Document

FOR IMMEDIATE RELEASE

SANDY SPRING BANCORP REPORTS SECOND QUARTER EARNINGS OF $24.7 MILLION

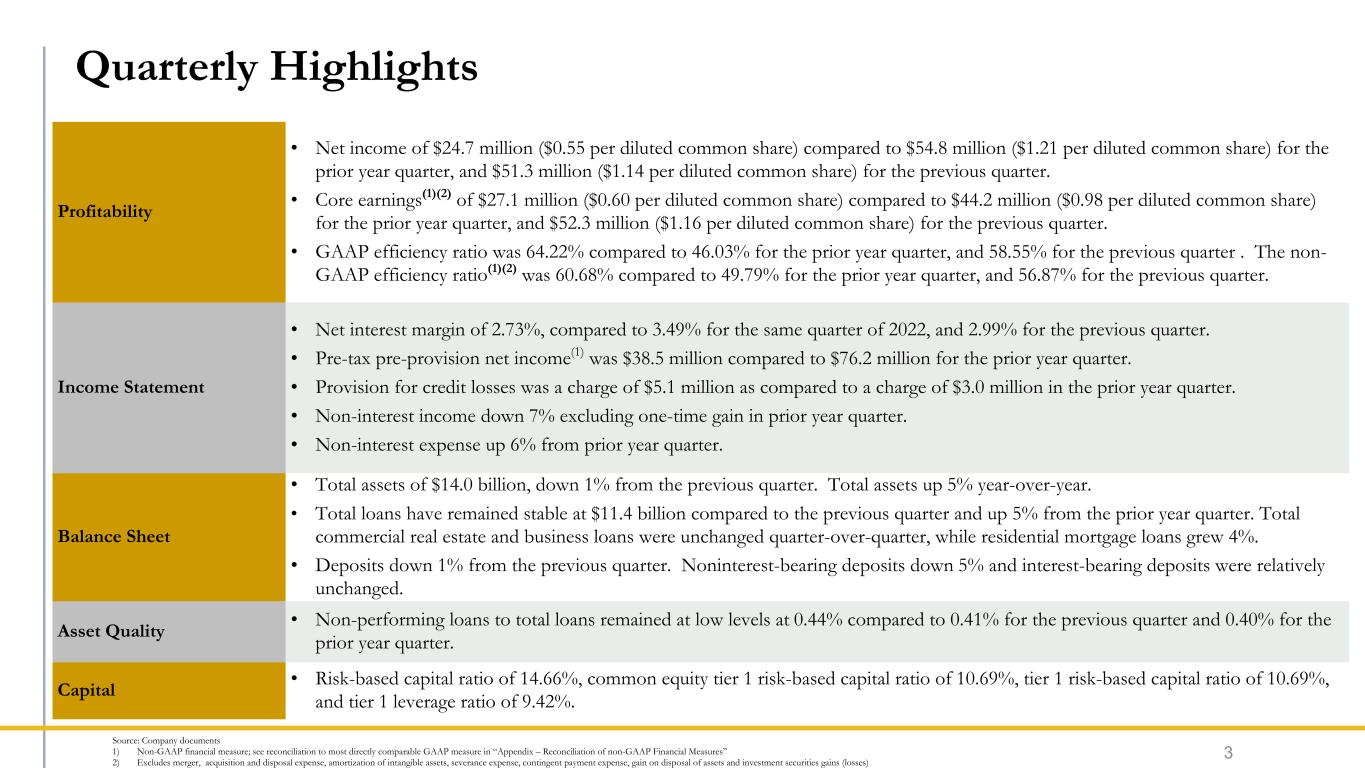

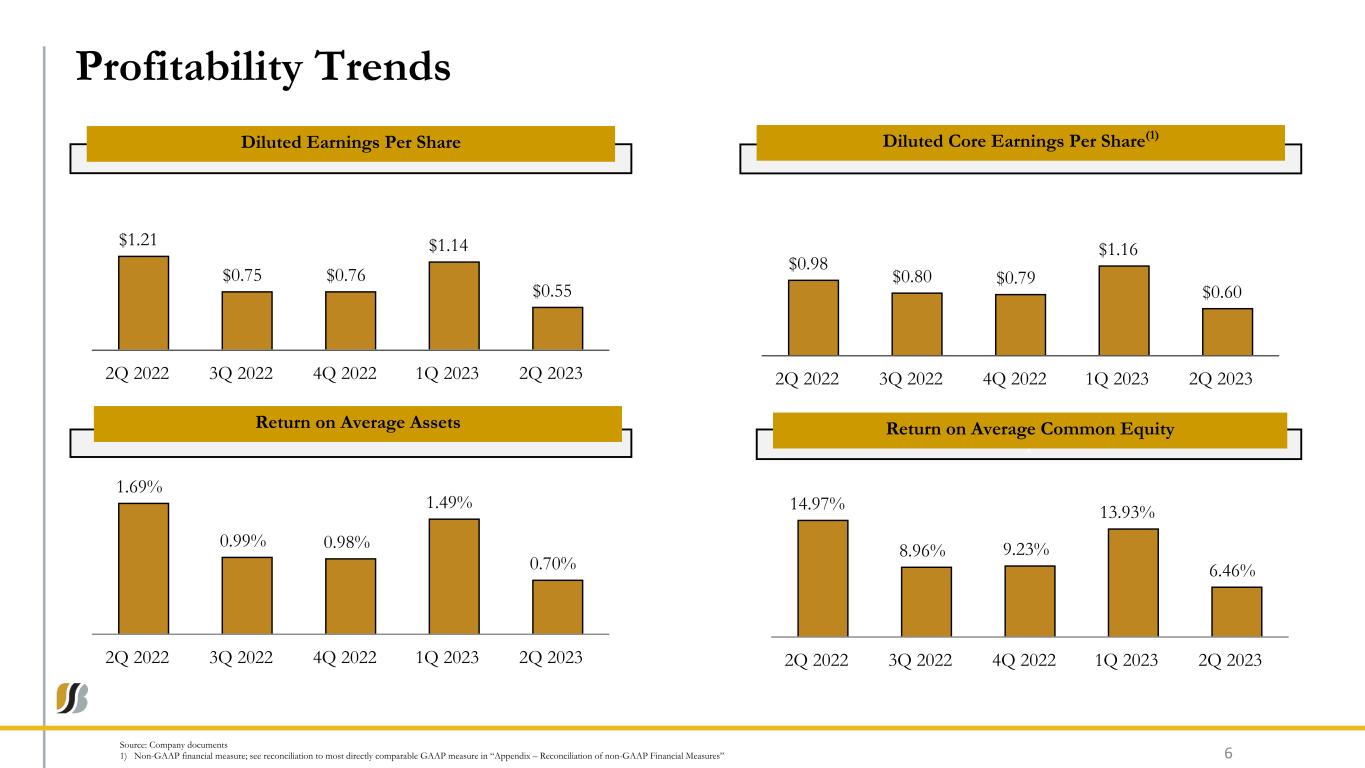

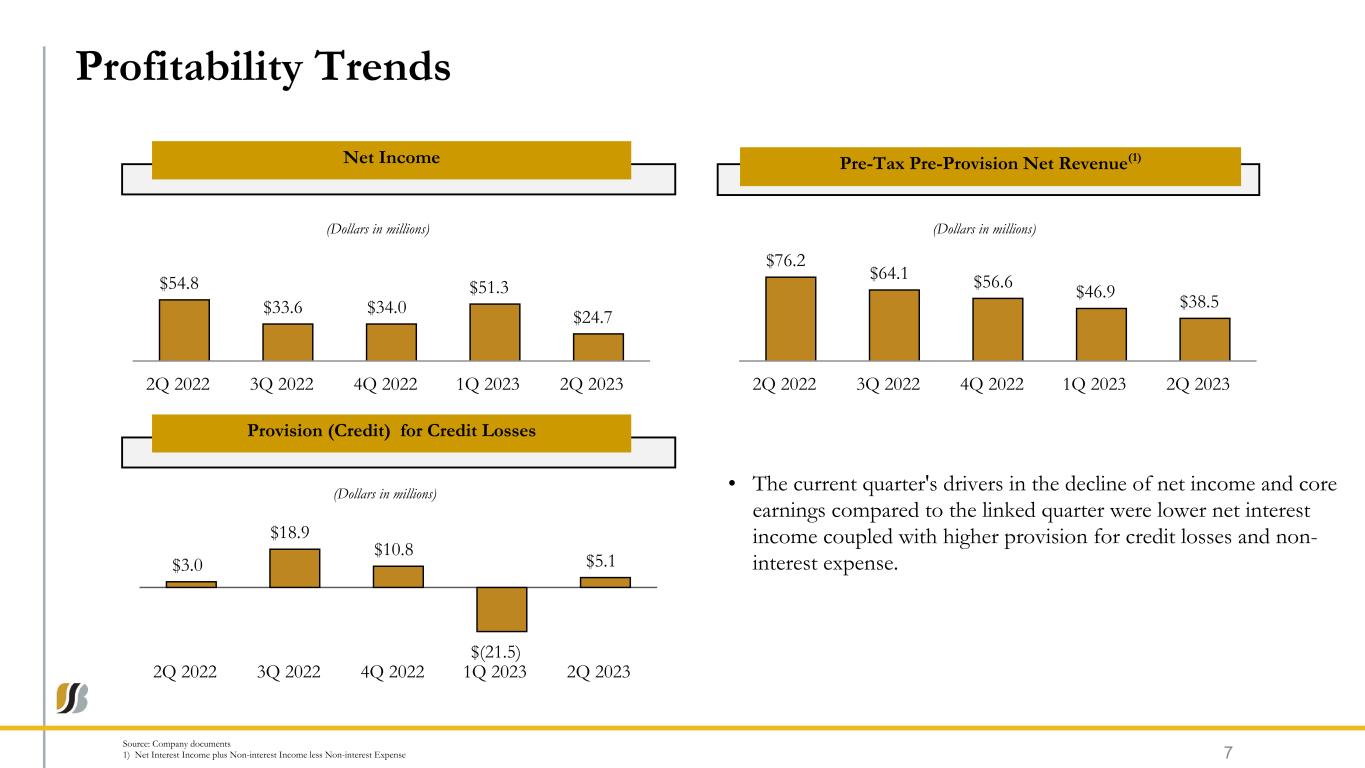

OLNEY, MARYLAND, July 25, 2023 — Sandy Spring Bancorp, Inc. (Nasdaq-SASR), the parent company of Sandy Spring Bank, reported net income of $24.7 million ($0.55 per diluted common share) for the quarter ended June 30, 2023, compared to net income of $51.3 million ($1.14 per diluted common share) for the first quarter of 2023 and $54.8 million ($1.21 per diluted common share) for the second quarter of 2022.

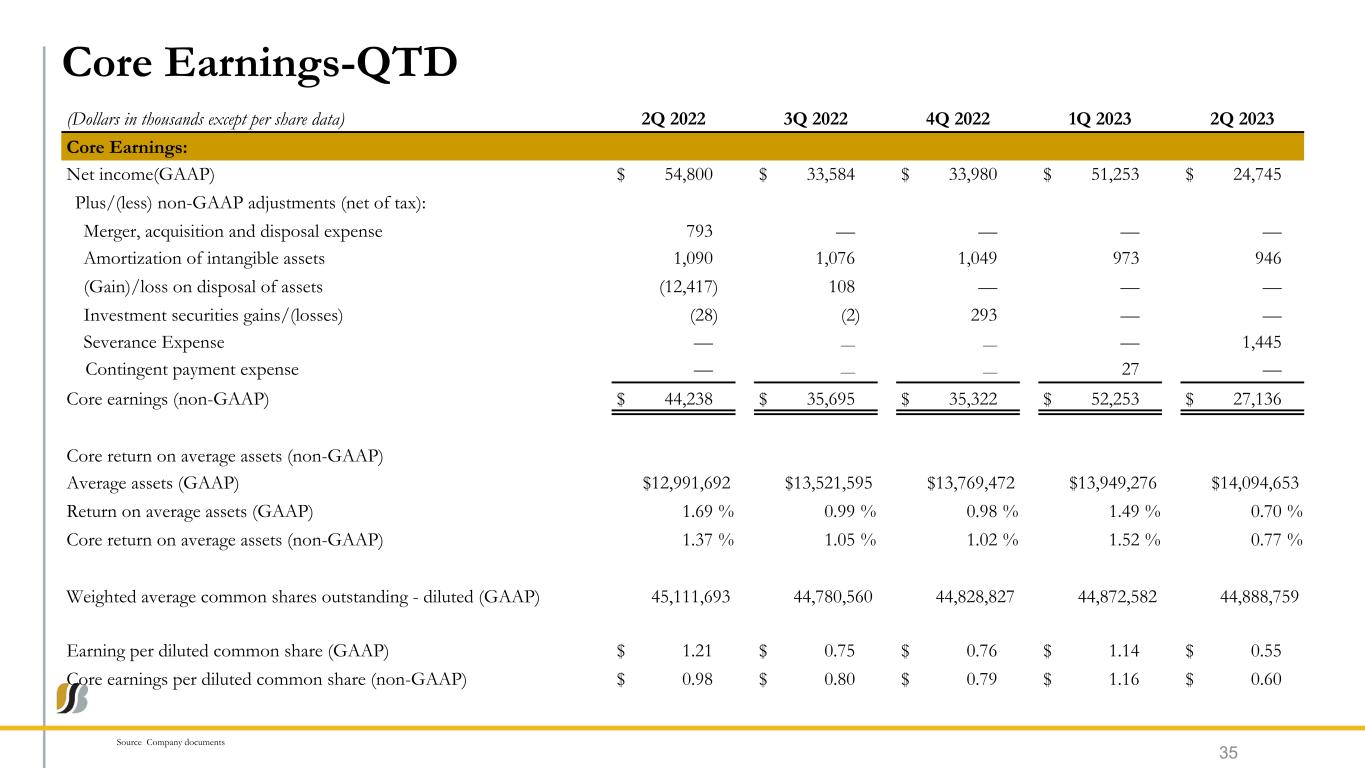

Current quarter core earnings were $27.1 million ($0.60 per diluted common share), compared to $52.3 million ($1.16 per diluted common share) for the quarter ended March 31, 2023 and $44.2 million ($0.98 per diluted common share) for the quarter ended June 30, 2022. Core earnings exclude the after-tax impact of amortization of intangibles, investment securities gains or losses and other non-recurring or extraordinary items. The current quarter's drivers in the decline of net income and core earnings compared to the linked quarter were lower net interest income coupled with higher provision for credit losses and higher non-interest expense. The provision for credit losses for the current quarter amounted to $5.1 million compared to a credit to provision of $21.5 million for the first quarter of 2023 and a provision of $3.0 million for the second quarter of 2022. The current quarter's provision was primarily the result of an individual reserve established on one large commercial real estate relationship along with the several charge-offs of non-accrual consumer loans.

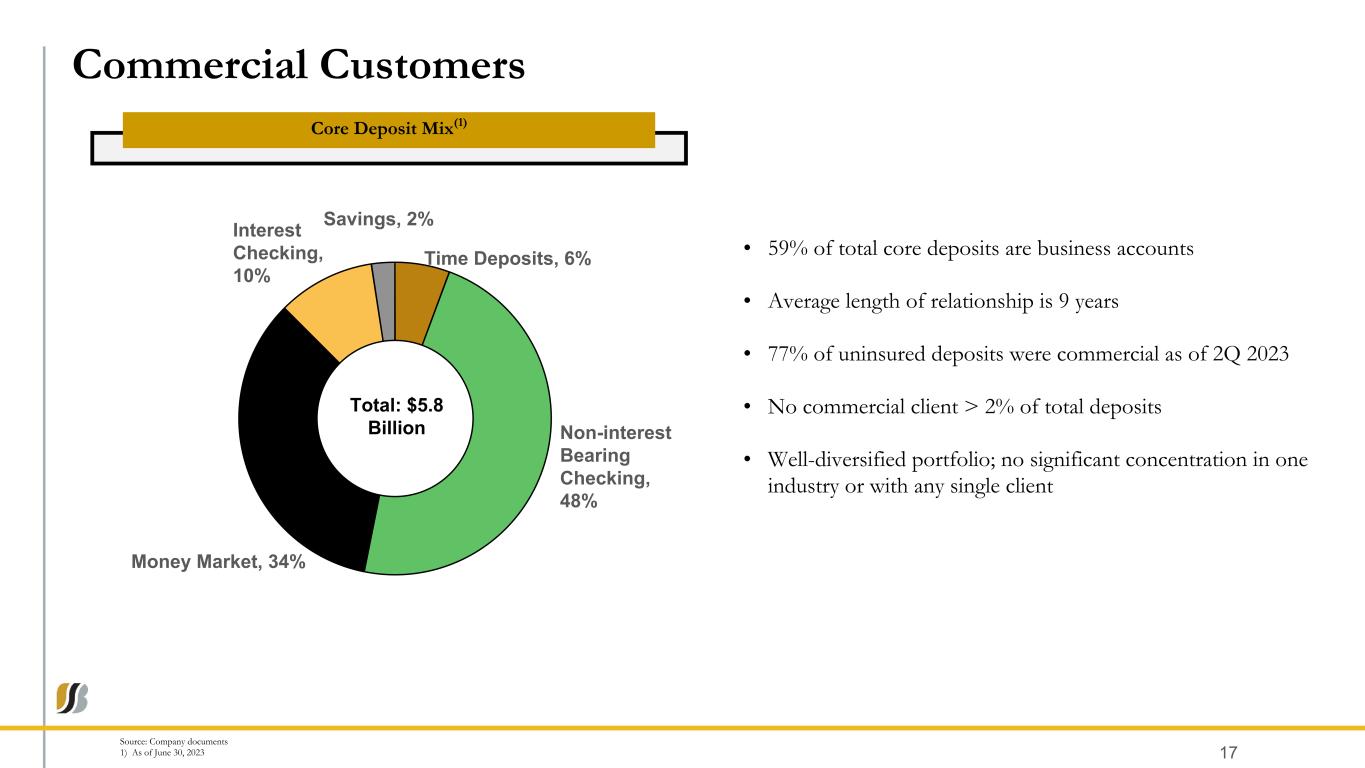

“As we have stated all year, we are keenly focused on growing client relationships and core funding. Despite the challenging banking environment in the first half of the year, which resulted in quarterly deposit outflow that was mostly observed early in the second quarter, our core deposits began to stabilize in the second half of this quarter. The decrease in non-interest bearing accounts can be attributed to clients shifting balances to interest bearing alternatives,” said Daniel J. Schrider, Chairman, President and CEO of Sandy Spring Bank.

“While the environment is challenging, we remain committed to taking care of our clients, engaging with our communities and helping businesses of all sizes in the Greater Washington region,” Schrider added.

Second Quarter Highlights

•Total assets at June 30, 2023 remained stable at $14.0 billion compared to $14.1 billion at March 31, 2023.

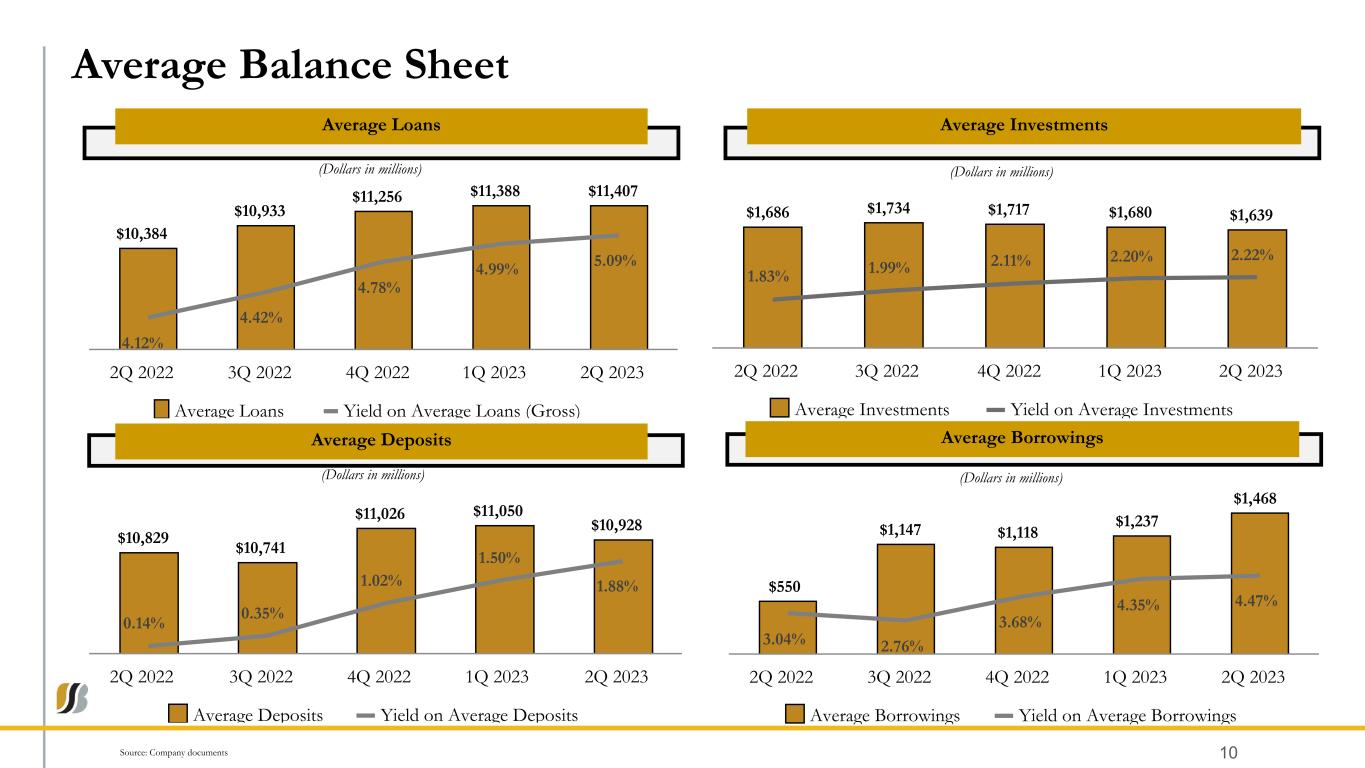

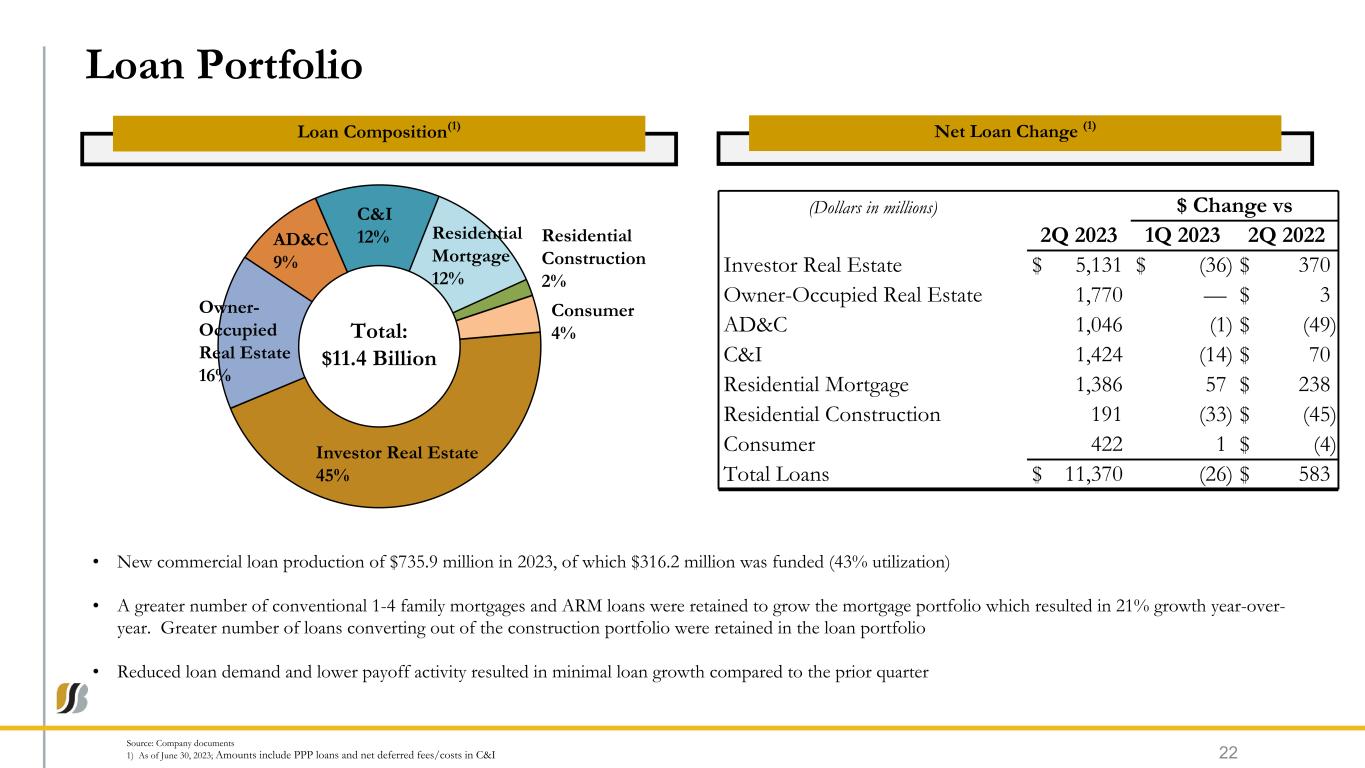

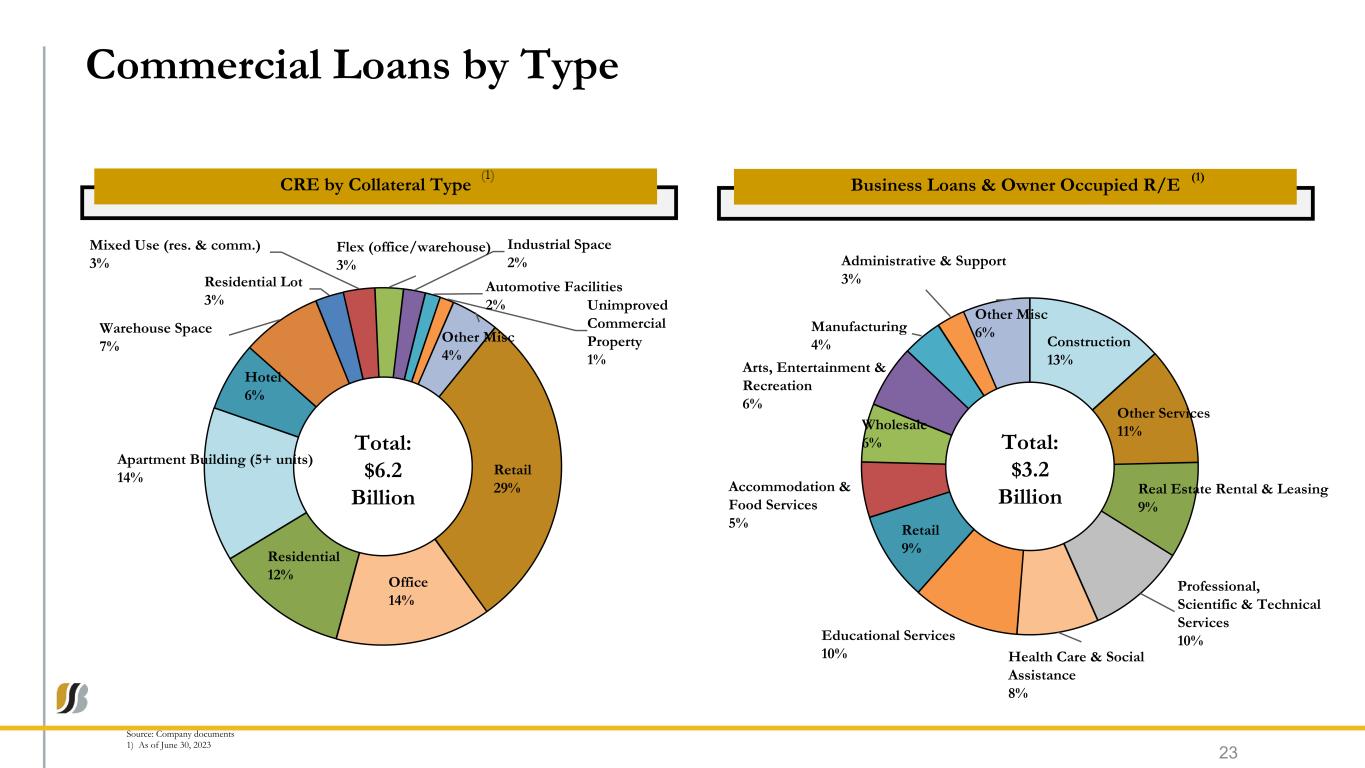

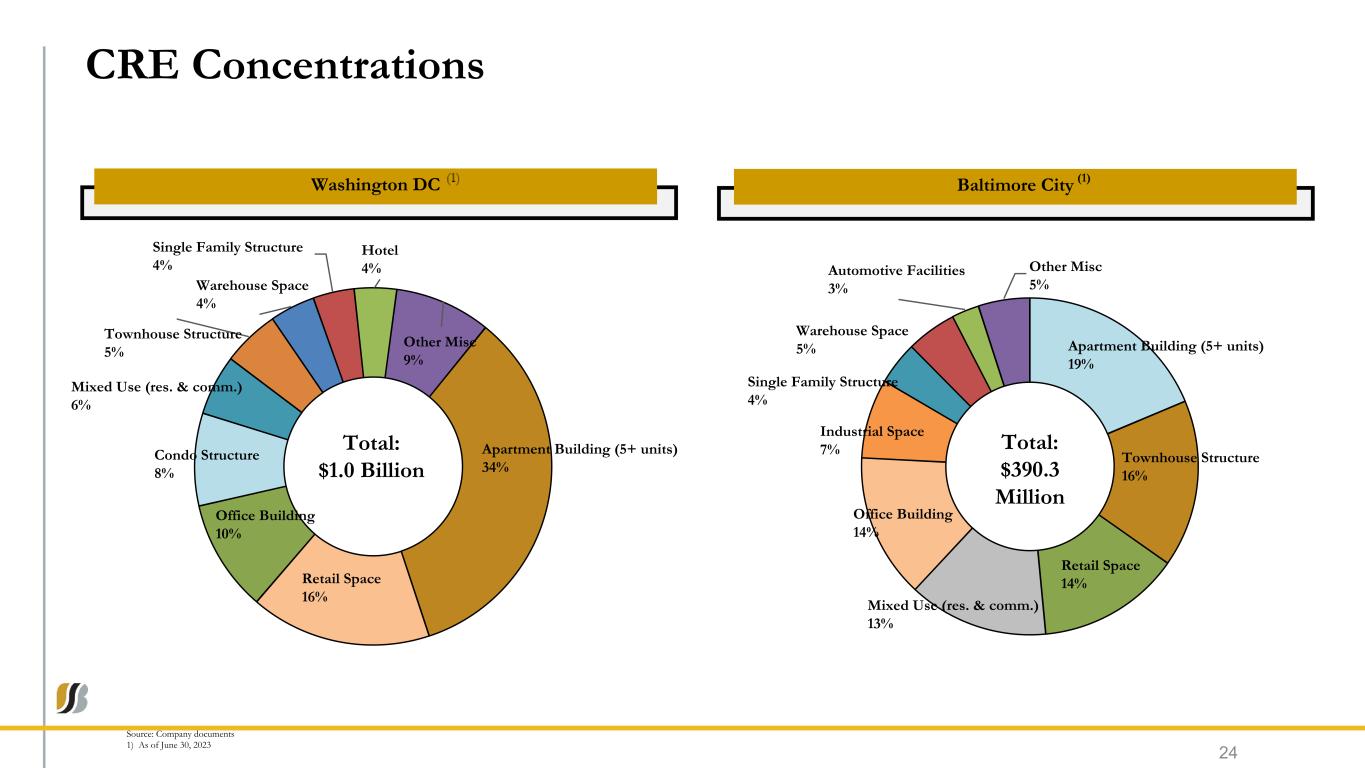

•Total loans remained at $11.4 billion at June 30, 2023 compared to March 31, 2023. Total commercial real estate and business loans were level quarter-over-quarter, while residential mortgage loans grew 4% due to the migration of construction loans into the residential mortgage portfolio.

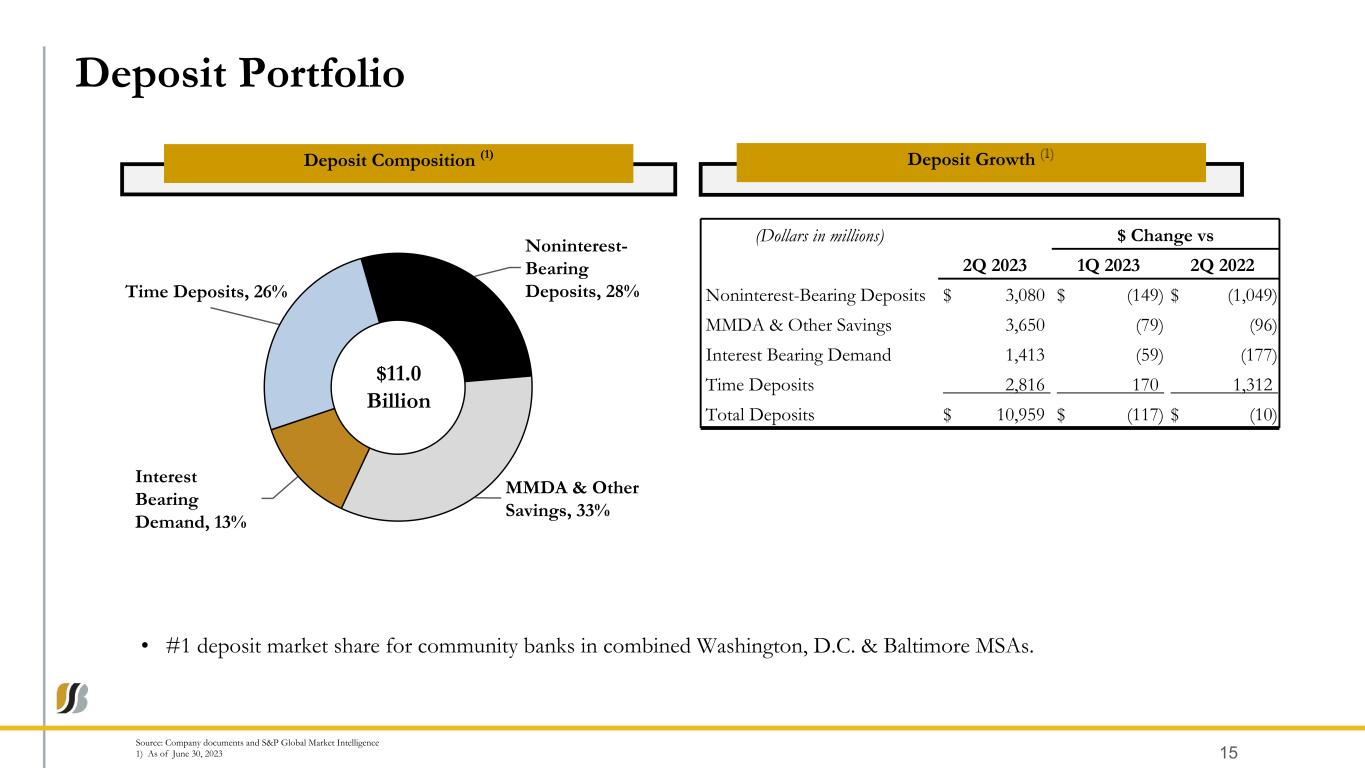

•Deposits decreased 1% to $11.0 billion at June 30, 2023 compared to $11.1 billion at March 31, 2023, as noninterest-bearing deposits declined 5%, primarily in commercial checking accounts, while interest-bearing deposits were relatively unchanged, as the 41% and 6% respective growth in savings accounts and time deposits was offset by the 9% decline in money market accounts.

•Total borrowings in the current quarter declined by $28.0 million or 2% over amounts at March 31, 2023. Fed funds purchased and FHLB advances decreased by $205.0 million and $150.0 million, respectively, which was partially offset by $300.0 million of borrowings through Federal Reserve Bank's Bank Term Funding Program.

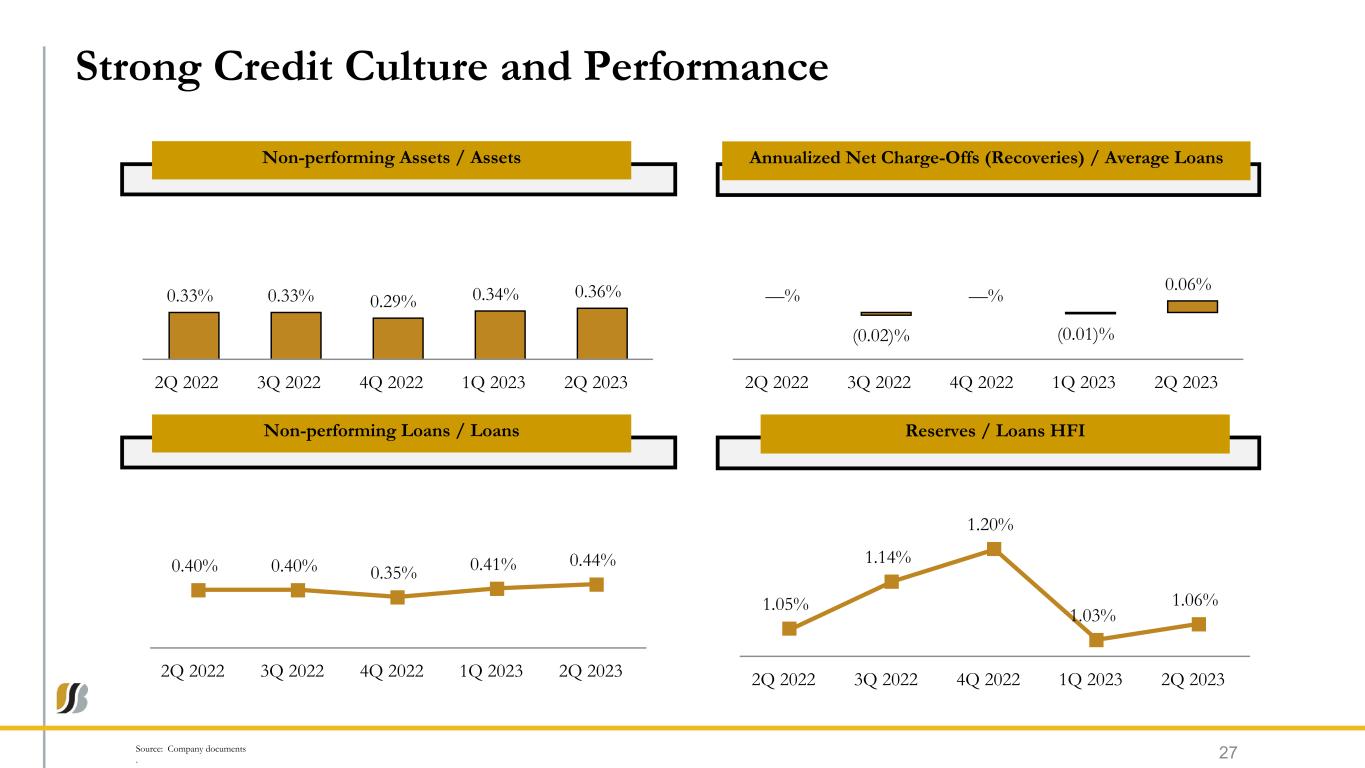

•Credit quality metrics remained at low levels during the current quarter compared to the previous quarter. The ratio of non-performing loans to total loans was 0.44% at June 30, 2023 compared to 0.41% for the previous quarter and 0.40% for the quarter ended June 30, 2022.

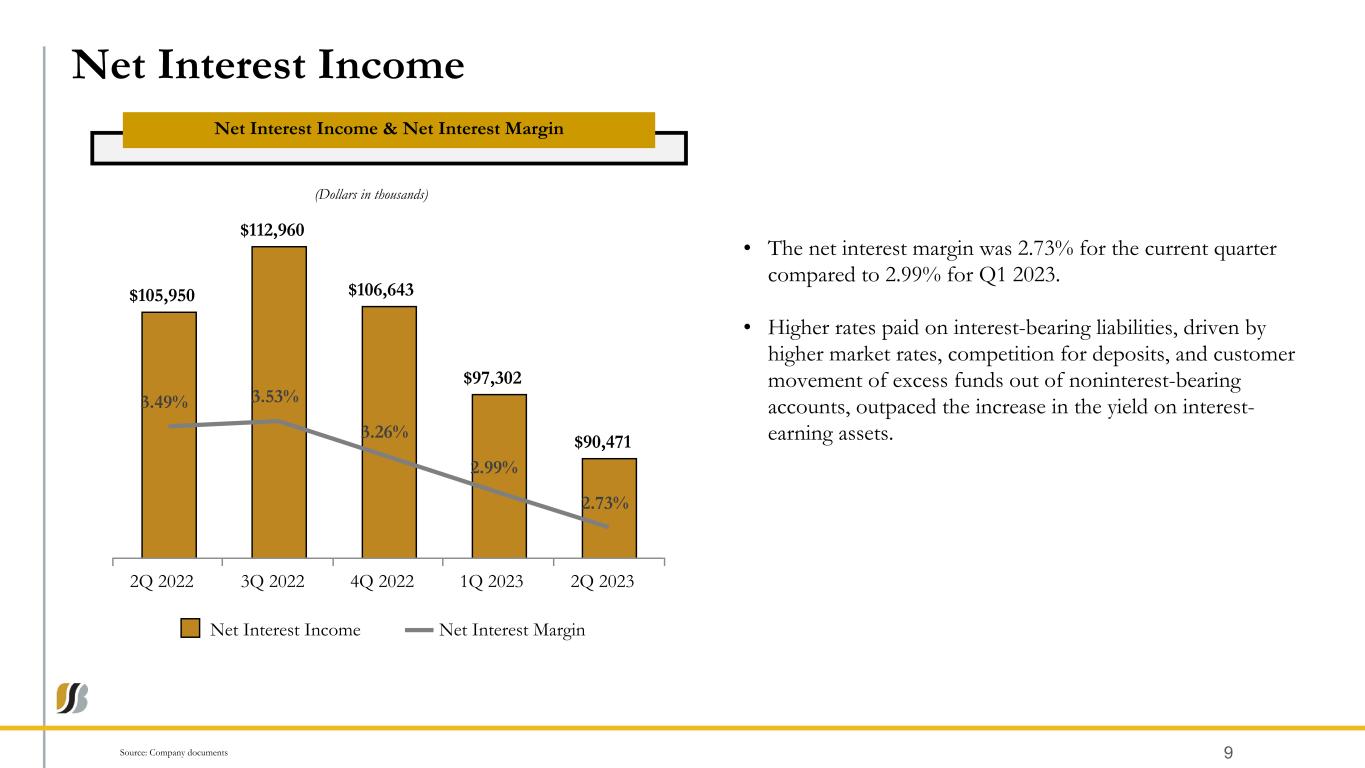

•Net interest income for the second quarter of 2023 declined $6.8 million or 7% compared to the previous quarter and $15.5 million or 15% compared to the second quarter of 2022. During the recent quarter, the growth in interest income of $6.8 million or 5% was more than offset by the $13.6 million or 25% increase in interest expense, a result of the increases in rates paid on deposits and higher borrowing costs.

•The net interest margin was 2.73% for the second quarter of 2023 compared to 2.99% for the first quarter of 2023 and 3.49% for the second quarter of 2022. Higher rates paid on interest-bearing liabilities, driven by higher market rates, competition for deposits, and customer movement of excess funds out of noninterest-bearing accounts, outpaced the increase in the yield on interest-earning assets. Compared to the linked quarter, the rate paid on interest-bearing liabilities rose 44 basis points, while the yield on interest-earning assets increased 12 basis points, resulting in the quarterly margin compression of 26 basis points.

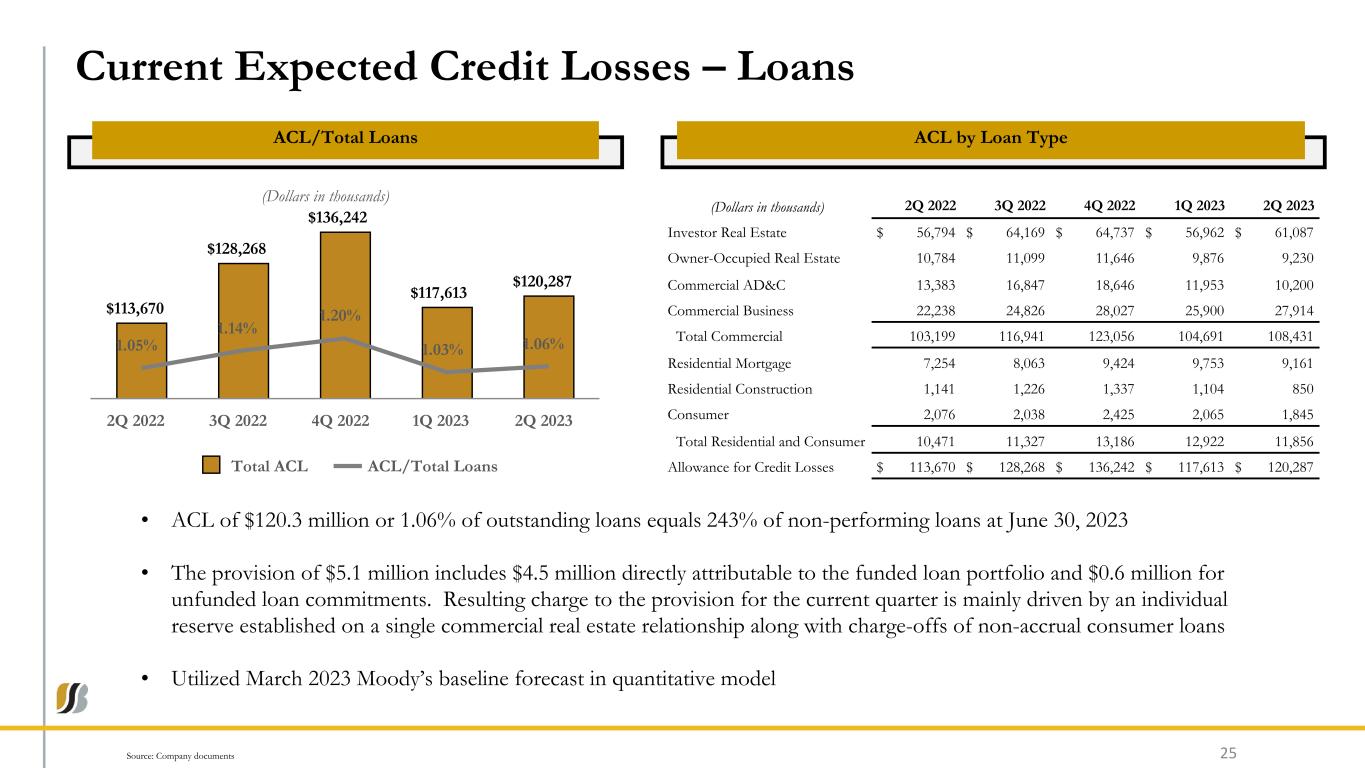

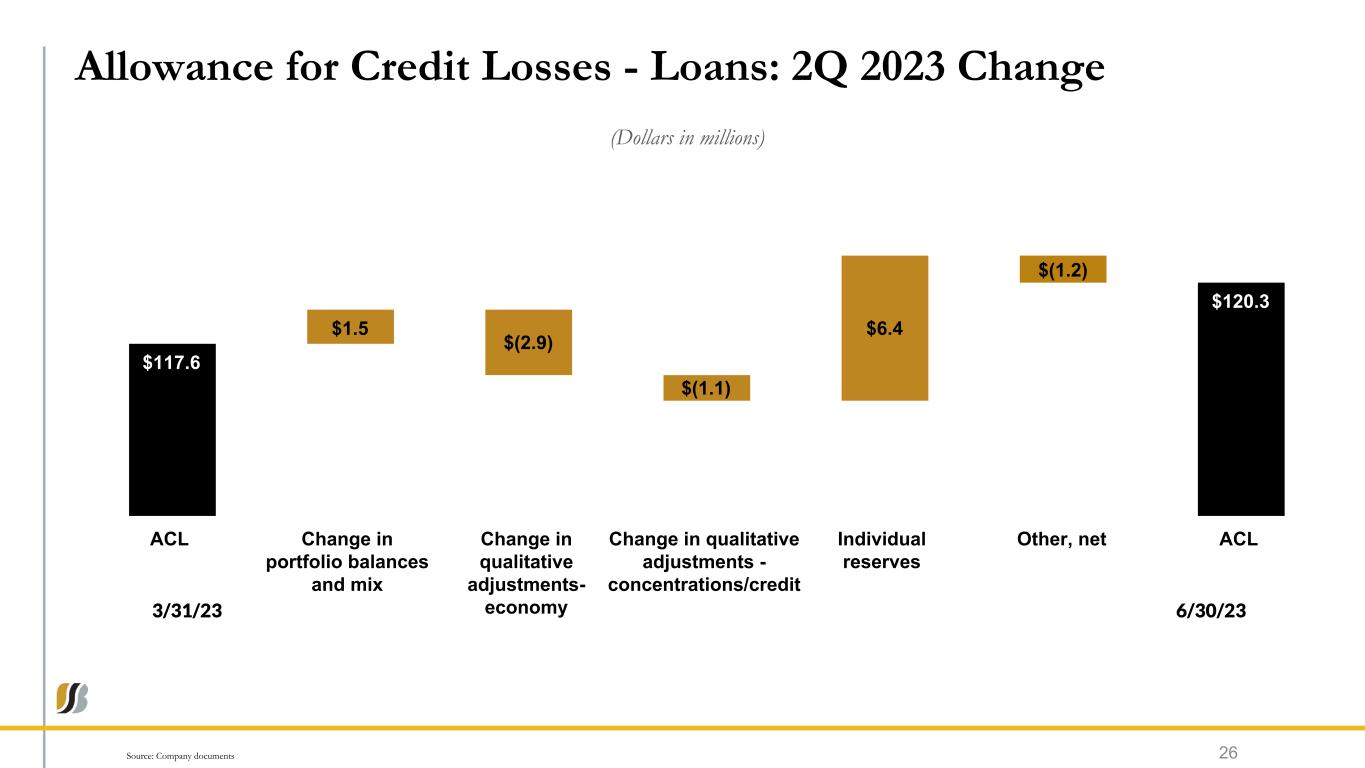

•Provision for credit losses directly attributable to the funded loan portfolio for the current quarter was a charge of $4.5 million compared to a credit to provision of $18.9 million in the previous quarter and a charge of $3.0 million in the prior year quarter. During the current quarter, the provision charge was mainly associated with an individual reserve established on one large commercial real estate relationship along with the several charge-offs of non-accrual consumer loans. In addition, during the current quarter the Company recorded a provision charge of $0.6 million associated with unfunded loan commitments.

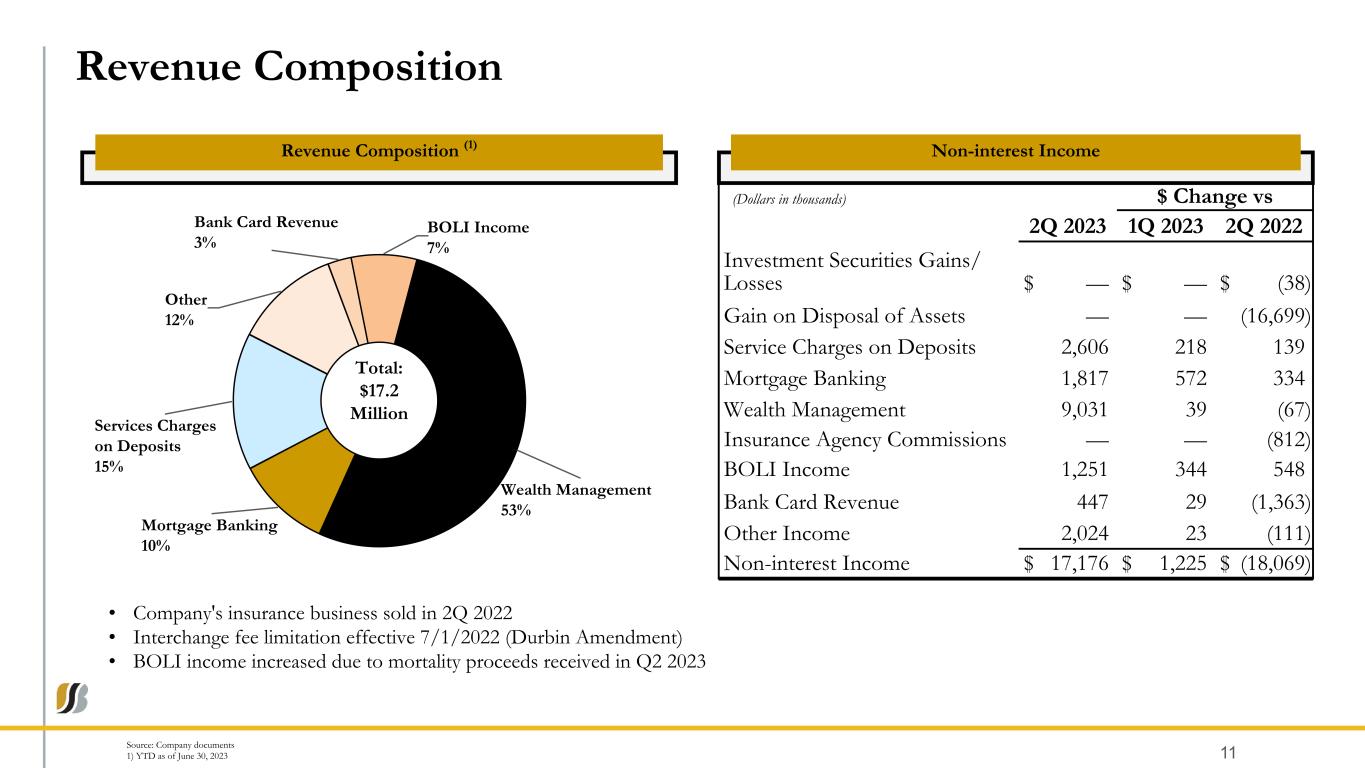

•Non-interest income for the second quarter of 2023 increased by 8% or $1.2 million compared to the linked quarter and declined by 51% or $18.1 million compared to the prior year quarter. Quarter-over-quarter increase was mainly driven by higher income from mortgage banking activities, BOLI income and service charges on deposit accounts. Year-over-year decrease was primarily a result of the sale of the Company's insurance segment during the second quarter of 2022 and the associated $16.7 million gain. Excluding this one-time gain, non-interest income declined by 7% or $1.4 million year-over-year due to lower insurance commission income as a result of the aforementioned sale and lower bank card fee income due to regulatory restrictions on transaction fees that became effective for the Company in the second half of 2022.

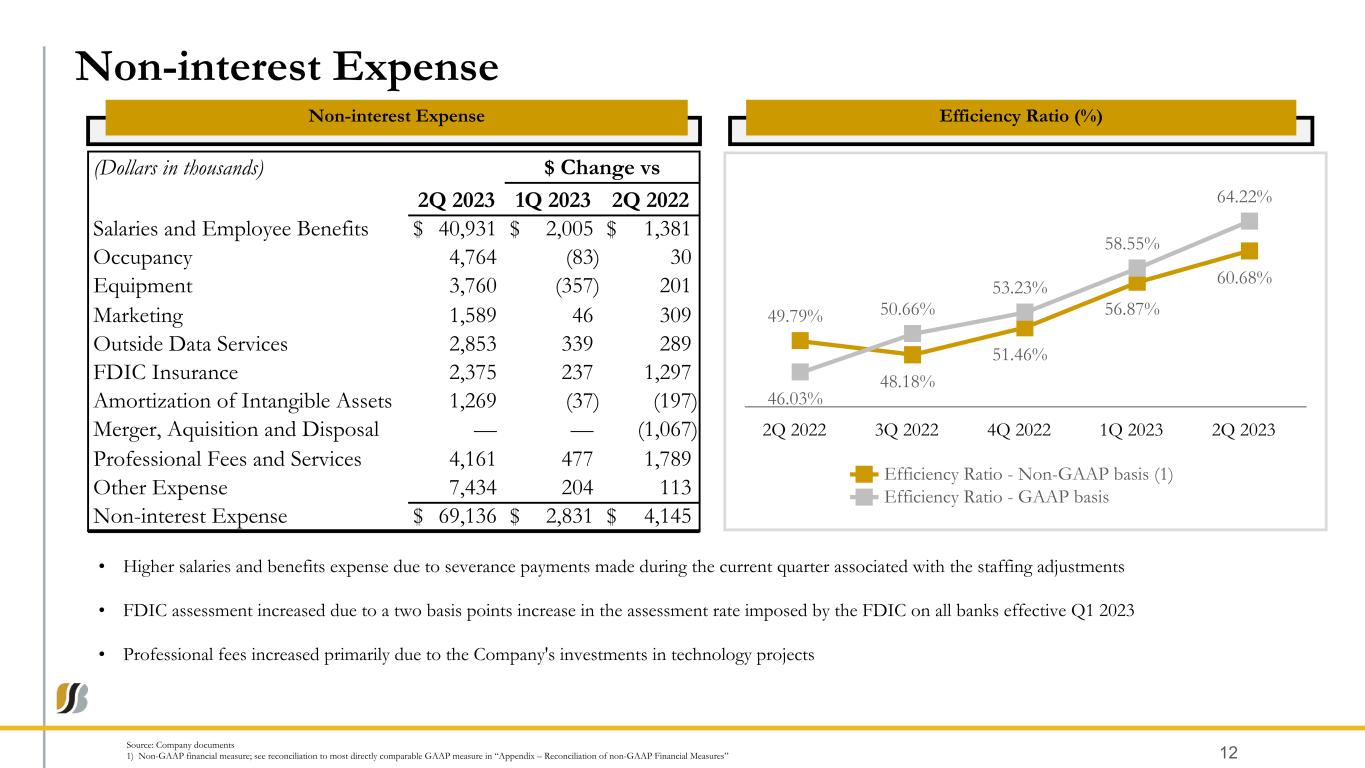

•Non-interest expense for the second quarter of 2023 increased $2.8 million or 4% compared to the first quarter of 2023 and $4.1 million or 6% compared to the prior year quarter. The current quarter's increase was mainly due to a higher compensation expense driven by $1.9 million of severance related expenses associated with staffing adjustments as a part of the broader cost control initiatives implemented by management during the current year.

•Return on average assets (“ROA”) for the quarter ended June 30, 2023 was 0.70% and return on average tangible common equity (“ROTCE”) was 8.93% compared to 1.49% and 19.10%, respectively, for the first quarter of 2023 and 1.69% and 20.83%, respectively, for the second quarter of 2022. On a non-GAAP basis, the current quarter's core ROA was 0.77% and core ROTCE was 9.43% compared to 1.52% and 19.11%, respectively, for the previous quarter and 1.37% and 16.49%, respectively, for the second quarter of 2022.

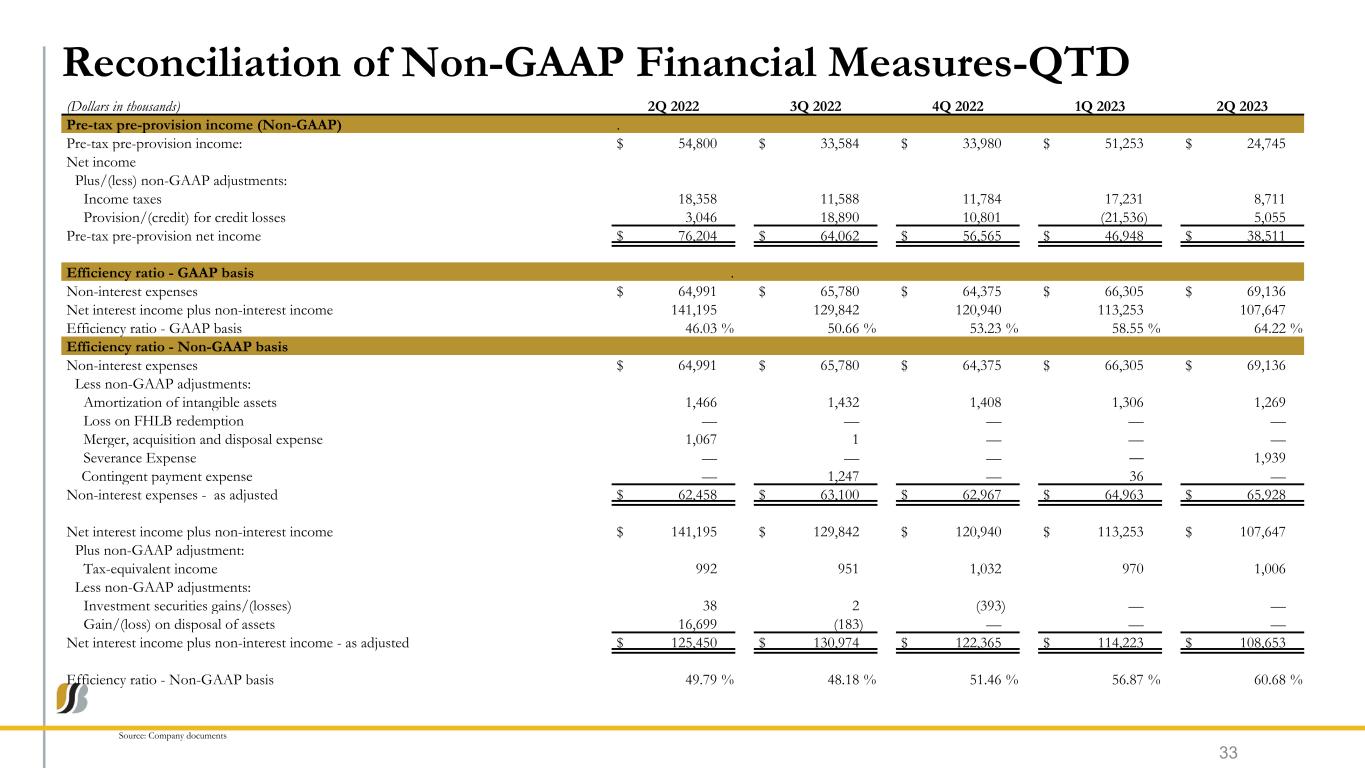

•The GAAP efficiency ratio was 64.22% for the second quarter of 2023, compared to 58.55% for the first quarter of 2023 and 46.03% for the second quarter of 2022. The non-GAAP efficiency ratio was 60.68% for the second quarter of 2023 compared to 56.87% for the first quarter of 2023 and 49.79% for the prior year quarter. The increase in both the GAAP and non-GAAP efficiency ratios (reflecting a decrease in efficiency) in the current quarter compared to the previous quarter and the second quarter of the prior year was the result of declines in net revenue from the prior periods coupled with the growth in non-interest expense.

Balance Sheet and Credit Quality

Total assets were $14.0 billion at June 30, 2023, as compared to $14.1 billion at March 31, 2023. Diminished loan demand coupled with low payoff activity during the current quarter resulted in total loans remaining relatively unchanged at $11.4 billion as of June 30, 2023. Total commercial real estate and business loans declined by $50.8 million or 1%, while total mortgage and consumer loans grew by $25.2 million or 1%. Overall, the loan portfolio mix stayed relatively unchanged compared to the previous quarter.

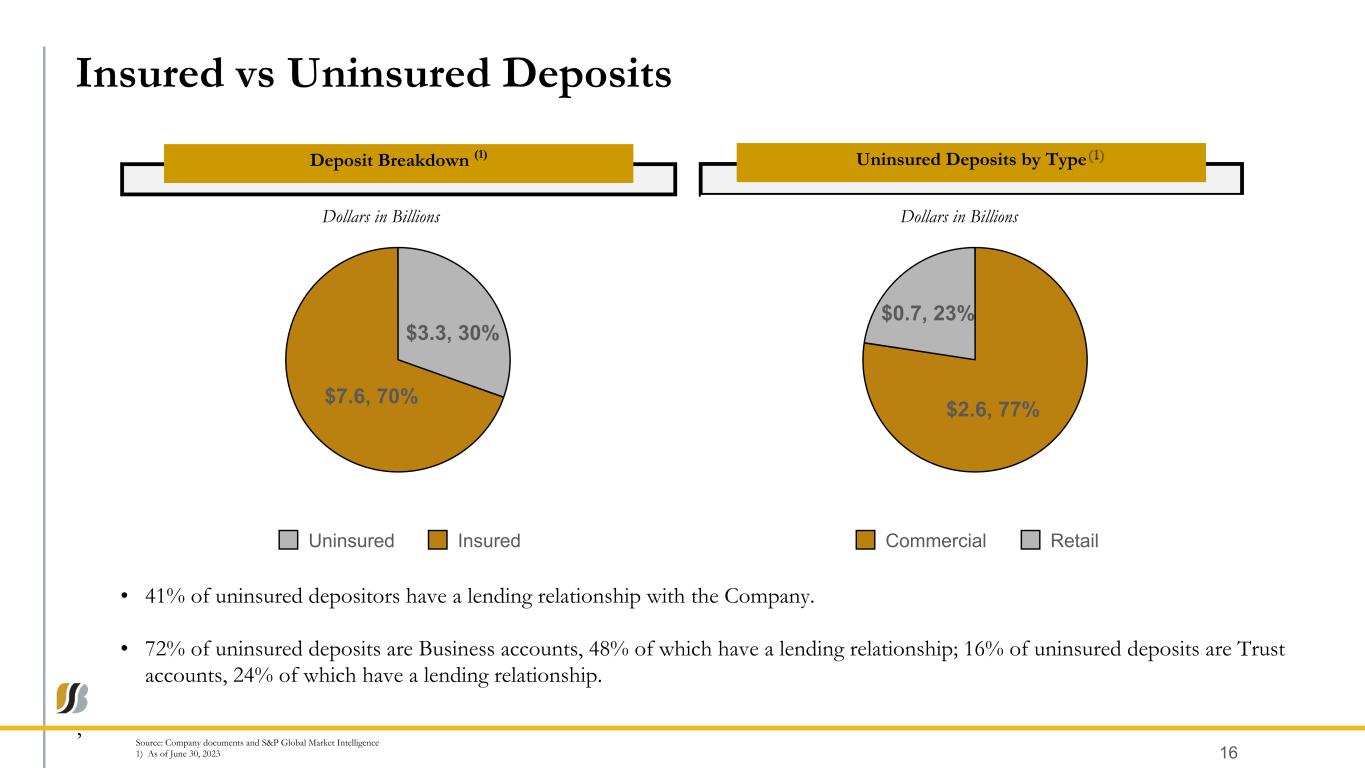

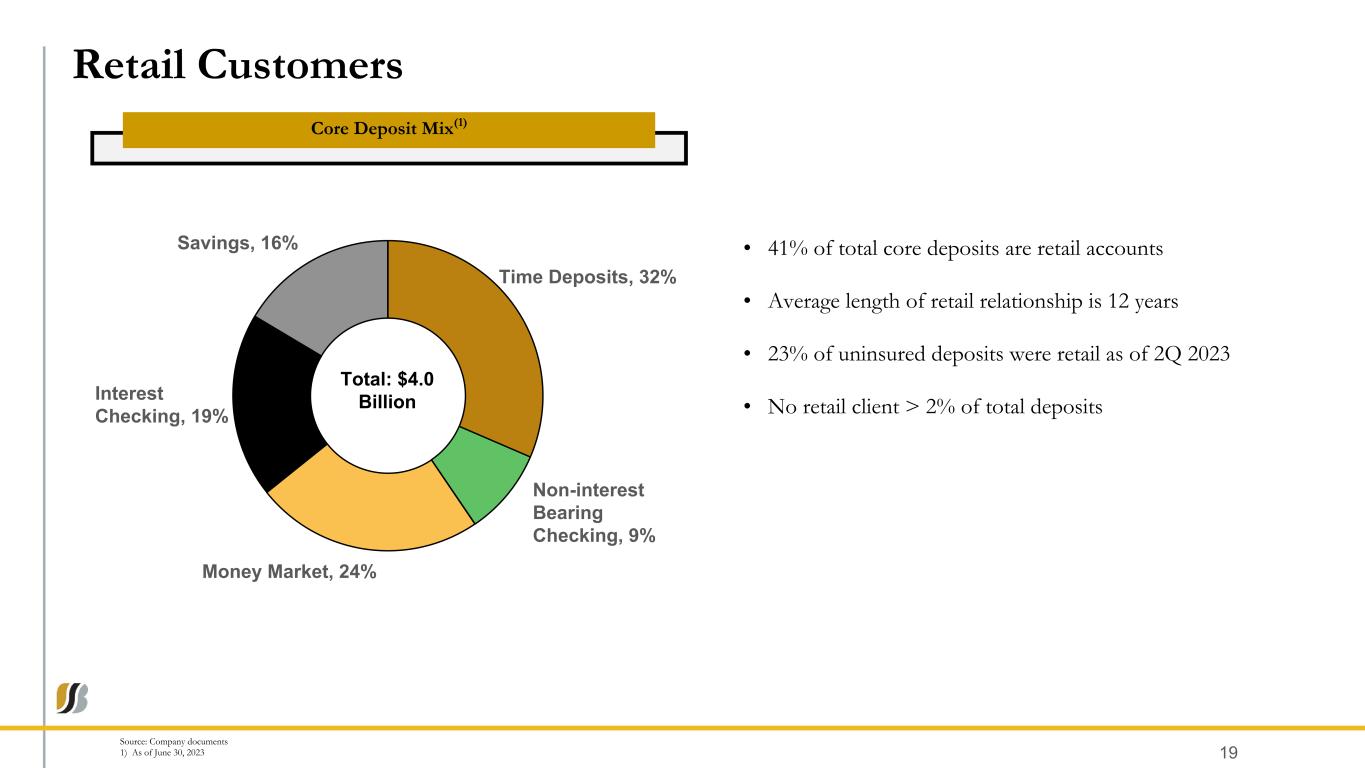

Deposits decreased $117.1 million or 1% to $11.0 billion at June 30, 2023 compared to $11.1 billion at March 31, 2023. During this period total noninterest-bearing deposits declined $148.8 million or 5%, primarily in commercial checking accounts, while the level of interest-bearing deposits remained steady. During the current quarter, savings accounts and time deposits grew 41% and 6%, respectively, while money market accounts declined by 9%. Quarterly deposit outflow was mostly observed early in the current quarter and stabilized during May and June. Core deposits, which exclude brokered relationships, represented 88% of the total deposits at the end of the current and previous quarter, respectively, reflecting the stability of the core deposit base. Total uninsured deposits at June 30, 2023 were approximately 30% of the total deposits. The Company offers its customers reciprocal deposit arrangements, which provide FDIC deposit insurance for accounts that would otherwise exceed deposit insurance limits. During the quarter ended June 30, 2023, balances in the Company's reciprocal deposit accounts increased by $230.0 million.

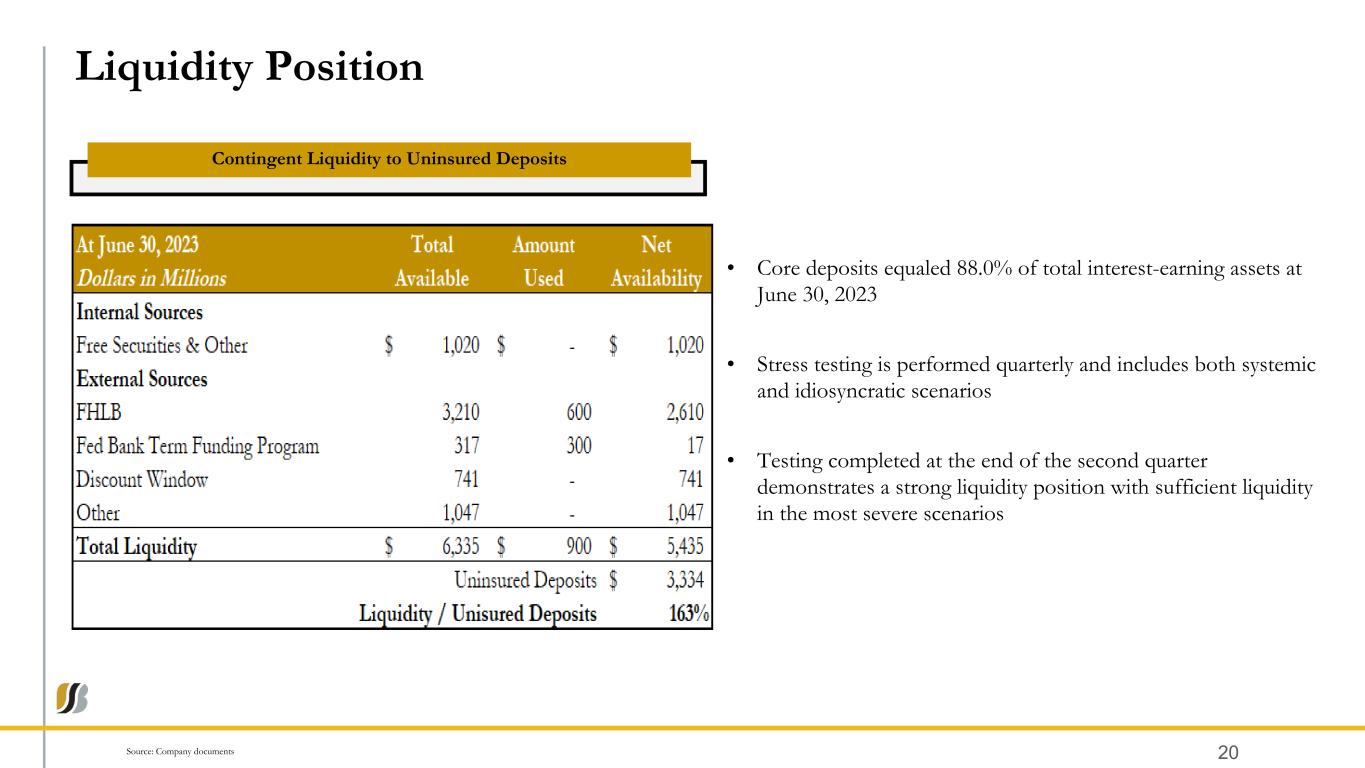

Total borrowings declined by $28.0 million or 2% at June 30, 2023 as compared to the previous quarter, driven by a $205.0 million and $150.0 million reductions in fed funds purchased and FHLB advances, respectively, partially offset by $300.0 million of borrowings through the Federal Reserve Bank's Bank Term Funding Program. At June 30, 2023, contingent liquidity, which consists of available FHLB borrowings, available funds through the Federal Reserve Bank's discount window and the Bank Term Funding Program, as well as excess cash and unpledged investment securities totaled $4.4 billion or 132% of uninsured deposits. In addition, the Company also had $1.0 billion in available fed funds, which provided total coverage of 163% of uninsured deposits.

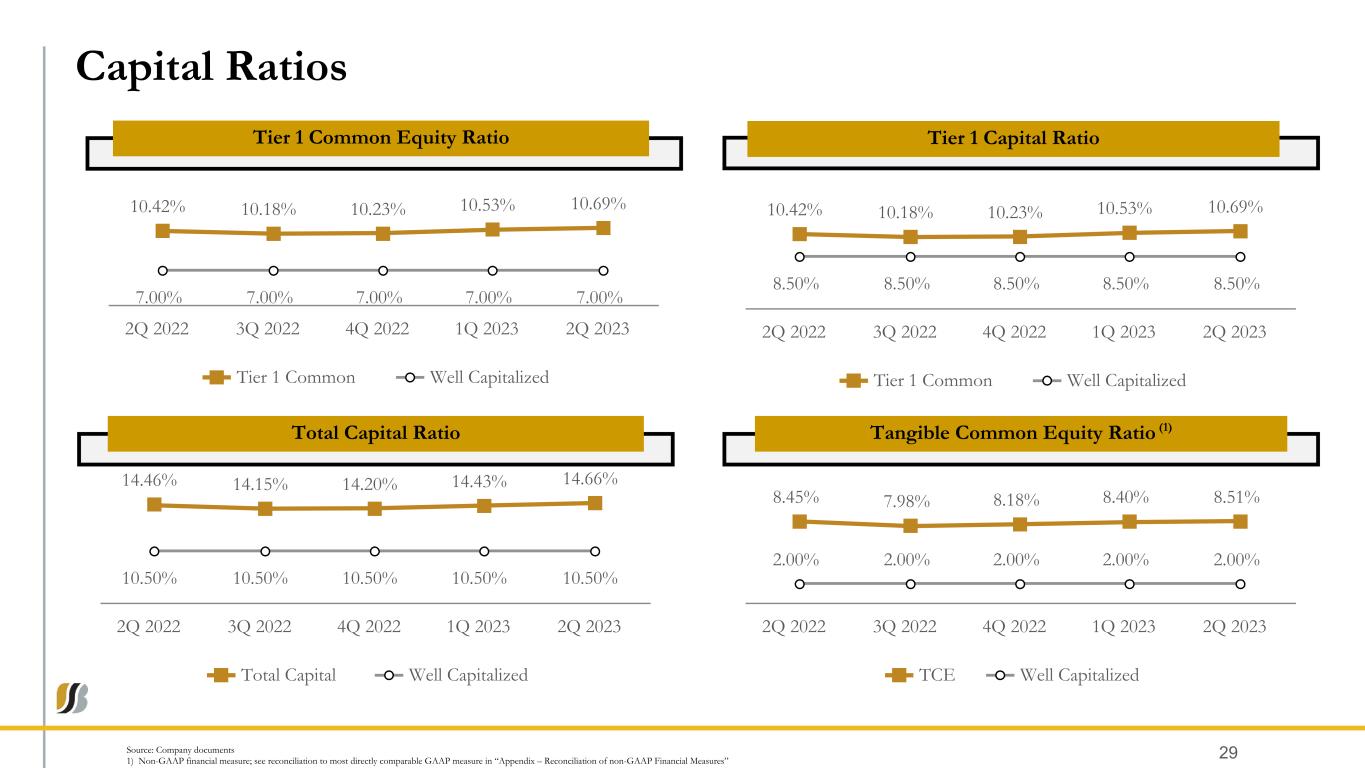

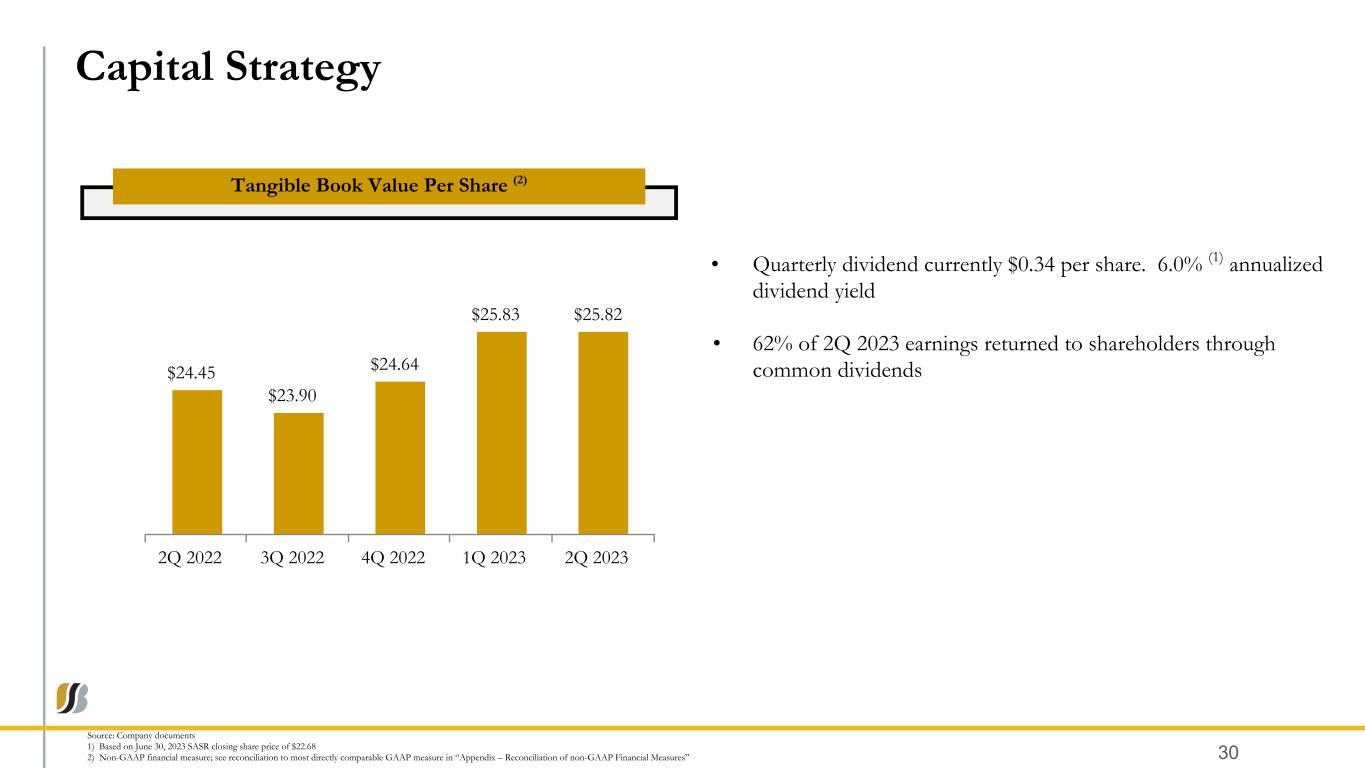

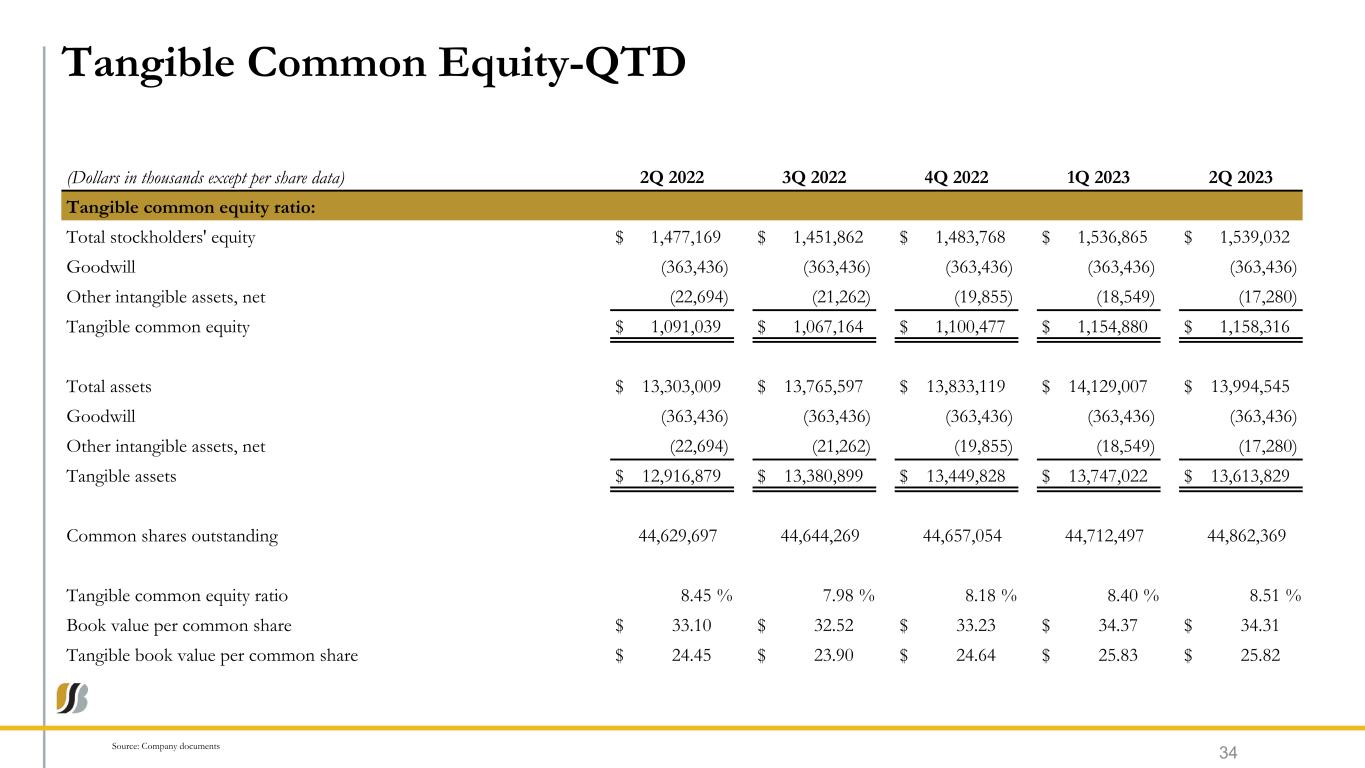

The tangible common equity ratio increased to 8.51% of tangible assets at June 30, 2023, compared to 8.40% at March 31, 2023. This increase reflected the impact of declining tangible assets while tangible common equity remained relatively unchanged quarter-over-quarter, as net retained earnings were offset by higher unrealized losses on available-for-sale investment securities.

At June 30, 2023, the Company had a total risk-based capital ratio of 14.66%, a common equity tier 1 risk-based capital ratio of 10.69%, a tier 1 risk-based capital ratio of 10.69%, and a tier 1 leverage ratio of 9.42%. All of these ratios remain well in excess of the mandated minimum regulatory requirements.

Non-performing loans include non-accrual loans and accruing loans 90 days or more past due. Overall credit quality remained stable at June 30, 2023 compared March 31, 2023, as the ratio of non-performing loans to total loans was 0.44% compared to 0.41%. These levels of non-performing loans compare to 0.40% for the prior year quarter and continue to indicate stable credit quality during a period of economic uncertainty. At June 30, 2023, non-performing loans totaled $49.5 million, compared to $47.2 million at March 31, 2023 and $43.5 million at June 30, 2022. Total net charge-offs for the current quarter amounted to $1.8 million compared to $0.3 million in net recoveries for the first quarter of 2023 and insignificant net charge-offs for the second quarter of 2022. The current quarter's net charge-offs occurred within the consumer loan portfolio due to the elimination of several non-accrual loans.

At June 30, 2023, the allowance for credit losses was $120.3 million or 1.06% of outstanding loans and 243% of non-performing loans, compared to $117.6 million or 1.03% of outstanding loans and 249% of non-performing loans at the end of the previous quarter and $113.7 million or 1.05% of outstanding loans and 261% of non-performing loans at the end of the second quarter of 2022. The increase in the allowance for the current quarter compared to the previous quarter reflects mainly an individual reserve recorded on a single commercial real estate relationship. A majority of the other assumptions within the allowance for credit losses were relatively unchanged at June 30, 2023 compared to March 31, 2023.

Income Statement Review

Quarterly Results

Net income was $24.7 million ($0.55 per diluted common share) for the three months ended June 30, 2023 compared to $51.3 million ($1.14 per diluted common share) for the three months ended March 31, 2023 and $54.8 million ($1.21 per diluted common share) for the prior year quarter. Current quarter's core earnings were $27.1 million ($0.60 per diluted common share), compared to $52.3 million ($1.16 per diluted common share) for the previous quarter and $44.2 million ($0.98 per diluted common share) for the quarter ended June 30, 2022. The decline in the current quarter's net income and core earnings compared to the previous quarter was the result of lower net interest income coupled with higher provision for credit losses and non-interest expense. Year-over-year decline in quarterly net income was mainly attributable to a $16.7 million gain earned during the prior year quarter associated with the sale of the Company's insurance segment. Excluding this one-time gain, the decrease in net income was due to lower net interest income and non-interest income along with higher non-interest expense.

Net interest income for the second quarter of 2023 decreased $6.8 million or 7% compared to the previous quarter and $15.5 million or 15% compared to the second quarter of 2022. Both quarterly and year-over-year decreases in net interest income were driven by higher interest expense, a result of higher funding costs, which outpaced growth in interest income. During the past twelve months, loan growth coupled with the rising interest rate environment was primarily responsible for a $44.2 million increase in interest income. This growth in interest income was more than offset by the $59.7 million growth in interest expense as funding costs have also risen in response to the rising rate environment and significant competition for deposits. Interest income growth occurred in all categories of commercial loans and, to a lesser degree, in residential mortgage loans, consumer loans and investment securities income. Interest expense grew primarily due to time and money market deposits, as well as the higher cost of borrowings in the current year period compared to the same period of the prior year.

The net interest margin was 2.73% for the second quarter of 2023 compared to 2.99% for the first quarter of 2023 and 3.49% for the second quarter of 2022. The contraction of the net interest margin for the current quarter was due to the higher rate paid on interest-bearing liabilities, which outpaced the increase in the yield on interest-earning assets. The overall rate and yield increases were driven by the multiple federal funds rate increases that occurred over the preceding twelve months coupled with the competition for deposits in the market, and customer movement of excess funds out of noninterest-bearing accounts into higher yielding products.

As compared to the prior year quarter, while the yield on interest-earning assets increased 100 basis points, while the rate paid on interest-bearing liabilities rose 250 basis points resulting in the margin compression of 76 basis points.

The total provision for credit losses was $5.1 million for the second quarter of 2023 compared to a credit to provision of $21.5 million for the previous quarter and a provision of $3.0 million for the second quarter of 2022. The provision for credit losses directly attributable to the funded loan portfolio was $4.5 million for the current quarter compared to a credit to the provision of $18.9 million for the first quarter of 2023 and the prior year quarter’s provision of $3.0 million. The current quarter's provision mainly reflects an individual reserve established on a single large commercial real estate relationship along with the several charge-offs of non-accrual consumer loans.

Non-interest income for the second quarter of 2023 increased by 8% or $1.2 million compared to the linked quarter and declined by 51% or $18.1 million compared to the prior year quarter. The current quarter's increase in non-interest income as compared to the previous quarter was mainly driven by higher income from mortgage banking activities, BOLI mortality-related income and service charges on deposit accounts. Year-over-year decrease was primarily a result of a sale of the Company's insurance segment during the second quarter of 2022 and the associated $16.7 million gain on sale. Excluding this one-time gain on sale, non-interest income declined by 7% or $1.4 million from the prior year quarter due to insurance commissions income as a result of the aforementioned sale and lower bank card income due to regulatory restrictions on transaction fees.

Non-interest expense for the second quarter of 2023 increased $2.8 million or 4% compared to the first quarter of 2023 and $4.1 million or 6% compared to the second quarter of 2022. The quarterly increase in non-interest expense is mainly attributable to a higher compensation and benefits costs associated with $1.9 million of severance expenses related to staffing adjustments made during the current quarter as a part of the broader cost control initiatives implemented by management during the current year. Higher non-interest expense for the current quarter, as compared to the prior year quarter, was due to higher FDIC insurance expense, a result of the two basis points increase in the assessment rate for all banks that became effective in 2023, higher professional and service fees related to the Company's investments in technology projects, and higher marketing expense associated with targeted advertising campaigns aimed at growing deposit relationships.

For the second quarter of 2023, the GAAP efficiency ratio was 64.22% compared to 58.55% for the first quarter of 2023 and 46.03% for the second quarter of 2022. The GAAP efficiency ratio rose from the prior year quarter primarily the result of the 24% decrease in GAAP revenue in combination with the 6% increase in GAAP non-interest expense. The non-GAAP efficiency ratio was 60.68% for the current quarter as compared to 56.87% for the first quarter of 2023 and 49.79% for the second quarter of 2022. The increase in the non-GAAP efficiency ratio (reflecting a decrease in efficiency) from the second quarter of the prior year to the current year quarter was primarily the result of the 13% decline in non-GAAP revenue, while non-GAAP expenses rose 6%.

ROA for the quarter ended June 30, 2023 was 0.70% and ROTCE was 8.93% compared to 1.49% and 19.10%, respectively, for the first quarter of 2023 and 1.69% and 20.83%, respectively, for the second quarter of 2022. On a non-GAAP basis, the current quarter's core ROA was 0.77% and core ROTCE was 9.43% compared to 1.52% and 19.11% for the first quarter of 2023 and 1.37% and 16.49%, respectively, for the second quarter of 2022.

Year-to-Date Results

The Company recorded net income of $76.0 million for the six months ended June 30, 2023 compared to net income of $98.7 million for the prior year. Core earnings were $79.4 million for the six months ended June 30, 2023 compared to $89.3 million for the prior year. Year-to-date net income declined as a result of lower net interest income, as the growth in interest expense exceeded the increase in interest income, a decline in non-interest income and higher non-interest expense. These contributors to the decline in net income during the current year-to-date period, were partially offset by a lower provision for credit losses as a result of significant credit recorded during the first quarter of the current year.

For the six months ended June 30, 2023, net interest income decreased $19.6 million compared to the prior year as a result of the $109.2 million increase in interest expense, partially offset by the $89.6 million increase in interest income. The increase in interest expense was primarily due to the additional interest expense associated with money market and time deposit accounts and, to a lesser degree, FHLB and Federal Reserve Bank borrowings. The net interest margin declined to 2.86% for the six months ended June 30, 2023, compared to 3.49% for the prior year, primarily as a result of higher funding cost due to the rising interest rate environment and market competition for deposits over the period.

The provision for credit losses for the six months ended June 30, 2023 amounted to a credit of $16.5 million as compared to a charge of $4.7 million for 2022. The significant credit to the provision for the six months ended June 30, 2023 was a reflection of the improving regional forecasted unemployment rate, observed during the early part of the current year, coupled with the continued strong credit performance of the loan portfolio.

For the six months ended June 30, 2023, non-interest income decreased 41% to $33.1 million compared to $55.8 million for 2022. During the prior year, Company realized a $16.7 million gain on the sale of its insurance segment. Excluding the gain, non-interest income decreased 15% or $6.0 million, driven by a $2.9 million decrease in insurance commissions, a $2.6 million decrease in bank card fees and a $0.7 million decrease in income from mortgage banking activities. The decline in income from mortgage banking activities is the result of the rising interest rate environment, which continues to dampen home sales and refinancing activity. Insurance commission income declined due to the disposition of the Company's insurance business during the second quarter of the prior year. Fees from bank cards diminished as a result of regulatory restrictions on transaction fees effective in the second half of the prior year. These decreases in non-interest income year-over-year, were partially offset by a $0.7 million increase in BOLI mortality-related income.

Non-interest expense increased 7% to $135.4 million for the six months ended June 30, 2023, compared to $127.1 million for 2022. The drivers of the increase in non-interest expense were a $3.5 million increase in professional fees, a $1.2 million increase in software expenses, a $0.9 million increase in compensation and benefits, and a $0.7 million increase in marketing expense. Year-over-year increases in both professional fees and software expenses were mainly associated with the Company's investments in technology and software projects. Increase in compensation and benefits expense was driven by severance related expenses associated with staffing adjustments. Increase in marketing expense over the prior year was due to targeted advertising campaigns aimed at growing deposit relationships.

For the six months ended June 30, 2023, the GAAP efficiency ratio was 61.31% compared to 48.30% for the same period in 2022. The non-GAAP efficiency ratio for the current year was 58.73% compared to the 49.57% for the prior year. The growth in the current year’s non-GAAP efficiency ratio compared to the prior year, indicating a decline in efficiency, was the result of the 10% decrease in non-GAAP revenue combined with the 6% growth in non-GAAP non-interest expense.

Explanation of Non-GAAP Financial Measures

This news release contains financial information and performance measures determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). The Company’s management believes that the supplemental non-GAAP information provides a better comparison of period-to-period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. Non-GAAP measures used in this release consist of the following:

•Tangible common equity and related measures are non-GAAP measures that exclude the impact of goodwill and other intangible assets.

•The non-GAAP efficiency ratio excludes amortization of intangible assets, investment securities gains/(losses), merger, acquisition and disposal expense, gain on disposal of assets, severance expense and contingent payment expense, and includes tax-equivalent income.

•Core earnings and the related measures of core earnings per diluted common share, core return on average assets and core return on average tangible common equity reflect net income exclusive of amortization of intangible assets, investment securities gains/(losses) and other non-recurring or extraordinary items, on a net of tax basis.

•Pre-tax pre-provision net income excludes income tax expense and the provision (credit) for credit losses.

These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Please refer to the non-GAAP Reconciliation tables included with this release for a reconciliation of these non-GAAP measures to the most directly comparable GAAP measure.

Conference Call

The Company’s management will host a conference call to discuss its second quarter results today at 2:00 p.m. (ET). A live Webcast of the conference call is available through the Investor Relations section of the Sandy Spring Website at www.sandyspringbank.com. Participants may call 1-833-470-1428. Please use the following access code: 573109. Visitors to the Website are advised to log on 10 minutes ahead of the scheduled start of the call. An internet-based replay will be available on the website until August 8, 2023. A replay of the teleconference will be available through the same time period by calling 1-866-813-9403 under conference call number 708305.

About Sandy Spring Bancorp, Inc.

Sandy Spring Bancorp, Inc., headquartered in Olney, Maryland, is the holding company for Sandy Spring Bank, a premier community bank in the Greater Washington, D.C. region. With over 50 locations, the bank offers a broad range of commercial and retail banking, mortgage, private banking, and trust services throughout Maryland, Virginia, and Washington, D.C. Through its subsidiaries, Rembert Pendleton Jackson and West Financial Services, Inc., Sandy Spring Bank also offers a comprehensive menu of wealth management services.

Category: Webcast

Source: Sandy Spring Bancorp, Inc.

Code: SASR-E

For additional information or questions, please contact:

Daniel J. Schrider, Chair, President & Chief Executive Officer, or

Philip J. Mantua, E.V.P. & Chief Financial Officer

Sandy Spring Bancorp

17801 Georgia Avenue

Olney, Maryland 20832

1-800-399-5919

Email: DSchrider@sandyspringbank.com

PMantua@sandyspringbank.com

Website: www.sandyspringbank.com

Media Contact:

Jen Schell, Senior Vice President

301-570-8331

jschell@sandyspringbank.com

Forward-Looking Statements

Sandy Spring Bancorp’s forward-looking statements are subject to significant risks and uncertainties that may cause actual results to differ materially from those in such statements. These risks and uncertainties include, but are not limited to, the risks identified in our quarterly and annual reports and the following: changes in general business and economic conditions nationally or in the markets that we serve; changes in consumer and business confidence, investor sentiment, or consumer spending or savings behavior; changes in the level of inflation; changes in the demand for loans, deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected; the impact of the interest rate environment on our business, financial condition and results of operations; the impact of compliance with changes in laws, regulations and regulatory interpretations, including changes in income taxes; changes in credit ratings assigned to us or our subsidiaries; the ability to realize benefits and cost savings from, and limit any unexpected liabilities associated with, any business combinations; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the impact of changes in accounting policies, including the introduction of new accounting standards; the impact of judicial or regulatory proceedings; the impact of fiscal and governmental policies of the United States federal government; the impact of health emergencies, epidemics or pandemics; the effects of climate change; and the impact of natural disasters, extreme weather events, military conflict, terrorism or other geopolitical events. Sandy Spring Bancorp provides greater detail regarding some of these factors in its Form 10-K for the year ended December 31, 2022, including in the Risk Factors section of that report, and in its other SEC reports. Sandy Spring Bancorp’s forward-looking statements may also be subject to other risks and uncertainties, including those that it may discuss elsewhere in this news release or in its filings with the SEC, accessible on the SEC’s Web site at www.sec.gov.

Sandy Spring Bancorp, Inc. and Subsidiaries

FINANCIAL HIGHLIGHTS - UNAUDITED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

%

Change |

|

Six Months Ended

June 30, |

|

%

Change |

(Dollars in thousands, except per share data) |

|

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

| Results of operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

$ |

90,471 |

|

$ |

105,950 |

|

(15) |

% |

|

$ |

187,773 |

|

$ |

207,401 |

|

(9) |

% |

| Provision/ (credit) for credit losses |

|

5,055 |

|

3,046 |

|

66 |

|

|

(16,481) |

|

4,681 |

|

N/M |

| Non-interest income |

|

17,176 |

|

35,245 |

|

(51) |

|

|

33,127 |

|

55,840 |

|

(41) |

|

| Non-interest expense |

|

69,136 |

|

64,991 |

|

6 |

|

|

135,441 |

|

127,138 |

|

7 |

|

| Income before income tax expense |

|

33,456 |

|

73,158 |

|

(54) |

|

|

101,940 |

|

131,422 |

|

(22) |

|

| Net income |

|

24,745 |

|

54,800 |

|

(55) |

|

|

75,998 |

|

98,735 |

|

(23) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to common shareholders |

|

$ |

24,712 |

|

$ |

54,606 |

|

(55) |

|

|

$ |

75,821 |

|

$ |

98,259 |

|

(23) |

|

Pre-tax pre-provision net income (1) |

|

$ |

38,511 |

|

$ |

76,204 |

|

(49) |

|

|

$ |

85,459 |

|

$ |

136,103 |

|

(37) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

0.70 |

% |

|

1.69 |

% |

|

|

|

1.09 |

% |

|

1.56 |

% |

|

|

| Return on average common equity |

|

6.46 |

% |

|

14.97 |

% |

|

|

|

10.12 |

% |

|

13.39 |

% |

|

|

Return on average tangible common equity (1) |

|

8.93 |

% |

|

20.83 |

% |

|

|

|

13.88 |

% |

|

18.62 |

% |

|

|

| Net interest margin |

|

2.73 |

% |

|

3.49 |

% |

|

|

|

2.86 |

% |

|

3.49 |

% |

|

|

Efficiency ratio - GAAP basis (2) |

|

64.22 |

% |

|

46.03 |

% |

|

|

|

61.31 |

% |

|

48.30 |

% |

|

|

Efficiency ratio - Non-GAAP basis (2) |

|

60.68 |

% |

|

49.79 |

% |

|

|

|

58.73 |

% |

|

49.57 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income per common share |

|

$ |

0.55 |

|

$ |

1.21 |

|

(55) |

% |

|

$ |

1.69 |

|

$ |

2.18 |

|

(22) |

% |

| Diluted net income per common share |

|

$ |

0.55 |

|

$ |

1.21 |

|

(55) |

|

|

$ |

1.69 |

|

$ |

2.17 |

|

(22) |

|

| Weighted average diluted common shares |

|

44,888,759 |

|

45,111,693 |

|

— |

|

|

44,876,873 |

|

45,223,086 |

|

(1) |

|

| Dividends declared per share |

|

$ |

0.34 |

|

$ |

0.34 |

|

— |

|

|

$ |

0.68 |

|

$ |

0.68 |

|

— |

|

| Book value per common share |

|

$ |

34.31 |

|

$ |

33.10 |

|

4 |

|

|

$ |

34.31 |

|

$ |

33.10 |

|

4 |

|

Tangible book value per common share (1) |

|

$ |

25.82 |

|

$ |

24.45 |

|

6 |

|

|

$ |

25.82 |

|

$ |

24.45 |

|

6 |

|

| Outstanding common shares |

|

44,862,369 |

|

44,629,697 |

|

1 |

|

|

44,862,369 |

|

44,629,697 |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial condition at period-end: |

|

|

|

|

|

|

|

|

|

|

|

|

| Investment securities |

|

$ |

1,463,554 |

|

$ |

1,595,424 |

|

(8) |

% |

|

$ |

1,463,554 |

|

$ |

1,595,424 |

|

(8) |

% |

| Loans |

|

11,369,639 |

|

10,786,290 |

|

5 |

|

|

11,369,639 |

|

10,786,290 |

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets |

|

13,994,545 |

|

13,303,009 |

|

5 |

|

|

13,994,545 |

|

13,303,009 |

|

5 |

|

| Deposits |

|

10,958,922 |

|

10,969,461 |

|

— |

|

|

10,958,922 |

|

10,969,461 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders' equity |

|

1,539,032 |

|

1,477,169 |

|

4 |

|

|

1,539,032 |

|

1,477,169 |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

Tier 1 leverage (3) |

|

9.42 |

% |

|

9.53 |

% |

|

|

|

9.42 |

% |

|

9.53 |

% |

|

|

Common equity tier 1 capital to risk-weighted assets (3) |

|

10.69 |

% |

|

10.42 |

% |

|

|

|

10.69 |

% |

|

10.42 |

% |

|

|

Tier 1 capital to risk-weighted assets (3) |

|

10.69 |

% |

|

10.42 |

% |

|

|

|

10.69 |

% |

|

10.42 |

% |

|

|

Total regulatory capital to risk-weighted assets (3) |

|

14.66 |

% |

|

14.46 |

% |

|

|

|

14.66 |

% |

|

14.46 |

% |

|

|

Tangible common equity to tangible assets (4) |

|

8.51 |

% |

|

8.45 |

% |

|

|

|

8.51 |

% |

|

8.45 |

% |

|

|

| Average equity to average assets |

|

10.89 |

% |

|

11.30 |

% |

|

|

|

10.80 |

% |

|

11.63 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit quality ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses to loans |

|

1.06 |

% |

|

1.05 |

% |

|

|

|

1.06 |

% |

|

1.05 |

% |

|

|

| Non-performing loans to total loans |

|

0.44 |

% |

|

0.40 |

% |

|

|

|

0.44 |

% |

|

0.40 |

% |

|

|

| Non-performing assets to total assets |

|

0.36 |

% |

|

0.33 |

% |

|

|

|

0.36 |

% |

|

0.33 |

% |

|

|

| Allowance for credit losses to non-performing loans |

|

243.21 |

% |

|

261.44 |

% |

|

|

|

243.21 |

% |

|

261.44 |

% |

|

|

Annualized net charge-offs/ (recoveries) to average loans (5) |

|

0.06 |

% |

|

— |

% |

|

|

|

0.03 |

% |

|

— |

% |

|

|

N/M - not meaningful

(1)Represents a non-GAAP measure.

(2)The efficiency ratio - GAAP basis is non-interest expense divided by net interest income plus non-interest income from the Condensed Consolidated Statements of Income. The traditional efficiency ratio - Non-GAAP basis excludes intangible asset amortization, merger, acquisition and disposal expense, severance expense and contingent payment expense from non-interest expense; and investment securities gains/ (losses) and gain on disposal of assets from non-interest income; and adds the tax-equivalent adjustment to net interest income. See the Reconciliation Table included with these Financial Highlights.

(3)Estimated ratio at June 30, 2023.

(4)The tangible common equity to tangible assets ratio is a non-GAAP ratio that divides assets excluding goodwill and other intangible assets into stockholders' equity after deducting goodwill and other intangible assets. See the Reconciliation Table included with these Financial Highlights.

(5)Calculation utilizes average loans, excluding residential mortgage loans held-for-sale.

Sandy Spring Bancorp, Inc. and Subsidiaries

RECONCILIATION TABLE - UNAUDITED (CONTINUED)

OPERATING EARNINGS - METRICS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| (Dollars in thousands) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Core earnings (non-GAAP): |

|

|

|

|

|

|

|

|

| Net income (GAAP) |

|

$ |

24,745 |

|

$ |

54,800 |

|

$ |

75,998 |

|

$ |

98,735 |

Plus/ (less) non-GAAP adjustments (net of tax)(1): |

|

|

|

|

|

|

|

|

| Merger, acquisition and disposal expense |

|

— |

|

793 |

|

— |

|

793 |

| Amortization of intangible assets |

|

946 |

|

1,090 |

|

1,919 |

|

2,211 |

|

|

|

|

|

|

|

|

|

| Severance expense |

|

1,445 |

|

— |

|

1,445 |

|

— |

| Gain on disposal of assets |

|

— |

|

(12,417) |

|

— |

|

(12,417) |

| Investment securities gains |

|

— |

|

(28) |

|

— |

|

(34) |

| Contingent payment expense |

|

— |

|

— |

|

27 |

|

— |

| Core earnings (Non-GAAP) |

|

$ |

27,136 |

|

$ |

44,238 |

|

$ |

79,389 |

|

$ |

89,288 |

|

|

|

|

|

|

|

|

|

Core earnings per diluted common share (non-GAAP): |

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding - diluted (GAAP) |

|

44,888,759 |

|

45,111,693 |

|

44,876,873 |

|

45,223,086 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per diluted common share (GAAP) |

|

$ |

0.55 |

|

$ |

1.21 |

|

$ |

1.69 |

|

$ |

2.17 |

| Core earnings per diluted common share (non-GAAP) |

|

$ |

0.60 |

|

$ |

0.98 |

|

$ |

1.77 |

|

$ |

1.97 |

|

|

|

|

|

|

|

|

|

| Core return on average assets (non-GAAP): |

|

|

|

|

|

|

|

|

| Average assets (GAAP) |

|

$ |

14,094,653 |

|

$ |

12,991,692 |

|

$ |

14,022,364 |

|

$ |

12,785,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (GAAP) |

|

0.70 |

% |

|

1.69 |

% |

|

1.09 |

% |

|

1.56 |

% |

| Core return on average assets (non-GAAP) |

|

0.77 |

% |

|

1.37 |

% |

|

1.14 |

% |

|

1.41 |

% |

|

|

|

|

|

|

|

|

|

| Return/ Core return on average tangible common equity (non-GAAP): |

|

|

|

|

|

|

|

|

| Net Income (GAAP) |

|

$ |

24,745 |

|

$ |

54,800 |

|

$ |

75,998 |

|

$ |

98,735 |

| Plus: Amortization of intangible assets (net of tax) |

|

946 |

|

1,090 |

|

1,919 |

|

2,211 |

| Net income before amortization of intangible assets |

|

$ |

25,691 |

|

$ |

55,890 |

|

$ |

77,917 |

|

$ |

100,946 |

|

|

|

|

|

|

|

|

|

| Average total stockholders' equity (GAAP) |

|

$ |

1,535,465 |

|

$ |

1,468,036 |

|

$ |

1,513,817 |

|

$ |

1,487,170 |

| Average goodwill |

|

(363,436) |

|

(367,986) |

|

(363,436) |

|

(369,098) |

| Average other intangible assets, net |

|

(18,074) |

|

(23,801) |

|

(18,724) |

|

(24,580) |

| Average tangible common equity (non-GAAP) |

|

$ |

1,153,955 |

|

$ |

1,076,249 |

|

$ |

1,131,657 |

|

$ |

1,093,492 |

|

|

|

|

|

|

|

|

|

Return on average tangible common equity (non-GAAP) |

|

8.93 |

% |

|

20.83 |

% |

|

13.88 |

% |

|

18.62 |

% |

| Core return on average tangible common equity (non-GAAP) |

|

9.43 |

% |

|

16.49 |

% |

|

14.15 |

% |

|

16.47 |

% |

(1) Tax adjustments have been determined using the combined marginal federal and state rate of 25.47% and 25.64% for 2023 and 2022, respectively.

132Sandy Spring Bancorp, Inc. and Subsidiaries

RECONCILIATION TABLE - UNAUDITED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| (Dollars in thousands) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Pre-tax pre-provision net income: |

|

|

|

|

|

|

|

|

| Net income (GAAP) |

|

$ |

24,745 |

|

$ |

54,800 |

|

$ |

75,998 |

|

$ |

98,735 |

| Plus/ (less) non-GAAP adjustments: |

|

|

|

|

|

|

|

|

| Income tax expense |

|

8,711 |

|

18,358 |

|

25,942 |

|

32,687 |

| Provision/ (credit) for credit losses |

|

5,055 |

|

3,046 |

|

(16,481) |

|

4,681 |

| Pre-tax pre-provision net income (non-GAAP) |

|

$ |

38,511 |

|

$ |

76,204 |

|

$ |

85,459 |

|

$ |

136,103 |

|

|

|

|

|

|

|

|

|

Efficiency ratio (GAAP): |

|

|

|

|

|

|

|

|

| Non-interest expense |

|

$ |

69,136 |

|

$ |

64,991 |

|

$ |

135,441 |

|

$ |

127,138 |

|

|

|

|

|

|

|

|

|

| Net interest income plus non-interest income |

|

$ |

107,647 |

|

$ |

141,195 |

|

$ |

220,900 |

|

$ |

263,241 |

|

|

|

|

|

|

|

|

|

| Efficiency ratio (GAAP) |

|

64.22% |

|

46.03 |

% |

|

61.31 |

% |

|

48.30 |

% |

|

|

|

|

|

|

|

|

|

| Efficiency ratio (Non-GAAP): |

|

|

|

|

|

|

|

|

| Non-interest expense |

|

$ |

69,136 |

|

$ |

64,991 |

|

$ |

135,441 |

|

$ |

127,138 |

| Less non-GAAP adjustments: |

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

|

1,269 |

|

1,466 |

|

2,575 |

|

2,974 |

|

|

|

|

|

|

|

|

|

| Merger, acquisition and disposal expense |

|

— |

|

1,067 |

|

— |

|

1,067 |

| Severance expense |

|

1,939 |

|

— |

|

1,939 |

|

— |

| Contingent payment expense |

|

— |

|

— |

|

36 |

|

— |

| Non-interest expense - as adjusted |

|

$ |

65,928 |

|

$ |

62,458 |

|

$ |

130,891 |

|

$ |

123,097 |

|

|

|

|

|

|

|

|

|

Net interest income plus non-interest income |

|

$ |

107,647 |

|

$ |

141,195 |

|

$ |

220,900 |

|

$ |

263,241 |

| Plus non-GAAP adjustment: |

|

|

|

|

|

|

|

|

| Tax-equivalent income |

|

1,006 |

|

992 |

|

1,976 |

|

1,858 |

| Less/ (plus) non-GAAP adjustment: |

|

|

|

|

|

|

|

|

| Investment securities gains |

|

— |

|

38 |

|

— |

|

46 |

| Gain on disposal of assets |

|

— |

|

16,699 |

|

— |

|

16,699 |

| Net interest income plus non-interest income - as adjusted |

|

$ |

108,653 |

|

$ |

125,450 |

|

$ |

222,876 |

|

$ |

248,354 |

|

|

|

|

|

|

|

|

|

Efficiency ratio (Non-GAAP) |

|

60.68% |

|

49.79 |

% |

|

58.73 |

% |

|

49.57 |

% |

|

|

|

|

|

|

|

|

|

| Tangible common equity ratio: |

|

|

|

|

|

|

|

|

| Total stockholders' equity |

|

$ |

1,539,032 |

|

$ |

1,477,169 |

|

$ |

1,539,032 |

|

$ |

1,477,169 |

| Goodwill |

|

(363,436) |

|

(363,436) |

|

(363,436) |

|

(363,436) |

| Other intangible assets, net |

|

(17,280) |

|

(22,694) |

|

(17,280) |

|

(22,694) |

| Tangible common equity |

|

$ |

1,158,316 |

|

$ |

1,091,039 |

|

$ |

1,158,316 |

|

$ |

1,091,039 |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

13,994,545 |

|

$ |

13,303,009 |

|

$ |

13,994,545 |

|

$ |

13,303,009 |

| Goodwill |

|

(363,436) |

|

(363,436) |

|

(363,436) |

|

(363,436) |

| Other intangible assets, net |

|

(17,280) |

|

(22,694) |

|

(17,280) |

|

(22,694) |

| Tangible assets |

|

$ |

13,613,829 |

|

$ |

12,916,879 |

|

$ |

13,613,829 |

|

$ |

12,916,879 |

|

|

|

|

|

|

|

|

|

Tangible common equity ratio |

|

8.51% |

|

8.45 |

% |

|

8.51 |

% |

|

8.45 |

% |

|

|

|

|

|

|

|

|

|

| Outstanding common shares |

|

44,862,369 |

|

44,629,697 |

|

44,862,369 |

|

44,629,697 |

| Tangible book value per common share |

|

$ |

25.82 |

|

$ |

24.45 |

|

$ |

25.82 |

|

$ |

24.45 |

Sandy Spring Bancorp, Inc. and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF CONDITION - UNAUDITED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in thousands) |

|

June 30,

2023 |

|

December 31,

2022 |

|

June 30,

2022 |

Assets |

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

96,482 |

|

|

$ |

88,152 |

|

|

$ |

84,215 |

|

| Federal funds sold |

|

240 |

|

|

193 |

|

|

291 |

|

| Interest-bearing deposits with banks |

|

333,405 |

|

|

103,887 |

|

|

136,773 |

|

| Cash and cash equivalents |

|

430,127 |

|

|

192,232 |

|

|

221,279 |

|

| Residential mortgage loans held for sale (at fair value) |

|

21,476 |

|

|

11,706 |

|

|

23,610 |

|

Investments held-to-maturity (fair values of $208,662, $220,123 and $250,915 at June 30, 2023, December 31, 2022 and June 30, 2022, respectively) |

|

247,814 |

|

|

259,452 |

|

|

274,337 |

|

| Investments available-for-sale (at fair value) |

|

1,143,688 |

|

|

1,214,538 |

|

|

1,268,823 |

|

| Other investments, at cost |

|

72,052 |

|

|

69,218 |

|

|

52,264 |

|

| Total loans |

|

11,369,639 |

|

|

11,396,706 |

|

|

10,786,290 |

|

| Less: allowance for credit losses - loans |

|

(120,287) |

|

|

(136,242) |

|

|

(113,670) |

|

| Net loans |

|

11,249,352 |

|

|

11,260,464 |

|

|

10,672,620 |

|

| Premises and equipment, net |

|

71,203 |

|

|

67,070 |

|

|

63,243 |

|

| Other real estate owned |

|

611 |

|

|

645 |

|

|

739 |

|

| Accrued interest receivable |

|

42,388 |

|

|

41,172 |

|

|

33,459 |

|

| Goodwill |

|

363,436 |

|

|

363,436 |

|

|

363,436 |

|

| Other intangible assets, net |

|

17,280 |

|

|

19,855 |

|

|

22,694 |

|

| Other assets |

|

335,118 |

|

|

333,331 |

|

|

306,505 |

|

| Total assets |

|

$ |

13,994,545 |

|

|

$ |

13,833,119 |

|

|

$ |

13,303,009 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Noninterest-bearing deposits |

|

$ |

3,079,896 |

|

|

$ |

3,673,300 |

|

|

$ |

4,129,440 |

|

| Interest-bearing deposits |

|

7,879,026 |

|

|

7,280,121 |

|

|

6,840,021 |

|

| Total deposits |

|

10,958,922 |

|

|

10,953,421 |

|

|

10,969,461 |

|

| Securities sold under retail repurchase agreements |

|

74,510 |

|

|

61,967 |

|

|

110,744 |

|

| Federal funds purchased |

|

— |

|

|

260,000 |

|

|

75,000 |

|

| Federal Reserve Bank borrowings |

|

300,000 |

|

|

— |

|

|

— |

|

| Advances from FHLB |

|

600,000 |

|

|

550,000 |

|

|

175,000 |

|

| Subordinated debt |

|

370,504 |

|

|

370,205 |

|

|

369,906 |

|

| Total borrowings |

|

1,345,014 |

|

|

1,242,172 |

|

|

730,650 |

|

| Accrued interest payable and other liabilities |

|

151,577 |

|

|

153,758 |

|

|

125,729 |

|

| Total liabilities |

|

12,455,513 |

|

|

12,349,351 |

|

|

11,825,840 |

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

|

Common stock -- par value $1.00; shares authorized 100,000,000; shares issued and outstanding 44,862,369, 44,657,054 and 44,629,697 at June 30, 2023, December 31, 2022 and June 30, 2022, respectively |

|

44,862 |

|

|

44,657 |

|

|

44,630 |

|

| Additional paid in capital |

|

737,740 |

|

|

734,273 |

|

|

730,285 |

|

| Retained earnings |

|

882,055 |

|

|

836,789 |

|

|

799,707 |

|

| Accumulated other comprehensive loss |

|

(125,625) |

|

|

(131,951) |

|

|

(97,453) |

|

| Total stockholders' equity |

|

1,539,032 |

|

|

1,483,768 |

|

|

1,477,169 |

|

| Total liabilities and stockholders' equity |

|

$ |

13,994,545 |

|

|

$ |

13,833,119 |

|

|

$ |

13,303,009 |

|

Sandy Spring Bancorp, Inc. and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF INCOME - UNAUDITED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| (Dollars in thousands, except per share data) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Interest income: |

|

|

|

|

|

|

|

|

| Interest and fees on loans |

|

$ |

144,274 |

|

|

$ |

106,221 |

|

|

$ |

284,001 |

|

|

$ |

205,715 |

|

| Interest on loans held for sale |

|

307 |

|

|

145 |

|

|

459 |

|

|

343 |

|

| Interest on deposits with banks |

|

4,922 |

|

|

358 |

|

|

7,608 |

|

|

471 |

|

| Interest and dividend income on investment securities: |

|

|

|

|

|

|

|

|

| Taxable |

|

6,848 |

|

|

4,630 |

|

|

13,856 |

|

|

8,737 |

|

| Tax-advantaged |

|

1,795 |

|

|

2,554 |

|

|

3,565 |

|

|

4,678 |

|

| Interest on federal funds sold |

|

4 |

|

|

1 |

|

|

8 |

|

|

1 |

|

| Total interest income |

|

158,150 |

|

|

113,909 |

|

|

309,497 |

|

|

219,945 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

| Interest on deposits |

|

51,325 |

|

|

3,795 |

|

|

92,113 |

|

|

6,088 |

|

Interest on retail repurchase agreements and federal funds purchased |

|

4,191 |

|

|

201 |

|

|

6,295 |

|

|

255 |

|

| Interest on advances from FHLB |

|

8,216 |

|

|

17 |

|

|

15,423 |

|

|

17 |

|

| Interest on subordinated debt |

|

3,947 |

|

|

3,946 |

|

|

7,893 |

|

|

6,184 |

|

| Total interest expense |

|

67,679 |

|

|

7,959 |

|

|

121,724 |

|

|

12,544 |

|

| Net interest income |

|

90,471 |

|

|

105,950 |

|

|

187,773 |

|

|

207,401 |

|

| Provision/ (credit) for credit losses |

|

5,055 |

|

|

3,046 |

|

|

(16,481) |

|

|

4,681 |

|

| Net interest income after provision/ (credit) for credit losses |

|

85,416 |

|

|

102,904 |

|

|

204,254 |

|

|

202,720 |

|

| Non-interest income: |

|

|

|

|

|

|

|

|

| Investment securities gains |

|

— |

|

|

38 |

|

|

— |

|

|

46 |

|

| Gain on disposal of assets |

|

— |

|

|

16,699 |

|

|

— |

|

|

16,699 |

|

| Service charges on deposit accounts |

|

2,606 |

|

|

2,467 |

|

|

4,994 |

|

|

4,793 |

|

| Mortgage banking activities |

|

1,817 |

|

|

1,483 |

|

|

3,062 |

|

|

3,781 |

|

| Wealth management income |

|

9,031 |

|

|

9,098 |

|

|

18,023 |

|

|

18,435 |

|

| Insurance agency commissions |

|

— |

|

|

812 |

|

|

— |

|

|

2,927 |

|

| Income from bank owned life insurance |

|

1,251 |

|

|

703 |

|

|

2,158 |

|

|

1,498 |

|

| Bank card fees |

|

447 |

|

|

1,810 |

|

|

865 |

|

|

3,478 |

|

| Other income |

|

2,024 |

|

|

2,135 |

|

|

4,025 |

|

|

4,183 |

|

| Total non-interest income |

|

17,176 |

|

|

35,245 |

|

|

33,127 |

|

|

55,840 |

|

| Non-interest expense: |

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

40,931 |

|

|

39,550 |

|

|

79,857 |

|

|

78,923 |

|

| Occupancy expense of premises |

|

4,764 |

|

|

4,734 |

|

|

9,611 |

|

|

9,768 |

|

| Equipment expenses |

|

3,760 |

|

|

3,559 |

|

|

7,877 |

|

|

7,095 |

|

| Marketing |

|

1,589 |

|

|

1,280 |

|

|

3,132 |

|

|

2,473 |

|

| Outside data services |

|

2,853 |

|

|

2,564 |

|

|

5,367 |

|

|

4,983 |

|

| FDIC insurance |

|

2,375 |

|

|

1,078 |

|

|

4,513 |

|

|

2,062 |

|

| Amortization of intangible assets |

|

1,269 |

|

|

1,466 |

|

|

2,575 |

|

|

2,974 |

|

| Merger, acquisition and disposal expense |

|

— |

|

|

1,067 |

|

|

— |

|

|

1,067 |

|

| Professional fees and services |

|

4,161 |

|

|

2,372 |

|

|

7,845 |

|

|

4,389 |

|

| Other expenses |

|

7,434 |

|

|

7,321 |

|

|

14,664 |

|

|

13,404 |

|

| Total non-interest expense |

|

69,136 |

|

|

64,991 |

|

|

135,441 |

|

|

127,138 |

|

| Income before income tax expense |

|

33,456 |

|

|

73,158 |

|

|

101,940 |

|

|

131,422 |

|

| Income tax expense |

|

8,711 |

|

|

18,358 |

|

|

25,942 |

|

|

32,687 |

|

| Net income |

|

$ |

24,745 |

|

|

$ |

54,800 |

|

|

$ |

75,998 |

|

|

$ |

98,735 |

|

|

|

|

|

|

|

|

|

|

| Net income per share amounts: |

|

|

|

|

|

|

|

|

| Basic net income per common share |

|

$ |

0.55 |

|

|

$ |

1.21 |

|

|

$ |

1.69 |

|

|

$ |

2.18 |

|

| Diluted net income per common share |

|

$ |

0.55 |

|

|

$ |

1.21 |

|

|

$ |

1.69 |

|

|

$ |

2.17 |

|

| Dividends declared per share |

|

$ |

0.34 |

|

|

$ |

0.34 |

|

|

$ |

0.68 |

|

|

$ |

0.68 |

|

Sandy Spring Bancorp, Inc. and Subsidiaries

HISTORICAL TRENDS - QUARTERLY FINANCIAL DATA - UNAUDITED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

| (Dollars in thousands, except per share data) |

|

Q2 |

|

Q1 |

|

Q4 |

|

Q3 |

|

Q2 |

|

Q1 |

|

|

|

|

| Profitability for the quarter: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax-equivalent interest income |

|

$ |

159,156 |

|

$ |

152,317 |

|

$ |

146,332 |

|

$ |

131,373 |

|

$ |

114,901 |

|

$ |

106,902 |

|

|

|

|

Interest expense |

|

67,679 |

|

54,045 |

|

38,657 |

|

17,462 |

|

7,959 |

|

4,585 |

|

|

|

|

| Tax-equivalent net interest income |

|

91,477 |

|

98,272 |

|

107,675 |

|

113,911 |

|

106,942 |

|

102,317 |

|

|

|

|

Tax-equivalent adjustment |

|

1,006 |

|

970 |

|

1,032 |

|

951 |

|

992 |

|

866 |

|

|

|

|

| Provision/ (credit) for credit losses |

|

5,055 |

|

(21,536) |

|

10,801 |

|

18,890 |

|

3,046 |

|

1,635 |

|

|

|

|

Non-interest income |

|

17,176 |

|

15,951 |

|

14,297 |

|

16,882 |

|

35,245 |

|

20,595 |

|

|

|

|

Non-interest expense |

|

69,136 |

|

66,305 |

|

64,375 |

|

65,780 |

|

64,991 |

|

62,147 |

|

|

|

|

| Income before income tax expense |

|

33,456 |

|

68,484 |

|

45,764 |

|

45,172 |

|

73,158 |

|

58,264 |

|

|

|

|

| Income tax expense |

|

8,711 |

|

17,231 |

|

11,784 |

|

11,588 |

|

18,358 |

|

14,329 |

|

|

|

|

| Net income |

|

$ |

24,745 |

|

$ |

51,253 |

|

$ |

33,980 |

|

$ |

33,584 |

|

$ |

54,800 |

|

$ |

43,935 |

|

|

|

|

| GAAP financial performance: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

0.70 |

% |

|

1.49 |

% |

|

0.98 |

% |

|

0.99 |

% |

|

1.69 |

% |

|

1.42 |

% |

|

|

|

|

| Return on average common equity |

|

6.46 |

% |

|

13.93 |

% |

|

9.23 |

% |

|

8.96 |

% |

|

14.97 |

% |

|

11.83 |

% |

|

|

|

|

| Return on average tangible common equity |

|

8.93 |

% |

|

19.10 |

% |

|

12.91 |

% |

|

12.49 |

% |

|

20.83 |

% |

|

16.45 |

% |

|

|

|

|

| Net interest margin |

|

2.73 |

% |

|

2.99 |

% |

|

3.26 |

% |

|

3.53 |

% |

|

3.49 |

% |

|

3.49 |

% |

|

|

|

|

| Efficiency ratio - GAAP basis |

|

64.22 |

% |

|

58.55 |

% |

|

53.23 |

% |

|

50.66 |

% |

|

46.03 |

% |

|

50.92 |

% |

|

|

|

|

| Non-GAAP financial performance: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pre-tax pre-provision net income |

|

$ |

38,511 |

|

$ |

46,948 |

|

$ |

56,565 |

|

$ |

64,062 |

|

$ |

76,204 |

|

$ |

59,899 |

|

|

|

|

| Core after-tax earnings |

|

$ |

27,136 |

|

$ |

52,253 |

|

$ |

35,322 |

|

$ |

35,695 |

|

$ |

44,238 |

|

$ |

45,050 |

|

|

|

|

| Core return on average assets |

|

0.77 |

% |

|

1.52 |

% |

|

1.02 |

% |

|

1.05 |

% |

|

1.37 |

% |

|

1.45 |

% |

|

|

|

|

| Core return on average common equity |

|

7.09 |

% |

|

14.20 |

% |

|

9.60 |

% |

|

9.53 |

% |

|

12.09 |

% |

|

12.13 |

% |

|

|

|

|

| Core return on average tangible common equity |

|

9.43 |

% |

|

19.11 |

% |

|

13.02 |

% |

|

12.86 |

% |

|

16.49 |

% |

|

16.45 |

% |

|

|

|

|

| Core earnings per diluted common share |

|

$ |

0.60 |

|

$ |

1.16 |

|

$ |

0.79 |

|

$ |

0.80 |

|

$ |

0.98 |

|

$ |

0.99 |

|

|

|

|

| Efficiency ratio - Non-GAAP basis |

|

60.68 |

% |

|

56.87 |

% |

|

51.46 |

% |

|

48.18 |

% |

|

49.79 |

% |

|

49.34 |

% |

|

|

|

|

| Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to common shareholders |

|

$ |

24,712 |

|

$ |

51,084 |

|

$ |

33,866 |

|

$ |

33,470 |

|

$ |

54,606 |

|

$ |

43,667 |

|

|

|

|

| Basic net income per common share |

|

$ |

0.55 |

|

$ |

1.14 |

|

$ |

0.76 |

|

$ |

0.75 |

|

$ |

1.21 |

|

$ |

0.97 |

|

|

|

|

| Diluted net income per common share |

|

$ |

0.55 |

|

$ |

1.14 |

|

$ |

0.76 |

|

$ |

0.75 |

|

$ |

1.21 |

|

$ |

0.96 |

|

|

|

|

| Weighted average diluted common shares |

|

44,888,759 |

|

44,872,582 |

|

44,828,827 |

|

44,780,560 |

|

45,111,693 |

|

45,333,292 |

|

|

|

|

| Dividends declared per share |

|

$ |

0.34 |

|

$ |

0.34 |

|

$ |

0.34 |

|

$ |

0.34 |

|

$ |

0.34 |

|

$ |

0.34 |

|

|

|

|

| Non-interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities gains/ (losses) |

|

$ |

— |

|

$ |

— |

|

$ |

(393) |

|

$ |

2 |

|

$ |

38 |

|

$ |

8 |

|

|

|

|

| Gain/ (loss) on disposal of assets |

|

— |

|

— |

|

— |

|

(183) |

|

16,699 |

|

— |

|

|

|

|

| Service charges on deposit accounts |

|

2,606 |

|

2,388 |

|

2,419 |

|

2,591 |

|

2,467 |

|

2,326 |

|

|

|

|

| Mortgage banking activities |

|

1,817 |

|

1,245 |

|

783 |

|

1,566 |

|

1,483 |

|

2,298 |

|

|

|

|

| Wealth management income |

|

9,031 |

|

8,992 |

|

8,472 |

|

8,867 |

|

9,098 |

|

9,337 |

|

|

|

|

| Insurance agency commissions |

|

— |

|

— |

|

— |

|

— |

|

812 |

|

2,115 |

|

|

|

|

| Income from bank owned life insurance |

|

1,251 |

|

907 |

|

950 |

|

693 |

|

703 |

|

795 |

|

|

|

|

| Bank card fees |

|

447 |

|

418 |

|

463 |

|

438 |

|

1,810 |