| 1-9047 | 04-2870273 | |||||||

| (Commission File Number) | (I.R.S. Employer identification No.) | |||||||

| INDEPENDENT BANK CORP. | ||||||||||||||

| Office Address: | 2036 Washington Street, | Hanover, | Massachusetts | 02339 | ||||||||||

| Mailing Address: | 288 Union Street, | Rockland, | Massachusetts | 02370 | ||||||||||

| (Address of principal executive offices, including zip code) | ||||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||

| Title of each Class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common Stock, $.01 par value per share | INDB | NASDAQ Global Select Market | ||||||

| Emerging growth company | ☐ | ||||

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION | ||||

| ITEM 7.01 | REGULATION FD DISCLOSURE | ||||

| ITEM 8.01 | OTHER EVENTS | ||||

ITEM 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS |

||||

| Exhibit Index | |||||

| Exhibit # | Exhibit Description | ||||

| 99.1 | |||||

| 99.2 | |||||

| 101 | The instance document does not appear in the interactive data file because its XBRL tags are embedded within the inline XBRL document | ||||

| 104 | Cover page interactive data file (formatted as inline XBRL and contained in Exhibit 101) | ||||

| INDEPENDENT BANK CORP. | |||||||||||

| Date: | July 17, 2025 | By: | /s/Mark J. Ruggiero | ||||||||

| MARK J. RUGGIERO | |||||||||||

| CHIEF FINANCIAL OFFICER | |||||||||||

| INDEPENDENT BANK CORP. FINANCIAL SUMMARY | |||||||||||||||||||||||||||||

| CONSOLIDATED BALANCE SHEETS | |||||||||||||||||||||||||||||

| (Unaudited, dollars in thousands) | % Change | % Change | |||||||||||||||||||||||||||

| June 30 2025 |

March 31 2025 |

June 30 2024 |

Jun 2025 vs. | Jun 2025 vs. | |||||||||||||||||||||||||

| Mar 2025 | Jun 2024 | ||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 219,414 | $ | 214,616 | $ | 192,845 | 2.24 | % | 13.78 | % | |||||||||||||||||||

| Interest-earning deposits with banks | 681,820 | 502,228 | 121,036 | 35.76 | % | 463.32 | % | ||||||||||||||||||||||

| Securities | |||||||||||||||||||||||||||||

| Trading | 4,801 | 4,816 | 4,384 | (0.31) | % | 9.51 | % | ||||||||||||||||||||||

| Equities | 21,258 | 21,250 | 21,028 | 0.04 | % | 1.09 | % | ||||||||||||||||||||||

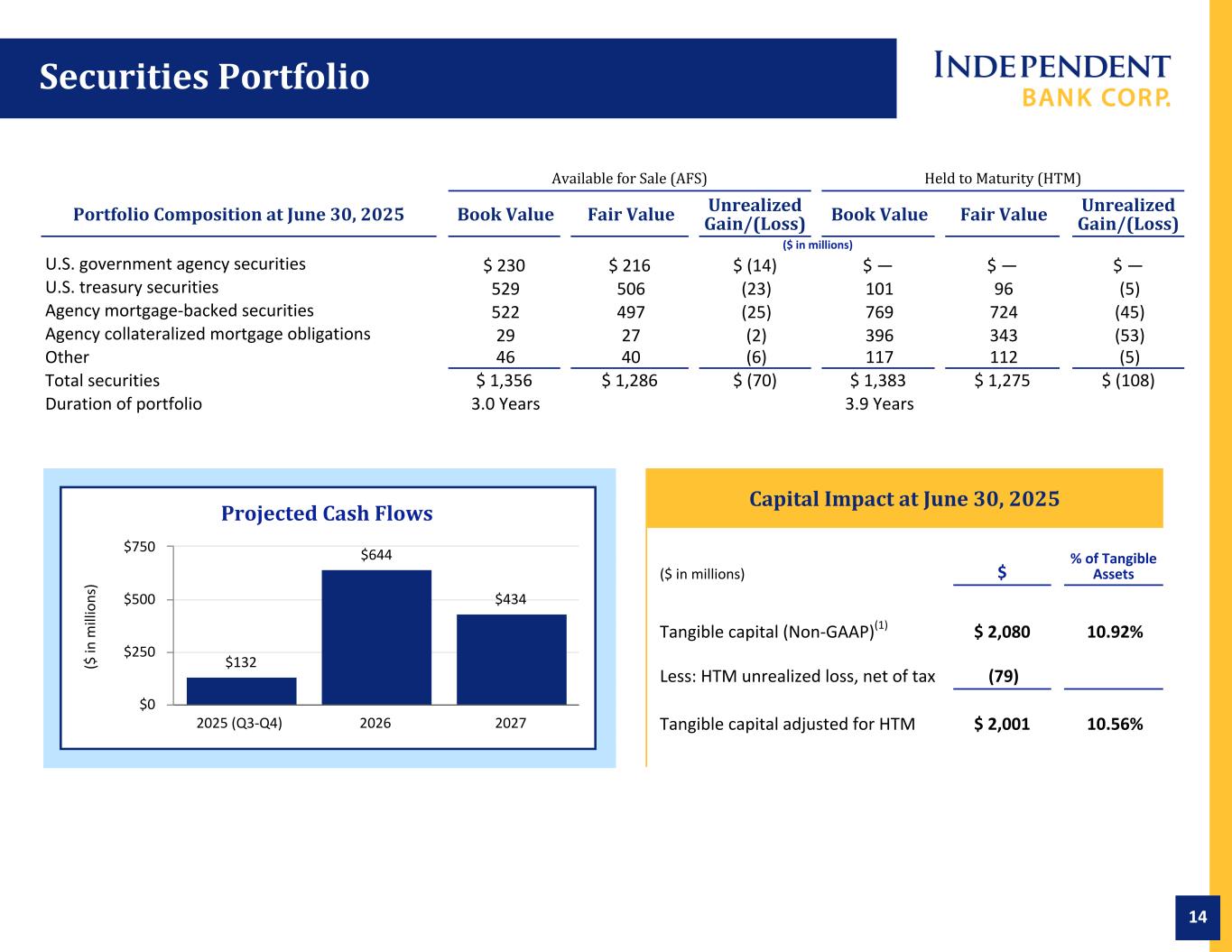

| Available for sale | 1,286,318 | 1,283,767 | 1,220,656 | 0.20 | % | 5.38 | % | ||||||||||||||||||||||

| Held to maturity | 1,382,903 | 1,409,959 | 1,519,655 | (1.92) | % | (9.00) | % | ||||||||||||||||||||||

| Total securities | 2,695,280 | 2,719,792 | 2,765,723 | (0.90) | % | (2.55) | % | ||||||||||||||||||||||

| Loans held for sale | 16,792 | 8,524 | 17,850 | 97.00 | % | (5.93) | % | ||||||||||||||||||||||

| Loans | |||||||||||||||||||||||||||||

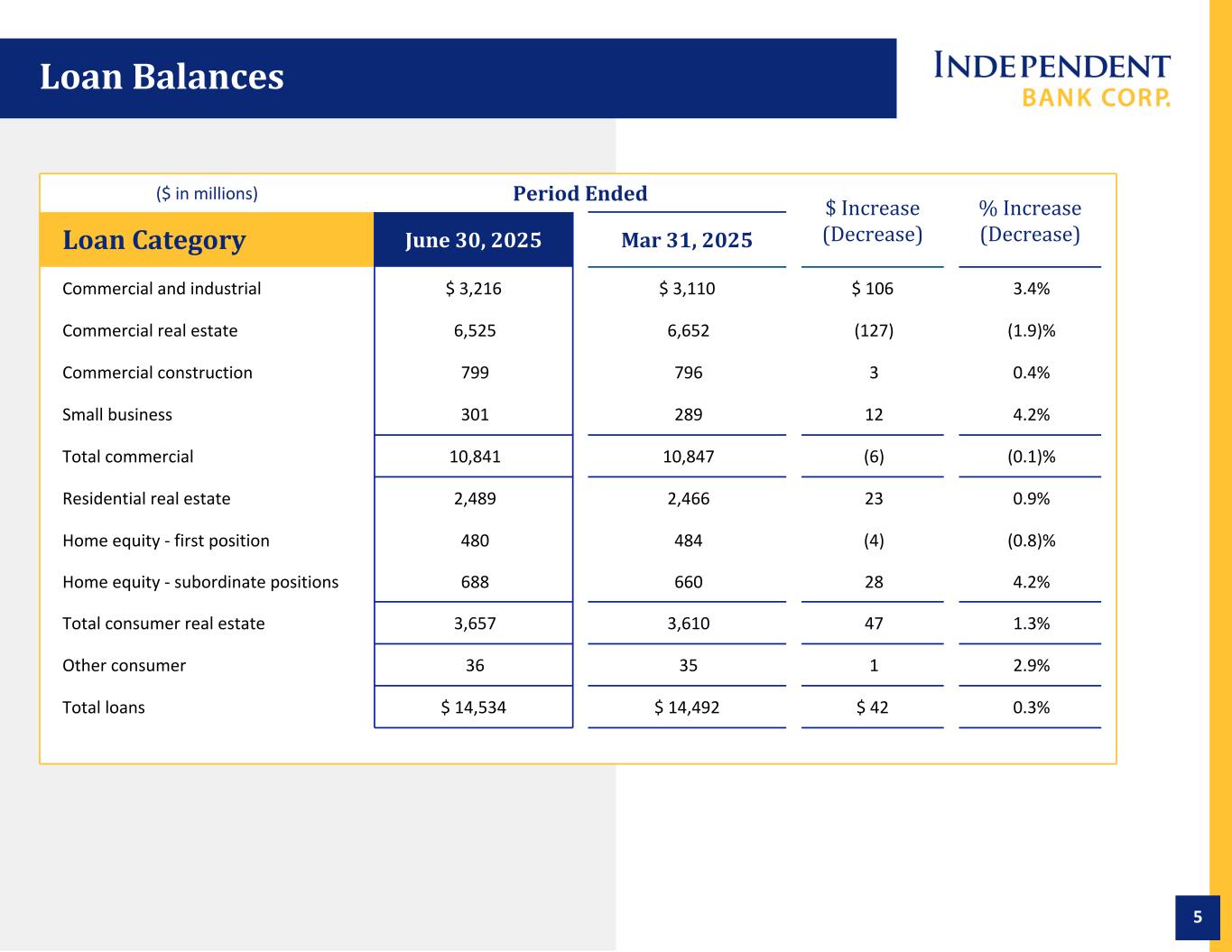

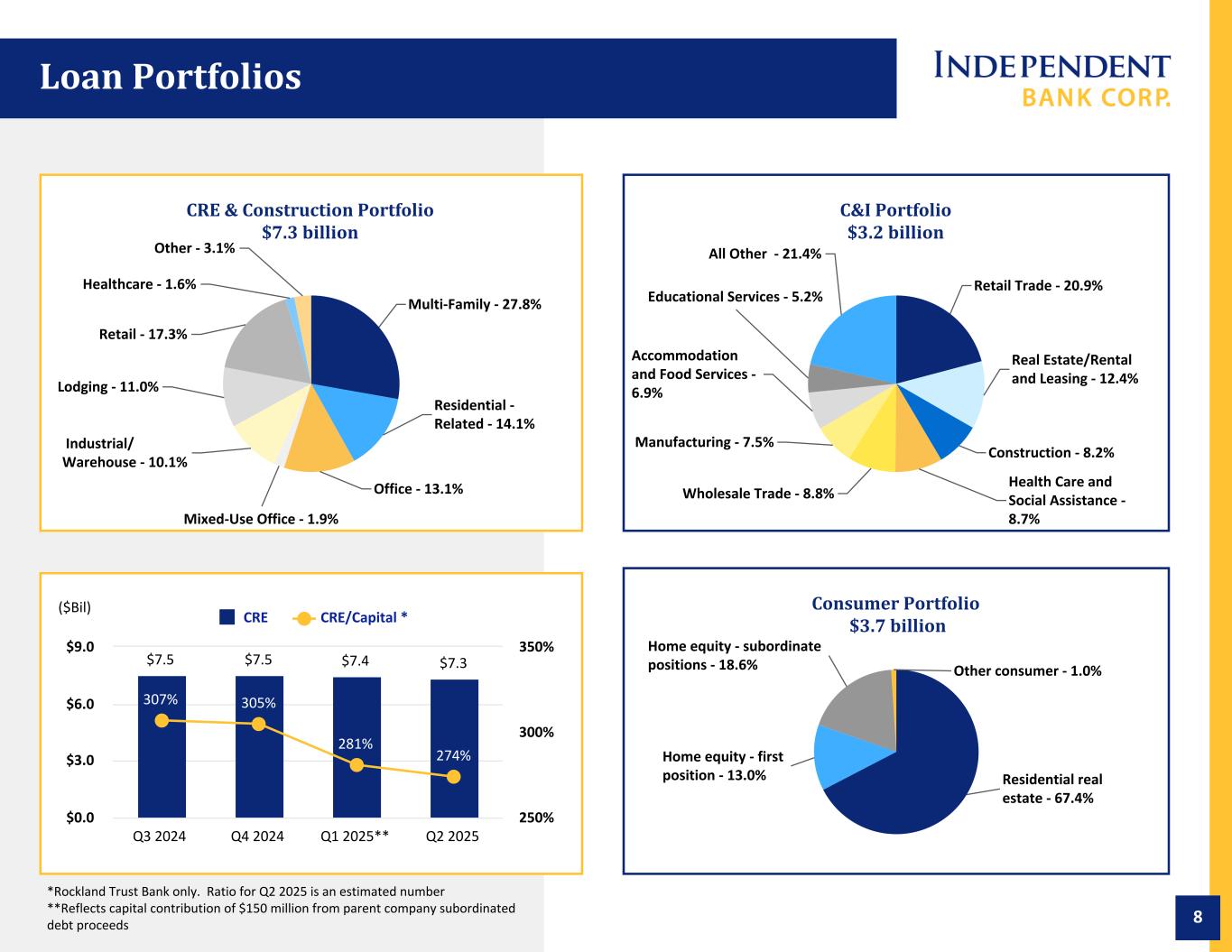

| Commercial and industrial | 3,215,480 | 3,110,432 | 3,009,469 | 3.38 | % | 6.85 | % | ||||||||||||||||||||||

| Commercial real estate | 6,525,438 | 6,651,475 | 6,745,088 | (1.89) | % | (3.26) | % | ||||||||||||||||||||||

| Commercial construction | 798,808 | 796,162 | 786,743 | 0.33 | % | 1.53 | % | ||||||||||||||||||||||

| Small business | 300,543 | 289,148 | 269,270 | 3.94 | % | 11.61 | % | ||||||||||||||||||||||

| Total commercial | 10,840,269 | 10,847,217 | 10,810,570 | (0.06) | % | 0.27 | % | ||||||||||||||||||||||

| Residential real estate | 2,489,166 | 2,465,731 | 2,439,646 | 0.95 | % | 2.03 | % | ||||||||||||||||||||||

| Home equity - first position | 479,641 | 484,384 | 504,403 | (0.98) | % | (4.91) | % | ||||||||||||||||||||||

| Home equity - subordinate positions | 688,456 | 659,582 | 612,404 | 4.38 | % | 12.42 | % | ||||||||||||||||||||||

| Total consumer real estate | 3,657,263 | 3,609,697 | 3,556,453 | 1.32 | % | 2.83 | % | ||||||||||||||||||||||

| Other consumer | 36,296 | 35,055 | 33,919 | 3.54 | % | 7.01 | % | ||||||||||||||||||||||

| Total loans | 14,533,828 | 14,491,969 | 14,400,942 | 0.29 | % | 0.92 | % | ||||||||||||||||||||||

| Less: allowance for credit losses | (144,773) | (144,092) | (150,859) | 0.47 | % | (4.03) | % | ||||||||||||||||||||||

| Net loans | 14,389,055 | 14,347,877 | 14,250,083 | 0.29 | % | 0.98 | % | ||||||||||||||||||||||

| Federal Home Loan Bank stock | 21,052 | 25,804 | 32,738 | (18.42) | % | (35.70) | % | ||||||||||||||||||||||

| Bank premises and equipment, net | 188,883 | 190,007 | 191,303 | (0.59) | % | (1.27) | % | ||||||||||||||||||||||

| Goodwill | 985,072 | 985,072 | 985,072 | — | % | — | % | ||||||||||||||||||||||

| Other intangible assets | 9,742 | 10,941 | 15,161 | (10.96) | % | (35.74) | % | ||||||||||||||||||||||

| Cash surrender value of life insurance policies | 305,077 | 306,077 | 300,111 | (0.33) | % | 1.65 | % | ||||||||||||||||||||||

| Other assets | 536,747 | 577,271 | 539,115 | (7.02) | % | (0.44) | % | ||||||||||||||||||||||

| Total assets | $ | 20,048,934 | $ | 19,888,209 | $ | 19,411,037 | 0.81 | % | 3.29 | % | |||||||||||||||||||

| Liabilities and Stockholders’ Equity | |||||||||||||||||||||||||||||

| Deposits | |||||||||||||||||||||||||||||

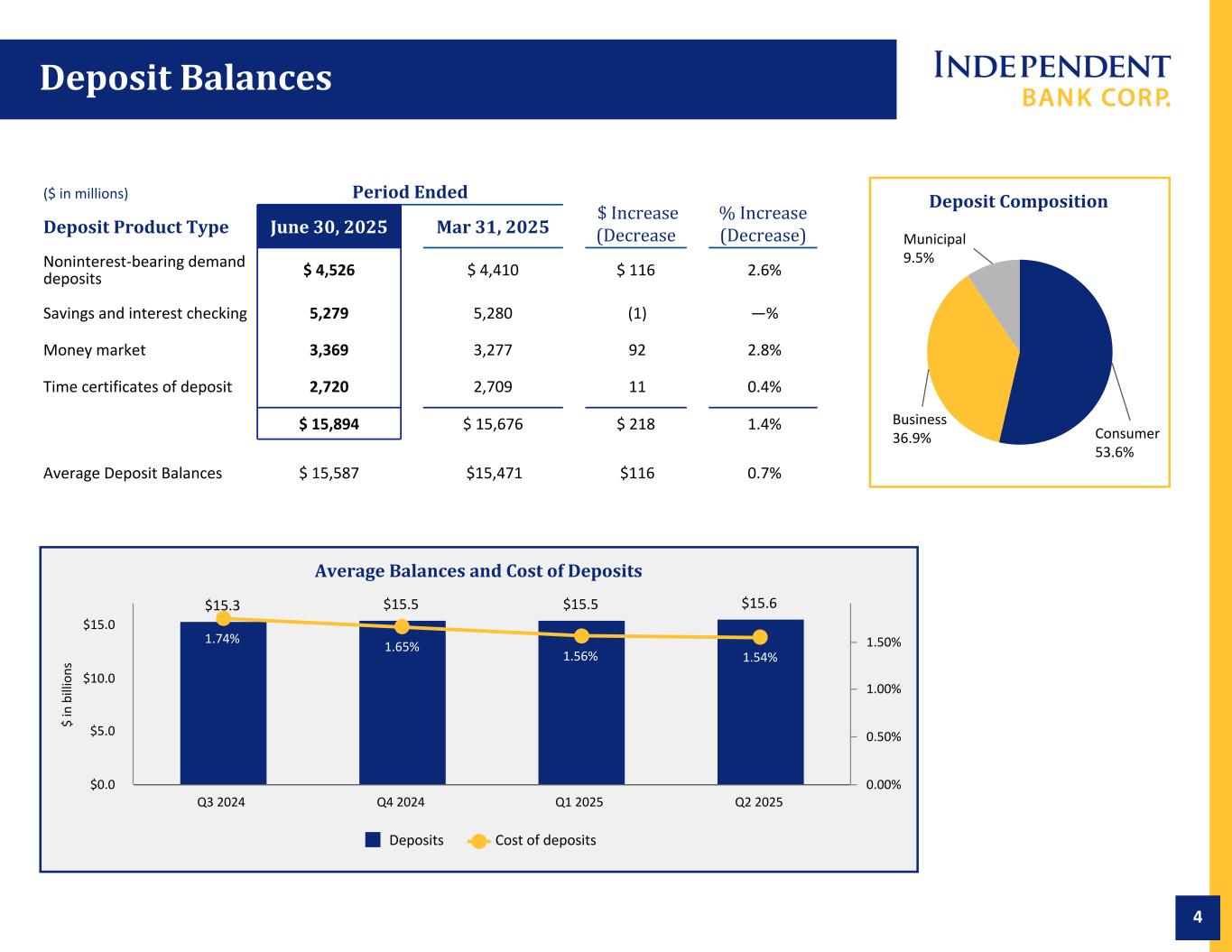

| Noninterest-bearing demand deposits | $ | 4,525,907 | $ | 4,409,878 | $ | 4,418,891 | 2.63 | % | 2.42 | % | |||||||||||||||||||

| Savings and interest checking | 5,279,280 | 5,279,549 | 5,241,154 | (0.01) | % | 0.73 | % | ||||||||||||||||||||||

| Money market | 3,368,354 | 3,277,078 | 3,058,109 | 2.79 | % | 10.14 | % | ||||||||||||||||||||||

| Time certificates of deposit | 2,720,199 | 2,709,512 | 2,691,433 | 0.39 | % | 1.07 | % | ||||||||||||||||||||||

| Total deposits | 15,893,740 | 15,676,017 | 15,409,587 | 1.39 | % | 3.14 | % | ||||||||||||||||||||||

| Borrowings | |||||||||||||||||||||||||||||

| Federal Home Loan Bank borrowings | 400,500 | 500,506 | 630,527 | (19.98) | % | (36.48) | % | ||||||||||||||||||||||

| Junior subordinated debentures, net | 62,861 | 62,861 | 62,859 | — | % | — | % | ||||||||||||||||||||||

| Subordinated debentures, net | 296,067 | 296,507 | — | (0.15) | % | 100.00% | |||||||||||||||||||||||

| Total borrowings | 759,428 | 859,874 | 693,386 | (11.68) | % | 9.52 | % | ||||||||||||||||||||||

| Total deposits and borrowings | 16,653,168 | 16,535,891 | 16,102,973 | 0.71 | % | 3.42 | % | ||||||||||||||||||||||

| Other liabilities | 320,910 | 318,926 | 388,815 | 0.62 | % | (17.46) | % | ||||||||||||||||||||||

| Total liabilities | 16,974,078 | 16,854,817 | 16,491,788 | 0.71 | % | 2.92 | % | ||||||||||||||||||||||

| Stockholders’ equity | |||||||||||||||||||||||||||||

| Common stock | 424 | 424 | 423 | — | % | 0.24 | % | ||||||||||||||||||||||

| Additional paid in capital | 1,914,556 | 1,911,162 | 1,904,869 | 0.18 | % | 0.51 | % | ||||||||||||||||||||||

| Retained earnings | 1,217,959 | 1,192,008 | 1,128,182 | 2.18 | % | 7.96 | % | ||||||||||||||||||||||

| Accumulated other comprehensive loss, net of tax | (58,083) | (70,202) | (114,225) | (17.26) | % | (49.15) | % | ||||||||||||||||||||||

| Total stockholders' equity | 3,074,856 | 3,033,392 | 2,919,249 | 1.37 | % | 5.33 | % | ||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 20,048,934 | $ | 19,888,209 | $ | 19,411,037 | 0.81 | % | 3.29 | % | |||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | |||||||||||||||||||||||||||||

| (Unaudited, dollars in thousands, except per share data) | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| % Change | % Change | ||||||||||||||||||||||||||||

| June 30 2025 |

March 31 2025 |

June 30 2024 |

Jun 2025 vs. | Jun 2025 vs. | |||||||||||||||||||||||||

| Mar 2025 | Jun 2024 | ||||||||||||||||||||||||||||

| Interest income | |||||||||||||||||||||||||||||

| Interest on federal funds sold and short-term investments | $ | 4,393 | $ | 1,438 | $ | 397 | 205.49 | % | 1,006.55 | % | |||||||||||||||||||

| Interest and dividends on securities | 15,881 | 15,297 | 13,994 | 3.82 | % | 13.48 | % | ||||||||||||||||||||||

| Interest and fees on loans | 197,778 | 195,093 | 197,274 | 1.38 | % | 0.26 | % | ||||||||||||||||||||||

| Interest on loans held for sale | 140 | 92 | 199 | 52.17 | % | (29.65) | % | ||||||||||||||||||||||

| Total interest income | 218,192 | 211,920 | 211,864 | 2.96 | % | 2.99 | % | ||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||||||||

| Interest on deposits | 59,843 | 59,436 | 61,469 | 0.68 | % | (2.65) | % | ||||||||||||||||||||||

| Interest on borrowings | 10,853 | 6,979 | 12,469 | 55.51 | % | (12.96) | % | ||||||||||||||||||||||

| Total interest expense | 70,696 | 66,415 | 73,938 | 6.45 | % | (4.38) | % | ||||||||||||||||||||||

| Net interest income | 147,496 | 145,505 | 137,926 | 1.37 | % | 6.94 | % | ||||||||||||||||||||||

| Provision for credit losses | 7,200 | 15,000 | 4,250 | (52.00) | % | 69.41 | % | ||||||||||||||||||||||

| Net interest income after provision for credit losses | 140,296 | 130,505 | 133,676 | 7.50 | % | 4.95 | % | ||||||||||||||||||||||

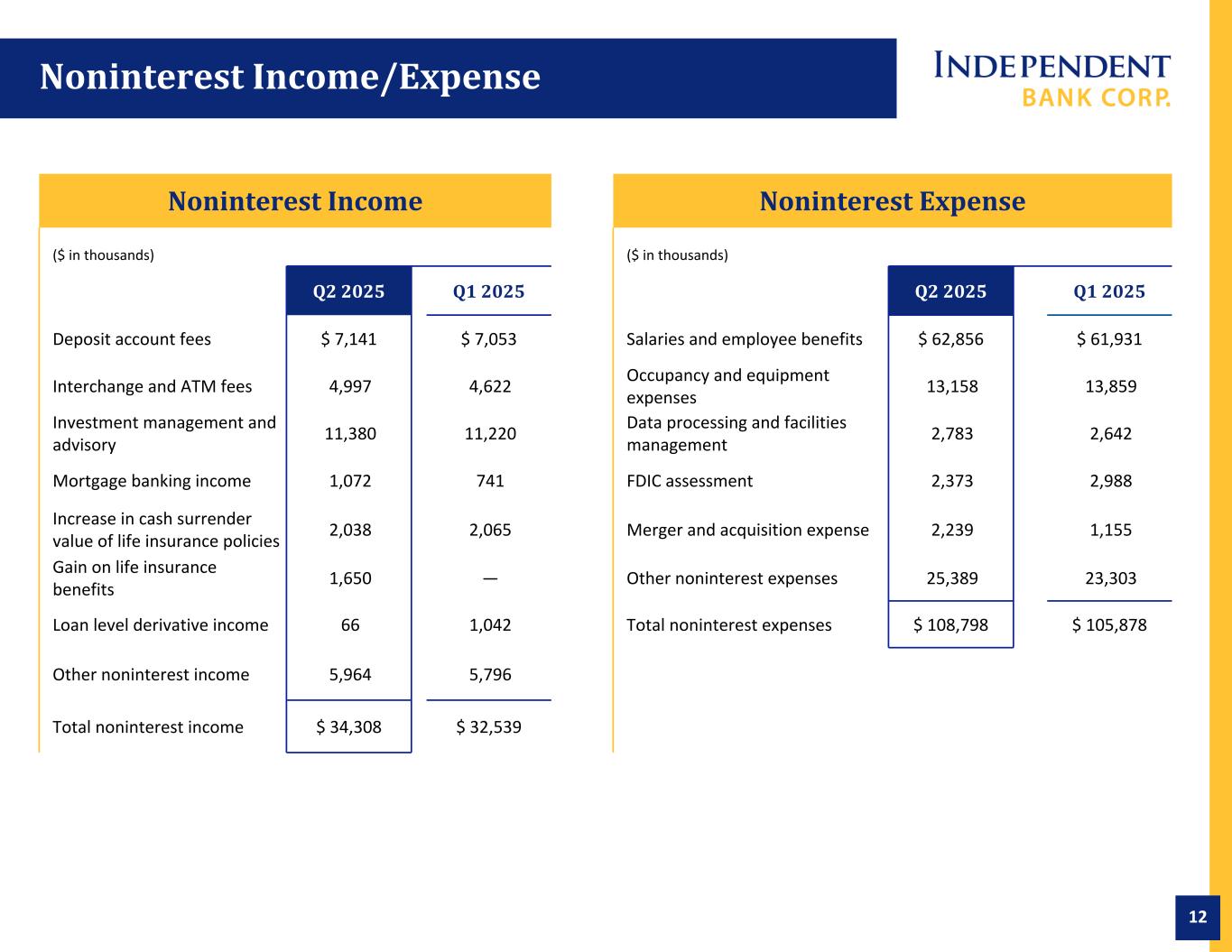

| Noninterest income | |||||||||||||||||||||||||||||

| Deposit account fees | 7,141 | 7,053 | 6,332 | 1.25 | % | 12.78 | % | ||||||||||||||||||||||

| Interchange and ATM fees | 4,997 | 4,622 | 4,753 | 8.11 | % | 5.13 | % | ||||||||||||||||||||||

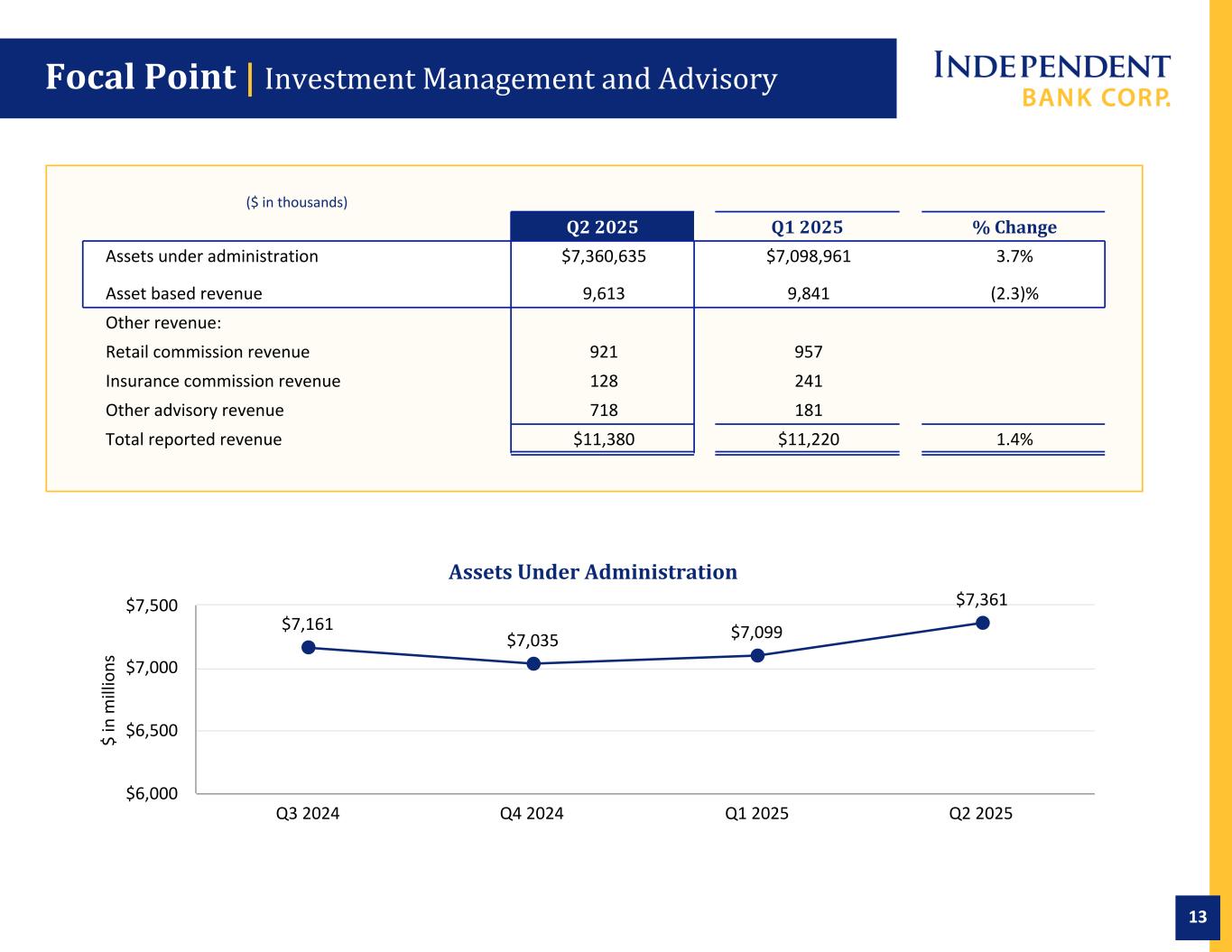

| Investment management and advisory | 11,380 | 11,220 | 10,987 | 1.43 | % | 3.58 | % | ||||||||||||||||||||||

| Mortgage banking income | 1,072 | 741 | 1,320 | 44.67 | % | (18.79) | % | ||||||||||||||||||||||

| Increase in cash surrender value of life insurance policies | 2,038 | 2,065 | 2,000 | (1.31) | % | 1.90 | % | ||||||||||||||||||||||

| Gain on life insurance benefits | 1,650 | — | — | 100.00% | 100.00% | ||||||||||||||||||||||||

| Loan level derivative income | 66 | 1,042 | 473 | (93.67) | % | (86.05) | % | ||||||||||||||||||||||

| Other noninterest income | 5,964 | 5,796 | 6,465 | 2.90 | % | (7.75) | % | ||||||||||||||||||||||

| Total noninterest income | 34,308 | 32,539 | 32,330 | 5.44 | % | 6.12 | % | ||||||||||||||||||||||

| Noninterest expenses | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 62,856 | 61,931 | 57,162 | 1.49 | % | 9.96 | % | ||||||||||||||||||||||

| Occupancy and equipment expenses | 13,158 | 13,859 | 12,472 | (5.06) | % | 5.50 | % | ||||||||||||||||||||||

| Data processing and facilities management | 2,783 | 2,642 | 2,405 | 5.34 | % | 15.72 | % | ||||||||||||||||||||||

| FDIC assessment | 2,373 | 2,988 | 2,694 | (20.58) | % | (11.92) | % | ||||||||||||||||||||||

| Merger and acquisition expense | 2,239 | 1,155 | — | 93.85 | % | 100.00% | |||||||||||||||||||||||

| Other noninterest expenses | 25,389 | 23,303 | 24,881 | 8.95 | % | 2.04 | % | ||||||||||||||||||||||

| Total noninterest expenses | 108,798 | 105,878 | 99,614 | 2.76 | % | 9.22 | % | ||||||||||||||||||||||

| Income before income taxes | 65,806 | 57,166 | 66,392 | 15.11 | % | (0.88) | % | ||||||||||||||||||||||

| Provision for income taxes | 14,705 | 12,742 | 15,062 | 15.41 | % | (2.37) | % | ||||||||||||||||||||||

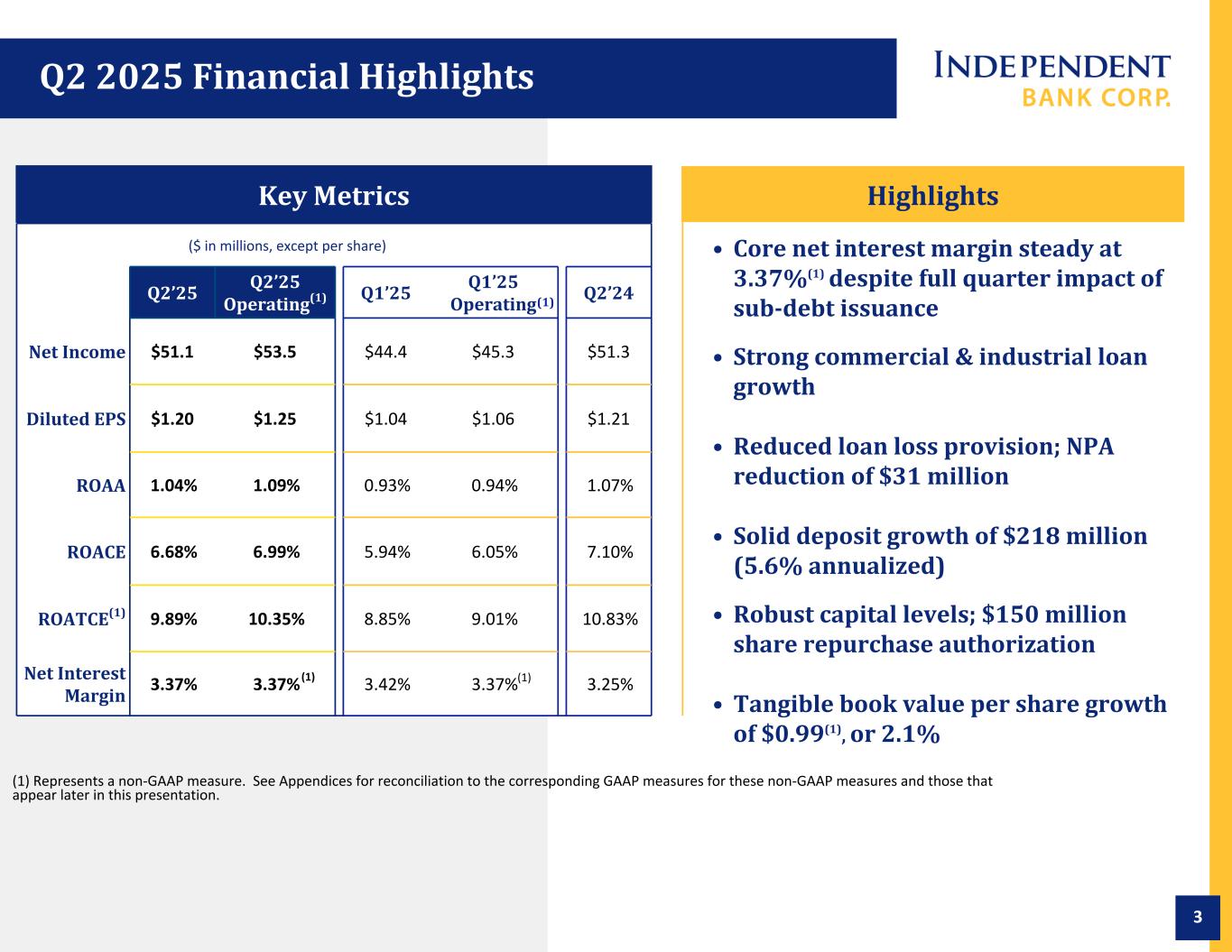

| Net Income | $ | 51,101 | $ | 44,424 | $ | 51,330 | 15.03 | % | (0.45) | % | |||||||||||||||||||

| Weighted average common shares (basic) | 42,623,978 | 42,550,274 | 42,468,658 | ||||||||||||||||||||||||||

| Common share equivalents | 17,153 | 22,353 | 4,308 | ||||||||||||||||||||||||||

| Weighted average common shares (diluted) | 42,641,131 | 42,572,627 | 42,472,966 | ||||||||||||||||||||||||||

| Basic earnings per share | $ | 1.20 | $ | 1.04 | $ | 1.21 | 15.38 | % | (0.83) | % | |||||||||||||||||||

| Diluted earnings per share | $ | 1.20 | $ | 1.04 | $ | 1.21 | 15.38 | % | (0.83) | % | |||||||||||||||||||

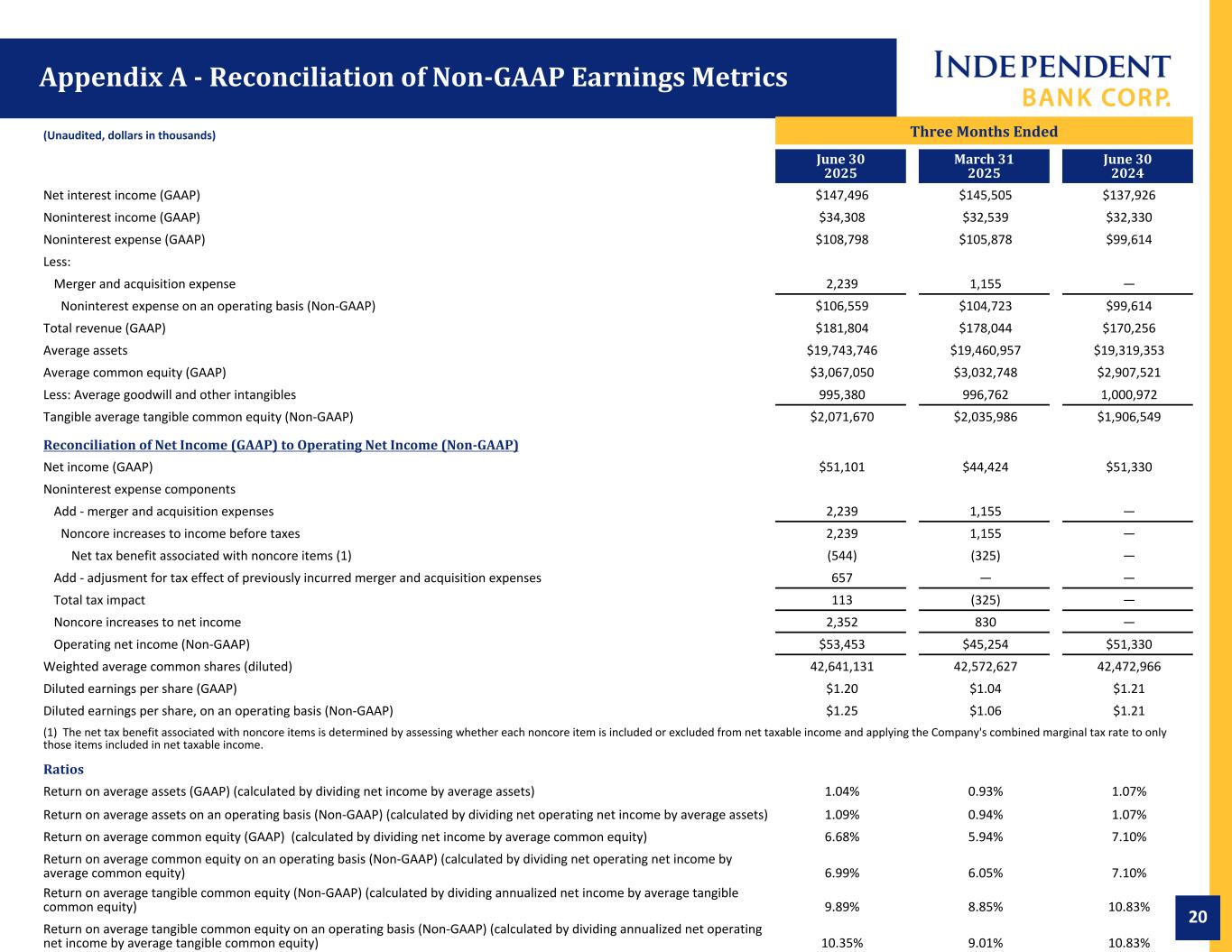

| Reconciliation of Net Income (GAAP) to Operating Net Income (Non-GAAP): | |||||||||||||||||||||||||||||

| Net income | $ | 51,101 | $ | 44,424 | $ | 51,330 | |||||||||||||||||||||||

| Noninterest expense components | |||||||||||||||||||||||||||||

| Add - merger and acquisition expenses | 2,239 | 1,155 | — | ||||||||||||||||||||||||||

| Noncore increases to income before taxes | 2,239 | 1,155 | — | ||||||||||||||||||||||||||

| Net tax benefit associated with noncore items (1) | (544) | (325) | — | ||||||||||||||||||||||||||

| Add - adjustment for tax effect of previously incurred merger and acquisition expenses | 657 | — | — | ||||||||||||||||||||||||||

| Total tax impact | 113 | (325) | — | ||||||||||||||||||||||||||

| Noncore increases to net income | 2,352 | 830 | — | ||||||||||||||||||||||||||

| Operating net income (Non-GAAP) | $ | 53,453 | $ | 45,254 | $ | 51,330 | 18.12 | % | 4.14 | % | |||||||||||||||||||

| Diluted earnings per share, on an operating basis (Non-GAAP) | $ | 1.25 | $ | 1.06 | $ | 1.21 | 17.92 | % | 3.31 | % | |||||||||||||||||||

| (1) The net tax benefit associated with noncore items is determined by assessing whether each noncore item is included or excluded from net taxable income and applying the Company's combined marginal tax rate to only those items included in net taxable income. | |||||||||||||||||||||||||||||

| Performance ratios | |||||||||||||||||||||||||||||

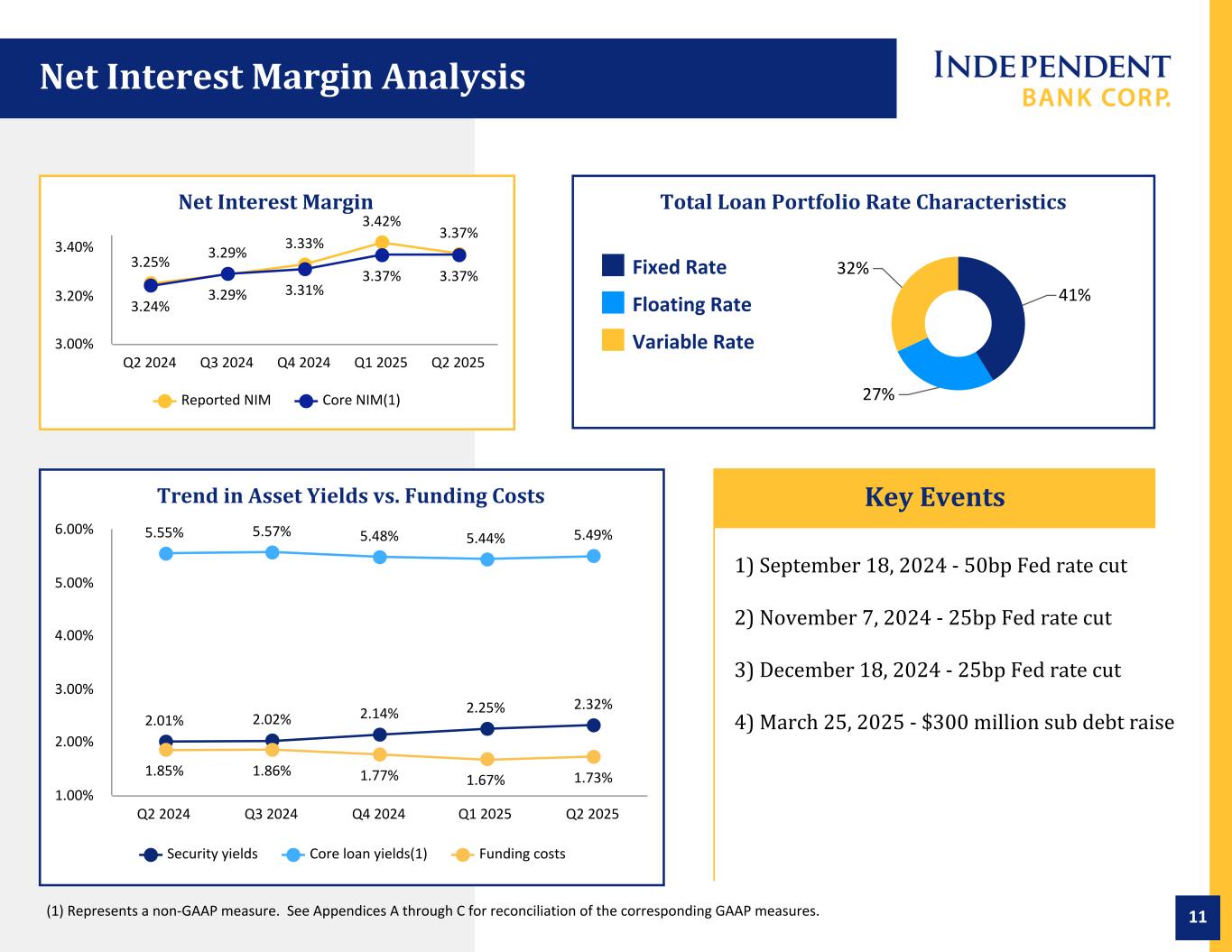

| Net interest margin (FTE) | 3.37 | % | 3.42 | % | 3.25 | % | |||||||||||||||||||||||

| Return on average assets (calculated by dividing net income by average assets) (GAAP) | 1.04 | % | 0.93 | % | 1.07 | % | |||||||||||||||||||||||

| Return on average assets on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average assets) | 1.09 | % | 0.94 | % | 1.07 | % | |||||||||||||||||||||||

| Return on average common equity (calculated by dividing net income by average common equity) (GAAP) | 6.68 | % | 5.94 | % | 7.10 | % | |||||||||||||||||||||||

| Return on average common equity on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average common equity) | 6.99 | % | 6.05 | % | 7.10 | % | |||||||||||||||||||||||

| Return on average tangible common equity (Non-GAAP) (calculated by dividing net income by average tangible common equity) | 9.89 | % | 8.85 | % | 10.83 | % | |||||||||||||||||||||||

| Return on average tangible common equity on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average tangible common equity) | 10.35 | % | 9.01 | % | 10.83 | % | |||||||||||||||||||||||

| Noninterest income as a % of total revenue (GAAP) (calculated by dividing total noninterest income by net interest income plus total noninterest income) | 18.87 | % | 18.28 | % | 18.99 | % | |||||||||||||||||||||||

| Noninterest income as a % of total revenue on an operating basis (Non-GAAP) (calculated by dividing total noninterest income on an operating basis by net interest income plus total noninterest income) | 18.87 | % | 18.28 | % | 18.99 | % | |||||||||||||||||||||||

| Efficiency ratio (GAAP) (calculated by dividing total noninterest expense by total revenue) | 59.84 | % | 59.47 | % | 58.51 | % | |||||||||||||||||||||||

| Efficiency ratio on an operating basis (Non-GAAP) (calculated by dividing total noninterest expense on an operating basis by total revenue) | 58.61 | % | 58.82 | % | 58.51 | % | |||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | ||||||||||||||||||||

| (Unaudited, dollars in thousands, except per share data) | ||||||||||||||||||||

| Six Months Ended | ||||||||||||||||||||

| % Change | ||||||||||||||||||||

| June 30 2025 |

June 30 2024 |

Jun 2025 vs. | ||||||||||||||||||

| Jun 2024 | ||||||||||||||||||||

| Interest income | ||||||||||||||||||||

| Interest on federal funds sold and short-term investments | $ | 5,831 | $ | 880 | 562.61 | % | ||||||||||||||

| Interest and dividends on securities | 31,178 | 28,226 | 10.46 | % | ||||||||||||||||

| Interest and fees on loans | 392,871 | 390,500 | 0.61 | % | ||||||||||||||||

| Interest on loans held for sale | 232 | 303 | (23.43) | % | ||||||||||||||||

| Total interest income | 430,112 | 419,909 | 2.43 | % | ||||||||||||||||

| Interest expense | ||||||||||||||||||||

| Interest on deposits | 119,279 | 115,789 | 3.01 | % | ||||||||||||||||

| Interest on borrowings | 17,832 | 28,755 | (37.99) | % | ||||||||||||||||

| Total interest expense | 137,111 | 144,544 | (5.14) | % | ||||||||||||||||

| Net interest income | 293,001 | 275,365 | 6.40 | % | ||||||||||||||||

| Provision for credit losses | 22,200 | 9,250 | 140.00 | % | ||||||||||||||||

| Net interest income after provision for credit losses | 270,801 | 266,115 | 1.76 | % | ||||||||||||||||

| Noninterest income | ||||||||||||||||||||

| Deposit account fees | 14,194 | 12,560 | 13.01 | % | ||||||||||||||||

| Interchange and ATM fees | 9,619 | 9,205 | 4.50 | % | ||||||||||||||||

| Investment management and advisory | 22,600 | 20,928 | 7.99 | % | ||||||||||||||||

| Mortgage banking income | 1,813 | 2,116 | (14.32) | % | ||||||||||||||||

| Increase in cash surrender value of life insurance policies | 4,103 | 3,928 | 4.46 | % | ||||||||||||||||

| Gain on life insurance benefits | 1,650 | 263 | 527.38 | % | ||||||||||||||||

| Loan level derivative income | 1,108 | 553 | 100.36 | % | ||||||||||||||||

| Other noninterest income | 11,760 | 12,720 | (7.55) | % | ||||||||||||||||

| Total noninterest income | 66,847 | 62,273 | 7.35 | % | ||||||||||||||||

| Noninterest expenses | ||||||||||||||||||||

| Salaries and employee benefits | 124,787 | 114,336 | 9.14 | % | ||||||||||||||||

| Occupancy and equipment expenses | 27,017 | 25,939 | 4.16 | % | ||||||||||||||||

| Data processing and facilities management | 5,425 | 4,888 | 10.99 | % | ||||||||||||||||

| FDIC assessment | 5,361 | 5,676 | (5.55) | % | ||||||||||||||||

| Merger and acquisition expense | 3,394 | — | 100.00% | |||||||||||||||||

| Other noninterest expenses | 48,692 | 48,662 | 0.06 | % | ||||||||||||||||

| Total noninterest expenses | 214,676 | 199,501 | 7.61 | % | ||||||||||||||||

| Income before income taxes | 122,972 | 128,887 | (4.59) | % | ||||||||||||||||

| Provision for income taxes | 27,447 | 29,787 | (7.86) | % | ||||||||||||||||

| Net Income | $ | 95,525 | $ | 99,100 | (3.61) | % | ||||||||||||||

| Weighted average common shares (basic) | 42,587,330 | 42,511,186 | ||||||||||||||||||

| Common share equivalents | 19,753 | 8,592 | ||||||||||||||||||

| Weighted average common shares (diluted) | 42,607,083 | 42,519,778 | ||||||||||||||||||

| Basic earnings per share | $ | 2.24 | $ | 2.33 | (3.86) | % | ||||||||||||||

| Diluted earnings per share | $ | 2.24 | $ | 2.33 | (3.86) | % | ||||||||||||||

| Reconciliation of Net Income (GAAP) to Operating Net Income (Non-GAAP): | ||||||||||||||||||||

| Net Income | $ | 95,525 | $ | 99,100 | ||||||||||||||||

| Noninterest expense components | ||||||||||||||||||||

| Add - merger and acquisition expenses | 3,394 | — | ||||||||||||||||||

| Noncore increases to income before taxes | 3,394 | — | ||||||||||||||||||

| Net tax benefit associated with noncore items (1) | (593) | — | ||||||||||||||||||

| Add - adjustment for tax effect of previously incurred merger and acquisition expenses | 381 | — | ||||||||||||||||||

| Total tax impact | (212) | — | ||||||||||||||||||

| Noncore increases to net income | 3,182 | — | ||||||||||||||||||

| Operating net income (Non-GAAP) | $ | 98,707 | $ | 99,100 | (0.40) | % | ||||||||||||||

| Diluted earnings per share, on an operating basis (Non-GAAP) | $ | 2.32 | $ | 2.33 | (0.43) | % | ||||||||||||||

| (1) The net tax benefit associated with noncore items is determined by assessing whether each noncore item is included or excluded from net taxable income and applying the Company's combined marginal tax rate to only those items included in net taxable income. | ||||||||||||||||||||

| Performance ratios | ||||||||||||||||||||

| Net interest margin (FTE) | 3.40 | % | 3.24 | % | ||||||||||||||||

| Return on average assets (GAAP) (calculated by dividing net income by average assets) | 0.98 | % | 1.03 | % | ||||||||||||||||

| Return on average assets on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average assets) | 1.02 | % | 1.03 | % | ||||||||||||||||

| Return on average common equity (GAAP) (calculated by dividing net income by average common equity) | 6.32 | % | 6.87 | % | ||||||||||||||||

| Return on average common equity on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average common equity) | 6.53 | % | 6.87 | % | ||||||||||||||||

| Return on average tangible common equity (Non-GAAP) (calculated by dividing net income by average tangible common equity) | 9.38 | % | 10.49 | % | ||||||||||||||||

| Return on average tangible common equity on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average tangible common equity) | 9.69 | % | 10.49 | % | ||||||||||||||||

| Noninterest income as a % of total revenue (GAAP) (calculated by dividing total noninterest income by net interest income plus total noninterest income) | 18.58 | % | 18.44 | % | ||||||||||||||||

| Noninterest income as a % of total revenue on an operating basis (Non-GAAP) (calculated by dividing total noninterest income on an operating basis by net interest income plus total noninterest income) | 18.58 | % | 18.44 | % | ||||||||||||||||

| Efficiency ratio (GAAP) (calculated by dividing total noninterest expense by total revenue) | 59.66 | % | 59.09 | % | ||||||||||||||||

| Efficiency ratio on an operating basis (Non-GAAP) (calculated by dividing total noninterest expense on an operating basis by total revenue) | 58.71 | % | 59.09 | % | ||||||||||||||||

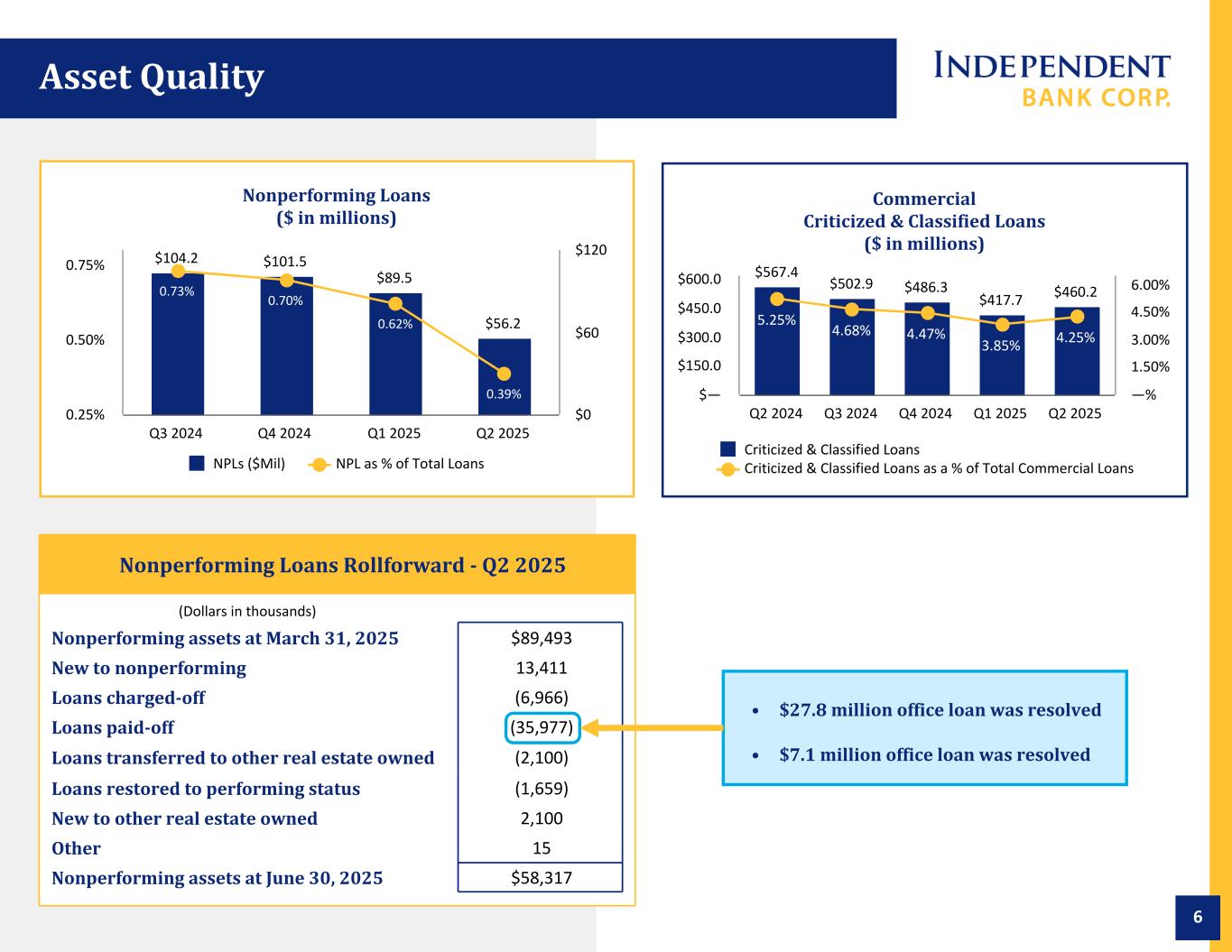

| ASSET QUALITY | ||||||||||||||||||||

| (Unaudited, dollars in thousands) | Nonperforming Assets At | |||||||||||||||||||

| June 30 2025 |

March 31 2025 |

June 30 2024 |

||||||||||||||||||

| Nonperforming loans | ||||||||||||||||||||

| Commercial & industrial loans | $ | 13,544 | $ | 9,683 | $ | 17,897 | ||||||||||||||

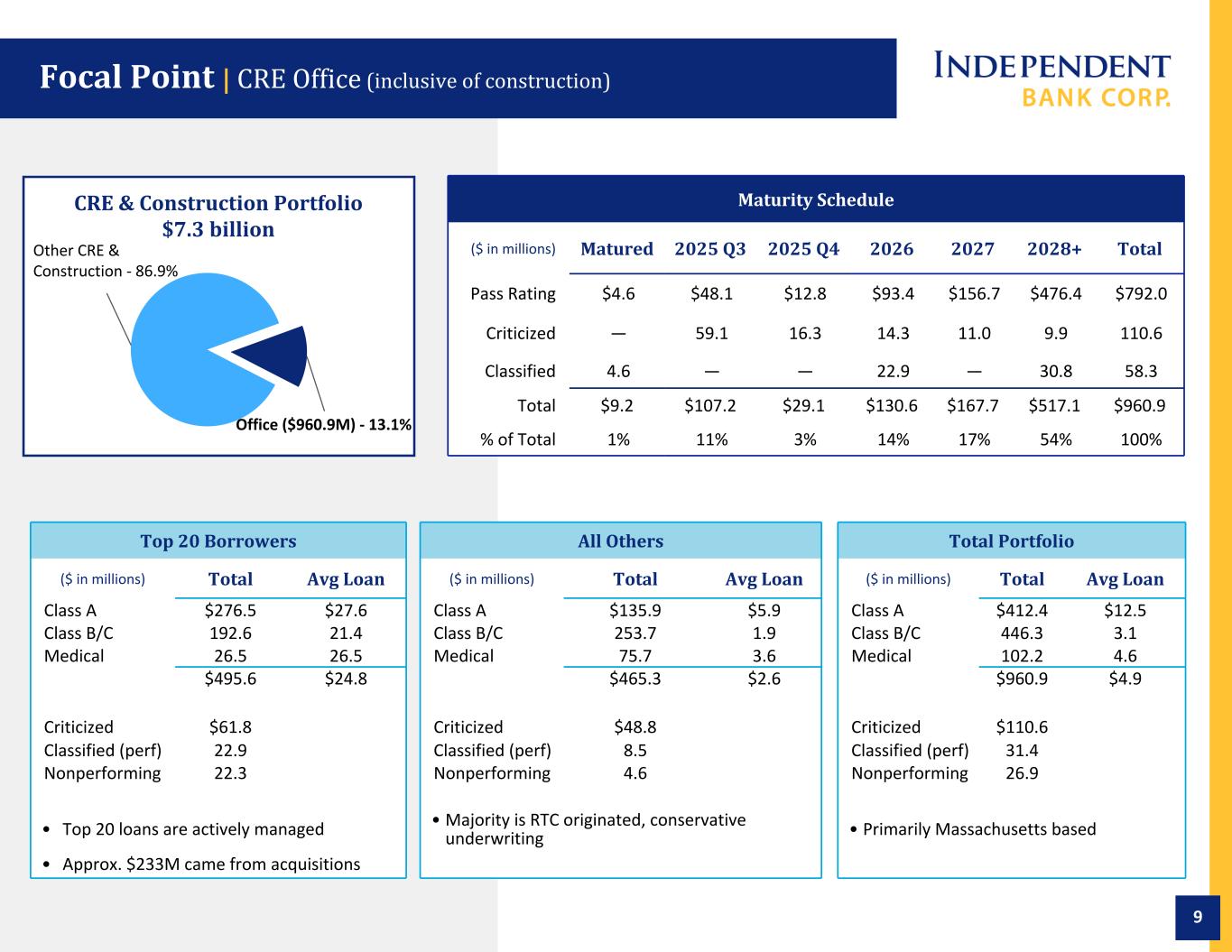

| Commercial real estate loans | 28,717 | 65,840 | 23,375 | |||||||||||||||||

| Small business loans | 173 | 156 | 437 | |||||||||||||||||

| Residential real estate loans | 10,013 | 10,966 | 10,629 | |||||||||||||||||

| Home equity | 3,765 | 2,840 | 5,090 | |||||||||||||||||

| Other consumer | 5 | 8 | 23 | |||||||||||||||||

| Total nonperforming loans | 56,217 | 89,493 | 57,451 | |||||||||||||||||

| Other real estate owned | 2,100 | — | 110 | |||||||||||||||||

| Total nonperforming assets | $ | 58,317 | $ | 89,493 | $ | 57,561 | ||||||||||||||

| Nonperforming loans/gross loans | 0.39 | % | 0.62 | % | 0.40 | % | ||||||||||||||

| Nonperforming assets/total assets | 0.29 | % | 0.45 | % | 0.30 | % | ||||||||||||||

| Allowance for credit losses/nonperforming loans | 257.53 | % | 161.01 | % | 262.59 | % | ||||||||||||||

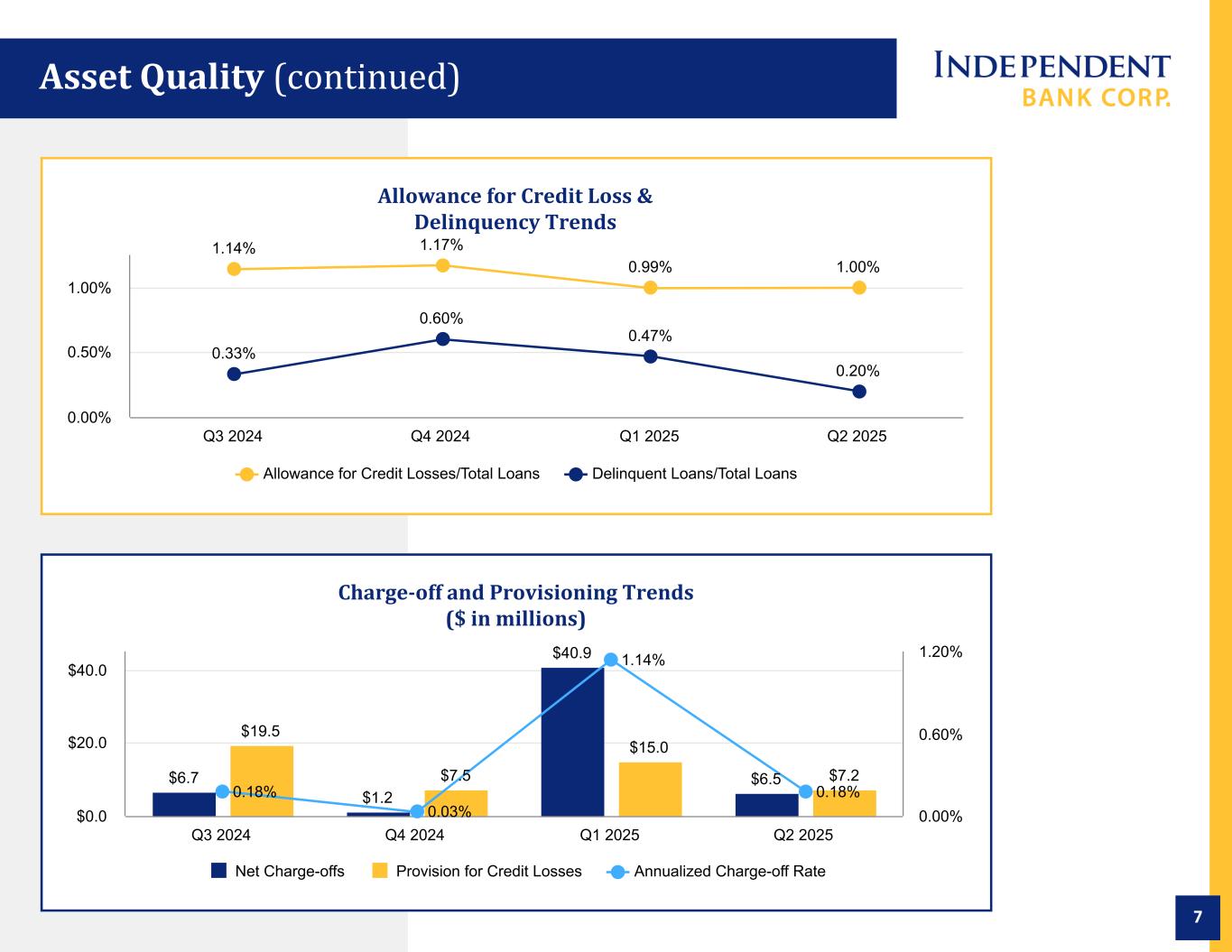

| Allowance for credit losses/total loans | 1.00 | % | 0.99 | % | 1.05 | % | ||||||||||||||

| Delinquent loans/total loans | 0.20 | % | 0.47 | % | 0.37 | % | ||||||||||||||

| Nonperforming Assets Reconciliation for the Three Months Ended | ||||||||||||||||||||

| June 30 2025 |

March 31 2025 |

June 30 2024 |

||||||||||||||||||

| Nonperforming assets beginning balance | $ | 89,493 | $ | 101,529 | $ | 57,051 | ||||||||||||||

| New to nonperforming | 13,411 | 41,777 | 6,201 | |||||||||||||||||

| Loans charged-off | (6,966) | (41,400) | (808) | |||||||||||||||||

| Loans paid-off | (35,977) | (10,932) | (3,458) | |||||||||||||||||

| Loans transferred to other real estate owned | (2,100) | — | — | |||||||||||||||||

| Loans restored to performing status | (1,659) | (1,356) | (1,429) | |||||||||||||||||

| New to other real estate owned | 2,100 | — | — | |||||||||||||||||

| Other | 15 | (125) | 4 | |||||||||||||||||

| Nonperforming assets ending balance | $ | 58,317 | $ | 89,493 | $ | 57,561 | ||||||||||||||

| Net Charge-Offs (Recoveries) | |||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| June 30 2025 |

March 31 2025 |

June 30 2024 |

June 30 2025 |

June 30 2024 |

|||||||||||||||||||||||||

| Net charge-offs (recoveries) | |||||||||||||||||||||||||||||

| Commercial and industrial loans | $ | 2,742 | $ | 53 | $ | (2) | $ | 2,795 | $ | (87) | |||||||||||||||||||

| Commercial real estate loans | 3,347 | 39,996 | — | 43,343 | — | ||||||||||||||||||||||||

| Small business loans | 51 | 99 | 48 | 150 | 118 | ||||||||||||||||||||||||

| Home equity | (49) | 78 | (137) | 29 | (270) | ||||||||||||||||||||||||

| Other consumer | 428 | 666 | 430 | 1,094 | 852 | ||||||||||||||||||||||||

| Total net charge-offs | $ | 6,519 | $ | 40,892 | $ | 339 | $ | 47,411 | $ | 613 | |||||||||||||||||||

| Net charge-offs to average loans (annualized) | 0.18 | % | 1.14 | % | 0.01 | % | 0.66 | % | 0.01 | % | |||||||||||||||||||

| BALANCE SHEET AND CAPITAL RATIOS | |||||||||||||||||

| June 30 2025 |

March 31 2025 |

June 30 2024 |

|||||||||||||||

| Gross loans/total deposits | 91.44 | % | 92.45 | % | 93.45 | % | |||||||||||

| Common equity tier 1 capital ratio (1) | 14.70 | % | 14.52 | % | 14.40 | % | |||||||||||

| Tier 1 leverage capital ratio (1) | 11.44 | % | 11.43 | % | 11.09 | % | |||||||||||

| Common equity to assets ratio GAAP | 15.34 | % | 15.25 | % | 15.04 | % | |||||||||||

| Tangible common equity to tangible assets ratio (2) | 10.92 | % | 10.78 | % | 10.42 | % | |||||||||||

| Book value per share GAAP | $ | 72.13 | $ | 71.19 | $ | 68.74 | |||||||||||

| Tangible book value per share (2) | $ | 48.80 | $ | 47.81 | $ | 45.19 | |||||||||||

| INDEPENDENT BANK CORP. SUPPLEMENTAL FINANCIAL INFORMATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited, dollars in thousands) | Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2025 | March 31, 2025 | June 30, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest | Interest | Interest | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Earned/ | Yield/ | Average | Earned/ | Yield/ | Average | Earned/ | Yield/ | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance | Paid (1) | Rate | Balance | Paid (1) | Rate | Balance | Paid (1) | Rate | ||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning deposits with banks, federal funds sold, and short term investments | $ | 406,108 | $ | 4,393 | 4.34 | % | $ | 141,410 | $ | 1,438 | 4.12 | % | $ | 47,598 | $ | 397 | 3.35 | % | ||||||||||||||||||||||||||||||||||||||

| Securities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities - trading | 4,796 | — | — | % | 4,513 | — | — | % | 4,739 | — | — | % | ||||||||||||||||||||||||||||||||||||||||||||

| Securities - taxable investments | 2,737,166 | 15,879 | 2.33 | % | 2,747,039 | 15,296 | 2.26 | % | 2,793,145 | 13,992 | 2.01 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Securities - nontaxable investments (1) | 195 | 2 | 4.11 | % | 195 | 1 | 2.08 | % | 189 | 2 | 4.26 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total securities | $ | 2,742,157 | $ | 15,881 | 2.32 | % | $ | 2,751,747 | $ | 15,297 | 2.25 | % | $ | 2,798,073 | $ | 13,994 | 2.01 | % | ||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 9,839 | 140 | 5.71 | % | 6,396 | 92 | 5.83 | % | 12,610 | 199 | 6.35 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Loans | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial (1) | 3,156,455 | 47,583 | 6.05 | % | 3,045,816 | 47,283 | 6.30 | % | 2,998,465 | 45,707 | 6.13 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate (1) | 6,585,559 | 85,871 | 5.23 | % | 6,719,504 | 84,919 | 5.13 | % | 6,698,076 | 87,047 | 5.23 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial construction | 809,839 | 13,766 | 6.82 | % | 785,312 | 13,167 | 6.80 | % | 834,876 | 15,451 | 7.44 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Small business | 294,562 | 4,929 | 6.71 | % | 290,245 | 4,778 | 6.68 | % | 265,273 | 4,376 | 6.63 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total commercial | 10,846,415 | 152,149 | 5.63 | % | 10,840,877 | 150,147 | 5.62 | % | 10,796,690 | 152,581 | 5.68 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Residential real estate | 2,471,810 | 28,079 | 4.56 | % | 2,464,464 | 27,716 | 4.56 | % | 2,427,635 | 26,472 | 4.39 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Home equity | 1,160,123 | 18,144 | 6.27 | % | 1,140,190 | 17,774 | 6.32 | % | 1,109,979 | 18,826 | 6.82 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total consumer real estate | 3,631,933 | 46,223 | 5.10 | % | 3,604,654 | 45,490 | 5.12 | % | 3,537,614 | 45,298 | 5.15 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Other consumer | 35,850 | 582 | 6.51 | % | 38,618 | 593 | 6.23 | % | 31,019 | 593 | 7.69 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 14,514,198 | $ | 198,954 | 5.50 | % | $ | 14,484,149 | $ | 196,230 | 5.49 | % | $ | 14,365,323 | $ | 198,472 | 5.56 | % | ||||||||||||||||||||||||||||||||||||||

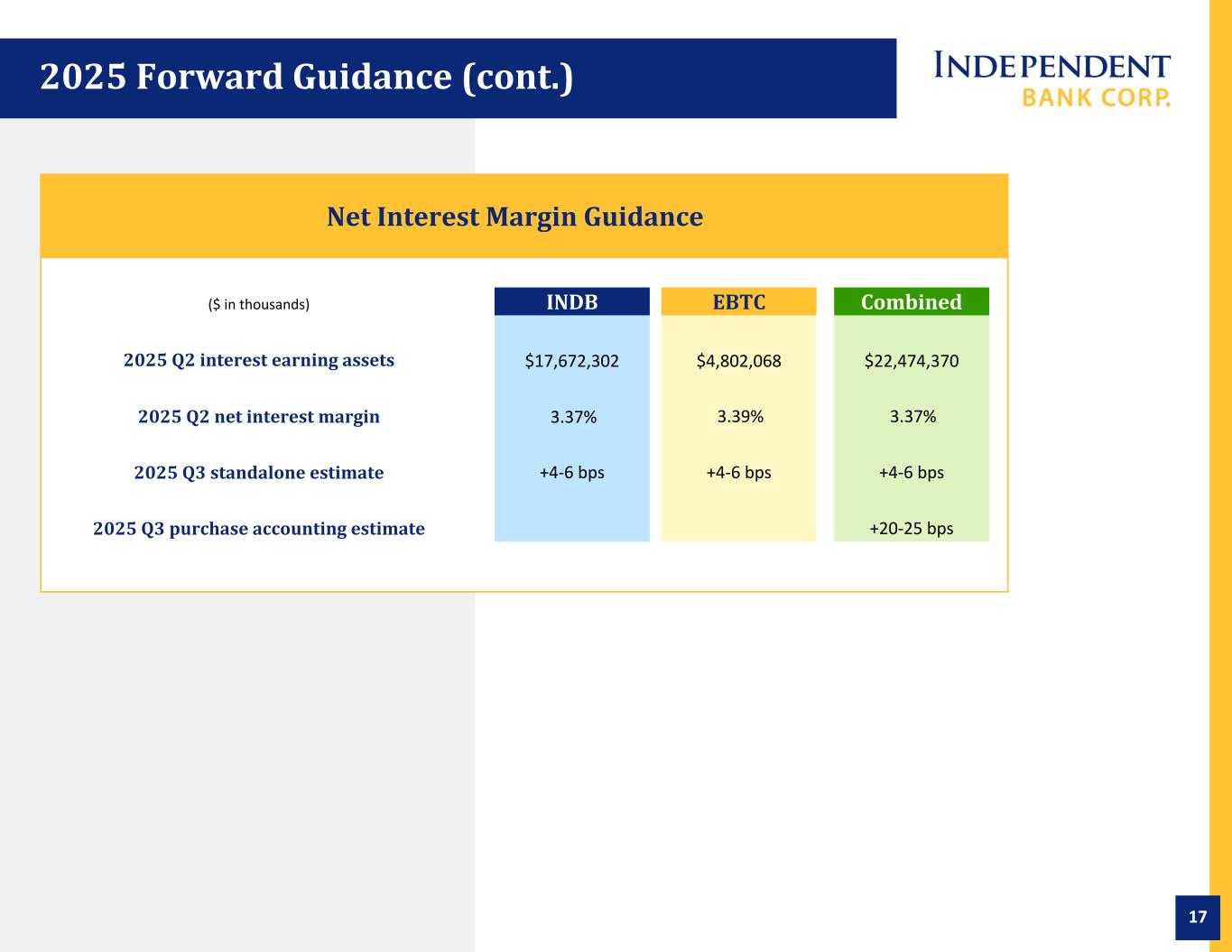

| Total interest-earning assets | $ | 17,672,302 | $ | 219,368 | 4.98 | % | $ | 17,383,702 | $ | 213,057 | 4.97 | % | $ | 17,223,604 | $ | 213,062 | 4.98 | % | ||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 196,147 | 197,536 | 178,558 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank stock | 22,900 | 27,646 | 41,110 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 1,852,397 | 1,852,073 | 1,876,081 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 19,743,746 | $ | 19,460,957 | $ | 19,319,353 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings and interest checking accounts | $ | 5,214,871 | $ | 16,553 | 1.27 | % | $ | 5,222,353 | $ | 16,162 | 1.26 | % | $ | 5,166,340 | $ | 16,329 | 1.27 | % | ||||||||||||||||||||||||||||||||||||||

| Money market | 3,295,080 | 19,090 | 2.32 | % | 3,178,879 | 17,710 | 2.26 | % | 2,909,503 | 17,409 | 2.41 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Time deposits | 2,705,299 | 24,200 | 3.59 | % | 2,723,975 | 25,564 | 3.81 | % | 2,579,336 | 27,731 | 4.32 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | $ | 11,215,250 | $ | 59,843 | 2.14 | % | $ | 11,125,207 | $ | 59,436 | 2.17 | % | $ | 10,655,179 | $ | 61,469 | 2.32 | % | ||||||||||||||||||||||||||||||||||||||

| Borrowings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank borrowings | 432,392 | 4,233 | 3.93 | % | 547,713 | 5,566 | 4.12 | % | 957,268 | 11,329 | 4.76 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Junior subordinated debentures | 62,861 | 976 | 6.23 | % | 62,860 | 974 | 6.28 | % | 62,859 | 1,140 | 7.29 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Subordinated debentures | 296,373 | 5,644 | 7.64 | % | 23,070 | 439 | 7.72 | % | — | — | — | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total borrowings | $ | 791,626 | $ | 10,853 | 5.50 | % | $ | 633,643 | $ | 6,979 | 4.47 | % | $ | 1,020,127 | $ | 12,469 | 4.92 | % | ||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 12,006,876 | $ | 70,696 | 2.36 | % | $ | 11,758,850 | $ | 66,415 | 2.29 | % | $ | 11,675,306 | $ | 73,938 | 2.55 | % | ||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | 4,372,122 | 4,345,631 | 4,360,897 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 297,698 | 323,728 | 375,629 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | $ | 16,676,696 | $ | 16,428,209 | $ | 16,411,832 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 3,067,050 | 3,032,748 | 2,907,521 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 19,743,746 | $ | 19,460,957 | $ | 19,319,353 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 148,672 | $ | 146,642 | $ | 139,124 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate spread (2) | 2.62 | % | 2.68 | % | 2.43 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin (3) | 3.37 | % | 3.42 | % | 3.25 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Supplemental Information | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits, including demand deposits | $ | 15,587,372 | $ | 59,843 | $ | 15,470,838 | $ | 59,436 | $ | 15,016,076 | $ | 61,469 | ||||||||||||||||||||||||||||||||||||||||||||

| Cost of total deposits | 1.54 | % | 1.56 | % | 1.65 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total funding liabilities, including demand deposits | $ | 16,378,998 | $ | 70,696 | $ | 16,104,481 | $ | 66,415 | $ | 16,036,203 | $ | 73,938 | ||||||||||||||||||||||||||||||||||||||||||||

| Cost of total funding liabilities | 1.73 | % | 1.67 | % | 1.85 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

(1) The total amount of adjustment to present interest income and yield on a fully tax-equivalent basis was $1.2 million for the three months ended June 30, 2025, $1.1 million for the three months ended March 31, 2025, and $1.2 million for the three months ended June 30, 2024, determined by applying the Company’s marginal tax rates in effect during each respective quarter. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Interest rate spread represents the difference between weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Net interest margin represents annualized net interest income as a percentage of average interest-earning assets. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Six Months Ended | ||||||||||||||||||||||||||||||||||||||

| June 30, 2025 | June 30, 2024 | |||||||||||||||||||||||||||||||||||||

| Interest | Interest | |||||||||||||||||||||||||||||||||||||

| Average | Earned/ | Yield/ | Average | Earned/ | Yield/ | |||||||||||||||||||||||||||||||||

| Balance | Paid | Rate | Balance | Paid | Rate | |||||||||||||||||||||||||||||||||

| Interest-earning assets | ||||||||||||||||||||||||||||||||||||||

| Interest earning deposits with banks, federal funds sold, and short term investments | $ | 274,490 | $ | 5,831 | 4.28 | % | $ | 49,091 | $ | 880 | 3.60 | % | ||||||||||||||||||||||||||

| Securities | ||||||||||||||||||||||||||||||||||||||

| Securities - trading | 4,655 | — | — | % | 4,759 | — | — | % | ||||||||||||||||||||||||||||||

| Securities - taxable investments | 2,742,075 | 31,175 | 2.29 | % | 2,830,302 | 28,223 | 2.01 | % | ||||||||||||||||||||||||||||||

| Securities - nontaxable investments (1) | 195 | 3 | 3.10 | % | 190 | 4 | 4.23 | % | ||||||||||||||||||||||||||||||

| Total securities | $ | 2,746,925 | $ | 31,178 | 2.29 | % | $ | 2,835,251 | $ | 28,227 | 2.00 | % | ||||||||||||||||||||||||||

| Loans held for sale | 8,127 | 232 | 5.76 | % | 9,853 | 303 | 6.18 | % | ||||||||||||||||||||||||||||||

| Loans | ||||||||||||||||||||||||||||||||||||||

| Commercial and industrial (1) | 3,101,441 | 94,866 | 6.17 | % | 2,973,982 | 90,302 | 6.11 | % | ||||||||||||||||||||||||||||||

| Commercial real estate (1) | 6,652,161 | 170,790 | 5.18 | % | 6,709,684 | 172,135 | 5.16 | % | ||||||||||||||||||||||||||||||

| Commercial construction | 797,643 | 26,933 | 6.81 | % | 838,678 | 30,872 | 7.40 | % | ||||||||||||||||||||||||||||||

| Small business | 292,415 | 9,707 | 6.69 | % | 261,147 | 8,536 | 6.57 | % | ||||||||||||||||||||||||||||||

| Total commercial | 10,843,660 | 302,296 | 5.62 | % | 10,783,491 | 301,845 | 5.63 | % | ||||||||||||||||||||||||||||||

| Residential real estate | 2,468,158 | 55,795 | 4.56 | % | 2,423,126 | 52,555 | 4.36 | % | ||||||||||||||||||||||||||||||

| Home equity | 1,150,212 | 35,918 | 6.30 | % | 1,102,418 | 37,270 | 6.80 | % | ||||||||||||||||||||||||||||||

| Total consumer real estate | 3,618,370 | 91,713 | 5.11 | % | 3,525,544 | 89,825 | 5.12 | % | ||||||||||||||||||||||||||||||

| Other consumer | 37,227 | 1,175 | 6.36 | % | 30,844 | 1,202 | 7.84 | % | ||||||||||||||||||||||||||||||

| Total loans | $ | 14,499,257 | $ | 395,184 | 5.50 | % | $ | 14,339,879 | $ | 392,872 | 5.51 | % | ||||||||||||||||||||||||||

| Total interest-earning assets | $ | 17,528,799 | $ | 432,425 | 4.97 | % | $ | 17,234,074 | $ | 422,282 | 4.93 | % | ||||||||||||||||||||||||||

| Cash and due from banks | 196,838 | 178,032 | ||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank stock | 25,260 | 44,157 | ||||||||||||||||||||||||||||||||||||

| Other assets | 1,852,236 | 1,842,859 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 19,603,133 | $ | 19,299,122 | ||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||||||||

| Savings and interest checking accounts | $ | 5,218,591 | $ | 32,715 | 1.26 | % | $ | 5,166,103 | $ | 31,185 | 1.21 | % | ||||||||||||||||||||||||||

| Money market | 3,237,300 | 36,800 | 2.29 | % | 2,876,759 | 33,400 | 2.33 | % | ||||||||||||||||||||||||||||||

| Time deposits | 2,714,586 | 49,764 | 3.70 | % | 2,438,277 | 51,204 | 4.22 | % | ||||||||||||||||||||||||||||||

| Total interest-bearing deposits | $ | 11,170,477 | $ | 119,279 | 2.15 | % | $ | 10,481,139 | $ | 115,789 | 2.22 | % | ||||||||||||||||||||||||||

| Borrowings | ||||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank borrowings | 489,733 | 9,799 | 4.03 | % | 1,071,282 | 25,960 | 4.87 | % | ||||||||||||||||||||||||||||||

| Junior subordinated debentures | 62,861 | 1,950 | 6.26 | % | 62,858 | 2,287 | 7.32 | % | ||||||||||||||||||||||||||||||

| Subordinated debentures | 160,477 | 6,083 | 7.64 | % | 20,326 | 508 | 5.03 | % | ||||||||||||||||||||||||||||||

| Total borrowings | $ | 713,071 | $ | 17,832 | 5.04 | % | $ | 1,154,466 | $ | 28,755 | 5.01 | % | ||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 11,883,548 | $ | 137,111 | 2.33 | % | $ | 11,635,605 | $ | 144,544 | 2.50 | % | ||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | 4,358,950 | 4,400,002 | ||||||||||||||||||||||||||||||||||||

| Other liabilities | 310,641 | 361,601 | ||||||||||||||||||||||||||||||||||||

| Total liabilities | $ | 16,553,139 | $ | 16,397,208 | ||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 3,049,994 | 2,901,914 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 19,603,133 | $ | 19,299,122 | ||||||||||||||||||||||||||||||||||

| Net interest income | $ | 295,314 | $ | 277,738 | ||||||||||||||||||||||||||||||||||

| Interest rate spread (2) | 2.64 | % | 2.43 | % | ||||||||||||||||||||||||||||||||||

| Net interest margin (3) | 3.40 | % | 3.24 | % | ||||||||||||||||||||||||||||||||||

| Supplemental Information | ||||||||||||||||||||||||||||||||||||||

| Total deposits, including demand deposits | $ | 15,529,427 | $ | 119,279 | $ | 14,881,141 | $ | 115,789 | ||||||||||||||||||||||||||||||

| Cost of total deposits | 1.55 | % | 1.56 | % | ||||||||||||||||||||||||||||||||||

| Total funding liabilities, including demand deposits | $ | 16,242,498 | $ | 137,111 | $ | 16,035,607 | $ | 144,544 | ||||||||||||||||||||||||||||||

| Cost of total funding liabilities | 1.70 | % | 1.81 | % | ||||||||||||||||||||||||||||||||||

| June 30 2025 |

March 31 2025 |

June 30 2024 |

|||||||||||||||||||||

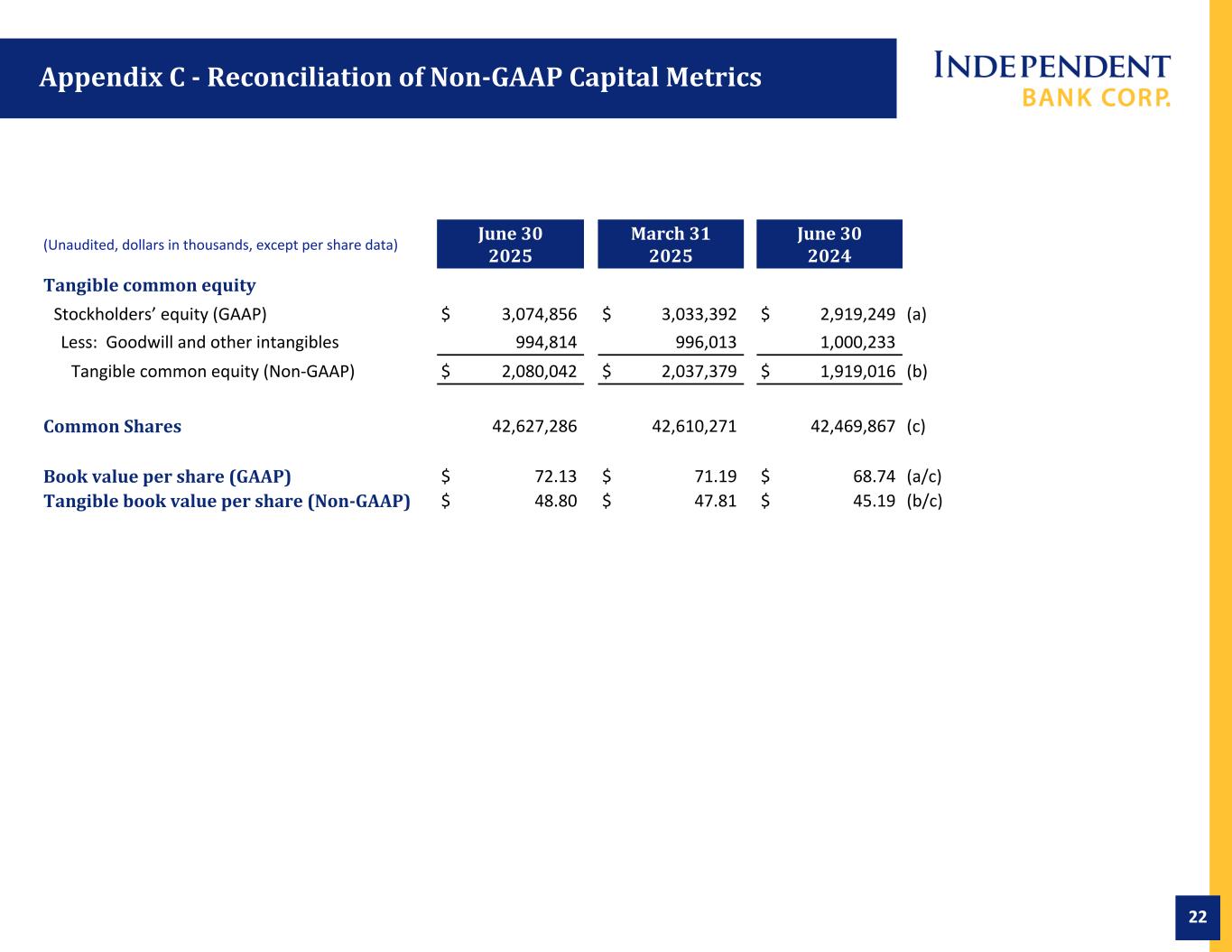

| Tangible common equity | (Dollars in thousands, except per share data) | ||||||||||||||||||||||

| Stockholders’ equity (GAAP) | $ | 3,074,856 | $ | 3,033,392 | $ | 2,919,249 | (a) | ||||||||||||||||

| Less: Goodwill and other intangibles | 994,814 | 996,013 | 1,000,233 | ||||||||||||||||||||

| Tangible common equity (Non-GAAP) | $ | 2,080,042 | $ | 2,037,379 | $ | 1,919,016 | (b) | ||||||||||||||||

| Tangible assets | |||||||||||||||||||||||

| Assets (GAAP) | $ | 20,048,934 | $ | 19,888,209 | $ | 19,411,037 | (c) | ||||||||||||||||

| Less: Goodwill and other intangibles | 994,814 | 996,013 | 1,000,233 | ||||||||||||||||||||

| Tangible assets (Non-GAAP) | $ | 19,054,120 | $ | 18,892,196 | $ | 18,410,804 | (d) | ||||||||||||||||

| Common Shares | 42,627,286 | 42,610,271 | 42,469,867 | (e) | |||||||||||||||||||

| Common equity to assets ratio (GAAP) | 15.34 | % | 15.25 | % | 15.04 | % | (a/c) | ||||||||||||||||

| Tangible common equity to tangible assets ratio (Non-GAAP) | 10.92 | % | 10.78 | % | 10.42 | % | (b/d) | ||||||||||||||||

| Book value per share (GAAP) | $ | 72.13 | $ | 71.19 | $ | 68.74 | (a/e) | ||||||||||||||||

| Tangible book value per share (Non-GAAP) | $ | 48.80 | $ | 47.81 | $ | 45.19 | (b/e) | ||||||||||||||||

| (Unaudited, dollars in thousands) | Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||

| June 30 2025 |

March 31 2025 |

June 30 2024 |

June 30 2025 |

June 30 2024 |

|||||||||||||||||||||||||

| Net interest income (GAAP) | $ | 147,496 | $ | 145,505 | $ | 137,926 | $ | 293,001 | $ | 275,365 | |||||||||||||||||||

| Noninterest income (GAAP) | $ | 34,308 | $ | 32,539 | $ | 32,330 | $ | 66,847 | $ | 62,273 | |||||||||||||||||||

| Total revenue (GAAP) | $ | 181,804 | $ | 178,044 | $ | 170,256 | $ | 359,848 | $ | 337,638 | |||||||||||||||||||

| Noninterest expense (GAAP) | 108,798 | $ | 105,878 | $ | 99,614 | $ | 214,676 | $ | 199,501 | ||||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||

| Merger and acquisition expense | 2,239 | 1,155 | — | 3,394 | — | ||||||||||||||||||||||||

| Noninterest expense on an operating basis (Non-GAAP) | $ | 106,559 | $ | 104,723 | $ | 99,614 | $ | 211,282 | $ | 199,501 | |||||||||||||||||||

| Average assets | $ | 19,743,746 | $ | 19,460,957 | $ | 19,319,353 | $ | 19,603,133 | $ | 19,299,122 | |||||||||||||||||||

| Average common equity (GAAP) | $ | 3,067,050 | $ | 3,032,748 | $ | 2,907,521 | $ | 3,049,994 | $ | 2,901,914 | |||||||||||||||||||

| Less: Average goodwill and other intangibles | 995,380 | 996,762 | 1,000,972 | 996,067 | 1,001,739 | ||||||||||||||||||||||||

| Tangible average tangible common equity (Non-GAAP) | $ | 2,071,670 | $ | 2,035,986 | $ | 1,906,549 | $ | 2,053,927 | $ | 1,900,175 | |||||||||||||||||||

| Reconciliation of Net Income (GAAP) to Operating Net Income (Non-GAAP) | |||||||||||||||||||||||||||||

| Net income (GAAP) | $ | 51,101 | $ | 44,424 | $ | 51,330 | $ | 95,525 | $ | 99,100 | |||||||||||||||||||

| Noninterest expense components | |||||||||||||||||||||||||||||

| Add - merger and acquisition expenses | 2,239 | 1,155 | — | 3,394 | — | ||||||||||||||||||||||||

| Noncore increases to income before taxes | 2,239 | 1,155 | — | 3,394 | — | ||||||||||||||||||||||||

| Net tax benefit associated with noncore items (1) | (544) | (325) | — | (593) | — | ||||||||||||||||||||||||

| Add - adjustment for tax effect of previously incurred merger and acquisition expenses | 657 | — | — | 381 | — | ||||||||||||||||||||||||

| Total tax impact | 113 | (325) | — | (212) | — | ||||||||||||||||||||||||

| Noncore increases to net income | 2,352 | 830 | — | 3,182 | — | ||||||||||||||||||||||||

| Operating net income (Non-GAAP) | $ | 53,453 | $ | 45,254 | $ | 51,330 | $ | 98,707 | $ | 99,100 | |||||||||||||||||||

| (1) The net tax benefit associated with noncore items is determined by assessing whether each noncore item is included or excluded from net taxable income and applying the Company's combined marginal tax rate to only those items included in net taxable income. | |||||||||||||||||||||||||||||

| Ratios | |||||||||||||||||||||||||||||

| Return on average assets (GAAP) (calculated by dividing net income by average assets) | 1.04 | % | 0.93 | % | 1.07 | % | 0.98 | % | 1.03 | % | |||||||||||||||||||

| Return on average assets on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average assets) | 1.09 | % | 0.94 | % | 1.07 | % | 1.02 | % | 1.03 | % | |||||||||||||||||||

| Return on average common equity (GAAP) (calculated by dividing net income by average common equity) | 6.68 | % | 5.94 | % | 7.10 | % | 6.32 | % | 6.87 | % | |||||||||||||||||||

| Return on average common equity on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average common equity) | 6.99 | % | 6.05 | % | 7.10 | % | 6.53 | % | 6.87 | % | |||||||||||||||||||

| Return on average tangible common equity (Non-GAAP) (calculated by dividing annualized net income by average tangible common equity) | 9.89 | % | 8.85 | % | 10.83 | % | 9.38 | % | 10.49 | % | |||||||||||||||||||

| Return on average tangible common equity on an operating basis (Non-GAAP) (calculated by dividing annualized net operating net income by average tangible common equity) | 10.35 | % | 9.01 | % | 10.83 | % | 9.69 | % | 10.49 | % | |||||||||||||||||||

| Noninterest income as a % of total revenue (GAAP) (calculated by dividing total noninterest income by total revenue) | 18.87 | % | 18.28 | % | 18.99 | % | 18.58 | % | 18.44 | % | |||||||||||||||||||

| Noninterest income as a % of total revenue on an operating basis (Non-GAAP) (calculated by dividing total noninterest income on an operating basis by total revenue) | 18.87 | % | 18.28 | % | 18.99 | % | 18.58 | % | 18.44 | % | |||||||||||||||||||

| Efficiency ratio (GAAP) (calculated by dividing total noninterest expense by total revenue) | 59.84 | % | 59.47 | % | 58.51 | % | 59.66 | % | 59.09 | % | |||||||||||||||||||

| Efficiency ratio on an operating basis (Non-GAAP) (calculated by dividing total noninterest expense on an operating basis by total revenue) | 58.61 | % | 58.82 | % | 58.51 | % | 58.71 | % | 59.09 | % | |||||||||||||||||||

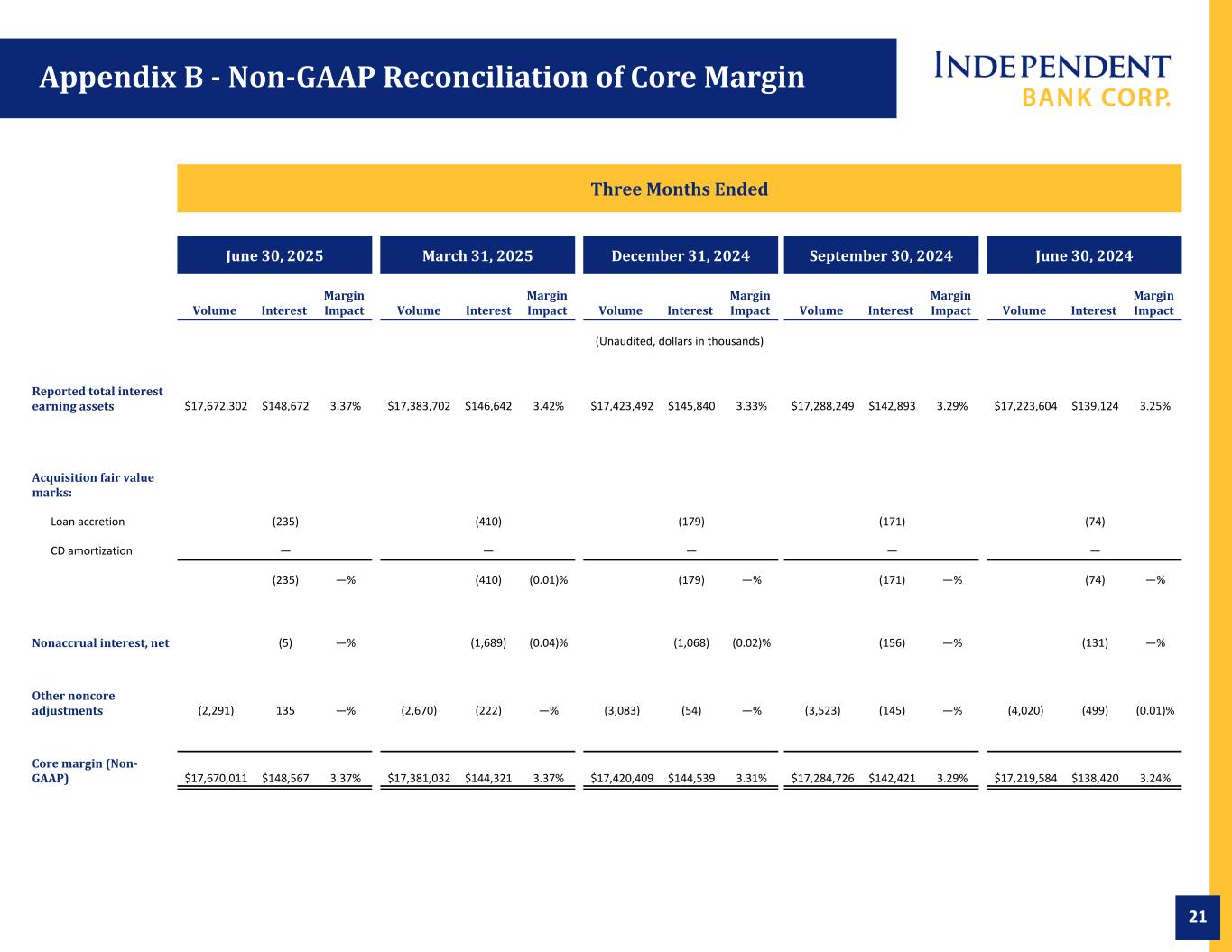

| (Unaudited, dollars in thousands) | Three Months Ended | ||||||||||||||||||||||

| June 30, 2025 | March 31, 2025 | ||||||||||||||||||||||

| Volume | Interest | Margin Impact | Volume | Interest | Margin Impact | ||||||||||||||||||

| Reported total interest earning assets | $ | 17,672,302 | $ | 148,672 | 3.37 | % | $ | 17,383,702 | $ | 146,642 | 3.42 | % | |||||||||||

| Acquisition fair value marks: | |||||||||||||||||||||||

| Loan accretion | (235) | — | % | (410) | (0.01) | % | |||||||||||||||||

| Nonaccrual interest, net | (5) | — | % | (1,689) | (0.04) | % | |||||||||||||||||

| Other noncore adjustments | (2,291) | 135 | — | % | (2,670) | (222) | — | % | |||||||||||||||

| Core margin (Non-GAAP) | $ | 17,670,011 | $ | 148,567 | 3.37 | % | $ | 17,381,032 | $ | 144,321 | 3.37 | % | |||||||||||