0000791963false00007919632022-08-012022-08-01

As filed with the Securities and Exchange Commission on January 29, 2024

___________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 29, 2024

OPPENHEIMER HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Commission File Number 1-12043

|

|

|

|

|

|

|

|

|

| Delaware |

|

98-0080034 |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

85 Broad Street

New York, New York 10004

(Address of principal executive offices) (Zip Code)

(212) 668-8000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Class A non-voting Common Stock |

OPY |

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 7 – REGULATION FD

ITEM 7.01 Regulation FD Disclosure.

On January 29, 2024, Oppenheimer Holdings Inc. (the “Company”) posted to the Investor Relations page of its website, www.oppenheimer.com, a presentation to investors regarding the Company in the form of the slides containing the information attached to this Current Report on Form 8-K as Exhibit 99.1 (the “Slides”). The Company may use the Slides, in whole or in part, and possibly with minor modifications, in connection with presentations to investors after such date.

By filing this Current Report on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation FD.

The information contained in the Slides is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

In accordance with General Instruction B.2 of this Current Report on Form 8-K, the information presented in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01. Financial Statements and Exhibits.

(d)Exhibits:

The following Exhibit is submitted herewith:

99.1 Investor Presentation (Fourth Quarter and Full Year 2023 Investor Update) posted on January 29, 2024 Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SIGNATURES

Oppenheimer Holdings Inc.

|

|

|

By: /s/ Brad M. Watkins

---------------------------------

Brad M. Watkins

Chief Financial Officer

(Duly Authorized Officer and Principal Financial and Accounting Officer) |

EXHIBIT INDEX

|

|

|

|

|

|

| Exhibit Number |

Description |

|

|

EX-99.1

2

opyq42023investorpresent.htm

EX-99.1

opyq42023investorpresent

Oppenheimer Holdings Inc. Fourth Quarter and Full Year 2023 Investor Update

Safe Harbor Statement This presentation and other written or oral statements made from time to time by representatives of Oppenheimer Holdings Inc. ("Oppenheimer” or the “company”) may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may relate to such matters as anticipated financial performance, future revenues or earnings, business prospects, new products or services, anticipated market performance and similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the company’s current beliefs, expectations and assumptions regarding the future of the company’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the company’s control. The company cautions that a variety of factors could cause the company’s actual results to differ materially from the anticipated results or other expectations expressed in the company’s forwarding-looking statements. These risks and uncertainties include, but are not limited to, those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2023 (the “2022 10-K”). In addition, important factors that could cause actual results to differ materially from those in the forward-looking statements include those factors discussed in Part I, “Item 2. Management’s Discussion & Analysis of Financial Condition and Results of Operations – Factors Affecting ‘Forward-Looking Statements’” of our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed with the SEC on October 27, 2023 (the “2023 10-Q3”). Any forward-looking statements herein are qualified in their entirety by reference to all such factors discussed in the 2022 10-K, the 2023 10-Q3 and the company’s other SEC filings. There can be no assurance that the company has correctly or completely identified and assessed all of the factors affecting the company’s business. Therefore, you should not rely on any of these forward-looking statements. Any forward-looking statement made by the company in this presentation is based only on information currently available to the company and speaks only as of the date on which it is made. The company does not undertake any obligation to publicly update or revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. 2

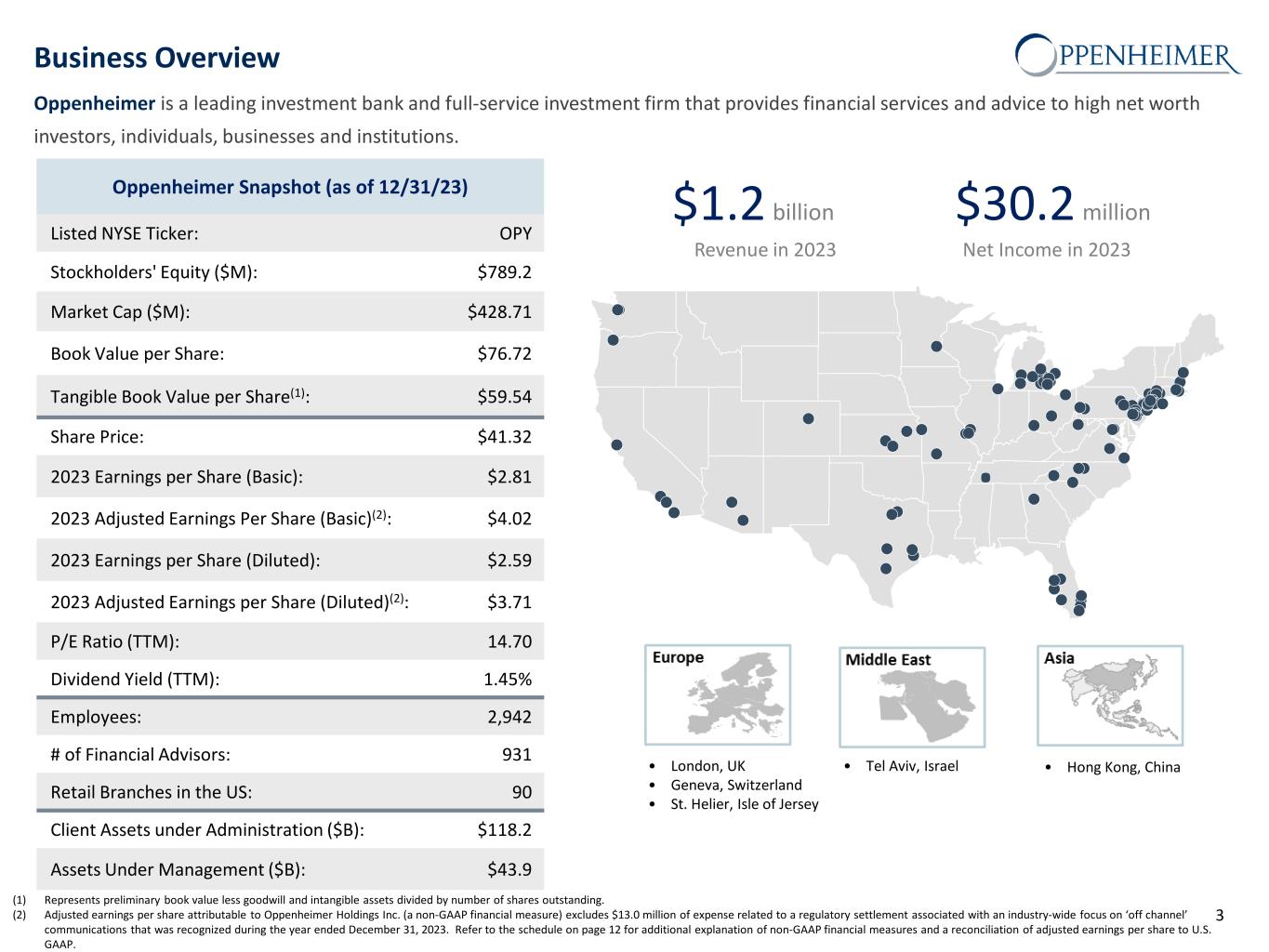

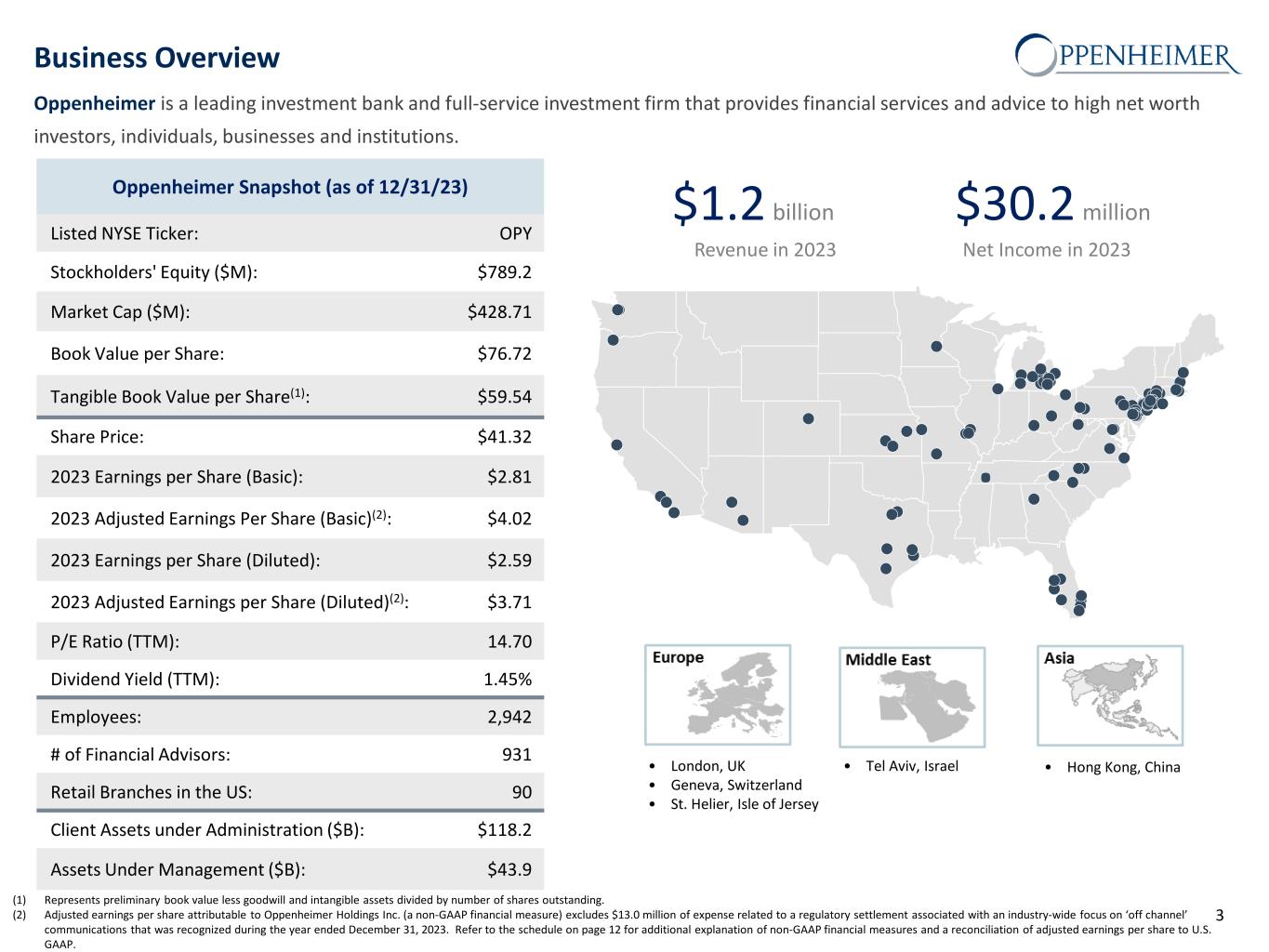

Oppenheimer is a leading investment bank and full-service investment firm that provides financial services and advice to high net worth investors, individuals, businesses and institutions. 3 • Hong Kong, China• London, UK • Geneva, Switzerland • St. Helier, Isle of Jersey • Tel Aviv, Israel $30.2 million Net Income in 2023 $1.2 billion Revenue in 2023 Business Overview Oppenheimer Snapshot (as of 12/31/23) Listed NYSE Ticker: OPY Stockholders' Equity ($M): $789.2 Market Cap ($M): $428.71 Book Value per Share: $76.72 Tangible Book Value per Share(1): $59.54 Share Price: $41.32 2023 Earnings per Share (Basic): $2.81 2023 Adjusted Earnings Per Share (Basic)(2): $4.02 2023 Earnings per Share (Diluted): $2.59 2023 Adjusted Earnings per Share (Diluted)(2): $3.71 P/E Ratio (TTM): 14.70 Dividend Yield (TTM): 1.45% Employees: 2,942 # of Financial Advisors: 931 Retail Branches in the US: 90 Client Assets under Administration ($B): $118.2 Assets Under Management ($B): $43.9 . (1) Represents preliminary book value less goodwill and intangible assets divided by number of shares outstanding. (2) Adjusted earnings per share attributable to Oppenheimer Holdings Inc. (a non-GAAP financial measure) excludes $13.0 million of expense related to a regulatory settlement associated with an industry-wide focus on ‘off channel’ communications that was recognized during the year ended December 31, 2023. Refer to the schedule on page 12 for additional explanation of non-GAAP financial measures and a reconciliation of adjusted earnings per share to U.S. GAAP.

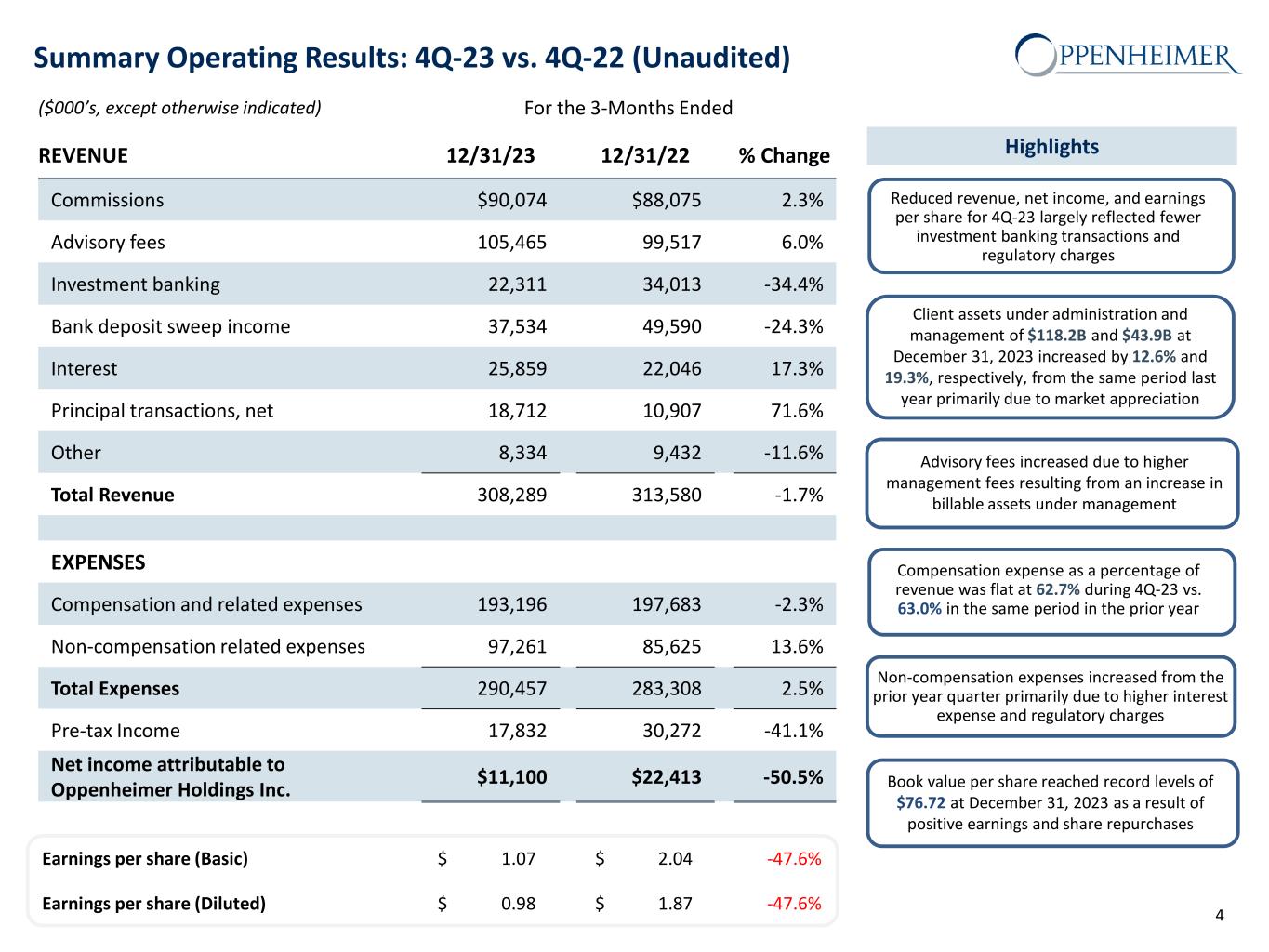

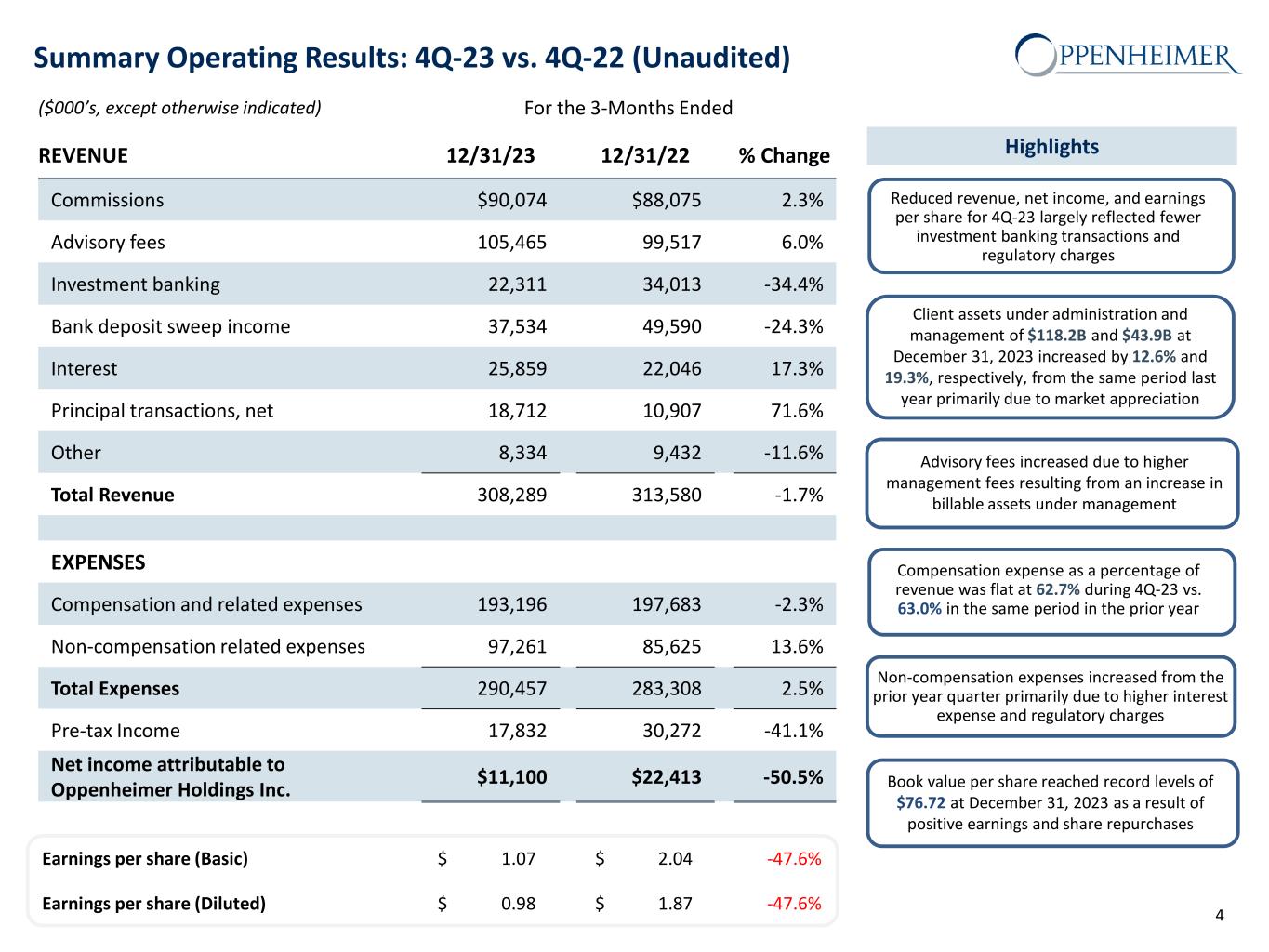

Earnings per share (Basic) $ 1.07 $ 2.04 -47.6% Earnings per share (Diluted) $ 0.98 $ 1.87 -47.6% Summary Operating Results: 4Q-23 vs. 4Q-22 (Unaudited) 4 Highlights ($000’s, except otherwise indicated) For the 3-Months Ended REVENUE 12/31/23 12/31/22 % Change Commissions $90,074 $88,075 2.3% Advisory fees 105,465 99,517 6.0% Investment banking 22,311 34,013 -34.4% Bank deposit sweep income 37,534 49,590 -24.3% Interest 25,859 22,046 17.3% Principal transactions, net 18,712 10,907 71.6% Other 8,334 9,432 -11.6% Total Revenue 308,289 313,580 -1.7% EXPENSES Compensation and related expenses 193,196 197,683 -2.3% Non-compensation related expenses 97,261 85,625 13.6% Total Expenses 290,457 283,308 2.5% Pre-tax Income 17,832 30,272 -41.1% Net income attributable to Oppenheimer Holdings Inc. $11,100 $22,413 -50.5% Reduced revenue, net income, and earnings per share for 4Q-23 largely reflected fewer investment banking transactions and regulatory charges Advisory fees increased due to higher management fees resulting from an increase in billable assets under management Client assets under administration and management of $118.2B and $43.9B at December 31, 2023 increased by 12.6% and 19.3%, respectively, from the same period last year primarily due to market appreciation Book value per share reached record levels of $76.72 at December 31, 2023 as a result of positive earnings and share repurchases Non-compensation expenses increased from the prior year quarter primarily due to higher interest expense and regulatory charges Compensation expense as a percentage of revenue was flat at 62.7% during 4Q-23 vs. 63.0% in the same period in the prior year

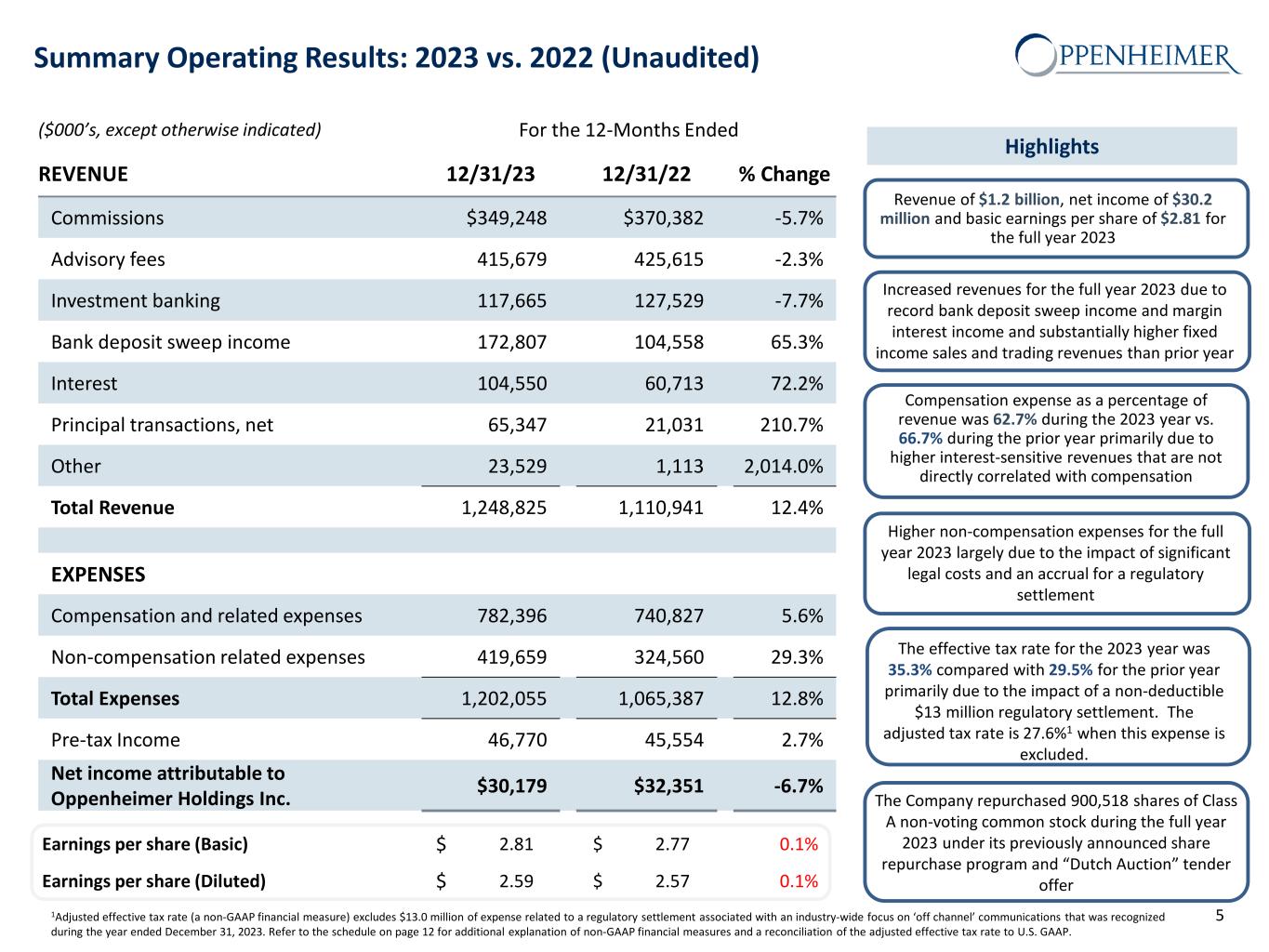

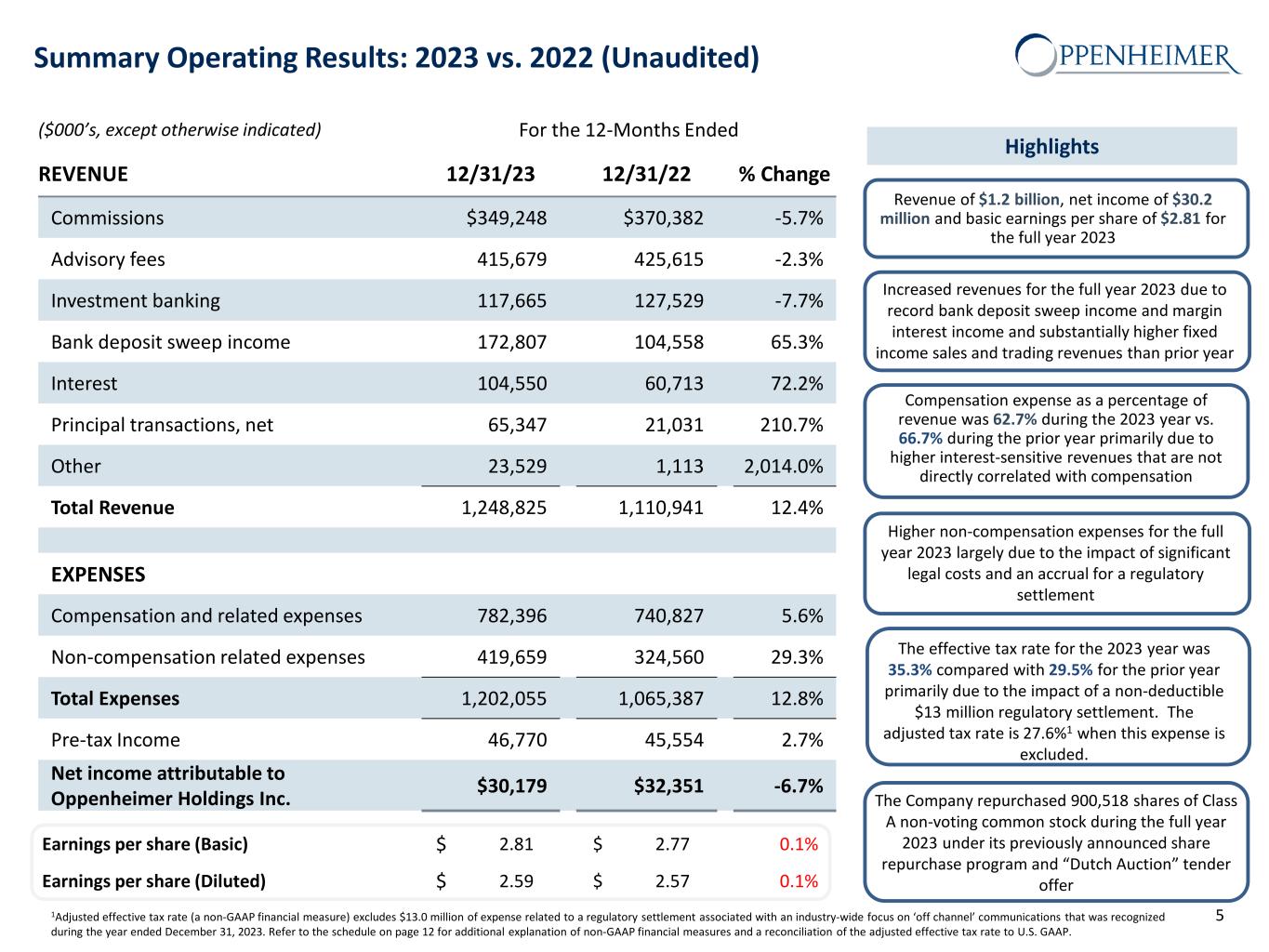

Earnings per share (Basic) $ 2.81 $ 2.77 0.1% Earnings per share (Diluted) $ 2.59 $ 2.57 0.1% Summary Operating Results: 2023 vs. 2022 (Unaudited) 5 Highlights ($000’s, except otherwise indicated) For the 12-Months Ended REVENUE 12/31/23 12/31/22 % Change Commissions $349,248 $370,382 -5.7% Advisory fees 415,679 425,615 -2.3% Investment banking 117,665 127,529 -7.7% Bank deposit sweep income 172,807 104,558 65.3% Interest 104,550 60,713 72.2% Principal transactions, net 65,347 21,031 210.7% Other 23,529 1,113 2,014.0% Total Revenue 1,248,825 1,110,941 12.4% EXPENSES Compensation and related expenses 782,396 740,827 5.6% Non-compensation related expenses 419,659 324,560 29.3% Total Expenses 1,202,055 1,065,387 12.8% Pre-tax Income 46,770 45,554 2.7% Net income attributable to Oppenheimer Holdings Inc. $30,179 $32,351 -6.7% Higher non-compensation expenses for the full year 2023 largely due to the impact of significant legal costs and an accrual for a regulatory settlement The Company repurchased 900,518 shares of Class A non-voting common stock during the full year 2023 under its previously announced share repurchase program and “Dutch Auction” tender offer Increased revenues for the full year 2023 due to record bank deposit sweep income and margin interest income and substantially higher fixed income sales and trading revenues than prior year Revenue of $1.2 billion, net income of $30.2 million and basic earnings per share of $2.81 for the full year 2023 Compensation expense as a percentage of revenue was 62.7% during the 2023 year vs. 66.7% during the prior year primarily due to higher interest-sensitive revenues that are not directly correlated with compensation The effective tax rate for the 2023 year was 35.3% compared with 29.5% for the prior year primarily due to the impact of a non-deductible $13 million regulatory settlement. The adjusted tax rate is 27.6%1 when this expense is excluded. 1Adjusted effective tax rate (a non-GAAP financial measure) excludes $13.0 million of expense related to a regulatory settlement associated with an industry-wide focus on ‘off channel’ communications that was recognized during the year ended December 31, 2023. Refer to the schedule on page 12 for additional explanation of non-GAAP financial measures and a reconciliation of the adjusted effective tax rate to U.S. GAAP.

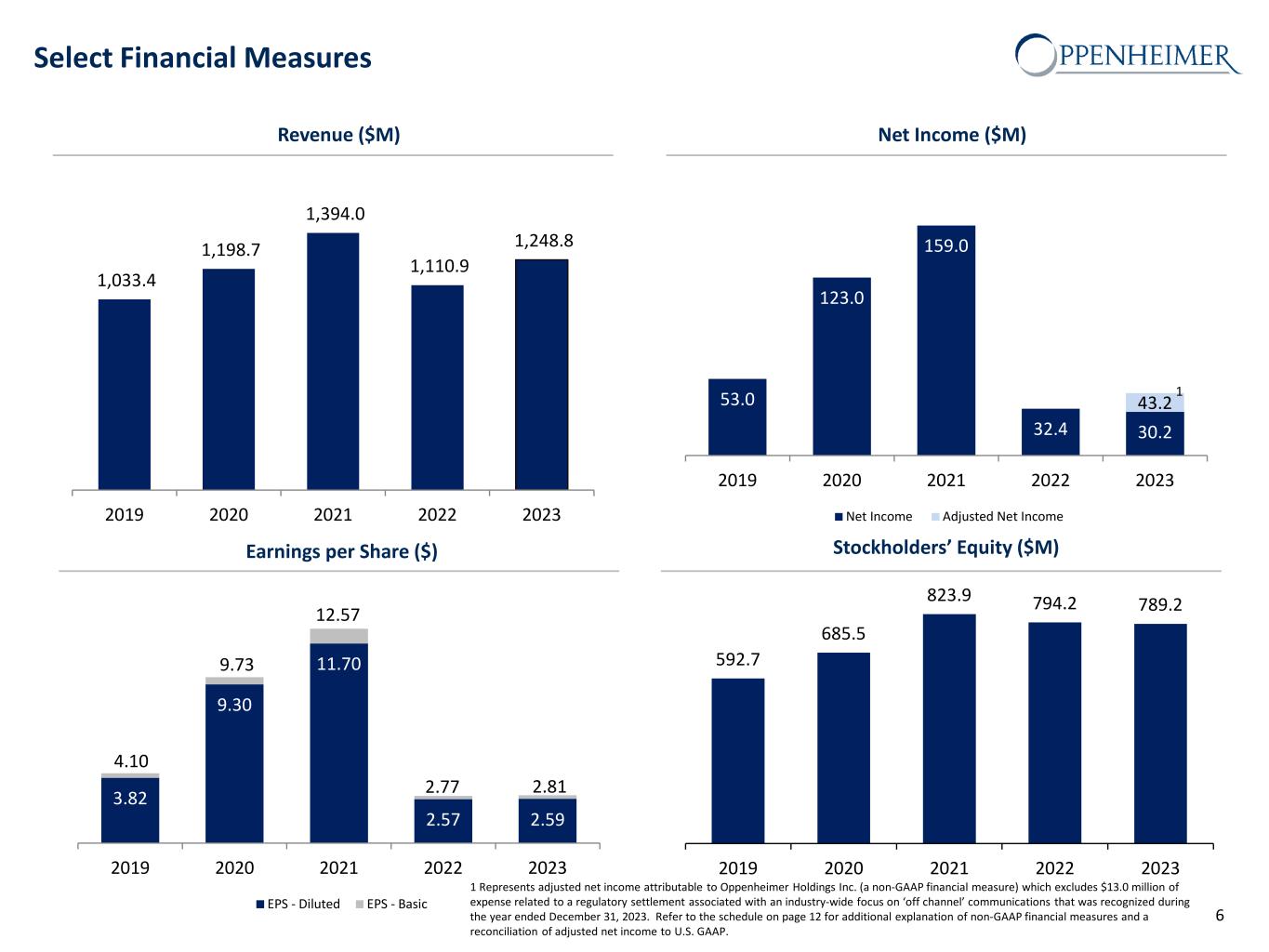

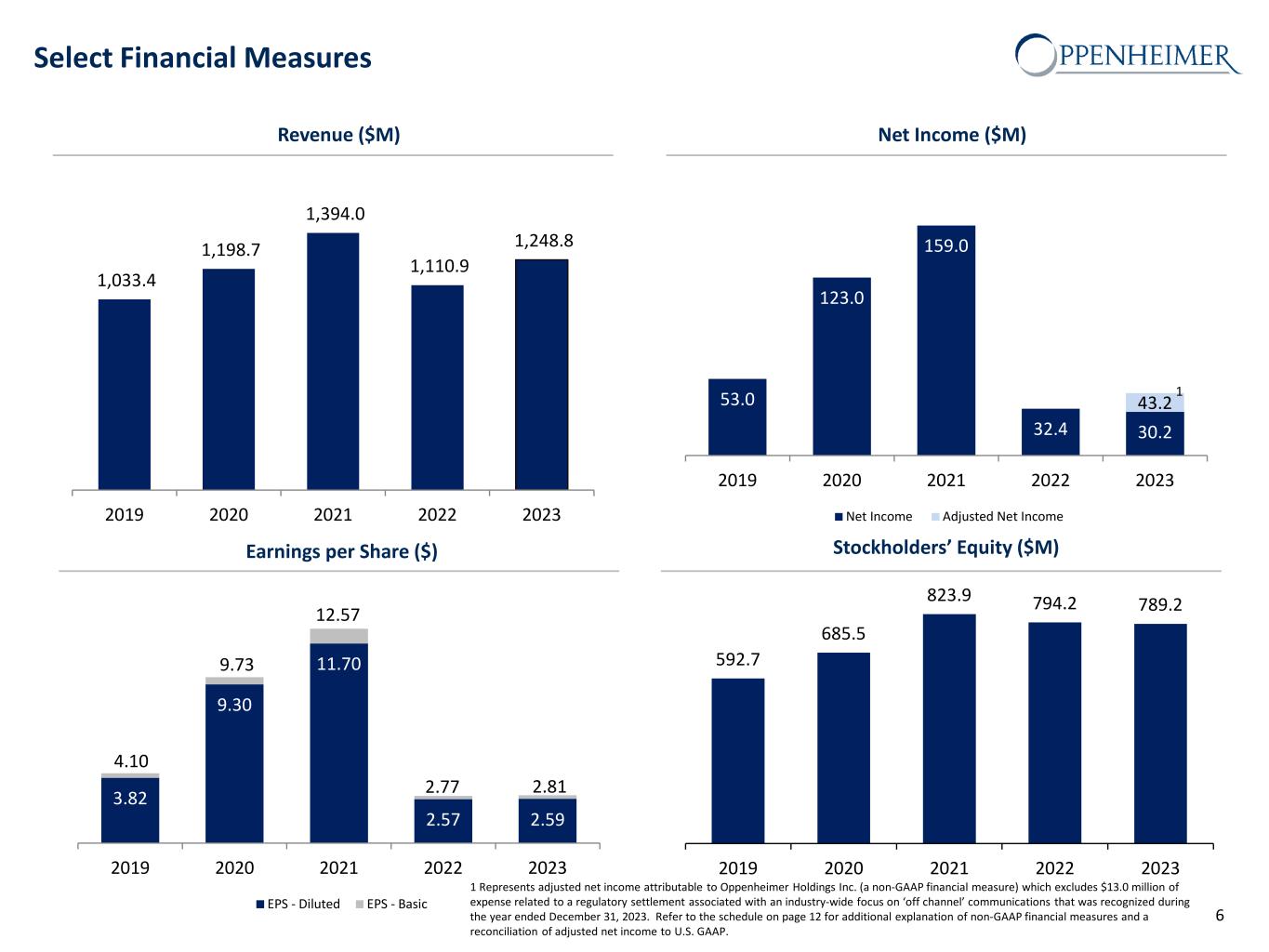

592.7 685.5 823.9 794.2 789.2 2019 2020 2021 2022 2023 Select Financial Measures Revenue ($M) Net Income ($M) Earnings per Share ($) Stockholders’ Equity ($M) 6 12.57 1,033.4 1,198.7 1,394.0 1,110.9 1,248.8 2019 2020 2021 2022 2023 3.82 9.30 11.70 2.57 2.59 2019 2020 2021 2022 2023 EPS - Diluted EPS - Basic 4.10 9.73 2.77 2.81 53.0 123.0 159.0 32.4 30.2 43.2 2019 2020 2021 2022 2023 Net Income Adjusted Net Income 1 1 Represents adjusted net income attributable to Oppenheimer Holdings Inc. (a non-GAAP financial measure) which excludes $13.0 million of expense related to a regulatory settlement associated with an industry-wide focus on ‘off channel’ communications that was recognized during the year ended December 31, 2023. Refer to the schedule on page 12 for additional explanation of non-GAAP financial measures and a reconciliation of adjusted net income to U.S. GAAP.

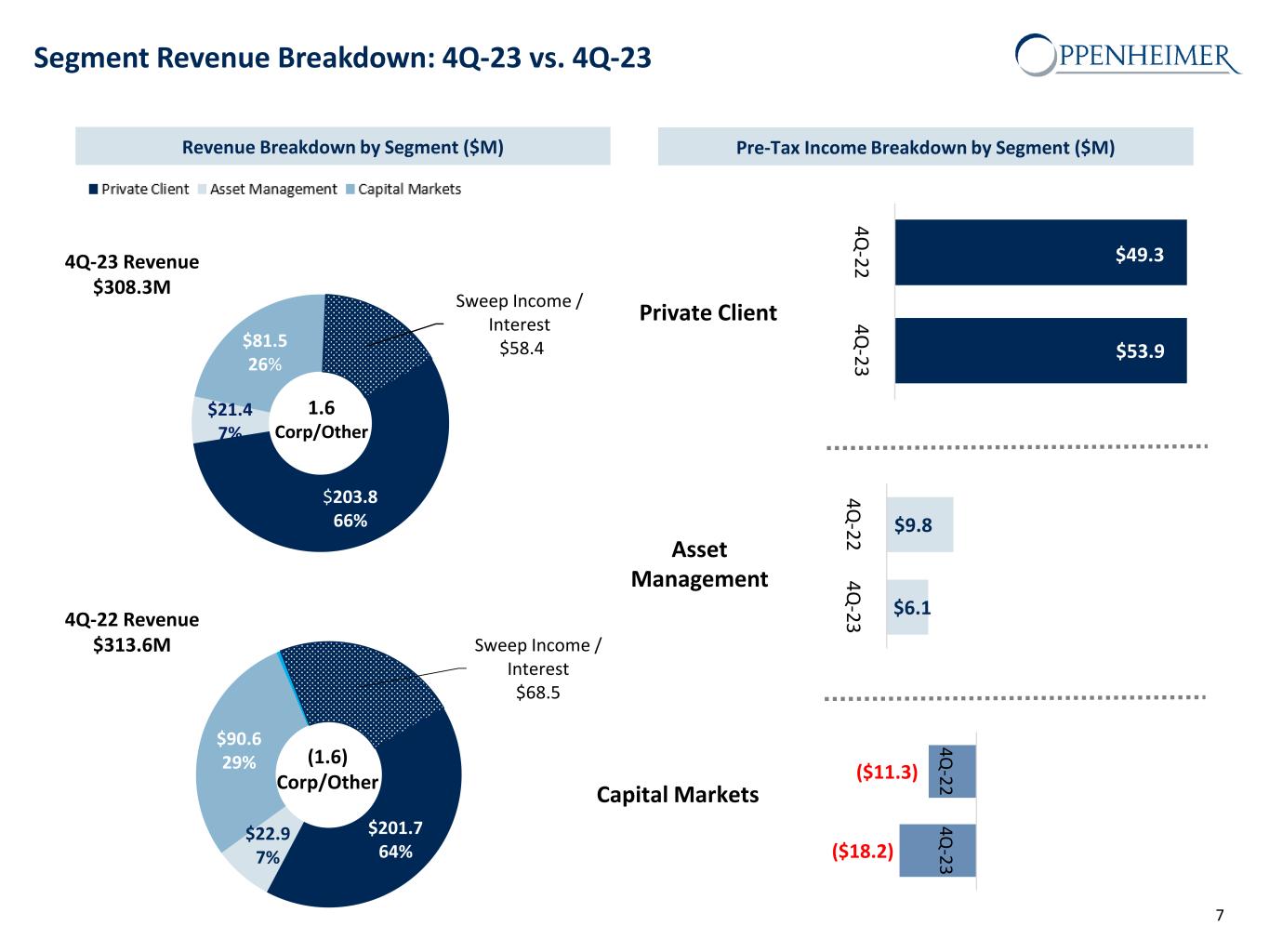

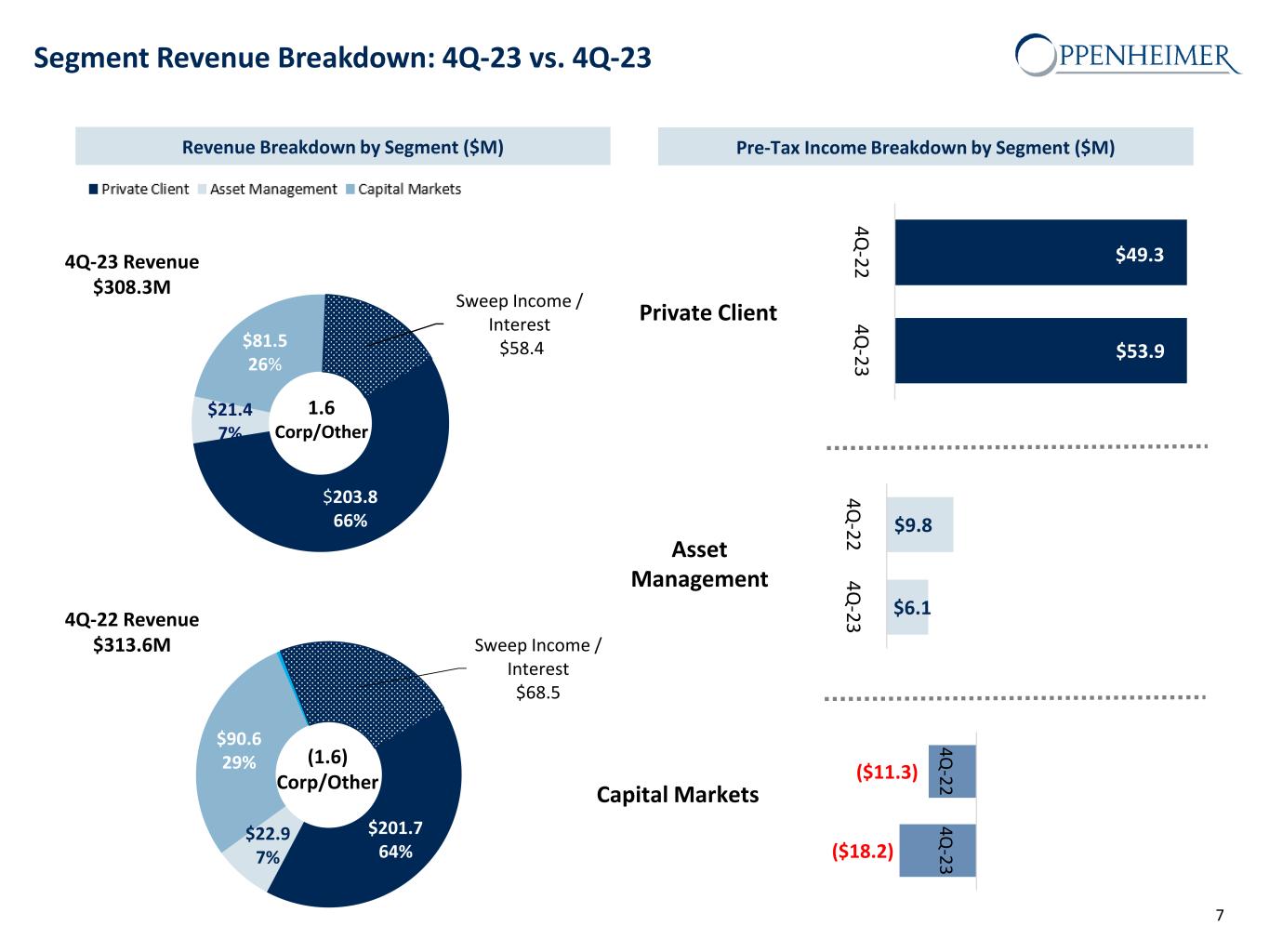

Segment Revenue Breakdown: 4Q-23 vs. 4Q-23 7 Pre-Tax Income Breakdown by Segment ($M)Revenue Breakdown by Segment ($M) 4Q-23 Revenue $308.3M 4Q-22 Revenue $313.6M Private Client Asset Management Capital Markets $ $203.8 66% $21.4 7% $81.5 26% Sweep Income / Interest $58.4 1.6 Corp/Other $201.7 64% $22.9 7% $90.6 29% Sweep Income / Interest $68.5 (1.6) Corp/Other $53.9 $49.3 $(5.0) $5.0 $15.0 $25.0 $35.0 $45.0 4Q -23 4Q -22 $6.1 $9.8 $(5.0) $5.0 $15.0 $25.0 $35.0 $45.0 4Q -23 4Q -22 ($18.2) ($11.3) $(25.0) $(15.0) $(5.0) $5.0 $15.0 $25.0 $35.0 $45.0 4Q -23 4Q -22

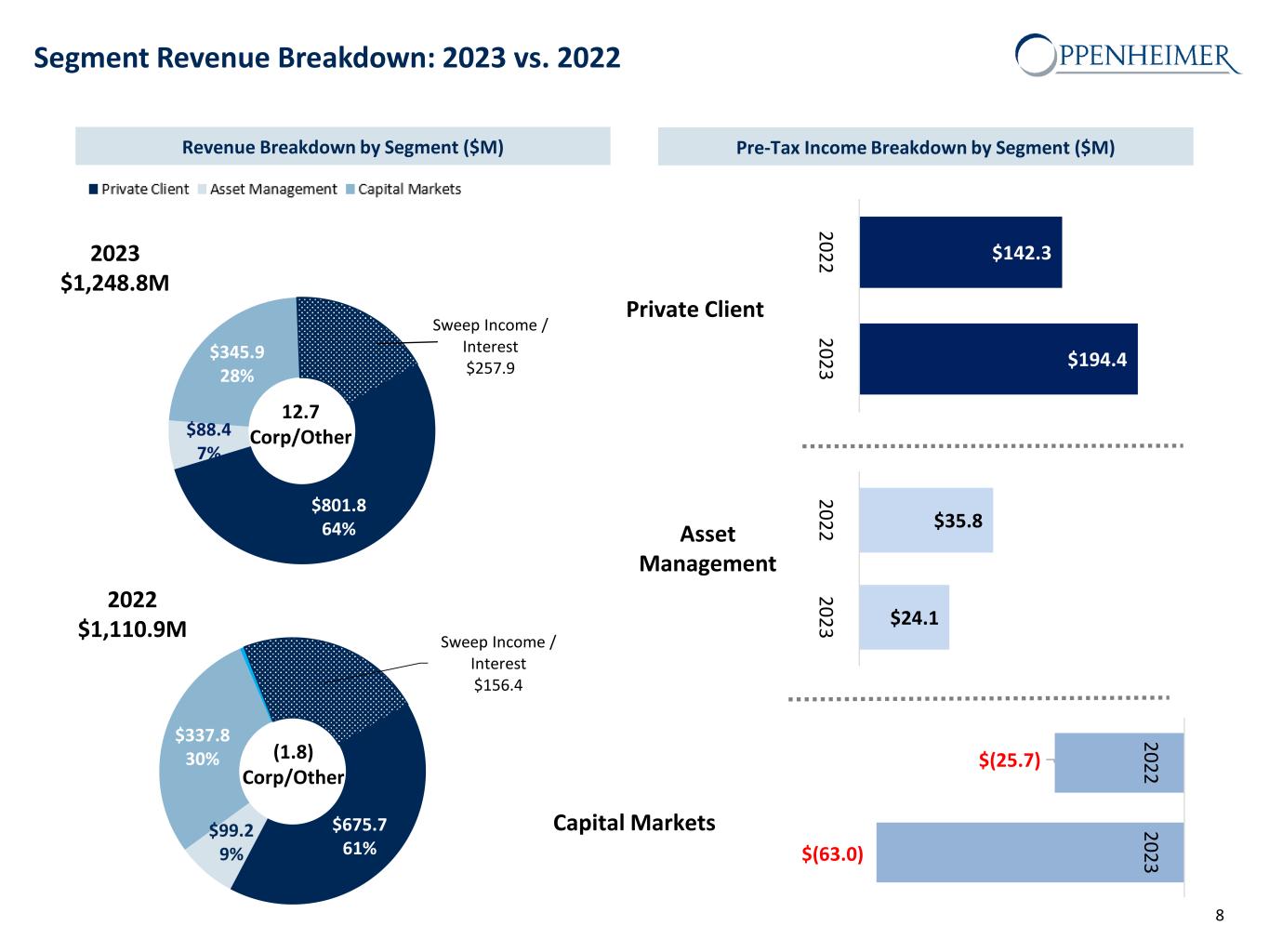

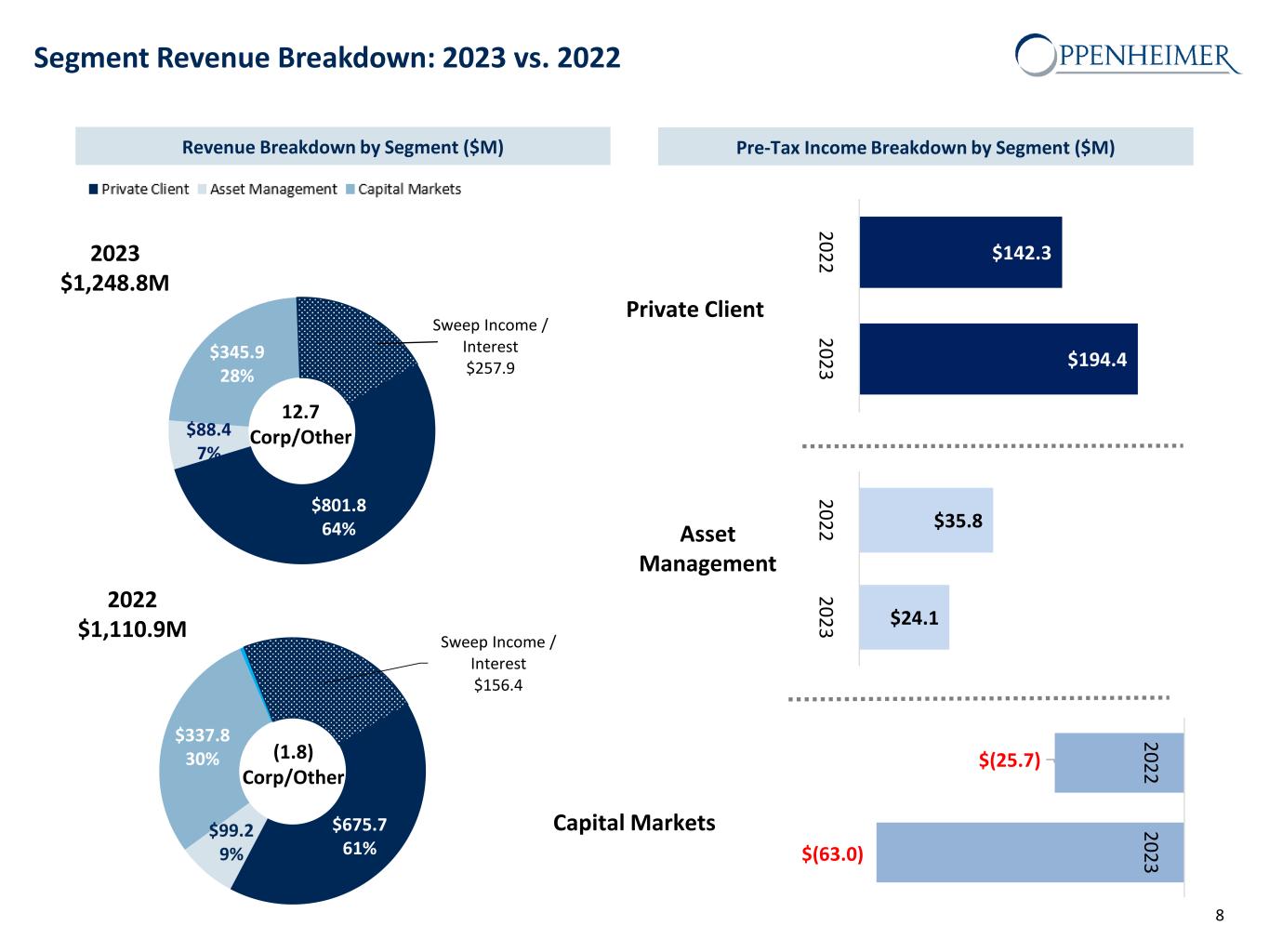

Segment Revenue Breakdown: 2023 vs. 2022 8 Pre-Tax Income Breakdown by Segment ($M)Revenue Breakdown by Segment ($M) Private Client Asset Management Capital Markets 2023 $1,248.8M 2022 $1,110.9M $142.3 $101.1 $ $ $194.4 $142.3 2023 2022 $24.1 $35.8 2023 2022 $(63.0) $(25.7) 2023 2022 $675.7 61% $99.2 9% $337.8 30% Sweep Income / Interest $156.4 (1.8) Corp/Other $801.8 64% $88.4 7% $345.9 28% Sweep Income / Interest $257.9 12.7 Corp/Other

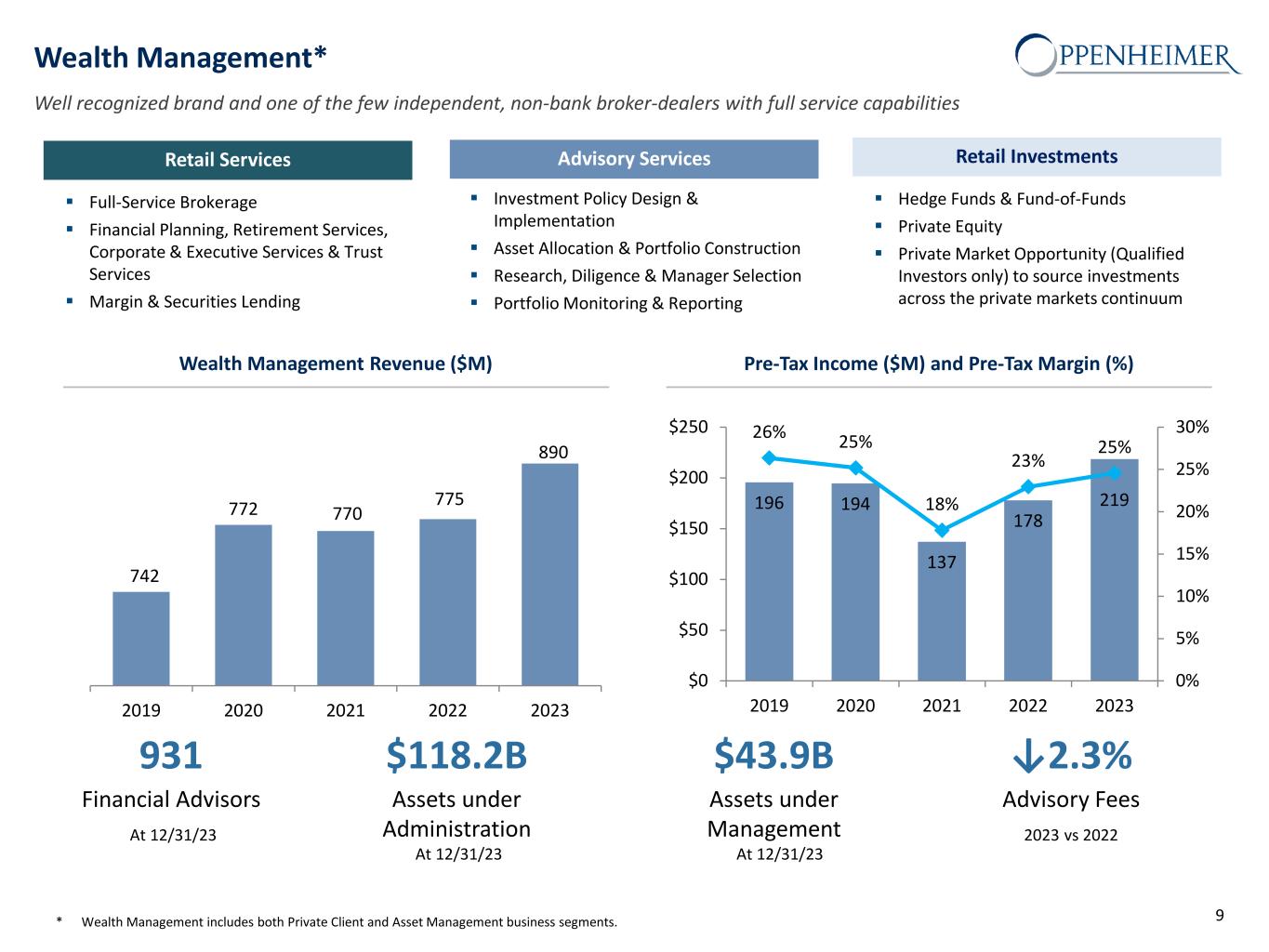

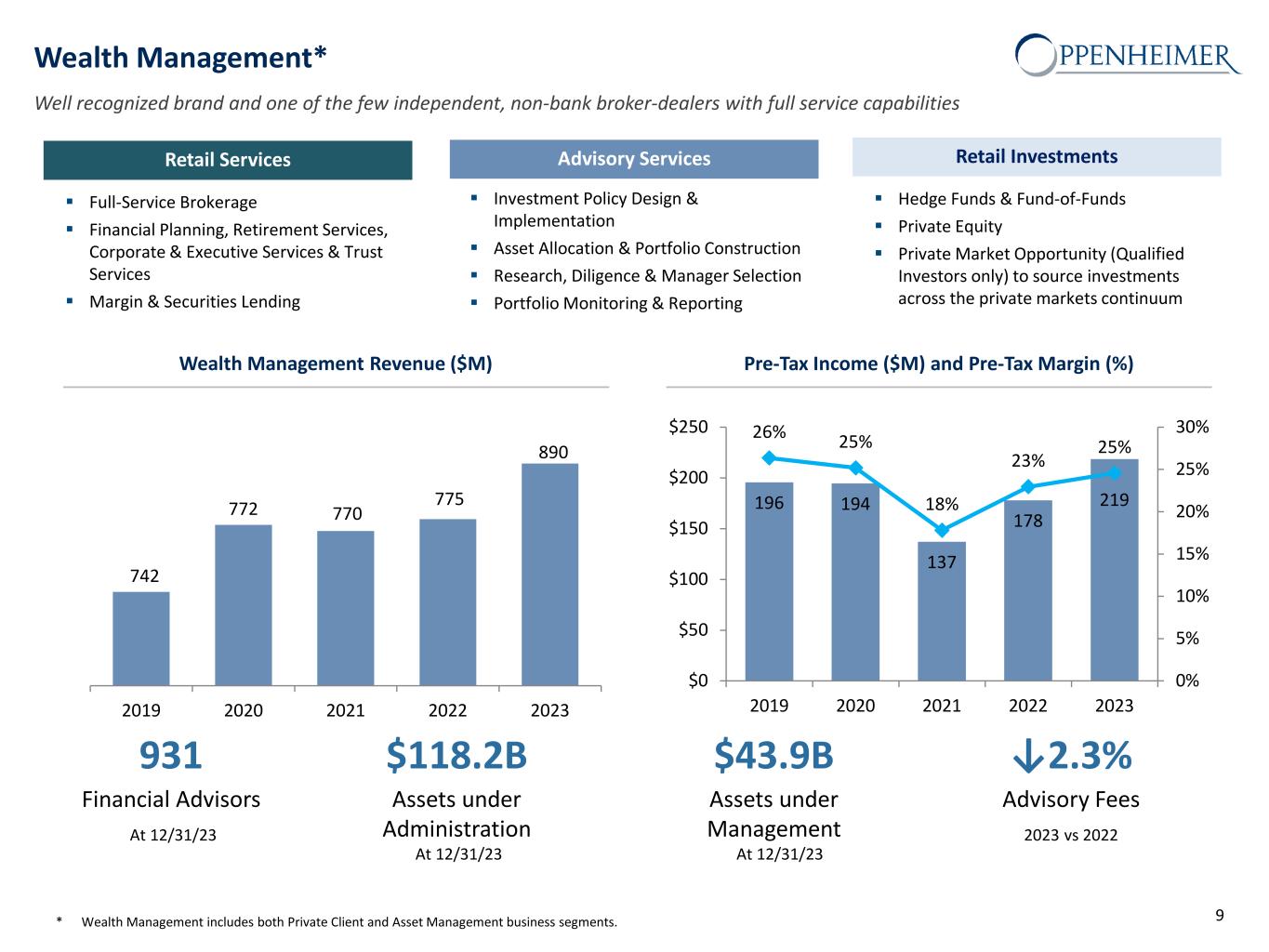

Wealth Management* Well recognized brand and one of the few independent, non-bank broker-dealers with full service capabilities Retail Services Full-Service Brokerage Financial Planning, Retirement Services, Corporate & Executive Services & Trust Services Margin & Securities Lending Advisory Services Investment Policy Design & Implementation Asset Allocation & Portfolio Construction Research, Diligence & Manager Selection Portfolio Monitoring & Reporting Retail Investments Hedge Funds & Fund-of-Funds Private Equity Private Market Opportunity (Qualified Investors only) to source investments across the private markets continuum Wealth Management Revenue ($M) Pre-Tax Income ($M) and Pre-Tax Margin (%) 931 Financial Advisors At 12/31/23 $118.2B Assets under Administration At 12/31/23 $43.9B Assets under Management At 12/31/23 ↓2.3% Advisory Fees 2023 vs 2022 * Wealth Management includes both Private Client and Asset Management business segments. 9 742 772 770 775 2019 2020 2021 2022 2023 890 196 194 137 178 219 26% 25% 18% 23% 25% 0% 5% 10% 15% 20% 25% 30% $0 $50 $100 $150 $200 $250 2019 2020 2021 2022 2023

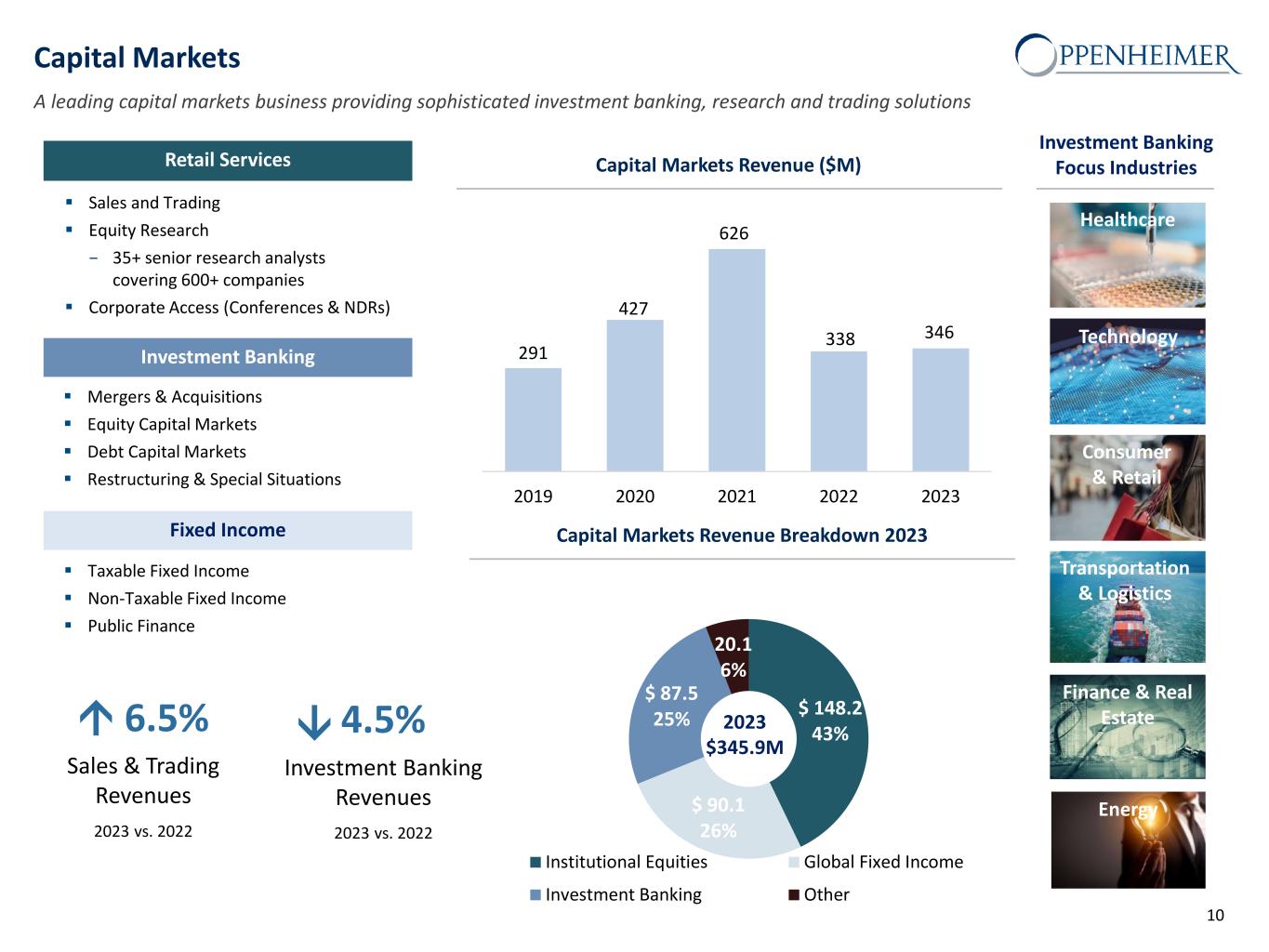

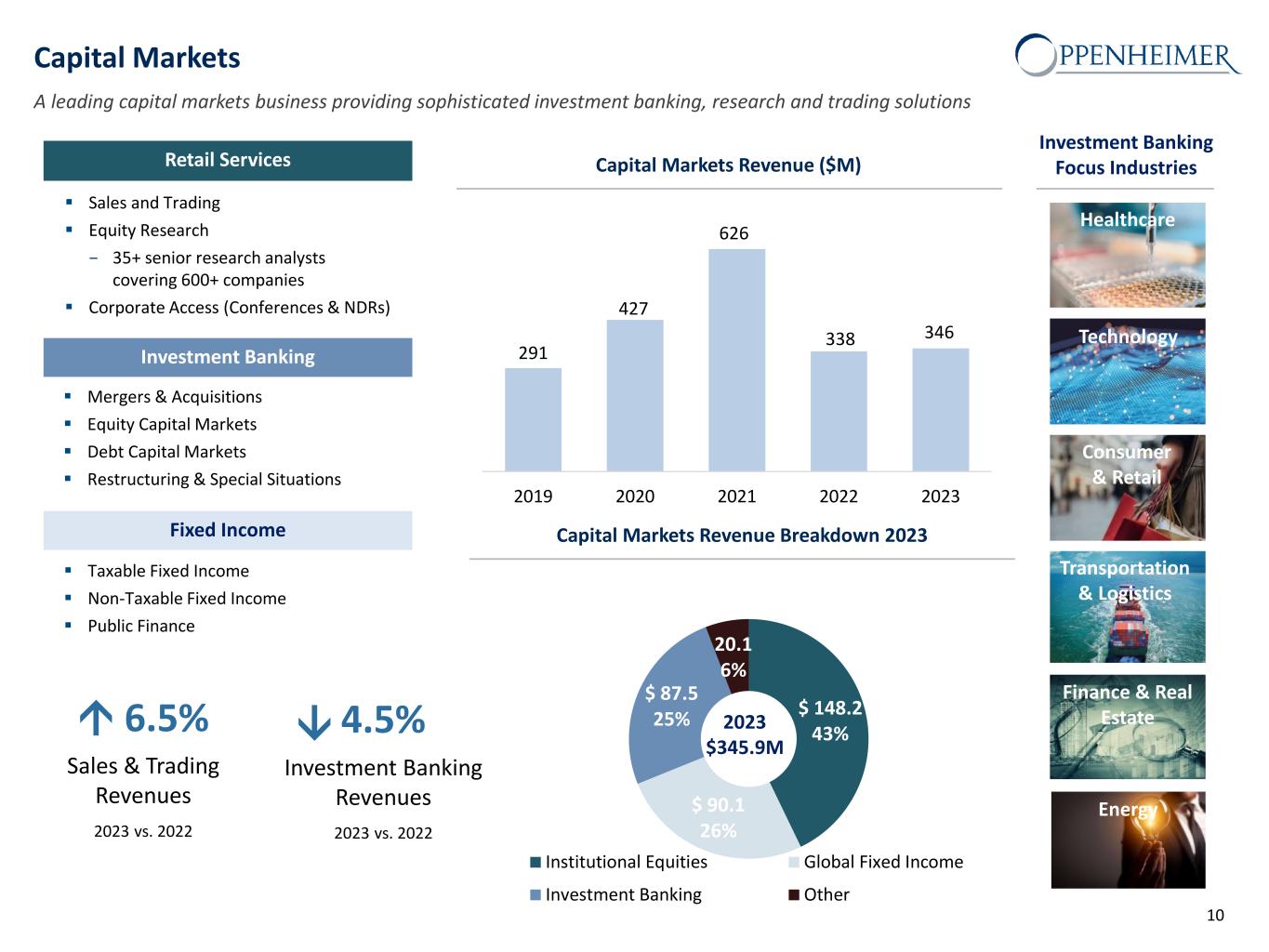

Capital Markets A leading capital markets business providing sophisticated investment banking, research and trading solutions Healthcare Technology Transportation & Logistics Finance & Real Estate Consumer & Retail Energy Capital Markets Revenue Breakdown 2023 Capital Markets Revenue ($M) Investment Banking Focus Industries 10 6.5% Sales & Trading Revenues 2023 vs. 2022 4.5% Investment Banking Revenues 2023 vs. 2022 Institutional Equities Sales and Trading Equity Research − 35+ senior research analysts covering 600+ companies Corporate Access (Conferences & NDRs) Investment Banking Mergers & Acquisitions Equity Capital Markets Debt Capital Markets Restructuring & Special Situations Fixed Income Taxable Fixed Income Non-Taxable Fixed Income Public Finance Retail Services 291 427 626 338 346 2019 2020 2021 2022 2023 $ 148.2 43% $ 90.1 26% $ 87.5 25% 20.1 6% Institutional Equities Global Fixed Income Investment Banking Other 2023 $345.9M

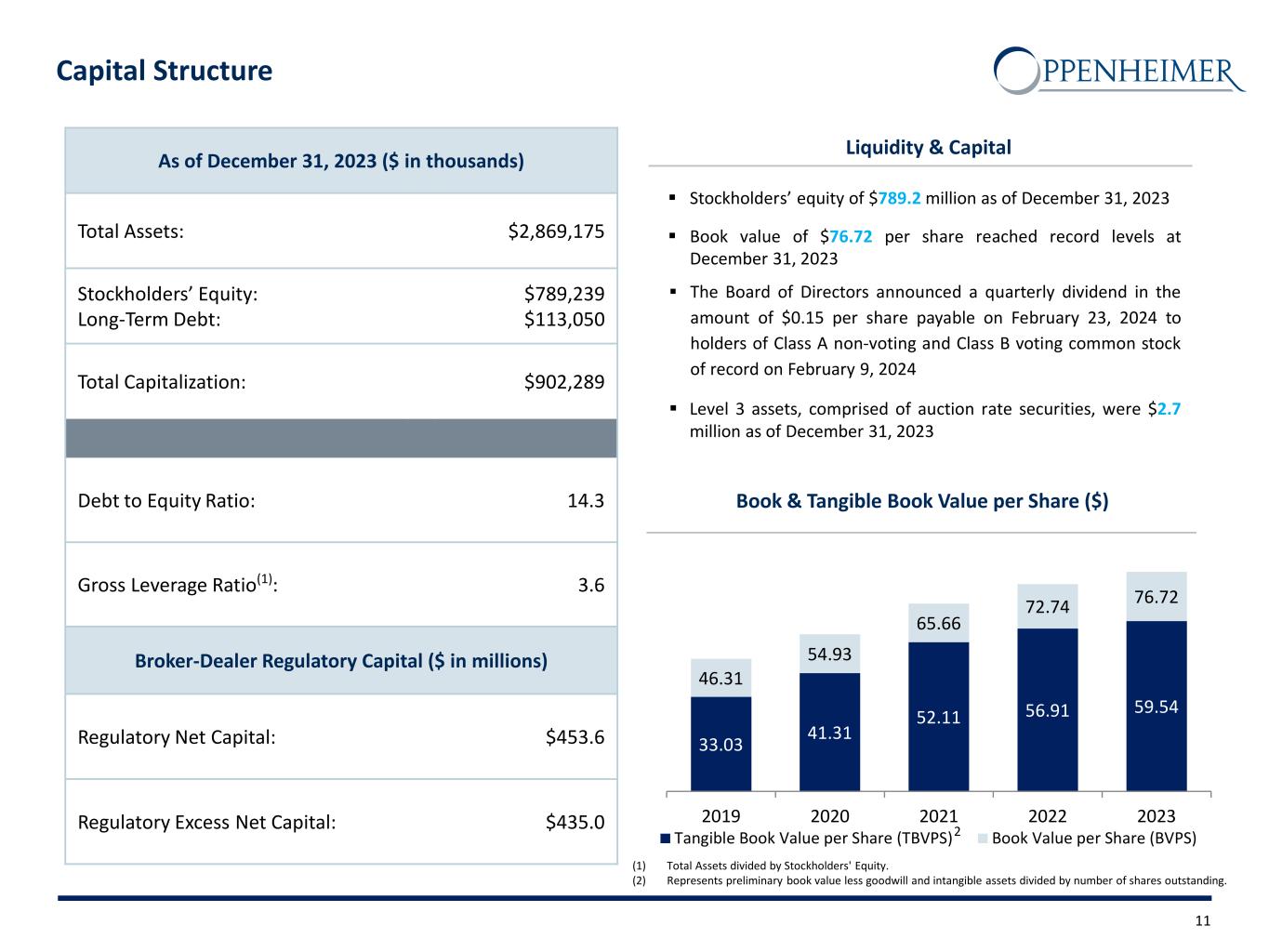

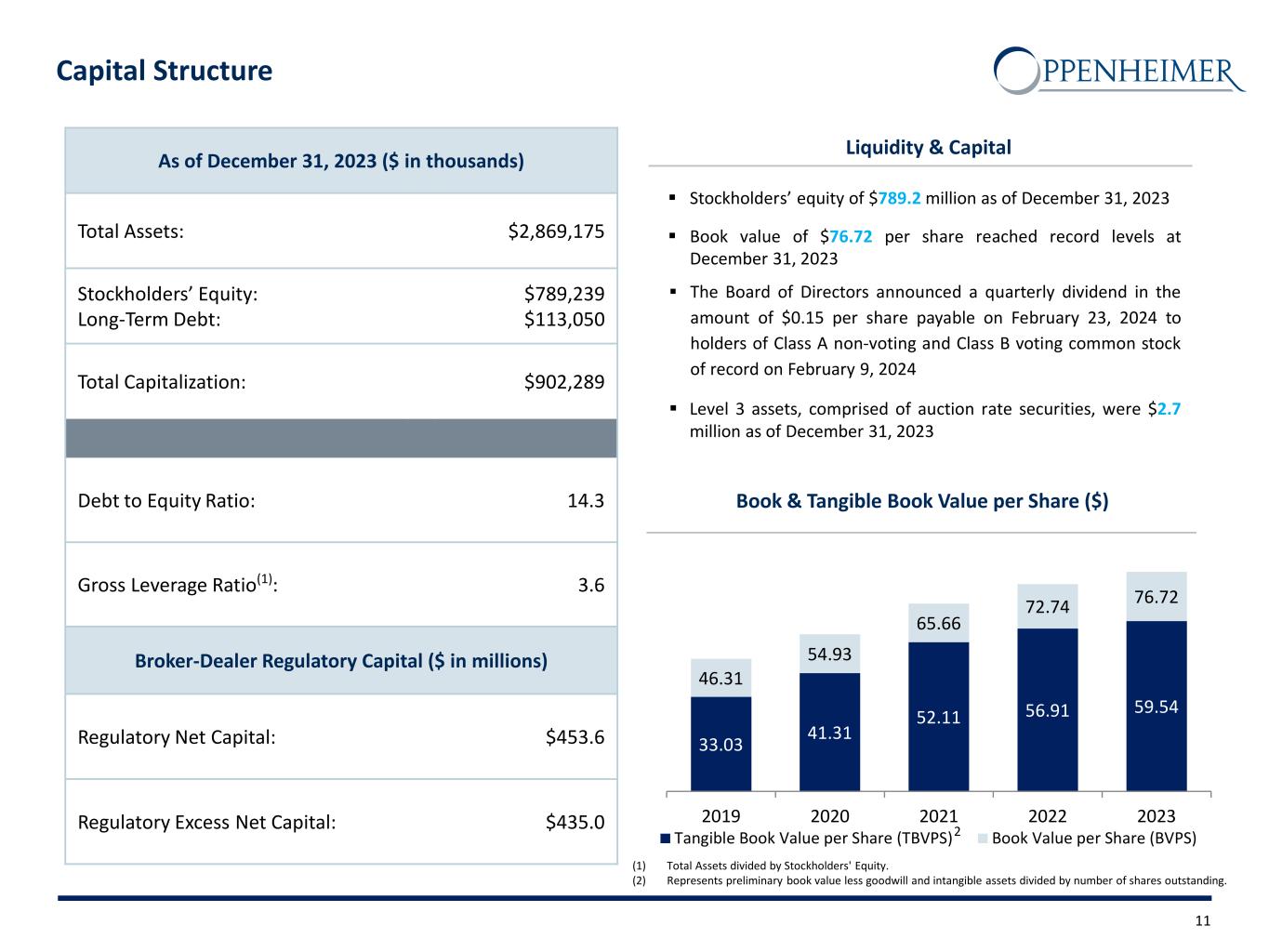

11 Capital Structure As of December 31, 2023 ($ in thousands) Total Assets: $2,869,175 Stockholders’ Equity: Long-Term Debt: $789,239 $113,050 Total Capitalization: $902,289 Debt to Equity Ratio: 14.3 Gross Leverage Ratio(1): 3.6 Broker-Dealer Regulatory Capital ($ in millions) Regulatory Net Capital: $453.6 Regulatory Excess Net Capital: $435.0 Book & Tangible Book Value per Share ($) Liquidity & Capital Stockholders’ equity of $789.2 million as of December 31, 2023 Book value of $76.72 per share reached record levels at December 31, 2023 The Board of Directors announced a quarterly dividend in the amount of $0.15 per share payable on February 23, 2024 to holders of Class A non-voting and Class B voting common stock of record on February 9, 2024 Level 3 assets, comprised of auction rate securities, were $2.7 million as of December 31, 2023 33.03 41.31 52.11 56.91 59.54 46.31 54.93 65.66 72.74 76.72 2019 2020 2021 2022 2023 Tangible Book Value per Share (TBVPS) Book Value per Share (BVPS) (1) Total Assets divided by Stockholders' Equity. (2) Represents preliminary book value less goodwill and intangible assets divided by number of shares outstanding. 2

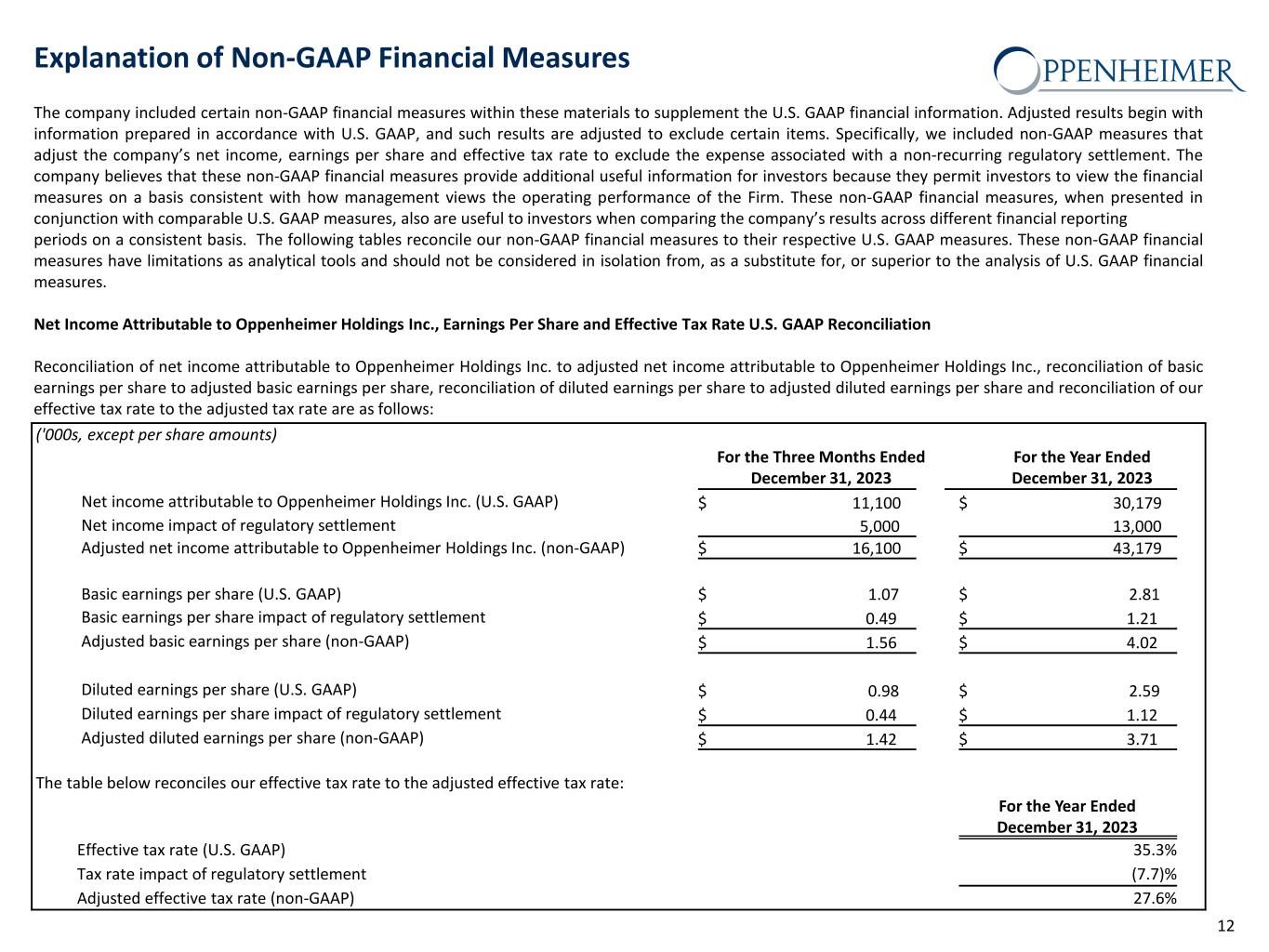

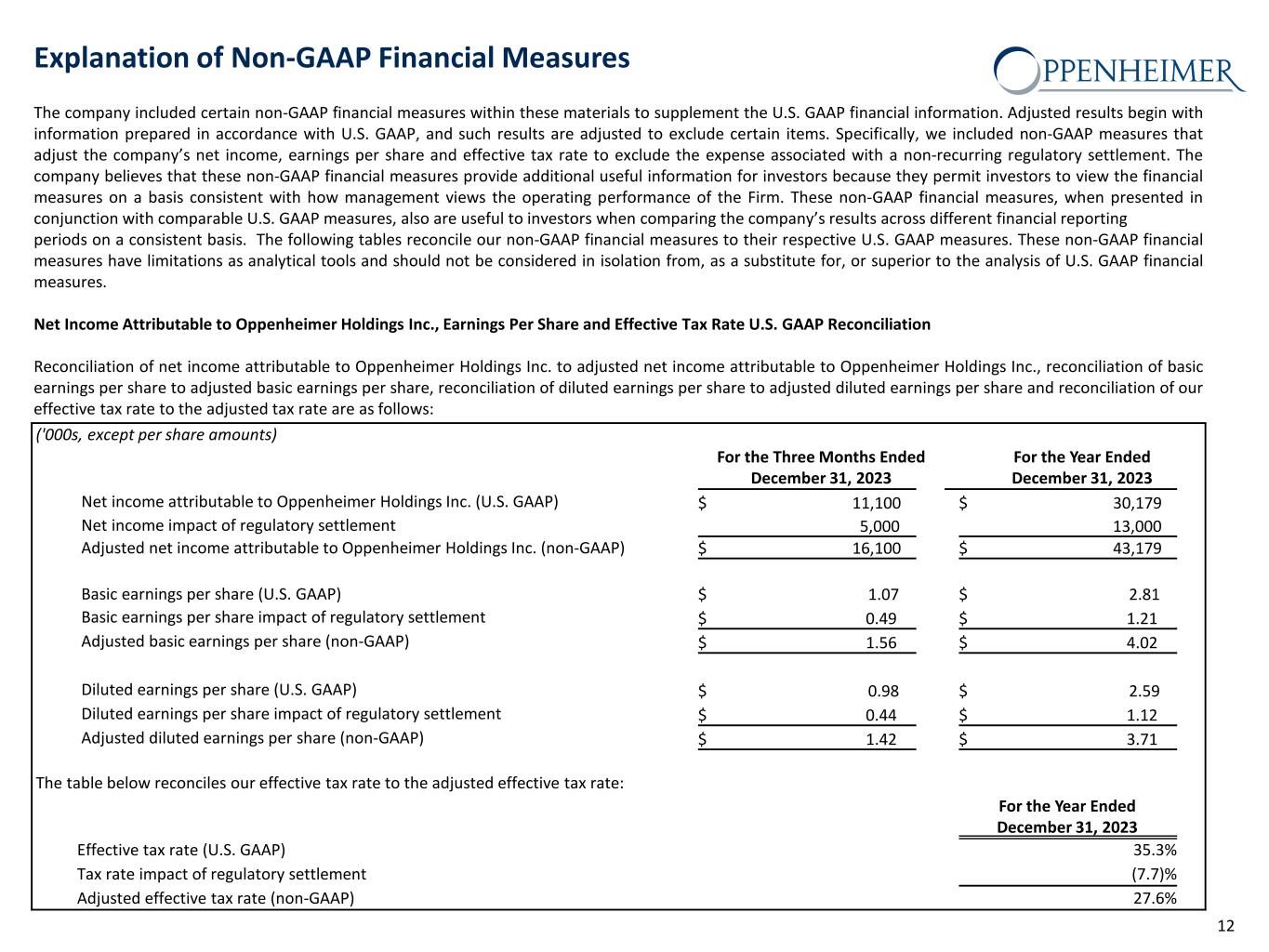

Explanation of Non-GAAP Financial Measures The company included certain non-GAAP financial measures within these materials to supplement the U.S. GAAP financial information. Adjusted results begin with information prepared in accordance with U.S. GAAP, and such results are adjusted to exclude certain items. Specifically, we included non-GAAP measures that adjust the company’s net income, earnings per share and effective tax rate to exclude the expense associated with a non-recurring regulatory settlement. The company believes that these non-GAAP financial measures provide additional useful information for investors because they permit investors to view the financial measures on a basis consistent with how management views the operating performance of the Firm. These non-GAAP financial measures, when presented in conjunction with comparable U.S. GAAP measures, also are useful to investors when comparing the company’s results across different financial reporting periods on a consistent basis. The following tables reconcile our non-GAAP financial measures to their respective U.S. GAAP measures. These non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation from, as a substitute for, or superior to the analysis of U.S. GAAP financial measures. Net Income Attributable to Oppenheimer Holdings Inc., Earnings Per Share and Effective Tax Rate U.S. GAAP Reconciliation Reconciliation of net income attributable to Oppenheimer Holdings Inc. to adjusted net income attributable to Oppenheimer Holdings Inc., reconciliation of basic earnings per share to adjusted basic earnings per share, reconciliation of diluted earnings per share to adjusted diluted earnings per share and reconciliation of our effective tax rate to the adjusted tax rate are as follows: ('000s, except per share amounts) For the Three Months Ended December 31, 2023 For the Year Ended December 31, 2023 Net income attributable to Oppenheimer Holdings Inc. (U.S. GAAP) $ 11,100 $ 30,179 Net income impact of regulatory settlement 5,000 13,000 Adjusted net income attributable to Oppenheimer Holdings Inc. (non-GAAP) $ 16,100 $ 43,179 Basic earnings per share (U.S. GAAP) $ 1.07 $ 2.81 Basic earnings per share impact of regulatory settlement $ 0.49 $ 1.21 Adjusted basic earnings per share (non-GAAP) $ 1.56 $ 4.02 Diluted earnings per share (U.S. GAAP) $ 0.98 $ 2.59 Diluted earnings per share impact of regulatory settlement $ 0.44 $ 1.12 Adjusted diluted earnings per share (non-GAAP) $ 1.42 $ 3.71 The table below reconciles our effective tax rate to the adjusted effective tax rate: For the Year Ended December 31, 2023 Effective tax rate (U.S. GAAP) 35.3% Tax rate impact of regulatory settlement (7.7)% Adjusted effective tax rate (non-GAAP) 27.6% 12

For more information contact Investor Relations at info@opco.com