0000791963false00007919632022-05-022022-05-02

As filed with the Securities and Exchange Commission on May 1, 2023

___________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 1, 2023

OPPENHEIMER HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Commission File Number 1-12043

|

|

|

|

|

|

|

|

|

| Delaware |

|

98-0080034 |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

85 Broad Street

New York, New York 10004

(Address of principal executive offices) (Zip Code)

(212) 668-8000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Class A non-voting common stock |

OPY |

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 7 – REGULATION FD

ITEM 7.01 Regulation FD Disclosure.

On May 1, 2023, Oppenheimer Holdings Inc. (the “Company”) posted to the Investor Relations page of its website, www.oppenheimer.com, a presentation to investors regarding the Company in the form of the slides containing the information attached to this Current Report on Form 8-K as Exhibit 99.1 (the “Slides”). The Company may use the Slides, in whole or in part, and possibly with minor modifications, in connection with presentations to investors after such date.

By filing this Current Report on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation FD.

The information contained in the Slides is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

In accordance with General Instruction B.2 of this Current Report on Form 8-K, the information presented in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01. Financial Statements and Exhibits.

(d)Exhibits:

The following Exhibit is submitted herewith:

99.1 Investor Presentation (First Quarter 2023 Investor Update) posted on May 1, 2023

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Oppenheimer Holdings Inc.

|

|

|

By: /s/ Brad M. Watkins

---------------------------------

Brad M. Watkins

Chief Financial Officer

(Duly Authorized Officer and Principal Financial and Accounting Officer) |

EXHIBIT INDEX

|

|

|

|

|

|

| Exhibit Number |

Description |

|

|

EX-99.1

2

opyq1-2023investorpresen.htm

EX-99.1

opyq1-2023investorpresen

Oppenheimer Holdings Inc. First Quarter 2023 Investor Update

Safe Harbor Statement This presentation and other written or oral statements made from time to time by representatives of Oppenheimer Holdings Inc. ("Oppenheimer” or the “company”) may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may relate to such matters as anticipated financial performance, future revenues or earnings, business prospects, new products or services, anticipated market performance and similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the company’s current beliefs, expectations and assumptions regarding the future of the company’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the company’s control. The company cautions that a variety of factors could cause the company’s actual results to differ materially from the anticipated results or other expectations expressed in the company’s forwarding-looking statements. These risks and uncertainties include, but are not limited to, those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2023 (the “2022 10-K”) and Quarterly Report on Form 10-Q for the quarter-ended March 31, 2023 filed with the SEC on April 28, 2023 (the “2023 10-Q1”). In addition, important factors that could cause actual results to differ materially from those in the forward-looking statements include those factors discussed in Part I, “Item 2. Management’s Discussion & Analysis of Financial Condition and Results of Operations – Factors Affecting ‘Forward-Looking Statements’” of the 2023 10-Q1. Any forward-looking statements herein are qualified in their entirety by reference to all such factors discussed in the 2022 10-K, the 2023 10-Q1 and the company’s other SEC filings. There can be no assurance that the company has correctly or completely identified and assessed all of the factors affecting the company’s business. Therefore, you should not rely on any of these forward-looking statements. Any forward- looking statement made by the company in this presentation is based only on information currently available to the company and speaks only as of the date on which it is made. The company does not undertake any obligation to publicly update or revise any forward- looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. 2

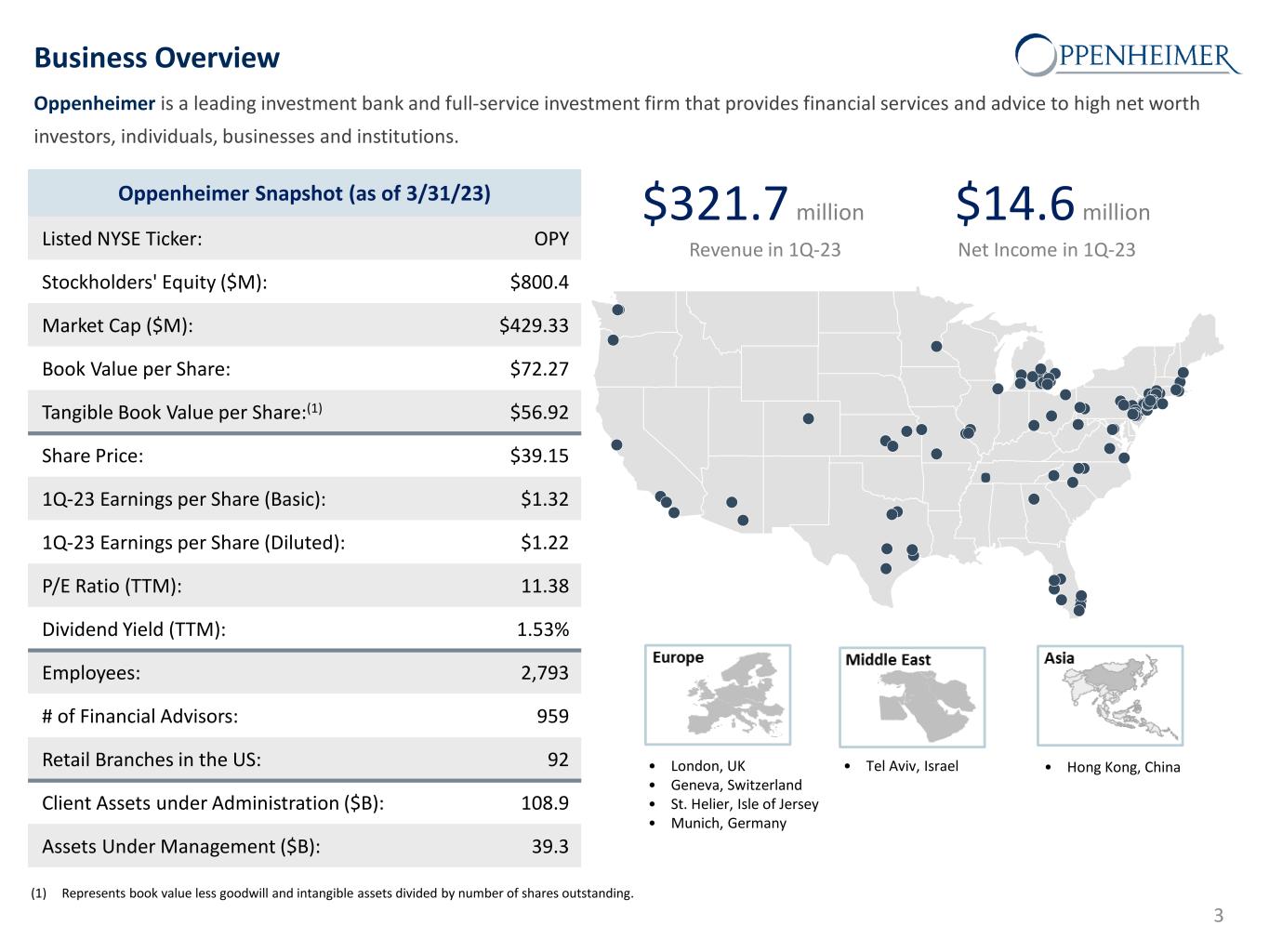

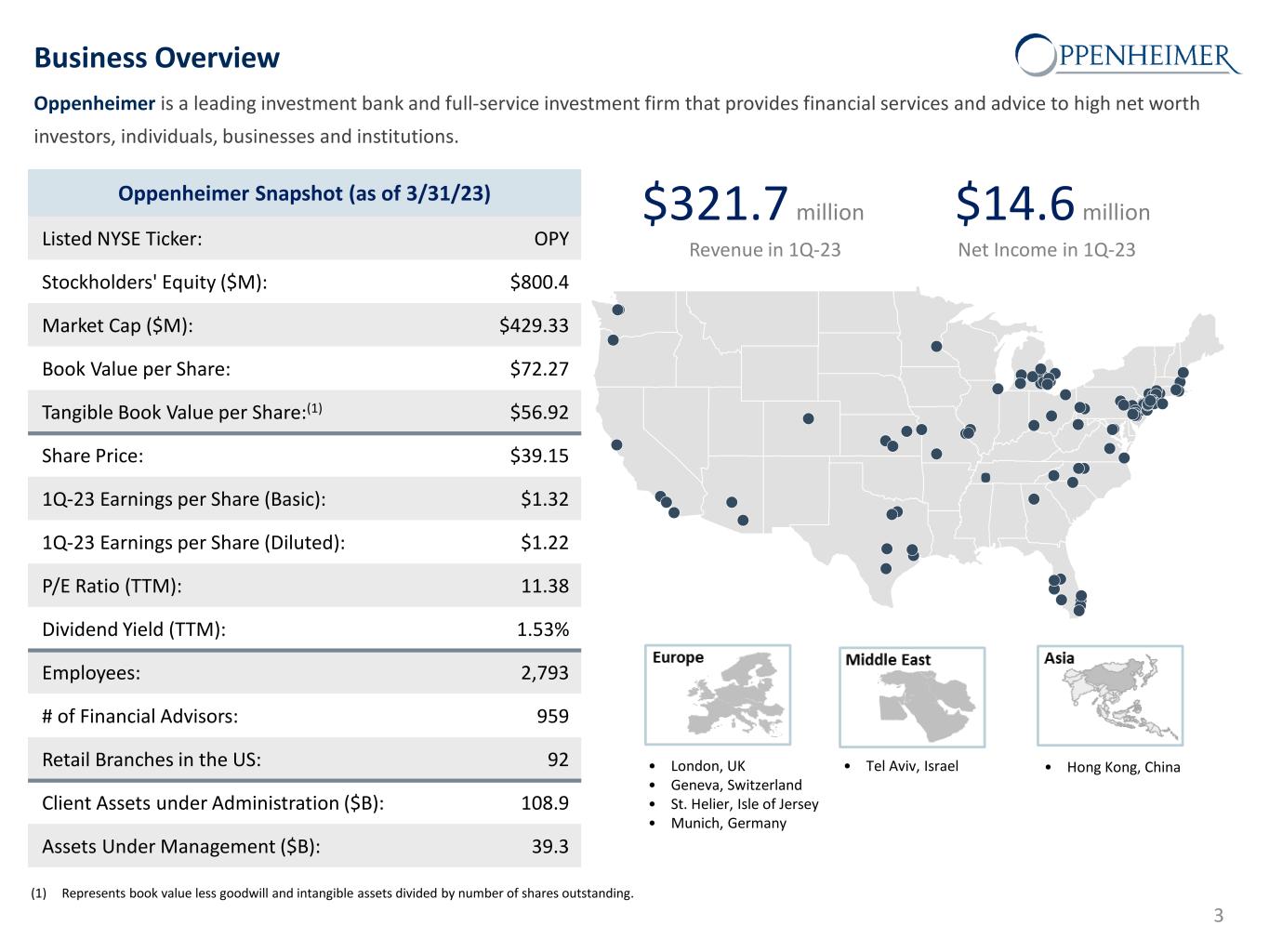

Oppenheimer is a leading investment bank and full-service investment firm that provides financial services and advice to high net worth investors, individuals, businesses and institutions. 3 • Hong Kong, China• London, UK • Geneva, Switzerland • St. Helier, Isle of Jersey • Munich, Germany • Tel Aviv, Israel (1) Represents book value less goodwill and intangible assets divided by number of shares outstanding. $14.6 million Net Income in 1Q-23 $321.7 million Revenue in 1Q-23 Business Overview Oppenheimer Snapshot (as of 3/31/23) Listed NYSE Ticker: OPY Stockholders' Equity ($M): $800.4 Market Cap ($M): $429.33 Book Value per Share: $72.27 Tangible Book Value per Share:(1) $56.92 Share Price: $39.15 1Q-23 Earnings per Share (Basic): $1.32 1Q-23 Earnings per Share (Diluted): $1.22 P/E Ratio (TTM): 11.38 Dividend Yield (TTM): 1.53% Employees: 2,793 # of Financial Advisors: 959 Retail Branches in the US: 92 Client Assets under Administration ($B): 108.9 Assets Under Management ($B): 39.3 .

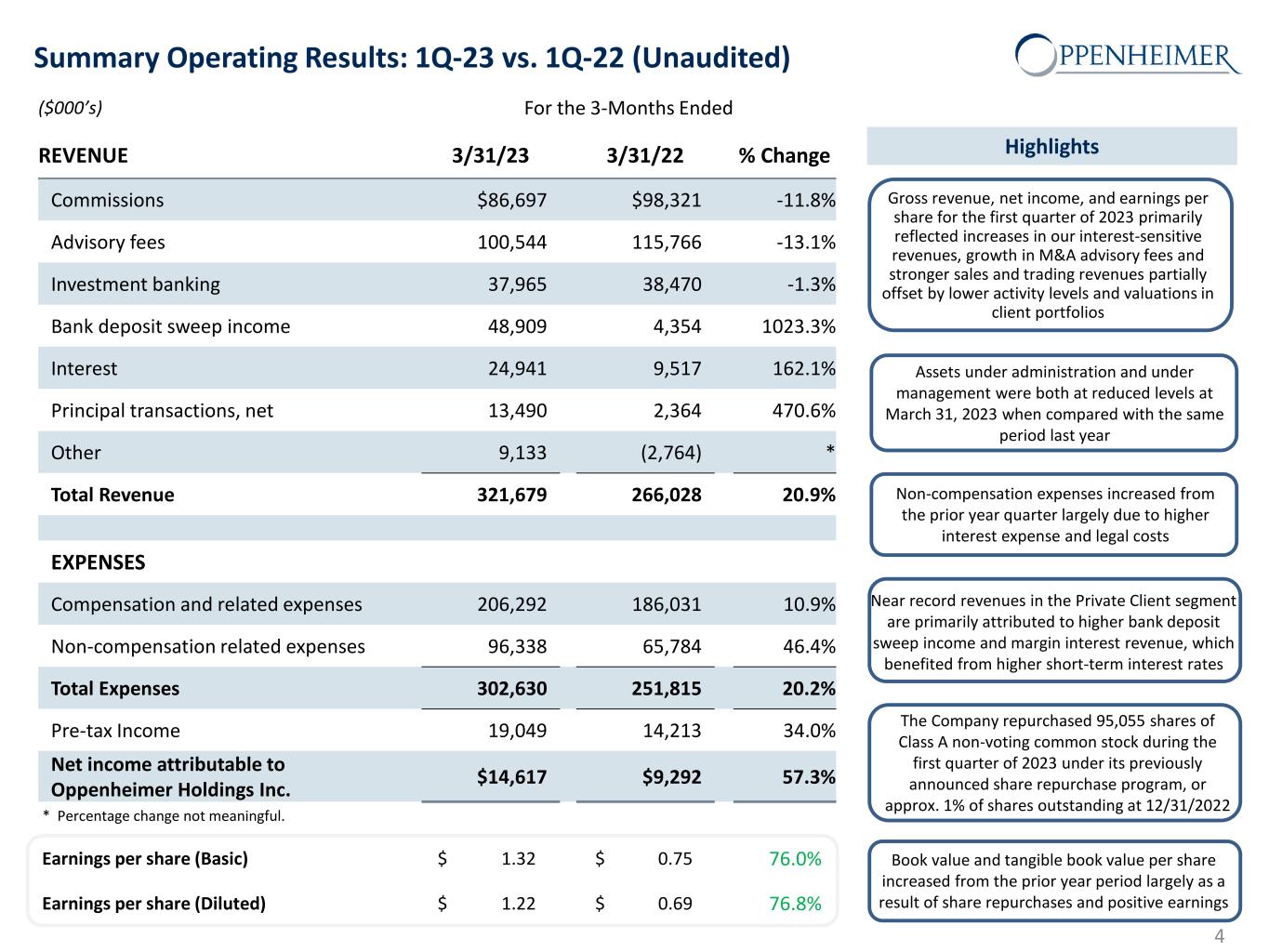

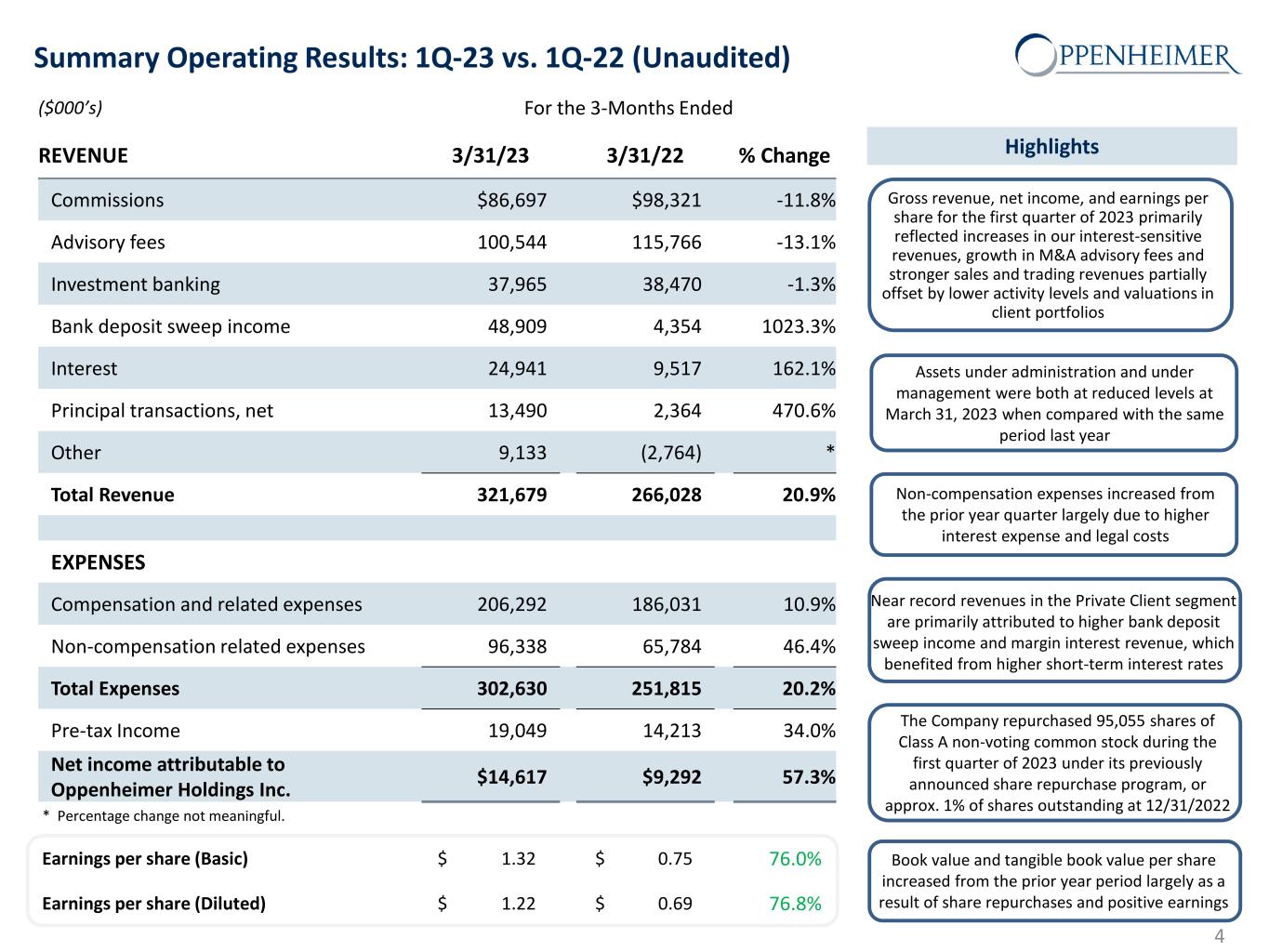

Earnings per share (Basic) $ 1.32 $ 0.75 76.0% Earnings per share (Diluted) $ 1.22 $ 0.69 76.8% Summary Operating Results: 1Q-23 vs. 1Q-22 (Unaudited) 4 Highlights ($000’s) For the 3-Months Ended REVENUE 3/31/23 3/31/22 % Change Commissions $86,697 $98,321 -11.8% Advisory fees 100,544 115,766 -13.1% Investment banking 37,965 38,470 -1.3% Bank deposit sweep income 48,909 4,354 1023.3% Interest 24,941 9,517 162.1% Principal transactions, net 13,490 2,364 470.6% Other 9,133 (2,764) * Total Revenue 321,679 266,028 20.9% EXPENSES Compensation and related expenses 206,292 186,031 10.9% Non-compensation related expenses 96,338 65,784 46.4% Total Expenses 302,630 251,815 20.2% Pre-tax Income 19,049 14,213 34.0% Net income attributable to Oppenheimer Holdings Inc. $14,617 $9,292 57.3% Gross revenue, net income, and earnings per share for the first quarter of 2023 primarily reflected increases in our interest-sensitive revenues, growth in M&A advisory fees and stronger sales and trading revenues partially offset by lower activity levels and valuations in client portfolios Assets under administration and under management were both at reduced levels at March 31, 2023 when compared with the same period last year Non-compensation expenses increased from the prior year quarter largely due to higher interest expense and legal costs Near record revenues in the Private Client segment are primarily attributed to higher bank deposit sweep income and margin interest revenue, which benefited from higher short-term interest rates The Company repurchased 95,055 shares of Class A non-voting common stock during the first quarter of 2023 under its previously announced share repurchase program, or approx. 1% of shares outstanding at 12/31/2022 Book value and tangible book value per share increased from the prior year period largely as a result of share repurchases and positive earnings * Percentage change not meaningful.

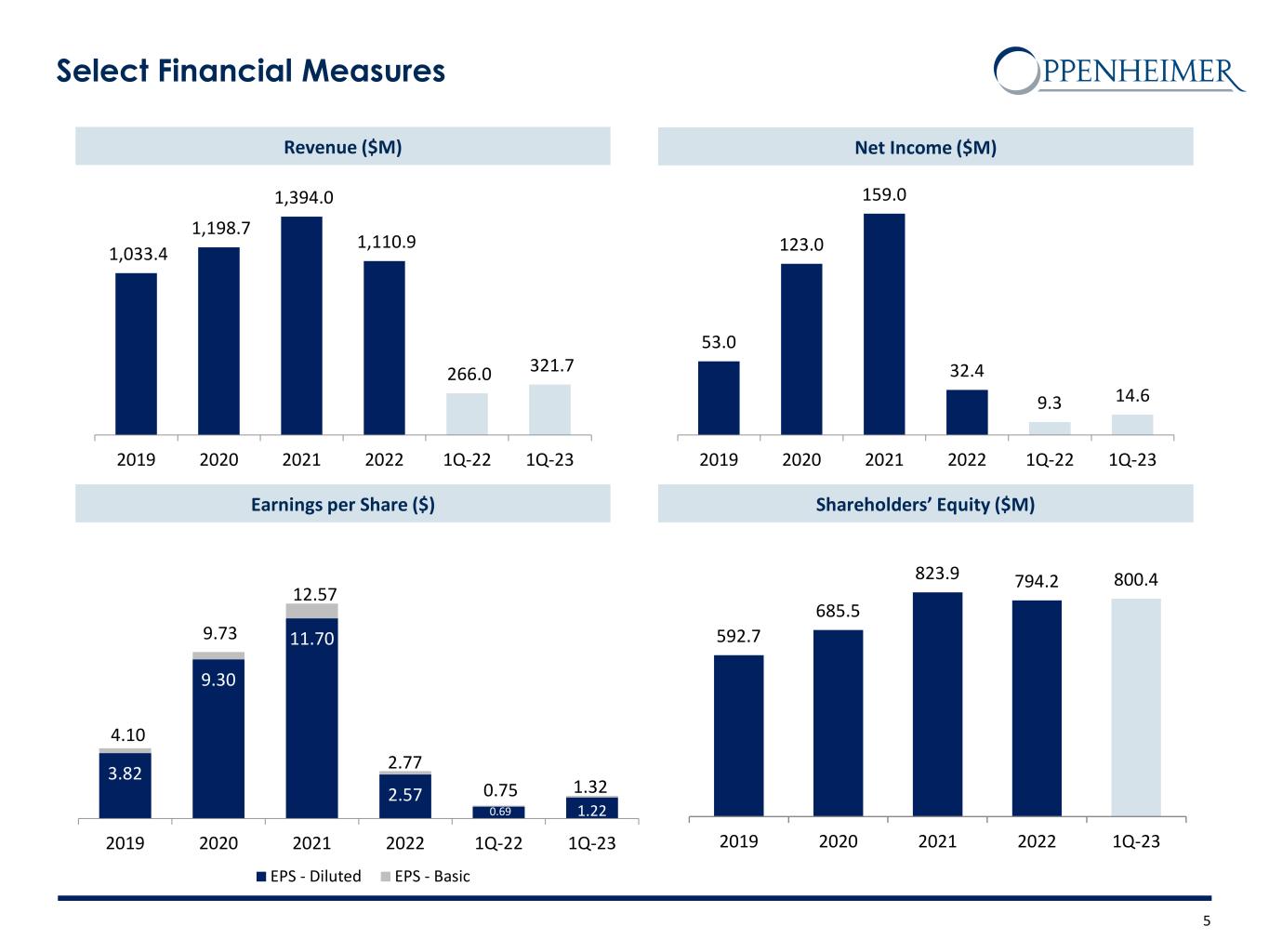

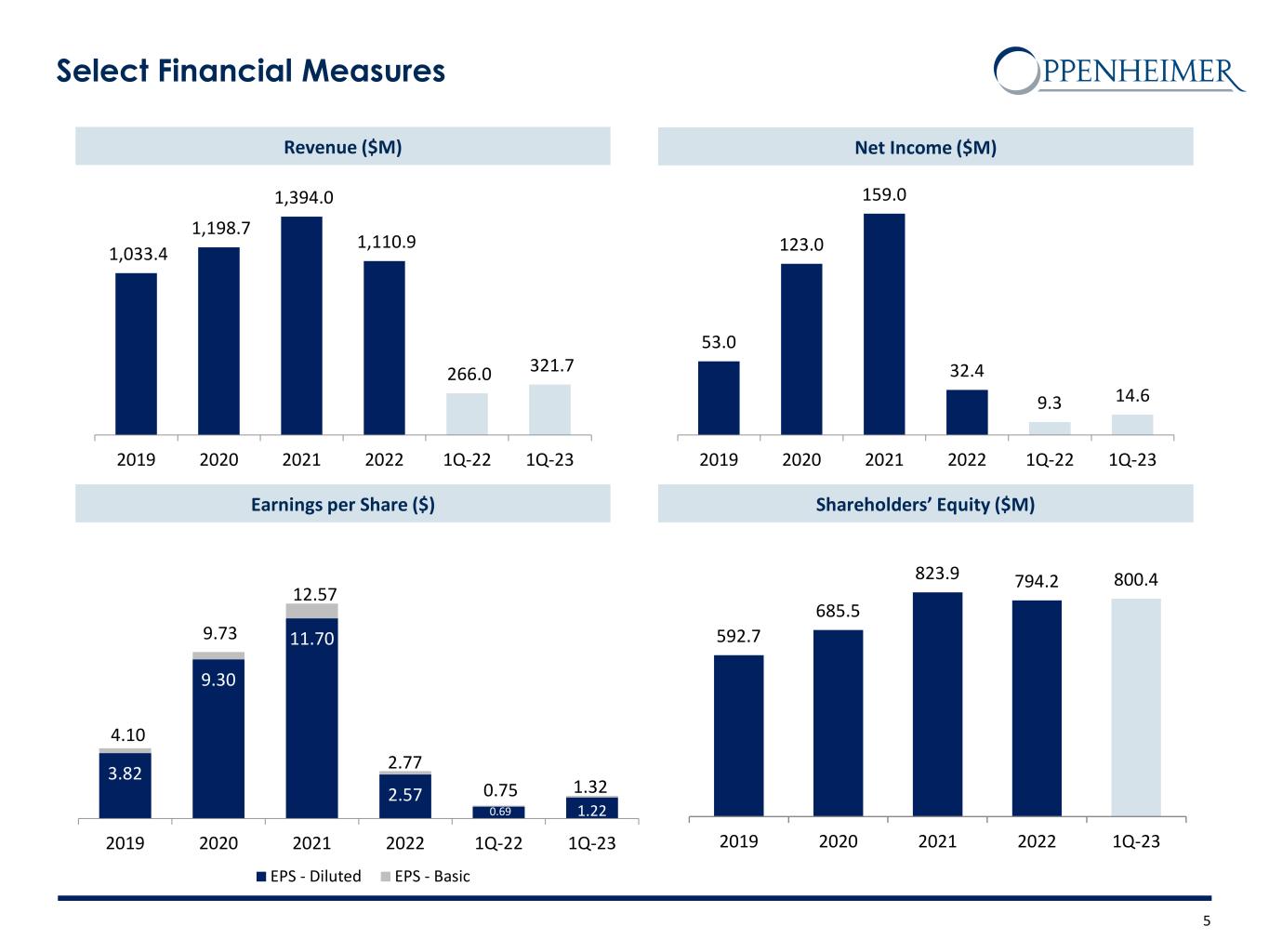

5 Select Financial Measures Earnings per Share ($) Net Income ($M)Revenue ($M) Shareholders’ Equity ($M) 1,033.4 1,198.7 1,394.0 1,110.9 266.0 321.7 2019 2020 2021 2022 1Q-22 1Q-23 53.0 123.0 159.0 32.4 9.3 14.6 2019 2020 2021 2022 1Q-22 1Q-23 3.82 9.30 11.70 2.57 0.69 1.22 2019 2020 2021 2022 1Q-22 1Q-23 EPS - Diluted EPS - Basic 1.320.75 2.77 12.57 9.73 4.10 592.7 685.5 823.9 794.2 800.4 2019 2020 2021 2022 1Q-23

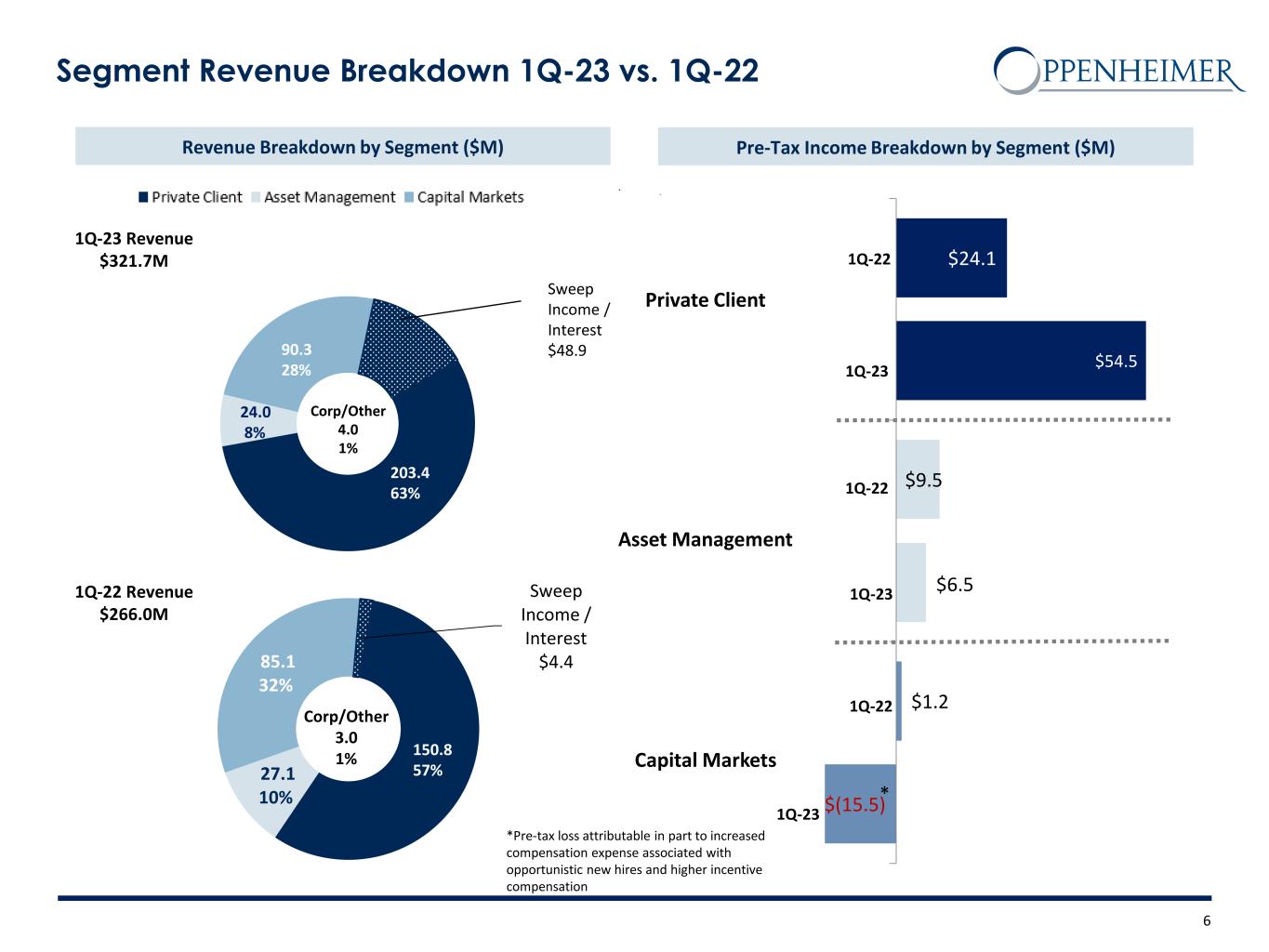

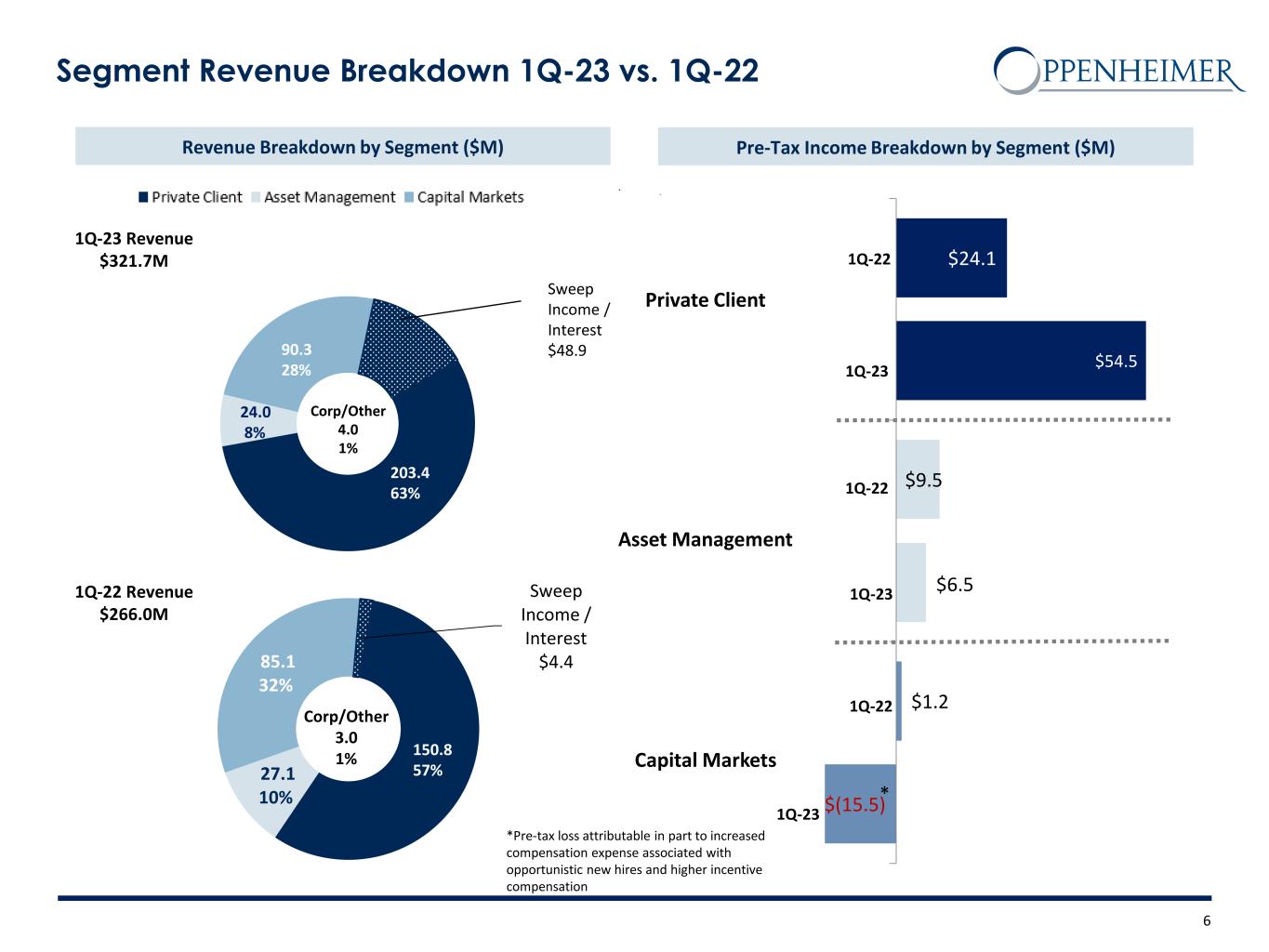

6 Segment Revenue Breakdown 1Q-23 vs. 1Q-22 Pre-Tax Income Breakdown by Segment ($M)Revenue Breakdown by Segment ($M) Private Client Asset Management Capital Markets 1Q-23 Revenue $321.7M 1Q-22 Revenue $266.0M $(15.5) $6.5 $1.2 $9.5 $24.1 1Q-22 1Q-22 1Q-22 1Q-23 1Q-23 1Q-23 203.4 63% 27.1 10% 85.1 32% Sweep Income / Interest $4.4 Corp/Other 3.0 1% 150.8 57% Corp/Other 4.0 1% 203.4 63% 24.0 8% 90.3 28% Sweep Income / Interest $48.9 $54.5 *Pre-tax loss attributable in part to increased compensation expense associated with opportunistic new hires and higher incentive compensation *

Wealth Management* Well recognized brand and one of the few independent, non-bank broker-dealers with full service capabilities Retail Services Full-Service Brokerage Financial Planning, Retirement Services, Corporate & Executive Services & Trust Services Margin & Securities Lending Advisory Services Investment Policy Design & Implementation Asset Allocation & Portfolio Construction Research, Diligence & Manager Selection Portfolio Monitoring & Reporting Retail Investments Hedge Funds & Fund-of-Funds Private Equity Private Market Opportunity (Qualified Investors only) to source investments across the private markets continuum Wealth Management Revenue ($M) Pre-Tax Income ($M) and Pre-Tax Margin (%) 959 Financial Advisors At 3/31/23 $108.9B Assets under Administration At 3/31/23 $39.3B Assets under Management At 3/31/23 ↓13.1% Advisory Fees 1Q-23 vs 1Q-22 * Wealth Management includes both Private Client and Asset Management business segments. 7 742 772 770 775 178 227 2019 2020 2021 2022 1Q-22 1Q-23 196 194 137 178 34 61 26% 25% 18% 23% 19% 27% 0% 5% 10% 15% 20% 25% 30% 0 50 100 150 200 250 2019 2020 2021 2022 1Q-22 1Q-23

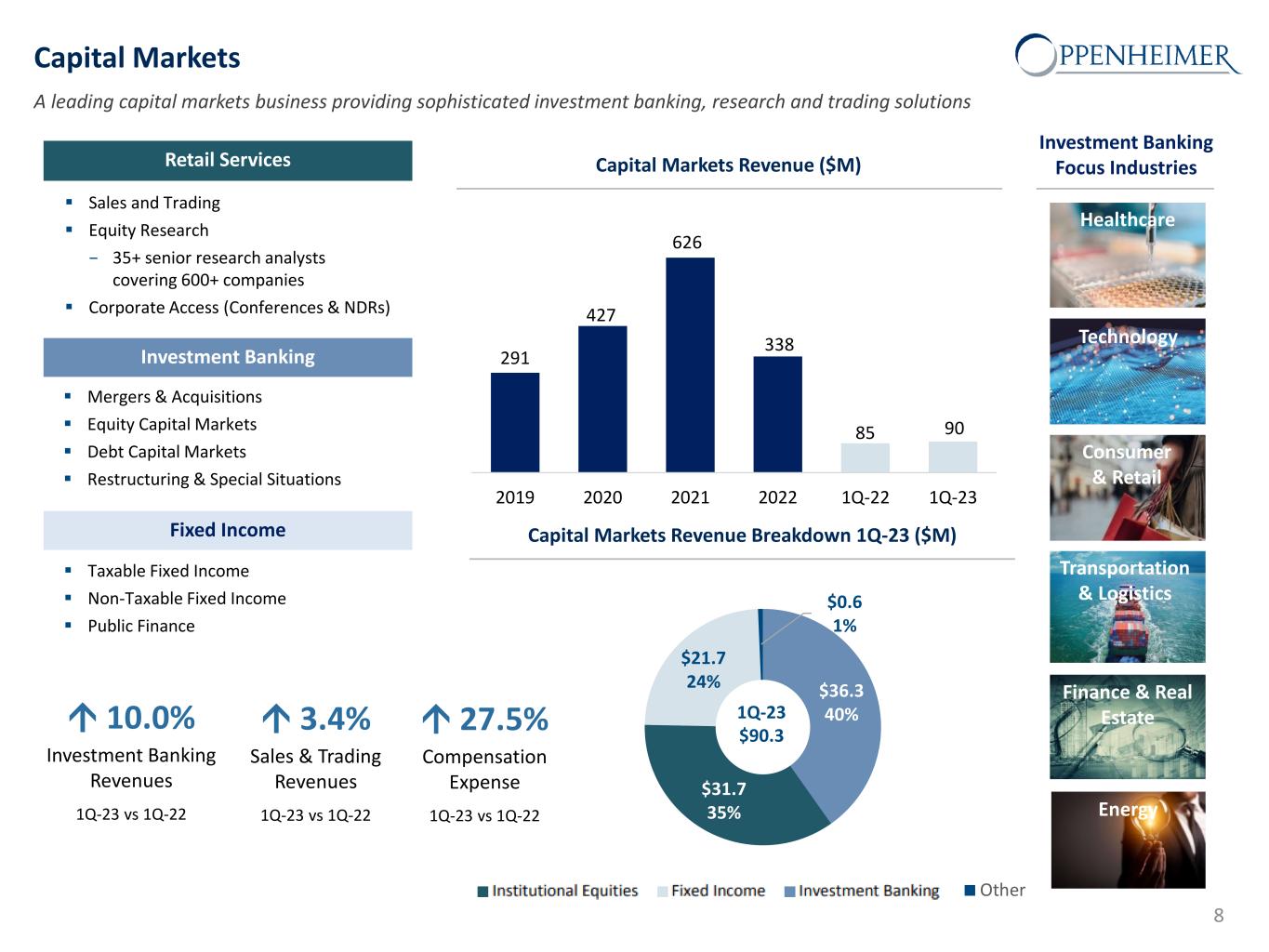

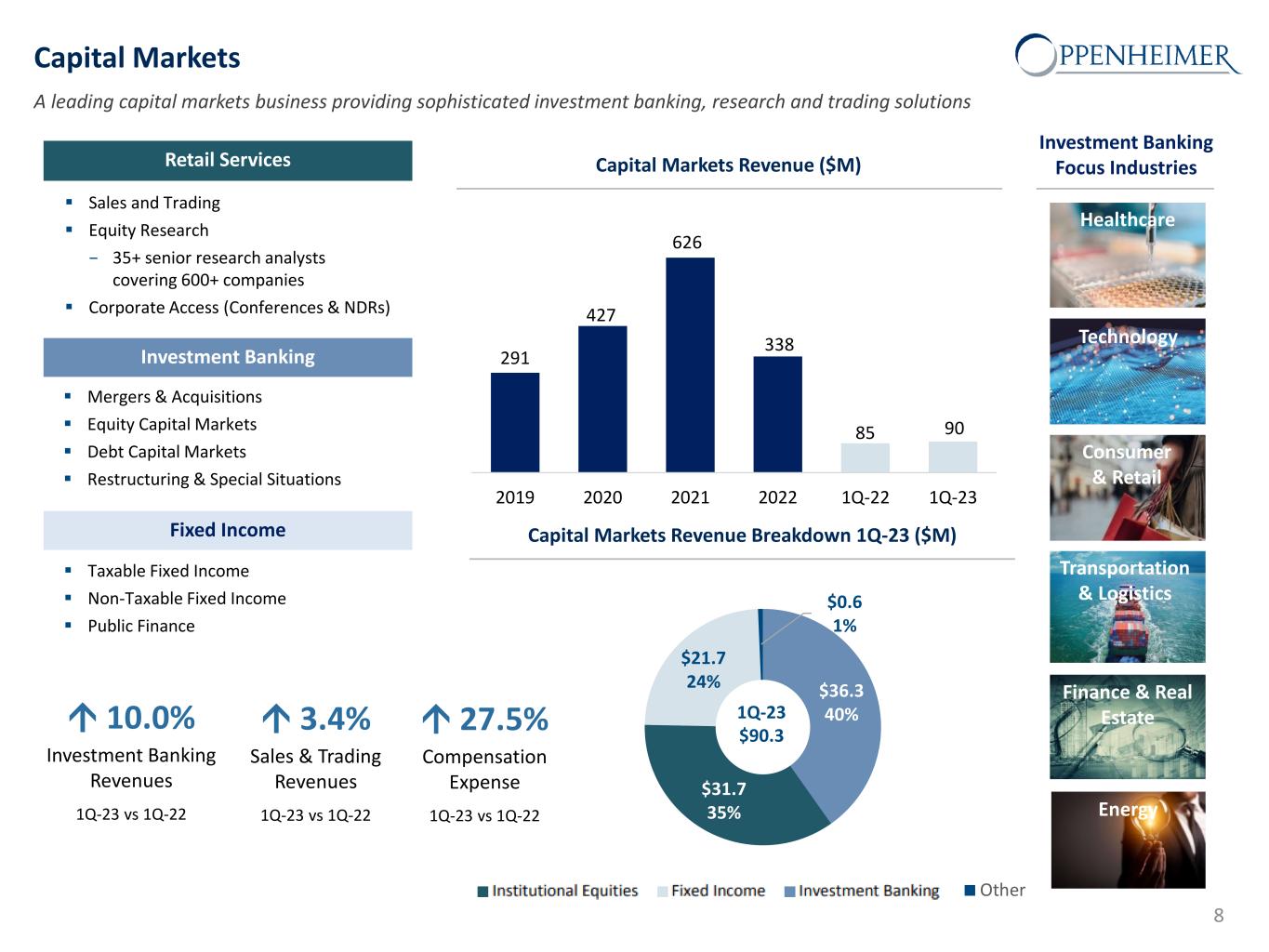

3.4% Sales & Trading Revenues 1Q-23 vs 1Q-22 Capital Markets A leading capital markets business providing sophisticated investment banking, research and trading solutions Healthcare Technology Transportation & Logistics Finance & Real Estate Consumer & Retail Energy Capital Markets Revenue Breakdown 1Q-23 ($M) Capital Markets Revenue ($M) Investment Banking Focus Industries 8 Institutional Equities Sales and Trading Equity Research − 35+ senior research analysts covering 600+ companies Corporate Access (Conferences & NDRs) Investment Banking Mergers & Acquisitions Equity Capital Markets Debt Capital Markets Restructuring & Special Situations Fixed Income Taxable Fixed Income Non-Taxable Fixed Income Public Finance Retail Services $36.3 40% $31.7 35% $21.7 24% $0.6 1% Other 1Q-23 $90.3 291 427 626 338 85 90 2019 2020 2021 2022 1Q-22 1Q-23 10.0% Investment Banking Revenues 1Q-23 vs 1Q-22 27.5% Compensation Expense 1Q-23 vs 1Q-22

9 Capital Structure Book & Tangible Book Value per Share ($) Liquidity & Capital (1) Total Assets divided by Total Stockholders' Equity. Stockholders’ equity of $800.4 million as of March 31, 2023 Book value ($72.27) and tangible book value ($56.92) per share increased from the prior year period largely as a result of share repurchases and positive earnings The Board of Directors announced a quarterly dividend in the amount of $0.15 per share payable on May 26, 2023 to holders of Class A non-voting and Class B voting common stock of record on May 12, 2023 Level 3 assets, comprised of auction rate securities, were $31.8 million as of March 31, 2023 As of March 31, 2023 ($ in thousands) Total Assets: $2,920,207 Stockholders’ Equity: Long-Term Debt: $800,425 $113,050 Total Capitalization: $913,475 Debt to Equity Ratio: 14.1% Gross Leverage Ratio(1): 3.6x Broker-Dealer Regulatory Capital ($ in millions) Regulatory Net Capital: $440.0 Regulatory Excess Net Capital: $418.0 33.03 41.31 52.11 56.91 52.58 56.92 46.31 54.93 65.66 2019 2020 2021 2022 1Q-22 1Q-23 Tangible Book Value per Share (TBVPS) Book Value per Share (BVPS) 72.41 66.45 72.27

For more information contact Investor Relations at info@opco.com