| 1-9047 | 04-2870273 | |||||||

| (Commission File Number) | (I.R.S. Employer identification No.) | |||||||

| INDEPENDENT BANK CORP. | ||||||||||||||

| Office Address: | 2036 Washington Street, | Hanover, | Massachusetts | 02339 | ||||||||||

| Mailing Address: | 288 Union Street, | Rockland, | Massachusetts | 02370 | ||||||||||

| (Address of principal executive offices, including zip code) | ||||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||

| Title of each Class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common Stock, $.01 par value per share | INDB | NASDAQ Global Select Market | ||||||

| Emerging growth company | ☐ | ||||

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION | ||||

| ITEM 7.01 | REGULATION FD DISCLOSURE | ||||

ITEM 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS |

||||

| Exhibit Index | |||||

| Exhibit # | Exhibit Description | ||||

| 99.1 | |||||

| 99.2 | |||||

| 101 | The instance document does not appear in the interactive data file because its XBRL tags are embedded within the inline XBRL document | ||||

| 104 | Cover page interactive data file (formatted as inline XBRL and contained in Exhibit 101) | ||||

| INDEPENDENT BANK CORP. | |||||||||||

| Date: | July 18, 2024 | By: | /s/Mark J. Ruggiero | ||||||||

| MARK J. RUGGIERO | |||||||||||

| CHIEF FINANCIAL OFFICER | |||||||||||

| INDEPENDENT BANK CORP. FINANCIAL SUMMARY | |||||||||||||||||||||||||||||

| CONSOLIDATED BALANCE SHEETS | |||||||||||||||||||||||||||||

| (Unaudited, dollars in thousands) | % Change | % Change | |||||||||||||||||||||||||||

| June 30 2024 |

March 31 2024 |

June 30 2023 |

Jun 2024 vs. | Jun 2024 vs. | |||||||||||||||||||||||||

| Mar 2024 | Jun 2023 | ||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 192,845 | $ | 165,331 | $ | 181,810 | 16.64 | % | 6.07 | % | |||||||||||||||||||

| Interest-earning deposits with banks | 121,036 | 55,985 | 126,454 | 116.19 | % | (4.28) | % | ||||||||||||||||||||||

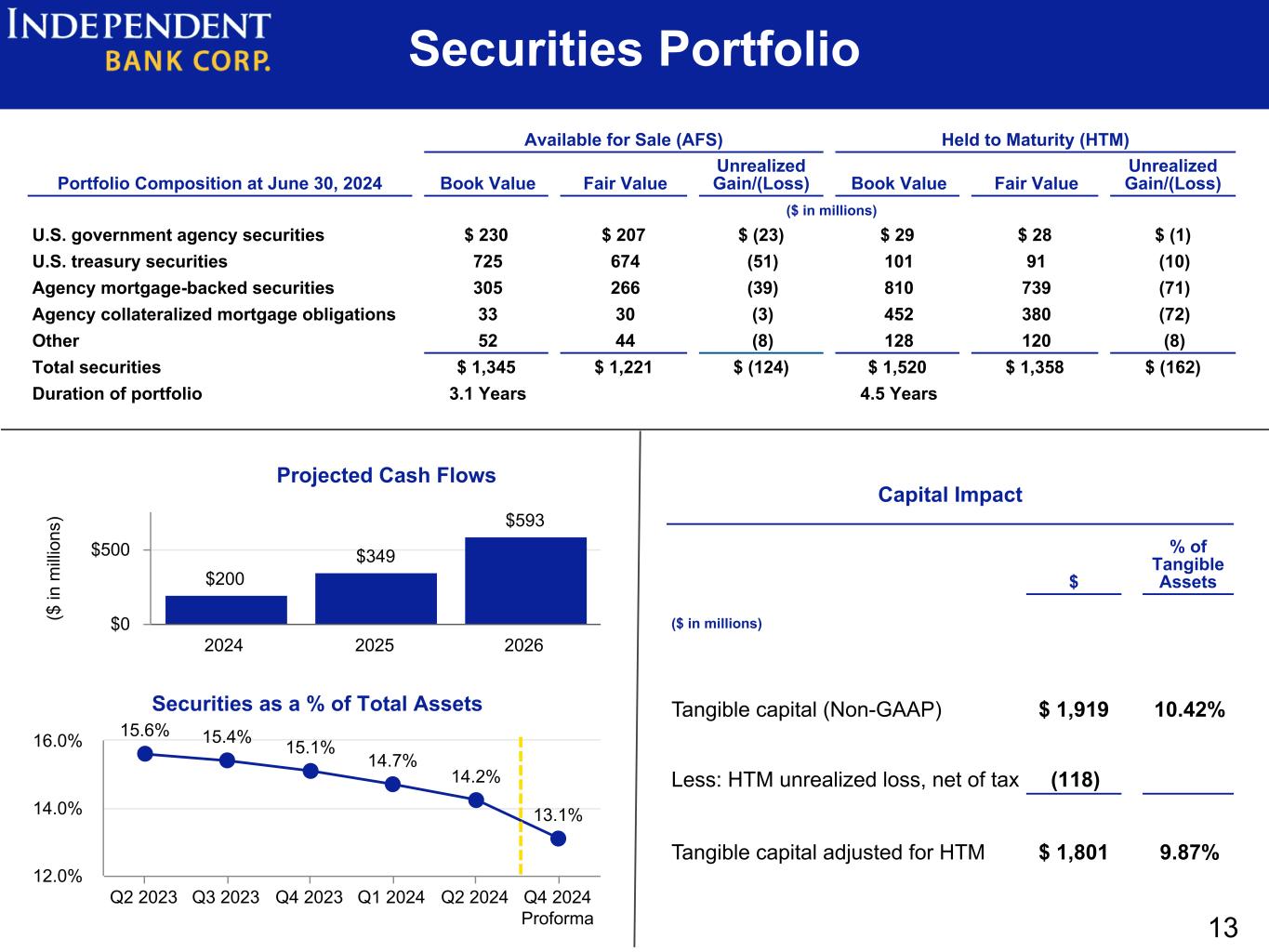

| Securities | |||||||||||||||||||||||||||||

| Trading | 4,384 | 4,759 | 4,477 | (7.88) | % | (2.08) | % | ||||||||||||||||||||||

| Equities | 21,028 | 22,858 | 21,800 | (8.01) | % | (3.54) | % | ||||||||||||||||||||||

| Available for sale | 1,220,656 | 1,272,831 | 1,372,903 | (4.10) | % | (11.09) | % | ||||||||||||||||||||||

| Held to maturity | 1,519,655 | 1,545,267 | 1,623,892 | (1.66) | % | (6.42) | % | ||||||||||||||||||||||

| Total securities | 2,765,723 | 2,845,715 | 3,023,072 | (2.81) | % | (8.51) | % | ||||||||||||||||||||||

| Loans held for sale | 17,850 | 11,340 | 6,577 | 57.41 | % | 171.40 | % | ||||||||||||||||||||||

| Loans | |||||||||||||||||||||||||||||

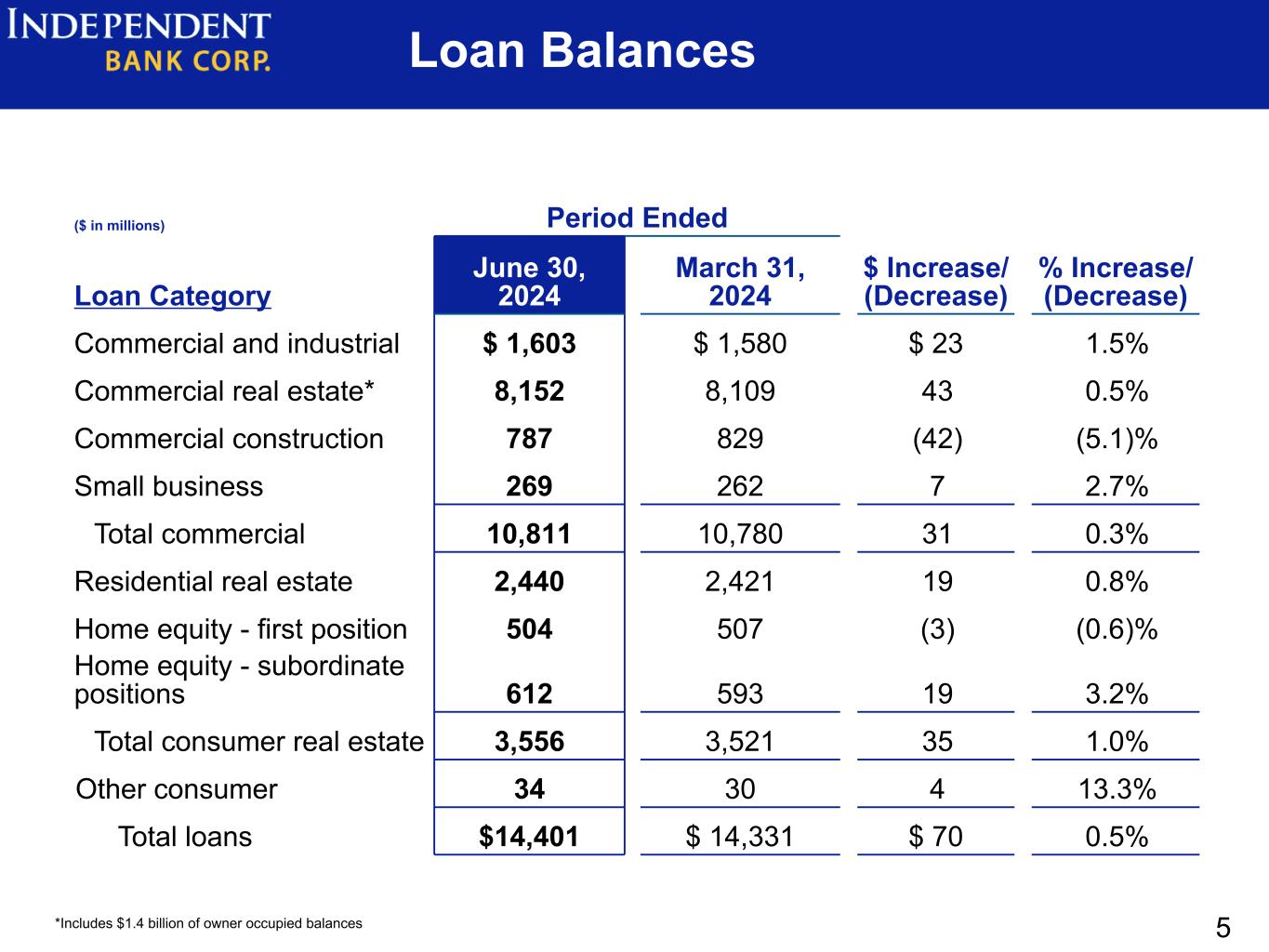

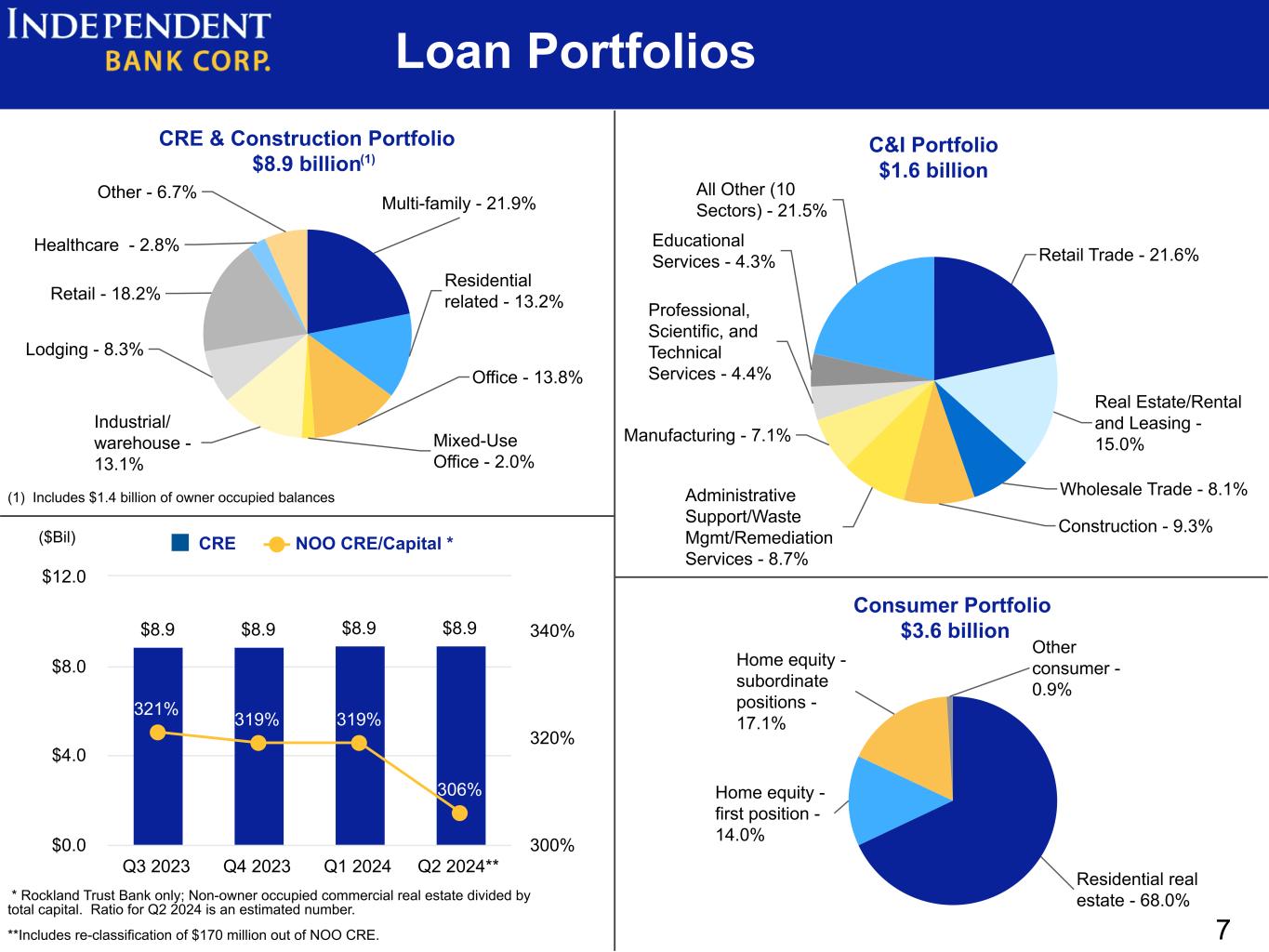

| Commercial and industrial | 1,602,752 | 1,580,041 | 1,723,219 | 1.44 | % | (6.99) | % | ||||||||||||||||||||||

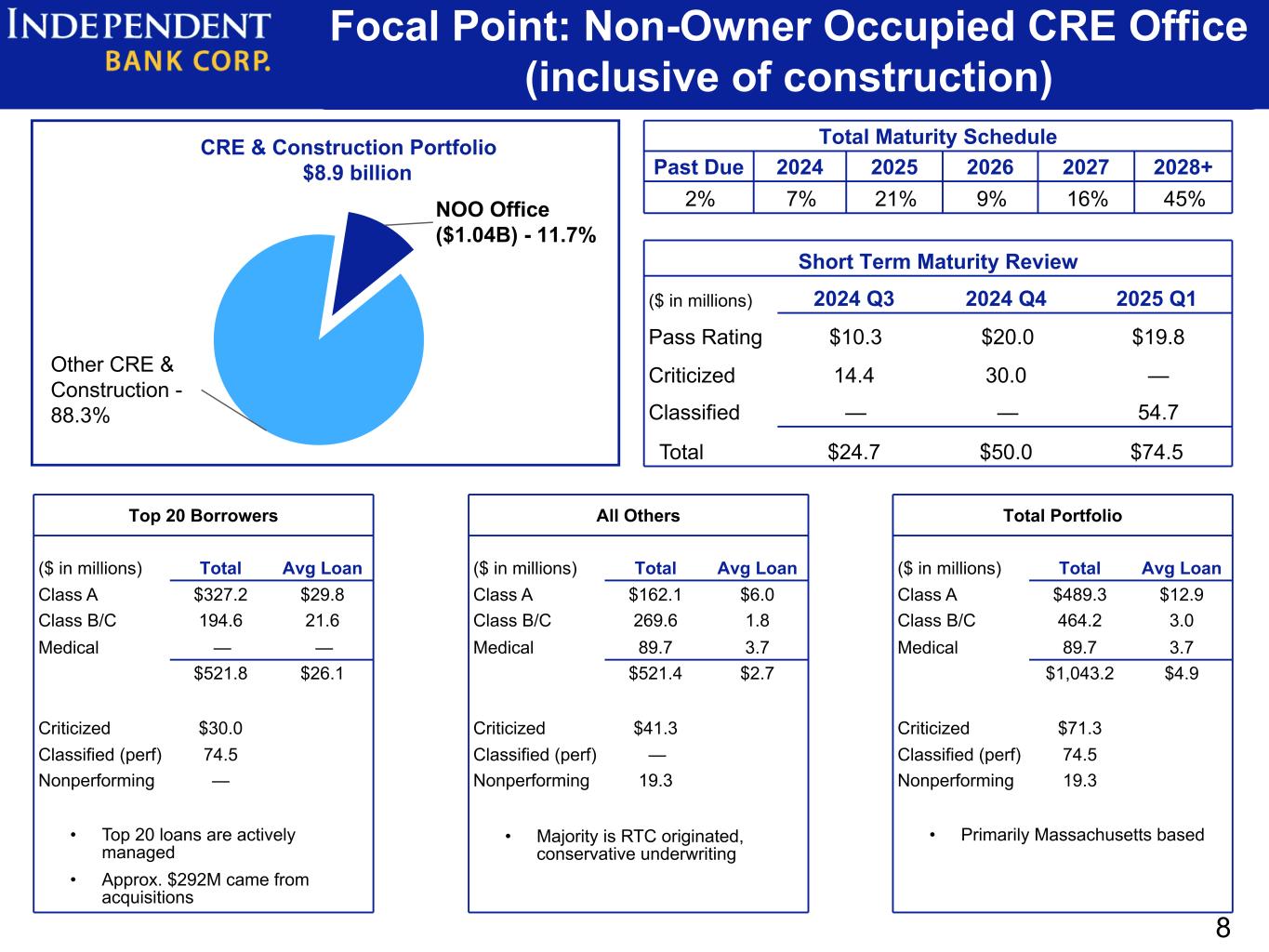

| Commercial real estate | 8,151,805 | 8,108,836 | 7,812,796 | 0.53 | % | 4.34 | % | ||||||||||||||||||||||

| Commercial construction | 786,743 | 828,900 | 1,022,796 | (5.09) | % | (23.08) | % | ||||||||||||||||||||||

| Small business | 269,270 | 261,690 | 237,092 | 2.90 | % | 13.57 | % | ||||||||||||||||||||||

| Total commercial | 10,810,570 | 10,779,467 | 10,795,903 | 0.29 | % | 0.14 | % | ||||||||||||||||||||||

| Residential real estate | 2,439,646 | 2,420,705 | 2,221,284 | 0.78 | % | 9.83 | % | ||||||||||||||||||||||

| Home equity - first position | 504,403 | 507,356 | 546,240 | (0.58) | % | (7.66) | % | ||||||||||||||||||||||

| Home equity - subordinate positions | 612,404 | 593,230 | 549,158 | 3.23 | % | 11.52 | % | ||||||||||||||||||||||

| Total consumer real estate | 3,556,453 | 3,521,291 | 3,316,682 | 1.00 | % | 7.23 | % | ||||||||||||||||||||||

| Other consumer | 33,919 | 29,836 | 27,326 | 13.68 | % | 24.13 | % | ||||||||||||||||||||||

| Total loans | 14,400,942 | 14,330,594 | 14,139,911 | 0.49 | % | 1.85 | % | ||||||||||||||||||||||

| Less: allowance for credit losses | (150,859) | (146,948) | (140,647) | 2.66 | % | 7.26 | % | ||||||||||||||||||||||

| Net loans | 14,250,083 | 14,183,646 | 13,999,264 | 0.47 | % | 1.79 | % | ||||||||||||||||||||||

| Federal Home Loan Bank stock | 32,738 | 46,304 | 39,488 | (29.30) | % | (17.09) | % | ||||||||||||||||||||||

| Bank premises and equipment, net | 191,303 | 192,563 | 193,642 | (0.65) | % | (1.21) | % | ||||||||||||||||||||||

| Goodwill | 985,072 | 985,072 | 985,072 | — | % | — | % | ||||||||||||||||||||||

| Other intangible assets | 15,161 | 16,626 | 21,537 | (8.81) | % | (29.60) | % | ||||||||||||||||||||||

| Cash surrender value of life insurance policies | 300,111 | 298,352 | 296,687 | 0.59 | % | 1.15 | % | ||||||||||||||||||||||

| Other assets | 539,115 | 523,679 | 527,328 | 2.95 | % | 2.24 | % | ||||||||||||||||||||||

| Total assets | $ | 19,411,037 | $ | 19,324,613 | $ | 19,400,931 | 0.45 | % | 0.05 | % | |||||||||||||||||||

| Liabilities and Stockholders’ Equity | |||||||||||||||||||||||||||||

| Deposits | |||||||||||||||||||||||||||||

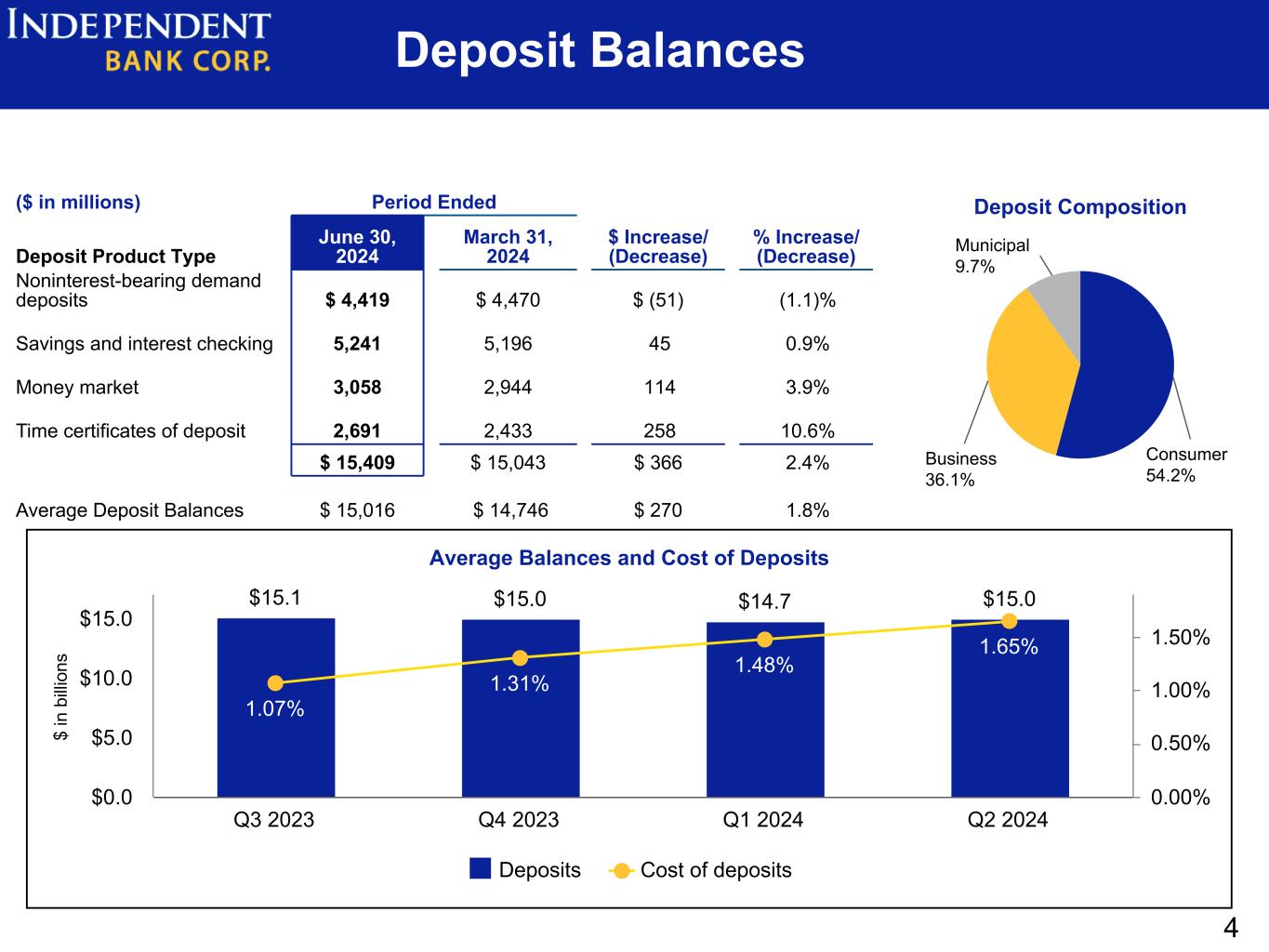

| Noninterest-bearing demand deposits | $ | 4,418,891 | $ | 4,469,820 | $ | 4,861,092 | (1.14) | % | (9.10) | % | |||||||||||||||||||

| Savings and interest checking | 5,241,154 | 5,196,195 | 5,525,223 | 0.87 | % | (5.14) | % | ||||||||||||||||||||||

| Money market | 3,058,109 | 2,944,221 | 3,065,520 | 3.87 | % | (0.24) | % | ||||||||||||||||||||||

| Time certificates of deposit | 2,691,433 | 2,432,985 | 1,796,216 | 10.62 | % | 49.84 | % | ||||||||||||||||||||||

| Total deposits | 15,409,587 | 15,043,221 | 15,248,051 | 2.44 | % | 1.06 | % | ||||||||||||||||||||||

| Borrowings | |||||||||||||||||||||||||||||

| Federal Home Loan Bank borrowings | 630,527 | 962,535 | 788,479 | (34.49) | % | (20.03) | % | ||||||||||||||||||||||

| Junior subordinated debentures, net | 62,859 | 62,858 | 62,857 | — | % | — | % | ||||||||||||||||||||||

| Subordinated debentures, net | — | — | 49,933 | nm | (100.00) | % | |||||||||||||||||||||||

| Total borrowings | 693,386 | 1,025,393 | 901,269 | (32.38) | % | (23.07) | % | ||||||||||||||||||||||

| Total deposits and borrowings | 16,102,973 | 16,068,614 | 16,149,320 | 0.21 | % | (0.29) | % | ||||||||||||||||||||||

| Other liabilities | 388,815 | 371,791 | 396,697 | 4.58 | % | (1.99) | % | ||||||||||||||||||||||

| Total liabilities | 16,491,788 | 16,440,405 | 16,546,017 | 0.31 | % | (0.33) | % | ||||||||||||||||||||||

| Stockholders’ equity | |||||||||||||||||||||||||||||

| Common stock | 423 | 422 | 440 | 0.24 | % | (3.86) | % | ||||||||||||||||||||||

| Additional paid in capital | 1,904,869 | 1,902,063 | 1,997,674 | 0.15 | % | (4.65) | % | ||||||||||||||||||||||

| Retained earnings | 1,128,182 | 1,101,061 | 1,009,735 | 2.46 | % | 11.73 | % | ||||||||||||||||||||||

| Accumulated other comprehensive loss, net of tax | (114,225) | (119,338) | (152,935) | (4.28) | % | (25.31) | % | ||||||||||||||||||||||

| Total stockholders' equity | 2,919,249 | 2,884,208 | 2,854,914 | 1.21 | % | 2.25 | % | ||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 19,411,037 | $ | 19,324,613 | $ | 19,400,931 | 0.45 | % | 0.05 | % | |||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | |||||||||||||||||||||||||||||

| (Unaudited, dollars in thousands, except per share data) | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| % Change | % Change | ||||||||||||||||||||||||||||

| June 30 2024 |

March 31 2024 |

June 30 2023 |

Jun 2024 vs. | Jun 2024 vs. | |||||||||||||||||||||||||

| Mar 2024 | Jun 2023 | ||||||||||||||||||||||||||||

| Interest income | |||||||||||||||||||||||||||||

| Interest on federal funds sold and short-term investments | $ | 397 | $ | 483 | $ | 3,312 | (17.81) | % | (88.01) | % | |||||||||||||||||||

| Interest and dividends on securities | 13,994 | 14,232 | 15,583 | (1.67) | % | (10.20) | % | ||||||||||||||||||||||

| Interest and fees on loans | 197,274 | 193,226 | 179,759 | 2.09 | % | 9.74 | % | ||||||||||||||||||||||

| Interest on loans held for sale | 199 | 104 | 39 | 91.35 | % | 410.26 | % | ||||||||||||||||||||||

| Total interest income | 211,864 | 208,045 | 198,693 | 1.84 | % | 6.63 | % | ||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||||||||

| Interest on deposits | 61,469 | 54,320 | 31,909 | 13.16 | % | 92.64 | % | ||||||||||||||||||||||

| Interest on borrowings | 12,469 | 16,286 | 14,238 | (23.44) | % | (12.42) | % | ||||||||||||||||||||||

| Total interest expense | 73,938 | 70,606 | 46,147 | 4.72 | % | 60.22 | % | ||||||||||||||||||||||

| Net interest income | 137,926 | 137,439 | 152,546 | 0.35 | % | (9.58) | % | ||||||||||||||||||||||

| Provision for credit losses | 4,250 | 5,000 | 5,000 | (15.00) | % | (15.00) | % | ||||||||||||||||||||||

| Net interest income after provision for credit losses | 133,676 | 132,439 | 147,546 | 0.93 | % | (9.40) | % | ||||||||||||||||||||||

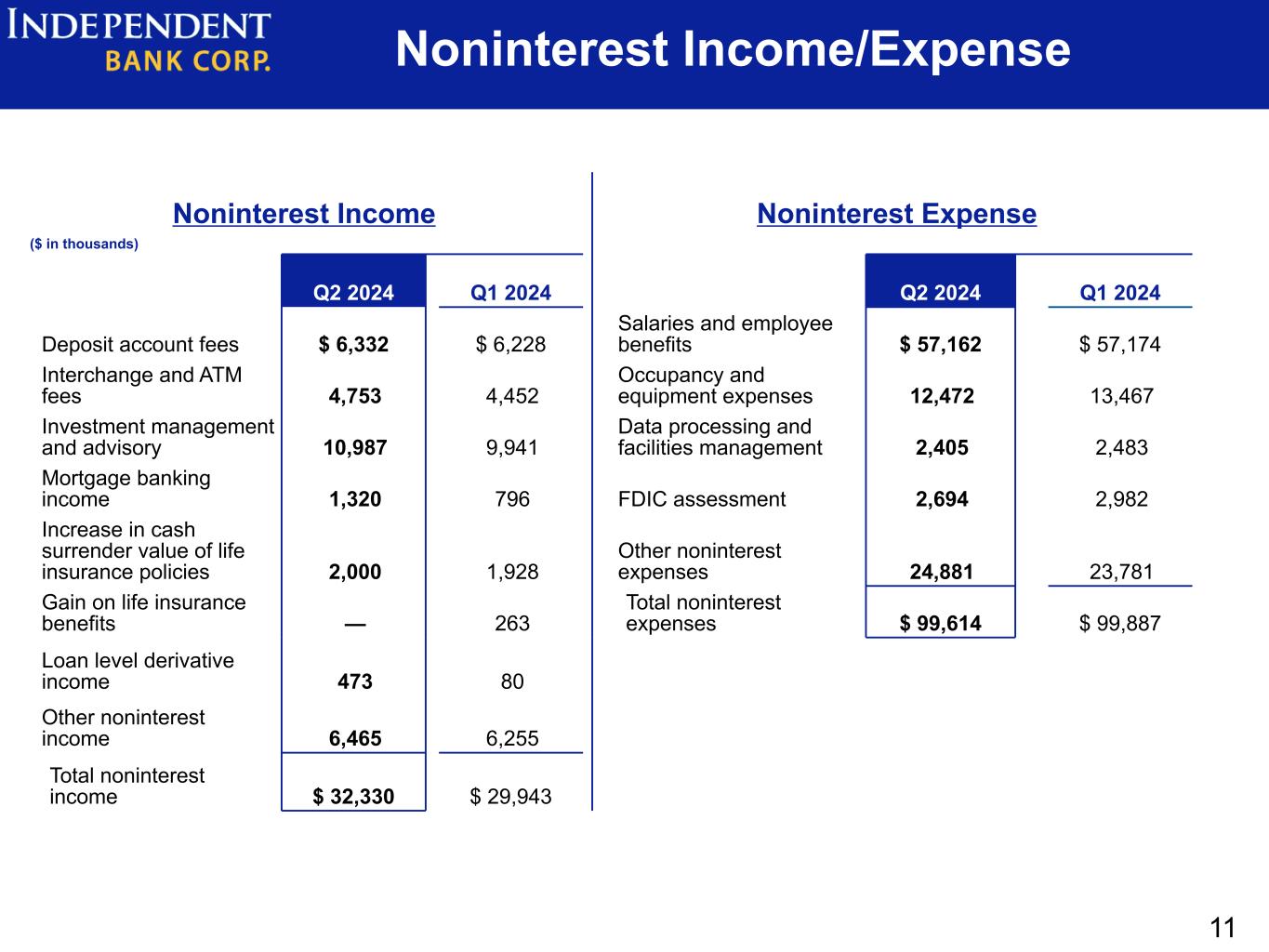

| Noninterest income | |||||||||||||||||||||||||||||

| Deposit account fees | 6,332 | 6,228 | 5,508 | 1.67 | % | 14.96 | % | ||||||||||||||||||||||

| Interchange and ATM fees | 4,753 | 4,452 | 4,478 | 6.76 | % | 6.14 | % | ||||||||||||||||||||||

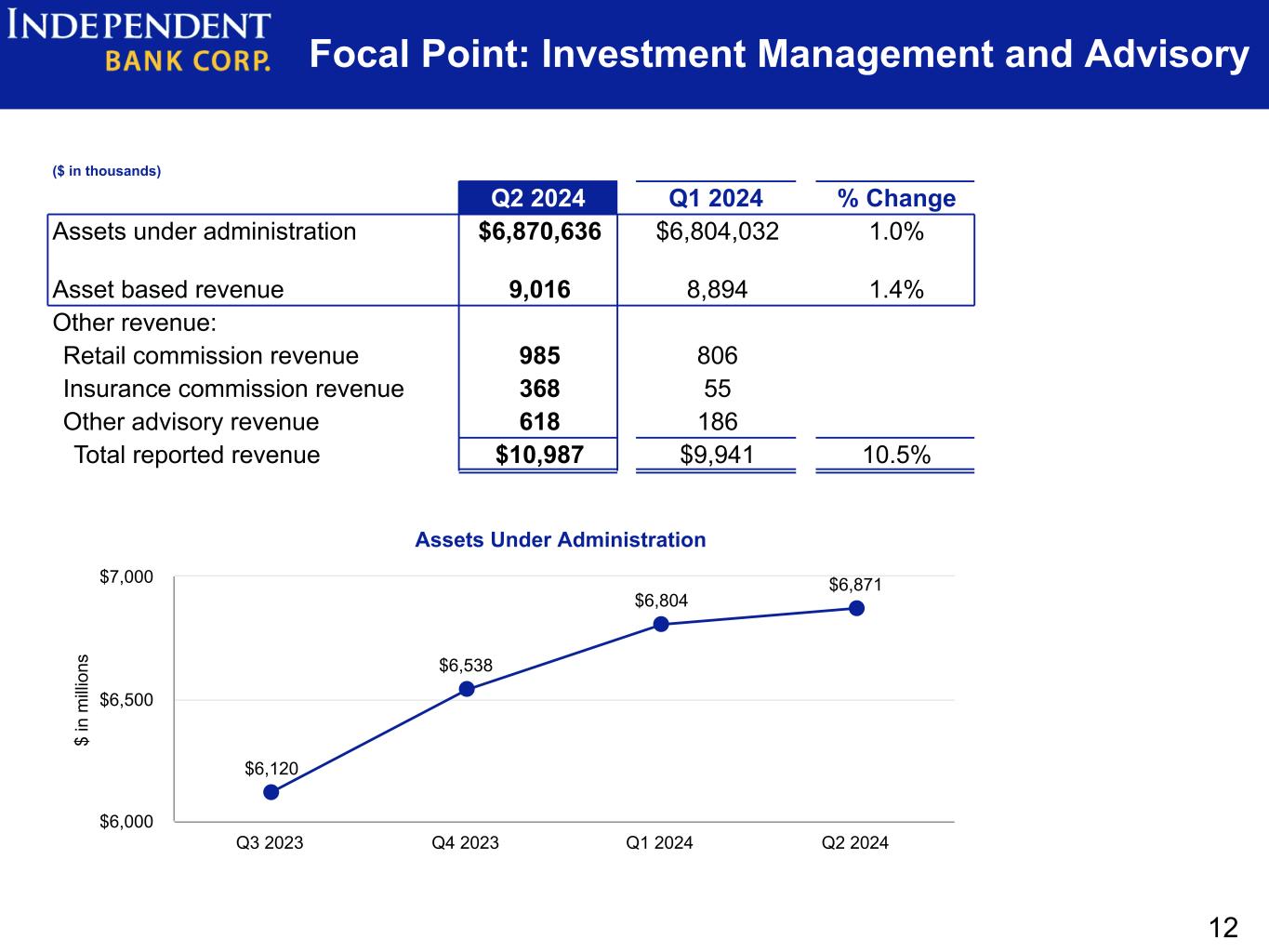

| Investment management and advisory | 10,987 | 9,941 | 10,348 | 10.52 | % | 6.18 | % | ||||||||||||||||||||||

| Mortgage banking income | 1,320 | 796 | 670 | 65.83 | % | 97.01 | % | ||||||||||||||||||||||

| Increase in cash surrender value of life insurance policies | 2,000 | 1,928 | 1,940 | 3.73 | % | 3.09 | % | ||||||||||||||||||||||

| Gain on life insurance benefits | — | 263 | 176 | (100.00) | % | (100.00) | % | ||||||||||||||||||||||

| Loan level derivative income | 473 | 80 | 1,275 | 491.25 | % | (62.90) | % | ||||||||||||||||||||||

| Other noninterest income | 6,465 | 6,255 | 6,362 | 3.36 | % | 1.62 | % | ||||||||||||||||||||||

| Total noninterest income | 32,330 | 29,943 | 30,757 | 7.97 | % | 5.11 | % | ||||||||||||||||||||||

| Noninterest expenses | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 57,162 | 57,174 | 53,975 | (0.02) | % | 5.90 | % | ||||||||||||||||||||||

| Occupancy and equipment expenses | 12,472 | 13,467 | 12,385 | (7.39) | % | 0.70 | % | ||||||||||||||||||||||

| Data processing and facilities management | 2,405 | 2,483 | 2,530 | (3.14) | % | (4.94) | % | ||||||||||||||||||||||

| FDIC assessment | 2,694 | 2,982 | 2,674 | (9.66) | % | 0.75 | % | ||||||||||||||||||||||

| Other noninterest expenses | 24,881 | 23,781 | 23,991 | 4.63 | % | 3.71 | % | ||||||||||||||||||||||

| Total noninterest expenses | 99,614 | 99,887 | 95,555 | (0.27) | % | 4.25 | % | ||||||||||||||||||||||

| Income before income taxes | 66,392 | 62,495 | 82,748 | 6.24 | % | (19.77) | % | ||||||||||||||||||||||

| Provision for income taxes | 15,062 | 14,725 | 20,104 | 2.29 | % | (25.08) | % | ||||||||||||||||||||||

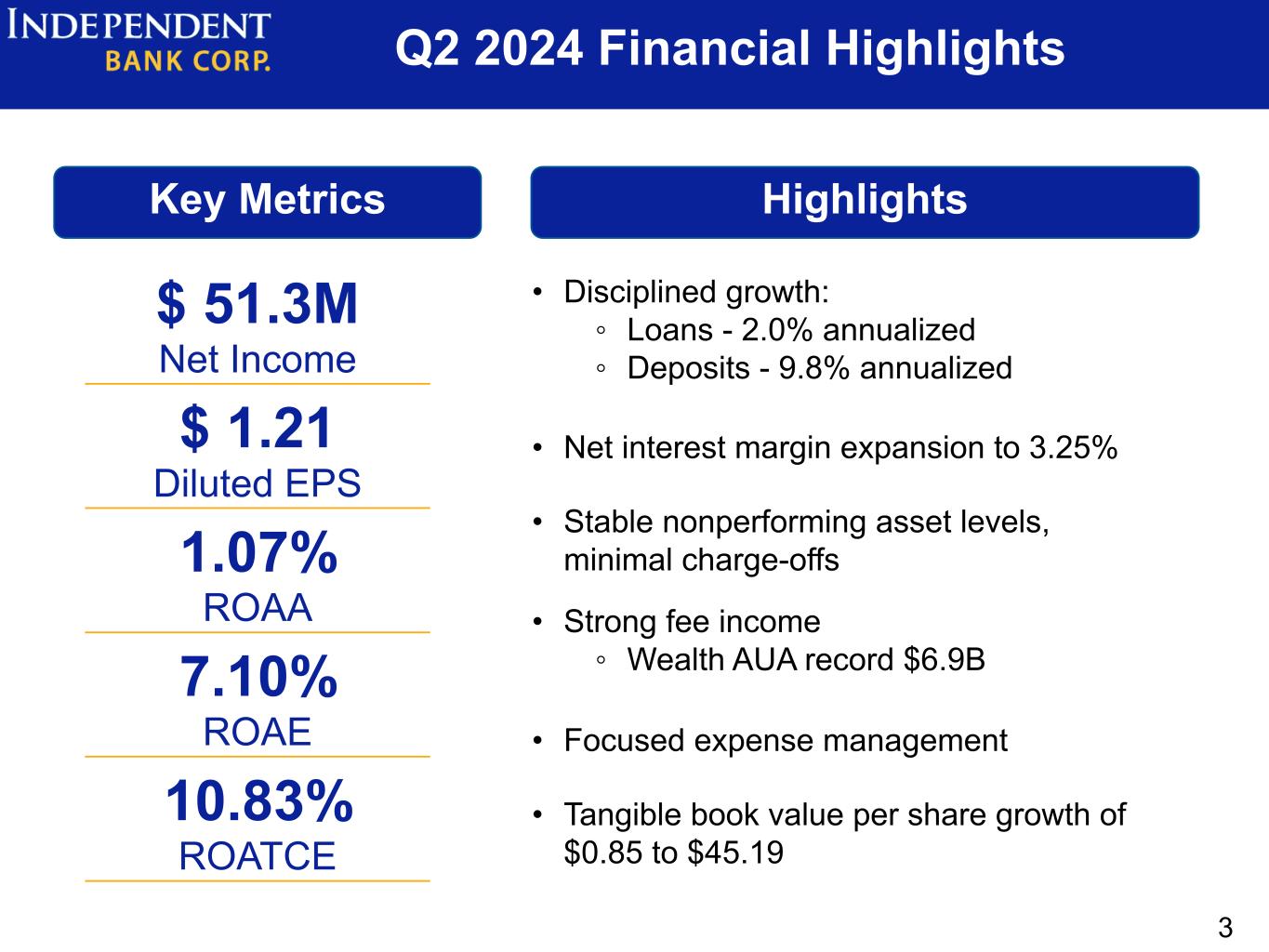

| Net Income | $ | 51,330 | $ | 47,770 | $ | 62,644 | 7.45 | % | (18.06) | % | |||||||||||||||||||

| Weighted average common shares (basic) | 42,468,658 | 42,553,714 | 44,129,152 | ||||||||||||||||||||||||||

| Common share equivalents | 4,308 | 12,876 | 7,573 | ||||||||||||||||||||||||||

| Weighted average common shares (diluted) | 42,472,966 | 42,566,590 | 44,136,725 | ||||||||||||||||||||||||||

| Basic earnings per share | $ | 1.21 | $ | 1.12 | $ | 1.42 | 8.04 | % | (14.79) | % | |||||||||||||||||||

| Diluted earnings per share | $ | 1.21 | $ | 1.12 | $ | 1.42 | 8.04 | % | (14.79) | % | |||||||||||||||||||

| Performance ratios | |||||||||||||||||||||||||||||

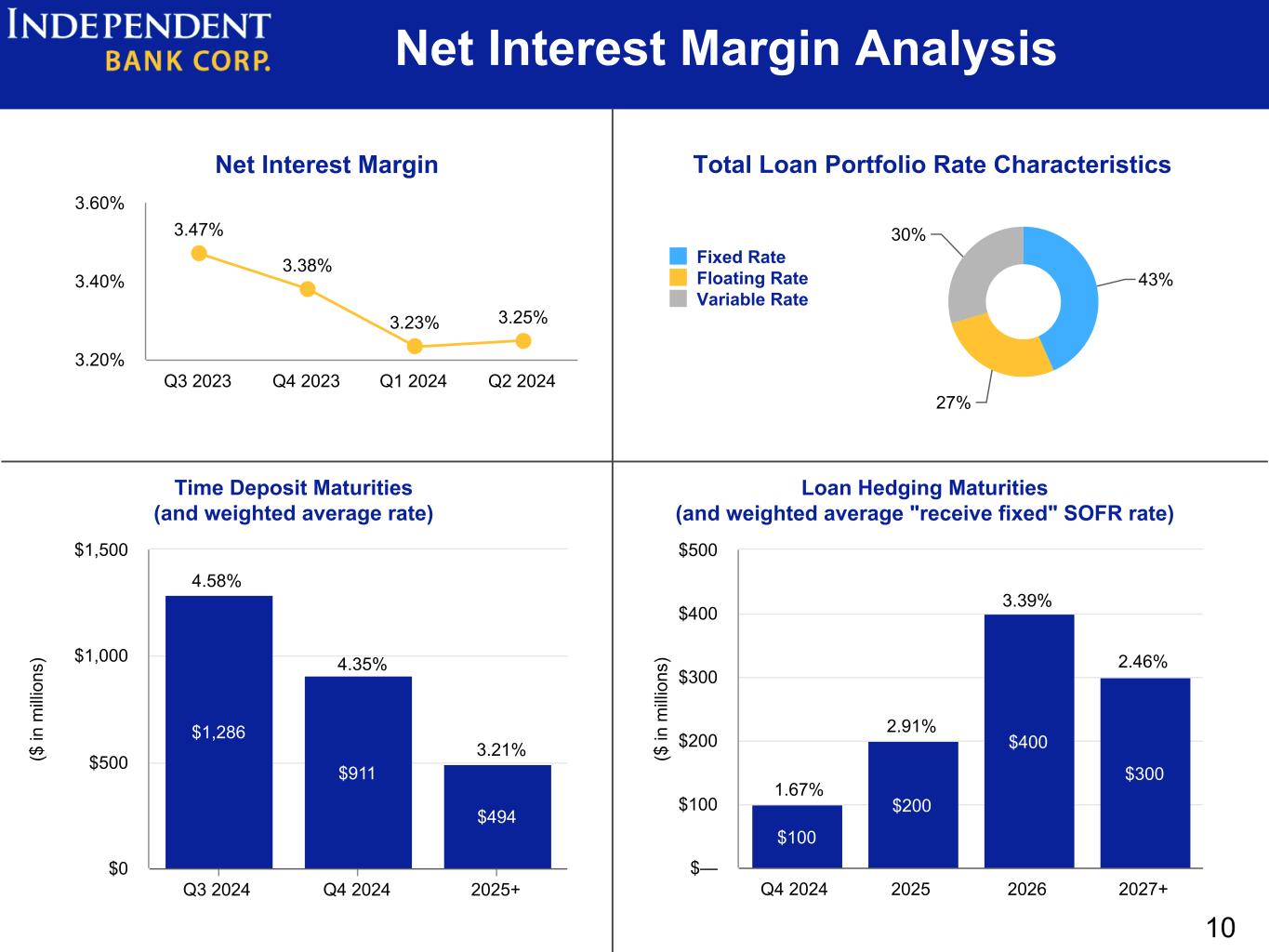

| Net interest margin (FTE) | 3.25 | % | 3.23 | % | 3.54 | % | |||||||||||||||||||||||

| Return on average assets (calculated by dividing net income by average assets) (GAAP) | 1.07 | % | 1.00 | % | 1.29 | % | |||||||||||||||||||||||

| Return on average common equity (calculated by dividing net income by average common equity) (GAAP) | 7.10 | % | 6.63 | % | 8.78 | % | |||||||||||||||||||||||

| Return on average tangible common equity (Non-GAAP) (calculated by dividing net income by average tangible common equity) | 10.83 | % | 10.15 | % | 13.54 | % | |||||||||||||||||||||||

| Noninterest income as a % of total revenue (calculated by dividing total noninterest income by net interest income plus total noninterest income) | 18.99 | % | 17.89 | % | 16.78 | % | |||||||||||||||||||||||

| Efficiency ratio (calculated by dividing total noninterest expense by total revenue) | 58.51 | % | 59.68 | % | 52.13 | % | |||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | ||||||||||||||||||||

| (Unaudited, dollars in thousands, except per share data) | ||||||||||||||||||||

| Six Months Ended | ||||||||||||||||||||

| % Change | ||||||||||||||||||||

| June 30 2024 |

June 30 2023 |

Jun 2024 vs. | ||||||||||||||||||

| Jun 2023 | ||||||||||||||||||||

| Interest income | ||||||||||||||||||||

| Interest on federal funds sold and short-term investments | $ | 880 | $ | 3,977 | (77.87) | % | ||||||||||||||

| Interest and dividends on securities | 28,226 | 30,893 | (8.63) | % | ||||||||||||||||

| Interest and fees on loans | 390,500 | 350,685 | 11.35 | % | ||||||||||||||||

| Interest on loans held for sale | 303 | 73 | 315.07 | % | ||||||||||||||||

| Total interest income | 419,909 | 385,628 | 8.89 | % | ||||||||||||||||

| Interest expense | ||||||||||||||||||||

| Interest on deposits | 115,789 | 54,584 | 112.13 | % | ||||||||||||||||

| Interest on borrowings | 28,755 | 19,500 | 47.46 | % | ||||||||||||||||

| Total interest expense | 144,544 | 74,084 | 95.11 | % | ||||||||||||||||

| Net interest income | 275,365 | 311,544 | (11.61) | % | ||||||||||||||||

| Provision for credit losses | 9,250 | 12,250 | (24.49) | % | ||||||||||||||||

| Net interest income after provision for credit losses | 266,115 | 299,294 | (11.09) | % | ||||||||||||||||

| Noninterest income | ||||||||||||||||||||

| Deposit account fees | 12,560 | 11,424 | 9.94 | % | ||||||||||||||||

| Interchange and ATM fees | 9,205 | 8,662 | 6.27 | % | ||||||||||||||||

| Investment management and advisory | 20,928 | 20,127 | 3.98 | % | ||||||||||||||||

| Mortgage banking income | 2,116 | 978 | 116.36 | % | ||||||||||||||||

| Increase in cash surrender value of life insurance policies | 3,928 | 3,794 | 3.53 | % | ||||||||||||||||

| Gain on life insurance benefits | 263 | 187 | 40.64 | % | ||||||||||||||||

| Loan level derivative income | 553 | 1,683 | (67.14) | % | ||||||||||||||||

| Other noninterest income | 12,720 | 12,144 | 4.74 | % | ||||||||||||||||

| Total noninterest income | 62,273 | 58,999 | 5.55 | % | ||||||||||||||||

| Noninterest expenses | ||||||||||||||||||||

| Salaries and employee benefits | 114,336 | 110,950 | 3.05 | % | ||||||||||||||||

| Occupancy and equipment expenses | 25,939 | 25,207 | 2.90 | % | ||||||||||||||||

| Data processing and facilities management | 4,888 | 5,057 | (3.34) | % | ||||||||||||||||

| FDIC assessment | 5,676 | 5,284 | 7.42 | % | ||||||||||||||||

| Other noninterest expenses | 48,662 | 47,718 | 1.98 | % | ||||||||||||||||

| Total noninterest expenses | 199,501 | 194,216 | 2.72 | % | ||||||||||||||||

| Income before income taxes | 128,887 | 164,077 | (21.45) | % | ||||||||||||||||

| Provision for income taxes | 29,787 | 40,186 | (25.88) | % | ||||||||||||||||

| Net Income | $ | 99,100 | $ | 123,891 | (20.01) | % | ||||||||||||||

| Weighted average common shares (basic) | 42,511,186 | 44,564,209 | ||||||||||||||||||

| Common share equivalents | 8,592 | 13,568 | ||||||||||||||||||

| Weighted average common shares (diluted) | 42,519,778 | 44,577,777 | ||||||||||||||||||

| Basic earnings per share | $ | 2.33 | $ | 2.78 | (16.19) | % | ||||||||||||||

| Diluted earnings per share | $ | 2.33 | $ | 2.78 | (16.19) | % | ||||||||||||||

| Performance ratios | ||||||||||||||||||||

| Net interest margin (FTE) | 3.24 | % | 3.67 | % | ||||||||||||||||

| Return on average assets (GAAP) (calculated by dividing net income by average assets) | 1.03 | % | 1.29 | % | ||||||||||||||||

| Return on average common equity (GAAP) (calculated by dividing net income by average common equity) | 6.87 | % | 8.70 | % | ||||||||||||||||

| Return on average tangible common equity (Non-GAAP) (calculated by dividing net income by average tangible common equity) | 10.49 | % | 13.42 | % | ||||||||||||||||

| Noninterest income as a % of total revenue (calculated by dividing total noninterest income by net interest income plus total noninterest income) | 18.44 | % | 15.92 | % | ||||||||||||||||

| Efficiency ratio (GAAP) (calculated by dividing total noninterest expense by total revenue) | 59.09 | % | 52.41 | % | ||||||||||||||||

| ASSET QUALITY | ||||||||||||||||||||

| (Unaudited, dollars in thousands) | Nonperforming Assets At | |||||||||||||||||||

| June 30 2024 |

March 31 2024 |

June 30 2023 |

||||||||||||||||||

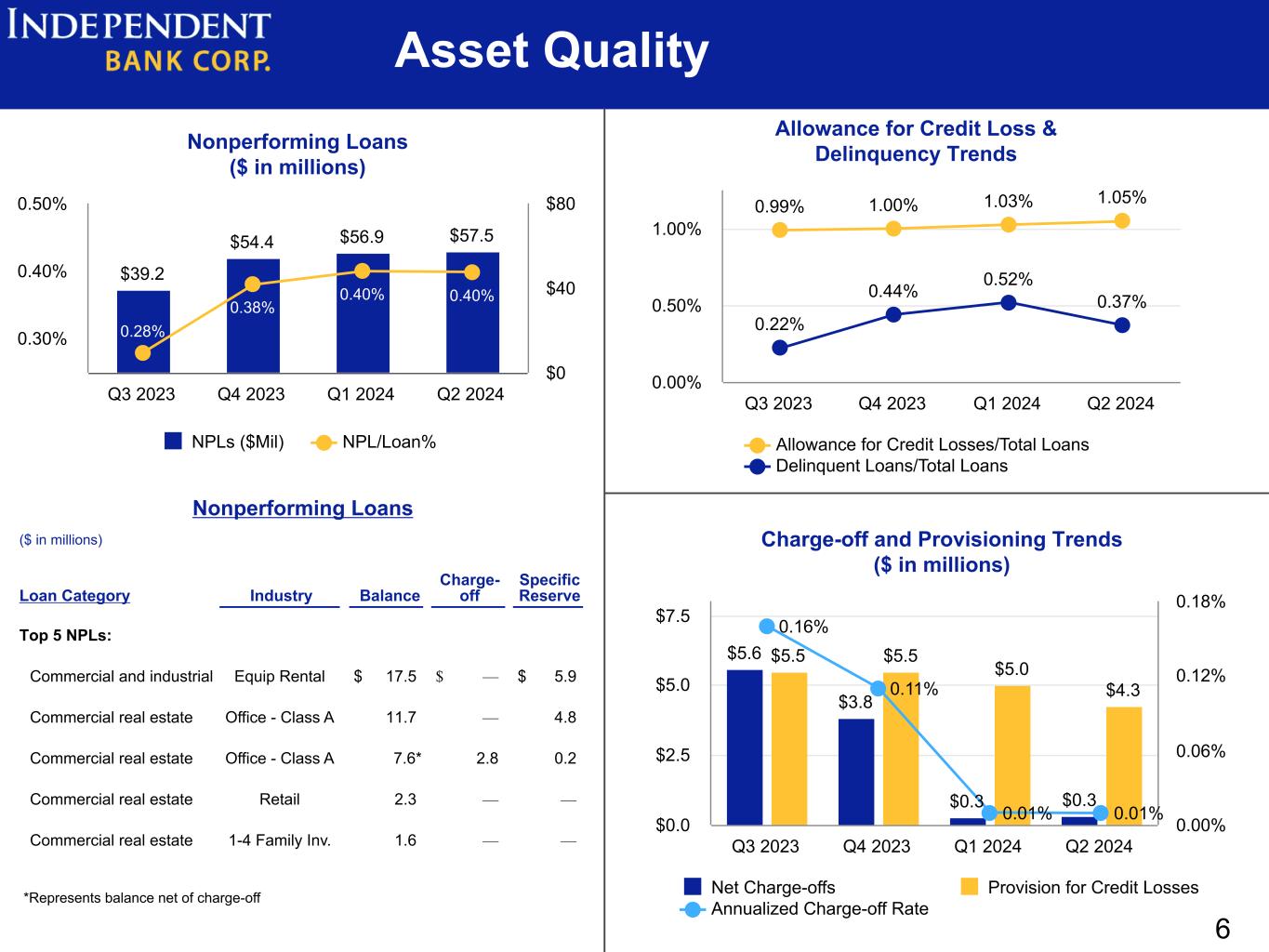

| Nonperforming loans | ||||||||||||||||||||

| Commercial & industrial loans | $ | 17,793 | $ | 17,640 | $ | 3,235 | ||||||||||||||

| Commercial real estate loans | 23,479 | 24,213 | 29,910 | |||||||||||||||||

| Small business loans | 437 | 316 | 348 | |||||||||||||||||

| Residential real estate loans | 10,629 | 9,947 | 8,179 | |||||||||||||||||

| Home equity | 5,090 | 4,805 | 3,944 | |||||||||||||||||

| Other consumer | 23 | 20 | 86 | |||||||||||||||||

| Total nonperforming loans | 57,451 | 56,941 | 45,702 | |||||||||||||||||

| Other real estate owned | 110 | 110 | 110 | |||||||||||||||||

| Total nonperforming assets | $ | 57,561 | $ | 57,051 | $ | 45,812 | ||||||||||||||

| Nonperforming loans/gross loans | 0.40 | % | 0.40 | % | 0.32 | % | ||||||||||||||

| Nonperforming assets/total assets | 0.30 | % | 0.30 | % | 0.24 | % | ||||||||||||||

| Allowance for credit losses/nonperforming loans | 262.59 | % | 258.07 | % | 307.75 | % | ||||||||||||||

| Allowance for credit losses/total loans | 1.05 | % | 1.03 | % | 0.99 | % | ||||||||||||||

| Delinquent loans/total loans | 0.37 | % | 0.52 | % | 0.30 | % | ||||||||||||||

| Nonperforming Assets Reconciliation for the Three Months Ended | ||||||||||||||||||||

| June 30 2024 |

March 31 2024 |

June 30 2023 |

||||||||||||||||||

| Nonperforming assets beginning balance | $ | 57,051 | $ | 54,493 | $ | 56,235 | ||||||||||||||

| New to nonperforming | 6,201 | 19,258 | 18,018 | |||||||||||||||||

| Loans charged-off | (808) | (881) | (23,767) | |||||||||||||||||

| Loans paid-off | (3,458) | (6,982) | (3,984) | |||||||||||||||||

| Loans restored to performing status | (1,429) | (8,855) | (680) | |||||||||||||||||

| Other | 4 | 18 | (10) | |||||||||||||||||

| Nonperforming assets ending balance | $ | 57,561 | $ | 57,051 | $ | 45,812 | ||||||||||||||

| Net Charge-Offs (Recoveries) | ||||||||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||

| June 30 2024 |

March 31 2024 |

June 30 2023 |

June 30 2024 |

June 30 2023 |

||||||||||||||||||||||||||||

| Net charge-offs (recoveries) | ||||||||||||||||||||||||||||||||

| Commercial and industrial loans | $ | (2) | $ | (85) | $ | 23,174 | $ | (87) | $ | 23,450 | ||||||||||||||||||||||

| Commercial real estate loans | — | — | — | — | — | |||||||||||||||||||||||||||

| Small business loans | 48 | 70 | 51 | 118 | 48 | |||||||||||||||||||||||||||

| Home equity | (137) | (133) | (10) | (270) | (26) | |||||||||||||||||||||||||||

| Other consumer | 430 | 422 | 269 | 852 | 550 | |||||||||||||||||||||||||||

| Total net charge-offs | $ | 339 | $ | 274 | $ | 23,484 | $ | 613 | $ | 24,022 | ||||||||||||||||||||||

| Net charge-offs to average loans (annualized) | 0.01 | % | 0.01 | % | 0.67 | % | 0.01 | % | 0.35 | % | ||||||||||||||||||||||

| BALANCE SHEET AND CAPITAL RATIOS | ||||||||||||||||||||

| June 30 2024 |

March 31 2024 |

June 30 2023 |

||||||||||||||||||

| Gross loans/total deposits | 93.45 | % | 95.26 | % | 92.73 | % | ||||||||||||||

| Common equity tier 1 capital ratio (1) | 14.42 | % | 14.16 | % | 14.06 | % | ||||||||||||||

| Tier 1 leverage capital ratio (1) | 11.09 | % | 10.95 | % | 10.85 | % | ||||||||||||||

| Common equity to assets ratio GAAP | 15.04 | % | 14.92 | % | 14.72 | % | ||||||||||||||

| Tangible common equity to tangible assets ratio (2) | 10.42 | % | 10.27 | % | 10.05 | % | ||||||||||||||

| Book value per share GAAP | $ | 68.74 | $ | 67.94 | $ | 64.69 | ||||||||||||||

| Tangible book value per share (2) | $ | 45.19 | $ | 44.34 | $ | 41.88 | ||||||||||||||

| INDEPENDENT BANK CORP. SUPPLEMENTAL FINANCIAL INFORMATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited, dollars in thousands) | Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2024 | March 31, 2024 | June 30, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest | Interest | Interest | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Earned/ | Yield/ | Average | Earned/ | Yield/ | Average | Earned/ | Yield/ | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance | Paid (1) | Rate | Balance | Paid (1) | Rate | Balance | Paid (1) | Rate | ||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning deposits with banks, federal funds sold, and short term investments | $ | 47,598 | $ | 397 | 3.35 | % | $ | 50,583 | $ | 483 | 3.84 | % | $ | 270,443 | $ | 3,312 | 4.91 | % | ||||||||||||||||||||||||||||||||||||||

| Securities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities - trading | 4,739 | — | — | % | 4,779 | — | — | % | 4,487 | — | — | % | ||||||||||||||||||||||||||||||||||||||||||||

| Securities - taxable investments | 2,793,145 | 13,992 | 2.01 | % | 2,867,460 | 14,231 | 2.00 | % | 3,071,752 | 15,581 | 2.03 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Securities - nontaxable investments (1) | 189 | 2 | 4.26 | % | 190 | 2 | 4.23 | % | 191 | 2 | 4.20 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total securities | $ | 2,798,073 | $ | 13,994 | 2.01 | % | $ | 2,872,429 | $ | 14,233 | 1.99 | % | $ | 3,076,430 | $ | 15,583 | 2.03 | % | ||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 12,610 | 199 | 6.35 | % | 7,095 | 104 | 5.90 | % | 2,977 | 39 | 5.25 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Loans | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial (1) | 1,583,858 | 28,305 | 7.19 | % | 1,559,978 | 27,629 | 7.12 | % | 1,686,348 | 29,451 | 7.00 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate (1) | 8,112,683 | 104,449 | 5.18 | % | 8,110,813 | 102,054 | 5.06 | % | 7,803,702 | 91,813 | 4.72 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Commercial construction | 834,876 | 15,451 | 7.44 | % | 842,480 | 15,421 | 7.36 | % | 1,044,650 | 17,212 | 6.61 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Small business | 265,273 | 4,376 | 6.63 | % | 257,022 | 4,160 | 6.51 | % | 230,371 | 3,501 | 6.10 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total commercial | 10,796,690 | 152,581 | 5.68 | % | 10,770,293 | 149,264 | 5.57 | % | 10,765,071 | 141,977 | 5.29 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Residential real estate | 2,427,635 | 26,472 | 4.39 | % | 2,418,617 | 26,083 | 4.34 | % | 2,153,563 | 20,943 | 3.90 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Home equity | 1,109,979 | 18,826 | 6.82 | % | 1,094,856 | 18,444 | 6.78 | % | 1,094,329 | 17,394 | 6.38 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total consumer real estate | 3,537,614 | 45,298 | 5.15 | % | 3,513,473 | 44,527 | 5.10 | % | 3,247,892 | 38,337 | 4.73 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Other consumer | 31,019 | 593 | 7.69 | % | 30,669 | 609 | 7.99 | % | 28,863 | 566 | 7.87 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total loans | $ | 14,365,323 | $ | 198,472 | 5.56 | % | $ | 14,314,435 | $ | 194,400 | 5.46 | % | $ | 14,041,826 | $ | 180,880 | 5.17 | % | ||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 17,223,604 | $ | 213,062 | 4.98 | % | $ | 17,244,542 | $ | 209,220 | 4.88 | % | $ | 17,391,676 | $ | 199,814 | 4.61 | % | ||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 178,558 | 177,506 | 178,707 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank stock | 41,110 | 47,203 | 44,619 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 1,876,081 | 1,809,640 | 1,826,879 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 19,319,353 | $ | 19,278,891 | $ | 19,441,881 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings and interest checking accounts | $ | 5,166,340 | $ | 16,329 | 1.27 | % | $ | 5,165,866 | $ | 14,856 | 1.16 | % | $ | 5,512,995 | $ | 9,425 | 0.69 | % | ||||||||||||||||||||||||||||||||||||||

| Money market | 2,909,503 | 17,409 | 2.41 | % | 2,844,014 | 15,991 | 2.26 | % | 3,044,486 | 12,331 | 1.62 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Time deposits | 2,579,336 | 27,731 | 4.32 | % | 2,297,219 | 23,473 | 4.11 | % | 1,630,015 | 10,153 | 2.50 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | $ | 10,655,179 | $ | 61,469 | 2.32 | % | $ | 10,307,099 | $ | 54,320 | 2.12 | % | $ | 10,187,496 | $ | 31,909 | 1.26 | % | ||||||||||||||||||||||||||||||||||||||

| Borrowings | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank borrowings | 957,268 | 11,329 | 4.76 | % | 1,185,296 | 14,631 | 4.96 | % | 1,068,585 | 12,576 | 4.72 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Junior subordinated debentures | 62,859 | 1,140 | 7.29 | % | 62,858 | 1,147 | 7.34 | % | 62,856 | 1,044 | 6.66 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Subordinated debentures | — | — | — | % | 40,651 | 508 | 5.03 | % | 49,921 | 618 | 4.97 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total borrowings | $ | 1,020,127 | $ | 12,469 | 4.92 | % | $ | 1,288,805 | $ | 16,286 | 5.08 | % | $ | 1,181,362 | $ | 14,238 | 4.83 | % | ||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 11,675,306 | $ | 73,938 | 2.55 | % | $ | 11,595,904 | $ | 70,606 | 2.45 | % | $ | 11,368,858 | $ | 46,147 | 1.63 | % | ||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | 4,360,897 | 4,439,107 | 4,873,767 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 375,629 | 347,573 | 336,210 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | $ | 16,411,832 | $ | 16,382,584 | $ | 16,578,835 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 2,907,521 | 2,896,307 | 2,863,046 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 19,319,353 | $ | 19,278,891 | $ | 19,441,881 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 139,124 | $ | 138,614 | $ | 153,667 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate spread (2) | 2.43 | % | 2.43 | % | 2.98 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin (3) | 3.25 | % | 3.23 | % | 3.54 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Supplemental Information | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits, including demand deposits | $ | 15,016,076 | $ | 61,469 | $ | 14,746,206 | $ | 54,320 | $ | 15,061,263 | $ | 31,909 | ||||||||||||||||||||||||||||||||||||||||||||

| Cost of total deposits | 1.65 | % | 1.48 | % | 0.85 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total funding liabilities, including demand deposits | $ | 16,036,203 | $ | 73,938 | $ | 16,035,011 | $ | 70,606 | $ | 16,242,625 | $ | 46,147 | ||||||||||||||||||||||||||||||||||||||||||||

| Cost of total funding liabilities | 1.85 | % | 1.77 | % | 1.14 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Six Months Ended | ||||||||||||||||||||||||||||||||||||||

| June 30, 2024 | June 30, 2023 | |||||||||||||||||||||||||||||||||||||

| Interest | Interest | |||||||||||||||||||||||||||||||||||||

| Average | Earned/ | Yield/ | Average | Earned/ | Yield/ | |||||||||||||||||||||||||||||||||

| Balance | Paid | Rate | Balance | Paid | Rate | |||||||||||||||||||||||||||||||||

| Interest-earning assets | ||||||||||||||||||||||||||||||||||||||

| Interest earning deposits with banks, federal funds sold, and short term investments | $ | 49,091 | $ | 880 | 3.60 | % | $ | 172,569 | $ | 3,977 | 4.65 | % | ||||||||||||||||||||||||||

| Securities | ||||||||||||||||||||||||||||||||||||||

| Securities - trading | 4,759 | — | — | % | 4,292 | — | — | % | ||||||||||||||||||||||||||||||

| Securities - taxable investments | 2,830,302 | 28,223 | 2.01 | % | 3,094,263 | 30,890 | 2.01 | % | ||||||||||||||||||||||||||||||

| Securities - nontaxable investments (1) | 190 | 4 | 4.23 | % | 192 | 4 | 4.20 | % | ||||||||||||||||||||||||||||||

| Total securities | $ | 2,835,251 | $ | 28,227 | 2.00 | % | $ | 3,098,747 | $ | 30,894 | 2.01 | % | ||||||||||||||||||||||||||

| Loans held for sale | 9,853 | 303 | 6.18 | % | 2,727 | 73 | 5.40 | % | ||||||||||||||||||||||||||||||

| Loans | ||||||||||||||||||||||||||||||||||||||

| Commercial and industrial (1) | 1,571,918 | 55,911 | 7.15 | % | 1,652,527 | 56,023 | 6.84 | % | ||||||||||||||||||||||||||||||

| Commercial real estate (1) | 8,111,748 | 206,526 | 5.12 | % | 7,788,304 | 181,394 | 4.70 | % | ||||||||||||||||||||||||||||||

| Commercial construction | 838,678 | 30,872 | 7.40 | % | 1,089,311 | 33,679 | 6.23 | % | ||||||||||||||||||||||||||||||

| Small business | 261,147 | 8,536 | 6.57 | % | 226,479 | 6,720 | 5.98 | % | ||||||||||||||||||||||||||||||

| Total commercial | 10,783,491 | 301,845 | 5.63 | % | 10,756,621 | 277,816 | 5.21 | % | ||||||||||||||||||||||||||||||

| Residential real estate | 2,423,126 | 52,555 | 4.36 | % | 2,105,311 | 40,301 | 3.86 | % | ||||||||||||||||||||||||||||||

| Home equity | 1,102,418 | 37,270 | 6.80 | % | 1,091,707 | 33,638 | 6.21 | % | ||||||||||||||||||||||||||||||

| Total consumer real estate | 3,525,544 | 89,825 | 5.12 | % | 3,197,018 | 73,939 | 4.66 | % | ||||||||||||||||||||||||||||||

| Other consumer | 30,844 | 1,202 | 7.84 | % | 30,940 | 1,143 | 7.45 | % | ||||||||||||||||||||||||||||||

| Total loans | $ | 14,339,879 | $ | 392,872 | 5.51 | % | $ | 13,984,579 | $ | 352,898 | 5.09 | % | ||||||||||||||||||||||||||

| Total interest-earning assets | $ | 17,234,074 | $ | 422,282 | 4.93 | % | $ | 17,258,622 | $ | 387,842 | 4.53 | % | ||||||||||||||||||||||||||

| Cash and due from banks | 178,032 | 180,047 | ||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank stock | 44,157 | 29,749 | ||||||||||||||||||||||||||||||||||||

| Other assets | 1,842,859 | 1,835,669 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 19,299,122 | $ | 19,304,087 | ||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||||||||

| Savings and interest checking accounts | $ | 5,166,103 | $ | 31,185 | 1.21 | % | $ | 5,628,535 | $ | 16,898 | 0.61 | % | ||||||||||||||||||||||||||

| Money market | 2,876,759 | 33,400 | 2.33 | % | 3,143,355 | 22,724 | 1.46 | % | ||||||||||||||||||||||||||||||

| Time deposits | 2,438,277 | 51,204 | 4.22 | % | 1,462,929 | 14,962 | 2.06 | % | ||||||||||||||||||||||||||||||

| Total interest-bearing deposits | $ | 10,481,139 | $ | 115,789 | 2.22 | % | $ | 10,234,819 | $ | 54,584 | 1.08 | % | ||||||||||||||||||||||||||

| Borrowings | ||||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank borrowings | 1,071,282 | 25,960 | 4.87 | % | 685,626 | 16,220 | 4.77 | % | ||||||||||||||||||||||||||||||

| Junior subordinated debentures | 62,858 | 2,287 | 7.32 | % | 62,856 | 2,045 | 6.56 | % | ||||||||||||||||||||||||||||||

| Subordinated debentures | 20,326 | 508 | 5.03 | % | 49,909 | 1,235 | 4.99 | % | ||||||||||||||||||||||||||||||

| Total borrowings | $ | 1,154,466 | $ | 28,755 | 5.01 | % | $ | 798,391 | $ | 19,500 | 4.93 | % | ||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 11,635,605 | $ | 144,544 | 2.50 | % | $ | 11,033,210 | $ | 74,084 | 1.35 | % | ||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | 4,400,002 | 5,045,694 | ||||||||||||||||||||||||||||||||||||

| Other liabilities | 361,601 | 355,097 | ||||||||||||||||||||||||||||||||||||

| Total liabilities | $ | 16,397,208 | $ | 16,434,001 | ||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 2,901,914 | 2,870,086 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 19,299,122 | $ | 19,304,087 | ||||||||||||||||||||||||||||||||||

| Net interest income | $ | 277,738 | $ | 313,758 | ||||||||||||||||||||||||||||||||||

| Interest rate spread (2) | 2.43 | % | 3.18 | % | ||||||||||||||||||||||||||||||||||

| Net interest margin (3) | 3.24 | % | 3.67 | % | ||||||||||||||||||||||||||||||||||

| Supplemental Information | ||||||||||||||||||||||||||||||||||||||

| Total deposits, including demand deposits | $ | 14,881,141 | $ | 115,789 | $ | 15,280,513 | $ | 54,584 | ||||||||||||||||||||||||||||||

| Cost of total deposits | 1.56 | % | 0.72 | % | ||||||||||||||||||||||||||||||||||

| Total funding liabilities, including demand deposits | $ | 16,035,607 | $ | 144,544 | $ | 16,078,904 | $ | 74,084 | ||||||||||||||||||||||||||||||

| Cost of total funding liabilities | 1.81 | % | 0.93 | % | ||||||||||||||||||||||||||||||||||

| June 30 2024 |

March 31 2024 |

June 30 2023 |

|||||||||||||||||||||

| Tangible common equity | (Dollars in thousands, except per share data) | ||||||||||||||||||||||

| Stockholders’ equity (GAAP) | $ | 2,919,249 | $ | 2,884,208 | $ | 2,854,914 | (a) | ||||||||||||||||

| Less: Goodwill and other intangibles | 1,000,233 | 1,001,698 | 1,006,609 | ||||||||||||||||||||

| Tangible common equity (Non-GAAP) | $ | 1,919,016 | $ | 1,882,510 | $ | 1,848,305 | (b) | ||||||||||||||||

| Tangible assets | |||||||||||||||||||||||

| Assets (GAAP) | $ | 19,411,037 | $ | 19,324,613 | $ | 19,400,931 | (c) | ||||||||||||||||

| Less: Goodwill and other intangibles | 1,000,233 | 1,001,698 | 1,006,609 | ||||||||||||||||||||

| Tangible assets (Non-GAAP) | $ | 18,410,804 | $ | 18,322,915 | $ | 18,394,322 | (d) | ||||||||||||||||

| Common Shares | 42,469,867 | 42,452,457 | 44,130,901 | (e) | |||||||||||||||||||

| Common equity to assets ratio (GAAP) | 15.04 | % | 14.92 | % | 14.72 | % | (a/c) | ||||||||||||||||

| Tangible common equity to tangible assets ratio (Non-GAAP) | 10.42 | % | 10.27 | % | 10.05 | % | (b/d) | ||||||||||||||||

| Book value per share (GAAP) | $ | 68.74 | $ | 67.94 | $ | 64.69 | (a/e) | ||||||||||||||||

| Tangible book value per share (Non-GAAP) | $ | 45.19 | $ | 44.34 | $ | 41.88 | (b/e) | ||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| June 30 2024 |

March 31 2024 |

June 30 2023 |

June 30 2024 |

June 30 2023 |

|||||||||||||||||||||||||

| Net income (GAAP) | $ | 51,330 | $ | 47,770 | $ | 62,644 | $ | 99,100 | $ | 123,891 | |||||||||||||||||||

| Average common equity (GAAP) | $ | 2,907,521 | $ | 2,896,307 | $ | 2,863,046 | $ | 2,901,914 | $ | 2,870,086 | |||||||||||||||||||

| Less: Average goodwill and other intangibles | 1,000,972 | 1,002,506 | 1,007,500 | 1,001,739 | 1,008,415 | ||||||||||||||||||||||||

| Tangible average tangible common equity (Non-GAAP) | $ | 1,906,549 | $ | 1,893,801 | $ | 1,855,546 | $ | 1,900,175 | $ | 1,861,671 | |||||||||||||||||||

| Return on average tangible common equity (Non-GAAP) (calculated by dividing annualized net income by average tangible common equity) | 10.83 | % | 10.15 | % | 13.54 | % | 10.49 | % | 13.42 | % | |||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||

| June 30, 2024 | March 31, 2024 | ||||||||||||||||||||||

| Volume | Interest | Margin Impact | Volume | Interest | Margin Impact | ||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||

| Reported total interest earning assets | $ | 17,223,604 | $ | 139,124 | 3.25 | % | $ | 17,244,542 | $ | 138,614 | 3.23 | % | |||||||||||

| Acquisition fair value marks: | |||||||||||||||||||||||

| Loan accretion | (74) | (109) | |||||||||||||||||||||

| CD amortization | — | 9 | |||||||||||||||||||||

| (74) | — | % | (100) | — | % | ||||||||||||||||||

| Nonaccrual interest, net | (131) | — | % | (341) | (0.01) | % | |||||||||||||||||

| Other noncore adjustments | (4,020) | (499) | (0.01) | % | (4,460) | (582) | (0.01) | % | |||||||||||||||

| Core margin (Non-GAAP) | $ | 17,219,584 | $ | 138,420 | 3.24 | % | $ | 17,240,082 | $ | 137,591 | 3.21 | % | |||||||||||