Exhibit 99.1 Jeff Tengel Chief Executive Officer Mark Ruggiero Chief Financial Officer & EVP/Consumer Lending November 2025

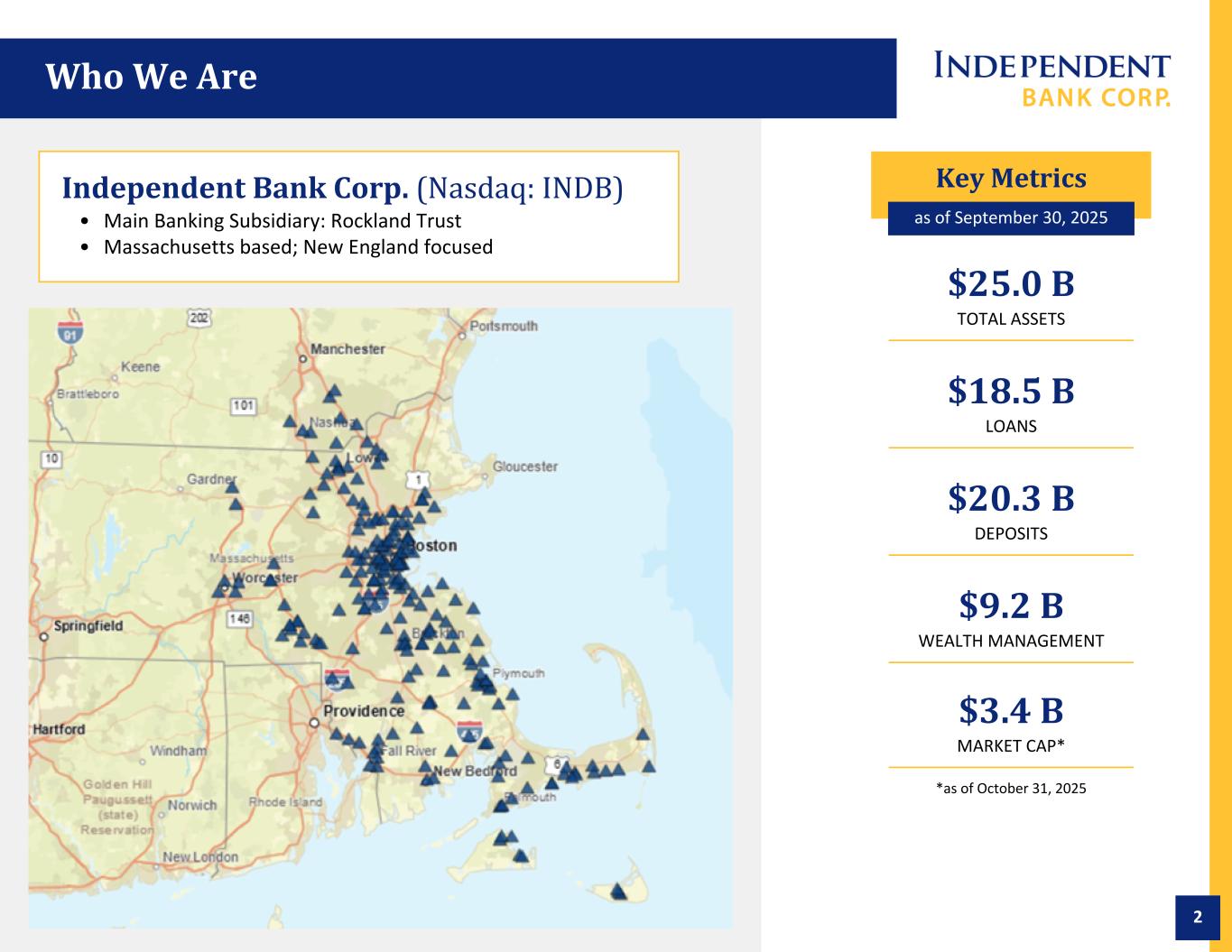

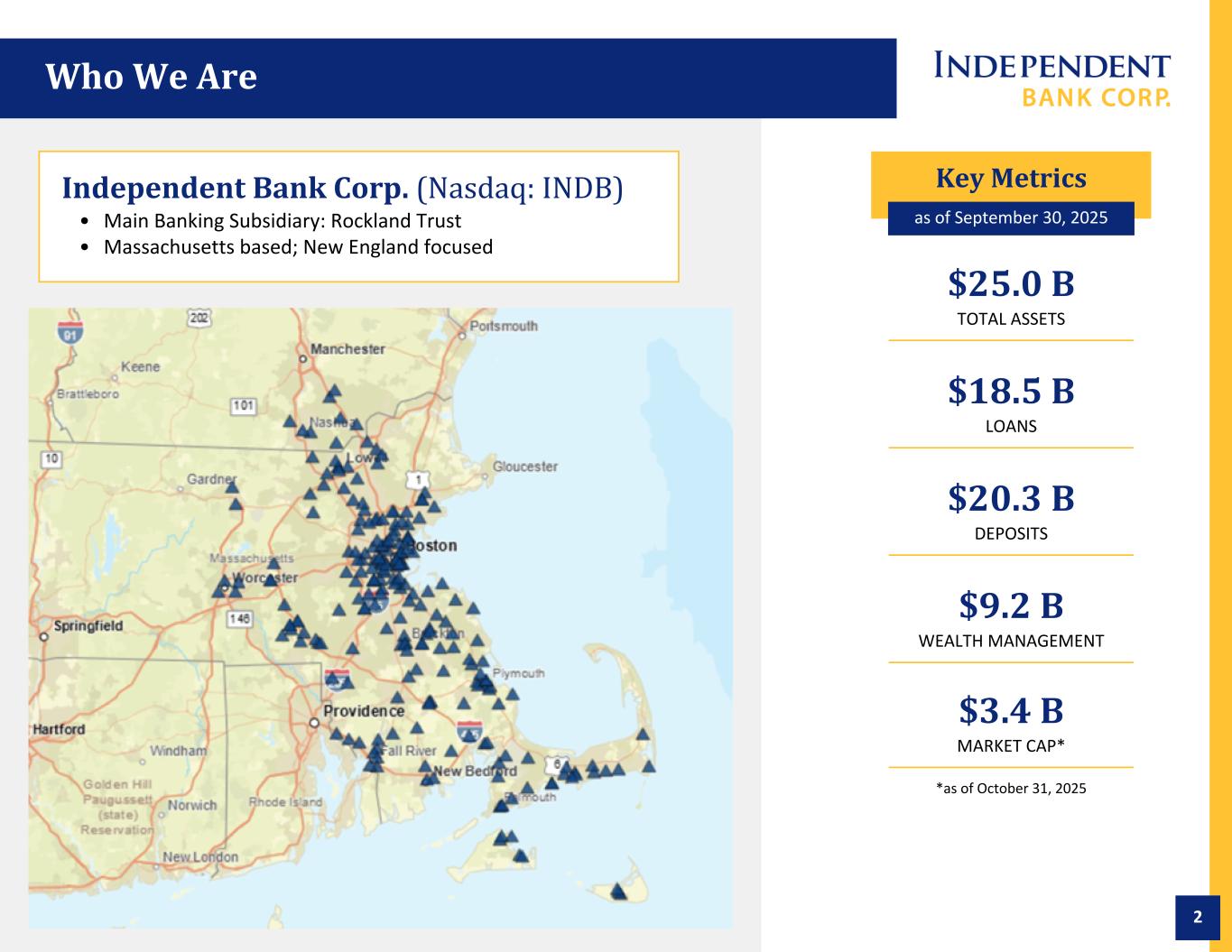

2 Who We Are Independent Bank Corp. (Nasdaq: INDB) • Main Banking Subsidiary: Rockland Trust • Massachusetts based; New England focused Key Metrics as of September 30, 2025 $25.0 B TOTAL ASSETS $18.5 B LOANS $20.3 B DEPOSITS $9.2 B WEALTH MANAGEMENT $3.4 B MARKET CAP* *as of October 31, 2025

3 Our Corporate Promises: We remain committed to our colleagues, customers, community and shareholders. This connects our purpose to everything we do. It transforms what banking means from a mere transaction to the chance to make a positive difference in the lives of others. This motivates our colleagues to do the best we can for every customer and cultivate sustainable value creation over the long-term. CULTURE | BRAND | VALUES Where Each Relationship Matters® Customers Colleagues ShareholdersCommunity Being the Bank Where Each Relationship Matters® is foundational to our vision We Are the Bank Where Each Relationship Matters®

4 Safe & Sound Customer Centric • Full suite of retail banking, commercial banking, and wealth product offerings • Relationship-oriented commercial lending with strong local market knowledge and presence • Exceptional third party customer service recognition in both commercial and retail • Strong brand awareness and reputation Attractive Market • Top performing MA-based bank with scale and density • Supported by strong economic growth and vitality in key markets served • Depth of market offers opportunities for continued growth • The Enterprise acquisition added density to existing markets and expands the Rockland franchise into Northern MA and Southern NH Strong, Resilient Franchise; Well Positioned for Growth High Performing • Consistent, strong profitability • Focused on maintaining good margins • Fee income contribution from scalable wealth franchise • Efficient cost structure focused on operating leverage • History of organic capital generation • Strong balance sheet • Prudent interest rate and liquidity risk management • Significant capital buffer • Diversified, low-cost deposit base • Experienced commercial lender with conservative credit culture • Proven operator and acquiror Company Overview

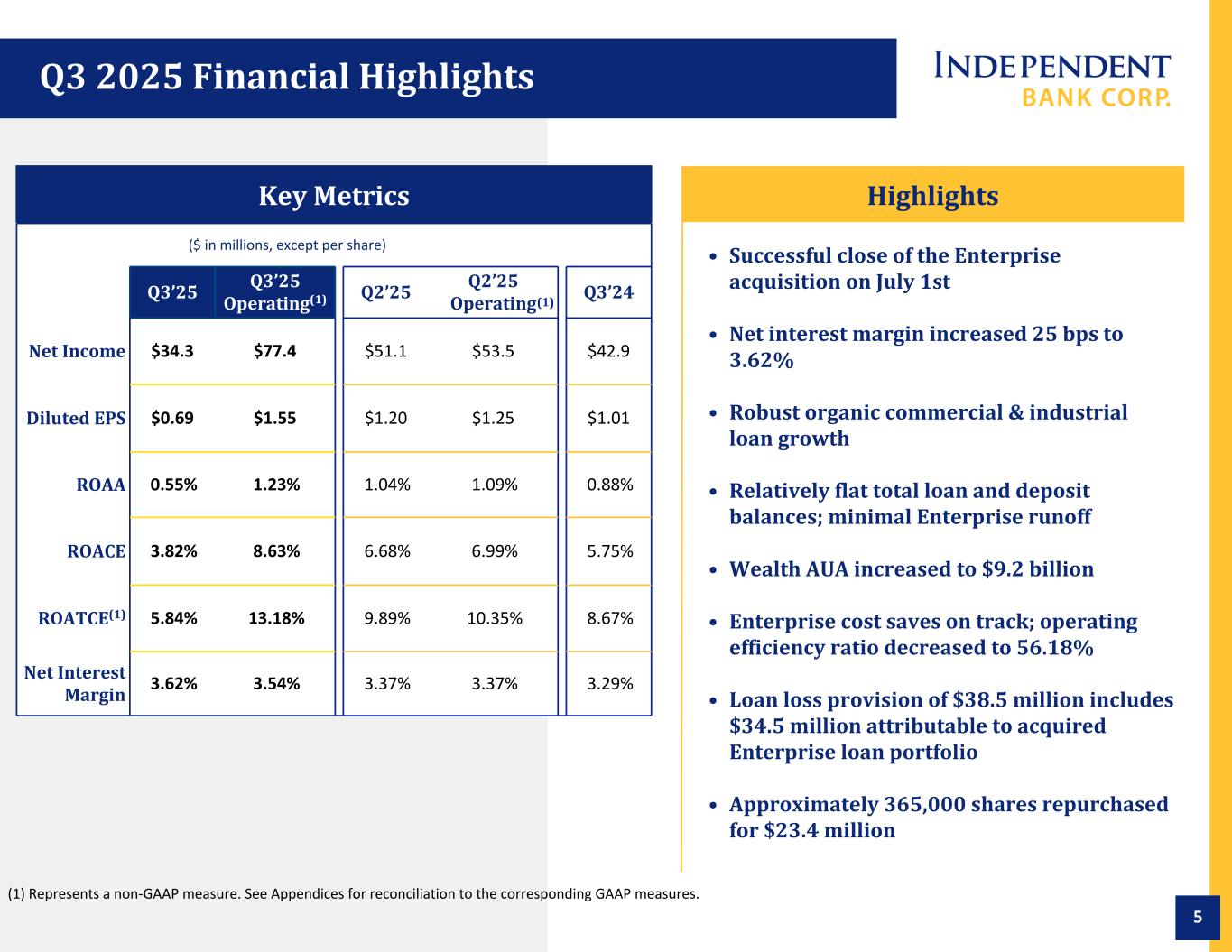

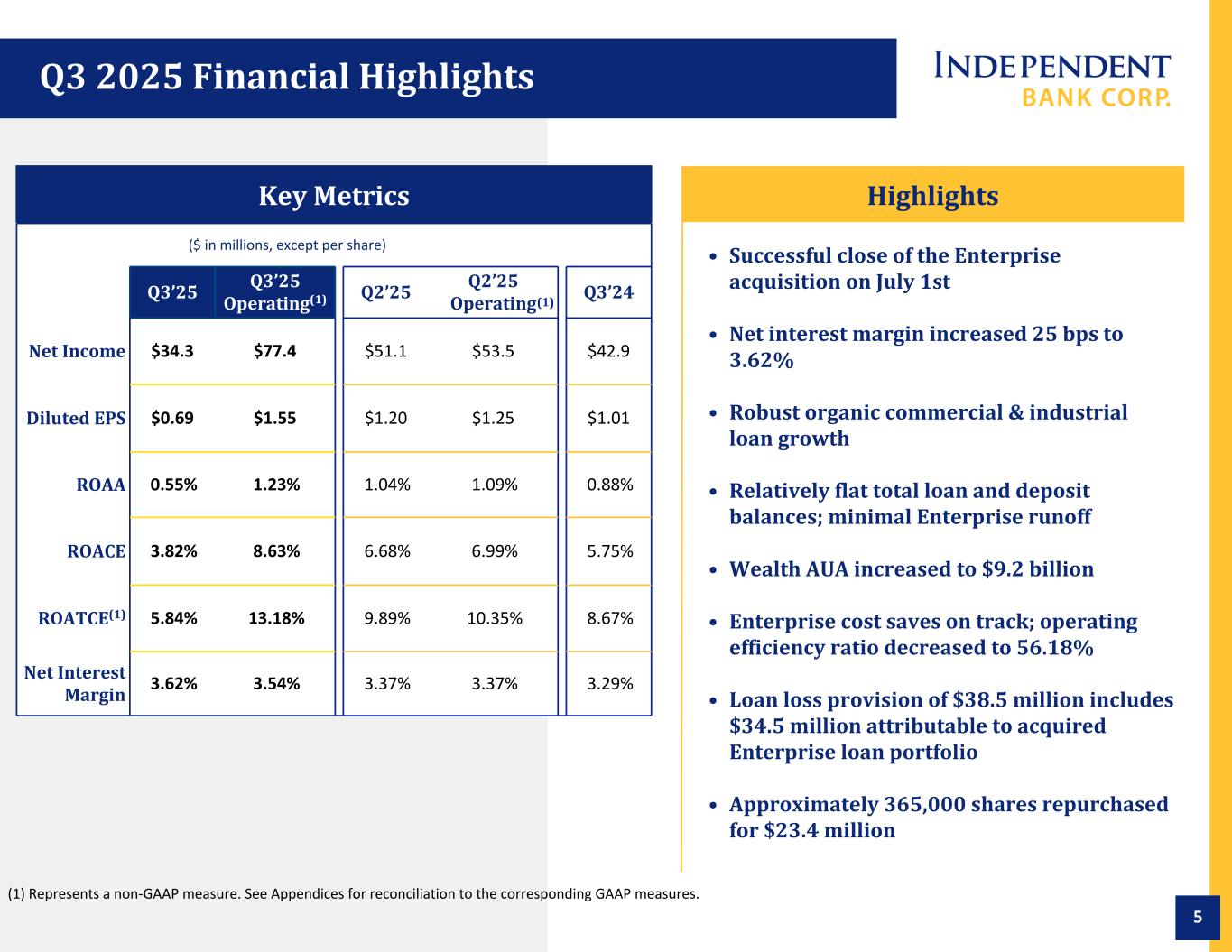

5 ($ in millions, except per share) Q3’25 Q3’25 Operating(1) Q2’25 Q2’25 Operating Q3’24 Net Income $34.3 $77.4 $51.1 $53.5 $42.9 Diluted EPS $0.69 $1.55 $1.20 $1.25 $1.01 ROAA 0.55% 1.23% 1.04% 1.09% 0.88% ROACE 3.82% 8.63% 6.68% 6.99% 5.75% ROATCE(1) 5.84% 13.18% 9.89% 10.35% 8.67% Net Interest Margin 3.62% 3.54% 3.37% 3.37% 3.29% Q3 2025 Financial Highlights Key Metrics Highlights • Successful close of the Enterprise acquisition on July 1st • Net interest margin increased 25 bps to 3.62% • Robust organic commercial & industrial loan growth • Relatively flat total loan and deposit balances; minimal Enterprise runoff • Wealth AUA increased to $9.2 billion • Enterprise cost saves on track; operating efficiency ratio decreased to 56.18% • Loan loss provision of $38.5 million includes $34.5 million attributable to acquired Enterprise loan portfolio • Approximately 365,000 shares repurchased for $23.4 million (1) (1) Represents a non-GAAP measure. See Appendices for reconciliation to the corresponding GAAP measures.

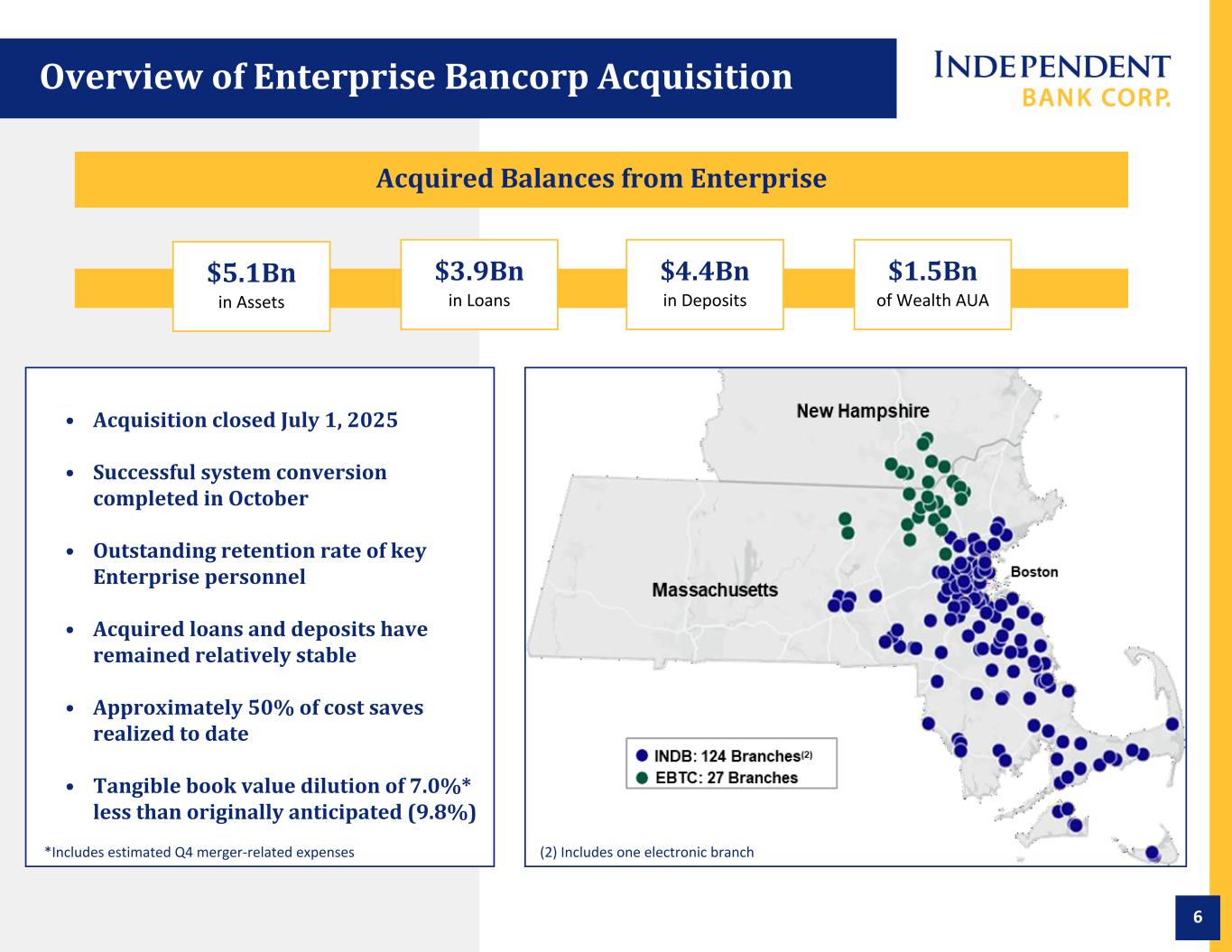

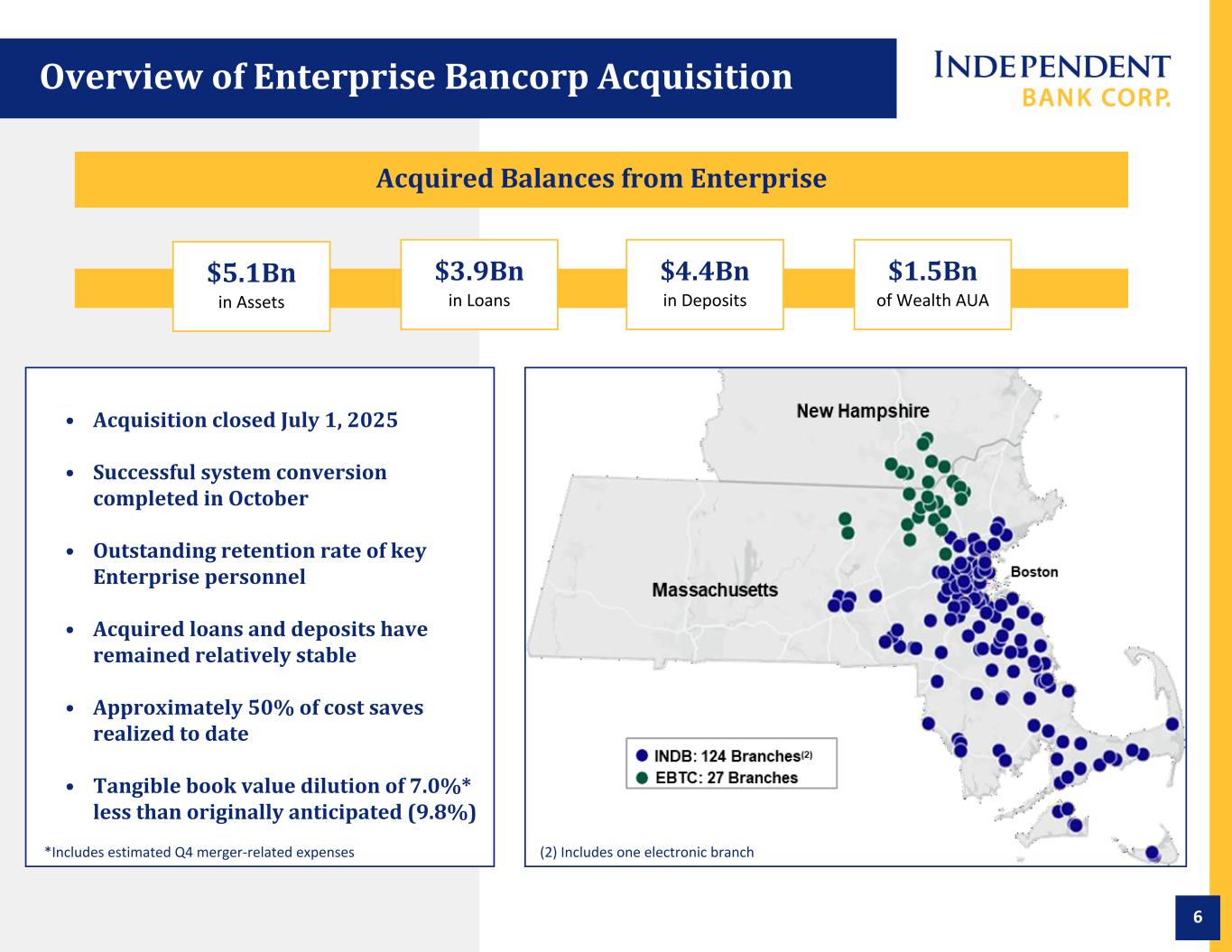

6 Overview of Enterprise Bancorp Acquisition Pro Forma Combined Company(2) • Acquisition closed July 1, 2025 • Successful system conversion completed in October • Outstanding retention rate of key Enterprise personnel • Acquired loans and deposits have remained relatively stable • Approximately 50% of cost saves realized to date • Tangible book value dilution of 7.0%* less than originally anticipated (9.8%) *Includes estimated Q4 merger-related expenses Acquired Balances from Enterprise $5.1Bn in Assets $3.9Bn in Loans $4.4Bn in Deposits $1.5Bn of Wealth AUA (2) Includes one electronic branch

7 Expanding Company Footprint Source: S&P Capital IQ Pro Note: Deposit/Market Share data above is as of June 30th of each respective year. 2025 data is inclusive of Enterprise acquisition. (1) Includes one electronic branch 2025 2024 Counties Branches Deposits ($bn) Market Share (%) Rank Branches Deposits ($bn) Market Share (%) Rank Plymouth, MA 28(1) 5.2 26.9 1 28(1) 4.7 25.2 1 Middlesex, MA 28 3.7 4.4 8 15 1.3 1.6 17 Norfolk, MA 19 2.5 6.8 5 19 2.4 6.7 5 Suffolk, MA 21 2.2 1.6 7 21 2.2 1.6 6 Essex, MA 10 1.4 4.4 8 6 0.8 2.6 10 Bristol, MA 8 1.6 9.5 5 8 1.4 9.0 5 Barnstable, MA 12 1.4 12.2 3 12 1.4 12.2 3 Worcester, MA 10 0.9 4.0 10 8 0.6 2.6 11 Rockingham, NH 4 0.6 4.8 6 — — — — Nantucket, MA 3 0.4 31.1 2 3 0.4 35.1 1 Hillsborough, NH 4 0.4 2.8 7 — — — — Dukes, MA 4 0.2 17.2 2 4 0.2 15.8 2 Total 151 $20.5 124 $15.4 Strategic Market Share Positioning Creating Top 10 Deposit Market Share in all Counties of Operation

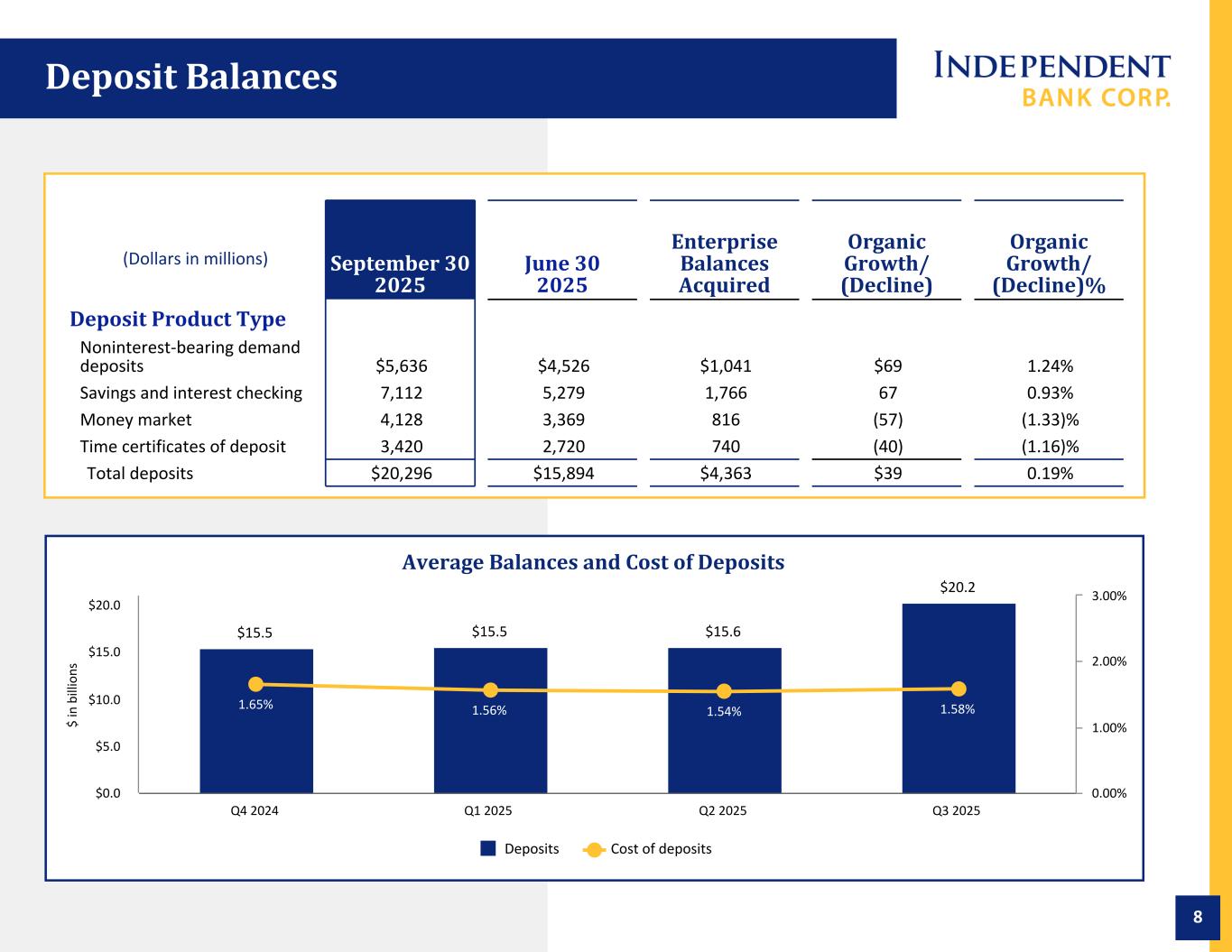

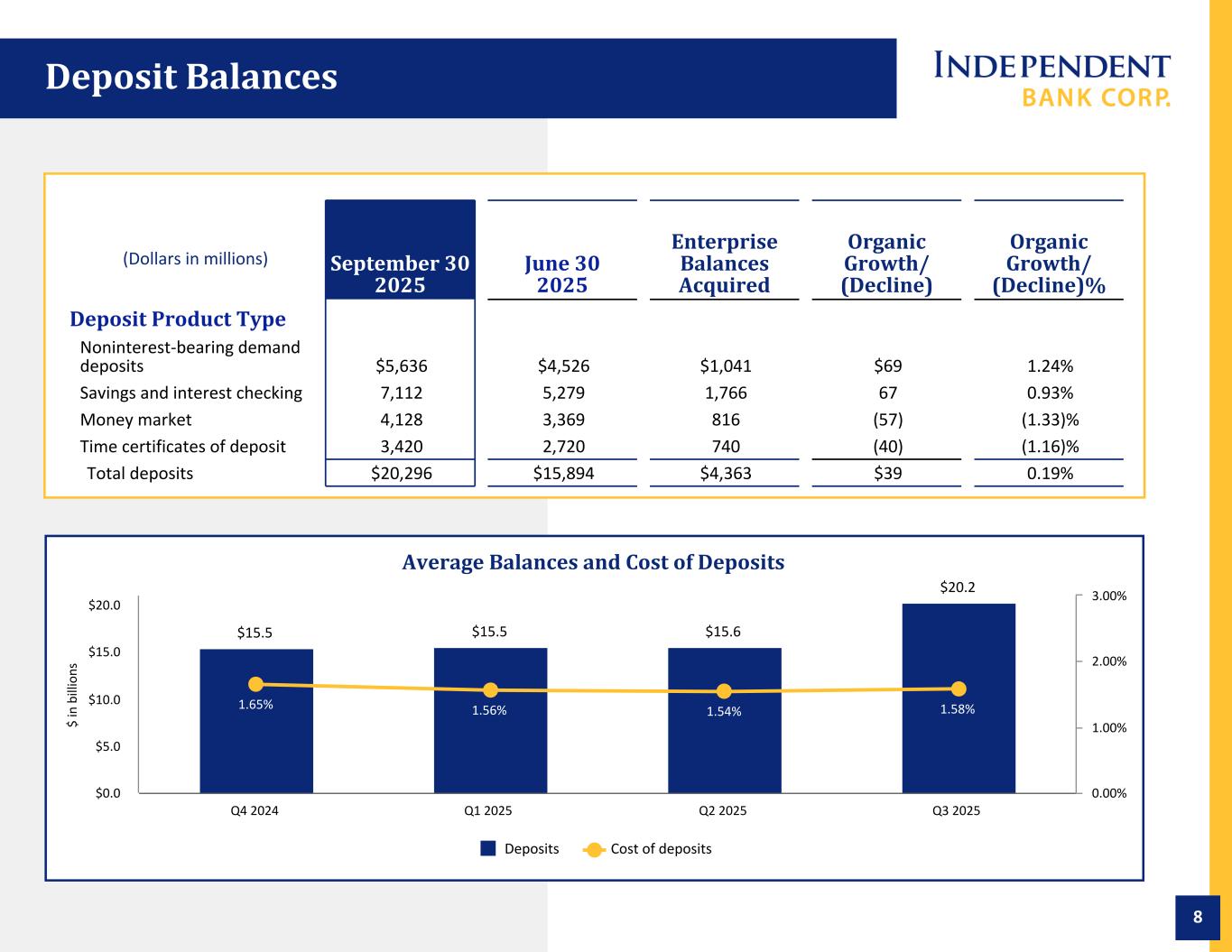

8 Deposit Balances (Dollars in millions) September 30 2025 June 30 2025 Enterprise Balances Acquired Organic Growth/ (Decline) Organic Growth/ (Decline)% Deposit Product Type Noninterest-bearing demand deposits $5,636 $4,526 $1,041 $69 1.24% Savings and interest checking 7,112 5,279 1,766 67 0.93% Money market 4,128 3,369 816 (57) (1.33)% Time certificates of deposit 3,420 2,720 740 (40) (1.16)% Total deposits $20,296 $15,894 $4,363 $39 0.19% $ in b ill io ns Average Balances and Cost of Deposits $15.5 $15.5 $15.6 $20.2 1.65% 1.56% 1.54% 1.58% Deposits Cost of deposits Q4 2024 Q1 2025 Q2 2025 Q3 2025 $0.0 $5.0 $10.0 $15.0 $20.0 0.00% 1.00% 2.00% 3.00%

9 Loan Balances (Dollars in millions) September 30 2025 June 30 2025 Enterprise Balances Acquired Organic Growth/ (Decline) Organic Growth/ (Decline)% Loan Category Commercial and industrial $4,532 3,427 979 $126 2.87% Commercial real estate 8,241 6,615 1,742 (115) (1.38)% Commercial construction 1,440 799 664 (23) (1.59)% Total commercial 14,213 10,841 3,385 (12) (0.09)% Residential real estate 2,917 2,489 426 2 0.08% Home equity 1,284 1,168 95 21 1.66% Total consumer real estate 4,201 3,657 521 23 0.55% Total other consumer 38 36 7 (5) (12.59)% Total loans $18,452 $14,534 $3,913 $6 0.03%

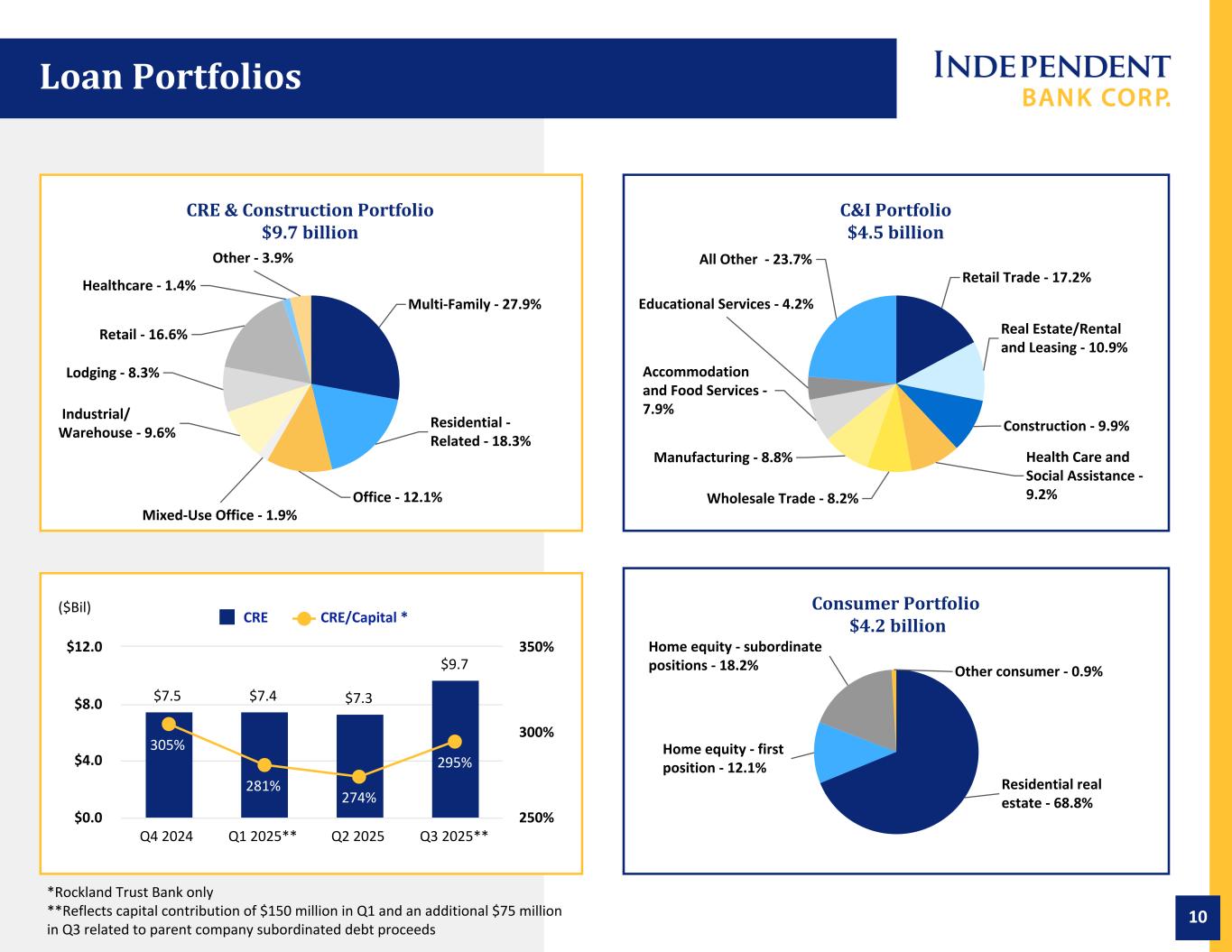

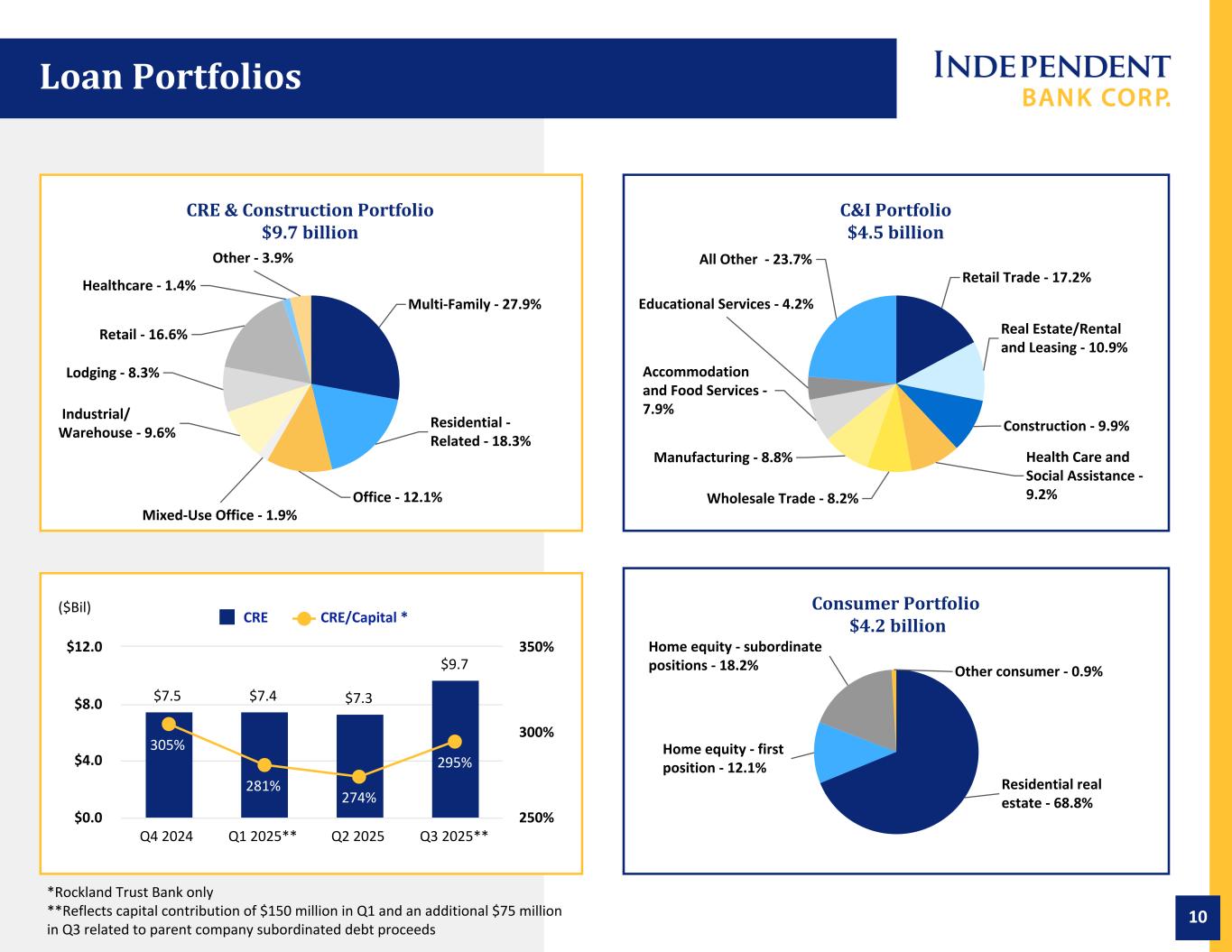

10 95% CRE & Construction Portfolio $9.7 billion Multi-Family - 27.9% Residential - Related - 18.3% Office - 12.1% Mixed-Use Office - 1.9% Industrial/ Warehouse - 9.6% Lodging - 8.3% Retail - 16.6% Healthcare - 1.4% Other - 3.9% C&I Portfolio $4.5 billion Retail Trade - 17.2% Real Estate/Rental and Leasing - 10.9% Construction - 9.9% Health Care and Social Assistance - 9.2%Wholesale Trade - 8.2% Manufacturing - 8.8% Accommodation and Food Services - 7.9% Educational Services - 4.2% All Other - 23.7% Consumer Portfolio $4.2 billion Residential real estate - 68.8% Home equity - first position - 12.1% Home equity - subordinate positions - 18.2% Other consumer - 0.9% $7.5 $7.4 $7.3 $9.7 305% 281% 274% 295% CRE CRE/Capital * Q4 2024 Q1 2025** Q2 2025 Q3 2025** $0.0 $4.0 $8.0 $12.0 250% 300% 350% ($Bil) *Rockland Trust Bank only **Reflects capital contribution of $150 million in Q1 and an additional $75 million in Q3 related to parent company subordinated debt proceeds Loan Portfolios

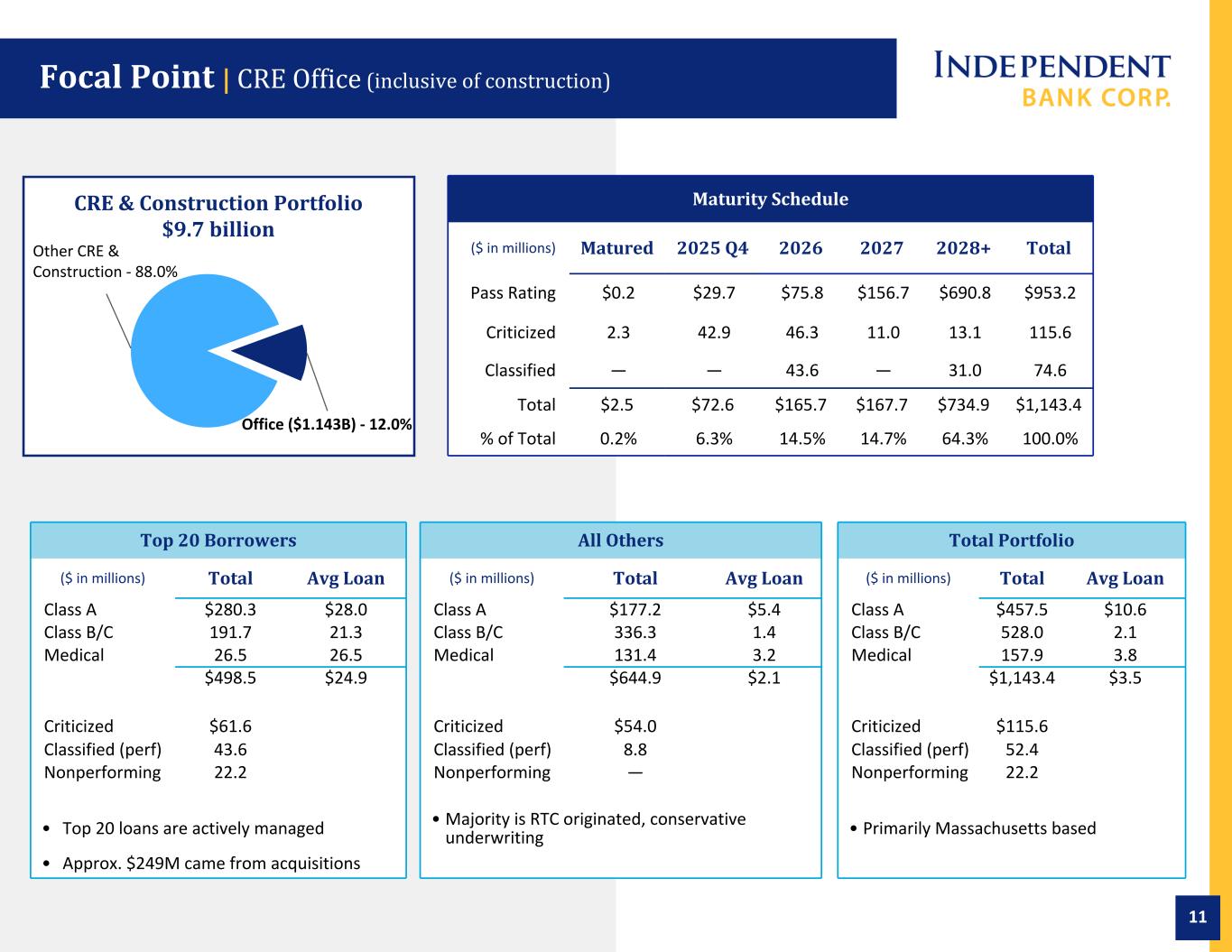

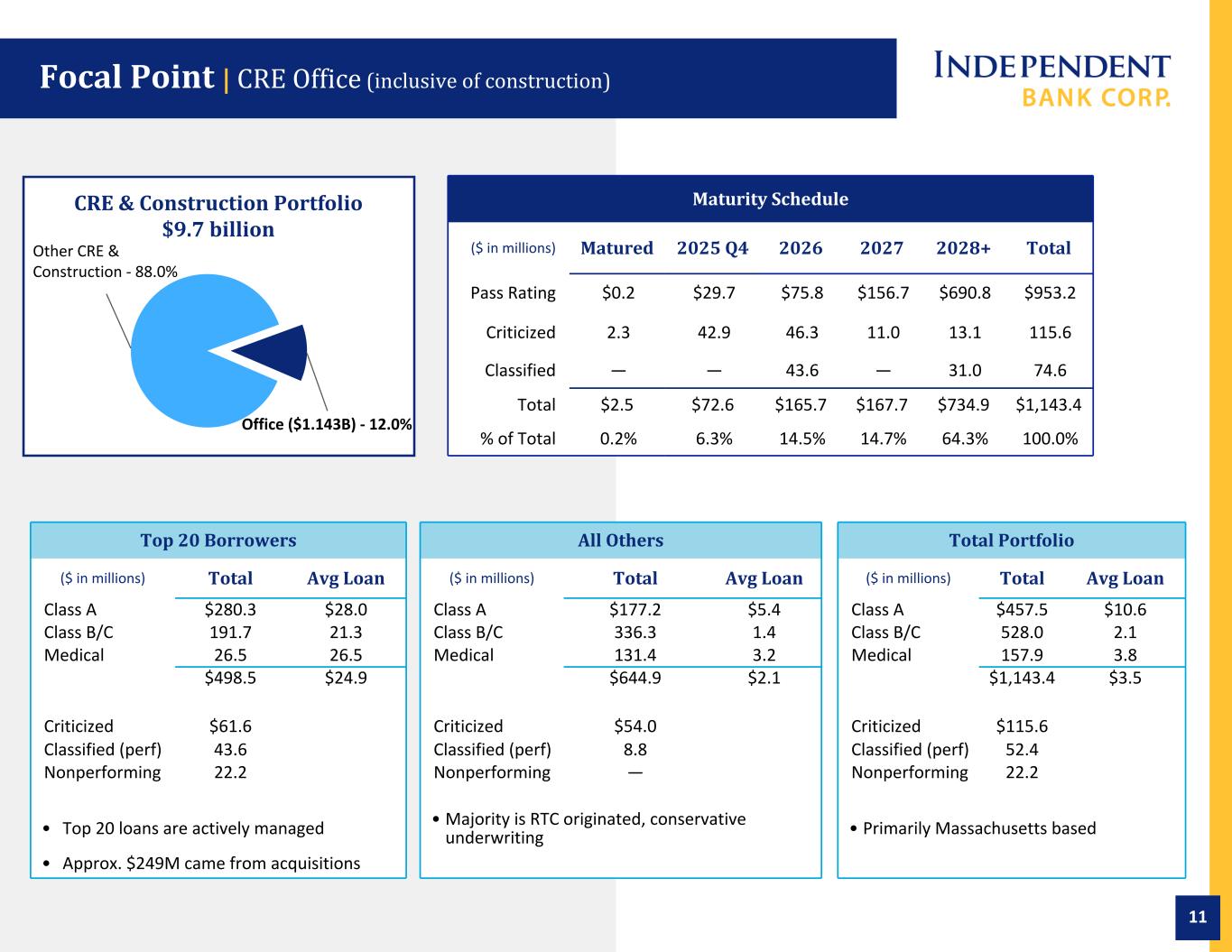

11 Top 20 Borrowers All Others Total Portfolio ($ in millions) Total Avg Loan ($ in millions) Total Avg Loan ($ in millions) Total Avg Loan Class A $280.3 $28.0 Class A $177.2 $5.4 Class A $457.5 $10.6 Class B/C 191.7 21.3 Class B/C 336.3 1.4 Class B/C 528.0 2.1 Medical 26.5 26.5 Medical 131.4 3.2 Medical 157.9 3.8 $498.5 $24.9 $644.9 $2.1 $1,143.4 $3.5 Criticized $61.6 Criticized $54.0 Criticized $115.6 Classified (perf) 43.6 Classified (perf) 8.8 Classified (perf) 52.4 Nonperforming 22.2 Nonperforming — Nonperforming 22.2 • Top 20 loans are actively managed • Majority is RTC originated, conservative underwriting • Primarily Massachusetts based • Approx. $249M came from acquisitions Maturity Schedule ($ in millions) Matured 2025 Q4 2026 2027 2028+ Total Pass Rating $0.2 $29.7 $75.8 $156.7 $690.8 $953.2 Criticized 2.3 42.9 46.3 11.0 13.1 115.6 Classified — — 43.6 — 31.0 74.6 Total $2.5 $72.6 $165.7 $167.7 $734.9 $1,143.4 % of Total 0.2% 6.3% 14.5% 14.7% 64.3% 100.0% CRE & Construction Portfolio $9.7 billion Office ($1.143B) - 12.0% Other CRE & Construction - 88.0% Focal Point | CRE Office (inclusive of construction)

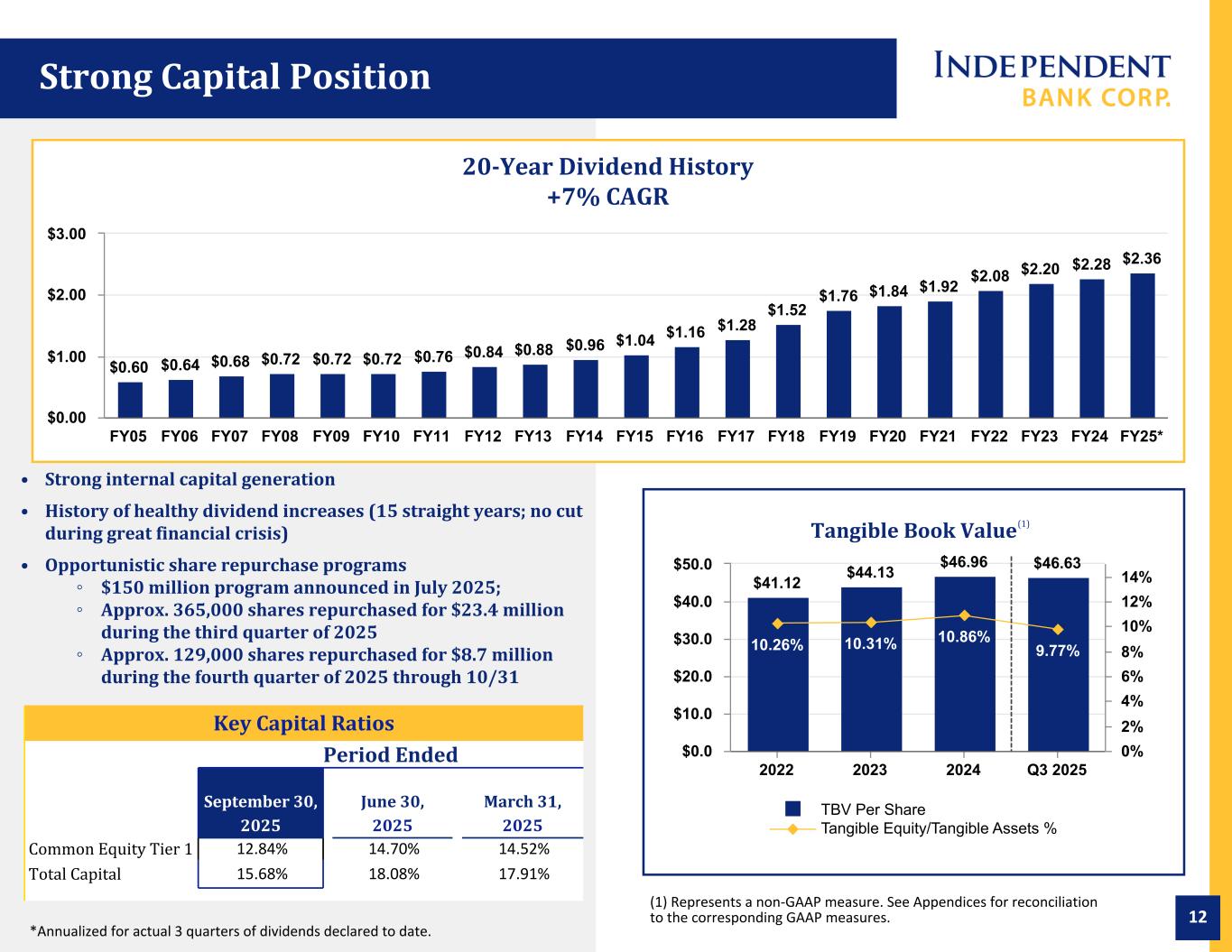

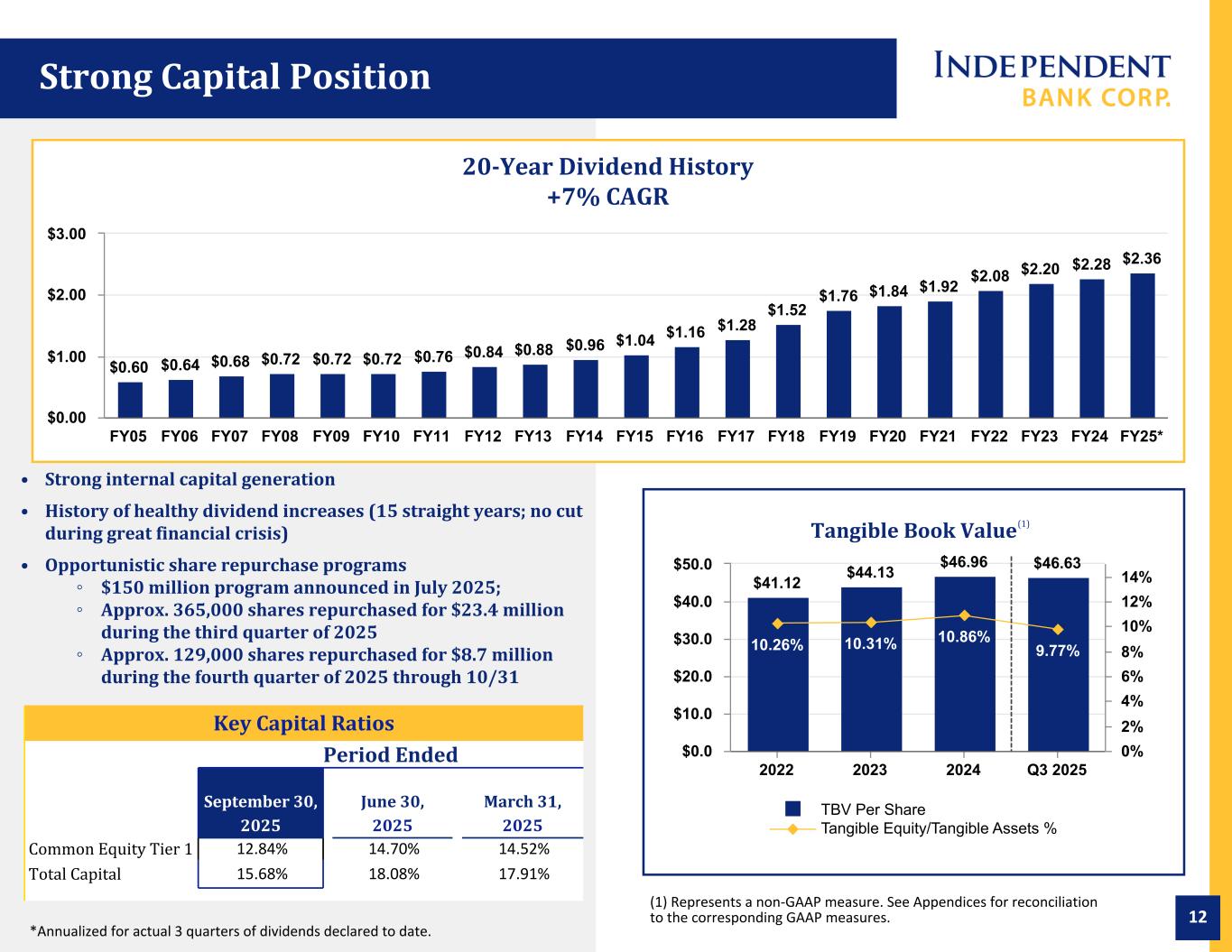

12 Tangible Book Value $41.12 $44.13 $46.96 $46.63 10.26% 10.31% 10.86% 9.77% TBV Per Share Tangible Equity/Tangible Assets % 2022 2023 2024 Q3 2025 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 0% 2% 4% 6% 8% 10% 12% 14% • Strong internal capital generation • History of healthy dividend increases (15 straight years; no cut during great financial crisis) • Opportunistic share repurchase programs ◦ $150 million program announced in July 2025; ◦ Approx. 365,000 shares repurchased for $23.4 million during the third quarter of 2025 ◦ Approx. 129,000 shares repurchased for $8.7 million during the fourth quarter of 2025 through 10/31 Key Capital Ratios Period Ended September 30, June 30, March 31, 2025 2025 2025 Common Equity Tier 1 12.84% 14.70% 14.52% Total Capital 15.68% 18.08% 17.91% Strong Capital Position 20-Year Dividend History +7% CAGR $0.60 $0.64 $0.68 $0.72 $0.72 $0.72 $0.76 $0.84 $0.88 $0.96 $1.04 $1.16 $1.28 $1.52 $1.76 $1.84 $1.92 $2.08 $2.20 $2.28 $2.36 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25* $0.00 $1.00 $2.00 $3.00 (1) (1) Represents a non-GAAP measure. See Appendices for reconciliation to the corresponding GAAP measures. *Annualized for actual 3 quarters of dividends declared to date.

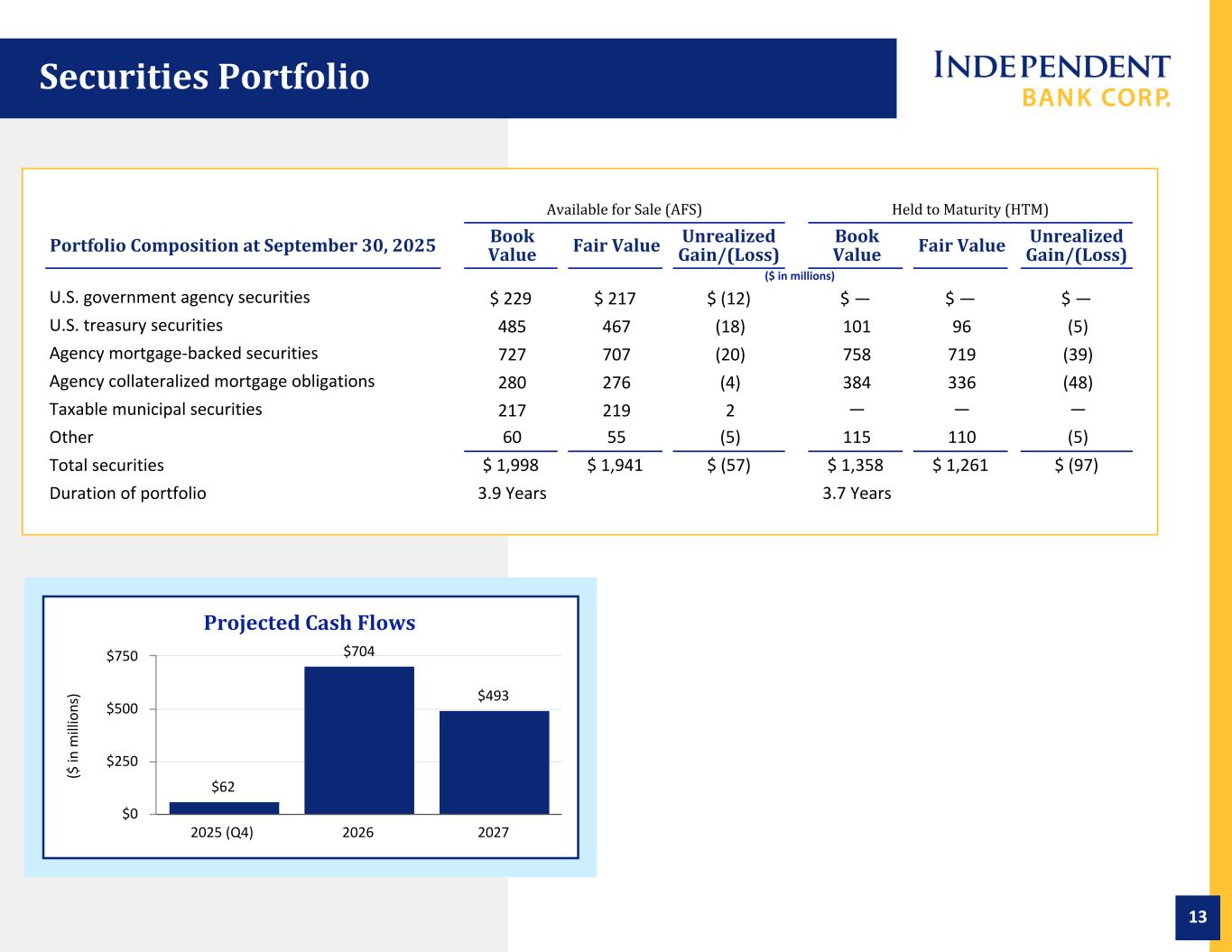

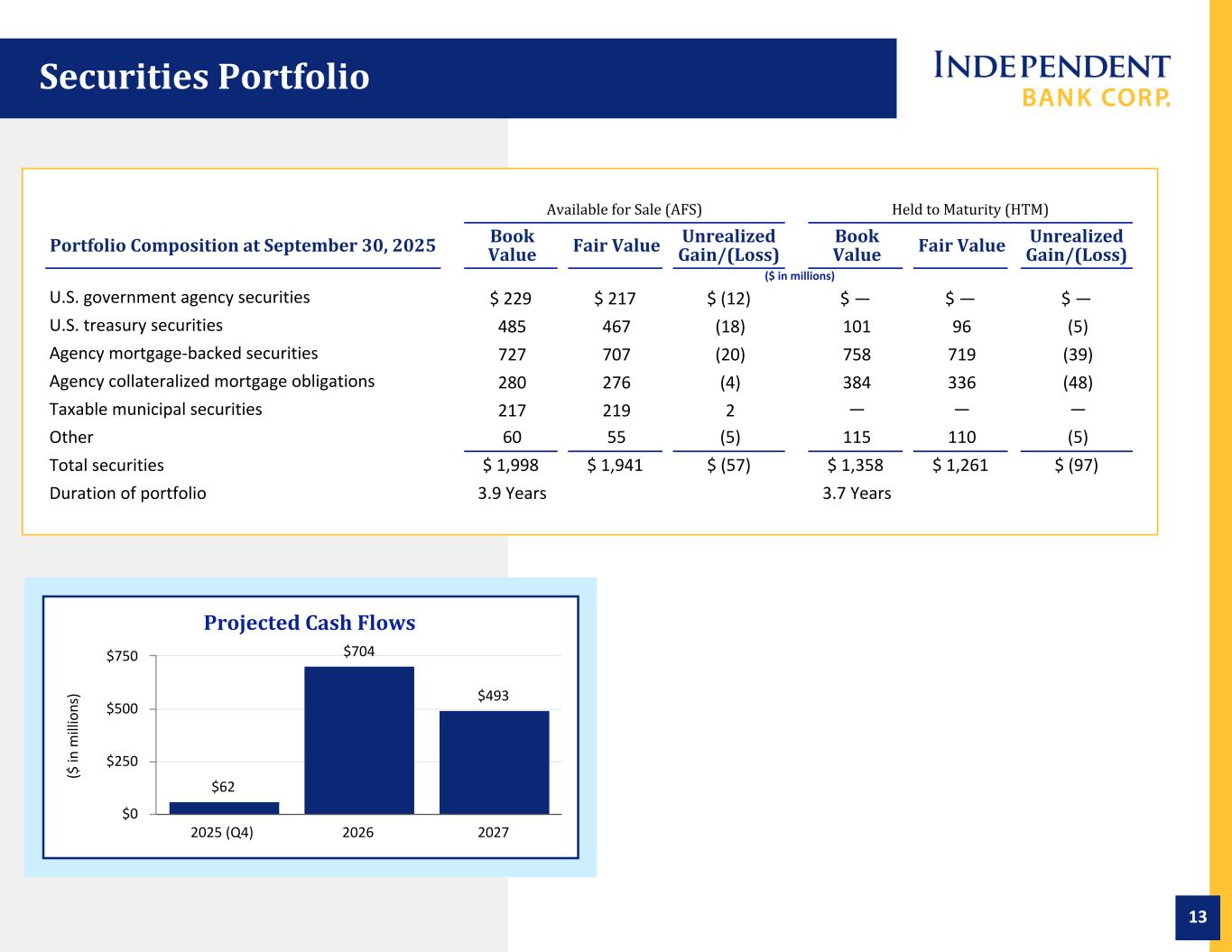

13 Available for Sale (AFS) Held to Maturity (HTM) Portfolio Composition at September 30, 2025 Book Value Fair Value Unrealized Gain/(Loss) Book Value Fair Value Unrealized Gain/(Loss) ($ in millions) U.S. government agency securities $ 229 $ 217 $ (12) $ — $ — $ — U.S. treasury securities 485 467 (18) 101 96 (5) Agency mortgage-backed securities 727 707 (20) 758 719 (39) Agency collateralized mortgage obligations 280 276 (4) 384 336 (48) Taxable municipal securities 217 219 2 — — — Other 60 55 (5) 115 110 (5) Total securities $ 1,998 $ 1,941 $ (57) $ 1,358 $ 1,261 $ (97) Duration of portfolio 3.9 Years 3.7 Years ($ in m ill io ns ) Projected Cash Flows $62 $704 $493 2025 (Q4) 2026 2027 $0 $250 $500 $750 Securities Portfolio

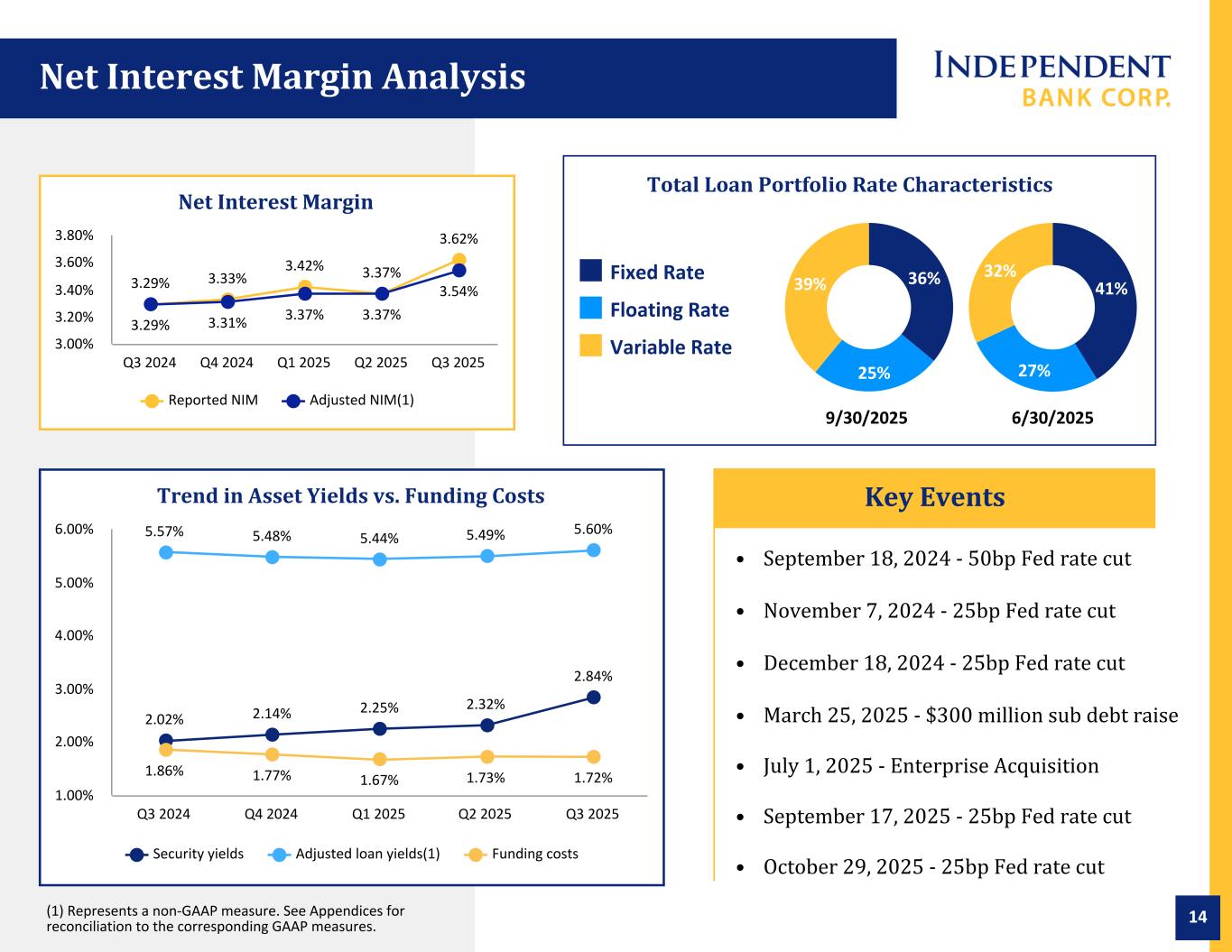

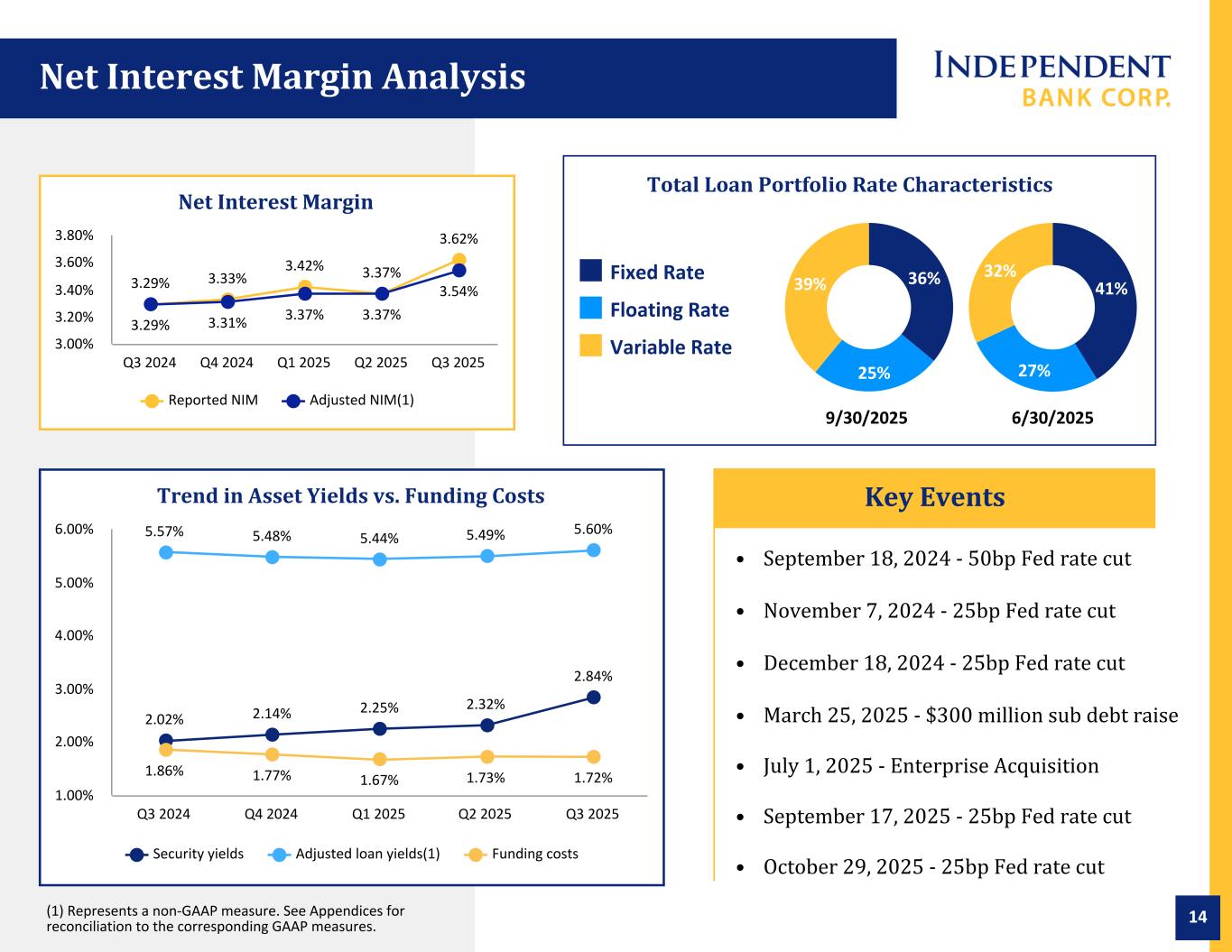

14 Net Interest Margin 3.29% 3.33% 3.42% 3.37% 3.62% 3.29% 3.31% 3.37% 3.37% 3.54% Reported NIM Adjusted NIM(1) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 3.00% 3.20% 3.40% 3.60% 3.80% 36% 25% 39% Fixed Rate Floating Rate Variable Rate Net Interest Margin Analysis Trend in Asset Yields vs. Funding Costs 2.02% 2.14% 2.25% 2.32% 2.84% 5.57% 5.48% 5.44% 5.49% 5.60% 1.86% 1.77% 1.67% 1.73% 1.72% Security yields Adjusted loan yields(1) Funding costs Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% • September 18, 2024 - 50bp Fed rate cut • November 7, 2024 - 25bp Fed rate cut • December 18, 2024 - 25bp Fed rate cut • March 25, 2025 - $300 million sub debt raise • July 1, 2025 - Enterprise Acquisition • September 17, 2025 - 25bp Fed rate cut • October 29, 2025 - 25bp Fed rate cut Key Events (1) Represents a non-GAAP measure. See Appendices for reconciliation to the corresponding GAAP measures. 41% 27% 32% 9/30/2025 6/30/2025 Total Loan Portfolio Rate Characteristics

15 $ in m ill io ns Assets Under Administration $7,035 $7,099 $7,361 $1,499 $360 $9,220 Q4 2024 Q1 2025 Q2 2025 EBTC Day 1 Acquired Balances Q3 Organic Growth Q3 2025 $— $5,000 $10,000 Focal Point | Investment Management and Advisory $ in b ill io ns Assets Under Administration 9% CAGR $4.9 $5.7 $5.8 $6.5 $7.0 $9.2 2020 2021 2022 2023 2024 Q3 2025 $— $5.0 $10.0 $ in m ill io ns Revenues 10% CAGR $29.4 $35.3 $36.8 $40.2 $42.7 $36.3 2020 2021 2022 2023 2024 YTD '25 $— $10.0 $20.0 $30.0 $40.0 $50.0

16 • Deepening of risk management infrastructure • Robust portfolio management activity in CRE office asset class • Stabilizing interest rate risk through volatile rate environment • Prioritizing liquidity and capital risk management • Focusing on deposit generation initiatives • Reducing CRE concentration • Optimize the Company’s capital position • Integrating the Enterprise Bancorp. acquisition • Focusing on core relationships • Expanding C&I lending business through new hires and new verticals • Taking disciplined approach to economic uncertainty • Further penetrating and cross-selling the acquired Enterprise customer base • Preparing for new core FIS processing system • Investing in digital/mobile technology • Facilities optimization, including select openings and closings • Piloting robotic processing solutions in operation areas Near-Term Priorities Growth Initiatives Efficiency Initiatives Balance Sheet Management Corporate Governance

17 • High quality franchise in attractive markets • Low risk balance sheet with strong core deposit funding base • Strong capital base, well-above regulatory mandated levels that enables maximum capital management flexibility • Earnings expected to notably improve as fixed assets reprice to prevailing market rates • Enterprise Bancorp acquisition is helping drive improved profitability metrics • While acknowledging recent asset quality challenges, our proactive response will reduce recent earnings volatility • Focused on positioning the Company for durable and consistent long-term returns for investors Positioned to grow, build, and acquire to drive long-term value creation INDB Investment Merits

18 This presentation contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations and business of the Company. These statements may be identified by such forward-looking terminology as “expect,” “achieve,” “plan,” “believe,” “outlook”, “projected”, “future,” “positioned,” “continued,” “will,” “would,” “potential,” “anticipated,” “guidance,” “targeted” or similar statements or variations of such terms. Actual results may differ from those contemplated by these forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to: • adverse economic conditions in the regional and local economies within the New England region and the Company’s market area; • events impacting the financial services industry, including high profile bank failures, and any resulting decreased confidence in banks among depositors, investors, and other counterparties, as well as competition for deposits and significant disruption, volatility and depressed valuations of equity and other securities of banks in the capital markets; • the effects to the Company of an increasingly competitive labor market, including the possibility that the Company will have to devote significant resources to attract and retain qualified personnel; • political and policy uncertainties, changes in U.S. and international trade policies, such as tariffs or other factors, the prolongment of the U.S. government shutdown, and the potential impact of such factors on the Company and its customers, including the potential for decreases in deposits and loan demand, unanticipated loan delinquencies, loss of collateral and decreased service revenues; • the instability or volatility in financial markets and unfavorable domestic or global general economic, political or business conditions, whether caused by geopolitical concerns, including the Russia/Ukraine conflict, the conflicts in Israel, Iran and surrounding areas and uncertainties surrounding the trajectories of such conflicts; • unanticipated loan delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on the Company’s local economies or the Company’s business caused by adverse weather conditions and natural disasters, changes in climate, public health crises or other external events and any actions taken by governmental authorities in response to any such events; • adverse changes or volatility in the local real estate market; • changes in interest rates and any resulting impact on interest earning assets and/or interest bearing liabilities, the level of voluntary prepayments on loans and the receipt of payments on mortgage-backed securities, decreased loan demand or increased difficulty in the ability of borrowers to repay variable rate loans; • risks related to the Company’s acquisition of Enterprise Bancorp, Inc., parent of Enterprise Bank and Trust Company (collectively, "Enterprise") and acquisitions generally, including disruption to current plans and operations; difficulties in customer and employee retention; fees, expenses and charges related to these transactions being significantly higher than anticipated; unforeseen integration issues or impairment of goodwill and/or other intangibles; and the Company’s inability to achieve expected revenues, cost savings, synergies, and other benefits at levels or within the timeframes originally anticipated; • the effect of laws, regulations, new requirements or expectations, or additional regulatory oversight in the highly regulated financial services industry, and the resulting need to invest in technology to meet heightened regulatory expectations, increased costs of compliance or required adjustments to strategy; • changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; • higher than expected tax expense, including as a result of failure to comply with general tax laws and changes in tax laws; • increased competition in the Company’s market areas, including competition that could impact deposit gathering, retention of deposits and the cost of deposits, increased competition due to the demand for innovative products and service offerings, and competition from non-depository institutions which may be subject to fewer regulatory constraints and lower cost structures; • a deterioration in the conditions of the securities markets; • a deterioration of the credit rating for U.S. long-term sovereign debt or uncertainties surrounding the federal budget; • inability to adapt to changes in information technology, including changes to industry accepted delivery models driven by a migration to the internet as a means of service delivery, including any inability to effectively implement new technology-driven products, such as artificial intelligence; • electronic or other fraudulent activity within the financial services industry, especially in the commercial banking sector; • adverse changes in consumer spending and savings habits; • the effect of laws and regulations regarding the financial services industry, including the need to invest in technology to meet heightened regulatory expectations or the introduction of new requirements or expectations resulting in increased costs of compliance or required adjustments to strategy; • changes in laws and regulations (including laws and regulations concerning taxes, banking, securities and insurance) generally applicable to the Company’s business and the associated costs of such changes; • the Company’s potential judgments, claims, damages, penalties, fines and reputational damage resulting from pending or future litigation and regulatory and government actions; • changes in accounting policies, practices and standards, as may be adopted by the regulatory agencies as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other accounting standard setters; • operational risks related to the Company and its customers’ reliance on information technology; cyber threats, attacks, intrusions, and fraud; and outages or other issues impacting the Company or its third party service providers which could lead to interruptions or disruptions of the Company’s operating systems, including systems that are customer facing, and adversely impact the Company’s business; and • any unexpected material adverse changes in the Company’s operations or earnings. The Company cautions readers not to place undue reliance on any forward-looking statements as the Company’s business and its forward-looking statements involve substantial known and unknown risks and uncertainties described above and in the Company’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q (“Risk Factors”). Except as required by law, the Company disclaims any intent or obligation to update publicly any such forward-looking statements, whether in response to new information, future events or otherwise. Any public statements or disclosures by the Company following this release which modify or impact any of the forward-looking statements contained in this release will be deemed to modify or supersede such statements in this release. In addition to the information set forth in this press release, you should carefully consider the Risk Factors. Forward Looking Statements

19 This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). This information may include operating net income and operating earnings per share (“EPS”), operating return on average assets, operating return on average common equity, operating return on average tangible common equity, operating noninterest expense, adjusted net interest margin (“adjusted NIM” or “adjusted margin”) and the associated adjusted loan yield, tangible book value per share, tangible common equity ratio and return on average tangible common equity. Management reviews its adjusted margin to determine any items that may impact the net interest margin that may be one-time in nature or not reflective of its core operating environment, such as low-yielding loans originated through government programs in response to the pandemic, or significant purchase accounting adjustments, or other adjustments such as nonaccrual interest reversals/recoveries and prepayment penalties. Management believes that adjusting for these items to arrive at an adjusted margin provides additional insight into the operating environment and how management decisions impact the net interest margin. Management also supplements its evaluation of financial performance with analysis of tangible book value per share (which is computed by dividing stockholders’ equity less goodwill and identifiable intangible assets, or “tangible common equity,” by common shares outstanding), the tangible common equity ratio (which is computed by dividing tangible common equity by “tangible assets,” defined as total assets less goodwill and other intangibles), and return on average tangible common equity (which is computed by dividing net income by average tangible common equity). The Company has included information on tangible book value per share, the tangible common equity ratio and return on average tangible common equity because management believes that investors may find it useful to have access to the same analytical tools used by management. As a result of merger and acquisition activity, the Company has recognized goodwill and other intangible assets in conjunction with business combination accounting principles. Excluding the impact of goodwill and other intangibles in measuring asset and capital values for the ratios provided, along with other bank standard capital ratios, provides a framework to compare the capital adequacy of the Company to other companies in the financial services industry. These non-GAAP measures should not be viewed as a substitute for operating results and other financial measures determined in accordance with GAAP. An item which management excludes when computing these non-GAAP measures can be of substantial importance to the Company’s results for any particular quarter or year. The Company’s non-GAAP performance measures, including operating net income, operating EPS, operating return on average assets, operating return on average common equity, operating noninterest expense, adjusted margin, tangible book value per share and the tangible common equity ratio, are not necessarily comparable to non-GAAP performance measures which may be presented by other companies. Non-GAAP Financial Measures

20 Appendix

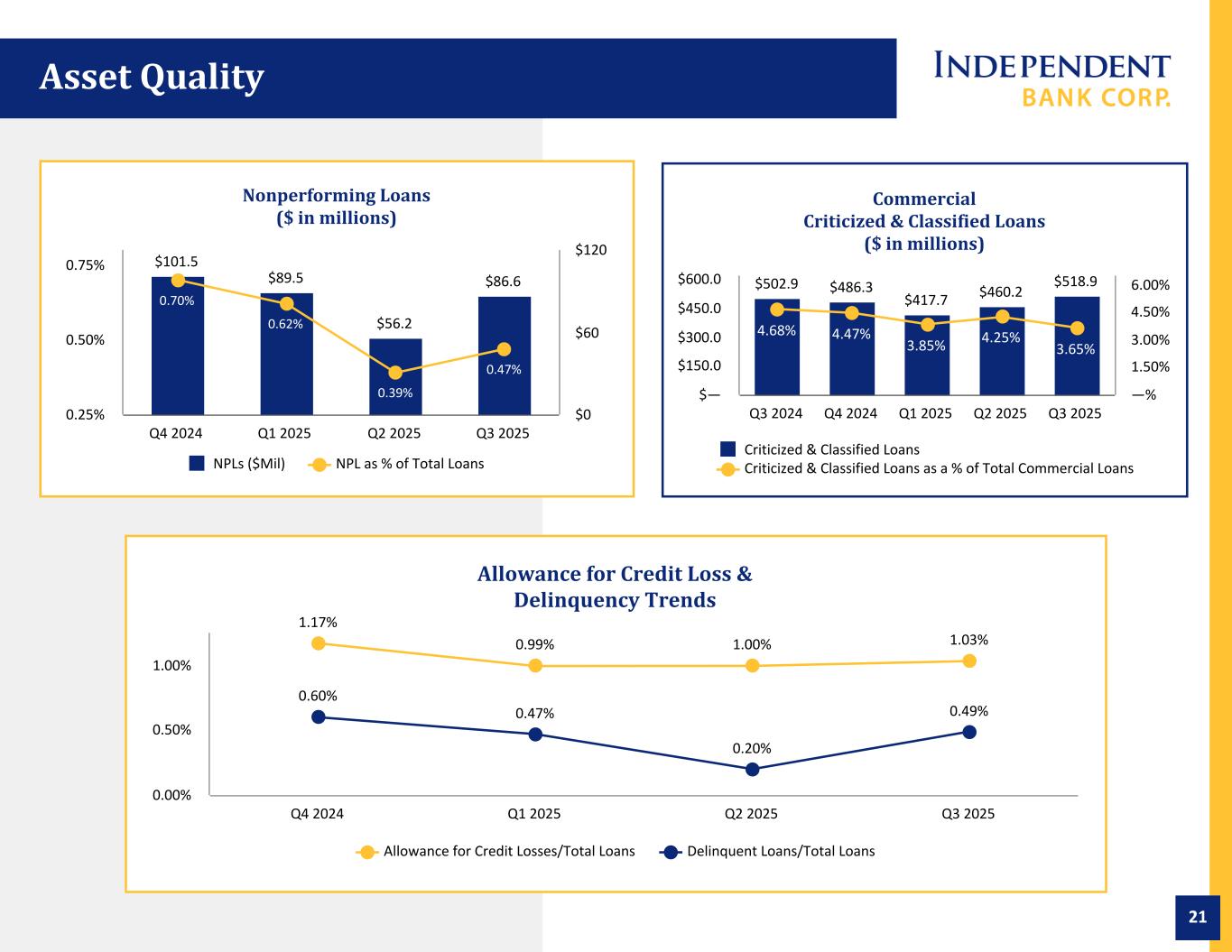

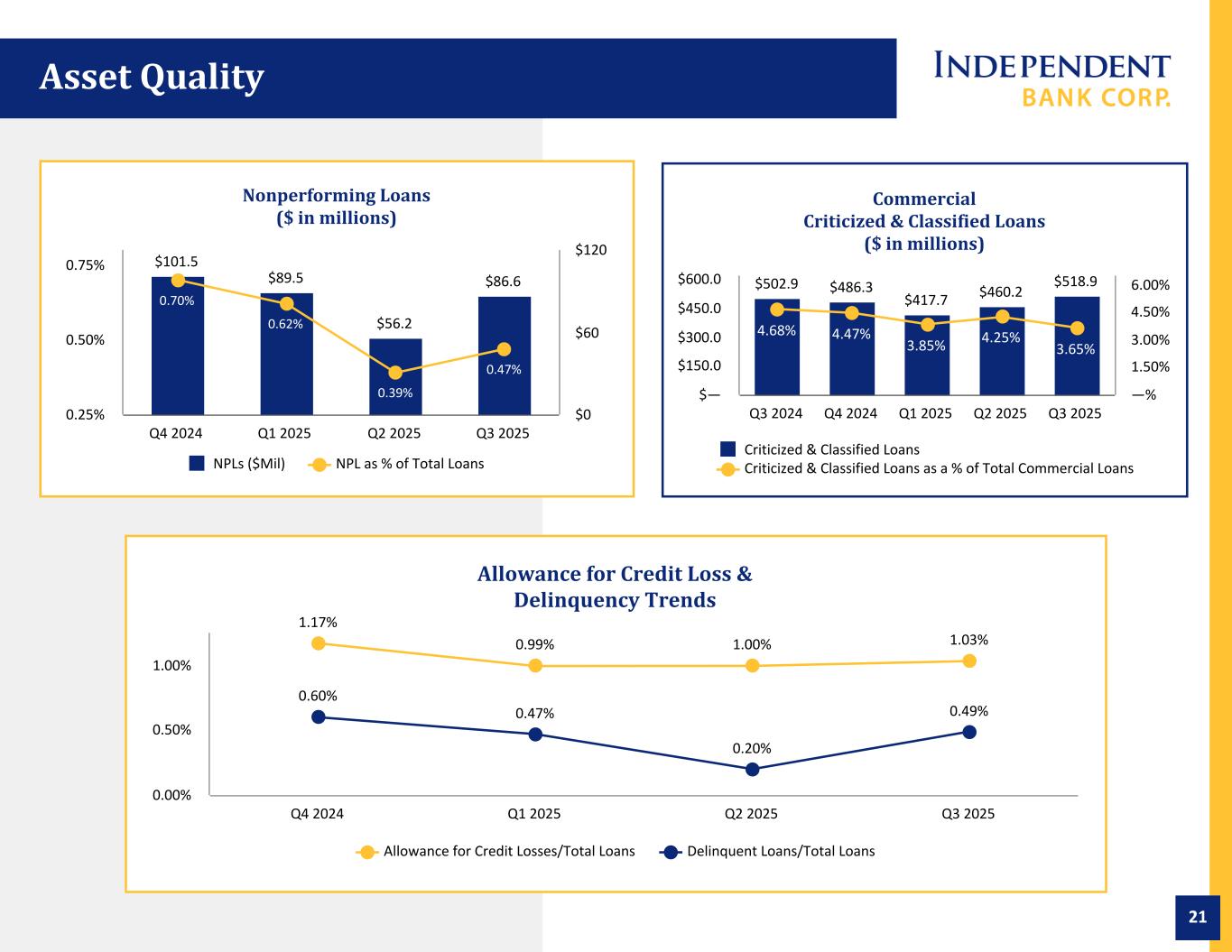

21 Nonperforming Loans ($ in millions) $101.5 $89.5 $56.2 $86.6 0.70% 0.62% 0.39% 0.47% NPLs ($Mil) NPL as % of Total Loans Q4 2024 Q1 2025 Q2 2025 Q3 2025 0.25% 0.50% 0.75% $0 $60 $120 Commercial Criticized & Classified Loans ($ in millions) $502.9 $486.3 $417.7 $460.2 $518.9 4.68% 4.47% 3.85% 4.25% 3.65% Criticized & Classified Loans Criticized & Classified Loans as a % of Total Commercial Loans Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $— $150.0 $300.0 $450.0 $600.0 —% 1.50% 3.00% 4.50% 6.00% Asset Quality Allowance for Credit Loss & Delinquency Trends 1.17% 0.99% 1.00% 1.03% 0.60% 0.47% 0.20% 0.49% Allowance for Credit Losses/Total Loans Delinquent Loans/Total Loans Q4 2024 Q1 2025 Q2 2025 Q3 2025 0.00% 0.50% 1.00%

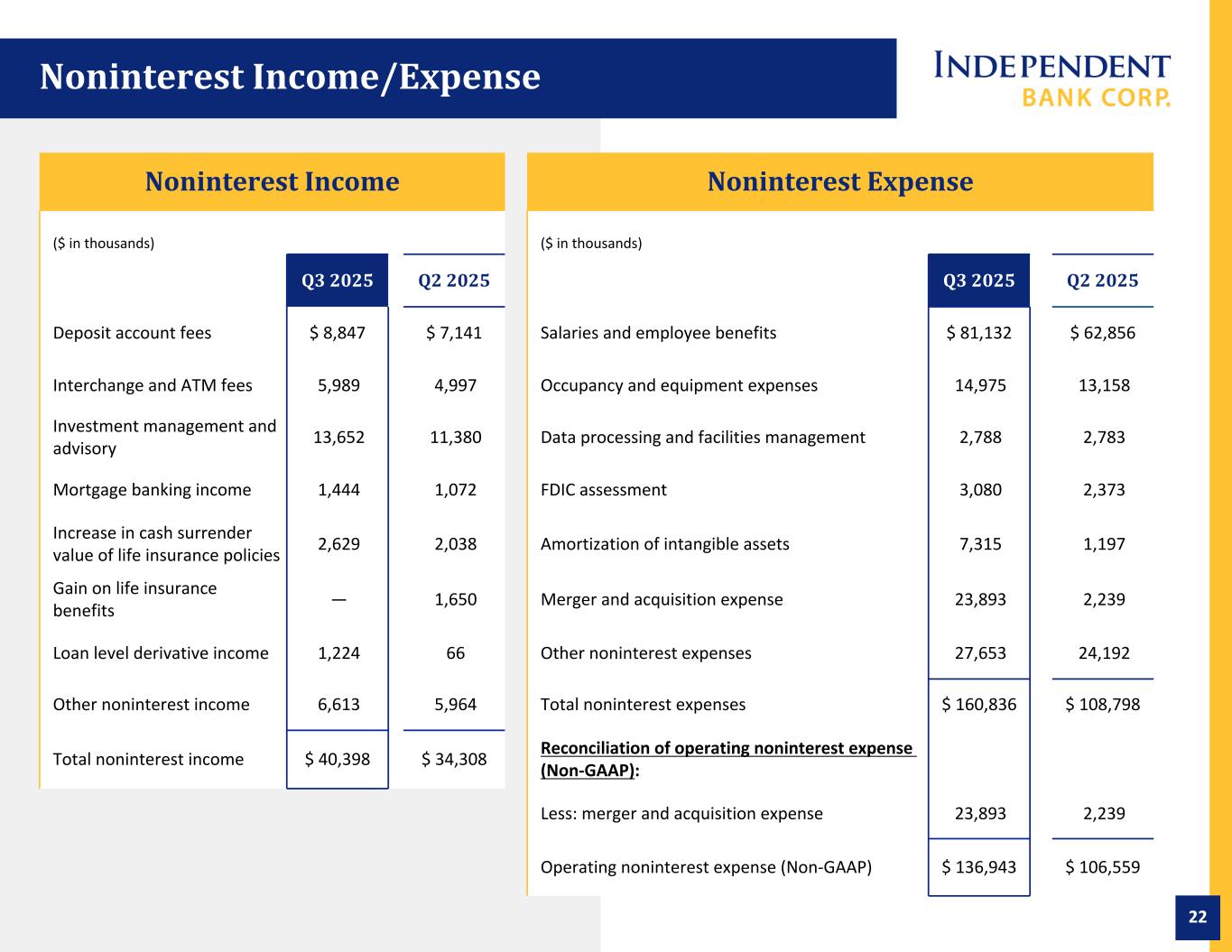

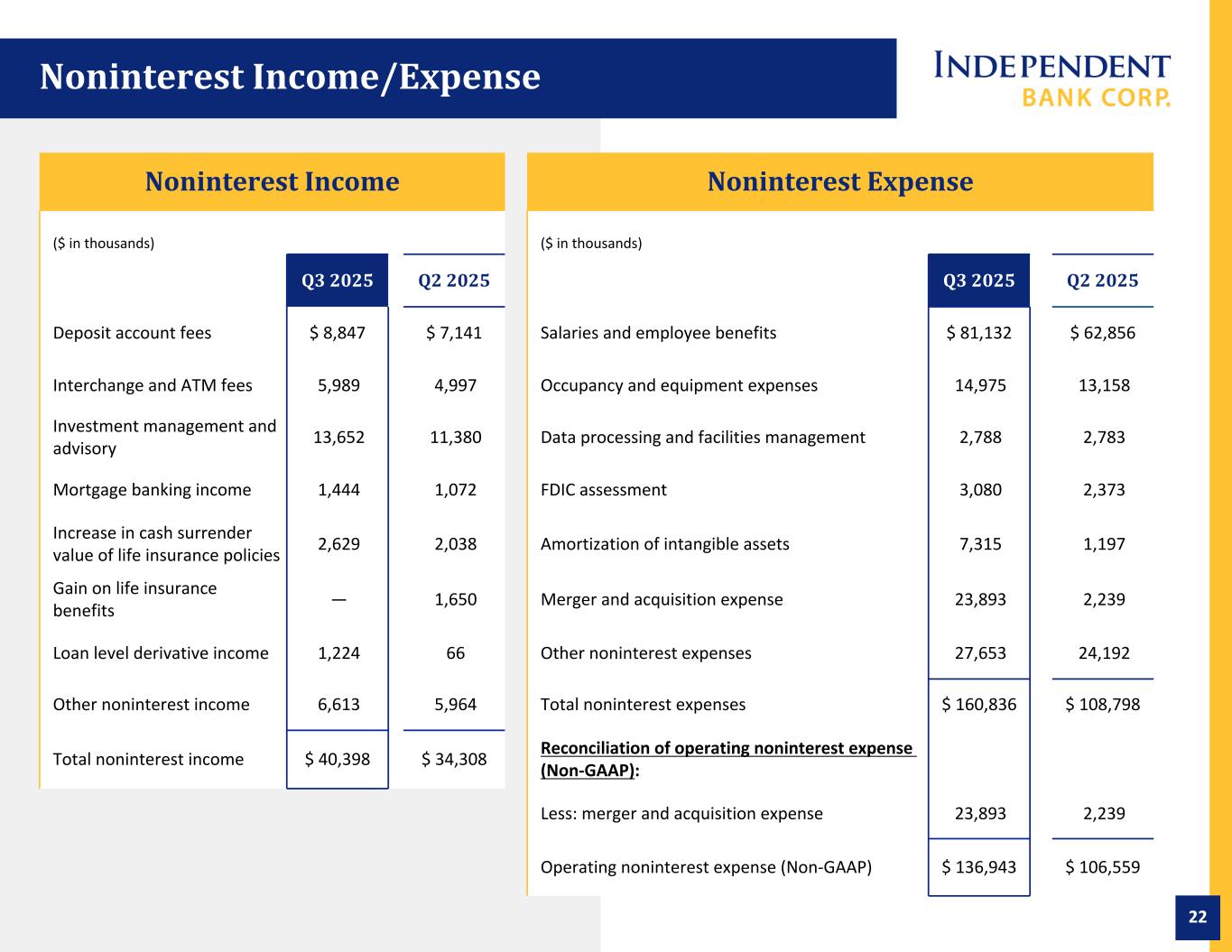

22 Noninterest Income Noninterest Expense ($ in thousands) ($ in thousands) Q3 2025 Q2 2025 Q3 2025 Q2 2025 Deposit account fees $ 8,847 $ 7,141 Salaries and employee benefits $ 81,132 $ 62,856 Interchange and ATM fees 5,989 4,997 Occupancy and equipment expenses 14,975 13,158 Investment management and advisory 13,652 11,380 Data processing and facilities management 2,788 2,783 Mortgage banking income 1,444 1,072 FDIC assessment 3,080 2,373 Increase in cash surrender value of life insurance policies 2,629 2,038 Amortization of intangible assets 7,315 1,197 Gain on life insurance benefits — 1,650 Merger and acquisition expense 23,893 2,239 Loan level derivative income 1,224 66 Other noninterest expenses 27,653 24,192 Other noninterest income 6,613 5,964 Total noninterest expenses $ 160,836 $ 108,798 Total noninterest income $ 40,398 $ 34,308 Reconciliation of operating noninterest expense (Non-GAAP): Less: merger and acquisition expense 23,893 2,239 Operating noninterest expense (Non-GAAP) $ 136,943 $ 106,559 Noninterest Income/Expense

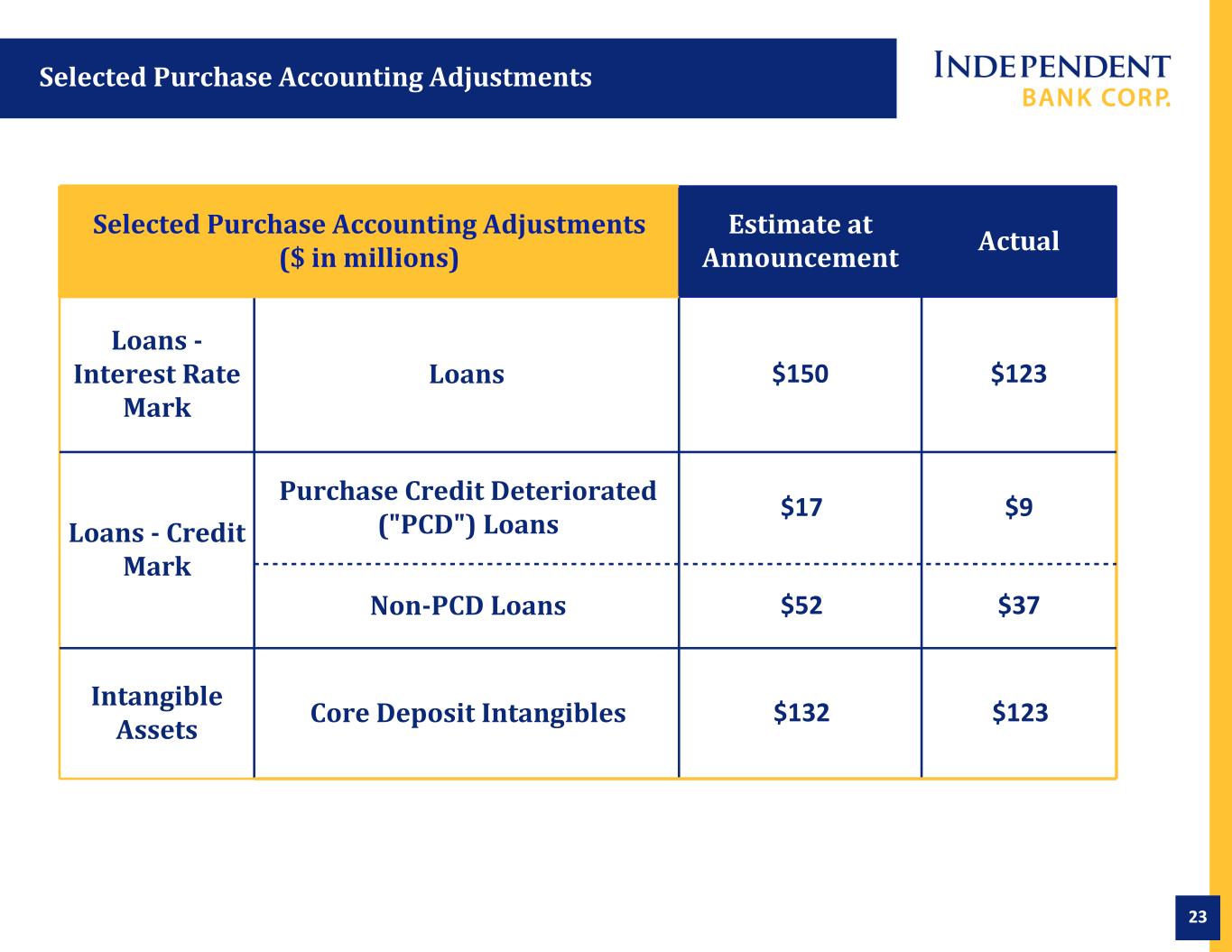

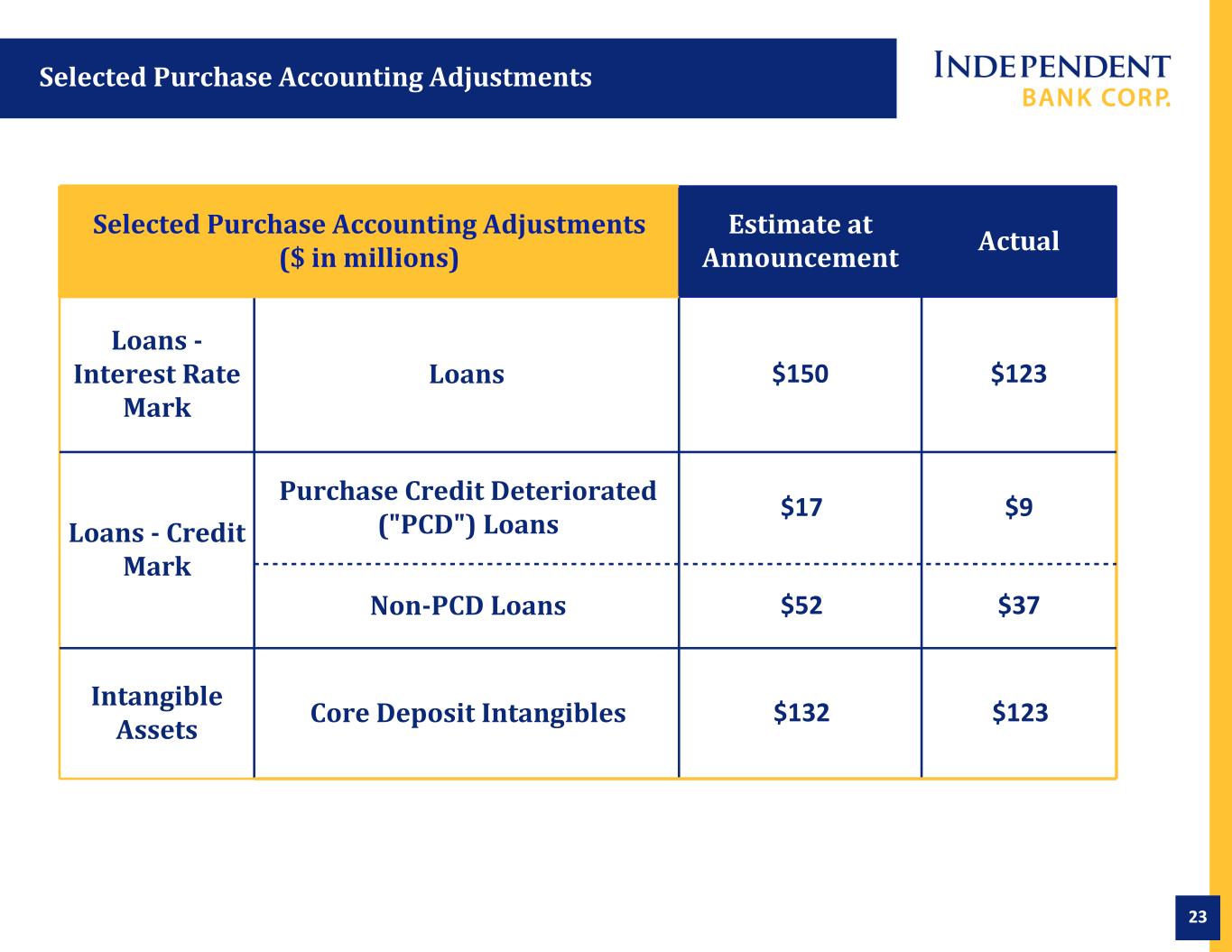

23 Selected Purchase Accounting Adjustments Pro Forma Combined Company(2) Selected Purchase Accounting Adjustments ($ in millions) Estimate at Announcement Actual Loans - Interest Rate Mark Loans $150 $123 Loans - Credit Mark Purchase Credit Deteriorated ("PCD") Loans $17 $9 Non-PCD Loans $52 $37 Intangible Assets Core Deposit Intangibles $132 $123

24 (Dollars in thousands) September 30, December 31, 2025 2024 2023 2022 Tangible common equity Stockholders' equity (GAAP) $3,546,887 $2,993,120 $2,895,251 $2,886,701 (a) Less: Goodwill and other intangibles 1,225,106 997,356 1,003,262 1,010,140 Tangible common equity $2,321,781 $1,995,764 $1,891,989 $1,876,561 (b) Common shares 49,787,305 42,500,611 42,873,187 45,641,238 (c) Book Value per share (GAAP) $71.24 $70.43 $67.53 $63.25 (a/c) Tangible book value per share (Non-GAAP) $46.63 $46.96 $44.13 $41.12 (b/c) Non-GAAP Reconciliation of Capital Metrics The following table reconciles Book Value per share, which is a GAAP based measure to Tangible Book Value per share, which is a non-GAAP based measure, at the dates indicated:

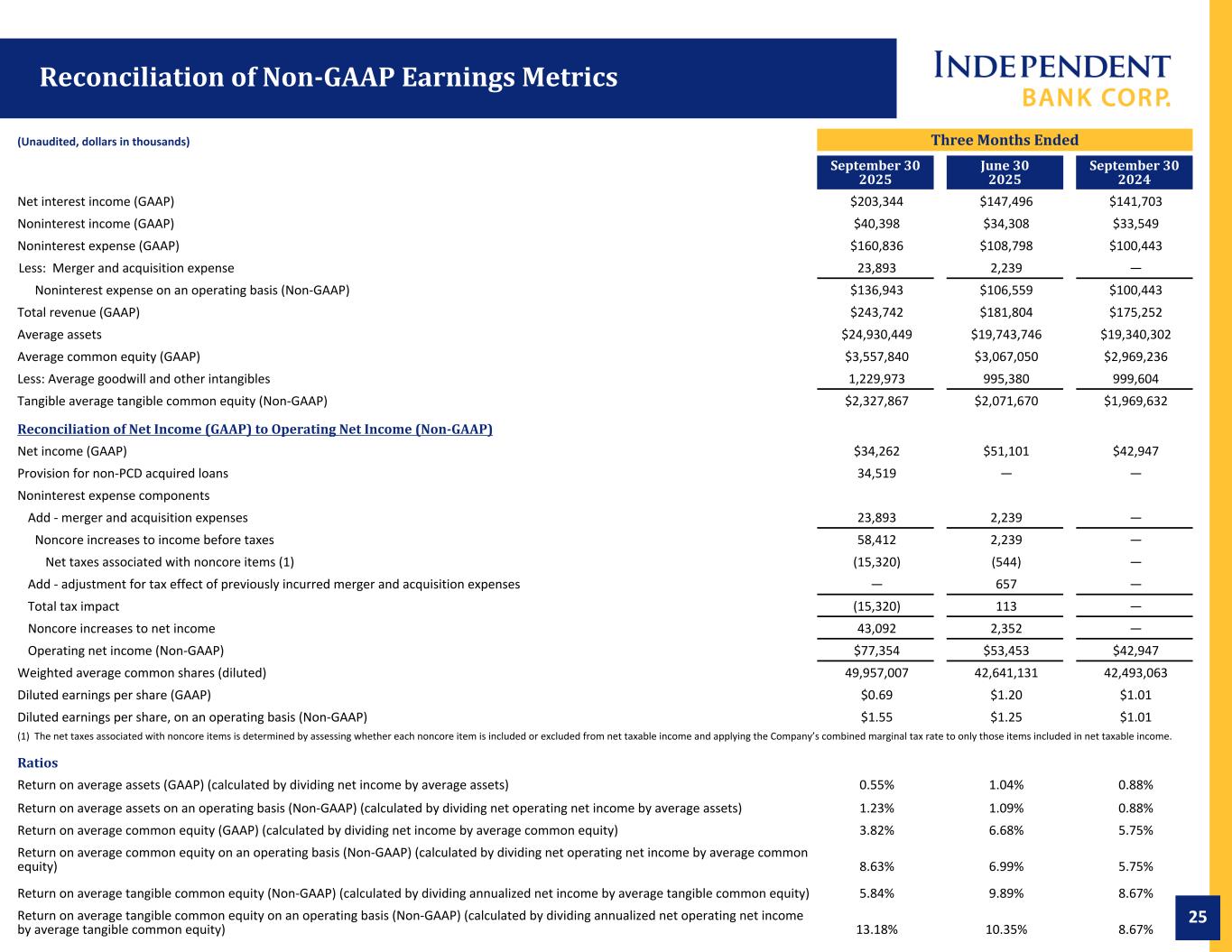

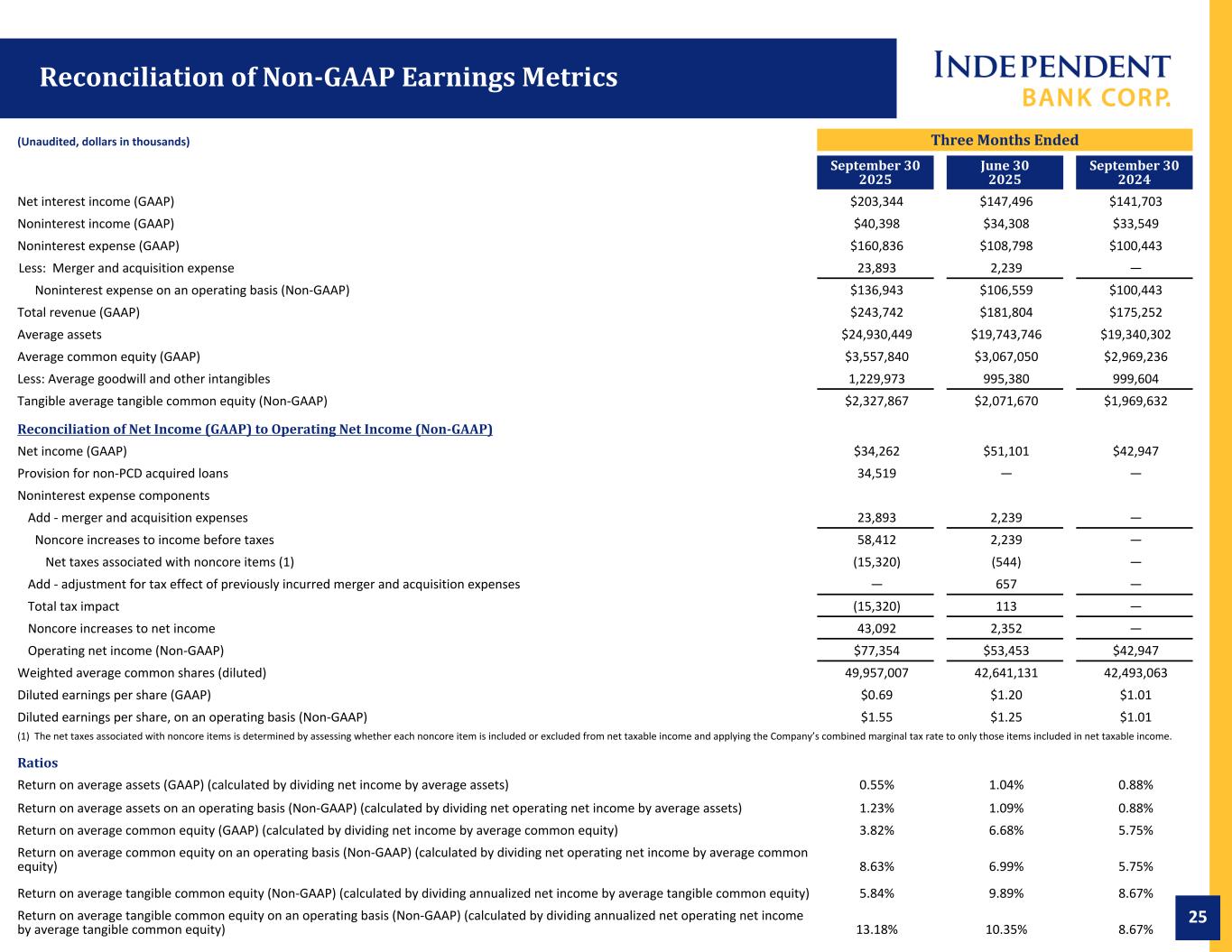

25 Reconciliation of Non-GAAP Earnings Metrics (Unaudited, dollars in thousands) Three Months Ended September 30 2025 June 30 2025 September 30 2024 Net interest income (GAAP) $203,344 $147,496 $141,703 Noninterest income (GAAP) $40,398 $34,308 $33,549 Noninterest expense (GAAP) $160,836 $108,798 $100,443 Less: Merger and acquisition expense 23,893 2,239 — Noninterest expense on an operating basis (Non-GAAP) $136,943 $106,559 $100,443 Total revenue (GAAP) $243,742 $181,804 $175,252 Average assets $24,930,449 $19,743,746 $19,340,302 Average common equity (GAAP) $3,557,840 $3,067,050 $2,969,236 Less: Average goodwill and other intangibles 1,229,973 995,380 999,604 Tangible average tangible common equity (Non-GAAP) $2,327,867 $2,071,670 $1,969,632 Reconciliation of Net Income (GAAP) to Operating Net Income (Non-GAAP) Net income (GAAP) $34,262 $51,101 $42,947 Provision for non-PCD acquired loans 34,519 — — Noninterest expense components Add - merger and acquisition expenses 23,893 2,239 — Noncore increases to income before taxes 58,412 2,239 — Net taxes associated with noncore items (1) (15,320) (544) — Add - adjustment for tax effect of previously incurred merger and acquisition expenses — 657 — Total tax impact (15,320) 113 — Noncore increases to net income 43,092 2,352 — Operating net income (Non-GAAP) $77,354 $53,453 $42,947 Weighted average common shares (diluted) 49,957,007 42,641,131 42,493,063 Diluted earnings per share (GAAP) $0.69 $1.20 $1.01 Diluted earnings per share, on an operating basis (Non-GAAP) $1.55 $1.25 $1.01 (1) The net taxes associated with noncore items is determined by assessing whether each noncore item is included or excluded from net taxable income and applying the Company’s combined marginal tax rate to only those items included in net taxable income. Ratios Return on average assets (GAAP) (calculated by dividing net income by average assets) 0.55% 1.04% 0.88% Return on average assets on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average assets) 1.23% 1.09% 0.88% Return on average common equity (GAAP) (calculated by dividing net income by average common equity) 3.82% 6.68% 5.75% Return on average common equity on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average common equity) 8.63% 6.99% 5.75% Return on average tangible common equity (Non-GAAP) (calculated by dividing annualized net income by average tangible common equity) 5.84% 9.89% 8.67% Return on average tangible common equity on an operating basis (Non-GAAP) (calculated by dividing annualized net operating net income by average tangible common equity) 13.18% 10.35% 8.67%

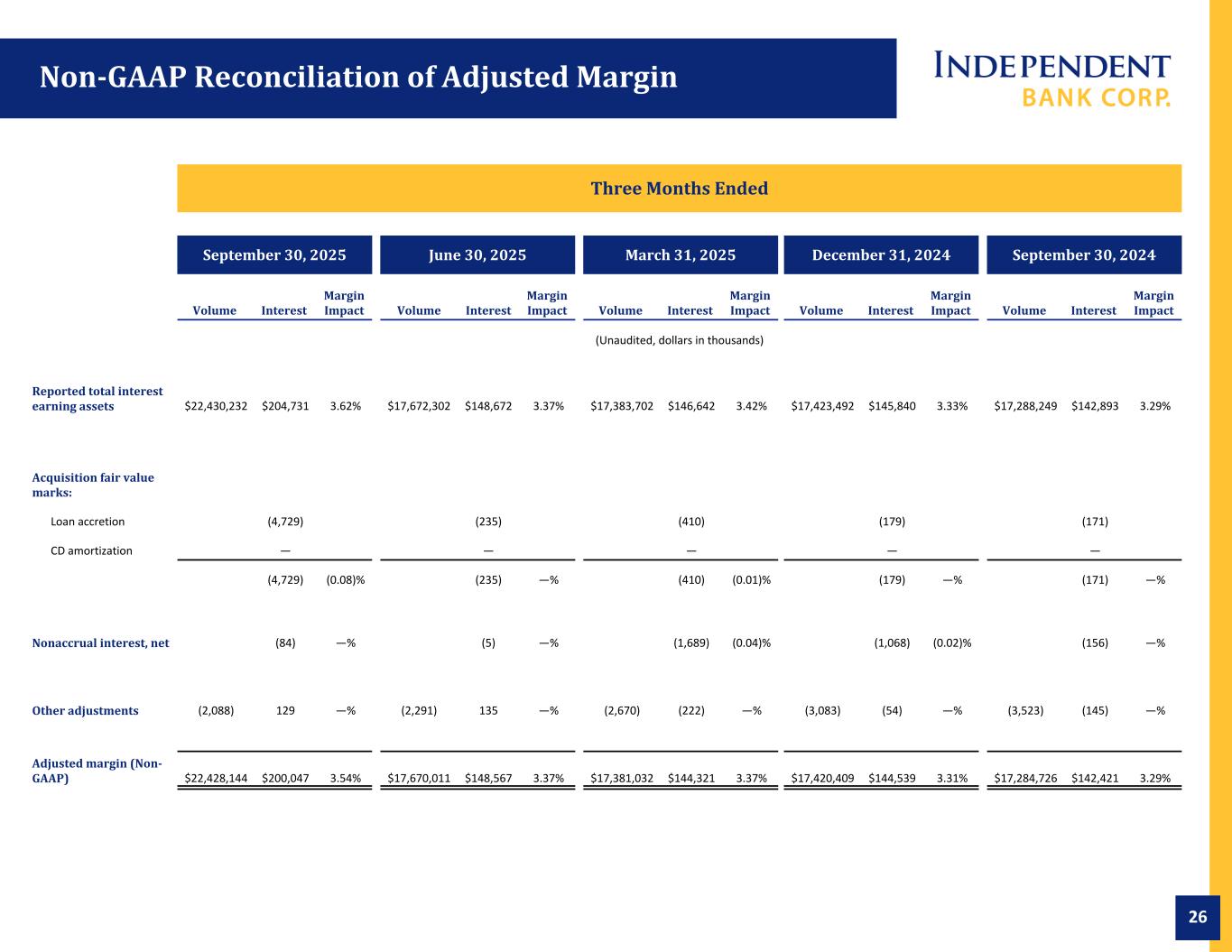

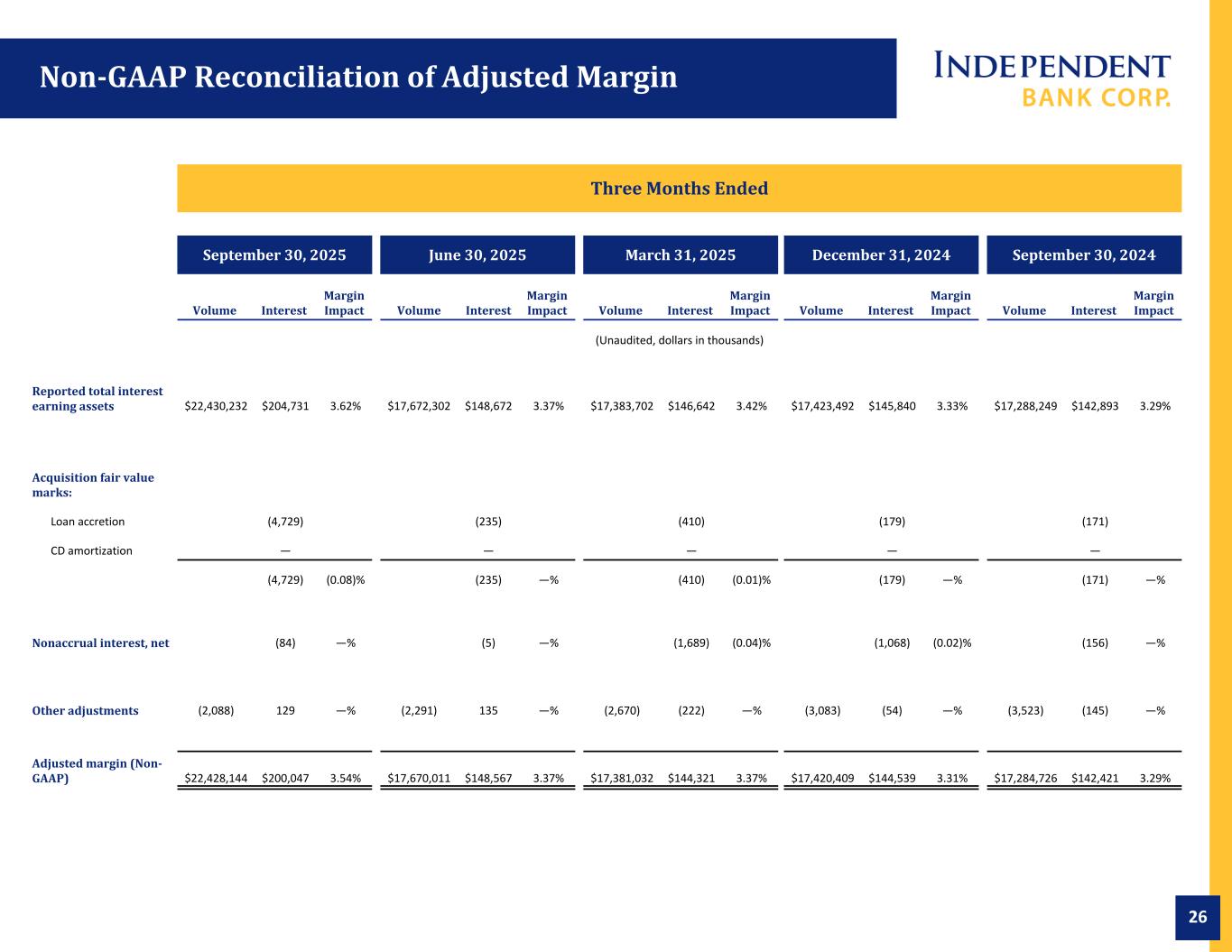

26 Three Months Ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Volume Interest Margin Impact Volume Interest Margin Impact Volume Interest Margin Impact Volume Interest Margin Impact Volume Interest Margin Impact (Unaudited, dollars in thousands) Reported total interest earning assets $22,430,232 $204,731 3.62% $17,672,302 $148,672 3.37% $17,383,702 $146,642 3.42% $17,423,492 $145,840 3.33% $17,288,249 $142,893 3.29% Acquisition fair value marks: Loan accretion (4,729) (235) (410) (179) (171) CD amortization — — — — — (4,729) (0.08)% (235) —% (410) (0.01)% (179) —% (171) —% Nonaccrual interest, net (84) —% (5) —% (1,689) (0.04)% (1,068) (0.02)% (156) —% Other adjustments (2,088) 129 —% (2,291) 135 —% (2,670) (222) —% (3,083) (54) —% (3,523) (145) —% Adjusted margin (Non- GAAP) $22,428,144 $200,047 3.54% $17,670,011 $148,567 3.37% $17,381,032 $144,321 3.37% $17,420,409 $144,539 3.31% $17,284,726 $142,421 3.29% Non-GAAP Reconciliation of Adjusted Margin