false00007795442023FYP3YoneoneP4Y00007795442022-10-022023-09-3000007795442023-04-01iso4217:USD00007795442023-12-15xbrli:shares0000779544us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-09-300000779544us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-10-0100007795442023-09-3000007795442022-10-01iso4217:USDxbrli:shares0000779544us-gaap:FoodAndBeverageMember2022-10-022023-09-300000779544us-gaap:FoodAndBeverageMember2021-10-032022-10-010000779544arkr:OtherRevenueMember2022-10-022023-09-300000779544arkr:OtherRevenueMember2021-10-032022-10-0100007795442021-10-032022-10-010000779544us-gaap:OccupancyMember2022-10-022023-09-300000779544us-gaap:OccupancyMember2021-10-032022-10-010000779544us-gaap:CommonStockMember2021-10-020000779544us-gaap:AdditionalPaidInCapitalMember2021-10-020000779544us-gaap:RetainedEarningsMember2021-10-020000779544us-gaap:ParentMember2021-10-020000779544us-gaap:NoncontrollingInterestMember2021-10-0200007795442021-10-020000779544us-gaap:RetainedEarningsMember2021-10-032022-10-010000779544us-gaap:ParentMember2021-10-032022-10-010000779544us-gaap:NoncontrollingInterestMember2021-10-032022-10-010000779544us-gaap:CommonStockMember2021-10-032022-10-010000779544us-gaap:AdditionalPaidInCapitalMember2021-10-032022-10-010000779544us-gaap:CommonStockMember2022-10-010000779544us-gaap:AdditionalPaidInCapitalMember2022-10-010000779544us-gaap:RetainedEarningsMember2022-10-010000779544us-gaap:ParentMember2022-10-010000779544us-gaap:NoncontrollingInterestMember2022-10-010000779544us-gaap:RetainedEarningsMember2022-10-022023-09-300000779544us-gaap:ParentMember2022-10-022023-09-300000779544us-gaap:NoncontrollingInterestMember2022-10-022023-09-300000779544us-gaap:AdditionalPaidInCapitalMember2022-10-022023-09-300000779544us-gaap:CommonStockMember2022-10-022023-09-300000779544us-gaap:CommonStockMember2023-09-300000779544us-gaap:AdditionalPaidInCapitalMember2023-09-300000779544us-gaap:RetainedEarningsMember2023-09-300000779544us-gaap:ParentMember2023-09-300000779544us-gaap:NoncontrollingInterestMember2023-09-300000779544us-gaap:CertificatesOfDepositMember2022-10-022023-09-300000779544us-gaap:CertificatesOfDepositMember2021-10-032022-10-010000779544us-gaap:NotesReceivableMember2022-10-022023-09-300000779544us-gaap:NotesReceivableMember2021-10-032022-10-010000779544arkr:RestaurantsAndBarsMember2023-09-30arkr:restaurant0000779544arkr:FastFoodConceptsAndCateringOperationsMember2023-09-300000779544arkr:NewYorkCityMember2023-09-300000779544stpr:DC2023-09-300000779544arkr:LasVegasNevadaMember2023-09-300000779544arkr:AtlanticCityMember2023-09-300000779544stpr:FL2023-09-300000779544stpr:AL2023-09-300000779544arkr:NewYorkNewYorkHotelAndCasinoResortMemberarkr:LasVegasMember2023-09-300000779544arkr:NewYorkNewYorkHotelAndCasinoResortMemberarkr:LasVegasMemberarkr:FoodCourtMember2023-09-300000779544arkr:LasVegasMemberarkr:PlanetHollywoodResortAndCasinoMember2023-09-300000779544arkr:FastFoodConceptMemberarkr:FoxwoodsResortCasinoMemberarkr:TampaMember2023-09-300000779544arkr:HollywoodMemberarkr:FastFoodConceptMemberarkr:HardRockHotelAndCasinoMember2023-09-300000779544stpr:ALarkr:OysterHouseMember2023-09-300000779544arkr:GulfShoresAlabamaMemberarkr:OysterHouseMember2023-09-300000779544arkr:OysterHouseMemberarkr:SpanishFortAlabamaMember2023-09-300000779544us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMemberarkr:OneHotelOperatorsMember2022-10-022023-09-30xbrli:pure0000779544us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMemberarkr:TwoHotelOperatorsMember2021-10-032022-10-010000779544us-gaap:CostOfGoodsTotalMemberarkr:TwoVendorsMemberus-gaap:SupplierConcentrationRiskMember2022-10-022023-09-300000779544us-gaap:CostOfGoodsTotalMemberarkr:TwoVendorsMemberus-gaap:SupplierConcentrationRiskMember2021-10-032022-10-010000779544us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2023-09-300000779544us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2023-09-300000779544us-gaap:BuildingAndBuildingImprovementsMember2023-09-300000779544us-gaap:LeaseholdImprovementsMembersrt:MinimumMember2023-09-300000779544us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2023-09-300000779544us-gaap:NoncompeteAgreementsMember2023-09-3000007795442023-07-022023-09-300000779544arkr:CateringServicesMember2022-10-022023-09-300000779544arkr:CateringServicesMember2021-10-032022-10-010000779544arkr:CateringServicesMember2023-09-300000779544arkr:CateringServicesMember2022-10-01arkr:segmentarkr:entity0000779544us-gaap:RelatedPartyMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-09-300000779544us-gaap:RelatedPartyMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-10-010000779544srt:MinimumMemberarkr:GallaghersSteakhouseMember2022-04-080000779544arkr:NewYorkNewYorkHotelAndCasinoLeaseMemberarkr:GallaghersSteakhouseMember2023-02-052023-04-280000779544arkr:AmericaMembersrt:MinimumMember2022-06-240000779544arkr:VillageEateriesMembersrt:MinimumMember2022-07-210000779544arkr:NewYorkNewYorkHotelAndCasinoLeaseMemberarkr:VillageEateriesMember2022-07-212023-09-3000007795442023-09-190000779544arkr:NewMeadowlandsRacetrackLLCMember2013-03-122013-03-120000779544arkr:MeadowlandsNewmarkLlcMember2013-03-120000779544arkr:NewMeadowlandsRacetrackLLCMember2013-11-192013-11-190000779544arkr:MeadowlandsNewmarkLlcMember2013-11-190000779544arkr:NewMeadowlandsRacetrackLLCMember2013-11-190000779544arkr:NewMeadowlandsRacetrackLLCMember2014-09-282015-10-030000779544arkr:NewMeadowlandsRacetrackLLCMember2017-02-072017-02-070000779544arkr:NewMeadowlandsRacetrackLLCMember2015-12-310000779544arkr:NewMeadowlandsRacetrackLLCMember2022-10-022023-09-300000779544arkr:NewMeadowlandsRacetrackLLCMember2021-10-032022-10-010000779544arkr:ArkMeadowlandsLLCMember2023-09-300000779544arkr:ArkMeadowlandsLLCMember2022-10-022023-09-300000779544us-gaap:RelatedPartyMemberarkr:ArkMeadowlandsLLCMember2023-09-300000779544us-gaap:RelatedPartyMemberarkr:ArkMeadowlandsLLCMember2022-10-010000779544arkr:MeadowlandsNewmarkLlcMember2014-04-252014-04-250000779544arkr:MeadowlandsNewmarkLlcMember2014-04-250000779544arkr:MeadowlandsNewmarkLlcMember2023-09-300000779544arkr:MeadowlandsNewmarkLlcMember2022-10-010000779544us-gaap:TrademarksMember2021-10-020000779544us-gaap:TrademarksMember2021-10-032022-10-010000779544us-gaap:TrademarksMember2022-10-010000779544us-gaap:TrademarksMember2022-10-022023-09-300000779544us-gaap:LeasesAcquiredInPlaceMember2023-09-300000779544us-gaap:LeasesAcquiredInPlaceMember2022-10-010000779544srt:MinimumMemberus-gaap:NoncompeteAgreementsMember2023-09-300000779544srt:MaximumMemberus-gaap:NoncompeteAgreementsMember2023-09-300000779544us-gaap:NoncompeteAgreementsMember2022-10-010000779544srt:MinimumMember2023-09-300000779544srt:MaximumMember2023-09-300000779544arkr:TheRusticInnMember2023-09-300000779544arkr:TheRusticInnMember2022-10-010000779544arkr:ShuckersIncMember2023-09-300000779544arkr:ShuckersIncMember2022-10-010000779544arkr:OysterHouseMember2023-09-300000779544arkr:OysterHouseMember2022-10-010000779544arkr:JBsOnTheBeachMember2023-09-300000779544arkr:JBsOnTheBeachMember2022-10-010000779544arkr:SequoiaRenovationMember2023-09-300000779544arkr:SequoiaRenovationMember2022-10-010000779544us-gaap:RevolvingCreditFacilityMember2023-09-300000779544us-gaap:RevolvingCreditFacilityMember2022-10-010000779544arkr:BlueMoonFishCompanyMember2023-09-300000779544arkr:BlueMoonFishCompanyMember2022-10-010000779544arkr:PaycheckProtectionProgramLoanMember2023-09-300000779544arkr:PaycheckProtectionProgramLoanMember2022-10-010000779544arkr:PriorCreditAgreementMember2023-03-302023-03-300000779544arkr:CreditAgreementMemberus-gaap:LineOfCreditMemberarkr:BankHapoalimBMMember2023-03-300000779544arkr:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberarkr:BankHapoalimBMMember2023-03-300000779544arkr:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberarkr:BankHapoalimBMMemberus-gaap:PrimeRateMember2023-03-302023-03-300000779544arkr:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberarkr:BankHapoalimBMMember2023-03-302023-03-300000779544arkr:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-03-302023-03-300000779544arkr:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-09-300000779544us-gaap:RevolvingCreditFacilityMemberarkr:TheRusticInnMemberarkr:BankHapoalimBMMemberarkr:AmendmentMember2018-06-010000779544us-gaap:RevolvingCreditFacilityMemberarkr:TheRusticInnMemberarkr:BankHapoalimBMMemberarkr:AmendmentMember2018-06-012018-06-01arkr:installment0000779544arkr:ShuckersIncMemberus-gaap:RevolvingCreditFacilityMemberarkr:BankHapoalimBMMemberarkr:AmendmentMember2018-06-010000779544arkr:ShuckersIncMemberus-gaap:RevolvingCreditFacilityMemberarkr:BankHapoalimBMMemberarkr:AmendmentMember2018-06-012018-06-010000779544us-gaap:RevolvingCreditFacilityMemberarkr:BankHapoalimBMMemberarkr:OysterHouseGulfShoresMemberarkr:AmendmentMember2018-06-012018-06-01arkr:note0000779544us-gaap:RevolvingCreditFacilityMemberarkr:BankHapoalimBMMemberarkr:OysterHouseGulfShoresMemberarkr:AmendmentMember2018-06-010000779544us-gaap:RevolvingCreditFacilityMemberarkr:OysterHouseSpanishFortMemberarkr:BankHapoalimBMMemberarkr:AmendmentMember2018-06-010000779544us-gaap:RevolvingCreditFacilityMemberarkr:OysterHouseSpanishFortMemberarkr:BankHapoalimBMMemberarkr:AmendmentMember2018-06-012018-06-010000779544us-gaap:RevolvingCreditFacilityMemberarkr:JBsOnTheBeachMemberarkr:BankHapoalimBMMember2019-05-150000779544us-gaap:RevolvingCreditFacilityMemberarkr:JBsOnTheBeachMemberarkr:BankHapoalimBMMember2019-05-152019-05-150000779544us-gaap:RevolvingCreditFacilityMemberarkr:SequoiaRenovationMemberarkr:BankHapoalimBMMember2019-05-150000779544us-gaap:RevolvingCreditFacilityMemberarkr:SequoiaRenovationMemberarkr:BankHapoalimBMMember2022-10-022023-09-300000779544us-gaap:RevolvingCreditFacilityMemberarkr:SequoiaRenovationMemberarkr:BankHapoalimBMMember2019-05-152019-05-150000779544us-gaap:NotesPayableOtherPayablesMemberarkr:PromissoryNoteBlueMoonFishCompanyMemberarkr:BlueMoonFishCompanyMember2020-12-012020-12-010000779544us-gaap:NotesPayableOtherPayablesMemberarkr:PromissoryNoteBlueMoonFishCompanyMemberarkr:BlueMoonFishCompanyMember2020-12-010000779544arkr:PaycheckProtectionProgramLoanMember2020-10-030000779544arkr:PaycheckProtectionProgramLoanMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-04-030000779544arkr:PaycheckProtectionProgramLoanMember2022-10-022023-09-300000779544arkr:PaycheckProtectionProgramLoanMember2021-10-032022-10-010000779544arkr:BankHapoalimBMNotesMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300000779544arkr:BlueMoonNoteMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300000779544us-gaap:NotesPayableOtherPayablesMember2023-09-3000007795442023-07-3100007795442023-07-012023-09-30arkr:option00007795442018-05-012018-05-01arkr:plaintiff0000779544us-gaap:SettledLitigationMemberarkr:FormerTippedServiceWorkersMember2022-10-022022-10-31arkr:plan0000779544arkr:StockOption2016PlanMember2022-10-022023-09-300000779544arkr:StockOption2010PlanMember2022-10-022023-09-3000007795442022-03-1500007795442022-03-152022-03-150000779544arkr:ExercisePriceOneMemberus-gaap:EmployeeStockOptionMember2021-10-032022-10-010000779544arkr:ExercisePriceOneMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2021-10-032022-10-010000779544arkr:ExercisePriceOneMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2021-10-032022-10-010000779544arkr:RangeOfExercisePricesOneMember2023-09-300000779544arkr:RangeOfExercisePricesOneMember2022-10-022023-09-300000779544arkr:RangeOfExercisePricesTwoMember2023-09-300000779544arkr:RangeOfExercisePricesTwoMember2022-10-022023-09-300000779544arkr:RangeOfExercisePricesThreeMember2023-09-300000779544arkr:RangeOfExercisePricesThreeMember2022-10-022023-09-300000779544arkr:RangeOfExercisePricesFourMember2023-09-300000779544arkr:RangeOfExercisePricesFourMember2022-10-022023-09-300000779544arkr:RangeOfExercisePricesFiveMember2022-10-022023-09-300000779544arkr:RangeOfExercisePricesFiveMember2023-09-300000779544us-gaap:GeneralBusinessMember2023-09-300000779544us-gaap:NewYorkStateDivisionOfTaxationAndFinanceMember2023-09-300000779544arkr:NewYorkCityMember2023-09-300000779544srt:MinimumMember2022-10-022023-09-300000779544srt:MaximumMember2022-10-022023-09-300000779544srt:MinimumMember2021-10-032022-10-010000779544srt:MaximumMember2021-10-032022-10-0100007795442022-11-092022-11-0900007795442023-02-092023-02-0900007795442023-05-092023-05-0900007795442023-08-082023-08-080000779544us-gaap:RelatedPartyMember2023-09-300000779544us-gaap:RelatedPartyMember2022-10-010000779544us-gaap:RelatedPartyMembersrt:MinimumMember2023-09-300000779544us-gaap:RelatedPartyMembersrt:MinimumMember2022-10-010000779544us-gaap:SubsequentEventMember2023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTIONS 13 AND 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2023

or,

☐ TRANSITION REPORT PURSUANT TO SECTIONS 13 AND 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

|

|

|

Commission File No. |

1-09453 |

| ARK RESTAURANTS CORP. |

| (Exact Name of Registrant as Specified in Its Charter) |

|

|

|

|

|

|

|

|

|

| New York |

|

13-3156768 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

| 85 Fifth Avenue, |

New York, |

NY |

10003 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 206-8800

Securities registered pursuant to section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

|

| |

Common Stock, par value $0.01 per share |

ARKR |

The NASDAQ Stock Market LLC |

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

|

|

|

Non-accelerated filer |

☒ |

|

Smaller Reporting Company |

☒ |

|

|

|

|

|

Emerging Growth Company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ☐ No ☒

As of April 1, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was $41,193,011.

At December 15, 2023, there were outstanding 3,604,157 shares of the registrant’s Common Stock, $0.01 par value.

DOCUMENTS INCORPORATED BY REFERENCE

In accordance with General Instruction G (3) of Form 10-K, certain information required by Part III hereof will either be incorporated into this Form 10-K by reference to the registrant’s definitive proxy statement for the registrant’s 2023 Annual Meeting of Stockholders filed within 120 days of September 30, 2023 or will be included in an amendment to this Form 10-K filed within 120 days of September 30, 2023.

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

On one or more occasions, we may make statements in this Annual Report on Form 10-K regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events. All statements, other than statements of historical facts, included or incorporated by reference herein relating to management’s current expectations of future financial performance, continued growth and changes in economic conditions or capital markets are forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Words or phrases such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “targets,” “will likely result,” “hopes,” “will continue” or similar expressions identify forward-looking statements. Forward-looking statements involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed. We caution that while we make such statements in good faith and we believe such statements are based on reasonable assumptions, including without limitation, management’s examination of historical operating trends, data contained in records and other data available from third parties, we cannot assure you that our projections will be achieved. Factors that may cause such differences include: economic conditions generally and in each of the markets in which we are located, the amount of sales contributed by new and existing restaurants, labor costs for our personnel, fluctuations in the cost of food products, adverse weather conditions, changes in consumer preferences and the level of competition from existing or new competitors. We have attempted to identify, in context, certain factors that we believe may cause actual future experience and results to differ materially from our current expectation regarding the relevant matter or subject area.

While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. You should evaluate all forward-looking statements made in this report in the context of the factors that could cause outcomes to differ materially from our expectations. These factors include, but are not limited to:

•the adverse impact of current and future economic conditions, including inflation, on our (i) operating results and financial condition, (ii) ability to comply with the terms and covenants of our debt agreements, and (iii) ability to pay or refinance our existing debt or to obtain additional financing;

•the adverse impact of the current political climate on our (i) operating results and financial condition, (ii) ability to comply with the terms and covenants of our debt agreements, and (iii) ability to pay or refinance our existing debt or to obtain additional financing;

•increases in food, beverage and supply costs, especially for seafood, shellfish, chicken and beef;

•increases in wages and benefit costs, including the cost of group medical insurance;

•our ability to open new restaurants in new and existing markets, including difficulty in finding sites and in negotiating acceptable leases;

•our ability to identify appropriate acquisition candidates and complete such acquisitions on acceptable terms;

•vulnerability to changes in consumer preferences and economic conditions;

•vulnerability to conditions in the cities in which we operate;

•vulnerability to adverse weather conditions and natural disasters given the geographic concentration and real estate intensive nature of our business;

•our ability to extend existing leases on favorable terms, if at all:

•negative publicity, whether or not valid, and our ability to respond to and effectively manage the accelerated impact of social media;

•risks associated with food safety and quality and food-borne illnesses;

•the reliance of the Company on the continued service of its executive officers;

•the impact of any security breaches of confidential customer information in connection with our electronic process of credit and debit card transactions; and

•the impact of any failure of our information technology system or any breach of our network security.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences we anticipate or affect us or our operations in the ways that we expect. The forward-looking statements included in this report are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law. If we do update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

From time to time, oral or written forward-looking statements are also included in our reports on Forms 10-K, 10-Q, and 8-K, our Schedule 14A, our press releases and other materials released to the public. Although we believe that at the time made, the expectations reflected in all of these forward-looking statements are and will be reasonable; any or all of the forward-looking statements in this Annual Report on Form 10-K, our reports on Forms 10-Q, and 8-K, our Schedule 14A and any other public statements that are made by us may prove to be incorrect. This may occur as a result of inaccurate assumptions or as a consequence of known or unknown risks and uncertainties. Many factors discussed in this Annual Report on Form 10-K, certain of which are beyond our control, will be important in determining our future performance. Consequently, actual results may differ materially from those that might be anticipated from forward-looking statements. In light of these and other uncertainties, you should not regard the inclusion of a forward-looking statement in this Annual Report on Form 10-K or other public communications that we might make as a representation by us that our plans and objectives will be achieved, and you should not place undue reliance on such forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related subjects in our subsequent periodic reports filed with the Securities and Exchange Commission on Forms 10-Q and 8-K and Schedule 14A.

Unless the context requires otherwise, references to “we,” “us,” “our,” “ARKR” and the “Company” refer specifically to Ark Restaurants Corp. and its subsidiaries, partnerships, variable interest entities and predecessor entities.

Item 1. Business

Overview

We are a New York corporation formed in 1983. As of the fiscal year ended September 30, 2023, we owned and/or operated 17 restaurants and bars, 16 fast food concepts and catering operations through our subsidiaries. Four of our restaurant and bar facilities are located in New York City, one is located in Washington, D.C., five are located in Las Vegas, Nevada, one is located in Atlantic City, New Jersey, four are located on the east coast of Florida and two are located on the Gulf Coast of Alabama.

Our restaurants are typically larger, destination properties intended to benefit from high patron traffic attributable to the uniqueness of the location and catered events. All of our expansion in recent years has been through acquisitions as follows: The Rustic Inn in Dania Beach, Florida (2014); Shuckers in Jensen Beach, Florida (2016); two Original Oyster Houses, one in Gulf Shores, Alabama and one in Spanish Fort, Alabama (2017), JB's on the Beach in Deerfield Beach, Florida (2019), and Blue Moon Fish Company (2021) in Lauderdale-by-the-Sea, Florida.

The names and themes of each of our restaurants are different except for our two Broadway Burger Bar and Grill restaurants and two Original Oyster House restaurants. The menus in our restaurants are extensive, offering a wide variety of high-quality foods at generally moderate prices. The atmosphere at many of the restaurants is lively and extremely casual. Most of the restaurants have separate bar areas, are open seven days a week and most serve lunch as well as dinner. A majority of our net sales are derived from dinner as opposed to lunch service.

While decor differs from restaurant to restaurant, interiors are marked by distinctive architectural and design elements which often incorporate dramatic interior open spaces and extensive glass exteriors. The wall treatments, lighting and decorations are typically vivid, unusual and, in some cases, highly theatrical.

The following table sets forth the restaurant properties we lease, own and operate as of September 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

Location |

Year

Opened(1)

|

Restaurant Size

(Square Feet)

|

Seating

Capacity(2)

Indoor-

(Outdoor)

|

Lease

Expiration(3)

|

| Sequoia |

Washington Harbour

Washington, D.C. |

1990 |

26,000 |

|

600 |

|

(400) |

2035 |

| Bryant Park Grill & Café (4) |

Bryant Park

New York, New York |

1995 |

25,000 |

|

180 |

|

(820) |

2025 |

| America |

New York-New York

Hotel and Casino

Las Vegas, Nevada |

1997 |

20,000 |

|

450 |

|

|

2034 |

| Gallagher’s Steakhouse |

New York-New York

Hotel and Casino

Las Vegas, Nevada |

1997 |

5,500 |

|

260 |

|

|

2033 |

| Gonzalez y Gonzalez |

New York-New York

Hotel and Casino

Las Vegas, Nevada |

1997 |

2,000 |

|

120 |

|

|

2034 |

| Broadway Burger Bar and Grill |

New York-New York

Hotel and Casino

Las Vegas, Nevada |

2007 |

1,500 |

|

100 |

|

|

2034 |

| Village Eateries (5) |

New York-New York

Hotel and Casino

Las Vegas, Nevada |

1997 |

6,300 |

|

400 |

|

(*) |

2035 |

| Yolos |

Planet Hollywood

Resort and Casino

Las Vegas, Nevada |

2007 |

4,100 |

|

206 |

|

|

2026 |

| Robert |

Museum of Arts & Design

New York, New York |

2009 |

5,530 |

|

150 |

|

|

2035 |

| Broadway Burger Bar and Grill |

Tropicana Hotel and Casino

Atlantic City, New Jersey |

2013 |

6,825 |

|

225 |

|

|

2033 |

| The Rustic Inn |

Dania Beach, Florida |

2014 |

16,150 |

|

575 |

|

(75) |

Owned |

| The Porch at Bryant Park (4)(6) |

Bryant Park

New York, New York |

2015 |

2,240 |

|

— |

|

(160) |

2025 |

| Shuckers |

Jensen Beach, Florida |

2016 |

7,310 |

|

220 |

|

(170) |

Owned |

| The Original Oyster House |

Gulf Shores, Alabama |

2017 |

9,230 |

|

300 |

|

|

Owned |

| The Original Oyster House |

Spanish Fort, Alabama |

2017 |

10,500 |

|

420 |

|

|

Owned |

| JB's on the Beach |

Deerfield Beach, Florida |

2019 |

10,000 |

|

365 |

|

(100) |

2044 |

| Blue Moon Fish Company |

Lauderdale-by-the-Sea, Florida |

2021 |

4,800 |

|

240 |

|

(30) |

2046 |

__________________________________

(1)Restaurants are, from time to time, renovated, renamed and/or converted from or to managed or owned facilities. “Year Opened” refers to the year in which we, or an affiliated predecessor of us, first opened, acquired or began managing a restaurant at the applicable location, notwithstanding that the restaurant may have been renovated, renamed and/or converted from or to a managed or owned facility since that date.

(2)Seating capacity refers to the seating capacity of the indoor part of a restaurant available for dining in all seasons and weather conditions. Outdoor seating capacity, if applicable, is set forth in parentheses and refers to the seating capacity of terraces and sidewalk cafes which are available for dining only in the warm seasons and then only inclement weather.

(3)Assumes the exercise of all of our available lease renewal options.

(4)The Company's leases for the Bryant Park Grill & Cafe and The Porch at Bryant Park expire on April 30, 2025. During July 2023 (for Bryant Park Grill & Cafe) and September 2023 (for The Porch at Bryant Park), the Company received requests for proposals (the "RFPs") from the landlord which we responded to on October 25, 2023. The RFPs for both locations are for new 10-year agreements with one five-year renewal option. The landlord has not indicated when they will be making decisions as to the successful bidder(s).

(5)We operate six small food court restaurants and one full-service restaurant in the Village Eateries food court at the New York-New York Hotel and Casino. We also operate that hotel’s room service, banquet facilities and employee cafeteria.

(6)This location is for a kiosk located at Bryant Park, New York, NY and all seating is outdoors.

(*)Represents common area seating.

The following table sets forth our less than wholly-owned properties that are managed by us, which have been consolidated as of September 30, 2023 – see Notes 1 and 2 to the Consolidated Financial Statements:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

Location |

Year

Opened(1)

|

Restaurant Size

(Square Feet)

|

Seating

Capacity(2)

Indoor-

(Outdoor)

|

Lease

Expiration(3)

|

| El Rio Grande (4)(5) |

Third Avenue

(between 38th and 39th Streets)

New York, New York |

1987 |

4,000 |

|

220 |

|

(60) |

2029 |

| Tampa Food Court (6)(7) |

Hard Rock Hotel and Casino

Tampa, Florida |

2004 |

4,000 |

|

250 |

|

(*) |

2029 |

| Hollywood Food Court (6)(7) |

Hard Rock Hotel and Casino

Hollywood, Florida |

2004 |

9,000 |

|

250 |

|

(*) |

2029 |

__________________________________

(1)Restaurants are, from time to time, renovated, renamed and/or converted from or to managed or owned facilities. “Year Opened” refers to the year in which we, or an affiliated predecessor of us, first opened, acquired or began managing a restaurant at the applicable location, notwithstanding that the restaurant may have been renovated, renamed and/or converted from or to a managed or owned facility since that date.

(2)Seating capacity refers to the seating capacity of the indoor part of a restaurant available for dining in all seasons and weather conditions. Outdoor seating capacity, if applicable, is set forth in parentheses and refers to the seating capacity of terraces and sidewalk cafes which are available for dining only in the warm seasons and then only inclement weather.

(3)Assumes the exercise of all our available lease renewal options.

(4)Management fees earned, which have been eliminated in consolidation, are based on a percentage of cash flow of the restaurant.

(5)We own a 19.2% interest in the partnership that owns El Rio Grande.

(6)Management fees earned, which have been eliminated in consolidation, are based on a percentage of gross sales of the restaurant.

(7)We own a 64.4% interest in the partnership that owns the Tampa and Hollywood Food Courts.

(*)Represents common area seating

Leases

We are not currently committed to any significant development projects, except for the refresh obligations in connection with the New York-New York Hotel and Casino lease renewals discussed below; however, we may take advantage of opportunities we consider to be favorable, when they occur, depending upon the availability of financing and other factors.

Restaurant Expansion and Other Developments

On April 8, 2022, the Company extended its lease for Gallagher's Steakhouse at the New York-New York Hotel and Casino in Las Vegas, NV through December 31, 2032. In connection with the extension, the Company agreed to spend a minimum of $1,500,000 to materially refresh the premises by April 30, 2023 (as extended from September 30, 2022 due to supply chain issues). Accordingly, the property was substantially closed for renovation on February 5, 2023 and reopened on April 28, 2023. The total cost of the refresh was approximately $1,900,000.

On June 24, 2022, the Company extended its lease for America at the New York-New York Hotel and Casino in Las Vegas, NV through December 31, 2033. In connection with the extension, the Company has agreed to spend a minimum of $4,000,000 to materially refresh the premises by December 31, 2024, subject to various extensions as set out in the agreement. No amounts have been expended to date related to this refresh.

On July 21, 2022, the Company extended its lease for the Village Eateries at the New York-New York Hotel and Casino in Las Vegas, NV through December 31, 2034. As part of this extension, the Broadway Burger Bar and Grill and Gonzalez y Gonzalez, were carved out of the Village Eateries footprint and the extended date for those two locations is December 31, 2033. In connection with the extension, the Company has agreed to spend a minimum of $3,500,000 to materially refresh all three of these premises by March 31, 2024 (as extended from June 30, 2023), subject to various extensions as set out in the agreement. To date approximately $300,000 has been spent on this refresh.

Each of the above refresh obligations are to be consistent with designs approved by the landlord which shall not be unreasonably withheld. We have and will continue to pay all rent as required by the leases without abatement during construction. Note that our substantial completion of work set forth in plans approved by the landlord shall constitute our compliance with the requirements of the completion deadlines, regardless of whether or not the amount actually expended in connection therewith is less than the minimum.

The opening of a new restaurant is invariably accompanied by substantial pre-opening expenses and early operating losses associated with the training of personnel, excess kitchen costs, costs of supervision and other expenses during the pre-opening period and during a post-opening “shake out” period until operations can be considered to be functioning normally. The amount of such pre-opening expenses and early operating losses can generally be expected to depend upon the size and complexity of the facility being opened.

Our restaurants generally do not achieve substantial increases in revenue from year to year, which we consider to be typical of the restaurant industry. To achieve significant increases in revenue or to replace revenue of restaurants that lose customer favor or which close because of lease expirations or other reasons, we would have to open additional restaurant facilities or expand existing restaurants. There can be no assurance that a restaurant will be successful after it is opened, particularly since in many instances we do not operate our new restaurants under a trade name currently used by us, thereby requiring new restaurants to establish their own identity.

We may take advantage of other opportunities we consider to be favorable, when they occur, depending upon the availability of financing and other factors.

Recent Restaurant Dispositions

On July 5, 2022, the Company terminated its lease for Lucky 7 at the Foxwoods Resort Casino. The closure did not result in a material change to the Company's operations.

Investment in New Meadowlands Racetrack LLC

On March 12, 2013, the Company made a $4,200,000 investment in the New Meadowlands Racetrack LLC (“NMR”) through its purchase of a membership interest in Meadowlands Newmark, LLC, an existing member of NMR with a then 63.7% ownership interest. On November 19, 2013, the Company invested an additional $464,000 in NMR through a purchase of an additional membership interest in Meadowlands Newmark, LLC resulting in a total ownership of 11.6% of Meadowlands Newmark, LLC, and an effective ownership interest in NMR of 7.4%, subject to dilution. In 2015, the Company invested an additional $222,000 in NMR and on February 7, 2017, the Company invested an additional $222,000 in NMR, both as a result of capital calls, bringing its total investment to $5,108,000 with no change in ownership.

The Company accounts for this investment at cost, less impairment, adjusted for subsequent observable price changes in accordance with Accounting Standards Update ("ASU") No. 2016-01. There are no observable prices for this investment.

During the years ended September 30, 2023 and October 1, 2022, the Company received distributions from NMR in the amounts of $52,000 and $421,000, respectively, which are included in other income in the consolidated statement of operations for the years then ended.

In addition to the Company’s ownership interest in NMR, if casino gaming is approved at the Meadowlands and NMR is granted the right to conduct said gaming, the Company shall be granted the exclusive right to operate the food and beverage concessions in the gaming facility with the exception of one restaurant.

In conjunction with this investment, the Company, through a 97% owned subsidiary, Ark Meadowlands LLC (“AM VIE”), also entered into a long-term agreement with NMR for the exclusive right to operate food and beverage concessions serving the new raceway facilities (the “Racing F&B Concessions”) located in the new raceway grandstand constructed at the Meadowlands Racetrack in northern New Jersey. Under the agreement, NMR is responsible to pay for the costs and expenses incurred in the operation of the Racing F&B Concessions, and all revenues and profits thereof inure to the benefit of NMR. AM VIE receives an annual fee equal to 5% of the net profits received by NMR from the Racing F&B Concessions during each calendar year. AM VIE is a variable interest entity; however, based on qualitative consideration of the contracts with AM VIE, the operating structure of AM VIE, the Company’s role with AM VIE, and that the Company is not obligated to absorb expected losses of AM VIE, the Company has concluded that it is not the primary beneficiary and not required to consolidate the operations of AM VIE.

The Company’s maximum exposure to loss as a result of its involvement with AM VIE is limited to a receivable from AM VIE’s primary beneficiary (NMR, a related party). As of September 30, 2023 and October 1, 2022, $11,000 and $22,000 were due AM VIE by NMR.

On April 25, 2014, the Company loaned $1,500,000 to Meadowlands Newmark, LLC. The note bears interest at 3%, compounded monthly and added to the principal, and is due in its entirety on January 31, 2024. The note may be prepaid, in whole or in part, at any time without penalty or premium. The principal and accrued interest related to this note in the amounts of $1,399,000 and $1,357,000, are included in Investment In and Receivable From New Meadowlands Racetrack in the consolidated balance sheets at September 30, 2023 and October 1, 2022, respectively. On April 30, 2023, the due date of the note was extended to June 30, 2029.

Restaurant Management

Each restaurant is managed by its own manager and has its own chef. Food products and other supplies are purchased primarily from various unaffiliated suppliers, in most cases by our headquarters' personnel. Each of our restaurants has two or more assistant managers and sous chefs (assistant chefs). Financial and management control is maintained at the corporate level through the use of automated systems that include centralized accounting and reporting.

Purchasing and Distribution

We strive to obtain quality menu ingredients, raw materials and other supplies and services for our operations from reliable sources at competitive prices. Substantially all menu items are prepared on each restaurant’s premises daily from scratch, using fresh ingredients. Each restaurant’s management determines the quantities of food and supplies required and then orders the items from local, regional and national suppliers on terms negotiated by our centralized purchasing staff. Restaurant-level inventories are maintained at a minimum dollar-value level in relation to sales due to the relatively rapid turnover of the perishable produce, poultry, meat, fish and dairy commodities that are used in operations.

We attempt to negotiate short-term and long-term supply agreements depending on market conditions and expected demand. However, we do not contract for long periods of time for our fresh commodities such as produce, poultry, meat, fish and dairy items and, consequently, such commodities can be subject to unforeseen supply and cost fluctuations. Independent food service distributors deliver most food and supply items daily to restaurants. The financial impact of the termination of any such supply agreements would not have a material adverse effect on our financial position. We believe that we have established stable long-term relationships with several key suppliers, particularly with respect to crabs and other shellfish.

Competition

The hospitality industry is highly competitive and is often affected by changes in taste and entertainment trends among the public, by local, national and economic conditions affecting spending habits, and by population and traffic patterns. We believe that the principal means of competition among restaurants include the location, type and quality of facilities and the type, quality and price of beverage and food served.

Our restaurants compete directly or indirectly with many well-established competitors, both nationally and locally owned, some with substantially greater financial resources than we have. Their resources and market presence may provide advantages in marketing, purchasing and negotiating leases. We compete with other restaurant and retail establishments for sites and finding management personnel.

Employees

At December 8, 2023, we employed 1,993 persons (including employees at managed facilities), 1,401 of whom were full-time employees, and 592 of whom were part-time employees; 39 of whom were headquarters personnel, 201 of whom were restaurant management personnel, 754 of whom were kitchen personnel and 999 of whom were restaurant service personnel. A number of our restaurant service personnel are employed on a part-time basis. Changes in minimum wage levels may adversely affect our labor costs and the restaurant industry generally because a large percentage of restaurant personnel are paid at or slightly above the minimum wage. Our employees are not covered by any collective bargaining agreements.

We have experienced aggressive competition for talent, wage inflation and pressure to improve workplace conditions and benefits as a result of the COVID-19 pandemic and various other economic factors. Our compensation packages may prove insufficient to attract and retain the best personnel in light of the challenges posed by the pandemic and wage pressures resulting from the labor shortage. Higher employee turnover levels or our failure to recruit and retain new restaurant employees in a timely manner could impact our ability to grow sales at existing restaurants or open new restaurants and result in higher than projected labor costs.

Government Regulation

We are subject to various federal, state and local laws affecting our business. Each restaurant is subject to licensing and regulation by a number of governmental authorities that may include alcoholic beverage control, health, sanitation, environmental, zoning and public safety agencies in the state or municipality in which the restaurant is located. Difficulties in obtaining or failures to obtain the required licenses or approvals could delay or prevent the development and openings of new restaurants, or could disrupt the operations of existing restaurants.

Alcoholic beverage control regulations require each of our restaurants to apply to a state authority and, in certain locations, county and municipal authorities for licenses and permits to sell alcoholic beverages on the premises. Typically, licenses must be renewed annually and may be subject to penalties, temporary suspension or revocation for cause at any time. Alcoholic beverage control regulations impact many aspects of the daily operations of our restaurants, including the minimum ages of patrons and employees consuming or serving such beverages; employee alcoholic beverages training and certification requirements; hours of operation; advertising; wholesale purchasing and inventory control of such beverages; seating of minors and the service of food within our bar areas; and the storage and dispensing of alcoholic beverages. State and local authorities in many jurisdictions routinely monitor compliance with alcoholic beverage laws. The failure to receive or retain, or a delay in obtaining, a liquor license for a particular restaurant could adversely affect our ability to obtain such licenses in jurisdictions where the failure to receive or retain, or a delay in obtaining, a liquor license occurred.

We are subject to “dram-shop” statutes in most of the states in which we have operations, which generally provide a person injured by an intoxicated person the right to recover damages from an establishment that wrongfully served alcoholic beverages to such person. We carry liquor liability coverage as part of our existing comprehensive general liability insurance. A settlement or judgment against us under a “dram-shop” statute in excess of liability coverage could have a material adverse effect on our operations.

Various federal and state labor laws govern our operations and our relationship with employees, including such matters as minimum wages, breaks, overtime, fringe benefits, safety, working conditions and citizenship requirements. We are also subject to the regulations of the Immigration and Naturalization Service. If our employees do not meet federal citizenship or residency requirements, their deportation could lead to a disruption in our work force. Significant government-imposed increases in minimum wages, paid leaves of absence and mandated health benefits, or increased tax reporting, assessment or payment requirements related to employees who receive gratuities could be detrimental to our profitability.

Our facilities must comply with the applicable requirements of the Americans With Disabilities Act of 1990 (“ADA”) and related state statutes. The ADA prohibits discrimination on the basis of disability with respect to public accommodations and employment. Under the ADA and related state laws, when constructing new restaurants or undertaking significant remodeling of existing restaurants, we must make them more readily accessible to disabled persons.

We are subject to federal and state environmental regulations, but these rules have not had a material effect on our operations. During fiscal 2023, there were no material capital expenditures for environmental control facilities and no material expenditures for this purpose are anticipated.

Seasonal Nature of Business

Our business is highly seasonal; however, our broader geographical reach as a result of recent acquisitions is expected to continue to mitigate some of the risk. For instance, the second quarter of our fiscal year, consisting of the non-holiday portion of the cold weather season in New York and Washington (January, February and March), is the poorest performing quarter; however, in recent years this has been partially offset by our locations in Florida as they experience increased results in the winter months. We achieve our best results during the warm weather, attributable to our extensive outdoor dining availability, particularly at Bryant Park in New York and Sequoia in Washington, D.C. (our largest restaurants) and our outdoor cafes. However, even during summer months these facilities can be adversely affected by unusually cool or rainy weather conditions. Our facilities in Las Vegas are indoor and generally operate on a more consistent basis throughout the year.

Available Information

We make available free of charge through our Internet website, www.arkrestaurants.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, statements of beneficial ownership of securities on Forms 3, 4 and 5 and amendments to these reports and statements filed or furnished pursuant to Section 13(a) and Section 16 of the Securities Exchange Act of 1934 as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the United States Securities and Exchange Commission, or SEC. These SEC reports can be accessed through the investor relations section of our website. The information found on our website is not part of this or any other report we file with or furnish to the SEC.

The above information is also available at the SEC’s Office of Investor Education and Advocacy at United States Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549-0213 or obtainable by calling the SEC at (800) 732-0330. In addition, the SEC maintains an Internet website at www.sec.gov, where the above information can be viewed.

Our principal executive offices are located at 85 Fifth Avenue, New York, New York 10003, and our telephone number is (212) 206-8800. Unless the context specifically requires otherwise, the terms the “Company,” “Ark,” “we,” “us” and “our” mean Ark Restaurants Corp., a Delaware corporation, and its consolidated subsidiaries.

Item 1A. Risk Factors

Not applicable.

Item 1B.

Not applicable.

Item 2. Properties

Unresolved Staff Comments Our restaurant facilities and our executive offices, with the exception of The Rustic Inn in Dania Beach, Florida, Shuckers in Jensen Beach, Florida and the two Original Oyster House properties in Alabama, are occupied under leases. Most of our restaurant leases provide for the payment of base rents plus real estate taxes, insurance and other expenses and, in certain instances, for the payment of a percentage of our sales at such facility. As of September 30, 2023, these leases (including leases for managed restaurants) have terms (including any available renewal options) expiring as follows:

|

|

|

|

|

|

|

Fiscal Year Lease

Terms Expire

|

Number of

Facilities

|

|

|

| 2023-2027 |

4 |

| 2028-2032 |

3 |

| 2033-2037 |

8 |

| 2038-2042 |

— |

| 2043-2047 |

2 |

Our executive, administrative and clerical offices are located in approximately 8,500 square feet of office space at 85 Fifth Avenue, New York, New York. Our lease for this office space expires in 2038.

For information concerning our future lease payments under non-cancelable operating leases, see Note 9 of the Notes to Consolidated Financial Statements.

Item 3. Legal Proceedings

In the ordinary course of our business, we are a party to various lawsuits arising from accidents at our restaurants and workers’ compensation claims, which are generally handled by our insurance carriers.

Our employment of management personnel, waiters, waitresses and kitchen staff at a number of different restaurants has resulted in the institution, from time to time, of litigation alleging violation by us of employment discrimination laws. We do not believe that any of such suits will have a material adverse effect upon us, our financial condition or operations.

Except as otherwise provided below, the Company is not subject to pending legal proceedings, other than ordinary claims incidental to its business, which the Company does not believe will materially impact results of operations.

On May 1, 2018, two former tipped service workers (the “Plaintiffs”), individually and on behalf of all other similarly situated personnel, filed a putative class action lawsuit (the “Complaint”) against the Company and certain subsidiaries as well as certain officers of the Company (the “Defendants”). Plaintiffs alleged, on behalf of themselves and the putative class, that the Company violated certain of the New York State Labor Laws and related regulations. In December 2020, the parties reached a settlement agreement resolving all issues alleged in the Complaint, which received final approval by the New York State Supreme Court in October 2022, for approximately $600,000, which was previously accrued on the October 1, 2022 consolidated balance sheet. Under the terms of the court approved settlement agreement, settlement proceeds were distributed to the Plaintiffs in the first quarter of fiscal 2023.

Item 4. Mine Safety Disclosures Item 5.

Not applicable.

PART II

Market For The Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market for Our Common Stock

Our common stock, $0.01 par value, is traded on the NASDAQ Capital Market under the symbol “ARKR.”

On December 11, 2023, there were approximately 29 holders of record of our common stock and the last reported sales price was $15.62. A substantially greater number of holders of our common stock are “street name” or beneficial holders, whose shares are held by banks, brokers and other financial institutions.

Dividend Policy

On November 9, 2022, February 9, 2023, May 9, 2023 and August 8, 2023, the Board of Directors of the Company (the "Board") declared quarterly cash dividends of $0.125, $0.125, $0.1875 and $0.1875, respectively, per share, which were paid on December 13, 2022, March 14, 2023, June 13, 2023 and September 13, 2023 to the stockholders of record of the Company's common stock at the close of business on November 30, 2022, February 28, 2023, May 31, 2023 and August 31, 2023. Future decisions to pay or to increase or decrease dividends are at the discretion of the Board and will depend upon operating performance and other factors.

Purchases of Equity Securities by Issuer and Affiliated Purchases

None

Recent Sales of Unregistered Securities

None

Securities Authorized for Issuance under Equity Compensation Plans

Prior to fiscal 2022, the Company had options outstanding under two stock option plans: the 2010 Stock Option Plan (the “2010 Plan”) and the 2016 Stock Option Plan (the “2016 Plan”). Options granted under both plans are exercisable at prices at least equal to the fair market value of such stock on the dates the options were granted and expire ten years after the date of grant.

On March 15, 2022, the shareholders of the Company approved the Ark Restaurants Corp. 2022 Stock Option Plan (the "2022 Plan"). Effective with this approval, the Company terminated the 2016 Plan along with the 63,750 authorized but unissued options under the 2016 Plan. Such termination did not affect any of the options previously issued and outstanding under the 2016 Plan, which remain outstanding in accordance with their terms. Under the 2022 Plan, 500,000 options were authorized for future grant and are exercisable at prices at least equal to the fair market value of such stock on the dates the options were granted. The options expire ten years after the date of grant.

During the year ended September 30, 2023, no options to purchase shares of common stock were issued by the Company.

During the year ended October 1, 2022, options to purchase 22,500 shares of common stock at an exercise price of $17.80 per share were granted to employees and directors of the Company (the "2022 Grant"). Such options are exercisable as to 25% of the shares commencing on the first anniversary of the date of grant and 25% each year thereafter. The grant date fair value of these stock options was $4.53 per share and totaled approximately $102,000.

The following is a summary of the securities issued and authorized for issuance under our Stock Option Plans at September 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

| Plan Category |

(a) Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights |

(b) Weighted

average exercise

price of

outstanding

options, warrants

and rights |

(c) Number of securities

remaining available for

future issuance under equity

compensation plans

(excluding securities

reflected in column (a)) |

| Equity compensation plans approved by shareholders |

471,250 |

$19.57 |

477,500 |

Equity compensation plans not approved by shareholders (1) |

None |

N/A |

None |

| Total |

471,250 |

$19.57 |

477,500 |

Of the 471,250 options outstanding as of September 30, 2023, 134,250 were held by the Company’s officers and directors.

(1)The Company has no equity compensation plans that were not approved by shareholders.

The Company also maintains a Section 162(m) Cash Bonus Plan. Under the Company's Section 162(m) Cash Bonus Plan, compensation paid in excess of $1,000,000 to any employee who is the chief executive officer, or one of the three highest paid executive officers on the last day of that tax year (other than the chief executive officer or the chief financial officer) is not tax deductible.

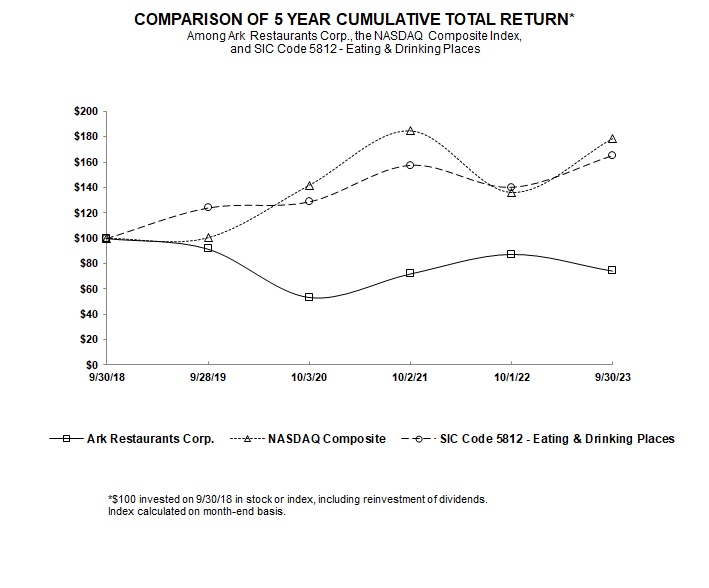

Stock Performance Graph

The graph set forth below compares the yearly percentage change in cumulative total shareholder return on the Company’s common stock for the five-year period commencing September 30, 2018 and ending September 30, 2023 against the cumulative total return on the NASDAQ Market Index and a peer group comprised of those public companies whose business activities fall within the same standard industrial classification code as the Company. This graph assumes a $100 investment in the Company’s common stock and in each index on September 30, 2018 and that all dividends paid by companies included in each index were reinvested.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cumulative Total Return |

|

09/30/18 |

|

09/28/19 |

|

10/03/20 |

|

10/02/21 |

|

10/01/22 |

|

09/30/23 |

| Ark Restaurants Corp. |

$100.00 |

|

|

$91.71 |

|

|

$53.42 |

|

|

$71.97 |

|

|

$87.49 |

|

|

$74.29 |

|

| NASDAQ Composite |

100.00 |

|

|

100.52 |

|

|

141.70 |

|

|

184.58 |

|

|

136.12 |

|

|

178.41 |

|

| SIC Code 5812 - Eating & Drinking Places |

100.00 |

|

|

123.91 |

|

|

128.67 |

|

|

157.26 |

|

|

140.14 |

|

|

164.87 |

|

Item 6. Reserved

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Statement Regarding Forward-Looking Disclosure

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our Consolidated Financial Statements and related notes included under Item 8 of this annual report. This discussion contains forward-looking statements, which involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors, including but not limited to, those discussed elsewhere in this annual report. Please see the discussion of forward-looking statements at the beginning of this annual report under "Special Note Regarding Forward-Looking Statements".

COVID-19 Pandemic

Recent global events, including the COVID-19 pandemic ("COVID-19"), have adversely affected global economies, disrupted global supply chains and labor force participation and created significant volatility and disruption of financial markets. As a result, we experienced significant and variable disruptions to our business as federal, state and local restrictions were mandated, among other remedial measures, to mitigate the spread of the COVID-19 virus. While restrictions on the type of permitted operating model and occupancy capacity may continue to change, during fiscal 2022 all of our restaurants operated with no restrictions, other than in New York City where customers were required to show proof of vaccination through November 1, 2022.

In addition to the associated impacts of COVID-19, our operating results have been impacted by geopolitical and other macroeconomic factors, leading to increased commodity and wage inflation and other increased costs. The ongoing effects of COVID-19 and its variants, along with other geopolitical and macroeconomic events, could lead to further government mandates, including but not limited to capacity restrictions, shifts in consumer behavior, wage inflation, staffing challenges, product and services cost inflation and disruptions in our supply chain. If these factors significantly impact our cash flow in the future, we may again implement mitigation actions such as suspending dividends, increasing borrowings or modifying our operating strategies. Some of these measures may have an adverse impact on our business, including possible impairments of assets.

Overview

As of September 30, 2023, the Company owned and operated 17 restaurants and bars, 16 fast food concepts and catering operations, exclusively in the United States, that have similar economic characteristics, nature of products and service, class of customer and distribution methods. The Company believes it meets the criteria for aggregating its operating segments into a single reporting segment in accordance with applicable accounting guidance.

Accounting Period

Our fiscal year ends on the Saturday nearest September 30. We report fiscal years under a 52/53-week format. This reporting method is used by many companies in the hospitality industry and is meant to improve year-to-year comparisons of operating results. Under this method, certain years will contain 53 weeks. The fiscal years ended September 30, 2023 and October 1, 2022 both included 52 weeks.

Seasonality

The Company has substantial fixed costs that do not decline proportionally with sales. Although our business is highly seasonal, our broader geographical reach as a result of recent acquisitions is expected to continue to mitigate some of the risk. For instance, the second quarter of our fiscal year, consisting of the non-holiday portion of the cold weather season in New York and Washington (January, February and March), is the poorest performing quarter; however, in recent years this has been partially offset by our locations in Florida as they experience increased results in the winter months.

We generally achieve our best results during the warm weather, attributable to our extensive outdoor dining availability, particularly at Bryant Park in New York and Sequoia in Washington, D.C. (our largest restaurants) and our outdoor cafes. However, even during summer months these facilities can be adversely affected by unusually cool or rainy weather conditions. Our facilities in Las Vegas are indoor and generally operate on a more consistent basis throughout the year.

Results of Operations

The Company’s operating loss for the year ended September 30, 2023 (which includes a goodwill impairment charge of $10,000,000) was $4,840,000, down 149.1% as compared to operating income of $9,864,000 for the year ended October 1, 2022. Excluding the goodwill impairment charge of $10,000,000, operating income for the year ended September 30, 2023 decreased 47.7% to $5,160,000 as compared to $9,864,000 for the year ended October 1, 2022. This decrease resulted primarily from increases in labor costs combined with increased base rents and inflationary pressures related to non-commodity items partially offset by an easing in commodity prices.

The following table summarizes the significant components of the Company’s operating results for the years ended September 30, 2023 and October 1, 2022, respectively:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

Variance |

|

September 30,

2023 |

|

October 1,

2022 |

|

$ |

|

% |

| REVENUES: |

(in thousands) |

|

|

|

|

| Food and beverage sales |

$ |

180,820 |

|

|

$ |

180,010 |

|

|

$ |

810 |

|

|

0.4 |

% |

| Other revenue |

3,973 |

|

|

3,664 |

|

|

309 |

|

|

8.4 |

% |

| Total revenues |

184,793 |

|

|

183,674 |

|

|

1,119 |

|

|

0.6 |

% |

| COSTS AND EXPENSES: |

|

|

|

|

|

|

|

| Food and beverage cost of sales |

49,624 |

|

|

52,573 |

|

|

(2,949) |

|

|

-5.6 |

% |

| Payroll expenses |

66,322 |

|

|

60,000 |

|

|

6,322 |

|

|

10.5 |

% |

| Occupancy expenses |

23,472 |

|

|

22,181 |

|

|

1,291 |

|

|

5.8 |

% |

| Other operating costs and expenses |

23,498 |

|

|

21,823 |

|

|

1,675 |

|

|

7.7 |

% |

| General and administrative expenses |

12,407 |

|

|

12,936 |

|

|

(529) |

|

|

-4.1 |

% |

| Goodwill impairment |

10,000 |

|

|

— |

|

|

10,000 |

|

|

N/A |

| Depreciation and amortization |

4,310 |

|

|

4,297 |

|

|

13 |

|

|

0.3 |

% |

| Total costs and expenses |

189,633 |

|

|

173,810 |

|

|

15,823 |

|

|

9.1 |

% |

| OPERATING INCOME (LOSS) |

$ |

(4,840) |

|

|

$ |

9,864 |

|

|

$ |

(14,704) |

|

|

-149.1 |

% |

Revenues

During the year ended September 30, 2023, revenues increased 0.6% as compared to revenues for the year ended October 1, 2022. This small increase was primarily as a result of the changes in same-store sales discussed below.

Food and Beverage Same-Store Sales

On a Company-wide basis, same-store food and beverage sales for the year ended September 30, 2023 were consistent with the year ended October 1, 2022 as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

Variance |

|

September 30,

2023 |

|

October 1,

2022 |

|

$ |

|

% |

|

(in thousands) |

|

|

|

|

| Las Vegas |

$ |

55,441 |

|

|

$ |

55,364 |

|

|

$ |

77 |

|

|

0.1 |

% |

| New York |

37,039 |

|

|

33,408 |

|

|

3,631 |

|

|

10.9 |

% |

| Washington, D.C. |

10,599 |

|

|

10,611 |

|

|

(12) |

|

|

-0.1 |

% |

| Atlantic City, NJ |

2,999 |

|

|

3,555 |

|

|

(556) |

|

|

-15.6 |

% |

| Alabama |

17,175 |

|

|

16,749 |

|

|

426 |

|

|

2.5 |

% |

| Florida |

55,122 |

|

|

58,624 |

|

|

(3,502) |

|

|

-6.0 |

% |

| Same-store sales |

178,375 |

|

|

178,311 |

|

|

$ |

64 |

|

|

— |

% |

| Other |

2,445 |

|

|

1,699 |

|

|

|

|

|

| Food and beverage sales |

$ |

180,820 |

|

|

$ |

180,010 |

|

|

|

|

|

_____________________

Entries related to percentages in the table above marked "—%" indicate percentage less than 1%.

Same-store sales in Las Vegas increased marginally primarily as a result of increased customer traffic and targeted menu price increases partially offset by the negative impact of the temporary closure of Gallagher's Steakhouse for renovation from February 5, 2023 to April 27, 2023. Same-store sales in New York increased 10.9% driven primarily by strong revenues from our event business and increased customer traffic. Same-store sales in Washington, DC decreased marginally driven primarily by lower headcounts in the third and fourth quarters partially offset by strong revenues from our event business and targeted menu price increases in the first two quarters. Same-store sales in Atlantic City decreased 15.6% as a result of lower customer traffic at the property where we are located. Same-store sales in Alabama increased 2.5% primarily as a result of increased customer traffic and targeted menu price increases. Same-store sales in Florida decreased 6.0% primarily as a result of lower headcounts as compared to the comparable prior period which benefited from outsized volumes as a result of the population increase in Southeast Florida as a result of the migration of people during the pandemic partially offset by targeted menu price increases.

Other food and beverage sales consist of sales related to new restaurants opened or acquired during the applicable period, sales related to properties that were closed (Lucky 7 - see Liquidity and Capital Resources - Recent Restaurant Dispositions) and other adjustments and fees.

Prior to the COVID-19 pandemic, our restaurants generally did not achieve substantial increases in revenue from year to year, which we consider to be typical of the restaurant industry. To achieve significant increases in revenue or to replace revenue of restaurants that lose customer favor or which close because of lease expirations or other reasons, we would have to open additional restaurant facilities or expand existing restaurants. There can be no assurance that a restaurant will be successful after it is opened, particularly since in many instances we do not operate our new restaurants under a trade name currently used by us, thereby requiring new restaurants to establish their own identity.

Other Revenues

Included in other revenues are purchase service fees which represent commissions earned by a subsidiary of the Company for providing purchasing services to other restaurant groups, as well as merchandise sales, license fees, property management fees and other rentals. The increase in other revenues for the year ended September 30, 2023 as compared to the year ended October 1, 2022 is primarily due to an increase in purchase service fees.

Costs and Expenses

Costs and expenses for the years ended September 30, 2023 and October 1, 2022 were as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Year Ended

September 30,

2023 |

|

% to

Total Revenues |

|

Year Ended

October 1,

2022 |

|

% to

Total Revenues |

|

Increase

(Decrease) |

| |

|

|

|

|

$ |

|

% |

| Food and beverage cost of sales |

$ |

49,624 |

|

|

26.9 |

% |

|

$ |

52,573 |

|

|

28.6 |

% |

|

$ |

(2,949) |

|

|

-5.6 |

% |

| Payroll expenses |

66,322 |

|

|

35.9 |

% |

|

60,000 |

|

|

32.7 |

% |

|

6,322 |

|

|

10.5 |

% |

| Occupancy expenses |

23,472 |

|

|

12.7 |

% |

|

22,181 |

|

|

12.1 |

% |

|

1,291 |

|

|

5.8 |

% |

| Other operating costs and expenses |

23,498 |

|

|

12.7 |

% |

|

21,823 |

|

|

11.9 |

% |

|

1,675 |

|

|

7.7 |

% |

| General and administrative expenses |

12,407 |

|

|

6.7 |

% |

|

12,936 |

|

|

7.0 |

% |

|

(529) |

|

|

-4.1 |

% |

| Goodwill impairment |

10,000 |

|

|

5.4 |

% |

|

— |

|

|

— |

% |

|

10,000 |

|

|

N/A |

| Depreciation and amortization |

4,310 |

|

|

2.3 |

% |

|

4,297 |

|

|

2.3 |

% |

|

13 |

|

|

0.3 |

% |

| Total costs and expenses |

$ |

189,633 |

|

|

|

|

$ |

173,810 |

|

|

|

|

$ |

15,823 |

|

|

|

Food and beverage costs as a percentage of total revenues for the year ended September 30, 2023 decreased as compared to last year primarily as a result of a very strong event business in New York City and Washington, D.C., which has higher margins, combined with some easing in commodity prices.

Payroll expenses as a percentage of total revenues for the year ended September 30, 2023 increased as compared to last year primarily as a result of increased labor costs in connection with record low unemployment and ongoing COVID-related labor challenges combined with merit increases and increasing minimum wages in the states where we operate.

Occupancy expenses as a percentage of total revenues for the year ended September 30, 2023 increased as compared to last year primarily as a result of increases in base rents and increases in property and liability insurance premiums.