00007899332023FYfalsehttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpenseP3YP3YP5YP3YP3YP3Y1111http://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligations00007899332023-01-012023-12-3100007899332023-06-30iso4217:USD0000789933us-gaap:CommonClassAMember2024-02-29xbrli:shares0000789933us-gaap:CommonClassBMember2024-02-290000789933nacco:A2023StockRepurchaseProgramMember2023-11-0700007899332022-01-012022-12-31iso4217:USDxbrli:shares00007899332023-12-3100007899332022-12-310000789933us-gaap:NonrelatedPartyMember2023-12-310000789933us-gaap:NonrelatedPartyMember2022-12-310000789933srt:AffiliatedEntityMember2023-12-310000789933srt:AffiliatedEntityMember2022-12-310000789933us-gaap:CommonClassAMember2023-12-310000789933us-gaap:CommonClassAMember2022-12-310000789933us-gaap:CommonClassBMember2022-12-310000789933us-gaap:CommonClassBMember2023-12-31xbrli:pure00007899332021-12-310000789933us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-12-310000789933us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310000789933us-gaap:AdditionalPaidInCapitalMember2021-12-310000789933us-gaap:RetainedEarningsMember2021-12-310000789933us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310000789933us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-01-012022-12-310000789933us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000789933us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-01-012022-12-310000789933us-gaap:RetainedEarningsMember2022-01-012022-12-310000789933us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310000789933us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310000789933us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310000789933us-gaap:AdditionalPaidInCapitalMember2022-12-310000789933us-gaap:RetainedEarningsMember2022-12-310000789933us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000789933us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-12-310000789933us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000789933us-gaap:RetainedEarningsMember2023-01-012023-12-310000789933us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000789933us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310000789933us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310000789933us-gaap:AdditionalPaidInCapitalMember2023-12-310000789933us-gaap:RetainedEarningsMember2023-12-310000789933us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-31nacco:segment00007899332023-10-012023-12-310000789933nacco:MineralAndRoyaltyInterestMember2023-01-012023-12-310000789933nacco:MineralAndRoyaltyInterestMember2022-01-012022-12-31utr:acre0000789933us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000789933nacco:CoalMiningMembernacco:TheFalkirkMiningCompanyMember2022-01-012022-12-310000789933nacco:CoalMiningMembernacco:TheFalkirkMiningCompanyMember2022-05-022022-05-020000789933nacco:CoalMiningMembernacco:TheFalkirkMiningCompanyMember2022-05-020000789933us-gaap:PrivateEquityFundsMember2022-01-012022-12-310000789933nacco:HLCPEthanolHoldcoLLCMember2022-12-012022-12-010000789933nacco:HLCPEthanolHoldcoLLCMember2022-01-012022-12-310000789933nacco:HLCPEthanolHoldcoLLCMember2023-01-012023-12-310000789933us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000789933srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2023-12-310000789933srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2023-12-310000789933nacco:MississippiLigniteMiningCompanyMember2023-10-012023-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembersrt:ExecutiveOfficerMembernacco:ParticipantsRetirementDateMember2023-01-012023-12-310000789933us-gaap:StockCompensationPlanMembersrt:MinimumMemberus-gaap:CommonClassAMembersrt:ExecutiveOfficerMembernacco:AwardDateMember2023-01-012023-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembersrt:ExecutiveOfficerMembernacco:AwardDateMember2023-01-012023-12-310000789933us-gaap:StockCompensationPlanMembersrt:MaximumMemberus-gaap:CommonClassAMembersrt:ExecutiveOfficerMembernacco:AwardDateMember2023-01-012023-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembersrt:ExecutiveOfficerMember2023-01-012023-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembersrt:ExecutiveOfficerMember2022-01-012022-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembersrt:ExecutiveOfficerMember2023-12-310000789933us-gaap:CommonClassAMemberus-gaap:RestrictedStockMembersrt:DirectorMember2023-01-012023-12-310000789933us-gaap:CommonClassAMemberus-gaap:RestrictedStockMembersrt:DirectorMember2022-01-012022-12-310000789933srt:BoardOfDirectorsChairmanMemberus-gaap:CommonClassAMemberus-gaap:RestrictedStockMember2022-01-012022-12-310000789933srt:BoardOfDirectorsChairmanMemberus-gaap:CommonClassAMemberus-gaap:RestrictedStockMember2023-01-012023-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembersrt:DirectorMembernacco:AwardDateMember2023-01-012023-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembernacco:ParticipantsRetirementFromBoardOfDirectorsMembersrt:DirectorMember2023-01-012023-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembersrt:DirectorMembernacco:MinimumAgeOfDirectorUponRetirementFromBoardMember2023-01-012023-12-310000789933us-gaap:CommonClassAMembernacco:VoluntarySharesMembersrt:DirectorMember2023-12-310000789933us-gaap:CommonClassAMembernacco:VoluntarySharesMembersrt:DirectorMember2023-01-012023-12-310000789933us-gaap:CommonClassAMembernacco:VoluntarySharesMembersrt:DirectorMember2022-01-012022-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembersrt:DirectorMember2023-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembersrt:DirectorMember2023-01-012023-12-310000789933us-gaap:StockCompensationPlanMemberus-gaap:CommonClassAMembersrt:DirectorMember2022-01-012022-12-310000789933srt:MinimumMember2023-01-012023-12-310000789933srt:MaximumMember2023-01-012023-12-310000789933srt:MaximumMembernacco:ThackerPassMember2023-01-012023-12-310000789933nacco:ThackerPassMemberus-gaap:EquipmentMember2023-01-012023-12-310000789933nacco:ThackerPassMember2023-01-012023-12-310000789933nacco:ThackerPassMember2023-12-310000789933nacco:CoalMiningMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000789933nacco:CoalMiningMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000789933us-gaap:OperatingSegmentsMembernacco:NorthAmericanMiningMember2023-01-012023-12-310000789933us-gaap:OperatingSegmentsMembernacco:NorthAmericanMiningMember2022-01-012022-12-310000789933us-gaap:OperatingSegmentsMembernacco:MineralsManagementMember2023-01-012023-12-310000789933us-gaap:OperatingSegmentsMembernacco:MineralsManagementMember2022-01-012022-12-310000789933us-gaap:CorporateNonSegmentMember2023-01-012023-12-310000789933us-gaap:CorporateNonSegmentMember2022-01-012022-12-310000789933srt:ConsolidationEliminationsMember2023-01-012023-12-310000789933srt:ConsolidationEliminationsMember2022-01-012022-12-310000789933us-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310000789933us-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310000789933us-gaap:TransferredOverTimeMember2023-01-012023-12-310000789933us-gaap:TransferredOverTimeMember2022-01-012022-12-310000789933us-gaap:TradeAccountsReceivableMember2022-12-310000789933us-gaap:TradeAccountsReceivableMember2023-12-310000789933us-gaap:TradeAccountsReceivableMember2023-01-012023-12-3100007899332024-01-012023-12-3100007899332025-01-012023-12-3100007899332026-01-012023-12-3100007899332027-01-012023-12-310000789933nacco:CoalLandsAndRealEstateMember2023-12-310000789933nacco:CoalLandsAndRealEstateMember2022-12-310000789933nacco:MineralInterestsMember2023-12-310000789933nacco:MineralInterestsMember2022-12-310000789933nacco:PlantAndEquipmentMember2023-12-310000789933nacco:PlantAndEquipmentMember2022-12-310000789933us-gaap:CoalSupplyAgreementsMember2023-12-310000789933us-gaap:CoalSupplyAgreementsMember2022-12-310000789933nacco:CoalMiningMemberus-gaap:OperatingSegmentsMember2021-12-310000789933us-gaap:CorporateNonSegmentMember2021-12-310000789933nacco:CoalMiningMemberus-gaap:OperatingSegmentsMember2022-12-310000789933us-gaap:CorporateNonSegmentMember2022-12-310000789933nacco:CoalMiningMemberus-gaap:OperatingSegmentsMember2023-12-310000789933us-gaap:CorporateNonSegmentMember2023-12-310000789933nacco:CaddoCreekMember2023-12-310000789933nacco:BellaireCorporationMember2021-12-310000789933nacco:BellaireCorporationMember2023-12-310000789933nacco:BellaireCorporationMember2022-12-310000789933nacco:NacoalMemberus-gaap:SecuredDebtMember2023-12-310000789933nacco:NacoalMember2022-12-310000789933nacco:NacoalMember2023-12-310000789933us-gaap:BaseRateMembernacco:NacoalMemberus-gaap:SecuredDebtMember2023-01-012023-12-310000789933nacco:NacoalMembernacco:SecuredOvernightFinancingRateMemberus-gaap:SecuredDebtMember2023-01-012023-12-310000789933nacco:NacoalMemberus-gaap:SecuredDebtMember2023-01-012023-12-310000789933us-gaap:SecuredDebtMember2023-01-012023-12-310000789933nacco:NacoalMemberus-gaap:SecuredDebtMember2022-12-310000789933srt:MaximumMembernacco:NacoalMemberus-gaap:SecuredDebtMember2023-01-012023-12-310000789933srt:MinimumMembernacco:NacoalMemberus-gaap:SecuredDebtMember2023-01-012023-12-310000789933nacco:NacoalMembernacco:DemandNotePayableToUnconsolidatedSubsidiaryMemberus-gaap:SecuredDebtMember2023-12-310000789933nacco:NacoalMembernacco:DemandNotePayableToUnconsolidatedSubsidiaryMemberus-gaap:SecuredDebtMember2022-12-310000789933nacco:NacoalMemberus-gaap:SecuredDebtMembernacco:NotesPayableMaturingAtVariousDatesThrough2029Member2023-12-31nacco:notePayablenacco:unitOfEquipment0000789933srt:ScenarioForecastMembernacco:NacoalMembernacco:NotesPayableMaturingDecember2026Memberus-gaap:SecuredDebtMember2026-12-150000789933nacco:NacoalMemberus-gaap:SecuredDebtMembernacco:NotesPayableMaturingAtVariousDatesThrough2029Member2022-12-310000789933us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000789933us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000789933us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000789933us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000789933us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000789933us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000789933us-gaap:FairValueInputsLevel1Membernacco:BellaireCorporationMemberus-gaap:FairValueMeasurementsRecurringMember2023-01-012023-12-310000789933us-gaap:FairValueInputsLevel1Membernacco:BellaireCorporationMemberus-gaap:FairValueMeasurementsRecurringMember2022-01-012022-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-01-012023-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-01-012022-12-310000789933nacco:MississippiLigniteMiningCompanyMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-01-012023-12-310000789933nacco:CoalMiningMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-01-012023-12-310000789933nacco:MineralManagementMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-01-012023-12-310000789933us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2022-09-300000789933nacco:MineralManagementMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2022-07-012022-09-300000789933us-gaap:FairValueInputsLevel2Member2023-12-310000789933us-gaap:FairValueInputsLevel2Member2022-12-310000789933us-gaap:CommonClassAMember2023-01-012023-12-31nacco:vote0000789933us-gaap:CommonClassBMember2023-01-012023-12-310000789933nacco:A2021StockRepurchaseProgramMemberus-gaap:CommonClassAMember2023-01-012023-12-310000789933us-gaap:CommonClassAMembernacco:A2023StockRepurchaseProgramMember2023-01-012023-12-310000789933nacco:A2021StockRepurchaseProgramMember2022-01-012022-12-310000789933us-gaap:StateAndLocalJurisdictionMember2023-12-310000789933us-gaap:StateAndLocalJurisdictionMember2022-12-310000789933srt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933srt:MaximumMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933srt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933srt:MaximumMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933srt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000789933srt:MaximumMemberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000789933srt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000789933srt:MaximumMemberus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000789933us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000789933us-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933us-gaap:PensionPlansDefinedBenefitMember2021-12-310000789933us-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2023-12-310000789933us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2022-12-310000789933srt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2023-12-310000789933srt:MaximumMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2023-12-310000789933us-gaap:CashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:CashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933srt:MinimumMemberus-gaap:CashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933srt:MaximumMemberus-gaap:CashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:MoneyMarketFundsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:MoneyMarketFundsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933srt:MinimumMemberus-gaap:MoneyMarketFundsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933srt:MaximumMemberus-gaap:MoneyMarketFundsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:DefinedBenefitPlanEquitySecuritiesUsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:DefinedBenefitPlanEquitySecuritiesUsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933us-gaap:DefinedBenefitPlanEquitySecuritiesUsMembersrt:MinimumMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:DefinedBenefitPlanEquitySecuritiesUsMembersrt:MaximumMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933srt:MinimumMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933srt:MaximumMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2023-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2022-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933us-gaap:DefinedBenefitPlanEquitySecuritiesUsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:DefinedBenefitPlanEquitySecuritiesUsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000789933us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000789933us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000789933us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000789933us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000789933us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310000789933srt:MinimumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000789933srt:MaximumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000789933srt:MinimumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000789933srt:MaximumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000789933srt:MinimumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000789933srt:MaximumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000789933us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310000789933nacco:CoalMiningMembernacco:CoalMiningCustomerMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310000789933nacco:CoalMiningMembernacco:CoalMiningCustomerMemberus-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310000789933us-gaap:RevenueFromContractWithCustomerMembernacco:NorthAmericanMiningMembernacco:NAMiningCustomerMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310000789933us-gaap:RevenueFromContractWithCustomerMembernacco:NorthAmericanMiningMembernacco:NAMiningCustomerMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310000789933nacco:UnconsolidatedMinesMembernacco:NacoalMember2023-12-310000789933nacco:UnconsolidatedMinesMembernacco:NacoalMember2022-12-310000789933nacco:NacoalMembernacco:UnconsolidatedMinesMember2023-12-310000789933nacco:NacoalMembernacco:UnconsolidatedMinesMember2022-12-310000789933nacco:NacoalMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembernacco:UnconsolidatedMinesMember2023-01-012023-12-310000789933nacco:NacoalMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembernacco:UnconsolidatedMinesMember2022-01-012022-12-310000789933nacco:NacoalMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembernacco:UnconsolidatedMinesMember2023-12-310000789933nacco:NacoalMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembernacco:UnconsolidatedMinesMember2022-12-310000789933nacco:UnconsolidatedMinesMembernacco:NacoalMember2023-01-012023-12-310000789933nacco:UnconsolidatedMinesMembernacco:NacoalMember2022-01-012022-12-310000789933nacco:JonesDayMember2023-01-012023-12-310000789933nacco:JonesDayMember2022-01-012022-12-310000789933nacco:AlfredM.RankinJr.Member2022-01-012022-12-310000789933nacco:AlfredM.RankinJr.Member2023-01-012023-12-310000789933srt:OilReservesMember2023-12-31utr:bbl0000789933srt:NaturalGasLiquidsReservesMember2023-12-310000789933nacco:ResidualGasMember2023-12-31utr:Mcf0000789933srt:OilReservesMember2022-12-310000789933srt:NaturalGasLiquidsReservesMember2022-12-310000789933nacco:ResidualGasMember2022-12-310000789933srt:OilReservesMember2023-01-012023-12-310000789933srt:NaturalGasLiquidsReservesMember2023-01-012023-12-310000789933nacco:ResidualGasMember2023-01-012023-12-310000789933nacco:CushingOKMember2023-01-012023-12-31iso4217:USDutr:bbl0000789933nacco:CushingOKMember2022-01-012022-12-31iso4217:USDutr:MMBTU0000789933us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310000789933us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310000789933us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310000789933us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310000789933us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

|

|

|

|

|

|

|

|

|

|

|

|

| (Mark One) |

|

|

|

| ☑ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the fiscal year ended |

December 31, 2023 |

or

|

|

|

|

|

|

|

|

|

| ☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 1-9172

NACCO INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

34-1505819 |

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

| |

|

|

|

|

|

|

|

|

5875 Landerbrook Drive, |

Suite 220 |

|

|

|

|

Cleveland, |

Ohio |

|

|

|

44124-4069 |

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant's telephone number, including area code: (440) 229-5151

Securities registered pursuant to Section 12(b) of the Act

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

| Class A Common Stock, $1 par value per share |

|

NC |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: Class B Common Stock, $1 par value per share. Class B Common Stock is not publicly listed for trade on any exchange or market system; however, Class B Common Stock is convertible into Class A Common Stock on a share-for-share basis.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No £

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes þ No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☐ |

Accelerated filer |

☑ |

Non-accelerated filer |

☐ |

Smaller reporting company |

☑ |

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No ☑

Aggregate market value of Class A Common Stock and Class B Common Stock held by non-affiliates as of June 30, 2023 (the last business day of the registrant's most recently completed second fiscal quarter): 156,415,693

Number of shares of Class A Common Stock outstanding at February 29, 2024: 5,929,944

Number of shares of Class B Common Stock outstanding at February 29, 2024: 1,565,685

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company's Proxy Statement for its 2024 annual meeting of stockholders are incorporated herein by reference in Part III of this Form 10-K.

NACCO INDUSTRIES, INC.

TABLE OF CONTENTS

PART I

Item 1. BUSINESS

General

NACCO Industries, Inc.® (“NACCO” or the “Company”) brings natural resources to life by delivering aggregates, minerals, reliable fuels and environmental solutions through its robust portfolio of NACCO Natural Resources® businesses. The Company operates under three business segments: Coal Mining, North American Mining® ("NAMining") and Minerals Management. The Coal Mining segment operates surface coal mines for power generation companies. The NAMining segment is a trusted mining partner for producers of aggregates, activated carbon, lithium and other industrial minerals. The Minerals Management segment, which includes the Catapult Mineral Partners (“Catapult”) business, acquires and promotes the development of mineral interests. Mitigation Resources of North America® (“Mitigation Resources”) provides stream and wetland mitigation solutions.

The Company has items not directly attributable to a reportable segment that are not included in the reported financial results of the operating segment. These items primarily include administrative costs related to public company reporting requirements, including management and board compensation, and the financial results of Bellaire Corporation ("Bellaire"), Mitigation Resources and other developing businesses. Bellaire manages the Company’s long-term liabilities related to former Eastern U.S. underground mining activities.

NACCO was incorporated as a Delaware corporation in 1986 in connection with the formation of a holding company structure for a predecessor corporation organized in 1913.

Business Strategy

NACCO’s portfolio of businesses operates under the umbrella of NACCO Natural Resources. Management continues to view the long-term business outlook for NACCO positively. The Company is pursuing growth and diversification by strategically leveraging its core mining and natural resources management skills to build a strong portfolio of affiliated businesses.

The Minerals Management segment, through the Company’s Catapult business unit, is focused on maximizing the value of existing mineral and royalty assets while it continues to pursue expansion of its asset base through acquisitions of additional mineral and royalty interests. The goal is to construct a high-quality diversified portfolio of oil and gas mineral and royalty interests in the United States that delivers near-term cash flow yields and long-term projected growth. The Company believes this business will provide unlevered after-tax returns on invested capital in the mid-teens as this business model matures. This business model can deliver higher average operating margins over the life of a reserve than traditional oil and gas companies that bear the cost of exploration, production and/or development as these costs are borne entirely by third-party exploration and development companies that lease the minerals. The Company is also considering additional investment opportunities, including non-operating working interests, as it continues to pursue diversification of revenue streams.

NAMining continues to focus on profit improvement initiatives as well as growth through additional business development activities. NAMining is targeting potential customers who require a broad range of minerals and materials where it can leverage the Company’s core mining skills. The goal is to build NAMining into a leading provider of contract mining services for customers who produce a wide variety of minerals and materials. NAMining intends to be a substantial contributor to operating profit over time, including in its Sawtooth Mining subsidiary when production commences at Thacker Pass, which is targeting initial production in late 2026. Once production commences, Sawtooth Mining Company, LLC ("Sawtooth") will receive a management fee per metric ton of lithium delivered. The pace of achieving substantially improved results at NAMining will depend on the execution and successful implementation of profit improvement initiatives in the aggregates operations, and the mix and scale of new projects. A number of initiatives have already delivered improved financial results.

Mitigation Resources continues to develop its business, which creates and sells stream and wetland mitigation credits, provides services to those engaged in permittee-responsible mitigation and provides mine reclamation and other environmental restoration services. This business offers an opportunity for growth and diversification in an industry where the Company has substantial knowledge and expertise and a strong reputation. Mitigation Resources is making strong progress toward its goal of becoming a top ten provider of stream and wetland mitigation services in the southeastern United States. The Company believes that Mitigation Resources can provide solid rates of return on capital employed as this business matures.

The Company also continues to pursue activities which can strengthen the resiliency of its existing coal mining operations. The Company remains focused on managing coal production costs and maximizing efficiencies and operating capacity at mine locations to help customers with management fee contracts be more competitive. These activities benefit both customers and the Company's Coal Mining segment, as fuel cost is a significant driver for power plant dispatch. Increased power plant dispatch results in increased demand for coal by the Coal Mining segment's customers. Fluctuating natural gas prices, weather and availability of renewable energy sources, such as wind and solar, could affect the amount of electricity dispatched from coal-fired power plants. While the Company realizes the coal mining industry faces political and regulatory challenges and demand for coal is projected to decline over the longer-term, the Company believes coal should be an essential part of the energy mix in the United States for the foreseeable future.

The Company continues to look for ways to create additional value by utilizing its core mining competencies around reclamation and permitting through the development of utility-scale solar projects. Reclaimed mining properties offer large tracts of land that could be well-suited for solar and other energy-related projects. These projects could be developed by the Company itself or through joint ventures that include partners with expertise in energy development projects.

The Company is committed to maintaining a conservative capital structure as it continues to grow and diversify, while avoiding unnecessary risk. Strategic diversification is designed to generate cash that can be re-invested to strengthen and expand the businesses. The Company also continues to maintain the highest levels of customer service and operational excellence with an unwavering focus on safety and environmental stewardship.

Business Developments

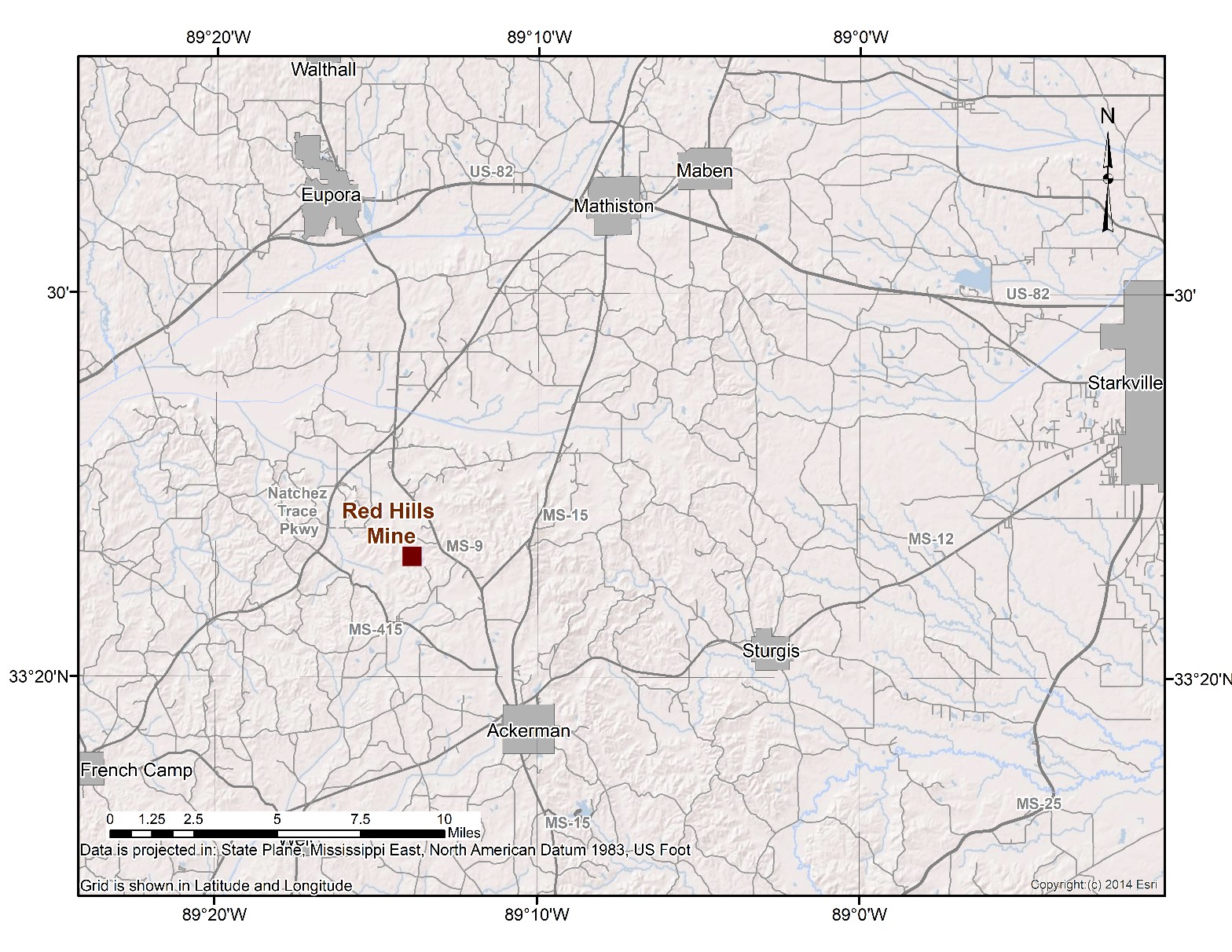

On December 18, 2023, Mississippi Lignite Mining Company ("MLMC") received a force majeure event notice from its customer related to an issue that began on December 15, 2023 and impacted one of two boilers at the Red Hills Power Plant. The notice did not provide a timeline for resolution of the issue. As of March 6, 2024, the impacted boiler is still not operational. The prolonged mechanical issue is expected to result in a reduction in customer demand and will have a significant impact on the Company's results of operations during 2024. The Company determined the anticipated reduction in customer demand caused by this issue was an indicator of potential impairment. The Company reviewed MLMC's long-lived assets for impairment as of December 31, 2023 and determined the carrying amount of its long-lived assets were not recoverable. As a result, the Company recorded a non-cash, long-lived asset impairment charge of $65.9 million in 2023. See Note 9 to the Consolidated Financial Statements in this Form 10-K for further information on the impairment analysis.

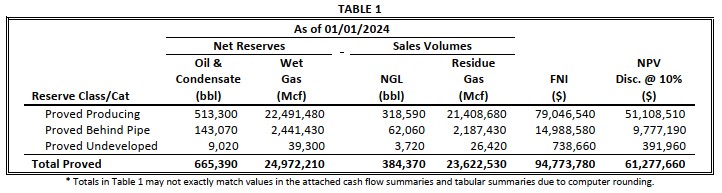

During 2023, Minerals Management, through Catapult, completed an acquisition of $36.7 million of mineral and royalty interests in the Texas portion of the Permian Basin. During 2022, Catapult acquired $11.4 million of mineral and royalty interests in the Texas portion of the Permian Basin and the Wyoming portion of the Powder River Basin as well as a small acquisition of mineral interests in the New Mexico portion of the Permian Basin.

During December 2023, NAMining executed a 15-year contract to mine phosphate at a quarry in central Florida. Production is expected to commence in the first half of 2024 once relocation and commissioning of a dragline is complete. NAMining also amended and extended existing limestone contracts with two customers and expanded the scope of work with another customer.

The Sabine Mining Company (“Sabine”) operates the Sabine Mine in Texas. All production from Sabine was delivered to

Southwestern Electric Power Company's (“SWEPCO”) Henry W. Pirkey Plant (the “Pirkey Plant”). SWEPCO is an American

Electric Power (“AEP”) company. As a result of the early retirement of the Pirkey Plant, Sabine ceased deliveries and final reclamation began on April 1, 2023. Funding for mine reclamation is the responsibility of SWEPCO, and Sabine receives compensation for providing mine reclamation services. Sabine will provide mine reclamation services through September 30, 2026. On October 1, 2026, SWEPCO will acquire all of the capital stock of Sabine and complete the remaining mine reclamation.

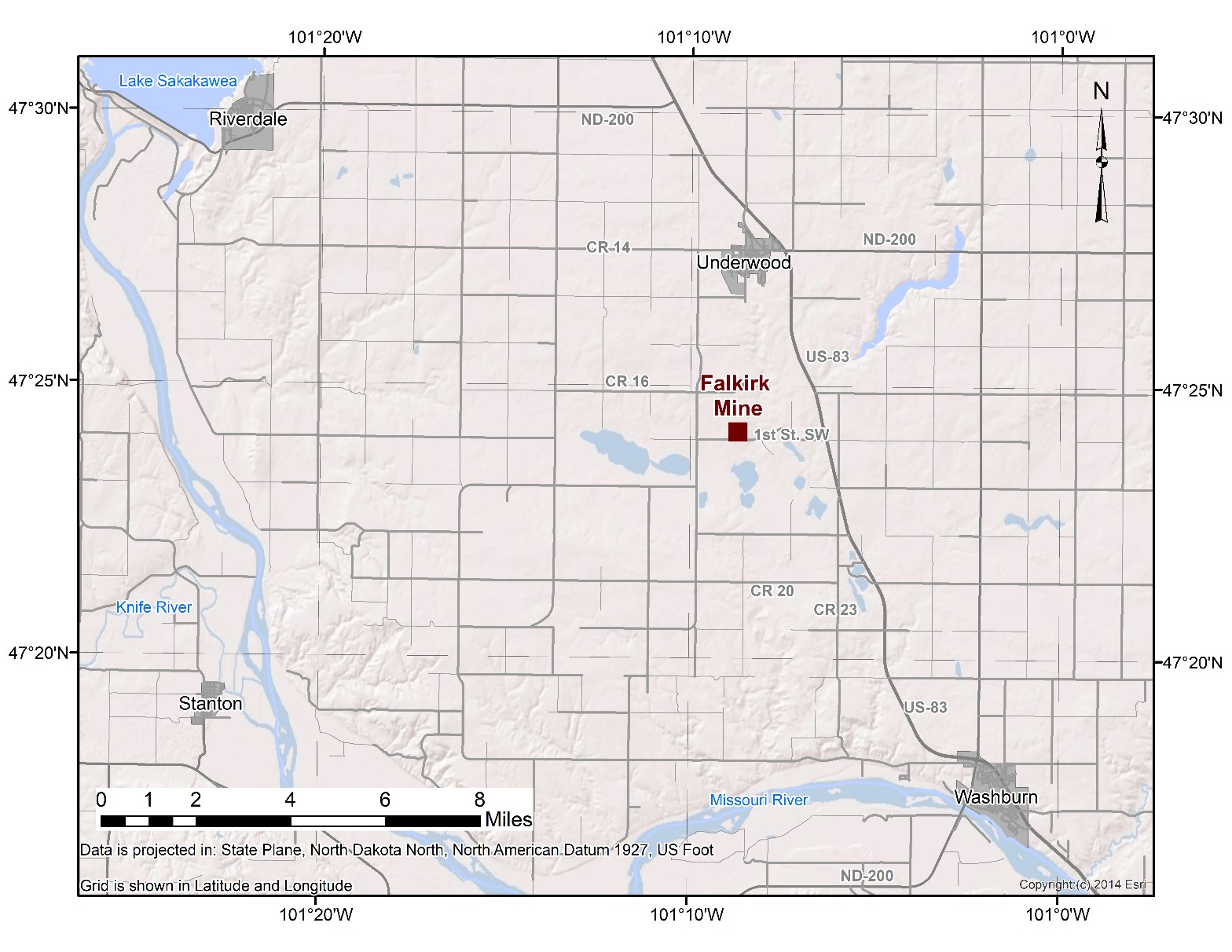

The Falkirk Mining Company ("Falkirk") operates the Falkirk Mine in North Dakota. Falkirk is the sole supplier of lignite coal to the Coal Creek Station power plant. On May 2, 2022, Great River Energy ("GRE") completed the sale of Coal Creek Station and the adjacent high-voltage direct current transmission line to Rainbow Energy Center, LLC (“Rainbow Energy”) and its affiliates. The Coal Sales Agreement (“CSA”) between Falkirk and Rainbow Energy became effective upon the closing of the transaction. Falkirk continues to supply all coal requirements of Coal Creek Station and is paid a management fee per ton of coal delivered. To support the transfer to new ownership, Falkirk agreed to a reduction in the current per ton management fee from the effective date of the CSA through May 31, 2024. After May 31, 2024, the per ton management fee increases to a higher base in line with 2021 fee levels, and thereafter adjusts annually according to an index which tracks broad measures of U.S. inflation. Rainbow Energy is responsible for funding all mine operating costs, including mine reclamation, and directly or indirectly providing all of the capital required to operate the mine. The initial production period is expected to run through May 1, 2032, but the CSA may be extended or terminated early under certain circumstances.

The Company recognized a gain of $30.9 million during 2022 as GRE paid the Company cash, transferred ownership of an office building, and conveyed membership units in Midwest AgEnergy Group, LLC (“MAG”), a North Dakota-based ethanol business as agreed to under the termination and release of claims agreement between Falkirk and GRE.

Prior to receiving the membership units from GRE, the Company held a $5.0 million investment in MAG. On December 1, 2022, HLCP Ethanol Holdco, LLC (“HLCP”) completed its acquisition of MAG. Upon closing of the transaction, NACCO transferred its ownership interest in MAG to HLCP and received a cash payment of $18.6 million during 2022.

The Company received additional payments totaling $3.6 million during 2023 in connection with a post-closing purchase price adjustment and the release of amounts held in escrow.

During 2023, the Board of Directors of the Company approved the termination of the Combined Defined Benefit Plan for NACCO and its subsidiaries (the “Combined Plan”) and Combined Plan participants were offered lump-sum distributions as part of the termination process. As a result of the lump-sum distributions, the Company recognized a non-cash, pension settlement charge of $1.8 million. See Note 14 to the Consolidated Financial Statements in this Form 10-K for further information on the Combined Plan.

In December 2023, the Company entered into a power purchase agreement with the Tennessee Valley Authority (“TVA”) for the energy generated from a proposed 67.5 MW solar photovoltaic electric generation facility to be developed on reclaimed land at the Company’s Red Hills Mine. The development of this project is subject to the favorable completion of an environmental impact study under the National Environmental Policy Act (“NEPA”) and approval of an interconnection agreement with TVA. In addition, the Company will enter into an engineering, procurement and construction agreement related to development of the project. The estimated commercial operation date for this generation facility is 2027.

Operations

Coal Mining Segment

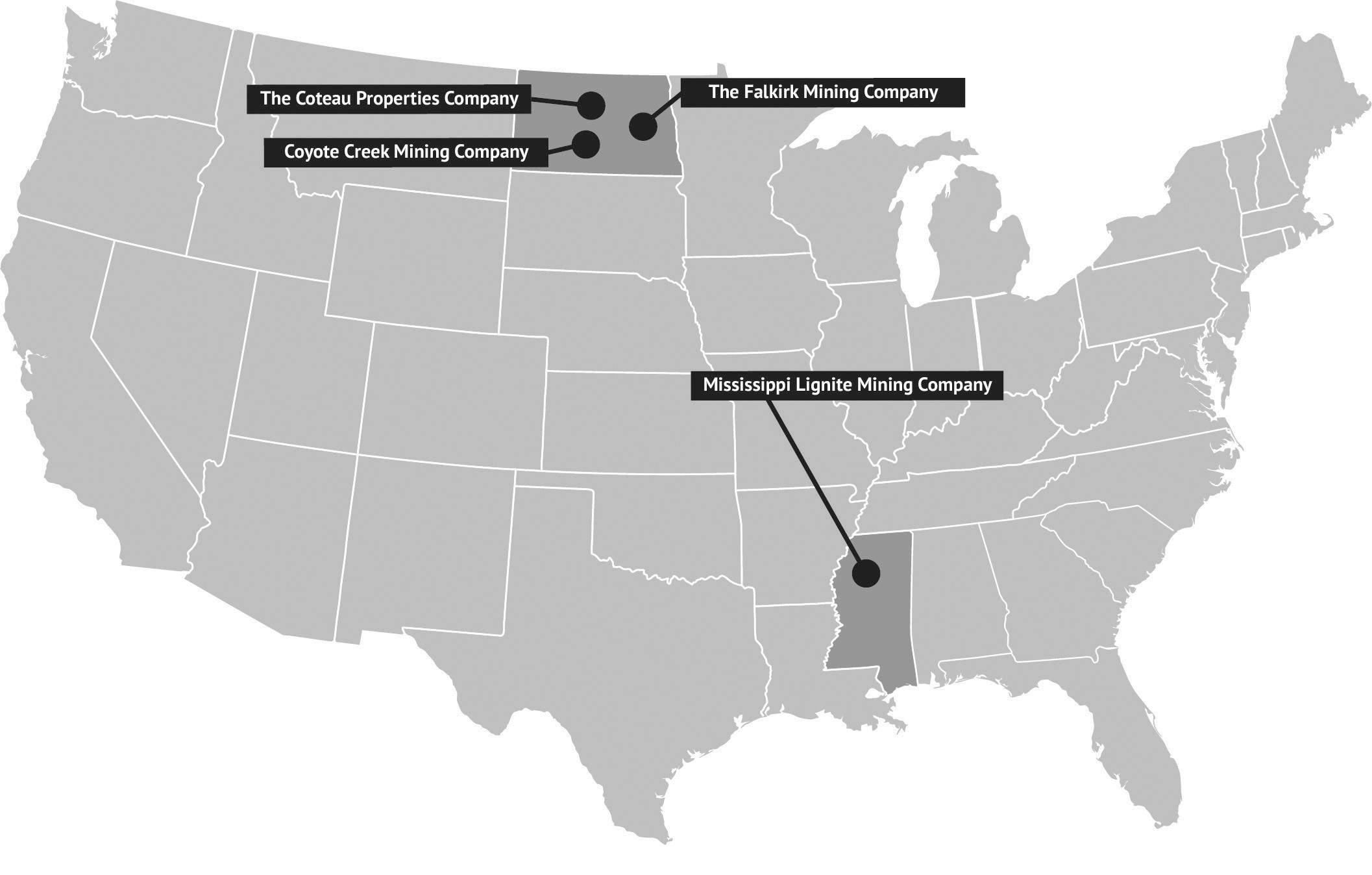

The Coal Mining segment, operating as North American Coal, LLC, operates surface coal mines under long-term contracts with power generation companies pursuant to a service-based business model. Coal is surface mined in North Dakota and Mississippi. Each mine is fully integrated with its customer's operations.

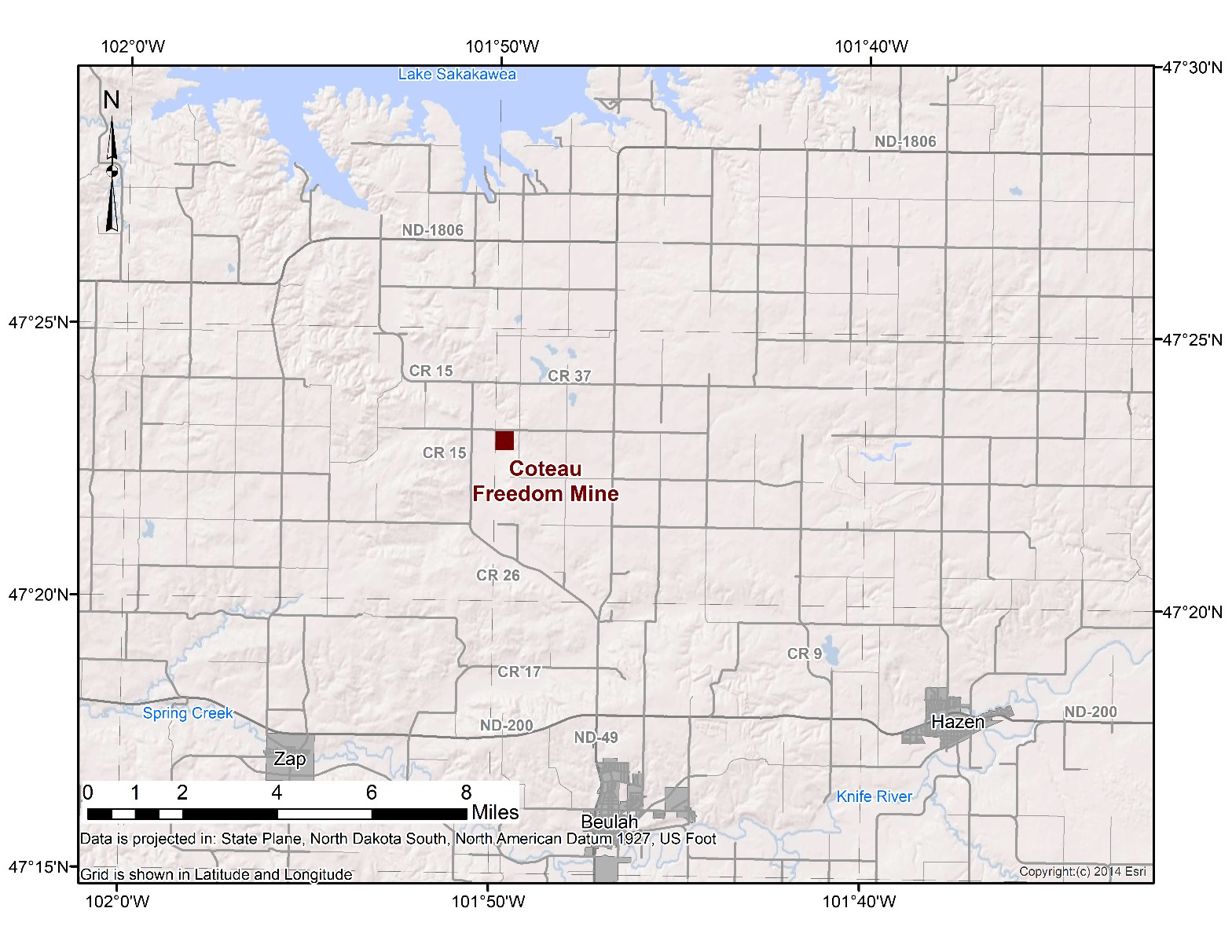

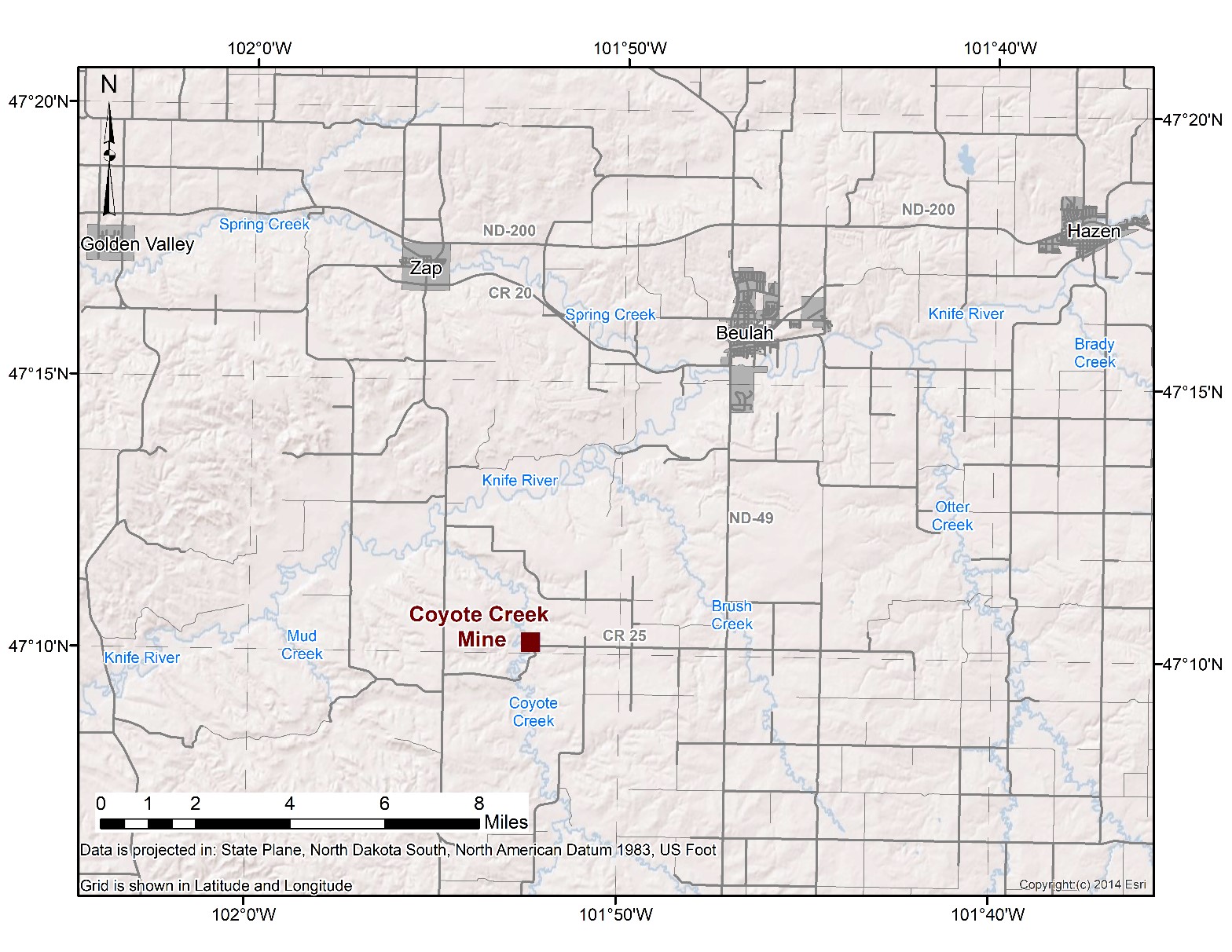

As of December 31, 2023, the Coal Mining segment's operating coal mines were: The Coteau Properties Company (“Coteau”), Coyote Creek Mining Company, LLC (“Coyote Creek”), Falkirk and MLMC. Each of these mines supply lignite coal for power generation and delivers its coal production to an adjacent power plant or synfuels plant under a long-term supply contract. MLMC’s coal supply contract contains a take or pay provision but contains a force majeure provision that allows for the temporary suspension of the take or pay provision during the duration of certain specified events beyond the control of either party; all other coal supply contracts are requirements contracts. Certain coal supply contracts can be terminated early, which would result in a reduction to future earnings.

The MLMC contract is the only operating coal contract in which the Company is responsible for all operating costs, capital requirements and final mine reclamation; therefore, MLMC is consolidated within NACCO’s financial statements. MLMC sells coal to its customer's Red Hills Power Plant at a contractually agreed-upon price which adjusts monthly, primarily based on changes in the level of established indices which reflect general U.S. inflation rates. Profitability at MLMC is affected by customer demand for coal and changes in the indices that determine sales price and actual costs incurred. As diesel fuel is heavily weighted among the indices used to determine the coal sales price, fluctuations in diesel fuel prices can result in significant fluctuations in earnings at MLMC. The Red Hills Power Plant supplies electricity to TVA under a long-term power purchase agreement. MLMC’s contract with its customer runs through April 1, 2032. TVA’s power portfolio includes coal, nuclear, hydroelectric, natural gas and renewables. The decision regarding which power plants to dispatch is determined by TVA. Reduction in dispatch of the Red Hills Power Plant will result in reduced earnings at MLMC. During 2023, MLMC completed mining in its original mine area and began mining in a new mine area. The move to the new mine area resulted in increased costs during 2023. MLMC does not anticipate opening additional mine areas through the remaining contract term unless doing so would result in improved economic returns.

On December 18, 2023, MLMC received a force majeure event notice from its customer related to an issue that began on December 15, 2023 and impacted one of two boilers at the Red Hills Power Plant. The notice did not provide a timeline for resolution of the issue. As of March 6, 2024, the impacted boiler is still not operational. The prolonged mechanical issue is expected to result in a reduction in customer demand and will have a significant impact on the Company's results of operations during 2024. The Company determined the anticipated reduction in customer demand caused by this issue was an indicator of potential impairment. The Company reviewed MLMC's long-lived assets for impairment as of December 31, 2023 and determined the carrying amount of its long-lived assets were not recoverable. As a result, the Company recorded a non-cash, long-lived asset impairment charge of $65.9 million in 2023. See Note 9 to the Consolidated Financial Statements in this Form 10-K for further information on the impairment analysis.

At Coteau, Coyote Creek and Falkirk, the Company is paid a management fee per ton of coal or heating unit (MMBtu) delivered. Each contract specifies the indices and mechanics by which fees change over time, generally in line with broad

measures of U.S. inflation. The customers are responsible for funding all mine operating costs, including final mine reclamation, and directly or indirectly providing all of the capital required to build and operate the mine. This contract structure eliminates exposure to spot coal market price fluctuations while providing income and cash flow with minimal capital investment. Other than at Coyote Creek, debt financing provided by or supported by the customers is without recourse to the Company. See Note 16 to the Consolidated Financial Statements in this Form 10-K for further discussion of Coyote Creek's guarantees.

Coteau, Coyote Creek, Falkirk and Sabine each meet the definition of a variable interest entity ("VIE"). In each case, NACCO

is not the primary beneficiary of the VIE as it does not exercise financial control; therefore, NACCO does not consolidate the

results of these operations within its financial statements. Instead, these contracts are accounted for as equity method

investments. The income before income taxes associated with these VIEs is reported as Earnings of unconsolidated operations

on the Consolidated Statements of Operations and the Company’s investment is reported on the line Investments in unconsolidated subsidiaries in the Consolidated Balance Sheets. The mines that meet the definition of a VIE are referred to collectively as the “Unconsolidated Subsidiaries.” For tax purposes, the Unconsolidated Subsidiaries are included within the NACCO consolidated U.S. tax return; therefore, the Income tax provision line on the Consolidated Statements of Operations includes income taxes related to these entities. See Note 16 to the Consolidated Financial Statements in this Form 10-K for further information on the Unconsolidated Subsidiaries.

The Company performs contemporaneous reclamation activities at each mine in the normal course of operations. Under all of the Unconsolidated Subsidiaries’ contracts, the customer has the obligation to fund final mine reclamation activities. Under certain contracts, the Unconsolidated Subsidiary holds the mine permit and is therefore responsible for final mine reclamation activities. To the extent the Unconsolidated Subsidiary performs such final reclamation, it is compensated for providing those services in addition to receiving reimbursement from customers for costs incurred.

See “Item 2. Properties" on page 31 in this Form 10-K for discussion of the Company's mineral resources and mineral reserves.

NAMining Segment

The NAMining segment provides value-added contract mining and other services for producers of industrial minerals. The segment is a platform for the Company’s growth and diversification of mining activities outside of the thermal coal industry. NAMining provides contract mining services for independently owned mines and quarries, creating value for its customers by performing the mining aspects of its customers’ operations. This allows customers to focus on their areas of expertise: materials handling and processing, product sales and distribution. As of December 31, 2023, NAMining operates in Florida, Texas, Arkansas, Virginia and Nebraska. In addition, Sawtooth Mining, LLC ("Sawtooth") provides mining design, consulting and will be the exclusive contract miner for the Thacker Pass lithium project in northern Nevada.

Certain of the entities within the NAMining segment are VIEs and are accounted for under the equity method as Unconsolidated Subsidiaries. See Note 16 to the Consolidated Financial Statements in this Form 10-K for further information on the Unconsolidated Subsidiaries.

Minerals Management Segment

The Minerals Management segment derives income primarily by leasing its royalty and mineral interests to third-party exploration and production companies, and, to a lesser extent, other mining companies, granting them the rights to explore, develop, mine, produce, market and sell gas, oil, and coal in exchange for royalty payments based on the lessees' sales of those minerals.

The Minerals Management segment owns royalty interests, mineral interests, non-participating royalty interests and overriding royalty interests.

•Royalty Interest. Royalty interests generally result when the owner of a mineral interest leases the underlying minerals to an exploration and production company pursuant to an oil and gas lease. Typically, the resulting royalty interest is a cost-free percentage of production revenues for minerals extracted from the acreage. A holder of royalty interests is generally not responsible for capital expenditures or lease operating expenses, but royalty interests may be calculated net of post-production expenses, and typically has no environmental liability. Royalty interests leased to producers expire upon the expiration of the oil and gas lease and revert to the mineral owner.

•Mineral Interest. Mineral interests are perpetual rights of the owner to explore, develop, exploit, mine and/or produce any or all of the minerals lying below the surface of the property. The holder of a mineral interest has the right to lease the minerals to an exploration and production company. Upon the execution of an oil and gas lease, the lessee (the exploration and production company) becomes the working interest owner and the lessor (the mineral interest owner) has a royalty interest.

•Non-Participating Royalty Interest (“NPRIs”). NPRI is an interest in oil and gas production which is created from the mineral estate. The NPRI is expense-free, bearing no operational costs of production. The term “non-participating” indicates that the interest owner does not share in the bonus, rentals from a lease, nor the right to participate in the execution of oil and gas leases. The NPRI owner does; however, typically receive royalty payments.

•Overriding Royalty Interest (“ORRIs”). ORRIs are created by carving out the right to receive royalties from a working interest. Like royalty interests, ORRIs do not confer an obligation to make capital expenditures or pay for lease operating expenses and have limited environmental liability; however, ORRIs may be calculated net of post-production expenses, depending on how the ORRI is structured. ORRIs that are carved out of working interests are linked to the same underlying oil and gas lease that created the working interest, and therefore, such ORRIs are typically subject to expiration upon the expiration or termination of the oil and gas lease.

The Company may own more than one type of mineral and royalty interest in the same tract of land. For example, where the Company owns an ORRI in a lease on the same tract of land in which it owns a mineral interest, the ORRI in that tract will relate to the same gross acres as the mineral interest in that tract.

The Minerals Management segment will benefit from the continued development of its mineral properties without the need for investment of additional capital once mineral and royalty interests have been acquired. The Minerals Management segment does not currently have any material investments under which it would be required to bear the cost of exploration, production or development.

Total consideration for the 2023 and 2022 acquisitions of mineral and royalty interests was $36.7 million and $11.9 million, respectively. The 2023 acquisition includes 43.4 thousand gross acres and 2.5 thousand net royalty acres. The 2022 acquisitions included 13.6 thousand gross acres and 880 net royalty acres. Total mineral and royalty interests include approximately 184.7 thousand gross acres and 63.3 thousand net royalty acres at December 31, 2023. Net royalty acres are calculated based on the Company’s ownership and royalty rate, normalized to a standard 1/8th royalty lease, and assumes a 1/4th royalty rate for unleased acres.

The Company's acquisition criteria for building a blended portfolio of mineral and royalty interests includes (i) new wells anticipated to come online within one to two years of investment, (ii) areas with forecasted future development within five years after acquisition and (iii) existing producing wells further along the decline curve that will generate stable cash flow. In addition, acquisitions should extend the geographic footprint to diversify across multiple basins with a preliminary focus on the more oil-rich Permian basin and a secondary focus on other diversifying basins to increase regional exposure. While the current focus is on the acquisition of mineral and royalty interests, the Company would also consider investments in ORRIs, NPRIs or non-operating working interests under certain circumstances. The current acquisition strategy does not contemplate any near-term working interest investments in which the Company would act as the operator.

The Company also manages legacy royalty and mineral interests located in Ohio (Utica and Marcellus shale natural gas), Louisiana (Haynesville shale and Cotton Valley formation natural gas), Texas (Cotton Valley and Austin Chalk formation natural gas), Mississippi (coal), Pennsylvania (coal, coalbed methane and Marcellus shale natural gas), Alabama (coal, coalbed methane and natural gas) and North Dakota (coal, oil and natural gas). The majority of the Company’s legacy reserves were acquired as part of its historical coal mining operations.

See “Item 2. Properties" on page 31 in this Form 10-K for discussion of the Company's proved reserves.

Customers

The principal customers of the Coal Mining segment are electric utilities and an independent power provider.

The principal customers of the NAMining segment are limestone producers and to a lesser extent, sand and gravel producers. In addition, NAMining will serve as exclusive contract miner for the Thacker Pass lithium project in northern Nevada.

The Minerals Management segment generates income primarily from royalty-based lease payments from oil, gas and to a lesser extent, coal producers. The pricing of oil, gas and coal sales is primarily determined by supply and demand in the marketplace and can fluctuate considerably. As a mineral owner, the Company has limited access to timely information, involvement, and operational control over the volumes of oil, gas and coal produced and sold and the terms and conditions on which such volumes are marketed and sold.

In 2023 and 2022, two customers individually accounted for more than 10% of consolidated revenues. The following represents the revenue attributable to each of these entities as a percentage of consolidated revenues for those years:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of Consolidated Revenues |

|

Segment |

|

2023 |

|

2022 |

|

|

|

Coal Mining customer |

|

40 |

% |

|

39 |

% |

|

|

|

NAMining customer |

|

22 |

% |

|

17 |

% |

|

|

|

|

|

|

|

|

|

|

The loss of either of these customers could have a material adverse effect on the results of operations attributable to the applicable segment and on the Company's consolidated results of operations.

Competition

Coteau, Coyote Creek, Falkirk and MLMC each have only one customer for which they extract and deliver coal. The Company's coal mines are directly adjacent to the customer’s property, with economical delivery methods that include conveyor belt delivery systems linked to the customer’s facilities or short-haul rail systems. All of the mines in the Coal Mining segment are the most economical suppliers to each of their respective customers as a result of transportation advantages over competitors. In addition, the customers' facilities were specifically designed to use the coal being mined.

The coal industry competes with other sources of energy, particularly oil, gas, hydro-electric power and nuclear power. In addition, it competes with subsidized sources of energy, primarily wind and solar. Among the factors that affect competition are the price and availability of oil and natural gas, environmental and related political considerations, the time and expenditures required to develop new energy sources, the cost of transportation, the cost of compliance with governmental regulations, the impact of federal and state energy policies, the impact of subsidies on pricing of renewable energy and the Company's customers' dispatch decisions, which may also take into account carbon dioxide emissions. The ability of the Coal Mining segment to maintain comparable levels of coal production at existing facilities and develop its reserves will depend upon the interaction of these factors.

Coal-fired electricity generating units are chosen to run primarily based on operating costs, of which fuel costs account for the largest share. Natural gas-fired power plants have the most potential to displace coal-fired electric baseload power generation in the near term. Federal and state mandates for increased use of electricity derived from renewable energy sources could also negatively affect demand for coal. Such mandates, combined with other incentives to use renewable energy sources, such as tax credits, make alternative fuel sources more competitive with coal. Fluctuations in natural gas prices and the availability of renewable energy sources, particularly wind, can contribute to changes in power plant dispatch and customer demand for coal. Over the longer term, the Company continues to believe that customer demand will remain pressured by regulations mandating or incentivizing the purchase of power from subsidized renewable energy sources, particularly wind and solar. See “Item 1. Business — Government Regulation" on page 8 in this Form 10-K for further discussion. Environmental, social and governance considerations can also have an impact on power plant dispatch and demand for coal.

Based on industry information, the Company believes it was one of the ten largest coal producers in the U.S. in 2023 based on total coal tons produced.

NAMining faces competition from producers of aggregates, lithium or other minerals that choose to self-perform mining operations and from other mining companies.

In the Minerals Management segment, the oil and gas industry is intensely competitive; the Company primarily competes with companies and investors for the acquisition of oil and gas properties, some of which have greater resources and may be able to pay more for productive oil and natural gas properties or to define, evaluate, bid for and purchase a greater number of properties than the Company’s financial resources permit. Additionally, many of the Minerals Management segment's competitors are, or are affiliated with, operators that engage in the exploration and production of their oil and gas properties, which allows them to acquire larger assets that include operated properties. Larger or more integrated competitors may be able to absorb the burden of existing, and any changes to, federal, state and local laws and regulations more easily than the Company can, which would adversely affect its competitive position. The integrated competitors may also have a better understanding of when minerals they acquire will be developed, as they are often the developer. The Minerals Management segment’s ability to acquire additional properties in the future will be dependent upon its ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. Further, oil and natural gas compete with other forms of energy available to customers, primarily based on price.

Changes in the availability or price of oil and natural gas or other forms of energy, as well as business conditions, conservation, legislation, regulations, and the ability to convert to alternate fuels and other forms of energy may affect the demand for oil and natural gas.

Seasonality

The Company has experienced limited variability in its results due to the effect of seasonality; however, variations in coal demand can occur as a result of the timing and duration of planned or unplanned outages at customers' facilities. Variations in coal demand can also occur as a result of changes in market prices of competing fuels such as natural gas, wind and solar power and demand for electricity, which can fluctuate based on changes in weather patterns.

The NAMining segment extracts a significant amount of the annual limestone produced in Florida. The Florida construction industry can be affected by the cyclicality of the economy, seasonal weather conditions and pandemics, all of which can result in variations in demand for aggregates.

In the Minerals Management segment, oil and natural gas wells have high initial production rates and follow a natural decline before settling into relatively stable, long-term production. Decline rates can vary due to factors like well depth, well length, geology, formation pressure, and facility design. In addition to the natural production decline curve, royalty income can fluctuate favorably or unfavorably in response to a number of factors outside of the Company's control, including the number of wells being operated by third parties, fluctuations in commodity prices (primarily oil and natural gas), fluctuations in production rates associated with operator decisions, regulatory risks, the Company's lessees' willingness and ability to incur well-development and other operating costs, and changes in the availability and continuing development of infrastructure.

Weather conditions affect the demand for, and prices of, natural gas and can also delay drilling activities. Demand for natural gas is typically higher during the winter, resulting in higher natural gas prices during the first and fourth quarters. Certain natural gas users utilize natural gas storage facilities and purchase some of their anticipated winter requirements during the summer, which can lessen seasonal demand fluctuations. Seasonal weather conditions can limit drilling and producing activities and other oil and natural gas operations. Due to these seasonal fluctuations, Minerals Management results of operations for individual quarterly periods may not be indicative of the results that may be realize on an annual basis.

Human Capital

As of December 31, 2023, the Company and its subsidiaries had approximately 1,700 employees, including approximately 1,100 employees at the Company’s unconsolidated mining operations, none of which are represented by a collective bargaining agreement. NACCO believes it has good relations with its employees.

Market-Based Compensation: NACCO believes its employees are critical to its success and invests in its employees by offering a market-based competitive total rewards package that includes a combination of salaries and wages and a benefits package that promotes employee well-being across all aspects of their lives. The Company offers a 100% 401(k) matching contribution up to 5% of compensation and a generous profit-sharing contribution for all of our full-time and part-time employees. The Company provides employee wages that are competitive and consistent with employee positions, skill levels, experience, knowledge and geographic location. Benefits offered to employees include:

•Medical, dental and vision benefits for employees, spouses and dependents;

•Flexible spending accounts for both healthcare and dependent care;

•Health savings accounts and health reimbursement accounts, both of which receive company contributions;

•Paid vacation and holidays;

•Parental leave;

•Short-term and long-term disability benefits;

•Wellness incentives for employees;

•Life and AD&D insurance benefits;

•Charitable donation matches; and

•Employee assistance program.

Employee Development: The Company recognizes that its culture and success is strengthened when employees are respected, motivated and engaged. The Company works to match employees with assignments that capitalize on the skills, talents and potential of each employee, and provides opportunities for professional growth. The Company believes in hiring, engaging, developing and promoting people who are fully able to meet the demands of each position, regardless of race, color, religion, gender, sexual orientation, gender identity, national origin, age, veteran status or disability.

Safety: Employee safety in the workplace is one of the Company’s core values. The Company is committed to strict compliance with applicable laws and regulations regarding workplace safety and provides on-going safety training, education and communication. The National Mining Association ranks NACCO as an industry leader in safety, and the Company's incident rate is consistently below the national average for comparable mines, based on Mine Safety and Health Administration data. The Company has earned more than 100 safety awards at the state and national levels. NACCO strives to have zero safety incidents or injuries. The Company's operations have onsite safety personnel who train employees in safe work practices, review safety-related incidents and recommend improvements when appropriate. Hazards in the workplace are actively identified and management tracks incidents so remedial actions can be taken to improve workplace safety. The Company believes communication related to “near misses,” safety incidents and protocols is essential to continuously developing and maintaining best-practices related to safety and enables identification and correction of operational practices that might impair employee safety or health.

Company Ethics: The Company has processes in place for compliance with its Code of Corporate Conduct, Insider Trading Policy and Anti-Corruption Policy. All of the Company's Directors and employees annually complete certifications with respect to compliance with the Company's Code of Corporate Conduct. In addition, all employees of the Company are required to complete annual Code of Corporate Conduct training. The Code of Corporate Conduct, Insider Trading Policy and Anti-Corruption Policy require employees to comply with applicable laws and regulations, maintain high ethical standards and report situations of actual or potential noncompliance. The Company also maintains an ethics related hotline, managed by a third party, through which individuals can anonymously raise concerns or ask questions about business behavior.

Community Engagement: The Company supports its local communities and is committed to helping them remain safe, healthy and resilient. The Company's past activities include corporate donations, volunteerism and education. Community engagement is encouraged and supported through the Company's matching gift program. The Company will match employee contributions up to $5,000 per employee if program criteria are met.

Please visit nacco.com/stewardship/ for the full text of certain NACCO stewardship policies.

Available Information

The Company makes its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports available through its website, www.nacco.com, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). The content of the Company's website is not incorporated by reference into this Form 10-K or in any other report or document filed with the SEC, and any reference to the Company's website is intended to be an inactive textual reference only. The SEC maintains an internet site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding the Company and other issuers that file electronically with the SEC.

Under Rule 12b-2 of the Exchange Act, the Company qualifies as a “smaller reporting company” because its public float as of the last business day of the Company’s most recently completed second quarter was less than $250 million. For as long as the Company remains a “smaller reporting company,” it may take advantage of certain exemptions from the SEC’s reporting requirements that are otherwise applicable to public companies that are not smaller reporting companies.

Government Regulation

The Company's operations are subject to various federal, state and local laws and regulations on matters such as employee health and safety, and certain environmental laws and regulations relating to, among other matters, the reclamation and restoration of coal mining properties, air pollution, water pollution, the disposal of wastes and effects on groundwater. In addition, the electric power generation industry is subject to extensive regulation regarding the environmental impact of its power generation activities that could affect demand for coal from the Company's Coal Mining segment.

Numerous governmental permits and approvals are required for coal mining operations. The Company's subsidiaries hold or will hold the necessary permits at all of its lignite coal mining operations. At the coal mining operations where the Company's subsidiaries hold the permits, the Company is required to prepare and present to federal, state or local governmental authorities data pertaining to the effect or impact that any proposed exploration for or production of coal may have upon the environment and public and employee health and safety.

Some laws, as discussed below, place many requirements on the Company's operations and its customers' operations. Federal and state regulations require regular monitoring of the Company's operations to ensure compliance.

Many aspects of the production, pricing and marketing of oil and natural gas are regulated by federal and state agencies. Legislation affecting the oil and natural gas industry is under constant review for amendment or expansion, which frequently increases the regulatory burden on affected members of the industry and could affect the results of the Company’s Minerals Management segment.

Mine Health and Safety Laws

The Federal Mine Safety and Health Act of 1977 imposes safety and health standards on all mining operations. Regulations are comprehensive and affect numerous aspects of mining operations, including training of mine personnel, mining procedures, blasting, the equipment used in mining operations and other matters. The Federal Mine Safety and Health Administration enforces compliance with these federal laws and regulations.

Environmental Laws

The Company's coal mining operations are subject to various federal environmental laws, as amended, including:

•the Surface Mining Control and Reclamation Act of 1977 (“SMCRA”);

•the Clean Air Act, including amendments to that act in 1990 (“CAA”);

•the Clean Water Act of 1972 (“CWA”);

•the Resource Conservation and Recovery Act ("RCRA");

•the National Environmental Policy Act of 1970 (“NEPA”); and

•the Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA").

In addition to these federal environmental laws, various states have enacted environmental laws that provide for higher levels of environmental compliance than similar federal laws. These state environmental laws require reporting, permitting and/or approval of many aspects of coal mining operations. Both federal and state inspectors regularly visit mines to enforce compliance. The Company has ongoing training, compliance and permitting programs to ensure compliance with such environmental laws. Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent and costly pollution control or waste handling, storage, transport, disposal or cleanup requirements could materially adversely affect the Coal Mining segment.

Surface Mining Control and Reclamation Act

SMCRA establishes mining, environmental protection and reclamation standards for all aspects of surface coal mining operations. Where state regulatory agencies have adopted federal mining programs under SMCRA, the state becomes the primary regulatory authority.

Coal mine operators must obtain SMCRA permits and permit renewals for coal mining operations from the applicable regulatory agency. These SMCRA permit provisions include requirements for coal prospecting, mine plan development, topsoil removal, storage and replacement, selective handling of overburden materials, mine pit backfilling and grading, protection of the hydrologic balance, surface drainage control, mine drainage and mine discharge control and treatment, and revegetation. Although mining permits have stated expiration dates, SMCRA provides for a right of successive renewal. The cost of obtaining surface mining permits can vary widely depending on the quantity and type of information that must be provided to obtain the permits.

The Abandoned Mine Land Fund, which is provided for by SMCRA, imposes a fee on certain coal mining operations. The proceeds are intended to be used principally to reclaim mine lands closed prior to 1977. In addition, the Abandoned Mine Land Fund also makes transfers annually to the United Mine Workers of America Combined Benefit Fund (the “Fund”), which provides health care benefits to retired coal miners who are beneficiaries of the Fund. The 2021 Infrastructure Investment and Jobs Act reauthorized the Abandoned Mine Land fee at a reduced rate. The fee for lignite coal was reduced from $0.08 per ton to $0.064 per ton and for other surface-mined coal from $0.28 per ton to $0.224 per ton. These fees have been reauthorized until the end of fiscal year 2035.

SMCRA establishes operational, reclamation and closure standards for surface coal mines. The Company accrues for the costs of current mine disturbance and final mine closure, including the cost of treating mine water discharges, at mines where the Company's subsidiaries hold the mining permit. While these obligations are largely unfunded, they can require securitization through bonding, with the exception of the final mine closure costs for the Coyote Creek Mine, which are being funded throughout the production stage.

SMCRA stipulates compliance with many other major environmental programs, including the CAA and CWA. The U.S. Army Corps of Engineers regulates activities affecting navigable waters, and the U.S. Bureau of Alcohol, Tobacco and Firearms regulates the use of explosives for blasting. In addition, the U.S. Environmental Protection Agency (the “EPA”), the U.S. Army Corps of Engineers and the Office of Surface Mining Reclamation and Enforcement ("OSMRE") have engaged in a series of rulemakings and other administrative actions under the CWA and other statutes that are directed at reducing the impact of coal mining operations on water bodies.

The Company does not believe there is any significant risk to the Company's subsidiaries' ability to maintain its existing mining permits or its ability to acquire future mining permits for its mines.

Greenhouse Gas (“GHG”) Emissions

In July 2019, the EPA finalized a rule that repealed the Clean Power Plan ("CPP") that had been finalized in 2015 and established new regulations addressing GHG emissions from existing coal-fueled electric generation units, referred to as the Affordable Clean Energy (“ACE”) rule. The ACE rule developed emission guidelines that states must use when developing plans to regulate GHG emissions from existing coal-fueled electric generating units (“EGUs”). In response to challenges brought by environmental groups and certain states, the U.S. Court of Appeals for the District of Columbia Circuit (the “D.C. Circuit Court”) vacated the ACE rule, including its repeal of the CPP, in January 2021 and remanded the rule to the EPA for further action. On June 30, 2022, the Supreme Court of the United States (“SCOTUS”) issued an opinion reversing the D.C. Circuit Court's decision, and finding that the EPA exceeded its statutory authority when it adopted the CPP.

On May 11, 2023, the EPA published a draft rule imposing limits on GHG emissions from existing coal and new natural-gas electric generating units, which could compel such facilities to install additional pollution controls or shut down ("CPP2"). The proposed CPP2 includes guidelines for carbon dioxide ("CO2") emissions from existing EGUs with a proposed compliance

date of January 1, 2030. For coal-fired steam EGUs that plan to operate past January 1, 2040, the EPA is proposing a best

system of emissions reduction ("BSER") of carbon capture and sequestration/storage ("CCS") with 90 percent capture of CO2

at the stack. For coal-fired steam EGUs that will permanently cease operations after December 31, 2031, but before January 1,

2040, the EPA is proposing a BSER of 40 percent natural gas co-firing on a heat input basis. Coal-fired steam EGUs that will permanently cease operations between December 31, 2031 and January 1, 2035, will be subject to an annual capacity factor

limit, and for units that will permanently cease operations before January 1, 2032, the EPA is proposing a BSER of routine

methods of operation and maintenance that maintain current emission rates. Each of the EGUs supplied by the Company would

be subject to these proposed requirements.

Additionally, the proposed CPP2 contains other actions, including revised new source performance standards for GHG

emissions from new and reconstructed fossil fuel-fired steam EGUs that undertake a large modification. These new rules may

raise the cost of fossil fuel generated energy, making coal-fired power plants less competitive, and/or result in early closure

which could have an adverse impact on demand for coal and ultimately result in the early closure of the mines servicing these

plants, including closure of the Company's coal mines. Any such closure of the Company's mines could have a material adverse

effect on the Company’s business, financial condition and results of operations.

Clean Air Act