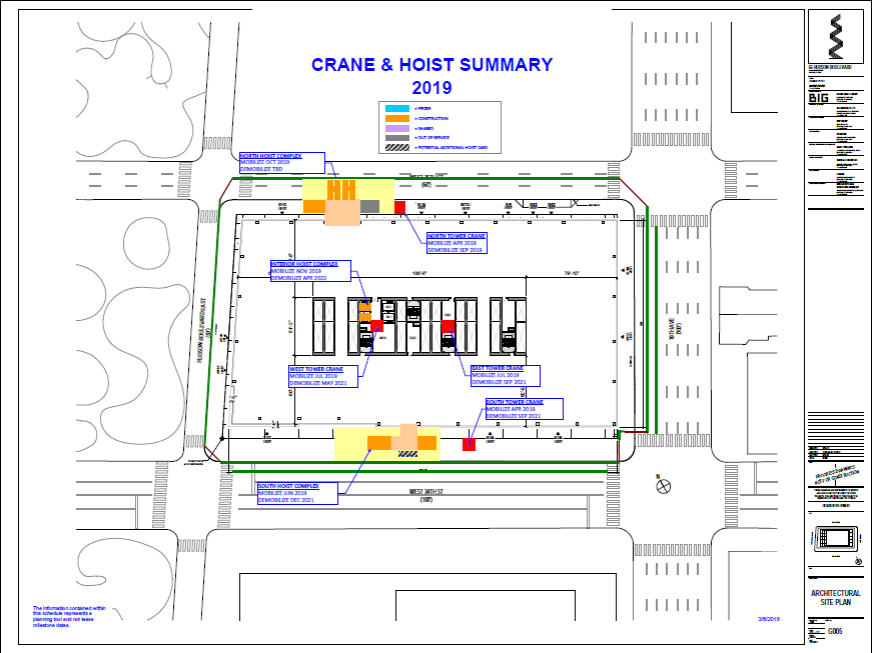

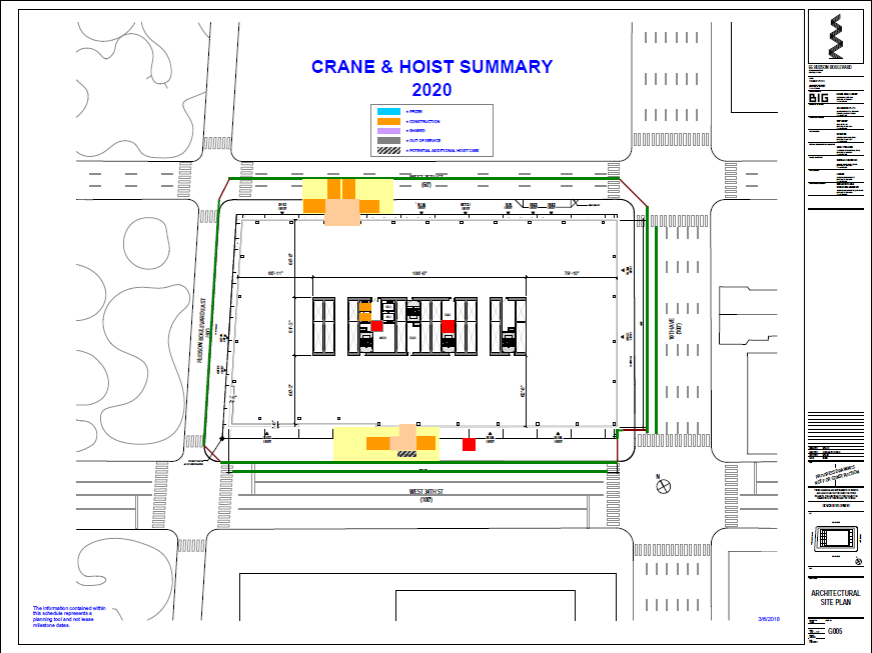

D.Substantial Completion of all Building freight elevators (or, in the alternative, outside hoists), which Tenant and other tenants have the right to use, in substantial accordance with the Base Building Plans, operational and available for Tenant’s non-exclusive use;

E.Substantial Completion of the Terrace, available for Tenant’s exclusive use in substantial accordance with Section 33.1(a); and

F.Substantial Completion of the Terrace Landscaping in substantial accordance with Section 33.1(a).

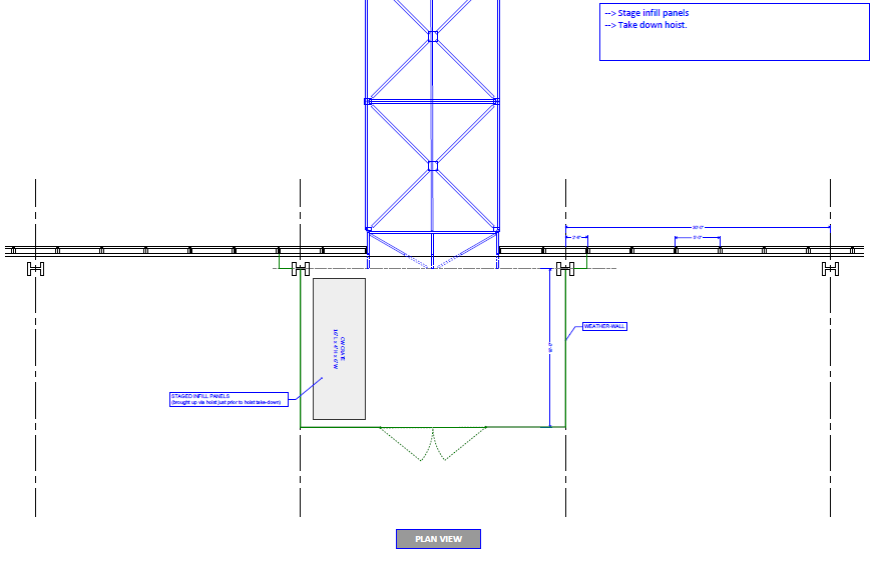

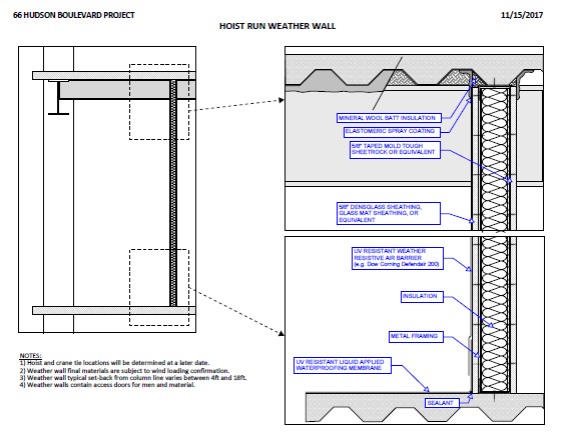

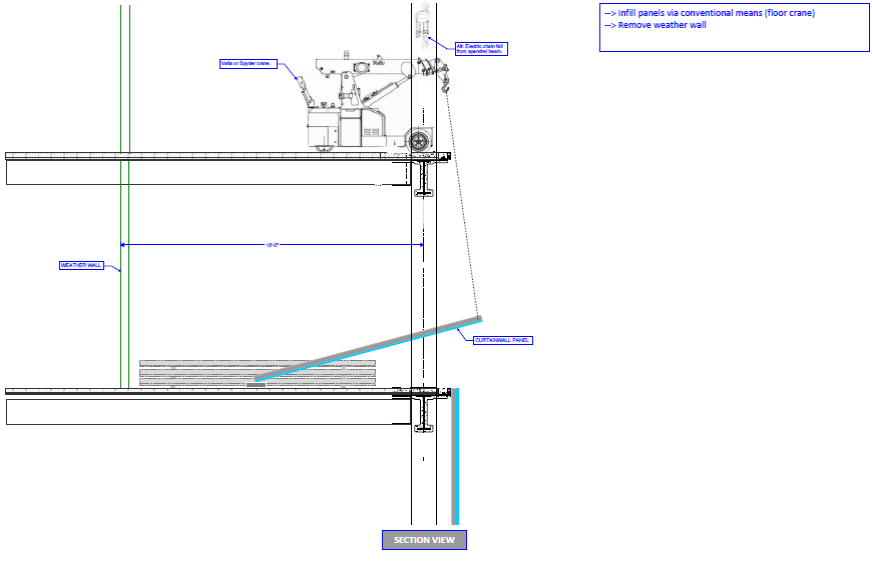

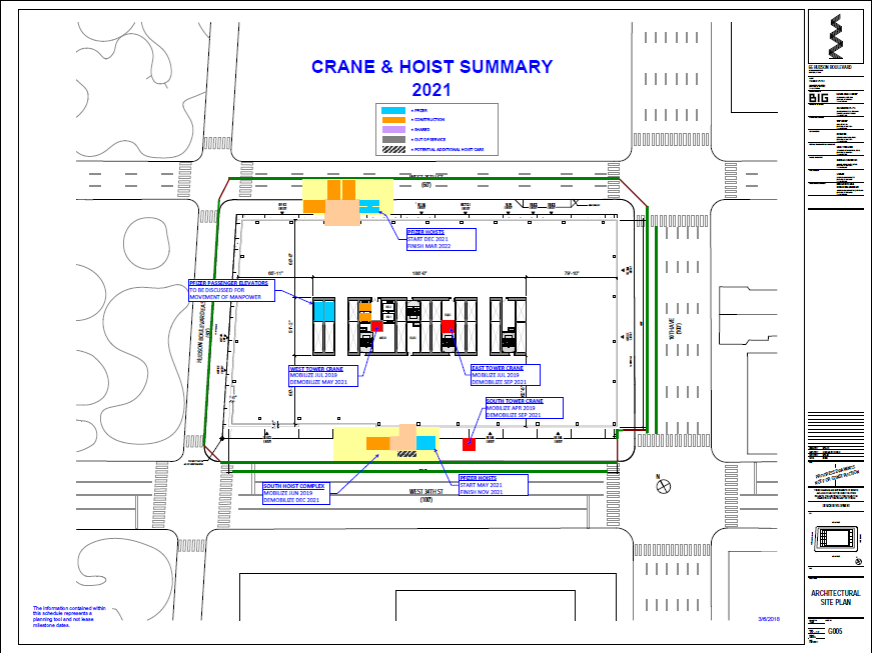

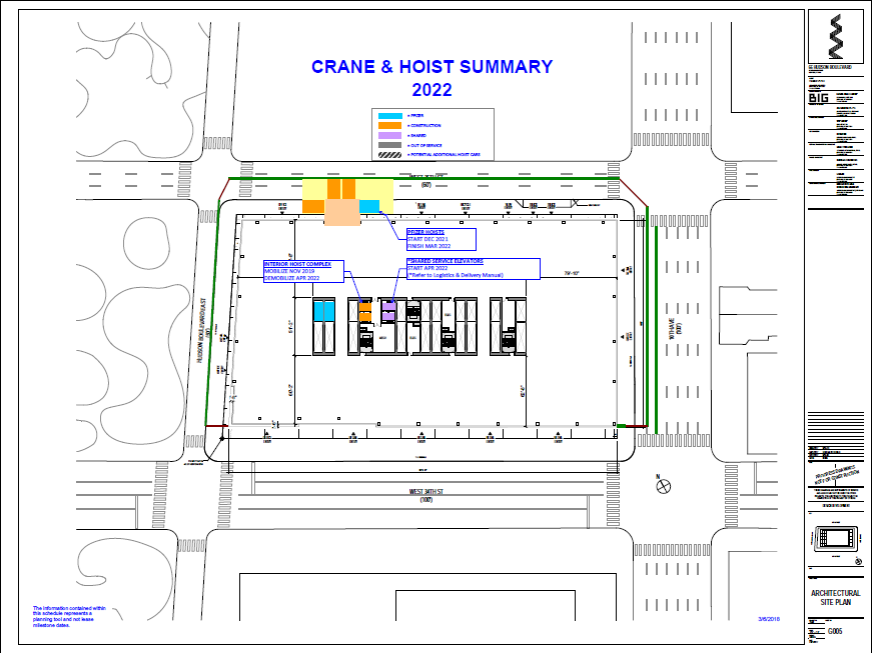

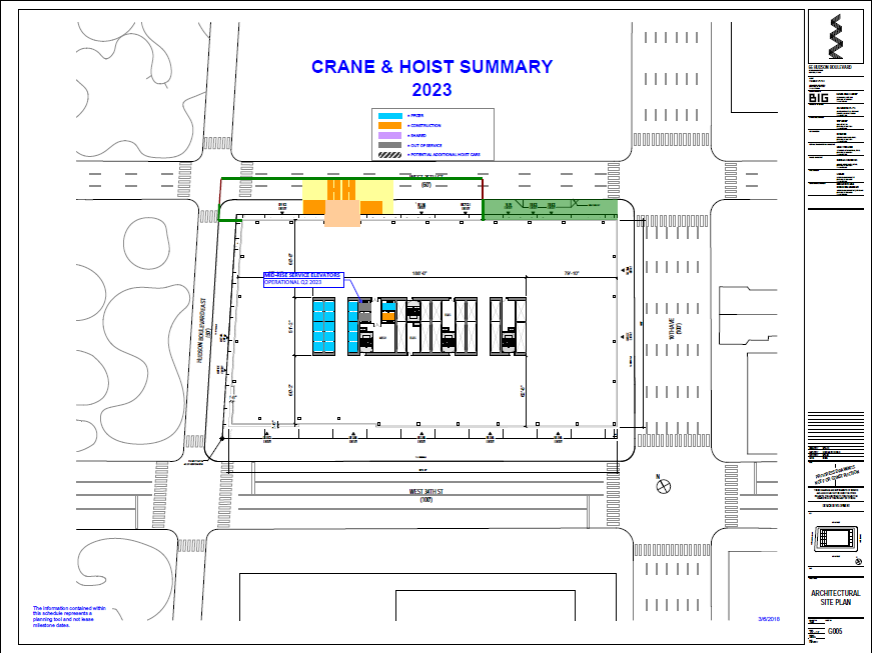

(iv)Removal of all hoists and temporary enclosures and weather rooms with respect thereto, repair in all material respects of any damage caused from removing the hoist, installation (and making weather tight) of all of the curtain wall and windows of the Building, on or before June 1, 2024 (as such Milestone Date shall be extended by Unavoidable Delay and/or Tenant Delay which actually delays satisfaction of this Milestone);

(v)Substantial Completion of the construction of each of the following, open and operational for Tenant’s non-exclusive use, on or before June 1, 2024 (as same shall be extended by Unavoidable Delay and/or Tenant Delay which actually delays satisfaction of this Milestone):

A.all passenger elevators in the Tenant Elevator Bank in substantial accordance with the Base Building Plans;

B.each Multi-Tenant Lobby, including each Multi-Tenant Security Desk and all elevator vestibules therein, in substantial accordance with the Base Building Plans and either the completion of all finishes of a public corridor spanning the core of the Building on the north side of the Building (the “North Corridor”) connecting on each end to Hudson Boulevard and 10th Avenue lobbies respectively, or the completion of temporary work visually separating the North Corridor from Multi-Tenant Lobbies in a manner intended to provide a permanent appearance utilizing finishes from the architectural vocabulary of the Multi-Tenant Lobbies;

C.the bicycle storage room in substantial accordance with Section 10.18;

D.the Messenger Center in substantial accordance with the Base Building Plans,

E.the Garage open and available for use;

F.the Building loading dock (or, in the alternative, equivalent loading provisions for Tenant requirements on-site), which Tenant and other tenants have the right to use, in substantial accordance with the Base Building Plans; and

G.all Building freight elevators which Tenant and other tenants have the right to use, in substantial accordance with the Base Building Plans.

(vi)Substantial Completion of the Terrace and Terrace Landscaping available for Tenant’s exclusive use in substantial accordance with Section 33.1(a), on or before June 1, 2024 (as same shall be extended by Unavoidable Delay and/or Tenant Delay which actually delays satisfaction of this Milestone); (vii)Satisfaction of each of the following on or before June 1, 2024 (as such Milestone Date shall be extended by Unavoidable Delay and/or Tenant Delay which actually delays satisfaction of this Milestone):

13

1930820.10 29086-0006-000

A.Issuance of temporary zero occupancy certificate of occupancy for the core and shell of the Building on or before June 1, 2024 (as same shall be extended by Unavoidable Delay and/or Tenant Delay which actually delays satisfaction of this Milestone); and

B.Substantial Completion of the Post-Turnover Work; and

(viii)Substantial Completion of Landlord’s Building Work which if not Substantially Complete adversely affects Tenant’s (i) performance of the Initial Installations and/or (ii) ability to occupy and use the Premises for the Permitted Uses, in either case, beyond a de minimis extent, on or before April 1, 2024 (as such Milestone Date shall be extended by Unavoidable Delay and/or Tenant Delay which actually delays satisfaction of this Milestone).

(b)In the event that Landlord has not achieved (or deemed to have achieved) any of the Milestones by the applicable Milestone Date, then the following terms and conditions shall apply:

(i)With respect to the Milestone in Section 2.8(a)(i), if there is an actual delay in Tenant’s completion of the Initial Installations and its ability to commence occupancy of the Premises (i.e., but for such Landlord failure Tenant would have completed its Initial Installations and commenced occupancy of the Premises in accordance with Tenant’s documented construction and move-in schedule (the number of days of any such delay being herein called “Actual Delay”) by a particular date (but not earlier than October 1, 2024) (the “Anticipated Occupancy Date”), then, if this Lease is then in full force and effect, as liquidated damages and Tenant’s sole remedy for not achieving the Milestone in Section 2.8(a)(i) on or before the applicable Milestone Date (except as otherwise expressly provided in this Section 2.8 or in Section 2.7 above), Tenant shall receive a credit against Fixed Rent and Recurring Additional Rent, to be applied from and after the Rent Commencement Date, with respect to the Initial Office Premises, equal to (A) 100% of Fixed Rent and Recurring Additional Rent with respect to the Initial Office Premises on a per diem basis for days for days 1–90 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved); (B) 150% of Fixed Rent and Recurring Additional Rent with respect to the Initial Office Premises on a per diem basis for days 91–150 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved); and (C) 200% of Fixed Rent and Recurring Additional Rent with respect to the Initial Office Premises on a per diem basis for each day from and after day 151 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved), in each case only to the extent of any Actual Delay;

(ii)With respect to the Milestone in Section 2.8(a)(ii), if there is an Actual Delay in Tenant’s completion of the Initial Installations and its ability to commence occupancy of the Storage Space by the Anticipated Occupancy Date, then, if this Lease is then in full force and effect, as liquidated damages and Tenant’s sole remedy for not achieving the Milestone in Section 2.8(a)(ii) on or before the applicable Milestone Date (except as otherwise expressly provided in this Section 2.8 or in Section 2.7 above), Tenant shall receive a credit against Fixed Rent and Recurring Additional Rent with respect to the Storage Space, to be applied from and after the Rent Commencement Date, with respect to the Storage Space, equal to (A) 100% of Fixed Rent and Recurring Additional Rent with respect to the Storage Space on a per diem basis for days for days 1–90 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved); (B) 150% of Fixed Rent and Recurring Additional Rent with respect to the Storage Space on a per diem basis for days 91–150 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved); and (C) 200% of Fixed Rent and Recurring Additional Rent with respect to the Storage Space on a per diem basis for each day from and after day 151 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved), in each case only to the extent of any Actual Delay; (iii)With respect to each Milestone in Section 2.8(a)(iii), if there is an Actual Delay in Tenant’s completion of the Initial Installations and its ability to commence occupancy of the Premises by the Anticipated Occupancy Date, such failure shall be deemed a Landlord Delay without advance notice thereof from Tenant, and Tenant shall be entitled to all of the remedies set forth in Section 2.6 until the applicable Milestone is achieved (or deemed to be achieved), only to the extent of any Actual Delay;

14

1930820.10 29086-0006-000

(iv)With respect to the Milestone in Section 2.8(a)(iv), if Tenant is then occupying the Initial Office Premises for the ordinary conduct of business, Tenant shall receive a credit against Fixed Rent and Recurring Additional Rent (on an RSF basis), to be applied from and after the Rent Commencement Date, with respect to the actual area (such area, the “Hoist Impacted Area”) on each floor of the Initial Office Premises that is unusable or in which Tenant is unable to reasonably perform the Initial Installations as a result of the failure of such Milestone to be satisfied, equal to (A) 100% of Fixed Rent and Recurring Additional Rent with respect to the Hoist Impacted Area on a per diem basis for days 1–90 after applicable Milestone Date until the Milestone is achieved (or deemed to be achieved); (B) 150% of Fixed Rent and Recurring Additional Rent with respect to the Hoist Impacted Area on a per diem basis for days 91–150 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved); and (C) 200% of Fixed Rent and Recurring Additional Rent with respect to the Hoist Impacted Area on a per diem basis for each day from and after day 151 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved);

(v)With respect to each Milestone in Section 2.8(a)(v), if Tenant elects in its sole discretion to commence occupancy of all or a part of the Premises for the ordinary conduct of business prior to achieving any such Milestone such that any credit against Fixed Rent and Recurring Additional Rent pursuant to Section 2.8(b)(i), Section 2.8(b)(iii), Section 2.8(b)(vii) and Section 2.8(b)(viii) has ceased to accrue (but not earlier than the Anticipated Occupancy Date) (the “Rent Credit Cessation Date”), then, provided this Lease is then in full force and effect, as liquidated damages and Tenant’s sole remedy therefor (except as otherwise expressly provided in this Section 2.8 or in Section 2.7 above), Tenant shall receive a credit against Fixed Rent and Recurring Additional Rent to be applied from and after the Rent Credit Cessation Date (“Per Diem Credit”), equal to (A) $2,000.00 per Milestone per day for days 1–90 after the Rent Credit Cessation Date until the applicable Milestone is achieved (or deemed to be achieved), (B) $4,000.00 per Milestone per day for days 91–120 after the Rent Credit Cessation Date until the applicable Milestone is achieved (or deemed to be achieved), (C) $6,000.00 per Milestone per day for days 121–150 after the Rent Credit Cessation Date until the applicable Milestone is achieved (or deemed to be achieved), and (D) $8,000.00 per Milestone per day for each day from and after day 151 after the Rent Credit Cessation Date until the applicable Milestone is achieved (or deemed to be achieved);

(vi)With respect the Milestone in Section 2.8(a)(vi), if Tenant elects in its sole discretion to commence occupancy of all or a part of the Premises for the ordinary conduct of business prior to achieving any such Milestone such that the Rent Credit Cessation Date has occurred, then, provided this Lease is then in full force and effect, as liquidated damages and Tenant’s sole remedy therefor (except as otherwise expressly provided in this Section 2.8 or in Section 2.7 above), Tenant shall receive a Per Diem Credit equal to (A) $2,000.00 per Milestone per day for days 1–90 after the Rent Credit Cessation Date until the applicable Milestone is achieved (or deemed to be achieved), (B) $4,000.00 per Milestone per day for days 91–120 after the Rent Credit Cessation Date until the applicable Milestone is achieved (or deemed to be achieved), (C) $6,000.00 per Milestone per day for days 121–150 after the Rent Credit Cessation Date until the applicable Milestone is achieved (or deemed to be achieved), and (D) $8,000.00 per Milestone per day for each day from and after day 151 after the Rent Credit Cessation Date until the applicable Milestone is achieved (or deemed to be achieved);

(vii)With respect to each Milestone in Section 2.8(a)(vii), if there is an Actual Delay in Tenant’s completion of the Initial Installations and its ability to commence occupancy of the Premises for the ordinary conduct of business by the Anticipated Occupancy Date, such failure shall be deemed a Landlord Delay without advance notice thereof from Tenant, and Tenant shall be entitled to all of the remedies set forth in Section 2.6 until the applicable Milestone is achieved (or deemed to be achieved), only to the extent of any Actual Delay; and

15

1930820.10 29086-0006-000

(viii)With respect to the Milestone in Section 2.8(a)(viii), if there is an Actual Delay in Tenant’s completion of the Initial Installations and its ability to commence occupancy of the Premises for the ordinary conduct of business by the Anticipated Occupancy Date, then, if this Lease is then in full force and effect, as liquidated damages and Tenant’s sole remedy for not achieving the Milestone in Section 2.8(a)(viii) on or before the applicable Milestone Date (except as otherwise expressly provided in this Section 2.8 or in Section 2.7 above), Tenant shall receive a credit against Fixed Rent and Recurring Additional Rent, to be applied from and after the Rent Commencement Date, with respect to the Initial Office Premises, equal to (A) 100% of Fixed Rent and Recurring Additional Rent with respect to the Initial Office Premises on a per diem basis for days for days 1–90 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved); (B) 150% of Fixed Rent and Recurring Additional Rent with respect to the Initial Office Premises on a per diem basis for days 91–150 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved); and (C) 200% of Fixed Rent and Recurring Additional Rent with respect to the Initial Office Premises on a per diem basis for each day from and after day 151 after the applicable Milestone Date until the Milestone is achieved (or deemed to be achieved); in each case only to the extent of any Actual Delay; and

(ix)With respect the Milestone in Section 2.8(a)(viii), if Tenant elects in its sole discretion to commence occupancy of all or a part of the Premises for the ordinary conduct of business prior to achieving such Milestone such that the Rent Credit Cessation Date has occurred, then, provided this Lease is then in full force and effect, as liquidated damages and Tenant’s sole remedy therefor (except as otherwise expressly provided in this Section 2.8 or in Section 2.7 above), Tenant shall receive a Per Diem Credit equal to (A) $2,500.00 per day for days 1–90 after the Rent Credit Cessation Date until such Milestone is achieved (or deemed to be achieved), (B) $4,500.00 per day for days 91–120 after the Rent Credit Cessation Date until such Milestone is achieved (or deemed to be achieved), (C) $6,500.00 per day for days 121–150 after the Rent Credit Cessation Date until such Milestone is achieved (or deemed to be achieved), and (D) $8,500.00 per day for each day from and after day 151 after the Rent Credit Cessation Date until such Milestone is achieved (or deemed to be achieved).

(c)Notwithstanding the foregoing, in no event shall any extension of the Milestone Dates, by reason of Unavoidable Delay under this Section 2.8, when aggregated, exceed 180 days.

(d)Notwithstanding anything to the contrary contained herein, in no event shall the cumulative effect of the credit against Fixed Rent and Recurring Additional Rent on account of any Landlord Delay pursuant to Sections 2.8(b)(iii) or Section 2.8(b)(vii) above be more than the largest number of days after the applicable Milestone Date (as such date may extended as therein provided, subject to the terms of Section 2.8(c)), that an applicable Milestone described in Section 2.8(a)(iii) or Section 2.8(a)(vii) above, as applicable, is not achieved until such applicable Milestone is achieved (or deemed to be achieved) (i.e., if the applicable Milestones described in Section 2.8(a)(iii) or Section 2.8(a)(vii) above are not achieved (or deemed to be achieved) by the applicable Milestone Date, the number of days used to calculate such credit under Section 2.8(b)(iii) for each such failure shall not be aggregated with each other and the number of says used to calculate such credit under Section 2.8(b)(vii) shall not be aggregated with each other, but rather the single longest period of delay shall be the number of days of delay used in determining the amount of the credit pursuant to Section 2.8(b)(iii) or Section 2.8(b)(vii), as applicable). For example, (i) if the Commencement Date is January 1, 2024, the Milestones in Sections 2.8(a)(iii)(A)–(C) are achieved March 1, 2024 (i.e., 60 days after the applicable Milestone Date), the Milestones in Sections 2.8(a)(iii)(D)–(F) are achieved April 30, 2024 (i.e., 120 days after the applicable Milestone Date) and there is an Actual Delay, then the number of days used to calculate the credits for all such Milestones under Sections 2.8(b)(iii) above shall not exceed 120 days in the aggregate; and (ii) if the Milestone in Sections 2.8(a)(vii)(A) is achieved July 31, 2024 (i.e., 60 days after the applicable Milestone Date), the Milestone in Sections 2.8(a)(vii)(B) is achieved August 30, 2024 (i.e., 90 days after the applicable Milestone Date) and there is an Actual Delay, then the number of days used to calculate the credits for all such Milestones under Sections 2.8(b)(vii) above shall not exceed 90 days in the aggregate.

16

1930820.10 29086-0006-000

(e)Any credits against Fixed Rent and Recurring Additional Rent pursuant to Section 2.8(b)(i), Section 2.8(b)(iii), Section 2.8(b)(vii) and/or Section 2.8(b)(viii) above, shall run concurrently and not consecutively and shall be Tenant’s sole remedy for not achieving the applicable Milestone under Section 2.8(a)(i), Section 2.8(a)(iii), Section 2.8(a)(vii) and/or Section 2.8(a)(viii) on or before the applicable Milestone Date (except as otherwise expressly provide in this Section 2.8 or Section 2.7 above) , and in no event shall the cumulative effect of the credit against Fixed Rent and Recurring Additional Rent pursuant to Section 2.8(b)(i), Section 2.8(b)(iii), Section 2.8(b)(vii) and/or Section 2.8(b)(viii) above exceed the total actual cumulative period of Actual Delay. Any credits against Fixed Rent and Recurring Additional Rent pursuant to Section 2.8(b)(i), Section 2.8(b)(iii), Section 2.8(b)(vii) and/or Section 2.8(b)(viii) above attributable to the same period of time, shall be based upon one item of delay (i.e., no “double” counting for overlapping periods of delay).

(f)Upon Landlord’s written request to Tenant (or upon Tenant’s written request to Landlord, subject to Landlord’s approval, which approval will not be unreasonably withheld, conditioned or delayed, and to the extent necessary to make up for the period of Actual Delay in Tenant being able to substantially complete the Initial Installations and commence occupancy of the Premises by the Anticipated Occupancy Date solely resulting from either the failure of the Turnover Work to have been Substantially Completed by January 1, 2024 or Landlord’s failure to achieve (or be deemed to have achieved) the applicable Milestone by the applicable Milestone Date, and provided that Tenant reasonably demonstrates that accelerating the performance of the Initial Installations will cause Tenant to be able to substantially complete the Initial Installations and commence occupancy of the Premises earlier than Tenant would have been able to without such acceleration), to the extent reasonably practicable, Tenant shall use commercially reasonable efforts to accelerate the performance of the Initial Installations, and Landlord shall reimburse Tenant for Tenant’s incremental out-of-pocket costs to so accelerate the performance of the Initial Installations (the costs described in this sentence being referred to as the “Accelerated Work Costs”). Notwithstanding the foregoing, prior to incurring any Accelerated Work Costs, Tenant shall notify Landlord (the “Accelerated Work Costs Notice”) in reasonably sufficient detail of the anticipated amount of the Accelerated Work Costs and the number of days that the Accelerated Work Costs are intended to make up in Tenant being able to substantially complete the Initial Installations and commence occupancy of the Premises by a particular date (but not earlier than the Anticipated Occupancy Date) (such date, the “Make-up Occupancy Date”). The amount of the Accelerated Work Costs set forth in the Accelerated Work Costs Notice shall be subject to Landlord’s approval, which approval shall not be unreasonably withheld, conditioned or delayed. Any disputes regarding the amount of the Accelerated Work Costs shall be resolved by arbitration pursuant to the provisions of Article 36. The parties acknowledge that if Landlord so approves the amount of the Accelerated Work Costs and pays the Accelerated Work Costs to Tenant as described above, then for purposes of the credits against Fixed Rent and Recurring Additional Rent described in Section 2.8(b)(i), Section 2.8(b)(iii), Section 2.8(b)(vii) and/or Section 2.8(b)(viii) above, Tenant shall be deemed to have completed its Initial Installations and commenced occupancy of the Premises for the ordinary conduct of business therein on the earlier of (x) the date which is 90 days after the date the Initial Installations are substantially completed or such earlier date that Tenant has in fact commenced occupancy of all or a part of the Premises for the ordinary conduct of business and (y) the Make-up Occupancy Date set forth in the Accelerated Work Costs Notice; provided, however, that for purposes of this clause (y), the Make-up Occupancy Date shall be postponed on a day-for-day basis until the date which is 90 days after the date the Initial Installations are substantially completed (or until such earlier date that Tenant has in fact commenced occupancy of all or a part of the Premises for the ordinary conduct of business) if and for so long as Tenant is performing the Initial Installations with all due diligence on an accelerated or expedited work basis as set forth in the Accelerated Work Costs Notice.

17

1930820.10 29086-0006-000

(g)If, at the time a credit against Fixed Rent and Recurring Additional Rent under this Section 2.8 is to be applied, a monetary Event of Default then exists, Landlord may offset the amount of any non-disputed sums owing to Landlord on account thereof from any such credit.

(h)Notwithstanding anything to the contrary contained in this Section 2.8, in no event shall any Actual Delay provided for herein extend beyond the earlier to occur of (i) the date that Tenant has in fact commenced occupancy of all or a part of the Premises for the ordinary conduct of business, or (ii) the date which is 90 days after the date Tenant is able to Substantially Complete the Initial Installations and legally occupy the Premises (i.e., a voluntary election by Tenant not to move into the Building when it is legally able to do so will not constitute an Actual Delay).

Section 38.9Termination Fee Letter of Credit. As security for Landlord’s obligation to pay a Termination Fee hereunder, simultaneously with the execution and delivery of this Lease by Landlord, Landlord has delivered to Tenant an irrevocable letter of credit (the “Termination Fee L/C”), issued by Signature Bank or another bank reasonably acceptable to Tenant (the “Issuing Bank”), which Issuing Bank shall be a member bank of the New York Clearinghouse Association (or, in the alternative, which shall have offices for banking purposes in the Borough of Manhattan) and shall have combined capital, surplus and undivided profits of not less than $1,500,000,000.00) and a credit rating from Moody’s Investors Service, Standard & Poor’s Rating Service, Kroll or a comparable credit rating agency of at least A (the “Credit Rating Requirement”), in substantially the form attached hereto as Exhibit CC, in an amount equal to $23,612,170.00 (subject to adjustment as herein provided) (the “Termination Fee Letter of Credit Amount”), which Termination Fee L/C shall have an initial expiry date of approximately the 1st anniversary of the Effective Date, which expiry date shall, subject to the provisions hereof, be automatically renewed, without amendment, for consecutive one (1) year periods until a final expiry date of no earlier than December 31, 2025 (the “Termination Fee L/C Outside Termination Date”). Tenant shall only have the right to draw on and receive the applicable portion of the proceeds (in accordance with the provisions of Section 2.7(e) above) of the Termination Fee L/C (a “Drawing Event”) if (i) this Lease is terminated as provided in Section 2.7 above and Landlord fails within thirty (30) days after such cancellation to pay Tenant the applicable Termination Fee, or (ii) the Issuing Bank sends notice to Tenant and Landlord (which notice must be delivered not less than ninety (90) days prior to the next succeeding expiration date) of the Issuing Bank’s intention not to renew the Termination Fee L/C prior to the Termination Fee L/C Outside Termination Date, and Landlord does not replace the Termination Fee L/C with a replacement letter of credit substantially in the form attached hereto as Exhibit CC (or such other form which is reasonably acceptable to Tenant) in the above amount issued by an Issuing Bank by no later than thirty (30) days after such notice of cancellation, in which case Tenant may draw on the entire proceeds of the Termination Fee L/C, or (iii) Tenant has evidence indicating that (x) the combined capital, surplus and undivided profits of the Issuing Bank shall be less than the minimum amount specified in the first sentence of this Section 2.9, or (y) the Issuing Bank has been downgraded below the Credit Rating Requirement, and upon the happening of either of the foregoing, (1) Tenant sends notice to Landlord requiring Landlord, within thirty (30) days, to replace the then existing Termination Fee L/C with a new letter of credit from an Issuing Bank satisfying the Credit Rating Requirement, and (2) Landlord does not deliver the new Termination Fee L/C in the times periods specified in clause (1) hereof, in which case Tenant may draw on the entire proceeds of the Termination Fee L/C. A drawing by Tenant under the Termination Fee L/C may be obtained by Tenant presenting to the Issuing Bank a sight draft without any other documentation whatsoever.

18

1930820.10 29086-0006-000

A drawing by Tenant of the Termination Fee L/C (and receipt by Tenant of the applicable proceeds thereof) shall constitute payment of the Termination Fee as required hereunder, provided, however, if a Drawing Event occurs as a result of clause (ii) or (iii) of this Section 2.9, Tenant shall hold the entire proceeds of the Termination Fee L/C as security until the earliest of (x) the occurrence of a Drawing Event resulting from clause (i) of this Section 2.9, (y) delivery of replacement Termination Fee L/C as provided above, and (z) the Termination Fee L/C Outside Termination Date (it being agreed that if no Drawing Event on account of clause (i) above occurs prior to the Termination Fee L/C Outside Termination Date, Tenant shall, within 5 Business Days following written request from Landlord, return the entire proceeds of the Termination Fee L/C to Landlord). If Landlord either (A) timely pays a Termination Fee, or (B) Tenant’s right to terminate this Lease pursuant to the provisions of Section 2.7 have lapsed or are of no further force or effect, or (C) Tenant has drawn on less than the entire proceeds of the Termination Fee L/C on account of the applicable Termination Fee being less than the entire proceeds of the Termination Fee L/C, then Tenant shall promptly (but in no event later than 10 Business Days following the occurrence of any such event) return the Termination Fee L/C or cash proceeds thereof, to Landlord, together with a letter signed by Tenant addressed to the Issuing Bank authorizing the cancellation of the Termination Fee L/C. In no event shall Tenant have the right to transfer the Termination Fee L/C to any Person other than an assignee of this Lease pursuant to an assignment permitted hereunder and, to the extent required, consented to by Landlord pursuant to the terms of Article 13 hereof. Notwithstanding anything to the contrary contained herein, the Termination Fee Letter of Credit Amount shall be subject to adjustment to equal at all times the then-applicable Maximum Termination Fee Amount as described in Section 2.7(e) above. Landlord shall promptly either (x) amend the then-existing Termination Fee L/C (which amendment, together with the then existing Termination Fee L/C shall meet all of the requirements of this Section 2.9), (y) provide an additional Termination Fee L/C meeting all of the requirements of this Section 2.9, or (z) provide a replacement Termination Fee L/C meeting all of the requirements of this Section 2.9, such that Tenant will at all times be holding a Termination Fee L/C meeting all of the requirements of this Section 2.9 in the amount of the then-applicable Maximum Termination Fee Amount as described in Section 2.7(e) above. Tenant shall reasonably cooperate in all respects in effectuating the provisions of the immediately preceding sentence, including, without limitation, consenting to an amendment of the then-existing Termination Fee L/C in the case of clause (x) above, or returning the then-existing Termination Fee L/C to Landlord (promptly after receipt of the replacement Termination Fee L/C) in the case of clause (z) above. In addition, if (I) a Drawing Event occurs as a result of clause (ii) or (iii) of this Section 2.9, (II) Tenant is holding the entire proceeds of the Termination Fee L/C as security, and (iii) the amount of the Maximum Termination Fee Amount as described in Section 2.7(e) above is reduced while Tenant is holding the entire proceeds of the Termination Fee L/C as security, then Tenant shall promptly return to Landlord the amount of the entire proceeds of the Termination Fee L/C by which the Maximum Termination Fee Amount as described in Section 2.7(e) above is so reduced (such that Tenant will be holding proceeds of the Termination Fee L/C as security in the amount of the then-applicable Maximum Termination Fee Amount as described in Section 2.7(e) above).

Article 3

USE AND OCCUPANCY

Section 38.1Permitted Uses. Tenant shall use and occupy the Premises for the Permitted Uses and for no other purpose. Tenant shall not use or occupy or permit the use or occupancy of any part of the Premises in a manner constituting a Prohibited Use. If Tenant uses the Premises for a purpose constituting a Prohibited Use, violating any Requirement, or causing the Building to be in violation of any Requirement, then Tenant shall promptly discontinue such use upon notice of such violation (subject to Tenant’s right to contest the same pursuant to Section 8.3).

19

1930820.10 29086-0006-000

Tenant, at its expense, shall procure (other than the Base Building CO) and at all times maintain and comply with the terms and conditions of all licenses and permits required for the lawful conduct of the Permitted Uses in the Premises including, without limitation, the Premises CO (as hereinafter defined). From and after the Commencement Date, Landlord shall maintain at all times during the Term a certificate of occupancy or a temporary certificate of occupancy for the Building (in either case, the “Base Building CO”) permitting the use of the Premises as offices, subject to Tenant’s compliance with its obligations under this Lease, including, without limitation, obtaining the required certificate of occupancy for the Premises permitting Tenant’s Permitted Use thereof (the “Premises CO”).

Section 38.2Additional Permitted Uses. (a) Subject to any restrictions set forth elsewhere in this Lease and receipt of all applicable permits in connection therewith, incidental to Tenant’s use of the Premises for general and executive offices as provided in this Article 3, Tenant, at Tenant’s sole cost and expense and in compliance with all applicable Requirements and the terms of this Lease, the Base Building CO and the Premises CO, shall also be permitted to use a portion (or portions) of the Premises as any of the following (in each case related to the business of any Permitted User and not open to the general public) (collectively, the “Additional Permitted Uses”): (i) a mailroom or mailrooms; (ii) a cafeteria or cafeterias; (iii) a word processing center or centers; (iv) a reproduction and copying facility or facilities for the business requirements of any Permitted User and/or clients of any Permitted User; (v) a training room or rooms for employees of Permitted Users; (vi) a dining facility or facilities; (vii) subject to Section 3.2(b), a fitness center; (ix) a Kitchen Facility; (x) board room(s); (xi) quiet rooms; (xii) auditorium, conference center(s) and/or special event center(s); (xiii) messenger facility(ies) and/or shipping/mail room(s); (xiv) trading floor(s); (xv) computer, data processing and communications facility(ies); (xvi) pantry(ies) and/or warming kitchen(s); (xvii) private or supplemental bathroom(s) with or without shower facilities; (xviii) storage room(s); (xix) copy and/or reproduction room(s); (xx) bike room(s); and (xxi) collaborative or social spaces for employees of Permitted Users (which may include pantries).

(a)Tenant shall not permit the use of the fitness center or otherwise utilize fitness equipment, if any, unless such fitness center or the floor on which such fitness equipment is utilized (i) is constructed with acoustical attenuation and any floor reinforcement, reasonably satisfactory to Landlord, which will absorb impact and vibrations from the dropping of such weights and/or other activities such that any vibration or noise as a result thereof does not interfere (except to a de minimis extent) with the use or enjoyment by other tenants and/or occupants of their respective premises in the Building; and (ii) is located on a floor directly above and contiguous to other space in the Building leased or occupied by Tenant. Landlord shall not permit a tenant under a lease entered into after the Effective Date to install a fitness center or otherwise utilize fitness equipment directly above a portion of the Initial Office Premises (or Substitute Office Premises, as the case may be), Pre-CD Expansion Space or Expansion Space, and agrees to use reasonable efforts to not permit a tenant under a lease entered into after the Effective Date from installing a fitness center directly above any other portion of the Premises.

(b)Notwithstanding anything to the contrary contained in this Section 3.2, in connection with any catered event hosted by Tenant in the Premises, Tenant shall have the right to serve liquor, wine and/or beer for on-premises consumption at such event; provided that, in each such instance: (i) Tenant or a third party server (such third party, the “Server”), as the case may be, shall if and to the extent required under applicable Requirements, have a valid off-premises liquor license and any other permit or approval required under applicable Requirements to permit Tenant or the Server, as the case may be, to so serve such wine and/or beer (and if applicable, evidence of same shall be delivered to Landlord); (ii) Tenant or the Server (if applicable), shall carry liquor liability or host liquor liability insurance coverage (and evidence of same shall be delivered to Landlord); and (iii) all applicable Requirements shall be complied with in connection therewith.

20

1930820.10 29086-0006-000

(c)On or before 60 days after the Effective Date, Landlord shall deliver to Tenant a plan and engineer’s narrative indicating which portions of the 25th floor will support a “live load” of 100 pounds per square foot with the additional shear studs to be installed in accordance with Exhibit C-4. Tenant shall have the right, at Tenant’s sole cost and expense, to reinforce floors of the Premises to 100 pounds per square foot “live load” in localized areas of the Premises and run power conduit to the underside of any floor of the Premises directly above and contiguous to another floor of the Premises; provided that, in the event Tenant is not reasonably able to locate any portion of the Premises used for an Additional Permitted Use which requires floor reinforcement (to increase the load capacity of the affected portion of the Premises for such Additional Permitted Use) during the performance of Tenant’s Initial Installations on a floor of the Premises directly above and contiguous to another floor of the Premises, then subject to Landlord’s reasonable approval of such reinforcement work (which approval shall not be unreasonably withheld or delayed), Tenant may perform such reinforcement work subject to the terms of this Lease, on the lowest floor of the Premises; provided and on condition that (i) such reinforcement is completed prior to the floor immediately below and contiguous to such lowest floor of the Premises being delivered to the tenant thereof for construction of its initial buildout (provided that Landlord delivered to Tenant prior notice of the date Landlord reasonably anticipates delivering such floor immediately below and contiguous to such lowest floor of the Premises, at least 6 months prior to the delivery of such floor to such tenant) and (ii) such reinforcement would not materially interfere with the use and occupancy by such tenant of such floor immediately below and contiguous to such lowest floor of the Premises. The provisions of this Section 3.2(d) shall be subject to, and as more particularly described in, Exhibit C-4 attached hereto.