false000078516100007851612023-04-272023-04-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): April 27, 2023

Encompass Health Corporation

(Exact name of Registrant as specified in its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

| 001-10315 |

63-0860407 |

| (Commission File Number) |

(IRS Employer Identification No.) |

|

|

9001 Liberty Parkway, Birmingham, Alabama 35242

(Address of Principal Executive Offices, Including Zip Code)

(205) 967-7116

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

| ☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

EHC |

New York Stock Exchange |

The information contained herein is being furnished pursuant to Item 2.02 of Form 8‑K, “Results of Operations and Financial Condition,” and Item 7.01 of Form 8-K, “Regulation FD Disclosure.” This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 2.02. Results of Operations and Financial Condition.

On April 27, 2023, Encompass Health Corporation (“Encompass Health” or the “Company”) issued a press release reporting the financial results of the Company for the three months ended March 31, 2023. A copy of the press release is attached to this report as Exhibit 99.1 and incorporated herein by reference.

The Company uses “same-store” comparisons to explain the changes in certain performance metrics and line items within its financial statements. Same-store comparisons are calculated based on hospitals open throughout both the full current and prior periods presented. These comparisons include the financial results of market consolidation transactions in existing markets, as it is difficult to determine, with precision, the incremental impact of these transactions on the Company's results of operations.

ITEM 7.01. Regulation FD Disclosure.

See Item 2.02, “Results of Operations and Financial Condition,” above.

In addition, a copy of the supplemental information which will be discussed during the Company’s earnings call at 10:00 a.m. Eastern Time on Friday, April 28, 2023 is attached to this report as Exhibit 99.2 and incorporated herein by reference.

Note Regarding Presentation of Non-GAAP Financial Measures

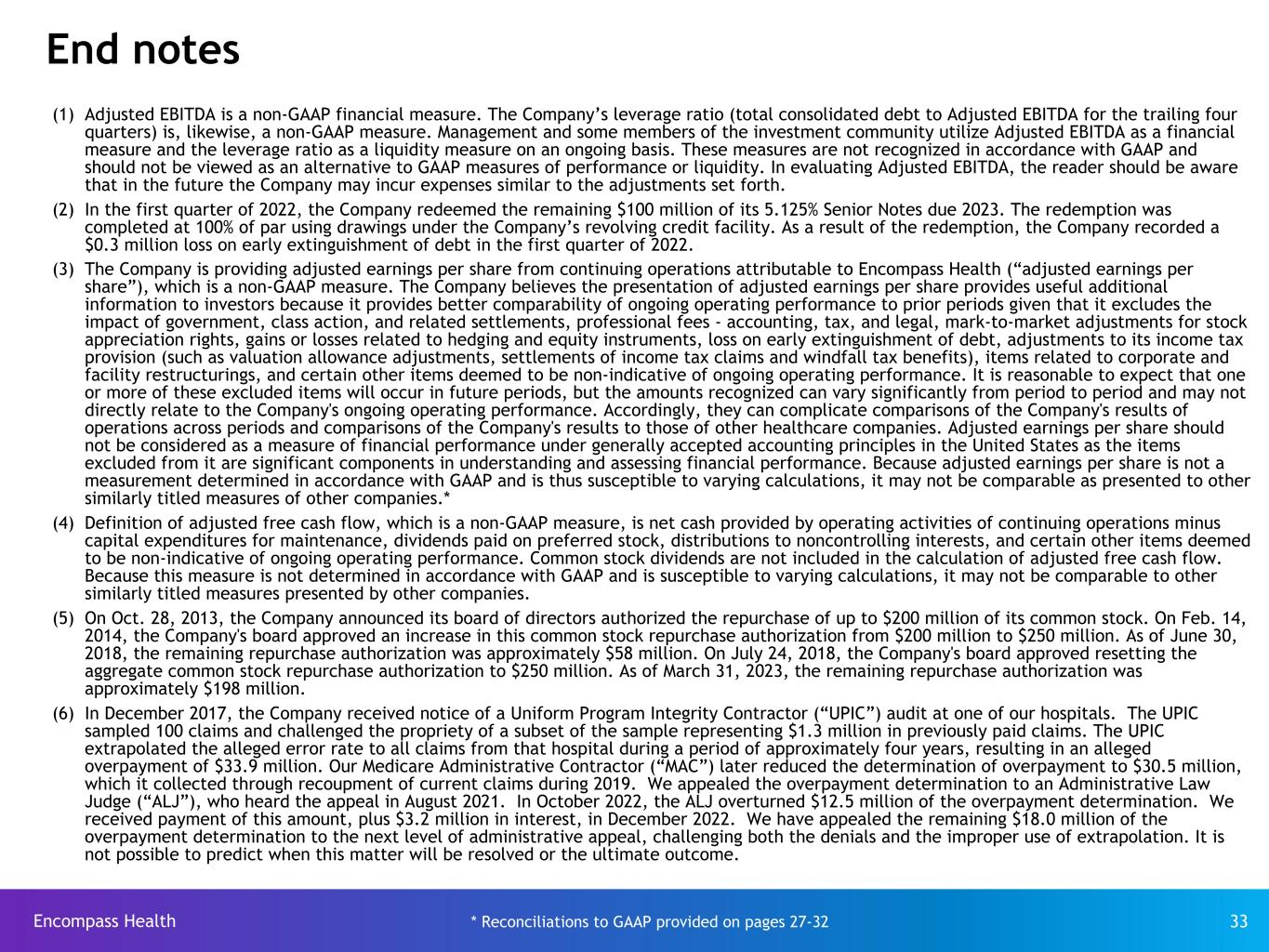

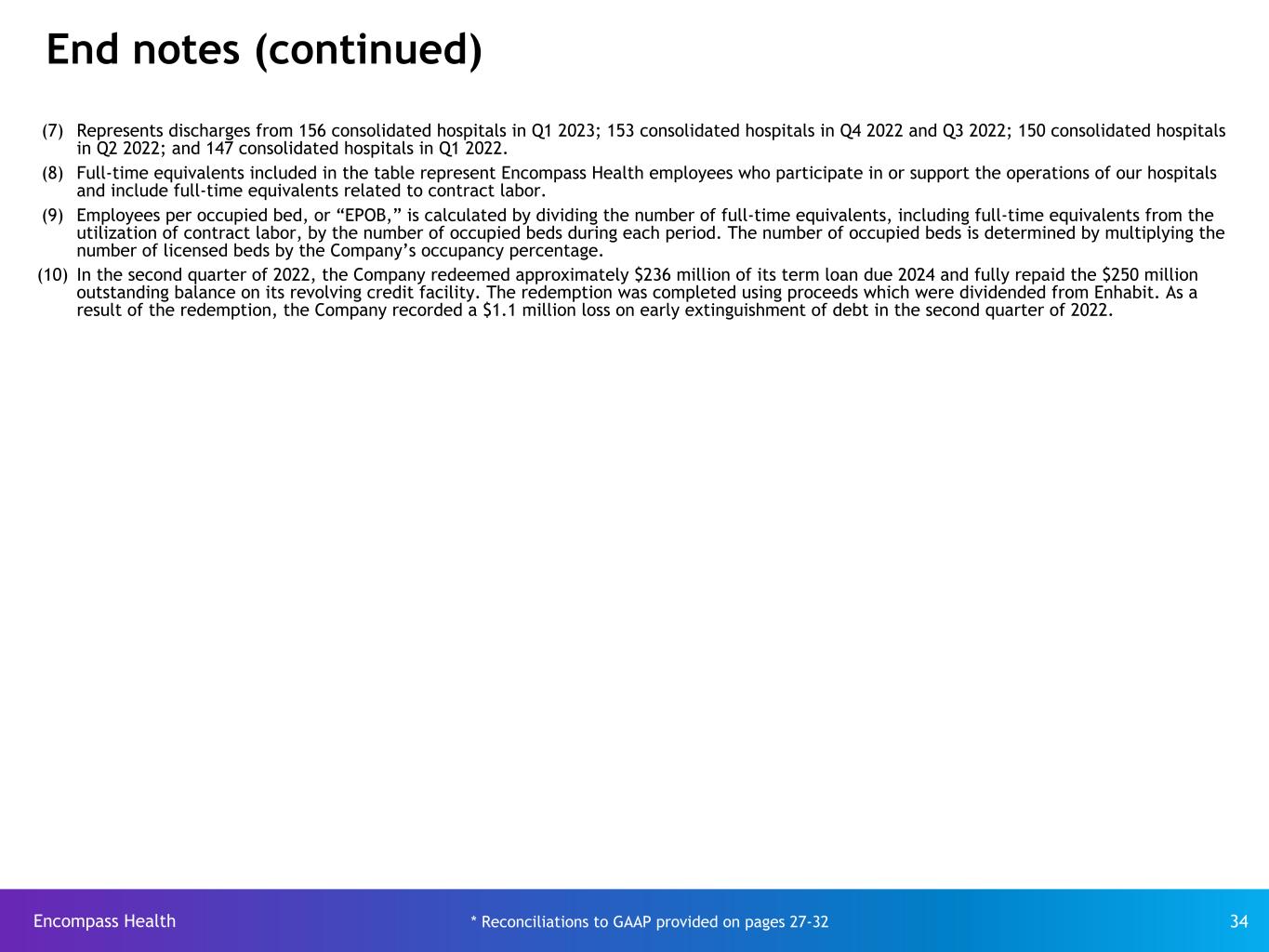

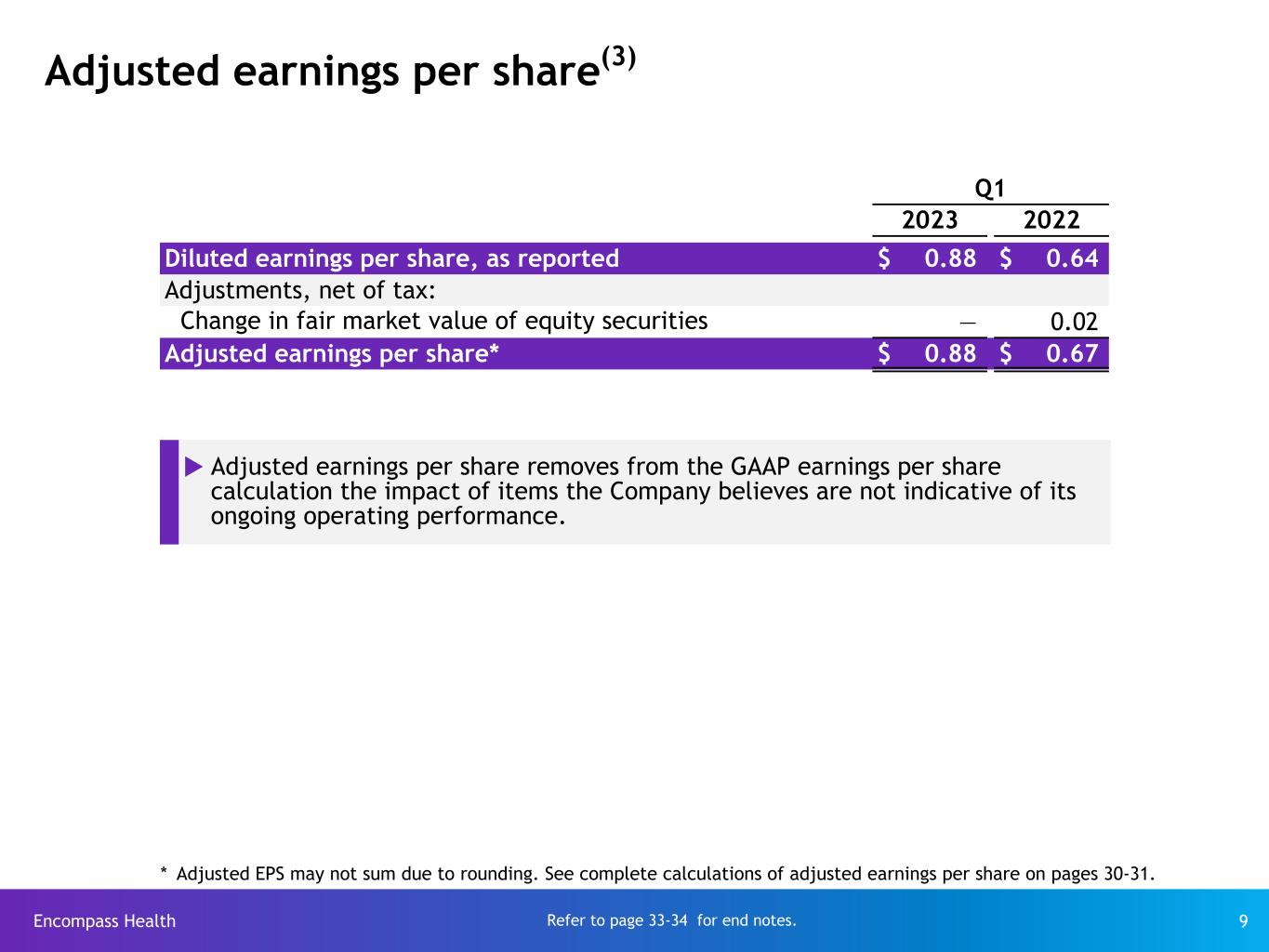

The financial data contained in the press release and supplemental information include non-GAAP financial measures, including the Company’s adjusted earnings per share, leverage ratio, Adjusted EBITDA, and adjusted free cash flow.

The Company is providing adjusted earnings per share from continuing operations attributable to Encompass Health (“adjusted earnings per share”). The Company believes the presentation of adjusted earnings per share provides useful additional information to investors because it provides better comparability of ongoing operating performance to prior periods given that it excludes the impact of government, class action, and related settlements; professional fees—accounting, tax, and legal; mark-to-market adjustments for stock appreciation rights; gains or losses related to hedging and equity instruments; loss on early extinguishment of debt; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); items related to corporate and facility restructurings; and certain other items the Company believes to be non-indicative of its ongoing operating performance. It is reasonable to expect that one or more of these excluded items will occur in future periods, but the amounts recognized can vary significantly from period to period and may not directly relate to the Company’s ongoing operating performance. Accordingly, they can complicate comparisons of the Company’s results of operations across periods and comparisons of the Company’s results to those of other healthcare companies. Adjusted earnings per share should not be considered as a measure of financial performance under generally accepted accounting principles in the United States (“GAAP”) as the items excluded from it are significant components in understanding and assessing financial performance. Because adjusted earnings per share is not a measurement determined in accordance with GAAP and is thus susceptible to varying calculations, it may not be comparable as presented to other similarly titled measures of other companies. The Company reconciles adjusted earnings per share to earnings per share in the press release attached as Exhibit 99.1 and the supplemental information attached as Exhibit 99.2.

The leverage ratio referenced therein is defined as the ratio of consolidated total debt to Adjusted EBITDA for the trailing four quarters. The Company believes its leverage ratio and Adjusted EBITDA are measures of its ability to service its debt and its ability to make capital expenditures. Additionally, the leverage ratio is a standard measurement used by investors to gauge the creditworthiness of an institution. The Company’s credit agreement also includes a maximum leverage ratio financial covenant which allows the Company to deduct cash on hand from consolidated total debt. In calculating the leverage ratio under our credit agreement, we are permitted to use pro forma Adjusted EBITDA, the calculation of which includes historical income statement items and pro forma adjustments, subject to certain limitations, resulting from (1) dispositions and repayments or incurrence of debt and (2) investments, acquisitions, mergers, amalgamations, consolidations and other operational changes to the extent such items or effects are not yet reflected in our trailing four-quarter financial statements. The Company reconciles Adjusted EBITDA to net cash provided by operating activities and net income in the press release attached as Exhibit 99.1 and the supplemental information attached as Exhibit 99.2.

The Company uses Adjusted EBITDA on a consolidated basis as a liquidity measure. The Company believes this financial measure on a consolidated basis is important in analyzing its liquidity because it is the key component of certain material covenants contained within the Company’s credit agreement, which is discussed in more detail in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, “Liquidity and Capital Resources,” and Note 10, Long-term Debt, to the consolidated financial statements included in its Annual Report on Form 10‑K for the year ended December 31, 2022 (the “2022 Form 10‑K”). These covenants are material terms of the credit agreement. Noncompliance with these financial covenants under the credit agreement—its interest coverage ratio and its leverage ratio—could result in the Company’s lenders requiring the Company to immediately repay all amounts borrowed. If the Company anticipated a potential covenant violation, it would seek relief from its lenders, which would have some cost to the Company, and such relief might be on terms less favorable to those in the Company’s existing credit agreement. In addition, if the Company cannot satisfy these financial covenants, it would be prohibited under the credit agreement from engaging in certain activities, such as incurring additional indebtedness, paying common stock dividends, making certain payments, and acquiring and disposing of assets. Consequently, Adjusted EBITDA is critical to the Company’s assessment of its liquidity.

In general terms, the credit agreement definition of Adjusted EBITDA, therein referred to as “Adjusted Consolidated EBITDA,” allows the Company to add back to consolidated net income interest expense, income taxes, and depreciation and amortization and then add back to consolidated net income (1) all unusual or nonrecurring items reducing consolidated net income (of which only up to $10 million in a year may be cash expenditures), (2) any losses from discontinued operations, (3) non-ordinary course fees, costs and expenses incurred with respect to any litigation or settlement, (4) share-based compensation expense, (5) costs and expenses associated with changes in the fair value of marketable securities, (6) costs and expenses associated with the issuance or prepayment debt and acquisitions, and (7) any restructuring charges and certain pro-forma cost savings and synergies related to transactions and initiatives, which in the aggregate are not in excess of 25% of Adjusted Consolidated EBITDA. The Company also subtracts from consolidated net income all unusual or nonrecurring items to the extent they increase consolidated net income.

The calculation of Adjusted EBITDA under the credit agreement does not require us to deduct net income attributable to noncontrolling interests or gains on fair value adjustments of hedging and equity instruments, disposal of assets, and development activities. It also does not allow us to add back losses on fair value adjustments of hedging instruments or unusual or nonrecurring cash expenditures in excess of $10 million. These items and amounts, in addition to the items falling within the credit agreement’s “unusual or nonrecurring” classification, may occur in future periods, but can vary significantly from period to period and may not directly relate to, or be indicative of, the Company's ongoing liquidity or operating performance. Accordingly, the Adjusted EBITDA calculation presented here includes adjustments for them.

Adjusted EBITDA is not a measure of financial performance under GAAP, and the items excluded from Adjusted EBITDA are significant components in understanding and assessing financial performance. Therefore, Adjusted EBITDA should not be considered a substitute for net income or cash flows from operating, investing, or financing activities. Because Adjusted EBITDA is not a measurement determined in accordance with GAAP and is thus susceptible to varying calculations, Adjusted EBITDA, as presented, may not be comparable to other similarly titled measures of other companies. Revenues and expenses are measured in accordance with the policies and procedures described in Note 1, Summary of Significant Accounting Policies, to the consolidated financial statements accompanying the 2022 Form 10-K.

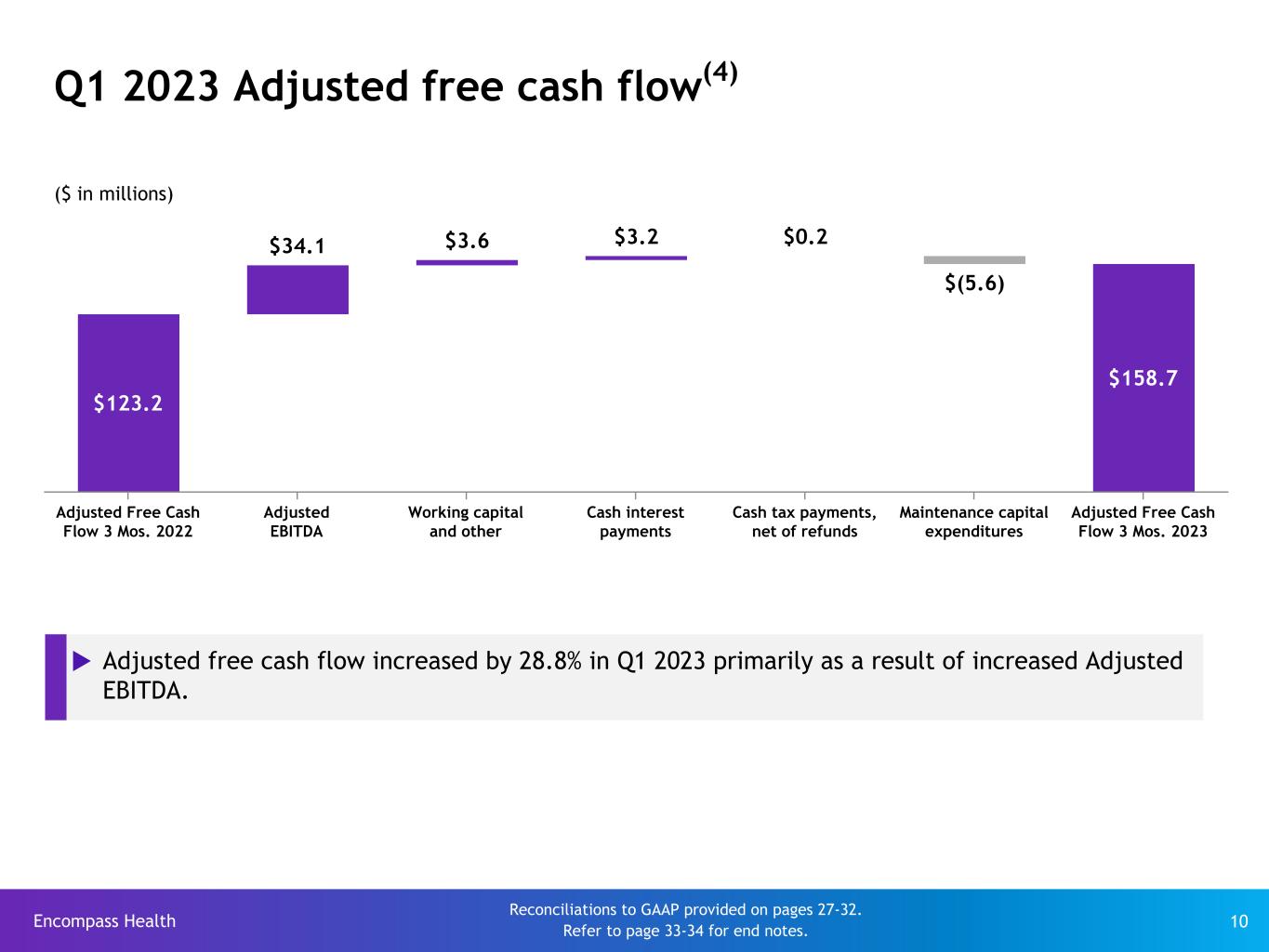

The Company also uses adjusted free cash flow as an analytical indicator to assess its performance. Management believes the presentation of adjusted free cash flow provides investors an efficient means by which they can evaluate the Company’s capacity to reduce debt, pursue development activities, and return capital to its common stockholders. The calculation of adjusted free cash flow and a reconciliation of net cash provided by operating activities to adjusted free cash flow are included in the press release attached as Exhibit 99.1 and the supplemental information attached as Exhibit 99.2. This measure is not a defined measure of financial performance under GAAP and should not be considered as an alternative to net cash provided by operating activities. The Company’s definition of adjusted free cash flow is limited and does not represent residual cash flows available for discretionary spending. Because this measure is not determined in accordance with GAAP and is susceptible to varying calculations, it may not be comparable to other similarly titled measures presented by other companies. See the consolidated statements of cash flows included in the 2022 Form 10-K and the condensed consolidated statements of cash flows included in the Company's quarterly report on Form 10-Q for the quarterly period ended March 31, 2023 (the "March 2023 Form 10-Q"), when filed, and in the press release attached as Exhibit 99.1 for the GAAP measures of cash flows from operating, investing, and financing activities.

Forward-Looking Statements

The information contained in the press release and supplemental information includes certain estimates, projections, and other forward-looking statements that involve known and unknown risks and relate to, among other things, future events, the business model, strategy, outlook and guidance, labor cost trends, financial plans, dividend strategies or payments, effective income tax rates, plans to repurchase its debt or equity securities, future financial performance, projected business results, ability to return value to its shareholders, projected capital expenditures and development plans, leverage ratio, acquisition opportunities, and the impact of future legislation or regulation. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “targets,” “potential,” or “continue” or the negative of these terms or other comparable terminology. These estimates, projections, and other forward-looking statements are based on assumptions the Company believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual results, and those differences may be material.

There can be no assurance that any estimates, projections, or forward-looking statements will be realized.

All such estimates, projections, and forward-looking statements speak only as of the date hereof. The Company undertakes no duty to publicly update or revise that information.

You are cautioned not to place undue reliance on the estimates, projections, and other forward-looking statements in this report, the press release, and supplemental information as they are based on current expectations and general assumptions and are subject to various risks, uncertainties, and other factors, including those set forth in the attached press release and in the 2022 Form 10‑K, the March 2023 Form 10-Q, when filed, and in other documents the Company previously filed with the SEC, many of which are beyond the Company’s control. These factors may cause actual results to differ materially from the views, beliefs, and estimates expressed herein.

ITEM 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

| Exhibit Number |

|

Description |

|

|

|

|

|

|

| 104 |

|

Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

| ENCOMPASS HEALTH CORPORATION |

| By: |

/S/ DOUGLAS E. COLTHARP |

|

Name: |

Douglas E. Coltharp |

|

Title: |

Executive Vice President and Chief Financial Officer |

Dated: April 27, 2023

EX-99.1

2

ehcearningsrelease33123.htm

EX-99.1

Document

|

|

|

|

|

|

| Media Contact |

April 27, 2023 |

| Casey Winger, 205 447-6410 |

|

| casey.winger@encompasshealth.com |

|

|

|

| Investor Relations Contact |

|

| Mark Miller, 205 970-5860 |

|

| mark.miller@encompasshealth.com |

|

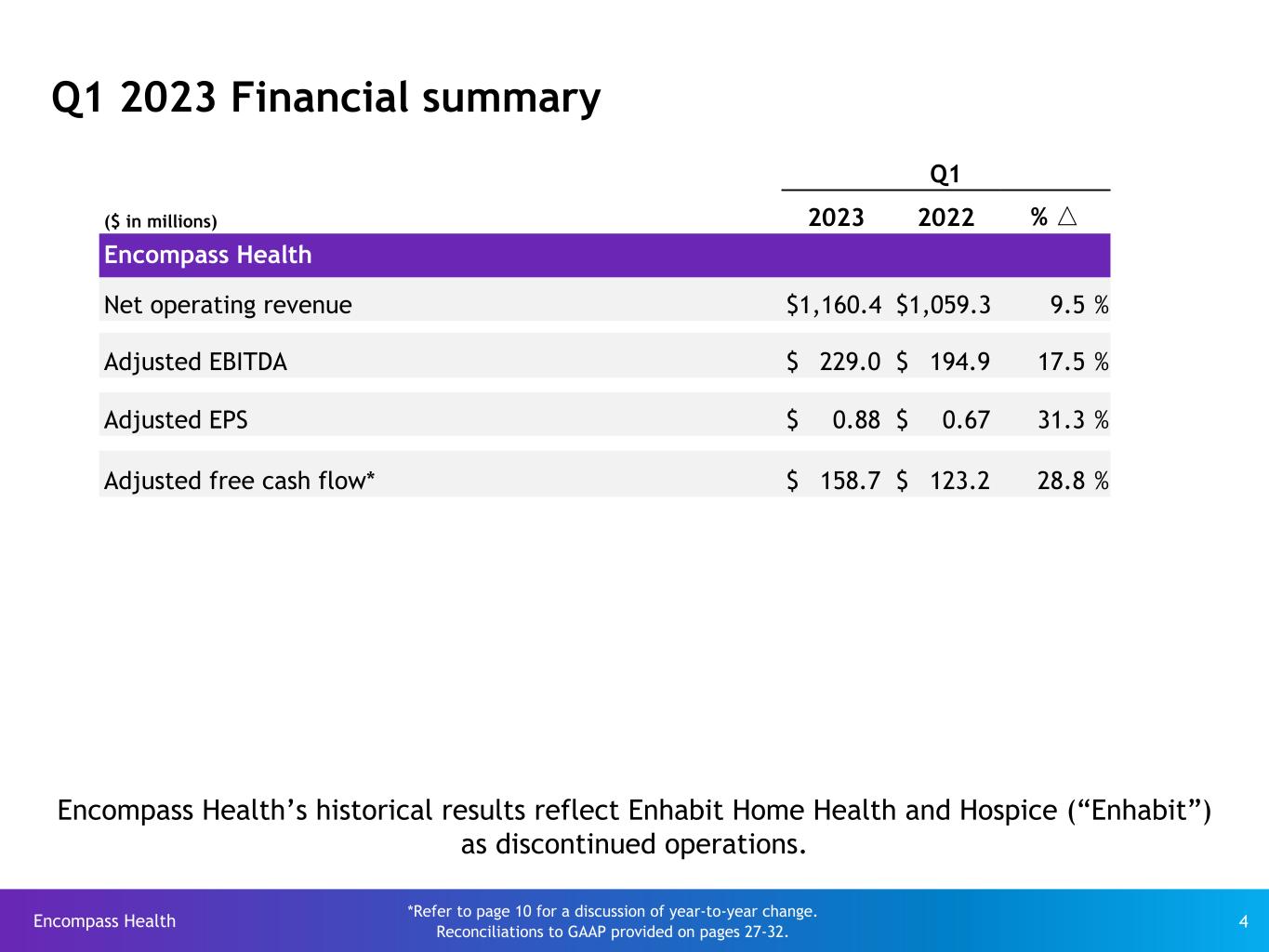

Encompass Health reports results for first quarter 2023

Increases full-year guidance

BIRMINGHAM, Ala. - Encompass Health Corporation (NYSE: EHC), the largest owner and operator of inpatient rehabilitation hospitals in the United States, today reported its results of operations for the first quarter ended March 31, 2023.

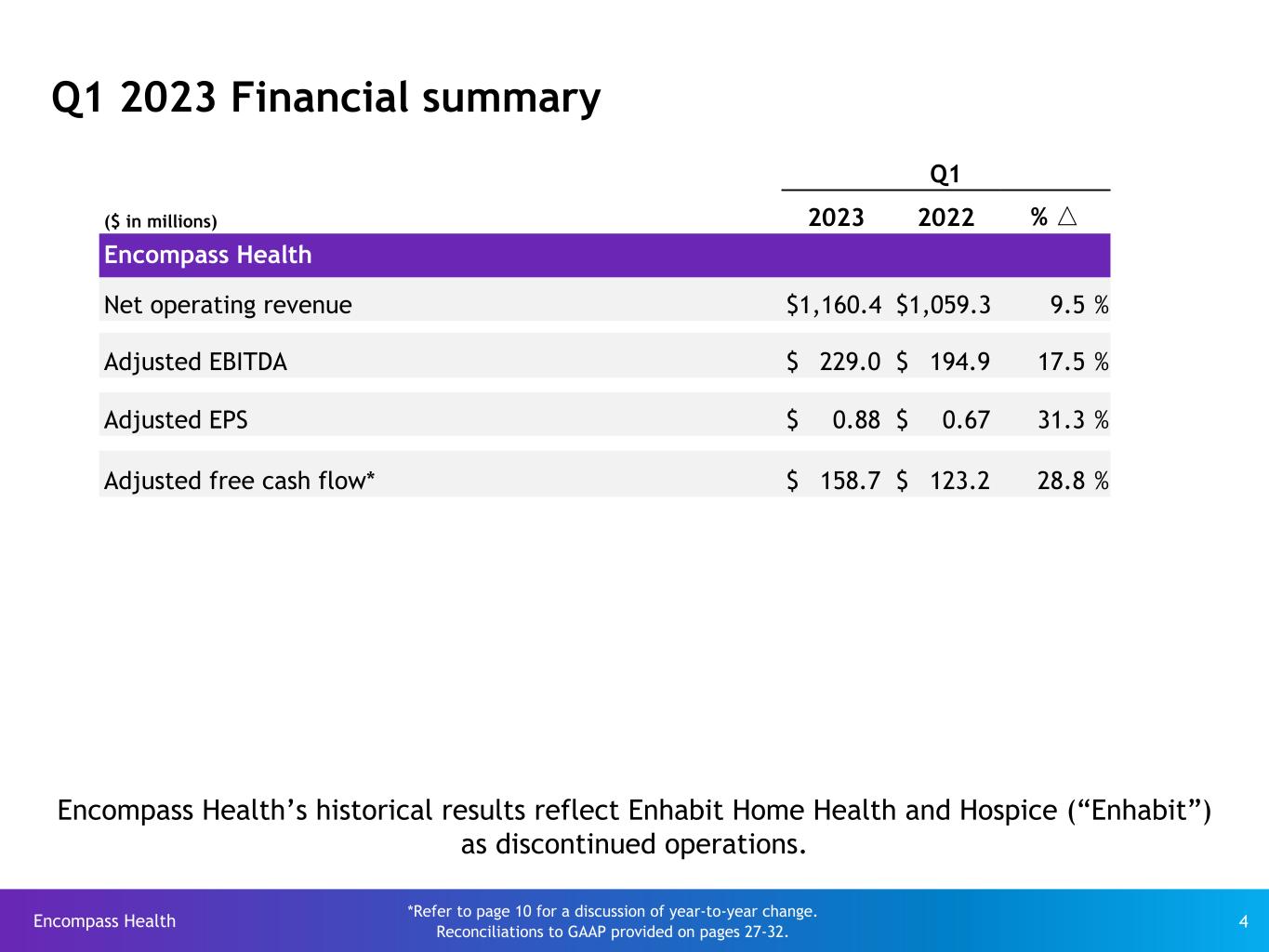

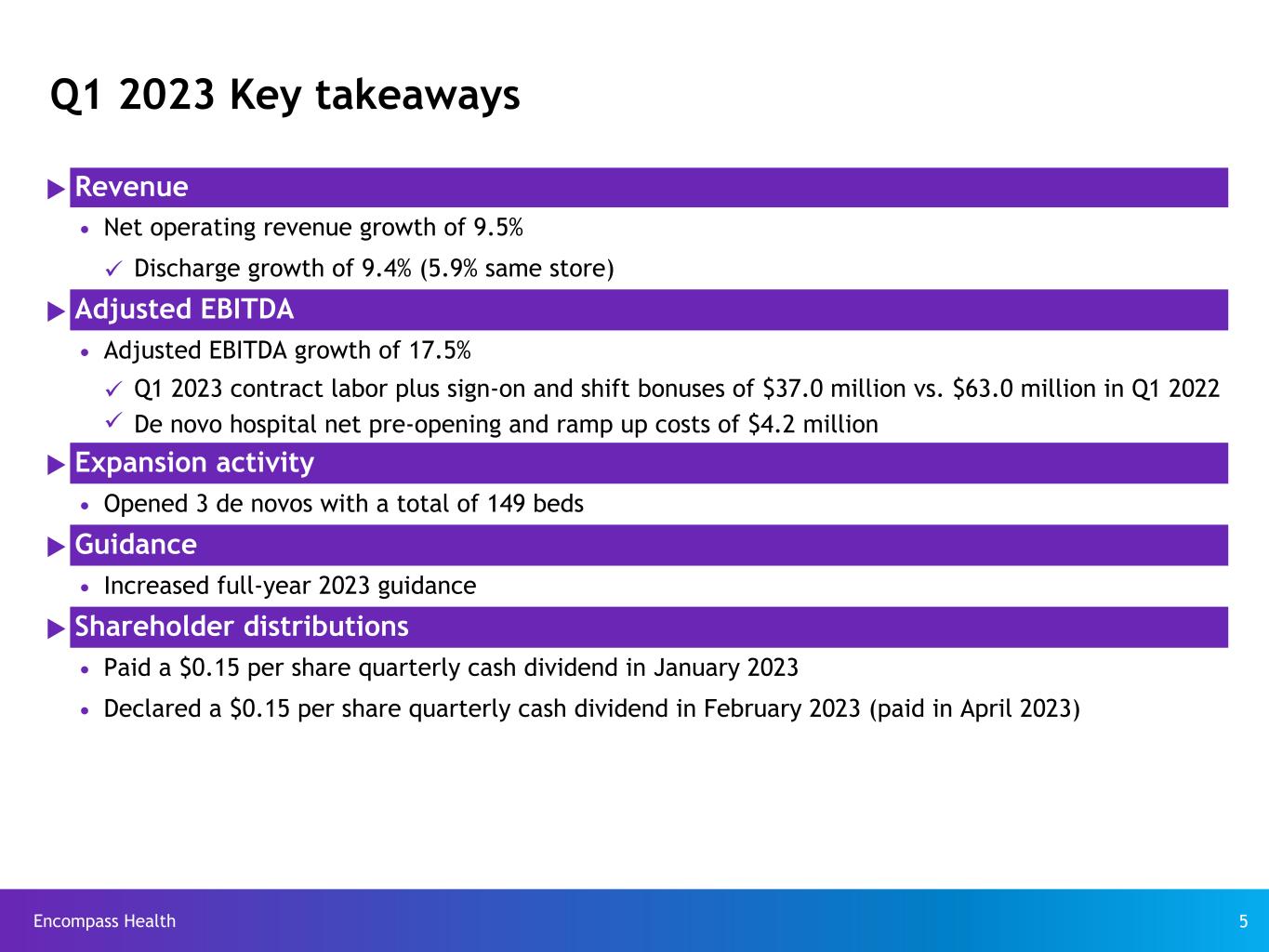

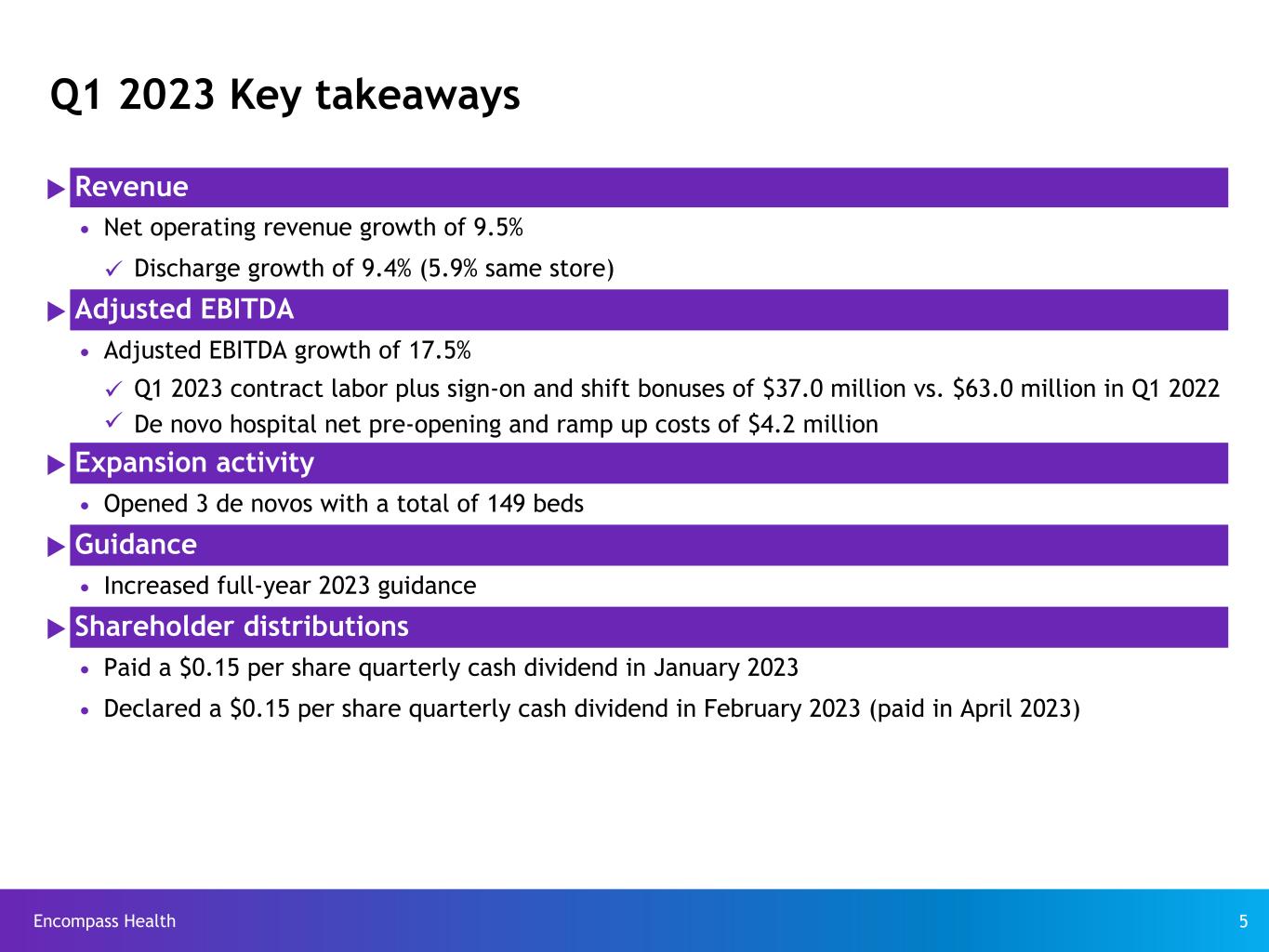

“We are very pleased with our first quarter performance,” said President and Chief Executive Officer of Encompass Health Mark Tarr. “Strong discharge growth of 9.4% combined with a substantial year-over-year improvement in labor costs to drive Adjusted EBITDA growth of 17.5%. Our value proposition and operating strategy continue to be validated and we remain highly optimistic about the long-term prospects of our business.”

Summary results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Growth |

|

Q1 2023 |

|

Q1 2022 |

|

Dollars |

|

Percent |

|

(In Millions, Except Per Share Data) |

| Net operating revenue |

$ |

1,160.4 |

|

|

$ |

1,059.3 |

|

|

$ |

101.1 |

|

|

9.5 |

% |

Income from continuing operations attributable to Encompass Health per diluted share |

0.88 |

|

|

0.64 |

|

|

0.24 |

|

|

37.5 |

% |

| Adjusted earnings per share |

0.88 |

|

|

0.67 |

|

|

0.21 |

|

|

31.3 |

% |

Cash flows provided by operating activities |

227.9 |

|

|

218.9 |

|

|

9.0 |

|

|

4.1 |

% |

| Adjusted EBITDA |

229.0 |

|

|

194.9 |

|

|

34.1 |

|

|

17.5 |

% |

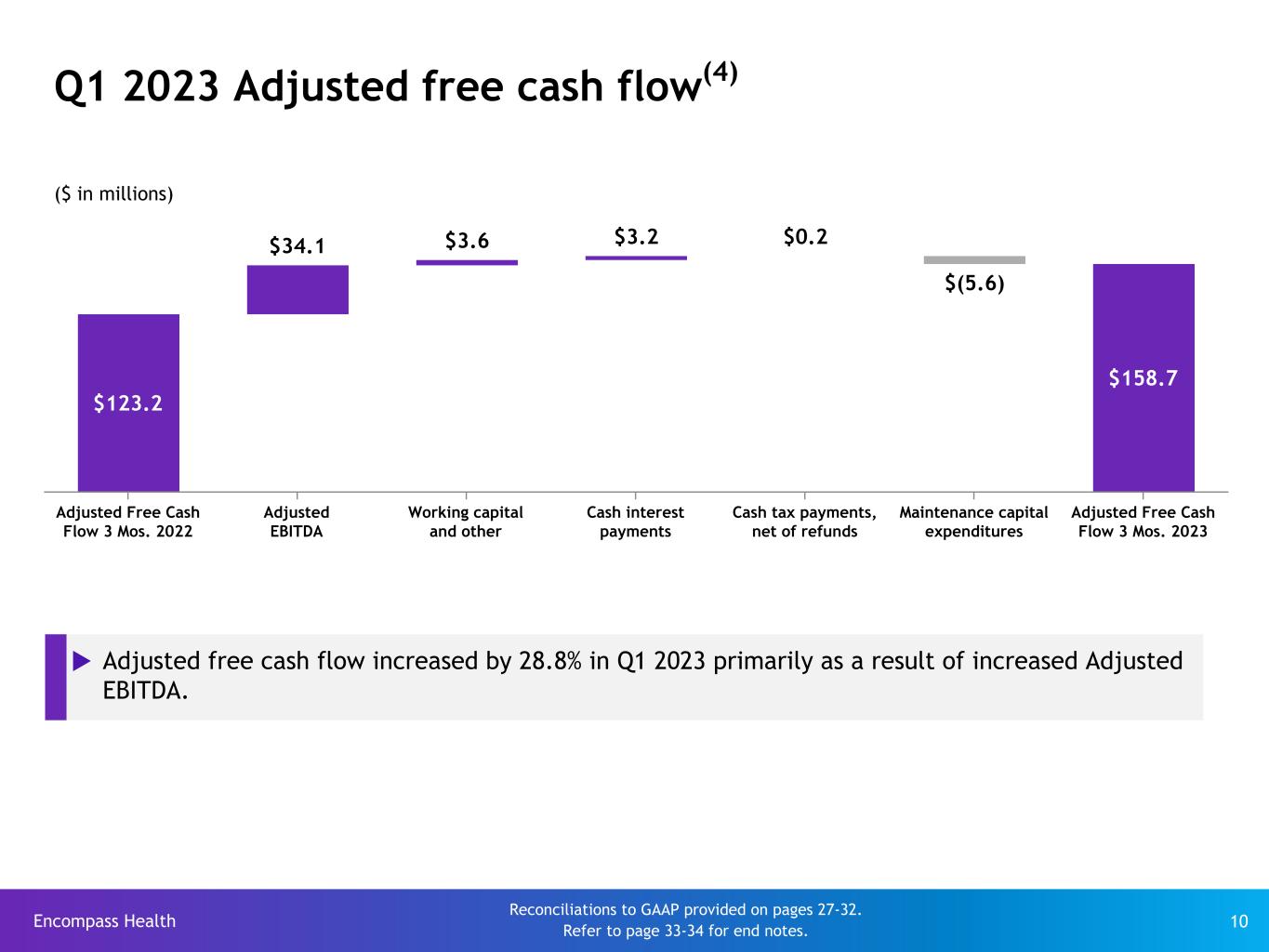

| Adjusted free cash flow |

158.7 |

|

|

123.2 |

|

|

35.5 |

|

|

28.8 |

% |

|

|

|

|

|

|

|

|

| (Actual Amounts) |

|

|

|

|

|

| Discharges |

55,557 |

|

50,771 |

|

|

|

9.4 |

% |

| Same-store discharge growth |

|

|

|

|

|

|

5.9 |

% |

| Net patient revenue per discharge |

$ |

20,415 |

|

|

$ |

20,409 |

|

|

|

|

— |

% |

See attached supplemental information for calculations of non-GAAP measures and reconciliations to their most comparable GAAP measure.

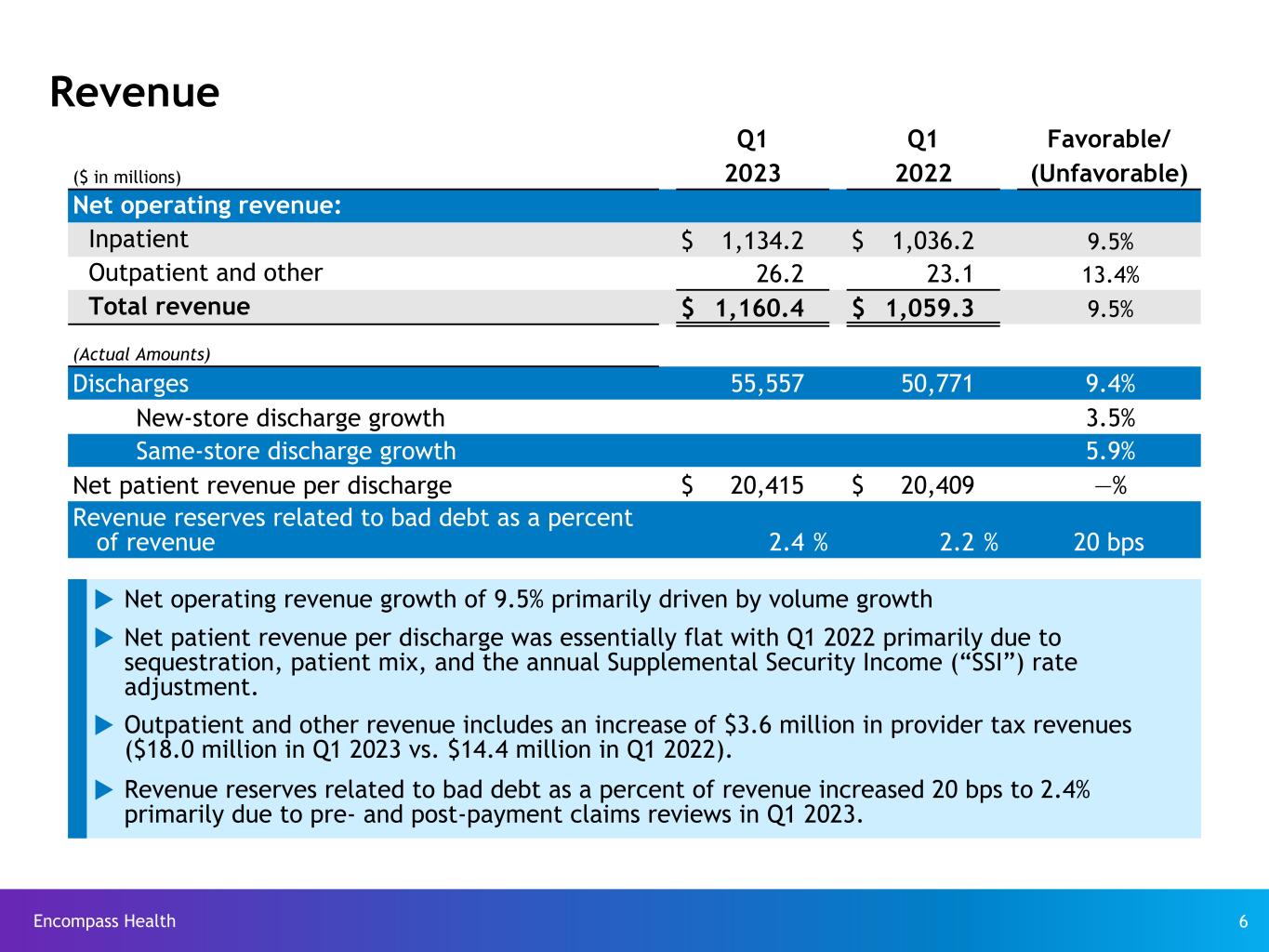

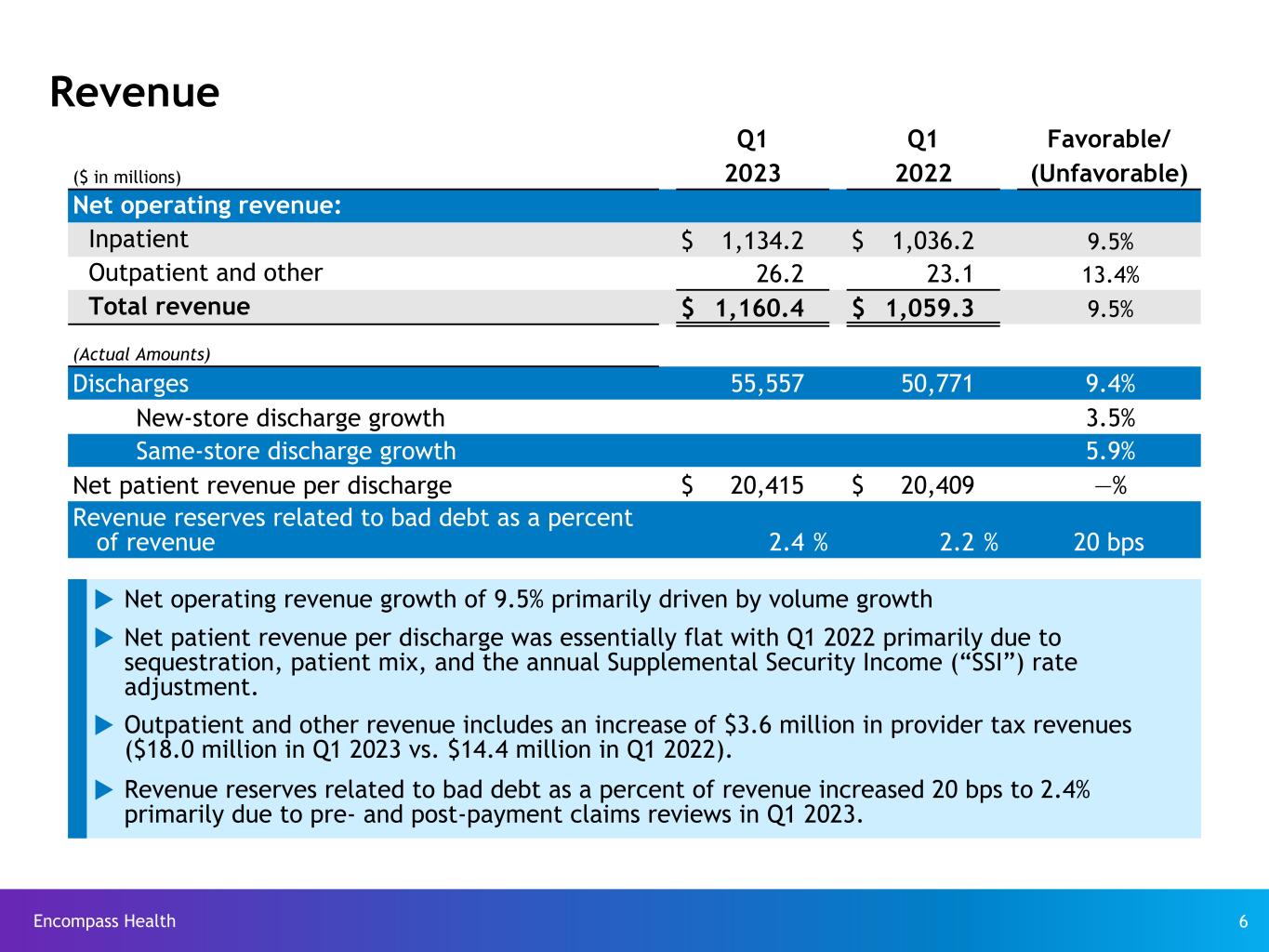

•Revenue growth of 9.5% resulted primarily from increased volumes. Total discharge growth for the first quarter of 2023 was 9.4% including same-store growth of 5.9%. Revenue reserves related to bad debt as a percent of revenue increased to 2.4%.

•Cash flows provided by operating activities increased 4.1% over the prior year to $227.9 million, due primarily to improved collections of accounts receivable.

•The 17.5% increase in Adjusted EBITDA primarily resulted from increased revenue and a decrease in contract labor expense and sign-on and shift bonuses.

2023 Guidance

The Company increased its full-year guidance as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Full-Year 2023 Guidance |

|

Previous Guidance |

|

Updated Guidance |

|

(In Millions, Except Per Share Data) |

| Net operating revenue |

$4,680 to $4,760 |

|

$4,700 to $4,770 |

| Adjusted EBITDA |

$860 to $900 |

|

$870 to $910 |

| Adjusted earnings per share from continuing operations attributable to Encompass Health |

$2.87 to $3.16 |

|

$2.94 to $3.23 |

For considerations regarding the Company’s 2023 guidance, see the supplemental information posted on the Company’s website at http://investor.encompasshealth.com. See also the “Other information” section below for an explanation of why the Company does not provide guidance for comparable GAAP measures for Adjusted EBITDA and adjusted earnings per share.

Earnings conference call and webcast

The Company will host an investor conference call at 10:00 a.m. Eastern Time on Friday, April 28, 2023 to discuss its results for the first quarter of 2023. For reference during the call, the Company will post certain supplemental information at http://investor.encompasshealth.com.

The conference call may be accessed by dialing 800 225-9448 and giving the conference ID EHCQ123. International callers should dial 203 518-9708 and give the same conference ID. Please call approximately ten minutes before the start of the call to ensure you are connected. The conference call will also be webcast live and will be available for on-line replay at http://investor.encompasshealth.com by clicking on an available link.

About Encompass Health

Encompass Health (NYSE: EHC) is the largest owner and operator of inpatient rehabilitation hospitals in the United States. With a national footprint that includes 157 hospitals in 37 states and Puerto Rico, the Company provides high-quality, compassionate rehabilitative care for patients recovering from a major injury or illness, using advanced technology and innovative treatments to maximize recovery. Encompass Health is ranked as one of Fortune's 100 Best Companies to Work For. For more information, visit encompasshealth.com, or follow us on our newsroom, Twitter, Instagram and Facebook.

Other information

The information in this press release is summarized and should be read in conjunction with the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 (the “March 2023 Form 10-Q”), when filed, as well as the Company’s Current Report on Form 8-K filed on April 27, 2023 (the “Q1 Earnings Form 8-K”), to which this press release is attached as Exhibit 99.1. In addition, the Company will post supplemental information today on its website at http://investor.encompasshealth.com for reference during its April 28, 2023 earnings call.

The financial data contained in the press release and supplemental information include non-GAAP financial measures, including the Company’s adjusted earnings per share, leverage ratio, Adjusted EBITDA, and adjusted free cash flow. Reconciliations to their most comparable GAAP measure, except with regard to non-GAAP guidance, are included below or in the Q1 Earnings Form 8-K. Readers are encouraged to review the “Note Regarding Presentation of Non-GAAP Financial Measures” included in the Q1 Earnings Form 8-K which provides further explanation and disclosure regarding the Company’s use of these non-GAAP financial measures.

Excluding net operating revenues, the Company does not provide guidance on a GAAP basis because it is unable to predict, with reasonable certainty, the future impact of items that are deemed to be outside the control of the Company or otherwise not indicative of its ongoing operating performance. Such items include government, class action, and related settlements; professional fees—accounting, tax, and legal; mark-to-market adjustments for stock appreciation rights; gains or losses related to hedging instruments; loss on early extinguishment of debt; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); items related to corporate and facility restructurings; and certain other items the Company believes to be not indicative of its ongoing operations. These items cannot be reasonably predicted and will depend on several factors, including industry and market conditions, and could be material to the Company’s results computed in accordance with GAAP.

However, the following reasonably estimable GAAP measures for 2023 would be included in a reconciliation for Adjusted EBITDA if the other reconciling GAAP measures could be reasonably predicted:

•Interest expense and amortization of debt discounts and fees - estimate of $145 million to $155 million

•Amortization of debt-related items - approximately $10 million

The Q1 Earnings Form 8-K and, when filed, the March 2023 Form 10-Q can be found on the Company’s website at http://investor.encompasshealth.com and the SEC's website at www.sec.gov.

Encompass Health Corporation and Subsidiaries

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

| |

2023 |

|

2022 |

|

|

|

|

|

(In Millions, Except Per Share Data) |

| Net operating revenues |

$ |

1,160.4 |

|

|

$ |

1,059.3 |

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

| Salaries and benefits |

629.0 |

|

|

587.4 |

|

|

|

|

|

| Other operating expenses |

177.9 |

|

|

159.0 |

|

|

|

|

|

| Occupancy costs |

13.8 |

|

|

15.4 |

|

|

|

|

|

| Supplies |

53.8 |

|

|

49.8 |

|

|

|

|

|

| General and administrative expenses |

43.4 |

|

|

37.4 |

|

|

|

|

|

| Depreciation and amortization |

63.9 |

|

|

57.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

981.8 |

|

|

906.7 |

|

|

|

|

|

| Loss on early extinguishment of debt |

— |

|

|

0.3 |

|

|

|

|

|

| Interest expense and amortization of debt discounts and fees |

36.4 |

|

|

39.6 |

|

|

|

|

|

| Other (income) expense |

(3.6) |

|

|

3.6 |

|

|

|

|

|

| Equity in net income of nonconsolidated affiliates |

(0.4) |

|

|

(0.9) |

|

|

|

|

|

| Income from continuing operations before income tax expense |

146.2 |

|

|

110.0 |

|

|

|

|

|

| Provision for income tax expense |

31.9 |

|

|

23.6 |

|

|

|

|

|

| Income from continuing operations |

114.3 |

|

|

86.4 |

|

|

|

|

|

| (Loss) income from discontinued operations, net of tax |

(1.0) |

|

|

23.7 |

|

|

|

|

|

| Net and comprehensive income |

113.3 |

|

|

110.1 |

|

|

|

|

|

| Less: Net income attributable to noncontrolling interests included in continuing operations |

(25.6) |

|

|

(22.0) |

|

|

|

|

|

| Less: Net income attributable to noncontrolling interests included in discontinued operations |

— |

|

|

(0.6) |

|

|

|

|

|

| Less: Net and comprehensive income attributable to noncontrolling interests |

(25.6) |

|

|

(22.6) |

|

|

|

|

|

| Net and comprehensive income attributable to Encompass Health |

$ |

87.7 |

|

|

$ |

87.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

| Basic |

99.4 |

|

|

99.2 |

|

|

|

|

|

| Diluted |

100.9 |

|

|

100.2 |

|

|

|

|

|

Earnings per common share: |

|

|

|

|

|

|

|

Basic earnings per share attributable to Encompass Health common shareholders: |

|

|

|

|

|

|

|

Continuing operations |

$ |

0.89 |

|

|

$ |

0.65 |

|

|

|

|

|

Discontinued operations |

(0.01) |

|

|

0.23 |

|

|

|

|

|

Net income |

$ |

0.88 |

|

|

$ |

0.88 |

|

|

|

|

|

Diluted earnings per share attributable to Encompass Health common shareholders: |

|

|

|

|

|

|

|

Continuing operations |

$ |

0.88 |

|

|

$ |

0.64 |

|

|

|

|

|

Discontinued operations |

(0.01) |

|

|

0.23 |

|

|

|

|

|

Net income |

$ |

0.87 |

|

|

$ |

0.87 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amounts attributable to Encompass Health common shareholders: |

|

|

|

|

|

|

|

| Income from continuing operations |

$ |

88.7 |

|

|

$ |

64.4 |

|

|

|

|

|

| (Loss) income from discontinued operations, net of tax |

(1.0) |

|

|

23.1 |

|

|

|

|

|

| Net income attributable to Encompass Health |

$ |

87.7 |

|

|

$ |

87.5 |

|

|

|

|

|

Encompass Health Corporation and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2023 |

|

December 31, 2022 |

|

| |

(In Millions) |

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

$ |

85.0 |

|

|

$ |

21.8 |

|

|

| Restricted cash |

34.3 |

|

|

31.6 |

|

|

| Accounts receivable |

514.5 |

|

|

536.8 |

|

|

| Other current assets |

127.9 |

|

|

127.0 |

|

|

|

|

|

|

|

| Total current assets |

761.7 |

|

|

717.2 |

|

|

| Property and equipment, net |

2,988.3 |

|

|

2,939.2 |

|

|

| Operating lease right-of-use assets |

212.7 |

|

|

212.5 |

|

|

| Goodwill |

1,270.7 |

|

|

1,263.2 |

|

|

| Intangible assets, net |

287.2 |

|

|

282.3 |

|

|

|

|

|

|

|

| Other long-term assets |

226.7 |

|

|

222.1 |

|

|

|

|

|

|

|

| Total assets |

$ |

5,747.3 |

|

|

$ |

5,636.5 |

|

|

| Liabilities and Shareholders’ Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Current portion of long-term debt |

$ |

26.0 |

|

|

$ |

25.2 |

|

|

| Current operating lease liabilities |

26.3 |

|

|

25.6 |

|

|

| Accounts payable |

141.1 |

|

|

132.9 |

|

|

|

|

|

|

|

|

|

|

|

|

| Accrued medical insurance |

31.8 |

|

|

25.0 |

|

|

| Accrued expenses and other current liabilities |

366.9 |

|

|

367.2 |

|

|

|

|

|

|

|

| Total current liabilities |

592.1 |

|

|

575.9 |

|

|

| Long-term debt, net of current portion |

2,722.5 |

|

|

2,741.8 |

|

|

| Long-term operating lease liabilities |

199.2 |

|

|

199.7 |

|

|

|

|

|

|

|

| Deferred income tax liabilities |

87.0 |

|

|

83.0 |

|

|

| Other long-term liabilities |

183.3 |

|

|

174.2 |

|

|

|

|

|

|

|

| |

3,784.1 |

|

|

3,774.6 |

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

|

| Redeemable noncontrolling interests |

37.5 |

|

|

35.6 |

|

|

| Shareholders’ equity: |

|

|

|

|

| Encompass Health shareholders’ equity |

1,383.5 |

|

|

1,310.3 |

|

|

| Noncontrolling interests |

542.2 |

|

|

516.0 |

|

|

| Total shareholders’ equity |

1,925.7 |

|

|

1,826.3 |

|

|

| Total liabilities and shareholders’ equity |

$ |

5,747.3 |

|

|

$ |

5,636.5 |

|

|

Encompass Health Corporation and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

|

| |

2023 |

|

2022 |

|

| |

(In Millions) |

|

| Cash flows from operating activities: |

|

|

|

|

| Net income |

$ |

113.3 |

|

|

$ |

110.1 |

|

|

| Loss (income) from discontinued operations, net of tax |

1.0 |

|

|

(23.7) |

|

|

| Adjustments to reconcile net income to net cash provided by operating activities— |

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

63.9 |

|

|

57.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

7.9 |

|

|

6.1 |

|

|

| Deferred tax expense |

4.0 |

|

|

2.3 |

|

|

|

|

|

|

|

|

|

|

|

|

| Other, net |

1.2 |

|

|

8.0 |

|

|

| Change in assets and liabilities, net of acquisitions— |

|

|

|

|

| Accounts receivable |

23.7 |

|

|

7.5 |

|

|

| Other assets |

(3.7) |

|

|

13.6 |

|

|

| Accounts payable |

1.2 |

|

|

9.4 |

|

|

|

|

|

|

|

|

|

|

|

|

| Other liabilities |

16.7 |

|

|

(8.5) |

|

|

|

|

|

|

|

| Net cash (used in) provided by operating activities of discontinued operations |

(1.3) |

|

|

36.4 |

|

|

| Total adjustments |

113.6 |

|

|

132.5 |

|

|

| Net cash provided by operating activities |

227.9 |

|

|

218.9 |

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

(96.6) |

|

|

(112.9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other, net |

(7.4) |

|

|

(8.8) |

|

|

| Net cash used in investing activities of discontinued operations |

— |

|

|

(1.4) |

|

|

| Net cash used in investing activities |

(104.0) |

|

|

(123.1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Principal payments on debt, including pre-payments |

(0.6) |

|

|

(103.9) |

|

|

|

|

|

|

|

| Borrowings on revolving credit facility |

30.0 |

|

|

130.0 |

|

|

| Payments on revolving credit facility |

(45.0) |

|

|

(25.0) |

|

|

|

|

|

|

|

| Debt amendment costs |

— |

|

|

(20.0) |

|

|

|

|

|

|

|

| Taxes paid on behalf of employees for shares withheld |

(7.7) |

|

|

(7.2) |

|

|

|

|

|

|

|

|

|

|

|

|

| Contributions from noncontrolling interests of consolidated affiliates |

17.0 |

|

|

14.0 |

|

|

| Dividends paid on common stock |

(15.6) |

|

|

(28.5) |

|

|

| Distributions paid to noncontrolling interests of consolidated affiliates |

(31.8) |

|

|

(20.8) |

|

|

| Other, net |

(4.3) |

|

|

(4.6) |

|

|

| Net cash provided by financing activities of discontinued operations |

— |

|

|

5.1 |

|

|

| Net cash used in financing activities |

(58.0) |

|

|

(60.9) |

|

|

| Increase in cash, cash equivalents, and restricted cash |

65.9 |

|

|

34.9 |

|

|

| Cash, cash equivalents, and restricted cash at beginning of period |

53.4 |

|

|

120.3 |

|

|

| Cash, cash equivalents, and restricted cash at end of period |

$ |

119.3 |

|

|

$ |

155.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Encompass Health Corporation and Subsidiaries

Condensed Consolidated Statements of Cash Flows (Continued)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2023 |

|

2022 |

|

|

(In Millions) |

|

| Reconciliation of Cash, Cash Equivalents, and Restricted Cash |

|

|

|

|

Cash and cash equivalents at beginning of period |

$ |

21.8 |

|

|

$ |

49.4 |

|

|

Restricted cash at beginning of period |

31.6 |

|

|

62.5 |

|

|

| Restricted cash included in other long-term assets at beginning of period |

— |

|

|

0.4 |

|

|

| Cash, cash equivalents, and restricted cash in discontinued operations at beginning of period |

— |

|

|

8.0 |

|

|

Cash, cash equivalents, and restricted cash at beginning of period |

$ |

53.4 |

|

|

$ |

120.3 |

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

$ |

85.0 |

|

|

$ |

76.6 |

|

|

Restricted cash at end of period |

34.3 |

|

|

57.3 |

|

|

Restricted cash included in other long-term assets at end of period |

— |

|

|

— |

|

|

| Cash, cash equivalents, and restricted cash in discontinued operations at end of period |

— |

|

|

21.3 |

|

|

Cash, cash equivalents, and restricted cash at end of period |

$ |

119.3 |

|

|

$ |

155.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Encompass Health Corporation and Subsidiaries

Supplemental Information

Earnings Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

|

(In Millions, Except Per Share Data) |

|

| Adjusted EBITDA |

$ |

229.0 |

|

|

$ |

194.9 |

|

|

|

|

|

|

Depreciation and amortization |

(63.9) |

|

|

(57.7) |

|

|

|

|

|

|

Interest expense and amortization of debt discounts and fees |

(36.4) |

|

|

(39.6) |

|

|

|

|

|

|

| Stock-based compensation |

(7.9) |

|

|

(6.1) |

|

|

|

|

|

|

| Loss on disposal or impairment of assets |

(0.7) |

|

|

(0.7) |

|

|

|

|

|

|

|

120.1 |

|

|

90.8 |

|

|

|

|

|

|

| Items not indicative of ongoing operating performance: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on early extinguishment of debt |

— |

|

|

(0.3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair market value of equity securities |

0.5 |

|

|

(2.5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pre-tax income |

120.6 |

|

|

88.0 |

|

|

|

|

|

|

Income tax expense |

(31.9) |

|

|

(23.6) |

|

|

|

|

|

|

Income from continuing operations (1) |

$ |

88.7 |

|

|

$ |

64.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

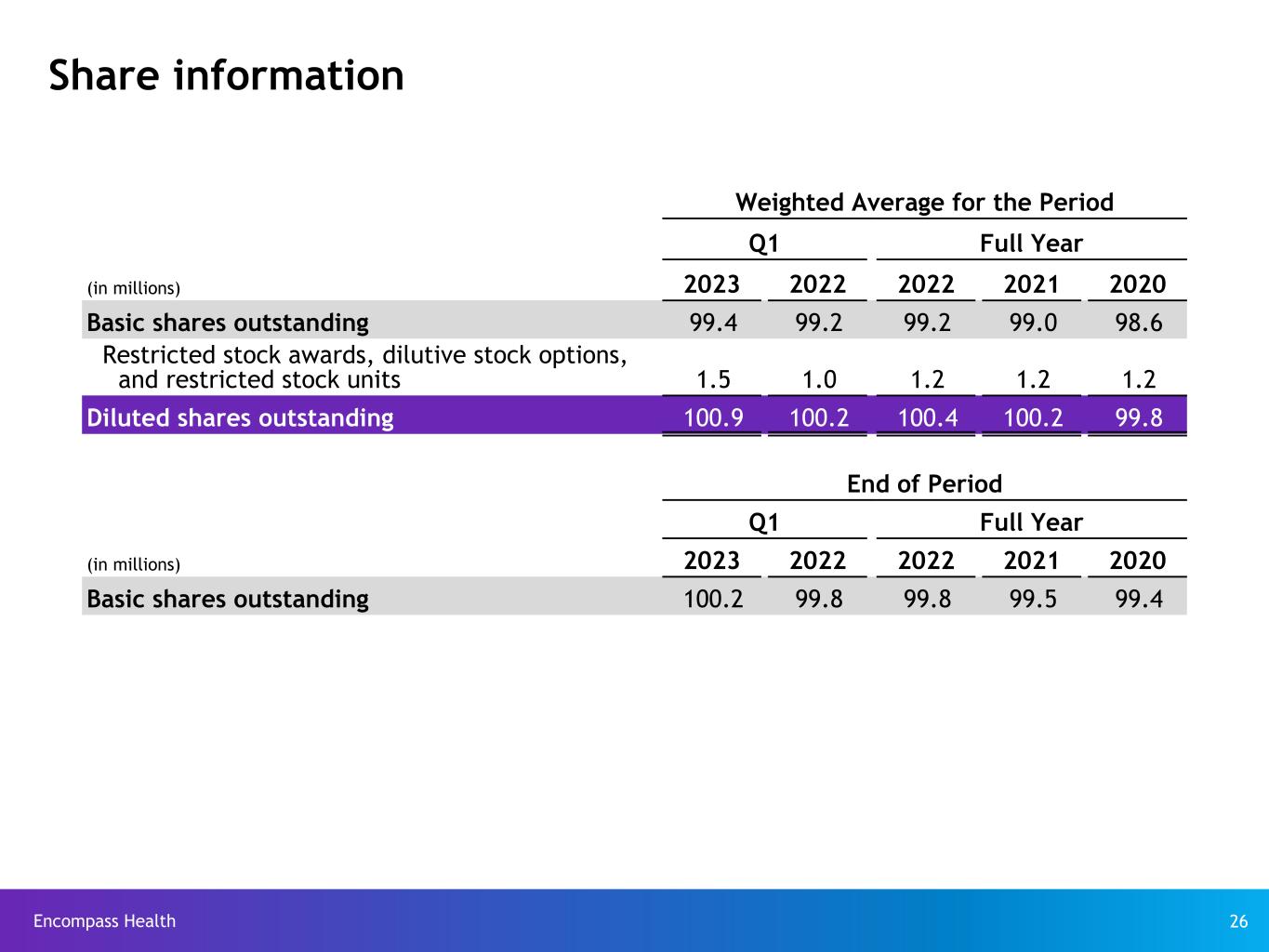

| Basic shares |

99.4 |

|

|

99.2 |

|

|

|

|

|

|

| Diluted shares |

100.9 |

|

|

100.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share (1) |

$ |

0.89 |

|

|

$ |

0.65 |

|

|

|

|

|

|

Diluted earnings per share (1) |

$ |

0.88 |

|

|

$ |

0.64 |

|

|

|

|

|

|

(1)Income from continuing operations attributable to Encompass Health

Encompass Health Corporation and Subsidiaries

Supplemental Information

Adjusted Earnings Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 |

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

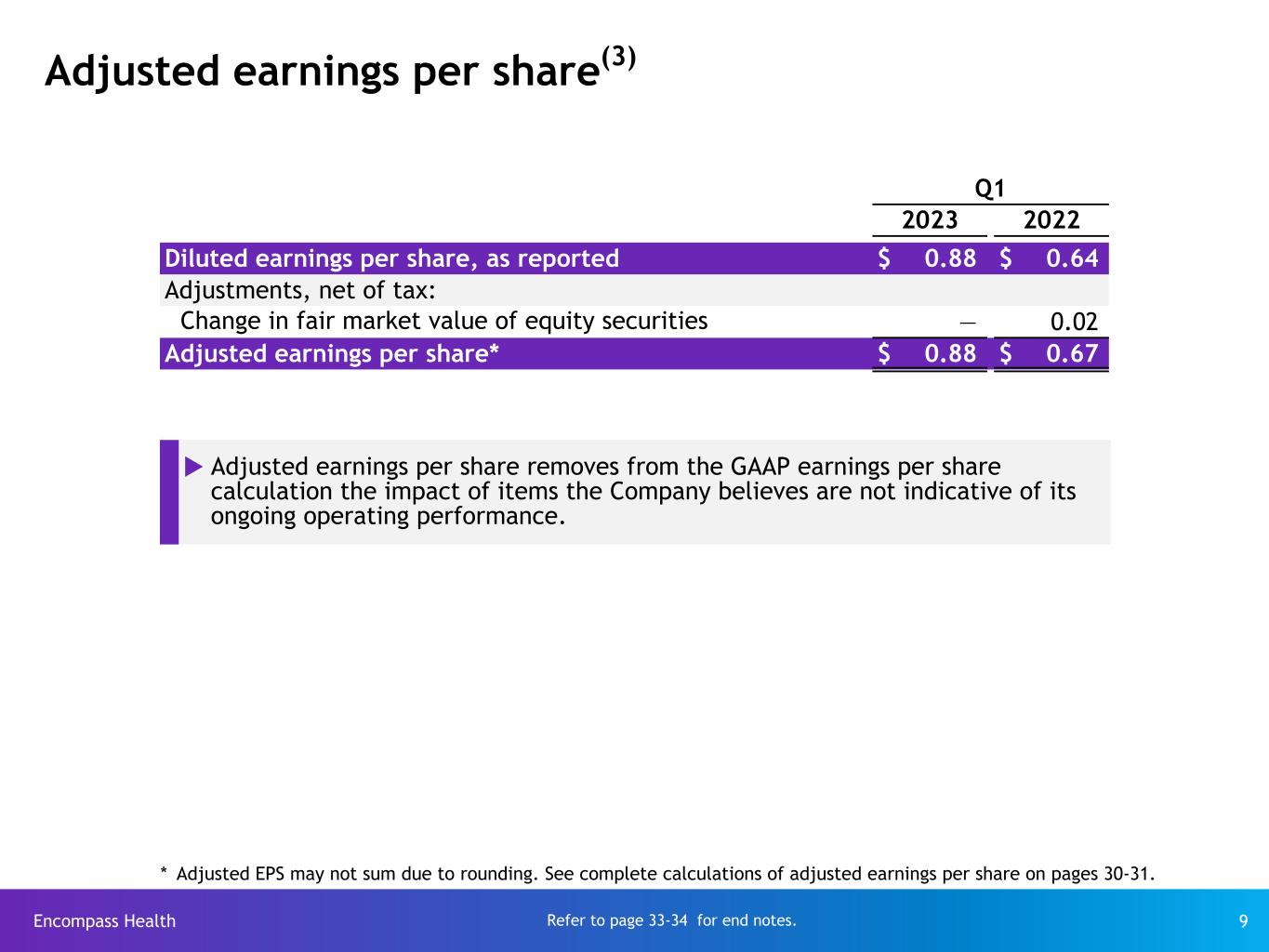

| Earnings per share, as reported |

$ |

0.88 |

|

|

$ |

0.64 |

|

|

|

|

|

|

| Adjustments, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair market value of equity securities |

— |

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings per share* |

$ |

0.88 |

|

|

$ |

0.67 |

|

|

|

|

|

|

* Adjusted EPS may not sum due to rounding.

Encompass Health Corporation and Subsidiaries

Supplemental Information

Reconciliation of Net Cash Provided by Operating Activities to Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

(In Millions) |

Net cash provided by operating activities |

$ |

227.9 |

|

|

$ |

218.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense and amortization of debt discounts and fees |

36.4 |

|

|

39.6 |

|

|

|

|

|

| Gain (loss) on sale of investments, excluding impairments |

1.7 |

|

|

(4.6) |

|

|

|

|

|

Equity in net income of nonconsolidated affiliates |

0.4 |

|

|

0.9 |

|

|

|

|

|

Net income attributable to noncontrolling interests in continuing operations |

(25.6) |

|

|

(22.0) |

|

|

|

|

|

Amortization of debt-related items |

(2.3) |

|

|

(2.3) |

|

|

|

|

|

Distributions from nonconsolidated affiliates |

(0.1) |

|

|

(1.0) |

|

|

|

|

|

| Current portion of income tax expense |

27.9 |

|

|

21.3 |

|

|

|

|

|

| Change in assets and liabilities |

(37.9) |

|

|

(22.0) |

|

|

|

|

|

| Cash used in (provided by) operating activities of discontinued operations |

1.3 |

|

|

(36.4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in fair market value of equity securities |

(0.5) |

|

|

2.5 |

|

|

|

|

|

| Other |

(0.2) |

|

|

— |

|

|

|

|

|

| Adjusted EBITDA |

$ |

229.0 |

|

|

$ |

194.9 |

|

|

|

|

|

Encompass Health Corporation and Subsidiaries

Supplemental Information

Reconciliation of Income from Continuing Operations Attributable to Encompass Health per Diluted Share to Adjusted Earnings Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

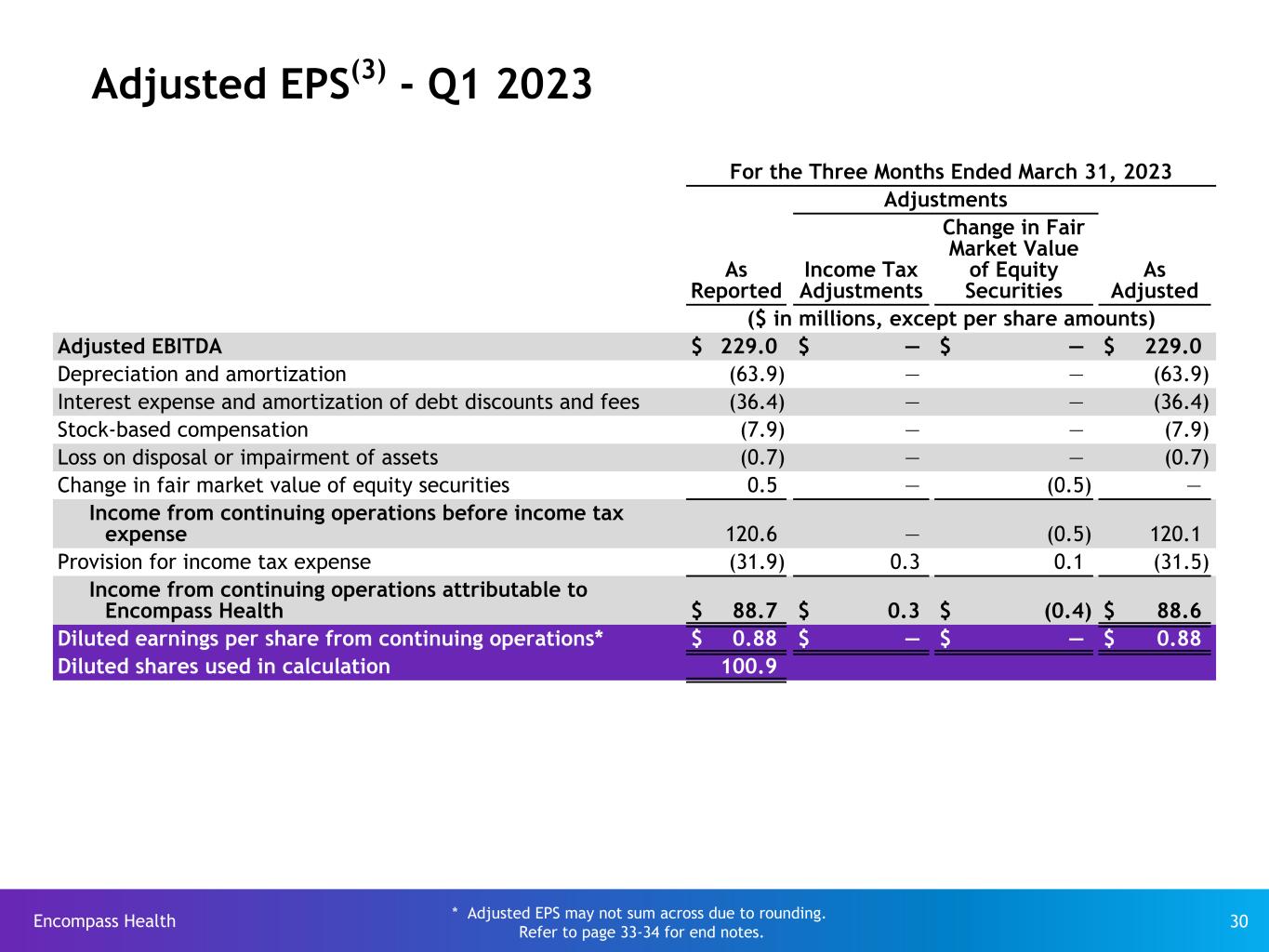

For the Three Months Ended March 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

|

|

As Reported |

|

|

|

|

|

|

|

|

|

|

|

Income Tax Adjustments |

|

|

|

|

|

|

|

Change in Fair Market Value of Equity Securities |

|

|

|

|

|

As Adjusted |

|

(In Millions, Except Per Share Amounts) |

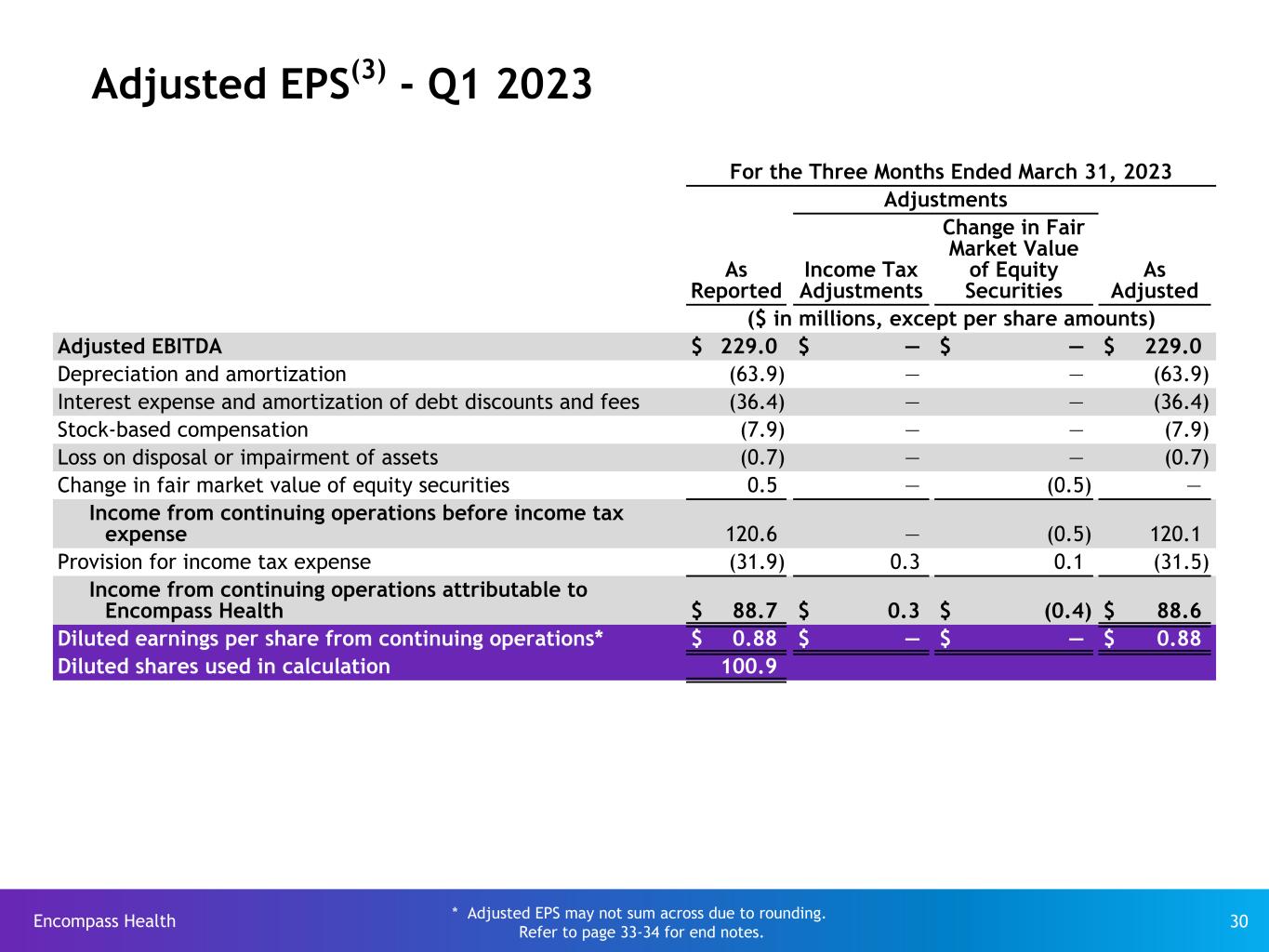

| Adjusted EBITDA* |

$ |

229.0 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

$ |

229.0 |

|

| Depreciation and amortization |

(63.9) |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

(63.9) |

|

Interest expense and amortization of debt discounts and fees |

(36.4) |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

(36.4) |

|

| Stock-based compensation |

(7.9) |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

(7.9) |

|

| Loss on disposal or impairment of assets |

(0.7) |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

(0.7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair market value of equity securities |

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

(0.5) |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations before income tax expense |

120.6 |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

(0.5) |

|

|

|

|

|

|

120.1 |

|

| Provision for income tax expense |

(31.9) |

|

|

|

|

|

|

|

|

|

|

|

|

0.3 |

|

|

|

|

|

|

|

|

0.1 |

|

|

|

|

|

|

(31.5) |

|

Income from continuing operations attributable to Encompass Health |

$ |

88.7 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.3 |

|

|

|

|

|

|

|

|

$ |

(0.4) |

|

|

|

|

|

|

$ |

88.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share from continuing operations** |

$ |

0.88 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

$ |

0.88 |

|

| Diluted shares used in calculation |

100.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Reconciliation to GAAP provided on page 10

** Adjusted EPS may not sum across due to rounding.

Encompass Health Corporation and Subsidiaries

Supplemental Information

Reconciliation of Income from Continuing Operations Attributable to Encompass Health per Diluted Share to Adjusted Earnings Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, 2022 |

|

|

|

|

|

|

|

|

|

|

|

Adjustments |

|

|

|

|

|

|

|

As Reported |

|

|

|

|

|

|

|

|

|

Loss on Early Exting. of Debt |

|

Income Tax Adjustments |

|

|

|

|

|

|

|

Change in Fair Market Value of Equity Securities |

|

|

|

|

|

As Adjusted |

|

(In Millions, Except Per Share Amounts) |

| Adjusted EBITDA* |

$ |

194.9 |

|

|

|

|

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

$ |

— |

|

|

|

|

|

|

$ |

194.9 |

|

| Depreciation and amortization |

(57.7) |

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

(57.7) |

|

Interest expense and amortization of debt discounts and fees |

(39.6) |

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

(39.6) |

|

| Stock-based compensation |

(6.1) |

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

(6.1) |

|

| Loss on disposal or impairment of assets |

(0.7) |

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

(0.7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on early extinguishment of debt |

(0.3) |

|

|

|

|

|

|

|

|

|

|

0.3 |

|

|

— |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair market value of equity securities |

(2.5) |

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

2.5 |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations before income tax expense |

88.0 |

|

|

|

|

|

|

|

|

|

|

0.3 |

|

|

— |

|

|

|

|

|

|

|

|

2.5 |

|

|

|

|

|

|

90.8 |

|

| Provision for income tax expense |

(23.6) |

|

|

|

|

|

|

|

|

|

|

(0.1) |

|

|

0.2 |

|

|

|

|

|

|

|

|

(0.6) |

|

|

|

|

|

|

(24.1) |

|

Income from continuing operations attributable to Encompass Health |

$ |

64.4 |

|

|

|

|

|

|

|

|

|

|

$ |

0.2 |

|

|

$ |

0.2 |

|

|

|

|

|

|

|

|

$ |

1.9 |

|

|

|

|

|

|

$ |

66.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share from continuing operations** |

$ |

0.64 |

|

|

|

|

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

$ |

0.02 |

|

|

|

|

|

|

$ |

0.67 |

|

| Diluted shares used in calculation |

100.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Reconciliation to GAAP provided on page 10

** Adjusted EPS may not sum across due to rounding.

Encompass Health Corporation and Subsidiaries

Supplemental Information

Reconciliation of Net Income to Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

|

|

| |

2023 |

|

2022 |

|

|

|

|

|

(In Millions) |

| Net income |

$ |

113.3 |

|

|

$ |

110.1 |

|

|

|

|

|

| Loss (income) from discontinued operations, net of tax, attributable to Encompass Health |

1.0 |

|

|

(23.7) |

|

|

|

|

|

| Net income attributable to noncontrolling interests included in continuing operations |

(25.6) |

|

|

(22.0) |

|

|

|

|

|

| Provision for income tax expense |

31.9 |

|

|

23.6 |

|

|

|

|

|

Interest expense and amortization of debt discounts and fees |

36.4 |

|

|

39.6 |

|

|

|

|

|

| Depreciation and amortization |

63.9 |

|

|

57.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on early extinguishment of debt |

— |

|

|

0.3 |

|

|

|

|

|

| Loss on disposal or impairment of assets |

0.7 |

|

|

0.7 |

|

|

|

|

|

| Stock-based compensation |

7.9 |

|

|

6.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in fair market value of equity securities |

(0.5) |

|

|

2.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

229.0 |

|

|

$ |

194.9 |

|

|

|

|

|

Encompass Health Corporation and Subsidiaries

Supplemental Information

Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

(In Millions) |

| Net cash provided by operating activities |

$ |

227.9 |

|

|

$ |

218.9 |

|

|

|

|

|

| Impact of discontinued operations |

1.3 |

|

|

(36.4) |

|

|

|

|

|

Net cash provided by operating activities of continuing operations |

229.2 |

|

|

182.5 |

|

|

|

|

|

| Capital expenditures for maintenance |

(37.8) |

|

|

(32.2) |

|

|

|

|

|

Distributions paid to noncontrolling interests of consolidated affiliates |

(31.8) |

|

|

(20.8) |

|

|

|

|

|

| Items not indicative of ongoing operating performance: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transaction costs and related liabilities |

(0.9) |

|

|

(6.3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted free cash flow |

$ |

158.7 |

|

|

$ |

123.2 |

|

|

|

|

|

For the three months ended March 31, 2023, net cash used in investing activities was $104.0 million and resulted primarily from capital expenditures. Net cash used in financing activities during the three months ended March 31, 2023 was $58.0 million and resulted primarily from net debt payments, distributions paid to noncontrolling interests of consolidated affiliates, and cash dividends paid on common stock partially offset by contributions from noncontrolling interest of consolidated affiliates.

For the three months ended March 31, 2022, net cash used in investing activities was $123.1 million and primarily resulted from capital expenditures. Net cash used in financing activities during the three months ended March 31, 2022 was $60.9 million and primarily resulted from cash dividends paid on common stock, distributions paid to noncontrolling interests of consolidated affiliates, and net debt repayments and issuance costs.

Encompass Health Corporation and Subsidiaries

Forward-Looking Statements