centerspacehomes.com INVESTOR PRESENTATION November 10, 2025 Railway Flats Apartments – Loveland, CO

centerspacehomes.com 2 Certain statements in this presentation are based on Centerspace’s current expectations and assumptions, and are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements do not discuss historical fact, but instead include statements related to expectations, projections, intentions, or other items related to the future. Forward-looking statements are typically identified by the use of terms such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “assumes,” “may,” “projects,” “outlook,” “future,” and variations of such words and similar expressions. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to be materially different from the results of operations, financial conditions, or plans expressed or implied by the forward-looking statements. Although the Company believes the expectations reflected in its forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be achieved. Any statements contained herein that are not statements of historical fact should be deemed forward-looking statements. As a result, reliance should not be placed on these forward-looking statements, as these statements are subject to known and unknown risks, uncertainties, and other factors beyond the Company's control and could differ materially from actual results and performance. Such risks and uncertainties are detailed from time to time in filings with the Securities and Exchange Commission (“SEC”), including the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, in its subsequent quarterly reports on Form 10-Q, and in other reports the Company files with the SEC from time to time. The Company assumes no obligation to update or supplement forward-looking statements that become untrue due to subsequent events. SAFE HARBOR STATEMENT & LEGAL DISCLOSURES

OUR VISION To be the premier provider of apartment homes in vibrant communities by focusing on integrity and serving others. TABLE OF CONTENTS Why Centerspace Operational Updates 2025 Transaction Activity Strong Fundamentals Appendix Arcata – Golden Valley, MN TABLE OF CONTENTS 3centerspacehomes.com Sugarmont – Salt Lake City, UT Westend – Denver, CO 4 5 10 17 26

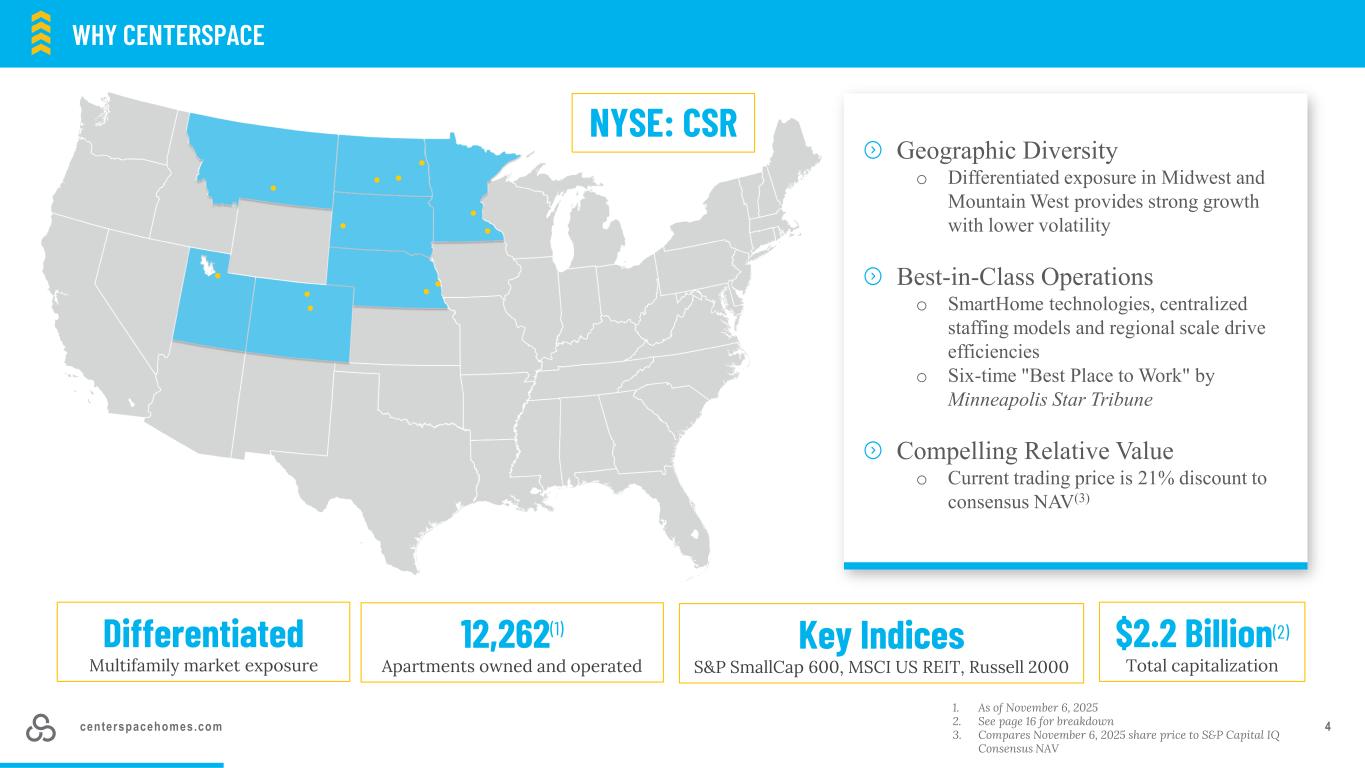

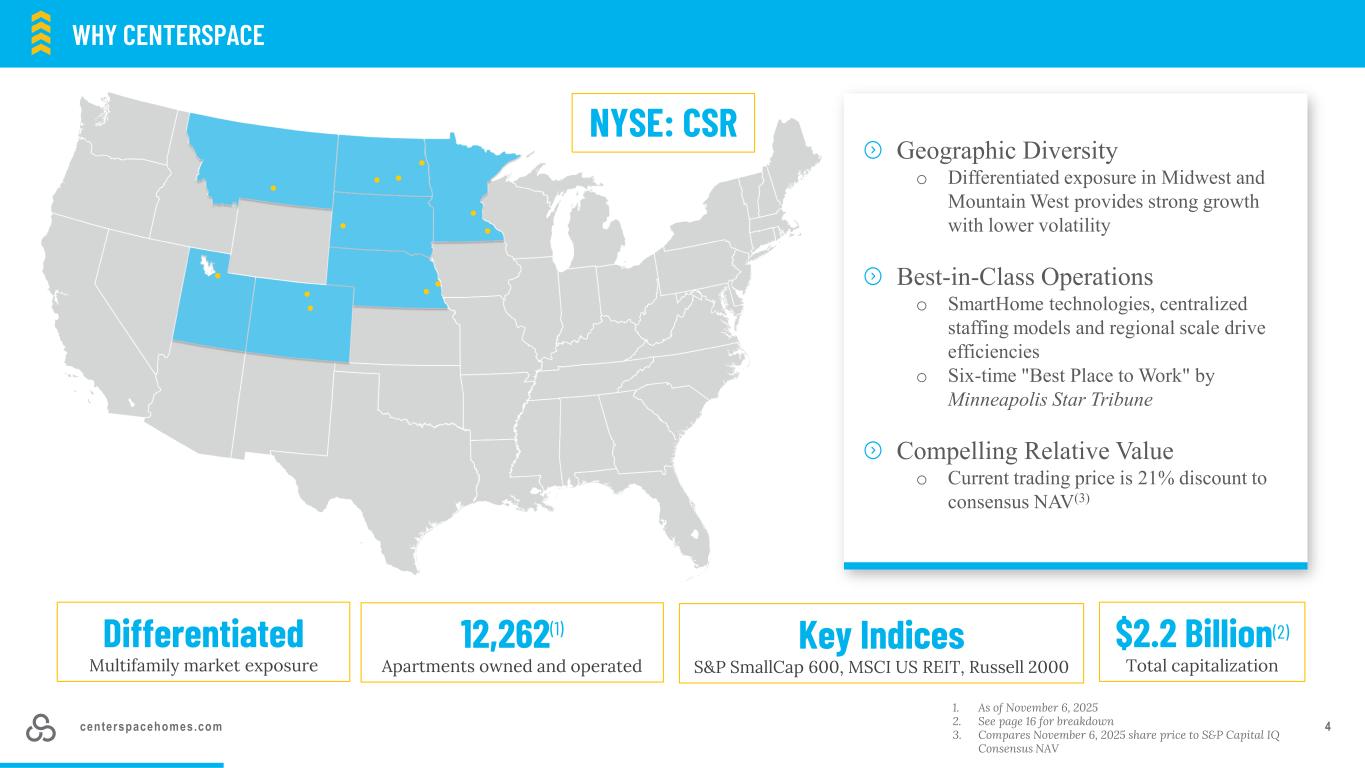

centerspacehomes.com 4 1. As of November 6, 2025 2. See page 16 for breakdown 3. Compares November 6, 2025 share price to S&P Capital IQ Consensus NAV Differentiated Multifamily market exposure 12,262(1) Apartments owned and operated NYSE: CSR $2.2 Billion(2) Total capitalization Key Indices S&P SmallCap 600, MSCI US REIT, Russell 2000 WHY CENTERSPACE Geographic Diversity o Differentiated exposure in Midwest and Mountain West provides strong growth with lower volatility Best-in-Class Operations o SmartHome technologies, centralized staffing models and regional scale drive efficiencies o Six-time "Best Place to Work" by Minneapolis Star Tribune Compelling Relative Value o Current trading price is 21% discount to consensus NAV(3)

centerspacehomes.com 5 OPERATIONAL UPDATES

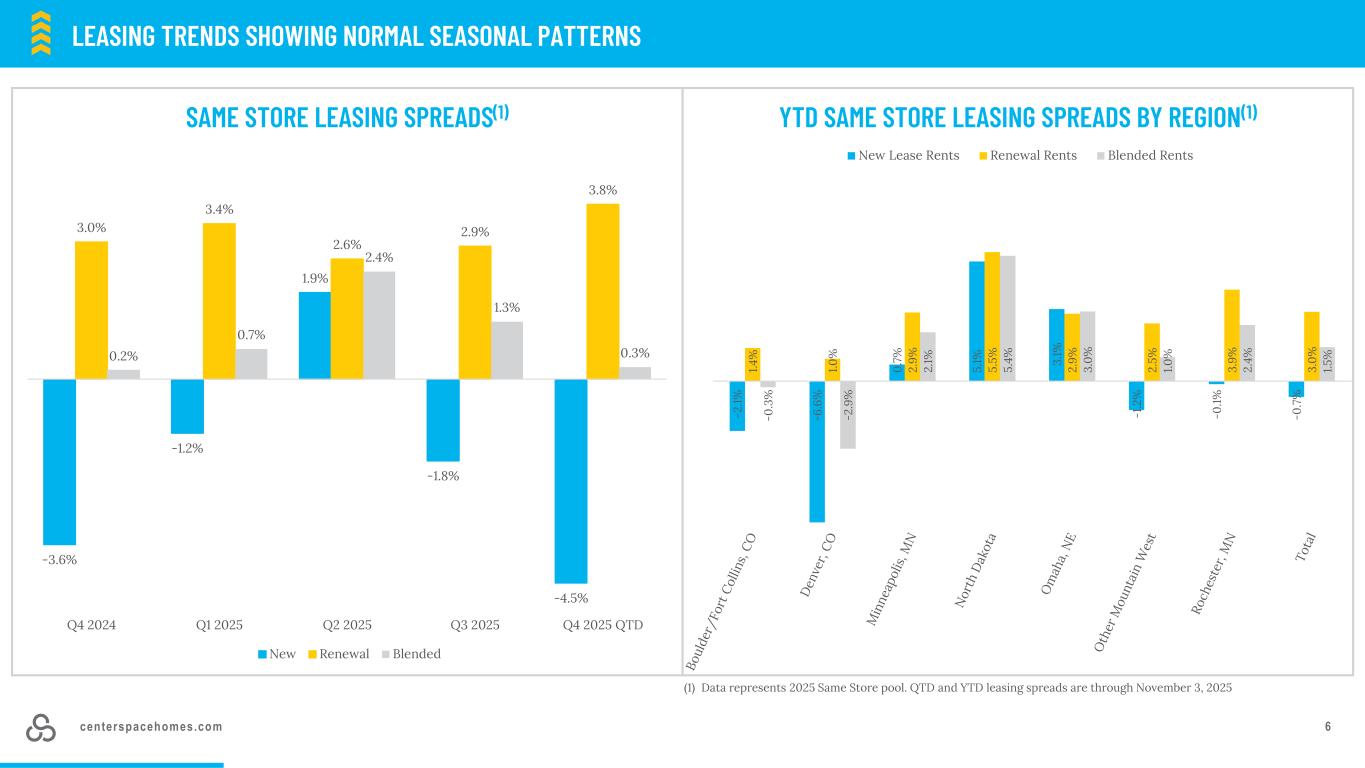

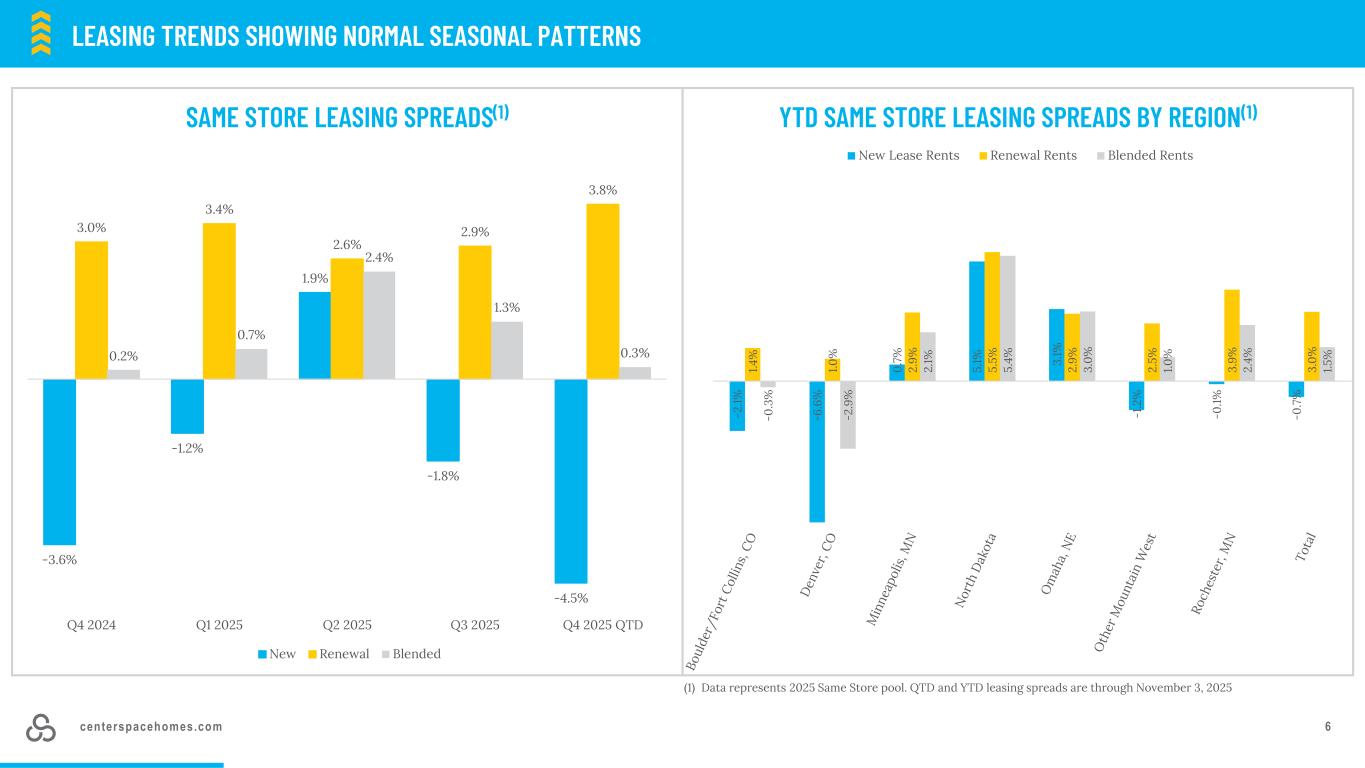

centerspacehomes.com 6 -3.6% -1.2% 1.9% -1.8% -4.5% 3.0% 3.4% 2.6% 2.9% 3.8% 0.2% 0.7% 2.4% 1.3% 0.3% Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 QTD SAME STORE LEASING SPREADS(1) New Renewal Blended -2 .1% -6 .6 % 0. 7% 5. 1% 3. 1% -1 .2 % -0 .1% -0 .7 % 1.4 % 1.0 % 2. 9% 5. 5% 2. 9% 2. 5% 3. 9% 3. 0% -0 .3 % -2 .9 % 2. 1% 5. 4% 3. 0% 1.0 % 2. 4% 1.5 % YTD SAME STORE LEASING SPREADS BY REGION(1) New Lease Rents Renewal Rents Blended Rents LEASING TRENDS SHOWING NORMAL SEASONAL PATTERNS (1) Data represents 2025 Same Store pool. QTD and YTD leasing spreads are through November 3, 2025

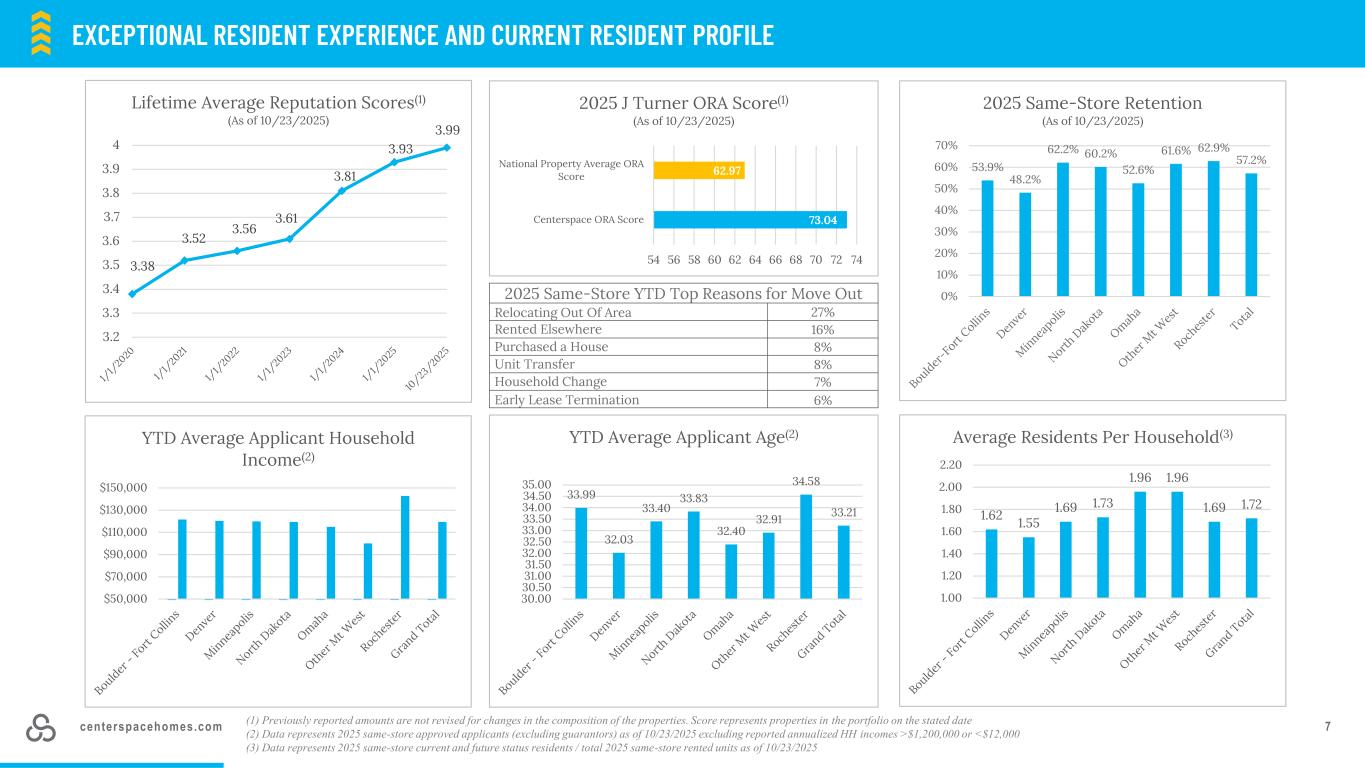

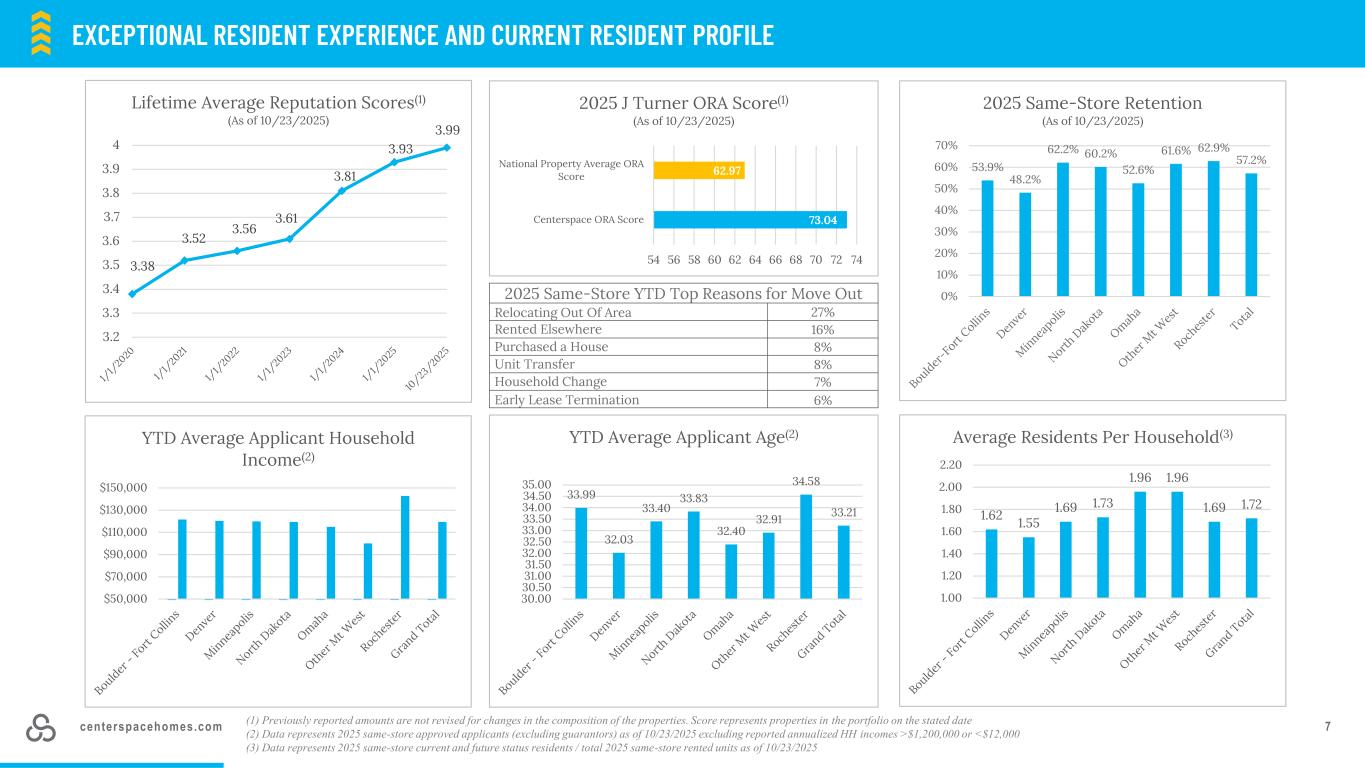

centerspacehomes.com 7 EXCEPTIONAL RESIDENT EXPERIENCE AND CURRENT RESIDENT PROFILE (1) Previously reported amounts are not revised for changes in the composition of the properties. Score represents properties in the portfolio on the stated date (2) Data represents 2025 same-store approved applicants (excluding guarantors) as of 10/23/2025 excluding reported annualized HH incomes >$1,200,000 or <$12,000 (3) Data represents 2025 same-store current and future status residents / total 2025 same-store rented units as of 10/23/2025 73.04 62.97 54 56 58 60 62 64 66 68 70 72 74 Centerspace ORA Score National Property Average ORA Score 2025 J Turner ORA Score(1) (As of 10/23/2025) 2025 Same-Store YTD Top Reasons for Move Out Relocating Out Of Area 27% Rented Elsewhere 16% Purchased a House 8% Unit Transfer 8% Household Change 7% Early Lease Termination 6% 53.9% 48.2% 62.2% 60.2% 52.6% 61.6% 62.9% 57.2% 0% 10% 20% 30% 40% 50% 60% 70% 2025 Same-Store Retention (As of 10/23/2025) 1.62 1.55 1.69 1.73 1.96 1.96 1.69 1.72 1.00 1.20 1.40 1.60 1.80 2.00 2.20 Average Residents Per Household(3) 3.38 3.52 3.56 3.61 3.81 3.93 3.99 3.2 3.3 3.4 3.5 3.6 3.7 3.8 3.9 4 Lifetime Average Reputation Scores(1) (As of 10/23/2025) $50,000 $70,000 $90,000 $110,000 $130,000 $150,000 YTD Average Applicant Household Income(2) 33.99 32.03 33.40 33.83 32.40 32.91 34.58 33.21 30.00 30.50 31.00 31.50 32.00 32.50 33.00 33.50 34.00 34.50 35.00 YTD Average Applicant Age(2)

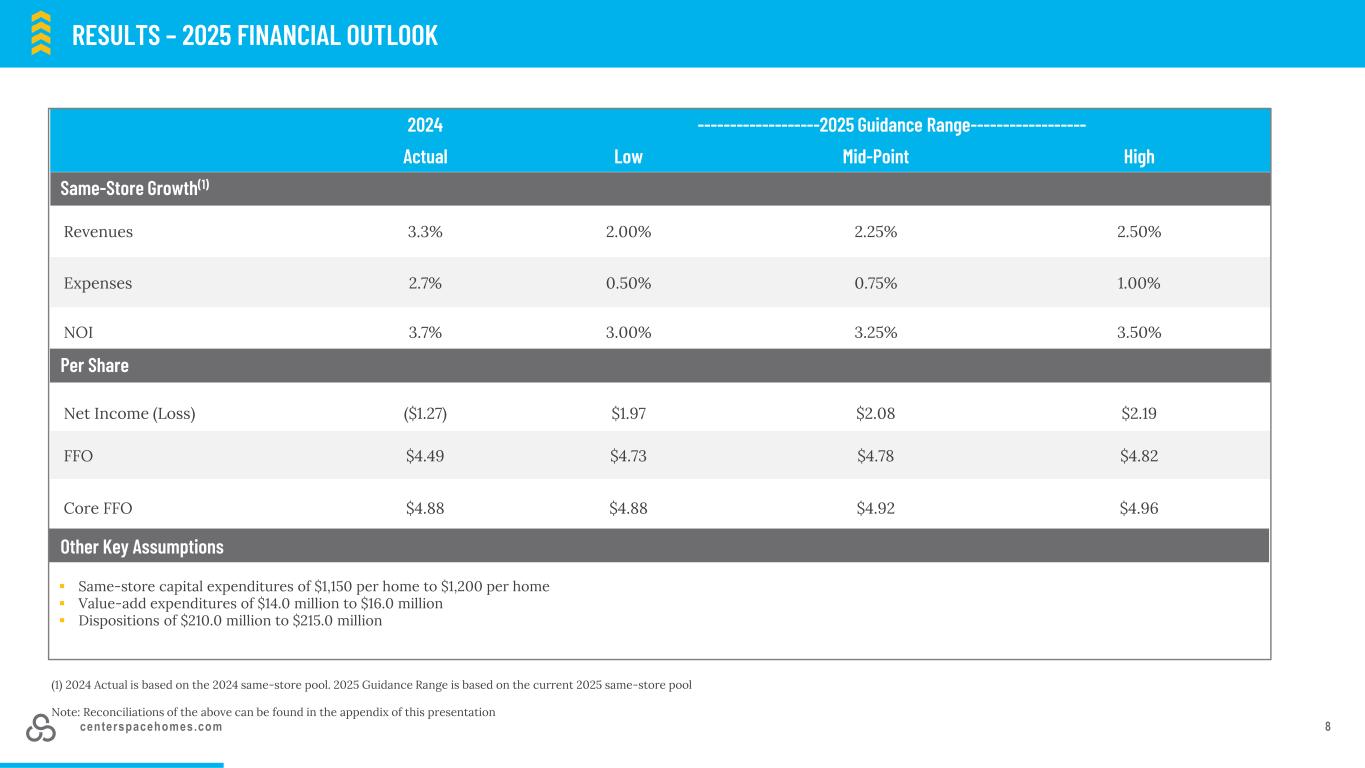

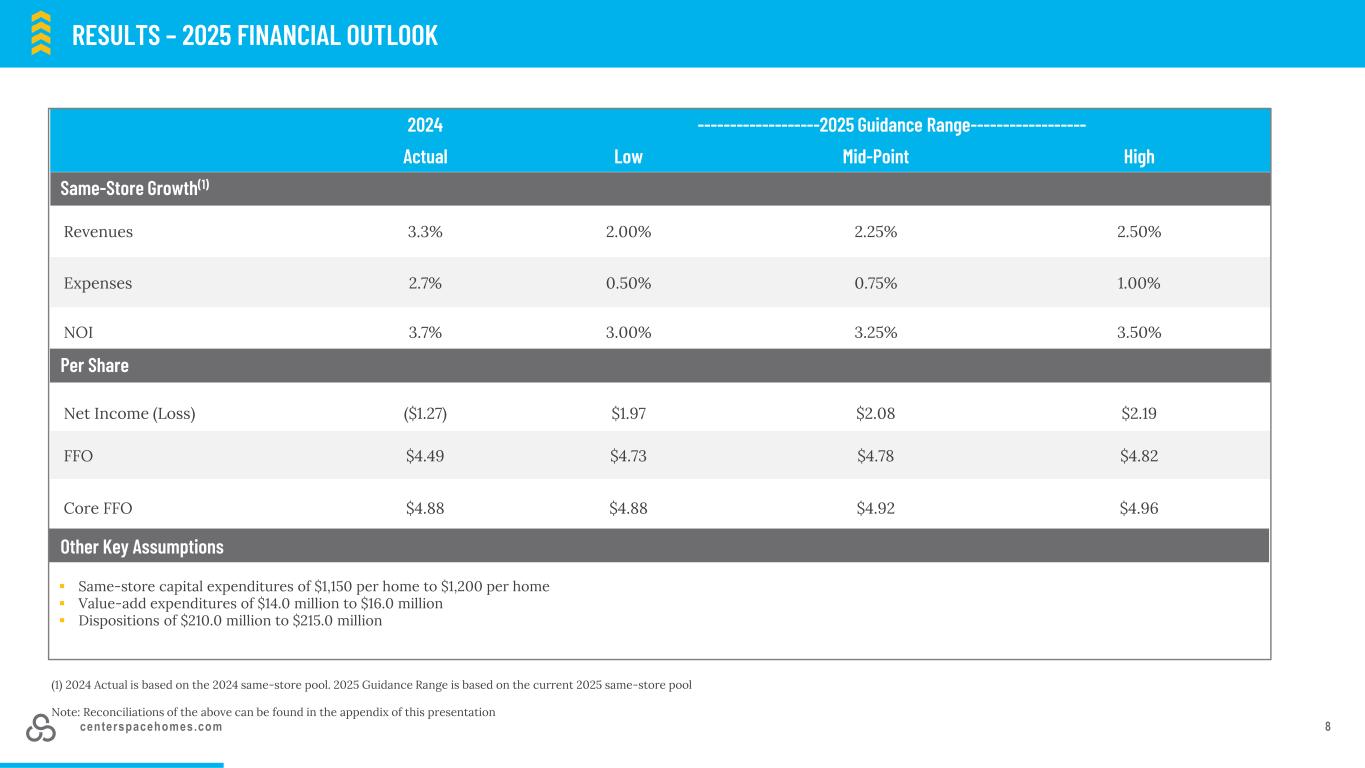

centerspacehomes.com 8 2024 -------------------2025 Guidance Range------------------ Actual Low Mid-Point High Revenues 3.3% 2.00% 2.25% 2.50% Expenses 2.7% 0.50% 0.75% 1.00% NOI 3.7% 3.00% 3.25% 3.50% Net Income (Loss) ($1.27) $1.97 $2.08 $2.19 FFO $4.49 $4.73 $4.78 $4.82 Core FFO $4.88 $4.88 $4.92 $4.96 Same-Store Growth(1) Per Share Other Key Assumptions RESULTS – 2025 FINANCIAL OUTLOOK ▪ Same-store capital expenditures of $1,150 per home to $1,200 per home ▪ Value-add expenditures of $14.0 million to $16.0 million ▪ Dispositions of $210.0 million to $215.0 million (1) 2024 Actual is based on the 2024 same-store pool. 2025 Guidance Range is based on the current 2025 same-store pool Note: Reconciliations of the above can be found in the appendix of this presentation

centerspacehomes.com RESULTS – FAVORABLE GROWTH PROFILE 9Note: Data is based on midpoint of 2025 guidance ranges provided by noted peers with Q3 2025 earnings. SMID Cap Apt group includes IRT, NXRT, and VRE. Non-coastal/Sunbelt group includes CPT, IRT, MAA, and NXRT. All multifamily group includes AVB, CPT, EQR, ESS, IRT, MAA, NXRT, UDR, and VRE. Source data: Company Filings 0.8% at Midpoint -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% CSR SMID Cap Apt Non-coastal/Sunbelt All Multifamily, ex CSR Core FFO/sh Growth, Guidance Midpoint 3.3% at Midpoint -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% CSR SMID Cap Apt Non-coastal/Sunbelt All Multifamily, ex CSR SS NOI Growth, Guidance Midpoint 2.3% at Midpoint 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% CSR SMID Cap Apt Non-coastal/Sunbelt All Multifamily, ex CSR SS Revenue Growth, Guidance Midpoint 0.8% at Midpoint 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% CSR SMID Cap Apt Non-coastal/Sunbelt All Multifamily, ex CSR SS Expense Growth, Guidance Midpoint

centerspacehomes.com 10 2025 TRANSACTION ACTIVITY

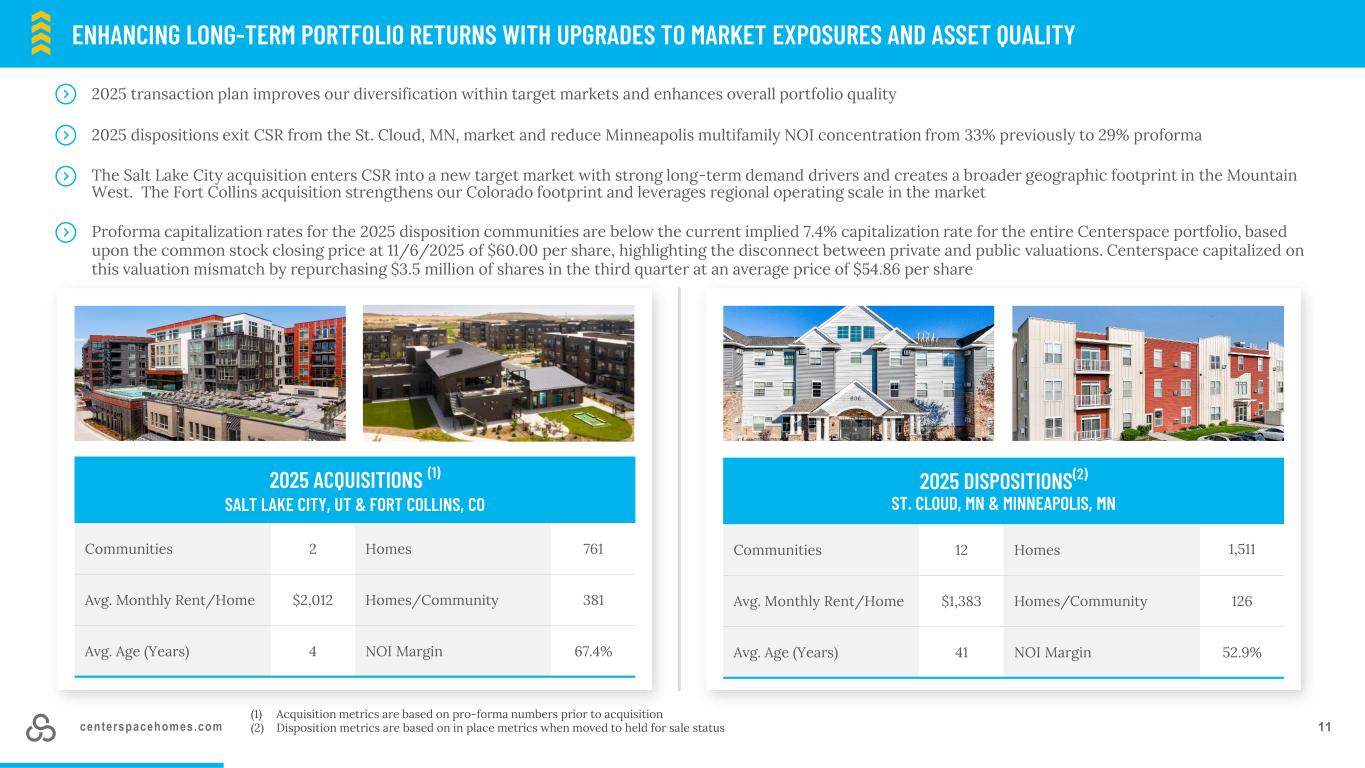

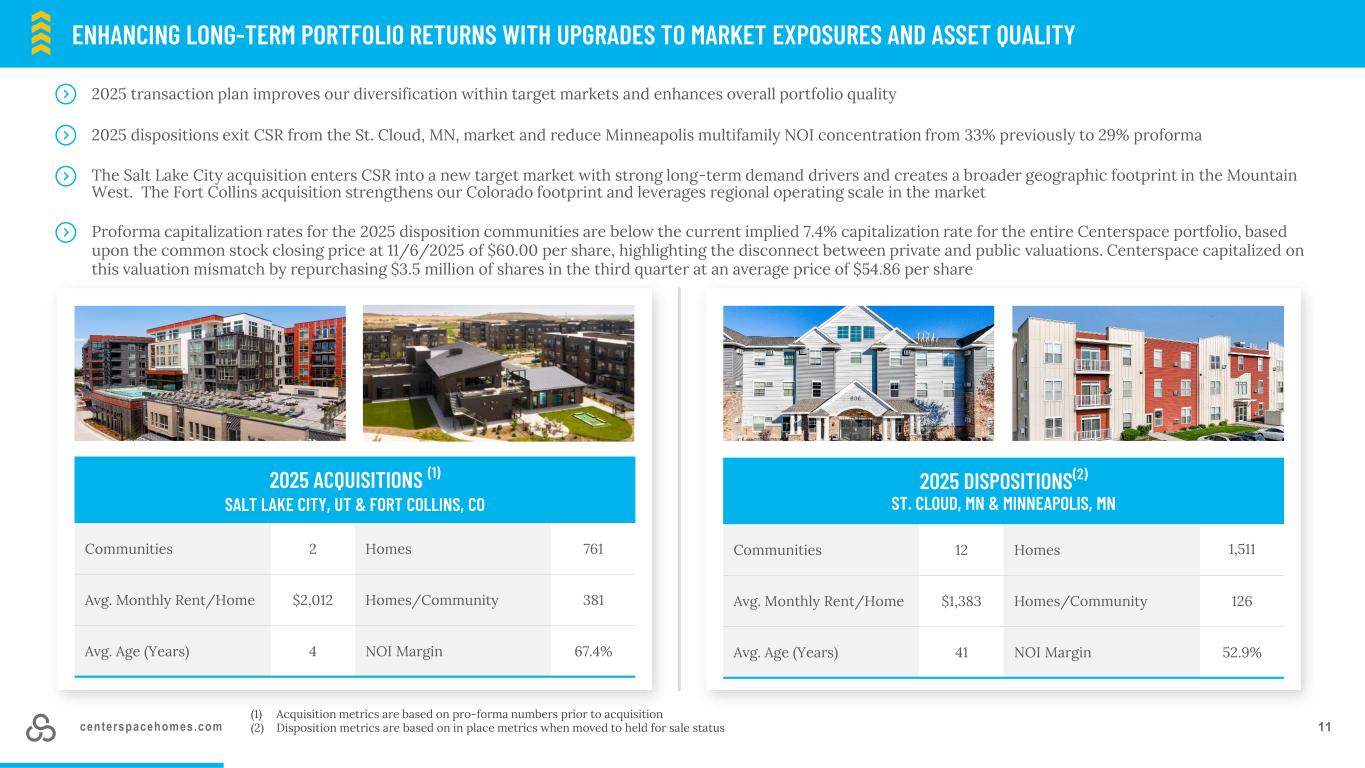

centerspacehomes.com ENHANCING LONG-TERM PORTFOLIO RETURNS WITH UPGRADES TO MARKET EXPOSURES AND ASSET QUALITY 11 2025 DISPOSITIONS(2) ST. CLOUD, MN & MINNEAPOLIS, MN Communities 12 Homes 1,511 Avg. Monthly Rent/Home $1,383 Homes/Community 126 Avg. Age (Years) 41 NOI Margin 52.9% 2025 ACQUISITIONS (1) SALT LAKE CITY, UT & FORT COLLINS, CO Communities 2 Homes 761 Avg. Monthly Rent/Home $2,012 Homes/Community 381 Avg. Age (Years) 4 NOI Margin 67.4% The Salt Lake City acquisition enters CSR into a new target market with strong long-term demand drivers and creates a broader geographic footprint in the Mountain West. The Fort Collins acquisition strengthens our Colorado footprint and leverages regional operating scale in the market Proforma capitalization rates for the 2025 disposition communities are below the current implied 7.4% capitalization rate for the entire Centerspace portfolio, based upon the common stock closing price at 11/6/2025 of $60.00 per share, highlighting the disconnect between private and public valuations. Centerspace capitalized on this valuation mismatch by repurchasing $3.5 million of shares in the third quarter at an average price of $54.86 per share 2025 dispositions exit CSR from the St. Cloud, MN, market and reduce Minneapolis multifamily NOI concentration from 33% previously to 29% proforma 2025 transaction plan improves our diversification within target markets and enhances overall portfolio quality (1) Acquisition metrics are based on pro-forma numbers prior to acquisition (2) Disposition metrics are based on in place metrics when moved to held for sale status

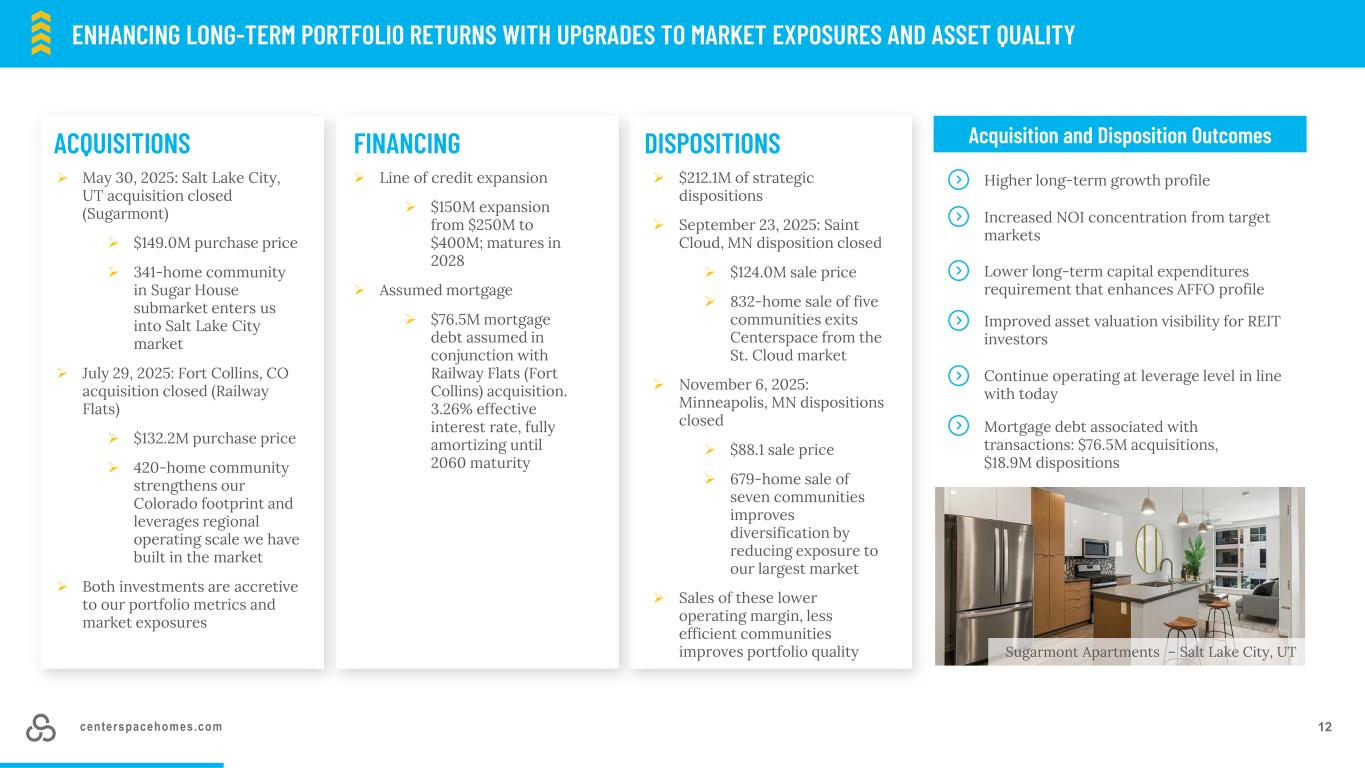

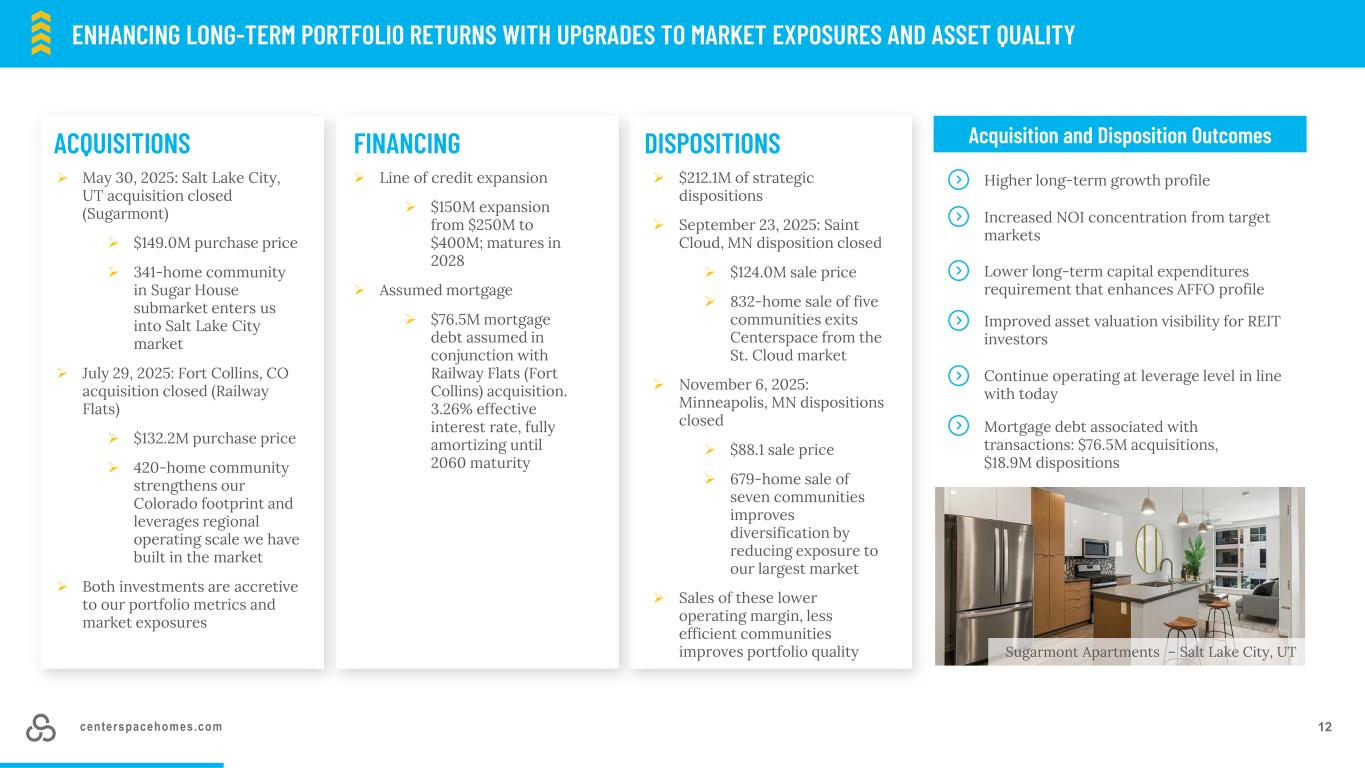

centerspacehomes.com 12 ➢ $212.1M of strategic dispositions ➢ September 23, 2025: Saint Cloud, MN disposition closed ➢ $124.0M sale price ➢ 832-home sale of five communities exits Centerspace from the St. Cloud market ➢ November 6, 2025: Minneapolis, MN dispositions closed ➢ $88.1 sale price ➢ 679-home sale of seven communities improves diversification by reducing exposure to our largest market ➢ Sales of these lower operating margin, less efficient communities improves portfolio quality DISPOSITIONSACQUISITIONS FINANCING ➢ May 30, 2025: Salt Lake City, UT acquisition closed (Sugarmont) ➢ $149.0M purchase price ➢ 341-home community in Sugar House submarket enters us into Salt Lake City market ➢ July 29, 2025: Fort Collins, CO acquisition closed (Railway Flats) ➢ $132.2M purchase price ➢ 420-home community strengthens our Colorado footprint and leverages regional operating scale we have built in the market ➢ Both investments are accretive to our portfolio metrics and market exposures ➢ Line of credit expansion ➢ $150M expansion from $250M to $400M; matures in 2028 ➢ Assumed mortgage ➢ $76.5M mortgage debt assumed in conjunction with Railway Flats (Fort Collins) acquisition. 3.26% effective interest rate, fully amortizing until 2060 maturity Acquisition and Disposition Outcomes Sugarmont Apartments – Salt Lake City, UT Higher long-term growth profile ENHANCING LONG-TERM PORTFOLIO RETURNS WITH UPGRADES TO MARKET EXPOSURES AND ASSET QUALITY Increased NOI concentration from target markets Lower long-term capital expenditures requirement that enhances AFFO profile Improved asset valuation visibility for REIT investors Continue operating at leverage level in line with today Mortgage debt associated with transactions: $76.5M acquisitions, $18.9M dispositions

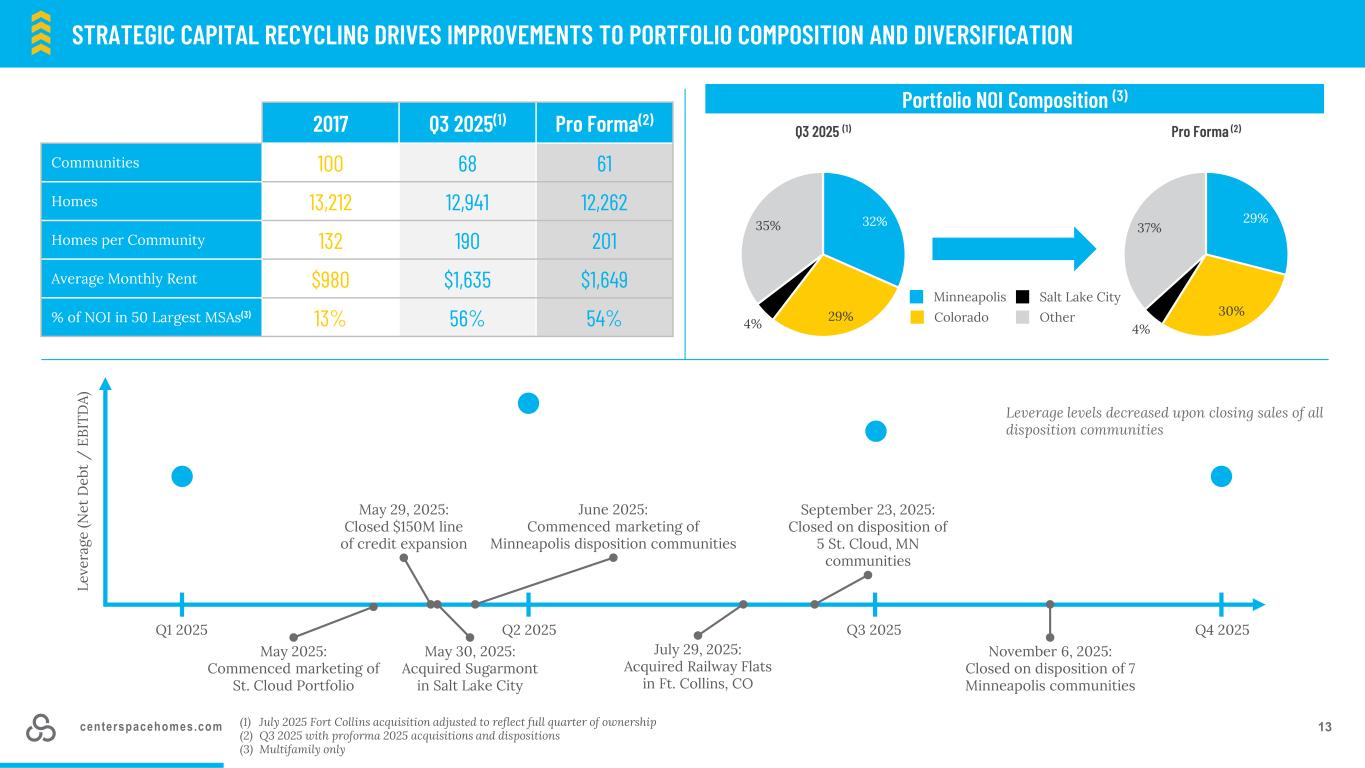

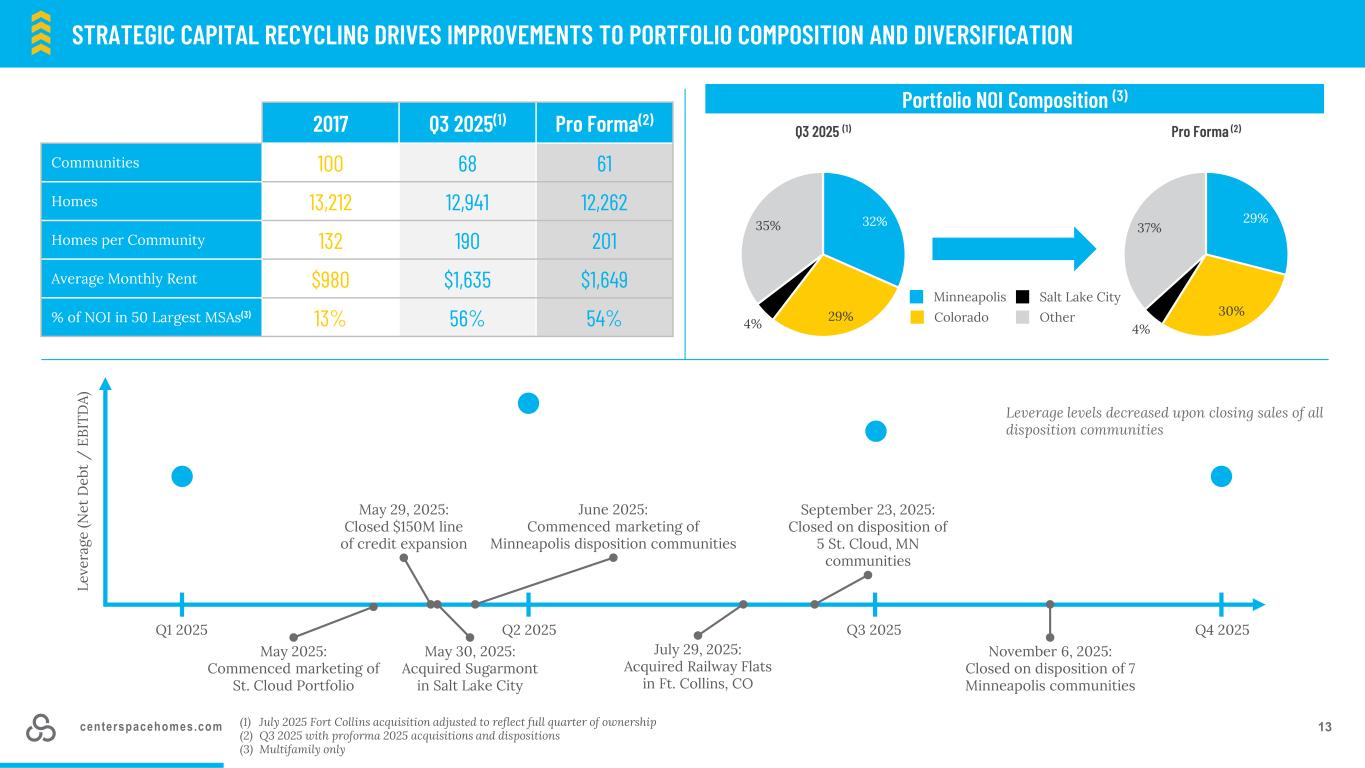

centerspacehomes.com 13 2017 Q3 2025(1) Pro Forma(2) Communities 100 68 61 Homes 13,212 12,941 12,262 Homes per Community 132 190 201 Average Monthly Rent $980 $1,635 $1,649 % of NOI in 50 Largest MSAs(3) 13% 56% 54% (1) July 2025 Fort Collins acquisition adjusted to reflect full quarter of ownership (2) Q3 2025 with proforma 2025 acquisitions and dispositions (3) Multifamily only STRATEGIC CAPITAL RECYCLING DRIVES IMPROVEMENTS TO PORTFOLIO COMPOSITION AND DIVERSIFICATION Minneapolis Colorado Salt Lake City Other Portfolio NOI Composition (3) May 29, 2025: Closed $150M line of credit expansion May 30, 2025: Acquired Sugarmont in Salt Lake City September 23, 2025: Closed on disposition of 5 St. Cloud, MN communities November 6, 2025: Closed on disposition of 7 Minneapolis communities July 29, 2025: Acquired Railway Flats in Ft. Collins, CO May 2025: Commenced marketing of St. Cloud Portfolio June 2025: Commenced marketing of Minneapolis disposition communities Q1 2025 Q3 2025Q2 2025 Le ve ra ge (N et D eb t / E BI T D A) Q4 2025 Leverage levels decreased upon closing sales of all disposition communities 32% 29%4% 35% Q3 2025 (1) 29% 30% 4% 37% Pro Forma (2)

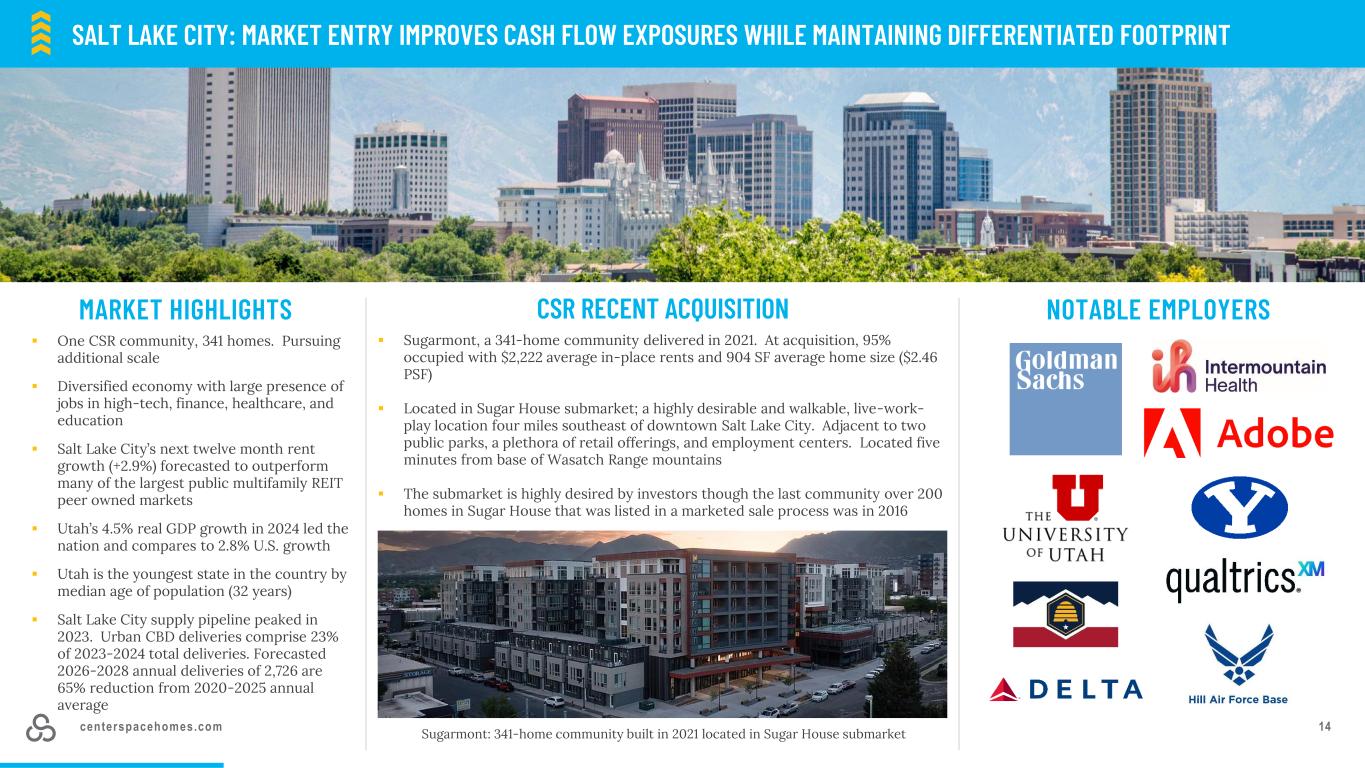

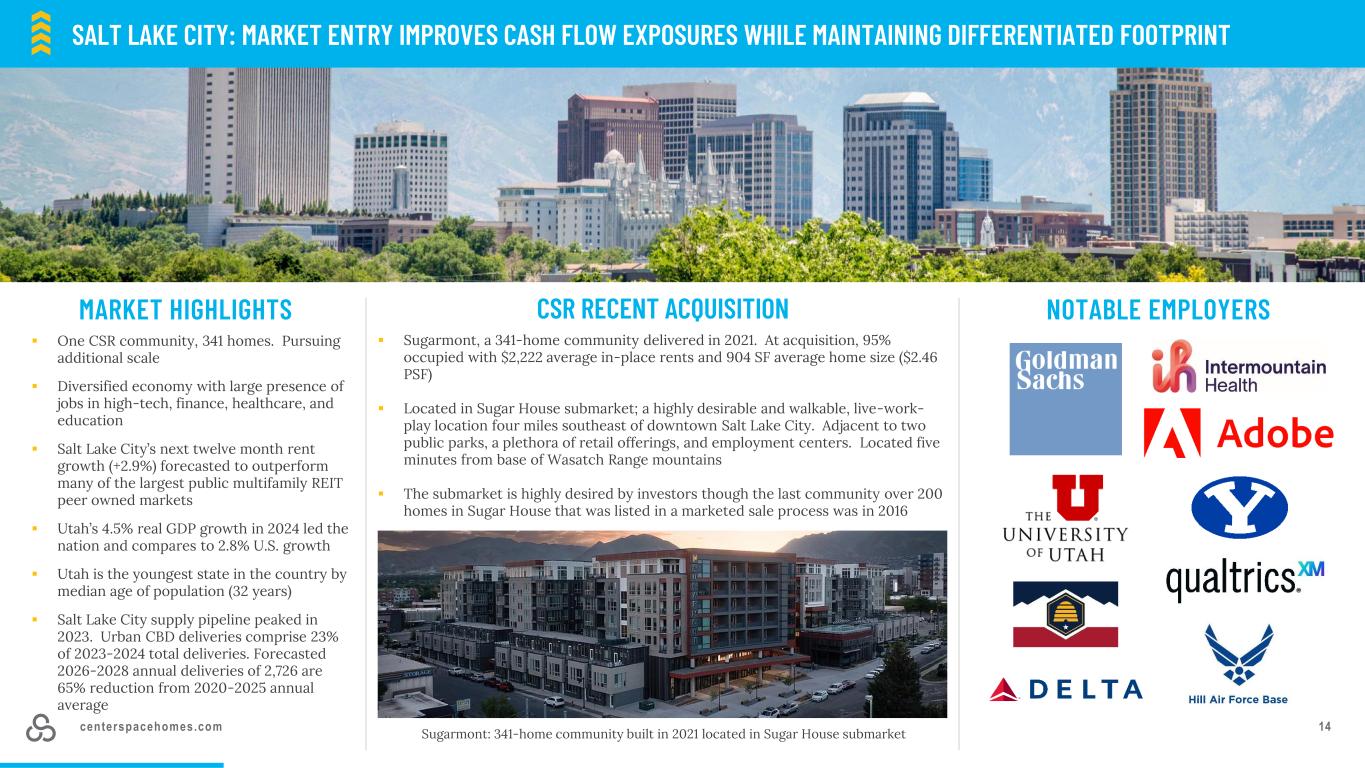

centerspacehomes.com 14 SALT LAKE CITY: MARKET ENTRY IMPROVES CASH FLOW EXPOSURES WHILE MAINTAINING DIFFERENTIATED FOOTPRINT ▪ One CSR community, 341 homes. Pursuing additional scale ▪ Diversified economy with large presence of jobs in high-tech, finance, healthcare, and education ▪ Salt Lake City’s next twelve month rent growth (+2.9%) forecasted to outperform many of the largest public multifamily REIT peer owned markets ▪ Utah’s 4.5% real GDP growth in 2024 led the nation and compares to 2.8% U.S. growth ▪ Utah is the youngest state in the country by median age of population (32 years) ▪ Salt Lake City supply pipeline peaked in 2023. Urban CBD deliveries comprise 23% of 2023-2024 total deliveries. Forecasted 2026-2028 annual deliveries of 2,726 are 65% reduction from 2020-2025 annual average MARKET HIGHLIGHTS NOTABLE EMPLOYERSCSR RECENT ACQUISITION ▪ Sugarmont, a 341-home community delivered in 2021. At acquisition, 95% occupied with $2,222 average in-place rents and 904 SF average home size ($2.46 PSF) ▪ Located in Sugar House submarket; a highly desirable and walkable, live-work- play location four miles southeast of downtown Salt Lake City. Adjacent to two public parks, a plethora of retail offerings, and employment centers. Located five minutes from base of Wasatch Range mountains ▪ The submarket is highly desired by investors though the last community over 200 homes in Sugar House that was listed in a marketed sale process was in 2016 Sugarmont: 341-home community built in 2021 located in Sugar House submarket

centerspacehomes.com 15 INNOVATION – PROVIDING DIFFERENTIATED EXPOSURESALT LAKE CITY: EXPANSION INTO HIGH-GROWTH INSTITUTIONAL MARKET Salt Lake City is the most supply constrained market relative to total population among largest publicly-traded multifamily REIT peer markets Lower supply relative to population provides pricing power and runway for rent growth including when coupled with the market’s sustainable economic growth outlook Sources: US Census Bureau, CoStar Notes: Q2 2024 inventory compared to 7/1/24 estimated population. Salt Lake City includes Salt Lake City, Provo, and Ogden MSAs. Salt Lake City Demand Drivers Strong demographic trends Business-friendliness Desirable quality of life Diversified economy Higher education institutions Emerging institutional market Sustainable growth outlook Fiscal stability #2 ranking in Milken Institute’s 2025 Best- Performing Large Cities index(1). Measuring 13 metrics related to labor market conditions, high- tech growth, access to economic opportunities #1 ranking in U.S. News & World Report’s 2025 Best States index(2). Measuring metrics across eight categories: economy, natural environment, fiscal stability, health care, education, infrastructure, crime, opportunity (1) Includes Ogden-Clearfield, UT MSA, ranked #2, and Salt Lake City, UT MSA, ranked #3; both of which are in the Salt Lake City Valley. Provo-Orem, UT MSA, also located in Salt Lake City Valley, ranked #15 (2) #1 ranking is for State of Utah 2.7M Salt Lake City metro population compares to Nashville (2.2M), Austin (2.6M), Charlotte (2.9M), Orlando (2.9M), Denver (3.1M), Minneapolis (3.8M) 5.2 5.6 6.4 6.7 7.4 7.6 7.6 7.7 7.9 8.1 8.1 8.5 8.8 9.0 9.2 9.4 9.8 10.0 10.5 11.8 Multifamily Inventory (Apartment Homes) per 100 People

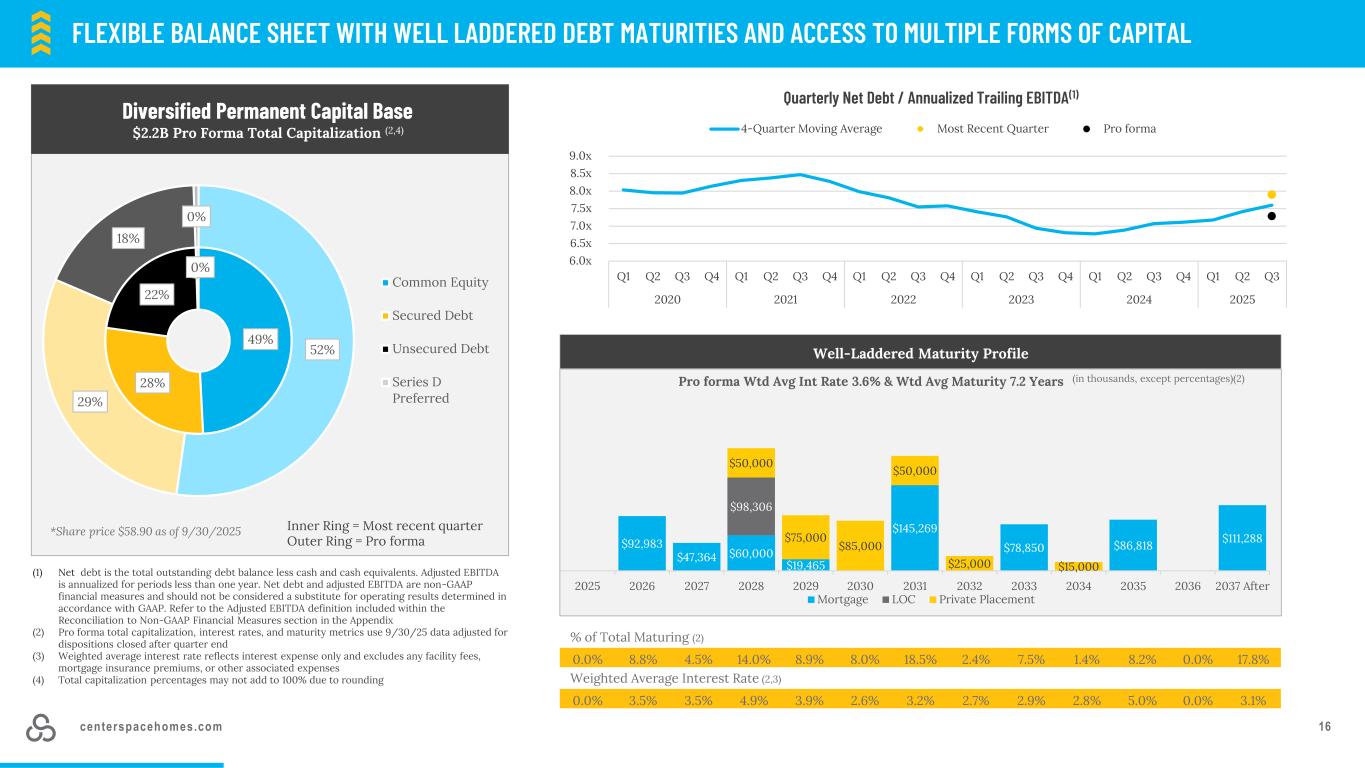

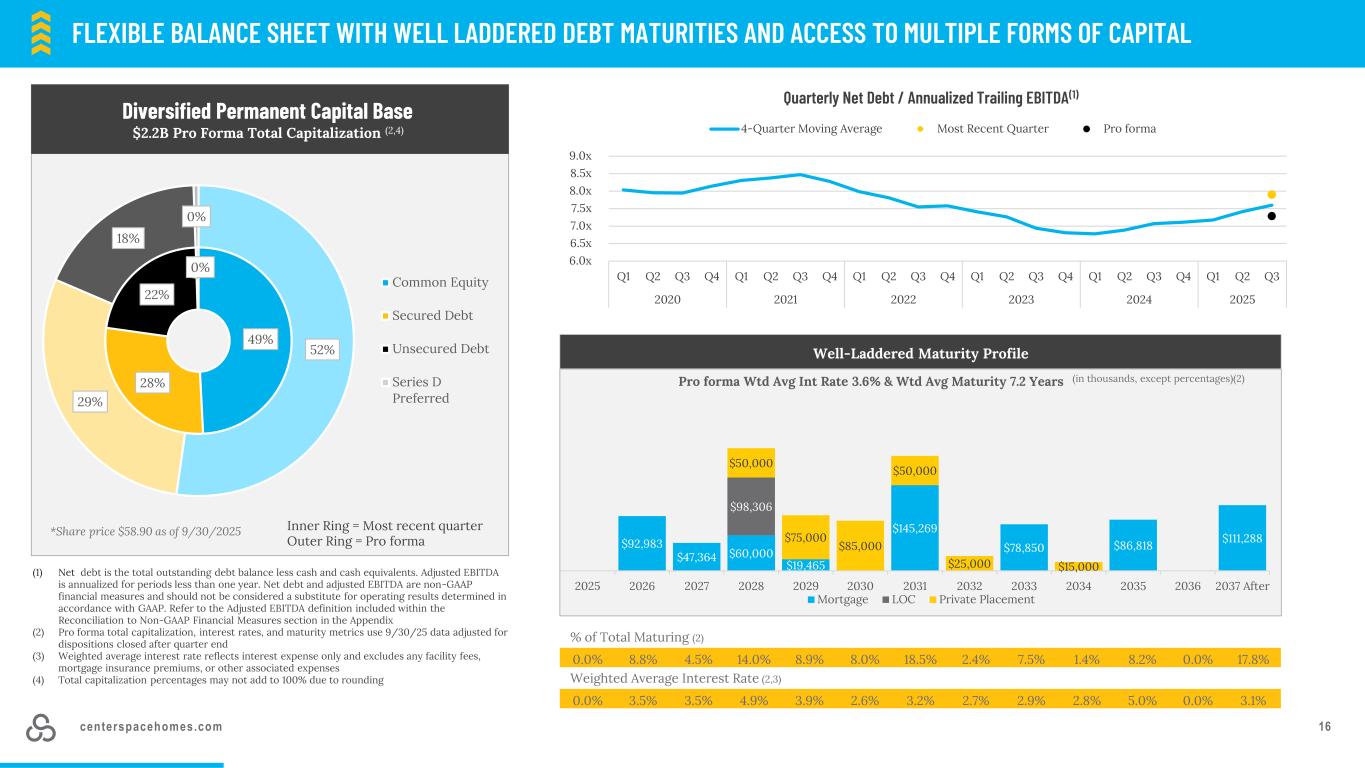

centerspacehomes.com 16 (1) Net debt is the total outstanding debt balance less cash and cash equivalents. Adjusted EBITDA is annualized for periods less than one year. Net debt and adjusted EBITDA are non-GAAP financial measures and should not be considered a substitute for operating results determined in accordance with GAAP. Refer to the Adjusted EBITDA definition included within the Reconciliation to Non-GAAP Financial Measures section in the Appendix (2) Pro forma total capitalization, interest rates, and maturity metrics use 9/30/25 data adjusted for dispositions closed after quarter end (3) Weighted average interest rate reflects interest expense only and excludes any facility fees, mortgage insurance premiums, or other associated expenses (4) Total capitalization percentages may not add to 100% due to rounding FLEXIBLE BALANCE SHEET WITH WELL LADDERED DEBT MATURITIES AND ACCESS TO MULTIPLE FORMS OF CAPITAL *Share price $58.90 as of 9/30/2025 Diversified Permanent Capital Base $2.2B Pro Forma Total Capitalization (2,4) % of Total Maturing (2) 0.0% 8.8% 4.5% 14.0% 8.9% 8.0% 18.5% 2.4% 7.5% 1.4% 8.2% 0.0% 17.8% Weighted Average Interest Rate (2,3) 0.0% 3.5% 3.5% 4.9% 3.9% 2.6% 3.2% 2.7% 2.9% 2.8% 5.0% 0.0% 3.1% Well-Laddered Maturity Profile Pro forma Wtd Avg Int Rate 3.6% & Wtd Avg Maturity 7.2 Years (in thousands, except percentages)(2) 49% 28% 22% 0% 52% 29% 18% 0% Common Equity Secured Debt Unsecured Debt Series D Preferred Inner Ring = Most recent quarter Outer Ring = Pro forma $92,983 $47,364 $60,000 $19,465 $145,269 $78,850 $86,818 $111,288 $98,306 $50,000 $75,000 $85,000 $50,000 $25,000 $15,000 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 After Mortgage LOC Private Placement 6.0x 6.5x 7.0x 7.5x 8.0x 8.5x 9.0x Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2020 2021 2022 2023 2024 2025 Quarterly Net Debt / Annualized Trailing EBITDA(1) 4-Quarter Moving Average Most Recent Quarter Pro forma

centerspacehomes.com 17 STRONG FUNDAMENTALS

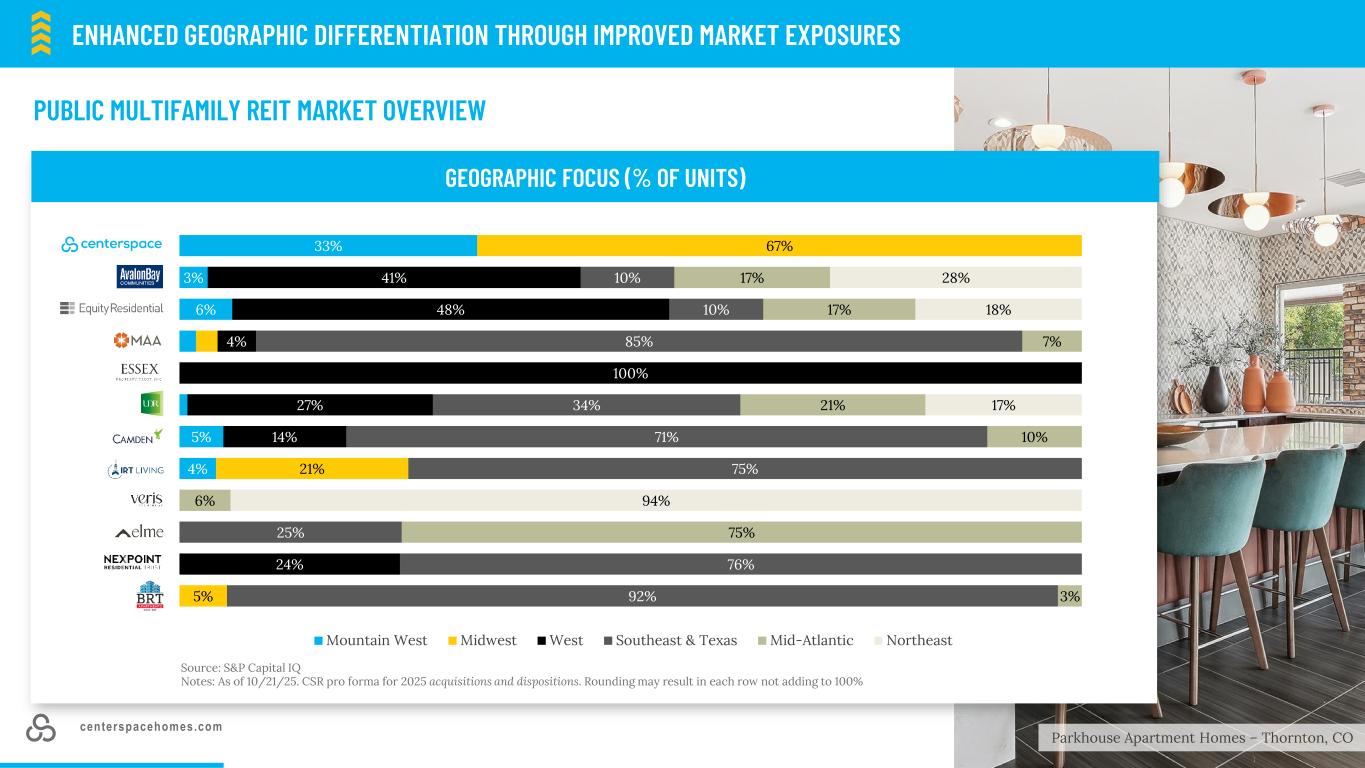

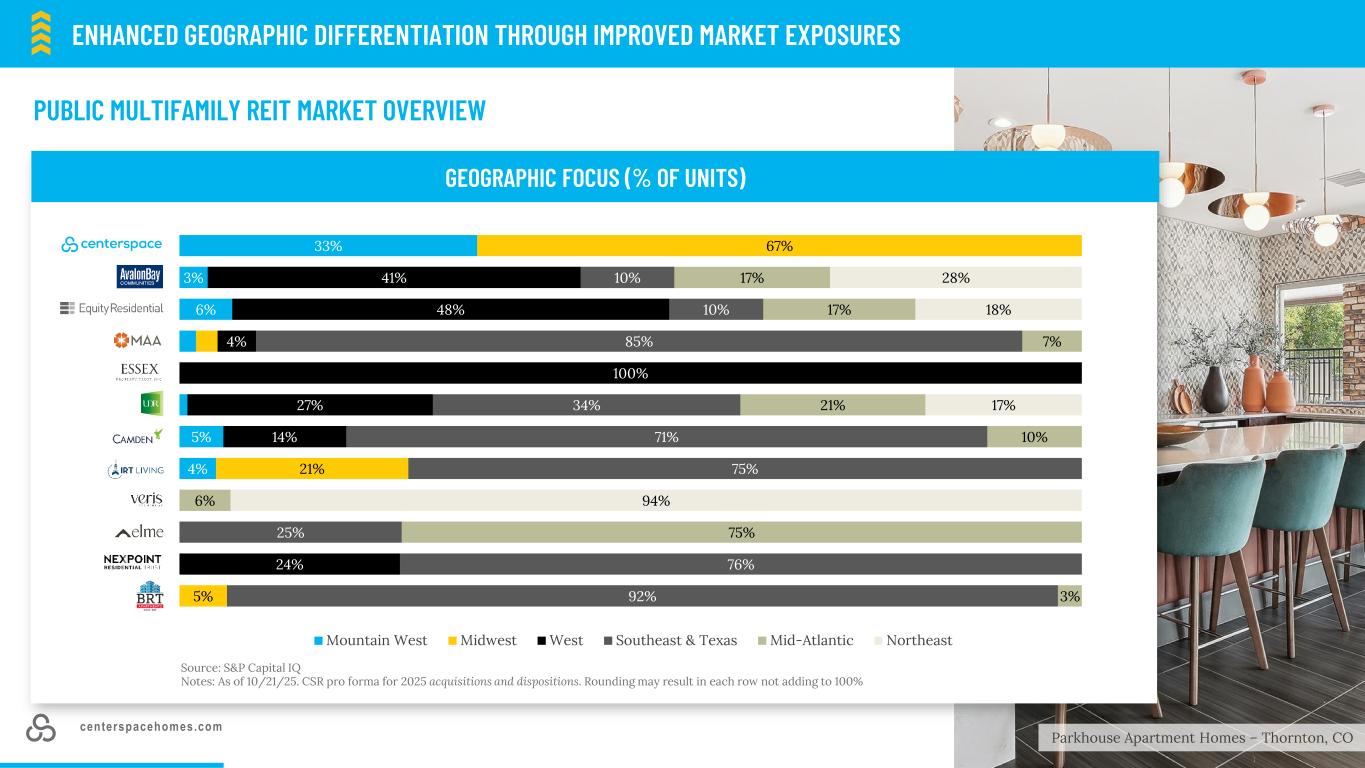

centerspacehomes.com 18Parkhouse Apartment Homes – Thornton, CO GEOGRAPHIC FOCUS (% OF UNITS) Source: S&P Capital IQ Notes: As of 10/21/25. CSR pro forma for 2025 acquisitions and dispositions. Rounding may result in each row not adding to 100% ENHANCED GEOGRAPHIC DIFFERENTIATION THROUGH IMPROVED MARKET EXPOSURES PUBLIC MULTIFAMILY REIT MARKET OVERVIEW 33% 3% 6% 5% 4% 67% 21% 5% 41% 48% 4% 100% 27% 14% 24% 10% 10% 85% 34% 71% 75% 25% 76% 92% 17% 17% 7% 21% 10% 6% 75% 3% 28% 18% 17% 94% Mountain West Midwest West Southeast & Texas Mid-Atlantic Northeast

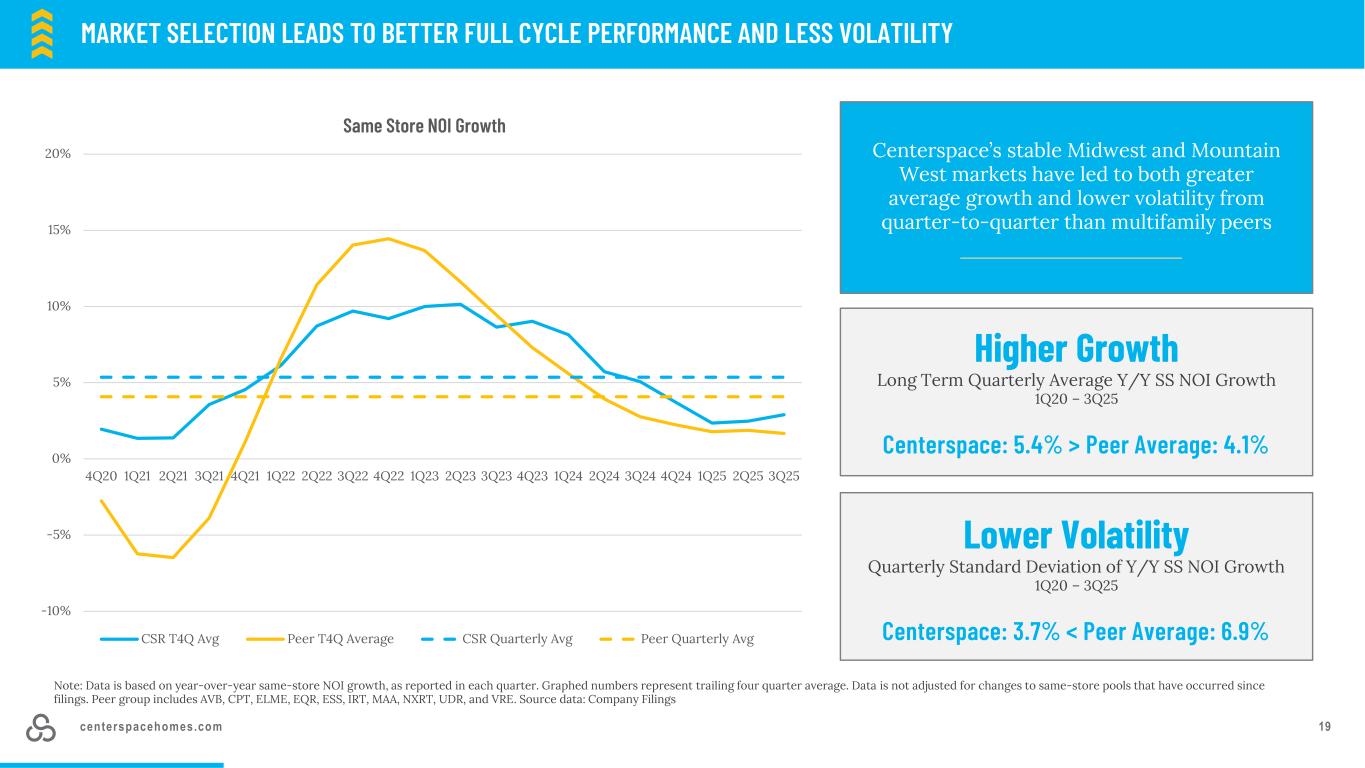

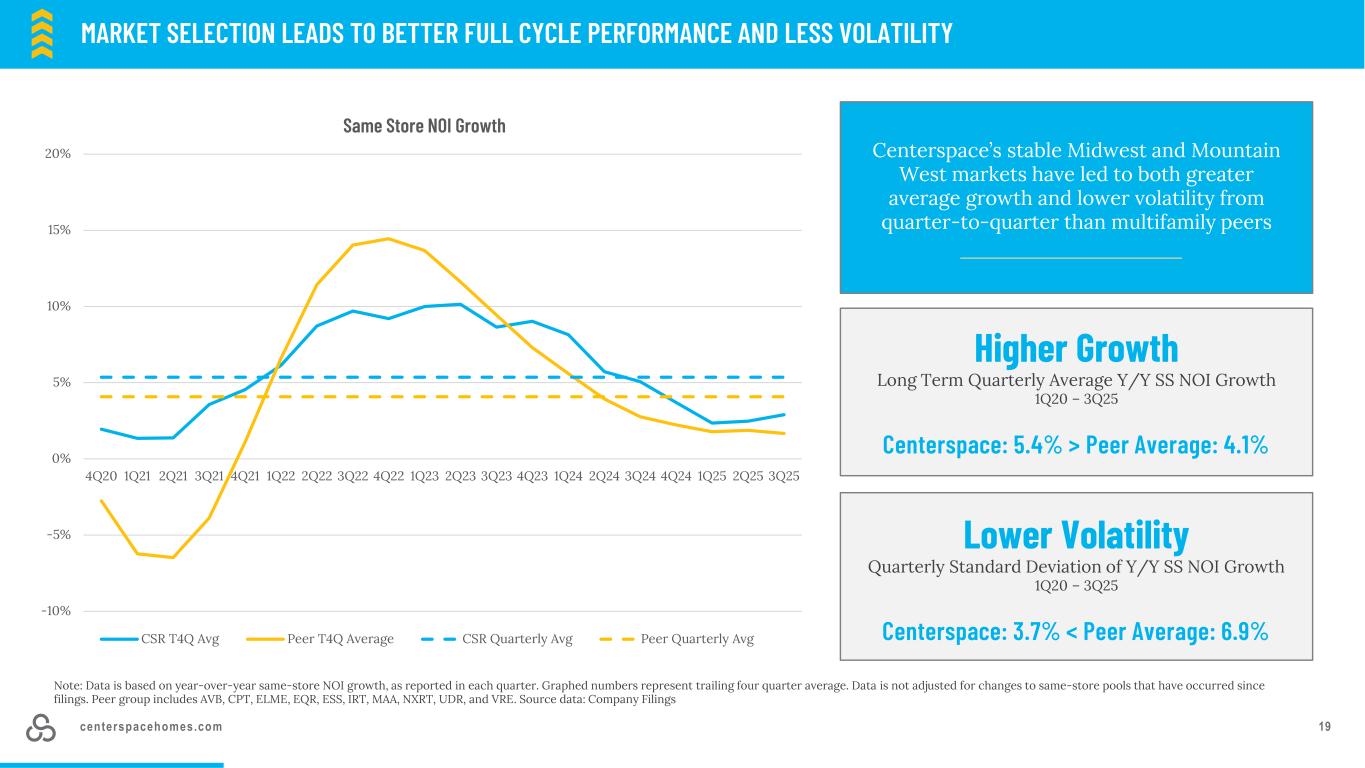

centerspacehomes.com 19 MARKET SELECTION LEADS TO BETTER FULL CYCLE PERFORMANCE AND LESS VOLATILITY Centerspace’s stable Midwest and Mountain West markets have led to both greater average growth and lower volatility from quarter-to-quarter than multifamily peers Higher Growth Long Term Quarterly Average Y/Y SS NOI Growth 1Q20 – 3Q25 Centerspace: 5.4% > Peer Average: 4.1% Lower Volatility Quarterly Standard Deviation of Y/Y SS NOI Growth 1Q20 – 3Q25 Centerspace: 3.7% < Peer Average: 6.9% Note: Data is based on year-over-year same-store NOI growth, as reported in each quarter. Graphed numbers represent trailing four quarter average. Data is not adjusted for changes to same-store pools that have occurred since filings. Peer group includes AVB, CPT, ELME, EQR, ESS, IRT, MAA, NXRT, UDR, and VRE. Source data: Company Filings -10% -5% 0% 5% 10% 15% 20% 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Same Store NOI Growth CSR T4Q Avg Peer T4Q Average CSR Quarterly Avg Peer Quarterly Avg

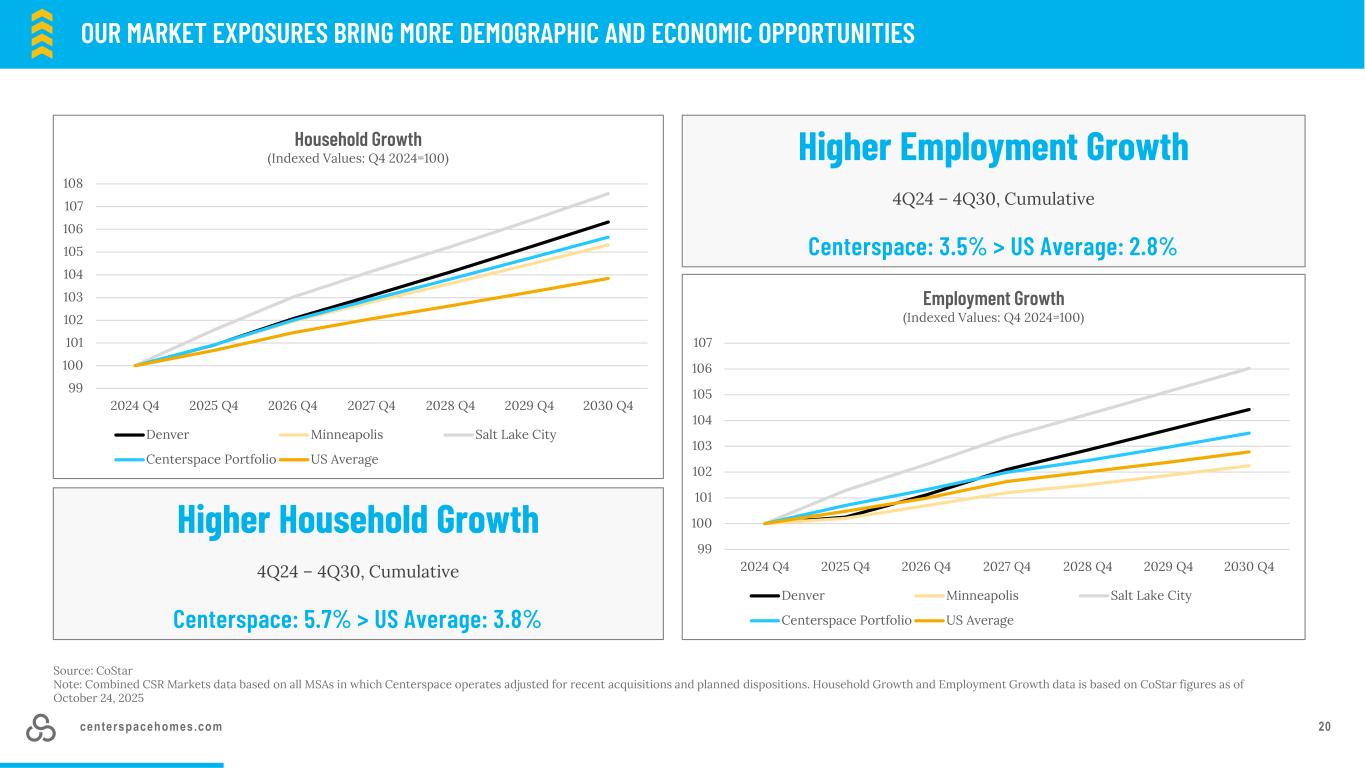

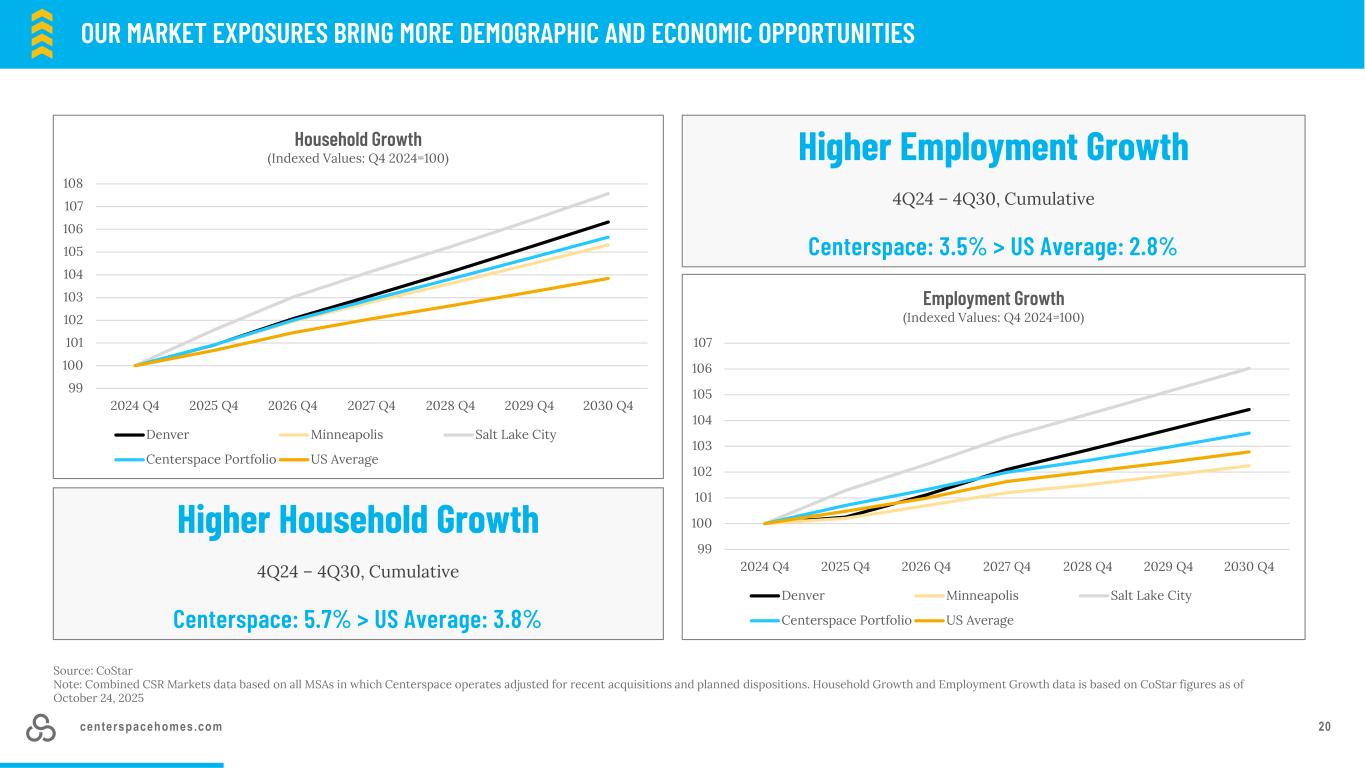

centerspacehomes.com 20 OUR MARKET EXPOSURES BRING MORE DEMOGRAPHIC AND ECONOMIC OPPORTUNITIES Higher Employment Growth 4Q24 – 4Q30, Cumulative Centerspace: 3.5% > US Average: 2.8% Higher Household Growth 4Q24 – 4Q30, Cumulative Centerspace: 5.7% > US Average: 3.8% Source: CoStar Note: Combined CSR Markets data based on all MSAs in which Centerspace operates adjusted for recent acquisitions and planned dispositions. Household Growth and Employment Growth data is based on CoStar figures as of October 24, 2025 99 100 101 102 103 104 105 106 107 2024 Q4 2025 Q4 2026 Q4 2027 Q4 2028 Q4 2029 Q4 2030 Q4 Employment Growth (Indexed Values: Q4 2024=100) Denver Minneapolis Salt Lake City Centerspace Portfolio US Average 99 100 101 102 103 104 105 106 107 108 2024 Q4 2025 Q4 2026 Q4 2027 Q4 2028 Q4 2029 Q4 2030 Q4 Household Growth (Indexed Values: Q4 2024=100) Denver Minneapolis Salt Lake City Centerspace Portfolio US Average

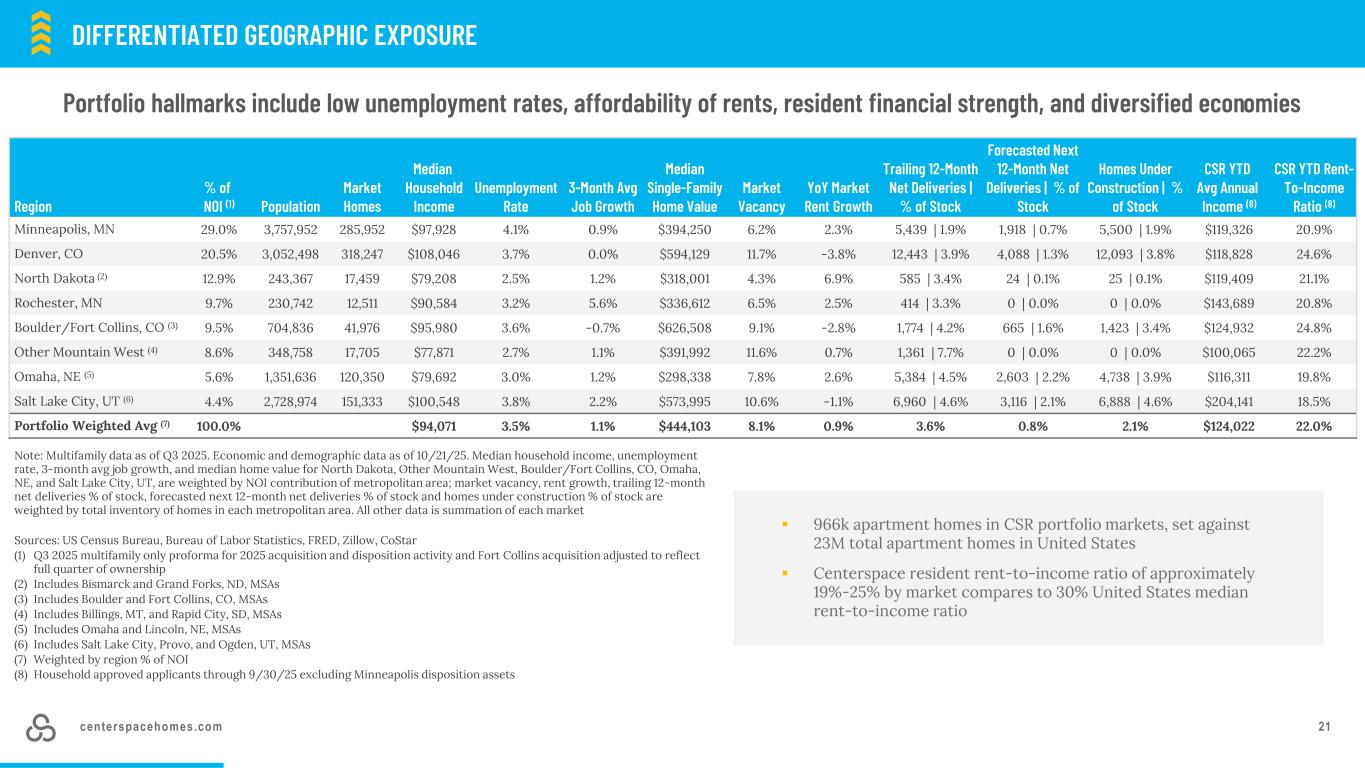

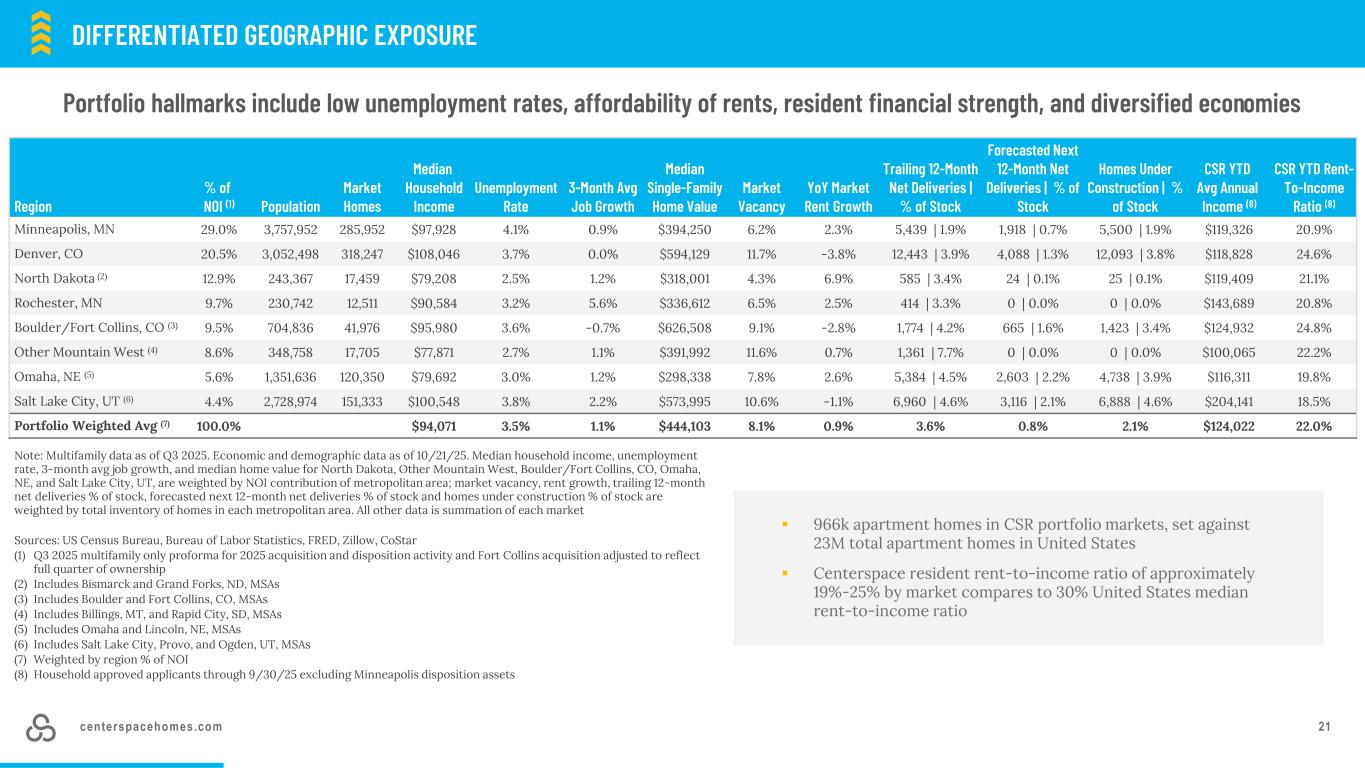

centerspacehomes.com 21 Region % of NOI (1) Population Market Homes Median Household Income Unemployment Rate 3-Month Avg Job Growth Median Single-Family Home Value Market Vacancy YoY Market Rent Growth Trailing 12-Month Net Deliveries | % of Stock Forecasted Next 12-Month Net Deliveries | % of Stock Homes Under Construction | % of Stock CSR YTD Avg Annual Income (8) CSR YTD Rent- To-Income Ratio (8) Minneapolis, MN 29.0% 3,757,952 285,952 $97,928 4.1% 0.9% $394,250 6.2% 2.3% 5,439 | 1.9% 1,918 | 0.7% 5,500 | 1.9% $119,326 20.9% Denver, CO 20.5% 3,052,498 318,247 $108,046 3.7% 0.0% $594,129 11.7% -3.8% 12,443 | 3.9% 4,088 | 1.3% 12,093 | 3.8% $118,828 24.6% North Dakota (2) 12.9% 243,367 17,459 $79,208 2.5% 1.2% $318,001 4.3% 6.9% 585 | 3.4% 24 | 0.1% 25 | 0.1% $119,409 21.1% Rochester, MN 9.7% 230,742 12,511 $90,584 3.2% 5.6% $336,612 6.5% 2.5% 414 | 3.3% 0 | 0.0% 0 | 0.0% $143,689 20.8% Boulder/Fort Collins, CO (3) 9.5% 704,836 41,976 $95,980 3.6% -0.7% $626,508 9.1% -2.8% 1,774 | 4.2% 665 | 1.6% 1,423 | 3.4% $124,932 24.8% Other Mountain West (4) 8.6% 348,758 17,705 $77,871 2.7% 1.1% $391,992 11.6% 0.7% 1,361 | 7.7% 0 | 0.0% 0 | 0.0% $100,065 22.2% Omaha, NE (5) 5.6% 1,351,636 120,350 $79,692 3.0% 1.2% $298,338 7.8% 2.6% 5,384 | 4.5% 2,603 | 2.2% 4,738 | 3.9% $116,311 19.8% Salt Lake City, UT (6) 4.4% 2,728,974 151,333 $100,548 3.8% 2.2% $573,995 10.6% -1.1% 6,960 | 4.6% 3,116 | 2.1% 6,888 | 4.6% $204,141 18.5% Portfolio Weighted Avg (7) 100.0% $94,071 3.5% 1.1% $444,103 8.1% 0.9% 3.6% 0.8% 2.1% $124,022 22.0% Note: Multifamily data as of Q3 2025. Economic and demographic data as of 10/21/25. Median household income, unemployment rate, 3-month avg job growth, and median home value for North Dakota, Other Mountain West, Boulder/Fort Collins, CO, Omaha, NE, and Salt Lake City, UT, are weighted by NOI contribution of metropolitan area; market vacancy, rent growth, trailing 12-month net deliveries % of stock, forecasted next 12-month net deliveries % of stock and homes under construction % of stock are weighted by total inventory of homes in each metropolitan area. All other data is summation of each market Sources: US Census Bureau, Bureau of Labor Statistics, FRED, Zillow, CoStar (1) Q3 2025 multifamily only proforma for 2025 acquisition and disposition activity and Fort Collins acquisition adjusted to reflect full quarter of ownership (2) Includes Bismarck and Grand Forks, ND, MSAs (3) Includes Boulder and Fort Collins, CO, MSAs (4) Includes Billings, MT, and Rapid City, SD, MSAs (5) Includes Omaha and Lincoln, NE, MSAs (6) Includes Salt Lake City, Provo, and Ogden, UT, MSAs (7) Weighted by region % of NOI (8) Household approved applicants through 9/30/25 excluding Minneapolis disposition assets INNOVATION – PROVIDING DIFFERENTIATED EXPOSURE ▪ 966k apartment homes in CSR portfolio markets, set against 23M total apartment homes in United States ▪ Centerspace resident rent-to-income ratio of approximately 19%-25% by market compares to 30% United States median rent-to-income ratio DIFFERENTIATED GEOGRAPHIC EXPOSURE Portfolio hallmarks include low unemployment rates, affordability of rents, resident financial strength, and diversified economies

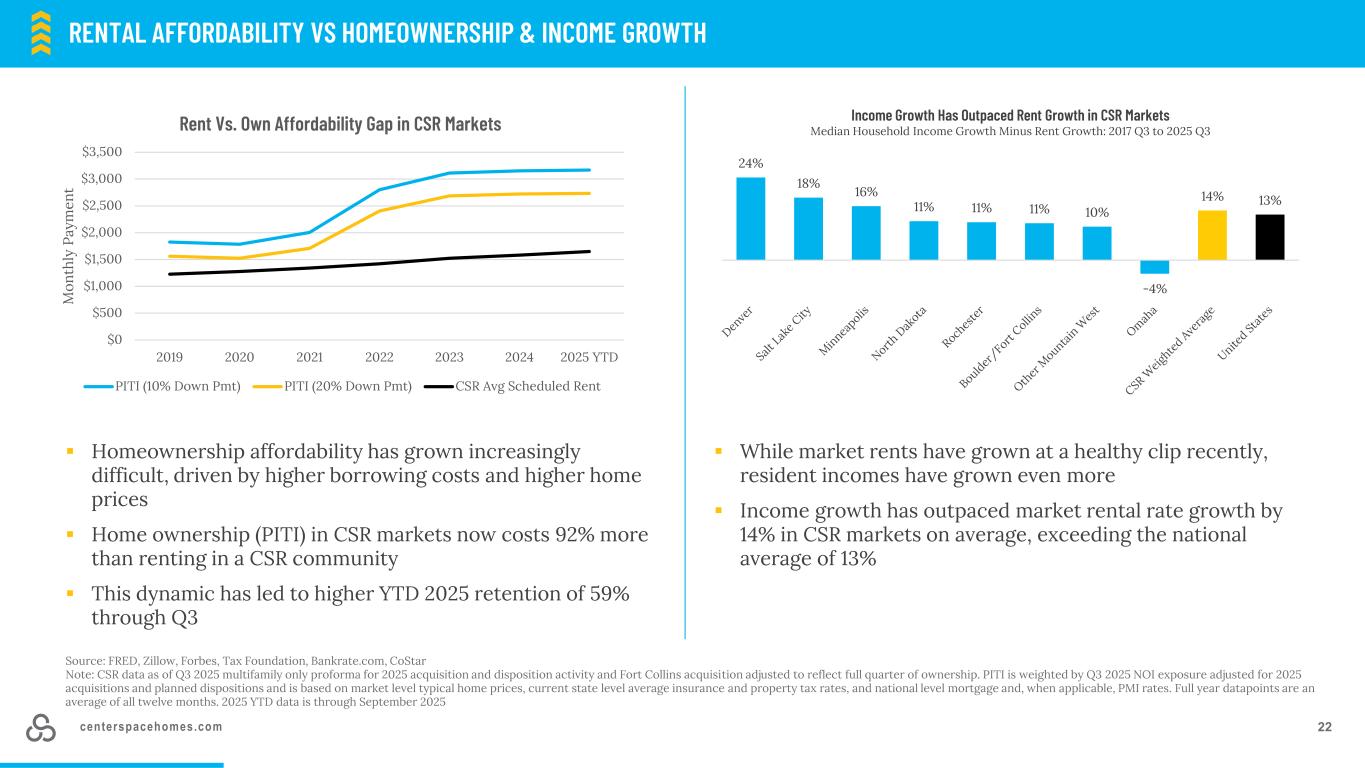

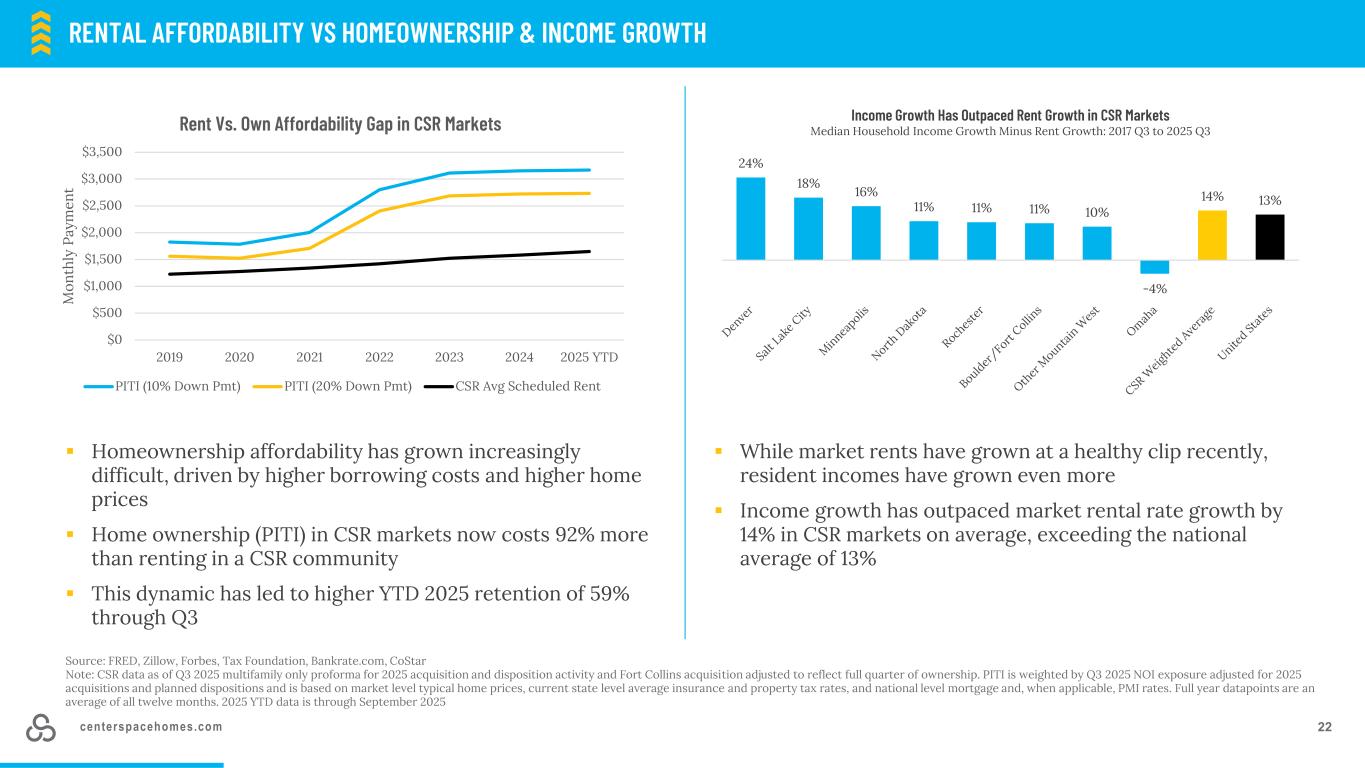

centerspacehomes.com 22 ▪ Homeownership affordability has grown increasingly difficult, driven by higher borrowing costs and higher home prices ▪ Home ownership (PITI) in CSR markets now costs 92% more than renting in a CSR community ▪ This dynamic has led to higher YTD 2025 retention of 59% through Q3 ▪ While market rents have grown at a healthy clip recently, resident incomes have grown even more ▪ Income growth has outpaced market rental rate growth by 14% in CSR markets on average, exceeding the national average of 13% Source: FRED, Zillow, Forbes, Tax Foundation, Bankrate.com, CoStar Note: CSR data as of Q3 2025 multifamily only proforma for 2025 acquisition and disposition activity and Fort Collins acquisition adjusted to reflect full quarter of ownership. PITI is weighted by Q3 2025 NOI exposure adjusted for 2025 acquisitions and planned dispositions and is based on market level typical home prices, current state level average insurance and property tax rates, and national level mortgage and, when applicable, PMI rates. Full year datapoints are an average of all twelve months. 2025 YTD data is through September 2025 RENTAL AFFORDABILITY VS HOMEOWNERSHIP & INCOME GROWTH 24% 18% 16% 11% 11% 11% 10% -4% 14% 13% Income Growth Has Outpaced Rent Growth in CSR Markets Median Household Income Growth Minus Rent Growth: 2017 Q3 to 2025 Q3 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2019 2020 2021 2022 2023 2024 2025 YTD M on th ly P ay m en t Rent Vs. Own Affordability Gap in CSR Markets PITI (10% Down Pmt) PITI (20% Down Pmt) CSR Avg Scheduled Rent

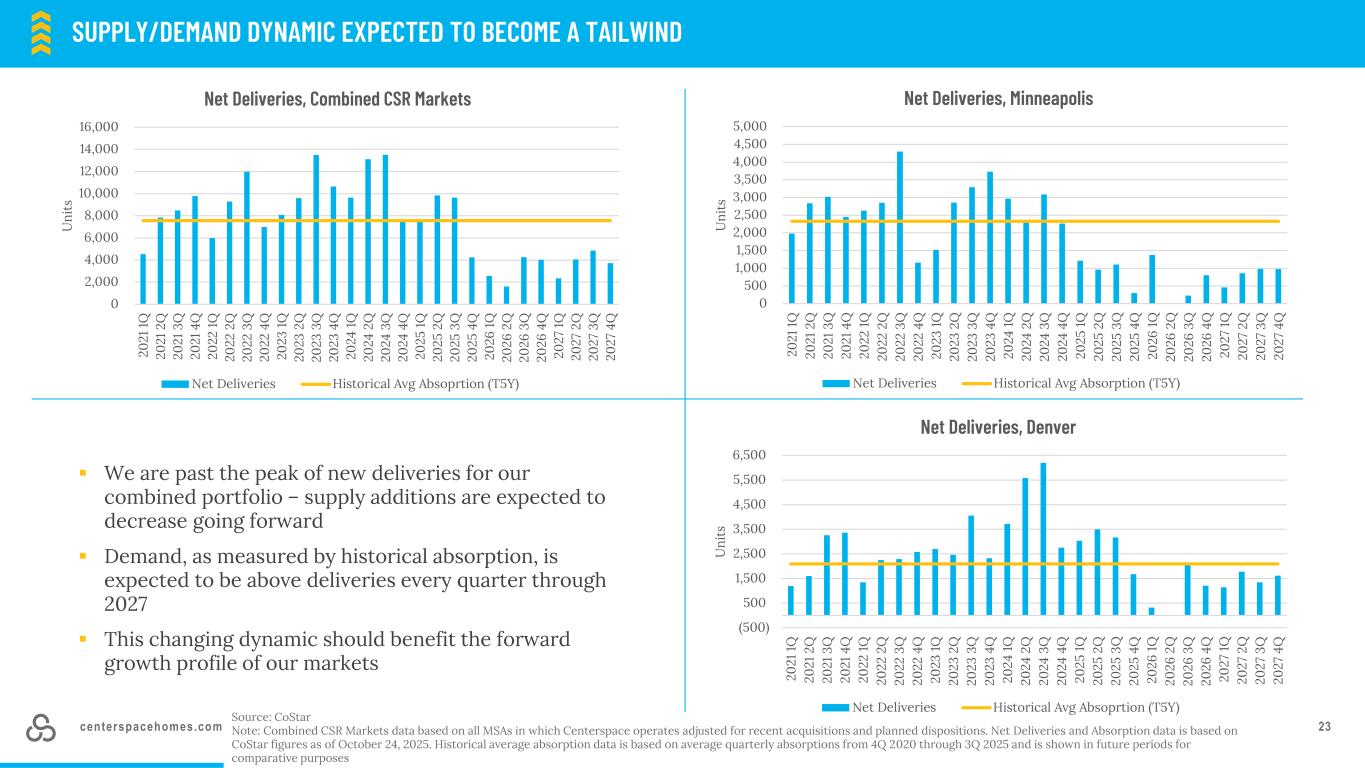

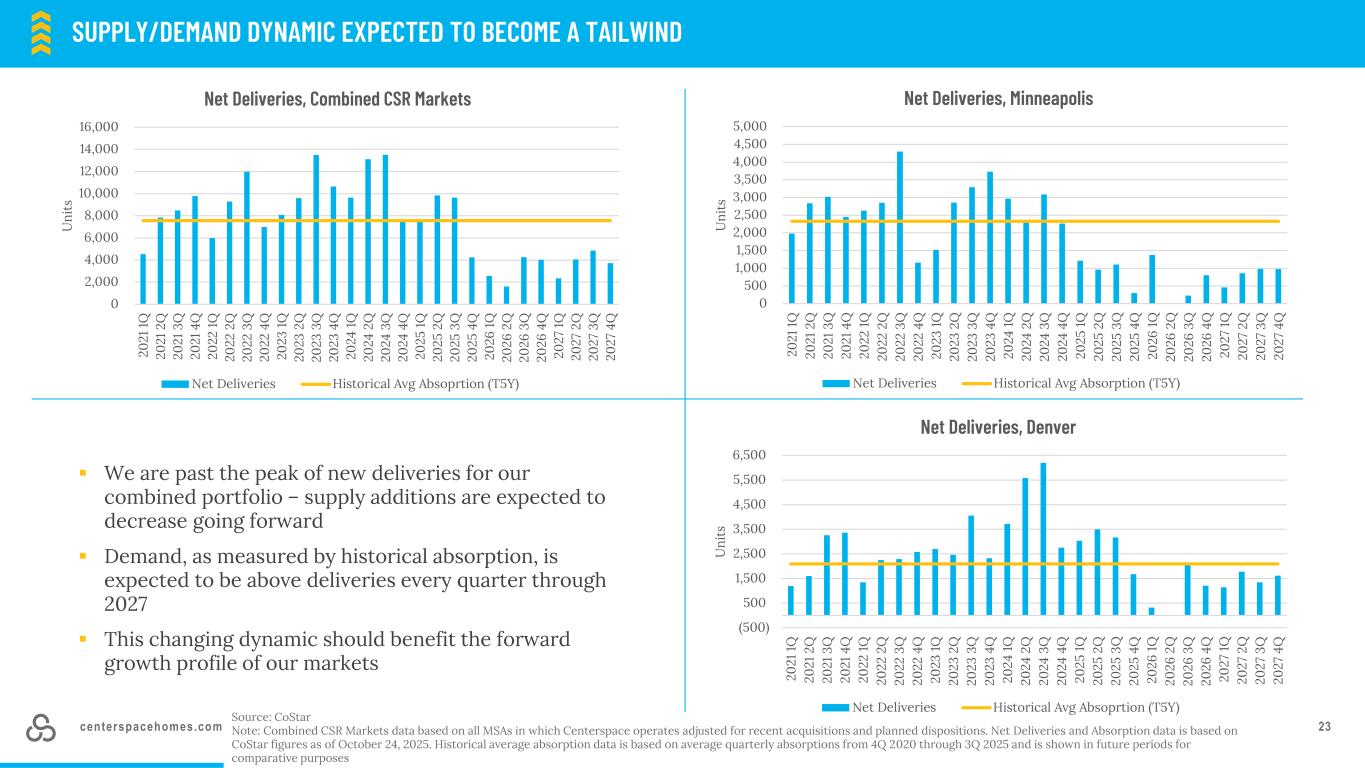

centerspacehomes.com 23 SUPPLY/DEMAND DYNAMIC EXPECTED TO BECOME A TAILWIND Source: CoStar Note: Combined CSR Markets data based on all MSAs in which Centerspace operates adjusted for recent acquisitions and planned dispositions. Net Deliveries and Absorption data is based on CoStar figures as of October 24, 2025. Historical average absorption data is based on average quarterly absorptions from 4Q 2020 through 3Q 2025 and is shown in future periods for comparative purposes ▪ We are past the peak of new deliveries for our combined portfolio – supply additions are expected to decrease going forward ▪ Demand, as measured by historical absorption, is expected to be above deliveries every quarter through 2027 ▪ This changing dynamic should benefit the forward growth profile of our markets 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 20 21 1Q 20 21 2 Q 20 21 3 Q 20 21 4 Q 20 22 1Q 20 22 2 Q 20 22 3 Q 20 22 4 Q 20 23 1Q 20 23 2 Q 20 23 3 Q 20 23 4 Q 20 24 1Q 20 24 2 Q 20 24 3 Q 20 24 4 Q 20 25 1Q 20 25 2 Q 20 25 3 Q 20 25 4 Q 20 26 1Q 20 26 2 Q 20 26 3 Q 20 26 4 Q 20 27 1Q 20 27 2 Q 20 27 3 Q 20 27 4 Q U ni ts Net Deliveries, Combined CSR Markets Net Deliveries Historical Avg Absoprtion (T5Y) 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 20 21 1Q 20 21 2 Q 20 21 3 Q 20 21 4 Q 20 22 1Q 20 22 2 Q 20 22 3 Q 20 22 4 Q 20 23 1Q 20 23 2 Q 20 23 3 Q 20 23 4 Q 20 24 1Q 20 24 2 Q 20 24 3 Q 20 24 4 Q 20 25 1Q 20 25 2 Q 20 25 3 Q 20 25 4 Q 20 26 1Q 20 26 2 Q 20 26 3 Q 20 26 4 Q 20 27 1Q 20 27 2 Q 20 27 3 Q 20 27 4 Q U ni ts Net Deliveries, Minneapolis Net Deliveries Historical Avg Absorption (T5Y) (500) 500 1,500 2,500 3,500 4,500 5,500 6,500 20 21 1Q 20 21 2 Q 20 21 3 Q 20 21 4 Q 20 22 1Q 20 22 2 Q 20 22 3 Q 20 22 4 Q 20 23 1Q 20 23 2 Q 20 23 3 Q 20 23 4 Q 20 24 1Q 20 24 2 Q 20 24 3 Q 20 24 4 Q 20 25 1Q 20 25 2 Q 20 25 3 Q 20 25 4 Q 20 26 1Q 20 26 2 Q 20 26 3 Q 20 26 4 Q 20 27 1Q 20 27 2 Q 20 27 3 Q 20 27 4 Q U ni ts Net Deliveries, Denver Net Deliveries Historical Avg Absoprtion (T5Y)

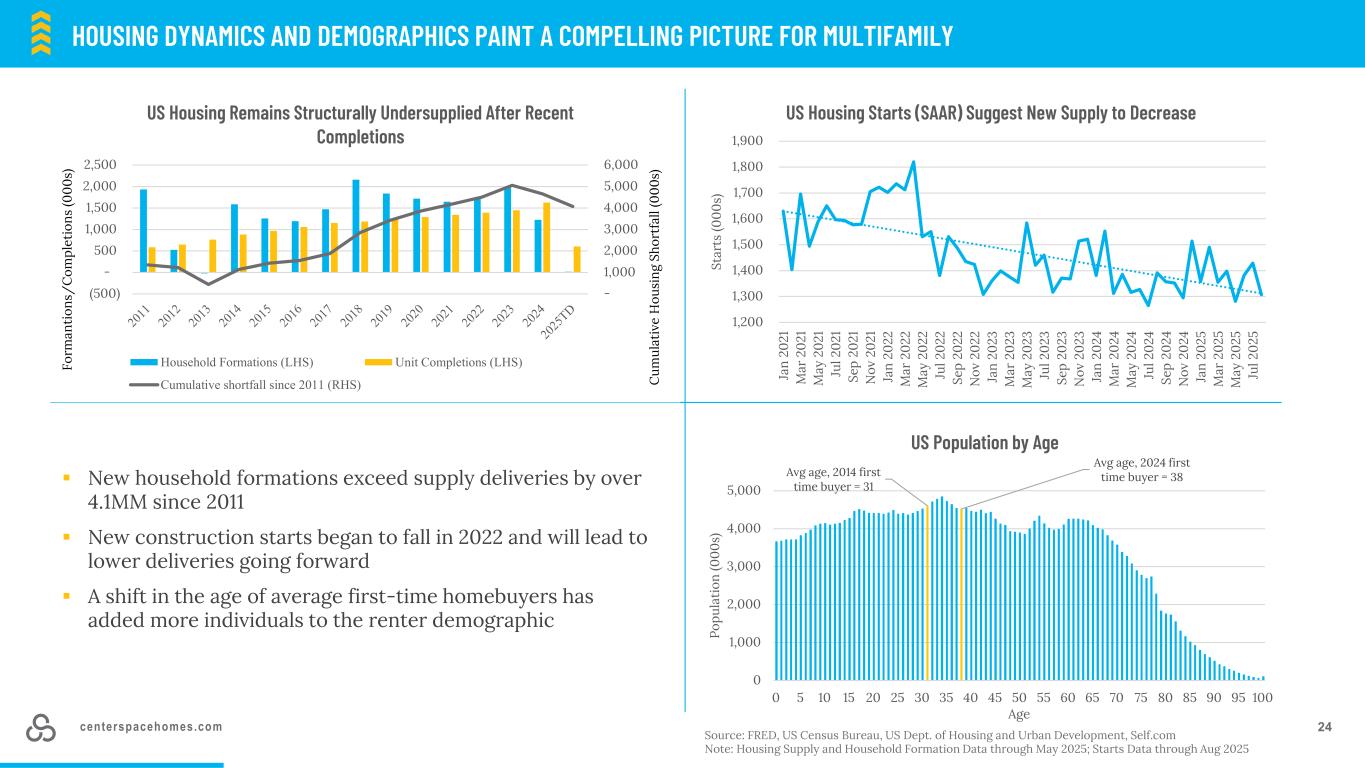

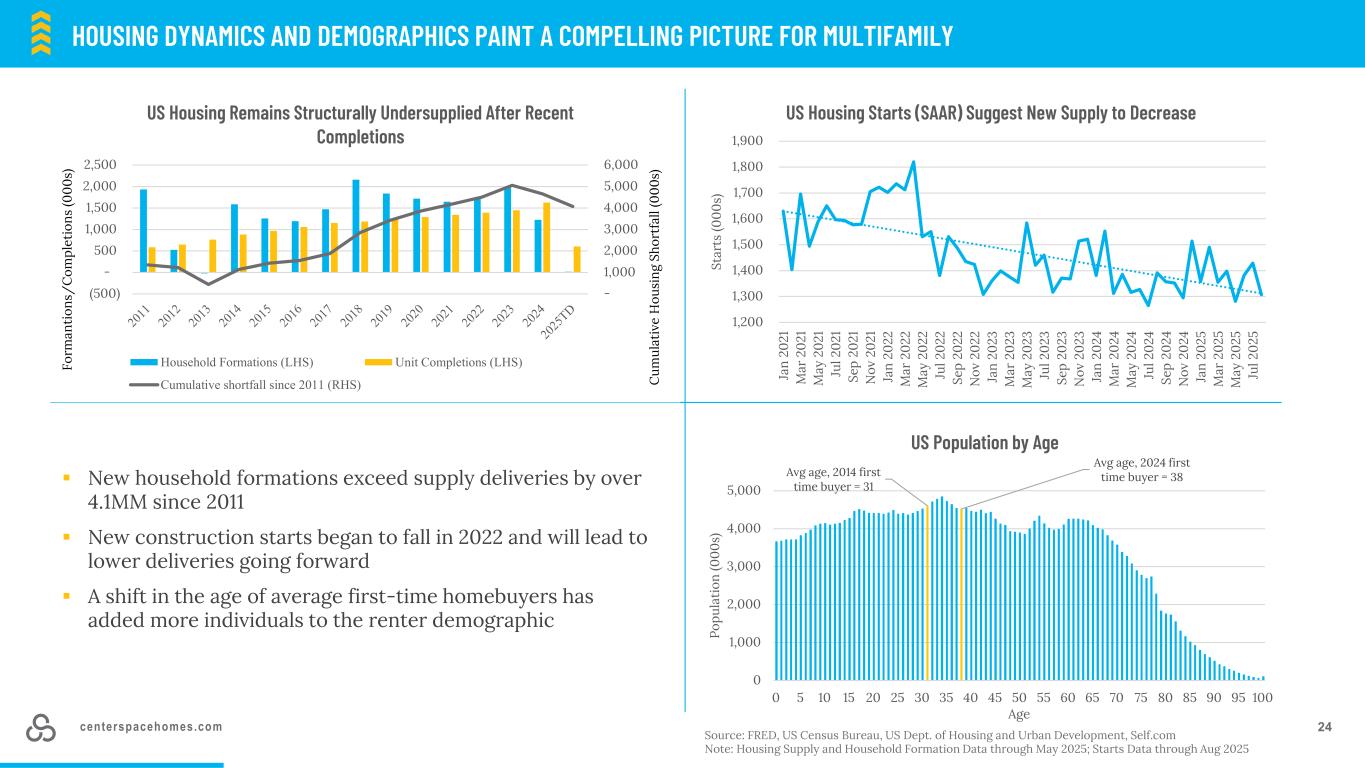

centerspacehomes.com GEOGRAPHIC DIFFERENTIATION HOUSING DYNAMICS AND DEMOGRAPHICS PAINT A COMPELLING PICTURE FOR MULTIFAMILY PROVEN EXECUTION 24 ▪ New household formations exceed supply deliveries by over 4.1MM since 2011 ▪ New construction starts began to fall in 2022 and will lead to lower deliveries going forward ▪ A shift in the age of average first-time homebuyers has added more individuals to the renter demographic Source: FRED, US Census Bureau, US Dept. of Housing and Urban Development, Self.com Note: Housing Supply and Household Formation Data through May 2025; Starts Data through Aug 2025 Avg age, 2014 first time buyer = 31 Avg age, 2024 first time buyer = 38 0 1,000 2,000 3,000 4,000 5,000 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 95 100 Po pu la ti on (0 00 s) Age US Population by Age - 1,000 2,000 3,000 4,000 5,000 6,000 (500) - 500 1,000 1,500 2,000 2,500 C um ul at iv e H ou si ng S ho rt fa ll (0 00 s) Fo rm an ti on s/ C om pl et io ns (0 00 s) US Housing Remains Structurally Undersupplied After Recent Completions Household Formations (LHS) Unit Completions (LHS) Cumulative shortfall since 2011 (RHS) 1,200 1,300 1,400 1,500 1,600 1,700 1,800 1,900 Ja n 20 21 M ar 2 02 1 M ay 2 02 1 Ju l 2 02 1 Se p 20 21 N ov 2 02 1 Ja n 20 22 M ar 2 02 2 M ay 2 02 2 Ju l 2 02 2 Se p 20 22 N ov 2 02 2 Ja n 20 23 M ar 2 02 3 M ay 2 02 3 Ju l 2 02 3 Se p 20 23 N ov 2 02 3 Ja n 20 24 M ar 2 02 4 M ay 2 02 4 Ju l 2 02 4 Se p 20 24 N ov 2 02 4 Ja n 20 25 M ar 2 02 5 M ay 2 02 5 Ju l 2 02 5 St ar ts (0 00 s) US Housing Starts (SAAR) Suggest New Supply to Decrease

centerspacehomes.com 25 ENVIRONMENTAL SOCIAL GOVERNANCE • Published sixth annual ESG report and inaugural Task Force on Climate Related Financial Disclosures (TCFD) Report • Surpassed 2027 coverage goals for each of energy data, waste data, leak detection, and LED lighting • Submitted our fourth annual GRESB submission in 2025, with score of 71 up 29% from initial submission • Implemented smart home technology at 74% of Centerspace communities (1) • Maintain a Supermajority Independent Board with 86% of board members being independent (1) • Senior leadership team is 58% female and Board of Trustees is 57% female • Received a #1 governance score from Institutional Shareholder Services • Received an A grade and 96 score on our public disclosures from GRESB • Donated $94,325 to national, regional, and diversity-promoting charities in 2024 • Named a Top Workplace by the Minneapolis Star Tribune for the sixth consecutive year in 2025 • Maintain a strong Diversity, Equity, and Inclusion committee that upholds our DE&I Corporate Policy • Team members completed over 2,700 volunteer hours in 2024 2025 REAL ESTATE TOP WORKPLACE TOP WORKPLACE FOR SIX CONSECUTIVE YEARS SIX MADACS AWARDS IN 2025 ENGAGEMENT – ENVIRONMENTAL, SOCIAL, AND GOVERNANCE HIGHLIGHTS AWARDS & RECOGNITION 1. As of November 6, 2025

centerspacehomes.com 26 APPENDIX

centerspacehomes.com 27 ▪ 7 CSR communities, 1,977 homes. Entered market Q4 2017 and achieved critical mass ▪ Diversified economy with large presence of aviation/aerospace, healthcare, telecommunications and tech employers ▪ Denver and Boulder realized $17 billion in venture capital funding for technology businesses from 2019-2023 ▪ Colorado ranked 2nd among all states in educational attainment and in U.S. healthiest states index ▪ CSR’s Fort Collins portfolio is a northern extension of our Denver footprint. Fort Collins’ economy is driven by advanced technology including notable semiconductor initiatives, manufacturing, water innovation, and bioscience. The market has robust access to cultural and recreational amenities, along with a high cost of single-family home ownership MARKET HIGHLIGHTS Lyra: 215-home community in Centennial; 2022 built in Denver’s SE Business Corridor CSR Portfolio NOI % 20.5% CSR Denver Portfolio Average Rent $1,942 CSR Household Average Annual Income $118,828 CSR Household Rent-to- Income Ratio 24.6% CSR Denver Portfolio Occupancy % 94.4% September 2025 Median Single-Family Home Value $594,129 August 2025 Unemployment Rate 3.7% DENVER: SCALED PORTFOLIO WITH LONG-TERM GROWTH CSR HIGHLIGHTS Source: FRED, Zillow, CoStar Note: CSR data as of Q3 2025 proforma for 2025 acquisition and disposition activity. Occupancy refers to average financial occupancy 100% Asset Class by % of NOI Class A 48% 52% Location by % of NOI Urban Suburban

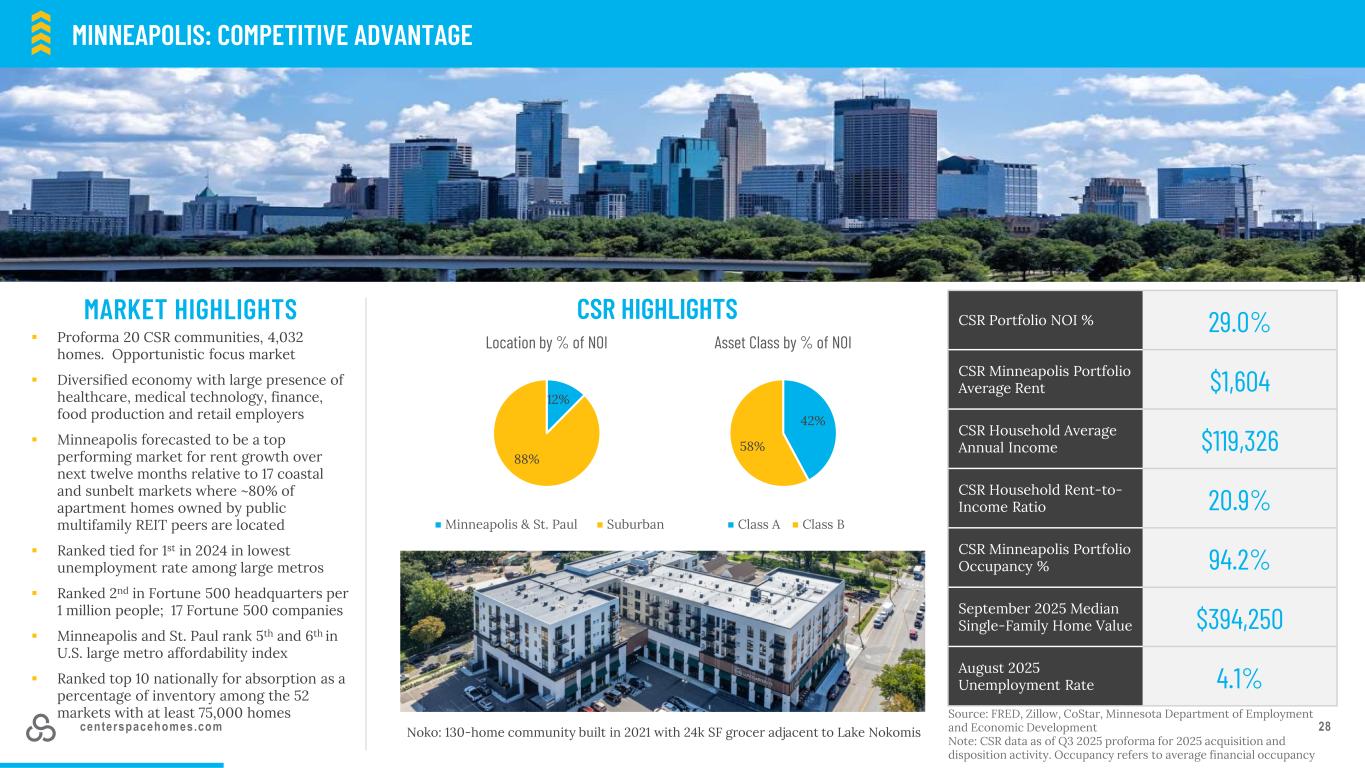

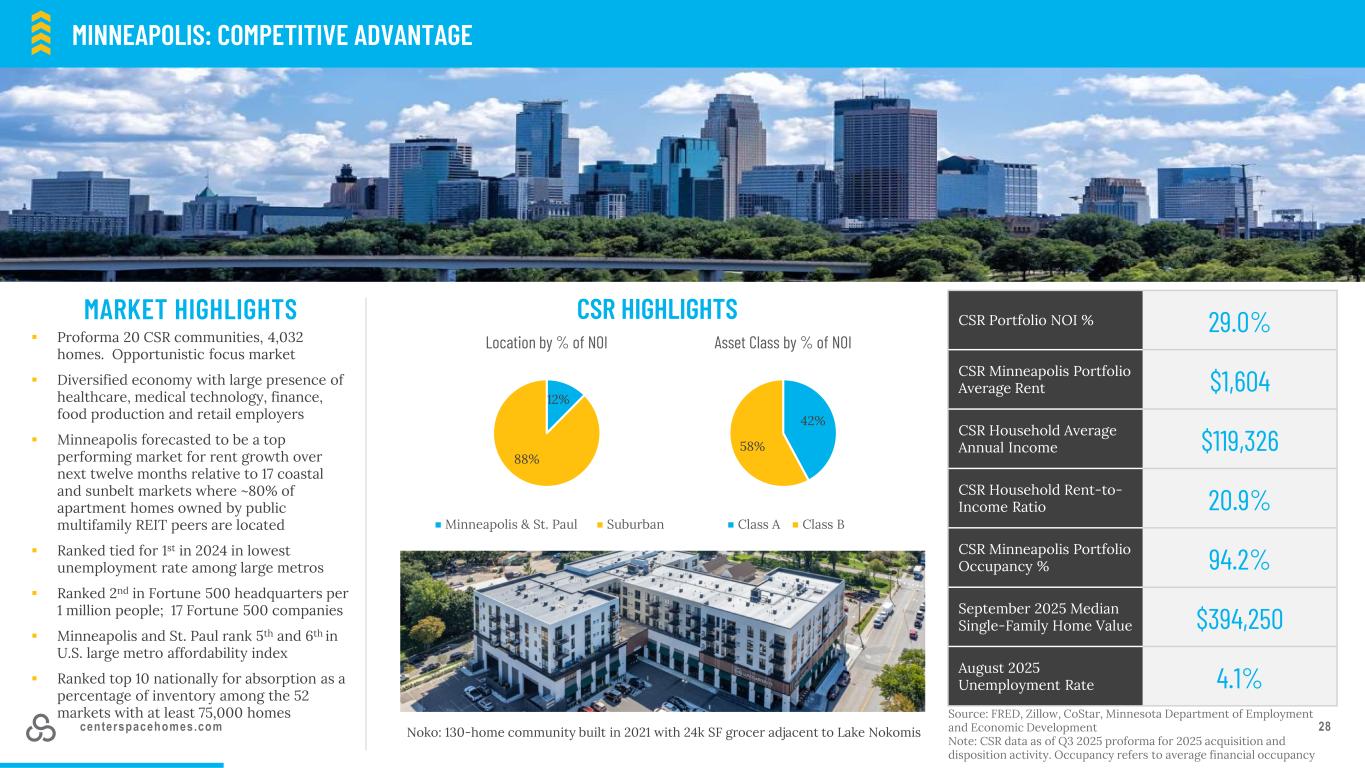

centerspacehomes.com 28 ▪ Proforma 20 CSR communities, 4,032 homes. Opportunistic focus market ▪ Diversified economy with large presence of healthcare, medical technology, finance, food production and retail employers ▪ Minneapolis forecasted to be a top performing market for rent growth over next twelve months relative to 17 coastal and sunbelt markets where ~80% of apartment homes owned by public multifamily REIT peers are located ▪ Ranked tied for 1st in 2024 in lowest unemployment rate among large metros ▪ Ranked 2nd in Fortune 500 headquarters per 1 million people; 17 Fortune 500 companies ▪ Minneapolis and St. Paul rank 5th and 6th in U.S. large metro affordability index ▪ Ranked top 10 nationally for absorption as a percentage of inventory among the 52 markets with at least 75,000 homes MARKET HIGHLIGHTS Noko: 130-home community built in 2021 with 24k SF grocer adjacent to Lake Nokomis CSR Portfolio NOI % 29.0% CSR Minneapolis Portfolio Average Rent $1,604 CSR Household Average Annual Income $119,326 CSR Household Rent-to- Income Ratio 20.9% CSR Minneapolis Portfolio Occupancy % 94.2% September 2025 Median Single-Family Home Value $394,250 August 2025 Unemployment Rate 4.1% MINNEAPOLIS: COMPETITIVE ADVANTAGE CSR HIGHLIGHTS Source: FRED, Zillow, CoStar, Minnesota Department of Employment and Economic Development Note: CSR data as of Q3 2025 proforma for 2025 acquisition and disposition activity. Occupancy refers to average financial occupancy 42% 58% Asset Class by % of NOI Class A Class B 12% 88% Location by % of NOI Minneapolis & St. Paul Suburban

centerspacehomes.com 29 RECONCILIATION TO NON-GAAP MEASURES Reconciliation of Net Income (Loss) Available to Common Shareholders to Funds From Operations and Core Funds From Operations Centerspace believes that FFO, which is a non-GAAP financial measure used as a standard supplemental measure for equity real estate investment trusts, is helpful to investors in understanding its operating performance, primarily because its calculation does not assume that the value of real estate assets diminishes predictably over time, as implied by the historical cost convention of GAAP and the recording of depreciation and amortization. Centerspace uses the definition of FFO adopted by the National Association of Real Estate Investment Trusts, Inc. (“Nareit”). Nareit defines FFO as net income or loss calculated in accordance with GAAP, excluding: • depreciation and amortization related to real estate; • gains and losses from the sale of certain real estate assets; • gains and losses from change in control; • impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity; and • similar adjustments for partially owned consolidated real estate entities. The exclusion in Nareit’s definition of FFO of gains and losses from the sale of real estate assets and impairment write-downs helps to identify the operating results of the long-term assets that form the base of the company's investments and assists management and investors in comparing those operating results between periods. Due to the limitations of the Nareit FFO definition, Centerspace has made certain interpretations in applying this definition. The company believes that all such interpretations not specifically identified in the Nareit definition are consistent with this definition. Nareit’s FFO White Paper 2018 Restatement clarified that impairment write-downs of land related to a REIT’s main business are excluded from FFO and a REIT has the option to exclude impairment write-downs of assets that are incidental to its main business. While FFO is widely used by Centerspace as a primary performance metric, not all real estate companies use the same definition of FFO or calculate FFO in the same way. Accordingly, FFO presented here is not necessarily comparable to FFO presented by other real estate companies. FFO should not be considered as an alternative to net income (loss) or any other GAAP measurement of performance, but rather should be considered as an additional, supplemental measure. FFO also does not represent cash generated from operating activities in accordance with GAAP, nor is it indicative of funds available to fund all cash flow needs, including the ability to service indebtedness or make distributions to shareholders. Core Funds from Operations (“Core FFO”) is FFO as adjusted for non-routine items or items not considered core to business operations. By further adjusting for items that are not considered part of core business operations, the company believes that Core FFO provides investors with additional information to compare core operating and financial performance between periods. Core FFO should not be considered as an alternative to net income (loss), or any other GAAP measurement of performance, but rather should be considered an additional supplemental measure. Core FFO also does not represent cash generated from operating activities in accordance with GAAP, nor is it indicative of funds available to fund the company's cash needs, including its ability to service indebtedness or make distributions to shareholders. Core FFO is a non-GAAP and non-standardized financial measure that may be calculated differently by other REITs and should not be considered a substitute for operating results determined in accordance with GAAP.

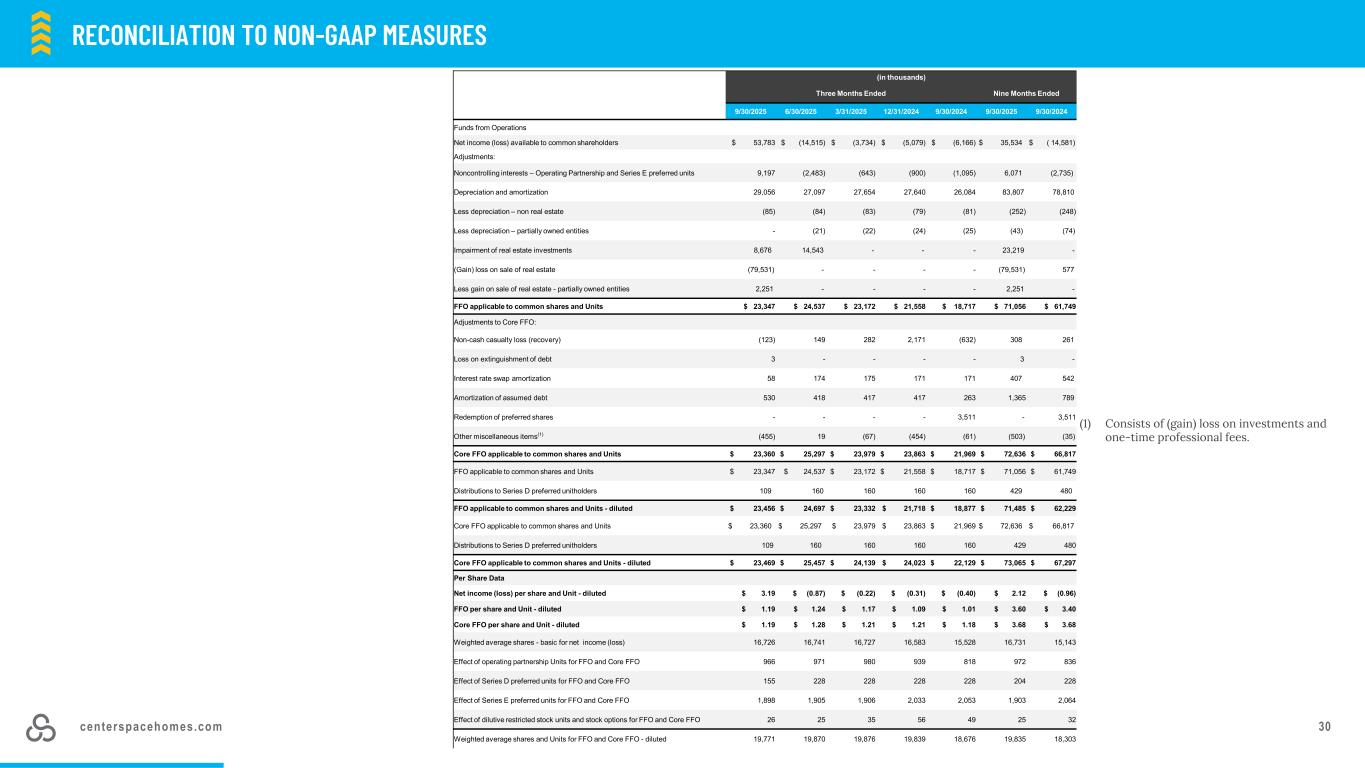

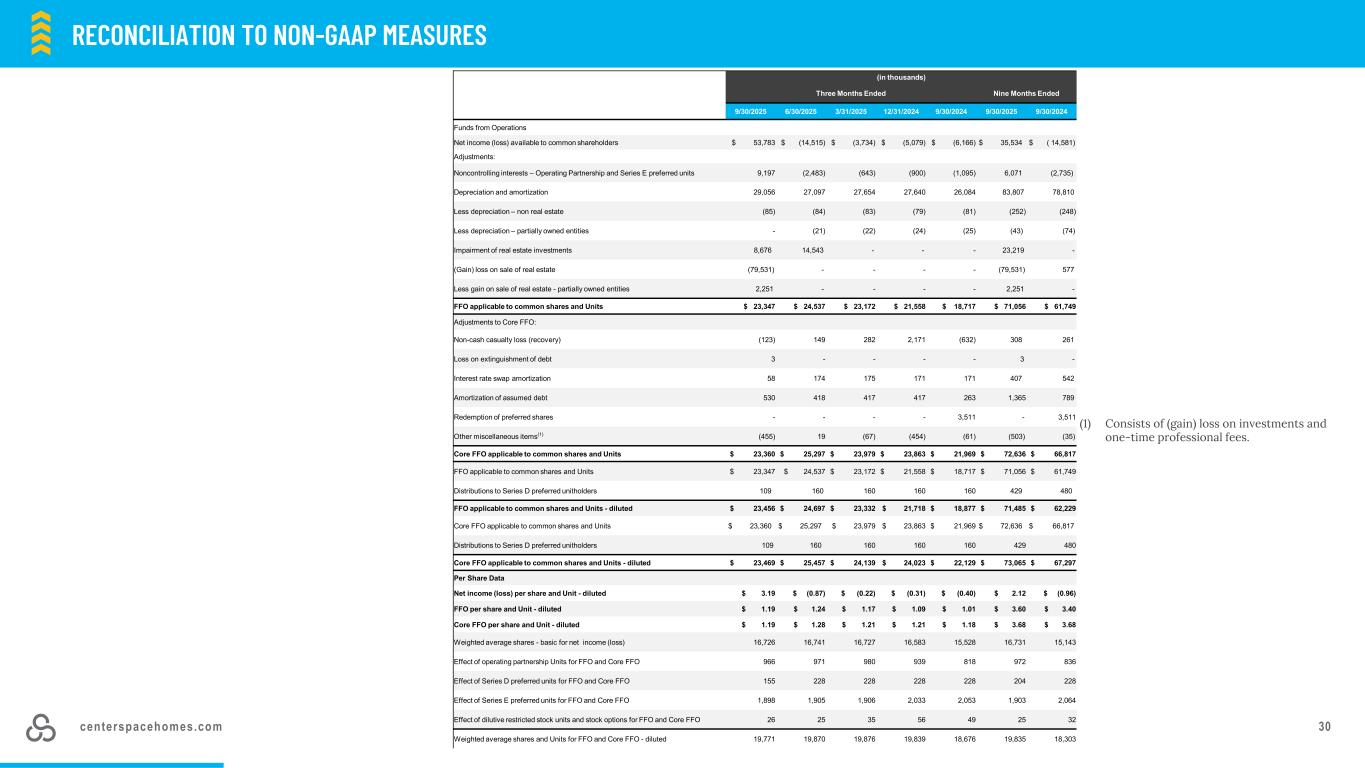

centerspacehomes.com 30 RECONCILIATION TO NON-GAAP MEASURES UpdatedRECONCILIATION TO NON-GAAP MEASURESRECONCILIATION TO NON-GAAP MEASURES (1) Consists of (gain) loss on investments and one-time professional fees. (in thousands) Three Months Ended Nine Months Ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 9/30/2025 9/30/2024 Funds from Operations Net income (loss) available to common shareholders $ 53,783 $ (14,515) $ (3,734) $ (5,079) $ (6,166) $ 35,534 $ ( 14,581) Adjustments: Noncontrolling interests – Operating Partnership and Series E preferred units 9,197 (2,483) (643) (900) (1,095) 6,071 (2,735) Depreciation and amortization 29,056 27,097 27,654 27,640 26,084 83,807 78,810 Less depreciation – non real estate (85) (84) (83) (79) (81) (252) (248) Less depreciation – partially owned entities - (21) (22) (24) (25) (43) (74) Impairment of real estate investments 8,676 14,543 - - - 23,219 - (Gain) loss on sale of real estate (79,531) - - - - (79,531) 577 Less gain on sale of real estate - partially owned entities 2,251 - - - - 2,251 - FFO applicable to common shares and Units $ 23,347 $ 24,537 $ 23,172 $ 21,558 $ 18,717 $ 71,056 $ 61,749 Adjustments to Core FFO: Non-cash casualty loss (recovery) (123) 149 282 2,171 (632) 308 261 Loss on extinguishment of debt 3 - - - - 3 - Interest rate swap amortization 58 174 175 171 171 407 542 Amortization of assumed debt 530 418 417 417 263 1,365 789 Redemption of preferred shares - - - - 3,511 - 3,511 Other miscellaneous items(1) (455) 19 (67) (454) (61) (503) (35) Core FFO applicable to common shares and Units $ 23,360 $ 25,297 $ 23,979 $ 23,863 $ 21,969 $ 72,636 $ 66,817 FFO applicable to common shares and Units $ 23,347 $ 24,537 $ 23,172 $ 21,558 $ 18,717 $ 71,056 $ 61,749 Distributions to Series D preferred unitholders 109 160 160 160 160 429 480 FFO applicable to common shares and Units - diluted $ 23,456 $ 24,697 $ 23,332 $ 21,718 $ 18,877 $ 71,485 $ 62,229 Core FFO applicable to common shares and Units $ 23,360 $ 25,297 $ 23,979 $ 23,863 $ 21,969 $ 72,636 $ 66,817 Distributions to Series D preferred unitholders 109 160 160 160 160 429 480 Core FFO applicable to common shares and Units - diluted $ 23,469 $ 25,457 $ 24,139 $ 24,023 $ 22,129 $ 73,065 $ 67,297 Per Share Data Net income (loss) per share and Unit - diluted $ 3.19 $ (0.87) $ (0.22) $ (0.31) $ (0.40) $ 2.12 $ (0.96) FFO per share and Unit - diluted $ 1.19 $ 1.24 $ 1.17 $ 1.09 $ 1.01 $ 3.60 $ 3.40 Core FFO per share and Unit - diluted $ 1.19 $ 1.28 $ 1.21 $ 1.21 $ 1.18 $ 3.68 $ 3.68 Weighted average shares - basic for net income (loss) 16,726 16,741 16,727 16,583 15,528 16,731 15,143 Effect of operating partnership Units for FFO and Core FFO 966 971 980 939 818 972 836 Effect of Series D preferred units for FFO and Core FFO 155 228 228 228 228 204 228 Effect of Series E preferred units for FFO and Core FFO 1,898 1,905 1,906 2,033 2,053 1,903 2,064 Effect of dilutive restricted stock units and stock options for FFO and Core FFO 26 25 35 56 49 25 32 Weighted average shares and Units for FFO and Core FFO - diluted 19,771 19,870 19,876 19,839 18,676 19,835 18,303

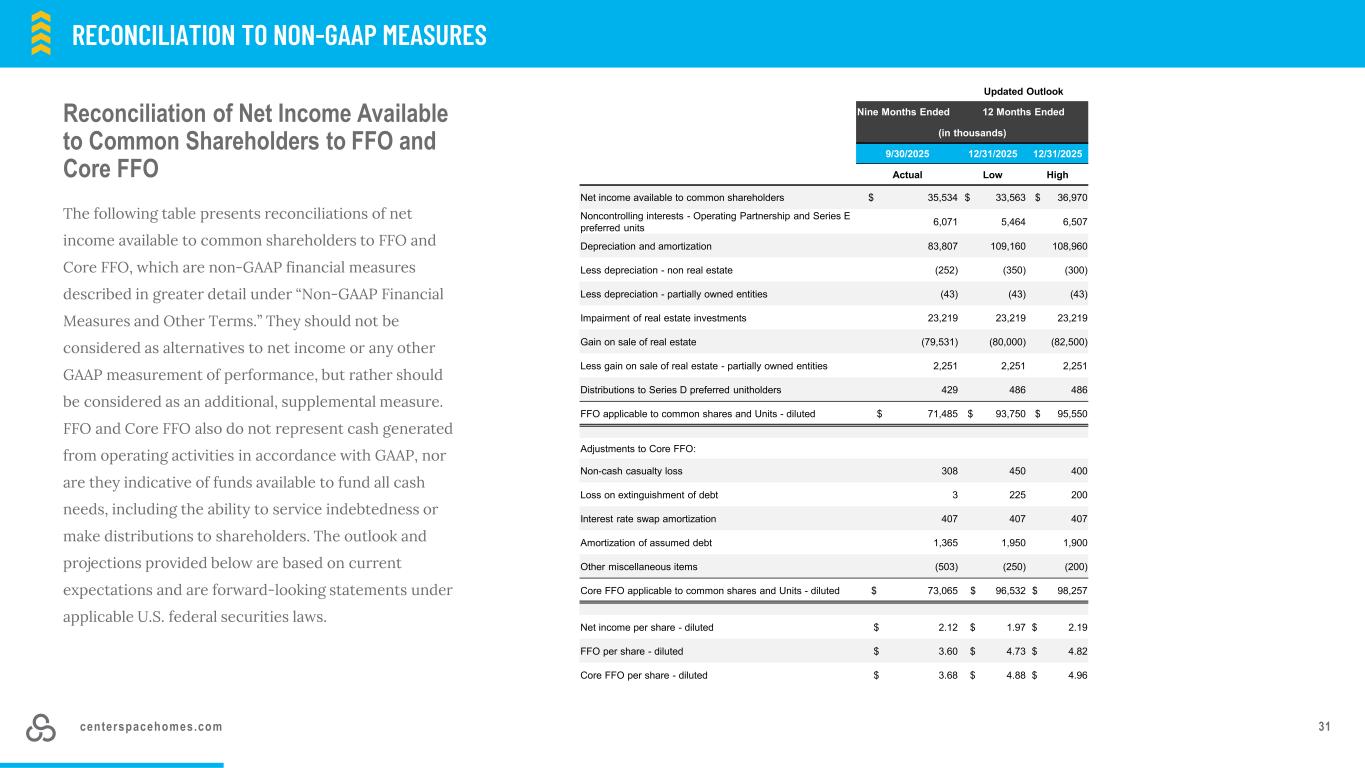

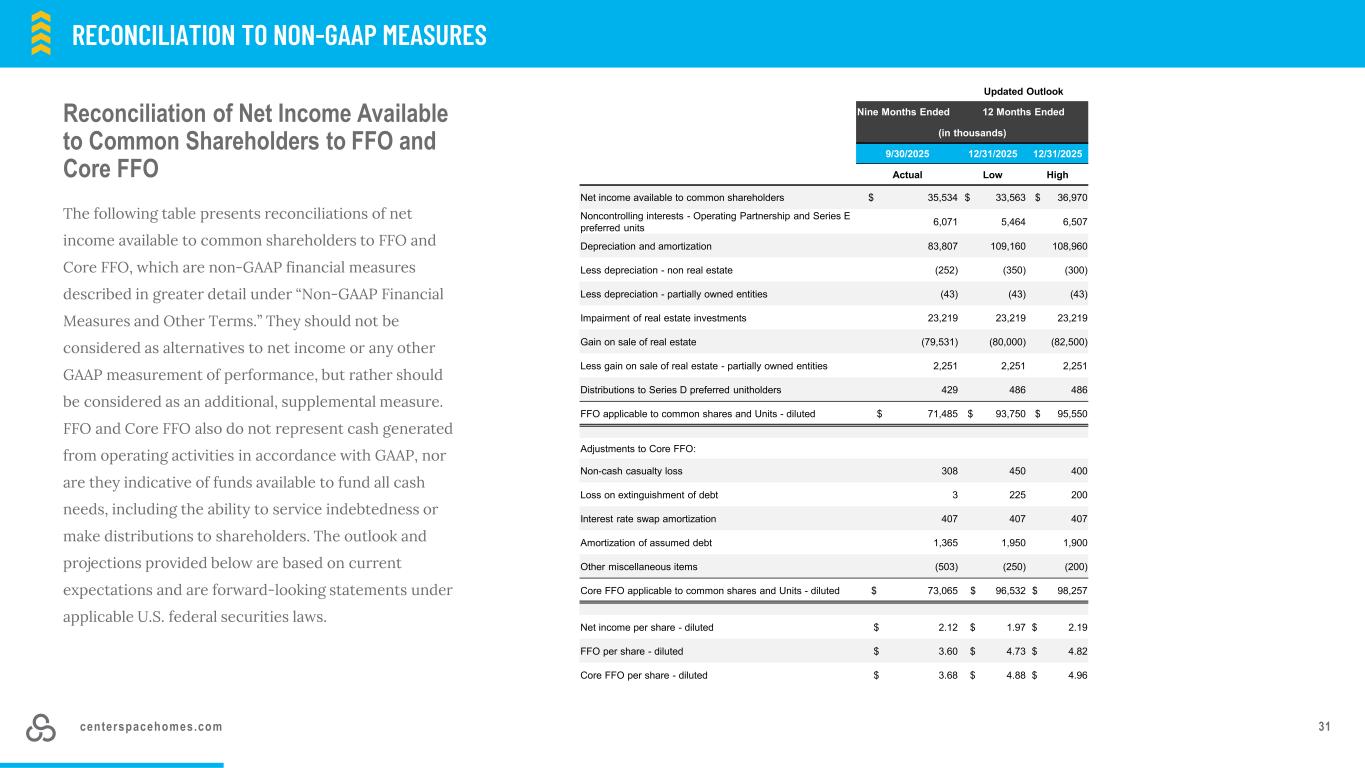

centerspacehomes.com 31 RECONCILIATION TO NON-GAAP MEASURESRECONCILIATION TO NON-GAAP MEASURES Reconciliation of Net Income Available to Common Shareholders to FFO and Core FFO The following table presents reconciliations of net income available to common shareholders to FFO and Core FFO, which are non-GAAP financial measures described in greater detail under “Non-GAAP Financial Measures and Other Terms.” They should not be considered as alternatives to net income or any other GAAP measurement of performance, but rather should be considered as an additional, supplemental measure. FFO and Core FFO also do not represent cash generated from operating activities in accordance with GAAP, nor are they indicative of funds available to fund all cash needs, including the ability to service indebtedness or make distributions to shareholders. The outlook and projections provided below are based on current expectations and are forward-looking statements under applicable U.S. federal securities laws. Updated Outlook Nine Months Ended 12 Months Ended (in thousands) 9/30/2025 12/31/2025 12/31/2025 Actual Low High Net income available to common shareholders $ 35,534 $ 33,563 $ 36,970 Noncontrolling interests - Operating Partnership and Series E preferred units 6,071 5,464 6,507 Depreciation and amortization 83,807 109,160 108,960 Less depreciation - non real estate (252) (350) (300) Less depreciation - partially owned entities (43) (43) (43) Impairment of real estate investments 23,219 23,219 23,219 Gain on sale of real estate (79,531) (80,000) (82,500) Less gain on sale of real estate - partially owned entities 2,251 2,251 2,251 Distributions to Series D preferred unitholders 429 486 486 FFO applicable to common shares and Units - diluted $ 71,485 $ 93,750 $ 95,550 Adjustments to Core FFO: Non-cash casualty loss 308 450 400 Loss on extinguishment of debt 3 225 200 Interest rate swap amortization 407 407 407 Amortization of assumed debt 1,365 1,950 1,900 Other miscellaneous items (503) (250) (200) Core FFO applicable to common shares and Units - diluted $ 73,065 $ 96,532 $ 98,257 Net income per share - diluted $ 2.12 $ 1.97 $ 2.19 FFO per share - diluted $ 3.60 $ 4.73 $ 4.82 Core FFO per share - diluted $ 3.68 $ 4.88 $ 4.96

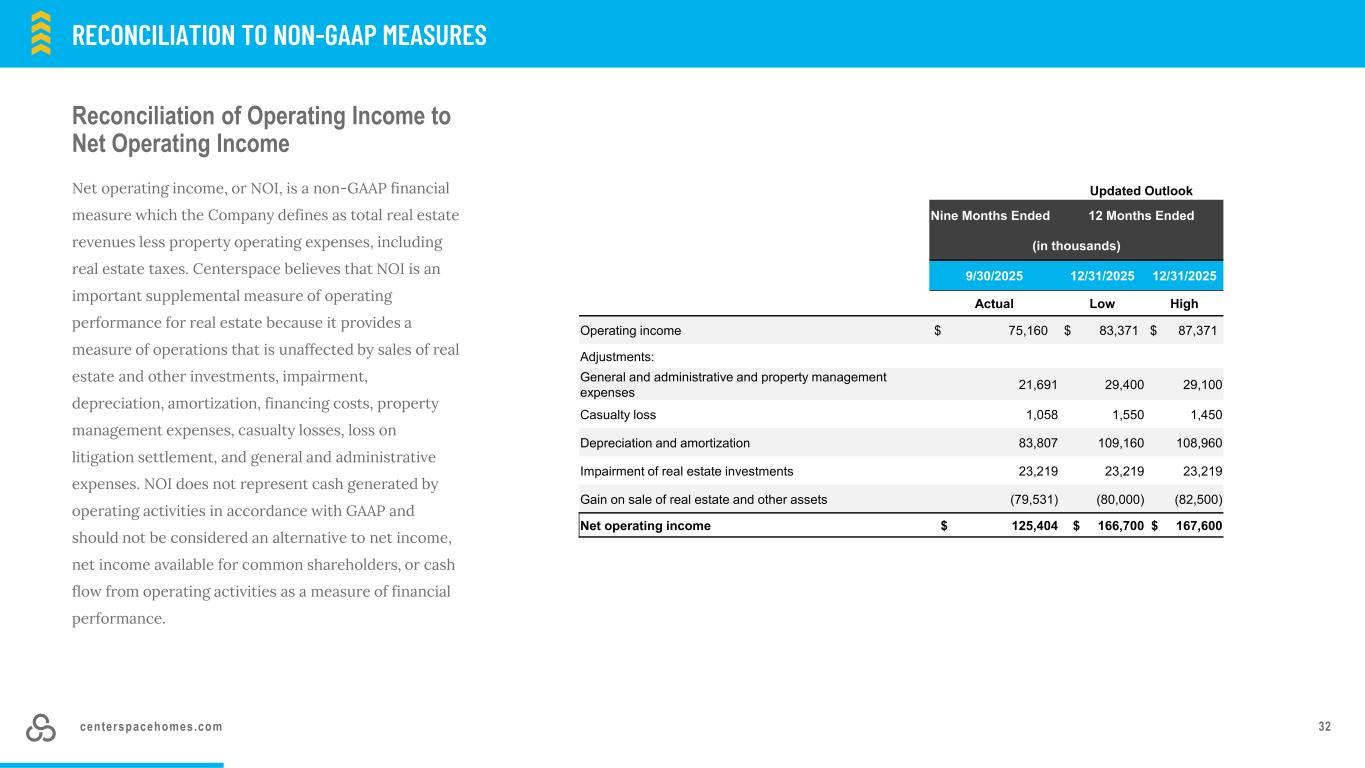

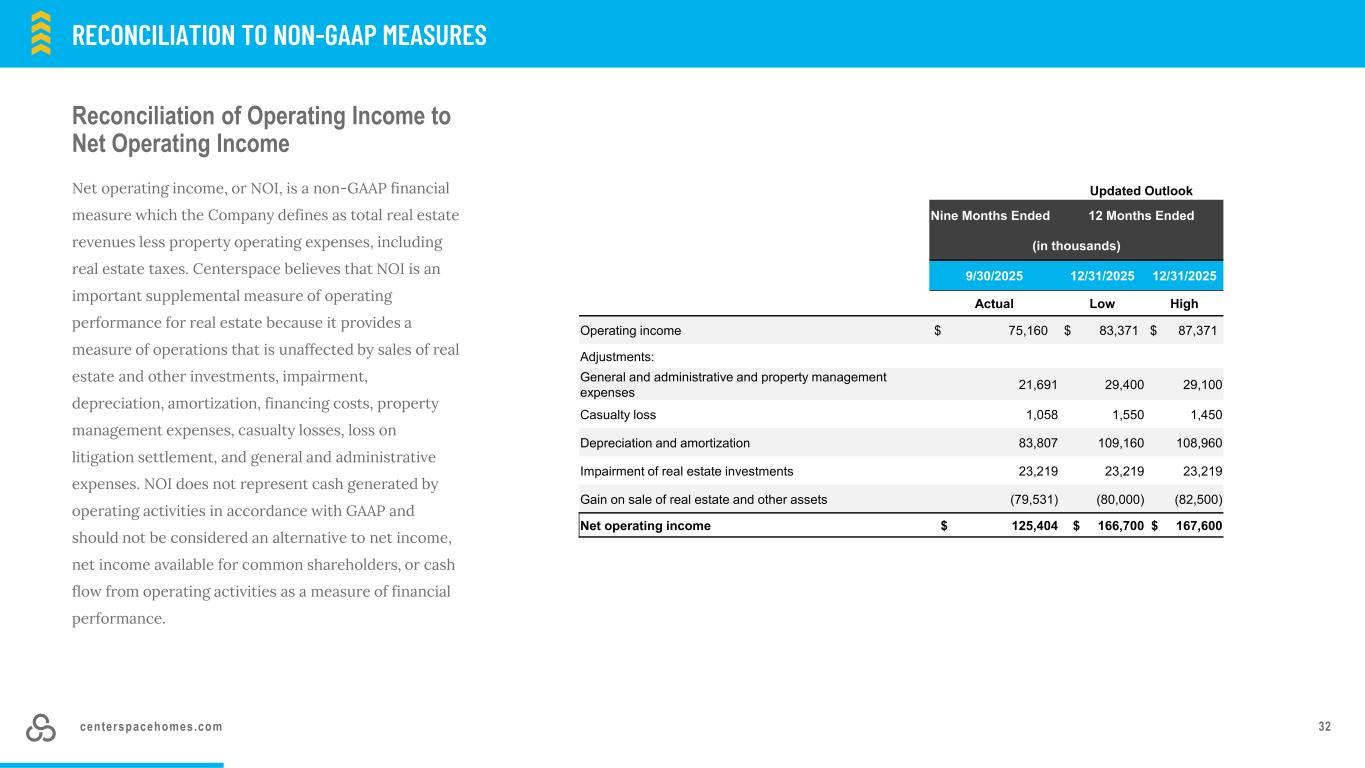

centerspacehomes.com 32 RECONCILIATION TO NON-GAAP MEASURESRECONCILIATION TO NON-GAAP MEASURES Reconciliation of Operating Income to Net Operating Income Net operating income, or NOI, is a non-GAAP financial measure which the Company defines as total real estate revenues less property operating expenses, including real estate taxes. Centerspace believes that NOI is an important supplemental measure of operating performance for real estate because it provides a measure of operations that is unaffected by sales of real estate and other investments, impairment, depreciation, amortization, financing costs, property management expenses, casualty losses, loss on litigation settlement, and general and administrative expenses. NOI does not represent cash generated by operating activities in accordance with GAAP and should not be considered an alternative to net income, net income available for common shareholders, or cash flow from operating activities as a measure of financial performance. Updated Outlook Nine Months Ended 12 Months Ended (in thousands) 9/30/2025 12/31/2025 12/31/2025 Actual Low High Operating income $ 75,160 $ 83,371 $ 87,371 Adjustments: General and administrative and property management expenses 21,691 29,400 29,100 Casualty loss 1,058 1,550 1,450 Depreciation and amortization 83,807 109,160 108,960 Impairment of real estate investments 23,219 23,219 23,219 Gain on sale of real estate and other assets (79,531) (80,000) (82,500) Net operating income $ 125,404 $ 166,700 $ 167,600

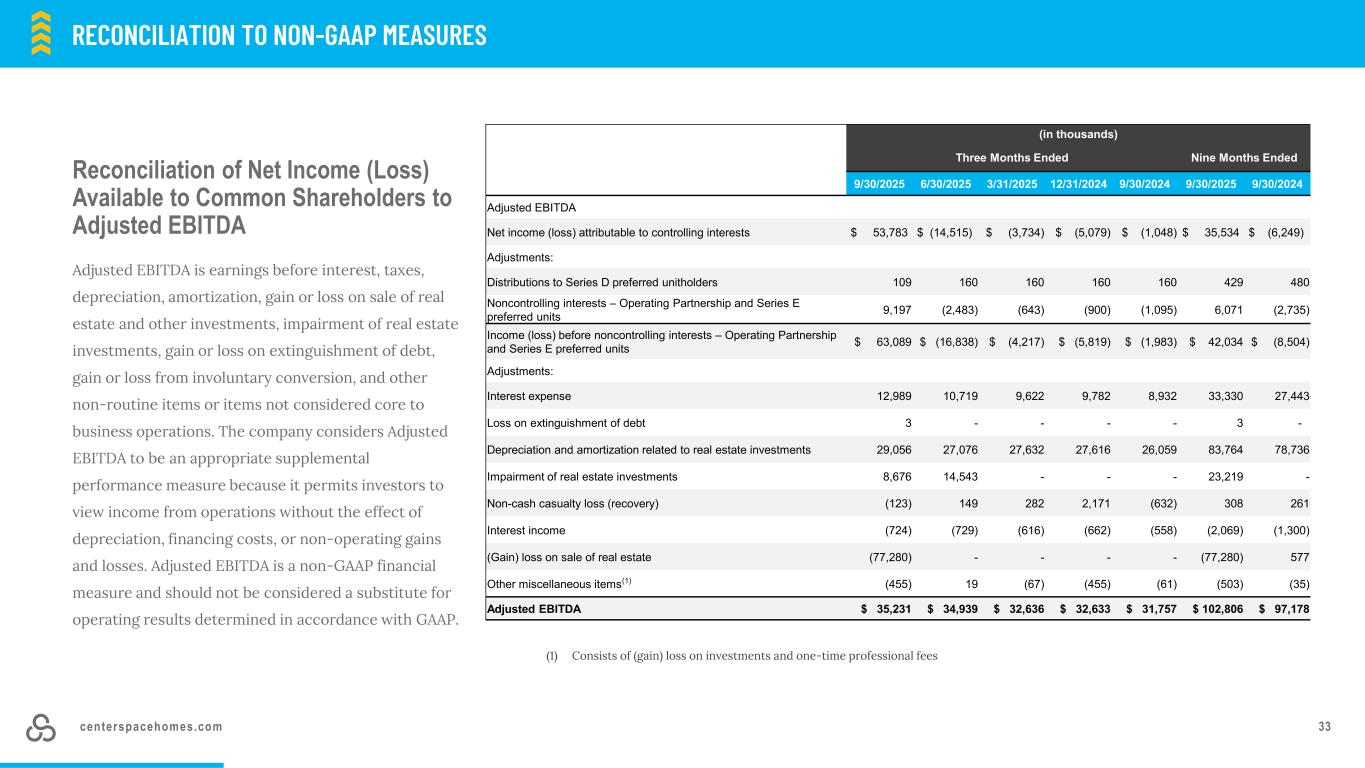

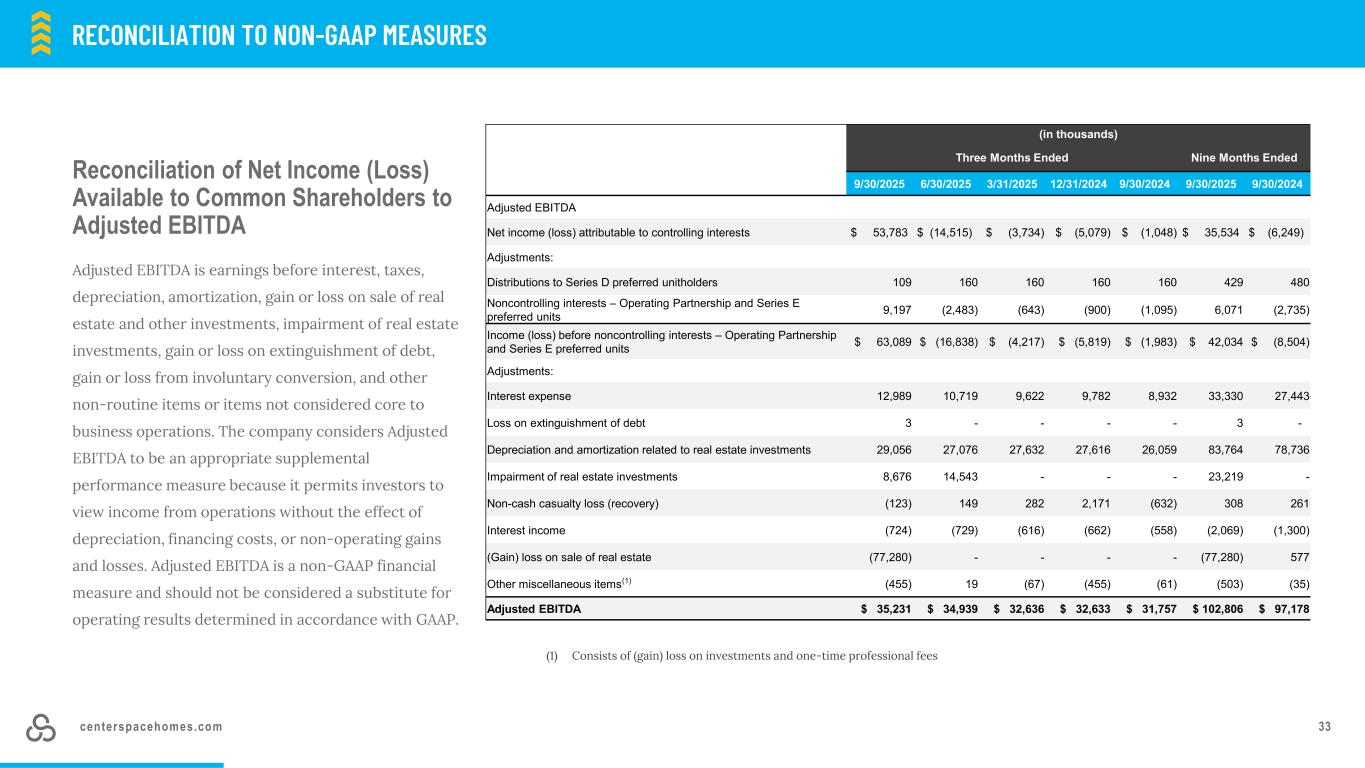

centerspacehomes.com 33 Reconciliation of Net Income (Loss) Available to Common Shareholders to Adjusted EBITDA Adjusted EBITDA is earnings before interest, taxes, depreciation, amortization, gain or loss on sale of real estate and other investments, impairment of real estate investments, gain or loss on extinguishment of debt, gain or loss from involuntary conversion, and other non-routine items or items not considered core to business operations. The company considers Adjusted EBITDA to be an appropriate supplemental performance measure because it permits investors to view income from operations without the effect of depreciation, financing costs, or non-operating gains and losses. Adjusted EBITDA is a non-GAAP financial measure and should not be considered a substitute for operating results determined in accordance with GAAP. RECONCILIATION TO NON-GAAP MEASURESRECONCILIATION TO NON-GAAP MEASURES (1) Consists of (gain) loss on investments and one-time professional fees (in thousands) Three Months Ended Nine Months Ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 9/30/2025 9/30/2024 Adjusted EBITDA Net income (loss) attributable to controlling interests $ 53,783 $ (14,515) $ (3,734) $ (5,079) $ (1,048) $ 35,534 $ (6,249) Adjustments: Distributions to Series D preferred unitholders 109 160 160 160 160 429 480 Noncontrolling interests – Operating Partnership and Series E preferred units 9,197 (2,483) (643) (900) (1,095) 6,071 (2,735) Income (loss) before noncontrolling interests – Operating Partnership and Series E preferred units $ 63,089 $ (16,838) $ (4,217) $ (5,819) $ (1,983) $ 42,034 $ (8,504) Adjustments: Interest expense 12,989 10,719 9,622 9,782 8,932 33,330 27,443 Loss on extinguishment of debt 3 - - - - 3 - Depreciation and amortization related to real estate investments 29,056 27,076 27,632 27,616 26,059 83,764 78,736 Impairment of real estate investments 8,676 14,543 - - - 23,219 - Non-cash casualty loss (recovery) (123) 149 282 2,171 (632) 308 261 Interest income (724) (729) (616) (662) (558) (2,069) (1,300) (Gain) loss on sale of real estate (77,280) - - - - (77,280) 577 Other miscellaneous items(1) (455) 19 (67) (455) (61) (503) (35) Adjusted EBITDA $ 35,231 $ 34,939 $ 32,636 $ 32,633 $ 31,757 $ 102,806 $ 97,178

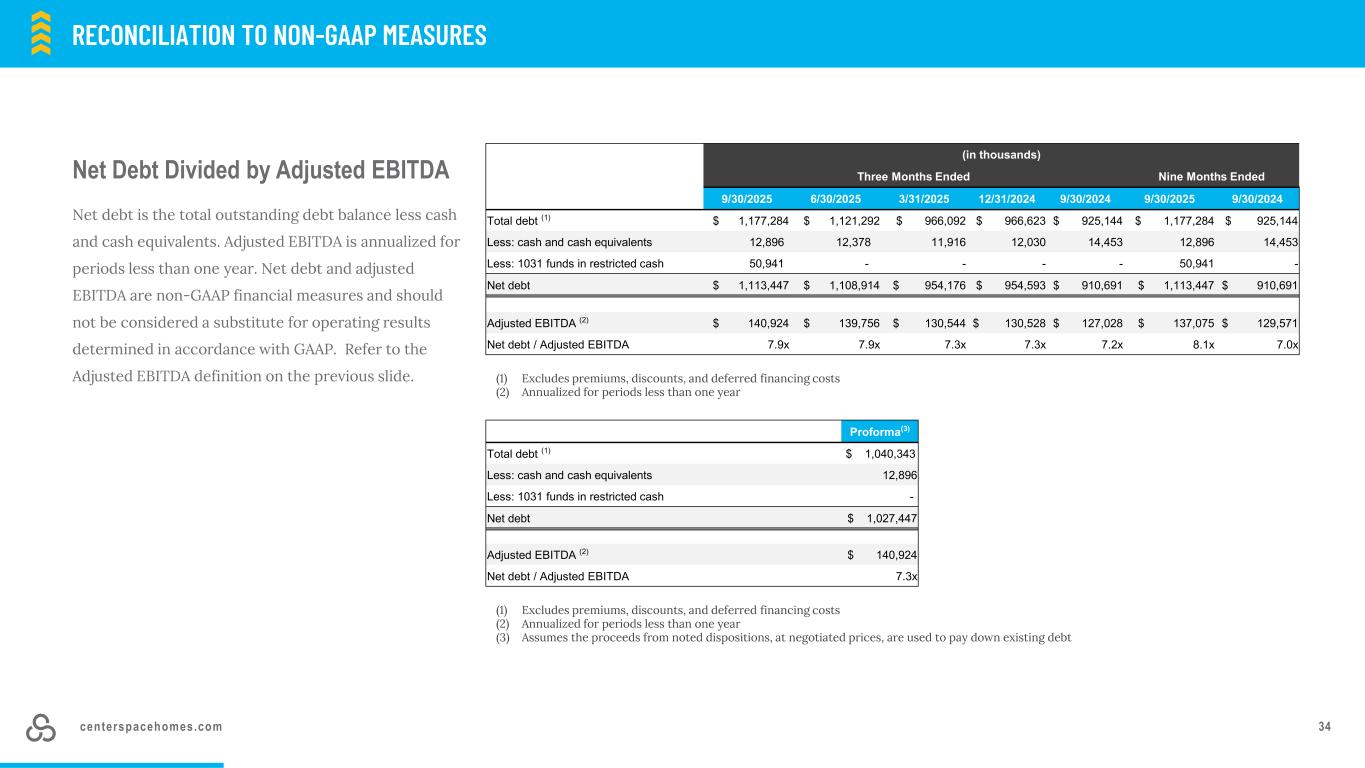

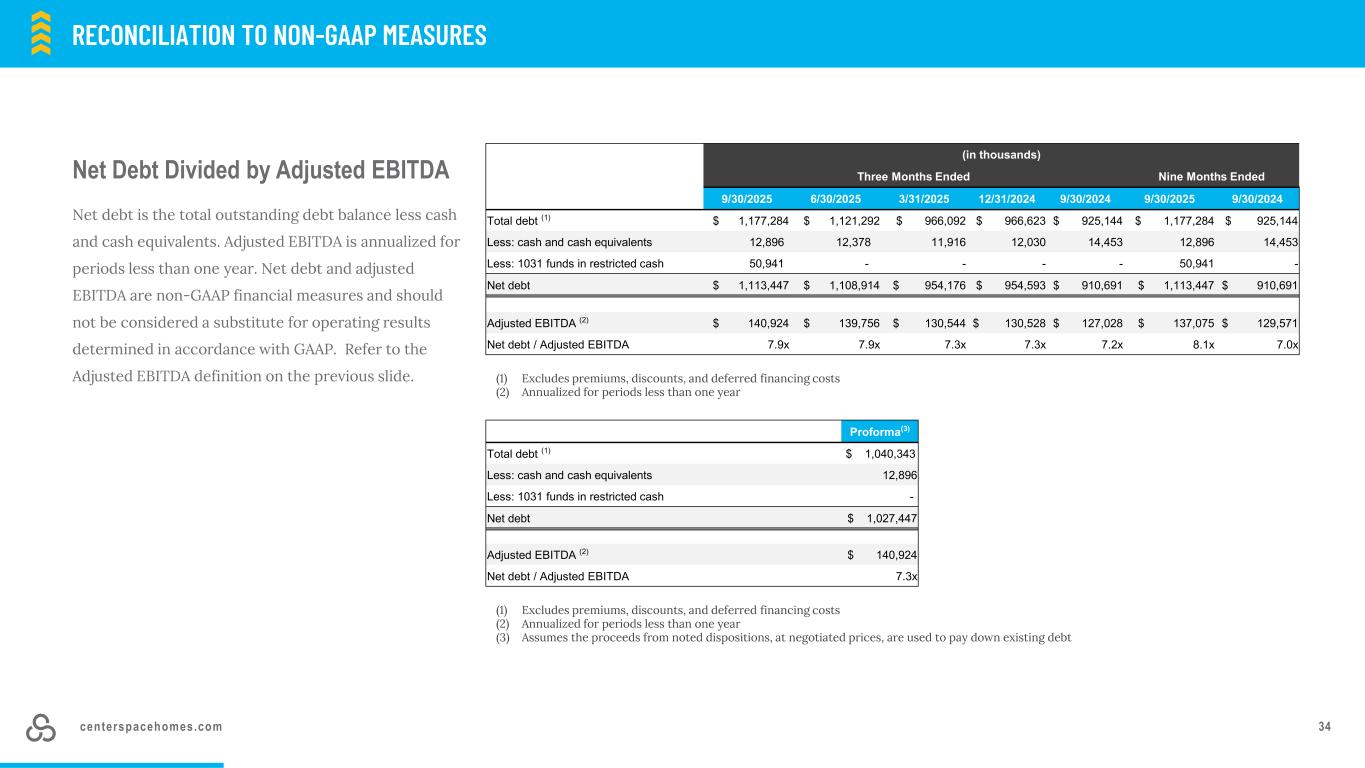

centerspacehomes.com 34 Net Debt Divided by Adjusted EBITDA Net debt is the total outstanding debt balance less cash and cash equivalents. Adjusted EBITDA is annualized for periods less than one year. Net debt and adjusted EBITDA are non-GAAP financial measures and should not be considered a substitute for operating results determined in accordance with GAAP. Refer to the Adjusted EBITDA definition on the previous slide. RECONCILIATION TO NON-GAAP MEASURESRECONCILIATION TO NON-GAAP MEASURES (1) Excludes premiums, discounts, and deferred financing costs (2) Annualized for periods less than one year (in thousands) Three Months Ended Nine Months Ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 9/30/2025 9/30/2024 Total debt (1) $ 1,177,284 $ 1,121,292 $ 966,092 $ 966,623 $ 925,144 $ 1,177,284 $ 925,144 Less: cash and cash equivalents 12,896 12,378 11,916 12,030 14,453 12,896 14,453 Less: 1031 funds in restricted cash 50,941 - - - - 50,941 - Net debt $ 1,113,447 $ 1,108,914 $ 954,176 $ 954,593 $ 910,691 $ 1,113,447 $ 910,691 Adjusted EBITDA (2) $ 140,924 $ 139,756 $ 130,544 $ 130,528 $ 127,028 $ 137,075 $ 129,571 Net debt / Adjusted EBITDA 7.9x 7.9x 7.3x 7.3x 7.2x 8.1x 7.0x Proforma(3) Total debt (1) $ 1,040,343 Less: cash and cash equivalents 12,896 Less: 1031 funds in restricted cash - Net debt $ 1,027,447 Adjusted EBITDA (2) $ 140,924 Net debt / Adjusted EBITDA 7.3x (1) Excludes premiums, discounts, and deferred financing costs (2) Annualized for periods less than one year (3) Assumes the proceeds from noted dispositions, at negotiated prices, are used to pay down existing debt