Document

Exhibit 99.1

Shareholder Relations NEWS RELEASE

288 Union Street

Rockland, Ma. 02370

INDEPENDENT BANK CORP. REPORTS FIRST QUARTER NET INCOME OF $44.4 MILLION

Solid Fundamentals Offset by Elevated Provision

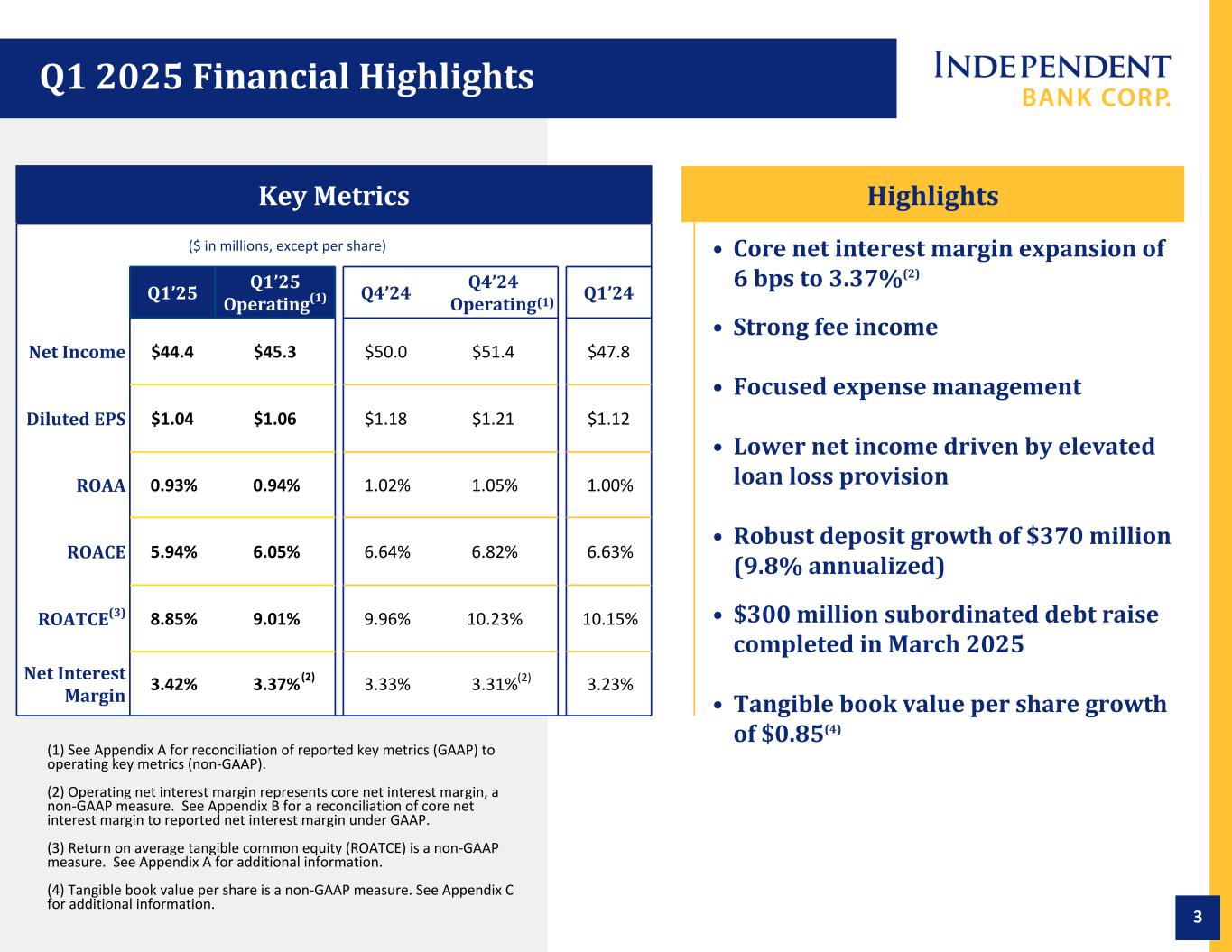

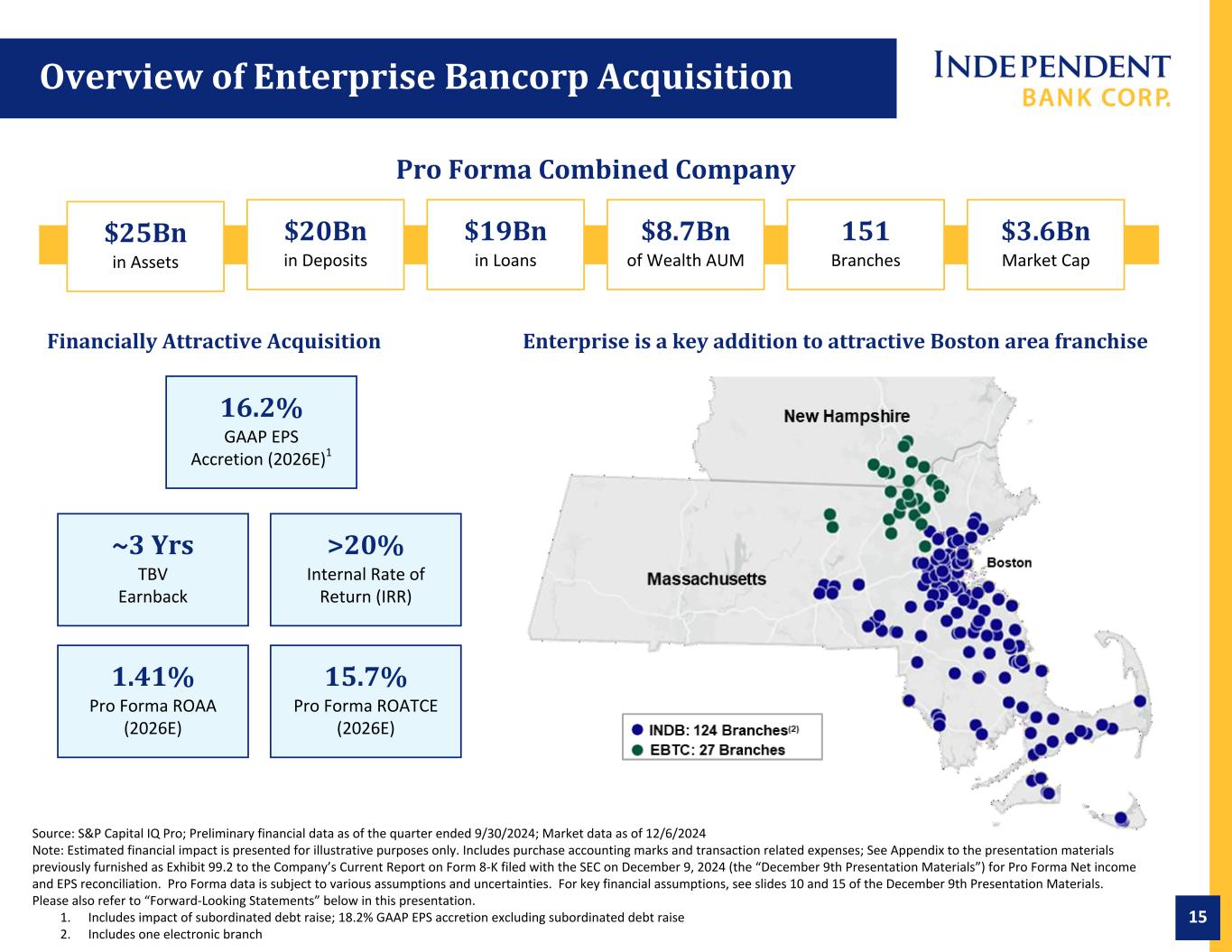

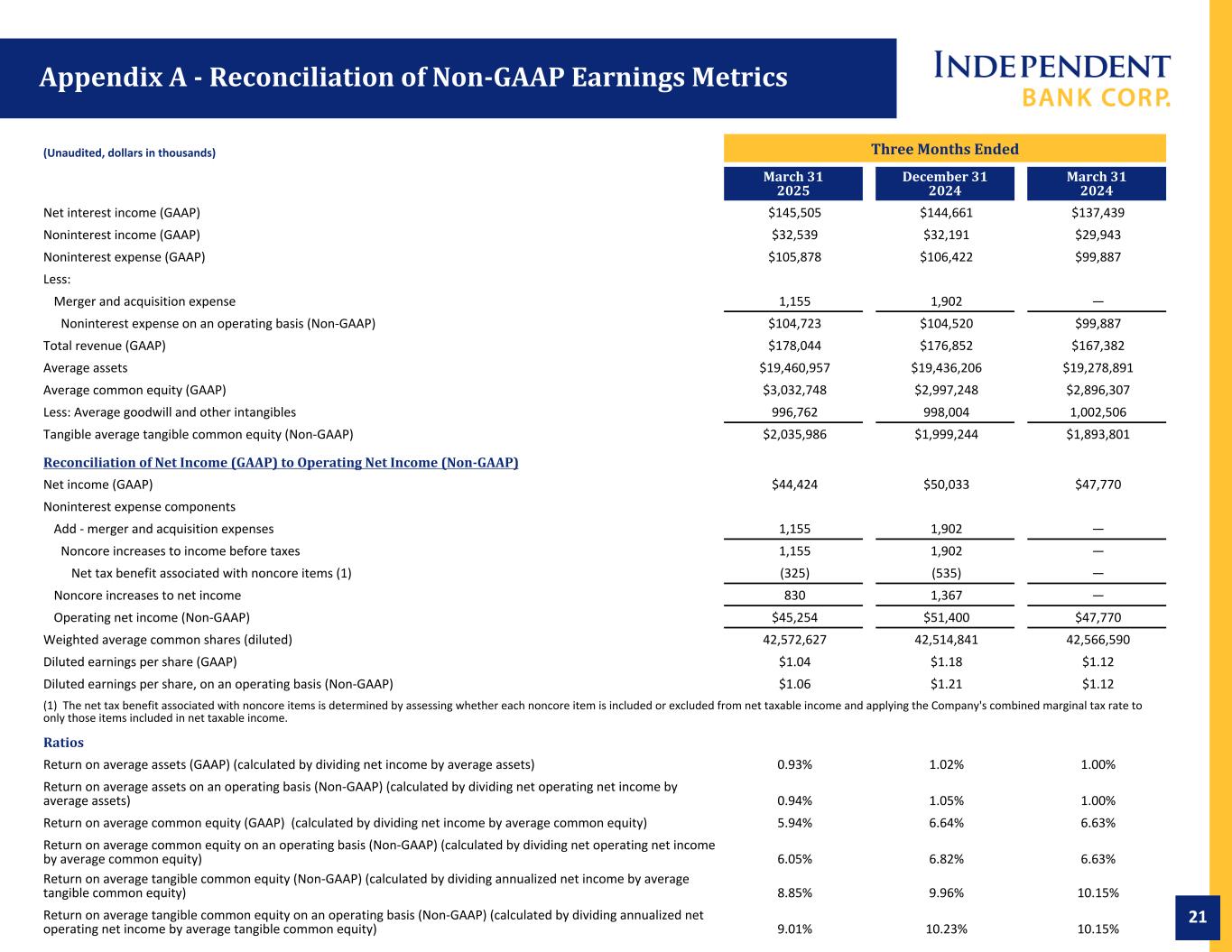

Rockland, Massachusetts (April 17, 2025) - Independent Bank Corp. (Nasdaq Global Select Market: INDB), parent of Rockland Trust Company, today announced 2025 first quarter net income of $44.4 million, or $1.04 per diluted share, as compared to 2024 fourth quarter net income of $50.0 million, or $1.18 per diluted share. The decline was primarily driven by a higher loan loss provision. These financial results include pre-tax merger-related costs of $1.2 million and $1.9 million for the first quarter of 2025 and fourth quarter of 2024, respectively, associated with the Company’s pending acquisition of Enterprise Bancorp, Inc. (“Enterprise”) and its subsidiary, Enterprise Bank. Excluding merger-related costs and the related tax effects, 2025 first quarter operating net income was $45.3 million, or $1.06 per diluted share, compared to $51.4 million, or $1.21 per diluted share for the 2024 fourth quarter. Please refer to Appendix B for a reconciliation of Non-GAAP earnings metrics.

FINANCIAL HIGHLIGHTS

•The Company generated a return on average assets and a return on average common equity of 0.93% and 5.94%, respectively, for the first quarter of 2025, as compared to 1.02% and 6.64%, respectively, for the prior quarter. On an operating basis, the Company generated a return on average assets and a return on average common equity of 0.94% and 6.05%, respectively, for the first quarter of 2025, as compared to 1.05% and 6.82%, respectively, for the prior quarter. Please refer to Appendix B for a reconciliation of Non-GAAP earnings metrics.

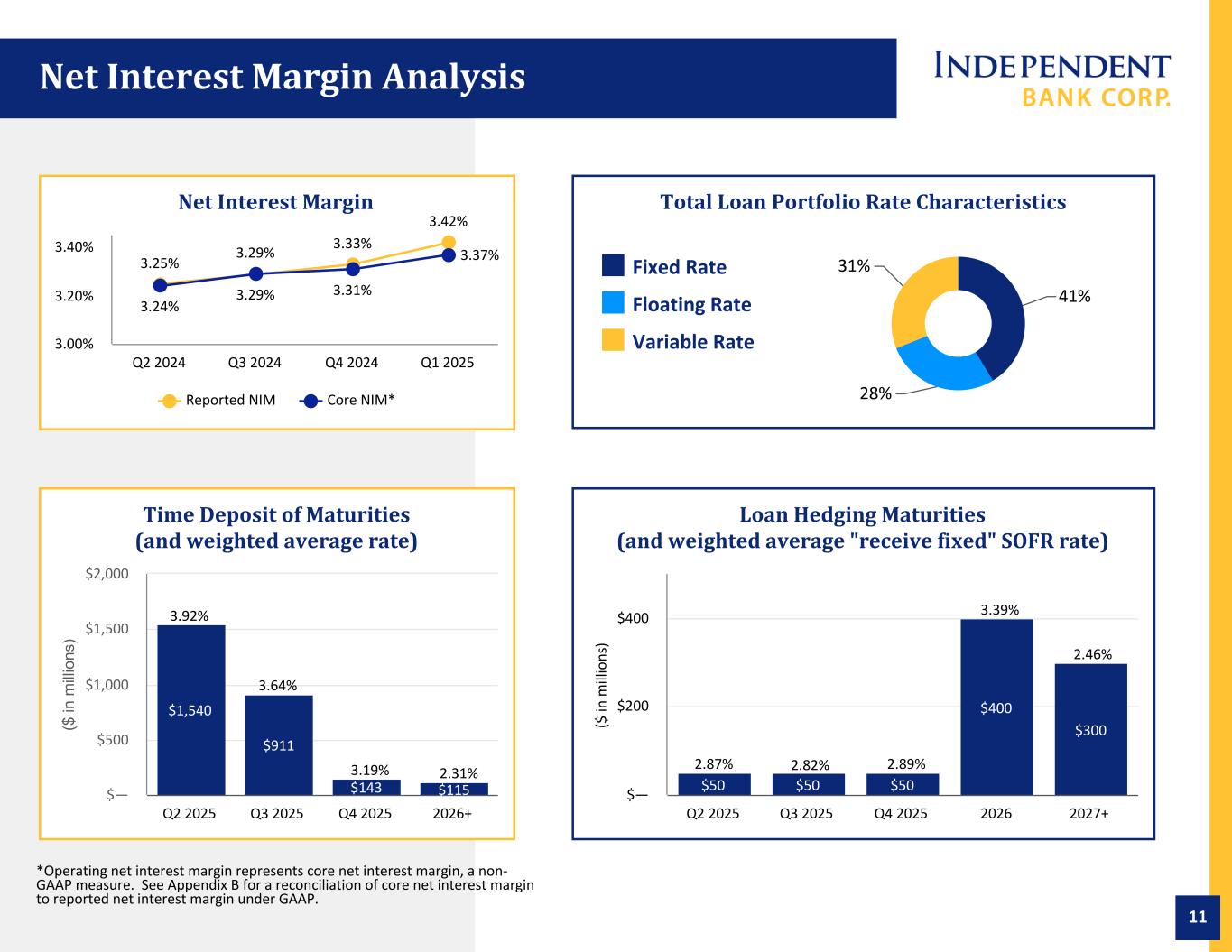

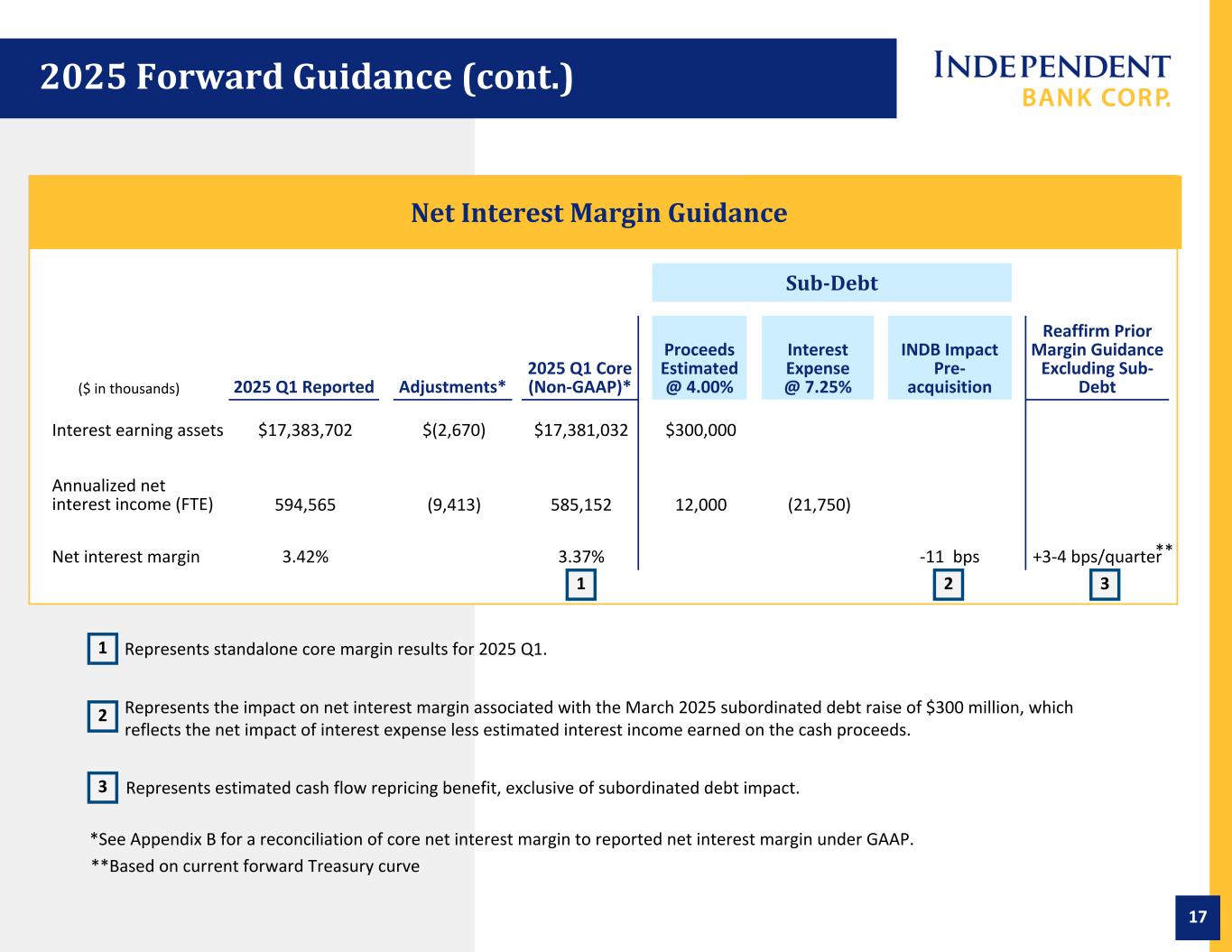

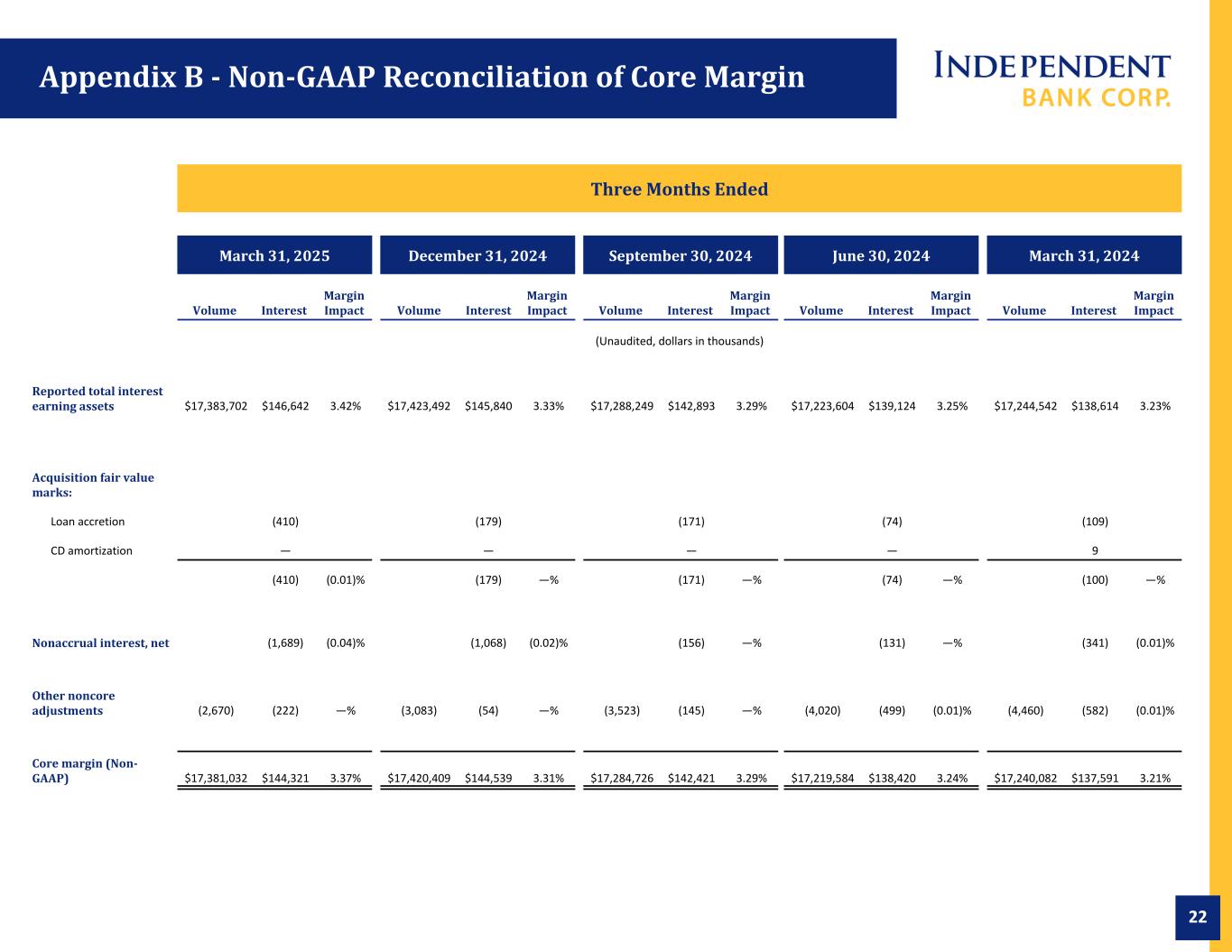

•The Company’s net interest margin of 3.42% increased 9 basis points compared to the prior quarter, and the core margin of 3.37% increased 6 basis points. Please refer to Appendix C for additional information regarding net interest margin and Non-GAAP reconciliation of core margin.

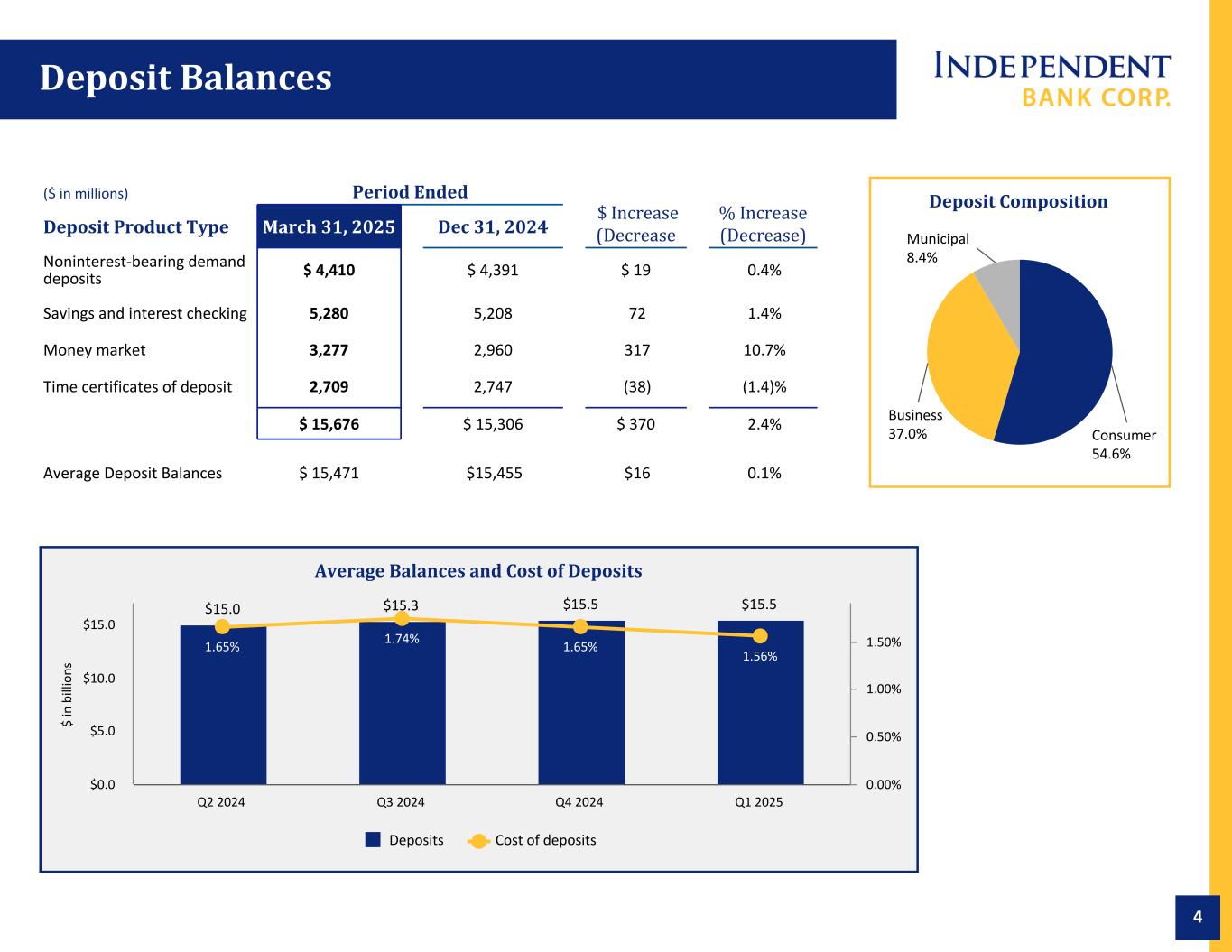

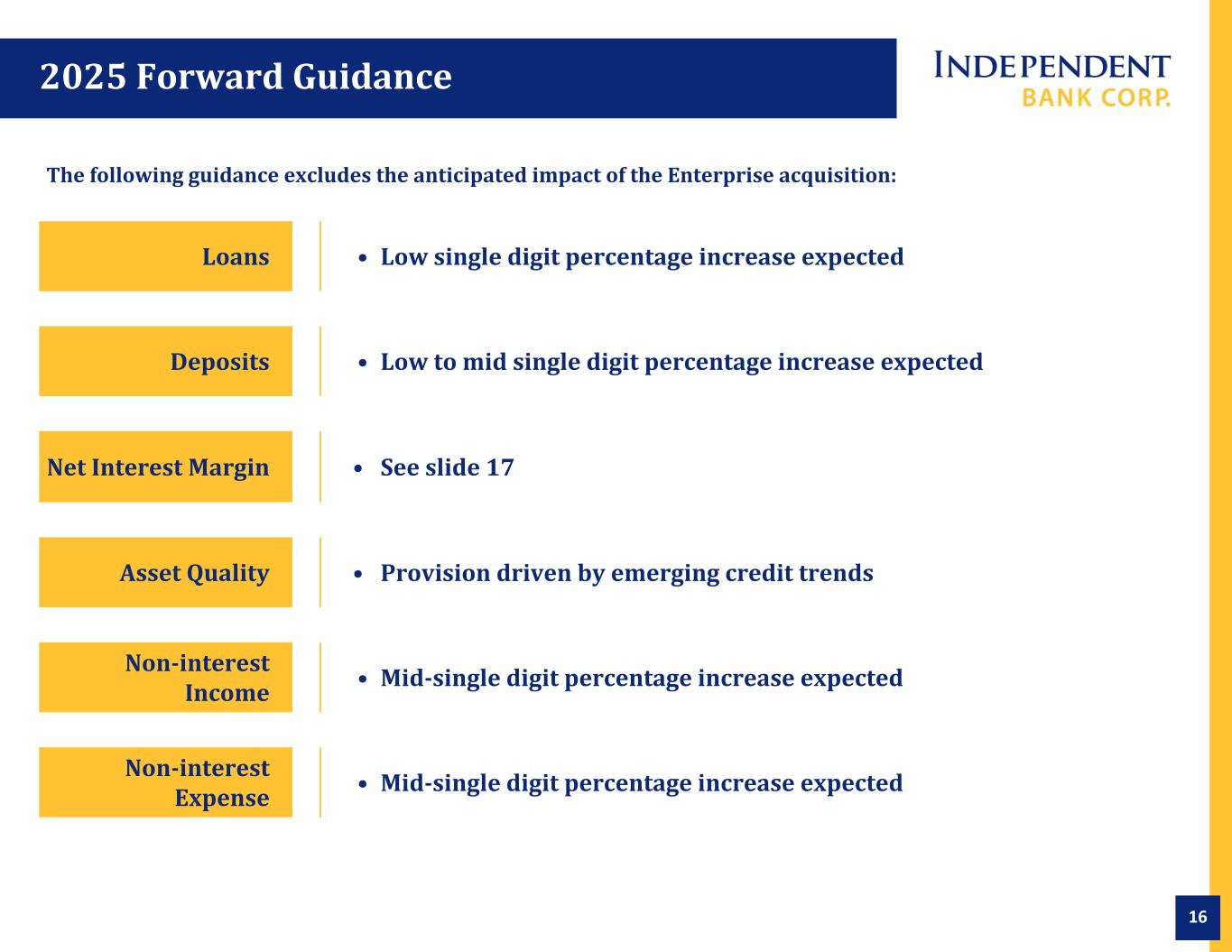

•Deposit balances of $15.7 billion at March 31, 2025 increased $370.0 million, or 2.4% (9.8% annualized), from the fourth quarter of 2024.

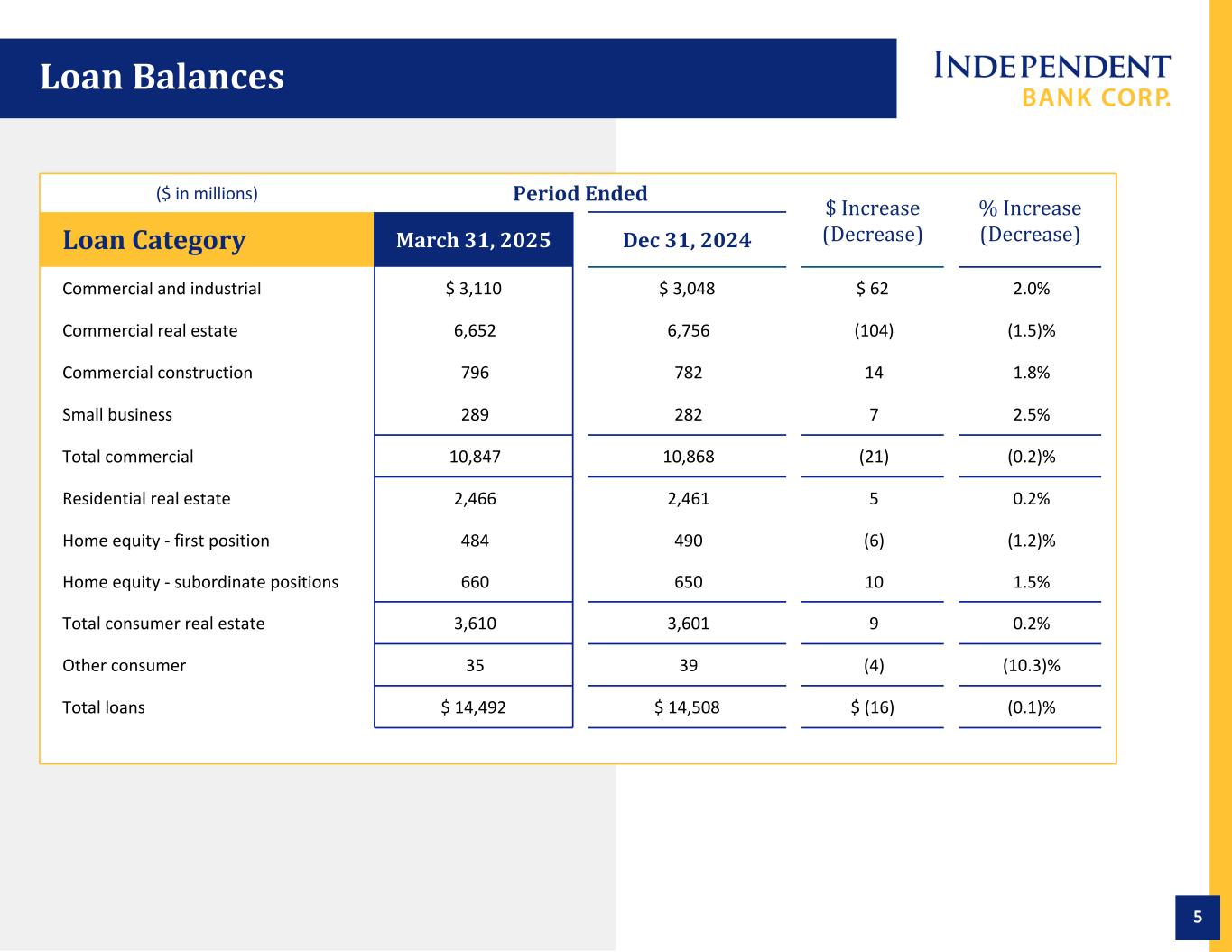

•Loan balances of $14.5 billion remained consistent with the prior quarter.

•The Company raised $300 million of subordinated debt in March 2025.

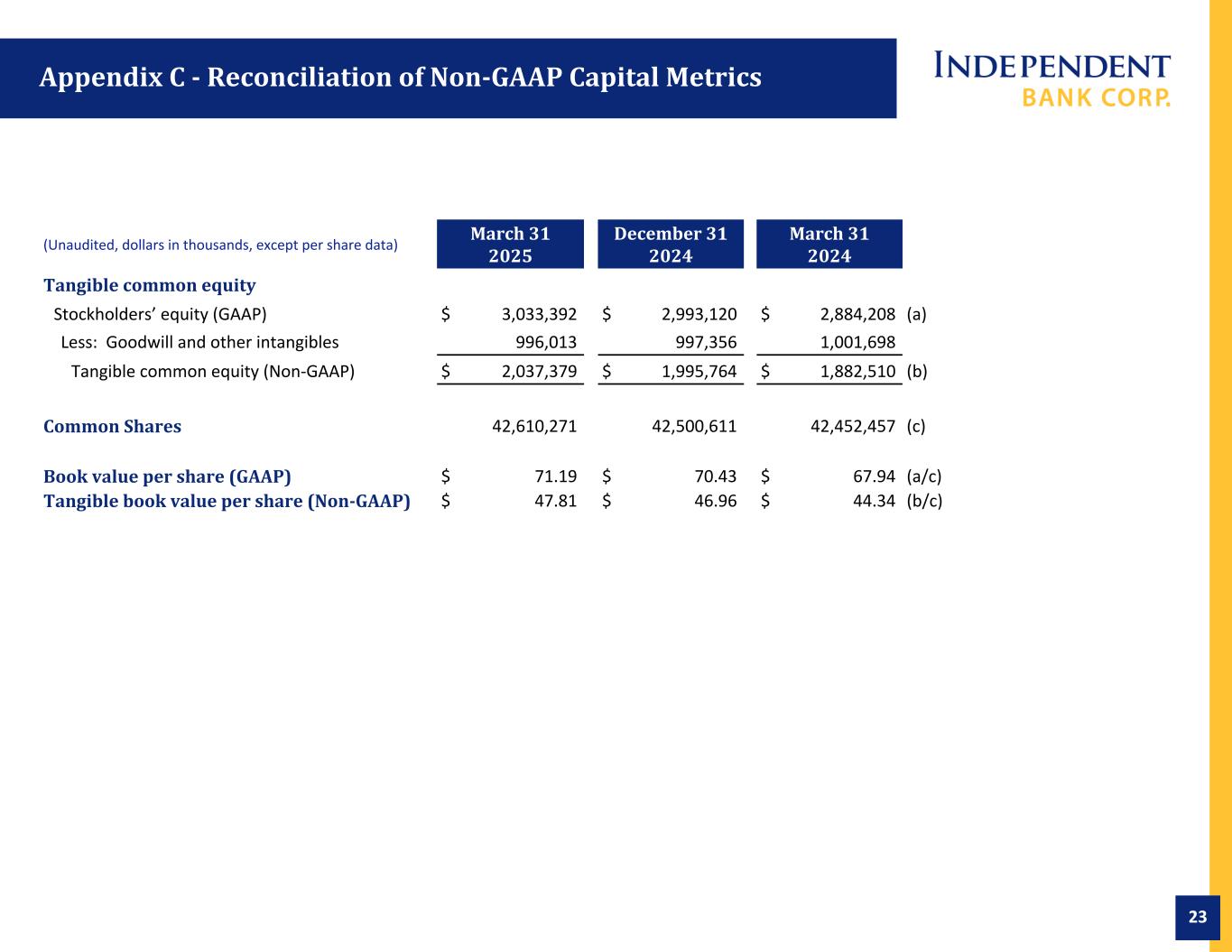

•Tangible book value of $47.81 per share at March 31, 2025 grew by $0.85 from the prior quarter. Please refer to Appendix A for a reconciliation of Non-GAAP balance sheet metrics.

•The Company increased its quarterly dividend by 4% in the first quarter of 2025.

CEO STATEMENT

“Despite the growing uncertainty in the overall economic environment, our results reflect positive activity in our core fundamentals,” said Jeffrey Tengel, the Chief Executive Officer of Independent Bank Corp. and Rockland Trust Company. “We continue to have success in balancing our commercial loan originations, deposits grew nicely, our margin expanded, we kept expenses well maintained, and we increased our dividend for the 15th consecutive year. In addition, we remain on track with our integration efforts related to the pending acquisition of Enterprise.”

BALANCE SHEET

Total assets of $19.9 billion at March 31, 2025 increased $514.6 million, or 2.7% (10.8% annualized), compared to the prior quarter, primarily due to increased cash balances associated with the March 2025 subordinated debt raise of $300 million.

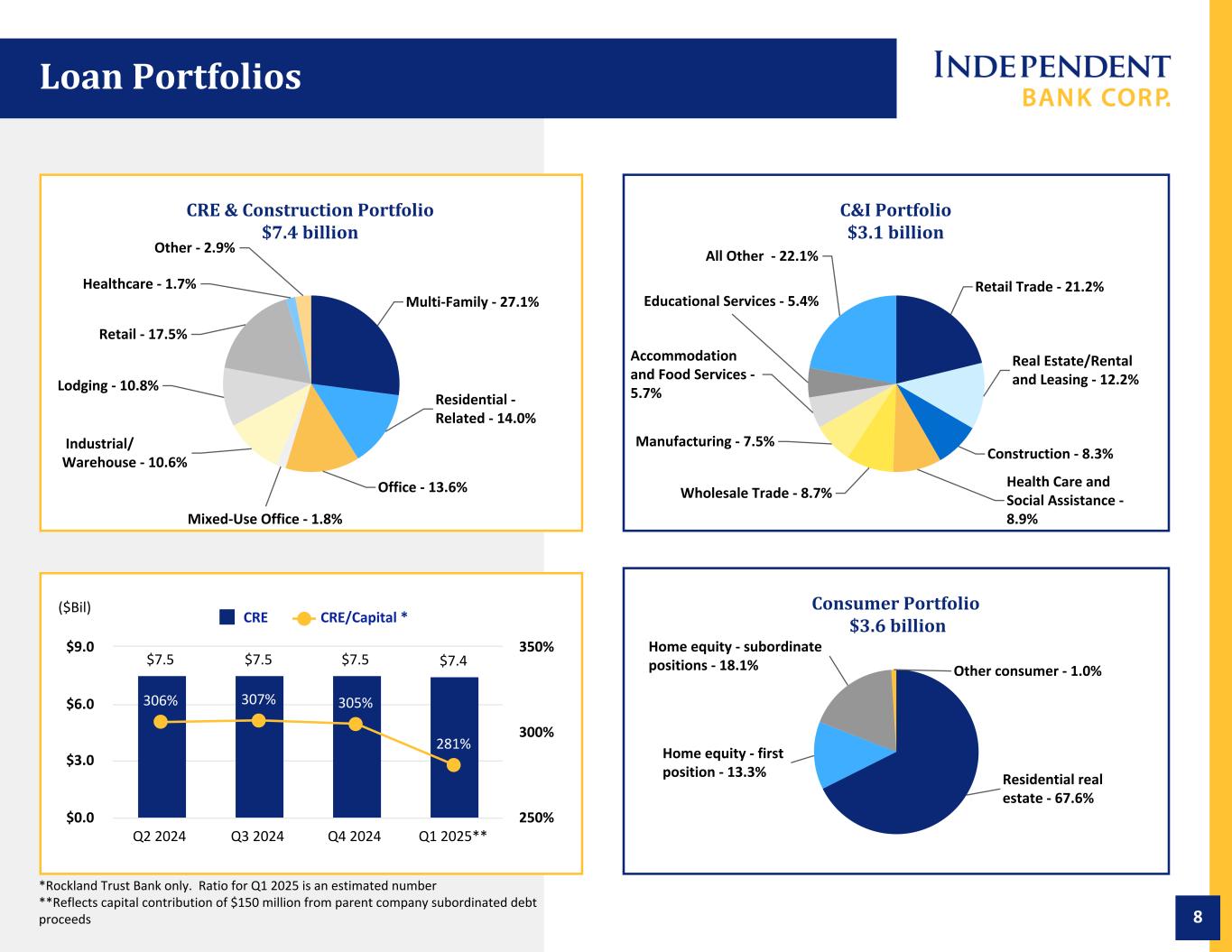

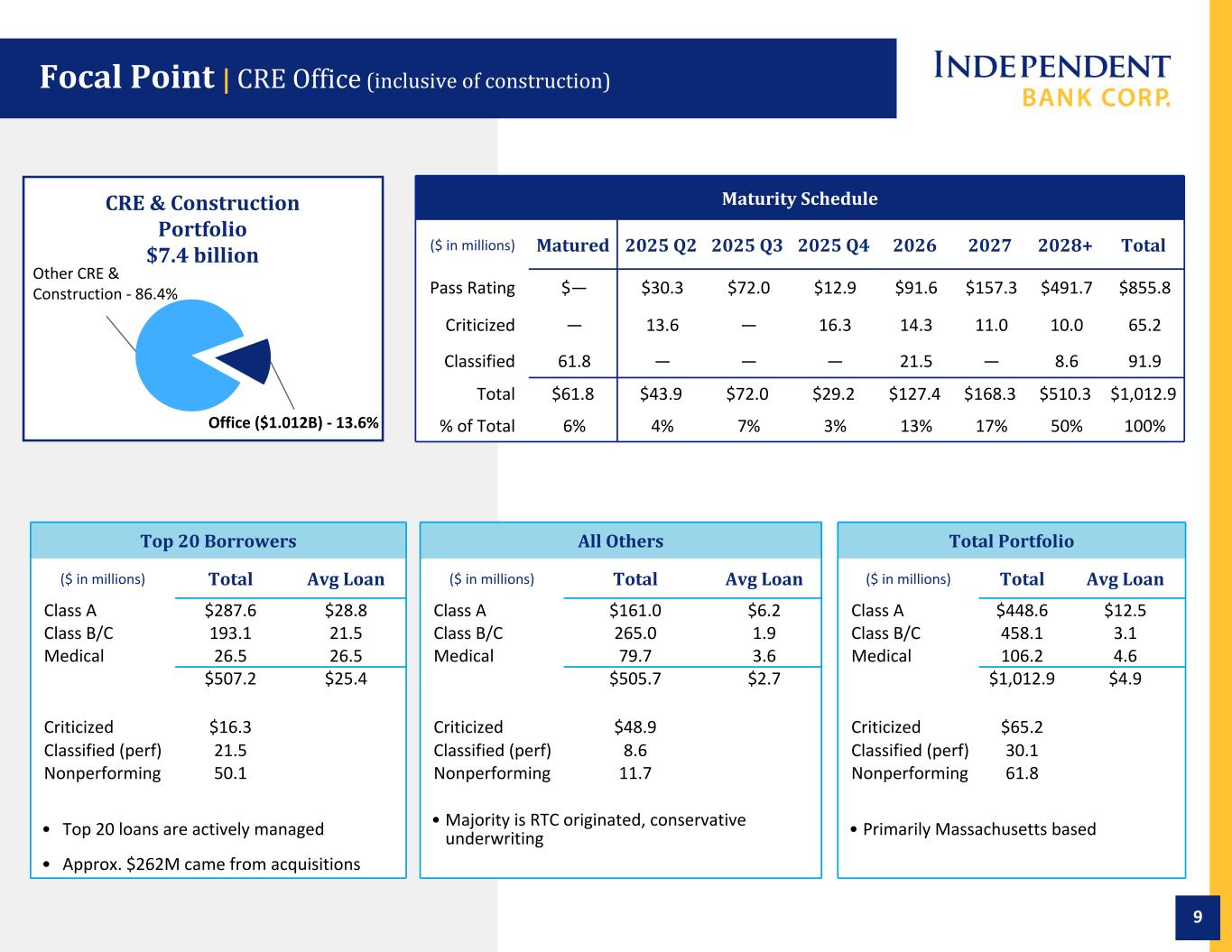

Total loans of $14.5 billion at March 31, 2025 remained consistent with prior quarter levels:

•On the commercial side, robust growth within the commercial and industrial portfolio of $62.8 million, or 2.1% (8.4% annualized), was offset by decreases in the combined commercial real estate and construction categories.

•The small business portfolio also continued its steady growth, rising by $7.4 million, or 2.6% (10.6% annualized), during the first quarter.

•On the consumer side, the total loan portfolio grew slightly by $4.6 million, or 0.1% from the prior quarter, as modest growth in residential real estate and home equity products was partially offset by decreases in other consumer loans.

Total deposits grew by $370.0 million, or 2.4% (9.8% annualized), to $15.7 billion at March 31, 2025, as compared to December 31, 2024, while average deposit balances for the first quarter remained consistent with the prior quarter at $15.5 billion:

•Robust growth driven by increases in non-maturity consumer, business and municipal categories, partially offset by a decline in higher cost time deposits.

•Overall core deposits increased to 82.7% of total deposits at March 31, 2025, as compared to 81.7% at December 31, 2024.

•Total noninterest bearing demand deposits represented 28.1% of total deposits at March 31, 2025, compared to 28.7% at December 31, 2024.

•The total cost of deposits for the first quarter of 1.56% decreased 9 basis points compared to the prior quarter.

Total period end borrowings increased by $158.5 million, or 22.6%, during the first quarter of 2025:

•On March 25, 2025, the Company completed an issuance of $300 million in subordinated notes. The fixed-to-floating rate notes, which are due in 2035 and callable in whole or in part in 2030, will bear interest at a fixed rate of 7.25% per year through April 1, 2030. Thereafter, the notes will bear interest at a floating rate through maturity, or the date of earlier redemption.

•Federal Home Loan Bank (“FHLB”) borrowings decreased $138.0 million compared to December 31, 2024, reflecting paydowns on short-term and overnight FHLB borrowings of $100.0 million and $38.0 million, respectively.

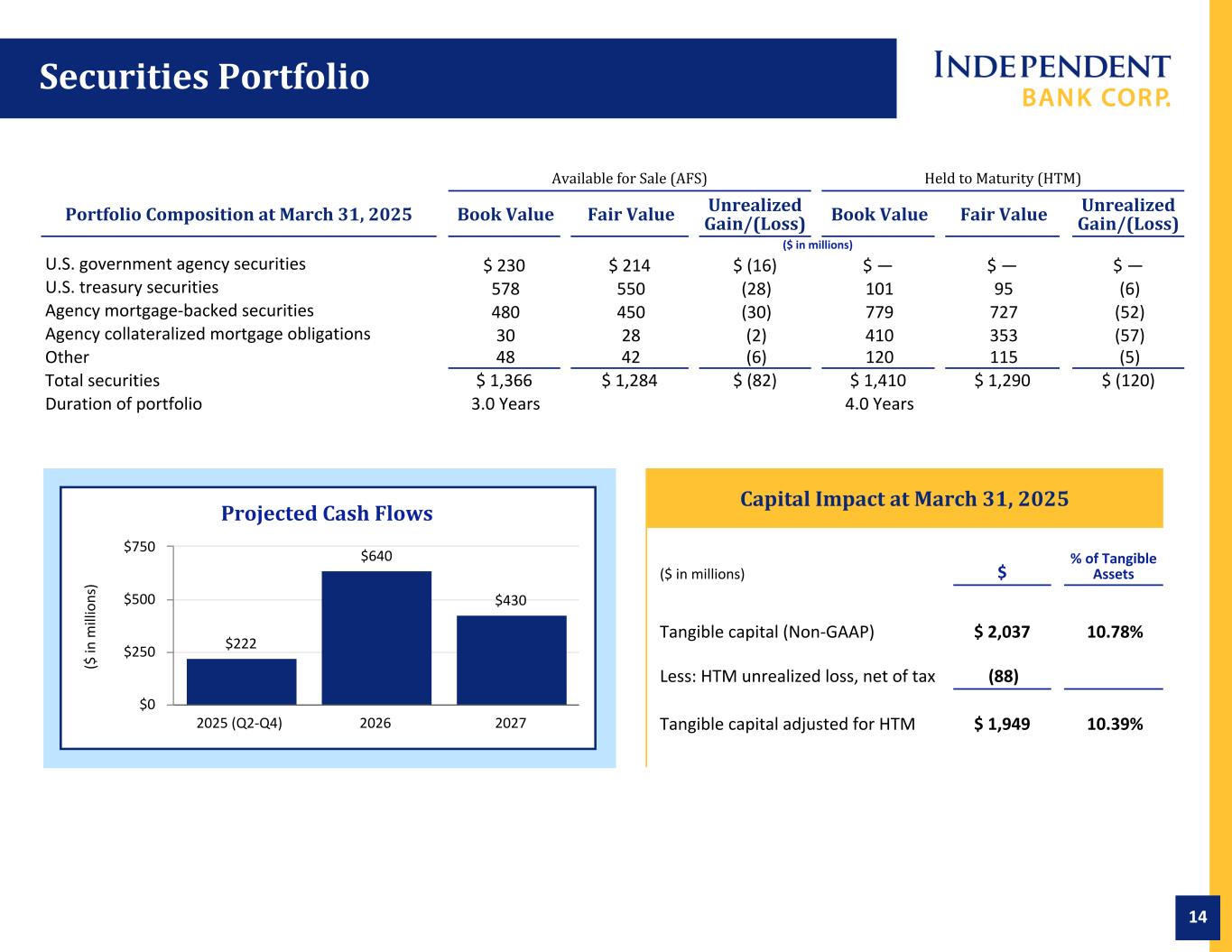

The Company’s securities portfolio remained at $2.7 billion for the first quarter of 2025:

•New purchases of $70.8 million and unrealized gains of $21.3 million in the available for sale portfolio were offset by maturities, calls, and paydowns in the combined available for sale and held to maturity portfolios during the quarter.

•Total securities represented 13.7% and 14.0% of total assets at March 31, 2025 and December 31, 2024, respectively.

Stockholders’ equity at March 31, 2025 increased $40.3 million, or 1.3%, compared to December 31, 2024, driven by strong earnings retention and unrealized gains on the available for sale investment securities portfolio included in other comprehensive income:

•The Company’s ratio of common equity to assets of 15.25% at March 31, 2025 represented a decrease of 20 basis points from December 31, 2024.

•The Company’s ratio of tangible common equity to tangible assets of 10.78% at March 31, 2025 represented a decrease of 8 basis points from the prior quarter and an increase of 51 basis points from the year ago period. Please refer to Appendix A for a detailed reconciliation of Non-GAAP balance sheet metrics.

•The Company’s book value per share increased by $0.76, or 1.1%, to $71.19 at March 31, 2025 as compared to the prior quarter.

•The Company’s tangible book value per share at March 31, 2025 grew by $0.85, or 1.8%, from the prior quarter to $47.81, and grew by 7.8% from the year ago period. Please refer to Appendix A for a reconciliation of Non-GAAP balance sheet metrics.

NET INTEREST INCOME

Net interest income for the first quarter of 2025 increased to $145.5 million, as compared to $144.7 million for the prior quarter.

•The net interest margin of 3.42% increased 9 basis points when compared to the prior quarter, and the core margin of 3.37% increased 6 basis points, driven primarily by decreased funding costs, partially offset by slightly lower loan yields. Please refer to Appendix C for additional information regarding the net interest margin and Non-GAAP reconciliation of core margin.

•Total loan yields decreased slightly to 5.49%, reflecting a full quarter’s impact of previous rate cuts, offset by cash flow repricing benefit and increased income from loan payoffs and purchase accounting accretion. Securities yields increased 11 basis points to 2.25% for the current quarter, reflecting the benefit of cash flow repricing.

•The Company’s overall cost of funding decreased by 10 basis points to 1.67% for the first quarter of 2025, fueled primarily by lower deposit costs.

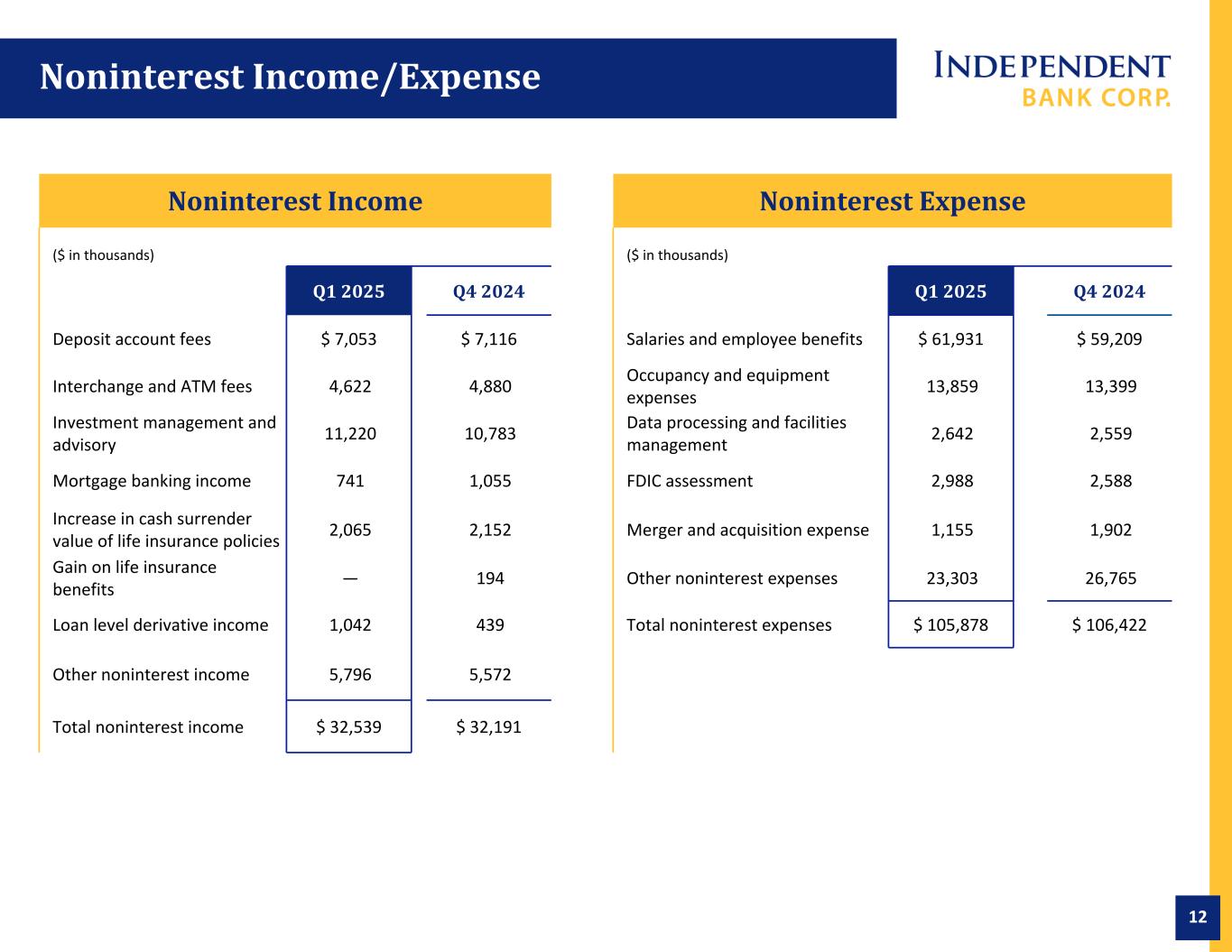

NONINTEREST INCOME

Noninterest income of $32.5 million for the first quarter of 2025 represented a decrease of $348,000, or 1.1%, as compared to the prior quarter. Significant changes in noninterest income for the first quarter of 2025 compared to the prior quarter included the following:

•Interchange and ATM fees decreased by $258,000, or 5.3%, driven by seasonally lower transaction volumes.

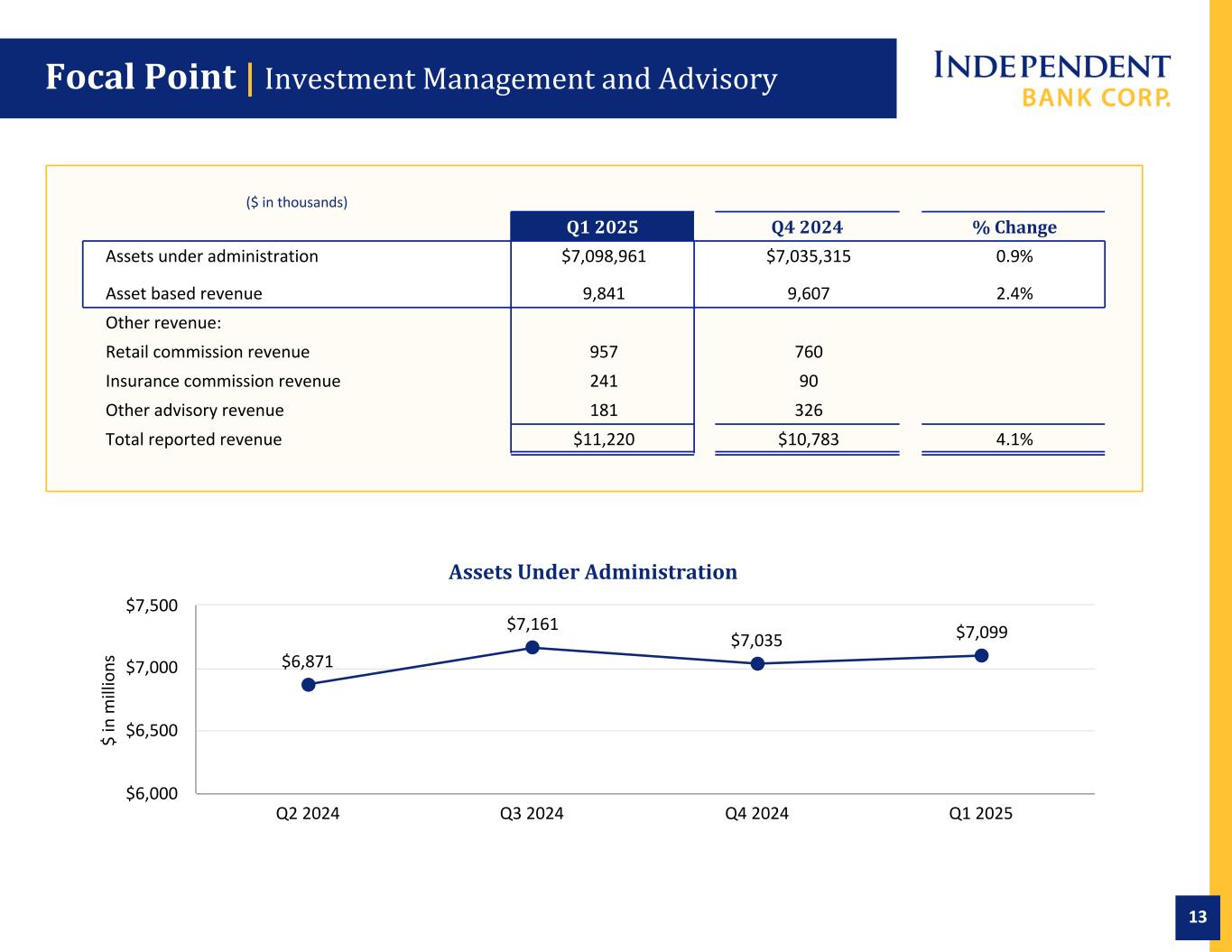

•Overall investment and advisory income increased by $437,000, or 4.1%, driven by higher asset based revenue and other fee income. Total assets under administration increased by $63.6 million, or 0.9%, during the quarter to $7.1 billion at March 31, 2025.

•Mortgage banking income decreased $314,000, or 29.8%, due to lower origination volume.

•The Company received proceeds on life insurance policies resulting in a gain of $194,000 for the fourth quarter of 2024, while no such gains were recognized during the first quarter of 2025.

•Loan level derivative income rose by $603,000, or 137.4%, reflecting volatility in customer demand.

NONINTEREST EXPENSE

Noninterest expense of $105.9 million for the first quarter of 2025 represented a decrease of $544,000, or 0.5%, as compared to the prior quarter. Significant changes in noninterest expense for the first quarter of 2025 compared to the prior quarter included the following:

•Salaries and employee benefits increased by $2.7 million, or 4.6%, driven primarily by a seasonal increase in payroll taxes of $1.5 million, as well as outsized interest rate-driven valuation fluctuations on the Company’s split-dollar bank-owned life insurance policies, which resulted in a $824,000 increase compared to the prior quarter.

•Occupancy and equipment expenses increased by $460,000, or 3.4%, driven by increases in snow removal and utilities costs, partially offset by a decrease in lease termination costs of approximately $550,000 that were recorded during the fourth quarter of 2024 related to the exit of an inactive branch location.

•FDIC assessment increased $400,000, or 15.5%, driven by a rise in the Company’s quarterly assessment charge and timing differences.

•The Company incurred merger and acquisition expenses of $1.2 million in the first quarter of 2025 and $1.9 million in the fourth quarter of 2024. All such costs were related to the Company’s pending acquisition of Enterprise.

•Other noninterest expense decreased by $3.5 million, or 12.9%, driven primarily by decreases in consulting fees of $1.2 million, reduced check losses $885,000, unrealized losses on equity securities of $764,000, and card issuance costs of $469,000.

The Company’s tax rate for the first quarter of 2025 increased to 22.29%, as compared to 20.49% for the prior quarter, due primarily to the purchase of additional certificated tax credits during the fourth quarter of 2024, as well as the release of $1.2 million in uncertain tax positions during the prior quarter.

ASSET QUALITY

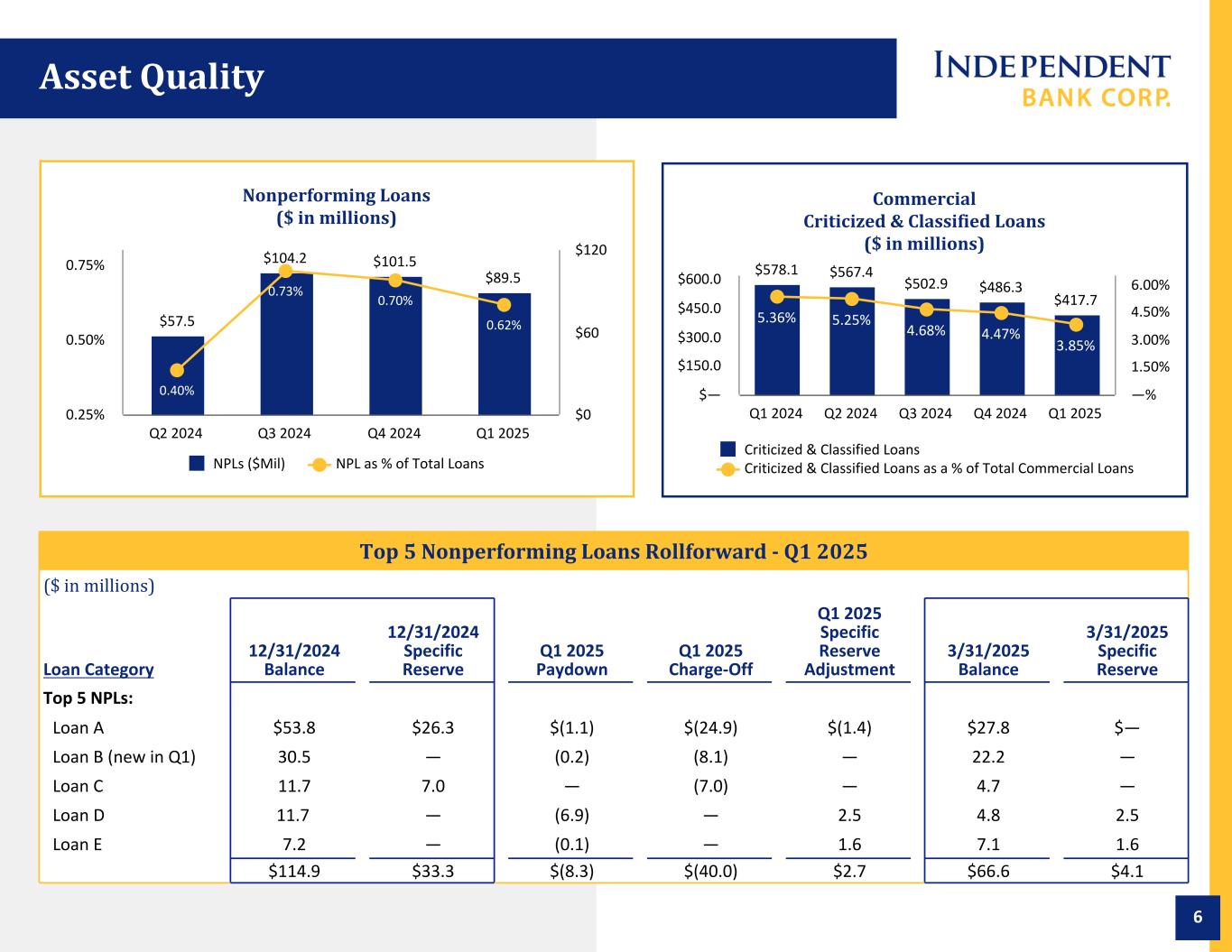

During the first quarter, the Company’s key asset quality activity and metrics were as follows:

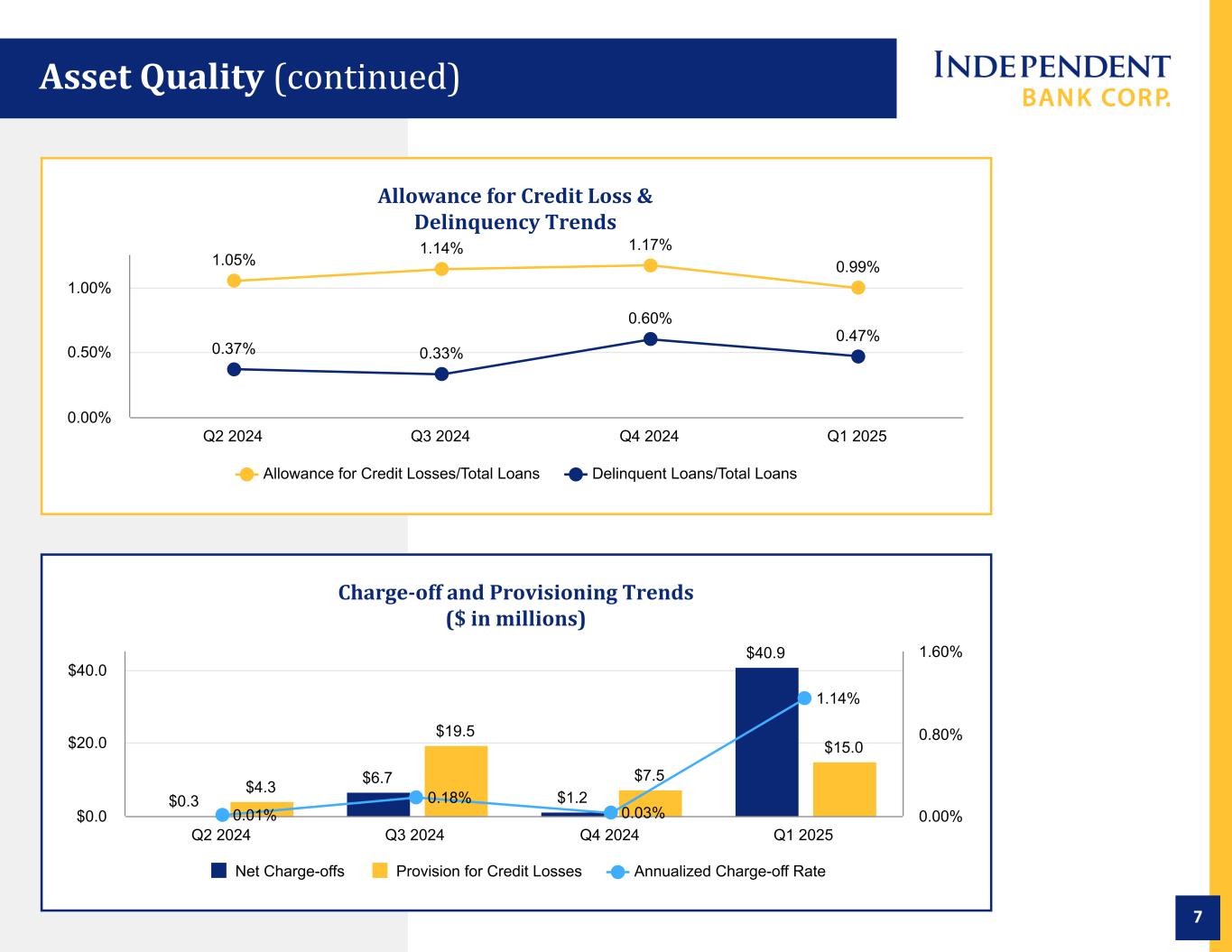

•Net charge-offs increased to $40.9 million, as compared to $1.2 million for the prior quarter, representing 1.14% and 0.03%, respectively, of average loans annualized. The 2025 first quarter charge-offs were primarily attributable to three previously classified commercial loans, two of which had been reserved for in prior periods.

•The first quarter provision for credit losses increased to $15.0 million, as compared to $7.5 million for the prior quarter, driven by the elevated charge-off activity and additional specific reserves.

•Nonperforming loans decreased to $89.5 million at March 31, 2025, as compared to $101.5 million at December 31, 2024, representing 0.62% and 0.70% of total loans, respectively.

•Delinquencies as a percentage of total loans decreased 13 basis points from the prior quarter to 0.47% at March 31, 2025.

•Total classified and criticized commercial loans decreased by $68.6 million, or 14.1% , during the quarter to $417.7 million at March 31, 2025, as compared to $486.3 million at December 31, 2024.

•The allowance for credit losses on total loans decreased to $144.1 million at March 31, 2025 compared to $170.0 million at December 31, 2024, and represented 0.99% and 1.17% of total loans, at March 31, 2025 and December 31, 2024, respectively.

CONFERENCE CALL INFORMATION

Jeffrey Tengel, Chief Executive Officer, and Mark Ruggiero, Chief Financial Officer and Executive Vice President of Consumer Lending, will host a conference call to discuss first quarter earnings at 5:30 p.m. Eastern Time on Thursday, April 17, 2025. Internet access to the call is available on the Company’s website at https://INDB.RocklandTrust.com or via telephonic access by dial-in at 1-888-336-7153 reference: INDB. A replay of the call will be available by calling 1-877-344-7529, Replay Conference Number: 6859369 and will be available through April 24, 2025. Additionally, a webcast replay will be available on the Company’s website until April 17, 2026.

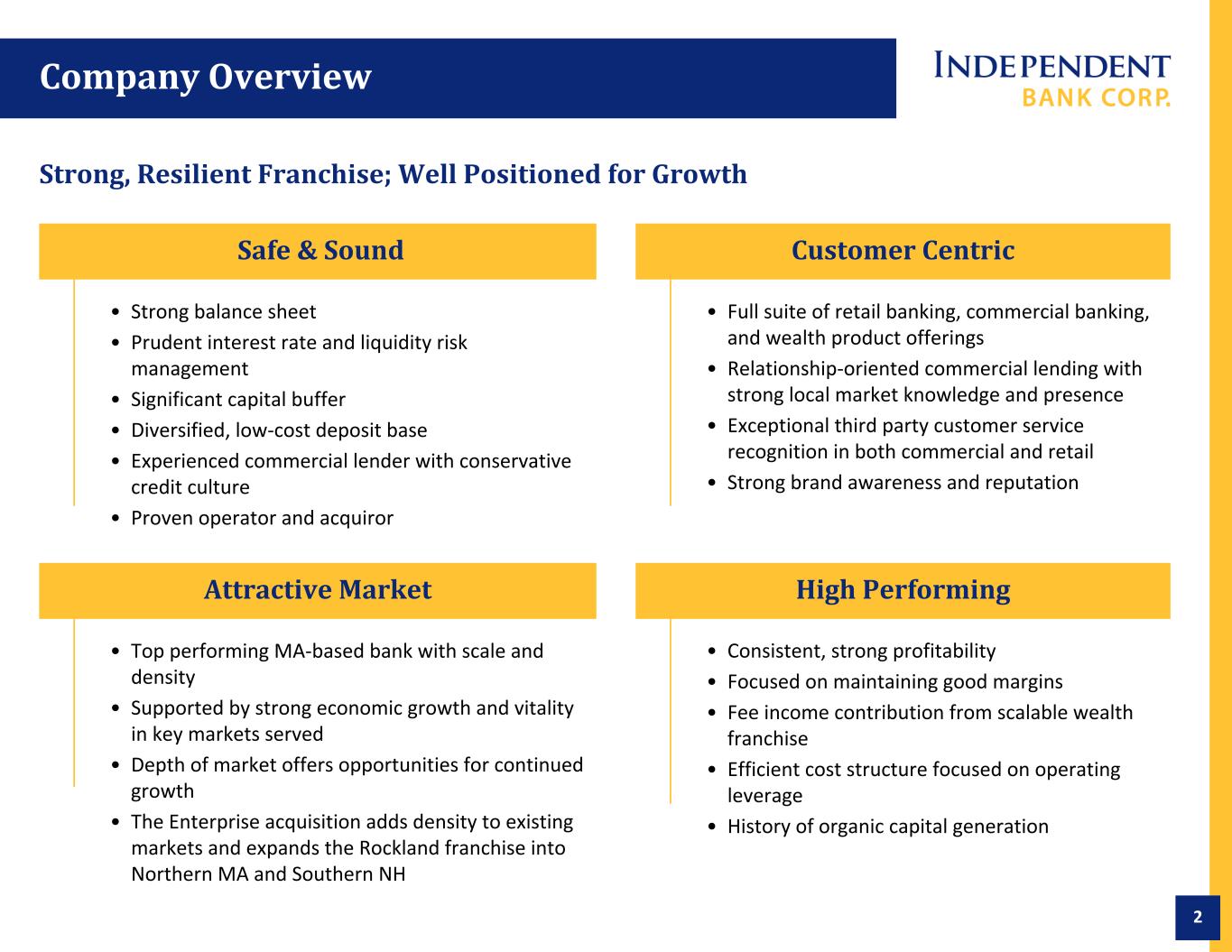

ABOUT INDEPENDENT BANK CORP.

Independent Bank Corp. (NASDAQ Global Select Market: INDB) is the holding company for Rockland Trust Company, a full-service commercial bank headquartered in Massachusetts. With retail branches in Eastern Massachusetts and Worcester County as well as commercial banking and investment management offices in Massachusetts and Rhode Island, Rockland Trust offers a wide range of banking, investment, and insurance services to individuals, families, and businesses. The Bank also offers a full suite of mobile, online, and telephone banking services. Rockland Trust is an FDIC member and an Equal Housing Lender.

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations and business of the Company. These statements may be identified by such forward-looking terminology as “expect,” “achieve,” “plan,” “believe,” “future,” “positioned,” “continued,” “will,” “would,” “potential,” or similar statements or variations of such terms. Actual results may differ from those contemplated by these forward-looking statements.

Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to:

•adverse economic conditions in the regional and local economies within the New England region and the Company’s market area;

•events impacting the financial services industry, including high profile bank failures, and any resulting decreased confidence in banks among depositors, investors, and other counterparties, as well as competition for deposits and significant disruption, volatility and depressed valuations of equity and other securities of banks in the capital markets;

•the effects to the Company of an increasingly competitive labor market, including the possibility that the Company will have to devote significant resources to attract and retain qualified personnel;

•the political and policy uncertainties associated with the new U.S. presidential administration, changes in U.S. and international trade policies, such as tariffs or other factors, and the potential impact of such factors on the Company and its customers, including the potential for decreases in deposits and loan demand, unanticipated loan delinquencies, loss of collateral and decreased service revenues;

•the instability or volatility in financial markets and unfavorable domestic or global general economic, political or business conditions, whether caused by geopolitical concerns, including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas and the possible expansion of such conflicts;

•unanticipated loan delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on the Company’s local economies or the Company's business caused by adverse weather conditions and natural disasters, changes in climate, public health crises or other external events and any actions taken by governmental authorities in response to any such events;

•adverse changes or volatility in the local real estate market;

•changes in interest rates and any resulting impact on interest earning assets and/or interest bearing liabilities, the level of voluntary prepayments on loans and the receipt of payments on mortgage-backed securities, decreased loan demand or increased difficulty in the ability of borrowers to repay variable rate loans;

•failure to consummate or a delay in consummating the acquisition of Enterprise, including as a result of any failure to obtain the necessary regulatory approvals or to satisfy any of the other conditions to the proposed transaction on a timely basis or at all;

•risks related to the company’s pending acquisition of Enterprise and acquisitions generally, including disruption to current plans and operations; difficulties in customer and employee retention; fees, expenses and charges related to these transactions being significantly higher than anticipated; unforeseen integration issues or impairment of goodwill and/or other intangibles; and the Company’s inability to achieve expected revenues, cost savings, synergies, and other benefits at levels or within the timeframes originally anticipated;

•the effect of laws, regulations, new requirements or expectations, or additional regulatory oversight in the highly regulated financial services industry, including as a result of intensified regulatory scrutiny in the aftermath of regional bank failures and the resulting need to invest in technology to meet heightened regulatory expectations, increased costs of compliance or required adjustments to strategy;

•changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System;

•higher than expected tax expense, including as a result of failure to comply with general tax laws and changes in tax laws;

•increased competition in the Company’s market areas, including competition that could impact deposit gathering, retention of deposits and the cost of deposits, increased competition due to the demand for innovative products and service offerings, and competition from non-depository institutions which may be subject to fewer regulatory constraints and lower cost structures;

•a deterioration in the conditions of the securities markets;

•a deterioration of the credit rating for U.S. long-term sovereign debt or uncertainties surrounding the federal budget;

•inability to adapt to changes in information technology, including changes to industry accepted delivery models driven by a migration to the internet as a means of service delivery, including any inability to effectively implement new technology-driven products, such as artificial intelligence;

•electronic or other fraudulent activity within the financial services industry, especially in the commercial banking sector;

•adverse changes in consumer spending and savings habits;

•the effect of laws and regulations regarding the financial services industry, including the need to invest in technology to meet heightened regulatory expectations or introduction of new requirements or expectations resulting in increased costs of compliance or required adjustments to strategy;

•changes in laws and regulations (including laws and regulations concerning taxes, banking, securities and insurance) generally applicable to the Company’s business and the associated costs of such changes;

•the Company’s potential judgments, claims, damages, penalties, fines and reputational damage resulting from pending or future litigation and regulatory and government actions;

•changes in accounting policies, practices and standards, as may be adopted by the regulatory agencies as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other accounting standard setters;

•operational risks related to the Company and its customers’ reliance on information technology; cyber threats, attacks, intrusions, and fraud; and outages or other issues impacting the Company or its third party service providers which could lead to interruptions or disruptions of the Company’s operating systems, including systems that are customer facing, and adversely impact the Company’s business; and

•any unexpected material adverse changes in the Company’s operations or earnings.

The Company wishes to caution readers not to place undue reliance on any forward-looking statements as the Company’s business and its forward-looking statements involve substantial known and unknown risks and uncertainties described in the Company’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q (“Risk Factors”). Except as required by law, the Company disclaims any intent or obligation to update publicly any such forward-looking statements, whether in response to new information, future events or otherwise. Any public statements or disclosures by the Company following this release which modify or impact any of the forward-looking statements contained in this release will be deemed to modify or supersede such statements in this release. In addition to the information set forth in this press release, you should carefully consider the Risk Factors.

This press release and the appendices attached to it contain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). This information may include operating net income and operating earnings per share (“EPS”), operating return on average assets, operating return on average common equity, operating return on average tangible common equity, core net interest margin (“core margin”), tangible book value per share and the tangible common equity ratio.

Operating net income, operating EPS, operating return on average assets and operating return on average common equity, exclude items that management believes are unrelated to the Company's core banking business such as merger and acquisition expenses, and other items, if applicable. Management uses operating net income and related ratios and operating EPS to measure the strength of the Company’s core banking business and to identify trends that may to some extent be obscured by such items. Management reviews its core margin to determine any items that may impact the net interest margin that may be one-time in nature or not reflective of its core operating environment, such as significant purchase accounting adjustments or other adjustments such as nonaccrual interest reversals/recoveries and prepayment penalties. Management believes that adjusting for these items to arrive at a core margin provides additional insight into the operating environment and how management decisions impact the net interest margin.

Management also supplements its evaluation of financial performance with analysis of tangible book value per share (which is computed by dividing stockholders’ equity less goodwill and identifiable intangible assets, or “tangible common equity,” by common shares outstanding), the tangible common equity ratio (which is computed by dividing tangible common equity by “tangible assets,” defined as total assets less goodwill and other intangibles), and return on average tangible common equity (which is computed by dividing net income by average tangible common equity). The Company has included information on tangible book value per share, the tangible common equity ratio and return on average tangible common equity because management believes that investors may find it useful to have access to the same analytical tools used by management. As a result of merger and acquisition activity, the Company has recognized goodwill and other intangible assets in conjunction with business combination accounting principles. Excluding the impact of goodwill and other intangibles in measuring asset and capital values for the ratios provided, along with other bank standard capital ratios, provides a framework to compare the capital adequacy of the Company to other companies in the financial services industry.

These non-GAAP measures should not be viewed as a substitute for operating results and other financial measures determined in accordance with GAAP. An item which management excludes when computing these non-GAAP measures can be of substantial importance to the Company’s results for any particular quarter or year. The Company’s non-GAAP performance measures, including operating net income, operating EPS, operating return on average assets, operating return on average common equity, core margin, tangible book value per share and the tangible common equity ratio, are not necessarily comparable to non-GAAP performance measures which may be presented by other companies.

Contacts:

Jeffrey Tengel

President and Chief Executive Officer

(781) 982-6144

Mark J. Ruggiero

Chief Financial Officer and

Executive Vice President of Consumer Lending

(781) 982-6281

Investor Relations:

Gerry Cronin

Director of Investor Relations

(774) 363-9872

Gerard.Cronin@rocklandtrust.com

Category: Earnings Releases

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INDEPENDENT BANK CORP. FINANCIAL SUMMARY |

|

|

|

|

|

|

| CONSOLIDATED BALANCE SHEETS |

|

|

|

|

| (Unaudited, dollars in thousands) |

|

|

|

|

|

|

% Change |

|

% Change |

|

March 31

2025 |

|

December 31

2024 |

|

March 31

2024 |

|

Mar 2025 vs. |

|

Mar 2025 vs. |

|

|

|

|

Dec 2024 |

|

Mar 2024 |

| Assets |

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

$ |

214,616 |

|

|

$ |

187,849 |

|

|

$ |

165,331 |

|

|

14.25 |

% |

|

29.81 |

% |

| Interest-earning deposits with banks |

502,228 |

|

|

32,041 |

|

|

55,985 |

|

|

nm |

|

797.08 |

% |

| Securities |

|

|

|

|

|

|

|

|

|

| Trading |

4,816 |

|

|

4,245 |

|

|

4,759 |

|

|

13.45 |

% |

|

1.20 |

% |

| Equities |

21,250 |

|

|

21,204 |

|

|

22,858 |

|

|

0.22 |

% |

|

(7.03) |

% |

| Available for sale |

1,283,767 |

|

|

1,250,944 |

|

|

1,272,831 |

|

|

2.62 |

% |

|

0.86 |

% |

| Held to maturity |

1,409,959 |

|

|

1,434,956 |

|

|

1,545,267 |

|

|

(1.74) |

% |

|

(8.76) |

% |

| Total securities |

2,719,792 |

|

|

2,711,349 |

|

|

2,845,715 |

|

|

0.31 |

% |

|

(4.43) |

% |

| Loans held for sale |

8,524 |

|

|

7,271 |

|

|

11,340 |

|

|

17.23 |

% |

|

(24.83) |

% |

| Loans |

|

|

|

|

|

|

|

|

|

| Commercial and industrial |

3,110,432 |

|

|

3,047,671 |

|

|

2,953,620 |

|

|

2.06 |

% |

|

5.31 |

% |

| Commercial real estate |

6,651,475 |

|

|

6,756,708 |

|

|

6,735,257 |

|

|

(1.56) |

% |

|

(1.24) |

% |

| Commercial construction |

796,162 |

|

|

782,078 |

|

|

828,900 |

|

|

1.80 |

% |

|

(3.95) |

% |

| Small business |

289,148 |

|

|

281,781 |

|

|

261,690 |

|

|

2.61 |

% |

|

10.49 |

% |

| Total commercial |

10,847,217 |

|

|

10,868,238 |

|

|

10,779,467 |

|

|

(0.19) |

% |

|

0.63 |

% |

| Residential real estate |

2,465,731 |

|

|

2,460,600 |

|

|

2,420,705 |

|

|

0.21 |

% |

|

1.86 |

% |

| Home equity - first position |

484,384 |

|

|

490,115 |

|

|

507,356 |

|

|

(1.17) |

% |

|

(4.53) |

% |

| Home equity - subordinate positions |

659,582 |

|

|

650,053 |

|

|

593,230 |

|

|

1.47 |

% |

|

11.18 |

% |

| Total consumer real estate |

3,609,697 |

|

|

3,600,768 |

|

|

3,521,291 |

|

|

0.25 |

% |

|

2.51 |

% |

| Other consumer |

35,055 |

|

|

39,372 |

|

|

29,836 |

|

|

(10.96) |

% |

|

17.49 |

% |

| Total loans |

14,491,969 |

|

|

14,508,378 |

|

|

14,330,594 |

|

|

(0.11) |

% |

|

1.13 |

% |

| Less: allowance for credit losses |

(144,092) |

|

|

(169,984) |

|

|

(146,948) |

|

|

(15.23) |

% |

|

(1.94) |

% |

| Net loans |

14,347,877 |

|

|

14,338,394 |

|

|

14,183,646 |

|

|

0.07 |

% |

|

1.16 |

% |

| Federal Home Loan Bank stock |

25,804 |

|

|

31,573 |

|

|

46,304 |

|

|

(18.27) |

% |

|

(44.27) |

% |

| Bank premises and equipment, net |

190,007 |

|

|

193,320 |

|

|

192,563 |

|

|

(1.71) |

% |

|

(1.33) |

% |

| Goodwill |

985,072 |

|

|

985,072 |

|

|

985,072 |

|

|

— |

% |

|

— |

% |

| Other intangible assets |

10,941 |

|

|

12,284 |

|

|

16,626 |

|

|

(10.93) |

% |

|

(34.19) |

% |

| Cash surrender value of life insurance policies |

306,077 |

|

|

303,965 |

|

|

298,352 |

|

|

0.69 |

% |

|

2.59 |

% |

|

|

|

|

|

|

|

|

|

|

| Other assets |

577,271 |

|

|

570,447 |

|

|

523,679 |

|

|

1.20 |

% |

|

10.23 |

% |

| Total assets |

$ |

19,888,209 |

|

|

$ |

19,373,565 |

|

|

$ |

19,324,613 |

|

|

2.66 |

% |

|

2.92 |

% |

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

|

|

|

|

|

|

|

| Noninterest-bearing demand deposits |

$ |

4,409,878 |

|

|

$ |

4,390,703 |

|

|

$ |

4,469,820 |

|

|

0.44 |

% |

|

(1.34) |

% |

| Savings and interest checking |

5,279,549 |

|

|

5,207,548 |

|

|

5,196,195 |

|

|

1.38 |

% |

|

1.60 |

% |

| Money market |

3,277,078 |

|

|

2,960,381 |

|

|

2,944,221 |

|

|

10.70 |

% |

|

11.31 |

% |

| Time certificates of deposit |

2,709,512 |

|

|

2,747,346 |

|

|

2,432,985 |

|

|

(1.38) |

% |

|

11.37 |

% |

| Total deposits |

15,676,017 |

|

|

15,305,978 |

|

|

15,043,221 |

|

|

2.42 |

% |

|

4.21 |

% |

| Borrowings |

|

|

|

|

|

|

|

|

|

| Federal Home Loan Bank borrowings |

500,506 |

|

|

638,514 |

|

|

962,535 |

|

|

(21.61) |

% |

|

(48.00) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Junior subordinated debentures, net |

62,861 |

|

|

62,860 |

|

|

62,858 |

|

|

— |

% |

|

— |

% |

| Subordinated debentures, net |

296,507 |

|

|

— |

|

|

— |

|

|

100.00% |

|

100.00% |

| Total borrowings |

859,874 |

|

|

701,374 |

|

|

1,025,393 |

|

|

22.60 |

% |

|

(16.14) |

% |

| Total deposits and borrowings |

16,535,891 |

|

|

16,007,352 |

|

|

16,068,614 |

|

|

3.30 |

% |

|

2.91 |

% |

| Other liabilities |

318,926 |

|

|

373,093 |

|

|

371,791 |

|

|

(14.52) |

% |

|

(14.22) |

% |

| Total liabilities |

16,854,817 |

|

|

16,380,445 |

|

|

16,440,405 |

|

|

2.90 |

% |

|

2.52 |

% |

| Stockholders’ equity |

|

|

|

|

|

|

|

|

|

| Common stock |

424 |

|

|

423 |

|

|

422 |

|

|

0.24 |

% |

|

0.47 |

% |

| Additional paid in capital |

1,911,162 |

|

|

1,909,980 |

|

|

1,902,063 |

|

|

0.06 |

% |

|

0.48 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retained earnings |

1,192,008 |

|

|

1,172,724 |

|

|

1,101,061 |

|

|

1.64 |

% |

|

8.26 |

% |

| Accumulated other comprehensive loss, net of tax |

(70,202) |

|

|

(90,007) |

|

|

(119,338) |

|

|

(22.00) |

% |

|

(41.17) |

% |

| Total stockholders' equity |

3,033,392 |

|

|

2,993,120 |

|

|

2,884,208 |

|

|

1.35 |

% |

|

5.17 |

% |

| Total liabilities and stockholders’ equity |

$ |

19,888,209 |

|

|

$ |

19,373,565 |

|

|

$ |

19,324,613 |

|

|

2.66 |

% |

|

2.92 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

nm = not meaningful

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS OF INCOME |

|

|

|

|

|

| (Unaudited, dollars in thousands, except per share data) |

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

% Change |

|

March 31

2025 |

|

December 31

2024 |

|

March 31

2024 |

|

Mar 2025 vs. |

|

Mar 2025 vs. |

|

|

|

|

Dec 2024 |

|

Mar 2024 |

| Interest income |

|

|

|

|

|

|

|

|

|

| Interest on federal funds sold and short-term investments |

$ |

1,438 |

|

|

$ |

3,154 |

|

|

$ |

483 |

|

|

(54.41) |

% |

|

197.72 |

% |

| Interest and dividends on securities |

15,297 |

|

|

14,807 |

|

|

14,232 |

|

|

3.31 |

% |

|

7.48 |

% |

| Interest and fees on loans |

195,093 |

|

|

198,177 |

|

|

193,226 |

|

|

(1.56) |

% |

|

0.97 |

% |

| Interest on loans held for sale |

92 |

|

|

182 |

|

|

104 |

|

|

(49.45) |

% |

|

(11.54) |

% |

| Total interest income |

211,920 |

|

|

216,320 |

|

|

208,045 |

|

|

(2.03) |

% |

|

1.86 |

% |

| Interest expense |

|

|

|

|

|

|

|

|

|

| Interest on deposits |

59,436 |

|

|

64,188 |

|

|

54,320 |

|

|

(7.40) |

% |

|

9.42 |

% |

| Interest on borrowings |

6,979 |

|

|

7,471 |

|

|

16,286 |

|

|

(6.59) |

% |

|

(57.15) |

% |

| Total interest expense |

66,415 |

|

|

71,659 |

|

|

70,606 |

|

|

(7.32) |

% |

|

(5.94) |

% |

| Net interest income |

145,505 |

|

|

144,661 |

|

|

137,439 |

|

|

0.58 |

% |

|

5.87 |

% |

| Provision for credit losses |

15,000 |

|

|

7,500 |

|

|

5,000 |

|

|

100.00 |

% |

|

200.00 |

% |

| Net interest income after provision for credit losses |

130,505 |

|

|

137,161 |

|

|

132,439 |

|

|

(4.85) |

% |

|

(1.46) |

% |

| Noninterest income |

|

|

|

|

|

|

|

|

|

| Deposit account fees |

7,053 |

|

|

7,116 |

|

|

6,228 |

|

|

(0.89) |

% |

|

13.25 |

% |

| Interchange and ATM fees |

4,622 |

|

|

4,880 |

|

|

4,452 |

|

|

(5.29) |

% |

|

3.82 |

% |

| Investment management and advisory |

11,220 |

|

|

10,783 |

|

|

9,941 |

|

|

4.05 |

% |

|

12.87 |

% |

| Mortgage banking income |

741 |

|

|

1,055 |

|

|

796 |

|

|

(29.76) |

% |

|

(6.91) |

% |

| Increase in cash surrender value of life insurance policies |

2,065 |

|

|

2,152 |

|

|

1,928 |

|

|

(4.04) |

% |

|

7.11 |

% |

| Gain on life insurance benefits |

— |

|

|

194 |

|

|

263 |

|

|

(100.00) |

% |

|

(100.00) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan level derivative income |

1,042 |

|

|

439 |

|

|

80 |

|

|

137.36 |

% |

|

1,202.50 |

% |

| Other noninterest income |

5,796 |

|

|

5,572 |

|

|

6,255 |

|

|

4.02 |

% |

|

(7.34) |

% |

| Total noninterest income |

32,539 |

|

|

32,191 |

|

|

29,943 |

|

|

1.08 |

% |

|

8.67 |

% |

| Noninterest expenses |

|

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

61,931 |

|

|

59,209 |

|

|

57,174 |

|

|

4.60 |

% |

|

8.32 |

% |

| Occupancy and equipment expenses |

13,859 |

|

|

13,399 |

|

|

13,467 |

|

|

3.43 |

% |

|

2.91 |

% |

| Data processing and facilities management |

2,642 |

|

|

2,559 |

|

|

2,483 |

|

|

3.24 |

% |

|

6.40 |

% |

| FDIC assessment |

2,988 |

|

|

2,588 |

|

|

2,982 |

|

|

15.46 |

% |

|

0.20 |

% |

| Merger and acquisition expense |

1,155 |

|

|

1,902 |

|

|

— |

|

|

(39.27) |

% |

|

100.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other noninterest expenses |

23,303 |

|

|

26,765 |

|

|

23,781 |

|

|

(12.93) |

% |

|

(2.01) |

% |

| Total noninterest expenses |

105,878 |

|

|

106,422 |

|

|

99,887 |

|

|

(0.51) |

% |

|

6.00 |

% |

| Income before income taxes |

57,166 |

|

|

62,930 |

|

|

62,495 |

|

|

(9.16) |

% |

|

(8.53) |

% |

| Provision for income taxes |

12,742 |

|

|

12,897 |

|

|

14,725 |

|

|

(1.20) |

% |

|

(13.47) |

% |

| Net Income |

$ |

44,424 |

|

|

$ |

50,033 |

|

|

$ |

47,770 |

|

|

(11.21) |

% |

|

(7.00) |

% |

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares (basic) |

42,550,274 |

|

|

42,494,409 |

|

|

42,553,714 |

|

|

|

|

|

| Common share equivalents |

22,353 |

|

|

20,432 |

|

|

12,876 |

|

|

|

|

|

| Weighted average common shares (diluted) |

42,572,627 |

|

|

42,514,841 |

|

|

42,566,590 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

$ |

1.04 |

|

|

$ |

1.18 |

|

|

$ |

1.12 |

|

|

(11.86) |

% |

|

(7.14) |

% |

| Diluted earnings per share |

$ |

1.04 |

|

|

$ |

1.18 |

|

|

$ |

1.12 |

|

|

(11.86) |

% |

|

(7.14) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Net Income (GAAP) to Operating Net Income (Non-GAAP): |

|

|

|

|

|

|

| Net income |

$ |

44,424 |

|

|

$ |

50,033 |

|

|

$ |

47,770 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest expense components |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add - merger and acquisition expenses |

1,155 |

|

|

1,902 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noncore increases to income before taxes |

1,155 |

|

|

1,902 |

|

|

— |

|

|

|

|

|

| Net tax benefit associated with noncore items (1) |

(325) |

|

|

(535) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noncore increases to net income |

830 |

|

|

1,367 |

|

|

— |

|

|

|

|

|

| Operating net income (Non-GAAP) |

$ |

45,254 |

|

|

$ |

51,400 |

|

|

$ |

47,770 |

|

|

(11.96) |

% |

|

(5.27) |

% |

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share, on an operating basis (Non-GAAP) |

$ |

1.06 |

|

|

$ |

1.21 |

|

|

$ |

1.12 |

|

|

(12.40) |

% |

|

(5.36) |

% |

|

|

|

|

|

|

|

|

|

|

| (1) The net tax benefit associated with noncore items is determined by assessing whether each noncore item is included or excluded from net taxable income and applying the Company's combined marginal tax rate to only those items included in net taxable income. |

|

|

|

|

|

|

|

|

|

|

| Performance ratios |

|

|

|

|

|

|

|

|

|

| Net interest margin (FTE) |

3.42 |

% |

|

3.33 |

% |

|

3.23 |

% |

|

|

|

|

| Return on average assets (calculated by dividing net income by average assets) (GAAP) |

0.93 |

% |

|

1.02 |

% |

|

1.00 |

% |

|

|

|

|

| Return on average assets on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average assets) |

0.94 |

% |

|

1.05 |

% |

|

1.00 |

% |

|

|

|

|

| Return on average common equity (calculated by dividing net income by average common equity) (GAAP) |

5.94 |

% |

|

6.64 |

% |

|

6.63 |

% |

|

|

|

|

| Return on average common equity on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average common equity) |

6.05 |

% |

|

6.82 |

% |

|

6.63 |

% |

|

|

|

|

| Return on average tangible common equity (Non-GAAP) (calculated by dividing net income by average tangible common equity) |

8.85 |

% |

|

9.96 |

% |

|

10.15 |

% |

|

|

|

|

| Return on average tangible common equity on an operating basis (Non-GAAP) (calculated by dividing net operating net income by average tangible common equity) |

9.01 |

% |

|

10.23 |

% |

|

10.15 |

% |

|

|

|

|

| Noninterest income as a % of total revenue (GAAP) (calculated by dividing total noninterest income by net interest income plus total noninterest income) |

18.28 |

% |

|

18.20 |

% |

|

17.89 |

% |

|

|

|

|

| Noninterest income as a % of total revenue on an operating basis (Non-GAAP) (calculated by dividing total noninterest income on an operating basis by net interest income plus total noninterest income) |

18.28 |

% |

|

18.20 |

% |

|

17.89 |

% |

|

|

|

|

| Efficiency ratio (GAAP) (calculated by dividing total noninterest expense by total revenue) |

59.47 |

% |

|

60.18 |

% |

|

59.68 |

% |

|

|

|

|

| Efficiency ratio on an operating basis (Non-GAAP) (calculated by dividing total noninterest expense on an operating basis by total revenue) |

58.82 |

% |

|

59.10 |

% |

|

59.68 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSET QUALITY |

|

|

| (Unaudited, dollars in thousands) |

|

Nonperforming Assets At |

|

|

March 31

2025 |

|

December 31

2024 |

|

March 31

2024 |

| Nonperforming loans |

|

|

|

|

|

|

| Commercial & industrial loans |

|

$ |

9,683 |

|

|

$ |

14,152 |

|

|

$ |

17,747 |

|

| Commercial real estate loans |

|

65,840 |

|

|

74,343 |

|

|

24,106 |

|

| Small business loans |

|

156 |

|

|

302 |

|

|

316 |

|

| Residential real estate loans |

|

10,966 |

|

|

10,243 |

|

|

9,947 |

|

| Home equity |

|

2,840 |

|

|

2,479 |

|

|

4,805 |

|

| Other consumer |

|

8 |

|

|

10 |

|

|

20 |

|

| Total nonperforming loans |

|

89,493 |

|

|

101,529 |

|

|

56,941 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other real estate owned |

|

— |

|

|

— |

|

|

110 |

|

| Total nonperforming assets |

|

$ |

89,493 |

|

|

$ |

101,529 |

|

|

$ |

57,051 |

|

|

|

|

|

|

|

|

| Nonperforming loans/gross loans |

|

0.62 |

% |

|

0.70 |

% |

|

0.40 |

% |

| Nonperforming assets/total assets |

|

0.45 |

% |

|

0.52 |

% |

|

0.30 |

% |

| Allowance for credit losses/nonperforming loans |

|

161.01 |

% |

|

167.42 |

% |

|

258.07 |

% |

| Allowance for credit losses/total loans |

|

0.99 |

% |

|

1.17 |

% |

|

1.03 |

% |

| Delinquent loans/total loans |

|

0.47 |

% |

|

0.60 |

% |

|

0.52 |

% |

|

|

|

Nonperforming Assets Reconciliation for the Three Months Ended |

|

|

March 31

2025 |

|

December 31

2024 |

|

March 31

2024 |

|

|

|

|

|

|

|

| Nonperforming assets beginning balance |

|

$ |

101,529 |

|

|

$ |

104,358 |

|

|

$ |

54,493 |

|

| New to nonperforming |

|

41,777 |

|

|

5,065 |

|

|

19,258 |

|

|

|

|

|

|

|

|

| Loans charged-off |

|

(41,400) |

|

|

(1,652) |

|

|

(881) |

|

| Loans paid-off |

|

(10,932) |

|

|

(4,975) |

|

|

(6,982) |

|

|

|

|

|

|

|

|

| Loans restored to performing status |

|

(1,356) |

|

|

(1,234) |

|

|

(8,855) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sale of other real estate owned |

|

— |

|

|

(110) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

(125) |

|

|

77 |

|

|

18 |

|

| Nonperforming assets ending balance |

|

$ |

89,493 |

|

|

$ |

101,529 |

|

|

$ |

57,051 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Charge-Offs (Recoveries) |

|

|

|

|

|

Three Months Ended |

|

|

|

March 31

2025 |

|

December 31

2024 |

|

March 31

2024 |

|

|

|

|

| Net charge-offs (recoveries) |

|

|

|

|

|

|

|

|

|

| Commercial and industrial loans |

$ |

53 |

|

|

$ |

8 |

|

|

$ |

(85) |

|

|

|

|

|

| Commercial real estate loans |

39,996 |

|

|

— |

|

|

— |

|

|

|

|

|

| Small business loans |

99 |

|

|

317 |

|

|

70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Home equity |

78 |

|

|

283 |

|

|

(133) |

|

|

|

|

|

| Other consumer |

666 |

|

|

604 |

|

|

422 |

|

|

|

|

|

| Total net charge-offs |

$ |

40,892 |

|

|

$ |

1,212 |

|

|

$ |

274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net charge-offs to average loans (annualized) |

1.14 |

% |

|

0.03 |

% |

|

0.01 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BALANCE SHEET AND CAPITAL RATIOS |

|

|

|

|

|

|

March 31

2025 |

|

December 31

2024 |

|

March 31

2024 |

| Gross loans/total deposits |

92.45 |

% |

|

94.79 |

% |

|

95.26 |

% |

| Common equity tier 1 capital ratio (1) |

14.52 |

% |

|

14.65 |

% |

|

14.16 |

% |

| Tier 1 leverage capital ratio (1) |

11.43 |

% |

|

11.32 |

% |

|

10.95 |

% |

| Common equity to assets ratio GAAP |

15.25 |

% |

|

15.45 |

% |

|

14.92 |

% |

| Tangible common equity to tangible assets ratio (2) |

10.78 |

% |

|

10.86 |

% |

|

10.27 |

% |

| Book value per share GAAP |

$ |

71.19 |

|

|

$ |

70.43 |

|

|

$ |

67.94 |

|

| Tangible book value per share (2) |

$ |

47.81 |

|

|

$ |

46.96 |

|

|

$ |

44.34 |

|

(1) Estimated number for March 31, 2025.

(2) See Appendix A for detailed reconciliation from GAAP to Non-GAAP ratios.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INDEPENDENT BANK CORP. SUPPLEMENTAL FINANCIAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited, dollars in thousands) |

|

Three Months Ended |

|

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

|

Interest |

|

|

|

|

Interest |

|

|

|

|

Interest |

|

|

|

|

Average |

|

Earned/ |

Yield/ |

|

Average |

|

Earned/ |

Yield/ |

|

Average |

|

Earned/ |

|

Yield/ |

|

|

Balance |

|

Paid (1) |

|

Rate |

|

Balance |

|

Paid (1) |

|

Rate |

|

Balance |

|

Paid (1) |

|

Rate |

| Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning deposits with banks, federal funds sold, and short term investments |

|

$ |

141,410 |

|

|

$ |

1,438 |

|

|

4.12 |

% |

|

$ |

270,603 |

|

|

$ |

3,154 |

|

|

4.64 |

% |

|

$ |

50,583 |

|

|

$ |

483 |

|

|

3.84 |

% |

| Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities - trading |

|

4,513 |

|

|

— |

|

|

— |

% |

|

4,366 |

|

|

— |

|

|

— |

% |

|

4,779 |

|

|

— |

|

|

— |

% |

| Securities - taxable investments |

|

2,747,039 |

|

|

15,296 |

|

|

2.26 |

% |

|

2,743,469 |

|

|

14,805 |

|

|

2.15 |

% |

|

2,867,460 |

|

|

14,231 |

|

|

2.00 |

% |

| Securities - nontaxable investments (1) |

|

195 |

|

|

1 |

|

|

2.08 |

% |

|

195 |

|

|

2 |

|

|

4.08 |

% |

|

190 |

|

|

2 |

|

|

4.23 |

% |

| Total securities |

|

$ |

2,751,747 |

|

|

$ |

15,297 |

|

|

2.25 |

% |

|

$ |

2,748,030 |

|

|

$ |

14,807 |

|

|

2.14 |

% |

|

$ |

2,872,429 |

|

|

$ |

14,233 |

|

|

1.99 |

% |

| Loans held for sale |

|

6,396 |

|

|

92 |

|

|

5.83 |

% |

|

12,882 |

|

|

182 |

|

|

5.62 |

% |

|

7,095 |

|

|

104 |

|

|

5.90 |

% |

| Loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial and industrial (1) |

|

3,045,816 |

|

|

47,283 |

|

|

6.30 |

% |

|

2,974,746 |

|

|

45,449 |

|

|

6.08 |

% |

|

2,949,499 |

|

|

44,618 |

|

|

6.08 |

% |

| Commercial real estate (1) |

|

6,719,504 |

|

|

84,919 |

|

|

5.13 |

% |

|

6,745,244 |

|

|

88,630 |

|

|

5.23 |

% |

|

6,721,292 |

|

|

85,065 |

|

|

5.09 |

% |

| Commercial construction |

|

785,312 |

|

|

13,167 |

|

|

6.80 |

% |

|

777,094 |

|

|

13,805 |

|

|

7.07 |

% |

|

842,480 |

|

|

15,421 |

|

|

7.36 |

% |

| Small business |

|

290,245 |

|

|

4,778 |

|

|

6.68 |

% |

|

275,934 |

|

|

4,583 |

|

|

6.61 |

% |

|

257,022 |

|

|

4,160 |

|

|

6.51 |

% |

| Total commercial |

|

10,840,877 |

|

|

150,147 |

|

|

5.62 |

% |

|

10,773,018 |

|

|

152,467 |

|

|

5.63 |

% |

|

10,770,293 |

|

|

149,264 |

|

|

5.57 |

% |

| Residential real estate |

|

2,464,464 |

|

|

27,716 |

|

|

4.56 |

% |

|

2,446,478 |

|

|

27,325 |

|

|

4.44 |

% |

|

2,418,617 |

|

|

26,083 |

|

|

4.34 |

% |

| Home equity |

|

1,140,190 |

|

|

17,774 |

|

|

6.32 |

% |

|

1,134,521 |

|

|

18,901 |

|

|

6.63 |

% |

|

1,094,856 |

|

|

18,444 |

|

|

6.78 |

% |

| Total consumer real estate |

|

3,604,654 |

|

|

45,490 |

|

|

5.12 |

% |

|

3,580,999 |

|

|

46,226 |

|

|

5.14 |

% |

|

3,513,473 |

|

|

44,527 |

|

|

5.10 |

% |

| Other consumer |

|

38,618 |

|

|

593 |

|

|

6.23 |

% |

|

37,960 |

|

|

663 |

|

|

6.95 |

% |

|

30,669 |

|

|

609 |

|

|

7.99 |

% |

| Total loans |

|

$ |

14,484,149 |

|

|

$ |

196,230 |

|

|

5.49 |

% |

|

$ |

14,391,977 |

|

|

$ |

199,356 |

|

|

5.51 |

% |

|

$ |

14,314,435 |

|

|

$ |

194,400 |

|

|

5.46 |

% |

| Total interest-earning assets |

|

$ |

17,383,702 |

|

|

$ |

213,057 |

|

|

4.97 |

% |

|

$ |

17,423,492 |

|

|

$ |

217,499 |

|

|

4.97 |

% |

|

$ |

17,244,542 |

|

|

$ |

209,220 |

|

|

4.88 |

% |

| Cash and due from banks |

|

197,536 |

|

|

|

|

|

|

181,566 |

|

|

|

|

|

|

177,506 |

|

|

|

|

|

| Federal Home Loan Bank stock |

|

27,646 |

|

|

|

|

|

|

29,944 |

|

|

|

|

|

|

47,203 |

|

|

|

|

|

| Other assets |

|

1,852,073 |

|

|

|

|

|

|

1,801,204 |

|

|

|

|

|

|

1,809,640 |

|

|

|

|

|

| Total assets |

|

$ |

19,460,957 |

|

|

|

|

|

|

$ |

19,436,206 |

|

|

|

|

|

|

$ |

19,278,891 |

|

|

|

|

|

| Interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Savings and interest checking accounts |

|

$ |

5,222,353 |

|

|

$ |

16,162 |

|

|

1.26 |

% |

|

$ |

5,181,107 |

|

|

$ |

17,171 |

|

|

1.32 |

% |

|

$ |

5,165,866 |

|

|

$ |

14,856 |

|

|

1.16 |

% |

| Money market |

|

3,178,879 |

|

|

17,710 |

|

|

2.26 |

% |

|

3,012,556 |

|

|

17,612 |

|

|

2.33 |

% |

|

2,844,014 |

|

|

15,991 |

|

|

2.26 |

% |

| Time deposits |

|

2,723,975 |

|

|

25,564 |

|

|

3.81 |

% |

|

2,779,704 |

|

|

29,405 |

|

|

4.21 |

% |

|

2,297,219 |

|

|

23,473 |

|

|

4.11 |

% |

| Total interest-bearing deposits |

|

$ |

11,125,207 |

|

|

$ |

59,436 |

|

|

2.17 |

% |

|

$ |

10,973,367 |

|

|

$ |

64,188 |

|

|

2.33 |

% |

|

$ |

10,307,099 |

|

|

$ |

54,320 |

|

|

2.12 |

% |

| Borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Federal Home Loan Bank borrowings |

|

547,713 |

|

|

5,566 |

|

|

4.12 |

% |

|

601,842 |

|

|

6,396 |

|

|

4.23 |

% |

|

1,185,296 |

|

|

14,631 |

|

|

4.96 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Junior subordinated debentures |

|

62,860 |

|

|

974 |

|

|

6.28 |

% |

|

62,860 |

|

|

1,075 |

|

|

6.80 |

% |

|

62,858 |

|

|

1,147 |

|

|

7.34 |

% |

| Subordinated debentures |

|

23,070 |

|

|

439 |

|

|

7.72 |

% |

|

— |

|

|

— |

|

|

— |

% |

|

40,651 |

|

|

508 |

|

|

5.03 |

% |

| Total borrowings |

|

$ |

633,643 |

|

|

$ |

6,979 |

|

|

4.47 |

% |

|

$ |

664,702 |

|

|

$ |

7,471 |

|

|

4.47 |

% |

|

$ |

1,288,805 |

|

|

$ |

16,286 |

|

|

5.08 |

% |

| Total interest-bearing liabilities |

|

$ |

11,758,850 |

|

|

$ |

66,415 |

|

|

2.29 |

% |

|

$ |

11,638,069 |

|

|

$ |

71,659 |

|

|

2.45 |

% |

|

$ |

11,595,904 |

|

|

$ |

70,606 |

|

|

2.45 |

% |

| Noninterest-bearing demand deposits |

|

4,345,631 |

|

|

|

|

|

|

4,481,669 |

|

|

|

|

|

|

4,439,107 |

|

|

|

|

|

| Other liabilities |

|

323,728 |

|

|

|

|

|

|

319,220 |

|

|

|

|

|

|

347,573 |

|

|

|

|

|

| Total liabilities |

|

$ |

16,428,209 |

|

|

|

|

|

|

$ |

16,438,958 |

|

|

|

|

|

|

$ |

16,382,584 |

|

|

|

|

|

| Stockholders’ equity |

|

3,032,748 |

|

|

|

|

|

|

2,997,248 |

|

|

|

|

|

|

2,896,307 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

19,460,957 |

|

|

|

|

|

|

$ |

19,436,206 |

|

|

|

|

|

|

$ |

19,278,891 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

|

$ |

146,642 |

|

|

|

|

|

|

$ |

145,840 |

|

|

|

|

|

|

$ |

138,614 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest rate spread (2) |

|

|

|

|

|

2.68 |

% |

|

|

|

|

|

2.52 |

% |

|

|

|

|

|

2.43 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin (3) |

|

|

|

|

|

3.42 |

% |

|

|

|

|

|

3.33 |

% |

|

|

|

|

|

3.23 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total deposits, including demand deposits |

|

$ |

15,470,838 |

|

|

$ |

59,436 |

|

|

|

|

$ |

15,455,036 |

|

|

$ |

64,188 |

|

|

|

|

$ |

14,746,206 |

|

|

$ |

54,320 |

|

|

|

| Cost of total deposits |

|