| Delaware | 0-14112 | 43-1128385 | ||||||

(State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

||||||

| Title of each class | Ticker symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $0.01 par value | JKHY | Nasdaq Global Select Market | ||||||

JACK HENRY & ASSOCIATES, INC. |

|||||||||||

| (Registrant) | |||||||||||

| Date: | February 4, 2025 | /s/ Mimi L. Carsley | |||||||||

| Mimi L. Carsley | |||||||||||

| Chief Financial Officer and Treasurer | |||||||||||

|

|||||

| Press Release | |||||

Mimi L. Carsley | Chief Financial Officer | mcarsley@jackhenry.com | |||||

| Current | ||||||||

| GAAP | Low | High | ||||||

| Revenue | $2,369 | $2,391 | ||||||

Operating margin3 |

23.0% | 23.2% | ||||||

| EPS | $5.78 | $5.87 | ||||||

Non-GAAP4 |

||||||||

| Adjusted revenue | $2,353 | $2,375 | ||||||

| Adjusted operating margin | 22.7% | 22.8% | ||||||

Second Qtr Revenue |

Second Qtr Operating Income |

F'25 YTD Net Income |

||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||

| GAAP | Non-GAAP1 |

GAAP | Non-GAAP1 |

GAAP | Non-GAAP1 |

|||||||||||||||||||||

| increased | increased | increased | increased | increased | increased | |||||||||||||||||||||

| 5.2% | 6.1% | 3.4% | 7.3% | 12.1% | 7.2% | |||||||||||||||||||||

F'25 YTD Revenue |

F'25 YTD Operating Income |

F'25 YTD EBITDA |

||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||

| GAAP | Non-GAAP1 |

GAAP | Non-GAAP1 |

Non-GAAP5 |

||||||||||||||||||||||

| increased | increased | increased | increased | increased | ||||||||||||||||||||||

| 5.2% | 5.7% | 9.0% | 4.2% | 3.9% | ||||||||||||||||||||||

|

1 |

|||||||

According to Greg Adelson, President and CEO, “We are pleased to report solid performance in the second quarter of our fiscal year. We continued our positive sales momentum with record sales attainment in Q2 for the second consecutive year while maintaining a robust sales pipeline for future opportunities. We are seeing strong demand for our products from both new and existing clients and are making substantial progress with our technology modernization strategy. Our focus on a people-first culture, service excellence, technology innovation, and a well-executed strategy continues to differentiate us in the market.” | |||||||||||||||||

| Revenue | |||||||||||||||||||||||||||||||||||

(Unaudited, in thousands) |

Three Months Ended December 31, |

% Change | Six Months Ended December 31, |

% Change | |||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

| Revenue | |||||||||||||||||||||||||||||||||||

| Services and Support | $ | 323,027 | $ | 311,992 | 3.5 | % | $ | 679,706 | $ | 654,197 | 3.9 | % | |||||||||||||||||||||||

| Percentage of Total Revenue | 56.3 | % | 57.2 | % | 57.9 | % | 58.6 | % | |||||||||||||||||||||||||||

| Processing | 250,821 | 233,709 | 7.3 | % | 495,123 | 462,872 | 7.0 | % | |||||||||||||||||||||||||||

| Percentage of Total Revenue | 43.7 | % | 42.8 | % | 42.1 | % | 41.4 | % | |||||||||||||||||||||||||||

| REVENUE | $ | 573,848 | $ | 545,701 | 5.2 | % | $ | 1,174,829 | $ | 1,117,069 | 5.2 | % | |||||||||||||||||||||||

|

2 |

|||||||

Operating Expenses and Operating Income |

||||||||||||||||||||||||||||||||||||||

(Unaudited, in thousands) |

Three Months Ended December 31, |

% Change | Six Months Ended December 31, |

% Change | ||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||||||

| Cost of Revenue | $ | 332,850 | $ | 320,979 | 3.7 | % | $ | 676,282 | $ | 643,981 | 5.0 | % | ||||||||||||||||||||||||||

Percentage of Total Revenue6 |

58.0 | % | 58.8 | % | 57.6 | % | 57.6 | % | ||||||||||||||||||||||||||||||

| Research and Development | 41,095 | 35,478 | 15.8 | % | 80,780 | 72,370 | 11.6 | % | ||||||||||||||||||||||||||||||

Percentage of Total Revenue6 |

7.2 | % | 6.5 | % | 6.9 | % | 6.5 | % | ||||||||||||||||||||||||||||||

| Selling, General, and Administrative | 76,901 | 70,277 | 9.4 | % | 143,489 | 149,051 | (3.7) | % | ||||||||||||||||||||||||||||||

Percentage of Total Revenue6 |

13.4 | % | 12.9 | % | 12.2 | % | 13.3 | % | ||||||||||||||||||||||||||||||

| OPERATING EXPENSES | 450,846 | 426,734 | 5.7 | % | 900,551 | 865,402 | 4.1 | % | ||||||||||||||||||||||||||||||

| OPERATING INCOME | $ | 123,002 | $ | 118,967 | 3.4 | % | $ | 274,278 | $ | 251,667 | 9.0 | % | ||||||||||||||||||||||||||

Operating Margin6 |

21.4 | % | 21.8 | % | 23.3 | % | 22.5 | % | ||||||||||||||||||||||||||||||

|

(Unaudited, in thousands,

except per share data)

|

Three Months Ended December 31, |

% Change | Six Months Ended December 31, |

% Change | |||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

| Income Before Income Taxes | $ | 127,381 | $ | 120,223 | 6.0 | % | $ | 284,179 | $ | 253,471 | 12.1 | % | |||||||||||||||||||||||

| Provision for Income Taxes | 29,536 | 28,258 | 4.5 | % | 67,143 | 59,827 | 12.2 | % | |||||||||||||||||||||||||||

| NET INCOME | $ | 97,845 | $ | 91,965 | 6.4 | % | $ | 217,036 | $ | 193,644 | 12.1 | % | |||||||||||||||||||||||

| Diluted earnings per share | $ | 1.34 | $ | 1.26 | 6.2 | % | $ | 2.97 | $ | 2.65 | 12.0 | % | |||||||||||||||||||||||

According to Mimi Carsley, CFO and Treasurer, “Our second quarter results included non-GAAP revenue growth of over 6%, led by our key revenue areas of public and private cloud and processing, which combined to grow by nearly 9%. That strong revenue growth and the leverage provided by our SaaS business model led to non-GAAP operating income growth of over 7%.” | |||||||||||||||||

|

3 |

|||||||

(Unaudited, in thousands) |

Three Months Ended December 31, | % Change | Six Months Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

GAAP Revenue** |

$ | 573,848 | $ | 545,701 | 5.2 | % | $ | 1,174,829 | $ | 1,117,069 | 5.2 | % | |||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

| Deconversion revenue | (69) | (4,882) | (3,766) | (9,018) | |||||||||||||||||||||||||||||||

NON-GAAP ADJUSTED REVENUE** |

$ | 573,779 | $ | 540,819 | 6.1 | % | $ | 1,171,063 | $ | 1,108,051 | 5.7 | % | |||||||||||||||||||||||

| GAAP Operating Income | $ | 123,002 | $ | 118,967 | 3.4 | % | $ | 274,278 | $ | 251,667 | 9.0 | % | |||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

Operating (income) loss from deconversions |

622 | (3,803) | (2,873) | (7,558) | |||||||||||||||||||||||||||||||

VEDIP program expense* |

— | — | — | 16,443 | |||||||||||||||||||||||||||||||

| NON-GAAP ADJUSTED OPERATING INCOME | $ | 123,624 | $ | 115,164 | 7.3 | % | $ | 271,405 | $ | 260,552 | 4.2 | % | |||||||||||||||||||||||

Non-GAAP Adjusted Operating Margin*** |

21.5 | % | 21.3 | % | 23.2 | % | 23.5 | % | |||||||||||||||||||||||||||

| GAAP Net Income | $ | 97,845 | $ | 91,965 | 6.4 | % | $ | 217,036 | $ | 193,644 | 12.1 | % | |||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

Net (income) loss from deconversions |

622 | (3,803) | (2,874) | (7,558) | |||||||||||||||||||||||||||||||

VEDIP program expense* |

— | — | — | 16,443 | |||||||||||||||||||||||||||||||

Tax impact of adjustments**** |

(149) | 913 | 690 | (2,132) | |||||||||||||||||||||||||||||||

| NON-GAAP ADJUSTED NET INCOME | $ | 98,318 | $ | 89,075 | 10.4 | % | $ | 214,852 | $ | 200,397 | 7.2 | % | |||||||||||||||||||||||

|

4 |

|||||||

| Three Months Ended December 31, 2024 | |||||||||||||||||||||||||||||

(Unaudited, in thousands) |

Core | Payments | Complementary | Corporate and Other | Total | ||||||||||||||||||||||||

| GAAP REVENUE | $ | 173,173 | $ | 214,836 | $ | 160,937 | $ | 24,902 | $ | 573,848 | |||||||||||||||||||

| Non-GAAP adjustments* | 20 | (34) | (60) | 5 | (69) | ||||||||||||||||||||||||

| NON-GAAP ADJUSTED REVENUE | 173,193 | 214,802 | 160,877 | 24,907 | 573,779 | ||||||||||||||||||||||||

| GAAP COST OF REVENUE | 70,739 | 114,738 | 63,384 | 83,989 | 332,850 | ||||||||||||||||||||||||

| Non-GAAP adjustments* | (88) | (53) | (99) | — | (240) | ||||||||||||||||||||||||

| NON-GAAP ADJUSTED COST OF REVENUE | 70,651 | 114,685 | 63,285 | 83,989 | 332,610 | ||||||||||||||||||||||||

| GAAP SEGMENT INCOME | $ | 102,434 | $ | 100,098 | $ | 97,553 | $ | (59,087) | |||||||||||||||||||||

| Segment Income Margin** | 59.2 | % | 46.6 | % | 60.6 | % | (237.3) | % | |||||||||||||||||||||

| NON-GAAP ADJUSTED SEGMENT INCOME | $ | 102,542 | $ | 100,117 | $ | 97,592 | $ | (59,082) | |||||||||||||||||||||

Non-GAAP Adjusted Segment Income Margin** |

59.2 | % | 46.6 | % | 60.7 | % | (237.2) | % | |||||||||||||||||||||

| Research and Development | 41,095 | ||||||||||||||||||||||||||||

| Selling, General, and Administrative | 76,901 | ||||||||||||||||||||||||||||

| Non-GAAP adjustments unassigned to a segment*** | (451) | ||||||||||||||||||||||||||||

| NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | 450,155 | ||||||||||||||||||||||||||||

| NON-GAAP ADJUSTED OPERATING INCOME | $ | 123,624 | |||||||||||||||||||||||||||

|

5 |

|||||||

| Three Months Ended December 31, 2023 | |||||||||||||||||||||||||||||

(Unaudited, in thousands) |

Core | Payments | Complementary | Corporate and Other | Total | ||||||||||||||||||||||||

| GAAP REVENUE | $ | 165,601 | $ | 203,839 | $ | 152,466 | $ | 23,795 | $ | 545,701 | |||||||||||||||||||

| Non-GAAP adjustments* | (1,929) | (1,555) | (1,355) | (43) | (4,882) | ||||||||||||||||||||||||

| NON-GAAP ADJUSTED REVENUE | 163,672 | 202,284 | 151,111 | 23,752 | 540,819 | ||||||||||||||||||||||||

| GAAP COST OF REVENUE | 69,370 | 111,623 | 62,825 | 77,161 | 320,979 | ||||||||||||||||||||||||

| Non-GAAP adjustments* | (321) | (51) | (249) | — | (621) | ||||||||||||||||||||||||

| NON-GAAP ADJUSTED COST OF REVENUE | 69,049 | 111,572 | 62,576 | 77,161 | 320,358 | ||||||||||||||||||||||||

| GAAP SEGMENT INCOME | $ | 96,231 | $ | 92,216 | $ | 89,641 | $ | (53,366) | |||||||||||||||||||||

Segment Income Margin** |

58.1 | % | 45.2 | % | 58.8 | % | (224.3) | % | |||||||||||||||||||||

| NON-GAAP ADJUSTED SEGMENT INCOME | $ | 94,623 | $ | 90,712 | $ | 88,535 | $ | (53,409) | |||||||||||||||||||||

| Non-GAAP Adjusted Segment Income Margin | 57.8 | % | 44.8 | % | 58.6 | % | (224.9) | % | |||||||||||||||||||||

| Research and Development | 35,478 | ||||||||||||||||||||||||||||

| Selling, General, and Administrative | 70,277 | ||||||||||||||||||||||||||||

Non-GAAP adjustments unassigned to a segment*** |

(458) | ||||||||||||||||||||||||||||

| NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | 425,655 | ||||||||||||||||||||||||||||

| NON-GAAP ADJUSTED OPERATING INCOME | $ | 115,164 | |||||||||||||||||||||||||||

|

6 |

|||||||

| Six Months Ended December 31, 2024 | |||||||||||||||||||||||||||||

(Unaudited, in thousands) |

Core | Payments | Complementary | Corporate and Other | Total | ||||||||||||||||||||||||

| GAAP REVENUE | $ | 368,797 | $ | 426,758 | $ | 332,639 | $ | 46,635 | $ | 1,174,829 | |||||||||||||||||||

| Non-GAAP adjustments* | (1,267) | (1,948) | (533) | (18) | (3,766) | ||||||||||||||||||||||||

| NON-GAAP ADJUSTED REVENUE | 367,530 | 424,810 | 332,106 | 46,617 | 1,171,063 | ||||||||||||||||||||||||

| GAAP COST OF REVENUE | 152,159 | 227,757 | 129,352 | 167,014 | 676,282 | ||||||||||||||||||||||||

| Non-GAAP adjustments* | (125) | (71) | (159) | — | (355) | ||||||||||||||||||||||||

| NON-GAAP ADJUSTED COST OF REVENUE | 152,034 | 227,686 | 129,193 | 167,014 | 675,927 | ||||||||||||||||||||||||

| GAAP SEGMENT INCOME | $ | 216,638 | $ | 199,001 | $ | 203,287 | $ | (120,379) | |||||||||||||||||||||

Segment Income Margin** |

58.7 | % | 46.6 | % | 61.1 | % | (258.1) | % | |||||||||||||||||||||

| NON-GAAP ADJUSTED SEGMENT INCOME | $ | 215,496 | $ | 197,124 | $ | 202,913 | $ | (120,397) | |||||||||||||||||||||

| Non-GAAP Adjusted Segment Income Margin | 58.6 | % | 46.4 | % | 61.1 | % | (258.3) | % | |||||||||||||||||||||

| Research and Development | 80,780 | ||||||||||||||||||||||||||||

| Selling, General, and Administrative | 143,489 | ||||||||||||||||||||||||||||

Non-GAAP adjustments unassigned to a segment*** |

(538) | ||||||||||||||||||||||||||||

| NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | 899,658 | ||||||||||||||||||||||||||||

| NON-GAAP ADJUSTED OPERATING INCOME | $ | 271,405 | |||||||||||||||||||||||||||

|

7 |

|||||||

| Six Months Ended December 31, 2023 | |||||||||||||||||||||||||||||

(Unaudited, in thousands) |

Core | Payments | Complementary | Corporate and Other | Total | ||||||||||||||||||||||||

| GAAP REVENUE | $ | 352,041 | $ | 403,195 | $ | 313,833 | $ | 48,000 | $ | 1,117,069 | |||||||||||||||||||

| Non-GAAP adjustments* | (3,595) | (2,560) | (2,806) | (57) | (9,018) | ||||||||||||||||||||||||

| NON-GAAP ADJUSTED REVENUE | 348,446 | 400,635 | 311,027 | 47,943 | 1,108,051 | ||||||||||||||||||||||||

| GAAP COST OF REVENUE | 145,296 | 220,449 | 123,783 | 154,453 | 643,981 | ||||||||||||||||||||||||

| Non-GAAP adjustments* | (425) | (98) | (367) | (1) | (891) | ||||||||||||||||||||||||

| NON-GAAP ADJUSTED COST OF REVENUE | 144,871 | 220,351 | 123,416 | 154,452 | 643,090 | ||||||||||||||||||||||||

| GAAP SEGMENT INCOME | $ | 206,745 | $ | 182,746 | $ | 190,050 | $ | (106,453) | |||||||||||||||||||||

Segment Income Margin** |

58.7 | % | 45.3 | % | 60.6 | % | (221.8) | % | |||||||||||||||||||||

| NON-GAAP ADJUSTED SEGMENT INCOME | $ | 203,575 | $ | 180,284 | $ | 187,611 | $ | (106,509) | |||||||||||||||||||||

| Non-GAAP Adjusted Segment Income Margin | 58.4 | % | 45.0 | % | 60.3 | % | (222.2) | % | |||||||||||||||||||||

| Research and Development | 72,370 | ||||||||||||||||||||||||||||

| Selling, General, and Administrative | 149,051 | ||||||||||||||||||||||||||||

Non-GAAP adjustments unassigned to a segment*** |

(17,012) | ||||||||||||||||||||||||||||

| NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | 847,499 | ||||||||||||||||||||||||||||

| NON-GAAP ADJUSTED OPERATING INCOME | $ | 260,552 | |||||||||||||||||||||||||||

|

8 |

|||||||

GAAP to Non-GAAP GUIDANCE (In millions, except per share data) |

Annual FY25 |

||||||||||||||||

| Low | High | ||||||||||||||||

| GAAP REVENUE | $ | 2,369 | $ | 2,391 | |||||||||||||

| Growth | 6.9 | % | 7.9 | % | |||||||||||||

Deconversions* |

$ | 16 | $ | 16 | |||||||||||||

NON-GAAP ADJUSTED REVENUE** |

$ | 2,353 | $ | 2,375 | |||||||||||||

| Non-GAAP Adjusted Growth | 7.0 | % | 8.0 | % | |||||||||||||

| GAAP OPERATING EXPENSES | $ | 1,823 | $ | 1,836 | |||||||||||||

| Growth | 5.6 | % | 6.4 | % | |||||||||||||

Deconversion costs* |

$ | 3 | $ | 3 | |||||||||||||

NON-GAAP ADJUSTED OPERATING EXPENSES** |

$ | 1,820 | $ | 1,833 | |||||||||||||

| Non-GAAP Adjusted Growth | 6.7 | % | 7.4 | % | |||||||||||||

| GAAP OPERATING INCOME | $ | 546 | $ | 555 | |||||||||||||

| Growth | 11.6 | % | 13.3 | % | |||||||||||||

| GAAP OPERATING MARGIN | 23.0 | % | 23.2 | % | |||||||||||||

NON-GAAP ADJUSTED OPERATING INCOME** |

$ | 533 | $ | 542 | |||||||||||||

| Non-GAAP Adjusted Growth | 8.2 | % | 9.9 | % | |||||||||||||

| NON-GAAP ADJUSTED OPERATING MARGIN | 22.7 | % | 22.8 | % | |||||||||||||

GAAP EPS*** |

$ | 5.78 | $ | 5.87 | |||||||||||||

| Growth | 10.6 | % | 12.3 | % | |||||||||||||

Non-GAAP EPS*** |

$ | 5.65 | $ | 5.74 | |||||||||||||

| Growth | 7.3 | % | 9.0 | % | |||||||||||||

|

9 |

|||||||

(Unaudited, in thousands) |

Six Months Ended December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Net income | $ | 217,036 | $ | 193,644 | |||||||

| Depreciation | 22,731 | 23,765 | |||||||||

| Amortization | 79,517 | 75,366 | |||||||||

| Change in deferred income taxes | (8,745) | (16,532) | |||||||||

| Other non-cash expenses | 15,535 | 15,693 | |||||||||

| Change in receivables | 49,811 | 90,702 | |||||||||

| Change in deferred revenue | (119,463) | (130,529) | |||||||||

Change in other assets and liabilities* |

(49,879) | (13,437) | |||||||||

| NET CASH FROM OPERATING ACTIVITIES | $ | 206,543 | $ | 238,672 | |||||||

|

10 |

|||||||

(Unaudited, in thousands) |

Six Months Ended December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Capital expenditures | (29,469) | (24,458) | |||||||||

| Proceeds from dispositions | — | 878 | |||||||||

| Purchased software | (3,528) | (2,971) | |||||||||

| Computer software developed | (85,803) | (83,408) | |||||||||

| Purchase of investments | (2,000) | (1,000) | |||||||||

| Proceeds from investments | 1,000 | — | |||||||||

| NET CASH FROM INVESTING ACTIVITIES | $ | (119,800) | $ | (110,959) | |||||||

(Unaudited, in thousands) |

Six Months Ended December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

Borrowings on credit facilities |

$ | 165,000 | $ | 220,000 | |||||||

| Repayments on credit facilities and financing leases | (165,000) | (240,000) | |||||||||

| Purchase of treasury stock | (17,050) | (20,000) | |||||||||

| Dividends paid | (80,193) | (75,722) | |||||||||

| Net cash from issuance of stock and tax related to stock-based compensation | (2,131) | 2,475 | |||||||||

| NET CASH FROM FINANCING ACTIVITIES | $ | (99,374) | $ | (113,247) | |||||||

|

11 |

|||||||

About Jack Henry & Associates, Inc.® |

Quarterly Conference Call | |||||||||||||

Jack HenryTM (Nasdaq: JKHY) is a well-rounded financial technology company that strengthens connections between financial institutions and the people and businesses they serve. We are an S&P 500 company that prioritizes openness, collaboration, and user centricity — offering banks and credit unions a vibrant ecosystem of internally developed modern capabilities as well as the ability to integrate with leading fintechs. For more than 48 years, Jack Henry has provided technology solutions to enable clients to innovate faster, strategically differentiate, and successfully compete while serving the evolving needs of their accountholders. We empower approximately 7,500 clients with people-inspired innovation, personal service, and insight-driven solutions that help reduce the barriers to financial health. Additional information is available at www.jackhenry.com. |

The Company will hold a conference call on February 5, 2025, at 7:45 a.m. Central Time, and investors are invited to listen at www.jackhenry.com. A webcast replay will be available approximately one hour after the event at ir.jackhenry.com/corporate-events-and-presentations and will remain available for one year. |

|||||||||||||

Statements made in this news release that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because forward-looking statements relate to the future, they are subject to inherent risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, but are not limited to, those discussed in the Company's Securities and Exchange Commission filings, including the Company's most recent reports on Form 10-K and Form 10-Q, particularly under the heading Risk Factors. Any forward-looking statement made in this news release speaks only as of the date of the news release, and the Company expressly disclaims any obligation to publicly update or revise any forward-looking statement, whether because of new information, future events or otherwise. |

MEDIA CONTACT | |||||||||||||

| Mark Folk | ||||||||||||||

| Corporate Communications | ||||||||||||||

| Jack Henry & Associates, Inc. | ||||||||||||||

| 704-890-5323 | ||||||||||||||

| MFolk@jackhenry.com | ||||||||||||||

| ANALYST CONTACT | ||||||||||||||

| Vance Sherard, CFA | ||||||||||||||

| Investor Relations | ||||||||||||||

| Jack Henry & Associates, Inc. | ||||||||||||||

| 417-235-6652 | ||||||||||||||

| VSherard@jackhenry.com | ||||||||||||||

|

12 |

|||||||

| Condensed Consolidated Statements of Income (Unaudited) | |||||||||||||||||||||||||||||||||||

(In thousands, except per share data) |

Three Months Ended December 31, | % Change | Six Months Ended December 31, | % Change | |||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||

| REVENUE | $ | 573,848 | $ | 545,701 | 5.2 | % | $ | 1,174,829 | $ | 1,117,069 | 5.2 | % | |||||||||||||||||||||||

| Cost of Revenue | 332,850 | 320,979 | 3.7 | % | 676,282 | 643,981 | 5.0 | % | |||||||||||||||||||||||||||

| Research and Development | 41,095 | 35,478 | 15.8 | % | 80,780 | 72,370 | 11.6 | % | |||||||||||||||||||||||||||

| Selling, General, and Administrative | 76,901 | 70,277 | 9.4 | % | 143,489 | 149,051 | (3.7) | % | |||||||||||||||||||||||||||

| EXPENSES | 450,846 | 426,734 | 5.7 | % | 900,551 | 865,402 | 4.1 | % | |||||||||||||||||||||||||||

| OPERATING INCOME | 123,002 | 118,967 | 3.4 | % | 274,278 | 251,667 | 9.0 | % | |||||||||||||||||||||||||||

| Interest income | 7,159 | 5,121 | 39.8 | % | 15,506 | 9,866 | 57.2 | % | |||||||||||||||||||||||||||

| Interest expense | (2,780) | (3,865) | (28.1) | % | (5,605) | (8,062) | (30.5) | % | |||||||||||||||||||||||||||

| Interest Income (Expense), net | 4,379 | 1,256 | 248.6 | % | 9,901 | 1,804 | 448.8 | % | |||||||||||||||||||||||||||

| INCOME BEFORE INCOME TAXES | 127,381 | 120,223 | 6.0 | % | 284,179 | 253,471 | 12.1 | % | |||||||||||||||||||||||||||

| Provision for Income Taxes | 29,536 | 28,258 | 4.5 | % | 67,143 | 59,827 | 12.2 | % | |||||||||||||||||||||||||||

| NET INCOME | $ | 97,845 | $ | 91,965 | 6.4 | % | $ | 217,036 | $ | 193,644 | 12.1 | % | |||||||||||||||||||||||

| Diluted net income per share | $ | 1.34 | $ | 1.26 | $ | 2.97 | $ | 2.65 | |||||||||||||||||||||||||||

| Diluted weighted average shares outstanding | 73,082 | 72,984 | 73,080 | 72,999 | |||||||||||||||||||||||||||||||

| Consolidated Balance Sheet Highlights (Unaudited) | |||||||||||||||||||||||||||||||||||

(In thousands) |

December 31, | % Change | |||||||||||||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 25,653 | $ | 26,709 | (4.0) | % | |||||||||||||||||||||||||||||

| Receivables | 283,223 | 270,551 | 4.7 | % | |||||||||||||||||||||||||||||||

| Total assets | 2,911,770 | 2,753,976 | 5.7 | % | |||||||||||||||||||||||||||||||

| Accounts payable and accrued expenses | $ | 209,926 | $ | 207,230 | 1.3 | % | |||||||||||||||||||||||||||||

| Current and long-term debt | 150,000 | 255,000 | (41.2) | % | |||||||||||||||||||||||||||||||

| Deferred revenue | 269,469 | 269,200 | 0.1 | % | |||||||||||||||||||||||||||||||

| Stockholders' equity | 1,975,565 | 1,724,387 | 14.6 | % | |||||||||||||||||||||||||||||||

|

13 |

|||||||

| Calculation of Non-GAAP Earnings Before Income Taxes, Depreciation and Amortization (Non-GAAP EBITDA) | |||||||||||||||||||||||||||||||||||

| Three Months Ended December 31, | % Change | Six Months Ended December 31, | % Change | ||||||||||||||||||||||||||||||||

(In thousands) |

2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||||||||||

| Net income | $ | 97,845 | $ | 91,965 | $ | 217,036 | $ | 193,644 | |||||||||||||||||||||||||||

| Net interest | (4,379) | (1,256) | (9,901) | (1,804) | |||||||||||||||||||||||||||||||

| Taxes | 29,536 | 28,258 | 67,143 | 59,827 | |||||||||||||||||||||||||||||||

| Depreciation and amortization | 51,754 | 49,896 | 102,248 | 99,131 | |||||||||||||||||||||||||||||||

| Less: Net income before interest expense, taxes, depreciation and amortization attributable to eliminated one-time adjustments* | 622 | (3,802) | (2,873) | 8,886 | |||||||||||||||||||||||||||||||

| NON-GAAP EBITDA | $ | 175,378 | $ | 165,061 | 6.3 | % | $ | 373,653 | $ | 359,684 | 3.9 | % | |||||||||||||||||||||||

*The fiscal second quarter 2025 and 2024 adjustments for net income before interest expense, taxes, depreciation and amortization were for deconversions. The fiscal year-to-date 2025 and 2024 adjustments were for deconversions in 2025 and deconversions and the VEDIP program expense in 2024 and were $(7,557) and $16,443, respectively. The VEDIP program expense for the fiscal six months ended December 31, 2023, was related to a Company voluntary separation program offered to certain eligible employees beginning in July 2023. | |||||||||||||||||||||||||||||||||||

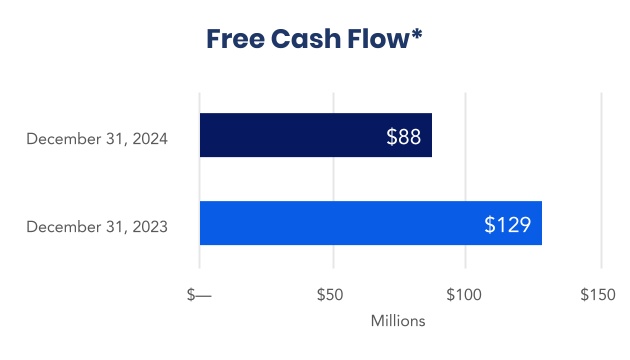

| Calculation of Free Cash Flow (Non-GAAP) | Six Months Ended December 31, | ||||||||||||||||||||||||||||||||||

(In thousands) |

2024 | 2023 | |||||||||||||||||||||||||||||||||

| Net cash from operating activities | $ | 206,543 | $ | 238,672 | |||||||||||||||||||||||||||||||

| Capitalized expenditures | (29,469) | (24,458) | |||||||||||||||||||||||||||||||||

| Internal use software | (3,528) | (2,971) | |||||||||||||||||||||||||||||||||

| Proceeds from sale of assets | — | 878 | |||||||||||||||||||||||||||||||||

| Capitalized software | (85,803) | (83,408) | |||||||||||||||||||||||||||||||||

| FREE CASH FLOW | $ | 87,743 | $ | 128,713 | |||||||||||||||||||||||||||||||

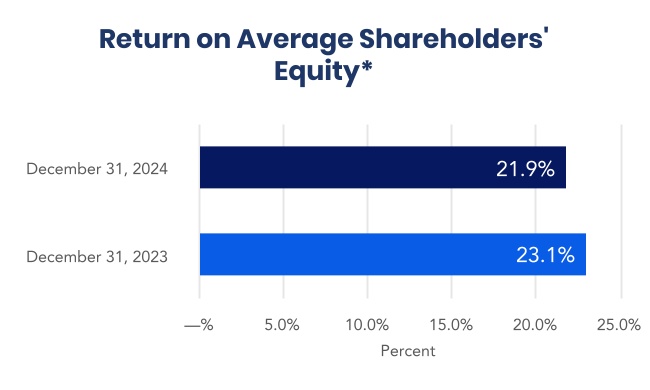

| Calculation of the Return on Average Shareholders’ Equity | December 31, | ||||||||||||||||||||||||||||||||||

(In thousands) |

2024 | 2023 | |||||||||||||||||||||||||||||||||

| Net income (trailing four quarters) | $ | 405,208 | $ | 372,966 | |||||||||||||||||||||||||||||||

| Average stockholder's equity (period beginning and ending balances) | 1,849,976 | 1,617,689 | |||||||||||||||||||||||||||||||||

| RETURN ON AVERAGE SHAREHOLDERS’ EQUITY | 21.9% | 23.1% | |||||||||||||||||||||||||||||||||

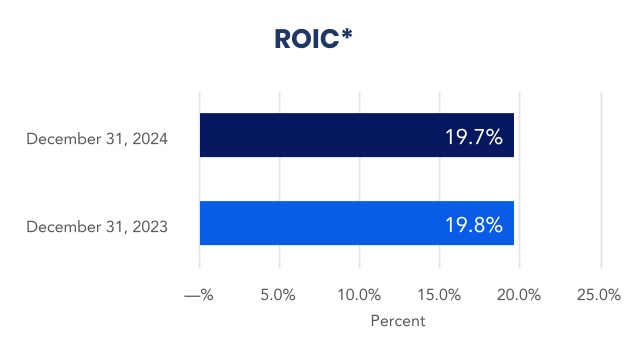

| Calculation of Return on Invested Capital (ROIC) (Non-GAAP) | December 31, | ||||||||||||||||||||||||||||||||||

(In thousands) |

2024 | 2023 | |||||||||||||||||||||||||||||||||

| Net income (trailing four quarters) | $ | 405,208 | $ | 372,966 | |||||||||||||||||||||||||||||||

| Average stockholder's equity (period beginning and ending balances) | 1,849,976 | 1,617,689 | |||||||||||||||||||||||||||||||||

| Average current maturities of long-term debt and financing leases (period beginning and ending balances) | 45,000 | 11 | |||||||||||||||||||||||||||||||||

| Average long-term debt (period beginning and ending balances) | 157,500 | 265,000 | |||||||||||||||||||||||||||||||||

| Average invested capital | $ | 2,052,476 | $ | 1,882,700 | |||||||||||||||||||||||||||||||

| ROIC | 19.7% | 19.8% | |||||||||||||||||||||||||||||||||

|

14 |

|||||||

| GAAP to Non-GAAP EPS Reconciliation Table | |||||

| FY25 Guidance | |||||

| GAAP EPS | $5.78-$5.87 | ||||

| Excluded Activity, net of Tax: | |||||

Deconversion* |

$0.13 | ||||

| Non-GAAP EPS | $5.65-$5.74 | ||||

|

15 |

|||||||