| Date of Report (Date of earliest event reported): | July 23, 2025 | |||||||

| North Carolina | 0-15572 | 56-1421916 | ||||||||||||

| (State or Other Jurisdiction | (Commission | (I.R.S. Employer | ||||||||||||

| of Incorporation) | File Number) | Identification Number) | ||||||||||||

| 300 SW Broad Street, | ||||||||||||||

| Southern Pines, | NC | 28387 | ||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||||

| Page | |||||

| Item 2.02 – Results of Operations and Financial Condition | 3 | ||||

| Item 9.01 – Financial Statements and Exhibits | 3 | ||||

| Signatures | 3 | ||||

| 4 | |||||

| 18 | |||||

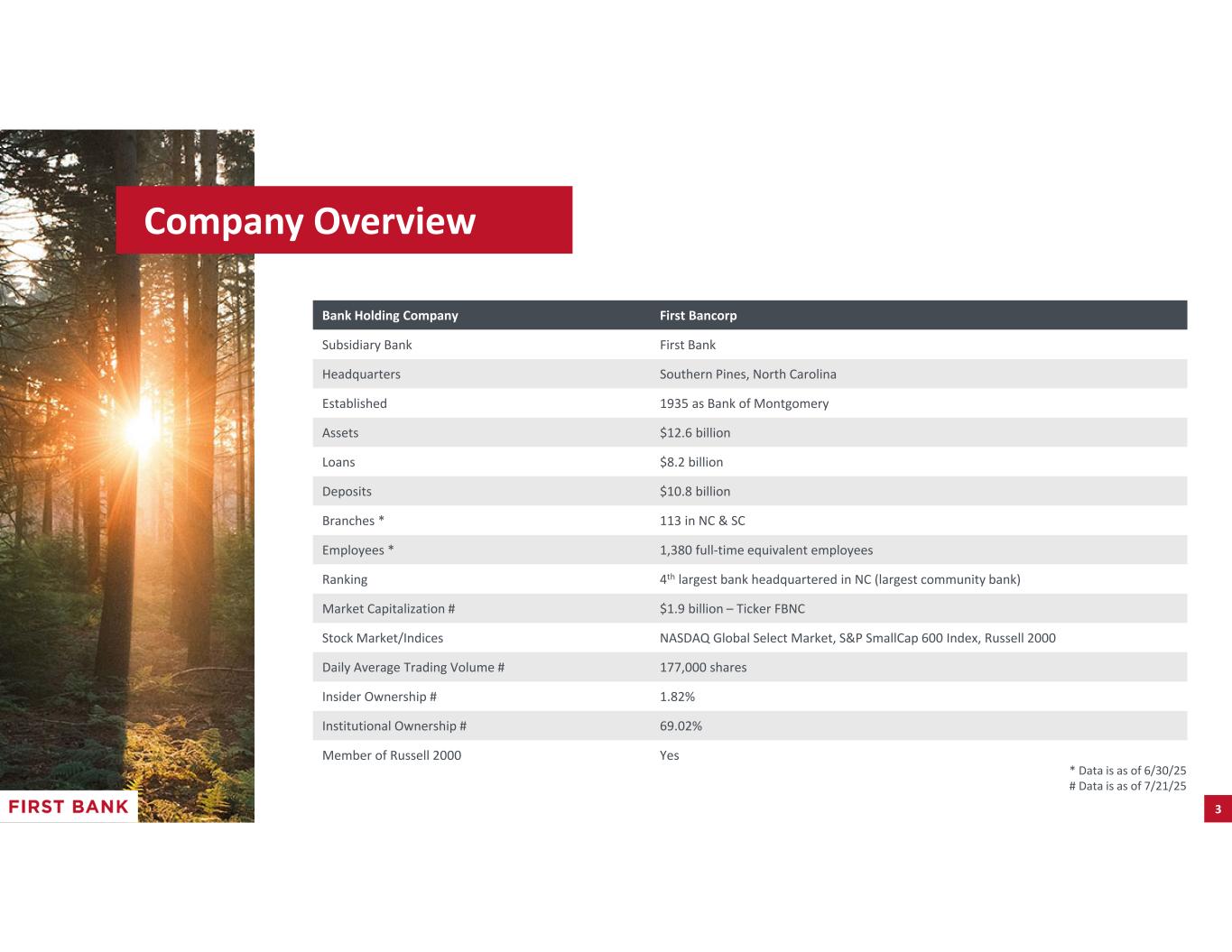

| First Bancorp | ||||||||||||||||||||

| July 23, 2025 | By: |

/s/ Richard H. Moore |

||||||||||||||||||

| Richard H. Moore | ||||||||||||||||||||

| Chief Executive Officer | ||||||||||||||||||||

| For Immediate Release: | For More Information, Contact: | ||||||||||

| July 23, 2025 | Hillary Kestler |

||||||||||

704-644-4137 |

|||||||||||

Second Quarter 2025 Financial Data |

Second Quarter 2025 Highlights |

||||||||||||||||||||||||||||

| (Dollars in 000s, except per share data) | Q2-2025 | Q1-2025 | Q2-2024 |

•Diluted earnings per share ("D-EPS") was $0.93 per share for the second quarter of 2025 compared to $0.88 for the linked quarter and $0.70 for the like quarter.

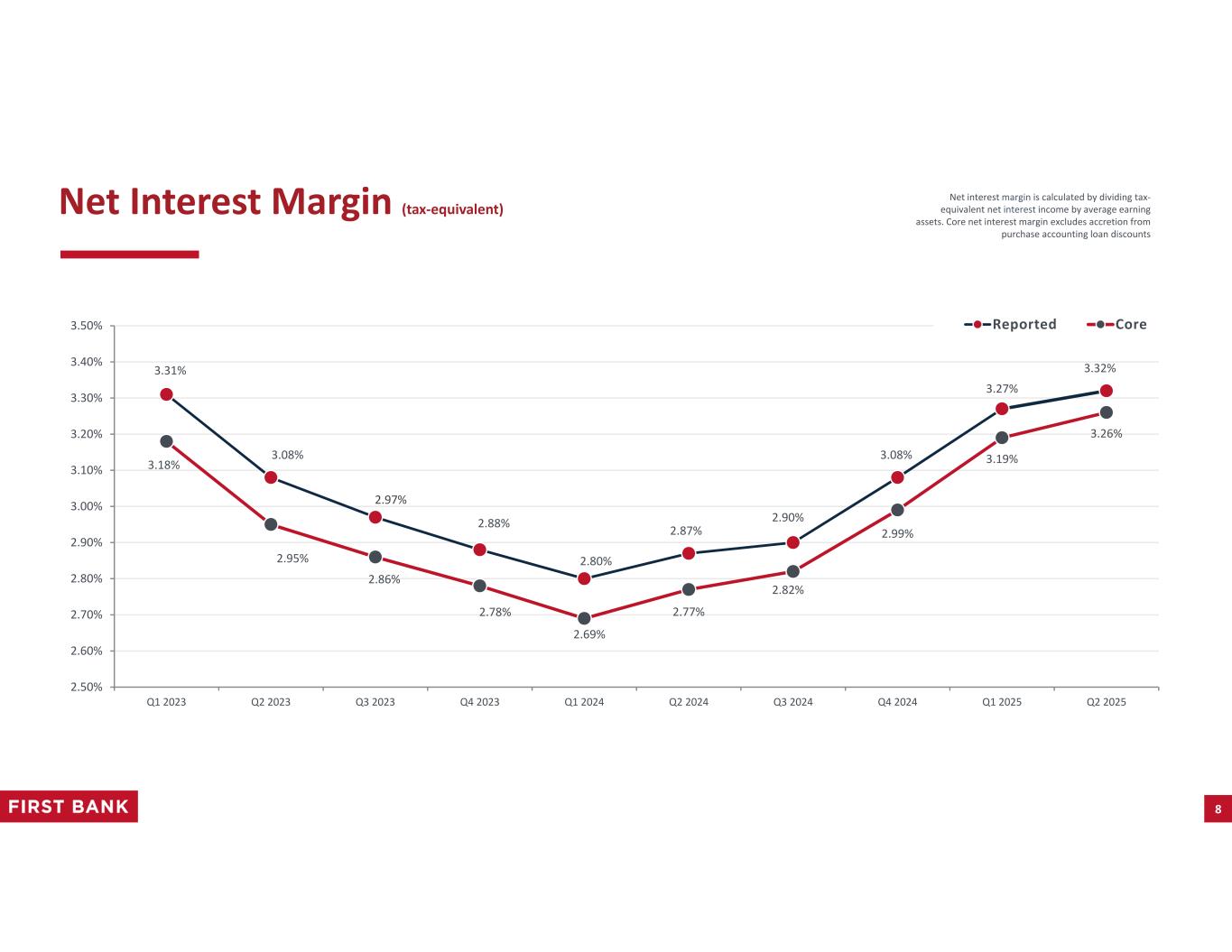

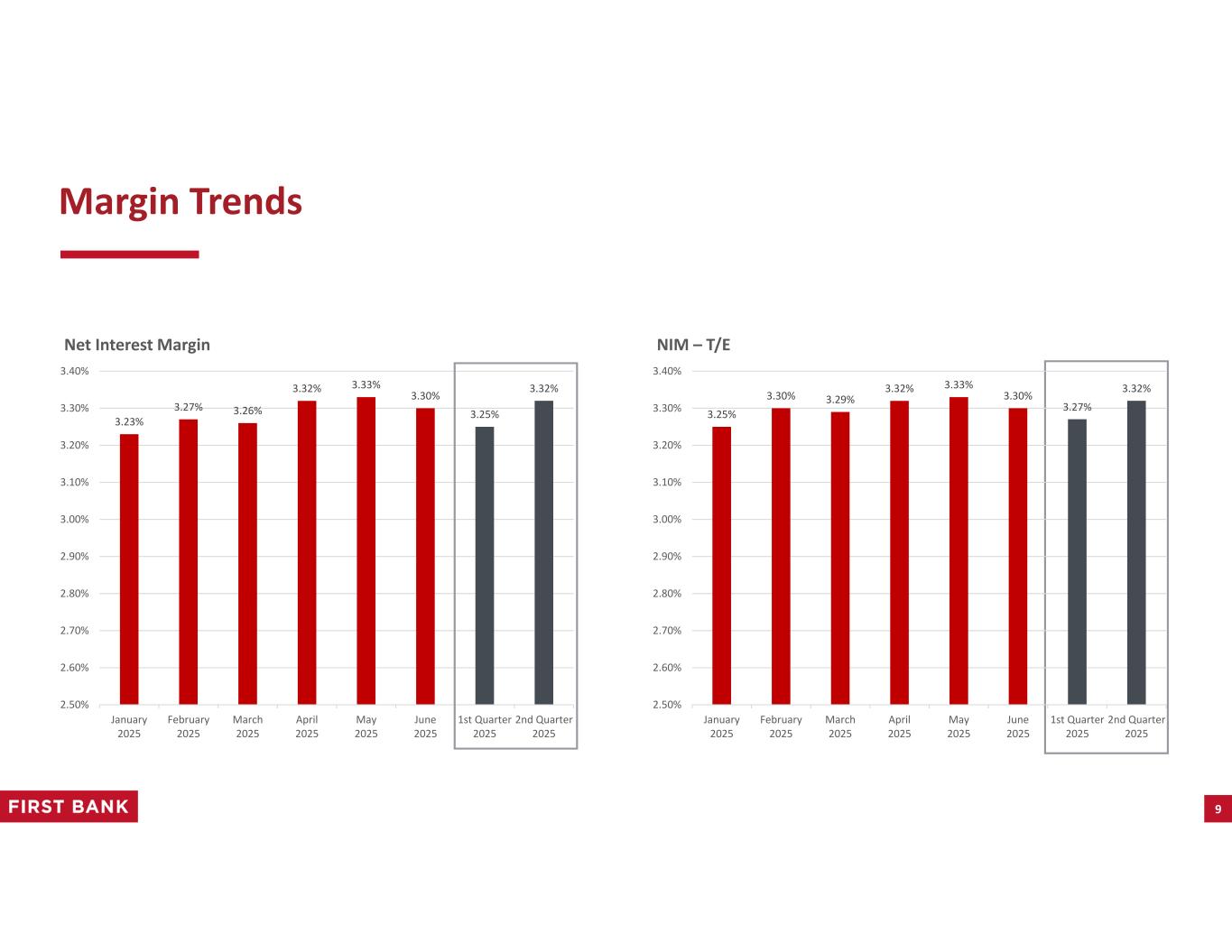

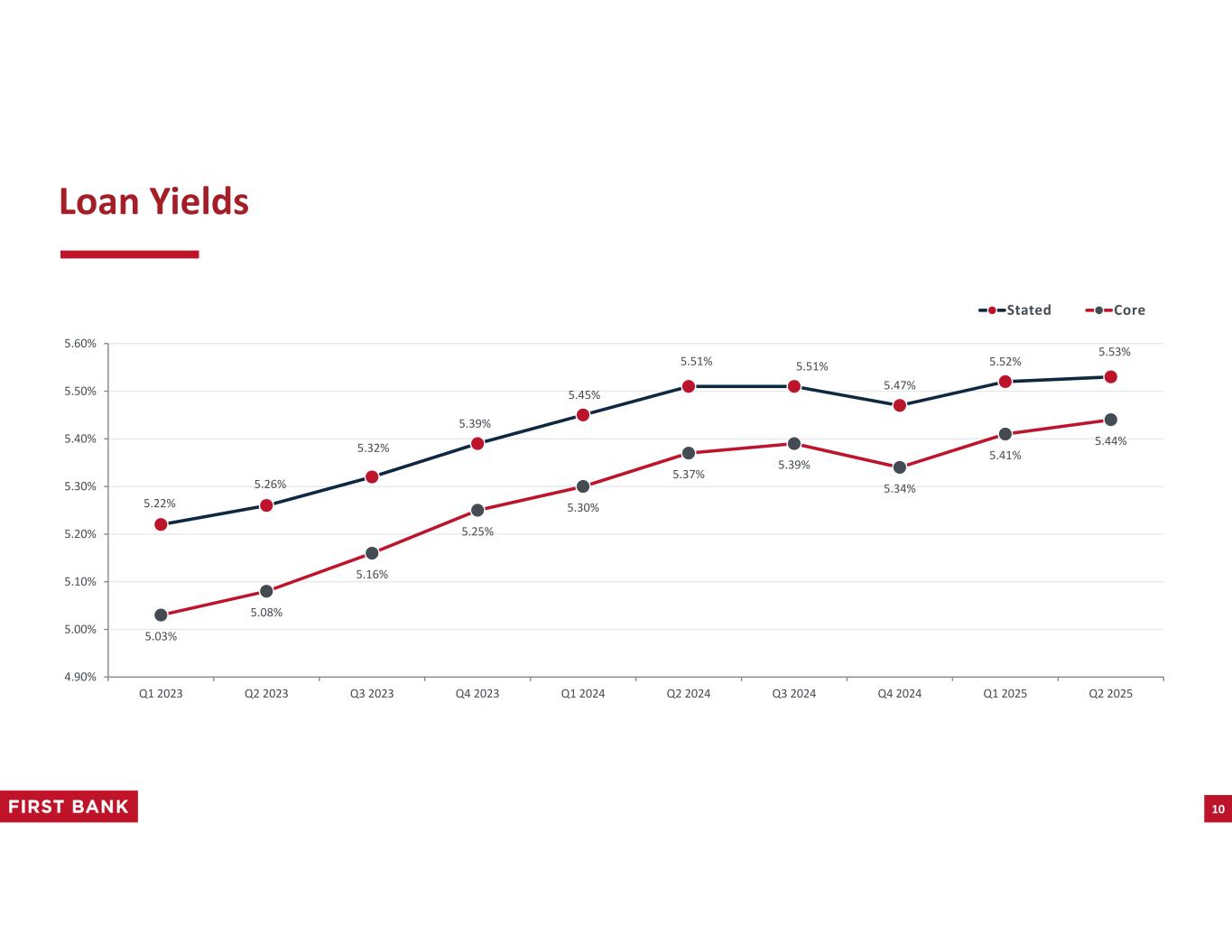

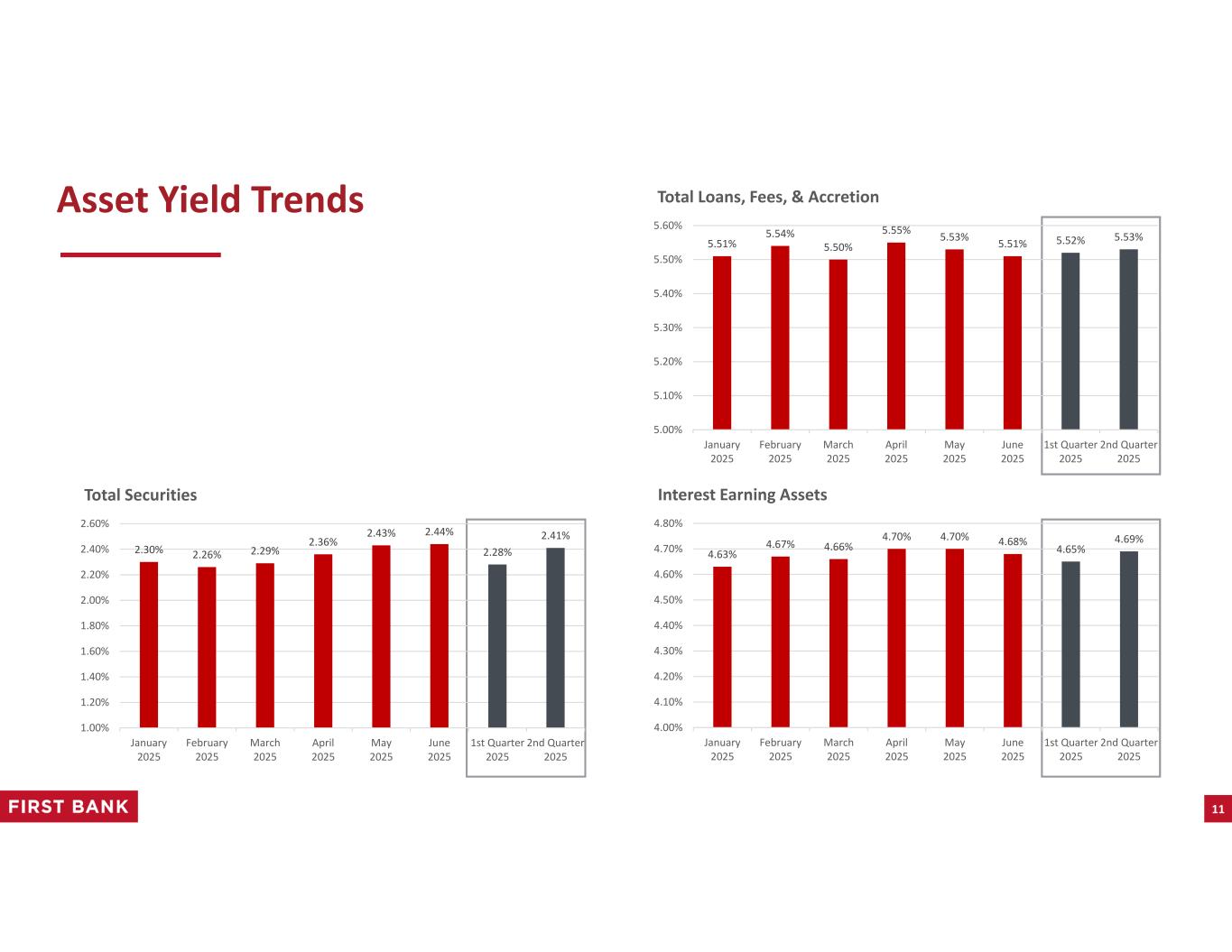

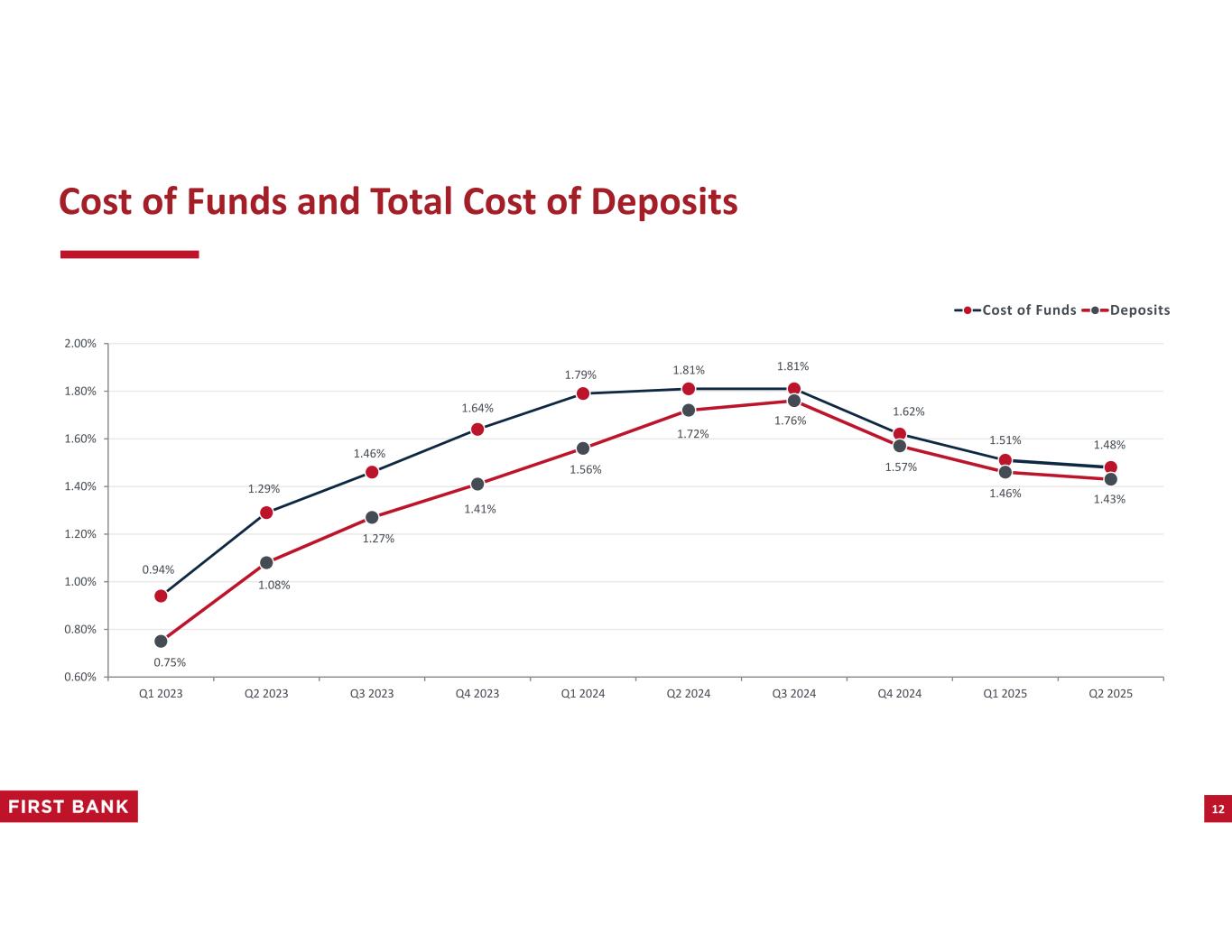

•Total loan yield expanded to 5.53%, up 1 basis point from the linked quarter and 3 basis points from the like quarter. Total cost of funds contracted 3 basis points to 1.48% for the quarter ended June 30, 2025 from 1.51% for the linked quarter and from 1.81% for the like quarter.

•The yield on securities increased 13 basis points to 2.41% for the quarter ended June 30, 2025 from 2.28% for the linked quarter. The Company purchased $127.0 million of CMOs yielding 5.16% during the second quarter.

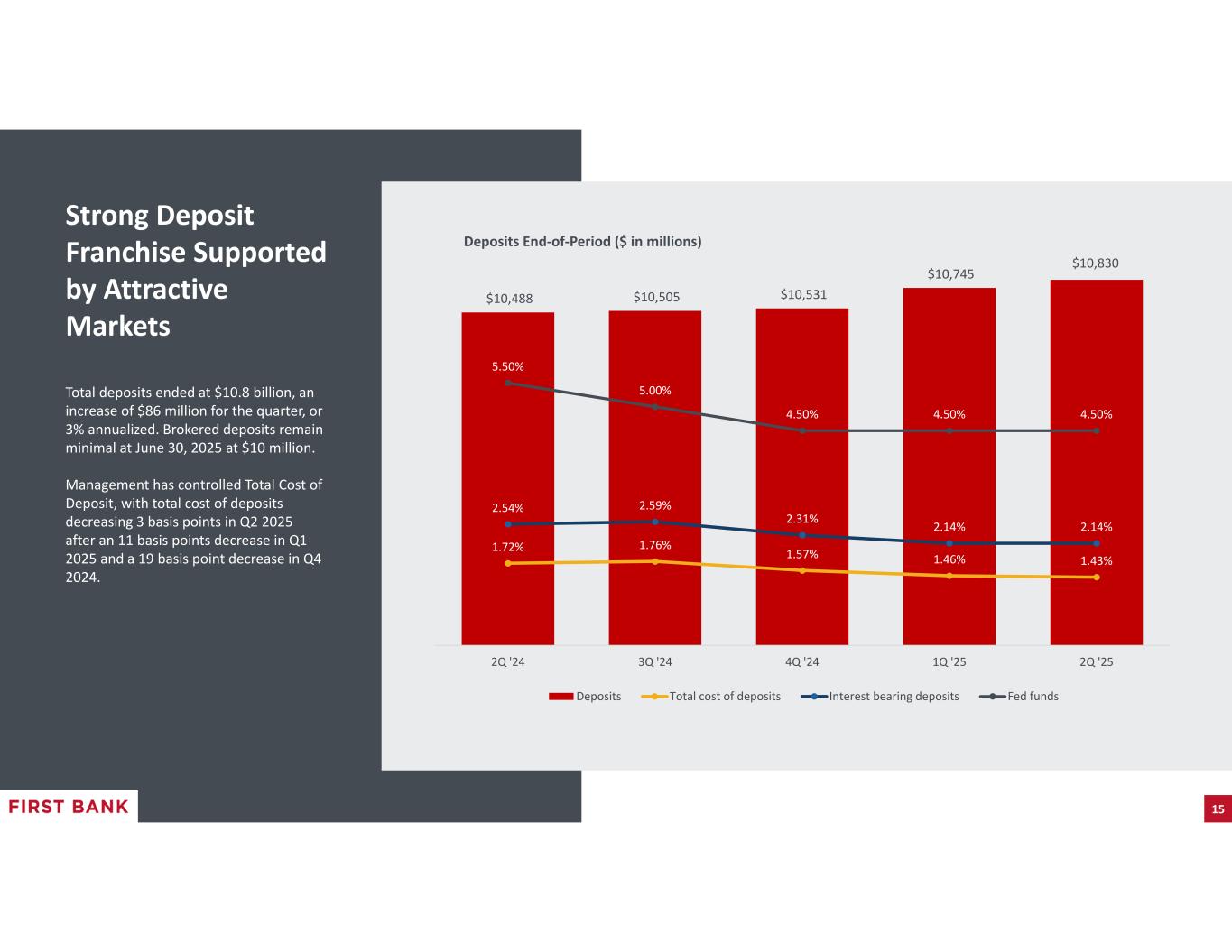

•Average core deposits were $10.7 billion for the second quarter of 2025, an increase of $140.4 million from the linked quarter, with $147.0 million of growth in noninterest bearing deposits and $21.3 million of growth in average money market accounts, partially offset by a decline of $30.7 million in average time deposits. Total cost of deposits was 1.43%, a decrease of 3 basis points from 1.46% for the linked quarter and 29 basis points from the like quarter at 1.72%. The Company continues to maintain a low level of wholesale funding with average borrowings of $92.2 million for the quarter ended June 30, 2025.

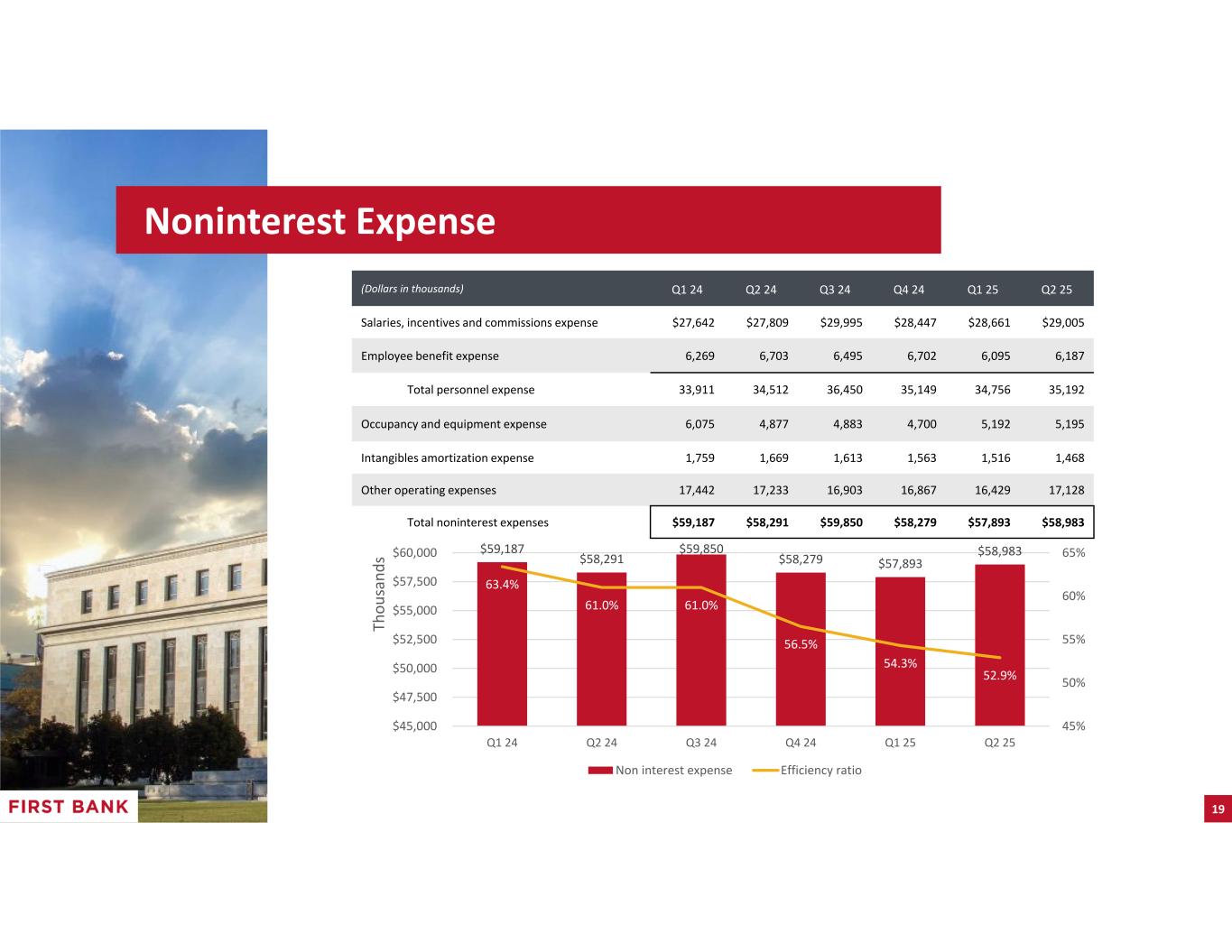

•We continue to focus on expense management. Noninterest expenses of $59.0 million represented a $1.1 million increase from the linked quarter and $0.7 million from the like quarter. The linked quarter increase was driven by a $0.7 million increase in Other operating expenses and a $0.4 million increase in Total personnel expense.

•Total loans were $8.2 billion at June 30, 2025, reflecting growth of $122.6 million, or 6.07% annualized, for the quarter and growth of $155.8 million, or 1.93%, from June 30, 2024.

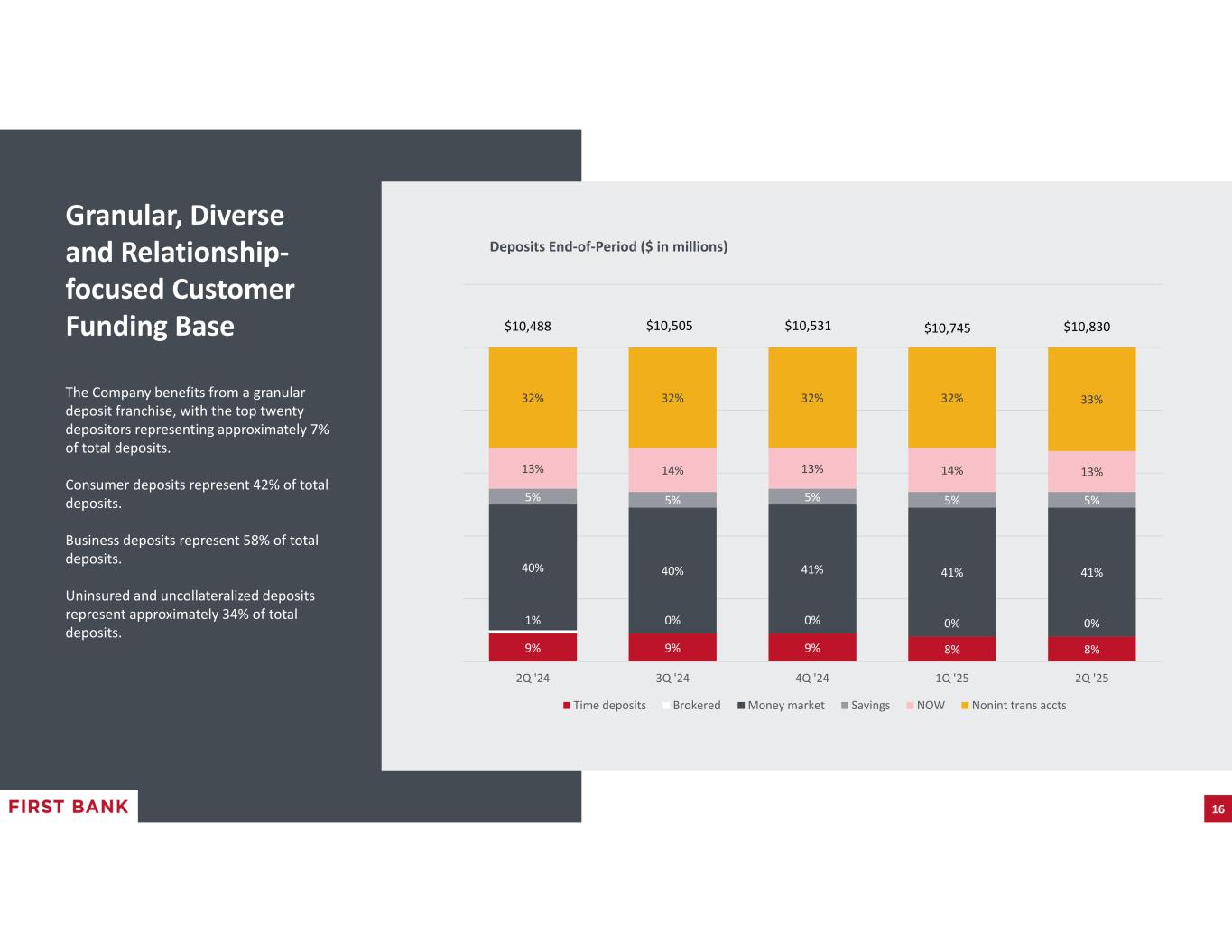

•Noninterest-bearing demand deposits were $3.5 billion, representing 33% of total deposits at June 30, 2025. During the second quarter of 2025, customer deposits grew $85.6 million driven by increases of $65.8 million in noninterest bearing deposits and $60.0 million in money market accounts.

•The on-balance sheet liquidity ratio was 20.0% at June 30, 2025, an increase from 19.8% for the linked quarter. Available off-balance sheet sources totaled $2.3 billion at June 30, 2025, resulting in a total liquidity ratio of 36.1%.

|

|||||||||||||||||||||||||

| Summary Income Statement | |||||||||||||||||||||||||||||

| Total interest income | $ | 136,741 | $ | 132,660 | $ | 128,822 | |||||||||||||||||||||||

| Total interest expense | 40,065 | 39,777 | 47,707 | ||||||||||||||||||||||||||

| Net interest income | 96,676 | 92,883 | 81,115 | ||||||||||||||||||||||||||

| Provision for credit losses | 2,212 | 1,116 | 541 | ||||||||||||||||||||||||||

| Noninterest income | 14,341 | 12,902 | 14,601 | ||||||||||||||||||||||||||

| Noninterest expenses | 58,983 | 57,893 | 58,291 | ||||||||||||||||||||||||||

| Income tax expense | 11,256 | 10,370 | 8,172 | ||||||||||||||||||||||||||

| Net income | $ | 38,566 | $ | 36,406 | $ | 28,712 | |||||||||||||||||||||||

| Key Metrics | |||||||||||||||||||||||||||||

| Diluted EPS | $ | 0.93 | $ | 0.88 | $ | 0.70 | |||||||||||||||||||||||

| Book value per share | 37.53 | 36.46 | 34.10 | ||||||||||||||||||||||||||

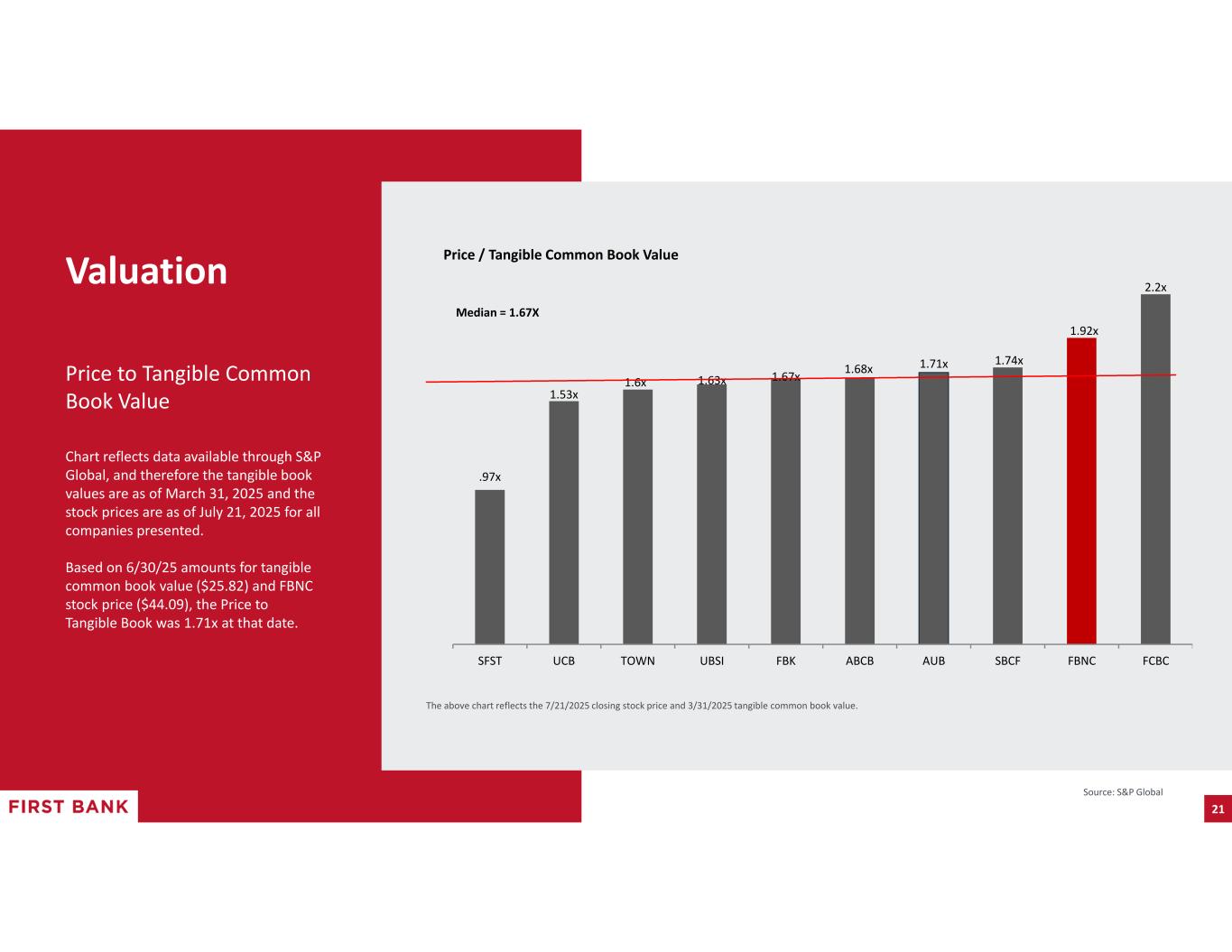

| Tangible book value per share | 25.82 | 24.69 | 22.19 | ||||||||||||||||||||||||||

| Return on average assets | 1.24 | % | 1.21 | % | 0.96 | % | |||||||||||||||||||||||

| Return on average common equity | 10.11 | % | 10.06 | % | 8.38 | % | |||||||||||||||||||||||

| Return on average tangible common equity | 15.25 | % | 15.54 | % | 13.60 | % | |||||||||||||||||||||||

| NIM | 3.32 | % | 3.25 | % | 2.84 | % | |||||||||||||||||||||||

| NIM- T/E | 3.32 | % | 3.27 | % | 2.87 | % | |||||||||||||||||||||||

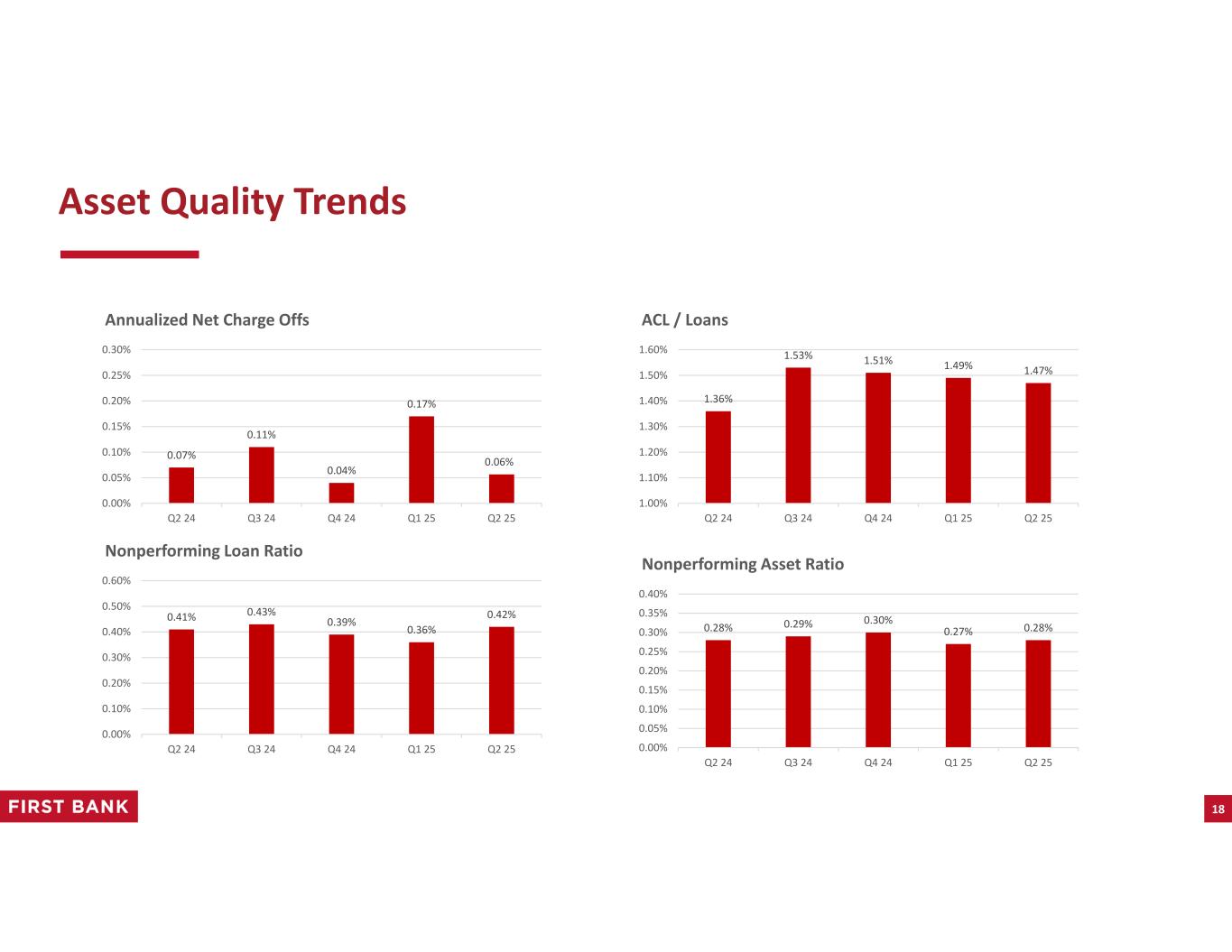

| Quarterly net charge-offs to average loans - annualized | 0.06 | % | 0.17 | % | 0.07 | % | |||||||||||||||||||||||

| Allowance for credit losses to total loans | 1.47 | % | 1.49 | % | 1.36 | % | |||||||||||||||||||||||

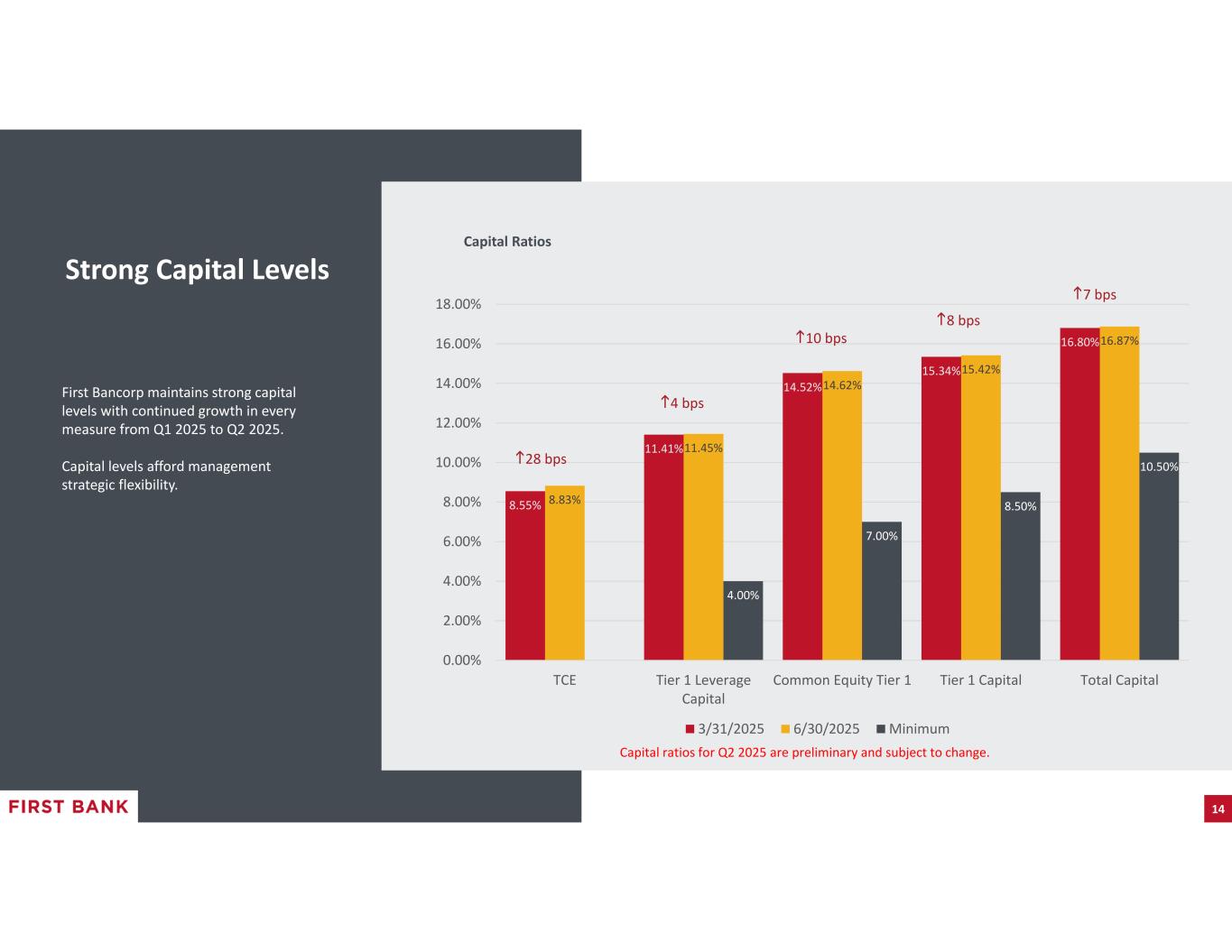

| Capital Ratios (1) | |||||||||||||||||||||||||||||

| Tangible common equity to tangible assets | 8.83 | % | 8.55 | % | 7.90 | % | |||||||||||||||||||||||

| Common equity tier I capital ratio | 14.62 | % | 14.52 | % | 13.99 | % | |||||||||||||||||||||||

| Total risk-based capital ratio | 16.87 | % | 16.80 | % | 16.24 | % | |||||||||||||||||||||||

|

Second Quarter 2025 Results |

||||

| Net Interest Income and Net Interest Margin | ||

|

Second Quarter 2025 Results |

||||

| For the Three Months Ended | ||||||||||||||||||||

| YIELD INFORMATION | June 30, 2025 | March 31, 2025 | June 30, 2024 | |||||||||||||||||

| Yield on loans | 5.53% | 5.52% | 5.50% | |||||||||||||||||

| Yield on securities | 2.41% | 2.28% | 1.72% | |||||||||||||||||

| Yield on other earning assets | 4.63% | 4.42% | 4.71% | |||||||||||||||||

| Yield on total interest-earning assets | 4.69% | 4.65% | 4.51% | |||||||||||||||||

| Cost of interest-bearing deposits | 2.14% | 2.14% | 2.54% | |||||||||||||||||

| Cost of borrowings | 7.22% | 7.31% | 7.09% | |||||||||||||||||

| Cost of total interest-bearing liabilities | 2.20% | 2.21% | 2.65% | |||||||||||||||||

| Total cost of funds | 1.48% | 1.51% | 1.81% | |||||||||||||||||

| Cost of total deposits | 1.43% | 1.46% | 1.72% | |||||||||||||||||

| Net interest margin (1) | 3.32% | 3.25% | 2.84% | |||||||||||||||||

| Net interest margin - tax-equivalent (2) | 3.32% | 3.27% | 2.87% | |||||||||||||||||

| Average prime rate | 7.50% | 7.50% | 8.50% | |||||||||||||||||

| (1) Calculated by dividing annualized net interest income by average earning assets for the period. | ||||||||||||||||||||

(2) Calculated by dividing annualized tax-equivalent net interest income by average earning assets for the period. The tax-equivalent amount reflects the tax benefit that the Company receives related to its tax-exempt loans and securities, which carry interest rates lower than similar taxable investments due to their tax-exempt status. This amount has been computed using the expected tax rate and is reduced by the related nondeductible portion of interest expense. | ||||||||||||||||||||

| Provision for Credit Losses and Credit Quality | ||

|

Second Quarter 2025 Results |

||||

|

ASSET QUALITY DATA

($ in thousands)

|

June 30, 2025 | March 31, 2025 | June 30, 2024 | |||||||||||||||||

| Nonperforming assets | ||||||||||||||||||||

| Nonaccrual loans | $ | 34,625 | $ | 29,081 | $ | 33,102 | ||||||||||||||

| Accruing loans > 90 days past due | — | — | — | |||||||||||||||||

| Total nonperforming loans | 34,625 | 29,081 | 33,102 | |||||||||||||||||

| Foreclosed real estate | 1,218 | 4,769 | 1,150 | |||||||||||||||||

| Total nonperforming assets | $ | 35,843 | $ | 33,850 | $ | 34,252 | ||||||||||||||

| Asset Quality Ratios | ||||||||||||||||||||

| Quarterly net charge-offs to average loans - annualized | 0.06 | % | 0.17 | % | 0.07 | % | ||||||||||||||

| Nonperforming loans to total loans | 0.42 | % | 0.36 | % | 0.54 | % | ||||||||||||||

| Nonperforming assets to total assets | 0.28 | % | 0.27 | % | 0.28 | % | ||||||||||||||

| Allowance for credit losses to total loans | 1.47 | % | 1.49 | % | 1.36 | % | ||||||||||||||

| Noninterest Income | ||

| Noninterest Expenses | ||

| Income Taxes | ||

|

Second Quarter 2025 Results |

||||

| Balance Sheet | ||

|

BALANCES

($ in thousands)

|

June 30, 2025 | March 31, 2025 | June 30, 2024 | Change 2Q25 vs 1Q25 |

Change 2Q25 vs 2Q24 |

|||||||||||||||||||||||||||

| Total assets | $ | 12,608,265 | $ | 12,436,245 | $ | 12,060,805 | 1.4% | 4.5% | ||||||||||||||||||||||||

| Loans | 8,225,650 | 8,103,033 | 8,069,848 | 1.5% | 1.9% | |||||||||||||||||||||||||||

| Investment securities | 2,661,236 | 2,582,781 | 2,390,811 | 3.0% | 11.3% | |||||||||||||||||||||||||||

| Total cash and cash equivalents | 711,286 | 772,441 | 608,412 | (7.9)% | 16.9% | |||||||||||||||||||||||||||

| Noninterest-bearing deposits | 3,542,626 | 3,476,786 | 3,339,678 | 1.9% | 6.1% | |||||||||||||||||||||||||||

| Interest-bearing deposits | 7,287,754 | 7,267,873 | 7,148,151 | 0.3% | 2.0% | |||||||||||||||||||||||||||

| Borrowings | 92,237 | 92,055 | 91,513 | 0.2% | 0.8% | |||||||||||||||||||||||||||

| Shareholders’ equity | 1,556,180 | 1,508,176 | 1,404,342 | 3.2% | 10.8% | |||||||||||||||||||||||||||

|

Second Quarter 2025 Results |

||||

| LOAN PORTFOLIO | June 30, 2025 | March 31, 2025 | June 30, 2024 | |||||||||||||||||||||||||||||||||||

| ($ in thousands) | Amount | Percentage | Amount | Percentage | Amount | Percentage | ||||||||||||||||||||||||||||||||

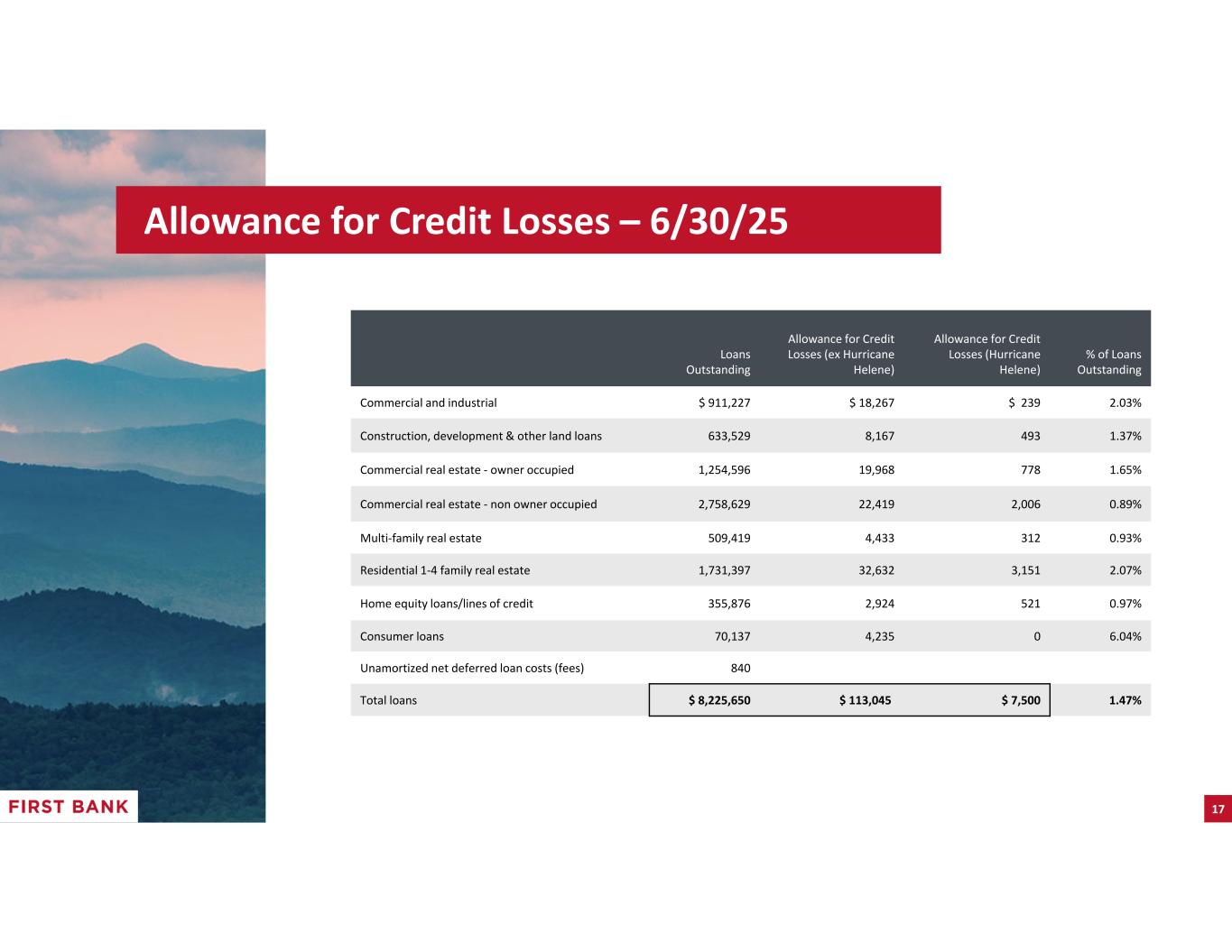

| Commercial and industrial | $ | 911,227 | 11 | % | $ | 890,071 | 11 | % | $ | 863,366 | 11 | % | ||||||||||||||||||||||||||

| Construction, development & other land loans | 633,529 | 8 | % | 644,439 | 8 | % | 764,418 | 9 | % | |||||||||||||||||||||||||||||

| Commercial real estate - owner occupied | 1,254,596 | 15 | % | 1,233,732 | 15 | % | 1,250,267 | 16 | % | |||||||||||||||||||||||||||||

| Commercial real estate - non-owner occupied | 2,758,629 | 34 | % | 2,701,746 | 34 | % | 2,561,803 | 32 | % | |||||||||||||||||||||||||||||

| Multi-family real estate | 509,419 | 6 | % | 512,958 | 6 | % | 497,187 | 6 | % | |||||||||||||||||||||||||||||

| Residential 1-4 family real estate | 1,731,397 | 21 | % | 1,709,593 | 21 | % | 1,729,050 | 21 | % | |||||||||||||||||||||||||||||

| Home equity loans/lines of credit | 355,876 | 4 | % | 341,240 | 4 | % | 326,411 | 4 | % | |||||||||||||||||||||||||||||

| Consumer loans | 70,137 | 1 | % | 68,115 | 1 | % | 76,638 | 1 | % | |||||||||||||||||||||||||||||

| Loans, gross | 8,224,810 | 100 | % | 8,101,894 | 100 | % | 8,069,140 | 100 | % | |||||||||||||||||||||||||||||

| Unamortized net deferred loan fees | 840 | 1,139 | 708 | |||||||||||||||||||||||||||||||||||

| Total loans | $ | 8,225,650 | $ | 8,103,033 | $ | 8,069,848 | ||||||||||||||||||||||||||||||||

| DEPOSIT PORTFOLIO | June 30, 2025 | March 31, 2025 | June 30, 2024 | |||||||||||||||||||||||||||||||||||

| ($ in thousands) | Amount | Percentage | Amount | Percentage | Amount | Percentage | ||||||||||||||||||||||||||||||||

| Noninterest-bearing checking accounts | $ | 3,542,626 | 33 | % | $ | 3,476,786 | 32 | % | $ | 3,339,678 | 32 | % | ||||||||||||||||||||||||||

| Interest-bearing checking accounts | 1,443,010 | 13 | % | 1,448,377 | 14 | % | 1,400,071 | 13 | % | |||||||||||||||||||||||||||||

| Money market accounts | 4,446,485 | 41 | % | 4,386,469 | 41 | % | 4,150,429 | 40 | % | |||||||||||||||||||||||||||||

| Savings accounts | 536,247 | 5 | % | 539,632 | 5 | % | 558,126 | 5 | % | |||||||||||||||||||||||||||||

| Other time deposits | 514,865 | 5 | % | 533,723 | 5 | % | 601,212 | 6 | % | |||||||||||||||||||||||||||||

| Time deposits >$250,000 | 337,382 | 3 | % | 349,990 | 3 | % | 389,281 | 4 | % | |||||||||||||||||||||||||||||

| Total customer deposits | 10,820,615 | 100 | % | 10,734,977 | 100 | % | 10,438,797 | 100 | % | |||||||||||||||||||||||||||||

| Brokered deposits | 9,765 | — | % | 9,682 | — | % | 49,032 | — | % | |||||||||||||||||||||||||||||

| Total deposits | $ | 10,830,380 | 100 | % | $ | 10,744,659 | 100 | % | $ | 10,487,829 | 100 | % | ||||||||||||||||||||||||||

| Capital | ||

|

Second Quarter 2025 Results |

||||

| CAPITAL RATIOS | June 30, 2025 (estimated) | March 31, 2025 | June 30, 2024 | |||||||||||||||||

| Tangible common equity to tangible assets (non-GAAP) | 8.83% | 8.55% | 7.90% | |||||||||||||||||

| Common equity tier I capital ratio | 14.62% | 14.52% | 13.99% | |||||||||||||||||

| Tier I leverage ratio | 11.45% | 11.41% | 11.24% | |||||||||||||||||

| Tier I risk-based capital ratio | 15.42% | 15.34% | 14.79% | |||||||||||||||||

| Total risk-based capital ratio | 16.87% | 16.80% | 16.24% | |||||||||||||||||

| Liquidity | ||

|

Second Quarter 2025 Results |

||||

| About First Bancorp | ||

| Non-GAAP Measures | ||

|

Second Quarter 2025 Results |

||||

| First Bancorp and Subsidiaries Financial Summary | ||

| CONSOLIDATED INCOME STATEMENT | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||||||||||||||||||

| ($ in thousands, except per share data - unaudited) | June 30, 2025 | March 31, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | |||||||||||||||||||||||||||

| Interest income | ||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 112,931 | $ | 110,533 | $ | 110,472 | $ | 223,464 | $ | 220,270 | ||||||||||||||||||||||

| Interest on investment securities: | ||||||||||||||||||||||||||||||||

| Taxable interest income | 16,857 | 15,524 | 11,291 | 32,381 | 24,019 | |||||||||||||||||||||||||||

| Tax-exempt interest income | 1,116 | 1,116 | 1,117 | 2,232 | 2,234 | |||||||||||||||||||||||||||

| Other, principally overnight investments | 5,837 | 5,487 | 5,942 | 11,324 | 8,913 | |||||||||||||||||||||||||||

| Total interest income | 136,741 | 132,660 | 128,822 | 269,401 | 255,436 | |||||||||||||||||||||||||||

| Interest expense | ||||||||||||||||||||||||||||||||

| Interest on deposits | 38,405 | 38,119 | 44,744 | 76,524 | 83,879 | |||||||||||||||||||||||||||

| Interest on borrowings | 1,660 | 1,658 | 2,963 | 3,318 | 11,168 | |||||||||||||||||||||||||||

| Total interest expense | 40,065 | 39,777 | 47,707 | 79,842 | 95,047 | |||||||||||||||||||||||||||

| Net interest income | 96,676 | 92,883 | 81,115 | 189,559 | 160,389 | |||||||||||||||||||||||||||

| Provision for credit losses | 2,212 | 1,116 | 541 | 3,328 | 1,741 | |||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 94,464 | 91,767 | 80,574 | 186,231 | 158,648 | |||||||||||||||||||||||||||

| Noninterest income | ||||||||||||||||||||||||||||||||

| Service charges on deposit accounts | 3,976 | 3,767 | 4,139 | 7,743 | 8,007 | |||||||||||||||||||||||||||

| Other service charges and fees | 6,595 | 5,883 | 5,314 | 12,478 | 10,884 | |||||||||||||||||||||||||||

| Presold mortgage loan fees and gains on sale | 315 | 450 | 588 | 765 | 926 | |||||||||||||||||||||||||||

| Commissions from sales of financial products | 1,388 | 1,408 | 1,377 | 2,796 | 2,697 | |||||||||||||||||||||||||||

| SBA loan sale gains | 151 | 52 | 1,336 | 203 | 2,231 | |||||||||||||||||||||||||||

| Bank-owned life insurance income | 1,221 | 1,228 | 1,179 | 2,449 | 2,343 | |||||||||||||||||||||||||||

| Securities losses, net | — | — | (186) | — | (1,161) | |||||||||||||||||||||||||||

| Other Income, net | 695 | 114 | 854 | 809 | 1,570 | |||||||||||||||||||||||||||

| Total noninterest income | 14,341 | 12,902 | 14,601 | 27,243 | 27,497 | |||||||||||||||||||||||||||

| Noninterest expenses | ||||||||||||||||||||||||||||||||

| Salaries, incentives and commissions expense | 29,005 | 28,661 | 27,809 | 57,666 | 55,451 | |||||||||||||||||||||||||||

| Employee benefit expense | 6,187 | 6,095 | 6,703 | 12,282 | 12,972 | |||||||||||||||||||||||||||

| Total personnel expense | 35,192 | 34,756 | 34,512 | 69,948 | 68,423 | |||||||||||||||||||||||||||

| Occupancy and equipment expense | 5,195 | 5,192 | 4,877 | 10,387 | 10,952 | |||||||||||||||||||||||||||

| Intangibles amortization expense | 1,468 | 1,516 | 1,669 | 2,984 | 3,428 | |||||||||||||||||||||||||||

| Other operating expenses | 17,128 | 16,429 | 17,233 | 33,557 | 34,675 | |||||||||||||||||||||||||||

| Total noninterest expenses | 58,983 | 57,893 | 58,291 | 116,876 | 117,478 | |||||||||||||||||||||||||||

| Income before income taxes | 49,822 | 46,776 | 36,884 | 96,598 | 68,667 | |||||||||||||||||||||||||||

| Income tax expense | 11,256 | 10,370 | 8,172 | 21,626 | 14,683 | |||||||||||||||||||||||||||

| Net income | $ | 38,566 | $ | 36,406 | $ | 28,712 | $ | 74,972 | $ | 53,984 | ||||||||||||||||||||||

| Earnings per common share: | ||||||||||||||||||||||||||||||||

| Basic | $ | 0.93 | $ | 0.88 | $ | 0.70 | $ | 1.81 | $ | 1.31 | ||||||||||||||||||||||

| Diluted | 0.93 | 0.88 | 0.70 | 1.81 | 1.31 | |||||||||||||||||||||||||||

|

Second Quarter 2025 Results |

||||

| First Bancorp and Subsidiaries Financial Summary | ||

CONSOLIDATED BALANCE SHEETS | ||||||||||||||||||||

| ($ in thousands - unaudited) | June 30, 2025 |

March 31, 2025 |

June 30, 2024 |

|||||||||||||||||

| Assets | ||||||||||||||||||||

| Cash and due from banks, noninterest-bearing | $ | 139,486 | $ | 149,781 | $ | 90,468 | ||||||||||||||

| Due from banks, interest-bearing | 571,800 | 622,660 | 517,944 | |||||||||||||||||

| Total cash and cash equivalents | 711,286 | 772,441 | 608,412 | |||||||||||||||||

| Securities available for sale | 2,144,831 | 2,064,516 | 1,867,211 | |||||||||||||||||

| Securities held to maturity | 516,405 | 518,265 | 523,600 | |||||||||||||||||

| Presold mortgages and SBA loans held for sale | 8,928 | 5,166 | 7,247 | |||||||||||||||||

| Loans | 8,225,650 | 8,103,033 | 8,069,848 | |||||||||||||||||

| Allowance for credit losses on loans | (120,545) | (120,631) | (110,058) | |||||||||||||||||

| Net loans | 8,105,105 | 7,982,402 | 7,959,790 | |||||||||||||||||

| Premises and equipment, net | 141,661 | 141,954 | 147,110 | |||||||||||||||||

| Accrued interest receivable | 36,681 | 35,452 | 35,605 | |||||||||||||||||

| Goodwill | 478,750 | 478,750 | 478,750 | |||||||||||||||||

| Other intangible assets, net | 19,920 | 21,388 | 26,080 | |||||||||||||||||

| Bank-owned life insurance | 190,817 | 189,597 | 186,031 | |||||||||||||||||

| Other assets | 253,881 | 226,314 | 220,969 | |||||||||||||||||

| Total assets | $ | 12,608,265 | $ | 12,436,245 | $ | 12,060,805 | ||||||||||||||

| Liabilities | ||||||||||||||||||||

| Deposits: | ||||||||||||||||||||

| Noninterest-bearing deposits | $ | 3,542,626 | $ | 3,476,786 | $ | 3,339,678 | ||||||||||||||

| Interest-bearing deposits | 7,287,754 | 7,267,873 | 7,148,151 | |||||||||||||||||

| Total deposits | 10,830,380 | 10,744,659 | 10,487,829 | |||||||||||||||||

| Borrowings | 92,237 | 92,055 | 91,513 | |||||||||||||||||

| Accrued interest payable | 4,340 | 4,935 | 5,728 | |||||||||||||||||

| Other liabilities | 125,128 | 86,420 | 71,393 | |||||||||||||||||

| Total liabilities | 11,052,085 | 10,928,069 | 10,656,463 | |||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||

| Common stock | 973,041 | 971,174 | 967,239 | |||||||||||||||||

| Retained earnings | 812,657 | 783,630 | 752,294 | |||||||||||||||||

| Stock in rabbi trust assumed in acquisition | (869) | (1,166) | (1,139) | |||||||||||||||||

| Rabbi trust obligation | 869 | 1,166 | 1,139 | |||||||||||||||||

| Accumulated other comprehensive loss | (229,518) | (246,628) | (315,191) | |||||||||||||||||

| Total shareholders’ equity | 1,556,180 | 1,508,176 | 1,404,342 | |||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 12,608,265 | $ | 12,436,245 | $ | 12,060,805 | ||||||||||||||

|

Second Quarter 2025 Results |

||||

| First Bancorp and Subsidiaries Financial Summary | ||

| TREND INFORMATION | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| June 30, 2025 | March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | ||||||||||||||||||||||||||||

PERFORMANCE RATIOS (annualized) |

||||||||||||||||||||||||||||||||

Return on average assets (1) |

1.24 | % | 1.21 | % | 0.12 | % | 0.61 | % | 0.96 | % | ||||||||||||||||||||||

Return on average common equity (2) |

10.11 | % | 10.06 | % | 0.96 | % | 5.14 | % | 8.38 | % | ||||||||||||||||||||||

Return on average tangible common equity (3) |

15.25 | % | 15.54 | % | 1.93 | % | 8.30 | % | 13.60 | % | ||||||||||||||||||||||

| COMMON SHARE DATA | ||||||||||||||||||||||||||||||||

| Cash dividends declared - common | $ | 0.23 | $ | 0.22 | $ | 0.22 | $ | 0.22 | $ | 0.22 | ||||||||||||||||||||||

| Book value per common share | $ | 37.53 | $ | 36.46 | $ | 34.96 | $ | 35.74 | $ | 34.10 | ||||||||||||||||||||||

Tangible book value per share (4) |

$ | 25.82 | $ | 24.69 | $ | 23.17 | $ | 23.91 | $ | 22.19 | ||||||||||||||||||||||

| Common shares outstanding at end of period | 41,468,098 | 41,368,828 | 41,347,418 | 41,340,099 | 41,187,943 | |||||||||||||||||||||||||||

| Weighted average shares outstanding - diluted | 41,441,393 | 41,406,525 | 41,422,973 | 41,366,743 | 41,262,091 | |||||||||||||||||||||||||||

CAPITAL INFORMATION (preliminary for current quarter) |

||||||||||||||||||||||||||||||||

Tangible common equity to tangible assets (5) |

8.83 | % | 8.55 | % | 8.22 | % | 8.47 | % | 7.90 | % | ||||||||||||||||||||||

| Common equity tier I capital ratio | 14.62 | % | 14.52 | % | 14.35 | % | 14.37 | % | 13.99 | % | ||||||||||||||||||||||

| Total risk-based capital ratio | 16.87 | % | 16.80 | % | 16.63 | % | 16.65 | % | 16.24 | % | ||||||||||||||||||||||

| (1) Calculated by dividing annualized net income by average assets. | ||||||||||||||||||||||||||||||||

(2) Calculated by dividing annualized tangible net income (net income adjusted for intangible asset amortization, net of tax), by average common equity. See Appendix A for the components of the calculation. | ||||||||||||||||||||||||||||||||

(3) Return on average tangible common equity is a non-GAAP financial measure. See Appendix A for the components of the calculation and the reconciliation of average common equity to average TCE. | ||||||||||||||||||||||||||||||||

(4) Tangible book value per share is a non-GAAP financial measure. See Appendix B for a reconciliation of common equity to tangible common equity and Appendix C for the resulting calculation. | ||||||||||||||||||||||||||||||||

(5) Tangible common equity ratio is a non-GAAP financial measure. See Appendix B for a reconciliation of common equity to tangible common equity and Appendix D for the resulting calculation. | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

|

INCOME STATEMENT

($ in thousands except per share data)

|

June 30, 2025 | March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | |||||||||||||||||||||||||||

| Net interest income | $ | 96,676 | $ | 92,883 | $ | 88,841 | $ | 83,043 | $ | 81,115 | ||||||||||||||||||||||

| Provision for credit losses | 2,212 | 1,116 | 507 | 14,200 | 541 | |||||||||||||||||||||||||||

| Noninterest income | 14,341 | 12,902 | (23,177) | 13,579 | 14,601 | |||||||||||||||||||||||||||

| Noninterest expense | 58,983 | 57,893 | 58,279 | 59,850 | 58,291 | |||||||||||||||||||||||||||

| Income before income taxes | 49,822 | 46,776 | 6,878 | 22,572 | 36,884 | |||||||||||||||||||||||||||

| Income tax expense | 11,256 | 10,370 | 3,327 | 3,892 | 8,172 | |||||||||||||||||||||||||||

| Net income | 38,566 | 36,406 | 3,551 | 18,680 | 28,712 | |||||||||||||||||||||||||||

| Earnings per common share - diluted | $ | 0.93 | $ | 0.88 | $ | 0.08 | $ | 0.45 | $ | 0.70 | ||||||||||||||||||||||

| (1) This amount reflects the tax benefit that the Company receives related to its tax-exempt loans and securities, which carry interest rates lower than similar taxable investments due to their tax-exempt status. This amount has been computed assuming the expected tax rate and is reduced by the related nondeductible portion of interest expense. | ||||||||||||||||||||||||||||||||

|

Second Quarter 2025 Results |

||||

| First Bancorp and Subsidiaries Financial Summary | ||

| For the Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2025 | March 31, 2025 | June 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | Average Volume |

Interest Earned or Paid |

Average Rate |

Average Volume |

Interest Earned or Paid |

Average Rate |

Average Volume |

Interest Earned or Paid |

Average Rate |

||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans (1) (2) | $ | 8,187,662 | $ | 112,931 | 5.53 | % | $ | 8,107,394 | $ | 110,533 | 5.52 | % | $ | 8,070,815 | $ | 110,472 | 5.50 | % | |||||||||||||||||||||||||||||||||||

| Taxable securities | 2,697,338 | 16,857 | 2.50 | % | 2,629,066 | 15,524 | 2.36 | % | 2,591,617 | 11,291 | 1.74 | % | |||||||||||||||||||||||||||||||||||||||||

| Non-taxable securities | 287,848 | 1,116 | 1.55 | % | 288,905 | 1,116 | 1.55 | % | 292,045 | 1,117 | 1.53 | % | |||||||||||||||||||||||||||||||||||||||||

| Short-term investments, primarily interest-bearing cash | 505,912 | 5,837 | 4.63 | % | 503,377 | 5,487 | 4.42 | % | 507,635 | 5,942 | 4.71 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 11,678,760 | 136,741 | 4.69 | % | 11,528,742 | 132,660 | 4.65 | % | 11,462,112 | 128,822 | 4.51 | % | |||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 153,074 | 133,756 | 84,674 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Premises and equipment | 142,090 | 143,064 | 149,643 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 484,448 | 421,248 | 358,852 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 12,458,372 | $ | 12,226,810 | $ | 12,055,281 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing checking | $ | 1,434,559 | $ | 2,426 | 0.68 | % | $ | 1,431,556 | $ | 2,497 | 0.71 | % | $ | 1,397,367 | $ | 2,424 | 0.70 | % | |||||||||||||||||||||||||||||||||||

| Money market deposits | 4,358,877 | 29,947 | 2.76 | % | 4,337,560 | 29,180 | 2.73 | % | 4,004,175 | 32,411 | 3.26 | % | |||||||||||||||||||||||||||||||||||||||||

| Savings deposits | 538,843 | 252 | 0.19 | % | 539,104 | 240 | 0.18 | % | 570,283 | 317 | 0.22 | % | |||||||||||||||||||||||||||||||||||||||||

| Other time deposits | 534,242 | 3,088 | 2.32 | % | 558,648 | 3,353 | 2.43 | % | 738,290 | 6,053 | 3.30 | % | |||||||||||||||||||||||||||||||||||||||||

| Time deposits >$250,000 | 345,916 | 2,692 | 3.12 | % | 352,174 | 2,849 | 3.28 | % | 371,471 | 3,539 | 3.83 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 7,212,437 | 38,405 | 2.14 | % | 7,219,042 | 38,119 | 2.14 | % | 7,081,586 | 44,744 | 2.54 | % | |||||||||||||||||||||||||||||||||||||||||

| Borrowings | 92,199 | 1,660 | 7.22 | % | 91,960 | 1,658 | 7.31 | % | 167,976 | 2,963 | 7.09 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 7,304,636 | 40,065 | 2.20 | % | 7,311,002 | 39,777 | 2.21 | % | 7,249,562 | 47,707 | 2.65 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing checking | 3,522,117 | 3,375,098 | 3,350,723 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 101,069 | 72,839 | 76,713 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 1,530,550 | 1,467,871 | 1,378,283 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 12,458,372 | $ | 12,226,810 | $ | 12,055,281 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net yield on interest-earning assets and net interest income | $ | 96,676 | 3.32 | % | $ | 92,883 | 3.25 | % | $ | 81,115 | 2.84 | % | |||||||||||||||||||||||||||||||||||||||||

| Net yield on interest-earning assets and net interest income – tax-equivalent (3) | $ | 96,887 | 3.32 | % | $ | 93,320 | 3.27 | % | $ | 81,847 | 2.87 | % | |||||||||||||||||||||||||||||||||||||||||

| Interest rate spread | 2.49 | % | 2.44 | % | 1.86 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Average prime rate | 7.50 | % | 7.50 | % | 8.50 | % | |||||||||||||||||||||||||||||||||||||||||||||||

|

Second Quarter 2025 Results |

||||

| First Bancorp and Subsidiaries Financial Summary | ||

| For the Six Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2025 | June 30, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | Average Volume |

Interest Earned or Paid |

Average Rate |

Average Volume |

Interest Earned or Paid |

Average Rate |

|||||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans (1) (2) | $ | 8,147,750 | $ | 223,464 | 5.52 | % | $ | 8,087,101 | $ | 220,270 | 5.47 | % | |||||||||||||||||||||||||||||||||||||||||

| Taxable securities | 2,663,390 | 32,381 | 2.43 | % | 2,703,441 | 24,019 | 1.78 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Non-taxable securities | 288,373 | 2,232 | 1.55 | % | 292,622 | 2,234 | 1.53 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Short-term investments, primarily interest-bearing cash | 504,652 | 11,324 | 4.52 | % | 392,790 | 8,913 | 4.56 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 11,604,165 | 269,401 | 4.67 | % | 11,475,954 | 255,436 | 4.47 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 143,469 | 87,754 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Premises and equipment | 142,574 | 150,401 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 453,023 | 369,132 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 12,343,231 | $ | 12,083,241 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing checking | $ | 1,433,066 | $ | 4,923 | 0.69 | % | $ | 1,400,425 | $ | 4,784 | 0.69 | % | |||||||||||||||||||||||||||||||||||||||||

| Money market deposits | 4,348,277 | 59,126 | 2.74 | % | 3,854,453 | 60,223 | 3.14 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Savings deposits | 538,973 | 493 | 0.18 | % | 581,339 | 625 | 0.22 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Other time deposits | 546,377 | 6,441 | 2.38 | % | 723,904 | 11,509 | 3.20 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Time deposits >$250,000 | 349,028 | 5,541 | 3.20 | % | 363,640 | 6,738 | 3.73 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 7,215,721 | 76,524 | 2.14 | % | 6,923,761 | 83,879 | 2.44 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Borrowings | 92,081 | 3,318 | 7.27 | % | 372,987 | 11,168 | 6.02 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 7,307,802 | 79,842 | 2.20 | % | 7,296,748 | 95,047 | 2.62 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing checking | 3,449,013 | 3,331,811 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 87,032 | 77,795 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 1,499,384 | 1,376,887 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 12,343,231 | $ | 12,083,241 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net yield on interest-earning assets and net interest income | $ | 189,559 | 3.29 | % | $ | 160,389 | 2.81 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Net yield on interest-earning assets and net interest income – tax-equivalent (3) | $ | 190,207 | 3.30 | % | $ | 161,852 | 2.83 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Interest rate spread | 2.47 | % | 1.85 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Average prime rate | 7.50 | % | 8.50 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

|

Second Quarter 2025 Results |

||||

| Reconciliation of non-GAAP measures | ||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| ($ in thousands) | June 30, 2025 | March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | |||||||||||||||||||||||||||

Net Income |

$ | 38,566 | $ | 36,406 | $ | 3,551 | $ | 18,680 | $ | 28,712 | ||||||||||||||||||||||

| Intangible asset amortization, net of taxes | 1,123 | 1,159 | 1,195 | 1,240 | 1,283 | |||||||||||||||||||||||||||

| Tangible Net income | $ | 39,689 | $ | 37,565 | $ | 4,746 | $ | 19,920 | $ | 29,995 | ||||||||||||||||||||||

| Average common equity | $ | 1,530,550 | $ | 1,467,871 | $ | 1,466,181 | $ | 1,445,029 | $ | 1,378,284 | ||||||||||||||||||||||

| Less: Average goodwill and other intangibles, net of related taxes | (486,393) | (487,395) | (488,624) | (489,987) | (491,318) | |||||||||||||||||||||||||||

| Average tangible common equity | $ | 1,044,157 | $ | 980,476 | $ | 977,557 | $ | 955,042 | $ | 886,966 | ||||||||||||||||||||||

| Return on average common equity | 10.11 | % | 10.06 | % | 0.96 | % | 5.14 | % | 8.38 | % | ||||||||||||||||||||||

| Return on average tangible common equity | 15.25 | % | 15.54 | % | 1.93 | % | 8.30 | % | 13.60 | % | ||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| ($ in thousands) | June 30, 2025 | March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | |||||||||||||||||||||||||||

Total shareholders' common equity |

$ | 1,556,180 | $ | 1,508,176 | $ | 1,445,611 | $ | 1,477,525 | $ | 1,404,342 | ||||||||||||||||||||||

| Less: Goodwill and other intangibles, net of related taxes | (485,657) | (486,749) | (487,660) | (489,139) | (490,439) | |||||||||||||||||||||||||||

| Tangible common equity | $ | 1,070,523 | $ | 1,021,427 | $ | 957,951 | $ | 988,386 | $ | 913,903 | ||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| ($ in thousands except per share data) | June 30, 2025 | March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | |||||||||||||||||||||||||||

Tangible common equity (Appendix B) |

$ | 1,070,523 | $ | 1,021,427 | $ | 957,951 | $ | 988,386 | $ | 913,903 | ||||||||||||||||||||||

Common shares outstanding |

41,468,098 | 41,368,828 | 41,347,418 | 41,340,099 | 41,187,943 | |||||||||||||||||||||||||||

| Tangible book value per common share | $ | 25.82 | $ | 24.69 | $ | 23.17 | $ | 23.91 | $ | 22.19 | ||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| ($ in thousands) | June 30, 2025 | March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | |||||||||||||||||||||||||||

Tangible common equity (Appendix B) |

$ | 1,070,523 | $ | 1,021,427 | $ | 957,951 | $ | 988,386 | $ | 913,903 | ||||||||||||||||||||||

Total assets |

12,608,265 | 12,436,245 | 12,147,694 | 12,153,430 | 12,060,805 | |||||||||||||||||||||||||||

| Less: Goodwill and other intangibles, net of related taxes | (485,657) | (486,749) | (487,660) | (489,139) | (490,439) | |||||||||||||||||||||||||||

| Tangible assets ("TA") | $ | 12,122,608 | $ | 11,949,496 | $ | 11,660,034 | $ | 11,664,291 | $ | 11,570,366 | ||||||||||||||||||||||

| TCE to TA ratio | 8.83 | % | 8.55 | % | 8.22 | % | 8.47 | % | 7.90 | % | ||||||||||||||||||||||

|

Second Quarter 2025 Results |

||||

| Reconciliation of non-GAAP measures, continued | ||

| For the Three Months Ended | ||||||||||||||||||||

| ($ in thousands) | June 30, 2025 | March 31, 2025 | June 30, 2024 | |||||||||||||||||

| Net income | $ | 38,566 | $ | 36,406 | $ | 28,712 | ||||||||||||||

| Impact of Hurricane Helene | ||||||||||||||||||||

| Provision for (benefit from) credit losses | (3,500) | (2,000) | — | |||||||||||||||||

| Total | (3,500) | (2,000) | — | |||||||||||||||||

| Less, tax impact | 812 | 464 | — | |||||||||||||||||

| After-tax impact of Hurricane Helene | (2,688) | (1,536) | — | |||||||||||||||||

| Adjusted net income | $ | 35,878 | $ | 34,870 | $ | 28,712 | ||||||||||||||

| Weighted average shares outstanding - diluted | 41,441,393 | 41,406,525 | 41,262,091 | |||||||||||||||||

| D-EPS | $ | 0.93 | $ | 0.88 | $ | 0.70 | ||||||||||||||

| Adjusted D-EPS | $ | 0.87 | $ | 0.84 | $ | 0.70 | ||||||||||||||

|

Second Quarter 2025 Results |

||||

| Supplemental information | ||

| For the Three Months Ended | ||||||||||||||||||||

|

NET INTEREST INCOME PURCHASE ACCOUNTING ADJUSTMENTS

($ in thousands)

|

June 30, 2025 | March 31, 2025 | June 30, 2024 | |||||||||||||||||

| Interest income - increased by accretion of loan discount on acquired loans | $ | 1,457 | $ | 1,789 | $ | 2,303 | ||||||||||||||

| Total interest income impact | 1,457 | 1,789 | 2,303 | |||||||||||||||||

| Interest expense - increased by discount accretion on deposits | (102) | (103) | (224) | |||||||||||||||||

| Interest expense - increased by discount accretion on borrowings | (194) | (191) | (190) | |||||||||||||||||

| Total net interest expense impact | (296) | (294) | (414) | |||||||||||||||||

| Total impact on net interest income | $ | 1,161 | $ | 1,495 | $ | 1,889 | ||||||||||||||