Document

News Release

|

|

|

|

|

|

|

|

|

|

|

|

| For Immediate Release: |

|

|

For More Information, Contact: |

| April 23, 2025 |

|

|

Hillary Kestler |

|

|

|

704-644-4137 |

First Bancorp Reports First Quarter Results

SOUTHERN PINES, N.C. - First Bancorp (the "Company") (NASDAQ - FBNC), the parent company of First Bank, reported unaudited first quarter earnings today. The Company announced net income of $36.4 million, or $0.88 diluted earnings per share ("D-EPS"), for the three months ended March 31, 2025 compared to $3.6 million, or $0.08 D-EPS, for the three months ended December 31, 2024 ("linked quarter") and $25.3 million, or $0.61 D-EPS, for the first quarter of 2024 ("like quarter").

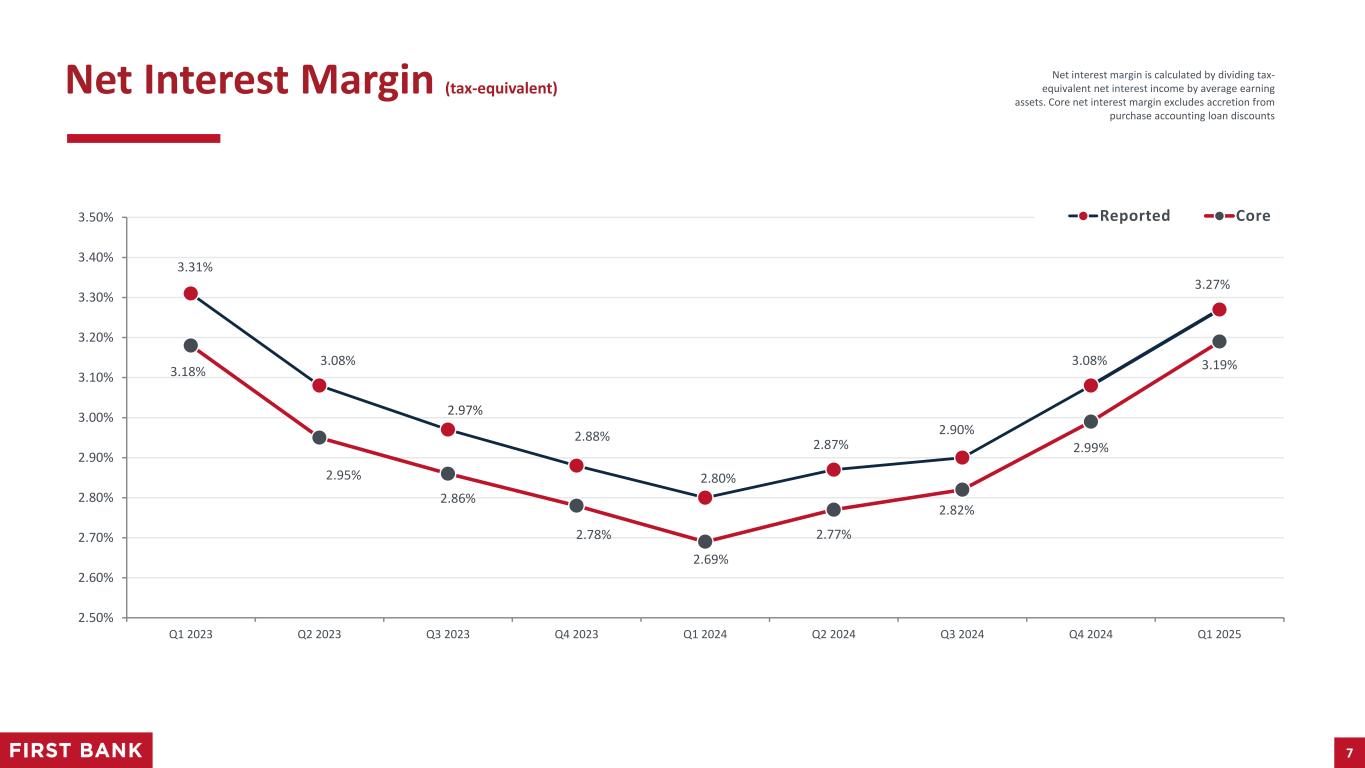

The Company continued its efforts to enhance net interest income and net interest margin. The Company recorded net interest income of $92.9 million for the first quarter of 2025, compared to $88.8 million for the linked quarter and $79.3 million for the like quarter. Tax equivalent net interest margin ("NIM-T/E") for the first quarter of 2025 expanded to 3.27% from 3.08% for the linked quarter and 2.80% for the like quarter.

First Bancorp also continued to maintain expense control with noninterest expenses contracting to $57.9 million for the first quarter of 2025, down from $58.3 million for the linked quarter and $59.2 million for the like quarter.

The results for the first quarter of 2025 include a $2.0 million reduction to the potential impacts to the allowance for credit losses from Hurricane Helene ($1.5 million after-taxes or $0.04 per diluted share). In addition, the results for the fourth quarter 2024 included a securities loss of $36.8 million ($28.2 million after-taxes, or $0.68 per diluted share), from the securities loss-earnback transaction that included the sale of $283.8 million of available-for-sale securities bearing 1.62%. The reconciliations from net income and D-EPS to adjusted net income and adjusted D-EPS (both non-GAAP measures) for the first quarter of 2025 and the fourth quarter of 2024 are presented in Appendix E.

Richard H. Moore, CEO and Chairman of the Company, stated “Our Company had a strong quarter highlighted by the execution of our succession plan elevating Adam Currie to Chief Executive Officer of First Bank. Our ability to enhance net interest income and margin as well as maintain prudent expense management bodes well for the future. We remain focused on maintaining credit quality and managing our balance sheet while continuing to provide excellent service to our customers. Our solid liquidity and excess capital will provide us strategic flexibility in the days ahead.”

|

|

|

First Quarter 2025 Highlights |

•NIM-T/E increased 19 basis points to 3.27% for the first quarter of 2025, up from 3.08% for the linked quarter and 2.80% in the like quarter. The Federal Reserve rate reductions in September, November and December continue to benefit our NIM-T/E.

|

|

|

|

|

|

|

First Quarter 2025 Results |

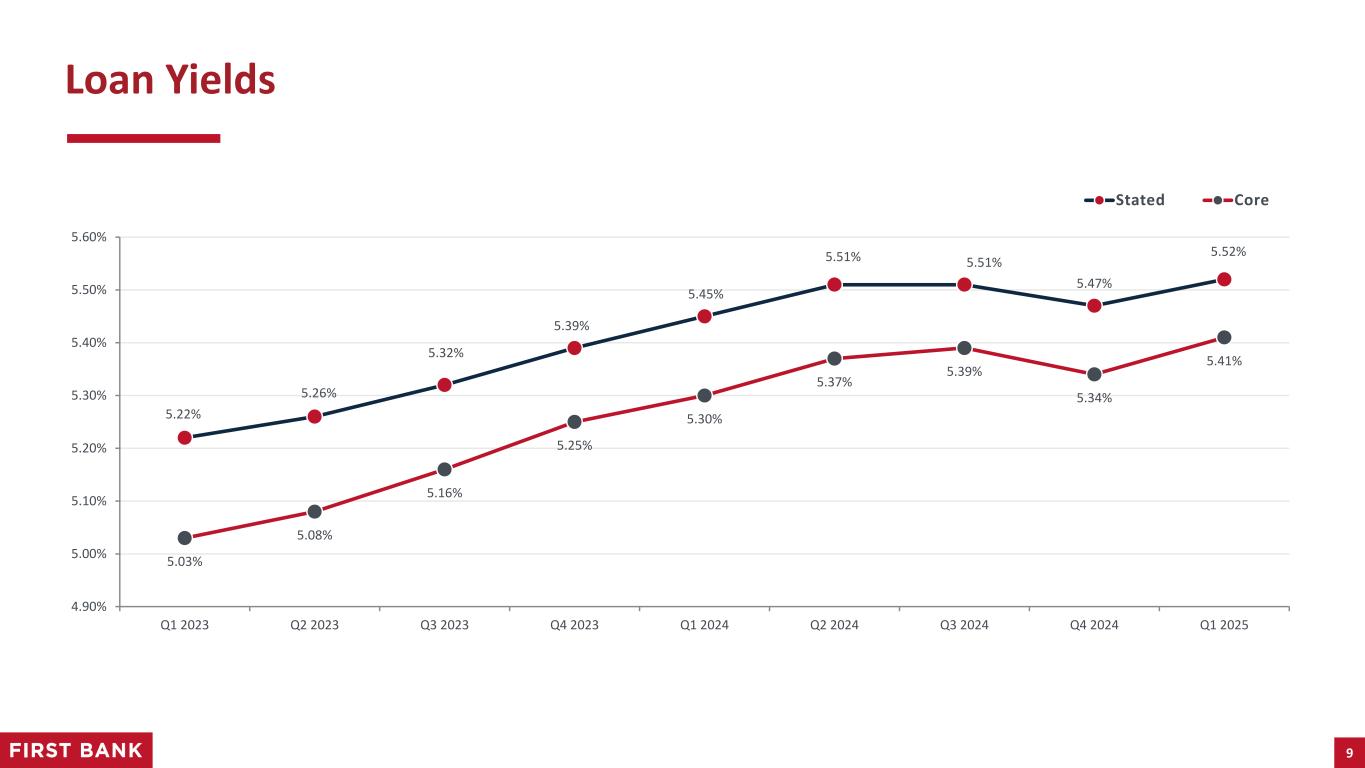

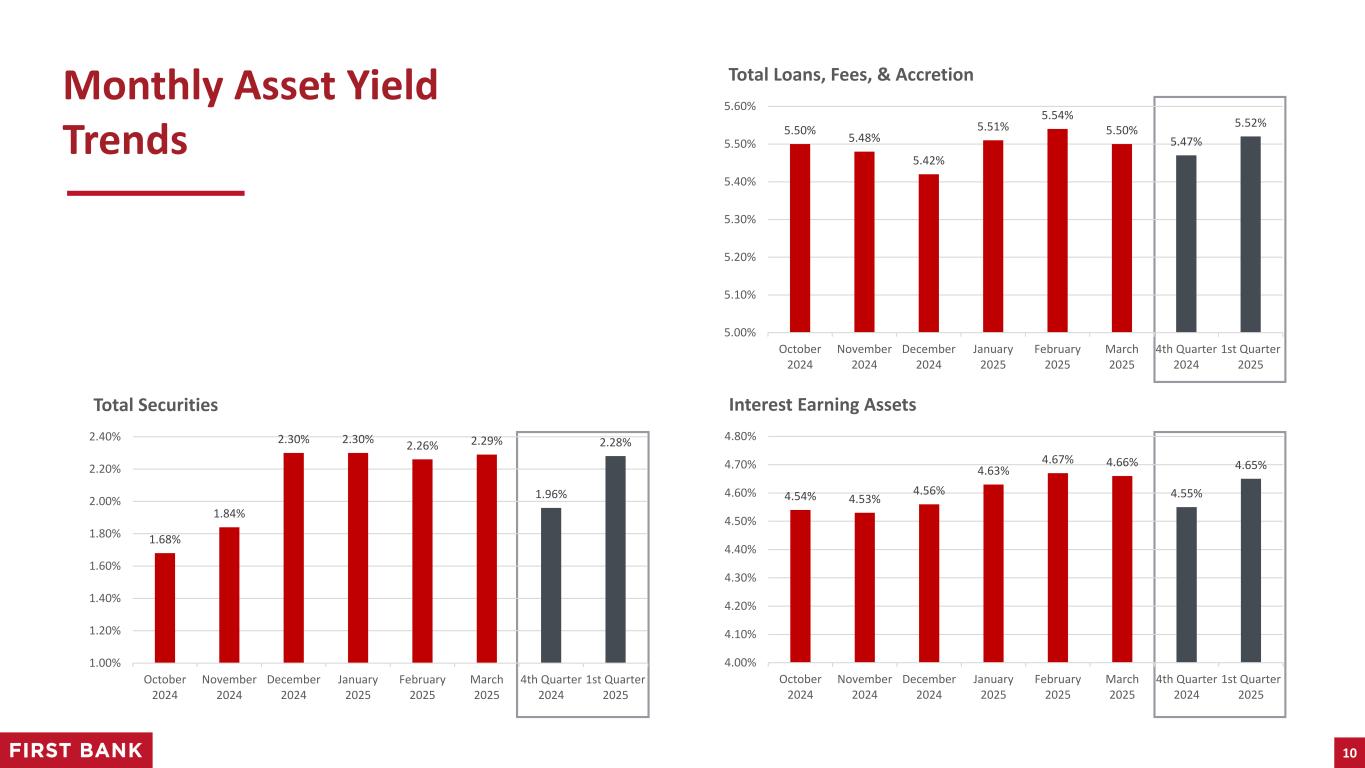

•Total loan yield expanded to 5.52%, up 5 basis points from the linked quarter and 7 basis points from the like quarter. Total cost of funds contracted 11 basis points to 1.51% for the quarter ended March 31, 2025 from 1.62% for the linked quarter and from 1.79% from the like quarter.

•The yield on securities increased 32 basis points to 2.28% for the quarter ended March 31, 2025 from 1.96% for the linked quarter. The increased yield on the new purchases from the securities loss-earnback transaction benefited less than half of the fourth quarter.

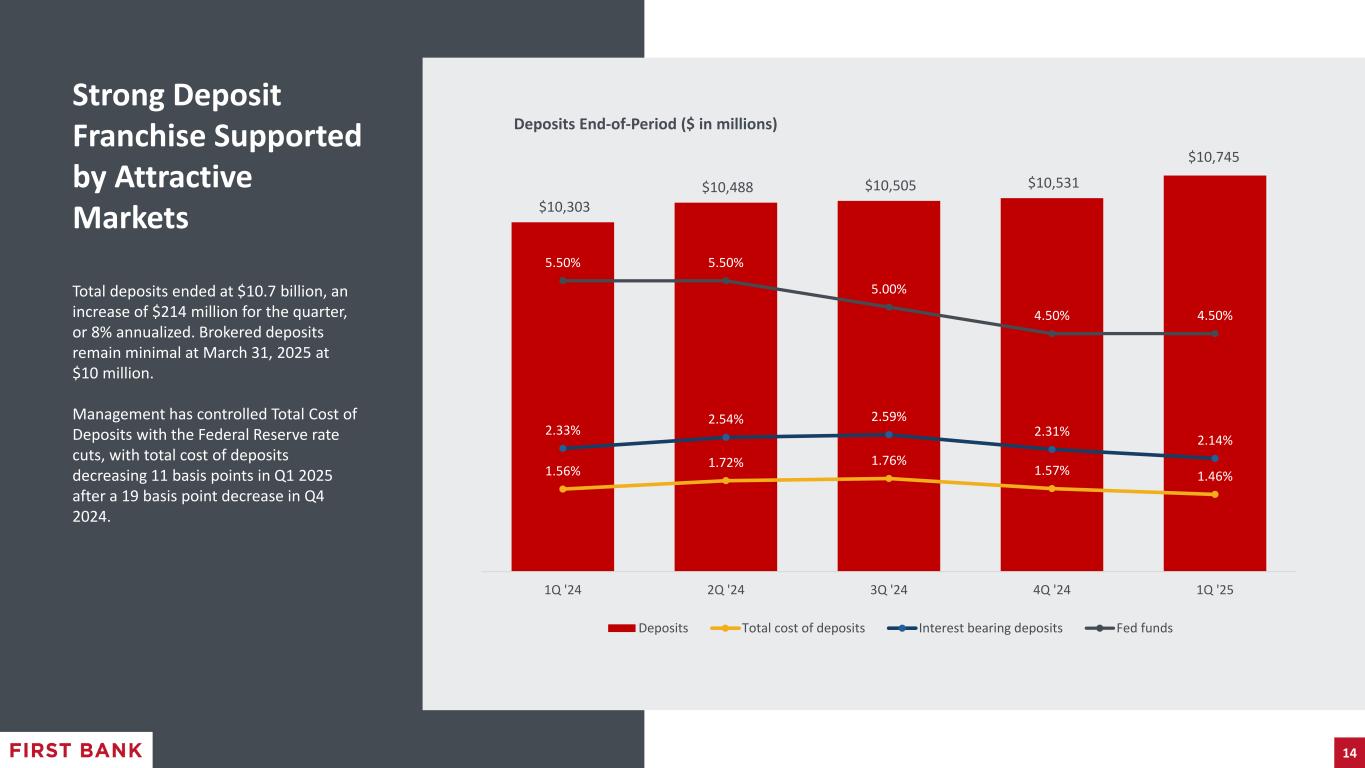

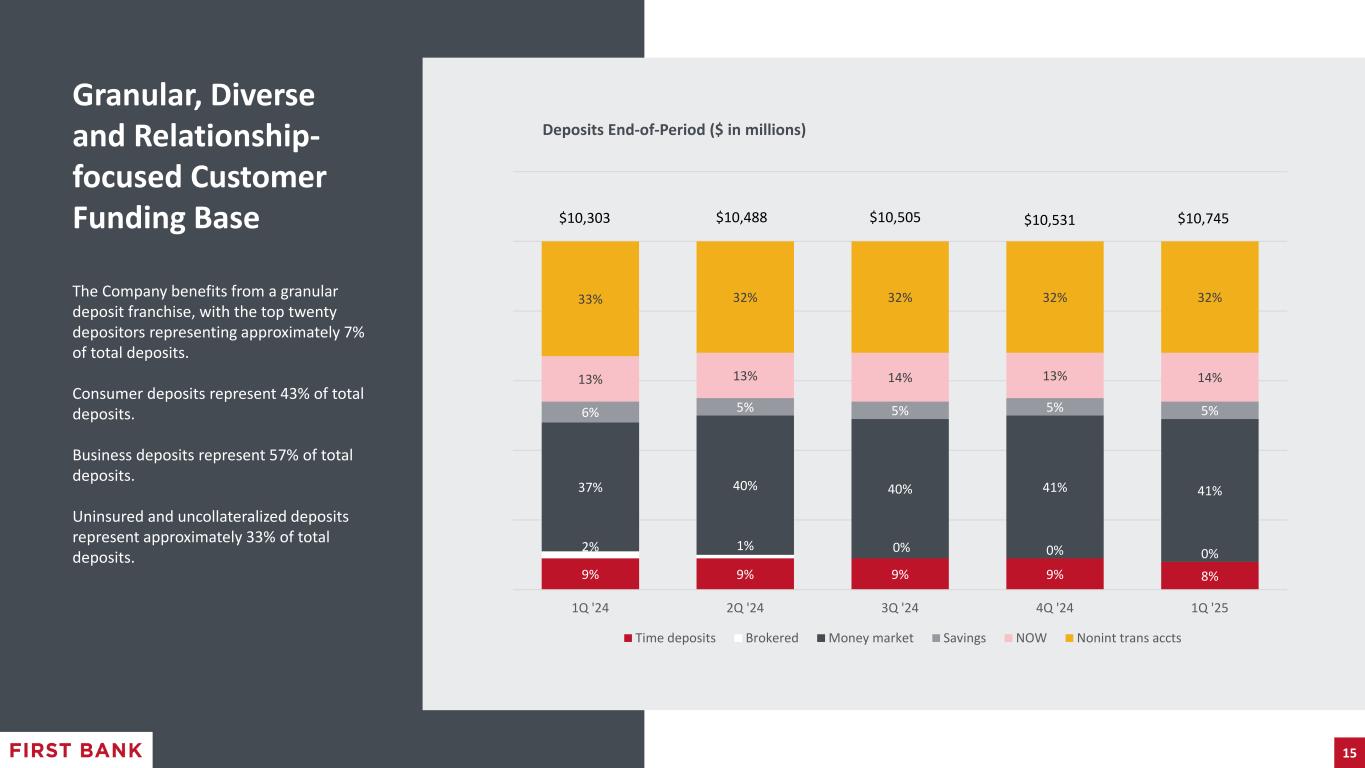

•Average deposits were $10.6 billion for the first quarter of 2025, an increase of $14.5 million from the linked quarter, with $106.9 million of growth in average interest bearing checking and money market accounts partially offset by a decline of $52.6 million in average noninterest bearing deposits. Total cost of deposits was 1.46%, a decrease of 11 basis points from 1.57% for the linked quarter and 10 basis points from 1.56% for the like quarter. The Company continues to maintain a low level of wholesale funding with average borrowings of $92.0 million for the quarter ended March 31, 2025.

•We continue to focus on expense management. Noninterest expenses of $57.9 million represented a reduction of $0.4 million from the linked quarter and $1.3 million from the like quarter. The linked quarter decrease was driven by a $0.7 million decrease in Bankcard expenses, and a $0.4 million decrease in Total personnel expense, with smaller decreases and increases in other expense categories. Full time equivalent employees decreased by 18 from 1,371 at December 31, 2024 to 1,353 at March 31, 2025.

•D-EPS was $0.88 per share for the first quarter of 2025 compared to $0.08 for the linked quarter and $0.61 per share for the like quarter. Adjusted D-EPS for the first quarter of 2025 was $0.84, up from the linked quarter's adjusted D-EPS of $0.76 and the like quarter's D-EPS of $0.61. See Appendix E for the components of these calculations.

•Net income was $36.4 million for the first quarter of 2025. Adjusted net income increased to $34.9 million for the three months ended March 31, 2025 from adjusted net income of $31.7 million for the linked quarter and net income of $25.3 million for the like quarter. See Appendix E for the components of these calculations.

•We continued to maintain excess capital at March 31, 2025 with a linked quarter increase of 18 basis points in common equity tier 1 ratio to 14.53% (estimated) and a similar 16 basis points linked quarter increase in total risk-based capital ratio to 16.79% (estimated). Both of these measures remain well above regulatory minimums or targets. During the first quarter of 2025, the Company repurchased 24,849 shares of common stock for a total cost of $1.0 million.

•Credit quality remained strong with a nonperforming assets ("NPA") to total assets ratio of 0.27% as of March 31, 2025, a decrease of 3 basis point from the linked quarter. During the first quarter of 2025, the Company recorded net charge offs of $3.3 million, an annualized 0.17% of average loans.

•Loan growth continued during the quarter, with loans totaling $8.1 billion at March 31, 2025, reflecting growth of $8.4 million, or 0.42%, for the quarter and growth of $26.5 million, or 0.33%, from March 31, 2024.

•Noninterest-bearing demand accounts were $3.5 billion, representing 32% of total deposits at March 31, 2025. During the first quarter of 2025, customer deposits grew $214.1 million with increases of $109.2 million in noninterest bearing deposits and $101.1 million in money market accounts.

•The on-balance sheet liquidity ratio was 19.8% at March 31, 2025, an increase from 17.6% for the linked quarter. Available off-balance sheet sources totaled $2.4 billion at March 31, 2025, resulting in a total liquidity ratio of 36.4%.

|

|

|

|

|

|

|

First Quarter 2025 Results |

|

|

|

| Net Interest Income and Net Interest Margin |

Net interest income for the first quarter of 2025 was $92.9 million, an increase of 4.5% from the linked quarter of $88.8 million and 17.2% from the like quarter of $79.3 million. The increase in net interest income from the linked and like quarters was primarily driven by our focused efforts to manage deposit costs while increasing loan yields after the rate cuts by the Federal Reserve in the second half of 2024 along with the increased securities yield resulting from the loss-earnback transaction in the fourth quarter of 2024.

The Company’s NIM-T/E for the first quarter of 2025 was 3.27%, an increase of 19 basis points from the linked quarter and 47 basis points from the like quarter. Within interest-earning assets, the loss-earnback transaction in the securities portfolio during the fourth quarter of 2024 resulted in an increase of 32 basis points as compared to the linked quarter. In addition, loan yields increased 5 basis points to 5.52%. Following the three rate cuts by the Federal Reserve between September and December, the rate on interest-bearing deposits fell 17 basis points during the quarter ended March 31, 2025. The like quarter expansion of NIM-T/E was driven by the same three factors described above resulting in an increase of 50 basis points in securities yield, an increase of 7 basis points in loan yields, and a decrease of 19 basis points in the rate on interest-bearing deposits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

| YIELD INFORMATION |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

| Yield on loans |

|

5.52% |

|

5.47% |

|

5.45% |

| Yield on securities |

|

2.28% |

|

1.96% |

|

1.78% |

| Yield on other earning assets |

|

4.42% |

|

4.49% |

|

4.30% |

| Yield on total interest-earning assets |

|

4.65% |

|

4.55% |

|

4.43% |

|

|

|

|

|

|

|

| Cost of interest-bearing deposits |

|

2.14% |

|

2.31% |

|

2.33% |

| Cost of borrowings |

|

7.31% |

|

7.66% |

|

5.71% |

| Cost of total interest-bearing liabilities |

|

2.21% |

|

2.38% |

|

2.59% |

| Total cost of funds |

|

1.51% |

|

1.62% |

|

1.79% |

| Cost of total deposits |

|

1.46% |

|

1.57% |

|

1.56% |

|

|

|

|

|

|

|

| Net interest margin (1) |

|

3.25% |

|

3.05% |

|

2.77% |

| Net interest margin - tax-equivalent (2) |

|

3.27% |

|

3.08% |

|

2.80% |

| Average prime rate |

|

7.50% |

|

7.81% |

|

8.50% |

|

|

|

|

|

|

|

| (1) Calculated by dividing annualized net interest income by average earning assets for the period. |

|

(2) Calculated by dividing annualized tax-equivalent net interest income by average earning assets for the period. The tax-equivalent amount reflects the tax benefit that the Company receives related to its tax-exempt loans and securities, which carry interest rates lower than similar taxable investments due to their tax-exempt status. This amount has been computed using the expected tax rate and is reduced by the related nondeductible portion of interest expense. |

See Appendix F regarding loan purchase discount accretion and its impact on the Company's NIM-T/E.

|

|

|

| Provision for Credit Losses and Credit Quality |

For the three months ended March 31, 2025 and March 31, 2024, the Company recorded $1.1 million and $1.2 million in provision for credit losses, respectively. The provision for the first quarter of 2025 was driven by loan growth of $8.4 million and net charge-offs of $3.3 million partially offset by the $2.0 million reduction in reserves for potential credit exposure from Hurricane Helene as well as a reduction in the level of unfunded commitment reserves. Net charge-offs for the first quarter of 2025 included $1.3 million related to the sale of a lending relationship as the result of an accelerated resolution.

|

|

|

|

|

|

|

First Quarter 2025 Results |

The March economic forecasts, which are a key driver in the Company's CECL model, are relatively consistent with the prior quarter.

Within the portions of Western North and South Carolina that were significantly impacted by Hurricane Helene starting late in the third quarter of 2024, the Company identified borrowers that were potentially impacted by the storm and subsequent economic impacts which represented approximately $722 million of loans outstanding as of March 31, 2025. Based upon its continuing evaluation of these potential impacts, the Company adjusted the incremental reserve for potential exposure from Hurricane Helene to $11.0 million as of March 31, 2025, a decrease of $2.0 million from December 31, 2024. The remaining incremental reserve contributes 14 basis points to the Allowance for Credit Losses at period end.

Asset quality remained strong with annualized net loan charge-offs of 0.17% for the first quarter of 2025. Total NPAs remained at a low level at $33.9 million at March 31, 2025, or 0.27% of total assets, down slightly from 0.30% at both December 31, 2024 and March 31, 2024.

The following table presents the summary of NPAs and asset quality ratios for each period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY DATA

($ in thousands)

|

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

| Nonperforming assets |

|

|

|

|

|

|

| Nonaccrual loans |

|

$ |

29,081 |

|

|

$ |

31,779 |

|

|

$ |

35,622 |

|

| Accruing loans > 90 days past due |

|

— |

|

|

— |

|

|

— |

|

| Total nonperforming loans |

|

29,081 |

|

|

31,779 |

|

|

35,622 |

|

| Foreclosed real estate |

|

4,769 |

|

|

4,965 |

|

|

926 |

|

| Total nonperforming assets |

|

$ |

33,850 |

|

|

$ |

36,744 |

|

|

$ |

36,548 |

|

|

|

|

|

|

|

|

| Asset Quality Ratios |

|

|

|

|

|

|

| Quarterly net charge-offs to average loans - annualized |

|

0.17 |

% |

|

0.04 |

% |

|

0.08 |

% |

| Nonperforming loans to total loans |

|

0.36 |

% |

|

0.39 |

% |

|

0.44 |

% |

| Nonperforming assets to total assets |

|

0.27 |

% |

|

0.30 |

% |

|

0.30 |

% |

| Allowance for credit losses to total loans |

|

1.49 |

% |

|

1.51 |

% |

|

1.36 |

% |

Noninterest income totaled $12.9 million during the first quarter of 2025, an increase from the negative $23.2 million recorded for the linked quarter which reflected the inclusion of the $36.8 million securities loss. Excluding the loss on securities in the linked quarter, noninterest income decreased $0.7 million, or 5.4%, primarily from seasonal decreases in service charges and gains on mortgages. As compared to the like quarter, noninterest income was substantially unchanged.

Noninterest expenses amounted to $57.9 million for the first quarter of 2025 compared to $58.3 million for the linked quarter and $59.2 million for the like quarter. The $0.4 million, or 0.7%, decrease in noninterest expense from the linked quarter was driven by a $0.4 million decrease in total personnel expense, as the Company continues to actively manage headcount.

The $1.3 million decrease from the like quarter was driven by focused efforts to reduce controllable expenses including technology, operating and labor costs. Other operating expenses decreased $1.0 million and Occupancy and equipment related expenses decreased $0.9 million. For that same period, despite the fact that base salaries declined slightly, Salaries, incentives and commissions expense increased $1.0 million primarily driven by higher incentives and commissions from improved operating results in 2025.

|

|

|

|

|

|

|

First Quarter 2025 Results |

Income tax expense totaled $10.4 million for the first quarter of 2025 compared to $3.3 million for the linked quarter and $6.5 million for the like quarter. These equated to effective tax rates of 22.2%, 48.4% and 20.5% for the respective periods. As previously disclosed, the effective tax rate for the linked quarter was impacted by lower pretax income as well as the inclusion of $2.4 million of incremental state tax-related expense related to a variety of factors.

Total assets at March 31, 2025 amounted to $12.4 billion, an increase of $288.6 million, or 9.63% annualized, from the linked quarter and an increase of $344.6 million, or 2.85%, from a year earlier. The increase from the prior periods was primarily related to deposit growth that generated investable funds which were deployed in loans and amounts due from banks, including the Federal Reserve.

Quarterly average balances for key balance sheet components are presented below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

AVERAGE BALANCES

($ in thousands)

|

|

March 31, 2025 |

|

December 31, 2024 |

|

|

|

March 31, 2024 |

|

Change

1Q25 vs 4Q24 |

|

Change

1Q25 vs 1Q24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

12,226,810 |

|

|

$ |

12,243,771 |

|

|

|

|

$ |

12,111,201 |

|

|

(0.1)% |

|

1.0% |

| Investment securities, at amortized cost |

|

2,917,971 |

|

|

2,825,154 |

|

|

|

|

3,108,464 |

|

|

3.3% |

|

(6.1)% |

| Loans |

|

8,107,394 |

|

|

7,993,671 |

|

|

|

|

8,103,387 |

|

|

1.4% |

|

—% |

| Earning assets |

|

11,528,742 |

|

|

11,592,480 |

|

|

|

|

11,489,796 |

|

|

(0.5)% |

|

0.3% |

| Deposits |

|

10,594,140 |

|

|

10,608,629 |

|

|

|

|

10,078,835 |

|

|

(0.1)% |

|

5.1% |

| Interest-bearing liabilities |

|

7,311,002 |

|

|

7,272,728 |

|

|

|

|

7,343,934 |

|

|

0.5% |

|

(0.4)% |

| Shareholders’ equity |

|

1,467,871 |

|

|

1,466,181 |

|

|

|

|

1,375,491 |

|

|

0.1% |

|

6.7% |

Primarily the result of decreased unrealized losses on the available for sale securities portfolio, total investment securities increased to $2.6 billion at March 31, 2025, reflecting a $19.7 million increase from the linked quarter. Total unrealized loss on available for sale investment securities was $321.2 million at March 31, 2025, as compared to $368.1 million at December 31, 2024 and $418.9 million at March 31, 2024. During the fourth quarter of 2024, as part of the loss-earnback transaction in the securities portfolio, $283.8 million of securities with a weighted average yield of 1.62% were sold at a loss of $36.8 million and $494.9 million of securities were purchased, with a weighted average yield of 5.21%.

Total loans amounted to $8.1 billion at March 31, 2025, an increase of $8.4 million, or 0.4%, from December 31, 2024 and an increase of $26.5 million, or 0.3%, from March 31, 2024. Please see below table for total loan portfolio mix. As of March 31, 2025, there were no notable concentrations in geographies within North Carolina and South Carolina or industries, including in office or hospitality categories, which are included in the "commercial real estate - non-owner occupied" category in the table below. The Company's exposure to non-owner occupied office loans represented approximately 6.0% of the total portfolio at March 31, 2025, with the largest loan being $26.3 million and with an average loan outstanding balance of $1.3 million. Non-owner occupied office loans are generally in non-metro markets and the ten largest loans in this category represent less than 2% of the total loan portfolio.

|

|

|

|

|

|

|

First Quarter 2025 Results |

The following table presents the period end balance and portfolio percentage by loan category.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOAN PORTFOLIO |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

| ($ in thousands) |

|

Amount |

|

Percentage |

|

Amount |

|

Percentage |

|

Amount |

|

Percentage |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial and industrial |

|

$ |

890,071 |

|

|

11 |

% |

|

$ |

919,690 |

|

|

11 |

% |

|

$ |

872,623 |

|

|

11 |

% |

| Construction, development & other land loans |

|

644,439 |

|

|

8 |

% |

|

647,167 |

|

|

8 |

% |

|

904,216 |

|

|

11 |

% |

| Commercial real estate - owner occupied |

|

1,233,732 |

|

|

15 |

% |

|

1,248,812 |

|

|

16 |

% |

|

1,238,759 |

|

|

15 |

% |

| Commercial real estate - non-owner occupied |

|

2,701,746 |

|

|

34 |

% |

|

2,625,554 |

|

|

33 |

% |

|

2,524,221 |

|

|

31 |

% |

| Multi-family real estate |

|

512,958 |

|

|

6 |

% |

|

506,407 |

|

|

6 |

% |

|

457,142 |

|

|

6 |

% |

| Residential 1-4 family real estate |

|

1,709,593 |

|

|

21 |

% |

|

1,729,322 |

|

|

21 |

% |

|

1,684,173 |

|

|

21 |

% |

| Home equity loans/lines of credit |

|

341,240 |

|

|

4 |

% |

|

345,883 |

|

|

4 |

% |

|

328,466 |

|

|

4 |

% |

| Consumer loans |

|

68,115 |

|

|

1 |

% |

|

70,653 |

|

|

1 |

% |

|

66,666 |

|

|

1 |

% |

| Loans, gross |

|

8,101,894 |

|

|

100 |

% |

|

8,093,488 |

|

|

100 |

% |

|

8,076,266 |

|

|

100 |

% |

| Unamortized net deferred loan fees |

|

1,139 |

|

|

|

|

1,188 |

|

|

|

|

240 |

|

|

|

| Total loans |

|

$ |

8,103,033 |

|

|

|

|

$ |

8,094,676 |

|

|

|

|

$ |

8,076,506 |

|

|

|

Total deposits were $10.7 billion at March 31, 2025, an increase of $214.1 million, or 8.2%, from December 31, 2024 and an increase of $441.3 million, or 4.3%, from March 31, 2024.

The Company has a diversified and granular deposit base which has remained a stable funding source with noninterest-bearing deposits comprising 32% of total deposits at March 31, 2025. As presented in the table below, our deposit mix has remained relatively consistent, with the exception of increased growth in money market accounts, partially offset by a decline in time deposits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DEPOSIT PORTFOLIO |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

| ($ in thousands) |

|

Amount |

|

Percentage |

|

Amount |

|

Percentage |

|

Amount |

|

Percentage |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing checking accounts |

|

$ |

3,476,786 |

|

|

32 |

% |

|

$ |

3,367,624 |

|

|

32 |

% |

|

$ |

3,362,265 |

|

|

33 |

% |

| Interest-bearing checking accounts |

|

1,448,377 |

|

|

14 |

% |

|

1,398,395 |

|

|

13 |

% |

|

1,401,724 |

|

|

13 |

% |

| Money market accounts |

|

4,386,469 |

|

|

41 |

% |

|

4,285,405 |

|

|

41 |

% |

|

3,787,323 |

|

|

37 |

% |

| Savings accounts |

|

539,632 |

|

|

5 |

% |

|

542,133 |

|

|

5 |

% |

|

584,901 |

|

|

6 |

% |

| Other time deposits |

|

533,723 |

|

|

5 |

% |

|

566,514 |

|

|

5 |

% |

|

607,359 |

|

|

6 |

% |

| Time deposits >$250,000 |

|

349,990 |

|

|

3 |

% |

|

360,854 |

|

|

4 |

% |

|

363,687 |

|

|

3 |

% |

| Total customer deposits |

|

10,734,977 |

|

|

100 |

% |

|

10,520,925 |

|

|

100 |

% |

|

10,107,259 |

|

|

98 |

% |

| Brokered deposits |

|

9,682 |

|

|

— |

% |

|

9,600 |

|

|

— |

% |

|

196,052 |

|

|

2 |

% |

| Total deposits |

|

$ |

10,744,659 |

|

|

100 |

% |

|

$ |

10,530,525 |

|

|

100 |

% |

|

$ |

10,303,311 |

|

|

100 |

% |

As of March 31, 2025 and December 31, 2024, estimated insured deposits totaled $6.5 billion, or 60.2%, and $6.4 billion, or 61.0%, respectively, of total deposits. In addition, at March 31, 2025 and December 31, 2024, there were collateralized deposits of $725.9 million and $690.5 million, respectively, such that approximately 66.9% and 67.6%, respectively, of our total deposits were insured or collateralized at those dates.

The Company maintains capital in excess of well-capitalized regulatory requirements, with an estimated total risk-based capital ratio at March 31, 2025 of 16.79%, up from the linked quarter ratio of 16.63% and the like quarter ratio of 15.85%.

|

|

|

|

|

|

|

First Quarter 2025 Results |

The increases during the first quarter of 2025 in risk-based capital ratios was driven by earnings in excess of capital uses for dividends and share repurchases during the quarter.

The Company has elected to exclude accumulated other comprehensive income ("AOCI") related primarily to available for sale securities from common equity tier 1 capital. AOCI is included in the Company’s tangible common equity ("TCE") to tangible assets ratio (a non-GAAP financial measure) which was 8.55% at March 31, 2025, an increase of 33 basis points from the linked quarter and 93 basis points from March 31, 2024. The first quarter increase in TCE was driven by earnings and improvements in the level of unrealized losses on the available for sale securities portfolio during the quarter. Refer to Appendix B for a reconciliation of common equity to TCE (a non-GAAP measure) and Appendix D for a calculation of the TCE ratio (a non-GAAP meansure).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CAPITAL RATIOS |

|

March 31, 2025 (estimated) |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

| Tangible common equity to tangible assets (non-GAAP) |

|

8.55% |

|

8.22% |

|

7.62% |

| Common equity tier I capital ratio |

|

14.53% |

|

14.35% |

|

13.50% |

| Tier I leverage ratio |

|

11.41% |

|

11.15% |

|

10.99% |

| Tier I risk-based capital ratio |

|

15.34% |

|

15.17% |

|

14.29% |

| Total risk-based capital ratio |

|

16.79% |

|

16.63% |

|

15.85% |

Liquidity is evaluated as both on-balance sheet (primarily cash and cash-equivalents, unpledged securities and other marketable assets) and off-balance sheet (readily available lines of credit and other funding sources). The Company continues to manage liquidity sources, including unused lines of credit, at levels believed to be adequate to meet its operating needs for the foreseeable future.

The Company's on-balance sheet liquidity ratio (net liquid assets as a percent of net liabilities) at March 31, 2025 was 19.8%. In addition, the Company had approximately $2.4 billion in available lines of credit at that date resulting in a total liquidity ratio of 36.4%.

|

|

|

|

|

|

|

First Quarter 2025 Results |

First Bancorp is a bank holding company headquartered in Southern Pines, North Carolina, with total assets of $12.4 billion. Its principal activity is the ownership and operation of First Bank, a state-chartered community bank that operates 113 branches in North Carolina and South Carolina. Since 1935, First Bank has taken a tailored approach to banking, combining best-in-class financial solutions, helpful local expertise, and technology to manage a home or business. First Bank also provides SBA loans to customers through its nationwide network of lenders. Member FDIC, Equal Housing Lender.

Please visit our website at www.LocalFirstBank.com for more information.

First Bancorp's common stock is traded on The NASDAQ Global Select Market under the symbol "FBNC."

Caution about Forward-Looking Statements: This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995, which statements are inherently subject to risks and uncertainties. Forward-looking statements are statements that include projections, predictions, expectations or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often characterized by the use of qualifying words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” or other words or phrases concerning opinions or judgments of the Company and its management about future events. Factors that could influence the accuracy of such forward-looking statements include, but are not limited to, the financial success or changing strategies of the Company’s customers, the Company’s level of success in integrating acquisitions, actions of government regulators, the level of market interest rates, and general economic conditions. For additional information about the factors that could affect the matters discussed in this paragraph, see the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K available at www.sec.gov. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward-looking statements. The Company is also not responsible for changes made to this press release by wire services, internet services or other media.

In this Earnings Release, we present certain measures of our performance that are calculated by methods other than in accordance with generally accepted accounting principles (“GAAP”). Company management uses these non-GAAP measures for purposes of evaluating our performance. Non-GAAP measures exclude or include amounts that are not normally excluded or included in the most directly comparable measure determined in accordance with GAAP. Company management believes an appropriate analysis of the Company's financial performance requires an understanding of the factors underlying such performance. Non-GAAP financial measures should not be viewed as substitutes for the most directly comparable financial measures calculated in accordance with GAAP. Please see the Appendices attached to this Earnings Release for reconciliations of return on tangible common equity, tangible common equity, tangible book value per share, the tangible common equity ratio, adjusted net income and adjusted D-EPS.

|

|

|

|

|

|

|

First Quarter 2025 Results |

|

|

|

First Bancorp and Subsidiaries

Financial Summary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED INCOME STATEMENT |

|

|

For the Three Months Ended |

|

|

| ($ in thousands, except per share data - unaudited) |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

|

| Interest income |

|

|

|

|

|

|

|

|

|

|

| Interest and fees on loans |

|

$ |

110,533 |

|

|

$ |

109,835 |

|

|

$ |

109,798 |

|

|

|

|

|

| Interest on investment securities: |

|

|

|

|

|

|

|

|

|

|

| Taxable interest income |

|

15,524 |

|

|

12,712 |

|

|

12,728 |

|

|

|

|

|

| Tax-exempt interest income |

|

1,116 |

|

|

1,116 |

|

|

1,117 |

|

|

|

|

|

| Other, principally overnight investments |

|

5,487 |

|

|

8,732 |

|

|

2,971 |

|

|

|

|

|

| Total interest income |

|

132,660 |

|

|

132,395 |

|

|

126,614 |

|

|

|

|

|

| Interest expense |

|

|

|

|

|

|

|

|

|

|

| Interest on deposits |

|

38,119 |

|

|

41,786 |

|

|

39,135 |

|

|

|

|

|

| Interest on borrowings |

|

1,658 |

|

|

1,768 |

|

|

8,205 |

|

|

|

|

|

| Total interest expense |

|

39,777 |

|

|

43,554 |

|

|

47,340 |

|

|

|

|

|

| Net interest income |

|

92,883 |

|

|

88,841 |

|

|

79,274 |

|

|

|

|

|

| Provision for credit losses |

|

1,116 |

|

|

507 |

|

|

1,200 |

|

|

|

|

|

| Net interest income after provision for credit losses |

|

91,767 |

|

|

88,334 |

|

|

78,074 |

|

|

|

|

|

| Noninterest income |

|

|

|

|

|

|

|

|

|

|

| Service charges on deposit accounts |

|

3,767 |

|

|

4,293 |

|

|

3,868 |

|

|

|

|

|

| Other service charges and fees |

|

5,883 |

|

|

5,828 |

|

|

5,570 |

|

|

|

|

|

| Presold mortgage loan fees and gains on sale |

|

450 |

|

|

676 |

|

|

338 |

|

|

|

|

|

| Commissions from sales of financial products |

|

1,408 |

|

|

1,202 |

|

|

1,320 |

|

|

|

|

|

| SBA loan sale gains |

|

52 |

|

|

291 |

|

|

895 |

|

|

|

|

|

| Bank-owned life insurance income |

|

1,228 |

|

|

1,225 |

|

|

1,164 |

|

|

|

|

|

| Securities losses, net |

|

— |

|

|

(36,820) |

|

|

(975) |

|

|

|

|

|

| Other Income, net |

|

114 |

|

|

128 |

|

|

716 |

|

|

|

|

|

| Total noninterest income |

|

12,902 |

|

|

(23,177) |

|

|

12,896 |

|

|

|

|

|

| Noninterest expenses |

|

|

|

|

|

|

|

|

|

|

| Salaries incentives and commissions expense |

|

28,661 |

|

|

28,447 |

|

|

27,642 |

|

|

|

|

|

| Employee benefit expense |

|

6,095 |

|

|

6,702 |

|

|

6,269 |

|

|

|

|

|

| Total personnel expense |

|

34,756 |

|

|

35,149 |

|

|

33,911 |

|

|

|

|

|

| Occupancy and equipment expense |

|

5,192 |

|

|

4,690 |

|

|

6,075 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Intangibles amortization expense |

|

1,516 |

|

|

1,563 |

|

|

1,759 |

|

|

|

|

|

| Other operating expenses |

|

16,429 |

|

|

16,877 |

|

|

17,442 |

|

|

|

|

|

| Total noninterest expenses |

|

57,893 |

|

|

58,279 |

|

|

59,187 |

|

|

|

|

|

| Income before income taxes |

|

46,776 |

|

|

6,878 |

|

|

31,783 |

|

|

|

|

|

| Income tax expense |

|

10,370 |

|

|

3,327 |

|

|

6,511 |

|

|

|

|

|

| Net income |

|

$ |

36,406 |

|

|

$ |

3,551 |

|

|

$ |

25,272 |

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.88 |

|

|

$ |

0.09 |

|

|

$ |

0.61 |

|

|

|

|

|

| Diluted |

|

0.88 |

|

|

0.08 |

|

|

0.61 |

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter 2025 Results |

|

|

|

First Bancorp and Subsidiaries

Financial Summary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

| ($ in thousands - unaudited) |

|

March 31, 2025 |

|

December 31, 2024 |

|

|

|

March 31, 2024 |

| Assets |

|

|

|

|

|

|

|

|

| Cash and due from banks, noninterest-bearing |

|

$ |

149,781 |

|

|

$ |

78,596 |

|

|

|

|

$ |

87,181 |

|

| Due from banks, interest-bearing |

|

622,660 |

|

|

428,911 |

|

|

|

|

266,661 |

|

| Total cash and cash equivalents |

|

772,441 |

|

|

507,507 |

|

|

|

|

353,842 |

|

|

|

|

|

|

|

|

|

|

| Securities available for sale |

|

2,064,516 |

|

|

2,043,062 |

|

|

|

|

2,088,483 |

|

| Securities held to maturity |

|

518,265 |

|

|

519,998 |

|

|

|

|

525,627 |

|

| Presold mortgages and SBA loans held for sale |

|

5,166 |

|

|

5,942 |

|

|

|

|

6,703 |

|

|

|

|

|

|

|

|

|

|

| Loans |

|

8,103,033 |

|

|

8,094,676 |

|

|

|

|

8,076,506 |

|

| Allowance for credit losses on loans |

|

(120,631) |

|

|

(122,572) |

|

|

|

|

(110,067) |

|

| Net loans |

|

7,982,402 |

|

|

7,972,104 |

|

|

|

|

7,966,439 |

|

|

|

|

|

|

|

|

|

|

| Premises and equipment, net |

|

141,954 |

|

|

143,459 |

|

|

|

|

150,546 |

|

| Accrued interest receivable |

|

35,452 |

|

|

36,329 |

|

|

|

|

35,147 |

|

| Goodwill |

|

478,750 |

|

|

478,750 |

|

|

|

|

478,750 |

|

| Other intangible assets, net |

|

21,388 |

|

|

22,904 |

|

|

|

|

27,748 |

|

| Bank-owned life insurance |

|

189,597 |

|

|

188,460 |

|

|

|

|

185,061 |

|

| Other assets |

|

226,314 |

|

|

229,179 |

|

|

|

|

273,251 |

|

| Total assets |

|

$ |

12,436,245 |

|

|

$ |

12,147,694 |

|

|

|

|

$ |

12,091,597 |

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

| Noninterest-bearing deposits |

|

$ |

3,476,786 |

|

|

$ |

3,367,624 |

|

|

|

|

$ |

3,362,265 |

|

| Interest-bearing deposits |

|

7,267,873 |

|

|

7,162,901 |

|

|

|

|

6,941,046 |

|

| Total deposits |

|

10,744,659 |

|

|

10,530,525 |

|

|

|

|

10,303,311 |

|

|

|

|

|

|

|

|

|

|

| Borrowings |

|

92,055 |

|

|

91,876 |

|

|

|

|

332,335 |

|

| Accrued interest payable |

|

4,935 |

|

|

4,604 |

|

|

|

|

9,847 |

|

| Other liabilities |

|

86,420 |

|

|

75,078 |

|

|

|

|

70,005 |

|

| Total liabilities |

|

10,928,069 |

|

|

10,702,083 |

|

|

|

|

10,715,498 |

|

|

|

|

|

|

|

|

|

|

| Shareholders’ equity |

|

|

|

|

|

|

|

|

| Common stock |

|

971,174 |

|

|

971,313 |

|

|

|

|

965,429 |

|

| Retained earnings |

|

783,630 |

|

|

756,327 |

|

|

|

|

732,643 |

|

| Stock in rabbi trust assumed in acquisition |

|

(1,166) |

|

|

(1,148) |

|

|

|

|

(1,396) |

|

| Rabbi trust obligation |

|

1,166 |

|

|

1,148 |

|

|

|

|

1,396 |

|

| Accumulated other comprehensive loss |

|

(246,628) |

|

|

(282,029) |

|

|

|

|

(321,973) |

|

| Total shareholders’ equity |

|

1,508,176 |

|

|

1,445,611 |

|

|

|

|

1,376,099 |

|

| Total liabilities and shareholders’ equity |

|

$ |

12,436,245 |

|

|

$ |

12,147,694 |

|

|

|

|

$ |

12,091,597 |

|

|

|

|

|

|

|

|

First Quarter 2025 Results |

|

|

|

First Bancorp and Subsidiaries

Financial Summary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TREND INFORMATION |

|

|

For the Three Months Ended |

|

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

June 30, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

PERFORMANCE RATIOS (annualized) |

|

|

|

|

|

|

|

|

|

|

Return on average assets (1) |

|

1.21 |

% |

|

0.12 |

% |

|

0.61 |

% |

|

0.96 |

% |

|

0.84 |

% |

Return on average common equity (2) |

|

10.06 |

% |

|

0.96 |

% |

|

5.14 |

% |

|

8.38 |

% |

|

7.39 |

% |

Return on average tangible common equity (3) |

|

15.54 |

% |

|

1.93 |

% |

|

8.30 |

% |

|

13.60 |

% |

|

12.13 |

% |

|

|

|

|

|

|

|

|

|

|

|

| COMMON SHARE DATA |

|

|

|

|

|

|

|

|

|

|

| Cash dividends declared - common |

|

$ |

0.22 |

|

|

$ |

0.22 |

|

|

$ |

0.22 |

|

|

$ |

0.22 |

|

|

$ |

0.22 |

|

| Book value per common share |

|

$ |

36.46 |

|

|

$ |

34.96 |

|

|

$ |

35.74 |

|

|

$ |

34.10 |

|

|

$ |

33.44 |

|

Tangible book value per share (4) |

|

$ |

24.69 |

|

|

$ |

23.17 |

|

|

$ |

23.91 |

|

|

$ |

22.19 |

|

|

$ |

21.49 |

|

| Common shares outstanding at end of period |

|

41,368,828 |

|

|

41,347,418 |

|

|

41,340,099 |

|

|

41,187,943 |

|

|

41,156,286 |

|

| Weighted average shares outstanding - diluted |

|

41,406,525 |

|

|

41,422,973 |

|

|

41,366,743 |

|

|

41,262,091 |

|

|

41,249,636 |

|

|

|

|

|

|

|

|

|

|

|

|

CAPITAL INFORMATION (estimates for current quarter) |

|

|

|

|

|

|

|

|

Tangible common equity to tangible assets (5) |

|

8.55 |

% |

|

8.22 |

% |

|

8.47 |

% |

|

7.90 |

% |

|

7.62 |

% |

| Common equity tier I capital ratio |

|

14.53 |

% |

|

14.35 |

% |

|

14.37 |

% |

|

13.99 |

% |

|

13.50 |

% |

| Total risk-based capital ratio |

|

16.79 |

% |

|

16.63 |

% |

|

16.65 |

% |

|

16.24 |

% |

|

15.85 |

% |

|

|

|

|

|

|

|

|

|

|

|

| (1) Calculated by dividing annualized net income by average assets. |

(2) Calculated by dividing annualized tangible net income (net income adjusted for intangible asset amortization, net of tax), by average common equity. See Appendix A for the components of the calculation. |

(3) Return on average tangible common equity is a non-GAAP financial measure. See Appendix A for the components of the calculation and the reconciliation of average common equity to average TCE. |

(4) Tangible book value per share is a non-GAAP financial measure. See Appendix B for a reconciliation of common equity to tangible common equity and Appendix C for the resulting calculation. |

(5) Tangible common equity ratio is a non-GAAP financial measure. See Appendix B for a reconciliation of common equity to tangible common equity and Appendix D for the resulting calculation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

INCOME STATEMENT

($ in thousands except per share data)

|

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

June 30, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

| Net interest income - tax-equivalent (1) |

|

$ |

93,320 |

|

|

$ |

89,587 |

|

|

$ |

83,765 |

|

|

$ |

81,848 |

|

|

$ |

80,005 |

|

| Taxable equivalent adjustment (1) |

|

437 |

|

|

746 |

|

|

722 |

|

|

733 |

|

|

731 |

|

| Net interest income |

|

92,883 |

|

|

88,841 |

|

|

83,043 |

|

|

81,115 |

|

|

79,274 |

|

| Provision for credit losses |

|

1,116 |

|

|

507 |

|

|

14,200 |

|

|

541 |

|

|

1,200 |

|

| Noninterest income |

|

12,902 |

|

|

(23,177) |

|

|

13,579 |

|

|

14,601 |

|

|

12,896 |

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest expense |

|

57,893 |

|

|

58,279 |

|

|

59,850 |

|

|

58,291 |

|

|

59,187 |

|

| Income before income taxes |

|

46,776 |

|

|

6,878 |

|

|

22,572 |

|

|

36,884 |

|

|

31,783 |

|

| Income tax expense |

|

10,370 |

|

|

3,327 |

|

|

3,892 |

|

|

8,172 |

|

|

6,511 |

|

| Net income |

|

36,406 |

|

|

3,551 |

|

|

18,680 |

|

|

28,712 |

|

|

25,272 |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share - diluted |

|

$ |

0.88 |

|

|

$ |

0.08 |

|

|

$ |

0.45 |

|

|

$ |

0.70 |

|

|

$ |

0.61 |

|

|

|

|

|

|

|

|

|

|

|

|

| (1) This amount reflects the tax benefit that the Company receives related to its tax-exempt loans and securities, which carry interest rates lower than similar taxable investments due to their tax-exempt status. This amount has been computed assuming the expected tax rate and is reduced by the related nondeductible portion of interest expense. |

|

|

|

|

|

|

|

First Quarter 2025 Results |

|

|

|

First Bancorp and Subsidiaries

Financial Summary |

AVERAGE BALANCES AND NET INTEREST INCOME ANALYSIS - QUARTERS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

| ($ in thousands) |

Average

Volume |

|

Interest

Earned

or Paid |

|

Average

Rate |

|

Average

Volume |

|

Interest

Earned

or Paid |

|

Average

Rate |

|

Average

Volume |

|

Interest

Earned

or Paid |

|

Average

Rate |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (1) (2) |

$ |

8,107,394 |

|

|

$ |

110,533 |

|

|

5.52 |

% |

|

$ |

7,993,671 |

|

|

$ |

109,835 |

|

|

5.47 |

% |

|

$ |

8,103,387 |

|

|

$ |

109,798 |

|

|

5.45 |

% |

| Taxable securities |

2,629,066 |

|

|

15,524 |

|

|

2.36 |

% |

|

2,535,232 |

|

|

12,712 |

|

|

2.01 |

% |

|

2,815,266 |

|

|

12,728 |

|

|

1.81 |

% |

| Non-taxable securities |

288,905 |

|

|

1,116 |

|

|

1.55 |

% |

|

289,922 |

|

|

1,116 |

|

|

1.54 |

% |

|

293,198 |

|

|

1,117 |

|

|

1.52 |

% |

| Short-term investments, primarily interest-bearing cash |

503,377 |

|

|

5,487 |

|

|

4.42 |

% |

|

773,655 |

|

|

8,732 |

|

|

4.49 |

% |

|

277,945 |

|

|

2,971 |

|

|

4.30 |

% |

| Total interest-earning assets |

11,528,742 |

|

|

132,660 |

|

|

4.65 |

% |

|

11,592,480 |

|

|

132,395 |

|

|

4.55 |

% |

|

11,489,796 |

|

|

126,614 |

|

|

4.43 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

133,756 |

|

|

|

|

|

|

80,481 |

|

|

|

|

|

|

90,833 |

|

|

|

|

|

| Premises and equipment |

143,064 |

|

|

|

|

|

|

144,467 |

|

|

|

|

|

|

151,159 |

|

|

|

|

|

| Other assets |

421,248 |

|

|

|

|

|

|

426,343 |

|

|

|

|

|

|

379,413 |

|

|

|

|

|

| Total assets |

$ |

12,226,810 |

|

|

|

|

|

|

$ |

12,243,771 |

|

|

|

|

|

|

$ |

12,111,201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing checking |

$ |

1,431,556 |

|

|

$ |

2,497 |

|

|

0.71 |

% |

|

$ |

1,389,063 |

|

|

$ |

2,438 |

|

|

0.70 |

% |

|

$ |

1,403,484 |

|

|

$ |

2,359 |

|

|

0.68 |

% |

| Money market deposits |

4,337,560 |

|

|

29,180 |

|

|

2.73 |

% |

|

4,273,170 |

|

|

31,430 |

|

|

2.93 |

% |

|

3,704,731 |

|

|

27,813 |

|

|

3.02 |

% |

| Savings deposits |

539,104 |

|

|

240 |

|

|

0.18 |

% |

|

542,861 |

|

|

269 |

|

|

0.20 |

% |

|

592,395 |

|

|

308 |

|

|

0.21 |

% |

| Other time deposits |

558,648 |

|

|

3,353 |

|

|

2.43 |

% |

|

598,152 |

|

|

4,192 |

|

|

2.79 |

% |

|

709,517 |

|

|

5,456 |

|

|

3.09 |

% |

| Time deposits >$250,000 |

352,174 |

|

|

2,849 |

|

|

3.28 |

% |

|

377,693 |

|

|

3,457 |

|

|

3.64 |

% |

|

355,809 |

|

|

3,199 |

|

|

3.62 |

% |

| Total interest-bearing deposits |

7,219,042 |

|

|

38,119 |

|

|

2.14 |

% |

|

7,180,939 |

|

|

41,786 |

|

|

2.31 |

% |

|

6,765,936 |

|

|

39,135 |

|

|

2.33 |

% |

| Borrowings |

91,960 |

|

|

1,658 |

|

|

7.31 |

% |

|

91,789 |

|

|

1,768 |

|

|

7.66 |

% |

|

577,998 |

|

|

8,205 |

|

|

5.71 |

% |

| Total interest-bearing liabilities |

7,311,002 |

|

|

39,777 |

|

|

2.21 |

% |

|

7,272,728 |

|

|

43,554 |

|

|

2.38 |

% |

|

7,343,934 |

|

|

47,340 |

|

|

2.59 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing checking |

3,375,098 |

|

|

|

|

|

|

3,427,690 |

|

|

|

|

|

|

3,312,899 |

|

|

|

|

|

| Other liabilities |

72,839 |

|

|

|

|

|

|

77,172 |

|

|

|

|

|

|

78,877 |

|

|

|

|

|

| Shareholders’ equity |

1,467,871 |

|

|

|

|

|

|

1,466,181 |

|

|

|

|

|

|

1,375,491 |

|

|

|

|

|

| Total liabilities and shareholders’ equity |

$ |

12,226,810 |

|

|

|

|

|

|

$ |

12,243,771 |

|

|

|

|

|

|

$ |

12,111,201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net yield on interest-earning assets and net interest income |

|

|

$ |

92,883 |

|

|

3.25 |

% |

|

|

|

$ |

88,841 |

|

|

3.05 |

% |

|

|

|

$ |

79,274 |

|

|

2.77 |

% |

| Net yield on interest-earning assets and net interest income – tax-equivalent (3) |

|

|

$ |

93,320 |

|

|

3.27 |

% |

|

|

|

$ |

89,587 |

|

|

3.08 |

% |

|

|

|

$ |

80,005 |

|

|

2.80 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest rate spread |

|

|

|

|

2.44 |

% |

|

|

|

|

|

2.17 |

% |

|

|

|

|

|

1.84 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average prime rate |

|

|

|

|

7.50 |

% |

|

|

|

|

|

7.81 |

% |

|

|

|

|

|

8.50 |

% |

(1) Average loans include nonaccruing loans, the effect of which is to lower the average rate shown. Interest earned includes recognized net loan fees, including late fees, prepayment fees, and net deferred loan (cost)/fee amortization in the amounts of $(294,000), $(340,000)and $(472,000) for the three months ended March 31, 2025, December 31, 2024 and March 31, 2024, respectively.

(2) Includes accretion of discount on acquired loans of $1.8 million, $2.2 million and $2.4 million for the three months ended March 31, 2025, December 31, 2024 and March 31, 2024, respectively.

(3) Includes tax-equivalent adjustments to reflect the tax benefit that we receive related to tax-exempt securities and loans as reduced by the related nondeductible portion of interest expense.

|

|

|

|

|

|

|

First Quarter 2025 Results |

|

|

|

| Reconciliation of non-GAAP measures |

APPENDIX A: Calculation of Return on TCE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

| ($ in thousands) |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

June 30, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

36,406 |

|

|

$ |

3,551 |

|

|

$ |

18,680 |

|

|

$ |

28,712 |

|

|

$ |

25,272 |

|

|

|

|

| Intangible asset amortization, net of taxes |

|

1,159 |

|

|

1,195 |

|

|

1,240 |

|

|

1,283 |

|

|

1,352 |

|

|

|

|

| Tangible Net income |

|

$ |

37,565 |

|

|

$ |

4,746 |

|

|

$ |

19,920 |

|

|

$ |

29,995 |

|

|

$ |

26,624 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common equity |

|

$ |

1,467,871 |

|

|

$ |

1,466,181 |

|

|

$ |

1,445,029 |

|

|

$ |

1,378,284 |

|

|

$ |

1,375,490 |

|

|

|

|

| Less: Average goodwill and other intangibles, net of related taxes |

|

(487,395) |

|

|

(488,624) |

|

|

(489,987) |

|

|

(491,318) |

|

|

(492,733) |

|

|

|

|

| Average tangible common equity |

|

$ |

980,476 |

|

|

$ |

977,557 |

|

|

$ |

955,042 |

|

|

$ |

886,966 |

|

|

$ |

882,757 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average common equity |

|

10.06 |

% |

|

0.96 |

% |

|

5.14 |

% |

|

8.38 |

% |

|

7.39 |

% |

|

|

|

| Return on average tangible common equity |

|

15.54 |

% |

|

1.93 |

% |

|

8.30 |

% |

|

13.60 |

% |

|

12.13 |

% |

|

|

|

APPENDIX B: Reconciliation of Common Equity to TCE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

| ($ in thousands) |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

June 30, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' common equity |

|

$ |

1,508,176 |

|

|

$ |

1,445,611 |

|

|

$ |

1,477,525 |

|

|

$ |

1,404,342 |

|

|

$ |

1,376,099 |

|

|

|

|

| Less: Goodwill and other intangibles, net of related taxes |

|

(486,749) |

|

|

(487,660) |

|

|

(489,139) |

|

|

(490,439) |

|

|

(491,740) |

|

|

|

|

| Tangible common equity |

|

$ |

1,021,427 |

|

|

$ |

957,951 |

|

|

$ |

988,386 |

|

|

$ |

913,903 |

|

|

$ |

884,359 |

|

|

|

|

APPENDIX C: Tangible Book Value Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

| ($ in thousands except per share data) |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

June 30, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible common equity (Appendix B) |

|

$ |

1,021,427 |

|

|

$ |

957,951 |

|

|

$ |

988,386 |

|

|

$ |

913,903 |

|

|

$ |

884,359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding |

|

41,368,828 |

|

|

41,347,418 |

|

|

41,340,099 |

|

|

41,187,943 |

|

|

41,156,286 |

|

|

|

|

| Tangible book value per common share |

|

$ |

24.69 |

|

|

$ |

23.17 |

|

|

$ |

23.91 |

|

|

$ |

22.19 |

|

|

$ |

21.49 |

|

|

|

|

APPENDIX D: TCE Ratio

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

| ($ in thousands) |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

June 30, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible common equity (Appendix B) |

|

$ |

1,021,427 |

|

|

$ |

957,951 |

|

|

$ |

988,386 |

|

|

$ |

913,903 |

|

|

$ |

884,359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

12,436,245 |

|

|

12,147,694 |

|

|

12,153,430 |

|

|

12,060,805 |

|

|

12,091,597 |

|

|

|

|

| Less: Goodwill and other intangibles, net of related taxes |

|

(486,749) |

|

|

(487,660) |

|

|

(489,139) |

|

|

(490,439) |

|

|

(491,740) |

|

|

|

|

| Tangible assets ("TA") |

|

$ |

11,949,496 |

|

|

$ |

11,660,034 |

|

|

$ |

11,664,291 |

|

|

$ |

11,570,366 |

|

|

$ |

11,599,857 |

|

|

|

|

| TCE to TA ratio |

|

8.55 |

% |

|

8.22 |

% |

|

8.47 |

% |

|

7.90 |

% |

|

7.62 |

% |

|

|

|

|

|

|

|

|

|

|

First Quarter 2025 Results |

|

|

|

| Reconciliation of non-GAAP measures, continued |

APPENDIX E: Adjusted EPS - diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

| ($ in thousands) |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

| Net income |

|

$ |

36,406 |

|

|

$ |

3,551 |

|

|

$ |

25,272 |

|

| Impact of Hurricane Helene |

|

|

|

|

|

|

| Provision for (benefit from) credit losses |

|

(2,000) |

|

|

— |

|

|

— |

|

| Building repairs and maintenance |

|

— |

|

|

(24) |

|

|

— |

|

| Other |

|

— |

|

|

(3) |

|

|

— |

|

| Total |

|

(2,000) |

|

|

(27) |

|

|

— |

|

| Less, tax impact |

|

464 |

|

|

6 |

|

|

— |

|

| After-tax impact of Hurricane Helene |

|

(1,536) |

|

|

(21) |

|

|

— |

|

|

|

|

|

|

|

|

| Impact of loss-earnback |

|

|

|

|

|

|

| Securities loss from loss-earnback |

|

— |

|

|

36,820 |

|

|

— |

|

| Less, tax impact |

|

— |

|

|

(8,660) |

|

|

— |

|

| After-tax impact of loss-earnback |

|

— |

|

|

28,160 |

|

|

— |

|

|

|

|

|

|

|

|

| Adjusted net income |

|

$ |

34,870 |

|

|

$ |

31,690 |

|

|

$ |

25,272 |

|

|

|

|

|

|

|

|

| Weighted average shares outstanding - diluted |

|

41,406,525 |

|

|